UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2012

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-53644

Strategic Storage Trust, Inc.

(Exact name of Registrant as specified in its charter)

| | |

| Maryland | | 32-0211624 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

111 Corporate Drive, Suite 120, Ladera Ranch, California 92694

(Address of principal executive offices)

(877) 327-3485

(Registrant’s telephone number)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of November 5, 2012: 44,859,624, $0.001 par value per share.

FORM 10-Q

STRATEGIC STORAGE TRUST, INC.

TABLE OF CONTENTS

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Form 10-Q of Strategic Storage Trust, Inc., other than historical facts, may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such statements include, in particular, statements about our plans, strategies, and prospects and are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this report is filed with the Securities and Exchange Commission. We cannot guarantee the accuracy of any such forward-looking statements contained in this Form 10-Q, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Any such forward-looking statements are subject to risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations and provide distributions to stockholders, and our ability to find suitable investment properties, may be significantly hindered. See the risk factors identified in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2011, as filed with the Securities and Exchange Commission, and Part II, Item 1A in this Form 10-Q for a discussion of some, although not all, of the risks and uncertainties that could cause actual results to differ materially from those presented in our forward-looking statements.

3

PART I. FINANCIAL INFORMATION

| ITEM 1. | CONSOLIDATED FINANCIAL STATEMENTS |

The information furnished in the accompanying consolidated balance sheets and related consolidated statements of operations, comprehensive loss, stockholders’ equity and cash flows reflects all adjustments that are, in management’s opinion, necessary for a fair and consistent presentation of the aforementioned financial statements.

The accompanying financial statements should be read in conjunction with the notes to our financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in this report on Form 10-Q. The accompanying financial statements should also be read in conjunction with our financial statements and notes thereto and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K for the year ended December 31, 2011. Our results of operations for the three and nine months ended September 30, 2012 are not necessarily indicative of the operating results expected for the full year.

4

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | |

| | | September 30, 2012 | | | December 31, 2011 | |

| ASSETS | | | | | | | | |

Cash and cash equivalents | | $ | 18,153,110 | | | $ | 13,217,410 | |

Real estate facilities: | | | | | | | | |

Land | | | 160,035,416 | | | | 149,269,391 | |

Buildings | | | 352,162,850 | | | | 330,842,349 | |

Site improvements | | | 33,197,296 | | | | 30,283,836 | |

| | | | | | | | |

| | | 545,395,562 | | | | 510,395,576 | |

Accumulated depreciation | | | (26,077,138 | ) | | | (15,971,288 | ) |

| | | | | | | | |

| | | 519,318,424 | | | | 494,424,288 | |

Construction in process | | | 5,490,980 | | | | 1,754,582 | |

| | | | | | | | |

Real estate facilities, net ($16,898,031 and $17,070,146 related to VIEs) | | | 524,809,404 | | | | 496,178,870 | |

Deferred financing costs, net of accumulated amortization | | | 5,302,363 | | | | 7,449,525 | |

Intangible assets, net of accumulated amortization | | | 9,171,336 | | | | 15,922,955 | |

Restricted cash | | | 5,776,900 | | | | 5,234,479 | |

Investments in unconsolidated joint ventures | | | 10,426,258 | | | | 9,180,538 | |

Other assets | | | 5,966,732 | | | | 3,250,490 | |

| | | | | | | | |

Total assets | | $ | 579,606,103 | | | $ | 550,434,267 | |

| | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

Secured debt ($10,167,873 and $10,210,249 related to VIEs) | | $ | 308,215,873 | | | $ | 330,043,207 | |

Accounts payable and accrued liabilities | | | 12,733,221 | | | | 7,855,033 | |

Due to affiliates | | | 1,472,198 | | | | 2,065,615 | |

Distributions payable | | | 2,537,231 | | | | 2,071,876 | |

| | | | | | | | |

Total liabilities | | | 324,958,523 | | | | 342,035,731 | |

Commitments and contingencies (Note 8) | | | | | | | | |

| | |

Redeemable common stock | | | 3,858,860 | | | | 2,807,837 | |

| | |

Stockholders’ equity: | | | | | | | | |

Strategic Storage Trust, Inc. stockholders’ equity: | | | | | | | | |

Common stock, $0.001 par value; 700,000,000 shares authorized; 44,455,216 and 35,020,561 shares issued and outstanding at September 30, 2012 and December 31, 2011, respectively | | | 44,455 | | | | 35,021 | |

Additional paid-in capital | | | 366,443,360 | | | | 285,211,557 | |

Distributions | | | (63,427,180 | ) | | | (42,602,530 | ) |

Accumulated deficit | | | (58,085,251 | ) | | | (42,955,433 | ) |

Accumulated other comprehensive loss | | | (519,177 | ) | | | (829,652 | ) |

| | | | | | | | |

Total Strategic Storage Trust, Inc. stockholders’ equity | | | 244,456,207 | | | | 198,858,963 | |

| | | | | | | | |

Noncontrolling interests in Operating Partnership | | | 444,867 | | | | 718,907 | |

Other noncontrolling interests | | | 5,887,646 | | | | 6,012,829 | |

| | | | | | | | |

Total noncontrolling interests | | | 6,332,513 | | | | 6,731,736 | |

| | | | | | | | |

Total stockholders’ equity | | | 250,788,720 | | | | 205,590,699 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 579,606,103 | | | $ | 550,434,267 | |

| | | | | | | | |

See notes to consolidated financial statements.

5

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

Revenues: | | | | | | | | | | | | | | | | |

Self storage rental income | | $ | 16,519,825 | | | $ | 13,541,019 | | | $ | 46,566,368 | | | $ | 34,273,574 | |

Ancillary operating income | | | 578,348 | | | | 389,788 | | | | 1,588,996 | | | | 833,706 | |

| | | | | | | | | | | | | | | | |

Total revenues | | | 17,098,173 | | | | 13,930,807 | | | | 48,155,364 | | | | 35,107,280 | |

| | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | |

Property operating expenses | | | 6,639,055 | | | | 5,473,623 | | | | 19,437,251 | | | | 14,010,707 | |

Property operating expenses – affiliates | | | 2,120,406 | | | | 1,582,602 | | | | 6,088,422 | | | | 3,967,143 | |

General and administrative | | | 588,841 | | | | 504,339 | | | | 1,796,843 | | | | 1,873,453 | |

Depreciation | | | 3,559,128 | | | | 2,606,478 | | | | 10,347,161 | | | | 6,670,201 | |

Intangible amortization expense | | | 2,723,705 | | | | 3,910,375 | | | | 8,811,619 | | | | 10,438,617 | |

Property acquisition expenses – affiliates | | | 770,915 | | | | 1,132,628 | | | | 1,034,065 | | | | 3,476,509 | |

Other property acquisition expenses | | | 598,210 | | | | 447,607 | | | | 1,076,986 | | | | 1,777,652 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 17,000,260 | | | | 15,657,652 | | | | 48,592,347 | | | | 42,214,282 | |

| | | | | | | | | | | | | | | | |

Operating income (loss) | | | 97,913 | | | | (1,726,845 | ) | | | (436,983 | ) | | | (7,107,002 | ) |

Other income (expense): | | | | | | | | | | | | | | | | |

Interest expense | | | (4,170,180 | ) | | | (3,322,089 | ) | | | (13,240,452 | ) | | | (8,447,257 | ) |

Deferred financing amortization expense | | | (913,391 | ) | | | (351,650 | ) | | | (2,900,719 | ) | | | (812,674 | ) |

Equity in earnings of real estate ventures | | | 206,761 | | | | 199,841 | | | | 660,764 | | | | 646,551 | |

Gain on sale of investment in unconsolidated joint venture | | | — | | | | — | | | | 815,000 | | | | — | |

Other | | | 158,074 | | | | (91,327 | ) | | | (60,711 | ) | | | (312,583 | ) |

| | | | | | | | | | | | | | | | |

Net loss | | | (4,620,823 | ) | | | (5,292,070 | ) | | | (15,163,101 | ) | | | (16,032,965 | ) |

Less: Net loss attributable to the noncontrolling interests in our Operating Partnership | | | 17,784 | | | | 3,088 | | | | 67,480 | | | | 10,590 | |

Net (income) loss attributable to other noncontrolling interests | | | (7,611 | ) | | | 142,563 | | | | (34,197 | ) | | | 411,126 | |

| | | | | | | | | | | | | | | | |

Net loss attributable to Strategic Storage Trust, Inc. | | $ | (4,610,650 | ) | | $ | (5,146,419 | ) | | $ | (15,129,818 | ) | | $ | (15,611,249 | ) |

| | | | | | | | | | | | | | | | |

Net loss per share – basic | | $ | (0.11 | ) | | $ | (0.16 | ) | | $ | (0.38 | ) | | $ | (0.52 | ) |

Net loss per share – diluted | | $ | (0.11 | ) | | $ | (0.16 | ) | | $ | (0.38 | ) | | $ | (0.52 | ) |

| | | | | | | | | | | | | | | | |

Weighted average shares outstanding – basic | | | 43,774,622 | | | | 32,447,080 | | | | 39,690,382 | | | | 30,156,290 | |

Weighted average shares outstanding – diluted | | | 43,774,622 | | | | 32,447,080 | | | | 39,690,382 | | | | 30,156,290 | |

| | | | | | | | | | | | | | | | |

See notes to consolidated financial statements.

6

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

Net loss | | $ | (4,620,823 | ) | | $ | (5,292,070 | ) | | $ | (15,163,101 | ) | | $ | (16,032,965 | ) |

Other comprehensive income (loss): | | | | | | | | | | | | | | | | |

Foreign currency translation adjustments | | | 664,135 | | | | (989,988 | ) | | | 606,509 | | | | (876,103 | ) |

Change in fair value of interest rate swap | | | (74,460 | ) | | | — | | | | (296,034 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Other comprehensive income (loss) | | | 589,675 | | | | (989,988 | ) | | | 310,475 | | | | (876,103 | ) |

| | | | | | | | | | | | | | | | |

Comprehensive loss | | | (4,031,148 | ) | | | (6,282,058 | ) | | | (14,852,626 | ) | | | (16,909,068 | ) |

Comprehensive loss allocated to noncontrolling interests: | | | | | | | | | | | | | | | | |

Comprehensive loss attributable to the noncontrolling interests in our Operating Partnership | | | 14,982 | | | | 3,203 | | | | 65,468 | | | | 16,658 | |

Comprehensive (income) loss attributable to other noncontrolling interests | | | (7,611 | ) | | | 142,563 | | | | (34,197 | ) | | | 411,126 | |

| | | | | | | | | | | | | | | | |

Comprehensive loss attributable to Strategic Storage Trust, Inc. | | $ | (4,023,777 | ) | | $ | (6,136,292 | ) | | $ | (14,821,355 | ) | | $ | (16,481,284 | ) |

| | | | | | | | | | | | | | | | |

See notes to consolidated financial statements.

7

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF

STOCKHOLDERS’ EQUITY

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Number of

Shares | | | Common

Stock

Par Value | | | Additional

Paid-in Capital | | | Distributions | | | Accumulated

Deficit | | | Accumulated

Other

Comprehensive

Income (Loss) | | | Noncontrolling

Interests in

Operating

Partnership | | | Total | |

Balance as of December 31, 2011 | | | 35,020,561 | | | $ | 35,021 | | | $ | 285,211,557 | | | $ | (42,602,530 | ) | | $ | (42,955,433 | ) | | $ | (829,652 | ) | | $ | 6,731,736 | | | $ | 205,590,699 | |

Gross proceeds from issuance of common stock | | | 9,488,178 | | | | 9,488 | | | | 95,486,916 | | | | — | | | | — | | | | — | | | | — | | | | 95,496,404 | |

Offering costs | | | — | | | | — | | | | (10,193,365 | ) | | | — | | | | — | | | | — | | | | — | | | | (10,193,365 | ) |

Changes to redeemable common stock | | | — | | | | — | | | | (3,552,025 | ) | | | — | | | | — | | | | — | | | | — | | | | (3,552,025 | ) |

Redemptions of common stock | | | (954,868 | ) | | | (955 | ) | | | (9,159,261 | ) | | | — | | | | — | | | | — | | | | — | | | | (9,160,216 | ) |

Issuance of restricted stock | | | 3,125 | | | | 3 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 3 | |

Distributions ($0.70 per share) | | | — | | | | — | | | | — | | | | (20,824,650 | ) | | | — | | | | — | | | | — | | | | (20,824,650 | ) |

Distributions for noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (190,537 | ) | | | (190,537 | ) |

Issuance of shares for distribution reinvestment plan | | | 898,220 | | | | 898 | | | | 8,852,483 | | | | — | | | | — | | | | — | | | | — | | | | 8,853,381 | |

Repurchase of limited partnership units in our Operating Partnership | | | — | | | | — | | | | (221,335 | ) | | | — | | | | — | | | | — | | | | (175,403 | ) | | | (396,738 | ) |

Stock based compensation expense | | | — | | | | — | | | | 18,390 | | | | — | | | | — | | | | — | | | | — | | | | 18,390 | |

Net loss attributable to Strategic Storage Trust, Inc. | | | — | | | | — | | | | — | | | | — | | | | (15,129,818 | ) | | | — | | | | — | | | | (15,129,818 | ) |

Net loss attributable to the noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (33,283 | ) | | | (33,283 | ) |

Foreign currency translation adjustment | | | — | | | | — | | | | — | | | | — | | | | — | | | | 606,509 | | | | — | | | | 606,509 | |

Change in fair value of interest rate swap | | | — | | | | — | | | | — | | | | — | | | | — | | | | (296,034 | ) | | | — | | | | (296,034 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as of September 30,2012 | | | 44,455,216 | | | $ | 44,455 | | | $ | 366,443,360 | | | $ | (63,427,180 | ) | | $ | (58,085,251 | ) | | $ | (519,177 | ) | | $ | 6,332,513 | | | $ | 250,788,720 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See notes to consolidated financial statements.

8

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | |

| | | Nine Months Ended

September 30, 2012 | | | Nine Months Ended

September 30, 2011 | |

Cash flows from operating activities: | | | | | | | | |

Net loss | | $ | (15,163,101 | ) | | $ | (16,032,965 | ) |

Adjustments to reconcile net loss to cash provided by operating activities: | | | | | | | | |

Depreciation and amortization expense | | | 22,059,499 | | | | 17,921,492 | |

Noncash interest expense | | | 136,110 | | | | 271,268 | |

Expense related to issuance of restricted stock | | | 18,393 | | | | 20,832 | |

Equity in income of unconsolidated joint ventures | | | (588,852 | ) | | | (535,387 | ) |

Distributions from unconsolidated joint ventures | | | 612,201 | | | | 602,863 | |

Gain on sale of investment in unconsolidated joint venture | | | (815,000 | ) | | | — | |

Foreign currency exchange (gain) loss | | | (119,864 | ) | | | 6,744 | |

Increase (decrease) in cash from changes in assets and liabilities: | | | | | | | | |

Restricted cash | | | (542,421 | ) | | | (2,904,119 | ) |

Other assets | | | (526,406 | ) | | | (1,544,117 | ) |

Accounts payable and other accrued liabilities | | | 1,916,597 | | | | 3,006,906 | |

Due to affiliates | | | (543,869 | ) | | | 391,619 | |

| | | | | | | | |

Net cash flows provided by operating activities | | | 6,443,287 | | | | 1,205,136 | |

| | | | | | | | |

Cash flows from investing activities: | | | | | | | | |

Purchases of real estate | | | (32,300,000 | ) | | | (112,505,427 | ) |

Additions to real estate facilities | | | (3,509,437 | ) | | | (3,278,895 | ) |

Development and construction of real estate facilities | | | (5,813,966 | ) | | | (1,688,046 | ) |

Deposits on acquisitions of real estate facilities | | | (2,334,059 | ) | | | 330,799 | |

Additional investment in unconsolidated joint ventures | | | (1,879,069 | ) | | | — | |

Proceeds from land disposition | | | 1,978,746 | | | | — | |

Proceeds from sale of investment in unconsolidated joint venture | | | 1,425,000 | | | | — | |

| | | | | | | | |

Net cash flows used in investing activities | | | (42,432,785 | ) | | | (117,141,569 | ) |

| | | | | | | | |

Cash flows from financing activities: | | | | | | | | |

Proceeds from issuance of secured debt | | | 12,414,588 | | | | 94,700,900 | |

Principal payments on secured debt | | | (2,328,447 | ) | | | (3,675,629 | ) |

Repayment of secured debt | | | (32,500,000 | ) | | | (9,939,555 | ) |

Deferred financing costs | | | (746,774 | ) | | | (2,830,598 | ) |

Gross proceeds from issuance of common stock | | | 95,496,404 | | | | 74,569,241 | |

Repurchase of limited partnership units in our Operating Partnership | | | (396,738 | ) | | | — | |

Offering costs | | | (10,193,365 | ) | | | (8,945,665 | ) |

Redemptions of common stock | | | (9,160,216 | ) | | | (7,335,752 | ) |

Distributions paid | | | (11,503,373 | ) | | | (8,913,690 | ) |

Distributions paid to noncontrolling interests | | | (193,078 | ) | | | (273,784 | ) |

Escrow receivable | | | 38,444 | | | | (135,350 | ) |

Due to affiliates | | | (49,548 | ) | | | 7,999 | |

| | | | | | | | |

Net cash flows provided by financing activities | | | 40,877,897 | | | | 127,228,117 | |

| | | | | | | | |

Effect of exchange rate changes on cash | | | 47,301 | | | | (154,088 | ) |

Increase in cash and cash equivalents | | | 4,935,700 | | | | 11,137,596 | |

Cash and cash equivalents, beginning of period | | | 13,217,410 | | | | 6,438,091 | |

| | | | | | | | |

Cash and cash equivalents, end of period | | $ | 18,153,110 | | | $ | 17,575,687 | |

| | | | | | | | |

Supplemental cash flow and non-cash transactions: | | | | | | | | |

Cash paid for interest | | $ | 13,305,331 | | | $ | 7,955,402 | |

Interest capitalized | | $ | 338,967 | | | $ | 220,351 | |

Distributions payable | | $ | 2,537,231 | | | $ | 1,932,123 | |

Issuance of shares pursuant to distribution reinvestment plan | | $ | 8,853,381 | | | $ | 6,498,031 | |

Assumption of notes payable issued in connection with purchase of real estate facilities | | $ | — | | | $ | 42,580,540 | |

Issuance of limited partnership units in connection with the purchase of real estate facilities | | $ | — | | | $ | 903,928 | |

See notes to consolidated financial statements.

9

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2012

Note 1. Organization

Strategic Storage Trust, Inc., a Maryland corporation (the “Company”), was formed on August 14, 2007 under the Maryland General Corporation Law for the purpose of engaging in the business of investing in self storage facilities. The Company’s year end is December 31. As used in this report, “we” “us” and “our” refer to Strategic Storage Trust, Inc.

Strategic Capital Holdings, LLC, a Virginia limited liability company (our “Sponsor”), is the sponsor of our Offering (as defined below). Our Sponsor was formed on July 21, 2004 to engage in private structured offerings of limited partnerships and other entities with respect to the acquisition, management and disposition of commercial real estate assets. Our Sponsor owns a majority of Strategic Storage Holdings, LLC, which is the sole member of our advisor and our property manager.

Our advisor is Strategic Storage Advisor, LLC, a Delaware limited liability company (our “Advisor”) which was formed on August 13, 2007. Our Advisor is responsible for managing our affairs on a day-to-day basis and identifying and making acquisitions and investments on our behalf under the terms of an advisory agreement we have with our Advisor (our “Advisory Agreement”). Some of the officers of our Advisor are also officers of our Sponsor and of us.

On August 24, 2007, our Advisor purchased 100 shares of our common stock for $1,000 and became our initial stockholder. Our Second Articles of Amendment and Restatement authorize 700,000,000 shares of common stock with a par value of $0.001 and 200,000,000 shares of preferred stock with a par value of $0.001.

Our operating partnership, Strategic Storage Operating Partnership, L.P., a Delaware limited partnership (our “Operating Partnership”), was formed on August 14, 2007. On August 24, 2007, our Advisor purchased a limited partnership interest in our Operating Partnership for $200,000 and on August 24, 2007, we contributed the initial $1,000 capital contribution we received to our Operating Partnership in exchange for the general partner interest. Our Operating Partnership owns, directly or indirectly through one or more special purpose entities, all of the self storage properties that we have acquired. As of September 30, 2012, we owned 99.62% of the limited partnership interests of our Operating Partnership. The remaining limited partnership interests are owned by our Advisor (0.05%) and unaffiliated third parties (0.33%). As the sole general partner of our Operating Partnership, we have the exclusive power to manage and conduct the business of our Operating Partnership. We will conduct certain activities (such as selling packing supplies and locks and renting trucks or other moving equipment) through our taxable REIT subsidiaries (the “TRSs”), which are our wholly-owned subsidiaries.

Our property manager is Strategic Storage Property Management, LLC, a Delaware limited liability company (our “Property Manager”), which was formed in August 2007 to manage our properties. Our Property Manager derives substantially all of its income from the property management services it performs for us.

On March 17, 2008, we began our initial public offering of common stock (our “Initial Offering”). On May 22, 2008, we satisfied the minimum offering requirements of the Initial Offering and commenced formal operations. On September 16, 2011, we terminated the Initial Offering, having sold approximately 29 million shares for gross proceeds of approximately $289 million. On September 22, 2011, we commenced our follow-on public offering of stock for a maximum of 110,000,000 shares of common stock, consisting of 100,000,000 shares for sale to the public (our “Primary Offering”) and 10,000,000 shares for sale pursuant to our distribution reinvestment plan (collectively, our “Offering”). We intend to invest a substantial amount of the net proceeds from our Offering in self storage facilities and related self storage real estate investments. Our Offering will not last beyond September 22, 2013 (two years after the effective date of our Offering), provided, however, that subject to applicable law, we may extend our Offering for an additional year, or, in certain circumstances, longer. We also reserve the right to terminate our Offering at any time. In addition to our Initial Offering and our Offering, in September 2009 we also issued approximately 6.2 million shares of common stock in connection with two mergers with private real estate investment trusts sponsored by our Sponsor.

Effective June 1, 2012, the offering price of our shares of common stock increased from $10.00 per share to $10.79 per share. This increase was primarily based on the April 2, 2012 estimated per share value of our common stock of $10.79 which was calculated based on the estimated value of our assets less the estimated value of our liabilities, or net asset value, divided by the number of shares outstanding on an adjusted fully diluted basis, calculated as of December 31, 2011. In light of the above-described net asset value calculation, our board of directors determined that it was appropriate to increase the per share offering price for new purchases of our shares commencing on June 1, 2012. This determination by our board of directors was subjective and was primarily based on (i) the estimated net asset value per share, which was predominantly based on an independent third party appraiser’s valuation of our properties as of December 31, 2011, (ii) the commissions and dealer manager fees payable in connection with the offering of our shares, (iii) our historical and anticipated results of operations and financial condition, (iv) our current and anticipated distribution payments, (v) our current and anticipated capital and debt structure, and (vi) our Advisor’s recommendations and assessment of our prospects and continued execution of our investment and operating strategies.

10

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2012

Our dealer manager is Select Capital Corporation, a California corporation (our “Dealer Manager”). Our Dealer Manager is responsible for marketing our shares being offered pursuant to the Offering. Our president owns a 15% beneficial non-voting equity interest in our Dealer Manager. U.S. Select Securities LLC, our dealer manager for our Initial Offering, was terminated as our dealer manager upon completion of our Initial Offering.

As we accept subscriptions for shares of our common stock, we transfer substantially all of the net proceeds of the Offering to our Operating Partnership as capital contributions in exchange for additional units of interest in our Operating Partnership. However, we are deemed to have made capital contributions in the amount of the gross offering proceeds received from investors and the Operating Partnership is deemed to have simultaneously paid the sales commissions and other costs associated with the Offering. In addition, our Operating Partnership is structured to make distributions with respect to limited partnership units (except for Class D units) that will be equivalent to the distributions made to holders of our common stock. In March 2011, we adopted Amendment No. 1 to our Operating Partnership’s First Amended and Restated Limited Partnership Agreement, which established Class D Units, and our Operating Partnership issued approximately 120,000 Class D Units in connection with our acquisition of the Las Vegas VII and Las Vegas VIII properties. The Class D Units have all of the rights, powers, duties and preferences of the Operating Partnership’s other limited partnership units, except that they are subject to an annual distribution limit (initially zero percent) and the holders of the Class D Units have agreed to modified exchange rights that prevent them from exercising their exchange rights until the occurrence of a specified event (see Note 8). Finally, a limited partner in our Operating Partnership may later exchange his or her limited partnership units in our Operating Partnership for shares of our common stock at any time after one year following the date of issuance of their limited partnership units, subject to certain restrictions as outlined in the limited partnership agreement. Our Advisor is prohibited from exchanging or otherwise transferring its limited partnership units so long as it is acting as our Advisor pursuant to our Advisory Agreement.

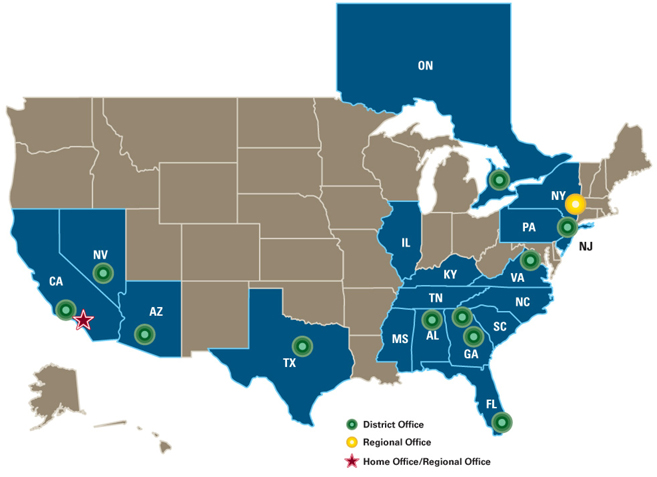

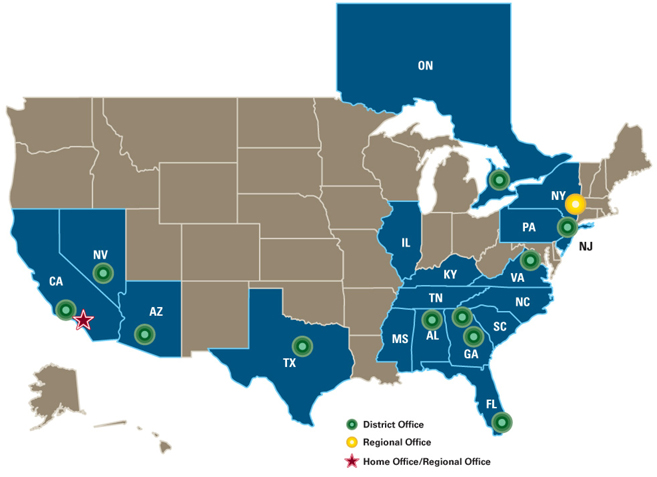

As of September 30, 2012, we wholly-owned 100 self storage facilities located in 17 states and Canada, comprising approximately 64,780 units and approximately 8.1 million rentable square feet. As of September 30, 2012, we also had minority interests in ten additional self storage facilities. Of those interests, one has been deemed to be a controlling interest and is therefore consolidated in our consolidated financial statements as discussed in Note 2. Additionally, we have an interest in a net leased industrial property in California with 356,000 rentable square feet leased to a single tenant.

Note 2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying interim consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) as contained within the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) and the rules and regulations of the SEC. Certain information and footnote disclosures required for annual financial statements have been condensed or excluded pursuant to SEC rules and regulations. Accordingly, the interim financial statements do not include all of the information and footnotes required by GAAP for complete financial statements. The accompanying financial statements reflect all adjustments which are, in the opinion of our management, of a normal recurring nature and necessary for a fair presentation of our financial position, results of operations and cash flows for the interim period. Operating results for the three and nine months ended September 30, 2012 are not necessarily indicative of the results that may be expected for the year ending December 31, 2012.

Effective September 15, 2009, the ASC was established as the single source of authoritative nongovernmental GAAP. Prior to the issuance of the ASC, all GAAP pronouncements were issued in separate topical pronouncements in the form of statements, staff positions or Emerging Issues Task Force Abstracts, and were referred to as such. While the ASC does not change GAAP, it introduces a new structure and supersedes all previously issued non-SEC accounting and reporting standards. In addition to the ASC, the Company is still required to follow SEC rules and regulations relating to the preparation of financial statements. The Company’s accounting policies are consistent with the guidance set forth by both ASC and the SEC.

Reclassifications

Certain amounts previously reported in our 2011 financial statements have been reclassified to conform to the fiscal 2012 presentation.

11

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2012

Principles of Consolidation

Our financial statements, the financial statements of our Operating Partnership, including its wholly-owned subsidiaries, the financial statements of Self Storage REIT, LLC (REIT I) and Self Storage REIT II, LLC (REIT II), and the accounts of variable interest entities (VIEs) for which we are the primary beneficiary are consolidated in the accompanying consolidated financial statements. The portion of these entities not wholly-owned by us is presented as noncontrolling interests both as of and during the periods presented. All significant intercompany accounts and transactions have been eliminated in consolidation.

Consolidation Considerations for Our Investments in Joint Ventures

Current accounting guidance provides a framework for identifying VIEs and determining when a company should include the assets, liabilities, noncontrolling interests, and results of activities of the VIE in its consolidated financial statements. In general, a VIE is an entity or other legal structure used to conduct activities or hold assets that either (1) has an insufficient amount of equity to carry out its principal activities without additional subordinated financial support, (2) has a group of equity owners that are unable to make significant decisions about its activities, or (3) has a group of equity owners that do not have the obligation to absorb losses or the right to receive returns generated by its operations. Generally, a VIE should be consolidated if a party with an ownership, contractual, or other financial interest in the VIE (a variable interest holder) has the power to direct the VIE’s most significant activities and the obligation to absorb losses or right to receive benefits of the VIE that could be significant to the VIE. A variable interest holder that consolidates the VIE is called the primary beneficiary. Upon consolidation, the primary beneficiary generally must initially record all of the VIE’s assets, liabilities, and noncontrolling interest at fair value and subsequently account for the VIE as if it were consolidated based on majority voting interest. As of September 30, 2012 and December 31, 2011, we had entered into contracts/interests that are deemed to be variable interests in VIEs. Those variable interests include both lease agreements and equity investments. We have evaluated those variable interests against the criteria for consolidation and determined that we are not the primary beneficiary of certain investments discussed further in the“Equity Investments” section of this note.

As of September 30, 2012 and December 31, 2011, we had an equity interest in a self storage property located in San Francisco, California (“SF property”) which was deemed to be a VIE of which we are the primary beneficiary. As such, the SF property has been consolidated in our consolidated financial statements since we acquired our interest in the property through the REIT I merger. In January 2010, we acquired an approximately 2% additional interest in the SF property, bringing our total interest to approximately 12%. The SF property is owned by a Delaware Statutory Trust (DST), and by virtue of the trust agreement the investors in the trust have no direct or indirect ability through voting rights to make decisions about the DST’s significant activities. The REIT I operating partnership (the “REIT I Operating Partnership”) has also entered into a lease agreement for the SF property, in which the REIT I Operating Partnership is the tenant, which exposes it to losses of the VIE that could be significant to the VIE and also allows it to direct activities of the VIE that determine its economic performance by means of its operation of the leased facility. The lease has an initial term of 10 years which commenced on December 19, 2006. The initial term of the lease may be extended at the option of the REIT I Operating Partnership for up to four successive five year terms. As of September 30, 2012, the consolidated joint venture had net real estate assets of approximately $16.9 million. Such assets are only available to satisfy the obligations of the SF property. We have also consolidated approximately $10.2 million of secured debt and approximately $5.9 million of noncontrolling interest related to this entity. The lenders of the secured debt have no recourse to other Company assets. Our Sponsor has entered into an agreement to indemnify us for any losses as a result of potential shortfalls in the lease payments required to be made by the REIT I Operating Partnership. Despite such indemnification, we continue to be deemed the primary beneficiary as our Sponsor is not deemed to have a variable interest in the SF property.

Use of Estimates

The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. The current economic environment has increased the degree of uncertainty inherent in these estimates and assumptions. Management adjusts such estimates when facts and circumstances dictate. The most significant estimates made include the allocation of property purchase price to tangible and intangible assets acquired and liabilities assumed at fair value, the determination if certain entities should be consolidated, the evaluation of potential impairment of long-lived assets and of assets held by equity method investees, and the useful lives of real estate assets and intangibles. Actual results could materially differ from those estimates.

Cash and Cash Equivalents

We consider all short-term, highly liquid investments that are readily convertible to cash with a maturity of three months or less at the time of purchase to be cash equivalents.

12

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2012

We may maintain cash equivalents in financial institutions in excess of insured limits, but believe this risk is mitigated by only investing in or through major financial institutions.

Restricted Cash

Restricted cash consists primarily of impound reserve accounts for property taxes, insurance and capital improvements in connection with the requirements of certain of our loan agreements.

Real Estate Purchase Price Allocation

We account for acquisitions in accordance with accounting guidance which requires that we allocate the purchase price of the property to the tangible and intangible assets acquired and the liabilities assumed based on estimated fair values. This guidance requires us to make significant estimates and assumptions, including fair value estimates, as of the acquisition date and to adjust those estimates as necessary during the measurement period (defined as the period, not to exceed one year, in which we may adjust the provisional amounts recognized for an acquisition). Acquisitions of portfolios of facilities are allocated to the individual facilities based upon an income approach or a cash flow analysis using appropriate risk adjusted capitalization rates which take into account the relative size, age, and location of the individual facility along with current and projected occupancy and rental rate levels or appraised values, if available. Allocations to the individual assets and liabilities are based upon comparable market sales information for land and estimates of depreciated replacement cost of equipment, building and site improvements. In allocating the purchase price, we determine whether the acquisition includes intangible assets or liabilities. Substantially all of the leases in place at acquired properties are at market rates, as the majority of the leases are month-to-month contracts. Accordingly, to date we have not allocated any portion of the purchase price to above or below market leases. We also consider whether in-place, market leases represent an intangible asset. We preliminarily allocated approximately $2.1 million of purchase price to intangible assets to recognize the value of in-place leases related to our acquisitions in the first nine months of 2012. We do not expect, nor to date have we recorded, intangible assets for the value of tenant relationships because we will not have concentrations of significant tenants and the average tenant turnover is fairly frequent. Our acquisition related transaction costs are required to be expensed as incurred. During the three and nine months ended September 30, 2012 we expensed approximately $1.4 million and $2.1 million, respectively, of acquisition related transaction costs and during the three and nine months ended September 30, 2011 we expensed approximately $1.6 million and $5.3 million, respectively, of acquisition related transaction costs.

Should the initial accounting for an acquisition be incomplete by the end of a reporting period that falls within the measurement period, we report provisional amounts in our financial statements. During the measurement period, we adjust the provisional amounts recognized at the acquisition date to reflect new information obtained about facts and circumstances that existed as of the acquisition date that, if known, would have affected the measurement of the amounts recognized as of that date and we record those adjustments to our financial statements. We apply those measurement period adjustments that we determine to be significant retrospectively to comparative information in our financial statements, potentially including adjustments to interest, depreciation and amortization expense.

Evaluation of Possible Impairment of Long-Lived Assets

Management will continually monitor events and changes in circumstances that could indicate that the carrying amounts of our long-lived assets, including those held through joint ventures, may not be recoverable. When indicators of potential impairment are present that indicate that the carrying amounts of the assets may not be recoverable, we will assess the recoverability of the assets by determining whether the carrying value of the long-lived assets will be recovered through the undiscounted future operating cash flows expected from the use of the asset and its eventual disposition. In the event that such expected undiscounted future cash flows do not exceed the carrying value, we will adjust the value of the long-lived assets to the fair value and recognize an impairment loss. As of September 30, 2012 and December 31, 2011, no impairment losses have been recognized.

Equity Investments

Our investments in unconsolidated real estate joint ventures and VIEs in which we are not the primary beneficiary, where we have significant influence, but not control, are recorded under the equity method of accounting in the accompanying consolidated financial statements. Under the equity method, our investments in real estate ventures are stated at cost and adjusted for our share of net earnings or losses and reduced by distributions. Equity in earnings of real estate ventures is generally recognized based on the allocation of cash distributions upon liquidation of the investment in accordance with the joint venture agreements.

Investments representing passive preferred equity and/or minority interests (less than 20%) are accounted for under the cost method. Under the cost method, our investments in real estate ventures are carried at cost and adjusted for other-than-temporary declines in fair value, distributions representing a return of capital and additional investments.

13

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2012

Through the mergers with REIT I and REIT II, we acquired five preferred equity and/or minority interests in unconsolidated joint ventures (one of which became wholly-owned in 2011, as further described in Note 3 and another which was sold in May 2012 as further described below), all of which were deemed to be VIEs. Additionally, during the third quarter of 2012, we purchased beneficial interests in a DST sponsored by our Sponsor (see Note 4). We have evaluated each variable interest against the amended criteria for consolidation and determined that we are not the primary beneficiary, generally due to our inability to direct significant activities that determine the economic performance of the VIE. Three of those investments are passive or limited partner interests in self storage facilities (such properties are owned by DSTs, and by virtue of the related trust agreements, the investors have no direct or indirect ability through voting rights to make decisions about the DSTs significant activities) and are therefore accounted for under the cost or equity method, as appropriate; our aggregate investment therein is approximately $1.8 million. Individually our ownership interest in those investments ranges from approximately 0.28% to 41%; the carrying value of the investments ranged from approximately $27,000 to $1.6 million and our risk of loss is limited to our individual investment therein.

In May 2012, our equity interests in an unconsolidated joint venture which owns a self storage facility in Baltimore, Maryland were redeemed for approximately $1.4 million. This resulted in a gain of approximately $0.8 million, which is included in gain on sale of investment in unconsolidated joint venture in our Consolidated Statements of Operations for the nine months ended September 30, 2012.

The remaining interest is in a net leased industrial property (“Hawthorne property”) in California with 356,000 rentable square feet leased to a single tenant. This investment is accounted for under the equity method of accounting and our risk of loss is limited to our investment, including our maximum exposure under the terms of a debt guarantee. We own a 12% interest in Westport LAX LLC, the joint venture that acquired the Hawthorne property and the carrying value in such investment is approximately $1.3 million. Hawthorne LLC, an affiliate of our Sponsor, owns 78% of Westport LAX LLC, and we have a preferred equity interest in Hawthorne LLC which entitles us to distributions equal to 10% per annum on our investment of approximately $7.3 million. The preferred equity interest has a redemption date in November 2013, subject to extension at our sole discretion. The preferred equity interest may be called at any time in whole or part by Hawthorne LLC or redeemed at any time by us. The remaining 10% interest in Westport LAX LLC is owned by a third party, who is also the co-manager, along with our Sponsor, of the Hawthorne property. Such third party is the acting property manager and directs the operating activities of the property that determine its economic performance. We, along with other non-affiliated parties, are guarantors on the approximately $19.3 million loan used to secure the Hawthorne property; the loan has a maturity date of August 1, 2020. As of September 30, 2012, our maximum exposure to loss as a result of our involvement with this VIE, consisting of our investment balance and our guarantee of the secured debt, totaled approximately $27.9 million.

Revenue Recognition

Management believes that all of our leases are operating leases. Rental income is recognized in accordance with the terms of the leases, which generally are month-to-month. Revenues from any long-term operating leases are recognized on a straight-line basis over the term of the lease. The excess of rents received over amounts contractually due pursuant to the underlying leases is included in accounts payable and accrued liabilities in our consolidated balance sheets and contractually due but unpaid rent is included in other assets.

Allowance for Doubtful Accounts

Tenant accounts receivable are reported net of an allowance for doubtful accounts. Management’s estimate of the allowance is based upon a review of the current status of tenant accounts receivable. It is reasonably possible that management’s estimate of the allowance will change in the future.

Depreciation of Real Property Assets

Our management is required to make subjective assessments as to the useful lives of our depreciable assets. We consider the period of future benefit of the asset to determine the appropriate useful lives.

Depreciation of our real property assets is charged to expense on a straight-line basis over the estimated useful lives as follows:

| | |

Description | | Standard Depreciable Life |

Land | | Not Depreciated |

Buildings | | 30 to 35 years |

Site Improvements | | 7 to 15 years |

14

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2012

Depreciation of Personal Property Assets

Personal property assets, consisting primarily of furniture, fixtures and equipment are depreciated on a straight-line basis over the estimated useful lives generally ranging from 3 to 5 years, and are included in other assets on our consolidated balance sheets.

Intangible Assets

We have allocated a portion of our real estate purchase price to in-place leases. We are amortizing in-place leases on a straight-line basis over the estimated future benefit period. As of September 30, 2012 and December 31, 2011, accumulated amortization of in-place lease intangibles totaled approximately $33.7 million and $24.9 million, respectively.

Amortization of Deferred Financing Costs

Costs incurred in connection with obtaining financing are deferred and amortized on a straight-line basis over the term of the related loan, which is not materially different than the effective interest method. As of September 30, 2012 and December 31, 2011, accumulated amortization of deferred financing costs totaled approximately $4.4 million and $1.5 million, respectively.

Organizational and Offering Costs

Our Advisor may fund organization and offering costs on our behalf. We are required to reimburse our Advisor for such organization and offering costs; provided, however, our Advisor must reimburse us within 60 days after the end of the month in which the Offering terminates to the extent we paid or reimbursed organization and offering costs (excluding sales commissions and dealer manager fees) in excess of 3.5% of the gross offering proceeds from the Primary Offering. If at any point in time we determine that the total organization and offering costs are expected to exceed 3.5% of the gross proceeds anticipated to be received from the Primary Offering, we will recognize such excess as a capital contribution from our Advisor. As of September 30, 2012, we do not believe total organization and offering costs will exceed 3.5% of the gross proceeds anticipated to be received from the Primary Offering. Offering costs are recorded as an offset to additional paid-in capital, and organization costs are recorded as an expense.

Redeemable Common Stock

We have adopted a share redemption program that may enable stockholders to sell their shares to us in limited circumstances.

We record amounts that are redeemable under the share redemption program as redeemable common stock in the accompanying consolidated balance sheets since the shares are mandatorily redeemable at the option of the holder and therefore their redemption is outside our control. The maximum amount redeemable under our share redemption program is limited to the number of shares we could repurchase with the amount of the net proceeds from the sale of shares under the distribution reinvestment plan. However, accounting guidance states that determinable amounts that can become redeemable but that are contingent on an event that is likely to occur (e.g., the passage of time) should be presented as redeemable when such amount is known. Therefore, the net proceeds from the distribution reinvestment plan are considered to be temporary equity and are presented as redeemable common stock in the accompanying consolidated balance sheets.

In addition, current accounting guidance requires, among other things, that financial instruments that represent a mandatory obligation of us to repurchase shares be classified as liabilities and reported at settlement value. Our redeemable common shares are contingently redeemable at the option of the holder. When we determine we have a mandatory obligation to repurchase shares under the share redemption program, we will reclassify such obligations from temporary equity to a liability based upon their respective settlement values.

During the nine months ended September 30, 2012, we redeemed approximately 955,000 shares of common stock for approximately $9.2 million ($9.59 per share). As of September 30, 2012, we had redemption requests for approximately 504,000 shares of common stock for approximately $4.8 million that, if honored in full, would have caused us to exceed the limits of the share redemption program. We honored such redemption requests, pursuant to the terms of the share redemption program, redeeming all death and disability redemption requests and approximately 65% of the other redemption requests. Such redemptions totaled approximately 352,000 shares for approximately $3.4 million ($9.61 per share) and were redeemed on October 31, 2012 and such amount was reclassified from redeemable common stock to accounts payable and accrued liabilities in the consolidated balance sheets as of September 30, 2012. As of September 30, 2012, we had approximately 152,000 shares that were requested for redemption, but could not be redeemed as it would have caused us to exceed the limits of the share redemption program. We treated the remainder of each redemption request as a request for redemption in the fourth quarter of 2012. We have funded all redemptions using proceeds from the sale of shares pursuant to our distribution reinvestment plan. Our board of directors may choose to amend, suspend or terminate our share redemption program upon 30 days’ written notice at any time.

15

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2012

Foreign Currency Translation

For non-U.S. functional currency operations, assets and liabilities are translated to U.S. dollars at current exchange rates. Revenues and expenses are translated at the average rates for the period. All related adjustments are recorded in other comprehensive income (loss) as a separate component of stockholders’ equity. Transactions denominated in a currency other than the functional currency of the related operation are recorded at rates of exchange in effect at the date of the transaction. Gains or losses on foreign currency transactions are recorded in other income (expense). During the three and nine months ended September 30, 2012 we recorded a gain of approximately $165,000 and $120,000, respectively, and during the three and nine months ended September 30, 2011 and we recorded a loss of approximately $42,000 and $7,000, respectively.

Accounting for Equity Awards

The cost of restricted stock is required to be measured based on the grant-date fair value and the cost to be recognized over the relevant service period.

Fair Value Measurements

The accounting standard for fair value measurements and disclosures defines fair value, establishes a framework for measuring fair value, and provides for expanded disclosure about fair value measurements. Fair value is defined by the accounting standard for fair value measurements and disclosures as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. It also establishes a fair value hierarchy that prioritizes observable and unobservable inputs used to measure fair value into three levels. The following summarizes the three levels of inputs and hierarchy of fair value we use when measuring fair value:

| | • | | Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that we have the ability to access; |

| | • | | Level 2 inputs may include quoted prices for similar assets and liabilities in active markets, as well as interest rates and yield curves that are observable at commonly quoted intervals; and |

| | • | | Level 3 inputs are unobservable inputs for the assets or liabilities that are typically based on an entity’s own assumptions as there is little, if any, related market activity. |

In instances where the determination of the fair value measurement is based on inputs from different levels of the fair value hierarchy, the fair value measurement will fall within the lowest level that is significant to the fair value measurement in its entirety.

The accounting guidance for fair value measurements and disclosures provides a framework for measuring fair value and establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. In determining fair value, we utilize valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible as well as consider counterparty credit risk in our assessment of fair value. Considerable judgment is necessary to interpret Level 2 and 3 inputs in determining fair value of our financial and non-financial assets and liabilities. Accordingly, there can be no assurance that the fair values we present herein are indicative of amounts that may ultimately be realized upon sale or other disposition of these assets.

Financial and non-financial assets and liabilities measured at fair value on a non-recurring basis in our consolidated financial statements consist of real estate and related assets and investments in unconsolidated joint ventures and related liabilities assumed and common stock issued related to our acquisitions. The fair values of these assets, liabilities and common stock were determined as of the acquisition dates using widely accepted valuation techniques, including (i) discounted cash flow analysis, which considers, among other things, leasing assumptions, growth rates, discount rates and terminal capitalization rates, (ii) income capitalization approach, which considers prevailing market capitalization rates, and (iii) comparable sales activity. In general, we consider multiple valuation techniques when measuring fair values. However, in certain circumstances, a single valuation technique may be appropriate. All of the fair values of the assets, liabilities and common stock as of the acquisition dates were derived using Level 3 inputs.

The carrying amounts of cash and cash equivalents, tenant accounts receivable, other assets, accounts payable and accrued liabilities, distributions payable and amounts due to affiliates approximate fair value because of the relatively short-term nature of these instruments.

The table below summarizes our fixed rate notes payable at September 30, 2012. The estimated fair value of financial instruments is subjective in nature and is dependent on a number of important assumptions, including discount rates and relevant comparable market information associated with each financial instrument. The fair value of the fixed rate notes payable was estimated

16

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2012

by discounting the future cash flows using the current rates at which similar loans would be made to borrowers with similar credit ratings and for the same remaining maturities. The use of different market assumptions and estimation methodologies may have a material effect on the reported estimated fair value amounts. Accordingly, the estimates presented below are not necessarily indicative of the amounts we would realize in a current market exchange.

| | | | | | | | |

| | | September 30, 2012 | |

| | | Fair Value | | | Carrying Value | |

Fixed Rate Secured Debt(1) | | $ | 248,250,754 | | | $ | 240,366,908 | |

| (1) | This table reflects both the terms of the First Amendment to Second Restated KeyBank Credit Facility and the closing of the KeyBank CMBS Loan discussed in Notes 5 and 11. |

As of September 30, 2012, we had an interest rate swap on one of our loans (See Notes 5 and 6). The valuation of this instrument was determined using widely accepted valuation techniques including discounted cash flow analysis on the expected cash flows of each derivative. This analysis reflects the contractual terms of the derivatives, including the period to maturity, and uses observable market-based inputs, including interest rate curves and implied volatilities. The fair values of interest rate swaps are determined using the market standard methodology of netting the discounted future fixed cash payments and the discounted expected variable cash receipts. The variable cash receipts are based on an expectation of future interest rates (forward curves) derived from observable market interest rate curves.

To comply with GAAP, we incorporate credit valuation adjustments to appropriately reflect both our own nonperformance risk and the respective counterparty’s nonperformance risk in the fair value measurements. In adjusting the fair value of our derivative contracts for the effect of nonperformance risk, we have considered the impact of netting and any applicable credit enhancements, such as collateral postings, thresholds, mutual puts, and guarantees.

Although we have determined that the majority of the inputs used to value our derivatives fall within Level 2 of the fair value hierarchy, the credit valuation adjustments associated with our derivatives utilize Level 3 inputs, such as estimates of current credit spreads to evaluate the likelihood of default by us and our counterparties. However, as of September 30, 2012, we have assessed the significance of the impact of the credit valuation adjustments on the overall valuation of our derivative positions and have determined that the credit valuation adjustments are not significant to the overall valuation of our derivatives. As a result, we have determined that our derivative valuations in their entirety are classified in Level 2 of the fair value hierarchy. As of September 30, 2012, we had $607,664 of Level 2 derivatives (interest rate swap) classified in accounts payable and accrued liabilities on our consolidated balance sheet.

Derivative Instruments and Hedging Activities

The accounting for changes in the fair value of derivatives depends on the intended use of the derivative and the resulting designation. Derivatives used to hedge exposure to changes in the fair value of an asset, liability or firm commitment attributable to a particular risk are considered fair value hedges. Derivatives used to hedge the exposure to variability in expected future cash flows or other types of forecasted transactions are considered cash flow hedges.

For derivatives designated as fair value hedges, changes in the fair value of the derivative and the hedged item related to the hedged risk are recognized in the statements of operations. For derivatives designated as cash flow hedges, the effective portion of changes in the fair value of the derivative is initially reported in other comprehensive income, outside of earnings and subsequently reclassified to earnings when the hedged transaction affects earnings.

Noncontrolling Interest in Consolidated Entities

We account for the noncontrolling interest in our Operating Partnership in accordance with amended accounting guidance. Due to our control through our general partnership interest in our Operating Partnership and the limited rights of the limited partner, our Operating Partnership, including its wholly-owned subsidiaries, is consolidated with the Company and the limited partner interest is reflected as a noncontrolling interest in the accompanying consolidated balance sheets. In addition, we account for the noncontrolling interest in the SF property in accordance with the amended accounting guidance. The noncontrolling interests shall continue to be attributed their share of income and losses, even if that attribution results in a deficit noncontrolling interest balance.

Income Taxes

We made an election to be taxed as a Real Estate Investment Trust (“REIT”), under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”), commencing with our taxable year ended December 31, 2008. To qualify as a

17

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2012

REIT, we must meet certain organizational and operational requirements, including a requirement to currently distribute at least 90% of the REIT’s ordinary taxable income to stockholders. As a REIT, we generally will not be subject to federal income tax on taxable income that we distribute to our stockholders. If we fail to qualify as a REIT in any taxable year, we will then be subject to federal income taxes on our taxable income at regular corporate rates and will not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year during which qualification is lost unless the IRS grants us relief under certain statutory provisions. Such an event could materially adversely affect our net income and net cash available for distribution to stockholders. However, we believe that we will be organized and operate in such a manner as to qualify for treatment as a REIT and intend to operate in the foreseeable future in such a manner that we will remain qualified as a REIT for federal income tax purposes. We have concluded that there are no significant uncertain tax positions requiring recognition or disclosure in our consolidated financial statements.

Even if we qualify for taxation as a REIT, we may be subject to certain state and local taxes on our income and property, and federal income and excise taxes on our undistributed income.

We have filed an election to treat the TRSs as taxable REIT subsidiaries. In general, the TRSs may perform additional services for our tenants and generally may engage in any real estate or non-real estate related business. The TRSs are subject to corporate federal and state income tax. The TRSs follow accounting guidance which requires the use of the asset and liability method. Deferred income taxes will represent the tax effect of future differences between the book and tax bases of assets and liabilities.

Per Share Data

Basic earnings per share attributable for all periods presented are computed by dividing net income (loss) by the weighted average number of shares outstanding during the period. Diluted earnings per share are computed by dividing net income (loss) by the weighted average number of shares outstanding, including all restricted stock grants as though fully vested. For the three and nine months ended September 30, 2012, 6,250 shares of unvested restricted stock were not included in the diluted weighted average shares as such shares were antidilutive and for the three and nine months ended September 30, 2011, 6,875 shares of unvested restricted stock were not included in the diluted weighted average shares as such shares were antidilutive.

Recently Issued Accounting Guidance

ASU No. 2011-05, “Presentation of Comprehensive Income” (“ASU 2011-05”), was issued in June 2011 to allow an entity the option to present the total of comprehensive income, the components of net income, and the components of other comprehensive income in either a single continuous statement of comprehensive income or two separate but consecutive statements. Under either option, an entity is required to present each component of net income along with total net income, each component of other comprehensive income along with a total for other comprehensive income, and a total amount for comprehensive income. ASU 2011-05 eliminates the option to present the components of other comprehensive income as part of the statement of changes in stockholders’ equity. ASU 2011-05 does not change the items that are required to be reported in other comprehensive income or when an item of other comprehensive income must be reclassified to net income and is required to be applied retrospectively. For public entities, this ASU is effective for fiscal years beginning after December 15, 2011. We adopted this ASU in the interim period ending March 31, 2012 by selecting the option of two separate but consecutive statements.

Note 3. USA Self Storage I, DST Acquisition

On February 1, 2011, we, through an indirect wholly-owned subsidiary, closed on the purchase of an additional 73.824% in beneficial interests (“Interests”) in USA Self Storage I, DST (the “DST”), a Delaware Statutory Trust sponsored by our Sponsor, from 36 third-party sellers pursuant to separate purchase agreements with each seller. None of the purchases was contingent upon any of the others. The agreed upon purchase price of the properties relating to the Interests acquired was approximately $27.7 million ($37.55 million total purchase price multiplied by 73.824%), consisting of $10.2 million in cash and the ratable portion of approximately $17.5 million of three separate bank loans held by the three property owning subtrusts (the “Subtrusts”) of the DST (the “Bank of America Loans”).

The acquisition brought our ownership of the DST to 93.577%, including 19.753% in Interests that were acquired previously in unrelated transactions. We closed on the purchase of the remaining 6.423% in Interests on February 15, 2011, with the majority of the consideration being provided in the form of approximately 70,000 limited partnership units in our Operating Partnership. We paid our Advisor approximately $377,000 in acquisition fees in connection with these acquisitions.

The DST, through the Subtrusts, owns 10 self storage facilities located in Georgia, North Carolina and Texas with an aggregate of approximately 5,440 units and 726,000 rentable square feet. The three Subtrusts lease their respective properties to master tenants (the “Tenants”) on a triple-net basis pursuant to master leases (the “Leases”) that have terms of 10 years and expire on November 1, 2015.

18

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2012

The Tenants are owned by affiliates of the Sponsor. Under the Leases, the Tenants pay a stated monthly rent equivalent to the monthly debt service payment under the Bank of America Loans, which is paid directly to the lender on behalf of the Subtrusts, a monthly stated rent equivalent to an investor return of 7.0% per annum, and may pay certain annual bonus rent per the terms of the Leases, both of which stated rent and bonus rent are remitted to the Subtrusts. As an Interest holder, we are entitled to our pro rata share of the total rent less the debt service under the Bank of America Loans. The Tenants are entitled to retain any cash flow in excess of these rent payments. We and our Sponsor have agreed to assign 100% of the economic benefits and obligations from these properties to us in exchange for indemnification by us for any potential liability incurred subsequent to the assignment by the Sponsor in connection with the Leases.

The properties owned by the Subtrusts are subject to the three Bank of America Loans, which had an aggregate principal balance of approximately $23.8 million as of February 1, 2011. The Bank of America Loans bear a fixed interest rate of 5.18%, had original terms of 10 years and mature on November 1, 2015. The Bank of America Loans required monthly interest-only payments during the first three years of their terms and now require monthly principal-and-interest payments based on a 30-year amortization period. Each of the Bank of America Loans is secured only by the properties owned by the respective Subtrust that obtained such loan.

Note 4. Real Estate Facilities

The following summarizes our activity in real estate facilities during the nine months ended September 30, 2012:

| | | | |

Real estate facilities | | | | |

Balance at December 31, 2011 | | $ | 510,395,576 | |

Facility acquisitions | | | 30,240,000 | |

Land disposition | | | (1,675,860 | ) |

Impact of foreign exchange rate changes | | | 951,648 | |

Improvements and additions | | | 5,484,198 | |

| | | | |

Balance at September 30, 2012 | | $ | 545,395,562 | |

| | | | |

| |

Accumulated depreciation | | | | |

Balance at December 31, 2011 | | $ | (15,971,288 | ) |

Depreciation expense | | | (10,105,850 | ) |

| | | | |

Balance at September 30, 2012 | | $ | (26,077,138 | ) |

| | | | |

The following table summarizes the preliminary purchase price allocation for our acquisitions for the nine months ended September 30, 2012:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property | | Acquisition

Date | | | Real Estate

Assets | | | Intangibles | | | Total(1) | | | Debt

Issued(2) | | | 2012

Revenue(3) | | | 2012

Property

Operating

Income(3)(4) | |

Chantilly– VA | | | 5/24/2012 | | | $ | 6,400,000 | | | $ | 900,000 | | | $ | 7,300,000 | | | $ | 3,500,000 | | | $ | 322,364 | | | $ | 205,021 | |

Savannah I– GA(5) | | | 8/16/2012 | | | $ | 2,460,000 | | | $ | 140,000 | | | $ | 2,600,000 | | | | — | | | $ | 40,443 | | | $ | 16,862 | |

Savannah II– GA(5) | | | 8/16/2012 | | | $ | 2,190,000 | | | $ | 110,000 | | | $ | 2,300,000 | | | | — | | | $ | 36,492 | | | $ | 11,545 | |

Columbia– SC(5) | | | 8/16/2012 | | | $ | 2,630,000 | | | $ | 70,000 | | | $ | 2,700,000 | | | | — | | | $ | 32,077 | | | $ | 3,844 | |

Lexington I– SC(5) | | | 8/16/2012 | | | $ | 1,810,000 | | | $ | 190,000 | | | $ | 2,000,000 | | | | — | | | $ | 28,869 | | | $ | 7,716 | |

Stuart I– FL(5) | | | 8/16/2012 | | | $ | 2,390,000 | | | $ | 110,000 | | | $ | 2,500,000 | | | | — | | | $ | 35,231 | | | $ | 15,453 | |

Lexington II – SC(5) | | | 8/16/2012 | | | $ | 4,130,000 | | | $ | 170,000 | | | $ | 4,300,000 | | | | — | | | $ | 50,862 | | | $ | 16,244 | |

Stuart II– FL(5) | | | 8/16/2012 | | | $ | 3,000,000 | | | $ | 100,000 | | | $ | 3,100,000 | | | | — | | | $ | 50,578 | | | $ | 24,651 | |

Bluffton– SC(5) | | | 8/16/2012 | | | $ | 5,230,000 | | | $ | 270,000 | | | $ | 5,500,000 | | | | — | | | $ | 73,153 | | | $ | 36,502 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | $ | 30,240,000 | | | $ | 2,060,000 | | | $ | 32,300,000 | | | $ | 3,500,000 | | | $ | 670,069 | | | $ | 337,838 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | The allocations noted above are based on a preliminary determination of the fair value of the total consideration provided. Such valuations may change as we complete our purchase price accounting. |

| (2) | See Note 5 for specific terms of the debt. |

| (3) | The operating results of the facilities acquired above have been included in the Company’s statement of operations since their respective acquisition date. |

19

STRATEGIC STORAGE TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2012

| (4) | Property operating income excludes corporate general and administrative expenses, asset management fees, interest expense, depreciation, amortization and acquisition expenses. |

| (5) | These eight self storage facilities located in Florida, Georgia and South Carolina are part of a portfolio known as the “Stockade Portfolio”; such portfolio includes a total of 16 properties. The second and third phase closed in the fourth quarter of 2012. See Note 11. |

The purchase price allocations included above are preliminary and therefore, subject to change upon the completion of our analysis of appraisals and other information related to the acquisitions. We anticipate finalizing the purchase price allocations by December 31, 2012 along with supplementary pro forma information.