|

Investor Presentation May 2014 Exhibit 99.1 Confidential – Not for distribution, in whole or in part, without the express written consent of Apollo Global Management, LLC. Information contained herein is as of March 31, 2014 unless otherwise noted |

|

Important Notes Regarding the Use of Index Comparison: Legal Disclaimer 1 This presentation is confidential and may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express consent of Apollo Global Management, LLC or any of its affiliates (“Apollo”). This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interests in the private investment funds discussed herein. The information contained in this presentation may change at any time without notice and Apollo does not have any responsibility to update the presentation to account for such change. Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the information contained herein, including, but not limited to, information obtained from third parties. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results or the actual performance of a Fund may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. “Assets Under Management,” or “AUM,” refers to the investments we manage or with respect to which we have control, including capital we have the right to call from our investors pursuant to their capital commitments to various funds. Our AUM equals the sum of: (i) the fair value of our private equity investments plus the capital that we are entitled to call from our investors pursuant to the terms of their capital commitments; (ii) the net asset value of our credit funds, other than certain collateralized loan obligations and collateralized debt obligations, which have a fee generating basis other than mark-to-market value of the underlying assets, plus used or available leverage and/or capital commitments; (iii) the gross asset values or net asset values of our real estate entities and the structured portfolio vehicle investments included within the funds we manage, which includes the leverage used by such structured portfolio vehicles; (iv) the incremental value associated with the reinsurance investments of the portfolio company assets that we manage; and (v) the fair value of any other investments that we manage plus unused credit facilities, including capital commitments for investments that may require pre-qualification before investment plus any other capital commitments available for investment that are not otherwise included in the clauses above. Our AUM measure includes Assets Under Management for which we charge either no or nominal fees. Our definition of AUM is not based on any definition of Assets Under Management contained in our operating agreement or in any of our Apollo fund management agreements. We consider multiple factors for determining what should be included in our definition of AUM. Such factors include but are not limited to (1) our ability to influence the investment decisions for existing and available assets; (2) our ability to generate income from the underlying assets in our funds; and (3) the AUM measures that we use internally or believe are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, our calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Index performance and yield data are shown for illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters, volatility, credit or other factors (such as number and types of securities). It may not be possible to directly invest in one or more of these indices and the holdings of any fund managed by Apollo may differ markedly from the holdings of any such index in terms of levels of diversification, types of securities or assets represented and other significant factors. Indices are unmanaged, do not charge any fees or expenses, assume reinvestment of income and do not employ special investment techniques such as leveraging or short selling. No such index is indicative of the future results of any fund managed by Apollo. Past performance is not indicative nor a guarantee of future returns. |

|

This presentation may contain forward looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, discussions related to Apollo’s expectations regarding the performance of its business, its liquidity and capital resources and other non-historical statements. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this presentation, the words “believe,” “anticipate,” “estimate,” “expect,” “intend” and similar expressions are intended to identify forward-looking statements. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. These statements are subject to certain risks, uncertainties and assumptions. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013 and Quarterly Report on Form 10-Q for the three months ended March 31, 2014, each as filed with the Securities and Exchange Commission (“SEC”), as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website as www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in other SEC filings. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise. Information contained herein may include information with respect to prior investment performance of one or more Apollo funds or investments including gross and/or net internal rates of return (“IRR”). Information with respect to prior performance, while a useful tool in evaluating Apollo’s investment activities, is not necessarily indicative of actual results that may be achieved for unrealized investments. “Gross IRR” of a private equity fund represents the cumulative investment-related cash flows for all of the investors in the fund on the basis of the actual timing of investment inflows and outflows (for unrealized investment assuming disposition of the respective “as of” dates referenced) aggregated on a gross basis quarterly, and the return is annualized and compounded before management fees, carried interest and certain other fund expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all of the returns would, if distributed, be payable to the fund’s investors. “Net IRR” of a private equity fund means the gross IRR applicable to all investors, including related parties which may not pay fees, net of management fees, organizational expenses, transaction costs, and certain other fund expenses (including interest incurred by the fund itself); the realized and estimated unrealized value is adjusted such that a percentage up to 20.0% of the unrealized gain is allocated to the general partner, thereby reducing the balance attributable to fund investors’ carried interest all offset to the extent of interest income, and measures returns based on amounts that, if distributed, would be paid to investors of the fund, to the extent that a private equity fund exceeds all requirements detailed within the applicable fund agreement. This presentation is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Apollo including any Apollo sponsored investment fund, whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Unless otherwise noted, information included herein is presented as of the dates indicated. The information contained herein may change at any time without notice. Apollo does not have any responsibility to update the presentation to account for such changes. Apollo makes no representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of any of the information contained herein, including, but not limited to, information obtained from third parties. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Forward Looking Statements and Other Important Disclosures 2 |

|

Agenda Topic 1) Apollo Overview 2) Segment update 3) Financial Overview 4) Appendix 3 |

|

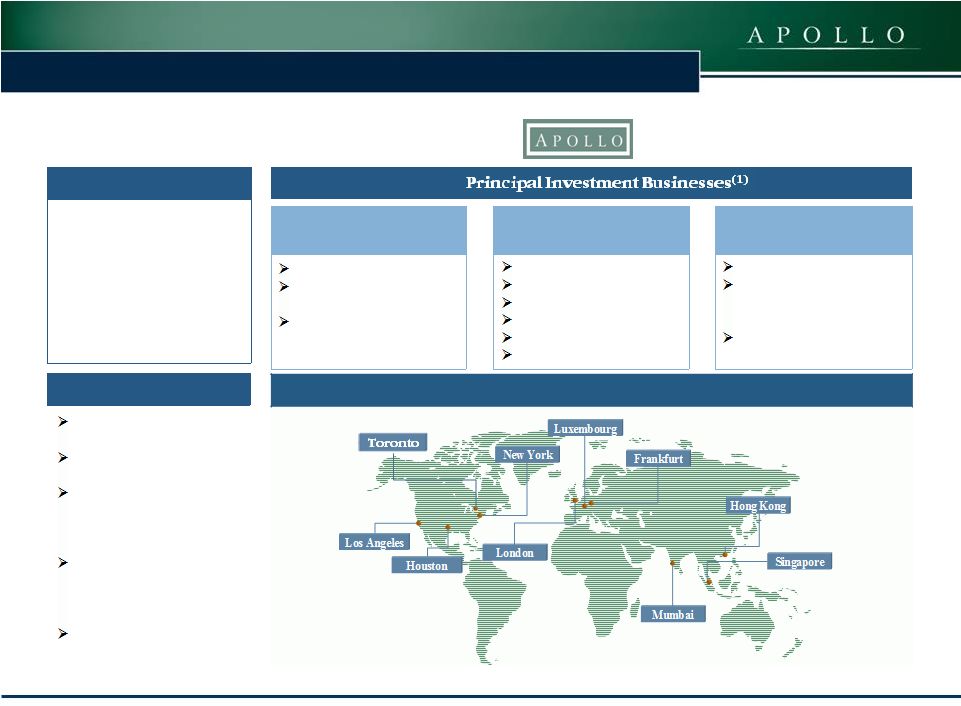

Firm Profile Founded: 1990 AUM: $159bn Employees: 761 Invs. Prof.: Global offices: Key Attributes Value-oriented Contrarian Opportunistic across market cycles and capital structures Integrated platform across asset classes and geographies Deep industry knowledge Private Equity $48bn AUM Opportunistic buyouts Distressed buyouts and debt investments Corporate carve-outs 1. As of March 31, 2014. Real Estate $9bn AUM Residential & Commercial Global private equity and distressed debt investments Performing fixed income (CMBS, CRE loans) Apollo Global Management Overview Credit $101bn AUM U.S. Performing Credit Opportunistic Credit European Credit Non-performing Loans Structured Credit Athene 302 Global Footprint 10 4 |

|

Apollo’s Key Strengths Diverse and integrated platform Strong management talent Global fundraising and originating capability Strong, consistent returns through cycles Attractive financial profile Large, diversified, and scalable integrated platform spanning several asset classes and geographies $159bn of AUM across private equity, credit, real estate, and permanent capital vehicles 125+ funds and managed accounts across multiple asset classes (1) Deep industry knowledge 5 Multi-disciplined and dedicated fundraising team – PE Fund VIII closed with $18.4bn in commitments Diverse global investor base, including marquee LPs Ability to fundraise and launch funds through the various economic cycles Long-term and diversified capital base (Athene, PE, managed accounts, etc) Steady underlying level of fee income Significant backlog of PE realizations Variable compensation structure Significant free cash flow generation Ample liquidity Debt / Fee-related EBITDA + 100% net realized carry ratio ~0.4x Value-oriented, contrarian investor with superior returns Successful investment track record across economic cycles – Firm for all seasons Apollo PE gross IRR of 39% and net IRR of 26% Strong credit performance across asset classes Managing partners worked together for more than 24 years Collectively own >50% of the Company Deep bench of investment professionals with strong alignment of interests with investors Robust governance structure Note: As of March 31, 2014. 1. Fund count includes only those greater than $100mm. 96% of total AUM in funds with contractual life of 7 years or more at inception 7% of total AUM in permanent capital vehicles with unlimited duration |

|

Apollo’s Integrated Business Model 6 Packaging Chemicals Cable Leisure Natural Resources Development of industry insight through: Industry Insights Management Relationships Investment Opportunities Credit Investment Opportunities Market Insights Market Relationships Private Equity Real Estate Over 300 current and former portfolio companies Strategic relationships with industry executives Significant relationships at CEO, CFO and board level Note: The listed companies are a sample of Apollo private equity and credit investments. The list was compiled based on non-performance criteria and is not representative of all transactions of a given type or investment of any Apollo fund generally, and are solely intended to be illustrative of the type of investments across certain core industries that may be made by the Apollo funds. There can be no guarantees that any similar investment opportunities will be available or pursued by Apollo in the future. The list contains companies which are not currently held in any Apollo portfolio. Natural Resources is included in Private Equity segment for reporting purposes. |

|

7 Chemicals Consumer & Retail Distribution & Transportation Financial & Business Services Manufacturing & Industrial Media, Cable & Leisure Packaging & Materials Satellite & Wireless Commodities Note: The listed companies are a sample of Apollo private equity and credit investments. The list was compiled based on non-performance criteria and is not representative of all transactions of a given type or investment of any Apollo fund generally, and are solely intended to be illustrative of the type of investments across certain core industries that may be made by the Apollo funds. There can be no guarantees that any similar investment opportunities will be available or pursued by Apollo in the future. The list contains companies which are not currently held in any Apollo portfolio. Apollo’s Expertise – Nine Core Industries |

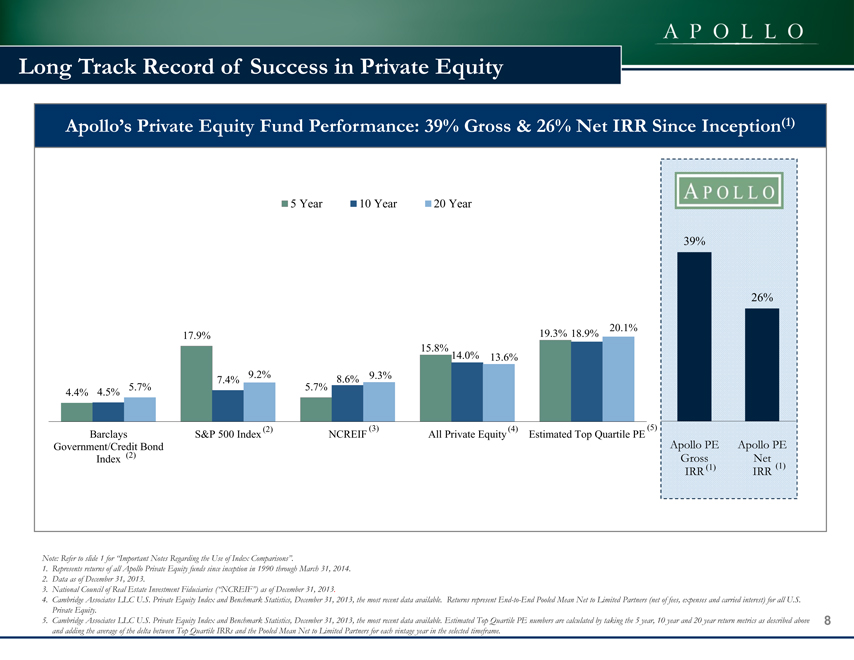

Long Track Record of Success in Private Equity

Apollo’s Private Equity Fund Performance: 39% Gross & 26% Net IRR Since Inception(1)

5 Year 10 Year 20 Year

39%

26%

17.9% 19.3% 18.9% 20.1%

15.8% 14.0% 13.6%

7.4% 9.2% 8.6% 9.3%

4.4% 4.5% 5.7% 5.7%

Barclays S&P 500 Index (2) NCREIF (3) All Private Equity (4) Estimated Top Quartile PE (5)

Government/Credit Bond Apollo PE Apollo PE

Index (2) Gross Net

IRR (1) IRR (1)

Note: Refer to slide 1 for “Important Notes Regarding the Use of Index Comparisons”.

1. Represents returns of all Apollo Private Equity funds since inception in 1990 through March 31, 2014.

2. Data as of December 31, 2013.

3. National Council of Real Estate Investment Fiduciaries (“NCREIF”) as of December 31, 2013.

4. Cambridge Associates LLC U.S. Private Equity Index and Benchmark Statistics, December 31, 2013, the most recent data available. Returns represent End-to-End Pooled Mean Net to Limited Partners (net of fees, expenses and carried interest) for all U.S. Private Equity.

5. Cambridge Associates LLC U.S. Private Equity Index and Benchmark Statistics, December 31, 2013, the most recent data available. Estimated Top Quartile PE numbers are calculated by taking the 5 year, 10 year and 20 year return metrics as described above and adding the average of the delta between Top Quartile IRRs and the Pooled Mean Net to Limited Partners for each vintage year in the selected timeframe.

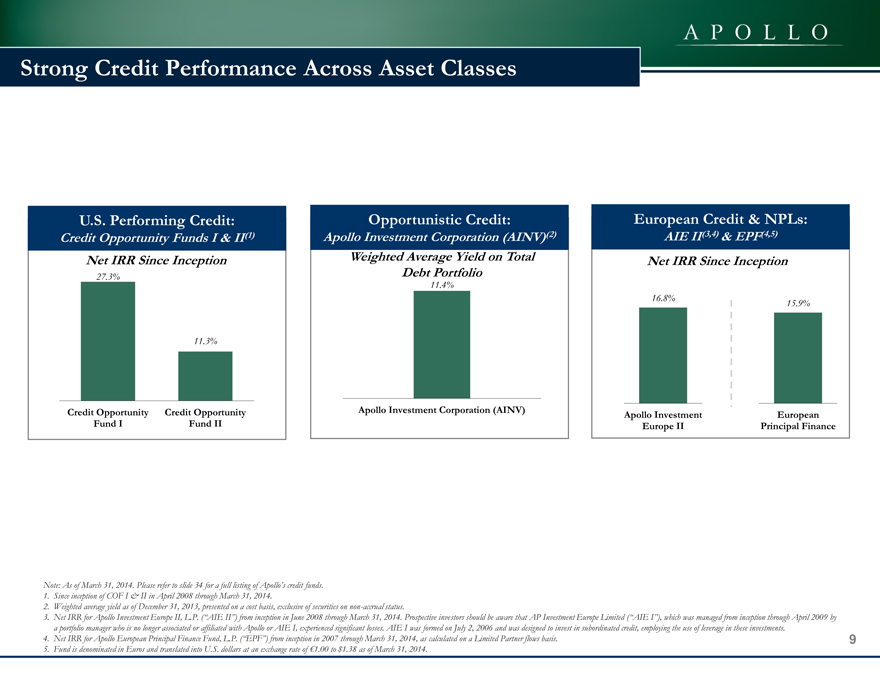

Strong Credit Performance Across Asset Classes

U.S. Performing Credit:

Credit Opportunity Funds I & II(1)

Net IRR Since Inception

27.3%

11.3%

Credit Opportunity Credit Opportunity

Fund I Fund II

Opportunistic Credit:

Apollo Investment Corporation (AINV)(2)

Weighted Average Yield on Total

Debt Portfolio

11.4%

Apollo Investment Corporation (AINV)

European Credit & NPLs:

AIE II(3,4) & EPF(4,5)

Net IRR Since Inception

16.8% 15.9%

Apollo Investment European

Europe II Principal Finance

Note: As of March 31, 2014. Please refer to slide 34 for a full listing of Apollo’s credit funds.

1. Since inception of COF I & II in April 2008 through March 31, 2014.

2. Weighted average yield as of December 31, 2013, presented on a cost basis, exclusive of securities on non-accrual status.

3. Net IRR for Apollo Investment Europe II, L.P. (“AIE II”) from inception in June 2008 through March 31, 2014. Prospective investors should be aware that AP Investment Europe Limited (“AIE I”), which was managed from inception through April 2009 by a portfolio manager who is no longer associated or affiliated with Apollo or AIE I, experienced significant losses. AIE I was formed on July 2, 2006 and was designed to invest in subordinated credit, employing the use of leverage in these investments.

4. Net IRR for Apollo European Principal Finance Fund, L.P. (“EPF”) from inception in 2007 through March 31, 2014, as calculated on a Limited Partner flows basis.

5. Fund is denominated in Euros and translated into U.S. dollars at an exchange rate of €1.00 to $1.38 as of March 31, 2014.

9

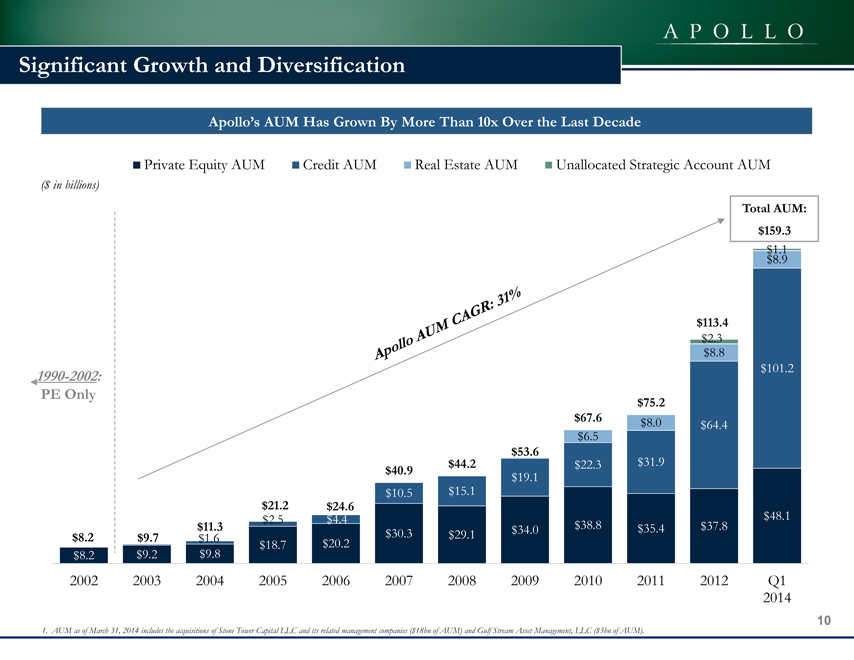

Significant Growth and Diversification

Apollo’s AUM Has Grown By More Than 10x Over the Last Decade

Private Equity AUM Credit AUM Real Estate AUM Unallocated Strategic Account AUM

($ in billions)

Total AUM:

$159.3

$1.1

$8.9

$113.4

$2.3

$8.8

1990-2002: $101.2

PE Only $75.2

$67.6 $8.0 $64.4

$6.5

$53.6

$40.9 $44.2 $22.3 $31.9

$19.1

$10.5 $15.1

$21.2 $24.6

$2.5 $4.4 $48.1

$ 11.3 $30.3 $29.1 $34.0 $38.8 $35.4 $37.8

$8.2 $9.7 $1.6 $18.7 $20.2

$8.2 $9.2 $9.8

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Q1

2014

1. AUM as of March 31, 2014 includes the acquisitions of Stone Tower Capital LLC and its related management companies ($18bn of AUM) and Gulf Stream Asset Management, LLC ($3bn of AUM).

10

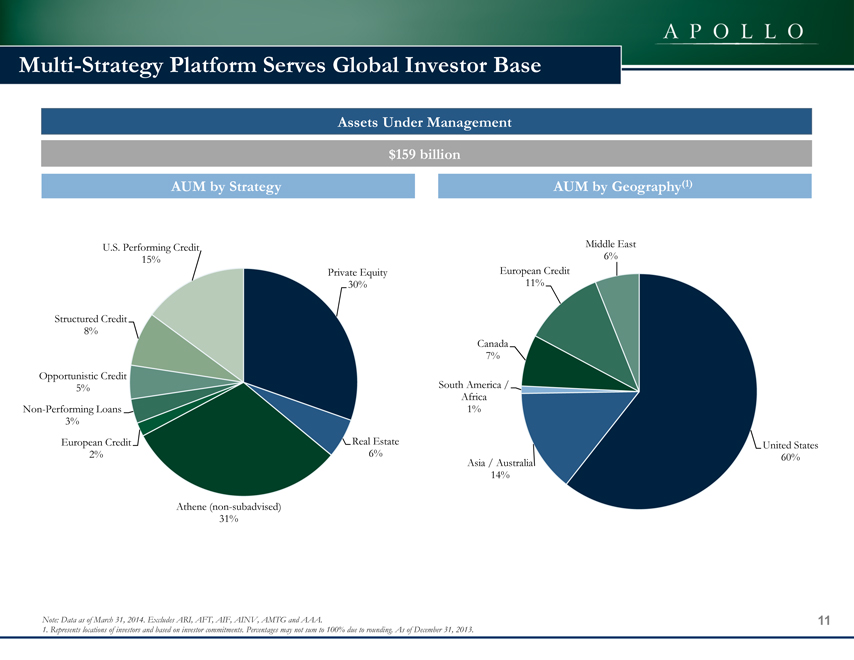

Multi-Strategy Platform Serves Global Investor Base

Assets Under Management

$159 billion

AUM by Strategy AUM by Geography(1)

U.S. Performing Credit

15%

Private Equity

30%

Structured Credit

8%

Opportunistic Credit

5%

Non-Performing Loans

3%

European Credit Real Estate

2% 6%

Athene (non-subadvised)

31%

Middle East

6%

European Credit

11%

Canada

7%

South America /

Africa

1%

United States

Asia / Australia 60%

14%

Note: Data as of March 31, 2014. Excludes ARI, AFT, AIF, AINV, AMTG and AAA.

1. Represents locations of investors and based on investor commitments. Percentages may not sum to 100% due to rounding. As of December 31, 2013.

11

|

12 Apollo Has a Clear Path for Continued Growth Scaling Existing Businesses Strategic Acquisitions and Alliances New Product Development Geographic Expansion Expand Distribution Channels Growth Strategies Apollo will continue to identify opportunities to leverage its existing platform and diversify into areas with meaningful synergies with its core business Selected Examples India PE and credit build-out Asia build-out and joint ventures London expansion Retail closed end funds Permanent capital vehicles (e.g., REITs) High net worth raises for credit vehicles Stone Tower Gulf Stream “Flagship” credit funds Emerging markets corporate credit Managed accounts Real estate mezzanine Athene Insurance-linked investment strategies CLO platform Energy credit Favorable Secular Trends Investors continue to increase allocations to alternatives Consolidation of relationships with branded, scale investment managers Increasing constraints on the global financial system Emergence of unconstrained credit as an asset class |

|

Agenda Topic 1) Apollo Overview 2) Segment update 3) Financial Overview 4) Appendix 13 |

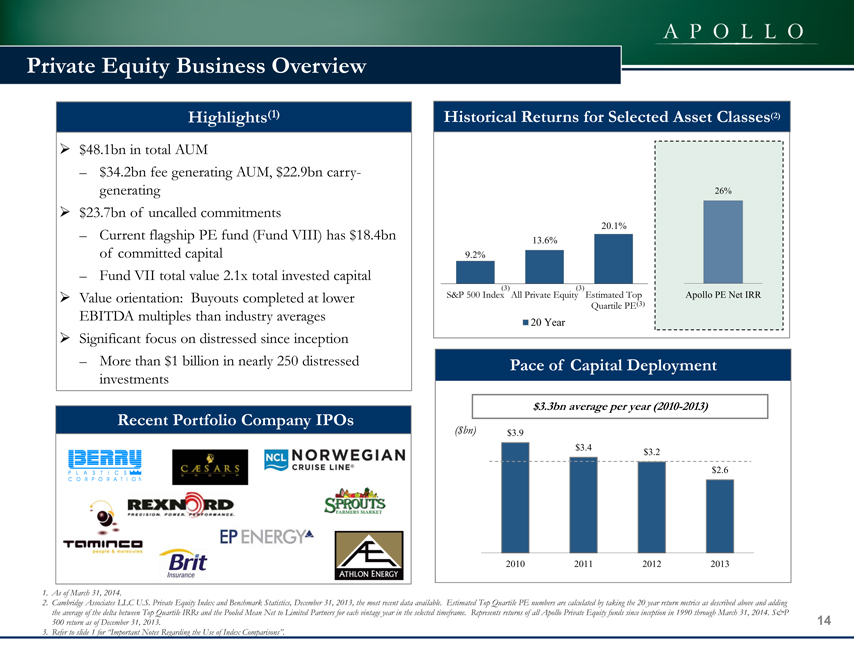

Private Equity Business Overview

Highlights(1)

$48.1bn in total AUM

– $34.2bn fee generating AUM, $22.9bn carry-generating $23.7bn of uncalled commitments

– Current flagship PE fund (Fund VIII) has $18.4bn of committed capital

– Fund VII total value 2.1x total invested capital Value orientation: Buyouts completed at lower EBITDA multiples than industry averages Significant focus on distressed since inception

– More than $1 billion in nearly 250 distressed investments

Historical Returns for Selected Asset Classes(2)

26%

20.1%

13.6%

9.2%

S&P 500 Index(3) All Private Equity(3) Estimated Top Apollo PE Net IRR

Quartile PE(3)

20 Year

Recent Portfolio Company IPOs

Pace of Capital Deployment

$3.3bn average per year (2010-2013)

($bn) $3.9

$3.4 $3.2

$2.6

2010 2011 2012 2013

1. As of March 31, 2014.

2. Cambridge Associates LLC U.S. Private Equity Index and Benchmark Statistics, December 31, 2013, the most recent data available. Estimated Top Quartile PE numbers are calculated by taking the 20 year return metrics as described above and adding the average of the delta between Top Quartile IRRs and the Pooled Mean Net to Limited Partners for each vintage year in the selected timeframe. Represents returns of all Apollo Private Equity funds since inception in 1990 through March 31, 2014. S&P 500 return as of December 31, 2013.

3. Refer to slide 1 for “Important Notes Regarding the Use of Index Comparisons”.

14

|

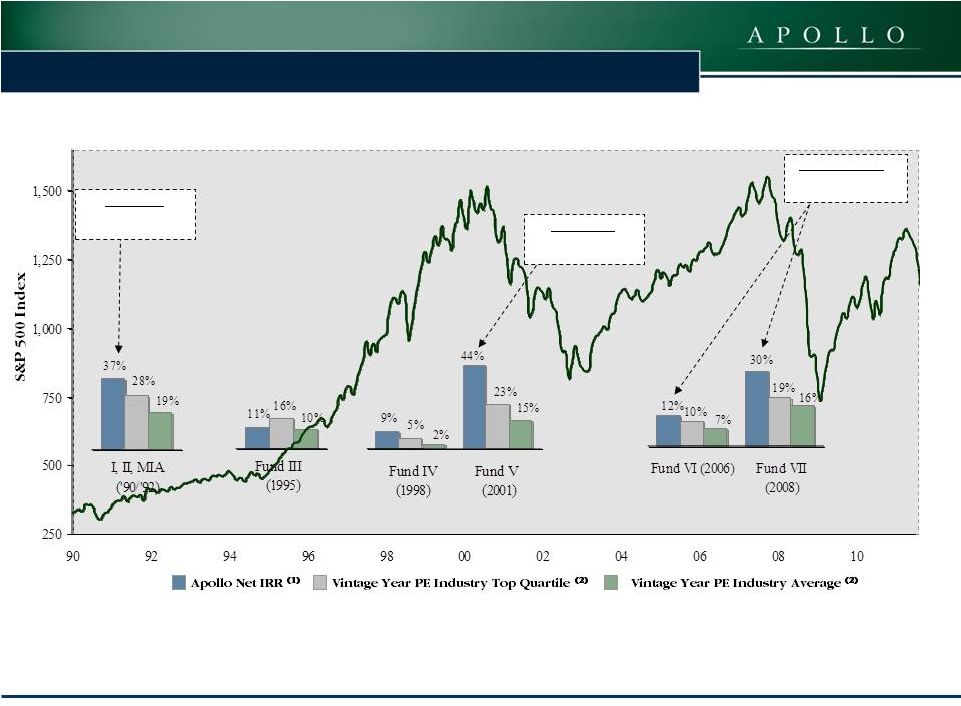

15 1990 - 1993 $3.4bn invested 2001 - 3Q03 $1.6bn invested 3Q07 – 2Q 2011 $15.5bn invested Significant Outperformance During Downturns 1. Represents net IRR for respective Apollo private equity fund as of March 31, 2014. Past performance not indicative of future results; please refer to slide 2 for the definition of net IRR. 2. Thomson Reuters. Data as of September 30, 3013, the latest data currently available. Top Quartile benchmarks represent the Upper Quartile Net IRRs for U.S. Buyout Funds of greater than $500 million by vintage year, unless otherwise noted. Vintage Year Average represents the average net IRR for the same categories as with the Top Quartile figures. See slide 1 for “Important Notes Regarding the Use of Index Comparisons in this Presentation”. |

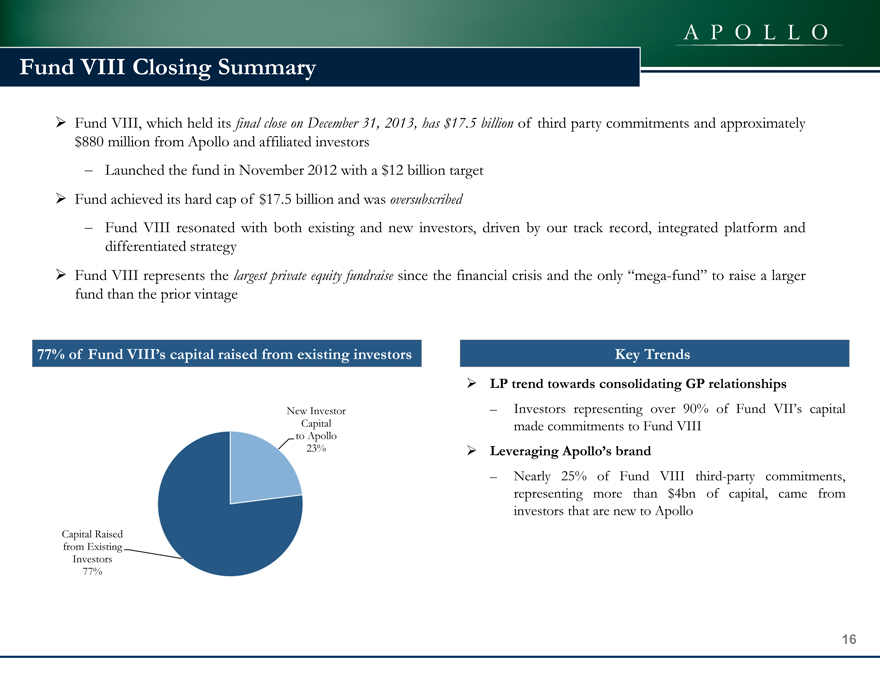

Fund VIII Closing Summary

Fund VIII, which held its final close on December 31, 2013, has $17.5 billion of third party commitments and approximately $880 million from Apollo and affiliated investors

– Launched the fund in November 2012 with a $12 billion target Fund achieved its hard cap of $17.5 billion and was oversubscribed

– Fund VIII resonated with both existing and new investors, driven by our track record, integrated platform and differentiated strategy Fund VIII represents the largest private equity fundraise since the financial crisis and the only “mega-fund” to raise a larger fund than the prior vintage

77% of Fund VIII’s capital raised from existing investors

New Investor Capital to Apollo 23%

Capital Raised from Existing 77% Investors

Key Trends

LP trend towards consolidating GP relationships

– Investors representing over 90% of Fund VII’s capital made commitments to Fund VIII

Cross-selling the Apollo platform

– Approximately 7% of Fund VIII third-party commitments, representing more than $1bn of capital, came from Apollo investors that had not previously invested in Apollo private equity funds

Leveraging Apollo’s brand

– Nearly 25% of Fund VIII third-party commitments, representing more than $4bn of capital, came from investors that are new to Apollo

16

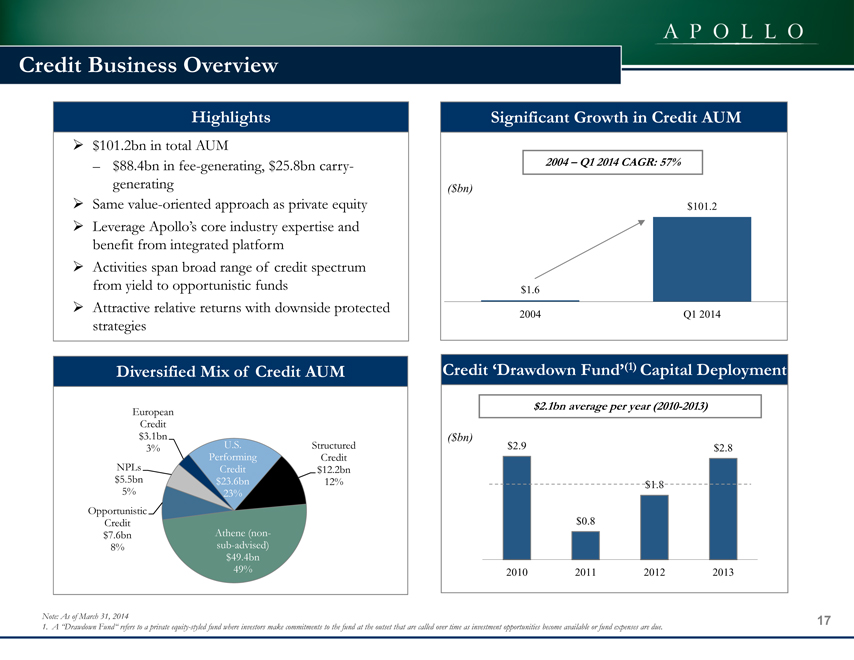

Credit Business Overview

Highlights

$101.2bn in total AUM

– $88.4bn in fee-generating, $25.8bn carry-generating Same value-oriented approach as private equity

Leverage Apollo’s core industry expertise and benefit from integrated platform Activities span broad range of credit spectrum from yield to opportunistic funds Attractive relative returns with downside protected strategies

Significant Growth in Credit AUM

2004 – Q1 2014 CAGR: 57%

($bn)

$101.2

$1.6

2004 Q1 2014

Diversified Mix of Credit AUM

European

Credit

$3.1bn

3% U.S. Structured

Performing Credit

NPLs Credit $12.2bn

$5.5bn $23.6bn 12%

5% 23%

Opportunistic

Credit

$7.6bn Athene (non-

8% sub-advised)

$49.4bn

49%

Credit ‘Drawdown Fund’(1) Capital Deployment

$2.1bn average per year (2010-2013)

($bn)

$2.9 $2.8

$1.8

$0.8

2010 2011 2012 2013

Note: As of March 31, 2014

1. A “Drawdown Fund” refers to a private equity-styled fund where investors make commitments to the fund at the outset that are called over time as investment opportunities become available or fund expenses are due.

17

|

Athene Holding Ltd. (“Athene”) is an insurance holding company focused on fixed annuities with approximately $59bn in assets and was founded in 2009 Earns the spread between its investment return on assets and the rate on its liabilities Originally funded through an Apollo-sponsored permanent capital vehicle (AP Alternative Assets, L.P.; NYSE Euronext: AAA) Led by seasoned management team with significant insurance experience Completed transformative Aviva USA acquisition in October 2013, adding approximately $44bn of AUM Seeks to grow annuity liabilities through three primary channels; retail issuance, institutional issuance, and acquisition Athene Asset Management, L.P. (AAM) is a subsidiary of Apollo and is included within the Credit segment Provides asset allocation services, direct asset management services, and a suite of other services to Athene Team of full-time dedicated investment professionals with deep experience in asset allocation 100% of Athene’s portfolio is allocated by AAM Approximately 17% of Athene’s portfolio directly managed by Apollo through sub-advisory agreements Apollo business model designed to scale in-line with Athene’s assets Assets Services Liabilities Assets Athene: Differentiated & Strategically Important Growth Driver 18 |

|

|

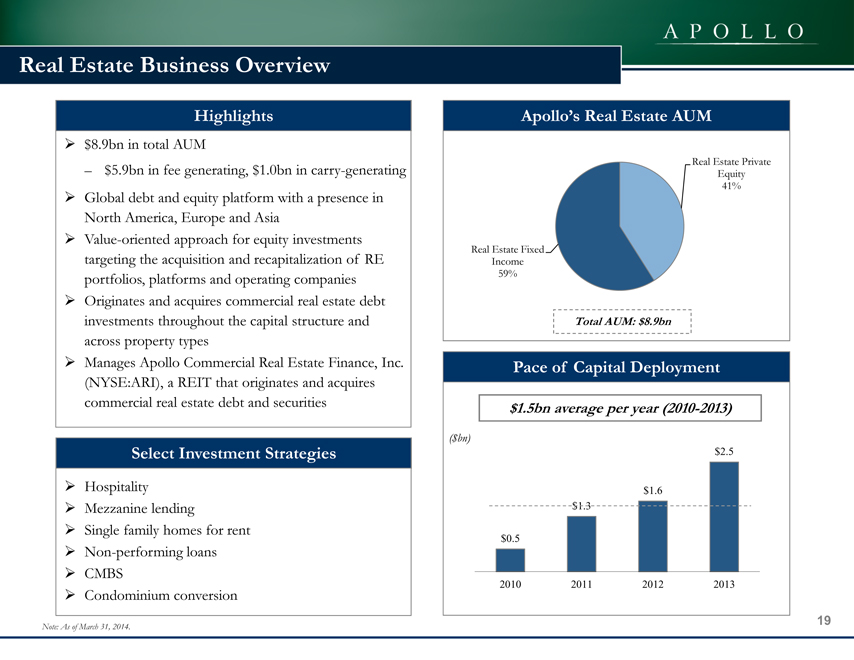

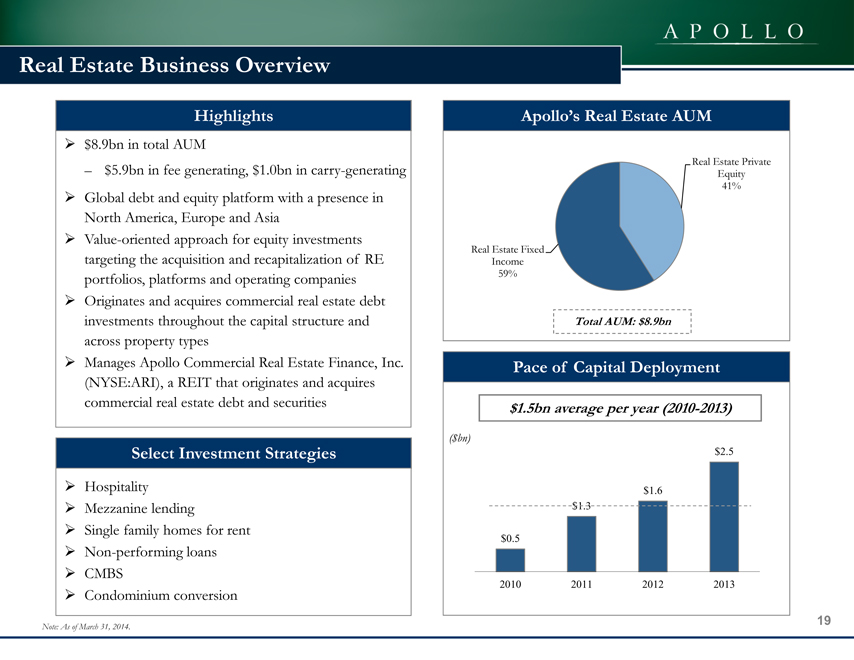

Real Estate Business Overview

Highlights

$8.9bn in total AUM

$5.9bn in fee generating, $1.0bn in carry-generating

Global debt and equity platform with a presence in North America, Europe and Asia

Value-oriented approach for equity investments targeting the acquisition and recapitalization of RE portfolios, platforms and operating companies

Originates and acquires commercial real estate debt investments throughout the capital structure and across property types

Manages Apollo Commercial Real Estate Finance, Inc. (NYSE:ARI), a REIT that originates and acquires commercial real estate debt and securities

Apollo’s Real Estate AUM

Real Estate Private

Equity

41%

Real Estate Fixed

Income

59%

Total AUM: $8.9bn

Select Investment Strategies

Hospitality

Mezzanine lending

Single family homes for rent

Non-performing loans

CMBS

Condominium conversion

Pace of Capital Deployment

$1.5bn average per year (2010-2013)

($bn)

$2.5

$1.6

$1.3

$0.5

2010 2011 2012 2013

Note: As of March 31, 2014.

19

|

Agenda Topic 1) Apollo Overview 2) Segment update 3) Financial Overview 4) Appendix 20 |

|

Financial Management Philosophies Financially conservative – Manage leverage and interest coverage ratios prudently – Generate significant free cash flow Focus on Management Business margins and liquidity – Stable non-performance based management revenue – Disciplined expenditure on compensation and non-compensation – Maintain sufficient liquidity in order to service debt obligations and maintain appropriate cash balances Flexible dividend policy – Flexible policy allowing management discretion to retain earnings for operational or investment needs Committed to maintaining a strong investment grade rating 21 |

|

22 ($mm, except per share data) 2011 2012 2013 LTM Q1 2014 Management business ENI – (pre-tax) $76 $223 $331 $417 Incentive business ENI (loss) – (pre-tax) (377) 1,411 1,797 1,188 ENI income tax provision 21 159 238 260 Total after-tax ENI (loss) ($322) $1,476 $1,889 $1,344 Total after-tax ENI (loss) per share ($0.86) $3.82 $4.80 $3.40 Fee-related EBITDA 197 339 438 560 Fee-related EBITDA + 100% net realized carry $531 $890 $1,915 $2,103 Distributions declared (1) $314 $539 $1,627 $1,645 Distributions declared per share $0.83 $1.35 $3.95 $3.43 1. Amounts include distributions to Class A shareholders, non-controlling interest in AOG and distribution equivalents on participating securities Strong Mgt. Business Growth & Significant Free Cash Flow |

|

Robust Growth in Fee-Generating AUM 23 ($mm) 2011 2012 2013 Q1 2014 Total AUM $75 $113 $161 $159 39.6% Fee-generating AUM $58 $82 $128 $129 42.3% Fee-generating AUM by Segment: Private equity $28 $28 $34 $34 9.2% Credit 27 50 88 88 70.7% Real estate 4 4 6 6 25.5% Total $58 $82 $128 $129 42.3% CAGR (2011-Q1 2014) |

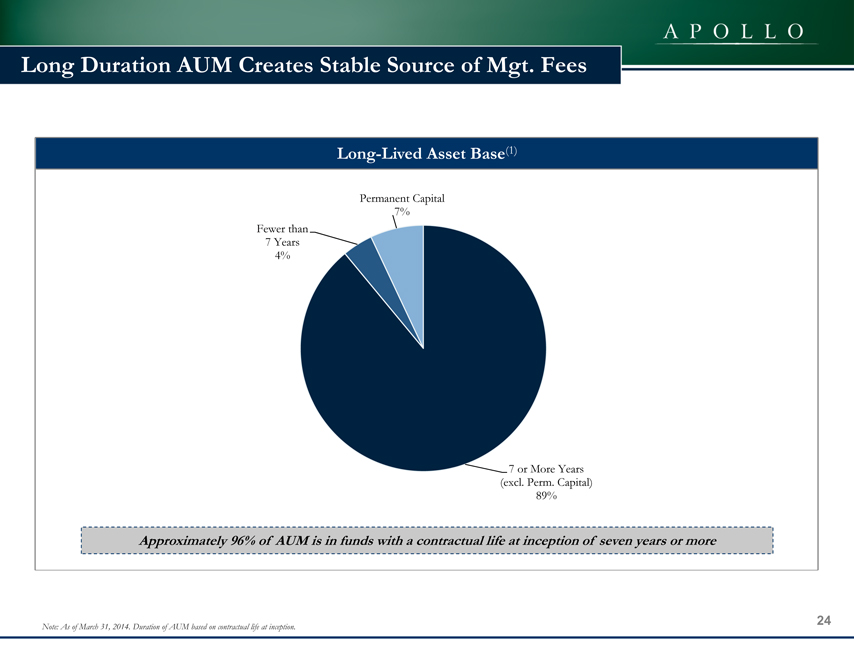

Long Duration AUM Creates Stable Source of Mgt. Fees

Long-Lived Asset Base(1)

Permanent Capital

7%

Fewer than

7 Years

4%

7 or More Years

(excl. Perm. Capital)

89%

Approximately 96% of AUM is in funds with a contractual life at inception of seven years or more

Note: As of March 31, 2014. Duration of AUM based on contractual life at inception.

24

|

Management Business Performance 25 ($mm, except per share data) 2011 2012 2013 LTM Q1 2014 Management fees $490 $623 $731 $791 Advisory & transaction fees 82 150 197 265 NII incentive fees - AINV 45 38 37 36 Total management business revenues 617 811 964 1,092 Compensation expenses 319 344 361 409 Non-compensation expenses 224 257 302 295 Other income (loss) & minority interest 3 12 30 29 76 223 331 417 Mgt. business ENI per share (pre-tax) $0.21 $0.58 $0.84 $1.05 Non-cash comp 68 69 66 107 Interest expense 41 37 29 25 Depreciation and amortization 11 10 11 11 Fee-related EBITDA 197 339 438 560 Operating metrics Mgt. business margin (%) 12% 27% 34% 38% Mgt. comp % of mgt. revenues 52% 42% 37% 37% Mgt. non-comp % mgt. revenues 36% 32% 31% 27% Management business ENI – (pre-tax) |

|

Incentive Business Performance 26 1. Using March 31, 2014, non-GAAP weighted average diluted shares outstanding. 2. Carried interest receivable less profit sharing payable on an unconsolidated basis. ($mm, except per share data) 2011 2012 2013 LTM Q1 2014 Economic ENI ENI – total carry: Private equity ($449) $1,668 $2,517 $1,630 Credit 7 481 337 270 Real estate 0 15 5 4 Total carry ($442) $2,164 $2,859 $1,903 ENI – total profit sharing expense: Private equity $727 $1,030 $709 Credit 36 138 143 146 Real estate 0 7 0 (1) Total profit sharing expense $872 $854 Equity method investment gain / (loss) 5 120 111 138 $1,188 Incentive business ENI (loss) per share (pre-tax) (1) ($1.01) $3.65 $4.56 $3.01 Net realized carry Realized carry: Private equity $571 $813 $2,063 $2,166 Credit 74 180 393 408 Real estate 0 5 1 0 Total realized carry $997 $2,456 $2,574 Realized profit sharing expense: Private equity $273 $383 $883 $933 Credit 37 63 95 97 Real estate 0 0 0 0 Total realized profit sharing expense $978 $1,030 Net realized carry $1,478 $1,544 $1,105 $1,173 $1,797 $1,295 $446 $551 $1,021 $516 $335 $645 ($377) ($60) ($97) Incentive business ENI (loss) (pre-tax) $1,411 $310 |

|

|

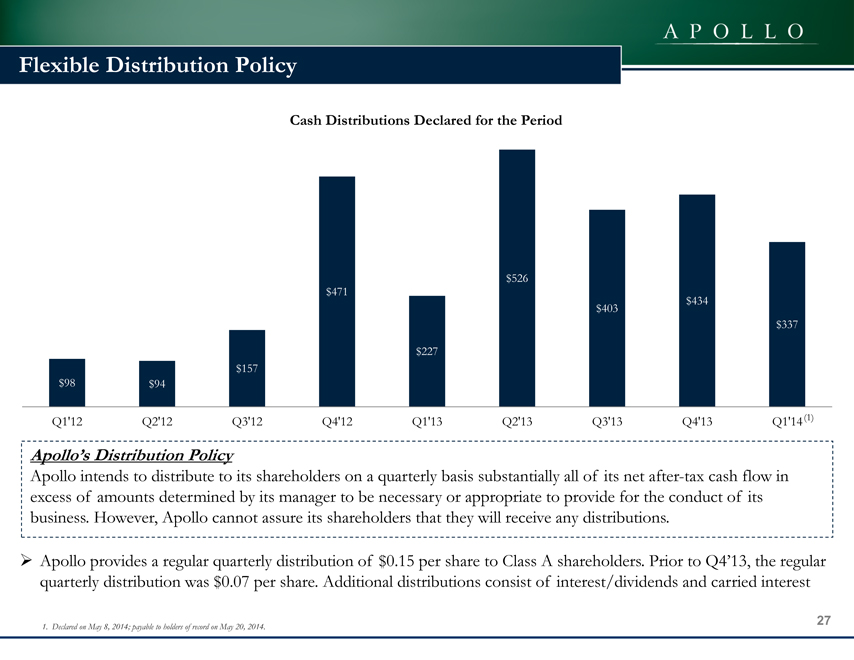

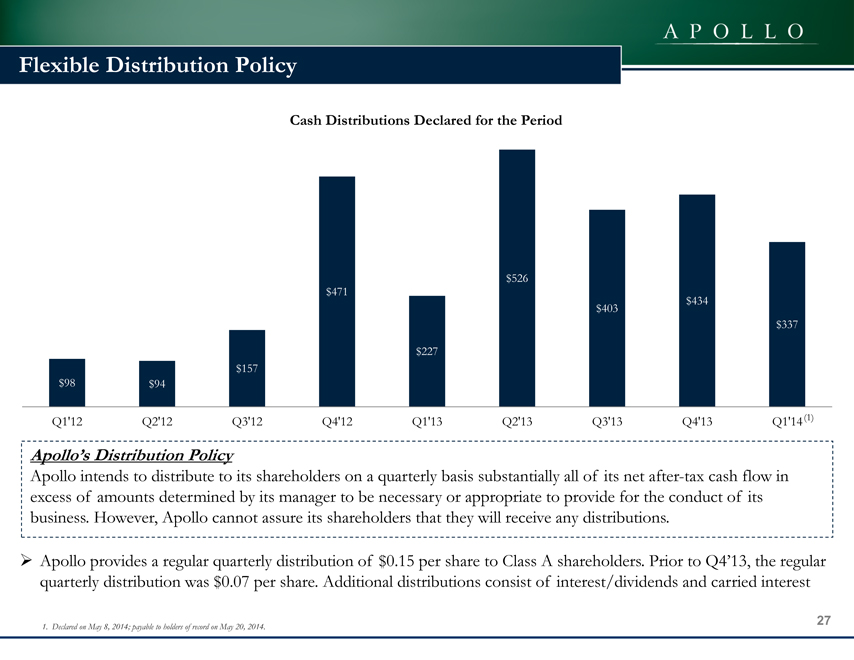

Flexible Distribution Policy

Cash Distributions Declared for the Period

$5

26

$471

$403 $434

$337

$227

$157

$98 $94

Q1’12 Q2’12 Q3’12 Q4’12 Q1’13 Q2’13 Q3’13 Q4’13 Q1’14 (1)

Apollo’s Distribution Policy

Apollo intends to distribute to its shareholders on a quarterly basis substantially all of its net after-tax cash flow in excess of amounts determined by its manager to be necessary or appropriate to provide for the conduct of its business. However, Apollo cannot assure its shareholders that they will receive any distributions.

Apollo provides a regular quarterly distribution of $0.15 per share to Class A shareholders. Prior to Q4’13, the regular quarterly distribution was $0.07 per share. Additional distributions consist of interest/dividends and carried interest

1. Declared on May 8, 2014; payable to holders of record on May 20, 2014.

27

|

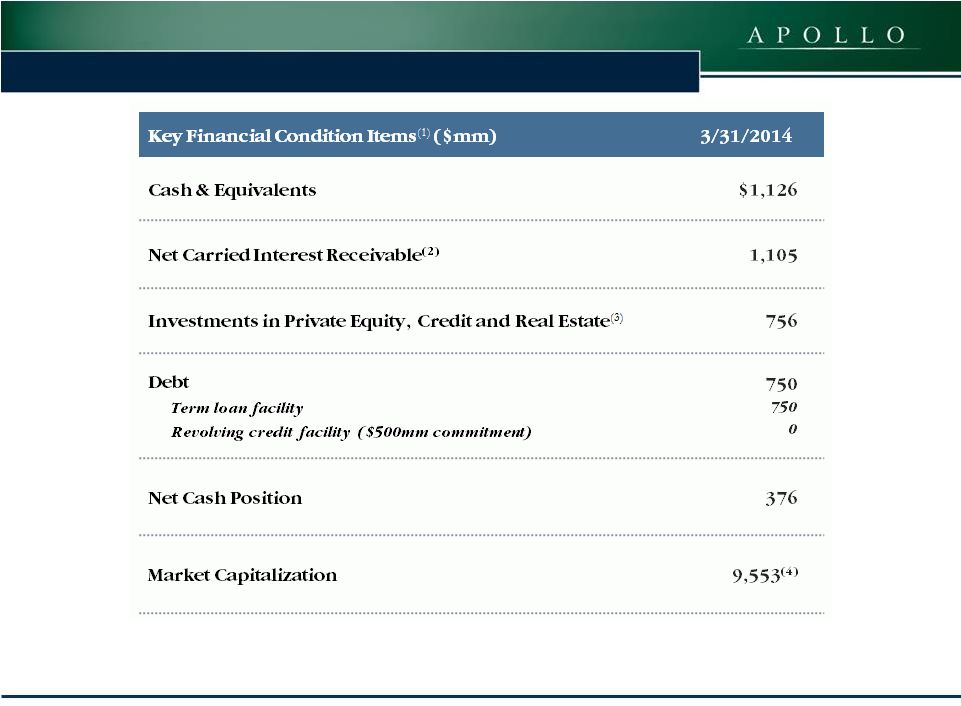

Strong Financial Condition With Low Levels of Debt 28 1. Financial condition amounts are shown without the impact of certain Apollo funds that are required to be consolidated on its financial statements under U.S. GAAP. 2. Net of profit sharing expense. 3. Includes total General Partner investments using equity method, fair value measurements of Apollo Senior Loan Fund, HFA and AAA (of which Apollo has a 2.6% ownership interest), and fair value measurement of Athene and AAA Services Derivatives. 4. As of May 15, 2014. Based on a share price of $25.28 and 377.9mm shares outstanding as of March 31, 2014, assuming full exchange of all outstanding Apollo Operating Group units as of such date into Class A shares. |

|

Selected Financial Metrics and Leverage Analysis 29 ($mm) 2011 2012 2013 LTM Q1 2014 Fee-related EBITDA $197 $339 $438 $560 Fee-related EBITDA + 100% of net realized carry 531 890 1,915 2,103 Interest expense 41 37 29 25 Debt 738 738 750 750 Leverage ratios: Fee-related EBITDA / interest expense 4.8x 9.1x 15.1x 22.5x Fee-related EBITDA + 100% of net realized carry / interest expense 13.0x 24.0x 66.0x 84.1x Debt / fee-related EBITDA 3.8x 2.2x 1.7x 1.3x Debt / fee-related EBITDA + 100% of net realized carry 1.4x 0.8x 0.4x 0.4x |

|

Agenda Topic 1) Apollo Overview 2) Segment update 3) Financial Overview 4) Appendix 30 |

|

Bridge to GAAP Financials 31 ($mm) 2011 2012 2013 LTM Q1 2014 Fee-Related EBITDA + 100% net realized carry $531 $890 $1,915 $2,103 Net unrealized carry (716) 740 208 (493) Net unrealized investment income 5 120 111 138 Net interest expense (41) (37) (29) (25) Depreciation and amortization (11) (10) (11) (11) Non-cash comp (68) (69) (66) (107) ENI tax provision (21) (159) (238) (238) Economic Net (Loss) Income (post-tax) ($322) $1,476 $1,890 $1,368 ENI tax provision 21 159 238 238 Income tax provision (12) (65) (108) (122) Net (loss) income attributable to non-controlling interests in Apollo Operating Group 940 (685) (1,258) (928) Non-cash charges related to equity-based compensation (1,082) (530) (60) (32) Amortization of intangible assets (15) (43) (43) (41) GAAP Net (Loss) Income ($469) $311 $659 $483 |

|

Carried Interest Income Receivable Note: Figures may not sum due to rounding. Amounts presented are on an unconsolidated basis. 32 ($mm) 2012 2013 Q1 2014 Private equity funds: Fund VII $904 $891 $774 Fund VI 270 698 522 Fund V 134 43 54 Fund IV 11 8 5 Other (AAA, Stanhope) 94 229 219 Total private equity funds $1,413 $1,868 $1,574 Credit funds: U.S. performing credit $402 $180 $163 Opportunistic credit 37 60 49 Structured credit 21 54 61 European credit 18 36 18 Non-performing loans 102 154 120 Total credit funds $580 $484 $410 Real estate funds CPI other $11 $5 $4 AGRE US real estate - 6 7 Other - 4 4 Total real estate funds $11 $15 $15 Total $2,004 $2,367 $1,999 |

|

Structure Chart as of May 9, 2014 33 100% 39.44% of the LP units of certain Apollo Operating Group Entities 11.82% of LP units 31.26% of total voting power Managing Partners APO (FC), LLC Apollo Asset Co., LLC APO Corp. Apollo Operating Group 39.44% of the LP units of certain Apollo Operating Group Entities 39.44% of the LP units of certain Apollo Operating Group Entities 100% 100% Intermediate Holding Companies Class A Shareholders (Class A Shares) AGM Management, LLC (Our Manager) BRH Holdings GP, Ltd. (Class B Shares) BRH Holdings, L.P. AP Professional Holdings, L.P. (60.56% of Apollo Operating Group Units) Contributing Partners 60.56% of the LP units of each Apollo Operating Group Entity 88.18% of LP units 68.74% of total voting power 100% of LP units GP GP Note: The organizational structure chart above depicts a simplified version of the Apollo structure. It does not include all legal entities in the structure. APOLLO GLOBAL MANAGEMENT, LLC (39.44% of Apollo Operating Group Units) |

|

Appendix: Credit Fund Summary Apollo Fund Year of Inception Apollo Fund Year of Inception Apollo / Artus Investors 2007 – 1 2007 ALM VII (R) Ltd. 2013 Apollo Credit Liquidity Fund 2007 ALM VII (R)-2 Ltd. 2013 Apollo Credit Opportunity Fund I 2008 ALM VIII 2013 Apollo Credit Opportunity Fund II 2008 ALM X 2014 Apollo Credit Opportunity Fund III 2013 ALME 2013 Apollo Senior Loan Fund 2010 Compass 2005-II 2006 Apollo European Principal Finance 2007 Compass 2007 2007 Apollo European Principal Finance II 2012 Cornerstone CLO 2007 Apollo Investment Corporation (NASDAQ: AINV) 2004 Rampart CLO 2006-I 2006 AP Investment Europe Limited (1) 2006 Rampart CLO 2007-I 2007 Apollo Investment Europe II 2008 Rashinban 2006 Apollo European Credit Fund 2011 Sextant 2006 2006 Apollo Senior Floating Rate Fund Inc (NYSE: AFT) 2011 Sextant 2007 2007 Apollo Strategic Value Fund 2006 Stone Tower CLO V 2006 Apollo Value Investment Fund 2003 Stone Tower CLO VI 2007 Apollo Credit Fund (2) 2005 Stone Tower CLO VII 2007 Apollo Credit Strategies Fund (2) 2011 Apollo Financial Credit Investment I 2011 Apollo Structured Credit Recovery Fund II 2012 Apollo Financial Credit Investment II 2013 ALM IV 2011 Apollo Total Return Fund 2014 ALM V 2012 Apollo Structured Credit Recovery Fund III 2014 ALM VI 2012 Apollo Credit Short Opportunities Fund 2014 ALM VII 2012 34 It should not be assumed that future Credit funds or CLOs will equal the performance of the funds and CLOs on this list, nor should it be assumed that the past performance of the funds and CLOs on this list are indicative or a guarantee of future performance of such funds and CLOs. (1) Fund is currently winding down. (2) Track record was accumulated by the investment committee, of which two members are no longer at the firm as of June 30, 2012. Note: As of April 2014, the following CLOs have been called: ALM I and III, Compass 2002-1, 2003-1, 2004-1 and 2005-I, Neptune, Granite Ventures I, II, and III, Stone Tower CLOs I, II, III, IV. This list excludes CDOs, SIVs, managed accounts and strategic partnerships. The above list is reflective of funds currently in existence as of April 2014 and excludes funds and investment vehicles that have since been dissolved but previously managed by Apollo. Additional information on such funds is available upon request. |