The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the attached prospectus are not an offer to sell nor do they seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

Filed Pursuant to Rule 424(B)(2)

Registration No. 333-156978

Subject to Completion, dated June 8, 2009

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus dated March 24, 2009)

11,000,000 Common Units

Representing Limited Partner Interests

We are selling 11,000,000 common units representing limited partner interests in El Paso Pipeline Partners, L.P. Our common units are traded on the New York Stock Exchange under the symbol “EPB.” On June 5, 2009, the last reported sale price of our common units on the New York Stock Exchange was $18.85 per common unit.

As a result of certain FERC rate-making policies, we require an owner of our common units to be an Eligible Holder. Eligible Holders are individuals or entities subject to United States federal income taxation on our income or entities not subject to such taxation as long as all of the entity’s owners are subject to such taxation.

Investing in our common units involves risks. Please read “Risk Factors” beginning onpage S-14 of this prospectus supplement and beginning on page 3 of the accompanying base prospectus.

PRICE$ PER COMMON UNIT

| | | | | | | | | | | | | |

| | | | | | Underwriting

| | | Proceeds to

| |

| | | Price to

| | | Discounts and

| | | El Paso Pipeline

| |

| | | Public | | | Commissions | | | Partners, L.P. | |

| |

| Per Common Unit | | $ | | | | $ | | | | $ | | |

| Total | | $ | | | | $ | | | | $ | | |

We have granted the underwriters a30-day option to purchase up to an additional 1,650,000 common units on the same terms and conditions set forth above if the underwriters sell more than 11,000,000 common units in this offering.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common units on or about June , 2009.

Joint Book-Running Managers

Co-Managers

| | |

| Credit Suisse | Goldman, Sachs & Co. | Raymond James |

June , 2009

TABLE OF CONTENTS

| | | | | |

Prospectus Supplement |

| | | S-1 | |

| | | S-14 | |

| | | S-15 | |

| | | S-16 | |

| | | S-17 | |

| | | S-18 | |

| | | S-19 | |

| | | S-21 | |

| | | S-21 | |

| | | S-21 | |

| | | S-22 | |

Prospectus |

| About This Prospectus | | | 1 | |

| Cautionary Note Regarding Forward-Looking Statements | | | 1 | |

| About El Paso Pipeline Partners, L.P. | | | 2 | |

| Risk Factors | | | 3 | |

| Use of Proceeds | | | 22 | |

| Ratio of Earnings to Fixed Charges | | | 22 | |

| Description of Debt Securities | | | 23 | |

| Description of Guarantees of Debt Securities | | | 33 | |

| Description of the Common Units | | | 34 | |

| Provisions of Our Partnership Agreement Relating to Cash Distributions | | | 36 | |

| Material Provisions of Our Partnership Agreement | | | 49 | |

| Conflicts of Interest and Fiduciary Duties | | | 62 | |

| Material Tax Considerations | | | 70 | |

| Plan of Distribution | | | 84 | |

| Legal Matters | | | 85 | |

| Experts | | | 85 | |

| Where You Can Find More Information | | | 86 | |

| Incorporation by Reference | | | 86 | |

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common units. The second part is the accompanying base prospectus, which gives more general information, some of which may not apply to this offering of common units. Generally, when we refer only to the “prospectus,” we are referring to both parts combined. If the information about the common unit offering varies between this prospectus supplement and the accompanying base prospectus, you should rely on the information in this prospectus supplement.

Any statement made in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Please read “Incorporation by Reference” onpage S-21 of this prospectus supplement.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement, the accompanying base prospectus and any free writing prospectus prepared by or on behalf of us relating to this offering of common units. Neither we nor the underwriters have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We are offering to sell the common units, and seeking offers to buy the common units, only in jurisdictions where offers and sales are permitted. You should not assume that the information contained in this prospectus supplement, the accompanying base prospectus or any free writing prospectus is accurate as of any date other than the dates shown in these documents or that any information we have incorporated by reference herein is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since such dates.

SUMMARY

This summary highlights information contained elsewhere in this prospectus supplement and the accompanying base prospectus. It does not contain all of the information that you should consider before making an investment decision. You should carefully read this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference for a more complete understanding of our business and the terms of our common units, as well as the tax and other considerations that are important to you in making your investment decision. You should pay special attention to the “Risk Factors” section beginning onpage S-14 of this prospectus supplement and in our Annual Report onForm 10-K for the year ended December 31, 2008 to determine whether an investment in our common units is appropriate for you. Unless the context otherwise indicates, the information included in this prospectus supplement assumes that the underwriters do not exercise their option to purchase additional common units.

References in this prospectus supplement to “we,” “our,” “us,” the “partnership” or similar terms refer to El Paso Pipeline Partners, L.P. in its individual capacity or to El Paso Pipeline Partners, L.P. and its operating subsidiaries, collectively, as the context requires. References in this prospectus to “El Paso” constitute references to El Paso Corporation and its affiliates (other than us). References to our “general partner” refer to El Paso Pipeline GP Company, L.L.C.

El Paso Pipeline Partners, L.P.

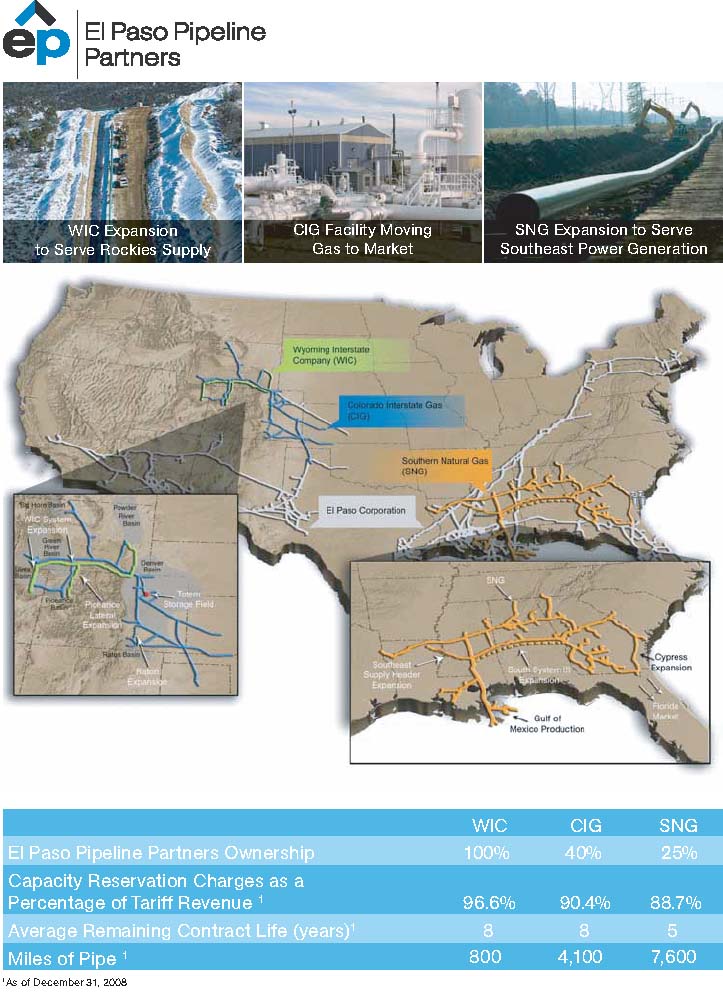

We are a Delaware master limited partnership formed in November 2007 by El Paso Corporation to own and operate natural gas transportation pipelines and storage assets. We conduct our business activities through various natural gas pipeline systems and storage facilities including the Wyoming Interstate Company, Ltd. (WIC) system, a 40 percent general partner interest in Colorado Interstate Gas Company (CIG) and a 25 percent general partner interest in Southern Natural Gas Company (SNG). In November 2007, we completed an initial public offering of our common units, issuing 28.8 million common units to the public. In conjunction with our formation, El Paso contributed to us 100 percent of WIC, as well as 10 percent general partner interests in each of CIG and SNG. In September 2008, we acquired from El Paso an additional 30 percent general partner interest in CIG and an additional 15 percent general partner interest in SNG.

Our Assets

WIC (100 Percent Interest). WIC is comprised of a mainline system that extends from western Wyoming to northeast Colorado (the Cheyenne Hub) and several lateral pipeline systems that extend from various interconnections along the WIC mainline into western Colorado and northeast Wyoming and into eastern Utah. WIC is one of the primary interstate natural gas transportation systems providing takeaway capacity from the mature Overthrust, Piceance, Uinta, Powder River and Green River Basins. CIG is the operator of the WIC system pursuant to a service agreement with WIC.

CIG (40 Percent Interest). CIG is comprised of pipelines that deliver natural gas from production areas in the U.S. Rocky Mountains and the Anadarko Basin directly to customers in Colorado, Wyoming and indirectly to the midwest, southwest, California and Pacific northwest. CIG also has four storage facilities located in Colorado and Kansas with approximately 29 billion cubic feet (Bcf) of underground working natural gas storage capacity and two natural gas processing plants located in Wyoming and Utah. CIG owns a 50 percent ownership interest in WYCO Development LLC (WYCO), a joint venture with an affiliate of Public Service Company of Colorado (PSCo), and effective November 2008, operates WYCO’s High Plains pipeline.

SNG (25 Percent Interest). SNG is comprised of pipelines extending from natural gas supply basins in Texas, Louisiana, Mississippi, Alabama and the Gulf of Mexico to market areas in Louisiana, Mississippi, Alabama, Florida, Georgia, South Carolina and Tennessee, including the metropolitan areas of Atlanta and Birmingham. SNG is the principal natural gas transporter to southeastern markets in Alabama, Georgia and South Carolina. SNG owns interests in two storage facilities along the system with approximately 60 Bcf of underground working natural gas storage capacity. The SNG system is also connected to El Paso’s Elba Island LNG terminal near Savannah, Georgia.

S-1

The table below provides detail on our transmission systems as of December 31, 2008:

| | | | | | | | | | | | | | | | | |

| | | As of December 31, 2008 | |

| | | Ownership

| | | Miles of

| | | Design

| | | Storage

| |

Transmission System | | Interest | | | Pipeline | | | Capacity | | | Capacity | |

| | | (percent) | | | | | | (MMcf/d)(a) | | | (Bcf) | |

| |

| WIC | | | 100 | | | | 800 | | | | 3,105 | | | | — | |

CIG(b) | | | 40 | | | | 4,100 | | | | 3,920 | | | | 29 | |

SNG(b)(c) | | | 25 | | | | 7,600 | | | | 3,700 | | | | 60 | |

| | |

| (a) | | Million cubic feet per day. |

| | |

| (b) | | Volumes reflected are 100 percent of the volumes transported on the CIG system and the SNG system, respectively. |

| (c) | | SNG’s storage capacity includes the storage capacity associated with its 50 percent ownership interest in Bear Creek Storage Company, a joint venture with Tennessee Gas Pipeline Company (TGP), an indirect wholly owned subsidiary of El Paso. |

Throughput. The following table sets forth the average daily throughput of each of WIC, CIG and SNG for the three months ended March 31, 2009 and 2008 and for each of the three calendar years ended December 31, 2008, 2007 and 2006:

| | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

| | | | |

| | | March 31, | | | Year Ended December 31, | |

| | | 2009 | | | 2008 | | | 2008 | | | 2007 | | | 2006 | |

| | | (BBtu/d)(a) | |

| |

WIC(b) | | | 2,705 | | | | 2,418 | | | | 2,543 | | | | 2,071 | | | | 1,914 | |

CIG(c)(d) | | | 2,505 | | | | 2,126 | | | | 2,225 | | | | 2,339 | | | | 2,008 | |

SNG(c) | | | 2,547 | | | | 2,624 | | | | 2,339 | | | | 2,345 | | | | 2,167 | |

| | |

| (a) | | Billion British thermal units per day. |

| | |

| (b) | | Throughput volumes presented are for WIC only and include 174 BBtu/d and 177 BBtu/d transported by WIC on behalf of CIG for the three months ended March 31, 2009 and 2008 and 181 BBtu/d, 239 BBtu/d and 204 BBtu/d transported by WIC on behalf of CIG for the years ended December 31, 2008, 2007 and 2006. |

| | |

| (c) | | Volumes reflected are 100 percent of the volumes transported on the CIG system and the SNG system, respectively. |

| | |

| (d) | | Throughput volumes include billable transportation throughput volumes for storage injection. |

Our Operations. The table below sets forth certain information regarding the assets, contracts and revenues for each of WIC, CIG and SNG, as of and for the year ended December 31, 2008:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | % of

| | | | |

| | | | | | | | | | | | | | | Physical

| | | | |

| | | | | | Tariff Revenue Composition %(a) | | | Design

| | | Weighted

| |

| | | Our

| | | Firm Contracts | | | | | | Capacity

| | | Average

| |

| | | Ownership

| | | Capacity

| | | Variable

| | | | | | Subscribed

| | | Remaining

| |

| | | Interest

| | | Reservation

| | | Usage

| | | Interruptible

| | | Under Firm

| | | Contract Life

| |

| | | (Percent) | | | Charges(b) | | | Charges | | | Contracts | | | Contracts(c) | | | (in Years)(d) | |

| |

| WIC | | | 100 | | | | 96.6 | % | | | 2.9 | % | | | 0.5 | % | | | 100 | % | | | 8 | |

| CIG | | | 40 | | | | 90.4 | % | | | 7.2 | % | | | 2.4 | % | | | 100 | % | | | 8 | |

| SNG | | | 25 | | | | 88.7 | % | | | 7.7 | % | | | 3.6 | % | | | 100 | % | | | 5 | |

| | |

| (a) | | Excludes liquids transportation revenue, amounts associated with retained fuel and, in the case of CIG, liquids revenue associated with CIG’s processing plants. The revenues described in this table constituted approximately 100%, 89% and 89% of WIC’s, CIG’s and SNG’s total revenues, respectively, earned during the year ended December 31, 2008. |

| | |

| (b) | | Approximately 10% and 9% of total capacity reservation revenues for CIG and SNG, respectively, are the result of storage service charges. |

| | |

| (c) | | Contract levels on CIG and WIC include forward haul capacity and back haul capacity. |

| | |

| (d) | | The weighted average remaining contract life is determined by weighting the remaining life of each contract by the amount of capacity that is covered by the contract as of December 31, 2008. |

S-2

Our systems provide a significant portion of our transportation and storage services through firm contracts that obligate our customers to pay a fixed monthly reservation or demand charge. When a customer uses the reserved capacity, our systems also collect usage charges based on the volume of natural gas actually transported or stored, which enables us to recover the system’s variable costs. Any portion of physical capacity under firm contracts that is not utilized may be used for interruptible service. Our systems derive a small portion of their revenues through interruptible contracts (which do not ensure service) with fees based on actual utilization. We believe that the high percentage of earnings derived from capacity reservation charges mitigates the risk of earnings fluctuations caused by changing supply and demand conditions.

Growth Projects. We intend to grow our business through organic expansion opportunities and through strategic asset acquisitions from third parties, El Paso or both. Each of WIC, CIG and SNG have significant contracted expansion projects in progress. These include the Piceance Lateral expansion and WIC System Expansion project at WIC, the Totem Gas Storage project and Raton 2010 expansion at CIG and the Cypress Phase III, South System III, and Southeast Supply Header projects at SNG. In the aggregate, we anticipate our proportionate share of expected capital expenditures for the contracted organic growth projects described above to be approximately $340 million from 2009 through 2013.

In addition to our backlog of contracted organic growth projects, we have other projects that are in various phases of commercial development. Many of the potential projects involve expansion capacity to serve increased natural gas-fired generation loads. For example, along SNG’s system, certain utilities have various projects under development that involve the conversion or replacement of oil-fired and coal-fired power plants to natural gas-fired generation. Along the Front Range of CIG’s system, utilities have various projects under development that involve constructing new natural gas-fired generation to provide backup capacity required when renewable generation is not available during certain daily or seasonal periods. Most of these potential expanded loads are for projects with in-service dates for 2014 and beyond. If we are successful in contracting for these new loads, then the capital requirements of such projects, which could be substantial, would be incremental to our backlog of contracted organic growth projects. Although we pursue the development of these potential projects from time to time, there can be no assurance that we will be successful in negotiating the definitive binding contracts necessary for such projects to be included in our backlog of contracted organic growth projects.

Our Relationship with El Paso Corporation

El Paso is an energy company founded in 1928 in El Paso, Texas that primarily operates in the regulated natural gas transportation sector and the exploration and production sector of the energy industry. El Paso reported 2008 revenues that exceeded $5.3 billion. El Paso reported that its pipeline segment generated approximately $1.3 billion of earnings before interest and taxes in 2008. El Paso’s common stock is traded on the New York Stock Exchange under the symbol “EP”.

El Paso owns our two percent general partner interest, all of our incentive distribution rights, a 72 percent limited partner interest in us, including both common and subordinated units, and the remaining 60 percent general partner interest in CIG and 75 percent general partner interest in SNG not owned by us. We have an omnibus agreement with El Paso and our general partner that governs our relationship with them regarding the provision of specified services to us, as well as certain reimbursement and indemnification matters.

As a substantial owner in us, El Paso is motivated to promote and support the successful execution of our business strategies, including utilizing our partnership as a growth vehicle for its natural gas transportation, storage and other energy infrastructure businesses. On September 30, 2008, we acquired an additional 30 percent general partner interest in CIG and an additional 15 percent general partner interest in SNG from El Paso. Although we expect to have the opportunity to make additional acquisitions directly from El Paso in the future, El Paso is under no obligation to make acquisition opportunities available to us.

Recent Developments

Operating Results. For the quarter ended March 31, 2009, we reported net income of $46.0 million, which represents a 67 percent increase compared with $27.6 million for the same period in 2008 and a 7 percent increase compared with $43.1 million reported for the fourth quarter of 2008. Distributable cash flow for the quarter ended

S-3

March 31, 2009 was $51.2 million, which represents an 84 percent increase compared with $27.8 million for the same period in 2008. For a reconciliation of distributable cash flow to net income, the nearest financial measure prepared in accordance with U.S. generally accepted accounting principles (GAAP), please readpage S-13. The increases in net income and distributable cash flow are due primarily to our higher ownership interests in CIG and SNG following the September 2008 acquisition of an additional 30 percent general partner interest in CIG and an additional 15 percent general partner interest in SNG from El Paso. Due to the seasonal nature of our business, our earnings have historically been higher in the first and fourth quarters than in the second and third quarters, and we expect this to be the case in 2009 as well.

Distribution. On April 21, 2009, the board of directors of El Paso Pipeline GP Company, L.L.C., our general partner, declared a cash distribution for the first quarter of 2009 of $0.3250 per unit ($1.30 annualized) that was paid on May 15, 2009 to common and subordinated unitholders of record as of May 1, 2009. This distribution represented an increase of 1.6 percent over the distribution of $0.3200 per unit for the quarter ended December 31, 2008 and a 13 percent increase over the distribution of $0.2875 per unit paid for the quarter ended March 31, 2008.

Business Strategies

Our primary business objectives are to generate stable cash flows sufficient to make distributions to our unitholders and to grow our business through the construction, development and acquisition of additional energy infrastructure assets. We intend to increase our cash distributions over time by enhancing the value of our transportation and storage assets by:

| | |

| | • | Providing outstanding customer service; |

| |

| | • | Focusing on increasing utilization, efficiency and cost control in our operations; |

| |

| | • | Pursuing economically attractive organic and greenfield expansion opportunities; |

| |

| | • | Pursuing strategic asset acquisitions from third parties and El Paso to grow our business; and |

| |

| | • | Maintaining the integrity and ensuring the safety of our pipeline systems and other assets. |

For a description of the risks associated with our business, which may prevent us from executing these strategies, please read “Risk Factors” beginning onpage S-14.

Our Executive Offices

Our principal executive offices are located at the El Paso Building, 1001 Louisiana Street, Houston, Texas 77002 and our telephone number is(713) 420-2600.

S-4

ORGANIZATIONAL STRUCTURE

The chart below depicts our organization and ownership structure as of the date of this prospectus supplement before giving effect to this offering.

Ownership of El Paso Pipeline Partners, L.P.

| | | | | |

| Public Common Units | | | 25.8 | % |

| El Paso Common Units | | | 48.1 | % |

| El Paso Subordinated Units | | | 24.1 | % |

| General Partner Interest (2,299,526 general partner units) | | | 2.0 | % |

| | | | | |

| Total | | | 100.0 | % |

| | | | | |

S-5

THE OFFERING

| | |

| Common Units Offered by Us | | 11,000,000 common units (12,650,000 common units if the underwriters exercise their option to purchase additional common units in full) |

| |

| Common Units Outstanding Before this Offering | | 84,965,923 |

| |

| Common Units Outstanding After this Offering | | 95,965,923 common units (97,615,923 common units if the underwriters exercise their option to purchase additional common units in full) |

| |

| Use of Proceeds | | We expect to receive net proceeds from this offering of approximately $ million, including our general partner’s proportionate capital contribution, after deducting underwriting discounts and commissions and estimated offering expenses. We will use the net proceeds of this offering, including our general partner’s proportionate capital contribution and any proceeds from the exercise of the underwriters’ option to purchase additional units, for general partnership purposes, including potential future acquisitions and growth capital expenditures. Pending the use of the proceeds for other purposes, we may apply some or all of the net proceeds to reduce outstanding borrowings under our revolving credit facility. Please read “Use of Proceeds.” |

| |

| Cash Distributions | | Our partnership agreement requires us to distribute all of our cash on hand at the end of each quarter, less reserves established by our general partner. We refer to this cash as “available cash,” and we define its meaning in our partnership agreement. Our partnership agreement also requires that we distribute all of our available cash from operating surplus each quarter in the following manner: |

| |

| | • first, 98% to the holders of common units and 2% to our general partner, until each common unit has received a minimum quarterly distribution of $0.28750 plus any arrearages from prior quarters; |

| |

| | • second, 98% to the holders of subordinated units and 2% to our general partner, until each subordinated unit has received a minimum quarterly distribution of $0.28750; and |

| |

| | • third, 98% to all unitholders, pro rata, and 2% to our general partner, until each unit has received a distribution of $0.33063. |

| |

| | If cash distributions to our unitholders exceed $0.33063 per unit in any quarter, our general partner will receive, in addition to distributions on its 2% general partner interest, increasing percentages, up to 48%, of the cash we distribute in excess of that amount. We refer to these distributions as “incentive distributions.” |

| |

| | On April 21, 2009, we announced a quarterly cash distribution for the quarter ended March 31, 2009 of $0.3250 per unit that was paid on May 15, 2009 to common and subordinated unitholders of record as of May 1, 2009. This represents an increase of 1.6 percent over the distribution of $0.3200 per unit for the quarter ended December 31, 2008 and a 13 percent increase over the distribution of $0.2875 per unit paid for the quarter ended March 31, 2008. |

S-6

| | |

| | Please read “Provisions of Our Partnership Agreement Relating to Cash Distributions” in the accompanying base prospectus for more information. |

| |

| Issuance of Additional Common Units | | We can issue an unlimited number of common units without the consent of our unitholders. |

| |

| Voting Rights | | Our general partner manages and operates us. Common unitholders only have limited voting rights on matters affecting our business. Common unitholders have no right to elect our general partner or the directors of its general partner on an annual or other continuing basis. Our general partner may not be removed except by a vote of the holders of at least 662/3 percent of the outstanding units, including any units owned by our general partner and its affiliates, voting together as a single class. Upon consummation of this offering, our general partner and its affiliates will own an aggregate of approximately 67.1 percent of our common and subordinated units. This will give El Paso the ability to prevent our general partner’s involuntary removal. |

| |

| Limited call right | | If at any time our general partner and its affiliates own more than 75 percent of our limited partner interests of any class excluding, until September 30, 2010, common units received by El Paso’s affiliates in connection with El Paso’s contribution to us of additional general partner interests in each of CIG and SNG in September 2008, our general partner will have the right, but not the obligation, which it may assign to any of its affiliates or to us, to acquire all, but not less than all, of the limited partner interests held by unaffiliated persons at a price not less than their then-current market price. As a result, unitholders may be required to sell common units at an undesirable time or price and may not receive any return on investment. Unitholders might also incur a tax liability upon a sale of such units. Our general partner is not obligated to obtain a fairness opinion regarding the value of the common units to be repurchased by it upon exercise of the limited call right. Currently, for purposes of the calculation of the limited call right, our general partner and its affiliates own 65.5 percent of our limited partner interests, excluding the common units received in September 2008. Giving effect to the offering, this ownership percentage will decrease to 58.0 percent. |

| |

| Eligible Holders and Redemption | | Only Eligible Holders will be entitled to receive distributions or be allocated income or loss from us. Eligible Holders are: |

| |

| | • individuals or entities subject to United States federal income taxation on the income generated by us; or |

| |

| | • entities that, while not subject to United States federal taxation on the income generated by us, have owners that are all subject to such taxation. |

| |

| | We have the right, which we may assign to any of our affiliates, but not the obligation, to redeem all of the common and subordinated units of any holder that is not an Eligible Holder or that has failed to certify or has falsely certified that such holder is an Eligible Holder. The purchase price for such redemption would be equal to the lower of the holder’s purchase price and the then-current market price of the |

S-7

| | |

| | units. The redemption price will be paid in cash or by delivery of a promissory note, as determined by our general partner. |

| |

| | Please read “Description of the Common Units — Transfer of Common Units” and “Our Partnership Agreement — Non-Eligible Holders; Redemption” in the accompanying base prospectus. |

| |

| Estimated Ratio of Taxable Income to Distributions | | We estimate that if you own the common units you purchase in this offering through the record date for distributions for the period ending December 31, 2011, you will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be 20 percent or less of the cash distributed to you with respect to that period. Please read “Material Tax Considerations” onpage S-18 of this prospectus supplement for an explanation of the basis for this estimate. |

| |

| Material Tax Considerations | | For a discussion of other material federal income tax consequences that may be relevant to prospective unitholders who are individual citizens or residents of the United States, please read “Material Tax Considerations” in the prospectus. |

| |

| New York Stock Exchange Symbol | | EPB |

| |

| Risk Factors | | You should read “Risk Factors” beginning onpage S-14 of this prospectus supplement and found in the documents incorporated herein by reference, as well as the other cautionary statements throughout this prospectus supplement, to ensure you understand the risks associated with an investment in our common units. |

S-8

SUMMARY HISTORICAL FINANCIAL DATA

The following table presents summary consolidated financial data and should be read together with the financial statements and related notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our Annual Report onForm 10-K(Form 10-K) for the year ended December 31, 2008 and our Quarterly Report onForm 10-Q(Form 10-Q) for the three months ended March 31, 2009, both of which are incorporated by reference into this prospectus supplement. Our summary historical financial data as of December 31, 2008 and 2007 and for the years ended December 31, 2008, 2007 and 2006 are derived from our audited financial statements included in ourForm 10-K, except for the retrospective application of Emerging Issues Task Force (EITF) IssueNo. 07-4,Application of the Two-Class Method under FASB Statement No. 128 to Master Limited Partnerships,onearnings-per-unit as further described below. Our summary historical financial data as of March 31, 2009 and 2008 and for each of the three months ended March 31, 2009 and 2008 are derived from our unaudited financial statements included in ourForm 10-Q. Due to the seasonal nature of our business, information for interim periods may not be indicative of our operating results for the entire year. The historical summary financial information for all periods presented is not necessarily indicative of the results to be expected in future periods.

For periods prior to the closing of our initial public offering on November 21, 2007, the selected financial data only reflects the operating results and financial position of WIC. In conjunction with our formation on November 21, 2007, El Paso contributed to us 10 percent general partner interests in each of CIG and SNG. On September 30, 2008, we acquired an additional 30 percent general partner interest in CIG and an additional 15 percent general partner interest in SNG from El Paso. We have recorded our share of CIG’s and SNG’s operating results as earnings from unconsolidated affiliates from the dates we received interests in these entities. Since our interests in CIG and SNG are not reflected for periods prior to November 2007, the historical results of operations and the period to period comparison of results may not be indicative of future operating results.

| | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

| | | Year Ended

| |

| | | March 31, | | | December 31, | |

| | | 2009 | | | 2008 | | | 2008 | | | 2007 | | | 2006 | |

| | | (in millions, except per unit data) | |

| |

Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

| Total operating revenues | | $ | 39.7 | | | $ | 33.7 | | | $ | 141.1 | | | $ | 110.4 | | | $ | 97.7 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Operation and maintenance | | | 9.6 | | | | 8.2 | | | | 33.6 | | | | 27.8 | | | | 14.3 | |

| Depreciation and amortization | | | 7.0 | | | | 6.2 | | | | 26.1 | | | | 15.7 | | | | 14.2 | |

| Taxes, other than income taxes | | | 1.2 | | | | 1.1 | | | | 4.3 | | | | 3.8 | | | | 2.1 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total operating expenses | | | 17.8 | | | | 15.5 | | | | 64.0 | | | | 47.3 | | | | 30.6 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating income | | | 21.9 | | | | 18.2 | | | | 77.1 | | | | 63.1 | | | | 67.1 | |

| | | | | | | | | | | | | | | | | | | | | |

| Earnings from unconsolidated affiliates | | | 29.0 | | | | 15.1 | | | | 58.8 | | | | 4.7 | | | | — | |

| Other income (expense), net | | | 0.2 | | | | (0.1 | ) | | | 1.5 | | | | 7.4 | | | | 3.6 | |

| Interest and debt expense, net | | | (5.1 | ) | | | (5.6 | ) | | | (22.9 | ) | | | (9.6 | ) | | | (5.5 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 46.0 | | | $ | 27.6 | | | $ | 114.5 | | | $ | 65.6 | | | $ | 65.2 | |

| | | | | | | | | | | | | | | | | | | | | |

Net income per limited partner unit — Basic

and Diluted(a): | | | | | | | | | | | | | | | | | | | | |

| Common units | | $ | 0.40 | | | $ | 0.32 | | | $ | 1.26 | | | $ | 0.11 | | | | | |

| Subordinated units | | | 0.40 | | | | 0.32 | | | | 1.12 | | | | 0.11 | | | | | |

S-9

| | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

| | | Year Ended

| |

| | | March 31, | | | December 31, | |

| | | 2009 | | | 2008 | | | 2008 | | | 2007 | | | 2006 | |

| | | (in millions, except per unit data) | |

| |

Balance Sheet Data (at period end): | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 1,425.0 | | | $ | 937.1 | | | $ | 1,434.6 | | | $ | 902.5 | | | | | |

| Total property, plant and equipment, net | | | 647.4 | | | | 624.8 | | | | 646.3 | | | | 612.2 | | | | | |

| Investments in unconsolidated affiliates | | | 718.5 | | | | 269.9 | | | | 715.9 | | | | 258.5 | | | | | |

| Long-term financing obligations, including capital lease obligation | | | 767.2 | | | | 502.8 | | | | 777.3 | | | | 462.9 | | | | | |

| Total partners’ capital | | | 643.4 | | | | 407.7 | | | | 634.4 | | | | 391.3 | | | | | |

| | |

| (a) | | During the first quarter of 2009, we adopted the provisions of EITF IssueNo. 07-4, Application of the Two-Class Method under FASB Statement No. 128 to Master Limited Partnerships, which changes the manner in which master limited partnerships calculate net income per unit. This standard requires the calculation of net income per unit based on actual distributions made to a master limited partnership’s unitholders, including the holders of incentive distribution rights (IDRs), for the related reporting period as further described in ourForm 10-Q for the three months ended March 31, 2009, incorporated by reference into this prospectus supplement. The adoption of this guidance requires retrospective application to all periods presented; accordingly, net income per limited partner unit presented in the table above reflects the adoption of EITFIssue No. 07-4 in all periods presented. Earnings per basic and diluted unit reported in ourForm 10-K prior to adoption of this standard was $1.22 per common and subordinated unit for the year ended December 31, 2008 and $0.13 per common unit and $0.09 per subordinated unit in 2007 for the period from the date of our IPO through December 31, 2007. |

S-10

RESULTS OF OPERATIONS

Our management uses earnings before interest expense and income taxes (EBIT) as a measure to assess the operating results and effectiveness of our businesses, which consist of consolidated operations as well as investments in unconsolidated affiliates. We believe EBIT is useful to our investors because it allows them to evaluate more effectively our operating performance using the same performance measure analyzed internally by our management. We define EBIT as net income adjusted for (1) items that do not impact our income from continuing operations, (2) interest and debt expense, net, and (3) income taxes. We exclude interest and debt expense from this measure so that investors may evaluate our operating results without regard to our financing methods. EBIT may not be comparable to measurements used by other companies. Additionally, EBIT should be considered in conjunction with net income and other performance measures such as operating income or operating cash flows. Below is a reconciliation of our EBIT to our net income for the three months ended March 31, 2009 and 2008 and for the years ended December 31, 2008, 2007 and 2006.

| | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

| | | Year Ended

| |

| | | March 31, | | | December 31, | |

| | | 2009 | | | 2008 | | | 2008 | | | 2007 | | | 2006 | |

| | | (in millions) | |

| |

| Operating revenues | | $ | 39.7 | | | $ | 33.7 | | | $ | 141.1 | | | $ | 110.4 | | | $ | 97.7 | |

| Operating expenses | | | (17.8 | ) | | | (15.5 | ) | | | (64.0 | ) | | | (47.3 | ) | | | (30.6 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Operating income | | | 21.9 | | | | 18.2 | | | | 77.1 | | | | 63.1 | | | | 67.1 | |

Earnings from unconsolidated affiliates(a) | | | 29.0 | | | | 15.1 | | | | 58.8 | | | | 4.7 | | | | — | |

| Other income (expense), net | | | 0.2 | | | | (0.1 | ) | | | 1.5 | | | | 7.4 | | | | 3.6 | |

| | | | | | | | | | | | | | | | | | | | | |

| EBIT | | | 51.1 | | | | 33.2 | | | | 137.4 | | | | 75.2 | | | | 70.7 | |

| Interest and debt expense, net | | | (5.1 | ) | | | (5.6 | ) | | | (22.9 | ) | | | (9.6 | ) | | | (5.5 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 46.0 | | | $ | 27.6 | | | $ | 114.5 | | | $ | 65.6 | | | $ | 65.2 | |

| | | | | | | | | | | | | | | | | | | | | |

| | |

| (a) | | On November 21, 2007, El Paso contributed the initial 10 percent general partner interests in CIG and SNG in connection with our formation. Effective September 2008, we acquired from El Paso an additional 30 percent general partner interest in CIG and an additional 15 percent general partner interest in SNG. |

Unconsolidated Affiliates

As of March 31, 2009, we owned a 40 percent general partner interest in CIG and a 25 percent general partner interest in SNG. In conjunction with our formation on November 21, 2007, El Paso contributed the initial 10 percent general partner interests in CIG and SNG. Effective September 2008, we acquired from El Paso an additional 30 percent general partner interest in CIG and an additional 15 percent general partner interest in SNG. We accounted for the acquisition of our additional interests prospectively beginning on the dates we received interests in these entities. Our equity in earnings for CIG and SNG for the quarterly periods ended March 31, 2009 and 2008 and the years ended December 31, 2008 and 2007, was as follows:

| | | | | | | | | | | | | | | | | |

| | | Earnings from

| |

| | | Unconsolidated Affiliates | |

| | | Three Months Ended

| | | | |

| | | March 31, | | | Year Ended December 31, | |

| | | 2009 | | | 2008 | | | 2008 | | | 2007 | |

| |

| CIG | | $ | 16.5 | | | $ | 5.7 | | | $ | 29.0 | | | $ | 2.1 | |

| SNG | | | 12.5 | | | | 9.4 | | | | 29.8 | | | | 2.6 | |

| | | | | | | | | | | | | | | | | |

| Total | | $ | 29.0 | | | $ | 15.1 | | | $ | 58.8 | | | $ | 4.7 | |

| | | | | | | | | | | | | | | | | |

S-11

The information presented below reflects 100 percent of the results of CIG and SNG.

| | | | | | | | | | | | | |

| | | Three Months Ended

| | | Year Ended

| |

| | | March 31, | | | December 31, | |

| | | 2009 | | | 2008 | | | 2008 | |

| | | (in millions) | |

| |

CIG | | | | | | | | | | | | |

| Operating revenues | | $ | 97 | | | $ | 90 | | | $ | 323 | |

| Operating expenses | | | (46 | ) | | | (40 | ) | | | (170 | ) |

| | | | | | | | | | | | | |

| Operating income | | | 51 | | | | 50 | | | | 153 | |

| Other income, net | | | 2 | | | | 1 | | | | 11 | |

| | | | | | | | | | | | | |

| EBIT | | | 53 | | | | 51 | | | | 164 | |

| Interest and debt expense | | | (12 | ) | | | (10 | ) | | | (38 | ) |

| Affiliated interest income, net | | | — | | | | 9 | | | | 23 | |

| | | | | | | | | | | | | |

| Income from continuing operations | | | 41 | | | | 50 | | | | 149 | |

| | | | | | | | | | | | | |

| Net income | | $ | 41 | | | $ | 50 | | | $ | 149 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Three Months Ended

| | | Year Ended

| |

| | | March 31, | | | December 31, | |

| | | 2009 | | | 2008 | | | 2008 | |

| | | (in millions) | |

| |

SNG | | | | | | | | | | | | |

Operating revenues(a) | | $ | 126 | | | $ | 163 | | | $ | 540 | |

| Operating expenses | | | (62 | ) | | | (62 | ) | | | (269 | ) |

| | | | | | | | | | | | | |

| Operating income | | | 64 | | | | 101 | | | | 271 | |

| Earnings from unconsolidated affiliates | | | 3 | | | | 4 | | | | 13 | |

| Other income (expense), net | | | (4 | ) | | | 4 | | | | 10 | |

| | | | | | | | | | | | | |

| EBIT | | | 63 | | | | 109 | | | | 294 | |

| Interest and debt expense | | | (16 | ) | | | (20 | ) | | | (72 | ) |

| Affiliated interest income | | | 1 | | | | 6 | | | | 13 | |

| | | | | | | | | | | | | |

| Income from continuing operations | | | 48 | | | | 95 | | | | 235 | |

| | | | | | | | | | | | | |

| Net income | | $ | 48 | | | $ | 95 | | | $ | 235 | |

| | | | | | | | | | | | | |

| | |

| (a) | | During the three months ended March 31, 2008, SNG recorded revenue of approximately $29 million in conjunction with amounts received under a Calpine bankruptcy settlement. |

S-12

Distributable Cash Flow

We use a non-GAAP financial measure “Distributable Cash Flow” to measure the amount of cash we can distribute to our unitholders. We define Distributable Cash Flow as Adjusted EBITDA less cash interest expense, maintenance capital expenditures, and other income and expenses, net, which primarily includes a non-cash allowance for equity funds used during construction (“AFUDC equity”) and other non-cash items. Adjusted EBITDA is defined as net income plus depreciation and amortization expense, interest and debt expense, net of interest income and the partnership’s share of distributions declared by CIG and SNG for the applicable period, less equity in earnings of CIG and SNG.

We also believe that the non-GAAP financial measure described above is useful to investors because this measurement is used by many companies in the industry as a measurement of operating and financial performance and is commonly employed by financial analysts and others to evaluate our operating and financial performance and to compare it with the performance of other publicly traded partnerships within the industry.

Distributable Cash Flow should not be considered an alternative to net income, earnings per unit, operating income, cash flow from operating activities or any other measure of financial performance presented in accordance with GAAP. Distributable Cash Flow excludes some, but not all, items that affect net income and operating income and this measure may vary among other companies. Therefore, Distributable Cash Flow as presented may not be comparable to a similarly titled measure of other companies. Furthermore, while Distributable Cash Flow is a measure we use to assess our ability to make distributions to our unitholders, it should not be viewed as indicative of the actual amount of cash that we have available for distributions or that we plan to distribute for a given period.

The table below provides our calculation of Distributable Cash Flow for the three months ended March 31, 2009 and 2008 and for the year ended December 31, 2008.

| | | | | | | | | | | | | |

| | | Three Months Ended

| | | Year Ended

| |

| | | March 31, | | | December 31, | |

| | | 2009 | | | 2008 | | | 2008 | |

| | | (in millions) | |

| |

| Net income | | $ | 46.0 | | | $ | 27.6 | | | $ | 114.5 | |

| Add: Interest and debt expense, net | | | 5.1 | | | | 5.6 | | | | 22.9 | |

| | | | | | | | | | | | | |

| EBIT | | | 51.1 | | | | 33.2 | | | | 137.4 | |

| Add: | | | | | | | | | | | | |

| Depreciation and amortization | | | 7.0 | | | | 6.2 | | | | 26.1 | |

| Distributions declared by CIG and SNG | | | 28.2 | | | | 13.3 | | | | 67.9 | |

| Less: | | | | | | | | | | | | |

| Equity earnings from CIG and SNG | | | (29.0 | ) | | | (15.1 | ) | | | (58.8 | ) |

| | | | | | | | | | | | | |

| Adjusted EBITDA | | | 57.3 | | | | 37.6 | | | | 172.6 | |

| Less: | | | | | | | | | | | | |

| Cash interest expense, net | | | (5.1 | ) | | | (5.6 | ) | | | (22.9 | ) |

| Maintenance capital expenditures | | | (0.6 | ) | | | (0.6 | ) | | | (1.3 | ) |

Other, net(a) | | | (0.4 | ) | | | (3.6 | ) | | | (2.2 | ) |

| | | | | | | | | | | | | |

| Distributable cash flow | | $ | 51.2 | | | $ | 27.8 | | | $ | 146.2 | |

| | | | | | | | | | | | | |

| | |

| (a) | | Includes certain non-cash items such as AFUDC equity and other items. |

S-13

RISK FACTORS

An investment in our common units involves risks. Before investing in our common units, you should carefully consider all of the information about risks included in “Item 1A. Risk Factors” and elsewhere in our Annual Report onForm 10-K for the year ended December 31, 2008, and the risk factors contained in the accompanying base prospectus, together with all of the other information included or incorporated by reference in this prospectus. If any of the risks were to occur, our business, financial condition, results of operations, cash flow and future prospects could be materially adversely affected. In such case, we may be unable to pay distributions on our common units, the trading price of our common units could decline and you could lose all or part of your investment.

S-14

USE OF PROCEEDS

We expect to receive net proceeds from this offering of approximately $ million, including our general partner’s proportionate capital contribution, or approximately $ million if the underwriters exercise their option to purchase additional common units in full, in each case after deducting underwriting discounts and commissions and estimated offering expenses.

We will use the net proceeds of this offering, including our general partner’s proportionate capital contribution and any exercise of the underwriters’ option to purchase additional units, for general partnership purposes, including potential future acquisitions and growth capital expenditures. Pending the use of the proceeds for other purposes, we may apply some or all of the net proceeds to reduce outstanding borrowings under our revolving credit facility.

As of June 5, 2009, an aggregate of approximately $588.1 million of borrowings were outstanding under our revolving credit facility. The weighted average interest rate on the total amount outstanding at June 5, 2009, was .9603 percent. Our revolving credit facility matures on November 21, 2012. We use revolving credit loans to fund growth capital expenditures and working capital requirements.

The underwriters may, from time to time, engage in transactions with and perform services for us and our affiliates in the ordinary course of their business. Affiliates of certain underwriters are lenders under our credit facility and, as such, could receive a substantial portion of the proceeds from this offering in the event of the repayment of borrowings under such facility. Please read “Underwriting.”

S-15

CAPITALIZATION

The following table shows our capitalization as of March 31, 2009 on an actual basis and as adjusted to reflect this offering of common units, including our general partner’s proportionate capital contribution of $ million, and the application of the net proceeds as described under “Use of Proceeds.”

You should read this information in conjunction with “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 1. Financial Statements” contained in our Quarterly Report onForm 10-Q for the three months ended March 31, 2009, which we incorporate by reference.

| | | | | | | | | |

| | | March 31, 2009 | |

| | | Historical | | | As Adjusted | |

| | | (in millions) | |

| |

Cash and cash equivalents | | $ | 1.2 | | | $ | | |

| | | | | | | | | |

Total long-term debt: | | | | | | | | |

| Revolving credit facility | | $ | 574.9 | | | $ | | |

| Other | | | 192.8 | | | | | |

| | | | | | | | | |

| Total debt | | $ | 767.7 | | | $ | | |

| | | | | | | | | |

Partners’ capital: | | | | | | | | |

| Common units | | $ | 1,071.4 | | | $ | | |

| Subordinated units | | | 291.6 | | | | | |

| General partner units | | | (719.6 | ) | | | | |

| | | | | | | | | |

| Total partners’ capital | | $ | 643.4 | | | $ | | |

| | | | | | | | | |

| Total capitalization | | $ | 1,411.1 | | | $ | | |

| | | | | | | | | |

S-16

PRICE RANGE OF COMMON UNITS AND DISTRIBUTIONS

Our common units are listed on the New York Stock Exchange under the symbol “EPB”. As of June 5, 2009, there were 84,965,923 common units outstanding, which were held by approximately 23 holders of record. The last reported sales price of the common units on the New York Stock Exchange on June 5, 2009 was $18.85 per unit.

The following table sets forth, for the periods indicated, the high and low sales prices per common unit, as reported on the New York Stock Exchange, and the amount of the cash distributions declared per common unit and subordinated unit:

| | | | | | | | | | | | | |

| | | | | | | Cash

|

| | | | | | | Distributions

|

| | | Price Range | | Per Common and

|

| | | High | | Low | | Subordinated Unit(a) |

| |

Year Ended December 31, 2009 | | | | | | | | | | | | |

| Second Quarter (through June 5, 2009) | | $ | 19.80 | | | $ | 16.92 | | | $ | — | (b) |

| First Quarter | | | 20.00 | | | | 14.91 | | | | 0.32500 | |

| | | | | | | | | | | | | |

Year Ended December 31, 2008 | | | | | | | | | | | | |

| Fourth Quarter | | | 21.80 | | | | 11.95 | | | | 0.32000 | |

| Third Quarter | | | 21.95 | | | | 11.72 | | | | 0.30000 | |

| Second Quarter | | | 24.35 | | | | 20.57 | | | | 0.29500 | |

| First Quarter | | | 25.00 | | | | 18.53 | | | | 0.28750 | |

| | | | | | | | | | | | | |

Year Ended December 31, 2007 | | | | | | | | | | | | |

Fourth Quarter(c) | | | 25.65 | | | | 20.24 | | | | 0.12813 | |

| | |

| (a) | | Distributions are shown for the quarter with respect to which they were declared. |

| | |

| (b) | | The distribution attributable to the quarter ending June 30, 2009 has not yet been declared or paid. We expect to declare and pay a cash distribution within 45 days following the end of the quarter. |

| | |

| (c) | | For the period from November 21, 2007, the date of our initial public offering, through December 31, 2007. |

S-17

MATERIAL TAX CONSIDERATIONS

The tax consequences to you of an investment in our common units will depend in part on your own tax circumstances. For a discussion of the principal federal income tax considerations associated with our operations and the purchase, ownership and disposition of our common units, please read “Material Tax Considerations” in the accompanying base prospectus. Please also read “Item 1A. Risk Factors — Tax Risks to Common Unitholders” in our Annual Report onForm 10-K for the year ended December 31, 2008 for a discussion of the tax risks related to purchasing and owning our common units. You are urged to consult with your own tax advisor about the federal, state, local and foreign tax consequences peculiar to your circumstances.

Partnership Status

The anticipated after-tax economic benefit of an investment in our common units depends largely on our being treated as a partnership for federal income tax purposes. We have not requested, and do not plan to request, a ruling from the IRS on this or any other tax matter affecting us. In order to be treated as a partnership for federal income tax purposes, at least 90% of our gross income must be from specific qualifying sources, such as the transportation and storage of natural gas and natural gas products or other passive types of income such as interest and dividends. For a more complete description of this qualifying income requirement, please read “Material Tax Considerations — Partnership Status” in the accompanying base prospectus.

If we were treated as a corporation for federal income tax purposes, we would pay federal income tax on our taxable income at the corporate tax rate, which is currently a maximum of 35%, and would likely pay state income tax at varying rates. Distributions to you would generally be taxed again as corporate distributions, and no income, gains, losses or deductions would flow through to you. Because a tax would be imposed upon us as a corporation, our cash available for distribution to you would be substantially reduced. Therefore, treatment of us as a corporation would result in a material reduction in the anticipated cash flow and after-tax return to the unitholders, likely causing a substantial reduction in the value of our common units.

Ratio of Taxable Income to Distributions

We estimate that if you purchase common units in this offering and own them through the record date for distributions for the period ending December 31, 2011, then you will be allocated, on a cumulative basis, an amount of federal taxable income for that period that will be 20% or less of the cash distributed to you with respect to that period. Thereafter, we anticipate that the ratio of allocable taxable income to cash distributions to the unitholders will increase. These estimates are based upon the assumption that gross income from operations will approximate the amount required to make the minimum quarterly distribution on all units and other assumptions with respect to capital expenditures, cash flow, net working capital and anticipated cash distributions. These estimates and assumptions are subject to, among other things, numerous business, economic, regulatory, competitive and political uncertainties beyond our control. Further, the estimates are based on current tax law and tax reporting positions that we will adopt and with which the IRS could disagree. Accordingly, we cannot assure you that these estimates will prove to be correct. The actual percentage of distributions that will constitute taxable income could be higher or lower than expected, and any differences could be material and could materially affect the value of the common units. For example, the ratio of allocable taxable income to cash distributions to a purchaser of common units in this offering will be greater, and perhaps substantially greater, than our estimate with respect to the period described above if:

| | |

| | • | gross income from operations exceeds the amount required to make minimum quarterly distributions on all units, yet we only distribute the minimum quarterly distributions on all units; or |

| |

| | • | we make a future offering of common units and use the proceeds of the offering in a manner that does not produce substantial additional deductions during the period described above, such as to repay indebtedness outstanding at the time of this offering or to acquire property that is not eligible for depreciation or amortization for federal income tax purposes or that is depreciable or amortizable at a rate significantly slower than the rate applicable to our assets at the time of this offering. |

Tax-Exempt Organizations and Other Investors

Ownership of common units by tax-exempt entities, regulated investment companies andnon-U.S. investors raises issues unique to such persons. Please read “Material Tax Considerations — Tax-Exempt Organizations and Other Investors” in the accompanying base prospectus.

S-18

UNDERWRITING

Under the terms and subject to the conditions contained in an underwriting agreement dated the date of this prospectus supplement, the underwriters have severally agreed to purchase, and we have agreed to sell, the number of common units set forth opposite the underwriter’s name. Morgan Stanley & Co. Incorporated, Barclays Capital Inc., Citigroup Global Markets Inc. and UBS Securities LLC are acting as joint bookrunners and representatives of the underwriters named below.

| | | | | |

| | | Number of

|

Underwriters | | Common Units |

| |

| Morgan Stanley & Co. Incorporated | | | | |

| Barclays Capital Inc. | | | | |

| Citigroup Global Markets Inc. | | | | |

| UBS Securities LLC | | | | |

| Credit Suisse Securities (USA) LLC | | | | |

| Goldman, Sachs & Co. | | | | |

| Raymond James & Associates, Inc. | | | | |

| | | | | |

| Total | | | 11,000,000 | |

| | | | | |

The underwriters are offering the common units subject to their acceptance of the common units from us and subject to prior sale. The underwriting agreement provides that the obligation of the underwriters to pay for and accept delivery of the common units offered by this prospectus supplement is subject to the approval of certain legal matters by their counsel and to certain other conditions. The underwriters are obligated to take and pay for all of the common units offered by this prospectus supplement if any such common units are taken. However, the underwriters are not required to take or pay for the common units covered by the underwriters’ option to purchase additional common units described below.

The representatives have advised us that the underwriters initially propose to offer part of the common units directly to the public at the public offering price listed on the cover page of this prospectus supplement and part to certain dealers at a price that represents a concession not in excess of $ per common unit under the public offering price. After the initial offering of the common units in this offering, the offering price and other selling terms may from time to time be varied by the underwriters.

We have granted to the underwriters an option, exercisable for 30 days from the date of this prospectus supplement, to purchase up to an aggregate of 1,650,000 additional common units at the public offering price listed on the cover page of this prospectus supplement, less underwriting discounts and commissions. If the underwriters’ option is exercised in full, the total price to the public would be $ , the total underwriters’ discounts and commissions would be $ and the total proceeds to us would be $ .

We estimate that ourout-of-pocket expenses for this offering, excluding underwriters’ discounts and commissions, will be approximately $500,000.

We, our general partner and certain of its affiliates, including the directors and officers of our general partner, have agreed not to, without the prior written consent of Morgan Stanley & Co. Incorporated, (1) offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any common units or any securities which may be converted into or exercised or exchanged for any common units, other than certain permitted transfers, issuances and grants of options (including pursuant to an existing employee benefit plan), or (2) enter into any swap or other arrangement that transfers, in whole or in part, any of the economic consequences of ownership of the common units or (3) file any registration statement relating to the offering of any common units or securities convertible or exchangeable into common units for a period of 90 days from the date of this prospectus supplement, except with respect to (a) the issuance of common units in connection with this offering, (b) issuances of common units, or securities convertible into or exercisable or exchangeable for common units, pursuant to the El Paso Pipeline GP Company, L.L.C. Long-Term Incentive Plan, (c) issuances of common units or securities

S-19

convertible into or exercisable or exchangeable for common units, pursuant to aForm S-4 in connection with a business combination or acquisition, provided that, such issuances shall not exceed 5% of the total number of outstanding common units and the recipient agrees to hold the balance of any common units sold pursuant to aForm S-4 for the balance of the 90-day period, (d) issuances of common units or other rights to acquire common units in private transactions in connection with future acquisitions, provided the persons receiving the common units or other rights to acquire the common units agree to be bound for the remainder of the 90-day period, or (e) the establishment of a trading plan pursuant toRule 10b5-1 under the Exchange Act for the transfer of common units, provided that such plan does not provide for the transfer of common units during the 90-day period. Additionally, pursuant to a Registration Rights Agreement, dated September 30, 2008, Tortoise Energy Infrastructure Corporation has agreed that neither it nor its affiliates will effect any public sale or distribution of the common units it owns during the30-day period beginning the day after the pricing date of this offering.

Morgan Stanley & Co. Incorporated, in its discretion, may release the common units and the other securities subject to thelock-up agreements described above in whole or in part at any time with or without notice. When determining whether or not to release common units and the other securities fromlock-up agreements, Morgan Stanley & Co. Incorporated will consider, among other factors, the unitholder’s reasons for requesting the release, the number of common units and other securities for which the release is being requested and the market conditions at the time.

In order to facilitate the offering of the common units, the underwriters may engage in transactions that stabilize, maintain or otherwise affect the price of the common units. Specifically, the underwriters may over-allot in connection with the offering, creating a short position in the common units for its own account. In addition, to cover over-allotments or to stabilize the price of the common units, the underwriters may bid for, and purchase, common units in the open market. Finally, the underwriters may reclaim selling concessions allowed to the underwriters or a dealer for distributing the common units in the offering, if the syndicate repurchases previously distributed common units in transactions to cover syndicate short positions, in stabilization transactions or otherwise. Any of these activities may stabilize or maintain the market price of the common units above independent market levels. The underwriters are not required to engage in these activities, and may end any of these activities without notice at any time.

We and the underwriters have agreed to indemnify each other against certain liabilities, including liabilities under the Securities Act.

Because the Financial Industry Regulatory Authority, or FINRA, views the common units offered hereby as interests in a direct participation program, the offering is being made in compliance with Rule 2810 of the National Association of Securities Dealers’, or NASD, Conduct Rules (which are part of the FINRA Rules). Investor suitability with respect to the common units should be judged similarly to the suitability with respect to other securities that are listed for trading on a national securities exchange.

Certain of the underwriters and their respective affiliates perform various financial advisory, investment banking and commercial banking services from time to time for us and our affiliates, for which they received or will receive customary fees and expense reimbursement. Additionally, affiliates of Morgan Stanley & Co. Incorporated, Citigroup Global Markets Inc., UBS Securities LLC, Credit Suisse Securities (USA) LLC and Goldman, Sachs & Co. are lenders under our credit facility and will receive a portion of the proceeds from this offering pursuant to the repayment of borrowings under that credit facility. Because we intend to use more than 10% of the net proceeds from this offering to reduce indebtedness owed by us to such affiliates, this offering is being conducted in compliance with the applicable requirements of FINRA Rule 5110 and Rule 2720 of the NASD Conduct Rules. Because a bona fide independent market exists for our common units, FINRA does not require that we use a qualified independent underwriter for this offering.

This prospectus supplement and the accompanying base prospectus may be used by the underwriters in connection with offers and sales of the common units in certain agented brokers’ transactions; however, the underwriters are not obligated to engage in such agented brokers’ transactions and may discontinue such activities without notice at any time.

S-20

LEGAL MATTERS

Andrews Kurth LLP, Houston, Texas, will pass upon the validity of the common units offered hereby and various other legal matters in connection with the offering on our behalf. Vinson & Elkins L.L.P., Houston, Texas, will pass upon certain legal matters in connection with the offering on behalf of the underwriters.

EXPERTS

The consolidated financial statements of El Paso Pipeline Partners, L.P. at December 31, 2008 and 2007 and for each of the three years in the period ended December 31, 2008, appearing in El Paso Pipeline Partners, L.P.’s Annual Report onForm 10-K for the year ended December 31, 2008 (the“Form 10-K”), have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The consolidated financial statements of Colorado Interstate Gas Company at December 31, 2008 and 2007 and for each of the three years in the period ended December 31, 2008 appearing in theForm 10-K, have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The consolidated financial statements of Southern Natural Gas Company at December 31, 2008 and 2007 and for each of the three years in the period ended December 31, 2008 appearing in theForm 10-K, have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein by reference, which is based in part on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm. The financial statements referred to above are incorporated herein by reference in reliance upon such reports given on the authority of such firms as experts in accounting and auditing.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” information into this document. This means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be part of this prospectus, and information that we file later with the SEC will automatically update and supersede the previously filed information. We incorporate by reference the documents listed below and any future filings made by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, excluding information deemed to be furnished and not filed with the SEC, until all the securities are sold:

| | |

| | • | Annual Report onForm 10-K (FileNo. 001-33825) for the year ended December 31, 2008, filed on March 2, 2009; |

| |

| | • | Quarterly Report onForm 10-Q (FileNo. 001-33825) for the quarter ended March 31, 2009, filed on May 11, 2009; |

| |

| | • | Current Report onForm 8-K (FileNo. 001-33825), filed on January 7, 2009; and |

| |

| | • | The description of our common units contained in our registration statement onForm 8-A (FileNo. 001-33825), filed on November 13, 2007. |

Each of these documents is available from the SEC’s website and public reference rooms described above. Through our website,http://www.eppipelinepartners.com, you can access electronic copies of documents we file with the SEC, including our annual reports onForm 10-K, quarterly reports onForm 10-Q and current reports onForm 8-K and any amendments to those reports. Information on our website is not incorporated by reference in this prospectus. Access to those electronic filings is available as soon as reasonably practical after filing with the SEC. You may also request a copy of those filings, excluding exhibits, at no cost by writing or telephoning Investor

S-21

Relations, El Paso Pipeline Partners, L.P., at our principal executive office, which is: El Paso Building, 1001 Louisiana Street, Houston, Texas 77002; Telephone:(713) 420-2600.

FORWARD-LOOKING STATEMENTS

Some of the information in this prospectus supplement, the accompanying base prospectus and the documents we incorporate by reference may contain forward-looking statements. Forward-looking statements give our current expectations, contain projections of results of operations or of financial condition, or forecasts of future events. Words such as “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “project,” “budget,” “potential,” or “continue,” and similar expressions are used to identify forward-looking statements. They can be affected by assumptions used or by known or unknown risks or uncertainties. Consequently, no forward-looking statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this prospectus. Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include:

| | |

| | • | changes in general economic conditions; |

| |

| | • | competitive conditions in our industry; |

| |

| | • | actions taken by third-party operators, processors and transporters; |

| |

| | • | changes in the availability and cost of capital, including limited access to capital markets; |

| |

| | • | operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; |

| |

| | • | the effects of existing and future laws and governmental regulations; |

| |

| | • | the effects of future litigation; and |

| |

| | • | certain factors discussed elsewhere in this prospectus. |

You are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this prospectus supplement, the accompanying base prospectus or the documents we incorporate by reference. Our actual results may differ significantly from the results discussed in the forward-looking statements. Such statements involve risks and uncertainties, including, but not limited to, the matters discussed in “Risk Factors” beginning onpage S-14 of this prospectus supplement, beginning on page 3 of the accompanying base prospectus and in our Annual Report onForm 10-K for the year ended December 31, 2008. If one or more of these risks or uncertainties materialize (or the consequences of such a development changes), or should underlying assumptions prove incorrect, actual outcomes may vary materially from those forecasted or expected. We undertake no responsibility to update forward-looking statements for changes related to these or any other factors that may occur subsequent to this filing for any reason.

S-22

PROSPECTUS

EL PASO PIPELINE PARTNERS, L.P.

$1,000,000,000

Common Units Representing Limited Partner Interests

Debt Securities

We may from time to time offer the following securities under this prospectus:

| | |

| | • | common units representing limited partner interests in El Paso Pipeline Partners, L.P.; and |

| |

| | • | debt securities of El Paso Pipeline Partners, L.P., which may be secured or unsecured senior debt securities or secured or unsecured subordinated debt securities. |

Certain subsidiaries of El Paso Pipeline Partners, L.P. may guarantee the debt securities.

The securities we may offer:

| | |

| | • | will have a maximum aggregate offering price of $1,000,000,000; |

| |

| | • | will be offered in amounts, at prices and on terms to be set forth in one or more accompanying prospectus supplements; and |

| |

| | • | may be offered separately or together, or in separate series. |

Our common units are listed on the New York Stock Exchange under the symbol “EPB.” We will provide information in the prospectus supplement, for the trading market, if any, for any debt securities we may offer.

You should carefully read this prospectus and any prospectus supplement before you invest. You also should read the documents we have referred you to in the “Where You Can Find More Information” section of this prospectus for information on us and our financial statements. This prospectus may not be used to consummate sales of securities unless accompanied by a prospectus supplement.

Investing in our securities involves risks. Limited partnerships are inherently different from corporations. You should carefully consider the risk factors beginning on page 3 of this prospectus and in the applicable prospectus supplement before you make an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 24, 2009.

TABLE OF CONTENTS

| | | | | |

| | | 1 | |

| | | 1 | |

| | | 2 | |

| | | 3 | |

| | | 22 | |

| | | 22 | |

| | | 23 | |

| | | 33 | |

| | | 34 | |

| | | 36 | |

| | | 49 | |

| | | 62 | |

| | | 70 | |

| | | 84 | |

| | | 85 | |

| | | 85 | |

| | | 86 | |

| | | 86 | |

You should rely only on the information contained in this prospectus, any prospectus supplement and the documents we have incorporated by reference. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus or any prospectus supplement, as well as the information we previously filed with the Securities and Exchange Commission that is incorporated by reference herein, is accurate as of any date other than its respective date.

ABOUT THIS PROSPECTUS