UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the registrantx Filed by a party other than the registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material pursuant to §240.14a-12 |

IPC The Hospitalist Company, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined.): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, schedule, or registration statement no.: |

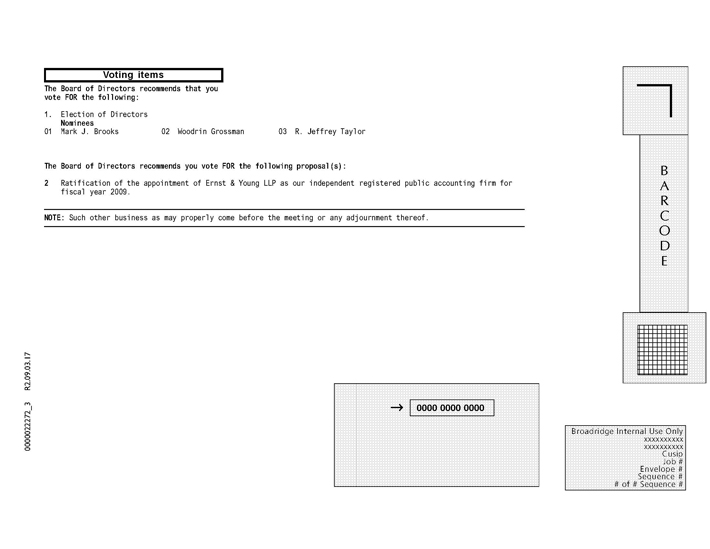

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 28, 2009

TO OUR STOCKHOLDERS:

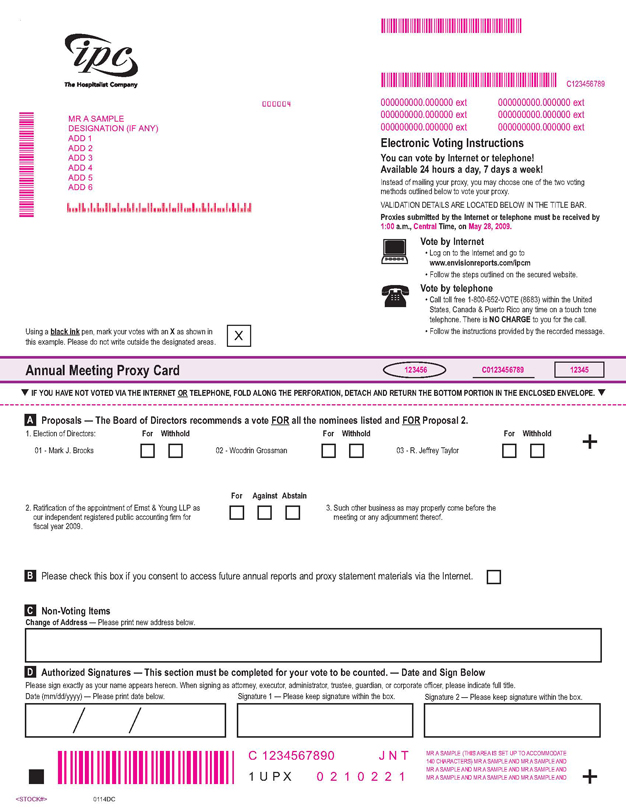

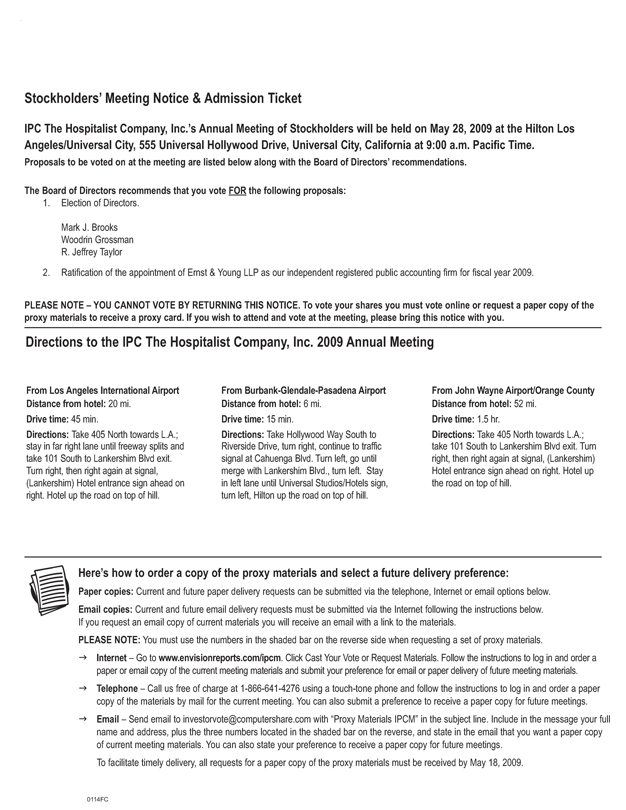

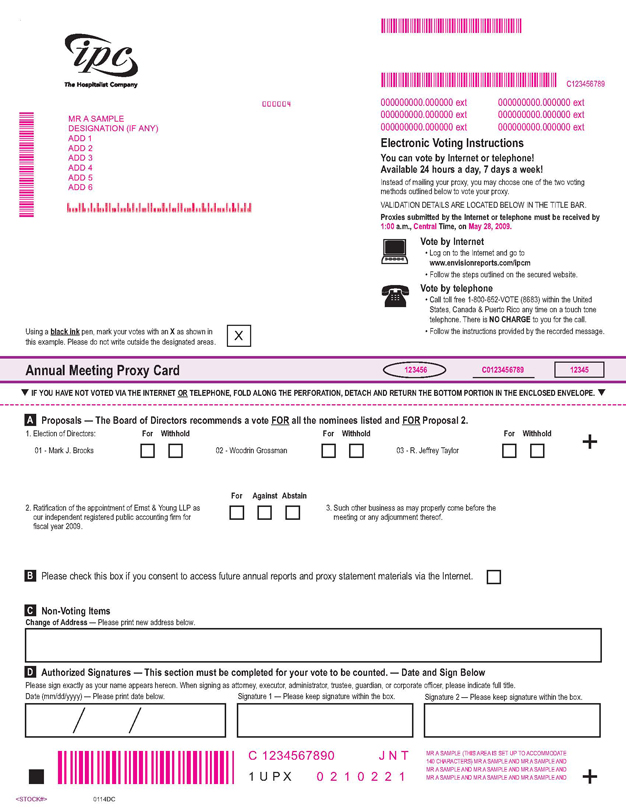

We will hold our 2009 annual meeting of the stockholders of IPC The Hospitalist Company, Inc., a Delaware corporation, on Thursday, May 28 at 9:00 a.m., Pacific time, at the Hilton Los Angeles/Universal City, 555 Universal Hollywood Drive, Universal City, California, for the following purposes, which are further described in the accompanying Proxy Statement:

| | (1) | To elect three Class II Directors to our Board of Directors to serve for a term of three years or until their successors are duly elected and qualified; |

| | (2) | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2009; and |

| | (3) | To transact other business as may properly come before the annual meeting or any adjournment thereof. |

Our Board of Directors has fixed the close of business on March 31, 2009 as the record date for the determination of stockholders entitled to vote at the meeting or any meetings held upon adjournment of the meeting. Only record holders of our common stock at the close of business on that day will be entitled to vote.

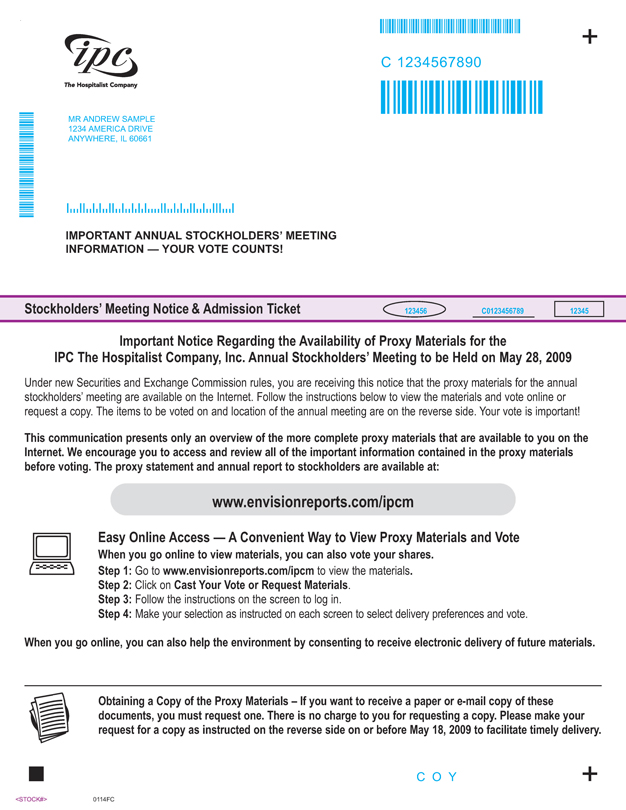

In accordance with rules and regulations adopted by the Securities and Exchange Commission, we are now providing access to our proxy materials over the Internet. Accordingly, we will mail, on or before April 17, 2009, a Notice of Internet Availability of Proxy Materials to our stockholders of record and beneficial owners as of the close of business on March 31, 2009. On the date of mailing of the Notice of Internet Availability of Proxy Materials, all stockholders and beneficial owners will have the ability to access the proxy materials on a website referred to and at the URL address included in the Notice of Internet Availability of Proxy Materials. These proxy materials will be available free of charge. You will not receive such Notice in the mail if you previously elected to receive a printed copy of the proxy materials.

The Notice of Internet Availability of Proxy Materials will also identify the date, time and location of the annual meeting; the matters to be acted upon at the meeting and the Board of Directors’ recommendation with regard to each matter; an e-mail address and a website where stockholders can request a paper or e-mail copy of our proxy statement, our annual report to stockholders and a form of proxy relating to the annual meeting; information on how to access the form of proxy; and information on how to obtain directions to attend the meeting and vote in person.

We invite you to attend the meeting and vote in person.If you cannot attend, to ensure that you are represented at the meeting, please vote, at your earliest convenience, using the telephone or Internet or request a proxy card to complete, sign and date and return by mail, in the postage prepaid envelope provided.If you attend the meeting, you may vote in person, even if you previously used the telephone or Internet voting systems or returned a signed proxy.

Please note that all votes cast via telephone or the Internet must be cast prior to11:00 p.m., Pacific Standard Time on Wednesday, May 27, 2009.

|

| By order of the Board of Directors, |

|

|

Adam D. Singer, M.D. Chief Executive Officer |

|

North Hollywood, California

April 10, 2009

PROXY STATEMENT

GENERAL INFORMATION

Our Board of Directors is soliciting proxies from our stockholders in connection with our 2009 annual meeting of stockholders, to be held on Thursday, May 28 at 9:00 a.m., Pacific time, at the Hilton Los Angeles/Universal City, 555 Universal Hollywood Drive, Universal City, California. The proxies will remain valid for use at any meetings held upon adjournment of that meeting. The record date for the meeting is the close of business on March 31, 2009. All holders of record of our common stock on the record date are entitled to notice of the meeting and to vote at the meeting and any meetings held upon adjournment of that meeting. Our principal executive offices are located at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602. Our telephone number is (888) 4IPC-DOC (888-447-2362). To obtain directions to our annual meeting, visit our website atwww.hospitalist.com.

In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each stockholder of record or beneficial owner, we are now furnishing proxy materials, which include this proxy statement and the accompanying proxy card, notice of annual meeting of stockholders, and annual report to stockholders, to our stockholders over the Internet. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials, unless you have previously made a permanent election to receive paper copies of these materials. Instead, the Notice of Internet Availability of Proxy Materials instructs you as to how you may access and review all of the important information contained in the proxy materials. The Notice of Internet Availability of Proxy Materials also instructs you as to how you may submit your proxy on the Internet. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials.

The Notice of Internet Availability of Proxy Materials was first mailed on or before April 17, 2009 to all stockholders of record as of March 31, 2009.

Whether or not you plan to attend the meeting in person, please vote, at your earliest convenience, using the telephone, Internet, or request a proxy card to complete, sign and date and return by mail, in the postage prepaid envelope provided, to ensure that your shares will be voted at the meeting. You may revoke your proxy at any time prior to its use by filing with our secretary an instrument revoking it or a duly executed proxy bearing a later date or by attending the meeting and voting in person.

Unless you instruct otherwise in the proxy, any proxy that is given and not revoked will be voted at the meeting:

| | • | | For each nominee to our Board of Directors; |

| | • | | For the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2009; and |

1

| | • | | As recommended by our Board of Directors, in its discretion, with regard to all other matters as may properly come before the annual meeting or any adjournment thereof. |

Voting Information

Our only voting securities are the outstanding shares of our common stock. At the record date, we had approximately 16,091,345 shares of common stock outstanding. Each stockholder is entitled to one vote per share on each matter that we will consider at this meeting. Stockholders are not entitled to cumulate votes. Brokers holding shares of record for their customers generally are not entitled to vote on some matters unless their customers give them specific voting instructions. If the broker does not receive specific instructions, the broker will note this on the proxy form or otherwise advise us that it lacks voting authority. The votes that the brokers would have cast if their customers had given them specific instructions are commonly called “broker non-votes.” If the stockholders of record present in person or represented by their proxies at the meeting hold at least a majority of our shares of common stock outstanding as of the record date, a quorum will exist for the transaction of business at the meeting. Stockholders attending the meeting in person or represented by proxy at the meeting who abstain from voting and broker non-votes are counted as present for quorum purposes.

Votes Required for Proposals

Directors are elected by a plurality of the votes cast, in person or by proxy, which means that the three nominees with the most votes will be elected. Abstentions and broker non-votes as to the election of any director nominees will not affect the outcome of the election of directors.

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2009 requires the affirmative vote of a majority of the shares of common stock present at the annual meeting, in person or by proxy and entitled to vote thereon. Abstentions with respect to this proposal will be treated as votes against the proposal. Broker non-votes with respect to this proposal will not be considered as present and entitled to vote on the proposal, which will therefore reduce the number of affirmative votes needed to approve the proposal.

Proxy Solicitation Costs

We will pay for the cost of preparing, assembling, printing and mailing these proxy materials to our stockholders, as well as the cost of soliciting proxies relating to the meeting. We may request banks and brokers to solicit their customers who beneficially own our common stock listed of record in names of nominees. We will reimburse these banks and brokers for their reasonable out-of-pocket expenses regarding these solicitations. Our officers, directors and employees may supplement the original solicitation by mail of proxies by telephone, facsimile, e-mail and personal solicitation. We will pay no additional compensation to our officers, directors and employees for these activities.

Delivery of Proxy Statement and Annual Report

Beneficial owners, but not record holders, of our common stock who share a single address may receive only one copy of the Notice of Internet Availability of Proxy Materials and, as applicable, an annual report and proxy statement, unless their broker has received contrary instructions from any beneficial owner at that address. This practice, known as “householding,” is designed to reduce printing and mailing costs. If any beneficial owner at such an address wishes to discontinue householding and receive a separate copy of the Notice of Internet Availability of Proxy Materials and, if applicable, an annual report and proxy statement, they should notify their broker. Beneficial owners sharing an address to which a single copy of the proxy statement and annual report was delivered can also request prompt delivery of a separate copy of the Notice of Internet Availability of Proxy Materials and, if applicable, proxy statement and annual report by contacting our Corporate Secretary at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602. Our telephone number is (888) 4IPC-DOC (888-447-2362).

2

Electronic Availability of Proxy Materials for 2009 Annual Meeting

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 28, 2009. This Proxy Statement and IPC’s Annual Report to Stockholders and Form 10–K for fiscal year 2008 are available electronically athttp://investors.hospitalist.com.

Electronic Delivery of Future Proxy Materials

You may elect to receive future proxy statements and annual reports over the Internet instead of receiving paper copies. If you are a stockholder of record, you can elect to access future proxy statements and annual reports electronically by marking the appropriate box on your proxy form. If you hold your shares through a broker, please check the information provided in the proxy materials mailed to you by your broker for instructions on how to elect this option. Your election to view these documents over the Internet will remain in effect unless you elect otherwise.

3

PROPOSAL NO. 1

ELECTION OF CLASS II DIRECTORS

At the annual meeting, you will elect three directors to serve as Class II Directors until the 2012 annual meeting of stockholders or until their respective successors are elected and qualified. The nominees for election as Class II Directors are identified below, each of which is currently serving on the Board of Directors and has indicated a willingness to serve if elected. However, if any nominee becomes unable to serve before the election, the shares represented by proxy may be voted for a substitute nominee designated by the Board of Directors.

No arrangement or understanding exists between any nominee and any other person or persons pursuant to which any nominee was or is to be selected as a director or nominee. None of the nominees has any family relationship with any other nominee or with any of our executive officers.

Information Concerning our Directors Nominated for Election

Class II Directors—Term Scheduled to Expire in 2012

Mark J. Brooks, age 42. Mr. Brooks has served as one of our directors since April 1998 and has served as chairman of our compensation committee since June 2008. Since its formation in January 2007, Mr. Brooks has served as a managing director of Scale Venture Partners. Prior to joining Scale Venture Partners, Mr. Brooks worked for Bank of America Ventures since 1995, ultimately serving as a managing director. Mr. Brooks currently sits on the Board of Directors of the following private companies: Alimera Sciences, Inc., National Healing Corporation, LivHome Inc. and Spinal Kinetics, Inc. Mr. Brooks received a B.A. in economics from Dartmouth College and an M.B.A. from the Wharton School at the University of Pennsylvania.

Woodrin Grossman, age 64. Mr. Grossman has served as one of our directors since March 2008, and currently serves as a member of our audit committee and our nominating and governance committee. Mr. Grossman retired in 2007 after serving as Senior Vice President-Strategy and Development of Odyssey HealthCare Inc. from January 2006 to December 2007 and as a director from July 2005 to January 2006. Prior to Odyssey HealthCare, Inc., Mr. Grossman worked for PricewaterhouseCoopers for 37 years, including 27 years as a partner of the firm and over five years as the health care practice leader of the firm. Mr. Grossman currently serves on the Board of Directors of Kinetic Concepts, Inc. and MedCath Corporation. Mr. Grossman received a B.S. in economics from Moravian College and an M.B.A. from the Wharton School at the University of Pennsylvania.

R. Jeffrey Taylor, age 60. Mr. Taylor has been a director and our President and Chief Operating Officer since he joined IPC in July 2000. Prior to joining our company, Mr. Taylor was the executive vice president of Atlanta-based Mariner Post-Acute Network. Prior to that, Mr. Taylor was chief executive officer of American Outpatient Services, Inc. and held various positions including executive vice president, chief administrative officer and general counsel with American Medical International, Inc. (now Tenet Healthcare Corp.; THC—NYSE). Mr. Taylor received a B.S. from the University of Utah and a J.D. from the University of Utah College of Law. Mr. Taylor has more than 25 years of experience in the areas of acute-care, sub-acute care and the outpatient dialysis segments of the healthcare industry.

The Board of Directors recommends a vote FOR the election of each of the named nominees as Class II Directors.

4

Information Concerning our Other Directors

The following persons are currently directors of the company whose terms will continue after the Annual Meeting.

Class I Directors—Term Scheduled to Expire in 2011

Adam D. Singer, M.D., age 48. Dr. Singer has been a director, Chairman, and our Chief Executive Officer since he founded IPC in 1995. In 1991, Dr. Singer acquired a private practice in pulmonary medicine that shortly thereafter merged with two other pulmonary physicians to become part of Consultants For Lung Disease, Inc. (now the Institute for Better Breathing). In 2006, Dr. Singer was designated Chief Medical Officer of IPC. Dr. Singer received his B.S. in Biology from the University of California, Los Angeles and his medical degree from the Chicago Medical School at Rosalind Franklin University. Dr. Singer performed a post-doctoral internship and residency in internal medicine and a fellowship in pulmonary medicine at University of Southern California.

Thomas P. Cooper, M.D., age 65. Dr. Cooper has served as one of our directors since August 2007 and has served as a member of our compensation committee and as chairman of our quality committee since June 2008. Since 1991, Dr. Cooper has been chairman of the board at VeriCare and currently serves as a director for Kindred Healthcare, Inc. (KND—NYSE) and Hanger Orthopedic Group (HGR—NYSE). Dr. Cooper has founded various healthcare related companies, including VeriCare, Spectrum Emergency Care, Correctional Medical Systems and Mobilex. Dr. Cooper is also a partner at Aperture Venture Partners, a venture capital firm. Dr. Cooper is currently an adjunct professor at the Columbia University School of Business teaching entrepreneurship. Dr. Cooper received a B.A. from DePauw University and a medical degree from Indiana University Medical School.

Chuck Timpe, age 62. Mr. Timpe has served as one of our directors since 1998 and as chairman of our audit committee since June 2002. From June 2003 to November 2008, Mr. Timpe served as the chief financial officer of Hythiam, Inc. (HYTM—NASDAQ). Prior to joining Hythiam, Mr. Timpe was chief financial officer, from its inception in February 1998 to June 2003, of Protocare, Inc., a clinical research and pharmaceutical outsourcing company which merged with Radiant Research, Inc. in March 2003. Previously, he was a principal in two private healthcare management consulting firms he co-founded, chief financial officer of National Pain Institute, treasurer and corporate controller for American Medical International, Inc. (now Tenet Healthcare Corp.; THC—NYSE), and a member of Arthur Andersen, LLP’s healthcare practice, specializing in public company and hospital system audits. Mr. Timpe is currently a business consultant. Mr. Timpe received his B.S. from University of Missouri, School of Business and Public Administration, and is a certified public accountant. Mr. Timpe has over 35 years experience in the healthcare industry as a senior healthcare financial executive and director.

Class III Directors—Term Scheduled to Expire in 2010

Francesco Federico, M.D., age 59. Dr. Federico has served as one of our directors since August 2008 and currently serves as a member of our quality committee. Since 1986, Dr. Federico has served as President, CEO and Director of the Lakeside organization—Lakeside Systems, Inc. (2007)—the Holding Company; Lakeside HealthCare, Inc. (1997)—the Management Services organization; Lakeside Medical Group (1986)—the Independent Practice organization; Lakeside Medical Associates (1993)—The Medical Group; Lakeside Comprehensive HealthCare (2006)—the Knox Keene Entity and Lakeside Surgery Center. Dr. Federico also serves on the Board of Directors of California Medical Group RRG Insurance Co., Glendale Memorial Hospital Foundation, the California Association of Physician Groups, and the Valley Community Clinic. Dr. Federico received a B.A. and a medical degree from Harvard University. Dr. Federico is board certified in internal medicine, medical oncology and nematology.

Patrick G. Hays, age 66.Mr. Hays has served as one of our directors since August 2008, and currently serves as a member of our audit committee and our nominating and governance committee. From 1995 until his retirement in 2000, Mr. Hays was President and Chief Executive Officer of the Blue Cross Blue Shield Association, the national coordinating body for the nation’s then 49 independent BC/BS plans. Mr. Hays founded

5

Sutter Health in Sacramento, CA. in 1980, where he served as its Chief Executive Officer for fifteen years. He is board certified in health care management and a Fellow of the American College of Healthcare Executives. He currently serves on the board of several mid-stage development healthcare companies, in addition to Trinity Health, American Healthcare Solutions and Cain Brothers Investment Bankers. Mr. Hays holds a B.A. from the University of Tulsa, and an M.H.A. from the University of Minnesota and also serves as a clinical professor at University of Southern California’s Graduate Health Services Administration Program.

C. Thomas Smith, age 70. Mr. Smith has served as one of our directors since January 2004, and currently serves as the chairman of our nominating and governance committee and as a member of our compensation committee. Mr. Smith retired in 2003 after over 11 years as president and chief executive officer of VHA Inc. Prior to VHA Inc., Mr. Smith spent over 30 years managing hospitals, with nearly half of this time serving as chief executive officer of Yale New Haven Hospital in New Haven, Connecticut. Mr. Smith serves on the boards of directors of Kinetic Concepts, Inc., Information Corporation of America and Advanced ICU Care. Mr. Smith has recently served as a director of Renal Care, Inc., Horizon Health Inc., Neoforma, Inc., Genentech, Inc. and Comp Health Group. Mr. Smith holds a B.A. from Baylor University and an M.B.A. from the University of Chicago.

Director Independence

Each of our non-employee directors qualifies as “independent” in accordance with the published listing requirements of NASDAQ. Dr. Singer and Mr. Taylor do not qualify as independent because they are employees.

The NASDAQ rules have objective tests and a subjective test for determining who is an “independent director.” Under the objective tests, a director cannot be considered independent if he or she:

| | • | | is an employee of the company; or |

| | • | | is a partner in, or an executive officer of, an entity to which the company made, or from which the company received, payments in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenue for that year. |

The subjective test states that an independent director must be a person who lacks a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

None of the non-employee directors was disqualified from “independent” status under the objective tests. In assessing independence under the subjective test, the Board took into account the standards in the objective tests, and reviewed and discussed additional information with regard to each director’s business and personal activities as they may relate to our company and its management. Based on all of the foregoing, as required by NASDAQ rules, the Board made a determination as to each independent director that no relationships exist which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board has not established categorical standards or guidelines to make these subjective determinations, but considers all relevant facts and circumstances.

Meetings of Non-management Directors

Non-management directors meet regularly in executive sessions without management. Executive sessions are held in conjunction with each regularly scheduled meeting of the Board of Directors.

Communications with the Board of Directors

Any interested party who desires to contact the Board of Directors or any member of the Board of Directors may do so by writing to: Board of Directors, c/o Corporate Secretary, IPC The Hospitalist Company, Inc., 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602. Copies of any such written communications received by the Corporate Secretary will be provided to the full Board of Directors or the

6

appropriate member depending on the facts and circumstances described in the communication unless they are considered, in the reasonable judgment of the Corporate Secretary, to be improper for submission to the intended recipient(s).

Meetings

In 2008, our Board of Directors held seven meetings, the audit committee held seven meetings, the compensation committee held five meetings, the nominating and governance committee held six meetings and the quality committee held three meetings. Each of our directors attended at least 75% of the total number of meetings of the Board of Directors and of the committees of the Board of Directors on which they served during 2008, other than Mr. Hays, who attended two of the three Board meetings that were held after he was appointed to the Board.

We encourage, but do not require, our directors to attend the annual meeting of stockholders.

Committees of our Board of Directors

Our Board of Directors has an audit committee, a compensation committee, a nominating and governance committee and a quality committee, each of which has the composition and responsibilities described below.

Audit Committee. The primary purpose of the audit committee is to oversee the integrity of our financial statements, our financial reporting process, the independent accountant’s qualifications and independence, the performance of the independent accountants and our compliance with legal and regulatory requirements on behalf of the Board. In particular, the audit committee is responsible for (1) selecting the independent auditor, (2) overseeing the work of the independent auditor and reviewing the overall scope of the audit, (3) reviewing all relationships between the independent auditor and our company, including non-audit services, in order to determine the independent auditor’s independence, (4) discussing the annual audited and quarterly financial statements with management and the independent auditor, (5) discussing with the management earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies, (6) discussing with management and the independent auditors the adequacy and effectiveness of our accounting and financial controls, including our policies and procedures to assess, monitor and manage business risk, (7) meeting separately, periodically, with management and the independent auditor, (8) reviewing with the independent auditor any audit problems or difficulties and management’s response, (9) establishing procedures for treatment of complaints received by our company or anonymous submissions by employees regarding accounting or auditing matters, (10) preparing a report for the annual proxy statement, (11) handling such other matters that are specifically delegated to the audit committee by the Board of Directors from time to time and (12) reporting regularly to the full Board of Directors.

Our audit committee consists of Mr. Timpe, who serves as chairman of the committee, Mr. Grossman and Mr. Hays. Mr. Hays joined the audit committee on August 14, 2008. Each of the committee members has been determined to be independent, and Mr. Grossman and Mr. Timpe have each been determined to be an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K. Our Board of Directors has adopted a written charter for our audit committee, which can be obtained without charge by contacting our Corporate Secretary at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602, (888) 4IPC-DOC (888-447-2362) or through our website, located atwww.hospitalist.com.

Compensation Committee. Our compensation committee assists our Board of Directors by ensuring that our officers and key executives are compensated in accordance with our total compensation objectives and executive compensation policy. In particular, the compensation committee is responsible for (1) reviewing key employee total compensation policies, plans and programs, (2) evaluating and approving the compensation of our executive officers, (3) reviewing and approving the terms and benefits of the employment contracts and other similar

7

arrangements between IPC and its executive officers, (4) reviewing and consulting with the chief executive officer on the selection of officers and evaluation of executive performance and other related matters, (5) reviewing and recommending stock plans and other incentive compensation plans, and (6) handling such other matters that are specifically delegated to the compensation committee by the Board of Directors from time to time.

Our compensation committee consists of Mr. Brooks, who was appointed to serve as chairman of the committee in June 2008, Dr. Cooper and Mr. Smith. Mr. Smith joined the compensation committee on August 14, 2008. Each of the committee members has been determined to be independent, and each of the members of this committee is also a “nonemployee director” as that term is defined under Rule 16b-3 of the Securities and Exchange Act of 1934 and an “outside director” as that term is defined in Treasury Regulation § 1.162-27(3). Our Board of Directors has adopted a written charter for our compensation committee, which can be obtained without charge by contacting our Corporate Secretary at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602, (888) 4IPC-DOC (888-447-2362) or through our website, located atwww.hospitalist.com.

Nominating and Governance Committee. Our nominating and governance committee assists our Board of Directors by identifying individuals qualified to become members of our Board and to develop our corporate governance principles. This committee’s responsibilities include: (1) evaluating the composition, size and governance of our Board of Directors and its committees and making recommendations regarding future planning and the appointment of directors to our committees, (2) assisting the Board in preliminary review of director independence, (3) recommending Board and Board committee assignments and compensation, (4) approving any employee director or senior executive standing for election for outside for-profit boards of directors, (5) evaluating and recommending candidates for election to our Board of Directors, (6) overseeing the succession planning of the chief executive officer and senior executive officers, (7) overseeing and evaluating our Board of Directors performance and self-evaluation process, (8) reviewing our corporate governance principles, governance-related stockholder proposals, and changes to the charter and bylaws and providing recommendations to the Board of Directors regarding possible changes, (9) reviewing and monitoring compliance with all laws and regulations not under the purview of the audit committee, (10) reviewing claims for indemnification, and (11) handling such other matters that are specifically delegated to the nominating and governance committee by the Board of Directors from time to time.

The nominating and governance committee does not have a specific set of minimum criteria for membership on the Board of Directors. In making its recommendations, however, it considers the mix of characteristics, experience, diverse perspectives and skills that is most beneficial to our company. Our nominating and governance committee will consider nominees for directors recommended by stockholders upon submission in writing in accordance with our bylaws to our Corporate Secretary of the names and qualifications of such nominees at the following address: IPC The Hospitalist Company, Inc., 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602. The committee does not intend to alter the manner in which it evaluates candidates based on whether the candidate was recommended by a stockholder or not.

In February 2009, the nominating and governance committee recommended to the Board of Directors the nominees standing for election at the 2009 annual meeting of stockholders, each of whom is currently serving on our Board of Directors.

Our nominating and governance committee consists of Mr. Smith, who serves as chairman of the committee, Mr. Grossman, and Mr. Hays. Mr. Hays joined the nominating and governance committee on August 14, 2008. Each of the committee members has been determined to be independent. Our Board of Directors has adopted a written charter for our nominating and governance committee, which can be obtained without charge by contacting our Corporate Secretary at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602, (888) 4IPC-DOC (888-447-2362) or through our website, located atwww.hospitalist.com.

8

Quality Committee. Our quality committee was established by the nominating and governance committee and was approved by the Board of Directors on March 19, 2008.The purpose of the quality committee is to oversee clinical quality and physician retention. In particular, the quality committee is responsible for (1) monitoring our performance on established internal and external benchmarking regarding clinical performance and outcomes, (2) overseeing our adoption and implementation of policies and procedures designed to provide that each individual cared for by its Hospitalists receive the appropriate level of care, (3) overseeing our adoption and implementation of a system to allow us to respond to federal, state, internal and external reports of clinical quality of care issues and review periodically whether such system functions adequately, (4) investigate, or ask our legal counsel to investigate, any matter brought to the attention of the quality committee within the scope of its duties, and obtain legal advice for this purpose, if, in its judgment, that is appropriate, (5) overseeing our physician retention and job satisfaction initiatives, (6) handling such other matters that are specifically delegated to the quality committee by the Board of Directors from time to time, and (7) reporting regularly to the full Board of Directors.

Our quality committee consists of Dr. Cooper, who serves as chairman of the committee, Dr. Federico, Dr. Singer, and Mr. Taylor. Dr. Federico joined the quality committee on August 14, 2008. Our Board of Directors has adopted a written charter for our quality committee, which can be obtained without charge by contacting our Corporate Secretary at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602, (888) 4IPC-DOC (888-447-2362) or through our website, located atwww.hospitalist.com.

Board of Directors Share Ownership Guideline

We have a share ownership guideline which applies to all members of our Board of Directors. The purpose of the policy is to encourage our Board of Directors to have an ownership stake in the company by retaining a specified number of shares of our common stock. The guideline is that each Director should retain all net shares obtained upon exercise of stock options and all vested shares of restricted stock up to a market value of three times the annual Board retainer, which at the current annual retainer of $25,000, is $75,000.

Code of Ethics and Code of Conduct

We have a code of ethics that applies to our chief executive officer, president, chief operating officer, chief financial officer, chief development officer, controller and principal accounting officer, and certain other designated employees. We also have a code of conduct that applies to all of our directors, officers and employees. The code of ethics and the code of conduct can be obtained without charge by contacting our Corporate Secretary at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602 or through our web site, located atwww.hospitalist.com.

9

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Independent Registered Public Accounting Firm

The audit committee has appointed Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2009. Representatives of Ernst & Young LLP are expected to attend the annual meeting in person to respond to appropriate questions and to make a statement if they so desire. If Ernst & Young LLP should decline to act or otherwise become incapable of acting, or if Ernst & Young LLP’s engagement is discontinued for any reason, the audit committee will appoint another independent registered public accounting firm to serve as our independent registered public accounting firm for 2009. Although we are not required to seek stockholder ratification of this appointment, the Board of Directors believes that doing so is consistent with corporate governance best practices. If the appointment is not ratified, the audit committee will explore the reasons for stockholder rejection and will reconsider the appointment.

The affirmative vote of a majority of the shares of common stock present at the annual meeting, in person or by proxy and entitled to vote thereon, is required for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2009. Abstentions with respect to this proposal will be treated as votes against the proposal. Broker non-votes with respect to this proposal will not be considered as present and entitled to vote on the proposal, which will therefore reduce the number of affirmative votes needed to approve the proposal.

The following table sets forth the aggregate professional fees billed to the company for the years ended December 31, 2008 and 2007 by Ernst & Young LLP, the company’s independent registered public accounting firm:

| | | | | | |

| | | 2008 | | 2007 |

Audit fees(1) | | $ | 457,659 | | $ | 225,000 |

Audit-related fees(2) | | | 98,218 | | | 661,155 |

Tax fees(3) | | | 283,375 | | | 224,729 |

All other fees | | | — | | | — |

| | | | | | |

| | $ | 839,252 | | $ | 1,110,884 |

| | | | | | |

| (1) | Includes fees for the audit of our consolidated financial statements and, in 2008, the audit of our internal controls over financial reporting and timely quarterly reviews. |

| (2) | Includes fees for professional services rendered in connection with SEC filings, including comfort letters, consents and comment letters. |

| (3) | Includes fees for professional services rendered for tax advice, tax planning, tax compliance, tax preparation services and other tax projects. |

In connection with the audit of our financial statements for fiscal 2008 and 2007, we entered into an agreement with Ernst & Young LLP which sets forth the terms by which Ernst & Young LLP will perform audit services for the company. That agreement is subject to alternative dispute resolution procedures, an exclusion of punitive damages and various other provisions.

Pre-approval Policies and Procedures

The audit committee is required to pre-approve the audit and non-audit services performed by the company’s independent registered public accounting firm in order to assure that the provision of such services does not impair the auditor’s independence. The audit committee pre-approved all such services in 2008 and

10

concluded that such services performed by Ernst & Young LLP were compatible with the maintenance of that firm’s independence in the conduct of its auditing functions.

The Board of Directors recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2009.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the ownership of our common stock as of March 2, 2009 by (a) all persons known by us to own beneficially more than 5% of our common stock, (b) each of our directors and named executive officers, and (c) all of our directors and named executive officers as a group. We know of no agreements among our stockholders which relate to voting or investment power over our common stock or any arrangement the operation of which may at a subsequent date result in a change of control of the company.

| | | | | |

Name and address of beneficial owner(1) | | Number of

shares

beneficially

owned | | Percentage

of shares

beneficially

owned | |

Entities affiliated with Bank of America Corporation(2) | | 1,719,207 | | 10.69 | % |

Morgenthaler Venture Partners IV, L.P.(3) | | 870,943 | | 5.41 | % |

Adam D. Singer, M.D.(4) | | 407,035 | | 2.53 | % |

R. Jeffrey Taylor(5) | | 208,065 | | 1.29 | % |

Devra G. Shapiro(6) | | 169,968 | | 1.06 | % |

Richard G. Russell(7) | | 84,385 | | * | |

Mark J. Brooks(8) | | 10,625 | | * | |

Thomas P. Cooper, M.D.(9) | | 22,099 | | * | |

Francesco Federico, M.D.(10) | | 7,736 | | * | |

Woodrin Grossman(11) | | 11,663 | | * | |

Patrick G. Hays(12) | | 7,392 | | * | |

C. Thomas Smith(13) | | 34,569 | | * | |

Chuck Timpe(14) | | 34,063 | | * | |

All directors and named executive officers as a group (11 persons) | | 997,600 | | 6.20 | % |

| * | Amount represents less than 1% of our common stock. |

| (1) | Unless otherwise set forth in the footnotes to the table above, the address of each beneficial owner is 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602. |

| (2) | The securities are held of record by Bank of America Corporation, or BAC, and its affiliates, including Bank of America Ventures, or BAV, and BankAmerica Investment Corporation, or BAIC. Under the terms of a management agreement between Scale Management LLC, or Scale, and BAC, Scale manages the investment of our securities that are held by BAV and BAIC and therefore may be deemed to have beneficial ownership of the securities held by BAV and BAIC. Mark J. Brooks, one of our directors, is a manager of Scale. Based upon information contained in a Schedule 13G filed with the SEC on February 11, 2009, the reported amounts include: (a) 1,318,535 shares of common stock beneficially owned by BAV, (b) 232,682 shares of common stock beneficially owned by BAIC, (c) 115,858 shares of common stock beneficially owned by Columbia Management Advisors, LLC, (d) 22 shares of common stock beneficially owned by Bank of America Securities LLC, (e) 41,485 shares of common stock beneficially owned by Banc of America Investment Advisors, Inc. and (f) 10,625 shares of common stock issuable upon exercise of stock options held by Mr. Brooks that were exercisable as of March 2, 2009 or within 60 days of such date. Mr. Brooks disclaims beneficial ownership of the securities held of record by BAV and BAIC except to the extent of his pecuniary interest therein, and as described in note (8), Mr. Brooks disclaims beneficial ownership of the shares issuable upon exercise of the stock options currently held by Mr. Brooks. BAC, as the parent of BAV and BAIC, may also be deemed to have voting and dispositive power over the shares held by BAV and BAIC as a result of certain approval rights with respect to such shares. The address of Scale, BAV and BAIC is 950 Tower Lane, Suite 700, Foster City, CA 94404, Attn: Mark J. Brooks. The address of BAC is Bank of America Corporate Center, 100 North Tryon Street, Floor 25, Charlotte, NC 28255. |

| (3) | The address for Morgenthaler Venture Partners IV, L.P., or MVP IV, is Attn: Robin Bellas, 50 Public Square, Suite 2700, Cleveland, OH 44113. Based upon information contained in a Schedule 13G filed with |

12

| | the SEC on February 9, 2009, the amount includes 870,943 shares of common stock held by MVP IV. In the case of MVP IV, the voting and disposition of the shares is determined by Morgenthaler Management Partners IV, L.P., which is the managing general partner of MVP IV. David T. Morgenthaler, Robert C. Bellas, Jr., John D. Lutsi, Gary J. Morgenthaler and Robert D. Pavey are the general partners of Morgenthaler Management Partners IV, L.P. and share voting and investment control over the shares held by MVP IV. Each general partner disclaims beneficial ownership of these shares, except to the extent of his or her pecuniary interest therein. |

| (4) | Amounts include (a) 276,500 shares of common stock held by ADS-IPC LLC of which Adam D. Singer, M.D. is the sole member, (b) 30,101 shares of common stock held by IPC Living Trust of which Adam D. Singer, M.D. is the sole beneficiary and sole trustee, (c) 30,006 shares of common stock held by Emerald Isle Trust of which Adam D. Singer, M.D. is trustee, (d) 30,006 shares of common stock held by Whitehall Trust of which Adam D. Singer, M.D. is trustee, and (e) 40,422 shares beneficially owned by Adam D. Singer, M.D. which may be purchased upon exercise of stock options that were exercisable as of March 2, 2009 or within 60 days after such date. |

| (5) | Amounts include 49,507 shares beneficially owned by R. Jeffrey Taylor, which may be purchased upon exercise of stock options that were exercisable as of March 2, 2009 or within 60 days after such date. |

| (6) | Amounts include (a) 138,512 shares of common stock held by The Alan and Devra Shapiro Trust dated June 9, 2003 of which Devra G. Shapiro is trustee and (b) 31,456 shares beneficially owned by Devra G. Shapiro which may be purchased upon exercise of stock options that were exercisable as of March 2, 2009 or within 60 days after such date. |

| (7) | Amounts include 18,106 shares beneficially owned by Richard G. Russell which may be purchased upon exercise of stock options that were exercisable as of March 2, 2009 or within 60 days after such date. |

| (8) | Amounts include 10,625 shares beneficially owned by Mark J. Brooks which may be purchased upon exercise of stock options that were exercisable as of March 2, 2009 or within 60 days after such date. Pursuant to policies of Scale and BAV, Mr. Brooks is obligated to transfer ownership of any such shares issued upon exercise to BAV. Mr. Brooks disclaims beneficial ownership of such shares that may be purchased upon exercise of stock options except to the extent of his pecuniary interest therein. |

| (9) | Amounts include (a) 20,537 shares beneficially owned by Thomas P. Cooper, M.D., which may be purchased upon exercise of stock options that were exercisable as of March 2, 2009 or within 60 days after such date and (b) 1,562 shares beneficially owned by Thomas P. Cooper, M.D., the receipt of which has been deferred by Thomas P. Cooper, M.D. in accordance with the Non-Employee Director Retainer Conversion Program of our 2007 Equity Participation Plan. |

| (10) | Amounts include 7,736 shares beneficially owned by Francesco Federico, M.D., which may be purchased upon exercise of stock options that were exercisable as of March 2, 2009 or within 60 days after such date. |

| (11) | Amounts include (a) 10,351 shares beneficially owned by Woodrin Grossman, which may be purchased upon exercise of stock options that were exercisable as of March 2, 2009 or within 60 days after such date and (b) 1,312 shares beneficially owned by Woodrin Grossman, the receipt of which has been deferred by Woodrin Grossman in accordance with the Non-Employee Director Retainer Conversion Program of our 2007 Equity Participation Plan. |

| (12) | Amounts include (a) 6,457 shares beneficially owned by Patrick G. Hays, which may be purchased upon exercise of stock options that were exercisable as of March 2, 2009 or within 60 days after such date and (b) 935 shares beneficially owned by Patrick G. Hays, the receipt of which has been deferred by Patrick G. Hays in accordance with the Non-Employee Director Retainer Conversion Program of our 2007 Equity Participation Plan. |

| (13) | Amounts include (a) 23,535 shares of common stock held by TMS Family Investments, Ltd., a limited partnership, (b) 10,528 shares beneficially owned by C. Thomas Smith, which may be purchased upon exercise of stock options that were exercisable as of March 2, 2009 or within 60 days after such date, and (c) 506 shares beneficially owned by C. Thomas Smith, the receipt of which has been deferred by C. Thomas Smith in accordance with the Non-Employee Director Retainer Conversion Program of our 2007 Equity Participation Plan. |

| (14) | Amounts include 6,369 shares beneficially owned by Chuck Timpe, which may be purchased upon exercise of stock options that were exercisable as of March 2, 2009 or within 60 days after such date. |

13

Information Concerning our Executive Officers

| | | | |

Name | | Age | | Position |

Adam D. Singer, M.D. | | 48 | | Chairman of the Board, Chief Executive Officer, Chief Medical Officer |

R. Jeffrey Taylor | | 60 | | President, Chief Operating Officer and Director |

Devra G. Shapiro | | 62 | | Chief Financial Officer and Corporate Secretary |

Richard G. Russell | | 49 | | Executive Vice President and Chief Development Officer |

Our executive officers are elected by, and serve at the discretion of, our Board of Directors. Set forth below is a brief description of the business experience of all executive officers other than Dr. Singer and Mr. Taylor, who are also directors and whose business experience is set forth above in the sections of this proxy statement entitled “Information Concerning our Directors Nominated for Election” and “Information Concerning our Other Directors.”

Devra G. Shapiro has been our Chief Financial Officer since she joined IPC in March 1998. Prior to joining our company, Ms. Shapiro served as chief financial officer for several start-up healthcare enterprises. From 1985 to 1990, Ms. Shapiro held executive financial positions with EPIC Healthcare Group and American Medical International, Inc. (now Tenet Healthcare Corp.; THC—NYSE). From 1974 to 1984, Ms. Shapiro specialized in healthcare with the public accounting firm of Arthur Andersen & Co. Ms. Shapiro received a B.A. and a Bachelor of Accountancy from the University of Houston. Ms. Shapiro has over 30 years experience as a financial executive and certified public accountant with a background in working with healthcare organizations.

Richard G. Russell has been our Executive Vice President and Chief Development Officer since he joined IPC in March 2003. Prior to joining our company, Mr. Russell was senior vice president of information technology and business planning for Cogent Healthcare, Inc., another national hospitalist organization, from 2002 to March 2003. Mr. Russell began his career as a senior consultant with McKinsey & Company and then held executive level positions in several entrepreneurial and healthcare operating companies. Mr. Russell received a B.S. in chemical engineering from the Case Western Reserve University and an M.B.A. from Harvard Business School and has 20 years experience in health care services.

None of our executive officers has any family relationship with any other executive officer or with any of our directors.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, and persons who beneficially own more than 10% of our outstanding common stock, to file with the SEC, initial reports of ownership and reports of changes in ownership of our equity securities. Such persons are required by SEC regulations to furnish us with copies of all such reports they file. To our knowledge, based solely on our review of the copies of such forms received by us, or written representations from our officers, directors and greater than 10% beneficial owners, we believe that our insiders complied with all applicable Section 16(a) filing requirements during 2008.

14

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information about our common stock that may be issued upon the exercise of options, warrants and rights under all of our existing equity compensation plans and agreements as of December 31, 2008, including our 1997 Equity Participation Plan, 2002 Equity Participation Plan, and 2007 Equity Participation Plan. The material terms of each of these plans and agreements are described in the notes to the December 31, 2008 consolidated financial statements, which are part of our Annual Report on Form 10-K for the year ended December 31, 2008, as filed with the SEC on March 2, 2009. Each of these plans was approved by our stockholders.

| | | | | | | | | |

Plan category | | Number of shares to be

issued upon exercise of

outstanding options,

warrants and rights | | Weighted average

exercise price of

outstanding options,

warrants and rights | | Number of shares remaining

available for future issuance

under equity compensation

plans (excluding securities

reflected in column (a)) | | Total of shares

reflected in columns

(a) and (c) |

| | (a) | | (b) | | (c) | | (d) |

Equity compensation plans approved by stockholders | | 678,432 | | $ | 10.71 | | 188,675 | | 867,107 |

Equity compensation plans not requiring stockholder approval | | — | | | — | | — | | — |

| | | | | | | | | |

Total | | 678,432 | | $ | 10.71 | | 188,675 | | 867,107 |

| | | | | | | | | |

As of December 31, 2008, there were 678,432 stock options outstanding with a weighted average exercise price of $10.71 and a weighted average remaining term of 8.3 years under the company’s equity compensation plans and there were 188,675 shares remaining to be awarded under our equity compensation plans.

COMPENSATION DISCUSSION AND ANALYSIS

Our compensation policy is designed to support the overall objective of maximizing long-term stockholder value by aligning the interests of executives with the interests of stockholders and rewarding executives for achieving corporate and individual objectives as established by our compensation committee. The executive compensation program is also designed to provide compensation opportunities that attract and retain the services of qualified executives in a highly competitive marketplace. For fiscal year 2008, our executive compensation program was comprised of three principal components: base salary, cash bonus incentives and long-term incentive opportunities through stock option grants.

Our Executive Compensation Philosophies and Policies

The compensation committee of the Board of Directors, composed entirely of independent directors, administers the company’s executive compensation program. The compensation committee is responsible for defining a total compensation policy that supports the organization’s overall business strategy and objectives, attracts and retains key executives, links total compensation with business objectives and organizational performance and provides competitive total compensation opportunities at a reasonable cost while enhancing stockholder value creation.

15

In February 2008 after the completion of our initial public offering, the compensation committee engaged an independent compensation consultant, Steven Hall & Partners (“Steven Hall”), to complete a market review of publicly traded companies of similar revenue size to serve as benchmark information for their compensation deliberations. The companies included in the market review were:

| | |

American Dental Partners, Inc. | | Medical Staffing Network Holdings, Inc. |

Athenahealth, Inc. | | Nighthawk Radiology Holdings, Inc. |

Continue Care Corporation | | Odyssey HealthCare, Inc. |

CorVel Corporation | | U.S. Physician Therapy, Inc. |

I-trax, Inc | | Virtual Radiologic Corporation |

Matria Healthcare, Inc. | | VistaCare, Inc. |

Base Salary

Base salary levels for the chief executive officer and the other executive officers are generally intended to compensate executives at salary levels comparable to the median of the appropriate competitive benchmarks described above. Base salaries are determined on an individual basis by evaluating each executive’s scope of responsibility, past performance and prior experience to determine prevailing compensation levels in relevant markets for executive talent. After our successful initial public offering in early 2008, the compensation committee recommended to our Board of Directors that the base salaries of the named executive officers be migrated to the median of the peer group of publicly traded companies developed by Steven Hall as described above. Base salaries for executives are reviewed annually by the compensation committee and if appropriate, the compensation committee recommends adjustments to the Board for determination. The base salaries paid to the chief executive officer and the executive officers in fiscal 2008 are set forth in the “Salary” column of the Summary Compensation Table.

Performance-Based Bonus

Performance bonuses tied to our operating results are a component of our executive compensation and are designed to motivate the executive to focus on our annual revenue and profitability, which we believe should improve long-term stockholder value over time. Our named executive officers are eligible to receive cash bonus incentive payments based upon the achievement of certain company goals and may also be awarded discretionary bonuses tied to individual performance, as determined by the compensation committee.

At the beginning of 2008, the compensation committee established performance objectives for the payment of cash bonus incentive payments for executive officers. Performance objectives were based on (1) the attainment of a pre-established target of adjusted earnings before interest, tax, depreciation and amortization, or adjusted EBITDA of $23.4 million, (2) the attainment of a pre-established target of revenue of $230.7 million and (3) the attainment of a quality goal based on establishing clinical quality metrics. The compensation committee adopted these targets because they encouraged continued growth in our top line while also rewarding the management of operating costs to deliver adjusted EBITDA at a level to increase overall stockholder value while continuing to deliver high quality patient care.

The compensation committee established a target percentage of base salary for the achievement of the objectives. Twenty-five percent of the bonus target was tied to the revenue goal, sixty-five percent was tied to the adjusted EBITDA goal and ten percent was tied to the quality goal. For Dr. Singer the bonus percentage of base salary target for achievement of 100% of the objectives was 70%. For Messrs. Taylor and Russell and Ms. Shapiro, the target percentage of base salary was 65%, 55% and 60%, respectively, for achievement of 100% of the objectives. The award for each named executive officer decreased by 5% for each percentage point below the target and increased 1% for each percentage point above the target with a maximum bonus of 150% of target.

The compensation committee set the target percentages of base salary for bonus purposes for Dr. Singer and Mr. Taylor generally at the median target bonus percentages of salary of the peer group identified in the study by

16

Steven Hall for Dr. Singer and Mr. Taylor. For Ms. Shapiro and Mr. Russell, the compensation committee set the target percentage of base salary based on a proportional percentage of Dr. Singer’s and Mr. Taylor’s targeted percentage to recognize their respective level of scope of responsibility with the company.

The following table is illustrative of potential awards to our executive officers of between 0% and 150% of their target bonus for 2008, assuming the quality target is met in all cases:

| | | | | | | | | | | | | | | | |

Achievement of Revenue and Adjusted EBITDA Objectives | | Percent of

Base Salary

and Dollar

Amount | | | Percent of

Base Salary

and Dollar

Amount | | | Percent of

Base Salary

and Dollar

Amount | | | Percent of

Base Salary

and Dollar

Amount | |

| | Singer | | | Taylor | | | Shapiro | | | Russell | |

150% of Objective | | | 101.5 | % | | | 94.3 | % | | | 87.0 | % | | | 79.8 | % |

| | $ | 454,720 | | | $ | 282,750 | | | $ | 226,200 | | | $ | 191,400 | |

| | | | |

125% | | | 85.8 | % | | | 79.6 | % | | | 73.5 | % | | | 67.4 | % |

| | $ | 384,160 | | | $ | 238,875 | | | $ | 191,100 | | | $ | 161,700 | |

| | | | |

110% | | | 76.3 | % | | | 70.9 | % | | | 65.4 | % | | | 60.0 | % |

| | $ | 341,824 | | | $ | 212,550 | | | $ | 170,040 | | | $ | 143,880 | |

| | | | |

100% | | | 70.0 | % | | | 65 .0 | % | | | 60.0 | % | | | 55.0 | % |

| | $ | 313,600 | | | $ | 195,000 | | | $ | 156,000 | | | $ | 132,000 | |

| | | | |

90% | | | 38.5 | % | | | 35.8 | % | | | 33.0 | % | | | 30.3 | % |

| | $ | 172,480 | | | $ | 107,250 | | | $ | 85,800 | | | $ | 72,600 | |

| | | | |

80% | | | 7.0 | % | | | 6.5 | % | | | 6.0 | % | | | 5.5 | % |

| | $ | 31,360 | | | $ | 19,500 | | | $ | 15,600 | | | $ | 13,200 | |

For fiscal 2008, the revenue goal was achieved at 109% of objective, the adjusted EBITDA goal was achieved at the 115% of objective and the quality goal was achieved at the 100% of objective. The cash bonus incentive payments made to the chief executive officer and to the other named executive officers for fiscal 2008 based upon the achievement of objectives at such percentage levels are set forth in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table.

Additionally, the compensation committee has the authority to grant a discretionary bonus to each executive officer for exceptional performance based upon additional factors, such as the number of acquisitions successfully completed, physician turnover reduced, enhancements to the information technology platform completed, new markets entered, new physicians hired, cash flow targets achieved and major projects such as system conversions completed. While the compensation committee believes that such factors will directly impact adjusted EBITDA and revenue growth, it has retained the discretion to award additional bonuses for satisfying such individual factors. Our Board of Directors granted a fiscal 2008 discretionary bonus in the amount of $250,000 to Dr. Singer upon the closing of our initial public offering on January 30, 2008, which amount is set forth in the “Bonus” column of the Summary Compensation Table. No other discretionary bonuses were granted for fiscal 2008.

Long-Term Equity Incentives

We believe that an ownership culture in our company is important to provide our executive officers with incentives to build value for our stockholders. We believe stock-based awards create such a culture and help to align the interests of our management and employees with the interests of our stockholders.

In furtherance of that goal, we have adopted the IPC The Hospitalist Company, Inc. 2007 Equity Participation Plan, which provides additional award availability to supplement the 1997 Equity Participation Plan and the 2002 Equity Participation Plan. The principal purpose of these plans is to attract, retain and motivate selected employees and directors through the granting of stock-based compensation awards. On an annual basis, our compensation committee awards options based on the peer group data developed by our compensation consultant, as described above. The determination of the mix of cash and equity compensation is refined over

17

time by the compensation committee. Additionally, in the future, our compensation committee and Board of Directors may consider awarding additional or alternative forms of equity incentives, such as grants of restricted stock, restricted stock units or other performance-based awards. The compensation committee intends to seek input from its independent compensation consultant concerning the mix of cash and equity compensation, as well as the type of equity awards to be granted in the future.

In 2008, the compensation committee, after reviewing the security ownership levels of named executive officers of the peer group of companies as described above, determined that additional grants were appropriate to bring our executives to the median of the peer group. Such grants awarded to the chief executive officer and the executive officers in fiscal 2008 are set forth in the “2008 Grants of Stock-Based Awards” table.

Benefits and Perquisites

Each of our named executive officers participates in the health and welfare benefit plans and fringe benefit programs generally available to all of our employees. Our Chief Executive Officer also receives the additional benefits reflected in the Summary Compensation Table under “All Other Compensation” and more fully described in footnote (4) thereto.

Severance and Change in Control Policy

In January 2008, we adopted an Executive Change in Control Plan for our named executive officers to reduce the need to negotiate individual severance agreements with departing executives in connection with a change in control of the company. Please see the description under “Executive Compensation—Potential Payments Upon Termination or Change in Control.” The employment agreements for the named executives provide for severance in various situations as described in “Executive Compensation—Potential Payments Upon Termination or Change in Control.”

18

EXECUTIVE COMPENSATION

The following table sets forth information regarding compensation earned by our chief executive officer, our president and chief operating officer, our chief financial officer, and our executive vice president and chief development officer during the fiscal years ended December 31, 2008, 2007 and 2006. We refer to these executive officers as our “named executive officers” elsewhere in this Proxy Statement.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary($) | | Bonus

($)(1) | | Option

Awards

($)(2) | | Non-Equity

Incentive Plan

Compensation

($)(3) | | All Other

Compensation

($) | | | Total

($) |

Adam D. Singer, M.D. | | 2008 | | $ | 444,294 | | $ | 250,000 | | $ | 64,782 | | $ | 350,185 | | $ | 31,877 | (4) | | $ | 1,141,438 |

Chief Executive Officer | | 2007 | | $ | 357,262 | | $ | 60,000 | | $ | 3,975 | | $ | 259,038 | | $ | 76,505 | | | $ | 756,780 |

and Chief Medical Officer | | 2006 | | $ | 340,000 | | $ | 100,000 | | $ | 539 | | $ | 32,300 | | $ | 72,595 | | | $ | 545,434 |

| | | | | | | |

Devra G. Shapiro | | 2008 | | $ | 258,289 | | $ | — | | $ | 81,024 | | $ | 174,199 | | $ | 15,331 | (5) | | $ | 528,843 |

Chief Financial Officer | | 2007 | | $ | 217,946 | | $ | 47,500 | | $ | 7,948 | | $ | 126,244 | | $ | 9,094 | | | $ | 408,732 |

| | 2006 | | $ | 209,100 | | $ | 50,000 | | $ | 539 | | $ | 15,892 | | $ | 9,223 | | | $ | 284,754 |

| | | | | | | |

R. Jeffrey Taylor | | 2008 | | $ | 298,863 | | $ | — | | $ | 96,690 | | $ | 217,749 | | $ | 19,253 | (6) | | $ | 632,555 |

President and Chief Operating Officer | | 2007 | | $ | 271,104 | | $ | 50,000 | | $ | 9,936 | | $ | 157,035 | | $ | 16,545 | | | $ | 504,620 |

| | 2006 | | $ | 260,100 | | $ | 50,000 | | $ | 539 | | $ | 19,768 | | $ | 17,795 | | | $ | 348,202 |

| | | | | | | |

Richard Russell | | 2008 | | $ | 238,562 | | $ | — | | $ | 58,952 | | $ | 147,399 | | $ | 13,939 | (7) | | $ | 458,852 |

Executive Vice President | | 2007 | | $ | 205,077 | | $ | 45,000 | | $ | 6,956 | | $ | 118,450 | | $ | 11,943 | | | $ | 387,426 |

and Chief Development Officer | | 2006 | | $ | 198,689 | | $ | 30,000 | | $ | 1,347 | | $ | 15,000 | | $ | 11,545 | | | $ | 256,781 |

| (1) | Amount reflects discretionary bonuses paid to the named executive officers during 2008, 2007 and 2006. |

| (2) | Amount reflects the expensed fair value of stock options recognized in 2008, 2007 and 2006 calculated in accordance with SFAS No. 123(R). See Note 6 of the “Notes to Consolidated Financial Statements—Stock-Based Compensation��� in our Annual Report on Form 10-K for the year ended December 31, 2008, as filed with the SEC on March 2, 2009, for a discussion of assumptions made in determining the compensation expense of our stock options for years ended December 31, 2008, 2007 and 2006. |

| (3) | The 2008, 2007 and 2006 amounts were awarded under the senior executive bonus plan. |

| (4) | Includes (a) Company 401(k) match of $7,750 and (b) health & welfare insurance of $6,896 and (c) vacation paid in lieu of time-off of $17,231 permitted pursuant to the terms of Dr. Singer’s employment agreement. |

| (5) | Includes (a) Company 401(k) match of $8,050 and (b) health & welfare insurance of $7,280 permitted pursuant to the terms of Ms. Shapiro’s employment agreement. |

| (6) | Includes (a) Company 401(k) match of $8,050, (b) health & welfare insurance of $9,581 permitted pursuant to the terms of Mr. Taylor’s employment agreement and (c) fair value of $1,622 for shares purchased through Company’s Non-Qualified Employee Stock Purchase Plan in 2008 which is calculated in accordance with SFAS No. 123(R). |

| (7) | Includes (a) Company 401(k) match of $7,750 and (b) health & welfare insurance of $4,567 permitted pursuant to the terms of Mr. Russell’s employment agreement and (c) fair value of $1,622 for shares purchased through Company’s Non-Qualified Employee Stock Purchase Plan in 2008 which is calculated in accordance with SFAS No. 123(R). |

19

Grants of Plan-Based Awards

Set forth below is information regarding awards granted to our named executive officers during 2008. All equity grants were made under our 2007 Equity Participation Plan:

2008 Grants of Plan-Based Awards

| | | | | | | | | | | | | | | | | | | |

Name | | Grant Date | | Estimated Future Potential Payouts Under

Non-Equity Incentive Plan Awards(1) | | All Other

Option

Awards:

Number of

Securities

Underlying

Options

(#) | | Exercise

Base

Price

of Option

Awards

($/share) | | Grant Date

Fair Value

of Option

Awards(2) |

| | | Threshold

$ | | Target

$ | | Maximum

$ | | | |

Adam D. Singer, M.D. | | | | $ | 31,360 | | $ | 313,600 | | $ | 454,720 | | | | | | | | |

Chief Executive Officer and Chairman of the Board | | 3/19/2008 | | | | | | | | | | | 40,000 | | $ | 17.54 | | $ | 278,770 |

| | | | | | | |

Devra G. Shapiro | | | | $ | 15,600 | | $ | 156,000 | | $ | 226,200 | | | | | | | | |

Chief Financial Officer | | 3/19/2008 | | | | | | | | | | | 45,000 | | $ | 17.54 | | $ | 313,616 |

| | | | | | | |

R. Jeffrey Taylor | | | | $ | 19,500 | | $ | 195,000 | | $ | 282,750 | | | | | | | | |

President and Chief Operating Officer | | 3/19/2008 | | | | | | | | | | | 53,000 | | $ | 17.54 | | $ | 369,369 |

| | | | | | | |

Richard Russell | | | | $ | 13,200 | | $ | 132,000 | | $ | 191,400 | | | | | | | | |

Executive Vice President and Chief Development Officer | | 3/19/2008 | | | | | | | | | | | 30,000 | | $ | 17.54 | | $ | 209,077 |

| (1) | Represents threshold, target and maximum payout levels under our annual cash incentive program for performance during the year ended December 31, 2008. See “Compensation Discussion and Analysis— Components of our Executive Compensation Program—Performance-Based Bonus” for a description of the program. For amounts actually paid out under the plan see “Summary Compensation Table” under the column titled “Non-Equity Incentive Plan Compensation.” |

| (2) | Valuation of these options is based on the dollar amount of share-based compensation that would be recognized for financial statement reporting purposes pursuant to SFAS 123(R) over the entire term of these options, except that such amounts do not reflect an estimate of forfeitures related to service-based vesting conditions. |

Narrative to Summary Compensation Table and Grants of Plan Based Awards

Awards

At the beginning of 2008, the compensation committee established potential bonuses for Dr. Singer, Ms. Shapiro, Mr. Taylor and Mr. Russell under our performance-based bonus plan. The payout formula was 25% tied to a revenue target, 65% to an adjusted EBITDA target and 10% to a quality target. Based on the company’s 2008 performance relative to its financial and quality targets, as described in “Compensation Discussion and Analysis—Performance-Based Bonus” and the individual performance of each executive, Dr. Singer, Ms. Shapiro, Mr. Taylor and Mr. Russell were awarded annual cash incentive payments under our performance-based bonus plan as reflected in the Summary Compensation Table under “Non-Equity Incentive Plan Compensation.”

On March 19, 2008, grants of options were made under the 2007 Equity Participation Plan to Dr. Singer, Ms. Shapiro, Mr. Taylor and Mr. Russell in the amounts of 40,000, 45,000, 53,000 and 30,000, respectively. All options were granted at an exercise price of $17.54 per share, which is equal to the closing price for our common stock on the NASDAQ Global Market on the date of grant. The shares vest 25% on the first anniversary of the date of grant and the balance vest ratably over the next thirty-six months.

20

Employment Agreements

We have entered into employment agreements with our named executive officers which include the specific terms set forth below.

Adam D. Singer, M.D.In January 2008, we entered into an amended and restated employment agreement with Dr. Singer, pursuant to which he agreed to continue to serve as our Chief Executive Officer and Chief Medical Officer. The employment agreement specifies that Dr. Singer’s employment with us is for a term of three years with automatic renewal for one year periods, unless either party provides 30 days prior written notice of its intention not to renew. Effective January 2008, Dr. Singer’s annual base salary was set at $448,000 and may be increased subject to annual review by the compensation committee. He is eligible to receive an annual bonus based upon performance targets, as determined by the compensation committee of our Board of Directors in accordance with the 2007 Equity Participation Plan. We maintain Dr. Singer’s professional liability insurance. He also receives 20 days of paid vacation and Dr. Singer is eligible to participate in various welfare and benefit plans generally in accordance with their terms.

Devra G. Shapiro. In January 2008, we entered into an amended and restated employment agreement with Ms. Shapiro, pursuant to which she agreed to continue to serve as our Chief Financial Officer. This employment agreement specifies that Ms. Shapiro’s employment with us is for a term of one year with automatic renewal for one year periods, unless either party provides 90 days prior written notice of its intention not to renew. Effective January 2008, Ms. Shapiro’s annual base salary was set at $260,000 and may be increased subject to annual review by the compensation committee. She is eligible to receive an annual bonus based on performance targets as determined by the compensation committee of our Board of Directors in accordance with the 2007 Equity Participation Plan.

R. Jeffrey Taylor. In January 2008, we entered into an amended and restated employment agreement with Mr. Taylor, pursuant to which he agreed to continue to serve as our President and Chief Operating Officer. The employment agreement specifies that Mr. Taylor’s employment with us is for a term of one year with automatic renewal for one year periods, unless either party provides 90 days prior written notice of its intention not to renew. Effective January 2008, Mr. Taylor’s annual base salary was set at $300,000 and may be increased subject to annual review by the compensation committee. He is eligible to receive an annual bonus based upon performance targets as determined by the compensation committee of our Board of Directors in accordance with the 2007 Equity Participation Plan.

Richard G. Russell. In January 2008, we entered into an amended and restated employment agreement with Mr. Russell, pursuant to which he agreed to serve as our Executive Vice President and Chief Development Officer. This employment agreement specifies that Mr. Russell’s employment with us is for a term of one year with automatic renewal for one year periods, unless either party provides 90 days prior written notice of its intention not to renew. Effective January 2008, Mr. Russell’s annual base salary was set at $240,000 and may be increased subject to annual review by the compensation committee. He is eligible to receive an annual bonus based on performance targets, as determined by the compensation committee of our Board of Directors in accordance with the 2007 Equity Participation Plan.

In addition, each named executive is entitled to reimbursement for all reasonable business and travel expenses, is eligible to receive 20 days of paid vacation annually, and is eligible to participate in our retirement, welfare and benefit plans and programs generally in accordance with their terms.

21

The following table summarizes the outstanding equity awards held by each of our named executive officers as of December 31, 2008: