UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Information Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

x Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

BLACKHAWK NETWORK HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | |

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-1 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: | | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

BLACKHAWK NETWORK HOLDINGS, INC.

6220 Stoneridge Mall Road

Pleasanton, CA 94588

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 10, 2016

On June 10, 2016, Blackhawk Network Holdings, Inc., or the Company, will hold its Annual Meeting of Stockholders at 10:00am Pacific Time. The meeting will be held at the Pleasanton Marriott hotel, 11950 Dublin Canyon Blvd., Pleasanton, CA 94588, for the following purposes:

1.To elect Richard H. Bard, Steven A. Burd, Robert L. Edwards and William Y. Tauscher as Class III directors;

2.To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 2016 fiscal year ending December 31, 2016;

3.To approve the Company’s Third Amended and Restated Certificate of Incorporation, in order to declassify the Board of Directors beginning at the Company’s annual meeting of stockholders in 2017; and

4.To transact such other business as may properly come before the meeting or at any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders who owned our common stock at the close of business on April 15, 2016, the record date set by our Board of Directors, can vote at this meeting or any adjournments or postponements thereof.

Our Board of Directors recommends that you vote “FOR” the election of the director nominees named in Proposal No. 1 of the Proxy Statement, “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm as described in Proposal No. 2 of the Proxy Statement, and “FOR” the approval of the Third Amended and Restated Certificate of Incorporation, in order to declassify the Board of Directors beginning at the Company’s annual meeting of stockholders in 2017 as described in Proposal No. 3 of the Proxy Statement.

For our Annual Meeting, we have elected to use the Internet as our primary means of providing our proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send to these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement and Annual Report to Stockholders, and for voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials free of charge, if they so choose. The electronic delivery of our proxy materials will significantly reduce our printing and mailing costs and the environmental impact of the proxy materials. The Notice of Internet Availability of Proxy Materials will also provide the date, time and location of the Annual Meeting; the matters to be acted upon at the meeting and the recommendation of the Board of Directors with regard to each matter; a toll-free number, an e-mail address and a website where stockholders can request a paper or email copy of the Proxy Statement, our Annual Report to Stockholders and a form of proxy relating to the Annual Meeting; information on how to access the form of proxy; and information on how to attend the Annual Meeting and vote in person.

You are cordially invited to attend the Annual Meeting, but whether or not you expect to attend in person, you are urged to vote and submit your proxy by following the voting procedures described in the Notice of Internet Availability of Proxy Materials or on the proxy card.

|

| | | | |

| | | By Order of the Board of Directors, |

| | | | | |

| | | /s/ Kirsten Richesson | |

| | | Kirsten Richesson | |

| | | General Counsel and Secretary |

| | | | | |

| Pleasanton, California | | | | |

| Dated: April , 2016 | | | | |

TABLE OF CONTENTS

BLACKHAWK NETWORK HOLDINGS, INC.

6220 Stoneridge Mall Road

Pleasanton, CA 94588

2016 PROXY STATEMENT

FOR THE 2016 ANNUAL MEETING OF THE STOCKHOLDERS

JUNE 10, 2016

The Board of Directors of Blackhawk Network Holdings, Inc. is soliciting your proxy to vote at the Annual Meeting of Stockholders to be held on June 10, 2016, at 10:00am, local time, and any adjournment or postponement of that meeting, or the Annual Meeting. The Annual Meeting will be held at the Pleasanton Marriott hotel, 11950 Dublin Canyon Blvd., Pleasanton, CA 94588.

We have elected to use the Internet as the primary means of providing our proxy materials to stockholders. Accordingly, on or about April 26, 2016, we are making this Proxy Statement and the accompanying proxy card, Notice of Annual Meeting of Stockholders and Annual Report on Form 10-K to Stockholders available on the Internet and mailing a Notice of Internet Availability of Proxy Materials to stockholders of record as of April 15, 2016, or the Record Date. Brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar notice. All stockholders as of the Record Date will have the ability to access the proxy materials on the website referred to in the Notice of Internet Availability of Proxy Materials or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically, including an option to request paper copies on an ongoing basis, may be found in the Notice of Internet Availability of Proxy Materials and on the website referred to in the notice. We intend to mail this Proxy Statement, together with the accompanying proxy card, to those stockholders entitled to vote at the Annual Meeting who have properly requested paper copies of such materials within three business days of request.

The only voting securities of Blackhawk Network Holdings, Inc. are shares of common stock, par value $0.001 per share, or Common Stock, of which there were shares outstanding as of the Record Date. We need the holders of a majority in voting power over the shares of Common Stock issued and outstanding and entitled to vote, present in person or represented by proxy, to hold the Annual Meeting.

In this Proxy Statement, we refer to Blackhawk Network Holdings, Inc. as the “Company,” “Blackhawk,” “we” or “us” and the Board of Directors as the “Board.” When we refer to Blackhawk’s fiscal year, we mean the 52‑week or 53‑week fiscal year ending on the Saturday closest to December 31. The fiscal year presented in this Proxy Statement consists of the 52‑week period ended January 2, 2016.

The Company’s Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, or the SEC, is available in the “Financials” section of our website at http://ir.blackhawknetwork.com. You also may obtain a copy of the Company’s Annual Report on Form 10-K, without charge, by contacting: General Counsel and Secretary, c/o Blackhawk Network Holdings, Inc., 6220 Stoneridge Mall Road, Pleasanton, CA 94588.

QUESTIONS AND ANSWERS

Proxy Material and Voting Information

Who can vote at the Annual Meeting?

Only stockholders that our records show owned shares of Common Stock as of the close of business on the Record Date may vote at the Annual Meeting. As of the Record Date, we had a total of shares of Common Stock issued and outstanding, which were held of record by approximately stockholders.

The stock transfer books will not be closed between the Record Date and the date of the Annual Meeting. Each share of Common Stock is entitled to one vote on each proposal.

What am I being asked to vote on?

You are being asked to vote “FOR” the following:

| |

| • | To elect Richard H. Bard, Steven A. Burd, Robert L. Edwards and William Y. Tauscher as Class III directors; |

| |

| • | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 2016 fiscal year ending December 31, 2016; and |

| |

| • | To approve the Third Amended and Restated Certificate of Incorporation, in order to declassify the Board beginning at the Company’s annual meeting of stockholders in 2017. |

In addition, you are entitled to vote on any other matters that are properly brought before the Annual Meeting.

How do I vote?

You may vote by mail or follow any alternative voting procedure described on the proxy card or the Notice of Internet Availability of Proxy Materials. To use an alternative voting procedure, follow the instructions on each proxy card that you receive or on the Notice of Internet Availability of Proxy Materials.

For the election of Class III directors, you may either vote “FOR” each of the four nominees or you may “WITHHOLD” your vote for any nominee you specify. For the ratification of the selection of the Company’s independent auditors and the Company’s Third Amended and Restated Certificate of Incorporation, in order to declassify the Board beginning at the Company’s annual meeting of stockholders in 2017, you may vote “FOR” or “AGAINST” or “ABSTAIN” from voting.

What is a stockholder of record?

If your shares were registered directly in your name with the transfer agent for our Common Stock, Wells Fargo Shareowner Services, then you are a stockholder of record. If you are a stockholder of record, you may vote in person at the Annual Meeting. Alternatively, you may vote by proxy over the Internet or, if you properly request and receive a proxy card by mail or email, by signing, dating and returning the proxy card, over the Internet or by telephone. Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy to ensure your vote is counted. Even if you have submitted a proxy before the Annual Meeting, you may still attend the Annual Meeting and vote in person. In such case, your previously submitted proxy will be disregarded.

| |

| • | To vote by proxy over the Internet, follow the instructions provided in the Notice of Internet Availability of Proxy Materials or on the proxy card. |

| |

| • | To vote by telephone, if you properly requested and received a proxy card by mail or email, you may vote by proxy by calling the toll free number found on the proxy card. |

| |

| • | To vote by mail, if you properly requested and received a proxy card by mail or email, simply complete, sign and date the proxy card and return it promptly. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

| |

| • | To vote in person, come to the Annual Meeting, and we will give you a ballot when you arrive. |

How do I vote my shares held in “Street Name?”

If your shares were held in an account at a brokerage firm, bank, dealer or other agent, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that institution. The institution holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct the institution that holds your shares instructions on how you would like your shares voted. If your broker or other agent does not receive voting instructions from you, how your shares will be voted (if at all) will depend on the type of proposal. Your brokers are not authorized to vote your “street name” shares for Proposals No. 1 or No. 3 without instructions from you and a “broker non-vote” will occur if you do not provide specific instructions to your brokers as to how to vote your “street name” shares. Your brokers may vote your “street name” shares for Proposal No. 2 at their discretion even if you do not provide voting instructions.

If you hold your shares in “street name,” you are invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy card from your brokerage firm, bank, dealer or other agent in advance.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. The holders of a majority of in voting power of Common Stock outstanding and entitled to vote on the Record Date, present in person or represented by proxy and entitled to vote, will constitute a quorum for the transaction of business at the Annual Meeting. As of the Record Date, there were shares of Common Stock outstanding. Each share of Common Stock is entitled to one (1) vote on each proposal. As of the Record Date, an aggregate of votes constituted the requisite majority in voting power for a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chair of the Annual Meeting or a majority in voting power over the stockholders entitled to vote at the Annual Meeting, present in person or represented by proxy, may adjourn the Annual Meeting to another time or place.

What is the required vote to approve each proposal?

The following table summarizes the effect of “broker non-votes” and of abstentions and votes required for passage of each matter requiring stockholder action at the Annual Meeting:

|

| | | | | | | | | |

| Matters Requiring Stockholder Action | | Brokers may vote

shares without

instructions from

beneficial owner | | Effect of “broker

non-votes” | | Effect of abstentions | | Vote Required |

To elect Richard H. Bard, Steven A. Burd, Robert L. Edwards and William Y. Tauscher as Class III directors (Proposal No. 1 on the Proxy Card)

| | No | | Broker non-votes have no effect and will not be counted towards the vote total for Proposal No. 1 and therefore will not affect the outcome of the election of Class III directors.

| | Abstentions will not affect the outcome of the election of Class III directors. | | You may vote “FOR” or “AGAINST” any or all director nominees. When a quorum is present, a plurality vote of the votes cast is required for the election of Class III directors. Therefore, the four nominees who receive the most “FOR” votes will be elected. Only votes “FOR” will affect the outcome. Broker non-votes and “WITHHOLD” votes will have no effect.

|

|

| | | | | | | | | |

| Matters Requiring Stockholder Action | | Brokers may vote

shares without

instructions from

beneficial owner | | Effect of “broker

non-votes” | | Effect of abstentions | | Vote Required |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 2016 fiscal year ending December 31, 2016 (Proposal No. 2 on the Proxy Card) | | Yes | | We do not expect that there will be any broker non-votes for Proposals No. 2. | | Abstentions will be counted towards the vote total for Proposal No. 2. Abstentions will have the same effect as a vote “AGAINST” the matter. | | You may vote “FOR” or “AGAINST” Proposal No. 2 or you may “ABSTAIN.” When a quorum is present, a majority of the shares of Common Stock either present in person or represented by proxy and entitled to vote on the matter must be voted “FOR” Proposal No. 2 in order for it to pass. If you “ABSTAIN” from voting, it will have the same effect as an “AGAINST” vote. Proposal No. 2 is considered a routine matter, and therefore no broker non-votes are expected in connection with Proposal No. 2. |

To approve the Third Amended and Restated Certificate of Incorporation, in order to declassify the Board beginning at the Company’s annual meeting of stockholders in 2017 (Proposal No. 3 on the Proxy Card) | | No | | Broker non-votes will be counted towards the vote total for Proposal No. 3 and will have the same effect as a vote “AGAINST”

this matter. | | Abstentions will be counted towards the vote total for Proposal No. 3. Abstentions will have the same effect as a vote “AGAINST” the matter. | | You may vote “FOR” or “AGAINST” Proposal No. 3 or you may “ABSTAIN.” When a quorum is present, seventy-five percent (75%) of the voting power of shares of Common Stock outstanding must be voted “FOR” Proposal No. 3 in order for it to pass. If you “ABSTAIN” from voting, it will have the same effect as an “AGAINST” vote. Broker non-votes will have the same effect as “AGAINST” votes. |

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, for the proposal to elect directors, “FOR” and “WITHHOLD” votes and broker non-votes and, with respect to the other proposals, “FOR” and “AGAINST” votes, abstentions and, if applicable, broker non-votes.

How do I vote via the Internet or telephone?

You may vote by proxy via the Internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials or on the proxy card. If you properly request and receive printed copies of the proxy materials by mail, you may vote by proxy by calling the toll-free number found on the proxy card. Please be aware that if you vote over the Internet or by telephone, you may incur costs such as telephone and Internet access charges, as applicable, for which you will be responsible. The Internet and telephone voting facilities for eligible stockholders of record will close at 11:59pm Eastern Time on June 9, 2016. The giving of such a telephonic or Internet proxy will not affect your right to vote in person should you decide to attend the Annual Meeting.

The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly.

What if I return a proxy card but do not make specific choices?

If we receive a signed and dated proxy card and the proxy card does not specify how your shares are to be voted, your shares will be voted “FOR” the election of each of the four nominees for director, “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm, and “FOR” the Third Amended and Restated Certificate of Incorporation, in order to declassify the Board beginning at the Company’s annual meeting of stockholders in 2017. If any other matter is properly presented at the Annual Meeting, your proxy (that is, one of the individuals named on your proxy card) will vote your shares using her best judgment.

Who is paying for this proxy solicitation?

The Company will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firm, bank, dealer or other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of materials?

If you receive more than one set of materials, your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must follow the instructions for voting on each Notice of Internet Availability of Proxy Materials or the proxy card that you receive by mail or email pursuant to your request, which include instructions for voting over the Internet, by telephone or by signing, dating and returning any of such proxy cards.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| |

| • | You may submit another properly completed proxy over the Internet, by telephone or by mail with a later date. |

| |

| • | You may send a written notice that you are revoking your proxy to our General Counsel and Secretary at Blackhawk Network Holdings, Inc., 6220 Stoneridge Mall Road, Pleasanton, CA 94588. |

| |

| • | You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your brokerage firm, bank, dealer or other agent, you should follow the instructions provided by them.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in the proxy materials for next year’s annual meeting, your proposal must be submitted in writing by December 27, 2016 to our General Counsel and Secretary at Blackhawk Network Holdings, Inc., 6220 Stoneridge Mall Road, Pleasanton, CA 94588. If you wish to submit a proposal that is not to be included in next year’s proxy materials pursuant to the SEC’s stockholder proposal procedures or to nominate a director, you must do so between February 10, 2017 and March 12, 2017; provided that if the date of the annual meeting is earlier than May 11, 2017 or later than August 9, 2017 your proposal to be timely must be submitted not earlier than the 120th day prior to the annual meeting date and not later than the 90th day prior to the annual meeting date or, if later, the 10th day following the day on which public disclosure of the annual meeting date is first made. You are also advised to review our Amended and Restated Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How can I find out the results of the voting at the Annual Meeting?

Voting results will be announced by the Company’s filing of a Current Report on Form 8-K within four business days after the Annual Meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days following the day that final results are available.

PROPOSAL NO. 1: ELECTION OF CLASS III DIRECTORS

Our Board currently consists of eleven directors and is divided into three classes that serve staggered three-year terms. Historically, each year only one class of directors stood for election at our Annual Meeting.

Although our Board believes that experience, stability and continuity among Board members are important factors in effective corporate governance, it also is aware of the increasing demand in the stockholder community for annual elections of directors as a means to promote Board accountability. Accordingly, our Board is recommending that the Company’s stockholders approve and adopt the Company’s Third Amended and Restated Certificate of Incorporation, in order to declassify the Board effective at the Company’s 2017 annual meeting of stockholders. To learn more about this proposal, please see “Proposal No. 3–Approval of the Company’s Third Amended and Restated Certificate of Incorporation, in order to declassify the Board of Directors beginning at the Company’s annual meeting of stockholders in 2017.”

Nominees

This year, upon the recommendation of our Nominating and Corporate Governance Committee, our Board nominated Richard H. Bard, Steven A. Burd, Robert L. Edwards and William Y. Tauscher to stand for election as Class III directors, each of whom is currently a director of the Company. If elected, each nominee will hold office for a three-year term ending in 2019 and until his successor has been elected and qualified, or until his earlier resignation or removal. However, in order to effect the declassifying of our Board contemplated by Proposal No. 3, these Class III nominees (together with the incumbent Class I and Class II directors) have tendered their resignations, with such resignations to become effective immediately prior to the 2017 annual meeting of stockholders, subject to the condition that stockholders approve the proposal, in order to declassify our Board. In that case, these Class III nominees will serve only a one-year term, and all directors will begin standing for annual election beginning at our 2017 annual meeting of stockholders.

Messrs. Bard, Burd, Edwards and Tauscher have each informed us that they are willing to serve as a director. If any nominee ceases to be a candidate for election for any reason, the Proxy will be voted for a substitute nominee designated by the Company’s Board. The Board currently has no reason to believe that any nominee will not remain a candidate for election as a director or will be unwilling to serve as a director if elected. See below under “Nominating and Corporate Governance Committee” for more information about the nomination process and the factors that our Nominating and Corporate Governance Committee considers to evaluate, identify and recommend nominees for the Board.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR

THE ELECTION OF EACH NAMED NOMINEE.

Set forth below is information as of the Record Date regarding our Class III nominees and our other current directors who will continue in office after the Annual Meeting:

|

| | | | | | | | | | | |

| Name | | Age | | Director Since | | Position/Office Held With the Company | |

| Class III Directors whose terms expire at the 2016 Annual Meeting | |

| Richard H. Bard | | 68 | | October 2014 | | Director | |

| Steven A. Burd | | 66 | | August 2007 | | Director | |

| Robert L. Edwards | | 60 | | July 2008 | | Director | |

| William Y. Tauscher | | 66 | | August 2007 | | Chairman of the Board and Head of International | |

| Class I Directors whose terms expire at the 2017 Annual Meeting (1) |

| Anil D. Aggarwal | | 46 | | February 2016 | | Director | |

| Lawrence F. Probst III | | 65 | | April 2008 | | Director | |

| Jane J. Thompson | | 64 | | October 2014 | | Director | |

| Class II Directors whose terms expire at the 2018 Annual Meeting (1) |

| Mohan Gyani | | 64 | | August 2007 | | Director | |

| Paul Hazen | | 74 | | August 2007 | | Director | |

| Talbott Roche | | 49 | | February 2016 | | President, Chief Executive Officer and Director | |

| Arun Sarin | | 61 | | August 2009 | | Director | |

____________________________________

(1) Does not give effect to the proposed declassification of the Board.

Set forth below is biographical information for the nominees and each person whose term of office as a director will continue after the Annual Meeting. The following includes certain information regarding our directors’ individual experiences, qualifications, attributes and skills that led the Board to conclude that they should serve as directors.

Class III Directors Who Stand for Re-election at this Annual Meeting

Richard H. Bard. Mr. Bard has served on the Board since October 2014. Mr. Bard is the Founder, Chairman and Chief Executive Officer of Bard Capital Group LLC, an operating and investment business. Mr. Bard currently serves as the Chairman of Blastrac Global, Inc., a privately held global machinery manufacturer, and Chairman and Co-CEO of Centennial Jet Partners LLC., a privately held company operating in the hospitality sector. Mr. Bard served as Vice Chairman of CIC Bancshares, Inc., a bank holding company, between 2010 to 2016. He served as manager of AmQuip Holdings, LLC, a provider of manned and bare rental lifting solutions, from 2007 to 2014 when it was acquired by Clearlake Capital Group, L.P. He also served as Chairman and Deputy Chairman of the Federal Reserve Bank of Kansas City from 2002 to 2006. He is a founding member of the Board of Visitors at Penn State’s Smeal College of Business, and he is a former Chairman of the Advisory Board of the Business School at University of Colorado at Denver. He also created the Bard Center for Entrepreneurship at the Business School of the University of Colorado at Denver. Mr. Bard brings to the Board extensive knowledge and experience as a director across a diverse set of companies and as an executive and entrepreneur.

Steven A. Burd. Mr. Burd has served on the Board since August 2007. Mr. Burd is the Founder of Burd Health LLC, a company helping large self-insured employers reduce health-care costs, and has been serving as its Chief Executive Officer since September 2013. He served as Chief Executive Officer of Safeway Inc., a retail food and drug company (which was acquired by Albertsons Holdings LLC, or Albertsons, in January 2015) from May 1993 to May 2013 and as President from October 1992 to April 2012. Mr. Burd served on the board of directors of Safeway from September 1993 to May 2013 and as Chairman of the board of directors of Safeway from May 1998 to May 2013. Mr. Burd is also a director of Kohl’s Corporation, a specialty department store company, and of the Prostate Cancer Foundation, a non-profit foundation funding prostate cancer research. He also served as a director of Physiotherapy Associates, a privately held company providing outpatient physical rehabilitation care, from January 2014 to March 2016. Mr. Burd brings to the Board considerable management, directorial, board committee experience and an understanding of our business.

Robert L. Edwards. Mr. Edwards has served on the Board since July 2008. Mr. Edwards was EVP and CFO of Safeway from March 2004 until April 2012, was Chief Executive Officer of Safeway from May 2013 until January 2015 and President of Safeway from April 2012 until Safeway was acquired Albertsons in January 2015 when he served as Chief Executive Officer of Albertsons until April 2015. Mr. Edwards also served as Vice Chairman of Albertsons in 2015. Prior to joining Safeway, from September 2003 to March 2004, he served as Executive Vice President and Chief Financial Officer of Maxtor Corporation, a hard disk drive manufacturer. From 1998 to August 2003, Mr. Edwards held various executive positions, including Chief Financial Officer and Chief Administrative Officer at Imation Corporation, a developer, manufacturer and supplier of magnetic and optical data storage media. Mr. Edwards serves as a director of Target Corp., a company operating general merchandise discount stores, where he serves on the Audit Committee and the finance committee. From November 2011 and June 2013, Mr. Edwards served as a director of KKR Financial Holdings LLC, a specialty finance company, where he served on the Audit Committee. From October 2008 to October 2012, he served on the board of directors of Flextronics International Ltd., an electronics manufacturing services provider. Mr. Edwards brings to the Board both a strong understanding of our business and extensive knowledge of financial reporting.

William Y. Tauscher. Mr. Tauscher served as our Chief Executive Officer between August 2010 and February 2016 and became our Head of International in February 2016. Mr. Tauscher has served as a member of the Board since August 2007 and as Chairman of the Board since August 2009. He also served as our Executive Chairman from March 2010 to August 2010 and as President from August 2010 to November 2010. Mr. Tauscher served on the board of directors of Safeway from May 1998 to January 2015, where he also served on the executive committee. Since 1986, he has been a managing member of the Tauscher Group, which invests and assists in the management of enterprises involved with home products, transportation, telecommunications and real estate. From 2004 to August 2010, he served as the Chief Executive Officer, and continues to serve as the Chairman of the board of directors, of Vertical Communications, Inc., a communications technology company. Mr. Tauscher also serves as a director of a number of privately held companies. Mr. Tauscher holds a B.S. in Administrative Sciences from Yale University. Mr. Tauscher brings to the Board significant experience as a senior executive and director of multiple companies.

Class I directors with terms expiring in 2017 (without giving effect to the declassification of the Board)

Anil D. Aggarwal. Mr. Aggarwal has served on the Board since February 2016. Mr. Aggarwal is currently employed at Oak HC/FT Partners, LLC, a venture capital firm, where he has served as Venture Partner since October 2014 and at Shoptalk Commerce, LLC, where he has served as Chief Executive Officer and Chairman since June 2015. From June 2011 to August 2014, Mr. Aggarwal served as Chief Executive Officer and Chairman of Money20/20, LLC, which was acquired in August 2014 by WGSN, Inc., for which Mr. Aggarwal has since served as a consultant, on behalf of an affiliate. From April 2012 to March 2013, Mr. Aggarwal served as Head of Business Development, Payments and Wallet at Google, Inc., a multinational technology company specializing in Internet-related services and products. From January 2008 until its acquisition by Google, Inc. in April 2012, he served as Chief Executive Officer and Chairman of TxVia, Inc., a company offering processing solutions for payments and financial services applications. Mr. Aggarwal has been an entrepreneur, investor and executive for more than fifteen years. Because of his experience in business management and the financial services industry, the Board believes that he is able to contribute valuable input on the strategic and business affairs to the Board.

Lawrence F. Probst III. Mr. Probst has served on the Board since April 2008. Mr. Probst has served on the board of directors of Electronic Arts Inc., or EA, a software company, since January 1991 and as Chairman of the board of directors since July 1994. He served as Executive Chairman of EA from March 2013 to December 2014. In addition, Mr. Probst served in a variety of senior management and executive positions at EA from 1984 until September 2008, including Chief Executive Officer from May 1991 to April 2007 and President from December 1990 to October 1997. Mr. Probst also sits on the boards of directors of two cancer research groups, the V Foundation and ABC2, and has served as the Chairman of the board of directors of the U.S. Olympic Committee since September 2008 and a member of the International Olympic Committee since September 2013. Mr. Probst brings to the Board extensive management, operational and board governance experience.

Jane J. Thompson. Ms. Thompson has served on the Board since October 2014. Ms. Thompson is the founder and CEO of Jane J. Thompson Financial Services LLC, a management consulting firm. From May 2002 to June 2011, Ms. Thompson served as President of Walmart Financial Services, a division of Walmart Stores, Inc. that provides money services, products and solutions to Walmart customers. Previously, she led the Sears Credit, Sears Home Services, and Sears Online groups within Sears, Roebuck & Company. Ms. Thompson has served on the board of directors of The Fresh Market, Inc., a specialty food retailer, since June 2012, on the board of directors of On Deck Capital, Inc., a provider of online loans for small businesses, since October 2014, on the board of directors of VeriFone Systems, Inc., a provider of electronic payment solutions, since March 2014, , and on the board of directors of Navient Corporation, a loan management, servicing and asset recovery company, since March 2014. Ms. Thompson brings to the Board extensive mass-market consumer financial services experience and over 30 years in senior executive and management positions with large, publicly traded companies.

Class II directors with terms expiring in 2018 (without giving effect to the declassification of the Board)

Mohan Gyani. Mr. Gyani has served on the Board since August 2007. He has served as Vice Chairman of the board of directors of Mobileum, Inc., a provider of mobile operator solutions, since January 2006, and also served as Chairman of the board of directors and Chief Executive Officer of Mobileum from May 2005 through December 2005. Mr. Gyani served as the President and Chief Executive Officer of AT&T Wireless Mobility Services, or AT&T Wireless, a company providing wireless voice and data communications services and products, from 2000 until his retirement from that company in 2003, after which he served as a senior advisor to the Chairman and Chief Executive Officer of AT&T Wireless through December 2004. From 1995 to 1999, Mr. Gyani was Executive Vice President and Chief Financial Officer of AirTouch Communications, Inc., a wireless telephone service provider. Upon the acquisition of AirTouch by Vodafone Group Plc., a global mobile communications company, Mr. Gyani served as Executive Director on the Board of Vodafone AirTouch Plc and as its head of strategy and M&A until July 1999. Mr. Gyani spent 15 years with Pacific Telesis Group, Inc., parent of Pacific Bell, a telecommunications company, where he held various financial and operational positions. Mr. Gyani serves on the boards of directors of Ruckus Wireless, Inc., a Wi-Fi technology company, and Digital Turbine, Inc., a mobile software company. He also serves on the board of directors of IDEA Cellular, a wireless service provider, and MUFG Union Bank, N.A., a full-service bank, and its financial holding company, MUFG Americas Holdings Corporation, as well as the boards of other private companies that are in the wireless mobile space. Previously, from March 2011 to July 2015, Mr. Gyani served as a director of Audience, Inc., a provider of intelligent voice and audio solutions, and as chairman from August 2011 to July 2015; from June 2007 to June 2010, he served on the board of directors of Mobile Telesystems, Inc., a cell phone operator; from March 2002 to August 2013, he served on the board of directors of Keynote Systems, Inc., a mobile and web cloud testing and monitoring company; and from October 2004 to January 2015, he served on the board of directors of Safeway. Mr. Gyani brings to the Board an in-depth knowledge of, and years of experience in, public company governance.

Paul Hazen. Mr. Hazen has served on the Board since August 2007. Mr. Hazen is the former Chairman and Chief Executive Officer of Wells Fargo & Company (Wells Fargo). Mr. Hazen joined Wells Fargo in 1970. He served as Vice Chairman from 1981 to 1984, President and Chief Operating Officer from 1984 to 1995, Chairman and Chief Executive Officer from January 1995 to November 1998, and Chairman from January 1995 to May 2001. Mr. Hazen was also the President of Wells Fargo Real Estate Investment Trust, a publicly traded REIT, from 1973 to 1978. Mr. Hazen retired after he left his post as Chairman of Wells Fargo in May 2001. Mr. Hazen is currently Chairman of Accel-KKR LLC, a private equity firm, and serves on the board of KSL Recreation Group, Inc., a hospitality firm. Past board positions include KKR Financial Holdings LLC (Chairman), a specialty finance company, Safeway (Lead Independent Director), Phelps Dodge International Corporation, a copper lining company, Vodafone Group Plc (Deputy Chairman and Lead Independent Director), a global mobile communications company, Willis Towers Watson Plc (formerly Willis Group Holdings Ltd.), an advisory, broking, and solutions company, Prosper Marketplace, Inc., a company providing online peer-to-peer lending marketplace services, National Retirement Partners, a financial services company, Xstrata Plc, a company providing metal mining services through its subsidiaries, the San Francisco Symphony, and the San Francisco Museum of Modern Art. Mr. Hazen also served on the Federal Advisory Council to the Federal Reserve from 1987 to 1991, acting as President of the Council in 1991, reporting to Alan Greenspan as Chairman. Mr. Hazen brings to the Board significant experience in business strategy as a current and past senior executive of large companies, as well as considerable directorial and board committee experience.

Talbott Roche. Ms. Roche has served on the Board since February 2016. Ms. Roche has served as Chief Executive Officer of the Company since February 2016 and President of the Company since November 2010. She originally joined the Company as Assistant Vice President in July 2001 while the Company was a specialty marketing division of Safeway. Ms. Roche transitioned to the role of Senior Vice President, Marketing, Product and Business Development in January 2005 and served in that position until November 2010. Prior to joining the Company, Ms. Roche served as a Branding Consultant and Director of New Business Development for Landor Associates, a marketing consulting firm, from October 2000 to July 2001. From 1996 to 2000, Ms. Roche held various executive positions at News Corporation, a media and marketing services company, including Senior Vice President, Sales for the Smart Source iGroup and Vice President, Sales for News America Marketing. From 2001 to 2007, Ms. Roche served as a member of the board of directors of Network Branded Prepaid Card Association, a leading trade association open to all companies involved in providing prepaid cards that carry a brand network logo to consumers, businesses and government. Ms. Roche holds a B.A. in economics from Stanford University. Because of her considerable business management experience and understanding of our business, the Board believes that she is able to contribute valuable input on the strategic and business affairs to the Board.

Arun Sarin. Mr. Sarin has served on the Board since August 2009. From April 2003 to July 2008, Mr. Sarin was the Chief Executive Officer of Vodafone Group Plc., a global mobile communications company. From October 2009 to October 2014, he served as a senior advisor to Kohlberg Kravis Roberts & Co., a private equity firm. Since October 2015, Mr. Sarin has served on the board of directors of Accenture plc, a management consulting, technology services and outsourcing company. Since September 2009, Mr. Sarin has served on the board of directors of The Charles Schwab Corporation, a provider of brokerage, banking and financial advisory services, and on the board of directors of Cisco Systems, Inc., a networking technology company. From August 2009 to January 2015, Mr. Sarin was a director of Safeway. From 1999 to 2008, he was a director of Vodafone Group Plc. From 1999 to 2003, he was a director of The Gap, Inc., a specialty retailer. From 2005 until 2009, he served as a member of the Court of Directors of the Bank of England. Mr. Sarin brings to the Board significant experience as a former senior executive of a large, global company, where he developed expertise in finance, marketing and operations, and considerable directorial and board committee experience.

CORPORATE GOVERNANCE

General

The Company aspires to the highest ethical standards for its employees, officers and directors, and remains committed to the interests of its stockholders. We believe we can achieve these objectives only with a plan for corporate governance that clearly defines responsibilities, sets high standards of conduct and promotes compliance with the law.

The Board has adopted formal corporate governance guidelines, as well as policies and procedures designed to foster the appropriate level of corporate governance. Some of these guidelines and procedures are discussed below. For further information, including electronic versions of our Code of Business Conduct and Ethics, our Corporate Governance Guidelines, our Audit Committee Charter, our Compensation Committee Charter and our Nominating and Corporate Governance Committee Charter, please visit the Corporate Governance section of our website (http://ir.blackhawknetwork.com) located under the Investor Overview heading. The contents of our website are not incorporated by reference into this Proxy Statement.

Independence of the Board of Directors

As required under the NASDAQ Stock Market LLC, or NASDAQ, listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. Our Board consults with our counsel to ensure that its determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent NASDAQ listing standards, as in effect from time to time.

The Board has undertaken a review of the independence of each director and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, the Board determined that Messrs. Aggarwal, Bard, Gyani, Hazen, Probst and Sarin and Ms. Thompson, representing seven of our eleven directors, are “independent directors” as defined under NASDAQ rules and in accordance with the regulations of the SEC. Our Board has affirmatively determined that Mr. Douglas J. Mackenzie was an independent director while serving on our Board during 2015.

Ms. Roche, our President and Chief Executive Officer, is not an independent director by virtue of her employment with us. Mr. Tauscher is our Head of International and was our Chief Executive Officer until February 2016 and therefore is not an independent director by virtue of his employment with us. Mr. Edwards was Chief Executive Officer of Safeway (which was the parent entity of the Company until April 14, 2014) until January 2015 and therefore is not an independent director by virtue of his prior employment with Safeway. Mr. Burd was Chief Executive Officer of Safeway until his retirement on May 14, 2013 and therefore is not an independent director by virtue of his prior employment with Safeway.

There are no family relationships among any of our directors or executive officers.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics that is applicable to all of our directors, officers and employees. A copy of the Company’s Code of Business Conduct and Ethics is available in the Corporate Governance section of our website (http://ir.blackhawknetwork.com) located under the Investor Overview heading and is also available in print upon request. Any amendments or waivers of the Code of Business Conduct and Ethics also will be posted on our website within four business days following the amendment or waiver as required by applicable rules and regulations of the SEC and the rules of the NASDAQ Stock Market. You also may obtain a copy of the Company’s Code of Business Conduct and Ethics, without charge, by contacting: General Counsel and Secretary, c/o Blackhawk Network Holdings, Inc., 6220 Stoneridge Mall Road, Pleasanton, CA 94588.

Information Regarding the Board of Directors and its Committees

Board Responsibilities; Role in Risk Oversight

The Board is responsible for, among other things, overseeing the conduct of our business; reviewing and, where appropriate, approving our major financial objectives, plans and actions; and reviewing the performance of our chief executive officer and other members of management. Following the end of each year, the Board conducts an annual self-evaluation, which includes a review of any areas in which the Board or management believes the Board can make a better contribution to our corporate governance, as well as a review of the committees’ structure and an assessment of the Board’s compliance with corporate governance principles. In fulfilling the Board’s responsibilities, directors have full access to our management and independent advisors. With respect to the Board’s role in our risk oversight, our Audit Committee discusses with management our policies with respect to risk assessment and risk management and our significant financial risk exposures and the actions management has taken to limit, monitor or control such exposures. Our Audit Committee reports to the full Board with respect to these matters, among others. Our Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and periodically reports to the entire Board about such risks.

Leadership Structure

The Board does not have a fixed policy regarding the separation of the offices of Chairman of the Board (Chairman) and Chief Executive Officer and believes that it should maintain the flexibility to select the Chairman and its Board leadership structure, from time to time, based on the criteria that it deems to be in the best interests of the Company and its stockholders.

At this time, the position of Chairman is held by Mr. William Y. Tauscher and the position of President and Chief Executive Officer is held by Ms. Talbott Roche. The Board has determined that, under current circumstances, the separation of the offices of Chairman and Chief Executive Officer will enhance oversight of management and Board function. This separation is designed to allow Ms. Roche the ability to focus on her responsibilities of running the Company, enhancing stockholder value and expanding and strengthening the Company’s business. Concurrently, Mr. Tauscher, as Chairman, can focus on leadership for the Board as it provides advice to and independent oversight of management. The Chairman also is responsible for setting the agendas and presiding over meetings of the Board (including executive sessions of the independent directors) and providing feedback and counsel to the Chief Executive Officer. The Board currently believes that this leadership structure is in the best interests of the Company’s stockholders at this time.

Mr. Hazen was elected by our independent directors as our Lead Independent Director of the Board on February 23, 2015. The appointment of a Lead Independent Director helps ensure that the Company benefits from effective oversight by its independent directors. As set forth in our Corporate Governance Guidelines, the Lead Independent Director’s duties include among other things: serving as a liaison between the Chairman and the independent directors; approving and including information sent to the Board and working to ensure that the directors have the information necessary to perform their duties; approving agendas for meetings of the Board and its committees; approving schedules for Board meetings to assure that there is sufficient time for discussion of all agenda items; having the authority to call meetings of the Independent Directors; and, if requested by large stockholders, ensuring that Mr. Hazen is available for consultation and direct communication.

Our Board has seven independent members within the meaning of the applicable NASDAQ listing standards. A number of our independent Board members are serving or have served as members of senior management of other public companies and are serving or have served as directors of other public companies. We have three Board committees composed solely of independent directors within the meaning of the applicable NASDAQ listing standards. We believe that the number of independent, experienced directors that compose our Board, along with the independent oversight of our Lead Independent Director, benefits the Company and its stockholders and enhances our Board leadership structure.

Board Meetings and Committees

Committees of the Board of Directors

The Board has established the following standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The conflicts committee, which was responsible for review of related party transactions in which Safeway was a party with an interest potentially adverse to our interests, was dissolved effective February 23, 2015, following the acquisition of Safeway by Albertsons on January 30, 2015.

|

| | |

| Board/Committee | | Primary Areas of Risk Oversight |

| Full Board | | Strategic, financial and execution risks and exposures associated with our business strategy, product innovation and sales road map, policy matters, significant litigation and regulatory exposures, and other current matters that may present material risk to our financial performance, operations, infrastructure, plans, prospects or reputation, acquisitions and divestitures. |

| Audit Committee | | Risks and exposures associated with financial matters, particularly financial reporting, tax, accounting, disclosure, internal control over financial reporting, investment guidelines and credit and liquidity matters, our programs and policies relating to legal compliance and strategy, and our operational infrastructure, particularly cyber security, reliability, business continuity and capacity. |

| Nominating and Corporate Governance Committee | | Risks and exposures associated with director and management succession planning, corporate governance and overall Board effectiveness. |

| Compensation Committee | | Risks and exposures associated with leadership assessment, executive compensation programs and arrangements, including overall incentive and equity plans. |

The following chart details the membership of each standing committee, which is current as of April 1, 2016.

|

| | | | | | |

| Name of Director | | Audit Committee | | Compensation Committee | | Nominating and Governance Committee |

| Anil D. Aggarwal | | | | | | M |

| Richard H. Bard | | M | | | | C |

| Steven A. Burd | | | | | | |

| Robert L. Edwards | | | | | | |

| Mohan Gyani | | C | | | | M |

| Paul Hazen | | | | C | | |

| Lawrence F. Probst III | | M | | | | |

| Talbott Roche | | | | | | |

| Arun Sarin | | | | M | | |

| William Y. Tauscher | | | | | | |

| Jane J. Thompson | | | | M | | |

M = Member

C = Chair

Meetings of the Board of Directors, Board and Committee Member Attendance and Annual Meeting Attendance

The Board met six times during 2015. The Audit Committee met five times, the Compensation Committee met four times and the Nominating and Corporate Governance Committee met three times during 2015. During 2015, all of the Board members (except for Mr. Sarin) attended 75% or more of the aggregate of the meetings of the Board and of the committees on which they served. We encourage all of our directors and nominees for director to attend our annual meeting of stockholders; however, attendance is not mandatory. Mr. Tauscher and Mr. Gyani attended the 2015 annual meeting of stockholders.

Audit Committee

Our Audit Committee oversees the corporate accounting and financial reporting process. Among other matters, the Audit Committee evaluates our independent registered public accounting firm’s qualifications, independence and performance, determines the engagement of the independent registered public accounting firm, reviews and approves the scope of the annual audit and the audit fees, discusses with management and our independent registered public accounting firm the results of the annual audit and the review of our quarterly consolidated financial statements, approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services, monitors the rotation of partners of the independent registered public accounting firm on the Company’s engagement team as required by law, reviews our critical accounting policies and estimates, oversees our internal audit function, including reviewing the organization, scope and effectiveness of our internal audit function and our disclosure and internal controls, and annually reviews the Audit Committee charter and the Audit Committee’s performance. The current members of our Audit Committee as of April 1, 2016 are Mr. Gyani, who is the chair of the Audit Committee, Mr. Bard and Mr. Probst. All members of the audit committee meet the requirements for financial literacy under applicable SEC rules and regulations and NASDAQ listing standards. The Board has determined that each of Mr. Gyani and Mr. Bard is an Audit Committee financial expert as defined under the applicable rules of the SEC and has the requisite financial sophistication as defined under the applicable rules and regulations of the NASDAQ Stock Market. The current members of the Audit Committee are independent directors as defined under the applicable rules and regulations of the SEC and the NASDAQ Stock Market. The Audit Committee operates under a written charter that satisfies the applicable standards of the SEC and the NASDAQ Stock Market. A copy of the Audit Committee charter is available to stockholders on our website at http://ir.blackhawknetwork.com.

Compensation Committee

Our Compensation Committee reviews and recommends policies relating to compensation and benefits of our officers and employees. Among other things, the Compensation Committee reviews and approves corporate goals and objectives relevant to compensation of our Chief Executive Officer and other executive officers, evaluates the

performance of these officers in light of those goals and objectives, sets the compensation of these officers based on such evaluations, administers the issuance of stock options, or Options, and other awards under our stock plans and annually reviews the Compensation Committee charter and the Compensation Committee’s performance. The current members of the Compensation Committee as of April 1, 2016 are Mr. Hazen, who is the chair of the Compensation Committee, Mr. Sarin and Ms. Thompson. The current members of the Compensation Committee are independent directors as defined under the applicable rules and regulations of the SEC, the NASDAQ Stock Market and the Internal Revenue Code of 1986, as amended, or the Code. The Compensation Committee reviews and evaluates, at least annually, the performance of the Compensation Committee and its members, including compliance of the Compensation Committee with its charter. A copy of the Compensation Committee charter is available to stockholders on our website at http://ir.blackhawknetwork.com.

In February 2015, the Compensation Committee amended the authority of its assignment of fiduciary duties to the Benefits Committee that provides that the Benefits Committee shall comprise up to five members among whom, the Chief Accounting Officer, the Group Vice President-Human Resources and the General Counsel shall be the permanent members. The Benefits Committee is the administrator and named fiduciary under the Employee Retirement Income Security Act of 1974 for purposes of administering the plans, programs and arrangements sponsored or contributed to by us.

In October 2015, the Compensation Committee established an Equity Committee consisting of the following officers who are subject to Section 16 of the Securities Exchange Act of 1934, as amended, or the Section 16 Officers, of the Company: Chief Accounting Officer, the General Counsel and Secretary, and the President. The Compensation Committee delegated to the Equity Committee the authority to grant Options or restricted stock units, or RSUs, to newly hired or newly promoted employees of the Company subject to the following limitations:

| |

| • | the Equity Committee must grant the equity awards within its authorization pursuant to the 2013 Equity Incentive Award Plan, or the 2013 Plan, and other applicable law; |

| |

| • | the maximum aggregate number of shares of Common Stock with respect to one or more equity awards that may be approved by the Equity Committee for any one employee during the calendar year measured from the date of grant shall be 100,000; |

| |

| • | the Equity Committee is not allowed to (i) grant any equity award to any Section 16 Officer of the Company, (ii) grant any performance-based compensation to any “covered employees” (as defined in Section 162(m) of the Code); or (iii) grant any equity award to any director or any officer who has been delegated authority to grant or amend the equity awards under the 2013 Plan. |

Compensation Consultant Fee Disclosure

During 2015, the Compensation Committee continued to engage Mercer, a wholly-owned subsidiary of Marsh & McLennan Companies, Inc., to assist the Compensation Committee with its responsibilities related to the Company’s executive and Board compensation programs. Other than the executive compensation consulting services to the Compensation Committee as described under “Executive Compensation—Compensation Discussion and Analysis,” Mercer did not provide any material services to the Company in 2015. Because of the policies and procedures that Mercer and the Compensation Committee have in place, the Compensation Committee believes that the advice it receives from the individual executive compensation consultant is objective and not influenced by Mercer’s or its affiliates’ relationships with the Company.

Mercer’s fees for executive compensation consulting to the Compensation Committee were approximately $155,000 during the 2015 fiscal year. Marsh, an affiliate of Mercer, provided insurance services to the Company with fees of approximately $16,000 during the 2015 fiscal year. The decision to engage Marsh was made by members of management and our Compensation Committee was aware of but did not review and approve, as those services were reviewed and approved by management in the ordinary course of business. Based on information provided by Mercer and by management of the Company, in March 2016, the Compensation Committee determined that no conflict of interest exists with, or was raised during the 2015 fiscal year by the work of, Mercer, and Mercer is independent considering all of the six factors enumerated by the SEC for evaluating adviser independence.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is responsible for making recommendations regarding candidates for directorships and the size and composition of the Board. In addition, the Nominating and Corporate Governance Committee is responsible for overseeing our corporate governance guidelines and reporting and making recommendations concerning governance matters. In evaluating, identifying and recommending nominees for the Board, our Nominating and Corporate Governance Committee considers, among other things,

| |

| • | applicable laws and regulations (including the NASDAQ listing standards); |

| |

| • | diversity, maturity, skills, experience, integrity, ability to make independent analytical inquires; and understanding of the Company’s business and business environment; and |

| |

| • | willingness to devote adequate time and effort to Board responsibilities and other relevant factors. |

We do not have a formal policy with regard to the consideration of diversity in identifying director nominees, but the Nominating and Corporate Governance Committee strives to nominate directors with a variety of individual backgrounds and complementary skills so that, as a group, the Board will possess the appropriate talent, skills and expertise to oversee our business and operations.

The Nominating and Corporate Governance Committee discusses and evaluates possible candidates in detail and the Company’s consultants are sometimes employed to help identify potential candidates. When determining whether to recommend an existing director for re-election, the Nominating and Corporate Governance Committee considers the diversity of backgrounds, experience, qualifications and performance of the existing directors to determine whether to recommend such existing members for re-election to the Board and has considered, among other things, (i) demonstrated leadership, (ii) past attendance at meetings, (iii) participation in and contributions to the activities of the Board during the director’s current term, (iv) the results of the most recent Board self-evaluation, (v) any occupation or business association change, and (vi) whether circumstances have arisen that may raise questions about a director’s continuing qualifications in relation to the Board’s membership, criteria or composition.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. Though the Compensation Committee has not established a formal policy with regard to consideration of director candidates recommended by stockholders, the Board believes that such the procedures set forth in the Company’s Amended and Restated Bylaws are currently sufficient and that the establishment of a formal policy is not necessary.

Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering or mailing a written recommendation along with any updates or supplements required by the Company’s Amended and Restated Bylaws, to the Company’s General Counsel and Secretary at the following address: Blackhawk Network Holdings, Inc., 6220 Stoneridge Mall Road, Pleasanton, CA 94588 not less than 90 days and not more than 120 days prior to the first anniversary of the Company’s annual meeting of stockholders for the preceding year; provided, however, that in the event that the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, such recommendation shall be delivered or mailed and received no earlier than 120th day prior to the Company’s annual meeting and no later than the 90th day prior to such annual meeting, or, if later, the 10th day following the day on which public disclosure of the date of such annual meeting was first made. Submissions must include the required information and follow the specified procedures set forth in the Company’s Amended and Restated Bylaws. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. The Nominating and Corporate Governance Committee will evaluate any director candidates that are properly recommended by stockholders in the same manner as it evaluates all other director candidates, as described above.

The Nominating and Corporate Governance Committee as of April 1, 2016 is composed of Mr. Bard, Mr. Aggarwal and Mr. Gyani, with Mr. Bard serving as the chair of the Compensation Committee. Potential candidates for nomination to the Board will be discussed by the Nominating and Corporate Governance Committee. The Board has affirmatively determined that each of Mr. Bard, Mr. Aggarwal and Mr. Gyani meets the definition of “independent

director” for purposes of the NASDAQ listing standards. A copy of the Nominating and Corporate Governance Committee charter is available to stockholders on our website at http://ir.blackhawknetwork.com.

Stockholder Communications with the Board of Directors

Stockholders and other interested parties may communicate with the Board at the following address:

The Board of Directors

c/o General Counsel and Secretary

Blackhawk Network Holdings, Inc.

6220 Stoneridge Mall Road

Pleasanton, CA 94588

Communications are distributed to the Board or to any individual director, as appropriate, depending on the facts and circumstances outlined in the communication. In addition, material that is unduly hostile, threatening, illegal or similarly unsuitable will be excluded, with the provision that any communication that is filtered out must be made available to any non-management director upon request.

Compensation Committee Interlocks and Insider Participation

During 2015, Messrs. Hazen and Sarin and Ms. Thompson served on our Compensation Committee. None of the members of our Compensation Committee during 2015 is or was formerly our officer or our employee. During 2015, none of our executive officers served on the compensation committee (or equivalent body) or board of directors of another entity whose executive officer served on the Compensation Committee. There are no family relationships among any of our directors or executive officers.

Limitation of Liability and Indemnification

Our Amended and Restated Certificate of Incorporation (both before and after any amendment approved pursuant to Proposal No. 3) and Amended and Restated Bylaws, provide that we will limit the liability of, and indemnify, our directors and officers and may limit the liability of, and indemnify, our employees and agents to the fullest extent permitted by the Delaware General Corporation Law, which prohibits our Amended and Restated Certificate of Incorporation from limiting the liability of our directors for the following:

| |

| • | any breach of the director’s duty of loyalty to us or to our stockholders; |

| |

| • | acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law; |

| |

| • | unlawful payment of dividends or unlawful stock repurchases or redemptions; and |

| |

| • | any transaction from which the director derived an improper personal benefit. |

If Delaware law is amended to authorize corporate action further eliminating or limiting the personal liability of a director, then the liability of our directors will be eliminated or limited to the fullest extent permitted by Delaware law, as so amended. Our Amended and Restated Certificate of Incorporation does not eliminate a director’s duty of care and, in appropriate circumstances, equitable remedies, such as injunctive or other forms of non-monetary relief, remain available under Delaware law. This provision also does not affect a director’s responsibilities under any other laws, such as the federal securities laws or other state or federal laws. The Company also is empowered to enter into indemnification agreements with our directors, officers, employees and other agents and to purchase and maintain insurance on behalf of any person who is or was a director or officer against any loss arising from any claim asserted against him or her and incurred by him or her in that capacity, subject to certain exclusions and limits of the amount of coverage. In addition to the indemnification required in our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws, we have entered into indemnification agreements with each of our directors, officers and certain employees. These agreements provide for the indemnification of our directors, officers and certain employees for all reasonable expenses and liabilities incurred in connection with any action or proceeding brought against them by reason of the fact that they are or were our agents.

PROPOSAL NO. 2: RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has engaged Deloitte & Touche LLP as our independent registered public accounting firm for the 2016 fiscal year ending December 31, 2016 and is seeking ratification of such selection by our stockholders at the Annual Meeting. Representatives of Deloitte & Touche LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our Amended and Restated Bylaws nor other governing documents or law require stockholder ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm. However, the Audit Committee is submitting the selection of Deloitte & Touche LLP to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain Deloitte & Touche LLP. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and our stockholders.

To be approved, the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm must receive a “FOR” vote from the holders of a majority in voting power over the shares of Common Stock that are present in person or represented by proxy and entitled to vote on the proposal. Abstentions and broker non-votes will be counted towards a quorum. Abstentions will have the same effect as an “AGAINST” vote for purposes of determining whether this matter has been approved. Broker non-votes will have no effect on the outcome of this proposal.

Principal Accountant Fees and Services

|

| | | | | | | | |

| Fee Category | | Fiscal 2015 Fees ($) | | Fiscal 2014 Fees ($) |

| Audit Fees | | $ | 2,333,000 |

| | $ | 2,532,000 |

|

| Tax Fees | | 850,000 |

| | 411,000 |

|

| Total Fees | | $ | 3,183,000 |

| | $ | 2,943,000 |

|

Audit Fees

Audit fees represent fees billed for professional services rendered for the audit of our annual financial statements, including reviews of our quarterly financial statements, as well as audit services provided in 2015 in connection with acquisitions, certain regulatory filings including our 2015 filings of reports on Form 8-K, consents and other SEC related work. Included in our Audit Fees for 2014 are also fees for services rendered in connection with the Safeway’s distribution of its remaining 37.8 million shares of our Class B common stock to Safeway stockholders, or the Spin-Off.

Tax Fees

Tax fees include fees for services relating to tax compliance, tax planning and tax advice. These services include assistance regarding federal, state and international tax compliance and tax return preparation.

All Other Fees

There were no other fees of Deloitte & Touche LLP during 2015 and 2014.

Pre-Approval Policies and Procedures

The Audit Committee pre-approves all audit and non-audit services provided by its independent registered public accounting firm. This policy is set forth in the charter of the Audit Committee and available on our website at http:// ir.blackhawknetwork.com. The Audit Committee approved all audit and other services provided by Deloitte for

2015 and the estimated costs of those services. Actual amounts billed, to the extent in excess of the estimated amounts, were periodically reviewed and approved by the Audit Committee.

The Audit Committee considered whether the non-audit services rendered by Deloitte were compatible with maintaining Deloitte’s independence and concluded that they were so compatible.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR

THE RATIFICATION OF THE SELECTION OF DELOITTE & TOUCHE LLP

AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR THE 2016 FISCAL YEAR ENDING DECEMBER 31, 2016.

PROPOSAL NO. 3: APPROVAL OF THE COMPANY’S THIRD AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION, IN ORDER TO DECLASSIFY THE BOARD OF DIRECTORS BEGINNING AT THE COMPANY’S ANNUAL MEETING OF STOCKHOLDERS IN 2017

The Company’s Second Amended and Restated Certificate of Incorporation, or the Certificate, currently in effect provides that the Board is classified into three classes, as nearly equal in number as possible, with one class to be elected by the stockholders each year for a three-year term.

While our Board continues to believe that experience, stability and continuity among Board members are important factors in effective corporate governance, it also is aware of the increasing demand in the stockholder community for annual election of directors as a means to promote Board accountability. Accordingly, both the Board and the Nominating and Corporate Governance Committee have concluded that it is in the best interests of the Company’s stockholders to declassify the Board.

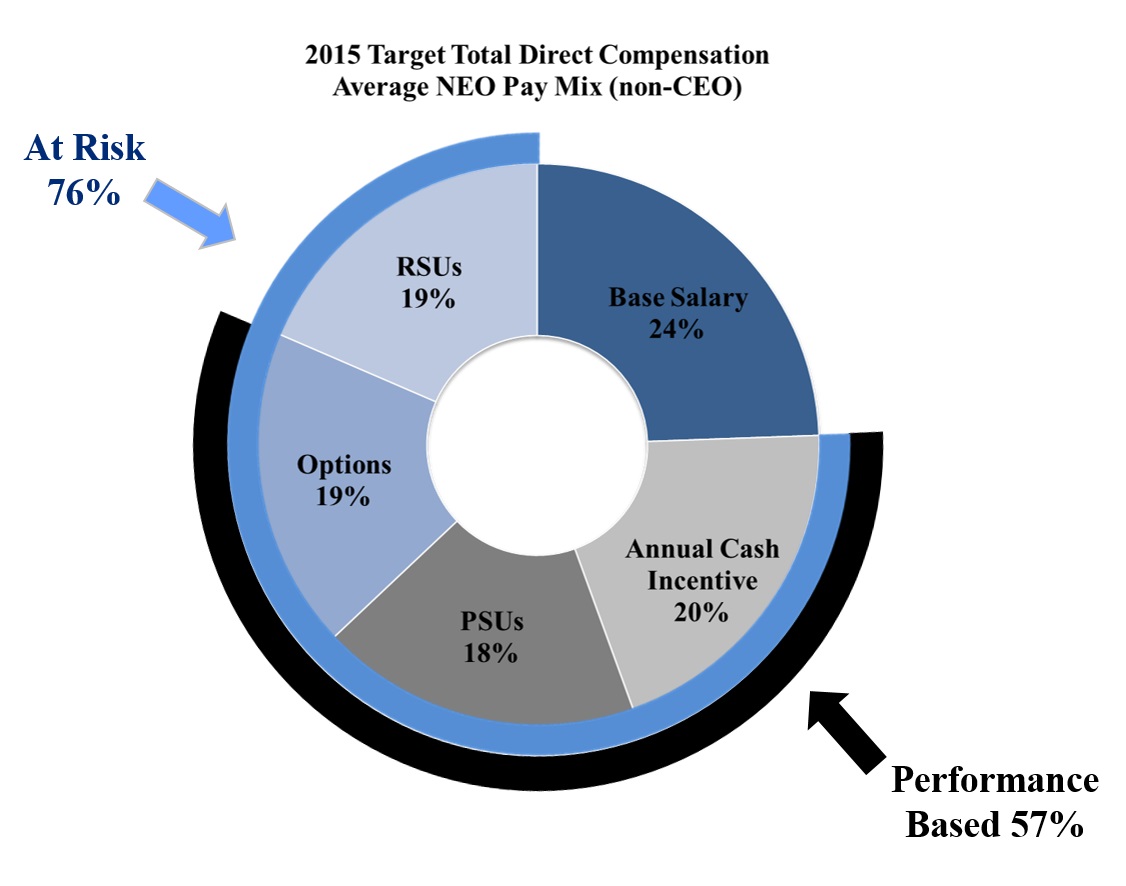

If the proposed Third Amended and Restated Certificate of Incorporation is approved by the requisite percentage of stockholders, the Company will transition to a declassified structure under which the entire Board will stand for election annually beginning in 2017. As part of the transition, the current Class I directors (currently serving a term expiring in 2017), Class II directors (currently serving a term expiring in 2018) and the Class III nominees being elected at this Annual Meeting will tender their resignations from the Board effective immediately prior to the 2017 annual meeting of stockholders. In that case, the terms of all incumbent directors will terminate at the 2017 annual meeting of stockholders, and all directors will begin standing for annual election beginning at the 2017 annual meeting.