Exhibit 99.2

NYSE: AWK

2013 Investor Day

December 17, 2013

NYSE: AWK

The American Water

Analyst Day Presentation

will start in:

Minutes

Please review the corresponding video link “Customer Service Video” on the American Water website

December 2013

NYSE: AWK www.amwater.com 3

NYSE: AWK

2013 Investor Day

Jeff Sterba President and CEO

December 17, 2013

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this presentation are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are predictions based on our current expectations and assumptions regarding future events and may relate to, among other things, our future financial performance, our growth and portfolio optimization strategies, our projected capital expenditures and related funding requirements, our ability to repay debt, our ability to finance current operations and growth initiatives, the impact of legal proceedings and potential fines and penalties, business process and technology improvement initiatives, trends in our industry, regulatory or legal developments or rate adjustments. Actual results could differ materially because of factors such as the completion of the independent audit of our financial statements; decisions of governmental and regulatory bodies, including decisions to raise or lower rates; the timeliness of regulatory commissions’ actions concerning rates; changes in laws, governmental regulations and policies, including environmental, health and water quality and public utility regulations and policies; weather conditions, patterns or events, including drought or abnormally high rainfall; changes in customer demand for, and patterns of use of, water, such as may result from conservation efforts; significant changes to our business processes and corresponding technology; our ability to appropriately maintain current infrastructure; our ability to obtain permits and other approvals for projects; changes in our capital requirements; our ability to control operating expenses and to achieve efficiencies in our operations; our ability to obtain adequate and cost-effective supplies of chemicals, electricity, fuel, water and other raw materials that are needed for our operations; our ability to successfully acquire and integrate water and wastewater systems that are complementary to our operations and the growth of our business or dispose of assets or lines of business that are not complementary to our operations and the growth of our business; cost overruns relating to improvements or the expansion of our operations; changes in general economic, business and financial market conditions; access to sufficient capital on satisfactory terms; fluctuations in interest rates; restrictive covenants in or changes to the credit ratings on our current or future debt that could increase our financing costs or affect our ability to borrow, make payments on debt or pay dividends; fluctuations in the value of benefit plan assets and liabilities that could increase our cost and funding requirements; our ability to utilize our U.S. and state net operating loss carryforwards; migration of customers into or out of our service territories; difficulty in obtaining insurance at acceptable rates and on acceptable terms and conditions; the incurrence of impairment charges ability to retain and attract qualified employees; and civil disturbance, or terrorist threats or acts or public apprehension about future disturbances or terrorist threats or acts.

Any forward-looking statements we make, speak only as of the date of this presentation. Except as required by law, we do not have any obligation, and we specifically disclaim any undertaking or intention, to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or otherwise.

December 2013

NYSE: AWK www.amwater.com 5

What you’ll hear today

1 12:30-1:15PM: Strategy Overview

• Jeff Sterba

2 1:15-1:45PM: Our success is built on …

• Walter Lynch – Regulated Operations

3 1:45-2:00PM: Break

4 2PM–2:30PM: Our success is built on …

• Sharon Cameron: Market Based Businesses

5 2:30-3:15PM: Our success results in …

• Susan Story

6 3:15 – 4PM: Wrap Up and Q&As

December 2013

NYSE: AWK www.amwater.com 6

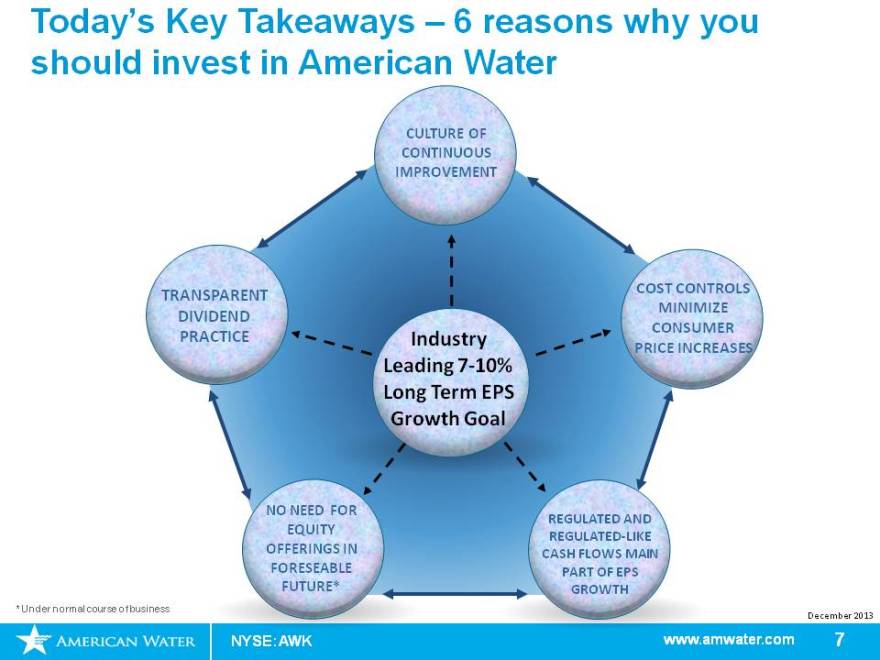

Today’s Key Takeaways – 6 reasons why you should invest in American Water

CULTURE OF

CONTINUOUS

IMPROVEMENT

TRANSPARENT COST CONTROLS

DIVIDEND MINIMIZE

CONSUMER

PRACTICE Industry PRICE INCREASES

Leading 7-10%

Long Term EPS

Growth Goal

NO NEED FOR REGULATED AND

EQUITY REGULATED-LIKE

OFFERINGS IN CASH FLOWS MAIN

FORESEABLE PART OF EPS

FUTURE* GROWTH

* Under normal course of business

December 2013

NYSE: AWK www.amwater.com 7

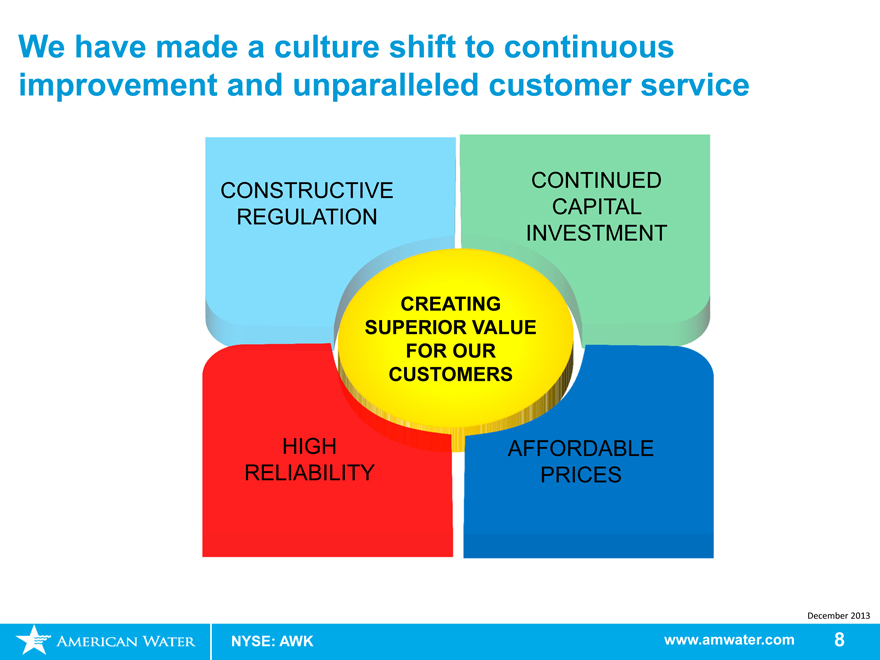

We have made a culture shift to continuous improvement and unparalleled customer service

CONSTRUCTIVE

CONTINUED

REGULATION

CAPITAL

INVESTMENT

CREATING

SUPERIOR VALUE

FOR OUR

CUSTOMERS

HIGH

AFFORDABLE

RELIABILITY

PRICES

December 2013

NYSE: AWK www.amwater.com 8

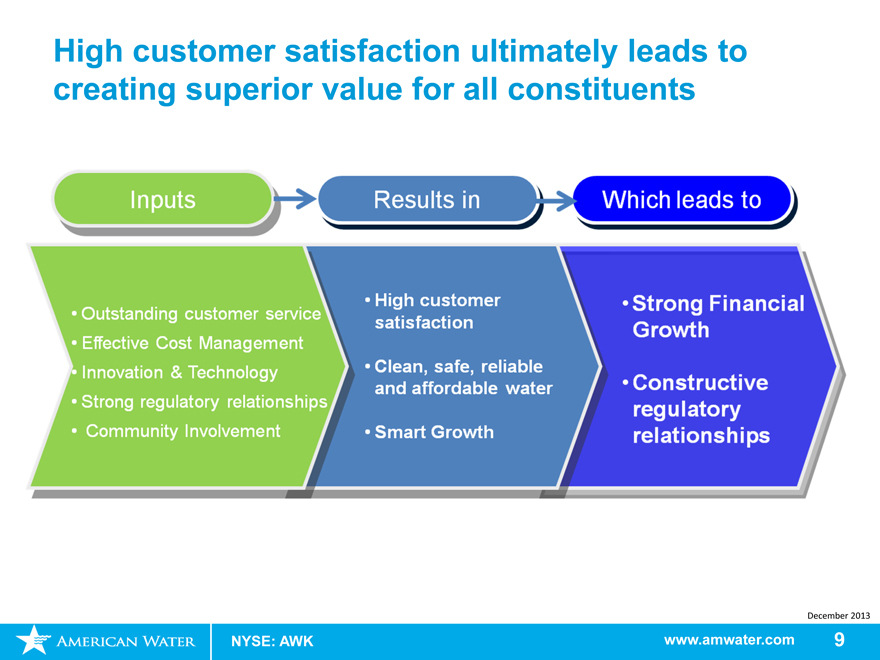

High customer satisfaction ultimately leads to creating superior value for all constituents

Inputs

Results in

Which leads to

Outstanding customer service

Effective Cost Management

Innovation & Technology

Strong regulatory relationships

Community Involvement

High customer satisfaction

Clean, safe, reliable and affordable water

Smart Growth

Strong Financial Growth

Constructive regulatory relationships

December 2013

NYSE: AWK www.amwater.com 9

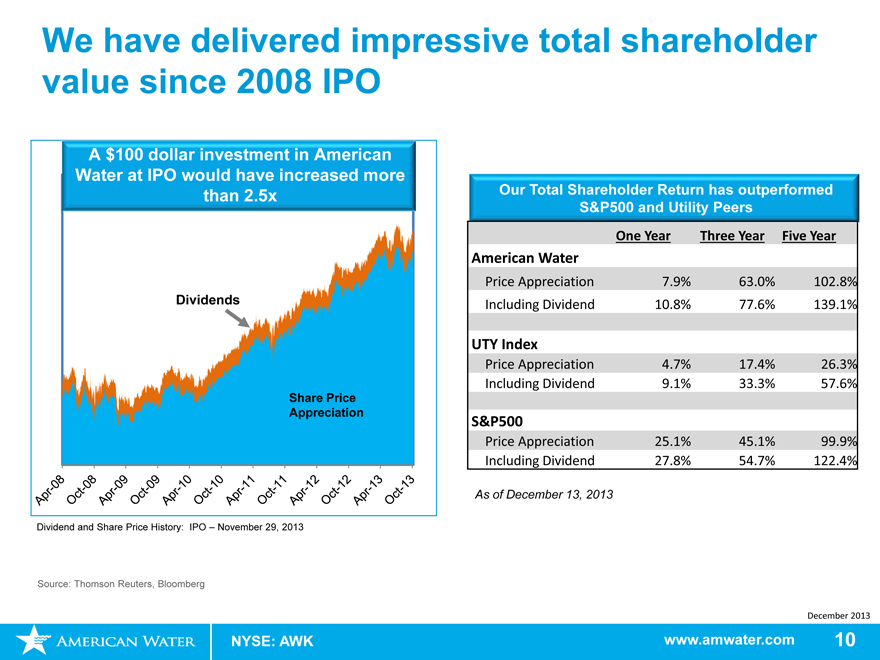

We have delivered impressive total shareholder value since 2008 IPO

A $100 dollar investment in American

Water at IPO would have increased more

than 2.5x

Dividends

Share Price

Appreciation

Dividend and Share Price History: IPO – November 29, 2013

Our Total Shareholder Return has outperformed

S&P500 and Utility Peers

One Year

Three Year

Five Year

American Water

Price Appreciation

79%.

63.0%

102.8%

Including Dividend

10.8%

77.6%

139.1%

UTY Index

Price Appreciation

4.7%

17.4%

26.3%

Including Dividend

9.1%

33.3%

57.6%

S&P500

Price Appreciation

25.1%

45.1%

99.9%

Including Dividend

27.8%

54.7%

122.4%

As of December 13, 2013

Source: Thomson Reuters, Bloomberg

December 2013

NYSE: AWK www.amwater.com 10

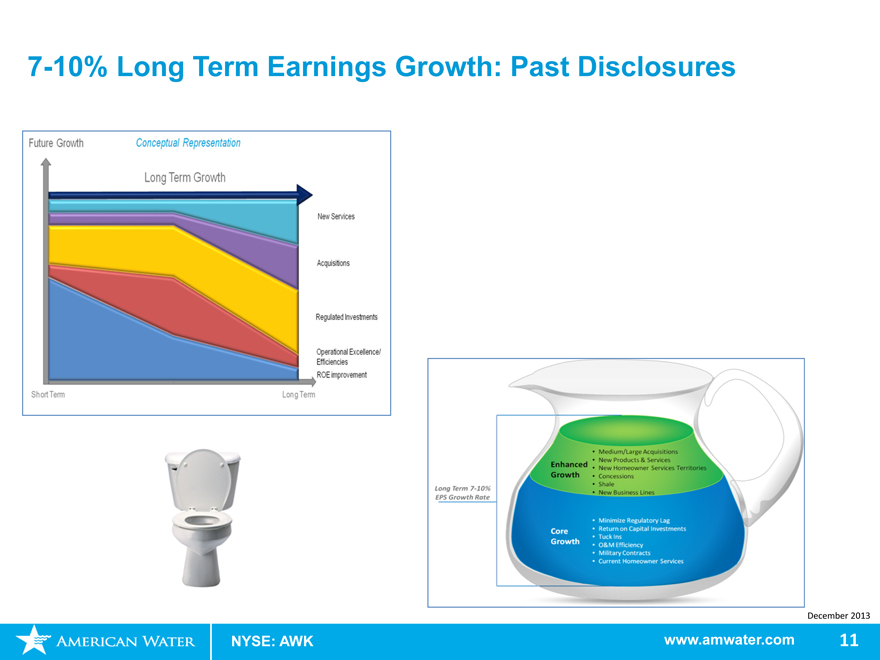

7-10% Long Term Earnings Growth: Past Disclosures

Future Growth

Conceptual Representation

Long Term Growth

New Services

Acquisitions

Regulated Investments

Operational Excellence/Efficiencies

ROE improvement

Short Term

Long Term

Long Term 7-10%

EPS Growth Rate

Enhanced Growth

Medium/Large Acquisitions

New Products & Services

New Homeowner Services Territories

Concessions

Shale

New Business Lines

Core Growth

Minimize Regulatory Lag

Return on Capital Investments

Tuck Ins

O&M Efficiency

Military Contracts

Current Homeowner Services

December 2013

NYSE: AWK www.amwater.com 11

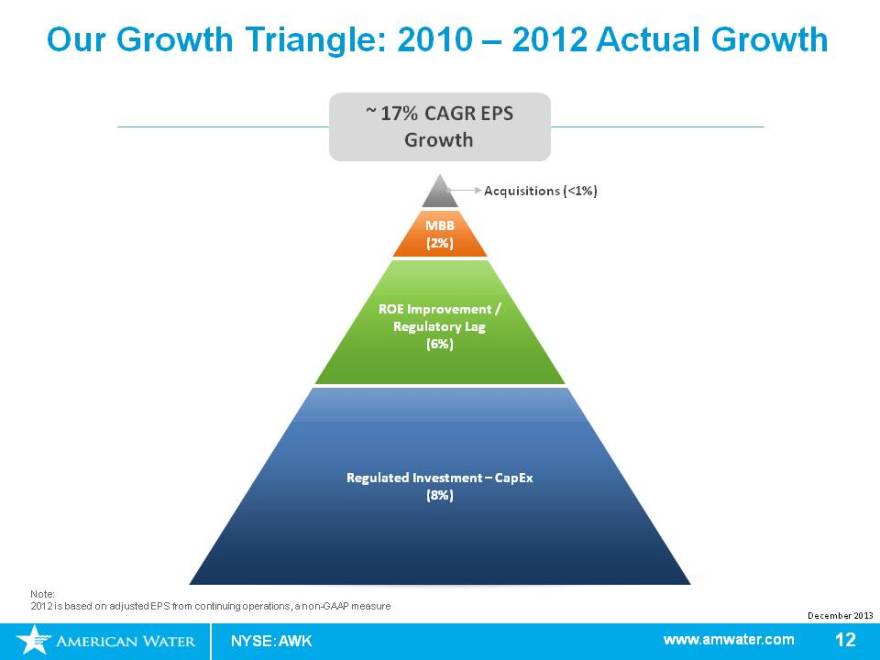

Our Growth Triangle: 2010 – 2012 Actual Growth

~ 17% CAGR EPS

Growth

Acquisitions (<1%)

MBB

(2%)

ROE Improvement /

Regulatory Lag

(6%)

Regulated Investment – CapEx

(8%)

Note:

2012 is based on adjusted EPS from continuing operations, a non-GAAP measure

December 2013

NYSE: AWK www.amwater.com 12

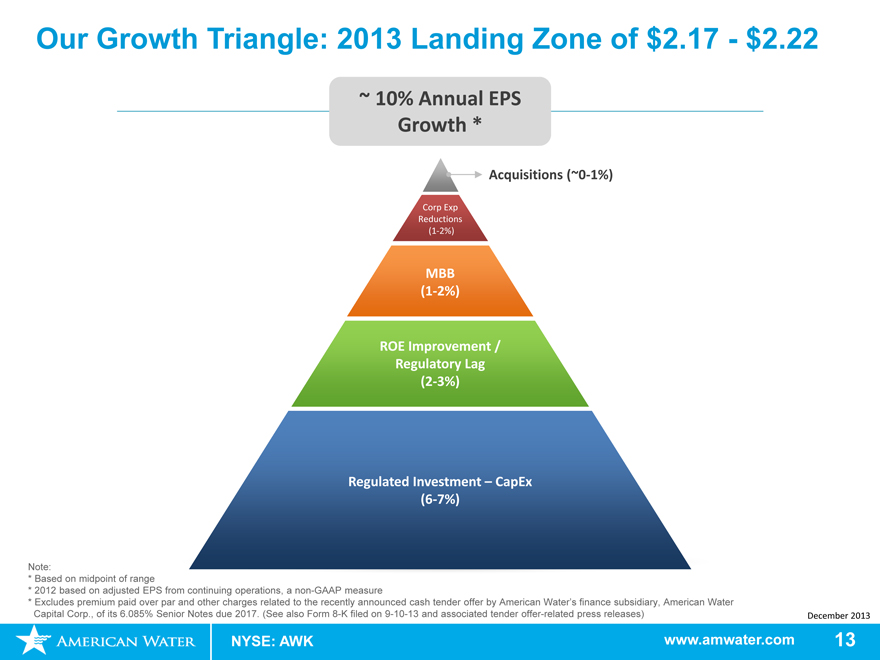

Our Growth Triangle: 2013 Landing Zone of $2.17—$2.22

~ 10% Annual EPS

Growth *

Acquisitions (~0-1%)

Corp Exp

Reductions

(1-2%)

MBB

(1-2%)

ROE Improvement /

Regulatory Lag

(2-3%)

Regulated Investment – CapEx

(6-7%)

Note:

* Based on midpoint of range

* 2012 based on adjusted EPS from continuing operations, a non-GAAP measure

* Excludes premium paid over par and other charges related to the recently announced cash tender offer by American Water’s finance subsidiary, American Water

Capital Corp., of its 6.085% Senior Notes due 2017. (See also Form 8-K filed on 9-10-13 and associated tender offer-related press releases)

December 2013

NYSE: AWK www.amwater.com 13

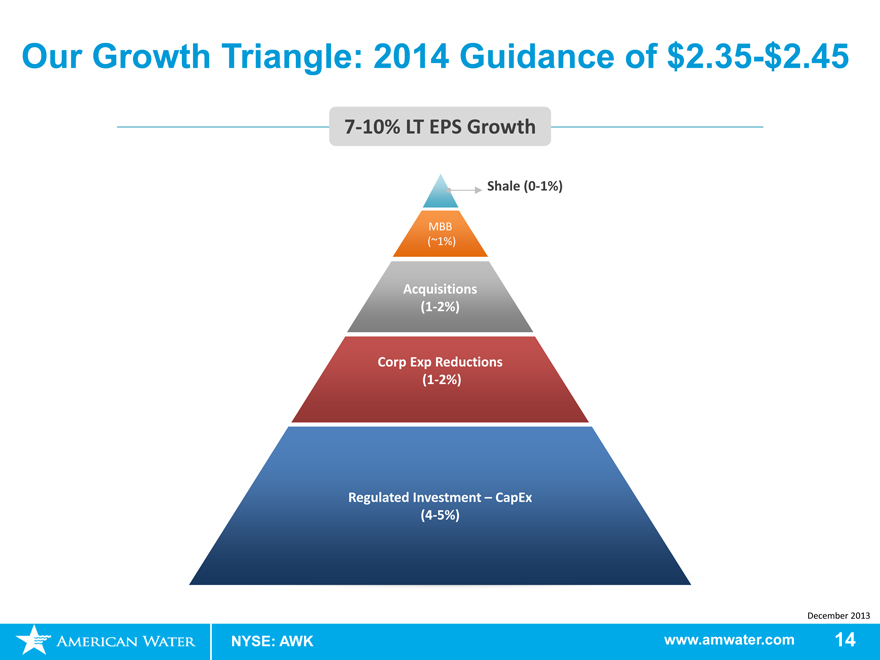

Our Growth Triangle: 2014 Guidance of $2.35-$2.45

7-10% LT EPS Growth

Shale (0-1%)

MBB

(~1%)

Acquisitions

(1-2%)

Corp Exp Reductions

(1-2%)

Regulated Investment – CapEx

(4-5%)

December 2013

NYSE: AWK www.amwater.com 14

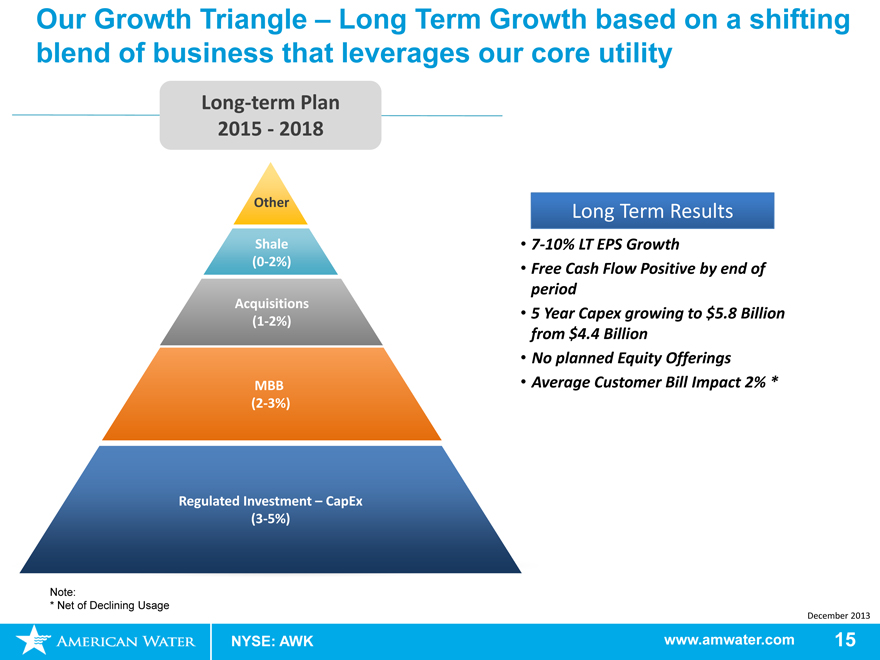

Our Growth Triangle – Long Term Growth based on a shifting blend of business that leverages our core utility

Long-term Plan

2015—2018

Other

Shale

(0-2%)

(<1%)

Acquisitions

(1-2%)

MBB

(2-3%)

Regulated Investment – CapEx

(3-5%)

Long Term Results

7-10% LT EPS Growth

Free Cash Flow Positive by end of period

5 Year Capex growing to $5.8 Billion from $4.4 Billion

No planned Equity Offerings

Average Customer Bill Impact 2% *

Note:

* Net of Declining Usage

December 2013

NYSE: AWK www.amwater.com 15

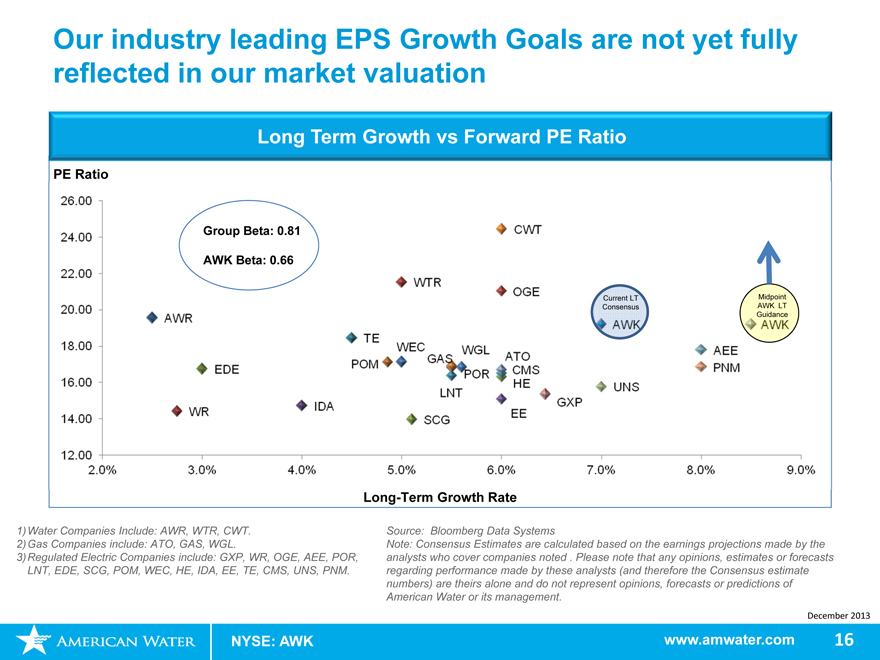

Our industry leading EPS Growth Goals are not yet fully reflected in our market valuation

Long Term Growth vs Forward PE Ratio

PE Ratio

Group Beta: 0.81

AWK Beta: 0.66

Current LT Midpoint

Consensus AWK LT

Guidance

Long-Term Growth Rate

1)Water Companies Include: AWR, WTR, CWT. 2)Gas Companies include: ATO, GAS, WGL.

3)Regulated Electric Companies include: GXP, WR, OGE, AEE, POR, LNT, EDE, SCG, POM, WEC, HE, IDA, EE, TE, CMS, UNS, PNM.

Source: Bloomberg Data Systems

Note: Consensus Estimates are calculated based on the earnings projections made by the analysts who cover companies noted . Please note that any opinions, estimates or forecasts regarding performance made by these analysts (and therefore the Consensus estimate numbers) are theirs alone and do not represent opinions, forecasts or predictions of American Water or its management.

December 2013

NYSE: AWK www.amwater.com 16

NYSE: AWK

Our success is built on …

Regulated Operations Overview Walter Lynch

Investment in Water and Wastewater Industry is urgently needed

Water: approximately one million miles of pipe in the U.S.

A major water main breaks every two minutes in the U.S.

Two trillion gallons of treated water lost every year at a cost of $2.6 billion

Wastewater: approximately 800 thousand miles of sewer mains

900 billion gallons of untreated sewage discharged each year

By 2020, 44% of U.S. pipe infrastructure to be classified as poor, very poor, or life elapsed

December 2013

NYSE: AWK www.amwater.com 18

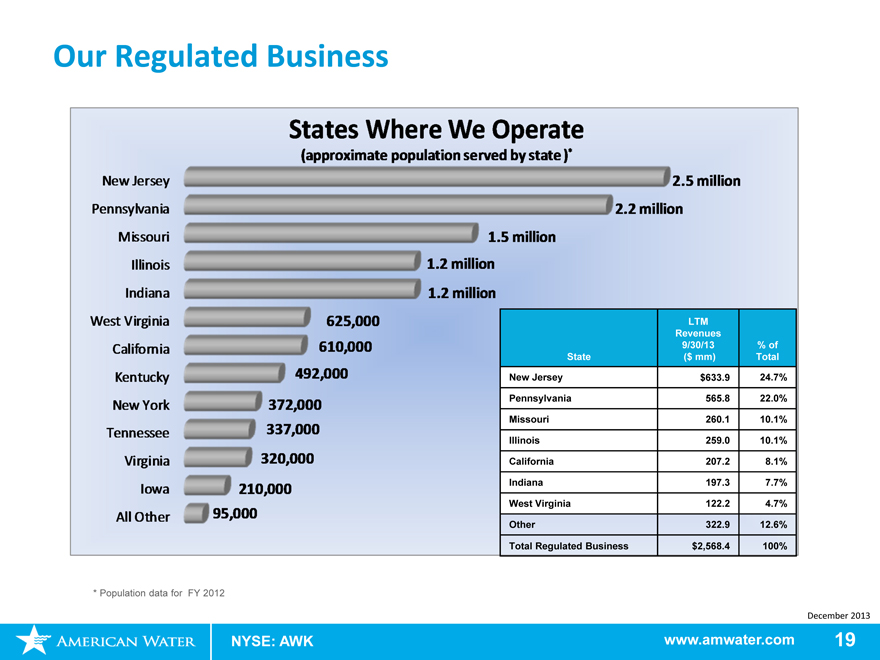

Our Regulated Business

States Where We Operate

(approximate population served by state )*

New Jersey 2.5 million

Pennsylvania 2.2 million

Missouri 1.5 million

Illinois 1.2 million

Indiana 1.2 million

West Virginia 625,000 LTM

Revenues

California 610,000 9/30/13% of

State($ mm) Total

Kentucky 492,000 New Jersey $633.9 24.7%

New York 372,000 Pennsylvania 565.8 22.0%

Missouri 260.1 10.1%

Tennessee 337,000 Illinois 259.0 10.1%

Virginia 320,000 California 207.2 8.1%

Iowa 210,000 Indiana 197.3 7.7%

West Virginia 122.2 4.7%

All Other 95,000 Other 322.9 12.6%

Total Regulated Business $2,568.4 100%

* Population data for FY 2012

December 2013

NYSE: AWK www.amwater.com 19

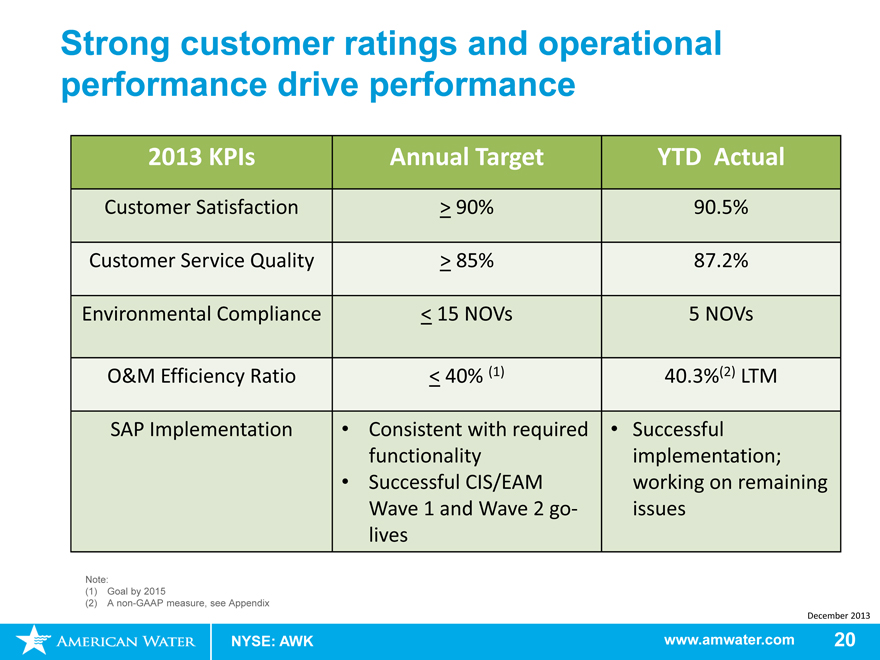

Strong customer ratings and operational performance drive performance

2013 KPIs Annual Target YTD Actual

Customer Satisfaction > 90% 90.5%

Customer Service Quality > 85% 87.2%

Environmental Compliance < 15 NOVs 5 NOVs

O&M Efficiency Ratio < 40% (1) 40.3%(2) LTM

SAP Implementation • Consistent with required • Successful

functionality implementation;

• Successful CIS/EAM working on remaining

Wave 1 and Wave 2 go- issues

lives

Note:

(1) Goal by 2015

(2) A non-GAAP measure, see Appendix

December 2013

NYSE: AWK www.amwater.com 20

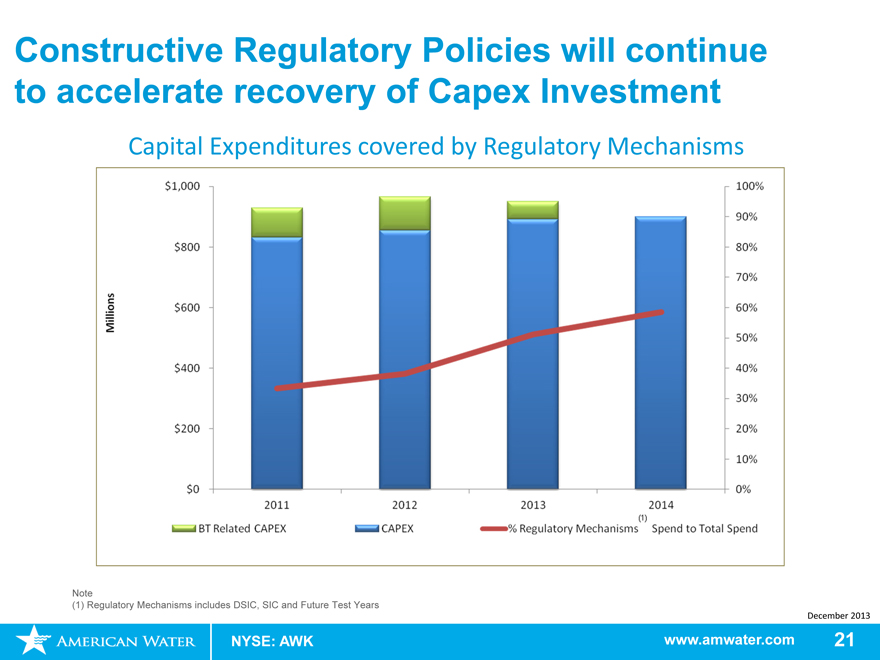

Constructive Regulatory Policies will continue to accelerate recovery of Capex Investment

Capital Expenditures covered by Regulatory Mechanisms

Note

(1) Regulatory Mechanisms includes DSIC, SIC and Future Test Years

December 2013

NYSE: AWK www.amwater.com 21

2014 Financial Plan- Summary

Capital Expenditure

($ in millions)

$1,200

$1,000

$800

$600

$400

$200

$0

2012 Actual 2013 Landing 2014 Plan 2015E 2016E 2017E 2018E

Zone

Regulated & Services Strategic Investment Regulated Acquisitions Market-Based Business

December 2013

NYSE: AWK www.amwater.com 22

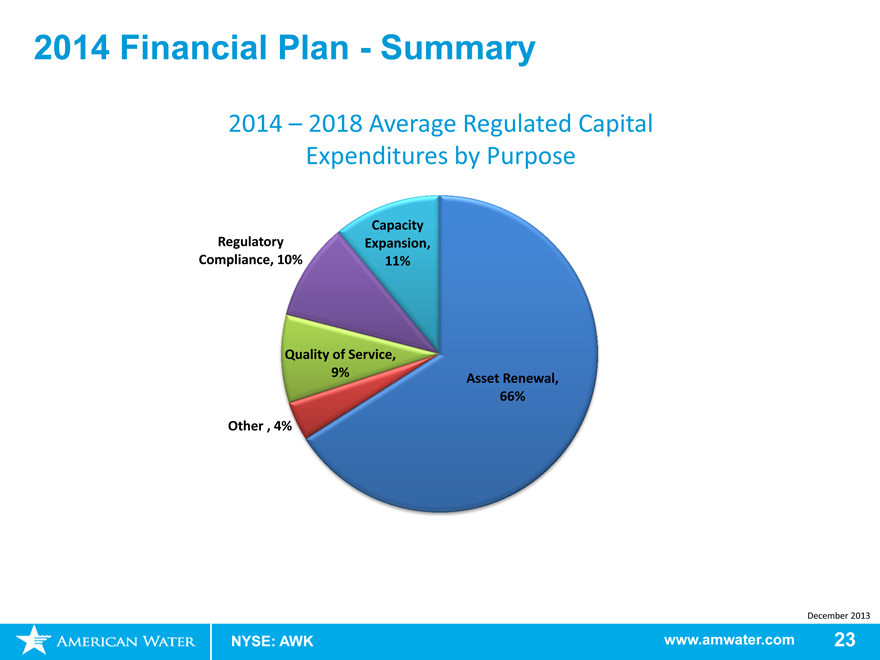

2014 Financial Plan—Summary

2014 – 2018 Average Regulated Capital Expenditures by Purpose

Capacity

Regulatory Expansion,

Compliance, 10% 11%

Quality of Service,

9%

Asset Renewal,

66%

Other , 4%

December 2013

NYSE: AWK www.amwater.com 23

Cost containment and timely return on our investments will drive added Capital Expenditures

O&M Efficiency Ratio

50%

44.2

42.4

40.1 39.5

40%

35.0

30%

20%

10%

0%

2010 2011 2012 2013Landing New 2018

Zone (LZ) Stretch

Target

New O&M stretch target of 35% by 2018

Pipe Replacement Life

(in years)

300

250

200

National

150 average

100

50

0

2010 2011 2012 2013LZ 2014E

Pipe Replacement life is shortening

December 2013

NYSE: AWK www.amwater.com 24

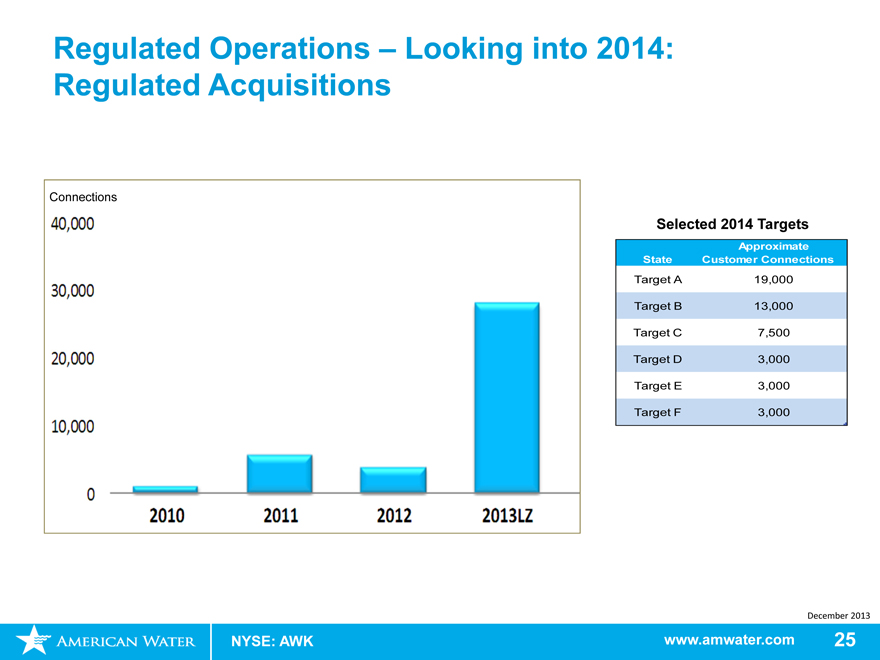

Regulated Operations – Looking into 2014: Regulated Acquisitions

Connections

Selected 2014 Targets

Approximate

State

Customer Connections

Target A

19,000

Target B

13,000

Target C

7,500

Target D

3,000

Target E

3,000

Target F

3,000

December 2013

NYSE: AWK

www.amwater.com

25

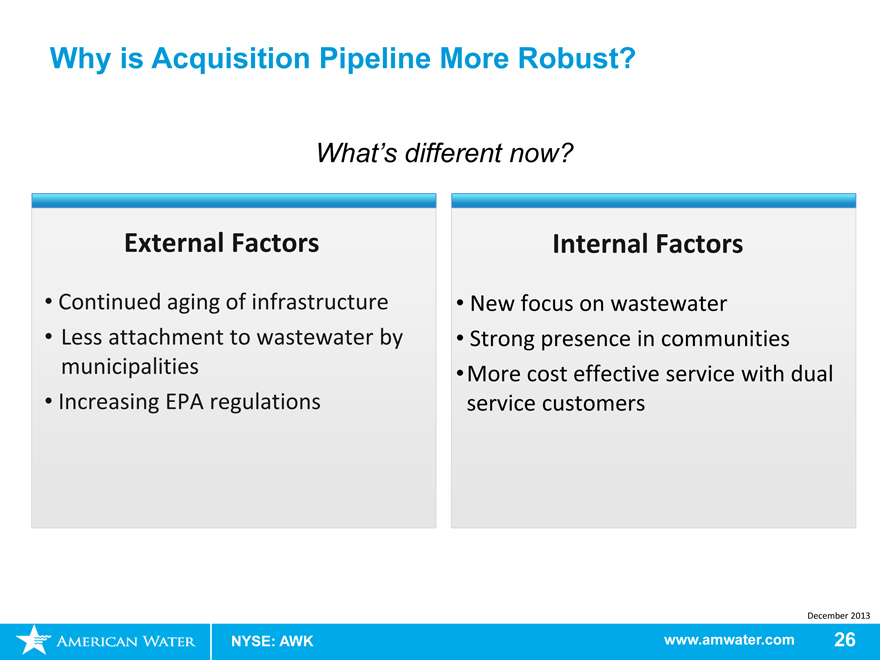

Why is Acquisition Pipeline More Robust?

What’s different now?

External Factors Internal Factors

Continued aging of infrastructure New focus on wastewater

Less attachment to wastewater by Strong presence in communities

municipalities • More cost effective service with dual

Increasing EPA regulations service customers

December 2013

NYSE: AWK www.amwater.com 26

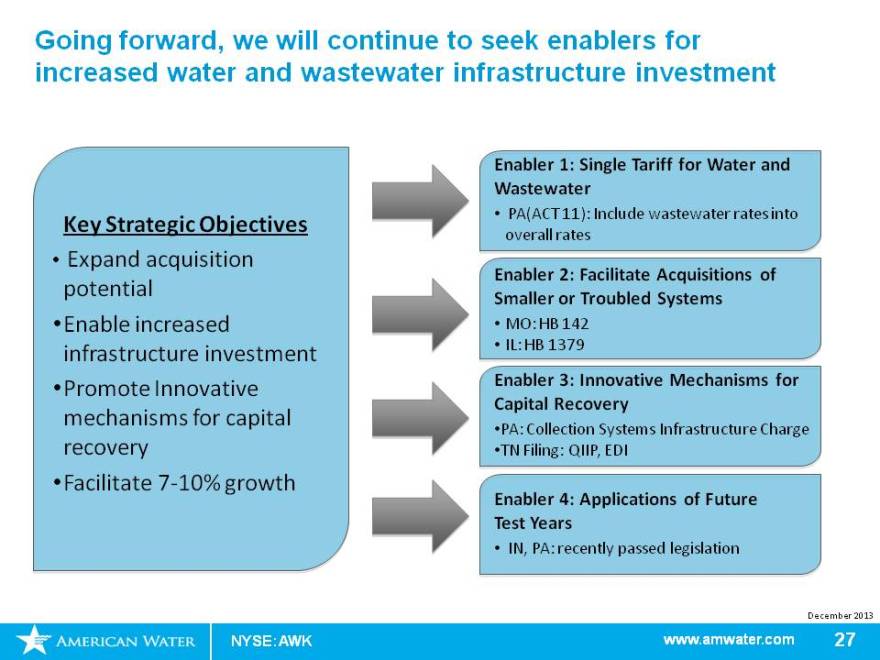

Going forward, we will continue to seek enablers for increased water and wastewater infrastructure investment

Key Strategic Objectives

Expand acquisition potential Enable increased infrastructure investment Promote Innovative mechanisms for capital recovery Facilitate 7-10% growth

Enabler 1: Single Tariff for Water and Wastewater

PA(ACT 11): Include wastewater rates into overall rates

Enabler 2: Facilitate Acquisitions of Smaller or Troubled Systems

MO: HB 142

IL: HB 1379

Enabler 3: Innovative Mechanisms for Capital Recovery

PA: Collection Systems Infrastructure Charge TN Filing: QIIP, EDI

Enabler 4: Applications of Future Test Years

IN, PA: recently passed legislation

December 2013

NYSE: AWK www.amwater.com 27

NYSE: AWK

Our success is built on …

Market Based Operations Overview Sharon Cameron

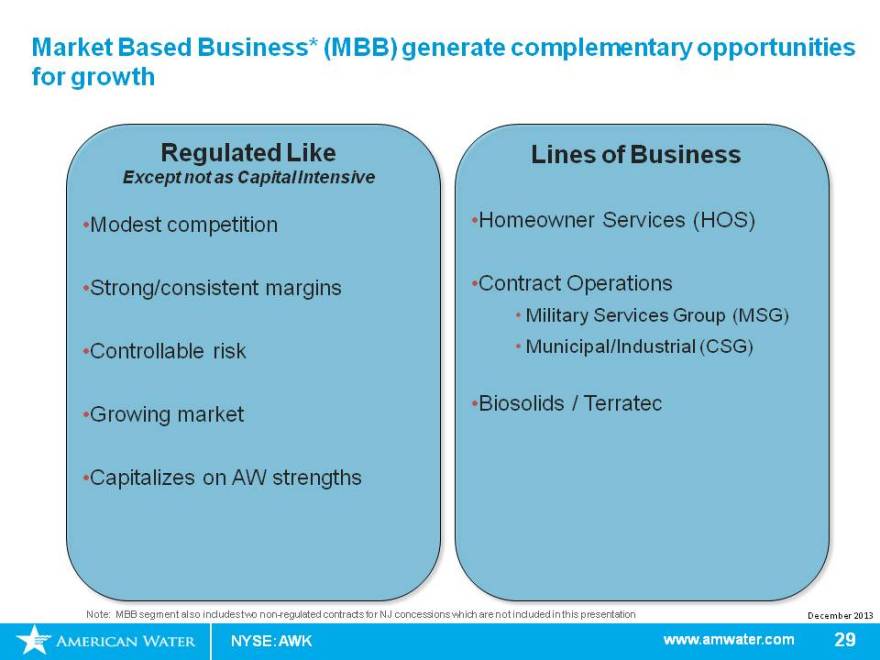

Market Based Business* (MBB) generate complementary opportunities for growth

Regulated Like

Except not as Capital Intensive

Modest competition Strong/consistent margins Controllable risk Growing market Capitalizes on AW strengths

Lines of Business

Homeowner Services (HOS)

Contract Operations

Military Services Group (MSG)

Municipal/Industrial (CSG)

Biosolids / Terratec

Note: MBB segment also includes two non-regulated contracts for NJ concessions which are not included in this presentation

December 2013

NYSE: AWK www.amwater.com 29

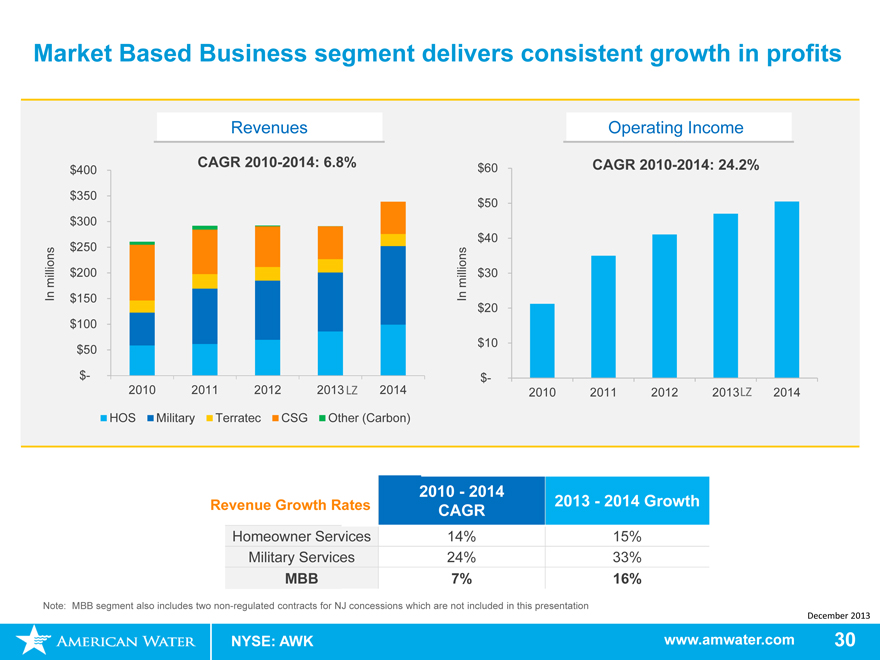

Market Based Business segment delivers consistent growth in profits

Revenues Operating Income

$400 CAGR 2010-2014: 6.8% $60 CAGR 2010-2014: 24.2%

$350 $50

$300

$40

$250

millions $200 millions $30

In $150 In

$20

$100

$50 $10

$- $-

2010 2011 2012 2013 LZ 2014 2010 2011 2012 2013LZ 2014

HOS Military Terratec CSG Other (Carbon)

2010—2014

Revenue Growth Rates CAGR 2013—2014 Growth

Homeowner Services 14% 15%

Military Services 24% 33%

MBB 7% 16%

Note: MBB segment also includes two non-regulated contracts for NJ concessions which are not included in this presentation

December 2013

NYSE: AWK www.amwater.com 30

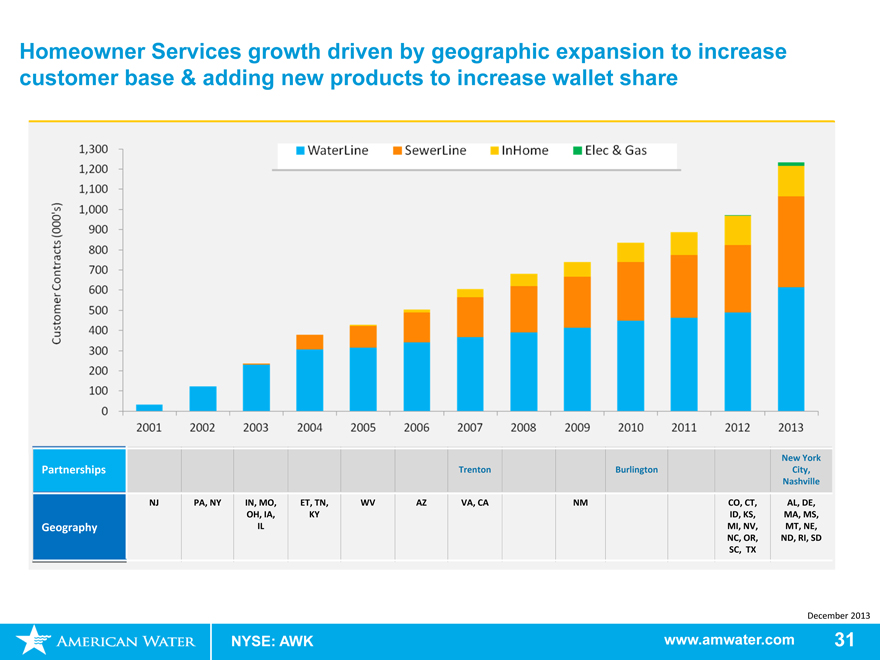

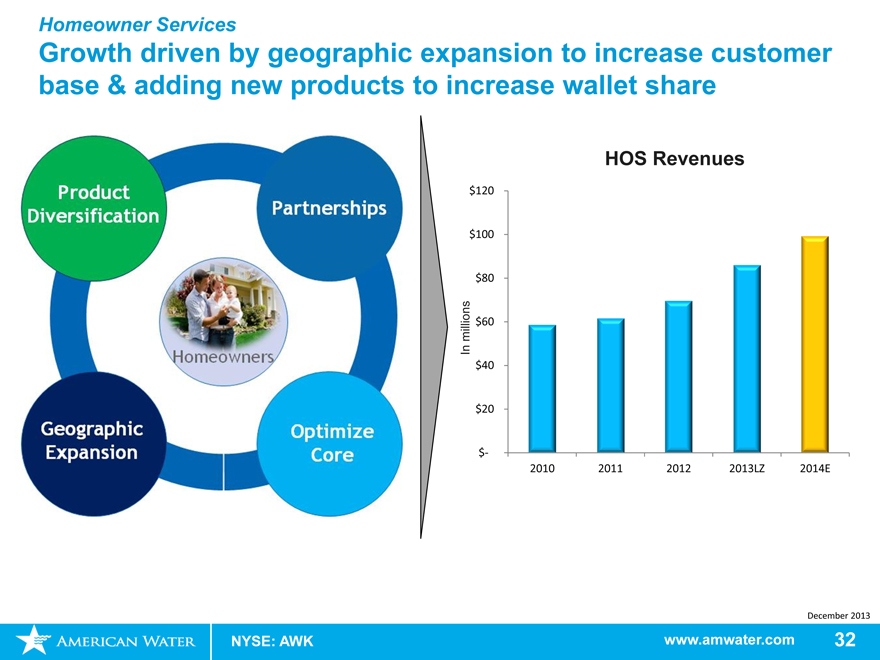

Homeowner Services growth driven by geographic expansion to increase customer base & adding new products to increase wallet share

New York

Partnerships Trenton Burlington City,

Nashville

NJ PA, NY IN, MO, ET, TN, WV AZ VA, CA NM CO, CT, AL, DE,

OH, IA, KY ID, KS, MA, MS,

Geography IL MI, NV, MT, NE,

NC, OR, ND, RI, SD

SC, TX

December 2013

NYSE: AWK www.amwater.com 31

Homeowner Services

Growth driven by geographic expansion to increase customer base & adding new products to increase wallet share

Product Diversification

Partnerships

Homeowners

Geographic Expansion

Optimize Core

HOS Revenues

$120

$100

$80

millions $60

In

$40

$20

$-

2010 2011 2012 2013LZ 2014E

December 2013

NYSE: AWK www.amwater.com 32

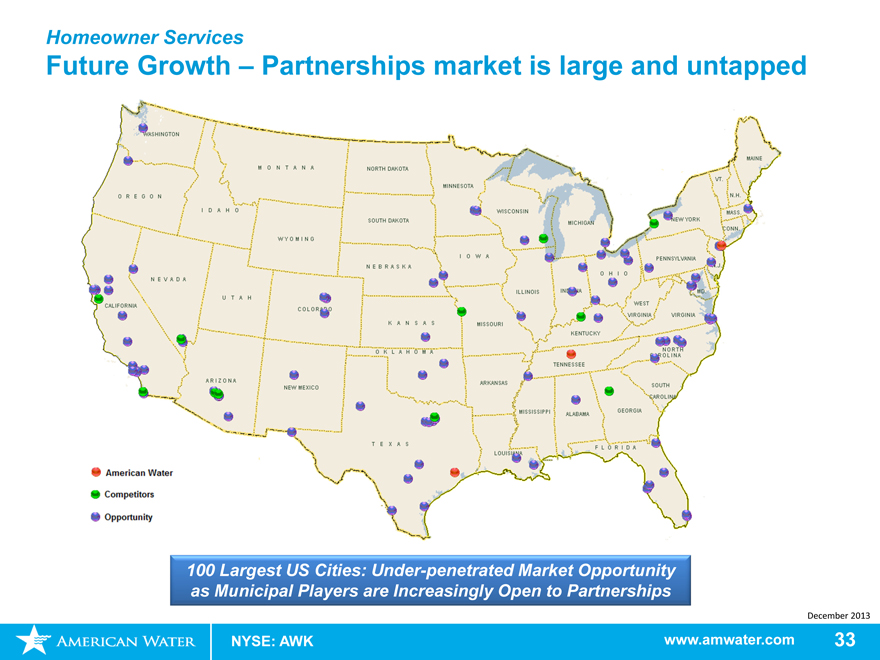

Homeowner Services

Future Growth – Partnerships market is large and untapped

100 Largest US Cities: Under-penetrated Market Opportunity as Municipal Players are Increasingly Open to Partnerships

December 2013

NYSE: AWK www.amwater.com 33

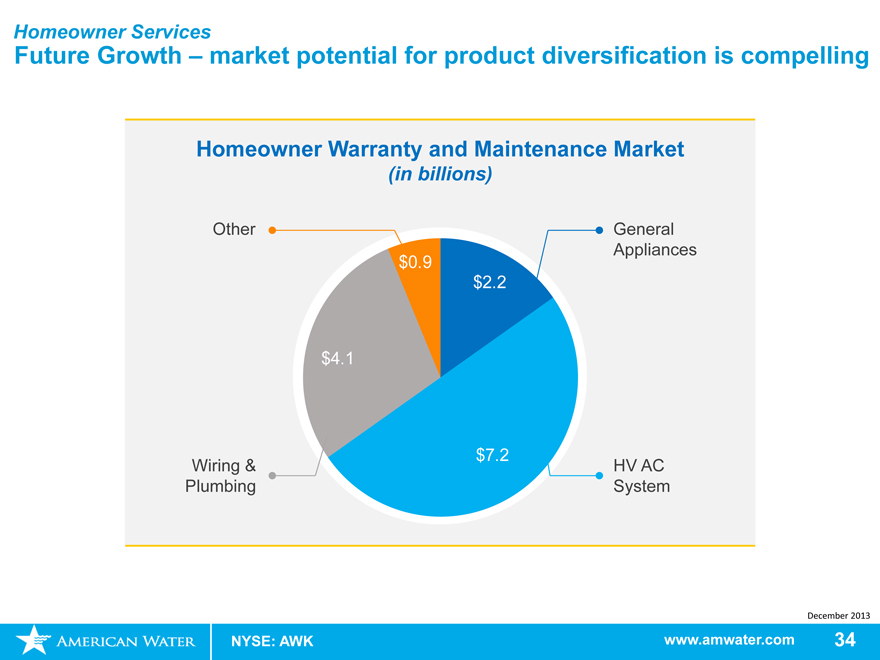

Homeowner Services

Future Growth – market potential for product diversification is compelling

Homeowner Warranty and Maintenance Market

(in billions)

Other General

Appliances

$0.9

$2.2

$4.1

$7.2

Wiring & HV AC

Plumbing System

December 2013

NYSE: AWK www.amwater.com 34

Military Services Group

Overall Growth Strategy

MSG Growth

Strategy

Add New Customers Optimize Existing Bases

1. Price Redeterminations

2. Infrastructure Modifications

Existing

Installations

December 2013

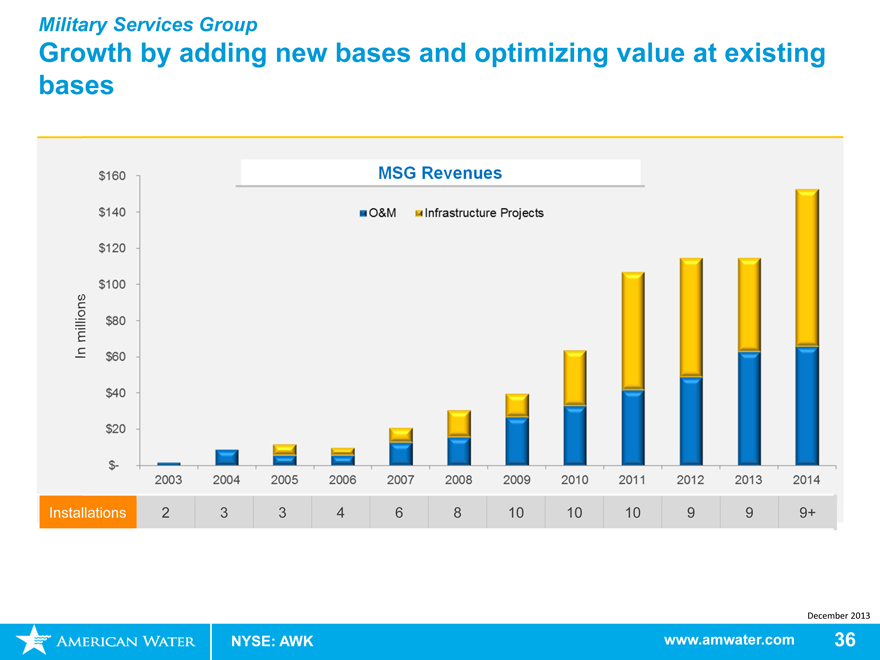

NYSE: AWK www.amwater.com 35

Military Services Group

Growth by adding new bases and optimizing value at existing bases

MSG Revenues

millions

In

Installations 2 3 3 4 6 8 10 10 10 9 9 9+

December 2013

NYSE: AWK www.amwater.com 36

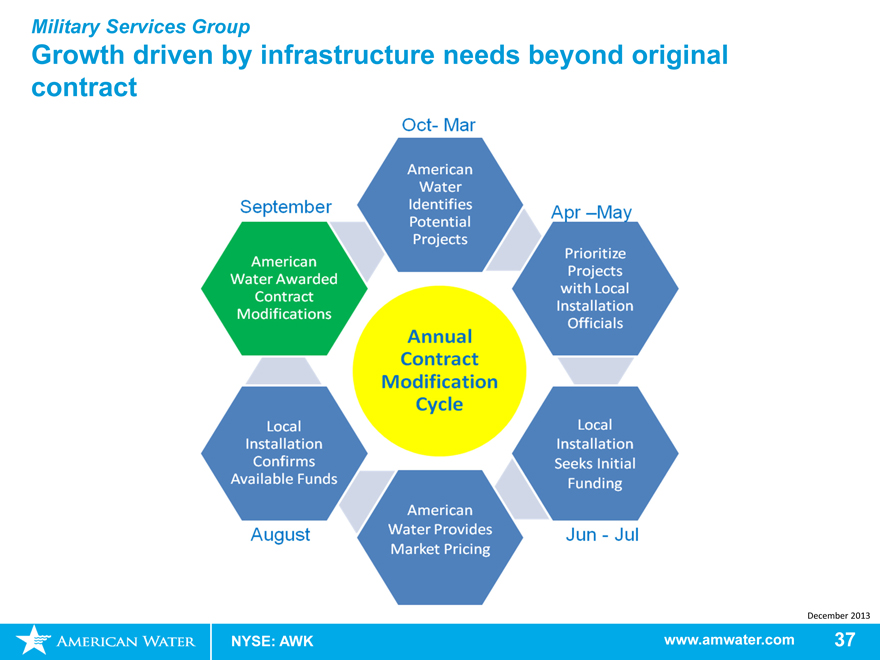

Military Services Group

Growth driven by infrastructure needs beyond original contract

Oct- Mar

American Water Identifies Potential Projects

September

American Water Awarded Contract Modifications

Apr – May

Prioritize Projects with Local Installation Officials

Local Installation Confirms Available Funds

August

American Water Provides Market Pricing

Local Installation Seeks Initial Funding

Jun – Jul

Annual Contract Modification Cycle

December 2013

NYSE: AWK www.amwater.com 37

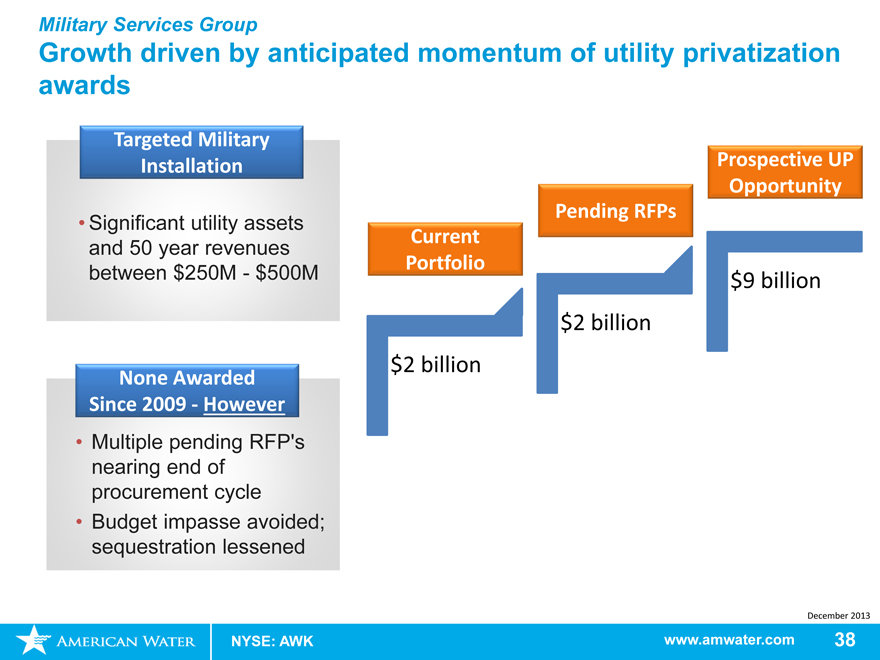

Military Services Group

Growth driven by anticipated momentum of utility privatization awards

Targeted Military

Installation Prospective UP

Opportunity

Significant utility assets Pending RFPs

and 50 year revenues Current

Portfolio

between $250M—$500M $9 billion

$2 billion

$2 billion

None Awarded

Since 2009—However

• Multiple pending RFP’s

nearing end of

procurement cycle

• Budget impasse avoided;

sequestration lessened

December 2013

NYSE: AWK www.amwater.com 38

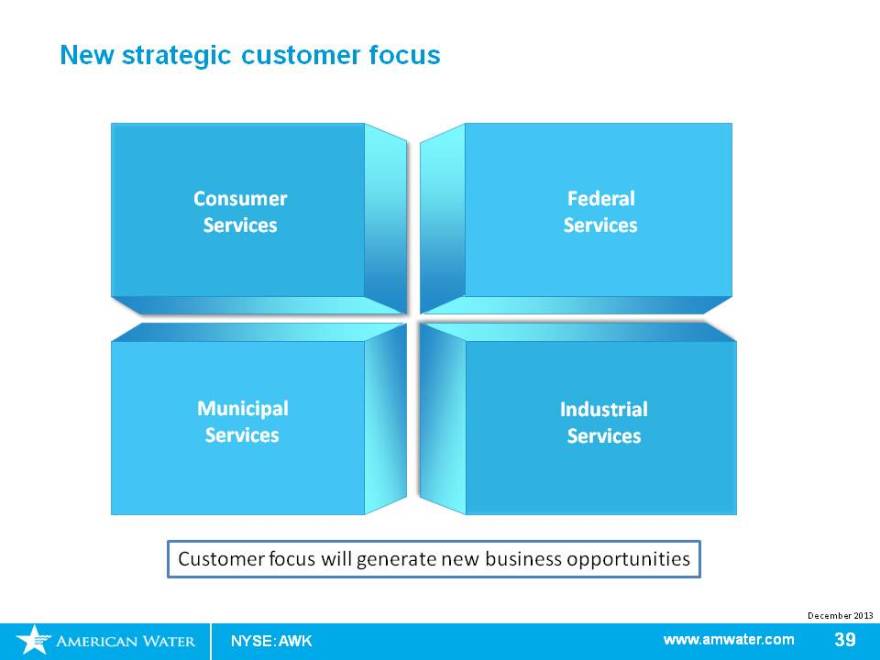

New strategic customer focus

Consumer

Federal

Services

Services

Municipal

Industrial

Services

Services

Customer focus will generate new business opportunities

December 2013

NYSE: AWK www.amwater.com 39

NYSE: AWK

Our Success results in:

Susan Story SVP and CFO

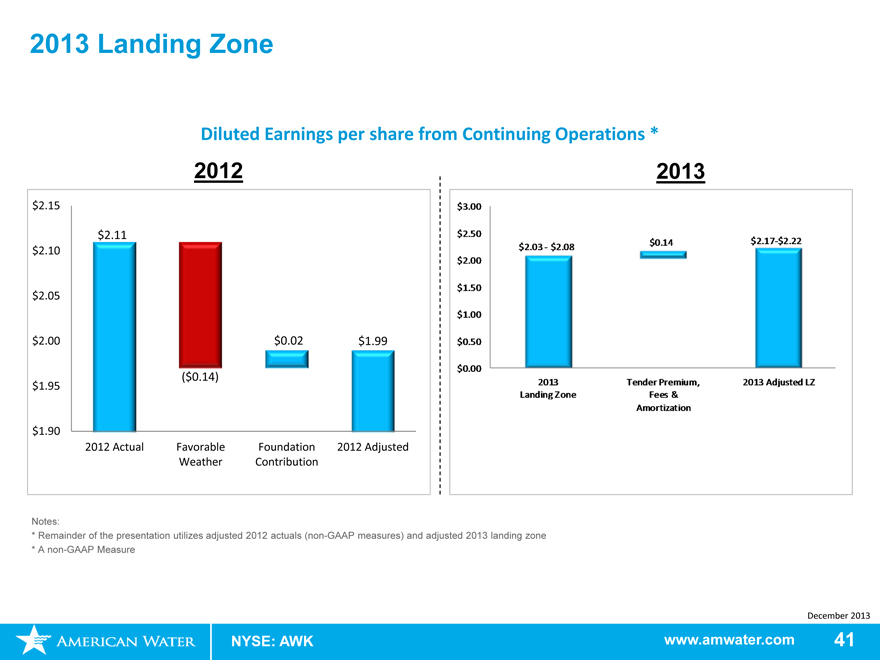

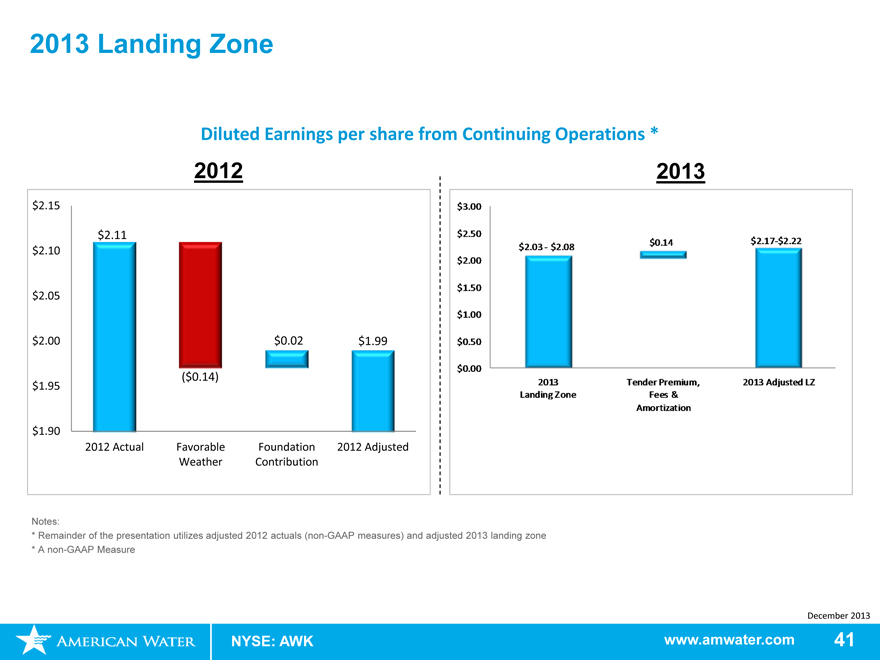

2013 Landing Zone

Diluted Earnings per share from Continuing Operations *

2012 2013

$ 2.15

$ 2.11

$ 2.10

$ 2.05

$ 2.00 $ 0.02 $ 1.99

($ 0.14)

$ 1.95

$ 1.90

2012 Actual Favorable Foundation 2012 Adjusted

Weather Contribution

$ 3.00

$ 2.50

$ 2.03—$ 2.08 $ 0.14 $ 2.17-$ 2.22

$ 2.00

$ 1.50

$ 1.00

$ 0.50

$ 0.00

2013 Tender Premium, 2013 Adjusted LZ

Landing Zone Fees &

Amortization

Notes:

* Remainder of the presentation utilizes adjusted 2012 actuals (non-GAAP measures) and adjusted 2013 landing zone

* A non-GAAP Measure

December 2013

NYSE: AWK www.amwater.com 41

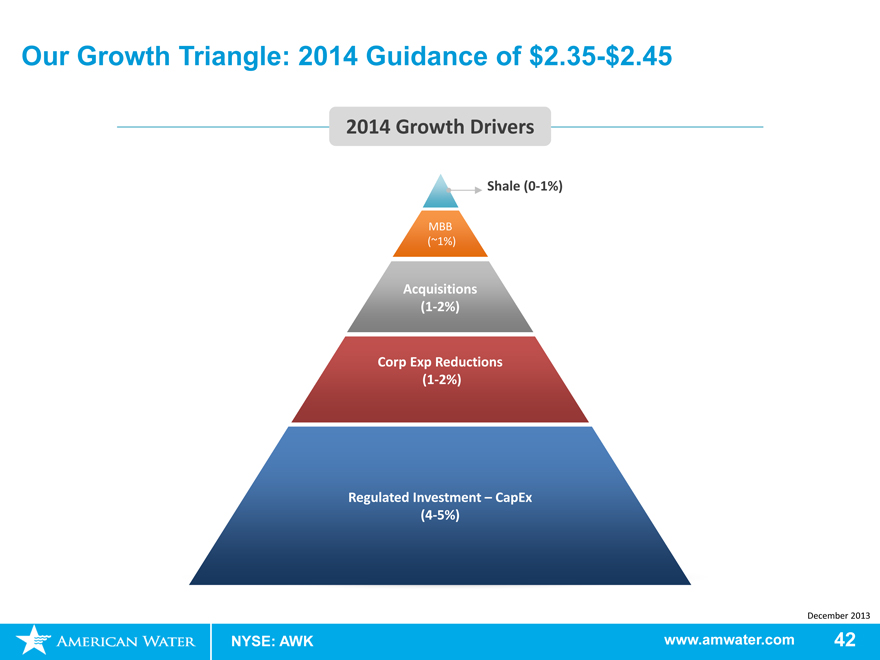

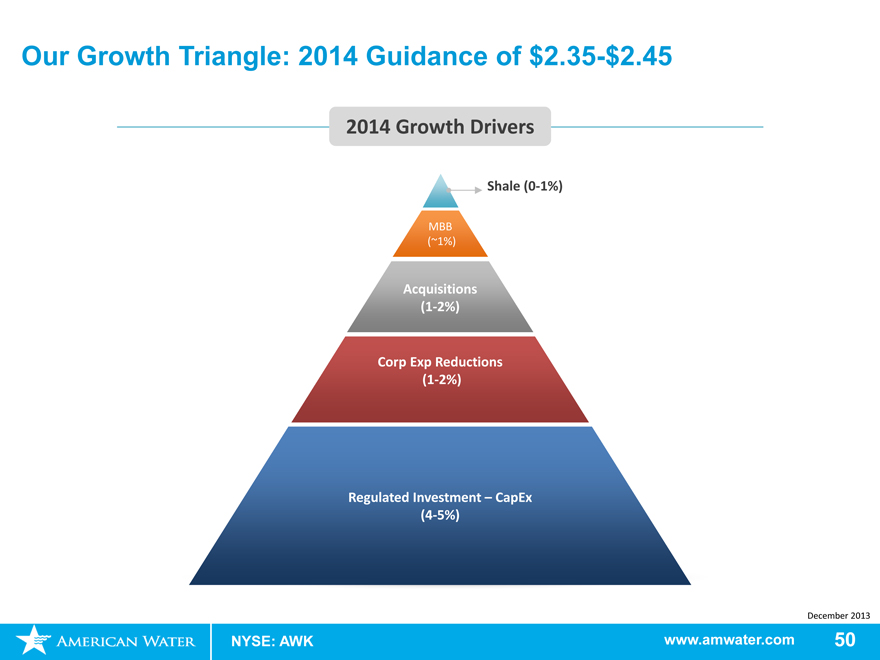

Our Growth Triangle: 2014 Guidance of $2.35-$2.45

2014 Growth Drivers

Shale (0-1%)

MBB (~1%)

Acquisitions

(1-2%)

Corp Exp Reductions

(1-2%)

Regulated Investment – CapEx

(4-5%)

December 2013

NYSE: AWK www.amwater.com 42

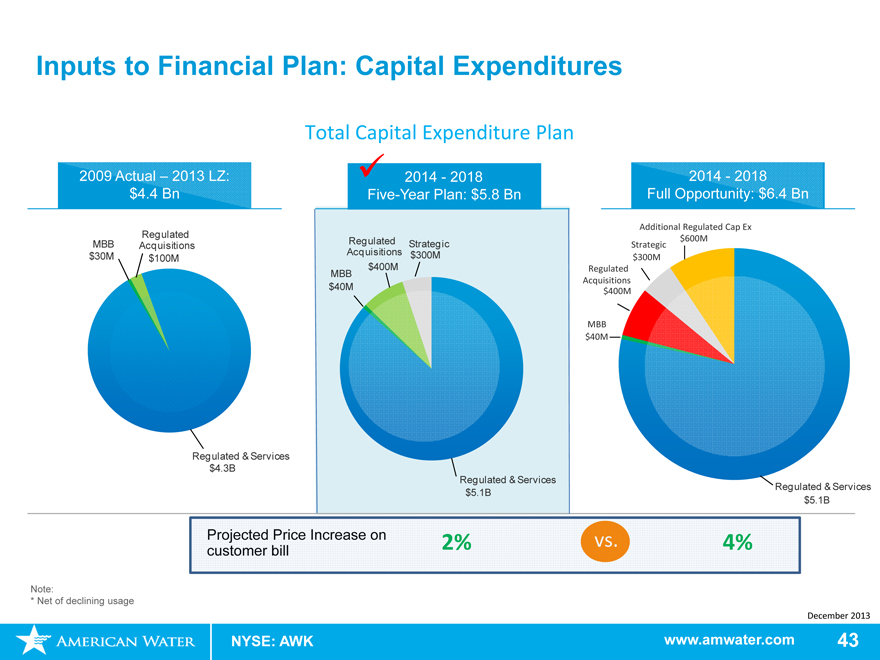

Inputs to Financial Plan: Capital Expenditures

Total Capital Expenditure Plan

2009 Actual – 2013 LZ:

$4.4 Bn

Regulated

MBB Acquisitions

$30M $100M

Regulated & Services

$4.3B

2014—2018

Five-Year Plan: $5.8 Bn

Regulated Strategic

Acquisitions $300M

$400M

MBB

$40M

Regulated & Services

$5.1B

2014—2018

Full Opportunity: $6.4 Bn

Additional Regulated Cap Ex

$600M

Strategic

$300M

Regulated

Acquisitions

$400M

MBB

$40M

Regulated & Services

$5.1B

Projected Price Increase on 2% vs. 4% customer bill

Note:

* Net of declining usage

December 2013

NYSE: AWK www.amwater.com 43

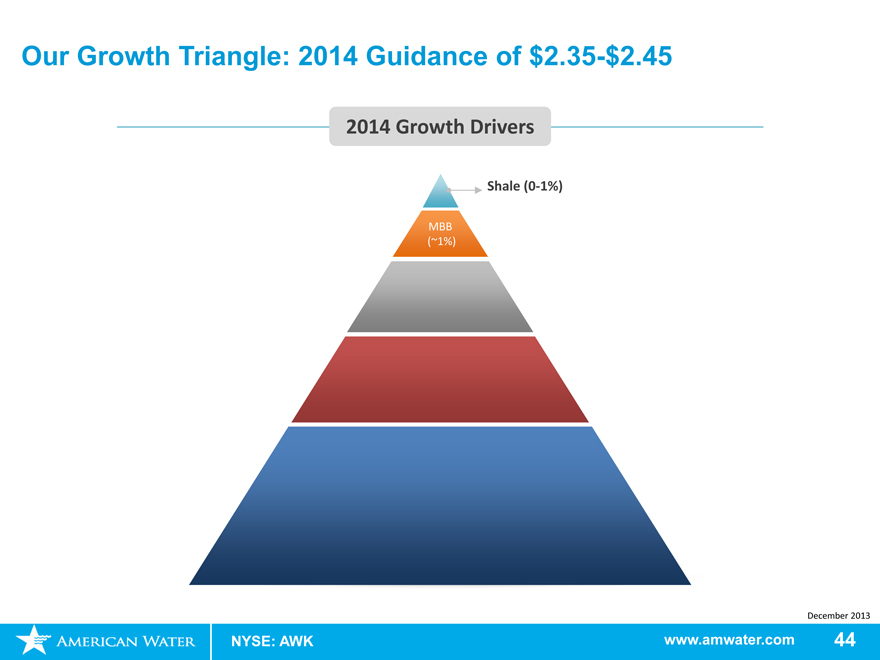

Our Growth Triangle: 2014 Guidance of $2.35-$2.45

2014 Growth Drivers

Shale (0-1%)

MBB (~1%)

December 2013

NYSE: AWK www.amwater.com 44

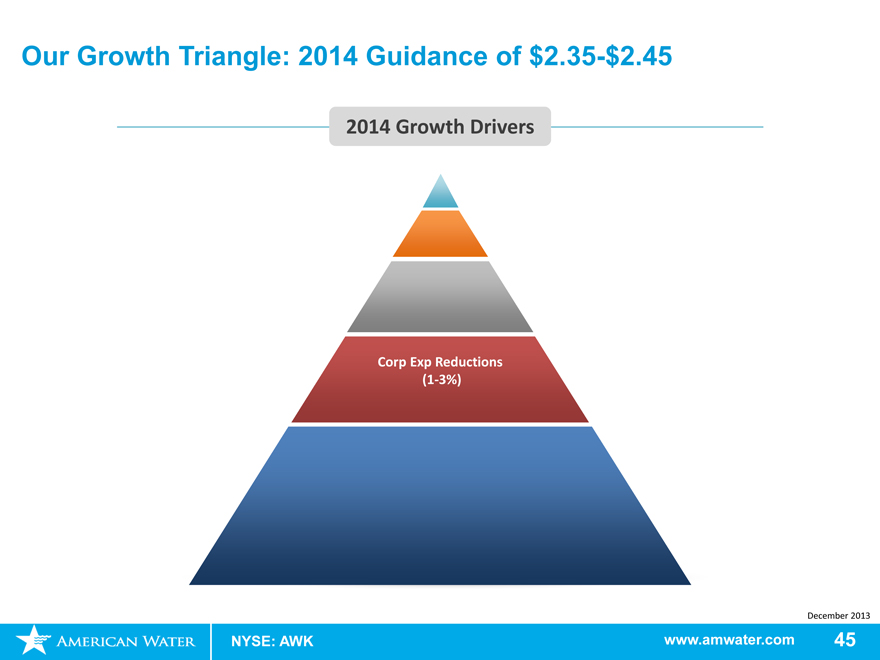

Our Growth Triangle: 2014 Guidance of $2.35-$2.45

2014 Growth Drivers

Corp Exp Reductions

(1-3%)

December 2013

NYSE: AWK www.amwater.com 45

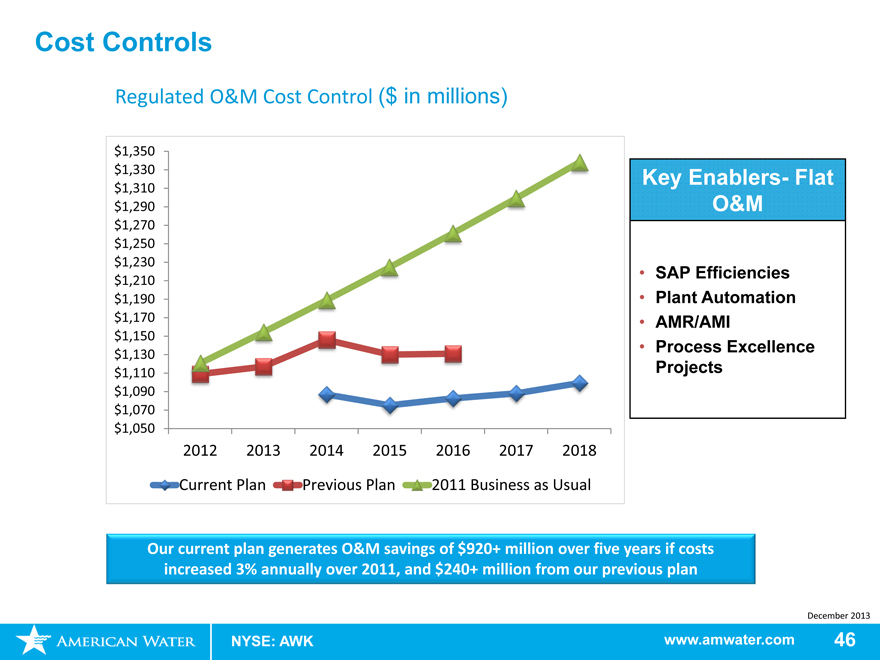

Cost Controls

Regulated O&M Cost Control ($ in millions)

$ 1,350

$ 1,330

$ 1,310

$ 1,290

$ 1,270

$ 1,250

$ 1,230

$ 1,210

$ 1,190

$ 1,170

$ 1,150

$ 1,130

$ 1,110

$ 1,090

$ 1,070

$ 1,050

2012 2013 2014 2015 2016 2017 2018

Current Plan Previous Plan 2011 Business as Usual

Key Enablers- Flat O&M

SAP Efficiencies

Plant Automation

AMR/AMI

Process Excellence Projects

Our current plan generates O&M savings of $920+ million over five years if costs increased 3% annually over 2011, and $240+ million from our previous plan

December 2013

NYSE: AWK www.amwater.com 46

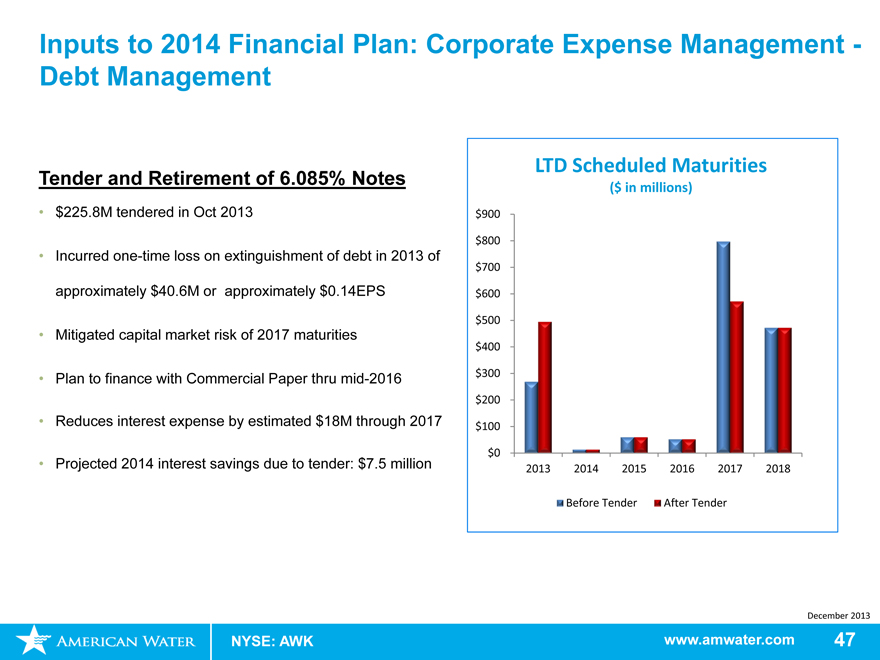

Inputs to 2014 Financial Plan: Corporate Expense Management -Debt Management

Tender and Retirement of 6.085% Notes

$225.8M tendered in Oct 2013

Incurred one-time loss on extinguishment of debt in 2013 of approximately $40.6M or approximately $0.14EPS

Mitigated capital market risk of 2017 maturities

Plan to finance with Commercial Paper thru mid-2016

Reduces interest expense by estimated $18M through 2017

Projected 2014 interest savings due to tender: $7.5 million

LTD Scheduled Maturities

($ in millions)

$900

$800

$700

$600

$500

$400

$300

$200

$100

$0

2013 2014 2015 2016 2017 2018

Before Tender After Tender

December 2013

NYSE: AWK www.amwater.com 47

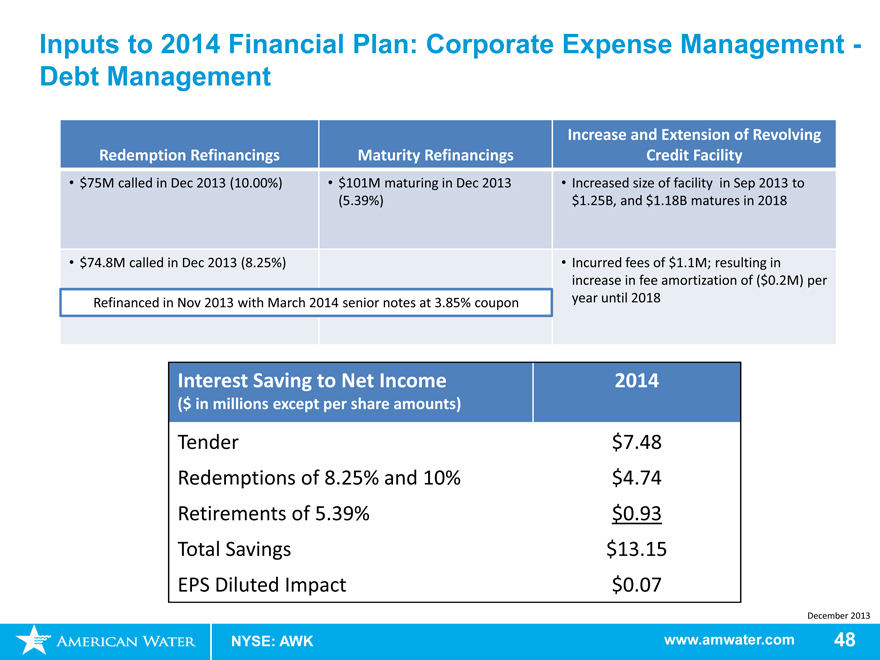

Inputs to 2014 Financial Plan: Corporate Expense Management -Debt Management

Increase and Extension of Revolving

Redemption Refinancings Maturity Refinancings Credit Facility

$ 75M called in Dec 2013 (10.00%) $101M maturing in Dec 2013 Increased size of facility in Sep 2013 to

(5.39%) $1.25B, and $1.18B matures in 2018

$ 74.8M called in Dec 2013 (8.25%) Incurred fees of $1.1M; resulting in

increase in fee amortization of ($0.2M) per

Refinanced in Nov 2013 with March 2014 senior notes at 3.85% coupon year until 2018

Interest Saving to Net Income 2014

($ in millions except per share amounts)

Tender $7.48

Redemptions of 8.25% and 10% $4.74

Retirements of 5.39% $0.93

Total Savings $13.15

EPS Diluted Impact $0.07

December 2013

NYSE: AWK www.amwater.com 48

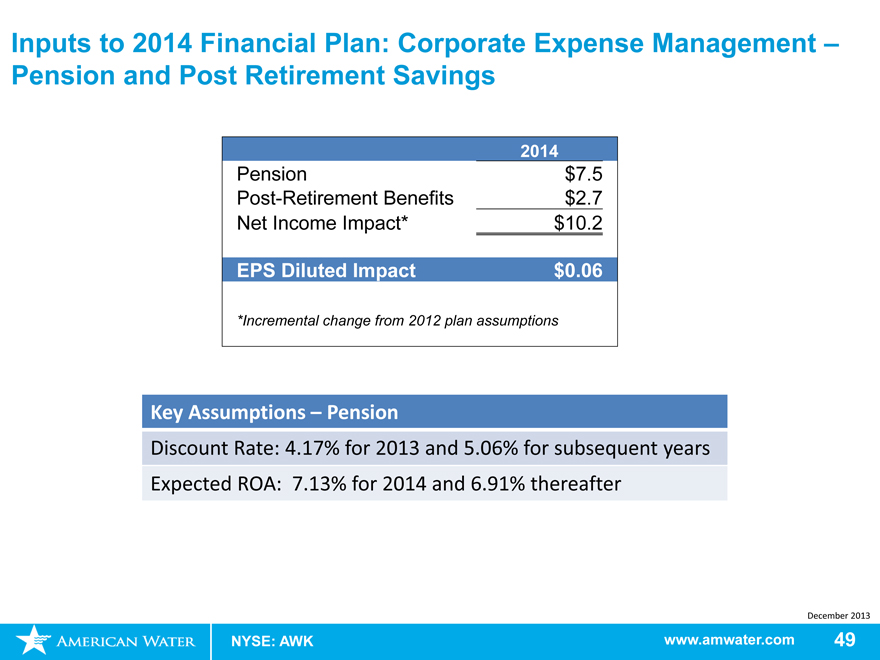

Inputs to 2014 Financial Plan: Corporate Expense Management – Pension and Post Retirement Savings

2014

Pension $7.5

Post-Retirement Benefits $2.7

Net Income Impact* $10.2

EPS Diluted Impact $0.06

*Incremental change from 2012 plan assumptions

Key Assumptions – Pension

Discount Rate: 4.17% for 2013 and 5.06% for subsequent years Expected ROA: 7.13% for 2014 and 6.91% thereafter

December 2013

NYSE: AWK www.amwater.com 49

Our Growth Triangle: 2014 Guidance of $2.35-$2.45

2014 Growth Drivers

Shale (0-1%)

MBB (~1%)

Acquisitions

(1-2%)

Corp Exp Reductions

(1-2%)

Regulated Investment – CapEx

(4-5%)

December 2013

NYSE: AWK www.amwater.com 50

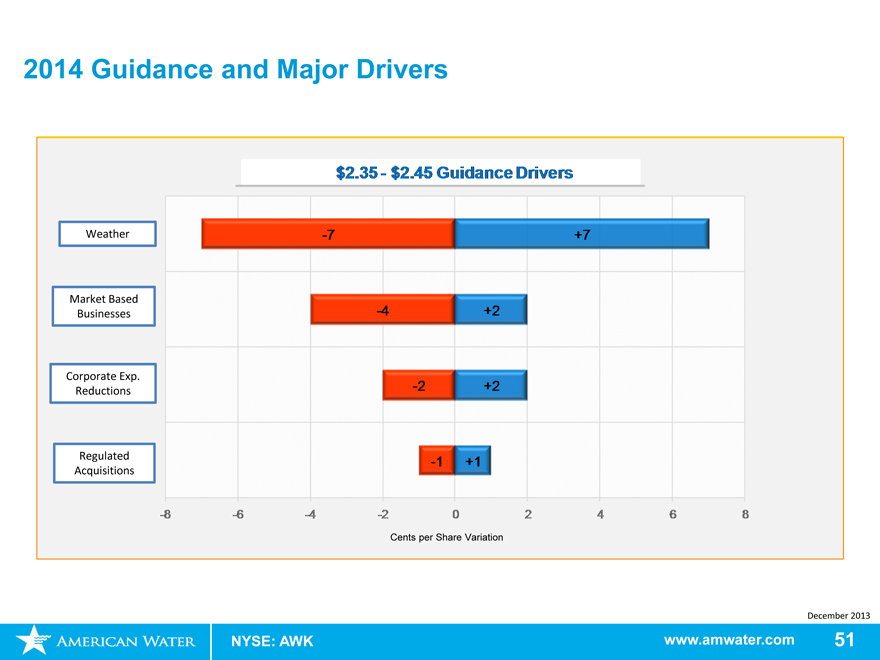

2014 Guidance and Major Drivers

$2.35—$2.45 Guidance Drivers

Weather -7 +7

Market Based

Businesses -4 +2

Corporate Exp.

Reductions -2 +2

Regulated -1 +1

Acquisitions

-8 -6 -4 -2 0 2 4 6 8

Cents per Share Variation

December 2013

NYSE: AWK www.amwater.com 51

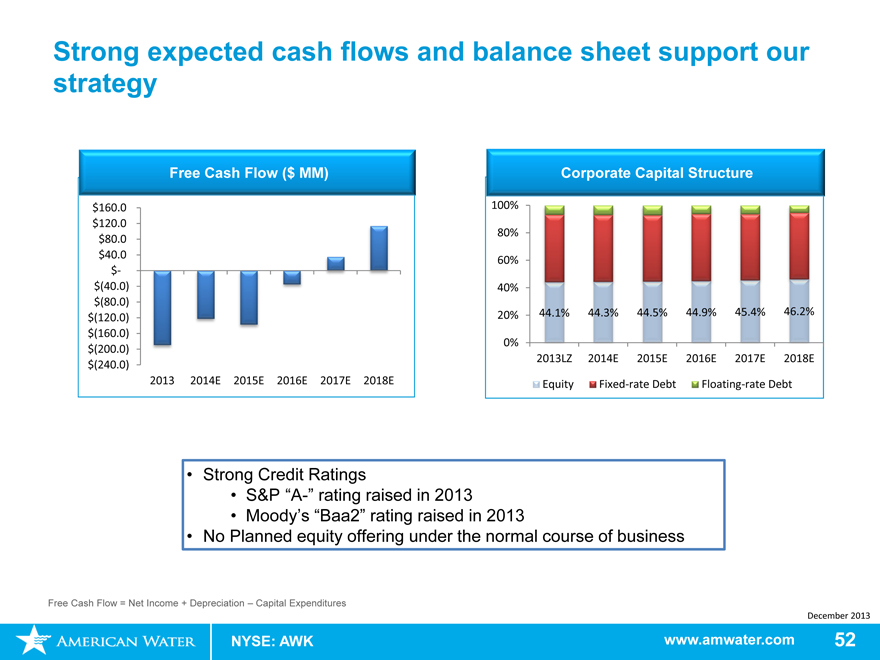

Strong expected cash flows and balance sheet support our strategy

Free Cash Flow ($ MM)

$160.0

$120.0

$80.0

$40.0

$-

$(40.0)

$(80.0)

$(120.0)

$(160.0)

$(200.0)

$(240.0)

2013 2014E 2015E 2016E 2017E 2018E

Corporate Capital Structure

100%

80%

60%

40%

20% 44.1% 44.3% 44.5% 44.9% 45.4% 46.2%

0%

2013LZ 2014E 2015E 2016E 2017E 2018E

Equity Fixed-rate Debt Floating-rate Debt

Strong Credit Ratings

S&P “A-” rating raised in 2013

Moody’s “Baa2” rating raised in 2013

No Planned equity offering under the normal course of business

Free Cash Flow = Net Income + Depreciation – Capital Expenditures

December 2013

NYSE: AWK www.amwater.com 52

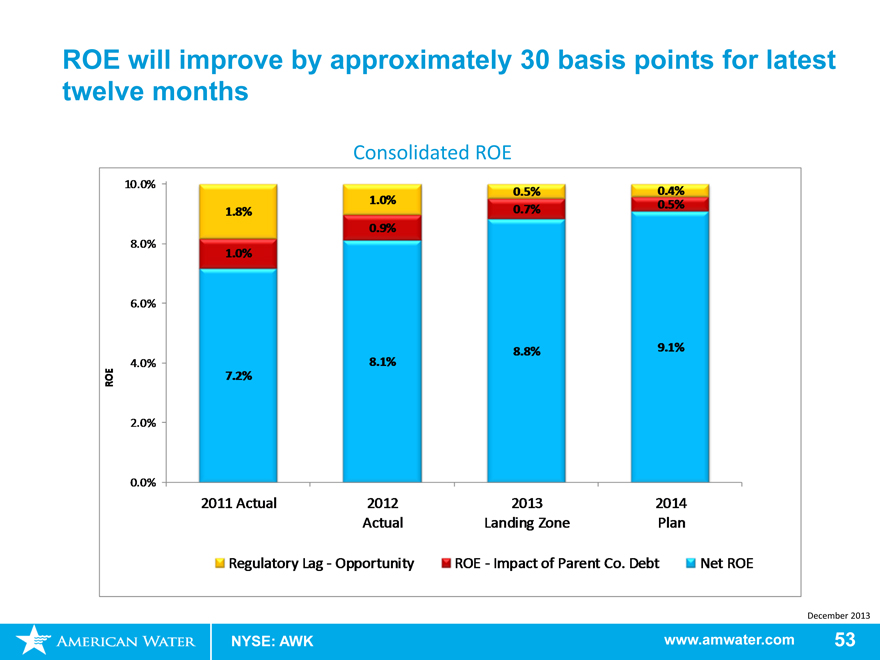

ROE will improve by approximately 30 basis points for latest twelve months

Consolidated ROE

10.0% 0.5% 0.4%

1.0% 0.5%

1.8% 0.7%

0.9%

8.0%

1.0%

6.0%

8.8% 9.1%

4.0% 8.1%

ROE 72%.

2.0%

0.0%

2011 Actual 2012 2013 2014

Actual Landing Zone Plan

Regulatory Lag - Opportunity ROE - Impact of Parent Co. Debt Net ROE

December 2013

NYSE: AWK www.amwater.com 53

Dividend History: IPO—Current

Dividend Practice

$0.30

Future dividend increases

aligned with normalized EPS $1.09

growth

$0.28

Payout ratio between 50-60

percent of net income

$0.26 $0.96

$0.24

$0.90

$0.86

$0.22

$0.82

$ 0.80*

$0.20

$0.18

Q308 Q408 Q109 Q209 Q309 Q409 Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411

Q112 Q212 Q312 Q412 Q113 Q213 Q313 Q413

Period (Quarterly Dividends Paid)

On December 13, 2013 declared quarterly cash dividend per common share of $0.28 payable on March 3, 2014 to all shareholders of record as of February 3, 2014

Note:

* Annualized dividend

Q1 2013 dividend was paid in Q4 2012

December 2013

NYSE: AWK www.amwater.com 54

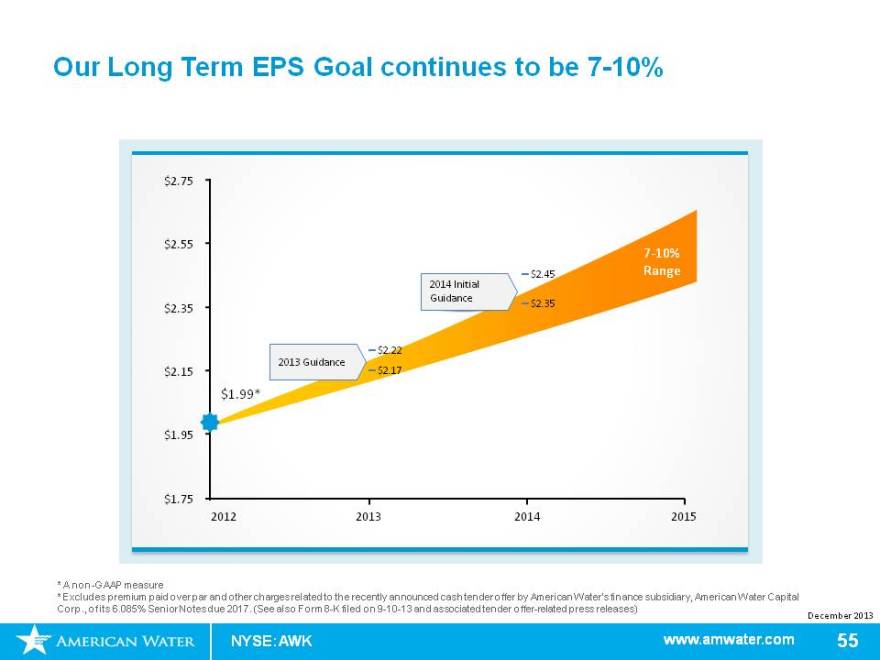

Our Long Term EPS Goal continues to be 7-10%

$ 2.75

$ 2.55

2014 Initial

Guidance

$ 2.35 $ 2.35

$2.22

$ 2.15 -$2.17

$ 1.99*

$ 1.95

$ 1.75

2012 2013 2014 2015

* A non-GAAP measure

* Excludes premium paid over par and other charges related to the recently announced cash tender offer by American Water’s finance subsidiary, American Water Capital Corp., of its 6.085% Senior Notes due 2017. (See also Form 8-K filed on 9-10-13 and associated tender offer-related press releases)

7-10%

Range

-$2.45

2013 Guideline

December 2013

NYSE: AWK www.amwater.com 55

NYSE: AWK

In Summary

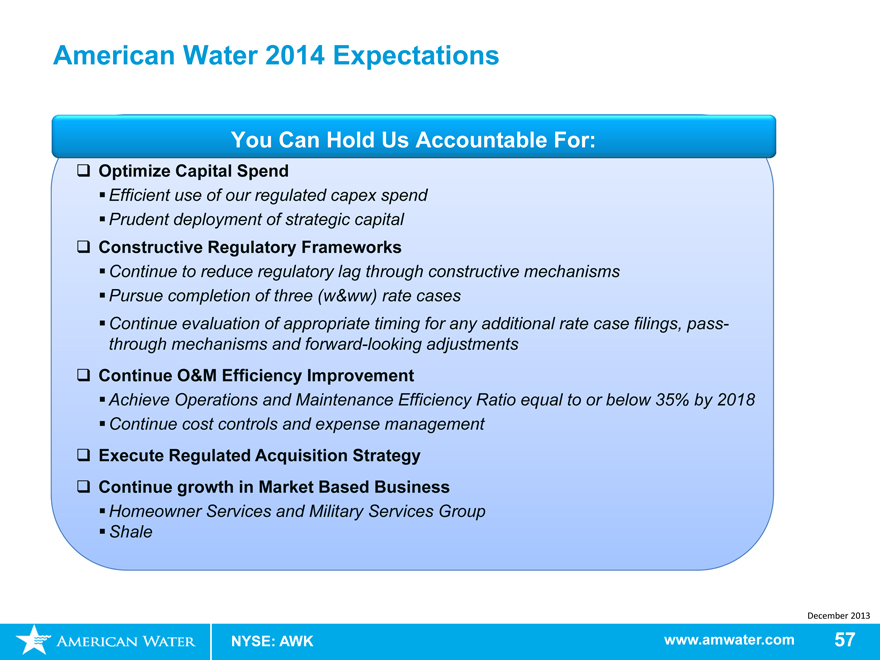

American Water 2014 Expectations

You Can Hold Us Accountable For:

Optimize Capital Spend

Efficient use of our regulated capex spend

Prudent deployment of strategic capital

Constructive Regulatory Frameworks

Continue to reduce regulatory lag through constructive mechanisms

Pursue completion of three (w&ww) rate cases

Continue evaluation of appropriate timing for any additional rate case filings, pass-through mechanisms and forward-looking adjustments

Continue O&M Efficiency Improvement

Achieve Operations and Maintenance Efficiency Ratio equal to or below 35% by 2018

Continue cost controls and expense management

Execute Regulated Acquisition Strategy

Continue growth in Market Based Business

Homeowner Services and Military Services Group

Shale

December 2013

NYSE: AWK www.amwater.com 57

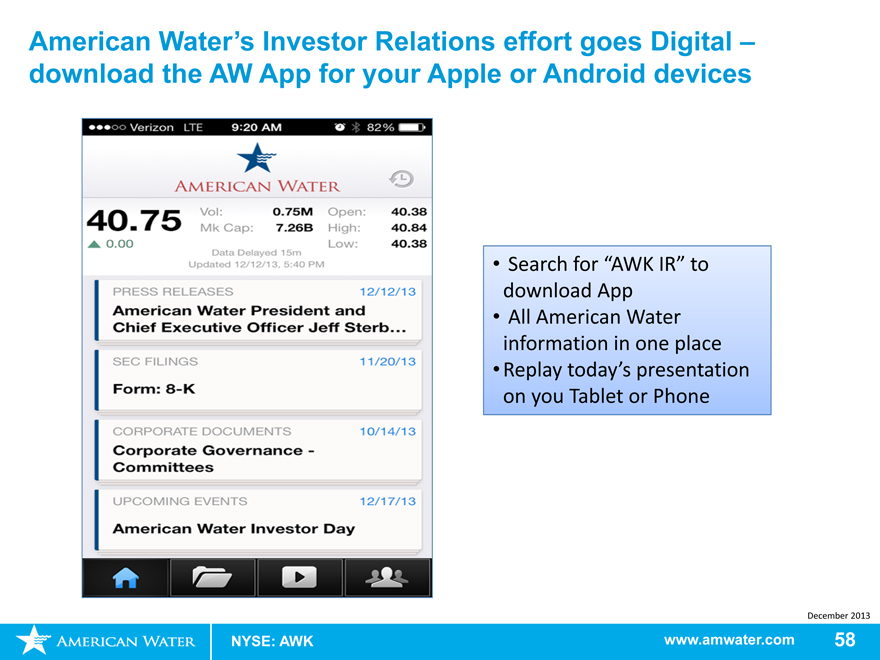

American Water’s Investor Relations effort goes Digital –download the AW App for your Apple or Android devices

Verzion LTE 9.20AM 82%

American Water

40.75

0.00

Vol: 0.75M

Mk Cap: 7.26B

Open: 40.38

High: 40.84

Low: 40.38

Data Delayed 15m Updated 12/12/13, 5:40 PM

Press Releases

American Water President and Chief Executive Officer Jeff Sterb…

Sec Filings 11/12/13

Form: 8-K

Corporate documents 10/14/13

Corporate Governance – Committees

Upcoming Events 12/17/13

American Water Investor Day

Search for “AWK IR” to download App

All American Water information in one place Replay today’s presentation on you Tablet or Phone

December 2013

NYSE: AWK www.amwater.com 58

NYSE: AWK

Q&A

NYSE: AWK

Appendix

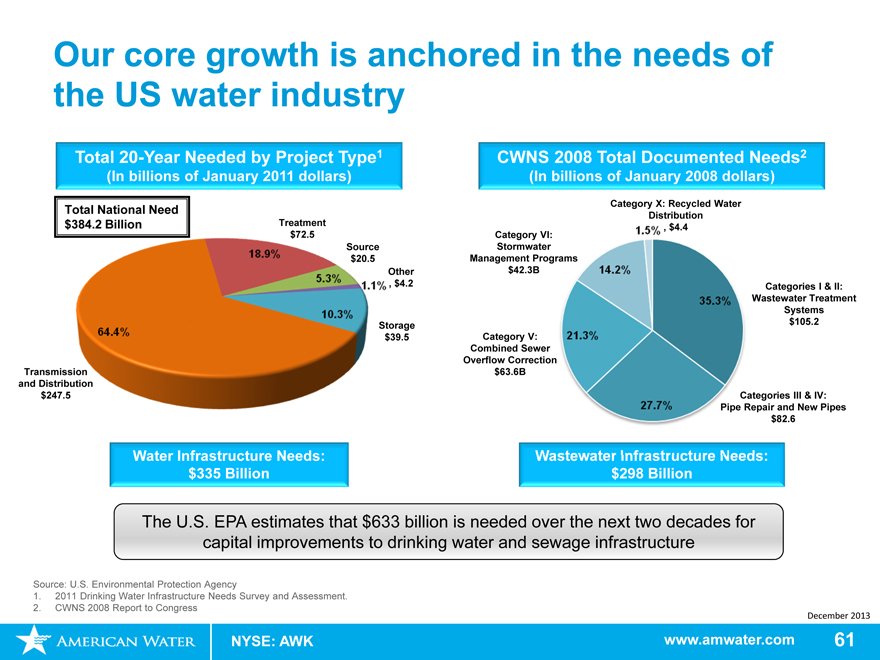

Our core growth is anchored in the needs of the US water industry

Total 20-Year Needed by Project Type1

(In billions of January 2011 dollars)

Total National Need

$384.2 Billion Treatment

$72.5

Source

$20.5

Other

, $4.2

Storage

$39.5

Transmission

and Distribution

$247.5

Water Infrastructure Needs:

$335 Billion

CWNS 2008 Total Documented Needs2

(In billions of January 2008 dollars)

Category X: Recycled Water

Distribution

, $4.4

Category VI:

Stormwater

Management Programs

$42.3B

Categories I & II:

Wastewater Treatment

Systems

$105.2

Category V:

Combined Sewer

Overflow Correction

$63.6B

Categories III & IV:

Pipe Repair and New Pipes

$82.6

Wastewater Infrastructure Needs:

$298 Billion

The U.S. EPA estimates that $633 billion is needed over the next two decades for capital improvements to drinking water and sewage infrastructure

Source: U.S. Environmental Protection Agency

1. 2011 Drinking Water Infrastructure Needs Survey and Assessment.

2. CWNS 2008 Report to Congress

December 2013

64.4% 18.9% 5.3% 10.3% 1.1% 14.2% 21.3% 27.7% 35.3% 1.5%

NYSE: AWK www.amwater.com 61

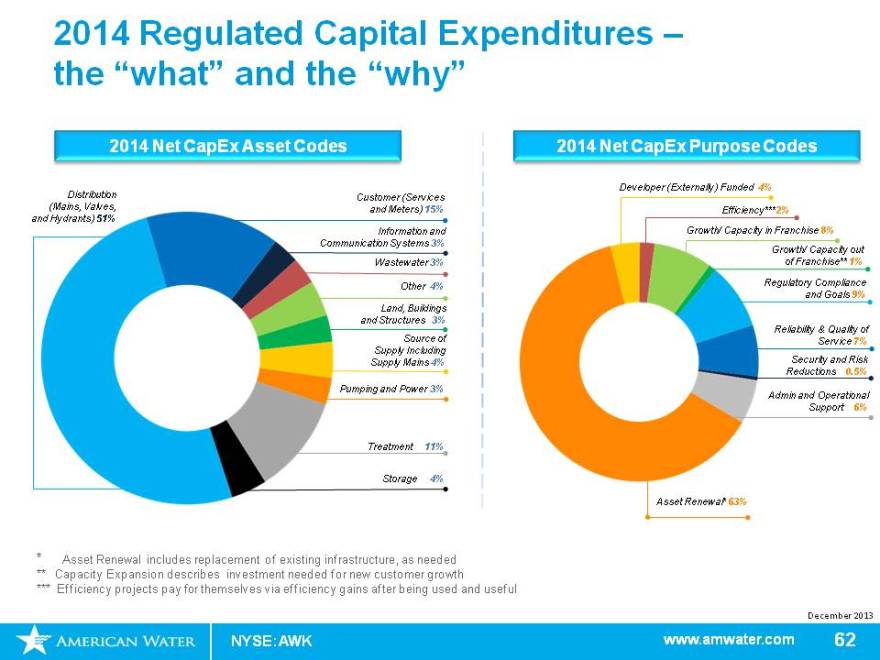

2014 Regulated Capital Expenditures –the “what” and the “why”

2014 Net CapEx Asset Codes

Distribution Customer (Services

(Mains, Valves, and Meters) 15%

and Hydrants) 51%

Information and

Communication Systems 3%

Wastewater 3%

Other 4%

Land, Buildings

and Structures 3%

Source of

Supply Including

Supply Mains 4%

Pumping and Power 3%

Treatment 11%

Storage 4%

2014 Net CapEx Purpose Codes

Developer (Externally) Funded 4%

Efficiency***2%

Growth/ Capacity in Franchise 8%

Growth/ Capacity out

of Franchise** 1%

Regulatory Compliance

and Goals 9%

Reliability & Quality of

Service 7%

Security and Risk

Reductions 0.5%

Admin and Operational

Support 6%

Asset Renewal* 63%

* Asset Renewal includes replacement of existing infrastructure, as needed

** Capacity Expansion describes investment needed for new customer growth

*** Efficiency projects pay for themselves via efficiency gains after being used and useful

December 2013

NYSE: AWK www.amwater.com 62

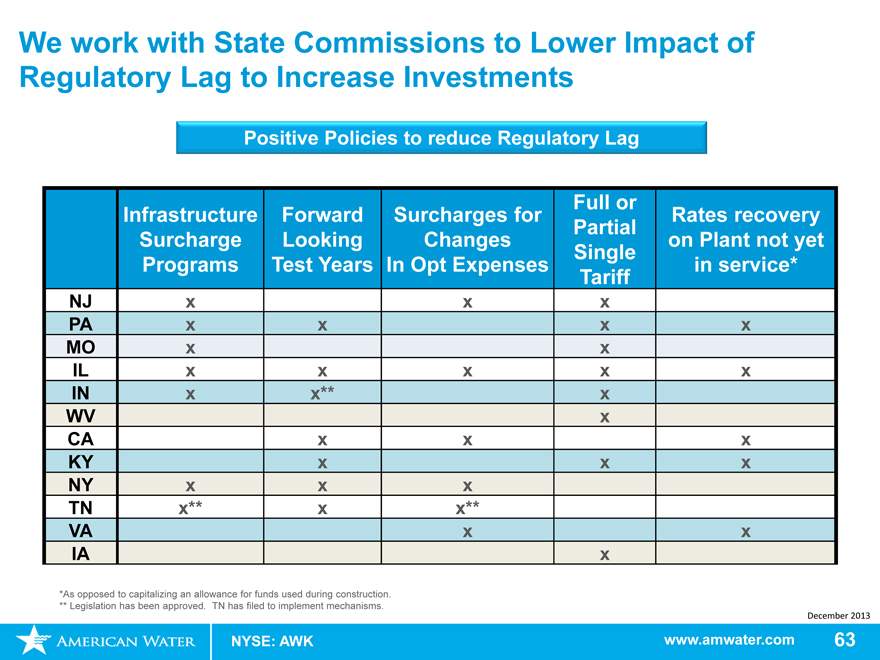

We work with State Commissions to Lower Impact of Regulatory Lag to Increase Investments

Positive Policies to reduce Regulatory Lag

Full or

Infrastructure Forward Surcharges for Rates recovery

Partial

Surcharge Looking Changes on Plant not yet

Single

Programs Test Years In Opt Expenses in service*

Tariff

NJ xx x

PA xx x x

MO xx

IL xx x x x

IN xx** x

WV x

CA xx x

KY xx x

NY xx x

TN x** x x**

VA xx

IA x

*As opposed to capitalizing an allowance for funds used during construction.

** Legislation has been approved. TN has filed to implement mechanisms.

December 2013

NYSE: AWK www.amwater.com 63

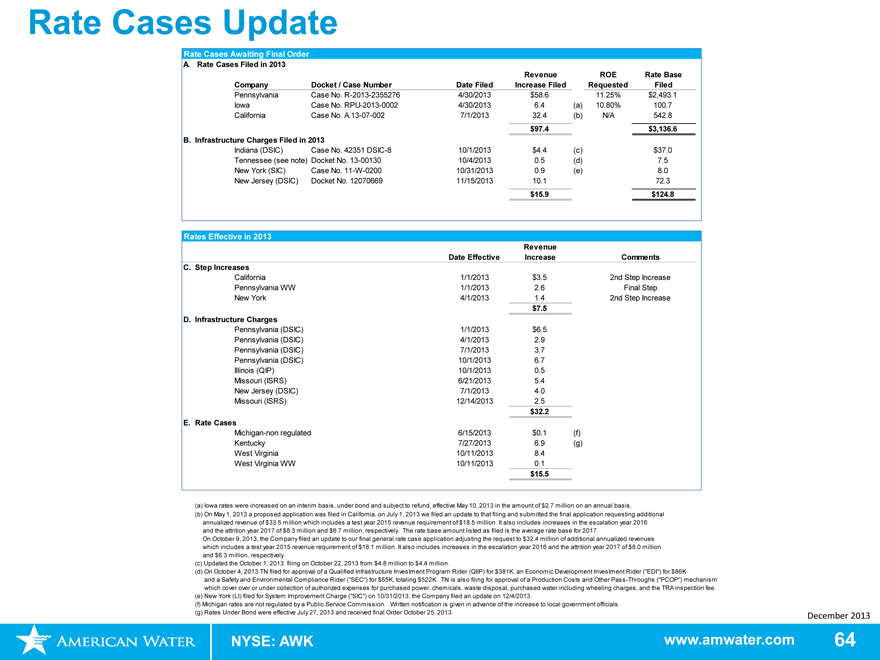

Rate Cases Update

Rate Cases Awaiting Final Order

A. Rate Cases Filed in 2013

Revenue ROE Rate Base

Company Docket / Case Number Date Filed Increase Filed Requested Filed

Pennsylvania Case No. R-2013-2355276 4/30/2013 $58.6 11.25% $2,493.1

Iowa Case No. RPU-2013-0002 4/30/2013 6.4 (a) 10.80% 100.7

California Case No. A.13-07-002 7/1/2013 32.4 (b) N/A 542.8

$97.4 $3,136.6

B. Infrastructure Charges Filed in 2013

Indiana (DSIC) Case No. 42351 DSIC-8 10/1/2013 $4.4 (c) $37.0

Tennessee (see note) Docket No. 13-00130 10/4/2013 0.5 (d) 7.5

New York (SIC) Case No. 11-W-0200 10/31/2013 0.9 (e) 8.0

New Jersey (DSIC) Docket No. 12070669 11/15/2013 10.1 72.3

$15.9 $124.8

Rates Effective in 2013

Revenue

Date Effective Increase Comments

C. Step Increases

California 1/1/2013 $3.5 2nd Step Increase

Pennsylvania WW 1/1/2013 2.6 Final Step

New York 4/1/2013 1.4 2nd Step Increase

$7.5

D. Infrastructure Charges

Pennsylvania (DSIC) 1/1/2013 $6.5

Pennsylvania (DSIC) 4/1/2013 2.9

Pennsylvania (DSIC) 7/1/2013 3.7

Pennsylvania (DSIC) 10/1/2013 6.7

Illinois (QIP) 10/1/2013 0.5

Missouri (ISRS) 6/21/2013 5.4

New Jersey (DSIC) 7/1/2013 4.0

Missouri (ISRS) 12/14/2013 2.5

$32.2

E. Rate Cases

Michigan-non regulated 6/15/2013 $0.1 (f)

Kentucky 7/27/2013 6.9 (g)

West Virginia 10/11/2013 8.4

West Virginia WW 10/11/2013 0.1

$15.5

(a) Iowa rates were increased on an interim basis, under bond and subject to refund, effective May 10, 2013 in the amount of $2.7 million on an annual basis.

(b) On May 1, 2013 a proposed application was filed in California, on July 1, 2013 we filed an update to that filing and submitted the final application requesting additional

annualized revenue of $33.5 million which includes a test year 2015 revenue requirement of $18.5 million. It also includes increases in the escalation year 2016

and the attrition year 2017 of $8.3 million and $6.7 million, respectively. The rate base amount listed as filed is the average rate base for 2017.

On October 9, 2013, the Company filed an update to our final general rate case application adjusting the request to $32.4 million of additional annualized revenues

which includes a test year 2015 revenue requirement of $18.1 million. It also includes increases in the escalation year 2016 and the attrition year 2017 of $8.0 million

and $6.3 million, respectively.

(c) Updated the October 1, 2013 filing on October 22, 2013 from $4.8 million to $4.4 million.

(d) On October 4, 2013 TN filed for approval of a Qualified Infrastructure Investment Program Rider (QIIP) for $381K, an Economic Development Investment Rider (“EDI”) for $86K

and a Safety and Environmental Compliance Rider (“SEC”) for $55K, totaling $522K. TN is also filing for approval of a Production Costs and Other Pass-Throughs (“PCOP”) mechanism

which cover over or under collection of authorized expenses for purchased power, chemicals, waste disposal, purchased water including wheeling charges, and the TRA inspection fee.

(e) New York (LI) filed for System Improvement Charge (“SIC”) on 10/31/2013, the Company filed an update on 12/4/2013.

(f) Michigan rates are not regulated by a Public Service Commission. Written notification is given in advance of the increase to local government officials.

(g) Rates Under Bond were effective July 27, 2013 and received final Order October 25, 2013.

December 2013

NYSE: AWK www.amwater.com 64

Regulated Utilities – Rate Base and Allowed Return on Equity

Last Rate Case Awarded—Largest Regulated Subsidiaries

Authorized Rate Base* $374,404 $706,386 $741,151 (b) $384,729 $831,375 (b)

Authorized ROE 9.99% (a) 9.34% 9.70% 9.70% 10.00%

Authorized Equity 53.00% (a) 48.10% 42.02% 44.70% 50.57% (d)

Effective Date of Rate Case 7/12/2012 (a) 10/1/2012 6/15/2012 10/25/2013 (c) 4/1/2012

Authorized Rate Base* $1,920,300 $128,882 (e) $2,081,818 (b) $119,254 (b) $448,841 (b)

Authorized ROE 10.15% 9.65% (e) 10.25% (f) 9.75% 9.90% (f)

Authorized Equity 52.00% 42.00% (e) 51.12% (d) 42.67% (d) 45.23% (d)

Effective Date of Rate Case 5/1/2012 4/1/2012 (e) 11/11/2011 12/12/2012 (g) 10/11/2013

*Rate Base stated in $000s

Notes:

a) CA has a separate Cost of Capital case, A11-05-003, which sets the rate of return outside of a general rate proceeding.

b) The Rate Base listed is the Company’s view of the Rate Base allowed in the case, the Rate Base was not disclosed in the Order or the applicable settlement agreement.

c) Rates Under Bond were effective July 27, 2013 and received final Order October 25, 2013.

d) The equity ratio listed is the Company’s view of the equity ratio allowed in the case, the actual equity ratio was not disclosed in the Order or the applicable settlement agreement

e) Information pertains only to the former company of Long Island American Water.

f) The ROE listed is the Company’s view of the ROE allowed in the case, the ROE was not disclosed in the Order or the applicable settlement agreement.

g) Rates Under Bond were effective July 12, 2012 and received final Order December 12, 2012.

December 2013

NYSE: AWK www.amwater.com 65

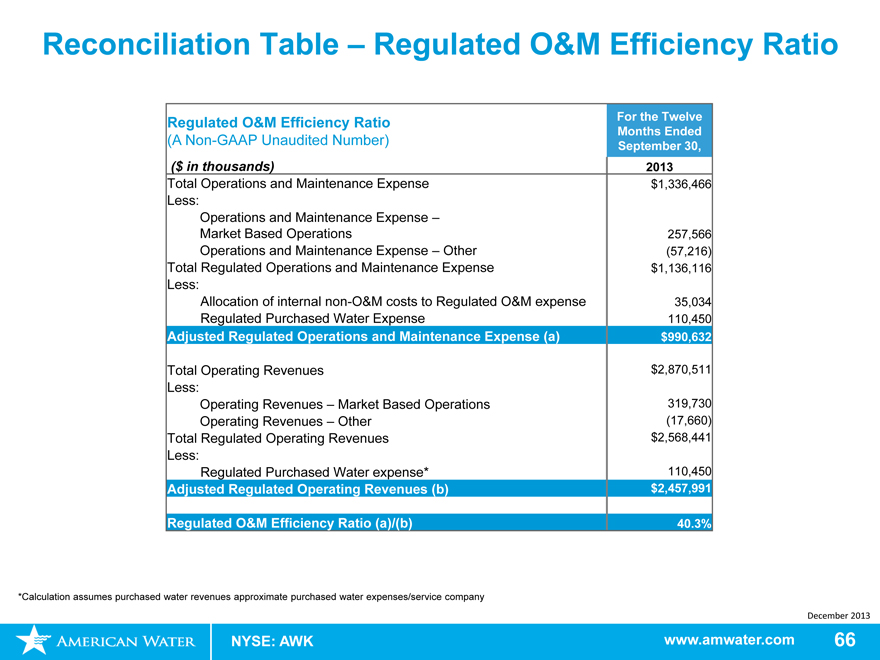

Reconciliation Table – Regulated O&M Efficiency Ratio

Regulated O&M Efficiency Ratio For the Twelve

Months Ended

(A Non-GAAP Unaudited Number) September 30,

($ in thousands) 2013

Total Operations and Maintenance Expense $1,336,466

Less:

Operations and Maintenance Expense –

Market Based Operations 257,566

Operations and Maintenance Expense – Other (57,216)

Total Regulated Operations and Maintenance Expense $1,136,116

Less:

Allocation of internal non-O&M costs to Regulated O&M expense 35,034

Regulated Purchased Water Expense 110,450

Adjusted Regulated Operations and Maintenance Expense (a) $990,632

Total Operating Revenues $2,870,511

Less:

Operating Revenues – Market Based Operations 319,730

Operating Revenues – Other (17,660)

Total Regulated Operating Revenues $2,568,441

Less:

Regulated Purchased Water expense* 110,450

Adjusted Regulated Operating Revenues (b) $2,457,991

Regulated O&M Efficiency Ratio (a)/(b) 40.3%

*Calculation assumes purchased water revenues approximate purchased water expenses/service company

December 2013

NYSE: AWK www.amwater.com 66

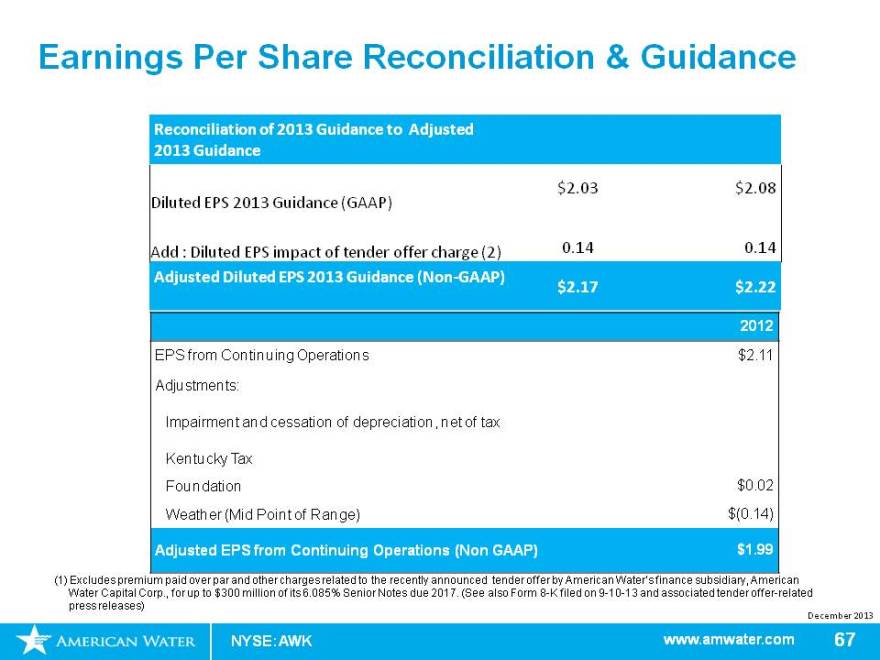

Earnings Per Share Reconciliation & Guidance

Reconciliation of 2013 Guidance to Adjusted

2013 Guidance

$2.03 $2.08

Diluted EPS 2013 Guidance (GAAP)

Add : Diluted EPS impact of tender offer charge (2) 0.14 0.14

Adjusted Diluted EPS 2013 Guidance (Non-GAAP)

$2.17 $2.22

2012

EPS from Continuing Operations $2.11

Adjustments:

Impairment and cessation of depreciation, net of tax

Kentucky Tax

Foundation $0.02

Weather (Mid Point of Range) $(0.14)

Adjusted EPS from Continuing Operations (Non GAAP) $1.99

(1) Excludes premium paid over par and other charges related to the recently announced tender offer by American Water’s finance subsidiary, American Water Capital Corp., for up to $300 million of its 6.085% Senior Notes due 2017. (See also Form 8-K filed on 9-10-13 and associated tender offer-related press releases)

December 2013

NYSE: AWK www.amwater.com 67