UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the registrant x Filed by a party other than the registrant ¨

Check the appropriate box:

| | | | |

| x | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material pursuant to §240.14a-12 |

|

IPC The Hospitalist Company, Inc. |

| (Name of Registrant as Specified in its Charter) |

|

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

|

| Payment of filing fee (Check the appropriate box): |

| |

| x | | No fee required |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined.): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials: |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | | | |

| | (2) | | Form, schedule, or registration statement no.: |

| | | | |

| | (3) | | Filing party: |

| | | | |

| | (4) | | Date filed: |

| | | | |

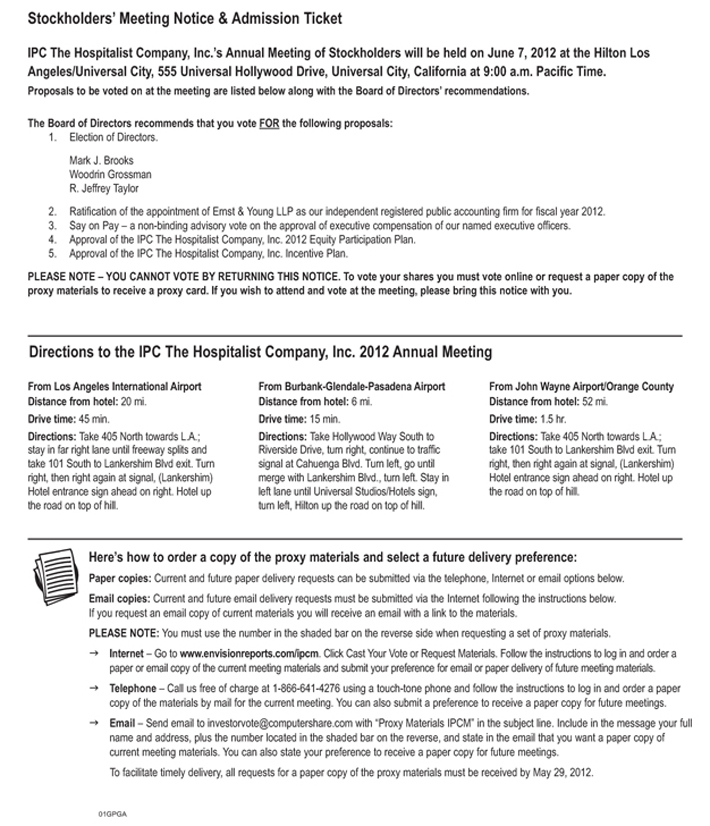

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 7, 2012

TO OUR STOCKHOLDERS:

We will hold our 2012 annual meeting of the stockholders of IPC The Hospitalist Company, Inc., a Delaware corporation, on Thursday, June 7 at 9:00 a.m., Pacific Time, at the Hilton Los Angeles/Universal City, 555 Universal Hollywood Drive, Universal City, California, for the following purposes, which are further described in the accompanying proxy statement:

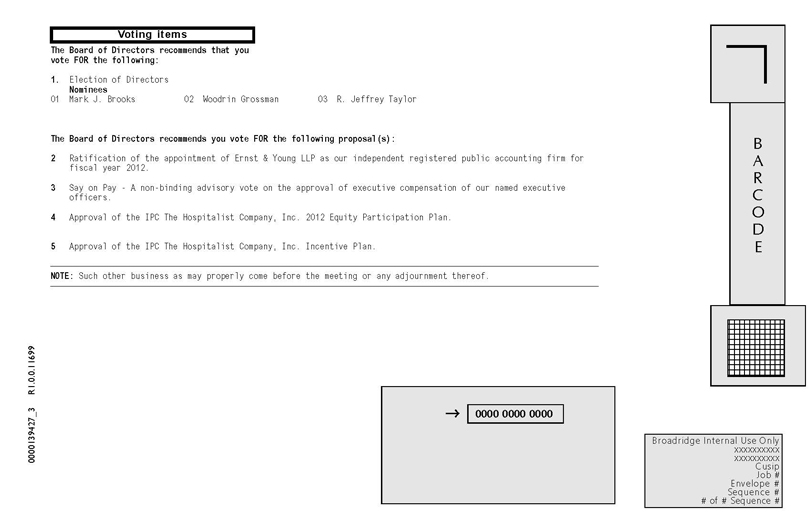

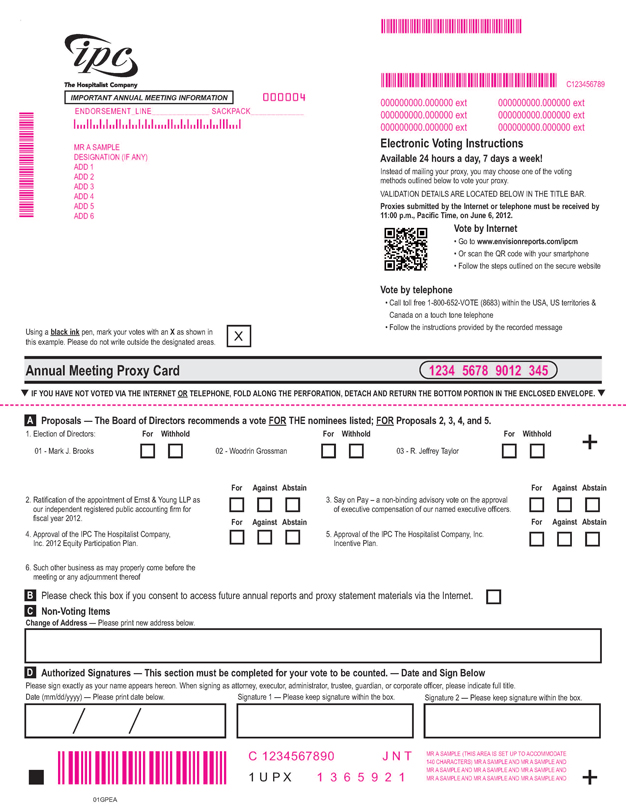

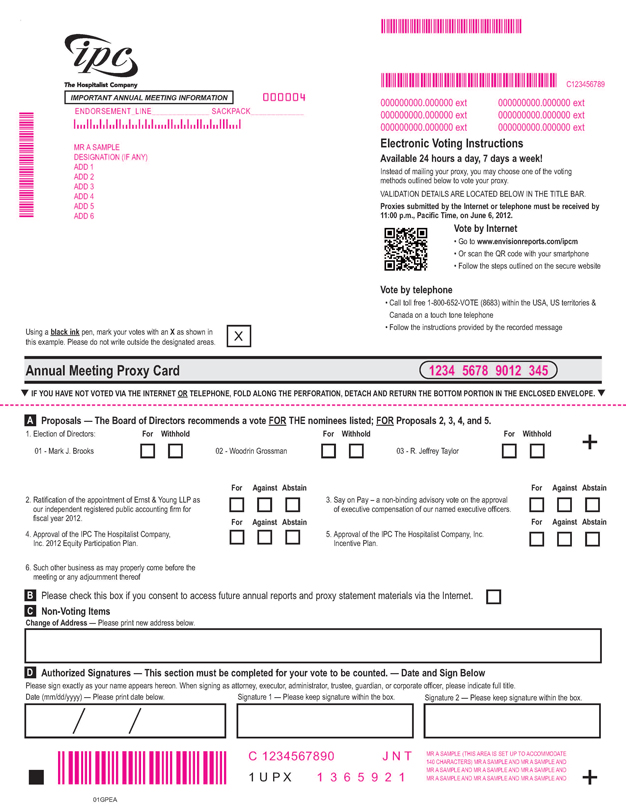

| | (1) | To elect three Class II Directors to our Board of Directors to serve for a term of three years or until their successors are duly elected and qualified; |

| | (2) | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2012; |

| | (3) | To hold a non-binding advisory vote on executive compensation; |

| | (4) | To approve IPC The Hospitalist Company, Inc. 2012 Equity Participation Plan; |

| | (5) | To approve IPC The Hospitalist Company, Inc. Incentive Plan; and |

| | (6) | To transact other business as may properly come before the annual meeting or any adjournment thereof. |

Our Board of Directors has fixed the close of business on April 9, 2012 as the record date for the determination of stockholders entitled to vote at the meeting or any meetings held upon adjournment of the meeting. Only record holders of our common stock at the close of business on that day will be entitled to vote.

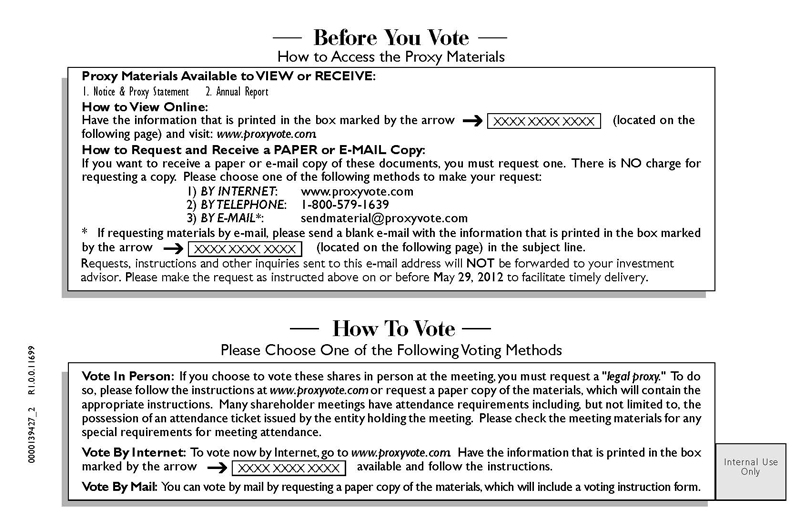

In accordance with rules and regulations adopted by the Securities and Exchange Commission, we are now providing access to our proxy materials over the Internet. Accordingly, we will mail, on or before April 27, 2012 a Notice of Internet Availability of Proxy Materials to our stockholders of record and beneficial owners as of the close of business on March 30, 2012. On the date of mailing of the Notice of Internet Availability of Proxy Materials, all stockholders and beneficial owners will have the ability to access the proxy materials on a website referred to and at the URL address included in the Notice of Internet Availability of Proxy Materials. These proxy materials will be available free of charge. You will not receive such Notice in the mail if you previously permanently elected to receive a printed copy of the proxy materials.

The Notice of Internet Availability of Proxy Materials will also identify the date, time and location of the annual meeting; the matters to be acted upon at the meeting and the Board of Directors’ recommendation with regard to each matter; an e-mail address and a website where stockholders can request a paper or e-mail copy of our proxy statement, our annual report to stockholders and a form of proxy relating to the annual meeting; information on how to access the form of proxy; and information on how to obtain directions to attend the meeting and vote in person.

We invite you to attend the meeting and vote in person.If you cannot attend, to ensure that you are represented at the meeting, please vote, at your earliest convenience, using the telephone or Internet or request a proxy card to complete, sign and date and return by mail, in the postage prepaid envelope provided.If you attend the meeting, you may vote in person, even if you previously used the telephone or Internet voting systems or returned a signed proxy.

Please note that all votes cast via telephone or the Internet must be cast prior to11:00 p.m., Pacific Time on Wednesday, June 6, 2012.

|

| By order of the Board of Directors, |

|

|

|

Adam D. Singer, M.D. Chief Executive Officer |

North Hollywood, California

April 23, 2012

PROXY STATEMENT

GENERAL INFORMATION

Our Board of Directors is soliciting proxies from our stockholders in connection with our 2012 annual meeting of stockholders, to be held on Thursday, June 7 at 9:00 a.m., Pacific Time, at the Hilton Los Angeles/Universal City, 555 Universal Hollywood Drive, Universal City, California. The proxies will remain valid for use at any meetings held upon adjournment of that meeting. The record date for the meeting is the close of business on March 30, 2012. All holders of record of our common stock on the record date are entitled to notice of the meeting and to vote at the meeting and any meetings held upon adjournment of that meeting. Our principal executive offices are located at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602. Our telephone number is (888) 4IPC-DOC (888-447-2362). To obtain directions to our annual meeting, visit our website atwww.hospitalist.com.

In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each stockholder of record or beneficial owner, we are now furnishing proxy materials, which include this proxy statement and the accompanying proxy card, notice of annual meeting of stockholders, and annual report to stockholders, to our stockholders over the Internet. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials, unless you have previously made a permanent election to receive paper copies of these materials. Instead, the Notice of Internet Availability of Proxy Materials instructs you as to how you may access and review all of the important information contained in the proxy materials. The Notice of Internet Availability of Proxy Materials also instructs you as to how you may submit your proxy on the Internet. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials.

The Notice of Internet Availability of Proxy Materials was first mailed on or before April 18, 2012 to all stockholders of record as of March 30, 2012.

Whether or not you plan to attend the meeting in person, please vote, at your earliest convenience, using the telephone, Internet, or request a proxy card to complete, sign and date and return by mail, in the postage prepaid envelope provided, to ensure that your shares will be voted at the meeting. You may revoke your proxy at any time prior to its use by filing with our secretary an instrument revoking it or a duly executed proxy bearing a later date or by attending the meeting and voting in person.

Unless you instruct otherwise in the proxy, any proxy that is given and not revoked will be voted at the meeting:

| | (1) | For each nominee to our Board of Directors; |

| | (2) | For the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2012; |

| | (3) | For the approval, on an advisory basis, of the executive compensation of our named executive officers; |

| | (4) | For approval of the IPC The Hospitalist Company, Inc. 2012 Equity Participation Plan; |

| | (5) | For approval of the IPC The Hospitalist Company, Inc. Incentive Plan; and |

| | (6) | As recommended by our Board of Directors, in its discretion, with regard to all other matters as may properly come before the annual meeting or any adjournment thereof. |

Voting Information

Our only voting securities are the outstanding shares of our common stock. At the record date, we had approximately 16,570,362 shares of common stock outstanding. Each stockholder is entitled to one vote per share on each matter that we will consider at this meeting. Stockholders are not entitled to cumulate votes. Brokers holding shares of record for their customers generally are not entitled to vote on some matters unless their customers give them specific voting instructions. If the broker does not receive specific instructions, the broker will note this on the proxy form or otherwise advise us that it lacks voting authority. The votes that the brokers would have cast if their customers had given them specific instructions are commonly called “broker non-votes.” If

1

the stockholders of record present in person or represented by their proxies at the meeting hold at least a majority of our shares of common stock outstanding as of the record date, a quorum will exist for the transaction of business at the meeting. Stockholders attending the meeting in person or represented by proxy at the meeting who abstain from voting and broker non-votes are counted as present for quorum purposes.

Votes Required for Proposals

Directors are elected by a plurality of the votes cast, in person or by proxy, which means that the three nominees with the most votes will be elected. Abstentions and broker non-votes as to the election of any director nominees will not affect the outcome of the election of directors.

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2012 requires the affirmative vote of a majority of the shares of common stock present at the annual meeting, in person or by proxy, and entitled to vote thereon. Abstentions with respect to this proposal will be treated as votes against the proposal. Broker non-votes with respect to this proposal will not be considered as present and entitled to vote on the proposal, which will therefore reduce the number of affirmative votes needed to approve the proposal.

The proposal regarding the advisory vote on executive compensation will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast in opposition to the proposal. Because your vote is advisory, it will not be binding on the board of directors or the Company. However, the board of directors will review the voting results and take them into consideration when making future decisions regarding executive compensation.

The approval of the IPC The Hospitalist Company, Inc. 2012 Equity Participation Plan requires the affirmative vote of a majority of the shares of common stock present at the annual meeting, in person or by proxy, and entitled to vote thereon. Abstentions with respect to this proposal will be treated as votes against the proposal. Broker non-votes with respect to this proposal will not be considered as present and entitled to vote on the proposal, which will therefore reduce the number of affirmative votes needed to approve the proposal.

The approval of the IPC The Hospitalist Company, Inc. Incentive Plan requires the affirmative vote of a majority of the shares of common stock present at the annual meeting, in person or by proxy, and entitled to vote thereon. Abstentions with respect to this proposal will be treated as votes against the proposal. Broker non-votes with respect to this proposal will not be considered as present and entitled to vote on the proposal, which will therefore reduce the number of affirmative votes needed to approve the proposal.

Proxy Solicitation Costs

We will pay for the cost of preparing, assembling, printing and mailing these proxy materials to our stockholders, as well as the cost of soliciting proxies relating to the meeting. We may request banks and brokers to solicit their customers who beneficially own our common stock listed of record in names of nominees. We will reimburse these banks and brokers for their reasonable out-of-pocket expenses regarding these solicitations. Our officers, directors and employees may supplement the original solicitation by mail of proxies by telephone, facsimile, e-mail and personal solicitation. We will pay no additional compensation to our officers, directors and employees for these activities.

Delivery of Proxy Statement and Annual Report

Beneficial owners, but not record holders, of our common stock who share a single address may receive only one copy of the Notice of Internet Availability of Proxy Materials and, as applicable, an annual report and proxy statement, unless their broker has received contrary instructions from any beneficial owner at that address. This practice, known as “householding,” is designed to reduce printing and mailing costs. If any beneficial owner at such an address wishes to discontinue householding and receive a separate copy of the Notice of Internet Availability of Proxy Materials and, if applicable, an annual report and proxy statement, they should notify their broker. Beneficial owners sharing an address to which a single copy of the proxy statement and annual report was delivered can also request prompt delivery of a separate copy of the Notice of Internet Availability of Proxy Materials and, if applicable, proxy statement and annual report by contacting our Corporate Secretary at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602. Our telephone number is (888) 4IPC-DOC (888-447-2362).

Electronic Availability of Proxy Materials for 2012 Annual Meeting

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on June 7, 2012. This proxy statement and IPC’s Annual Report to Stockholders and Form 10–K for fiscal year 2011 are available electronically athttp://investors.hospitalist.com.

2

Electronic Delivery of Future Proxy Materials

You may elect to receive future proxy statements and annual reports over the Internet instead of receiving paper copies. If you are a stockholder of record, you can elect to access future proxy statements and annual reports electronically by marking the appropriate box on your proxy form. If you hold your shares through a broker, please check the information provided in the proxy materials mailed to you by your broker for instructions on how to elect this option. Your election to view these documents over the Internet will remain in effect unless you elect otherwise.

3

PROPOSAL NO. 1

ELECTION OF CLASS II DIRECTORS

At the annual meeting, you will elect three directors to serve as Class II Directors until the 2015 annual meeting of stockholders or until their respective successors are elected and qualified. The nominees for election as Class II Directors are identified below, each of whom is currently serving on the Board of Directors and has indicated a willingness to serve if elected. However, if any nominee becomes unable to serve before the election, the shares represented by proxy may be voted for a substitute nominee designated by the Board of Directors.

No arrangement or understanding exists between any nominee and any other person or persons pursuant to whom any nominee was or is to be selected as a director or nominee. None of the nominees has any family relationship with any other nominee or with any of our executive officers.

Information Concerning our Directors Nominated for Election

Class II Directors—Term Scheduled to Expire in 2015

Mark J. Brooks, age 45. Mr. Brooks has served as one of our directors since April 1999 and has served as a member of our audit committee since July 2011 and as chairman of our compensation committee since June 2008. Since its formation in January 2007, Mr. Brooks has served as a managing director of Scale Venture Partners. Prior to joining Scale Venture Partners, Mr. Brooks worked for Bank of America Ventures since 1995, ultimately serving as a managing director. Mr. Brooks currently sits on the boards of directors of Alimera Sciences, Inc., (NASDAQ—ALIM) and the following private companies: National Healing Corporation, LivHome Inc., Spinal Kinetics, Inc., Oraya Therapeutics, Inc. and New Century Hospice, Inc. Mr. Brooks received a B.A. in economics from Dartmouth College and an M.B.A. from the Wharton School at the University of Pennsylvania. Mr. Brooks’ qualifications to serve on our Board of Directors include his many years of experience as a venture capital investor in various healthcare service organizations including our Company, his thirteen years of experience serving on our Board of Directors, his many years of service on the boards of directors of other healthcare companies and a deep understanding of healthcare finance.

Woodrin Grossman, age 67. Mr. Grossman has served as one of our directors and as a member of our audit committee and our nominating and governance committee since March 2008. Mr. Grossman retired in 2007 after serving as Senior Vice President-Strategy and Development of Odyssey HealthCare Inc. (NASDAQ-ODSY) from January 2006 to December 2007 and as a director from July 2005 to January 2006. Prior to Odyssey HealthCare, Inc., Mr. Grossman worked for PricewaterhouseCoopers for 37 years, including 27 years as a partner of the firm and over five years as the health care practice leader of the firm. Mr. Grossman currently serves on the board of directors of MedCath Corporation (NASDAQ-MDTH) and served as a director of Kinetic Concepts, Inc. in the past five years. Mr. Grossman received a B.S. in economics from Moravian College and an M.B.A. from the Wharton School at the University of Pennsylvania. Mr. Grossman’s qualifications to serve on our Board of Directors include his many years of experience as a partner and the healthcare practice leader at a large international public accounting firm providing auditing and consulting services to multi-state healthcare companies, his experience as a senior executive responsible for strategy and development for a public healthcare services firm and his experience serving on the boards of directors of other public and private healthcare companies, together with his deep understanding of healthcare finance, accounting and auditing.

R. Jeffrey Taylor, age 63. Mr. Taylor has been a director and our President and Chief Operating Officer since he joined IPC in July 2000, and currently serves as a member of our quality committee. Prior to joining IPC, Mr. Taylor was the executive vice president of Atlanta-based Mariner Post-Acute Network. Prior to that, Mr. Taylor was chief executive officer of American Outpatient Services, Inc. and held various positions including executive vice president, chief administrative officer and general counsel with American Medical International, Inc. (now Tenet Healthcare Corp.; NYSE-THC). From July 2009 through December 2011, Mr. Taylor also served on the board of directors of Dormir, Inc. Mr. Taylor received a B.S. from the University of Utah and a J.D. from the University of Utah College of Law. Mr. Taylor has more than 25 years of experience in the areas of acute-care, sub-acute care and the outpatient dialysis segments of the healthcare industry. Mr. Taylor’s qualifications to serve on our Board of Directors include his twelve years as our President and Chief Operating Officer, his many years experience as a senior executive responsible for operations in multi-state public and private healthcare services companies, his legal background in healthcare and his service on the board of directors of another healthcare services company.

The Board of Directors recommends a vote FOR the election of each of the named nominees as Class II Directors.

4

Information Concerning our Other Directors

The following persons are currently directors of the Company whose terms will continue after the annual meeting.

Class I Directors—Term Scheduled to Expire in 2014

Adam D. Singer, M.D., age 52. Dr. Singer has been a director, Chairman, and our Chief Executive Officer since he founded IPC in 1995, and in 2006, was designated as our Chief Medical Officer. Dr. Singer currently serves as a member of our quality committee. In 1991, Dr. Singer acquired a private practice in pulmonary medicine that shortly thereafter merged with two other pulmonary physicians’ practices to become part of Consultants For Lung Disease, Inc. (now the Institute for Better Breathing). Dr. Singer received his B.S. in Biology from the University of California, Los Angeles and his medical degree from the Chicago Medical School at Rosalind Franklin University. Dr. Singer performed a post-doctoral internship and residency in internal medicine and a fellowship in pulmonary medicine at University of Southern California. Dr. Singer’s qualifications to serve on our Board of Directors include his position as our Chief Executive Officer since inception of the Company, his position as our Chief Medical Officer and his background as founder the Company and one of the founders of the hospitalist movement. In addition, Dr. Singer has been a practicing physician and brings to our Board of Directors and our Company a depth of understanding of physician culture.

Thomas P. Cooper, M.D., age 68. Dr. Cooper has served as one of our directors since August 2007 and has served as a member of our compensation committee and as chairman of our quality committee since June 2008. Since 1991, Dr. Cooper has been chairman of the board at VeriCare and currently serves as a lead director for Kindred Healthcare, Inc. (NYSE-KND) and Hanger Orthopedic Group (NYSE-HGR). Dr. Cooper has founded various healthcare related companies, including VeriCare, Spectrum Emergency Care, Correctional Medical Systems and Mobilex. Dr. Cooper is also a partner at Aperture Venture Partners, a venture capital firm and serves as a senior advisor to Frazier Healthcare, a private equity firm. Dr. Cooper was an adjunct professor at the Columbia University School of Business teaching entrepreneurship. Dr. Cooper received a B.A. from DePauw University and a medical degree from Indiana University Medical School. Dr. Cooper’s qualifications to serve on our Board of Directors include his many years of experience as a physician executive and founder of several multi-state healthcare service organizations, his experience as a healthcare investor, his background in academics and his service on the boards of directors of several other public and private healthcare service companies. In addition, Dr. Cooper has been a practicing physician and brings to our Board of Directors a depth of understanding of physician culture.

Chuck Timpe, age 65. Mr. Timpe has served as one of our directors since 1998 and has served as a member of our nominating and governance committee since September 2011 and as chairman of our audit committee since 1999. Mr. Timpe also serves as a director and chairman of the audit committee of CrowdGather, Inc. (OTCBB-CRWG). From June 2003 until his retirement in November 2008, Mr. Timpe served as the chief financial officer of Hythiam, Inc. (now Catasys Inc.; OTCBB-CATS). Prior to joining Hythiam, Mr. Timpe was chief financial officer, from its inception in February 1998 to June 2003, of Protocare, Inc., a clinical research and pharmaceutical outsourcing company which merged with Radiant Research, Inc. in March 2003. Previously, he was a principal in two private healthcare management consulting firms he co-founded, chief financial officer of National Pain Institute, treasurer and corporate controller for American Medical International, Inc. (now Tenet Healthcare Corp.; NYSE-THC), and a member of Arthur Andersen, LLP’s healthcare practice, specializing in public company and hospital system audits. Mr. Timpe is currently a business consultant. Mr. Timpe received his B.S. from University of Missouri, School of Business and Public Administration, and is a certified public accountant (inactive). Mr. Timpe has over 40 years experience in the healthcare industry as a senior healthcare financial executive and director. Mr. Timpe’s qualifications to serve on our Board of Directors include his many years of experience as a senior healthcare financial executive with both public and private multi-state healthcare service organizations, his experience with a large public accounting firm specializing in healthcare practice, his fourteen years of experience serving on our Board of Directors, his service on the boards of directors of other public companies and private healthcare companies and his deep understanding of healthcare finance.

Class III Directors—Term Scheduled to Expire in 2013

Francesco Federico, M.D., age 62. Dr. Federico has served as one of our directors and as a member of our quality committee since August 2008. Currently, Dr. Federico serves as Senior Vice President of Heritage Provider Network in charge of Clinical Operations for Lakeside Community HealthCare Medical Group. From 2009-2011, he was involved in transition operations for Heritage Provider Network, Inc, which is a California Knox Keene Entity that provides services for over 500,000 managed care members. Dr. Federico has served as President, CEO and Director of the Lakeside organization—Lakeside Systems, Inc. (2007-2009)—the Holding Company; Lakeside HealthCare, Inc. (1997-2009)—the Management Services organization; Lakeside Medical Group (1986-2009)—the Independent Practice organization; Lakeside Medical Associates (1993-2009)—The Medical Group; Lakeside Comprehensive HealthCare (2006-2009)—the Knox Keene Entity and Lakeside Surgery Center (2006-2009). Currently, he serves on the board of directors of Glendale Memorial Hospital Foundation and the Valley Community Clinic. Dr. Federico also served on the board of directors of California Medical Group RRG Insurance Co (2005-2009) and the California Association of Physician Group (2000-2010). Dr. Federico received a B.A. and a medical degree from Harvard University. Dr. Federico is board certified in internal medicine, medical oncology and hematology. Dr. Federico’s qualifications to serve on our Board of Directors include his many years of experience as a chief executive officer of physician management and other healthcare organizations and his experience with physician reimbursement and professional liability risk areas. In addition, Dr. Federico has been a practicing physician and brings to our Board of Directors a depth of understanding of physician culture.

5

C. Thomas Smith, age 74. Mr. Smith has served as one of our directors and as the chairman of our nominating and governance committee since January 2004, and as a member of our compensation committee since August 2008. Mr. Smith retired in 2003 after over 11 years as president and chief executive officer of VHA Inc., a national cooperative of approximately 1,600 hospitals and their physicians focused on selective shared business practices to improve operational effectiveness. Prior to VHA Inc., Mr. Smith spent over 30 years managing hospitals, with nearly half of this time serving as chief executive officer of Yale New Haven Hospital in New Haven, Connecticut. Mr. Smith serves on the boards of directors of Information Corporation of America and Advanced ICU Care. In the past five years, Mr. Smith has served as a director of Kinetic Concepts, Inc., Renal Care, Inc., Horizon Health Inc., Neoforma, Inc., and Comp Health Group. Mr. Smith holds a B.A. from Baylor University and an M.B.A. from the University of Chicago. Mr. Smith’s qualifications to serve on our Board of Directors include his years of experience as chief executive officer of VHA Inc, his over thirty years of experience managing hospitals, his eight years serving on our Board of Directors and service on the boards of directors of other public and private healthcare service companies.

Director Independence

Each of our non-employee directors qualifies as “independent” in accordance with the published listing requirements of NASDAQ. Dr. Singer and Mr. Taylor do not qualify as independent because they are employees.

The NASDAQ rules have objective tests and a subjective test for determining who is an “independent director.” Under the objective tests, a director cannot be considered independent if he or she:

| | • | | is an employee of the Company; or |

| | • | | is a partner in, or an executive officer of, an entity to which the Company made, or from which the Company received, payments in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenue for that year. |

The subjective test states that an independent director must be a person who lacks a relationship that, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

None of the non-employee directors was disqualified from “independent” status under the objective tests. In assessing independence under the subjective test, the Board of Directors took into account the standards in the objective tests, and reviewed and discussed additional information with regard to each director’s business and personal activities as they may relate to our Company and its management. Based on all of the foregoing, as required by NASDAQ rules, the Board of Directors made a determination as to each independent director that no relationships exist which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board of Directors has not established categorical standards or guidelines to make these subjective determinations, but considers all relevant facts and circumstances.

Meetings of Non-Management Directors

Non-management directors meet regularly in executive sessions without management. Executive sessions are held in conjunction with each regularly scheduled meeting of the Board of Directors.

Communications with the Board of Directors

Any interested party who desires to contact the Board of Directors or any member of the Board of Directors may do so by writing to: Board of Directors, c/o Corporate Secretary, IPC The Hospitalist Company, Inc., 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602. Copies of any such written communications received by the Corporate Secretary will be provided to the full Board of Directors or the appropriate member depending on the facts and circumstances described in the communication unless they are considered, in the reasonable judgment of the Corporate Secretary, to be improper for submission to the intended recipient(s).

Meetings

In 2011, our Board of Directors held seven meetings, the audit committee held six meetings, the compensation committee held seven meetings, the nominating and governance committee held five meetings and the quality committee held four meetings. Each of our directors attended at least 75% of the total number of meetings of the Board of Directors and of the committees of the Board of Directors on which they served during 2011.

We encourage, but do not require, our directors to attend the annual meeting of stockholders.

6

Committees of our Board of Directors

Our Board of Directors has an audit committee, a compensation committee, a nominating and governance committee and a quality committee, each of which has the composition and responsibilities described below.

Audit Committee. The primary purpose of the audit committee is to oversee the integrity of our financial statements, our financial reporting process, the independent auditor’s qualifications and independence, the performance of the independent auditor and our compliance with legal and regulatory requirements on behalf of the Board. In particular, the audit committee is responsible for (1) selecting the independent auditor, (2) overseeing the work of the independent auditor and reviewing the overall scope of the audit, (3) reviewing all relationships between the independent auditor and our Company, including non-audit services, in order to determine the independent auditor’s independence, (4) discussing the annual audited and quarterly financial statements with management and the independent auditor, (5) discussing with management earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies, (6) discussing with management and the independent auditors the adequacy and effectiveness of our accounting and financial controls, including our policies and procedures to assess, monitor and manage business risk, (7) meeting separately, periodically, with management and the independent auditor, (8) reviewing with the independent auditor any audit problems or difficulties and management’s response, (9) establishing procedures for treatment of complaints received by our Company or anonymous submissions by employees regarding accounting or auditing matters, (10) preparing a report for the annual proxy statement, (11) handling such other matters that are specifically delegated to the audit committee by the Board of Directors from time to time and (12) reporting regularly to the full Board of Directors.

Our audit committee consists of Mr. Timpe, who serves as chairman of the committee, Mr. Brooks and Mr. Grossman. Each of the committee members has been determined to be independent and determined to be an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K. Our Board of Directors has adopted a written charter for our audit committee, which can be obtained without charge by contacting our Corporate Secretary at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602, (888) 4IPC-DOC (888-447-2362) or through our website, located atwww.hospitalist.com.

Compensation Committee. Our compensation committee assists our Board of Directors by ensuring that our officers and key executives are compensated in accordance with our total compensation objectives and executive compensation policy. The compensation committee is responsible for (1) reviewing key employee total compensation policies, plans and programs, (2) evaluating and recommending to the Board of Directors the compensation of our executive officers, (3) reviewing and recommending to the Board of Directors the terms and benefits of the employment contracts and other similar arrangements between our Company and its executive officers, (4) reviewing and consulting with the chief executive officer on the selection of officers and evaluation of executive performance and other related matters, (5) reviewing and recommending stock plans and other incentive compensation plans, (6) reviewing and assessing the risks inherent in the compensation structure, (7) reviewing the Compensation Discussion & Analysis section for our Company’s annual proxy statement, (8) providing a report for the annual proxy statement and (9) handling such other matters that are specifically delegated to the compensation committee by the Board of Directors from time to time.

Our compensation committee consists of Mr. Brooks, who serves as chairman of the committee, Dr. Cooper and Mr. Smith. Each of the committee members has been determined to be independent, and each of the members of this committee is also a “nonemployee director” as that term is defined under Rule 16b-3 of the Securities and Exchange Act of 1934 and an “outside director” as that term is defined in Treasury Regulation § 1.162-27(3). Our Board of Directors has adopted a written charter for our compensation committee, which can be obtained without charge by contacting our Corporate Secretary at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602, (888) 4IPC-DOC (888-447-2362) or through our website, located atwww.hospitalist.com.

Nominating and Governance Committee. Our nominating and governance committee assists our Board of Directors by identifying individuals qualified to become members of our Board of Directors and developing our corporate governance principles. This committee’s responsibilities include: (1) evaluating the composition, size and governance of our Board of Directors and its committees and making recommendations regarding future planning and the appointment of directors to our committees, (2) assisting the Board of Directors in reviewing director independence, (3) recommending Board committee assignments and compensation, (4) approving any employee director or senior executive standing for election for outside for-profit boards of directors, (5) evaluating and recommending candidates for election to our Board of Directors, (6) overseeing the succession planning of the chief executive officer and senior executive officers, (7) overseeing the self-evaluation process for our Board of Directors and each Board committee, (8) reviewing our corporate governance principles, governance-related stockholder proposals, and changes to the charter and bylaws and providing recommendations to the Board of Directors regarding possible changes, (9) reviewing and monitoring compliance with all laws and regulations not under the purview of another board committee, (10) reviewing claims for indemnification, and (11) handling such other matters that are specifically delegated to the nominating and governance committee by the Board of Directors from time to time.

7

The nominating and governance committee does not have a specific set of minimum criteria for membership on the Board of Directors. In making its recommendations, however, it considers the mix of characteristics, experience, diverse perspectives and skills that it believes is most beneficial to our Company. Although the Board of Directors does not have a formal diversity policy, the committee and the Board of Directors will consider such factors as they deem appropriate to assist in developing a Board of Directors and committees that are diverse in nature and comprised of experienced and seasoned individuals. These factors focus on skills, expertise and background and may include decision-making ability, judgment, personal integrity and reputation, healthcare and physician management experience, and the extent to which the candidate would be a desirable addition to the Board of Directors and any Board committees. Our nominating and governance committee will consider nominees for directors recommended by stockholders upon submission in writing in accordance with our bylaws to our Corporate Secretary of the names and qualifications of such nominees at the following address: IPC The Hospitalist Company, Inc., 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602. The committee does not intend to alter the manner in which it evaluates candidates based on whether the candidate was recommended by a stockholder or not.

In March 2012, the nominating and governance committee recommended to our Board of Directors the nominees standing for election at the 2012 annual meeting of stockholders, each of whom is currently serving on our Board of Directors.

Our nominating and governance committee consists of Mr. Smith, who serves as chairman of the committee, Mr. Grossman, and Mr. Timpe. Each of the committee members has been determined to be independent. Our Board of Directors has adopted a written charter for our nominating and governance committee, which can be obtained without charge by contacting our Corporate Secretary at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602, (888) 4IPC-DOC (888-447-2362) or through our website, located atwww.hospitalist.com.

Quality Committee. Our quality committee oversees clinical quality, professional liability (malpractice), physician leadership and physician retention. In particular, the quality committee is responsible for (1) monitoring our performance on established internal and external benchmarking regarding clinical performance and outcomes, (2) overseeing our adoption and implementation of policies and procedures designed to provide quality patient care, (3) overseeing the Company’s programs and initiatives to develop physician leadership, including local leadership at the practice group level, (4) overseeing our adoption and implementation of a system to allow us to respond to federal, state, internal and external reports of clinical quality of care issues and review periodically whether such system functions adequately, (5) overseeing the Company’s malpractice claims management process and related mitigation efforts, (6) investigate, or ask our legal counsel to investigate, any matter brought to the attention of the quality committee within the scope of its duties, and obtain legal advice for this purpose, if, in its judgment, that is appropriate, (7) overseeing our physician retention and job satisfaction initiatives, (8) handling such other matters that are specifically delegated to the quality committee by the Board of Directors from time to time, and (9) reporting regularly to the full Board of Directors.

Our quality committee consists of Dr. Cooper, who serves as chairman of the committee, Dr. Federico, Dr. Singer, and Mr. Taylor. Our Board of Directors has adopted a written charter for our quality committee, which can be obtained without charge by contacting our Corporate Secretary at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602, (888) 4IPC-DOC (888-447-2362) or through our website, located atwww.hospitalist.com.

8

Board of Directors Share Ownership Guideline

We have a share ownership guideline which applies to all non-management members of our Board of Directors. The purpose of the policy is to encourage members of our Board of Directors to have an ownership stake in the Company by retaining at least a specified minimum number of shares of our common stock. The guideline is that each director should retain all net shares obtained upon exercise of stock options, net realizable shares of vested but unexercised stock options and all vested shares of restricted stock until they own shares or equivalent net unexercised options with at least a market value of five times the annual Board retainer, which at the current annual retainer of $30,000, is equal to $150,000.

Risk Oversight

Our Board of Directors oversees an enterprise-wide approach to risk management. A fundamental part of risk management is understanding the risks a company faces and what steps management is taking to manage those risks and also to formulate, with management, what level of risk is appropriate for the Company. The involvement of the full Board of Directors in setting the Company’s business strategy is a key part of its assessment of management’s appetite for risk and also a determination of what constitutes an appropriate level of risk for the Company. In 2011, the full Board of Directors reviewed an annual enterprise risk management assessment, which was prepared by the Company’s chief financial officer. In this process, risk was assessed throughout the business, focusing on seven primary areas of risk: strategic, regulatory, operational, development, financial, technology and legal.

While the Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the audit committee focuses on financial risk, including internal controls and the Company’s investment policies, and regulatory risk related to physician billing. The Company’s nominating and governance committee assists the Board of Directors in fulfilling its oversight responsibility with respect to healthcare regulatory and compliance activities and all other compliance areas not under the purview of another Board committee. The quality committee oversees risks related to physician retention, professional liability (malpractice) and clinical quality matters. In addition, in setting compensation, the compensation committee strives to create incentives that encourage a level of risk-taking behavior consistent with the Company’s business strategy.

Board Leadership Structure

Our Chief Executive Officer also serves as Chairman of our Board of Directors. We believe that having a single person serve as both Chief Executive Officer and Chairman, combined with independent directors with strong leadership experience and independent Board committees, provides the right form of leadership for our Company.

Adam Singer, M.D., the founder of our Company and one of the founders of the hospitalist movement, serves as both Chief Executive Officer and Chairman of the Board and as such, demonstrates that the Company is under strong leadership with a single person setting the tone and strategic direction. Based on Dr. Singer’s deep understanding of our business and his involvement in the day-to-day operations of the Company, we believe he is in the best position to serve as Chairman to identify for the Board of Directors the challenges and issues that the Company faces. In addition, we believe that a physician serving in both the Chief Executive Officer and Chairman roles at this time communicates a strong emphasis that we are a physician provider organization.

Dr. Singer possesses detailed and in-depth knowledge of the issues, opportunities and challenges facing the Company and is thus uniquely positioned to develop agendas that ensure that the Board of Directors’ time and attention are focused on the most critical matters. His combined role enables decisive leadership, ensures clear accountability, and enhances our ability to communicate our message and strategy clearly and consistently to our most important assets, our physicians and other providers, in addition to our stockholders and other stakeholders.

Each of the directors other than Dr. Singer and Mr. Taylor, our President and Chief Operating Officer, is independent and the Board of Directors believes that the independent directors, without a named lead director, provide effective oversight of and facilitate direct communications with management. Moreover, in addition to feedback provided during the course of meetings of the Board of Directors, the independent directors meet in executive session at each regular Board meeting or more frequently, as needed. The Board of Directors believes that this approach effectively encourages full engagement of all independent directors in executive sessions, while avoiding unnecessary hierarchy and complements the combined Chief Executive Officer/Chairman structure. In addition, three of our four standing committees are composed entirely of independent directors, and have the power and authority to engage legal, financial and other advisors as they may deem necessary, without consulting or obtaining the approval of the full Board of Directors or management. The fourth standing committee, the quality committee, includes the two independent directors who are physicians (one of whom is the committee chair) in addition to our two management directors.

Code of Ethics and Code of Conduct

We have a code of ethics that applies to our chief executive officer, president, chief operating officer, chief financial officer, chief administrative officer, chief development officer, chief clinical officer, our chief accounting officer and controller, our principal accounting officer, and certain other designated employees. We also have a code of conduct that applies to all of our directors, officers and employees. The code of ethics and the code of conduct can be obtained without charge by contacting our Corporate Secretary at 4605 Lankershim Boulevard, Suite 617, North Hollywood, California 91602 or through our web site, located atwww.hospitalist.com.

9

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Independent Registered Public Accounting Firm

The audit committee has appointed Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012. Representatives of Ernst & Young LLP are expected to attend the annual meeting in person to respond to appropriate questions and to make a statement if they so desire. If Ernst & Young LLP should decline to act or otherwise become incapable of acting, or if Ernst & Young LLP’s engagement is discontinued for any reason, the audit committee will appoint another independent registered public accounting firm to serve as our independent registered public accounting firm for 2012. Although we are not required to seek stockholder ratification of this appointment, the Board of Directors believes that doing so is consistent with corporate governance best practices. If the appointment is not ratified, the audit committee will explore the reasons for stockholder rejection and will reconsider the appointment.

The affirmative vote of a majority of the shares of common stock present at the annual meeting, in person or by proxy, and entitled to vote thereon, is required for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2012. Abstentions with respect to this proposal will be treated as votes against the proposal. Broker non-votes with respect to this proposal will not be considered as present and entitled to vote on the proposal, which will therefore reduce the number of affirmative votes needed to approve the proposal.

The following table sets forth the aggregate professional fees billed to the Company for the years ended December 31, 2011 and 2010 by Ernst & Young LLP, the Company’s independent registered public accounting firm:

| | | | | | | | |

| | | 2011 | | | 2010 | |

Audit fees (1) | | $ | 473,900 | | | $ | 473,900 | |

Audit-related fees (2) | | | 1,000 | | | | — | |

Tax fees (3) | | | 279,000 | | | | 277,000 | |

All other fees | | | — | | | | — | |

| | | | | | | | |

| | $ | 753,900 | | | $ | 750,900 | |

| | | | | | | | |

| (1) | Includes fees for the audit of our consolidated financial statements and the audit of our internal controls over financial reporting and timely quarterly reviews. |

| (2) | Includes fees for professional services rendered in connection with SEC filings, including comfort letters, consents and comment letters. |

| (3) | Includes fees for professional services rendered for tax advice, tax planning, tax compliance, tax preparation services and other tax projects. |

In connection with the audit of our financial statements for fiscal 2011 and 2010, we entered into an agreement with Ernst & Young LLP which sets forth the terms by which Ernst & Young LLP will perform audit services for the Company.

Pre-approval Policies and Procedures

The audit committee is required to pre-approve the audit and non-audit services performed by the Company’s independent registered public accounting firm in order to assure that the provision of such services does not impair the auditor’s independence. The audit committee pre-approved all such services in 2010 and 2011 and concluded that such services performed by Ernst & Young LLP were compatible with the maintenance of that firm’s independence in the conduct of its auditing functions.

The Board of Directors recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2012.

10

PROPOSAL NO. 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act requires that public companies give their stockholders the opportunity to vote, on an advisory (nonbinding) basis, on the compensation of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s executive compensation disclosure rules. Accordingly, stockholders of the Company are being given the opportunity to vote on a proposal, commonly known as a “say-on-pay” proposal, to endorse or not endorse our compensation program for our named executive officers as reflected in this proxy statement in accordance with the SEC’s executive compensation disclosure rules.

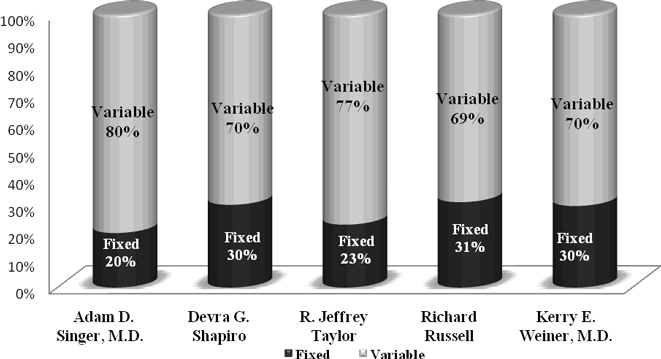

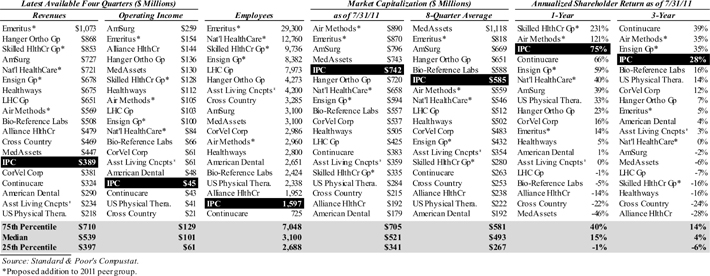

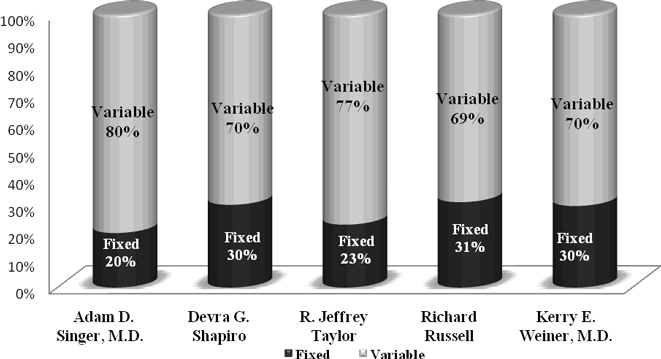

As described in the Compensation Discussion and Analysis section of this proxy statement, the Company’s executive compensation is designed to support the overall objective of maximizing long-term stockholder value by aligning the interests of executives with the interests of stockholders and rewards executive for achieving predefined objectives as established by our compensation committee. The executive compensation program is also designed to provide compensation opportunities that attract and retain the services of qualified executives in a highly competitive marketplace. The Board of Directors believes that this structure has been successful in recruiting and retaining our management team as evidenced by the Company’s financial success over the past several years and low turnover of the management team. The Board of Directors, using the services of an outside consultant who performs no other services for the Company, closely monitors best practices, the compensation programs and pay levels of executives at peer companies to ensure that our compensation programs are within the norm of a range of market practices. Our executive pay programs are heavily weighted towards at-risk compensation in the form of performance-based cash bonuses and equity awards. Over the last two years, at least 69% of the total compensation of our four named executive officers was at risk, as set forth in the 2011 Summary Compensation Table.

The Board of Directors urges stockholders to carefully read the “Compensation Discussion and Analysis” section of this proxy statement, which describes in more detail our executive compensation policies and procedures, as well as the 2011 Summary Compensation Table and related executive compensation tables and narrative discussions.

The proposal regarding the advisory vote on executive compensation will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast in opposition to the proposal. Because your vote is advisory, it will not be binding upon the Board of Directors. However, the Board of Directors may take into account the outcome of the vote when considering future executive compensation arrangements.

Accordingly, we ask our stockholders to vote on the following resolution at the annual meeting:

“RESOLVED that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2012 Annual Meeting of Stockholders pursuant to the executive compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the 2011 Summary Compensation Table and related executive compensation tables and narrative disclosure.”

The Board of Directors recommends a vote FOR the approval of the executive compensation of our named executive officers, as disclosed in this proxy statement.

11

PROPOSAL NO. 4

APPROVAL OF THE IPC THE HOSPITALIST COMPANY, INC.

2012 EQUITY PARTICIPATION PLAN

The Company’s Board of Directors is recommending stockholder approval of the IPC The Hospitalist Company, Inc. 2012 Equity Participation Plan (the “2012 Plan”). The purposes of the 2012 Plan are:

| | • | | To align the interests of the Company’s stockholders and the recipients of awards under the 2012 Plan by increasing the proprietary interest of such recipients in the Company’s growth and success; |

| | • | | To advance the interests of the Company by attracting and retaining officers, other employees non-employee directors and independent contractors; and |

| | • | | To motivate such persons to act in the long-term best interests of the Company and its stockholders. |

Under the 2012 Plan, the Company may grant:

| | • | | non-qualified stock options; |

| | • | | “incentive stock options” (within the meaning of Section 422 of the Internal Revenue Code); |

| | • | | stock appreciation rights (“SARs”); |

| | • | | restricted stock, unrestricted stock and restricted stock units (“Stock Awards”); and |

| | • | | performance equity awards. |

As of December 31, 2011, approximately one thousand and eight hundred employees and six non-employee directors would be eligible to participate in the 2012 Plan if selected by the Committee; however, participation in our long-term incentive plans has historically been limited to certain senior-level employees, and this group included approximately forty-two employees as of March 2012. The closing price of our common stock on April 11, 2012 was $35.08 per share. Upon approval of the 2012 Plan, no additional awards will be granted under the IPC The Hospitalist Company, Inc. 2007 Equity Participation Plan (the “Prior Plan”).

Plan Highlights

Some of the key features of the 2012 Plan include:

| | • | | The 2012 Plan will be administered by a committee of the Company’s Board of Directors that is comprised entirely of independent directors; |

| | • | | Options and SARs granted under the 2012 Plan may not be repriced without stockholder approval; |

| | • | | The number of shares authorized for grants under the 2012 Plan is 2,100,000 shares; |

| | • | | Under the 2012 Plan, the maximum number of shares of the Company’s common stock (“Common Stock”) available for awards is 2,100,000, reduced by number of shares of Common Stock subject to awards granted under the Prior Plan after December 31, 2011, with such reduction equal to one times the number of shares subject to an option or Free-Standing SAR and two times the number of shares subject to a Stock Award or Performance Award; |

| | • | | The number of shares available for issuance under the 2012 Plan will be reduced by two shares for any shares subject to a Stock Award or performance award and by one share for any shares subject to a stock option or SAR; and |

| | • | | The purchase price of options and the base price for SARs granted under the 2012 Plan may not be less than the fair market value of a share of the Company’s common stock on the date of grant. |

12

Description of the 2012 Plan

The following description is qualified in its entirety by reference to the plan document, a copy of which is attached as Appendix A and incorporated into this proxy statement by reference.

Administration

The 2012 Plan will be administered by a committee designated by the Board of Directors or a subcommittee thereof (the “Plan Committee”), consisting of two or more members of the Board. Each member of the Plan Committee shall be (i) a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act, (ii) an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code, or (iii) “independent” within the meaning of the rules of the Nasdaq Stock Market.

Subject to the express provisions of the 2012 Plan, the Plan Committee will have the authority to select eligible persons to receive awards and determine all of the terms and conditions of each award. All awards will be evidenced by an agreement containing such provisions not inconsistent with the 2012 Plan as the Plan Committee will approve. The Plan Committee will also have authority to establish rules and regulations for administering the 2012 Plan and to decide questions of interpretation or application of any provision of the 2012 Plan. The Plan Committee may, subject to Section 162(m) of the Internal Revenue Code, take any action such that (1) any outstanding options and SARs will become exercisable in part or in full, (2) all or a portion of a restriction period on any Stock Award will lapse, (3) all or a portion of any performance period applicable to any restricted stock, restricted stock units or performance equity awards will lapse, and (4) any performance measures applicable to any outstanding award will be deemed satisfied at the target, maximum or any other level.

The Plan Committee may delegate some or all of its power and authority under the 2012 Plan to the Board, the Chief Executive Officer or other executive officer of the Company as the Plan Committee deems appropriate, except that it may not delegate its power and authority to the Chief Executive Officer or any executive officer with regard to awards to persons who are (i) “covered employees” within the meaning of Section 162(m) of the Internal Revenue Code or are likely to become such while an award is outstanding, or (ii) subject to Section 16 of the Securities Exchange Act of 1934, as amended.

Available Shares

Subject to the adjustment provisions included in the 2012 Plan, the maximum number of shares of Common Stock available for awards under the 2012 Plan is 2,100,000 (reduced by the number of shares of Common Stock subject to awards granted under the Prior Plan after December 31, 2011, with such reduction equal to one times the number of shares subject to an option or Free-Standing SAR and two times the number of shares subject to a Stock Award or Performance Award), of which no more than 2,100,000 shares in the aggregate maybe issued in connection with incentive stock options. The number of available shares will be reduced by the sum of (i) the aggregate number of shares of Common Stock which become subject to outstanding options and free-standing SARs, and (ii) two times the aggregate number of shares of Common Stock which become subject to Stock Awards or performance equity awards. To the extent that shares of Common Stock subject to an outstanding option, free-standing SAR, Stock Award or performance award granted under either the 2012 Plan or the Prior Plan are not issued or delivered by reason of (i) the expiration, termination, cancellation or forfeiture of such award (excluding shares of Common Stock subject to an option cancelled upon settlement of a related tandem SAR or subject to a tandem SAR cancelled upon exercise of a related option), (ii) the settlement of such award in cash, or (iii) the use of such shares to pay the withholding taxes for Stock Awards or performance equity awards, then such shares of Common Stock will again be available under the 2012 Plan; provided, however, that shares of Common Stock subject to an award under the 2012 Plan will not again be available under this Plan if such shares are (x) shares that were subject to a stock-settled SAR and were not issued or delivered upon the net settlement of such SAR, (y) shares delivered to or withheld by the Company to pay the exercise price or withholding taxes related to an outstanding option or SAR and (z) shares repurchased by the Company on the open market with the proceeds of an option exercise. The number of shares that will again become available will be one share for each share subject to an option or free-standing SAR granted under the 2012 Plan or the Prior Plan and two shares for each share subject to a Stock Award or performance award granted under the 2012 Plan or the Prior Plan.

To the extent necessary for an award to be qualified performance-based compensation under Section 162(m) of the Internal Revenue Code, and the regulations thereunder, (i) the maximum number of shares of Common Stock with respect to which options, or SARs or a combination thereof may be granted during any fiscal year of the Company to any person shall be 325,000, subject to adjustment in the event of any equity restructuring (within the meaning of Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation), such as a stock dividend, stock split, spinoff, rights offering or recapitalization or any other change in corporate capitalization, such as a merger, consolidation, reorganization or partial or

13

complete liquidation and (ii) the maximum number of shares of Common Stock with respect to which Stock Awards subject to Performance Measures or Performance Equity Awards denominated in Common Stock may be earned by any Person for each 12-month period during a Performance Period shall be 325,000, subject to adjustment in the event of any equity restructuring (within the meaning of Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation), such as a stock dividend, stock split, spinoff, rights offering or recapitalization or any other change in corporate capitalization, such as a merger, consolidation, reorganization or partial or complete liquidation; and (iii) the maximum amount that maybe earned by any Person for each 12-month period during a Performance Period with respect to Performance Equity Awards denominated in cash shall be $3,000,000.

Change in Control

In the event of change in control of the Company, the Board (as constituted prior to the Change in Control) may, in its discretion require that (i) some or all outstanding options and SARs shall immediately become exercisable in full or in part, (ii) the restriction period applicable to some or all outstanding restricted stock awards and restricted stock unit awards shall lapse in full or in part, (iii) the performance period applicable to some or all outstanding awards shall lapse in full or in part, and (iv) the performance measures applicable to some or all outstanding awards shall be deemed to be satisfied at the target, maximum or any other level. In addition, in the event of a change in control, the Board may, in its discretion, require that shares of stock of the company resulting from such change in control, or the parent thereof, be substituted for some or all of the shares of common stock subject to outstanding awards as determined by the Board, and/or require outstanding awards to be surrendered to the Company and provide for the holder of the award to receive a payment in an amount equal to the value of the award, as determined pursuant to the terms of the Plan, in cash, shares of common stock in the company resulting from the change in control, or the parent thereof, or a combination of cash and shares.

Under the terms of the 2012 Plan, a change in control is generally defined as the occurrence of any one or more of the following: (i) the acquisition by any person of beneficial ownership of more than fifty percent (50%) of the outstanding voting shares of Common Stock; (ii) a merger, consolidation or other reorganization involving the Company if the stockholders of the Company and their affiliates, immediately before such merger, consolidation or other reorganization, do not, as a result of such merger, consolidation, or other reorganization, own directly or indirectly, more than fifty percent (50%) of the combined voting power of the then outstanding voting shares of the person resulting from such merger, consolidation or other reorganization; (iii) a complete liquidation or dissolution of the Company; or (iv) the sale or other disposition of all or substantially all of the assets of the Company and its Subsidiaries determined on a consolidated basis. Under the terms of the 2012 Plan, a person is generally defined as any individual, sole proprietorship, corporation, partnership, joint venture, limited liability company, association, joint-stock company, trust, unincorporated organization, institution, public benefit corporation, entity or government instrumentality, division, agency, body or department.

Effective Date, Termination and Amendment

If approved by stockholders, the 2012 Plan will become effective as of the date of the Board’s approval and will terminate as of the first annual meeting of the Company’s stockholders to occur on or after the tenth anniversary of the effective date, unless earlier terminated by the Board of Directors. The Board may amend the at any time, subject to stockholder approval if (i) required by applicable law, rule or regulation, including Section 162(m) of the Internal Revenue Code and any rule of the Nasdaq Stock market, or (ii) the Board seeks to modify the option and SAR repricing provisions in the 2012 Plan. No amendment may impair the rights of a holder of an outstanding award without the consent of such holder.

Stock Options and SARs

The 2012 Plan provides for the grant of stock options and SARs. The Plan Committee will determine the conditions to the vesting and exercisability of each option and SAR.

Each option will be exercisable for no more than seven years after its date of grant, unless the optionee owns greater than 10% of the voting power of all shares of capital stock of the Company (a “ten percent holder”), in which case the option will be exercisable for no more than five years after its date of grant. Except in the case of substitute awards granted in connection with a corporate transaction, the exercise price of an option will not be less than 100% of the fair market value of a share of Common Stock on the date of grant, unless the optionee is a ten percent holder, in which case the option exercise price will be the price required by the Internal Revenue Code, currently 110% of fair market value.

Each SAR will be exercisable for no more than seven years after its date of grant. Except for SARs granted in exchange or as a substitute for an option, the base price of an SAR will not be less than 100% of the fair market value of a share of Common Stock on the date of grant, provided that the base price of an SAR granted in tandem with an option (a “tandem SAR”) will be the exercise price

14

of the related option. An SAR entitles the holder to receive upon exercise (subject to withholding taxes) shares of Common Stock (which may be restricted stock) with a value equal to the difference between the fair market value of the Common Stock on the exercise date and the base price of the SAR.

All of the terms relating to the exercise, cancellation or other disposition of options and SARs following the termination of employment of a participant, whether by reason of disability, retirement, death or any other reason, will be determined by the Plan Committee.

Stock Awards

The 2012 Plan provides for the grant of Stock Awards. The Plan Committee may grant a Stock Award as a restricted stock award, unrestricted stock award or a restricted stock unit award. Under the 2102 Plan, restricted stock unit awards include deferred stock unit awards granted to the Company’s non-employee directors. Except as otherwise determined by the Plan Committee, restricted stock awards and restricted stock unit awards will be non-transferable and subject to forfeiture if the holder does not remain continuously in the employment of the Company during the restriction period or if specified performance measures (if any) are not attained during the performance period.

Unless otherwise set forth in a restricted stock award agreement, the holder of shares of restricted stock awarded will have rights as a stockholder of the Company, including the right to vote and receive dividends with respect to the shares of restricted stock, provided however, that (i) distributions other than regular cash dividends, and (ii) regular cash dividends with respect to shares of Common Stock that are subject to performance-based vesting conditions, in each case will be deposited by the Company and will be subject to the same restrictions as the restricted stock.

The agreement awarding restricted stock units will specify (i) whether such award may be settled in shares of Common Stock, cash or a combination thereof, and (ii) whether the holder will be entitled to receive on a current or deferred basis, dividend equivalents, with respect to such award. Any dividend equivalents with respect to restricted stock units that are subject to performance-based vesting conditions will be subject to the same restrictions as such restricted stock units. Prior to settlement of a restricted stock unit, the holder of a restricted stock unit will have no rights as a stockholder of the Company.

All of the terms relating to the satisfaction of performance measures and the termination of a restriction period, or the forfeiture and cancellation of a Stock Award upon a termination of employment, whether by reason of disability, retirement, death or any other reason, will be determined by the Plan Committee.

Performance Equity Awards

The 2012 Plan also provides for the grant of performance equity awards. The agreement relating to a performance award will specify whether such award may be settled in shares of Common Stock (including shares of restricted stock), cash or a combination thereof. The agreement relating to a performance award will provide, in the manner determined by the Plan Committee, for the vesting of such performance award if the specified performance measures are satisfied or met during the specified performance period. Any dividend or dividend equivalents with respect to a performance award that is subject to performance-based vesting conditions will be subject to the same restrictions as such performance award. Prior to the settlement of a performance award in shares of Common Stock, the holder of such award will have no rights as a stockholder of the Company with respect to such shares. All of the terms relating to the satisfaction of performance measures and the termination of a performance period, or the forfeiture and cancellation of a performance award upon a termination of employment, whether by reason of disability, retirement, death or any other reason, will be determined by the Plan Committee.

Performance Measures

Under the 2012 Plan, the vesting, exercisability or payment of certain awards may be made subject to the satisfaction of performance measures. The performance goals applicable to a particular award will be determined by the Plan Committee at the time of grant. To the extent an award is intended to qualify for the performance-based exemption from the $1 million deduction limit under Section 162(m) of the Internal Revenue Code, as described below, the performance measures will be one or more of the following corporate-wide or subsidiary, division, operating unit or individual measures, stated in either absolute terms or relative terms, such as rates of growth or improvement: share price (including growth measures and total stockholder return or attainment by a share of Common Stock of a specified fair market value for a specified period of time), earnings (either in the aggregate or on a per-share basis), return to stockholders (including dividends), return on assets, return on investments, return on equity, return on sales, earnings of the Company before or after taxes and/or interest, EBITDA (actual and adjusted and either in the aggregate or on a per-share basis), revenues, market share, cash flow or cost reduction goals, interest expense after taxes, return on investment capital, economic value created, gross margin, operating margin, net income before or after taxes, pretax earnings before interest, depreciation and

15

amortization, pretax operating earnings after interest expense and before incentives and/or extraordinary or special items, operating earnings, net cash provided by operations, costs, aggregate product unit and pricing targets, achievement of business or operational goals relating to business development, achievement of diversity objectives, results of customer or employee satisfaction surveys, debt ratings, debt leverage and debt service, and strategic business criteria, consisting of one or more objectives based on meeting specified market penetration, geographic business expansion goals, cost targets, customer satisfaction, reductions in errors and omissions, reductions in lost business, management of employment practices and employee benefits, supervision of litigation and information technology, quality and quality audit scores, operating and maintenance cost management, employee or provider productivity, number of employees or providers either on a headcount or equivalency basis, efficiency, objectively identified project milestones, production volume levels, and goals relating to acquisitions or divestitures, achievement of a clinical quality goal, or any combination of the foregoing. The applicable performance measures may be applied on a pre- or post-tax basis. In the sole discretion of the Plan Committee, but subject to Section 162(m) of the Internal Revenue Code, the Plan Committee may amend or adjust the performance measures or other terms and conditions of an outstanding award in recognition of unusual, nonrecurring or one-time events affecting the Company or its financial statements or changes in law or accounting principles.

Federal Income Tax Consequences