Exhibit 99.1

CAPE BANCORP

Market Focused Community Bank Positioned for Growth

Full Conversion and Acquisition Community Meeting

CAPE BANCORP

This presentation is for informational purposes only and does not constitute an offer to sell shares of common stock of Cape Bancorp, Inc.

Please refer to the prospectus dated November 13, 2007

CAPE BANCORP

Forward-Looking Statements

Certain comments in this presentation are forward-looking statements, which can be identified by the use of such words as estimate, project, believe, intend, anticipate, plan, seek, expect and similar expressions. These forward-looking statements include, but are not limited to:

statements of our goals, intentions and expectations;

statements regarding our business plans and prospects and growth and operating strategies; statements regarding the asset quality of our loan and investment portfolios; and estimates of our risks and future costs and benefits.

These forward-looking statements are subject to significant risks, assumptions and uncertainties, including, among other things, the following important factors that could affect the actual outcome of future events: significantly increased competition among depository and other financial institutions; inflation and changes in market interest rates that reduce our net interest margin or reduce the fair value of financial instruments; general economic conditions, either nationally or in our market area, that are worse than expected; adverse changes in the securities markets; legislative or regulatory changes that adversely affect our business; our ability to successfully integrate Boardwalk Bank; our ability to enter new markets successfully and take advantage of growth opportunities, and the possible short-term dilutive effect of potential acquisitions or de novo branches, if any; changes in management’s estimate of the adequacy of the allowance for loan and lease losses; effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; costs and effects of litigation and unexpected or adverse outcomes in such litigations; changes in consumer spending, borrowing and savings habits; changes in accounting policies and practices, as may be adopted by bank regulatory agencies and the Financial Accounting Standards Board; inability of third-party providers to perform their obligations to us; and changes in our organization, compensation and benefit plans. Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these forward-looking statements.

Cape Bancorp, Inc. has filed a prospectus concerning the conversion with the Securities and Exchange Commission. Prospective purchasers of Cape Savings Bank are urged to read the prospectus because it contains important information. Prospective purchasers are able to obtain all documents filed with the SEC by Cape Bancorp, Inc. free of charge at the SEC’s website, www.sec.gov. In addition, documents filed with the SEC by Cape Bancorp, Inc. are available free of charge from the Corporate Secretary of Cape Bancorp, Inc. at 225 North Main Street, Cape May Court House, New Jersey 08210, telephone (800) 858-BANK. The directors, executive officers, and certain other members of management and the employees of Cape Bancorp, Inc. are participants in the solicitation of proxies in favor of the conversion from the mutual to stock form of ownership. Information about the directors and executive officers of Cape Bancorp, Inc. is included in the prospectus and the proxy statement/prospectus filed with the SEC.

The shares of common stock of Cape Bancorp, Inc. are not savings accounts or savings deposits, may lose value and are not insured by the Federal Deposit Insurance Corporation or any other government agency.

CAPE BANCORP

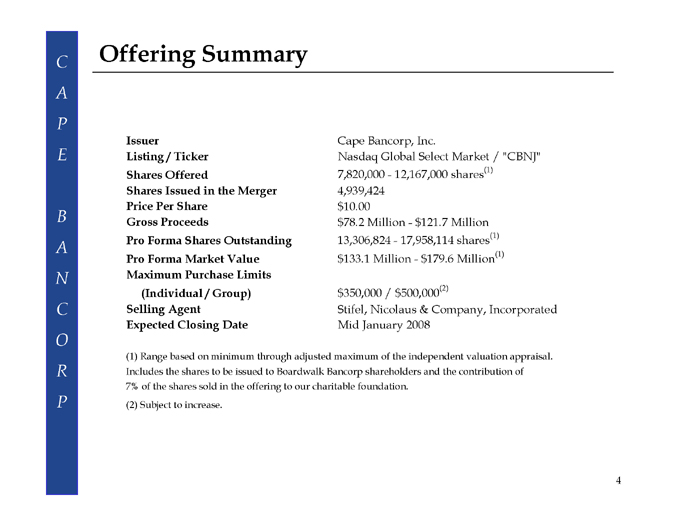

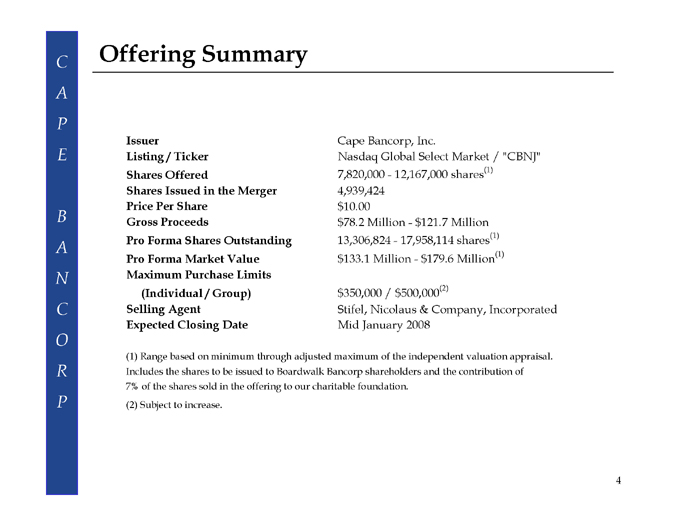

Offering Summary

Issuer

Listing / Ticker Shares Offered

Shares Issued in the Merger Price Per Share Gross Proceeds Pro Forma Shares Outstanding Pro Forma Market Value Maximum Purchase Limits (Individual / Group) Selling Agent Expected Closing Date

Cape Bancorp, Inc.

Nasdaq Global Select Market / “CBNJ” 7,820,000—12,167,000 shares(1) 4,939,424 $10.00 $78.2 Million—$121.7 Million 13,306,824—17,958,114 shares(1) $133.1 Million—$179.6 Million(1)

$350,000 / $500,000(2)

Stifel, Nicolaus & Company, Incorporated Mid January 2008

(1) Range based on minimum through adjusted maximum of the independent valuation appraisal. Includes the shares to be issued to Boardwalk Bancorp shareholders and the contribution of 7% of the shares sold in the offering to our charitable foundation.

CAPE BANCORP

Boardwalk Acquisition Overview

Purchase Price per Share: Aggregate Transaction Value: Form of Consideration: Exchange Ratio: Price / Book Value (1): Price / Tangible Book Value (1): Price / LTM EPS (1): Board of Directors:

Structure:

Termination Fee:

$23.00 $101.0 million

50% common stock / 50% cash

Fixed at 2.3 shares of Cape Bancorp common stock 196.1% 196.1% 53.5x Three directors from Boardwalk Bancorp (Michael D. Devlin, Agostino R. Fabietti and Thomas K. Ritter) will join both the Cape Bancorp and Cape Savings Bank Boards of Directors

Boardwalk Bancorp will be merged with and into Cape Bancorp and Cape Savings Bank will acquire Boardwalk Bank by merging Boardwalk Bank with and into Cape Savings Bank

$5.0 million

(1) | | At or for the 12 months ended June 30, 2007. 5 |

CAPE BANCORP

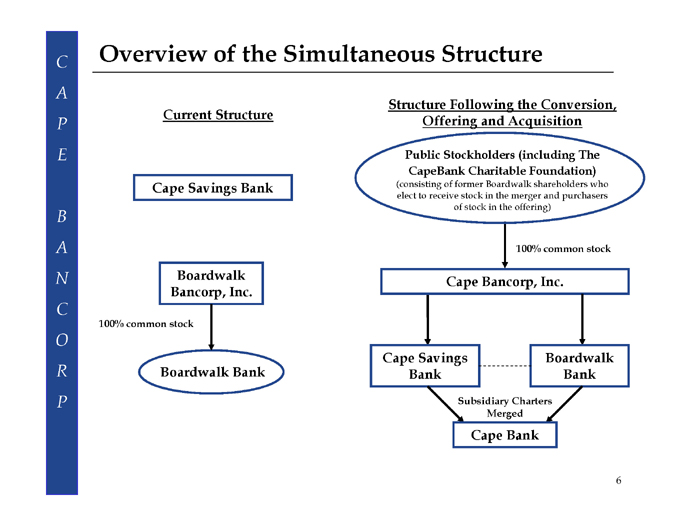

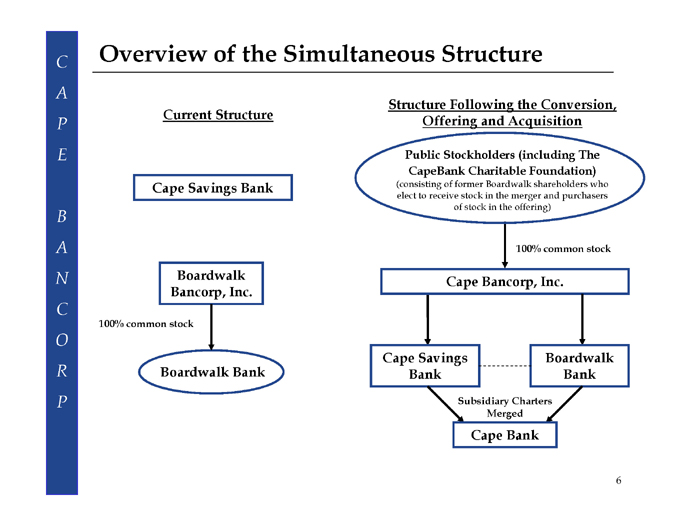

Overview of the Simultaneous Structure

Current Structure

Cape Savings Bank

Boardwalk Bancorp, Inc.

100% common stock

Boardwalk Bank

Structure Following the Conversion, Offering and Acquisition

Public Stockholders (including The CapeBank Charitable Foundation)

(consisting of former Boardwalk shareholders who elect to receive stock in the merger and purchasers of stock in the offering)

100% common stock

Cape Bancorp, Inc.

Cape Savings Bank

Boardwalk Bank

Subsidiary Charters Merged

Cape Bank

CAPE BANCORP

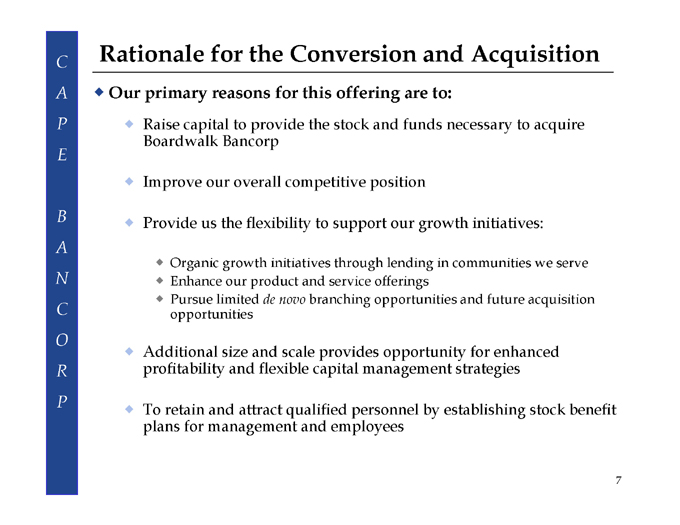

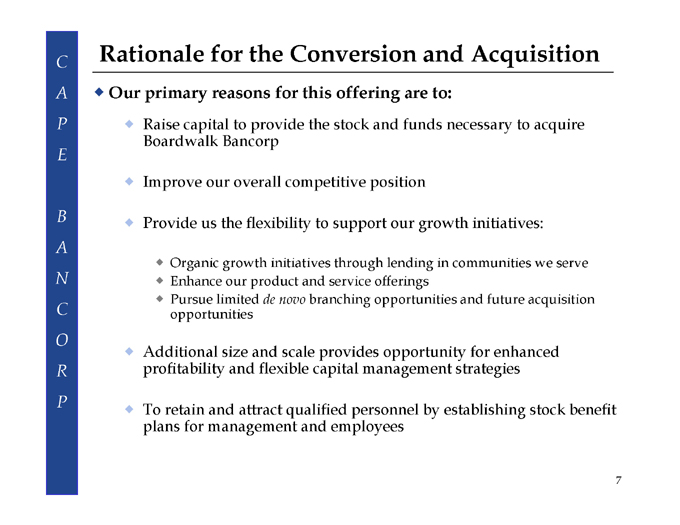

Rationale for the Conversion and Acquisition

Our primary reasons for this offering are to:

Raise capital to provide the stock and funds necessary to acquire Boardwalk Bancorp

Improve our overall competitive position

Provide us the flexibility to support our growth initiatives:

Organic growth initiatives through lending in communities we serve

Enhance our product and service offerings

Pursue limited de novo branching opportunities and future acquisition opportunities

Additional size and scale provides opportunity for enhanced profitability and flexible capital management strategies

To retain and attract qualified personnel by establishing stock benefit plans for management and employees

CAPE BANCORP

Corporate Overviews

Cape Savings Bank

Organized in 1923 as a New Jersey-chartered mutual savings bank

Headquartered in Cape May Court House, New Jersey

Operate from 13-full service locations in Cape May and Atlantic Counties

Customers consist primarily of individuals and small businesses

Financial data as of September 30, 2007:

Assets $620.1 million

Deposits $489.6 million

Net Loans $450.1 million

Equity $72.7 million

Boardwalk Bancorp

Boardwalk Bancorp is the holding company for Boardwalk Bank, a New Jersey-chartered commercial bank chartered in 1999.

Headquartered in Linwood, New Jersey

Operate 7 full-service branch offices in Cape May and Atlantic Counties and an loan production office in Cumberland County

Customers consist primarily of small to medium-sized businesses and individuals

Financial data as of September 30, 2007:

Assets $445.3 million

Deposits $311.2 million

Net Loans $298.1 million

Equity $49.9 million

CAPE BANCORP

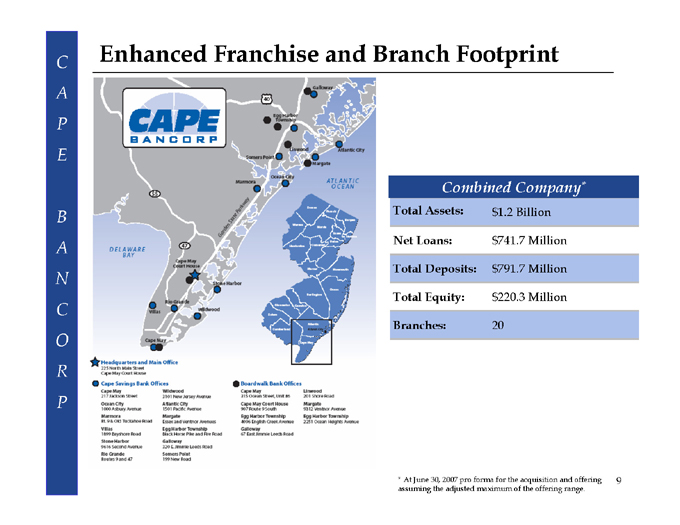

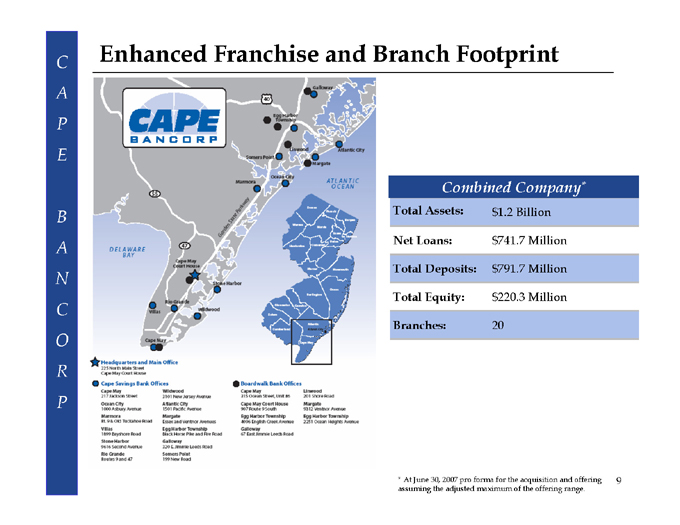

Enhanced Franchise and Branch Footprint

Combined Company*

Total Assets: $1.2 Billion

Net Loans: $741.7 Million

Total Deposits: $791.7 Million

Total Equity: $220.3 Million

Branches: 20

* | | At June 30, 2007 pro forma for the acquisition and offering 9 assuming the adjusted maximum of the offering range. |

9

CAPE BANCORP

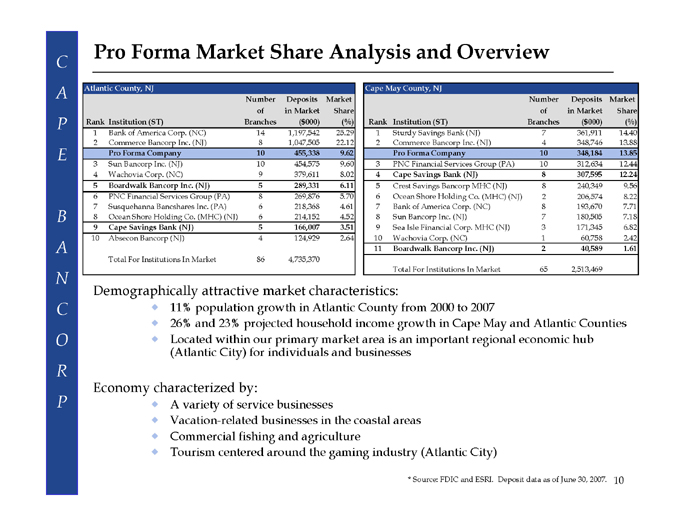

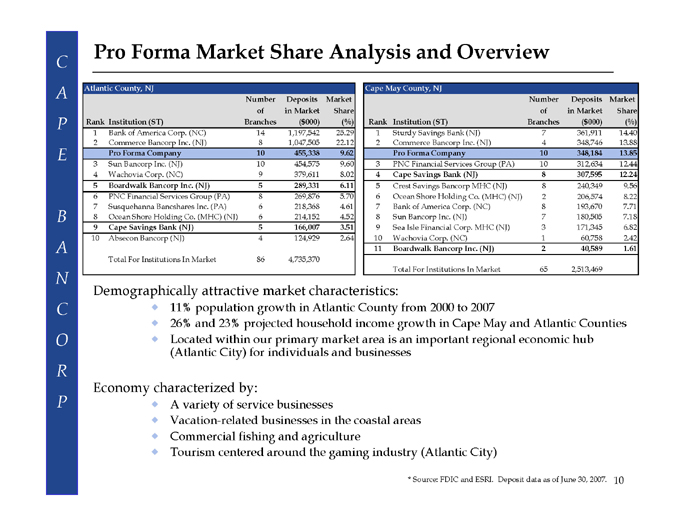

Pro Forma Market Share Analysis and Overview

Atlantic County, NJ

Rank Institution (ST) Number of Branches Deposits in Market ($ 000)

Market Share (%)

1 | | Bank of America Corp. (NC) 14 1,197,542 25.29 |

2 | | Commerce Bancorp Inc. (NJ) 8 1,047,505 22.12 |

Pro Forma Company 10 455,338 9.62

3 | | Sun Bancorp Inc. (NJ) 10 454,575 9.60 |

4 | | Wachovia Corp. (NC) 9 379,611 8.02 |

5 | | Boardwalk Bancorp Inc. (NJ) 5 289,331 6.11 |

6 | | PNC Financial Services Group (PA) 8 269,876 5.70 |

7 | | Susquehanna Bancshares Inc. (PA) 6 218,368 4.61 |

8 | | Ocean Shore Holding Co. (MHC) (NJ) 6 214,152 4.52 |

9 Cape Savings Bank (NJ) 5 166,007 3.51

10 Absecon Bancorp (NJ) 4 124,929 2.64

Total For Institutions In Market 86 4,735,370

Cape May County, NJ

Rank Institution (ST) Number of Branches Deposits in Market ($ 000) Market Share (%)

1 | | Sturdy Savings Bank (NJ) 7 361,911 14.40 |

2 | | Commerce Bancorp Inc. (NJ) 4 348,746 13.88 |

Pro Forma Company 10 348,184 13.85

3 | | PNC Financial Services Group (PA) 10 312,634 12.44 |

4 | | Cape Savings Bank (NJ) 8 307,595 12.24 |

5 | | Crest Savings Bancorp MHC (NJ) 8 240,349 9.56 |

6 | | Ocean Shore Holding Co. (MHC) (NJ) 2 206,574 8.22 |

7 | | Bank of America Corp. (NC) 8 193,670 7.71 |

8 | | Sun Bancorp Inc. (NJ) 7 180,505 7.18 |

9 Sea Isle Financial Corp. MHC (NJ) 3 171,345 6.82

10 Wachovia Corp. (NC) 1 60,758 2.42

11 Boardwalk Bancorp Inc. (NJ) 2 40,589 1.61

Total For Institutions In Market 65 2,513,469

Demographically attractive market characteristics:

11% population growth in Atlantic County from 2000 to 2007

26% and 23% projected household income growth in Cape May and Atlantic Counties

Located within our primary market area is an important regional economic hub (Atlantic City) for individuals and businesses

Economy characterized by:

A variety of service businesses

Vacation-related businesses in the coastal areas

Commercial fishing and agriculture

Tourism centered around the gaming industry (Atlantic City)

* | | Source: FDIC and ESRI. Deposit data as of June 30, 2007. 10 |

CAPE BANCORP

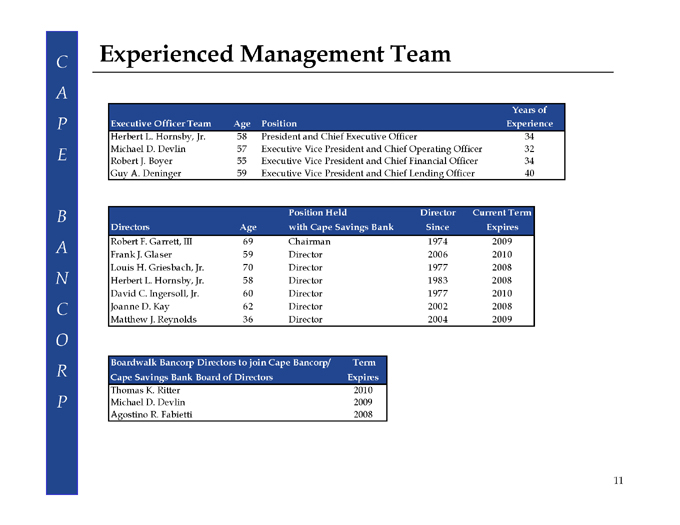

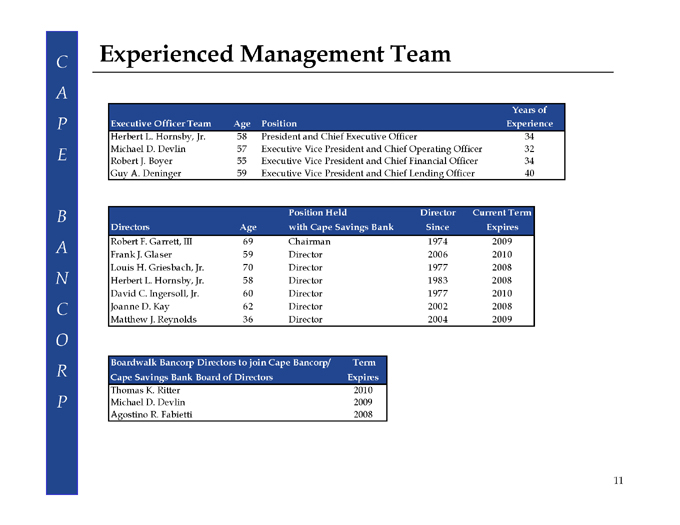

Experienced Management Team

Executive Officer Team Age Position Years of Experience

Herbert L. Hornsby, Jr. 58 President and Chief Executive Officer 34

Michael D. Devlin 57 Executive Vice President and Chief Operating Officer 32

Robert J. Boyer 55 Executive Vice President and Chief Financial Officer 34

Guy A. Deninger 59 Executive Vice President and Chief Lending Officer 40

Directors Age Position Held with Cape Savings Bank Director Since Current Term Expires

Robert F. Garrett, III 69 Chairman 1974 2009

Frank J. Glaser 59 Director 2006 2010

Louis H. Griesbach, Jr. 70 Director 1977 2008

Herbert L. Hornsby, Jr. 58 Director 1983 2008

David C. Ingersoll, Jr. 60 Director 1977 2010

Joanne D. Kay 62 Director 2002 2008

Matthew J. Reynolds 36 Director 2004 2009

Boardwalk Bancorp Directors to join Cape Bancorp/ Term

Cape Savings Bank Board of Directors Expires

Thomas K. Ritter 2010

Michael D. Devlin 2009

Agostino R. Fabietti 2008

11

CAPE BANCORP

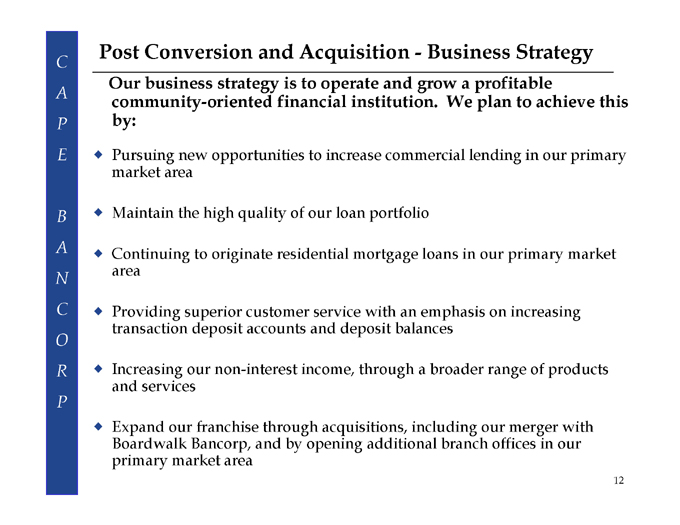

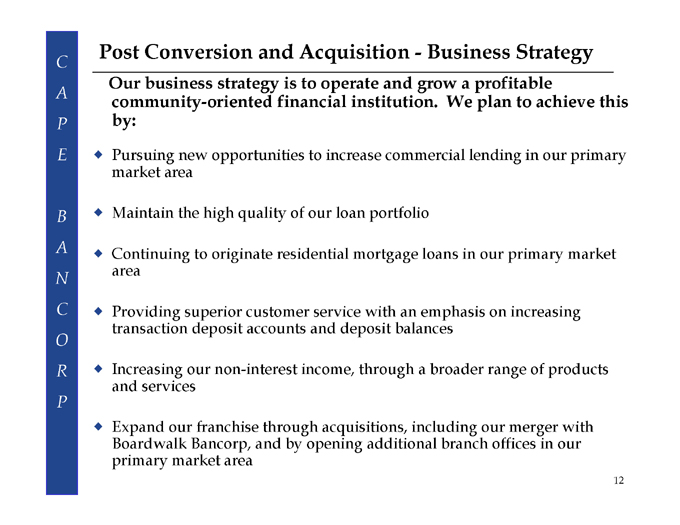

Post Conversion and Acquisition—Business Strategy

Our business strategy is to operate and grow a profitable community-oriented financial institution. We plan to achieve this by:

Pursuing new opportunities to increase commercial lending in our primary market area

Maintain the high quality of our loan portfolio

Continuing to originate residential mortgage loans in our primary market area

Providing superior customer service with an emphasis on increasing transaction deposit accounts and deposit balances

Increasing our non-interest income, through a broader range of products and services

Expand our franchise through acquisitions, including our merger with Boardwalk Bancorp, and by opening additional branch offices in our primary market area

12

CAPE BANCORP

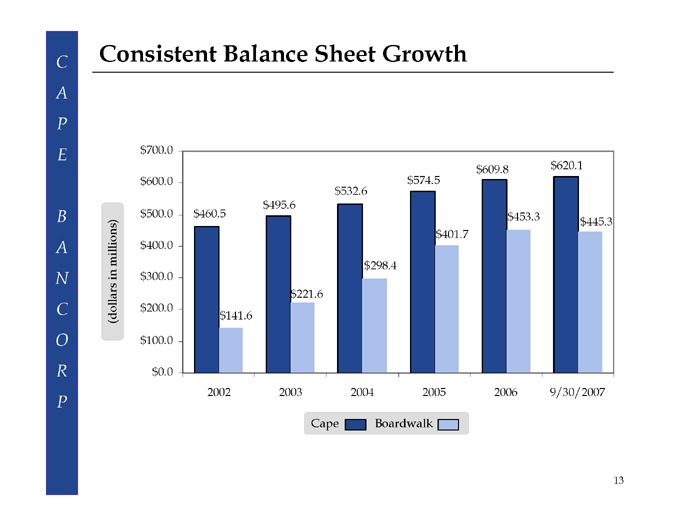

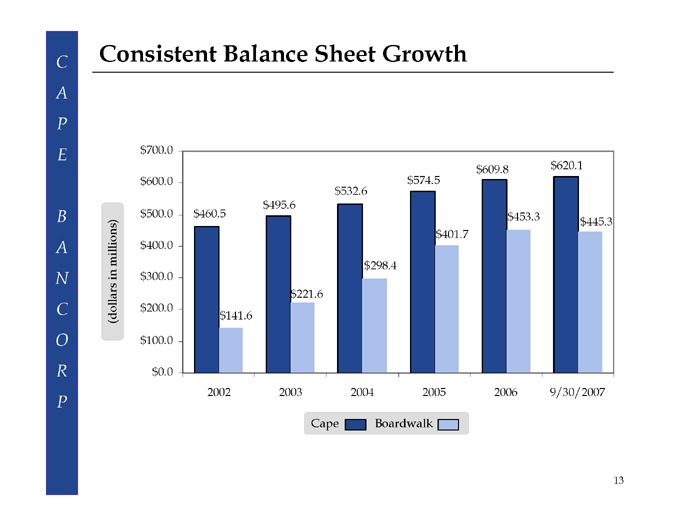

Consistent Balance Sheet Growth

$700.0

$600.0

$500.0

$400.0

$300.0

$200.0

$100.0

$0.0

$460.5

$141.6

$495.6

$221.6

$532.6

$298.4

$574.5

$401.7

$609.8

$453.3

$620.1

$445.3

2002 2003 2004 2005 2006 9/30/2007

Cape

Boardwalk

(dollars in millions)

13

CAPE BANCORP

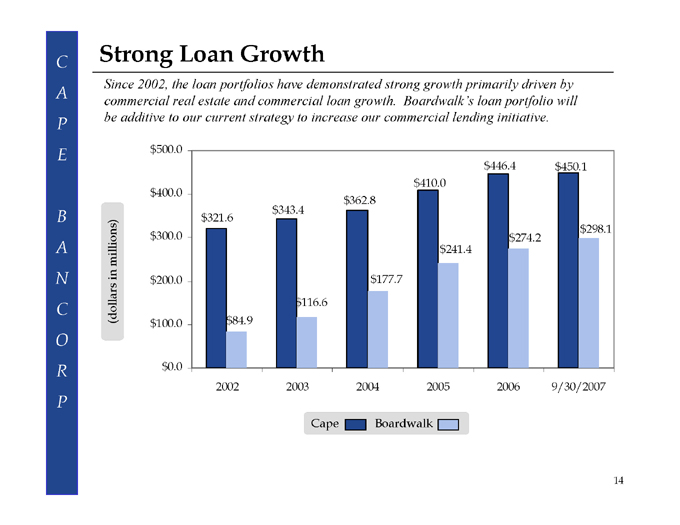

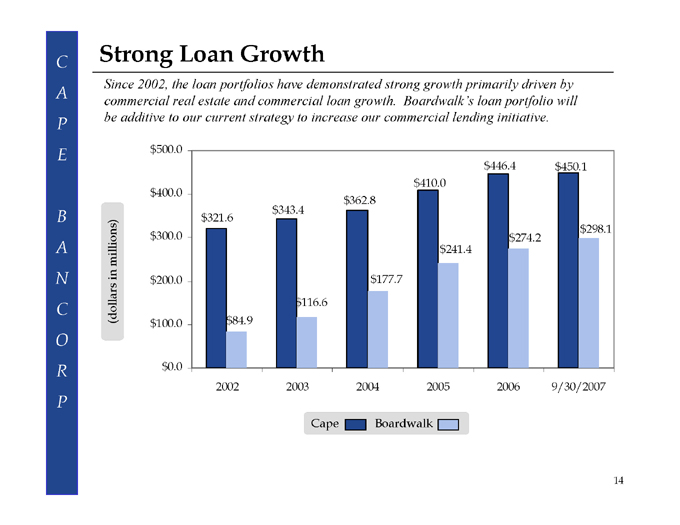

Strong Loan Growth

Since 2002, the loan portfolios have demonstrated strong growth primarily driven by commercial real estate and commercial loan growth. Boardwalk’s loan portfolio will be additive to our current strategy to increase our commercial lending initiative.

$500.0 $400.0 $300.0 $200.0 $100.0 $0.0

$321.6 $84.9 $343.4

$116.6 $362.8 $177.7 $410.0 $241.4 $446.4 $274.2 $450.1 $298.1

2002 2003 2004 2005 2006 9/30/2007

Cape

Boardwalk

(dollars in millions)

14

CAPE BANCORP

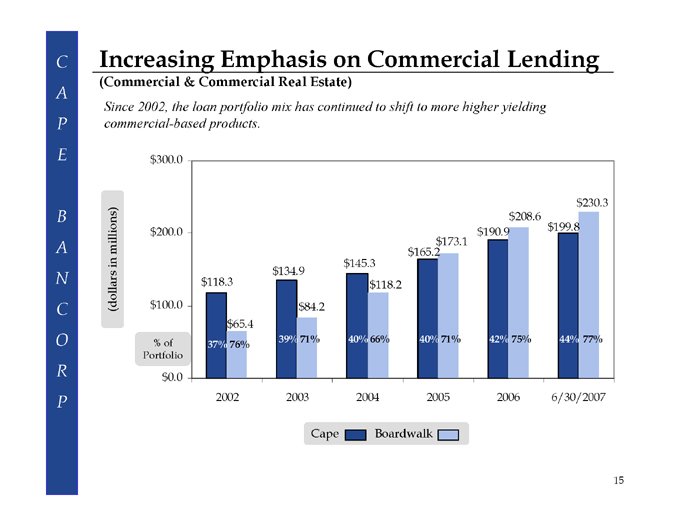

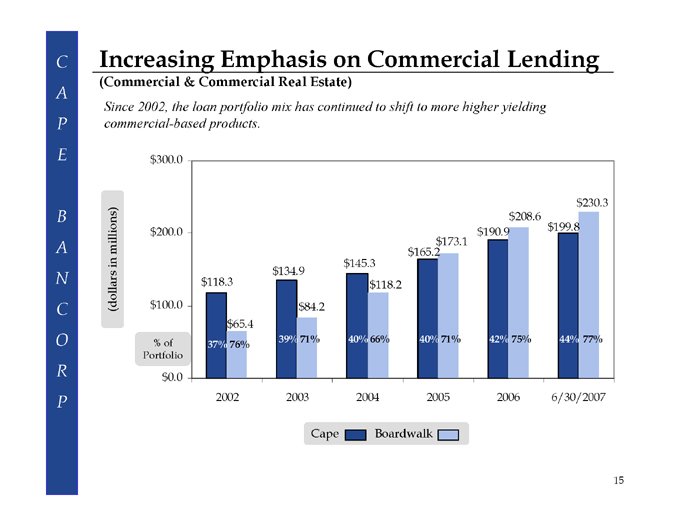

Increasing Emphasis on Commercial Lending

(Commercial & Commercial Real Estate)

Since 2002, the loan portfolio mix has continued to shift to more higher yielding commercial-based products.

$300.0

$200.0

$100.0

% of Portfolio $0.0

$230.3 $208.6 $190.9 $199.8 $173.1 $165.2 $145.3 $134.9 $118.3 $118.2 $84.2 $65.4

39% 71% 40% 66% 40% 71% 42% 75% 44% 77% 37% 76%

2002 2003 2004 2005 2006 6/30/2007

Cape Boardwalk

(dollars in millions)

15

CAPE BANCORP

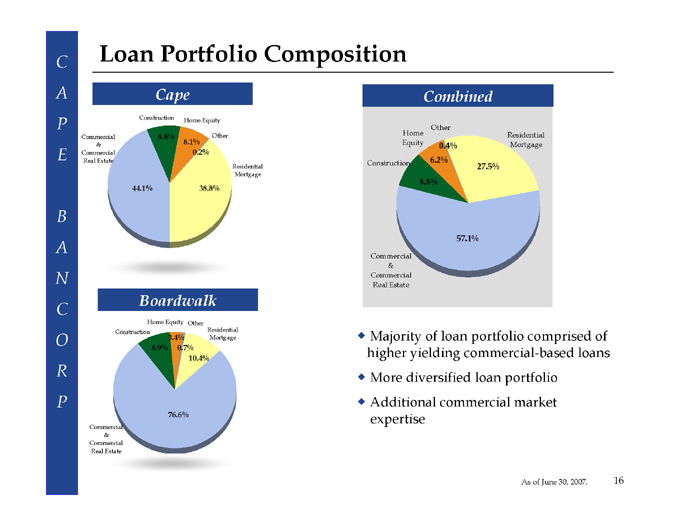

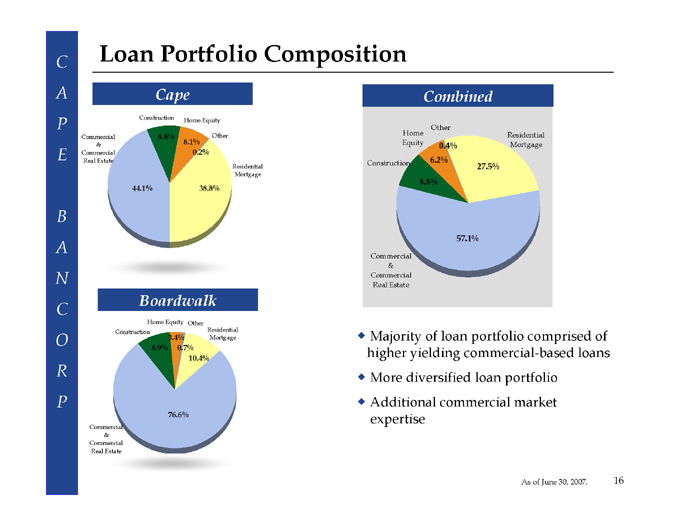

Loan Portfolio Composition

Cape

Construction Home Equity Commercial 8.8% Other

& 8.1%

Commercial 0.2% Real Estate

Residential Mortgage

44.1% 38.8%

Boardwalk

Home Equity Other

Construction Residential 3.4% Mortgage

8.9% 0.7% 10.4%

76.6%

Commercial & Commercial Real Estate

Combined

Other

Home Residential Equity 0.4% Mortgage Construction 6.2% 27.5% 8.8%

57.1%

Commercial & Commercial Real Estate

Majority of loan portfolio comprised of higher yielding commercial-based loans More diversified loan portfolio Additional commercial market expertise

As of June 30, 2007. 16

CAPE BANCORP

Disciplined Credit Culture

Since 2002, both banks have maintained a conservative credit culture resulting in superior asset quality.

Cape

2002 2003 2004 2005 2006 9/30/2007

NPAs / Total Assets 0.31% 0.38% 0.23% 0.49% 0.62% 0.54%

NPLs/ Total Loans 0.36% 0.55% 0.34% 0.68% 0.84% 0.74%

Allowance/NPLs 190.20% 160.30% 289.86% 134.52% 105.20% 118.82%

Allowance/Total Loans 0.69% 0.88% 0.98% 0.91% 0.89% 0.88%

Boardwalk

2002 2003 2004 2005 2006 9/30/2007

NPAs / Total Assets 0.51% 0.71% —— 0.11% 0.29%

NPLs/ Total Loans 0.84% 1.32% —— 0.17% 0.43%

Allowance/NPLs 184.32% 94.82% —— 681.88% 283.13%

Allowance/Total Loans 1.55% 1.26% 1.21% 1.17% 1.18% 1.22%

17

CAPE BANCORP

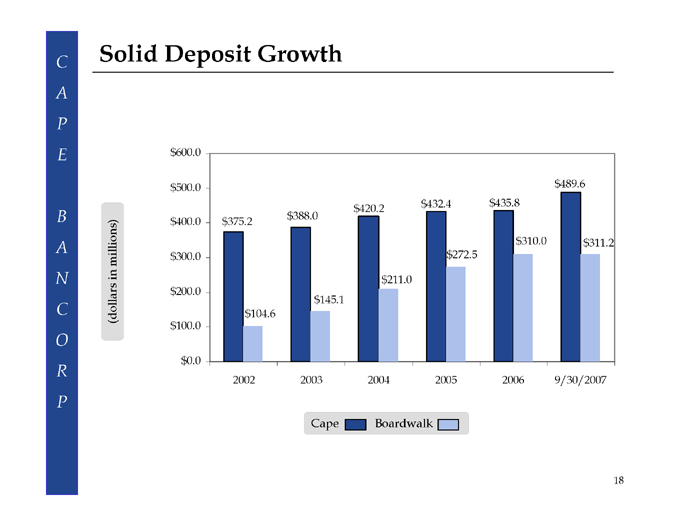

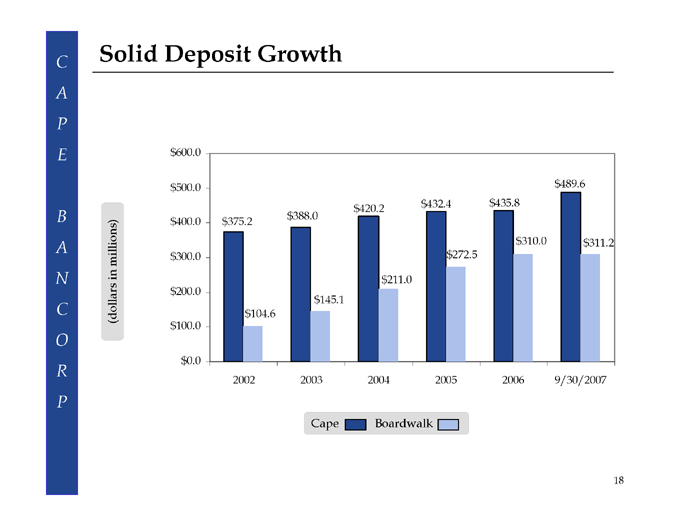

Solid Deposit Growth

$600.0 $500.0 $400.0 $300.0 $200.0 $100.0 $0.0

$489.6 $432.4 $435.8 $420.2 $388.0 $375.2 $310.0 $311.2 $272.5

$211.0 $145.1 $104.6

2002 2003 2004 2005 2006 9/30/2007

Cape Boardwalk

(dollars in millions)

18

CAPE BANCORP

Conversion Offering Information

CAPE BANCORP

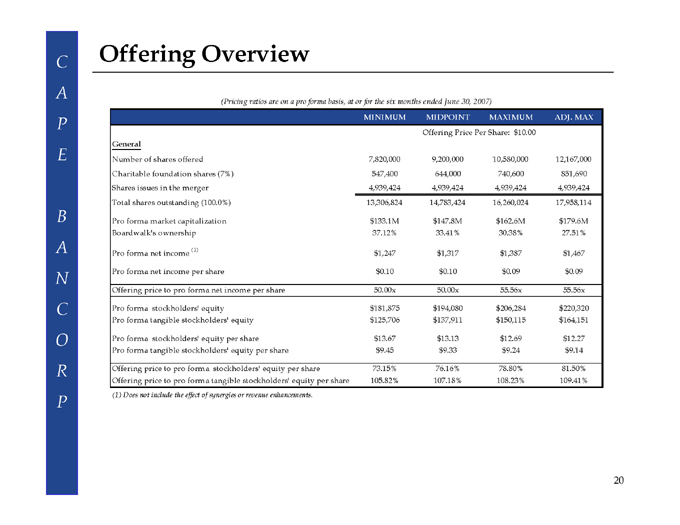

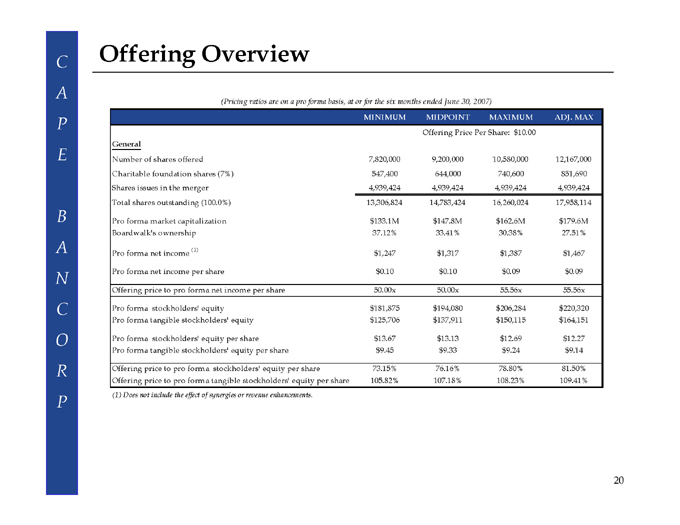

Offering Overview

(Pricing ratios are on a pro forma basis, at or for the six months ended June 30, 2007)

MINIMUM MIDPOINT MAXIMUM ADJ. MAX

Offering Price Per Share: $ 10.00

General

Number of shares offered 7,820,000 9,200,000 10,580,000 12,167,000

Charitable foundation shares (7%) 547,400 644,000 740,600 851,690

Shares issues in the merger 4,939,424 4,939,424 4,939,424 4,939,424

Total shares outstanding (100.0%) 13,306,824 14,783,424 16,260,024 17,958,114

Pro forma market capitalization $133.1M $147.8M $162.6M $ 179.6M

Boardwalk’s ownership 37.12% 33.41% 30.38% 27.51%

Pro forma net income (1) $ 1,247 $ 1,317 $ 1,387 $ 1,467

Pro forma net income per share $ 0.10 $ 0.10 $ 0.09 $ 0.09

Offering price to pro forma net income per share 50.00x 50.00x 55.56x 55.56x

Pro forma stockholders’ equity $ 181,875 $ 194,080 $ 206,284 $ 220,320

Pro forma tangible stockholders’ equity $ 125,706 $ 137,911 $ 150,115 $ 164,151

Pro forma stockholders’ equity per share $ 13.67 $ 13.13 $ 12.69 $ 12.27

Pro forma tangible stockholders’ equity per share $ 9.45 $ 9.33 $ 9.24 $ 9.14

Offering price to pro forma stockholders’ equity per share 73.15% 76.16% 78.80% 81.50%

Offering price to pro forma tangible stockholders’ equity per share 105.82% 107.18% 108.23% 109.41%

(1) | | Does not include the effect of synergies or revenue enhancements. |

20

CAPE BANCORP

Attractive Valuation

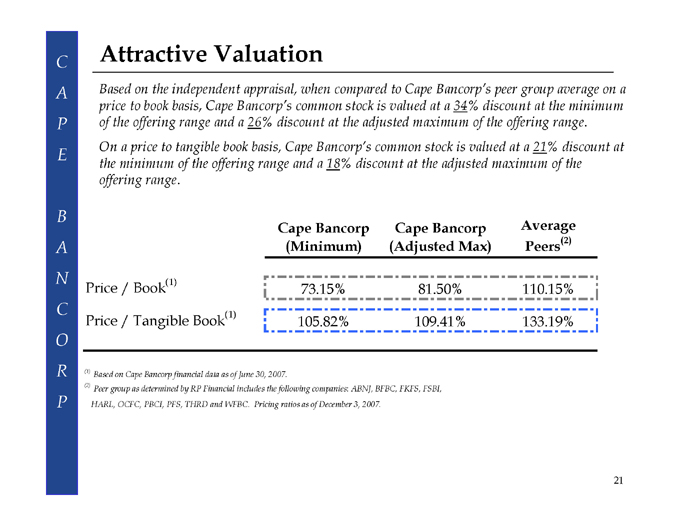

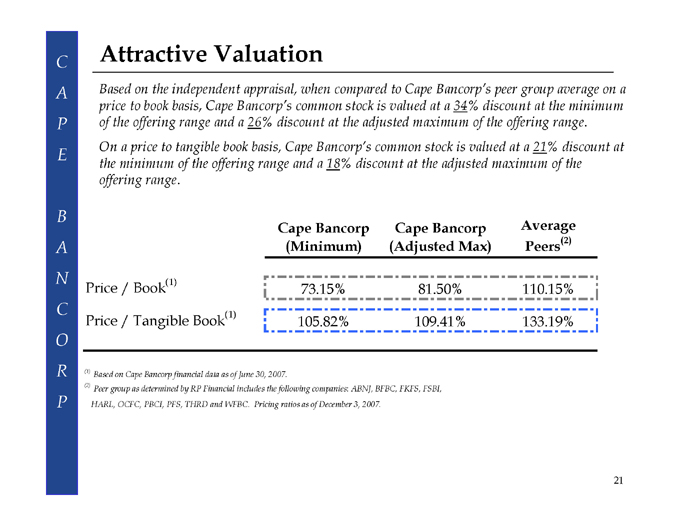

Based on the independent appraisal, when compared to Cape Bancorp’s peer group average on a price to book basis, Cape Bancorp’s common stock is valued at a 34% discount at the minimum of the offering range and a 26% discount at the adjusted maximum of the offering range. On a price to tangible book basis, Cape Bancorp’s common stock is valued at a 21% discount at the minimum of the offering range and a 18% discount at the adjusted maximum of the offering range.

Cape Bancorp (Minimum) Cape Bancorp (Adjusted Max) Average Peers(2)

Price / Book(1) 73.15% 81.50% 110.15%

Price / Tangible Book(1) 105.82% 109.41% 133.19%

(1) | | Based on Cape Bancorp financial data as of June 30, 2007. |

(2) Peer group as determined by RP Financial includes the following companies: ABNJ, BFBC, FKFS, FSBI, HARL, OCFC, PBCI, PFS, THRD and WFBC. Pricing ratios as of December 3, 2007.

21

CAPE BANCORP

Investment Highlights

Merger solidifies Cape’s position as the largest banking institution headquartered in Cape May and Atlantic Counties

Merger combines two companies with strong cultural compatibility and complementary business models

Growing presence in demographically attractive markets

Seasoned management team with an intimate knowledge of the local markets and strong ties to the community

Diversified loan portfolio with a continuing emphasis on commercial lending

Increase in loan-to-one borrower limit creates additional lending flexibility

Conservative credit practices have maintained superior asset quality

Established local identity in the communities served

22

CAPE BANCORP

Important!!

You were mailed proxy materials on November 23rd regarding our proposed conversion. Even if you’re not buying,

Please remember to Vote!!

Not voting has the same effect as voting “Against” the plan of conversion and establishment and funding of the charitable foundation.

23

CAPE BANCORP

How to Order

Complete and sign the Stock Order Form

Payment

Enclose a check or money order

Authorize withdrawal from deposit account, other than those accounts with check-writing privileges.

If you are interested in using your IRA funds held at Cape Savings Bank, or elsewhere, please call the Stock Information Center for assistance at least two weeks before the offering deadline. IRA purchases typically involve special procedures and additional paperwork, requiring further processing time

Stock Order Form and payment must be received at the Stock Information Center on or before 12:00 Noon, Eastern time, December 17, 2007

24

CAPE BANCORP

Questions?

Stock Information Center

211 North Main Street Building 211, Suite 104 Cape May Court House, NJ 08210

(609) 465-7421 (local) (800) 694-8800 (toll free)

10:00 a.m. to 4:00 p.m., Monday – Friday, not open on weekends and bank holidays

25