2012 Earnings Guidance January 18, 2012 Exhibit 99.2 |

January 2012 2 Certain statements in this presentation are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are predictions based on our current expectations and assumptions regarding future events and may relate to, among other things, our future financial performance, including return on equity performance, our growth and portfolio optimization strategies, our projected capital expenditures and related funding requirements, our ability to repay debt, our ability to finance current operations and growth initiatives, the impact of legal proceedings and potential fines and penalties, business process and technology improvement i nitiatives, trends in our industry, regulatory or legal developments or rate adjustments. Actual results could differ materially because of factors such as decisions of governmental and regulatory bodies, including decisions to raise or lower rates; the timeliness of regulatory commissions’ actions concerning rates; changes in laws, governmental regulations and policies, including environmental, health and water quality and public utility regulations and policies; weather conditions, patterns or events, including drought or abnormally high rainfall; changes in customer demand for, and patterns of use of, water, such as may result from conservation efforts; significant changes to our business processes and corresponding technology; our ability to appropriately maintain current infrastructure; our ability to obtain permits and other approvals for projects; changes in our capital requirements; our ability to control operating expenses and to achieve efficiencies in our operations; our ability to obtain adequate and cost-effective supplies of chemicals, electricity, fuel, water and other raw materials that are needed for our operations; our ability to successfully acquire and integrate water and wastewater systems that are complementary to our operations and the growth of our business or dispose of assets or lines of business that are not complementary to our operations and the growth of our business; cost overruns relating to improvements or the expansion of our operations; changes in general economic, business and financial market conditions; access to sufficient capital on satisfactory terms; fluctuations in interest rates; restrictive covenants in or changes to the credit ratings on our current or future debt that could increase our financing costs or affect our ability to borrow, make payments on debt or pay dividends; fluctuations in the value of benefit plan assets and liabilities that could increase our cost and funding requirements; our ability to utilize our U.S. and state net operating loss carryforwards; migration of customers into or out of our service territories; difficulty in obtaining insurance at acceptable rates and on acceptable terms and conditions; the incurrence of impairment charges ability to retain and attract qualified employees; and civil disturbance, or terrorist threats or acts or public apprehension about future disturbances or terrorist threats or acts. Any forward-looking statements we make, speak only as of the date of this presentation. Except as required by law, we specifically disclaim any undertaking or intention to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or otherwise. Cautionary Statement Concerning Forward-Looking Statements |

2011 - What happened 3 January 2012 •Portfolio Optimization •Divested TX, AWM •Acquired MO •Executed Agreements AZ, NM, OH and NY •Net Utility Plant • Invested approximately $900 Million •Market-Based Operations •Homeowner Service Contracts reach 880,000 •Improving ROE •2010 ended at 6.4% •2011 estimate: 7.2% - 7.4% •Total Shareholder Returns •30% at 12/31/2011 •Cash Dividends Increased 5% •Yield 2.89% at 12/31/11 •Rate Cases Effective in 8 states in 2011 •$158.3 Million • Infrastructure Charges awarded of $10.7 Million •Rate Cases Filed in 10 states •Decisions Pending in 8 states •Address Regulatory Lag • Declining Usage •Infrastructure Charges (New Jersey, Illinois) •O&M Efficiency Ratio improvement • Expense Management •Rate Case Effectiveness •Business Transformation •On schedule for 2014 completion Operating Efficiency Regulatory Environment Growth Shareholder Value |

January 2012 4 2012 Range: Solid Growth Powers Earnings Range from Ongoing Operations of $1.90 - $2.00 Key Drivers • Annual infrastructure investment of approximately $900 million • Continued improvement in operating efficiency ratio toward 5-year goal of 40% • Completion of current portfolio optimization transactions • Continued low interest rate environment • Completion of outstanding rate cases • Continued dividend focus • No equity offering 2012 Range $1.90 - $2.00 • 2011 Range excludes the impact from discontinued operations and the one-time contribution of appreciated land to a county authority in Lexington, Kentucky |

5 * Not to scale 2012 Earnings Per Share Range: Key Factors Influencing Earnings Range Interest Rates (+/- 1%) 2012 EPS Range $1.90 - $2.00 Consumption (+/-1%) Fuel & Power (+/- 10%) Chemicals (+/- 10%) O&M Expense (+/- 1%) $2.03 $1.87 $1.90 $2.00 January 2012 |

January 2012 6 AWK 2011 Accomplishments 2012 Expectations Continue Portfolio Optimization Initiative Finalize transactions in NM, AZ, NY and Ohio Identify additional valued-added opportunities Actively Address Regulatory Lag that Impacts Returns on Investments Expect to file 4 general rate cases in 2012 Infrastructure Surcharges filings in 4-6 states Address usage trends via rate case or other filings Continue Operating Efficiency Improvement Five-year goal below 40% Efficient use of our Capital Invest approximately $900 million to upgrade infrastructure Enhance DSIC like mechanisms Optimize Supply Chain Increase Earned Regulated Return Expand Market Based businesses - focusing on Homeowner Services & Military Contract Operations Optimize Municipal Contract Operations Business Model Execution of Portfolio Optimization Initiative Closed MO acquisition, TX sale and sale of Applied Water Management (AWM) Filed for regulatory approvals for transactions in NM, AZ, NY and Ohio Resolved Rate Cases worth $296.5 MM of filed Annualized Revenues Rate cases effective in 8 states generating approximately $158.3 million in annualized revenue increases and $10.7 million in infrastructure surcharges, assuming normal usage patterns. Filed 10 rate proceedings in 2011 requesting $282.9 million in annualized revenue Initiated state specific efforts to address declining usage in all rate cases filed in 2011 Continued Operating Efficiency improvement Continued improvement in Return on Equity What We Accomplished in 2011 In 2012 You Can Expect Us To |

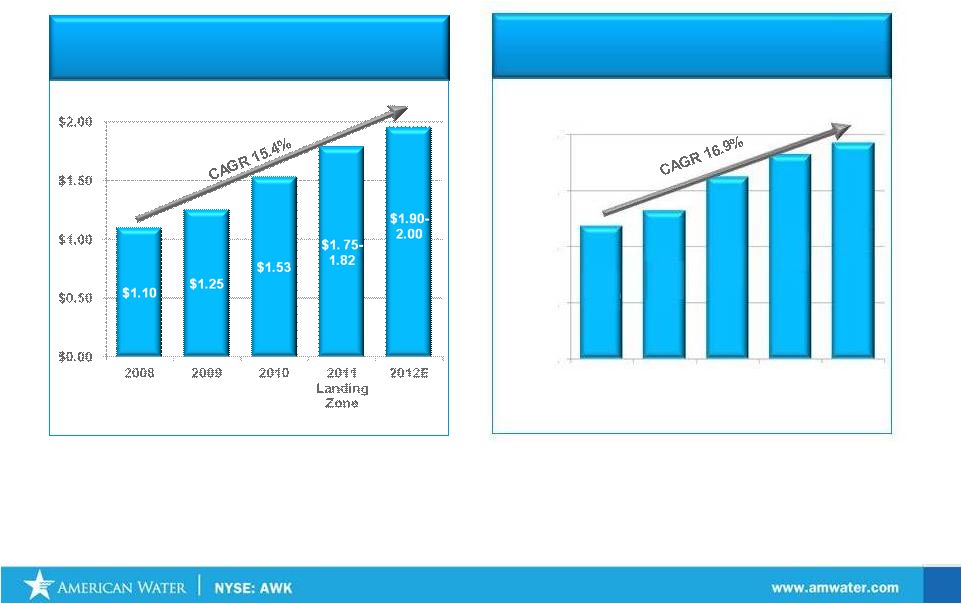

January 2012 American Water: Providing Value to Investors • The Adjusted 2011 EPS Range, a non-GAAP measure, does not recognize an approximate 9 cent benefit to earnings per share from the cessation of depreciation for discontinued operations in Arizona, New Mexico, Texas and Ohio. • CAGR percentages calculated to midpoint of 2012 estimates • 2008 and 2009 EPS and ROE exclude impairment charges Earnings Per Share 7 Mid- range Return of Equity 8.00% 6.00% 4.00% 2.00% 0.00% 4.12% 4.99% 6.49% 7.2% 7.4% 7.5% 7.9% 2008 2009 2010 2011 Landing Zone 2012E |

8 January 2012 |

January 2012 Return on Equity Excluding Impairment Charge (A Non-GAAP Unaudited Number) Historical ($ in thousands ) 2008 2009 2010 Net income (Loss) from Continuing Operations ($562,421) ($233,083) $267,827 Adjustments Impairment charges 738,475 443,024 0 Adjusted net income excluding impairment charge $176,054 $209,941 $267,827 Year end stockholders’ equity $4,102,001 $4,000,859 $4,127,725 Add impairment charge, net of tax 738,475 443,024 0 Adjusted stockholders’ equity excluding impairment charge, net of tax $4278,055 $4,210,800 $4,127,725 ROE Percentage 4.12% 4.99% 6.49% 9 Net Income (Loss) – Earnings per Share Excluding Impairment Charge (A Non-GAAP Unaudited Number) Historical ($ in thousands, except per share data) 2008 2009 2010 Net income, (Loss) ($562,421) ($233,083) $267,827 Add: Impairment 750,000 450,000 0 Net income excluding impairment charge before associated tax benefit 187,579 216,917 267,827 Less: Income tax benefit relating to impairment charge 11,525 6,976 0 Adjusted net income excluding impairment charge $176,054 $209,941 $267,827 Basic earnings per common share excluding impairment charge: Adjusted net income excluding impairment charge $1.10 $1.25 $1.53 Diluted earnings per common share excluding impairment charge: Adjusted net income excluding impairment charge $1.10 $1.25 $1.53 Reconciliation Tables |