UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 18, 2021

IVERIC bio, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36080 | | 20-8185347 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

Five Penn Plaza, Suite 2372

New York, NY 10001

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (212) 845-8200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | ISEE | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Forward-Looking Statements

Any statements in this Current Report on Form 8-K about IVERIC bio, Inc.'s (the "Company") future expectations, plans and prospects constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Forward-looking statements include any statements about the Company’s strategy, future operations and future expectations and plans and prospects for the Company, and any other statements containing the words “anticipate,” “believe,” “estimate,” “expect,” “intend”, “goal,” “future”, “may”, “might,” “plan,” “predict,” “project,” “seek,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions. In this Current Report on Form 8-K, the Company’s forward looking statements include statements about the timing, progress and results of clinical trials, including expectations regarding patient enrollment and retention in GATHER2 and the availability of top-line data from that trial, the Company’s development and regulatory strategy for Zimura, including its potential development in other forms or stages of dry age-related macular degeneration, and the potential utility of Zimura and its other research and development programs. Such forward-looking statements involve substantial risks and uncertainties that could cause the Company’s development programs, future results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, those related to the progression and duration of the COVID-19 pandemic and responsive measures thereto and related effects on the Company’s research and development programs, operations and financial position, the initiation and the progress of research and development programs and clinical trials, availability of data from these programs, expectations for regulatory matters, reliance on clinical trial sites, contract research organizations and other third parties, establishment of manufacturing capabilities, developments from the Company’s competitors and the marketplace for its products, need for additional financing and negotiation and consummation of business development transactions and other factors discussed in the “Risk Factors” section contained in the quarterly and annual reports that the Company files with the Securities and Exchange Commission. Any forward-looking statements represent the Company’s views only as of the date of this Current Report on Form 8-K. The Company anticipates that subsequent events and developments may cause its views to change. While the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so except as required by law.

Item 8.01 Other Events

GATHER2 Enrollment and Availability of Topline Data

On June 18, 2021, the Company announced that it is expecting to complete patient enrollment for GATHER2, its ongoing Phase 3 clinical trial of Zimura® (avacincaptad pegol) for the treatment of geographic atrophy ("GA") secondary to age-related macular degeneration ("AMD"), in late July of this year. The Company expects top-line data from GATHER2 to become available during the second half of 2022, approximately one year after the enrollment of the last patient plus the time needed for database lock and analysis.

GATHER2 Patient Retention and GATHER1 Patient Retention

The Company also announced that patient retention in GATHER2 is exceeding expectations. The Company is targeting patient retention for the trial, as measured by the injection fidelity rate through month 12, of greater than 90%. The 12-month injection fidelity rate for GATHER1, the Company's completed Phase 3 clinical trial evaluating Zimura for the treatment of GA secondary to AMD, was 87%. The injection fidelity rate is calculated by dividing the total number of actual injections for all patients by the total number of expected injections based on the total number of patients enrolled in the trial.

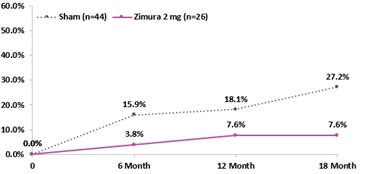

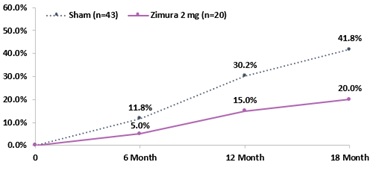

GATHER1 Post-Hoc Analyses in Drusen and Nascent GA

In addition, the Company also announced results from new post-hoc analyses performed on data from GATHER1. The post-hoc analyses evaluated the progression of drusen and nascent GA, both of which are earlier forms of dry AMD, in patients treated with Zimura 2 mg as compared to patients in the sham group. The data show a 19.6% absolute reduction in the rate of progression from drusen to incomplete Retinal Pigment Epithelial and Outer Retinal Atrophy ("iRORA") or complete Retinal Pigment Epithelial and Outer Retinal Atrophy ("cRORA"), for the Zimura 2 mg group as compared to sham at 18 months, representing a relative risk reduction of 72%. The data also show a 21.8% absolute reduction in the rate of progression from iRORA to cRORA for the Zimura 2 mg group as compared to sham at 18 months, representing a relative risk of reduction of 52%.

The graphs below illustrate the results from these post-hoc analyses:

Proportion of patients that progress from drusen to iRORA or cRORA (Zimura 2 mg compared to sham)

Proportion of patients that progress from iRORA to cRORA (Zimura 2 mg compared to sham)

Based on these results, the Company intends to study Zimura in earlier stages of dry AMD.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| IVERIC bio, Inc. |

| |

| Date: June 21, 2021 | By: | /s/ David F. Carroll |

| | David F. Carroll |

| | Senior Vice President, Chief Financial Officer and Treasurer |