Exhibit 99.1

Presentation to AAA Investors on Athene February 2013

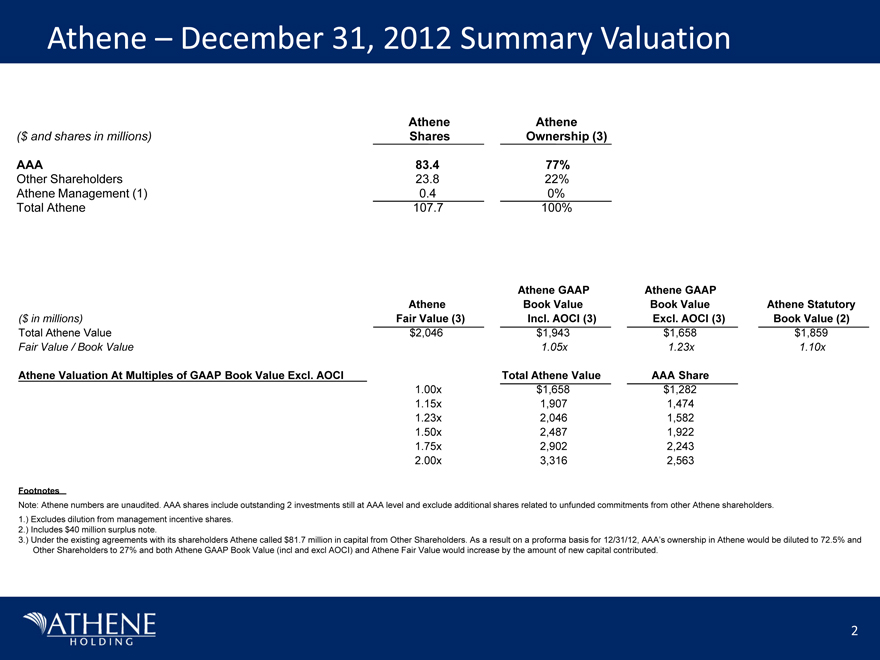

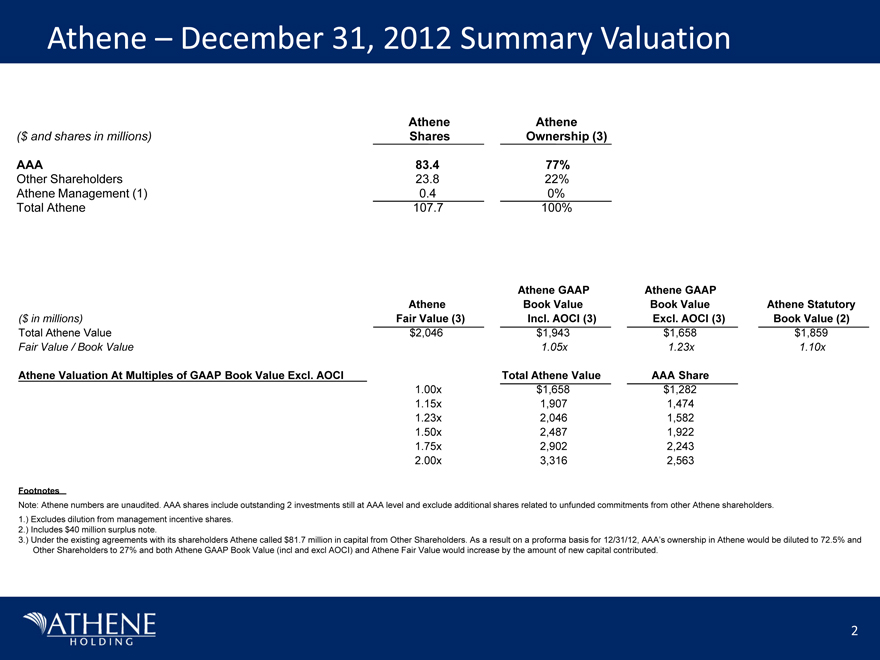

Athene – December 31, 2012 Summary Valuation 2 Athene GAAP Athene GAAP Athene

Book Value Book Value Athene Statutory ($ in millions) Fair Value (3) Incl. AOCI

(3) Excl. AOCI (3) Book Value (2) Total Athene Value $2,046 $1,943 $1,658 $1,859

Fair Value / Book Value 1.05x 1.23x 1.10x Athene Valuation At Multiples of GAAP

Book Value Excl. AOCI Total Athene Value AAA Share 1.00x $1,658 $1,282 1.15x

1,907 1,474 1.23x 2,046 1,582 1.50x 2,487 1,922 1.75x 2,902 2,243 2.00x 3,316

2,563 Footnotes Note: Athene numbers are unaudited. AAA shares include

outstanding 2 investments still at AAA level and exclude additional shares

related to unfunded commitments from other Athene shareholders. 1.) Excludes

dilution from management incentive shares. 2.) Includes $40 million surplus

note. 3.) Under the existing agreements with its shareholders Athene called

$81.7 million in capital from Other Shareholders. As a result on a proforma

basis for 12/31/12, AAA’s ownership in Athene would be diluted to 72.5% and

Other Shareholders to 27% and both Athene GAAP Book Value (incl and excl AOCI)

and Athene Fair Value would increase by the amount of new capital contributed.

Athene Athene ($ and shares in millions) Shares Ownership (3) AAA 83.4 77% Other

Shareholders 23.8 22% Athene Management (1) 0.4 0% Total Athene 107.7 100%

3 The Business Model Athene is effectively a spread business Athene earns the

difference between its investment return on assets and the rate on its

liabilitiesReturn on equity (ROE) benefits from targeted leverage of

approximately 10x-14x (using a non GAAP Management View measure)Because fixed

annuities provide stable, long-term funding, Athene’s objective is to capture

today’s historically high spreads for the life of the liabilitiesAs of September

30, 2012, 80% of the liabilities are subject to surrender charges and 44% of the

liabilities also have Market Value Adjustments. Surrender charges and Market

Value Adjustments discourage withdrawal, but cannot prevent them. The

Opportunity Athene was formed in July 2009 to capitalize on favorable market

conditions in the dislocated annuity insurancesector Upheaval / volatility in

financial markets increased the demand for guaranteed savings products by retail

investorsLife insurers withdrew from the fixed annuity market and are writing

less new business and looking to divest blocks of existing liabilities due to

capital needs that were impacted negatively by the financial crisisRegulatory

environment encourages many insurance companies to explore

reinsuranceDemographics point to a long-term opportunity, driven by dramatically

increased need for tax-efficient savings vehicles to support aging baby-boomers

The Partnership Athene and Apollo bring together a unique combination of

insurance industry experience, investment and risk management expertise and

access to capital Athene was envisioned by Jim Belardi and Chip Gillis, two

executives with extensive experience in both insurance and asset managementThey

are supported by a team with significant actuarial, risk management, and product

design expertiseApollo Global Management LLC’s (“Apollo” or “AGM”) early

involvement represented a vote of confidence, and provided invaluable exposure

to risk management, investment capabilities and client relationships The Vision

Athene is positioned to become a global leader in the fixed annuity business

Athene has successfully executed a number of acquisitions (Liberty Life

Insurance Company (“LLIC”), Investors Insurance Corporation (“IIC”),

Presidential Life Insurance Company (“PLIC”)), and currently in the process of

closing the Aviva USA acquisition, to build scaleThe next stage is to

consolidate and expand Athene from a strong base, with a focus on policyholder

protection, disciplined production of quality business and market-leading risk

management Athene – Who We Are

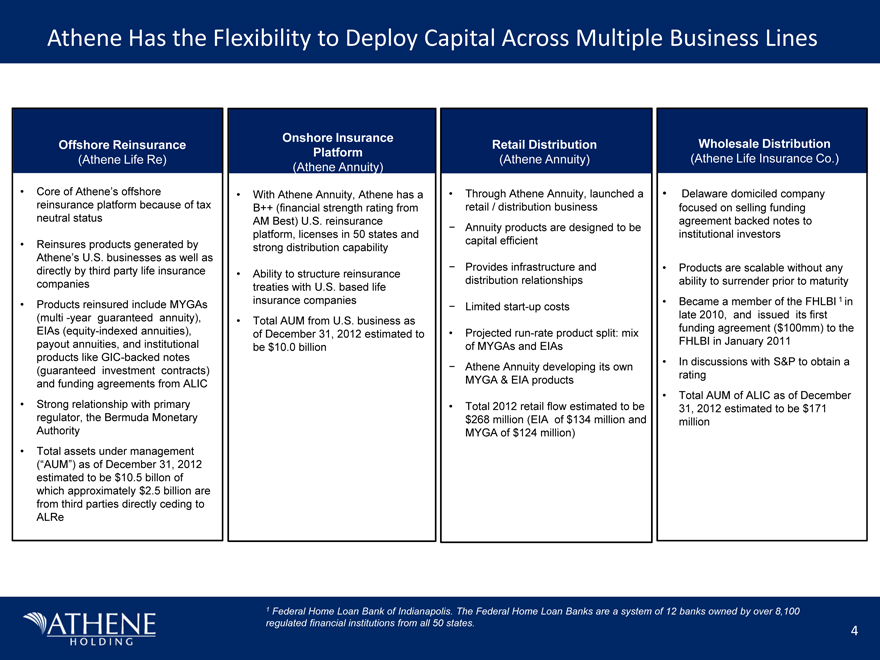

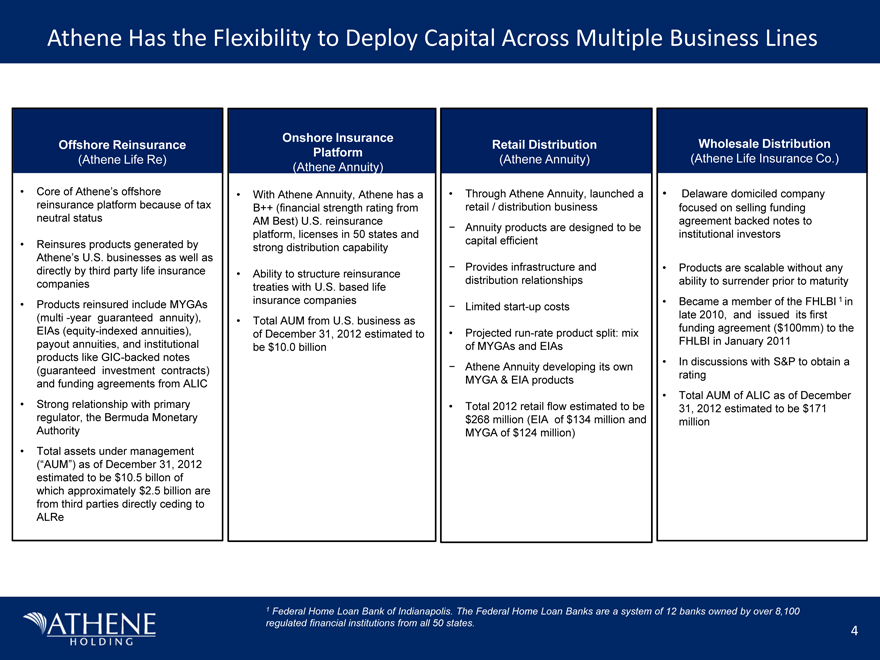

Onshore Life Insurance Platform (Athene Annuity) Wholesale Distribution (Athene

Life Insurance Co) Offshore Reinsurance (Athene Life Re) Core of Athene’s

offshore reinsurance platform because of tax neutral status Reinsures products

generated by Athene’s U.S. businesses as well as directly by third party life

insurance companies Products reinsured include MYGAs (multi -year guaranteed

annuity), EIAs (equity-indexed annuities), payout annuities, and institutional

products like GIC-backed notes (guaranteed investment contracts) and funding

agreements from ALIC Strong relationship with primary regulator, the Bermuda

Monetary Authority Total assets under management (“AUM”) as of December 31, 2012

estimated to be $10.5 billon of which approximately $2.5 billion are from third

parties directly ceding to ALRe Onshore Insurance Platform (Athene Annuity)

Wholesale Distribution (Athene Life Insurance Co.) Retail Distribution (Athene

Annuity) With Athene Annuity, Athene has a B++ (financial strength rating from

AM Best) U.S. reinsurance platform, licenses in 50 states and strong

distribution capability Ability to structure reinsurance treaties with U.S.

based life insurance companies Total AUM from U.S. business as of December 31,

2012 estimated to be $10.0 billion Delaware domiciled company focused on

selling funding agreement backed notes to institutional investors Products are

scalable without any ability to surrender prior to maturity Became a member of

the FHLBI 1 in late 2010, and issued its first funding agreement ($100mm) to the

FHLBI in January 2011 In discussions with S&P to obtain a rating Total AUM of

ALIC as of December 31, 2012 estimated to be $171 million Through Athene

Annuity, launched a retail / distribution business Annuity products are designed

to be capital efficient Provides infrastructure and distribution relationships

Limited start-up costs Projected run-rate product split: mix of MYGAs and EIAs

Athene Annuity developing its own MYGA & EIA products Total 2012 retail flow

estimated to be $268 million (EIA of $134 million and MYGA of $124 million) 1

Federal Home Loan Bank of Indianapolis. The Federal Home Loan Banks are a system

of 12 banks owned by over 8,100 regulated financial institutions from all 50

states. 4 Athene Has the Flexibility to Deploy Capital Across Multiple Business

Lines

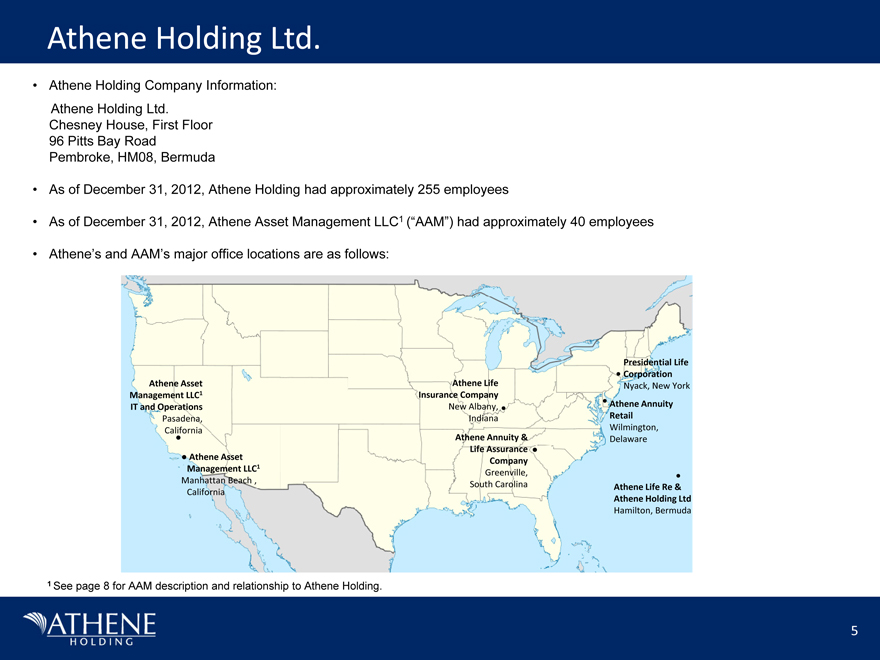

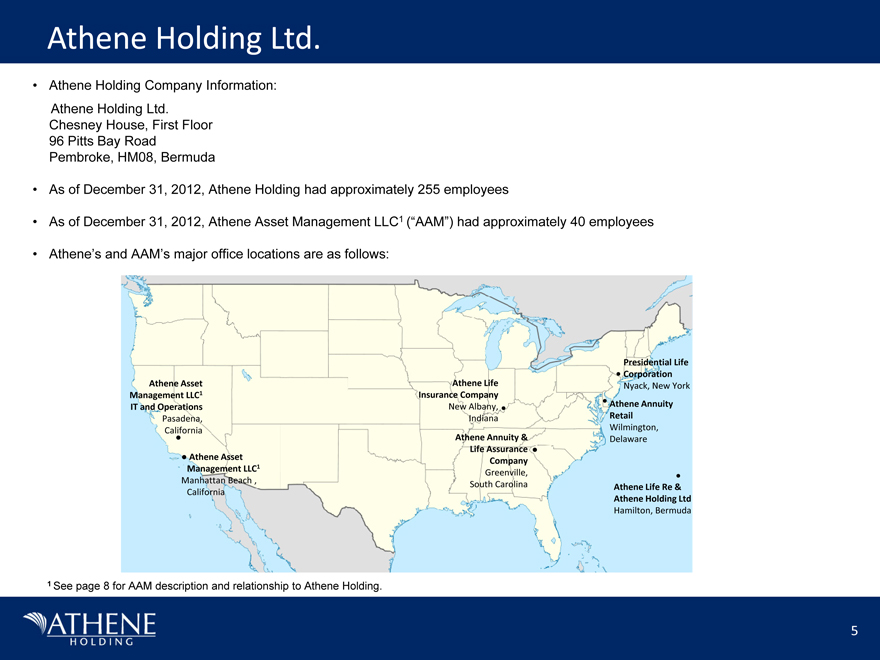

5 | | Athene Holding Company Information: Athene Holding Ltd. Chesney House, First |

Floor 96 Pitts Bay Road Pembroke, HM08, Bermuda As of December 31, 2012, Athene

Holding had approximately 255 employees As of December 31, 2012, Athene Asset

Management LLC1 (“AAM”) had approximately 40 employees Athene’s and AAM’s major

office locations are as follows: Athene Asset Management LLC1 Manhattan

Beach , California Athene Life Re & Athene Holding Ltd Hamilton, Bermuda

Athene Annuity Retail Wilmington, Delaware Athene Life Insurance Company New

Albany, Indiana Presidential Life Corporation Nyack, New York Athene Annuity

& Life Assurance Company Greenville, South Carolina Athene Asset Management

LLC1 IT and Operations Pasadena, California 1 See page 8 for AAM description and

relationship to Athene Holding. Athene Holding Ltd.

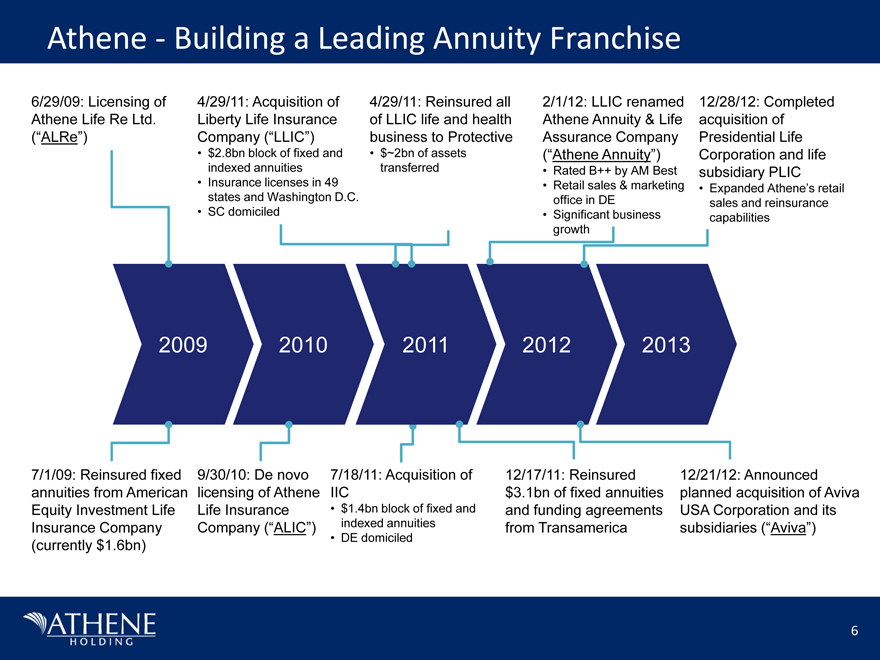

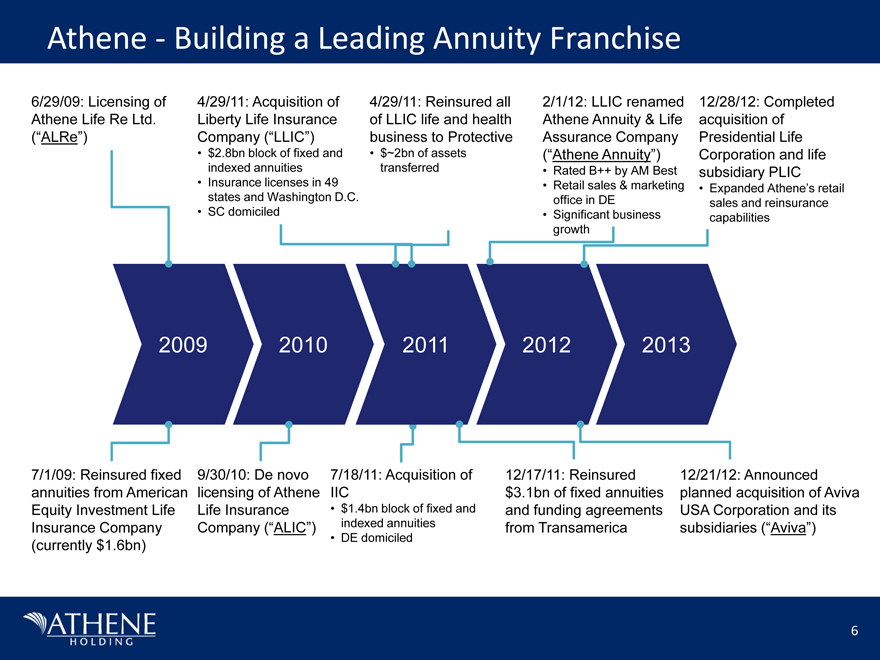

6 | | Athene—Building a Leading Annuity Franchise 2009 6/29/09: Licensing of |

Athene Life Re Ltd. (“ALRe”) 2010 2011 2012 2013 4/29/11: Acquisition of Liberty

Life Insurance Company (“LLIC”) $2.8bn block of fixed and indexed annuities

Insurance licenses in 49 states and Washington D.C. SC domiciled 7/18/11:

Acquisition of IIC $1.4bn block of fixed and indexed annuities DE domiciled

2/1/12: LLIC renamed Athene Annuity & Life Assurance Company (“Athene Annuity”)

Rated B++ by AM Best Retail sales & marketing office in DE Significant business

growth 12/21/12: Announced planned acquisition of Aviva USA Corporation and its

subsidiaries (“Aviva”) 4/29/11: Reinsured all of LLIC life and health business

to Protective $~2bn of assets transferred 12/17/11: Reinsured $3.1bn of fixed

annuities and funding agreements from Transamerica 12/28/12: Completed

acquisition of Presidential Life Corporation and life subsidiary PLIC Expanded

Athene’s retail sales and reinsurance capabilities 9/30/10: De novo licensing of

Athene Life Insurance Company (“ALIC”) 7/1/09: Reinsured fixed annuities from

American Equity Investment Life Insurance Company (currently $1.6bn)

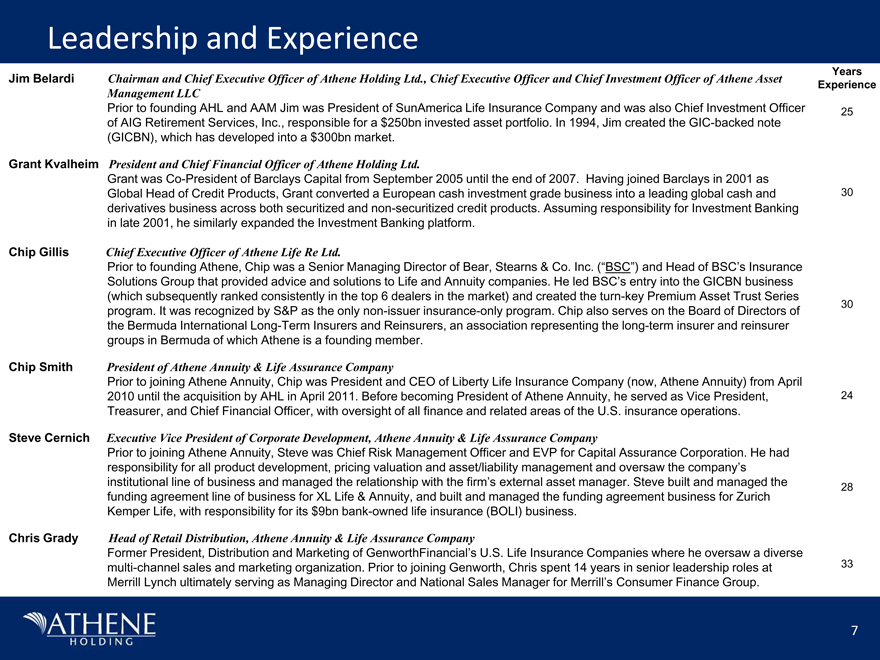

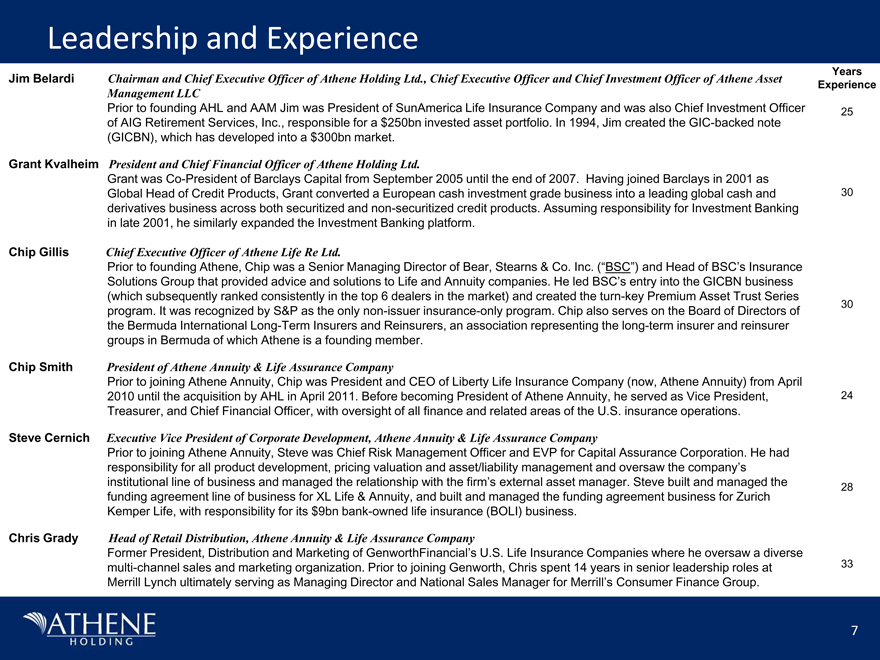

Jim BelardiChairman and Chief Executive Officer of Athene Holding Ltd., Chief

Executive Officer and Chief Investment Officer of Athene Asset Management LLC

Prior to founding AHL and AAM Jim was President of SunAmerica Life Insurance

Company and was also Chief Investment Officer of AIG Retirement Services, Inc.,

responsible for a $250bn invested asset portfolio. In 1994, Jim created the

GIC-backed note (GICBN), which has developed into a $300bn market. Grant

KvalheimPresident and Chief Financial Officer of Athene Holding Ltd. Grant

was Co-President of Barclays Capital from September 2005 until the end of 2007.

Having joined Barclays in 2001 as Global Head of Credit Products, Grant

converted a European cash investment grade business into a leading global cash

and derivatives business across both securitized and non-securitized credit

products. Assuming responsibility for Investment Banking in late 2001, he

similarly expanded the Investment Banking platform. Chip GillisChief Executive

Officer of Athene Life Re Ltd. Prior to founding Athene, Chip was a Senior

Managing Director of Bear, Stearns & Co. Inc. (“BSC”) and Head of BSC’s

Insurance Solutions Group that provided advice and solutions to Life and Annuity

companies. He led BSC’s entry into the GICBN business (which subsequently ranked

consistently in the top 6 dealers in the market) and created the turn-key

Premium Asset Trust Series program. It was recognized by S&P as the only

non-issuer insurance-only program. Chip also serves on the Board of Directors of

the Bermuda International Long-Term Insurers and Reinsurers, an association

representing the long-term insurer and reinsurer groups in Bermuda of which

Athene is a founding member. Chip SmithPresident of Athene Annuity & Life

Assurance Company Prior to joining Athene Annuity, Chip was President and CEO

of Liberty Life Insurance Company (now, Athene Annuity) from April 2010 until

the acquisition by AHL in April 2011. Before becoming President of Athene

Annuity, he served as Vice President, Treasurer, and Chief Financial Officer,

with oversight of all finance and related areas of the U.S. insurance

operations. Steve CernichExecutive Vice President of Corporate Development,

Athene Annuity & Life Assurance Company Prior to joining Athene Annuity,

Steve was Chief Risk Management Officer and EVP for Capital Assurance

Corporation. He had responsibility for all product development, pricing

valuation and asset/liability management and oversaw the company’s institutional

line of business and managed the relationship with the firm’s external asset

manager. Steve built and managed the funding agreement line of business for XL

Life & Annuity, and built and managed the funding agreement business for Zurich

Kemper Life, with responsibility for its $9bn bank-owned life insurance (BOLI)

business. Chris GradyHead of Retail Distribution, Athene Annuity & Life

Assurance Company Former President, Distribution and Marketing of

GenworthFinancial’s U.S. Life Insurance Companies where he oversaw a diverse

multi-channel sales and marketing organization. Prior to joining Genworth, Chris

spent 14 years in senior leadership roles at Merrill Lynch ultimately serving as

Managing Director and National Sales Manager for Merrill’s Consumer Finance

Group. Years Experience 25 30 30 24 28 33 7 Leadership and Experience

Athene Asset Management – Strategy & Philosophy AAM1 is a buy and hold, total

return focused asset manager. As a result of the focus on asset allocation and

the need to adjust allocations as markets change, management views realized

gains as an important part of Athene’s earnings. Primarily manages diversified

fixed income portfolios, including allocations to Alternative Investments (hedge

funds, private equity) AAM is able to capture excess spread and generate

investment alpha through opportunistic portfolio allocation and by taking

complexity and illiquidity risk as well as credit risk Because Athene is a

patient, long-term investor that is comfortable with difficult to understand

products and situations, AAM is able to take advantage of opportunities often

overlooked by others AAM was formed shortly after the 2008 credit crisis, and

took advantage of opportunities to purchase high quality assets at depressed

prices Experienced in the nuances of insurance regulatory regimes and structures

efficient portfolios to optimize regulatory capital requirements Employs

sophisticated risk management practices to measure, manage, and shape the risk

in its portfolios Utilizes proprietary models to value, trade, and manage assets

Individual security selection is driven by fundamental credit analysis Generally

seeks investments that are cash flowing, exhibit mispricing or asset

dislocation, avoid binary outcomes, and are pull to par over the investment

horizon AAM manages all Athene assets. Of the total Athene AUM as of December

31, 2012, 63% is internally managed, 33% is sub- advised by Apollo and 4% is

sub-advised by other managers 8 1 AAM is owned by Apollo Global Management LLC

(“AGM” or “Apollo”) and certain members of Athene’s management team

Athene Asset Management – Risk Management AAM also provides asset risk

management services, utilizing a suite of systems, models, and methodologies in

measuring, managing, and monitoring the various risks in the asset portfolios

managed by AAM. AAM employs individuals with extensive risk management

experience across a variety of fixed income assets and trading environments. AAM

prepares weekly and monthly Risk Reports used by management, the Board, and

portfolio managers in tracking various risk metrics (durations, convexity,

weighted average life, deltas, cash flow mismatches, etc.) and investment risk

limits in the asset portfolios and relative to the liabilities. AAM measures

liquidity in the asset portfolio, hedges non-USD FX risk, and performs

credit-related and other macroeconomic stress tests to the portfolios. AAM

reports to the Risk Committee of Athene’s Board of Directors that convenes

quarterly to discuss risks and opportunities in Athene’s various portfolios and

to decide on changes in risk management focus or strategy, if any. 9

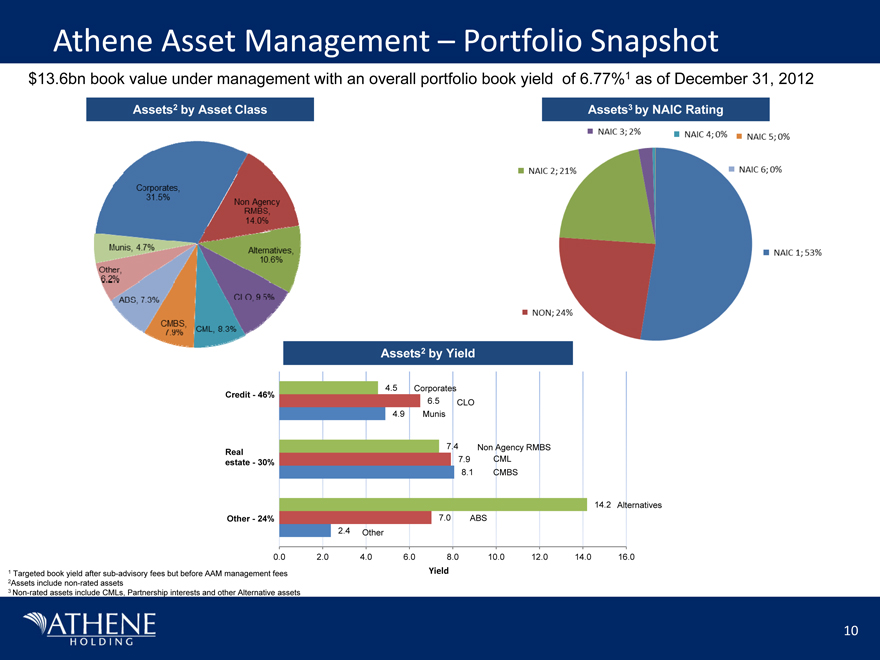

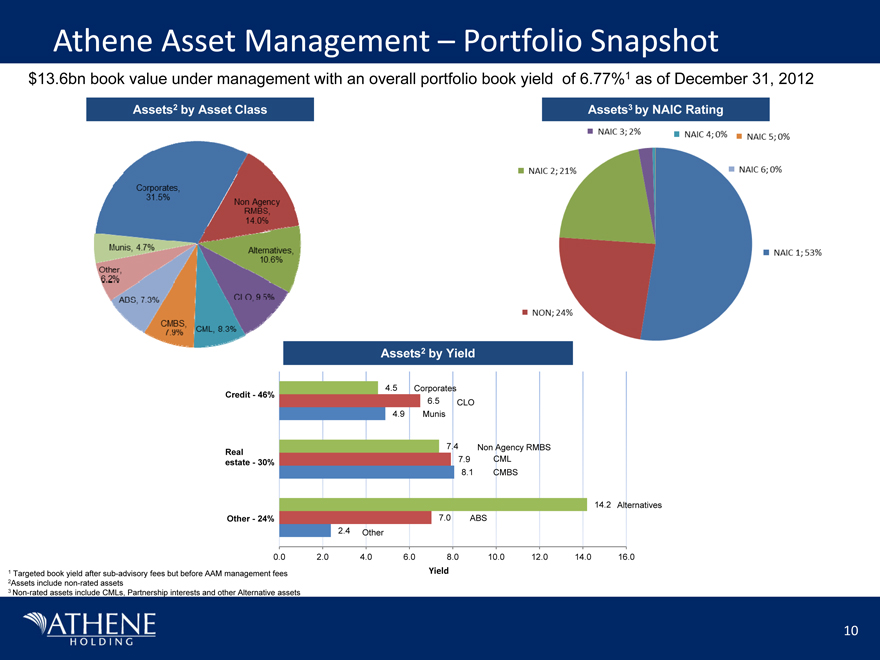

Athene Asset Management – Portfolio Snapshot $13.6bn book value under management

with an overall portfolio book yield of 6.77%1 as of December 31, 2012 Assets2

by Yield (CHART) 10 1 Targeted book yield after sub-advisory fees but before AAM

management fees 2Assets include non-rated assets 3 Non-rated assets include

CMLs, Partnership interests and other Alternative assets Assets3 by NAIC Rating

Assets2 by Asset Class

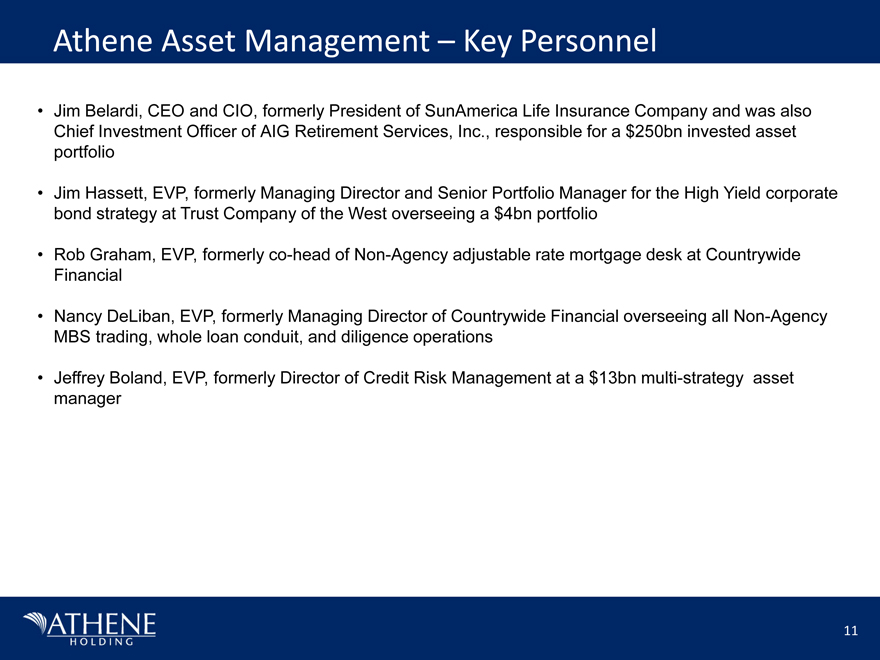

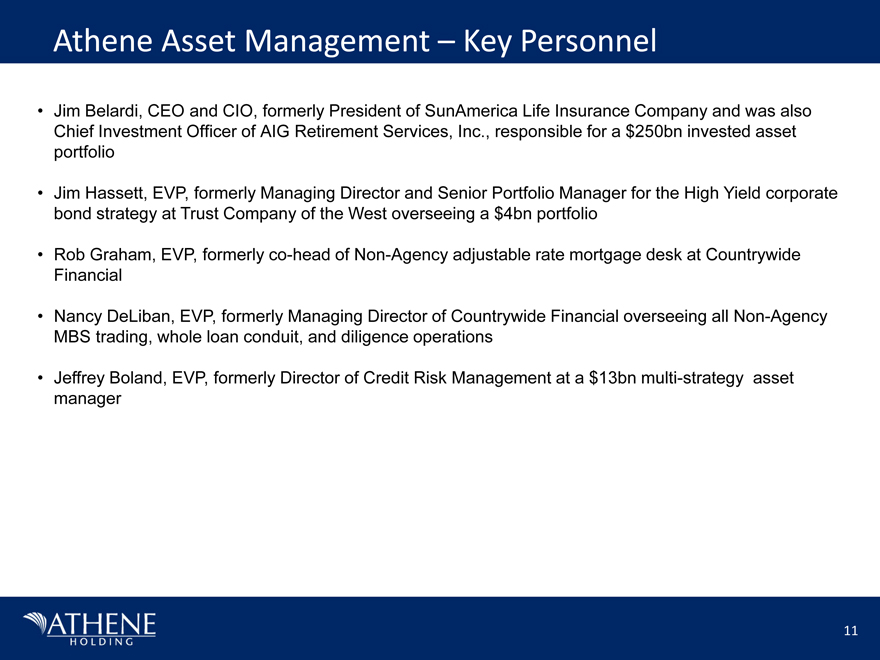

Athene Asset Management – Key Personnel Jim Belardi, CEO and CIO, formerly

President of SunAmerica Life Insurance Company and was also Chief Investment

Officer of AIG Retirement Services, Inc., responsible for a $250bn invested

asset portfolio Jim Hassett, EVP, formerly Managing Director and Senior

Portfolio Manager for the High Yield corporate bond strategy at Trust Company of

the West overseeing a $4bn portfolio Rob Graham, EVP, formerly co-head of

Non-Agency adjustable rate mortgage desk at Countrywide Financial Nancy DeLiban,

EVP, formerly Managing Director of Countrywide Financial overseeing all

Non-Agency MBS trading, whole loan conduit, and diligence operations Jeffrey

Boland, EVP, formerly Director of Credit Risk Management at a $13bn

multi-strategy asset manager 11

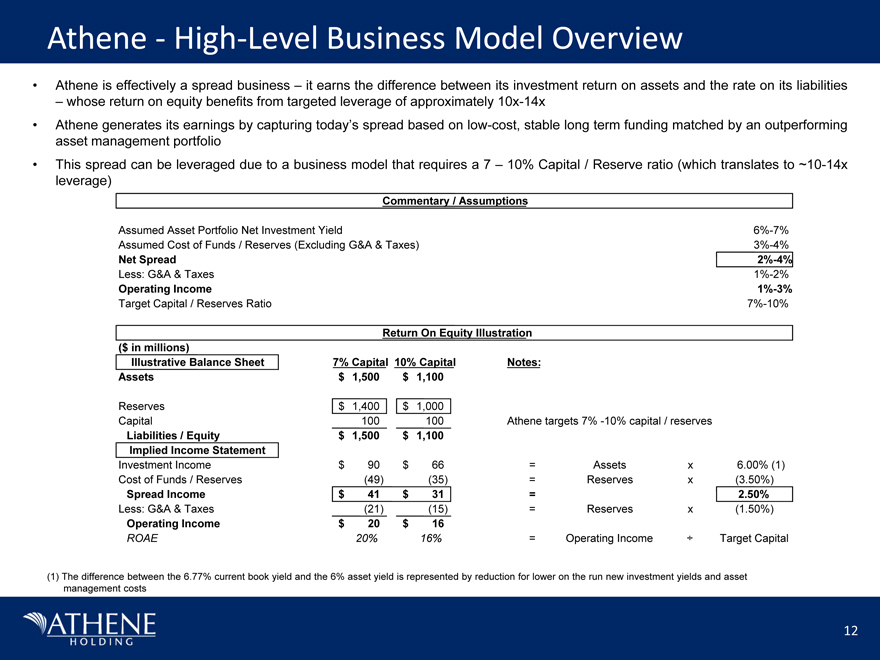

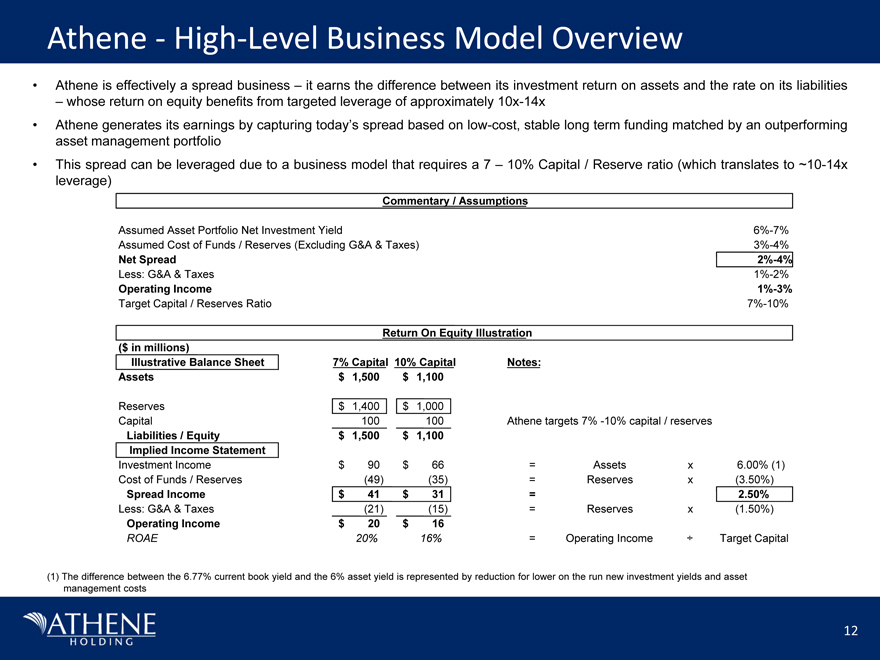

Athene—High-Level Business Model Overview 12 Athene is effectively a spread

business – it earns the difference between its investment return on assets and

the rate on its liabilities – whose return on equity benefits from targeted

leverage of approximately 10x-14x Athene generates its earnings by capturing

today’s spread based on low-cost, stable long term funding matched by an

outperforming asset management portfolio This spread can be leveraged due to a

business model that requires a 7 – 10% Capital / Reserve ratio (which translates

to ~10-14x leverage) (1) The difference between the 6.77% current book yield and

the 6% asset yield is represented by reduction for lower on the run new

investment yields and asset management costs

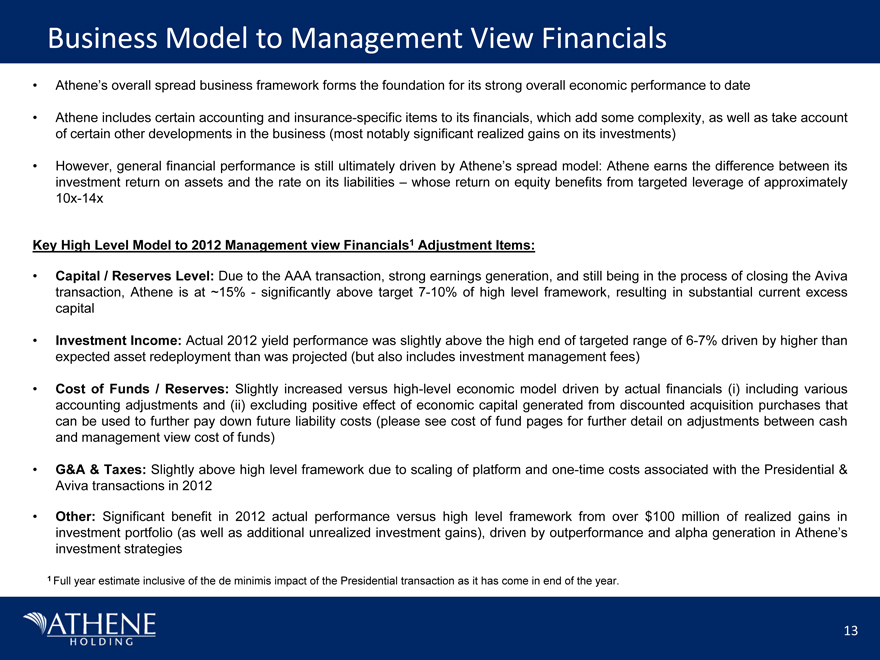

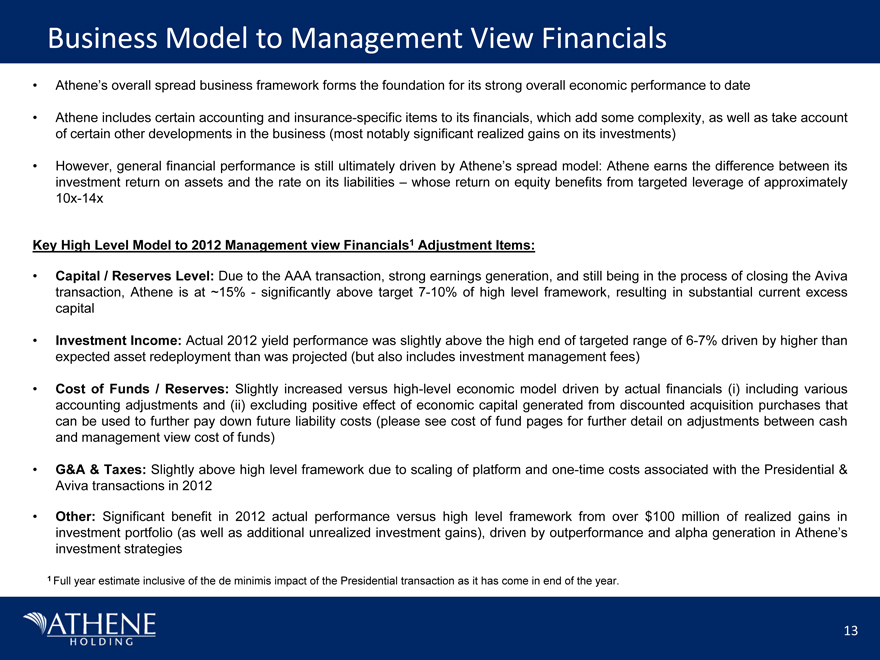

Business Model to Management View Financials 13 Athene’s overall spread business

framework forms the foundation for its strong overall economic performance to

date Athene includes certain accounting and insurance-specific items to its

financials, which add some complexity, as well as take account of certain other

developments in the business (most notably significant realized gains on its

investments) However, general financial performance is still ultimately driven

by Athene’s spread model: Athene earns the difference between its investment

return on assets and the rate on its liabilities – whose return on equity

benefits from targeted leverage of approximately 10x-14x Key High Level Model to

2012 Management view Financials1 Adjustment Items: Capital / Reserves Level: Due

to the AAA transaction, strong earnings generation, and still being in the

process of closing the Aviva transaction, Athene is at ~15%—significantly

above target 7-10% of high level framework, resulting in substantial current

excess capital Investment Income: Actual 2012 yield performance was slightly

above the high end of targeted range of 6-7% driven by higher than expected

asset redeployment than was projected (but also includes investment management

fees) Cost of Funds / Reserves: Slightly increased versus high-level economic

model driven by actual financials (i) including various accounting adjustments

and (ii) excluding positive effect of economic capital generated from discounted

acquisition purchases that can be used to further pay down future liability

costs (please see cost of fund pages for further detail on adjustments between

cash and management view cost of funds) G&A & Taxes: Slightly above high level

framework due to scaling of platform and one-time costs associated with the

Presidential & Aviva transactions in 2012 Other: Significant benefit in 2012

actual performance versus high level framework from over $100 million of

realized gains in investment portfolio (as well as additional unrealized

investment gains), driven by outperformance and alpha generation in Athene’s

investment strategies 1 Full year estimate inclusive of the de minimis impact of

the Presidential transaction as it has come in end of the year.

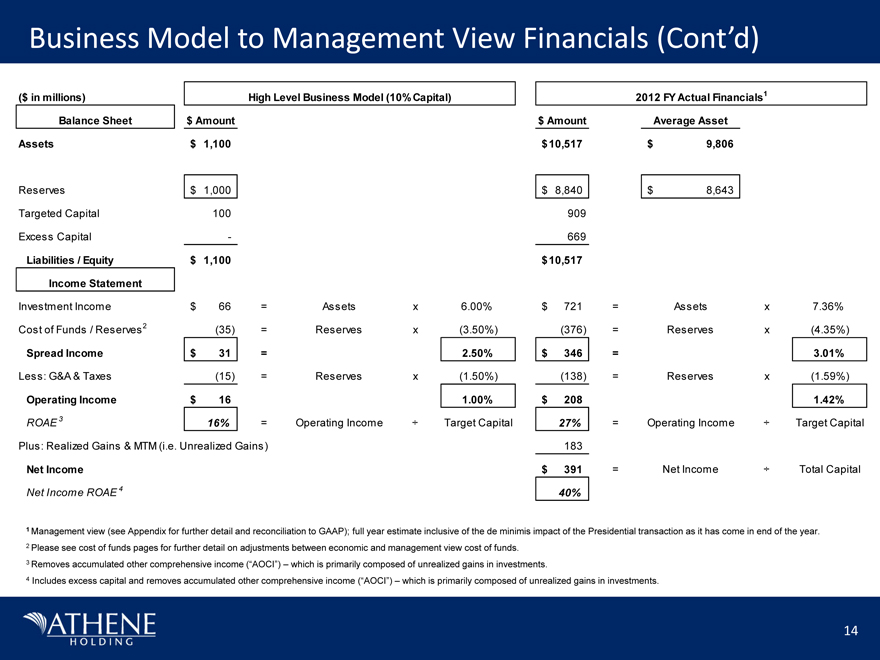

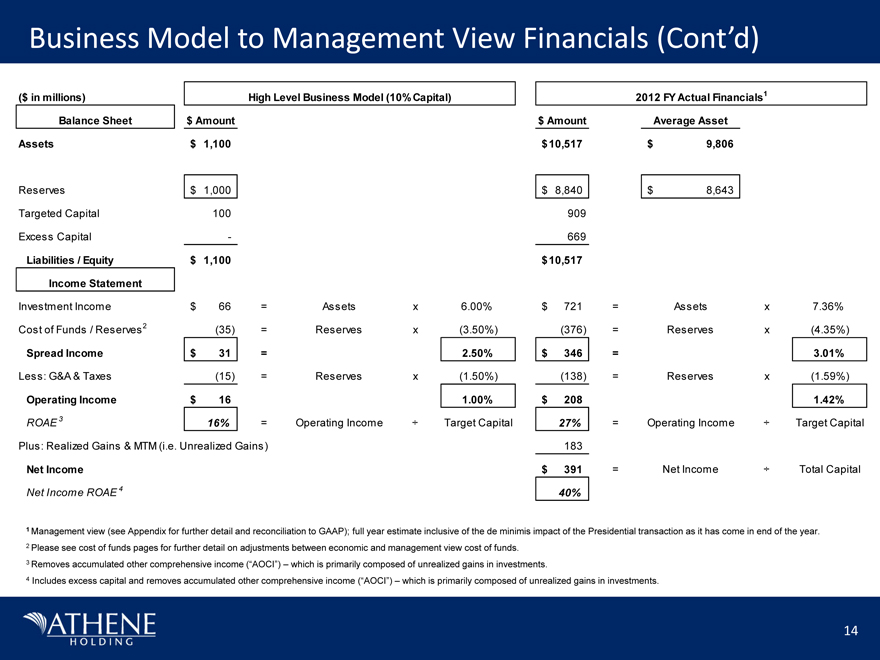

Business Model to Management View Financials (Cont’d) 14 1 Management view (see

Appendix for further detail and reconciliation to GAAP); full year estimate

inclusive of the de minimis impact of the Presidential transaction as it has

come in end of the year. 2 Please see cost of funds pages for further detail on

adjustments between economic and management view cost of funds. 3 Removes

accumulated other comprehensive income (“AOCI”) – which is primarily composed of

unrealized gains in investments. 4 Includes excess capital and removes

accumulated other comprehensive income (“AOCI”) – which is primarily composed of

unrealized gains in investments.

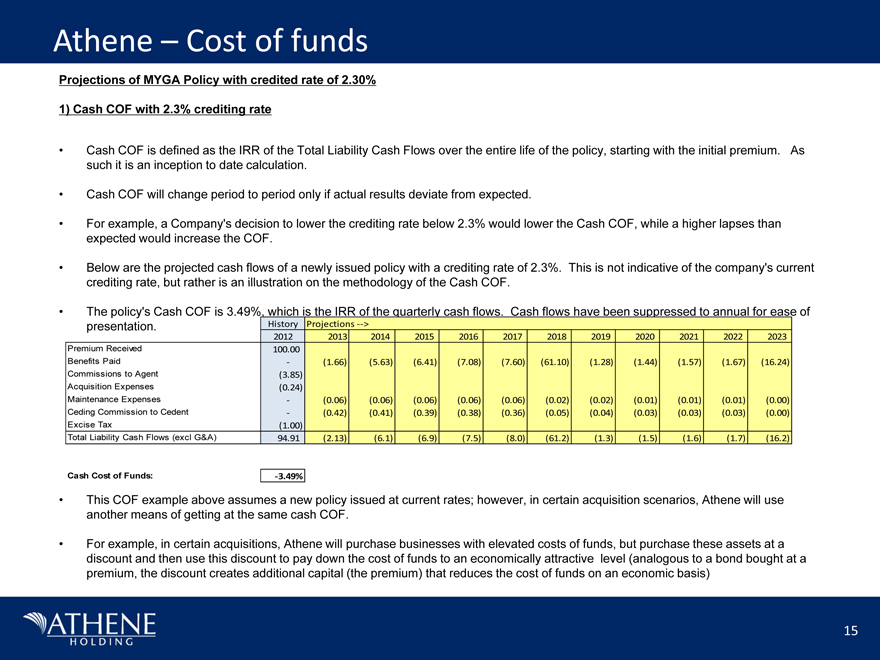

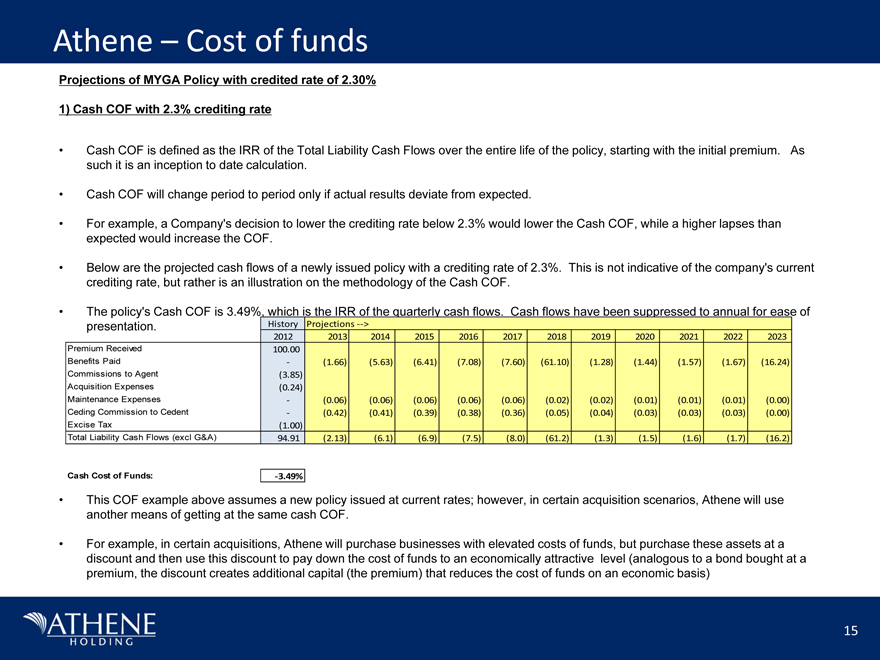

Athene – Cost of funds 15 Projections of MYGA Policy with credited rate of 2.30%

1) Cash COF with 2.3% crediting rate Cash COF is defined as the IRR of the Total

Liability Cash Flows over the entire life of the policy, starting with the

initial premium. As such it is an inception to date calculation. Cash COF will

change period to period only if actual results deviate from expected. For

example, a Company’s decision to lower the crediting rate below 2.3% would lower

the Cash COF, while a higher lapses than expected would increase the COF. Below

are the projected cash flows of a newly issued policy with a crediting rate of

2.3%. This is not indicative of the company’s current crediting rate, but rather

is an illustration on the methodology of the Cash COF. The policy’s Cash COF is

3.49%, which is the IRR of the quarterly cash flows. Cash flows have been

suppressed to annual for ease of presentation. This COF example above assumes a

new policy issued at current rates; however, in certain acquisition scenarios,

Athene will use another means of getting at the same cash COF. For example, in

certain acquisitions, Athene will purchase businesses with elevated costs of

funds, but purchase these assets at a discount and then use this discount to pay

down the cost of funds to an economically attractive level (analogous to a bond

bought at a premium, the discount creates additional capital (the premium) that

reduces the cost of funds on an economic basis)

Athene – Cost of funds (Cont’d) 16 2) Management View COF1 Athene’s management

view financials include certain accounting-based items that create differences

with cash (i.e. economic) COF First, management view COF applies some

insurance-based accounting concepts (most notably DAC) that add non-cash

expenses to the cost of liabilities Second, in the case of acquisitions,

management view COF excludes any additional capital created from purchases made

at a discount – capital that from an economic basis can be used to further pay

down the cost of liabilities Management view COF differs in approach from cash

COF as the former incorporates certain GAAP accounting concepts without

purporting to be in accordance with GAAP1 However, from an underwriting and

economic point of view, Athene follows the approach of Cash COF 1 Management

View accounting; please see Appendix for bridge between Management View and

GAAP.

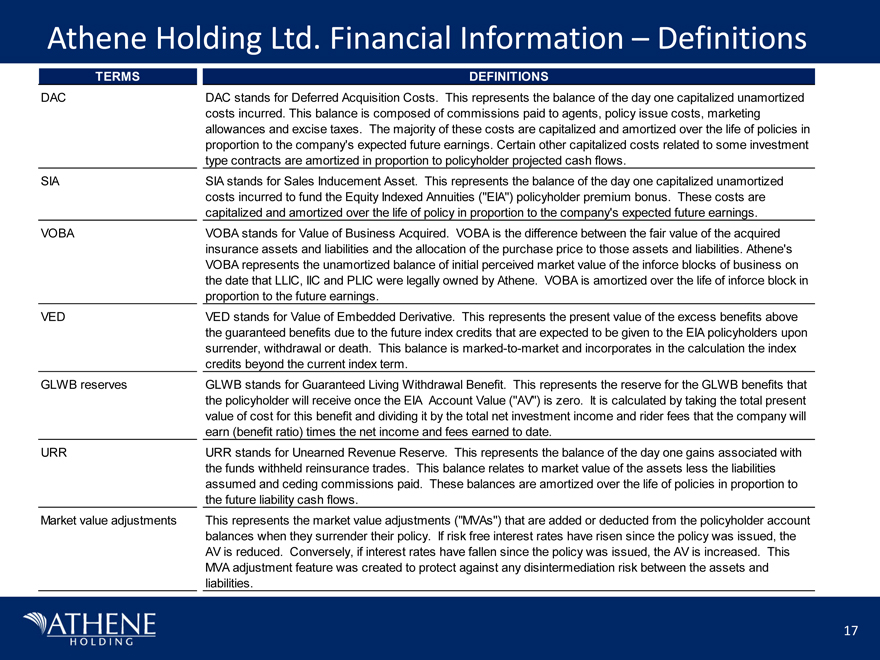

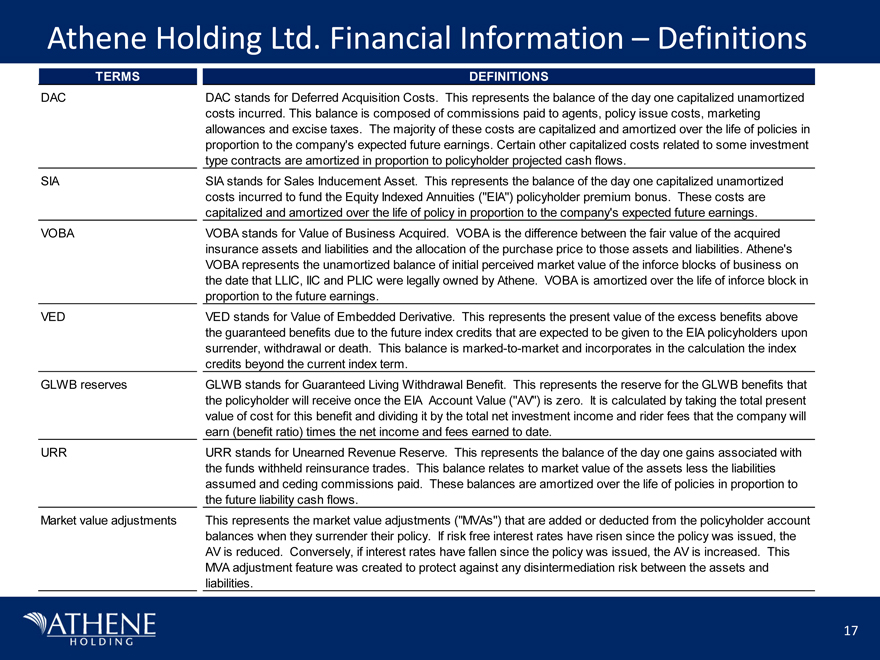

17 Athene Holding Ltd. Financial Information – Definitions

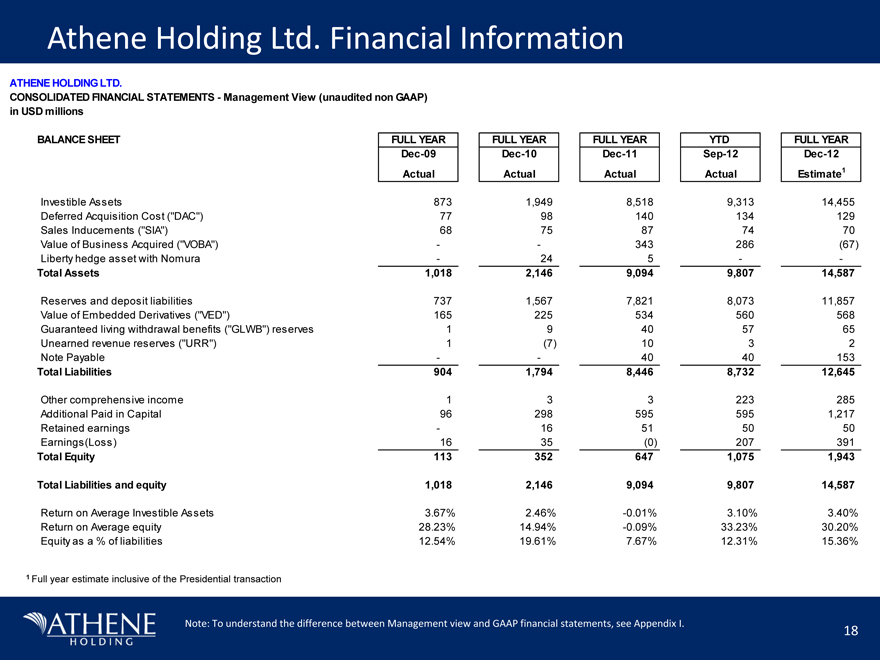

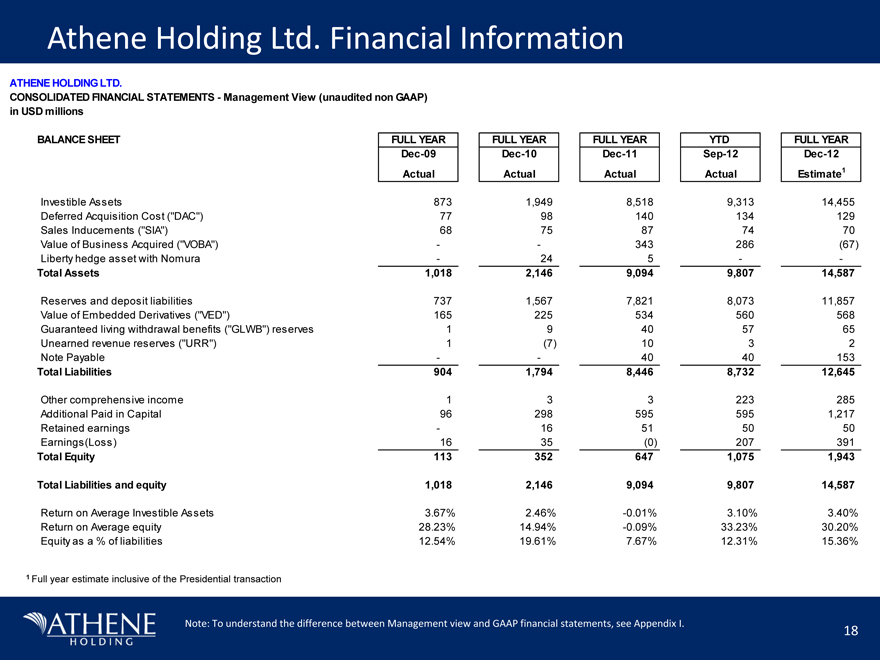

18 Athene Holding Ltd. Financial Information 1 Full year estimate inclusive of

the Presidential transaction Note: To understand the difference between

Management view and GAAP financial statements, see Appendix I.

19 Athene Holding Ltd. Financial Information (Cont’d) Note: To understand the

difference between Management view and GAAP financial statements, see Appendix

I. 1 Full year estimate inclusive of the de minimis impact of the Presidential

transaction as it has come in end of the year. 2 Consists of index credits with

associated call option payoffs and GLWB expense for EIA policies, interest

credited on MYGA policies and total earnings on AEGON short term portfolio net

of associated DAC amortizations 3 Included in the G&A expenses are compensation

for management services payable to Apollo. The compensation is based on a

percentage of capital and surplus and will be expensed to mid 2019. However,

upon the sale of the company or a QIPO event, the remainder of the unamortized

compensation that would have been expensed to 2019 will be immediately

recognized 4 Realized capital gains and losses on securities, net of incentive

fees and any impairments 5 Market Value Adjustments 6 Unrealized gains or losses

from securities held within third party funds withheld accounts 7 Consists of

option income in excess of option payoffs and change in VED reserves in excess

of index credits for EIA policies 8 Consists of amortization of DAC, URR, SIA,

VOBA, associated with non operating earnings. Also includes bargain purchase

gain and change in GLWB reserves associated with non operating earnings 9

Unrealized gains or losses on derivative instruments (interest rate swaps, etc.)

10 The 2011 earnings were impacted by the hedging of the Liberty transaction 11

Based on Investible Assets

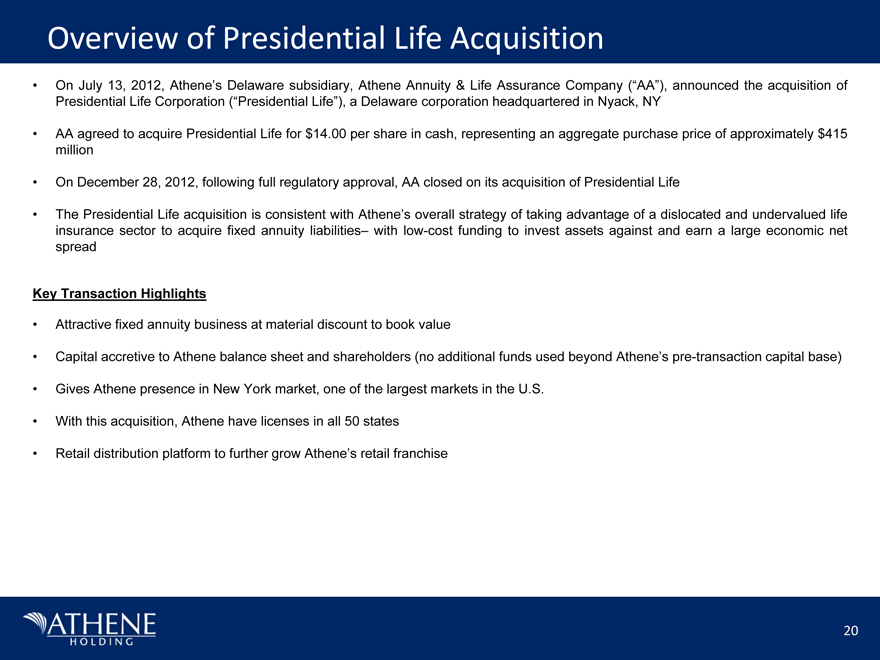

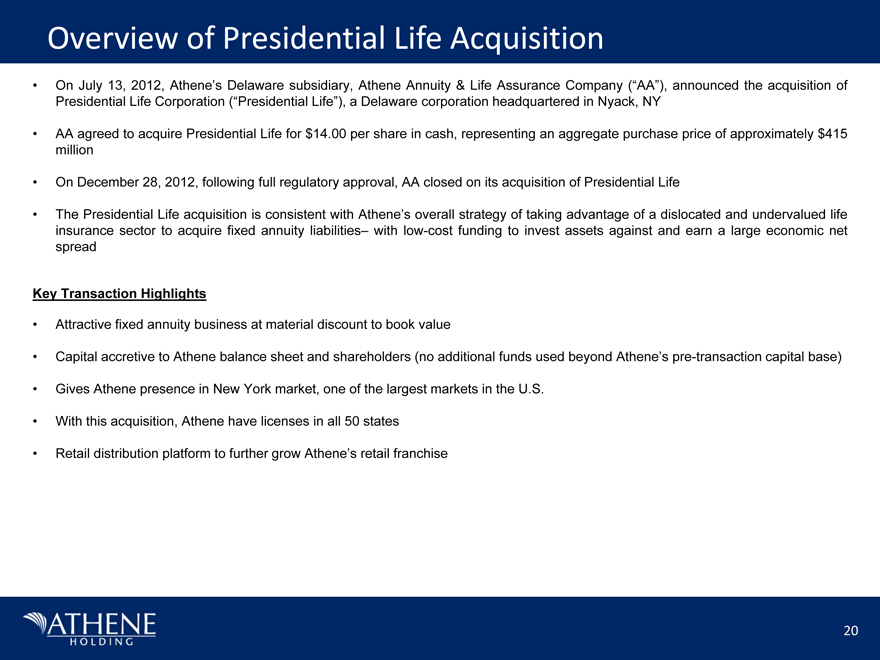

Overview of Presidential Life Acquisition 20 On July 13, 2012, Athene’s Delaware

subsidiary, Athene Annuity & Life Assurance Company (“AA”), announced the

acquisition of Presidential Life Corporation (“Presidential Life”), a Delaware

corporation headquartered in Nyack, NY AA agreed to acquire Presidential Life

for $14.00 per share in cash, representing an aggregate purchase price of

approximately $415 million On December 28, 2012, following full regulatory

approval, AA closed on its acquisition of Presidential Life The Presidential

Life acquisition is consistent with Athene’s overall strategy of taking

advantage of a dislocated and undervalued life insurance sector to acquire fixed

annuity liabilities– with low-cost funding to invest assets against and earn a

large economic net spread Key Transaction Highlights Attractive fixed annuity

business at material discount to book value Capital accretive to Athene balance

sheet and shareholders (no additional funds used beyond Athene’s pre-transaction

capital base) Gives Athene presence in New York market, one of the largest

markets in the U.S. With this acquisition, Athene have licenses in all 50 states

Retail distribution platform to further grow Athene’s retail franchise

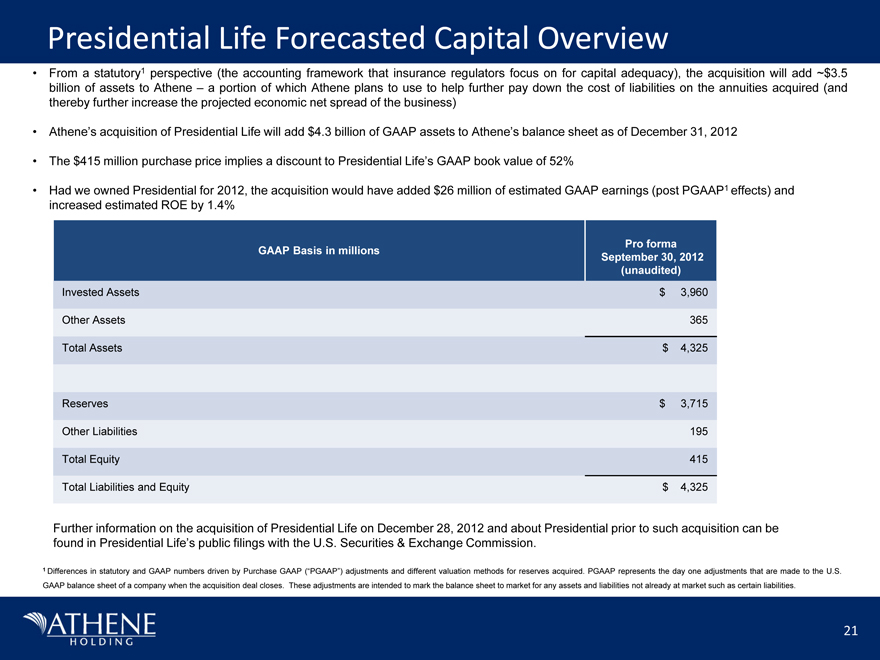

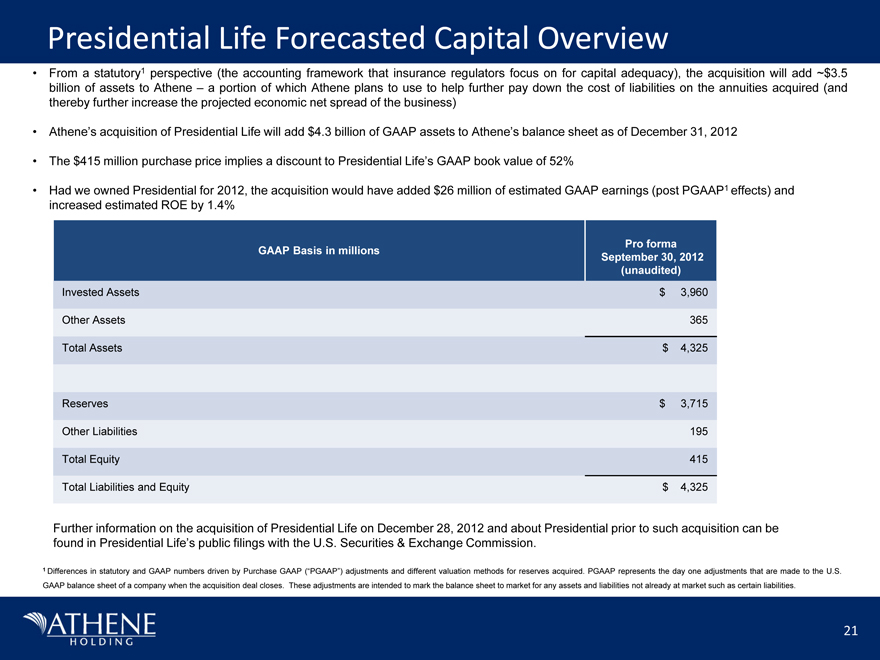

GAAP Basis in millions Pro forma September 30, 2012(unaudited) Invested Assets $

3,960 Other Assets 365 Total Assets $ 4,325 Reserves $ 3,715 Other Liabilities

195 Total Equity 415 Total Liabilities and Equity $ 4,325 21 Further information

on the acquisition of Presidential Life on December 28, 2012 and about

Presidential prior to such acquisition can be found in Presidential Life’s

public filings with the U.S. Securities & Exchange Commission. Presidential Life

Forecasted Capital Overview 1 Differences in statutory and GAAP numbers driven

by Purchase GAAP (“PGAAP”) adjustments and different valuation methods for

reserves acquired. PGAAP represents the day one adjustments that are made to the

U.S. GAAP balance sheet of a company when the acquisition deal closes. These

adjustments are intended to mark the balance sheet to market for any assets and

liabilities not already at market such as certain liabilities. From a statutory1

perspective (the accounting framework that insurance regulators focus on for

capital adequacy), the acquisition will add ~$3.5 billion of assets to Athene –

a portion of which Athene plans to use to help further pay down the cost of

liabilities on the annuities acquired (and thereby further increase the

projected economic net spread of the business) Athene’s acquisition of

Presidential Life will add $4.3 billion of GAAP assets to Athene’s balance sheet

as of December 31, 2012 The $415 million purchase price implies a discount to

Presidential Life’s GAAP book value of 52% Had we owned Presidential for 2012,

the acquisition would have added $26 million of estimated GAAP earnings (post

PGAAP1 effects) and increased estimated ROE by 1.4%

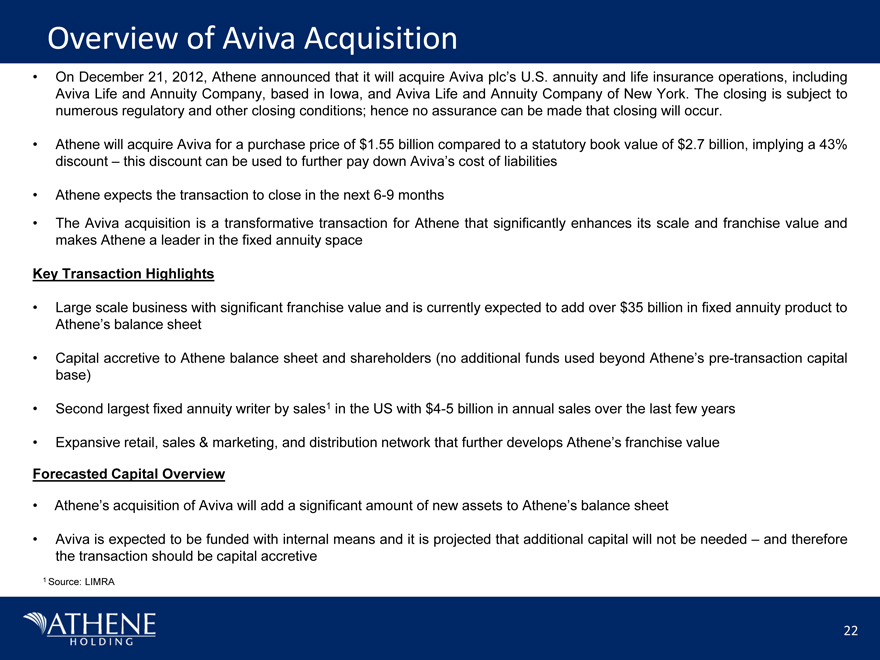

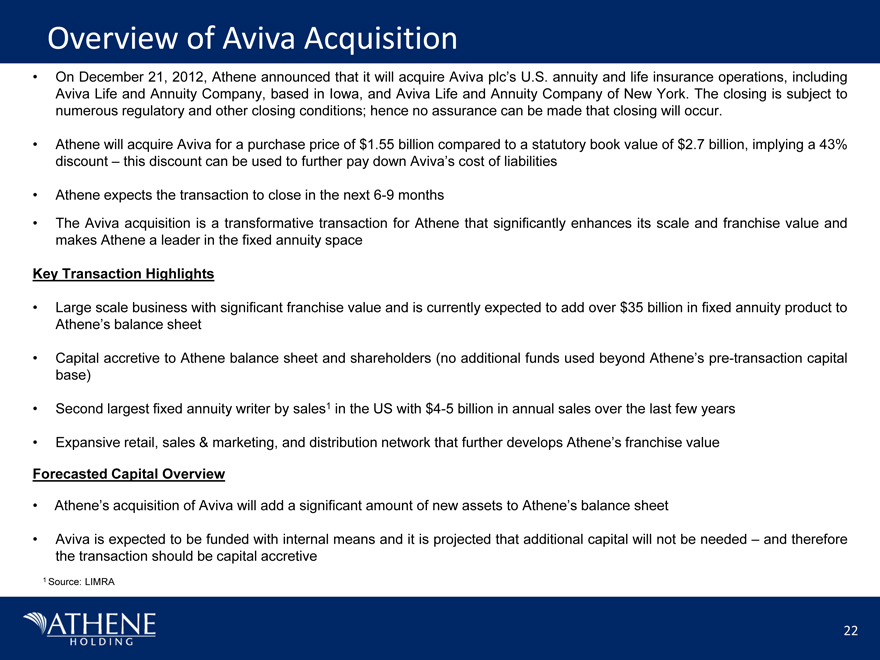

22 On December 21, 2012, Athene announced that it will acquire Aviva plc’s U.S.

annuity and life insurance operations, including Aviva Life and Annuity Company,

based in Iowa, and Aviva Life and Annuity Company of New York. The closing is

subject to numerous regulatory and other closing conditions; hence no assurance

can be made that closing will occur. Athene will acquire Aviva for a purchase

price of $1.55 billion compared to a statutory book value of $2.7 billion,

implying a 43% discount – this discount can be used to further pay down Aviva’s

cost of liabilities Athene expects the transaction to close in the next 6-9

months The Aviva acquisition is a transformative transaction for Athene that

significantly enhances its scale and franchise value and makes Athene a leader

in the fixed annuity space Key Transaction Highlights Large scale business with

significant franchise value and is currently expected to add over $35 billion in

fixed annuity product to Athene’s balance sheet Capital accretive to Athene

balance sheet and shareholders (no additional funds used beyond Athene’s

pre-transaction capital base) Second largest fixed annuity writer by sales1 in

the US with $4-5 billion in annual sales over the last few years Expansive

retail, sales & marketing, and distribution network that further develops

Athene’s franchise value Forecasted Capital Overview Athene’s acquisition of

Aviva will add a significant amount of new assets to Athene’s balance sheet

Aviva is expected to be funded with internal means and it is projected that

additional capital will not be needed – and therefore the transaction should be

capital accretive 1 Source: LIMRA Overview of Aviva Acquisition

23 This presentation does not constitute an offer to sell, or the solicitation

of an offer to buy, any security of Athene Holding Ltd. (“Athene”). Certain

information contained herein maybe “forward – looking” in nature. These

statements include, but are not limited to, discussions related to Athene’s

expectations regarding the performance of its business, its liquidity and

capital resources and the other non^historical statements. These forward^looking

statements are based on management’s beliefs, as well as assumptions made by,

and information currently available to, management. When used in this

presentation, the words “believe,” “anticipate,” “estimate,” “expect,” “intend”

and similar expressions are intended to identify forward^looking statements.

Although management believes that the expectations reflected in these

forward^looking statements are reasonable, it can give no assurance that these

expectations will prove to have been correct. These statements are subject to

certain risks, uncertainties and assumptions. Due to these various risks,

uncertainties and assumptions, actual events or results or the actual

performance of Athene may differ materially from those reflected or contemplated

in such forward-looking statements. We undertake no obligation to publicly

update or review any forward^looking statements, whether as a result of new

information, future developments or otherwise. Information contained herein

may include information respecting prior performance of Athene. Information

respecting prior performance, while a useful tool, is not necessarily indicative

of actual results to be achieved in the future, which is dependent upon many

factors, many of which are beyond the control of Athene. The information

contained herein is not a guarantee of future performance by Athene, and actual

outcomes and results may differ materially from any historic, pro forma or

projected financial results indicated herein. Certain of the financial

information contained herein is unaudited or based on the application of

non-GAAP financial measures. These non^GAAP financial measures should be

considered in addition to and not as a substitute for, or superior to, financial

measures presented in accordance with GAAP. Furthermore, certain financial

information is based on estimates of management. These estimates, which are

based on the reasonable expectations of management, are subject to change and

there can be no assurance that they will prove to be correct. The information

that an evaluator may require in order to properly evaluate the business,

prospects or value of Athene. AAA or Athene does not have any obligation to

update this presentation and the information may change at any time without

notice. Certain of the information used in preparing this presentation was

obtained from third parties or public sources. No representation or warranty,

express or implied, is made or given by or on behalf of Athene or any other

person as to the accuracy, completeness or fairness of such information, and no

responsibility or liability is accepted for any such information. The

information on page 2 was prepared by AAA. This document is not intended to be,

nor should it be construed or used as, financial, legal, tax, insurance or

investment advice. There can be no assurance that Athene will achieve its

objectives. Past performance is not indicative of future success. All

information is as of the dates indicated herein. Disclaimer

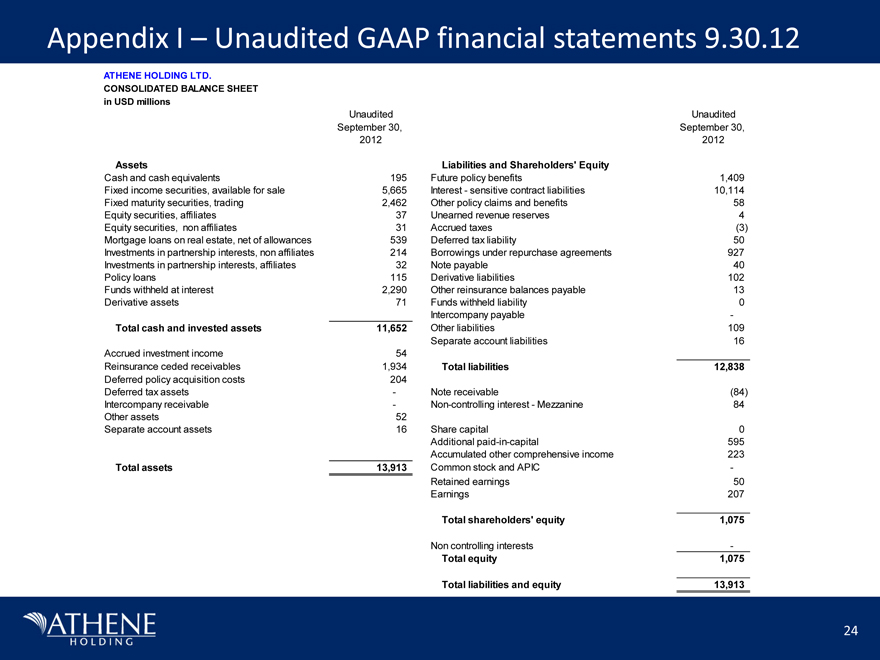

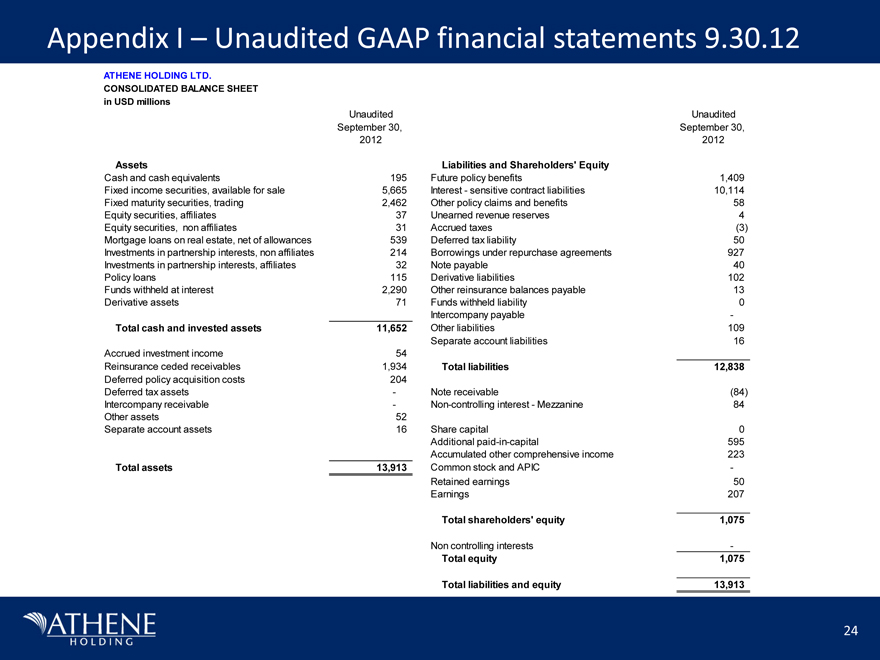

24 Appendix I – Unaudited GAAP financial statements 9.30.12

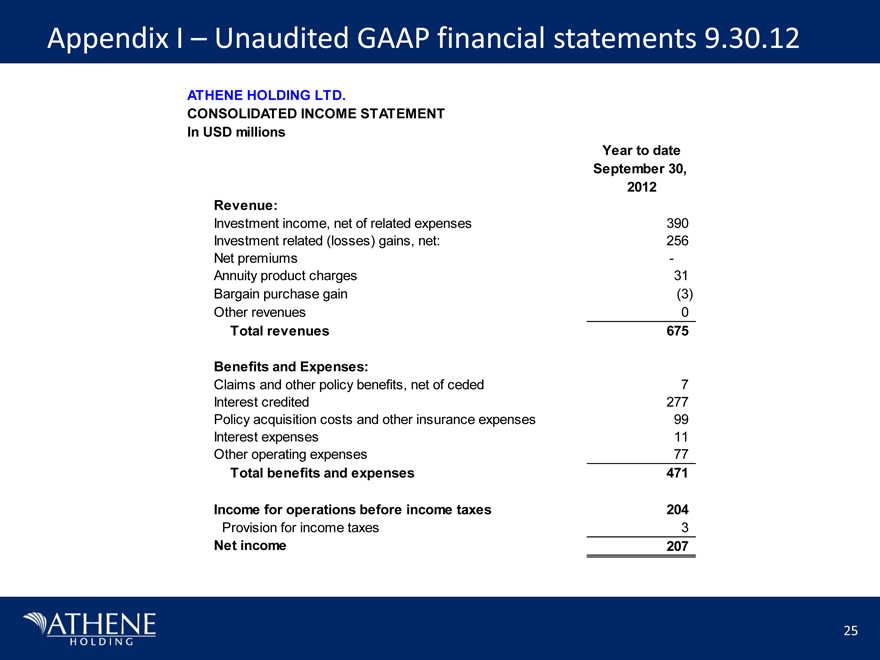

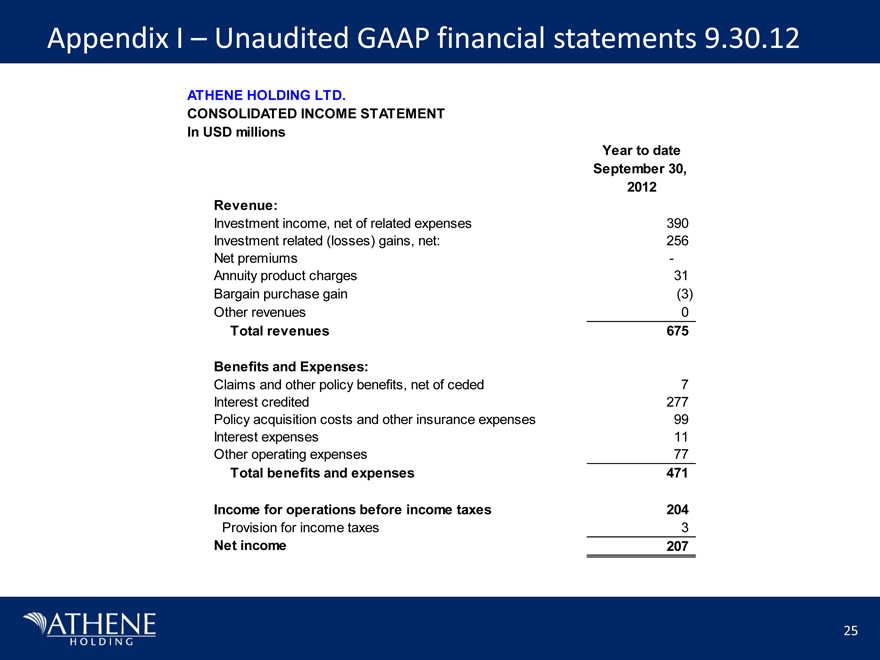

25 Appendix I – Unaudited GAAP financial statements 9.30.12

26 Appendix I – Management View Financials Management’s view of the financial

statements differs from the Audited Financial Statements view Management balance

sheets are presented without the assets and liabilities relating to the effects

of reinsurance to Protective Life and the AEGON short portfolio1 It excludes the

impact of grossing up the assets and liabilities from the consolidation effect

from the CMBS Partnerships2. Other adjustments include reclassifications of

negative liability balances to the assets section, such as VOBA and other

liabilities, including accruals for expenses Management income statements

present results by re-categorizing transactions into operating and non-operating

based on management’s view of what constitutes as operating income 1 AEGON short

portfolio represents a group of assets for which the credit risk has been

reinsured out of the company via total return swap 2 CMBS partnerships

represents a partnership investment that is consolidated for GAAP and is

composed of highly rated CMBS assets backing a fixed credit facility

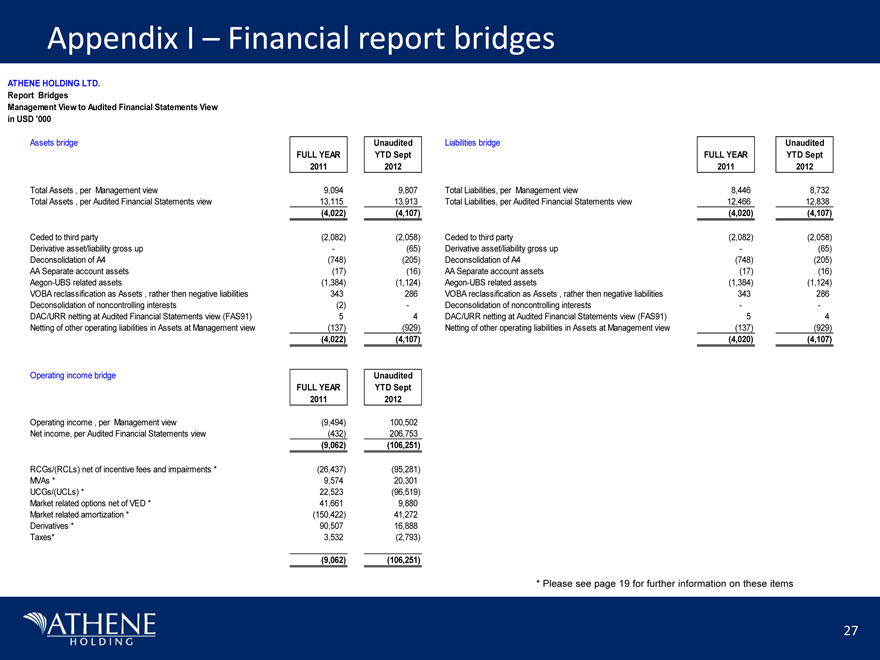

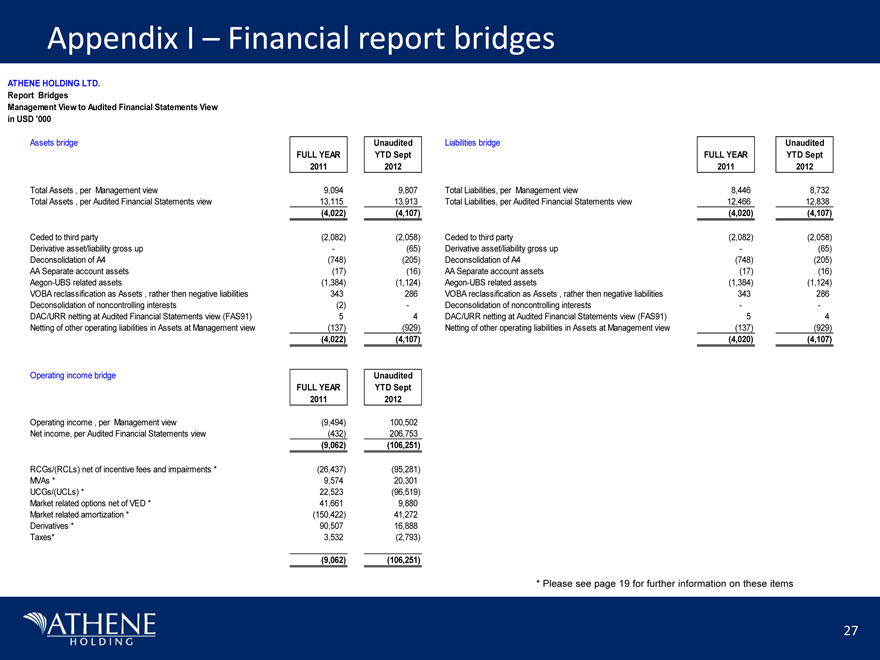

27 Appendix I – Financial report bridges * Please see page 19 for further

information on these items