American Water Earnings Guidance NYSE: AWK Exhibit 99.2

Forward-Looking Statements Certain statements in this presentation including, without limitation, 2017 and 2018 earnings per share guidance, guidance on projected long-term financial and operational performance, the estimated and potential future impacts of enacted tax reform legislation and the assumptions and limitations upon which such estimates were based, the level of future capital expenditures, rate base and potential dividend growth, estimates regarding the company’s projected financial condition, tax status and net operating loss position, and the impact of tax reform legislation on future capital raising activities, are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “propose,” “assume,” “forecast,” “likely,” “outlook,” “future,” “pending,” “goal,” “objective,” “potential,” “continue,” “seek to,” “may,” “can,” “will,” “should” and “could” and or the negative of such terms or other variations or similar expressions. These forward-looking statements are predictions based on American Water’s current expectations and assumptions regarding future events. They are not guarantees or assurances of any outcomes, financial results of levels of activity, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may differ materially from those discussed in the forward-looking statements included in this presentation as a result of the factors discussed in the Company’s Annual Report on Form 10-K for the year ended Dec. 31, 2016, the Company’s Form 8-K dated Jan. 16, 2018, and subsequent filings with the SEC, and because of factors such as: the decisions of governmental and regulatory bodies, including decisions to raise or lower rates; the timeliness and outcome of regulatory commissions’ actions concerning rates, capital structure, authorized return on equity, capital investment, permitting, and other decisions; changes in laws, governmental regulations and policies, including environmental, health and safety, water quality, and public utility and tax regulations and policies, and impacts resulting from U.S., state and local elections; potential costs and liabilities of American Water for environmental laws and similar matters resulting from, among other things, water and wastewater service provided to customers, including, for example, water management solutions focused on customers in the natural gas exploration and production market; the outcome of litigation and similar government actions, including matters related to the Freedom Industries chemical spill in West Virginia, and the preliminarily approved global class action settlement related to this chemical spill; weather conditions and events, climate change patterns, and natural disasters, including drought or abnormally high rainfall, strong winds, coastal and intercoastal flooding, earthquakes, landslides, hurricanes, tornadoes, wildfires, electrical storms and solar flares; changes in customer demand for, and patterns of use of, water, such as may result from conservation efforts; its ability to appropriately maintain current infrastructure, including its operational and information technology (“IT”) systems, and manage the expansion of its business; its ability to obtain permits and other approvals for projects; changes in its capital requirements; its ability to control operating expenses and to achieve efficiencies in its operations; the intentional or unintentional acts of a third party, including contamination of its water supplies or water provided to its customers; exposure or infiltration of its critical infrastructure, operational technology and IT systems, including the disclosure of sensitive or confidential information contained therein, through physical or cyber-attacks or other disruptions; its ability to obtain adequate and cost-effective supplies of chemicals, electricity, fuel, water and other raw materials that are needed for its operations; its ability to successfully meet growth projections and capitalize on growth opportunities, including its ability to, among other things, acquire and integrate water and wastewater systems into its regulated operations and enter into contracts and other agreements with, or otherwise obtain, new customers in its Market-based Businesses; cost overruns relating to improvements in or the expansion of its operations; its ability to maintain safe work sites; risks and uncertainties associated with contracting with the U.S. government, including ongoing compliance with applicable government procurement and security regulations; changes in general economic, political, business and financial market conditions; access to sufficient capital on satisfactory terms and when and as needed to support operations and capital expenditures; fluctuations in interest rates; restrictive covenants in or changes to the credit ratings on its current or future debt that could increase its financing costs or funding requirements or affect its ability to borrow, make payments on debt or pay dividends; fluctuations in the value of benefit plan assets and liabilities that could increase its financing costs and funding requirements; changes in Federal or state income, general and other tax laws, the availability of tax credits and tax abatement programs, and the ability to utilize its U.S. and state net operating loss carryforwards; migration of customers into or out of its service territories; the use by municipalities of the power of eminent domain or other authority to condemn its systems; difficulty in obtaining, or the inability to obtain, insurance at acceptable rates and on acceptable terms and conditions; its ability to retain and attract qualified employees; labor actions including work stoppages and strikes; the incurrence of impairment charges related to American Water’s goodwill or other assets; civil disturbances, terrorist threats or acts, or public apprehension about future disturbances or terrorist threats or acts; and the impact of new accounting standards or changes to existing standards. These forward-looking statements are qualified by, and should be read together with, the risks and uncertainties set forth above and the risk factors included in the company’s SEC filings, and readers should refer to such risks, uncertainties and risk factors in evaluating such forward-looking statements. Any forward-looking statements speak only as of the date of this presentation. The company does not have or undertake any obligation or intention to update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as otherwise required by the Federal securities laws. Furthermore, it may not be possible to assess the impact of any such factor on the company’s businesses, either viewed independently or together, or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive.

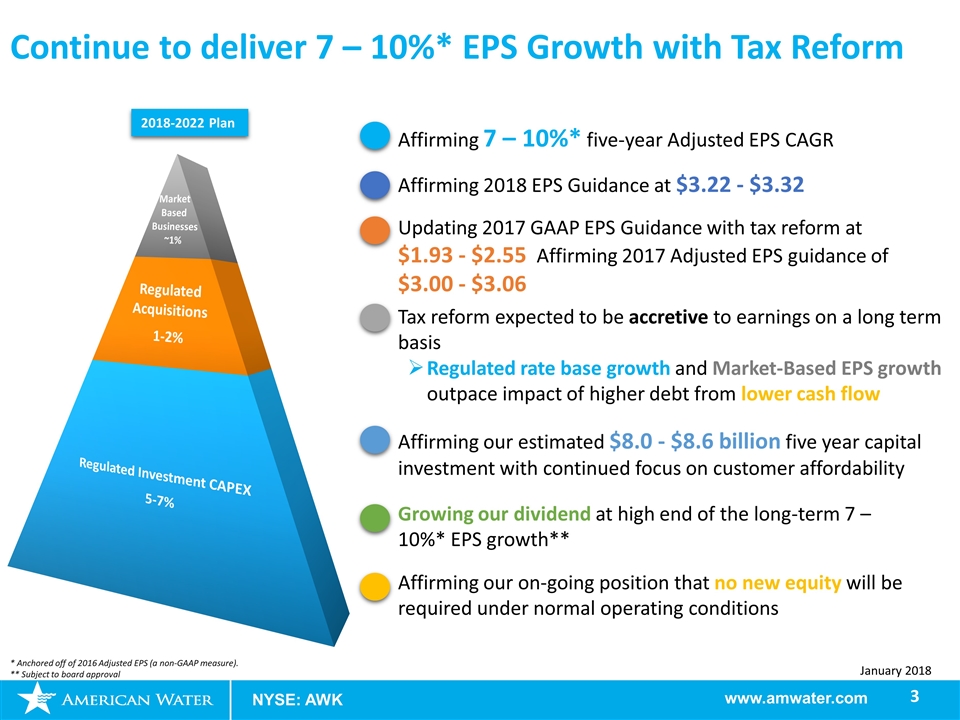

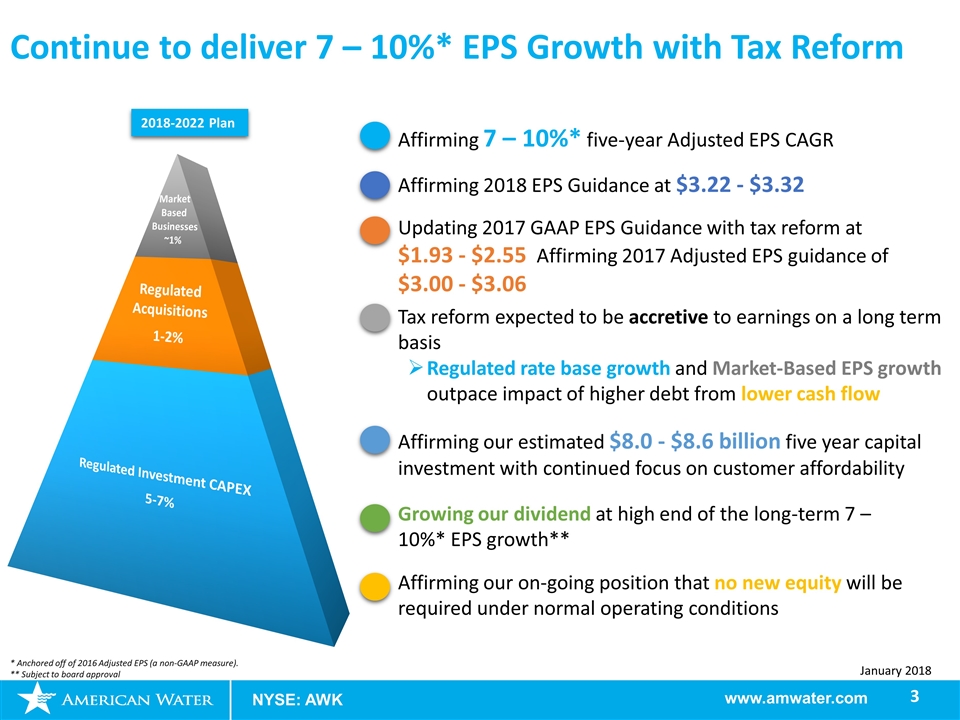

Continue to deliver 7 – 10%* EPS Growth with Tax Reform Affirming 7 – 10%* five-year Adjusted EPS CAGR Affirming 2018 EPS Guidance at $3.22 - $3.32 Updating 2017 GAAP EPS Guidance with tax reform at $1.93 - $2.55 Affirming 2017 Adjusted EPS guidance of $3.00 - $3.06 Affirming our estimated $8.0 - $8.6 billion five year capital investment with continued focus on customer affordability Affirming our on-going position that no new equity will be required under normal operating conditions Tax reform expected to be accretive to earnings on a long term basis Regulated rate base growth and Market-Based EPS growth outpace impact of higher debt from lower cash flow Growing our dividend at high end of the long-term 7 – 10%* EPS growth** * Anchored off of 2016 Adjusted EPS (a non-GAAP measure). ** Subject to board approval 2018-2022 Plan Regulated Investment CAPEX 5-7% Market Based Businesses ~1% Regulated Acquisitions 1-2%

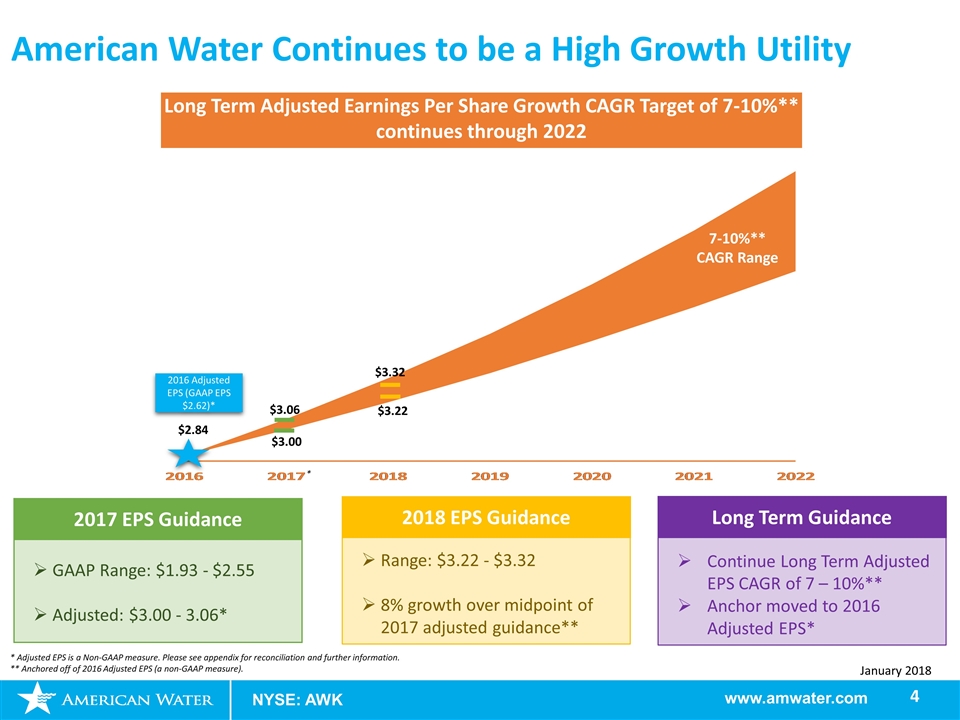

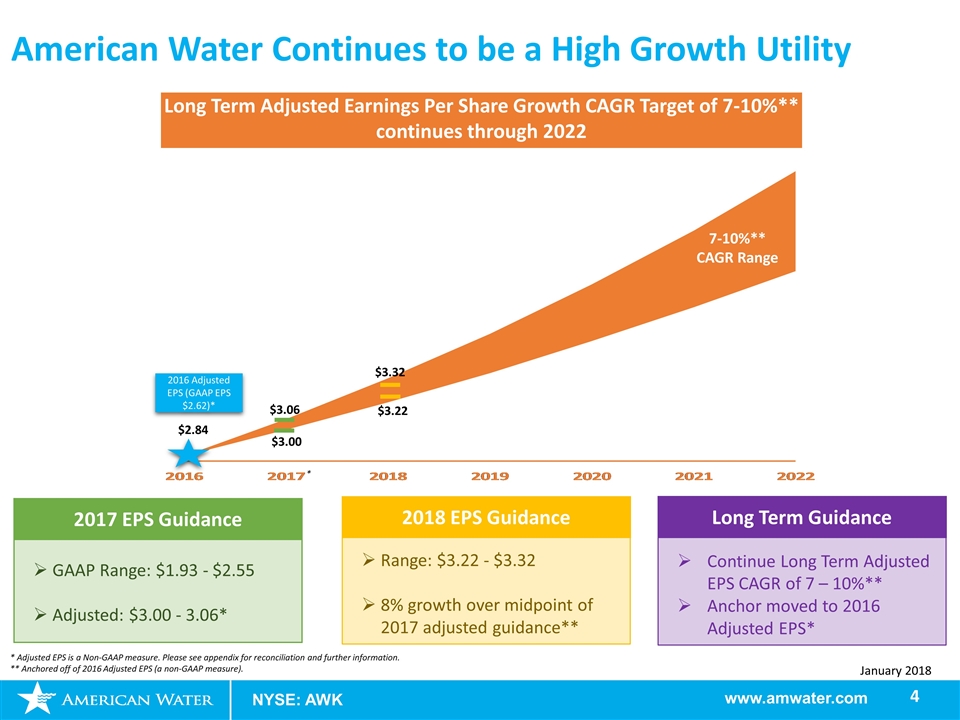

Long Term Adjusted Earnings Per Share Growth CAGR Target of 7-10%** continues through 2022 American Water Continues to be a High Growth Utility $3.32 $3.22 $2.84 GAAP Range: $1.93 - $2.55 Adjusted: $3.00 - 3.06* 2017 EPS Guidance Range: $3.22 - $3.32 8% growth over midpoint of 2017 adjusted guidance** Continue Long Term Adjusted EPS CAGR of 7 – 10%** Anchor moved to 2016 Adjusted EPS* $3.06 $3.00 7-10%** CAGR Range 2016 Adjusted EPS (GAAP EPS $2.62)* * Adjusted EPS is a Non-GAAP measure. Please see appendix for reconciliation and further information. ** Anchored off of 2016 Adjusted EPS (a non-GAAP measure). 2018 EPS Guidance Long Term Guidance *

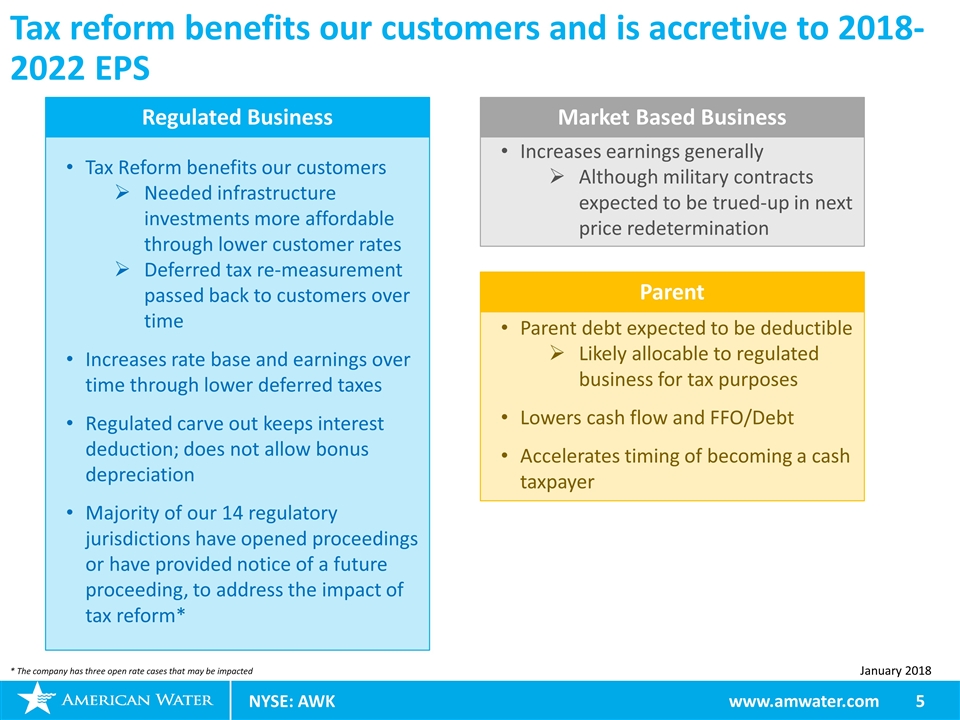

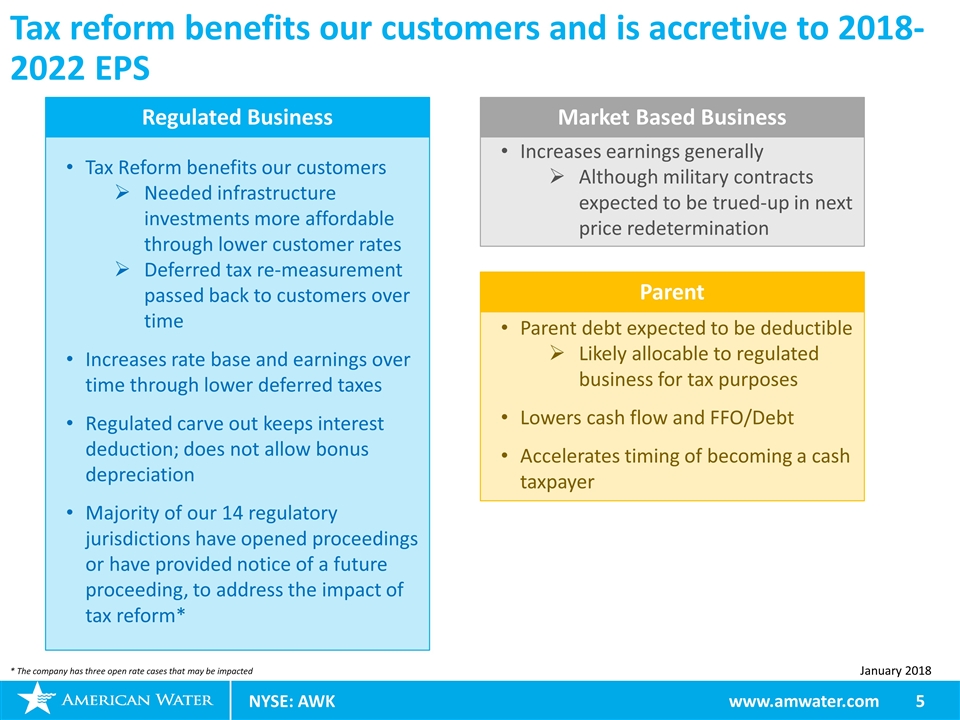

Tax reform benefits our customers and is accretive to 2018-2022 EPS www.amwater.com Tax Reform benefits our customers Needed infrastructure investments more affordable through lower customer rates Deferred tax re-measurement passed back to customers over time Increases rate base and earnings over time through lower deferred taxes Regulated carve out keeps interest deduction; does not allow bonus depreciation Majority of our 14 regulatory jurisdictions have opened proceedings or have provided notice of a future proceeding, to address the impact of tax reform* Parent debt expected to be deductible Likely allocable to regulated business for tax purposes Lowers cash flow and FFO/Debt Accelerates timing of becoming a cash taxpayer Regulated Business Increases earnings generally Although military contracts expected to be trued-up in next price redetermination Market Based Business Parent * The company has three open rate cases that may be impacted

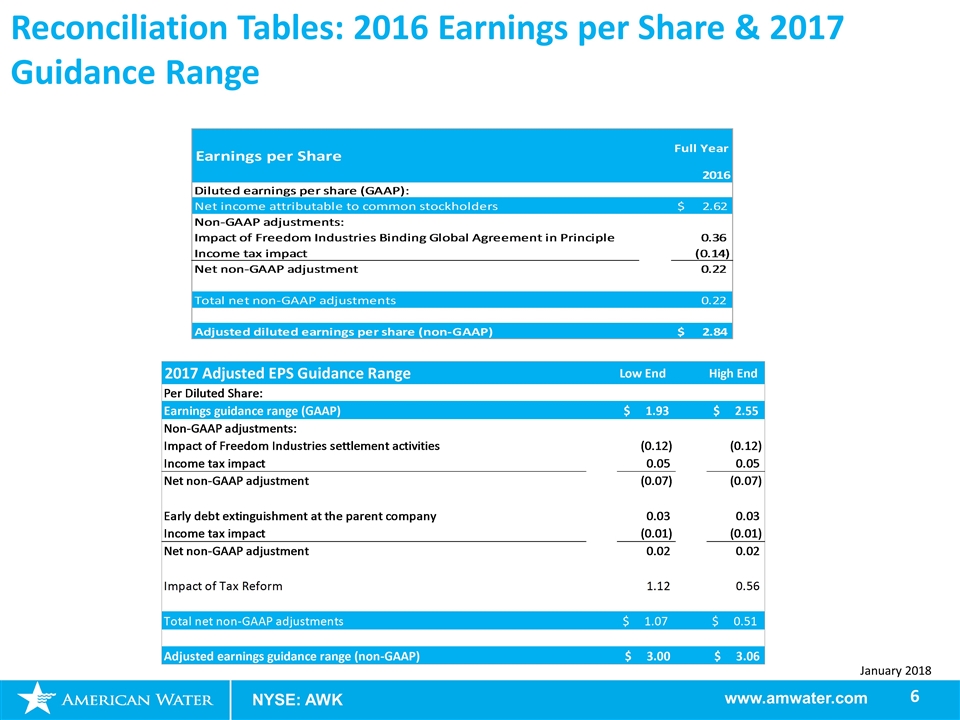

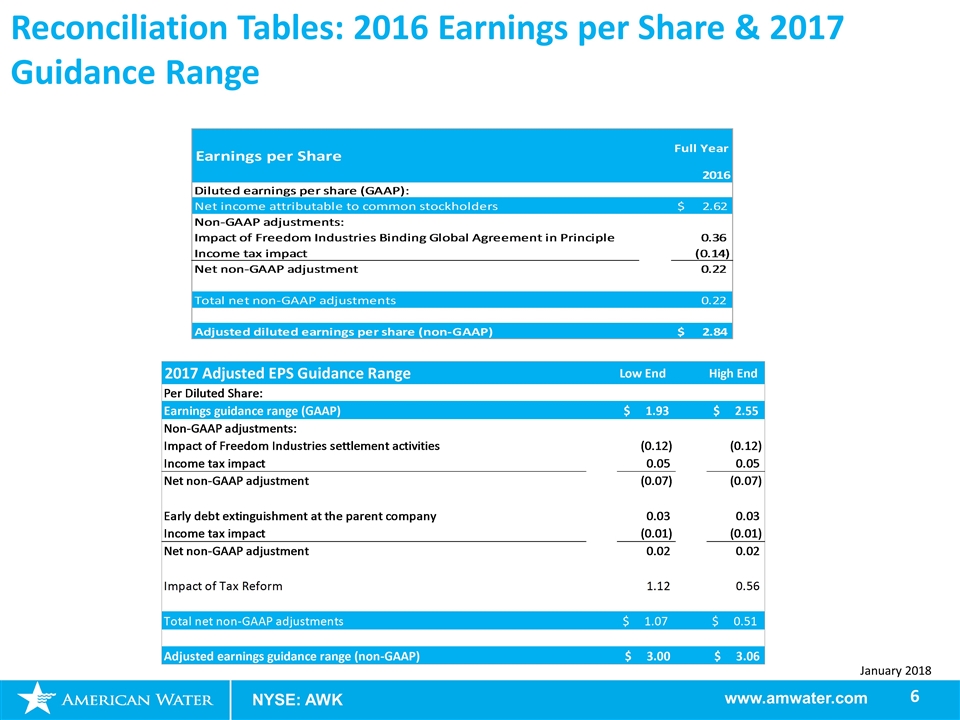

Reconciliation Tables: 2016 Earnings per Share & 2017 Guidance Range