Fall 2021 Investor Day: Exciting Road Ahead as a Pure- Play Regulated Water Utility November 3, 2021 Exhibit 99.2

Aaron Musgrave Senior Director, Investor Relations

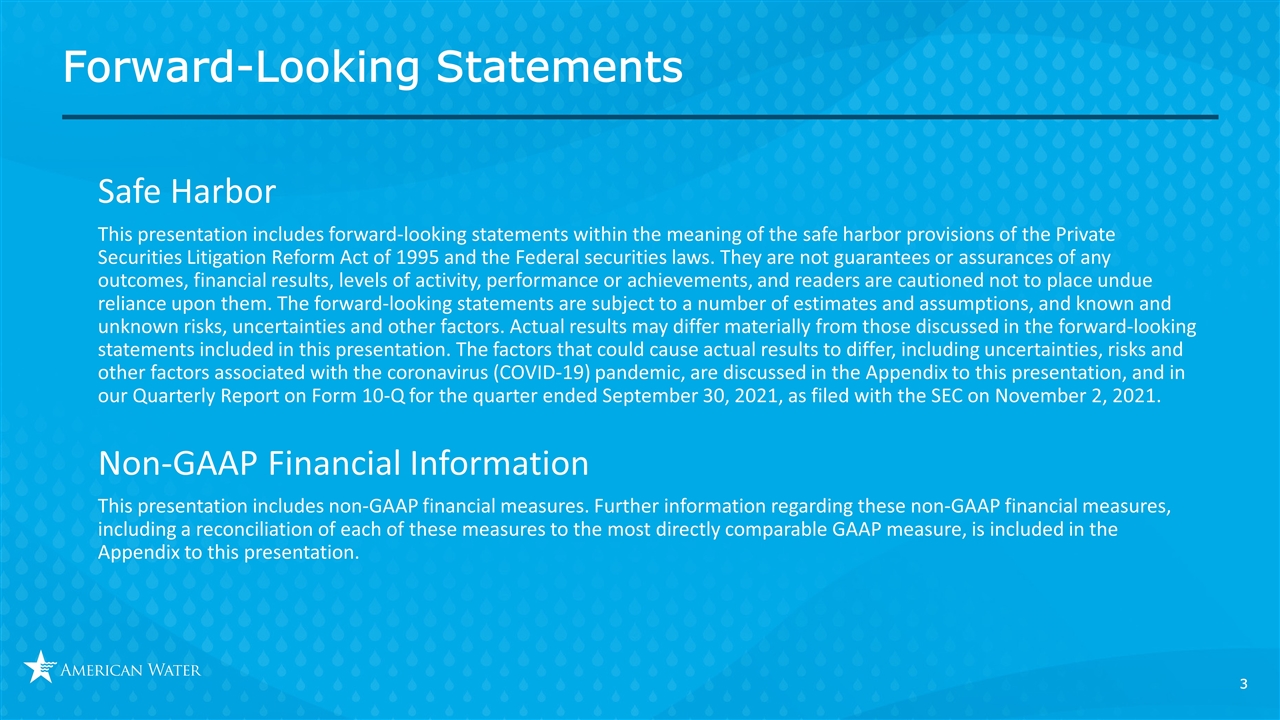

Forward-Looking Statements Safe Harbor This presentation includes forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. They are not guarantees or assurances of any outcomes, financial results, levels of activity, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may differ materially from those discussed in the forward-looking statements included in this presentation. The factors that could cause actual results to differ, including uncertainties, risks and other factors associated with the coronavirus (COVID-19) pandemic, are discussed in the Appendix to this presentation, and in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2021, as filed with the SEC on November 2, 2021. Non-GAAP Financial Information This presentation includes non-GAAP financial measures. Further information regarding these non-GAAP financial measures, including a reconciliation of each of these measures to the most directly comparable GAAP measure, is included in the Appendix to this presentation.

Safety Above All 1 Bedrock of Culture 2 Zero Injuries 3 Virtual Investor Day 4 Daylight Savings Time Ends Sunday, Nov. 7; Be Safe When Driving 5 Emotional Safety Safety is a priority in everything that we do

Walter Lynch President and Chief Executive Officer

Agenda Q&A Session 5 Minute Break 5 Financial Strategy Susan Hardwick, EVP and CFO 3 Operating Strategy Cheryl Norton, EVP and COO 2 Vision and Business Outlook Walter Lynch, President and CEO 1 6 Closing Remarks Walter Lynch, President and CEO 4

Strategic Focus - Creating Value for the Long Term 1 2 3 Vision Operate where we can create value for customers, employees and shareholders Develop and invest in our people Champion an inclusive and high performing culture

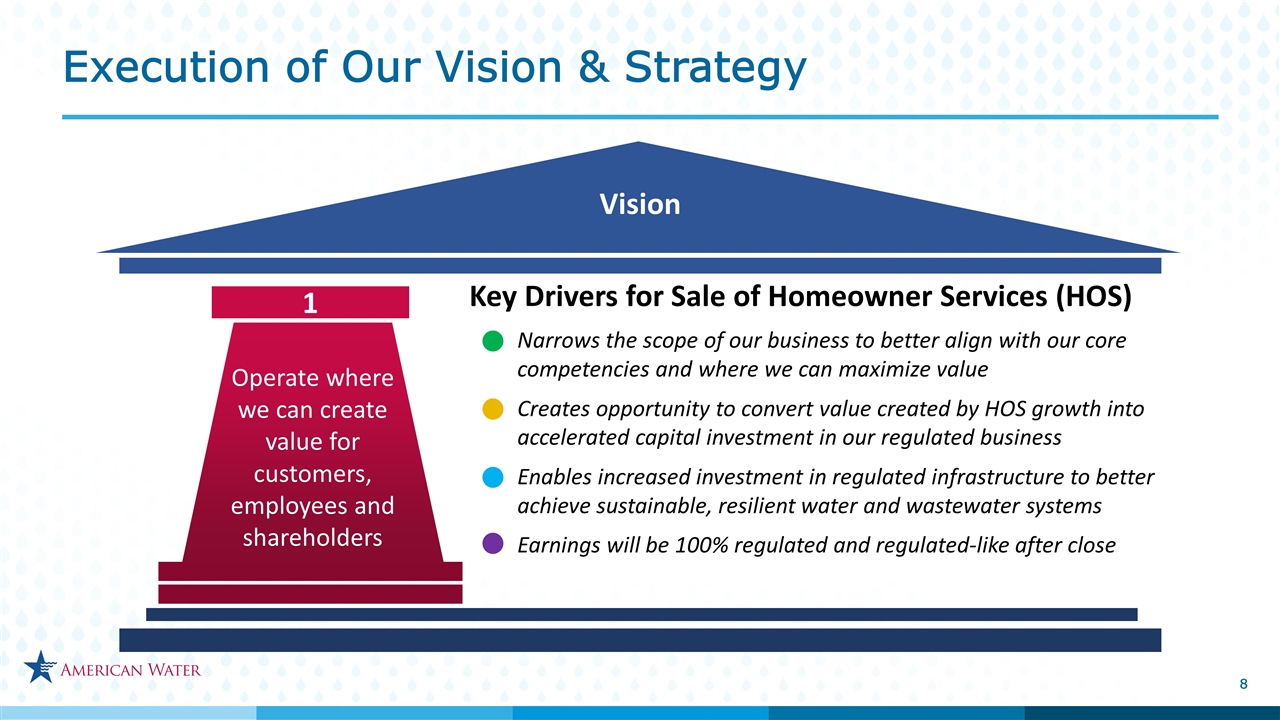

Execution of Our Vision & Strategy Key Drivers for Sale of Homeowner Services (HOS) Narrows the scope of our business to better align with our core competencies and where we can maximize value Creates opportunity to convert value created by HOS growth into accelerated capital investment in our regulated business Enables increased investment in regulated infrastructure to better achieve sustainable, resilient water and wastewater systems Earnings will be 100% regulated and regulated-like after close Vision 1 Operate where we can create value for customers, employees and shareholders Operate where we can create value for customers, employees and shareholders

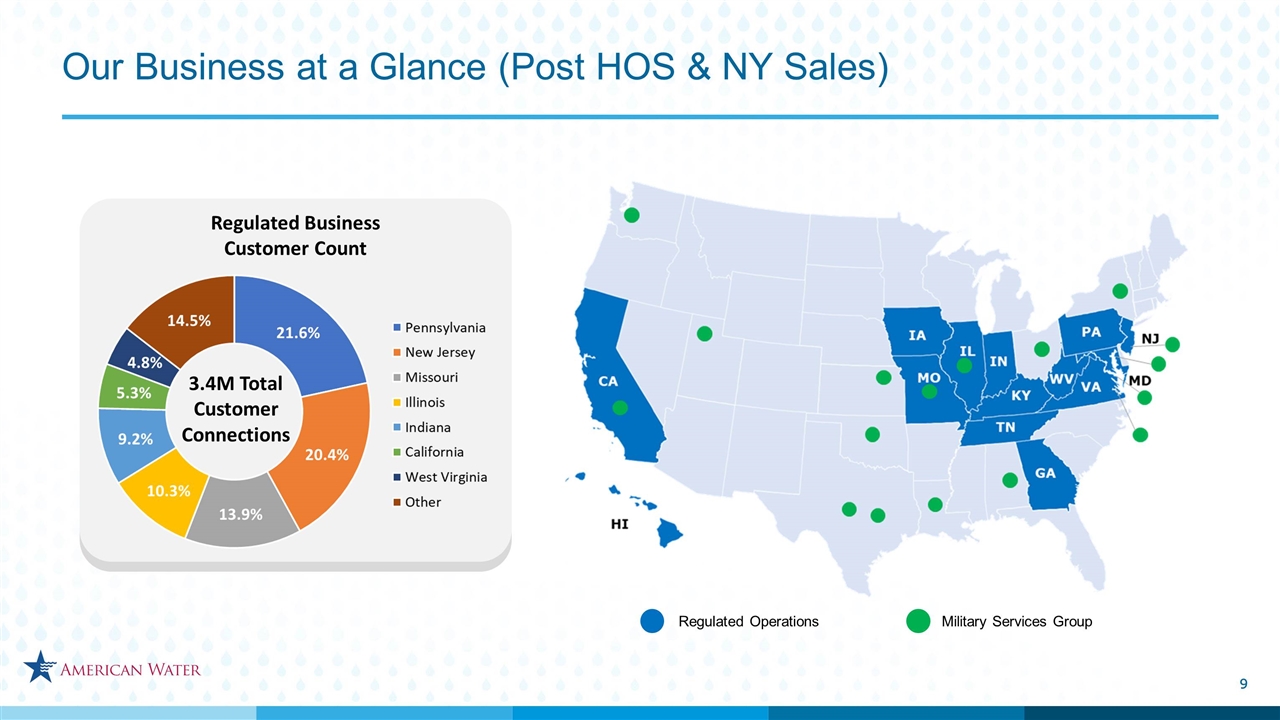

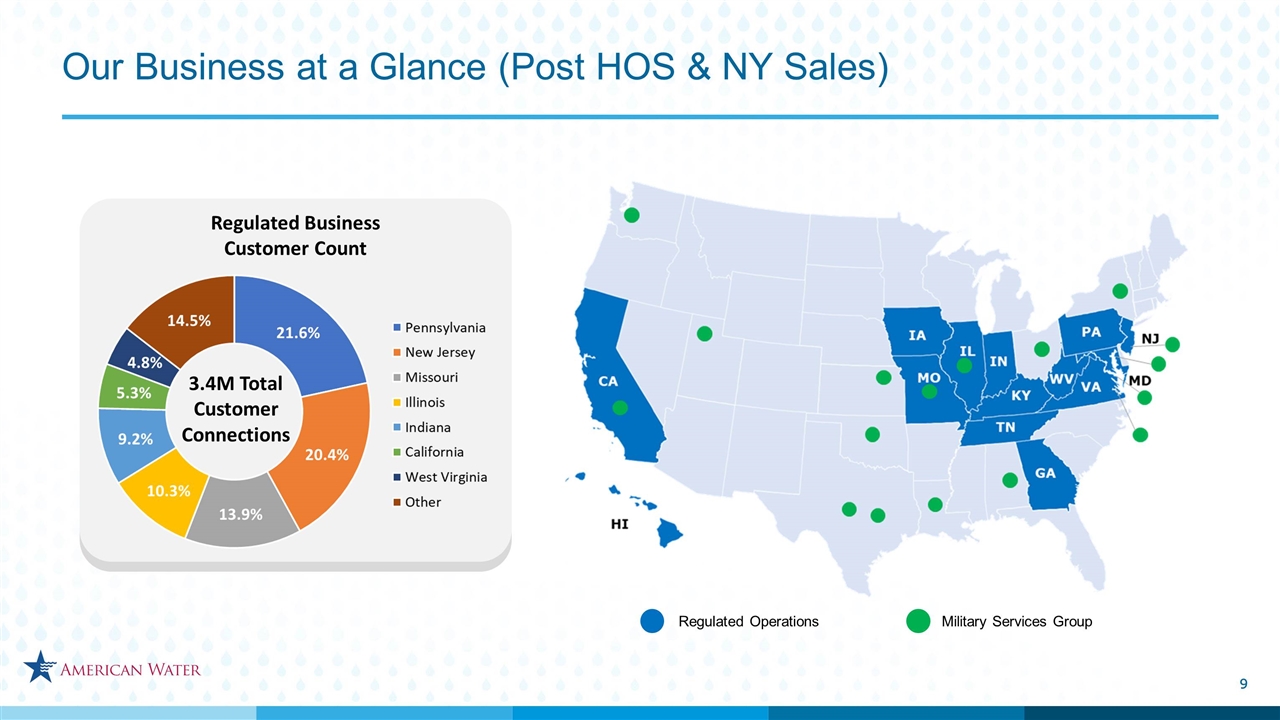

Our Business at a Glance (Post HOS & NY Sales) Regulated Operations Military Services Group Regulated Business Customer Count 3.4M Total Customer Connections

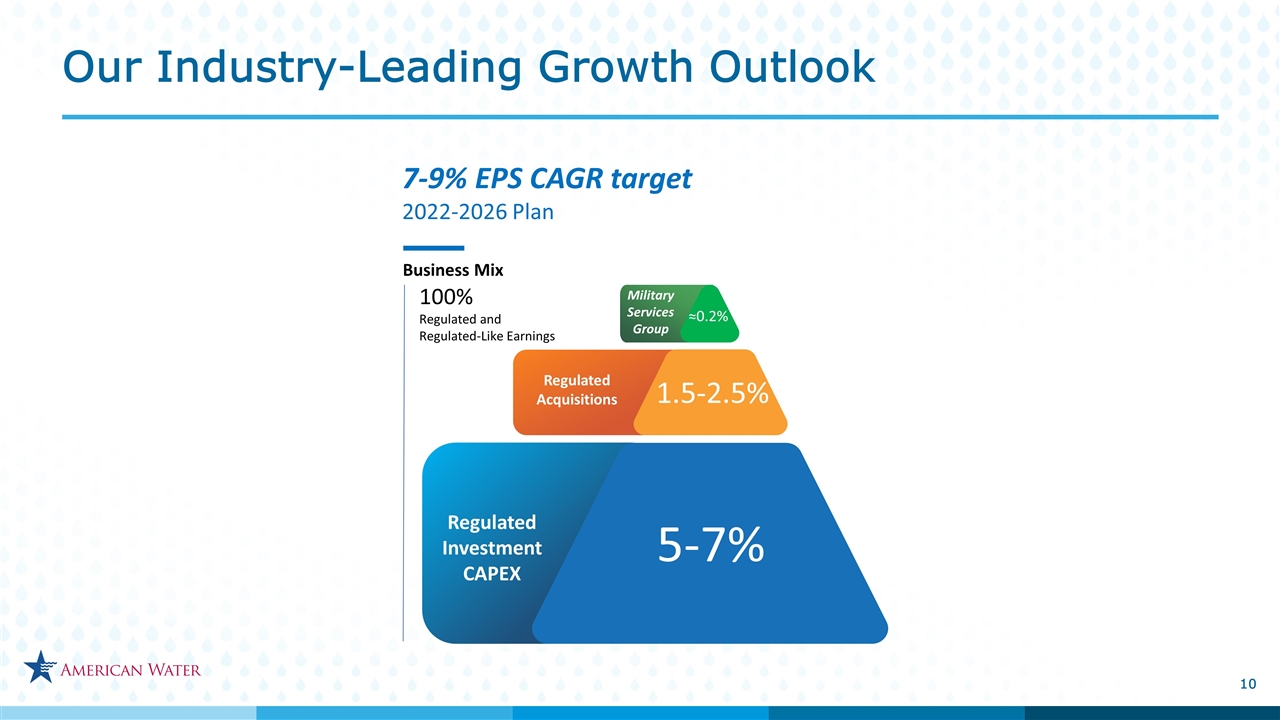

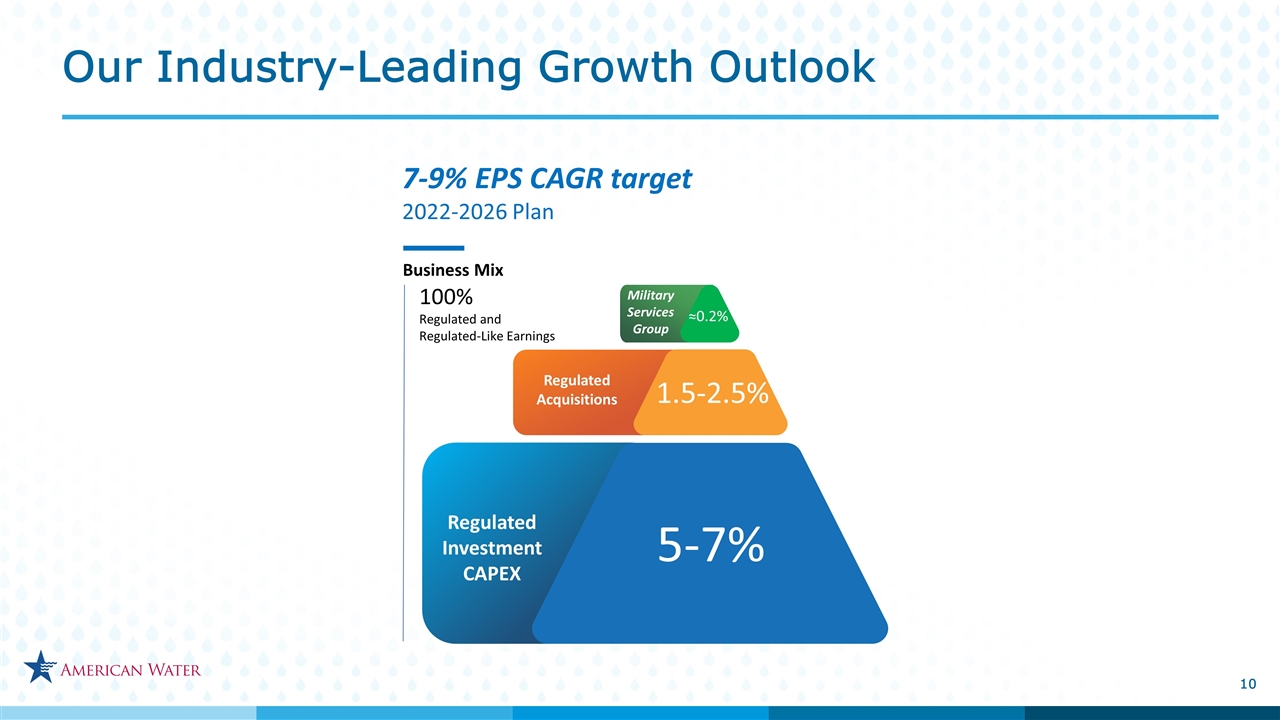

7-9% EPS CAGR target 2022-2026 Plan Regulated Investment CAPEX Regulated Investment CAPEX ~0.5% 5-7% 2-3% Regulated Investment CAPEX Regulated Acquisitions ~1% 5-7% 1.5-2.5% ≈0.2% Business Mix 100% Regulated and Regulated-Like Earnings Military Services Group Our Industry-Leading Growth Outlook

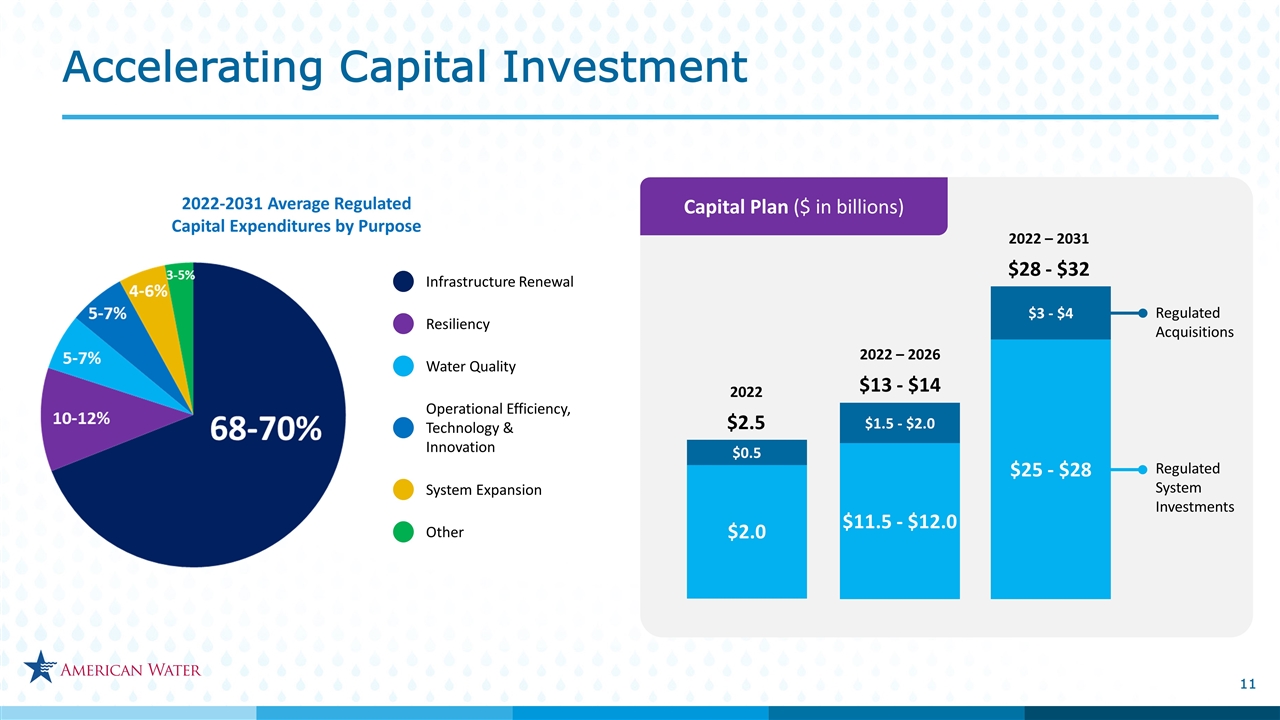

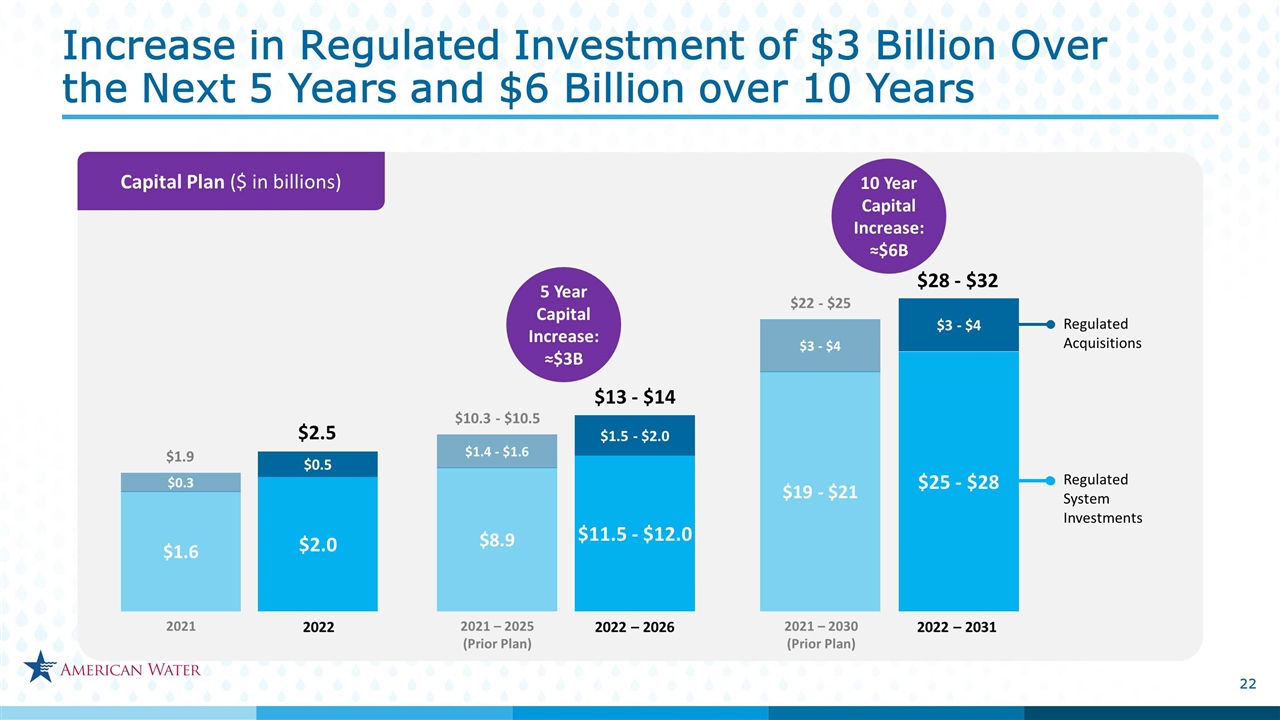

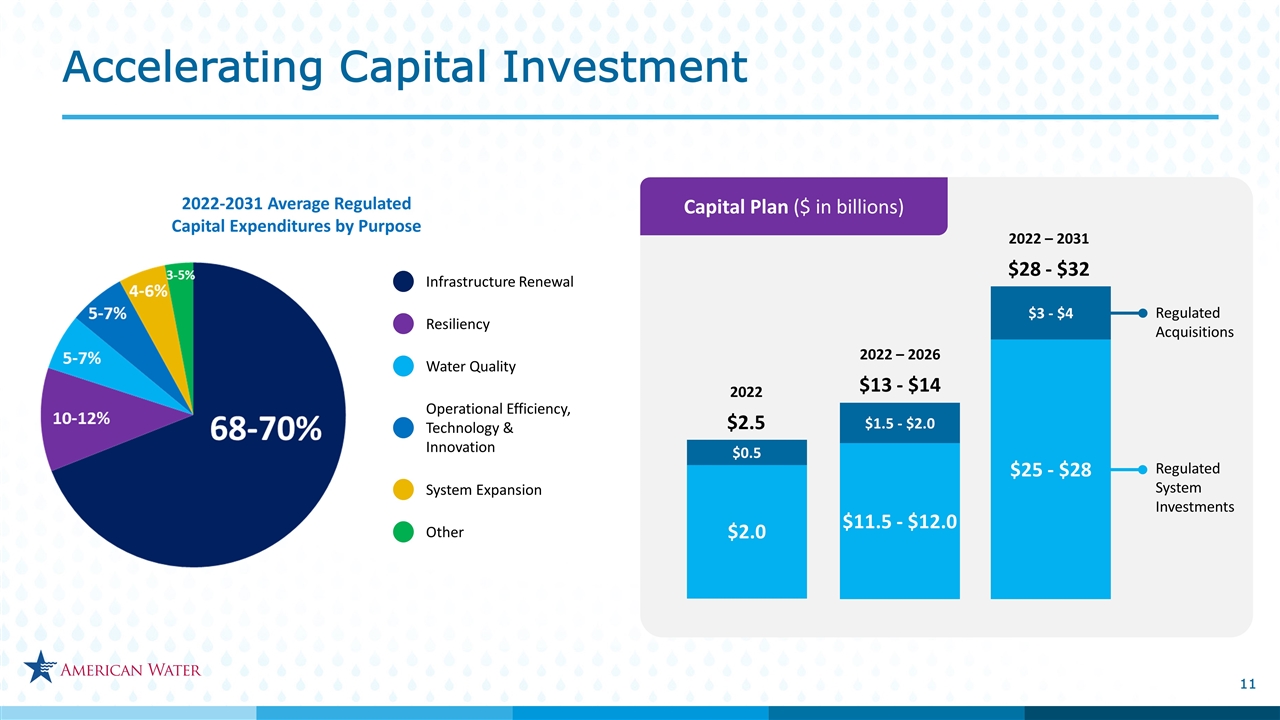

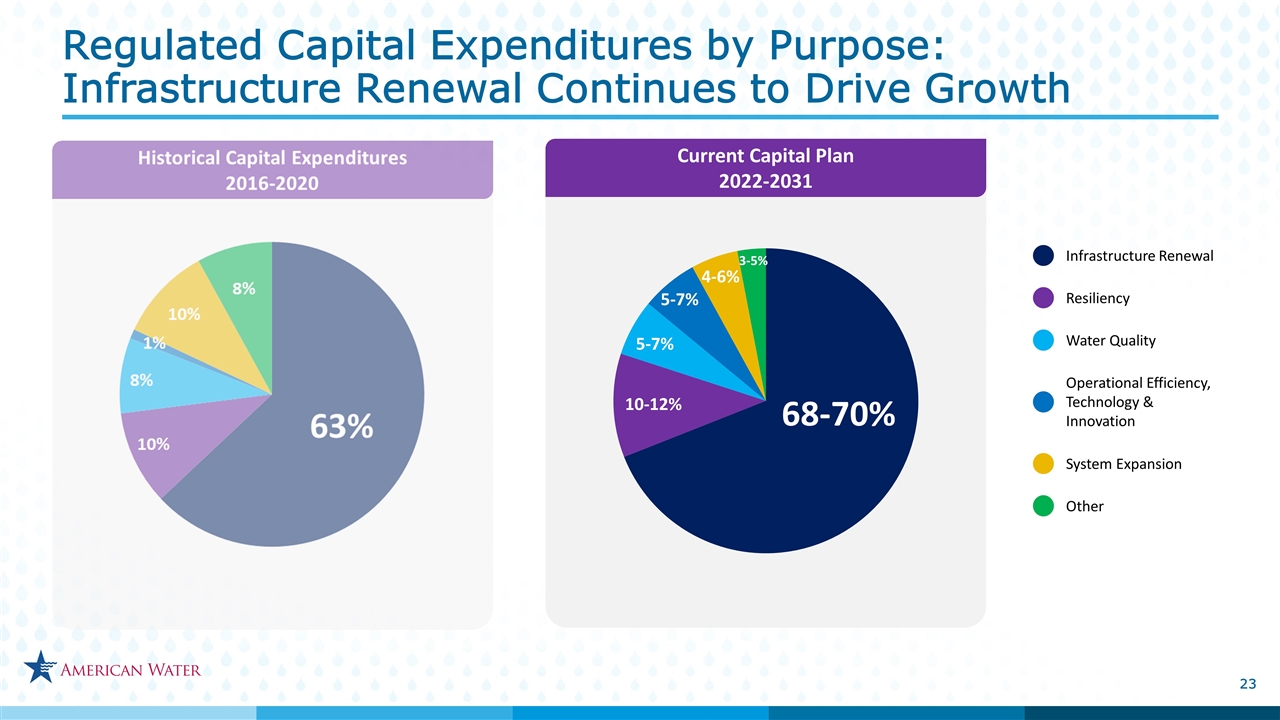

$11.5 - $12.0 $1.5 - $2.0 $25 - $28 $3 - $4 2022 – 2026 $13 - $14 2022 – 2031 $28 - $32 $2.0 $0.5 2022 $2.5 Regulated System Investments Regulated Acquisitions 2022-2031 Average Regulated Capital Expenditures by Purpose Capital Plan ($ in billions) Accelerating Capital Investment Infrastructure Renewal Operational Efficiency, Technology & Innovation Water Quality Resiliency System Expansion Other

What can help us do more System investment needs Customer affordability O&M and capital efficiencies Regulatory support and constructive legislation Increase customer base Balancing Investment Opportunity & Customer Affordability

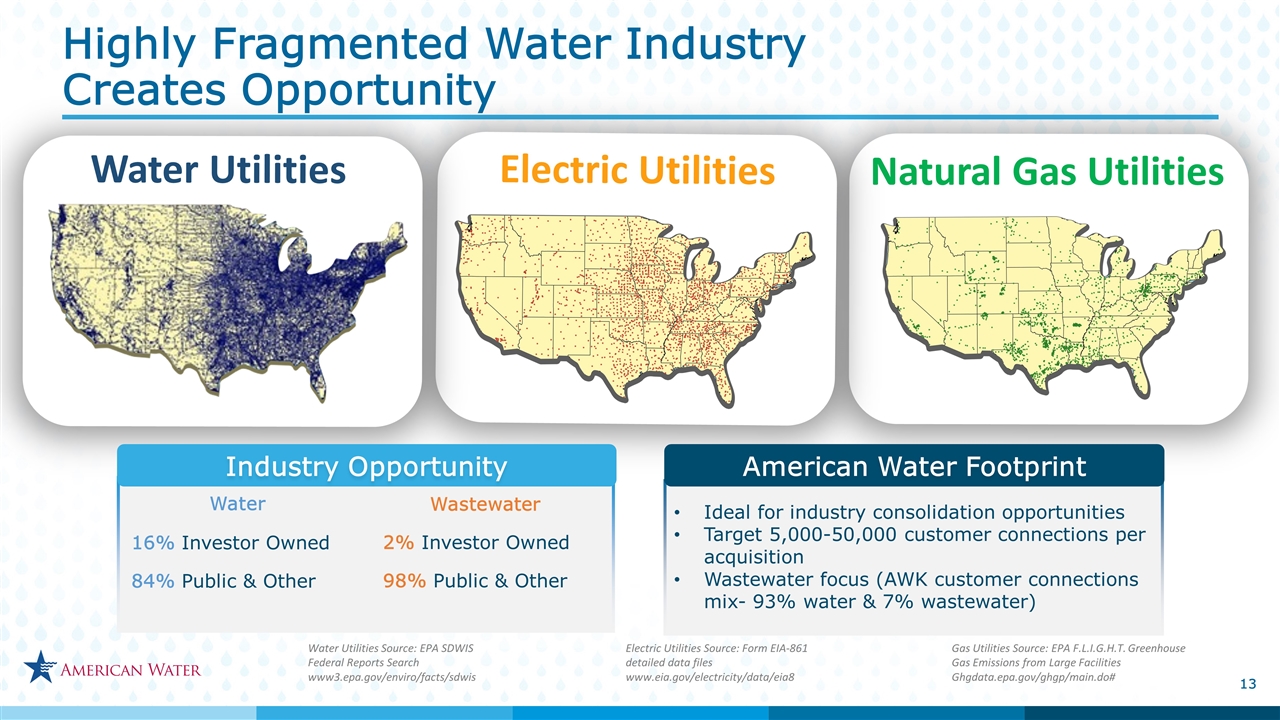

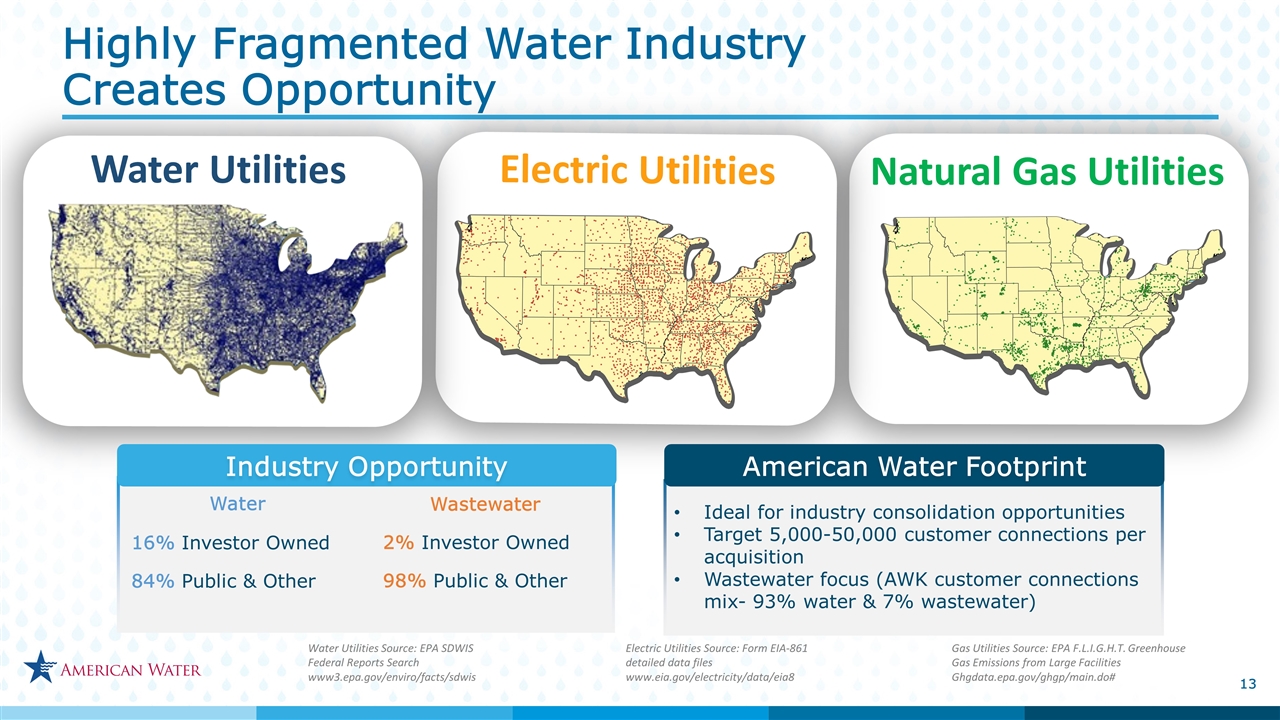

Natural Gas Utilities Electric Utilities Water Utilities Water Utilities Source: EPA SDWIS Federal Reports Search www3.epa.gov/enviro/facts/sdwis Electric Utilities Source: Form EIA-861 detailed data files www.eia.gov/electricity/data/eia8 Gas Utilities Source: EPA F.L.I.G.H.T. Greenhouse Gas Emissions from Large Facilities Ghgdata.epa.gov/ghgp/main.do# Industry Opportunity Water 16% Investor Owned 84% Public & Other Wastewater 2% Investor Owned 98% Public & Other American Water Footprint Ideal for industry consolidation opportunities Target 5,000-50,000 customer connections per acquisition Wastewater focus (AWK customer connections mix- 93% water & 7% wastewater) Highly Fragmented Water Industry Creates Opportunity

Engagement on regulatory and legislative policy Focus on Efficient Operations Scale and large customer base People with deep utility experience Increase wastewater within and adjacent to water footprint Focus on efficient operations Leveraging Our Competitive Advantages

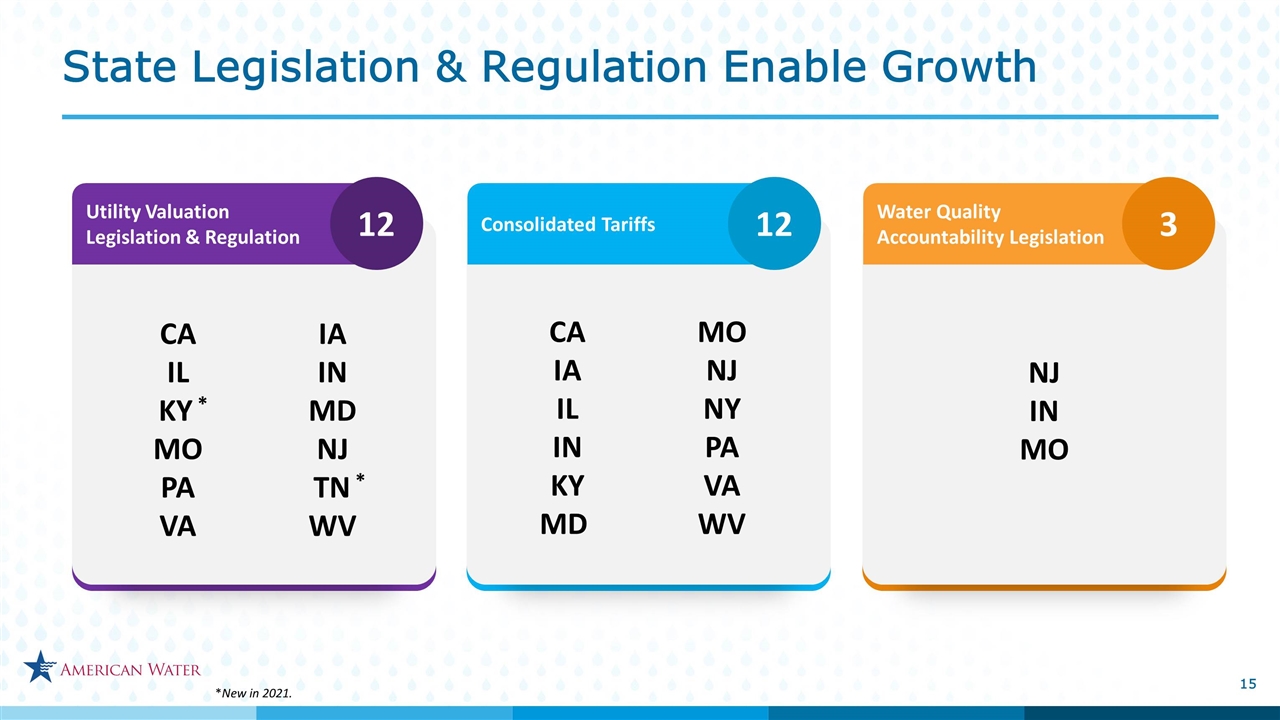

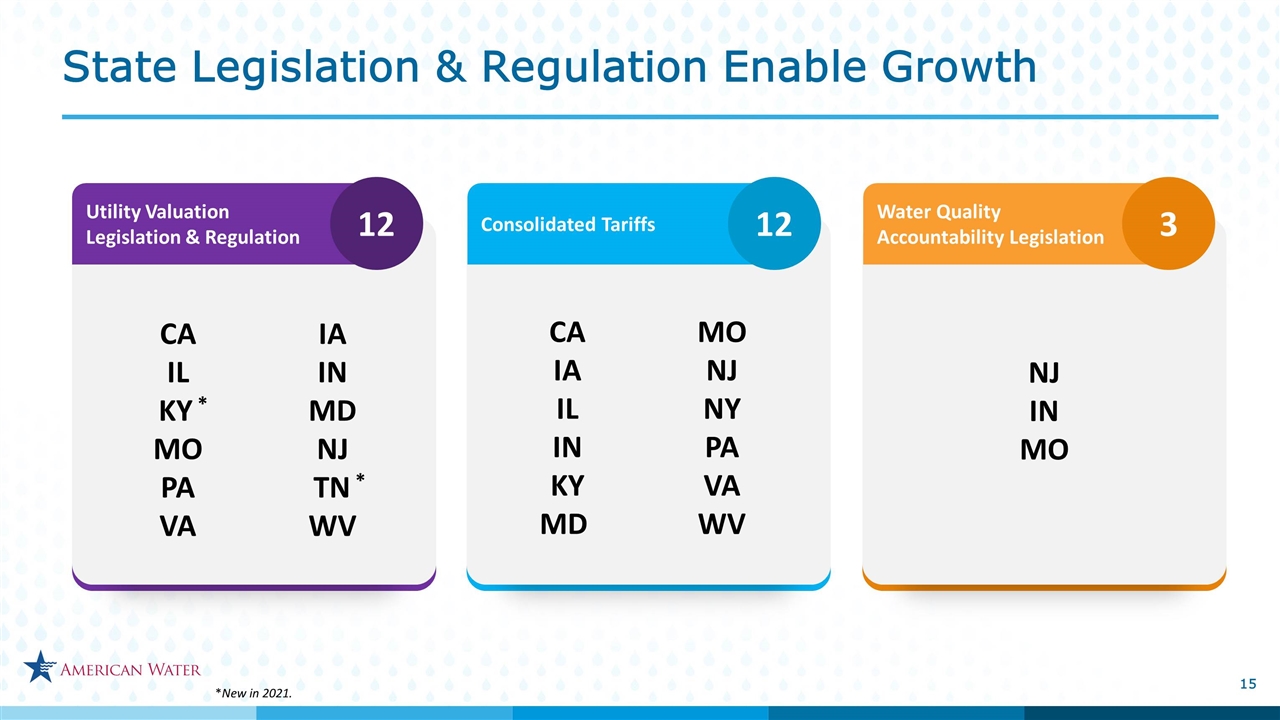

State Legislation & Regulation Enable Growth Utility Valuation Legislation & Regulation Consolidated Tariffs Water Quality Accountability Legislation 12 12 3 CA IL KY * MO PA VA IA IN MD NJ TN * WV CA IA IL IN KY MD MO NJ NY PA VA WV NJ IN MO *New in 2021.

Rate Case Process to Fully Reflect Acquisitions & Inclusion into Rate Base Close & Customers Served at Existing Rates Regulatory Approval to Close Agreement Process Growing Opportunity for Customer Connections Over Five-Year Outlook Under Agreement* as of November 1, 2021 ≈82,700 Customer Connections 31 Acquisitions Closed YTD as of November 1, 2021 CA: 3 IL: 5 IN: 1 MO: 11 NJ: 2 PA: 7 VA: 1 WV: 1 ≈7,450 Customer Connections 14 Acquisitions in 6 States * Does not reflect the announced pending sale of NYAW. CA: 1 IL: 3 IN: 2 MO: 4 PA: 2 WV: 2 ≈1,300,000 Customer Connections in Pipeline Opportunity A – 78,000 Opportunity B – 50,000 Opportunity C – 50,000 Opportunity D – 33,000 Opportunity E – 30,000 Regulated Acquisitions Update

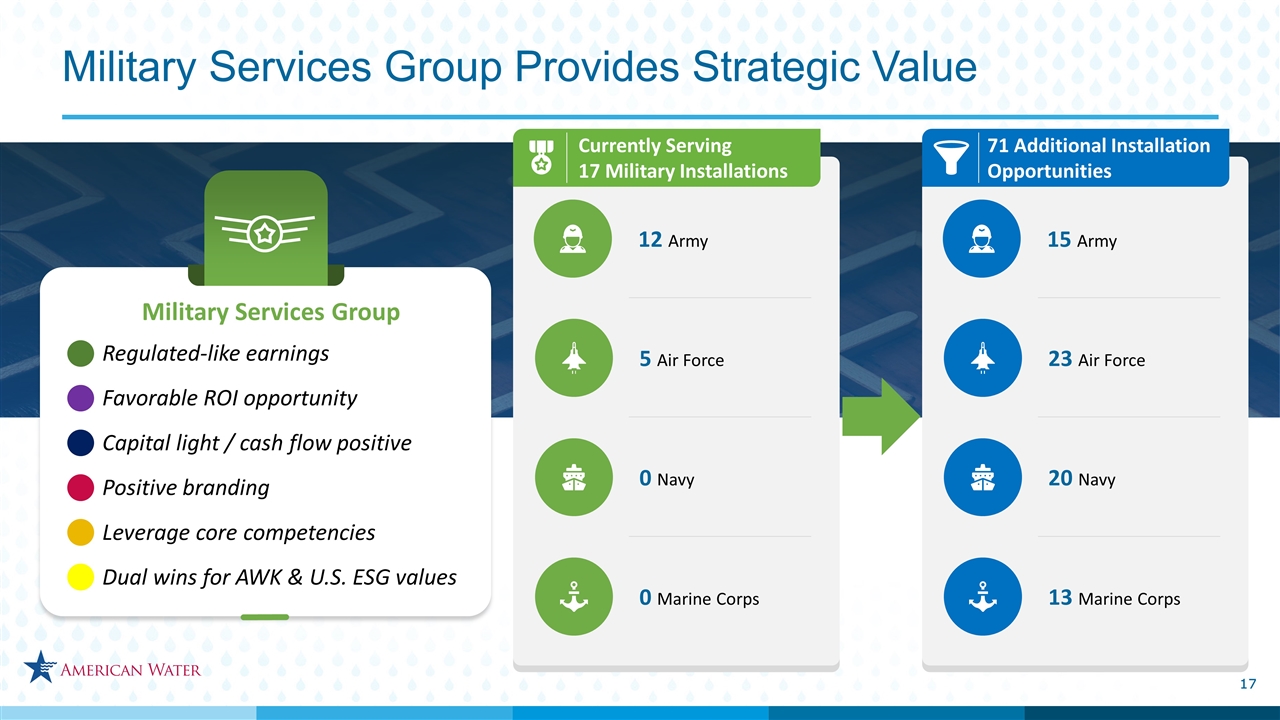

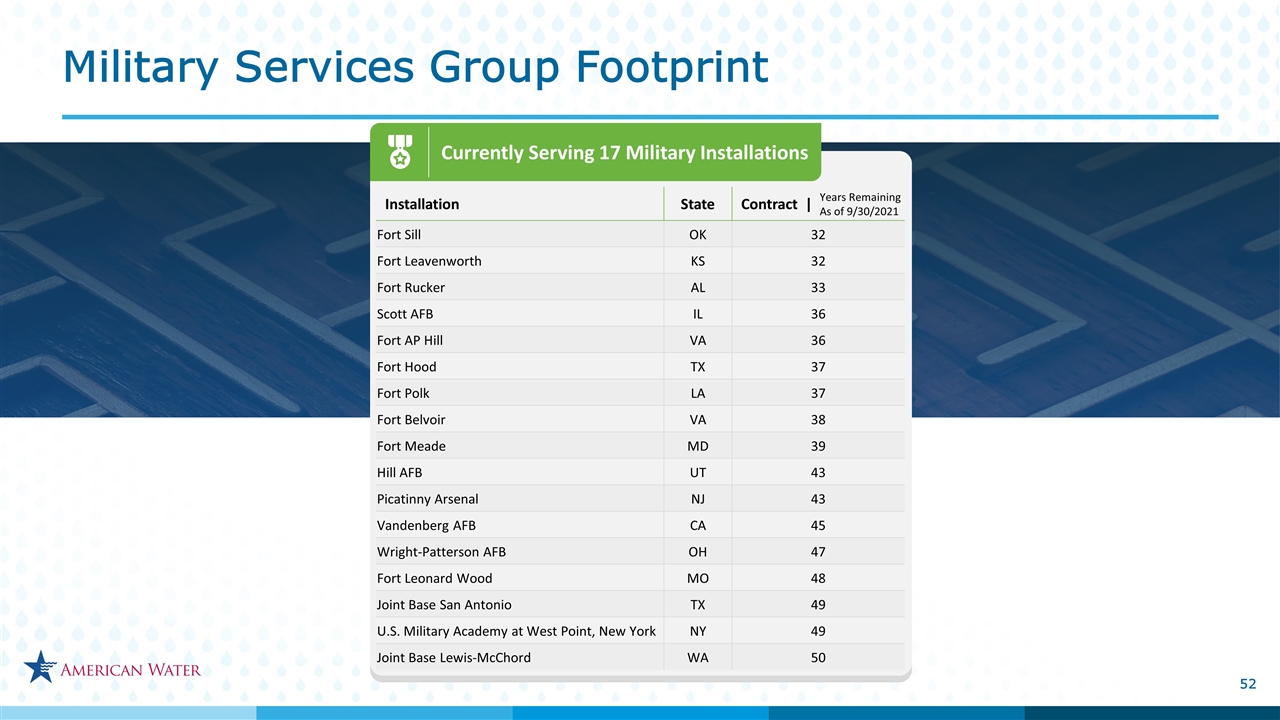

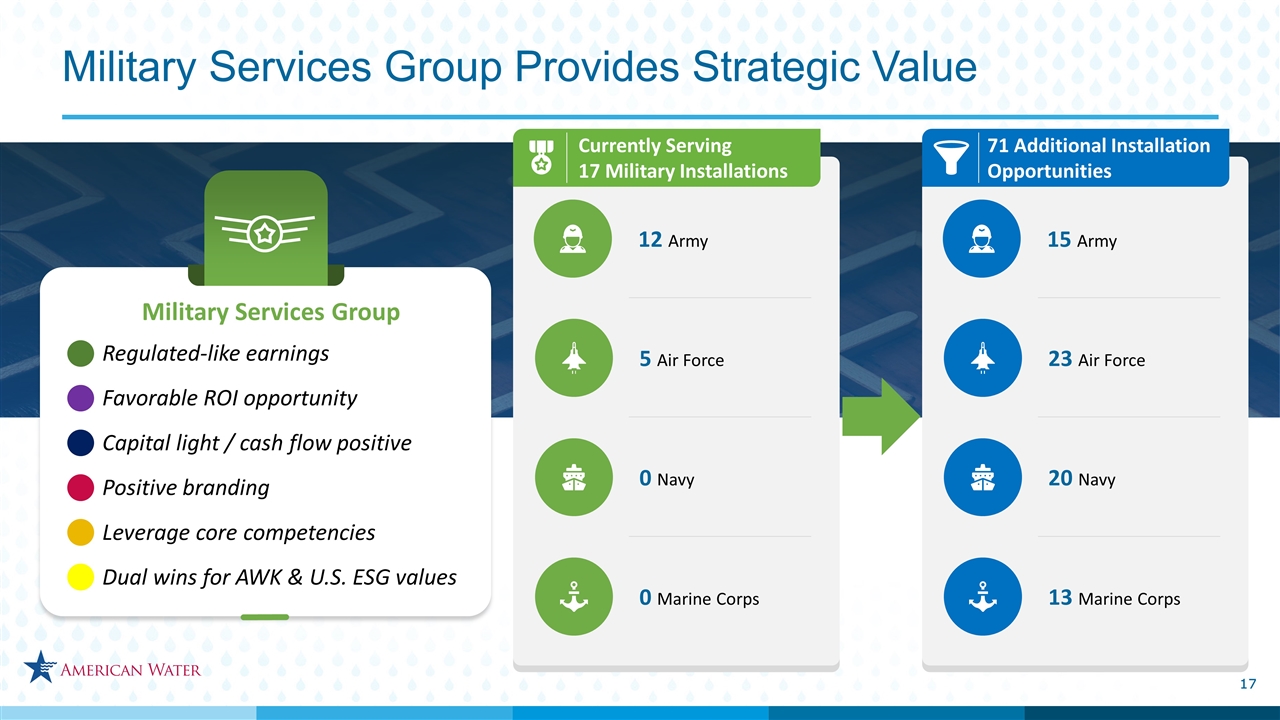

Regulated-like earnings Favorable ROI opportunity Capital light / cash flow positive Positive branding Leverage core competencies Dual wins for AWK & U.S. ESG values Military Services Group Currently Serving 17 Military Installations Military Services Group Provides Strategic Value 5 Air Force 0 Navy 0 Marine Corps 12 Army 71 Additional Installation Opportunities 23 Air Force 20 Navy 13 Marine Corps 15 Army

Objectives for the Next Five Years: 2022-2026 Plan Advance infrastructure improvement through five-year capital investment plan of approximately $13 - $14 billion and expected ten-year plan of approximately $28 - $32 billion Accelerate growth through acquisitions Strengthen position as leading Environmental, Social and Governance (ESG) investment Focus on customer affordability by continuing to drive O&M efficiency through strategic approach to managing costs Optimize recovery of capital investment through effective regulatory strategies AWK Growth Outlook 7-9% EPS CAGR Target Regulated Investment CAPEX Regulated Investment CAPEX ~0.5% 5-7% 2-3% Regulated Investment CAPEX Regulated Acquisitions ~1% 5-7% 1.5-2.5% Military Services Group ≈0.2% Business Mix 100% Regulated and Regulated-Like Earnings

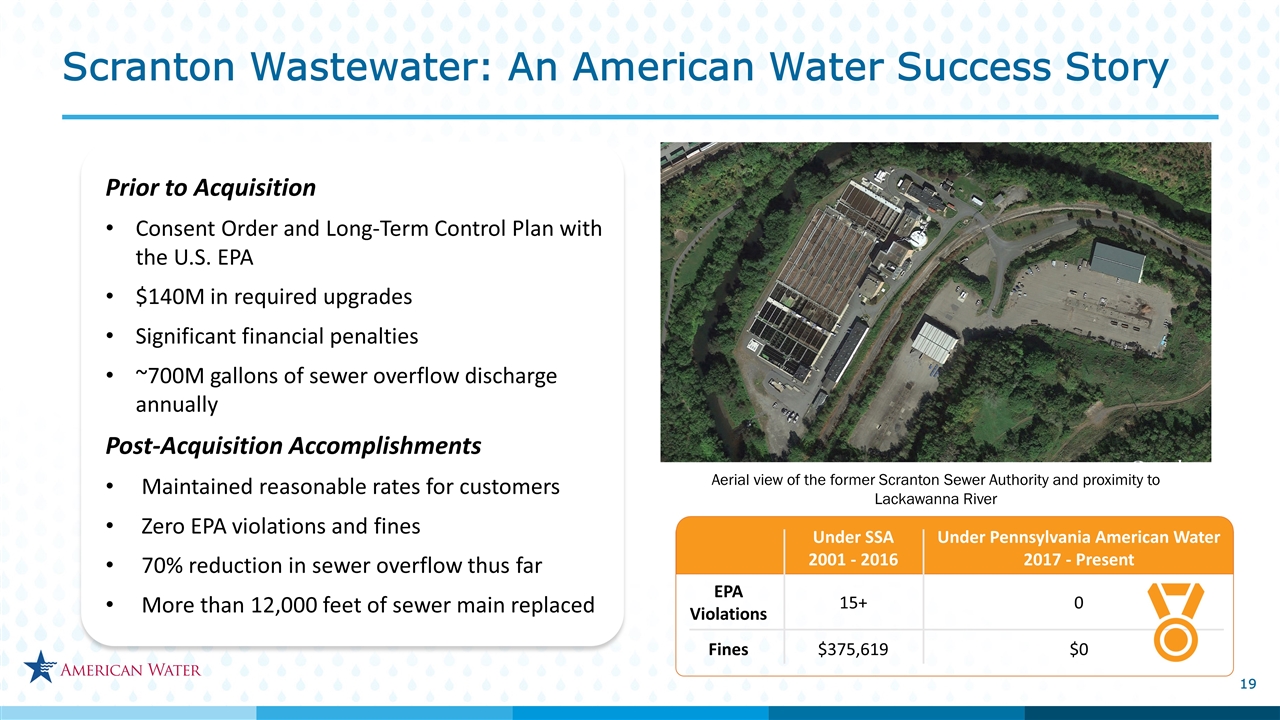

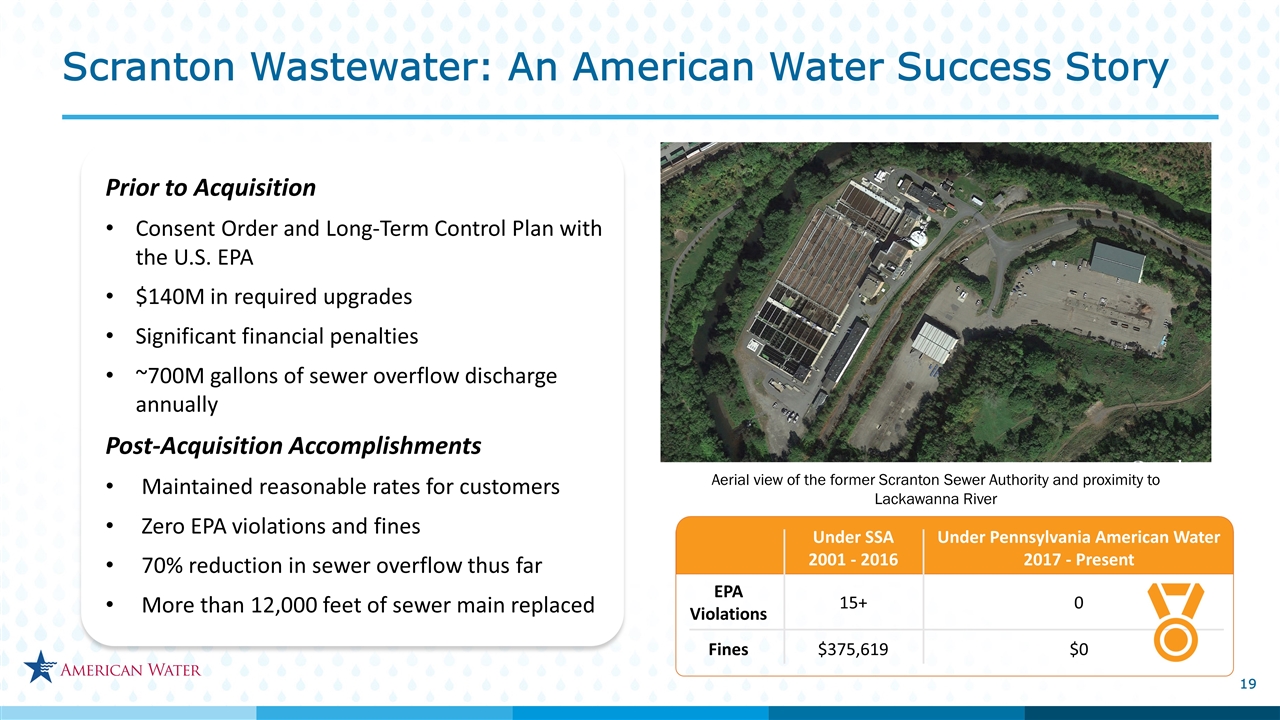

Scranton Wastewater: An American Water Success Story Aerial view of the former Scranton Sewer Authority and proximity to Lackawanna River Prior to Acquisition Consent Order and Long-Term Control Plan with the U.S. EPA $140M in required upgrades Significant financial penalties ~700M gallons of sewer overflow discharge annually Post-Acquisition Accomplishments Maintained reasonable rates for customers Zero EPA violations and fines 70% reduction in sewer overflow thus far More than 12,000 feet of sewer main replaced Under SSA 2001 - 2016 Under Pennsylvania American Water 2017 - Present EPA Violations 15+ 0 Fines $375,619 $0

Cheryl Norton Executive VP & Chief Operating Officer

Water and Wastewater Industry in the U.S. 2021 Grade Drinking Water Report Card C- Not American Water pipes 2021 Grade Wastewater Report Card D+ Critical need for multi-decade investment Approximately 51,000 community water systems, 16,000 wastewater systems Nationwide, there is an estimated 250,000 to 300,000 water main breaks per year; equivalent to a water main break every two minutes Over 2.1 trillion gallons of treated water is lost each year American Society of Civil Engineers Grades U.S. Infrastructure Resiliency Investments to Manage Climate Variability Since 2017, replacement rates for wastewater collection pipes have essentially stagnated 900 billion gallons of untreated wastewater discharged into our waterways each year Source: ASCE’s 2021 Infrastructure Report Card

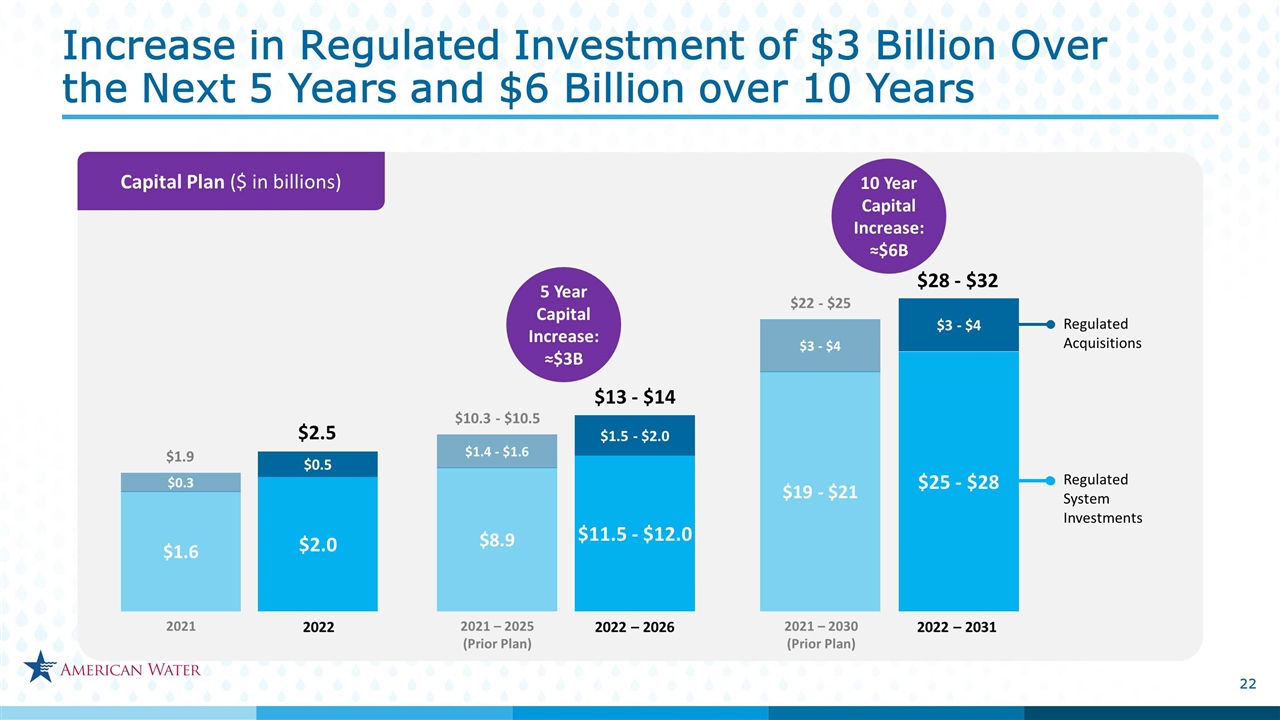

Capital Plan ($ in billions) $1.6 $8.9 $1.4 - $1.6 $19 - $21 $3 - $4 $10.3 - $10.5 $22 - $25 $1.9 $0.3 2021 2021 – 2025 (Prior Plan) 2021 – 2030 (Prior Plan) $2.0 $0.5 $2.5 $11.5 - $12.0 $1.5 - $2.0 $13 - $14 $25 - $28 $3 - $4 $28 - $32 Regulated System Investments Regulated Acquisitions 2022 2022 – 2026 2022 – 2031 5 Year Capital Increase: ≈$3B 10 Year Capital Increase: ≈$6B Increase in Regulated Investment of $3 Billion Over the Next 5 Years and $6 Billion over 10 Years

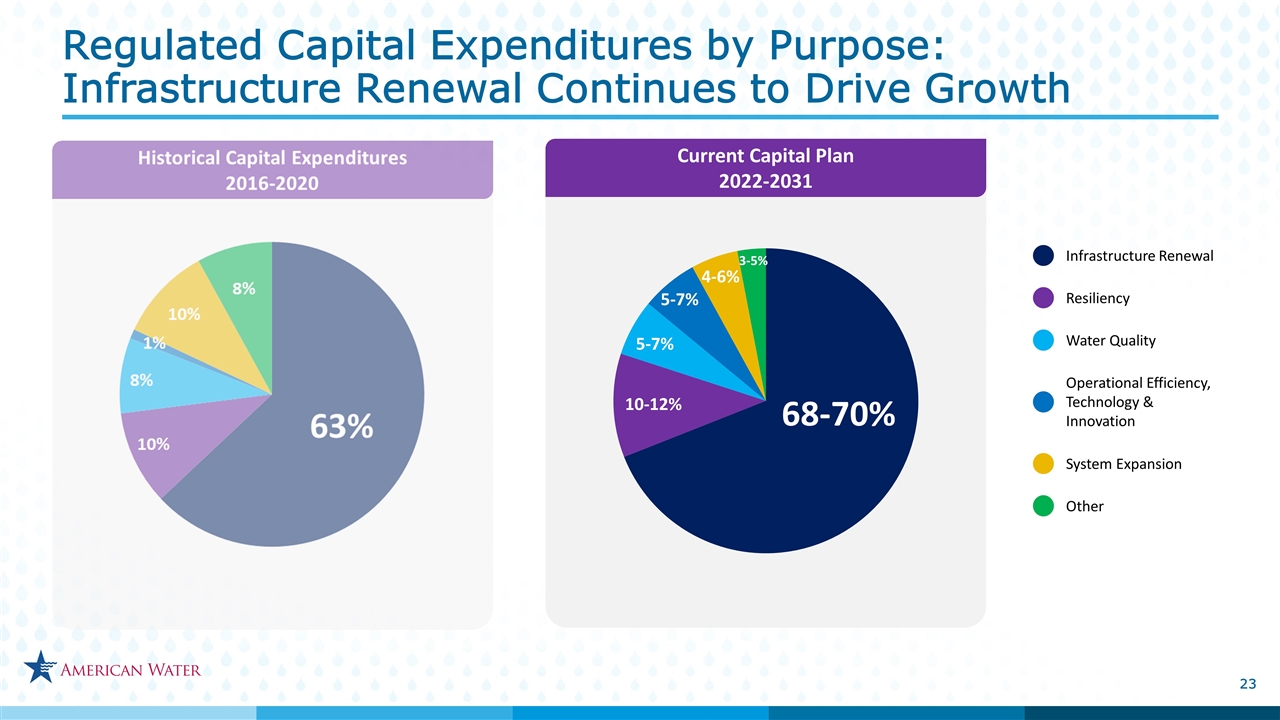

Regulated Capital Expenditures by Purpose: Infrastructure Renewal Continues to Drive Growth Infrastructure Renewal Operational Efficiency, Technology & Innovation Water Quality Resiliency System Expansion Other Current Capital Plan 2022-2031

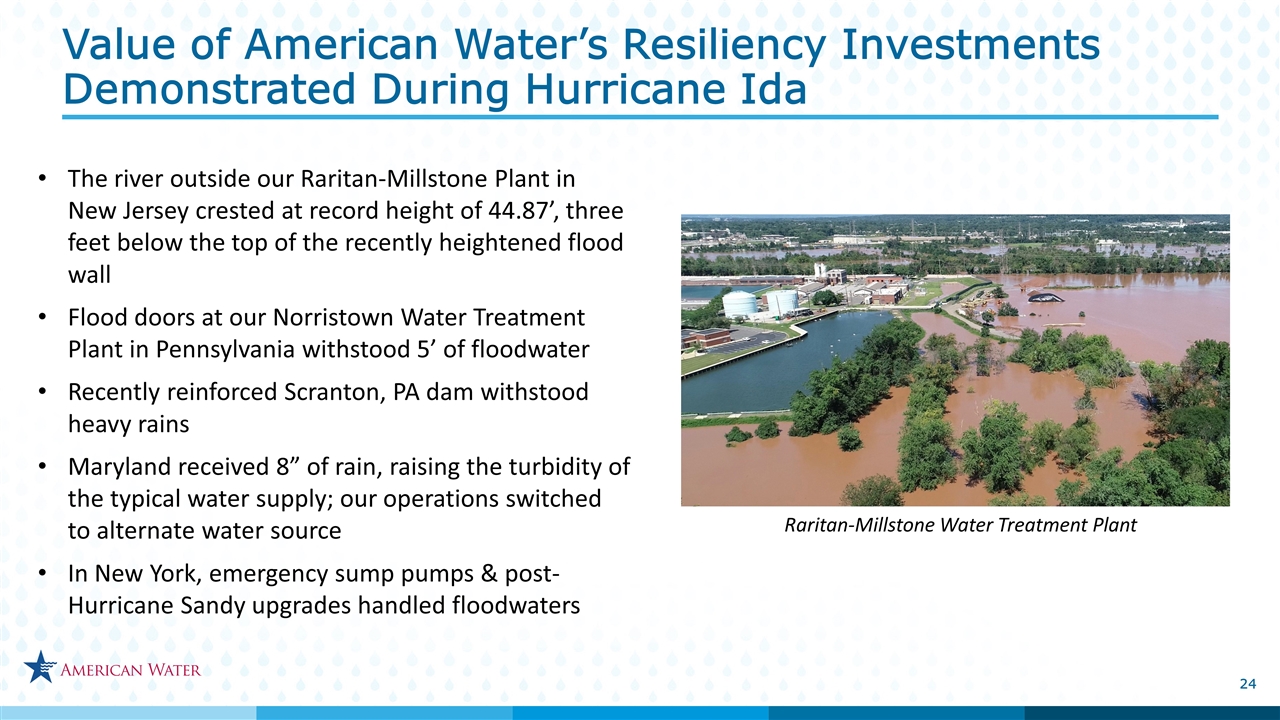

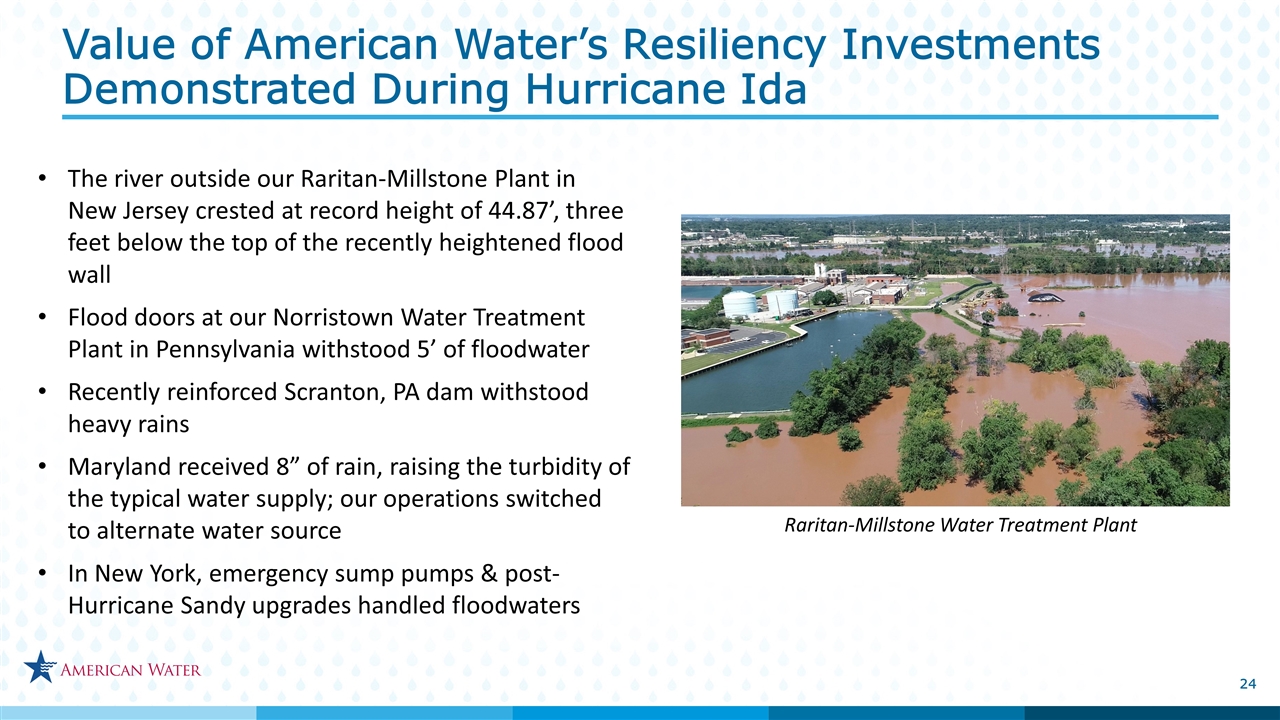

Value of American Water’s Resiliency Investments Demonstrated During Hurricane Ida The river outside our Raritan-Millstone Plant in New Jersey crested at record height of 44.87’, three feet below the top of the recently heightened flood wall Flood doors at our Norristown Water Treatment Plant in Pennsylvania withstood 5’ of floodwater Recently reinforced Scranton, PA dam withstood heavy rains Maryland received 8” of rain, raising the turbidity of the typical water supply; our operations switched to alternate water source In New York, emergency sump pumps & post-Hurricane Sandy upgrades handled floodwaters Raritan-Millstone Water Treatment Plant

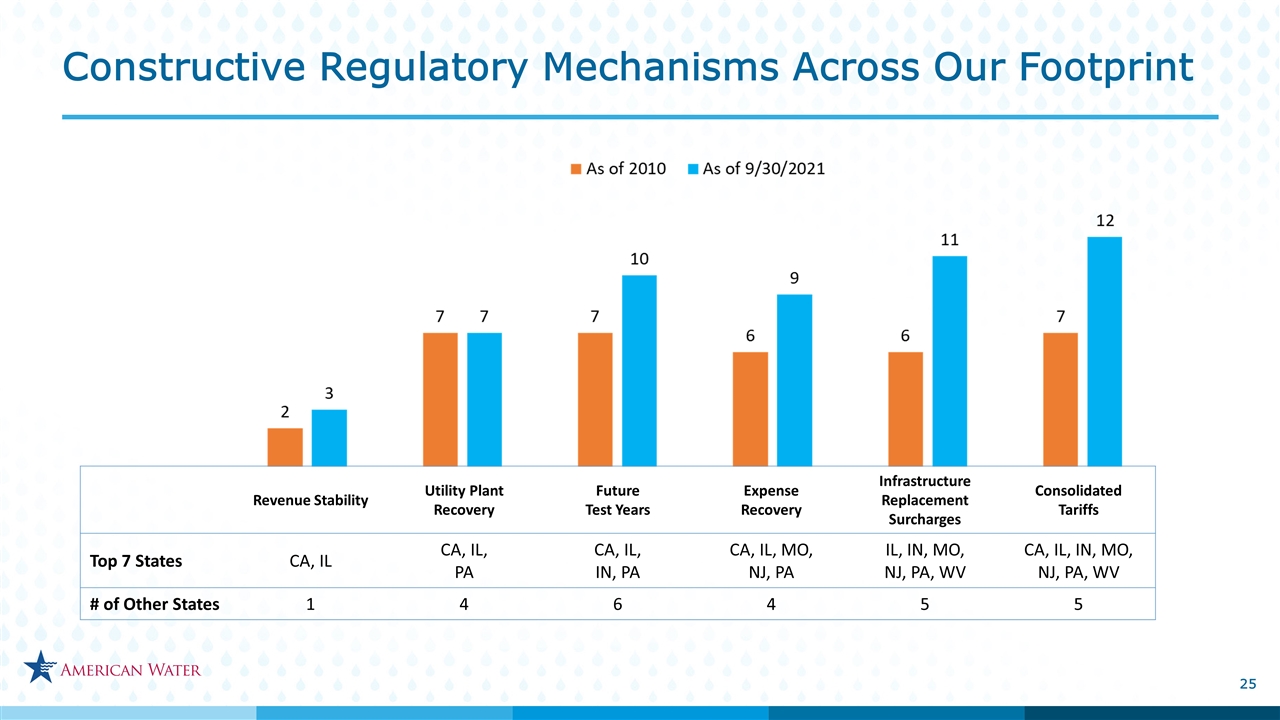

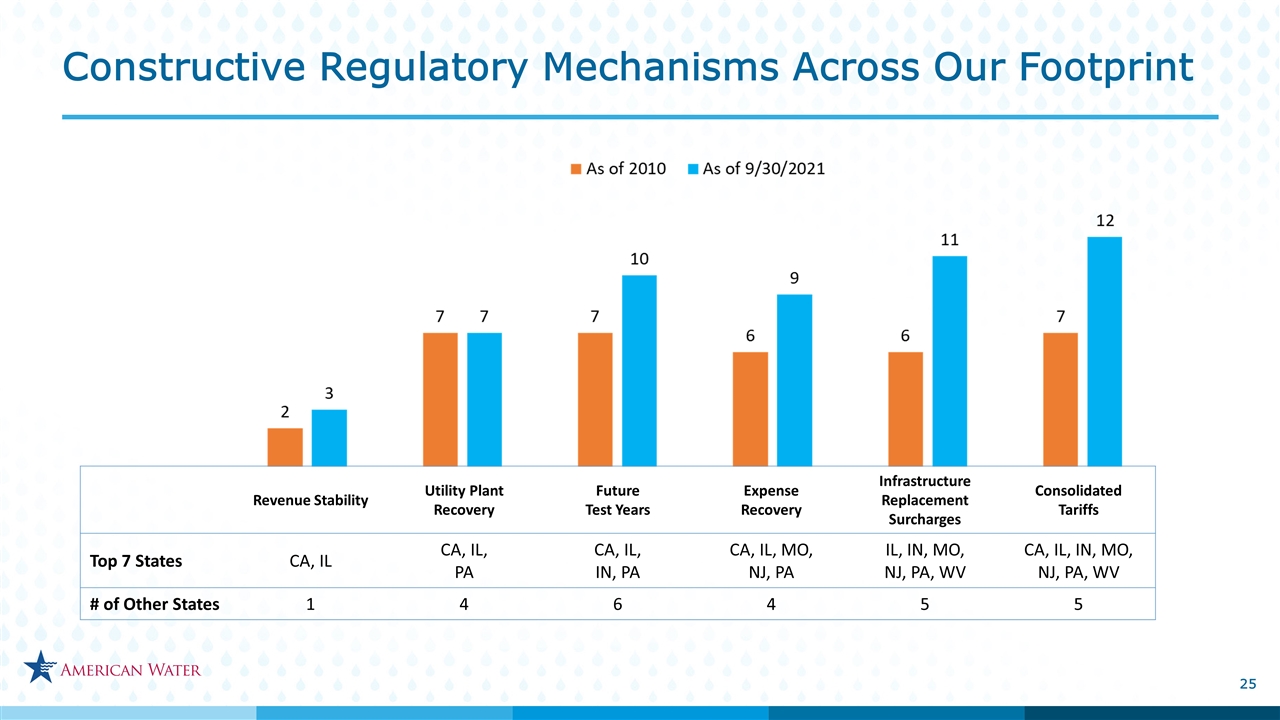

Constructive Regulatory Mechanisms Across Our Footprint Revenue Stability Utility Plant Recovery Future Test Years Expense Recovery Infrastructure Replacement Surcharges Consolidated Tariffs Top 7 States CA, IL CA, IL, PA CA, IL, IN, PA CA, IL, MO, NJ, PA IL, IN, MO, NJ, PA, WV CA, IL, IN, MO, NJ, PA, WV # of Other States 1 4 6 4 5 5

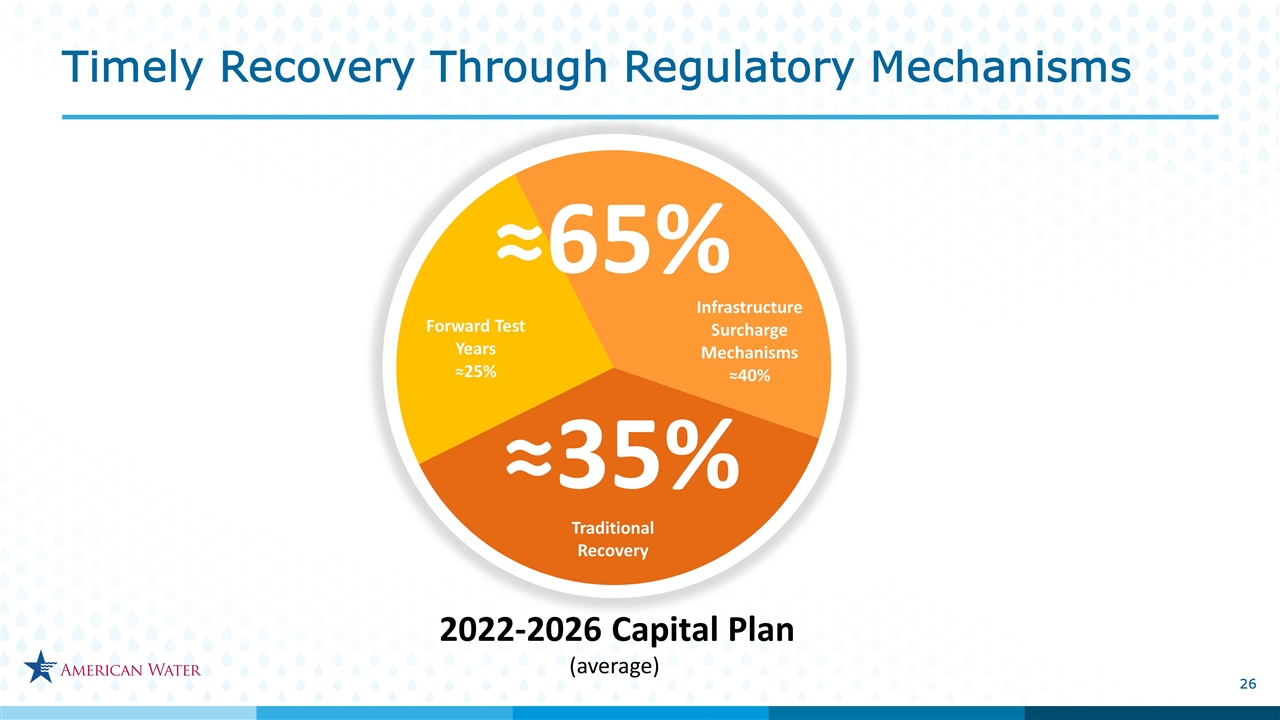

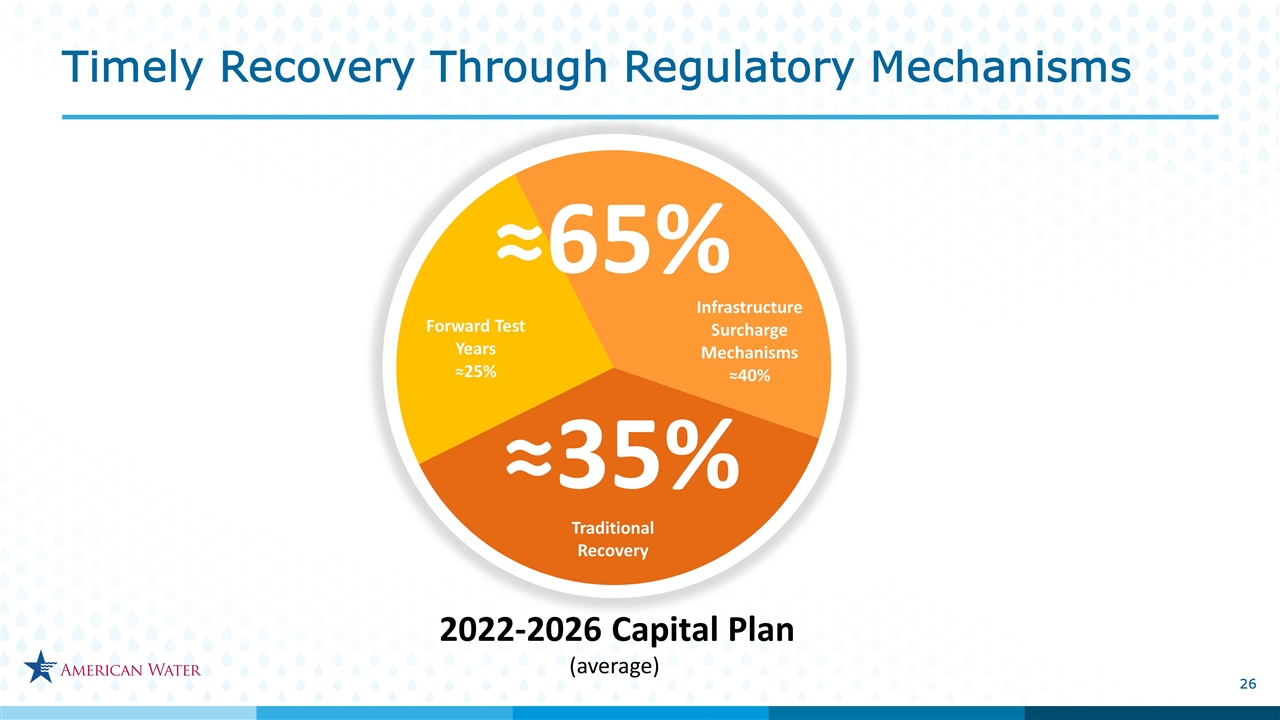

Timely Recovery Through Regulatory Mechanisms 2022-2026 Capital Plan (average) Traditional Recovery Forward Test Years (25%) Infrastructure Surcharge Mechanisms (38%) ≈35% ≈65%

Strong customer focus Embrace innovation Continuous execution CULTURE SUPPLY CHAIN Enabling employees Enhancing customer experience Best-in-class operations TECHNOLOGY Leverage our scale More competitive pricing/buying power Access to supply Commitment to diverse suppliers Strategic Approach to Managing Costs

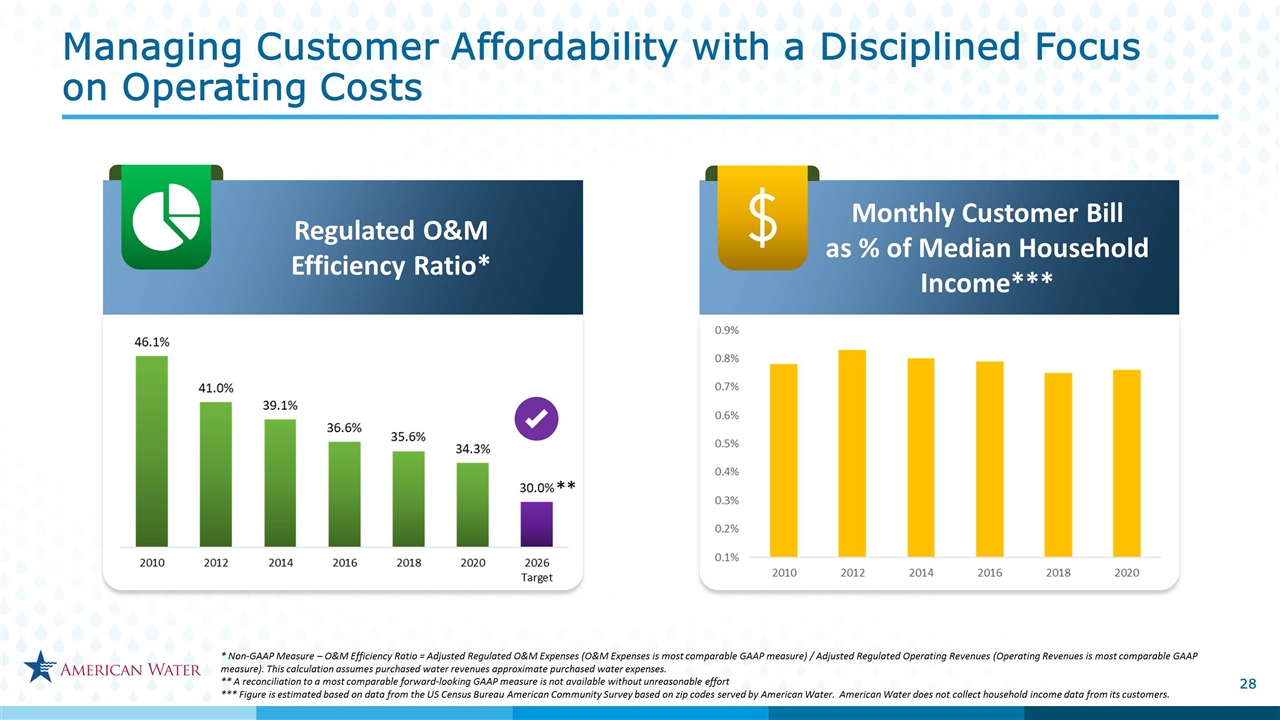

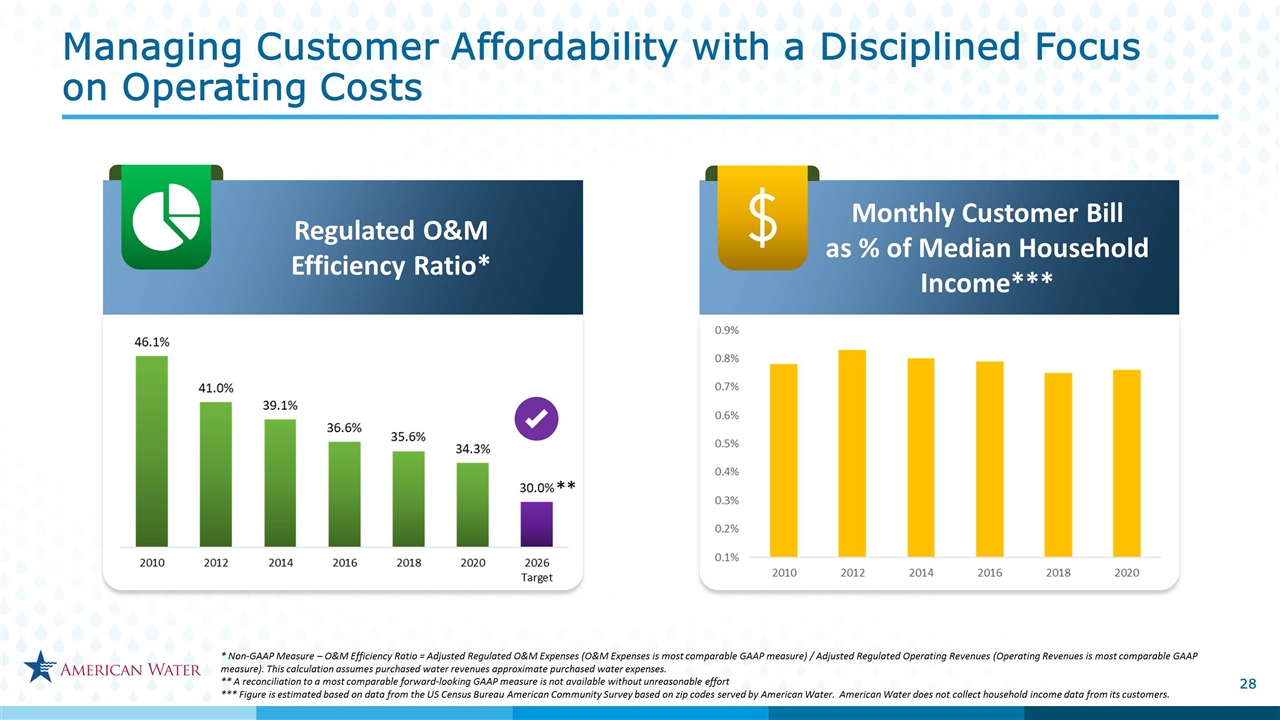

Monthly Customer Bill as % of Median Household Income*** Managing Customer Affordability with a Disciplined Focus on Operating Costs Regulated O&M Efficiency Ratio* * Non-GAAP Measure – O&M Efficiency Ratio = Adjusted Regulated O&M Expenses (O&M Expenses is most comparable GAAP measure) / Adjusted Regulated Operating Revenues (Operating Revenues is most comparable GAAP measure). This calculation assumes purchased water revenues approximate purchased water expenses. ** A reconciliation to a most comparable forward-looking GAAP measure is not available without unreasonable effort *** Figure is estimated based on data from the US Census Bureau American Community Survey based on zip codes served by American Water. American Water does not collect household income data from its customers. **

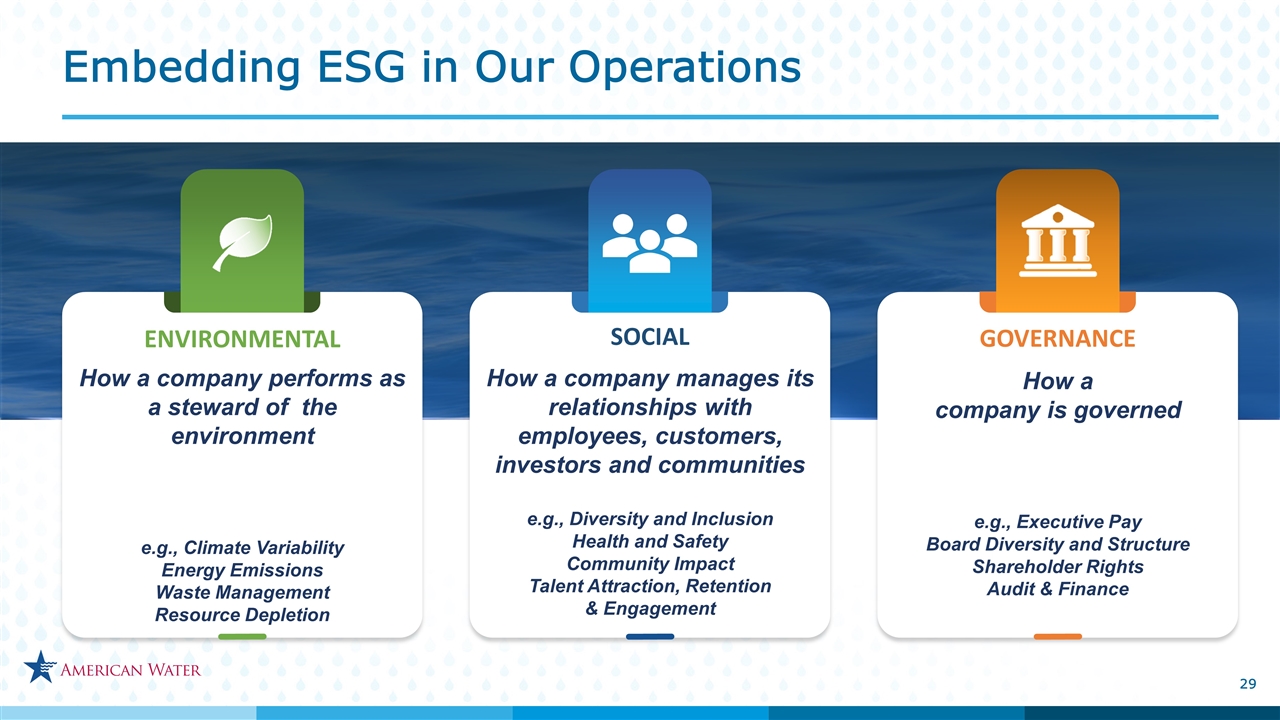

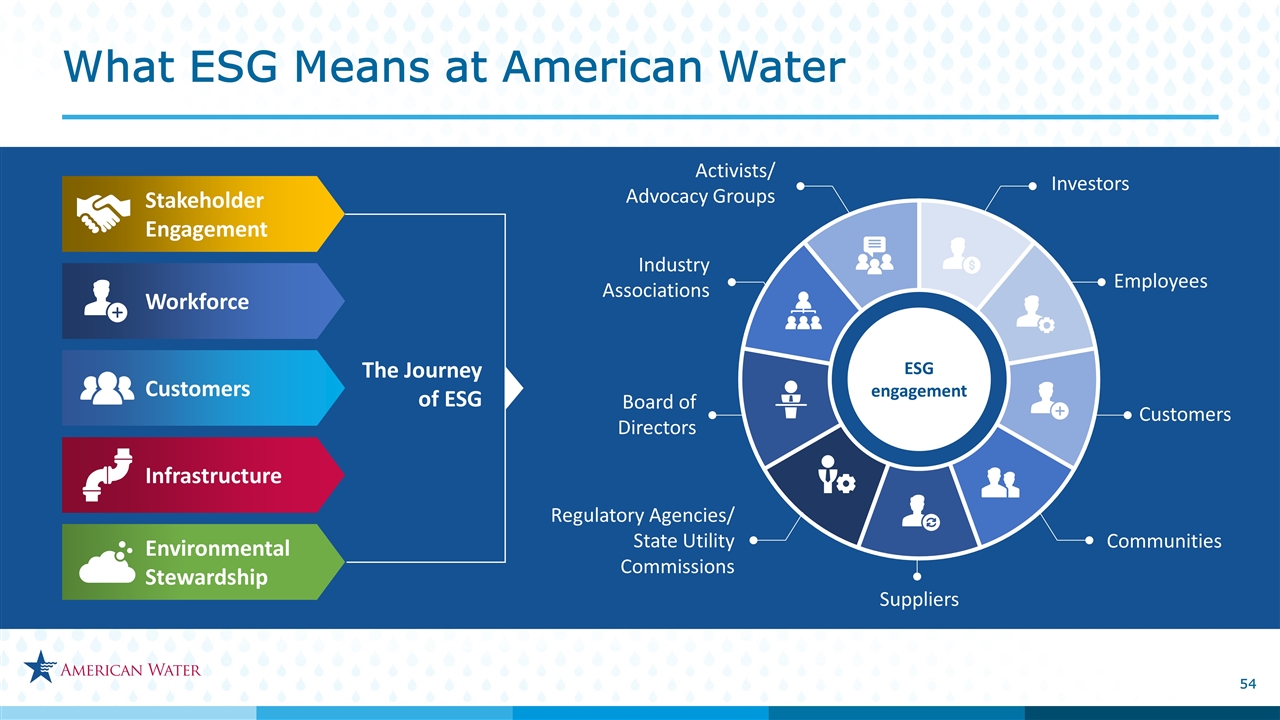

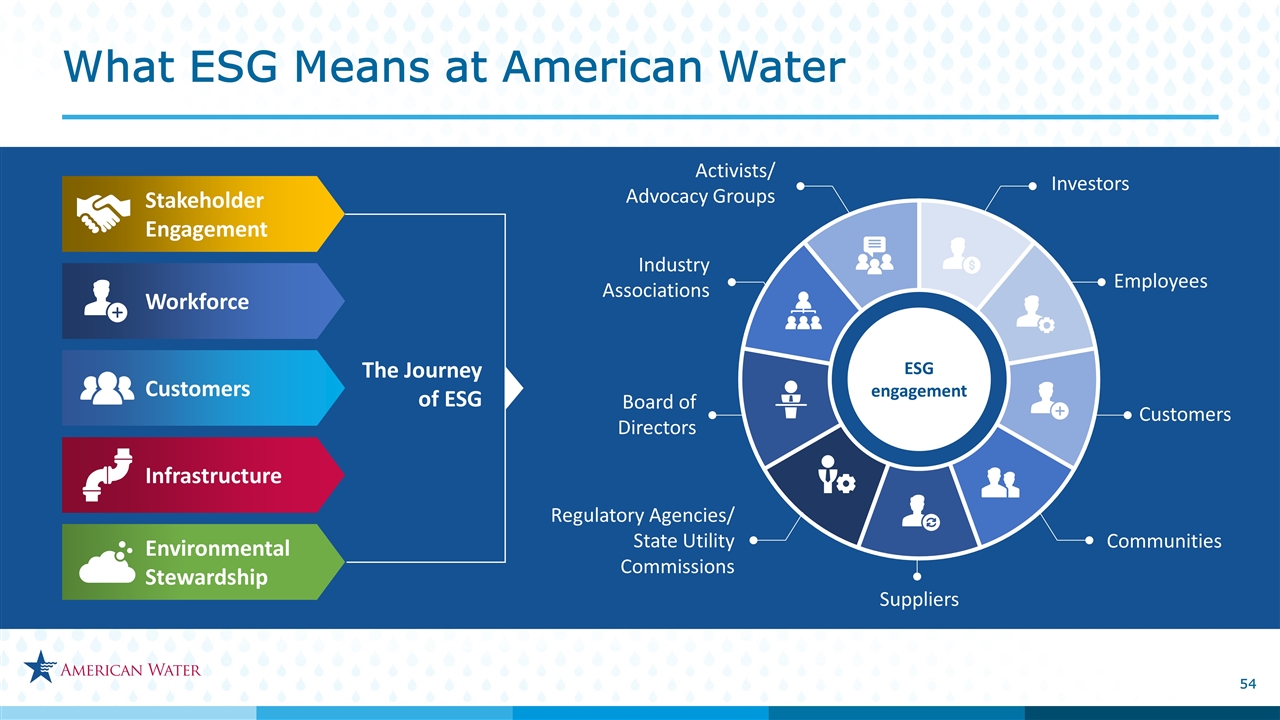

Embedding ESG in Our Operations How a company performs as a steward of the environment e.g., Climate Variability Energy Emissions Waste Management Resource Depletion ENVIRONMENTAL How a company is governed e.g., Executive Pay Board Diversity and Structure Shareholder Rights Audit & Finance GOVERNANCE How a company manages its relationships with employees, customers, investors and communities e.g., Diversity and Inclusion Health and Safety Community Impact Talent Attraction, Retention & Engagement SOCIAL

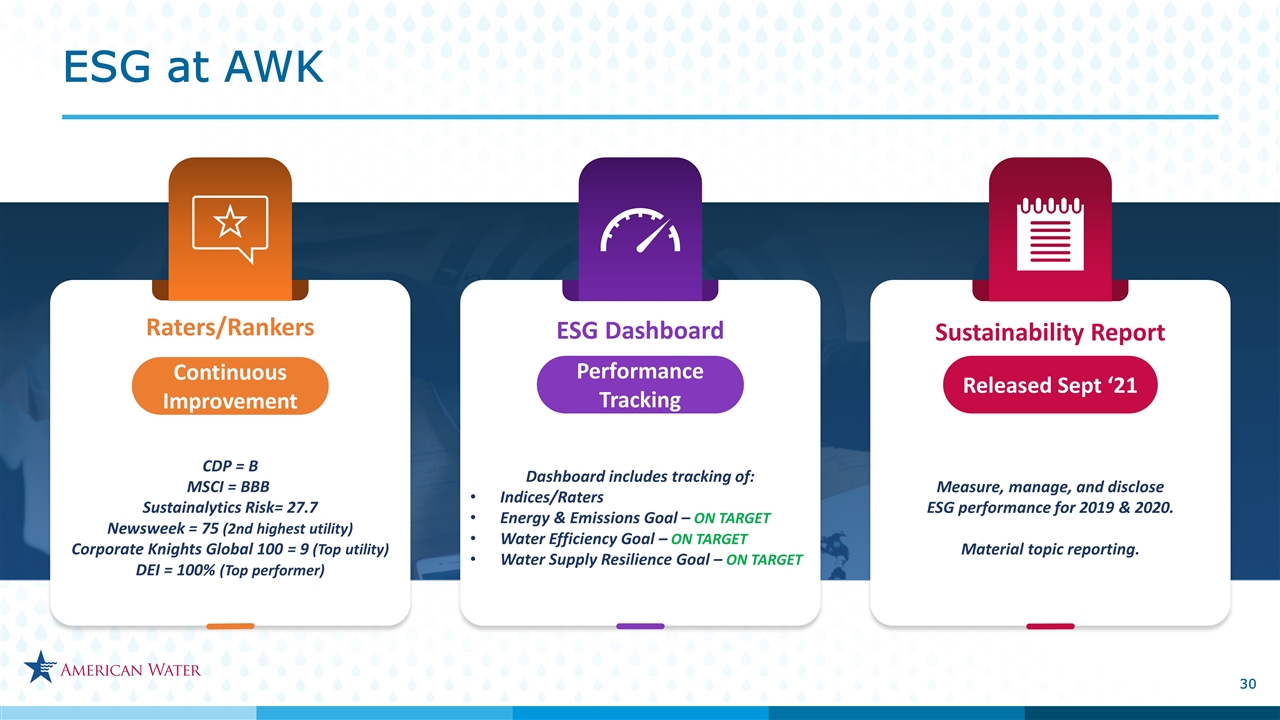

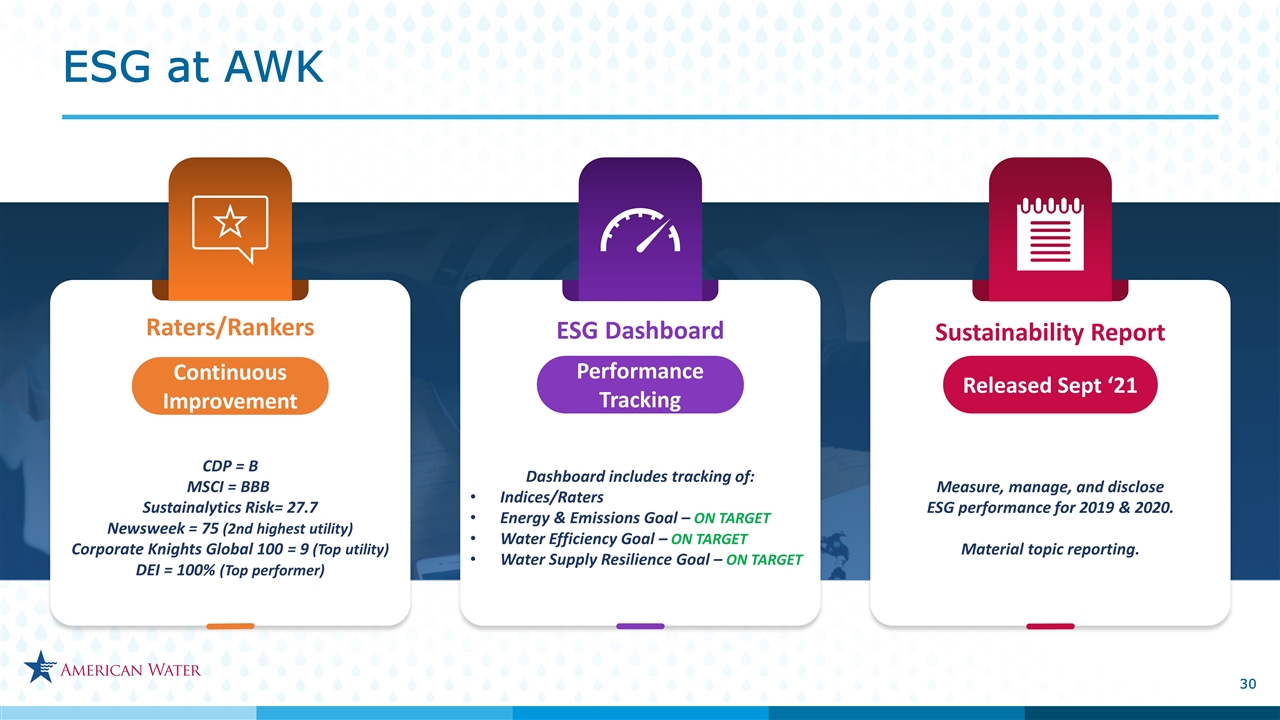

Raters/Rankers Continuous Improvement CDP = B MSCI = BBB Sustainalytics Risk= 27.7 Newsweek = 75 (2nd highest utility) Corporate Knights Global 100 = 9 (Top utility) DEI = 100% (Top performer) ESG Dashboard Performance Tracking Dashboard includes tracking of: Indices/Raters Energy & Emissions Goal – ON TARGET Water Efficiency Goal – ON TARGET Water Supply Resilience Goal – ON TARGET Sustainability Report Measure, manage, and disclose ESG performance for 2019 & 2020. Material topic reporting. Released Sept ‘21 ESG at AWK

Susan Hardwick Executive VP & Chief Financial Officer

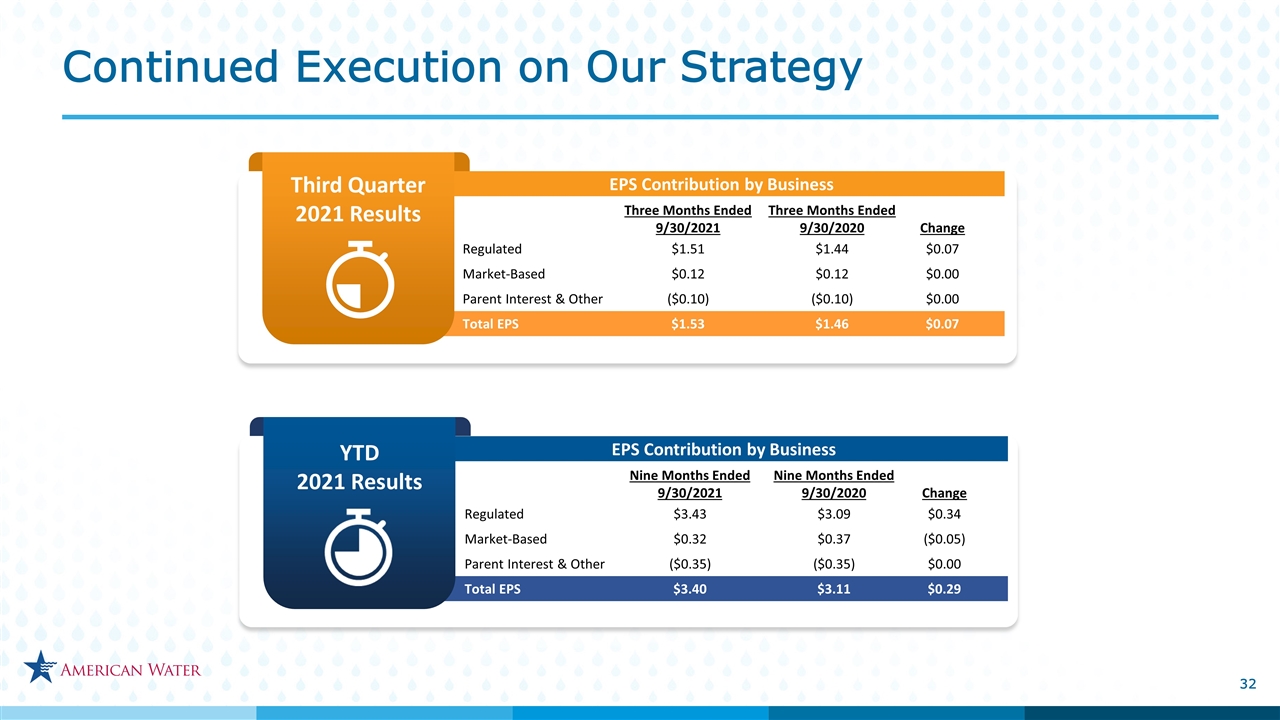

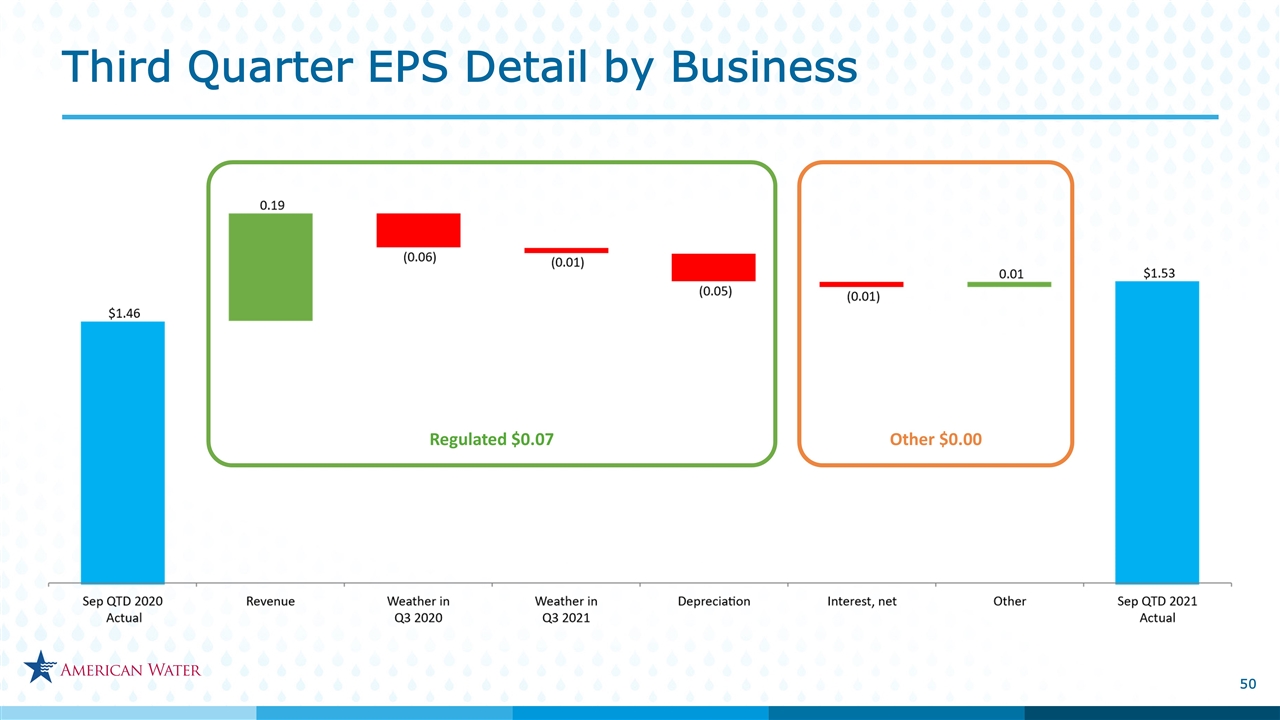

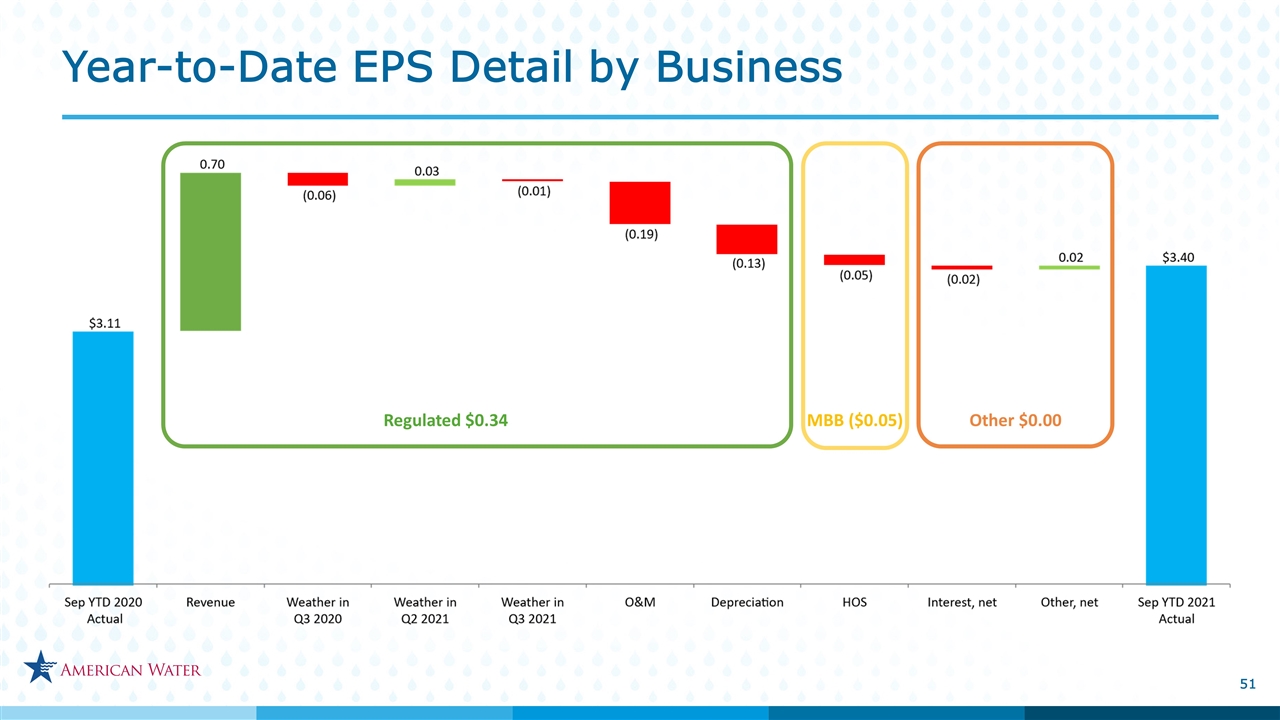

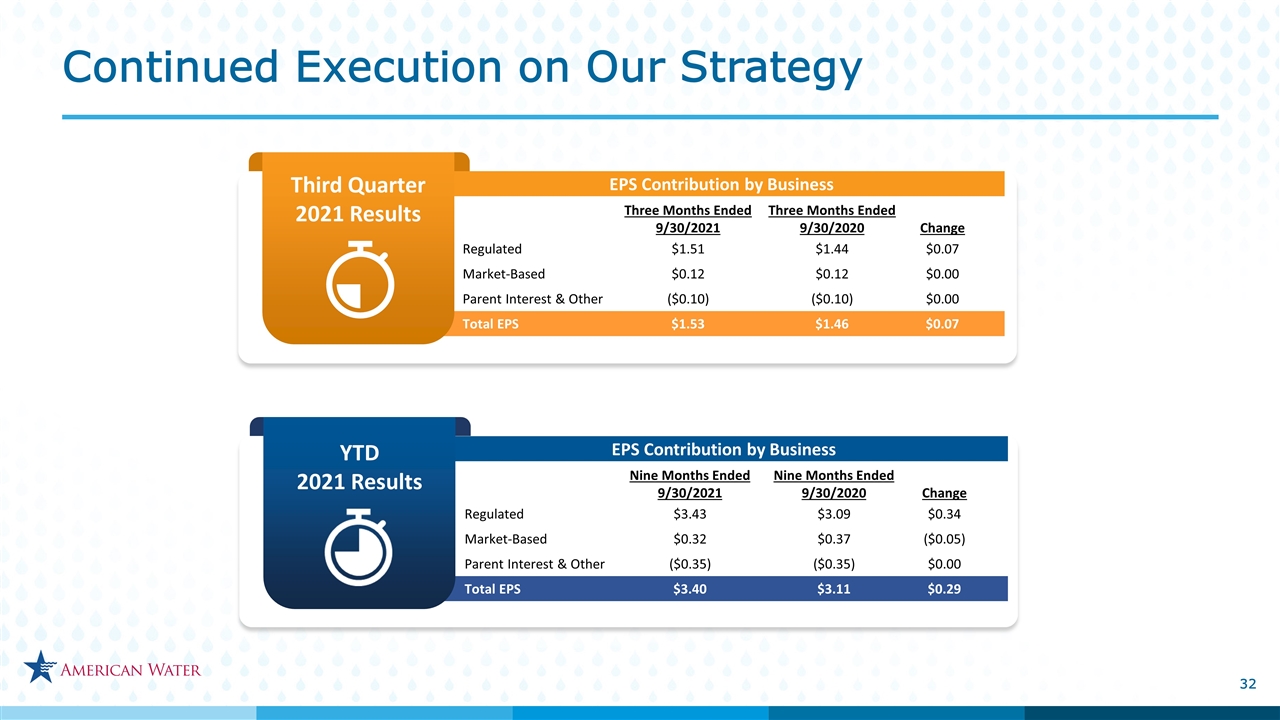

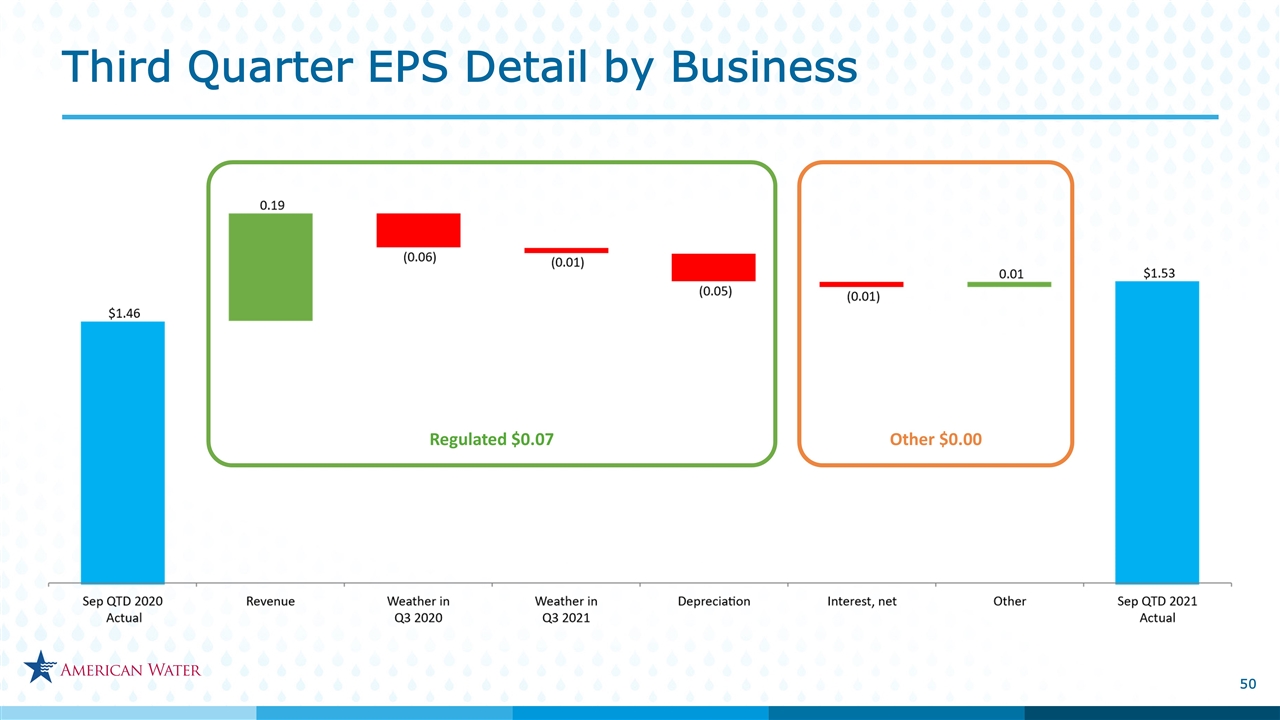

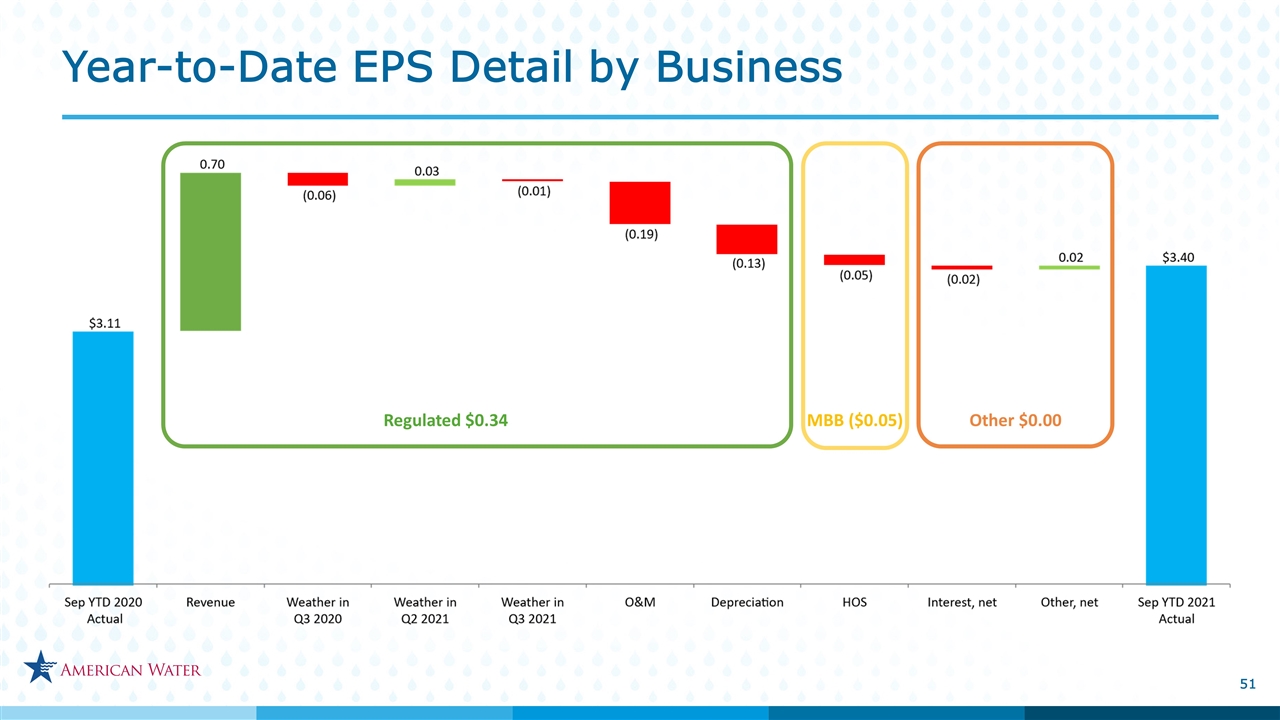

EPS Contribution by Business Nine Months Ended 9/30/2021 Nine Months Ended 9/30/2020 Change Regulated $3.43 $3.09 $0.34 Market-Based $0.32 $0.37 ($0.05) Parent Interest & Other ($0.35) ($0.35) $0.00 Total EPS $3.40 $3.11 $0.29 EPS Contribution by Business Three Months Ended 9/30/2021 Three Months Ended 9/30/2020 Change Regulated $1.51 $1.44 $0.07 Market-Based $0.12 $0.12 $0.00 Parent Interest & Other ($0.10) ($0.10) $0.00 Total EPS $1.53 $1.46 $0.07 Third Quarter 2021 Results YTD 2021 Results Continued Execution on Our Strategy

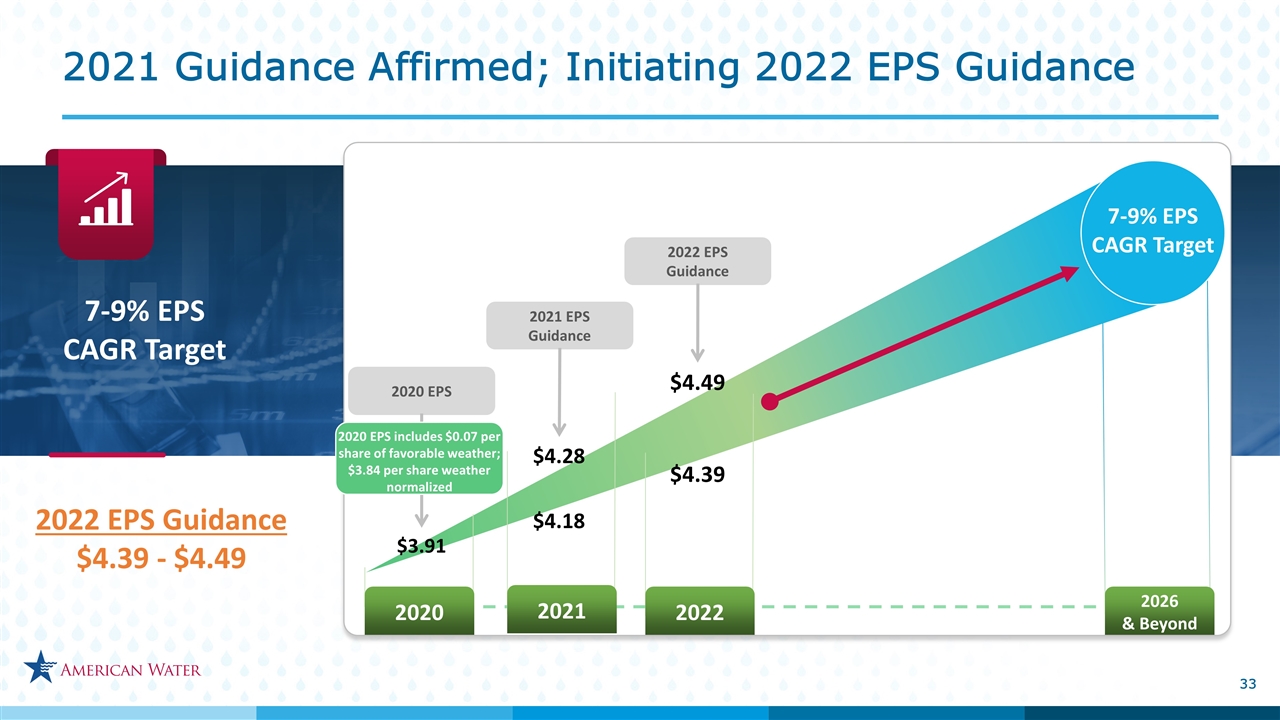

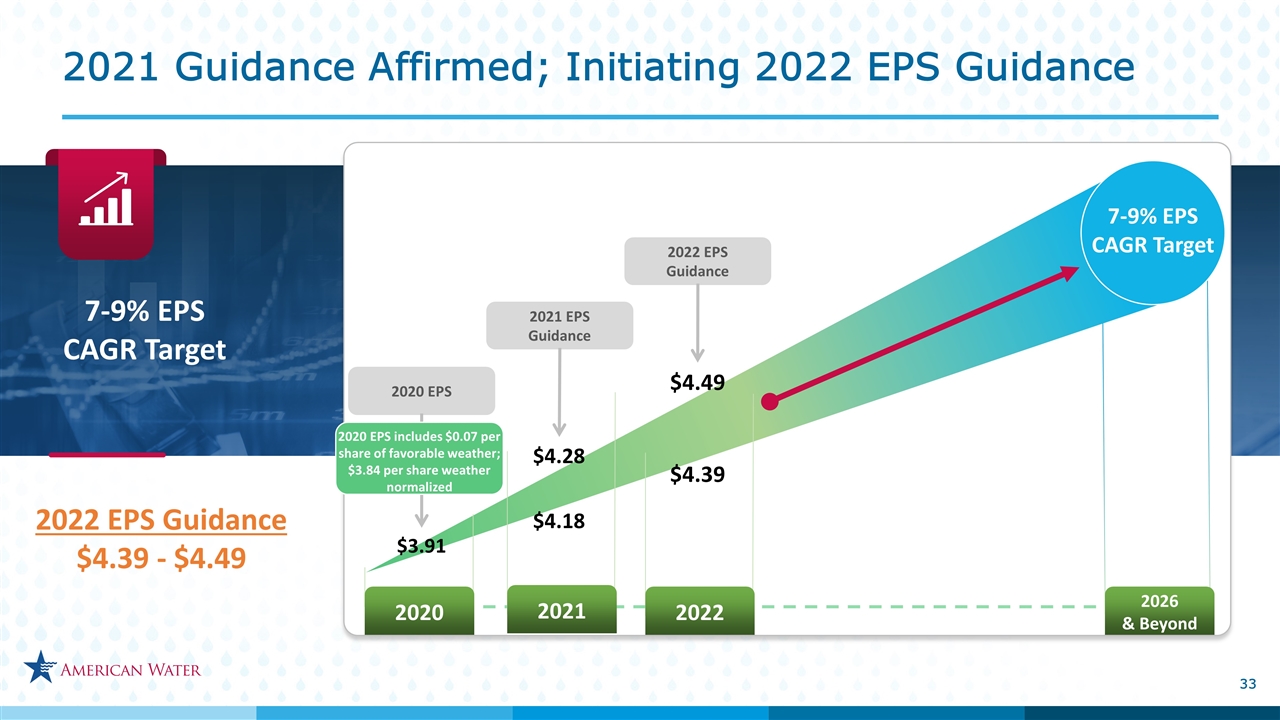

2021 Guidance Affirmed; Initiating 2022 EPS Guidance 2020 2022 2026 & Beyond 2020 EPS 2022 EPS Guidance 7-9% EPS CAGR Target $4.49 $4.39 $3.91 7-9% EPS CAGR Target 2022 EPS Guidance $4.39 - $4.49 2020 EPS includes $0.07 per share of favorable weather; $3.84 per share weather normalized 2021 2021 EPS Guidance $4.28 $4.18

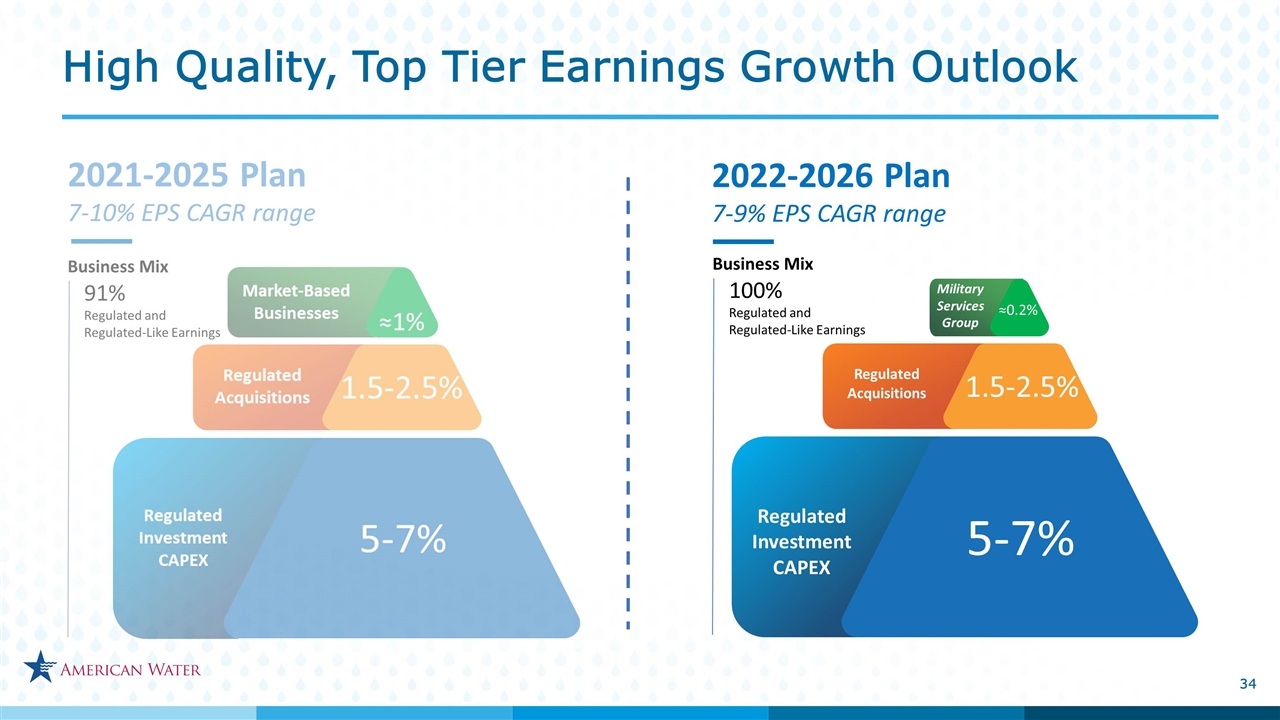

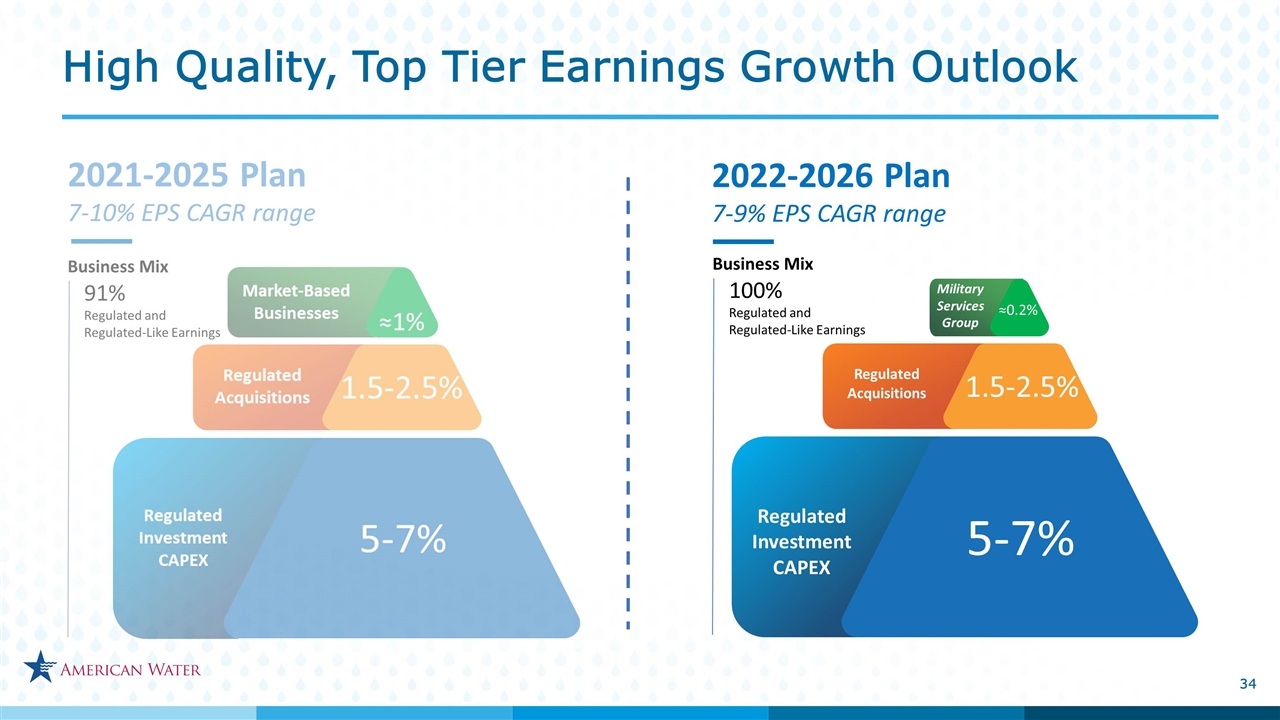

2022-2026 Plan 7-9% EPS CAGR range Regulated Investment CAPEX Regulated Investment CAPEX ~0.5% 5-7% 2-3% Regulated Investment CAPEX Regulated Acquisitions ~1% 5-7% 1.5-2.5% ≈0.2% Business Mix 100% Regulated and Regulated-Like Earnings Business Mix 91% Regulated and Regulated-Like Earnings 2021-2025 Plan 7-10% EPS CAGR range Military Services Group High Quality, Top Tier Earnings Growth Outlook

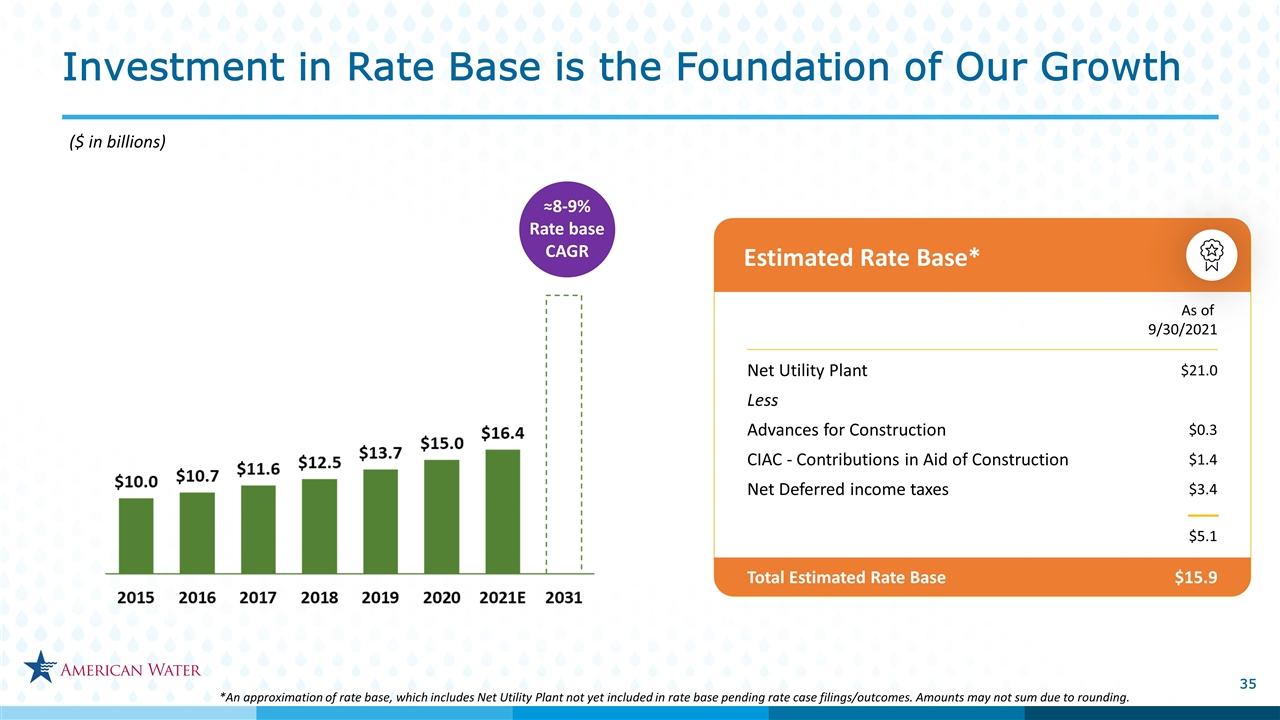

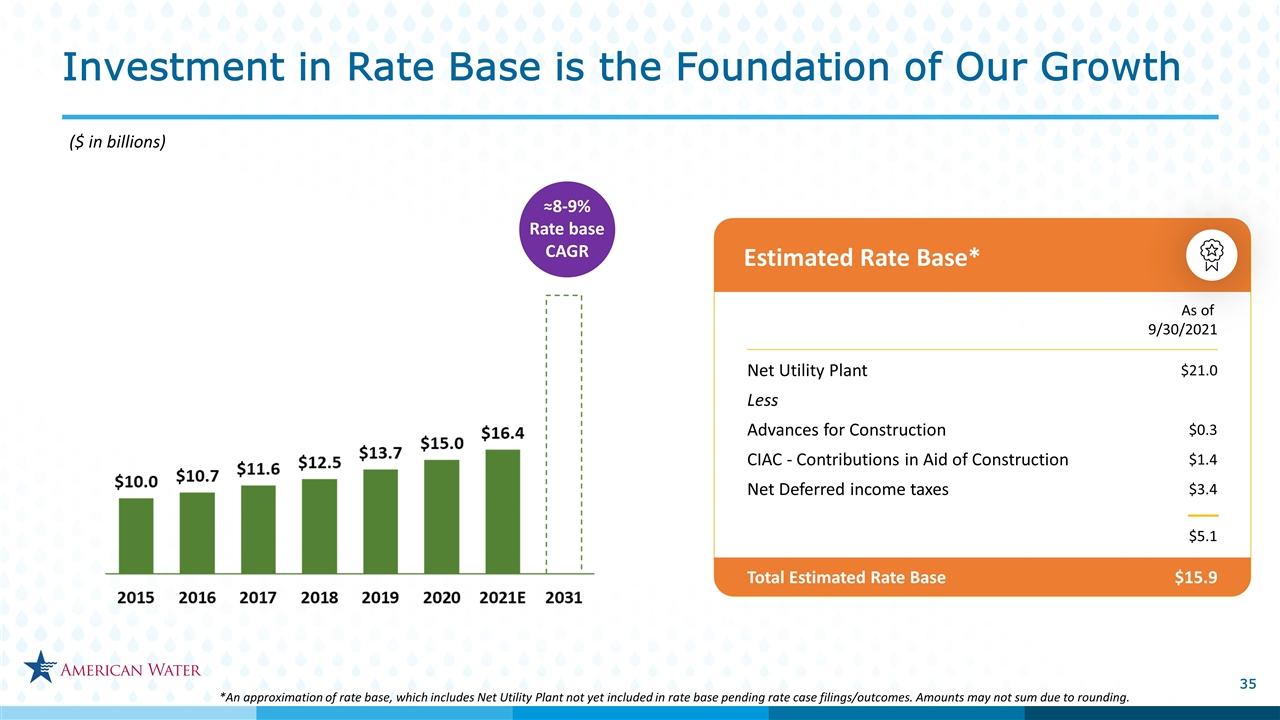

Investment in Rate Base is the Foundation of Our Growth ≈8-9% Rate base CAGR Estimated Rate Base* Net Utility Plant $21.0 Less Advances for Construction $0.3 CIAC - Contributions in Aid of Construction $1.4 Net Deferred income taxes $3.4 As of 9/30/2021 $5.1 Total Estimated Rate Base $15.9 *An approximation of rate base, which includes Net Utility Plant not yet included in rate base pending rate case filings/outcomes. Amounts may not sum due to rounding. ($ in billions)

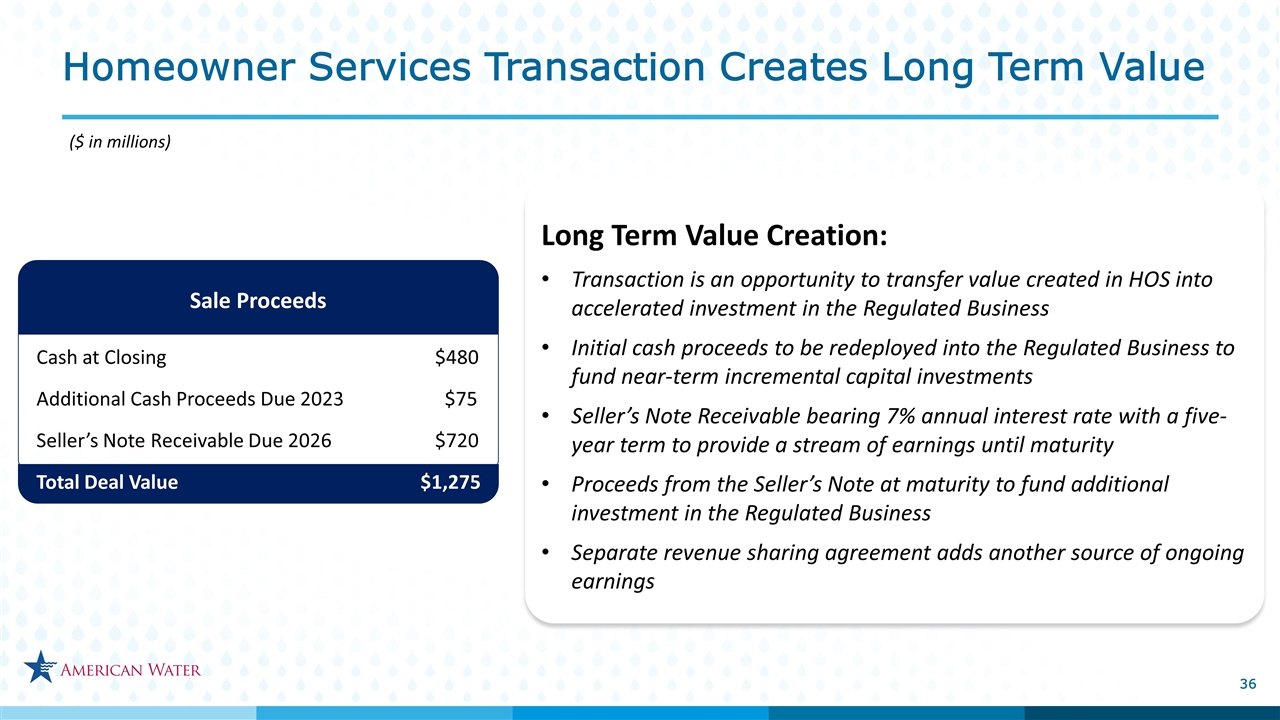

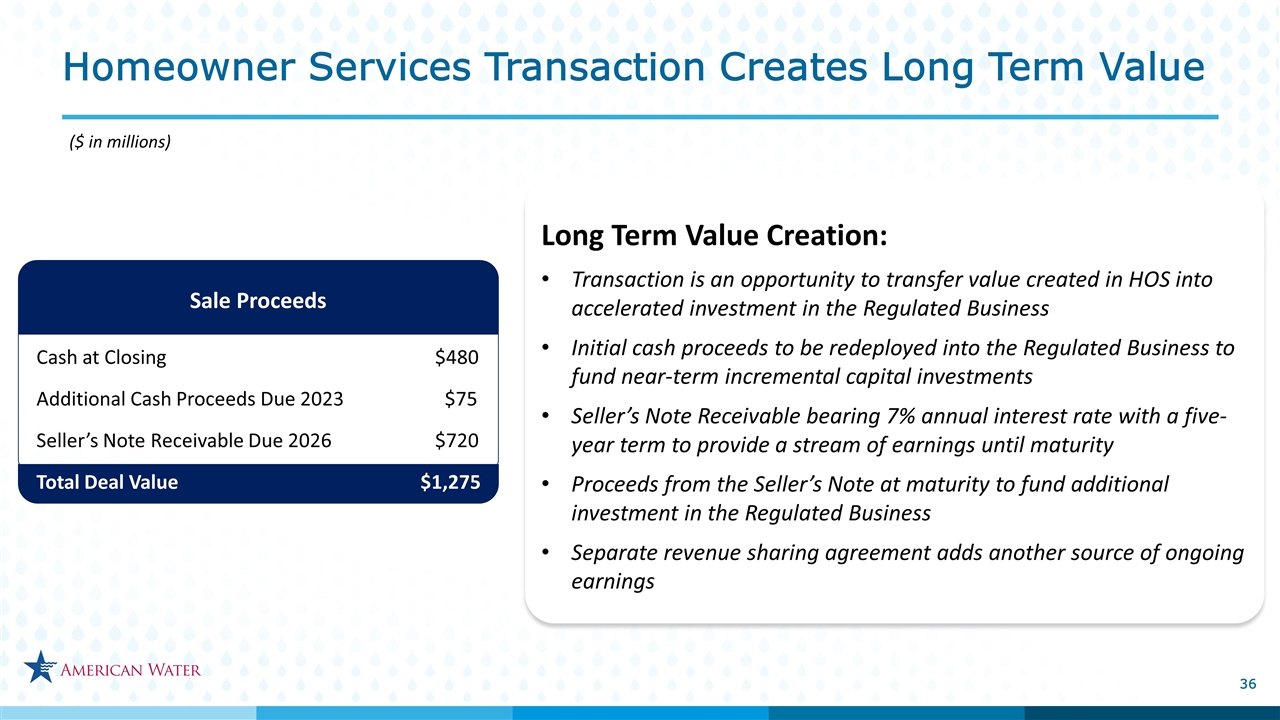

($ in millions) Sale Proceeds Cash at Closing $480 Additional Cash Proceeds Due 2023 $75 Seller’s Note Receivable Due 2026 $720 Total Deal Value$1,275 Long Term Value Creation: Transaction is an opportunity to transfer value created in HOS into accelerated investment in the Regulated Business Initial cash proceeds to be redeployed into the Regulated Business to fund near-term incremental capital investments Seller’s Note Receivable bearing 7% annual interest rate with a five-year term to provide a stream of earnings until maturity Proceeds from the Seller’s Note at maturity to fund additional investment in the Regulated Business Separate revenue sharing agreement adds another source of ongoing earnings Homeowner Services Transaction Creates Long Term Value

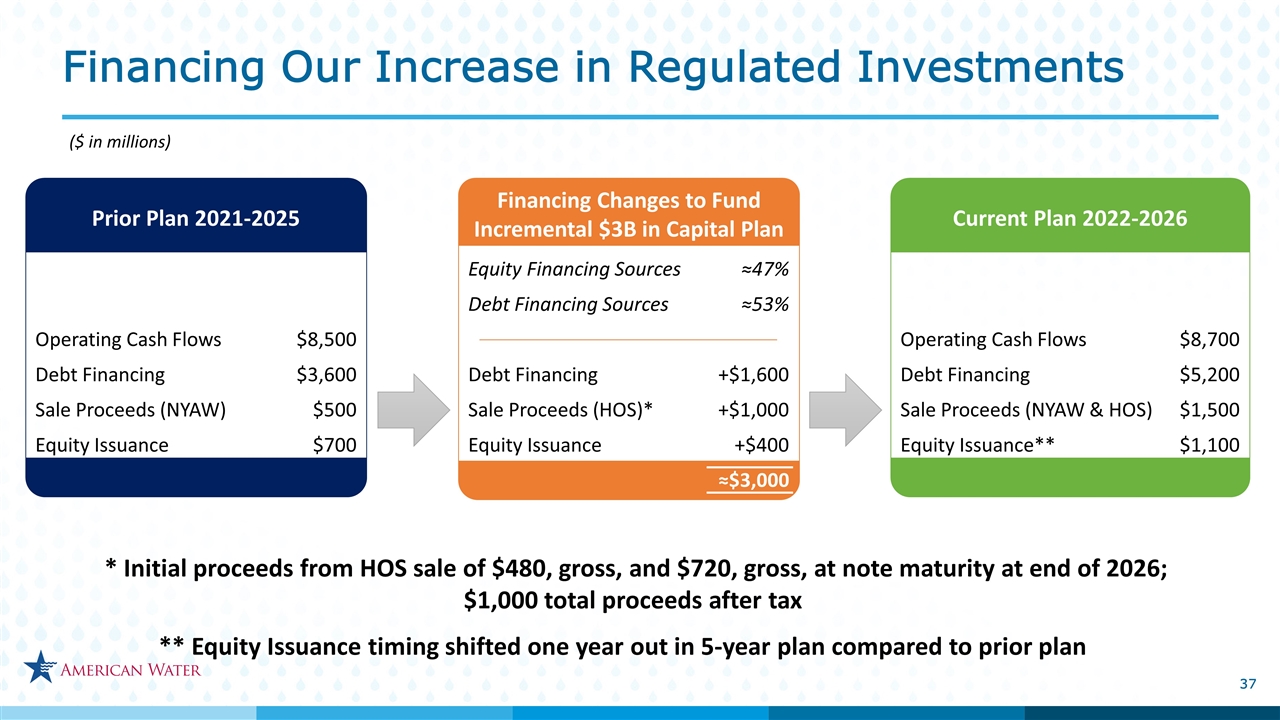

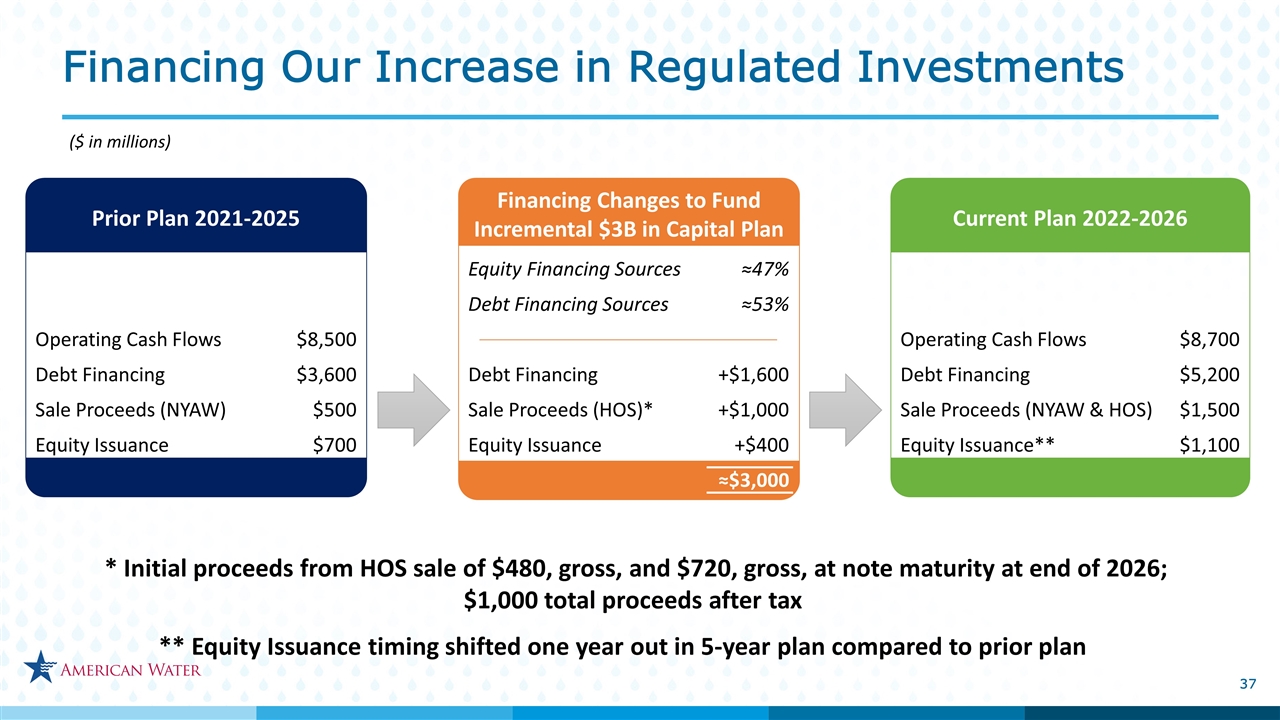

($ in millions) Prior Plan 2021-2025 Financing Changes to Fund Incremental $3B in Capital Plan Current Plan 2022-2026 Financing Our Increase in Regulated Investments Operating Cash Flows $8,500 Debt Financing $3,600 Sale Proceeds (NYAW) $500 Equity Issuance $700 Operating Cash Flows $8,700 Debt Financing $5,200 Sale Proceeds (NYAW & HOS) $1,500 Equity Issuance** $1,100 Equity Financing Sources ≈47% Debt Financing Sources ≈53% Debt Financing +$1,600 Sale Proceeds (HOS)* +$1,000 Equity Issuance +$400 ≈$3,000 ** Equity Issuance timing shifted one year out in 5-year plan compared to prior plan * Initial proceeds from HOS sale of $480, gross, and $720, gross, at note maturity at end of 2026; $1,000 total proceeds after tax

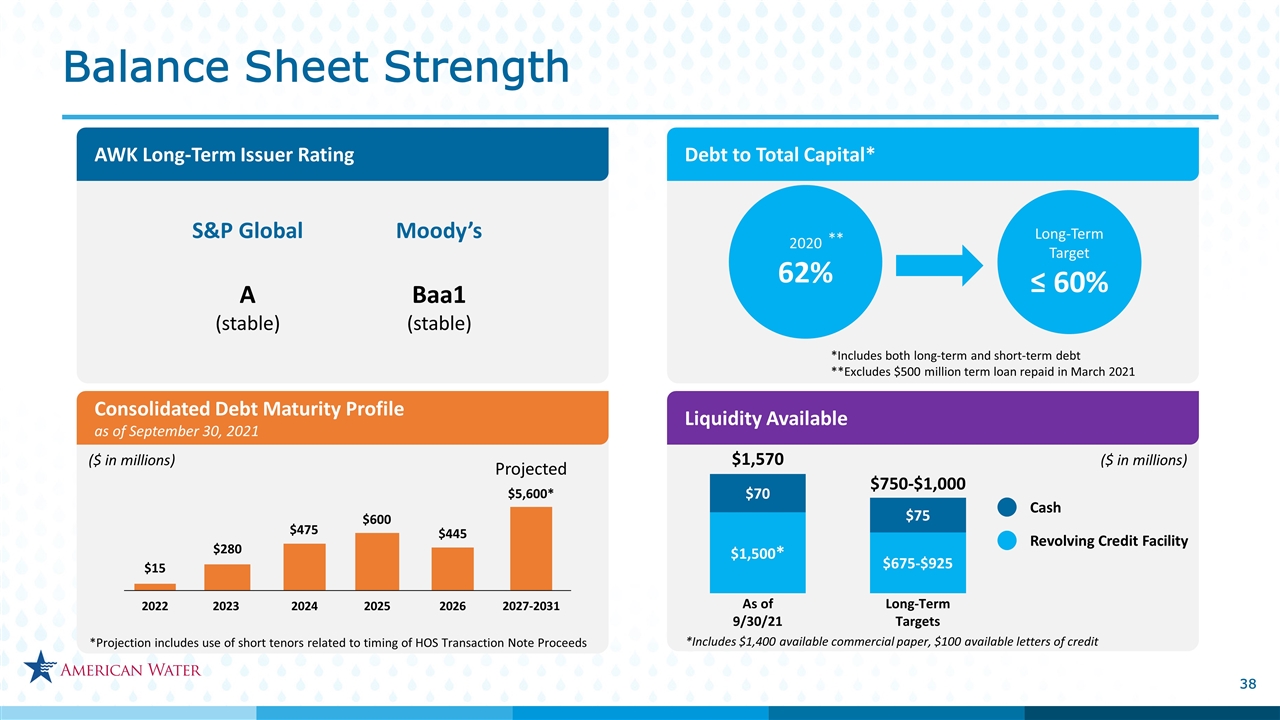

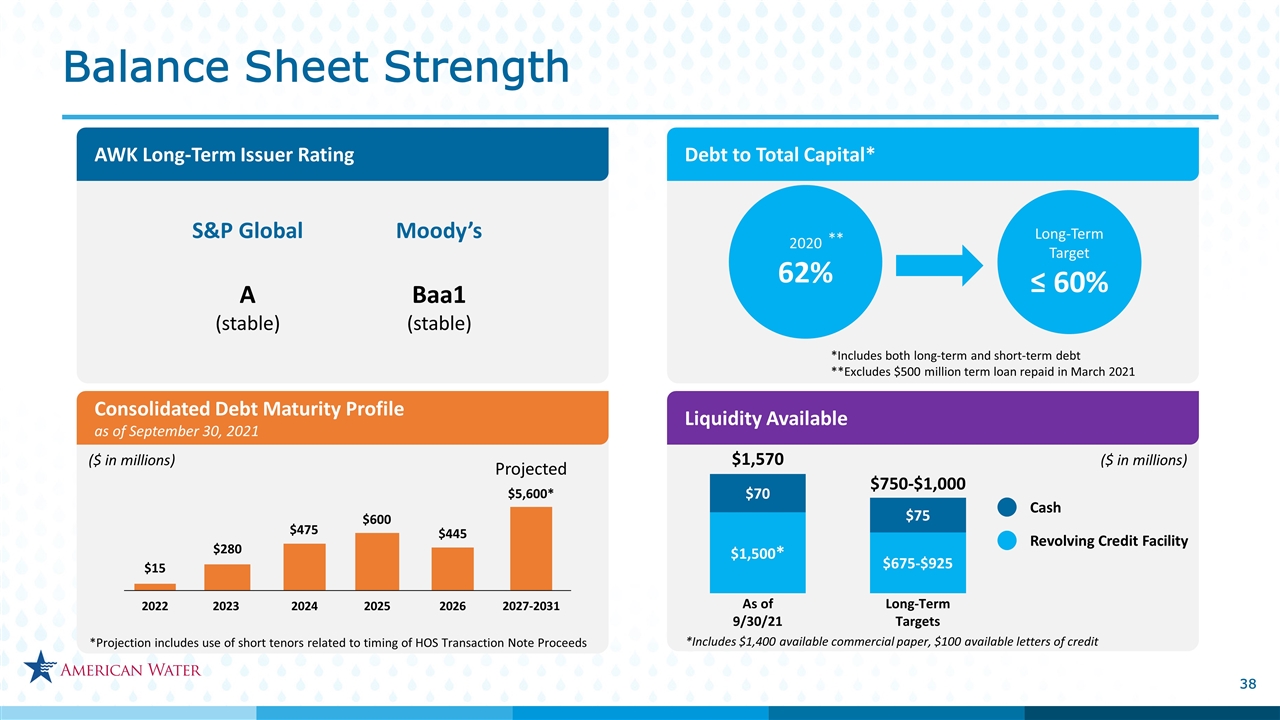

Balance Sheet Strength AWK Long-Term Issuer Rating Consolidated Debt Maturity Profile as of September 30, 2021 Liquidity Available A (stable) Baa1 (stable) S&P Global Moody’s $15 2022 $280 2023 $475 2024 $600 2025 2026 $445 $1,500* As of 9/30/21 $70 $1,570 $675-$925 Long-Term Targets $75 $750-$1,000 Revolving Credit Facility Cash 2027-2031 $5,600* Projected *Includes $1,400 available commercial paper, $100 available letters of credit *Projection includes use of short tenors related to timing of HOS Transaction Note Proceeds Debt to Total Capital* 2020 62% Long-Term Target ≤ 60% *Includes both long-term and short-term debt **Excludes $500 million term loan repaid in March 2021 ** ($ in millions) ($ in millions)

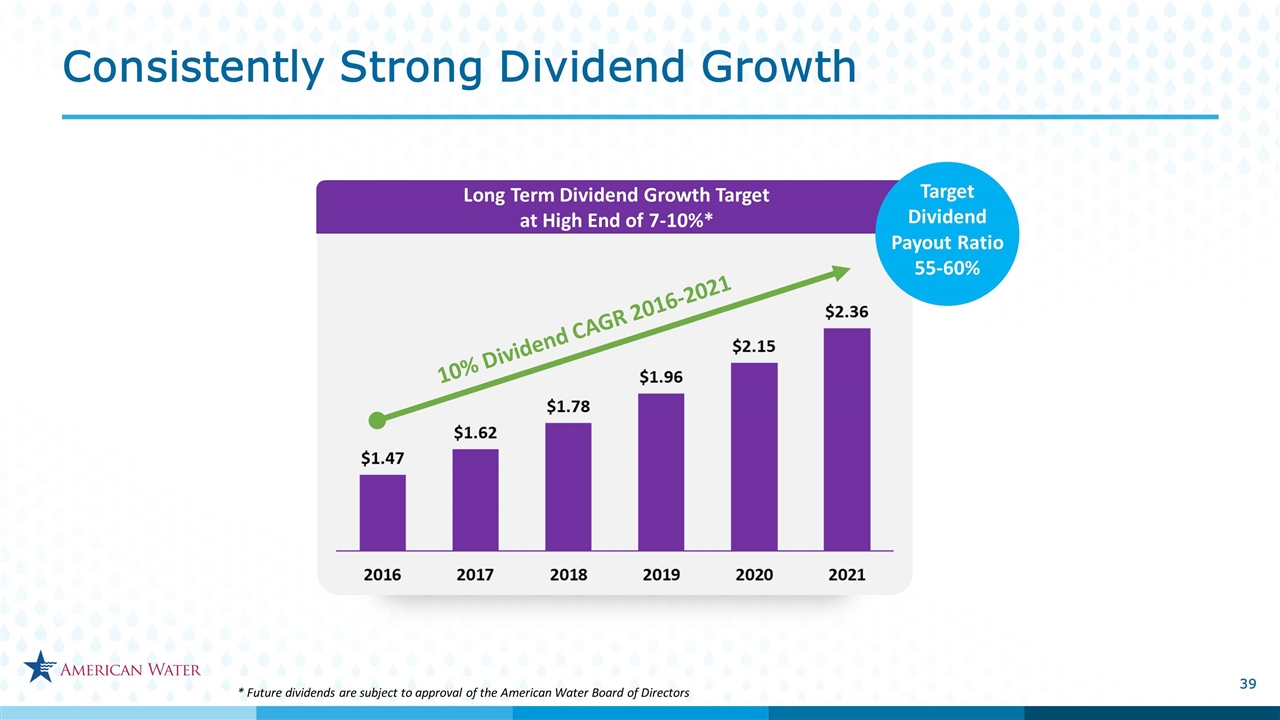

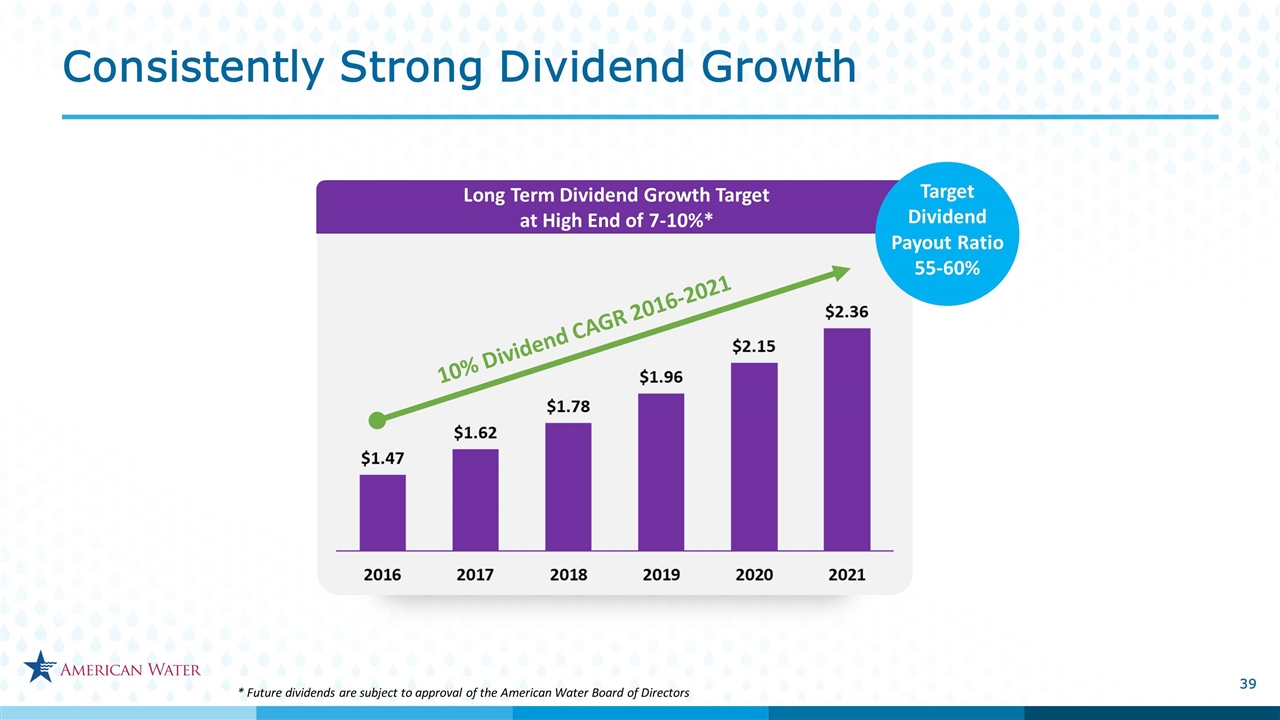

Consistently Strong Dividend Growth * Future dividends are subject to approval of the American Water Board of Directors Long Term Dividend Growth Target at High End of 7-10%* Target Dividend Payout Ratio 55-60% 10% Dividend CAGR 2016-2021

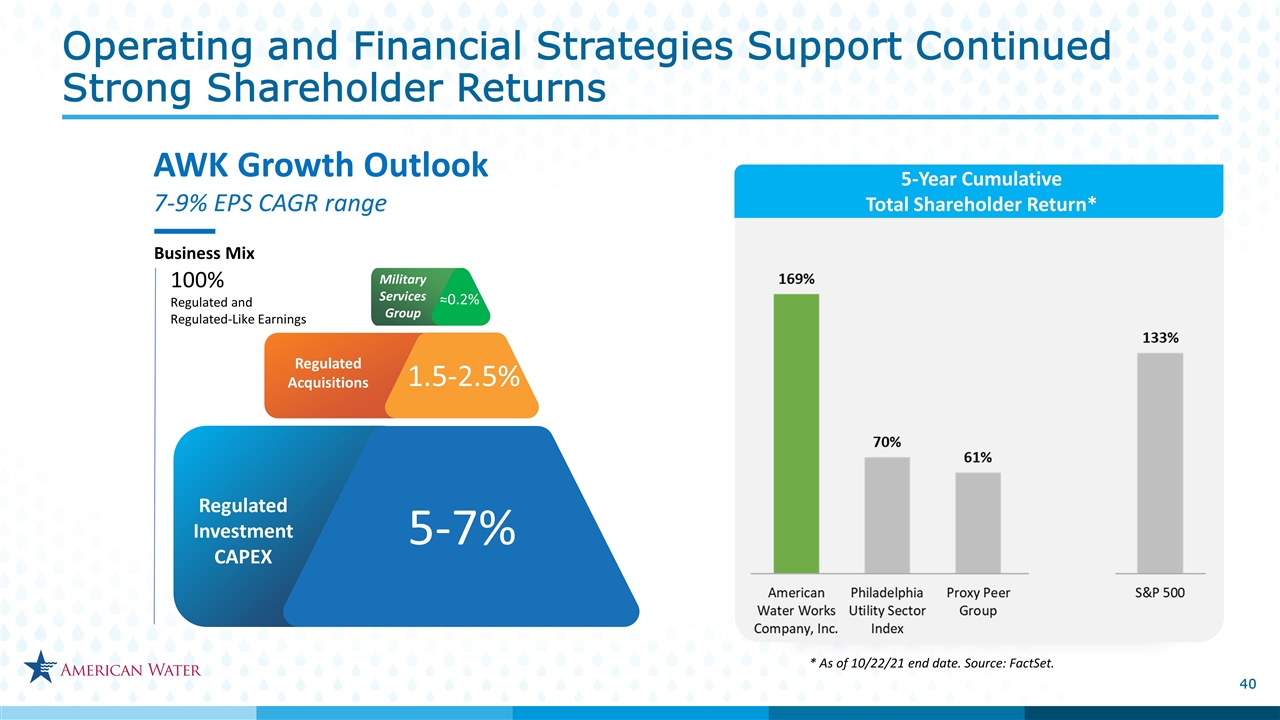

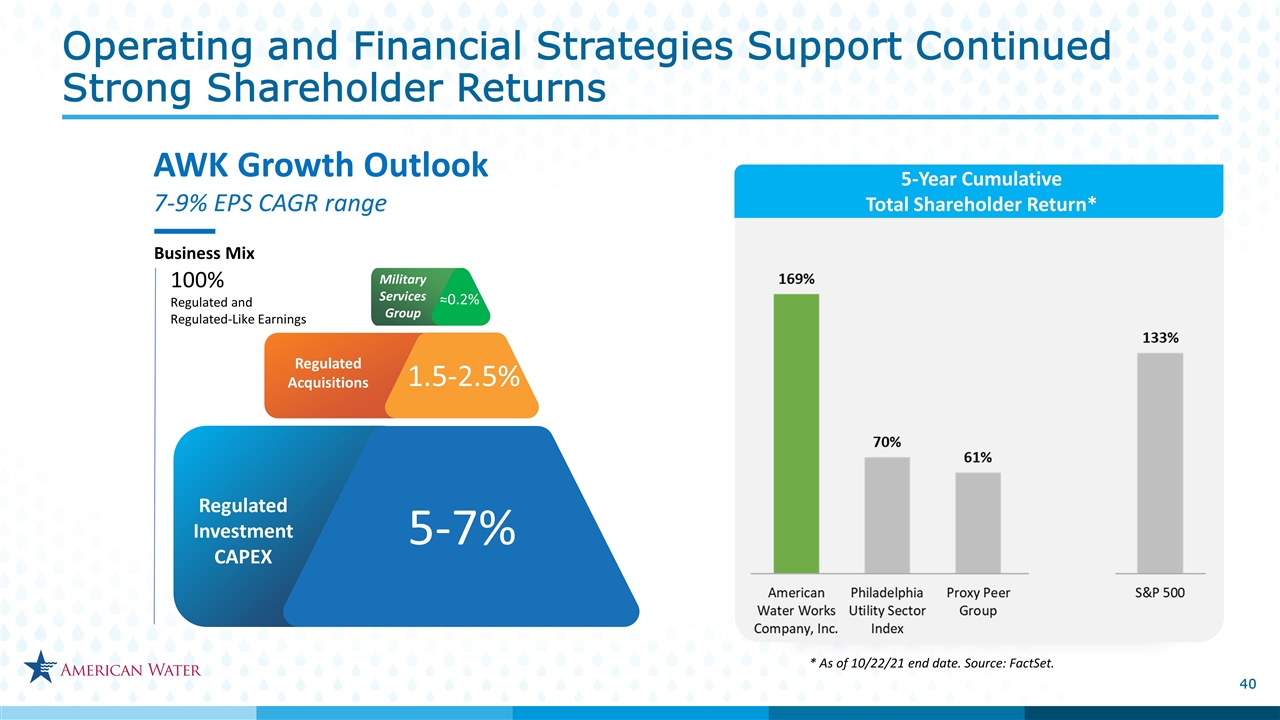

Operating and Financial Strategies Support Continued Strong Shareholder Returns 5-Year Cumulative Total Shareholder Return* * As of 10/22/21 end date. Source: FactSet. AWK Growth Outlook 7-9% EPS CAGR range Regulated Investment CAPEX Regulated Investment CAPEX ~0.5% 5-7% 2-3% Regulated Investment CAPEX Regulated Acquisitions ~1% 5-7% 1.5-2.5% ≈0.2% Business Mix 100% Regulated and Regulated-Like Earnings Military Services Group

Walter Lynch President and Chief Executive Officer

Our Strengths People Inclusion & empowerment pave a path for employee & company success. Employees are the Heart of our Business Performance Safety is both a strategy & core company value. Safety is More Than “the Right Thing to Do” Safety Solutions Provider Growth enables investment in training, cyber security, infrastructure, & communities. Providing Water and Wastewater Solutions ESG ESG affirms the values we have upheld for decades. Leading by Example Going beyond the minimum requirement to solidify our position as a leader in O&M excellence. Excellence is Getting the Fundamentals Right

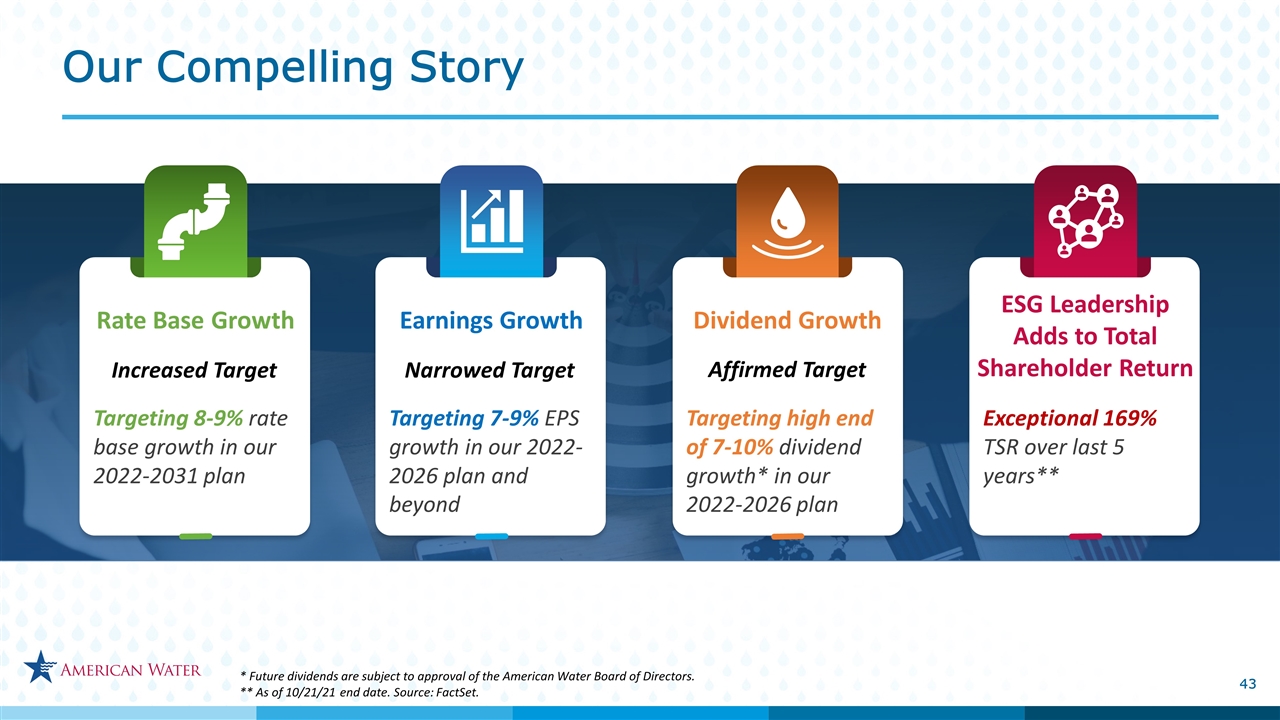

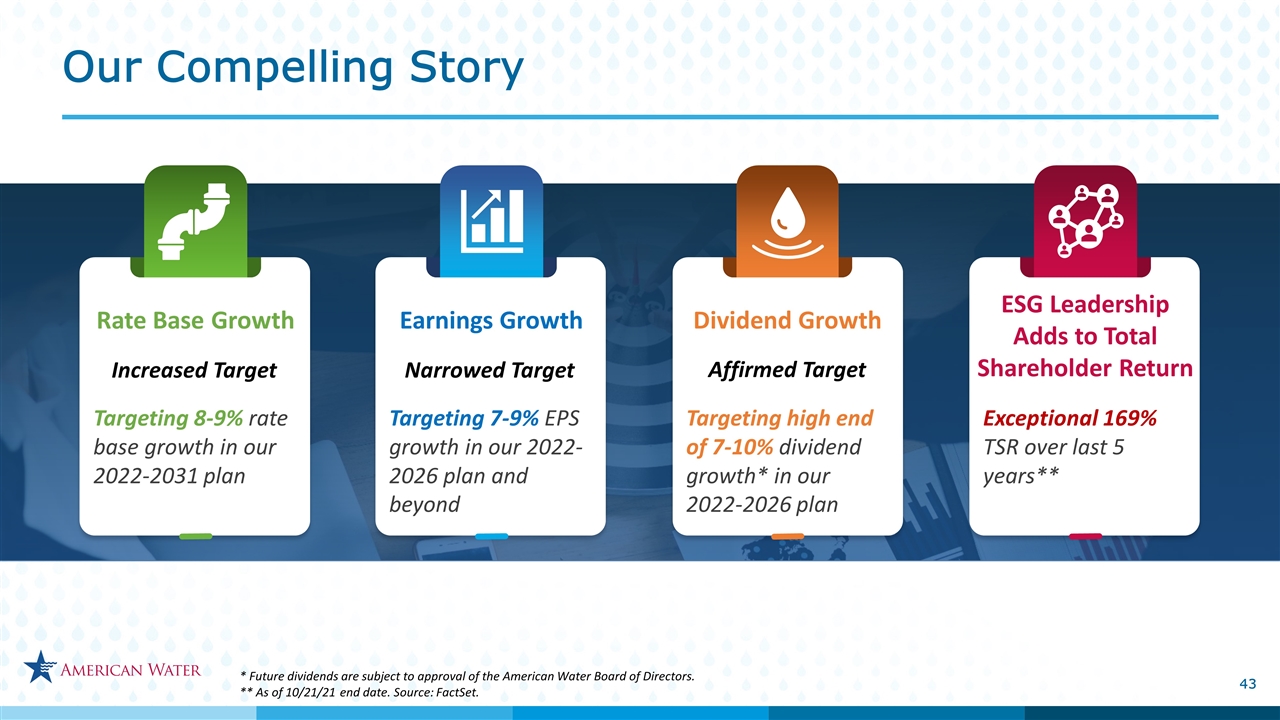

Dividend Growth Targeting high end of 7-10% dividend growth* in our 2022-2026 plan ESG Leadership Adds to Total Shareholder Return Exceptional 169% TSR over last 5 years** Earnings Growth Targeting 7-9% EPS growth in our 2022-2026 plan and beyond Rate Base Growth Targeting 8-9% rate base growth in our 2022-2031 plan * Future dividends are subject to approval of the American Water Board of Directors. ** As of 10/21/21 end date. Source: FactSet. Increased Target Narrowed Target Affirmed Target Our Compelling Story

5 Minute Break

Q&A Session

Investor Relations Contacts Aaron Musgrave, CPA Senior Director, Investor Relations aaron.musgrave@amwater.com Michael Tavani, CFA Senior Manager, Investor Relations michael.tavani@amwater.com Janelle McNally Senior Manager, Investor Relations & ESG janelle.mcnally@amwater.com Upcoming Events November 7-9, 2021 EEI Financial Conference

Appendix

Forward-Looking Statements Statements made, referred to or relied upon in this presentation, including, without limitation, with respect to: earnings per share guidance; dividend growth guidance; the timing and outcome of pending or future acquisition activity; our future financial performance, liquidity and cash flows; our ability to finance our current operations, capital expenditures and growth initiatives by accessing the debt and equity capital markets; the impacts to us attributable to the COVID-19 pandemic health event; the amount and allocation of future capital investments and expenditures; estimated revenues, regulatory recovery and other decisions in general rate cases and other proceedings; estimates regarding our projected rate base, growth, results of operations and financial condition; our projected regulated adjusted operation and maintenance efficiency ratio; growth and portfolio optimization strategies, including with respect to the announced sale of our New York subsidiary and the Homeowner Services Group and the amount of proceeds or gain or loss to be recognized therefrom; our ability to complete the proposed sale of the Homeowner Services Group on a timely basis or at all, and the accounting, financial and other impacts of the proposed transaction; the ability to achieve our strategies and goals related to the transaction, including the repayment of the Seller note receivable and the redeployment of the net proceeds therefrom; trends in the industries in which we operate, including macro trends with respect to our efforts related to customer, technology and work execution; the outcome and impact on us of governmental and regulatory investigations and proceedings and related potential fines, penalties and other sanctions; our ability to execute our business and operational strategy; and regulatory, legislative, tax policy or legal developments, are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “propose,” “assume,” “forecast,” “likely”, “uncertain”, “outlook,” “future,” “pending,” “goal,” “objective,” “potential,” “continue,” “seek to,” “may,” “can,” “will,” “should” and “could” or the negative of such terms or other variations or similar expressions. These forward-looking statements are predictions based on our current expectations and assumptions regarding future events. They are not guarantees or assurances of any outcomes, financial results, levels of activity, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, known and unknown risks, uncertainties and other factors. Actual results may vary materially from those discussed in the forward-looking statements included in this presentation as a result of the factors discussed in our Annual Report on Form 10-K for the year ended December 31, 2020, as filed with the SEC on February 24, 2021, and subsequent filings with the SEC, and because of factors including, without limitation: the ability to obtain required consents and regulatory and other approvals required to complete, and satisfying other conditions to the closing of, the proposed transaction; the amount of proceeds to be received from the proposed sale, due to, among other things, closing and post-closing adjustments to the purchase price as provided in the purchase agreement; the post-closing operating and financial results of the Homeowner Services business; unexpected costs, liabilities or delays associated with the contemplated transaction; the decisions of governmental and regulatory bodies and the timeliness and outcome of regulatory commissions’ and other authorities’ actions; changes in customer demand for, and patterns of use of, water; limitations on the availability of our water supplies or sources of water, or restrictions on its use thereof; a loss of one or more large industrial or commercial customers; changes in laws, governmental regulations and policies; impacts resulting from U.S., state and local elections and changes in executive administrations; weather conditions and events, climate variability patterns, and natural disasters, including drought or abnormally high rainfall, prolonged and abnormal ice or freezing conditions, strong winds, coastal and intercoastal flooding, pandemics (including COVID-19) and epidemics, earthquakes, landslides, hurricanes, tornadoes, wildfires, electrical storms, sinkholes and solar flares; the outcome of litigation and similar governmental and regulatory proceedings, investigations or actions; risks associated with our aging infrastructure and our ability to appropriately improve the resiliency of, or maintain and replace, current or future infrastructure, systems and assets; exposure or infiltration of our technology and critical infrastructure systems through physical or cyber attacks or other means; our ability to obtain permits and other approvals for projects and construction of various water and wastewater facilities; changes in our capital requirements; our ability to control operating expenses and to achieve efficiencies in our operations; the intentional or unintentional actions of a third party, including contamination of our water supplies or the water provided to our customers; our ability to obtain adequate and cost-effective supplies of equipment, chemicals, electricity, fuel, water and other raw materials; our ability to successfully meet growth projections for our businesses and capitalize on growth opportunities; our ability to acquire, close and successfully integrate regulated operations and market-based businesses, enter into contracts and other agreements with, or otherwise obtain, new customers in our market-based businesses, and realize anticipated benefits and synergies from new acquisitions; risks and uncertainties associated with contracting with the U.S. government; cost overruns relating to our operations; our ability to successfully develop and implement new technologies; our ability to maintain safe work sites; our exposure to liabilities related to environmental laws and similar matters; changes in general economic, political, business and financial market conditions, including with respect to the COVID-19 pandemic; access to sufficient debt and/or equity capital on satisfactory terms and when and as needed to support operations and capital expenditures; fluctuations in interest rates; our ability to comply with negative and affirmative covenants in our current or future indebtedness; the issuance of new or modified credit ratings or outlooks or other communications by credit rating agencies on us or on our current or future debt; our ability to issue, repay or redeem debt, pay dividends or make distributions; fluctuations in the value of benefit plan assets and liabilities; changes in federal or state general, income and other tax laws, including future significant tax legislation, the availability of or our compliance with the terms of applicable tax credits and tax abatement programs, and our ability to utilize our U.S. federal and state income tax net operating loss carryforwards; the use by municipalities of the power of eminent domain or other authority or the assertion of similar rights by private landowners; any difficulty or inability for us to obtain insurance; the incurrence of impairment charges related to goodwill or other assets; labor actions; our ability to attract and retain qualified employees; civil disturbances or unrest, or terrorist threats or acts; and other factors as may be set forth in the Company’s SEC filings. These and other forward-looking statements are qualified by, and should be read together with, the risks and uncertainties set forth above and the risk factors and cautionary statements included in our annual, quarterly and other SEC filings, and readers should refer to such risks, uncertainties, risk factors and statements in evaluating such forward-looking statements. Any forward-looking statements American Water makes speak only as of the date this presentation was first used or given. We do not have and do not undertake any obligation or intention to update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as otherwise required by the Federal securities laws. New factors emerge from time to time, and it is not possible for the Company to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on our businesses, either viewed independently or together, or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive.

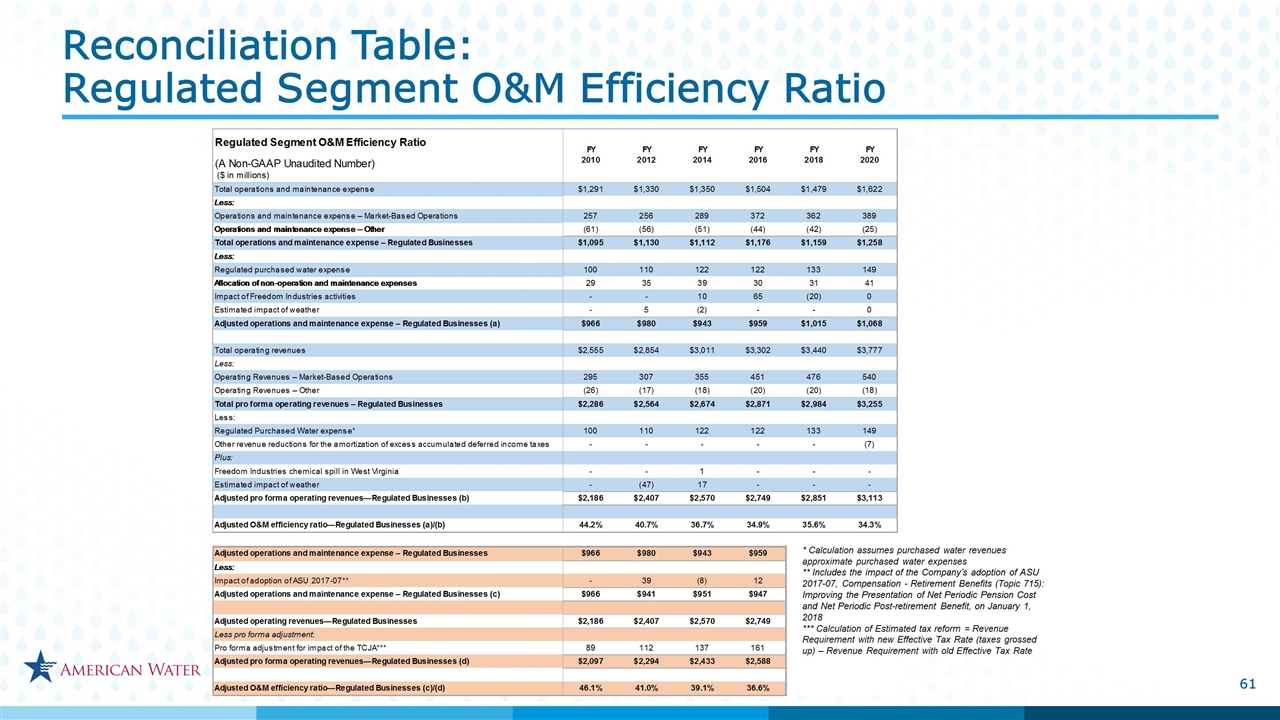

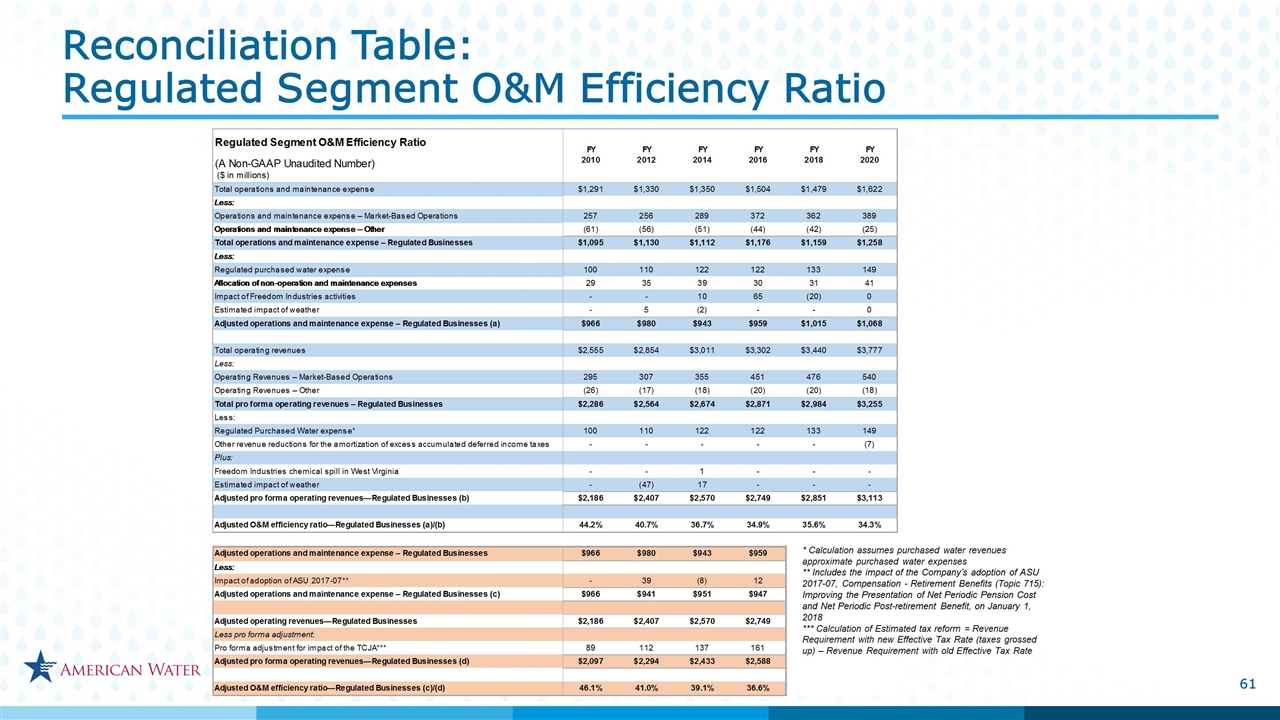

Non-GAAP Financial Information This presentation includes adjusted regulated O&M efficiency ratios, both historical and forward-looking, which exclude from their calculation (i) estimated purchased water and other revenues and purchased water expenses, (ii) the impact of the Freedom Industries chemical spill in 2014 and certain related settlement activities recognized in 2016 and 2018, (iii) the estimated impact in 2012 and 2014 of weather, (iv) as to operating revenues, the amortization of excess accumulated deferred income taxes, and (v) the allocable portion of non-O&M support services costs, mainly depreciation and general taxes. Also, an alternative presentation of these ratios has been provided for each of 2010, 2012, 2014 and 2016, which includes a pro forma adjustment for the impact of the Tax Cuts and Jobs Act of 2017, and includes for 2012, 2014 and 2016 the impact of our implementation of Accounting Standards Update 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Post-retirement Benefit, on January 1, 2018. These items were excluded from the O&M efficiency ratio calculation as they are not reflective of management’s ability to increase the efficiency of its Regulated Businesses. For that reason, these adjusted regulated O&M efficiency ratios constitute “non-GAAP financial measures” under SEC rules. We evaluate our operating performance using these ratios and believe that the presentation of them is useful to investors because the ratios directly measure improvement in the operating performance and efficiency of our regulated businesses. These ratios are derived from our consolidated financial information but are not presented in our consolidated financial statements prepared in accordance with GAAP. These non-GAAP financial measures supplement and should be read in conjunction with our GAAP disclosures and should be considered as an addition to, and not a substitute for, any GAAP measure. These ratios (i) are not accounting measures based on GAAP; (ii) are not based on a standard, objective industry definition or method of calculation; (iii) may not be comparable to other companies’ operating measures; and (iv) should not be used in place of the GAAP information provided elsewhere in this presentation. Management is unable to present a reconciliation of adjustments to the components of the forward-looking adjusted regulated O&M efficiency ratio without unreasonable effort because management cannot reliably predict the nature, amount or probable significance of all the adjustments for future periods; however, these adjustments may, individually or in the aggregate, cause each of the non-GAAP financial measure components of the forward-looking ratios to differ significantly from the most directly comparable GAAP financial measure. Set forth in this appendix are tables that reconcile each of the components of our historical adjusted regulated O&M efficiency ratios to its most directly comparable GAAP financial measure. All references throughout this presentation to EPS or earnings per share refer to diluted EPS attributable to common shareholders.

Third Quarter EPS Detail by Business Regulated $0.07 Other $0.00

Year-to-Date EPS Detail by Business MBB ($0.05) Regulated $0.34 Other $0.00

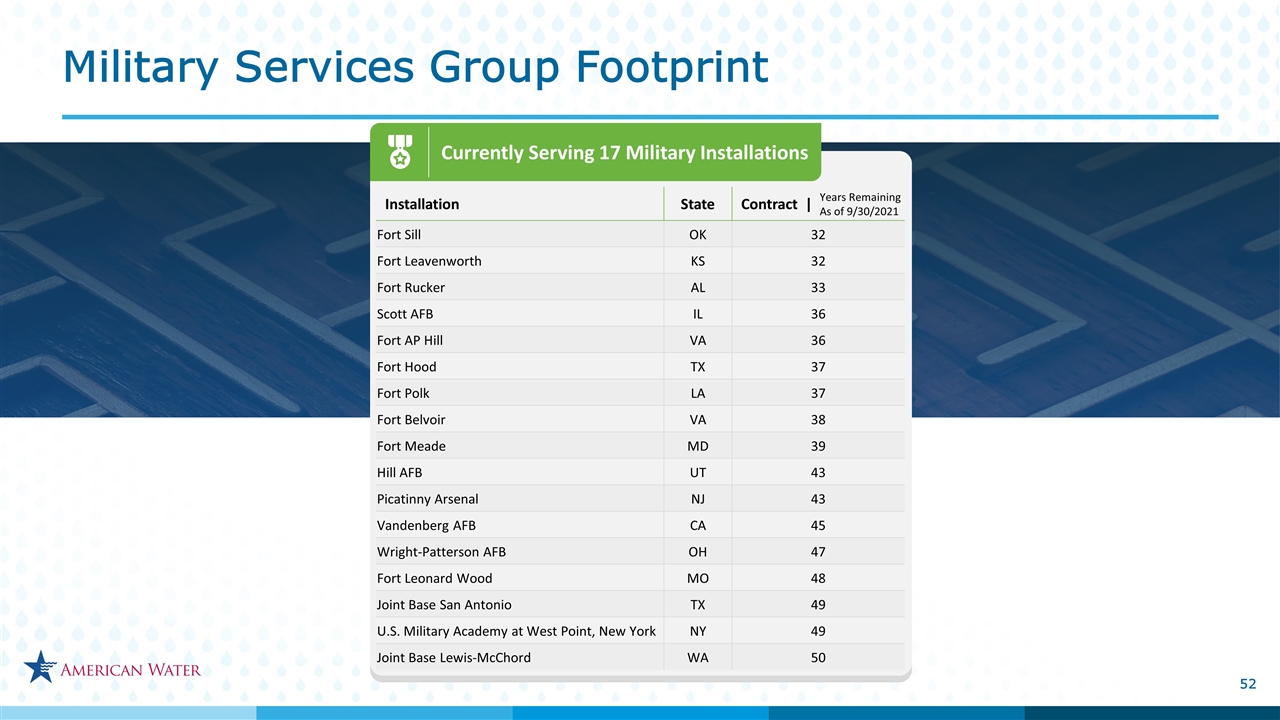

Installation State Contract | Fort Sill OK 32 Fort Leavenworth KS 32 Fort Rucker AL 33 Scott AFB IL 36 Fort AP Hill VA 36 Fort Hood TX 37 Fort Polk LA 37 Fort Belvoir VA 38 Fort Meade MD 39 Hill AFB UT 43 Picatinny Arsenal NJ 43 Vandenberg AFB CA 45 Wright-Patterson AFB OH 47 Fort Leonard Wood MO 48 Joint Base San Antonio TX 49 U.S. Military Academy at West Point, New York NY 49 Joint Base Lewis-McChord WA 50 Years Remaining As of 9/30/2021 Currently Serving 17 Military Installations Military Services Group Footprint

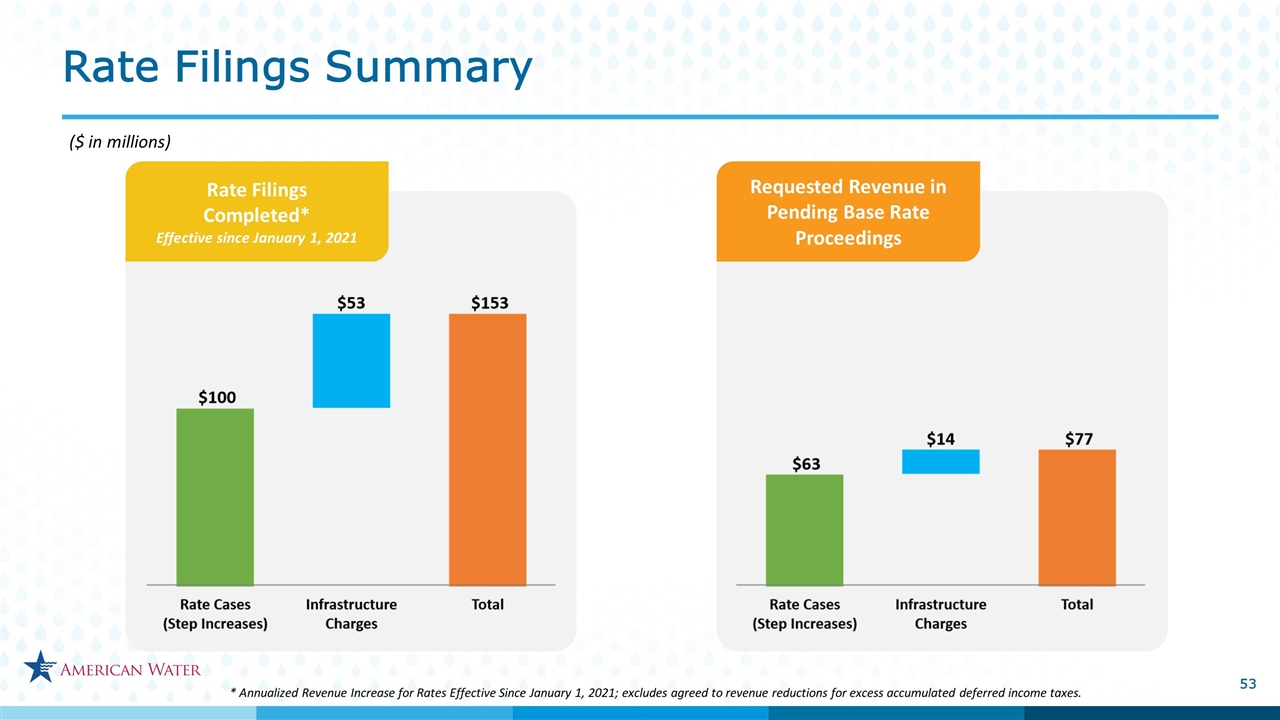

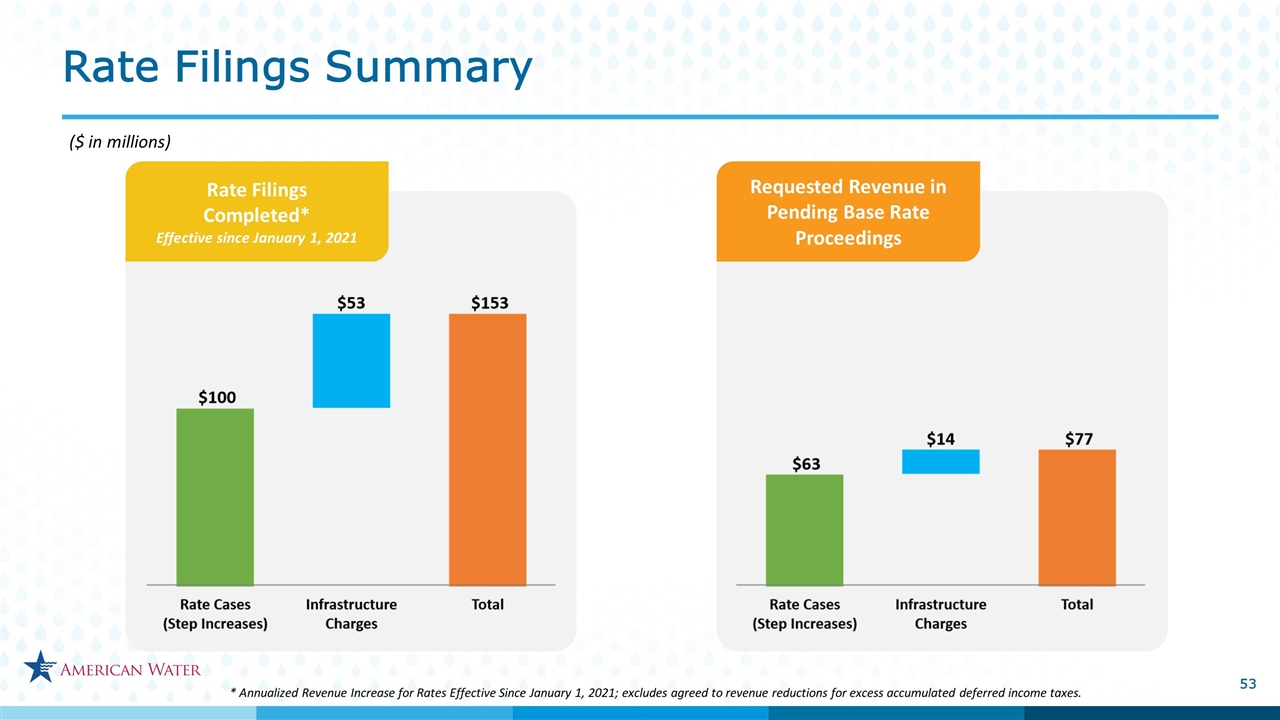

Rate Filings Summary Requested Revenue in Pending Base Rate Proceedings * Annualized Revenue Increase for Rates Effective Since January 1, 2021; excludes agreed to revenue reductions for excess accumulated deferred income taxes. Rate Filings Completed* Effective since January 1, 2021 ($ in millions)

What ESG Means at American Water Investors ESG engagement Stakeholder Engagement Workforce Customers Infrastructure Environmental Stewardship The Journey of ESG Employees Customers Communities Suppliers Regulatory Agencies/ State Utility Commissions Board of Directors Industry Associations Activists/ Advocacy Groups

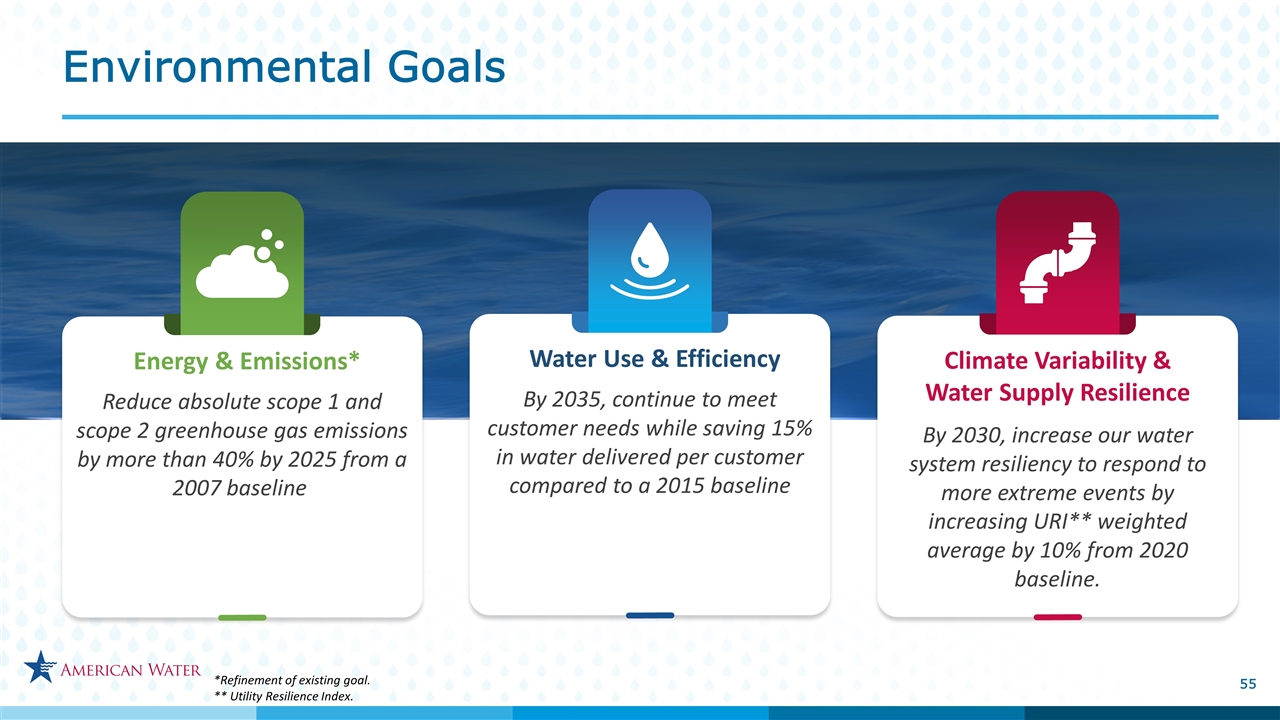

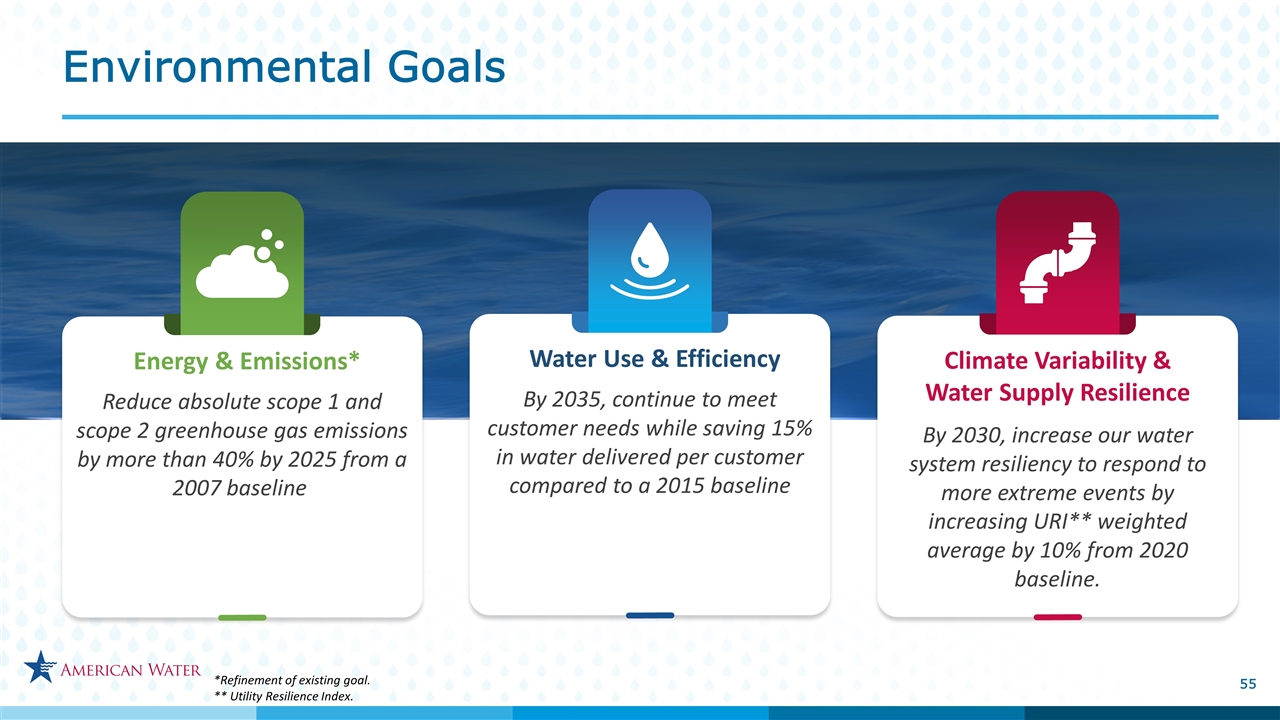

Environmental Goals *Refinement of existing goal. ** Utility Resilience Index. Reduce absolute scope 1 and scope 2 greenhouse gas emissions by more than 40% by 2025 from a 2007 baseline Energy & Emissions* By 2030, increase our water system resiliency to respond to more extreme events by increasing URI** weighted average by 10% from 2020 baseline. Climate Variability & Water Supply Resilience By 2035, continue to meet customer needs while saving 15% in water delivered per customer compared to a 2015 baseline Water Use & Efficiency

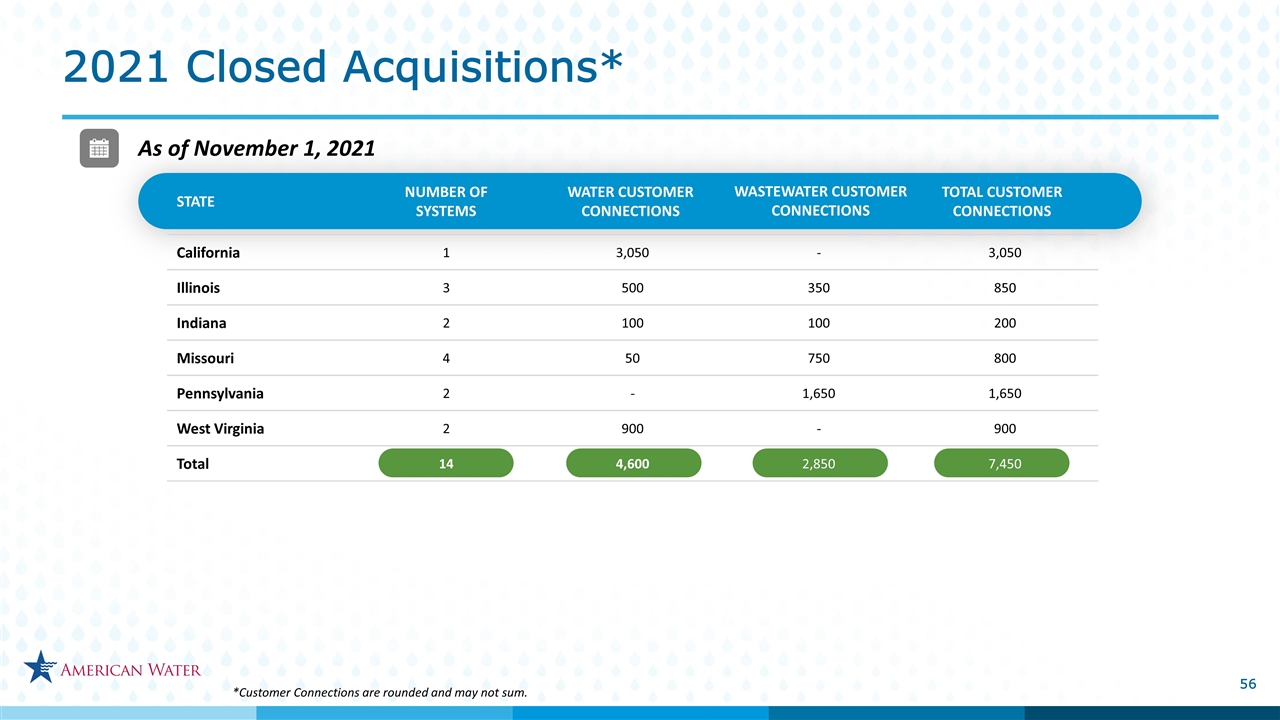

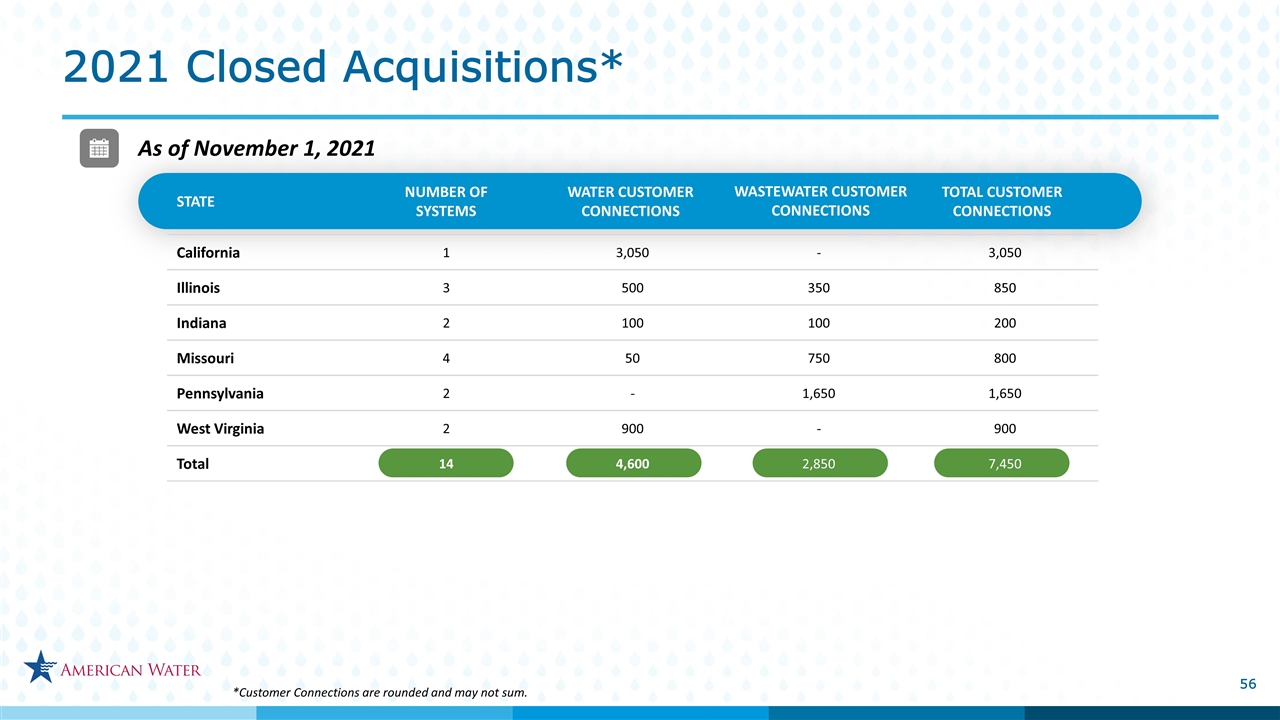

As of November 1, 2021 STATE NUMBER OF SYSTEMS WATER CUSTOMER CONNECTIONS WASTEWATER CUSTOMER CONNECTIONS TOTAL CUSTOMER CONNECTIONS California 1 3,050 - 3,050 Illinois 3 500 350 850 Indiana 2 100 100 200 Missouri 4 50 750 800 Pennsylvania 2 - 1,650 1,650 West Virginia 2 900 - 900 Total 14 4,600 2,850 7,450 2021 Closed Acquisitions* *Customer Connections are rounded and may not sum.

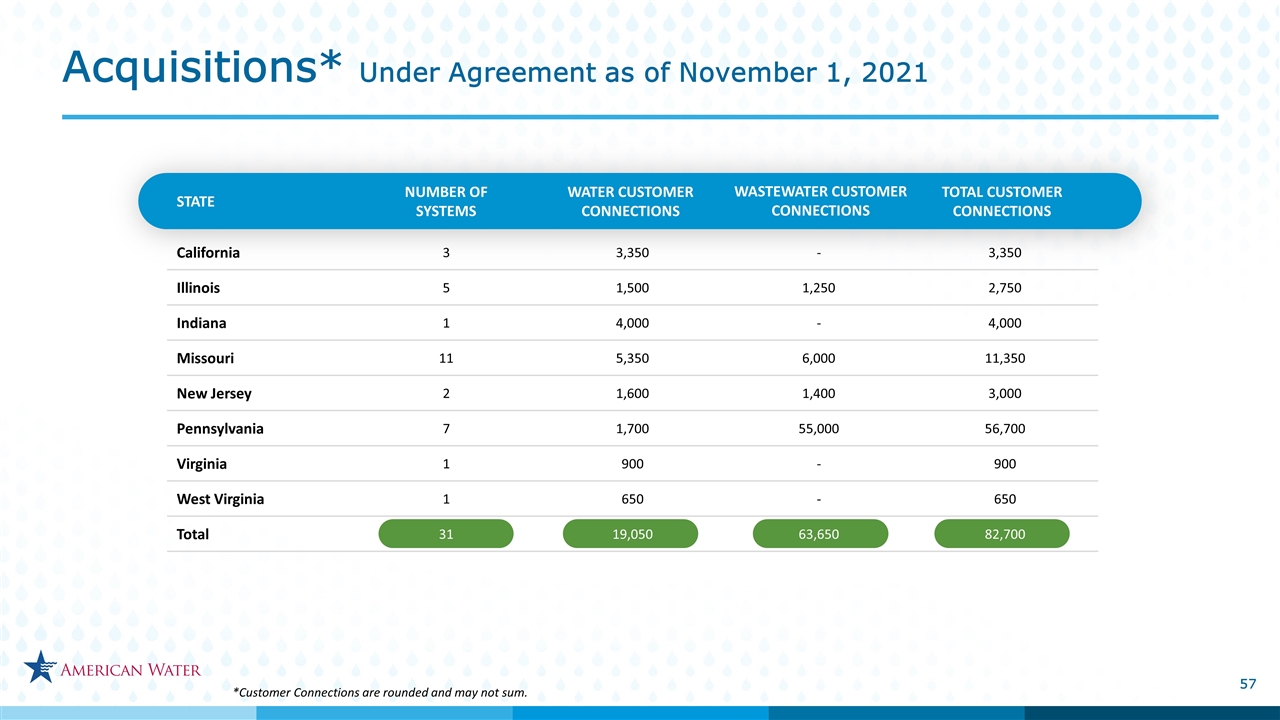

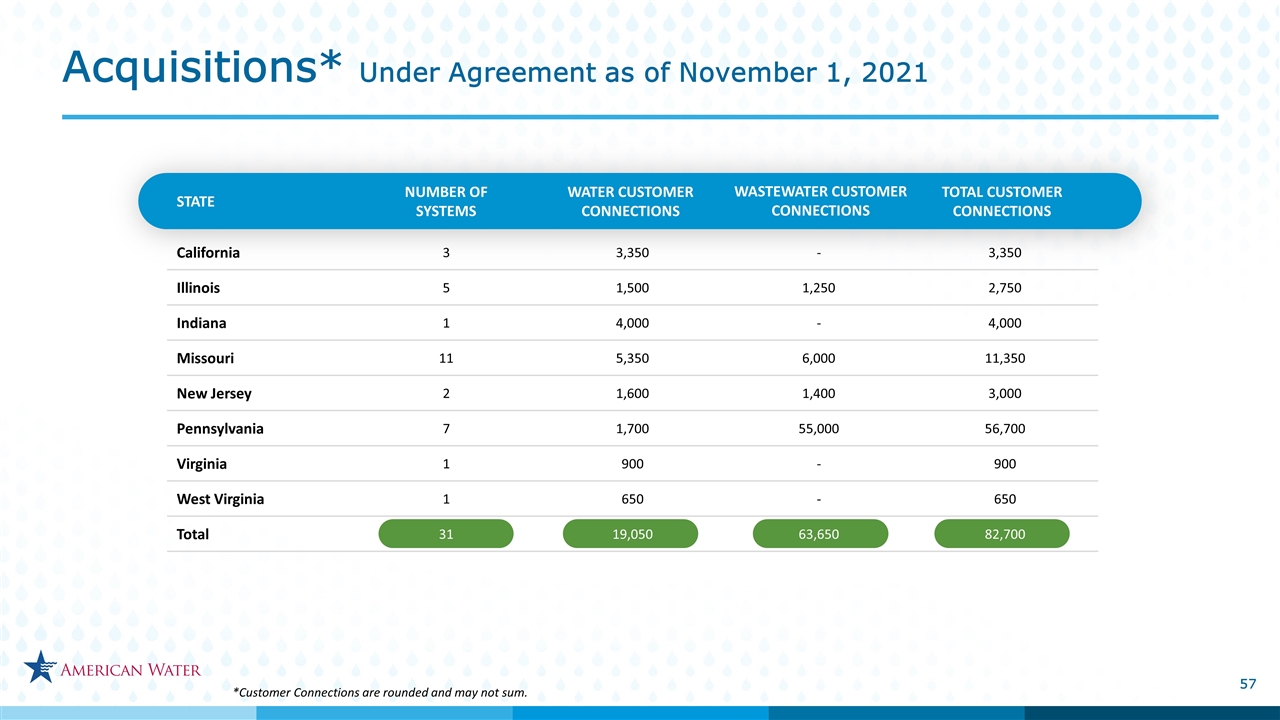

*Customer Connections are rounded and may not sum. STATE NUMBER OF SYSTEMS WATER CUSTOMER CONNECTIONS WASTEWATER CUSTOMER CONNECTIONS TOTAL CUSTOMER CONNECTIONS California 3 3,350 - 3,350 Illinois 5 1,500 1,250 2,750 Indiana 1 4,000 - 4,000 Missouri 11 5,350 6,000 11,350 New Jersey 2 1,600 1,400 3,000 Pennsylvania 7 1,700 55,000 56,700 Virginia 1 900 - 900 West Virginia 1 650 - 650 Total 31 19,050 63,650 82,700 Acquisitions* Under Agreement as of November 1, 2021

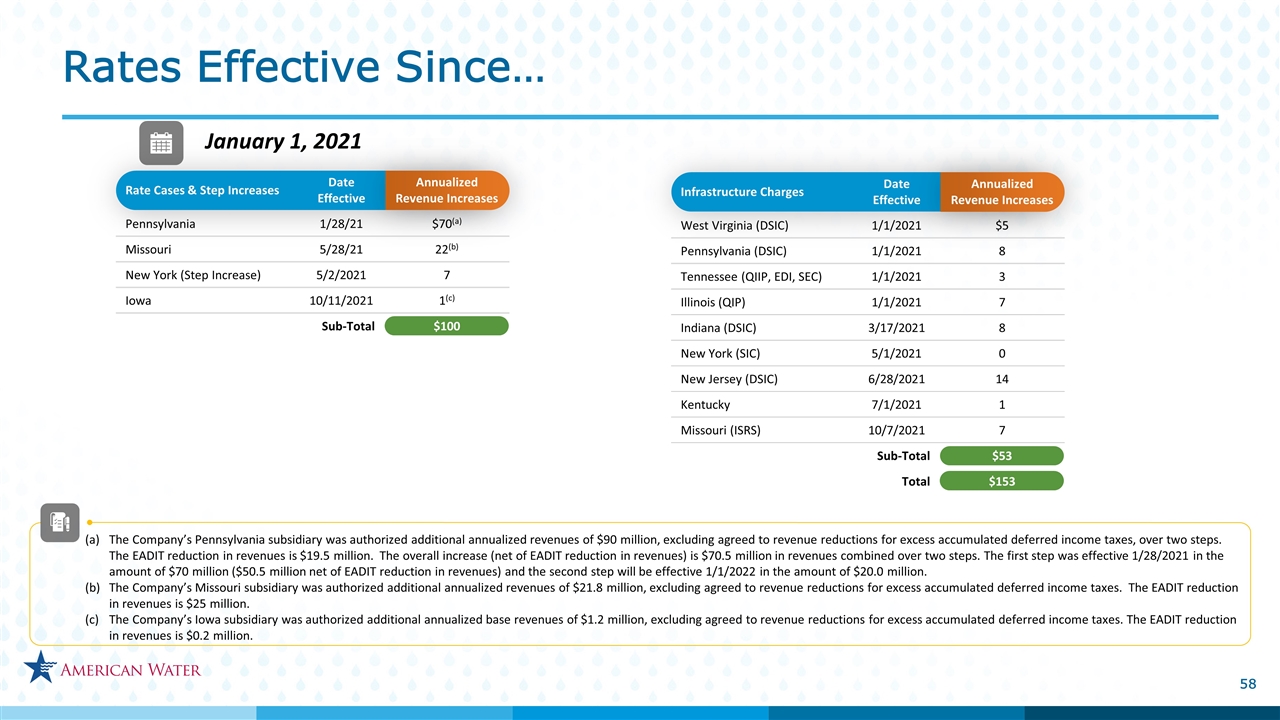

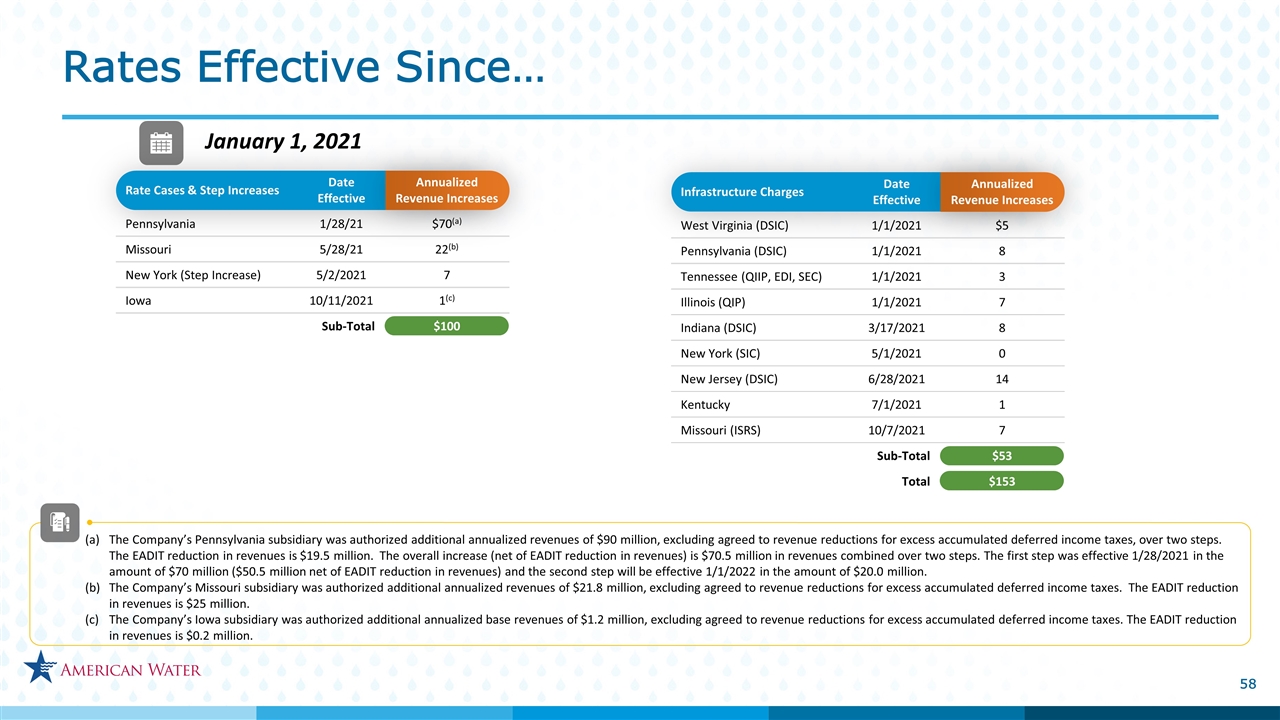

January 1, 2021 The Company’s Pennsylvania subsidiary was authorized additional annualized revenues of $90 million, excluding agreed to revenue reductions for excess accumulated deferred income taxes, over two steps. The EADIT reduction in revenues is $19.5 million. The overall increase (net of EADIT reduction in revenues) is $70.5 million in revenues combined over two steps. The first step was effective 1/28/2021 in the amount of $70 million ($50.5 million net of EADIT reduction in revenues) and the second step will be effective 1/1/2022 in the amount of $20.0 million. The Company’s Missouri subsidiary was authorized additional annualized revenues of $21.8 million, excluding agreed to revenue reductions for excess accumulated deferred income taxes. The EADIT reduction in revenues is $25 million. The Company’s Iowa subsidiary was authorized additional annualized base revenues of $1.2 million, excluding agreed to revenue reductions for excess accumulated deferred income taxes. The EADIT reduction in revenues is $0.2 million. Infrastructure Charges Date Effective Annualized Revenue Increases West Virginia (DSIC) 1/1/2021 $5 Pennsylvania (DSIC) 1/1/2021 8 Tennessee (QIIP, EDI, SEC) 1/1/2021 3 Illinois (QIP) 1/1/2021 7 Indiana (DSIC) 3/17/2021 8 New York (SIC) 5/1/2021 0 New Jersey (DSIC) 6/28/2021 14 Kentucky 7/1/2021 1 Missouri (ISRS) 10/7/2021 7 Sub-Total $53 Total $153 Rate Cases & Step Increases Date Effective Annualized Revenue Increases Pennsylvania 1/28/21 $70(a) Missouri 5/28/21 22(b) New York (Step Increase) 5/2/2021 7 Iowa 10/11/2021 1(c) Sub-Total $100 Rates Effective Since…

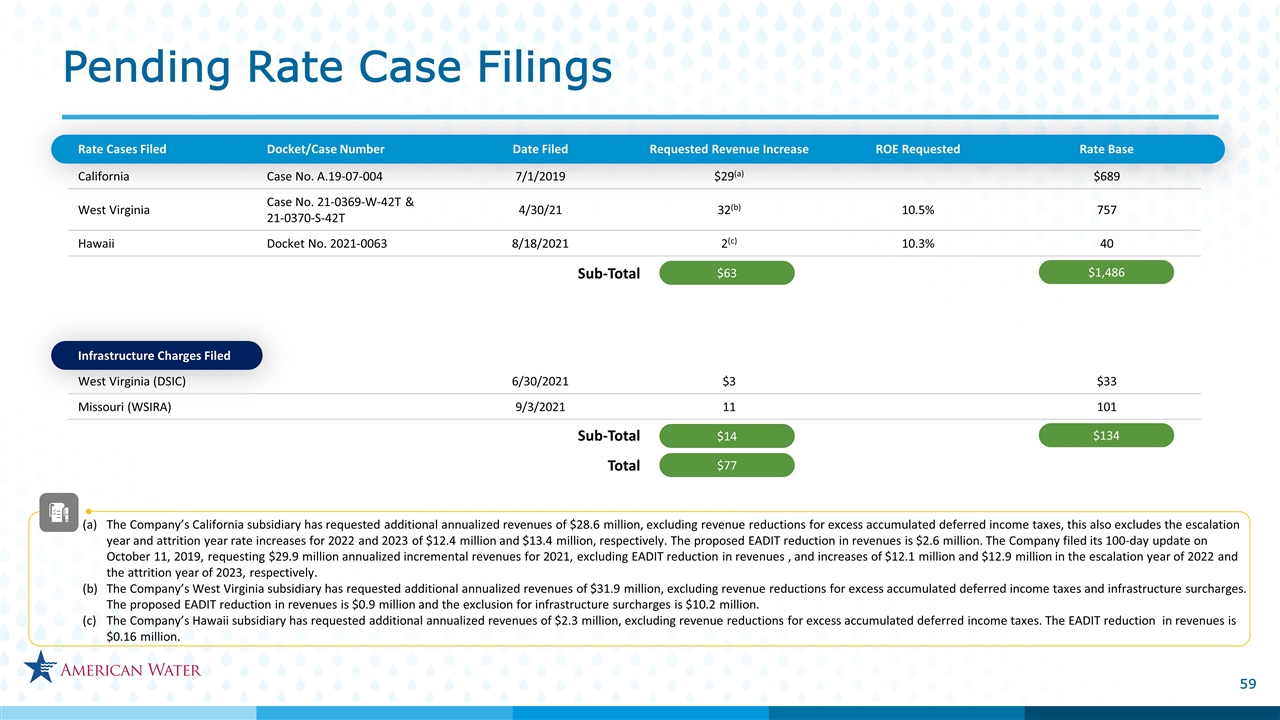

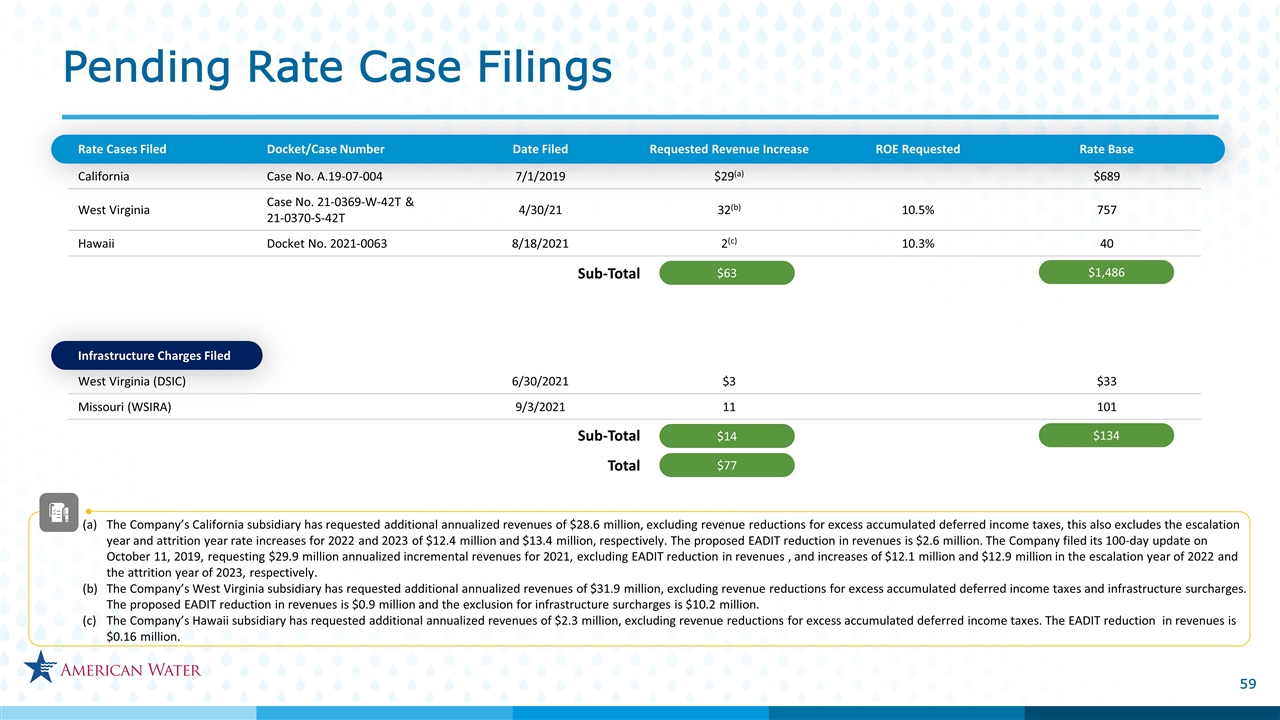

California Case No. A.19-07-004 7/1/2019 $29(a) $689 West Virginia Case No. 21-0369-W-42T & 21-0370-S-42T 4/30/21 32(b) 10.5% 757 Hawaii Docket No. 2021-0063 8/18/2021 2(c) 10.3% 40 $63 Sub-Total Rate Cases Filed Docket/Case Number Date Filed Requested Revenue Increase ROE Requested Rate Base $1,486 The Company’s California subsidiary has requested additional annualized revenues of $28.6 million, excluding revenue reductions for excess accumulated deferred income taxes, this also excludes the escalation year and attrition year rate increases for 2022 and 2023 of $12.4 million and $13.4 million, respectively. The proposed EADIT reduction in revenues is $2.6 million. The Company filed its 100-day update on October 11, 2019, requesting $29.9 million annualized incremental revenues for 2021, excluding EADIT reduction in revenues , and increases of $12.1 million and $12.9 million in the escalation year of 2022 and the attrition year of 2023, respectively. The Company’s West Virginia subsidiary has requested additional annualized revenues of $31.9 million, excluding revenue reductions for excess accumulated deferred income taxes and infrastructure surcharges. The proposed EADIT reduction in revenues is $0.9 million and the exclusion for infrastructure surcharges is $10.2 million. The Company’s Hawaii subsidiary has requested additional annualized revenues of $2.3 million, excluding revenue reductions for excess accumulated deferred income taxes. The EADIT reduction in revenues is $0.16 million. Pending Rate Case Filings Infrastructure Charges Filed West Virginia (DSIC) 6/30/2021 $3 $33 Missouri (WSIRA) 9/3/2021 11 101 $14 Total $134 $77 Sub-Total

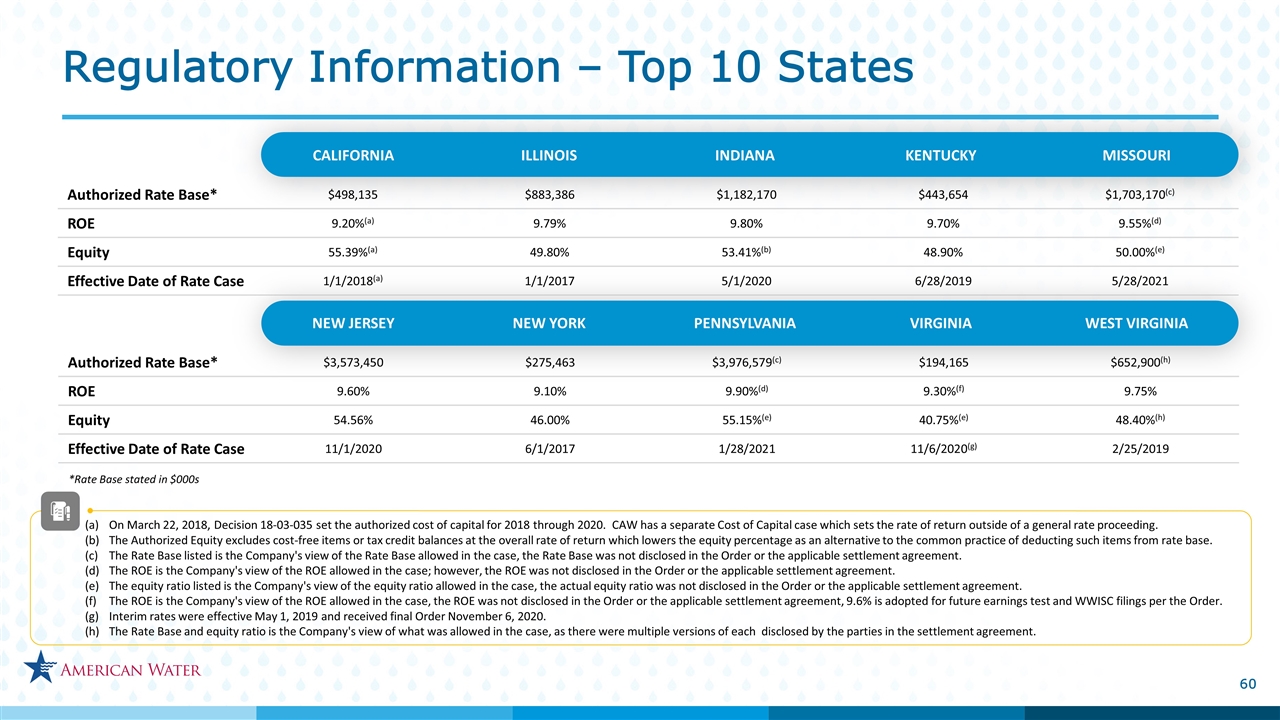

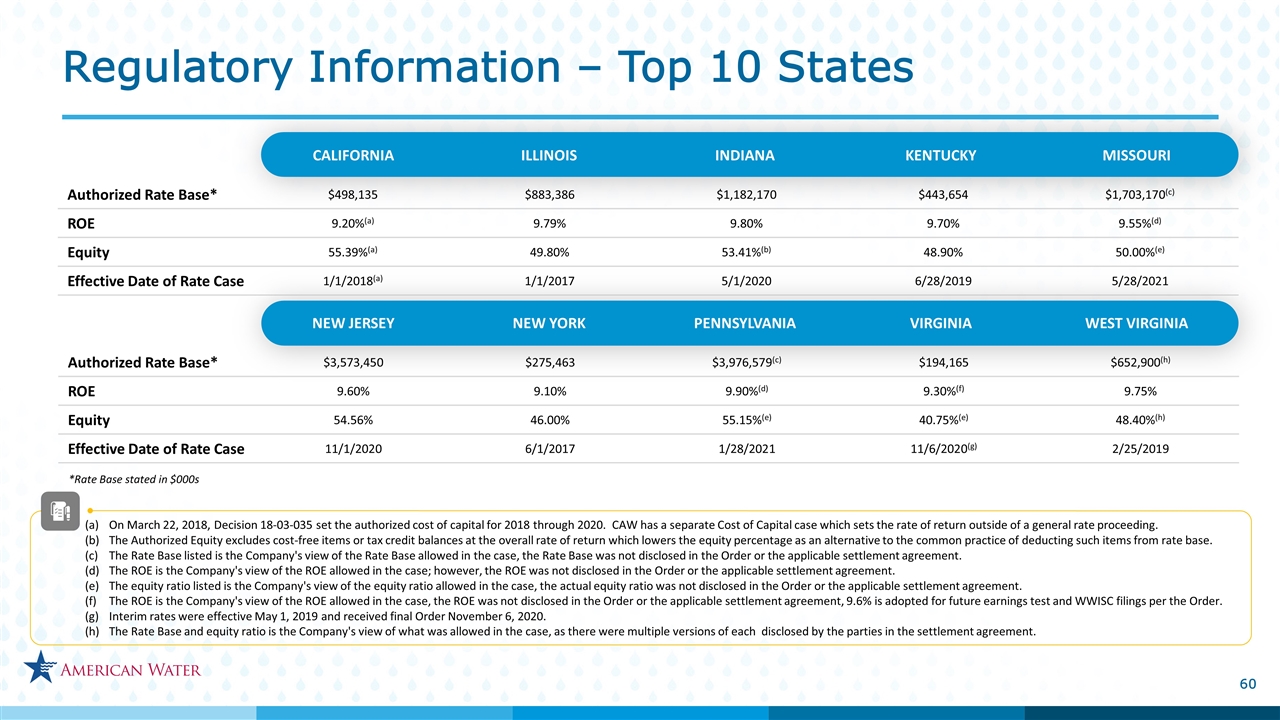

NEW JERSEY NEW YORK PENNSYLVANIA VIRGINIA WEST VIRGINIA CALIFORNIA ILLINOIS INDIANA KENTUCKY MISSOURI *Rate Base stated in $000s Authorized Rate Base* $498,135 $883,386 $1,182,170 $443,654 $1,703,170(c) ROE 9.20%(a) 9.79% 9.80% 9.70% 9.55%(d) Equity 55.39%(a) 49.80% 53.41%(b) 48.90% 50.00%(e) Effective Date of Rate Case 1/1/2018(a) 1/1/2017 5/1/2020 6/28/2019 5/28/2021 Authorized Rate Base* $3,573,450 $275,463 $3,976,579(c) $194,165 $652,900(h) ROE 9.60% 9.10% 9.90%(d) 9.30%(f) 9.75% Equity 54.56% 46.00% 55.15%(e) 40.75%(e) 48.40%(h) Effective Date of Rate Case 11/1/2020 6/1/2017 1/28/2021 11/6/2020(g) 2/25/2019 On March 22, 2018, Decision 18-03-035 set the authorized cost of capital for 2018 through 2020. CAW has a separate Cost of Capital case which sets the rate of return outside of a general rate proceeding. The Authorized Equity excludes cost-free items or tax credit balances at the overall rate of return which lowers the equity percentage as an alternative to the common practice of deducting such items from rate base. The Rate Base listed is the Company's view of the Rate Base allowed in the case, the Rate Base was not disclosed in the Order or the applicable settlement agreement. The ROE is the Company's view of the ROE allowed in the case; however, the ROE was not disclosed in the Order or the applicable settlement agreement. The equity ratio listed is the Company's view of the equity ratio allowed in the case, the actual equity ratio was not disclosed in the Order or the applicable settlement agreement. The ROE is the Company's view of the ROE allowed in the case, the ROE was not disclosed in the Order or the applicable settlement agreement, 9.6% is adopted for future earnings test and WWISC filings per the Order. Interim rates were effective May 1, 2019 and received final Order November 6, 2020. The Rate Base and equity ratio is the Company's view of what was allowed in the case, as there were multiple versions of each disclosed by the parties in the settlement agreement. Regulatory Information – Top 10 States

* Calculation assumes purchased water revenues approximate purchased water expenses ** Includes the impact of the Company’s adoption of ASU 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Post-retirement Benefit, on January 1, 2018 *** Calculation of Estimated tax reform = Revenue Requirement with new Effective Tax Rate (taxes grossed up) – Revenue Requirement with old Effective Tax Rate Reconciliation Table: Regulated Segment O&M Efficiency Ratio