|

Exhibit 99.2

|

Exhibit 99.2 2016 Investor Conference December 15, 2016

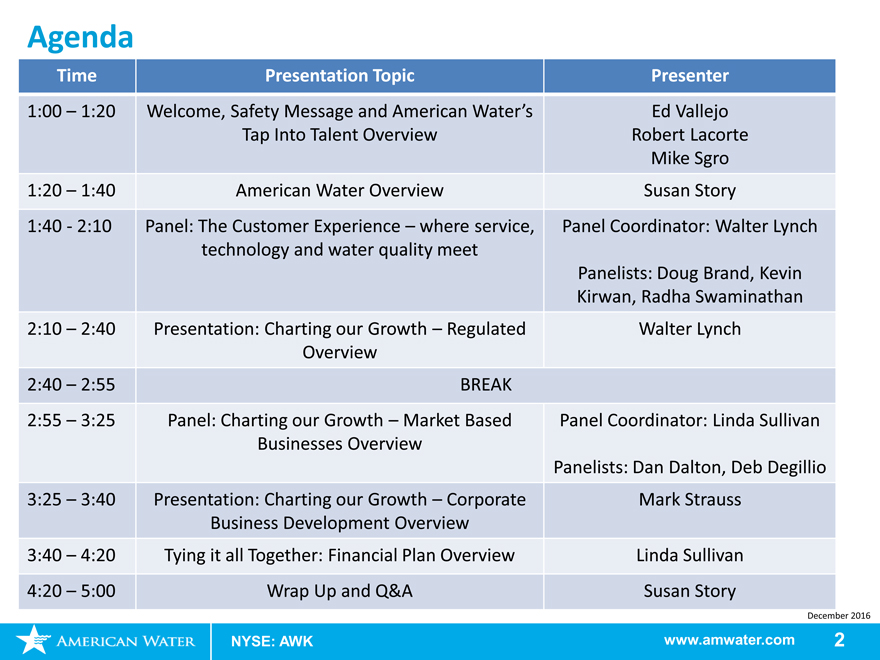

Agenda

Time Presentation Topic Presenter

1:00 – 1:20Welcome, Safety Message and American Water’sEd Vallejo

Tap Into Talent OverviewRobert Lacorte

Mike Sgro

1:20 – 1:40American Water OverviewSusan Story

1:40 - 2:10 Panel: The Customer Experience – where service,Panel Coordinator: Walter Lynch

technology and water quality meet

Panelists: Doug Brand, Kevin

Kirwan, Radha Swaminathan

2:10 – 2:40Presentation: Charting our Growth – RegulatedWalter Lynch

Overview

2:40 – 2:55BREAK

2:55 – 3:25Panel: Charting our Growth – Market BasedPanel Coordinator: Linda Sullivan

Businesses Overview

Panelists: Dan Dalton, Deb Degillio

3:25 – 3:40Presentation: Charting our Growth – CorporateMark Strauss

Business Development Overview

3:40 – 4:20Tying it all Together: Financial Plan OverviewLinda Sullivan

4:20 – 5:00Wrap Up and Q&ASusan Story

December 2016

NYSE: AWKwww.amwater.com2

Forward-Looking Statements

Ed Vallejo

Vice President Financial Planning and Investor Relations

December 2016

NYSE: AWK www.amwater.com 3

Forward-Looking Statements and Other Information

Certain statements in this presentation, including, without limitation, earnings guidance, the outcome of pending or future acquisition activity, American Water’s growth

strategy, the amount and allocation of future capital investments, and estimated revenues from rate cases and other governmental agency authorizations, are forward-

looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. These forward-

looking statements are predictions based on American Water’s current expectations and assumptions regarding future events. They are not guarantees or assurances of any

outcomes, financial results of levels of activity, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking

statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may differ materially from

those discussed in the forward-looking statements included in this press release as a result of the factors discussed in American Water’s Annual Report on Form10-K for the

year ended December 31, 2015, and in subsequent filings with the Securities and Exchange Commission (SEC), and because of factors such as: the timing and decisions of

governmental and regulatory bodies, including decisions to raise or lower rates; changes in laws, governmental regulations and policies, including environmental, health

and safety, water quality, and public utility regulations and policies, and impacts resulting from the November 2016 U.S., state and local elections; potential costs and

liabilities of American Water for environmental and similar matters resulting from, among other things, the provision of water services to customers in the natural gas

exploration and production market; the outcome of litigation and government action related to the Freedom Industries chemical spill in West Virginia, including matters

pertaining to the binding agreement in principle to settle claims arising from this chemical spill; weather conditions, patterns or events or natural disasters, including

drought or abnormally high rainfall, strong winds, coastal and intercoastal flooding, earthquakes, landslides, hurricanes and tornadoes, and cooler than normal

temperatures; changes in customer demand for, and patterns of use of, water, such as may result from conservation efforts; its ability to appropriately maintain or upgrade

current infrastructure, including technology systems, and manage the expansion of its business; its ability to obtain permits and other approvals for projects; changes in its

capital requirements; its ability to control operating expenses and to achieve efficiencies in its operations; the intentional or unintentional acts of a third party, including

contamination of its water supplies or water supplied to its customers and attacks on, or infiltration of, its computer systems or other critical infrastructure; its ability to

obtain adequate and cost-effective supplies of chemicals, electricity, fuel, water and other raw materials that are needed for its operations; its ability to successfully meet

growth projections and capitalize on growth opportunities, including its ability to, among other things, acquire and integrate water and wastewater systems into its

regulated operations and enter into contracts and other agreements with, or otherwise obtain, new customers in its Market-based Businesses; cost overruns relating to

improvements in or the expansion of its operations; its ability to maintain safe work sites; changes in general economic, political, business and financial market conditions;

access to sufficient capital on satisfactory terms and when and as needed to support operations and capital expenditures; fluctuations in interest rates; restrictive covenants

in or changes to the credit ratings on its current or future debt that could increase its financing costs or affect its ability to borrow, make payments on debt or pay dividends;

fluctuations in the value of benefit plan assets and liabilities that could increase its financing costs and funding requirements; changes in Federal or state income tax laws,

including tax reform, the availability of tax credits and tax abatement programs, and the ability to utilize its U.S. and state net operating loss carryforwards; migration of

customers into or out of its service territories; the use by municipalities of the power of eminent domain or other authority to condemn its systems; difficulty in obtaining,

or the inability to obtain, insurance at acceptable rates and on acceptable terms and conditions; its ability to retain and attract qualified employees; labor actions, including

work stoppages and strikes; the incurrence of impairment charges related to American Water’s goodwill or other assets; and civil disturbances, terrorist threats or acts, or

public apprehension about future disturbances or terrorist threats or acts. These forward-looking statements are qualified by, and should be read together with, the risks

and uncertainties set forth above and the risk factors and other statements included in American Water’s 2015 Form10-K and in subsequent filings with the SEC, and

readers should refer to such risks, uncertainties and risk factors in evaluating such forward-looking statements. Any forward-looking statements speak only as of the date

this presentation is first given. American Water does not have or undertake any obligation or intention to update or revise any forward-looking statement, whether as a

result of new information, future events, changed circumstances or otherwise, except as otherwise required by the Federal securities laws. Furthermore, it may not be

possible to assess the impact of the foregoing factors on American Water’s businesses, either viewed independently or together, or the extent to which any factor, or

combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as

exhaustive.

In this presentation, all statements related to earnings per share, or EPS, refer to diluted EPS from continuing operations.

December 2016

NYSE: AWK www.amwater.com 4

Safety Message

Robert Lacorte Financial Analyst

Author: Don’t Die in a Car

December 2016

NYSE: AWK www.amwater.com 5

Tap Into Talent

Mike Sgro

Executive Vice President, General Counsel & Corporate Secretary

December 2016

NYSE: AWK www.amwater.com 6

“It’s Water by American”

Kentucky American Water

“It’s Water by American”

By: Scott Simpson and Charlie Boland Kentucky American Water

Overview

Susan Story President and Chief Executive Officer

December 2016

NYSE: AWK www.amwater.com 8

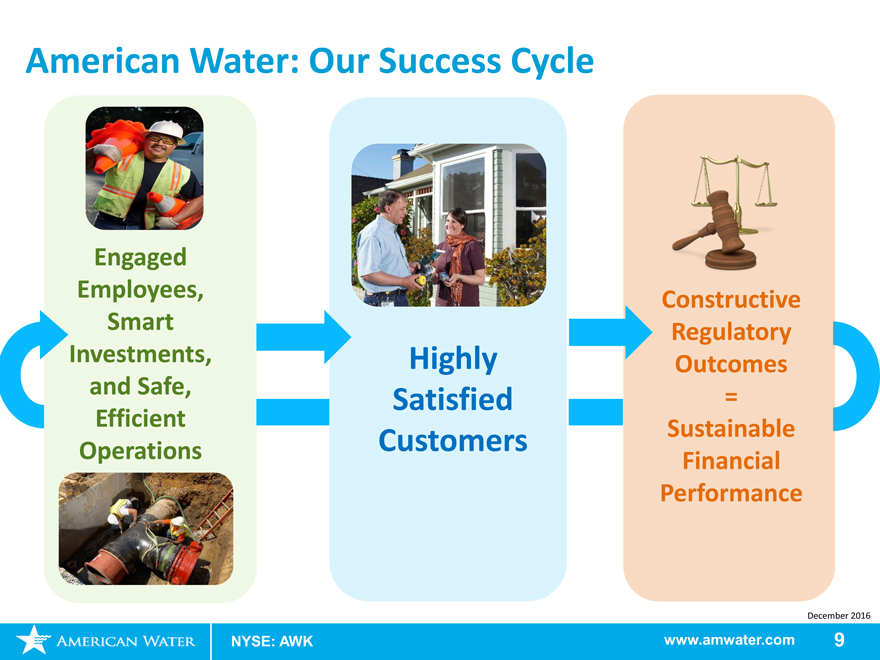

American Water: Our Success Cycle

Engaged

Employees, Constructive

Smart Regulatory

Investments, HighlyOutcomes

and Safe, Satisfied=

Efficient

Operations CustomersSustainable

Financial

Performance

December 2016

NYSE: AWK www.amwater.com9

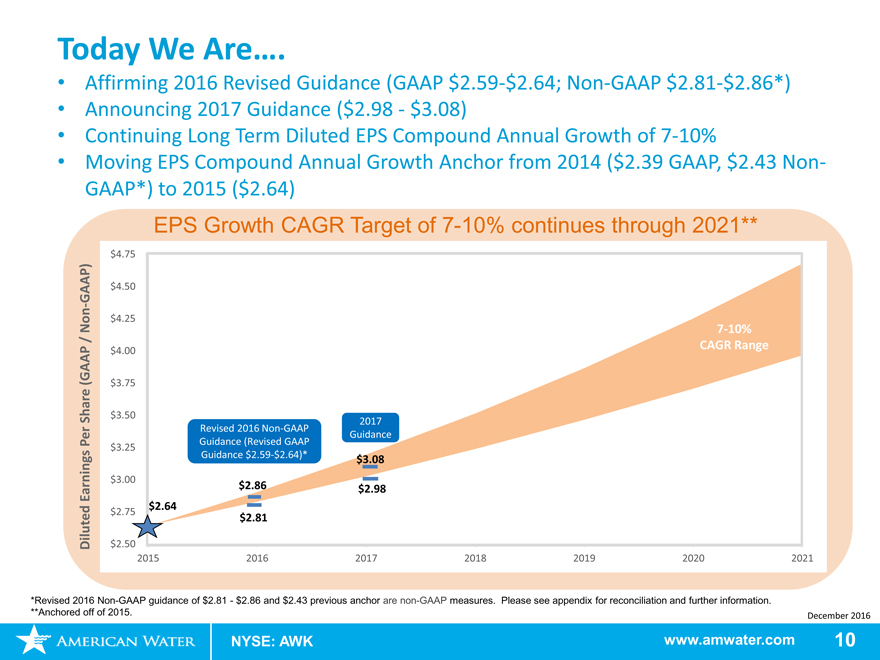

Today We Are….

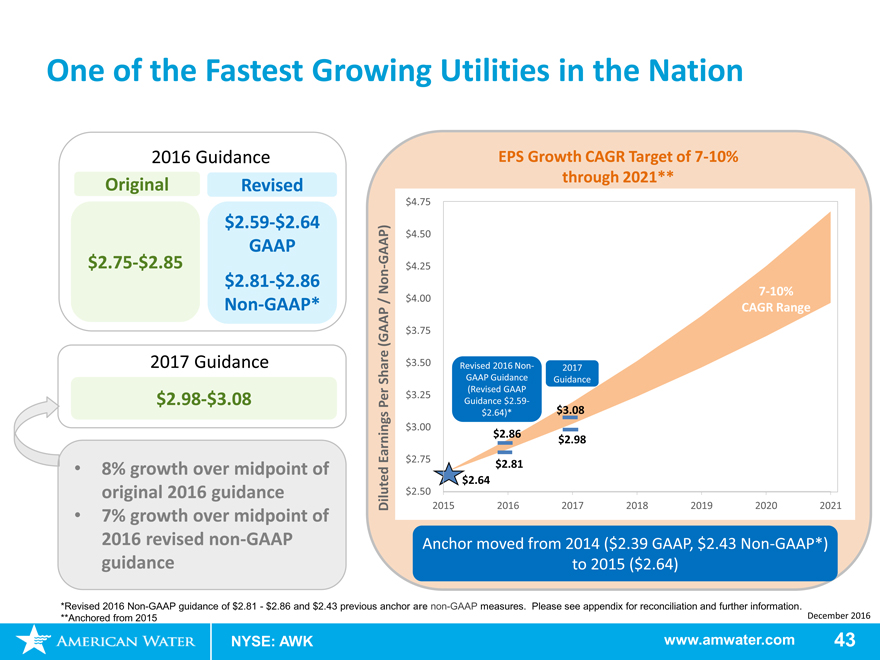

Affirming 2016 Revised Guidance (GAAP$2.59-$2.64;Non-GAAP$2.81-$2.86*)

Announcing 2017 Guidance ($2.98—$3.08)

Continuing Long Term Diluted EPS Compound Annual Growth of7-10%

Moving EPS Compound Annual Growth Anchor from 2014 ($2.39 GAAP, $2.43Non- GAAP*) to 2015 ($2.64)

EPS Growth CAGR Target of7-10% continues through 2021**

$4.75

GAAP) $4.50

-

$4.25

Non7-10%

/ CAGR Range

(GAAP $4.00

$3.75

Share $3.50

2017

Revised 2016Non-GAAP

Guidance

Per Guidance (Revised GAAP

$3.25 Guidance$2.59-$2.64)*

$3.08

$3.00

Earnings $2.86 $2.98

$2.64

$2.75

$2.81

Diluted $2.50

2015 2016 2017 2018 2019 2020 2021

*Revised 2016Non-GAAP guidance of $2.81—$2.86 and $2.43 previous anchor arenon-GAAP measures. Please see appendix for reconciliation and further information.

**Anchored off of 2015. December 2016

NYSE: AWK www.amwater.com 10

Possible Impacts of President-Elect Trump’s Administration

Infrastructure Department of Support for More

Focus Defense Natural Gas

and Financing Sequestration Pipelines

Federal Taxes Interest Rates

December 2016

NYSE: AWK www.amwater.com 11

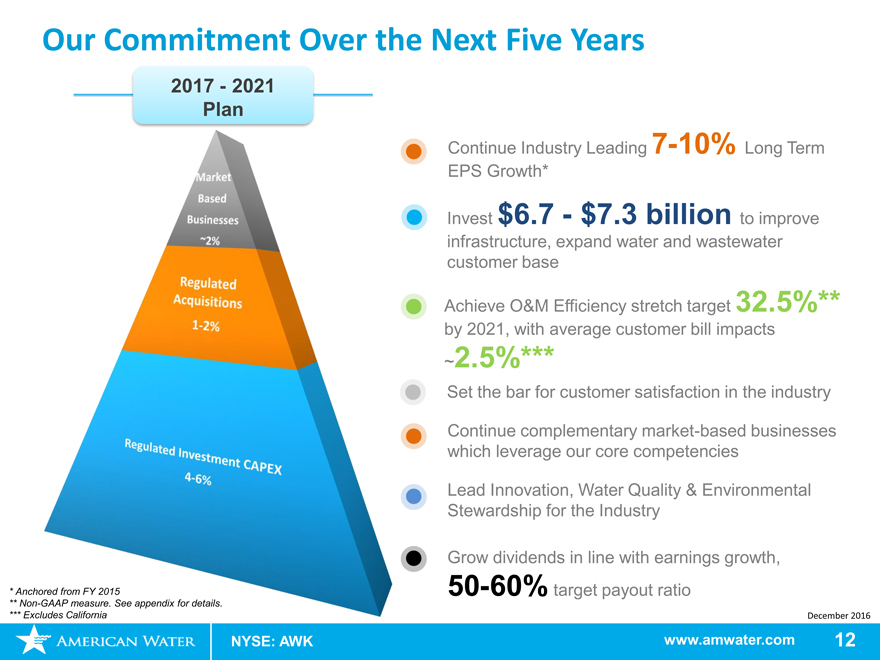

Our Commitment Over the Next Five Years

2017—2021 Plan

NYSE: AWK

Continue Industry Leading7-10% Long Term EPS Growth*

Invest $6.7—$7.3 billion to improve

infrastructure, expand water and wastewater customer base Achieve O&M Efficiency stretch target 32.5%** by 2021, with average customer bill impacts

~2.5%***

Set the bar for customer satisfaction in the industry

Continue complementary market-based businesses which leverage our core competencies

Lead Innovation, Water Quality & Environmental Stewardship for the Industry

Grow dividends in line with earnings growth,

50-60% target payout ratio

December 2016

www.amwater.com 12

Ancho

**Non-*** Exc

The Customer Experience:

Where Service, Technology & Water Quality Meet

Walter Lynch Doug Brand Kevin KirwanRadha Swaminathan

Chief Operating Senior Director VP OperationsChief Technology and

Officer Customer Experience New Jersey AmericanInnovation Officer

Water

December 2016

NYSE: AWK www.amwater.com 13

The Customer Experience:

Where Service, Technology & Water Quality Meet

December 2016

NYSE: AWK www.amwater.com 14

Charting Our Growth: Regulated Overview

Walter Lynch

Chief Operating Officer

December 2016

NYSE: AWK www.amwater.com15

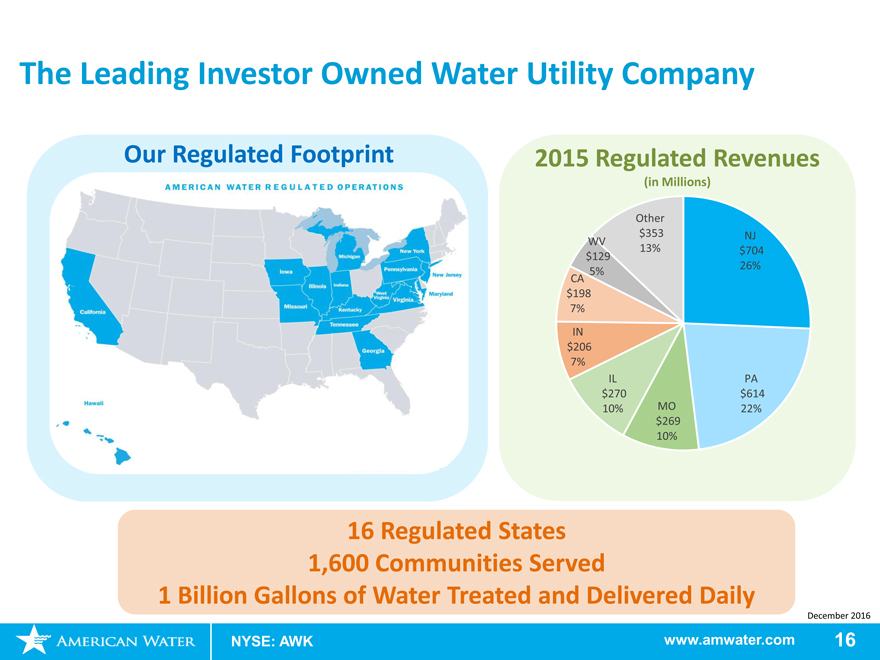

The Leading Investor Owned Water Utility Company

Our Regulated Footprint 2015 Regulated Revenues

(in Millions)

Other

WV $353NJ

$129 13%$704

5% 26%

CA

$198

7%

IN

$206

7%

IL PA

$270 $614

10% MO22%

$269

10%

16 Regulated States 1,600 Communities Served

1 Billion Gallons of Water Treated and Delivered Daily

December 2016

NYSE: AWK www.amwater.com 16

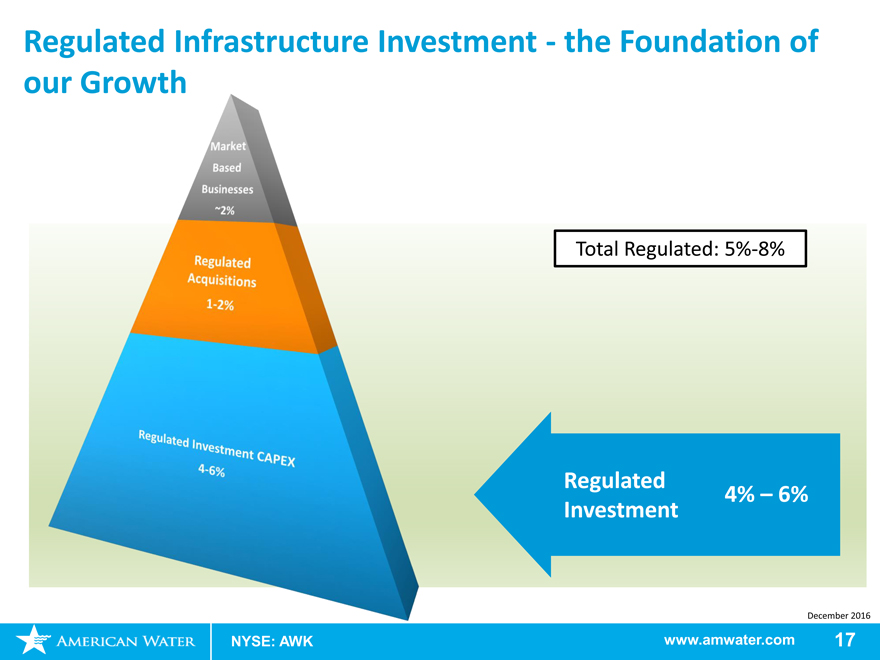

Regulated Infrastructure Investment—the Foundation of our Growth

Total Regulated:5%-8%

Regulated

4% – 6% Investment

December 2016

NYSE: AWK www.amwater.com 17

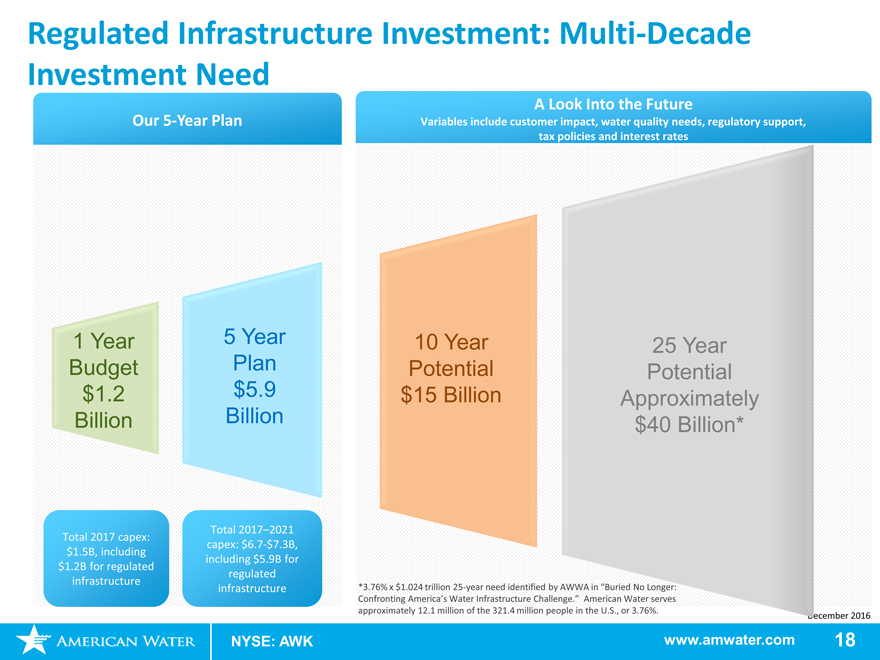

Regulated Infrastructure Investment: Multi-Decade

Investment Need

A Look Into the Future

Our5-Year Plan Variables include customer impact, water quality needs, regulatory support,

tax policies and interest rates

1 Year 5 Year 10 Year25 Year

Budget Plan PotentialPotential

$1.2 $5.9 $15 BillionApproximately

Billion Billion $40 Billion*

Total 2017–2021

Total 2017 capex:

capex:$6.7-$7.3B,

$1.5B, including

including $5.9B for

$1.2B for regulated

regulated

infrastructure

infrastructure *3.76% x $1.024 trillion25-year need identified by AWWA in “Buried No Longer:

Confronting America’s Water Infrastructure Challenge.” American Water serves

approximately 12.1 million of the 321.4 million people in the U.S., or 3.76%.ecember 2016

NYSE: AWK www.amwater.com18

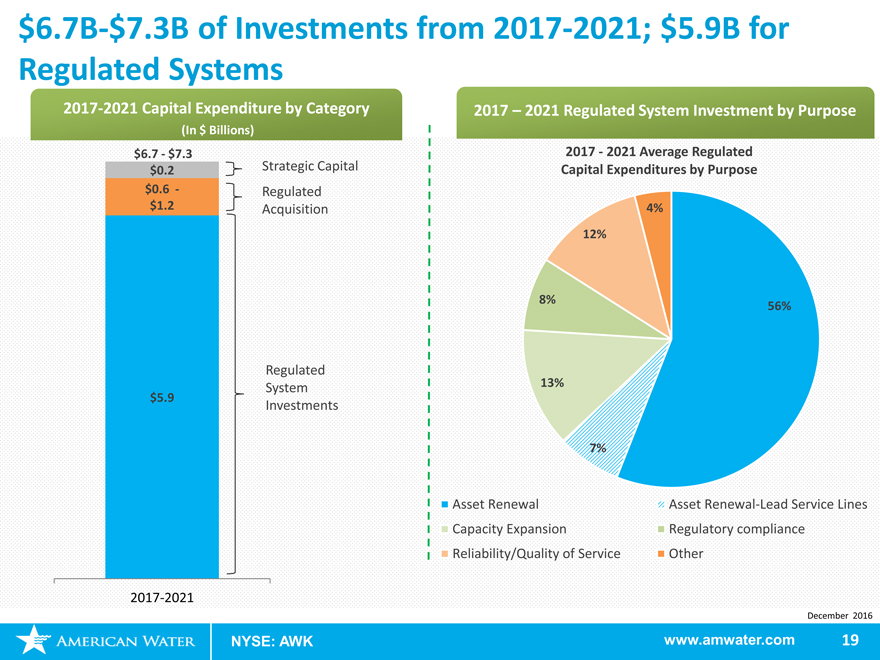

$6.7B-$7.3B of Investments from 2017-2021; $5.9B for Regulated Systems

2017-2021 Capital Expenditure by Category 2017 – 2021 Regulated System Investment by Purpose

(In $ Billions)

$6.7—$7.3 2017—2021 Average Regulated

$0.2 Strategic Capital Capital Expenditures by Purpose

$0.6 —Regulated

$1.2 Acquisition 4%

12%

8%

56%

Regulated

System 13%

$5.9

Investments

7%

Asset Renewal Asset Renewal-Lead Service Lines

Capacity Expansion Regulatory compliance

Reliability/Quality of Service Other

2017-2021

December 2016

NYSE: AWK www.amwater.com 19

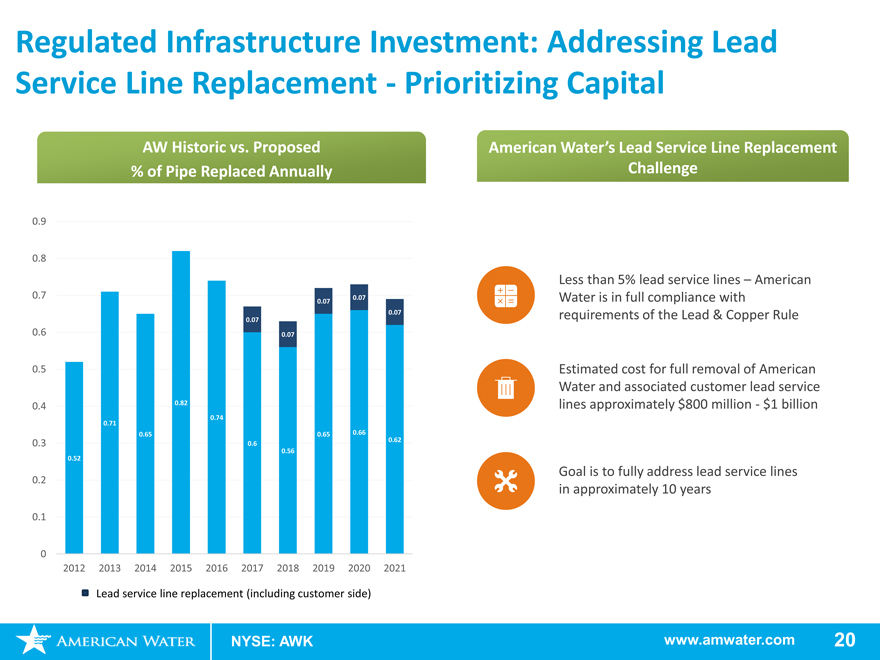

Regulated Infrastructure Investment: Addressing Lead Service Line Replacement—Prioritizing Capital

AW Historic vs. Proposed % of Pipe Replaced Annually

0.9

0.8

0.7 0.07 0.07

0.07 0.07 0.6 0.07

0.5

0.4 0.82

0.71 0.74

0.65 0.65 0.66

0.62

0.3 0.6

0.56 0.52

0.2

0.1

0

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Lead service line replacement (including customer side)

NYSE: AWK

American Water’s Lead Service Line Replacement

Challenge

Less than 5% lead service lines – American Water is in full compliance with requirements of the Lead & Copper Rule

Estimated cost for full removal of American Water and associated customer lead service lines approximately $800 million—$1 billion

Goal is to fully address lead service lines in approximately 10 years

www.amwater.com 20

Regulated Infrastructure Investment: Customer Bill Impact is Key to Capital Program

Balancing Capital Needs & Customer Bills

System Customer

Investment Bill

Needs Impacts

What Can Help Us Do More….

Regulatory Support and

O&M and Capital Constructive

Efficiency Regulation

December 2016

NYSE: AWK www.amwater.com 21

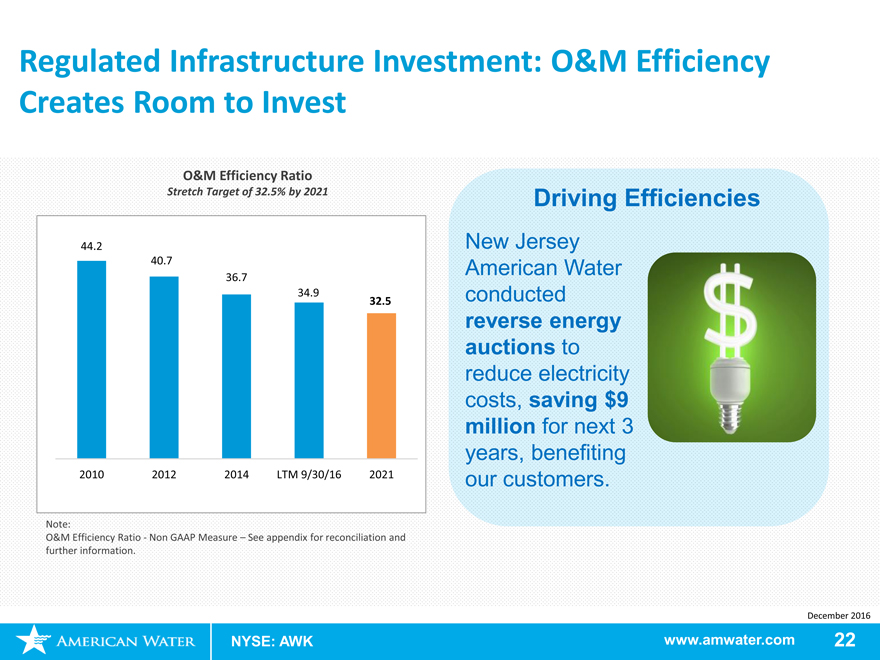

Regulated Infrastructure Investment: O&M Efficiency Creates Room to Invest

O&M Efficiency Ratio

Stretch Target of 32.5% by 2021

44.2

40.7

36.7

34.9

32.5

2010 2012 2014 LTM 9/30/16 2021

Note:

O&M Efficiency Ratio—Non GAAP Measure – See appendix for reconciliation and

further information.

NYSE: AWK

Driving Efficiencies

New Jersey

American Water

conducted

reverse energy

auctions to

reduce electricity

costs, saving $9

million for next 3

years, benefiting

our customers.

December 2016

www.amwater.com 22

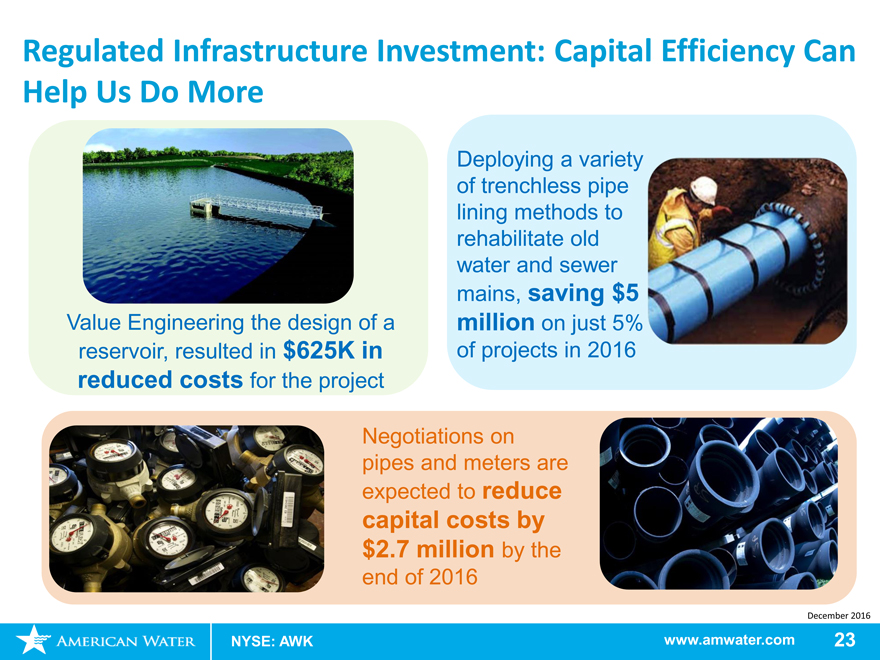

Regulated Infrastructure Investment: Capital Efficiency Can

Help Us Do More

Deploying a variety of trenchless pipe lining methods to rehabilitate old water and sewer

mains, saving $5

Value Engineering the design of a million on just 5% reservoir, resulted in $625K in of projects in 2016 reduced costs for the project

Negotiations on pipes and meters are expected to reduce

capital costs by

$2.7 million by the

end of 2016

December 2016

NYSE: AWK www.amwater.com 23

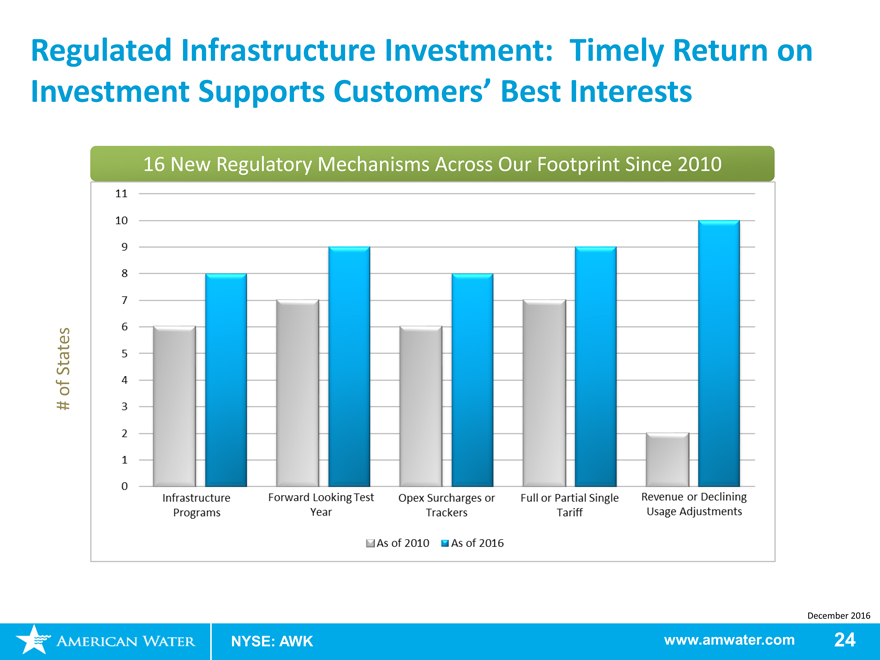

Regulated Infrastructure Investment: Timely Return on

Investment Supports Customers’ Best Interests

16 New Regulatory Mechanisms Across Our Footprint Since 2010

States

of

#

December 2016

NYSE: AWK www.amwater.com 24

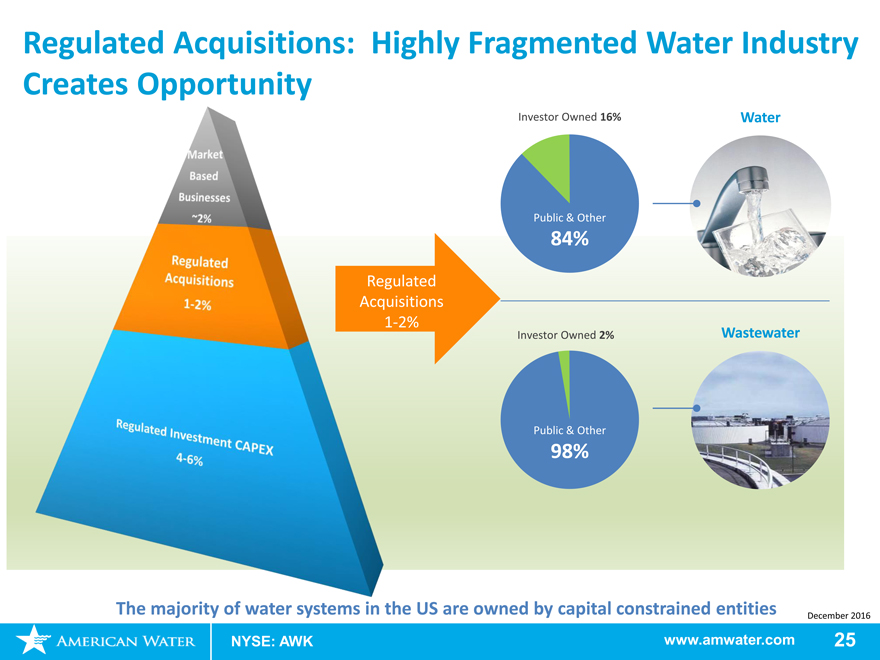

Regulated Acquisitions: Highly Fragmented Water Industry

Creates Opportunity

Investor Owned 16% Water

Public & Other

84%

lated

tions

2%

Investor Owned 2% Wastewater

Public & Other

98%

The majority of water systems in the US are owned by capital constrained entities

NYSE: AWK www.amwater.com 25

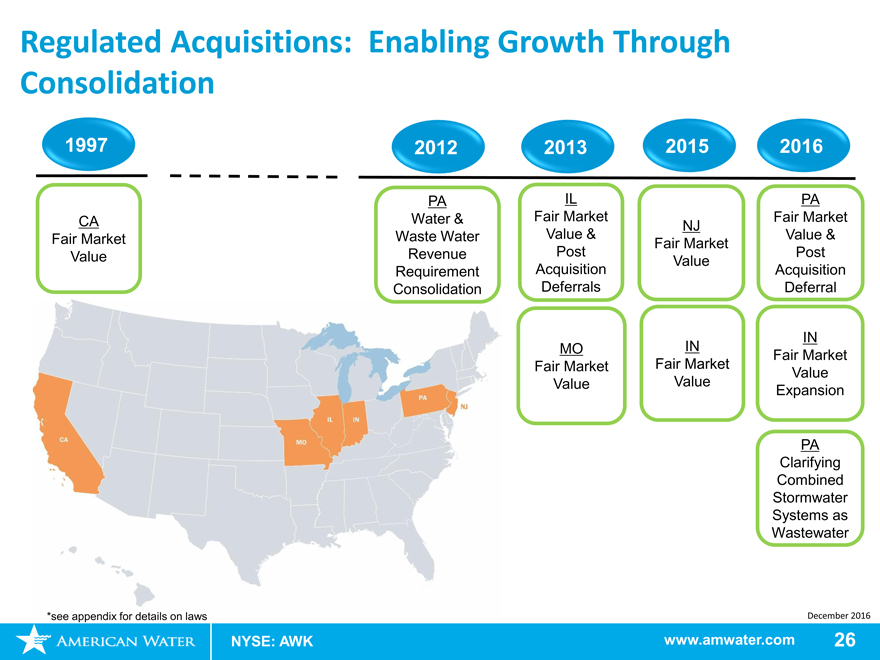

Regulated Acquisitions: Enabling Growth Through

Consolidation

1997 2012 2013 2015 2016

PA IL PA

CA Water & Fair Market Fair Market

NJ

Fair Market Waste Water Value & Value &

Fair Market

Value Revenue Post Post

Value

Requirement Acquisition Acquisition

Consolidation Deferrals Deferral

IN

MO IN

Fair Market

Fair Market Fair Market

Value

Value Value

Expansion

PA

Clarifying

Combined

Stormwater

Systems as

Wastewater

*see appendix for details on laws December 2016

NYSE: AWK www.amwater.com 26

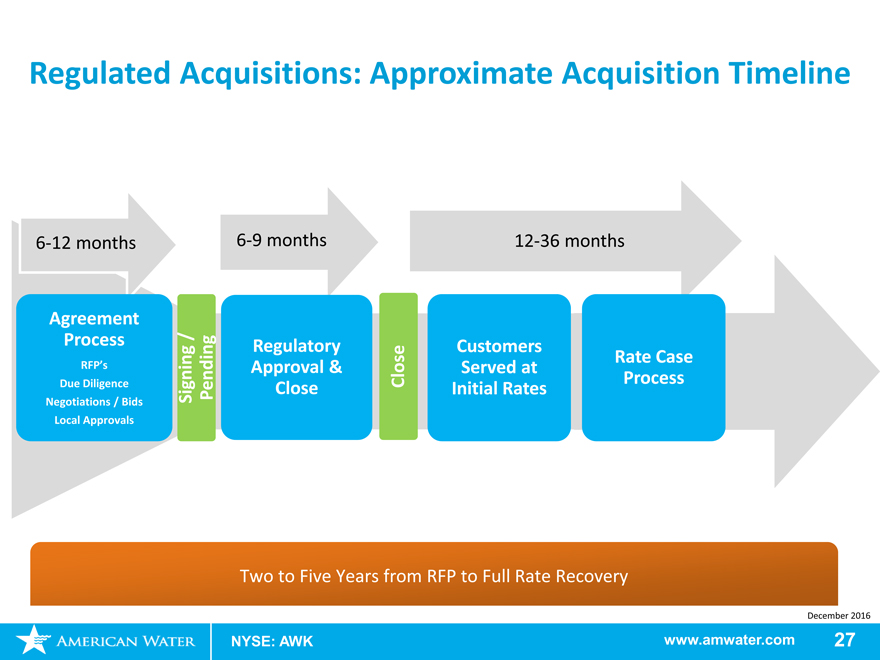

Regulated Acquisitions: Approximate Acquisition Timeline

6-12 months 6-9months12-36 months

Agreement

Process / RegulatoryCustomers

Rate Case

Due RFP’s Diligence Approval &CloseServed atProcess

Signing Pending CloseInitial Rates

Negotiations / Bids

Local Approvals

Two to Five Years from RFP to Full Rate Recovery

December 2016

NYSE: AWKwww.amwater.com27

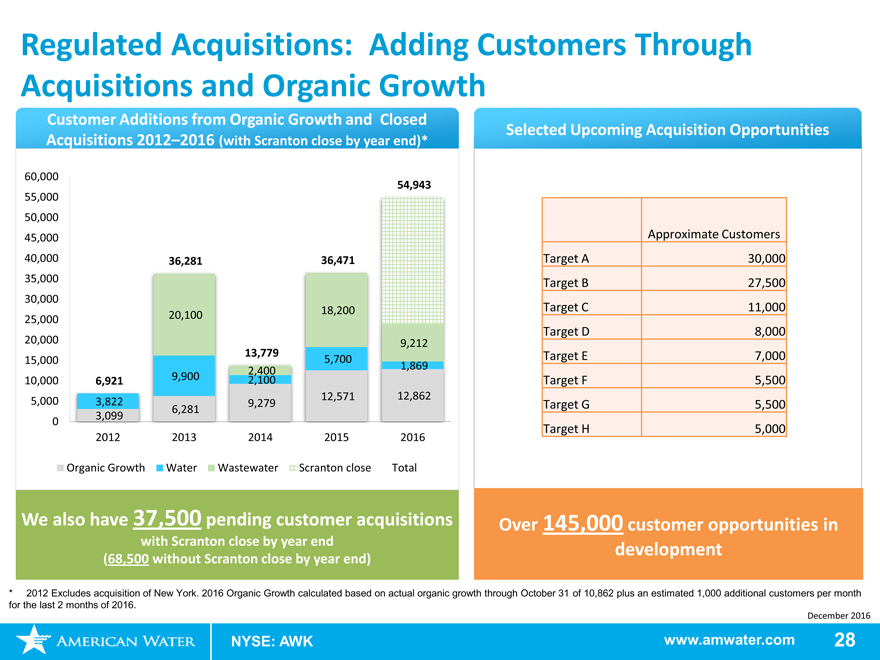

Regulated Acquisitions: Adding Customers Through Acquisitions and Organic Growth

Customer Additions from Organic Growth and Closed

Selected Upcoming Acquisition Opportunities

Acquisitions 2012–2016 (with Scranton close by year end)*

60,000

54,943

55,000

50,000

45,000 Approximate Customers

40,000 36,28136,471Target A30,000

35,000 Target B27,500

30,000

18,200Target C11,000

25,000 20,100

Target D8,000

20,000 9,212

15,000 13,7795,700Target E7,000

2,4001,869

10,000 6,921 9,9002,100Target F5,500

12,57112,862

5,000 3,822 6,2819,279Target G5,500

0 3,099

Target H5,000

2012 2013201420152016

Organic Growth WaterWastewaterScranton closeTotal

We also have 37,500 pending customer acquisitions Over 145,000 customer opportunities in

with Scranton close by year end development

(68,500 without Scranton close by year end)

* 2012 Excludes acquisition of New York. 2016 Organic Growth calculated based on actual organic growth through October 31 of 10,862 plus an estimated 1,000 additional customers per month

for the last 2 months of 2016.

December 2016

NYSE: AWK www.amwater.com 28

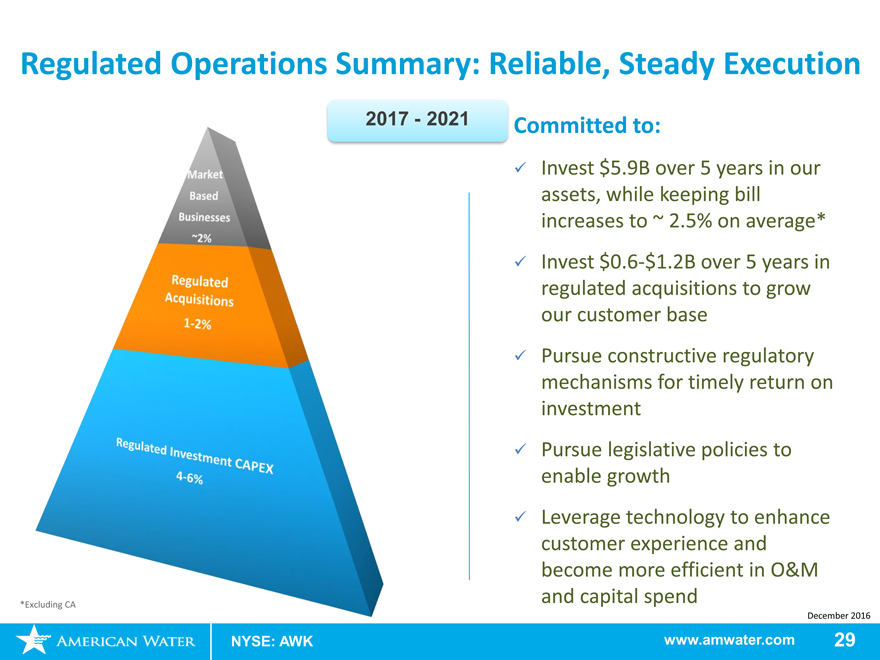

Regulated Operations Summary: Reliable, Steady Execution

2017—2021

Committed to:

Invest $5.9B over 5 years in our assets, while keeping bill increases to ~ 2.5% on average*

Invest$0.6-$1.2B over 5 years in regulated acquisitions to grow our customer base

Pursue constructive regulatory mechanisms for timely return on investment

Pursue legislative policies to enable growth

Leverage technology to enhance customer experience and become more efficient in O&M

and capital spend

*Excluding CA

December 2016

NYSE: AWK www.amwater.com 29

“H2O Serenade”

Missouri American Water

“H2O Serenade”

By: Terrance Green Missouri American Water

Charting Our Growth:

Market Based Business Overview

Linda Sullivan Deb Degillio Dan Dalton

Chief Financial President President and CEO

Officer American Water Keystone Clearwater

Enterprises Solutions

December 2016

NYSE: AWK www.amwater.com 31

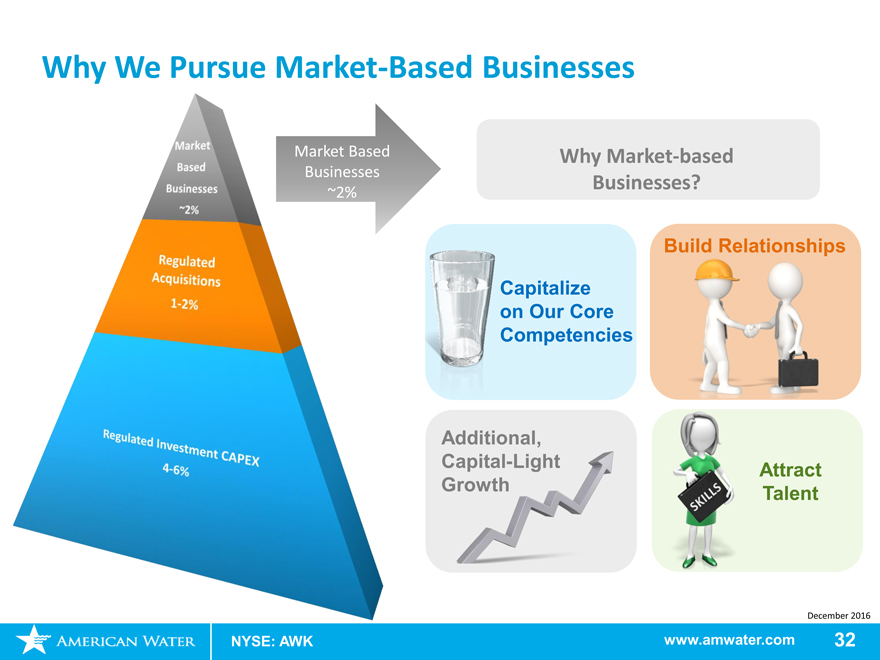

Why We Pursue Market-Based Businesses

Market Based Why Market-based

Businesses

~2% Businesses?

Build Relationships

Capitalize

on Our Core

Competencies

Additional,

Capital-Light Attract

Growth Talent

December 2016

NYSE: AWK www.amwater.com 32

American Water Enterprises: Our Portfolio of Businesses

Homeowner Services

Warranty products and services for homeowners

Partnerships with NYC, OUC, Nashville and others

Fastest Growing AWK Business

> 800,000 Customers

> 1.6 million con

9.1% estimated income CAGR 2 2016

Contract

Services

O&M contracts

Public-private partnerships

Minimal Capital Investment

Strategic Value to AWK

> 40 contracts

Short tomid-term contracts

Military Services

Operate and maintain water and waste water assets on base

50 year contracts

Identify and implement infrastructure projects

Steady

Acquisition of

New Bases

12 bases served today

12 water and 11 wastewater plants

> 1,700 miles of main and services

Aging infrastructure

December 2016

www.amwater.com 33

American Water Enterprises: Strategy for Growth

Military Services

Pursue New Contracts

Enhance our competitive strategy

Mitigate external threats to utility privatization program

Leverage potential Department Of Defense sequester changes

Home Owner Services

Expand Partnerships

Product Diversification

Geographic Expansion

Optimize Core

Contract Services

Targeted O&M growth

Strategic public-private partnerships

Portfolio optimization

NYSE: AWK

December 2016

www.amwater.com 34

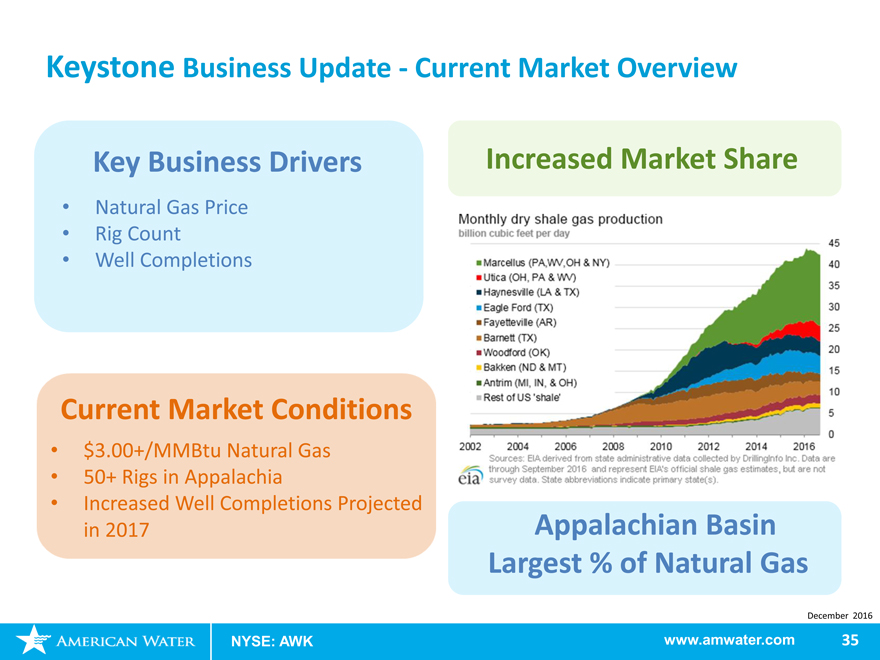

Keystone Business Update—Current Market Overview

Key Business Drivers

Increased Market Share

Natural Gas Price

Rig Count

Well Completions

Current Market Conditions

• $3.00+/MMBtu Natural Gas

• 50+ Rigs in Appalachia

• Increased Well Completions Projected

in 2017 Appalachian Basin

Largest % of Natural Gas

December 2016

NYSE: AWK www.amwater.com 35

Keystone: Our Strategy for Growth

Core Business Municipal Asset

Expansion Services Ownership

December 2016

NYSE: AWK www.amwater.com 36

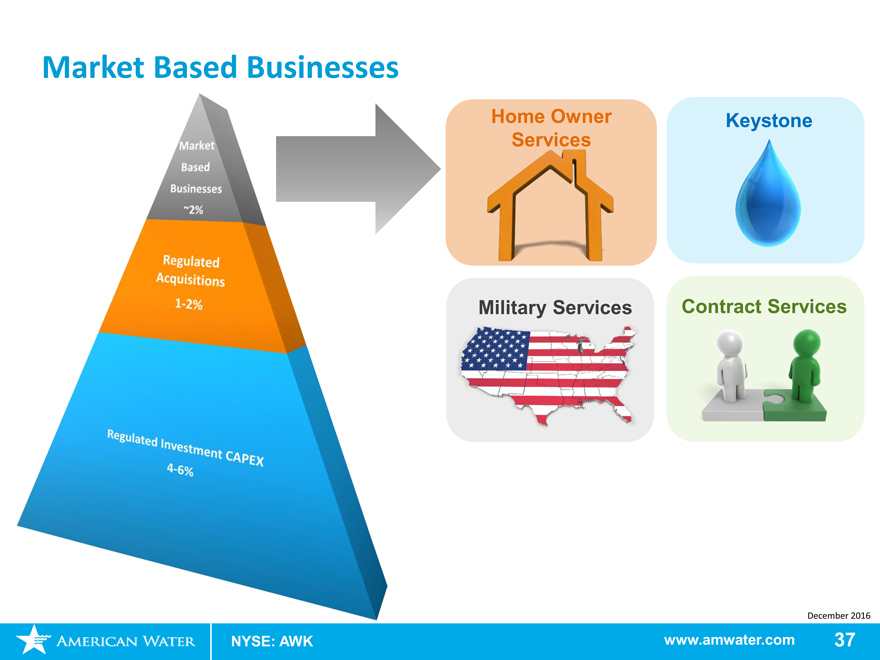

Market Based Businesses

Home Owner Keystone Services

Military Services Contract Services

December 2016

NYSE: AWK www.amwater.com 37

Charting Our Growth:

Corporate Business Development Overview

Mark Strauss

Senior Vice President—Corporate Strategy and Business

Development

December 2016

NYSE: AWK www.amwater.com 38

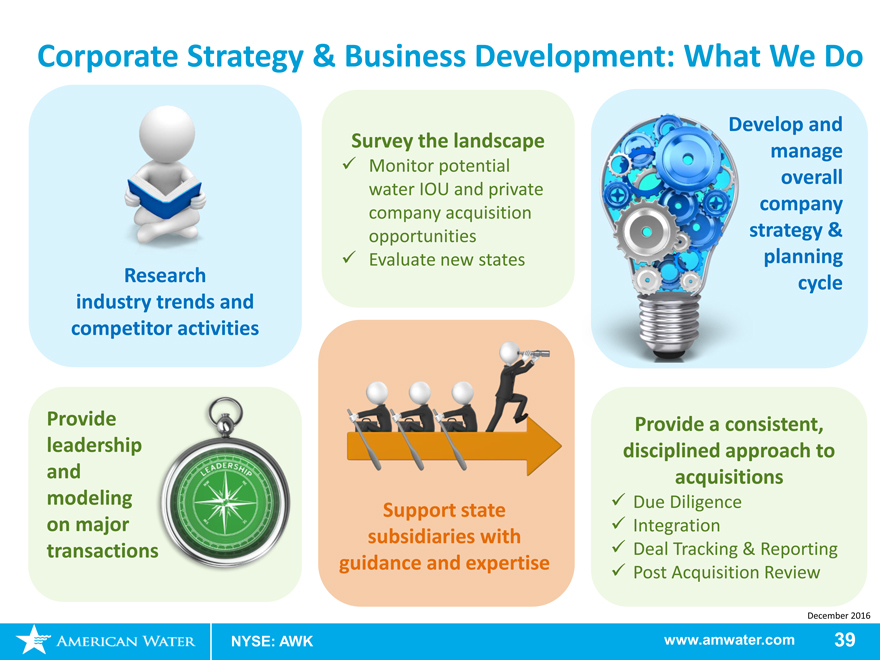

Corporate Strategy & Business Development: What We Do

Research industry trends and competitor activities

Survey the landscape

Monitor potential

water IOU and private

company acquisition

opportunities

Evaluate new states

Provide

leadership

and

modeling Support state

on major subsidiaries with

transactions guidance and expertise

velop and

manage

overall

company

strategy &

planning

cycle

Provide a consistent, disciplined approach to acquisitions

Due Diligence

Integration

Deal Tracking & Reporting

Post Acquisition Review

December 2016

www.amwater.com 39

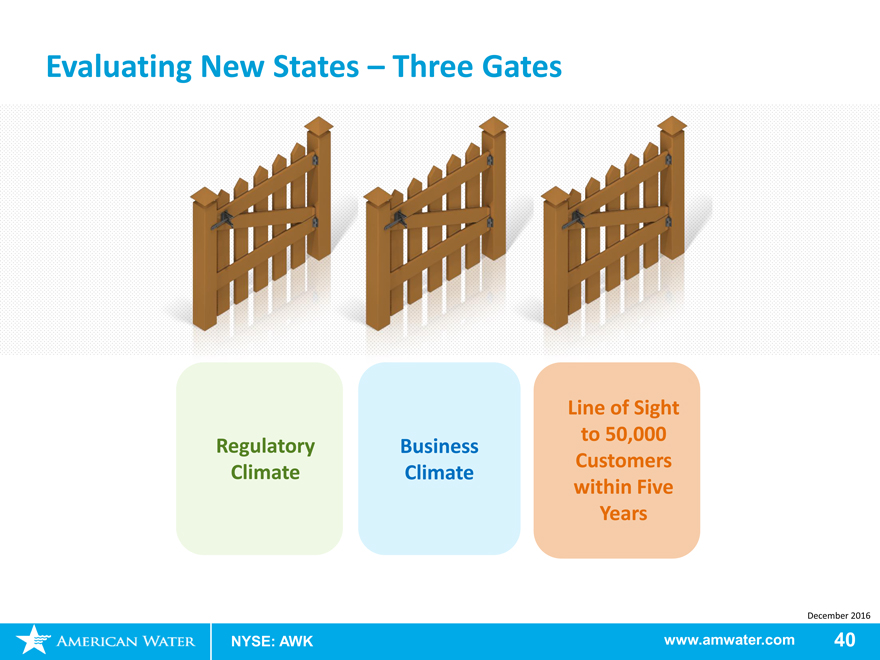

Evaluating New States – Three Gates

Line of Sight to 50,000 Regulatory Business Customers Climate Climate within Five Years

December 2016

NYSE: AWK www.amwater.com 40

Bringing It All Together: Our Financial Plan

Linda Sullivan

Chief Financial Officer

December 2016

NYSE: AWK www.amwater.com 41

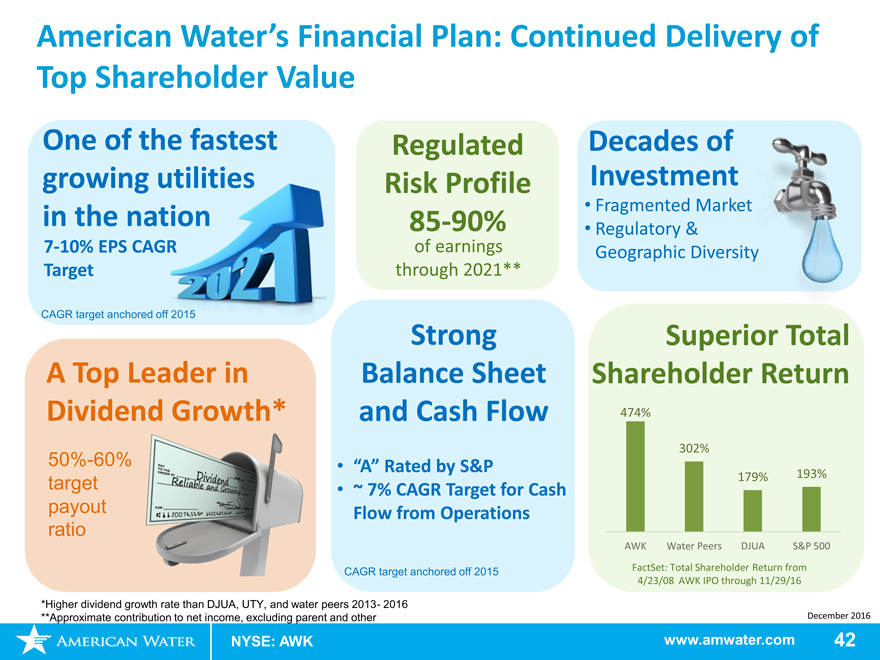

American Water’s Financial Plan: Continued Delivery of

Top Shareholder Value

One of the fastest

growing u

in the na

7-10% EPS CAGR

Target

CAGR target anchored off 2015

A Top Leader in

Dividend Growth*

50%-60%

target

payout

ratio

Regulated Risk Profile

85-90%

of earnings through 2021**

Strong Balance Sheet and Cash Flow

“A” Rated by S&P

~ 7% CAGR Target for Cash Flow from Operations

CAGR target anchored off 2015

*Higher dividend growth rate than DJUA, UTY, and water peers 2013- 2016 **Approximate contribution to net income, excluding parent and other

Decades of Investment

• Fragmented Market

• Regulatory & Geographic Diversity

Superior Total

Shareholder Return

474%

302%

179%

193%

AWK Water Peers

DJUA

S&P 500

FactSet: Total Shareholder Return from 4/23/08 AWK IPO through 11/29/16

December 2016

www.amwater.com 42

One of the Fastest Growing Utilities in the Nation

2016 Guidance EPS Growth CAGR Target of7-10% Original through 2021**

Revised

$4.75

$2.59-$2.64

GAAP GAAP) $4.50

$2.75-$2.85—$4.25$2.81-$2.86 Non

7-10%

/ $4.00

Non-GAAP* AAP CAGR Range

$3.75

(G

2017 Guidance $3.50 Revised 2016 Non-

2017 Share GAAP Guidance Guidance (Revised GAAP $3.25$2.98-$3.08 Per Guidance$2.59- $2.64)* $3.08 $3.00 $2.86 $2.98

Earnings $2.75

• 8% growth over midpoint of $2.81

$2.64

original 2016 guidance $2.50

Diluted 2015 2016 2017 2018 2019 2020 2021

• 7% growth over midpoint of

2016 revisednon-GAAP Anchor moved from 2014 ($2.39 GAAP, $2.43Non-GAAP*) guidance to 2015 ($2.64)

*Revised 2016Non-GAAP guidance of $2.81—$2.86 and $2.43 previous anchor arenon-GAAP measures. Please see appendix for reconciliation and further information.

**Anchored from 2015 December 2016

NYSE: AWK www.amwater.com 43

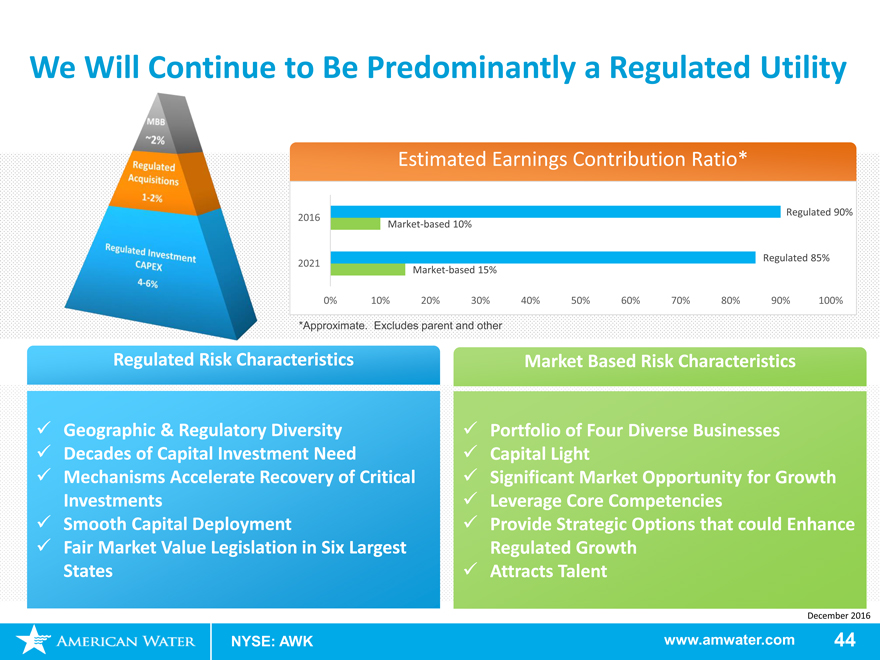

We Will Continue to Be Predominantly a Regulated Utility

Estimated Earnings Contribution Ratio*

Regulated 90% 2016 Market-based 10%

Regulated 85% 2021 Market-based 15%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

*Approximate. Excludes parent and other

Regulated Risk Characteristics

Geographic & Regulatory Diversity

Decades of Capital Investment Need

Mechanisms Accelerate Recovery of Critical Investments

Smooth Capital Deployment

Fair Market Value Legislation in Six Largest States

Market Based Risk Characteristics

Portfolio of Four Diverse Businesses

Capital Light

Significant Market Opportunity for Growth

Leverage Core Competencies

Provide Strategic Options that could Enhance Regulated Growth

Attracts Talent

December 2016

NYSE: AWK

www.amwater.com 44

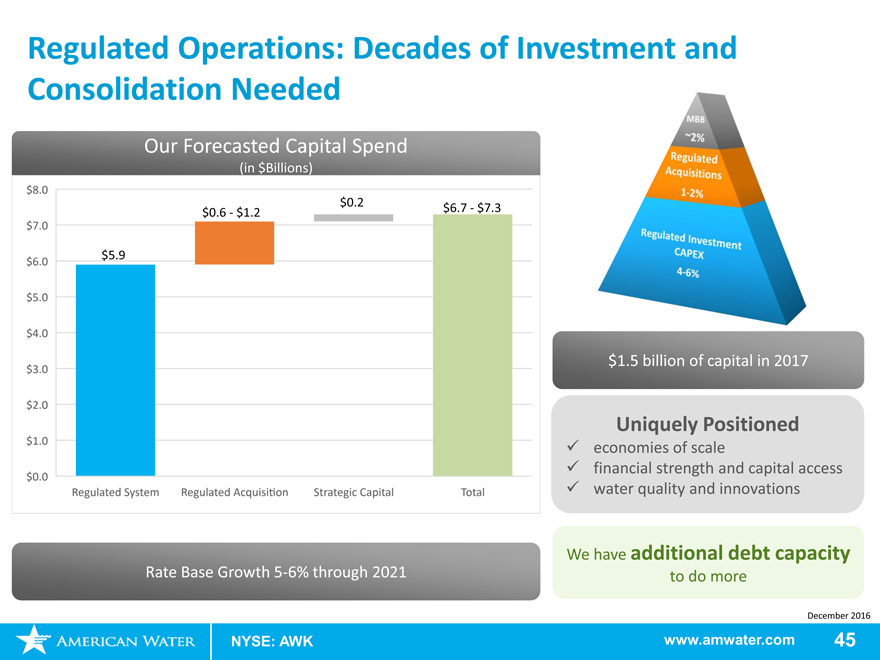

Regulated Operations: Decades of Investment and

Consolidation Needed

Our Forecasted Capital Spend

(in $Billions)

$0.2

$0.6—$1.2 $6.7—$7.3

$5.9

$1.5 billion of capital in 2017

Uniquely Positioned

economies of scale

financial strength and capital access

water quality and innovations

We have additional debt capacity

Rate Base Growth5-6% through 2021 to do more

December 2016

NYSE: AWK www.amwater.com 45

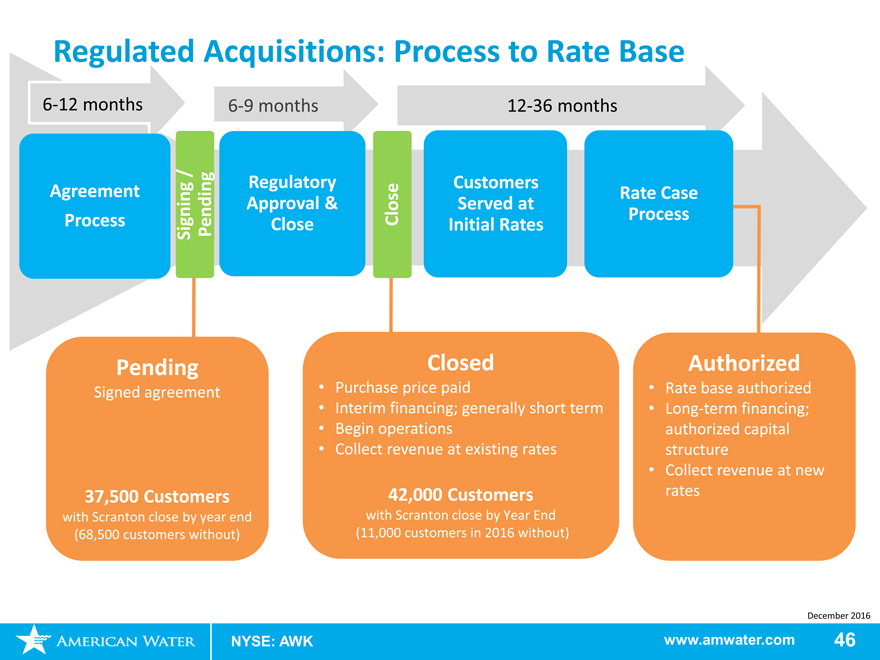

Regulated Acquisitions: Process to Rate Base

6-12 months6-9 months12-36 months

/

Agreement RegulatoryCustomers

Approval &Served at

Process Signing Pending CloseCloseInitial Rates

Pending Closed

Signed agreement • Purchase price paid

Interim financing; generally short term

Begin operations

Collect revenue at existing rates

37,500 Customers 42,000 Customers

with Scranton close by year end with Scranton close by Year End

(68,500 customers without) (11,000 customers in 2016 without)

Rate Case

Process

Authorized

Rate base authorized

Long-term financing; authorized capital structure

Collect revenue at new rates

December 2016

NYSE: AWK

www.amwater.com 46

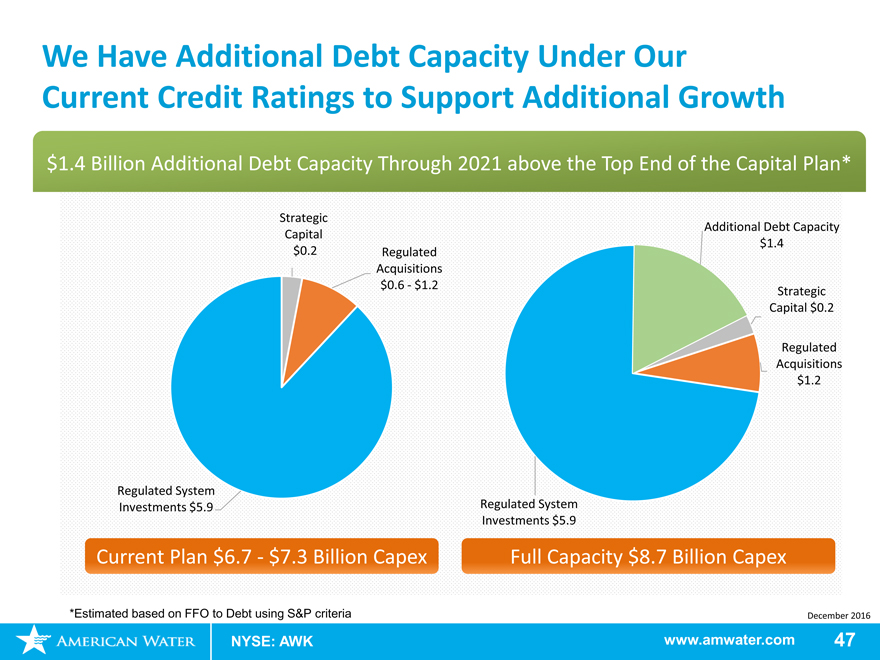

We Have Additional Debt Capacity Under Our Current Credit Ratings to Support Additional Growth

$1.4 Billion Additional Debt Capacity Through 2021 above the Top End of the Capital Plan*

Strategic

Additional Debt Capacity Capital $1.4 $0.2 Regulated Acquisitions $0.6—$1.2 Strategic Capital $0.2

Regulated Acquisitions $1.2

Regulated System

Investments $5.9 Regulated System Investments $5.9

Current Plan $6.7—$7.3 Billion Capex Full Capacity $8.7 Billion Capex

*Estimated based on FFO to Debt using S&P criteria December 2016

NYSE: AWK www.amwater.com 47

II. 2015 Financial Plan: Regulated

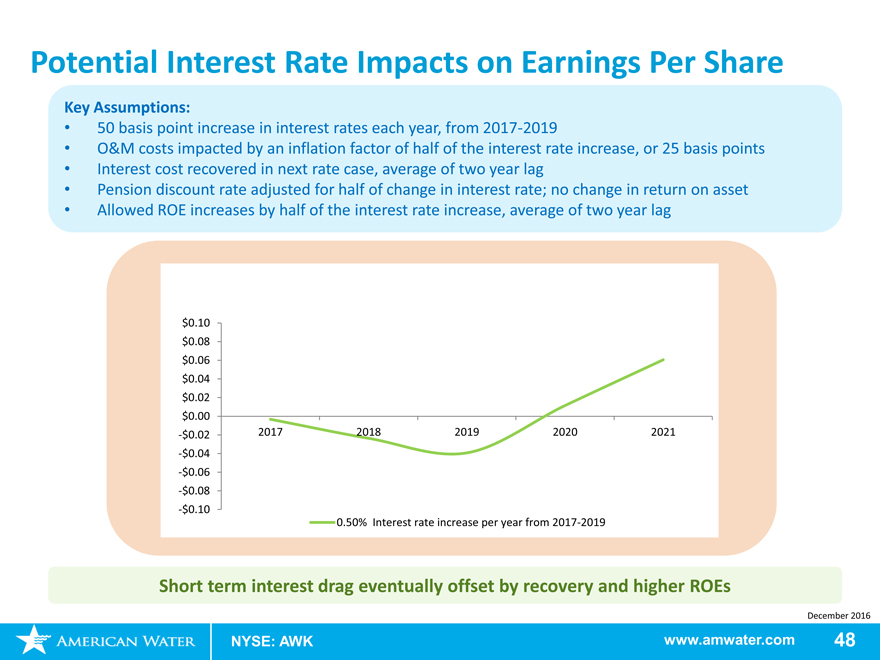

Potential Interest Rate Impacts on Earnings Per Share

Key Assumptions:

50 basis point increase in interest rates each year, from 2017-2019

O&M costs impacted by an inflation factor of half of the interest rate increase, or 25 basis points

Interest cost recovered in next rate case, average of two year lag

Pension discount rate adjusted for half of change in interest rate; no change in return on asset

Allowed ROE increases by half of the interest rate increase, average of two year lag

$ 0.10

$ 0.08

$ 0.06

$ 0.04

$ 0.02

$ 0.00

-$ 0.02 20172018201920202021

-$ 0.04

-$ 0.06

-$ 0.08

-$ 0.10

0.50% Interest rate increase per year from 2017-2019

Short term interest drag eventually offset by recovery and higher ROEs

December 2016

NYSE: AWK www.amwater.com 48

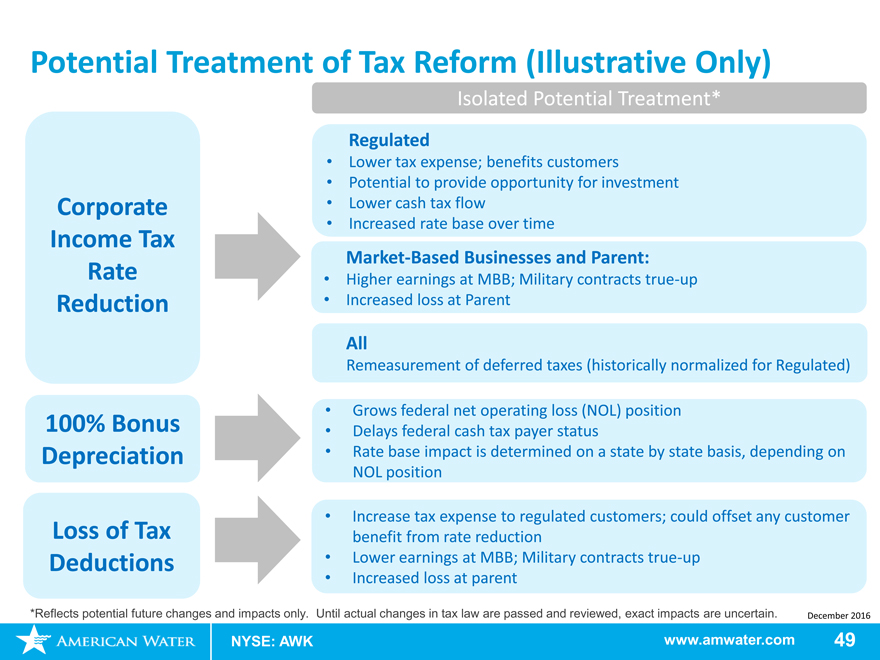

Potential Treatment of Tax Reform (Illustrative Only)

Corporate Income Tax Rate Reduction

100% Bonus Depreciation

Loss of Tax Deductions

*Reflects potential future changes and impacts only.

NYSE: AWK

Isolated Potential Treatment*

Regulated

Lower tax expense; benefits customers

Potential to provide opportunity for investment

Lower cash tax flow

Increased rate base over time

Market-Based Businesses and Parent:

Higher earnings at MBB; Military contractstrue-up

Increased loss at Parent

All

Remeasurement of deferred taxes (historically normalized for Regulated)

Grows federal net operating loss (NOL) position

Delays federal cash tax payer status

Rate base impact is determined on a state by state basis, depending on NOL position

Increase tax expense to regulated customers; could offset any customer benefit from rate reduction

Lower earnings at MBB; Military contractstrue-up

Increased loss at parent

Until actual changes in tax law are passed and reviewed, exact impacts are uncertain. December 2016

www.amwater.com 49

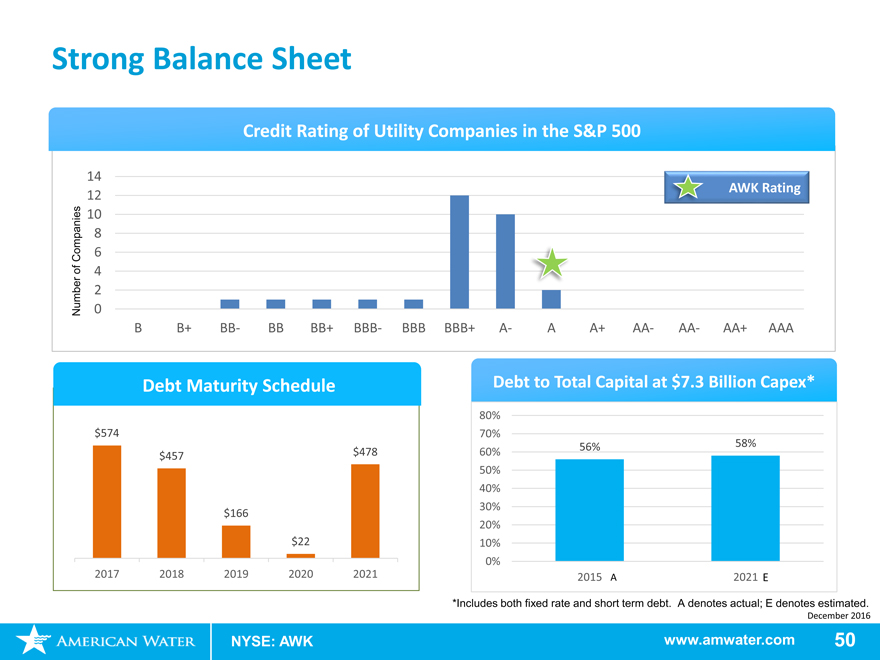

Strong Balance Sheet

Credit Rating of Utility Companies in the S&P 500

14 AWK Rating

12

10

8

Companies 6

of 4

2

Number 0

B B+BB- BB BB+BBB- BBB BBB+A- A A+AA-AA- AA+ AAA

Debt Maturity Schedule Debt to Total Capital at $7.3 Billion Capex*

80%

$574 70%

$478 60% 56% 58%

$457

50%

40%

30%

$166

20%

$22 10%

0%

2017 2018 2019 2020 2021 2015 A 2021 E

*Includes both fixed rate and short term debt. A denotes actual; E denotes estimated.

December 2016

NYSE: AWK www.amwater.com 50

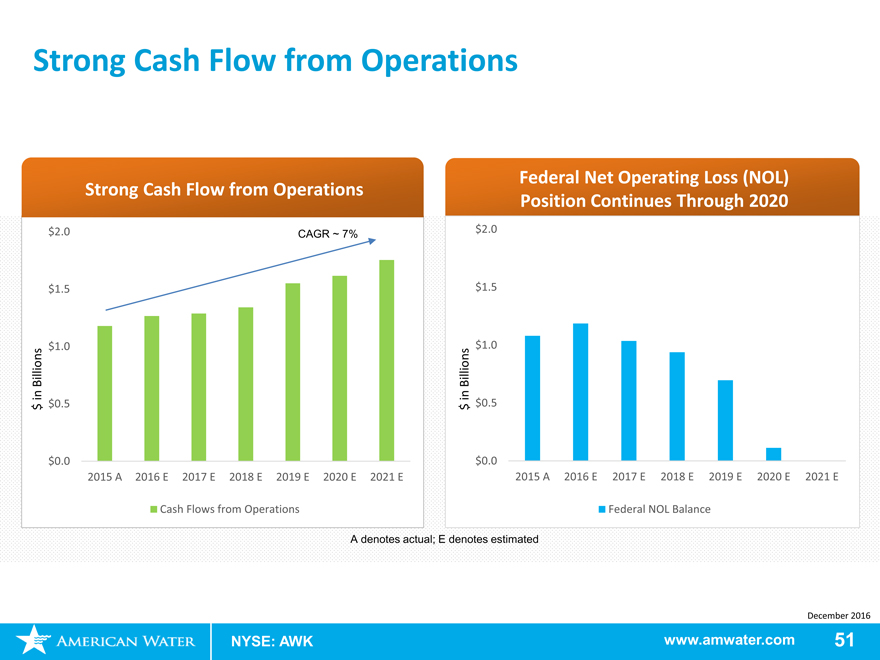

Strong Cash Flow from Operations

Strong Cash Flow from Operations

Federal Net Operating Loss (NOL) Strong Cash Flow from Operations Position Continues Through 2020

$2.0 CAGR ~ 7% $2.0

$1.5 $1.5

Billions $1.0 Billions $1.0 in in $ $0.5 $ $0.5

$0.0 $0.0

2015 A 2016 E 2017 E 2018 E 2019 E 2020 E 2021 E2015 A2016 E2017 E 2018 E 2019 E2020 E2021 E

Cash Flows from Operations Federal NOL Balance

A denotes actual; E denotes estimated

December 2016

NYSE: AWK www.amwater.com 51

A Top Leader in Dividend Growth

10.2% Dividend CAGR since 2011

Target to grow dividends in line

with7-10% EPS growth

Current dividend $0.375 / quarter

Target payout ratio50-60% of

earnings

American Water Dividends 2011-2016*

$1.80 CAGR 10.2% $1.60 $1.47 $1.40 $1.33 $1.21 $1.20 $1.09 $0.96 $1.00 $0.90

$0.80 $0.60 $0.40 $0.20

$0.00

2011 2012 * 2013 * 2014 2015 2016

*The dividend normally paid in 1Q 2013 was actually accelerated and paid in late December 2012 to allow shareholders to take advantage of 2012 dividend tax rates. For the purposes of this presentation, this $0.25 dividend has been deducted from 2012 and added to 2013 to show the more normal dividend trend.

December 2016

NYSE: AWK www.amwater.com 52

Financial Overview:

Continuing Delivery of Shareholder Value

- 2021

Plan

Targets:

Grow EPS long term at7-10%…

One of the fastest growing utilities in the nation

Maintain our predominantly regulated risk profile…

Market based businesses targeted to represent10-15%

of earnings

Decades of regulated investment needed; fragmented market provides consolidation opportunities

Target to grow dividends in line with earnings…

Payout ratio between50-60% of earnings

Strong balance sheet and operating cash flows

Deliver superior total shareholder return

Combined EPS and dividend growth

December 2016

NYSE: AWK www.amwater.com 53

Wrap Up

Susan Story President and Chief Executive Officer

December 2016

NYSE: AWK www.amwater.com 54

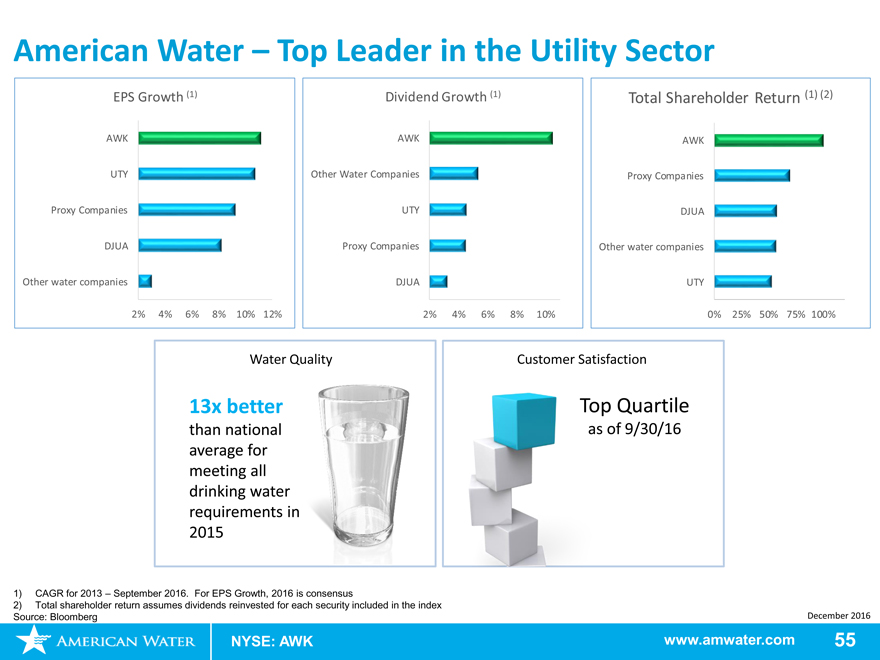

American Water – Top Leader in the Utility Sector

EPS Growth (1) Dividend Growth (1)Total ShareholderReturn (1) (2)

AWK AWKAWK

UTY Other Water CompaniesProxy Companies

Proxy Companies UTYDJUA

DJUA Proxy CompaniesOther water companies

Other water companies DJUAUTY

2% 4% 6% 8% 10%12%2% 4% 6%8%10%0% 25%50% 75% 100%

Water Quality Customer Satisfaction

13x better Quartile

than national of 9/30/16 average for meeting all drinking water requirements in 2015

1) CAGR for 2013 – Se owth, 2016 is consensus

2) Total shareholder re invested for each security included in the index

Source: Bloomberg

NYSE: AWK

December 2016

www.amwater.com 55

American Water Key Takeaways

Industry leading, multi-decade growth

from infrastructure investment and consolidation of a fragmented market

Track record of Differentiated

executing our strategies strategy

converging people,

technology and

novation to deliver

superior customer

service, waterquality and efficiency

December 2016

NYSE: AWK www.amwater.com56

Investor Relations Contacts:

Ed Vallejo

Vice President – Investor Relations Edward.vallejo@amwater.com

Melissa Schwarzell

Director– Investor Relations Melissa.Schwarzell@amwater.com

Tel:856-566-4005 Fax:856-782-2782

New website design at www.amwater.com coming January 2017

December 2016

NYSE: AWK www.amwater.com 57

Appendix

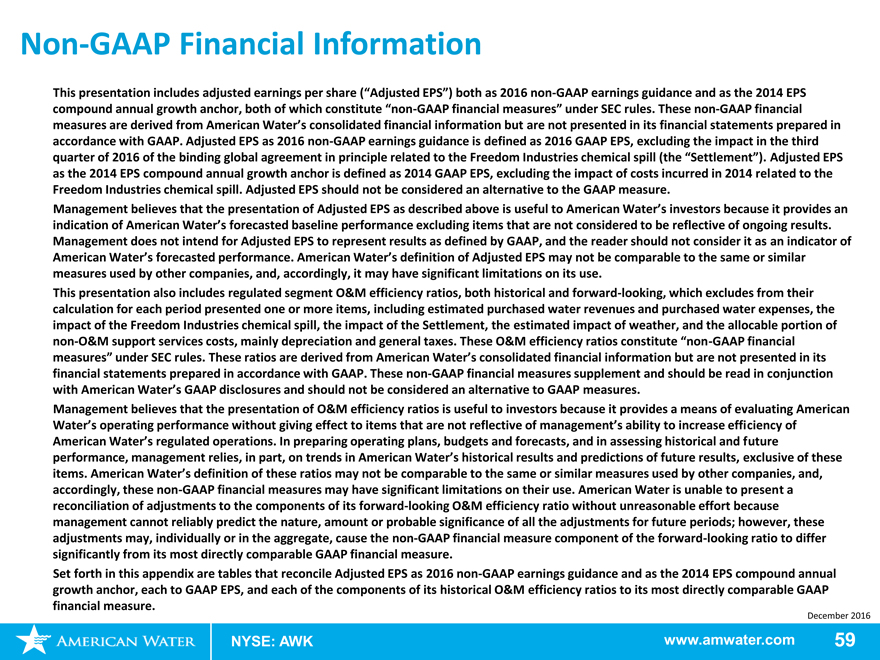

Non-GAAP Financial Information

This presentation includes adjusted earnings per share (“Adjusted EPS”) both as 2016non-GAAP earnings guidance and as the 2014 EPS compound annual growth anchor, both of which constitute“non-GAAP financial measures” under SEC rules. Thesenon-GAAP financial measures are derived from American Water’s consolidated financial information but are not presented in its financial statements prepared in accordance with GAAP. Adjusted EPS as 2016non-GAAP earnings guidance is defined as 2016 GAAP EPS, excluding the impact in the third quarter of 2016 of the binding global agreement in principle related to the Freedom Industries chemical spill (the “Settlement”). Adjusted EPS as the 2014 EPS compound annual growth anchor is defined as 2014 GAAP EPS, excluding the impact of costs incurred in 2014 related to the Freedom Industries chemical spill. Adjusted EPS should not be considered an alternative to the GAAP measure.

Management believes that the presentation of Adjusted EPS as described above is useful to American Water’s investors because it provides an indication of American Water’s forecasted baseline performance excluding items that are not considered to be reflective of ongoing results. Management does not intend for Adjusted EPS to represent results as defined by GAAP, and the reader should not consider it as an indicator of

American Water’s forecasted performance. American Water’s definition of Adjusted EPS may not be comparable to the same or similar measures used by other companies, and, accordingly, it may have significant limitations on its use.

This presentation also includes regulated segment O&M efficiency ratios, both historical and forward-looking, which excludes from their calculation for each period presented one or more items, including estimated purchased water revenues and purchased water expenses, the impact of the Freedom Industries chemical spill, the impact of the Settlement, the estimated impact of weather, and the allocable portion ofnon-O&M support services costs, mainly depreciation and general taxes. These O&M efficiency ratios constitute“non-GAAP financial measures” under SEC rules. These ratios are derived from American Water’s consolidated financial information but are not presented in its financial statements prepared in accordance with GAAP. Thesenon-GAAP financial measures supplement and should be read in conjunction with American Water’s GAAP disclosures and should not be considered an alternative to GAAP measures.

Management believes that the presentation of O&M efficiency ratios is useful to investors because it provides a means of evaluating American

Water’s operating performance without giving effect to items that are not reflective of management’s ability to increase efficiency of American Water’s regulated operations. In preparing operating plans, budgets and forecasts, and in assessing historical and future performance, management relies, in part, on trends in American Water’s historical results and predictions of future results, exclusive of these items. American Water’s definition of these ratios may not be comparable to the same or similar measures used by other companies, and, accordingly, thesenon-GAAP financial measures may have significant limitations on their use. American Water is unable to present a reconciliation of adjustments to the components of its forward-looking O&M efficiency ratio without unreasonable effort because management cannot reliably predict the nature, amount or probable significance of all the adjustments for future periods; however, these adjustments may, individually or in the aggregate, cause thenon-GAAP financial measure component of the forward-looking ratio to differ significantly from its most directly comparable GAAP financial measure.

Set forth in this appendix are tables that reconcile Adjusted EPS as 2016non-GAAP earnings guidance and as the 2014 EPS compound annual growth anchor, each to GAAP EPS, and each of the components of its historical O&M efficiency ratios to its most directly comparable GAAP financial measure.

December 2016

NYSE: AWK www.amwater.com 59

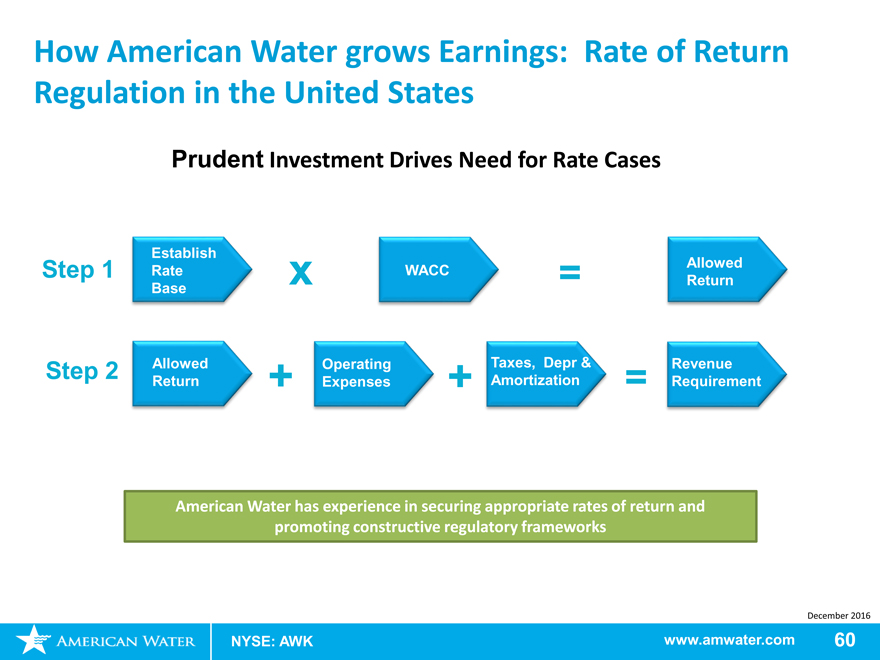

How American Water grows Earnings: Rate of Return Regulation in the United States

Prudent Investment Drives Need for Rate Cases

Establish

Allowed

Step 1 RatexWACC=Return

Base

AllowedOperatingTaxes, Depr &Revenue

Step 2 Return+Expenses+Amortization=Requirement

American Water has experience in securing appropriate rates of return and

promoting constructive regulatory frameworks

December 2016

NYSE: AWK www.amwater.com 60

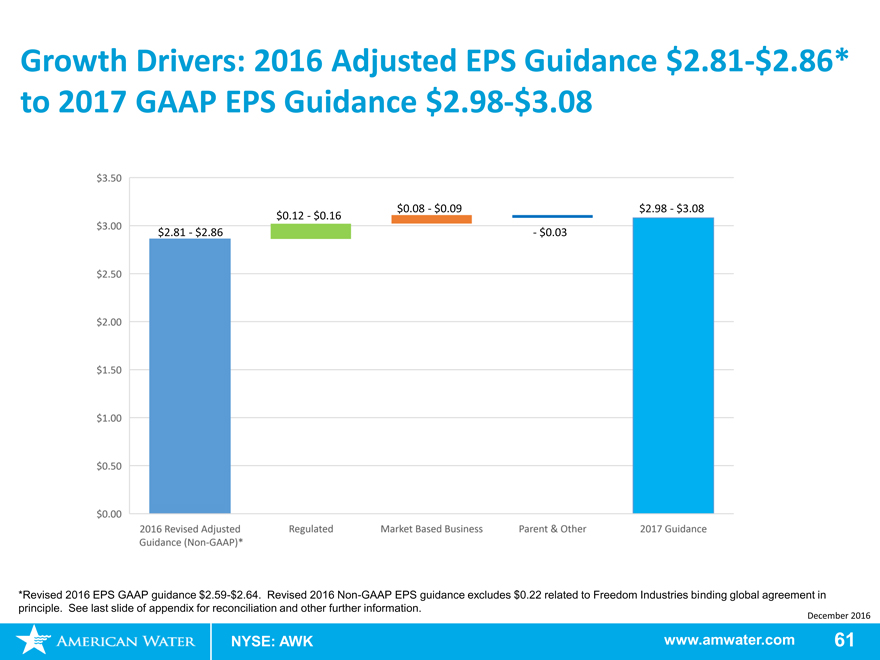

Growth Drivers: 2016 Adjusted EPS Guidance$2.81-$2.86* to 2017 GAAP EPS Guidance$2.98-$3.08

$0.08—$0.09 $2.98—$3.08 $0.12—$0.16 $2.81—$2.86—$0.03

*Revised 2016 EPS GAAP guidance$2.59-$2.64. Revised 2016Non-GAAP EPS guidance excludes $0.22 related to Freedom Industries binding global agreement in principle. See last slide of appendix for reconciliation and other further information. December 2016

NYSE: AWK

www.amwater.com 61

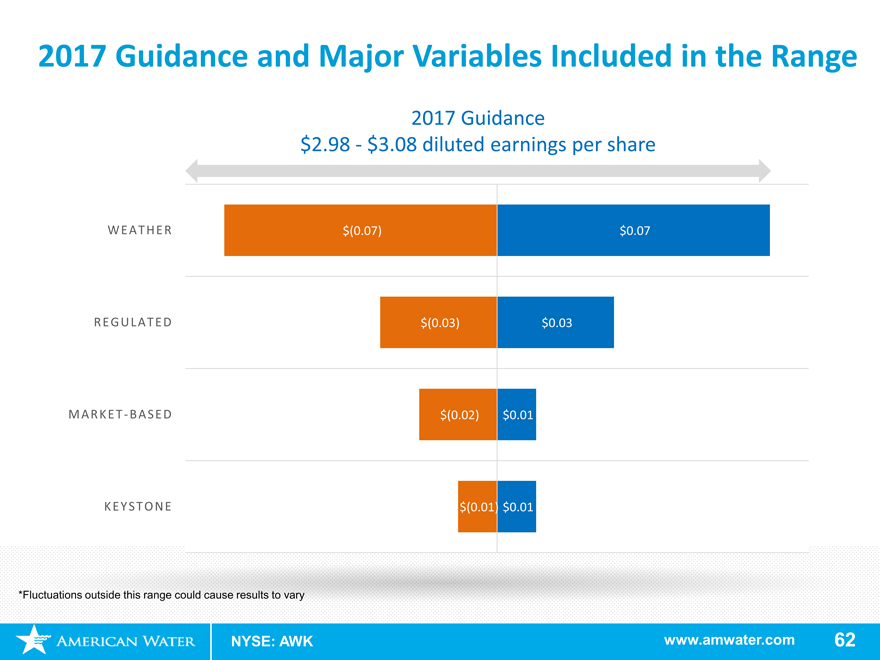

2017 Guidance and Major Variables Included in the Range

2017 Guidance

$2.98—$3.08 diluted earnings per share

WEATHER $(0.07) $0.07 REGULATED $(0.03) $0.03 MARKET-BASED $(0.02) $0.01 KEYSTONE $(0.01) $0.01

*Fluctuations outside this range could cause results to vary

NYSE: AWK www.amwater.com 62

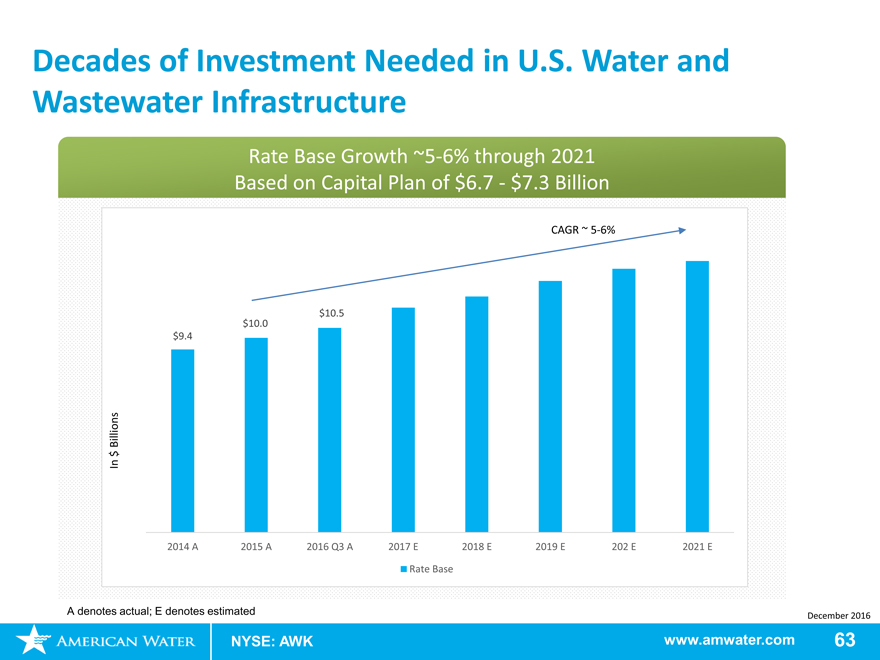

Decades of Investment Needed in U.S. Water and

Wastewater Infrastructure

Rate Base Growth~5-6% through 2021

Based on Capital Plan of $6.7—$7.3 Billion

CAGR ~5-6%

$10.5

$10.0 $9.4

Billions $ In

2014 A 2015 A 2016 Q3 A 2017 E 2018 E 2019 E 202 E 2021 E

Rate Base

A denotes actual; E denotes estimated

December 2016

NYSE: AWK www.amwater.com 63

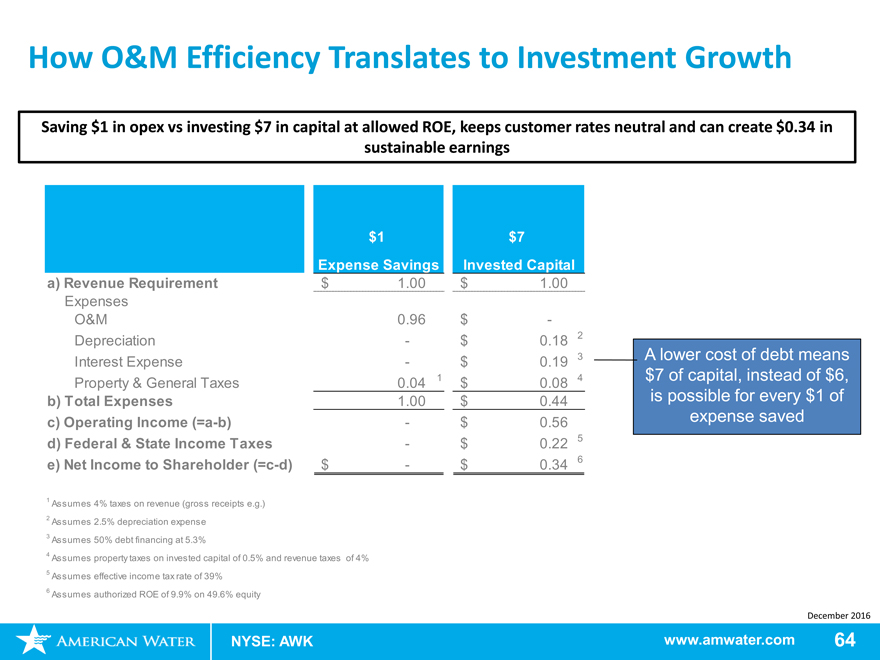

How O&M Efficiency Translates to Investment Growth

Saving $1 in opex vs investing $7 in capital at allowed ROE, keeps customer rates neutral and can create $0.34 in sustainable earnings

$1$7

Expense Savings Invested Capital

a) Revenue Requirement $1.00$1.00

Expenses

O&M 0.96$-

Depreciation -$0.182

Interest Expense -$0.193 A lower cost of debt means

14 $7 of capital, instead of $6,

Property & General Taxes 0.04$0.08

b) Total Expenses 1.00$0.44is possible for every $1 of

c) Operating Income(=a-b) -$0.56expense saved

d) Federal & State Income Taxes -$0.225

e) Net Income to Shareholder(=c-d) $-$0.346

1 Assumes 4% taxes on revenue (gross receipts e.g.)

2 Assumes 2.5% depreciation expense

3 Assumes 50% debt financing at 5.3%

4 Assumes property taxes on invested capital of 0.5% and revenue taxes of 4%

5 Assumes effective income tax rate of 39%

6 Assumes authorized ROE of 9.9% on 49.6% equity

December 2016

NYSE: AWK www.amwater.com64

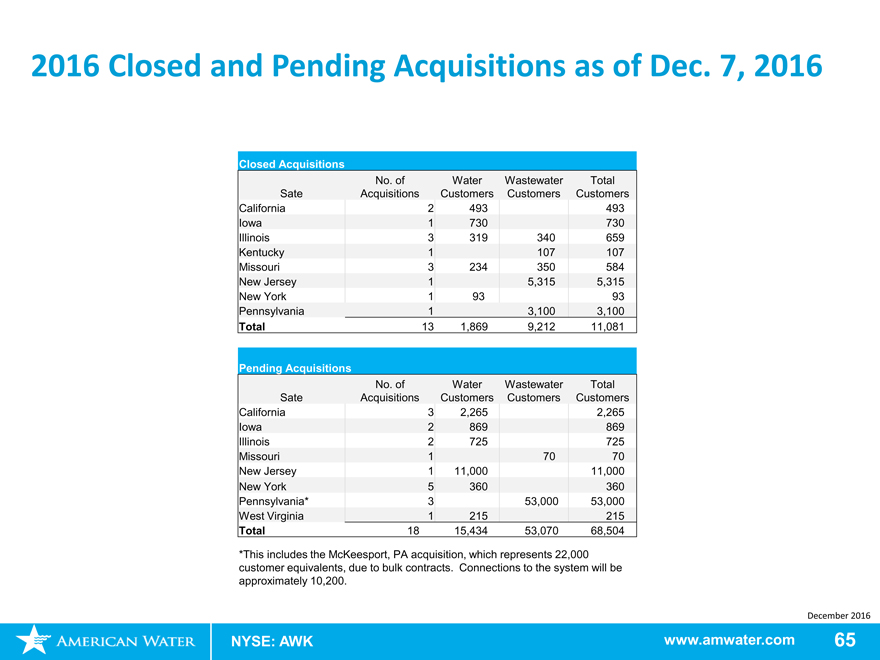

2016 Closed and Pending Acquisitions as of Dec. 7, 2016

Closed Acquisitions

No. of WaterWastewaterTotal

Sate Acquisitions CustomersCustomersCustomers

California 2493493

Iowa 1730730

Illinois 3319340659

Kentucky 1107107

Missouri 3234350584

New Jersey 15,3155,315

New York 19393

Pennsylvania 13,1003,100

Total 131,8699,21211,081

Pending Acquisitions

No. of WaterWastewaterTotal

Sate Acquisitions CustomersCustomersCustomers

California 32,2652,265

Iowa 2869869

Illinois 2725725

Missouri 17070

New Jersey 111,00011,000

New York 5360360

Pennsylvania* 353,00053,000

West Virginia 1215215

Total 18 15,43453,07068,504

*This includes the McKeesport, PA acquisition, which represents 22,000

customer equivalents, due to bulk contracts. Connections to the system will be

approximately 10,200.

December 2016

NYSE: AWK www.amwater.com 65

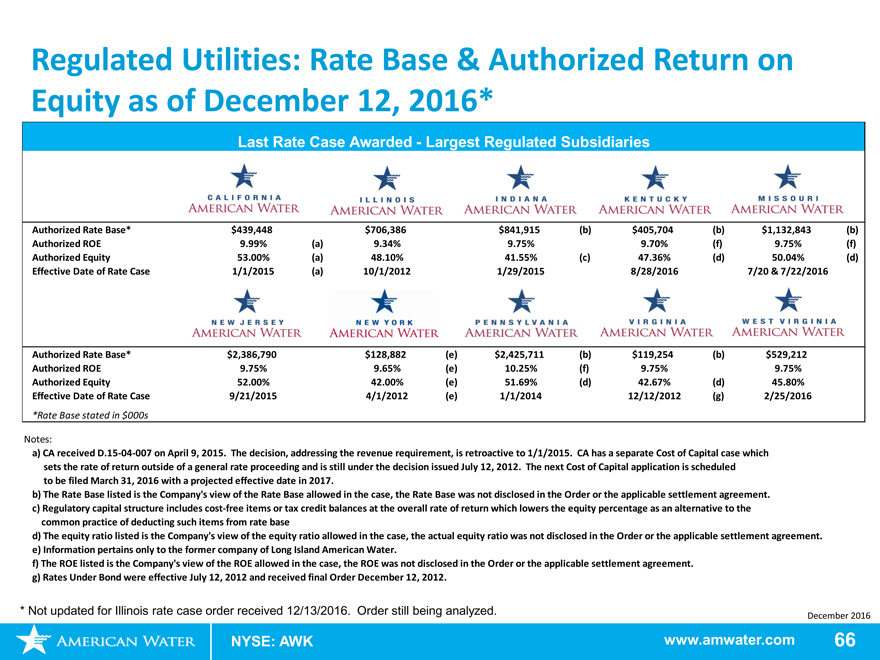

Regulated Utilities: Rate Base & Authorized return on

Equity as of December 12, 2016*

Last Rate Case Awarded—Largest Regulated Subsidiaries

Authorized Rate Base* $439,448 4

Authorized ROE 9.99%

Authorized Equity 53.00% %

Effective Date of Rate Case 1/1/2015 (a)10/1/20121/29/20158/28/20167/20 & 7/22/2016

Authorized Rate Base* $2,386,790 $128,882(e)$2,425,711(b)$119,254(b)$529,212

Authorized ROE 9.75% 9.65%(e)10.25%(f)9.75%9.75%

Authorized Equity 52.00% 42.00%(e)51.69%(d)42.67%(d)45.80%

Effective Date of Rate Case 9/21/2015 4/1/2012(e)1/1/201412/12/2012(g)2/25/2016

*Rate Base stated in $000s

Notes:

CA receivedD.15-04-007 on April 9, 2015. The decision, addressing the revenue requirement, is retroactive to 1/1/2015. CA has a separate Cost of Capital case which sets the rate of return outside of a general rate proceeding and is still under the decision issued July 12, 2012. The next Cost of Capital application is scheduled to be filed March 31, 2016 with a projected effective date in 2017.

The Rate Base listed is the Company’s view of the Rate Base allowed in the case, the Rate Base was not disclosed in the Order or the applicable settlement agreement.

Regulatory capital structure includes cost-free items or tax credit balances at the overall rate of return which lowers the equity percentage as an alternative to the common practice of deducting such items from rate base

The equity ratio listed is the Company’s view of the equity ratio allowed in the case, the actual equity ratio was not disclosed in the Order or the applicable settlement agreement.

Information pertains only to the former company of Long Island American Water.

The ROE listed is the Company’s view of the ROE allowed in the case, the ROE was not disclosed in the Order or the applicable settlement agreement.

Rates Under Bond were effective July 12, 2012 and received final Order December 12, 2012.

* Not updated for Illinois rate case order received 12/13/2016. Order still being analyzed.

December 2016

NYSE: AWK www.amwater.com 66

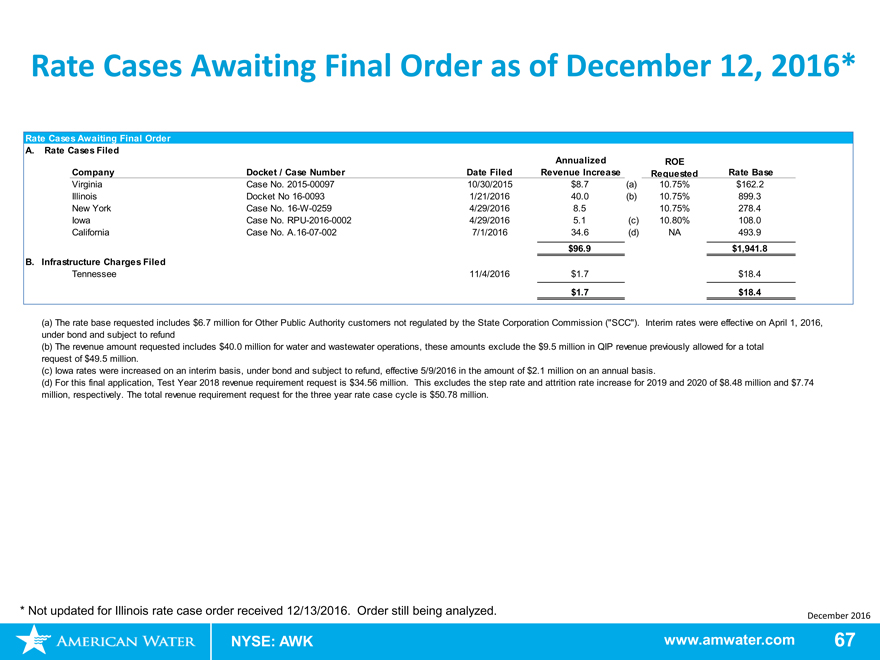

Rate Cases Awaiting Final Order as of December 12, 2016*

Rate Cases Awaiting Final Order

A. Rate Cases Filed

AnnualizedROE

Company Docket / Case NumberDate FiledRevenue IncreaseRequestedRate Base

Virginia Case No.2015-0009710/30/2015$8.7(a)10.75%$162.2

Illinois Docket No16-00931/21/201640.0(b)10.75%899.3

New York CaseNo.16-W-02594/29/20168.510.75%278.4

Iowa CaseNo.RPU-2016-00024/29/20165.1(c)10.80%108.0

California Case No.A.16-07-0027/1/201634.6(d)NA493.9

$96.9$1,941.8

B. Infrastructure Charges Filed

Tennessee 11/4/2016$1.7$18.4

$1.7$18.4

(a) The rate base requested includes $6.7 million for Other Public Authority customers not regulated by the State Corporation Commission (“SCC”). Interim rates were effective on April 1, 2016, under bond and subject to refund (b) The revenue amount requested includes $40.0 million for water and wastewater operations, these amounts exclude the $9.5 million in QIP revenue previously allowed for a total request of $49.5 million.

Iowa rates were increased on an interim basis, under bond and subject to refund, effective 5/9/2016 in the amount of $2.1 million on an annual basis.

For this final application, Test Year 2018 revenue requirement request is $34.56 million. This excludes the step rate and attrition rate increase for 2019 and 2020 of $8.48 million and $7.74

million, respectively. The total revenue requirement request for the three year rate case cycle is $50.78 million.

* Not updated for Illinois rate case order received 12/13/2016. Order still being analyzed.

December 2016

NYSE: AWK www.amwater.com 67

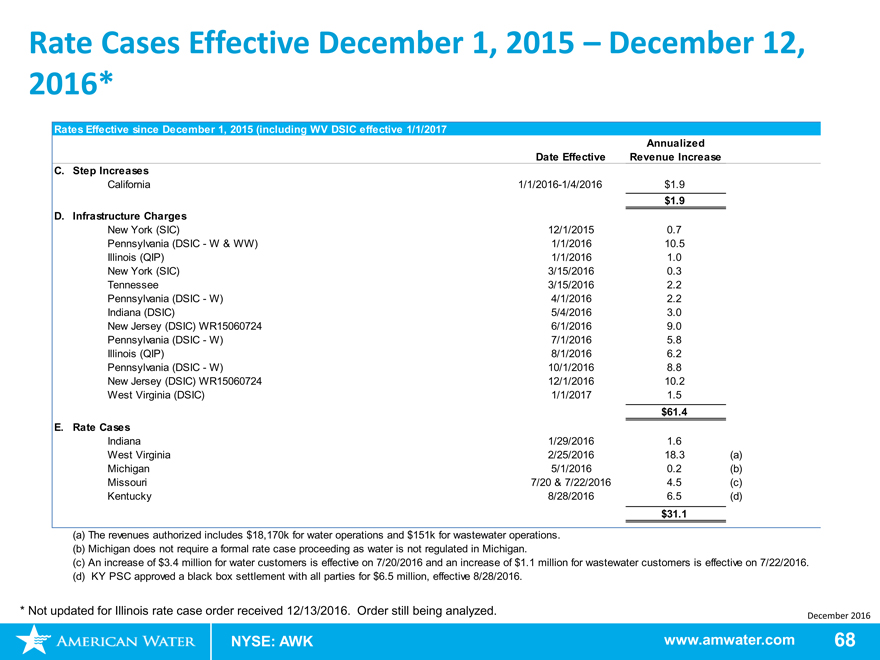

Rate Cases Effective December 1, 2015 – December 12,

2016*

Rates Effective since December 1, 2015 (including WV DSIC effective 1/1/2017

Annualized

Date EffectiveRevenue Increase

C. Step Increases

California 1/1/2016-1/4/2016$1.9

$1.9

D. Infrastructure Charges

New York (SIC) 12/1/20150.7

Pennsylvania (DSIC—W & WW) 1/1/201610.5

Illinois (QIP) 1/1/20161.0

New York (SIC) 3/15/20160.3

Tennessee 3/15/20162.2

Pennsylvania (DSIC—W) 4/1/20162.2

Indiana (DSIC) 5/4/20163.0

New Jersey (DSIC) WR15060724 6/1/20169.0

Pennsylvania (DSIC—W) 7/1/20165.8

Illinois (QIP) 8/1/20166.2

Pennsylvania (DSIC—W) 10/1/20168.8

New Jersey (DSIC) WR15060724 12/1/201610.2

West Virginia (DSIC) 1/1/20171.5

$61.4

E. Rate Cases

Indiana 1/29/20161.6

West Virginia 2/25/201618.3(a)

Michigan 5/1/20160.2(b)

Missouri 7/20 & 7/22/20164.5(c)

Kentucky 8/28/20166.5(d)

$31.1

The revenues authorized includes $18,170k for water operations and $151k for wastewater operations.

Michigan does not require a formal rate case proceeding as water is not regulated in Michigan.

An increase of $3.4 million for water customers is effective on 7/20/2016 and an increase of $1.1 million for wastewater customers is effective on 7/22/2016.

KY PSC approved a black box settlement with all parties for $6.5 million, effective 8/28/2016.

* Not updated for Illinois rate case order received 12/13/2016. Order still being analyzed.

December 2016

NYSE: AWK www.amwater.com 68

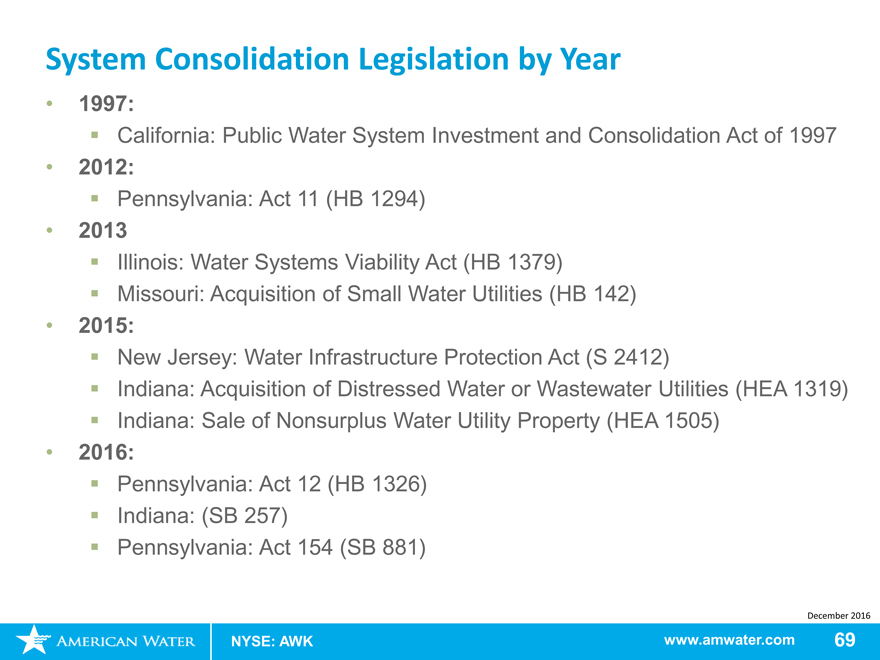

System Consolidation Legislation by Year

1997:

California: Public Water System Investment and Consolidation Act of 1997

2012:

Pennsylvania: Act 11 (HB 1294)

2013

Illinois: Water Systems Viability Act (HB 1379)

Missouri: Acquisition of Small Water Utilities (HB 142)

2015:

New Jersey: Water Infrastructure Protection Act (S 2412)

Indiana: Acquisition of Distressed Water or Wastewater Utilities (HEA 1319)

Indiana: Sale of Nonsurplus Water Utility Property (HEA 1505)

2016:

Pennsylvania: Act 12 (HB 1326)

Indiana: (SB 257)

Pennsylvania: Act 154 (SB 881)

December 2016

NYSE: AWK www.amwater.com 69

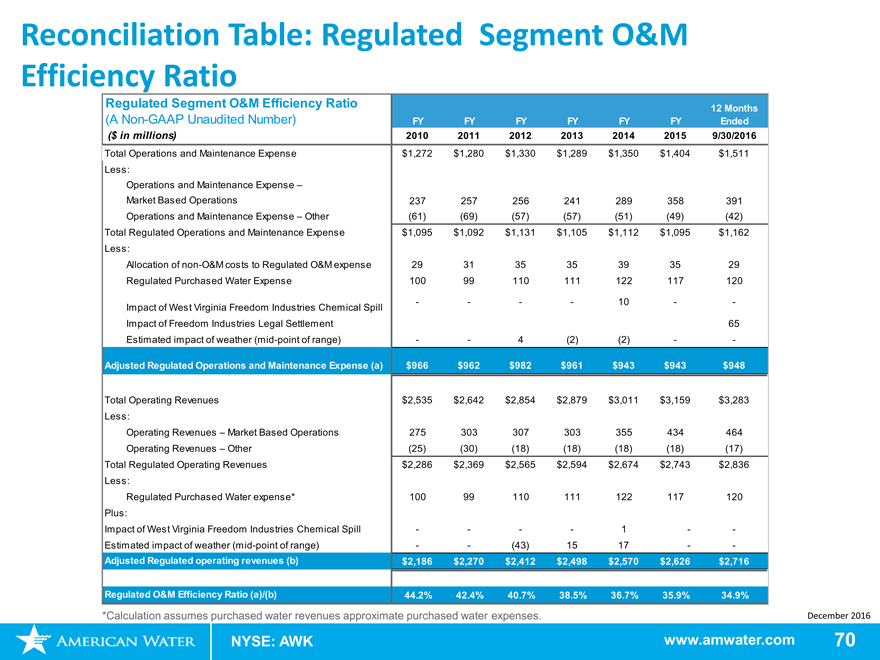

Reconciliation Table: Regulated Segment O&M

Efficiency Ratio

Regulated Segment O&M Efficiency Ratio 12 Months

(ANon-GAAP Unaudited Number) FY FYFYFYFYFYEnded

($ in millions) 2010 201120122013201420159/30/2016

Total Operations and Maintenance Expense $1,272 $1,280$1,330$1,289$1,350$1,404$1,511

Less:

Operations and Maintenance Expense –

Market Based Operations 237 257256241289358391

Operations and Maintenance Expense – Other (61) (69)(57)(57)(51)(49)(42)

Total Regulated Operations and Maintenance Expense $1,095 $1,092$1,131$1,105$1,112$1,095$1,162

Less:

Allocation ofnon-O&M costs to Regulated O&M expense 29 313535393529

Regulated Purchased Water Expense 100 99110111122117120

Impact of West Virginia Freedom Industries Chemical Spill - ---10--

Impact of Freedom Industries Legal Settlement 65

Estimated impact of weather(mid-point of range) - -4(2)(2)--

Adjusted Regulated Operations and Maintenance Expense (a) $966 $962$982$961$943$943$948

Total Operating Revenues $2,535 $2,642$2,854$2,879$3,011$3,159$3,283

Less:

Operating Revenues – Market Based Operations 275 303307303355434464

Operating Revenues – Other (25) (30)(18)(18)(18)(18)(17)

Total Regulated Operating Revenues $2,286 $2,369$2,565$2,594$2,674$2,743$2,836

Less:

Regulated Purchased Water expense* 100 99110111122117120

Plus:

Impact of West Virginia Freedom Industries Chemical Spill - ---1--

Estimated impact of weather(mid-point of range) - -(43)1517--

Adjusted Regulated operating revenues (b) $2,186 $2,270$2,412$2,498$2,570$2,626$2,716

Regulated O&M Efficiency Ratio (a)/(b) 44.2% 42.4%40.7%38.5%36.7%35.9%34.9%

*Calculation assumes purchased water revenues approximate purchased water expenses. December 2016

NYSE: AWK www.amwater.com70

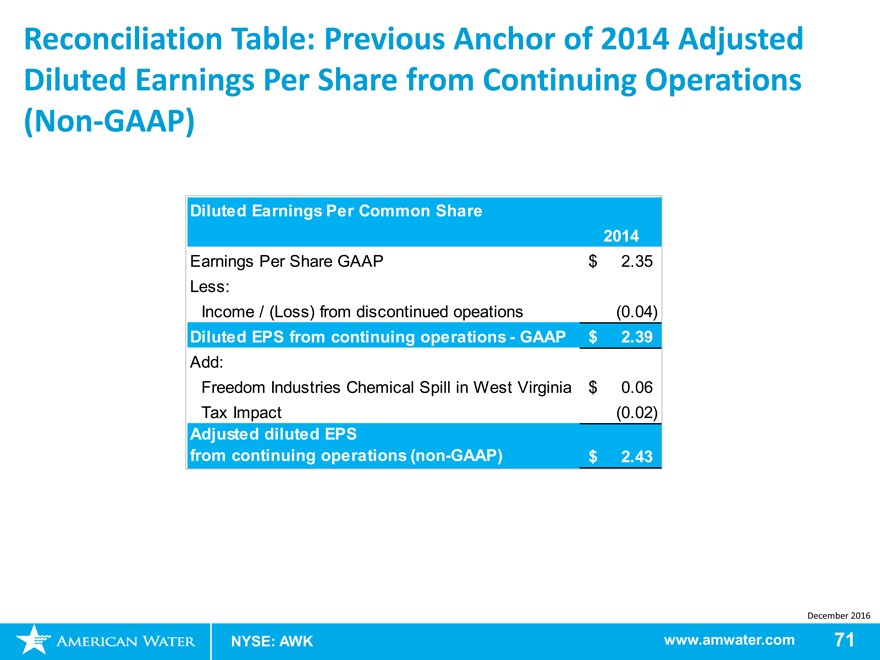

Reconciliation Table: Previous Anchor of 2014 Adjusted Diluted Earnings Per Share from Continuing Operations

(Non-GAAP)

Diluted Earnings Per Common Share

2014

Earnings Per Share GAAP $2.35

Less:

Income / (Loss) from discontinued operations (0.04)

Diluted EPS from continuing operations—GAAP $2.39

Add:

Freedom Industries Chemical Spill in West Virginia $0.06

Tax Impact (0.02)

Adjusted diluted EPS

from continuing operations(non-GAAP) $2.43

December 2016

NYSE: AWK www.amwater.com 71

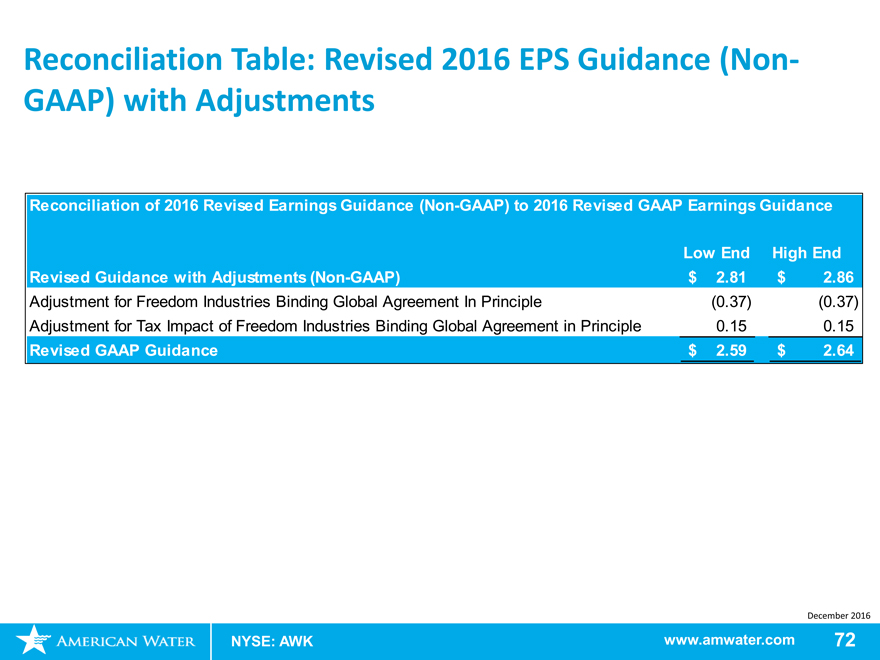

Reconciliation Table: Revised 2016 EPS Guidance (Non-

GAAP) with Adjustments

Reconciliation of 2016 Revised Earnings Guidance(Non-GAAP) to 2016 Revised GAAP Earnings Guidance

Low End High End

Revised Guidance with Adjustments(Non-GAAP) $2.81$2.86

Adjustment for Freedom Industries Binding Global Agreement In Principle (0.37)(0.37)

Adjustment for Tax Impact of Freedom Industries Binding Global Agreement in Principle 0.150.15

Revised GAAP Guidance $2.59$2.64

December 2016

NYSE: AWK www.amwater.com 72