INDEPENDENT AUDITOR'S REPORT AND FINANCIAL STATEMENTS FOR LENDSURE MORTGAGE CORP. FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

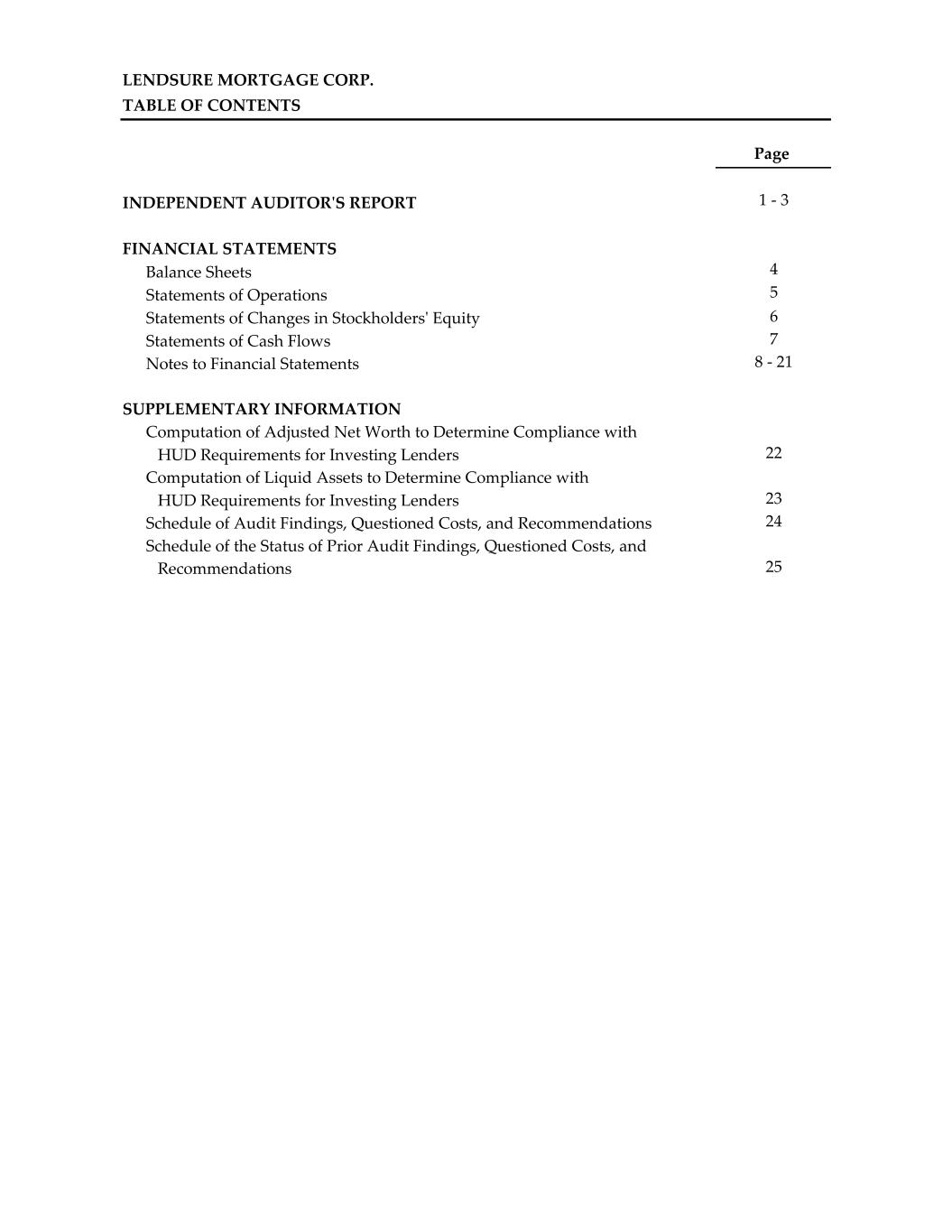

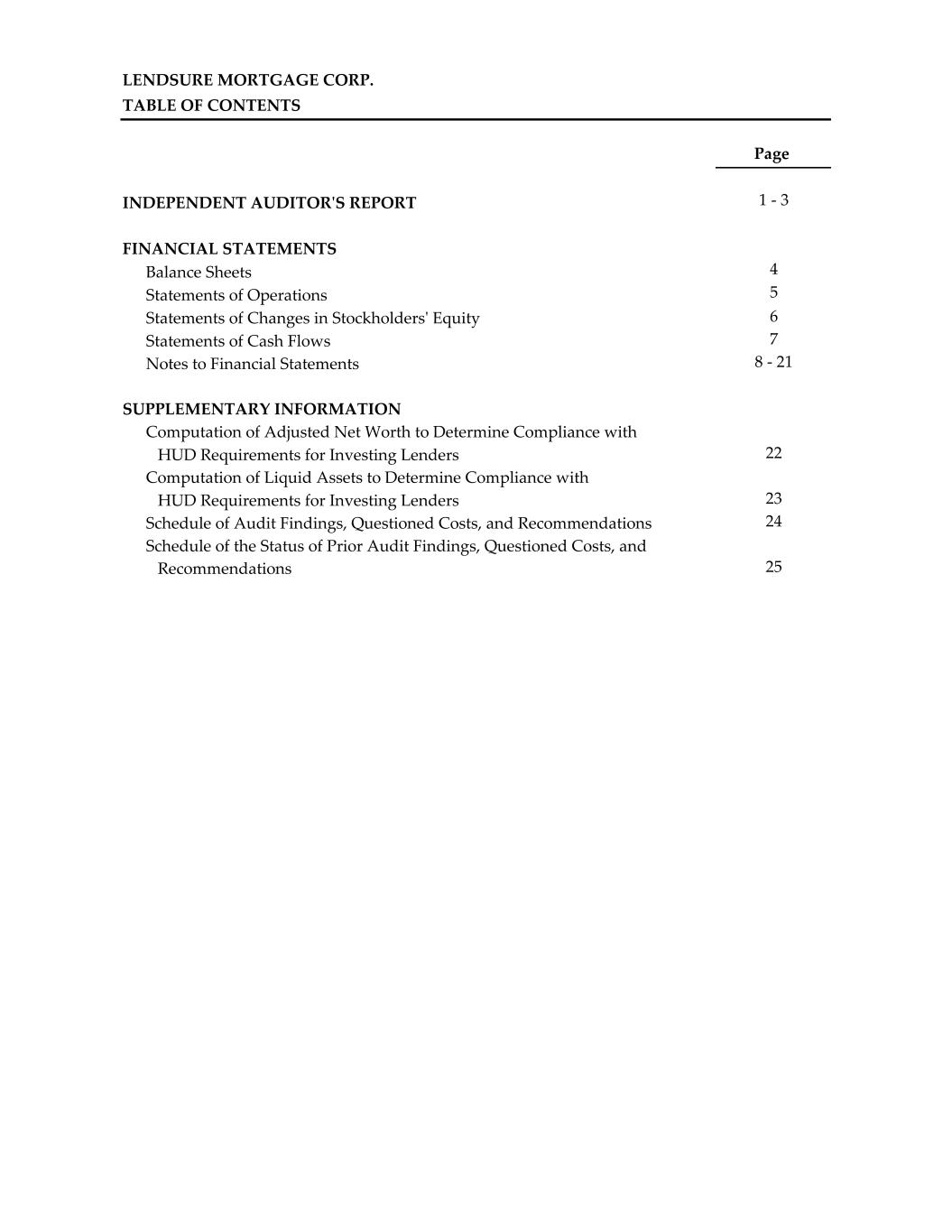

LENDSURE MORTGAGE CORP. TABLE OF CONTENTS Page INDEPENDENT AUDITOR'S REPORT 1 - 3 FINANCIAL STATEMENTS Balance Sheets 4 Statements of Operations 5 Statements of Changes in Stockholders' Equity 6 Statements of Cash Flows 7 Notes to Financial Statements 8 - 21 SUPPLEMENTARY INFORMATION Computation of Adjusted Net Worth to Determine Compliance with HUD Requirements for Investing Lenders 22 Computation of Liquid Assets to Determine Compliance with HUD Requirements for Investing Lenders 23 Schedule of Audit Findings, Questioned Costs, and Recommendations 24 Schedule of the Status of Prior Audit Findings, Questioned Costs, and Recommendations 25

9780 S Meridian Blvd., Suite 500 Englewood, CO 80112 303-721-6131 www.richeymay.com Assurance | Tax | Advisory INDEPENDENT AUDITOR’S REPORT To the Stockholders LendSure Mortgage Corp. San Diego, California Report on the Audit of the Financial Statements Opinion We have audited the financial statements of LendSure Mortgage Corp., which comprise the balance sheets as of December 31, 2024 and 2023, and the related statements of operations, changes in stockholders’ equity, and cash flows for the years then ended, and the related notes to the financial statements. In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of LendSure Mortgage Corp. as of December 31, 2024 and 2023, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS) and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States (Government Auditing Standards). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of LendSure Mortgage Corp. and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about LendSure Mortgage Corp.’s ability to continue as a going concern for one year after the date the financial statements are issued.

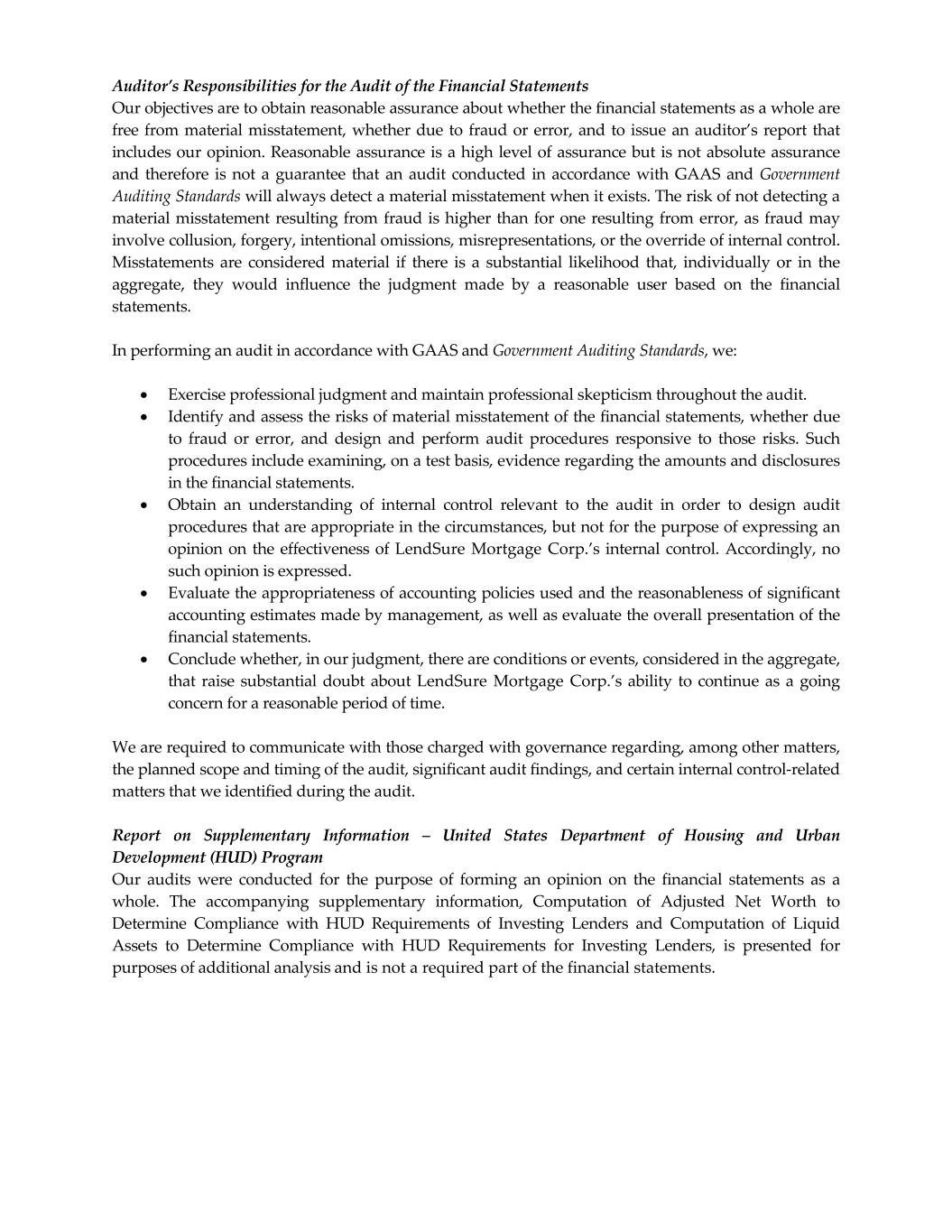

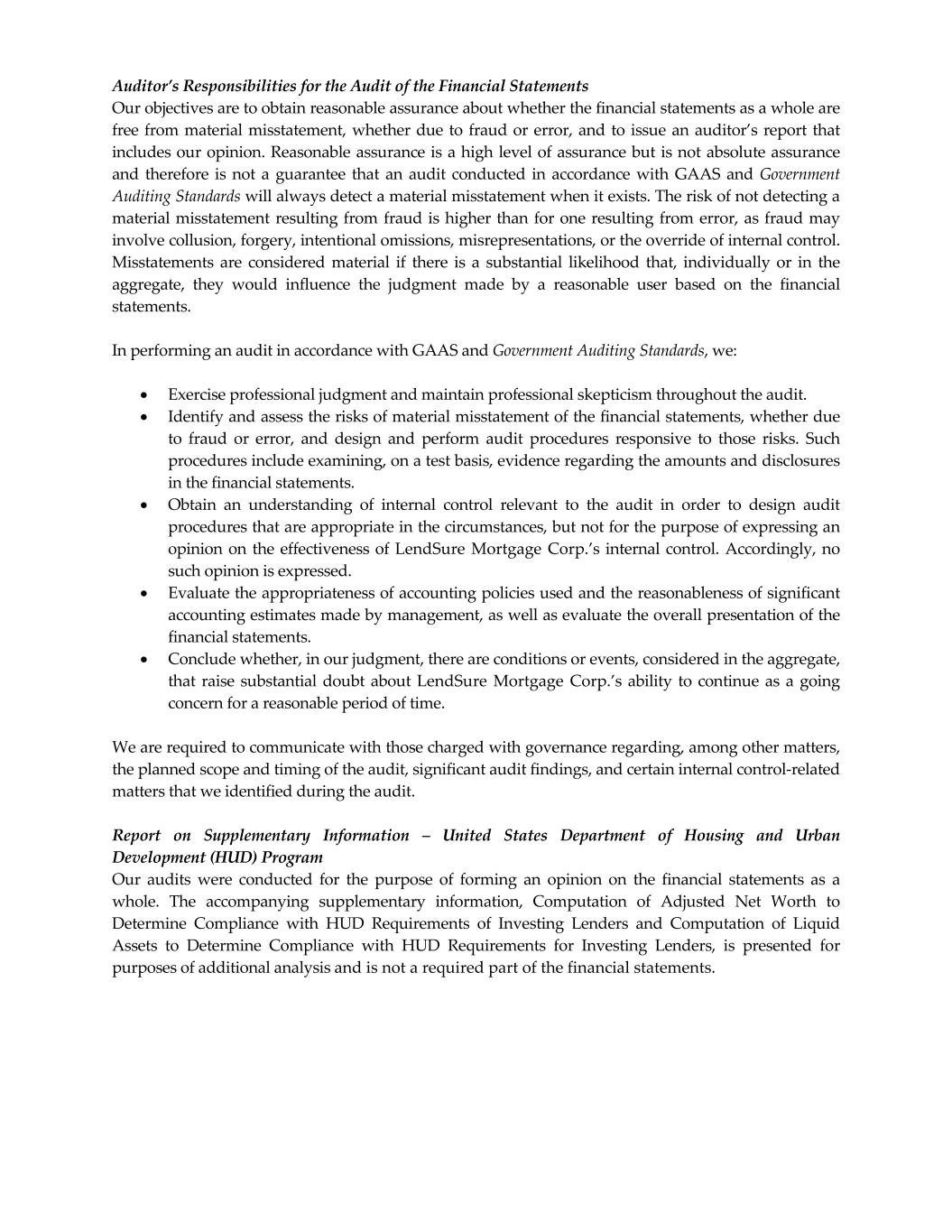

Auditor’s Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS and Government Auditing Standards will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements. In performing an audit in accordance with GAAS and Government Auditing Standards, we: • Exercise professional judgment and maintain professional skepticism throughout the audit. • Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of LendSure Mortgage Corp.’s internal control. Accordingly, no such opinion is expressed. • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. • Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about LendSure Mortgage Corp.’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. Report on Supplementary Information – United States Department of Housing and Urban Development (HUD) Program Our audits were conducted for the purpose of forming an opinion on the financial statements as a whole. The accompanying supplementary information, Computation of Adjusted Net Worth to Determine Compliance with HUD Requirements of Investing Lenders and Computation of Liquid Assets to Determine Compliance with HUD Requirements for Investing Lenders, is presented for purposes of additional analysis and is not a required part of the financial statements.

This supplementary information is the responsibility of management and was derived from and relates directly to the underlying accounting and other records used to prepare the financial statements. Such information has been subjected to the auditing procedures applied in the audits of the financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the financial statements or to the financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United States of America. In our opinion, the accompanying supplementary information is fairly stated in all material respects in relation to the financial statements as a whole. The accompanying Schedule of the Status of Prior Audit Findings, Questioned Costs, and Recommendations has not been subjected to the auditing procedures applied in the audits of the financial statements, and accordingly, we do not express an opinion or provide any assurance on it. Englewood, Colorado February 26, 2025

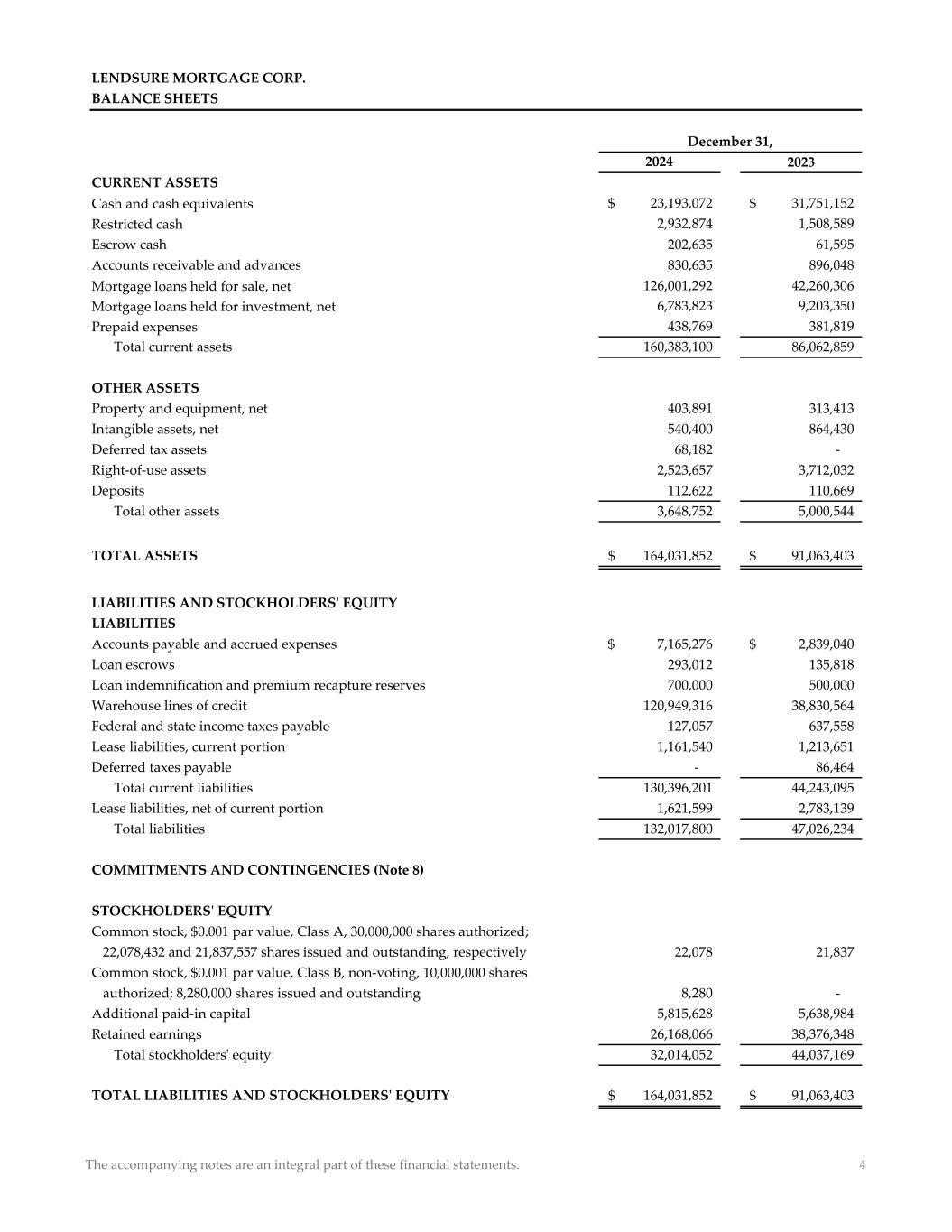

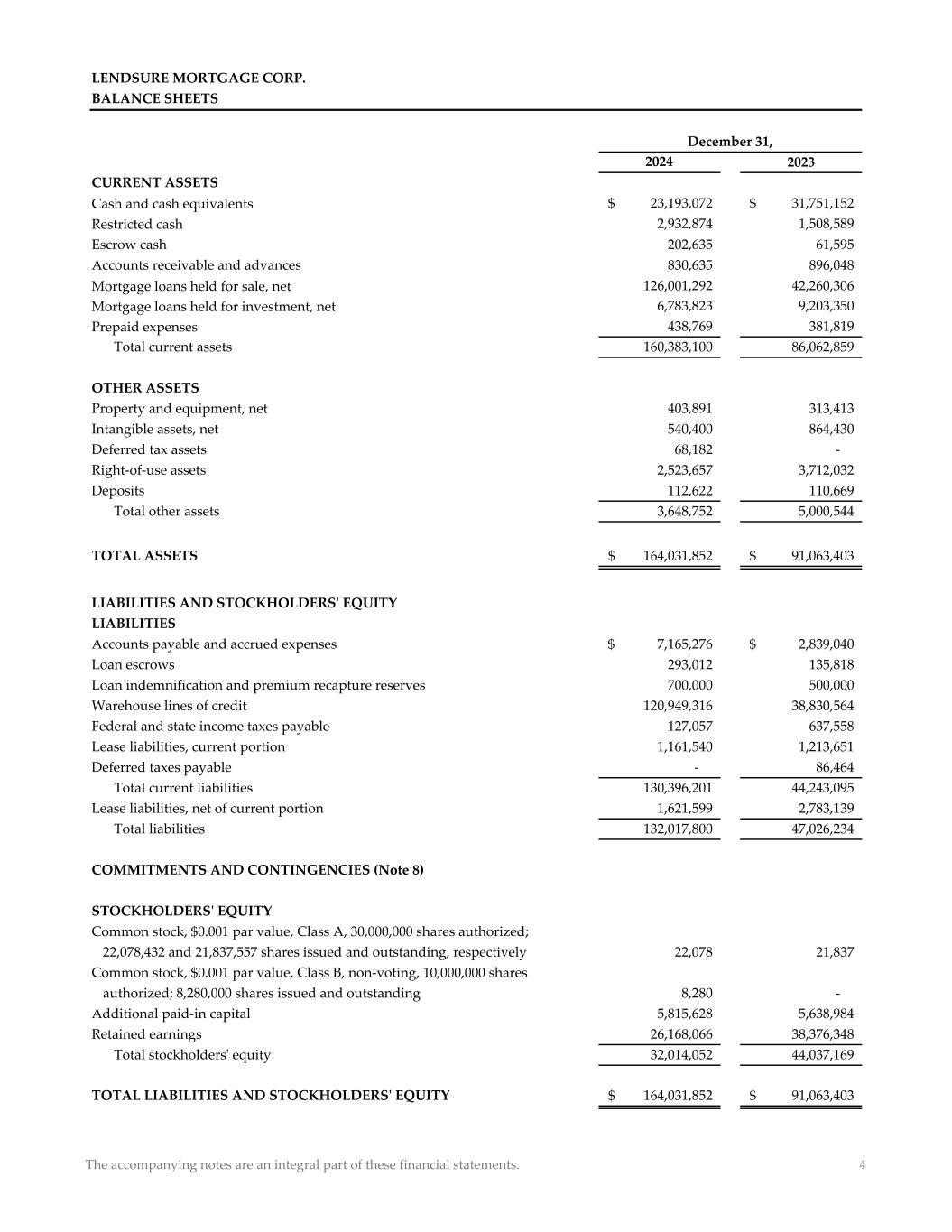

2024 2023 CURRENT ASSETS Cash and cash equivalents 23,193,072$ 31,751,152$ Restricted cash 2,932,874 1,508,589 Escrow cash 202,635 61,595 Accounts receivable and advances 830,635 896,048 Mortgage loans held for sale, net 126,001,292 42,260,306 Mortgage loans held for investment, net 6,783,823 9,203,350 Prepaid expenses 438,769 381,819 Total current assets 160,383,100 86,062,859 OTHER ASSETS Property and equipment, net 403,891 313,413 Intangible assets, net 540,400 864,430 Deferred tax assets 68,182 - Right-of-use assets 2,523,657 3,712,032 Deposits 112,622 110,669 Total other assets 3,648,752 5,000,544 TOTAL ASSETS 164,031,852$ 91,063,403$ LIABILITIES AND STOCKHOLDERS' EQUITY LIABILITIES Accounts payable and accrued expenses 7,165,276$ 2,839,040$ Loan escrows 293,012 135,818 Loan indemnification and premium recapture reserves 700,000 500,000 Warehouse lines of credit 120,949,316 38,830,564 Federal and state income taxes payable 127,057 637,558 Lease liabilities, current portion 1,161,540 1,213,651 Deferred taxes payable - 86,464 Total current liabilities 130,396,201 44,243,095 Lease liabilities, net of current portion 1,621,599 2,783,139 Total liabilities 132,017,800 47,026,234 COMMITMENTS AND CONTINGENCIES (Note 8) STOCKHOLDERS' EQUITY Common stock, $0.001 par value, Class A, 30,000,000 shares authorized; 22,078,432 and 21,837,557 shares issued and outstanding, respectively 22,078 21,837 Common stock, $0.001 par value, Class B, non-voting, 10,000,000 shares authorized; 8,280,000 shares issued and outstanding 8,280 - Additional paid-in capital 5,815,628 5,638,984 Retained earnings 26,168,066 38,376,348 Total stockholders' equity 32,014,052 44,037,169 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 164,031,852$ 91,063,403$ LENDSURE MORTGAGE CORP. BALANCE SHEETS December 31, The accompanying notes are an integral part of these financial statements. 4

STATEMENTS OF OPERATIONS 2024 2023 REVENUE Gain on sale of mortgage loans held for sale, net of direct costs of $1,904,127 and $2,417,671, respectively 52,128,943$ 30,758,227$ Loan origination fees, net of direct costs of $1,789,913 and $1,689,895, respectively 4,168,940 2,900,811 Interest income 7,790,732 7,395,807 Interest expense and warehouse fees (5,234,079) (5,900,571) Other income 200,450 1,219,416 Total revenue 59,054,986 36,373,690 EXPENSES Salaries, commissions and benefits 35,812,745 25,349,679 Occupancy, equipment and communication 3,527,615 3,903,778 General and administrative 1,698,092 1,685,951 Provision for premium recapture 613,126 72,566 Depreciation and amortization 475,755 310,222 Total expenses 42,127,333 31,322,196 NET INCOME BEFORE TAXES 16,927,653 5,051,494 Provision for income taxes, current 4,736,815 1,319,109 Deferred taxes (154,645) (17,986) Total taxes 4,582,170 1,301,123 NET INCOME 12,345,483$ 3,750,371$ LENDSURE MORTGAGE CORP. Years Ended December 31, The accompanying notes are an integral part of these financial statements. 5

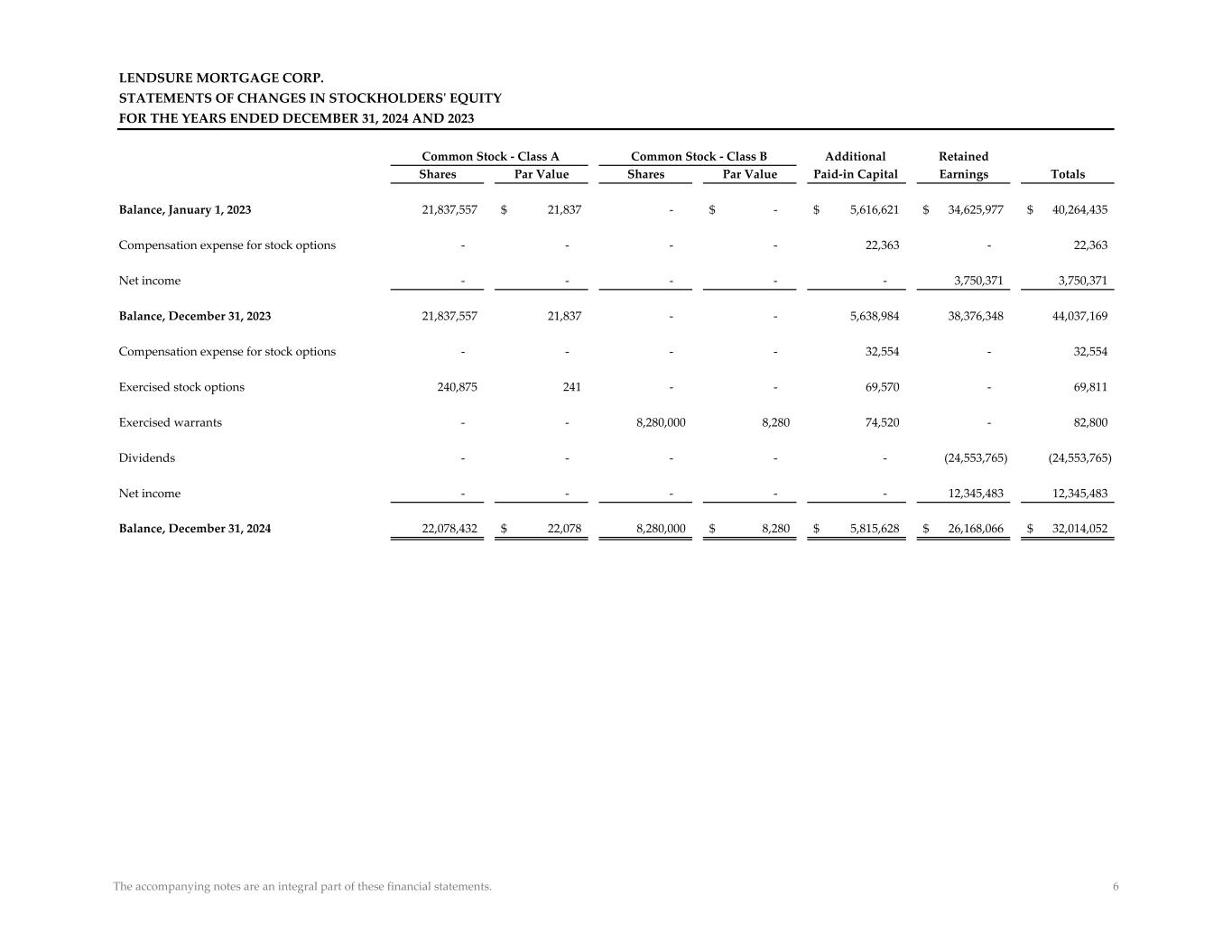

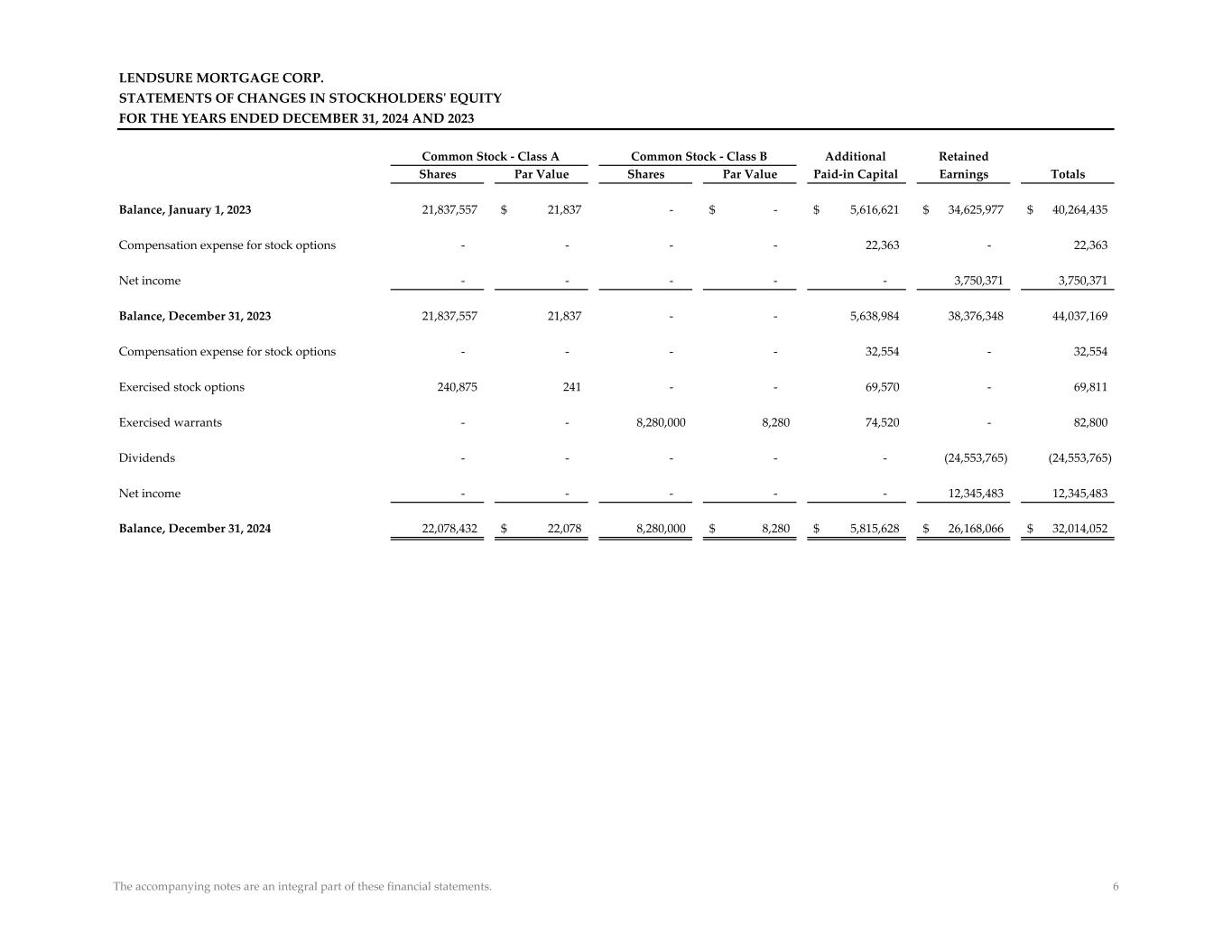

LENDSURE MORTGAGE CORP. STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 Additional Retained Shares Par Value Shares Par Value Paid-in Capital Earnings Totals Balance, January 1, 2023 21,837,557 21,837$ - -$ 5,616,621$ 34,625,977$ 40,264,435$ Compensation expense for stock options - - - - 22,363 - 22,363 Net income - - - - - 3,750,371 3,750,371 Balance, December 31, 2023 21,837,557 21,837 - - 5,638,984 38,376,348 44,037,169 Compensation expense for stock options - - - - 32,554 - 32,554 Exercised stock options 240,875 241 - - 69,570 - 69,811 Exercised warrants - - 8,280,000 8,280 74,520 - 82,800 Dividends - - - - - (24,553,765) (24,553,765) Net income - - - - - 12,345,483 12,345,483 Balance, December 31, 2024 22,078,432 22,078$ 8,280,000 8,280$ 5,815,628$ 26,168,066$ 32,014,052$ Common Stock - Class B Common Stock - Class A The accompanying notes are an integral part of these financial statements. 6

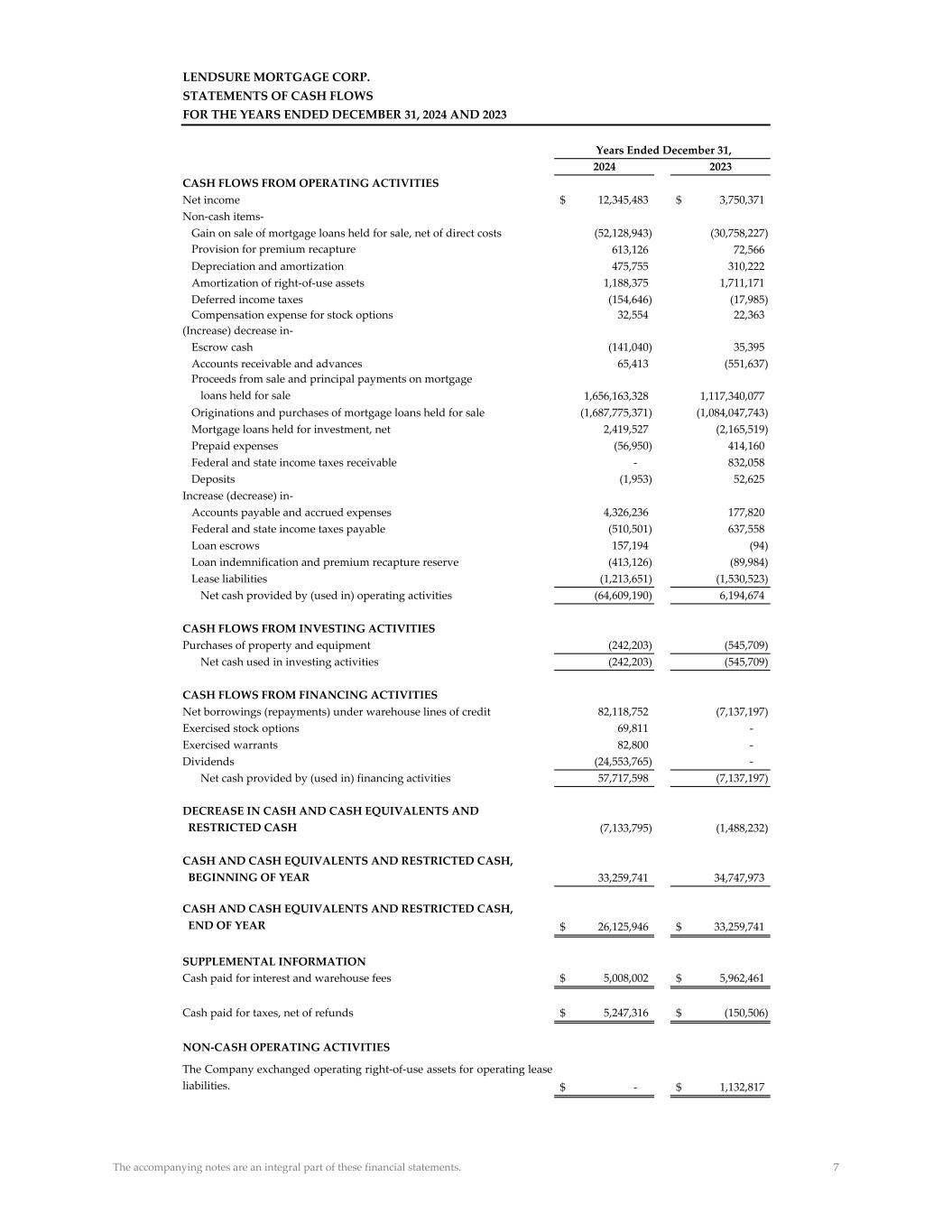

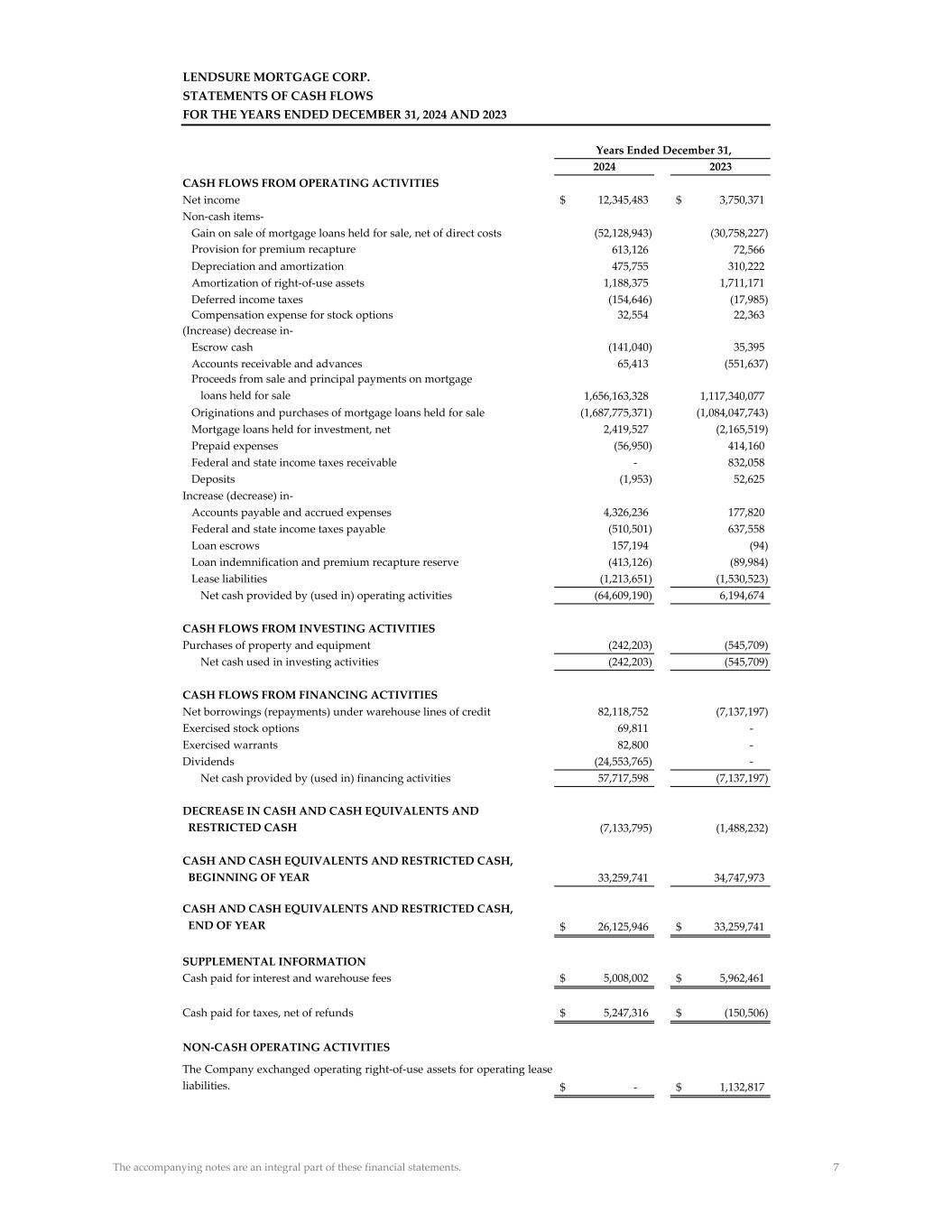

LENDSURE MORTGAGE CORP. STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 2024 2023 CASH FLOWS FROM OPERATING ACTIVITIES Net income 12,345,483$ 3,750,371$ Non-cash items- Gain on sale of mortgage loans held for sale, net of direct costs (52,128,943) (30,758,227) Provision for premium recapture 613,126 72,566 Depreciation and amortization 475,755 310,222 Amortization of right-of-use assets 1,188,375 1,711,171 Deferred income taxes (154,646) (17,985) Compensation expense for stock options 32,554 22,363 (Increase) decrease in- Escrow cash (141,040) 35,395 Accounts receivable and advances 65,413 (551,637) Proceeds from sale and principal payments on mortgage loans held for sale 1,656,163,328 1,117,340,077 Originations and purchases of mortgage loans held for sale (1,687,775,371) (1,084,047,743) Mortgage loans held for investment, net 2,419,527 (2,165,519) Prepaid expenses (56,950) 414,160 Federal and state income taxes receivable - 832,058 Deposits (1,953) 52,625 Increase (decrease) in- Accounts payable and accrued expenses 4,326,236 177,820 Federal and state income taxes payable (510,501) 637,558 Loan escrows 157,194 (94) Loan indemnification and premium recapture reserve (413,126) (89,984) Lease liabilities (1,213,651) (1,530,523) Net cash provided by (used in) operating activities (64,609,190) 6,194,674 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property and equipment (242,203) (545,709) Net cash used in investing activities (242,203) (545,709) CASH FLOWS FROM FINANCING ACTIVITIES Net borrowings (repayments) under warehouse lines of credit 82,118,752 (7,137,197) Exercised stock options 69,811 - Exercised warrants 82,800 - Dividends (24,553,765) - Net cash provided by (used in) financing activities 57,717,598 (7,137,197) DECREASE IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH (7,133,795) (1,488,232) CASH AND CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING OF YEAR 33,259,741 34,747,973 CASH AND CASH EQUIVALENTS AND RESTRICTED CASH, END OF YEAR 26,125,946$ 33,259,741$ SUPPLEMENTAL INFORMATION Cash paid for interest and warehouse fees 5,008,002$ 5,962,461$ Cash paid for taxes, net of refunds 5,247,316$ (150,506)$ NON-CASH OPERATING ACTIVITIES The Company exchanged operating right-of-use assets for operating lease liabilities. -$ 1,132,817$ Years Ended December 31, The accompanying notes are an integral part of these financial statements. 7

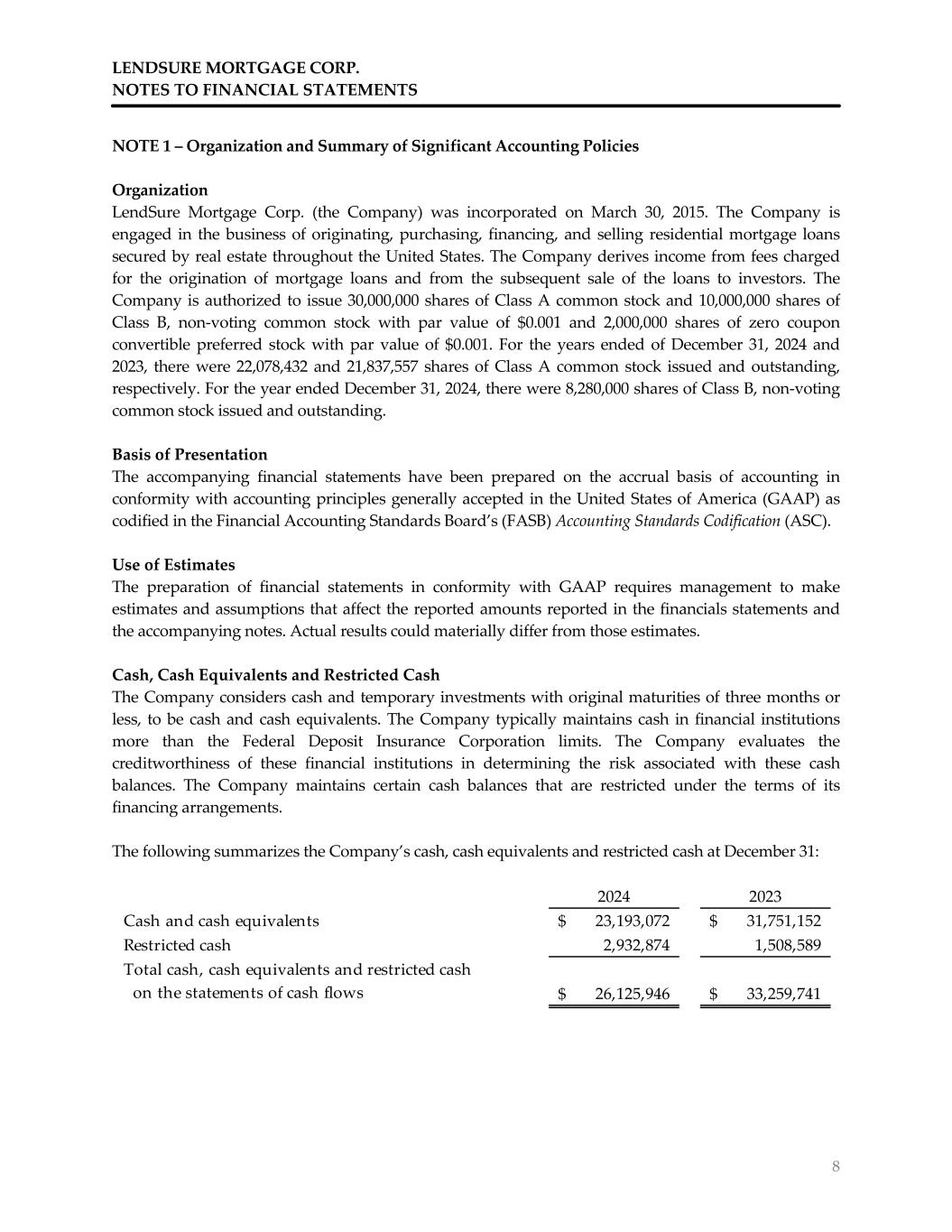

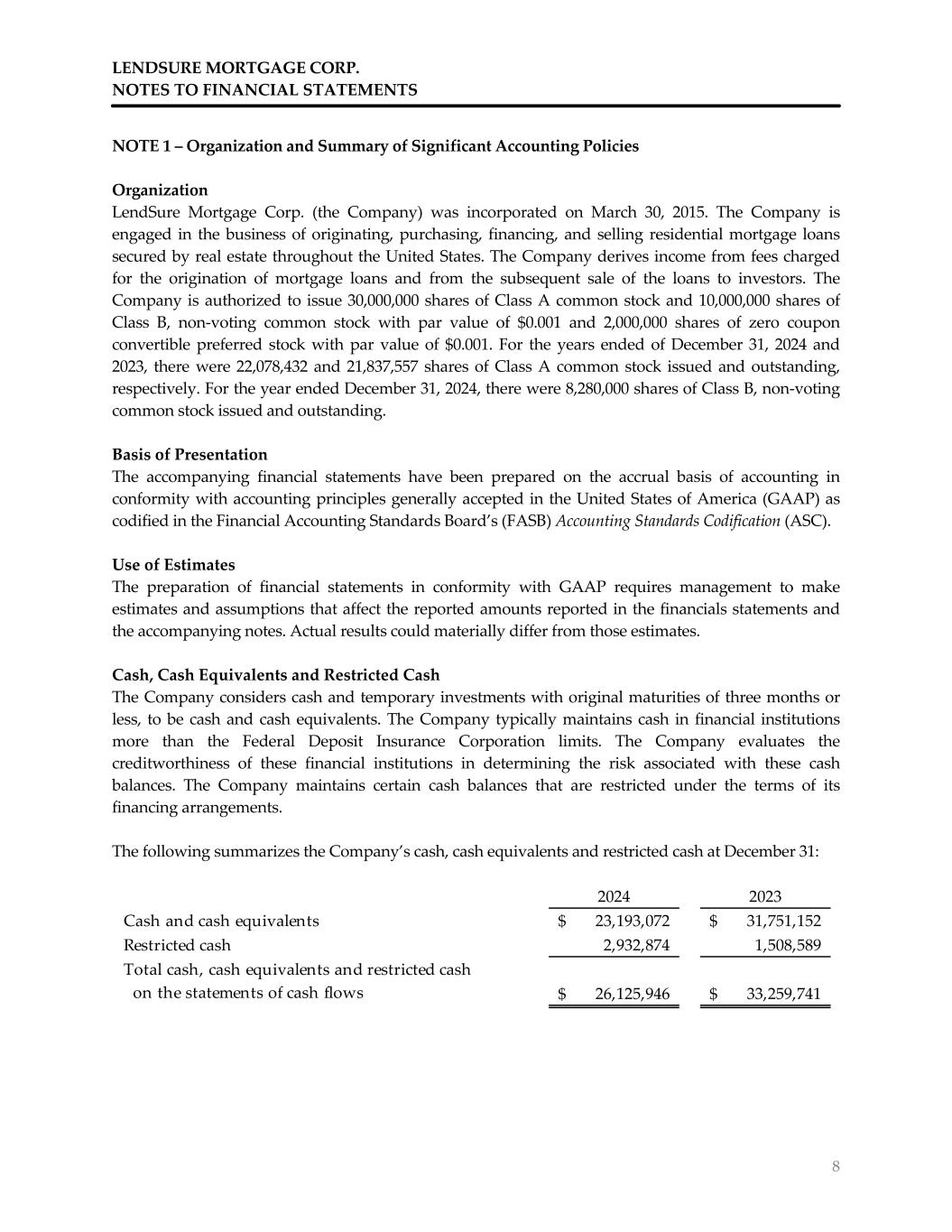

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 8 NOTE 1 – Organization and Summary of Significant Accounting Policies Organization LendSure Mortgage Corp. (the Company) was incorporated on March 30, 2015. The Company is engaged in the business of originating, purchasing, financing, and selling residential mortgage loans secured by real estate throughout the United States. The Company derives income from fees charged for the origination of mortgage loans and from the subsequent sale of the loans to investors. The Company is authorized to issue 30,000,000 shares of Class A common stock and 10,000,000 shares of Class B, non-voting common stock with par value of $0.001 and 2,000,000 shares of zero coupon convertible preferred stock with par value of $0.001. For the years ended of December 31, 2024 and 2023, there were 22,078,432 and 21,837,557 shares of Class A common stock issued and outstanding, respectively. For the year ended December 31, 2024, there were 8,280,000 shares of Class B, non-voting common stock issued and outstanding. Basis of Presentation The accompanying financial statements have been prepared on the accrual basis of accounting in conformity with accounting principles generally accepted in the United States of America (GAAP) as codified in the Financial Accounting Standards Board’s (FASB) Accounting Standards Codification (ASC). Use of Estimates The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts reported in the financials statements and the accompanying notes. Actual results could materially differ from those estimates. Cash, Cash Equivalents and Restricted Cash The Company considers cash and temporary investments with original maturities of three months or less, to be cash and cash equivalents. The Company typically maintains cash in financial institutions more than the Federal Deposit Insurance Corporation limits. The Company evaluates the creditworthiness of these financial institutions in determining the risk associated with these cash balances. The Company maintains certain cash balances that are restricted under the terms of its financing arrangements. The following summarizes the Company’s cash, cash equivalents and restricted cash at December 31: 2024 2023 Cash and cash equivalents 23,193,072$ 31,751,152$ Restricted cash 2,932,874 1,508,589 Total cash, cash equivalents and restricted cash on the statements of cash flows 26,125,946$ 33,259,741$

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 9 Escrow Cash The Company maintains escrow accounts in trust for funds held on behalf of borrowers for taxes, property insurance and mortgage insurance premiums, which are included in escrow cash on the balance sheets. Mortgage Loans Held for Sale and Revenue Recognition The Company does not issue rate locks and, therefore, has elected not to use the fair value option on mortgage loans held for sale (MLHFS). MLHFS are recorded at the lower of cost or fair value as determined on an aggregate loan basis. Fair value for mortgage loans is generally based on current delivery prices. Loan origination fees, net of direct origination costs, are deferred and recognized at the time the loan is sold and are recorded in gain on sale of MLHFS on the statements of operations. Sales proceeds reflect the cash received from investors through the sale of the loan and servicing release premium. MLHFS are considered sold when the Company surrenders control over the financial assets. Control is considered to have been surrendered when the transferred assets have been isolated from the Company, beyond the reach of the Company and its creditors; the investor obtains the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred assets; and the Company does not maintain effective control over the transferred assets through either an agreement that both entitles and obligates the Company to repurchase or redeem the transferred assets before their maturity or the ability to unilaterally cause the holder to return specific financial assets. The Company typically considers the above criteria to have been met upon acceptance and receipt of sales proceeds from the investor. Mortgage Loans Held for Investment, net and Revenue Recognition Mortgage loans held for investment (MLHI) for which management has the intent and ability to hold for the foreseeable future, or until maturity or pay off, are carried at amortized cost, reduced by a valuation allowance for estimated credit losses, when applicable. Amortized cost is the principal balance outstanding, net of purchase premiums and discounts and deferred fees and costs. Loan origination fees, net of certain direct origination costs, are deferred and recognized in interest income using methods that approximate a level yield without anticipating prepayments. The accrual of interest is generally discontinued when a loan becomes 90 days past due and is not well collateralized and in the process of collection, or when management believes, after considering economic and business conditions and collection efforts, that the principal or interest will not be collectible in the normal course of business. Past due status is based on contractual terms of the loan. A loan is considered to be past due when a scheduled payment has not been received 30 days after the contractual due date. All accrued interest is reversed against interest income when a loan is placed on nonaccrual status. Interest received on such loans is accounted for using the cost-recovery method, until qualifying for return to accrual. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current, there is a sustained period of repayment performance, and future payments are reasonably assured.

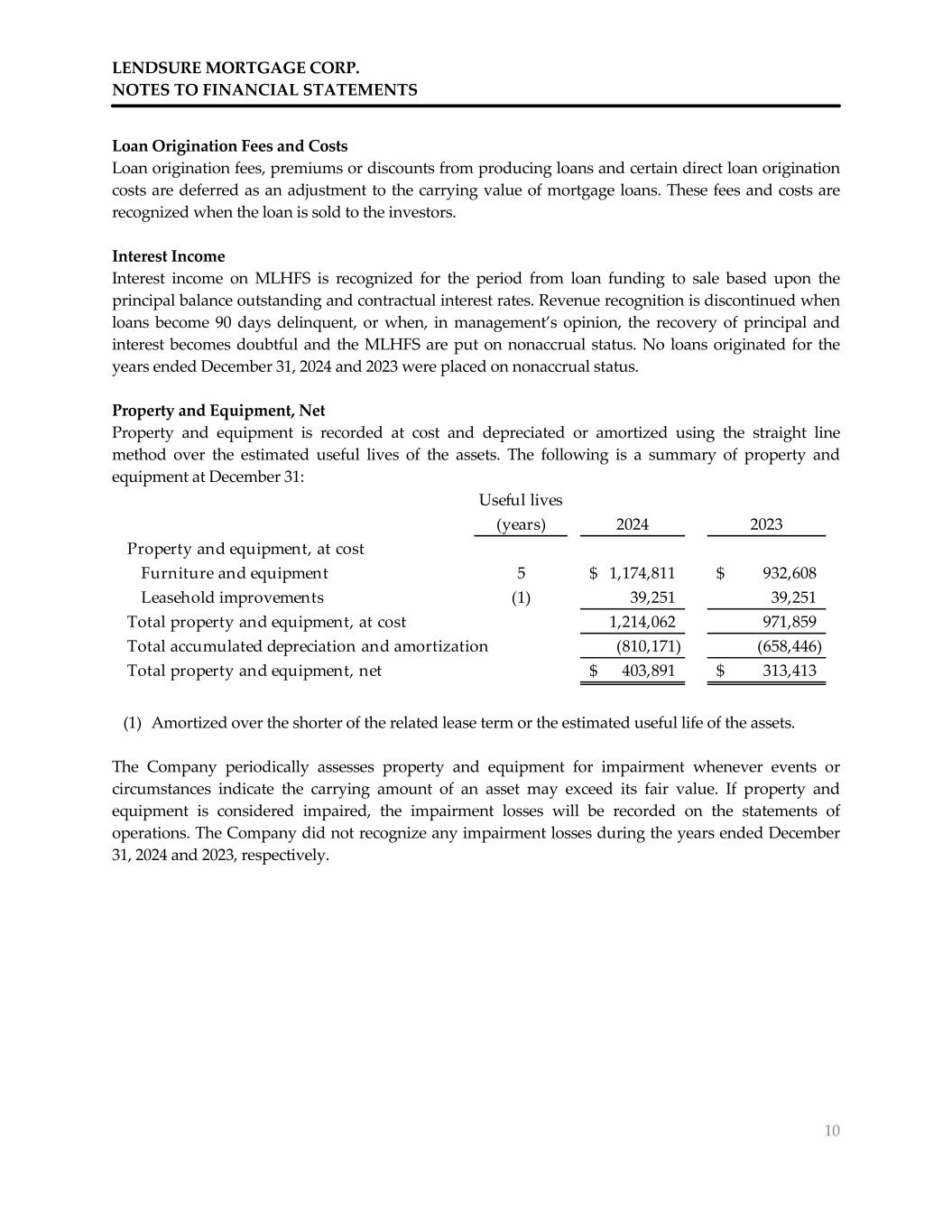

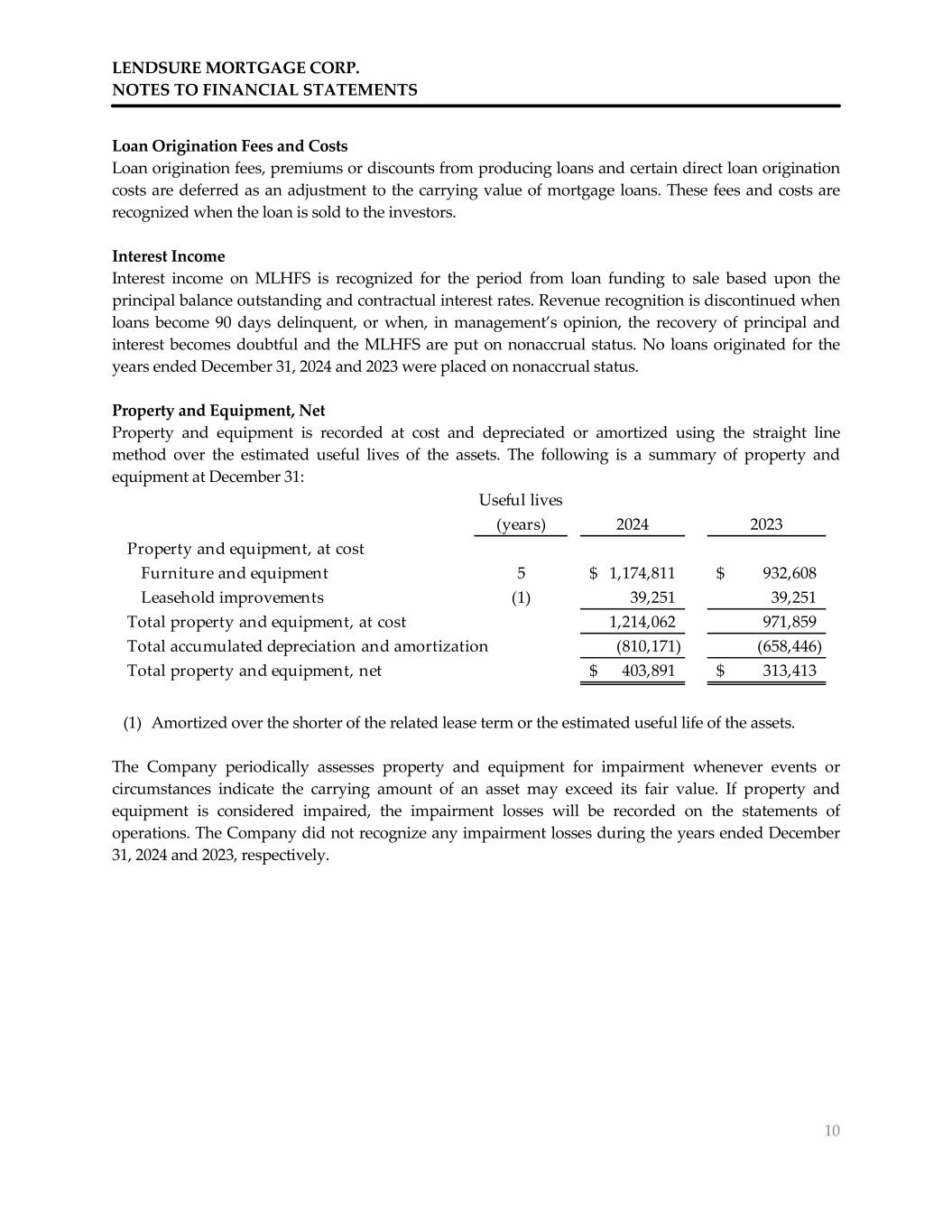

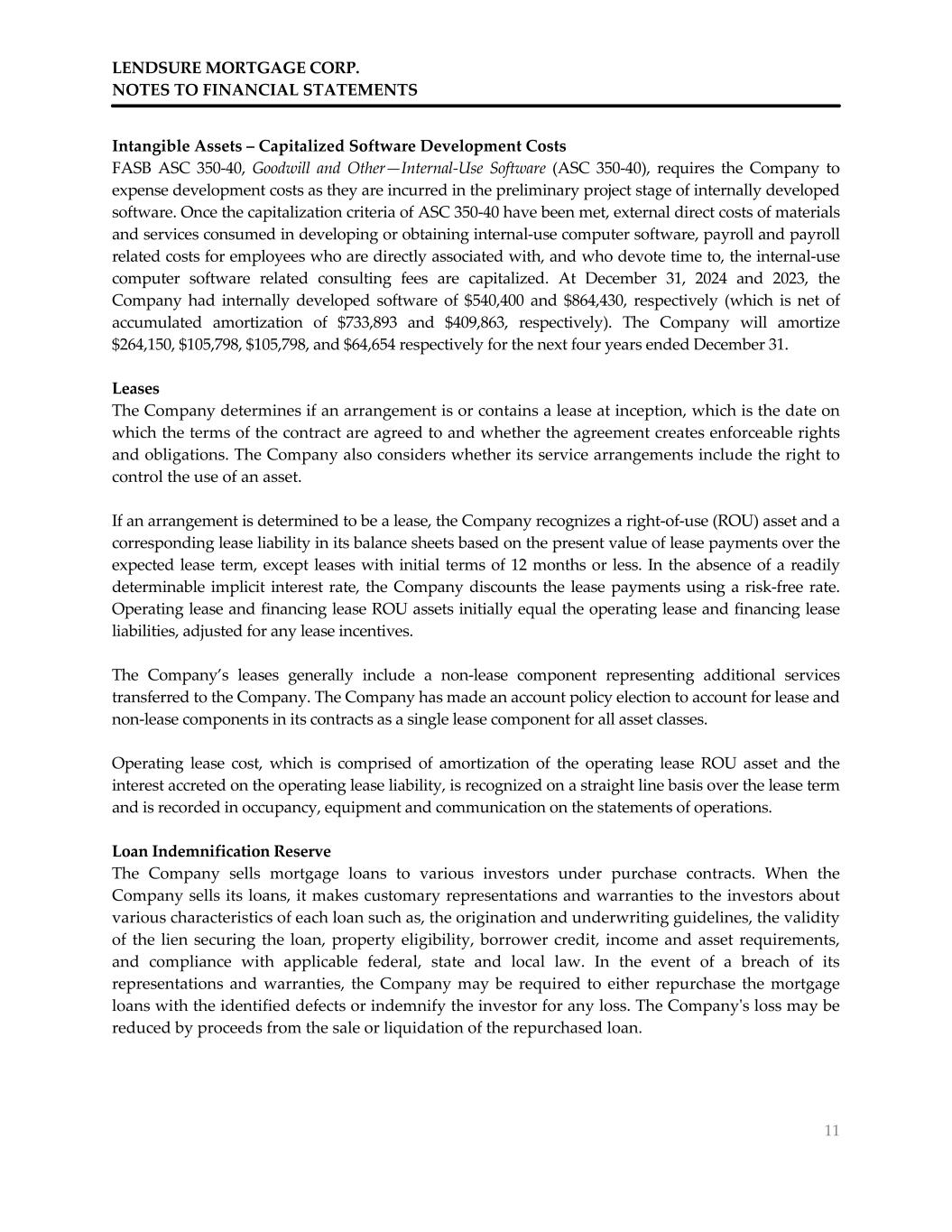

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 10 Loan Origination Fees and Costs Loan origination fees, premiums or discounts from producing loans and certain direct loan origination costs are deferred as an adjustment to the carrying value of mortgage loans. These fees and costs are recognized when the loan is sold to the investors. Interest Income Interest income on MLHFS is recognized for the period from loan funding to sale based upon the principal balance outstanding and contractual interest rates. Revenue recognition is discontinued when loans become 90 days delinquent, or when, in management’s opinion, the recovery of principal and interest becomes doubtful and the MLHFS are put on nonaccrual status. No loans originated for the years ended December 31, 2024 and 2023 were placed on nonaccrual status. Property and Equipment, Net Property and equipment is recorded at cost and depreciated or amortized using the straight line method over the estimated useful lives of the assets. The following is a summary of property and equipment at December 31: (1) Amortized over the shorter of the related lease term or the estimated useful life of the assets. The Company periodically assesses property and equipment for impairment whenever events or circumstances indicate the carrying amount of an asset may exceed its fair value. If property and equipment is considered impaired, the impairment losses will be recorded on the statements of operations. The Company did not recognize any impairment losses during the years ended December 31, 2024 and 2023, respectively. Useful lives (years) 2024 2023 Property and equipment, at cost Furniture and equipment 5 1,174,811$ 932,608$ Leasehold improvements (1) 39,251 39,251 Total property and equipment, at cost 1,214,062 971,859 Total accumulated depreciation and amortization (810,171) (658,446) Total property and equipment, net 403,891$ 313,413$

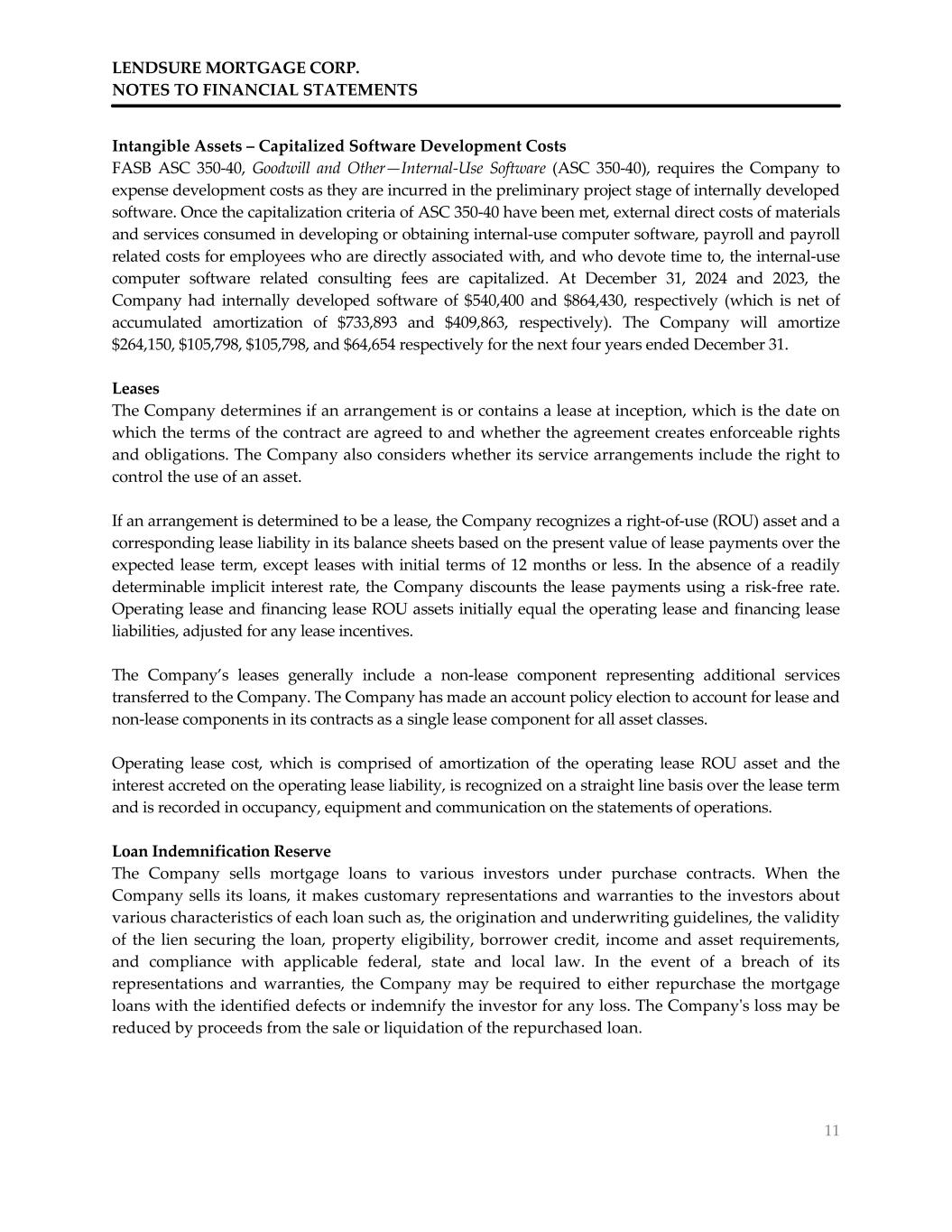

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 11 Intangible Assets – Capitalized Software Development Costs FASB ASC 350-40, Goodwill and Other—Internal-Use Software (ASC 350-40), requires the Company to expense development costs as they are incurred in the preliminary project stage of internally developed software. Once the capitalization criteria of ASC 350-40 have been met, external direct costs of materials and services consumed in developing or obtaining internal-use computer software, payroll and payroll related costs for employees who are directly associated with, and who devote time to, the internal-use computer software related consulting fees are capitalized. At December 31, 2024 and 2023, the Company had internally developed software of $540,400 and $864,430, respectively (which is net of accumulated amortization of $733,893 and $409,863, respectively). The Company will amortize $264,150, $105,798, $105,798, and $64,654 respectively for the next four years ended December 31. Leases The Company determines if an arrangement is or contains a lease at inception, which is the date on which the terms of the contract are agreed to and whether the agreement creates enforceable rights and obligations. The Company also considers whether its service arrangements include the right to control the use of an asset. If an arrangement is determined to be a lease, the Company recognizes a right-of-use (ROU) asset and a corresponding lease liability in its balance sheets based on the present value of lease payments over the expected lease term, except leases with initial terms of 12 months or less. In the absence of a readily determinable implicit interest rate, the Company discounts the lease payments using a risk-free rate. Operating lease and financing lease ROU assets initially equal the operating lease and financing lease liabilities, adjusted for any lease incentives. The Company’s leases generally include a non-lease component representing additional services transferred to the Company. The Company has made an account policy election to account for lease and non-lease components in its contracts as a single lease component for all asset classes. Operating lease cost, which is comprised of amortization of the operating lease ROU asset and the interest accreted on the operating lease liability, is recognized on a straight line basis over the lease term and is recorded in occupancy, equipment and communication on the statements of operations. Loan Indemnification Reserve The Company sells mortgage loans to various investors under purchase contracts. When the Company sells its loans, it makes customary representations and warranties to the investors about various characteristics of each loan such as, the origination and underwriting guidelines, the validity of the lien securing the loan, property eligibility, borrower credit, income and asset requirements, and compliance with applicable federal, state and local law. In the event of a breach of its representations and warranties, the Company may be required to either repurchase the mortgage loans with the identified defects or indemnify the investor for any loss. The Company's loss may be reduced by proceeds from the sale or liquidation of the repurchased loan.

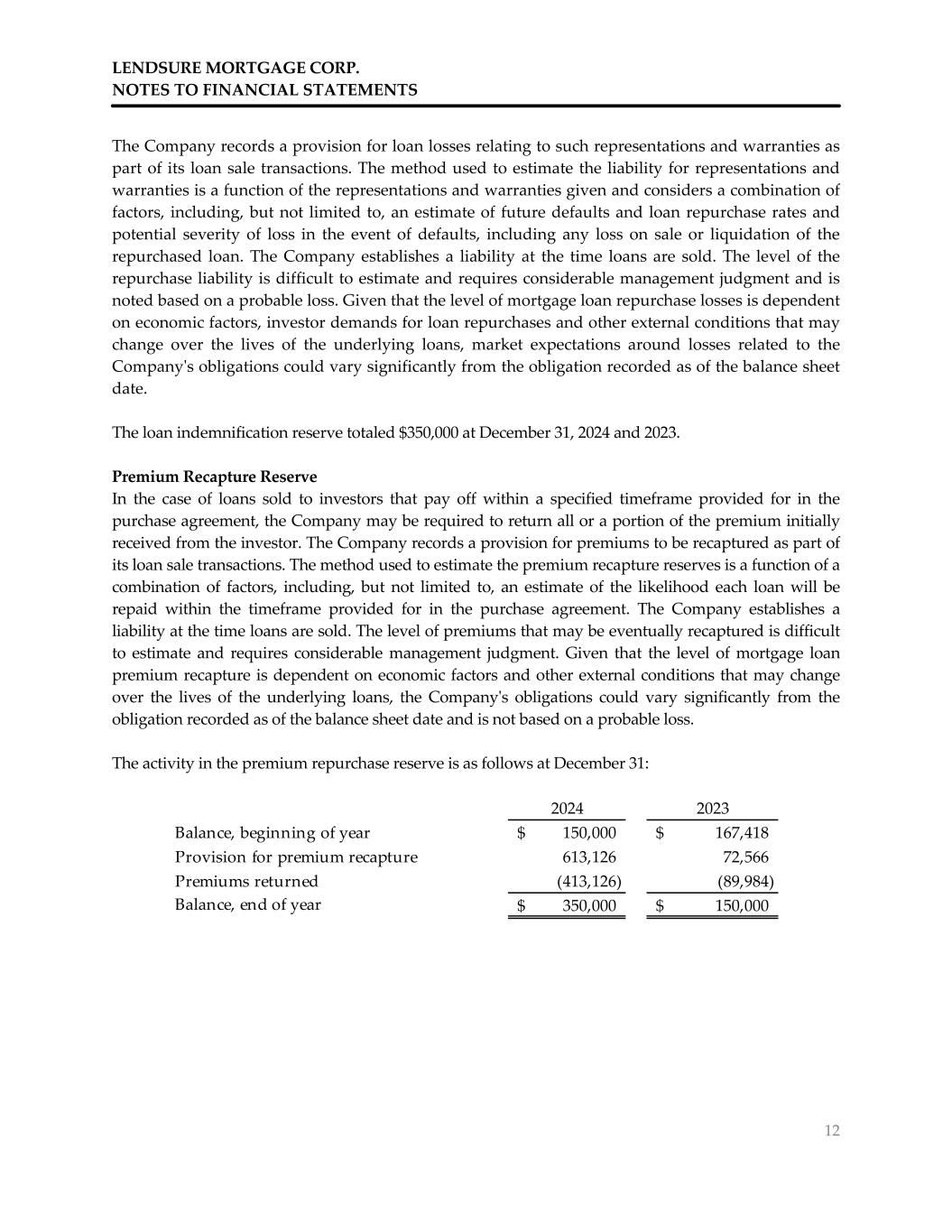

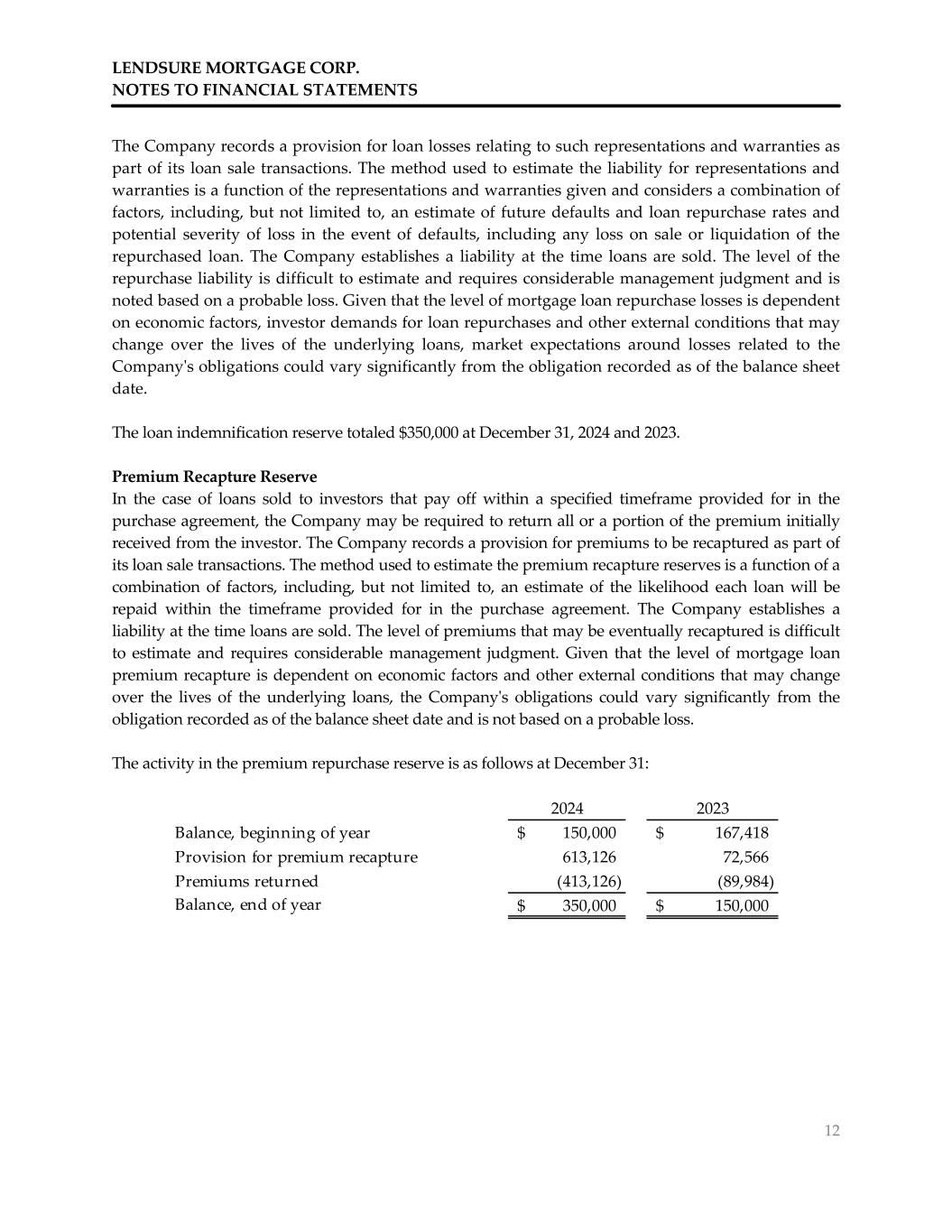

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 12 The Company records a provision for loan losses relating to such representations and warranties as part of its loan sale transactions. The method used to estimate the liability for representations and warranties is a function of the representations and warranties given and considers a combination of factors, including, but not limited to, an estimate of future defaults and loan repurchase rates and potential severity of loss in the event of defaults, including any loss on sale or liquidation of the repurchased loan. The Company establishes a liability at the time loans are sold. The level of the repurchase liability is difficult to estimate and requires considerable management judgment and is noted based on a probable loss. Given that the level of mortgage loan repurchase losses is dependent on economic factors, investor demands for loan repurchases and other external conditions that may change over the lives of the underlying loans, market expectations around losses related to the Company's obligations could vary significantly from the obligation recorded as of the balance sheet date. The loan indemnification reserve totaled $350,000 at December 31, 2024 and 2023. Premium Recapture Reserve In the case of loans sold to investors that pay off within a specified timeframe provided for in the purchase agreement, the Company may be required to return all or a portion of the premium initially received from the investor. The Company records a provision for premiums to be recaptured as part of its loan sale transactions. The method used to estimate the premium recapture reserves is a function of a combination of factors, including, but not limited to, an estimate of the likelihood each loan will be repaid within the timeframe provided for in the purchase agreement. The Company establishes a liability at the time loans are sold. The level of premiums that may be eventually recaptured is difficult to estimate and requires considerable management judgment. Given that the level of mortgage loan premium recapture is dependent on economic factors and other external conditions that may change over the lives of the underlying loans, the Company's obligations could vary significantly from the obligation recorded as of the balance sheet date and is not based on a probable loss. The activity in the premium repurchase reserve is as follows at December 31: 2024 2023 Balance, beginning of year 150,000$ 167,418$ Provision for premium recapture 613,126 72,566 Premiums returned (413,126) (89,984) Balance, end of year 350,000$ 150,000$

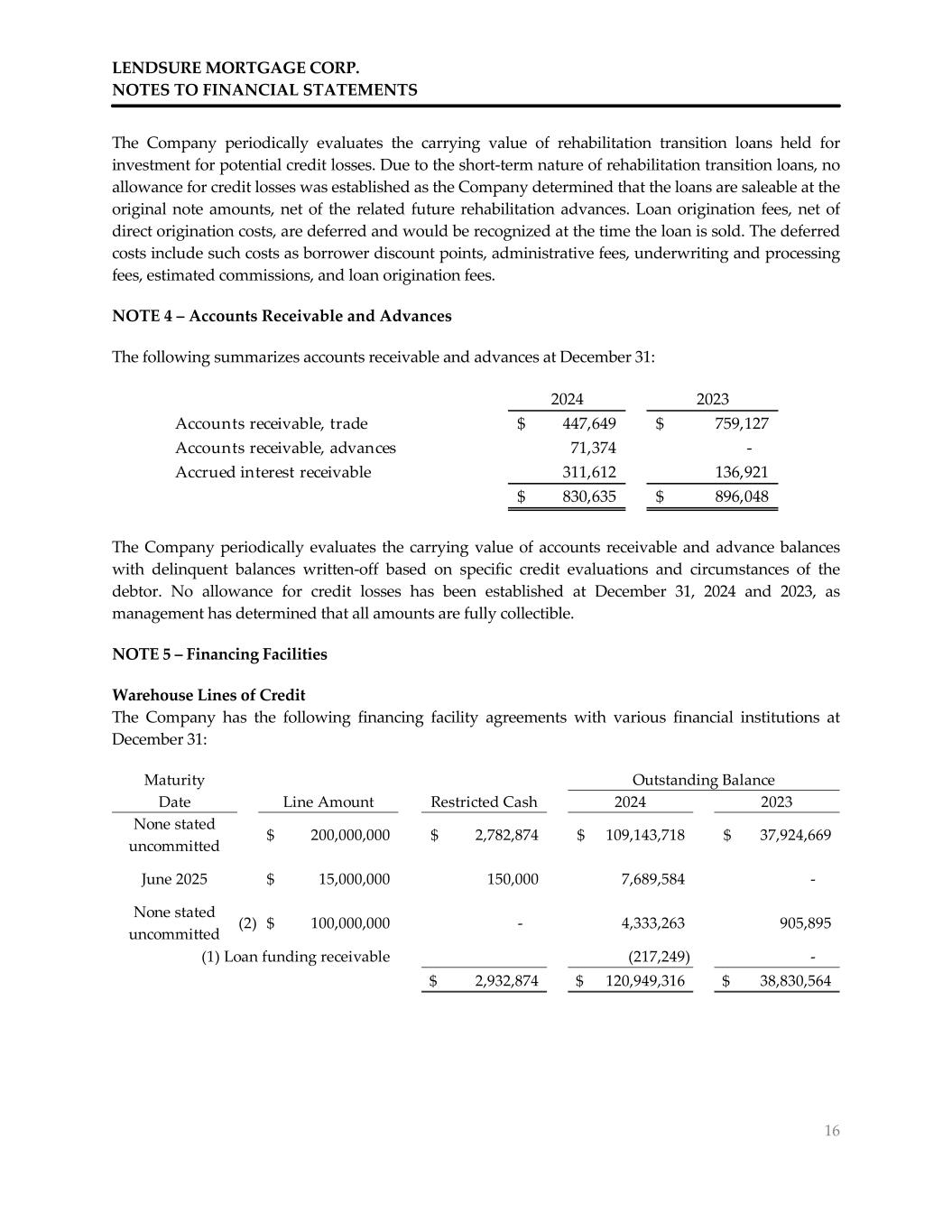

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 13 Income Taxes Income taxes are provided for the tax effects of transactions reported in the financial statements and consist of taxes currently due plus deferred taxes related primarily to differences between the basis of certain assets and liabilities for financial and tax reporting. The deferred taxes represent the future tax return consequences of those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred tax assets are limited to amounts considered to be realizable in future periods. The Company accounts for any interest and penalties related to unrecognized tax benefits as part of the income tax provision. The Company has no federal or state tax examinations in process that would have a material impact on the financial statements as of December 31, 2024. The assumptions about future taxable income require considerable management judgment and are consistent with the plans and estimates the Company is using to manage the underlying business. In evaluating the objective evidence that historical results provide, the Company considers the past three years of operating history and cumulative operating income. Stock Based Compensation In July 2015, the Company adopted an Equity Incentive Plan pursuant to which the Company's Board of Directors may grant stock options and other awards to employees. The Company accounts for stock- based compensation in accordance with ASC 718 Compensation-Stock Compensation (ASC 718). Accordingly, the Company measures the cost of stock-based awards using the grant-date fair value of the award and recognizes that cost over the requisite service period. The fair value of each stock option granted under the Company's stock-based compensation plan is estimated on the date of grant using the Black-Scholes option-pricing model and assumptions outlined in Note 12. ASC 718 requires forfeitures to be estimated at the time of grant and prospectively revised, if necessary, in subsequent periods if actual forfeitures differ from initial estimates. Stock-based compensation recorded for those stock-based awards that were expected to vest is $32,554 and $22,363 and is included in salaries, commissions and benefits on the statements of operations for the years ended December 31, 2024 and 2023, respectively. Advertising and Marketing Advertising and marketing is expensed as incurred and amounted to $489,939 and $431,878 for the years ended December 31, 2024 and 2023, respectively, and is included in general and administrative expenses on the statements of operations. Risks and Uncertainties In the normal course of business, companies in the mortgage banking industry encounter certain economic, liquidity and regulatory risks. Economic risk includes interest rate risk and credit risk. Interest rate risk The Company’s MLHFS commitments to originate loans are subject to interest rate risk. In a rising interest rate environment, the Company may experience a decrease in loan origination, as well as decreases in the value of MLHFS not committed to investors and commitments to originate loans, which may negatively impact the Company’s operations.

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 14 Credit risk Credit risk is the risk of default that may result from the borrowers’ inability or unwillingness to make contractually required payments during the period in which mortgage loans are being held for sale by the Company. The Company sells mortgage loans to investors without recourse. As such, the investors have assumed the risk of loss or default by the borrower. However, the Company is usually required by these investors to make certain standard representations and warranties relating to credit information, loan documentation and collateral. To the extent that the Company does not comply with such representations, or there are early payment defaults, the Company may be required to repurchase the loans or indemnify these investors for any losses from borrower defaults. In addition, if loans pay off within a specified time frame, the Company may be required to refund a portion of the sales proceeds to the investors. Liquidity risk The Company’s business requires substantial cash to support its operating activities. As a result, the Company is dependent on its financing facilities for continued operations. If the Company’s principal lenders decide to terminate or not to renew these facilities with the Company, the loss of borrowing capacity could have an adverse impact on the Company’s financial statements unless the Company found a suitable alternative source. Regulatory risk The Company is subject to extensive and comprehensive regulation under federal, state, and local laws in the United States. These laws and regulations significantly affect the way in which the Company does business and can restrict the scope of the Company’s existing business and limit the Company’s ability to expand product offerings to pursue acquisitions or can make origination or servicing costs higher, which could have an impact on financial results. Economic risk Existing economic conditions such as market volatility, geopolitical risks, inflation, and uncertainties in the banking sector as well as residential real estate market conditions have and may continue to materially and adversely affect the Company’s revenue and results of operations. NOTE 2 – Mortgage Loans Held for Sale, Net The Company sells substantially all its originated mortgage loans in the secondary market with servicing released.

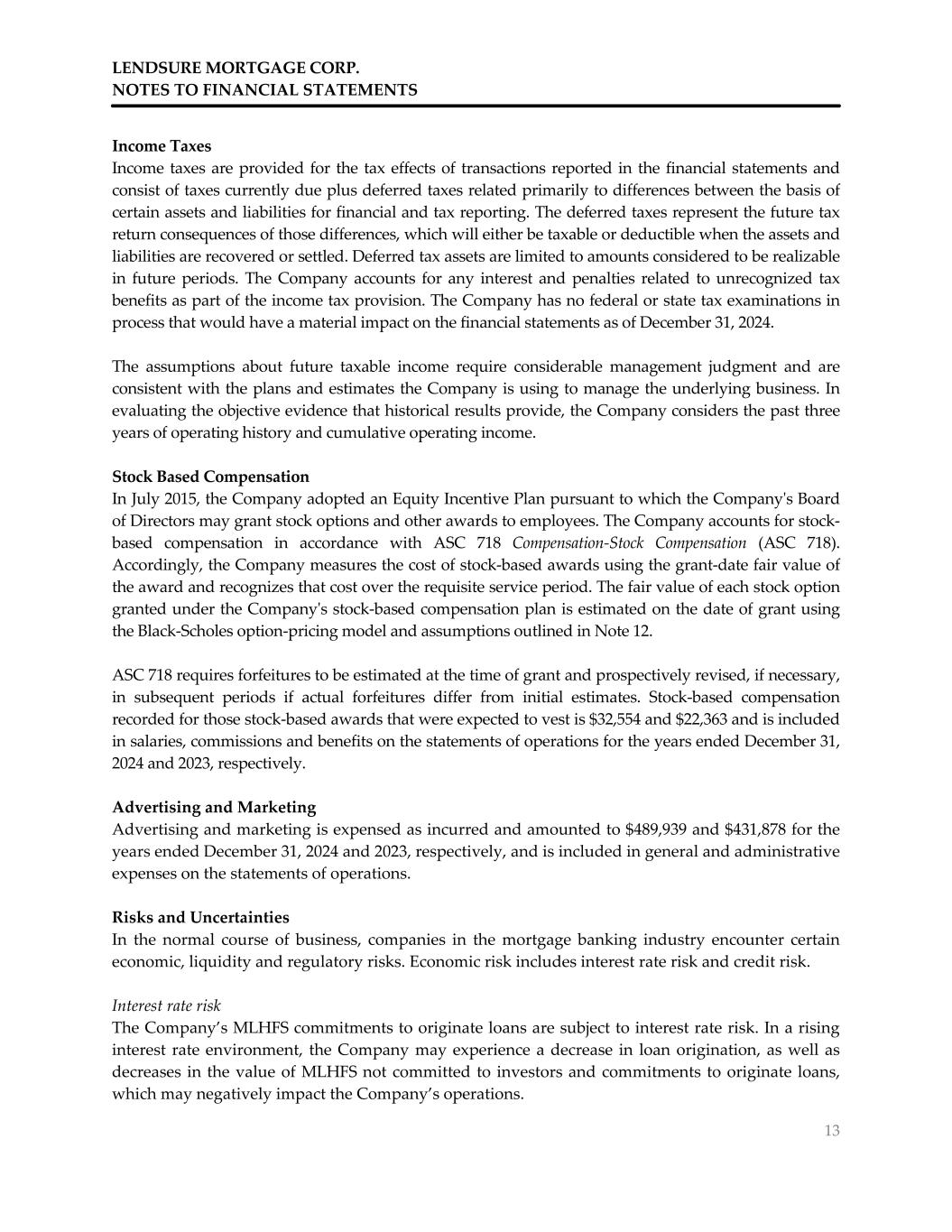

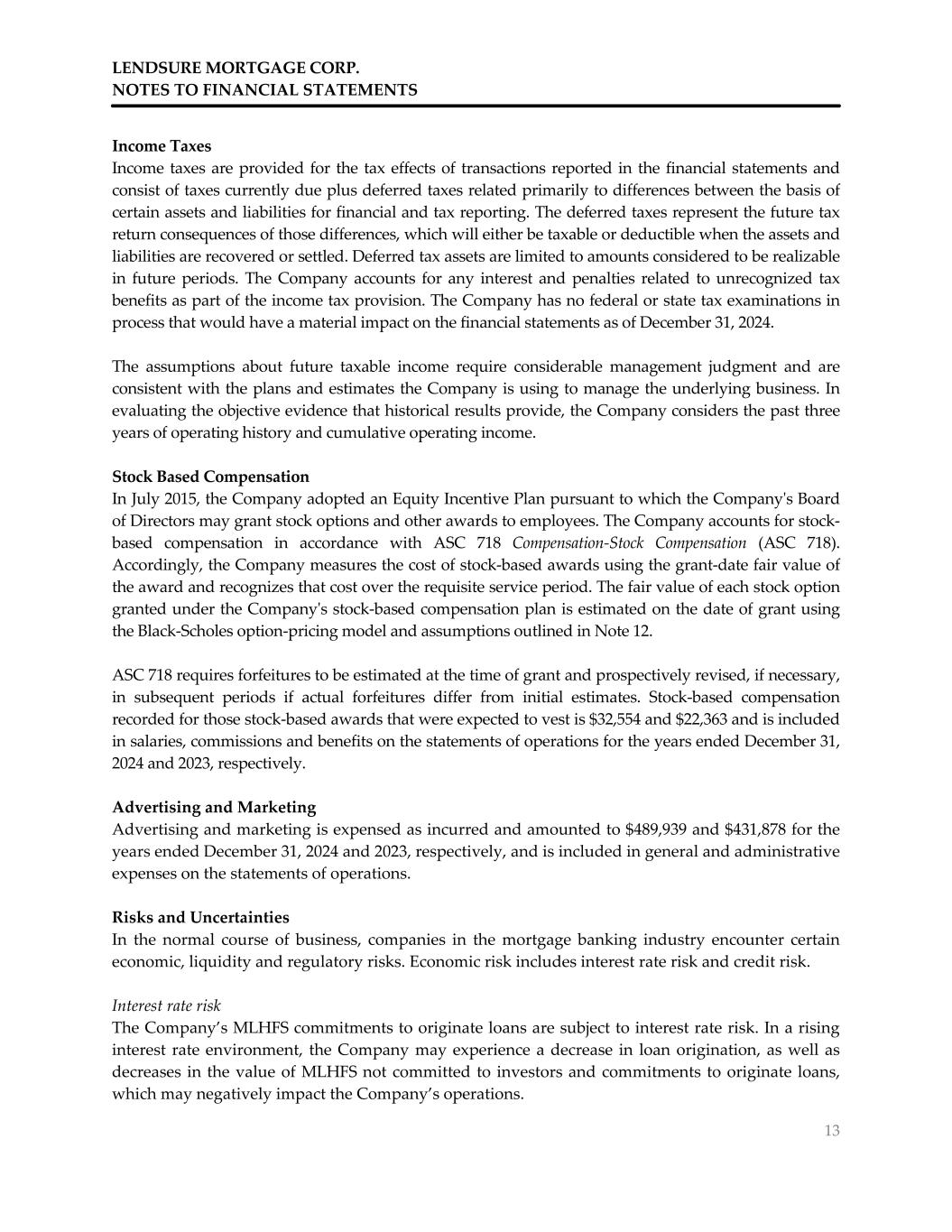

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 15 MLHFS, net are as follows at December 31: The deferred costs include such costs as borrower discount points, administrative fees, underwriting and processing fees, estimated commissions, and loan origination fees. NOTE 3 – Mortgage Loans Held for Investment, Net The following summarizes MLHI, net at December 31: Mortgage Loans Held for Investment The Company has repurchased mortgage loans, as well as unsaleable loans transferred from MLHFS, in which management has the intent and ability to hold for the foreseeable future, or until maturity or pay off. MLHI are carried at amortized cost, reduced by a valuation allowance for estimated credit losses, when applicable. Rehabilitation Transition Loans The Company provides financing to individuals and business entities who are renovating and selling homes. The individual loans typically mature 12 months after inception. Rehabilitation transition loans are initially recorded at the original note amount with a corresponding liability recorded for future advances. Interest on rehabilitation transition loans is payable between 9.75% to 12.99% per annum at December 31, 2024. The future rehabilitation advances represents the undrawn portion of the rehabilitation transition loans. The Company has the commitment to fund such rehabilitation advances when the borrower elects to draw on the commitment. Draw proceeds requested by the borrower increase the principal balance of the rehabilitation transition loans, with a corresponding decrease in the future rehabilitation advances payable, during the period the rehabilitation transition loans are held by the Company. Interest income on rehabilitation transition loans is received monthly by the Company. 2024 2023 MLHFS 126,939,258$ 42,566,886$ Deferred costs (937,966) (306,580) 126,001,292$ 42,260,306$ 2024 2023 MLHI 5,639,530$ 4,535,138$ Rehabilitation transition loans 1,321,532 5,436,000 Future rehabilitation advances (101,644) (649,596) Deferred costs (10,595) (53,192) Valuation allowance for estimated credit losses (65,000) (65,000) 6,783,823$ 9,203,350$

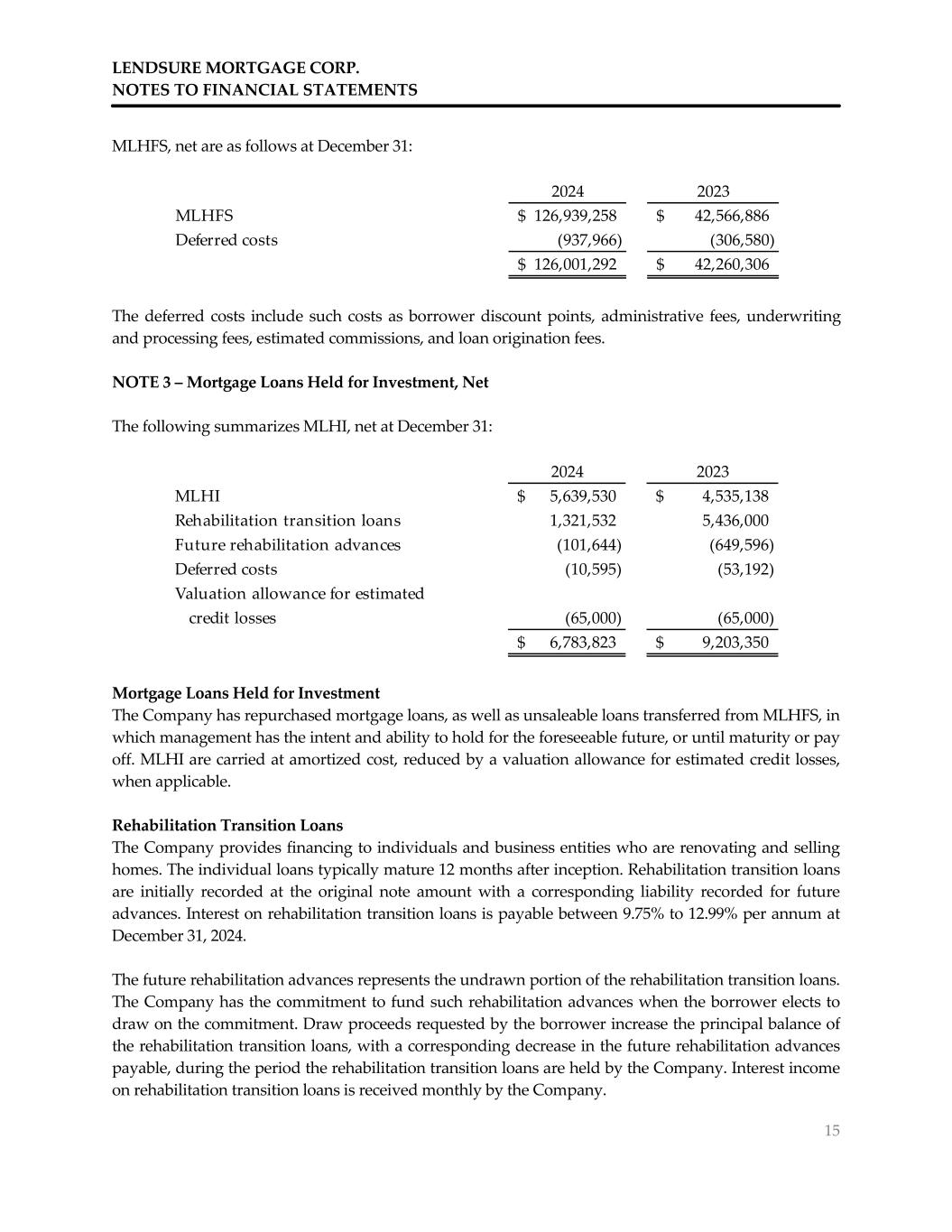

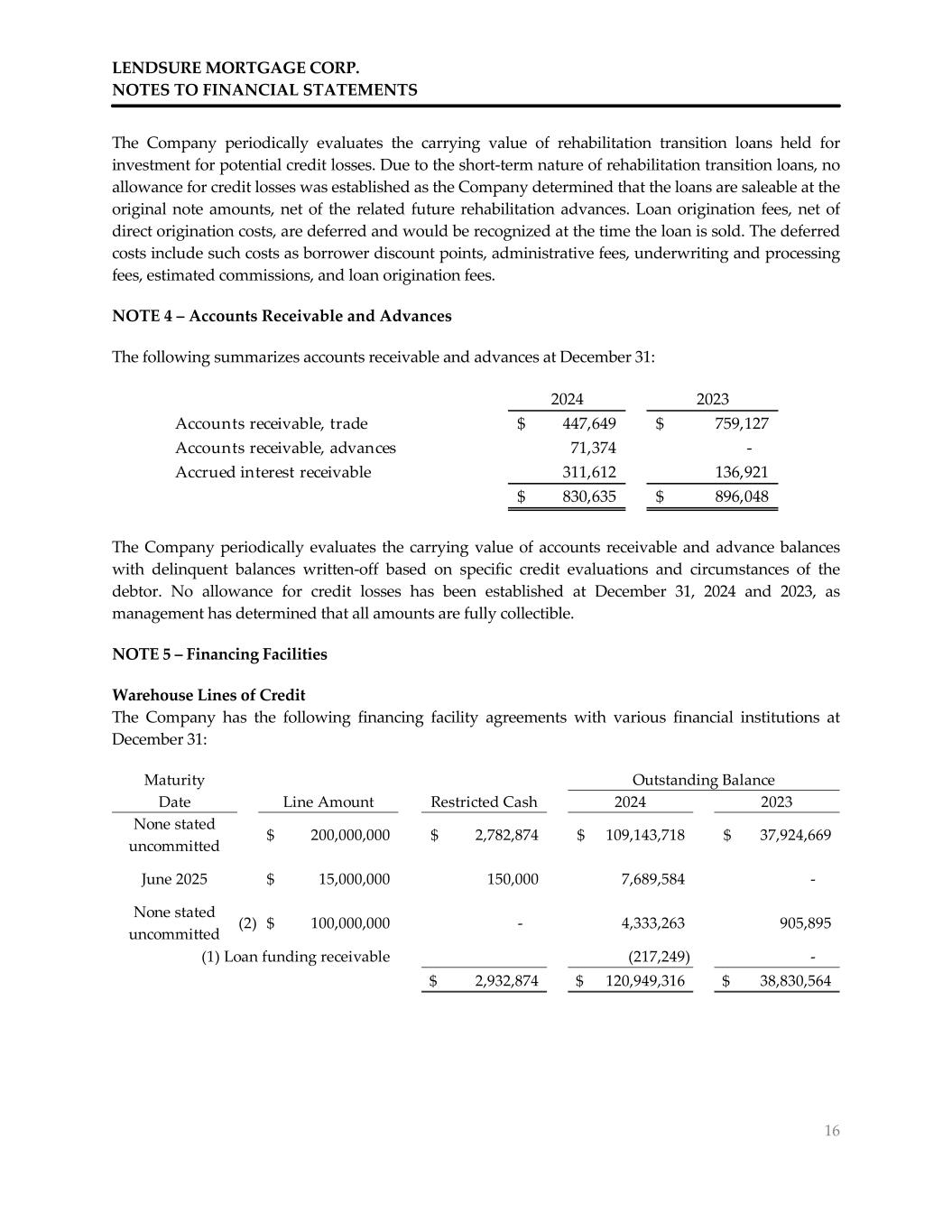

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 16 The Company periodically evaluates the carrying value of rehabilitation transition loans held for investment for potential credit losses. Due to the short-term nature of rehabilitation transition loans, no allowance for credit losses was established as the Company determined that the loans are saleable at the original note amounts, net of the related future rehabilitation advances. Loan origination fees, net of direct origination costs, are deferred and would be recognized at the time the loan is sold. The deferred costs include such costs as borrower discount points, administrative fees, underwriting and processing fees, estimated commissions, and loan origination fees. NOTE 4 – Accounts Receivable and Advances The following summarizes accounts receivable and advances at December 31: The Company periodically evaluates the carrying value of accounts receivable and advance balances with delinquent balances written-off based on specific credit evaluations and circumstances of the debtor. No allowance for credit losses has been established at December 31, 2024 and 2023, as management has determined that all amounts are fully collectible. NOTE 5 – Financing Facilities Warehouse Lines of Credit The Company has the following financing facility agreements with various financial institutions at December 31: 2024 2023 Accounts receivable, trade 447,649$ 759,127$ Accounts receivable, advances 71,374 - Accrued interest receivable 311,612 136,921 830,635$ 896,048$ Maturity Date Line Amount Restricted Cash 2024 2023 None stated uncommitted 200,000,000$ 2,782,874$ 109,143,718$ 37,924,669$ June 2025 15,000,000$ 150,000 7,689,584 - None stated uncommitted (2) 100,000,000$ - 4,333,263 905,895 (1) Loan funding receivable (217,249) - 2,932,874$ 120,949,316$ 38,830,564$ Outstanding Balance

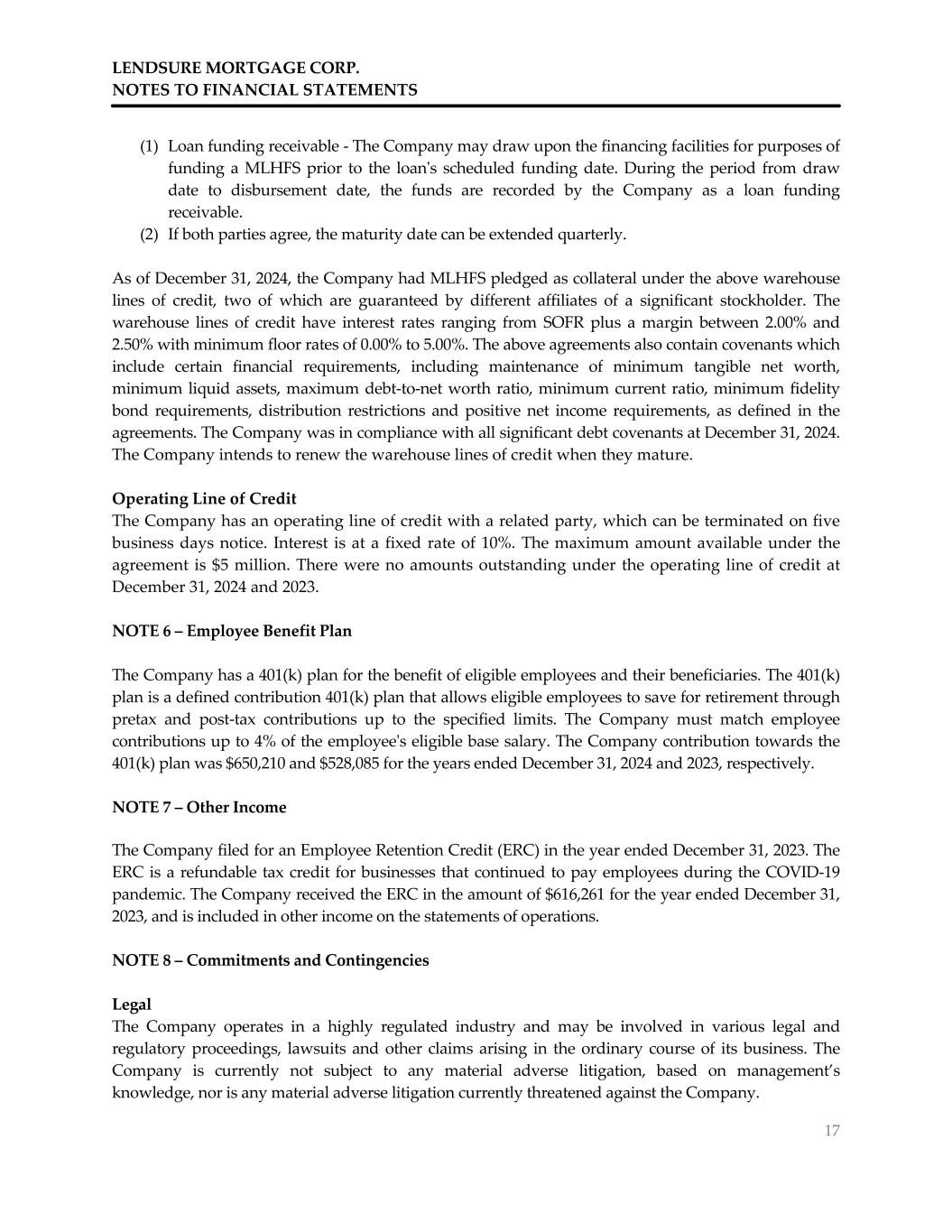

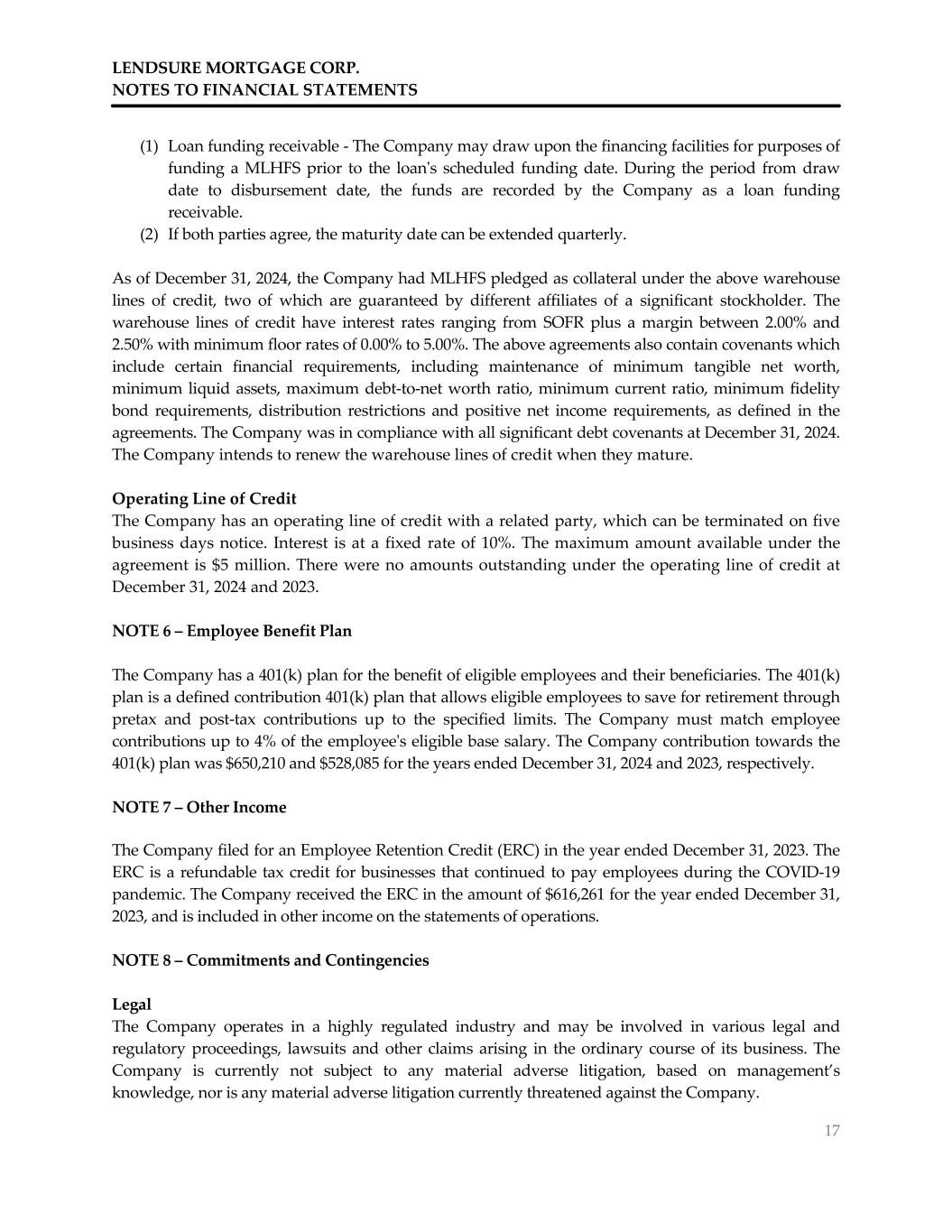

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 17 (1) Loan funding receivable - The Company may draw upon the financing facilities for purposes of funding a MLHFS prior to the loan's scheduled funding date. During the period from draw date to disbursement date, the funds are recorded by the Company as a loan funding receivable. (2) If both parties agree, the maturity date can be extended quarterly. As of December 31, 2024, the Company had MLHFS pledged as collateral under the above warehouse lines of credit, two of which are guaranteed by different affiliates of a significant stockholder. The warehouse lines of credit have interest rates ranging from SOFR plus a margin between 2.00% and 2.50% with minimum floor rates of 0.00% to 5.00%. The above agreements also contain covenants which include certain financial requirements, including maintenance of minimum tangible net worth, minimum liquid assets, maximum debt-to-net worth ratio, minimum current ratio, minimum fidelity bond requirements, distribution restrictions and positive net income requirements, as defined in the agreements. The Company was in compliance with all significant debt covenants at December 31, 2024. The Company intends to renew the warehouse lines of credit when they mature. Operating Line of Credit The Company has an operating line of credit with a related party, which can be terminated on five business days notice. Interest is at a fixed rate of 10%. The maximum amount available under the agreement is $5 million. There were no amounts outstanding under the operating line of credit at December 31, 2024 and 2023. NOTE 6 – Employee Benefit Plan The Company has a 401(k) plan for the benefit of eligible employees and their beneficiaries. The 401(k) plan is a defined contribution 401(k) plan that allows eligible employees to save for retirement through pretax and post-tax contributions up to the specified limits. The Company must match employee contributions up to 4% of the employee's eligible base salary. The Company contribution towards the 401(k) plan was $650,210 and $528,085 for the years ended December 31, 2024 and 2023, respectively. NOTE 7 – Other Income The Company filed for an Employee Retention Credit (ERC) in the year ended December 31, 2023. The ERC is a refundable tax credit for businesses that continued to pay employees during the COVID-19 pandemic. The Company received the ERC in the amount of $616,261 for the year ended December 31, 2023, and is included in other income on the statements of operations. NOTE 8 – Commitments and Contingencies Legal The Company operates in a highly regulated industry and may be involved in various legal and regulatory proceedings, lawsuits and other claims arising in the ordinary course of its business. The Company is currently not subject to any material adverse litigation, based on management’s knowledge, nor is any material adverse litigation currently threatened against the Company.

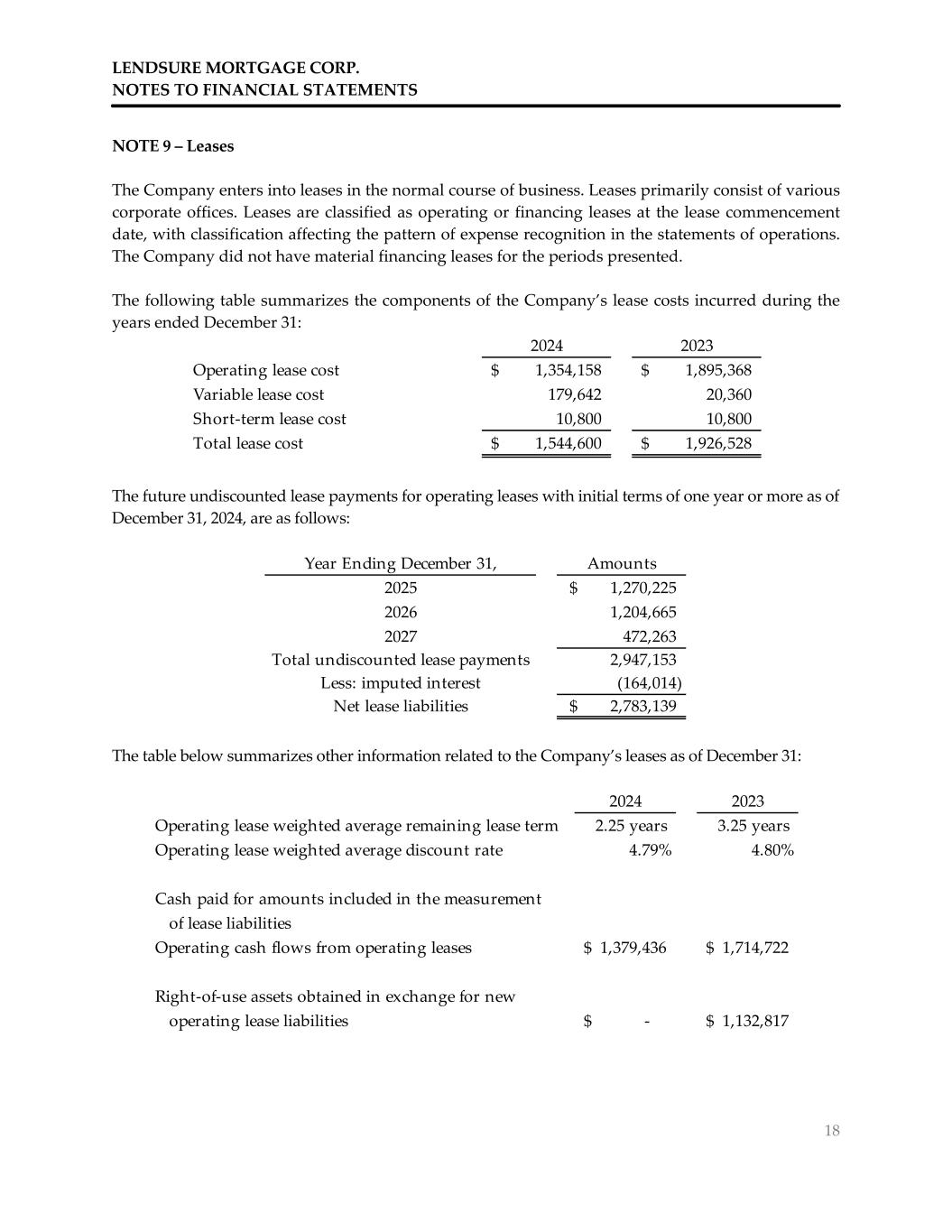

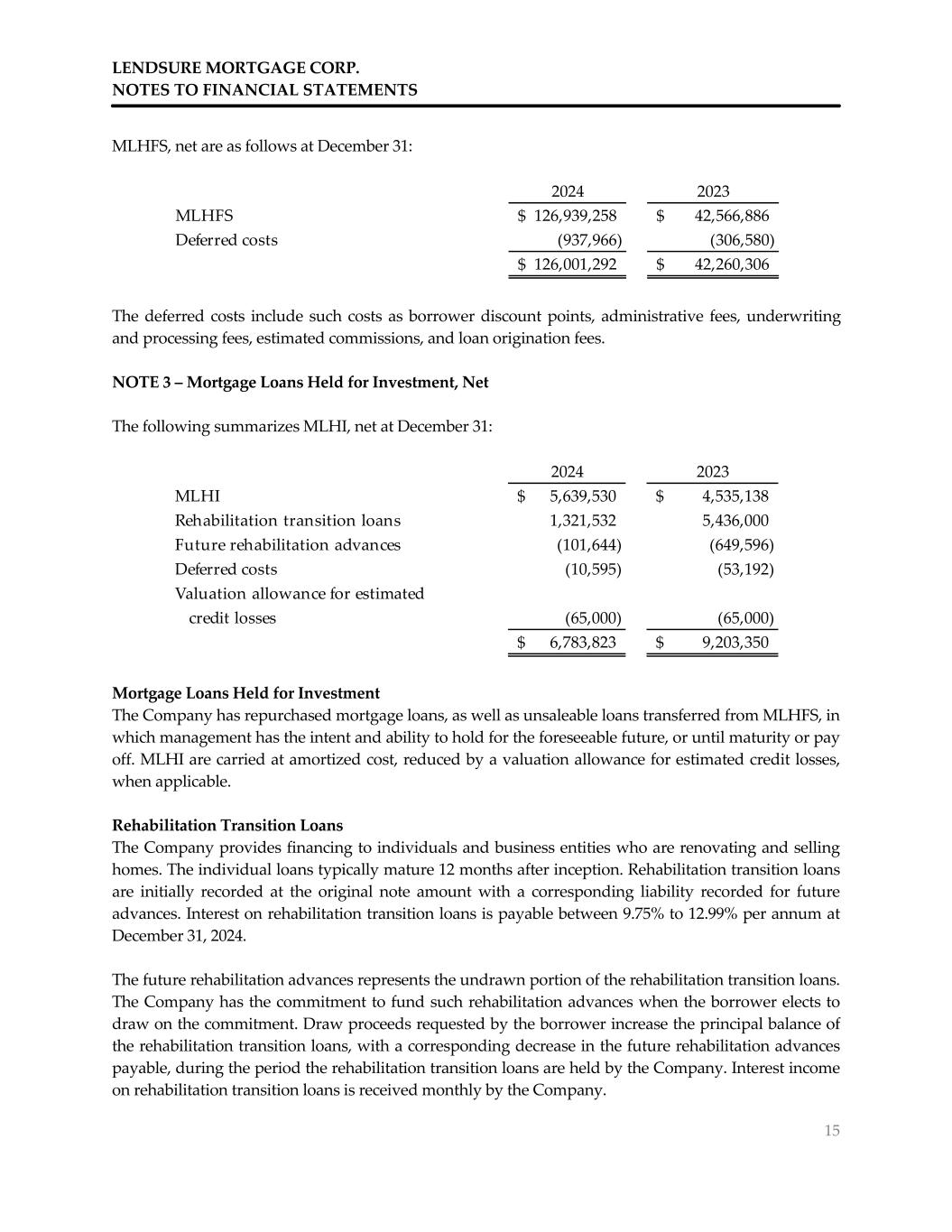

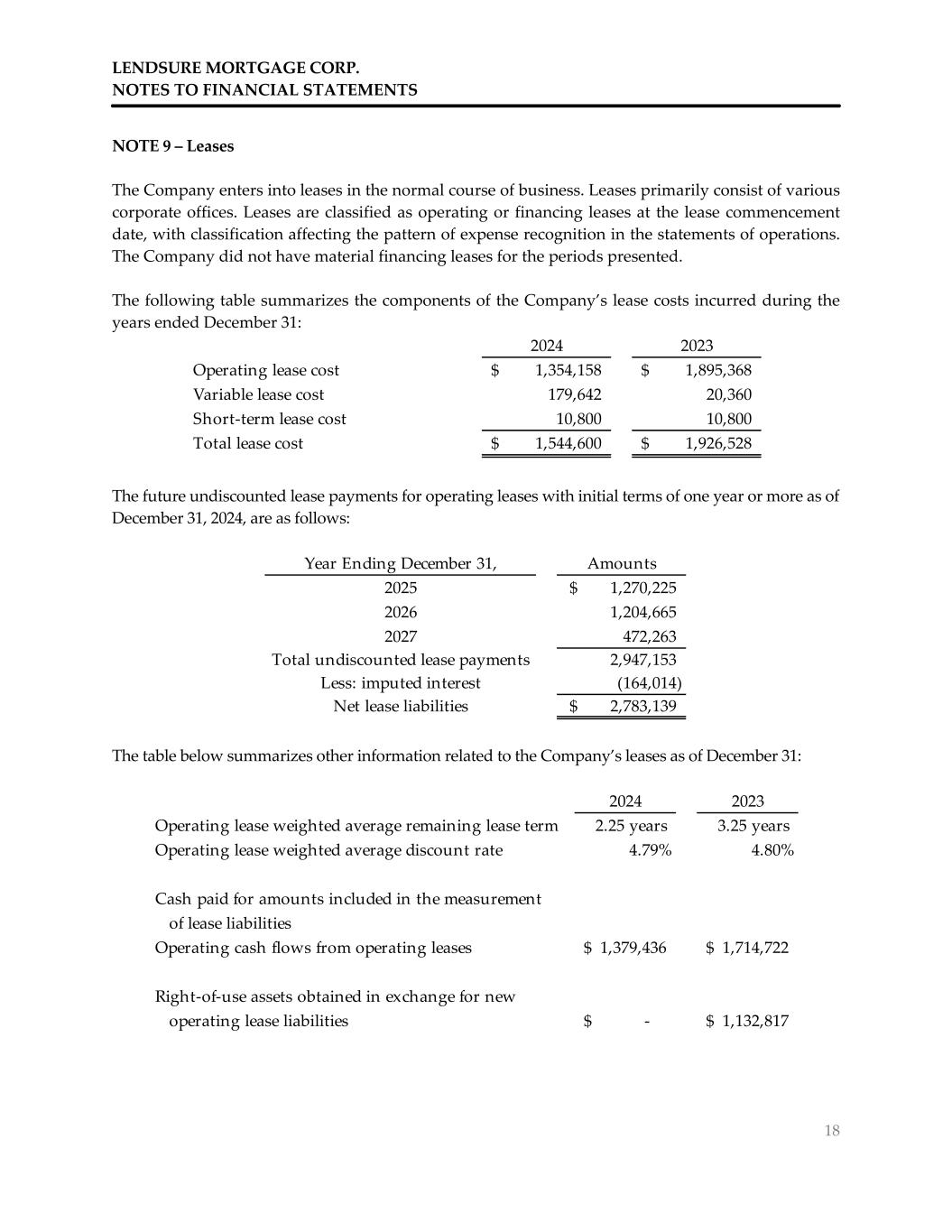

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 18 NOTE 9 – Leases The Company enters into leases in the normal course of business. Leases primarily consist of various corporate offices. Leases are classified as operating or financing leases at the lease commencement date, with classification affecting the pattern of expense recognition in the statements of operations. The Company did not have material financing leases for the periods presented. The following table summarizes the components of the Company’s lease costs incurred during the years ended December 31: The future undiscounted lease payments for operating leases with initial terms of one year or more as of December 31, 2024, are as follows: The table below summarizes other information related to the Company’s leases as of December 31: 2024 2023 Operating lease cost 1,354,158$ 1,895,368$ Variable lease cost 179,642 20,360 Short-term lease cost 10,800 10,800 Total lease cost 1,544,600$ 1,926,528$ Year Ending December 31, Amounts 2025 1,270,225$ 2026 1,204,665 2027 472,263 Total undiscounted lease payments 2,947,153 Less: imputed interest (164,014) Net lease liabilities 2,783,139$ 2024 2023 Operating lease weighted average remaining lease term 2.25 years 3.25 years Operating lease weighted average discount rate 4.79% 4.80% Cash paid for amounts included in the measurement of lease liabilities Operating cash flows from operating leases 1,379,436$ 1,714,722$ Right-of-use assets obtained in exchange for new operating lease liabilities -$ 1,132,817$

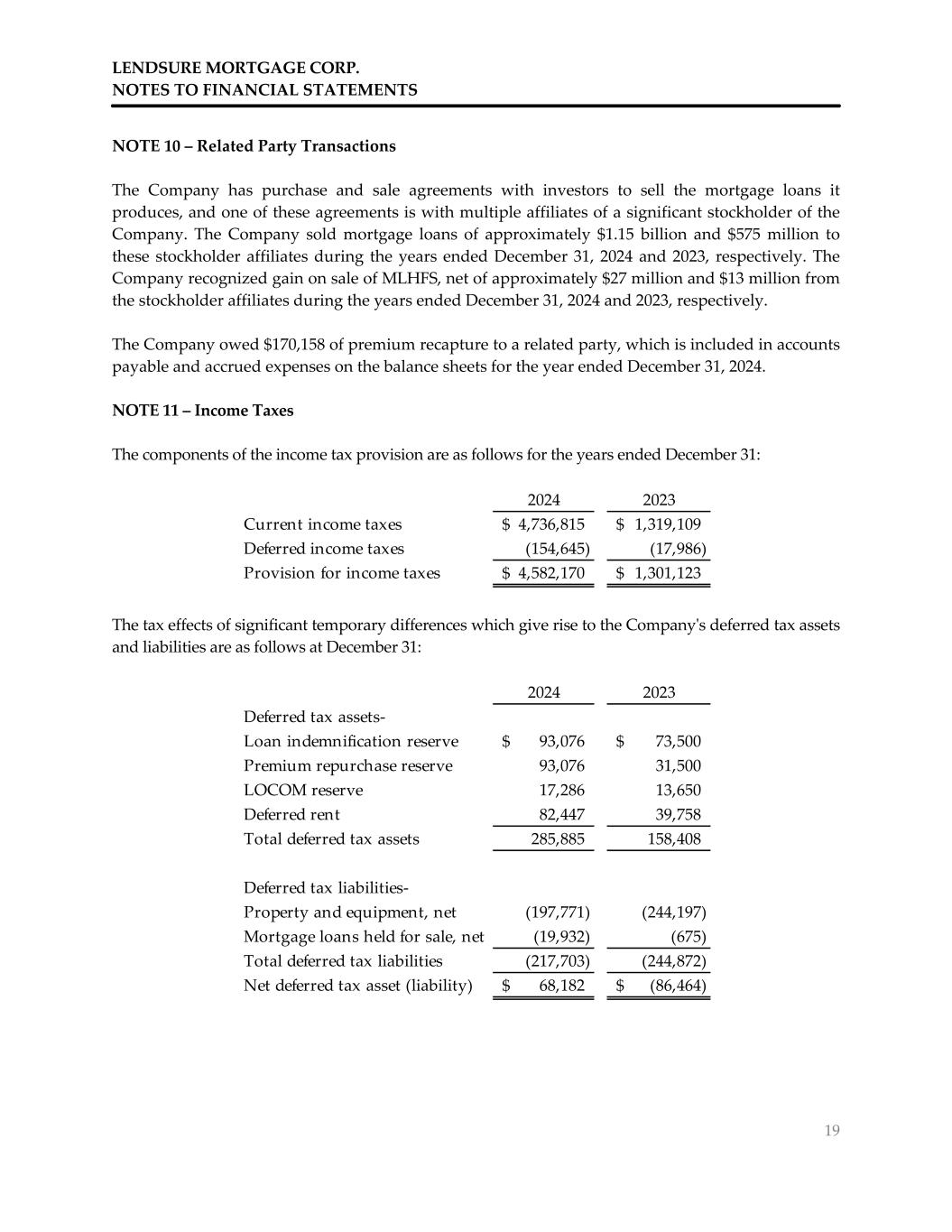

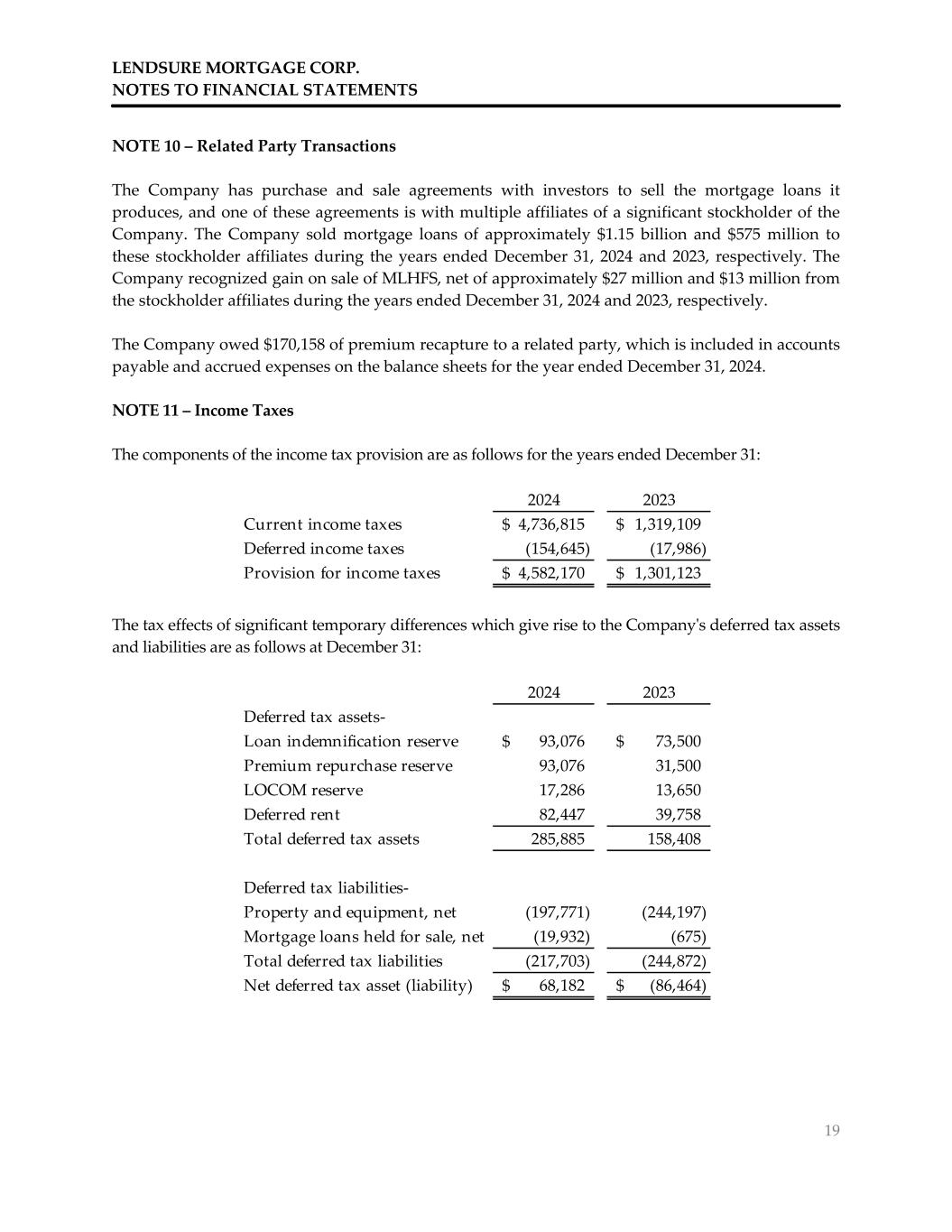

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 19 NOTE 10 – Related Party Transactions The Company has purchase and sale agreements with investors to sell the mortgage loans it produces, and one of these agreements is with multiple affiliates of a significant stockholder of the Company. The Company sold mortgage loans of approximately $1.15 billion and $575 million to these stockholder affiliates during the years ended December 31, 2024 and 2023, respectively. The Company recognized gain on sale of MLHFS, net of approximately $27 million and $13 million from the stockholder affiliates during the years ended December 31, 2024 and 2023, respectively. The Company owed $170,158 of premium recapture to a related party, which is included in accounts payable and accrued expenses on the balance sheets for the year ended December 31, 2024. NOTE 11 – Income Taxes The components of the income tax provision are as follows for the years ended December 31: The tax effects of significant temporary differences which give rise to the Company's deferred tax assets and liabilities are as follows at December 31: 2024 2023 Current income taxes 4,736,815$ 1,319,109$ Deferred income taxes (154,645) (17,986) Provision for income taxes 4,582,170$ 1,301,123$ 2024 2023 Deferred tax assets- Loan indemnification reserve 93,076$ 73,500$ Premium repurchase reserve 93,076 31,500 LOCOM reserve 17,286 13,650 Deferred rent 82,447 39,758 Total deferred tax assets 285,885 158,408 Deferred tax liabilities- Property and equipment, net (197,771) (244,197) Mortgage loans held for sale, net (19,932) (675) Total deferred tax liabilities (217,703) (244,872) Net deferred tax asset (liability) 68,182$ (86,464)$

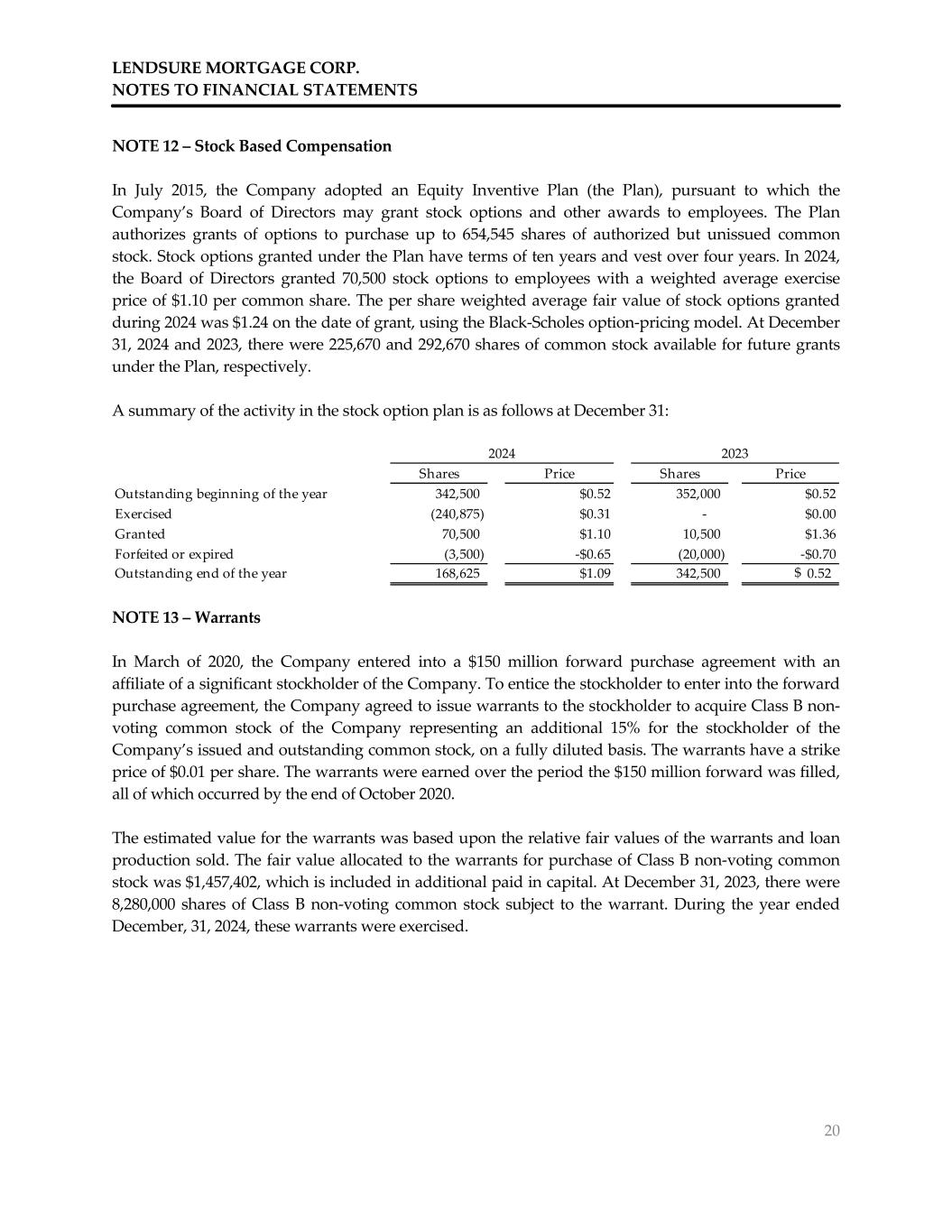

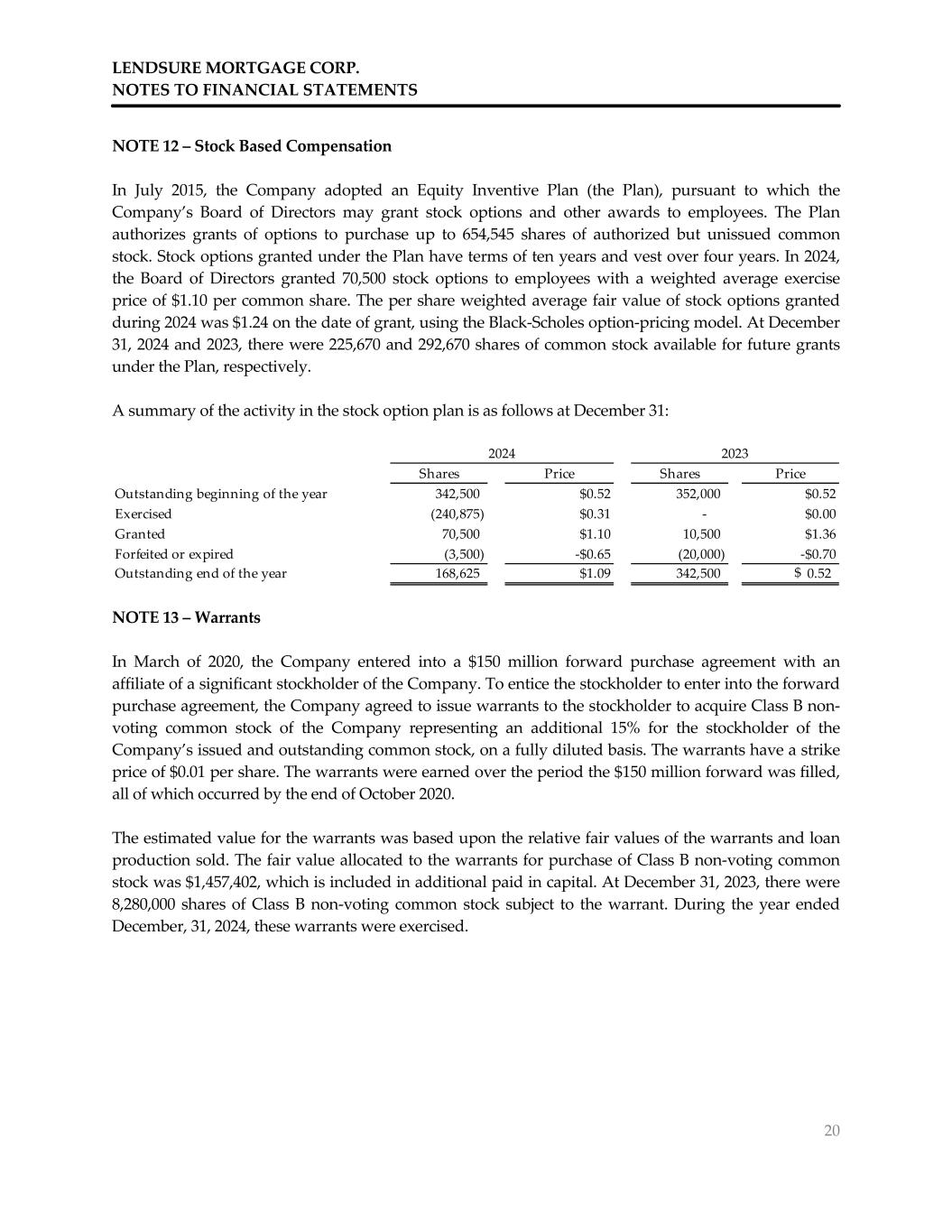

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 20 NOTE 12 – Stock Based Compensation In July 2015, the Company adopted an Equity Inventive Plan (the Plan), pursuant to which the Company’s Board of Directors may grant stock options and other awards to employees. The Plan authorizes grants of options to purchase up to 654,545 shares of authorized but unissued common stock. Stock options granted under the Plan have terms of ten years and vest over four years. In 2024, the Board of Directors granted 70,500 stock options to employees with a weighted average exercise price of $1.10 per common share. The per share weighted average fair value of stock options granted during 2024 was $1.24 on the date of grant, using the Black-Scholes option-pricing model. At December 31, 2024 and 2023, there were 225,670 and 292,670 shares of common stock available for future grants under the Plan, respectively. A summary of the activity in the stock option plan is as follows at December 31: NOTE 13 – Warrants In March of 2020, the Company entered into a $150 million forward purchase agreement with an affiliate of a significant stockholder of the Company. To entice the stockholder to enter into the forward purchase agreement, the Company agreed to issue warrants to the stockholder to acquire Class B non- voting common stock of the Company representing an additional 15% for the stockholder of the Company’s issued and outstanding common stock, on a fully diluted basis. The warrants have a strike price of $0.01 per share. The warrants were earned over the period the $150 million forward was filled, all of which occurred by the end of October 2020. The estimated value for the warrants was based upon the relative fair values of the warrants and loan production sold. The fair value allocated to the warrants for purchase of Class B non-voting common stock was $1,457,402, which is included in additional paid in capital. At December 31, 2023, there were 8,280,000 shares of Class B non-voting common stock subject to the warrant. During the year ended December, 31, 2024, these warrants were exercised. Shares Price Shares Price Outstanding beginning of the year 342,500 $0.52 352,000 $0.52 Exercised (240,875) $0.31 - $0.00 Granted 70,500 $1.10 10,500 $1.36 Forfeited or expired (3,500) -$0.65 (20,000) -$0.70 Outstanding end of the year 168,625 $1.09 342,500 0.52$ 2024 2023

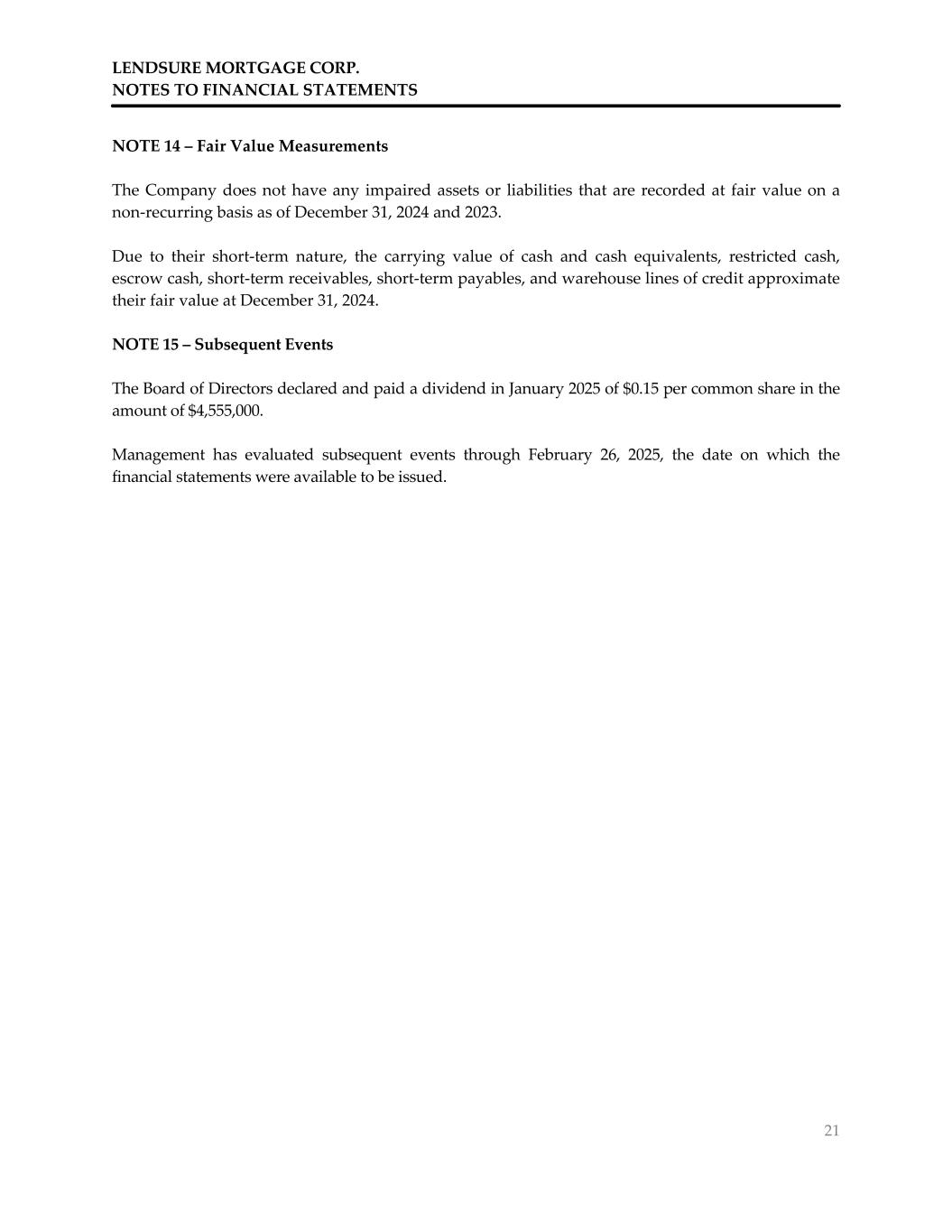

LENDSURE MORTGAGE CORP. NOTES TO FINANCIAL STATEMENTS 21 NOTE 14 – Fair Value Measurements The Company does not have any impaired assets or liabilities that are recorded at fair value on a non-recurring basis as of December 31, 2024 and 2023. Due to their short-term nature, the carrying value of cash and cash equivalents, restricted cash, escrow cash, short-term receivables, short-term payables, and warehouse lines of credit approximate their fair value at December 31, 2024. NOTE 15 – Subsequent Events The Board of Directors declared and paid a dividend in January 2025 of $0.15 per common share in the amount of $4,555,000. Management has evaluated subsequent events through February 26, 2025, the date on which the financial statements were available to be issued.

SUPPLEMENTARY INFORMATION

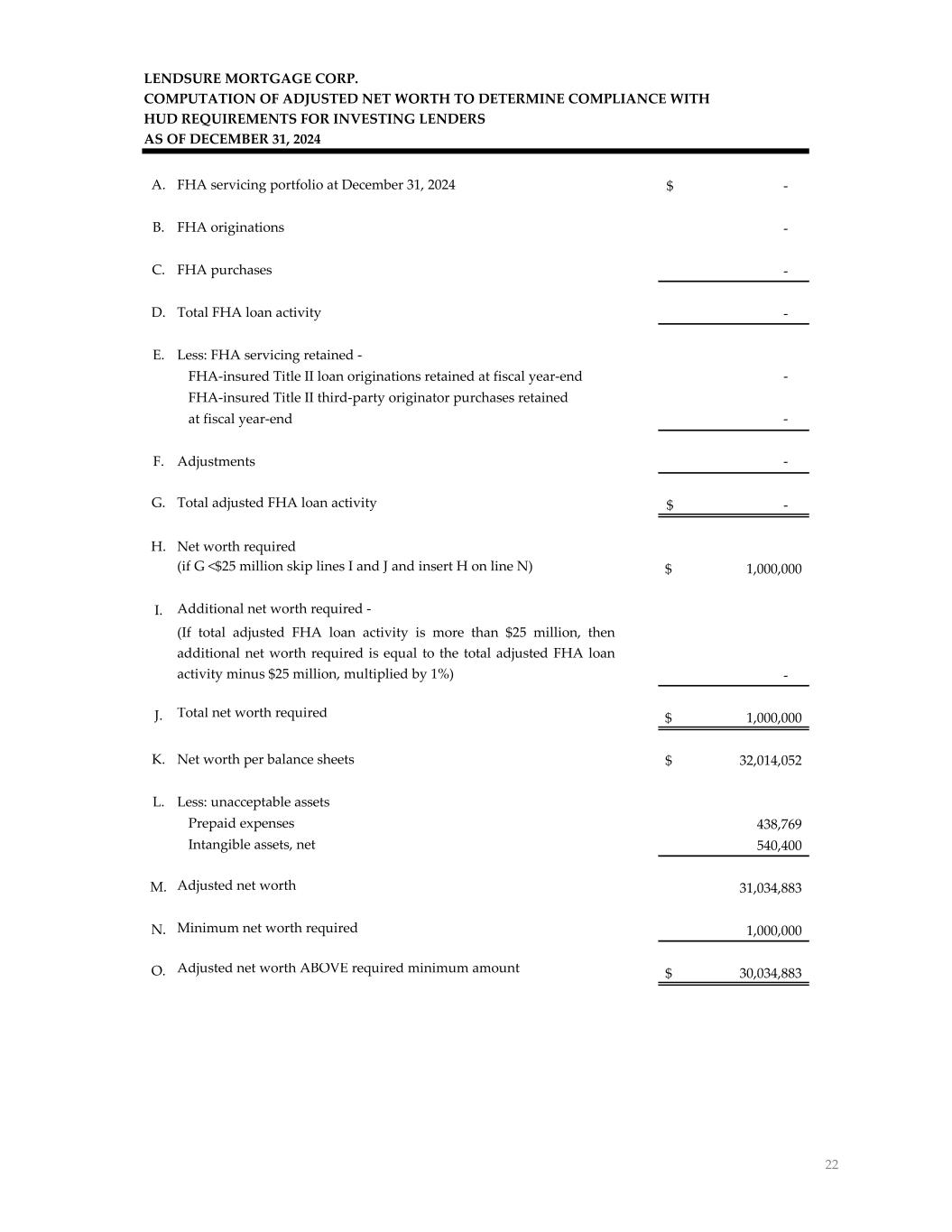

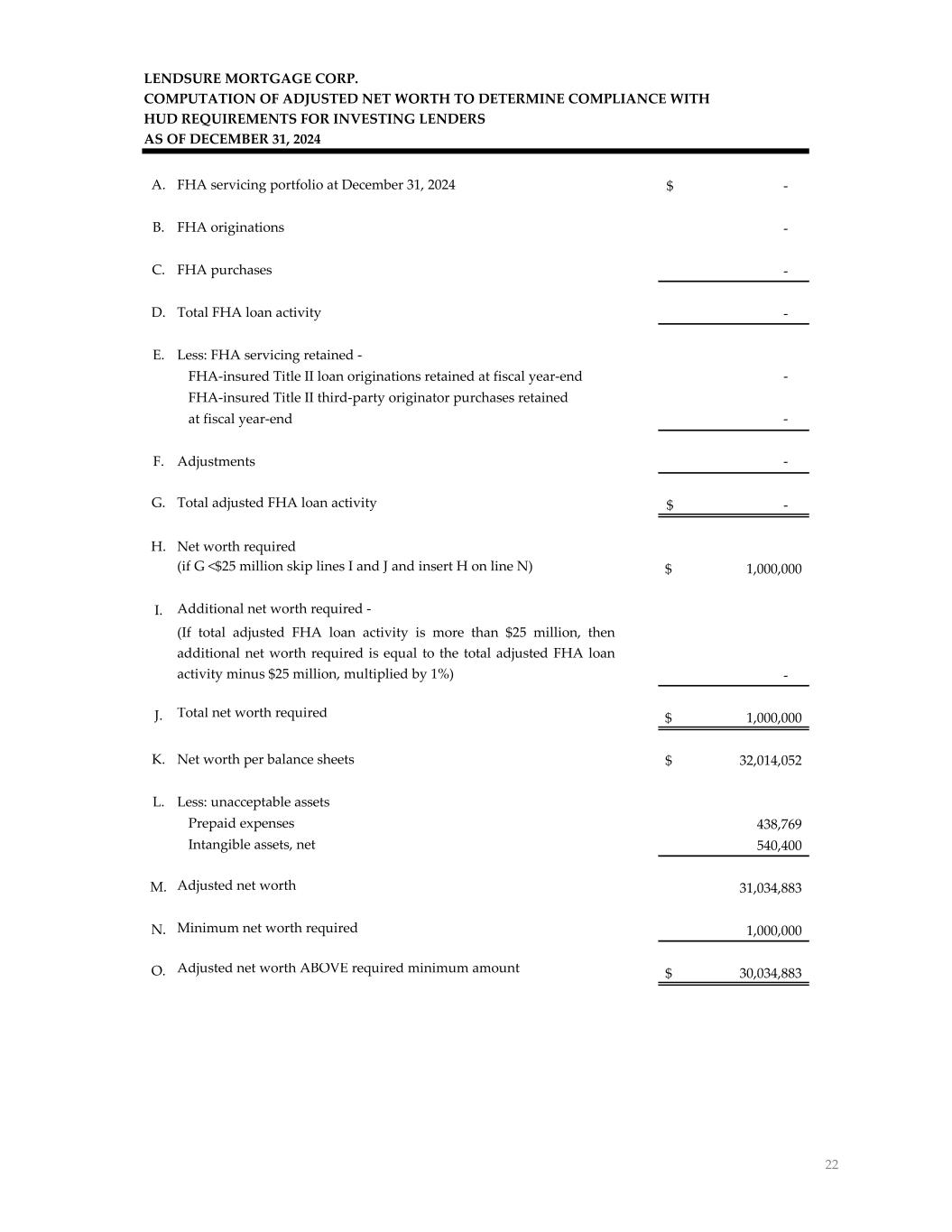

LENDSURE MORTGAGE CORP. COMPUTATION OF ADJUSTED NET WORTH TO DETERMINE COMPLIANCE WITH HUD REQUIREMENTS FOR INVESTING LENDERS AS OF DECEMBER 31, 2024 A. FHA servicing portfolio at December 31, 2024 -$ B. FHA originations - C. FHA purchases - D. Total FHA loan activity - E. Less: FHA servicing retained - FHA-insured Title II loan originations retained at fiscal year-end - FHA-insured Title II third-party originator purchases retained at fiscal year-end - F. Adjustments - G. Total adjusted FHA loan activity -$ H. Net worth required (if G <$25 million skip lines I and J and insert H on line N) 1,000,000$ I. Additional net worth required - - J. Total net worth required 1,000,000$ K. Net worth per balance sheets 32,014,052$ L. Less: unacceptable assets Prepaid expenses 438,769 Intangible assets, net 540,400 M. Adjusted net worth 31,034,883 N. Minimum net worth required 1,000,000 O. Adjusted net worth ABOVE required minimum amount 30,034,883$ (If total adjusted FHA loan activity is more than $25 million, then additional net worth required is equal to the total adjusted FHA loan activity minus $25 million, multiplied by 1%) 22

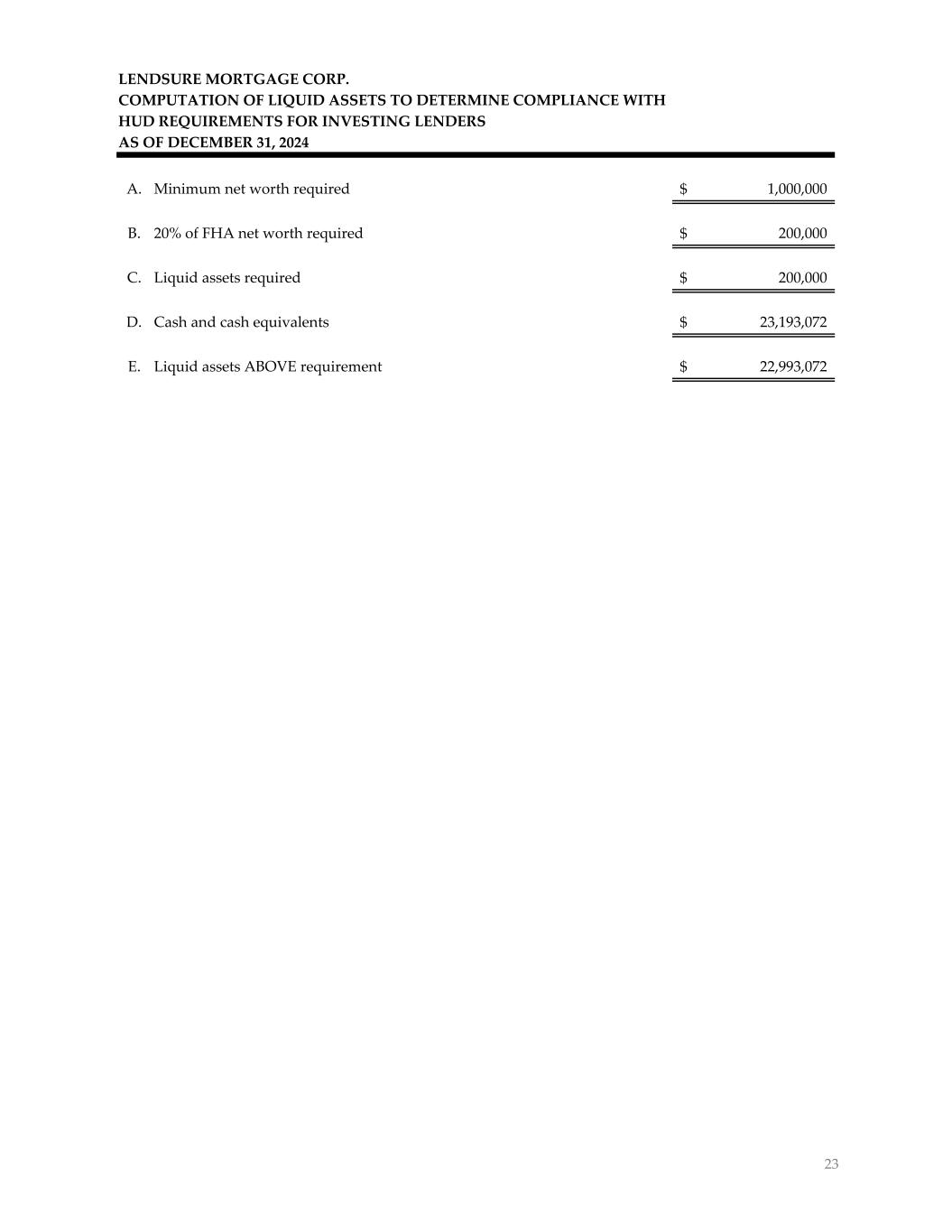

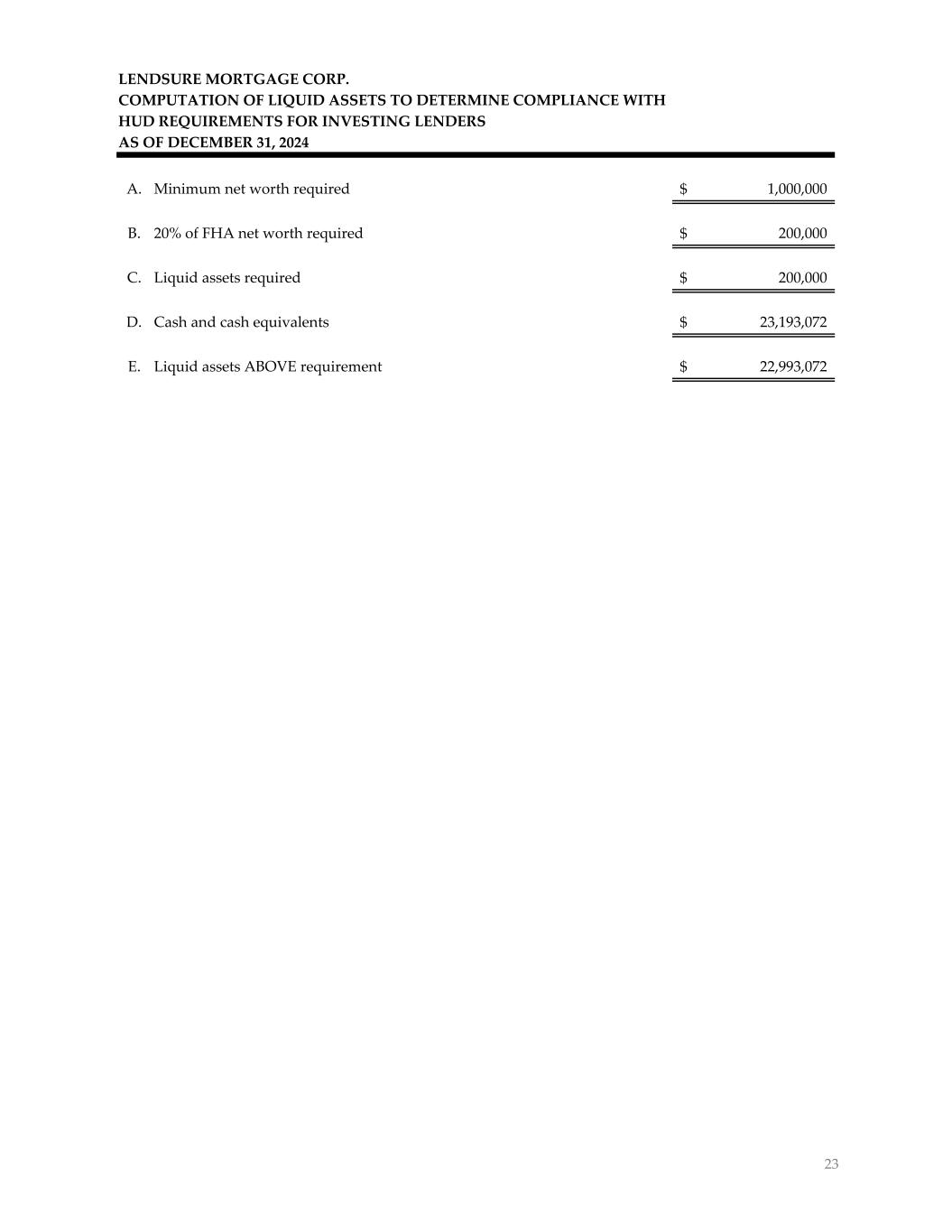

LENDSURE MORTGAGE CORP. COMPUTATION OF LIQUID ASSETS TO DETERMINE COMPLIANCE WITH HUD REQUIREMENTS FOR INVESTING LENDERS AS OF DECEMBER 31, 2024 A. Minimum net worth required 1,000,000$ B. 20% of FHA net worth required 200,000$ C. Liquid assets required 200,000$ D. Cash and cash equivalents 23,193,072$ E. Liquid assets ABOVE requirement 22,993,072$ 23

LENDSURE MORTGAGE CORP. SCHEDULE OF AUDIT FINDINGS, QUESTIONED COSTS, AND RECOMMENDATIONS 24 CURRENT YEAR FINDINGS Our audit disclosed no findings that are required to be reported herein under the HUD Consolidated Audit Guide.

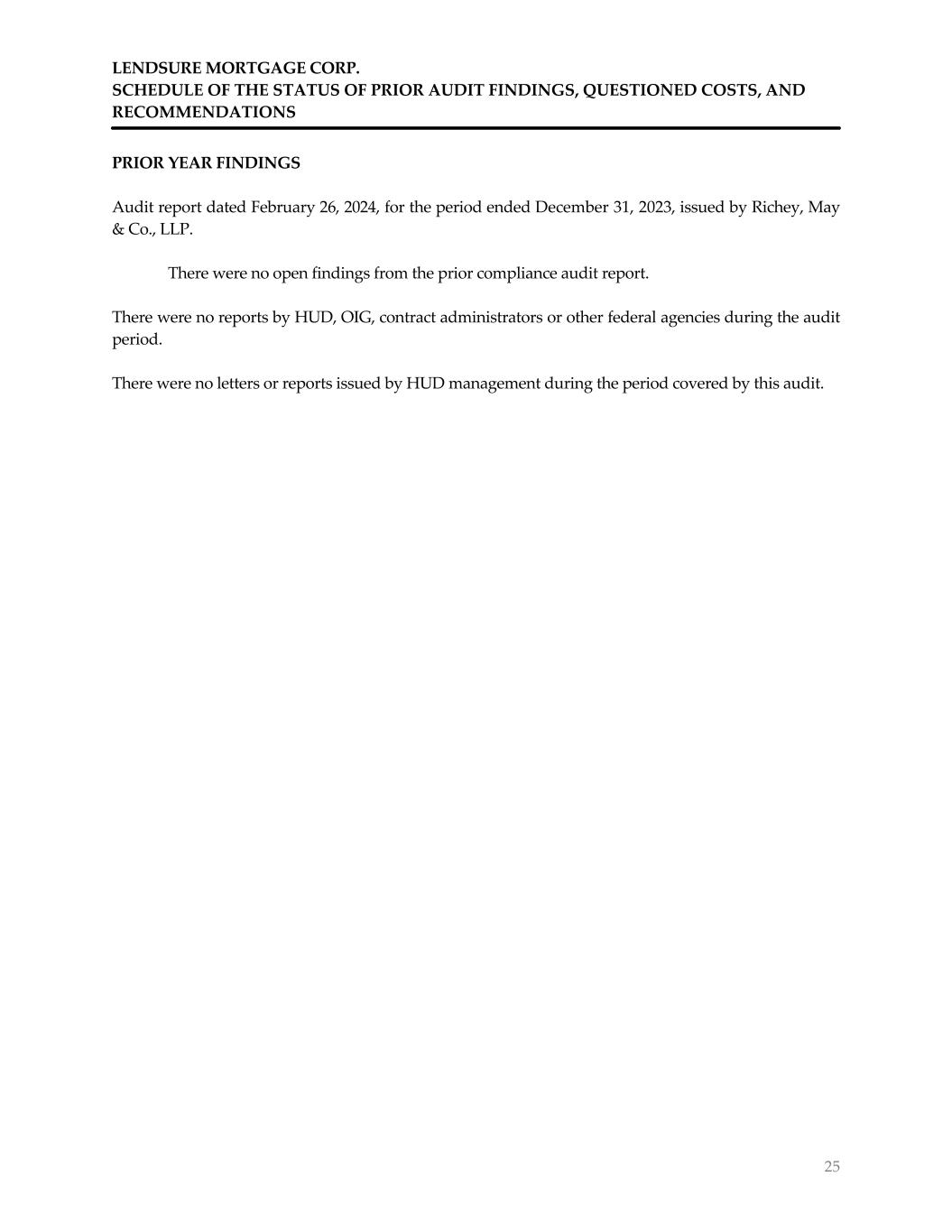

LENDSURE MORTGAGE CORP. SCHEDULE OF THE STATUS OF PRIOR AUDIT FINDINGS, QUESTIONED COSTS, AND RECOMMENDATIONS 25 PRIOR YEAR FINDINGS Audit report dated February 26, 2024, for the period ended December 31, 2023, issued by Richey, May & Co., LLP. There were no open findings from the prior compliance audit report. There were no reports by HUD, OIG, contract administrators or other federal agencies during the audit period. There were no letters or reports issued by HUD management during the period covered by this audit.