Exhibit 99.2 A P O L L O G L O B A L M A N A G E M E N T Apollo Global Management, Inc. Third Quarter 2019 Earnings October 31, 2019

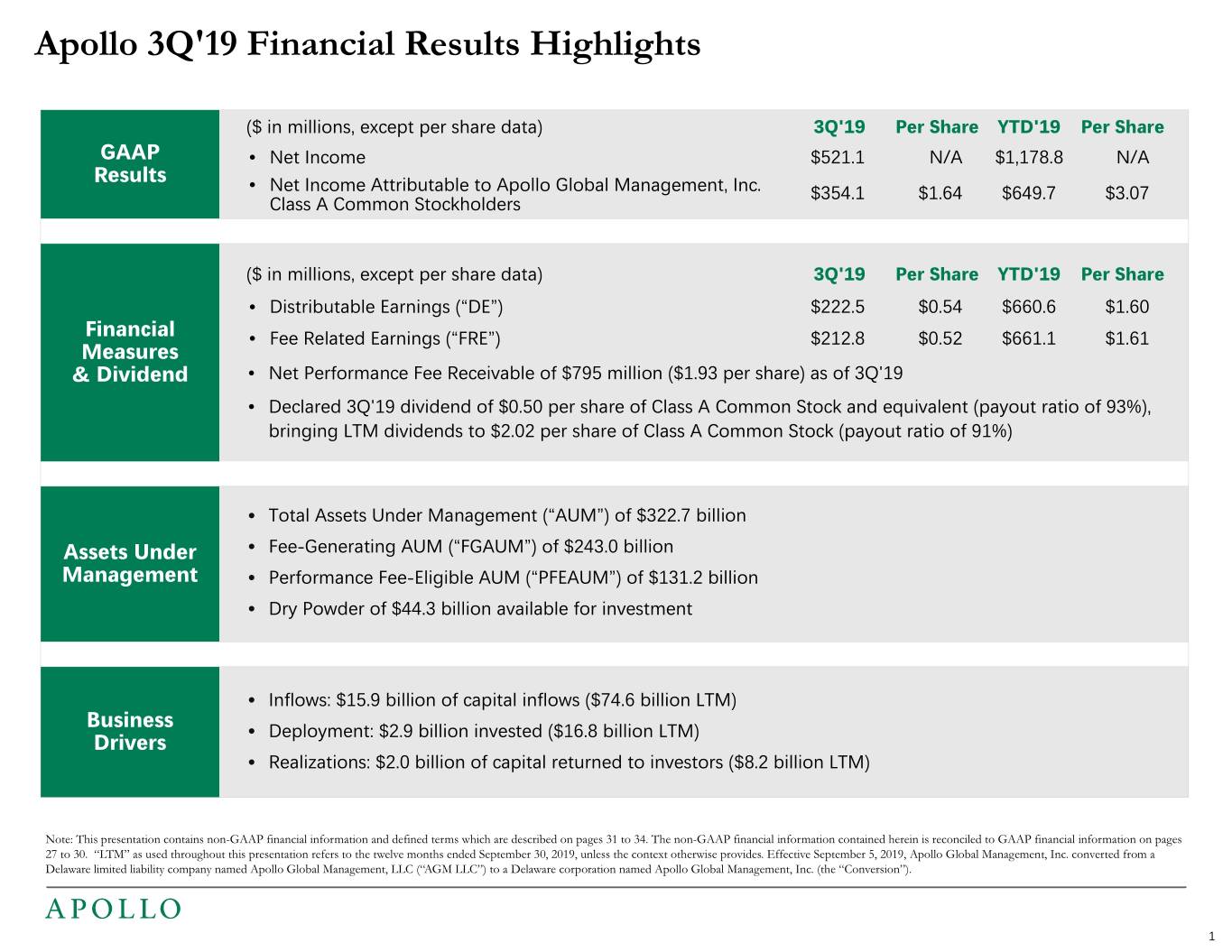

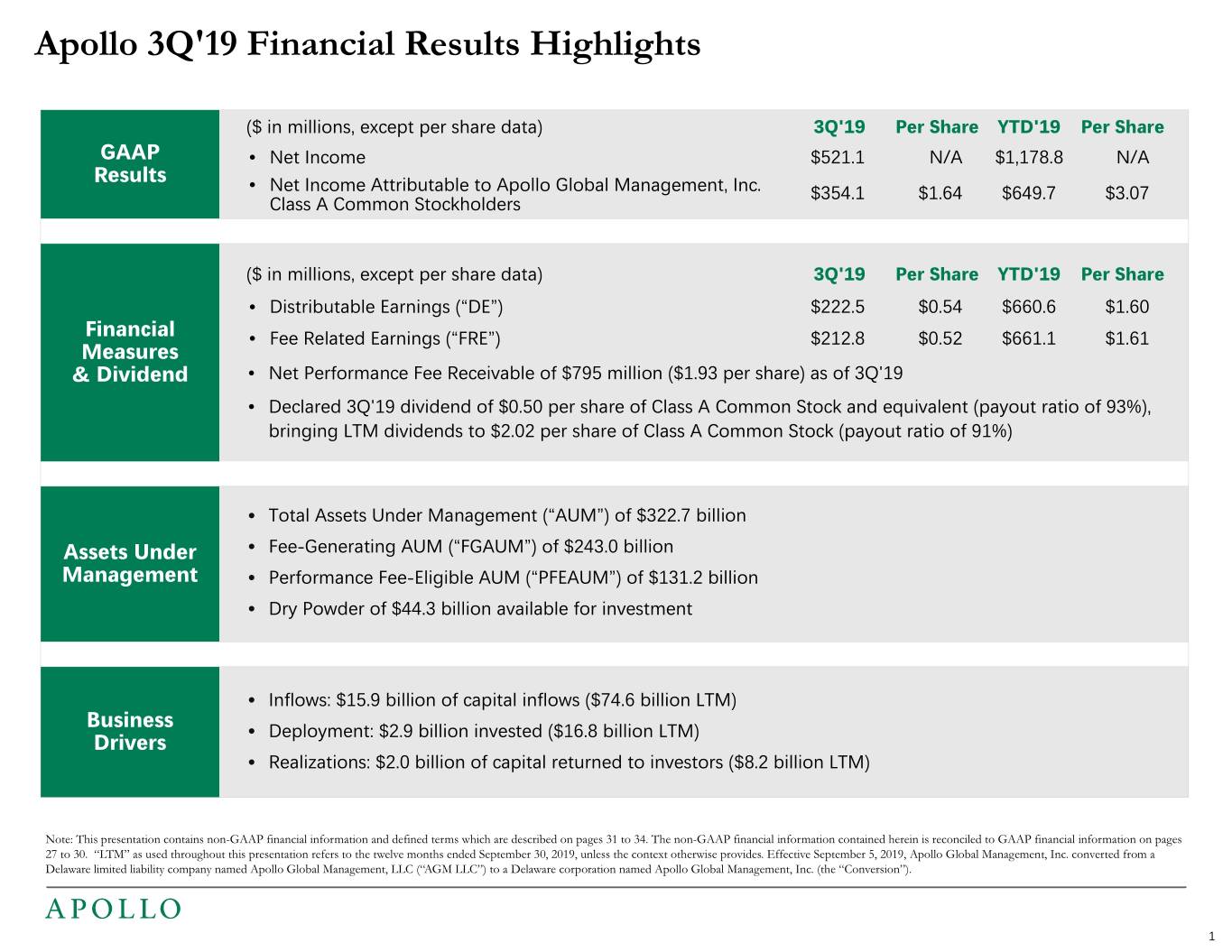

Apollo 3Q'19 Financial Results Highlights ($ in millions, except per share data) 3Q'19 Per Share YTD'19 Per Share • Net Income of $521.1 million GAAP • Net Income $521.1 N/A $1,178.8 N/A Results • Net Income Attributable to Apollo Global • Net Income Attributable to Apollo Global Management, Inc. $354.1 $1.64 $649.7 $3.07 Class A Common Stockholders Management, LLC Class A Shareholders of $354.1 million ($1.64/share) ($ in millions, except per share data) 3Q'19 Per Share YTD'19 Per Share • Distributable Earnings (“DE”) $222.5 $0.54 $660.6 $1.60 Financial • Fee Related Earnings (“FRE”) $212.8 $0.52 $661.1 $1.61 Measures & Dividend • Net Performance Fee Receivable of $795 million ($1.93 per share) as of 3Q'19 • Declared 3Q'19 dividend of $0.50 per share of Class A Common Stock and equivalent (payout ratio of 93%), bringing LTM dividends to $2.02 per share of Class A Common Stock (payout ratio of 91%) • Total Assets Under Management (“AUM”) of $322.7 billion Assets Under • Fee-Generating AUM (“FGAUM”) of $243.0 billion Management • Performance Fee-Eligible AUM (“PFEAUM”) of $131.2 billion • Dry Powder of $44.3 billion available for investment • Inflows: $15.9 billion of capital inflows ($74.6 billion LTM) Business • Deployment: $2.9 billion invested ($16.8 billion LTM) Drivers • Realizations: $2.0 billion of capital returned to investors ($8.2 billion LTM) Note: This presentation contains non-GAAP financial information and defined terms which are described on pages 31 to 34. The non-GAAP financial information contained herein is reconciled to GAAP financial information on pages 27 to 30. “LTM” as used throughout this presentation refers to the twelve months ended September 30, 2019, unless the context otherwise provides. Effective September 5, 2019, Apollo Global Management, Inc. converted from a Delaware limited liability company named Apollo Global Management, LLC (“AGM LLC”) to a Delaware corporation named Apollo Global Management, Inc. (the “Conversion”). 1

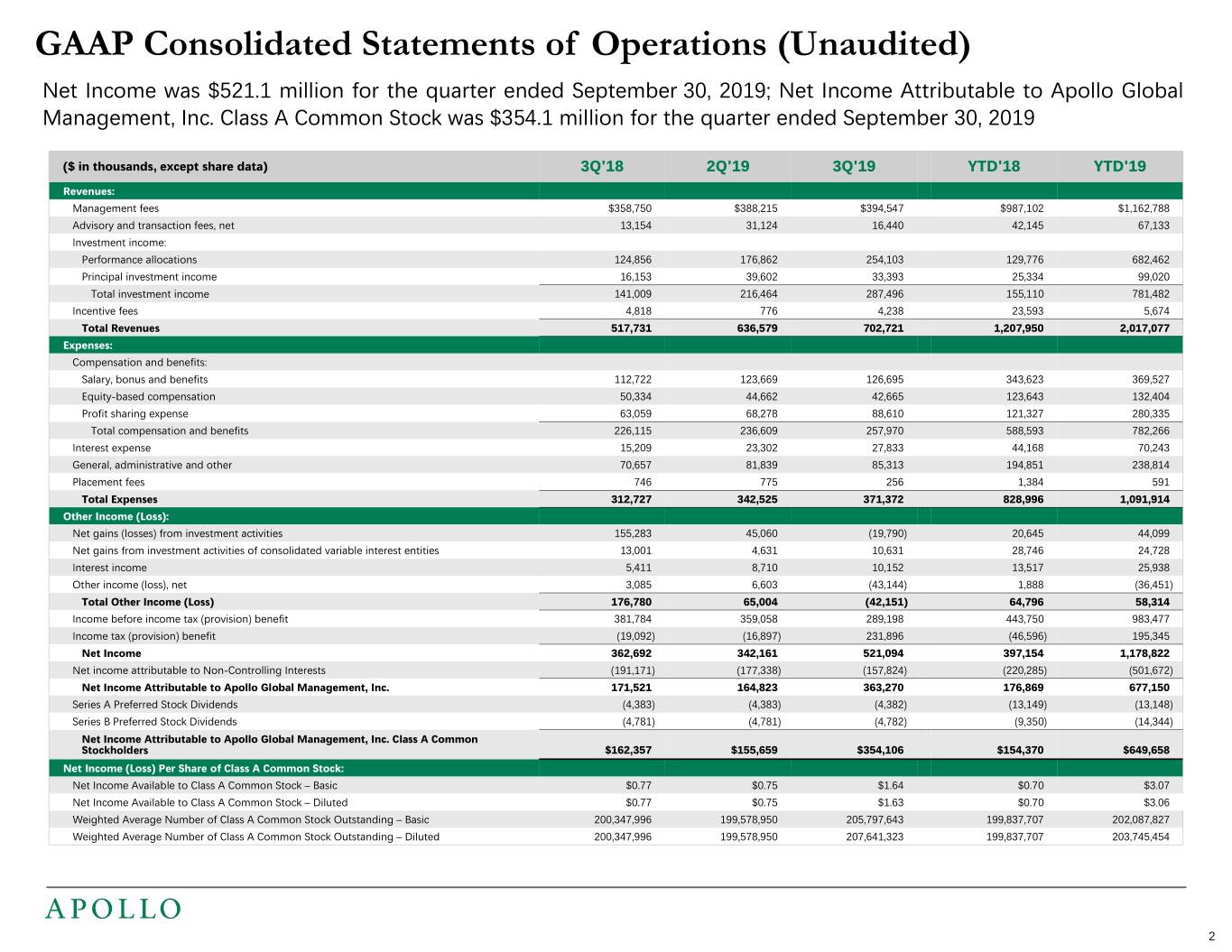

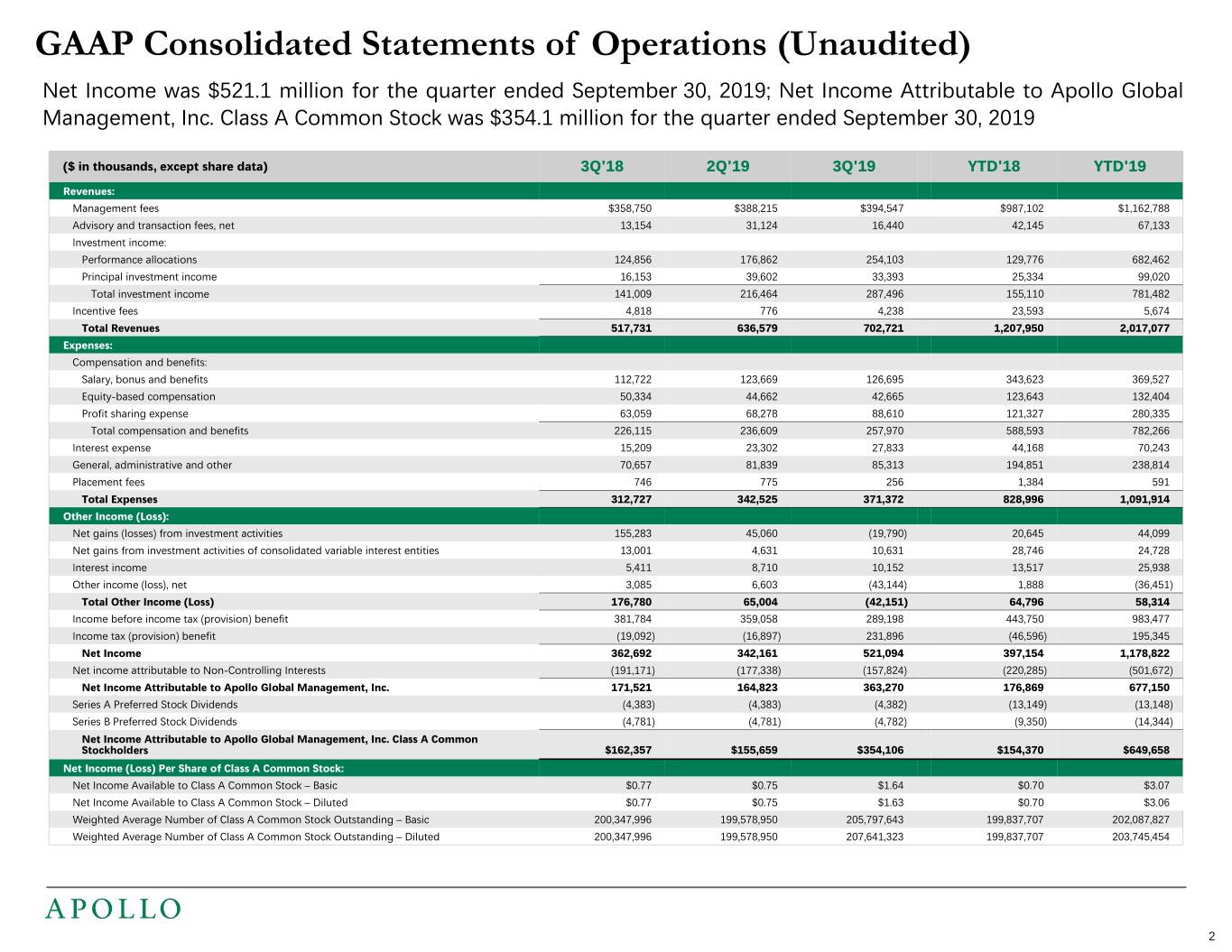

GAAP Consolidated Statements of Operations (Unaudited) Net Income was $521.1 million for the quarter ended September 30, 2019; Net Income Attributable to Apollo Global Management, Inc. Class A Common Stock was $354.1 million for the quarter ended September 30, 2019 ($ in thousands, except share data) 3Q'18 2Q'19 3Q'19 YTD'18 YTD'19 Revenues: Management fees $358,750 $388,215 $394,547 $987,102 $1,162,788 Advisory and transaction fees, net 13,154 31,124 16,440 42,145 67,133 Investment income: Performance allocations 124,856 176,862 254,103 129,776 682,462 Principal investment income 16,153 39,602 33,393 25,334 99,020 Total investment income 141,009 216,464 287,496 155,110 781,482 Incentive fees 4,818 776 4,238 23,593 5,674 Total Revenues 517,731 636,579 702,721 1,207,950 2,017,077 Expenses: Compensation and benefits: Salary, bonus and benefits 112,722 123,669 126,695 343,623 369,527 Equity-based compensation 50,334 44,662 42,665 123,643 132,404 Profit sharing expense 63,059 68,278 88,610 121,327 280,335 Total compensation and benefits 226,115 236,609 257,970 588,593 782,266 Interest expense 15,209 23,302 27,833 44,168 70,243 General, administrative and other 70,657 81,839 85,313 194,851 238,814 Placement fees 746 775 256 1,384 591 Total Expenses 312,727 342,525 371,372 828,996 1,091,914 Other Income (Loss): Net gains (losses) from investment activities 155,283 45,060 (19,790) 20,645 44,099 Net gains from investment activities of consolidated variable interest entities 13,001 4,631 10,631 28,746 24,728 Interest income 5,411 8,710 10,152 13,517 25,938 Other income (loss), net 3,085 6,603 (43,144) 1,888 (36,451) Total Other Income (Loss) 176,780 65,004 (42,151) 64,796 58,314 Income before income tax (provision) benefit 381,784 359,058 289,198 443,750 983,477 Income tax (provision) benefit (19,092) (16,897) 231,896 (46,596) 195,345 Net Income 362,692 342,161 521,094 397,154 1,178,822 Net income attributable to Non-Controlling Interests (191,171) (177,338) (157,824) (220,285) (501,672) Net Income Attributable to Apollo Global Management, Inc. 171,521 164,823 363,270 176,869 677,150 Series A Preferred Stock Dividends (4,383) (4,383) (4,382) (13,149) (13,148) Series B Preferred Stock Dividends (4,781) (4,781) (4,782) (9,350) (14,344) Net Income Attributable to Apollo Global Management, Inc. Class A Common Stockholders $162,357 $155,659 $354,106 $154,370 $649,658 Net Income (Loss) Per Share of Class A Common Stock: Net Income Available to Class A Common Stock – Basic $0.77 $0.75 $1.64 $0.70 $3.07 Net Income Available to Class A Common Stock – Diluted $0.77 $0.75 $1.63 $0.70 $3.06 Weighted Average Number of Class A Common Stock Outstanding – Basic 200,347,996 199,578,950 205,797,643 199,837,707 202,087,827 Weighted Average Number of Class A Common Stock Outstanding – Diluted 200,347,996 199,578,950 207,641,323 199,837,707 203,745,454 2

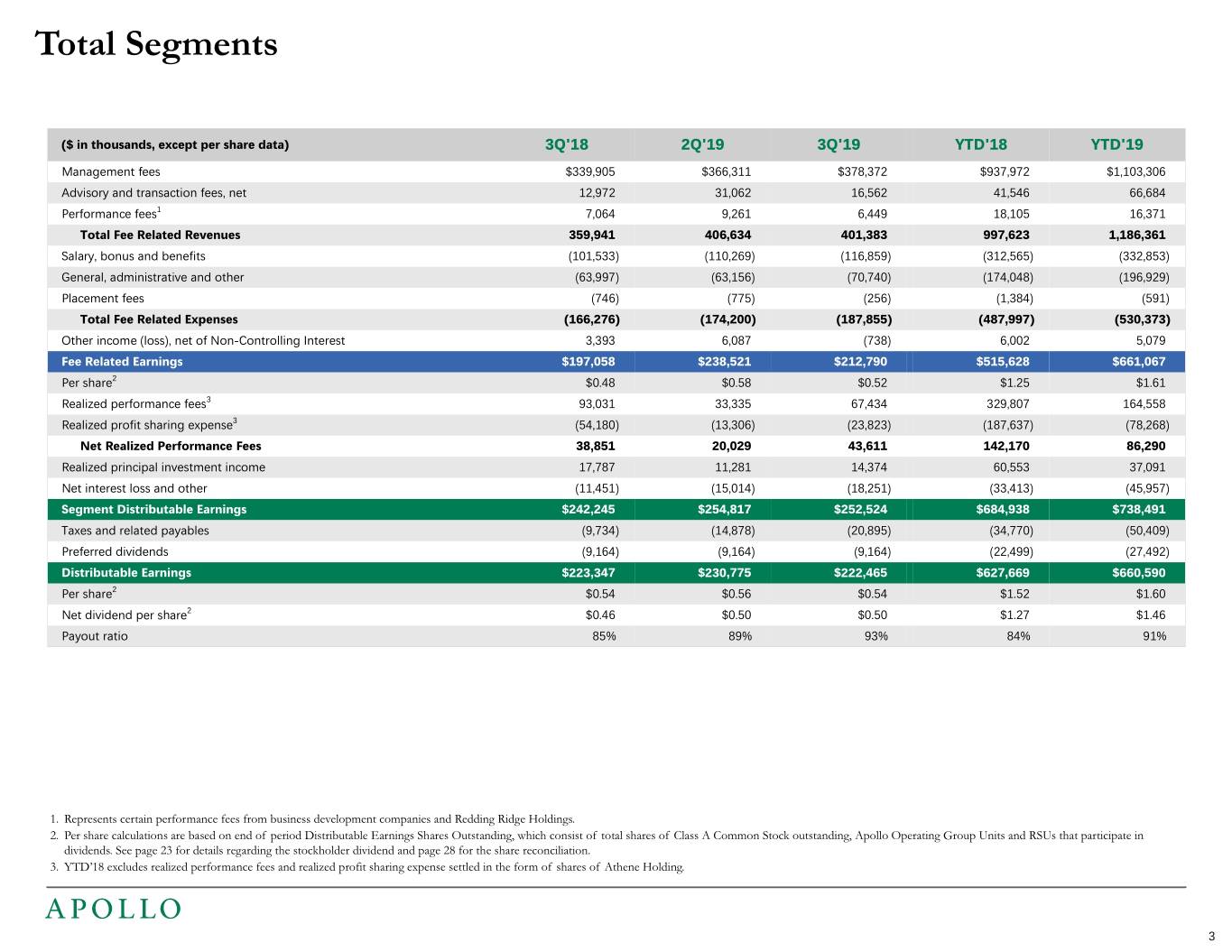

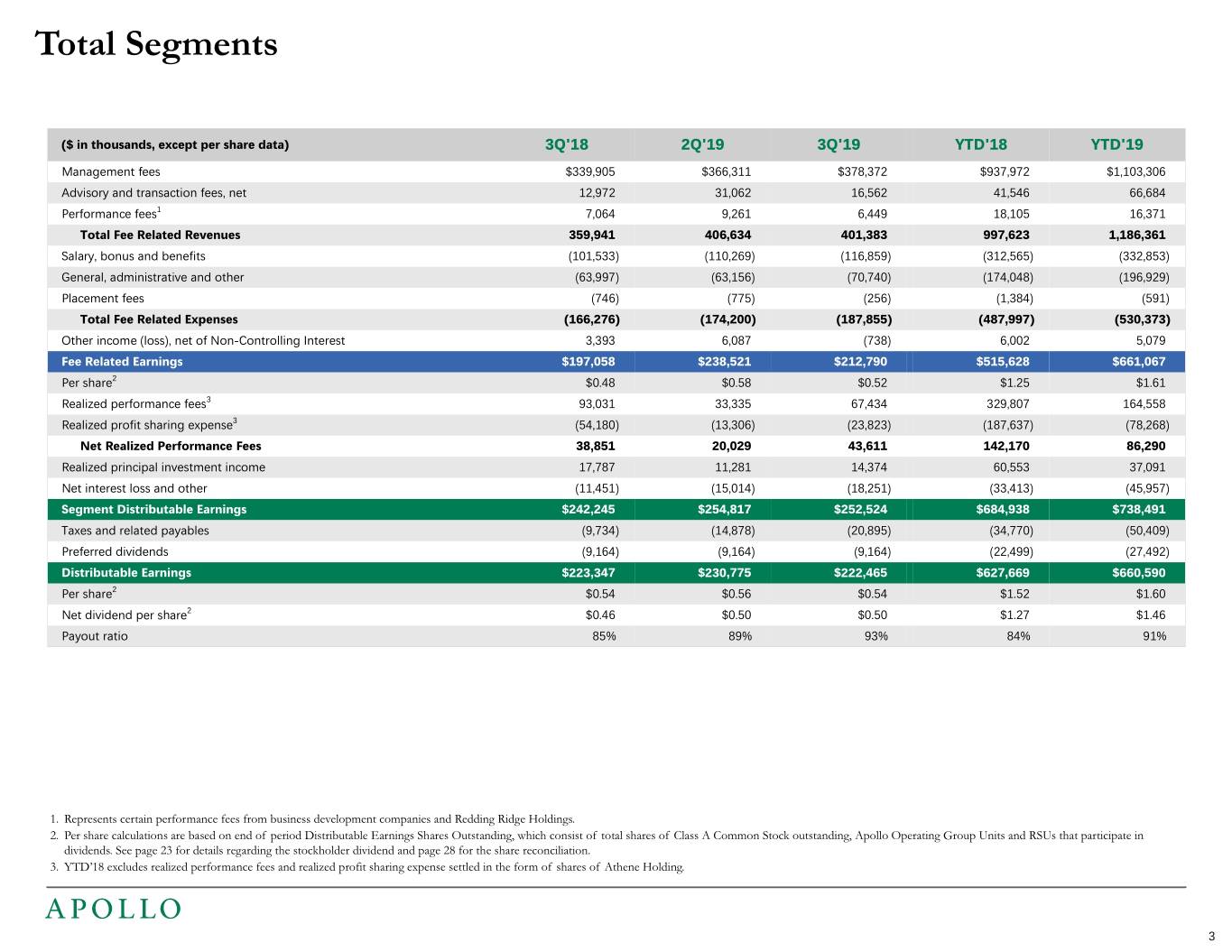

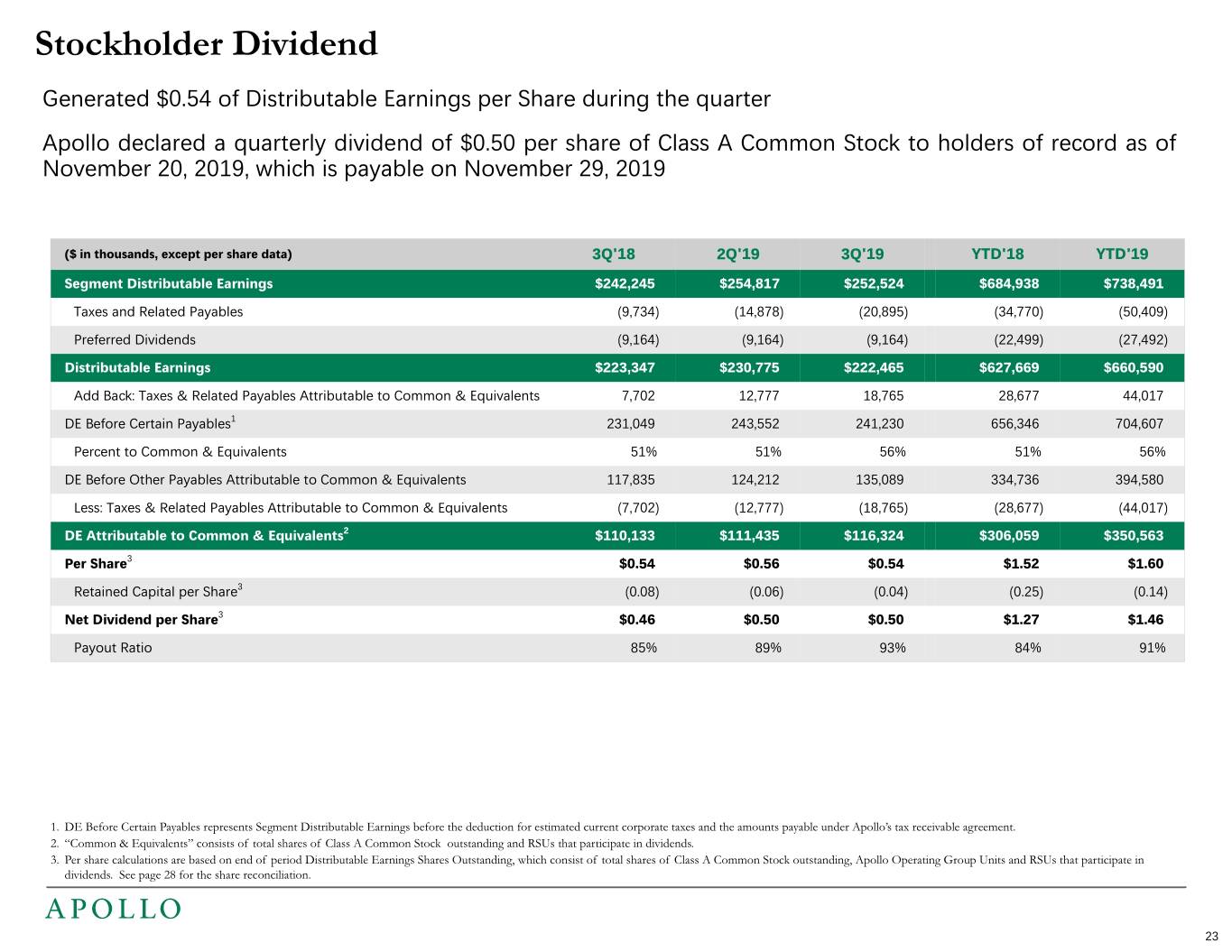

Total Segments ($ in thousands, except per share data) 3Q'18 2Q'19 3Q'19 YTD'18 YTD'19 Management fees $339,905 $366,311 $378,372 $937,972 $1,103,306 Advisory and transaction fees, net 12,972 31,062 16,562 41,546 66,684 Performance fees1 7,064 9,261 6,449 18,105 16,371 Total Fee Related Revenues 359,941 406,634 401,383 997,623 1,186,361 Salary, bonus and benefits (101,533) (110,269) (116,859) (312,565) (332,853) General, administrative and other (63,997) (63,156) (70,740) (174,048) (196,929) Placement fees (746) (775) (256) (1,384) (591) Total Fee Related Expenses (166,276) (174,200) (187,855) (487,997) (530,373) Other income (loss), net of Non-Controlling Interest 3,393 6,087 (738) 6,002 5,079 Fee Related Earnings $197,058 $238,521 $212,790 $515,628 $661,067 Per share2 $0.48 $0.58 $0.52 $1.25 $1.61 Realized performance fees3 93,031 33,335 67,434 329,807 164,558 Realized profit sharing expense3 (54,180) (13,306) (23,823) (187,637) (78,268) Net Realized Performance Fees 38,851 20,029 43,611 142,170 86,290 Realized principal investment income 17,787 11,281 14,374 60,553 37,091 Net interest loss and other (11,451) (15,014) (18,251) (33,413) (45,957) Segment Distributable Earnings $242,245 $254,817 $252,524 $684,938 $738,491 Taxes and related payables (9,734) (14,878) (20,895) (34,770) (50,409) Preferred dividends (9,164) (9,164) (9,164) (22,499) (27,492) Distributable Earnings $223,347 $230,775 $222,465 $627,669 $660,590 Per share2 $0.54 $0.56 $0.54 $1.52 $1.60 Net dividend per share2 $0.46 $0.50 $0.50 $1.27 $1.46 Payout ratio 85% 89% 93% 84% 91% 1. Represents certain performance fees from business development companies and Redding Ridge Holdings. 2. Per share calculations are based on end of period Distributable Earnings Shares Outstanding, which consist of total shares of Class A Common Stock outstanding, Apollo Operating Group Units and RSUs that participate in dividends. See page 23 for details regarding the stockholder dividend and page 28 for the share reconciliation. 3. YTD’18 excludes realized performance fees and realized profit sharing expense settled in the form of shares of Athene Holding. 3

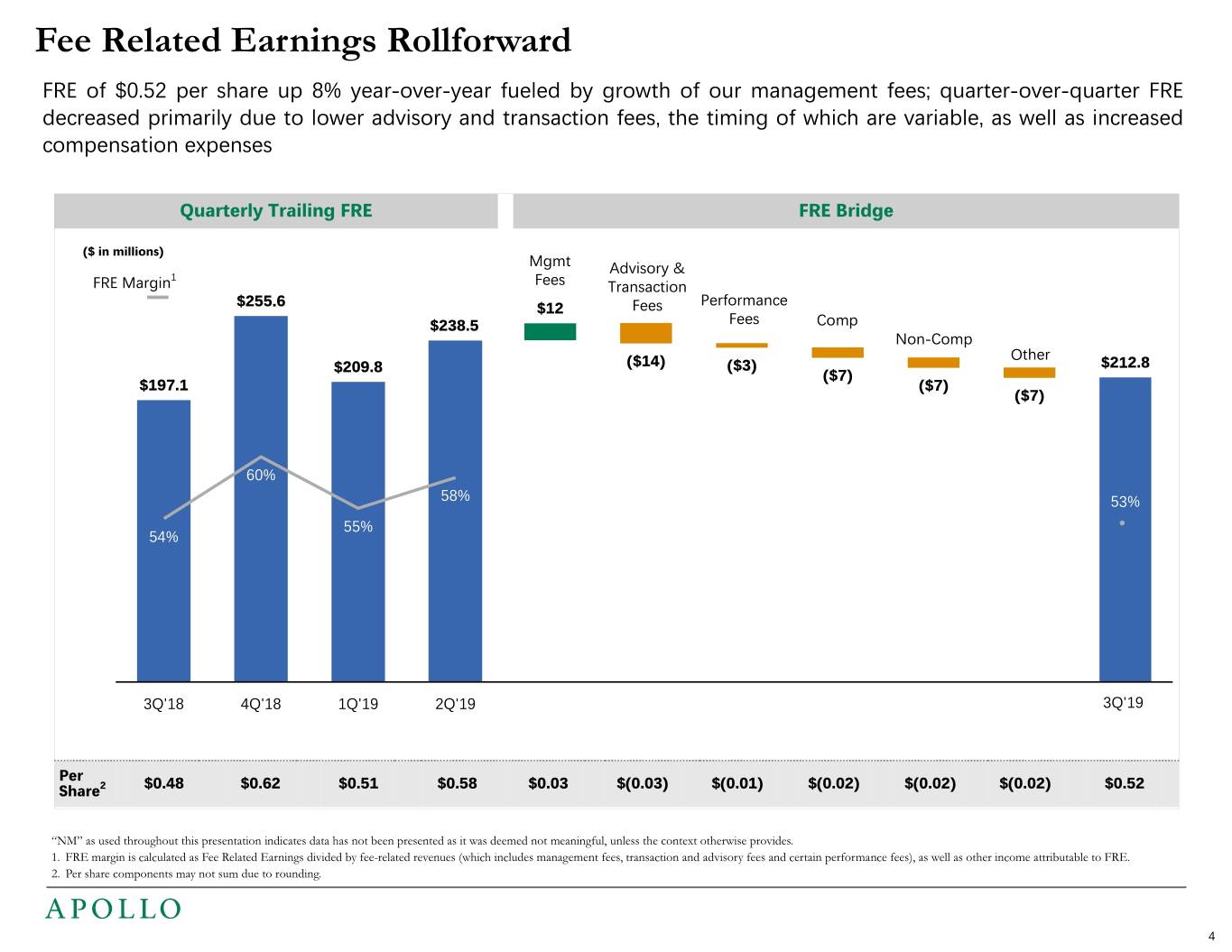

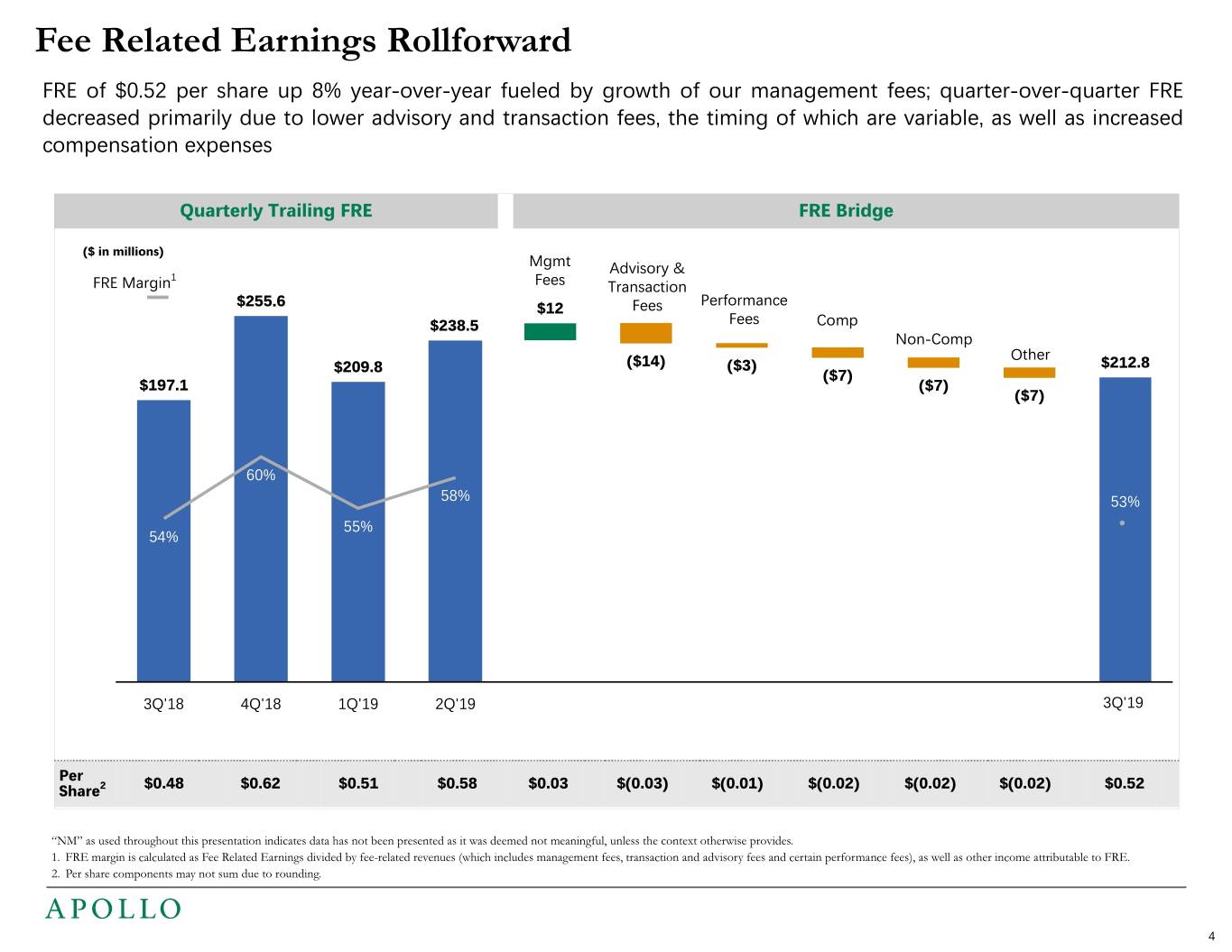

Fee Related Earnings Rollforward FRE of $0.52 per share up 8% year-over-year fueled by growth of our management fees; quarter-over-quarter FRE decreased primarily due to lower advisory and transaction fees, the timing of which are variable, as well as increased compensation expenses Quarterly Trailing FRE FRE Bridge ($ in millions) Mgmt Advisory & 1 FRE Margin Fees Transaction Performance $255.6 $12 Fees $238.5 Fees Comp Non-Comp Other $209.8 ($14) ($3) $212.8 ($7) $197.1 ($7) ($7) 60% 58% 53% 55% • 54% 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 Per Share2 $0.48 $0.62 $0.51 $0.58 $0.03 $(0.03) $(0.01) $(0.02) $(0.02) $(0.02) $0.52 “NM” as used throughout this presentation indicates data has not been presented as it was deemed not meaningful, unless the context otherwise provides. 1. FRE margin is calculated as Fee Related Earnings divided by fee-related revenues (which includes management fees, transaction and advisory fees and certain performance fees), as well as other income attributable to FRE. 2. Per share components may not sum due to rounding. 4

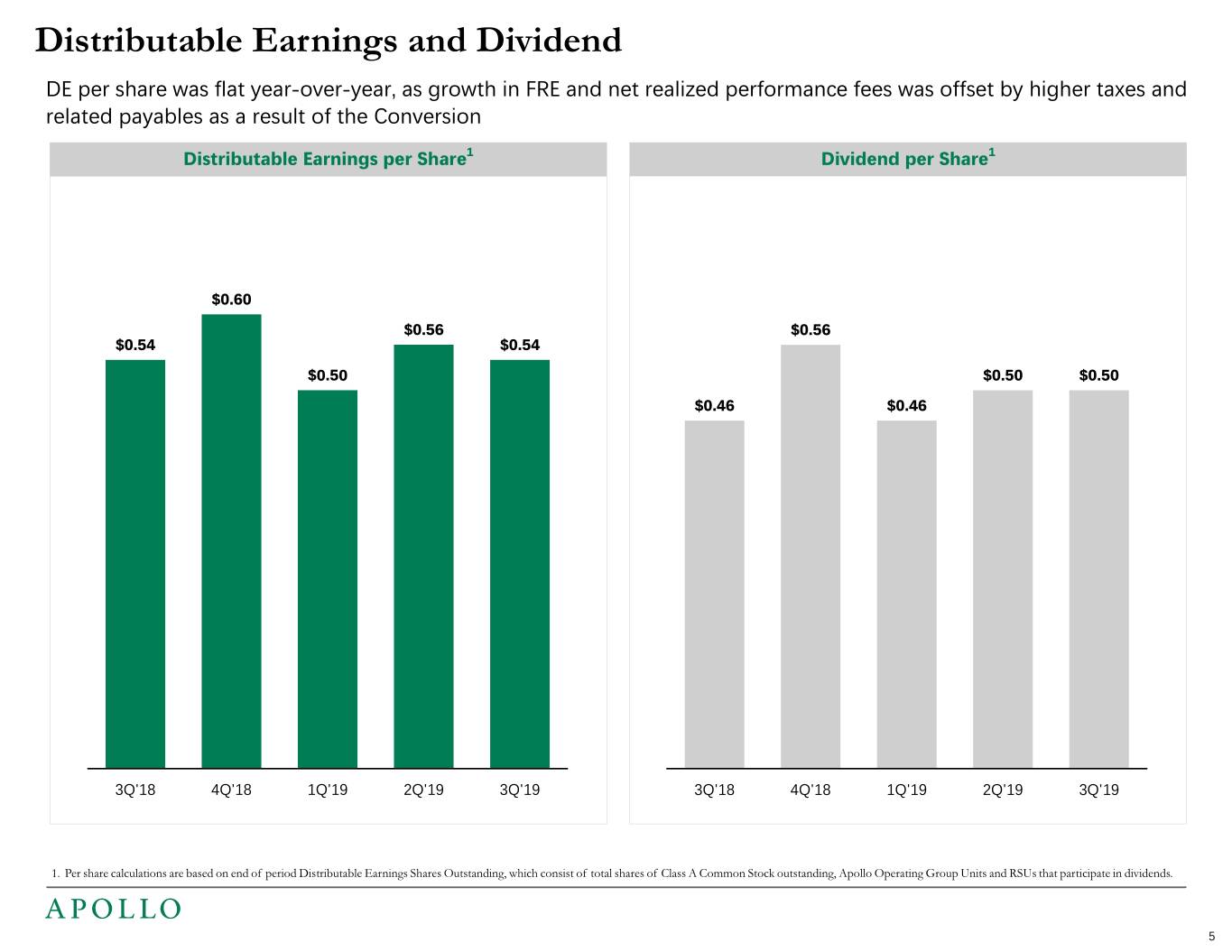

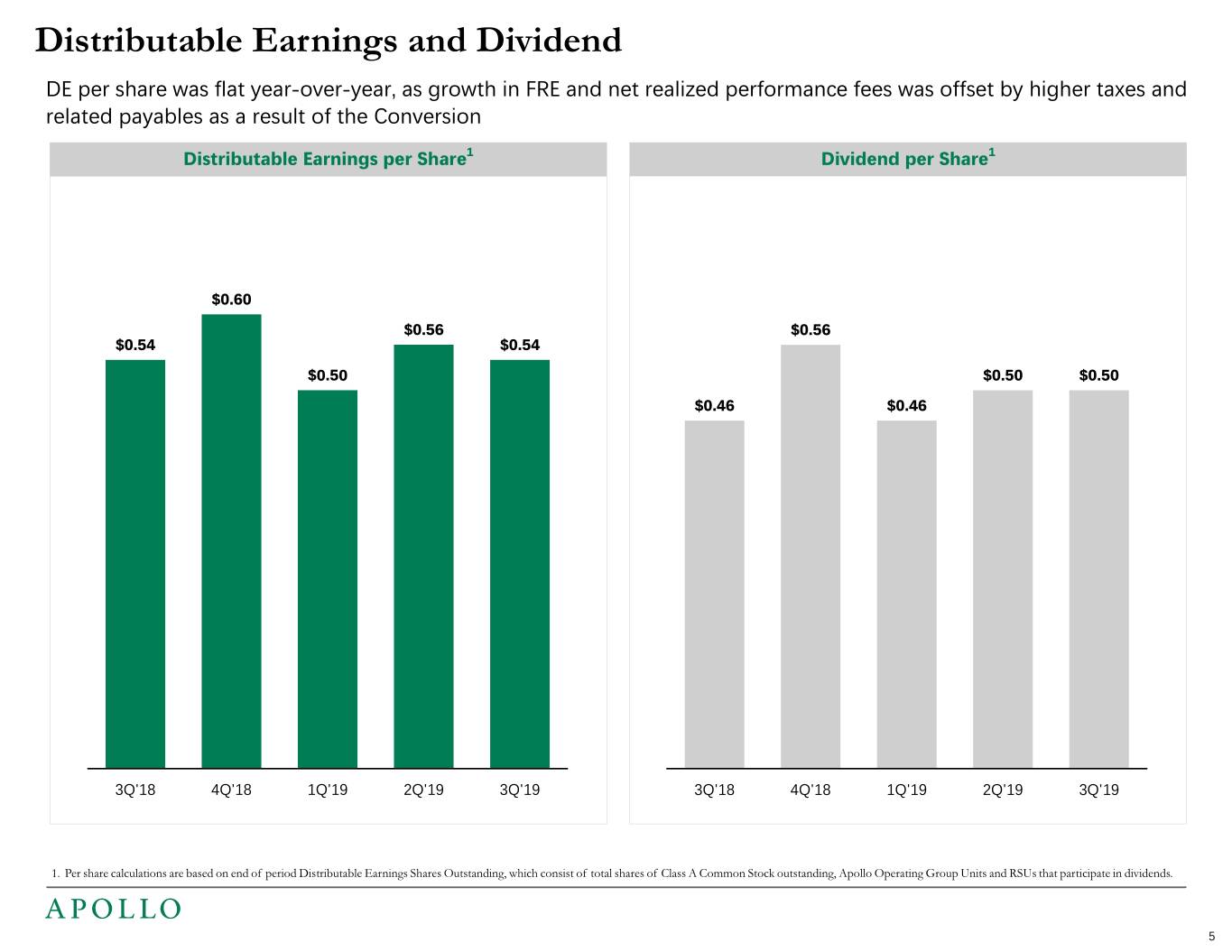

Distributable Earnings and Dividend DE per share was flat year-over-year, as growth in FRE and net realized performance fees was offset by higher taxes and related payables as a result of the Conversion Distributable Earnings per Share1 Dividend per Share1 $0.60 $0.56 $0.56 $0.54 $0.54 $0.50 $0.50 $0.50 $0.46 $0.46 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 1. Per share calculations are based on end of period Distributable Earnings Shares Outstanding, which consist of total shares of Class A Common Stock outstanding, Apollo Operating Group Units and RSUs that participate in dividends. 5

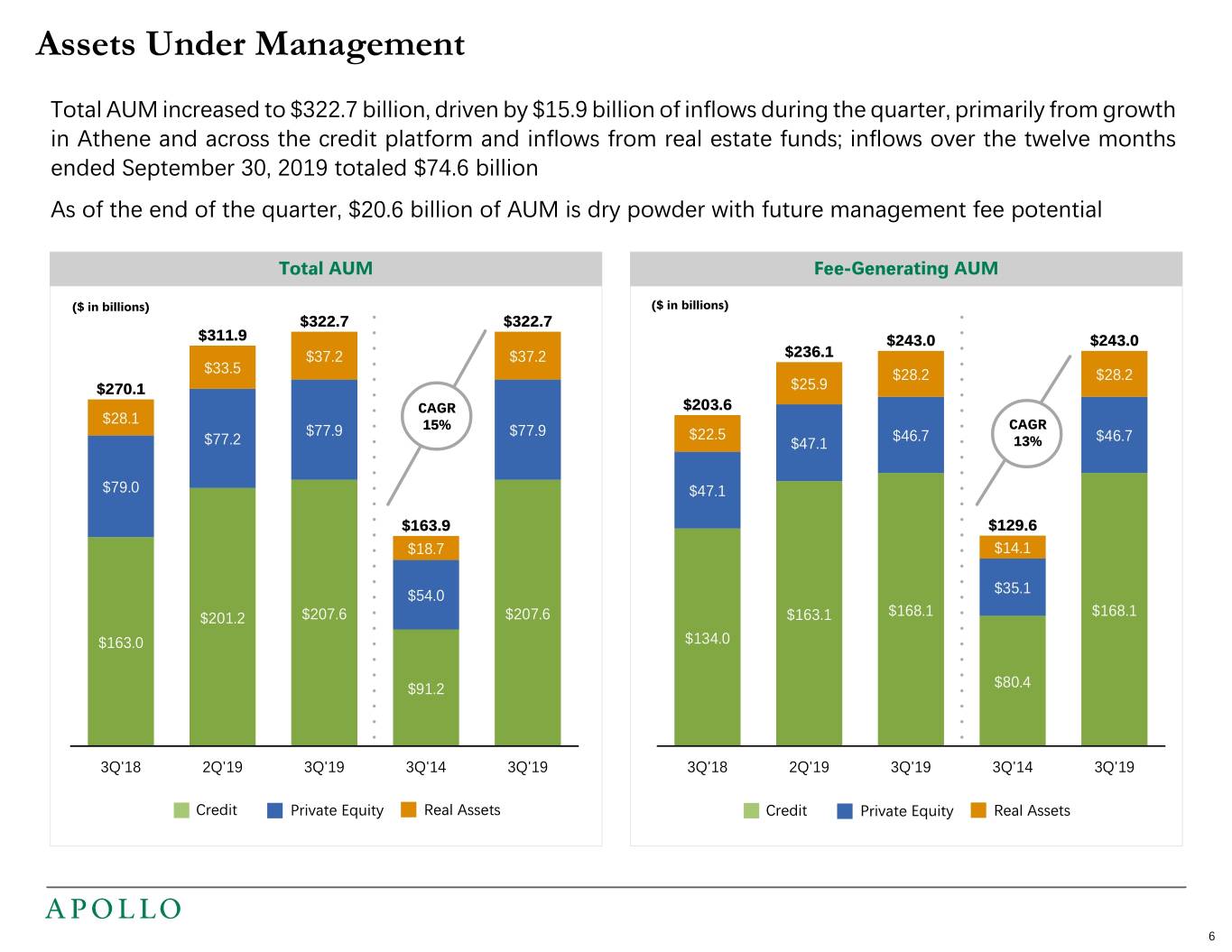

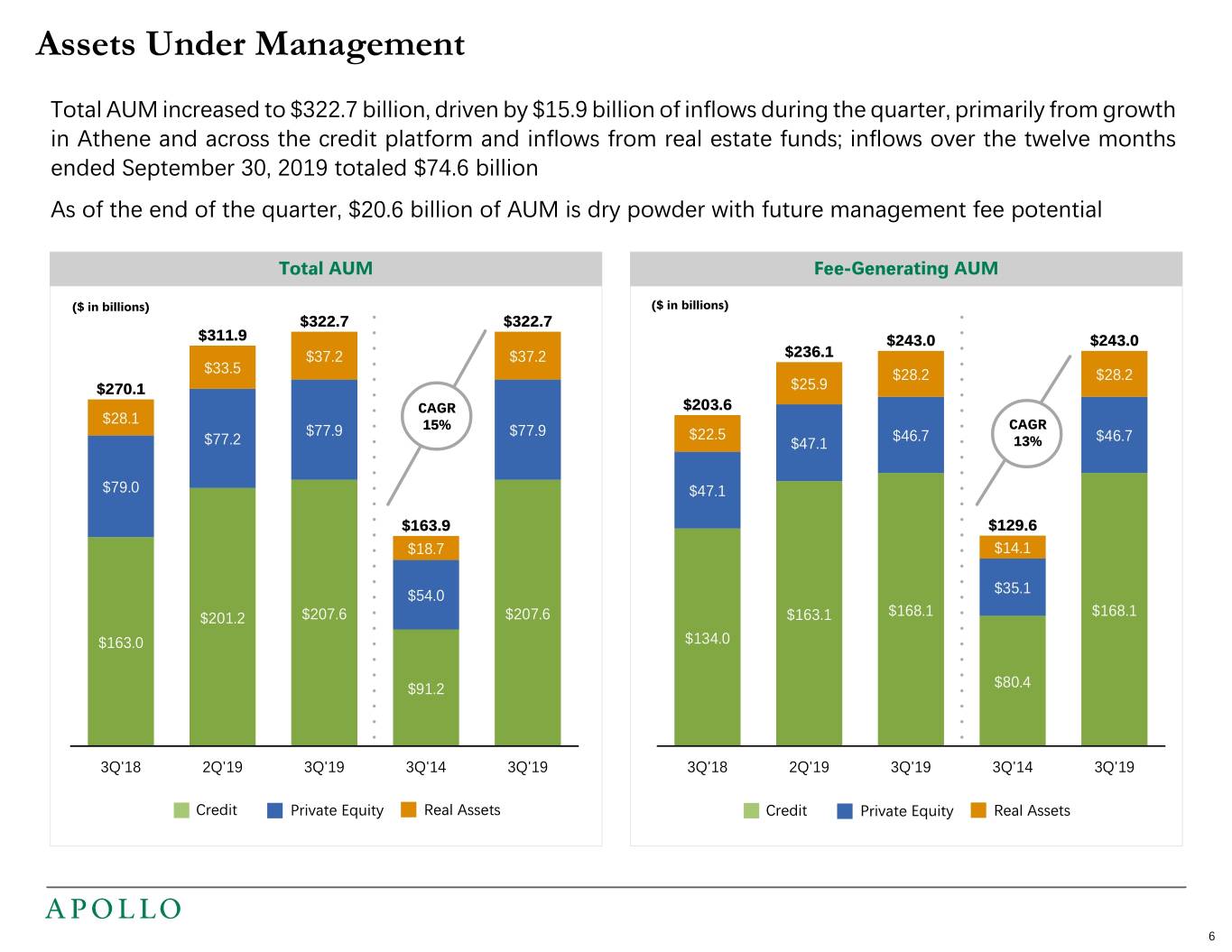

Assets Under Management Total AUM increased 3% quarter-over- Total AUM increased to $322.7 billion, driven by $15.9 billion of inflows during the quarter, primarily from growth quarter and 19% year-over-year to $322.7 in Athene and across the credit platform and inflows from real estate funds; inflows over the twelve months billion driven by $15.9 billion of inflows, ended September 30, 2019 totaled $74.6 billion offset by $3.7 billion of outflows As of the end of the quarter, $20.6 billion of AUM is dry powder with future management fee potential Fee-Generating AUM increased 3% quarter-over-quarter to $243.0 billion, Total AUM Fee-Generating AUM driven by $12.2 billion of inflows, offset ($ in billions) ($ in billions) by $4.4 billion of outflows $322.7 $322.7 $311.9 $243.0 $243.0 $37.2 $37.2 $236.1 $33.5 $28.2 $28.2 $270.1 $25.9 CAGR $203.6 $28.1 15% CAGR $77.9 $77.9 $22.5 $46.7 $46.7 $77.2 $47.1 13% $79.0 $47.1 $163.9 $129.6 $18.7 $14.1 $54.0 $35.1 $201.2 $207.6 $207.6 $163.1 $168.1 $168.1 $163.0 $134.0 $91.2 $80.4 3Q'18 2Q'19 3Q'19 3Q'14 3Q'19 3Q'18 2Q'19 3Q'19 3Q'14 3Q'19 Credit Private Equity Real Assets Credit Private Equity Real Assets 1. Total AUM includes $6.3 billion of AUM related to Redding Ridge which is excluded from fee-generating AUM as Apollo earns fees based on net equity. 6

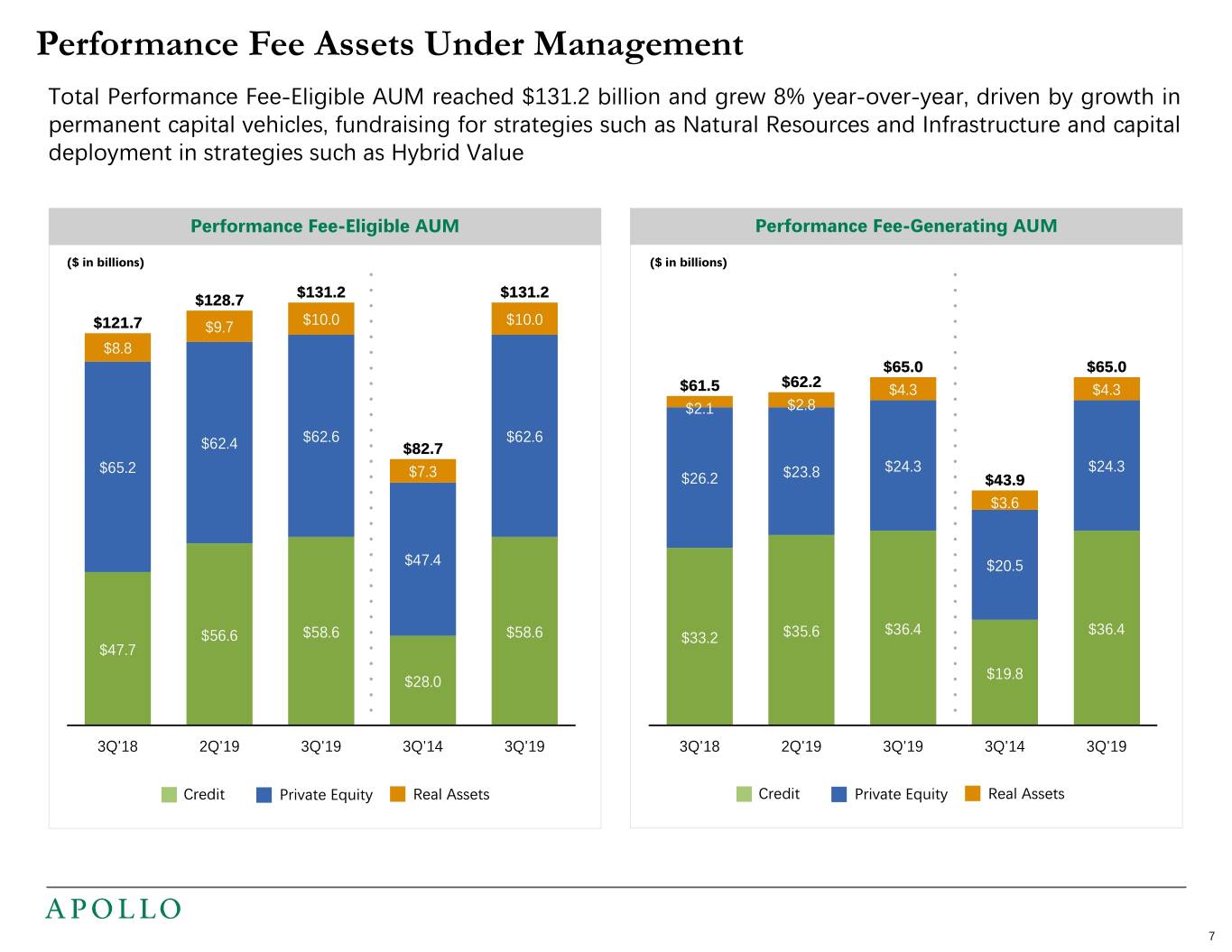

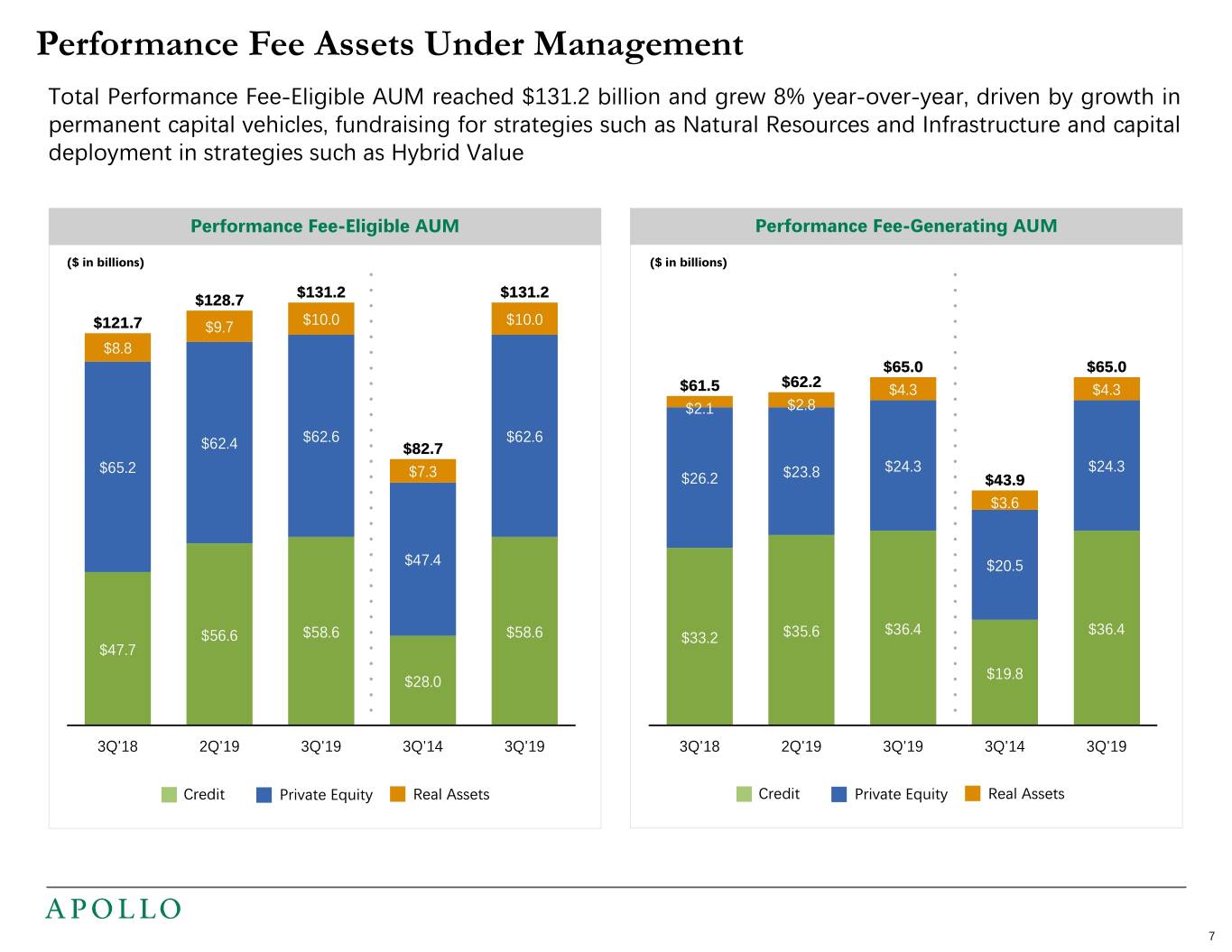

Performance Fee Assets Under Management Total Performance Fee-Eligible AUM reached $131.2 billion and grew 8% year-over-year, driven by growth in Total Performance Fee Eligible permanent capital vehicles, fundraising for strategies such as Natural Resources and Infrastructure and capital AUM increased to $131.2 billion, up deployment in strategies such as Hybrid Value 8% quarter-over-quarter after a broad recovery in credit markets Performance Fee-Eligible AUM Performance Fee-Generating AUM from the previous quarter, and strong performance in our Credit ($ in billions) ($ in billions) segment $131.2 $131.2 $128.7 $121.7 $9.7 $10.0 $10.0 $8.8 $65.0 $65.0 $61.5 $62.2 $4.3 $4.3 $2.1 $2.8 $62.6 $62.6 $62.4 $82.7 $65.2 $7.3 $23.8 $24.3 $24.3 $26.2 $43.9 $3.6 $47.4 $20.5 $36.4 $36.4 $56.6 $58.6 $58.6 $33.2 $35.6 $47.7 $19.8 $28.0 3Q'18 2Q'19 3Q'19 3Q'14 3Q'19 3Q'18 2Q'19 3Q'19 3Q'14 3Q'19 Credit Private Equity Real Assets Credit Private Equity Real Assets 7

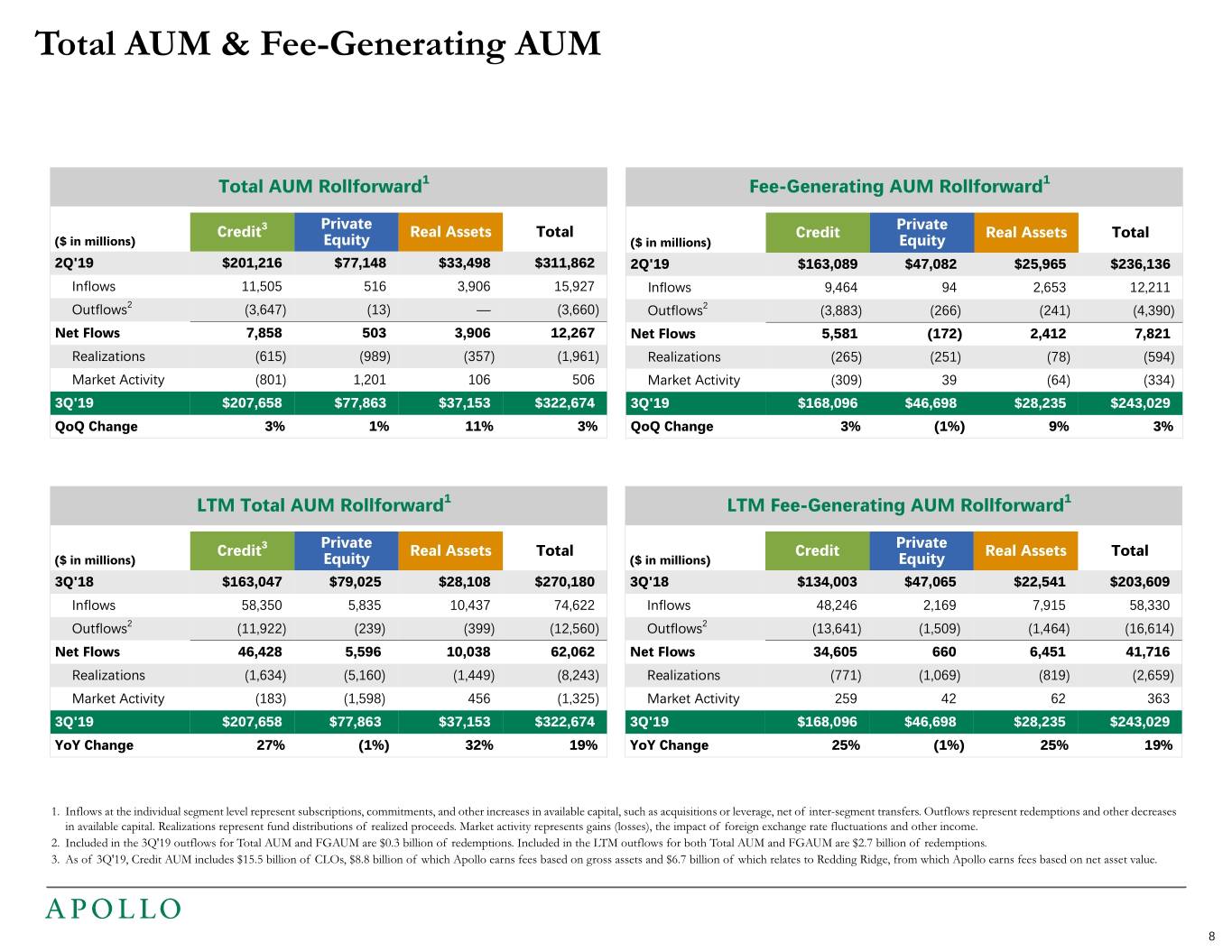

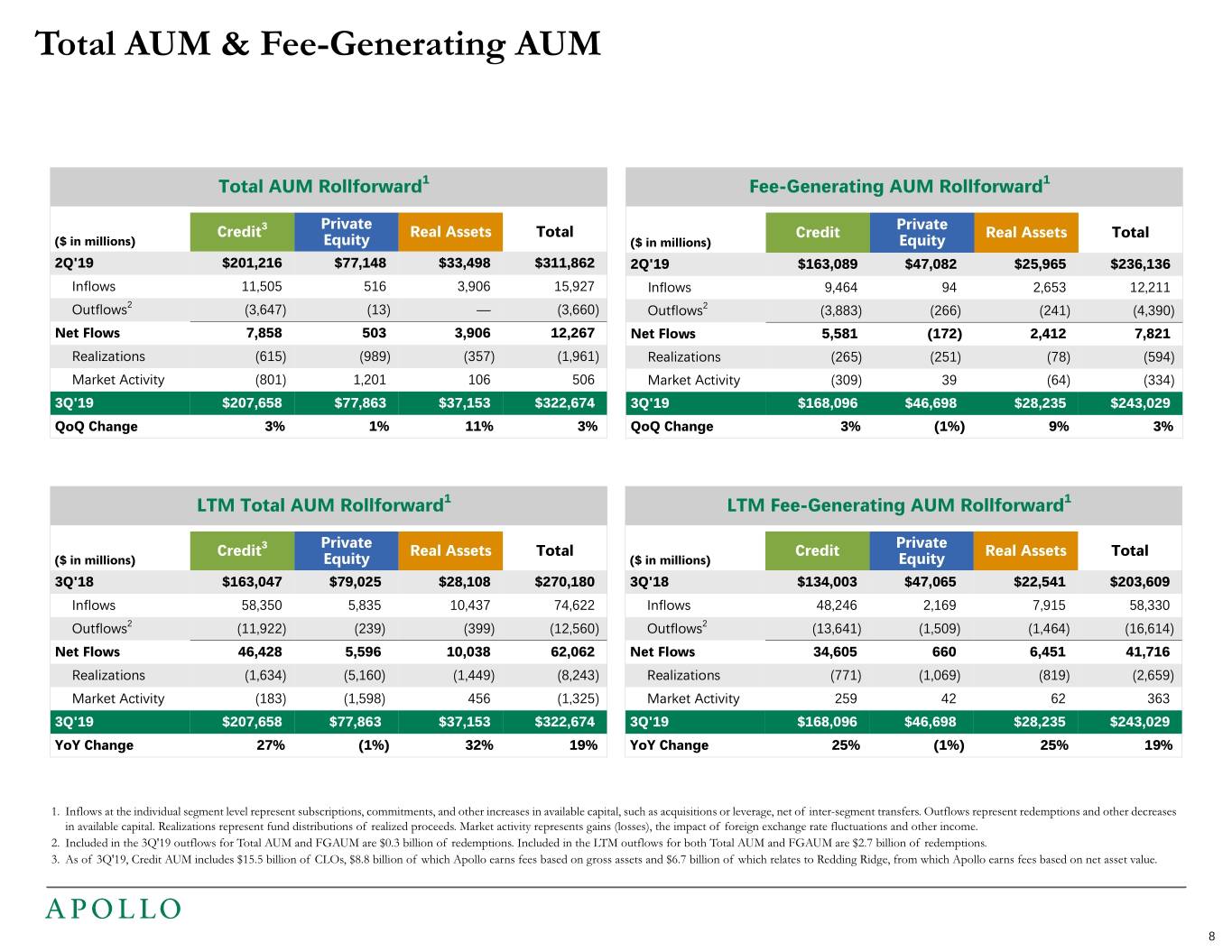

Total AUM & Fee-Generating AUM Total AUM Rollforward1 Fee-Generating AUM Rollforward1 3 Private Private Credit Real Assets Total Credit Real Assets Total ($ in millions) Equity ($ in millions) Equity 2Q'19 $201,216 $77,148 $33,498 $311,862 2Q'19 $163,089 $47,082 $25,965 $236,136 Inflows 11,505 516 3,906 15,927 Inflows 9,464 94 2,653 12,211 Outflows2 (3,647) (13) — (3,660) Outflows2 (3,883) (266) (241) (4,390) Net Flows 7,858 503 3,906 12,267 Net Flows 5,581 (172) 2,412 7,821 Realizations (615) (989) (357) (1,961) Realizations (265) (251) (78) (594) Market Activity (801) 1,201 106 506 Market Activity (309) 39 (64) (334) 3Q'19 $207,658 $77,863 $37,153 $322,674 3Q'19 $168,096 $46,698 $28,235 $243,029 QoQ Change 3% 1% 11% 3% QoQ Change 3% (1%) 9% 3% LTM Total AUM Rollforward1 LTM Fee-Generating AUM Rollforward1 3 Private Private Credit Real Assets Total Credit Real Assets Total ($ in millions) Equity ($ in millions) Equity 3Q'18 $163,047 $79,025 $28,108 $270,180 3Q'18 $134,003 $47,065 $22,541 $203,609 Inflows 58,350 5,835 10,437 74,622 Inflows 48,246 2,169 7,915 58,330 Outflows2 (11,922) (239) (399) (12,560) Outflows2 (13,641) (1,509) (1,464) (16,614) Net Flows 46,428 5,596 10,038 62,062 Net Flows 34,605 660 6,451 41,716 Realizations (1,634) (5,160) (1,449) (8,243) Realizations (771) (1,069) (819) (2,659) Market Activity (183) (1,598) 456 (1,325) Market Activity 259 42 62 363 3Q'19 $207,658 $77,863 $37,153 $322,674 3Q'19 $168,096 $46,698 $28,235 $243,029 YoY Change 27% (1%) 32% 19% YoY Change 25% (1%) 25% 19% 1. Inflows at the individual segment level represent subscriptions, commitments, and other increases in available capital, such as acquisitions or leverage, net of inter-segment transfers. Outflows represent redemptions and other decreases in available capital. Realizations represent fund distributions of realized proceeds. Market activity represents gains (losses), the impact of foreign exchange rate fluctuations and other income. 2. Included in the 3Q'19 outflows for Total AUM and FGAUM are $0.3 billion of redemptions. Included in the LTM outflows for both Total AUM and FGAUM are $2.7 billion of redemptions. 3. As of 3Q'19, Credit AUM includes $15.5 billion of CLOs, $8.8 billion of which Apollo earns fees based on gross assets and $6.7 billion of which relates to Redding Ridge, from which Apollo earns fees based on net asset value. 8 1. Inflows at the individual segment level represent subscriptions, commitments, and other increases in available capital, such as acquisitions or leverage, net of inter-segment transfers. Outflows represent redemptions and other decreases in available capital. Realizations represent fund distributions of realized proceeds. Market activity represents gains (losses), the impact of foreign exchange rate fluctuations and other income. 2. Included in the 3Q'19 outflows for Total AUM and FGAUM are $0.3 billion and $0.3 billion of redemptions, respectively. Included in the LTM outflows for Total AUM and FGAUM are $2.7 billion and $2.7 billion of redemptions, respectively.

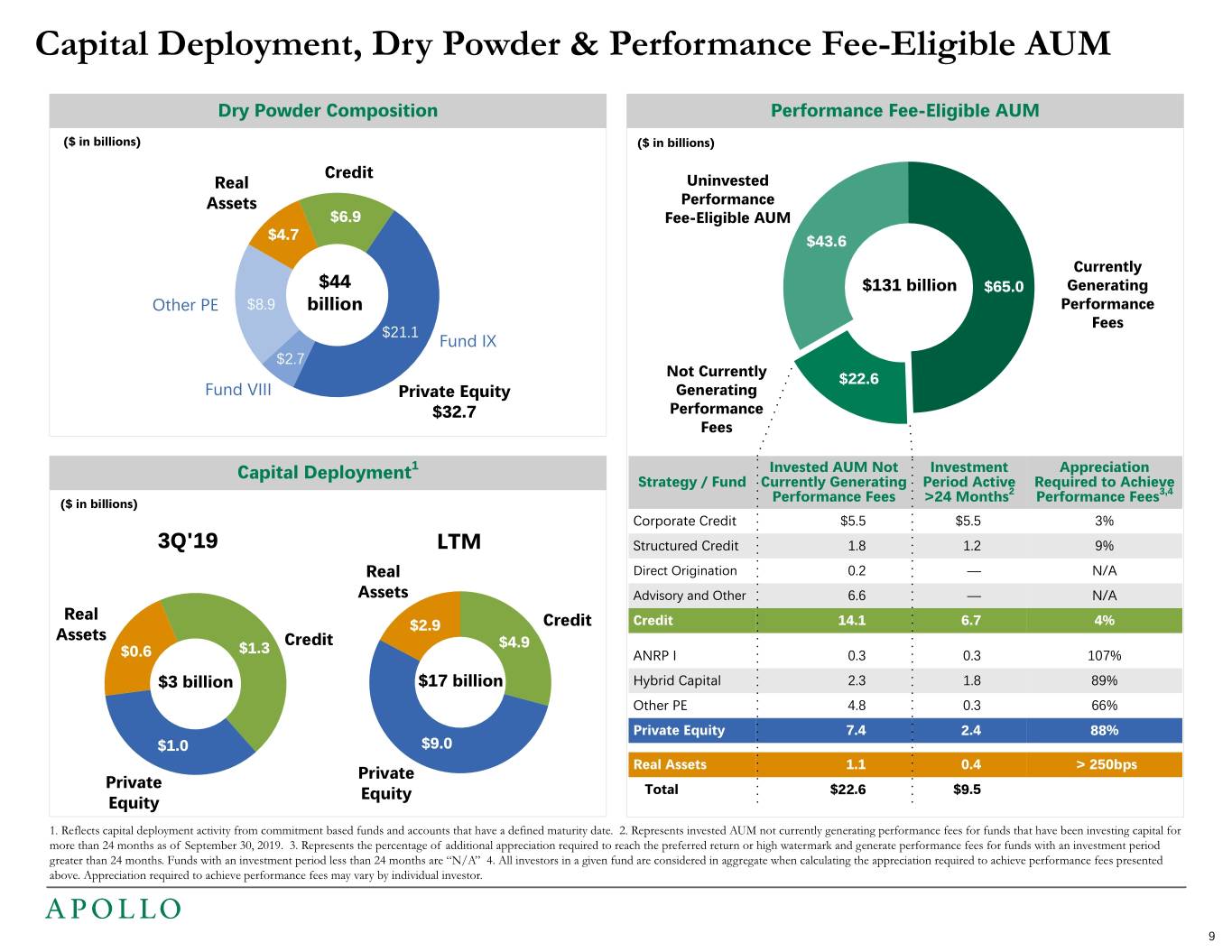

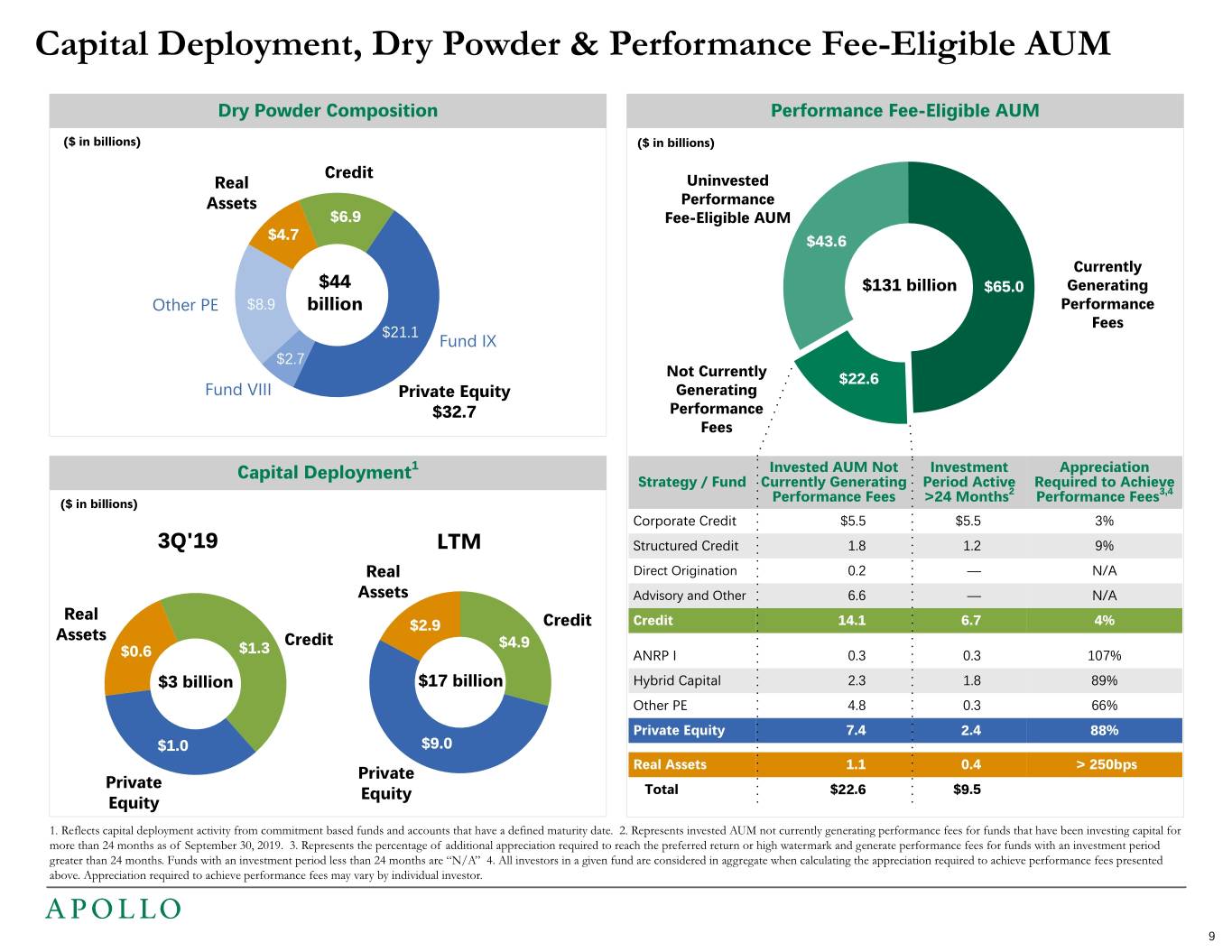

Capital Deployment, Dry Powder & Performance Fee-Eligible AUM Dry Powder Composition Performance Fee-Eligible AUM ($ in billions) ($ in billions) Credit Real Uninvested Assets Performance $6.9 Fee-Eligible AUM $4.7 $43.6 Currently $44 $131 billion $65.0 Generating Other PE $8.9 billion Performance Fees $21.1 Fund IX $2.7 Not Currently $22.6 Fund VIII Private Equity Generating $32.7 Performance Fees Capital Deployment1 Invested AUM Not Investment Appreciation Strategy / Fund Currently Generating Period Active Required to Achieve 2 3,4 ($ in billions) Performance Fees >24 Months Performance Fees Corporate Credit $5.5 $5.5 3% YTD'19 3Q'19 LTM Structured Credit 1.8 1.2 9% Real Real Direct Origination 0.2 — N/A Credit Assets Assets Advisory and Other 6.6 — N/A Real $4.0 $2.9 Credit Credit 14.1 6.7 4% $1.7 Assets Credit $4.9 $0.6 $1.3 ANRP I 0.3 0.3 107% $12 billion $3 billion $17 billion Hybrid Capital 2.3 1.8 89% Other PE 4.8 0.3 66% Private Equity 7.4 2.4 88% $6.6 $1.0 $9.0 Private Real Assets 1.1 0.4 > 250bps Private Equity Private Equity Total $22.6 $9.5 Equity 1. Reflects capital deployment activity from commitment based funds and accounts that have a defined maturity date. 2. Represents invested AUM not currently generating performance fees for funds that have been investing capital for more than 24 months as of September 30, 2019. 3. Represents the percentage of additional appreciation required to reach the preferred return or high watermark and generate performance fees for funds with an investment period greater than 24 months. Funds with an investment period less than 24 months are “N/A” 4. All investors in a given fund are considered in aggregate when calculating the appreciation required to achieve performance fees presented above. Appreciation required to achieve performance fees may vary by individual investor. 9

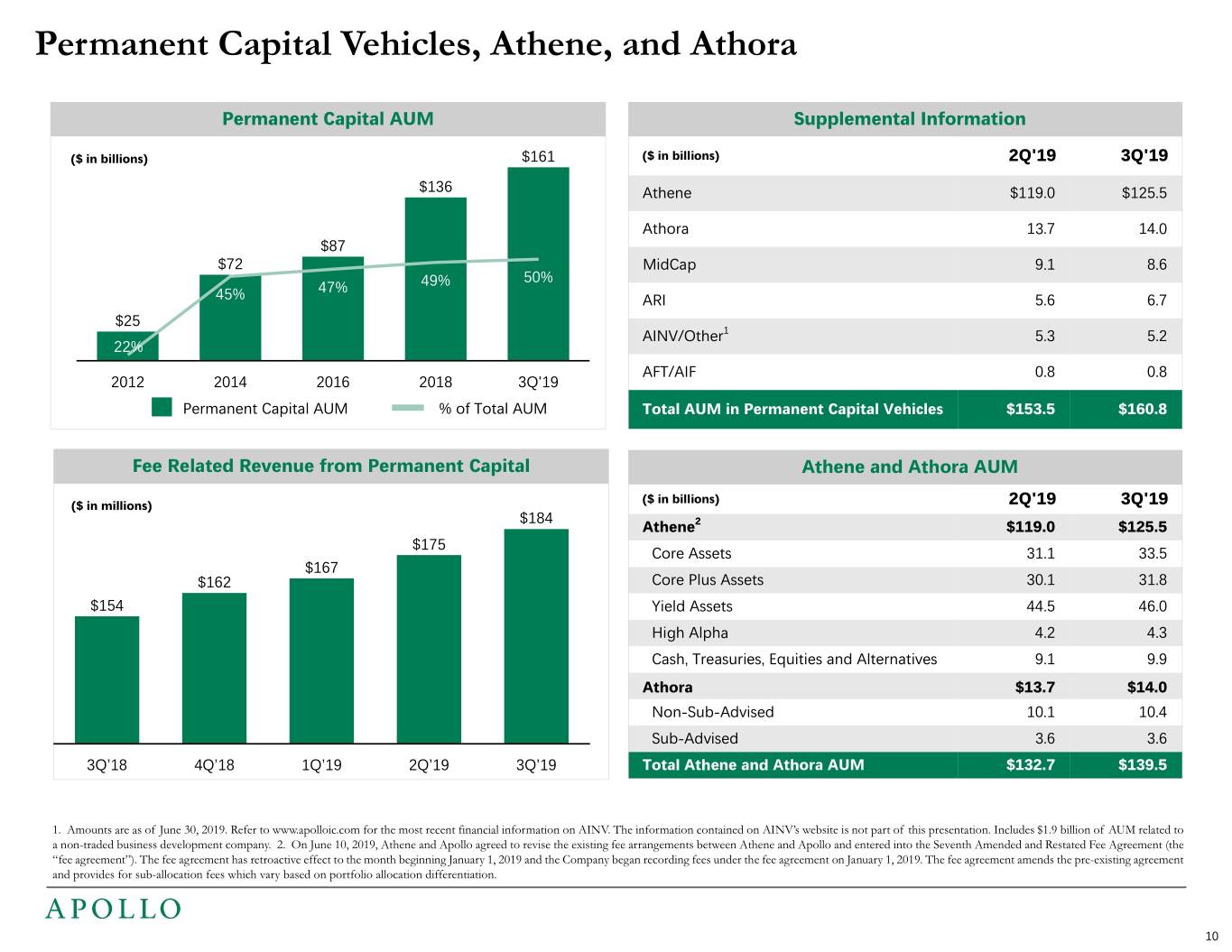

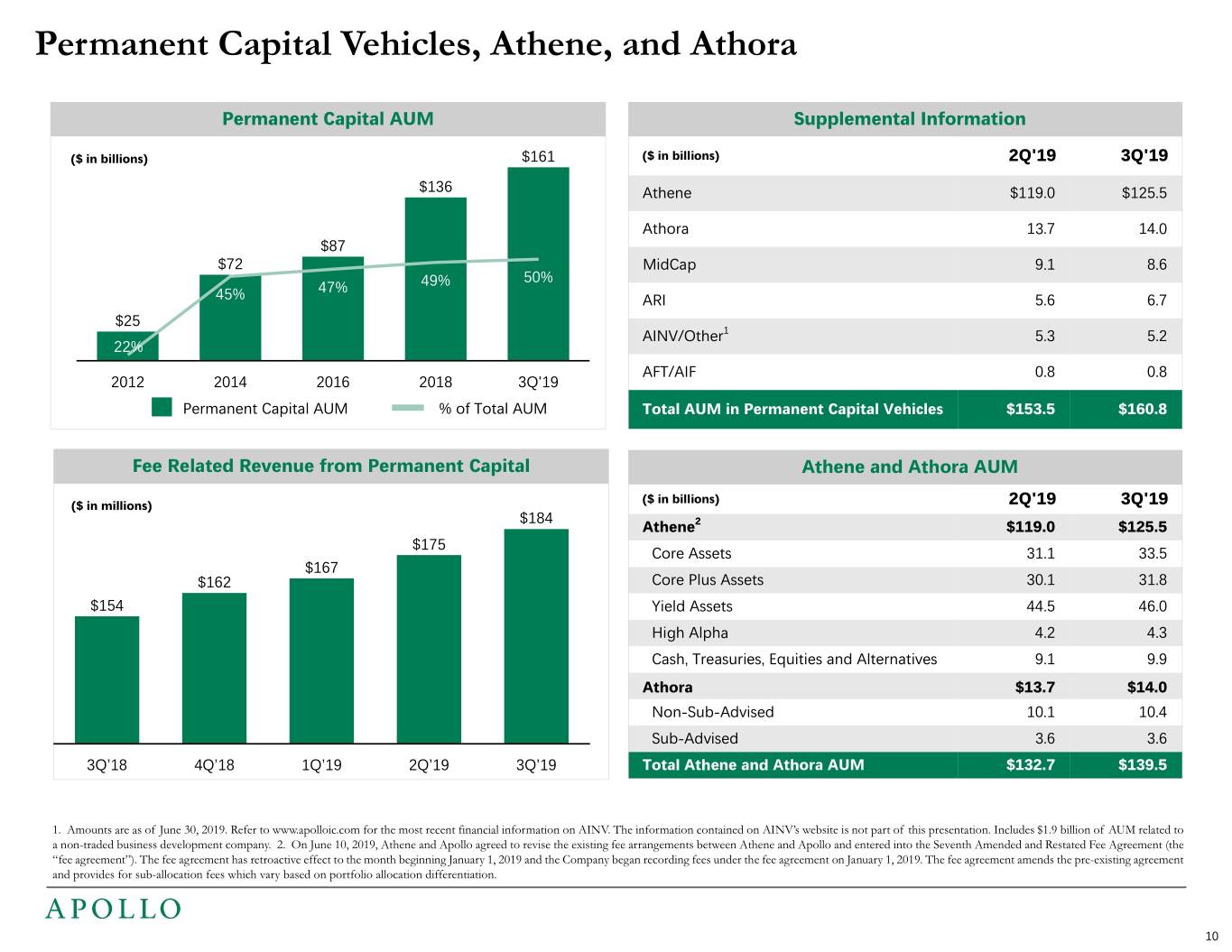

Permanent Capital Vehicles, Athene, and Athora Permanent Capital AUM Supplemental Information Supplemental Information ($ in billions) $161 ($ in billions) 2Q'19 3Q'19 ($ in billions) 3Q'19 $136 Athene $119.0 $125.5 Athene $125.5 Athora 13.7 14.0 Athora 14.0 $87 $72 MidCap 9.1 8.6 MidCap 8.6 50% 47% 49% 45% ARI 5.6 6.7 ARI 6.7 $25 AINV/Other1 5.3 5.2 AINV/Other1 5.2 22% AFT/AIF 0.8 0.8 AFT/AIF 0.8 2012 2014 2016 2018 3Q'19 Permanent CapitalPer iAUMod Ending % of Total AUM Total AUM in Permanent Capital Vehicles $153.5 $160.8 Total AUM in Permanent Capital Vehicles $160.8 Fee Related Revenue from Permanent Capital Athene and Athora AUM Athene and Athora AUM ($ in billions) ($ in billions) 3Q'19 ($ in millions) 2Q'19 3Q'19 $184 2 Athene2 $119.0 $125.5 Athene $125.5 $175 Core Assets 31.1 33.5 Core Assets 33.5 $167 $162 Core Plus Assets 30.1 31.8 Core Plus Assets 31.8 $154 Yield Assets 44.5 46.0 Yield Assets 46.0 High Alpha 4.2 4.3 High Alpha 4.3 Cash, Treasuries, Equities and Alternatives 9.1 9.9 Cash, Treasuries, Equities and Alternatives 9.9 Athora $13.7 $14.0 Athora $14.0 Non-Sub-Advised 10.1 10.4 Non-Sub-Advised 10.4 Sub-Advised 3.6 3.6 Sub-Advised 3.6 3Q’18 4Q’18 1Q’19 2Q’19 3Q’19 Total Athene and Athora AUM $132.7 $139.5 Total Athene and Athora AUM $139.5 1. Amounts are as of June 30, 2019. Refer to www.apolloic.com for the most recent financial information on AINV. The information contained on AINV’s website is not part of this presentation. Includes $1.9 billion of AUM related to a non-traded business development company. 2. On June 10, 2019, Athene and Apollo agreed to revise the existing fee arrangements between Athene and Apollo and entered into the Seventh Amended and Restated Fee Agreement (the “fee agreement”). The fee agreement has retroactive effect to the month beginning January 1, 2019 and the Company began recording fees under the fee agreement on January 1, 2019. The fee agreement amends the pre-existing agreement and provides for sub-allocation fees which vary based on portfolio allocation differentiation. 10

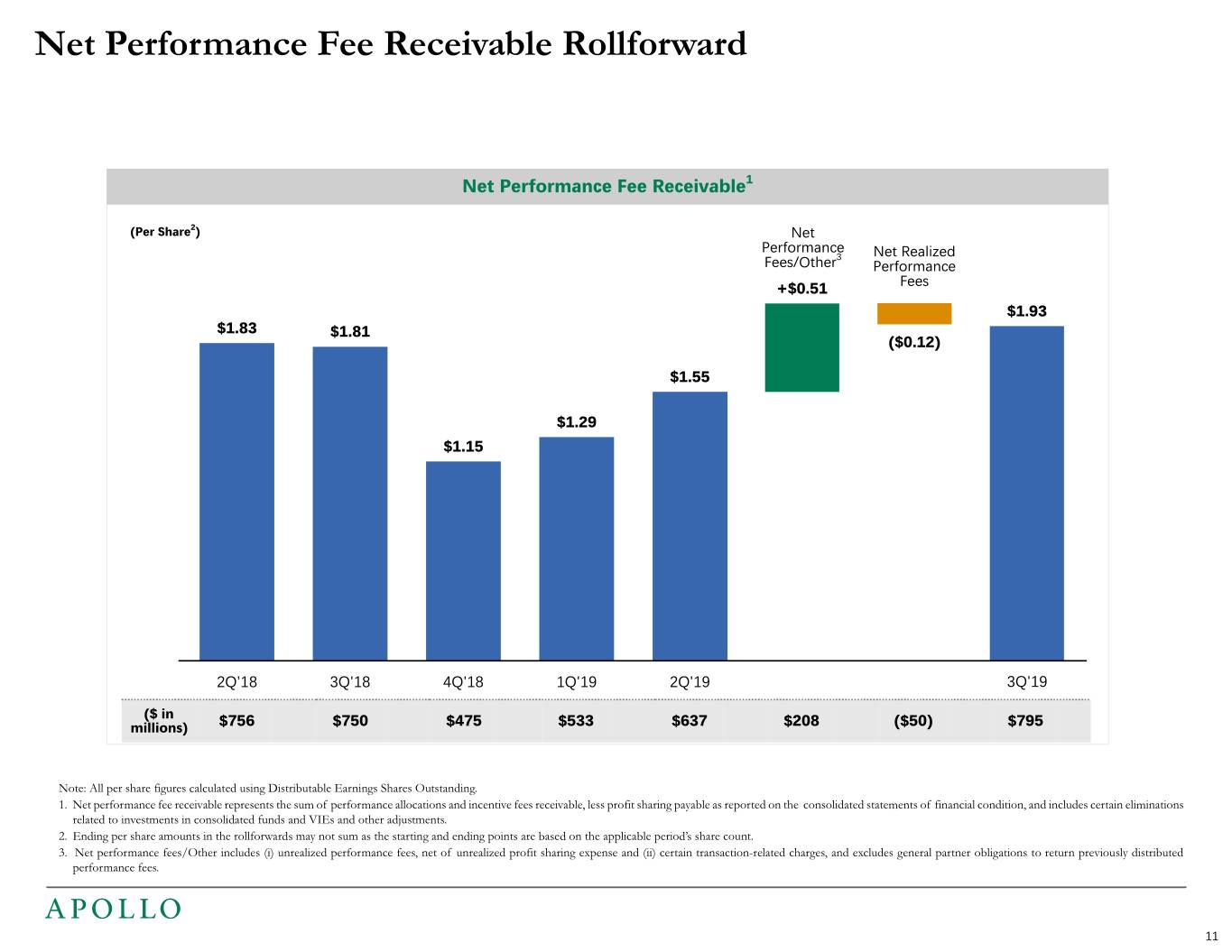

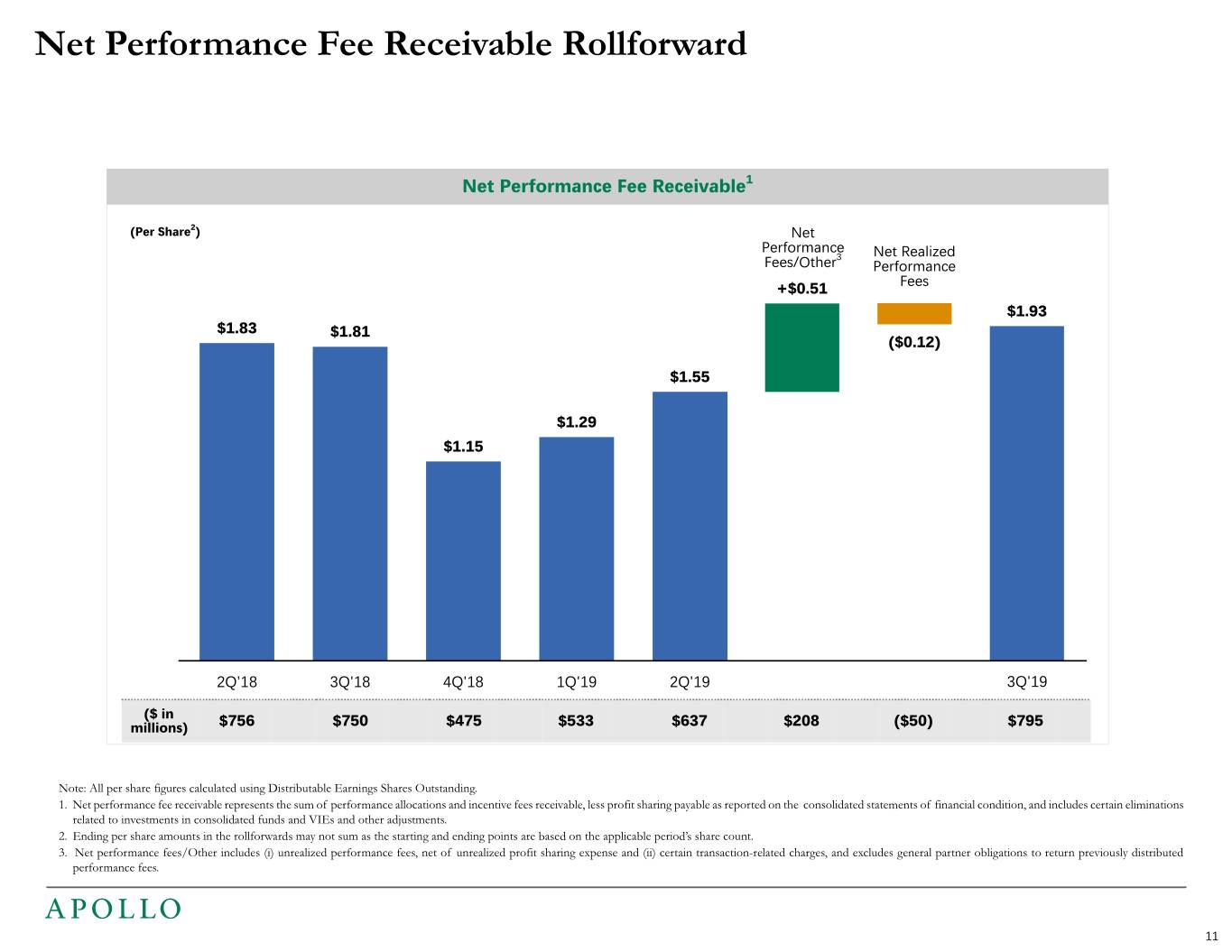

Net Performance Fee Receivable Rollforward The net performance fee receivable balance increased quarter-over- quarter primarily driven by unrealized mark-to-market gains Net Performance Fee Receivable1 (Per Share2) Net Performance 3 Net Realized Fees/Other Performance Fees +$0.51 $1.93 $1.83 $1.81 ($0.12) $1.55 $1.29 $1.15 2Q’18 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 ($ in millions) $756 $750 $475 $533 $637 $208 ($50) $795 Note: All per share figures calculated using Distributable Earnings Shares Outstanding. 1. Net performance fee receivable represents the sum of performance allocations and incentive fees receivable, less profit sharing payable as reported on the consolidated statements of financial condition, and includes certain eliminations related to investments in consolidated funds and VIEs and other adjustments. 2. Ending per share amounts in the rollforwards may not sum as the starting and ending points are based on the applicable period’s share count. 3. Net performance fees/Other includes (i) unrealized performance fees, net of unrealized profit sharing expense and (ii) certain transaction-related charges, and excludes general partner obligations to return previously distributed performance fees. 11

Segment Highlights

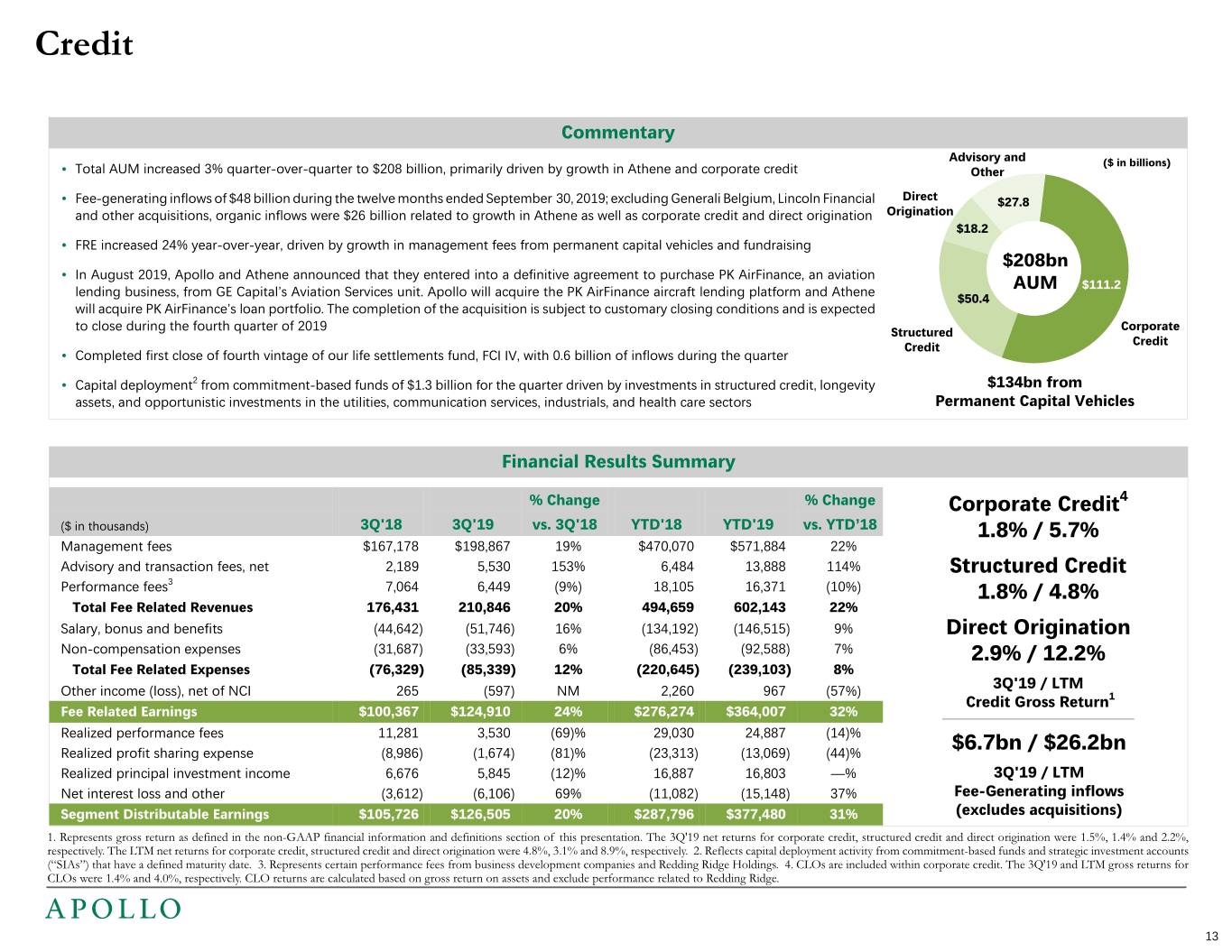

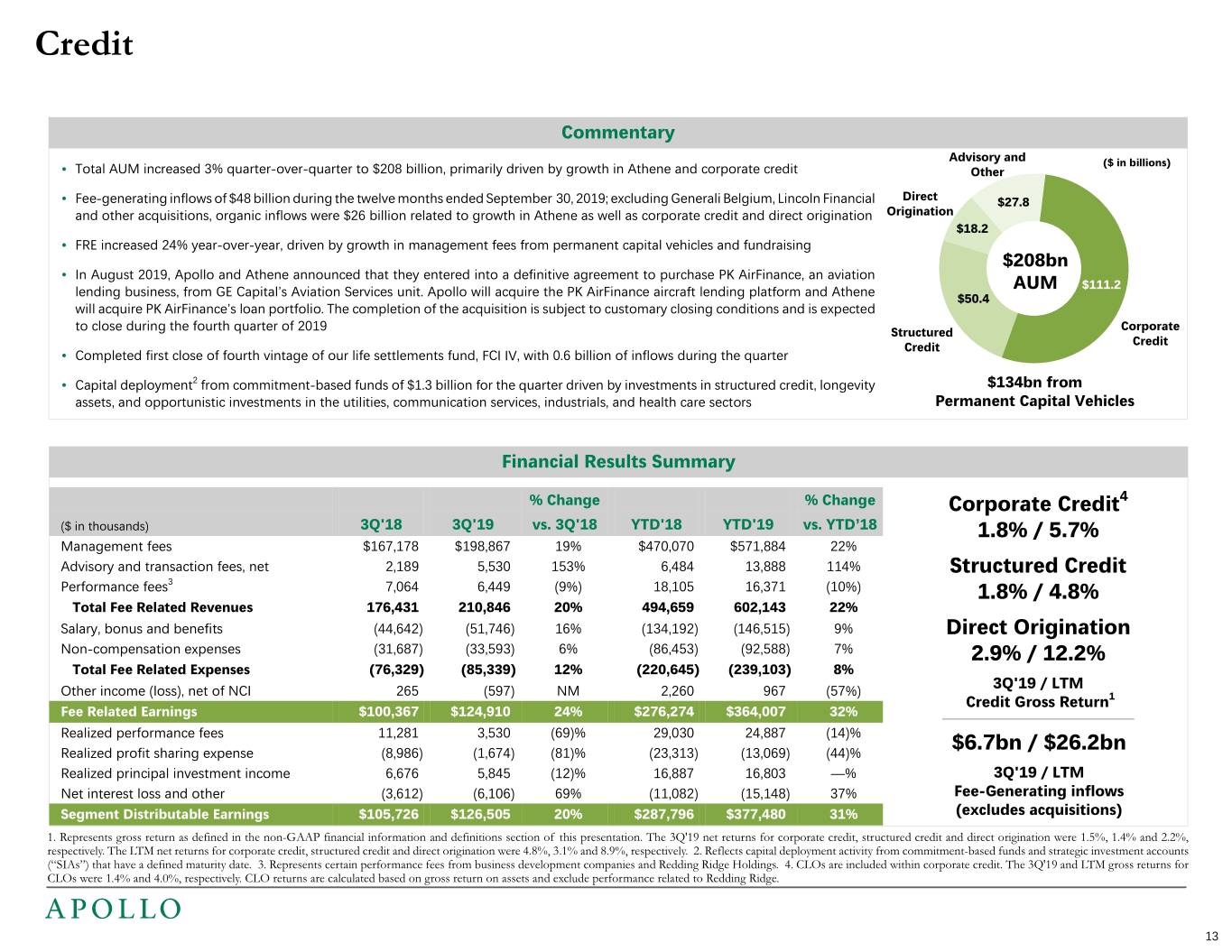

Credit (2.0%) / 2.2% • AUM increased 3% quarter-over-quarter and 27% year-over-year to $208 billion and includes approximately Commentary Advisory and $134 billion from Permanent Capital Vehicles ($ in billions) 3Q'19 / LTM • Total AUM increased 3% quarter-over-quarter to $208 billion, primarily driven by growth in Athene and corporate credit Other Credit Gross Return1 • Generated inflows of $12 billion during the quarter, driven by Athora’s acquisition of Generali Belgium, which • Fee-generating inflows of $48 billion during the twelve months ended September 30, 2019; excluding Generali Belgium, Lincoln Financial Direct $27.8 added approximately $6.5 billion of assets to Apollo’s Credit business AUM, organic growth from Athene and other acquisitions, organic inflows were $26 billion related to growth in Athene as well as corporate credit and direct origination Origination $18.2 and the addition of Aspen Insurance Holdings Limited to our European advisory platform • FRE increased 24% year-over-year, driven by growth in management fees from permanent capital vehicles and fundraising $1.3bn / $4.9bn 2 $208bn • Capital deployment of $1.3 billion for the quarter driven by fund investments in structured credit, longevity • In August 2019, Apollo and Athene announced that they entered into a definitive agreement to purchase PK AirFinance, an aviation 3Q'19 / LTM lending business, from GE Capital’s Aviation Services unit. Apollo will acquire the PK AirFinance aircraft lending platform and Athene AUM $111.2 Deployment2 assets, and opportunistic investments in the consumer discretionary, utilities, communication services, and $50.4 industrials sectors will acquire PK AirFinance’s loan portfolio. The completion of the acquisition is subject to customary closing conditions and is expected Corporate to close during the fourth quarter of 2019 Structured Credit 1 Credit • Credit 3Q'19 gross returns of 1.8% for Corporate Credit, 1.8% for Structured Credit and 2.9% for Direct • Completed first close of fourth vintage of our life settlements fund, FCI IV, with 0.6 billion of inflows during the quarter Origination, respectively, resulting from positive returns across fund categories $180.2 billion • Capital deployment2 from commitment-based funds of $1.3 billion for the quarter driven by investments in structured credit, longevity $134bn from Total AUM up 27% YoY assets, and opportunistic investments in the utilities, communication services, industrials, and health care sectors Permanent Capital Vehicles Financial Results Summary % Change % Change Corporate Credit4 Corporate Credit4 $9.5bn ($ in thousands) 3Q'18 3Q'19 vs. 3Q'18 YTD'18 YTD'19 vs. YTD’18 1.8% / 5.7% 1.8% / 8.2% 1Q'19 Fee-Generating inflows Management fees $167,178 $198,867 19% $470,070 $571,884 22% Advisory and transaction fees, net 2,189 5,530 153% 6,484 13,888 114% Structured Credit Structured Credit Performance fees3 7,064 6,449 (9%) 18,105 16,371 (10%) 1.8% / 4.8% 1.8% / 10.3% Total Fee Related Revenues 176,431 210,846 20% 494,659 602,143 22% $48.2bn Salary, bonus and benefits (44,642) (51,746) 16% (134,192) (146,515) 9% Direct Origination Direct Origination LTM Fee-Generating inflows Non-compensation expenses (31,687) (33,593) 6% (86,453) (92,588) 7% 2.9% / 12.2% 2.9% / 9.4% Total Fee Related Expenses (76,329) (85,339) 12% (220,645) (239,103) 8% 3Q'19 / YTD'19 Other income (loss), net of NCI 265 (597) NM 2,260 967 (57%) 3Q'19 / LTM Credit Gross Return1 Credit Gross Return1 Fee Related Earnings $100,367 $124,910 24% $276,274 $364,007 32% $207.7bn Realized performance fees 11,281 3,530 (69)% 29,030 24,887 (14)% Realized profit sharing expense (8,986) (1,674) (81)% (23,313) (13,069) (44)% $6.7bn / $26.2bn $6.2bn / $6.2bn Total AUM up 3% QoQ Realized principal investment income 6,676 5,845 (12)% 16,887 16,803 —% 3Q'19 / LTM 3Q'19 / YTD'19 Net interest loss and other (3,612) (6,106) 69% (11,082) (15,148) 37% Fee-Generating inflows Fee-Generating inflows Segment Distributable Earnings $105,726 $126,505 20% $287,796 $377,480 31% (excludes acquisitions) (excludes acquisitions) 1. Represents gross return as defined in the non-GAAP financial information and definitions section of this presentation. The 3Q'19 net returns for corporate credit, structured credit and direct origination were 1.5%, 1.4% and 2.2%, 1. Represents gross return as defined in the non-GAAP financial information and definitions section of this presentation. The 3Q'19 net returns for Corporate Credit, Structured Credit and Direct Origination were 1.5%, 1.4% and 2.2%, respectively. The LTM net returns for corporate credit, structured credit and direct origination were 4.8%, 3.1% and 8.9%, respectively. 2. Reflects capital deployment activity from commitment-based funds and strategic investment accounts respectively. The YTD'19 net returns for Corporate Credit, Structured Credit and Direct Origination were 7.4%, 8.5% and 7.0%, respectively. 2. Reflects capital deployment activity from commitment-based funds and strategic investment (“SIAs”) that have a defined maturity date. 3. Represents certain performance fees from business development companies and Redding Ridge Holdings. 4. CLOs are included within corporate credit. The 3Q'19 and LTM gross returns for accounts (“SIAs”) that have a defined maturity date. 3. Represents certain performance fees from business development companies and Redding Ridge Holdings. 4. CLOs are included within Corporate Credit. The 3Q'19 and YTD'19 CLOs were 1.4% and 4.0%, respectively. CLO returns are calculated based on gross return on assets and exclude performance related to Redding Ridge. gross returns for CLOs were 1.4% and 4.0%, respectively. CLO returns are calculated based on gross return on assets and exclude performance related to Redding Ridge. 13 $1.3bn / $4.9bn 3Q'19 / LTM Deployment2

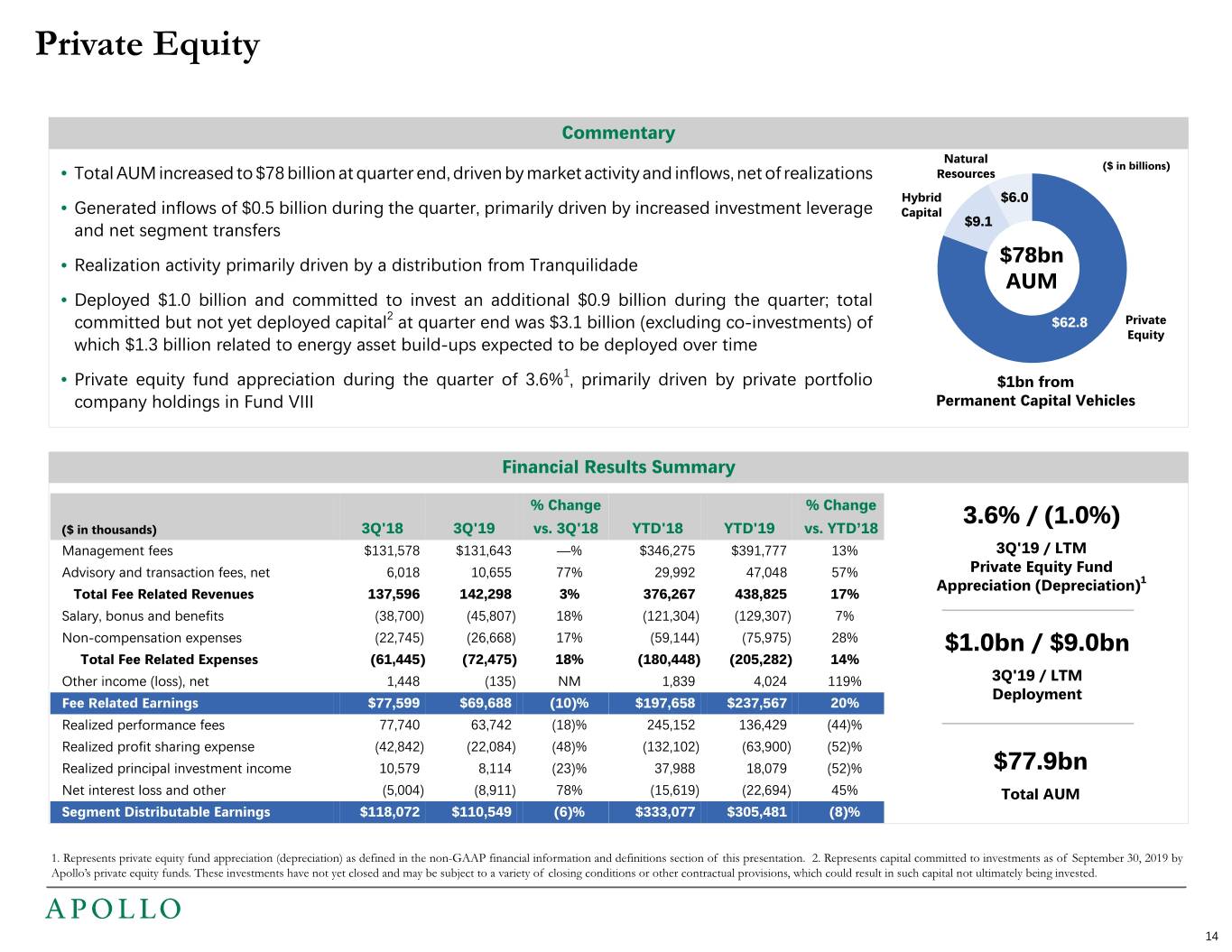

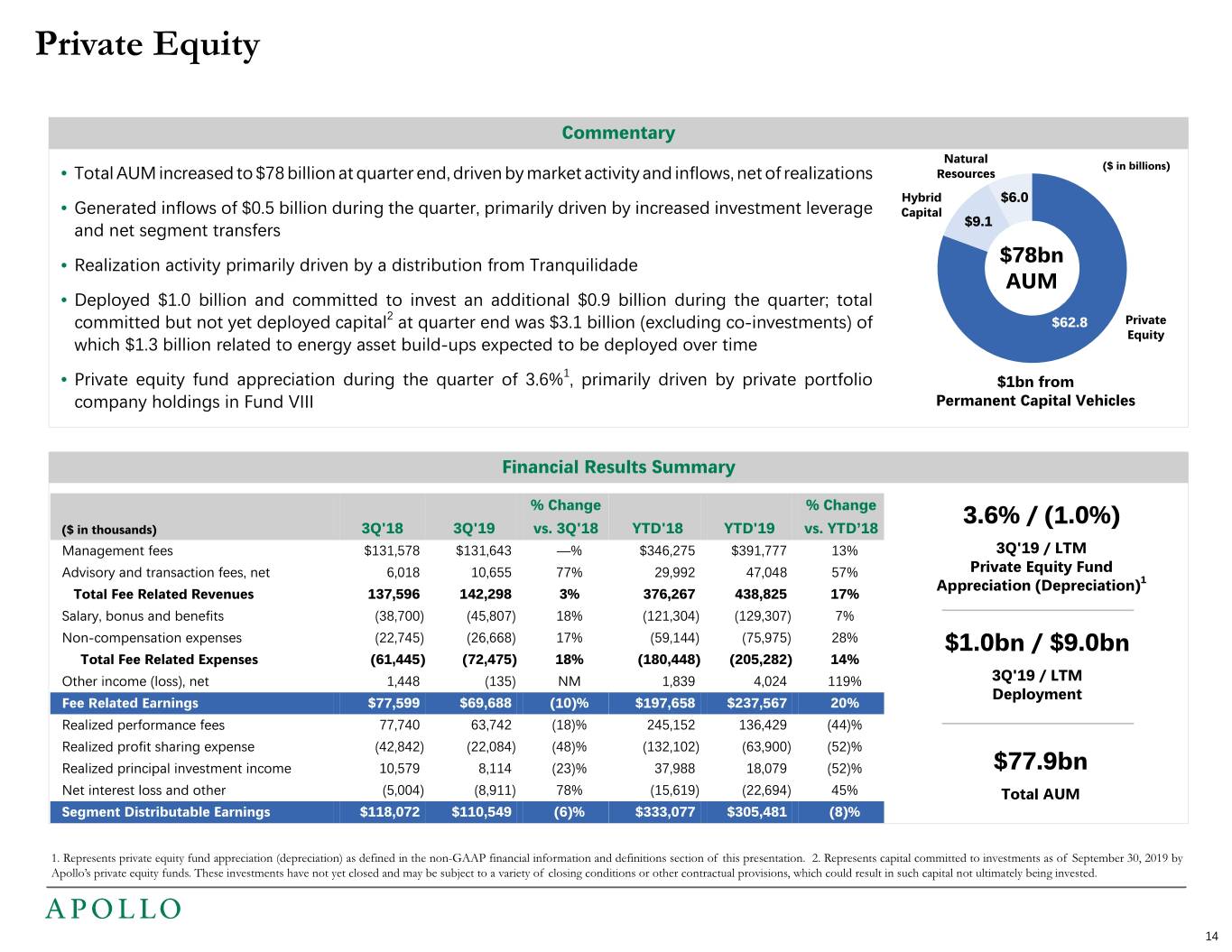

Private Equity Commentary Natural ($ in billions) • Total AUM increased to $78 billion at quarter end, driven by market activity and inflows, net of realizations Resources Hybrid $6.0 • Generated inflows of $0.5 billion during the quarter, primarily driven by increased investment leverage Capital and net segment transfers $9.1 • Realization activity primarily driven by a distribution from Tranquilidade $78bn AUM • Deployed $1.0 billion and committed to invest an additional $0.9 billion during the quarter; total 2 committed but not yet deployed capital at quarter end was $3.1 billion (excluding co-investments) of $62.8 Private Equity which $1.3 billion related to energy asset build-ups expected to be deployed over time 1 • Private equity fund appreciation during the quarter of 3.6% , primarily driven by private portfolio $1bn from company holdings in Fund VIII Permanent Capital Vehicles Financial Results Summary % Change % Change 3.6% / (1.0%) 3.6% / 11.1% ($ in thousands) 3Q'18 3Q'19 vs. 3Q'18 YTD'18 YTD'19 vs. YTD’18 Management fees $131,578 $131,643 —% $346,275 $391,777 13% 3Q'19 / LTM 3Q'19 / YTD'19 Advisory and transaction fees, net 6,018 10,655 77% 29,992 47,048 57% Private Equity Fund Private Equity Fund Appreciation (Depreciation)1 Appreciation (Depreciation)1 Total Fee Related Revenues 137,596 142,298 3% 376,267 438,825 17% Salary, bonus and benefits (38,700) (45,807) 18% (121,304) (129,307) 7% Non-compensation expenses (22,745) (26,668) 17% (59,144) (75,975) 28% $1.0bn / $9.0bn $1.0bn / $6.6bn Total Fee Related Expenses (61,445) (72,475) 18% (180,448) (205,282) 14% Other income (loss), net 1,448 (135) NM 1,839 4,024 119% 3Q'19 / LTM 3Q'19 / YTD'19 Deployment Deployment Fee Related Earnings $77,599 $69,688 (10)% $197,658 $237,567 20% Realized performance fees 77,740 63,742 (18)% 245,152 136,429 (44)% Realized profit sharing expense (42,842) (22,084) (48)% (132,102) (63,900) (52)% Realized principal investment income 10,579 8,114 (23)% 37,988 18,079 (52)% $77.9bn $69.7mm Net interest loss and other (5,004) (8,911) 78% (15,619) (22,694) 45% Total AUM Total FRE up (10)% YoY Segment Distributable Earnings $118,072 $110,549 (6)% $333,077 $305,481 (8)% 1. Represents private equity fund appreciation (depreciation) as defined in the non-GAAP financial information and definitions section of this presentation. 2. Represents capital committed to investments as of September 30, 2019 by Apollo’s private equity funds. These investments have not yet closed and may be subject to a variety of closing conditions or other contractual provisions, which could result in such capital not ultimately being invested. 14

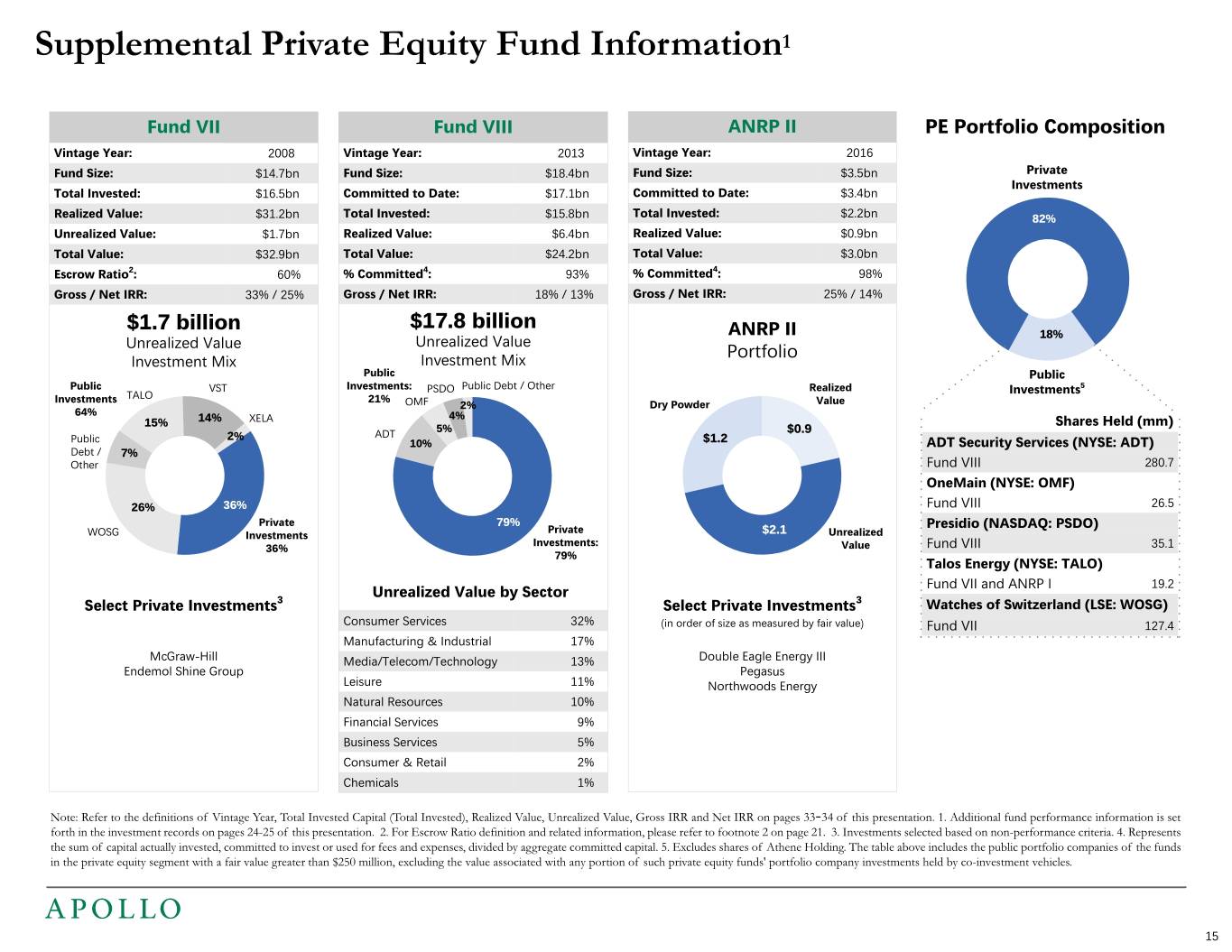

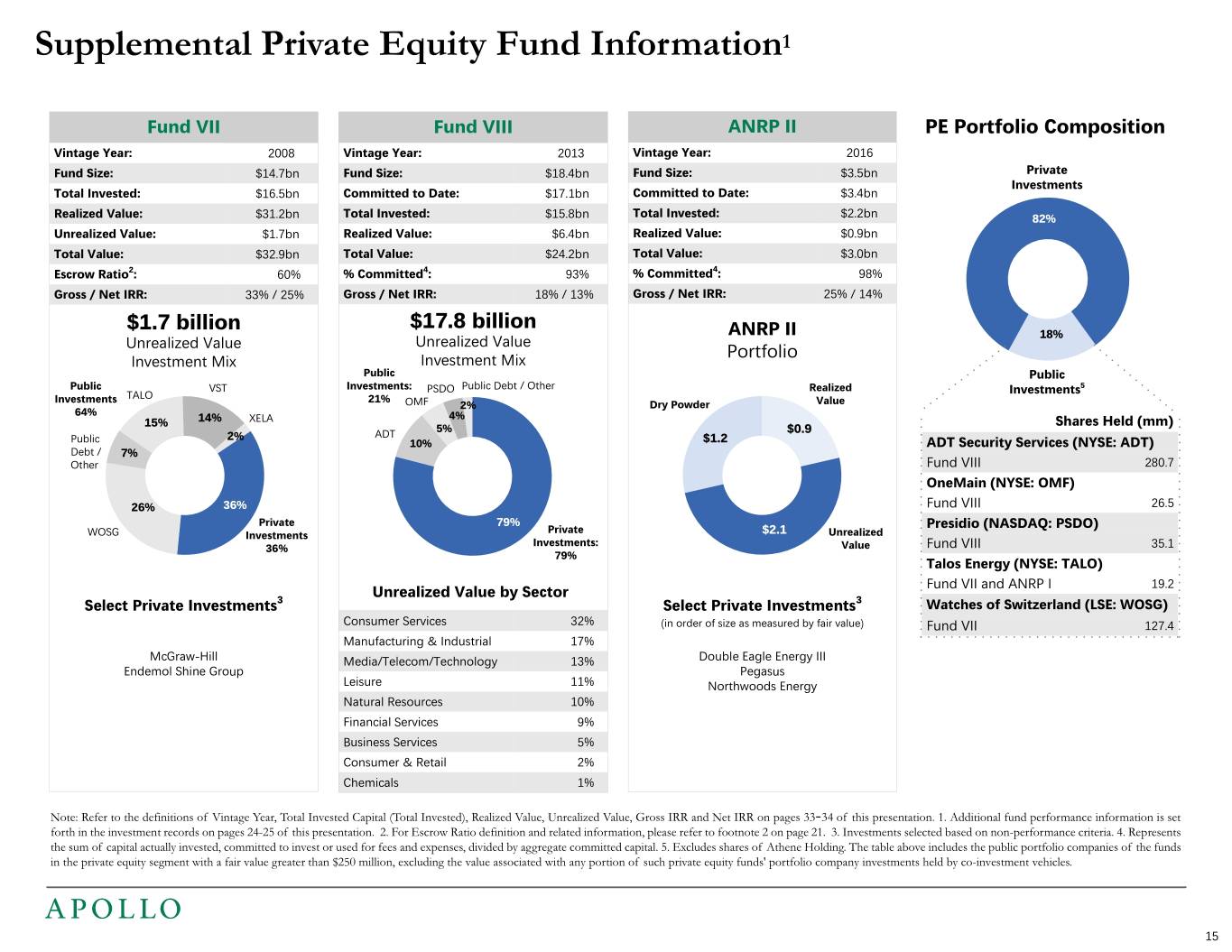

Supplemental Private Equity Fund Information1 Fund VII Fund VIII ANRP II PE Portfolio Composition Vintage Year: 2008 Vintage Year: 2013 Vintage Year: 2016 Fund Size: $14.7bn Fund Size: $18.4bn Fund Size: $3.5bn Private Investments Total Invested: $16.5bn Committed to Date: $17.1bn Committed to Date: $3.4bn Realized Value: $31.2bn Total Invested: $15.8bn Total Invested: $2.2bn 82% Unrealized Value: $1.7bn Realized Value: $6.4bn Realized Value: $0.9bn Total Value: $32.9bn Total Value: $24.2bn Total Value: $3.0bn Escrow Ratio2: 60% % Committed4: 93% % Committed4: 98% Gross / Net IRR: 33% / 25% Gross / Net IRR: 18% / 13% Gross / Net IRR: 25% / 14% $1.7 billion $17.8 billion ANRP II Unrealized Value 18% Unrealized Value Portfolio Investment Mix Investment Mix Public Public Public VST Investments: PSDO Public Debt / Other Realized Investments5 Investments TALO 21% OMF 2% Dry Powder Value 64% 4% 15% 14% XELA Shares Held (mm) 5% $0.9 2% ADT Public 10% $1.2 ADT Security Services (NYSE: ADT) Debt / 7% Other Fund VIII 280.7 OneMain (NYSE: OMF) 26% 36% Fund VIII 26.5 Private 79% Private Presidio (NASDAQ: PSDO) WOSG Investments $2.1 Unrealized Investments: 36% Value Fund VIII 35.1 79% Talos Energy (NYSE: TALO) Fund VII and ANRP I 19.2 Unrealized Value by Sector Select Private Investments3 Select Private Investments3 Watches of Switzerland (LSE: WOSG) Consumer Services 32% (in order of size as measured by fair value) Fund VII 127.4 Manufacturing & Industrial 17% McGraw-Hill Media/Telecom/Technology 13% Double Eagle Energy III Endemol Shine Group Pegasus Leisure 11% Northwoods Energy Natural Resources 10% Financial Services 9% Business Services 5% Consumer & Retail 2% Chemicals 1% Note: Refer to the definitions of Vintage Year, Total Invested Capital (Total Invested), Realized Value, Unrealized Value, Gross IRR and Net IRR on pages 33-34 of this presentation. 1. Additional fund performance information is set forth in the investment records on pages 24-25 of this presentation. 2. For Escrow Ratio definition and related information, please refer to footnote 2 on page 21. 3. Investments selected based on non-performance criteria. 4. Represents the sum of capital actually invested, committed to invest or used for fees and expenses, divided by aggregate committed capital. 5. Excludes shares of Athene Holding. The table above includes the public portfolio companies of the funds in the private equity segment with a fair value greater than $250 million, excluding the value associated with any portion of such private equity funds' portfolio company investments held by co-investment vehicles. 15

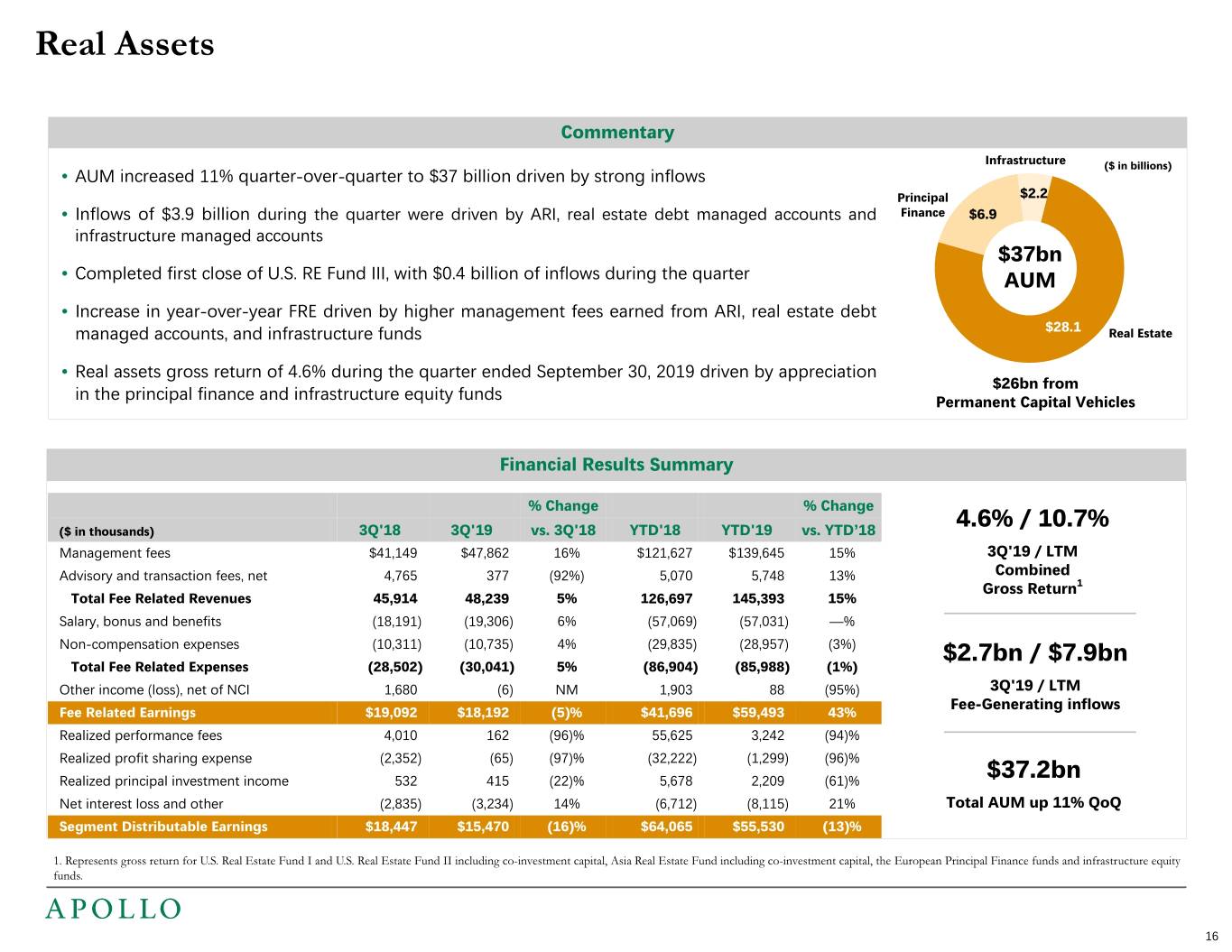

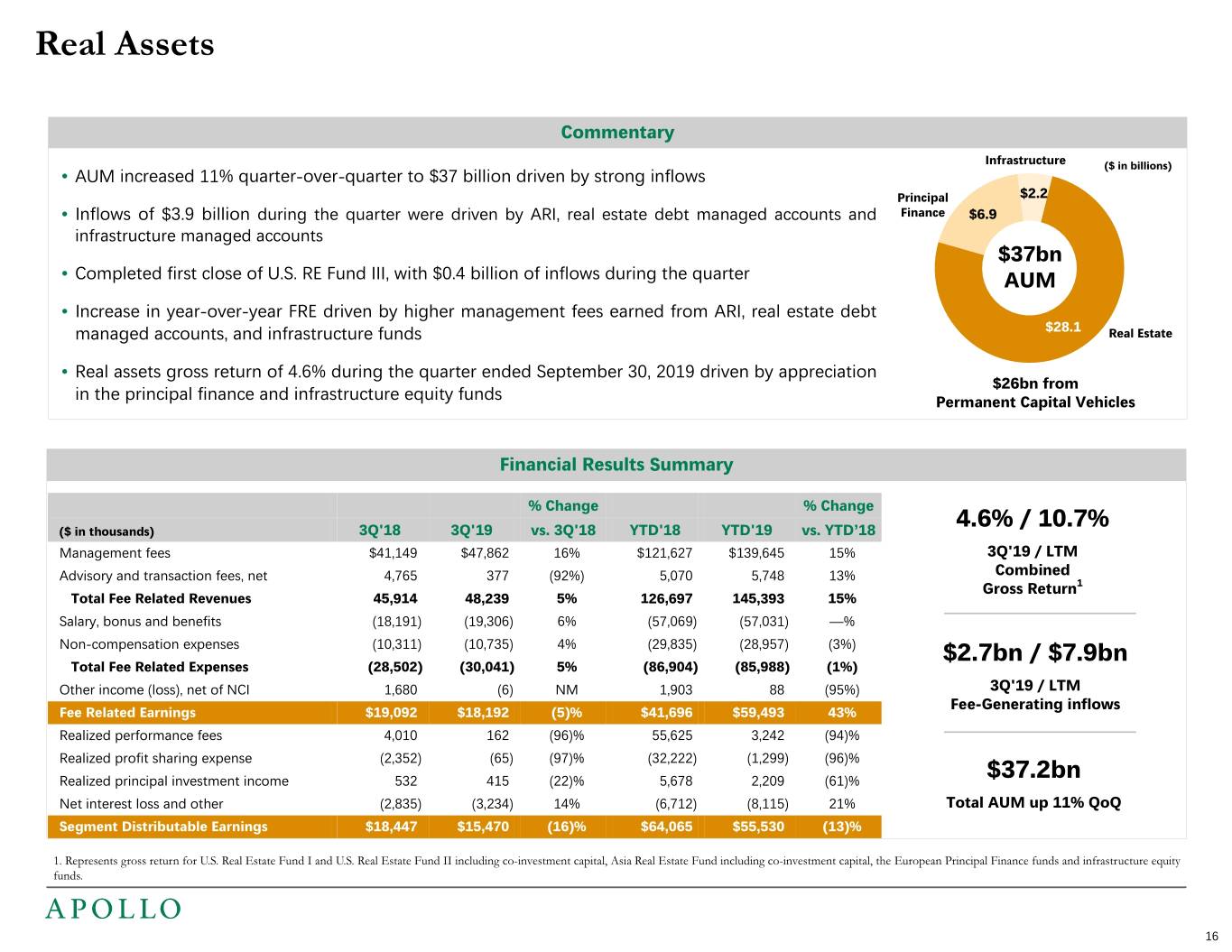

Real Assets Commentary Infrastructure ($ in billions) • AUM increased 11% quarter-over-quarter to $37 billion driven by strong inflows Principal $2.2 • Inflows of $3.9 billion during the quarter were driven by ARI, real estate debt managed accounts and Finance $6.9 infrastructure managed accounts $37bn • Completed first close of U.S. RE Fund III, with $0.4 billion of inflows during the quarter AUM • Increase in year-over-year FRE driven by higher management fees earned from ARI, real estate debt $28.1 managed accounts, and infrastructure funds Real Estate • Real assets gross return of 4.6% during the quarter ended September 30, 2019 driven by appreciation $26bn from in the principal finance and infrastructure equity funds Permanent Capital Vehicles Financial Results Summary % Change % Change 4.6% / 10.7% ($ in thousands) 3Q'18 3Q'19 vs. 3Q'18 YTD'18 YTD'19 vs. YTD’18 4.6% / 9.3% Management fees $41,149 $47,862 16% $121,627 $139,645 15% 3Q'19 / LTM 3Q'19 / YTD'19 Advisory and transaction fees, net 4,765 377 (92%) 5,070 5,748 13% Combined Combined Gross Return1 1 Total Fee Related Revenues 45,914 48,239 5% 126,697 145,393 15% Gross Return Salary, bonus and benefits (18,191) (19,306) 6% (57,069) (57,031) —% Non-compensation expenses (10,311) (10,735) 4% (29,835) (28,957) (3%) $2.7bn / $7.9bn $2.7bn / $5.6bn Total Fee Related Expenses (28,502) (30,041) 5% (86,904) (85,988) (1%) Other income (loss), net of NCI 1,680 (6) NM 1,903 88 (95%) 3Q'19 / LTM 3Q'19 / YTD'19 Fee-Generating inflows Fee-Generating inflows Fee Related Earnings $19,092 $18,192 (5)% $41,696 $59,493 43% Realized performance fees 4,010 162 (96)% 55,625 3,242 (94)% Realized profit sharing expense (2,352) (65) (97)% (32,222) (1,299) (96)% Realized principal investment income 532 415 (22)% 5,678 2,209 (61)% $37.2bn Net interest loss and other (2,835) (3,234) 14% (6,712) (8,115) 21% Total AUM up 11% QoQ Segment Distributable Earnings $18,447 $15,470 (16)% $64,065 $55,530 (13)% 1. Represents gross return for U.S. Real Estate Fund I and U.S. Real Estate Fund II including co-investment capital, Asia Real Estate Fund including co-investment capital, the European Principal Finance funds and infrastructure equity funds. 16 1. Represents gross return for U.S. Real Estate Fund I and U.S. Real Estate Fund II including co-investment capital, Asia Real Estate Fund including co-investment capital, the European Principal Finance funds, and Infrastructure Equity. The 3Q'19 and LTM real assets net returns for were 3.5% and 3.7%, respectively.

Balance Sheet Highlights

GAAP Consolidated Statements of Financial Condition (Unaudited) ($ in thousands, except share data) As of As of September 30, 2019 December 31, 2018 Assets: Cash and cash equivalents $1,242,817 $609,747 Restricted cash 19,777 3,457 U.S. Treasury securities, at fair value 551,681 392,932 Investments (includes performance allocations of $1,480,577 and $912,182 as of September 30, 2019 and December 31, 2018, respectively) 3,472,909 2,722,612 Assets of consolidated variable interest entities 1,244,868 1,290,891 Incentive fees receivable 3,093 6,792 Due from related parties 440,071 378,108 Deferred tax assets, net 530,954 306,094 Other assets 278,664 192,169 Lease assets 190,618 — Goodwill 88,852 88,852 Total Assets $8,064,304 $5,991,654 Liabilities and Stockholders’ Equity Liabilities: Accounts payable and accrued expenses $96,820 $70,878 Accrued compensation and benefits 166,161 73,583 Deferred revenue 172,157 111,097 Due to related parties 507,113 425,435 Profit sharing payable 693,618 452,141 Debt 2,348,440 1,360,448 Liabilities of consolidated variable interest entities 897,866 934,438 Other liabilities 132,023 111,794 Lease liabilities 207,673 — Total Liabilities 5,221,871 3,539,814 Stockholders’ Equity: Apollo Global Management, Inc. stockholders’ equity: Series A Preferred Shares, 11,000,000 shares issued and outstanding as of December 31, 2018 — 264,398 Series A Preferred Stock, 11,000,000 shares issued and outstanding as of September 30, 2019 264,398 — Series B Preferred Shares, 12,000,000 shares issued and outstanding as of December 31, 2018 — 289,815 Series B Preferred Stock, 12,000,000 shares issued and outstanding as of September 30, 2019 289,815 — Class A Shares, no par value, unlimited shares authorized, 201,400,500 shares issued and outstanding as of December 31, 2018 — — Class A Common Stock, $0.00001 par value, 90,000,000,000 shares authorized, 222,403,296 shares issued and outstanding as of September 30, 2019 — — Class B Shares, no par value, unlimited shares authorized, 1 share issued and outstanding as of December 31, 2018 — — Class B Common Stock, $0.00001 par value, 999,999,999 shares authorized, 1 share issued and outstanding as of September 30, 2019 — — Class C Common Stock, $0.00001 par value, 1 share authorized, 1 share issued and outstanding as of September 30, 2019 — — Additional paid in capital 1,217,231 1,299,418 Accumulated earnings (deficit) — (473,276) Accumulated other comprehensive loss (6,827) (4,159) Total Apollo Global Management, Inc. Stockholders’ Equity 1,764,617 1,376,196 Non-Controlling Interests in consolidated entities 266,016 271,522 Non-Controlling Interests in Apollo Operating Group 811,800 804,122 Total Stockholders’ Equity 2,842,433 2,451,840 Total Liabilities and Stockholders’ Equity $8,064,304 $5,991,654 18

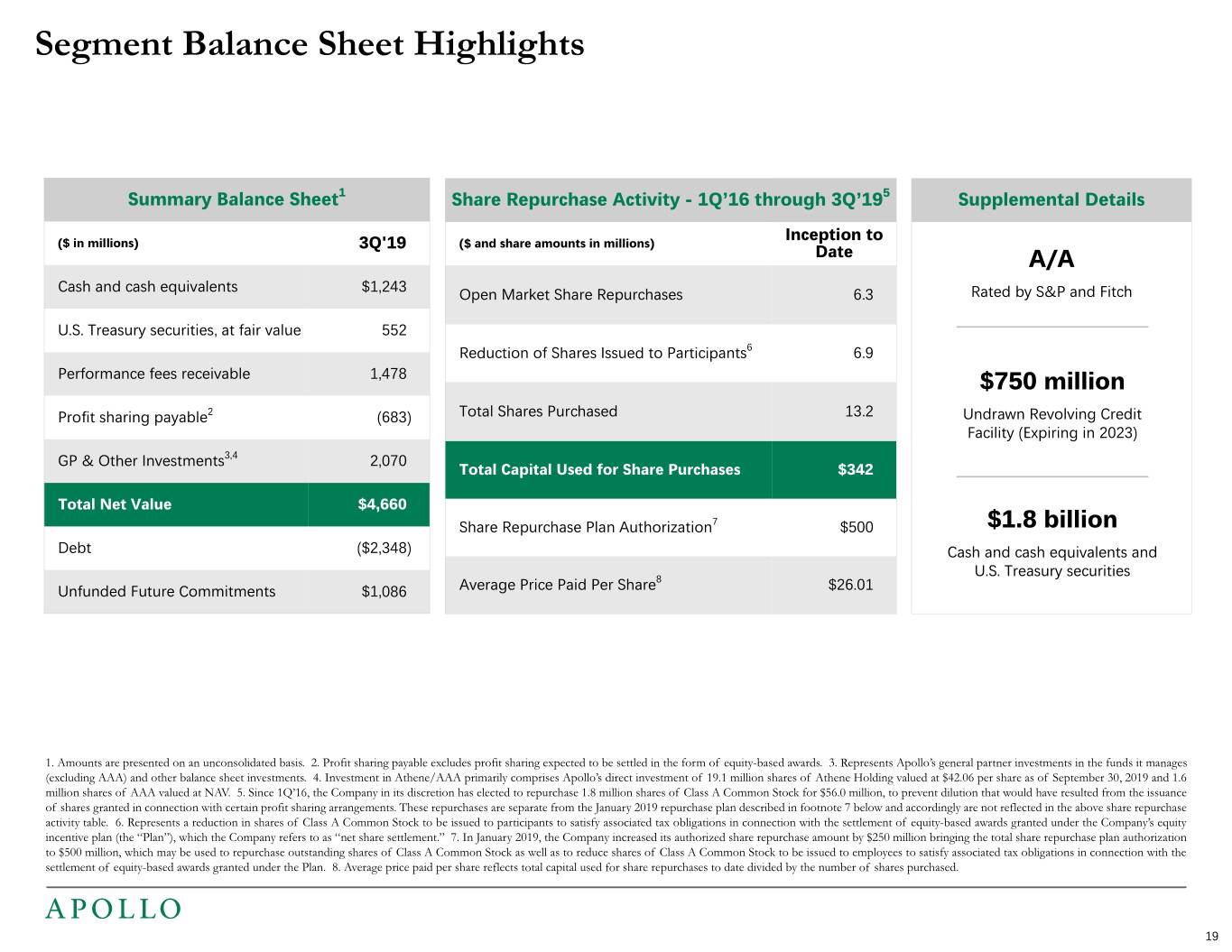

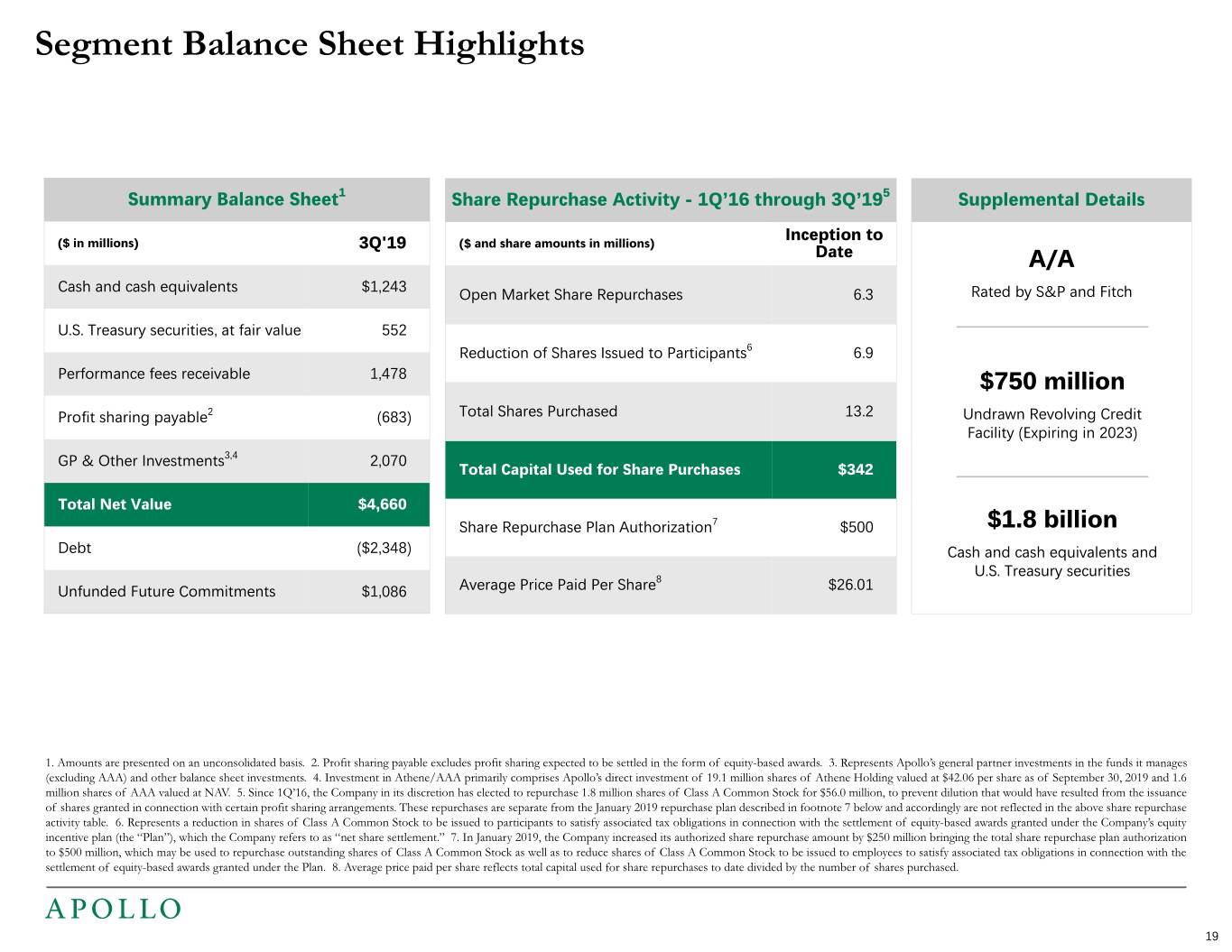

Segment Balance Sheet Highlights Long-term debt of $2.3 billion (with maturities in 2024, 2026, 2029, 2039 and 2048) and an undrawn $750 million revolving credit facility (expiring in 2023) Summary Balance Sheet1 Share Repurchase Activity - 1Q’16 through 3Q’195 Supplemental Details During the quarter, 0.1 million shares of Class A Common Stock were repurchased for $3.8 million in open market 7 Inception to transactions as part of the publicly announced share repurchase program ($ in millions) 3Q'19 ($ and share amounts in millions) Date A/A Cash and cash equivalents $1,243 Open Market Share Repurchases 6.3 Rated by S&P and Fitch U.S. Treasury securities, at fair value 552 1 5 Reduction of Shares Issued to Participants6 6.9 Summary Balance Sheet Share Repurchase Activity - 1Q’16 through 3Q’19 Supplemental Details Performance fees receivable 1,478 Inception to $750 million ($ in millions) 3Q'19 ($ and share amounts in millions) Date Profit sharing payable2 (683) Total Shares Purchased 13.2 Undrawn Revolving Credit Cash and cash equivalents $1,243 A/A Facility (Expiring in 2023) Open Market Share Repurchases 6.3 Rated by S&P and Fitch GP & Other Investments3,4 2,070 U.S. Treasury securities, at fair value 552 Total Capital Used for Share Purchases $342 Reduction of Shares Issued to Participants6 6.9 Total Net Value $4,660 Performance fees receivable 1,478 Share Repurchase Plan Authorization7 $500 $1.8 billion $750 million Profit sharing payable2 (683) Total Shares Purchased 13.2 Debt ($2,348) Cash and cash equivalents and Undrawn Revolving Credit U.S. Treasury securities Facility (Expiring in 2023) 8 GP & Other Investments3,4 2,070 Unfunded Future Commitments $1,086 Average Price Paid Per Share $26.01 Total Capital Used for Share Purchases $342 Total Net Value $4,660 Share Repurchase Plan Authorization7 $500 Debt ($2,348) $1.8 billion 8 Cash and cash equivalents and Unfunded Future Commitments $1,086 Average Price Paid Per Share $26.01 U.S. Treasury securities 1. Amounts are presented on an unconsolidated basis. 2. Profit sharing payable excludes profit sharing expected to be settled in the form of equity-based awards. 3. Represents Apollo’s general partner investments in the funds it manages (excluding AAA) and other balance sheet investments. 4. Investment in Athene/AAA primarily comprises Apollo’s direct investment of 19.1 million shares of Athene Holding valued at $42.06 per share as of September 30, 2019 and 1.6 million shares of AAA valued at NAV. 5. Since 1Q’16, the Company in its discretion has elected to repurchase 1.8 million shares of Class A Common Stock for $56.0 million, to prevent dilution that would have resulted from the issuance of shares granted in connection with certain profit sharing arrangements. These repurchases are separate from the January 2019 repurchase plan described in footnote 7 below and accordingly are not reflected in the above share repurchase activity table. 6. Represents a reduction in shares of Class A Common Stock to be issued to participants to satisfy associated tax obligations in connection with the settlement of equity-based awards granted under the Company’s equity incentive plan (the “Plan”), which the Company refers to as “net share settlement.” 7. In January 2019, the Company increased its authorized share repurchase amount by $250 million bringing the total share repurchase plan authorization to $500 million, which may be used to repurchase outstanding shares of Class A Common Stock as well as to reduce shares of Class A Common Stock to be issued to employees to satisfy associated tax obligations in connection with the settlement of equity-based awards granted under the Plan. 8. Average price paid per share reflects total capital used for share repurchases to date divided by the number of shares purchased. 19

Supplemental Details

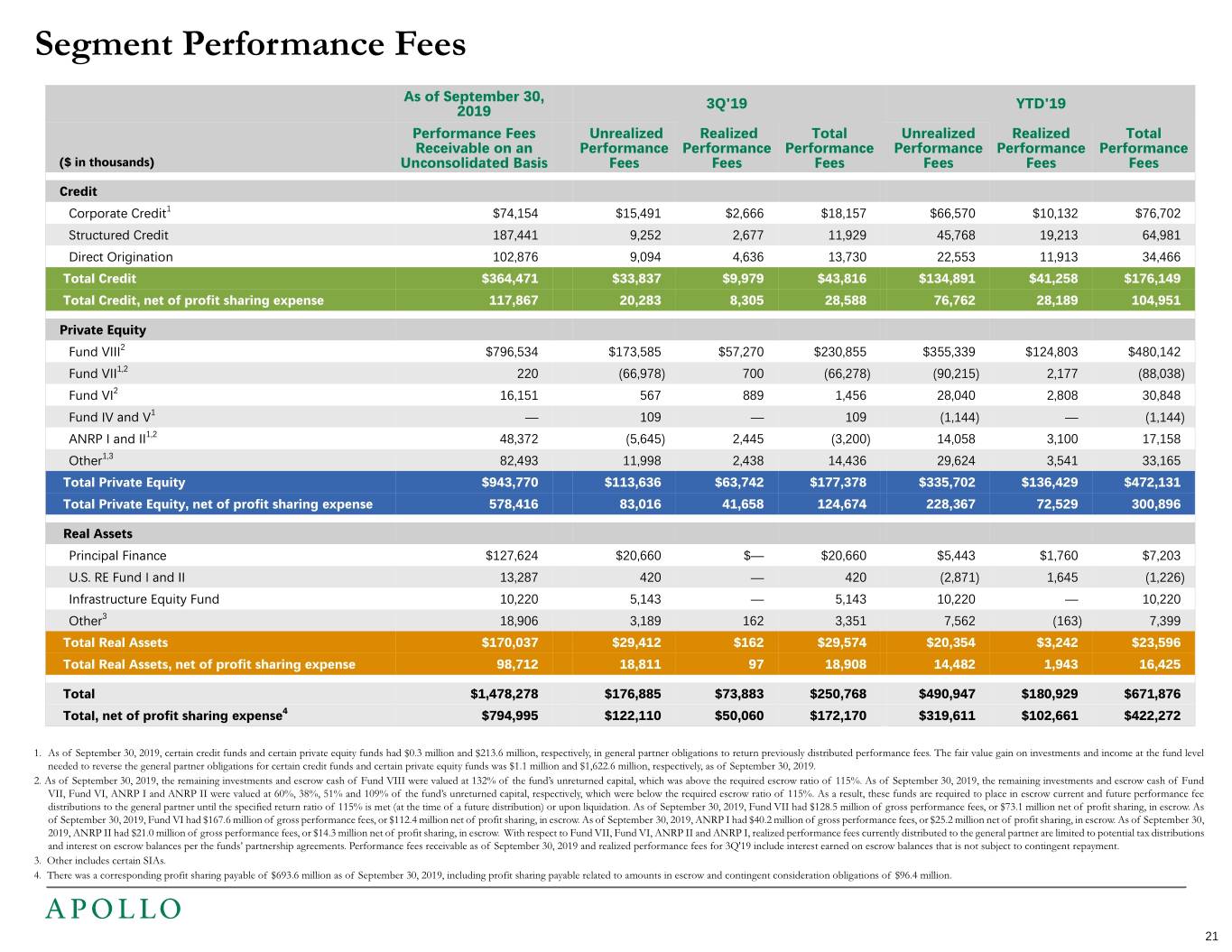

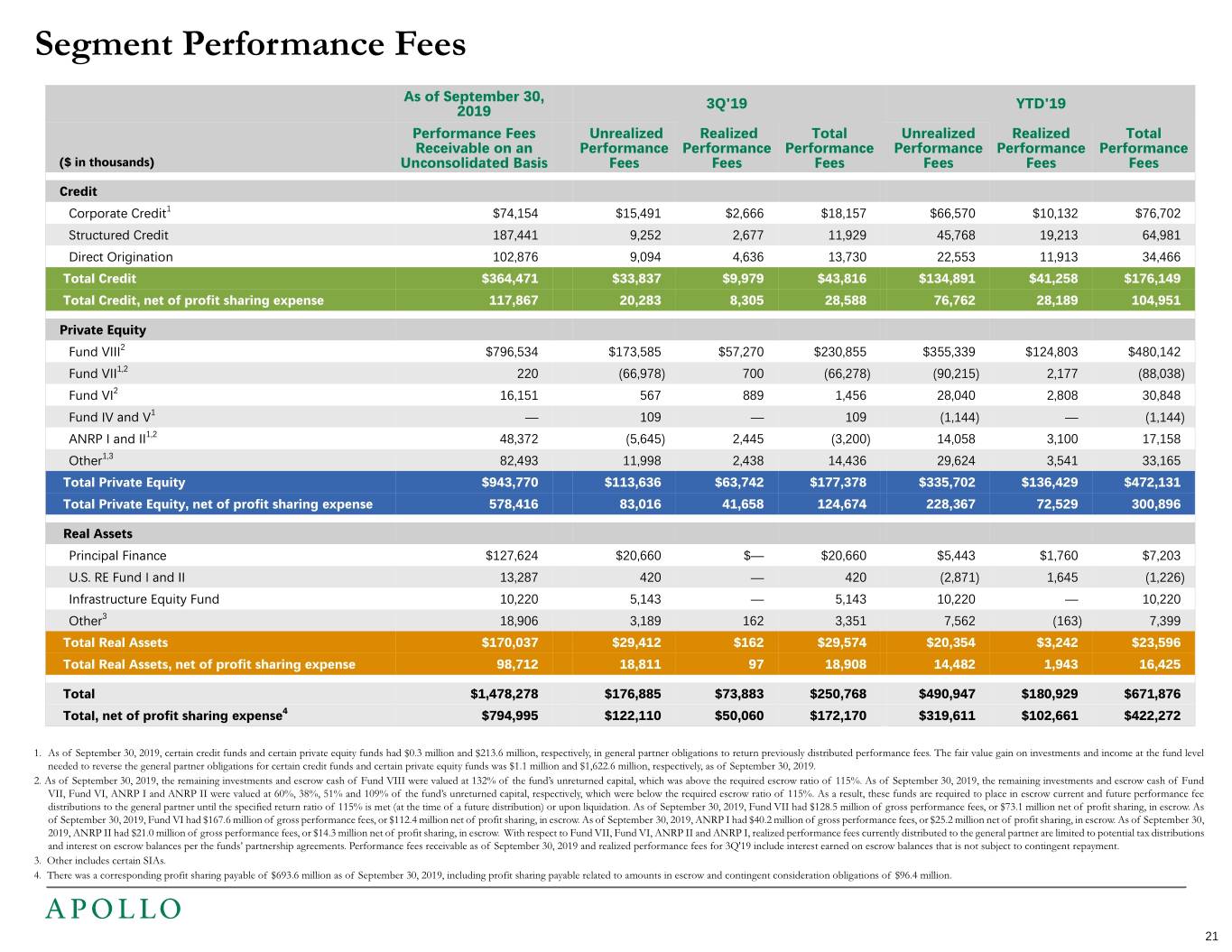

Segment Performance Fees As of September 30, 3Q'19 YTD'19 2019 Performance Fees Unrealized Realized Total Unrealized Realized Total Receivable on an Performance Performance Performance Performance Performance Performance ($ in thousands) Unconsolidated Basis Fees Fees Fees Fees Fees Fees Credit Corporate Credit1 $74,154 $15,491 $2,666 $18,157 $66,570 $10,132 $76,702 Structured Credit 187,441 9,252 2,677 11,929 45,768 19,213 64,981 Direct Origination 102,876 9,094 4,636 13,730 22,553 11,913 34,466 Total Credit $364,471 $33,837 $9,979 $43,816 $134,891 $41,258 $176,149 Total Credit, net of profit sharing expense 117,867 20,283 8,305 28,588 76,762 28,189 104,951 Private Equity Fund VIII2 $796,534 $173,585 $57,270 $230,855 $355,339 $124,803 $480,142 Fund VII1,2 220 (66,978) 700 (66,278) (90,215) 2,177 (88,038) Fund VI2 16,151 567 889 1,456 28,040 2,808 30,848 Fund IV and V1 — 109 — 109 (1,144) — (1,144) ANRP I and II1,2 48,372 (5,645) 2,445 (3,200) 14,058 3,100 17,158 Other1,3 82,493 11,998 2,438 14,436 29,624 3,541 33,165 Total Private Equity $943,770 $113,636 $63,742 $177,378 $335,702 $136,429 $472,131 Total Private Equity, net of profit sharing expense 578,416 83,016 41,658 124,674 228,367 72,529 300,896 Real Assets Principal Finance $127,624 $20,660 $— $20,660 $5,443 $1,760 $7,203 U.S. RE Fund I and II 13,287 420 — 420 (2,871) 1,645 (1,226) Infrastructure Equity Fund 10,220 5,143 — 5,143 10,220 — 10,220 Other3 18,906 3,189 162 3,351 7,562 (163) 7,399 Total Real Assets $170,037 $29,412 $162 $29,574 $20,354 $3,242 $23,596 Total Real Assets, net of profit sharing expense 98,712 18,811 97 18,908 14,482 1,943 16,425 Total $1,478,278 $176,885 $73,883 $250,768 $490,947 $180,929 $671,876 Total, net of profit sharing expense4 $794,995 $122,110 $50,060 $172,170 $319,611 $102,661 $422,272 1. As of September 30, 2019, certain credit funds and certain private equity funds had $0.3 million and $213.6 million, respectively, in general partner obligations to return previously distributed performance fees. The fair value gain on investments and income at the fund level needed to reverse the general partner obligations for certain credit funds and certain private equity funds was $1.1 million and $1,622.6 million, respectively, as of September 30, 2019. 2. As of September 30, 2019, the remaining investments and escrow cash of Fund VIII were valued at 132% of the fund’s unreturned capital, which was above the required escrow ratio of 115%. As of September 30, 2019, the remaining investments and escrow cash of Fund VII, Fund VI, ANRP I and ANRP II were valued at 60%, 38%, 51% and 109% of the fund’s unreturned capital, respectively, which were below the required escrow ratio of 115%. As a result, these funds are required to place in escrow current and future performance fee distributions to the general partner until the specified return ratio of 115% is met (at the time of a future distribution) or upon liquidation. As of September 30, 2019, Fund VII had $128.5 million of gross performance fees, or $73.1 million net of profit sharing, in escrow. As of September 30, 2019, Fund VI had $167.6 million of gross performance fees, or $112.4 million net of profit sharing, in escrow. As of September 30, 2019, ANRP I had $40.2 million of gross performance fees, or $25.2 million net of profit sharing, in escrow. As of September 30, 2019, ANRP II had $21.0 million of gross performance fees, or $14.3 million net of profit sharing, in escrow. With respect to Fund VII, Fund VI, ANRP II and ANRP I, realized performance fees currently distributed to the general partner are limited to potential tax distributions and interest on escrow balances per the funds’ partnership agreements. Performance fees receivable as of September 30, 2019 and realized performance fees for 3Q'19 include interest earned on escrow balances that is not subject to contingent repayment. 3. Other includes certain SIAs. 4. There was a corresponding profit sharing payable of $693.6 million as of September 30, 2019, including profit sharing payable related to amounts in escrow and contingent consideration obligations of $96.4 million. 21

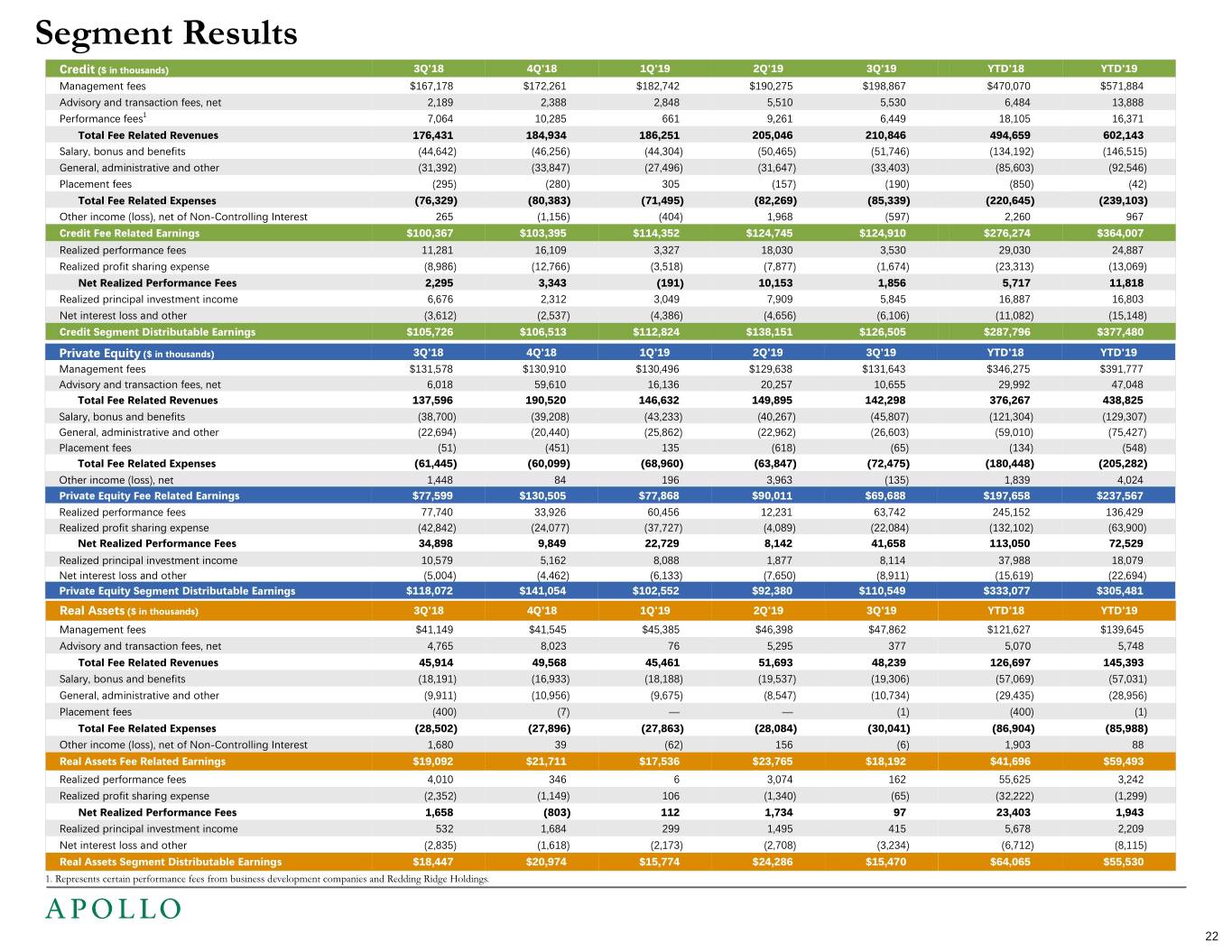

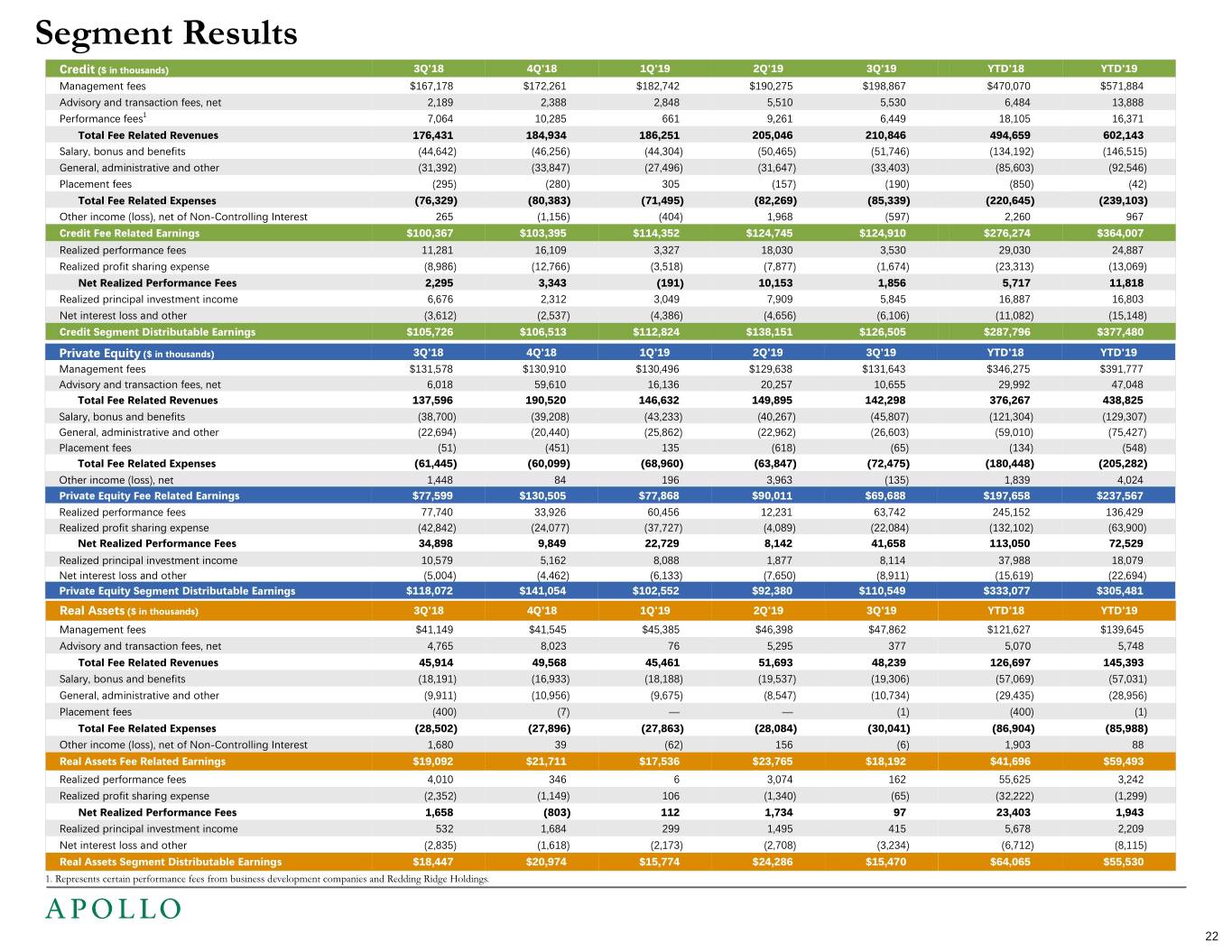

Segment Results Credit ($ in thousands) 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 YTD'18 YTD'19 Management fees $167,178 $172,261 $182,742 $190,275 $198,867 $470,070 $571,884 Advisory and transaction fees, net 2,189 2,388 2,848 5,510 5,530 6,484 13,888 Performance fees1 7,064 10,285 661 9,261 6,449 18,105 16,371 Total Fee Related Revenues 176,431 184,934 186,251 205,046 210,846 494,659 602,143 Salary, bonus and benefits (44,642) (46,256) (44,304) (50,465) (51,746) (134,192) (146,515) General, administrative and other (31,392) (33,847) (27,496) (31,647) (33,403) (85,603) (92,546) Placement fees (295) (280) 305 (157) (190) (850) (42) Total Fee Related Expenses (76,329) (80,383) (71,495) (82,269) (85,339) (220,645) (239,103) Other income (loss), net of Non-Controlling Interest 265 (1,156) (404) 1,968 (597) 2,260 967 Credit Fee Related Earnings $100,367 $103,395 $114,352 $124,745 $124,910 $276,274 $364,007 Realized performance fees 11,281 16,109 3,327 18,030 3,530 29,030 24,887 Realized profit sharing expense (8,986) (12,766) (3,518) (7,877) (1,674) (23,313) (13,069) Net Realized Performance Fees 2,295 3,343 (191) 10,153 1,856 5,717 11,818 Realized principal investment income 6,676 2,312 3,049 7,909 5,845 16,887 16,803 Net interest loss and other (3,612) (2,537) (4,386) (4,656) (6,106) (11,082) (15,148) Credit Segment Distributable Earnings $105,726 $106,513 $112,824 $138,151 $126,505 $287,796 $377,480 Private Equity ($ in thousands) 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 YTD'18 YTD'19 Management fees $131,578 $130,910 $130,496 $129,638 $131,643 $346,275 $391,777 Advisory and transaction fees, net 6,018 59,610 16,136 20,257 10,655 29,992 47,048 Total Fee Related Revenues 137,596 190,520 146,632 149,895 142,298 376,267 438,825 Salary, bonus and benefits (38,700) (39,208) (43,233) (40,267) (45,807) (121,304) (129,307) General, administrative and other (22,694) (20,440) (25,862) (22,962) (26,603) (59,010) (75,427) Placement fees (51) (451) 135 (618) (65) (134) (548) Total Fee Related Expenses (61,445) (60,099) (68,960) (63,847) (72,475) (180,448) (205,282) Other income (loss), net 1,448 84 196 3,963 (135) 1,839 4,024 Private Equity Fee Related Earnings $77,599 $130,505 $77,868 $90,011 $69,688 $197,658 $237,567 Realized performance fees 77,740 33,926 60,456 12,231 63,742 245,152 136,429 Realized profit sharing expense (42,842) (24,077) (37,727) (4,089) (22,084) (132,102) (63,900) Net Realized Performance Fees 34,898 9,849 22,729 8,142 41,658 113,050 72,529 Realized principal investment income 10,579 5,162 8,088 1,877 8,114 37,988 18,079 Net interest loss and other (5,004) (4,462) (6,133) (7,650) (8,911) (15,619) (22,694) Private Equity Segment Distributable Earnings $118,072 $141,054 $102,552 $92,380 $110,549 $333,077 $305,481 Real Assets ($ in thousands) 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 YTD'18 YTD'19 Management fees $41,149 $41,545 $45,385 $46,398 $47,862 $121,627 $139,645 Advisory and transaction fees, net 4,765 8,023 76 5,295 377 5,070 5,748 Total Fee Related Revenues 45,914 49,568 45,461 51,693 48,239 126,697 145,393 Salary, bonus and benefits (18,191) (16,933) (18,188) (19,537) (19,306) (57,069) (57,031) General, administrative and other (9,911) (10,956) (9,675) (8,547) (10,734) (29,435) (28,956) Placement fees (400) (7) — — (1) (400) (1) Total Fee Related Expenses (28,502) (27,896) (27,863) (28,084) (30,041) (86,904) (85,988) Other income (loss), net of Non-Controlling Interest 1,680 39 (62) 156 (6) 1,903 88 Real Assets Fee Related Earnings $19,092 $21,711 $17,536 $23,765 $18,192 $41,696 $59,493 Realized performance fees 4,010 346 6 3,074 162 55,625 3,242 Realized profit sharing expense (2,352) (1,149) 106 (1,340) (65) (32,222) (1,299) Net Realized Performance Fees 1,658 (803) 112 1,734 97 23,403 1,943 Realized principal investment income 532 1,684 299 1,495 415 5,678 2,209 Net interest loss and other (2,835) (1,618) (2,173) (2,708) (3,234) (6,712) (8,115) Real Assets Segment Distributable Earnings $18,447 $20,974 $15,774 $24,286 $15,470 $64,065 $55,530 1. Represents certain performance fees from business development companies and Redding Ridge Holdings. 22

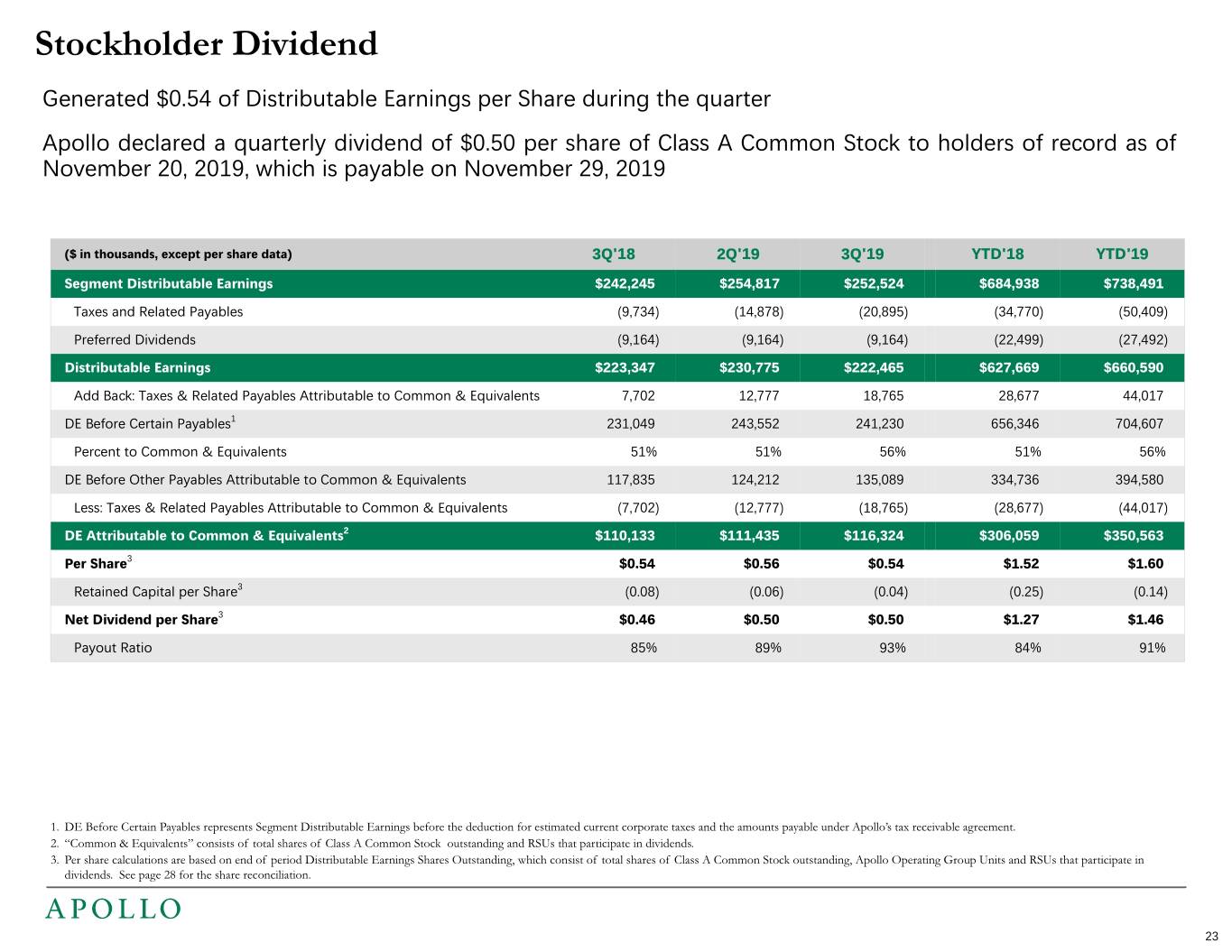

Stockholder Dividend Generated $0.54 of Distributable Earnings per Share during the quarter Apollo declared a quarterly dividend of $0.50 per share of Class A Common Stock to holders of record as of November 20, 2019, which is payable on November 29, 2019 ($ in thousands, except per share data) 3Q'18 2Q'19 3Q'19 YTD'18 YTD'19 Segment Distributable Earnings $242,245 $254,817 $252,524 $684,938 $738,491 Taxes and Related Payables (9,734) (14,878) (20,895) (34,770) (50,409) Preferred Dividends (9,164) (9,164) (9,164) (22,499) (27,492) Distributable Earnings $223,347 $230,775 $222,465 $627,669 $660,590 Add Back: Taxes & Related Payables Attributable to Common & Equivalents 7,702 12,777 18,765 28,677 44,017 DE Before Certain Payables1 231,049 243,552 241,230 656,346 704,607 Percent to Common & Equivalents 51% 51% 56% 51% 56% DE Before Other Payables Attributable to Common & Equivalents 117,835 124,212 135,089 334,736 394,580 Less: Taxes & Related Payables Attributable to Common & Equivalents (7,702) (12,777) (18,765) (28,677) (44,017) DE Attributable to Common & Equivalents2 $110,133 $111,435 $116,324 $306,059 $350,563 Per Share3 $0.54 $0.56 $0.54 $1.52 $1.60 Retained Capital per Share3 (0.08) (0.06) (0.04) (0.25) (0.14) Net Dividend per Share3 $0.46 $0.50 $0.50 $1.27 $1.46 Payout Ratio 85% 89% 93% 84% 91% 1. DE Before Certain Payables represents Segment Distributable Earnings before the deduction for estimated current corporate taxes and the amounts payable under Apollo’s tax receivable agreement. 2. “Common & Equivalents” consists of total shares of Class A Common Stock outstanding and RSUs that participate in dividends. 3. Per share calculations are based on end of period Distributable Earnings Shares Outstanding, which consist of total shares of Class A Common Stock outstanding, Apollo Operating Group Units and RSUs that participate in dividends. See page 28 for the share reconciliation. 23

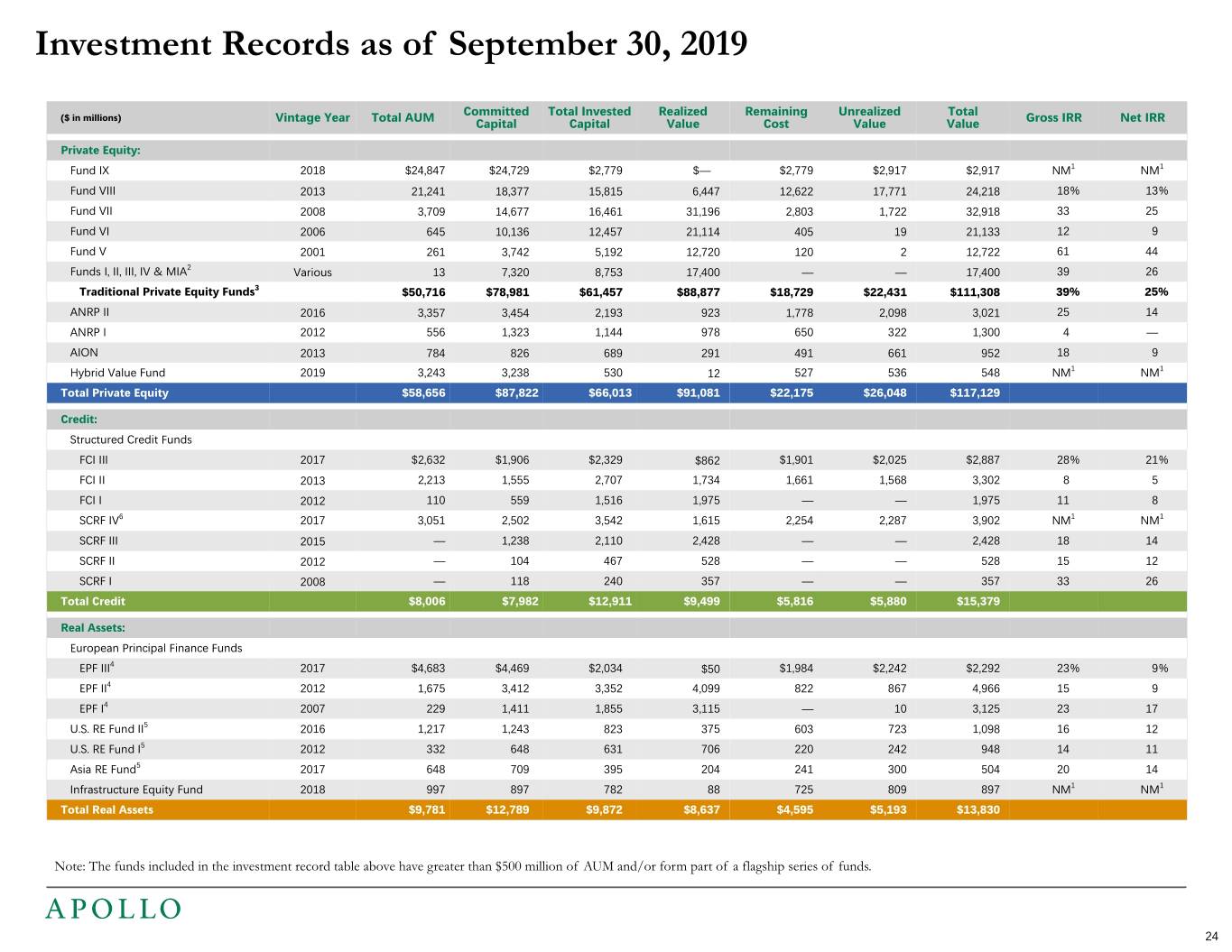

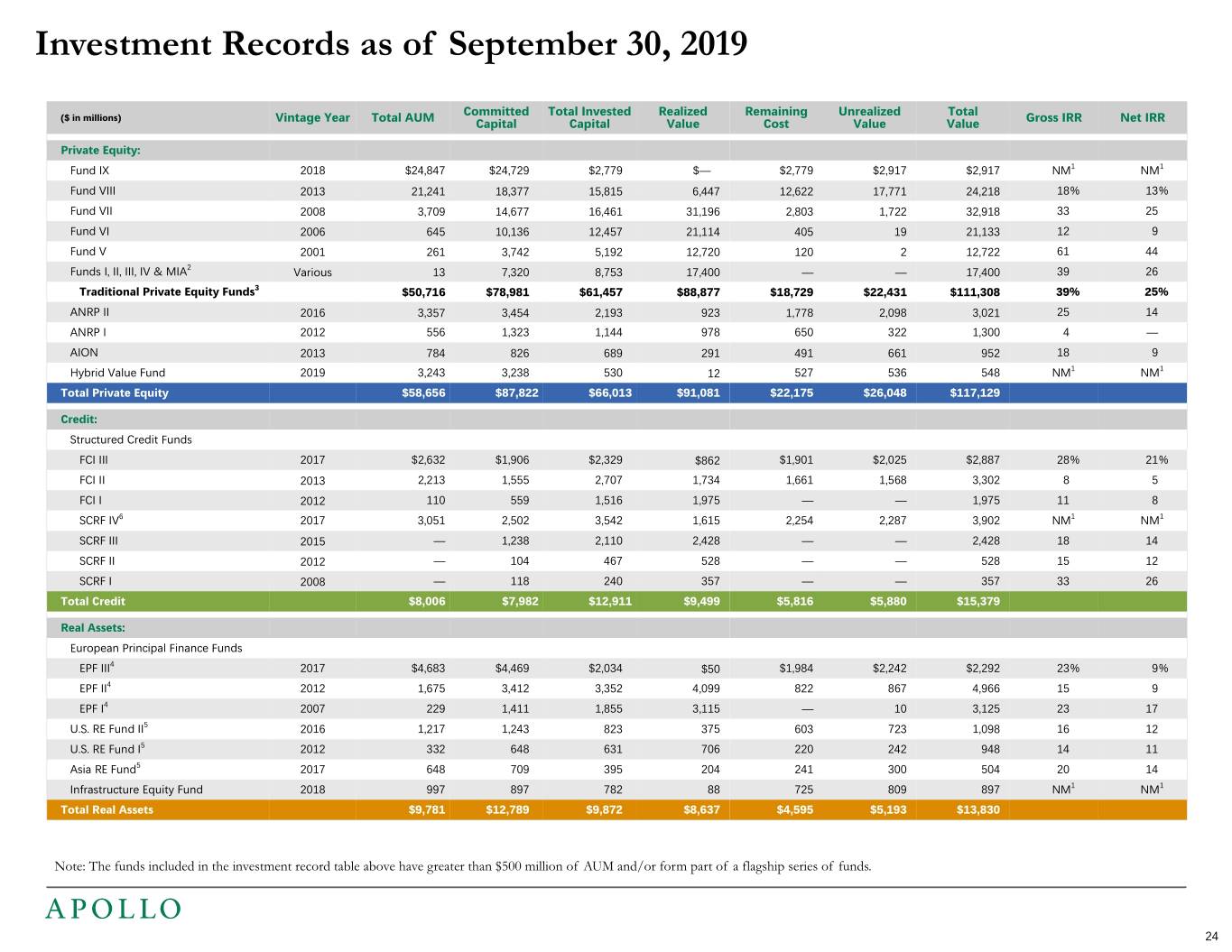

Investment Records as of September 30, 2019 Committed Total Invested Realized Remaining Unrealized Total ($ in millions) Vintage Year Total AUM Capital Capital Value Cost Value Value Gross IRR Net IRR Private Equity: Fund IX 2018 $24,847 $24,729 $2,779 $— $2,779 $2,917 $2,917 NM1 NM1 Fund VIII 2013 21,241 18,377 15,815 6,447 12,622 17,771 24,218 18% 13% Fund VII 2008 3,709 14,677 16,461 31,196 2,803 1,722 32,918 33 25 Fund VI 2006 645 10,136 12,457 21,114 405 19 21,133 12 9 Fund V 2001 261 3,742 5,192 12,720 120 2 12,722 61 44 Funds I, II, III, IV & MIA2 Various 13 7,320 8,753 17,400 — — 17,400 39 26 Traditional Private Equity Funds3 $50,716 $78,981 $61,457 $88,877 $18,729 $22,431 $111,308 39% 25% ANRP II 2016 3,357 3,454 2,193 923 1,778 2,098 3,021 25 14 ANRP I 2012 556 1,323 1,144 978 650 322 1,300 4 — AION 2013 784 826 689 291 491 661 952 18 9 Hybrid Value Fund 2019 3,243 3,238 530 12 527 536 548 NM1 NM1 Total Private Equity $58,656 $87,822 $66,013 $91,081 $22,175 $26,048 $117,129 Credit: Structured Credit Funds FCI III 2017 $2,632 $1,906 $2,329 $862 $1,901 $2,025 $2,887 28% 21% FCI II 2013 2,213 1,555 2,707 1,734 1,661 1,568 3,302 8 5 FCI I 2012 110 559 1,516 1,975 — — 1,975 11 8 SCRF IV6 2017 3,051 2,502 3,542 1,615 2,254 2,287 3,902 NM1 NM1 SCRF III 2015 — 1,238 2,110 2,428 — — 2,428 18 14 SCRF II 2012 — 104 467 528 — — 528 15 12 SCRF I 2008 — 118 240 357 — — 357 33 26 Total Credit $8,006 $7,982 $12,911 $9,499 $5,816 $5,880 $15,379 Real Assets: European Principal Finance Funds EPF III4 2017 $4,683 $4,469 $2,034 $50 $1,984 $2,242 $2,292 23% 9% EPF II4 2012 1,675 3,412 3,352 4,099 822 867 4,966 15 9 EPF I4 2007 229 1,411 1,855 3,115 — 10 3,125 23 17 U.S. RE Fund II5 2016 1,217 1,243 823 375 603 723 1,098 16 12 U.S. RE Fund I5 2012 332 648 631 706 220 242 948 14 11 Asia RE Fund5 2017 648 709 395 204 241 300 504 20 14 Infrastructure Equity Fund 2018 997 897 782 88 725 809 897 NM1 NM1 Total Real Assets $9,781 $12,789 $9,872 $8,637 $4,595 $5,193 $13,830 Note: The funds included in the investment record table above have greater than $500 million of AUM and/or form part of a flagship series of funds. 24

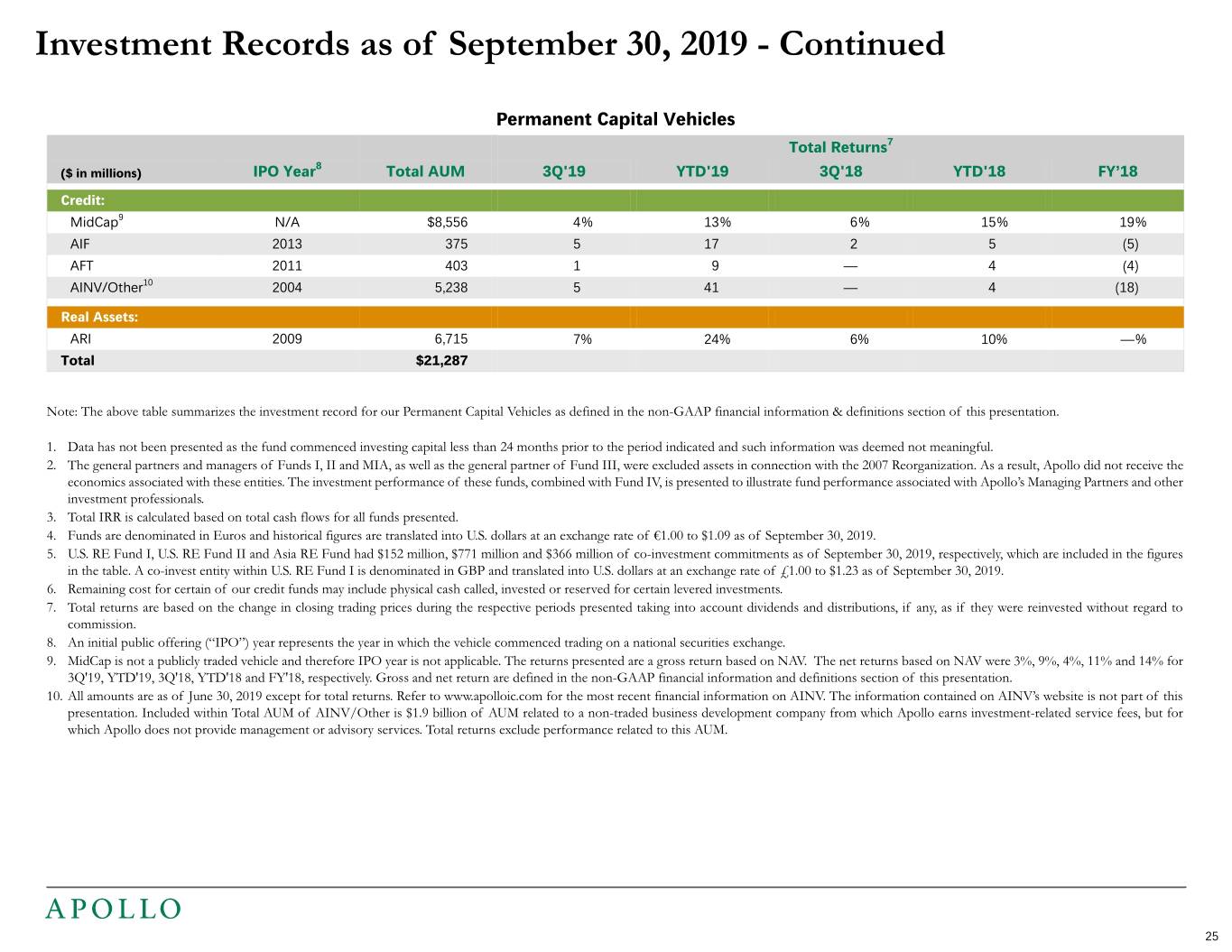

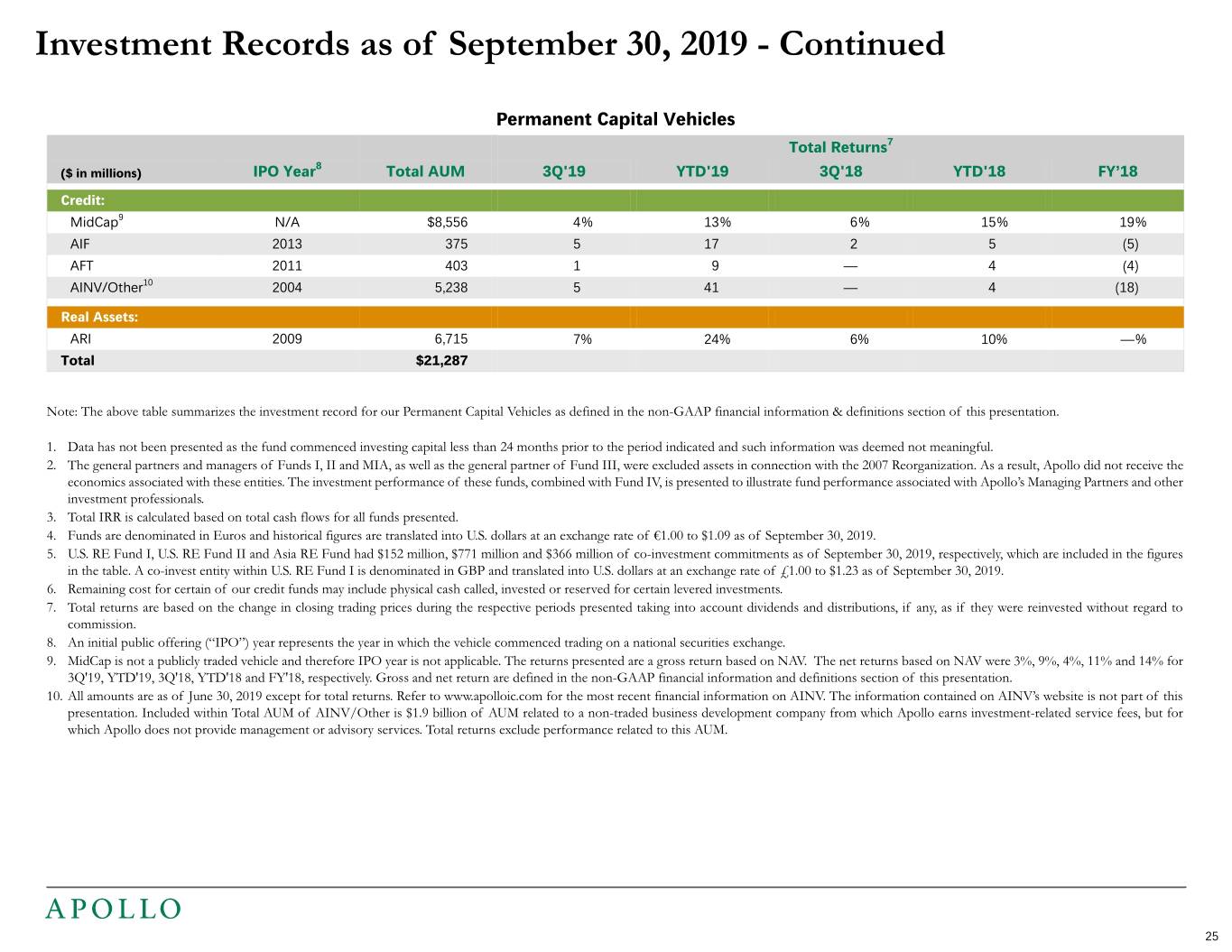

Investment Records as of September 30, 2019 - Continued Permanent Capital Vehicles Total Returns7 8 ($ in millions) IPO Year Total AUM 3Q'19 YTD'19 3Q'18 YTD'18 FY’18 Credit: MidCap9 N/A $8,556 4% 13% 6% 15% 19% AIF 2013 375 5 17 2 5 (5) AFT 2011 403 1 9 — 4 (4) AINV/Other10 2004 5,238 5 41 — 4 (18) Real Assets: ARI 2009 6,715 7% 24% 6% 10% —% Total $21,287 Note: The above table summarizes the investment record for our Permanent Capital Vehicles as defined in the non-GAAP financial information & definitions section of this presentation. 1. Data has not been presented as the fund commenced investing capital less than 24 months prior to the period indicated and such information was deemed not meaningful. 2. The general partners and managers of Funds I, II and MIA, as well as the general partner of Fund III, were excluded assets in connection with the 2007 Reorganization. As a result, Apollo did not receive the economics associated with these entities. The investment performance of these funds, combined with Fund IV, is presented to illustrate fund performance associated with Apollo’s Managing Partners and other investment professionals. 3. Total IRR is calculated based on total cash flows for all funds presented. 4. Funds are denominated in Euros and historical figures are translated into U.S. dollars at an exchange rate of €1.00 to $1.09 as of September 30, 2019. 5. U.S. RE Fund I, U.S. RE Fund II and Asia RE Fund had $152 million, $771 million and $366 million of co-investment commitments as of September 30, 2019, respectively, which are included in the figures in the table. A co-invest entity within U.S. RE Fund I is denominated in GBP and translated into U.S. dollars at an exchange rate of £1.00 to $1.23 as of September 30, 2019. 6. Remaining cost for certain of our credit funds may include physical cash called, invested or reserved for certain levered investments. 7. Total returns are based on the change in closing trading prices during the respective periods presented taking into account dividends and distributions, if any, as if they were reinvested without regard to commission. 8. An initial public offering (“IPO”) year represents the year in which the vehicle commenced trading on a national securities exchange. 9. MidCap is not a publicly traded vehicle and therefore IPO year is not applicable. The returns presented are a gross return based on NAV. The net returns based on NAV were 3%, 9%, 4%, 11% and 14% for 3Q'19, YTD'19, 3Q'18, YTD'18 and FY'18, respectively. Gross and net return are defined in the non-GAAP financial information and definitions section of this presentation. 10. All amounts are as of June 30, 2019 except for total returns. Refer to www.apolloic.com for the most recent financial information on AINV. The information contained on AINV’s website is not part of this presentation. Included within Total AUM of AINV/Other is $1.9 billion of AUM related to a non-traded business development company from which Apollo earns investment-related service fees, but for which Apollo does not provide management or advisory services. Total returns exclude performance related to this AUM. 25

Reconciliations and Disclosures

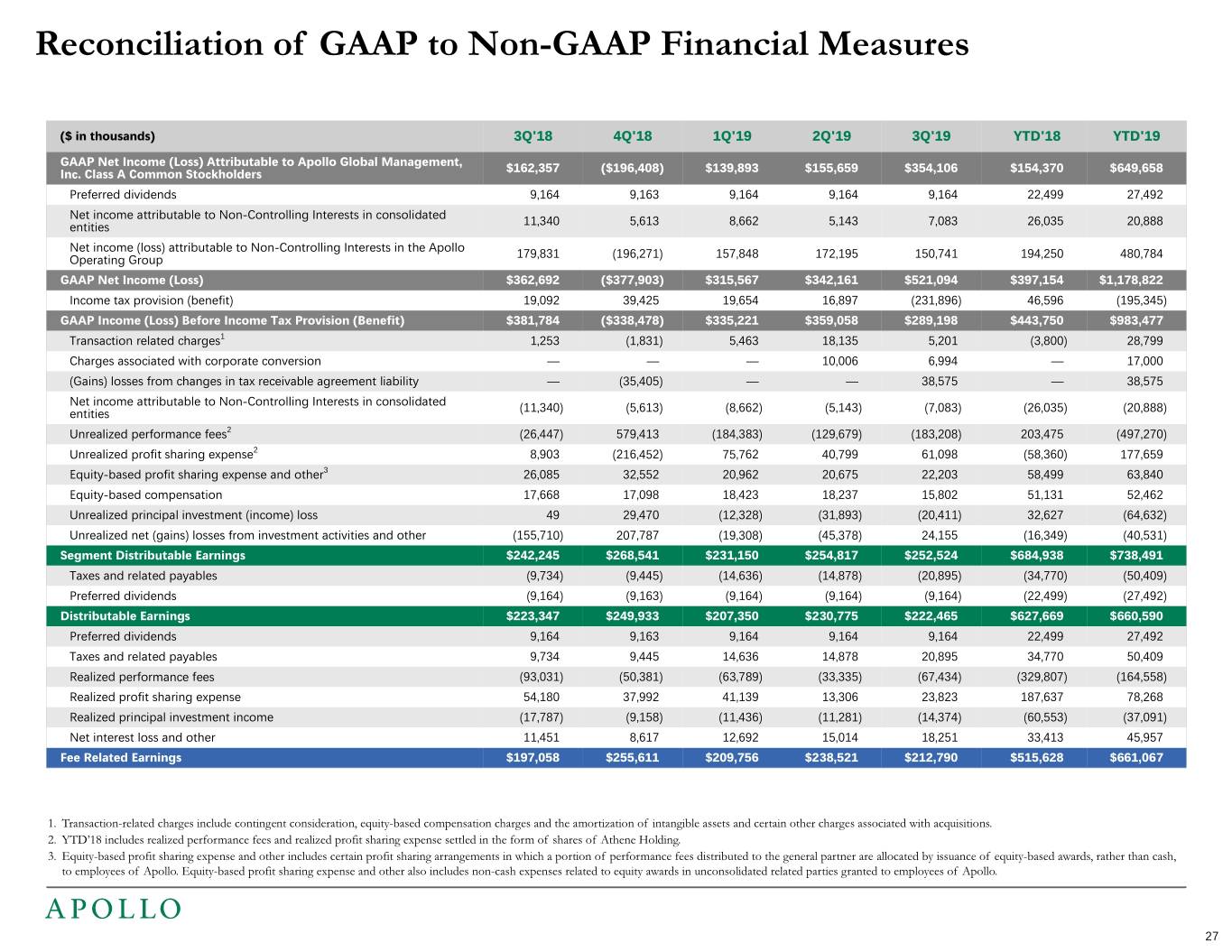

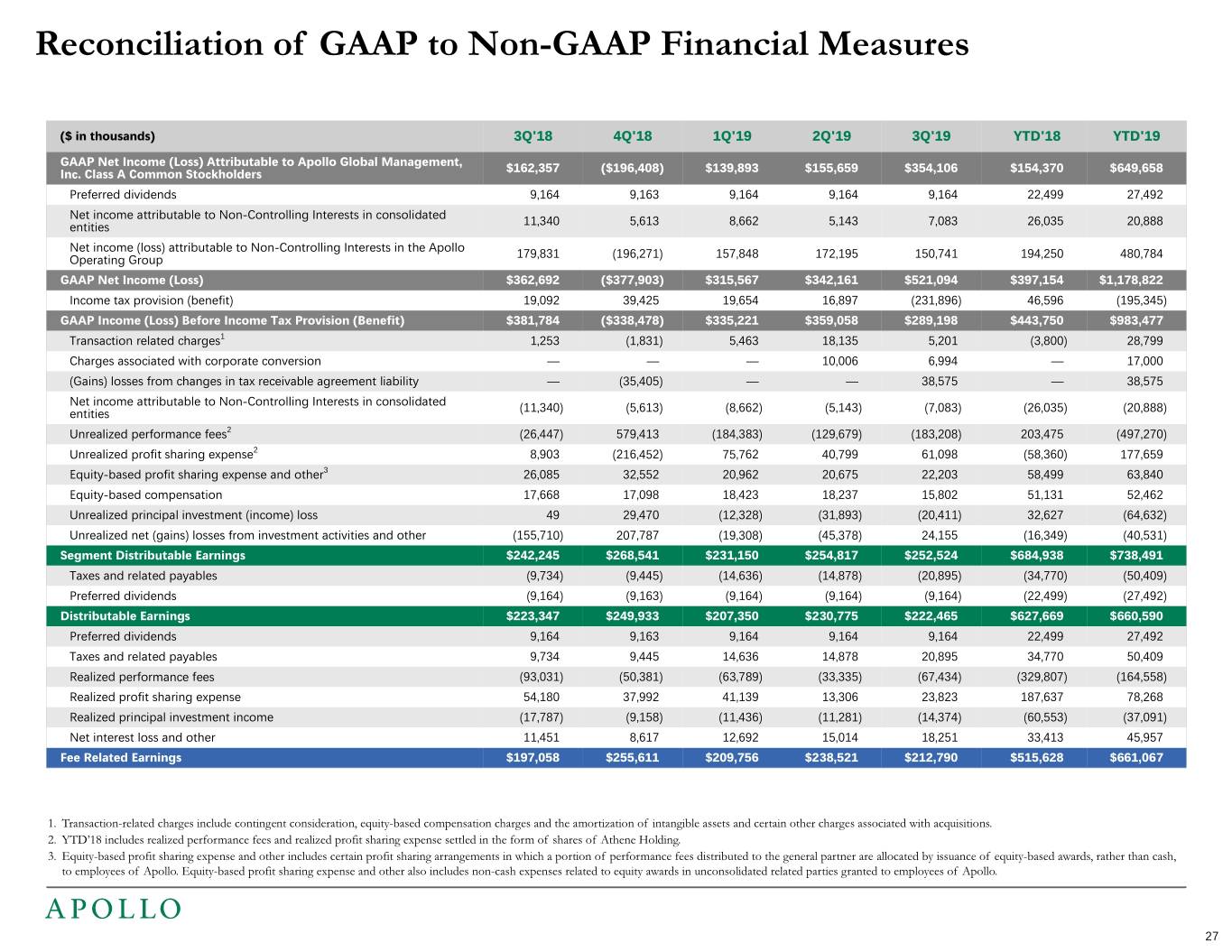

Reconciliation of GAAP to Non-GAAP Financial Measures ($ in thousands) 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 YTD'18 YTD'19 GAAP Net Income (Loss) Attributable to Apollo Global Management, Inc. Class A Common Stockholders $162,357 ($196,408) $139,893 $155,659 $354,106 $154,370 $649,658 Preferred dividends 9,164 9,163 9,164 9,164 9,164 22,499 27,492 Net income attributable to Non-Controlling Interests in consolidated entities 11,340 5,613 8,662 5,143 7,083 26,035 20,888 Net income (loss) attributable to Non-Controlling Interests in the Apollo ) Operating Group 179,831 (196,271 157,848 172,195 150,741 194,250 480,784 GAAP Net Income (Loss) $362,692 ($377,903) $315,567 $342,161 $521,094 $397,154 $1,178,822 Income tax provision (benefit) 19,092 39,425 19,654 16,897 (231,896) 46,596 (195,345) GAAP Income (Loss) Before Income Tax Provision (Benefit) $381,784 ($338,478) $335,221 $359,058 $289,198 $443,750 $983,477 Transaction related charges1 1,253 (1,831) 5,463 18,135 5,201 (3,800) 28,799 Charges associated with corporate conversion — — — 10,006 6,994 — 17,000 (Gains) losses from changes in tax receivable agreement liability — (35,405) — — 38,575 — 38,575 Net income attributable to Non-Controlling Interests in consolidated ) ) ) ) ) ) ) entities (11,340 (5,613 (8,662 (5,143 (7,083 (26,035 (20,888 Unrealized performance fees2 (26,447) 579,413 (184,383) (129,679) (183,208) 203,475 (497,270) Unrealized profit sharing expense2 8,903 (216,452) 75,762 40,799 61,098 (58,360) 177,659 Equity-based profit sharing expense and other3 26,085 32,552 20,962 20,675 22,203 58,499 63,840 Equity-based compensation 17,668 17,098 18,423 18,237 15,802 51,131 52,462 Unrealized principal investment (income) loss 49 29,470 (12,328) (31,893) (20,411) 32,627 (64,632) Unrealized net (gains) losses from investment activities and other (155,710) 207,787 (19,308) (45,378) 24,155 (16,349) (40,531) Segment Distributable Earnings $242,245 $268,541 $231,150 $254,817 $252,524 $684,938 $738,491 Taxes and related payables (9,734) (9,445) (14,636) (14,878) (20,895) (34,770) (50,409) Preferred dividends (9,164) (9,163) (9,164) (9,164) (9,164) (22,499) (27,492) Distributable Earnings $223,347 $249,933 $207,350 $230,775 $222,465 $627,669 $660,590 Preferred dividends 9,164 9,163 9,164 9,164 9,164 22,499 27,492 Taxes and related payables 9,734 9,445 14,636 14,878 20,895 34,770 50,409 Realized performance fees (93,031) (50,381) (63,789) (33,335) (67,434) (329,807) (164,558) Realized profit sharing expense 54,180 37,992 41,139 13,306 23,823 187,637 78,268 Realized principal investment income (17,787) (9,158) (11,436) (11,281) (14,374) (60,553) (37,091) Net interest loss and other 11,451 8,617 12,692 15,014 18,251 33,413 45,957 Fee Related Earnings $197,058 $255,611 $209,756 $238,521 $212,790 $515,628 $661,067 1. Transaction-related charges include contingent consideration, equity-based compensation charges and the amortization of intangible assets and certain other charges associated with acquisitions. 2. YTD’18 includes realized performance fees and realized profit sharing expense settled in the form of shares of Athene Holding. 3. Equity-based profit sharing expense and other includes certain profit sharing arrangements in which a portion of performance fees distributed to the general partner are allocated by issuance of equity-based awards, rather than cash, to employees of Apollo. Equity-based profit sharing expense and other also includes non-cash expenses related to equity awards in unconsolidated related parties granted to employees of Apollo. 27

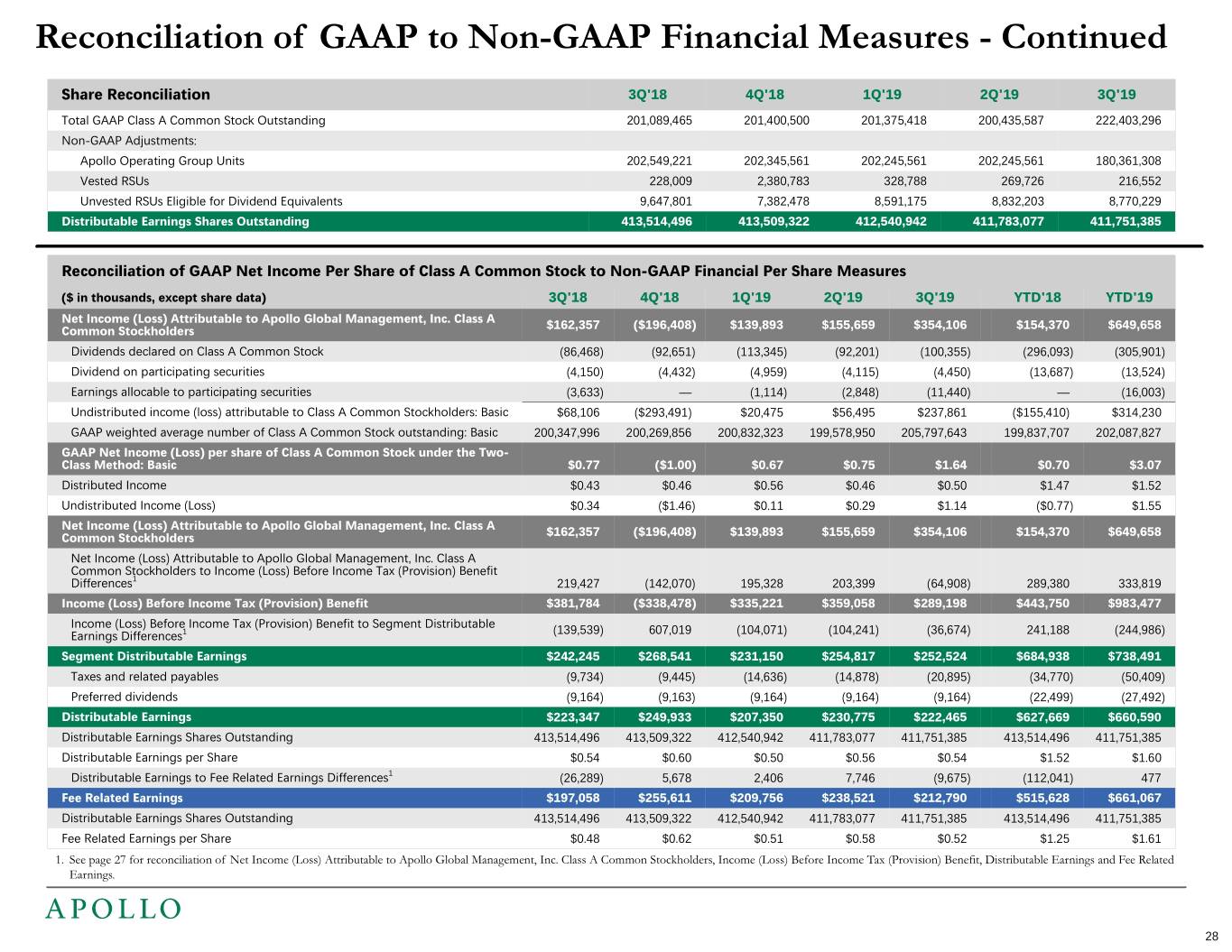

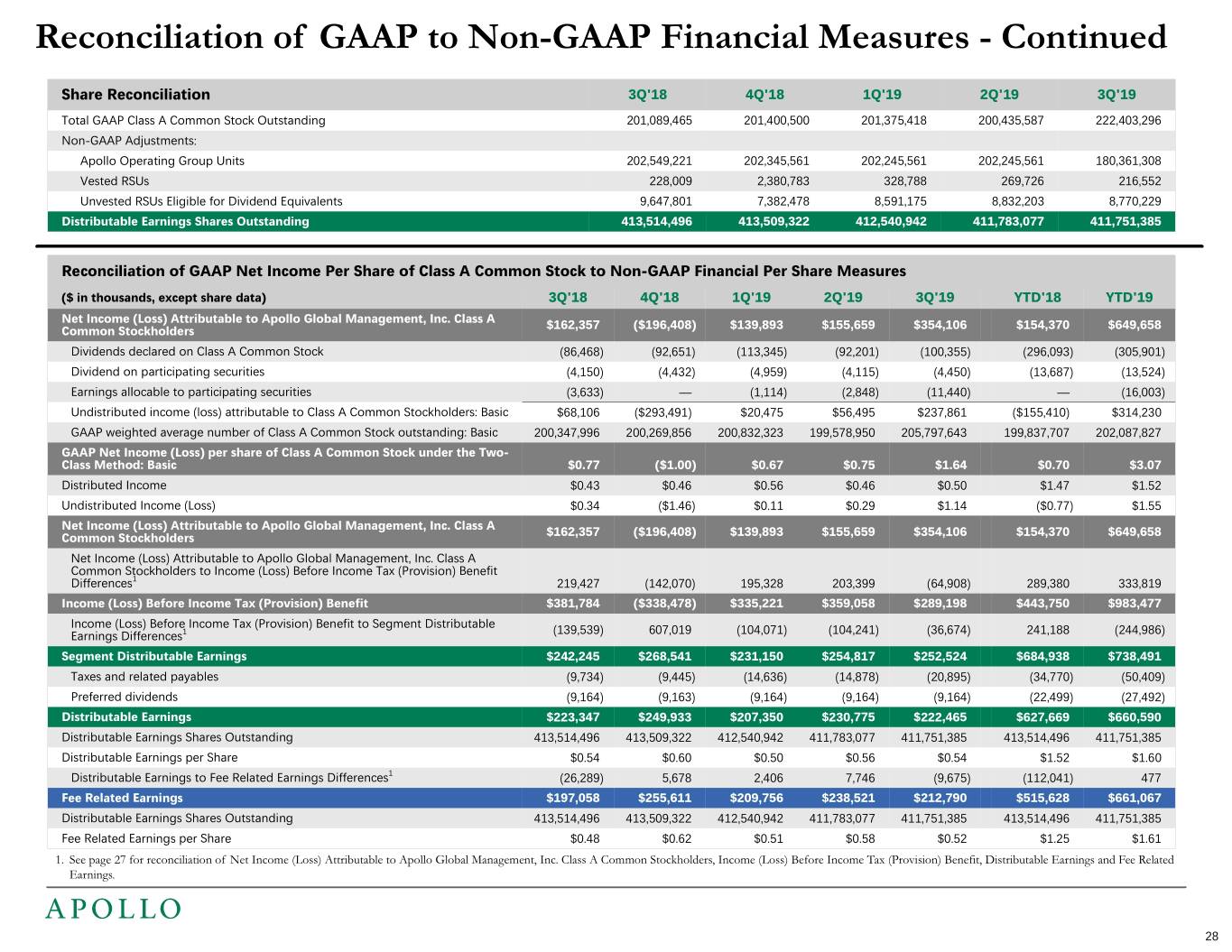

Reconciliation of GAAP to Non-GAAP Financial Measures - Continued Share Reconciliation 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 Total GAAP Class A Common Stock Outstanding 201,089,465 201,400,500 201,375,418 200,435,587 222,403,296 Non-GAAP Adjustments: Apollo Operating Group Units 202,549,221 202,345,561 202,245,561 202,245,561 180,361,308 Vested RSUs 228,009 2,380,783 328,788 269,726 216,552 Unvested RSUs Eligible for Dividend Equivalents 9,647,801 7,382,478 8,591,175 8,832,203 8,770,229 Distributable Earnings Shares Outstanding 413,514,496 413,509,322 412,540,942 411,783,077 411,751,385 Reconciliation of GAAP Net Income Per Share of Class A Common Stock to Non-GAAP Financial Per Share Measures ($ in thousands, except share data) 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 YTD'18 YTD'19 Net Income (Loss) Attributable to Apollo Global Management, Inc. Class A Common Stockholders $162,357 ($196,408) $139,893 $155,659 $354,106 $154,370 $649,658 Dividends declared on Class A Common Stock (86,468) (92,651) (113,345) (92,201) (100,355) (296,093) (305,901) Dividend on participating securities (4,150) (4,432) (4,959) (4,115) (4,450) (13,687) (13,524) Earnings allocable to participating securities (3,633) — (1,114) (2,848) (11,440) — (16,003) Undistributed income (loss) attributable to Class A Common Stockholders: Basic $68,106 ($293,491) $20,475 $56,495 $237,861 ($155,410) $314,230 GAAP weighted average number of Class A Common Stock outstanding: Basic 200,347,996 200,269,856 200,832,323 199,578,950 205,797,643 199,837,707 202,087,827 GAAP Net Income (Loss) per share of Class A Common Stock under the Two- Class Method: Basic $0.77 ($1.00) $0.67 $0.75 $1.64 $0.70 $3.07 Distributed Income $0.43 $0.46 $0.56 $0.46 $0.50 $1.47 $1.52 Undistributed Income (Loss) $0.34 ($1.46) $0.11 $0.29 $1.14 ($0.77) $1.55 Net Income (Loss) Attributable to Apollo Global Management, Inc. Class A Common Stockholders $162,357 ($196,408) $139,893 $155,659 $354,106 $154,370 $649,658 Net Income (Loss) Attributable to Apollo Global Management, Inc. Class A Common Stockholders to Income (Loss) Before Income Tax (Provision) Benefit Differences1 219,427 (142,070) 195,328 203,399 (64,908) 289,380 333,819 Income (Loss) Before Income Tax (Provision) Benefit $381,784 ($338,478) $335,221 $359,058 $289,198 $443,750 $983,477 Income (Loss) Before Income Tax (Provision) Benefit to Segment Distributable 1 ) ) ) ) ) Earnings Differences (139,539 607,019 (104,071 (104,241 (36,674 241,188 (244,986 Segment Distributable Earnings $242,245 $268,541 $231,150 $254,817 $252,524 $684,938 $738,491 Taxes and related payables (9,734) (9,445) (14,636) (14,878) (20,895) (34,770) (50,409) Preferred dividends (9,164) (9,163) (9,164) (9,164) (9,164) (22,499) (27,492) Distributable Earnings $223,347 $249,933 $207,350 $230,775 $222,465 $627,669 $660,590 Distributable Earnings Shares Outstanding 413,514,496 413,509,322 412,540,942 411,783,077 411,751,385 413,514,496 411,751,385 Distributable Earnings per Share $0.54 $0.60 $0.50 $0.56 $0.54 $1.52 $1.60 Distributable Earnings to Fee Related Earnings Differences1 (26,289) 5,678 2,406 7,746 (9,675) (112,041) 477 Fee Related Earnings $197,058 $255,611 $209,756 $238,521 $212,790 $515,628 $661,067 Distributable Earnings Shares Outstanding 413,514,496 413,509,322 412,540,942 411,783,077 411,751,385 413,514,496 411,751,385 Fee Related Earnings per Share $0.48 $0.62 $0.51 $0.58 $0.52 $1.25 $1.61 1. See page 27 for reconciliation of Net Income (Loss) Attributable to Apollo Global Management, Inc. Class A Common Stockholders, Income (Loss) Before Income Tax (Provision) Benefit, Distributable Earnings and Fee Related Earnings. 28

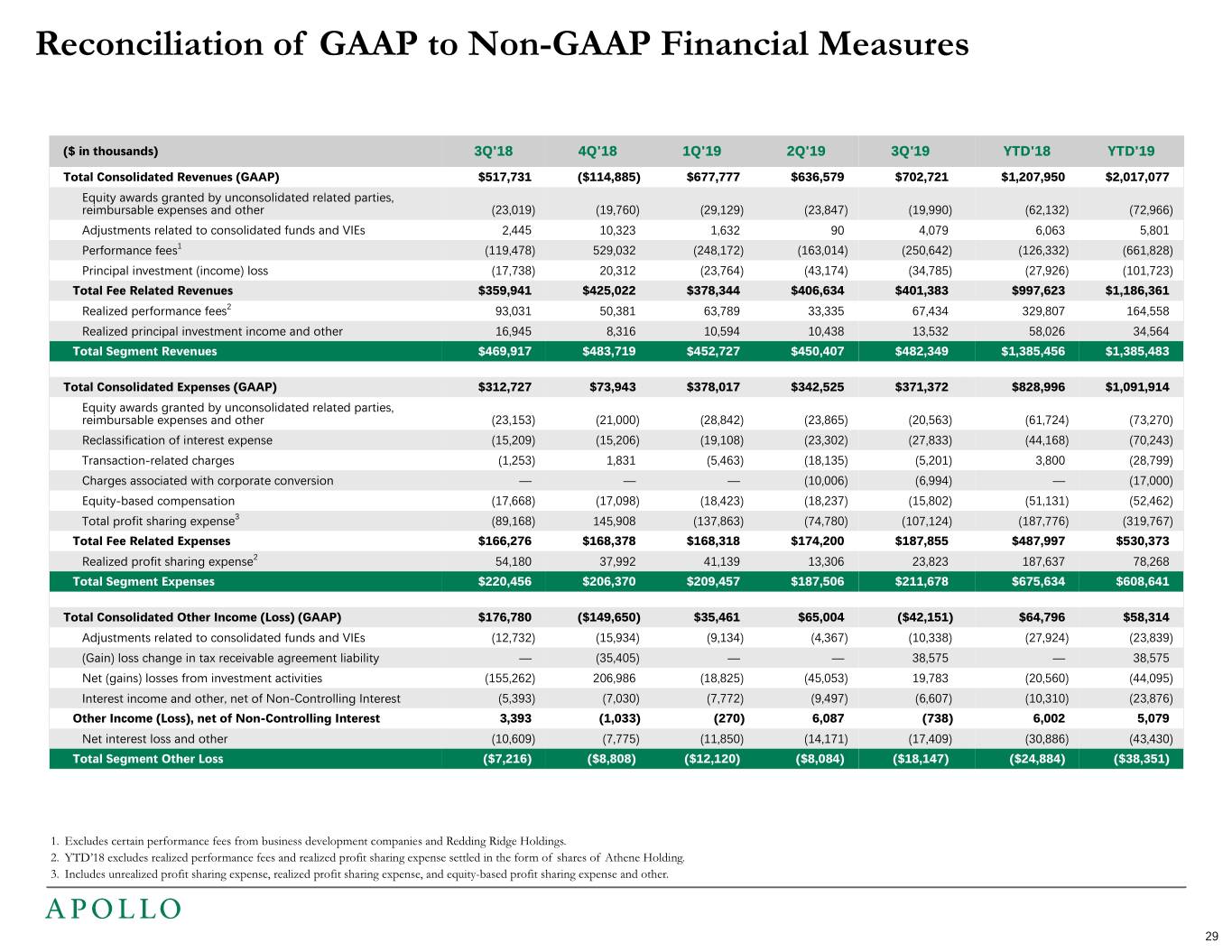

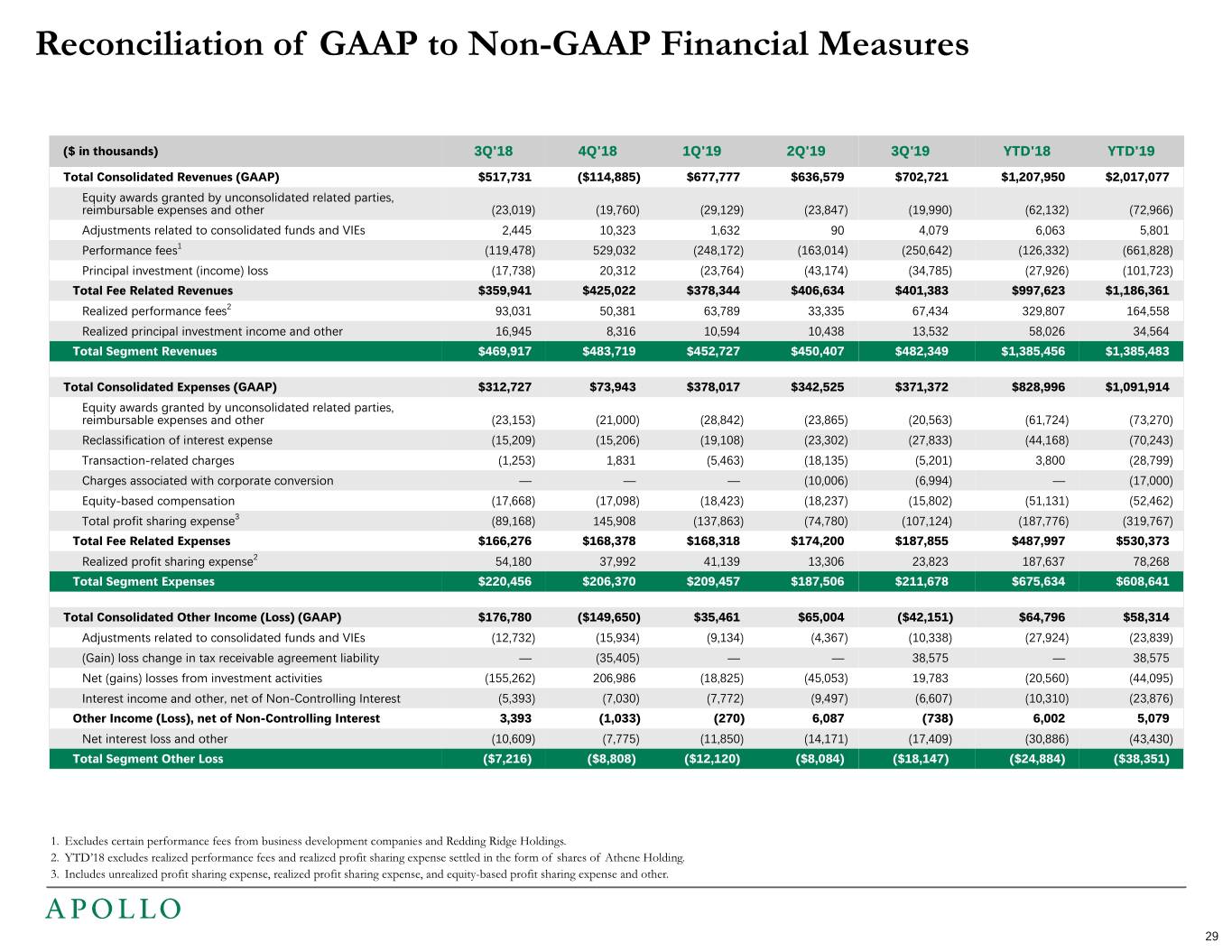

Reconciliation of GAAP to Non-GAAP Financial Measures ($ in thousands) 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 YTD'18 YTD'19 Total Consolidated Revenues (GAAP) $517,731 ($114,885) $677,777 $636,579 $702,721 $1,207,950 $2,017,077 Equity awards granted by unconsolidated related parties, reimbursable expenses and other (23,019) (19,760) (29,129) (23,847) (19,990) (62,132) (72,966) Adjustments related to consolidated funds and VIEs 2,445 10,323 1,632 90 4,079 6,063 5,801 Performance fees1 (119,478) 529,032 (248,172) (163,014) (250,642) (126,332) (661,828) Principal investment (income) loss (17,738) 20,312 (23,764) (43,174) (34,785) (27,926) (101,723) Total Fee Related Revenues $359,941 $425,022 $378,344 $406,634 $401,383 $997,623 $1,186,361 Realized performance fees2 93,031 50,381 63,789 33,335 67,434 329,807 164,558 Realized principal investment income and other 16,945 8,316 10,594 10,438 13,532 58,026 34,564 Total Segment Revenues $469,917 $483,719 $452,727 $450,407 $482,349 $1,385,456 $1,385,483 Total Consolidated Expenses (GAAP) $312,727 $73,943 $378,017 $342,525 $371,372 $828,996 $1,091,914 Equity awards granted by unconsolidated related parties, reimbursable expenses and other (23,153) (21,000) (28,842) (23,865) (20,563) (61,724) (73,270) Reclassification of interest expense (15,209) (15,206) (19,108) (23,302) (27,833) (44,168) (70,243) Transaction-related charges (1,253) 1,831 (5,463) (18,135) (5,201) 3,800 (28,799) Charges associated with corporate conversion — — — (10,006) (6,994) — (17,000) Equity-based compensation (17,668) (17,098) (18,423) (18,237) (15,802) (51,131) (52,462) Total profit sharing expense3 (89,168) 145,908 (137,863) (74,780) (107,124) (187,776) (319,767) Total Fee Related Expenses $166,276 $168,378 $168,318 $174,200 $187,855 $487,997 $530,373 Realized profit sharing expense2 54,180 37,992 41,139 13,306 23,823 187,637 78,268 Total Segment Expenses $220,456 $206,370 $209,457 $187,506 $211,678 $675,634 $608,641 Total Consolidated Other Income (Loss) (GAAP) $176,780 ($149,650) $35,461 $65,004 ($42,151) $64,796 $58,314 Adjustments related to consolidated funds and VIEs (12,732) (15,934) (9,134) (4,367) (10,338) (27,924) (23,839) (Gain) loss change in tax receivable agreement liability — (35,405) — — 38,575 — 38,575 Net (gains) losses from investment activities (155,262) 206,986 (18,825) (45,053) 19,783 (20,560) (44,095) Interest income and other, net of Non-Controlling Interest (5,393) (7,030) (7,772) (9,497) (6,607) (10,310) (23,876) Other Income (Loss), net of Non-Controlling Interest 3,393 (1,033) (270) 6,087 (738) 6,002 5,079 Net interest loss and other (10,609) (7,775) (11,850) (14,171) (17,409) (30,886) (43,430) Total Segment Other Loss ($7,216) ($8,808) ($12,120) ($8,084) ($18,147) ($24,884) ($38,351) 1. Excludes certain performance fees from business development companies and Redding Ridge Holdings. 2. YTD’18 excludes realized performance fees and realized profit sharing expense settled in the form of shares of Athene Holding. 3. Includes unrealized profit sharing expense, realized profit sharing expense, and equity-based profit sharing expense and other. 29

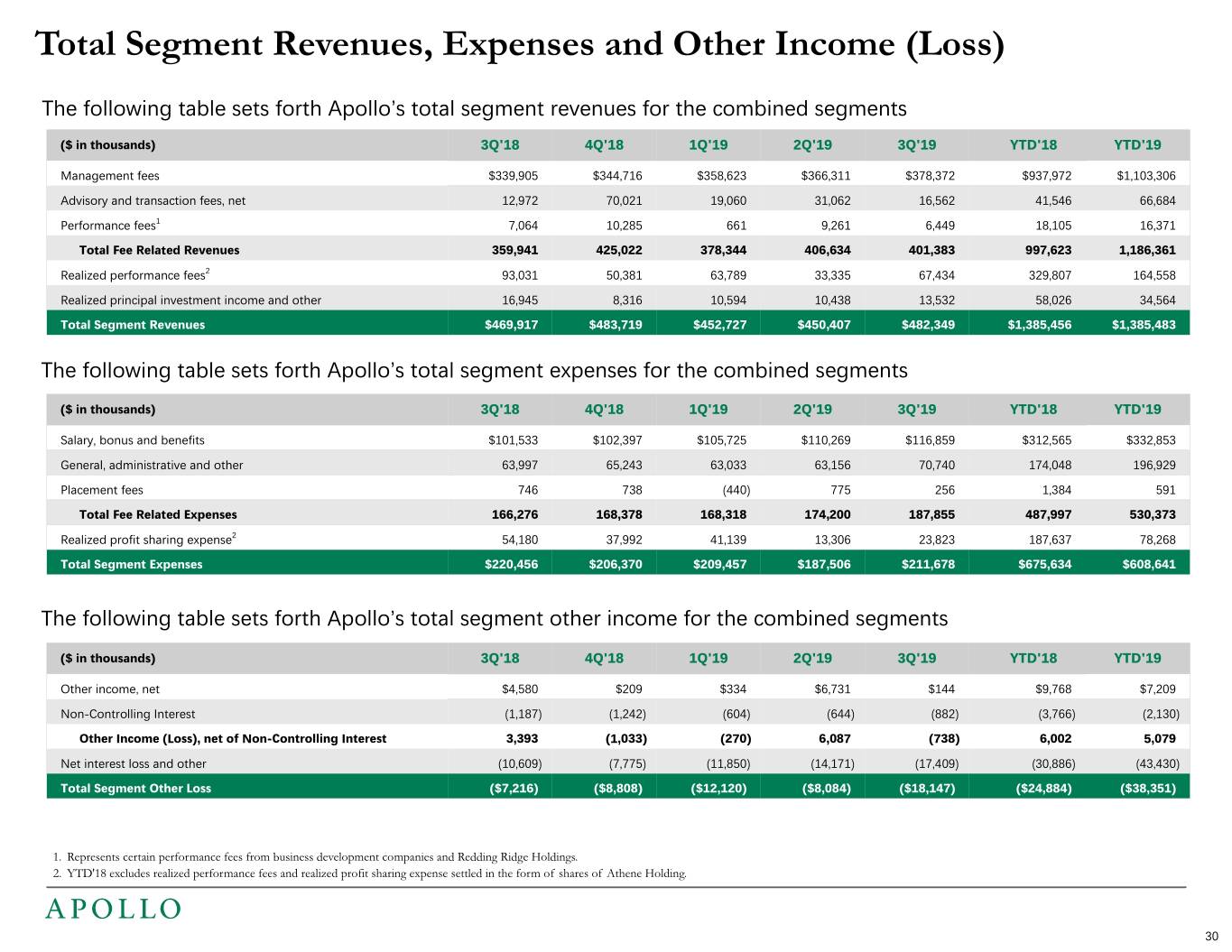

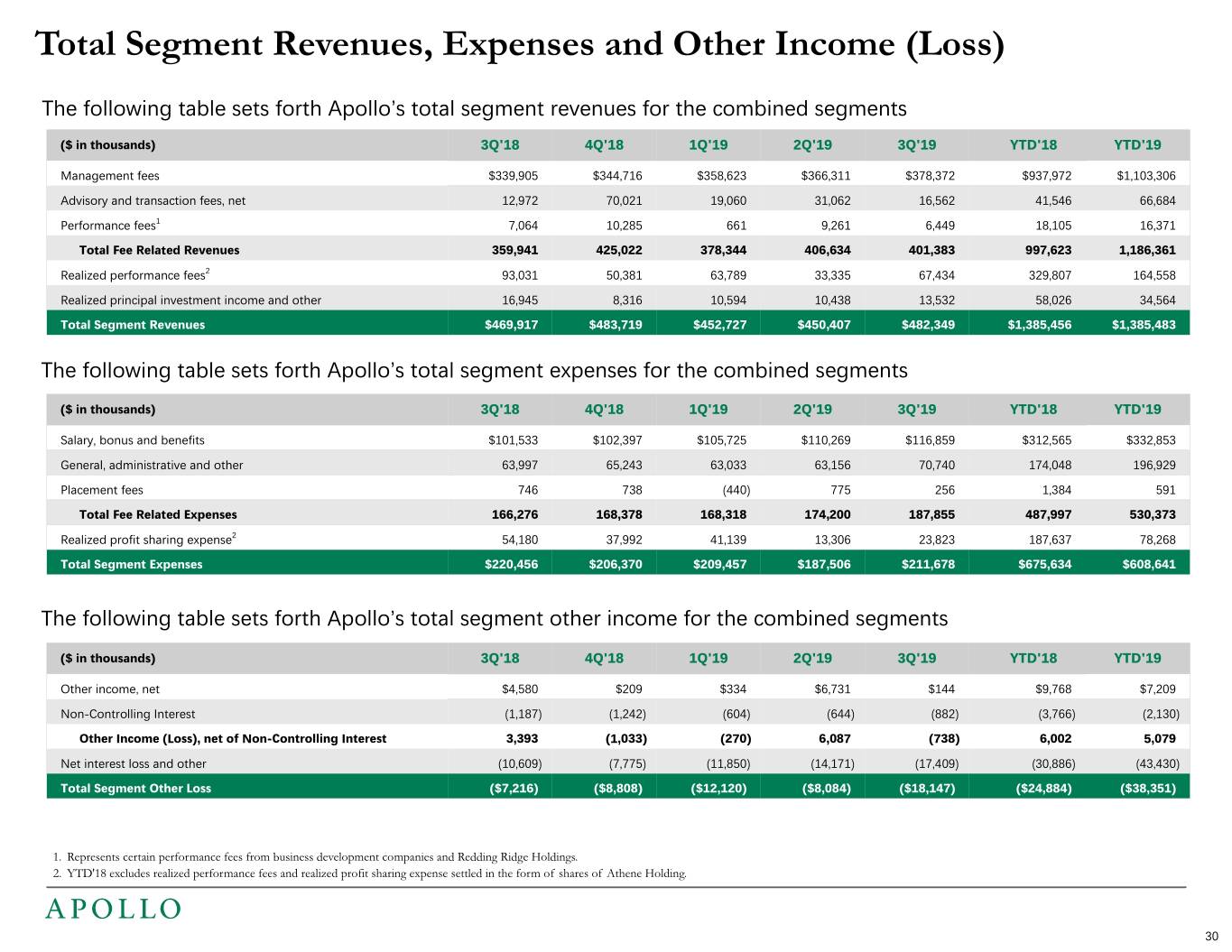

Total Segment Revenues, Expenses and Other Income (Loss) The following table sets forth Apollo’s total segment revenues for the combined segments ($ in thousands) 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 YTD'18 YTD'19 Management fees $339,905 $344,716 $358,623 $366,311 $378,372 $937,972 $1,103,306 Advisory and transaction fees, net 12,972 70,021 19,060 31,062 16,562 41,546 66,684 Performance fees1 7,064 10,285 661 9,261 6,449 18,105 16,371 Total Fee Related Revenues 359,941 425,022 378,344 406,634 401,383 997,623 1,186,361 Realized performance fees2 93,031 50,381 63,789 33,335 67,434 329,807 164,558 Realized principal investment income and other 16,945 8,316 10,594 10,438 13,532 58,026 34,564 Total Segment Revenues $469,917 $483,719 $452,727 $450,407 $482,349 $1,385,456 $1,385,483 The following table sets forth Apollo’s total segment expenses for the combined segments ($ in thousands) 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 YTD'18 YTD'19 Salary, bonus and benefits $101,533 $102,397 $105,725 $110,269 $116,859 $312,565 $332,853 General, administrative and other 63,997 65,243 63,033 63,156 70,740 174,048 196,929 Placement fees 746 738 (440) 775 256 1,384 591 Total Fee Related Expenses 166,276 168,378 168,318 174,200 187,855 487,997 530,373 Realized profit sharing expense2 54,180 37,992 41,139 13,306 23,823 187,637 78,268 Total Segment Expenses $220,456 $206,370 $209,457 $187,506 $211,678 $675,634 $608,641 The following table sets forth Apollo’s total segment other income for the combined segments ($ in thousands) 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 YTD'18 YTD'19 Other income, net $4,580 $209 $334 $6,731 $144 $9,768 $7,209 Non-Controlling Interest (1,187) (1,242) (604) (644) (882) (3,766) (2,130) Other Income (Loss), net of Non-Controlling Interest 3,393 (1,033) (270) 6,087 (738) 6,002 5,079 Net interest loss and other (10,609) (7,775) (11,850) (14,171) (17,409) (30,886) (43,430) Total Segment Other Loss ($7,216) ($8,808) ($12,120) ($8,084) ($18,147) ($24,884) ($38,351) 1. Represents certain performance fees from business development companies and Redding Ridge Holdings. 2. YTD'18 excludes realized performance fees and realized profit sharing expense settled in the form of shares of Athene Holding. 30

Non-GAAP Financial Information & Definitions Apollo discloses the following financial measures that are calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America (“Non-GAAP”): • “Segment Distributable Earnings”, or “Segment DE”, is the key performance measure used by management in evaluating the performance of Apollo’s credit, private equity and real assets segments. Management uses Segment DE to make key operating decisions such as the following: • Decisions related to the allocation of resources such as staffing decisions including hiring and locations for deployment of the new hires; • Decisions related to capital deployment such as providing capital to facilitate growth for the business and/or to facilitate expansion into new businesses; • Decisions related to expenses, such as determining annual discretionary bonuses and equity-based compensation awards to its employees. With respect to compensation, management seeks to align the interests of certain professionals and selected other individuals with those of the investors in the funds and those of Apollo’s stockholders by providing such individuals a profit sharing interest in the performance fees earned in relation to the funds. To achieve that objective, a certain amount of compensation is based on Apollo’s performance and growth for the year; and • Decisions related to the amount of earnings available for dividends to Class A Common Stockholders, holders of RSUs that participate in dividends and holders of AOG Units. Segment DE is the sum of (i) total management fees and advisory and transaction fees, (ii) other income (loss), (iii) realized performance fees, excluding realizations received in the form of shares and (iv) realized investment income, less (x) compensation expense, excluding the expense related to equity-based awards, (y) realized profit sharing expense, and (z) non-compensation expenses. Segment DE represents the amount of Apollo’s net realized earnings, excluding the effects of the consolidation of any of the related funds, Taxes and Related Payables, transaction-related charges and any acquisitions. Transaction-related charges includes equity-based compensation charges, the amortization of intangible assets, contingent consideration and certain other charges associated with acquisitions. In addition, Segment DE excludes non-cash revenue and expense related to equity awards granted by unconsolidated related parties to employees of the Company, compensation and administrative related expense reimbursements, as well as the assets, liabilities and operating results of the funds and VIEs that are included in the consolidated financial statements. • “Distributable Earnings” or “DE” represents Segment DE less estimated current corporate, local and non-U.S. taxes as well as the current payable under Apollo’s tax receivable agreement. DE is net of preferred dividends, if any, to Series A and Series B Preferred Stockholders. DE excludes the impacts of the remeasurement of the tax receivable agreement resulting from changes in the associated deferred tax balance, including the impacts related to the Tax Cuts & Jobs Act enacted on December 22, 2017 and changes in estimated future tax rates. Management believes that excluding the remeasurement of the tax receivable agreement and deferred taxes from Segment DE and DE, respectively, is meaningful as it increases comparability between periods. Remeasurement of the tax receivable agreement and deferred taxes are estimates and may change due to changes in interpretations and assumptions of tax legislation. • “Fee Related Earnings”, or “FRE”, is derived from our segment reported results and refers to a component of DE that is used as a supplemental performance measure to assess whether revenues that we believe are generally more stable and predictable in nature, primarily consisting of management fees, are sufficient to cover associated operating expenses and generate profits. FRE is the sum across all segments of (i) management fees, (ii) advisory and transaction fees, (iii) performance fees earned from business development companies and Redding Ridge Holdings and (iv) other income, net, less (x) salary, bonus and benefits, excluding equity-based compensation (y) other associated operating expenses and (z) non-controlling interests in the management companies of certain funds the Company manages. 31

Non-GAAP Financial Information & Definitions Cont’d • “Assets Under Management”, or “AUM”, refers to the assets of the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment- related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. Our AUM equals the sum of: i) the net asset value, or “NAV,” plus used or available leverage and/or capital commitments, or gross assets plus capital commitments, of the credit funds, partnerships and accounts for which we provide investment management or advisory services, other than certain collateralized loan obligations (“CLOs”), collateralized debt obligations (“CDOs”), and certain permanent capital vehicles, which have a fee-generating basis other than the mark-to-market value of the underlying assets; ii) the fair value of the investments of the private equity and real assets funds, partnerships and accounts we manage or advise, plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments, plus portfolio level financings; for certain permanent capital vehicles in real assets, gross asset value plus available financing capacity; iii) the gross asset value associated with the reinsurance investments of the portfolio company assets we manage or advise; and iv) the fair value of any other assets that we manage or advise for the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment- related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre-qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above. Our AUM measure includes Assets Under Management for which we charge either nominal or zero fees. Our AUM measure also includes assets for which we do not have investment discretion, including certain assets for which we earn only investment-related service fees, rather than management or advisory fees. Our definition of AUM is not based on any definition of Assets Under Management contained in our operating agreement or in any of our Apollo fund management agreements. We consider multiple factors for determining what should be included in our definition of AUM. Such factors include but are not limited to (1) our ability to influence the investment decisions for existing and available assets; (2) our ability to generate income from the underlying assets in our funds; and (3) the AUM measures that we use internally or believe are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, our calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Our calculation also differs from the manner in which our affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways. We use AUM, Capital Deployed and Dry Powder as performance measurements of our investment activities, as well as to monitor fund size in relation to professional resource and infrastructure needs. • “AUM with Future Management Fee Potential” refers to the committed uninvested capital portion of total AUM not currently earning management fees. The amount depends on the specific terms and conditions of each fund. • “Fee-Generating AUM” consists of assets of the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services and on which we earn management fees, monitoring fees or other investment-related fees pursuant to management or other fee agreements on a basis that varies among the Apollo funds, partnerships and accounts. Management fees are normally based on “net asset value,” “gross assets,” “adjusted par asset value,” “adjusted cost of all unrealized portfolio investments,” “capital commitments,” “adjusted assets,” “stockholders’ equity,” “invested capital” or “capital contributions,” each as defined in the applicable management agreement. Monitoring fees, also referred to as advisory fees, with respect to the structured portfolio company investments of the funds, partnerships and accounts we manage or advise, are generally based on the total value of such structured portfolio company investments, which normally includes leverage, less any portion of such total value that is already considered in Fee-Generating AUM. • “Performance Fee-Eligible AUM” refers to the AUM that may eventually produce performance fees. All funds for which we are entitled to receive a performance fee allocation or incentive fee are included in Performance Fee-Eligible AUM, which consists of the following: • “Performance Fee-Generating AUM”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment- related services, that is currently above its hurdle rate or preferred return, and profit of such funds, partnerships and accounts is being allocated to, or earned by, the general partner in accordance with the applicable limited partnership agreements or other governing agreements; • “AUM Not Currently Generating Performance Fees”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services that is currently below its hurdle rate or preferred return; and • “Uninvested Performance Fee-Eligible AUM”, which refers to capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment- related services that is available for investment or reinvestment subject to the provisions of applicable limited partnership agreements or other governing agreements, which capital is not currently part of the NAV or fair value of investments that may eventually produce performance fees allocable to, or earned by, the general partner. 32