UNITED STATES

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes XNo __

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes†No'

The number of shares of registrant’s common stock outstanding, as August 13, 2009 was 268,199,033.

2

F-1

F-2

F-3

PLATINUM STUDIOS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2009

(UNAUDITED)

( 1 )Description of business

Nature of operations– The Company controls a library consisting of more than 5,600 characters and is engaged principally as a comics-based entertainment company adapting characters and storylines for production in film, television, publishing and all other media.

Platinum Studios, LLC was formed and operated as a California limited liability company from its inception on November 20, 1996 through September 14, 2006. On September 15, 2006, Platinum Studios, LLC filed with the State of California to convert Platinum Studios, LLC into Platinum Studios, Inc., (“the Company”, “Platinum”) a California corporation.

This change to the Company structure was made in preparation of a private placement memorandum and common stock offering in October, 2006 (Note 12).

( 2 )Basis of financial statement presentation and consolidation

The accompanying unaudited financial statements of the Company have been prepared in accordance with United States generally accepted accounting principles for interim financial statements and with the instructions to Form 10-Q and Article 10 of Regulation S-X, promulgated by the Securities and Exchange Commission (the “SEC”). Accordingly, they do not include all of the information and disclosures required by United States generally accepted accounting principles for complete financial statements. The consolidated financial statements include the financial condition and results of operations of our wholly-owned subsidiary, Long Distance Films, Inc. and its two wholly-owned subsidiaries Dead Of Night Investment Company, LLC and Dead Of Night Production Company, LLC. Intercompany balances and transactions have been eliminated in consolidation. In the opinion of management, all adjustments (consisting of normal re curring adjustments) considered necessary for a fair presentation have been included. The results of operations for interim periods are not necessarily indicative of the results that may be expected for the fiscal year. The financial statements should be read in conjunction with the Company’s December 31, 2008 financial statements and accompanying notes included in the Company’s Annual Report on Form 10-K (the “Annual Report”). All terms used but not defined elsewhere herein have the meanings ascribed to them in the Annual Report.

The balance sheet at December 31, 2008 has been derived from the audited financial statements at that date but does not include all the information and footnotes required by United States generally accepted accounting principles for complete financial statements.

( 3 )Going concern

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred significant losses which have resulted in an accumulated deficit of $21,792,582 as of June 30, 2009. The Company plans to seek additional financing in order to execute its business plan, but there is no assurance the Company will be able to obtain such financing on terms favorable to the Company or at all. These items raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying financial statements do not include any adjustments to reflect the possible future effects related to recovery and classification of assets, or the amounts and classifications of liabilities that might result from the outcome of this uncertainty.

( 4 )Summary of significant accounting policies

Reclassifications– Certain prior year amounts have been reclassified in order to conform to the current year’s presentation.

Revenue recognition- Revenue from the licensing of characters and storylines (“the properties”) owned by the Company are recognized in accordance with guidance provided in Securities and Exchange Commission Staff Accounting Bulletin No. 104 “Revenue Recognition” (an amendment of Staff Accounting Bulletin No. 101 “Revenue Recognition”) (“SAB 104”). Under the SAB 104 guidelines, revenue is recognized when the earnings process is complete. This is considered to have occurred when persuasive evidence of an agreement between the customer and the Company exists, when the properties are made available to the licensee and the Company has satisfied its obligations under the agreement, when the fee is fixed or determinable and when collection is reasonably assured.

The Company derives its licensing revenue primarily from options to purchase rights, the purchase of rights to properties and first look deals. For option agreements and first look deals that contain non-refundable payment obligations to us, we recognize such non-refundable payments as revenue at the inception of the agreement and receipt of payment, prior to the collection of any additional amounts due, provided all the criteria for revenue recognition under SAB 104 have been met. First look deals that have contingent components are deferred and recognized at the later of the expiration of the first look period or in accordance with the terms of the first look contract.

For licenses requiring material continuing involvement or performance based obligations, by the Company, the revenue is recognized as and when such obligations are fulfilled.

The Company records as deferred revenue any licensing fees collected in advance of obligations being fulfilled or if a licensee is not sufficiently creditworthy, the Company will not record deferred revenue until payments are received.

( 4 )Summary of significant accounting policies (continued)

License agreements typically include reversion rights which allow the Company to repurchase property rights which have not been used by the studio (the buyer) in production within a specified period of time as defined in the purchase agreement. The cost to repurchase the rights is generally based on the costs incurred by the studio to further develop the characters and story lines.

Use of estimates- The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimatesand assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of financial statements, and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

Cash and cash equivalents– The Company considers all highly liquid investment securities with an original maturity date of three months or less to be cash equivalents.

Accounts receivable– Trade receivables are carried at original invoice amount. The company does not regularly issue credit to its customers. The Company performs ongoing reviews of its receivables for collectability. Trade receivables are written off when deemed uncollectable. Recoveries of trade receivables previously written off are recorded as income when received. No trade receivables were written off for the six months ended June 30, 2009 and 2008. The Company’s allowance for doubtful accounts was $0 as of June 30, 2009 and December 31, 2008.

Concentrations of risk- Financial instruments that potentially subject the Company to concentrations of credit risk consist primarily of uninsured cash balances. The Company maintains its cash balances with what management believes to be a high credit quality financial institution. At times, balances within the Company’s cash accounts may exceed the Federal Deposit Insurance Corporation (FDIC) limit of $250,000. During the three six months ended June 30, 2009 and 2008, the Company had customer revenues representing a concentration of the Company’s total revenues. For the three and six months ended June 30, 2009, one customer represented approximately 92% of total revenues. For the three months ended June 30, 2008, three customers represented approximately 66%, 13% and 11% of total revenues, respectively. For the six months ended June 30, 2008, four customers represented approximately 45%, 18%, 14% and 9% of total revenues, respectively.

Derivative Instruments –Platinum Studios entered into a Credit Agreement on May 6, 2009, with Scott Rosenberg in connection with the issuance of two secured promissory notes and an unsecured promissory note. Two warrants were issued to Scott Rosenberg in connection with the issuance of various promissory notes as of May 6, 2009 and June 3, 2009.

A description of the notes is as follows:

May 6, 2009 Secured Debt- The May 6, 2009 Secured Debt has an aggregate principal amount of $2,400,000, and is convertible into shares of the Company’s common stock at a conversion price of $0.048. The May 6, 2009 Secured Debt bears interest at the rate of eight percent per annum. Upon the occurrence of an event of default, the May 6, 2009 Secured Debt bears interest at the rate of ten percent per annum. Interest is payable upon the expiration of the notes on May 6, 2010. The original principal amount of $2,400,000 is to be repaid upon the expiration of the notes on May 6, 2010. The Company may prepay the notes at any time. The May 6, 2009 Secured Debt has the following features that can be considered to be embedded derivatives: (i) the conversion feature of the notes, (ii) a holder’s right to force a redemption of the Notes upon an event of default, and, (iii) the increased interest rate upon an event of default. In connection with this debt the Company also issued warrants to purchase 25,000,000 shares of the Company’s common stock for $0.048 per share.

June 3, 2009 Secured Debt- The June 3, 2009 Secured Debt has an aggregate principal amount of $1,350,000, and is convertible into shares of the Company’s common stock at a conversion price of $0.038. The June 3, 2009 Secured Debt bears interest at the rate of eight percent per annum. Upon the occurrence of an event of default, the June 3, 2009 Secured Debt bears interest at the rate of ten percent per annum. Interest is payable upon the expiration of the notes on June 3, 2010. The original principal amount of $1,350,000 is to be repaid upon the expiration of the notes on June 3, 2010. The Company may prepay the notes at any time. The June 3, 2009 Secured Debt has the following features that can be considered to be embedded derivatives: (i) the conversion feature of the notes, (ii) a holder’s right to force a redemption of the Notes upon an event of default, and, (iii) the increased interest rate upon an event of default. In connection with this debt the Company also issued warrants to purchase 14,062,500 shares of the Company’s common stock for $0.038 per share.

June 3, 2009 Unsecured Debt- The June 3, 2009 Unsecured Debt has an aggregate principal amount of $544,826, and is convertible into shares of the Company’s common stock at a conversion price of $0.048. The June 3, 2009 Unsecured Debt bears interest at the rate of eight percent per annum. Upon the occurrence of an event of default, the June 3, 2009 Unsecured Debt bears interest at the rate of ten percent per annum. The Company is required to make payments of $29,687.50 per month. The monthly payments are to be applied first to interest and second to principal. The remaining principal amount is to be repaid upon the expiration of the note on June 3, 2010. The Company may prepay the note at any time. The June 3, 2009 Unsecured Debt has the following features that can be considered to be embedded derivatives: (i) the conversion feature of the notes, (ii) a holder’s right to force a redemption of the Notes upon an event of default, and, (iii) the increased interest rate upon an event of default.

( 4 )Summary of significant accounting policies (continued)

In determining the fair market value of the embedded derivatives, we used discounted cash flows analysis. We also used a binomial option pricing model to value the warrants issued in connection with these debts. The Company determined the fair value of the embedded derivatives to be $715,904 and the fair value of the warrants to be $934,000. These embedded derivatives have been accounted for as a debt discount that will be amortized over the one year life of the notes. Amortization of the debt discount has resulted in a $156,560 increase to interest expense for the three and six months ended June 30, 2009.

A description of the Warrants is as follows:

1) The May 6, 2009 warrant entitles the holder to purchase up to 25,000,000 shares of the Company’s common stock at a price of $0.048 per share. The May 6, 2009 warrant is exercisable up until May 6, 2019. The May 6, 2009 warrant shall expire and no longer be exercisable upon a change in control. The exercise price and the number of shares underlying the warrant is subject to anti-dilution adjustments from time to time if the Company issues common stock at below the exercise price at that time for the warrants.

2) The June 3, 2009 warrant entitles the holder to purchase up to 14,062,500 shares of the Company’s common stock at a price of $0.038 per share. The June 3, 2009 warrant is exercisable up until June 3, 2019. The June 3, 2009 warrant shall expire and no longer be exercisable upon a change in control. The exercise price and the number of shares underlying the warrant is subject to anti-dilution adjustments from time to time if the Company issues common stock at below the exercise price at that time for the warrants.

In determining the fair market value of the Warrants, we used the binomial model with the following significant assumptions: exercise price $0.038 – $0.048, trading prices $0.04 -$0.042, expected volatility 115.6% - 116.2%, expected life of 60 months, dividend yield of 0.00% and a risk free rate of 3.2% - 3.56%. The fair value of these warrants has been recorded as part of the debt discount as discussed above as well as being recognized as a derivative liability. The derivative liability will be re-valued at each reporting date with changes in value being recognized as part of current earnings.

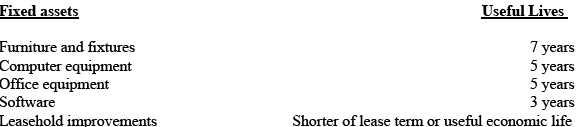

Depreciation- Depreciation is computed on the straight-line method over the following estimated useful lives:

( 4 )Summary of significant accounting policies (continued)

Character development costs- Character development costs consist primarily of costs to acquire properties from the creator, development of the property using internal or independent writers and artists, and the registration of a property for a trademark or copyright. These costs are capitalized in the year incurred if the Company has executed a contract or is negotiating a revenue generating opportunity for the property. If the property derives a revenue stream that is estimable, the capitalized costs associated with the property are expensed as revenue is recognized. During the three and six months ended June 30, 2009 no character costs were capitalized.

If the Company determines there is no determinable market for a property, it is deemed impaired and is written off.

Purchased intangible assets and long-lived assets– Intangible assets are capitalized at acquisition costs and intangible assets with definite lives are amortized on the straight-line basis. The Company periodically reviews the carrying amounts of intangible assets and property in conformance with the Statement of Financial Accounting Standards No. 144,

Accounting for the Impairment or Disposal of Long-Lived Assets(SFAS 144). Under SFAS 144, long-lived assets, such as property and equipment, and purchased intangibles subject to amortization, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to the estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated future cash flows, the impairment charge to be recognized is measured by the excess of the carrying amount over the fair value of the asset.

Advertising costs- Advertising costs are expensed the later of when incurred or when the advertisement is first run. For the three and six months ended June 30, 2009 advertising expenses were $0. For the three and six months ended June 30, 2008 advertising expenses were $11,935 and $47,510, respectively.

Research and development- Research and development costs, primarily character development costs and design not associated with an identifiable revenue opportunity, are charged to operations as incurred. For the three and six months ended June 30, 2009 research and development expenses were $47,126 and $85,048, respectively. For the three and six months ended June 30, 2008 research and development expenses were $145,674 and $358,227, respectively.

Income taxes– The Company has accounted for income taxes using the liability method, whereby deferred tax assets and liability account balances are determined based on differences between financial reporting and tax basis of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company was subject to an annual minimum tax of $800.

( 4 )Summary of significant accounting policies (continued)

Net income/(loss) per share– In accordance with SFAS No. 128 “Earnings Per Share”, basic income per share is computed by dividing net income (loss) available to common stockholders by the weighted average number of shares of common stock outstanding during the periods, excluding shares subject to repurchase or forfeiture. Diluted income per share increases the shares outstanding for the assumption of the vesting of restricted stock and the exercise of dilutive stock options and warrants, using the treasure stock method, unless the effect is anti-dilutive.

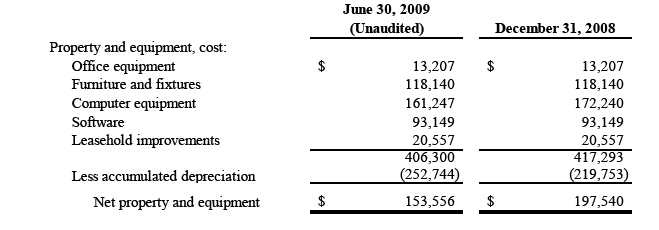

( 5 )Property and equipment

Property and equipment are recorded at cost. The cost of repairs and maintenance are expensed when incurred, while expenditures refurbishments and improvements that significantly add to the productive capacity or extend the useful life of an asset are capitalized. Upon asset retirement or disposal, any resulting gain or loss is included in the results of operations.

( 6 )Character Rights

Character rights are recorded at cost. On June 12, 2008, the Company received a valuation of its intellectual property which consists of a library of comic characters. The valuation provides that the fair market value exceeds the Company’s cost.

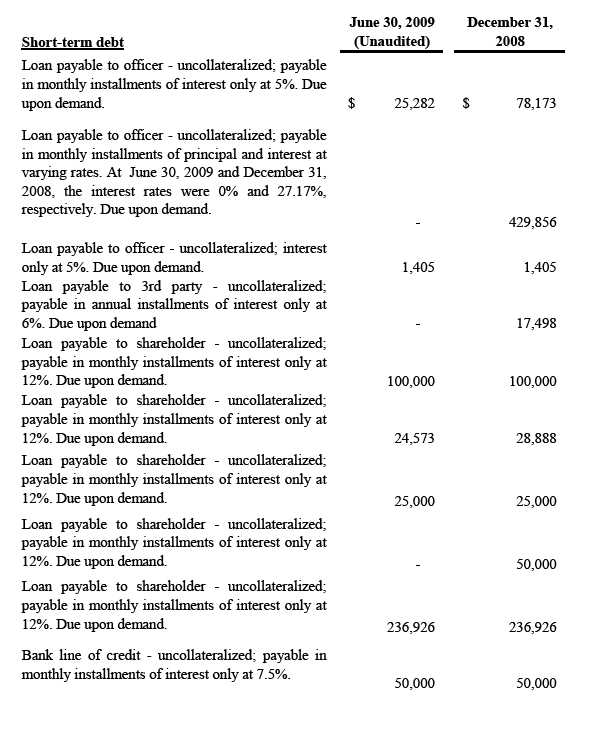

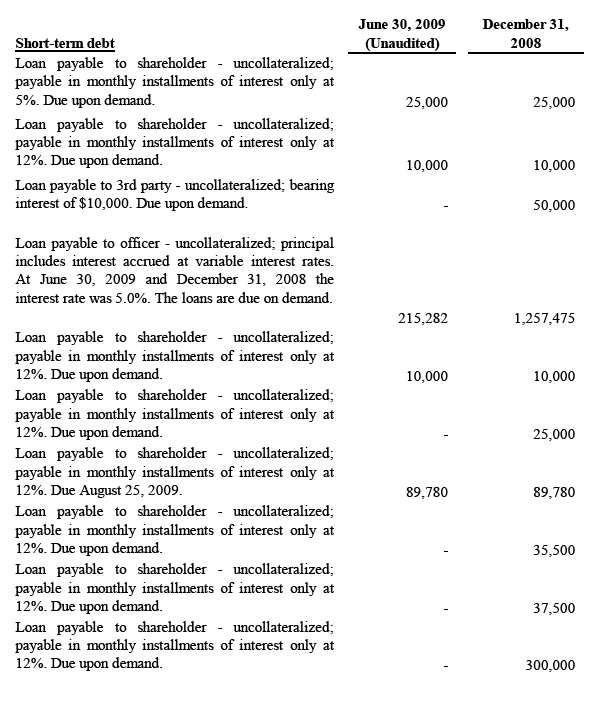

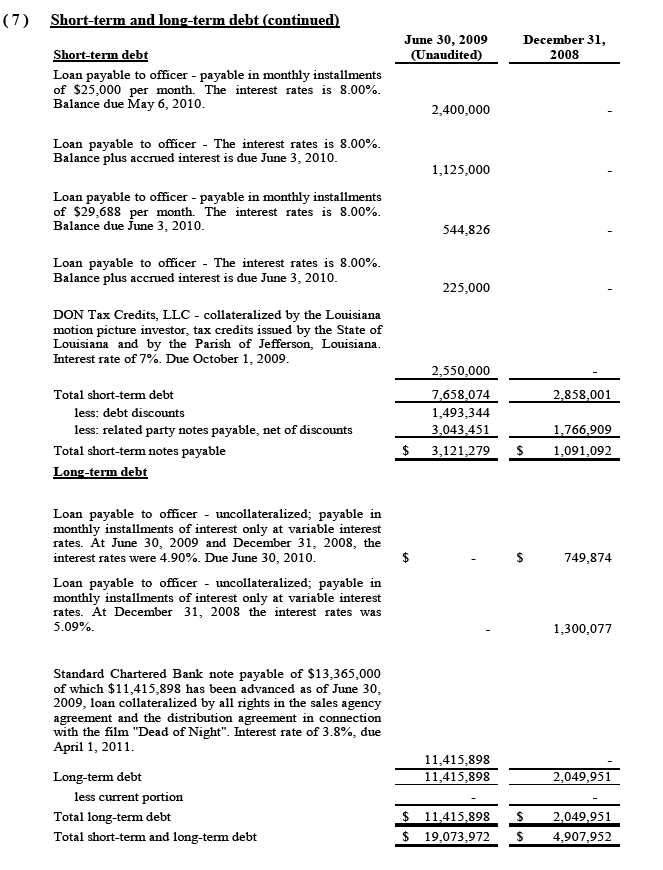

( 7 )Short-term and long-term debt

( 7 )Short-term and long-term debt (continued)

( 7 )Short-term and long-term debt (continued)

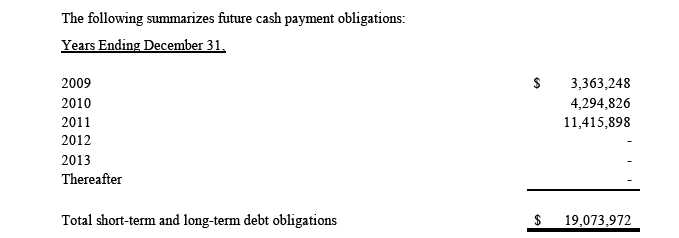

( 8 )Operating and capital leases

The Company has entered into operating leases having expiration dates through 2011 for real estate and various equipment needs, including office facilities, computers, office equipment and a vehicle.

On July 10, 2006, the Company entered into an operating agreement for the lease of real property located in Los Angeles, California. The agreement has a five year term, commencing September 1, 2006 and ending August 31, 2011. The Company is currently in default of its lease agreement and is negotiating new lease terms.

The Company has various non-cancelable leases for computers, software, and furniture, at a cost of $273,150 at June 30, 2009 and December 31, 2008. The capital leases are secured by the assets which cannot be freely sold until the maturity date of the lease. Accumulated amortization for equipment under capital lease totaled $163,477 and $139,271 at June 30, 2009 and December 31, 2008, respectively. Future required payments at June 30, 2009, under these leases is as follows:

( 9 )Commitments and Contingencies

During 2004, the Company entered into an agreement with Top Cow Productions, Inc. to acquire certain rights in and to certain comic books, related characters, storylines and intellectual property (the properties). The current agreement period expires on June 30, 2010. The Company has the right to extend the agreement for an additional twelve month period for an additional $350,000 and has pre-paid $75,000 toward this extended period. If the Company enters into production on a particular property, additional fees based on a percentage of the adjusted gross revenue resulting from the production, as defined in the agreement, will be due to the owner. The agreement is collateralized by a security interest in and to all rights licensed or granted to the Company under this agreement including the right to receive revenue. The current agreement period cost of $350,000 is included in Other Assets on the balance sheet and is being amortized on a straight-line basis beginning in 2006 when the rights became available for exploitation.

On July 15, 2008, Platinum Studios, Inc. purchased Wowio, LLC an on-line distributor of e-books. Under the terms of the Agreement the Company acquired from the Members of Wowio, LLC 100% of the membership interests of WOWIO for a total purchase price of $3,150,000 payable in shares of common stock of the Company. Under the terms of the Agreement, the number of shares of Common Stock issued on a particular payment date will be calculated by dividing one third of the purchase price by the average closing trading price of a share of the Common Stock for the five trading days immediately prior to such payment date, with a minimum price of $0.15 per share. On July 16, 2008, 7,000,000 shares were issued to the former members of Wowio, LLC representing one third of the total purchase price. One-third of the shares were issued on the three-month anniversary of the closing date and one-third of the shares were issued duri ng the three months ended March 31, 2009.

Wowio, LLC, is a leading online source for downloading digital books and comics. This acquisition was intended to continue the expansion of Platinum Studios’ global digital media distribution strategy.

The total basis of Wowio, LLC’s contributed assets and liabilities as of the closing date of the purchase was allocated to the estimated fair value of assets acquired and liabilities assumed as set forth in the following table:

( 9 )Commitments and Contingencies (continued)

The purchase of Wowio, LLC resulted in the recording of $2,499,380 in goodwill. At December 31, 2008 it was determined that this asset was fully impaired and the full amount was expensed.

On June 30, 2009 the Company sold Wowio,LLC to related parties for the assumption of an aggregate of $1,636,064 in debt owed by the Company and an additional $1,513,936 to be paid via a royalty of 20% of gross revenues generated by Wowio Penn, its successors and assigns, after which the royalty rate would decrease to 10%, and remain at 10% in perpetuity. See note 15, discontinued operations, for discussion of the impact of the sale on current operations.

As of June 30, 2009, eight unsecured short term notes totaling $571,279 have exceeded their maturity date, are due upon demand, and could be considered in default. The Company is currently negotiating with the note holders to extend the maturity dates of these notes.

( 10 )Long Distance Films, Inc. and Dead of Night Productions

On December 10, 2008, the Company purchased Long Distance Films, Inc. to facilitate the financing and production of the film currently titled “Dead of Night”. Long Distance Films, Inc. has no assets, liabilities or equity other than 100 shares of common stock wholly owned by Platinum Studios, Inc. Additionally, Long Distance Films had recorded no revenue or expenses. As consideration for this acquisition the Company closed a financing arrangement to provide funding for the production of “Dead of Night”.

On October 24, 2008 the Company Created Dead of Night Productions, LLC and Dead of Night Investments, LLC in order to facilitate the production of the film “Dead of Night”. Dead of Night Productions, LLC and Dead of Night Investments, LLC are wholly-owned subsidiaries of Long Distance Films, Inc.

As of June 30, 2009, Dead of Night Productions, LLC has incurred $12,854,448 in film development costs for the film “Dead of Night”. These costs have been paid through related debt financing which has a balance of $13,965,898 at June 30, 2009.

( 11 )Related party transactions

The Company has an exclusive option to enter licensing/acquisition of rights agreements for individual characters, subject to existing third party rights, within the RIP Awesome Library of RIP Media, Inc., a related entity in which Scott Rosenberg is a majority shareholder. The Company did not exercise this right during the six months ended June 30, 2009 and the years ended December 31, 2008 and 2007.

( 11 )Related party transactions (continued)

Scott Mitchell Rosenberg also provides production consulting services to the Company’s customers (production companies) through Scott Mitchell Rosenberg Productions (another related entity) wholly owned by Scott Mitchell Rosenberg. At the time the Company enters into a purchase agreement with a production company, a separate contract may be entered into between the related entity and the production company. In addition, consulting services regarding development of characters and storylines may also be provided to the Company by this related entity. Revenue would be paid directly to the related entity by the production company.

For the six months ended June 30, 2009, Scott Mitchell Rosenberg loaned the company an additional $1,103,534 to help fund operations.

For the six months ended June 30, 2009, the Company repaid $71,675 in loans and interest on loans provided by Brian Altounian.

The Company entered into a Credit Agreement on May 6, 2009, with Scott Rosenberg in connection with the issuance of two secured promissory notes and an unsecured promissory note. Two warrants were issued to Scott Rosenberg in connection with the issuance of various promissory notes as of May 6, 2009 and June 3, 2009.

A description of the notes is as follows:

May 6, 2009 Secured Debt- The May 6, 2009 Secured Debt has an aggregate principal amount of $2,400,000, and is convertible into shares of the Company’s common stock at a conversion price of $0.048. The May 6, 2009 Secured Debt bears interest at the rate of eight percent per annum. Upon the occurrence of an event of default, the May 6, 2009 Secured Debt bears interest at the rate of ten percent per annum. Interest is payable upon the expiration of the notes on May 6, 2010. The original principal amount of $2,400,000 is to be repaid upon the expiration of the notes on May 6, 2010. The Company may prepay the notes at any time. The May 6, 2009 Secured Debt has the following features that can be considered to be embedded derivatives: (i) the conversion feature of the notes, (ii) a holder’s right to force a redemption of the Notes upon an event of default, and, (iii) the increased interest rate upon an event of default. In connection with this debt the Company also issued warrants to purchase 25,000,000 shares of the Company’s common stock for $0.048 per share.

June 3, 2009 Secured Debt- The June 3, 2009 Secured Debt has an aggregate principal amount of $1,350,000, and is convertible into shares of the Company’s common stock at a conversion price of $0.038. The June 3, 2009 Secured Debt bears interest at the rate of eight percent per annum. Upon the occurrence of an event of default, the June 3, 2009 Secured Debt bears interest at the rate of ten percent per annum. Interest is payable upon

the expiration of the notes on June 3, 2010. The original principal amount of $1,350,000 is to be repaid upon the expiration of the notes on June 3, 2010. The Company may prepay the notes at any time. The June 3, 2009 Secured Debt has the following features that can be considered to be embedded derivatives: (i) the conversion feature of the notes, (ii) a

( 11 )Related party transactions (continued)

holder’s right to force a redemption of the Notes upon an event of default, and, (iii) the increased interest rate upon an event of default. In connection with this debt the Company also issued warrants to purchase 14,062,500 shares of the Company’s common stock for $0.038 per share.

June 3, 2009 Unsecured Debt- The June 3, 2009 Unsecured Debt has an aggregate principal amount of $544,826, and is convertible into shares of the Company’s common stock at a conversion price of $0.048. The June 3, 2009 Unsecured Debt bears interest at the rate of eight percent per annum. Upon the occurrence of an event of default, the June 3, 2009 Unsecured Debt bears interest at the rate of ten percent per annum. The Company is required to make payments of $29,687.50 per month. The monthly payments are to be applied first to interest and second to principal. The remaining principal amount is to be repaid upon the expiration of the note on June 3, 2010. The Company may prepay the note at any time. The June 3, 2009 Unsecured Debt has the following features that can be considered to be embedded derivatives: (i) the conversion feature of the notes, (ii) a holder’s right to force a redemption of the Notes upon an event of default, and, (iii) the increased interest rate upon an event of default.

In determining the fair market value of the embedded derivatives, we used discounted cash flows analysis. We also used a binomial option pricing model to value the warrants issued in connection with these debts. The Company determined the fair value of the embedded derivatives to be $715,904 and the fair value of the warrants to be $934,000. These embedded derivatives have been accounted for as a debt discount that will be amortized over the one year life of the notes. Amortization of the debt discount has resulted in a $156,560 increase to interest expense for the three and six months ended June 30, 2009.

A description of the Warrants is as follows:

1) The May 6, 2009 warrant entitles the holder to purchase up to 25,000,000 shares of the Company’s common stock at a price of $0.048 per share. The May 6, 2009 warrant is exercisable up until May 6, 2019. The May 6, 2009 warrant shall expire and no longer be exercisable upon a change in control. The exercise price and the number of shares underlying the warrant is subject to anti-dilution adjustments from time to time if the Company issues common stock at below the exercise price at that time for the warrants.

2) The June 3, 2009 warrant entitles the holder to purchase up to 14,062,500 shares of the Company’s common stock at a price of $0.038 per share. The June 3, 2009 warrant is exercisable up until June 3, 2019. The June 3, 2009 warrant shall expire and no longer be exercisable upon a change in control. The exercise price and the

number of shares underlying the warrant is subject to anti-dilution adjustments from time to time if the Company issues common stock at below the exercise price at that time for the warrants.

( 11 )Related party transactions (continued)

In determining the fair market value of the Warrants, we used the binomial model with the following significant assumptions: exercise price $0.038 – $0.048, trading prices $0.04 -$0.042, expected volatility 115.6% - 116.2%, expected life of 60 months, dividend yield of 0.00% and a risk free rate of 3.2% - 3.56%. The fair value of these warrants has been recorded as part of the debt discount as discussed above as well as being recognized as a derivative liability. The derivative liability will be re-valued at each reporting date with changes in value being recognized as part of current earnings.

( 12 )Stockholders equity

Platinum Studios LLC filed Articles of Incorporation with the Secretary of the State of California on September 15, 2006, by which Platinum Studios, LLC converted from a California limited liability company into Platinum Studios, Inc., a California corporation. On September 15, 2006, 135,000,000 common shares were issued for conversion of LLC interests as all members of the limited liability company became shareholders of the corporation, maintaining their same percentage ownership, with no additional contribution required by any of the members to the corporation.

A Private Placement Memorandum was issued on February 2, 2009, offering up to 30,000,000 shares of common stock, $0.0001 par value per share, for sale to Accredited Investors (as defined in the memorandum), at a price of $0.05 per share on a “best efforts” basis, for a total offering price to investors of $1,500,000. The proceeds of the offering were used for property acquisitions, marketing and general and administrative expenses. The offering closed on June 20, 2009. As of June 30, 2009 the Company has sold 1,300,000 shares resulting in proceeds of $65,000.

Effective July 12, 2007, the Company obtained board approval of an incentive plan under which equity incentives would be granted to officers, employees, non-employee directors and consultants of the Company. The board further resolved for 45,000,000 shares of the Company’s common stock, $0.0001 par value, be reserved for issuance in accordance with the requirements of this plan. As of June 30, 2009, the Company granted stock options to purchase up to an aggregate of 37,172,296 shares of its common stock to employees and consultants and granted 7,950,000 shares of restricted common stock to employees and consultants.

( 12 )Stockholders equity (continued)

Of the stock options granted, the following were granted to executive officers

| Brian Altounian | 7,965,000 options |

| Helene Pretsky | 6,000,000 options |

Of the restricted stock issued, the following were issued to executive officers:

| Brian Altounian | 5,250,000 shares |

| Helene Pretsky | 2,000,000 shares |

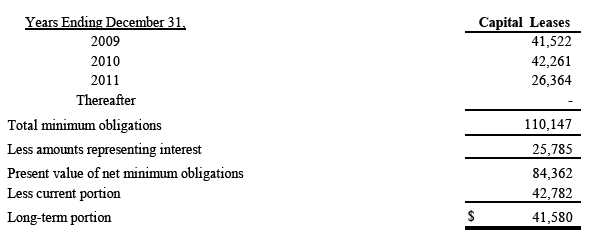

( 13 )Stock Compensation

Warrants and options outstanding at June 30, 2009 are summarized as follows:

( 14 )Income taxes

Deferred taxes are provided on a liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss and tax credit carryforwards and deferred tax liabilities are recognized for deductible temporary differences and operating loss and tax credit carryforwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax basis. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in the tax laws and rates on the date of enactment. The Company or one of its subsidiaries files income tax returns in the U.S. federal jurisdiction, and the st ate of California. With few exceptions, the Company is no longer subject to U.S. federal, state and local, or non-U.S. income tax examinations by tax authorities for years before 2006.

The Company adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, on January 1, 2007. Included in the balance at June 30, 2009 and December 31, 2008, are no tax positions for which the ultimate deductibility is highly certain but for which there is uncertainty about the timing of such deductibility.

The Company has not filed a tax return for the years ended December 31, 2008, 2007 and 2006.

Minimum state tax payments have accrued in states for which the company has operated since 2006. Upon filing all amounts paid will be subject to penalties and interest according to the state tax jurisdiction. The statue of limitations remains open on all years from 2006 going forward. The statute will not begin to run until the Company files the tax return. Once the returns have been filed the IRS will have three years to examine and adjust the amounts reported.

The Company operates at a loss and will only be liable for minimum state tax payments once a return is filed. No unrecognized liability will be added to the Company’s balance sheet for the un-filed returns as the amounts reported are an immaterial amount.

The Company’s policy is to recognize interest accrued related to unrecognized tax benefits in interest expense and penalties in operating expenses.

Deferred tax assets and liabilities are adjusted for the effects of changes in the tax laws and rates on the date of enactment.

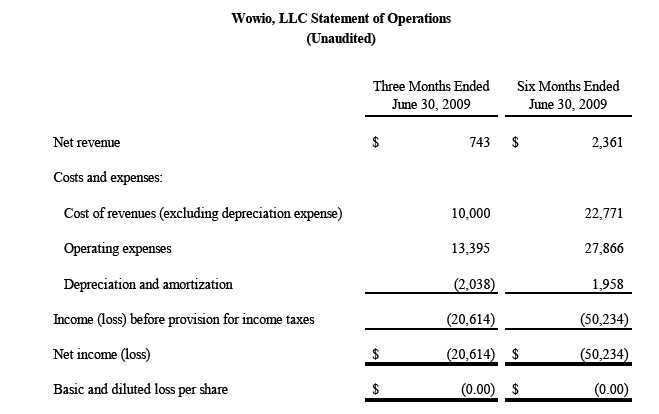

( 15 )Discontinued Operations

On June 30, 2009 the Company sold Wowio,LLC to related parties for the assumption of an aggregate of $1,636,064 in debt owed by the Company and an additional $1,513,936 to be paid via a royalty of 20% of gross revenues generated by Wowio Penn, its successors and assigns, after which the royalty rate would decrease to 10%, and remain at 10% in perpetuity. The sale of Wowio resulted in a decrease in the Company’s debt and has allowed management to focus on the Company’s core comic business. The company considers Wowio LLC’s results of operations to be immaterial to the Company’s overall performance and does not expect the sale to have a material effect on operations. Below are Wowio, LLC’s results of operations for the three and six months ended June 30, 2009:

( 16 )Subsequent events

In May 2009, the FASB issued SFAS No. 165, “ Subsequent Events ”, (“SFAS 165”). SFAS 165 is effective for financial statements ending after June 15, 2009, and we adopted SFAS 165 during the three months ended June 30, 2009. SFAS 165 establishes general standards of accounting for and disclosure of subsequent events that occur after the balance sheet date. Entities are also required to disclose the date through which subsequent events have been evaluated. We have evaluated subsequent events through August 19, 2009, the date of issuance of our financial statements in this Form 10-Q.

On July 21, 2009 the Company issued 224,700 shares of common stock for payment of services. The fair value of the shares total $10,700.

ITEM 2: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FORWARD-LOOKING STATEMENTS

Some of the information in this prospectus contains forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by forward-looking words such as "may," "expect," "anticipate," "believe," "estimate" and "continue," or similar words. You should read statements that contain these words carefully because they:

·discuss our future expectations;

·contain projections of our future results of operations or of our financial condition; and ·state other "forward-looking" information.

We believe it is important to communicate our expectations. However, there may be events in the future that we are not able to accurately predict or over which we have no control. Our actual results and the timing of certain events could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under "Risk Factors," "Business" and elsewhere in this prospectus. See "Risk Factors."

GENERAL

We are a comics-based entertainment company. We own the rights to a library of over 5,600 of comic book characters, which we adapt and produce for film, television and all other media. Our library contains characters in a full range of genre and styles. With deals in place with film studios and media players, our management believes we are positioned to become a leader in the creation of new content across all media.

We are focused on adding titles and expanding our library with the primary goal of creating new franchise properties and characters. In addition to in-house development and further acquisitions, we are developing content with professionals outside the realm of comic books. We have teamed up with screenwriters, producers, directors, movie stars, and novelists to develop entertainment content and potential new franchise properties. We believe our core brand offers a broader range of storylines and genres than the traditional superhero-centric genre. Management believes this approach is maintained with Hollywood in mind, as the storylines offer the film industry fresh, high-concept brandable content as a complimentary alternative to traditional super hero storylines.

Over the next several years, we are working to become the leading independent comic book commercialization producer for the entertainment industry across all platforms including film, television, direct-to-home, publishing, and digital media, creating merchandising vehicles through all retail product lines. Our management believes this will allow us to maximize the potential and value of our owned content creator relationships and acquisitions, story development and character/franchise brand-building capabilities while keeping required capital investment relatively low.

We derive revenues from a number of sources in each of the following areas: Print Publishing, Digital Publishing, Filmed Entertainment, and Merchandise/Licensing.

Set forth below is a discussion of the financial condition and results of operations of Platinum Studios, Inc. (the “Company”, “we”, “us,” and “our”) for the three and six months ended June 30 , 2009 and 2008. The following discussion should be read in conjunction with the information set forth in the consolidated financial statements and the related notes thereto appearing elsewhere in this report.

RESULTS OF CONSOLIDATED OPERATIONS – THREE AND SIX MONTHS ENDED JUNE 30, 2009 COMPARED TO THE THREE AND SIX MONTHS ENDED JUNE 30, 2008

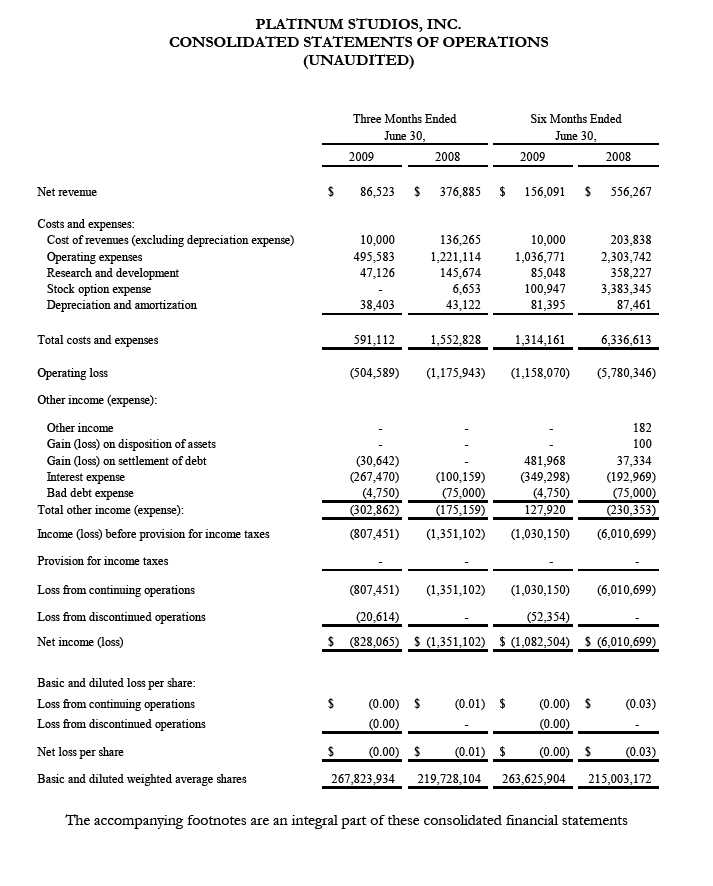

NET REVENUE (UNAUDITED)

Net revenue for the three and six months ended June 30, 2009 was $86,523 and $156,091, respectively compared to $376,885 and $556,267 for the three and six months ended June 30, 2008, respectively. Currently the Company derives most of its revenue from options to purchase rights, the purchase of rights to properties and first look deals. This type of revenue can vary significantly between quarters and years. The revenues for the three and six months ended June 30, 2009 primarily represented purchased rights revenue from two customers. The revenues for the three months ended June 30, 2008 represented $297,695 in purchased rights revenue from two customers. The revenues for the six months ended June 30, 2008 represented $397,695 in purchased rights revenue from three customers.

Cost of revenues

For the three and six months ended June 30, 2009 cost of revenues were $10,000 compared to $136,265 and $203,838 for the three and six months ended June 30, 2008. The decrease is primarily due royalty fees paid in the third quarter of 2008 combined with the elimination of printed comics due to cash conservation initiatives.

Operating expenses

Operating expenses decreased $725,531 or 59% for the three months ended June 30, 2009 to $495,583, as compared to $1,221,114 for the three months ended June 30, 2008. The decrease was primarily due to decreased payroll and contractor costs. Operating expenses decreased $1,266,471 or 55% for the six months ended June 30, 2009 to $1,036,771, as compared to $2,303,742 for the six months ended June 30, 2008.The decrease was due to decreases in advertising costs, accounting fees, payroll and contractor costs as the Company has worked to stream line its business model to conserve cash while being able to make necessary expenditures to ensure the growth of the Company.

Research and development

Research and development costs decreased $98,548 or 68% for the three months ended June 30, 2009 to $47,126 as compared to $145,674 for the three months ended September 30, 2008. The decrease was primarily due to decreased artwork expense, salary expense and consulting fees. Research and development costs decreased $273,179 or 76% for the six months ended June 30, 2009 to $85,048 as compared to $358,227 for the six months ended June 30, 2008. The decrease was primarily due to decreased artwork expense, consulting fees and legal fees.

Stock option expense

Stock option expense for the three months ended June 30, 2009 was $0 compared to $6,653 for the same period in 2008. Stock option expense for the six months ended June 30, 2009 was $100,947 compared to $3,383,345 for the same period in 2008. This expense was due to the granting of options as part of the employee incentive plan. The majority of these options vested at the time of the grant, resulting in a significant non-cash expense for the first quarter of 2008. The Company does not anticipate additional expense of this magnitude in future quarters.

Depreciation and amortization

For the three and six months ended June 30, 2009 depreciation and amortization was $38,403 and $81,395, respectively, compared to $43,122 and $87,461 for the three and six months ended June 30, 2008.

Gain on settlement of debt

The company recorded a gain on settlement of debt of $481,968 for the six months ended June 30, 2009 and a loss on settlement of debt three months ended June 30, 2009 of $30,642. This net gain was primarily due to the final payment due Wowio former partners, partially offset by losses incurred in the settlement of accounts payable and notes payable through the issuance of common stock.

As a result of the foregoing, the net loss decreased by $543,651 for the three months ended June 30, 2009 to $807,451 and decreased by $4,928,195 for the six months ended June 30, 2009 to $1,082,504 as compared to the same periods in 2008.

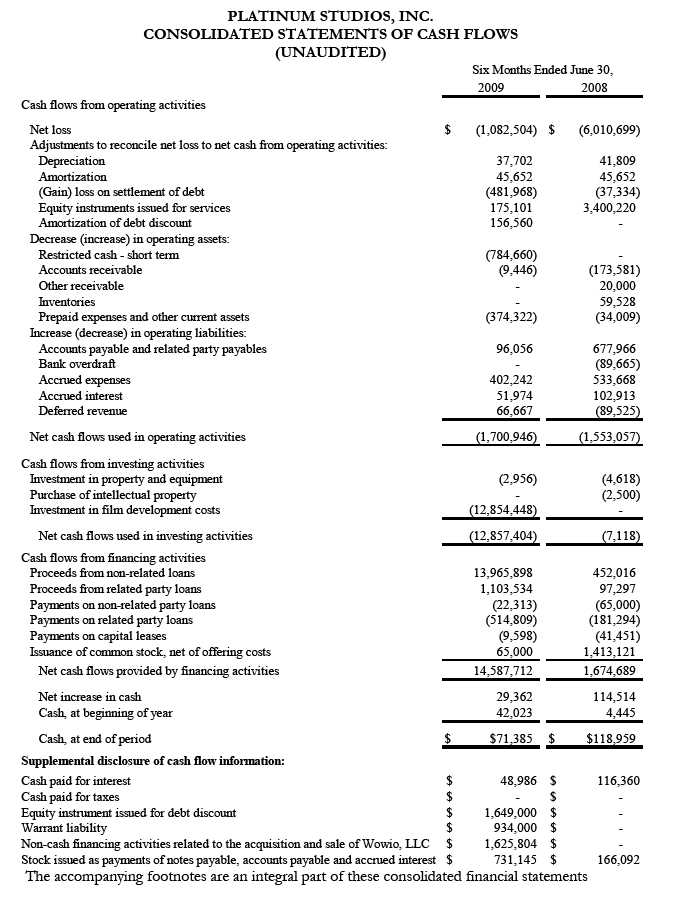

LIQUIDITY AND CAPITAL RESOURCES (UNAUDITED)

Net cash used in operations during the six months ended June 30, 2009 was $1,700,946.

Net cash used by investing activities was $12,857,404 for the three months ended June 30, 2009, primarily due to the production of the film ”Dead of Night”.

Net cash provided by financing activities was $14,587,712 for the six months ended June 30, 2009, primarily attributed to financing secured for the production of the film “Dead of Night”.

At June 30, 2009 the Company had cash balances of $71,385 and restricted cash balances of $784,660. Restricted cash will be used in the production of the film “Dead of Night”. The Company will issue additional equity and may consider debt financing to fund future growth opportunities and support operations. Although the Company believes its unique intellectual content offers the opportunity for significantly improved operating results in future quarters, no assurance can be given that the Company will operate on a profitable basis in 2009, or ever, as such performance is subject to numerous variables and uncertainties, many of which are out of the Company’s control.

MARKET RISKS

We conduct our operations in primary functional currencies: the United States dollar, the British pound and the Australian dollar. Historically, neither fluctuations in foreign exchange rates nor changes in foreign economic conditions have had a significant impact on our financial condition or results of operations. We currently do not hedge any of our foreign currency exposures and are therefore subject to the risk of exchange rate fluctuations. We invoice our international customers primarily in U.S. dollars, except in the United Kingdom and Australia, where we invoice our customers primarily in British pounds and Australian dollars, respectively. In the future we anticipate billing certain European customers in Euros, though we have not done so to date.

We are exposed to foreign exchange rate fluctuations as the financial results of foreign subsidiaries are translated into U.S. dollars in consolidation and as our foreign currency consumer receipts are converted into U.S. dollars. Our exposure to foreign exchange rate fluctuations also arises from payables and receivables to and from our foreign subsidiaries, vendors and customers. Foreign exchange rate fluctuations did not have a material impact on our financial results in the six months ended June 30, 2009 or in the years ended December 31, 2008, 2007 and 2006.

Financial instruments which potentially subject us to concentrations of credit risk consist principally of cash and cash equivalents and trade accounts receivable. We place our cash and cash equivalents with high credit quality institutions to limit credit exposure. We believe no significant concentration of credit risk exists with respect to these investments.

Concentrations of credit risk with respect to trade accounts receivable are limited due to the wide variety of customers who are dispersed across many geographic regions.

GOING CONCERN

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred significant losses which have resulted in an accumulated deficit of $21,792,582 as of June 30, 2009. The Company plans to seek additional financing in order to execute its business plan, but there is no assurance the Company will be able to obtain such financing on terms favorable to the Company or at all. These items raise

substantial doubt about the Company’s ability to continue as a going concern. The accompanying financial statements do not include any adjustments to reflect the possible future effects related to recovery and classification of assets, or the amounts and classifications of liabilities that might result from the outcome of this uncertainty.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off balance sheet arrangements that are reasonably likely to have a current or future effect on our financial condition, revenues, results of operations, liquidity or capital expenditures.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

REVENUE RECOGNITION. Revenue from the licensing of characters and storylines (“the properties”) owned by the Company are recognized in accordance with guidance provided in Securities and Exchange Commission Staff Accounting Bulletin No. 104 “Revenue Recognition” (an amendment of Staff Accounting Bulletin No. 101 “Revenue Recognition”) (“SAB 104”). Under the SAB 104 guidelines, revenue is recognized when the earnings process is complete. This is considered to have occurred when persuasive evidence of an agreement between the customer and the Company exists, when the properties are made available to the licensee and the Company has satisfied its obligations under the agreement, when the fee is fixed or determinable and when collection is reasonably assured. The Company derives its licensing revenue primarily from options to purchase rights, the purchase of rights to properties and fi rst look deals. For option agreements and first look deals that contain non-refundable payment obligations to us, we recognize such non-refundable payments as revenue at the inception of the agreement and receipt of payment, prior to the collection of any additional amounts due, provided all the criteria for revenue recognition under SAB 104 have been met. First look deals that have contingent components are deferred and recognized at the later of the expiration of the first look period or in accordance with the terms of the first look contract. For licenses requiring material continuing involvement or performance based obligations, by the Company, the revenue is recognized as and when such obligations are fulfilled. The Company records as deferred revenue any licensing fees collected in advance of obligations being fulfilled or if a licensee is not sufficiently creditworthy, the Company will record deferred revenue until payments are received. License agreements typically include reversion rights which allo w the Company to repurchase property rights which have not been used by the studio (the buyer) in production within a specified period of time as defined in the purchase agreement. The cost to repurchase the rights is generally based on the costs incurred by the studio to further develop the characters and story lines.

CHARACTER DEVELOPMENT COSTS. Character development costs consist primarily of costs to acquire properties from the creator, development of the property using internal or independent writers and artists, and the registration of a property for a trademark or copyright. These costs are capitalized in the year incurred if the Company has executed a contract or is negotiating a revenue generating opportunity for the property. If the property derives a revenue stream that is estimable, the capitalized costs associated with the property are expensed as

revenue is recognized. If the Company determines there is no determinable market for a property, it is deemed impaired and is written off.

On June 12, 2008, the Company received a valuation of its intellectual property which consists of a library of comic characters. The valuation provides that the fair market value of a 100% equity interest in the intellectual property held and controlled by the Company under a going-concern premise is $150,038,000. The valuation was conducted by Sanli Pastore & Hill, Inc. (“SP&H”) at the request of the Company. In performing the valuation SP&H used the American Society of Appraisers definition of fair market value.

PURCHASED INTANGIBLE ASSETS AND LONG-LIVED ASSETS. Intangible assets are capitalized at acquisition costs and intangible assets with definite lives are amortized on the straight-line basis. The Company periodically reviews the carrying amounts of intangible assets and property in conformance with the Statement of Financial Accounting Standards No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets (SFAS 144). Under SFAS 144, long-lived assets, such as property and equipment, and purchased intangibles subject to amortization, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to the estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its es timated future cash flows, the impairment charge to be recognized is measured by the excess of the carrying amount over the fair value of the asset.

ADVERTISING COSTS. Advertising costs are expensed the later of when incurred or when the advertisement is first run. For the three and six months ended June 30, 2009 advertising expenses were $0. For the three and six ended June 30, 2008 advertising expenses were $11,935 and $47,510, respectively.

RESEARCH AND DEVELOPMENT. Research and development costs, primarily character development costs and design not associated with an identifiable revenue opportunity, are charged to operations as incurred. For the three and six months ended June 30, 2009 research and development expenses were $47,126 and $85,048, respectively. For the three and six months ended June 30, 2008 research and development expenses were $145,674 and 358,227, respectively.

INCOME TAXES. From inception thru September 14, 2006 the Company operated as a limited liability company and elected to be taxed similar to a partnership. Accordingly, each member was responsible for reporting its respective share of the Company’s net income or loss for Federal and California income tax purposes and the Company did not pay Federal income tax. From September 15, 2006 forward the Company has accounted for income taxes using the liability method, whereby deferred tax assets and liability account balances are determined based on differences between financial reporting and tax basis of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company was subject to an annual minimum tax of $800 and a fee based on gross receipts in California from inception through September 14, 2006.

DERIVATIVE INSTRUMENTS. Platinum Studios entered into a Credit Agreement on May 6, 2009, with Scott Rosenberg in connection with the issuance of two secured promissory notes and an unsecured promissory note. Two warrants were issued to Scott Rosenberg in connection with the issuance of various promissory notes as of May 6, 2009 and June 3, 2009.

A description of the notes is as follows:

May 6, 2009 Secured Debt- The May 6, 2009 Secured Debt has an aggregate principal amount of $2,400,000, and is convertible into shares of the Company’s common stock at a conversion price of $0.048. The May 6, 2009 Secured Debt bears interest at the rate of eight percent per annum. Upon the occurrence of an event of default, the May 6, 2009 Secured Debt bears interest at the rate of ten percent per annum. Interest is payable upon the expiration of the notes on May 6, 2010. The original principal amount of $2,400,000 is to be repaid upon the expiration of the notes on May 6, 2010. The Company may prepay the notes at any time. The May 6, 2009 Secured Debt has the following features that can be considered to be embedded derivatives: (i) the conversion feature of the notes, (ii) a holder’s right to force a redemption of the Notes upon an event of default, and, (iii) the increased interest rate upon an event of default. In connection with this debt the Company also issued warrants to purchase 25,000,000 shares of the Company’s common stock for $0.048 per share.

June 3, 2009 Secured Debt- The June 3, 2009 Secured Debt has an aggregate principal amount of $1,350,000, and is convertible into shares of the Company’s common stock at a conversion price of $0.038. The June 3, 2009 Secured Debt bears interest at the rate of eight percent per annum. Upon the occurrence of an event of default, the June 3, 2009 Secured Debt bears interest at the rate of ten percent per annum. Interest is payable upon the expiration of the notes on June 3, 2010. The original principal amount of $1,350,000 is to be repaid upon the expiration of the notes on June 3, 2010. The Company may prepay the notes at any time. The June 3, 2009 Secured Debt has the following features that can be considered to be embedded derivatives: (i) the conversion feature of the notes, (ii) a holder’s right to force a redemption of the Notes upon an event of default, and, (iii) the increased interest rate upon an event of default. In connection with this debt the Company also issued warrants to purchase 14,062,500 shares of the Company’s common stock for $0.038 per share.

June 3, 2009 Unsecured Debt- The June 3, 2009 Unsecured Debt has an aggregate principal amount of $544,826, and is convertible into shares of the Company’s common stock at a conversion price of $0.048. The June 3, 2009 Unsecured Debt bears interest at the rate of eight percent per annum. Upon the occurrence of an event of default, the June 3, 2009 Unsecured Debt bears interest at the rate of ten percent per annum. The Company is required to make payments of $29,687.50 per month. The monthly payments are to be applied first to interest and second to principal. The remaining principal amount is to be repaid upon the expiration of the note on June 3, 2010. The Company may prepay the note at any time. The June 3, 2009 Unsecured Debt has the following features that can be considered to be embedded derivatives: (i) the conversion feature of the notes, (ii) a holder’s right to force a redemption of the Notes upon an event of default, and, (iii) the increased interest rate upon an event of default.

In determining the fair market value of the embedded derivatives, we used discounted cash flows analysis. We also used a binomial option pricing model to value the warrants issued in connection with these debts. The Company determined the fair value of the embedded derivatives to be $715,904 and the fair value of the warrants to be $934,000. These embedded derivatives have been accounted for as a debt discount that will be amortized over the one year life of the notes. Amortization of the debt discount has resulted in a $156,560 increase to interest expense for the three and six months ended June 30, 2009.

A description of the Warrants is as follows:

1) The May 6, 2009 warrant entitles the holder to purchase up to 25,000,000 shares of the Company’s common stock at a price of $0.048 per share. The May 6, 2009 warrant is exercisable up until May 6, 2019. The May 6, 2009 warrant shall expire and no longer be exercisable upon a change in control. The exercise price and the number of shares underlying the warrant is subject to anti-dilution adjustments from time to time if the Company issues common stock at below the exercise price at that time for the warrants.

2) The June 3, 2009 warrant entitles the holder to purchase up to 14,062,500 shares of the Company’s common stock at a price of $0.038 per share. The June 3, 2009 warrant is exercisable up until June 3, 2019. The June 3, 2009 warrant shall expire and no longer be exercisable upon a change in control. The exercise price and the number of shares underlying the warrant is subject to anti-dilution adjustments from time to time if the Company issues common stock at below the exercise price at that time for the warrants.

In determining the fair market value of the Warrants, we used the binomial model with the following significant assumptions: exercise price $0.038 – $0.048, trading prices $0.04 - $0.042, expected volatility 115.6% - 116.2%, expected life of 60 months, dividend yield of 0.00% and a risk free rate of 3.2% - 3.56%. The fair value of these warrants has been recorded as part of the debt discount as discussed above as well as being recognized as a derivative liability. The derivative liability will be re-valued at each reporting date with changes in value being recognized as part of current earnings.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK

n/a

ITEM 4T. CONTROLS AND PROCEDURES

As of the end of the period covered by this report, we conducted an evaluation, under the supervision and with the participation of our chief executive officer and chief financial officer of our disclosure controls and procedures (as defined in Rule 13a-15(e) and Rule 15d-15(e) of the Exchange Act). Based upon this evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures are effective to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is: (1) accumulated and communicated to our management, including our chief executive officer and chief financial officer, as appropriate to allow timely decisions regarding required disclosure; and (2) recorded, processed, summarized and reported, within the time periods specified in the Commission's rules and forms. There was no change to our internal controls or in other factors that could affect these controls during our last fiscal quarter that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

In addition to the material weaknesses previously disclosed in the Registrant’s Form 10-K filed on April 15, 2009, the Company did not maintain effective controls over cash and accounts payable transactions. In response to the identified material weaknesses the Company intends to better enforce its processes and procedures.

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

Michael Tierney v. Platinum.A former employee of the Company has filed a suit against the Company claiming, among other things, wrongful termination, fraudulent inducement, defamation, violation of California Labor Code. No specific damages have been pleaded. This former employee was terminated for cause as a result of grossly negligent/intentional misrepresentation of contractual relations with third parties in marketing materials. The misrepresentations caused the company to lose a potential deal with a particularly well-known comics website. The Company believes this case is without merit and intends to vigorously defend these claims.

Transcontinental Printing v. Platinum.The Company has received several demand letters from Transcontinental Printing, demanding payment for an outstanding invoice in the amount$111,567.85. The company has tried to enter into some settlement with this vendor but to no avail as of yet. On July 2, 2009, Transcontinental filed suit against the Company for payment on the invoice in the Superior court of California. The company will continue to aggressively pursue a settlement with this vendor to try and avoid proceeding with the lawsuit. The lawsuit is being handled on behalf of the Company by Dieterich & Mazerei LP..

Harrison Kordestani v. Platinum.Harrison Kordestani was a principal of Arclight Films, with whom the Company had entered into a film slate agreement. One of the properties that had been subject to the slate agreement was “Dead of Night.” Arclight fired Mr. Kordestani and subsequently released Dead of Night from the slate agreement. In late January 2009, Mr. Krodestani had an attorney contact the Company as well as its new partners who were on the verge of closing the financing for the “Dead of Night.” Mr. Kordestani, through his counsel, claimed he was entitled to reimbursement for certain monies invested in the film while it had been subject to the Arclight slate agreement. Mr. Krodestani’s cliam was wholly without merit and an attempt to force an unwarranted settlement because he knew we were about to close a deal. We responded immediately through outside counsel and asserted that he was engaging in extortion and the company would pursue him vigorously if he continued to try and interfere with our deal. The company has not heard anything further from Mr. Kordestani but will vigorously defend any suit that Mr. Kordestani attempts to bring.

Doubleclick, Inc. v. Platinum.On February 19, 2009, a lawsuit was filed by Doubleclick, Inc. against the Company in the Supreme Court of the State of New York. The claim is basically a breach of contract claim. The contract at issue was a three-year agreement to provide ad serving services, requiring a minimum $3,500/month payment with no termination clause. The employee who executed the agreement without having counsel review it is no longer with the Company. Between February and June 2008, the Company attempted to negotiate an “out” without luck. The service was far too expensive and the Company could no longer afford it and stopped using it around June/July 2008. Doubleclick is seeking approximately $118,000, plus interest and late fees for the balance of the contract. The Company has engaged outside counsel, Jeffrey Reina with the law firm of LIPSITZ GREEN SCIME CAMBRIA LLP in Buffalo, NY to handle this matter. The Company intends to answer the complaint and then aggressively pursue a settlement with Doubleclick

Paul Franz v. WOWIO, LLC and Platinum. A lawsuit was filed against WOWIO and the Company by Paul Franz, a former consultant to WOWIO, asserting that WOWIO had breached its payment obligations under a consulting agreement. The complaint has not yet been served on the Company. The Company recognizes there may be some risk on this case and is aggressively going to attempt to resolve this matter. The potential exposure in this matter is close to the amount demanded, however efforts will be made to settle for only a portion of those monies.

With exception to the litigation disclosed above, we are not currently a party to, nor is any of our property currently the subject of, any additional pending legal proceeding that will have a material adverse effect on our business. None of our directors, officers or affiliates is involved in a proceeding adverse to our business or has a material interest adverse to our business.

ITEM 1A. RISK FACTORS

There are no material changes from the risk factors previously disclosed in the Registrant’s Form 10-K filed on April 15, 2009.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

During the six months ended June 30, 2009, the Company sold 1,300,000 shares of our common stock, resulting in proceeds to the company of $65,000.

The Company relied an exemption from the registration requirements of the Act for the private placement of these securities pursuant to Section 4(2) of the Act and/or Regulation D promulgated there under since, among other things, the transaction did not involve a public offering, the investors were accredited investors and/or qualified institutional buyers, the investors had access to information about us and their investment, the investors took the securities for investment and not resale, and we took appropriate measures to restrict the transfer of the securities.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None

ITEM 6. EXHIBITS

| 31.1 | * | Certification by Chief Executive Officer, required by Rule 13a-14(a) or Rule 15d-14(a) of the |

| Exchange Act | ||

| 31.2 | * | Certification by Interim Chief Financial Officer, required by Rule 13a-14(a) or Rule 15d-14(a) |

| of the Exchange Act | ||

| 32.1 | * | Certification by Chief Executive Officer, required by Rule 13a-14(b) or Rule 15d-14(b) of the |

| Exchange Act and Section 1350 of Chapter 63 of Title 18 of the United States Code | ||

32.2* Certification by Interim Chief Financial Officer, required by Rule 13a-14(b) or Rule 15d-14(b) of the Exchange Act and Section 1350 of Chapter 63 of Title 18 of the United States Code*Filed herewith

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Los Angeles, State of California, on August 19, 2009.

Platinum Studios, Inc.

By: /s/ Scott Mitchell Rosenberg

Scott Mitchell Rosenberg

Chief Executive Officer

and Chairman of the Board

By: /s/ Brian Altounian

Brian Altounian

President, Chief Operating Officer

& Principal Financial and Accounting

Officer