2019 Investor Day We keep life flowing ® December 11, 2019 Exhibit 99.2

Welcome We keep life flowing ® Ed Vallejo Vice President, Investor Relations

Safety Message Ed Vallejo

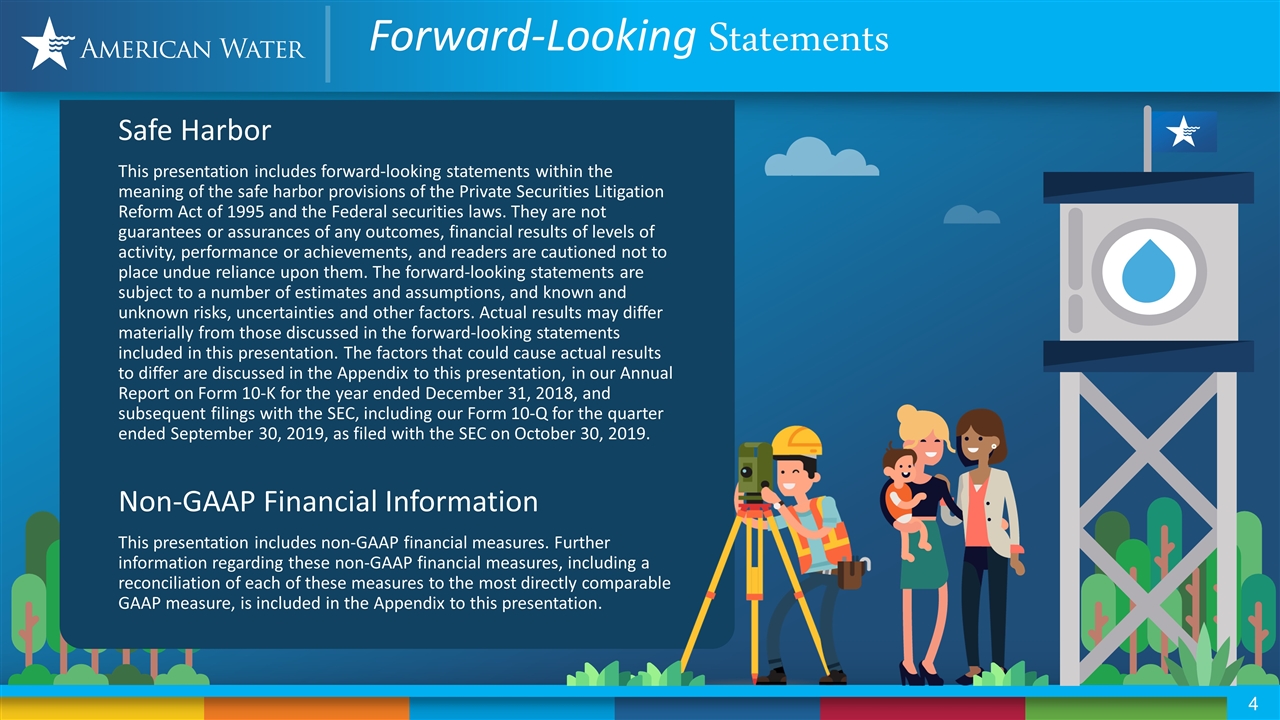

Safe Harbor This presentation includes forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. They are not guarantees or assurances of any outcomes, financial results of levels of activity, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may differ materially from those discussed in the forward-looking statements included in this presentation. The factors that could cause actual results to differ are discussed in the Appendix to this presentation, in our Annual Report on Form 10-K for the year ended December 31, 2018, and subsequent filings with the SEC, including our Form 10-Q for the quarter ended September 30, 2019, as filed with the SEC on October 30, 2019. Non-GAAP Financial Information This presentation includes non-GAAP financial measures. Further information regarding these non-GAAP financial measures, including a reconciliation of each of these measures to the most directly comparable GAAP measure, is included in the Appendix to this presentation. Forward-Looking Statements

Investor Day Agenda 8:45 am Susan Story: Overview and Strategy 9:15 am Walter Lynch: Addressing Water Quality Challenges 9:45 am 15 Minute Break 10:00 am Susan Hardwick: Focus on Capital Investment 10:30 am 11:30 am Walter Lynch & Susan Hardwick: Regulated Operations & Financial Overview 11:45 am Q&A 12:30 pm Conference Wrap-Up 8:30 am Ed Vallejo: Welcome and Safety Message Susan Story: Closing Remarks

Strategy Execution November 7, 2019 We keep life flowing ® Susan Story President and Chief Executive Officer Welcome We keep life flowing ®

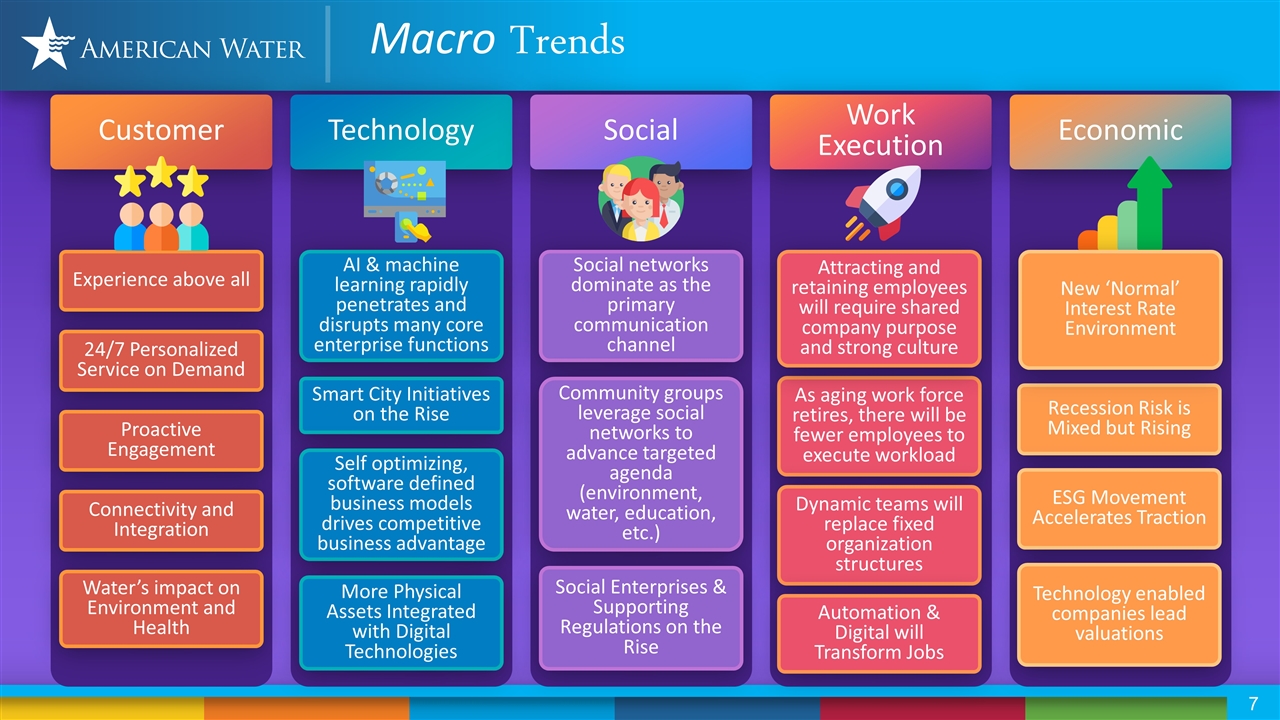

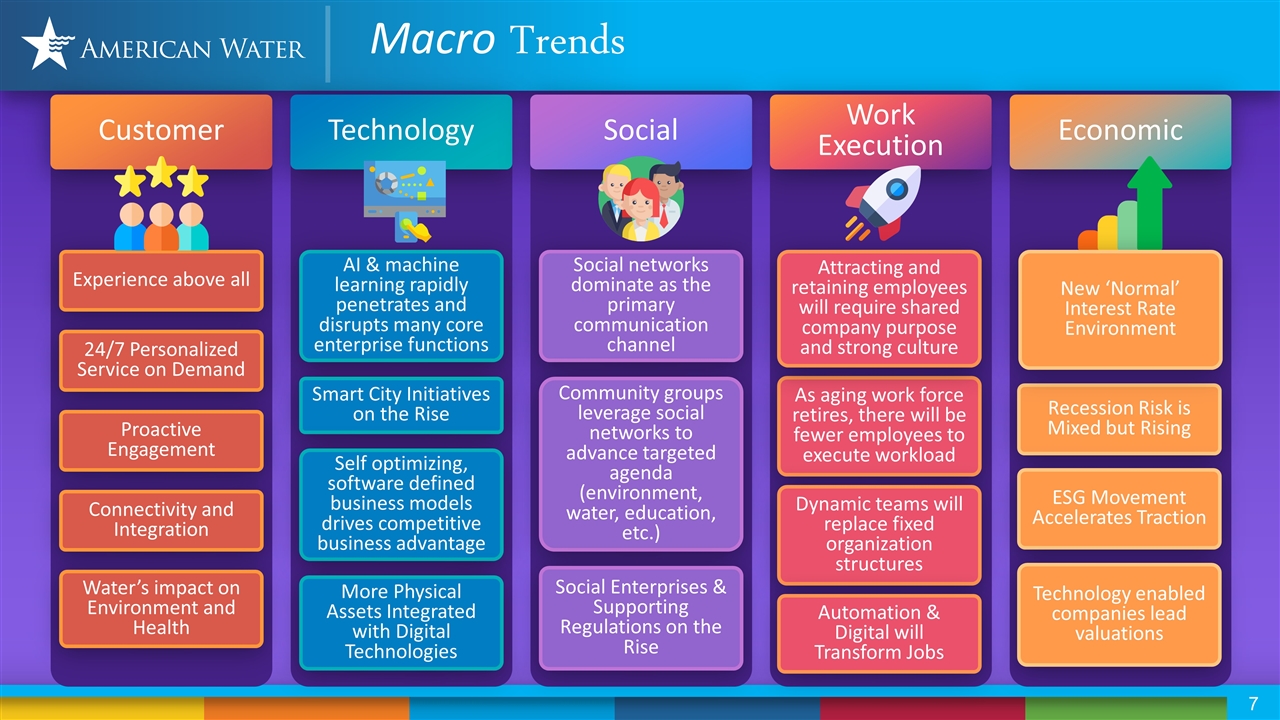

Macro Trends Customer Technology Social Work Execution Economic Experience above all 24/7 Personalized Service on Demand Proactive Engagement Connectivity and Integration Water’s impact on Environment and Health AI & machine learning rapidly penetrates and disrupts many core enterprise functions Smart City Initiatives on the Rise Self optimizing, software defined business models drives competitive business advantage More Physical Assets Integrated with Digital Technologies Social networks dominate as the primary communication channel Community groups leverage social networks to advance targeted agenda (environment, water, education, etc.) Social Enterprises & Supporting Regulations on the Rise As aging work force retires, there will be fewer employees to execute workload Dynamic teams will replace fixed organization structures Automation & Digital will Transform Jobs Recession Risk is Mixed but Rising ESG Movement Accelerates Traction Technology enabled companies lead valuations Attracting and retaining employees will require shared company purpose and strong culture New ‘Normal’ Interest Rate Environment

We keep life flowing Trusted source of everything water “ ” execution of business fundamentals Highest in customer satisfaction Set the bar for water quality, water source monitoring, and water technology across US Proven and predictable financial performance and growth CUSTOMER OBSESSED The industry leader What Won’t Change… Our Strategy: Purpose Driven. People Powered. Safety Trust Teamwork Environmental Leadership High Performance Values Everything Water Best in Class Strategies Customer Obsessed. Trusted Source of ®

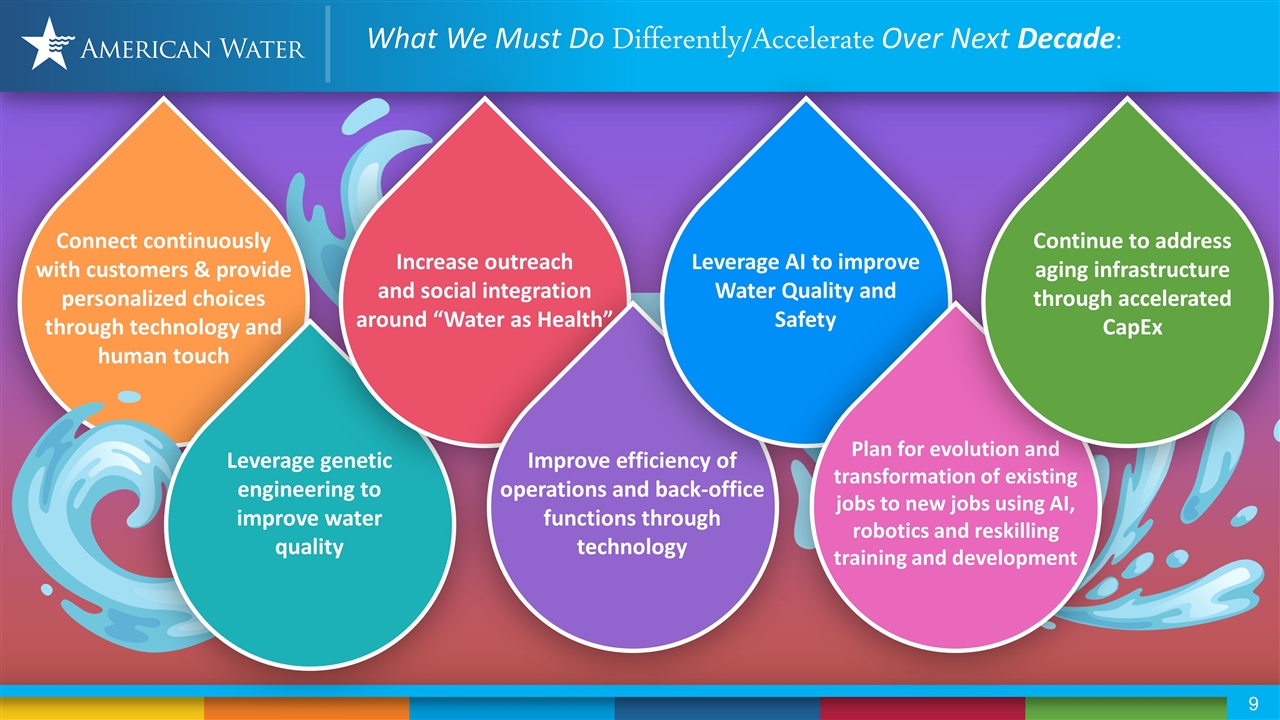

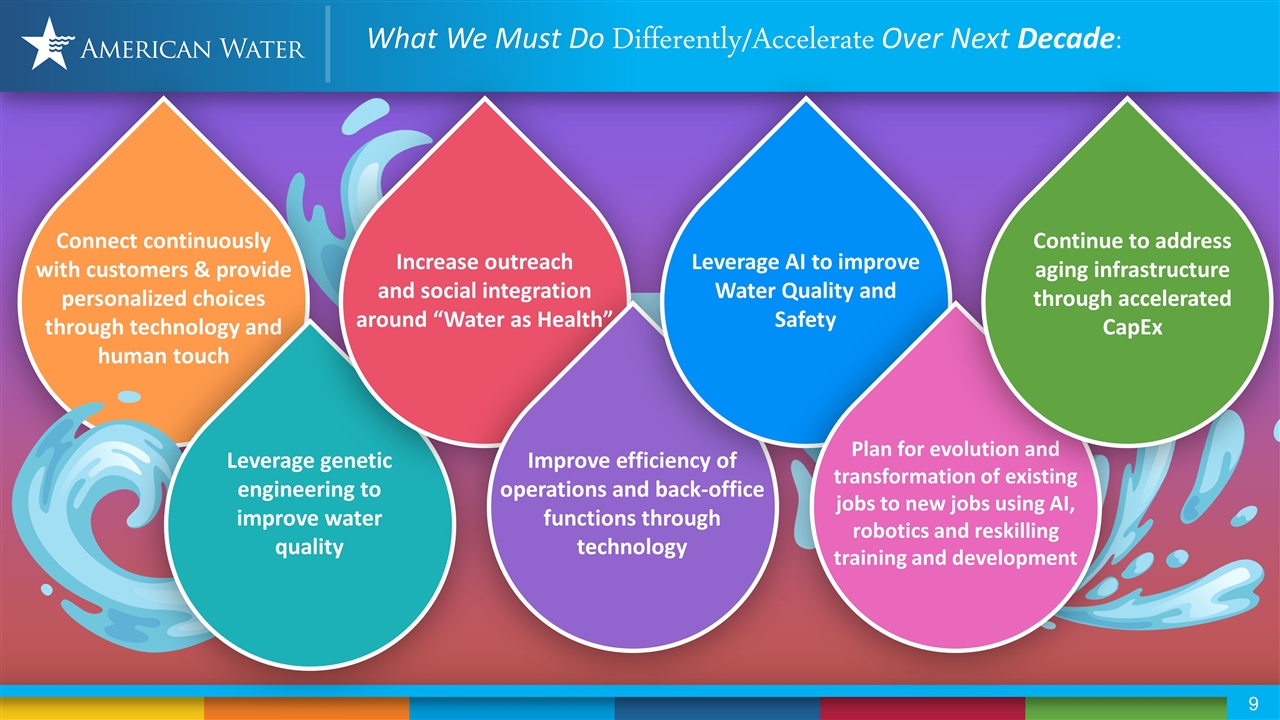

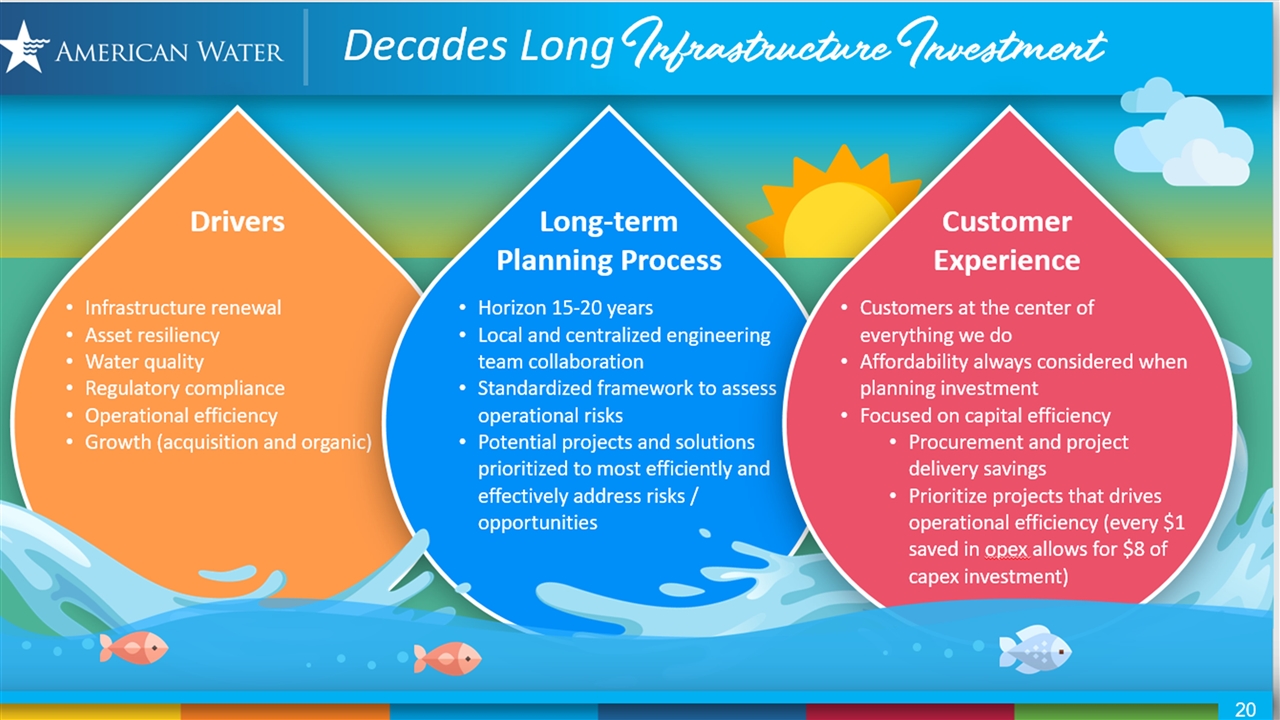

Connect continuously with customers & provide personalized choices through technology and human touch What We Must Do Differently/Accelerate Over Next Decade: Leverage genetic engineering to improve water quality Increase outreach and social integration around “Water as Health” Improve efficiency of operations and back-office functions through technology Leverage AI to improve Water Quality and Safety Plan for evolution and transformation of existing jobs to new jobs using AI, robotics and reskilling training and development Continue to address aging infrastructure through accelerated CapEx

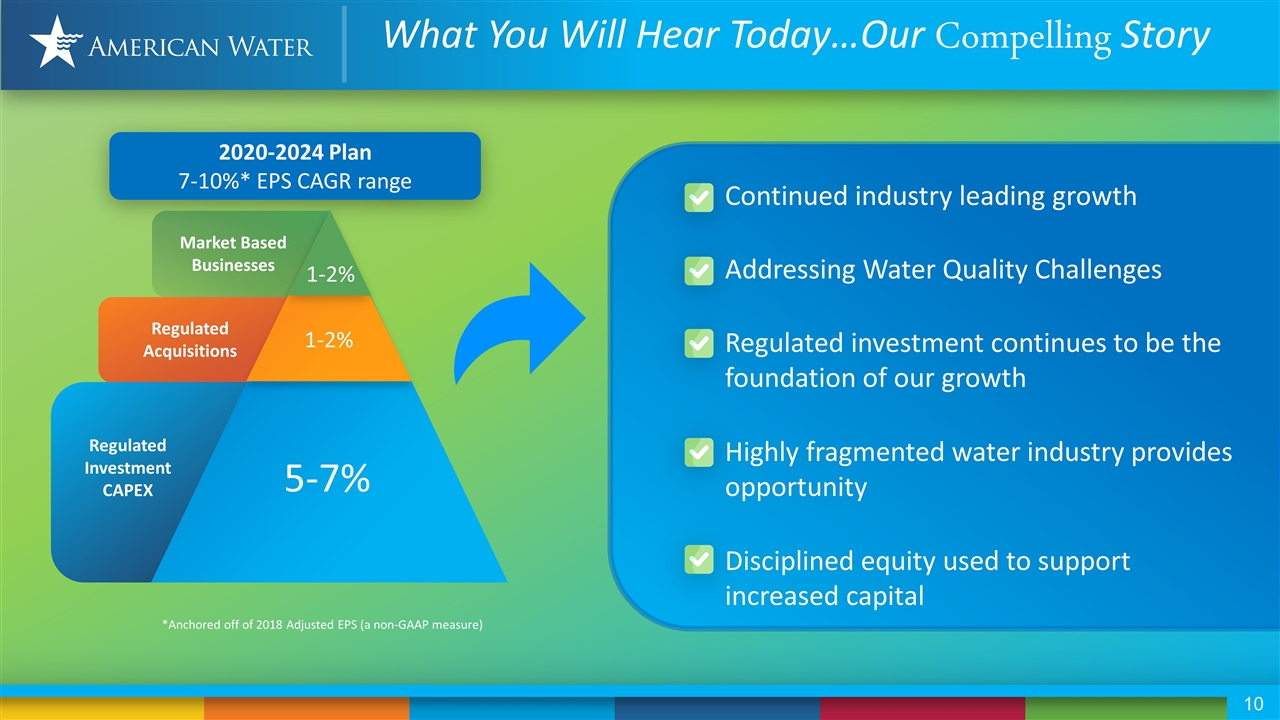

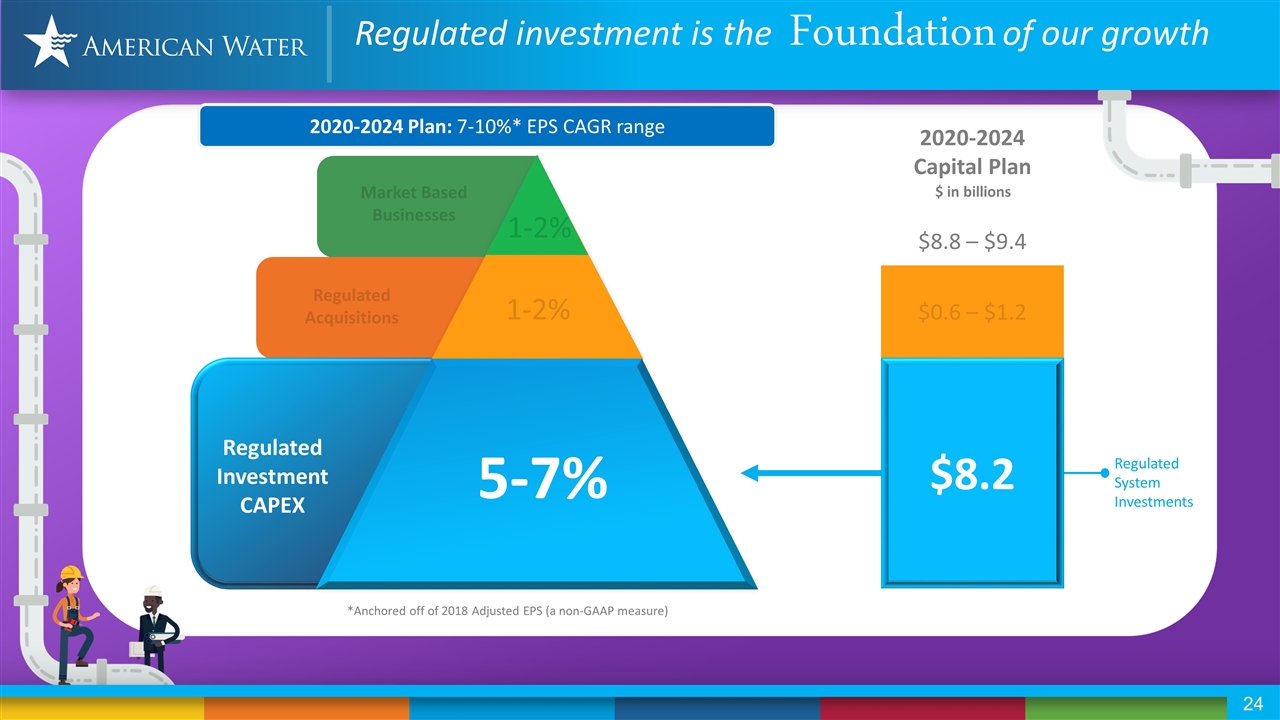

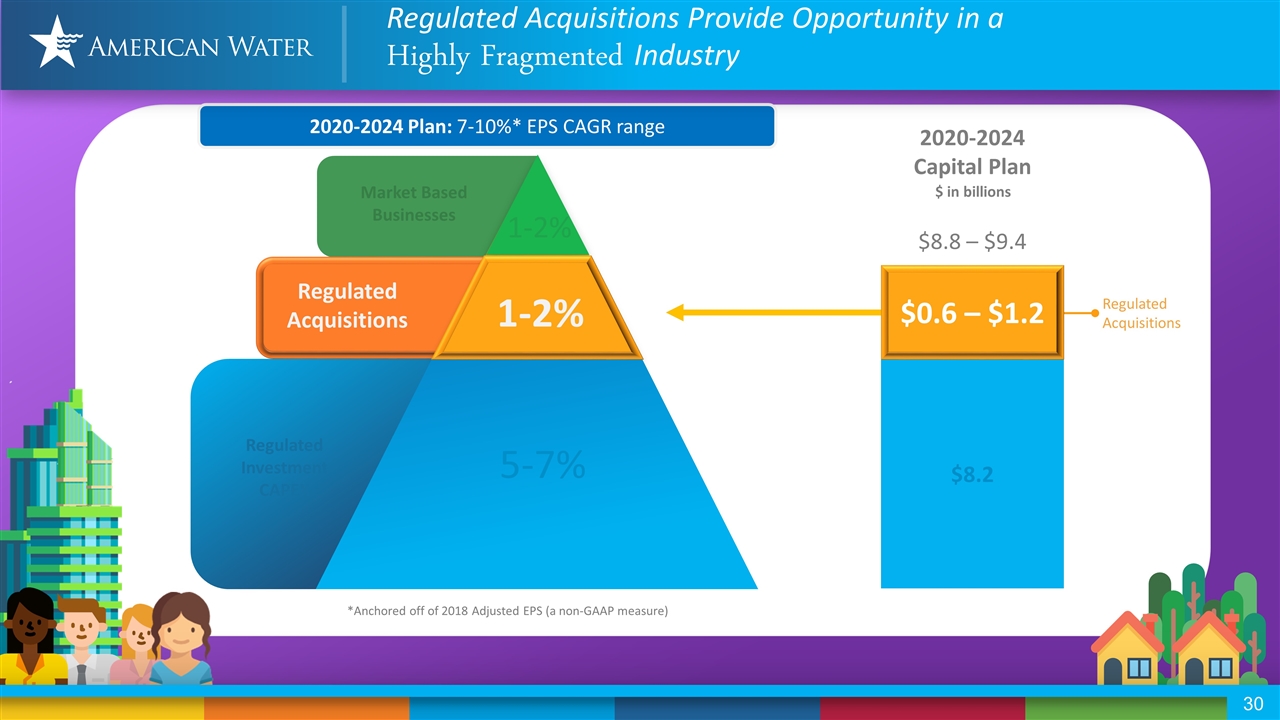

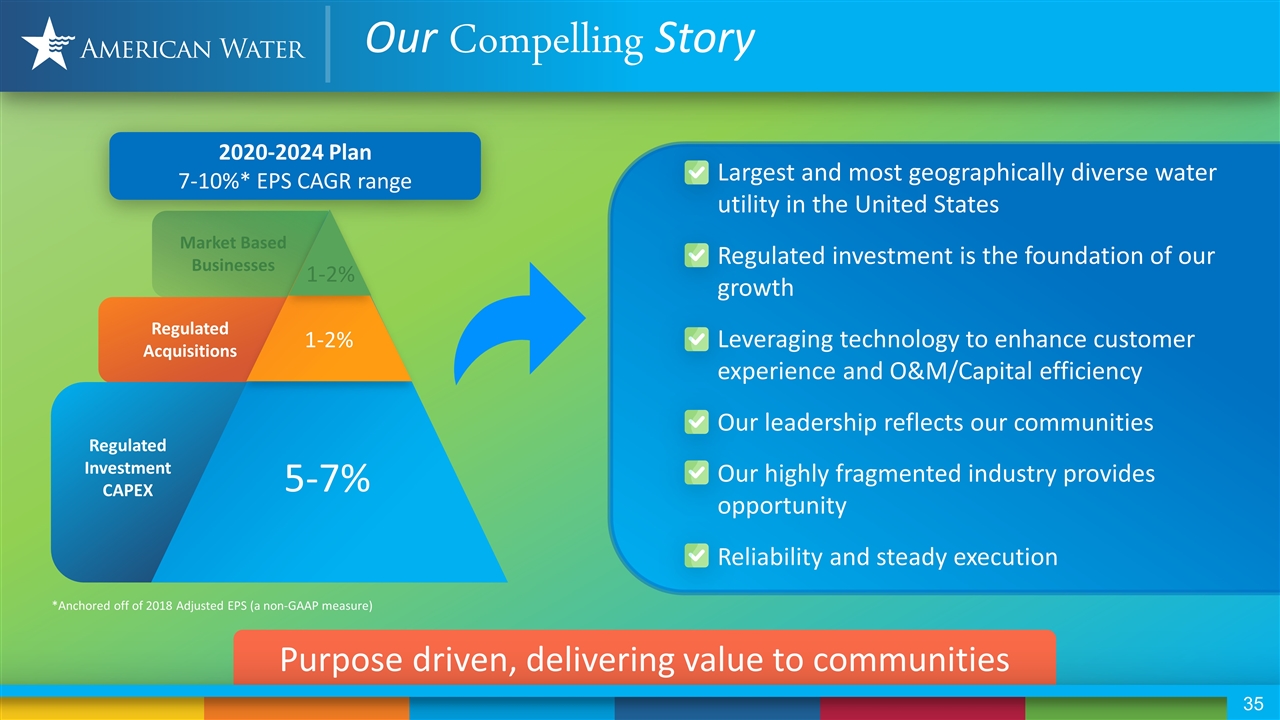

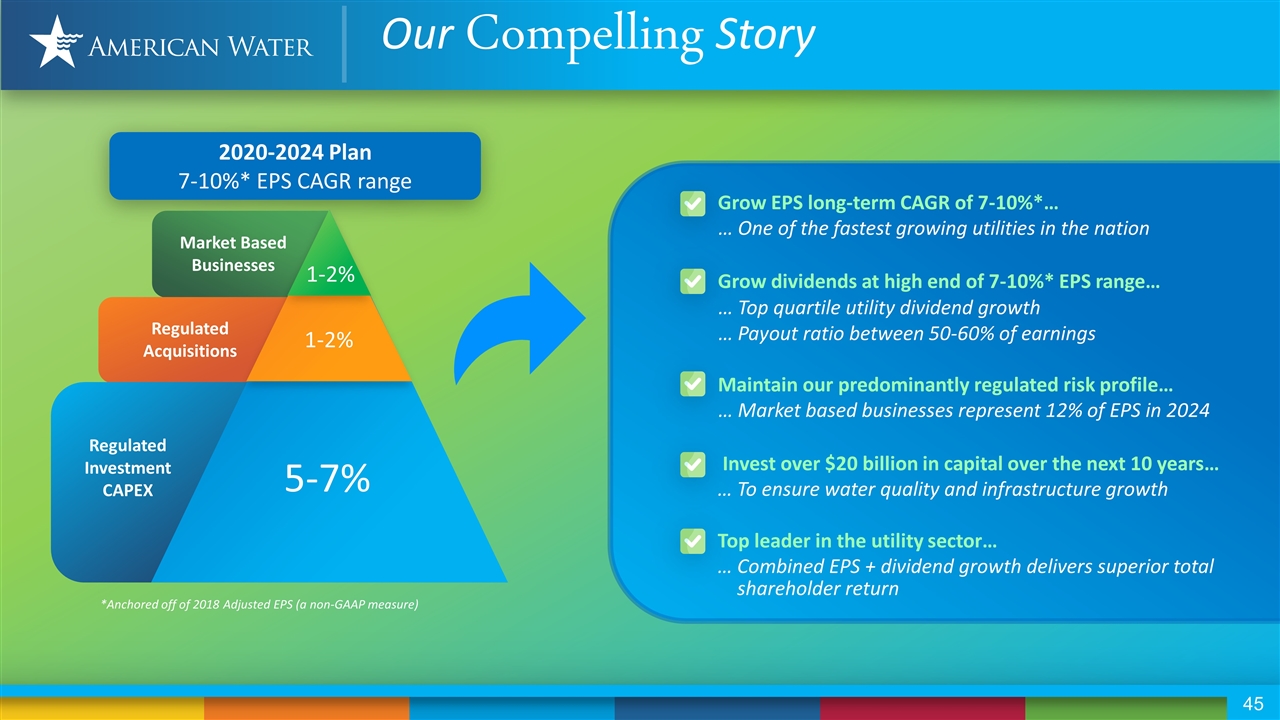

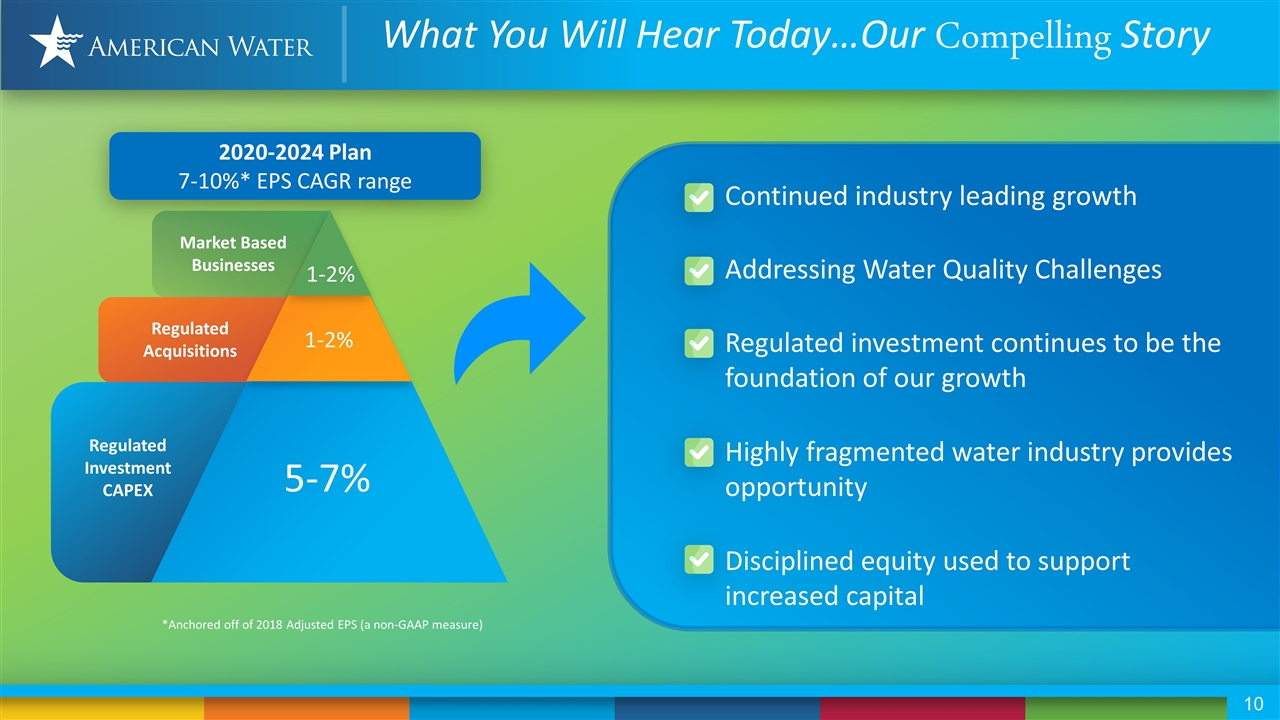

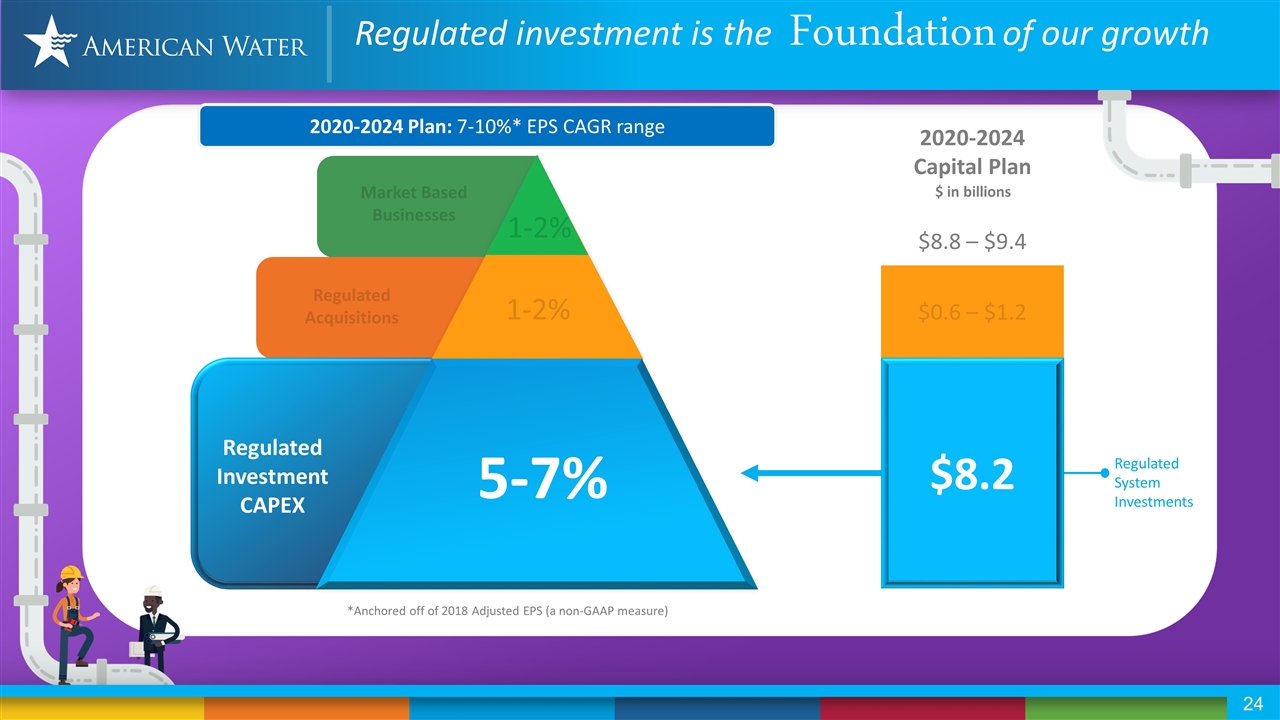

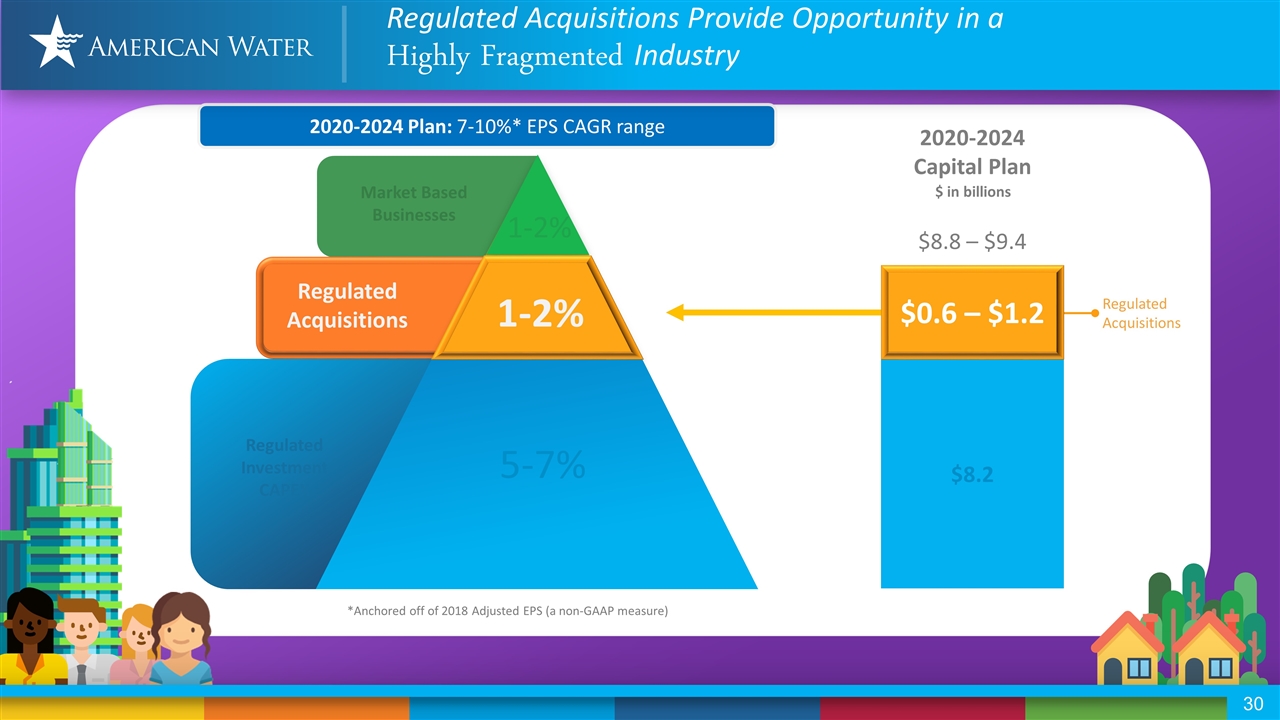

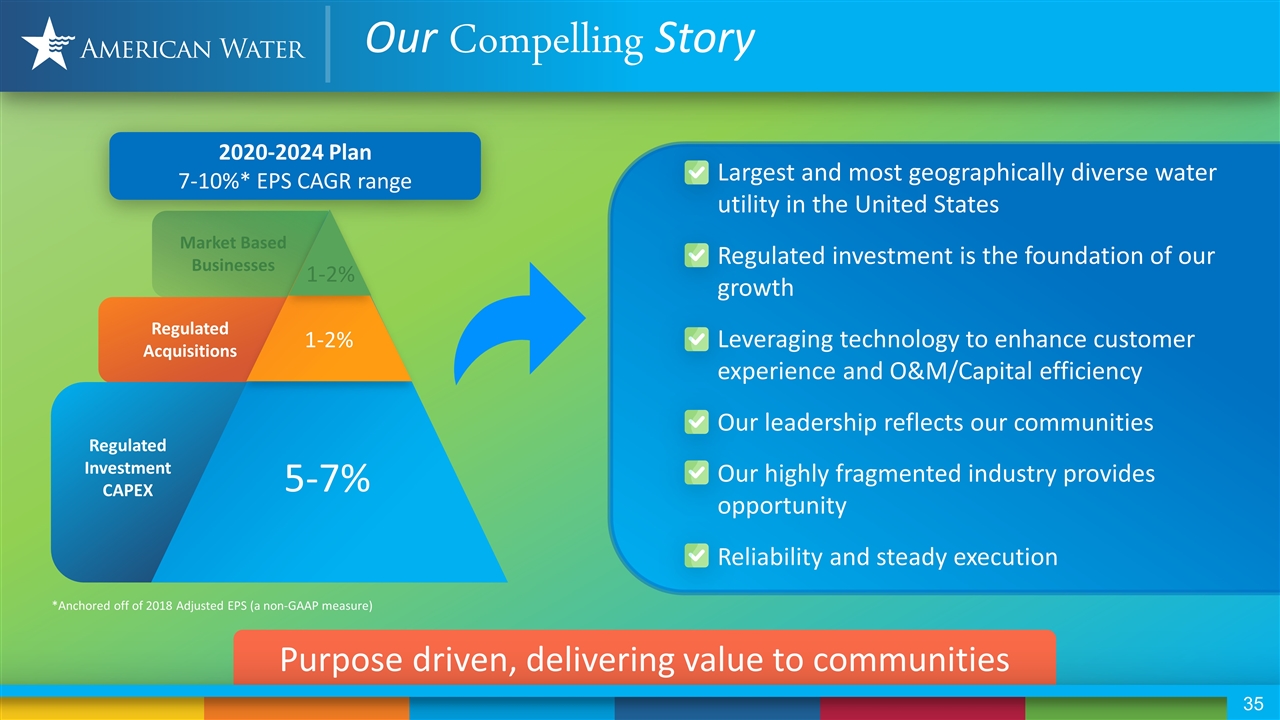

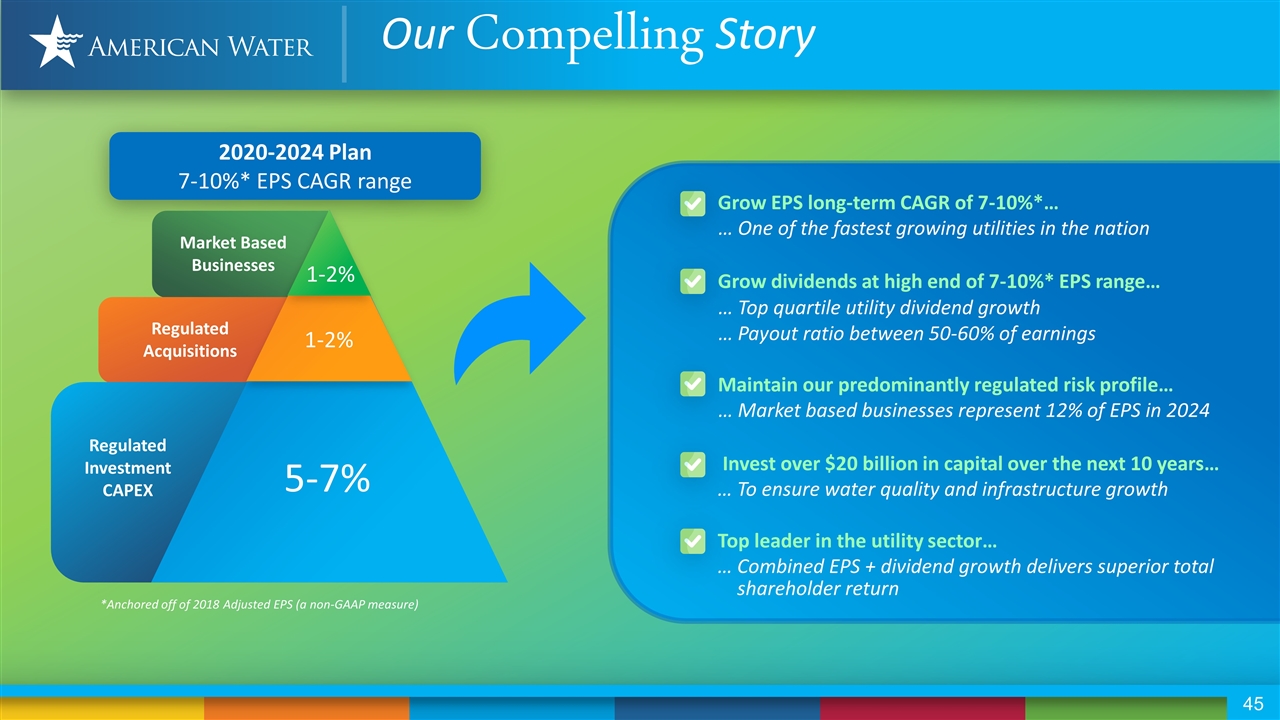

2020-2024 Plan 7-10%* EPS CAGR range Regulated Acquisitions Regulated Investment CAPEX 1-2% 1-2% 5-7% Market Based Businesses *Anchored off of 2018 Adjusted EPS (a non-GAAP measure) Continued industry leading growth Regulated investment continues to be the foundation of our growth Highly fragmented water industry provides opportunity Disciplined equity used to support increased capital Addressing Water Quality Challenges What You Will Hear Today…Our Compelling Story

Strategy Execution November 7, 2019 We keep life flowing ® Walter Lynch Chief Operating Officer Water Quality We keep life flowing ®

We keep life flowing Water Quality Video ®

Water Quality is essential to our business We keep life flowing ® Emerging Contaminants Ground Water Contamination Algal Contamination Chemical Spill in Water Supply Cross Connection Control Failure Movement of Groundwater Plume Abnormal Weather Events Water Quality Challenges

We keep life flowing ® Walter Lynch Chief Operating Officer Cheryl Norton Senior Vice President, Eastern Division & President - NJ Kevin Kirwan Senior Vice President, Chief Environmental & Operational Excellence Officer Dr. Lauren Weinrich Principal Scientist, Water Intelligence

American Water on Water Quality What is Water Quality and challenges associated? What is AW doing about these challenges? Stakeholder perspectives: Regulatory, Investors and customer What are the Water Quality Challenges? How is AW leading the way to ensure water is clean, safe & reliable? What is the value to Regulators, Investors and Customers?

15 minute break

We keep life flowing ® Susan Hardwick Chief Financial Officer Bruce Hauk Senior Vice President, Midwest Division & President - IL David Choate Vice President, Engineering

We keep life flowing Capital Investment Video ®

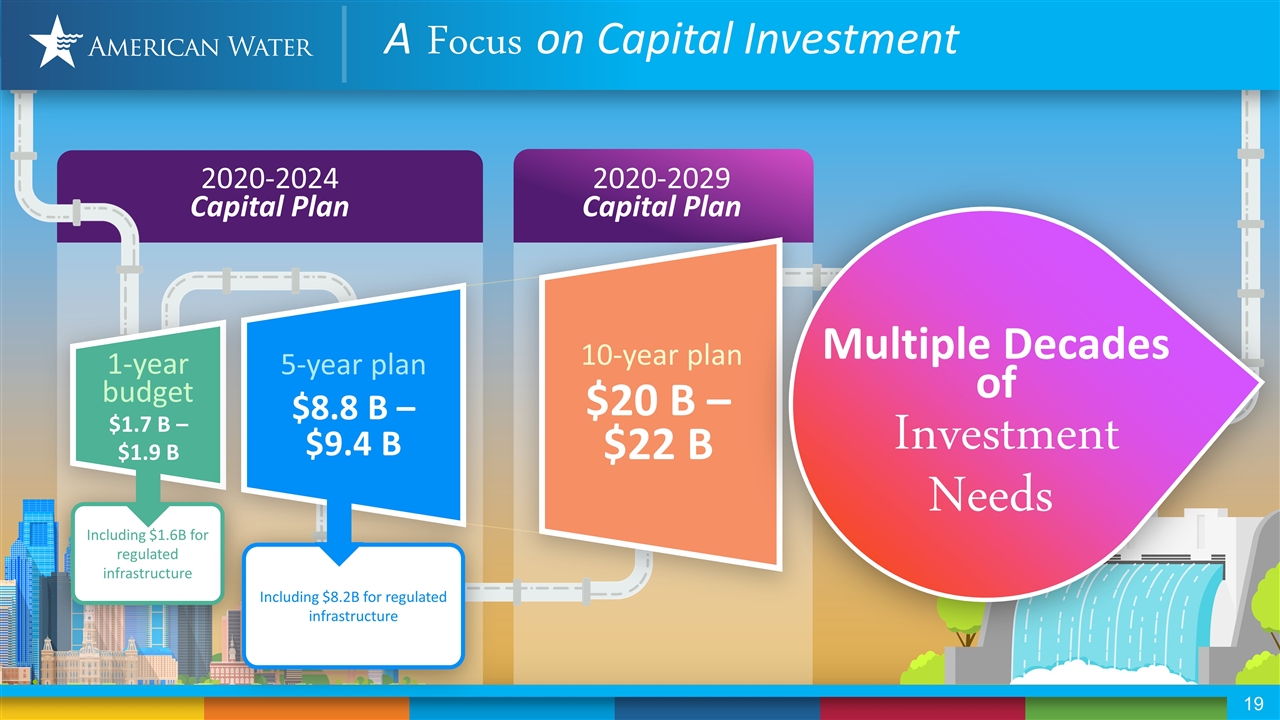

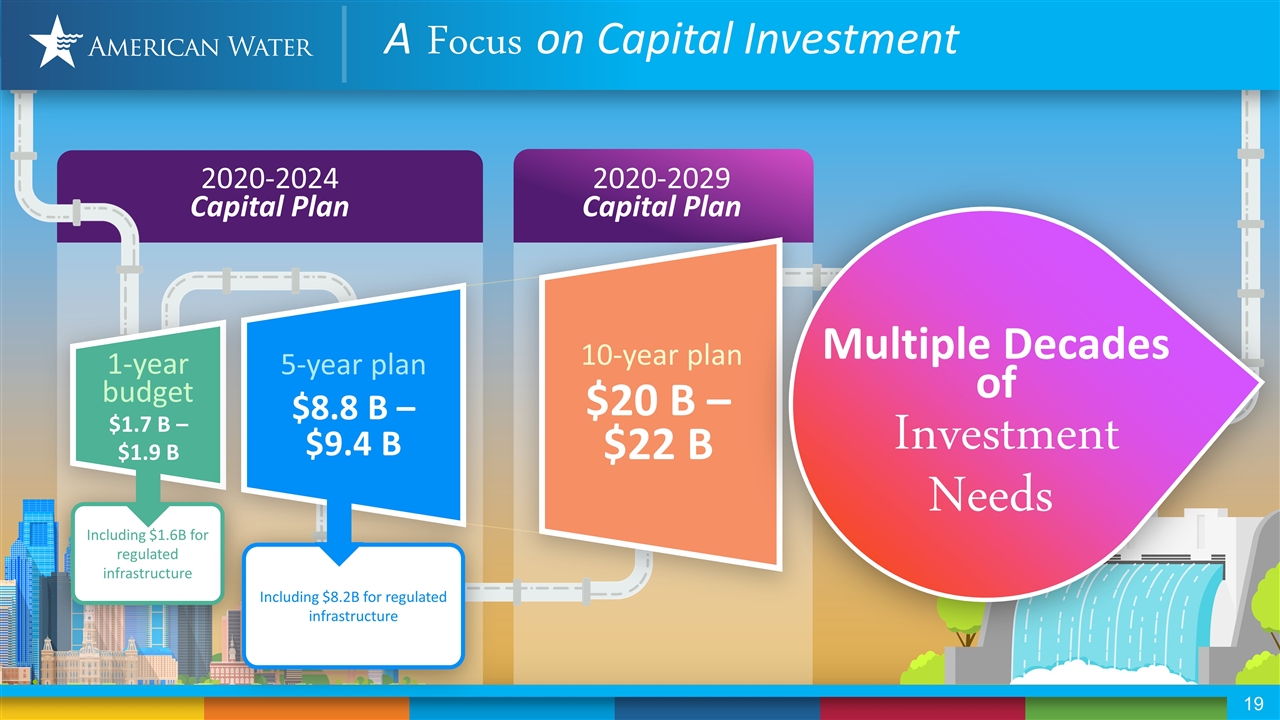

2020-2024 Capital Plan 2020-2029 Capital Plan 1-year budget $1.7 B – $1.9 B 5-year plan $8.8 B – $9.4 B 10-year plan $20 B – $22 B Including $1.6B for regulated infrastructure Including $8.2B for regulated infrastructure *3.76% x $1.024 trillion 25-year need identified by AWWA in “Buried No Longer: Confronting America’s Water Infrastructure Challenge.” American Water serves approximately 12.1 million of the 321.4 million people in the U.S., or 3.76%. Multiple Decades of Investment Needs A Focus on Capital Investment

Strategy Execution November 7, 2019 We keep life flowing ® Walter Lynch Chief Operating Officer Regulated Operations We keep life flowing ®

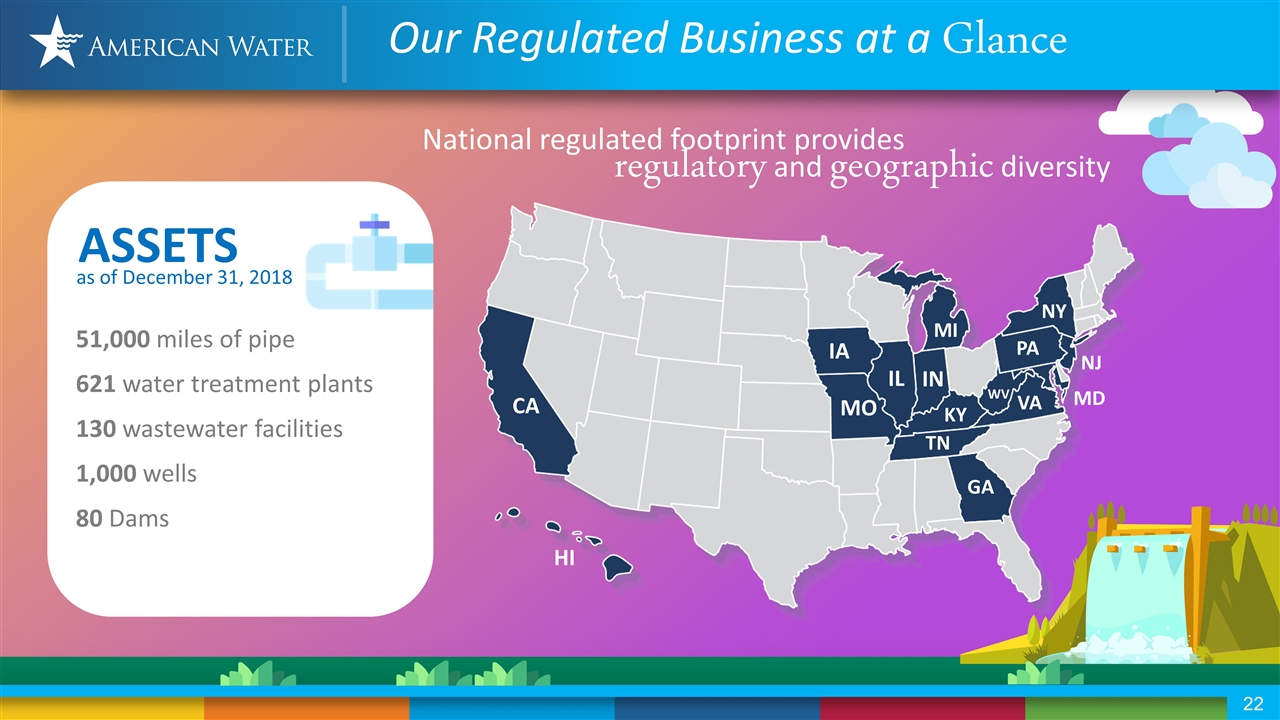

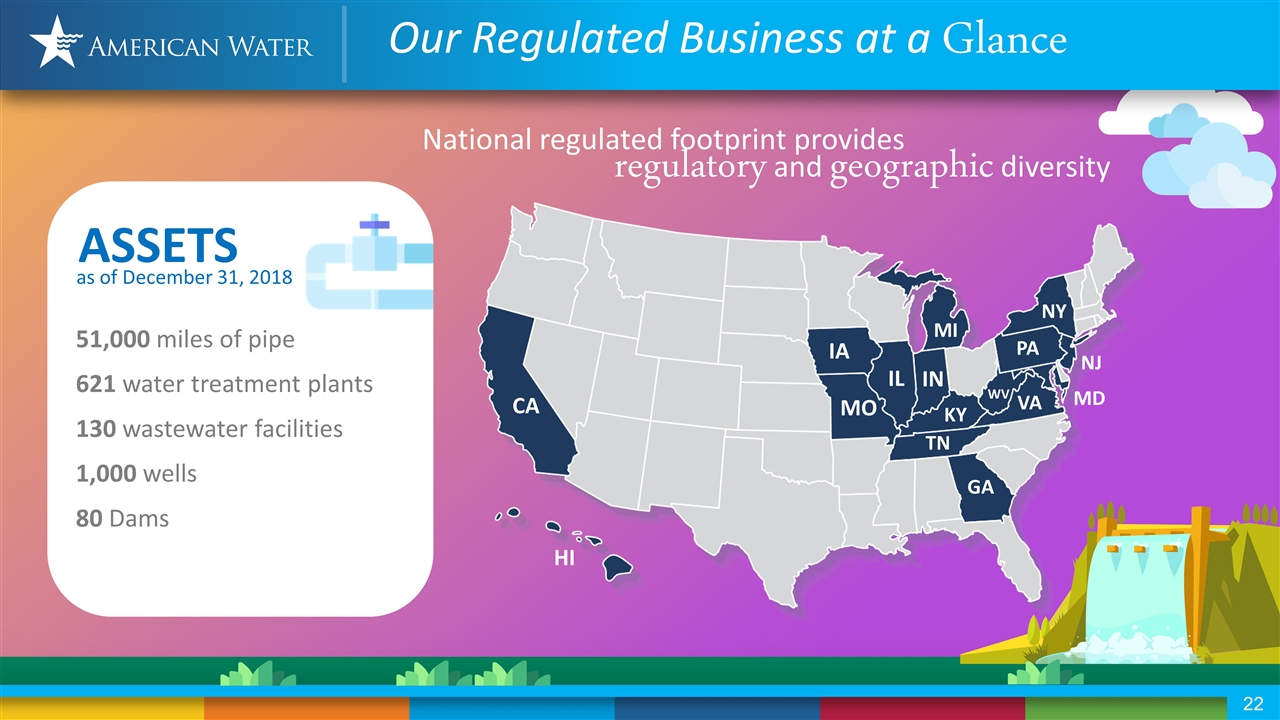

National regulated footprint provides regulatory and geographic diversity CA HI MO IA IL IN MI KY TN WV PA NY VA NJ MD GA 51,000 miles of pipe 621 water treatment plants 130 wastewater facilities 1,000 wells 80 Dams ASSETS as of December 31, 2018 Our Regulated Business at a Glance

Richard Svindland President - California and Hawaii Nick Rowe Senior Vice President, Southeast Division & President - KY Darlene Williams President Tennessee Bruce Hauk Senior Vice President, Midwest Division & President - IL Matthew Prine President Indiana & Michigan Randy Moore President Iowa Deborah Dewey President Missouri Mike Doran Senior Vice President, Mid-Atlantic Division & President - PA Robert Burton President West Virginia Cheryl Norton Senior Vice President, Eastern Division & President - NJ Lynda DiMenna President New York Barry Suits President Virginia & Maryland Our Leadership Reflects Our Communities

z Regulated System Investments 2020-2024 Capital Plan Regulated Investment CAPEX $ in billions 5-7% $0.6 – $1.2 $8.8 – $9.4 1-2% 1-2% Market Based Businesses Regulated Acquisitions Regulated investment is the Foundation of our growth $8.2 2020-2024 Plan: 7-10%* EPS CAGR range *Anchored off of 2018 Adjusted EPS (a non-GAAP measure)

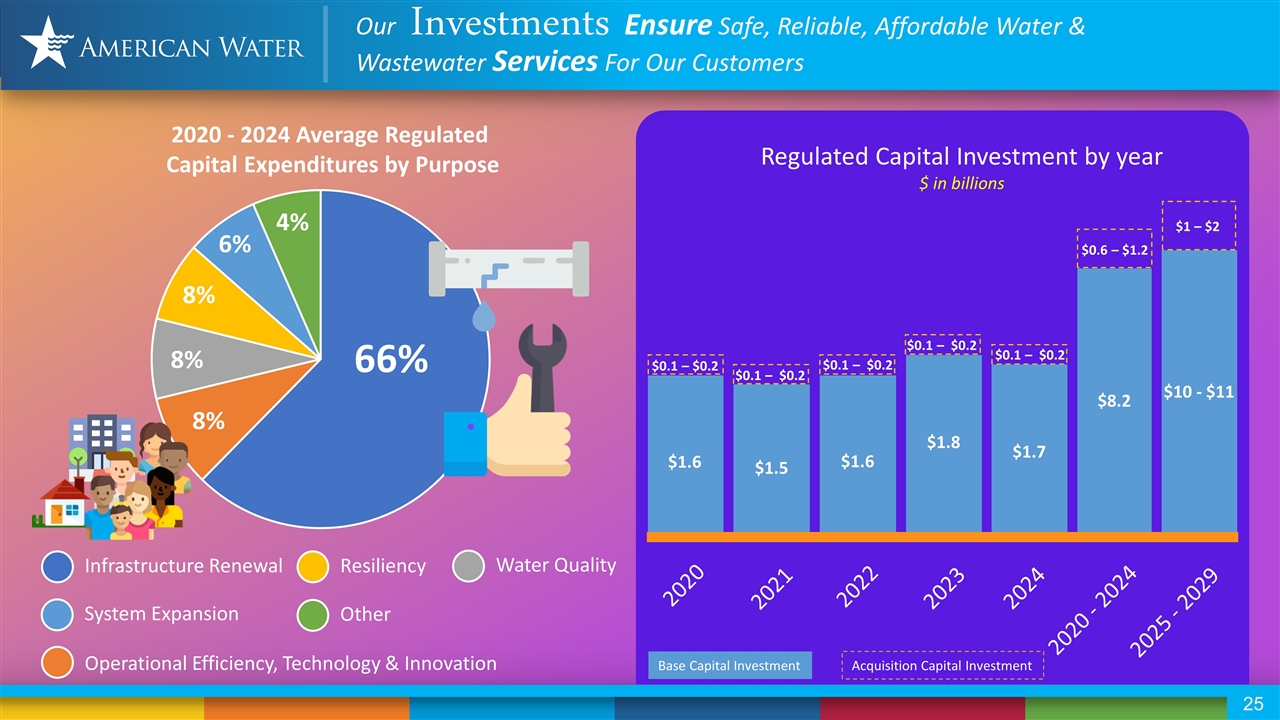

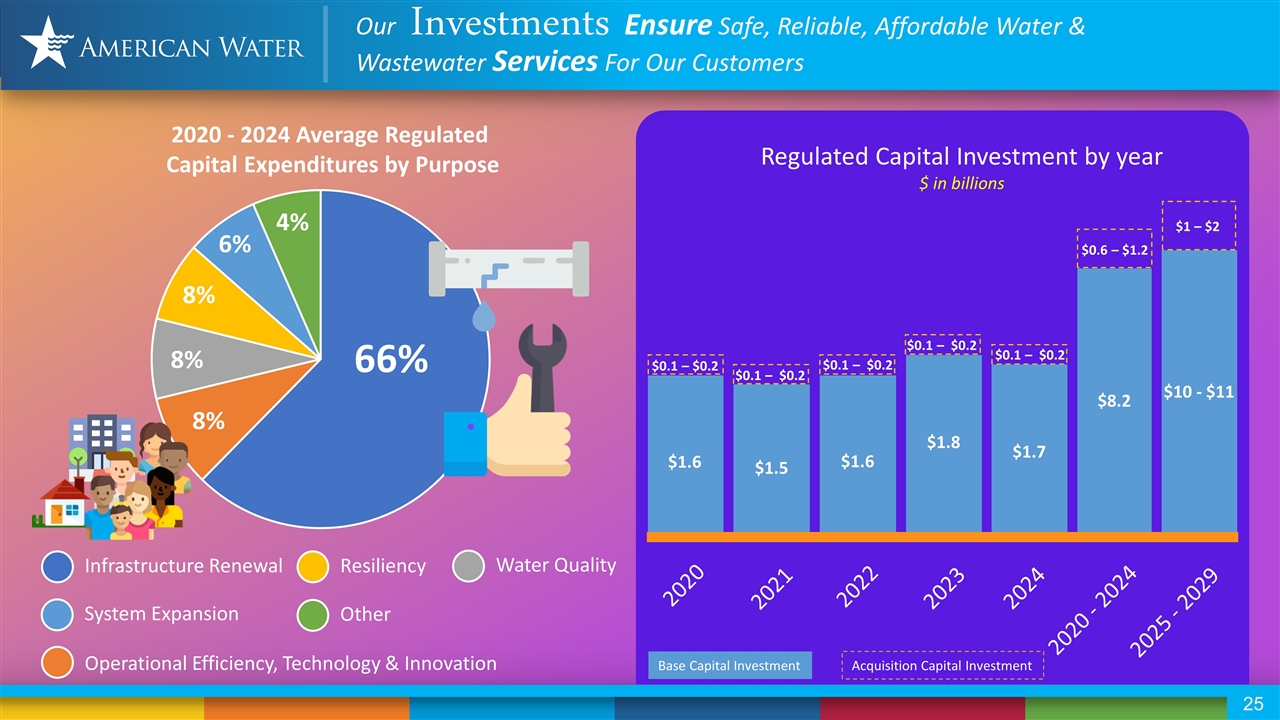

Our Investments Ensure Safe, Reliable, Affordable Water & Wastewater Services For Our Customers Regulated Capital Investment by year $ in billions 2020 2021 2022 2023 2024 2020 - 2024 2025 - 2029 66% 8% 8% 8% 6% 4% Infrastructure Renewal Operational Efficiency, Technology & Innovation Water Quality Resiliency System Expansion Other 2020 - 2024 Average Regulated Capital Expenditures by Purpose $0.1 – $0.2 $8.2 $1 – $2 $10 - $11 $0.1 – $0.2 $0.1 – $0.2 $0.6 – $1.2 $0.1 – $0.2 $0.1 – $0.2 $1.6 $1.5 $1.6 $1.8 $1.7 Base Capital Investment Acquisition Capital Investment

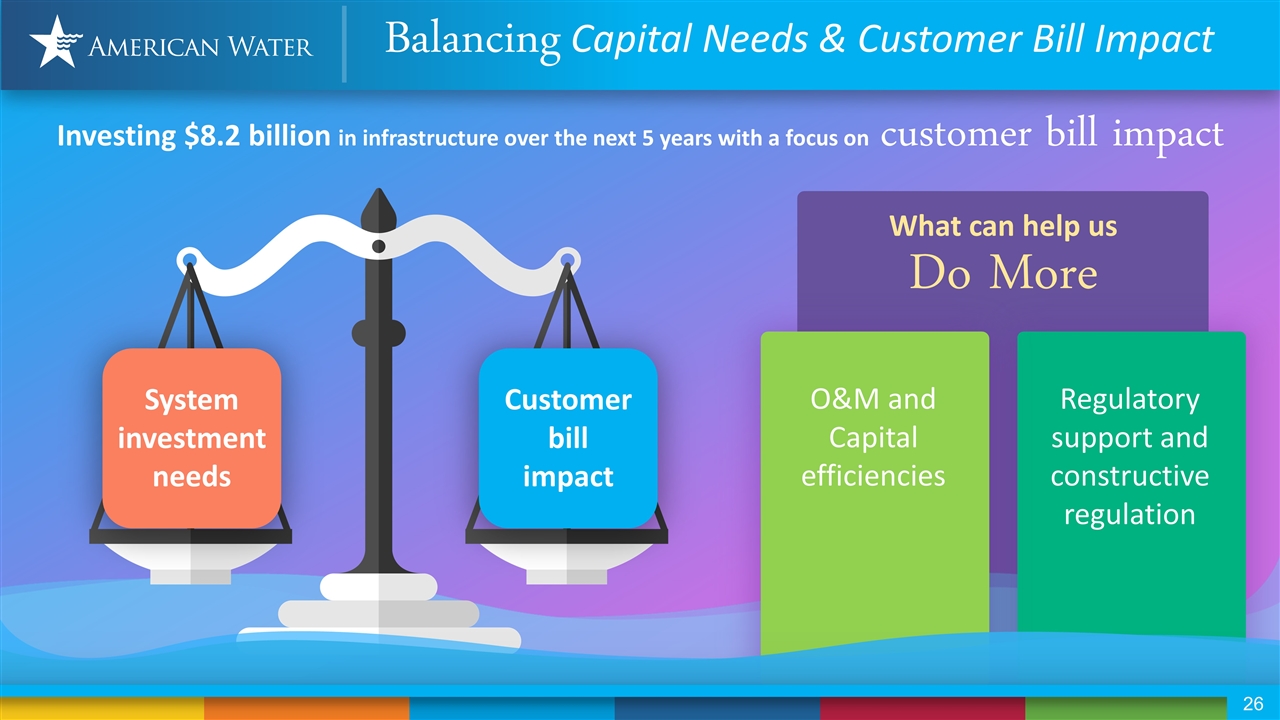

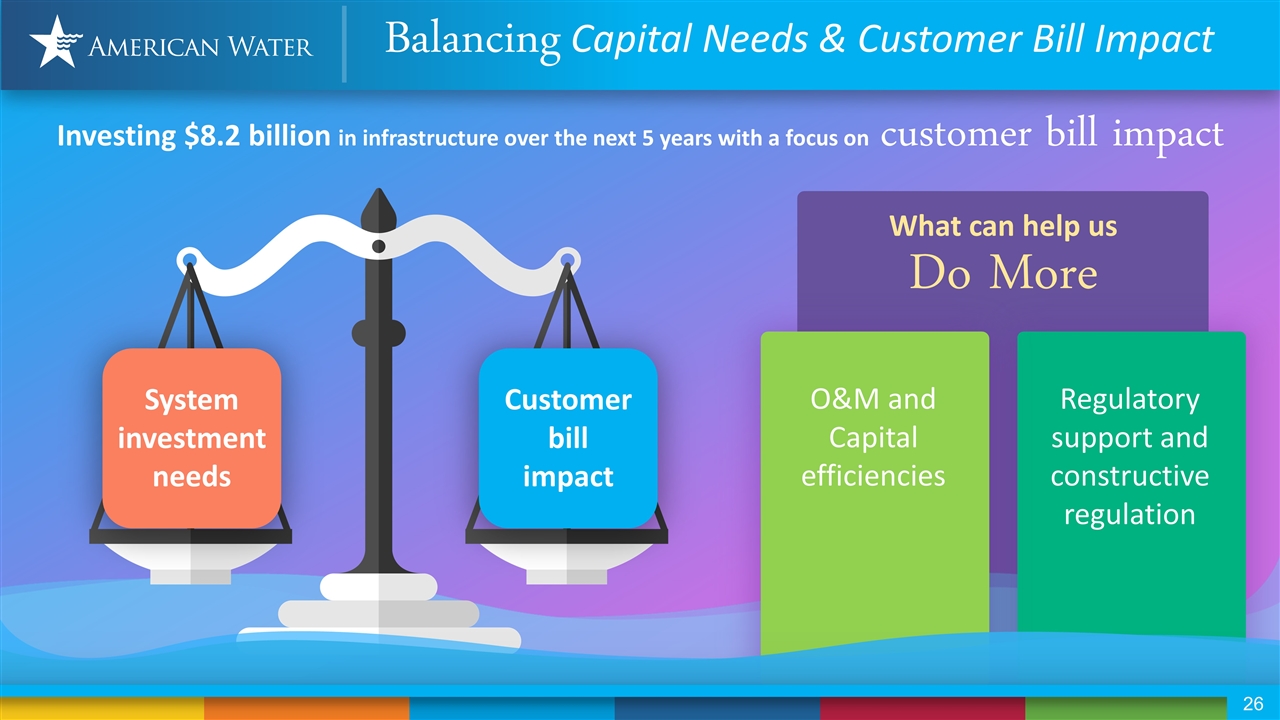

Regulatory support and constructive regulation Investing $8.2 billion in infrastructure over the next 5 years with a focus on customer bill impact System investment needs Customer bill impact O&M and Capital efficiencies What can help us Do More Balancing Capital Needs & Customer Bill Impact

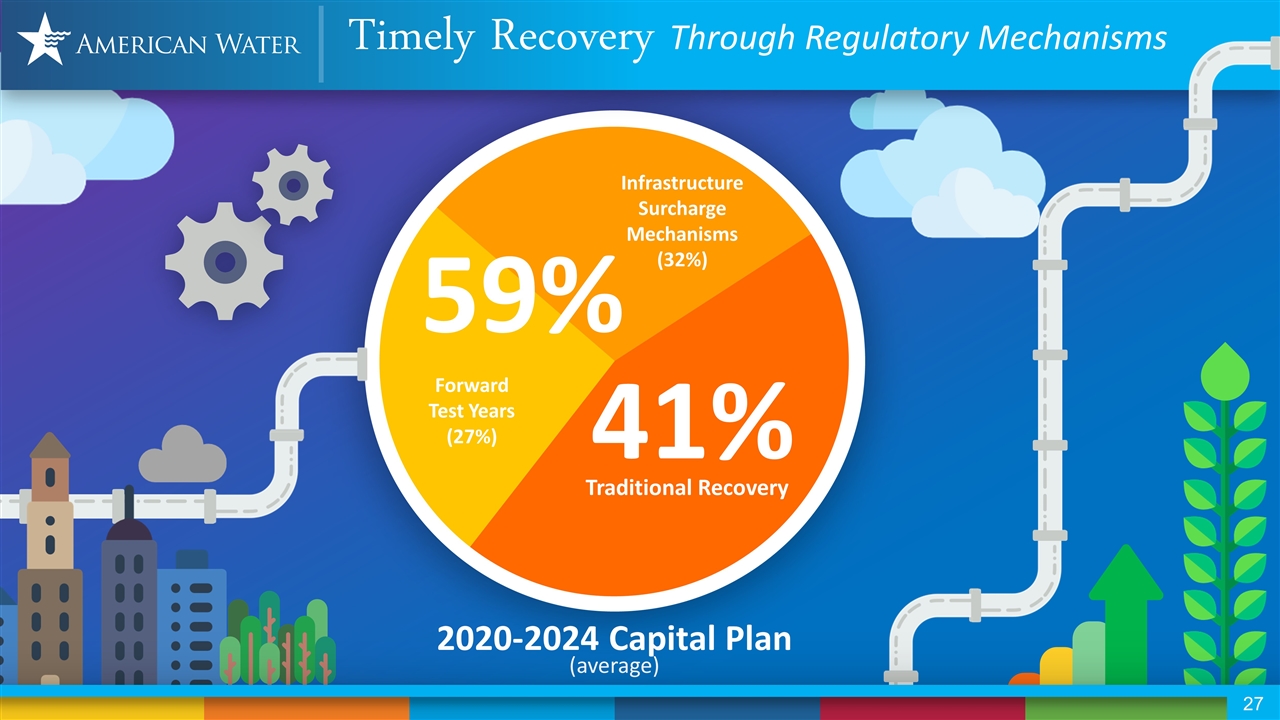

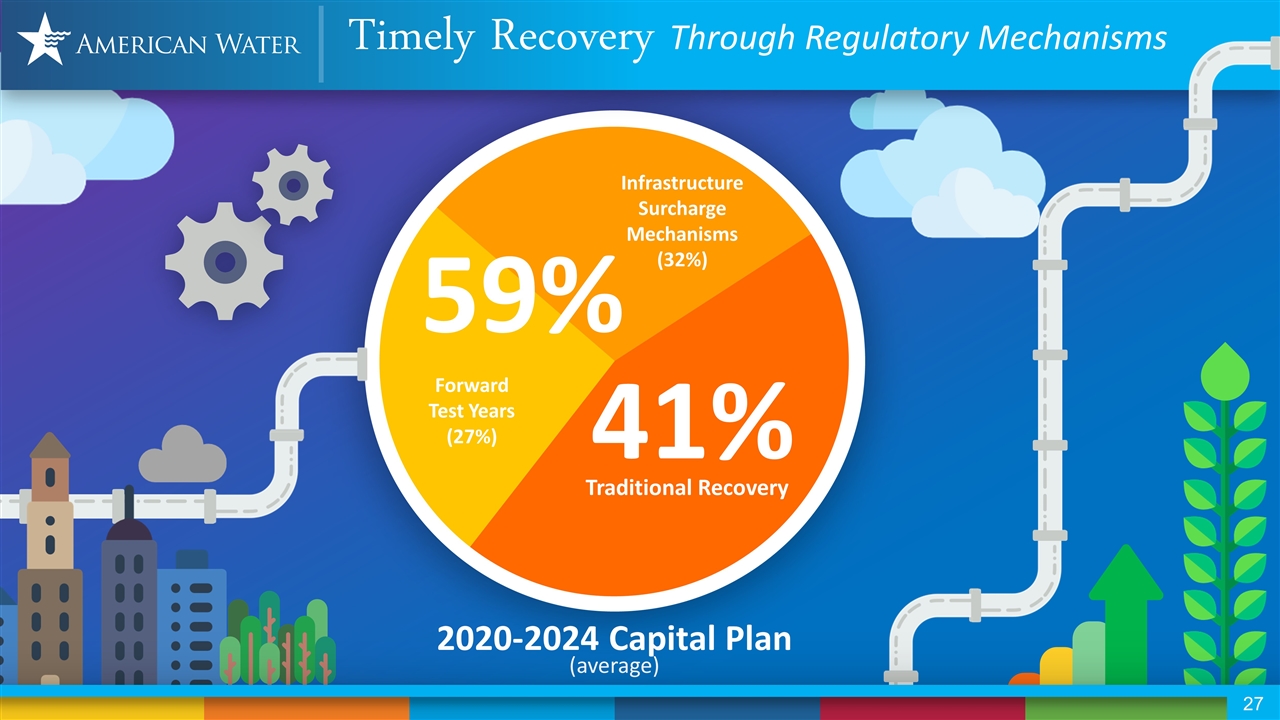

Timely Recovery Through Regulatory Mechanisms 2020-2024 Capital Plan Traditional Recovery 41% Forward Test Years (27%) Infrastructure Surcharge Mechanisms (32%) 59% (average)

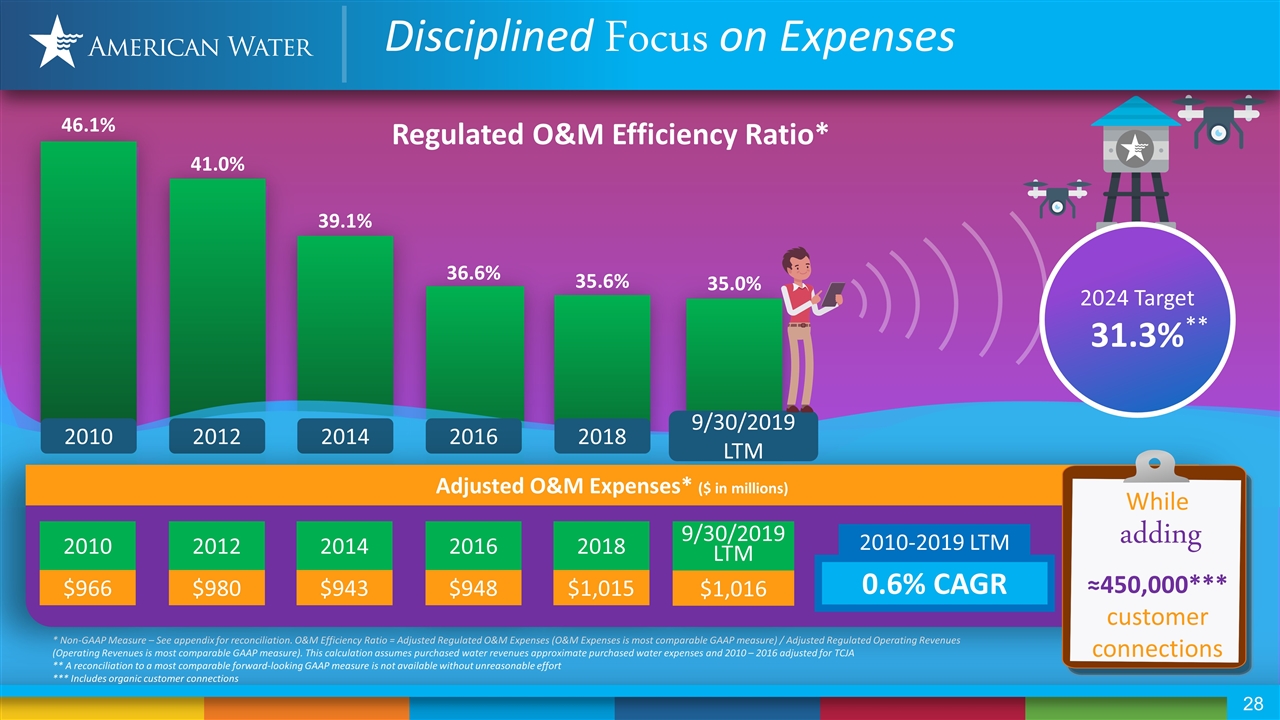

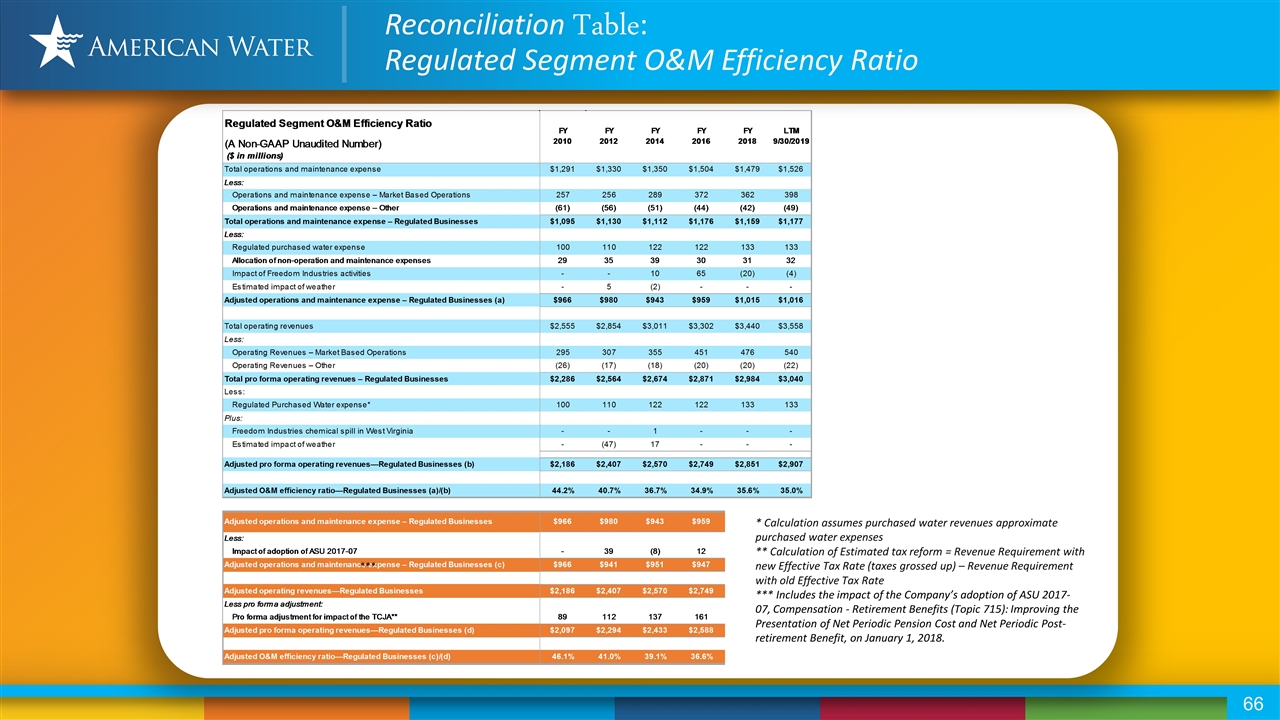

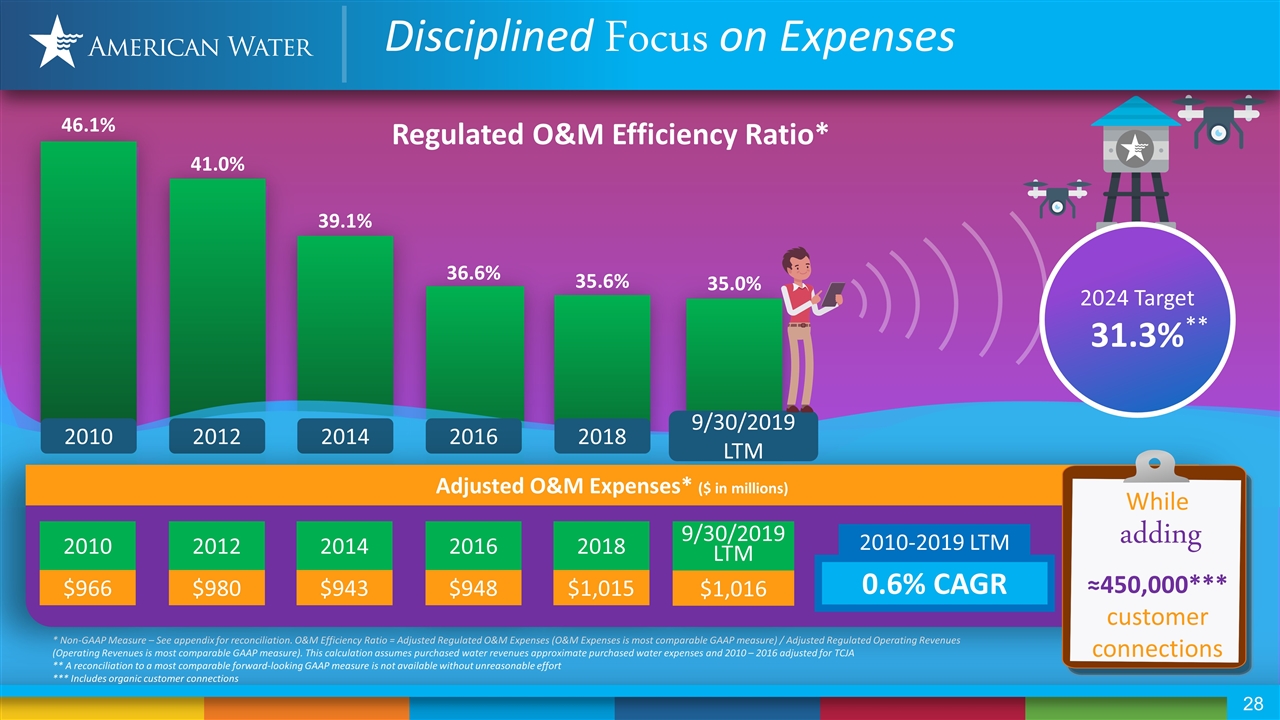

41.0% 39.1% 36.6% 35.6% 2012 2014 2016 2024 Target 31.3% Regulated O&M Efficiency Ratio* ** * Non-GAAP Measure – See appendix for reconciliation. O&M Efficiency Ratio = Adjusted Regulated O&M Expenses (O&M Expenses is most comparable GAAP measure) / Adjusted Regulated Operating Revenues (Operating Revenues is most comparable GAAP measure). This calculation assumes purchased water revenues approximate purchased water expenses and 2010 – 2016 adjusted for TCJA ** A reconciliation to a most comparable forward-looking GAAP measure is not available without unreasonable effort *** Includes organic customer connections $980 2012 $943 2014 $948 2016 $1,015 2018 0.6% CAGR Adjusted O&M Expenses* ($ in millions) 2010-2019 LTM 2018 46.1% 2010 35.0% 9/30/2019 LTM $1,016 9/30/2019 LTM $966 2010 This Photo by Unknown Author is licensed under CC BY-SA While adding ≈450,000*** customer connections Disciplined Focus on Expenses

We keep life flowing Acquisition Video ®

z 2020-2024 Plan: 7-10%* EPS CAGR range *Anchored off of 2018 Adjusted EPS (a non-GAAP measure) Regulated Acquisitions 2020-2024 Capital Plan Regulated Investment CAPEX $ in billions 5-7% $8.2 $8.8 – $9.4 1-2% Market Based Businesses 1-2% Regulated Acquisitions $0.6 – $1.2 Regulated Acquisitions Provide Opportunity in a Highly Fragmented Industry

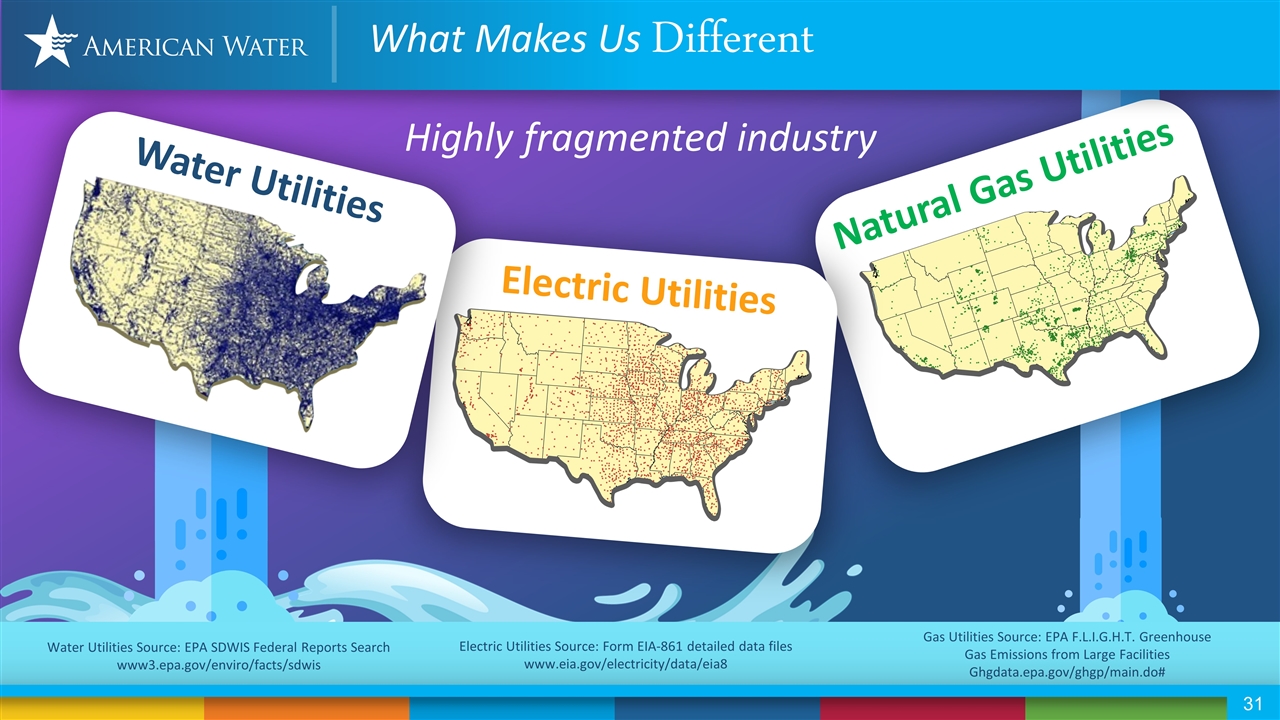

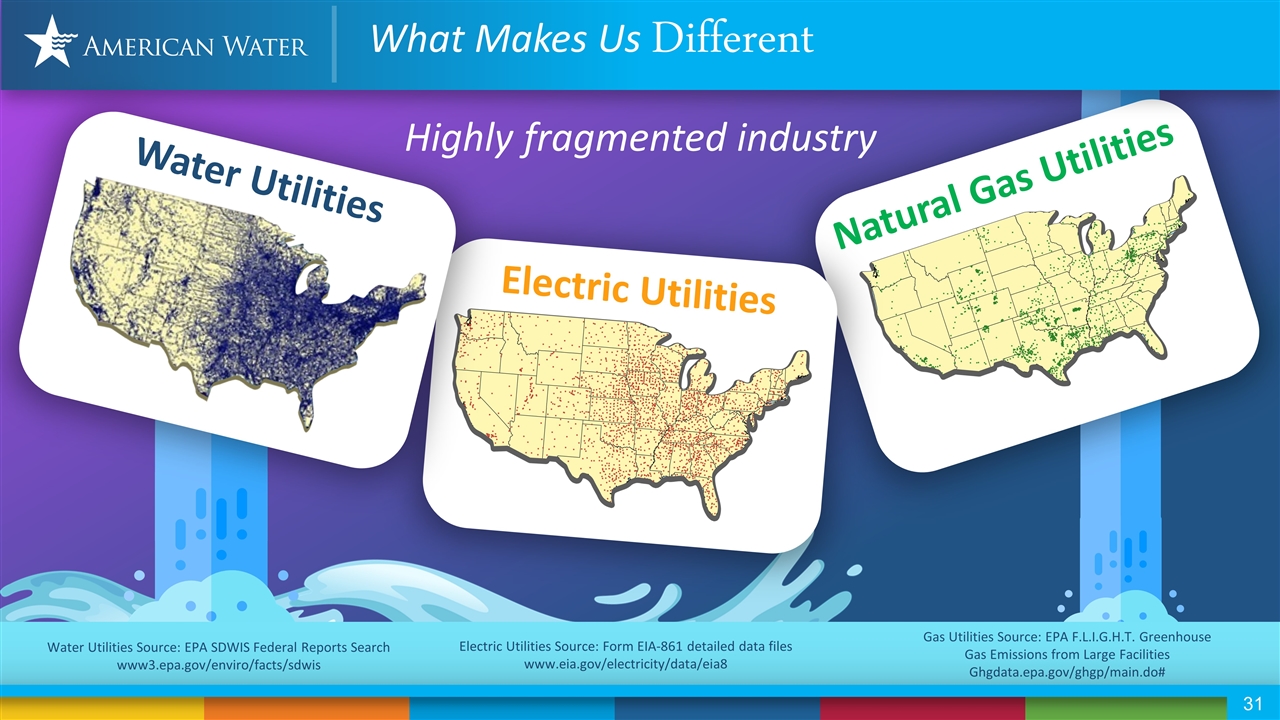

Highly fragmented industry Natural Gas Utilities What Makes Us Different Water Utilities Source: EPA SDWIS Federal Reports Search www3.epa.gov/enviro/facts/sdwis Electric Utilities Source: Form EIA-861 detailed data files www.eia.gov/electricity/data/eia8 Gas Utilities Source: EPA F.L.I.G.H.T. Greenhouse Gas Emissions from Large Facilities Ghgdata.epa.gov/ghgp/main.do# Water Utilities Electric Utilities

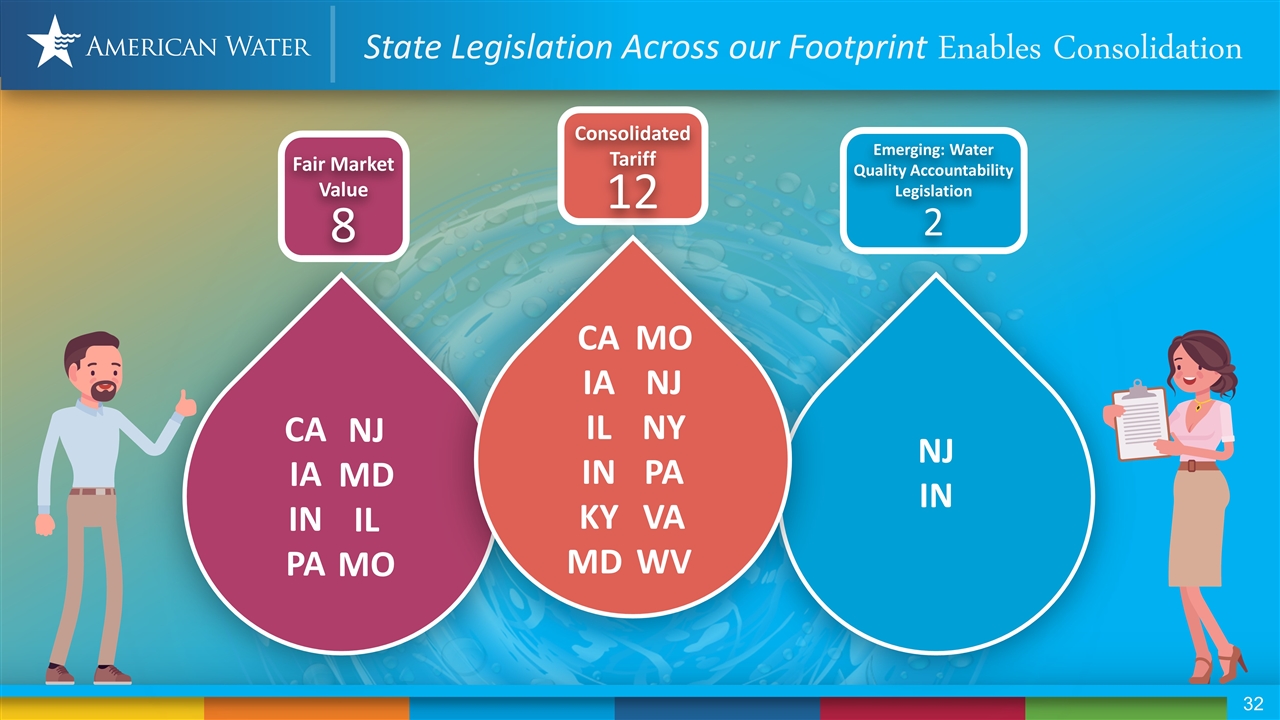

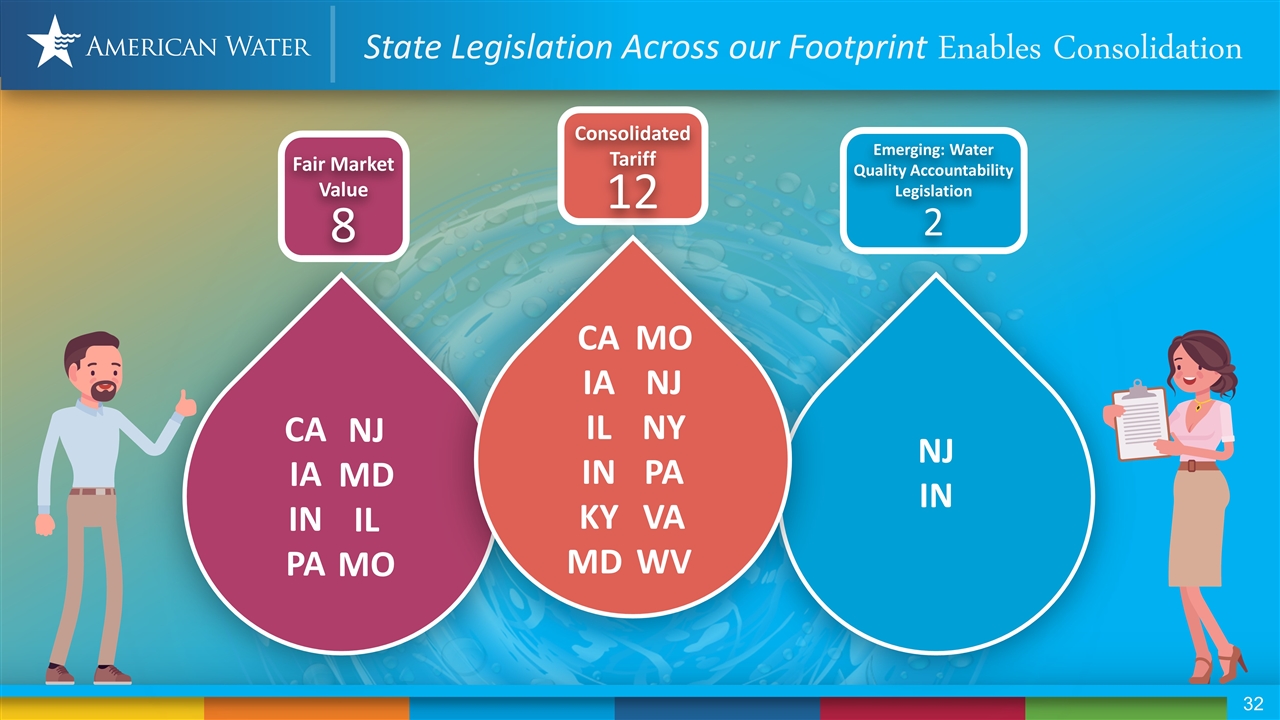

State Legislation Across our Footprint Enables Consolidation Fair Market Value 8 CA IA IN PA NJ MD IL MO Emerging: Water Quality Accountability Legislation 2 Consolidated Tariff 12 NJ IN CA IA IL IN KY MD MO NJ NY PA VA WV

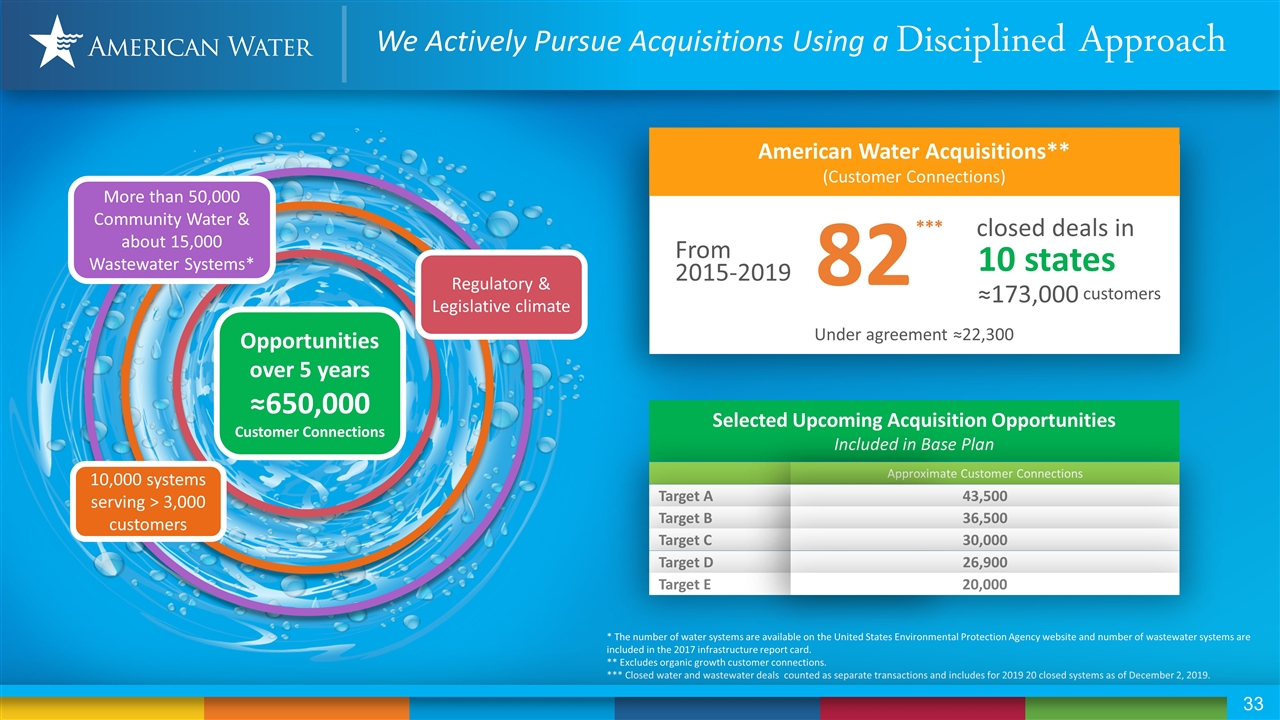

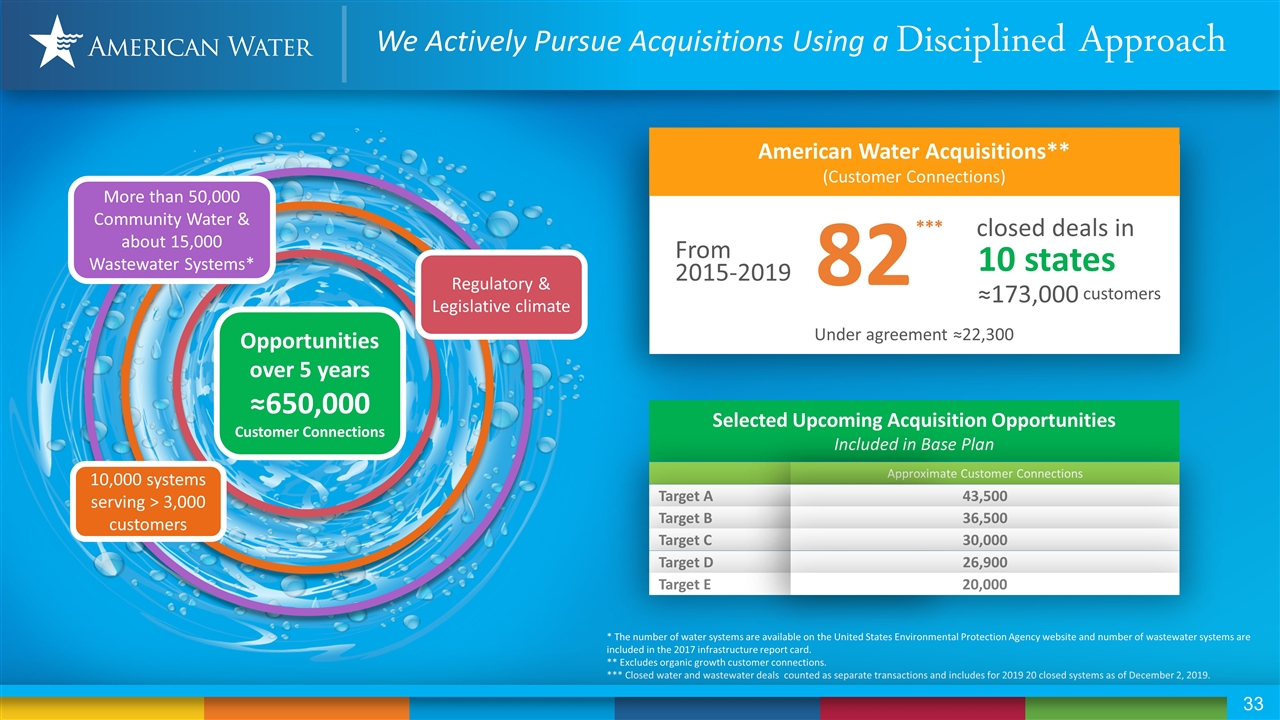

American Water Acquisitions** (Customer Connections) Selected Upcoming Acquisition Opportunities Included in Base Plan Under agreement ≈22,300 More than 50,000 Community Water & about 15,000 Wastewater Systems* 10,000 systems serving > 3,000 customers Regulatory & Legislative climate Opportunities over 5 years ≈650,000 Customer Connections * The number of water systems are available on the United States Environmental Protection Agency website and number of wastewater systems are included in the 2017 infrastructure report card. ** Excludes organic growth customer connections. *** Closed water and wastewater deals counted as separate transactions and includes for 2019 20 closed systems as of December 2, 2019. Approximate Customer Connections 82 2015-2019 From closed deals in 10 states ≈173,000 customers *** Target A Target B Target C Target D Target E 43,500 36,500 30,000 26,900 20,000 We Actively Pursue Acquisitions Using a Disciplined Approach

Impact of AW on Communities Scranton, PA Ransom, IL Bel Air, MD

2020-2024 Plan 7-10%* EPS CAGR range Regulated Acquisitions Regulated Investment CAPEX 1-2% 1-2% 5-7% Market Based Businesses *Anchored off of 2018 Adjusted EPS (a non-GAAP measure) Our Compelling Story Largest and most geographically diverse water utility in the United States Our leadership reflects our communities Regulated investment is the foundation of our growth Our highly fragmented industry provides opportunity Leveraging technology to enhance customer experience and O&M/Capital efficiency Reliability and steady execution Purpose driven, delivering value to communities

Strategy Execution November 7, 2019 We keep life flowing ® Susan Hardwick Chief Financial Officer Financial Overview We keep life flowing ®

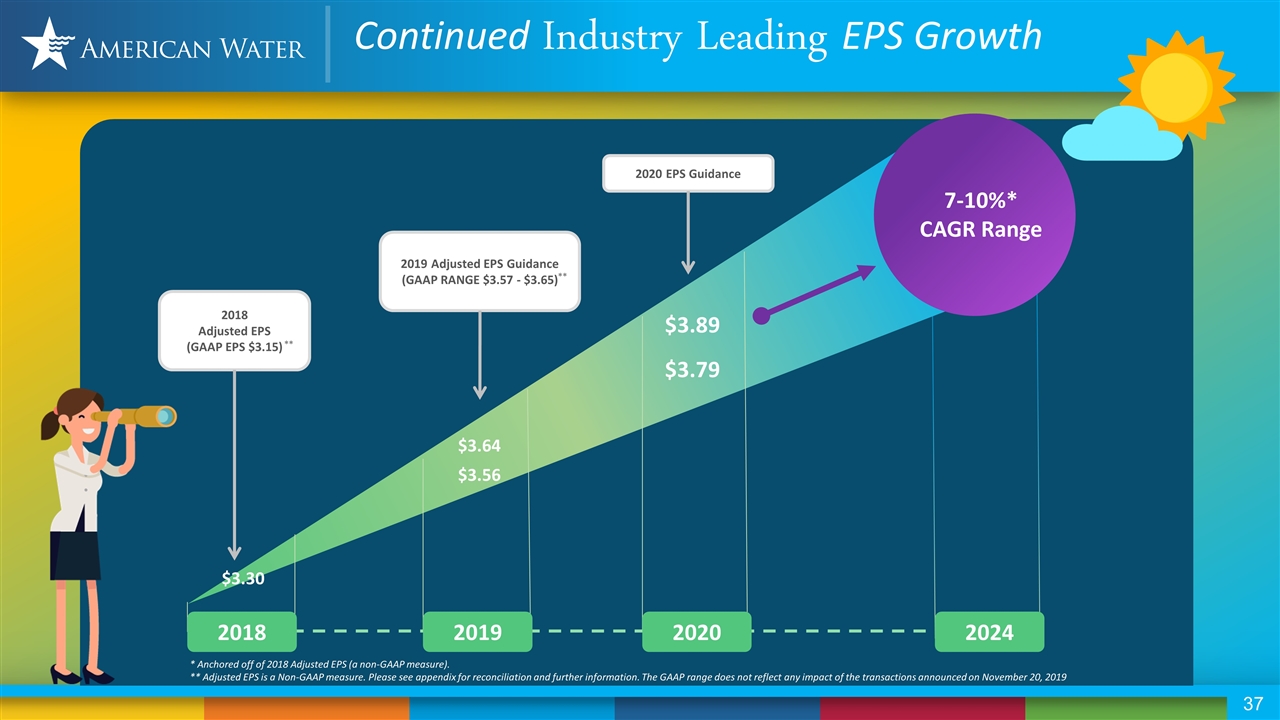

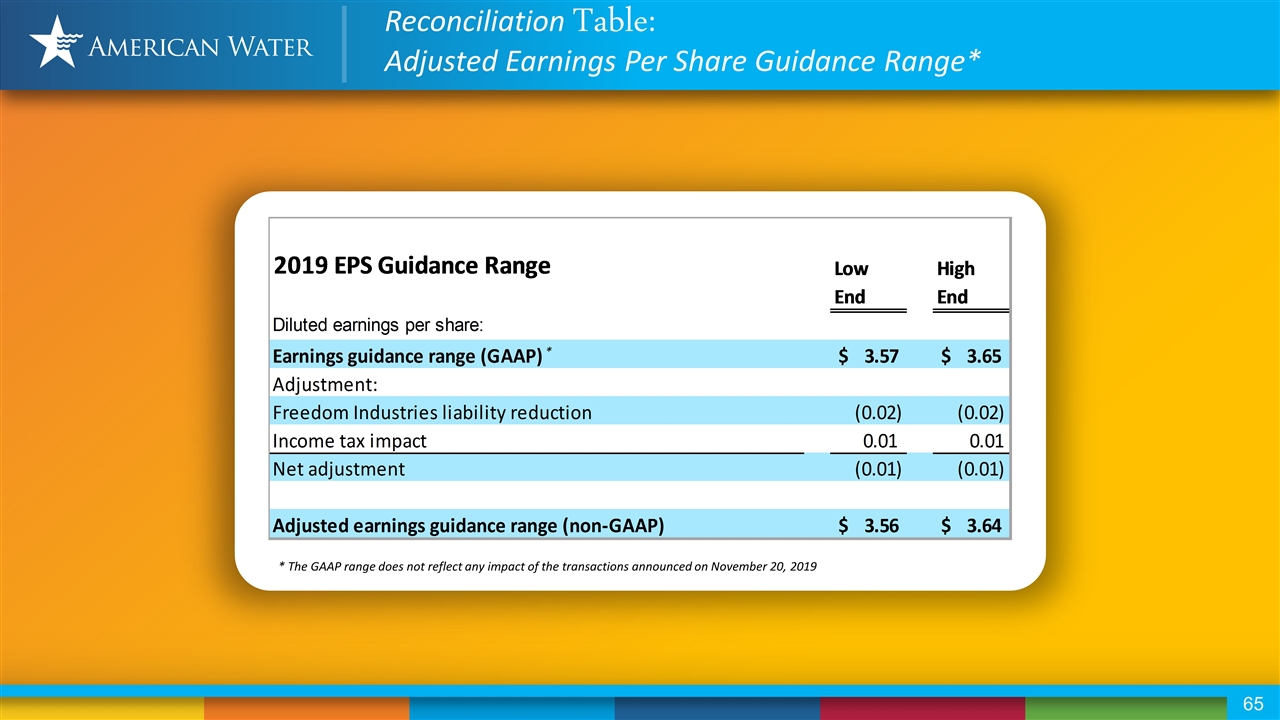

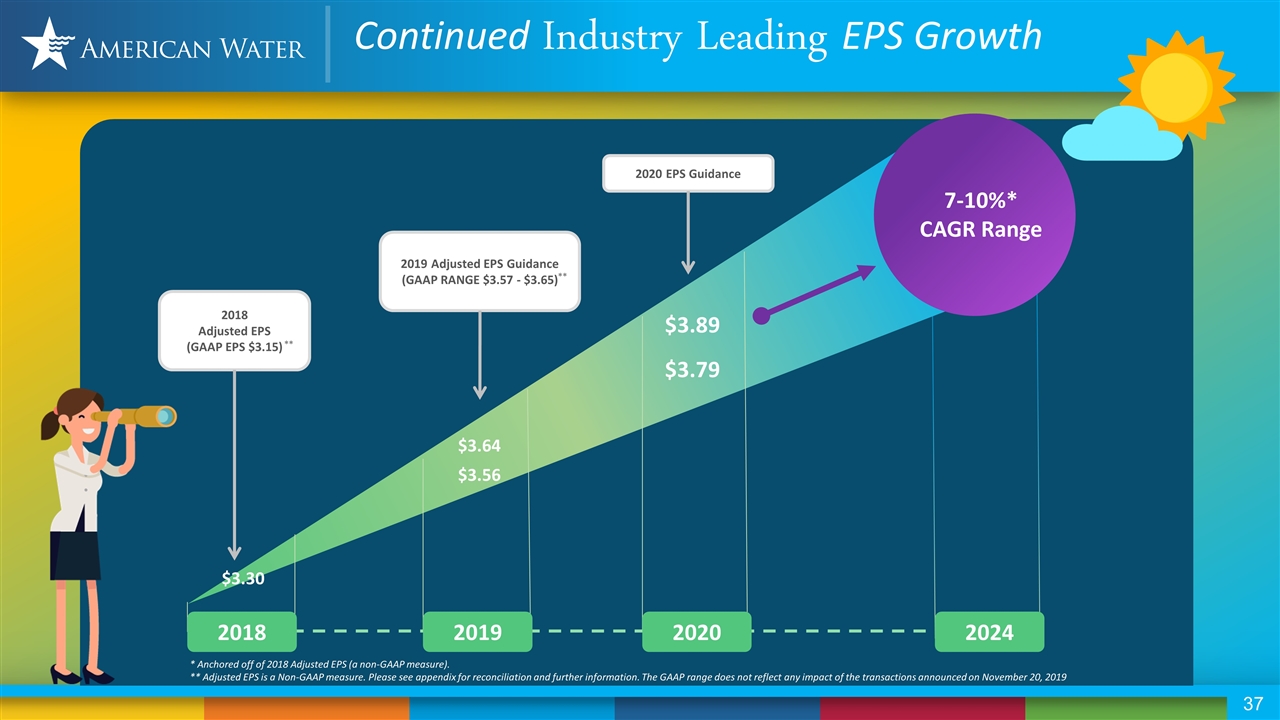

* Anchored off of 2018 Adjusted EPS (a non-GAAP measure). ** Adjusted EPS is a Non-GAAP measure. Please see appendix for reconciliation and further information. The GAAP range does not reflect any impact of the transactions announced on November 20, 2019 2018 2019 2020 2024 2018 Adjusted EPS (GAAP EPS $3.15) 2019 Adjusted EPS Guidance (GAAP RANGE $3.57 - $3.65) 2020 EPS Guidance $3.89 $3.79 7-10%* CAGR Range $3.64 $3.56 $3.30 ** ** Continued Industry Leading EPS Growth

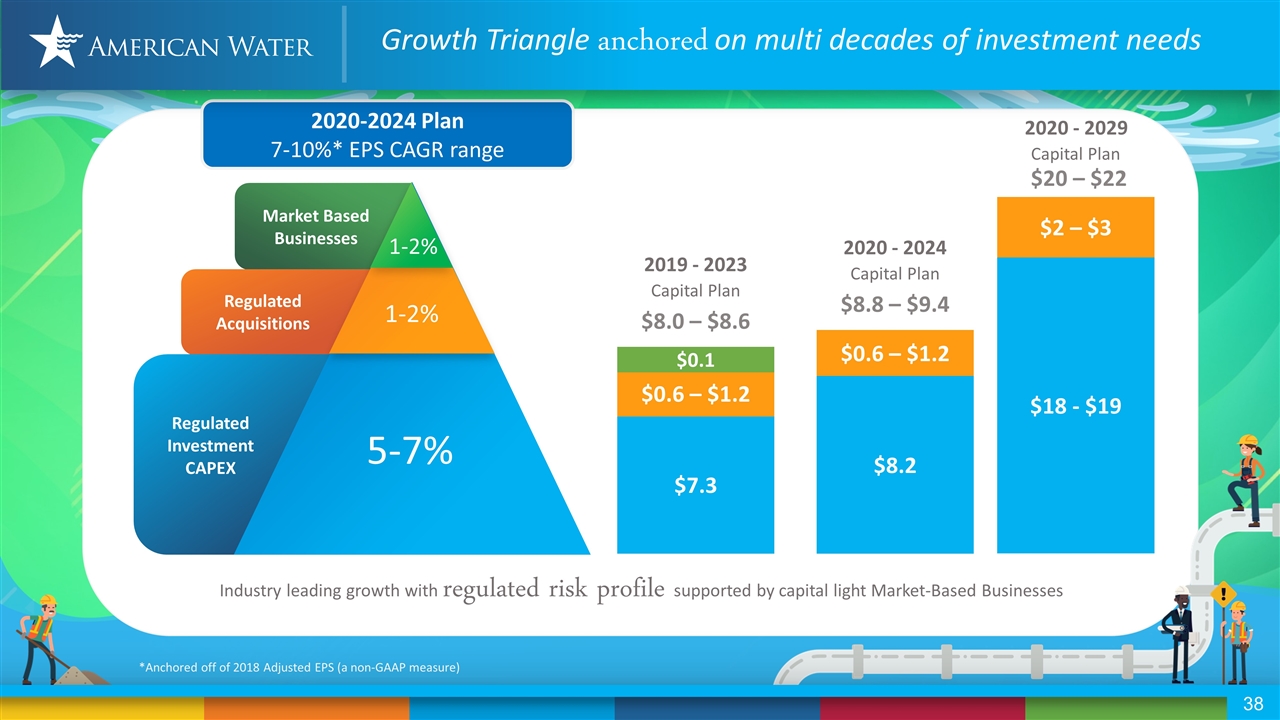

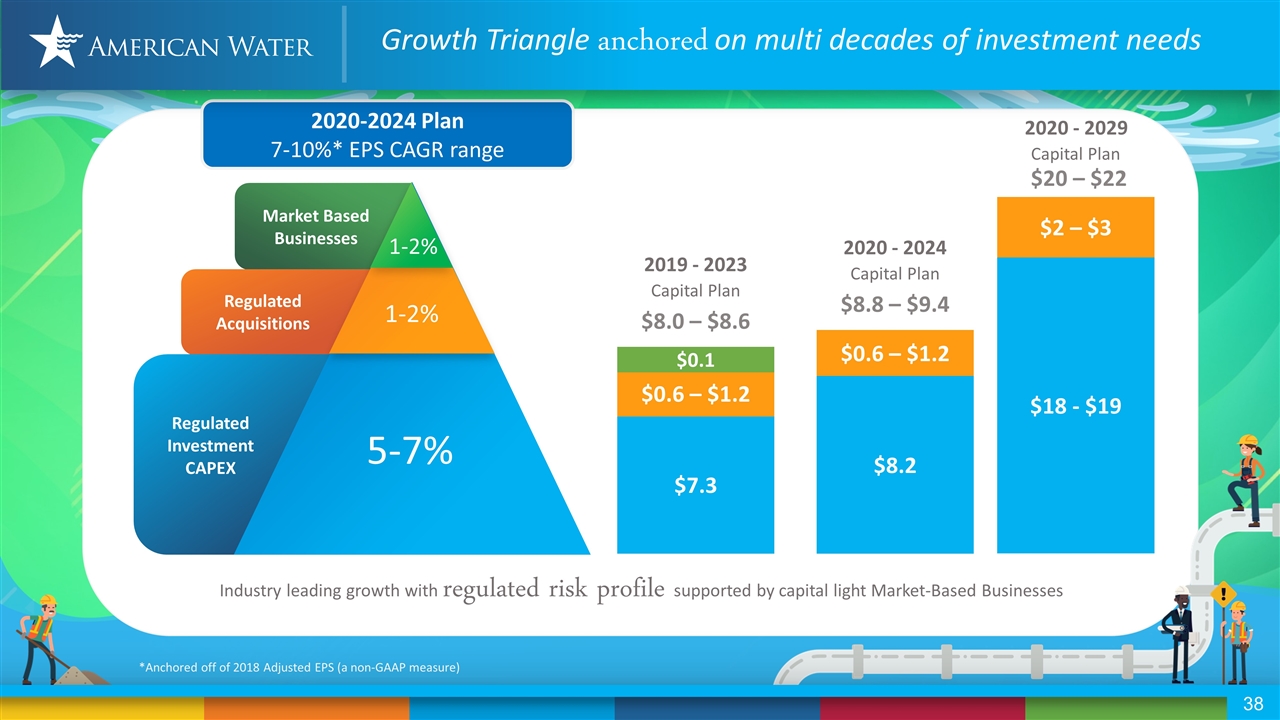

z 2020-2024 Plan 7-10%* EPS CAGR range Regulated Acquisitions Regulated Investment CAPEX 1-2% 1-2% 5-7% Market Based Businesses *Anchored off of 2018 Adjusted EPS (a non-GAAP measure) $8.2 2020 - 2024 $0.6 – $1.2 $8.8 – $9.4 Capital Plan Industry leading growth with regulated risk profile supported by capital light Market-Based Businesses $18 - $19 2020 - 2029 $2 – $3 $20 – $22 Capital Plan 2019 - 2023 $8.0 – $8.6 Capital Plan $7.3 $0.6 – $1.2 $0.1 Growth Triangle anchored on multi decades of investment needs

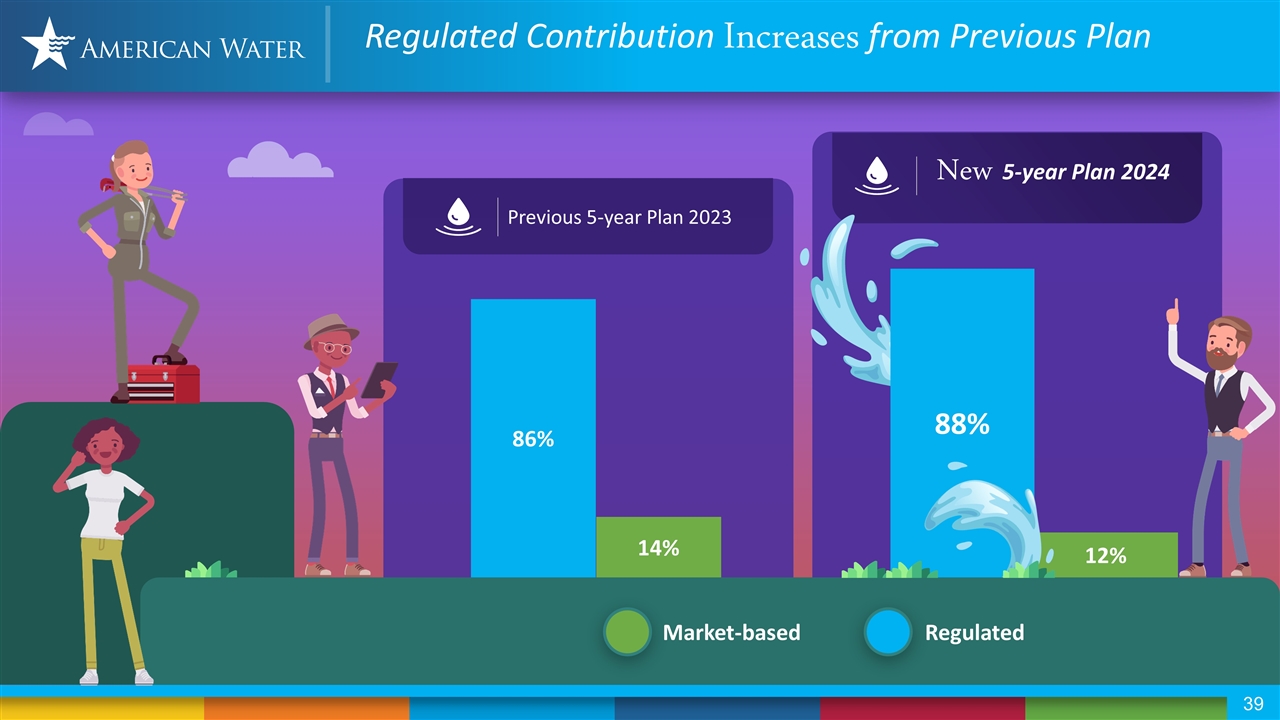

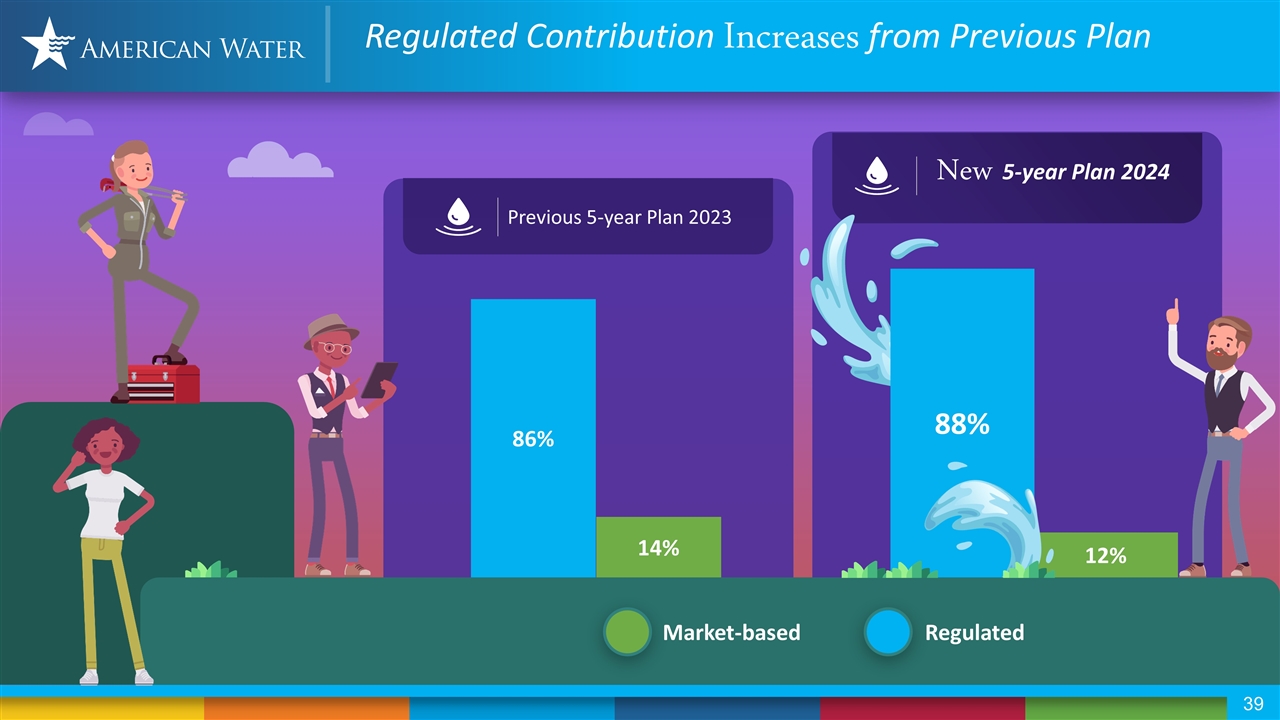

Regulated Contribution Increases from Previous Plan 14% 86% 12% Previous 5-year Plan 2023 New 5-year Plan 2024 88% Regulated Market-based

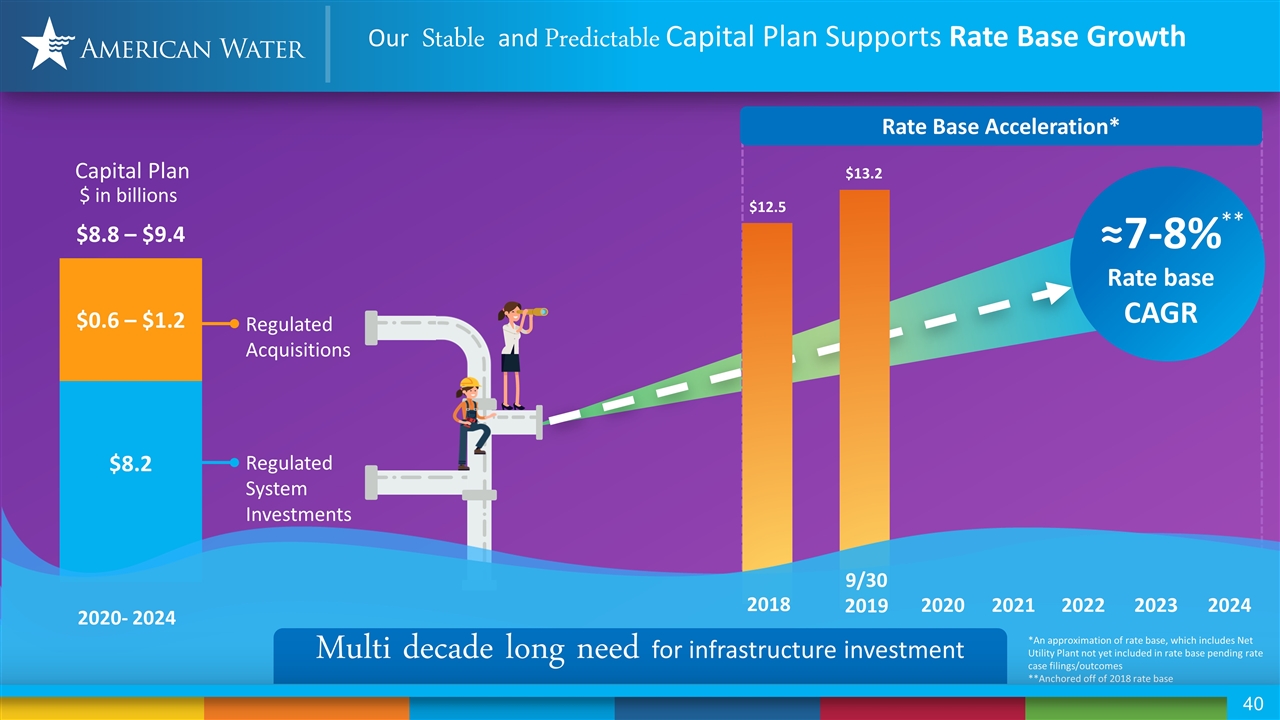

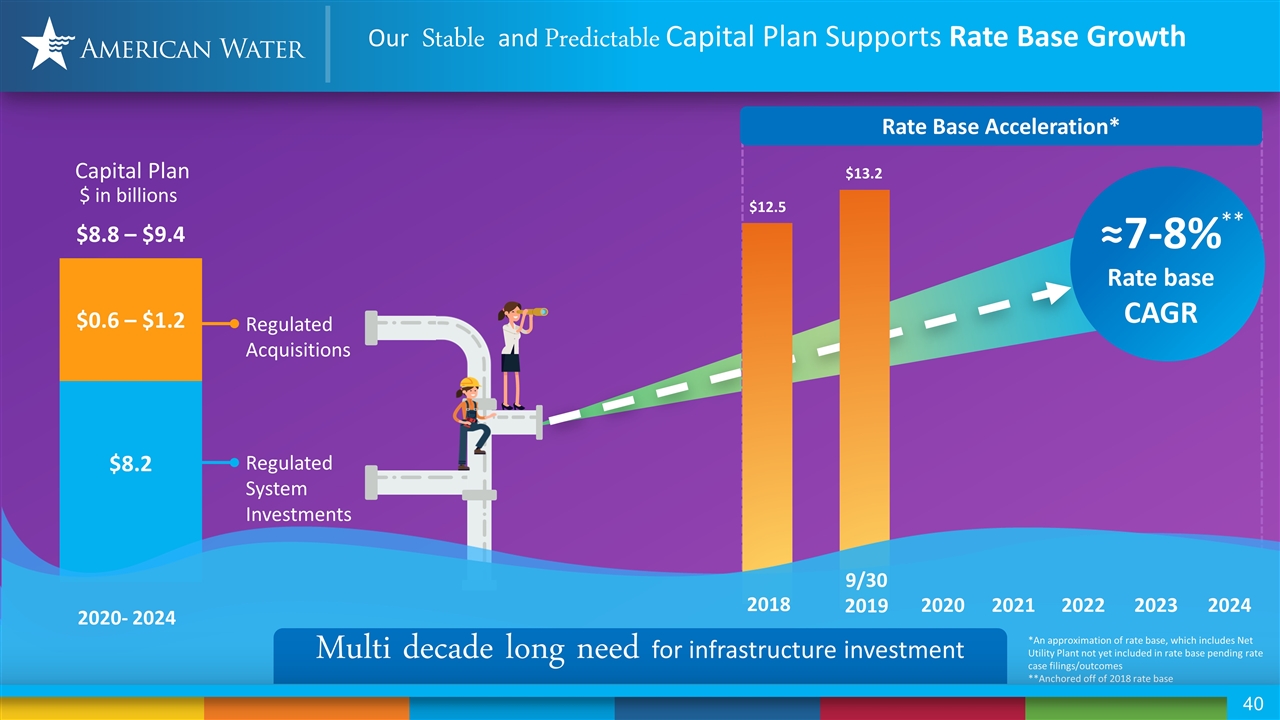

$8.2 $0.6 – $1.2 $8.8 – $9.4 Our Stable and Predictable Capital Plan Supports Rate Base Growth 2020- 2024 Regulated System Investments Regulated Acquisitions $ in billions 2020 2021 2022 2023 $12.5 $13.2 Multi decade long need for infrastructure investment 2024 9/30 2019 ≈7-8% Rate base CAGR Capital Plan *An approximation of rate base, which includes Net Utility Plant not yet included in rate base pending rate case filings/outcomes **Anchored off of 2018 rate base 2018 Rate Base Acceleration* **

Portfolio optimization leads to 2 capital light, cash flow positive business lines Positive branding Enhances customer satisfaction Capital light Leverages core competencies MSG HOS 1.5 million customers with 3 million protection plan contracts Over 40 different partnerships with municipal water, gas and electric utilities Integration of Pivotal Home Solutions progressing well 16 bases in current footprint Opportunity for infrastructure upgrades on existing bases Cash flow positive Builds relationships Market-Based Businesses Provide Strategic Value

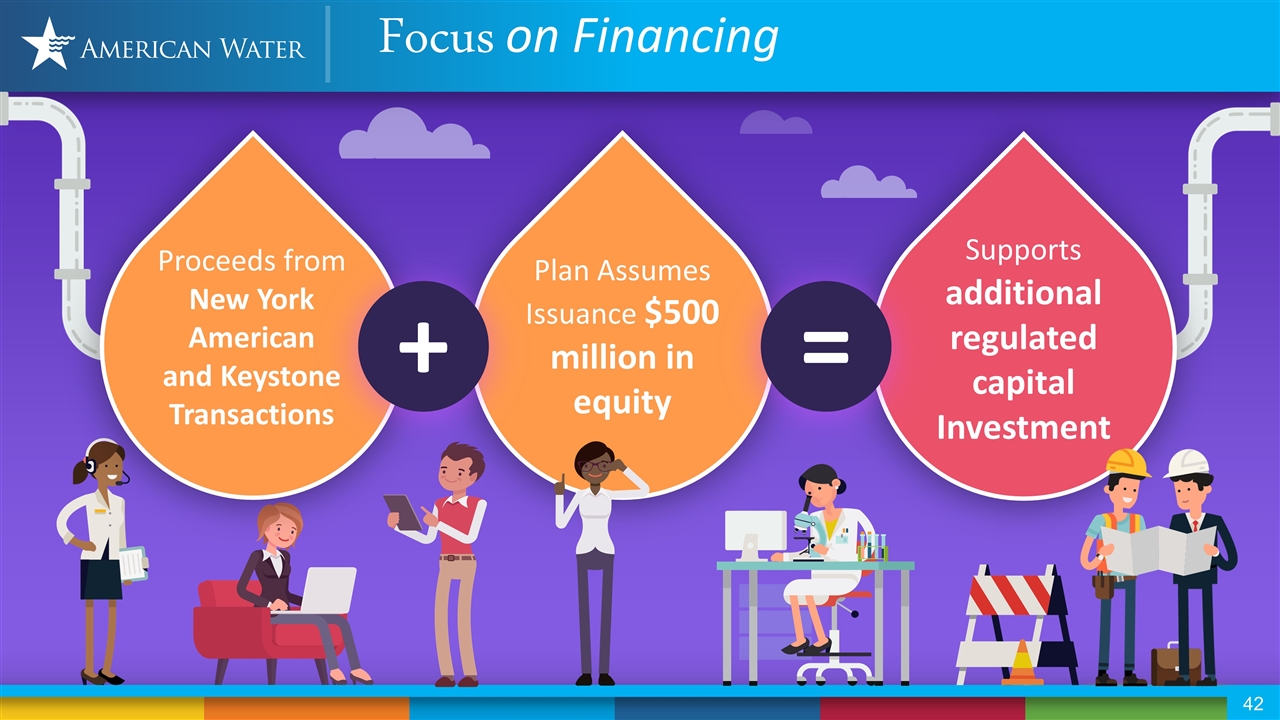

Focus on Financing Assumes Issue $500 million in equity Supports $560 million in additional capital Which will increase rate base CAGR by x% Plan Assumes Issuance $500 million in equity Supports additional regulated capital Investment = Proceeds from New York American and Keystone Transactions + Focus on Financing

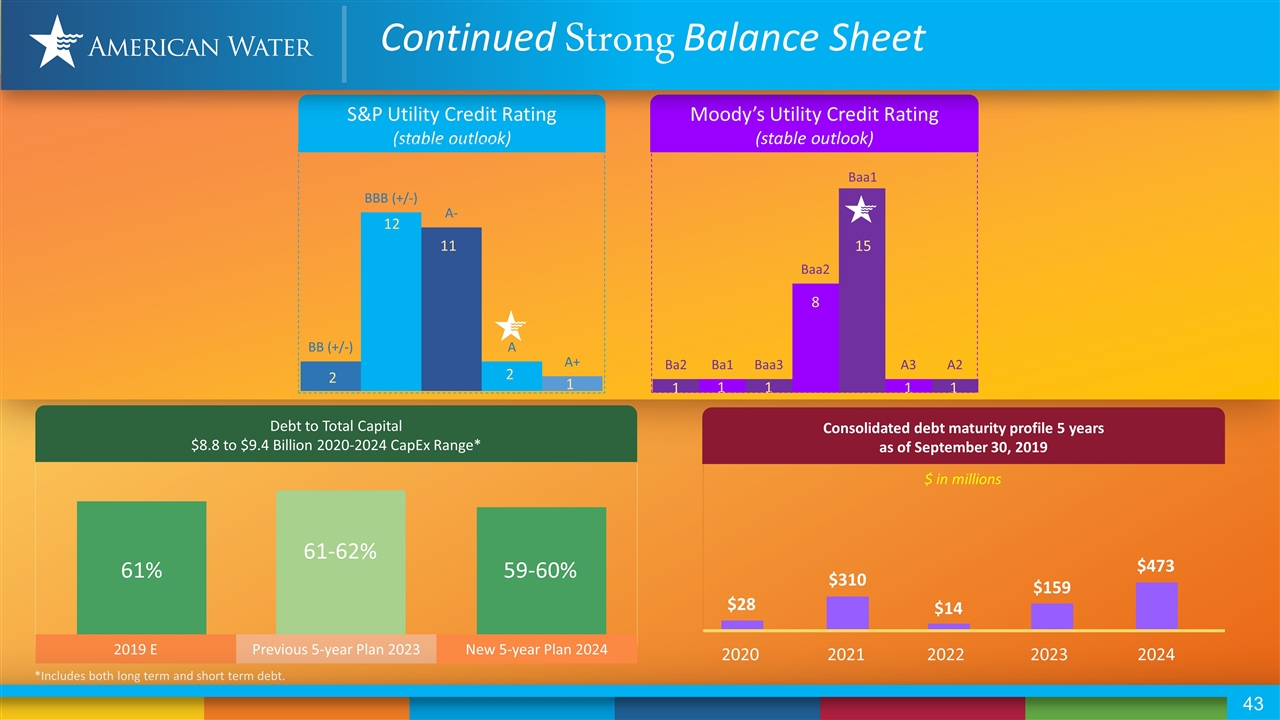

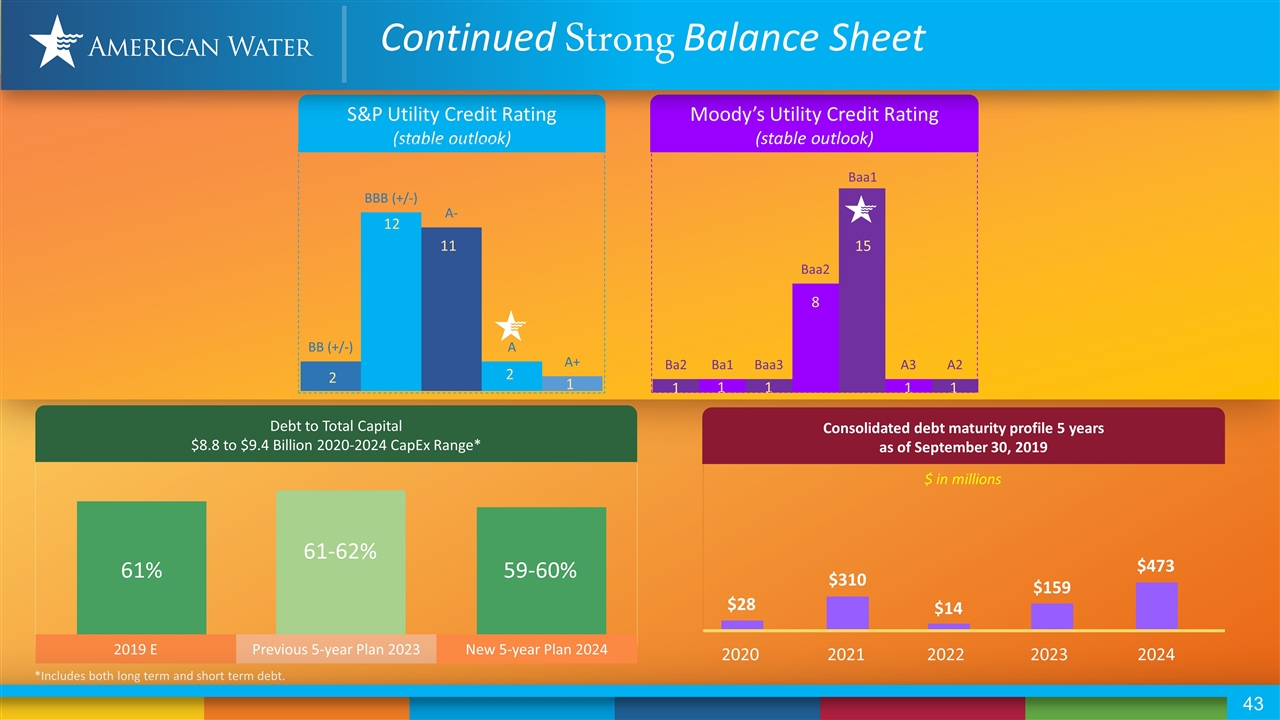

*Includes both long term and short term debt. 2019 E Previous 5-year Plan 2023 61-62% Debt to Total Capital $8.8 to $9.4 Billion 2020-2024 CapEx Range* 2 S&P Utility Credit Rating (stable outlook) Moody’s Utility Credit Rating (stable outlook) $14 $310 $28 $159 $473 $ in millions 2020 2021 2022 2023 2024 Consolidated debt maturity profile 5 years as of September 30, 2019 New 5-year Plan 2024 59-60% 61% Continued Strong Balance Sheet

$1.96 ** 6 consecutive years of ≈10% dividend growth $1.33 $1.47 $1.62 $1.78 2015 2016 2017 2018 2019 *Future dividends are subject to approval of the American Water Board of Directors **Anchored off of 2014 dividend paid ≈10.4%** 5-year CAGR 2024 2020 Target long term dividend growth CAGR at High End of 7-10% range* Top Leader in Dividend Growth

2020-2024 Plan 7-10%* EPS CAGR range Regulated Acquisitions Regulated Investment CAPEX 1-2% 1-2% 5-7% Market Based Businesses Grow EPS long-term CAGR of 7-10%*… … One of the fastest growing utilities in the nation *Anchored off of 2018 Adjusted EPS (a non-GAAP measure) Our disciplined financial management continues to deliver Best In Class” “The customer and shareholder value Top leader in the utility sector… … Combined EPS + dividend growth delivers superior total Invest over $20 billion in capital over the next 10 years… … To ensure water quality and infrastructure growth Maintain our predominantly regulated risk profile… … Market based businesses represent 12% of EPS in 2024 Grow dividends at high end of 7-10%* EPS range… … Top quartile utility dividend growth … Payout ratio between 50-60% of earnings Our Compelling Story shareholder return

Susan Story President and Chief Executive Officer Closing Remarks We keep life flowing ®

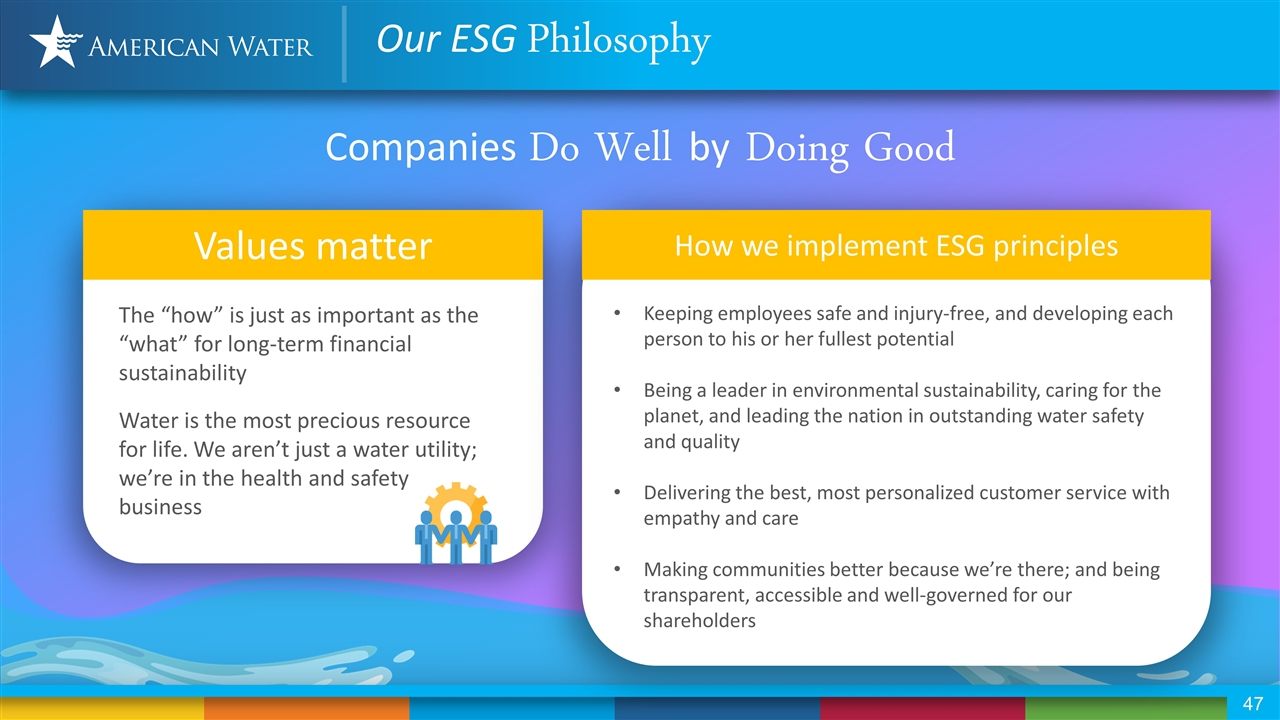

Values matter The “how” is just as important as the “what” for long-term financial sustainability Water is the most precious resource for life. We aren’t just a water utility; we’re in the health and safety business How we implement ESG principles Keeping employees safe and injury-free, and developing each person to his or her fullest potential Being a leader in environmental sustainability, caring for the planet, and leading the nation in outstanding water safety and quality Delivering the best, most personalized customer service with empathy and care Making communities better because we’re there; and being transparent, accessible and well-governed for our shareholders Companies Do Well by Doing Good Our ESG Philosophy

#23 on Barron’s 100 Most Sustainable Companies; Highest ranked Utility Bloomberg Gender Equality Index Top 100 Best for Vets Employers by Military Times New in 2019 American Water commits to further diversity in leadership through a partnership with Paradigm for Parity American Water awards grants to local firefighters to support the safety of local communities West Virginia American Water’s Kanawha Valley Plant Wins 1st Place in the WV-AWWA Tap Water Taste Test “American Water Receives 9 Directors Awards from the EPA’s Partnership for Safe Water for Excellence in Water Quality” Philadelphia Inquirer Lists American Water as a Top-ranked Company on Diversity, Governance & Transparency American Water earns 2019 Military Friendly® Bronze Employer designation American Water employees contribute 4,800 volunteer hours across U.S. during month of service United Way Awards American Water Employees the ‘Leading the Way Award’ for generosity Environmental Business Journal Recognizes American Water for Business Achievement Peter Drucker Institute & Wall Street Journal Management Top 250 has American Water as the highest ranked utility company Young artists earn funds for their schools through Illinois American Water’s “Imagine a day Without Water” art contest Members of American Water earns 2020 Military Friendly® Spouse Employer designation Doing Well while Doing Good

Doing Well… a) Source Factset: 2014 GAAP EPS – 2019 Estimate Comparable Adjusted EPS for three quarters actuals plus fourth quarter FactSet consensus estimates b) Source Factset: 2018 Estimate Comparable Adjusted EPS – 2019 Estimate Comparable Adjusted EPS for three quarters actuals plus fourth quarter FactSet consensus estimates c) Source Factset Historical DPS (2014 – 2018) d) Water peers include: AWR, CTWS, CWT, MSEX, SJW, WTR, YORW Historical EPS Growth (d) (d) 2018-2019 EPS Growth(b) 2014-2019 EPS Growth(a) AWK Daily Stock Price 2018-2019 Dividend Growth 2014-2019 Dividend Growth (d) (d) Historical Dividend Growth “ Doing Well… by Doing Good ”

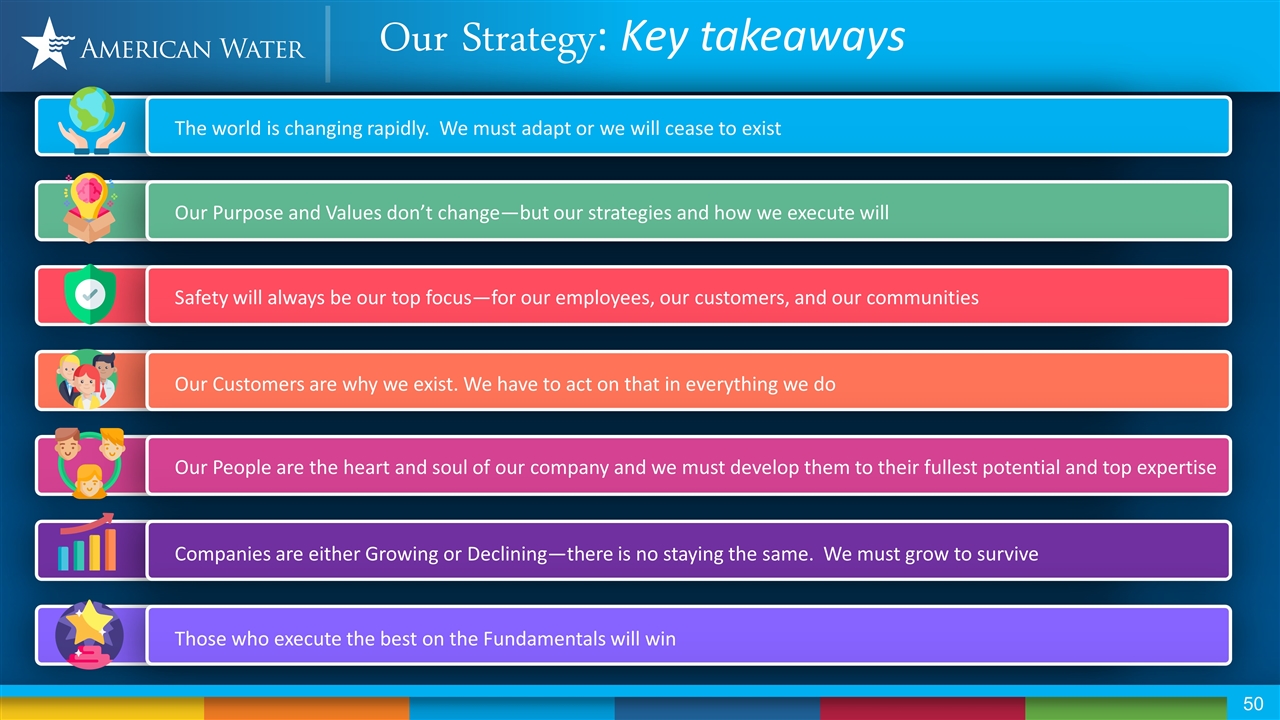

The world is changing rapidly. We must adapt or we will cease to exist Our Purpose and Values don’t change—but our strategies and how we execute will Safety will always be our top focus—for our employees, our customers, and our communities Our Customers are why we exist. We have to act on that in everything we do Our People are the heart and soul of our company and we must develop them to their fullest potential and top expertise Companies are either Growing or Declining—there is no staying the same. We must grow to survive Those who execute the best on the Fundamentals will win Our Strategy: Key takeaways

Q&A Session

Ed Vallejo Vice President, Investor Relations edward.vallejo@amwater.com Ralph Jedlicka Director, Investor Relations ralph.jedlicka@amwater.com Abbey Barksdale Manager, ESG abbey.barksdale@amwater.com We keep life flowing ® Ed Vallejo Vice President, Investor Relations edward.vallejo@amwater.com Ralph Jedlicka Director, Investor Relations ralph.jedlicka@amwater.com Abbey Barksdale Manager, ESG abbey.barksdale@amwater.com Investor Relations Contacts

Appendix

Forward-Looking Statements Certain statements in this presentation including, without limitation, with respect to 2019 adjusted earnings guidance; 2020 earnings guidance; dividend growth guidance; the outcome of pending or future acquisition activity; the size and timing of any future equity offerings by the Company to support its capital expenditures; the amount of proceeds to be received by the Company from its previously announced sale of New York American Water Company, Inc. and Keystone Clearwater Solutions, LLC; the amount and allocation of future capital investments and expenditures; estimated revenues and regulatory recovery from rate cases and other governmental agency authorizations; estimates regarding the Company’s projected rate base, growth, results of operations and financial condition; the projected growth and size of the regulated businesses; the potential growth, size, income and cash flows of the market-based businesses (individually or in the aggregate); the ability to capitalize on existing or future utility privatization opportunities; the Company’s projected regulated operation and maintenance efficiency ratio; macro trends, including with respect to the Company’s efforts related to customer, technology and work execution; the Company’s ability to execute its business and operational strategy; and projected impacts of the Tax Cuts and Jobs Act (the “TCJA”), are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “propose,” “assume,” “forecast,” “outlook,” “future,” “pending,” “goal,” “objective,” “potential,” “continue,” “seek to,�� “may,” “can,” “will,” “should” and “could” and or the negative of such terms or other variations or similar expressions. These forward-looking statements are predictions based on management’s current expectations and assumptions regarding future events. They are not guarantees or assurances of any outcomes, financial results of levels of activity, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may differ materially from those discussed in the forward-looking statements included in this presentation as a result of the factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, and subsequent filings with the SEC, including the Company’s Form 10-Q for the quarter ended September 30, 2019, as filed with the SEC on October 30, 2019, and because of factors including, without limitation: the decisions of governmental and regulatory bodies, including decisions to raise or lower customer rates; the timeliness and outcome of regulatory commissions’ actions concerning rates, capital structure, authorized return on equity, capital investment, system acquisitions and dispositions, taxes, permitting and other decisions; changes in laws, governmental regulations and policies, including with respect to environmental, health and safety, water quality and emerging contaminants, public utility and tax regulations and policies, and impacts resulting from U.S., state and local elections; weather conditions and events, climate variability patterns, and natural disasters, including drought or abnormally high rainfall, prolonged and abnormal ice or freezing conditions, strong winds, coastal and intercoastal flooding, earthquakes, landslides, hurricanes, tornadoes, wildfires, electrical storms and solar flares; the outcome of litigation and similar governmental proceedings, investigations or actions; the Company’s ability to control operating expenses and to achieve efficiencies in its operations; the Company’s ability to successfully meet growth projections for its businesses and capitalize on growth opportunities, including its ability to, among other things, acquire, close and successfully integrate regulated operations and market-based businesses, enter into contracts and other agreements with, or otherwise obtain, new customers in the Company’s market-based businesses, and realize anticipated benefits and synergies from new acquisitions; the Company’s exposure to liabilities related to environmental laws and similar matters; the use by municipalities and private landowners of the power of eminent domain or other similar authority against one or more of the Company’s utility subsidiaries; the Company’s access to sufficient capital on satisfactory terms and when and as needed to support operations and capital expenditures; and changes in federal or state general, income and other tax laws, including any further rules, regulations, interpretations and guidance by the U.S. Department of the Treasury and state or local taxing authorities related to the enactment of the TCJA, the availability of tax credits and tax abatement programs, and the Company’s ability to utilize its U.S. federal and state income tax net operating loss carryforwards. These and other forward-looking statements are qualified by, and should be read together with, the risks and uncertainties set forth above and the risk factors and cautionary statements included in the Company’s annual and quarterly SEC filings, and readers should refer to such risks, uncertainties, risk factors and statements in evaluating such forward-looking statements. Any forward-looking statements speak only as of the date of this presentation. The Company does not have or undertake any obligation or intention to update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as otherwise required by the Federal securities laws. Furthermore, it may not be possible to assess the impact of any such factor on the Company’s businesses, either viewed independently or together, or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive.

Non-GAAP Financial Information This presentation includes adjusted earnings per share (“Adjusted EPS”) both as the Company’s 2019 adjusted earnings guidance and as the 2018 earnings per share (“EPS”) compound annual growth rate anchor, both of which constitute “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures are derived from the Company’s consolidated financial information but are not presented in the Company’s consolidated financial statements prepared in accordance with GAAP. Adjusted EPS as 2019 adjusted earnings guidance is defined as GAAP EPS excluding the impact of previously-reported settlement activities related to the Freedom Industries chemical spill in West Virginia. Adjusted EPS as the 2018 EPS compound annual growth rate anchor is defined as 2018 GAAP EPS, excluding the impact of (1) the gain recognized in the third quarter of 2018 on the sale of the majority of the Contract Services Group’s operation and maintenance (“O&M”) contracts; (2) a goodwill and intangible asset impairment charge related to the narrowing of the scope of the business of Keystone Clearwater Solutions in the third quarter of 2018; and (3) the June 2018 insurance settlement related to the Freedom Industries chemical spill in West Virginia. Management believes that these non-GAAP financial measures are useful to investors because they provide an indication of the Company’s baseline performance excluding items that are not considered by management to be reflective of the Company’s ongoing operating results. Management believes that these non-GAAP financial measures will allow investors to understand better the operating performance of the Company’s businesses and will facilitate a meaningful year-to-year comparison of its results of operations. Although management uses these non-GAAP financial measures internally to evaluate the Company’s results of operations, management does not intend results excluding the items to represent results as defined by GAAP, and investors should not consider them as indicators of performance. These non-GAAP financial measures are derived from the Company’s consolidated financial information but are not presented in its consolidated financial statements prepared in accordance with GAAP, and thus they should be considered in addition to, and not as a substitute for, measures of financial performance prepared in accordance with GAAP. In addition, the Company’s definition of Adjusted EPS may not be comparable to the same or similar measures used by other companies, and, accordingly, they may have significant limitations on their use. This presentation also includes adjusted regulated segment O&M efficiency ratios, both historical and forward-looking, which, in addition to the pro forma adjustment for the impact of the Tax Cuts and Jobs Act (the “TCJA”), excludes from its calculation (i) estimated purchased water revenues and purchased water expenses, (ii) the impact of the Freedom Industries chemical spill in 2014 and certain related settlement activities recognized in 2016, 2018 and 2019, (iii) the estimated impact in 2012 and 2014 of weather, and (iv) the allocable portion of non-O&M support services costs, mainly depreciation and general taxes. Also, an alternative presentation of this ratio has been provided for each of 2010, 2012, 2014 and 2016 which includes the pro forma adjustment for the impact of the TCJA and includes for 2012, 2014 and 2016 the impact of the Company’s implementation of Accounting Standards Update 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Post-retirement Benefit, on January 1, 2018. These adjusted O&M efficiency ratios constitute “non-GAAP financial measures” under SEC rules. These ratios are derived from the Company’s consolidated financial information but are not presented in its consolidated financial statements prepared in accordance with GAAP. These non-GAAP financial measures supplement and should be read in conjunction with the Company’s GAAP disclosures but should not be considered an alternative to the GAAP measures. Management believes that the presentation of the Company’s adjusted O&M efficiency ratios is useful to investors because it provides a means of evaluating the Company’s operating performance without giving effect to items that are not reflective of management’s ability to increase efficiency of the Company’s regulated operations. In preparing operating plans, budgets and forecasts, and in assessing historical and future performance, management relies, in part, on trends in the Company’s historical results and predictions of future results, exclusive of these items. The Company’s definition of these ratios may not be comparable to the same or similar measures used by other companies, and, accordingly, these non-GAAP financial measures may have significant limitations on their use. Management is unable to present a reconciliation of adjustments to the components of the forward-looking O&M efficiency ratio without unreasonable effort because management cannot reliably predict the nature, amount or probable significance of all the adjustments for future periods; however, these adjustments may, individually or in the aggregate, cause the non-GAAP financial measure component of the forward-looking ratio to differ significantly from the most directly comparable GAAP financial measure. Set forth in this appendix are tables that reconcile Adjusted EPS as 2019 adjusted EPS guidance and as the 2018 EPS compound annual growth rate anchor, each to GAAP EPS, and each of the components of its historical O&M efficiency ratios to its most directly comparable GAAP financial measure. All references throughout this presentation to EPS refer to diluted EPS attributable to common shareholders.

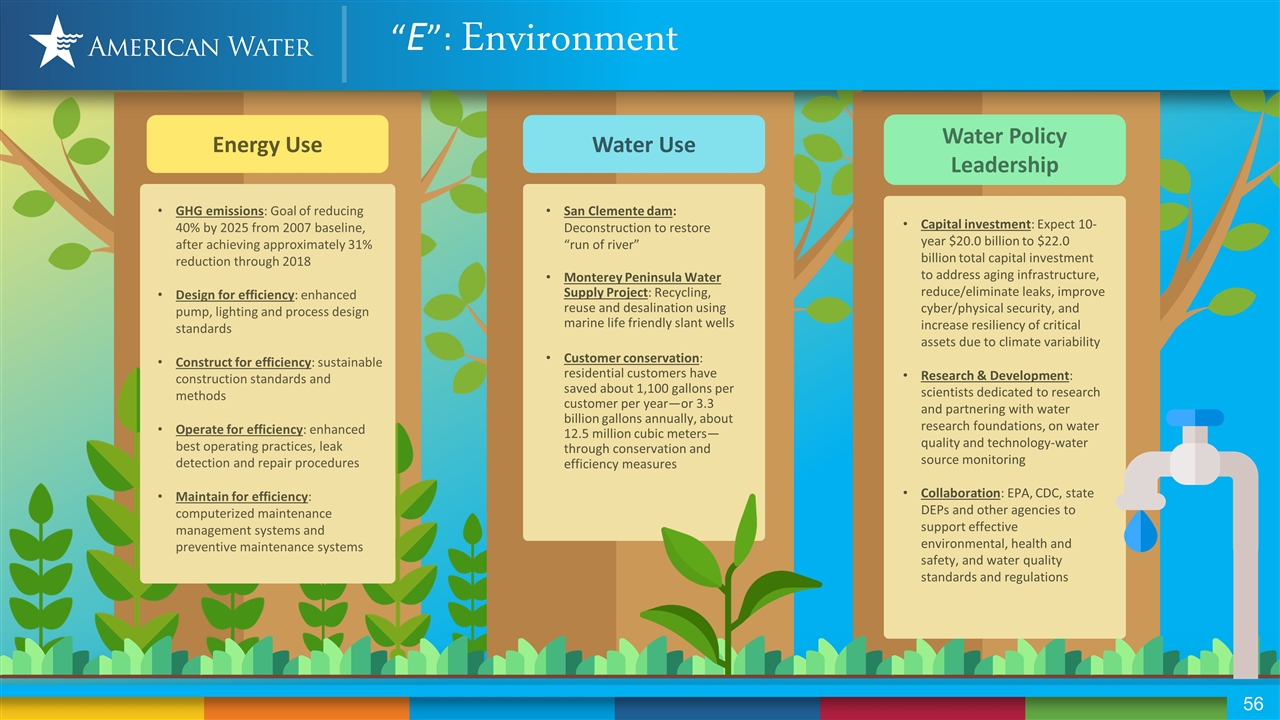

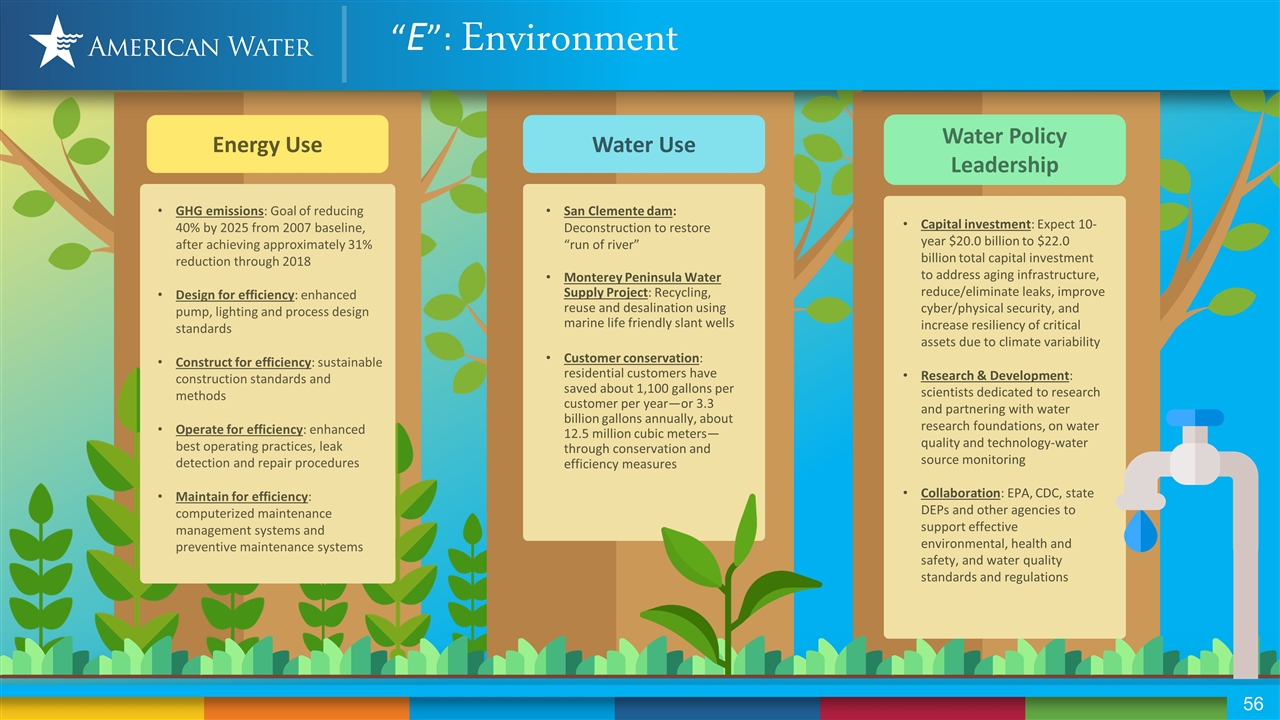

Energy Use GHG emissions: Goal of reducing 40% by 2025 from 2007 baseline, after achieving approximately 31% reduction through 2018 Design for efficiency: enhanced pump, lighting and process design standards Construct for efficiency: sustainable construction standards and methods Operate for efficiency: enhanced best operating practices, leak detection and repair procedures Maintain for efficiency: computerized maintenance management systems and preventive maintenance systems Water Use San Clemente dam: Deconstruction to restore “run of river” Monterey Peninsula Water Supply Project: Recycling, reuse and desalination using marine life friendly slant wells Customer conservation: residential customers have saved about 1,100 gallons per customer per year—or 3.3 billion gallons annually, about 12.5 million cubic meters—through conservation and efficiency measures Water Policy Leadership Capital investment: Expect 10-year $20.0 billion to $22.0 billion total capital investment to address aging infrastructure, reduce/eliminate leaks, improve cyber/physical security, and increase resiliency of critical assets due to climate variability Research & Development: scientists dedicated to research and partnering with water research foundations, on water quality and technology-water source monitoring Collaboration: EPA, CDC, state DEPs and other agencies to support effective environmental, health and safety, and water quality standards and regulations “E”: Environment

Our People Our Customers Customer data protection: we do not share or sell personal customer data Technology development: ensuring a personalized positive experience Customer satisfaction: Top Quartile in the water industry Online communities as of 10/2019: Our Communities Community service: More than 5,000 hours in 2018 for company-sponsored events Charity support: Sponsored national workplace giving campaigns with the United Way and Water For People, as well as supporting our employees’ own charitable endeavors through the American Water Charitable Foundation American Water Charitable Foundation: - Union sportsmen’s alliance projects - Parks partnerships projects - Employee match program - Keep Communities Flowing Training: During 2018, nearly 80,000 hours of annual employee safety training Employee engagement: Frequent surveys with formalized employee action teams Frontline employees: driving technology development Union representation: As of December 31, 2018, 49% of workforce in jobs represented by unions Diverse job candidate pools: During 2018, 86% of job requisitions had a diverse candidate pool, with more than 52% of transfers/promotions filled by minority, female, veteran or disabled individuals Culture: Diverse, inclusive culture characterized by respect and dignity of every employee 87,058 fans 32,076 followers 7,610,976 views 17,911 followers “S”: Social Responsibility

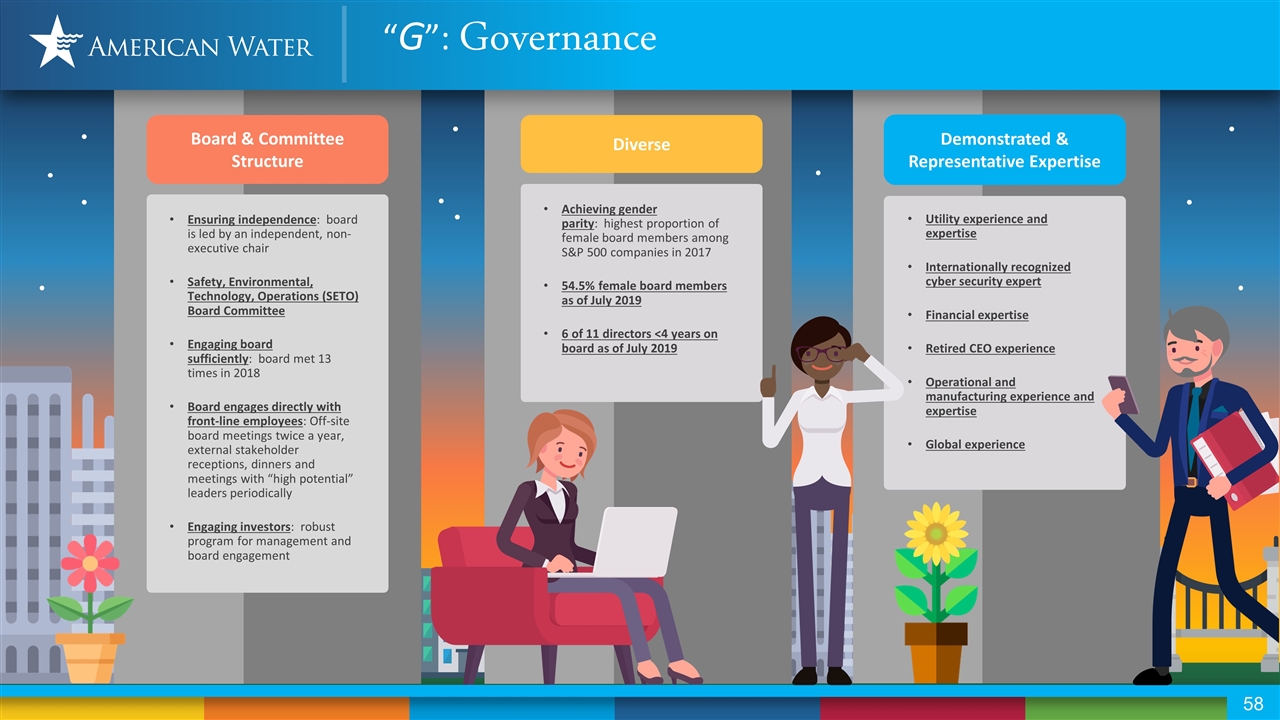

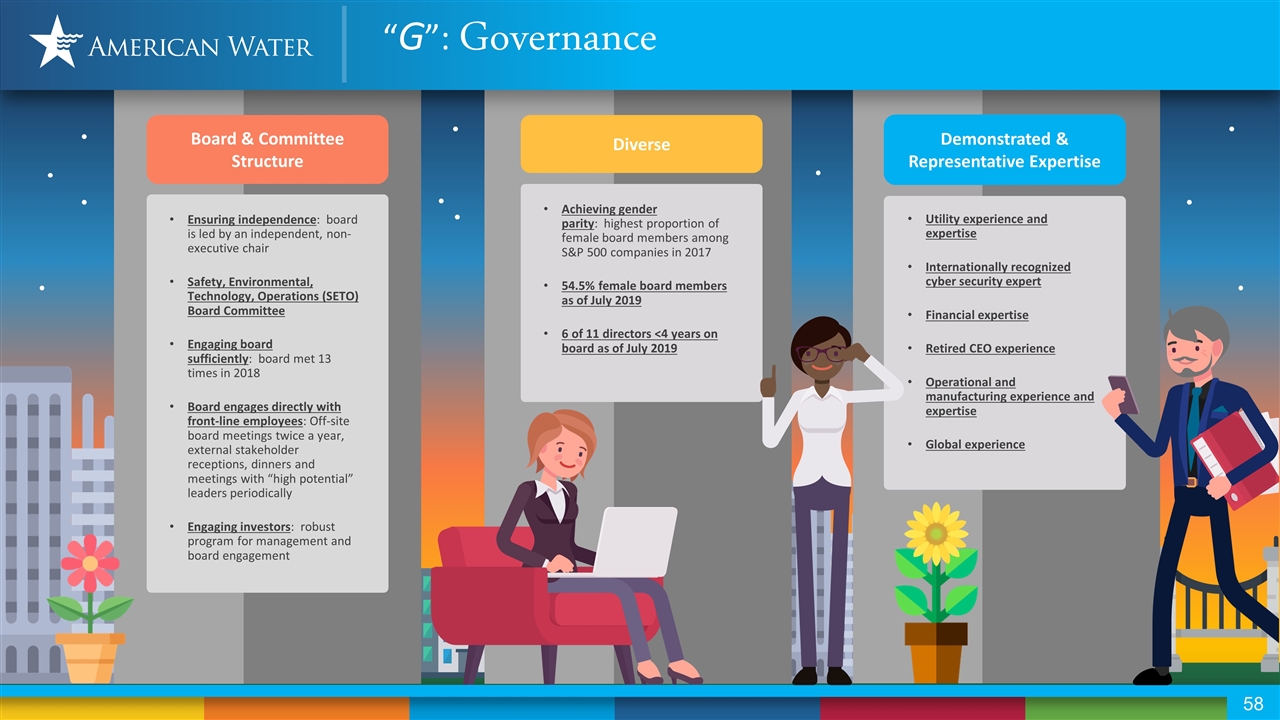

Board & Committee Structure Ensuring independence: board is led by an independent, non-executive chair Safety, Environmental, Technology, Operations (SETO) Board Committee Engaging board sufficiently: board met 13 times in 2018 Board engages directly with front-line employees: Off-site board meetings twice a year, external stakeholder receptions, dinners and meetings with “high potential” leaders periodically Engaging investors: robust program for management and board engagement Diverse Achieving gender parity: highest proportion of female board members among S&P 500 companies in 2017 54.5% female board members as of July 2019 6 of 11 directors <4 years on board as of July 2019 Demonstrated & Representative Expertise Utility experience and expertise Internationally recognized cyber security expert Financial expertise Retired CEO experience Operational and manufacturing experience and expertise Global experience “G”: Governance

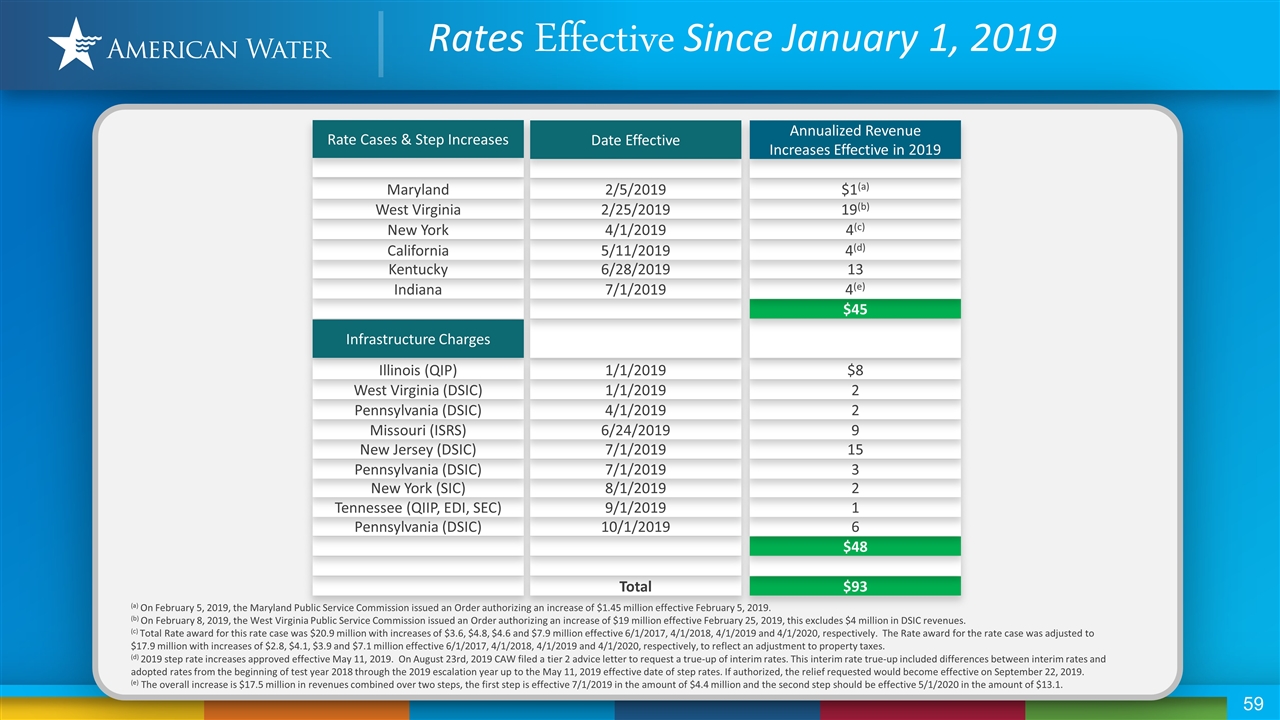

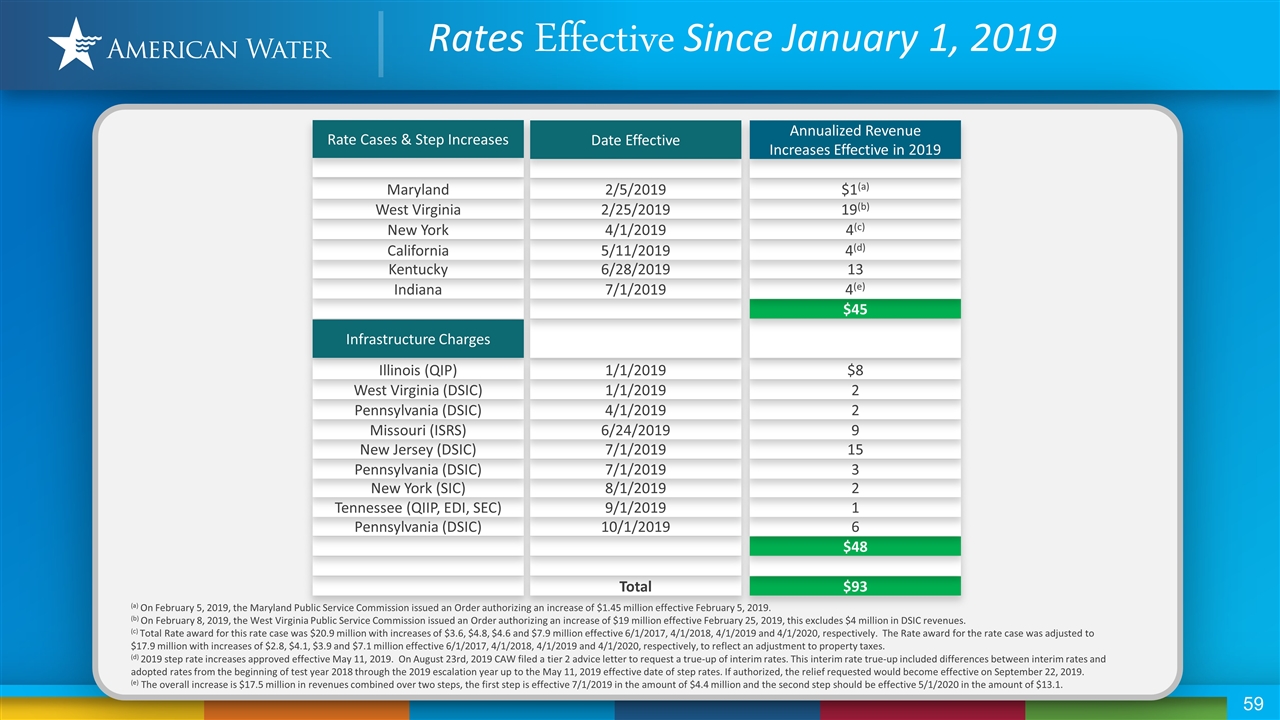

Rates Effective Since January 1, 2019 Total $93 $48 Pennsylvania (DSIC) 10/1/2019 6 Tennessee (QIIP, EDI, SEC) 9/1/2019 1 New York (SIC) 8/1/2019 2 Pennsylvania (DSIC) 7/1/2019 3 New Jersey (DSIC) 7/1/2019 15 Missouri (ISRS) 6/24/2019 9 Pennsylvania (DSIC) 4/1/2019 2 West Virginia (DSIC) 1/1/2019 2 Illinois (QIP) 1/1/2019 $8 Infrastructure Charges $45 (a) On February 5, 2019, the Maryland Public Service Commission issued an Order authorizing an increase of $1.45 million effective February 5, 2019. (b) On February 8, 2019, the West Virginia Public Service Commission issued an Order authorizing an increase of $19 million effective February 25, 2019, this excludes $4 million in DSIC revenues. (c) Total Rate award for this rate case was $20.9 million with increases of $3.6, $4.8, $4.6 and $7.9 million effective 6/1/2017, 4/1/2018, 4/1/2019 and 4/1/2020, respectively. The Rate award for the rate case was adjusted to $17.9 million with increases of $2.8, $4.1, $3.9 and $7.1 million effective 6/1/2017, 4/1/2018, 4/1/2019 and 4/1/2020, respectively, to reflect an adjustment to property taxes. (d) 2019 step rate increases approved effective May 11, 2019. On August 23rd, 2019 CAW filed a tier 2 advice letter to request a true-up of interim rates. This interim rate true-up included differences between interim rates and adopted rates from the beginning of test year 2018 through the 2019 escalation year up to the May 11, 2019 effective date of step rates. If authorized, the relief requested would become effective on September 22, 2019. (e) The overall increase is $17.5 million in revenues combined over two steps, the first step is effective 7/1/2019 in the amount of $4.4 million and the second step should be effective 5/1/2020 in the amount of $13.1. Indiana 7/1/2019 4(e) Kentucky 6/28/2019 13 California 5/11/2019 4(d) New York 4/1/2019 4(c) West Virginia 2/25/2019 19(b) Maryland 2/5/2019 $1(a) Rate Cases & Step Increases Date Effective Annualized Revenue Increases Effective in 2019

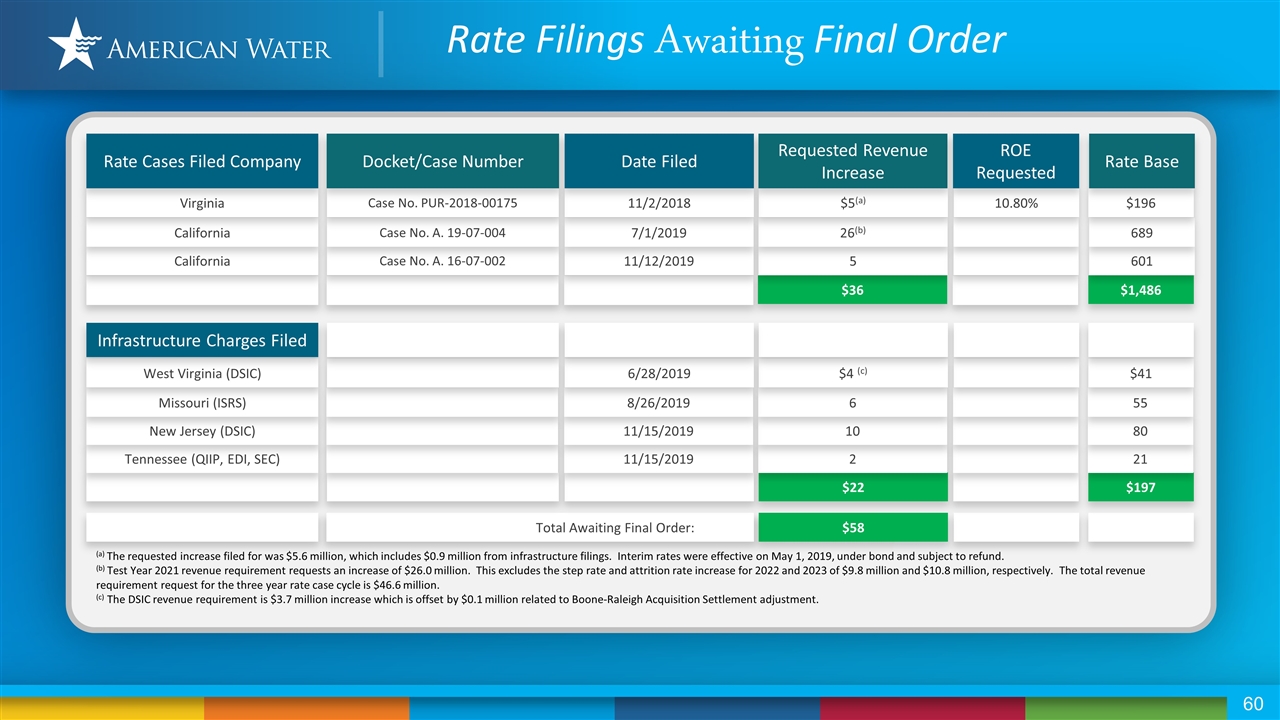

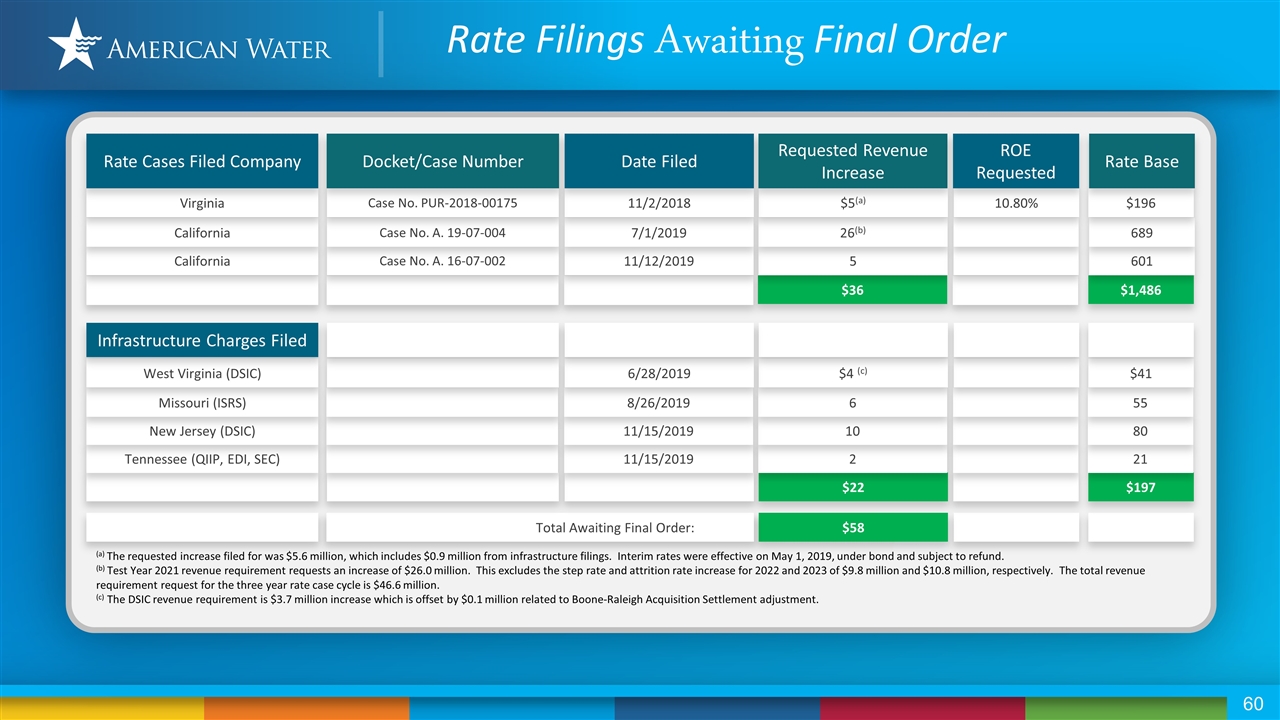

Rate Filings Awaiting Final Order $58 Total Awaiting Final Order: $18(d) 9/14/2018 Case No. 45142 Indiana Rate Case and Infrastructure Settlements awaiting Regulatory Approval $197 $22 21 2 11/15/2019 Tennessee (QIIP, EDI, SEC) 80 10 11/15/2019 New Jersey (DSIC) 55 6 8/26/2019 Missouri (ISRS) $41 $4 (c) 6/28/2019 West Virginia (DSIC) Infrastructure Charges Filed $1,486 $36 5 26(b) 11/12/2019 Case No. A. 16-07-002 California 601 7/1/2019 Case No. A. 19-07-004 California 689 $196 10.80% $5(a) 11/2/2018 Case No. PUR-2018-00175 Virginia Rate Cases Filed Company Docket/Case Number Date Filed Requested Revenue Increase ROE Requested Rate Base (a) The requested increase filed for was $5.6 million, which includes $0.9 million from infrastructure filings. Interim rates were effective on May 1, 2019, under bond and subject to refund. (b) Test Year 2021 revenue requirement requests an increase of $26.0 million. This excludes the step rate and attrition rate increase for 2022 and 2023 of $9.8 million and $10.8 million, respectively. The total revenue requirement request for the three year rate case cycle is $46.6 million. (c) The DSIC revenue requirement is $3.7 million increase which is offset by $0.1 million related to Boone-Raleigh Acquisition Settlement adjustment.

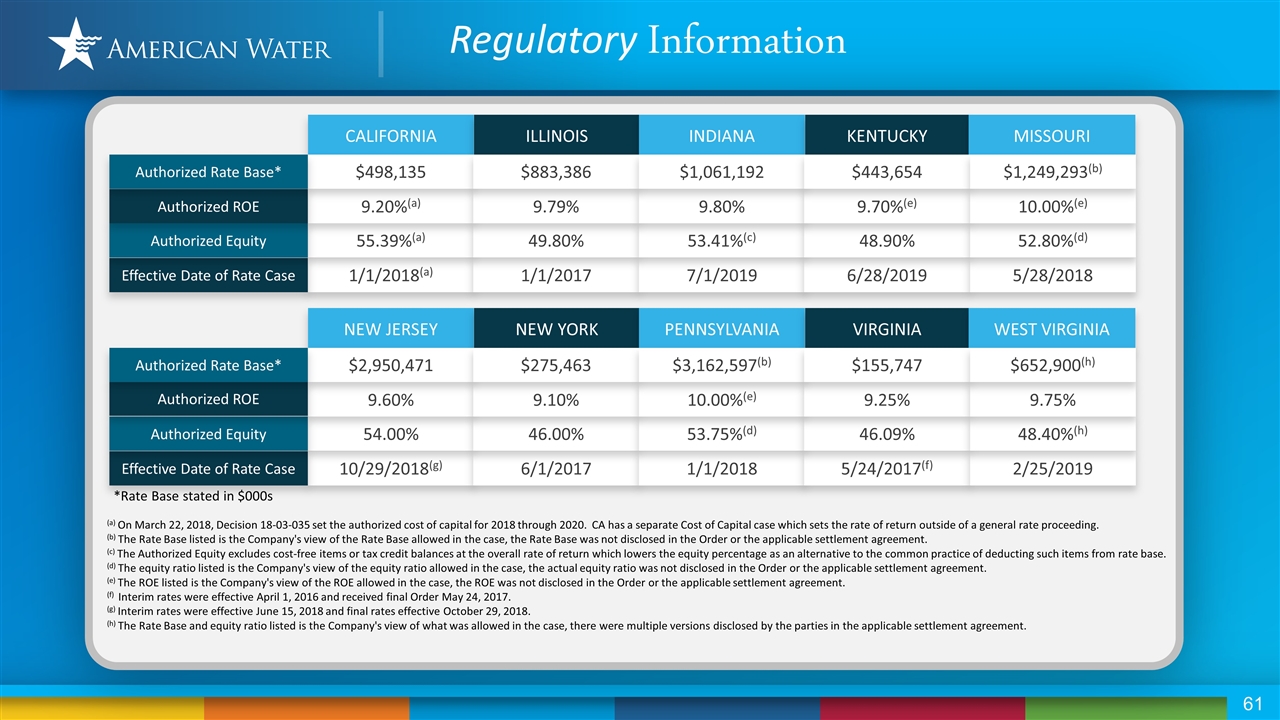

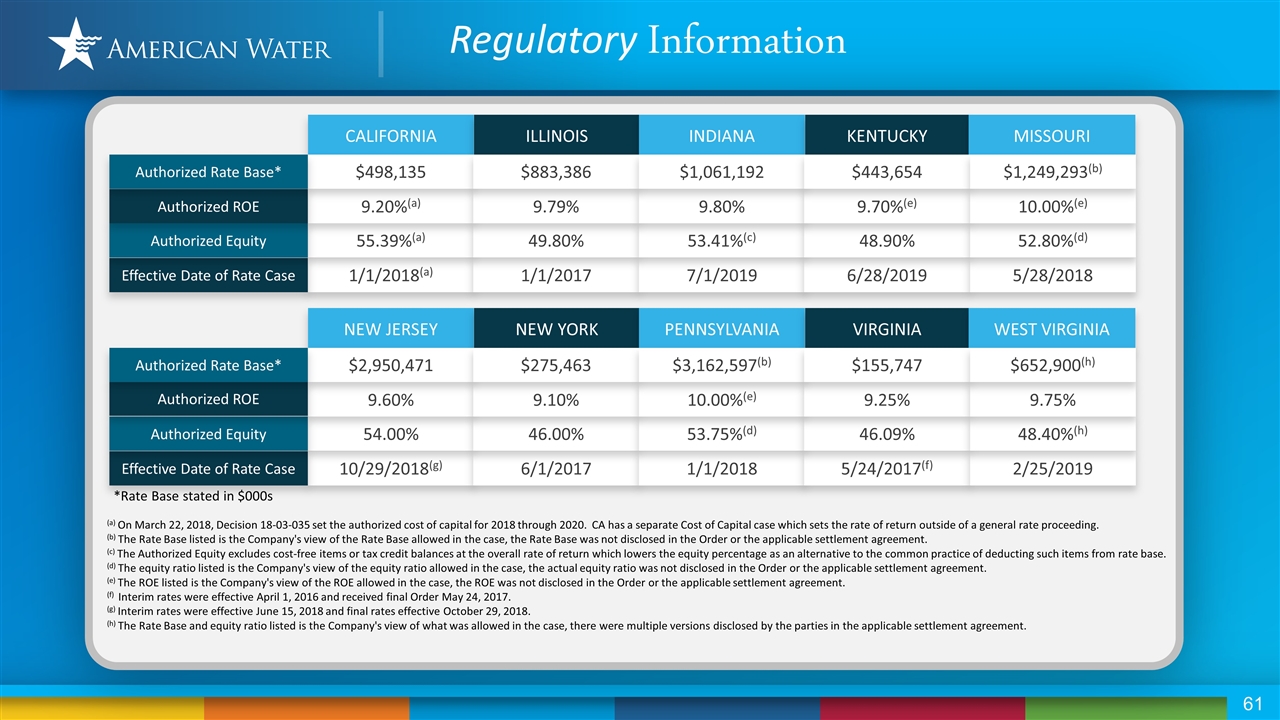

Regulatory Information CALIFORNIA ILLINOIS INDIANA KENTUCKY MISSOURI 1/1/2018(a) Effective Date of Rate Case 1/1/2017 7/1/2019 6/28/2019 5/28/2018 55.39%(a) Authorized Equity 49.80% 53.41%(c) 48.90% 52.80%(d) 9.20%(a) Authorized ROE 9.79% 9.80% 9.70%(e) 10.00%(e) $498,135 Authorized Rate Base* $883,386 $1,061,192 $443,654 $1,249,293(b) NEW JERSEY NEW YORK PENNSYLVANIA VIRGINIA WEST VIRGINIA 10/29/2018(g) Effective Date of Rate Case 6/1/2017 1/1/2018 5/24/2017(f) 2/25/2019 54.00% Authorized Equity 46.00% 53.75%(d) 46.09% 48.40%(h) 9.60% Authorized ROE 9.10% 10.00%(e) 9.25% 9.75% $2,950,471 Authorized Rate Base* $275,463 $3,162,597(b) $155,747 $652,900(h) *Rate Base stated in $000s (a) On March 22, 2018, Decision 18-03-035 set the authorized cost of capital for 2018 through 2020. CA has a separate Cost of Capital case which sets the rate of return outside of a general rate proceeding. (b) The Rate Base listed is the Company's view of the Rate Base allowed in the case, the Rate Base was not disclosed in the Order or the applicable settlement agreement. (c) The Authorized Equity excludes cost-free items or tax credit balances at the overall rate of return which lowers the equity percentage as an alternative to the common practice of deducting such items from rate base. (d) The equity ratio listed is the Company's view of the equity ratio allowed in the case, the actual equity ratio was not disclosed in the Order or the applicable settlement agreement. (e) The ROE listed is the Company's view of the ROE allowed in the case, the ROE was not disclosed in the Order or the applicable settlement agreement. (f) Interim rates were effective April 1, 2016 and received final Order May 24, 2017. (g) Interim rates were effective June 15, 2018 and final rates effective October 29, 2018. (h) The Rate Base and equity ratio listed is the Company's view of what was allowed in the case, there were multiple versions disclosed by the parties in the applicable settlement agreement.

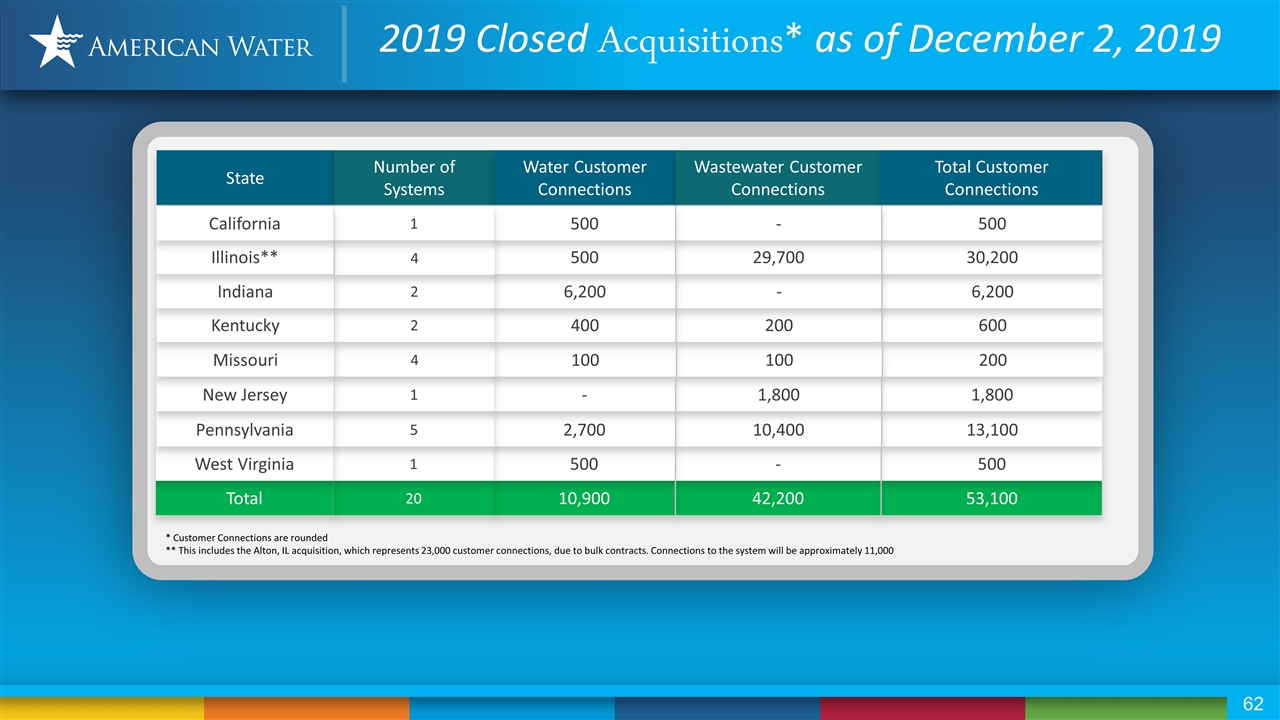

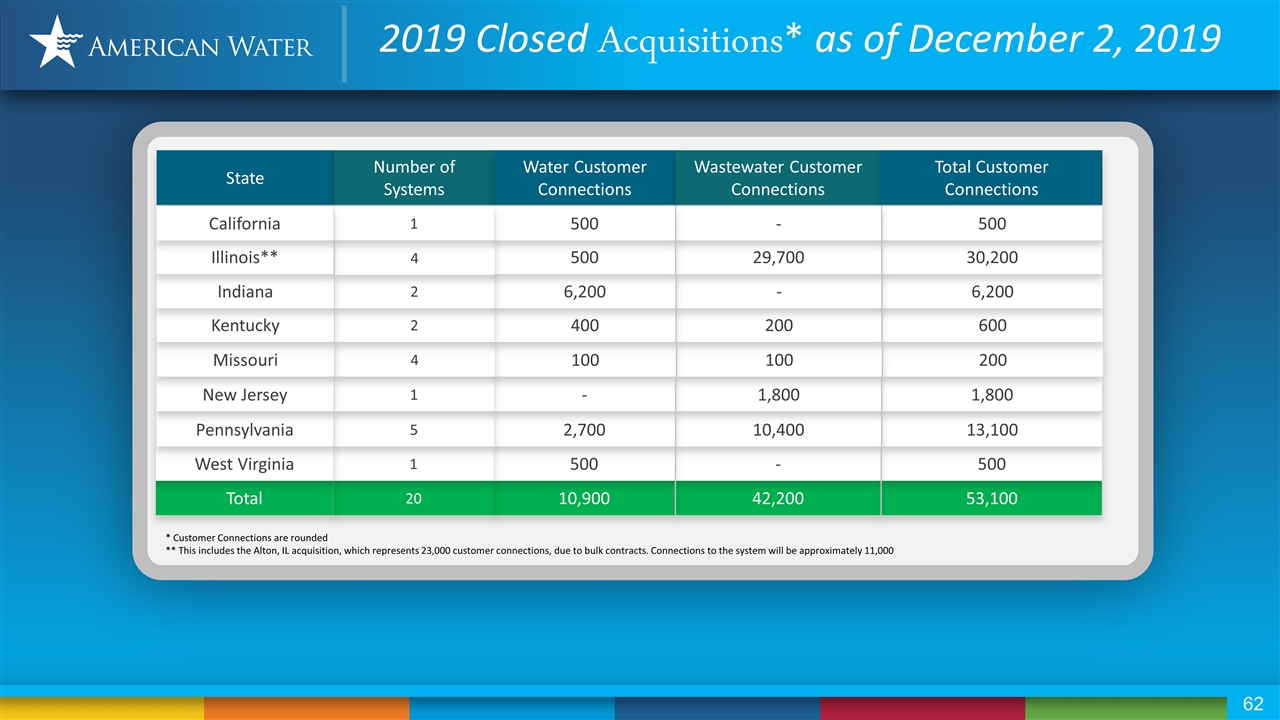

53,100 42,200 10,900 20 Total 500 - 500 1 West Virginia 13,100 10,400 2,700 5 Pennsylvania * Customer Connections are rounded ** This includes the Alton, IL acquisition, which represents 23,000 customer connections, due to bulk contracts. Connections to the system will be approximately 11,000 State Number of Systems Water Customer Connections Wastewater Customer Connections Total Customer Connections 1,800 1,800 - 1 New Jersey 200 100 100 4 Missouri 600 200 400 2 Kentucky 6,200 - 6,200 2 Indiana 30,200 29,700 500 4 Illinois** 500 - 500 1 California 2019 Closed Acquisitions* as of December 2, 2019

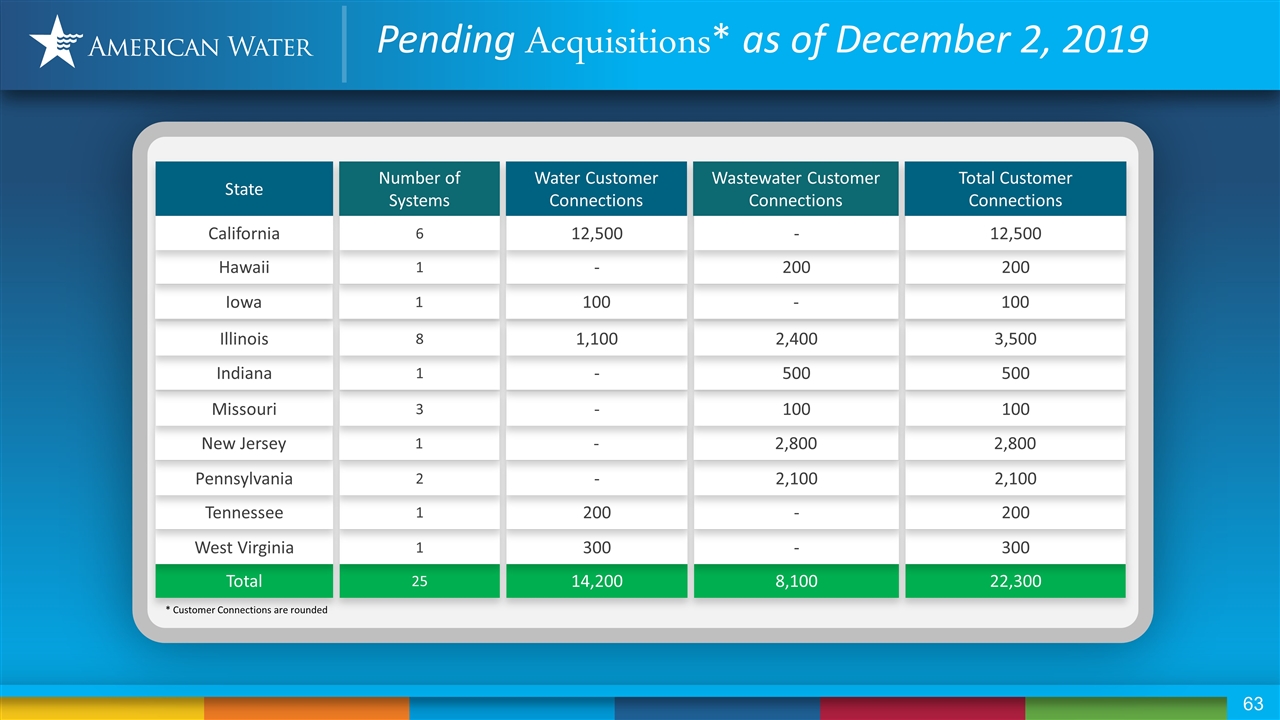

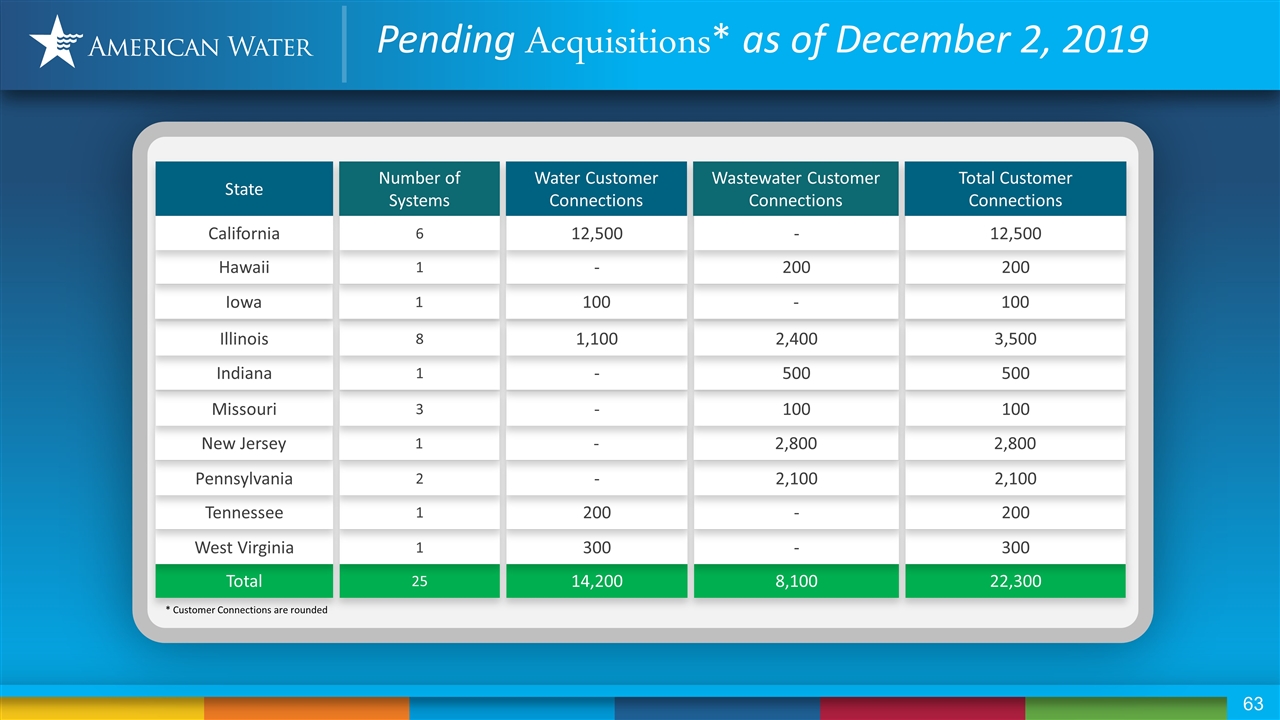

22,300 8,100 14,200 25 Total 300 - 300 1 West Virginia 200 - 200 1 Tennessee 2,100 2,100 - 2 Pennsylvania 2,800 2,800 - 1 New Jersey 100 100 - 3 Missouri 500 500 - 1 Indiana * Customer Connections are rounded State Number of Systems Water Customer Connections Wastewater Customer Connections Total Customer Connections 3,500 2,400 1,100 8 Illinois 100 - 100 1 Iowa 200 200 - 1 Hawaii 12,500 - 12,500 6 California Pending Acquisitions* as of December 2, 2019

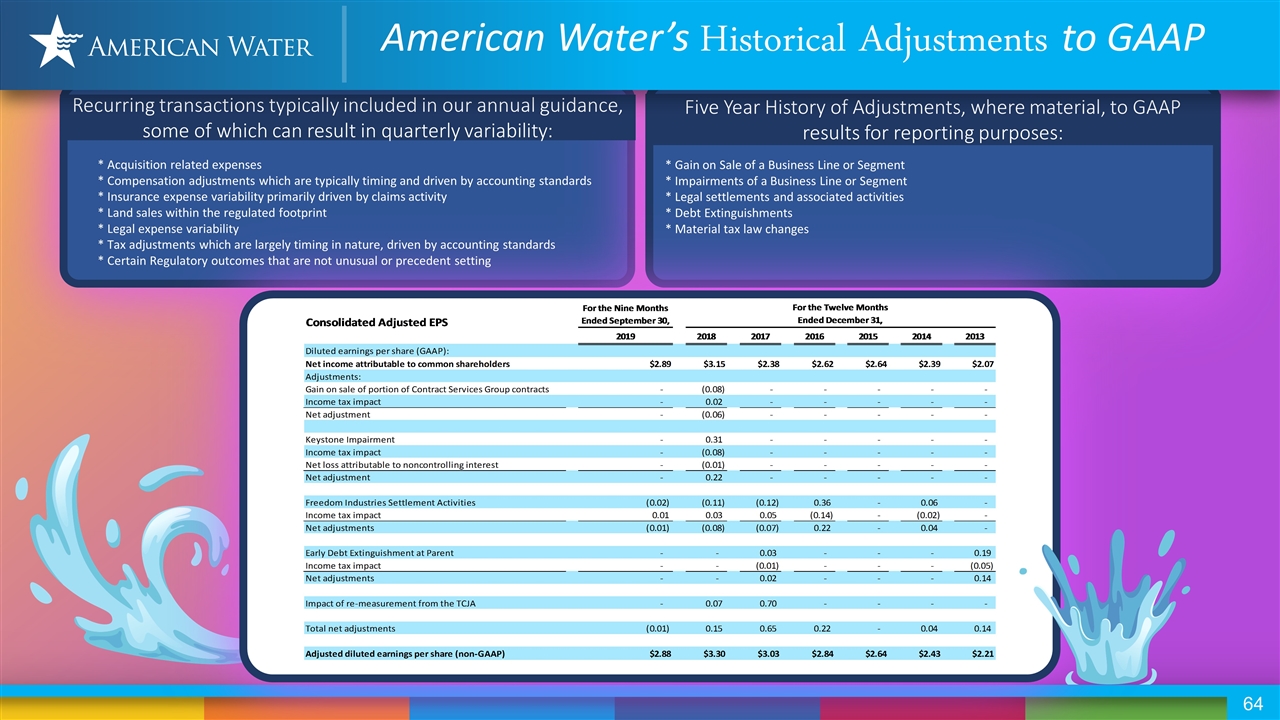

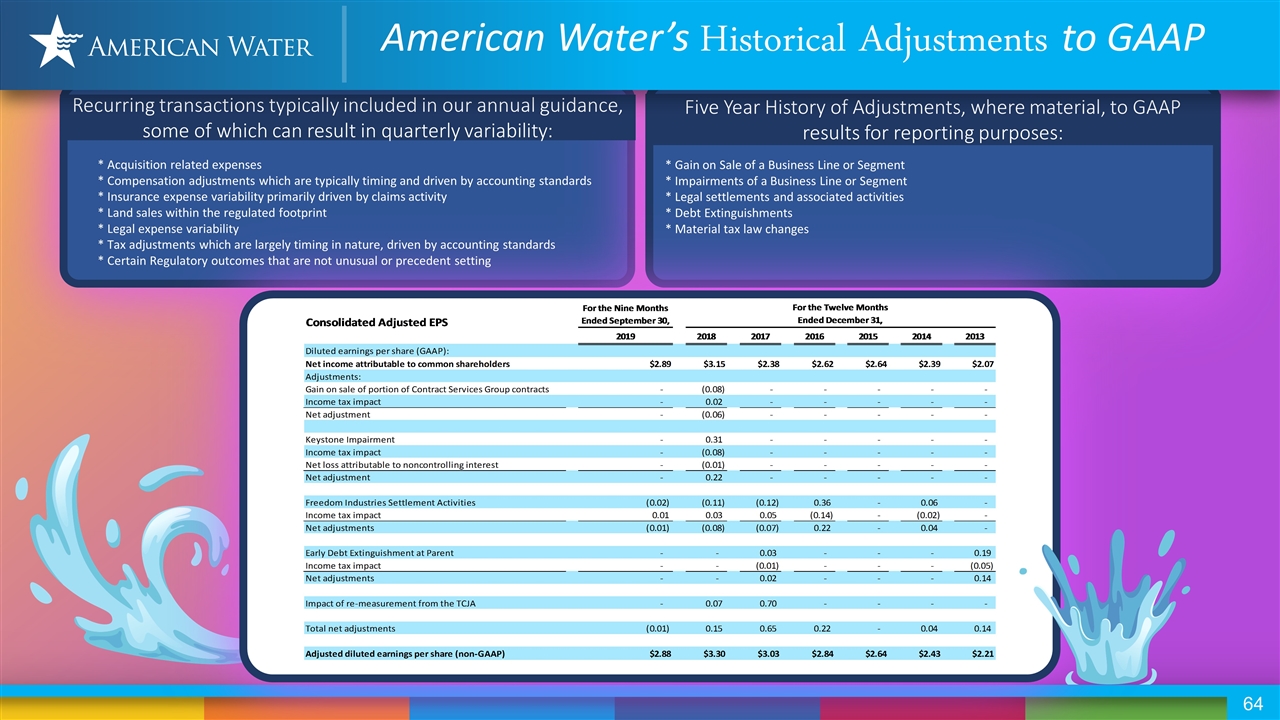

Recurring transactions typically included in our annual guidance, some of which can result in quarterly variability: * Acquisition related expenses * Compensation adjustments which are typically timing and driven by accounting standards * Insurance expense variability primarily driven by claims activity * Land sales within the regulated footprint * Legal expense variability * Tax adjustments which are largely timing in nature, driven by accounting standards * Certain Regulatory outcomes that are not unusual or precedent setting Five Year History of Adjustments, where material, to GAAP results for reporting purposes: * Gain on Sale of a Business Line or Segment * Impairments of a Business Line or Segment * Legal settlements and associated activities * Debt Extinguishments * Material tax law changes American Water’s Historical Adjustments to GAAP

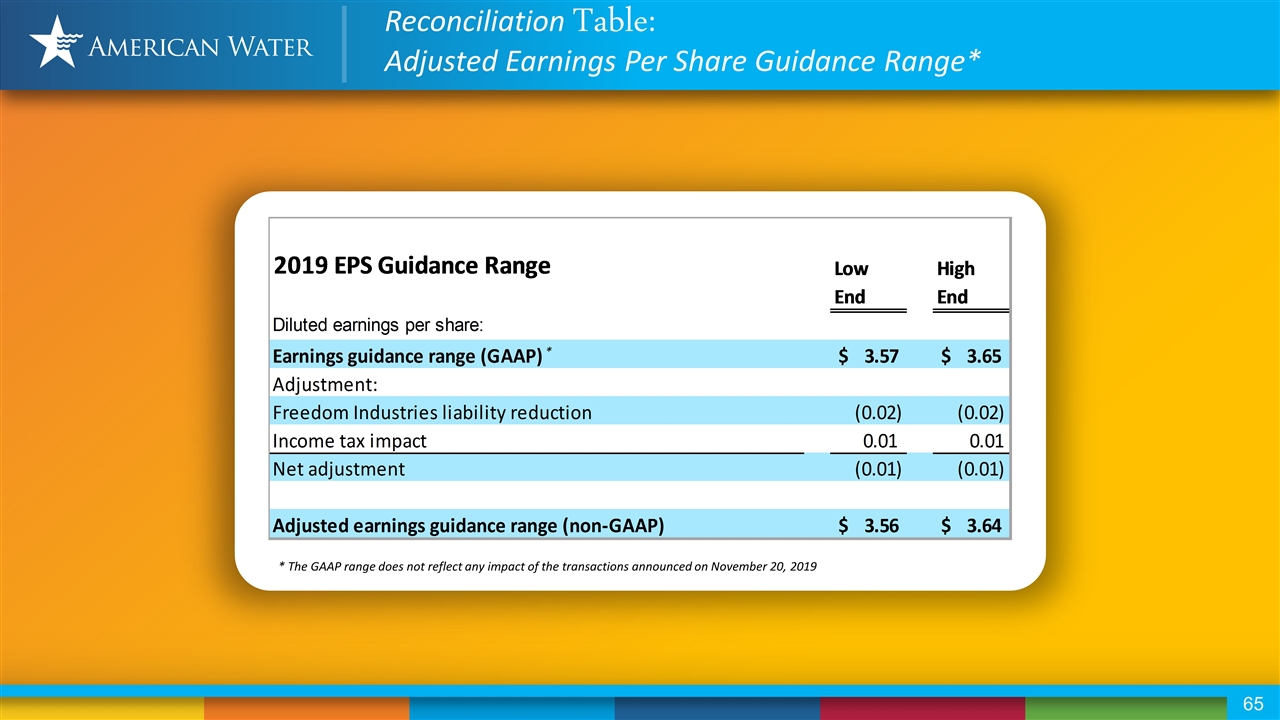

Reconciliation Table: Adjusted Earnings Per Share Guidance Range* * The GAAP range does not reflect any impact of the transactions announced on November 20, 2019 *

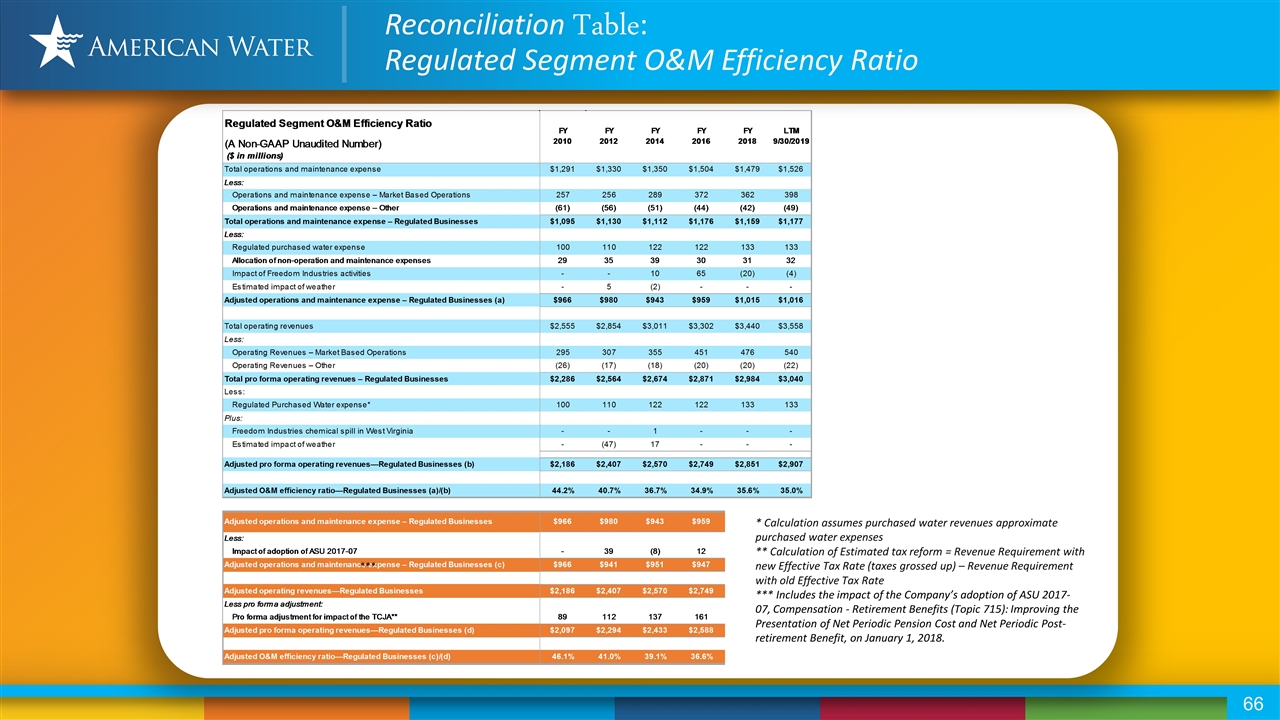

* Calculation assumes purchased water revenues approximate purchased water expenses ** Calculation of Estimated tax reform = Revenue Requirement with new Effective Tax Rate (taxes grossed up) – Revenue Requirement with old Effective Tax Rate *** Includes the impact of the Company’s adoption of ASU 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Post-retirement Benefit, on January 1, 2018. *** Reconciliation Table: Regulated Segment O&M Efficiency Ratio