July 27, 2010

Ms. Jennifer Thompson

Accounting Branch Chief

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549-3561

| Re: | El Paso Pipeline Partners, L.P. Form 10-Q for the quarter ended March 31, 2010 Filed May 10, 2010 File No. 1-33825 |

| | |

Dear Ms. Thompson,

We received your letter dated July 19, 2010, commenting on the above referenced document. Below are the comments contained in your letter followed by our response.

Form 10-Q for the quarter ended March 31, 2010

Note 5. Long-term Debt and Other Financing Obligations, page 8

| 1. | We read that on March 30, 2010, El Paso Pipeline Operating Company, LLC, your wholly-owned subsidiary, issued $425.0 million of senior unsecured notes to the public. We also read that the EPB Operating notes are fully and unconditionally guaranteed on a senior basis by you. We note that you have not provided condensed consolidating financial information as required by Rule 3-10(c)(4) of Regulation S-X. We understand from a phone conversation with your CFO, Mr. John R. Sult, that you believe that Rule 3-10(c) of Regulation S-X applies to this guarantee of debt, but you are relying on Note 1 to Rule 3-10(c) to only provide narrative disclosures about this guarantee. We have the following comments: |

| · | It remains unclear to us that you meet all of the criteria specified by Note 1 to Rule 3-10(c) to permit you to only provide narrative disclosures about this guarantee. Specifically, it is unclear to us how you concluded that all of your subsidiaries other than EPB Operating are minor. Please provide us with your analysis of how you concluded that you did not need to provide the condensed consolidating financial information as required by Rule 3-10(c) (4) of Regulation S-X. |

| · | If you continue to believe that you meet all of the criteria to permit you to only provide narrative disclosures about this guarantee, your current disclosures within this footnote do not appear to contain all of the disclosures required by Note 1 to Rule 3-10 (c). Please confirm to us in future filings, if you have guarantees that qualify for you to provide only narrative disclosures under Note 1 to Rule 3-10 (c), you will provide all of the disclosures specified by that Note. |

U.S. Securities and Exchange Commission

Division of Corporation Finance

July 23, 2010

Page 2

Response

Rule 3-10 (c) states that when an operating subsidiary issues securities and its parent company guarantees those securities, the registration statement, parent company annual or quarterly report need not include the financial statements of the issuer if:

| (1) | The issuer is 100% owned by the parent company guarantor; |

| (2) | The guarantee is full and unconditional; |

| (3) | No other subsidiary of the parent company guarantees the securities; |

| (4) | The parent company’s financial statements are filed for the periods specified by Rule 3-01 and Rule 3-02 and include, in a footnote, condensed consolidating financial information for the same periods with a separate column for: |

| b. | The subsidiary issuer; |

| c. | Any other subsidiaries of the parent company on a combined basis; |

| d. | Consolidating adjustments; and |

| e. | The total consolidated amounts. |

Note to paragraph (c)

| 1. | Instead of the condensed consolidating financial information required by paragraph (c)(4), the parent company's financial statements may include a footnote stating, if true, that the parent company has no independent assets or operations, the guarantee is full and unconditional, and any subsidiaries of the parent company other than the subsidiary issuer are minor. The footnote also must include the narrative disclosures specified in paragraphs (i)(9) and (i)(10) of this section. |

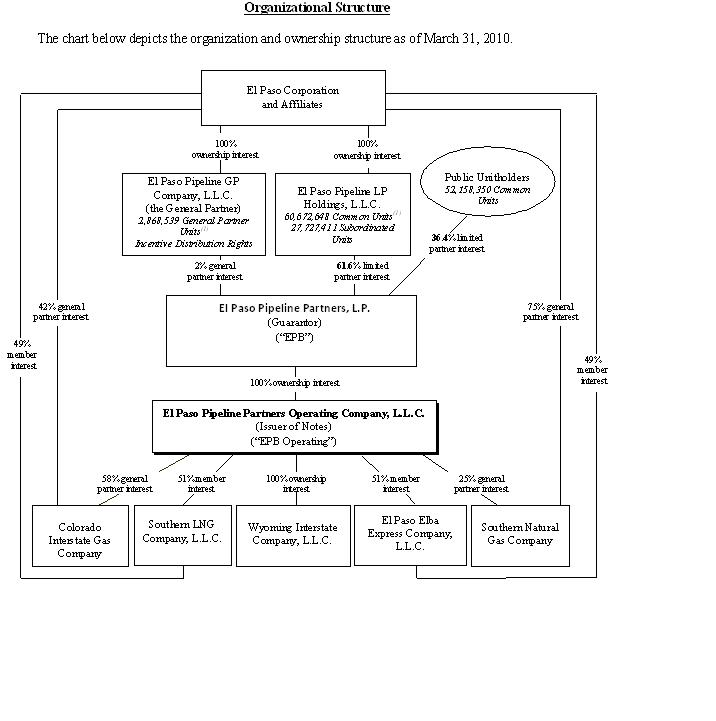

As shown in the enclosed ownership diagram on Exhibit 1, EPB Operating, the issuer, is 100% owned by its parent company, El Paso Pipeline Partners, L.P. (“EPB”). EPB has fully and unconditionally guaranteed the debt issued by EPB Operating and no other subsidiaries of EPB guarantee the notes. EPB has no operations and its only asset (except for intercompany balances that eliminate in consolidation) is the investment in EPB Operating. EPB has no direct subsidiaries other than EPB Operating. All other subsidiaries are direct or indirect subsidiaries of EPB Operating, the issuer. Consequently, there is no difference between the consolidated financial statements of EPB and EPB Operating other than the intercompany balances and the related consolidating eliminations. As such, since EPBR 17;s only subsidiary is EPB Operating, we concluded the criterion that subsidiaries of the parent company, other than the subsidiary issuer, are minor has been met. As a result we respectfully submit that the exception to providing the condensed consolidating financial information otherwise required by paragraph (c) (4) is available.

Our footnote disclosures in our Form 10-Q for the quarter ended March 31, 2010 state that “…the EPB Operating notes are fully and unconditionally guaranteed on a senior unsecured basis by us…” and “…. we have no independent assets or operations apart from those owned by EPB Operating.” In future filings, we will supplement our existing disclosures to address additional narrative disclosure required by Note 1 to Rule 3-10 (c).

U.S. Securities and Exchange Commission

Division of Corporation Finance

July 23, 2010

Page 3

In connection with providing these responses, we acknowledge that:

| · | we are responsible for the adequacy and accuracy of the disclosure in the filings; |

| · | staff comments or changes to disclosures in response to staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| · | we may not assert staff comments in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Should you have any further questions regarding this letter or need further information to assist you in our review, please contact me at 713-420-5700.

Sincerely,

/s/ John R. Sult

John R. Sult

Senior Vice President, Chief Financial Officer

El Paso Pipeline GP Company, L.L.C.

General Partner of El Paso Pipeline Partners, L.P.

Enclosures

Cc: Lisa Sellars, Division of Corporation Finance, U.S. Securities and Exchange Commission

James C. Yardley, President and Chief Executive Office, El Paso Pipeline GP Company, LLC

Elaine Pickle, Ernst & Young

Exhibit 1