Exhibit 99.2

A Global Health & Wellness Destination in Airports The XpresSpa Group February 19, 2020

1 A large and growing market 2 Dominant player in airport wellness with vast expansion potential 3 Strong unit - level economics with <2.5 years payback period 4 New leadership with strong vision driving meaningful improvement Why invest with XpresSpa?

- $4.2 Trillion global Health & Wellness industry - $120 Billion Spa economy is growing due to strong unit level economics and rising consumer interest in Health & Wellness - 150,000 Spas globally actively employing 2.6 Million people The Health & Wellness Industry Consumer spending patterns are shiftin g in our favor

$1.5 T rillion in global airport infrastructure spending is projected by 2023 T ravel R etai l has nearly tripled over the pas t 15 years 4

XpresSpa is the answer to growing traveler demands 1 Increasing number of travelers with longer average wait times 2 Growing desire for stress relief before travel 3 More travele rs are seeking experiences at the airport 5

1 Increasing number of travelers with longer average wait times • 2.8 Million passengers fly in and out of U.S. airports every day • About 20% of flights delayed in 2019 • Post security wait time for North American travelers is averaging over 90 minutes • Air travel was estimated to have grown 6% in 2019, including 465 Million business trips 6

2 Growing desire for stress relief before travel • B usiness travel and chronic illness are linked due to the stress and toll of travel on the body • 87% of employers are committed to workplace wellness, and 73% offer a wellness program • 62% of consumers desire to spend more on self - care, Health and Wellness experiences and related products 7

3 More travelers are seeking experiences at the airport • T oday’s traveler prioritizes quality, curation and experience. XpresSpa can not be “Amazon - ed” • Millennials spend nearly 25% of disposable income on Health and Wellness • 23% of travelers are frequent fliers who have a household income of over $100,000 8

We offer busy people a n opportunity to relax and renew on - the - go with innovative services and products 9

T he leading health and wellness destination in airports in the U.S. and worldwide Locations 5 0+ Airports globally 25 Services annually 1M Years of history 1 5 … and now under new leadership 10

New Leadership Team Doug Satzman, Chief Executive Officer Previous Experience CEO, Joe Coffee Company CEO, Le Pain Quotidien SVP, Starbucks Coffee - EMEA VP, Starbucks Coffee - U.S. License Stores (Airports, Lodging, Universities, Healthcare, Offices ) Scott Milford, Chief People Officer VP, People Operations, Soul Cycle SVP, Human Resources, Le Pain Quotidien Chief Human Resources Officer, Town Sports, Int. VP, Partner Resources, Starbucks Coffee Omar Haynes, Director of Finance, Analytics and Treasury Iga Wyrzykowski, Director of Store Design and Construction Tesh Ramsarup, Director of Operations Services 11

2018/2019 Comp Sales 10 consecutive months of Comp Sales Increase

Massage 13

Nail Care 14

Facials 15

Waxing 16

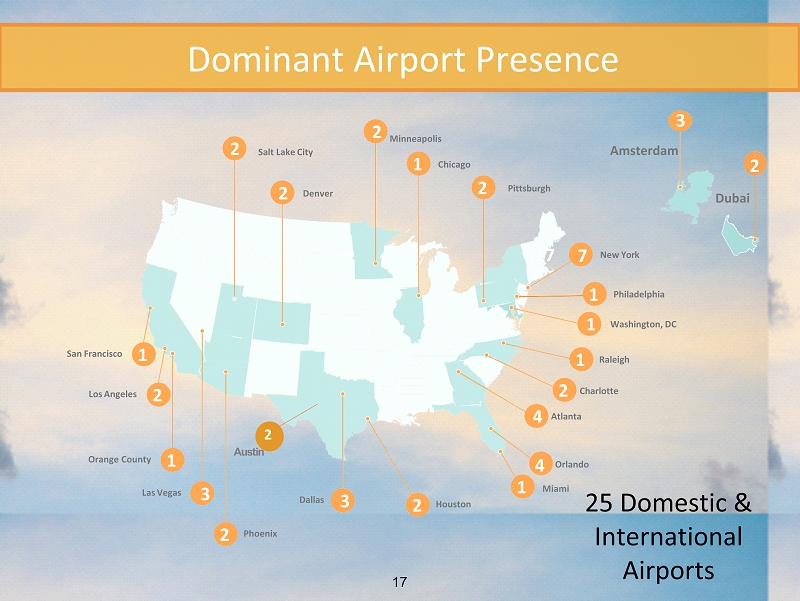

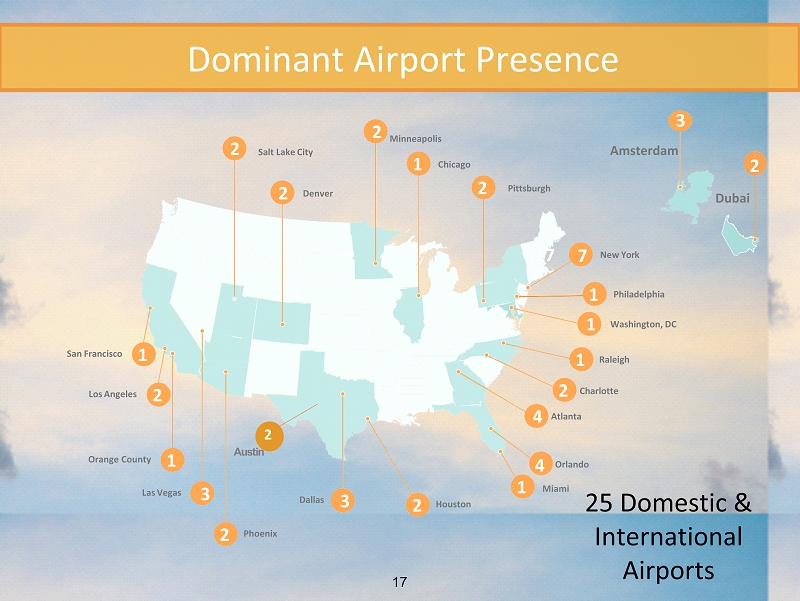

25 Domestic & International Airports Dominant Airport Presence 17 Minneapolis Denver 2 2 Salt Lake City 2 Chicago 1 Pittsbu r gh 2 Amsterdam Dubai New York Philadelphia Washington, DC 1 1 Raleigh 1 2 4 4 1 2 7 Charlotte Atlanta Orlando Miami Las Vegas 3 Phoenix 2 Orange County 1 Los Angeles 2 San Francisco 1 Dallas 3 Houston Austin 2 3 2 7

0 10 20 30 40 50 XpresSpa holds over 60% U.S. market share 3.3X Bigger than Closest Competitor 18

https://www.worldatlas.com/articles/busiest - airports - in - united - states.html XpresSpa is in e very one of the busiest U.S. airports with 2.5X growth potential in these airports alone 19 Airport Code Total passengers Total XpresSpa Opportunity Potential Hartsfield – Jackson Atlanta International ATL 103,902,992 4 6 10 Los Angeles International LAX 84,557,968 2 7 9 O'Hare International ORD 79,828,183 1 7 8 Dallas/Fort Worth International DFW 67,092,194 3 4 7 Denver International DEN 61,379,396 2 4 6 John F. Kennedy International JFK 59,392,500 6 1 7 San Francisco International SFO 55,822,129 1 5 6 McCarran International LAS 48,566,803 3 2 5 Charlotte Douglas International CLT 45,909,899 2 3 5 Orlando International MCO 44,511,265 4 1 5 Miami International MIA 44,071,313 1 3 4 Phoenix Sky Harbor International PHX 43,921,670 2 2 4 George Bush Intercontinental IAH 40,696,189 1 3 4 Total 779,652,501 32 48 80

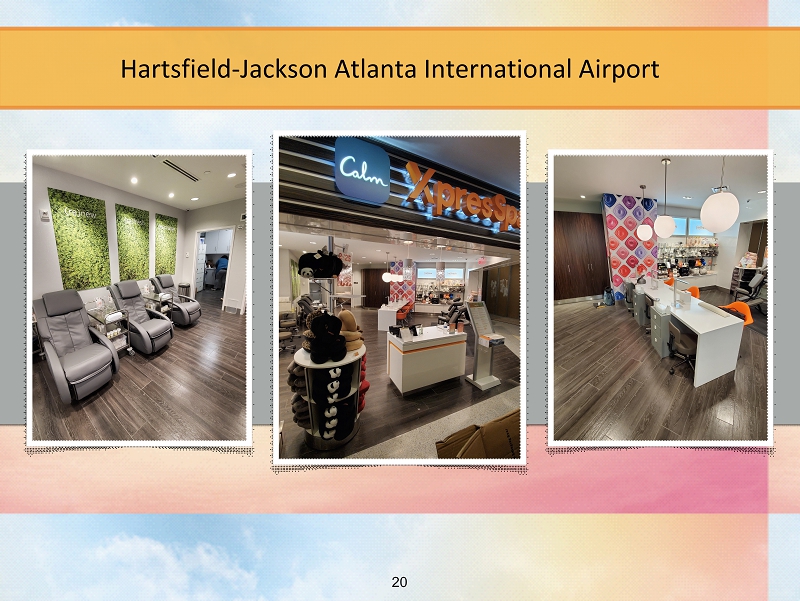

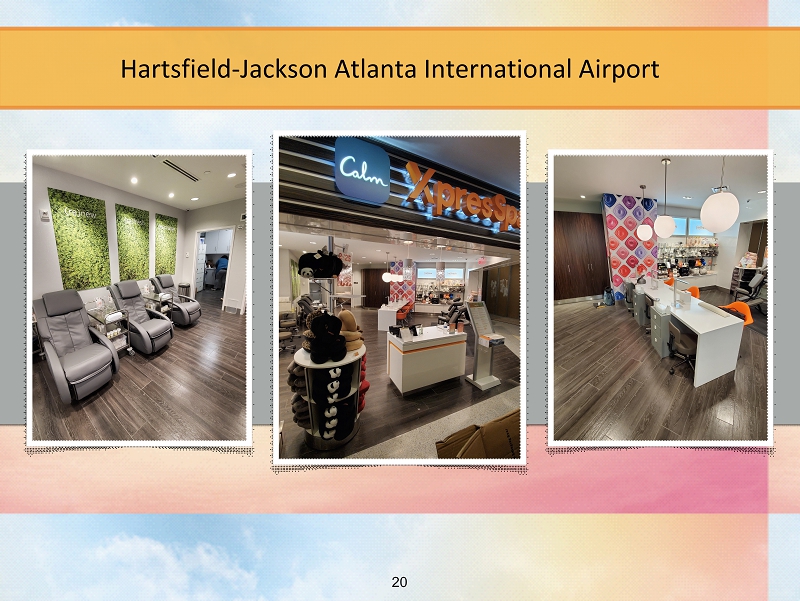

Hartsfield - Jackson Atlanta International Airport 20

Austin - Bergstrom International Airport 21

Amsterdam, Netherlands 22

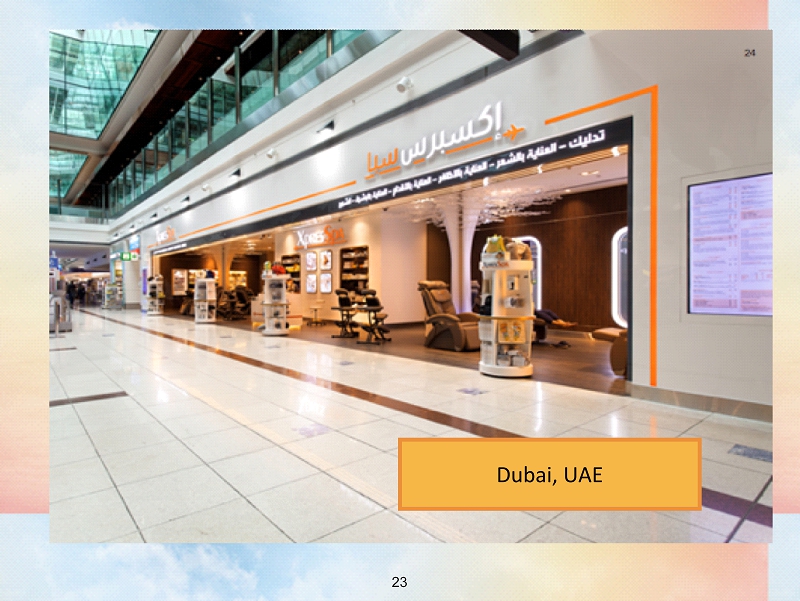

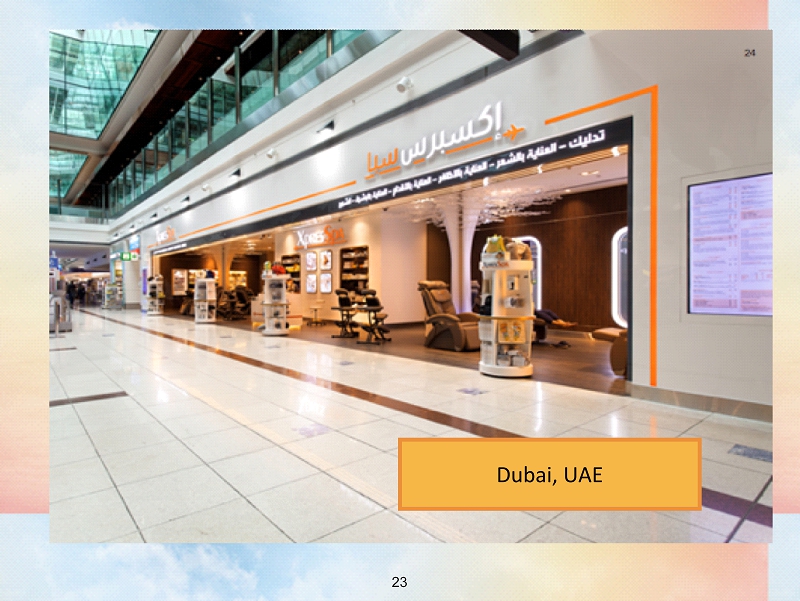

Dubai, UAE 23

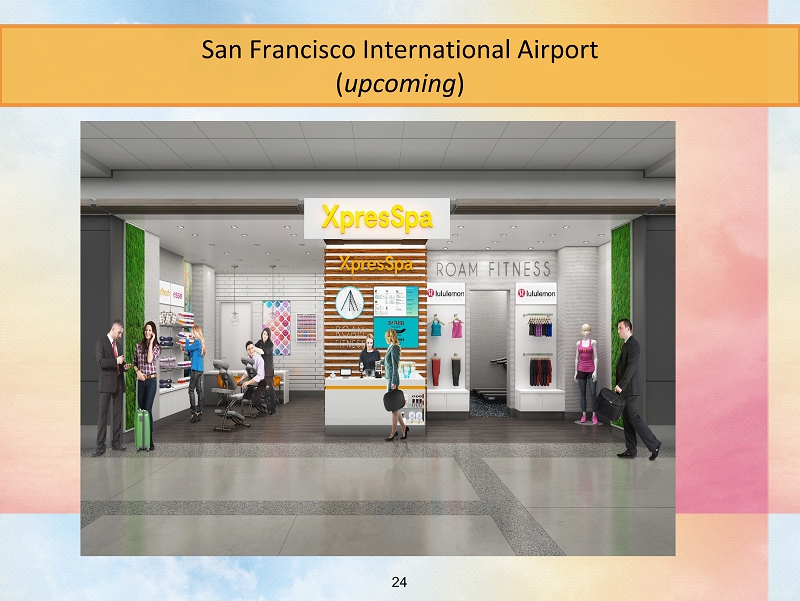

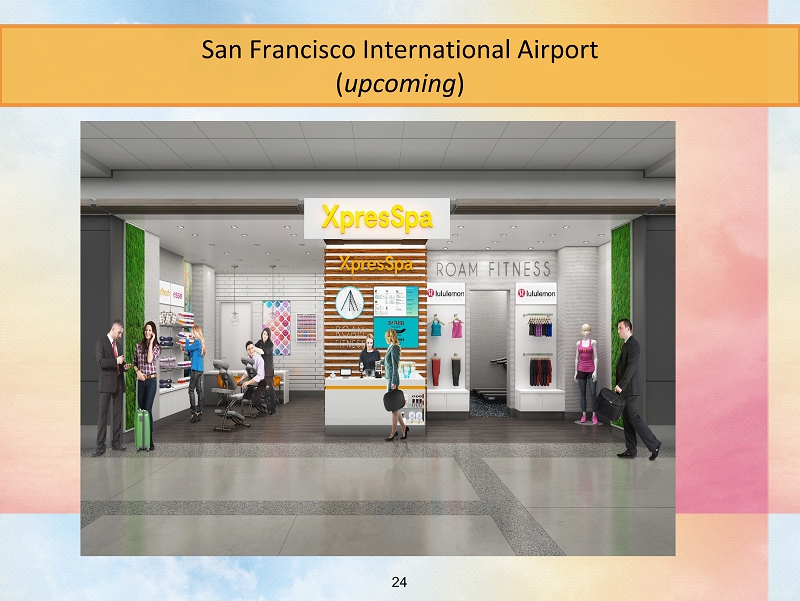

San Francisco International Airport ( upcoming ) 24

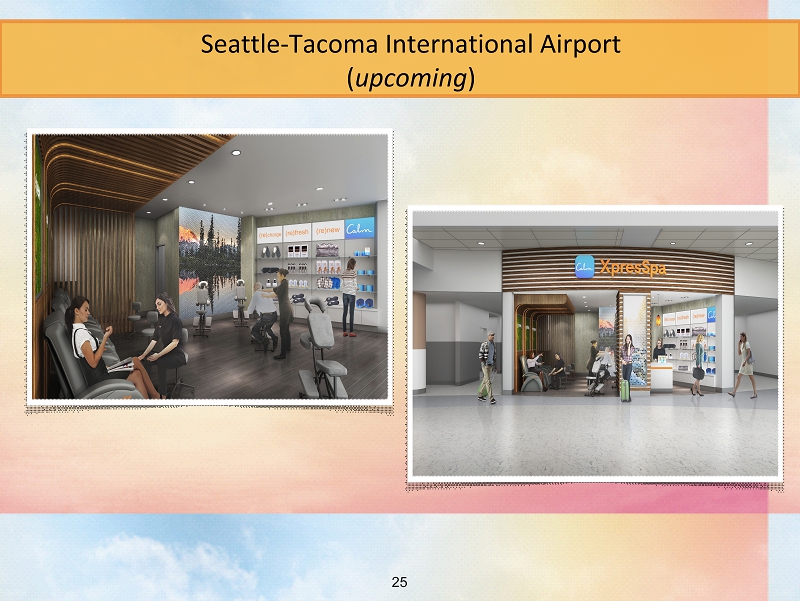

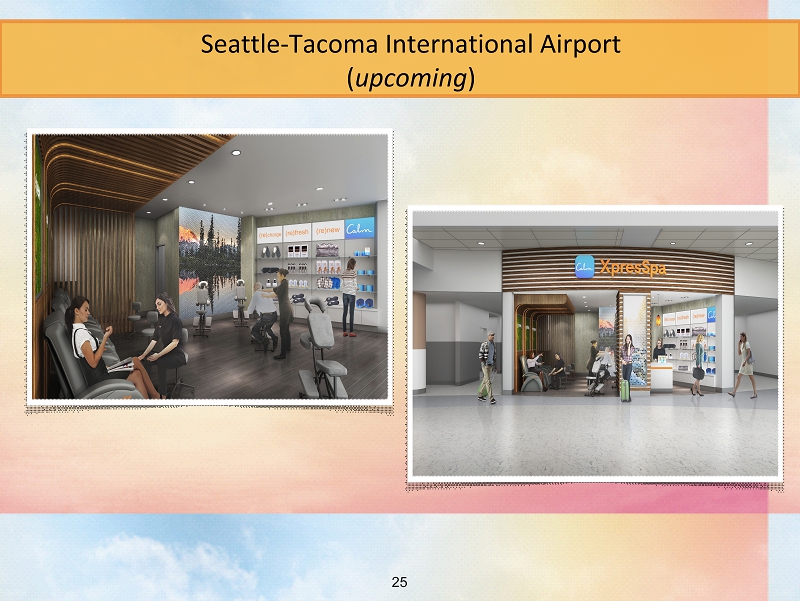

Seattle - Tacoma International Airport ( upcoming ) 25

Dubai International Airport ( upcoming ) 26

TYPICAL SIZE 5 00 - 1, 5 00 S F AVERAGE UNIT SALES $850,000 - $1,000,000 AVERAGE SALES PER SQUARE FOOT $850 - $1,000 AVERAGE INVESTMENT COST $300,000 - $600,000 AVERAGE UNIT CONTRIBUTION 18% - 22% PAYBACK PERIOD AVERAGE LEASE TERM 2. 0 – 2.5 YEARS 5 – 7 YEARS 16% 84% YTD Q3 2019 Sales Breakdown Service s Retail Strong Unit - Level Economics 27

Strategic Priorities D rive T op L ine Revenue R educe C osts / D rive B ottom L ine R evamp P roducts / D evelop P artnerships D isciplined D evelopment 28

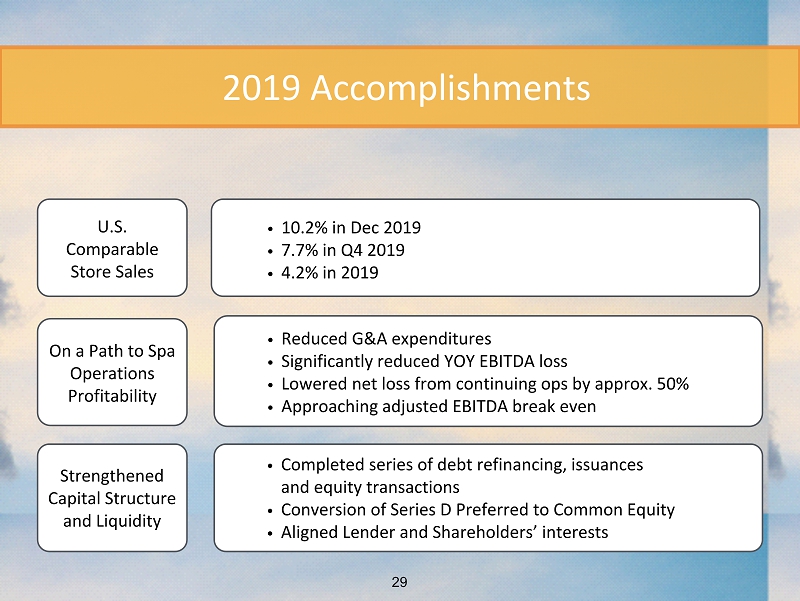

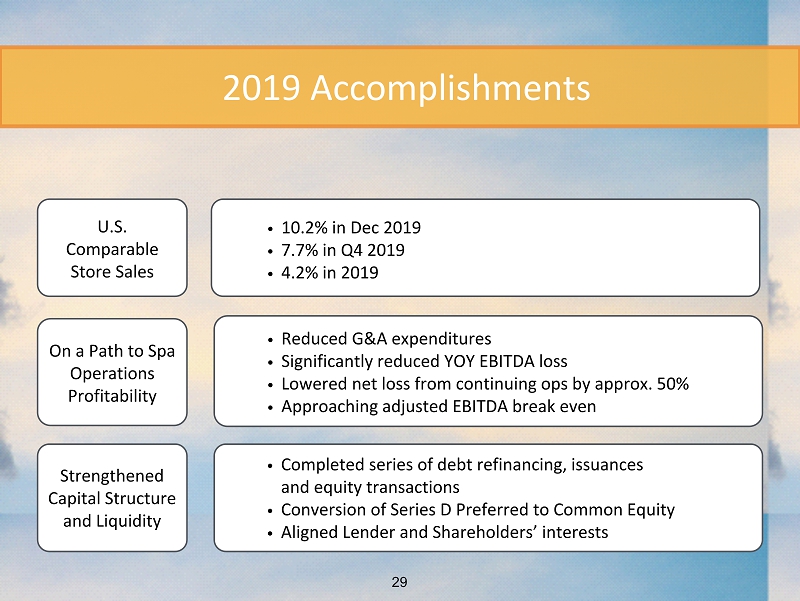

2019 Accomplishments Strengthened Capital Structure and Liquidity • Completed series of debt refinancing , issuances and equity transactions • Conversion of Series D Preferred to Common Equity • Aligned Lender and S hareholders’ interests • Reduced G&A expenditures • Significantly reduced YOY EBITDA loss • Lowered net loss from continuing ops by approx. 50% • Approaching adjusted EBITDA break even On a Path to Spa Operations Profitability • 10.2% in Dec 2019 • 7.7% in Q4 2019 • 4.2% in 2019 U.S. Comparable Store Sales 29

2019 Accomplishments Strategic Partnerships • Expanded and extended Calm partnership • Activated Persona Nutrition (Nestle Health) partnership • Testing Nira CBD products • Improved in - store technology to gain process efficiencies • Launched new digital training program leveraging gaming methodology • Developed first mobile App Technology • Opened 5 company - operated spas • Opened 1 st franchise - operated spa • C ompleted streamlining of store portfolio Development & Optimization 30

2020 Agenda Bring Health & Wellness Innovation to our Spas Secure New Strategic Partnerships Accelerate Organic Revenue Growth & Pursue Disciplined Development Continue Working Capital & Cap Ex Financings Improve Business Process Improvements to Yield Further Cost Savings Incubate New Health & Wellness Concepts Build a S ustainable & E nduring B rand while A chieving P ositive EBITDA P rofitability by Y ear - E nd 31

Investor Considerations 1 Dominant U.S market presence w ith vast expansion potential New L eadership driving meaningful improvements across business Attractive partner for H ealth & W ellness companies given unique Real Estate 2 3 Strengthened capital structure and financial flexibility 4 Plan to a chieve EBITDA profitability in 2020 5 32

A Global Health & Wellness Destination in Airports The XpresSpa Group February 19, 2020

Safe Harbor Statement This presentation includes forward - looking statements, which may be identified by words such as “believes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “should,” “seeks,” ”future,” “continue,” or the negative of such terms, or other comparable terminology . Forward - looking statements relating to expectations about future results or events are based upon information available to XpresSpa Group as of today's date, and are not guarantees of the future performance of the company, and actual results may vary materially from the results and expectations discussed . Additional information concerning these and other risks is contained in XpresSpa Group’s most recently filed Annual Report on Form 10 - K, Quarterly Report on Form 10 - Q, recent Current Reports on Form 8 - K and other SEC filings . All subsequent written and oral forward - looking statements concerning XpresSpa Group, or other matters and attributable to XpresSpa Group or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above . XpresSpa Group does not undertake any obligation to publicly update any of these forward - looking statements to reflect events or circumstances that may arise after the date hereof . Trademark Usage XpresSpa Group, the XpresSpa Group logo, and other XpresSpa Group trademarks, service marks, and designs are registered or unregistered trademarks of XpresSpa Group Inc . and its subsidiaries in the United States and in foreign countries . This presentation contains trade names, trademarks and service marks of other companies . All such trade names, trademarks and service marks of other companies are property of their respective owners . Use of Non - GAAP Financial Measures XpresSpa uses GAAP and non - GAAP measurements to assess the trends in its business . Items XpresSpa reviews on an ongoing basis are revenues, comparable store sales (which it defines as sales from stores opened longer than a year compared to the same period sales of those stores a year ago), store contribution margins, and number of transactions (which is a way to measure traffic in spas) . In addition, XpresSpa monitors stores’ performance compared to its model store metrics to ensure that it is consistently opening spas that have the same or similar return dynamics as historical stores . XpresSpa believes the trends exhibited by its business are strong and substantiate its continued investment in additional locations and infrastructure . Disclaimers 34

• https://www.faa.gov/air_traffic/by_the_numbers/ • https://www.transtats.bts.gov/Data_Elements.aspx?Data=1 • https://www.supplychaindive.com/news/with - more - security - and - little - storage - airport - retail - challenges - the - supply/530392/ • https://www.transtats.bts.gov/OT_Delay/OT_DelayCause1.asp • https://www.vanemag.com/travel - tips/the - biggest - airport - wellness - trends - of - 2019/ • https://www.sfmic.com/10 - workplace - wellness - programs - statistics/ • https://www.marketing - resource - directory.com/article/every - experience - matters - at - least - it - should.html • https://www.creativegroupinc.com/2019/08/19/10 - stats - that - prove - the - experience - economy - is - here - to - stay/#_edn9 • https://www.aarp.org/research/topics/life/info - 2017/2018 - travel - trends.html • https://www.cbinsights.com/research/report/wellness - trends - 2019/ • https://www.fastcompany.com/90316778/airports - might - be - the - future - of - wellness • https://www.transportation.gov/briefing - room/dot0718 • https://www.underscore.co.uk/uncovered/business - travel/ • https://www.ustravel.org/system/files/media_root/document/Outlook_Back_Page_May_2016.html • https://www.businesstravelnews.com/Lodging/Business - Travelers - Are - Getting - Better - About - Wellness - on - the - Road • https://www.forbes.com/sites/daniellebrooker/2018/12/29/business - travel - could - do - with - a - wellness - injection/#6b32276c5890 Sources

A Global Health & Wellness Destination in Airports The XpresSpa Group February 19, 2020