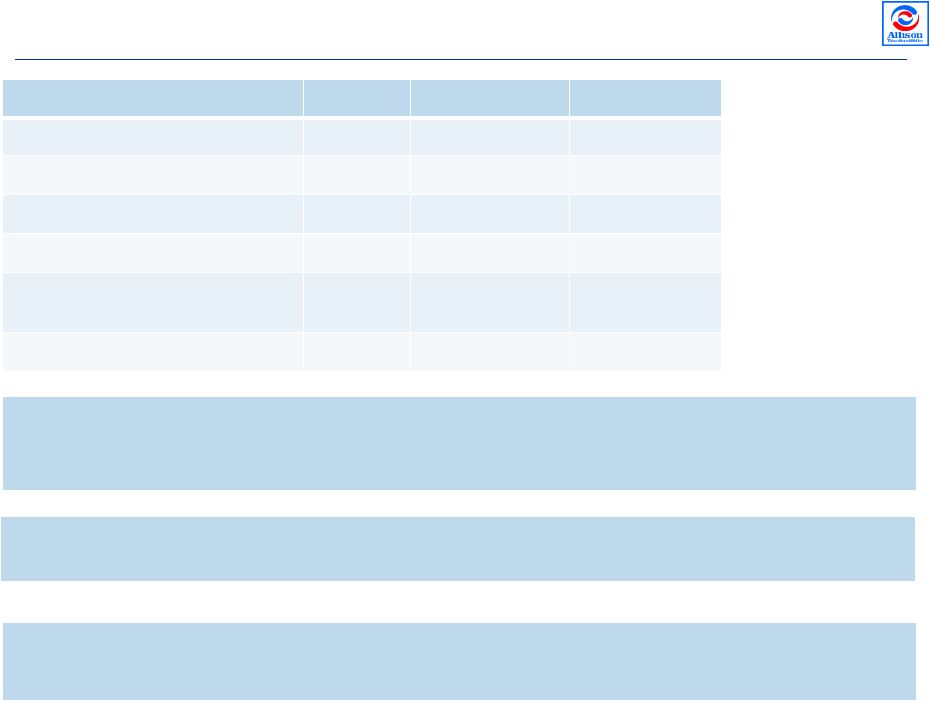

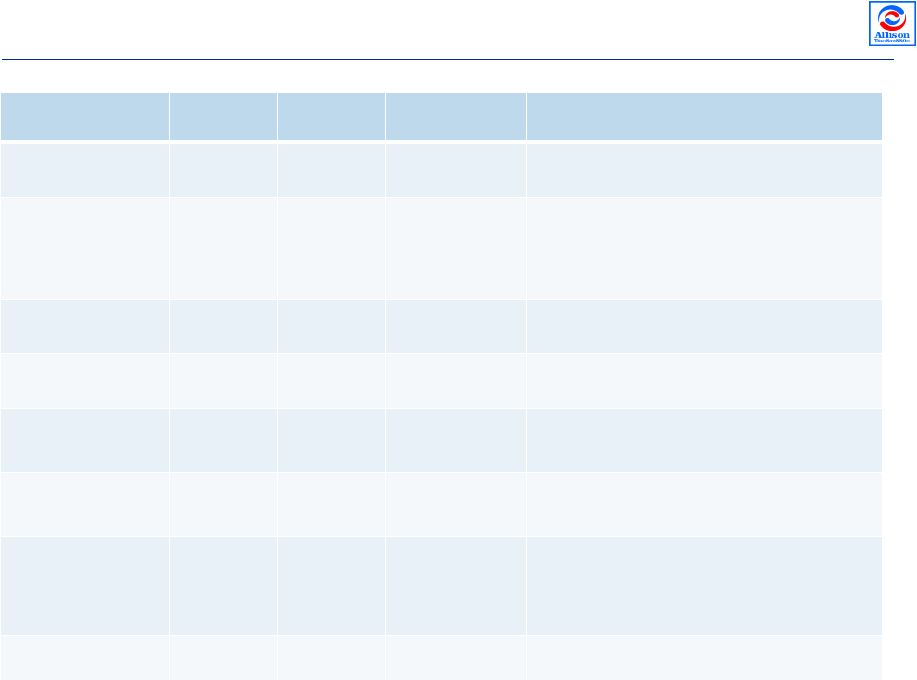

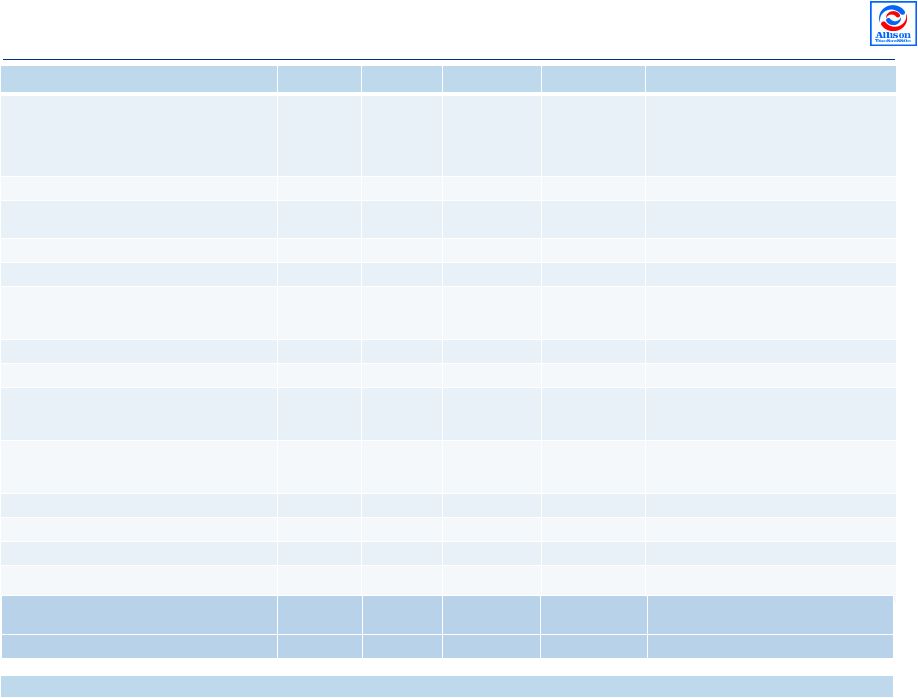

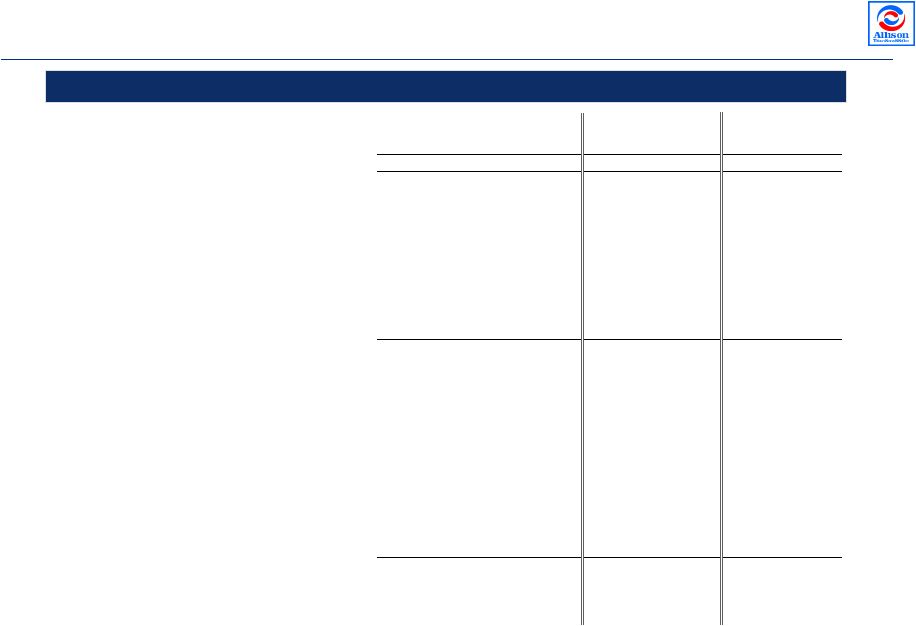

Non-GAAP Financial Information 3 We use Adjusted net income, Adjusted EBITDA, Adjusted EBITDA margin, adjusted free cash flow and free cash flow to evaluate our performance relative to that of our peers. In addition, the Senior Secured Credit Facility has certain covenants that incorporate Adjusted EBITDA. However, Adjusted net income, Adjusted EBITDA, Adjusted EBITDA margin, adjusted free cash flow and free cash flow are not measurements of financial performance under GAAP, and these metrics may not be comparable to similarly titled measures of other companies. Adjusted net income is calculated as the sum of net income (loss), interest expense, net, income tax expense, trade name impairment and amortization of intangible assets, less cash interest expense, net and cash income taxes. Adjusted EBITDA is calculated as the sum of Adjusted net income, cash interest expense, net, cash income taxes, depreciation of property, plant and equipment and other adjustments as defined by the Senior Secured Credit Facility and as further described below. Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by net sales. Free cash flow is calculated as net cash provided by operating activities less capital expenditures. Adjusted free cash flow is free cash flow adjusted for non-recurring items. We use Adjusted net income to measure our overall profitability because it better reflects our cash flow generation by capturing the actual cash taxes paid rather than our tax expense as calculated under GAAP and excludes the impact of the non-cash annual amortization of certain intangible assets that were created at the time of the Acquisition Transaction. We use Adjusted EBITDA and Adjusted EBITDA margin to evaluate and control our cash operating costs and to measure our operating profitability. We use adjusted free cash flow and free cash flow to evaluate the amount of cash generated by the business that, after the capital investment needed to maintain and grow our business, can be used for strategic opportunities, including investing in our business and strengthening our balance sheet. We believe the presentation of Adjusted net income, Adjusted EBITDA, Adjusted EBITDA margin, adjusted free cash and free cash flow enhances our investors' overall understanding of the financial performance and cash flow of our business. You should not consider Adjusted net income, Adjusted EBITDA, Adjusted EBITDA margin, adjusted free cash flow and free cash flow as an alternative to net income (loss), determined in accordance with GAAP, as an indicator of operating performance, or as an alternative to net cash provided by operating activities, determined in accordance with GAAP, as an indicator of Allison’s cash flow. |