June 2016 Investor Presentation Exhibit 99.1

Today’s agenda Rubicon Overview Rubicon’s Plan to Improve Performance and Deliver Value Rubicon’s Highly Qualified Board and Nominees Paragon’s Unqualified Nominees Are the Wrong Choice for the Rubicon Board June 2016

About rubicon technology Rubicon was founded in 2000 and is a recognized global leader in sapphire technology Pioneer in large area sapphire production for LED and optical markets Most vertically integrated supplier of sapphire Serving a variety of customers in growth markets Focused on development of products to meet the needs of new customers and emerging applications June 2016 The First Choice for Commercial Sapphire

demand for sapphire Sapphire is the substrate for 97% of all white LED chips Sapphire’s hardness, transparency and other physical properties make it the material of choice for a range of technologies Camera lens covers, biometric devices and watch faces Sapphire has been adopted as a component in mobile technology in recent years Developments of new markets for sapphire New applications for specialized sapphire wafers Opening new markets through new sapphire technologies June 2016 End Market Demand LEDs Mobile Devices Optical/Industrial

sapphire industry overview The sapphire industry grew rapidly from 2006-2011 with the rise of the LED industry With the maturing of the LED backlighting market (TVs) before the adoption of the LED general lighting market, sapphire pricing began to fall From 2013-2015, the possibility that Apple would use sapphire as the faceplate for smartphones – offering the potential to more than double global demand – attracted additional competitors Subsidies from the Chinese government facilitated the capacity additions That application failed to develop resulting in severe excess capacity in the global sapphire industry and deep reductions in the price of sapphire Sapphire pricing has fallen from $25 per mm of two-inch to $1.25 Rubicon is pursuing a strategy of differentiation, leveraging our reputation for product quality and our ability to innovate in new sapphire production processes and larger geometries New market opportunities where majority of sapphire providers cannot meet specifications New technologies with IP protection Combination of vertical integration and capabilities (6” PSS) June 2016

Industry’s Most Vertically Integrated Supplier June 2016 1) Raw Material Production 2) Crystal Growth 3) Core Fabrication 4) Slicing 5) Polishing 6) PSS/Patterning Greater control of cost and quality / Most reliable supplier

Sapphire technology leadership Rubicon’s sapphire quality is recognized as the best in the world Innovation Large crystal pioneers First to develop 200 kg boules First to market with 6 and 8” polished wafers First to market with 6” PSS LANCE – large, thick rectangular windows Sapphire coating on glass and other materials June 2016

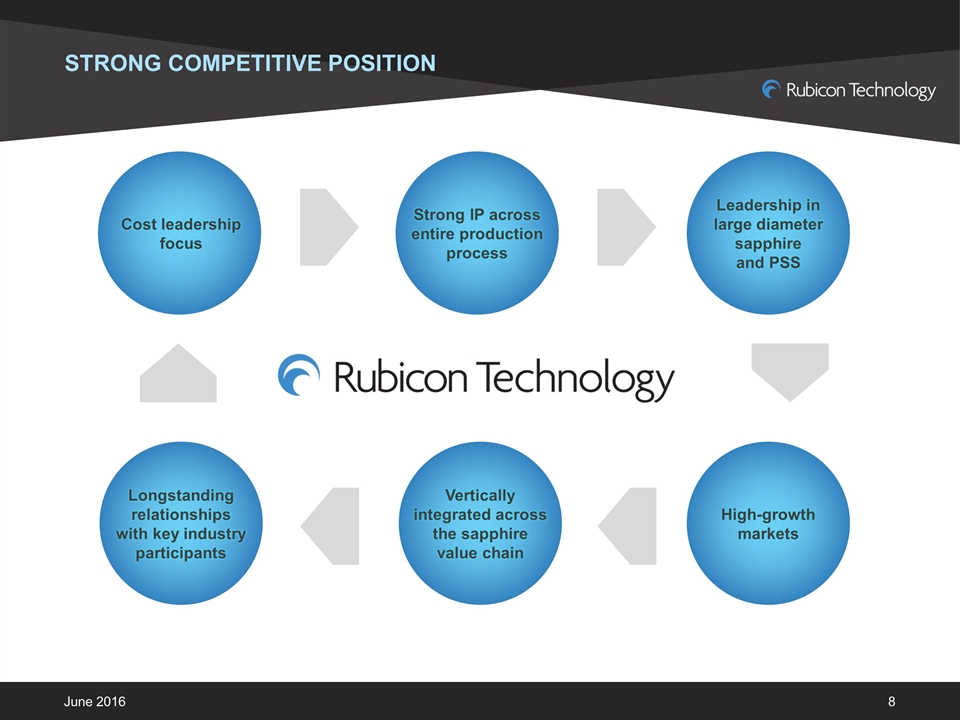

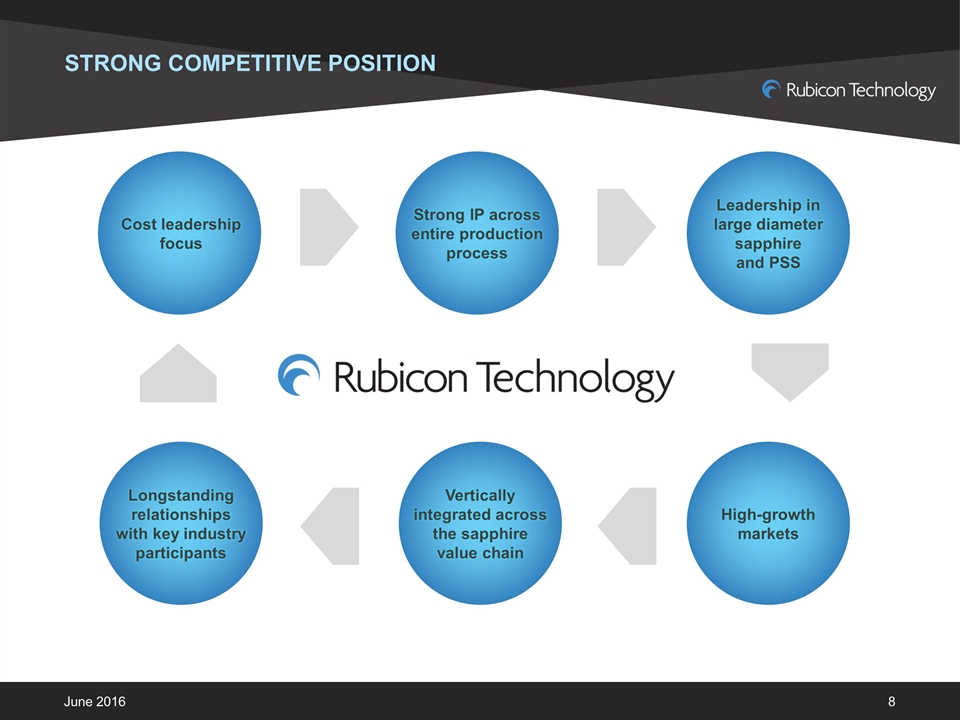

STRONG competitive POSITION June 2016 Strong IP across entire production process Leadership in large diameter sapphire and PSS High-growth markets Vertically integrated across the sapphire value chain Longstanding relationships with key industry participants Cost leadership focus

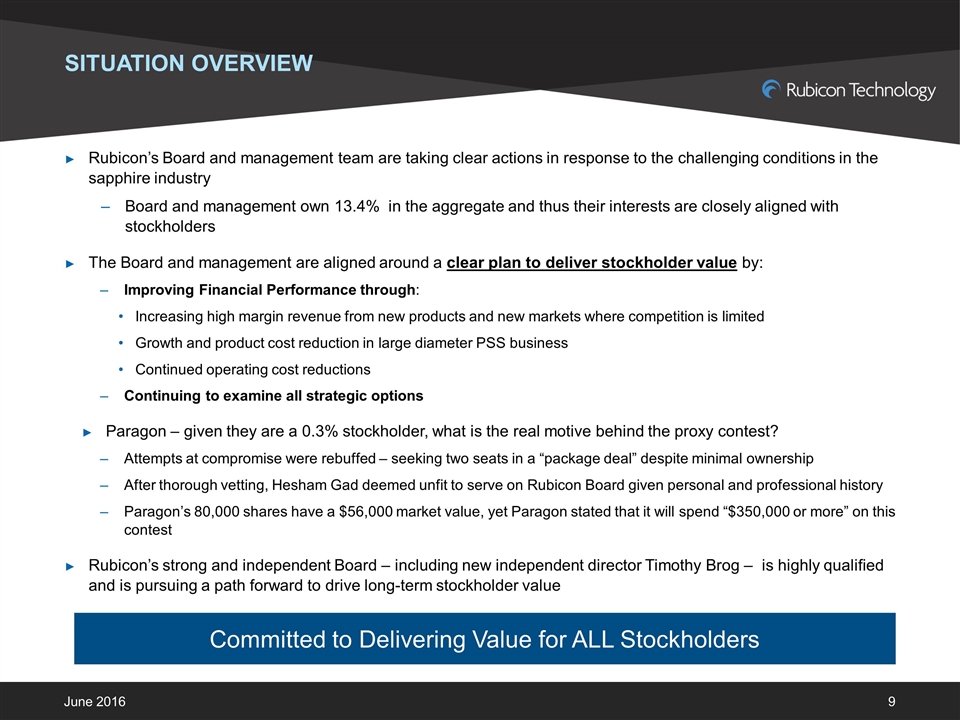

Situation overview Rubicon’s Board and management team are taking clear actions in response to the challenging conditions in the sapphire industry Board and management own 13.4% in the aggregate and thus their interests are closely aligned with stockholders The Board and management are aligned around a clear plan to deliver stockholder value by: Improving Financial Performance through: Increasing high margin revenue from new products and new markets where competition is limited Growth and product cost reduction in large diameter PSS business Continued operating cost reductions Continuing to examine all strategic options Paragon – given they are a 0.3% stockholder, what is the real motive behind the proxy contest? Attempts at compromise were rebuffed – seeking two seats in a “package deal” despite minimal ownership After thorough vetting, Hesham Gad deemed unfit to serve on Rubicon Board given personal and professional history Paragon’s 80,000 shares have a $56,000 market value, yet Paragon stated that it will spend “$350,000 or more” on this contest Rubicon’s strong and independent Board – including new independent director Timothy Brog – is highly qualified and is pursuing a path forward to drive long-term stockholder value June 2016 Committed to Delivering Value for ALL Stockholders

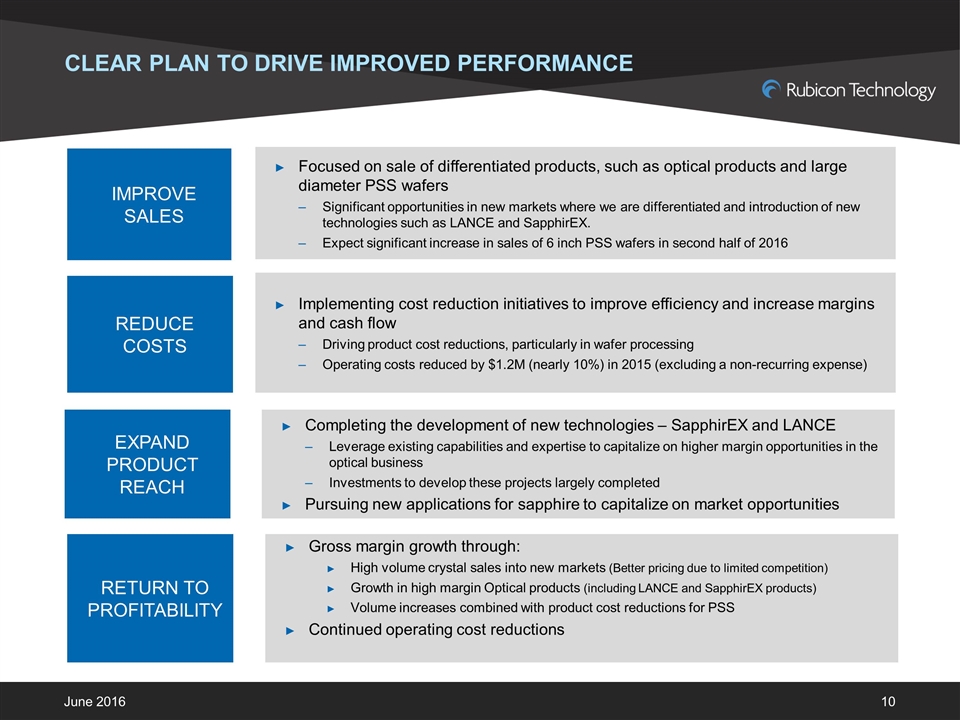

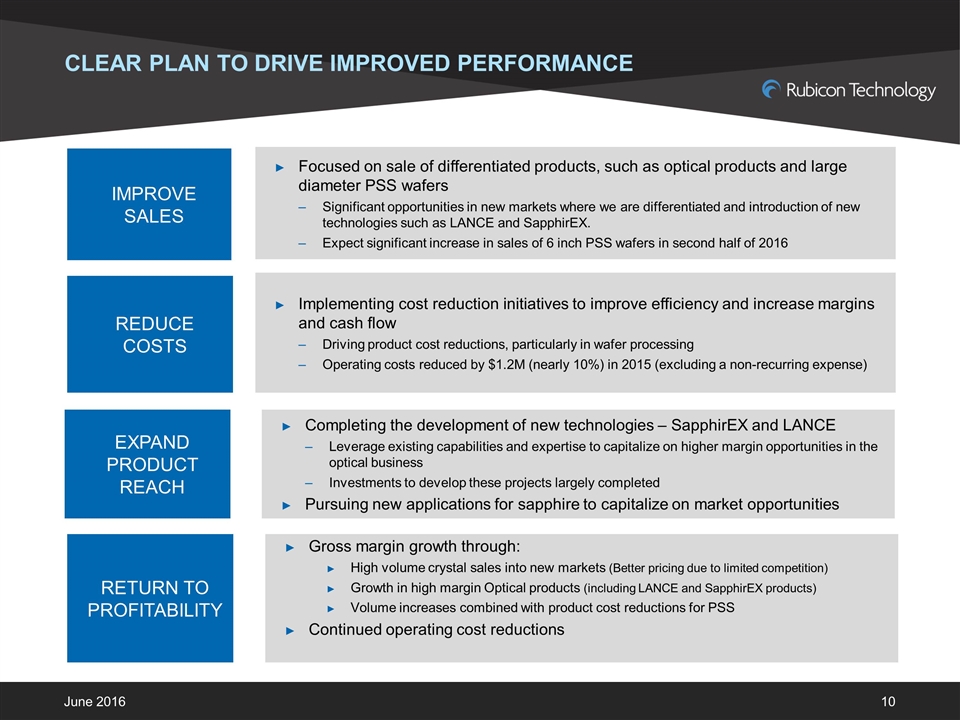

CLEAR PLAN TO DRIVE IMPROVED PERFORMANCE June 2016 Focused on sale of differentiated products, such as optical products and large diameter PSS wafers Significant opportunities in new markets where we are differentiated and introduction of new technologies such as LANCE and SapphirEX. Expect significant increase in sales of 6 inch PSS wafers in second half of 2016 Improve SaleS Implementing cost reduction initiatives to improve efficiency and increase margins and cash flow Driving product cost reductions, particularly in wafer processing Operating costs reduced by $1.2M (nearly 10%) in 2015 (excluding a non-recurring expense) Reduce costs Expand Product Reach Completing the development of new technologies – SapphirEX and LANCE Leverage existing capabilities and expertise to capitalize on higher margin opportunities in the optical business Investments to develop these projects largely completed Pursuing new applications for sapphire to capitalize on market opportunities Return to profitability Gross margin growth through: High volume crystal sales into new markets (Better pricing due to limited competition) Growth in high margin Optical products (including LANCE and SapphirEX products) Volume increases combined with product cost reductions for PSS Continued operating cost reductions

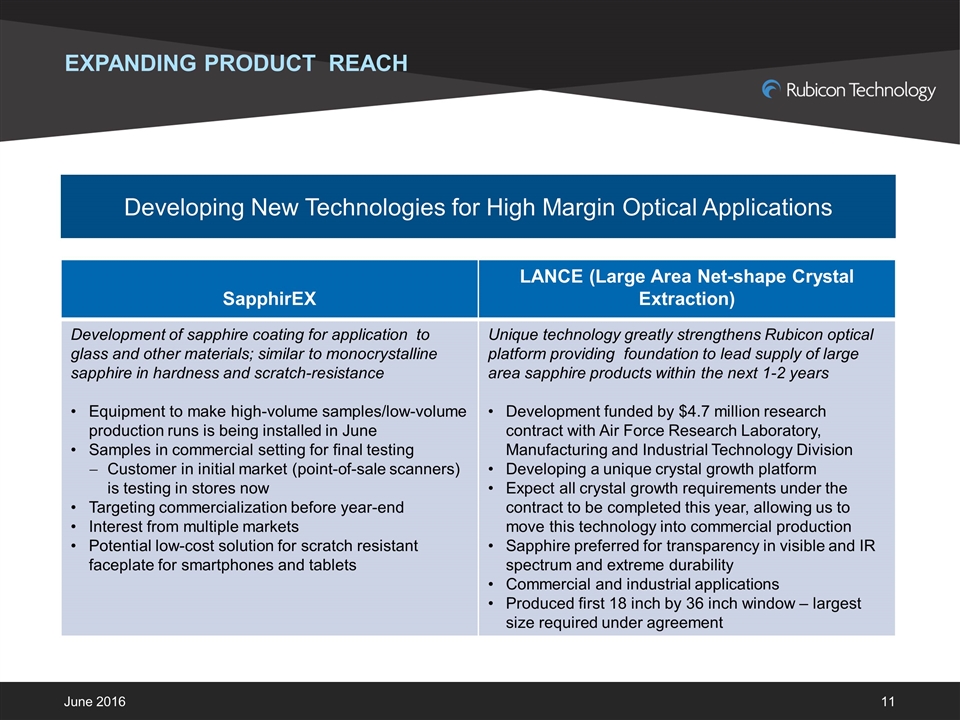

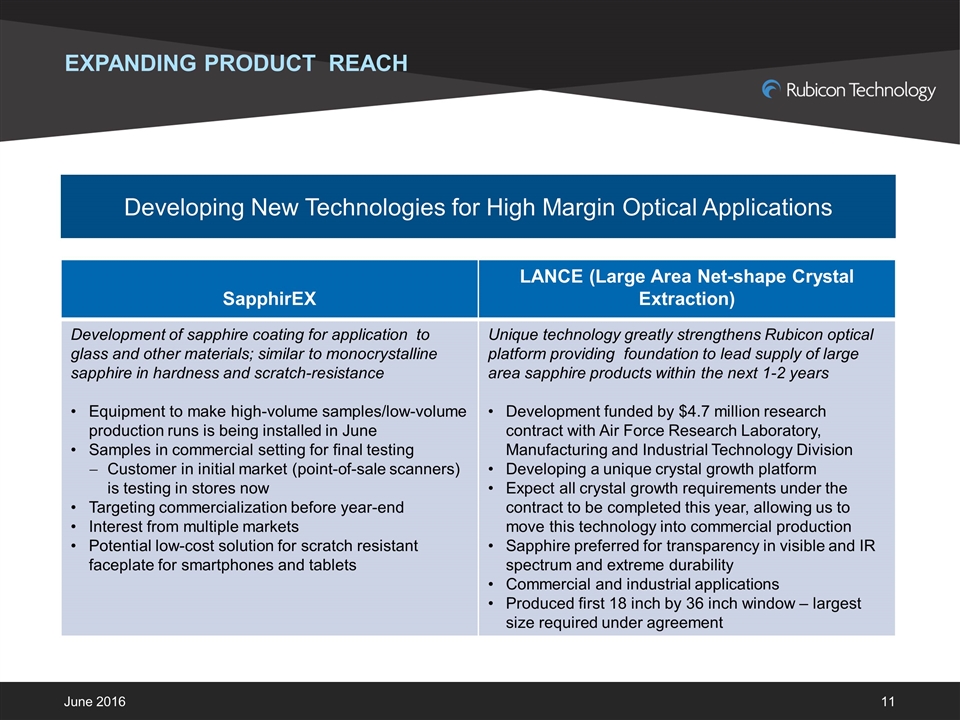

EXPANDING PRODUCT REACH June 2016 SapphirEX LANCE (Large Area Net-shape Crystal Extraction) Development of sapphire coating for application to glass and other materials; similar to monocrystalline sapphire in hardness and scratch-resistance Equipment to make high-volume samples/low-volume production runs is being installed in June Samples in commercial setting for final testing Customer in initial market (point-of-sale scanners) is testing in stores now Targeting commercialization before year-end Interest from multiple markets Potential low-cost solution for scratch resistant faceplate for smartphones and tablets Unique technology greatly strengthens Rubicon optical platform providing foundation to lead supply of large area sapphire products within the next 1-2 years Development funded by $4.7 million research contract with Air Force Research Laboratory, Manufacturing and Industrial Technology Division Developing a unique crystal growth platform Expect all crystal growth requirements under the contract to be completed this year, allowing us to move this technology into commercial production Sapphire preferred for transparency in visible and IR spectrum and extreme durability Commercial and industrial applications Produced first 18 inch by 36 inch window – largest size required under agreement Developing New Technologies for High Margin Optical Applications

NEW MARKET OPPORTUNITIES Rubicon is working with developers of potential new applications for sapphire that would leverage Rubicon’s unique set of sapphire knowledge and capabilities CONSUMER ELECTRONICS Expanding beyond LED and smartphone markets In discussions with, and providing samples to, a developer of a new technology that could begin driving significant demand in the next 12 months MEDICAL DEVICES Providing samples of specialized 6 inch wafers to a major medical device manufacturer for development of new products MILITARY AND SEMICONDUCTOR New technologies in development using sapphire Smaller in scale but with high margin opportunities June 2016

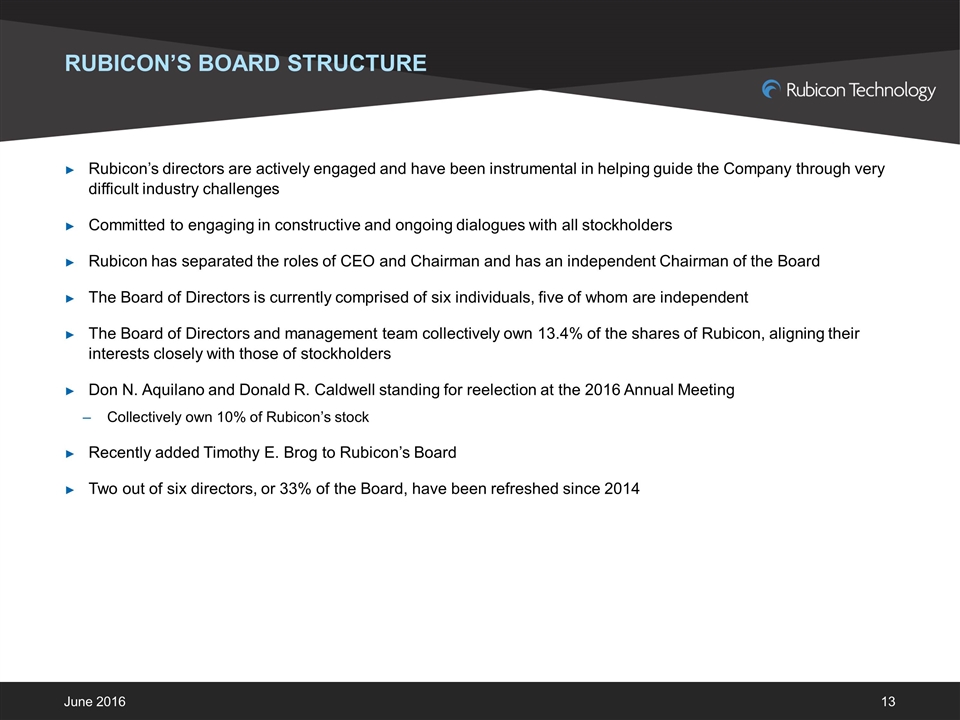

Rubicon’s board structure Rubicon’s directors are actively engaged and have been instrumental in helping guide the Company through very difficult industry challenges Committed to engaging in constructive and ongoing dialogues with all stockholders Rubicon has separated the roles of CEO and Chairman and has an independent Chairman of the Board The Board of Directors is currently comprised of six individuals, five of whom are independent The Board of Directors and management team collectively own 13.4% of the shares of Rubicon, aligning their interests closely with those of stockholders Don N. Aquilano and Donald R. Caldwell standing for reelection at the 2016 Annual Meeting Collectively own 10% of Rubicon’s stock Recently added Timothy E. Brog to Rubicon’s Board Two out of six directors, or 33% of the Board, have been refreshed since 2014 June 2016

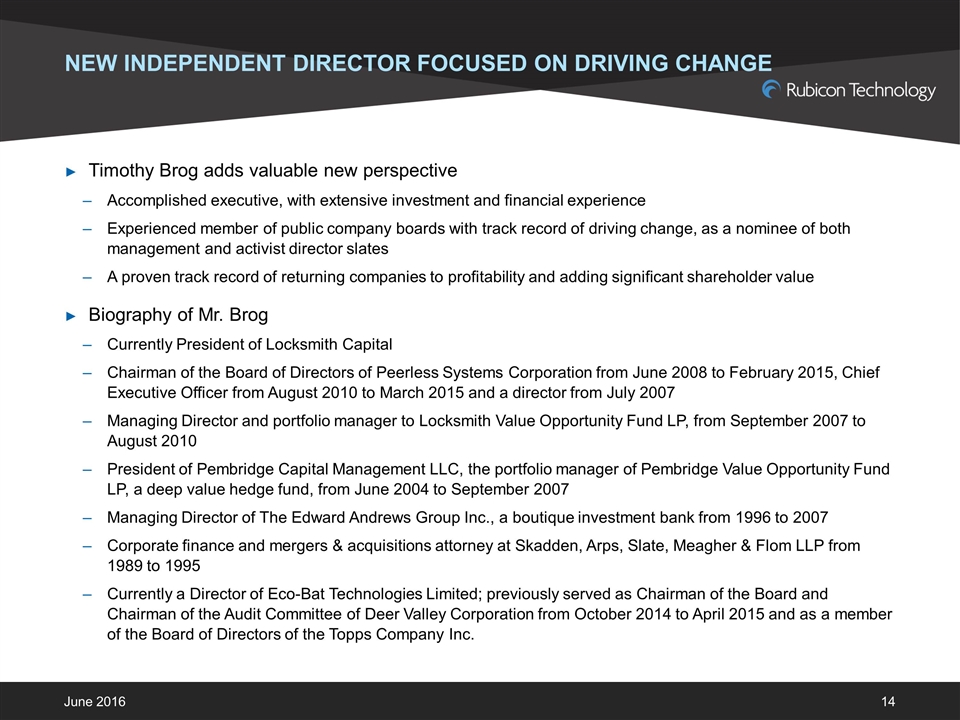

NEW INDEPENDENT DIRECTOR FOCUSED ON DRIVING CHANGE Timothy Brog adds valuable new perspective Accomplished executive, with extensive investment and financial experience Experienced member of public company boards with track record of driving change, as a nominee of both management and activist director slates A proven track record of returning companies to profitability and adding significant shareholder value Biography of Mr. Brog Currently President of Locksmith Capital Chairman of the Board of Directors of Peerless Systems Corporation from June 2008 to February 2015, Chief Executive Officer from August 2010 to March 2015 and a director from July 2007 Managing Director and portfolio manager to Locksmith Value Opportunity Fund LP, from September 2007 to August 2010 President of Pembridge Capital Management LLC, the portfolio manager of Pembridge Value Opportunity Fund LP, a deep value hedge fund, from June 2004 to September 2007 Managing Director of The Edward Andrews Group Inc., a boutique investment bank from 1996 to 2007 Corporate finance and mergers & acquisitions attorney at Skadden, Arps, Slate, Meagher & Flom LLP from 1989 to 1995 Currently a Director of Eco-Bat Technologies Limited; previously served as Chairman of the Board and Chairman of the Audit Committee of Deer Valley Corporation from October 2014 to April 2015 and as a member of the Board of Directors of the Topps Company Inc. June 2016

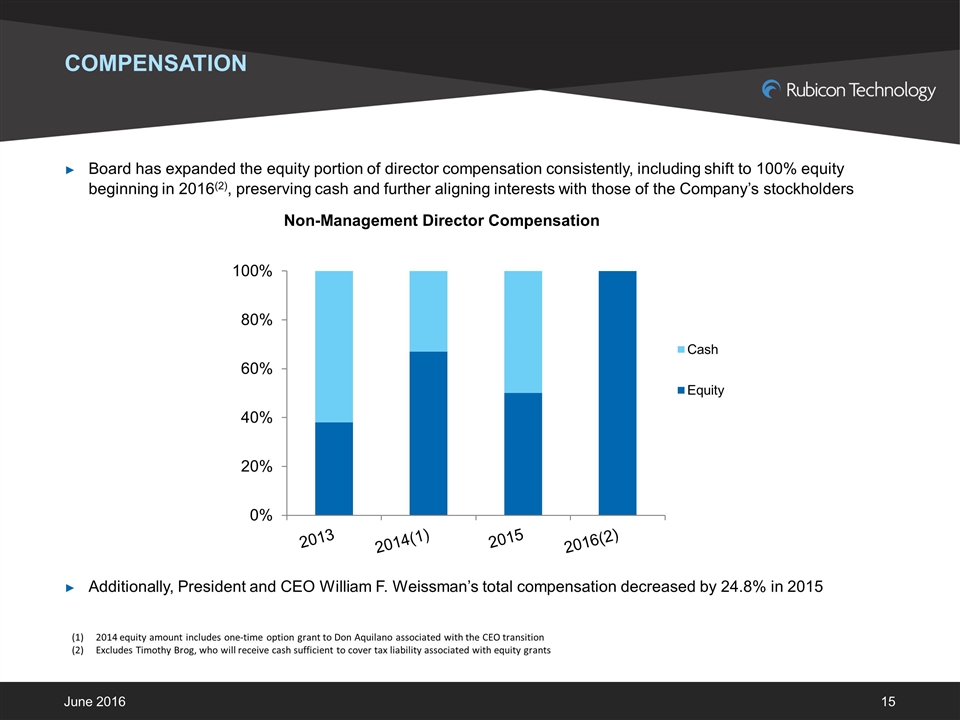

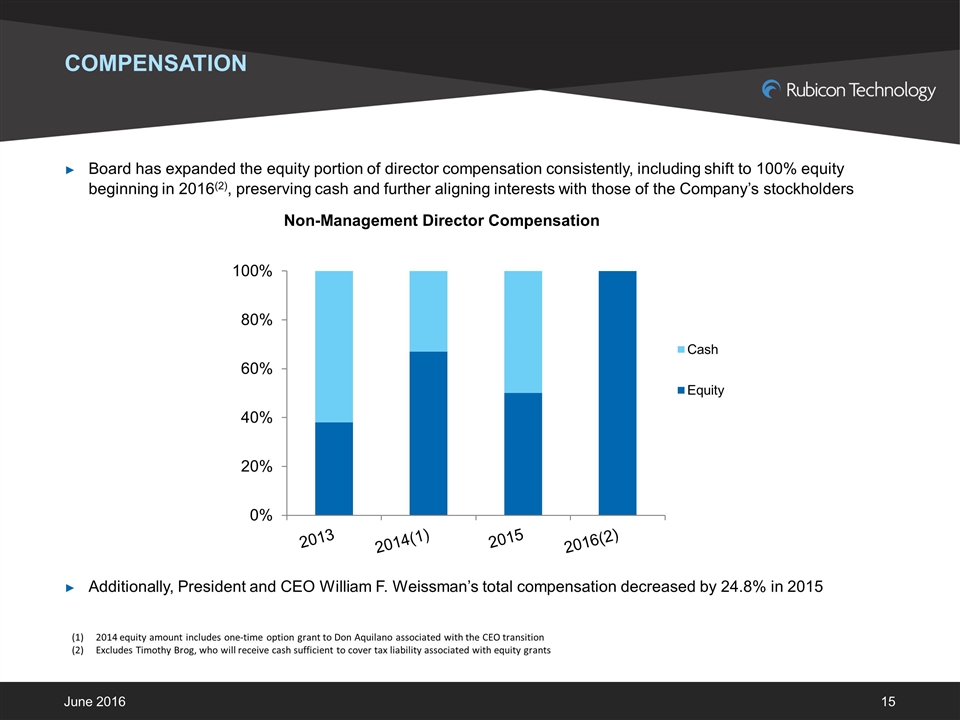

Board has expanded the equity portion of director compensation consistently, including shift to 100% equity beginning in 2016(2), preserving cash and further aligning interests with those of the Company’s stockholders Additionally, President and CEO William F. Weissman’s total compensation decreased by 24.8% in 2015 Compensation June 2016 2014 equity amount includes one-time option grant to Don Aquilano associated with the CEO transition Excludes Timothy Brog, who will receive cash sufficient to cover tax liability associated with equity grants Non-Management Director Compensation

Rubicon's nominees ARE HIGHLY Qualified June 2016 Don N. Aquilano Chairman of the Board Member of the Audit and Nominating Governance Committees Managing Director and President of Gazelle TechVentures Actively involved with Rubicon’s operations and the markets it serves for many years Instrumental in guiding the Company through its management transition Brings extensive financial expertise and knowledge of good governance practices to the Board MBA from Harvard Business School Donald R. Caldwell Member of Compensation and Nominating and Governance Committees Chairman and Chief Executive Officer, Cross Atlantic Capital Partners, Inc. Serves as a director at a number of companies across a range of industries, including banking, investment management, specialty chemicals, and software solutions Brings to the Board extensive experience in corporate strategy development, corporate governance and financial expertise acquired through 40 years of business experience MBA from Harvard Business School Together, Aquilano and Caldwell own 10% of Rubicon’s stock – clear alignment with ALL stockholders

PARAGON’s nominees ARE not Qualified to SERVE on Rubicon’s Board June 2016 Hesham M. Gad Plead guilty to theft from a prior employer in 2008 at the expense of charitable organizations and was charged with making false statements to a government authority in 2011 Waged two previous proxy contests, gaining control of Paragon Technologies and SED International Holdings. Under Mr. Gad’s leadership: SED was recently forced into involuntary bankruptcy proceeding Paragon reported net losses in four of last six years and was used by Mr. Gad as a personal vehicle to wage proxy fights Despite failures, Mr. Gad consistently rewards himself with significant compensation at both companies Jack H. Jacobs Closely affiliated with Mr. Gad, having served on Paragon and SED boards During short tenure on SED board, approved substantial consulting fees paid to Mr. Gad while SED spiraled toward insolvency During two stints on Premier Exhibitions, Inc. board, the company suffered considerable financial losses Board’s Nominating and Corporate Governance Committee interviewed and vetted Messrs. Gad and Jacobs in an effort to reach constructive resolution – determined Mr. Gad unfit to sit on Rubicon Board due to personal and professional history Our offer to consider appointing Mr. Jacobs to avoid costly and distracting proxy contest was rebuffed by Mr. Gad Mr. Jacobs’ close ties with Mr. Gad and business failures raise significant concerns

paragon is the wrong choice June 2016 Paragon Technologies Unwilling to work constructively to avoid costly public battle Mr. Gad unfit to serve on Rubicon’s Board given history of personal and professional behavior Mr. Gad has led another company – which he gained control of through a proxy contest – into involuntary bankruptcy Mr. Gad is using Paragon as a personal vehicle to wage costly proxy contests against companies in unrelated industries to no apparent benefit of Paragon shareholders and at their expense Paragon spends “$350,000 or more” on this proxy contest, although its investment in Rubicon has a mere $56,000 market value Paragon is not even transparent with its own shareholders, completely omitting from a May 2016 shareholder letter that SED was forced into involuntary bankruptcy AND that Paragon is waging an expensive proxy fight against Rubicon Both Paragon nominees have approved high salaries or fees to themselves at the expense of stockholders Mr. Jacobs’ close affiliation with Gad raises questions about his ability to act independently Mr. Gad and Mr. Jacobs appear to be seeking to further their own self-interested agenda Paragon’s nominees are NOT qualified to serve on Rubicon’s Board

Summary Rubicon’s highly qualified Board and management are focused on executing clear plan to deliver value and consistently invite and consider constructive feedback from stockholders The recent addition of a new independent director demonstrates Rubicon’s readiness to evaluate the Board and act in the best interest of all stockholders In stark contrast to Rubicon’s efforts, Paragon has refused to work constructively and instead waged a proxy contest Despite Paragon’s aggressive campaign, Rubicon’s Board is aligned around acting in best interest of ALL stockholders June 2016 Vote “FOR” Don N. Aquilano and Donald R. Caldwell on the WHITE Proxy Card

Safe harbor statement Forward-Looking Statements Certain of the statements in this presentation, particularly those preceded by, followed by or including the words “believes,” “expects,” “anticipates,” “intends,” “should,” “estimates,” or similar expressions, or those relating to or anticipating financial results for periods beyond the end of the year 2015, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. For those statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management's beliefs and certain assumptions made by us. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, the statements. These risks and uncertainties include changes in the average selling prices of sapphire products, our successful development and market acceptance of new products, dependence on key customers, potential disruptions in our supply of electricity, changes in our product mix, our ability to protect our intellectual property rights, the competitive environment, the availability and cost of raw materials, the cost of compliance with environmental standards, the ability to make effective acquisitions and successfully integrate newly acquired businesses into existing operations and other risks and uncertainties described in the Company's most recent Form 10-K and other filings with the SEC. For these reasons, readers are cautioned not to place undue reliance on the Company's forward-looking statements. Any forward-looking statement that the Company makes speaks only as of the date of such statement, and the Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. June 2016