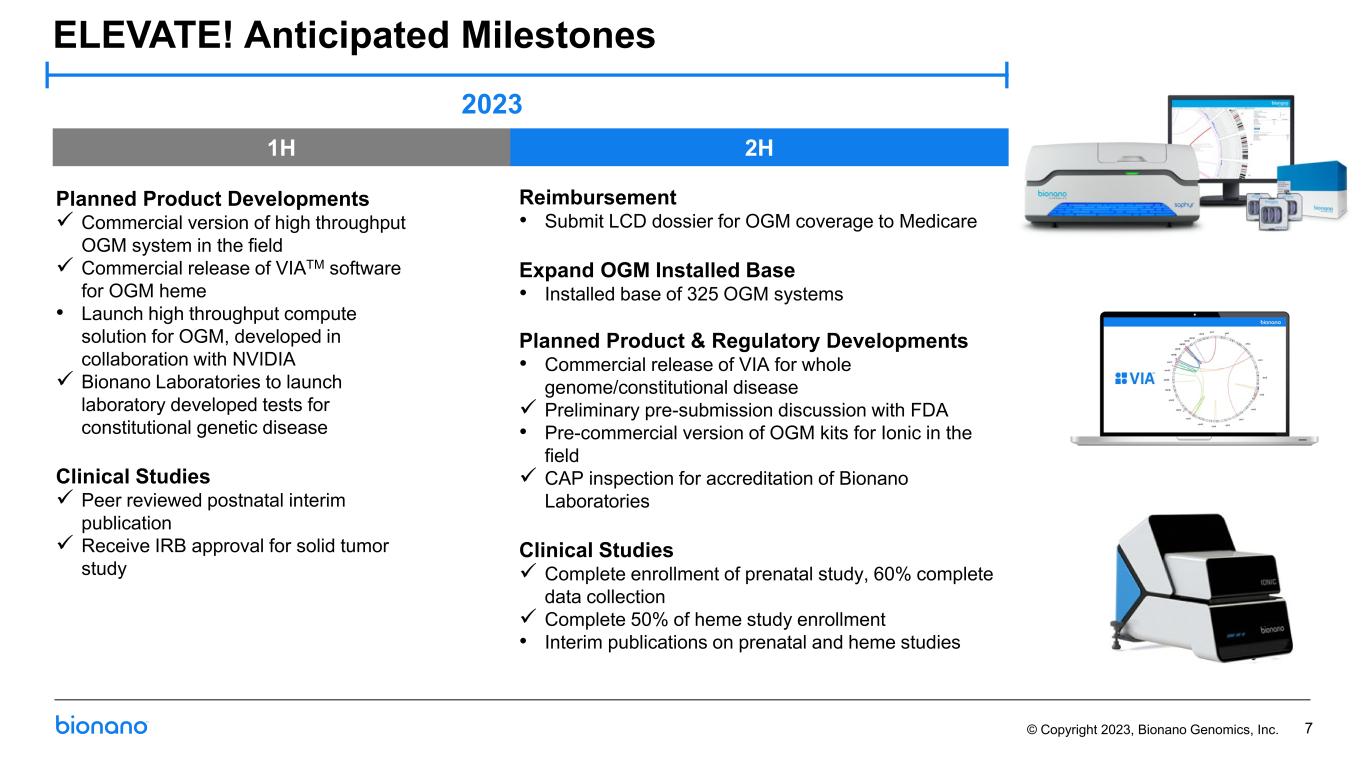

© Copyright 2023, Bionano Genomics, Inc. Legal Disclaimer This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “expect,” “plan," anticipate,” “estimate,” “intend,” “should,” “believe,” “would,” “could,” “potential,” “outlook,” “guidance,” “goal” and similar expressions (as well as other words or expressions referencing future events, conditions or circumstances and the negatives thereof) convey uncertainty of future events or outcomes and are intended to identify these forward-looking statements. Forward-looking statements include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things: (i) growth drivers and expected levels of our organic growth, including anticipated growth of installed base; (ii) the impact of our investment in R&D and commercial and educational initiatives, including timely and successful launch of our next-gen OGM system and the timing of our planned product developments and clinical study results and milestones; (iii) anticipated goals and milestones, including the 2023 ELEVATE! strategy, our anticipated 2023 milestones, and our 4 Strategic Pillars; (iv) our ability to stay in front of competitors' improvements in technologies; (v) our estimates of anticipated market opportunity and underlying assumptions; (vi) our quarterly and annual revenue outlook; (vii) the anticipated benefits and ultimate success of our collaborations; and (viii) other statements that are not historical facts. Each of these forward-looking statements involves risks and uncertainties. Actual results or developments may differ materially from those projected or implied in these forward-looking statements. Factors that may cause such a difference include the risks and uncertainties associated with: (i) the impact of global and macroeconomic events, such as recent and potential future bank failures, and the ongoing Ukraine-Russia and Israel-Hamas conflicts and related sanctions, on our business and the global economy; (ii) challenges inherent in developing, manufacturing and commercializing products; (iii) our ability to further deploy new products and applications and expand the markets for our technology platforms; (iv) third parties’ abilities to manufacture our instruments and consumables; (v) our expectations and beliefs regarding future growth of the business and the markets in which we operate; (vi) the accuracy of our estimates; (vii) our ability to fund our operations and continue as a "going concern"; (viii) the completion and success of our clinical studies; (ix) the timing and mix of customer orders among our products; (x) the success of products competitive with our own; (xi) our ability to integrate our recently acquired business into our strategic plan; (xii) changes in our strategic and commercial plans; and (xiii) the application of generally accepted accounting principles which are highly complex and involve many subjective assumptions. We are under no duty to update any of these forward-looking statements after the date of this presentation to conform these statements to actual results or revised expectations, except as required by law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this presentation. Moreover, except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements contained in this presentation. More information about these and other statements, risks and uncertainties is contained in our filings with the U.S. Securities and Exchange Commission, including, without limitation, our Annual Report on Form 10-K for the year ended December 31, 2022 and in other filings subsequently made by us with the Securities and Exchange Commission. All forward-looking statements contained in this presentation speak only as of the date on which they were made and are based on management’s assumptions and estimates as of such date. We do not undertake any obligation to publicly update any forward-looking statements, whether as a result of the receipt of new information, the occurrence of future events or otherwise except as required by law.

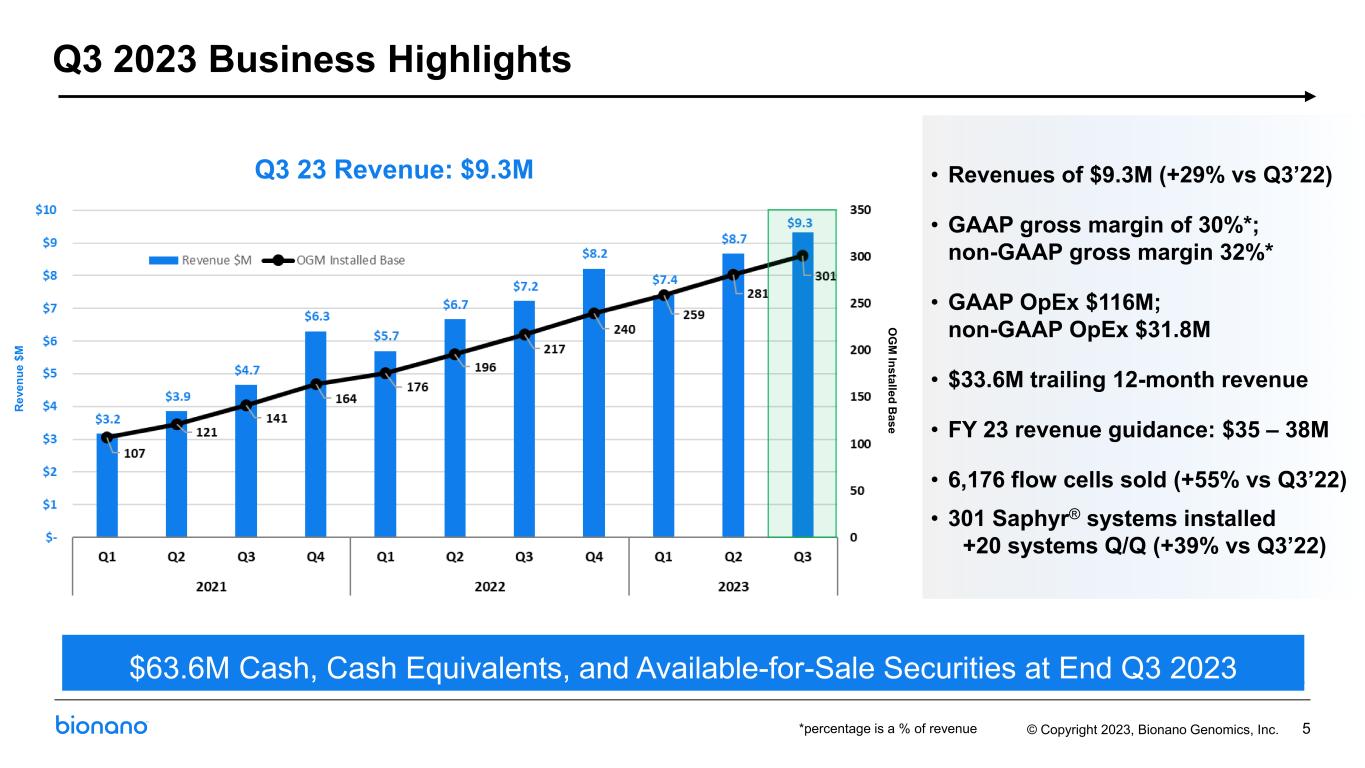

© Copyright 2023, Bionano Genomics, Inc. 8 Bionano Genomics, Inc. Reconciliation of GAAP Operating Expense to Non-GAAP Operating Expense (Unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 GAAP gross margin: GAAP revenue $ 9,318,000 $ 7,221,000 $ 25,395,000 $ 19,587,000 GAAP cost of revenue 6,569,000 5,412,000 18,267,000 15,447,000 GAAP gross profit 2,749,000 1,809,000 7,128,000 4,140,000 GAAP gross margin % 30 % 25 % 28 % 21 % Adjusted non-GAAP gross margin: GAAP revenue $ 9,318,000 $ 7,221,000 $ 25,395,000 $ 19,587,000 GAAP cost of revenue 6,569,000 5,412,000 18,267,000 15,447,000 Stock-based compensation expense (187,000) — (531,000) — Adjusted non-GAAP cost of revenue 6,382,000 5,412,000 17,736,000 15,447,000 Adjusted non-GAAP gross profit 2,936,000 1,809,000 7,659,000 4,140,000 Adjusted non-GAAP gross margin % 32 % 25 % 30 % 21 % GAAP operating expense GAAP selling, general and administrative expense $ 24,896,000 $ 21,216,000 $ 77,809,000 $ 63,275,000 Stock-based compensation expense (2,556,000) (2,453,000) (7,368,000) (6,537,000) Intangible asset amortization (1,792,000) (1,419,000) (5,377,000) (4,257,000) Change in fair value of contingent consideration (310,000) (79,000) (2,528,000) (237,000) Transaction related expenses $ (929,000) $ (87,000) $ (929,000) $ (87,000) Adjusted non-GAAP selling, general and administrative expense 19,309,000 17,178,000 61,607,000 52,157,000 GAAP research and development expense $ 13,785,000 $ 12,742,000 $ 42,331,000 $ 35,036,000 Stock-based compensation expense (1,249,000) (3,606,000) (3,907,000) (10,401,000) Adjusted non-GAAP research and development expense 12,536,000 9,136,000 38,424,000 24,635,000 GAAP goodwill impairment loss $ 77,280,000 $ — $ 77,280,000 $ — Goodwill impairment loss $ (77,280,000) $ — $ (77,280,000) $ — Adjusted non-GAAP goodwill impairment loss $ — $ — $ — $ — Total adjusted non-GAAP operating expense $ 31,845,000 $ 26,314,000 $ 100,031,000 $ 76,792,000