INDEPENDENT AUDITORSʹ REPORT AND FINANCIAL STATEMENTS FOR LENDSURE MORTGAGE CORP. FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021

LENDSURE MORTGAGE CORP. TABLE OF CONTENTS Page INDEPENDENT AUDITORS’ REPORT 1 ‐ 3 FINANCIAL STATEMENTS Balance Sheets 4 Statements of Operations 5 Statements of Changes in Stockholdersʹ Equity 6 Statements of Cash Flows 7 Notes to Financial Statements 8 ‐ 22 SUPPLEMENTARY INFORMATION Computation of Adjusted Net Worth to Determine Compliance with HUD Net Worth Requirements 23

9780 S Meridian Blvd., Suite 500 Englewood, CO 80112 303‐721‐6131 www.richeymay.com Assurance | Tax | Advisory INDEPENDENT AUDITORSʹ REPORT To the Stockholders LendSure Mortgage Corp. San Diego, California Report on the Audit of the Financial Statements Opinion We have audited the accompanying financial statements of LendSure Mortgage Corp., which comprise the balance sheets as of December 31, 2022 and 2021, and the related statements of operations, changes in stockholders’ equity, and cash flows for the years then ended, and the related notes to the financial statements. In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of LendSure Mortgage Corp. as of December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS) and the standards applicable to financial audits contained in Government Auditing Standards issued by the Comptroller General of the United States. Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of LendSure Mortgage Corp. and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about LendSure Mortgage Corp.’s ability to continue as a going concern for one year after the date the financial statements are issued.

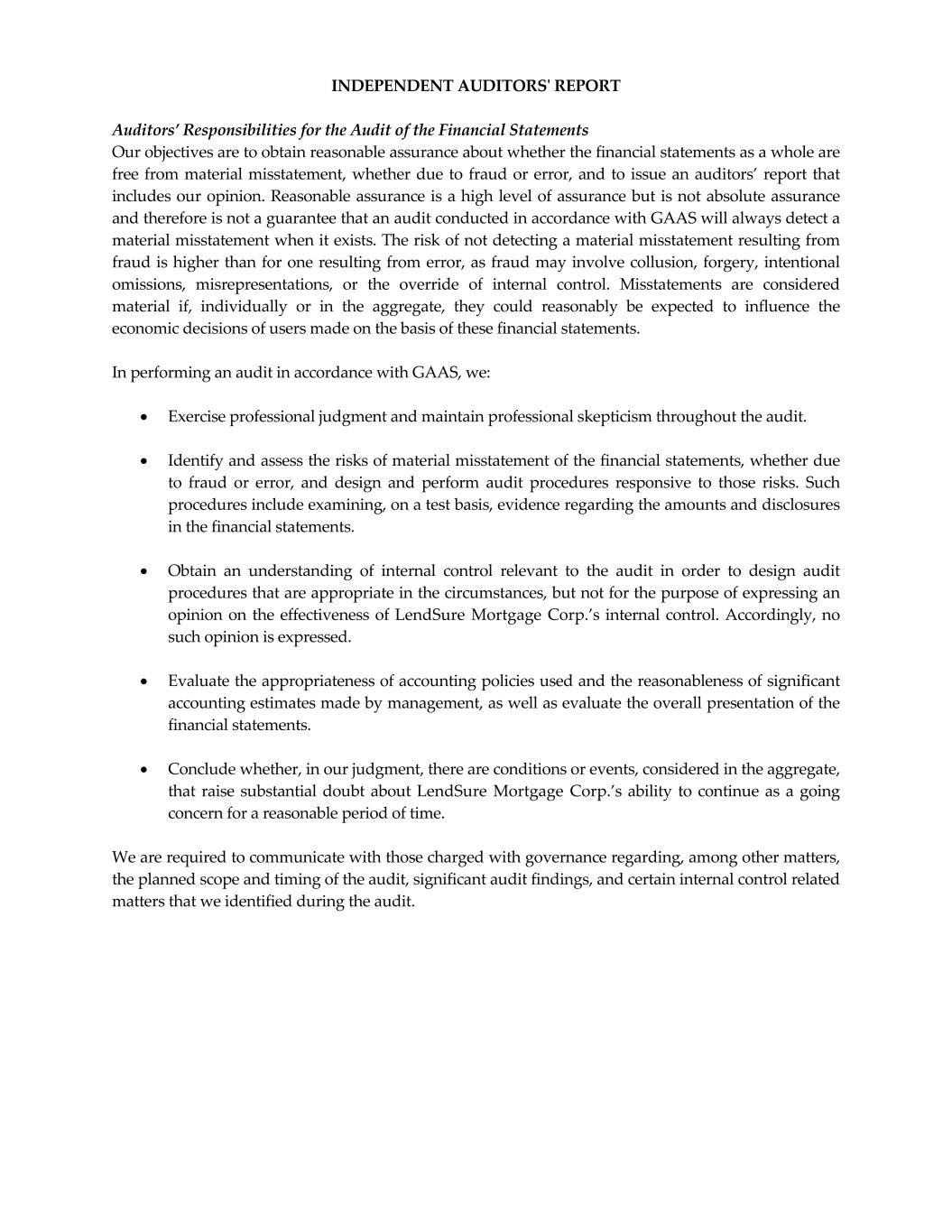

INDEPENDENT AUDITORSʹ REPORT Auditors’ Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users made on the basis of these financial statements. In performing an audit in accordance with GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of LendSure Mortgage Corp.’s internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about LendSure Mortgage Corp.’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit.

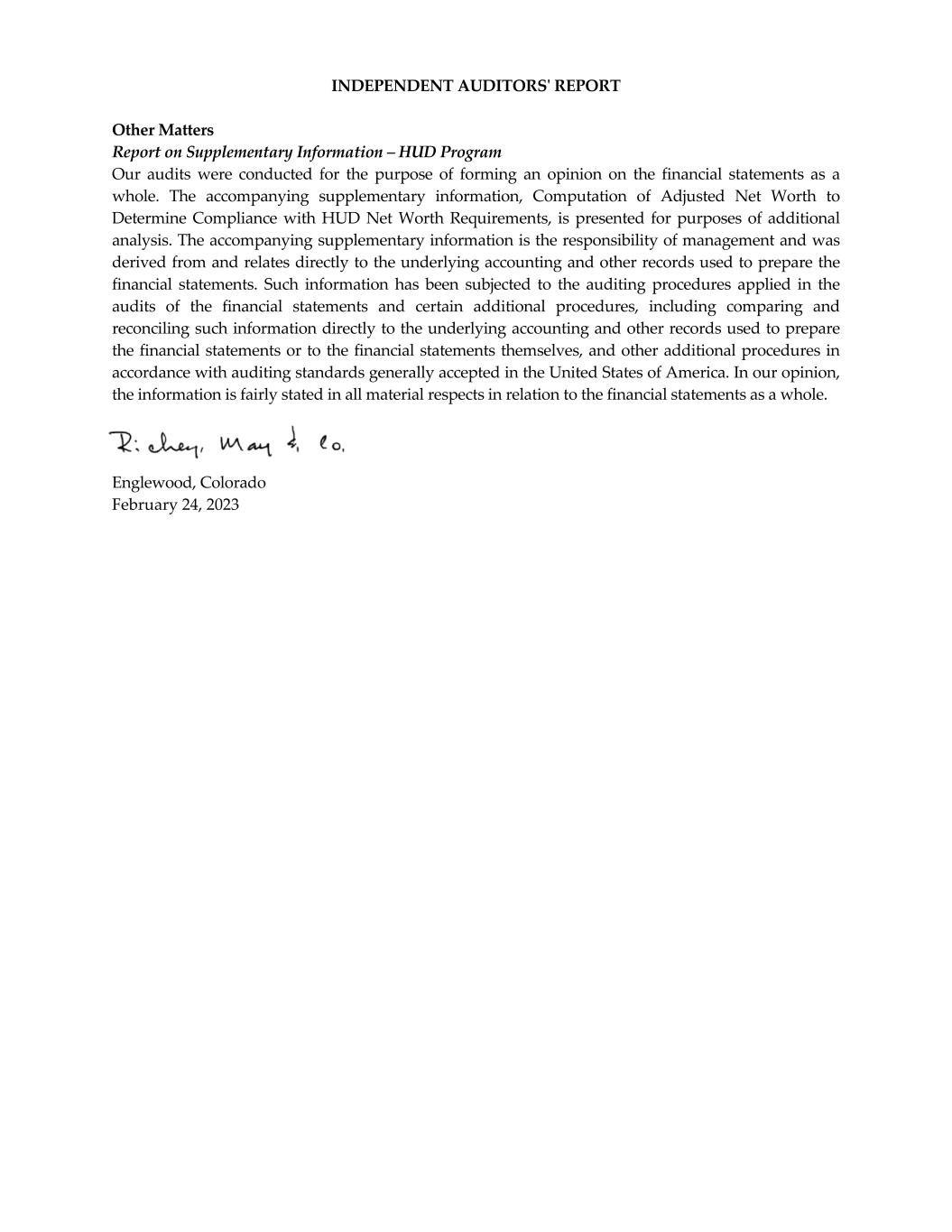

INDEPENDENT AUDITORSʹ REPORT Other Matters Report on Supplementary Information – HUD Program Our audits were conducted for the purpose of forming an opinion on the financial statements as a whole. The accompanying supplementary information, Computation of Adjusted Net Worth to Determine Compliance with HUD Net Worth Requirements, is presented for purposes of additional analysis. The accompanying supplementary information is the responsibility of management and was derived from and relates directly to the underlying accounting and other records used to prepare the financial statements. Such information has been subjected to the auditing procedures applied in the audits of the financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the financial statements or to the financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United States of America. In our opinion, the information is fairly stated in all material respects in relation to the financial statements as a whole. Englewood, Colorado February 24, 2023

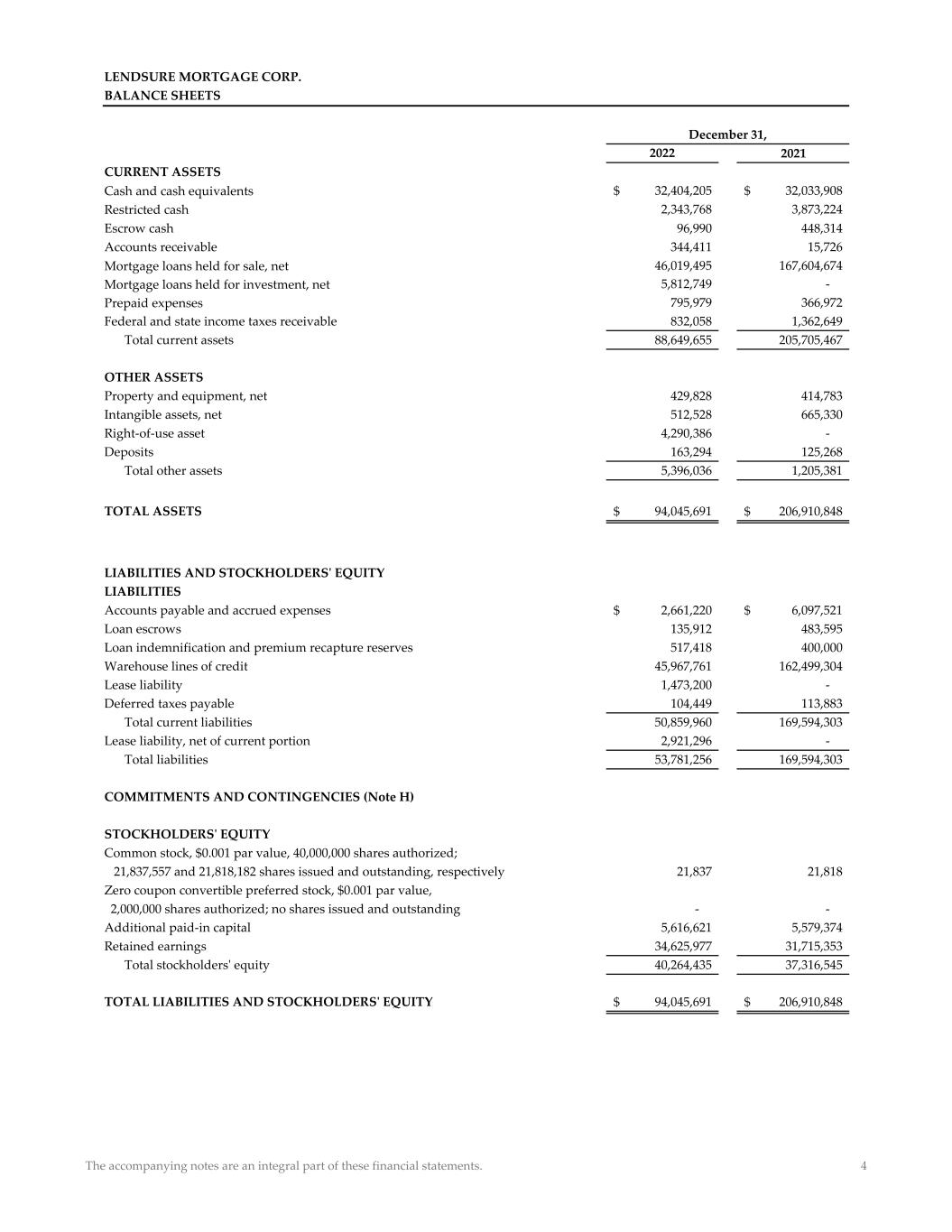

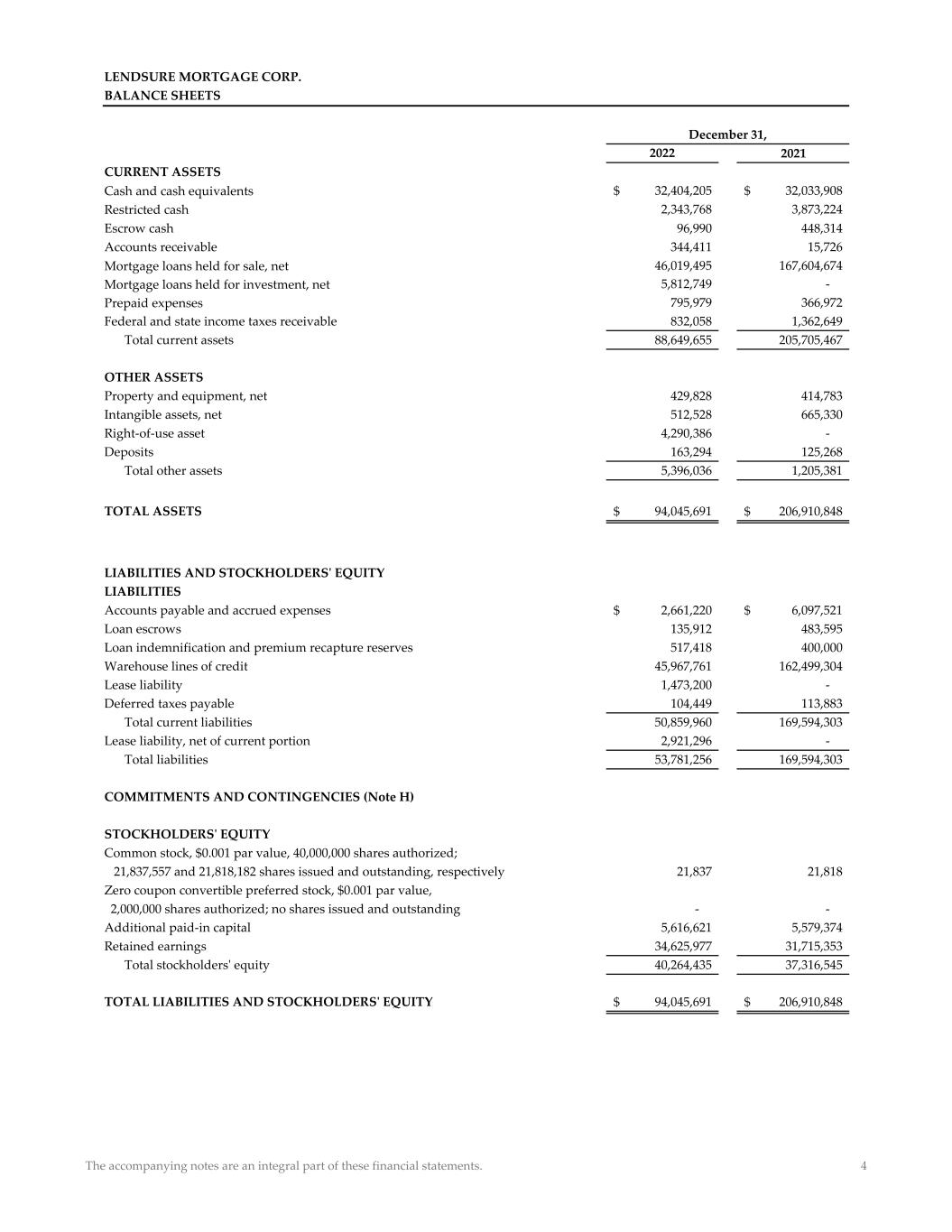

2022 2021 CURRENT ASSETS Cash and cash equivalents 32,404,205$ 32,033,908$ Restricted cash 2,343,768 3,873,224 Escrow cash 96,990 448,314 Accounts receivable 344,411 15,726 Mortgage loans held for sale, net 46,019,495 167,604,674 Mortgage loans held for investment, net 5,812,749 ‐ Prepaid expenses 795,979 366,972 Federal and state income taxes receivable 832,058 1,362,649 Total current assets 88,649,655 205,705,467 OTHER ASSETS Property and equipment, net 429,828 414,783 Intangible assets, net 512,528 665,330 Right‐of‐use asset 4,290,386 ‐ Deposits 163,294 125,268 Total other assets 5,396,036 1,205,381 TOTAL ASSETS 94,045,691$ 206,910,848$ LIABILITIES AND STOCKHOLDERSʹ EQUITY LIABILITIES Accounts payable and accrued expenses 2,661,220$ 6,097,521$ Loan escrows 135,912 483,595 Loan indemnification and premium recapture reserves 517,418 400,000 Warehouse lines of credit 45,967,761 162,499,304 Lease liability 1,473,200 ‐ Deferred taxes payable 104,449 113,883 Total current liabilities 50,859,960 169,594,303 Lease liability, net of current portion 2,921,296 ‐ Total liabilities 53,781,256 169,594,303 COMMITMENTS AND CONTINGENCIES (Note H) STOCKHOLDERSʹ EQUITY Common stock, $0.001 par value, 40,000,000 shares authorized; 21,837,557 and 21,818,182 shares issued and outstanding, respectively 21,837 21,818 Zero coupon convertible preferred stock, $0.001 par value, 2,000,000 shares authorized; no shares issued and outstanding ‐ ‐ Additional paid‐in capital 5,616,621 5,579,374 Retained earnings 34,625,977 31,715,353 Total stockholdersʹ equity 40,264,435 37,316,545 TOTAL LIABILITIES AND STOCKHOLDERSʹ EQUITY 94,045,691$ 206,910,848$ LENDSURE MORTGAGE CORP. BALANCE SHEETS December 31, The accompanying notes are an integral part of these financial statements. 4

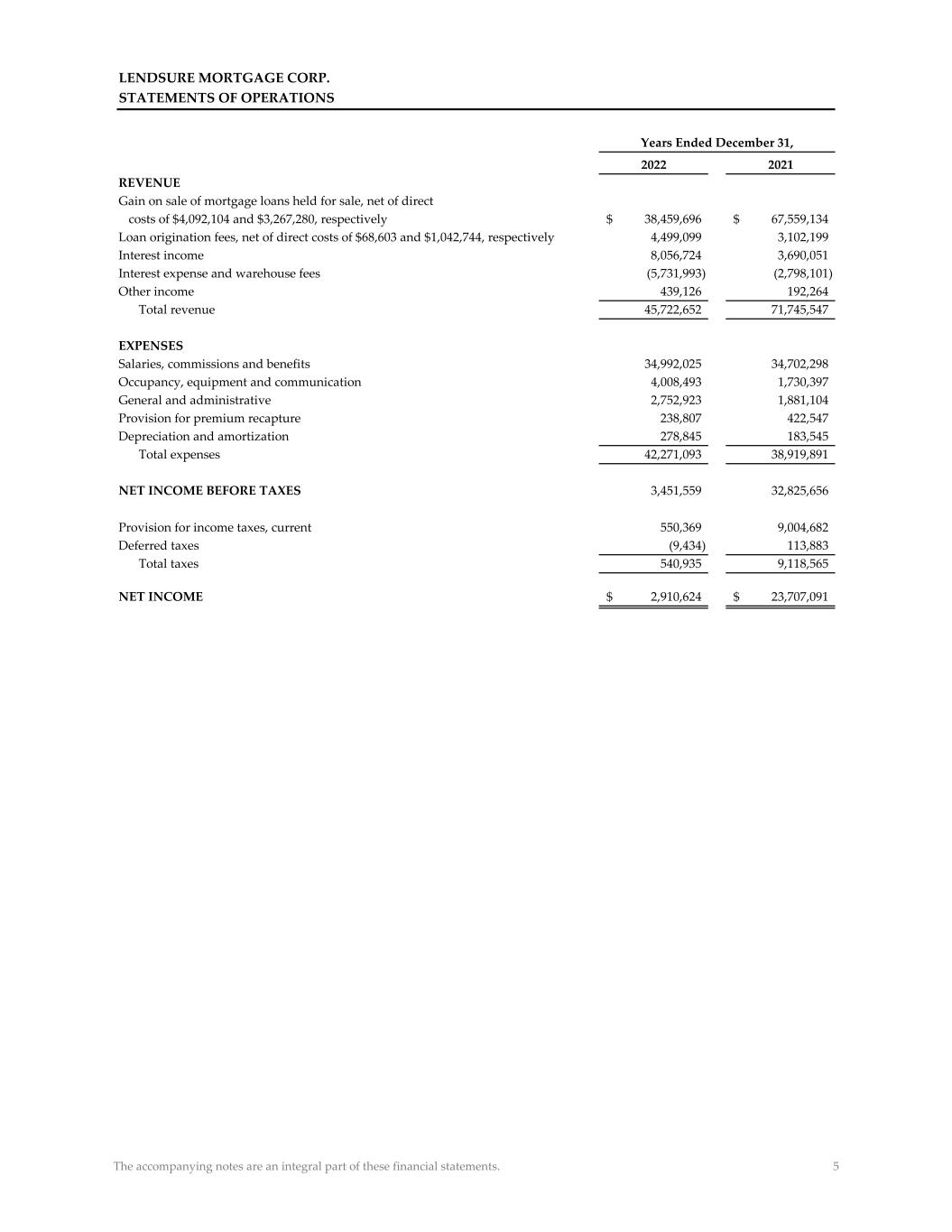

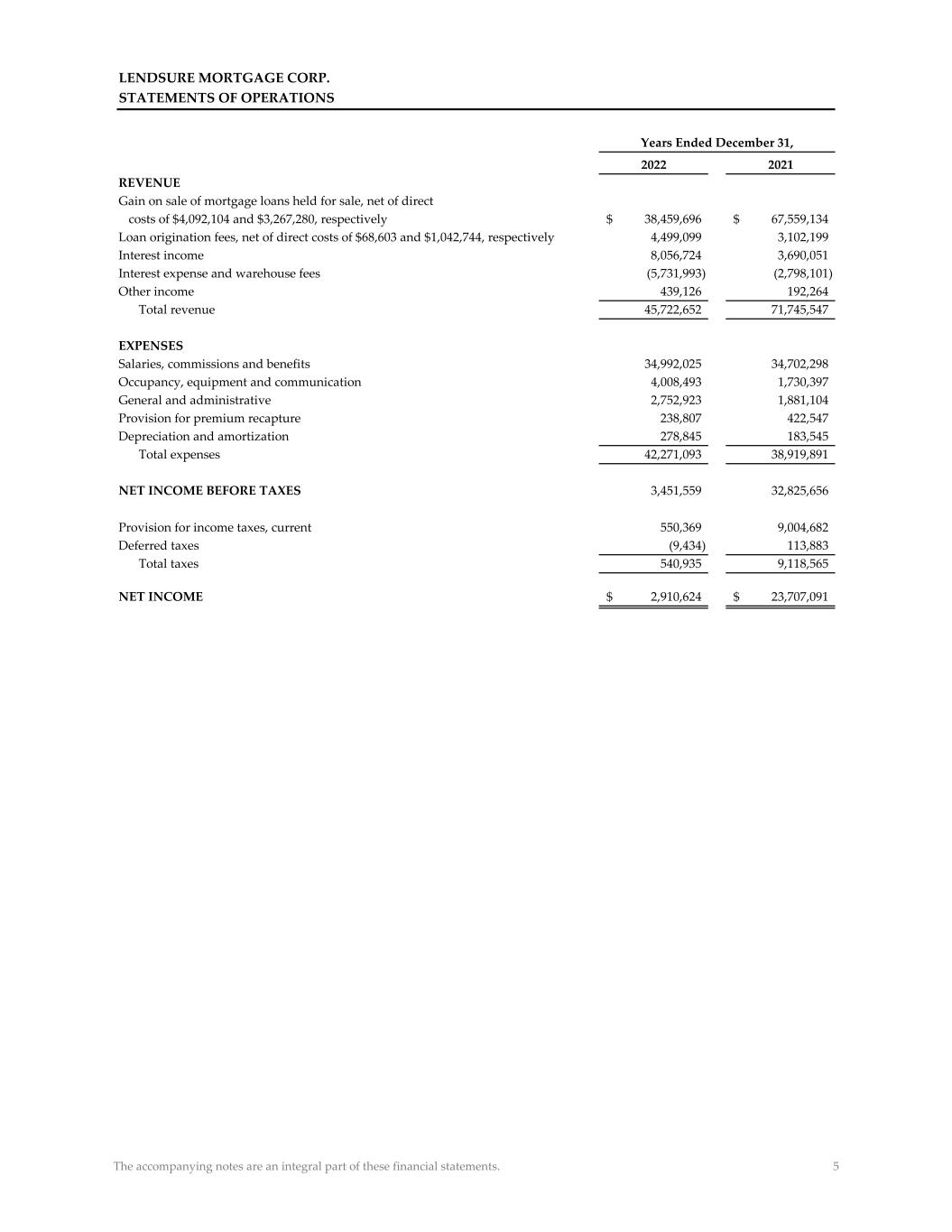

STATEMENTS OF OPERATIONS 2022 2021 REVENUE Gain on sale of mortgage loans held for sale, net of direct costs of $4,092,104 and $3,267,280, respectively 38,459,696$ 67,559,134$ Loan origination fees, net of direct costs of $68,603 and $1,042,744, respectively 4,499,099 3,102,199 Interest income 8,056,724 3,690,051 Interest expense and warehouse fees (5,731,993) (2,798,101) Other income 439,126 192,264 Total revenue 45,722,652 71,745,547 EXPENSES Salaries, commissions and benefits 34,992,025 34,702,298 Occupancy, equipment and communication 4,008,493 1,730,397 General and administrative 2,752,923 1,881,104 Provision for premium recapture 238,807 422,547 Depreciation and amortization 278,845 183,545 Total expenses 42,271,093 38,919,891 NET INCOME BEFORE TAXES 3,451,559 32,825,656 Provision for income taxes, current 550,369 9,004,682 Deferred taxes (9,434) 113,883 Total taxes 540,935 9,118,565 NET INCOME 2,910,624$ 23,707,091$ LENDSURE MORTGAGE CORP. Years Ended December 31, The accompanying notes are an integral part of these financial statements. 5

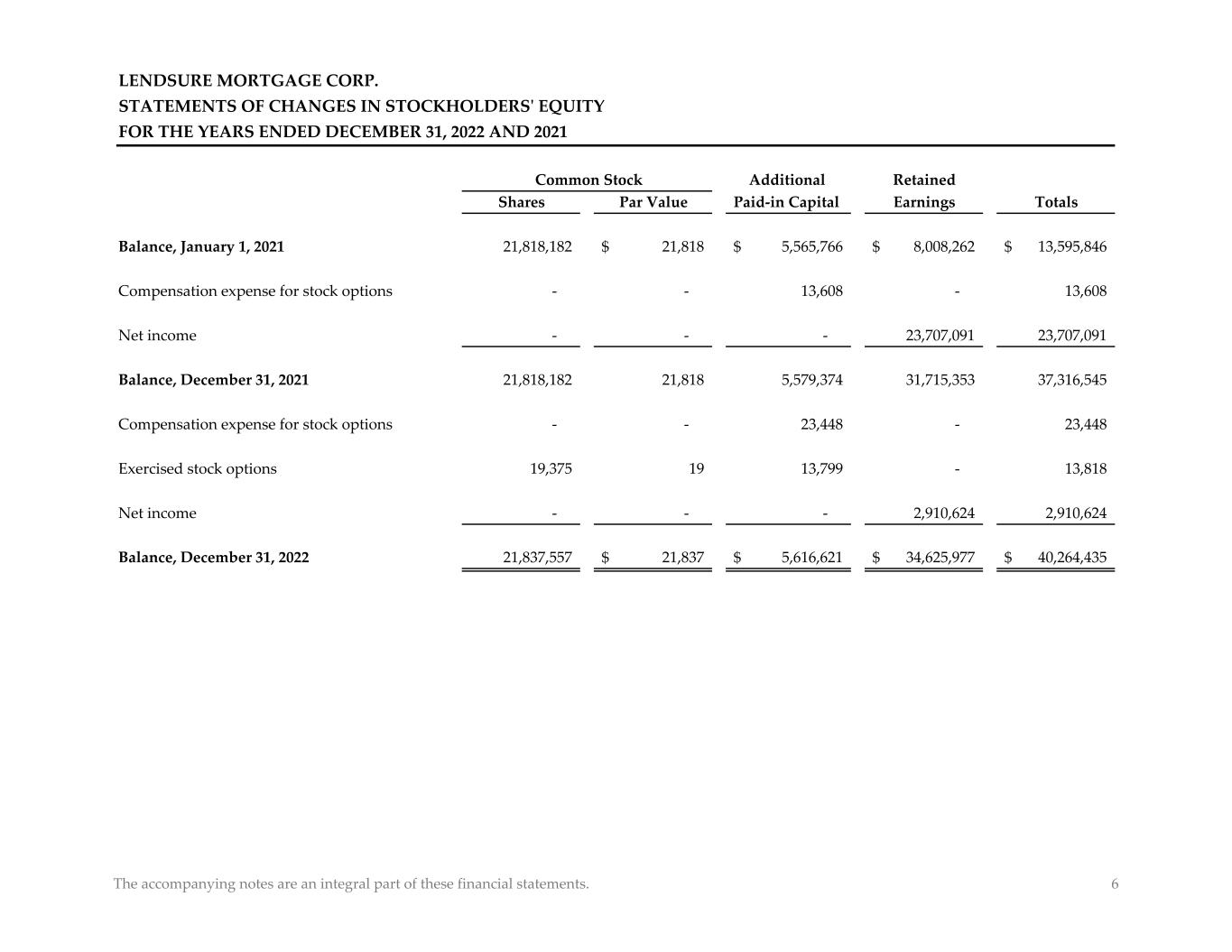

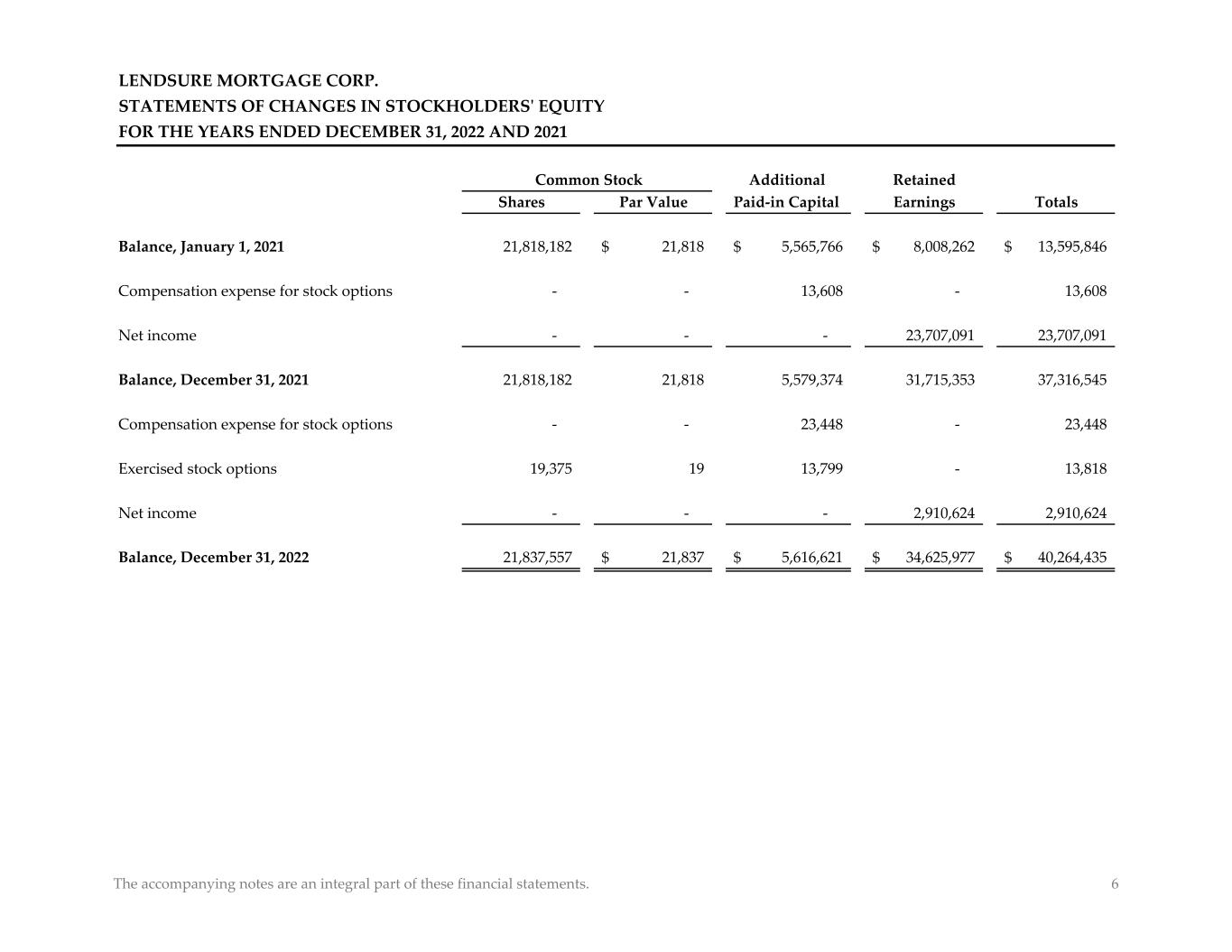

LENDSURE MORTGAGE CORP. STATEMENTS OF CHANGES IN STOCKHOLDERSʹ EQUITY FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021 Additional Retained Shares Par Value Paid‐in Capital Earnings Totals Balance, January 1, 2021 21,818,182 21,818$ 5,565,766$ 8,008,262$ 13,595,846$ Compensation expense for stock options ‐ ‐ 13,608 ‐ 13,608 Net income ‐ ‐ ‐ 23,707,091 23,707,091 Balance, December 31, 2021 21,818,182 21,818 5,579,374 31,715,353 37,316,545 Compensation expense for stock options ‐ ‐ 23,448 ‐ 23,448 Exercised stock options 19,375 19 13,799 ‐ 13,818 Net income ‐ ‐ ‐ 2,910,624 2,910,624 Balance, December 31, 2022 21,837,557 21,837$ 5,616,621$ 34,625,977$ 40,264,435$ Common Stock The accompanying notes are an integral part of these financial statements. 6

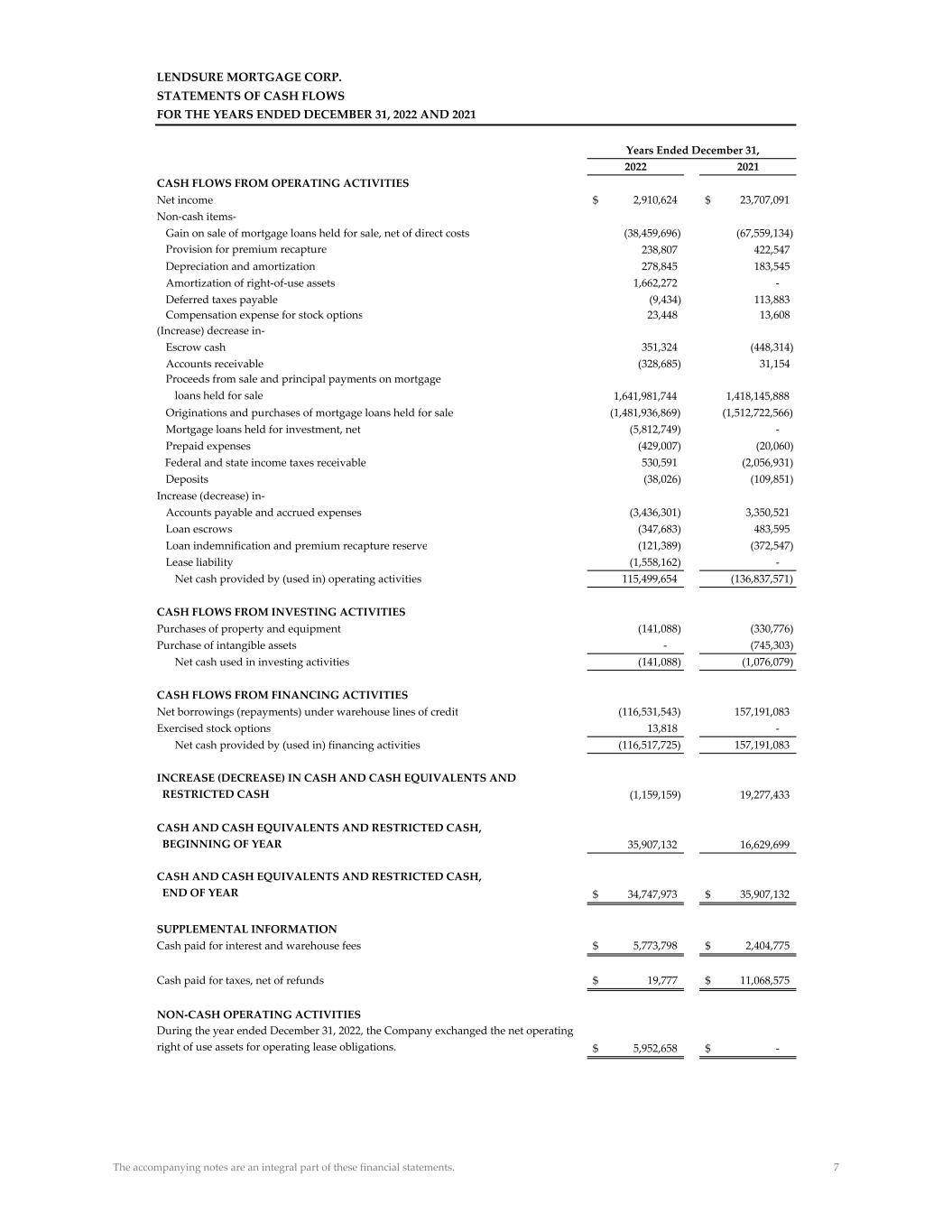

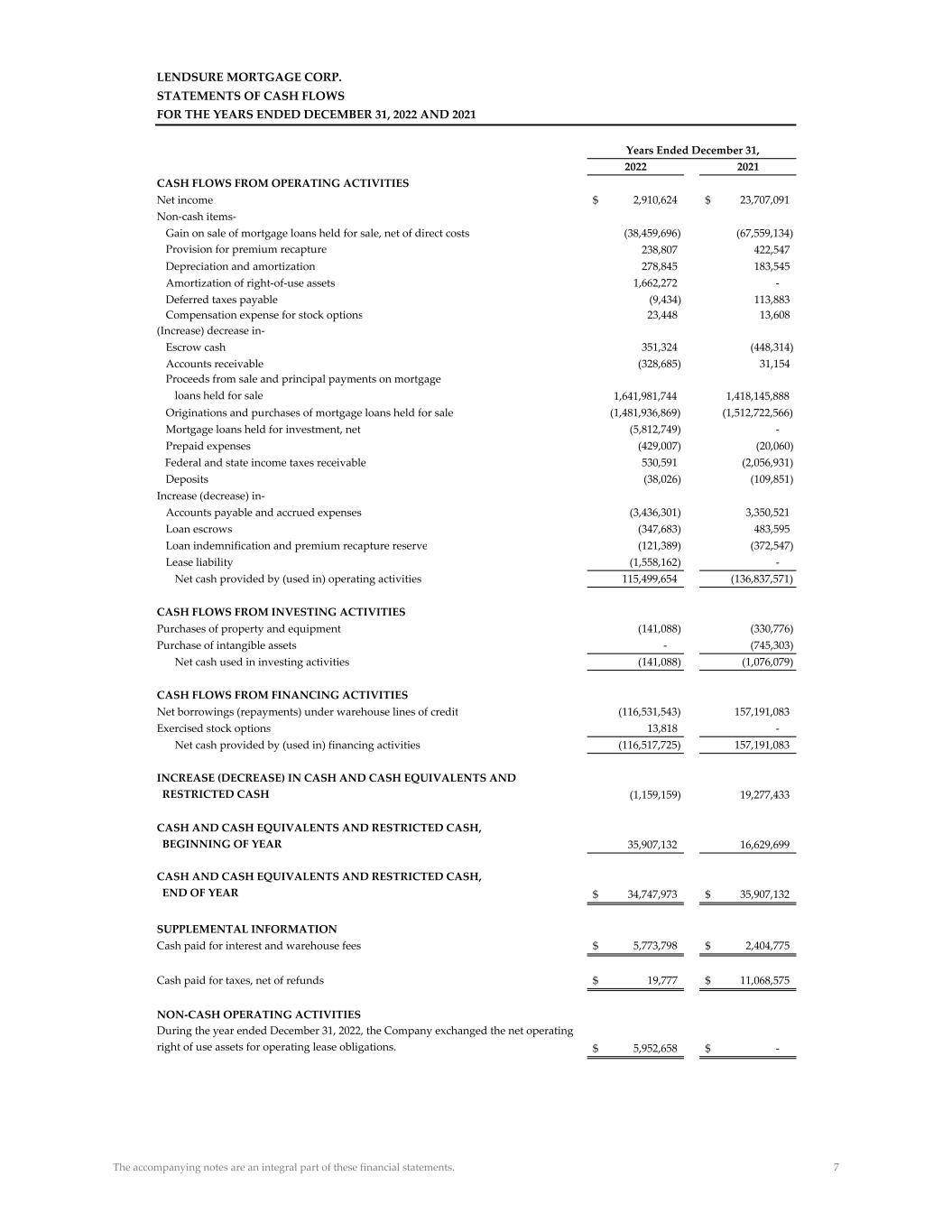

LENDSURE MORTGAGE CORP. STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021 2022 2021 CASH FLOWS FROM OPERATING ACTIVITIES Net income 2,910,624$ 23,707,091$ Non‐cash items‐ Gain on sale of mortgage loans held for sale, net of direct costs (38,459,696) (67,559,134) Provision for premium recapture 238,807 422,547 Depreciation and amortization 278,845 183,545 Amortization of right‐of‐use assets 1,662,272 ‐ Deferred taxes payable (9,434) 113,883 Compensation expense for stock options 23,448 13,608 (Increase) decrease in‐ Escrow cash 351,324 (448,314) Accounts receivable (328,685) 31,154 Proceeds from sale and principal payments on mortgage loans held for sale 1,641,981,744 1,418,145,888 Originations and purchases of mortgage loans held for sale (1,481,936,869) (1,512,722,566) Mortgage loans held for investment, net (5,812,749) ‐ Prepaid expenses (429,007) (20,060) Federal and state income taxes receivable 530,591 (2,056,931) Deposits (38,026) (109,851) Increase (decrease) in‐ Accounts payable and accrued expenses (3,436,301) 3,350,521 Loan escrows (347,683) 483,595 Loan indemnification and premium recapture reserve (121,389) (372,547) Lease liability (1,558,162) ‐ Net cash provided by (used in) operating activities 115,499,654 (136,837,571) CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property and equipment (141,088) (330,776) Purchase of intangible assets ‐ (745,303) Net cash used in investing activities (141,088) (1,076,079) CASH FLOWS FROM FINANCING ACTIVITIES Net borrowings (repayments) under warehouse lines of credit (116,531,543) 157,191,083 Exercised stock options 13,818 ‐ Net cash provided by (used in) financing activities (116,517,725) 157,191,083 INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH (1,159,159) 19,277,433 CASH AND CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING OF YEAR 35,907,132 16,629,699 CASH AND CASH EQUIVALENTS AND RESTRICTED CASH, END OF YEAR 34,747,973$ 35,907,132$ SUPPLEMENTAL INFORMATION Cash paid for interest and warehouse fees 5,773,798$ 2,404,775$ Cash paid for taxes, net of refunds 19,777$ 11,068,575$ NON‐CASH OPERATING ACTIVITIES During the year ended December 31, 2022, the Company exchanged the net operating right of use assets for operating lease obligations. 5,952,658$ ‐$ Years Ended December 31, The accompanying notes are an integral part of these financial statements. 7

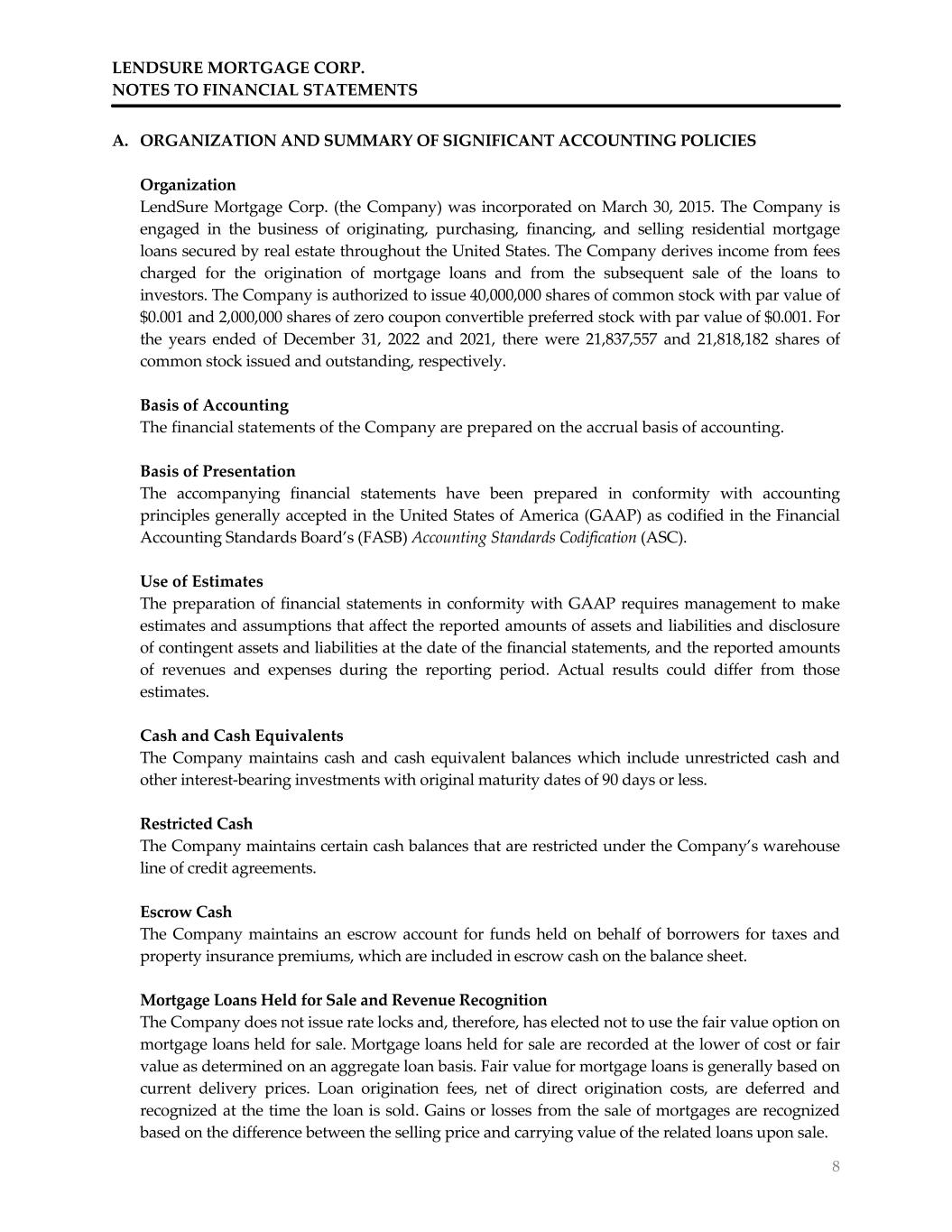

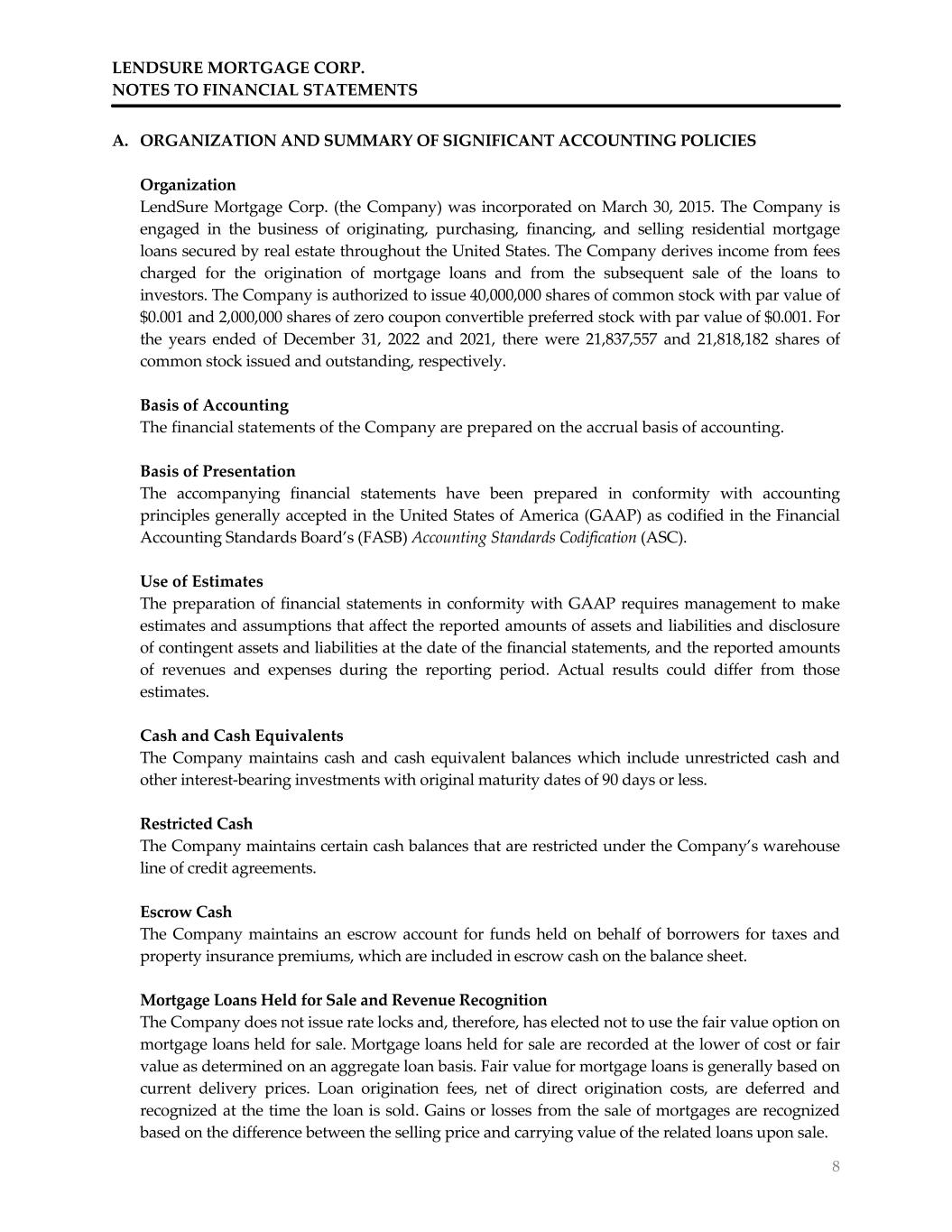

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 8 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Organization LendSure Mortgage Corp. (the Company) was incorporated on March 30, 2015. The Company is engaged in the business of originating, purchasing, financing, and selling residential mortgage loans secured by real estate throughout the United States. The Company derives income from fees charged for the origination of mortgage loans and from the subsequent sale of the loans to investors. The Company is authorized to issue 40,000,000 shares of common stock with par value of $0.001 and 2,000,000 shares of zero coupon convertible preferred stock with par value of $0.001. For the years ended of December 31, 2022 and 2021, there were 21,837,557 and 21,818,182 shares of common stock issued and outstanding, respectively. Basis of Accounting The financial statements of the Company are prepared on the accrual basis of accounting. Basis of Presentation The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP) as codified in the Financial Accounting Standards Board’s (FASB) Accounting Standards Codification (ASC). Use of Estimates The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Cash and Cash Equivalents The Company maintains cash and cash equivalent balances which include unrestricted cash and other interest‐bearing investments with original maturity dates of 90 days or less. Restricted Cash The Company maintains certain cash balances that are restricted under the Company’s warehouse line of credit agreements. Escrow Cash The Company maintains an escrow account for funds held on behalf of borrowers for taxes and property insurance premiums, which are included in escrow cash on the balance sheet. Mortgage Loans Held for Sale and Revenue Recognition The Company does not issue rate locks and, therefore, has elected not to use the fair value option on mortgage loans held for sale. Mortgage loans held for sale are recorded at the lower of cost or fair value as determined on an aggregate loan basis. Fair value for mortgage loans is generally based on current delivery prices. Loan origination fees, net of direct origination costs, are deferred and recognized at the time the loan is sold. Gains or losses from the sale of mortgages are recognized based on the difference between the selling price and carrying value of the related loans upon sale.

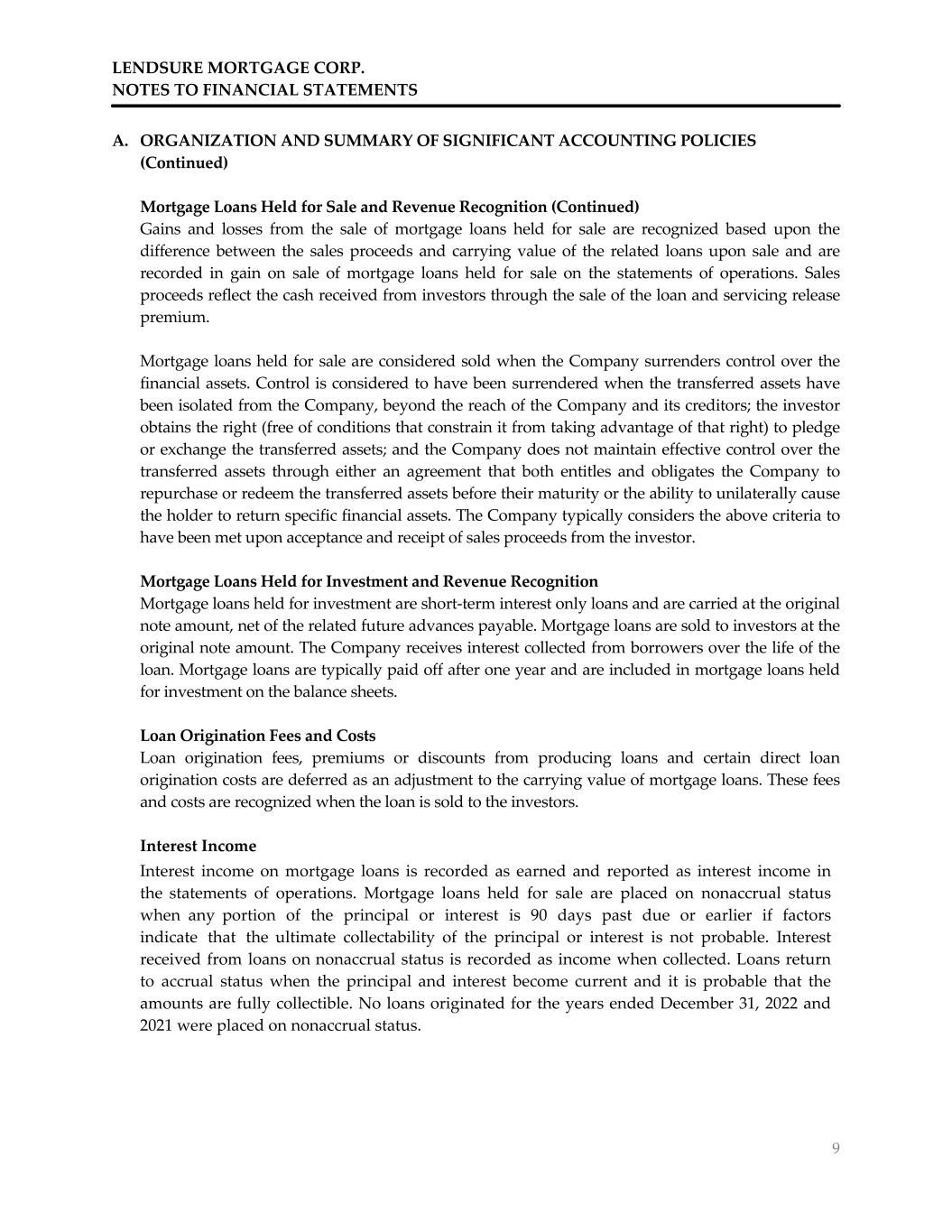

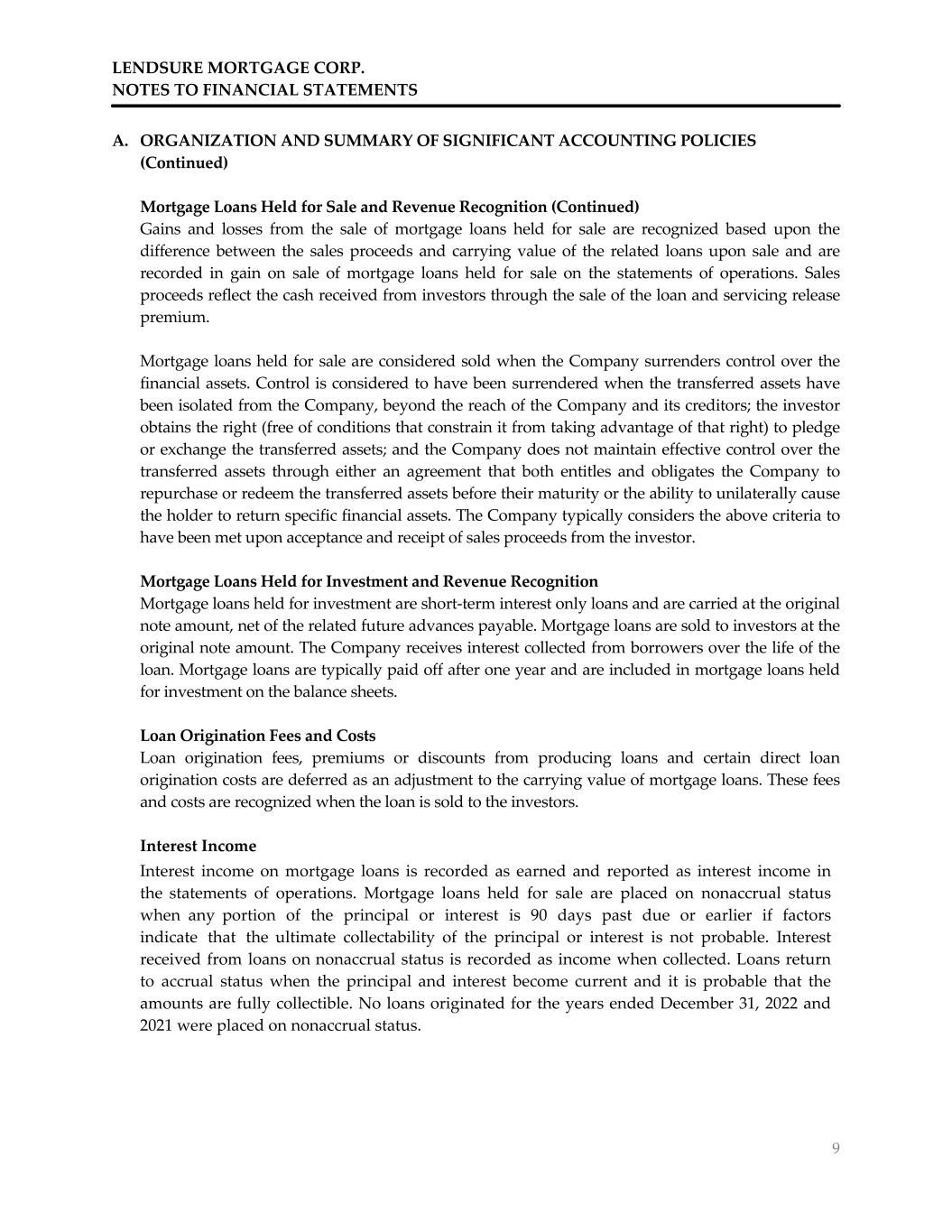

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 9 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Mortgage Loans Held for Sale and Revenue Recognition (Continued) Gains and losses from the sale of mortgage loans held for sale are recognized based upon the difference between the sales proceeds and carrying value of the related loans upon sale and are recorded in gain on sale of mortgage loans held for sale on the statements of operations. Sales proceeds reflect the cash received from investors through the sale of the loan and servicing release premium. Mortgage loans held for sale are considered sold when the Company surrenders control over the financial assets. Control is considered to have been surrendered when the transferred assets have been isolated from the Company, beyond the reach of the Company and its creditors; the investor obtains the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred assets; and the Company does not maintain effective control over the transferred assets through either an agreement that both entitles and obligates the Company to repurchase or redeem the transferred assets before their maturity or the ability to unilaterally cause the holder to return specific financial assets. The Company typically considers the above criteria to have been met upon acceptance and receipt of sales proceeds from the investor. Mortgage Loans Held for Investment and Revenue Recognition Mortgage loans held for investment are short‐term interest only loans and are carried at the original note amount, net of the related future advances payable. Mortgage loans are sold to investors at the original note amount. The Company receives interest collected from borrowers over the life of the loan. Mortgage loans are typically paid off after one year and are included in mortgage loans held for investment on the balance sheets. Loan Origination Fees and Costs Loan origination fees, premiums or discounts from producing loans and certain direct loan origination costs are deferred as an adjustment to the carrying value of mortgage loans. These fees and costs are recognized when the loan is sold to the investors. Interest Income Interest income on mortgage loans is recorded as earned and reported as interest income in the statements of operations. Mortgage loans held for sale are placed on nonaccrual status when any portion of the principal or interest is 90 days past due or earlier if factors indicate that the ultimate collectability of the principal or interest is not probable. Interest received from loans on nonaccrual status is recorded as income when collected. Loans return to accrual status when the principal and interest become current and it is probable that the amounts are fully collectible. No loans originated for the years ended December 31, 2022 and 2021 were placed on nonaccrual status.

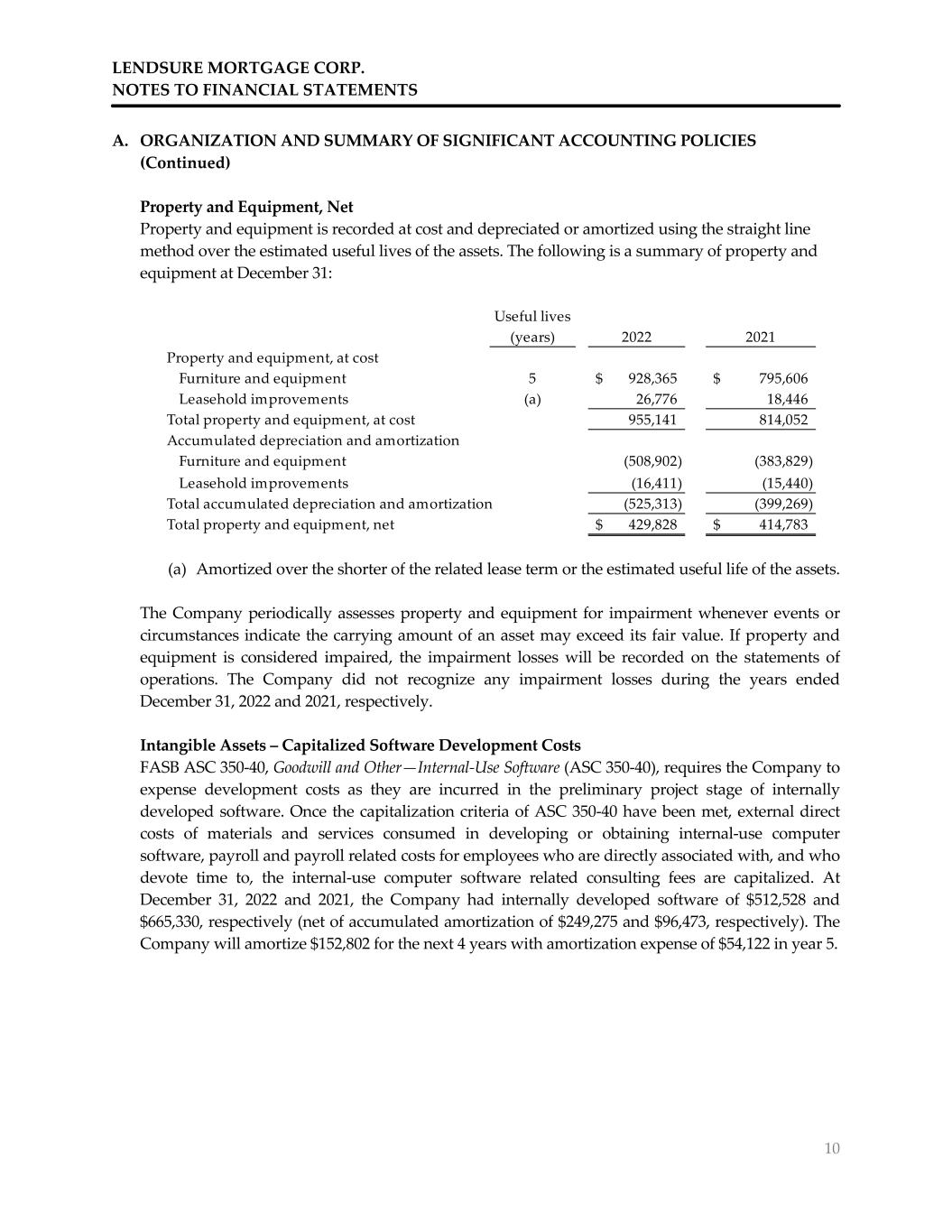

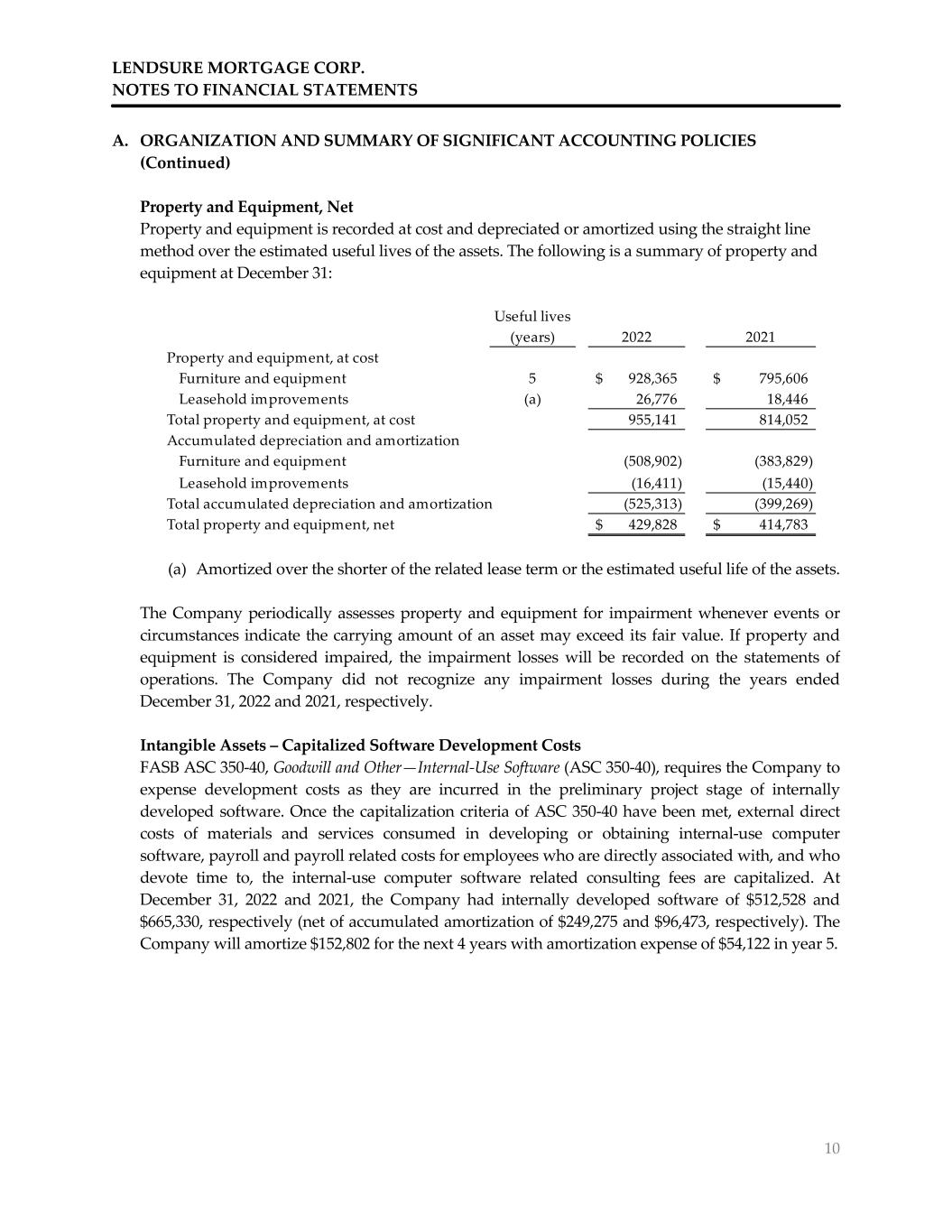

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 10 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Property and Equipment, Net Property and equipment is recorded at cost and depreciated or amortized using the straight line method over the estimated useful lives of the assets. The following is a summary of property and equipment at December 31: (a) Amortized over the shorter of the related lease term or the estimated useful life of the assets. The Company periodically assesses property and equipment for impairment whenever events or circumstances indicate the carrying amount of an asset may exceed its fair value. If property and equipment is considered impaired, the impairment losses will be recorded on the statements of operations. The Company did not recognize any impairment losses during the years ended December 31, 2022 and 2021, respectively. Intangible Assets – Capitalized Software Development Costs FASB ASC 350‐40, Goodwill and Other—Internal‐Use Software (ASC 350‐40), requires the Company to expense development costs as they are incurred in the preliminary project stage of internally developed software. Once the capitalization criteria of ASC 350‐40 have been met, external direct costs of materials and services consumed in developing or obtaining internal‐use computer software, payroll and payroll related costs for employees who are directly associated with, and who devote time to, the internal‐use computer software related consulting fees are capitalized. At December 31, 2022 and 2021, the Company had internally developed software of $512,528 and $665,330, respectively (net of accumulated amortization of $249,275 and $96,473, respectively). The Company will amortize $152,802 for the next 4 years with amortization expense of $54,122 in year 5. Useful lives (years) 2022 2021 Property and equipment, at cost Furniture and equipment 5 928,365$ 795,606$ Leasehold improvements (a) 26,776 18,446 Total property and equipment, at cost 955,141 814,052 Accumulated depreciation and amortization Furniture and equipment (508,902) (383,829) Leasehold improvements (16,411) (15,440) Total accumulated depreciation and amortization (525,313) (399,269) Total property and equipment, net 429,828$ 414,783$

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 11 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Leases On January 1, 2022, the Company adopted FASB ASC 842, Leases (ASC 842) under the modified retrospective approach, which eliminates the requirement to restate the prior period financial statements. The Company determines if an arrangement is or contains a lease at inception, which is the date on which the terms of the contract are agreed to and the agreement creates enforceable rights and obligations. Additionally, the Company considers whether its service arrangements include the right to control the use of the asset. The Company elected the “package of practical expedients,” which permit the Company to retain lease classification and initial direct costs for any identified leases that exist prior to adoption. Under this transition guidance, the Company also has not reassessed whether any existing contracts at January 1, 2022 are or contain leases and has carried forward its initial determination under legacy lease guidance. The Company has not elected to adopt the “hindsight” practical expedient, and therefore measured the right‐of‐use (ROU) asset and lease liability using the remaining portion of the lease term at adoption on January 1, 2022. The Company made an accounting policy election available under the new lease standard to not recognize lease assets and lease liabilities for leases with a term of 12 months or less. For all other leases, the initial measurement of the ROU asset and lease liability is based on the present value of future lease payments over the lease term at the commencement date of the lease. The Company utilizes the incremental borrowing rate to determine the present value of lease payments. The Company’s leases generally include a non‐lease component representing additional services transferred to the Company. The Company has made an account policy election to account for lease and non‐lease components in its contracts as a single lease component for all asset classes. The Company recognizes lease expense on a straight‐line basis excluding short‐term and variable lease payments which are recognized as incurred. Short‐term lease costs represent payments for leases with a term of 12 months or less. Loan Indemnification Reserve The Company sells mortgage loans to various investors under purchase contracts. When the Company sells its loans, it makes customary representations and warranties to the investors about various characteristics of each loan such as the origination and underwriting guidelines the validity of the lien securing the loan, property eligibility, borrower credit, income and asset requirements, and compliance with applicable federal, state and local law. In the event of a breach of its representations and warranties, the Company may be required to either repurchase the mortgage loans with the identified defects or indemnify the investor for any loss. The Companyʹs loss may be reduced by proceeds from the sale or liquidation of the repurchased loan.

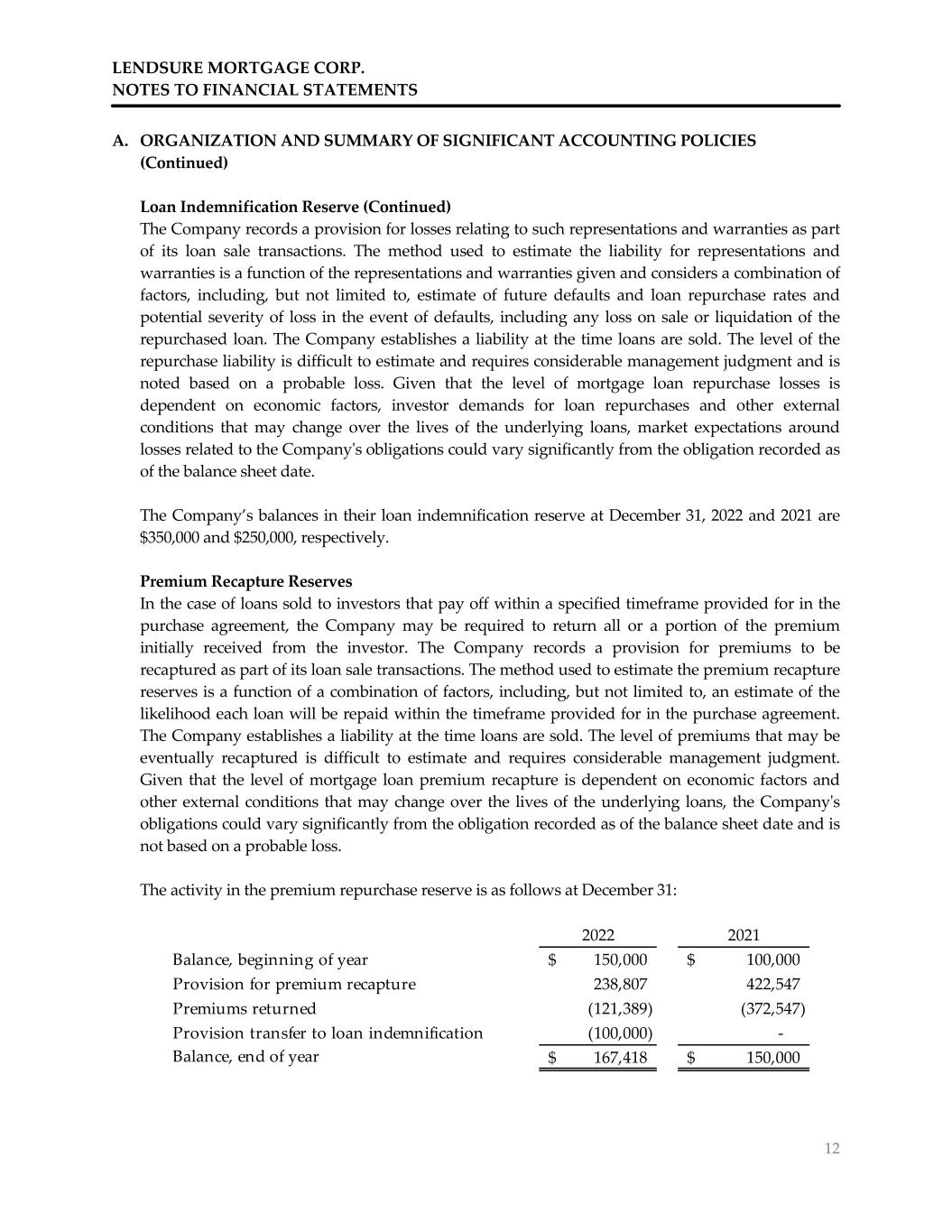

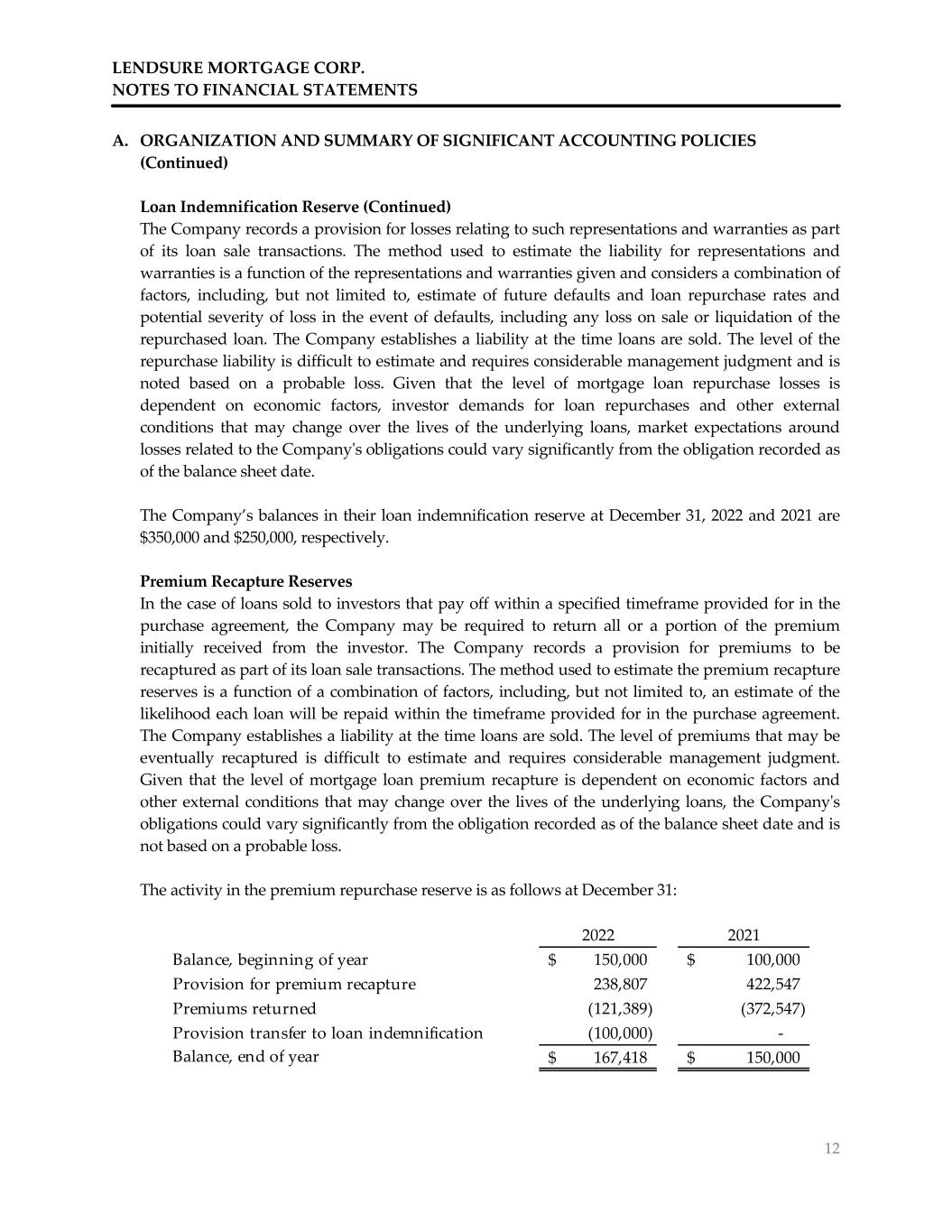

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 12 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Loan Indemnification Reserve (Continued) The Company records a provision for losses relating to such representations and warranties as part of its loan sale transactions. The method used to estimate the liability for representations and warranties is a function of the representations and warranties given and considers a combination of factors, including, but not limited to, estimate of future defaults and loan repurchase rates and potential severity of loss in the event of defaults, including any loss on sale or liquidation of the repurchased loan. The Company establishes a liability at the time loans are sold. The level of the repurchase liability is difficult to estimate and requires considerable management judgment and is noted based on a probable loss. Given that the level of mortgage loan repurchase losses is dependent on economic factors, investor demands for loan repurchases and other external conditions that may change over the lives of the underlying loans, market expectations around losses related to the Companyʹs obligations could vary significantly from the obligation recorded as of the balance sheet date. The Company’s balances in their loan indemnification reserve at December 31, 2022 and 2021 are $350,000 and $250,000, respectively. Premium Recapture Reserves In the case of loans sold to investors that pay off within a specified timeframe provided for in the purchase agreement, the Company may be required to return all or a portion of the premium initially received from the investor. The Company records a provision for premiums to be recaptured as part of its loan sale transactions. The method used to estimate the premium recapture reserves is a function of a combination of factors, including, but not limited to, an estimate of the likelihood each loan will be repaid within the timeframe provided for in the purchase agreement. The Company establishes a liability at the time loans are sold. The level of premiums that may be eventually recaptured is difficult to estimate and requires considerable management judgment. Given that the level of mortgage loan premium recapture is dependent on economic factors and other external conditions that may change over the lives of the underlying loans, the Companyʹs obligations could vary significantly from the obligation recorded as of the balance sheet date and is not based on a probable loss. The activity in the premium repurchase reserve is as follows at December 31: 2022 2021 Balance, beginning of year 150,000$ 100,000$ Provision for premium recapture 238,807 422,547 Premiums returned (121,389) (372,547) Provision transfer to loan indemnification (100,000) ‐ Balance, end of year 167,418$ 150,000$

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 13 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Income Taxes Income taxes are provided for the tax effects of transactions reported in the financial statements and consist of taxes currently due plus deferred taxes related primarily to differences between the basis of certain assets and liabilities for financial and tax reporting. The deferred taxes represent the future tax return consequences of those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred tax assets are limited to amounts considered to be realizable in future periods. The Company accounts for any interest and penalties related to unrecognized tax benefits as part of the income tax provision. The Company has no federal or state tax examinations in process as of December 31, 2022 that would have a material impact on the financial statements. The assumptions about future taxable income require significant judgment and are consistent with the plans and estimates the Company is using to manage the underlying business. In evaluating the objective evidence that historical results provide, the Company considers the past three years of operating history and cumulative operating income. Stock‐Based Compensation In July 2015, the Company adopted an Equity Incentive Plan pursuant to which the Companyʹs Board of Directors may grant stock options and other awards to employees. The Company accounts for stock‐based compensation in accordance with ASC 718 Compensation‐Stock Compensation. Accordingly, the Company measures the cost of stock‐based awards using the grant‐date fair value of the award and recognizes that cost over the requisite service period. The fair value of each stock option granted under the Companyʹs stock‐based compensation plan is estimated on the date of grant using the Black‐Scholes option‐pricing model and assumptions outlined in Note L. ASC‐718 requires forfeitures to be estimated at the time of grant and prospectively revised, if necessary, in subsequent periods if actual forfeitures differ from initial estimates. Stock‐based compensation recorded for those stock‐based awards that were expected to vest is $23,448 and $13,608 and is included in salaries, commissions and benefits on the statements of operations for the years ended December 31, 2022 and 2021, respectively. Advertising and Marketing Advertising and marketing is expensed as incurred and amounted to $549,116 and $403,448 for the years ended December 31, 2022 and 2021, respectively, and is included in general and administrative expenses on the statements of operations.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 14 A. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Risks and Uncertainties In the normal course of business, companies in the mortgage banking industry encounter certain economic and regulatory risks. Economic risks include interest rate risk and credit risk. The Company is subject to interest rate risk to the extent that in a rising interest rate environment, the Company may experience a decrease in loan production, as well as decreases in the value of mortgage loans held for sale not committed to investors and commitments to originate loans, which may negatively impact the Company’s operations. Credit risk is the risk of default that may result from the borrowers’ inability or unwillingness to make contractually required payments during the period in which loans are being held for sale by the Company. The Company sells mortgage loans to investors without recourse. As such, the investors have assumed the risk of loss or default by the borrower. However, the Company is usually required by these investors to make certain standard representations and warranties relating to credit information, loan documentation and collateral. To the extent that the Company does not comply with such representations, or there are early payment defaults, the Company may be required to repurchase the loans or indemnify these investors for any losses from borrower defaults. In addition, if loans payoff within a specified time frame, the Company may be required to refund a portion of the sales proceeds to the investors. A large portion of all properties securing the Companyʹs mortgage loans sold, mortgage loans held for sale and mortgage loans held for investment for the years ended December 31, 2022 and 2021 are located in California, and the downturn in economic conditions in that regionʹs real estate market could have a material adverse impact on the Companyʹs financial condition and results of operations. The Company’s business requires substantial cash to support its operating activities. As a result, the Company is dependent on its warehouse lines of credit, and other financing facilities to finance its continued operations. If the Company’s principal lenders decided to terminate or not to renew any of these financing facilities with the Company, the loss of borrowing capacity could have a material adverse impact on the Company’s financial statements unless the Company found a suitable alternative source. With the rapid rise in mortgage interest rates compounding with housing affordability and inventory issues, the mortgage banking industry has been significantly disrupted. The operational and financial performance of the Company depends on future economic developments, and such uncertainty may have an adverse impact on the Company’s financial performance. Reclassifications Certain reclassifications have been made to prior year balances to conform to the current year financial statement presentation.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 15 B. MORTGAGE LOANS HELD FOR SALE, NET Mortgage loans held for sale, net are as follows at December 31: The deferred costs, net include such costs as borrower discount points, administrative fees, underwriting and processing fees, estimated commissions, and loan origination fees. C. MORTGAGE LOANS HELD FOR INVESTMENT, NET Mortgage loans held for investment are as follows at December 31, 2022: Rehab Transition Loans The Company provides financing to individuals and business entities who are renovating and selling homes. The individual loans typically mature 12 months after inception. These loans are pledged under a warehouse line of credit agreement (Note D). Rehab transition loans are initially recorded at the original note amount with a corresponding liability recorded for future advances. Interest on rehab transition loans is payable between 7.99% to 10.99% per annum at December 31, 2022. The future rehab advances represents the undrawn portion of the rehab transition loans. The Company has the commitment to fund such rehabilitation advances when the borrower elects to draw on the commitment. Draw proceeds requested by the borrower increase the principal balance of the rehab transition loans, with a corresponding decrease in the future rehab advances payable, during the period the rehab transition loans are held by the Company. Interest income on rehab transition loans is received monthly by the Company. 2022 2021 Mortgage loans held for sale 46,496,541$ 168,418,429$ Deferred costs, net (477,496) (813,755) 46,019,045$ 167,604,674$ 2022 Rehab transition loans 5,895,000$ Future rehab advances (795,943) Bridge loans 878,700 Deferred costs (165,008) 5,812,749$

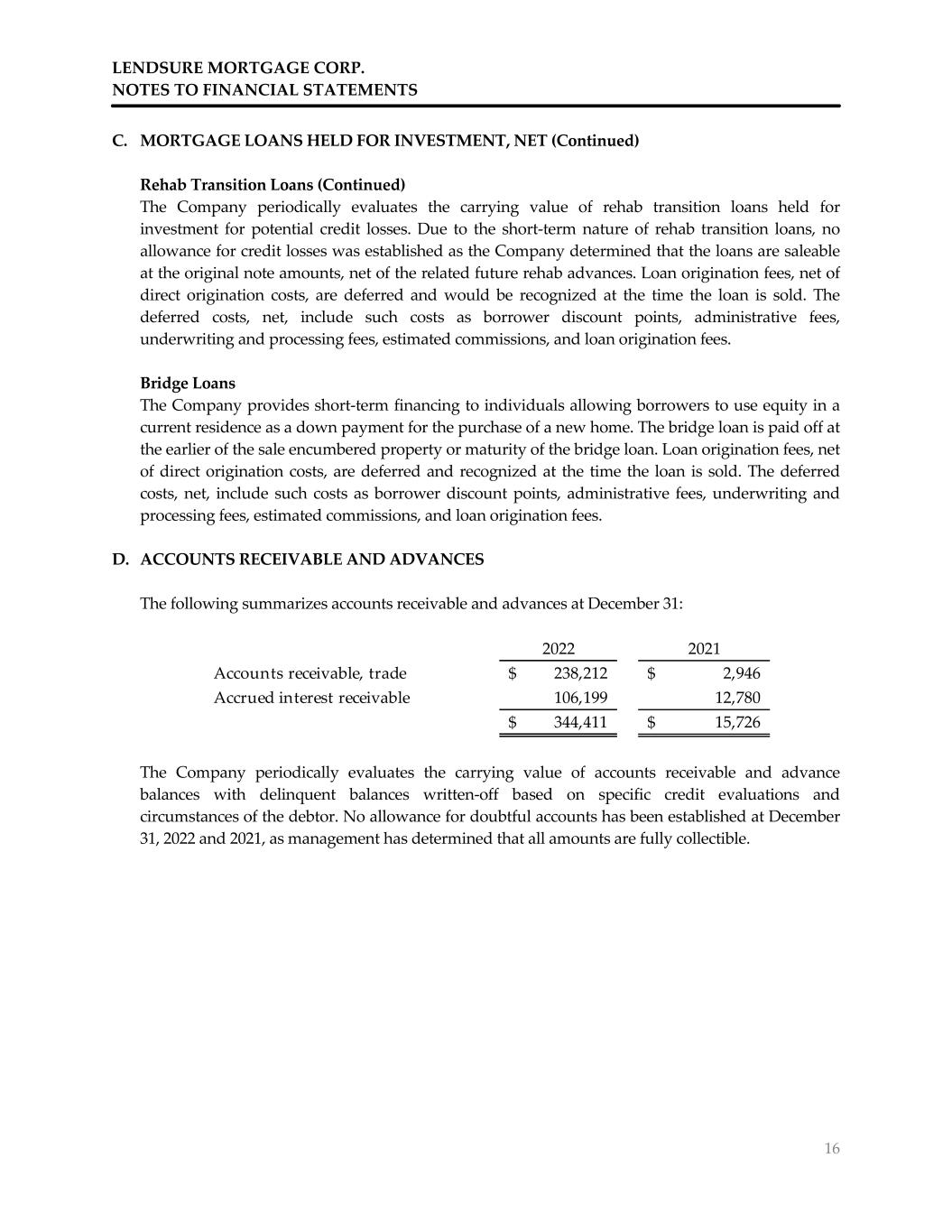

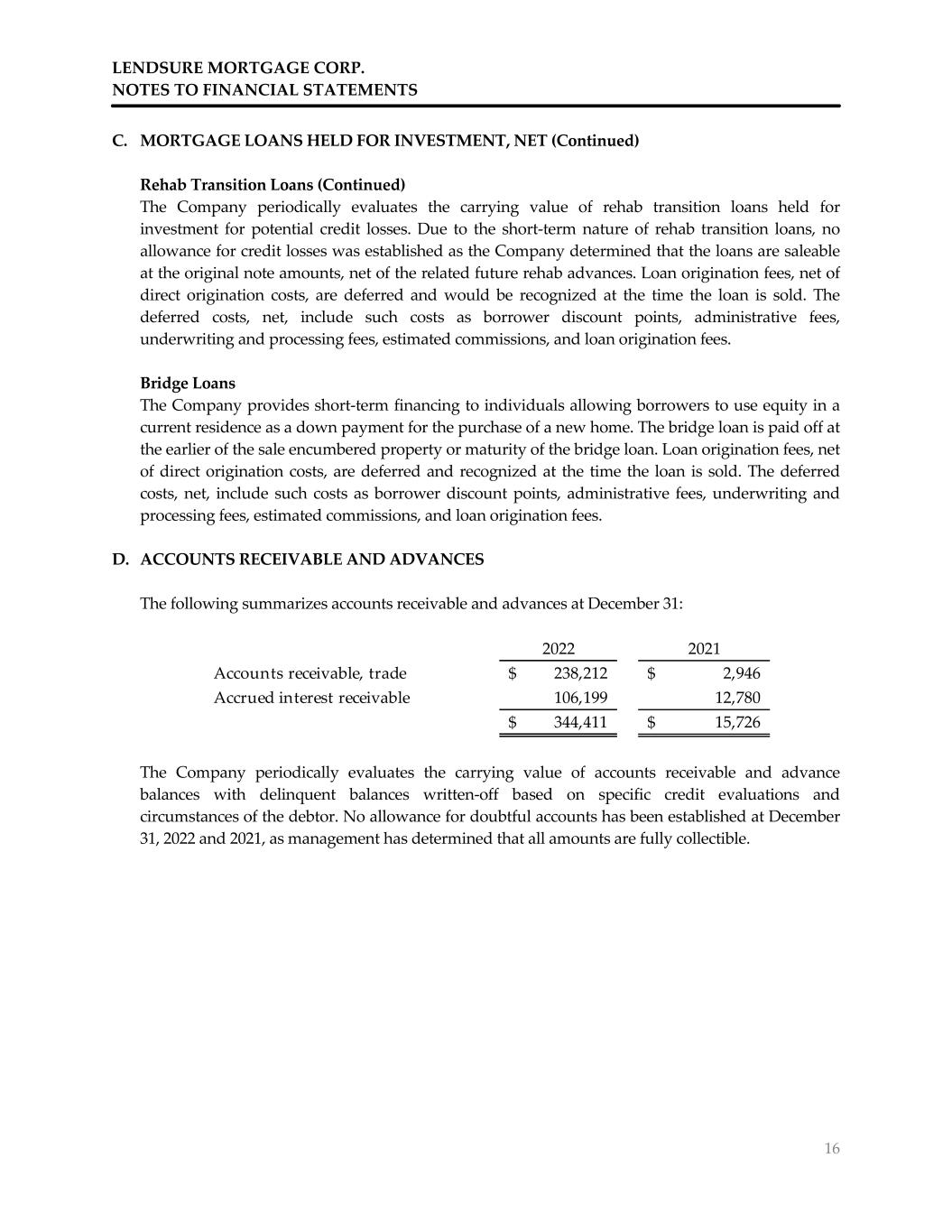

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 16 C. MORTGAGE LOANS HELD FOR INVESTMENT, NET (Continued) Rehab Transition Loans (Continued) The Company periodically evaluates the carrying value of rehab transition loans held for investment for potential credit losses. Due to the short‐term nature of rehab transition loans, no allowance for credit losses was established as the Company determined that the loans are saleable at the original note amounts, net of the related future rehab advances. Loan origination fees, net of direct origination costs, are deferred and would be recognized at the time the loan is sold. The deferred costs, net, include such costs as borrower discount points, administrative fees, underwriting and processing fees, estimated commissions, and loan origination fees. Bridge Loans The Company provides short‐term financing to individuals allowing borrowers to use equity in a current residence as a down payment for the purchase of a new home. The bridge loan is paid off at the earlier of the sale encumbered property or maturity of the bridge loan. Loan origination fees, net of direct origination costs, are deferred and recognized at the time the loan is sold. The deferred costs, net, include such costs as borrower discount points, administrative fees, underwriting and processing fees, estimated commissions, and loan origination fees. D. ACCOUNTS RECEIVABLE AND ADVANCES The following summarizes accounts receivable and advances at December 31: The Company periodically evaluates the carrying value of accounts receivable and advance balances with delinquent balances written‐off based on specific credit evaluations and circumstances of the debtor. No allowance for doubtful accounts has been established at December 31, 2022 and 2021, as management has determined that all amounts are fully collectible. 2022 2021 Accounts receivable, trade 238,212$ 2,946$ Accrued interest receivable 106,199 12,780 344,411$ 15,726$

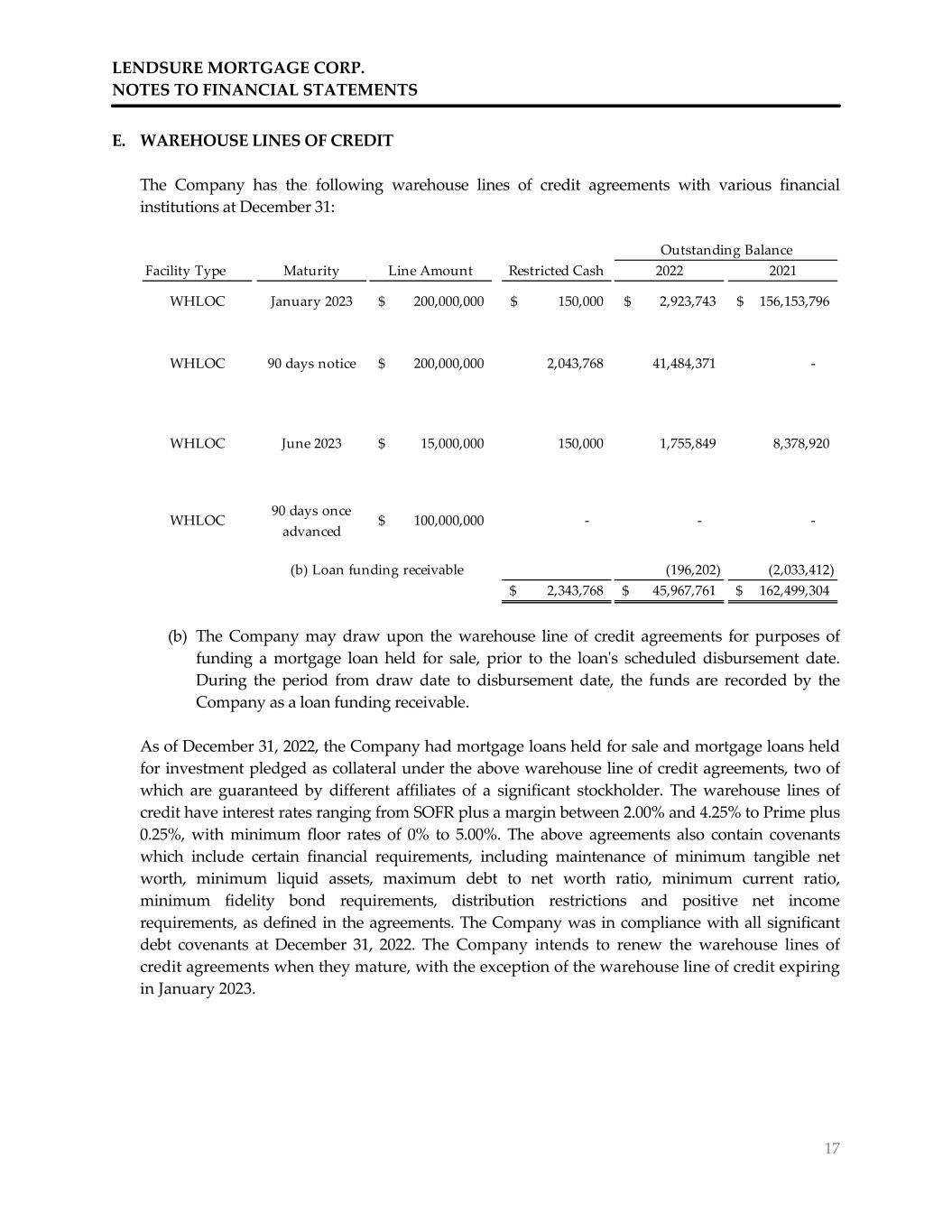

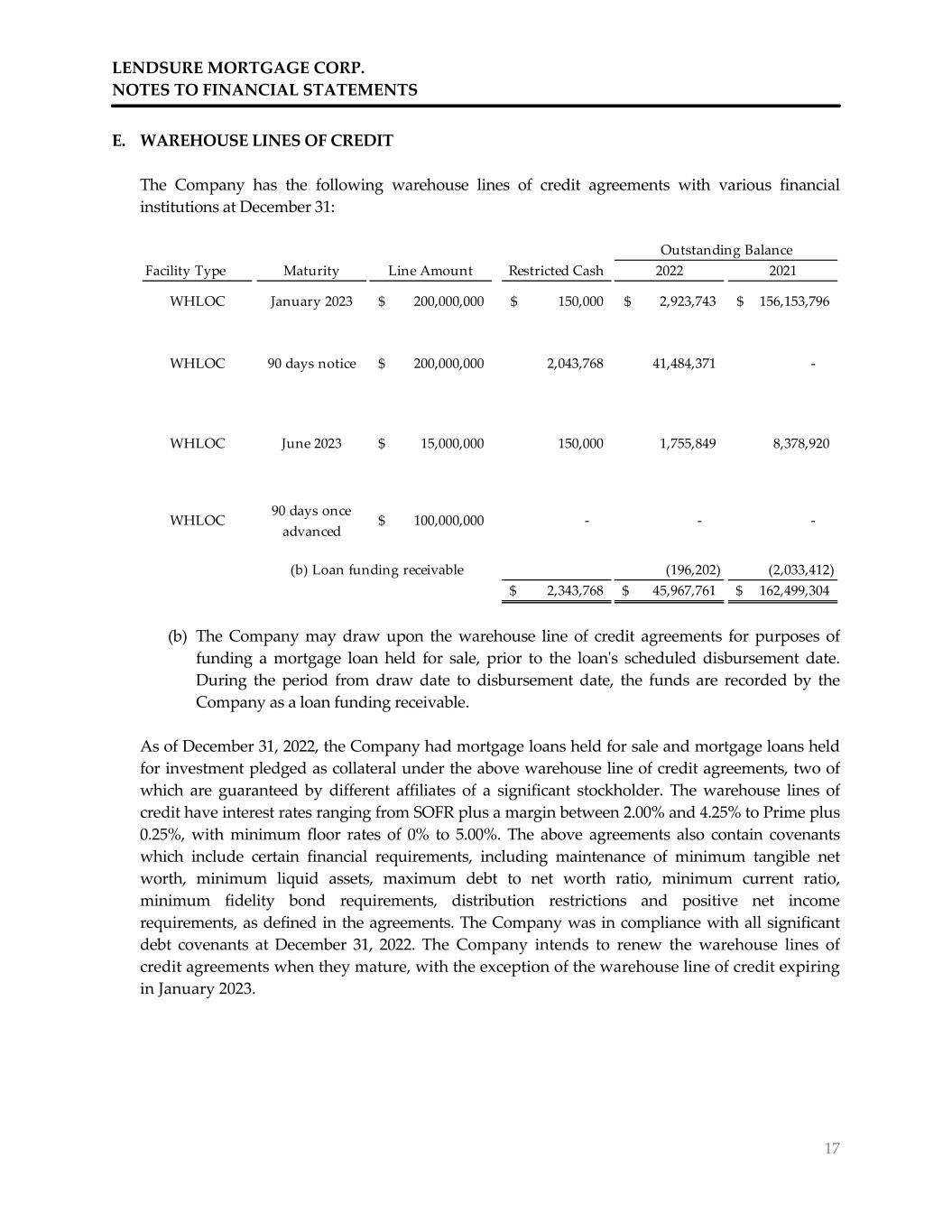

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 17 E. WAREHOUSE LINES OF CREDIT The Company has the following warehouse lines of credit agreements with various financial institutions at December 31: (b) The Company may draw upon the warehouse line of credit agreements for purposes of funding a mortgage loan held for sale, prior to the loanʹs scheduled disbursement date. During the period from draw date to disbursement date, the funds are recorded by the Company as a loan funding receivable. As of December 31, 2022, the Company had mortgage loans held for sale and mortgage loans held for investment pledged as collateral under the above warehouse line of credit agreements, two of which are guaranteed by different affiliates of a significant stockholder. The warehouse lines of credit have interest rates ranging from SOFR plus a margin between 2.00% and 4.25% to Prime plus 0.25%, with minimum floor rates of 0% to 5.00%. The above agreements also contain covenants which include certain financial requirements, including maintenance of minimum tangible net worth, minimum liquid assets, maximum debt to net worth ratio, minimum current ratio, minimum fidelity bond requirements, distribution restrictions and positive net income requirements, as defined in the agreements. The Company was in compliance with all significant debt covenants at December 31, 2022. The Company intends to renew the warehouse lines of credit agreements when they mature, with the exception of the warehouse line of credit expiring in January 2023. Facility Type Maturity Line Amount Restricted Cash 2022 2021 WHLOC January 2023 200,000,000$ 150,000$ 2,923,743$ 156,153,796$ WHLOC 90 days notice 200,000,000$ 2,043,768 41,484,371 ‐ WHLOC June 2023 15,000,000$ 150,000 1,755,849 8,378,920 WHLOC 90 days once advanced 100,000,000$ ‐ ‐ ‐ (196,202) (2,033,412) 2,343,768$ 45,967,761$ 162,499,304$ Outstanding Balance (b) Loan funding receivable

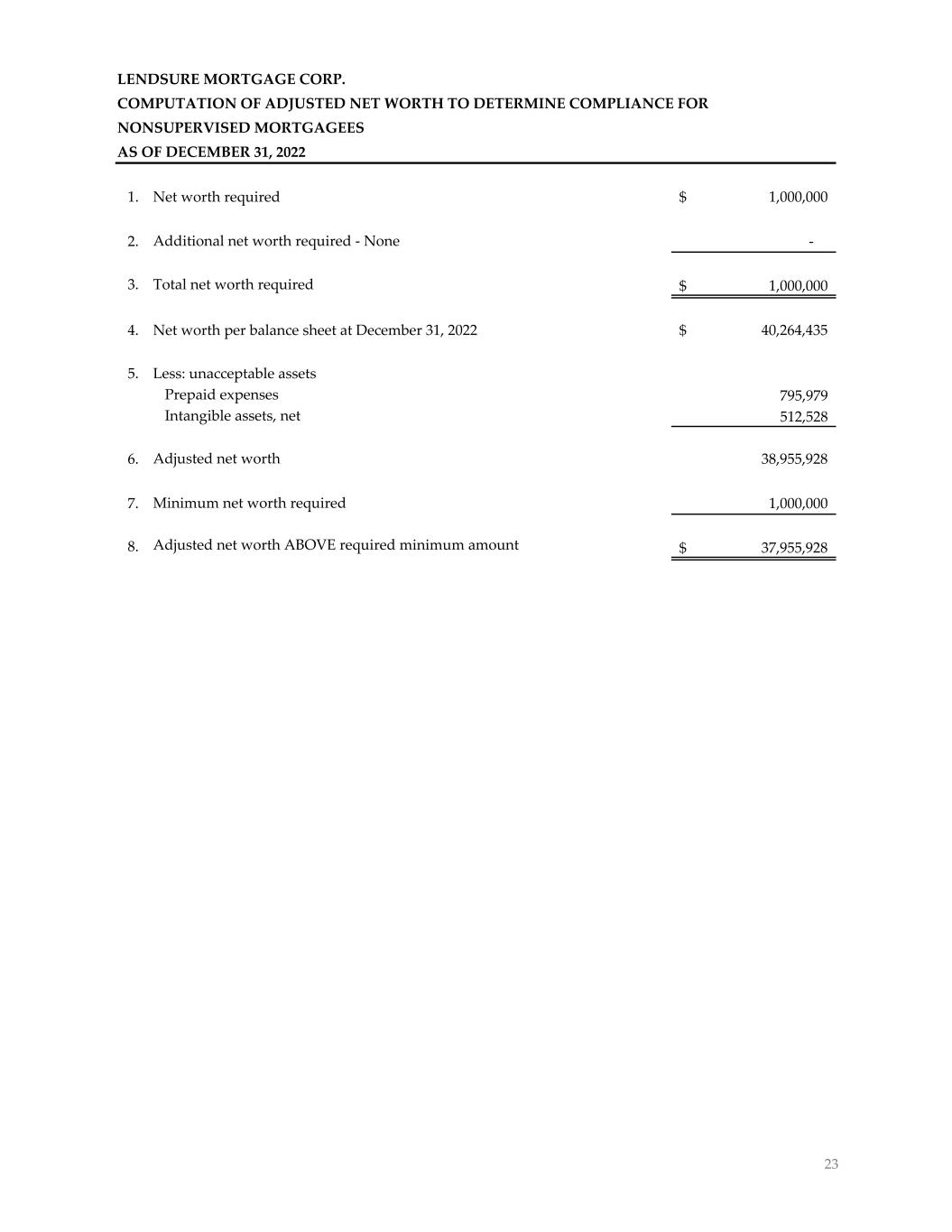

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 18 F. OPERATING LINES OF CREDIT The Company has an operating line of credit with a related party, which can be terminated on five business days notice. Interest is at a fixed rate of 10%. The maximum amount available under the agreement is $5 million. There were no amounts outstanding under the operating line of credit at December 31, 2022 and 2021. G. EMPLOYEE BENEFIT PLAN The Company has a 401(k) plan for the benefit of eligible employees and their beneficiaries. The 401(k) plan is a defined contribution 401(k) plan that allows eligible employees to save for retirement through pretax and post‐tax contributions up to the specified limits. The Company must match employee contributions up to 4% of the employeeʹs eligible base salary. The Company contribution towards the 401(k) plan was $604,882 and $509,484 for the years ended December 31, 2022 and 2021, respectively. H. COMMITMENTS AND CONTINGENCIES Regulatory Contingencies The Company is subject to periodic audits and examinations, both formal and informal in nature, from various federal and state agencies, including those made as part of regulatory oversight of mortgage origination and financing activities. Such audits and examinations could result in additional actions, penalties or fines by state or federal governmental bodies, regulators or the courts. Legal The Company operates in a highly regulated industry and may be involved in various legal and regulatory proceedings, lawsuits and other claims arising in the ordinary course of its business. The Company currently has no significant legal, regulatory proceedings, lawsuits or other claims against the Company. The amount, if any, of ultimate liability with respect to such matters cannot be determined, but despite the inherent uncertainties of litigation, management currently believes that the ultimate disposition of any such proceedings and exposure will not have, individually or taken together, a material adverse effect on the financial condition, results of operations, or cash flows of the Company. However, actual outcomes may differ from those expected. The Company accrues for losses when they are probable to occur, and such losses are reasonably estimable. Legal costs are expensed as incurred and are included in general and administrative on the statements of operations. Regulatory Net Worth Requirements In accordance with the regulatory requirements of HUD, governing non‐supervised, direct endorsement mortgagees, the Company is required to maintain a minimum net worth (as defined by HUD). At December 31, 2022, the Company exceeded the minimum net worth requirement.

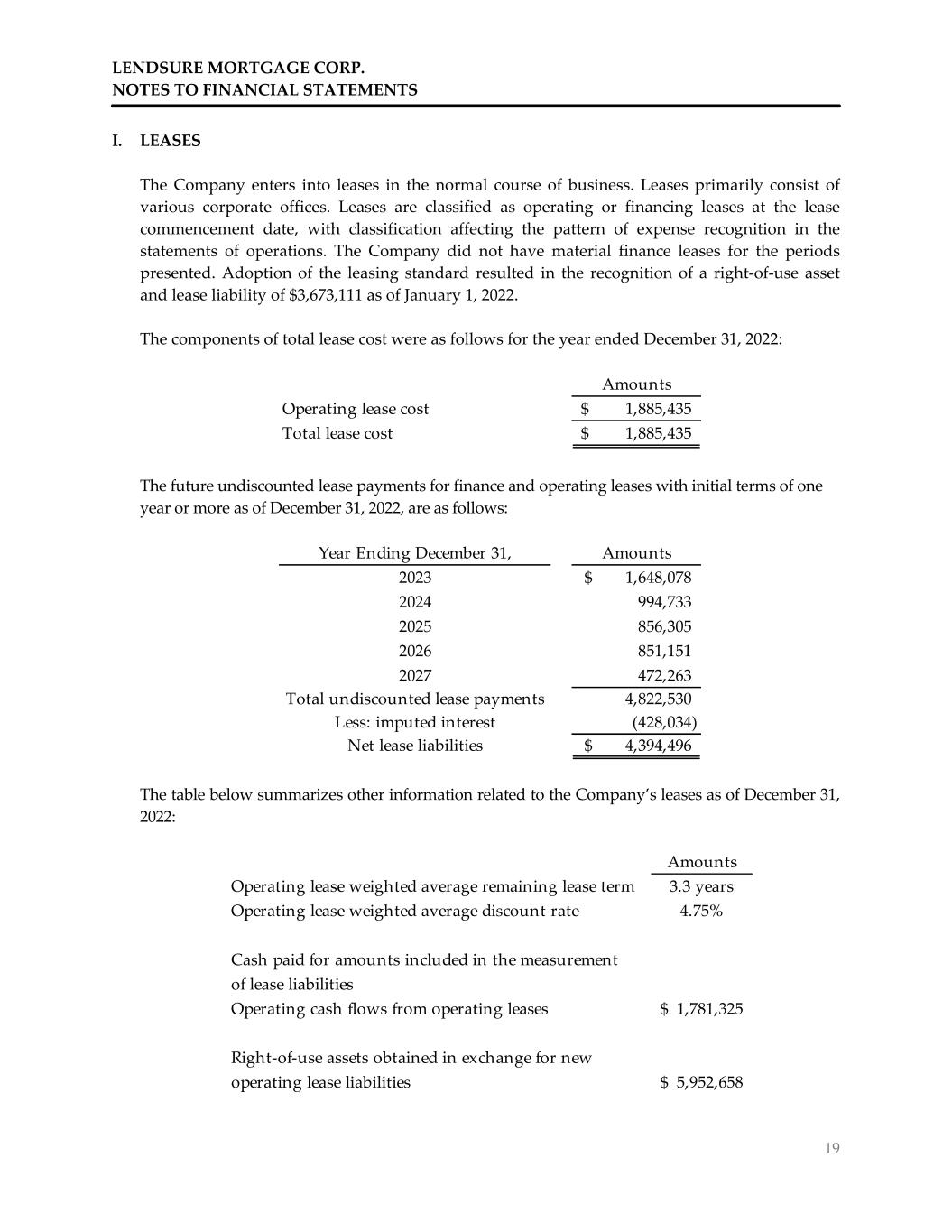

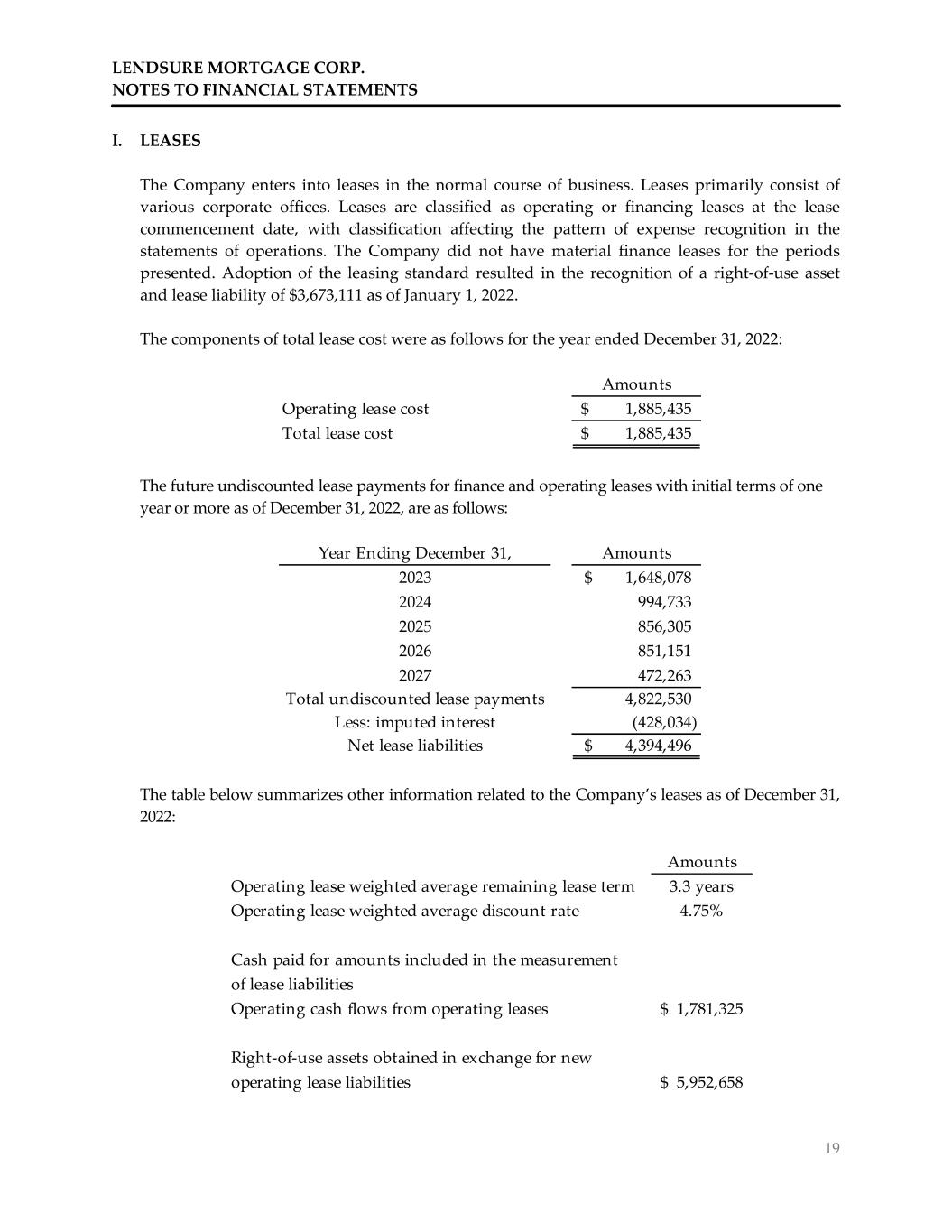

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 19 I. LEASES The Company enters into leases in the normal course of business. Leases primarily consist of various corporate offices. Leases are classified as operating or financing leases at the lease commencement date, with classification affecting the pattern of expense recognition in the statements of operations. The Company did not have material finance leases for the periods presented. Adoption of the leasing standard resulted in the recognition of a right‐of‐use asset and lease liability of $3,673,111 as of January 1, 2022. The components of total lease cost were as follows for the year ended December 31, 2022: The future undiscounted lease payments for finance and operating leases with initial terms of one year or more as of December 31, 2022, are as follows: The table below summarizes other information related to the Company’s leases as of December 31, 2022: Amounts Operating lease cost 1,885,435$ Total lease cost 1,885,435$ Year Ending December 31, Amounts 2023 1,648,078$ 2024 994,733 2025 856,305 2026 851,151 2027 472,263 Total undiscounted lease payments 4,822,530 Less: imputed interest (428,034) Net lease liabilities 4,394,496$ Amounts Operating lease weighted average remaining lease term 3.3 years Operating lease weighted average discount rate 4.75% Cash paid for amounts included in the measurement of lease liabilities Operating cash flows from operating leases 1,781,325$ Right‐of‐use assets obtained in exchange for new operating lease liabilities 5,952,658$

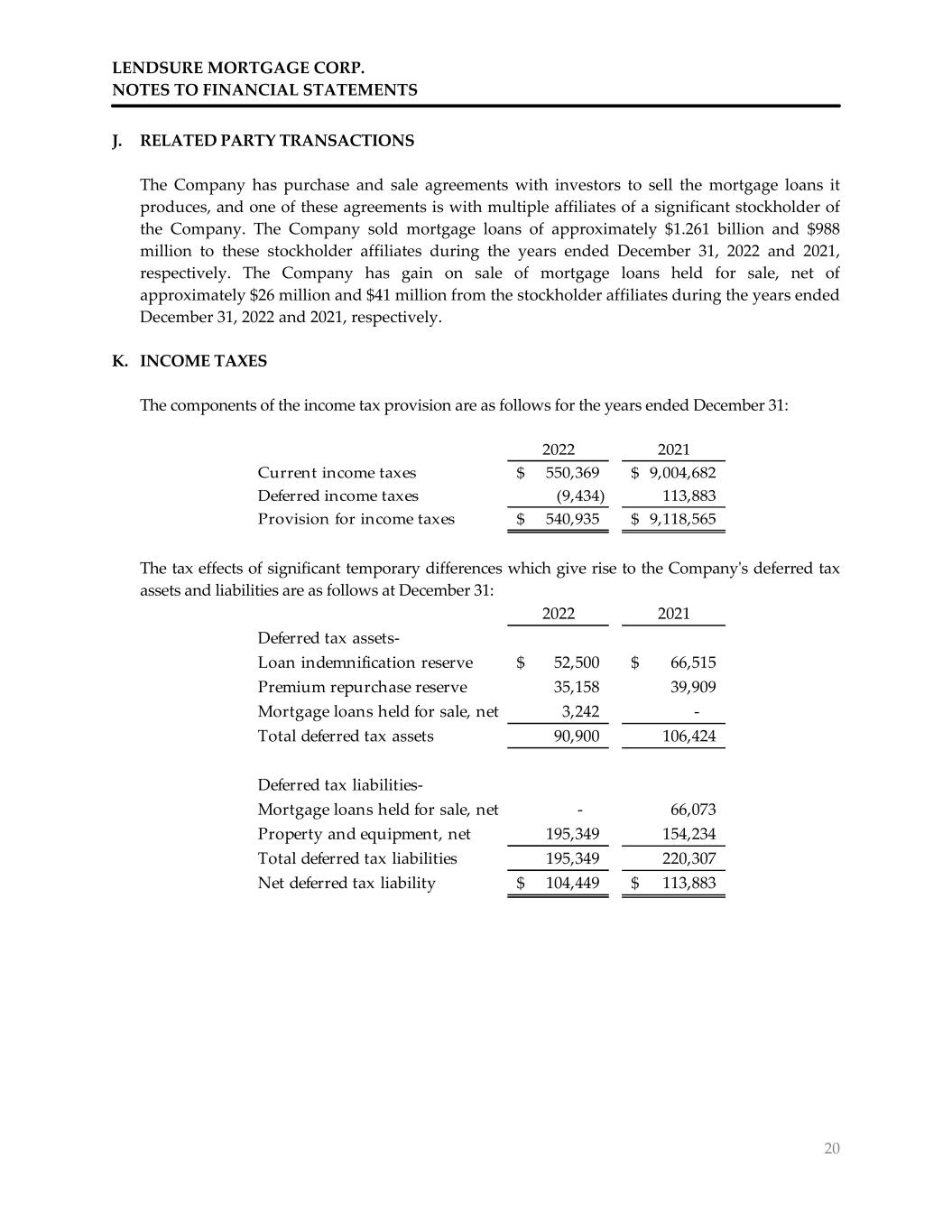

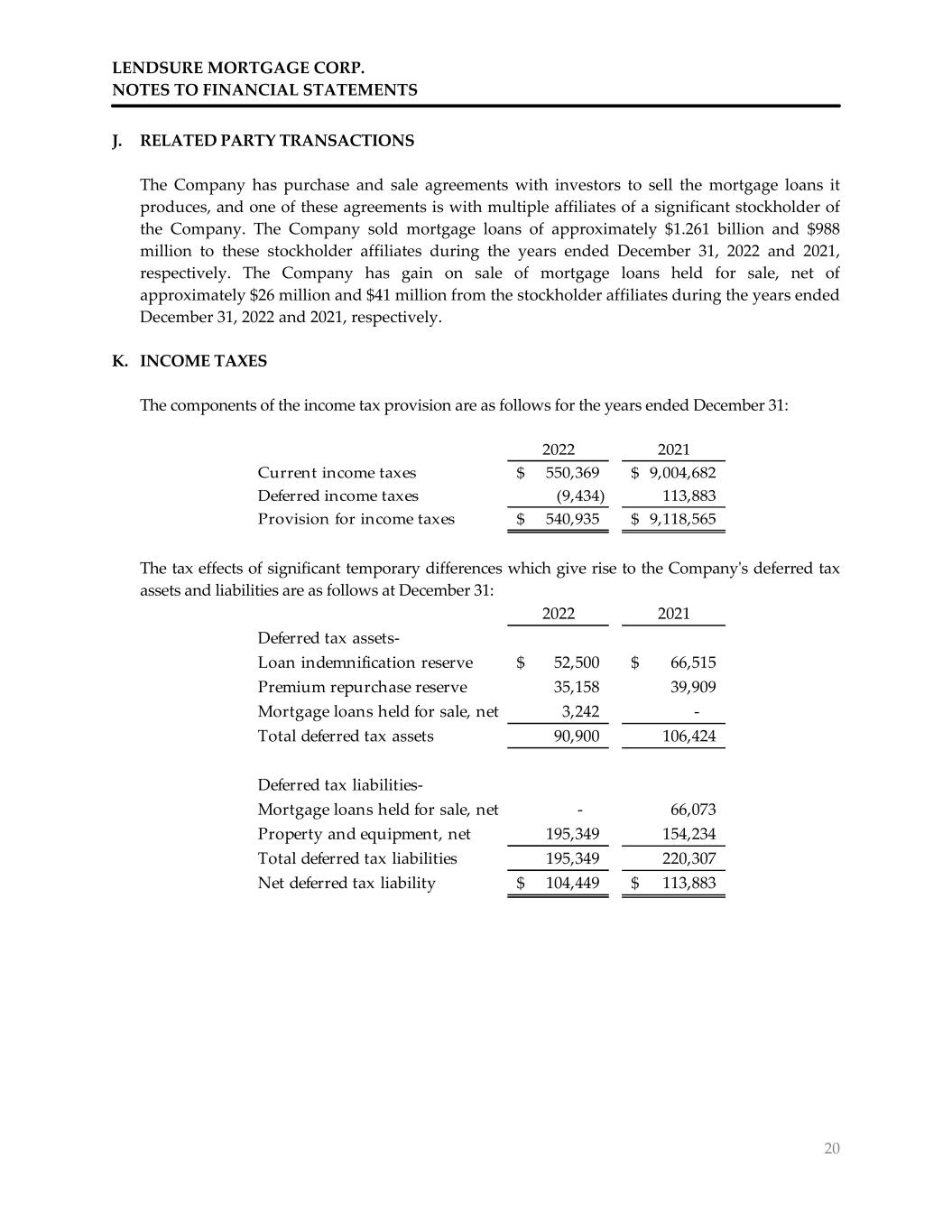

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 20 J. RELATED PARTY TRANSACTIONS The Company has purchase and sale agreements with investors to sell the mortgage loans it produces, and one of these agreements is with multiple affiliates of a significant stockholder of the Company. The Company sold mortgage loans of approximately $1.261 billion and $988 million to these stockholder affiliates during the years ended December 31, 2022 and 2021, respectively. The Company has gain on sale of mortgage loans held for sale, net of approximately $26 million and $41 million from the stockholder affiliates during the years ended December 31, 2022 and 2021, respectively. K. INCOME TAXES The components of the income tax provision are as follows for the years ended December 31: The tax effects of significant temporary differences which give rise to the Companyʹs deferred tax assets and liabilities are as follows at December 31: 2022 2021 Current income taxes 550,369$ 9,004,682$ Deferred income taxes (9,434) 113,883 Provision for income taxes 540,935$ 9,118,565$ 2022 2021 Deferred tax assets‐ Loan indemnification reserve 52,500$ 66,515$ Premium repurchase reserve 35,158 39,909 Mortgage loans held for sale, net 3,242 ‐ Total deferred tax assets 90,900 106,424 Deferred tax liabilities‐ Mortgage loans held for sale, net ‐ 66,073 Property and equipment, net 195,349 154,234 Total deferred tax liabilities 195,349 220,307 Net deferred tax liability 104,449$ 113,883$

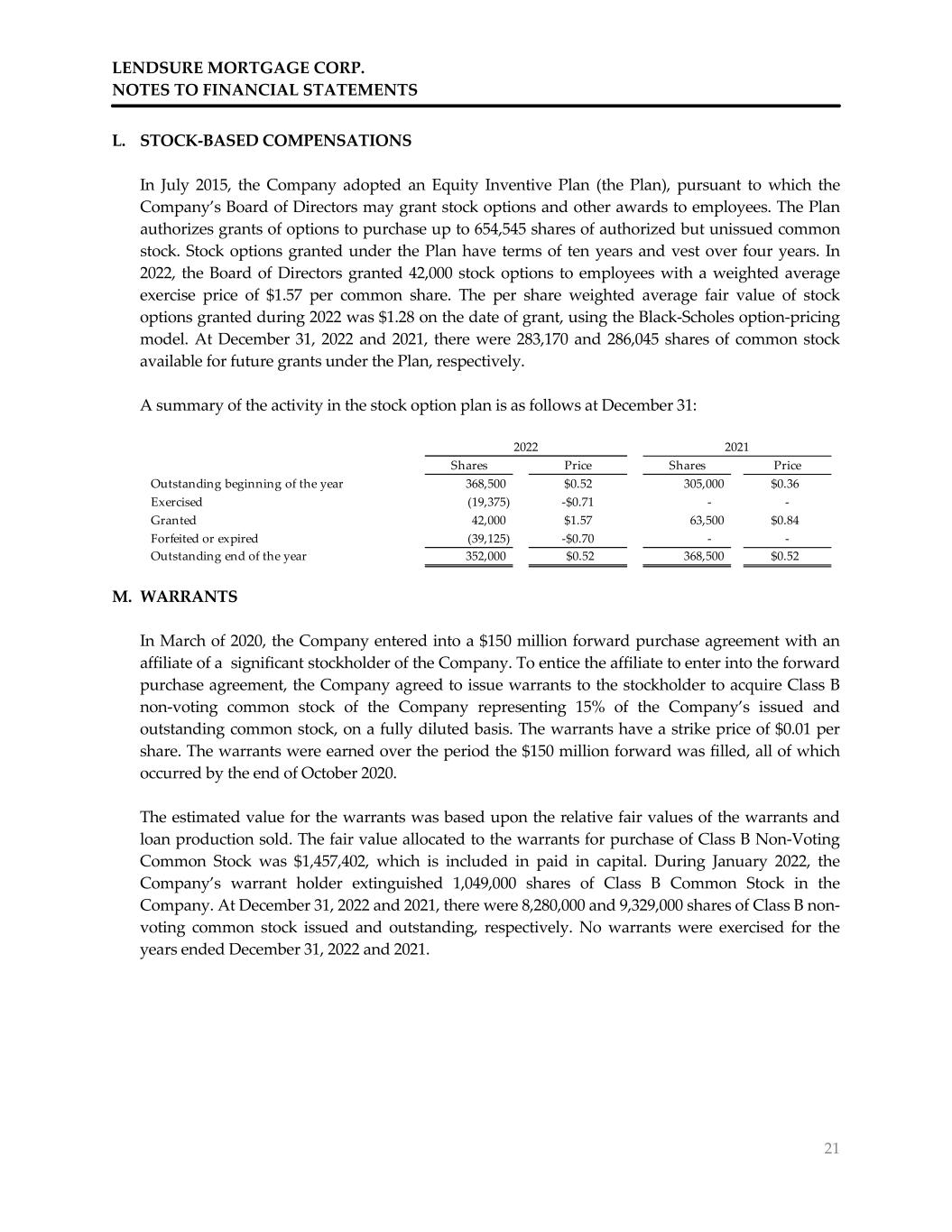

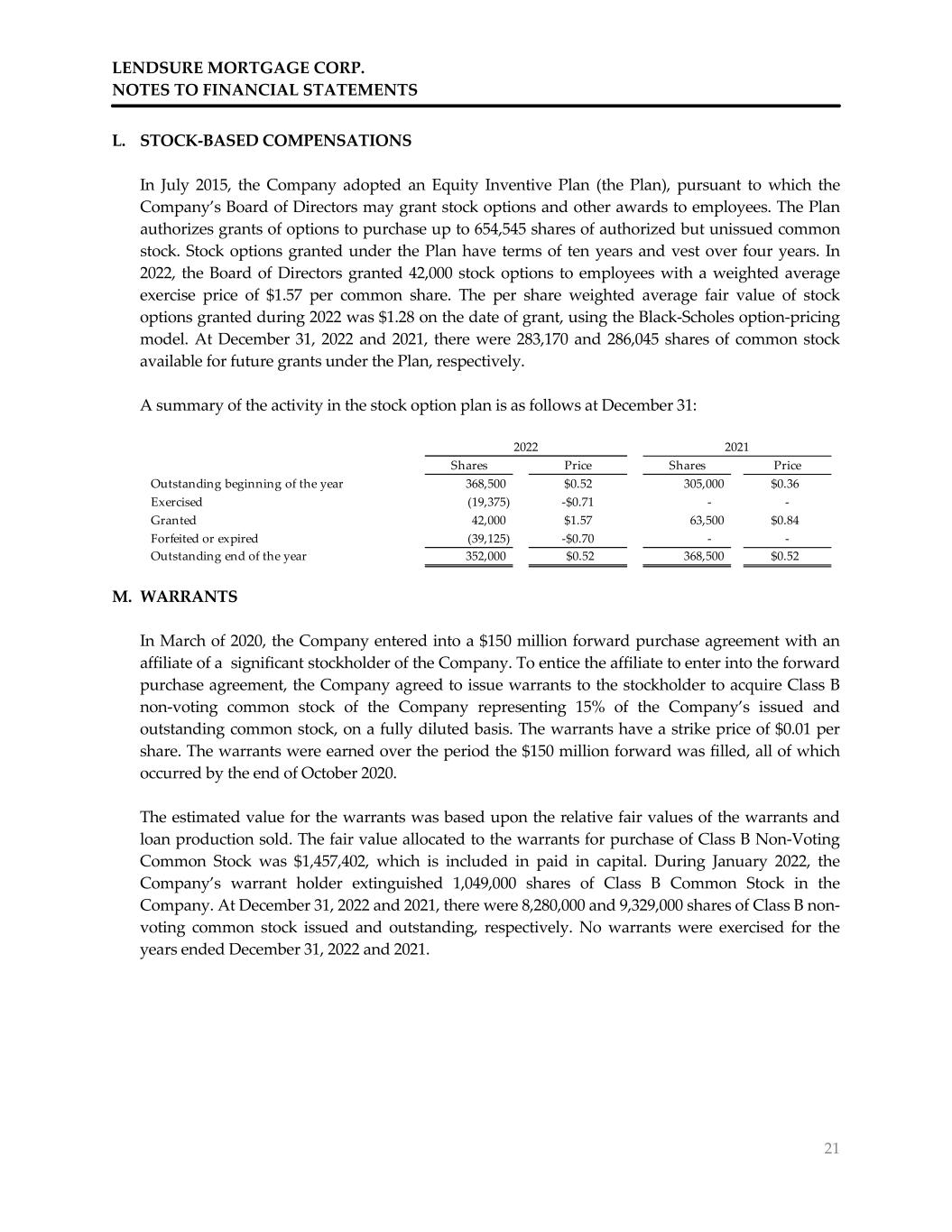

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 21 L. STOCK‐BASED COMPENSATIONS In July 2015, the Company adopted an Equity Inventive Plan (the Plan), pursuant to which the Company’s Board of Directors may grant stock options and other awards to employees. The Plan authorizes grants of options to purchase up to 654,545 shares of authorized but unissued common stock. Stock options granted under the Plan have terms of ten years and vest over four years. In 2022, the Board of Directors granted 42,000 stock options to employees with a weighted average exercise price of $1.57 per common share. The per share weighted average fair value of stock options granted during 2022 was $1.28 on the date of grant, using the Black‐Scholes option‐pricing model. At December 31, 2022 and 2021, there were 283,170 and 286,045 shares of common stock available for future grants under the Plan, respectively. A summary of the activity in the stock option plan is as follows at December 31: M. WARRANTS In March of 2020, the Company entered into a $150 million forward purchase agreement with an affiliate of a significant stockholder of the Company. To entice the affiliate to enter into the forward purchase agreement, the Company agreed to issue warrants to the stockholder to acquire Class B non‐voting common stock of the Company representing 15% of the Company’s issued and outstanding common stock, on a fully diluted basis. The warrants have a strike price of $0.01 per share. The warrants were earned over the period the $150 million forward was filled, all of which occurred by the end of October 2020. The estimated value for the warrants was based upon the relative fair values of the warrants and loan production sold. The fair value allocated to the warrants for purchase of Class B Non‐Voting Common Stock was $1,457,402, which is included in paid in capital. During January 2022, the Company’s warrant holder extinguished 1,049,000 shares of Class B Common Stock in the Company. At December 31, 2022 and 2021, there were 8,280,000 and 9,329,000 shares of Class B non‐ voting common stock issued and outstanding, respectively. No warrants were exercised for the years ended December 31, 2022 and 2021. Shares Price Shares Price Outstanding beginning of the year 368,500 $0.52 305,000 $0.36 Exercised (19,375) ‐$0.71 ‐ ‐ Granted 42,000 $1.57 63,500 $0.84 Forfeited or expired (39,125) ‐$0.70 ‐ ‐ Outstanding end of the year 352,000 $0.52 368,500 $0.52 2022 2021

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 22 N. FAIR VALUE MEASUREMENTS The Company does not have any impaired assets or liabilities that are recorded at fair value on a non‐recurring basis as of December 31, 2022 and 2021. Due to their short‐term nature, the carrying value of cash and cash equivalents, restricted cash, escrow cash, short‐term receivables, mortgage loans held for sale, fixed assets, short‐term payables, and warehouse lines of credit approximate their fair value at December 31, 2022. O. SUBSEQUENT EVENTS Management has evaluated subsequent events through February 24, 2023, the date on which the financial statements were available to be issued.

SUPPLEMENTARY INFORMATION

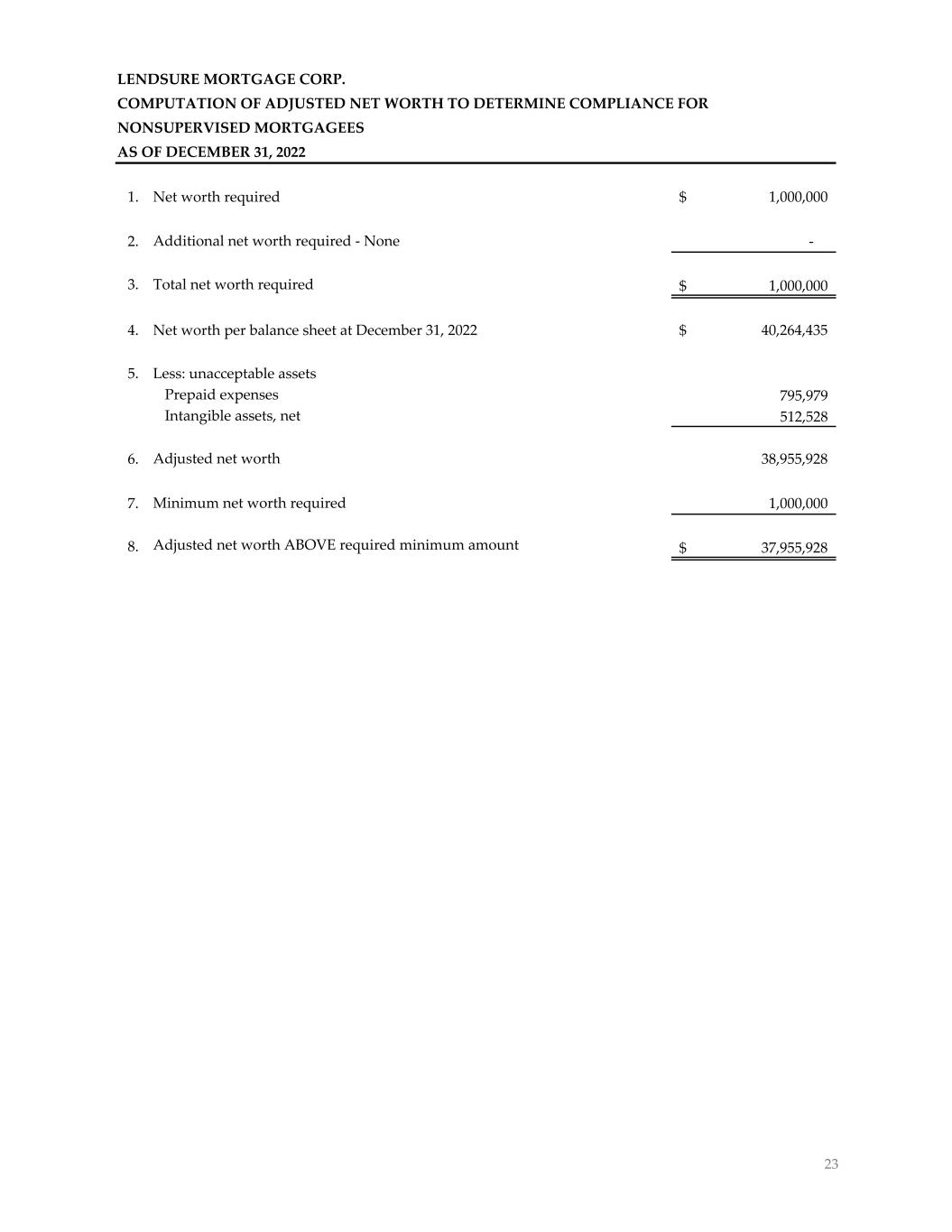

LENDSURE MORTGAGE CORP. COMPUTATION OF ADJUSTED NET WORTH TO DETERMINE COMPLIANCE FOR NONSUPERVISED MORTGAGEES AS OF DECEMBER 31, 2022 1. Net worth required 1,000,000$ 2. Additional net worth required ‐ None ‐ 3. Total net worth required 1,000,000$ 4. Net worth per balance sheet at December 31, 2022 40,264,435$ 5. Less: unacceptable assets Prepaid expenses 795,979 Intangible assets, net 512,528 6. Adjusted net worth 38,955,928 7. Minimum net worth required 1,000,000 8. Adjusted net worth ABOVE required minimum amount 37,955,928$ 23