Table of ContentsAs filed with the Securities and Exchange Commission on May 2, 2008

Registration No. 333-146098

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3 to

FORM S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

RHI Entertainment, Inc.

(Exact name of registrant as specified in its charter)

|  |  |  |  |  |  |

| Delaware |  |  | 36-4614616 |  |  | 7812 |

(State or other jurisdiction of

incorporation or organization) |  |  | (I.R.S. Employer

Identification No.) |  |  | (Primary Standard Industrial Classification Code Number) |

1325 Avenue of the Americas, 21st Floor

New York, NY 10019

(212) 977-9001

(Address, including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

Henry S. Hoberman

Executive Vice President & General Counsel

RHI Entertainment, Inc.

1325 Avenue of the Americas, 21st Floor

New York, New York 10019

(212) 977-9001

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|  |  |  |

Raymond Y. Lin, Esq.

Senet S. Bischoff, Esq.

Latham & Watkins LLP

885 Third Avenue

New York, New York 10022

(212) 906-1200 |  |  | Rod Miller, Esq.

Weil Gotshal & Manges LLP

767 Fifth Avenue

New York, New York 10153

(212) 310-8000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ![[ ]](https://capedge.com/proxy/S-1A/0000950136-08-002289/ebox.gif)

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![[ ]](https://capedge.com/proxy/S-1A/0000950136-08-002289/ebox.gif)

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![[ ]](https://capedge.com/proxy/S-1A/0000950136-08-002289/ebox.gif)

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![[ ]](https://capedge.com/proxy/S-1A/0000950136-08-002289/ebox.gif)

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ![[ ]](https://capedge.com/proxy/S-1A/0000950136-08-002289/ebox.gif)

CALCULATION OF REGISTRATION FEE

|  |  |  |  |  |  |  |  |  |  |  |  |

| Title of Each Class of Securities to be Registered |  |  | Proposed

Maximum Aggregate

Offering Price(1)(2) |  |  | Amount of

Registration Fee(3) |

| Common stock, par value $0.01 per share |  |  |  | $ | 250,000,000 |  |  |  |  | $ | 7,675.00 |  |

| (1) | Includes shares of common stock issuable upon exercise of the underwriters’ option to purchase additional shares of common stock. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of ContentsThe information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to completion, dated May 2, 2008

Prospectus

shares

RHI Entertainment, Inc.

Common Stock

This is an initial public offering of shares of common stock by RHI Entertainment, Inc. The estimated initial public offering price is between $ and $ per share.

Prior to this offering, there has been no public market for our common stock. We have applied for our common stock to be listed on the Nasdaq Global Market under the symbol ‘‘RHIE.’’

We will be a holding company and our sole asset will be approximately % ( % if the underwriters’ over-allotment option is exercised in full) of the common membership units in RHI Entertainment Holdings II, LLC, or Holdings II. KRH Investments LLC, or KRH, will own the remaining approximately % ( % if the underwriters’ over-allotment option is exercised in full) of the common membership units in Holdings II. Beginning six months from the completion of this offering, KRH will be entitled to exchange its common membership units in Holdings II for, at our option, shares of RHI Entertainment, Inc. common stock on a one-for-one basis (as adjusted to account for stock splits, recapitalizations or similar events) or cash, or a combination of both stock and cash. Our only business will be acting as the sole manager of Holdings II and, as such, we will operate and control all of the business and affairs of Holdings II. We will use the proceeds of this offering to purchase newly issued common membership units from Holdings II. See ‘‘Use of proceeds’’ and ‘‘Underwriting.’’

|  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Per Share |  |  | Total |

| Initial public offering price |  |  |  | $ | |  |  |  |  | $ | |  |

| Underwriting discounts and commissions |  |  |  | $ |  |  |  |  |  | $ |  |  |

| Proceeds to us (before expenses) |  |  |  | $ |  |  |  |  |  | $ |  |  |

Investing in our common stock involves a high degree of risk. See ‘‘Risk factors’’ beginning on page 16.

RHI Entertainment, Inc. has granted the underwriters an option for a period of 30 days to purchase up to additional shares of common stock on the same terms and conditions set forth above to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to investors on or about , 2008.

|  |  |  |

| JPMorgan |  |  | Banc of America Securities LLC |

| Cowen and Company |  |  | Thomas Weisel Partners LLC |

This prospectus is dated , 2008.

Table of Contents

Table of contents

Unless otherwise indicated or unless the context indicates otherwise, all references in this prospectus to:

|  |  |

| • | ‘‘RHI LLC’’ refers to RHI Entertainment, LLC, a Delaware limited liability company that is the current operating company for our business, and the sole asset of RHI Entertainment Holdings II, LLC. |

|  |  |

| • | ‘‘Holdings II’’ refers to RHI Entertainment Holdings II, LLC, a Delaware limited liability company which will hold RHI Entertainment, LLC as its sole asset and which RHI Inc. will acquire an interest in and become the sole managing member of, upon completion of this offering. |

|  |  |

| • | ‘‘RHI,’’ ‘‘RHI Inc.,’’ ‘‘the company,’’ ‘‘us,’’ ‘‘we,’’ or ‘‘our’’ refer to the issuer, RHI Entertainment, Inc., a newly formed Delaware corporation, and its consolidated subsidiaries, including Holdings II and RHI LLC and their subsidiaries and predecessor companies. |

i

Table of Contents |  |  |

| • | ‘‘KRH’’ refers to KRH Investments LLC (prior to the offering, known as RHI Entertainment Holdings, LLC), a Delaware limited liability company, which together with RHI Inc. will be the members of Holdings II upon completion of this offering. |

|  |  |

| • | ‘‘Holdings’’ refers to RHI Entertainment Holdings, LLC, a Delaware limited liability company, before it changed its name to KRH. |

|  |  |

| • | ‘‘Kelso’’ refers to Kelso & Company L.P., a Delaware limited partnership, and the principal investor in KRH. |

|  |  |

| • | ‘‘Predecessor Company’’ refers to Hallmark Entertainment LLC, our operating company prior to January 12, 2006 (for purposes of our financial data). |

|  |  |

| • | ‘‘Successor Company’’ refers to RHI LLC, our operating company from January 12, 2006 (inception) to the present (for purposes of our financial data). |

|  |  |

| • | ‘‘Hallmark Cards’’ refers to Hallmark Cards Inc., a Delaware corporation. |

|  |  |

| • | ‘‘Crown Media’’ refers to Crown Media Holdings, Inc., a Delaware corporation and a subsidiary of Hallmark Cards. |

|  |  |

| • | ‘‘Hallmark Entertainment’’ refers to Hallmark Entertainment LLC, a Delaware limited liability company, its consolidated subsidiaries and the predecessor company of RHI LLC before it was acquired and renamed in January 2006. |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Industry and market data and forward-looking statements used throughout this prospectus are derived from various industry and other independent sources, including the ‘Communications Industry Forecast 2007-2011’ published in August 2007 by Veronis Suhler Stevenson, SNL Kagan Worldwide Media Estimates, or Kagan; and Nielsen Media Research, or Nielsen. These third party industry publications and forecasts generally state that the information contained therein has been obtained from sources generally believed to be reliable. We have relied on the accuracy of such data and statements without carrying out an independent verification thereof. The industry forward-looking statements included in this prospectus may be materially different than actual results.

ii

Table of ContentsProspectus summary

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. You should read the following summary together with the more detailed information regarding us and our common stock being sold in this offering, including our financial statements and the related notes, appearing elsewhere in this prospectus.

RHI overview

We develop, produce and distribute new made-for-television movies, mini-series and other television programming worldwide. We are the leading provider of new long-form television content with a 22% market share of domestic made-for-television (MFT) movies and mini-series and a 52% market share of domestic mini-series between 2000 and 2005, based on research provided by Nielsen. We also selectively produce new episodic series programming for television. In addition to our development, production and distribution of new content, we own an extensive library of existing long-form television content, which we license primarily to broadcast and cable networks worldwide.

Our business is comprised of new film production and the licensing of existing content from our film library. In our production process, we reduce risk through an economic model that generates contractual sales for the majority of our production costs in advance of delivering our content (pre-sales). It is our practice not to commence production until we have a firm order for an initial license fee that typically equals 30% to 60% of our production costs. The initial licensee is generally a U.S. broadcast or cable network that pays the fee to acquire the right to air our content for a defined period of time. We are also able to license the same programming to international broadcast and cable networks. It is our practice not to begin production unless a significant number of these foreign license agreements are secured or under negotiation.

In January 2006, Robert Halmi, Jr., members of management, Kelso and other investors acquired Hallmark Entertainment from Hallmark Cards and renamed it RHI Entertainment, LLC, or RHI LLC. In December 2006, RHI LLC acquired the domestic rights to Crown Media’s film library. The acquisition of the library was primarily a repurchase of the domestic rights to titles that Crown Media had acquired from Hallmark Entertainment in September 2001. These acquisitions substantially reunited the original assets of Hallmark Entertainment. We believe that these assets are being managed more efficiently and profitably as an independent operation.

Operating independently has enabled us to diversify the type of content we develop, produce and distribute. Previously, a large portion of our content was developed and produced for the Hallmark Channel and targeted the demographic of that channel. As an independent company, we have broadened the type of content we develop and produce and expanded the networks to whom we license and distribute. We do not expect to produce and deliver a significant amount of new content for the Hallmark Channel in 2008. However, under our existing license agreement, we will continue to license existing titles from our film library to the Hallmark Channel for at least the next five years. With a more diversified content offering, we have been able to access new distribution platforms, including ION Media Networks, direct-to-video, video-on-demand and pay-per-view.

Revenue, Adjusted EBITDA (as defined below under ‘‘Summary consolidated historical and pro forma financial and operating information’’) and net loss for the year ended December 31, 2007 were $232.0 million, $33.0 million and $(22.6) million, respectively, compared to $191.8 million, $(68.1) million and $(9.2) million, respectively, for the year ended December 31, 2006. We believe that the improvement of our 2007 operating results over the prior year demonstrates the effectiveness of our new business strategy.

During 2008, we expect to develop, produce and distribute approximately 40 MFT movies and mini-series. Historically, we have been able to scale our production volume and diversify our

1

Table of Contentscontent offering in order to meet market demand. We believe our award winning content offers customers a variety of cost-effective programming that drives ratings and, in turn, generates additional demand for our library content. In nine of the last 13 seasons, we have developed and distributed either the highest-rated U.S. broadcast MFT movie or mini-series episode. In addition, our productions have won 104 Emmy® Awards, 15 Golden Globe Awards and eight Peabody Awards.

We have focused on, and invested in, an extensive library of MFT movies and mini-series. We now own rights to more than 1,000 titles, or over 3,500 broadcast hours, of long-form television programming, the majority of which has been developed and produced by us. We believe that our library is one of the largest of its kind.

Our customers include a variety of domestic broadcast and cable networks, such as ABC, CBS, the Hallmark Channel, Lifetime, NBC, SCI-FI Network, Spike TV and USA Network, as well as large international broadcasters, including Antena-3, M6, PROSIEBEN-SAT1, TF1, Seven Network and Sky. In addition, our on-going productions and extensive library provide us with the ability to exploit new business opportunities beyond our traditional distribution channels. These opportunities include increased international distribution and cable syndication, network programming (ION Media Networks, or ION), direct-to-video, video-on-demand, or VOD and pay-per-view, or PPV. For example, under our agreement with ION, we are providing programming for its primetime weekend schedule (7 p.m. to 11 p.m. Friday, Saturday and Sunday).

In addition to pre-selling licensing rights, we mitigate production risk by focusing on relatively low cost programming, with production expenses ranging from $2.0 to $4.0 million for a MFT movie and $8.0 to $20.0 million for a mini-series. In addition, we have a relatively short production cycle, between 30 and 60 days for a MFT movie and 60 and 90 days for a mini-series, and relatively low annual working capital requirements. These factors will enable us to develop, produce and distribute approximately 40 MFT movies and mini-series in 2008. We believe that these characteristics, combined with our expanding distribution opportunities, will continue to create long-term value for us while limiting our risk.

Market & competitive overview

We provide programming to meet the increasing demand of television broadcasters and cable networks for original content that drives ratings and advertising revenue, as well as to expand business opportunities by delivering content to new distribution platforms. The demand for original programming is strong and global growth trends are encouraging. According to Kagan, global television programming revenue from U.S.-produced programming is expected to reach more than $48.2 billion by 2011, representing a 4.4% compound annual growth rate, or CAGR, from $40.6 billion in 2007. Kagan also anticipates that U.S. basic cable programming spending will grow at a CAGR of 8.1% from 2007 to 2011 and that international demand for U.S.-produced programming will grow by an average of 5.5% per year over the same period. As the number of cable channels and other outlets for television product expand, demand for television content will increase, and content companies such as ours are expected to benefit. According to Veronis Suhler Stevenson, DVD revenue in the home video market is expected to climb to nearly $31.2 billion annually by 2011, representing a CAGR of 4.0% from 2007. In addition, according to Veronis Suhler Stevenson, the residential wired cable VOD market is projected to grow to $2.5 billion in 2011, representing a 16.1% CAGR from 2007, while the internet download of video content market is expected to grow 50.9% annually over the same period to $1.8 billion by 2011.

Our primary competitors in long-form television content include studio television divisions, such as Buena Vista International Television and Paramount Television, and broadcast and cable networks, such as CBS and HBO. From 2000 to 2005, we developed and distributed 223 MFT movies and mini-series which, based on research provided by Nielsen, was more than our three nearest competitors combined.

2

Table of ContentsCompany strengths

Clear market leader — Our long history of award winning content, and global footprint have positioned us as the market leader of long-form television production, evidenced by our 22% share of the domestic original MFT movie and mini-series market, more than twice that of our nearest competitor, and our 52% share of the domestic mini-series market, based on research provided by Nielsen from 2000 to 2005.

Proven production model — Our business model enables us to generate contractual sales for our new productions in advance of their delivery and provides visibility into long-term cash flows from the licensing of rights to content in our film library. Key production model elements include:

|  |

| • | commencing production only when we have a firm order for an initial license fee; |

|  |

| • | collecting a significant portion of this contracted cash during production and the remaining contracted cash before the expiration of the initial licensing period; and |

|  |

| • | contracting with additional customers to pre-sell rights which account for a majority of our production costs prior to delivery of our content. |

Long-term contracted library cash flows — Our large long-form television programming library provides us with consistent, highly profitable, growing contractual cash flows. The combination of those high-margin cash flows and our access to additional distribution platforms generates significant operating leverage in our business model. As of December 31, 2007, we had $314.3 million of future cash flows under contract from the licensing of content in our library, which represents 24% more than we had at December 31, 2006.

Expanding customer base — The global growth of cable networks and increasing demand for our library product have resulted in a growing customer base. Our traditional customer base has included domestic broadcast and cable networks, such as ABC and the Hallmark Channel, as well as large international broadcasters. Following our independence, we have experienced new content demand from cable networks and have been able to further diversify our customer base to include networks such as ION and SCI-FI Network. We are also augmenting our distribution platforms to new outlets such as VOD and PPV.

Leading content provider — Our consistent high ratings and various television awards are a testament to the quality of our content. We have developed and distributed either the highest–

rated US broadcast MFT movie or mini-series in nine of the last 13 seasons. Our productions have won 104 Emmy® Awards, 15 Golden Globe Awards and eight Peabody Awards.

Highly experienced management team — Our senior management team, which has on average over 20 years of industry experience, has developed, produced and distributed more than 2,500 broadcast hours of television programming, and has a strong reputation for efficient and timely execution within the industry.

Company strategy

The company intends to pursue a strategy of significant growth by pursuing the following:

Capture growth opportunities in the worldwide television market — We intend to use our production capabilities and significant library to sell into the growing number of broadcast and cable channels and other new outlets for television programming.

Adapt our product to meet the demands of a diverse customer base — We intend to broaden and diversify the type of film content we distribute in order to meet the demands of our expanding distribution channels. For example, we recently developed and distributed action/thriller MFT movies for the SCI-FI Network and Spike TV.

Target new distribution platforms — We are well-positioned to benefit from the emergence of new distribution platforms, such as direct-to-video, VOD and PPV. Distributing our content

3

Table of Contentsthrough new channels increases the value of our original production content and enhances the value of our long form television library. We intend to take advantage of viable alternative distribution outlets as they emerge.

Exploit our growing library — Our library is enhanced each year with the addition of our new MFT movies, mini-series and other television programming. Moreover, with the acquisition of the Crown Media library in late 2006, we more than doubled the number of titles in our library. We expect to achieve growth through the licensing and re-licensing of existing and new content to broadcast and cable networks. Our cost to produce new content is generally recouped by the end of its initial licensing term, thus we expect those re-licensing terms to generate high-margin incremental cash flows. Our independence allows us to license our library content to a larger and more diversified customer base, providing operating leverage and further enhancing the economics of our business model.

Our history

Robert Halmi, Sr. has been involved with the development of MFT movies and mini-series for nearly 30 years along with his son, Robert Halmi, Jr. Since joining his father in 1979, Mr. Halmi, Jr. has managed the operations of the business.

In 1994, RHI Entertainment, Inc., a publicly traded company, was acquired by Hallmark Cards and renamed Hallmark Entertainment. While owned by Hallmark Cards, the company expanded and broadened its production and developed the Hallmark Entertainment Network internationally, which ultimately led to the development and launching of the Hallmark Channel in the United States. In September 2001, Hallmark Entertainment sold the majority of its film library to Crown Media. In January 2006, Robert Halmi, Jr., members of management, Kelso and other investors acquired Hallmark Entertainment from Hallmark Cards and renamed it RHI Entertainment, LLC, or RHI LLC. In December 2006, RHI LLC reacquired the domestic rights to Crown Media’s film library.

We are a Delaware corporation, incorporated on August 24, 2007, and our principal executive offices are located at 1325 Avenue of the Americas, 21st Floor, New York, New York 10019. Our telephone number is (212) 977-9001, and our website address is http://www.rhifilms.com. We do not incorporate the information on our website into this prospectus and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

4

Table of ContentsOur reorganization

Overview

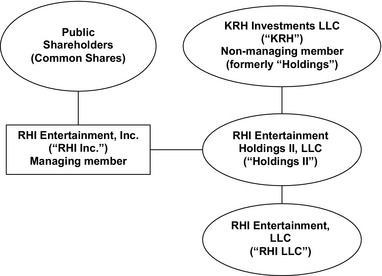

The business of the company has been historically conducted through RHI LLC, which, upon completion of this offering, will be a wholly-owned subsidiary of Holdings II. RHI Inc. and Holdings II were formed in connection with this offering. RHI Inc. will be the public vehicle for this offering and its primary asset will be common membership units in Holdings II. Holdings II will have two members, which will be RHI Inc. and KRH. Prior to this offering, KRH owned all of the ownership interests in RHI LLC. Upon completion of this offering, KRH will contribute its ownership interests in RHI LLC to Holdings II for common membership interests in Holdings II. Concurrently, RHI Inc. will purchase from Holdings II a number of newly issued common membership units equal to the number of common shares sold in the public offering, at a price per unit equal to the public offering price per share.

Upon completion of this offering, we will be a holding company that manages Holdings II, but will have no business operations or material assets other than approximately % of the common membership units in Holdings II ( % if the underwriters exercise their over-allotment option in full). KRH, owned by Robert Halmi, Jr., members of management, Kelso and other investors, will hold the remaining approximately % of common membership units in Holdings II ( % if the underwriters exercise their over-allotment option in full). Our only source of cash flow from operations will be distributions from Holdings II pursuant to the Holdings II limited liability company operating agreement, or the Holdings II LLC Agreement. See ‘‘Risk factors — Risks related to our corporat e structure’’ and ‘‘Relationships and certain related transactions — Transactions with KRH — Holdings II LLC Agreement.’’

The graphic below illustrates our anticipated structure immediately following completion of this offering.

5

Table of ContentsAfter the reorganization and the completion of this offering, KRH will:

|  |  |

| • | so long as KRH holds at least 35% of the outstanding common membership units in Holdings II, have the right to designate four director designees to RHI Inc.’s seven-member board of directors who will be voted upon and possibly elected by RHI Inc.’s stockholders (and if KRH owns more than 5% but less than 35% of the outstanding common membership units in Holdings II, it will have the right to designate a number of nominees to RHI Inc.’s board of directors constituting a minority of the members of the board of directors), with special approval rights over specified matters relating to Holdings II if any of these designees are not nominated or elected to RHI Inc.’s board; See ‘‘Management — Board composition followi ng the offering.’’ |

|  |  |

| • | beginning six months from the completion of this offering, be entitled to exchange its common membership units in Holdings II for, at RHI Inc.’s option, shares of RHI Inc. common stock on a one-for-one basis (as adjusted to account for stock splits, recapitalizations or similar events) or cash, or a combination of both stock and cash; and |

|  |  |

| • | have certain registration rights with respect to any shares of RHI Inc.’s common stock that it receives upon its exchange of common membership units in Holdings II, including the right to cause RHI Inc. to register for resale RHI Inc.’s common stock received by it as a result of any such exchange. |

As a result of the future exchange of common membership units in Holdings II for cash or shares of common stock of RHI Inc., KRH will be entitled to receive periodic cash payments representing 85% of the amount of cash savings, if any, in U.S. federal, state and local income or franchise tax that RHI Inc. realizes as a result of such exchanges (or is deemed to realize, in the case of an early termination). See ‘‘Risk factors — Risks related to our corporate structure’’ and ‘‘Relationships and certain related transactions — Transactions with KRH.’’

Reorganization and offering transactions

|  |  |

| 1. | On August 24, 2007, RHI Inc., a Delaware corporation, was formed. Robert Halmi, Jr. became the initial shareholder by purchasing 100 shares for $1,000. |

|  |  |

| 2. | On September 6, 2007, Holdings II, a Delaware limited liability company, was formed. |

|  |  |

| 3. | On , 2008, RHI Entertainment Holdings, LLC borrowed $30.0 million under a new senior unsecured term loan facility and contributed all of the net proceeds to our common equity capital. |

|  |  |

| 4. | Immediately prior to the completion of this offering, the entity named RHI Entertainment Holdings, LLC will change its name to KRH Investments LLC. |

|  |  |

| 5. | Immediately prior to the completion of this offering, KRH will contribute its 100% ownership interest in RHI LLC to Holdings II in consideration for 100% of the common membership units in Holdings II and Holdings II’s assumption of all of KRH’s obligations under its financial advisory agreement with Kelso. |

|  |  |

| 6. | Upon completion of this offering, the net proceeds received from this offering will be contributed by RHI Inc. to Holdings II in exchange for % of the common membership units in Holdings II. Holdings II will use the proceeds that it receives to pay certain fees and expenses in connection with the reorganization and offering transactions, to fund a distribution to KRH to repay the KRH unsecured term loan facility in its entirety and to repay a portion of our existing senior second lien credit facility; the remaining proceeds, if any, will be used for general corporate purposes, which may include the repayment of borrowings under our revolving credit facility. We will contribute to Holdings II any net proceeds received from the underwriters’ exercise of the over-allotment option in exchange for additional newly issued common membership units in Holdings II equal to the number of shares of common stock issued in the exercise of the over-allotment option. See ‘‘Use of proceeds.’’ |

6

Table of Contents |  |  |

| 7. | Upon completion of this offering, RHI Inc. will be the sole managing member of Holdings II, but will hold a minority of the economic interests. KRH will be a non-managing member of Holdings II, but will hold a majority of the economic interests. Distributions will be made in accordance with the relative economic interests of RHI Inc. and KRH in Holdings II. |

As a result of the foregoing reorganization and offering transactions, RHI Inc. will hold a number of common membership units in Holdings II equal to the number of outstanding shares of RHI Inc. common stock.

The reorganization and offering transactions are fully described under ‘‘Corporate history and reorganization’’ and ‘‘Relationships and certain related transactions.’’

Sponsor overview

Kelso, the principal investor in KRH, is a New York-based private investment firm founded in 1971. Since 1980, Kelso has acquired over 90 companies with total initial capital at closing of approximately $50.0 billion.

7

Table of ContentsThe offering

|  |  |

| Common stock offered by RHI Inc. |  | shares of common stock, par value of $0.01 per share |

| | |

|  |  |

| Common stock of RHI Inc. outstanding immediately after this offering if the underwriter’s over-allotment option is not exercised |  | shares |

| | |

|  |  |

| Common membership units in Holdings II to be outstanding immediately after this offering if the underwriter’s over-allotment option is not exercised |  | common membership units |

| | |

|  |  |

| Common membership units in Holdings II held by RHI Inc. |  | common membership units |

| | |

|  |  |

| Common membership units in Holdings II held by KRH |  | common membership units |

| | |

|  |  |

| Over-allotment option |  | shares if the underwriters exercise the over-allotment option in full |

| | |

|  |  |

| Common stock of RHI Inc. outstanding immediately after this offering if the underwriter’s over-allotment is exercised in full |  | shares |

| | |

|  |  |

| Common membership units in Holdings II to be outstanding immediately after this offering if the underwriter’s over-allotment option is exercised in full |  | common membership units |

| | |

|  |  |

| KRH’s exchange rights |  | Beginning six months from the completion of this offering, KRH will be entitled to exchange its common membership units in Holdings II for, at our option, shares of RHI Inc. common stock on a one-for-one basis (as adjusted to account for stock splits, recapitalizations or similar events) or cash, or a combination of both stock and cash. If, immediately following this offering, KRH had all of its common membership units in Holdings II exchanged for shares of our common stock, KRH would own approximately % of all outstanding shares of our common stock ( % if the underwriters exercised their over-allotment option in full). |

| | |

|  |  |

| Use of proceeds |  | We estimate that we will receive net proceeds from the sale of our common stock in this offering of approximately $ million after underwriting discounts |

| | |

8

Table of Contents |  |  |

|  | and commissions. We will contribute the net proceeds from this offering to Holdings II in exchange for newly issued common membership units in Holdings II. We expect that Holdings II will then use the net proceeds received from us as follows: |

| | |

|  |  |  |

|  | • | approximately $ million will be used to fund a distribution to KRH to repay its unsecured term loan facility in its entirety; |

| | |

|  |  |  |

|  | • | approximately $ million will be used to repay a portion of our senior second lien credit facility; |

| | |

|  |  |  |

|  | • | approximately $ million will be used to pay fees and expenses in connection with the reorganization and offering transactions, including $6.0 million to Kelso in exchange for the termination of our fee obligations under our existing financial advisory agreement; and |

| | |

|  |  |  |

|  | • | any remaining proceeds (currently estimated at approximately $ million) will be used for general corporate purposes, which may include the repayment of borrowings under our revolving credit facility. |

| | |

|  |  |

|  | Because affiliates of J.P. Morgan Securities Inc. are lenders under the KRH unsecured term loan facility and our senior credit facilities, affiliates of such underwriter will receive a portion of the proceeds of this offering. See ‘‘Underwriting.’’ |

| | |

|  |  |

|  | See ‘‘Use of proceeds’’ and ‘‘Description of senior credit facilities.’’ |

| | |

|  |  |

| Dividend policy |  | We have not paid dividends on our common stock in the past and do not currently intend to do so in the near future. Our board of directors has discretion, however, to determine if and when a dividend will be payable in the future. Our board of directors will likely consider a variety of factors, including general economic conditions, future prospects for the business, the company’s cash requirements and any other factors that the board deems relevant. See ‘‘Dividend policy,’’ ‘‘Management’s discussion and analysis of financial condition and results of operations — Liquidity and capital resources.’’ |

| | |

|  |  |

| Voting rights |  | Our stockholders have one vote for each share of common stock held by them and are entitled to vote, on a non-cumulative basis, at all stockholders’ meetings. See ‘‘Description of capital stock — Common stock.’’ |

| | |

|  |  |

| Risk factors |  | See ‘‘Risk factors’’ and other information included in this prospectus for a discussion of some of the factors you |

| | |

9

Table of Contents |  |  |

|  | should consider before deciding to purchase our common stock. |

| | |

|  |  |

| Proposed Nasdaq symbol |  | ‘‘RHIE’’ |

| | |

Unless otherwise stated herein, the information in this prospectus assumes that:

|  |  |

| • | the initial public offering price will be $ per share, the midpoint of the price range set forth on the cover of this prospectus; |

|  |  |

| • | the underwriters will not exercise their right to purchase up to additional shares of common stock from us to cover over-allotments; and |

|  |  |

| •�� | the reorganization is completed in connection with the completion of this offering. |

Other than 100 shares of common stock issued to Robert Halmi, Jr. in connection with the formation of RHI Inc., no shares of our common stock are outstanding before completion of this offering. The number of additional shares of common stock to be outstanding after completion of this offering is based on shares of our common stock to be sold in this offering and, except where we state otherwise, the information regarding our common stock presented in this prospectus excludes:

|  |  |

| • | shares of common stock issuable upon exchange of common membership units in Holdings II; and |

|  |  |

| • | shares that will be reserved for issuance pursuant to our equity compensation plans. |

10

Table of ContentsSummary consolidated historical and

pro forma financial and operating information

The following tables set forth summary consolidated financial and operating information on a historical and pro forma basis.

Our summary consolidated historical financial information presented below as of December 31, 2007 and 2006 and for the year ended December 31, 2007 (successor), the period from January 12, 2006 (inception) to December 31, 2006 (successor) and for the year ended December 31, 2005 (predecessor) have been derived from our audited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of future operating results.

The ‘‘Pro Forma’’ column in the summary consolidated financial data and operating information presented below gives pro forma effect to the reorganization and offering transactions, as described under ‘‘Corporate history and reorganization’’ and the application of the estimated proceeds from the sale by us of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus.

The summary consolidated historical and pro forma financial and operating information should be read in conjunction with ‘‘Capitalization,’’ ‘‘Unaudited pro forma financial information,’’ ‘‘Management’s discussion and analysis of financial condition and results of operations’’ and the consolidated financial statements and the related notes thereto and the other financial information included elsewhere in this prospectus.

The business of the company has been historically conducted through RHI LLC, which, upon completion of this offering, will be a wholly-owned subsidiary of Holdings II. RHI Inc. and Holdings II were formed in connection with this offering. RHI Inc. will be the public vehicle for this offering and its primary asset will be common membership units in Holdings II. Holdings II will have two members, which will be RHI Inc. and KRH. Prior to the offering, KRH owned all of the ownership interests in RHI LLC. Upon completion of this offering, KRH will contribute its ownership interests in RHI LLC to Holdings II for common membership interests in Holdings II. Concurrently, RHI Inc. will purchase from Holdings II a number of newly issued common membership units equal to the number of common shares sold in the public offering, at a price per unit equal to the public offering price per share.

11

Table of Contents

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Pro Forma |  |  | Successor |  |  | Predecessor |

| |  |  | Year Ended

December 31, |  |  | Year Ended

December 31, |  |  | Year Ended

December 31, |

| (Dollars and shares in thousands, except per share data) |  |  | 2007 |  |  | 2007 |  |  | 2006(1) |  |  | 2005 |

| |  |  | (unaudited) |  |  | |  |  | |  |  | |

| Results of operations data: |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Revenue |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Production |  |  |  | $ | |  |  |  |  | $ | 133,149 |  |  |  |  | $ | 108,035 |  |  |  |  | $ | 158,034 |  |

| Library |  |  |  |  | |  |  |  |  |  | 98,862 |  |  |  |  |  | 83,732 |  |  |  |  |  | 91,970 |  |

| Total revenue |  |  |  |  | |  |  |  |  |  | 232,011 |  |  |  |  |  | 191,767 |  |  |  |  |  | 250,004 |  |

| Gross profit (loss)(2) |  |  |  |  | |  |  |  |  |  | 94,937 |  |  |  |  |  | 73,637 |  |  |  |  |  | (199,153 | ) |

| Gross profit percentage |  |  |  |  |  | % |  |  |  |  | 41 | % |  |  |  |  | 38 | % |  |  |  |  | N/M |  |

| Income (loss) from operations |  |  |  |  | |  |  |  |  |  | 47,326 |  |  |  |  |  | 28,616 |  |  |  |  |  | (367,592 | ) |

| Non-controlling interest in income (loss) of consolidated entity |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Net loss(3) |  |  |  |  | |  |  |  |  |  | (22,597 | ) |  |  |  |  | (9,241 | ) |  |  |  |  | (389,090 | ) |

| Pro forma net income (loss) per share: |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Basic |  |  |  | $ |  |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Diluted |  |  |  | $ |  |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Pro forma shares used to compute net income (loss) per share: |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Basic |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Diluted |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Other financial data: |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Net cash provided by (used in): |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Operating activities |  |  |  | $ |  |  |  |  |  | $ | (88,778 | ) |  |  |  | $ | (99,518 | ) |  |  |  | $ | 13,742 |  |

| Investing activities |  |  | |  |  |  |  | (132 | ) |  |  |  |  | (579,865 | ) |  |  |  |  | (206 | ) |

| Financing activities |  |  | |  |  |  |  | 86,566 |  |  |  |  |  | 683,134 |  |  |  |  |  | 58,800 |  |

| Purchase of property and equipment |  |  | |  |  |  |  | (132 | ) |  |  |  |  | (223 | ) |  |  |  |  | (206 | ) |

| Adjusted EBITDA (unaudited)(4) |  |  | |  |  |  |  | 33,009 |  |  |  |  |  | (68,082 | ) |  |  |  |  | (13,520 | ) |

12

Table of ContentsThe following unaudited table reconciles net loss to Adjusted EBITDA for the periods presented:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Pro Forma |  |  | Successor |  |  | Predecessor |

| |  |  | Year Ended

December 31, |  |  | Year Ended

December 31, |  |  | Year Ended

December 31, |

| (Dollars in thousands) |  |  | 2007 |  |  | 2007 |  |  | 2006(1) |  |  | 2005 |

| |  |  | (unaudited) |  |  | |  |  | |  |  | |

| Net loss(3) |  |  |  | $ |  |  |  |  |  | $ | (22,597 | ) |  |  |  | $ | (9,241 | ) |  |  |  | $ | (389,090 | ) |

| Interest expense, net |  |  |  |  | |  |  |  |  |  | 51,487 |  |  |  |  |  | 32,610 |  |  |  |  |  | 22,566 |  |

Income tax (benefit)

expense |  |  |  |  | |  |  |  |  |  | 1,424 |  |  |  |  |  | 6,341 |  |  |  |  |  | — |  |

| Depreciation of fixed assets |  |  |  |  | |  |  |  |  |  | 204 |  |  |  |  |  | 172 |  |  |  |  |  | 189 |  |

| Amortization of film production costs, including impairment charge |  |  |  |  | |  |  |  |  |  | 122,493 |  |  |  |  |  | 113,186 |  |  |  |  |  | 442,747 |  |

| Goodwill impairment charge |  |  |  |  | |  |  |  |  |  | — |  |  |  |  |  | — |  |  |  |  |  | 141,365 |  |

| Amortization of intangible assets |  |  |  |  | |  |  |  |  |  | 1,327 |  |  |  |  |  | 1,473 |  |  |  |  |  | — |  |

| Capitalized film production costs, net of changes in accrued film production costs |  |  |  |  | |  |  |  |  |  | (146,173 | ) |  |  |  |  | (212,623 | ) |  |  |  |  | (231,297 | ) |

| Loss on extinguishment of debt |  |  |  |  | |  |  |  |  |  | 17,297 |  |  |  |  |  | — |  |  |  |  |  | — |  |

| Financing-related expenses |  |  |  |  | |  |  |  |  |  | 7,547 |  |  |  |  |  | — |  |  |  |  |  | — |  |

| Adjusted EBITDA(4) |  |  |  | $ | |  |  |  |  | $ | 33,009 |  |  |  |  | $ | (68,082 | ) |  |  |  | $ | (13,520 | ) |

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Pro Forma |  |  | Successor |  |  | Predecessor |

| |  |  | As of

December 31, |  |  | As of

December 31, |  |  | As of

December 31, |

| (Dollars in thousands) |  |  | 2007 |  |  | 2007 |  |  | 2006 |  |  | 2005 |

| |  |  | (unaudited) |  |  | |  |  | |  |  | |

| Consolidated balance sheet data (end of period): |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Cash |  |  |  | $ | |  |  |  |  | $ | 1,407 |  |  |  |  | $ | 3,751 |  |  |  |  | $ | 73,401 |  |

| Film production costs, net |  |  | |  |  |  |  | 754,337 |  |  |  |  |  | 702,578 |  |  |  |  |  | 458,036 |  |

| Total assets |  |  | |  |  |  |  | 953,395 |  |  |  |  |  | 859,655 |  |  |  |  |  | 786,656 |  |

| Debt |  |  | |  |  |  |  | 655,951 |  |  |  |  |  | 565,000 |  |  |  |  |  | — |  |

| Notes and amounts payable to affiliates, net |  |  | |  |  |  |  | — |  |  |  |  |  | — |  |  |  |  |  | 641,938 |  |

| Non-controlling interest in consolidated entity |  |  | |  |  |  |  | — |  |  |  |  |  | — |  |  |  |  |  | — |  |

| Member’s equity (deficit) |  |  | |  |  |  |  | 100,413 |  |  |  |  |  | 132,858 |  |  |  |  |  | (85,642 | ) |

13

Table of Contents

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| (Dollars in thousands) |  |  | 2007 |  |  | 2006 |  |  | 2005 |  |  | 2004 |  |  | 2003 |

| Other Operating Data (unaudited): |  |  | |  |  | |  |  | |  |  | |  |  | |

| Number of films delivered during the year ended December 31, |  |  |  |  | 43 |  |  |  |  |  | 32 |  |  |  |  |  | 44 |  |  |  |  |  | 48 |  |  |  |  |  | 50 |  |

| Average cost per film for the year ended December 31,(5) |  |  |  | $ | 3,293 |  |  |  |  | $ | 3,440 |  |  |  |  | $ | 4,460 |  |  |  |  | $ | 6,705 |  |  |  |  | $ | 6,670 |  |

| Number of titles in our library as of December 31, |  |  |  |  | 1,055 |  |  |  |  |  | 1,012 |  |  |  |  |  | 421 |  |  |  |  |  | 377 |  |  |  |  |  | 331 |  |

| Number of hours of programming in our library as of December 31, |  |  |  |  | 3,864 |  |  |  |  |  | 3,746 |  |  |  |  |  | 1,297 |  |  |  |  |  | 1,162 |  |  |  |  |  | 1,035 |  |

| (1) | The operating results for the year ended December 31, 2006 reflect the period from January 12, 2006 (inception) through December 31, 2006. The Predecessor Company’s operating results for the period January 1, 2006 to January 11, 2006 are excluded. From January 1, 2006 to January 11, 2006, the Predecessor Company generated $1.2 million of revenue, a $(2.5) million loss from operations and a $(3.2) million net loss. |

| (2) | Gross profit (loss) for the year ended December 31, 2005 includes an impairment charge to film production costs of $295.2 million. In 2005, in connection with the pending sale of the company, a review of recoverability of assets was performed. As a result of this review, a $295.2 million charge was taken for impairment of film production costs. This non-cash impairment charge was recorded to reflect the net realizable value of the film library based on the negotiated purchase price for the company. There was no charge for impairment in 2006. |

| (3) | Net loss for the year ended December 31, 2005 includes impairment charges of $295.2 million to film production costs and $141.4 million to goodwill. In connection with the pending sale of the company in early 2006, a $141.4 million non-cash goodwill impairment charge was recorded in 2005 to reflect the fair value of goodwill based on the negotiated purchase price for the company. |

| (4) | Adjusted EBITDA represents net loss before interest expense, net, income tax (benefit) expense, depreciation of fixed assets, amortization of film production costs (including impairment charge), goodwill impairment charge, amortization of intangible assets and any loss on extinguishment of debt and financing-related expenses, reduced by our capitalized film production costs net of changes in accrued film production costs during the applicable period. We deduct our capitalized film production costs net of changes in accrued film production costs because we consider our film production spending to be a material aspect of our ongoing operating performance. We add back any loss on extinguishment of debt and financing-related expenses because we do not consider it to be a material aspect of our ongoing operating perfor mance. Financing-related expenses for the year ended December 31, 2007 consist of $3.7 million of professional fees incurred for the consideration of financing structures and $3.9 million of legal and accounting fees incurred in connection with a prior postponement of our initial public offering. We present Adjusted EBITDA because we consider it an important supplemental measure of our performance and believe a comparable measure is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry, many of which present Adjusted EBITDA or a comparable measure when reporting their results. We also use Adjusted EBITDA for the following purposes: our management uses Adjusted EBITDA to assess our operating performance; our compensation committee judges the performance of our executives and calculates their compensation, at least in part, based on our Adjusted EBITDA performance; and Adjusted EBITDA is also widely used by us and others in our indust ry to evaluate and price potential acquisition candidates. |

| | Adjusted EBITDA is a measure of our performance that is not required by, or presented in accordance with, GAAP. Adjusted EBITDA has limitations as an analytical tool, is not a measurement of our financial performance under GAAP and should not be considered as an |

14

Table of Contents | alternative to net income, operating income or any other performance measures derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our liquidity. |

You are encouraged to evaluate such adjustments and the reasons we consider them appropriate for supplemental analysis. As an analytical tool, Adjusted EBITDA is subject to, among others, the following limitations:

| • | Adjusted EBITDA does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments; |

| • | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| • | Adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debts; |

| • | although depreciation and certain amortization expenses are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future; and |

| • | other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting their usefulness as comparative measures. |

Because of these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally. See the Statements of Cash Flows included in our consolidated financial statements.

| (5) | Consists of film production costs (including negative cost, net of any incentives or subsidies, and excluding residuals, participations and capitalized overhead and interest) for the fiscal year indicated divided by the number of films delivered in such fiscal year. |

15

Table of ContentsRisk factors

You should carefully consider the risks described below and all other information contained in this prospectus before making an investment decision. If any of the following risks, as well as other risks and uncertainties that are not yet identified or that we currently think are immaterial, actually occur, our business, financial condition and results of operations could be materially and adversely affected. In that event, the trading price of our shares could decline, and you may lose part or all of your investment.

Risks related to our business

We have incurred net losses in the past and may continue to experience net losses in the future, which may reduce our ability to raise needed capital.

We have incurred net losses in the past largely due to amortization of film production costs, inclusive of impairment charges, and interest expense on our outstanding indebtedness. During the year ended December 31, 2007, a loss on extinguishment of debt was recorded with respect to the refinancing of our credit facilities. During the year ended December 31, 2005, non-cash impairment charges with respect to film production costs and goodwill were recorded to reflect the net realizable value of the company’s assets based on the negotiated purchase price of the company. We intend to repay a portion of our outstanding indebtedness upon the completion of this offering. Should we continue to incur losses in the future, our ability to raise needed financing, or to do so on favorable terms, may be limited.

We principally operate in one business: the development, production and distribution of long-form television content; our lack of a diversified business could adversely affect us.

We derive substantially all of our revenue from the development, production and distribution of MFT movies, mini-series and other television programming. Since we depend on demand for long-form television content, our financial condition would suffer significantly if audience demand for our product declines in the future. This demand is driven by the interests of the viewers and the financial strength of the various networks. Unlike our major competitors, which are divisions of major media companies which generate revenue from a variety of other operations, we depend primarily on the success of our MFT movies and mini-series. In recent years, the major U.S. broadcast networks migrated away from airing long-form television programs in favor of reality programming. If a new type of content becomes popular in the television entertainment industry, or the networks perceive changes in audience demand for our content, the ability to license our MFT movies, mini-series and other television programming either domestically or internationally may be negatively impacted and we may suffer significant financial losses.

Delays and changed delivery dates can have a material impact on the timing of our revenue recognition and receipt of cash, which may affect our financial results and ultimately decrease the value of our stock price.

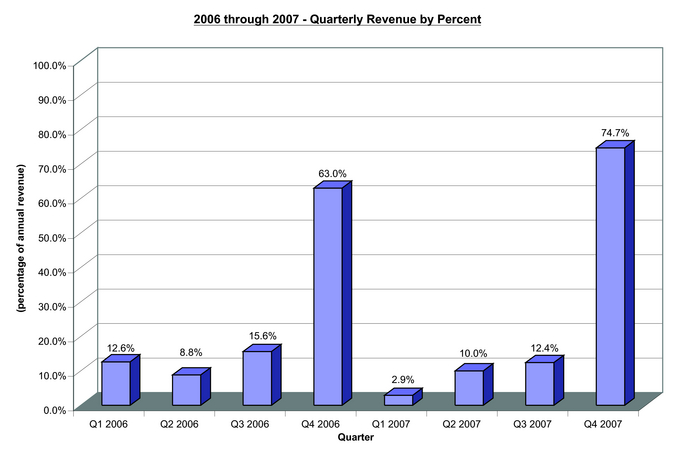

In accordance with GAAP, we do not recognize revenue from the distribution and licensing of our productions until several criteria are met, including such productions being made available for exhibition by a third party distributor or licensee. Historically, a majority of our annual productions have been completed and made available to our licensees during the third and fourth quarter of our fiscal year. Typically, our MFT movies, mini-series and other television programming are ordered in the beginning of our fiscal year, and produced during the spring and summer, with distribution beginning in the fall. To the extent that we have any production delays due to weather, equipment malfunctions, creative differences or labor strikes, the timing can shift from one quarter to the next, which will cause us to recognize that revenue in the next quarter or fiscal year and have a material impact on our results of operations. If we decide to give guidance on our financial condition or results of operation, we may not achieve those projections due to a variety of factors including those discussed in this prospectus. Furthermore,

16

Table of Contentsdue to unpredictable factors that may occur during production, we believe that quarterly comparisons of our financial results should not be relied upon as an indication of our future performance.

Our success depends on our ability to develop, produce and distribute quality MFT movies and mini-series that achieve acceptance from our target audiences.

An uncertainty always exists with the production of television content whose success is subject to viewer tastes and preferences that can change in unpredictable ways. Generally, the popularity of our programs depends on many factors, including the critical acclaim they receive, the genre, the specific subject matter, the actors and other key talent and the format of their initial release. Recently, to respond to market demand, we have begun to develop and produce film content outside of our traditional genres, including a number of action/thriller MFT movies targeted at a younger 18-34 year old demographic. We cannot assure you that these action/thriller movies will achieve high ratings. In addition, to respond to future market demand, we may need to produce genres that we lack experience in delivering. We cannot be certain that we will produce MFT movies or mini-series in new genres that will achieve high ratings.

The delivery of a MFT movie or mini-series that does not achieve high ratings can adversely affect our financial condition and results of operations in three ways. First, we rely heavily on our ability to license our original productions several times, but the receipt of low ratings for a particular MFT movie or mini-series will hinder our ability to re-license that program to another customer in the future. Second, the initial customer may decide against licensing the rights to any of our future MFT movies or mini-series due to the lack of profitability from the prior production. Third, one or more MFT movies or mini-series that do not achieve high ratings may cause a negative impact to our reputation and could also cause our significant customers to look to one of our competitors to fulfill their long-form television programming needs.

We have a significant concentration of our revenue from a limited number of licensees.

In 2007, approximately 74% of our revenue was earned from our top ten customers, with approximately 17% of that revenue generated from the Hallmark Channel. We have decreased our dependence on the Hallmark Channel over the last year by reducing the number of original productions we license to it. As a percentage of our total original MFT movies and mini-series productions licensed to broadcast and cable networks, the Hallmark Channel comprised approximately 73% in 2005, 69% in 2006 and 28% in 2007. We expect the Hallmark Channel to comprise less than 10% of our total original MFT movies and mini-series licensed to broadcast and cable networks in 2008. Furthermore, our agreement to produce original programming for the Hallmark Channel, which we have relied upon in the past, expired at the end of 2007 and we and the Hallmark Channel have not entered into a renewal agreement. A disruption to, or termination of, our relationship with any of our significant licensees could cause our company to suffer significant financial losses. Additionally, as of December 31, 2007, approximately $74.4 million, or 65%, of the company’s accounts receivable was due from these ten customers. Because the licensing of our content for network and cable television is highly concentrated, an adverse change in our relationship with any of our significant customers could have a material adverse impact on our financial condition.

We often rely on third party production companies to produce our MFT movies and mini-series.

We hire independent contractors and engage third party production companies to produce our MFT movies, mini-series and other television programming. The success of our programming will depend to a degree on our ability and the ability of these third parties to avoid production problems and delays and to hire, retain and motivate top creative talent. Making films is an activity that requires the services of individuals, such as actors, directors and producers, each of whom have unique creative talents. Individuals with those talents may be more difficult to identify, hire and retain than are individuals with general business management skills. We have

17

Table of Contentsto rely, in large part, on these independent contractors and production companies to hire and retain creative talent to assist us in making our films. If they experience difficulty in hiring, retaining or motivating creative talent, the production of our films could be delayed or the success of our films could be adversely affected.

Once we license our programming to a third party, we rely on that party to promote, market and advertise our programming to its customer base in order to sustain high television ratings. If our licensed distributors fail to effectively promote our programs, the ratings of our programming will suffer and we may have a difficult time re-licensing such programming, which may have a material adverse effect on our financial condition and future results of operations.

We have licensed to broadcast and cable networks the right to air our long-form television content. We also license our content to other parties in order to take advantage of emerging distribution platforms, such as direct-to-video, VOD and PPV. Licensed distributors’ decisions regarding the timing of release and promotional support of our television content are important in determining the success of our MFT movies, mini-series and other television programming. We do not control the timing and manner in which our customers distribute our productions. Because we rely on those with initial rights in our content to create a high-level of interest in our programming, any decision by them not to distribute or promote one of our productions or, instead, to promote our competitors’ television programs or related products more than they promote ours could have a material adverse effect on our business and financial condition. In addition, upon the completio n of a license term, we have the ability to re-license the same programming to another party. If during the initial license term, our programming does not enjoy high ratings, our ability to re-license these programs in the future will become difficult and our reputation and opportunity to license new programming may be adversely affected.

We place significant reliance on a single production company to produce most of our content.

We utilize independent contractors and engage third party production companies to produce or assist in the production of our films. We have a team of creative personnel who read scripts and evaluate talent, but the filming, editing and final production of our films is primarily performed by third party producers and independent contractors. In 2007, Larry Levinson Productions and affiliated companies, or Levinson Productions, produced more than 50% of our MFT movies and mini-series. We expect Levinson Productions to produce 20% to 30% of our new content in 2008. If Levinson Productions no longer produces or assists in the production of our MFT movies and mini-series, we would have to expend significant time, money and resources to find another company to produce our content and we may not be able to meet our creative needs and timely completion of our content with a new production company.

Our business involves risks of liability claims for entertainment content, which could adversely affect our business, results of operations and financial condition.

As an owner and distributor of entertainment content, we may face potential liability for:

|  |  |

| • | right of publicity or misappropriation; |

|  |  |

| • | actions for royalties and accountings; |

|  |  |

| • | copyright or trademark infringement (as discussed below); and |

|  |  |

| • | other claims based on the nature and content of the materials distributed. |

These types of claims have been brought, sometimes successfully, against broadcasters, producers and distributors of entertainment content. Any imposition of liability that is not covered by

18

Table of Contentsinsurance or is in excess of insurance coverage could have a material adverse effect on our business, results of operations and financial condition.

Our success depends on certain key employees.

Our success greatly depends on our employees. In particular, we are dependent upon the services of our President and Chief Executive Officer, Robert Halmi, Jr., select members of our senior management and certain creative employees such as directors and producers. We have entered into employment agreements with Mr. Halmi, Jr. and with all of our top executive officers and production executives. However, although it is standard in the television industry to rely on employment agreements as a method of retaining the services of key employees, these agreements cannot assure us of the continued services of such employees. Although we carry key employee insurance for Mr. Halmi, Jr., the proceeds from an insurance payout would not compensate for the loss of our President and Chief Executive Officer’s creativity and knowledge of the long-form television business. The loss of Mr. Halmi, Jr.’s services or a substantial group of key employe es could have a material adverse effect on our business and results of operations.

We must continue to augment our film library with new titles on an annual basis in order to maintain contracted cash flows generated by our film library.

Although we own rights in more than 1,000 titles, or over 3,500 broadcast hours, of long-form television programming, we must continue to add to the already existing titles in our film library. As audience tastes and demands change over time, some of our older content loses a portion of its licensing value. To meet market demand, we must continue to deliver new content that will achieve high ratings and increased viewership. If we do not augment our film library with new content that will meet market and audience demand, our film library cash flow will decrease and negatively impact our profits.

In addition, the size of our film library may decrease over time due to the expiration of our distribution rights to certain titles in our film library. Although we own the distribution rights in perpetuity for the majority of titles in our library, our rights to approximately 38% of the titles in our film library will ultimately expire. By December 31, 2012, our intellectual property rights in 86 of our films, or approximately 8% of our existing titles, will terminate. Therefore, we must continue to develop, produce and distribute new content in an effort to replenish the titles available for distribution and to sustain our business model.

We may not be able to sustain our proven production model of generating contractual sales and collecting a significant portion of our production costs in advance of the delivery of our content to an initial licensee.

Historically, our production model has enabled us to contract for and collect license fees recouping the majority of our production costs for our MFT movies and mini-series before delivery of our content to an initial licensee. Although we intend to adhere to our practice of commencing production when we have contracted license fees for a significant portion of our production costs, we cannot assure you that this will always be the case. We may begin production for a MFT or mini-series without an initial licensee’s firm order, or we may rely on an alternative means of revenue to recoup our production costs. Most recently, we entered into an agreement with ION under which our licensing revenue is derived from the sale of associated advertising time made available during the airing of our programming. We may determine that there are other ways of licensing our content, or our customers may change the way they license productions and such alternative met hods may not include an upfront license fee that recoups a majority of our production costs before we deliver the content.

We face risks relating to the international distribution of our films and related products.

Because we have historically derived approximately one-half of our revenue (59%, 54% and 40% in 2007, 2006 and 2005, respectively) from the exploitation of our films in territories outside of the United States, our business is subject to risks inherent in international trade, many of which are beyond our control. These risks include:

19

Table of Contents |  |  |

| • | laws and policies affecting trade, investment and taxes, including laws and policies relating to the repatriation of funds and withholding taxes and changes in these laws; |

|  |  |

| • | differing cultural tastes and attitudes, including various censorship laws; |

|  |  |

| • | differing degrees of protection for intellectual property; |

|  |  |

| • | financial instability and increased market concentration of buyers in foreign television markets; |

|  |  |

| • | the instability of foreign economies and governments; |

|  |  |

| • | fluctuating foreign exchange rates; and |

|  |  |

| • | war and acts of terrorism. |

The advancement of video technologies may cause advertisers to shift their expenditures to media in which their commercial messages are not circumvented by technology, leading to a reduction in television advertising and a reduction in demand for our programming.

The entertainment industry in general and the television industry in particular continue to undergo significant technological developments. Advances in technologies or alternative methods of product delivery or storage or certain changes in consumer behavior driven by these or other technologies and methods of delivery and storage could have a negative effect on our business. In particular, broadcast and cable networks place significant reliance on the revenue stream generated from commercial advertising. Since the introduction of video technology such as Digital Video Recording, or DVR, television audiences now have the ability to circumvent commercials while they view television programming, which could negatively impact advertising demand for the advertisers for our content, and could therefore adversely affect our revenue. Similarly, further increases in the use of portable devices that allow users to view content of their own choosing while avoiding traditi onal commercial advertisements could adversely affect our revenue. If we cannot successfully exploit these and other emerging technologies, it could have a material adverse effect on our business, results of operations and financial condition.

This technology has impacted the Nielsen ratings, which advertisers utilize to determine the rates for advertising time which they purchase from the television networks. Lower Nielsen ratings may result in a decrease in the amount of advertising revenue received by the networks and the networks may not have sufficient cash flow to license our programming at current rates.

Our agreement with ION Media Networks poses additional risks to our business, including our direct reliance on advertising revenue instead of our traditional revenue generated from licensing fees.

Traditionally, our revenue has come from the licensing of our original MFT movies, mini-series and other television programming, as well as licensing content from our film library. On June 29, 2007, we began providing programming for ION’s weekend primetime schedule in exchange for the right to receive the revenue from the sale of all but two minutes of advertising inventory per broadcast hour during which our programming airs. We will share equally in the revenue generated from our advertising sales with ION after we pay certain guarantee payments to ION, and after we recoup certain costs and expenses, including such guarantee payments. We rely on ION’s advertising sales staff to sell the advertising space directly to advertisers on our behalf. Further, DVR technology may cause advertisers to decrease their spending for broadcast and cable television advertising. Our agreement provides that we must pay ION a minimum guarantee for the adver tising inventory regardless of the amount of advertising revenue actually generated during the year. If advertising spending decreases, or ION’s advertising sales force is unable to sell advertising space for us, the advertising revenue we expect to earn from providing content to ION may be reduced and the value of our film library could be negatively impacted. Consequently, we could potentially fail to recoup our costs related to the ION contract, which would have a material adverse effect on our total cash flow. See ‘‘Business — Company strategy — Target new distribution platforms.’’

20

Table of ContentsWe could be adversely affected by strikes and other union activity.

We do not have any unionized employees within our company, but we do rely on members of the Screen Actors Guild, the Writers Guild of America, the Directors Guild of America and other guilds in connection with most of our productions. We are currently subject to collective bargaining agreements with these unions and, therefore, must comply with all provisions of those agreements in order to hire actors, directors or writers who are members of these guilds. Provisions in each labor contract with each of the Guilds obligate us to pay residuals to their members based on various criteria including the airing of films or cash collections. If we fail to pay such residuals to those entitled to receive them, any of the unions that represent our actors, writers and directors may have the right to foreclose on the film giving rise to such residual in order to compensate its union members accordingly. Additionally, we may be adversely impacted by work stoppages or strikes. For example, the four-month long strike by the Writers Guild, which ended February 2008, diminished the pool of writers available to us during such work stoppage. The collective bargaining agreement with the Screen Actors Guild expires in June 2008, and a halt or delay in negotiating a new industry-wide union contract, depending on the length of time involved, could lead to a strike by union members and cause delays in the development, production and completion of our films and thereby could adversely affect the revenue that our films generate. Any new collective bargaining agreements may increase our expenses in the future.

Business interruptions and disasters could adversely affect our operations.

Our operations are vulnerable to outages and interruptions due to fire, flood, power loss, telecommunications failures and similar events beyond our control. In addition, we have a film vault located in California and a backup storage facility located in New Jersey. Our California film vault has, in the past, and may, in the future, be subject to earthquakes as well as electrical blackouts as a consequence of a shortage of available electrical power. Although we have developed certain plans to respond in the event of a disaster, there can be no assurance that such plans will be effective in the event of a specific disaster. In addition, we have business interruption insurance as well as property damage insurance to cover losses that stem from an event that could disrupt our business. However, films are unique in nature and cannot be easily reproduced. If our storage facilities were to suffer damage or destruction such that our films were no longer able to be lic ensed to third parties, our opportunity to generate revenue by re-licensing our content would be limited and would potentially impact our earnings and financial condition.

We may incur significant expenses in order to protect and defend against intellectual property claims, including claims where others may assert intellectual property infringement claims against us.