As filed with the Securities and Exchange Commission on April 5, 2012

Registration No. 333-168905

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 3

to

FORM S-11

REGISTRATION STATEMENT

UNDERTHE SECURITIES ACT OF 1933

STRATEGIC STORAGE TRUST, INC.

(Exact Name of Registrant as Specified in Its Governing Instruments)

111 Corporate Drive, Suite 120

Ladera Ranch, California 92694

(877) 327-3485

(Address, Including Zip Code and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Paula Mathews

Executive Vice President

Strategic Storage Trust, Inc.

111 Corporate Drive, Suite 120

Ladera Ranch, California 92694

(877) 327-3485

(Name, Address, Including Zip Code and Telephone Number,

Including Area Code, of Agent for Service)

Copies to:

Michael K. Rafter, Esq.

Howard S. Hirsch, Esq.

Baker, Donelson, Bearman, Caldwell and Berkowitz, PC

3414 Peachtree Road

Suite 1600

Atlanta, Georgia 30326

(404) 577-6000

Approximate date of commencement of proposed sale to the public: As soon as practicable following effectiveness of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check One):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant files a further amendment which specifically states that this Registration Statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement becomes effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

This Post-Effective Amendment No. 3 consists of the following:

| 1. | The Registrant’s prospectus dated September 22, 2011; |

| 2. | Supplement No. 5 dated April 5, 2012. Supplement No. 5 amends and supersedes all prior supplements to the prospectus; |

| 3. | Part II, included herewith; and |

| 4. | Signatures, included herewith. |

Maximum Offering of 110,000,000 Shares of Common Stock

Strategic Storage Trust, Inc. is a Maryland corporation that elected to qualify as a real estate investment trust, or REIT, for federal income tax purposes for the taxable year ended December 31, 2008. We expect to use a substantial amount of the net proceeds from this follow-on offering to invest in self storage facilities and related self storage real estate investments. As of August 31, 2011, we were the only public non-traded self storage REIT and owned 77 properties in 17 states and Canada. We are externally managed by Strategic Storage Advisor, LLC, our advisor, which is an affiliate of our sponsor, Strategic Capital Holdings, LLC.

We are offering up to 100,000,000 shares of our common stock in our primary offering for $10.00 per share, with discounts available for certain categories of purchasers as described in “Plan of Distribution.” We are also offering up to 10,000,000 shares of our common stock pursuant to our distribution reinvestment plan at a purchase price during this offering of $9.50 per share. We will offer these shares until September 22, 2013, which is two years after the effective date of this offering, unless extended by our board of directors for an additional year as permitted under applicable law, or extended with respect to shares offered pursuant to our distribution reinvestment plan. Some jurisdictions require us to renew this registration annually. We reserve the right to reallocate shares between our primary offering and our distribution reinvestment plan. We also reserve the right to terminate this offering in our sole discretion. As of August 31, 2011, we had received aggregate gross offering proceeds of approximately $276 million from the sale of approximately 27.7 million shares in our initial public offering.

See “Risk Factors” beginning on page 18 to read about the risks you should consider before buying shares of our common stock. These risks include the following:

| | • | | We are a “blind pool” because we have not identified any properties to acquire with the net proceeds from this offering. As a result, you will not be able to evaluate the economic merits of our future investments prior to their purchase. We may be unable to invest the net proceeds from this offering on acceptable terms to investors, or at all. |

| | • | | As of June 30, 2011, our accumulated deficit was approximately $32.1 million, and we anticipate that our operations will not be profitable in 2011. |

| | • | | No public market currently exists for shares of our common stock and we may not list our shares on a national securities exchange before three to five years after completion of this offering, if at all. It may be difficult to sell your shares. If you sell your shares, it will likely be at a substantial discount. |

| | • | | We have paid distributions from sources other than our cash flows from operations, including from the net proceeds from our initial public offering. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. Until we generate operating cash flows sufficient to pay distributions to you, we may pay distributions from the net proceeds of this offering or from borrowings in anticipation of future cash flows. We also may be required to sell assets or issue new securities for cash in order to pay distributions. Any such actions could reduce the amount of capital we ultimately invest in assets and negatively impact the amount of income available for future distributions. |

| | • | | We have no employees and must depend on our advisor to select investments and conduct our operations, and there is no guarantee that our advisor will devote adequate time or resources to us. |

| | • | | Our board of directors may change any of our investment objectives, including our focus on self storage facilities. |

| | • | | We will pay substantial fees and expenses to our advisor, its affiliates and participating broker-dealers, which will reduce cash available for investment and distribution. |

| | • | | There are substantial conflicts of interest among us and our sponsor, advisor, property manager and dealer manager. |

| | • | | This is a “best efforts” offering. If we raise substantially less than the maximum offering, we may not be able to invest in a diverse portfolio of real estate and real estate-related investments, and the value of your investment may fluctuate more widely with the performance of specific investments. |

| | • | | We may fail to remain qualified as a REIT, which could adversely affect our operations and our ability to make distributions. |

| | • | | We may incur substantial debt, which could hinder our ability to pay distributions to our stockholders or could decrease the value of your investment. |

This investment involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment.

Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of our common stock, determined if this prospectus is truthful or complete or passed on or endorsed the merits of this offering. Any representation to the contrary is a criminal offense.

The use of projections or forecasts in this offering is prohibited. Any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any present or future cash benefit or tax consequence which may flow from an investment in our shares of common stock is prohibited.

| | | | | | | | | | | | | | | | |

| | | Price

to Public | | | Sales

Commissions* | | | Dealer

Manager Fee* | | | Net Proceeds

(Before Expenses) | |

Primary Offering | | | | | | | | | | | | | | | | |

Per Share | | $ | 10.00 | | | $ | 0.70 | | | $ | 0.30 | | | $ | 9.00 | |

Total Maximum | | $ | 1,000,000,000 | | | $ | 70,000,000 | | | $ | 30,000,000 | | | $ | 900,000,000 | |

Distribution Reinvestment Plan | | | | | | | | | | | | | | | | |

Per Share | | $ | 9.50 | | | $ | — | | | $ | — | | | $ | 9.50 | |

Total Maximum | | $ | 95,000,000 | | | $ | — | | | $ | — | | | $ | 95,000,000 | |

| * | The maximum amount of sales commissions we will pay is 7% of the gross offering proceeds in our primary offering. The maximum amount of dealer manager fees we will pay is 3% of the gross offering proceeds in our primary offering. The sales commissions and, in some cases, the dealer manager fee, will not be charged or may be reduced with regard to shares sold to or for the account of certain categories of purchasers. The reduction in these fees will be accompanied by a reduction in the per share purchase price, except that shares sold under the distribution reinvestment plan will be sold at $9.50 per share. See “Plan of Distribution.” |

Select Capital Corporation is the dealer manager of this offering and will offer the shares on a best efforts basis. Our dealer manager is a member firm of the Financial Industry Regulatory Authority. An affiliate of our sponsor owns a 15% non-voting equity interest in the dealer manager. The minimum permitted purchase is generally $1,000.

September 22, 2011

SUITABILITY STANDARDS

An investment in our shares of common stock involves significant risks and is only suitable for persons who have adequate financial means, desire a relatively long-term investment and will not need liquidity from their investment. Initially, there will be no public market for our shares and we cannot assure you that one will develop, which means that it may be difficult for you to sell your shares. This investment is not suitable for persons who seek liquidity or guaranteed income, or who seek a short-term investment.

In consideration of these factors, we have established suitability standards for an initial purchaser or subsequent transferee of our shares. These suitability standards require that a purchaser of shares have, excluding the value of a purchaser’s home, furnishings and automobiles, either:

| | • | | a net worth of at least $250,000; or |

| | • | | a gross annual income of at least $70,000 and a net worth of at least $70,000. |

In all states, net worth is to be determined excluding the value of a purchaser’s home, furnishings and automobiles. Several states have established suitability requirements that are more stringent than our standards described above. Shares will be sold only to investors in these states who meet our suitability standards set forth above along with the special suitability standards set forth below:

| | • | | For Kansas Residents –It is recommended by the office of the Kansas Securities Commissioner that Kansas investors not invest, in the aggregate, more than 10% of their liquid net worth in this and other direct participation investments. Liquid net worth is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities. |

| | • | | For Kentucky Residents –Shares will only be sold to residents of the State of Kentucky representing that they have a liquid net worth of at least ten times their investment in us and other similar direct participation programs and that they meet one of our suitability standards. |

| | • | | For Missouri Residents –Shares will only be sold to residents of the State of Missouri representing that they will not invest, in the aggregate, more than 10% of their liquid net worth in us and that they meet one of our suitability standards. |

| | • | | For Alabama, Iowa, Massachusetts, Michigan, North Dakota, Ohio and Tennessee Residents –Shares will only be sold to residents of the States of Alabama, Iowa, Massachusetts, Michigan, North Dakota, Ohio and Tennessee representing that they have a liquid net worth of at least ten times their investment in us and our affiliates and that they meet one of our suitability standards. |

| | • | | For Oregon and Pennsylvania Residents– Shares will only be sold to residents of the States of Oregon and Pennsylvania representing that they have a net worth of at least ten times their investment in us and our affiliates and that they meet one of our suitability standards. |

The minimum purchase is 100 shares ($1,000), except in certain states as described below. After you have purchased the minimum investment, any additional purchases must be investments of at least $100, except for purchases of shares pursuant to our distribution reinvestment plan, which may be in lesser amounts. You may not transfer fewer shares than the minimum purchase requirement. In addition, you may not transfer or subdivide your shares so as to retain fewer than the number of shares required for the minimum purchase. In order to satisfy the minimum purchase requirements for retirement plans, unless otherwise prohibited by state law, a husband and wife may jointly contribute funds from their separate individual retirement accounts (IRAs), provided that each such contribution is made in

i

increments of $100. You should note that an investment in shares of our common stock will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Internal Revenue Code (Code).

The minimum purchase for Minnesota, New Jersey, New York and North Carolina residents is 250 shares ($2,500), except for IRAs which must purchase a minimum of 100 shares ($1,000). After you have purchased the minimum investment, any additional purchases must be investments of at least $100, except for purchases of shares pursuant to our distribution reinvestment plan, which may be in lesser amounts.

Our sponsor and each participating broker-dealer, authorized representative or any other person selling shares on our behalf are required to make every reasonable effort to determine that the purchase of shares is a suitable and appropriate investment for each investor based on information provided by the investor regarding the investor’s financial situation and investment objectives. Our sponsor or the participating broker-dealer, authorized representative or any other person selling shares on our behalf will make this determination based on information provided by such investor to our sponsor or the participating broker-dealer, authorized representative or any other person selling shares on our behalf, including such investor’s age, investment objectives, investment experience, income, net worth, financial situation and other investments held by such investor, as well as any other pertinent factors.

Our sponsor or the participating broker-dealer, authorized representative or any other person selling shares on our behalf will maintain records for at least six years of the information used to determine that an investment in the shares is suitable and appropriate for each investor.

In making this determination, our sponsor or the participating broker-dealer, authorized representative or other person selling shares on our behalf will, based on a review of the information provided by you, consider whether you:

| | • | | meet the minimum income and net worth standards established in your state; |

| | • | | can reasonably benefit from an investment in our common stock based on your overall investment objectives and portfolio structure; |

| | • | | are able to bear the economic risk of the investment based on your overall financial situation; and |

| | • | | have an apparent understanding of: |

| | • | | the fundamental risks of an investment in our common stock; |

| | • | | the risk that you may lose your entire investment; |

| | • | | the lack of liquidity of our common stock; |

| | • | | the restrictions on transferability of our common stock; |

| | • | | the background and qualifications of our advisor and its affiliates; and |

| | • | | the tax consequences of an investment in our common stock. |

In the case of sales to fiduciary accounts, the suitability standards must be met either by the fiduciary account, the person who directly or indirectly supplied the funds for the purchase of the shares or the beneficiary of the account. Given the long-term nature of an investment in our shares, our investment objectives and the relative illiquidity of our shares, our suitability standards are intended to help ensure that shares of our common stock are an appropriate investment for those of you who become investors.

ii

TABLE OF CONTENTS

iii

iv

v

QUESTIONS AND ANSWERS ABOUT THIS OFFERING

Below we have provided some of the more frequently asked questions and answers relating to an offering of this type. Please see “Prospectus Summary” and the remainder of this prospectus for more detailed information about this offering.

| Q: | What is a real estate investment trust? |

| A: | In general, a real estate investment trust, or REIT, is a company that: |

| | • | | combines the capital of many investors to acquire or provide financing for commercial real estate; |

| | • | | allows individual investors the opportunity to invest in a diversified portfolio of real estate under professional management; |

| | • | | pays distributions to investors of at least 90% of its taxable income; and |

| | • | | avoids the “double taxation” treatment of income that generally results from investments in a corporation because a REIT generally is not subject to federal corporate income taxes on its net income, provided certain income tax requirements are satisfied. |

| Q: | What is Strategic Storage Trust, Inc.? |

| A: | Strategic Storage Trust, Inc. is a Maryland corporation that elected to qualify as a REIT for federal income tax purposes for the taxable year ended December 31, 2008. We are currently the only public non-traded self storage REIT. We do not have any employees and are externally managed by our advisor, Strategic Storage Advisor, LLC. |

| Q: | Do you currently own any self storage facilities? |

| A: | Yes. As of August 31, 2011, our self storage portfolio was comprised as follows: |

| | | | | | | | | | |

State | | No. of

Properties | | Units | | | Sq. Ft.

(net) | |

Alabama(1) | | 2 | | | 1,075 | | | | 144,500 | |

Arizona | | 4 | | | 1,970 | | | | 242,850 | |

California(1) | | 8 | | | 6,480 | | | | 831,700 | |

Florida | | 6 | | | 5,850 | | | | 602,150 | |

Georgia | | 9 | | | 4,870 | | | | 663,200 | |

Illinois | | 4 | | | 2,475 | | | | 370,400 | (2) |

Kentucky | | 5 | | | 2,800 | | | | 401,000 | |

Mississippi | | 1 | | | 600 | | | | 66,600 | |

Nevada | | 8 | | | 4,710 | | | | 563,700 | |

New Jersey | | 4 | | | 3,560 | | | | 336,000 | |

New York | | 1 | | | 690 | | | | 82,800 | |

North Carolina | | 3 | | | 1,580 | | | | 178,900 | |

Ontario, Canada | | 2 | | | 1,860 | | | | 211,000 | |

Pennsylvania | | 4 | | | 2,220 | | | | 269,900 | |

South Carolina | | 1 | | | 460 | | | | 65,200 | |

Tennessee | | 1 | | | 800 | | | | 100,400 | |

Texas(1) | | 10 | | | 6,250 | | | | 933,300 | |

Virginia | | 4 | | | 2,450 | | | | 257,800 | |

| | | | | | | | | | |

Total | | 77 | | | 50,700 | | | | 6,321,400 | |

| | | | | | | | | | |

1

| (1) | Does not include properties in which we own a minority interest, including the interests owned in the Montgomery County Self Storage, DST properties, the San Francisco Self Storage DST property, the Hawthorne property, the WP Baltimore Self Storage property and the Southwest Colonial, DST properties. |

| (2) | Includes approximately 85,000 rentable square feet of industrial warehouse/office space at the Chicago – Ogden Ave. property. |

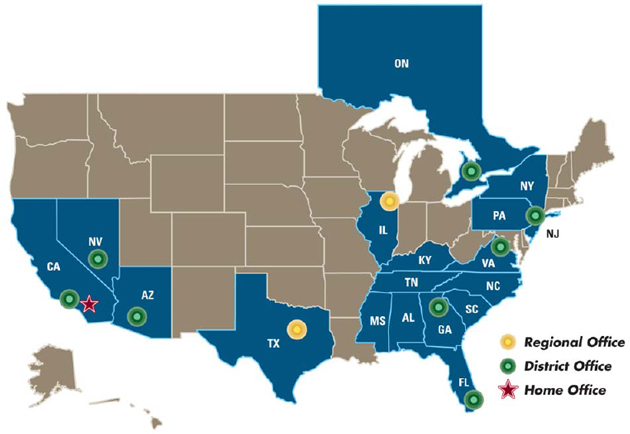

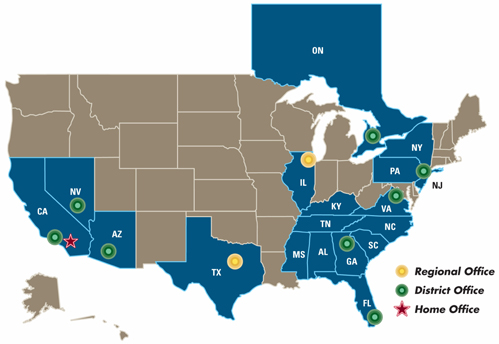

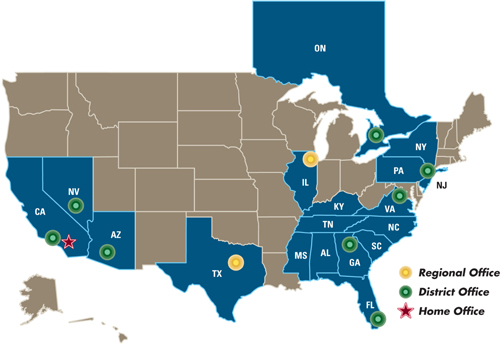

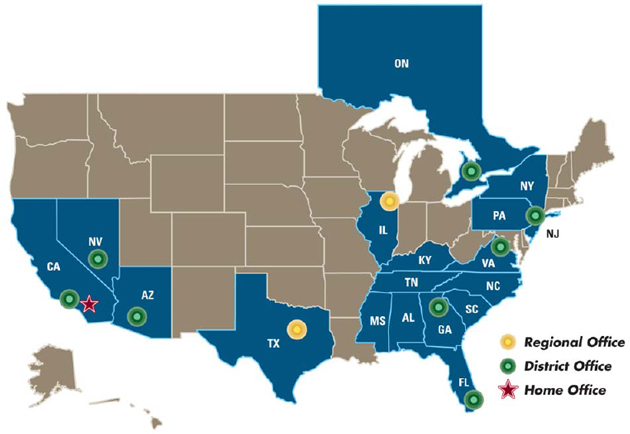

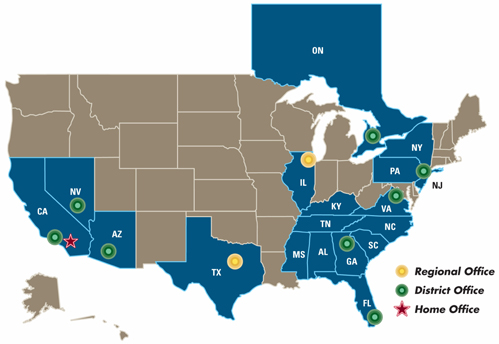

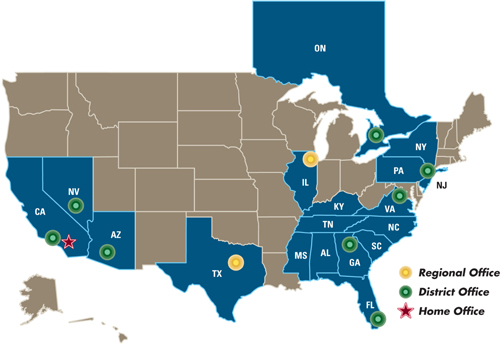

The map below shows the geographic location of our self storage portfolio as of August 31, 2011.

| Q: | What is your acquisition strategy? |

| A: | We intend to invest a substantial amount of the net proceeds we raise in this offering in self storage facilities and related self storage real estate investments throughout the United States. We may also invest a portion of the net proceeds in self storage facilities outside the United States. Self storage facilities are properties that offer do-it-yourself, month-to-month storage space rental for personal or business use. According to the Self Storage Association’s Self Storage Industry Fact Sheet, the self storage industry in the United States consists of approximately 2.2 billion rentable square feet at approximately 46,500 facilities. The industry is highly fragmented and is comprised mainly of local operators and a few national owners and operators, including, we believe, only four publicly-traded self storage REITs. We believe the following factors will allow us to achieve market penetration, name recognition and national brand awareness and loyalty in the self storage industry, which will result in greater economies of scale: |

| | • | | the size and diversification of our self storage portfolio; |

2

| | • | | the management team of our advisor and property manager, which, in addition to our executive officers described elsewhere in this prospectus, includes regional and district property management professionals and on-site property management personnel; and |

| | • | | our self storage branding strategy whereby we intend to re-brand every self storage facility under the “SmartStopTM Self Storage” brand over the next several years, our call center which provides 24/7 access to information regarding our self storage facilities, and our new customer-friendly and mobile phone-friendly self storage website,www.smartstopselfstorage.com, which allows potential self storage customers to locate available units at any of our properties. |

| Q: | What is your strategy for use of debt? |

| A: | We intend to continue to use low leverage (50% or less) to make our investments during this offering. However, at certain times during this offering, our debt leverage levels may be temporarily higher as we acquire properties in advance of funds being raised in this offering. Our board of directors will regularly monitor our investment pipeline in relation to our projected fundraising efforts and otherwise evaluate market conditions related to our debt leverage ratios throughout this offering. As of June 30, 2011, our debt leverage was approximately 50%. |

| Q: | How many shares do you currently have outstanding? |

| A: | As of August 31, 2011, we have approximately 32.7 million shares of common stock issued and outstanding, which includes unregistered shares issued in connection with two mergers with private real estate investment trusts sponsored by our sponsor. Through August 31, 2011, we have received aggregate gross offering proceeds of approximately $276 million from the sale of approximately 27.7 million shares in our initial public offering. |

| Q: | What will you do with the money raised in this offering? |

| A: | We will use the net offering proceeds from your investment to primarily make self storage investments pursuant to our acquisition strategy. We will primarily focus on investments that produce current income. The diversification of our portfolio is dependent upon the amount of proceeds we receive in this offering. If we sell the maximum offering, we estimate that approximately 88.25% of the money you invest will be used to primarily make investments in self storage facilities and related self storage real estate investments and pay real estate-related acquisition fees and acquisition expenses, while the remaining 11.75% will be used to pay sales commissions, dealer manager fees and other offering expenses. We expect our acquisition fees and acquisition expenses to constitute approximately 2.99% of our gross offering proceeds, which will allow us to invest approximately 85.26% in real estate investments. We may also use net offering proceeds to pay down debt or make distributions if our cash flows from operations are insufficient. See “Estimated Use of Proceeds.” As of June 30, 2011, we had approximately $215 million in debt outstanding, approximately $7.2 million of which was variable rate debt (excluding net unamortized debt discounts of approximately $1.6 million). Until we invest the proceeds of this offering pursuant to our acquisition strategy, we may invest in short-term, highly liquid or other authorized investments. Such short-term investments will not earn significant returns, and we cannot guarantee how long it will take to fully invest the proceeds from this offering in properties. |

3

| Q: | How will you own the self storage properties? |

| A: | Strategic Storage Operating Partnership, L.P., our subsidiary operating partnership, will own, directly or indirectly through one or more special purpose entities, all of the self storage properties that we acquire. We are the sole general partner of our operating partnership, and therefore, we completely control the operating partnership. This structure is commonly known as an UPREIT. |

| A: | UPREIT stands for “Umbrella Partnership Real Estate Investment Trust.” An UPREIT is a REIT that holds all or substantially all of its properties through an operating partnership in which the REIT holds a controlling interest. Using an UPREIT structure may give us an advantage in acquiring properties from persons who might not otherwise sell their properties because of unfavorable tax results. Generally, a sale of property directly to a REIT, or a contribution in exchange for REIT shares, is a taxable transaction to the selling property owner. However, in an UPREIT structure, a seller of a property who desires to defer taxable gain on the sale of property may transfer the property to the UPREIT in exchange for limited partnership units in the UPREIT’s operating partnership without recognizing gain for tax purposes. |

| Q: | What is a taxable REIT subsidiary? |

| A: | A taxable REIT subsidiary is a fully taxable corporation that can perform activities unrelated to the leasing of self storage space to tenants or customers, such as third-party management, development and other independent business activities, as well as provide products and services to our tenants or customers. Our company is allowed to own up to 100% of the stock of taxable REIT subsidiaries. We will be subject to a 100% penalty tax on certain amounts if the economic arrangements among our tenants and customers, our taxable REIT subsidiary and us are not comparable to similar arrangements among unrelated parties. We, along with Strategic Storage TRS, Inc., our wholly-owned subsidiary, made an election to treat Strategic Storage TRS, Inc. as a taxable REIT subsidiary. Strategic Storage TRS, Inc. will, among other things, conduct certain activities (such as selling tenant insurance, moving supplies and locks and renting trucks or other moving equipment) that, if conducted by us, could cause us to receive non-qualifying income under the REIT gross income tests. We also have a Canadian taxable REIT subsidiary that currently conducts similar activities for the properties we acquire in Canada. |

| Q: | If I buy shares, will I receive distributions, and how often? |

| A: | Yes. We currently pay and expect to continue to pay distributions on a monthly basis to our stockholders. See “Description of Shares — Distribution Policy” and “— Distribution Declaration History.” |

| Q: | Will the distributions I receive be taxable as ordinary income? |

| A: | Yes and no. Generally, distributions that you receive, including distributions that are reinvested pursuant to our distribution reinvestment plan, will be taxed as ordinary income to the extent they are from current or accumulated earnings and profits. We expect that some portion of your distributions may not be subject to tax in the year received because depreciation expense reduces taxable income but does not reduce cash available for distribution. In addition, we may make distributions using offering proceeds. We are not prohibited from using offering proceeds to make distributions by our charter, bylaws or investment policies, and we may use an unlimited |

4

| | amount from any source to pay our distributions. The portion of your distribution that is not subject to tax immediately is considered a return of investors’ capital for tax purposes and will reduce the tax basis of your investment. This, in effect, defers a portion of your tax until your investment is sold or we are liquidated, at which time you would be taxed at capital gains rates. However, because each investor’s tax considerations are different, we suggest that you consult with your tax advisor. You also should review the section of this prospectus entitled “Federal Income Tax Considerations.” |

| Q: | What kind of offering is this? |

| A: | Through our dealer manager, we are offering a maximum of 100,000,000 shares of our common stock at $10.00 per share in our primary offering on a “best efforts” basis. We are also offering 10,000,000 shares of our common stock at $9.50 per share pursuant to our distribution reinvestment plan to those stockholders who elect to participate in such plan as described in this prospectus. We reserve the right to reallocate the shares of common stock we are offering between our primary offering and our distribution reinvestment plan. We commenced our initial public offering of shares of our common stock on March 17, 2008. On September 16, 2011 we terminated our initial public offering. On September 22, 2011, we commenced this “best efforts” public offering of up to 110,000,000 shares of our common stock. As of August 31, 2011, we had received aggregate gross offering proceeds of approximately $276 million from the sale of approximately 27.7 million shares in our initial public offering. |

| Q: | How does a “best efforts” offering work? |

| A: | When shares are offered to the public on a “best efforts” basis, the dealer manager and the participating broker-dealers are only required to use their best efforts to sell the shares and have no firm commitment or obligation to purchase any of the shares. Therefore, we may not sell all or any of the shares that we are offering. |

| Q: | How long will this offering last? |

| A: | The offering will not last beyond September 22, 2013 (two years after the effective date of this offering); provided, however, that the amount of shares of our common stock registered pursuant to this offering is the amount that we reasonably expect to be offered and sold within two years from the initial effective date of this offering and, to the extent permitted by applicable law, we may extend this offering for an additional year, or, in certain circumstances, longer. We reserve the right to terminate this offering earlier at any time. |

| A: | Generally, you may buy shares pursuant to this prospectus provided that you have either (1) a net worth of at least $70,000 and a gross annual income of at least $70,000, or (2) a net worth of at least $250,000. For this purpose, net worth does not include your home, furnishings and automobiles. Some states have higher suitability requirements. You should carefully read the more detailed description under “Suitability Standards” immediately following the cover page of this prospectus. |

| Q: | For whom is an investment in your shares recommended? |

| A: | An investment in our shares may be appropriate if you (1) meet the suitability standards as set forth herein, (2) seek to diversify your personal portfolio with a finite-life, real estate-based investment, (3) seek to receive current income, (4) seek to preserve capital, (5) wish to obtain the |

5

| | benefits of potential long-term capital appreciation, and (6) are able to hold your investment for a long period of time. On the other hand, we caution persons who require liquidity or guaranteed income, or who seek a short-term investment. |

| Q: | May I make an investment through my IRA, SEP or other tax-deferred account? |

| A: | Yes. You may make an investment through your individual retirement account (IRA), a simplified employee pension (SEP) plan or other tax-deferred account. In making these investment decisions, you should consider, at a minimum, (1) whether the investment is in accordance with the documents and instruments governing your IRA, plan or other account, (2) whether the investment satisfies the fiduciary requirements associated with your IRA, plan or other account, (3) whether the investment will generate unrelated business taxable income (UBTI) to your IRA, plan or other account, (4) whether there is sufficient liquidity for such investment under your IRA, plan or other account, (5) the need to value the assets of your IRA, plan or other account annually or more frequently, and (6) whether the investment would constitute a prohibited transaction under applicable law. |

| Q: | Is there any minimum investment required? |

| A: | Yes. Generally, you must invest at least $1,000. Investors who already own our shares can make additional purchases for less than the minimum investment. Some states require a higher minimum investment. You should carefully read the more detailed description of the minimum investment requirements appearing under “Suitability Standards” immediately following the cover page of this prospectus. |

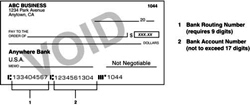

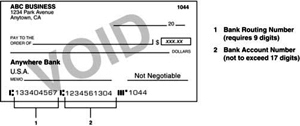

| Q: | How do I subscribe for shares? |

| A: | If you meet the suitability standards described herein and choose to purchase shares in this offering, you must complete a subscription agreement, like the one contained in this prospectus as Appendix A, for a specific number of shares and pay for the shares at the time you subscribe. |

| Q: | May I reinvest my distributions? |

| A: | Yes. Under our distribution reinvestment plan, you may reinvest the distributions you receive. The purchase price per share under our distribution reinvestment plan will be $9.50 per share during this offering. No sales commissions or dealer manager fees will be paid on shares sold under the distribution reinvestment plan. Please see “Description of Shares — Distribution Reinvestment Plan” for more information regarding our distribution reinvestment plan. |

| Q: | If I buy shares in this offering, how may I later sell them? |

| A: | At the time you purchase the shares, they will not be listed for trading on any national securities exchange. As a result, if you wish to sell your shares, you may not be able to do so promptly or at all, or you may only be able to sell them at a substantial discount from the price you paid. In general, however, you may sell your shares to any buyer that meets the applicable suitability standards unless such sale would cause the buyer to own more than 9.8% of the value of our then-outstanding capital stock (which includes common stock and any preferred stock we may issue) or more than 9.8% of the value or number of shares, whichever is more restrictive, of our then-outstanding common stock. See “Suitability Standards” and “Description of Shares — Restrictions on Ownership and Transfer.” We are offering a share redemption program, as discussed under “Description of Shares — Share Redemption Program,” which may provide limited liquidity for some of our stockholders; however, our share redemption program contains |

6

| | significant restrictions and limitations and we may suspend or terminate our share redemption program if our board of directors determines that such program is not in the best interests of our stockholders. |

| Q: | What are some of the more significant risks involved in an investment in your shares? |

| A: | An investment in our shares is subject to significant risks. You should carefully consider the information set forth under “Risk Factors” beginning on page 18 for a discussion of the material risk factors relevant to an investment in our shares. Some of the more significant risks include the following: |

| | • | | We have limited established financing sources and we cannot assure you that we will be successful in the marketplace. |

| | • | | We have incurred operating losses to date, have an accumulated deficit and our operations will not be profitable in 2011. |

| | • | | There is currently no public trading market for our shares and there may never be one; therefore, it will likely be difficult for you to sell your shares. |

| | • | | Because this is a “blind pool” offering, you will not have the opportunity to evaluate the investments we will make with the proceeds of this offering before you purchase our shares. |

| | • | | To date, we have paid a majority of our distributions from sources other than cash flow from operations; therefore, we will have fewer funds available for the acquisition of properties, and our stockholders’ overall return may be reduced. |

| | • | | Our ability to operate profitably will depend upon the ability of our advisor to efficiently manage our day-to-day operations and the ability of our property manager to effectively manage our properties. |

| | • | | Our advisor, property manager and their officers and certain of our key personnel will face competing demands relating to their time, and this may cause our operating results to suffer. |

| | • | | Our advisor will face conflicts of interest relating to the incentive fee structure under our advisory agreement, which could result in actions that are not necessarily in the long-term best interests of our stockholders. |

| | • | | You are bound by the majority vote on matters on which our stockholders are entitled to vote and, therefore, your vote on a particular matter may be superseded by the vote of other stockholders. |

| | • | | Because our president, H. Michael Schwartz, owns a 15% beneficial non-voting equity interest in our dealer manager, you may not have the benefit of an independent review of the prospectus or our company as is customarily performed in underwritten offerings. |

| | • | | Payment of fees to our advisor and its affiliates will reduce cash available for investment and distribution. |

| | • | | Because we are focused on the self storage industry, our rental revenues will be significantly influenced by demand for self storage space generally, and a decrease in such demand would likely have a greater adverse effect on our rental revenues than if we owned a more diversified real estate portfolio. |

7

| | • | | We will depend on our on-site personnel to maximize customer satisfaction at each of our facilities, and any difficulties we encounter in hiring, training and retaining skilled field personnel may adversely affect our rental revenues. |

| | • | | We may suffer reduced or delayed revenues for, or have difficulty selling, properties with vacancies. |

| | • | | We may not be able to sell our properties at a price equal to, or greater than, the price for which we purchased such properties, which may lead to a decrease in the value of our assets. |

| | • | | Adverse economic conditions will negatively affect our returns and profitability. |

| | • | | High interest rates may make it difficult for us to refinance properties, which could reduce the number of properties we can acquire and the amount of cash distributions we can make. |

| | • | | Continued disruptions in the credit markets could have a material adverse effect on our results of operations, financial condition and ability to pay distributions to you. |

| | • | | Failure to qualify as a REIT would adversely affect our operations and our ability to make distributions, as we would incur additional tax liabilities. |

| | • | | You may have tax liability on distributions you elect to reinvest in our common stock. |

| | • | | There are special considerations that apply to pension or profit-sharing trusts or IRAs investing in our shares which could cause an investment in our company to be a prohibited transaction and could result in additional tax consequences. |

| Q: | Will I be notified of how my investment is doing? |

| A: | Yes. We will provide you with periodic updates on the performance of your investment with us, including: |

| | • | | supplements to the prospectus during the offering period; |

| | • | | quarterly distribution reports; |

| | • | | an annual IRS Form 1099. |

We intend to provide annually the estimated value of our shares and to include this information in our annual report. Until 18 months after we have completed our last offering (excluding offerings under our distribution reinvestment plan), we intend to use the most recent price paid to acquire a share in our offering (ignoring purchase price discounts for certain categories of purchasers) as our estimated per share value of our shares. This estimated per share value may bear little relationship to, and will likely exceed, what you might receive for your shares if you tried to sell them or if we liquidated our portfolio. See the “Risk Factors — Risks Related to this Offering and Our Corporate Structure” and the “Investment By Tax-Exempt Entities and ERISA Considerations — Annual Valuation Requirement” sections of this prospectus.

| Q: | When will I get my detailed tax information? |

| A: | Your IRS Form 1099 will be placed in the mail by January 31 of each year. |

8

| Q: | Who can help answer my questions? |

| A: | If you have more questions about the offering or if you would like additional copies of this prospectus, you should contact your registered representative or contact: |

Select Capital Corporation

31351 Rancho Viejo Road, Suite 205

San Juan Capistrano, California 92675

Telephone: (866) 699-5338

9

PROSPECTUS SUMMARY

This prospectus summary highlights material information contained elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that is important to you. To understand this offering fully, you should read the entire prospectus carefully, including the “Questions and Answers About this Offering” and “Risk Factors” sections and the financial statements (including the financial statements incorporated by reference in this prospectus), before making a decision to invest in our shares.

Strategic Storage Trust, Inc.

Strategic Storage Trust, Inc. is a Maryland corporation incorporated in 2007 that elected to qualify as a REIT for federal income tax purposes for the taxable year ended December 31, 2008. We commenced our initial public offering of shares of our common stock on March 17, 2008 on a “best efforts” basis. On September 16, 2011 we terminated our initial public offering. On September 22, 2011, commenced this “best efforts” public offering of up to 110,000,000 shares of our common stock. As of August 31, 2011, we had received aggregate gross offering proceeds of approximately $276 million from the sale of approximately 27.7 million shares in our initial public offering. We expect to use a substantial amount of the net proceeds from this offering to invest in self storage facilities and related self storage real estate investments. As of August 31, 2011, we owned 77 properties in 17 states and Canada. We have not yet identified any specific self storage facilities we will acquire with the future proceeds from this offering.

Our office is located at 111 Corporate Drive, Suite 120, Ladera Ranch, California 92694. Our telephone number is (949) 429-6600 and our fax number is (949) 429-6606. Additional information about us may be obtained atwww.strategicstoragetrust.com, but the contents of that site are not incorporated by reference in or otherwise a part of this prospectus.

Our Advisor

Strategic Storage Advisor, LLC is our advisor and will be responsible for managing our affairs on a day-to-day basis and identifying and making acquisitions on our behalf, subject to oversight by our board of directors. Our advisor was formed in Delaware in 2007 and is owned by Strategic Storage Holdings, LLC, which is owned by Strategic Capital Holdings, LLC, our sponsor, and certain officers of us and our advisor and other individuals. See the “Management — Our Advisor” section of this prospectus.

Our Sponsor

Our advisor is managed by our sponsor, Strategic Capital Holdings, LLC. Our sponsor was formed in 2004 to engage in private structured offerings of limited partnerships, limited liability companies, REITs and other entities with respect to the acquisition, management and disposition of commercial real estate. The privately-offered programs sponsored or co-sponsored by our sponsor include 11 single-asset commercial real estate tenant-in-common offerings, two privately-offered REITs, four multi-asset Delaware Statutory Trust offerings, one single-asset Delaware Statutory Trust offering and one single-asset real estate limited liability company. Since its formation, our sponsor has participated in acquisitions of 88 self storage facilities representing approximately 7.1 million rentable square feet and 11 other commercial properties representing approximately 2.9 million rentable square feet.

Our Property Manager

Strategic Storage Property Management, LLC, a Delaware limited liability company, is our property manager and manages our properties. See “Management — Affiliated Companies — Our Property Manager” and “Conflicts of Interest.” Our property manager was formed in 2007 to manage our properties. See “Management Compensation” for a discussion of the fees and expense reimbursements payable to our property manager. Our property manager derives substantially all of its income from the property management services it performs for us.

As of August 31, 2011, our property manager and its affiliates managed 86 self storage facilities with approximately 7.0 million rentable square feet located in 18 states. The officers and employees of our property manager have significant experience managing self storage facilities throughout the United States. Many of our senior property management

10

personnel previously worked for large self storage operators, including publicly-traded self storage REITs. As of August 31, 2011, our property manager employed approximately 190 property management personnel, including two regional managers, seven district managers and one area manager.

Our Management

We operate under the direction of our board of directors, the members of which are accountable to us and our stockholders as fiduciaries. Currently, we have three directors — H. Michael Schwartz, our Chief Executive Officer and President, and two independent directors, Harold “Skip” Perry and Timothy S. Morris. Certain of our executive officers and directors are affiliated with our advisor. Our charter, which requires that a majority of our directors be independent of our advisor, provides that our independent directors are responsible for reviewing the performance of our advisor and must approve other matters set forth in our charter. See the “Conflicts of Interest — Certain Conflict Resolution Procedures” section of this prospectus. Our directors will be elected annually by our stockholders.

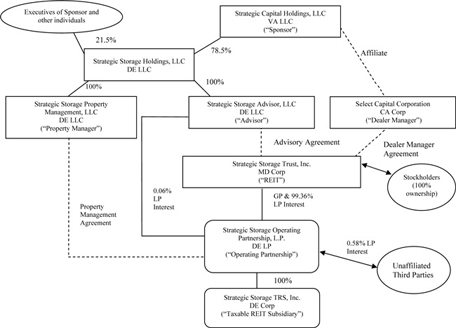

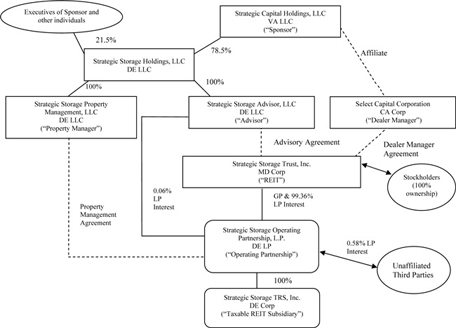

Our Structure

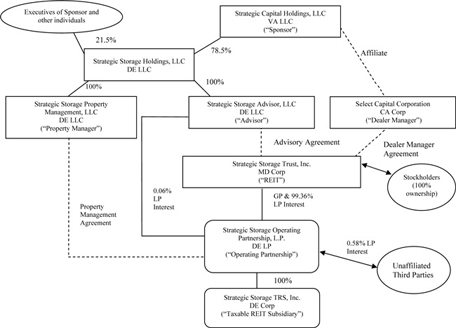

Below is a chart showing our ownership structure and the entities that are affiliated with our advisor and sponsor as of August 31, 2011.

* The address of all of these entities, except for Select Capital Corporation, is 111 Corporate Drive, Suite 120, Ladera Ranch, California 92694. The address for Select Capital Corporation is 31351 Rancho Viejo Road, Suite 205, San Juan Capistrano, California 92675.

** H. Michael Schwartz, our President and President of our advisor, owns (1) a 51% beneficial interest in Strategic Capital Holdings, LLC, (2) a minority beneficial interest in Strategic Storage Holdings, LLC and (3) a 15% beneficial non-voting equity interest in Select Capital Corporation.

11

Conflicts of Interest

Our advisor will experience conflicts of interest in connection with the management of our business affairs, including the following:

| | • | | The management personnel of our advisor and its affiliates previously made investment decisions for various other affiliated programs, many of which invested in self storage properties, and to the extent management personnel of our advisor and its affiliates participate in other self storage programs in the future, they will need to determine which investment opportunities to recommend to us or an affiliated program or joint venture and also determine how to allocate resources among us and the other affiliated programs; |

| | • | | Our advisor may receive higher fees by providing an investment opportunity to an entity other than us; |

| | • | | We may engage in transactions with other programs sponsored by affiliates of our advisor which may entitle such affiliates to fees in connection with their services, as well as entitle our advisor and its affiliates to fees on both sides of the transaction; |

| | • | | We may structure the terms of joint ventures between us and other programs sponsored by our advisor and its affiliates; |

| | • | | Our advisor and its affiliates, including Strategic Storage Property Management, LLC, our property manager, will have to allocate their time between us and other real estate programs and activities in which they are involved; |

| | • | | Our advisor and its affiliates will receive substantial fees in connection with transactions involving the purchase, management and sale of our properties regardless of the quality of the property acquired or the services provided to us; and |

| | • | | Our advisor may receive substantial compensation in connection with a potential listing or other liquidity event. |

These conflicts of interest could result in decisions that are not in our best interests. See the “Conflicts of Interest” and the “Risk Factors — Risks Related to Conflicts of Interest” sections of this prospectus for a detailed discussion of the various conflicts of interest relating to your investment, as well as the procedures that we have established to mitigate a number of these potential conflicts.

Compensation to Our Advisor and its Affiliates

Our advisor and its affiliates will receive compensation and reimbursements for services relating to this offering and the investment and management of our assets. The most significant items of compensation are summarized in the table below. Please see the “Management Compensation” section of this prospectus for a complete discussion of the compensation payable to our advisor and its affiliates. The sales commissions and dealer manager fees may vary for different categories of purchasers as described in the “Plan of Distribution” section of this prospectus. The table below assumes that the maximum amount of shares will be sold through distribution channels associated with the highest possible sales commissions and dealer manager fees and accounts for the fact that shares will be sold through our distribution reinvestment plan at $9.50 per share with no sales commissions and no dealer manager fees.

12

| | | | |

Type of Compensation (Recipient) | | Determination of Amount | | Estimated Amount for Maximum Offering (110,000,000 shares) |

| | |

| | Offering Stage | | |

| | |

Sales Commissions (Participating Dealers) | | 7% of gross proceeds of our primary offering; we will not pay any sales commissions on sales of shares under our distribution reinvestment plan; the dealer manager will reallow all sales commissions to participating broker-dealers. | | $70,000,000 |

| | |

Dealer Manager Fee (Dealer Manager) | | Up to 3% of gross proceeds of our primary offering; we will not pay a dealer manager fee on sales of shares under our distribution reinvestment plan. | | $30,000,000 |

| | |

Other Offering Expenses (Advisor) | | Estimated to be 1.75% of gross offering proceeds from our primary offering in the event we raise the maximum offering. | | $17,500,000 |

| | |

| | Operational Stage | | |

| | |

Acquisition Fees (Advisor) | | 2.5% of the contract purchase price of each property or other real estate investments we acquire. | | $21,350,000 (estimate without leverage) $41,800,000 (estimate assuming 49% leverage) |

| | |

Acquisition Expenses (Advisor) | | Estimated to be 1% of the purchase price of each property. | | $8,500,000 (estimate without leverage) $16,725,000 (estimate assuming 49% leverage) |

| | |

Asset Management Fees (Advisor) | | Monthly fee of up to 0.0833%, which is one-twelfth of 1%, of our aggregate asset value, subject to certain conditions. | | Not determinable at this time. |

| | |

Property Management Fees (Property Manager) | | Aggregate property management fees of 6% of gross revenues received for management of our self storage properties. These property management fees may be paid or re-allowed to third party property managers. | | Not determinable at this time. |

| | |

Operating Expenses (Advisor and Property Manager) | | Reimbursement of our advisor and property manager for costs of providing administrative services, subject to the limitation that we will not reimburse our advisor or property manager for any amount by which our operating expenses at the end of the four preceding fiscal quarters exceeds the greater of (i) 2% of average invested assets, or (ii) 25% of net income other than any additions to reserves for depreciation, bad debt or other similar non-cash reserves and excluding any gain from the sale of assets for that period. | | Not determinable at this time. |

| | |

Incentive Plan Compensation (employees and affiliates of Advisor) | | We may issue stock based awards to our independent directors and to employees and affiliates of our advisor. The total number of shares of common stock we have reserved for issuance under our Employee and Director Long-Term Incentive Plan may not exceed 10% of our outstanding shares at any time. | | Not determinable at this time. |

| | |

| | Liquidation/Listing Stage | | |

| | |

Subordinated Disposition Fee (Advisor) | | Up to one-half of the total real estate commission paid but in no event to exceed an amount equal to 3% of the contract price for property sold. Fee only paid if stockholders paid return of investors’ capital plus 6% annual cumulative, non-compounded return. | | Not determinable at this time. |

| | |

Subordinated Share of Net Sale Proceeds (payable only if we are not listed on an exchange) (Advisor) | | We will pay the advisor a share of net sale proceeds equal to: 5% if stockholders paid return of investors’ capital plus between 6% and 8% annual cumulative, non-compounded return; 10% if stockholders paid return of investors’ capital plus between 8% and 10% annual cumulative, non-compounded return; or 15% if stockholders paid return of investors’ capital plus a 10% or more annual cumulative, non-compounded return. | | Not determinable at this time. |

| | |

Subordinated Performance Fee Due Upon Termination of Advisory Agreement (payable only if we are not listed on an exchange) (Advisor) | | In the event that the advisory agreement is terminated in certain situations, we will pay the advisor a subordinated performance fee based on the appraised value of the assets minus liabilities (less any payments made to advisor for subordinated share of net sale proceeds) equal to: 5% if stockholders paid return of investors’ capital plus between 6% and 8% annual cumulative, non-compounded return; | | Not determinable at this time. |

13

| | | | |

Type of Compensation (Recipient) | | Determination of Amount | | Estimated Amount for Maximum Offering (110,000,000 shares) |

| | |

| | 10% if stockholders paid return of investors’ capital plus between 8% and 10% annual cumulative, non-compounded return; or 15% if stockholders paid return of investors’ capital plus a 10% or more annual cumulative, non-compounded return. | | |

| | |

Subordinated Incentive Listing Fee (payable only if we are listed on an exchange) (Advisor) | | In the event we list our stock on a national securities exchange, we must pay a listing fee equal to the following percentages of the amount by which the market value of our stock plus all prior distributions exceeds invested capital plus the below preferred returns: 5% if stockholders paid return of investors’ capital plus between 6% and 8% annual cumulative, non-compounded return; 10% if stockholders paid return of investors’ capital plus between 8% and 10% annual cumulative, non-compounded return; or 15% if stockholders paid return of investors’ capital plus a 10% or more annual cumulative, non-compounded return. | | Not determinable at this time. |

See “Management Compensation” for a detailed explanation of these fees and various limitations related to these fees.

Our REIT Status

If we continue to qualify as a REIT, we generally will not be subject to federal income tax on income that we distribute to our stockholders. Under the Code, a REIT is subject to numerous organizational and operational requirements, including a requirement that it distribute at least 90% of its annual taxable income to its stockholders. If we fail to qualify for taxation as a REIT in any year, our income will be taxed at regular corporate rates, and we may be precluded from qualifying for treatment as a REIT for the four-year period following our failure to qualify. Even if we continue to qualify as a REIT for federal income tax purposes, we may still be subject to state and local taxes on our income and property and to federal income and excise taxes on our undistributed income.

Estimated Use of Proceeds

If we sell the maximum offering in our primary offering, we estimate that approximately 88.25% of our gross offering proceeds will be used to primarily make investments in self storage facilities and related self storage real estate investments and pay real estate-related acquisition fees and acquisition expenses, while the remaining 11.75% will be used to pay sales commissions, dealer manager fees, and other offering expenses. We expect our acquisition fees and acquisition expenses to be approximately 2.99% of gross offering proceeds, which will allow us to invest approximately 85.26% in real estate investments. We may also use net offering proceeds to pay down debt or to fund distributions if our cash flows from operations are insufficient. We will not pay sales commissions or a dealer manager fee on shares sold under our distribution reinvestment plan. Please see the “Estimated Use of Proceeds” section of this prospectus.

Primary Investment Objectives

Our primary investment objectives are to:

| | • | | invest in income-producing real property in a manner that allows us to qualify as a REIT for federal income tax purposes; |

| | • | | provide regular cash distributions to our stockholders; |

| | • | | preserve and protect your invested capital; and |

| | • | | achieve appreciation in the value of our properties over the long term. |

14

See the “Investment Objectives, Strategy and Related Policies” section of this prospectus for a more complete description of our investment policies and restrictions.

Liquidity Events

Subject to then-existing market conditions and the sole discretion of our board of directors, we intend to achieve one or more of the following liquidity events within three to five years after completion of this offering:

| | • | | list our shares on a national securities exchange; |

| | • | | merge, reorganize or otherwise transfer our company or its assets to another entity that has listed securities; |

| | • | | commence selling our properties and liquidate our company; or |

| | • | | otherwise create a liquidity event for our stockholders. |

However, we cannot assure you that we will achieve one or more of the above-described liquidity events within the time frame contemplated or at all. This time frame represents our best faith estimate of the time necessary to build a portfolio sufficient enough to effectuate one of the liquidity events listed above. Our board of directors has the sole discretion to continue operations beyond five years after completion of the offering if it deems such continuation to be in the best interests of our stockholders.

Our Borrowing Strategy and Policies

We intend to continue to use low leverage (50% or less) to make our investments during this offering. However, at certain times during this offering, our debt leverage levels may be temporarily higher as we acquire properties in advance of funds being raised in this offering. Our board of directors will regularly monitor our investment pipeline in relation to our projected fundraising efforts and otherwise evaluate market conditions related to our debt leverage ratios throughout this offering. As of June 30, 2011 our debt leverage was approximately 50%.

We may incur our indebtedness in the form of bank borrowings, purchase money obligations to the sellers of properties and publicly- or privately-placed debt instruments or financing from institutional investors or other lenders. We may obtain a credit facility or separate loans for each acquisition. Our indebtedness may be unsecured or may be secured by mortgages or other interests in our properties. We may use borrowing proceeds to finance acquisitions of new properties, to pay for capital improvements, repairs or buildouts, to refinance existing indebtedness, to pay distributions, to fund redemptions of our shares or to provide working capital.

There is no limitation on the amount we can borrow for the purchase of any property. Our aggregate borrowings, secured and unsecured, must be reasonable in relation to our net assets and must be reviewed by our board of directors at least quarterly. Our charter limits our borrowing to 300% of our net assets, as defined (approximately 75% of the cost of our assets), unless any excess borrowing is approved by a majority of our independent directors and is disclosed to our stockholders in our next quarterly report after such approval. Except as set forth in our charter regarding debt limits, we may re-evaluate and change our debt strategy and policies in the future without a stockholder vote.

Distribution Policy

To maintain our qualification as a REIT, we are required to make aggregate annual distributions to our stockholders of at least 90% of our annual taxable income (which does not necessarily equal net income as calculated in accordance with generally accepted accounting principles in the United States). Our board of directors may authorize distributions in excess of those required for us to maintain our REIT status depending on our financial condition and such other factors as our board of directors deems

15

relevant. We have not established a minimum distribution level. We calculate our monthly distributions based upon daily record and distribution declaration dates, so investors may be entitled to distributions immediately upon purchasing our shares. We commenced operations and began calculating distributions on May 22, 2008 and expect to continue to pay distributions on a monthly basis to our stockholders. To date, we have paid a majority of our distributions from our offering proceeds. To the extent we pay distributions in excess of our operating cash flow, we may continue to pay such excess distributions from the proceeds of this offering or by borrowing funds from third parties on a short-term basis, issuing new securities or selling assets. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. See the “Description of Shares — Distribution Policy” and “— Distribution Declaration History” sections of this prospectus for a more complete description of our stockholder distribution policy and declaration history.

Distribution Reinvestment Plan

Under our distribution reinvestment plan, you may reinvest the distributions you receive in additional shares of our common stock. The purchase price per share under our distribution reinvestment plan will be $9.50 per share during this offering. No sales commissions or dealer manager fees will be paid on shares sold under the distribution reinvestment plan. If you participate in the distribution reinvestment plan, you will not receive the cash from your distributions, other than special distributions that are designated by our board of directors. As a result, you may have a tax liability with respect to your share of our taxable income, but you will not receive cash distributions to pay such liability. We may terminate the distribution reinvestment plan at our discretion at any time upon ten days’ prior written notice to you. See the “Description of Shares — Distribution Reinvestment Plan” section of this prospectus.

Share Redemption Program

Our board of directors has adopted a share redemption program that enables you to sell your shares back to us in limited circumstances. Our share redemption program generally permits you to submit your shares for redemption after you have held them for at least one year, subject to the significant restrictions and limitations described below.

There are several restrictions on your ability to sell your shares to us under our share redemption program. You generally have to hold your shares for one year before submitting your shares for redemption under the program; however, we may waive the one-year holding period in the event of the death, disability or bankruptcy of a stockholder. In addition, we will limit the number of shares redeemed pursuant to our share redemption program as follows: (1) during any calendar year, we will not redeem in excess of 5% of the weighted average number of shares outstanding during the prior calendar year; and (2) funding for the redemption of shares will be limited to the amount of net proceeds we receive from the sale of shares under our distribution reinvestment plan. These limits may prevent us from accommodating all requests made in any year.

During the term of this offering (effective October 1, 2011), and subject to certain provisions described in “Description of Shares — Share Redemption Program,” the redemption price per share, or Redemption Amount, will depend on the length of time you have held such shares as follows: 90.0% of the Redemption Amount after one year from the purchase date; 92.5% of the Redemption Amount after two years from the purchase date; 95.0% of the Redemption Amount after three years from the purchase date; and 100% of the Redemption Amount after four years from the purchase date. The Redemption Amount shall equal the amount you paid for your shares, until the offering price changes or net asset value is calculated, as described in more detail in “Description of Shares — Share Redemption Program.”

During the six month period ended June 30, 2011, we redeemed approximately 439,000 shares for approximately $4.2 million ($9.68 per share). As of June 30, 2011, there were approximately 316,000

16

shares related to redemption requests to be processed subsequent to June 30, 2011. On July 29, 2011, we satisfied all of the eligible redemption requests. During the year ended December 31, 2010, we redeemed 381,834 shares of common stock for approximately $3.7 million ($9.57 per share). During the year ended December 31, 2009, we redeemed 11,916 shares of common stock for approximately $0.1 million ($9.59 per share). We redeemed no shares of common stock in the year ended December 31, 2008. We have funded all redemptions using proceeds from the sale of shares pursuant to our distribution reinvestment plan. See “Description of Shares — Share Redemption Program” below.

ERISA Considerations

The section of this prospectus entitled “Investment by Tax-Exempt Entities and ERISA Considerations” describes the effect the purchase of shares will have on individual retirement accounts and retirement plans subject to the Employee Retirement Income Security Act of 1974, as amended (ERISA), and/or the Code. ERISA is a federal law that regulates the operation of certain tax-advantaged retirement plans. Any retirement plan trustee or individual considering purchasing shares for a retirement plan or an individual retirement account should read the “Investment by Tax-Exempt Entities and ERISA Considerations” section of this prospectus very carefully.

Description of Shares

Uncertificated Shares

Our board of directors has authorized the issuance of our shares without certificates. We expect that, unless and until our shares are listed on a national securities exchange, we will not issue shares in certificated form. Our transfer agent will maintain a stock ledger that contains the name and address of each stockholder and the number of shares that the stockholder holds. With respect to uncertificated stock, we will continue to treat the stockholder registered on our stock ledger as the owner of the shares until the record owner and the new owner deliver a properly executed stock transfer form to us, along with a fee to cover reasonable transfer costs, in an amount determined by our board of directors. We will provide the required form to you upon request.

Stockholder Voting Rights

We intend to hold annual meetings of our stockholders for the purpose of electing our directors and conducting other business matters that may be presented at such meetings. We may also call special meetings of stockholders from time to time. You are entitled to one vote for each share of common stock you own at any of these meetings.

Restrictions on Share Ownership

Our charter contains restrictions on ownership of our shares that prevent any one person from owning more than 9.8% in value of our outstanding shares and more than 9.8% in value or number, whichever is more restrictive, of any class or series of our outstanding shares of stock unless waived by our board of directors. These restrictions are designed to enable us to comply with ownership restrictions imposed on REITs by the Code. For a more complete description of the shares, including restrictions on the ownership of shares, please see the “Description of Shares” section of this prospectus. Our charter also limits your ability to transfer your shares to prospective stockholders unless (1) they meet the minimum suitability standards regarding income or net worth, and (2) the transfer complies with the minimum purchase requirements, which are both described in the “Suitability Standards” section immediately following the cover page of this prospectus.

17

RISK FACTORS

An investment in our shares involves various risks and uncertainties. You should carefully consider the following risk factors in conjunction with the other information contained in this prospectus before purchasing our shares. The risks discussed in this prospectus can adversely affect our business, operating results, prospects and financial condition. These risks could cause the value of our shares to decline and could cause you to lose all or part of your investment.

Risks Related to an Investment in Strategic Storage Trust, Inc.

We have limited established financing sources and we cannot assure you that we will be successful in the marketplace.

We were incorporated in August 2007 and commenced active business operations on May 22, 2008. As of August 31, 2011, we owned 77 properties in 17 states and Canada. You should consider our prospects in light of the risks, uncertainties and difficulties frequently encountered by companies that are in a similar stage of development.

To be successful in this market, we must, among other things:

| | • | | identify and acquire investments that further our investment objectives; |

| | • | | increase awareness of the “Strategic Storage Trust, Inc.” name within the investment products market; |

| | • | | expand and maintain our network of participating broker-dealers; |

| | • | | attract, integrate, motivate and retain qualified personnel to manage our day-to-day operations; |

| | • | | respond to competition for our targeted real estate properties and other investments as well as for potential investors; and |

| | • | | continue to build and expand our operational structure to support our business. |

We cannot guarantee that we will succeed in achieving these goals, and our failure to do so could cause stockholders to lose a portion of their investment.

We have incurred operating losses to date, have an accumulated deficit and our operations will not be profitable in 2011.

We incurred a net loss of approximately $1.5 million for the fiscal year ended December 31, 2008, our initial year of operations, a net loss of approximately $7.3 million for the fiscal year ended December 31, 2009, and a net loss of approximately $12.8 million for the fiscal year ended December 31, 2010. Our accumulated deficits were approximately $1.5 million, $8.8 million and $21.6 million as of December 31, 2008, December 31, 2009 and December 31, 2010, respectively. Given that we are still early in our fundraising and acquisition stage of development, our operations will not be profitable in 2011.

There is currently no public trading market for our shares and there may never be one; therefore, it will likely be difficult for you to sell your shares.

There is currently no public market for our shares and there may never be one. You may not sell your shares unless the buyer meets applicable suitability and minimum purchase standards. Our charter also prohibits the ownership by any one individual of more than 9.8% of our stock, unless waived by our board of

18

directors, which may inhibit large investors from desiring to purchase your shares. Moreover, our share redemption program includes numerous restrictions that would limit your ability to sell your shares to us. Our board of directors could choose to amend, suspend or terminate our share redemption program upon 30 days’ notice. Therefore, it may be difficult for you to sell your shares promptly or at all. If you are able to sell your shares, you will likely have to sell them at a substantial discount to the price you paid for the shares. It also is likely that your shares would not be accepted as the primary collateral for a loan. You should purchase the shares only as a long-term investment because of their illiquid nature.

You may be unable to sell your shares because your ability to have your shares redeemed pursuant to our share redemption program is subject to significant restrictions and limitations.

Even though our share redemption program may provide you with a limited opportunity to sell your shares to us after you have held them for a period of one year, you should be fully aware that our share redemption program contains significant restrictions and limitations. Further, our board may limit, suspend, terminate or amend any provision of the share redemption program upon 30 days’ notice. Redemption of shares, when requested, will generally be made quarterly. During any calendar year, we will not redeem in excess of 5% of the weighted average number of shares outstanding during the prior calendar year and redemptions will be funded solely from proceeds from our distribution reinvestment plan. Therefore, in making a decision to purchase our shares, you should not assume that you will be able to sell any of your shares back to us pursuant to our share redemption program at any particular time or at all. Please see “Description of Shares — Share Redemption Program” for more information regarding our share redemption program.

If we, through our advisor, are unable to find suitable investments, then we may not be able to achieve our investment objectives or pay distributions.