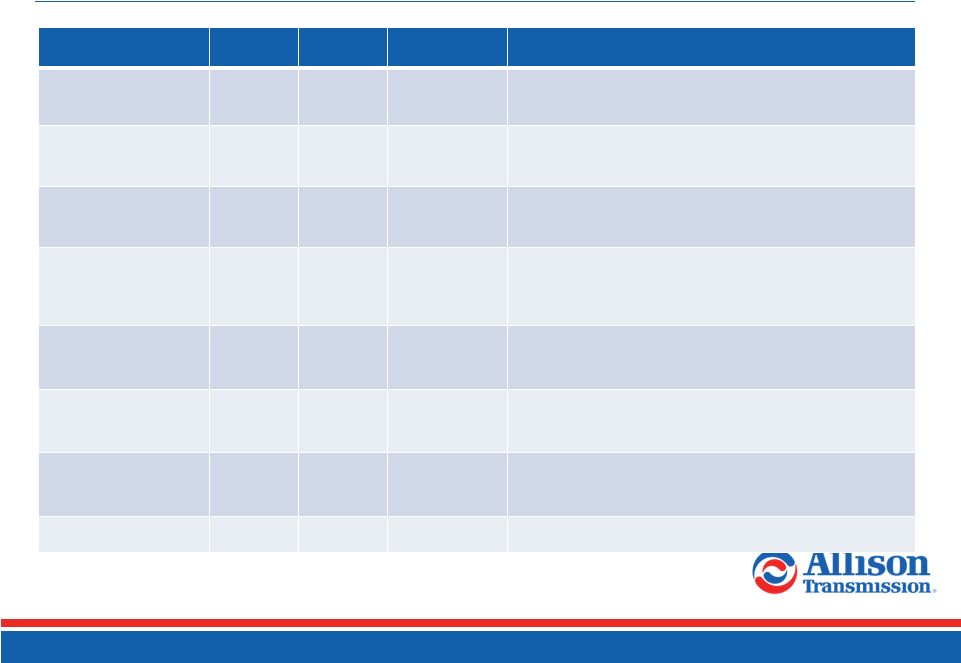

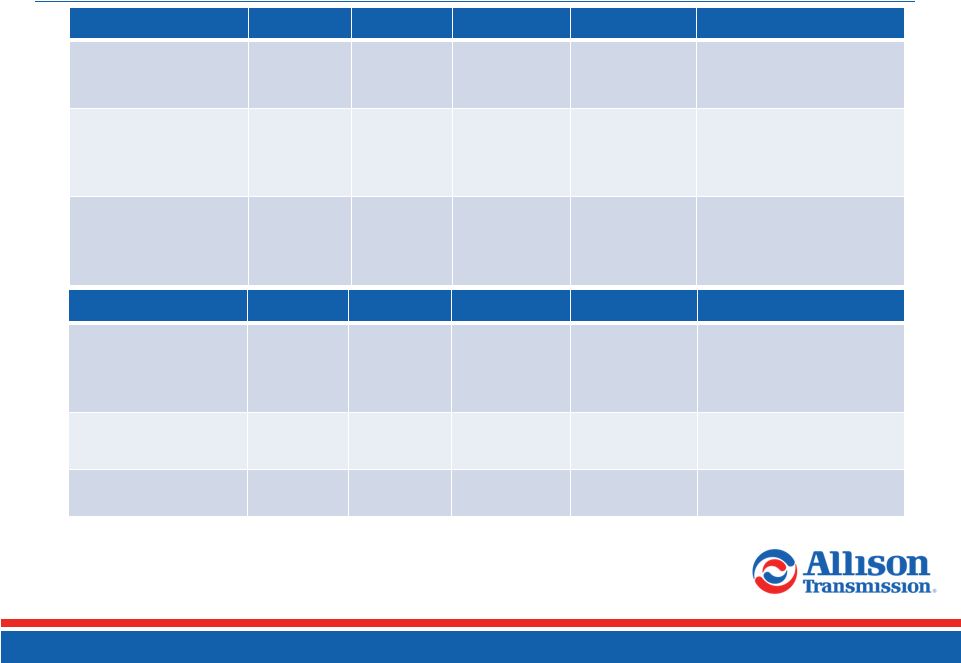

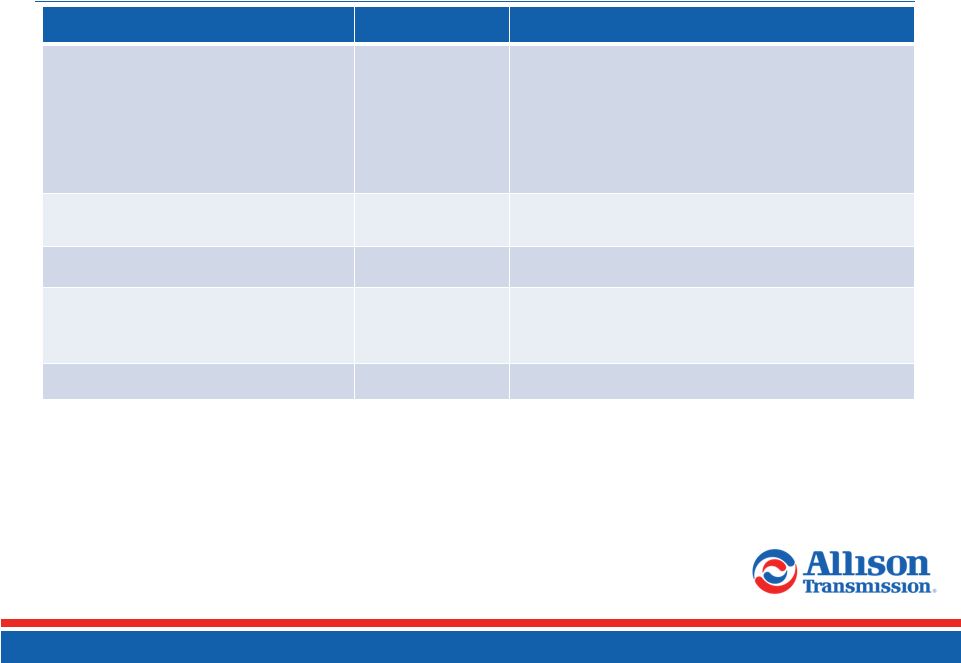

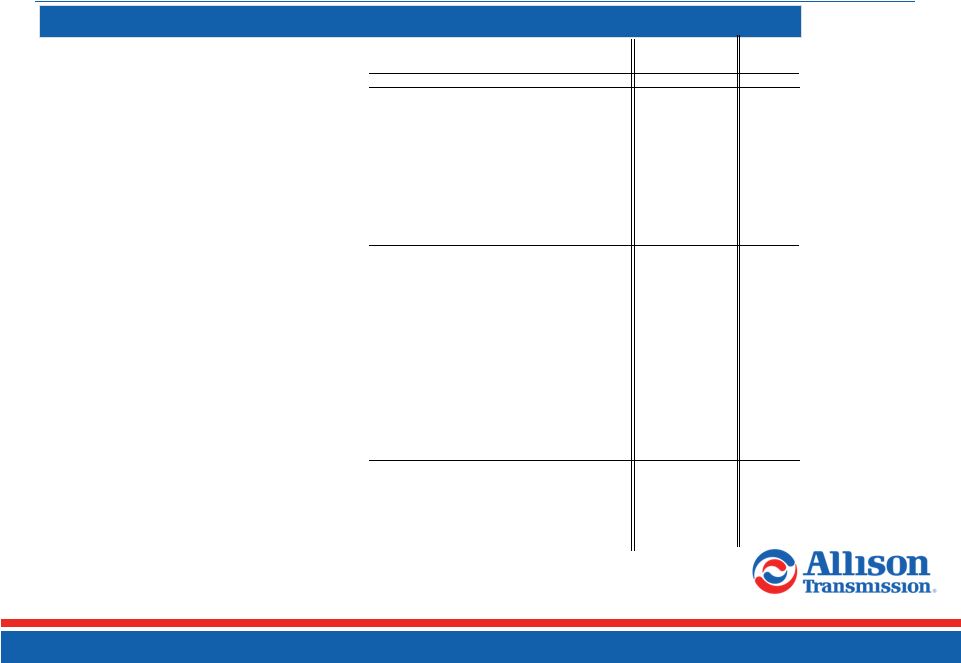

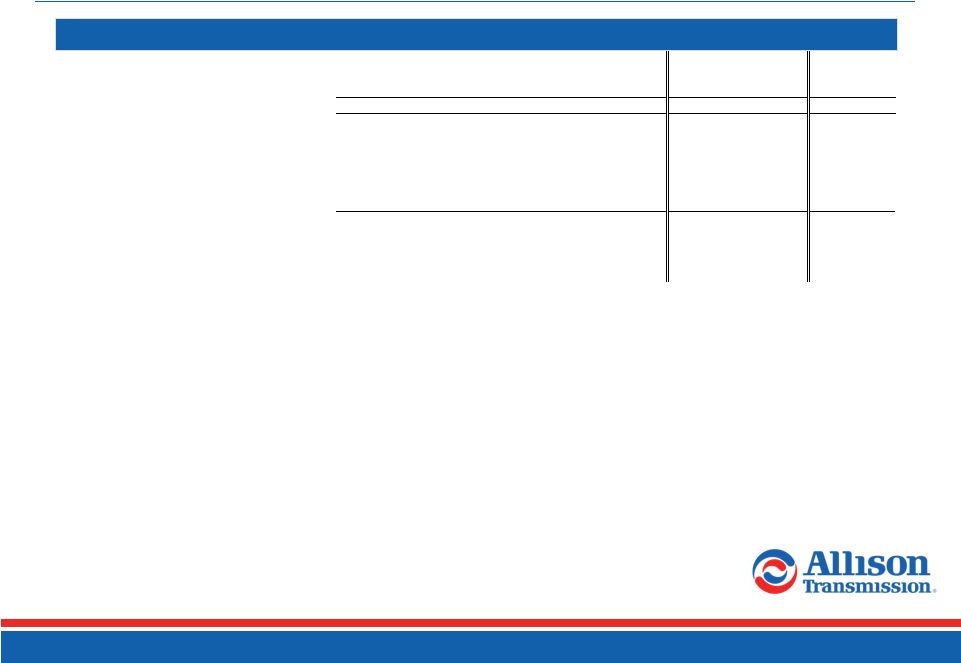

7 Q2 2014 Financial Performance ($ in millions, except share data) Q2 2014 Q2 2013 $ Var % Var Commentary Net Sales $536.1 $512.1 $24.0 4.7% Increase principally driven by the continued recovery in the North America On-Highway and Off-Highway end markets, and higher demand in the Service Parts, Support Equipment & Other end market partially offset by lower demand in the Outside North America end markets and previously contemplated reductions in U.S. defense spending Cost of Sales $297.6 $286.0 ($11.6) (4.1%) Gross Profit $238.5 $226.1 $12.4 5.5% Increase principally driven by increased net sales and price increases on certain products partially offset by unfavorable material cost Operating Expenses Selling, general and administrative expenses $85.1 $85.6 $0.5 0.6% Engineering – research and development $21.2 $22.8 $1.6 7.0% Decrease principally driven by reduced product initiatives spending Total operating expenses $106.3 $108.4 $2.1 1.9% Operating Income $132.2 $117.7 $14.5 12.3% Interest Expense, net ($36.6) ($33.3) ($3.3) (9.9%) Increase principally driven by less favorable mark-to-market adjustments for interest rate derivatives partially offset by debt repayments and lower LIBOR swap and senior secured credit facility rates Other Expense, net ($0.9) ($2.6) $1.7 65.4% Decrease principally driven by gains on derivative contracts and favorable foreign exchange partially offset by lower grant program income Income Before Income Taxes $94.7 $81.8 $12.9 15.8% Income Tax Expense ($37.5) ($31.3) ($6.2) (19.8%) Change in effective tax rate principally driven by the change in discrete activity Net Income $57.2 $50.5 $6.7 13.3% Diluted Earnings Per Share $0.31 $0.26 $0.05 19.2% Q2 2014: 181.6M shares; Q2 2013: 189.9M shares Adjusted EBITDA (1) $186.1 $171.6 $14.5 8.4% Adjusted EBITDA excluding technology-related license expenses (1) $186.1 $171.6 $14.5 8.4% Adjusted Net Income (1) $116.6 $89.4 $27.2 30.4% (1) See Appendix for a reconciliation from Net Income. |