UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-53644

Strategic Storage Trust, Inc.

(Exact name of Registrant as specified in its charter)

| | |

| Maryland | | 32-0211624 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

111 Corporate Drive, Suite 120, Ladera Ranch,

California 92694

(Address of principal executive offices)

(877) 327-3485

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| None | | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment of this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large Accelerated Filer | | ¨ | | Accelerated Filer | | ¨ |

| Non-Accelerated Filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of voting common stock held by non-affiliates was approximately $467,000,000 assuming a market value of $10.79 per share, as of June 30, 2012.

As of March 21, 2013, there were 47,235,295 outstanding shares of common stock of the registrant.

Documents Incorporated by Reference:

Registrant incorporates by reference in Part III (Items 10, 11, 12, 13 and 14) of this Form 10-K portions of its Definitive Proxy Statement for the 2013 Annual Meeting of Stockholders.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Form 10-K of Strategic Storage Trust, Inc., other than historical facts, may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such statements include, in particular, statements about our plans, strategies, and prospects and are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this report is filed with the Securities and Exchange Commission. We cannot guarantee the accuracy of any such forward-looking statements contained in this Form 10-K, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Any such forward-looking statements are subject to risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations and provide distributions to stockholders, and our ability to find suitable investment properties, may be significantly hindered.

All forward-looking statements should be read in light of the risks identified in Part I, Item 1A of this Form 10-K.

1

PART I

Overview

Strategic Storage Trust, Inc., a Maryland corporation (the “Company”), was formed on August 14, 2007 for the purpose of engaging in the business of investing in self storage facilities. The Company made an election to be taxed as a real estate investment trust (“REIT”) beginning with the taxable year ended December 31, 2008. As used in this report, “we” “us” and “our” refer to Strategic Storage Trust, Inc.

Strategic Capital Holdings, LLC (our “Sponsor”), is the sponsor of our Offering (as defined below). Our Sponsor was formed on July 21, 2004 to engage in private structured offerings of limited partnerships and other entities with respect to the acquisition, management and disposition of commercial real estate assets. Our Sponsor owns a majority of Strategic Storage Holdings, LLC, which is the sole member of our advisor, Strategic Storage Advisor, LLC (our “Advisor”), and our property manager, Strategic Storage Property Management, LLC (our “Property Manager”). We have no paid employees. Our Advisor is responsible for managing our affairs on a day-to-day basis and identifying and making acquisitions and investments on our behalf under the terms of an advisory agreement with our Advisor. Our Advisor was formed on August 13, 2007. See Note 1 of the Notes to the Consolidated Financial Statements contained in this report for further details about our affiliates.

On March 17, 2008, we began our initial public offering of common stock (our “Initial Offering”). On May 22, 2008, we satisfied the minimum offering requirements of the Initial Offering and commenced formal operations. On September 16, 2011, we terminated the Initial Offering, having sold approximately 29 million shares for gross proceeds of approximately $289 million. On September 22, 2011, we commenced our follow-on public offering of stock for a maximum of 110,000,000 shares of common stock, consisting of 100,000,000 shares for sale to the public (our “Primary Offering”) and 10,000,000 shares for sale pursuant to our distribution reinvestment plan (collectively, our “Offering”). We intend to invest a substantial amount of the net proceeds from our Offering in self storage facilities and related self storage real estate investments. Based on the current expiration date of our Offering on September 22, 2013, and our current sales pace, which our board of directors believes should allow us to raise sufficient capital to move to the next phase of our life cycle, our board of directors approved closing our Offering within the original two year offering period. We currently expect to close our Offering on or around September 22, 2013, although the board of directors has reserved its right to close the Offering prior to that date if the board of directors deems it appropriate. Our board may also extend our Offering for an additional year, or in certain circumstances, longer. We currently plan to continue to offer shares under our distribution reinvestment plan beyond the above date; however, we may terminate the distribution reinvestment plan offering at any time. As of December 31, 2012, we had issued approximately 42.7 million shares of common stock for approximately $426 million in our Initial Offering and our Offering and also issued 6.2 million shares in a private offering. As of December 31, 2012, we had approximately 46.2 million shares issued and outstanding.

Effective June 1, 2012, the offering price of our shares of common stock increased from $10.00 per share to $10.79 per share. This increase was primarily based on the April 2, 2012 estimated per share value of our common stock of $10.79 which was calculated based on the estimated value of our assets less the estimated value of our liabilities, or net asset value, divided by the number of shares outstanding on an adjusted fully diluted basis, calculated as of December 31, 2011. In light of the above-described net asset value calculation, our board of directors determined that it was appropriate to increase the per share offering price for new purchases of our shares commencing on June 1, 2012. This determination by our board of directors was subjective and was primarily based on (i) the estimated net asset value per share, which was predominantly based on an independent third party appraiser’s valuation of our properties as of December 31, 2011, (ii) the commissions and dealer manager fees payable in connection with the offering of our shares, (iii) our historical and anticipated results of operations and financial condition, (iv) our current and anticipated distribution payments, (v) our current and anticipated capital and debt structure, and (vi) our Advisor’s recommendations and assessment of our prospects and continued execution of our investment and operating strategies.

2

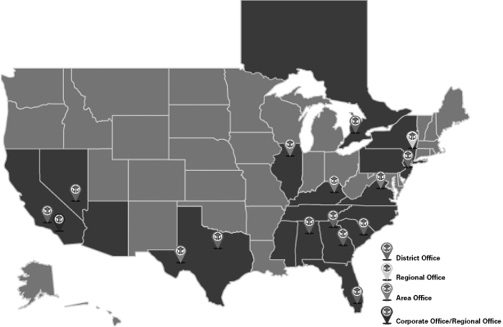

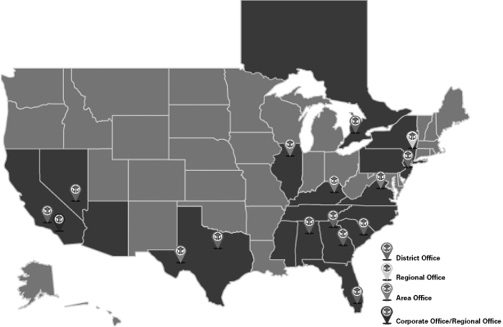

As of December 31, 2012, we wholly-owned 110 self storage facilities located in 17 states (Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Mississippi, Nevada, New Jersey, New York, North Carolina, Pennsylvania, South Carolina, Tennessee, Texas and Virginia) and Canada comprising approximately 70,190 units and approximately 9.2 million rentable square feet. As of December 31, 2012, we also had minority interests in eight additional self storage facilities. Of those interests, one has been deemed to be a controlling interest and is therefore consolidated in our consolidated financial statements as discussed in Note 2. Additionally, we have an interest in a net leased industrial property in California with 356,000 rentable square feet leased to a single tenant. While our properties are branded under the “SmartStop® Self Storage” brand, we do not own or control this brand. Strategic Storage Holdings, LLC, the parent company of our Advisor and Property Manager, owns and controls the intellectual property rights to the “SmartStop® Self Storage” brand, the websitewww.smartstopselfstorage.com and other intellectual property currently being used by us in connection with our self storage properties. We are currently authorized to use this brand and other intellectual property pursuant to a license. In the event that we ever cease to operate under this brand, which has garnered substantial value due to its goodwill and reputation associated therewith, we may lose market share and customers, and we could incur significant costs to change the signage and otherwise change our brand.

Industry Summary

“Self storage” refers to properties that offer do-it-yourself, month-to-month storage space rental for personal or business use. Self storage offers a cost-effective and flexible storage alternative. Tenants rent fully-enclosed spaces or parking spaces that can vary in size according to their specific needs and to which they have unlimited, exclusive access. Tenants have responsibility for moving their items into and out of their units. Self storage unit sizes typically range from five feet by five feet to 10 feet by 30 feet.

Self storage provides a convenient way for individuals and businesses to store their possessions, whether due to a life change or simply because of a need for additional storage space. According to the 2012 Self Storage Almanac, self storage facilities generally have a tenant mix of approximately 75% residential, 19% commercial, 3% military and 3% students. The mix of residential tenants using a self storage property is determined by a property’s local demographics and often includes people who are looking to downsize their living space or who are not yet settled in a large home. The items residential tenants place in self storage properties range from cars, boats and recreational vehicles to furniture, household items and appliances. Commercial tenants tend to include small business owners who require easy and frequent access to their goods, records or extra inventory, or storage for seasonal goods. Self storage properties provide an accessible storage alternative at a relatively low cost. Properties generally have on-site managers who supervise and run the day-to-day operations, providing tenants with assistance as needed. The six key demand drivers of self storage are: (1) population growth; (2) percentage of renter-occupied housing units; (3) average household size; (4) average household income; (5) supply constraints; and (6) economic growth. Tenants choose a self storage property based largely on the convenience of the site to their home or business. Therefore, high-density, high-traffic population centers are ideal locations for a self storage property. A property’s perceived security and the general professionalism of the site managers and staff are also contributing factors to a site’s ability to secure rentals. Although most self storage properties are leased to tenants on a month-to-month basis, tenants tend to continue their leases for extended periods of time. However, there are seasonal fluctuations in occupancy rates for self storage properties. Generally, there is increased leasing activity at self storage properties during the summer months due to the higher number of people who relocate during this period.

As population densities have increased in the U.S., there has been an increase in self storage awareness and development. According to the Self Storage Association’s Self Storage Industry Fact Sheet (June 2012):

| | • | | at year-end 1984 there were 6,601 facilities with 289.7 million square feet of rentable self storage in the U.S. At year-end 2011 there were approximately 49,940 “primary” self storage facilities in the U.S. representing approximately 2.3 billion square feet; |

| | • | | at year end 2011 there were approximately 58,500 self storage facilities worldwide including more than 3,000 self storage facilities in Canada; |

3

| | • | | the top five self storage companies own and operate just 9.8% of all “primary” facilities; |

| | • | | 75% of all self storage companies own and operate just one “primary” self storage facility; and |

| | • | | it took the self storage industry more than 25 years to build its first billion square feet of space; it added the second billion square feet in just eight years (1998-2005). |

The growth in the industry has created more competition in various geographic regions. This has led to an increased emphasis on site location, property design, innovation and functionality to accommodate local planning and zoning boards and to distinguish a facility from other offerings in the market. This is especially true for new sites slated for high-density population centers.

Recently, self storage operators have placed increased emphasis on offering ancillary products which provide incremental revenues. Moving and packing supplies, such as locks and boxes, and the offering of other services, such as tenant insurance, truck rentals, help to increase revenues. As more sophisticated self storage operators continue to develop innovative products and services such as online rentals, 24-hour accessibility, automated kiosk rentals, climate-controlled storage, wine storage, tenant-service call center access and after-hours storage, local operators may be increasingly unable to meet higher tenant expectations, which could encourage consolidation in the industry.

We expect the “baby boomer” generation to have a major impact on the future of the self storage industry. During the 19-year period from 1946 to 1964, approximately 77 million babies, or “baby boomers,” were born in the U.S. According to the U.S. Census Bureau, “baby boomers” make up nearly 27% of the U.S. population. These “baby boomers” are heading towards retirement age and have accumulated possessions which they wish to retain. As the “baby boomers” move into retirement age and begin to downsize their households, we believe there will be a great need for self storage facilities to assist them in protecting and housing these possessions for prolonged periods of time.

We also believe that the self storage industry possesses attractive characteristics not found in other commercial real estate sectors, including the following:

| | • | | no reliance on a “single large tenant” whose vacating can have a devastating impact on rental revenue; |

| | • | | no leasing commissions and/or tenant improvements; |

| | • | | relatively low capital expenditures; |

| | • | | brand names can be developed at local, regional and even national levels; |

| | • | | opportunity for a great deal of geographic diversification, which could enhance the stability and predictability of cash flows; and |

| | • | | the lowest loan default rate of any commercial property type. |

Business Overview

Unlike many other REITs and real estate companies, we are an operating business. We acquire, develop, redevelop, own, operate and manage self storage facilities. Our self storage facilities offer inexpensive, easily accessible, enclosed storage space or parking space to residential and commercial users on a month-to-month basis. Most of our facilities are fenced with computerized gates and are well lighted. Many of our properties are single-story, thereby providing customers with the convenience of direct vehicle access to their storage spaces. At certain facilities, we offer climate-controlled units that generally offer heating in the winter and cooling in the summer. Many of our facilities also offer outside vehicle, boat and recreational vehicle storage areas. Our facilities generally are constructed of masonry or steel walls resting on concrete slabs and have standing seam metal, shingle, or tar and gravel roofs. Customers have access to their storage units from 6:00AM – 10:00PM

4

(365 days per year), and some of our facilities provide 24-hour access. Individual storage spaces are secured by a lock furnished by the customer to provide the customer with control of access to the space. Our facilities range in size from approximately 21,700 to approximately 311,800 net rentable square feet, with an average of approximately 84,000 net rentable square feet.

As an operating business, self storage requires a much greater focus on strategic and operational management. Below are some of the strategies and tactics we are utilizing to grow a diversified portfolio of self storage facilities that we believe will maximize cash available for distributions and potential for appreciation in the value of our properties over the long term.

Initial Growth and Branding Stage.

Since our inception, we have been focused on building a diversified portfolio of self storage facilities. As of December 31, 2012, we had acquired 110 facilities in 17 states and Canada. We have been branding our facilities under the “SmartStop® Self Storage” brand. We utilize a call center which focuses on generating reservations and assisting customers with their current storage accounts, such as taking payments or answering general questions. Additionally, we developed a customer-friendly and mobile phone-friendly self storage website,www.smartstopselfstorage.com, which allows potential self storage customers to locate available units at any of our properties, and our SmartTracker Inventory ListSM App, which allows customers to organize and track the contents of their self storage units via their iPhone or Android device. We believe that the implementation of these and other branding and marketing initiatives will enhance brand awareness and drive revenue growth in the future.

Focus on Increasing Revenue and Creating Greater Efficiencies.

We continue to place a significant amount of focus on revenue generation opportunities at our self storage facilities and capitalizing on economies of scale from our growing portfolio. Below are a few of the specific measures we have taken to improve our operating performance at our existing facilities:

| | • | | Standardized Sales Processes.We have put forth a standardized sales approach so that the rental experience is consistent at each of our facilities. All employees are trained in our sales approach and techniques that facilitate the generation of business. |

| | • | | Integrated Marketing Strategy.We have developed an integrated marketing strategy for our online, phone and walk-in customers, which includes our customer-friendly and mobile-friendly self storage website, allowing potential customers to locate available units at any of our properties. Also, our web marketing tools, pay-per-click campaign (to generate leads and improve brand recognition), search engine optimization process to obtain a dominant position in browser listings and our social media campaigns provide us with a technological edge over competitors. |

| | • | | Facility Monitoring Activities. We are seeking to increase revenue and net operating income at each of our facilities by (i) closely monitoring call volume, reservation activity and occupancy in relation to our marketing activities, (ii) analyzing market supply and demand factors, as well as occupancy trends, in setting rental rates, promotional discounts and target marketing initiatives, (iii) continuous refinement of our algorithms that manage our rental rate increases to existing customers at our self storage facilities (“Revenue Optimization System”), and (iv) closely managing our controllable operating costs. |

| | • | | Revenue Optimization System.We utilize a Revenue Optimization System (“ROS”) which allows us to analyze every unit at every property individually and manage our available unit inventory through a sophisticated system of algorithms which automatically triggers pricing adjustments. This system allows us to instantly respond to market demand and maximize revenues. |

| | • | | Creating Operational Efficiencies. As we continue to grow our portfolio of self storage facilities, we will be able to consolidate and streamline a number of aspects of our operations through economies of |

5

| | scale. For example, as a result of our size and geographic diversification, as well as our institution of a blanket property and casualty insurance program over all of our properties nationwide, we have reduced our total insurance costs per property. We are also negotiating national contracts and rates with other key vendors and service providers. Additionally, we have implemented a labor scheduling model that takes a standardized approach to staffing our facilities. This allows us to better manage our labor hours and better predict our labor costs. To the extent we can continue to acquire facilities in clusters within geographic regions, we believe efficiencies will continue to improve. |

| | • | | Increasing Focus on Ancillary Revenue. We are increasing our focus on certain ancillary revenue opportunities. We have increased the emphasis on selling our customers tenant insurance to protect their belongings against loss or damage. We offer a wide assortment of packing and moving supplies that a customer would need to properly protect their items while in storage. We have implemented a standardized approach on how to sell these items to our customers as well. Additionally, we have national truck rental contracts with Penske and Budget to assist customers with their move. Furthermore, we have added the capability for customers to purchase boxes, locks and packing supplies online through our website. Users of this service pick up the supplies at their nearest SmartStop® facility, which increases revenue and increases the likelihood of such customers becoming self storage customers at one of our facilities. |

Growth Opportunities.

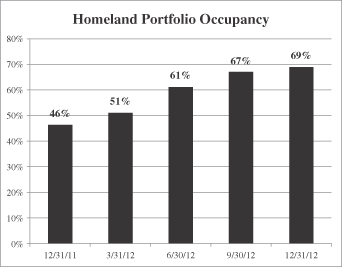

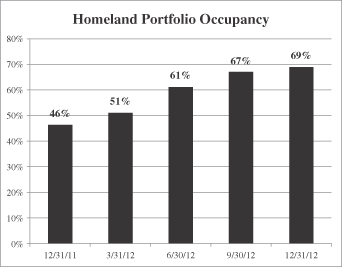

While our primary focus is on acquiring stabilized self storage facilities that contribute to net cash flow, we have acquired a number of facilities that are either in the lease-up or development stage. By purchasing facilities that are still in the lease-up stage, we believe we can enhance stockholder value through the leasing efforts of our Property Manager and efficiencies created by our brand, website and other marketing efforts. Due to a lack of new supply in certain markets, we believe we can also create long-term stockholder value by developing or redeveloping certain self storage facilities.

Investment Objectives

Overview

We will invest a substantial amount of the net proceeds of the Offering in self storage facilities and related self storage real estate investments. In the event we raise the maximum offering from our Primary Offering, we anticipate that approximately 88.25% of our gross offering proceeds will be used to primarily make investments in self storage facilities and related self storage real estate investments and pay real estate-related acquisition fees and acquisition expenses, while the remaining 11.75% will be used to pay sales commissions, dealer manager fees and other offering expenses. We may also use net offering proceeds to pay down debt or make distributions if our cash flows from operations are insufficient. Our investment objectives, strategy and policies may be amended or changed at any time by our board of directors. Although we have no plans at this time to change any of our investment objectives, our board of directors may change any and all such investment objectives, including our focus on self storage facilities, if our board believes such changes are in the best interests of our stockholders. In addition, we may invest in real estate properties other than self storage facilities if our board deems such investments to be in the best interests of our stockholders. We cannot assure our stockholders that our policies or investment objectives will be attained or that the value of our common stock will not decrease.

Primary Investment Objectives

Our primary investment objectives are to:

| | • | | invest in income-producing real property in a manner that allows us to qualify as a REIT for federal income tax purposes; |

| | • | | provide regular cash distributions to our stockholders; |

6

| | • | | preserve and protect our stockholders’ invested capital; and |

| | • | | achieve appreciation in the value of our properties over the long term. |

We cannot assure our stockholders that we will attain these primary investment objectives.

Exchange Listing and Other Liquidity Events

Our board will determine when, and if, to apply to have our shares of common stock listed for trading on a national securities exchange subject to satisfying then-existing applicable listing requirements. Subject to then-existing market conditions and the sole discretion of our board of directors, we intend to seek one or more of the following liquidity events within three to five years after completion of the Offering:

| | • | | list our shares on a national securities exchange; |

| | • | | merge, reorganize or otherwise transfer our company or its assets to another entity with listed securities; |

| | • | | commence the sale of all of our properties and liquidate our company; or |

| | • | | otherwise create a liquidity event for our stockholders. |

However, we cannot assure our stockholders that we will achieve one or more of the above-described liquidity events within the time frame contemplated or at all. This time frame represents our best faith estimate of the time necessary to build a portfolio sufficient enough to effectuate one of the liquidity events listed above. Our board of directors has the sole discretion to continue operations beyond five years after completion of the Offering if it deems such continuation to be in the best interests of our stockholders. Even if we do accomplish one or more of these liquidity events, we cannot guarantee that a public market will develop for the securities listed or that such securities will trade at a price higher than what our stockholders paid for their shares in our Offering. At the time it becomes necessary for our board of directors to determine which liquidity event, if any, is in the best interests of us and our stockholders, we expect that the board will take all relevant factors at that time into consideration when making a liquidity event decision. We expect that the board will consider various factors including, but not limited to, costs and expenses related to each possible liquidity event and the potential subordinated fees or other consideration that would be paid to our Advisor.

Our Self Storage Acquisition Strategy

We will focus on the acquisition, ownership, operation and development of self storage facilities and activities relating to this type of property. Self storage refers to properties that offer do-it-yourself, month-to-month storage space rental for personal or business use. According to the Self Storage Association’s Self Storage Industry Fact Sheet, the self storage industry in the United States consists of approximately 2.3 billion rentable square feet at approximately 49,940 facilities (where self storage is the primary source of revenue). The industry is highly fragmented, comprised mainly of local operators and a few national owners and operators, including, we believe, only four publicly traded self storage REITs. We believe the following factors will allow us to achieve market penetration, name recognition and national brand awareness and loyalty in the self storage industry, which will result in greater economies of scale:

| | • | | the size and diversification of our self storage portfolio, which, as of December 31, 2012, consisted of 110 properties in 17 states and Canada with approximately 70,190 units and approximately 9.2 million square feet; |

| | • | | the management team of our Advisor and Property Manager which, in addition to our executive officers, includes regional and district property management professionals and on-site property management personnel; |

| | • | | our self storage branding strategy whereby we intend to re-brand every self storage facility we acquire under the “SmartStop® Self Storage” brand and our call center which provides access to information regarding our self storage facilities; and |

7

| | • | | our integrated marketing strategy for our online, phone and walk-in customers, which includes our customer-friendly and mobile-friendly self storage website, allowing potential customers to locate available units at any of our properties. Also, our web marketing tools, pay-per-click campaign (to generate leads and improve brand recognition), search engine optimization process to obtain a dominant position in browser listings and our social media campaigns provide us with a technological edge over competitors. |

We intend to focus on pursuing acquisitions of self storage facilities in markets with varying economic and demographic characteristics, including large urban cities, densely populated suburban cities and smaller rural cities, as long as the property meets our acquisition criteria. We also intend to expand and develop certain facilities we purchase in order to capitalize on underutilization and excess demand. The development of certain facilities we purchase may include an expansion of the self storage units or the services and ancillary products offered as well as making units available for office space. However, future investments will not be limited to any geographic area, to a type of facility or to a specified percentage of our total assets. We may invest a portion of the net proceeds we raise in self storage facilities outside the United States. We will strategically invest in specific domestic or foreign markets when opportunities that meet our investment criteria are available. In general, when evaluating potential acquisitions of self storage facilities, the primary factor we will consider is the property’s current and projected cash flow.

General Acquisition and Investment Policies

While we intend to focus our investment strategy on self storage facilities and related self storage real estate investments, we may invest in other storage-related investments such as storage facilities for automobiles, recreation vehicles and boats. We may additionally invest in other types of commercial real estate properties if our board of directors deems appropriate; however, we have no current intention of investing more than 20% of the net proceeds of the Offering in such other commercial real estate properties. We will seek to make investments that will satisfy the primary investment objective of providing regular cash distributions to our stockholders. However, because a significant factor in the valuation of income-producing real property is its potential for future appreciation, we anticipate that some properties we acquire may have the potential for both growth in value and for providing regular cash distributions to our stockholders. As a secondary focus, in an effort to maximize stockholder value, we have also acquired, and may continue to acquire, value-added properties in lease-up stage, as well as development properties. We believe that this strategy will benefit the overall composition of our portfolio in the future.

Our Advisor will have substantial discretion with respect to the selection of specific properties. However, each acquisition will be approved by our board of directors. The consideration paid for a property will ordinarily be based on the fair market value of the property as determined by a majority of our board of directors. In selecting a potential property for acquisition, we and our Advisor will consider a number of factors, including, but not limited to, the following:

| | • | | projected demand for self storage facilities in the area; |

| | • | | a property’s geographic location and type; |

| | • | | a property’s physical location in relation to population density, traffic counts and access; |

| | • | | construction quality and condition; |

| | • | | potential for capital appreciation; |

| | • | | proposed purchase price, terms and conditions; |

| | • | | historical financial performance; |

| | • | | rental rates and occupancy levels for the property and competing properties in the area; |

| | • | | potential for rent increases; |

8

| | • | | demographics of the area; |

| | • | | operating expenses being incurred and expected to be incurred, including, but not limited to property taxes and insurance costs; |

| | • | | potential capital improvements and reserves required to maintain the property; |

| | • | | prospects for liquidity through sale, financing or refinancing of the property; |

| | • | | potential competitors for expanding the physical layout of the property; |

| | • | | the potential for the construction of new properties in the area; |

| | • | | treatment under applicable federal, state and local tax and other laws and regulations; |

| | • | | evaluation of title and obtaining of satisfactory title insurance; and |

| | • | | evaluation of any reasonably ascertainable risks such as environmental contamination. |

There is no limitation on the number, size or type of properties that we may acquire or on the percentage of net offering proceeds that may be invested in any particular property type or single property. The number and mix of properties will depend upon real estate market conditions and other circumstances existing at the time of acquisition and the amount of proceeds raised in the Offering. In determining whether to purchase a particular property, we may obtain an option on such property. The amount paid for an option, if any, is normally surrendered if the property is not purchased and may or may not be credited against the purchase price if the property is ultimately purchased.

Our Borrowing Strategy and Policies

Although we intend to use low leverage (50% or less) to make our investments during the Offering, at certain times during the Offering, including the present, our debt leverage levels may be temporarily higher as we acquire properties in advance of funds being raised in the Offering. At the current time, the debt markets are attractive, and our board believes that a higher debt leverage in these markets is beneficial to our long-term interests. Our board of directors will regularly monitor our investment pipeline in relation to our projected fundraising efforts and otherwise evaluate market conditions related to our debt leverage ratios throughout the Offering. As of December 31, 2012, our book value based debt leverage was approximately 56% (leverage as of December 31, 2012 calculated based on gross asset value was approximately 51%).

We may incur our indebtedness in the form of bank borrowings, purchase money obligations to the sellers of properties and publicly—or privately-placed debt instruments or financing from institutional investors or other lenders. We may obtain a credit facility or separate loans for each acquisition. Our indebtedness may be unsecured or may be secured by mortgages or other interests in our properties. We may use borrowing proceeds to finance acquisitions of new properties, to pay for capital improvements, repairs or buildouts, to refinance existing indebtedness, to pay distributions, to fund redemptions of our shares or to provide working capital.

There is no limitation on the amount we can borrow for the purchase of any property. Our aggregate borrowings, secured and unsecured, must be reasonable in relation to our net assets and must be reviewed by our board of directors at least quarterly. Our charter limits our borrowing to 300% of our net assets, as defined (approximately 75% of the cost basis of our assets), unless any excess borrowing is approved by a majority of our independent directors and is disclosed to our stockholders in our next quarterly report, with a justification for such excess.

We may borrow amounts from our Advisor or its affiliates only if such loan is approved by a majority of our directors, including a majority of our independent directors, not otherwise interested in the transaction, as fair, competitive, commercially reasonable and no less favorable to us than comparable loans between unaffiliated parties under the circumstances.

9

Except as set forth in our charter regarding debt limits, we may re-evaluate and change our debt strategy and policies in the future without a stockholder vote. Factors that we could consider when re-evaluating or changing our debt strategy and policies include then-current economic and market conditions, the relative cost of debt and equity capital, any acquisition opportunities, the ability of our properties to generate sufficient cash flow to cover debt service requirements and other similar factors. Further, we may increase or decrease our ratio of debt to equity in connection with any change of our borrowing policies.

Acquisition Structure

Although we are not limited as to the form our investments may take, our investments in real estate will generally constitute acquiring fee title or interests in joint ventures or similar entities that own and operate real estate. We may also enter into the following types of leases relating to real property:

| | • | | a ground lease in which we enter into a long-term lease (generally greater than 30 years) with the owner for use of the property during the term whereby the owner retains title to the land; or |

| | • | | a master lease in which we enter into a long-term lease (typically ten years with multiple renewal options) with the owner in which we agree to pay rent to the owner and pay all costs of operating and maintaining the property (a net lease) and typically have an option to purchase the property in the future. |

We will make acquisitions of our real estate investments directly or indirectly through our Operating Partnership. We will acquire interests in real estate either directly through our Operating Partnership or indirectly through limited liability companies or limited partnerships, or through investments in joint ventures, partnerships, co-tenancies or other co-ownership arrangements with other owners of properties, affiliates of our Advisor or other persons.

Conditions to Closing Acquisitions

We will not purchase any property unless and until we obtain at least a Phase I environmental assessment and history for the property and we are sufficiently satisfied with the property’s environmental status. In addition, we will generally condition our obligation to close the purchase of any property on the delivery and verification of certain documents from the seller or other independent professionals, including but not limited to, where appropriate:

| | • | | property surveys and site audits; |

| | • | | building plans and specifications, if available; |

| | • | | soil reports, seismic studies, flood zone studies, if available; |

| | • | | licenses, permits, maps and governmental approvals; |

| | • | | historical financial statements and tax statement summaries of the properties; |

| | • | | proof of marketable title, subject to such liens and encumbrances as are acceptable to us; and |

| | • | | liability and title insurance policies. |

Joint Venture Investments

As of December 31, 2012, we had entered into several joint venture arrangements (see Note 2 of the Notes to the Consolidated Financial Statements contained in this report). In the future we may acquire some of our properties in joint ventures, some of which may be entered into with affiliates of our Advisor. We may also enter into joint ventures, general partnerships, co-tenancies and other participations with real estate developers, owners and others for the purpose of owning and leasing real properties. Among other reasons, we may want to acquire properties through a joint venture with third parties or affiliates in order to diversify our portfolio of properties in

10

terms of geographic region or property type or to co-invest with one of our property management partners. Joint ventures may also allow us to acquire an interest in a property without requiring that we fund the entire purchase price. In addition, certain properties may be available to us only through joint ventures. In determining whether to recommend a particular joint venture, our Advisor will evaluate the real property which such joint venture owns or is being formed to own under the same criteria described elsewhere in this annual report.

We may enter into joint ventures with affiliates of our Sponsor, Advisor or any affiliate thereof for the acquisition of properties, but only provided that:

| | • | | a majority of our directors, including a majority of our independent directors not otherwise interested in the transaction, approve the transaction as being fair and reasonable to us; and |

| | • | | the investment by us and the joint venture partner are on substantially the same terms and conditions. |

To the extent possible and if approved by our board of directors, including a majority of our independent directors, we will attempt to obtain a right of first refusal or option to buy if such venture partner elects to sell its interest in the joint venture or the property held by the joint venture. In the event that the venture partner were to elect to sell such interest, however, we may not have sufficient funds to exercise our right of first refusal to buy the venture partner’s interest. Entering into joint ventures with affiliates of our Advisor will result in certain conflicts of interest.

Co-Investment with Tenant-In-Common Programs and Delaware Statutory Trusts

Persons selling real estate held for investment often seek to reinvest the proceeds of that sale in another real estate investment in an effort to obtain favorable tax treatment under Section 1031 of the Internal Revenue Code (the “Code”). Our Sponsor has been and may continue to be a sponsor of tenant-in-common programs and Delaware Statutory Trusts (“DSTs”), such transactions referred to as like-kind exchanges.

For each tenant-in-common program, our Sponsor or one of its affiliates will create a single member limited liability company (each of which we refer to as a Strategic Capital Exchange Entity). A Strategic Capital Exchange Entity will acquire all or part of a real estate property to be owned in co-tenancy arrangements with persons wishing to engage in like-kind exchanges (tenant-in-common participants). Generally, a Strategic Capital Exchange Entity will acquire the subject property, and through a registered broker-dealer, market a private placement memorandum for the sale of co-tenancy interests in that property. In many instances, affiliates of our Advisor will sell or contribute a property to a Strategic Capital Exchange Entity for the purpose of selling off the property. Properties acquired in connection with the tenant-in-common program, if any, initially may be partially or entirely financed with debt. When a tenant-in-common participant wishes to acquire a co-tenancy interest, the Strategic Capital Exchange Entity will deed an undivided co-tenancy interest in the subject property to a newly-formed single-member limited liability company that is owned by the tenant-in-common participant.

A DST is a separate legal entity created as a trust under Delaware law that allows persons wishing to engage in like-kind exchanges to reinvest their proceeds in commercial real estate. In such a transaction, the DST acquires title to the property or properties and borrows money, which is secured by such properties, from the lender, and the exchange participant owns a beneficial interest in the DST.

In 2010 we increased our ownership in Self Storage I DST, one of the DSTs acquired in a previous merger, from 3.05% to 19.75%. We subsequently acquired the remaining interests in Self Storage I DST, such that we owned 100% of the interests as of February 2011. During 2012, we also acquired all of the interests in Madison County Self Storage DST, a DST sponsored by our Sponsor, such that we owned 100% of the interests as of December 28, 2012. We may in the future make additional investments in the other DSTs sponsored by our Sponsor or invest in other similar programs, but will only do so if our board of directors, including a majority of our independent directors, determines that our participation is in the best interest of our stockholders.

11

We may co-invest in a property or DST only if a majority of our directors, including a majority of our independent directors, not otherwise interested in the transaction approves of the transaction as being fair, competitive and commercially reasonable to us. We anticipate that in the event we purchase a tenant-in-common or DST interest from a Strategic Capital Exchange Entity, generally we will purchase the interest at the Strategic Capital Exchange Entity’s cost (before offering expenses and fees). However, if the price to us is in excess of the cost of the asset paid by our affiliate, a majority of our directors, including a majority of our independent directors not otherwise interested in the transaction, must determine that substantial justification for such excess exists and that such excess is reasonable. In no event shall the cost to us of such asset exceed the greater of the Strategic Capital Exchange Entity’s cost or the current appraised value for the property or DST interest as determined by an independent appraiser. Although the Strategic Capital Exchange Entity will charge fees and expenses to tenant-in-common participants and/or will sell the tenant-in-common or DST interests at a price above the price it paid for the property, we will not pay any fees or expenses to the Strategic Capital Exchange Entity. We intend to pay our Advisor the acquisition fees and reimburse our Advisor for its expenses to the same extent as with other types of property acquisitions.

All purchasers of co-tenancy interests, including our Operating Partnership if it purchases co-tenancy interests, will be required to execute a tenant-in-common agreement with the other purchasers of co-tenancy interests in that particular property. For a DST investment, each investor is required to execute a trust agreement. If we purchase these co-ownership interests, we will be subject to various risks associated with co-ownership arrangements which are not otherwise present in real estate investments, such as the risk that the interests of the non-affiliated investors will become adverse to our interests.

In any co-ownership arrangement, our Sponsor, the Strategic Capital Exchange Entity, or the other investors may have economic or business interests or goals that are or may become inconsistent with our business interests or goals. For instance, our Sponsor will receive substantial fees in connection with its sponsoring of a co-ownership arrangement (although we will not be required to pay such fees) and our participation in such a transaction likely would facilitate its consummation of the transactions. For these reasons, our Advisor may face a conflict in structuring the terms of the relationship between our interests and the interest of our Sponsor or the Strategic Capital Exchange Entity. As a result, agreements and transactions between the parties with respect to the property will not have the benefit of arm’s-length negotiation of the type normally conducted between unrelated parties.

Construction and Development Activities

From time to time, we may construct and develop real estate assets or render services in connection with these activities. We may be able to reduce overall purchase costs by constructing and developing a property versus purchasing a completed property. Developing and constructing properties would, however, expose us to risks such as cost overruns, carrying costs of projects under construction or development, availability and costs of materials and labor, weather conditions and government regulation. To comply with the applicable requirements under federal income tax law, we intend to limit our construction and development activities to performing oversight and review functions, including reviewing the construction design proposals, negotiating and contracting for feasibility studies and supervising compliance with local, state or federal laws and regulations, negotiating contracts, overseeing construction, and obtaining financing. In addition, we may use taxable REIT subsidiaries or certain independent contractors to carry out these oversights and review functions. We will retain independent contractors to perform the actual construction work. As of December 31, 2012, we had one property that was under construction in Canada.

Government Regulations

Our business will be subject to many laws and governmental regulations. Changes in these laws and regulations, or their interpretation by agencies and courts, occur frequently.

12

Americans with Disabilities Act

Under the Americans with Disabilities Act of 1990, or ADA, all public accommodations and commercial facilities are required to meet certain federal requirements related to access and use by disabled persons. These requirements became effective in 1992. Complying with the ADA requirements could require us to remove access barriers. Failing to comply could result in the imposition of fines by the federal government or an award of damages to private litigants. Although we intend to acquire properties that substantially comply with these requirements, we may incur additional costs to comply with the ADA. In addition, a number of additional federal, state and local laws may require us to modify any properties we purchase, or may restrict further renovations thereof, with respect to access by disabled persons. Additional legislation could impose financial obligations or restrictions with respect to access by disabled persons. Although we believe that these costs will not have a material adverse effect on us, if required changes involve a greater amount of expenditures than we currently anticipate, our ability to make expected distributions could be adversely affected.

Environmental Matters

Under various federal, state and local laws, ordinances and regulations, a current or previous owner or operator of real property may be held liable for the costs of removing or remediating hazardous or toxic substances. These laws often impose clean-up responsibility and liability without regard to whether the owner or operator was responsible for, or even knew of, the presence of the hazardous or toxic substances. The costs of investigating, removing or remediating these substances may be substantial, and the presence of these substances may adversely affect our ability to rent units or sell the property, or to borrow using the property as collateral, and may expose us to liability resulting from any release of or exposure to these substances. If we arrange for the disposal or treatment of hazardous or toxic substances at another location, we may be liable for the costs of removing or remediating these substances at the disposal or treatment facility, whether or not the facility is owned or operated by us. We may be subject to common law claims by third parties based on damages and costs resulting from environmental contamination emanating from a site that we own or operate. Certain environmental laws also impose liability in connection with the handling of or exposure to asbestos-containing materials, pursuant to which third parties may seek recovery from owners or operators of real properties for personal injury associated with asbestos-containing materials and other hazardous or toxic substances.

Other Regulations

The properties we acquire likely will be subject to various federal, state and local regulatory requirements, such as zoning and state and local fire and life safety requirements. Failure to comply with these requirements could result in the imposition of fines by governmental authorities or awards of damages to private litigants. We intend to acquire properties that are in material compliance with all such regulatory requirements. However, we cannot assure our stockholders that these requirements will not be changed or that new requirements will not be imposed which would require significant unanticipated expenditures by us and could have an adverse effect on our financial condition and results of operations.

Disposition Policies

As of December 31, 2012, we had not disposed of any of our self storage facilities. We generally intend to hold each property we acquire for an extended period. However, we may sell a property at any time if, in our judgment, the sale of the property is in the best interests of our stockholders.

The determination of whether a particular property should be sold or otherwise disposed of will generally be made after consideration of relevant factors, including prevailing economic conditions, other investment opportunities and considerations specific to the condition, value and financial performance of the property. In connection with our sales of properties, we may lend the purchaser all or a portion of the purchase price. In these instances, our taxable income may exceed the cash received in the sale.

13

We may sell assets to third parties or to affiliates of our Advisor. Our nominating and corporate governance committee of our board of directors, which is comprised solely of independent directors, must review and approve all transactions between us and our Advisor and its affiliates.

Investment Limitations in Our Charter

Our charter places numerous limitations on us with respect to the manner in which we may invest our funds, most of which are required by various provisions of the Statement of Policy Regarding Real Estate Investment Trusts published by the North American Securities Administrators Association (NASAA REIT Guidelines). So long as our shares are not listed on a national securities exchange, the NASAA REIT Guidelines apply to us, and we will not:

| | • | | Invest in equity securities unless a majority of our directors, including a majority of our independent directors, not otherwise interested in the transaction approve such investment as being fair, competitive and commercially reasonable. |

| | �� | | Invest in commodities or commodity futures contracts, except for futures contracts when used solely for the purpose of hedging in connection with our ordinary business of investing in real estate assets and mortgages. |

| | • | | Invest in real estate contracts of sale, otherwise known as land sale contracts, unless the contract is in recordable form and is appropriately recorded in the chain of title. |

| | • | | Make or invest in mortgage loans unless an appraisal is obtained concerning the underlying property, except for those mortgage loans insured or guaranteed by a government or government agency. In cases where our independent directors determine, and in all cases in which the transaction is with any of our directors or our Advisor and its affiliates, we will obtain an appraisal from an independent appraiser. We will maintain such appraisal in our records for at least five years and it will be available to our stockholders for inspection and duplication. We will also obtain a mortgagee’s or owner’s title insurance policy as to the priority of the mortgage or condition of the title. |

| | • | | Make or invest in mortgage loans, including construction loans, on any one property if the aggregate amount of all mortgage loans on such property would exceed an amount equal to 85% of the appraised value of such property, as determined by an appraisal, unless substantial justification exists for exceeding such limit because of the presence of other loan underwriting criteria. |

| | • | | Make or invest in mortgage loans that are subordinate to any mortgage or equity interest of any of our directors, our Advisor or their respective affiliates. |

| | • | | Make investments in unimproved property or indebtedness secured by a deed of trust or mortgage loans on unimproved property in excess of 10% of our total assets. |

| | • | | Issue equity securities on a deferred payment basis or other similar arrangement. |

| | • | | Issue debt securities in the absence of adequate cash flow to cover debt service. |

| | • | | Issue equity securities that are assessable after we have received the consideration for which our board of directors authorized their issuance. |

| | • | | Issue “redeemable securities” redeemable solely at the option of the holder, which restriction has no effect on our ability to implement our share redemption program. |

| | • | | When applicable, grant warrants or options to purchase shares to our Advisor or its affiliates or to officers or directors affiliated with our Advisor except on the same terms as options or warrants that are sold to the general public. Further, the amount of the options or warrants cannot exceed an amount equal to 10% of outstanding shares on the date of grant of the warrants and options. |

| | • | | Lend money to our directors, or to our Advisor or its affiliates, except for certain mortgage loans described above. |

14

Changes in Investment Policies and Limitations

Our charter requires that our independent directors review our investment policies at least annually to determine that the policies we are following are in the best interests of our stockholders. Each determination and the basis therefor is required to be set forth in the applicable meeting minutes. The methods of implementing our investment policies may also vary as new investment techniques are developed. The methods of implementing our investment objectives and policies, except as otherwise provided in our charter, may be altered by a majority of our directors, including a majority of our independent directors, without the approval of our stockholders. The determination by our board of directors that it is no longer in our best interests to continue to be qualified as a REIT shall require the concurrence of two-thirds of the board of directors. Investment policies and limitations specifically set forth in our charter, however, may only be amended by a vote of the stockholders holding a majority of our outstanding shares.

Investments in Mortgages

As of December 31, 2012, we had not invested in any mortgages. While we intend to emphasize equity real estate investments and, hence, operate as what is generally referred to as an “equity REIT,” as opposed to a “mortgage REIT,” we may invest in first or second mortgage loans, mezzanine loans secured by an interest in the entity owning the real estate or other similar real estate loans consistent with our REIT status. We may make such loans to developers in connection with construction and redevelopment of self storage facilities. Such mortgages may or may not be insured or guaranteed by the Federal Housing Administration, the Veterans Benefits Administration or another third party. We may also invest in participating or convertible mortgages if our directors conclude that we and our stockholders may benefit from the cash flow or any appreciation in the value of the subject property. Such mortgages are similar to equity participation.

Affiliate Transaction Policy

During 2010 we increased our ownership in Self Storage I DST, a DST sponsored by our Sponsor, from 3.05% to 19.75%. We subsequently acquired the remaining interests, such that we owned 100% of the interests as of February 2011. In 2011 and 2012, we increased our preferred equity investment in USA Hawthorne, LLC, the entity which has a direct interest in a net leased industrial property (“Hawthorne property”) in California with 356,000 rentable square feet leased to a single tenant, by approximately $0.7 million to approximately $6.9 million. During 2012, we acquired all of the interests in Madison County Self Storage DST, a DST sponsored by our Sponsor, such that we owned 100% of the interests as of December 28, 2012. See Note 2 of the Notes to the Consolidated Financial Statements contained in this report. We may purchase additional properties from one or more affiliates of our Advisor in the future. Our board of directors has established a nominating and corporate governance committee, which will review and approve all matters the board believes may involve a conflict of interest. This committee is composed solely of independent directors. This committee of our board of directors will approve all transactions between us and our Advisor and its affiliates.

Investment Company Act of 1940 and Certain Other Policies

We intend to operate in such a manner that we will not be subject to regulation under the Investment Company Act of 1940, or the 1940 Act. Our Advisor will continually review our investment activity to attempt to ensure that we do not come within the application of the 1940 Act. Among other things, our Advisor will attempt to monitor the proportion of our portfolio that is placed in various investments so that we do not come within the definition of an “investment company” under the 1940 Act. If at any time the character of our investments could cause us to be deemed as an investment company for purposes of the 1940 Act, we will take all necessary actions to attempt to ensure that we are not deemed to be an “investment company.” In addition, we do not intend to underwrite securities of other issuers or actively trade in loans or other investments.

Subject to the restrictions we must follow in order to qualify to be taxed as a REIT, we may make investments other than as previously described, although we do not currently intend to do so. We have authority to purchase or otherwise reacquire our common shares or any of our other securities. We have no present

15

intention of repurchasing any of our common shares except pursuant to our share redemption program, and we would only take such action in conformity with applicable federal and state laws and the requirements for qualifying as a REIT under the Code.

Employees

We have no paid employees. The employees of our Advisor provide management, acquisition, advisory and certain administrative services for us.

Competition

The extent of competition in the market area depends significantly on local market conditions. The primary factors upon which competition in the self storage industry is based are location, rental rates, suitability of the property’s design and the manner in which the property is operated and marketed. We believe we compete successfully on these bases.

Many of our competitors are larger and have substantially greater resources than we do. Such competitors may, among other possible advantages, be capable of paying higher prices for acquisitions and obtaining financing on better terms than us.

Industry Segments

We internally evaluate all of our properties and interests therein as one industry segment and, accordingly, we do not report segment information.

Geographic Information

Our Canadian real estate assets represent approximately $34.2 million or approximately 6.0% of our net carrying value of real estate assets as of December 31, 2012. For the year ended December 31, 2012, approximately $1.7 million, or approximately 2.6% of our revenues, were generated by our Canadian real estate assets. As of December 31, 2012, one of our Canadian real estate assets is in the construction stage and is not yet generating revenue.

Below are risks and uncertainties that could adversely affect our operations that we believe are material to stockholders. Other risks and uncertainties may exist that we do not consider material based on the information currently available to us at this time.

Risks Related to this Offering and an Investment in Strategic Storage Trust, Inc.

We have limited established financing sources and we cannot assure our stockholders that we will be successful in the marketplace.

We were incorporated in August 2007 and commenced active business operations on May 22, 2008. As of December 31, 2012, we owned 110 properties in 17 states and Canada. Our stockholders should consider our prospects in light of the risks, uncertainties and difficulties frequently encountered by companies that are in a similar stage of development.

To be successful in this market, we must, among other things:

| | • | | identify and acquire investments that further our investment objectives; |

| | • | | increase awareness of the “Strategic Storage Trust, Inc.” name within the investment products market; |

16

| | • | | expand and maintain our network of participating broker-dealers; |

| | • | | attract, integrate, motivate and retain qualified personnel to manage our day-to-day operations; |

| | • | | respond to competition for our targeted real estate properties and other investments as well as for potential investors; and |

| | • | | continue to build and expand our operational structure to support our business. |

We cannot guarantee that we will succeed in achieving these goals, and our failure to do so could cause stockholders to lose a portion of their investment.

We have incurred losses to date, have an accumulated deficit and we will not be profitable in 2013.

We incurred net losses of approximately $19.0 million, $21.4 million and $12.8 million for the fiscal years ended December 31, 2012, 2011 and 2010, respectively. Our accumulated deficits were approximately $61.9 million, $43.0 million and $21.6 million as of December 31, 2012, 2011 and 2010, respectively. Given that we are still in our fundraising and acquisition stage of development, we will not be profitable in 2013.

To date, we have paid a majority of our distributions from sources other than cash flow from operations; therefore, we will have fewer funds available for the acquisition of properties, and our stockholders’ overall return may be reduced.

In the event we do not have enough cash from operations to fund our distributions, we may borrow, issue additional securities or sell assets in order to fund the distributions or make the distributions out of net proceeds from the Offering. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. Through December 31, 2012, we had received aggregate gross offering proceeds of approximately $137 million from the sale of approximately 13.7 million shares in our Offering, and aggregate gross offering proceeds of approximately $426 million from the sale of approximately 42.7 million shares in our Initial Offering and Offering. For the years ended December 31, 2008 and 2009, we funded 100% of our distributions using proceeds from our Initial Offering. For the year ended December 31, 2010, we funded 6.5% of our distributions using cash flow from operations and 93.5% using proceeds from our Initial Offering. For the year ended December 31, 2011, we funded 13.3% of our distributions using cash flow from operations and 86.7% using proceeds from our Initial Offering and Offering. For the year ended December 31, 2012, we funded 33.9% of our distributions using cash flow from operations and 66.1% using proceeds from our Initial Offering and Offering. If we continue to pay distributions from sources other than cash flow from operations, we will have fewer funds available for acquiring properties, which may reduce our stockholders’ overall returns.

We may be unable to pay or maintain cash distributions or increase distributions over time.

There are many factors that can affect the availability and timing of cash distributions to stockholders. During the term of the Offering, distributions will be based principally on distribution expectations of our potential investors and cash available from our operations. The amount of cash available for distribution will be affected by many factors, such as our ability to buy properties as offering proceeds become available, the yields on securities of other real estate programs that we invest in and our operating expense levels, as well as many other variables. Actual cash available for distribution may vary substantially from estimates. We cannot assure our stockholders that we will be able to pay or maintain distributions or that distributions will increase over time, nor can we give any assurance that rents from the properties will increase, that the securities we buy will increase in value or provide constant or increased distributions over time, or that future acquisitions of real properties will increase our cash available for distribution to stockholders. Our actual results may differ significantly from the assumptions used by our board of directors in establishing the distribution rate to stockholders.

17

In determining our estimated net asset value per share, we primarily relied upon a valuation of our portfolio of properties as of December 31, 2011. Valuations and appraisals of our properties are estimates of fair value and may not necessarily correspond to realizable value upon the sale of such properties; therefore our estimated net asset value per share may not reflect the amount that would be realized upon a sale of each of our properties.

For the purposes of calculating the estimated net asset value per share, an independent third party appraiser valued our properties as of December 31, 2011. The valuation methodologies used to value our properties involved certain subjective judgments. Ultimate realization of the value of an asset depends to a great extent on economic and other conditions beyond our control and the control of our advisor and independent appraiser. Further, valuations do not necessarily represent the price at which an asset would sell, since market prices of assets can only be determined by negotiation between a willing buyer and seller. Therefore, the valuations of our properties and our investments in real estate related assets may not correspond to the timely realizable value upon a sale of those assets. Because the price our stockholders will pay for shares in this offering is primarily based on the estimated net asset value per share, our stockholders may pay more than realizable value when they purchase shares or receive less than realizable value for their investment when they sell shares.

Our share price is primarily based on the estimated per share value of our shares, but also based upon subjective judgments, assumptions and opinions by management, which may or may not turn out to be correct. Therefore, our share price may not reflect the precise amount that might be paid to a stockholder for their shares in a market transaction.

Our current share price is primarily based on our net asset value per share, which was based on an estimate of the value of our properties—consisting principally of illiquid commercial real estate—as of December 31, 2011. The valuation methodologies used by the independent appraiser retained by our board of directors to estimate the value of our wholly-owned self storage facilities as of December 31, 2011 involved subjective judgments, assumptions and opinions, which may or may not turn out to be correct. In addition, our board of directors based our share price primarily on the estimated net asset value per share which, although heavily reliant upon the independent appraisal, involved certain subjective judgments, assumptions and opinions of management. As a result, our share price may not reflect the precise amount that might be paid to for our stockholders’ shares in a market transaction.

If we, through our Advisor, are unable to find suitable investments, then we may not be able to achieve our investment objectives or pay distributions.

Our ability to achieve our investment objectives and to pay distributions is dependent upon the performance of our Advisor in selecting our investments and arranging financing. As of December 31, 2012, we owned 110 properties in 17 states and Canada. Our stockholders will essentially have no opportunity to evaluate the terms of transactions or other economic or financial data concerning our investments prior to the time we make them. Our stockholders must rely entirely on the management ability of our Advisor and the oversight of our board of directors. We cannot be sure that our Advisor will be successful in obtaining suitable investments on financially attractive terms or that, if it makes investments on our behalf, our objectives will be achieved. If we are unable to find suitable investments, we will hold the proceeds of the Offering in an interest-bearing account or invest the proceeds in short-term, investment-grade investments. In such an event, our ability to pay distributions to our stockholders would be adversely affected.

We may suffer from delays in locating suitable investments, which could adversely affect our ability to make distributions and the value of our stockholders’ investments.

We could suffer from delays in locating suitable investments, particularly as a result of our reliance on our Advisor at times when management of our Advisor is simultaneously seeking to locate suitable investments for other affiliated programs. Delays we encounter in the selection, acquisition and development of income-producing properties are likely to adversely affect our ability to make distributions and may also adversely affect

18

the value of our stockholders’ investments. In such event, we may pay all or a substantial portion of our distributions from the proceeds of the Offering or from borrowings in anticipation of future cash flow, which may constitute a return of our stockholders’ capital. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies. We have established no maximum of distributions to be paid from such funds. Distributions from the proceeds of the Offering or from borrowings also could reduce the amount of capital we ultimately invest in properties. This, in turn, would reduce the value of our stockholders’ investments. In particular, if we acquire properties prior to the start of construction or during the early stages of construction, it will typically take several months to complete construction and rent available storage space. Therefore, our stockholders could suffer delays in the receipt of cash distributions attributable to those particular properties.

If our Advisor or Property Manager loses or is unable to obtain key personnel, our ability to implement our investment objectives could be delayed or hindered, which could adversely affect our ability to make distributions and the value of our stockholders’ investments.