SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

¨ | Preliminary Information Statement |

¨ | Confidential, For Use of the Commission only (as permitted by Rule 14c-5(d)(2)) |

x | Definitive Information Statement |

PRETORIA RESOURCES TWO, INC. |

(Name of Registrant as Specified in Its Charter) |

Payment of Filing Fee (Check the appropriate box):

x | No Fee Required |

¨ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

¨ | Fee paid previously with preliminary materials: |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | |

| | (1) | Amount previously paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing party: |

| | | |

| | (4) | Date filed: |

PRETORIA RESOURCES TWO, INC. |

405 West Main Street, |

West Fargo, ND 58078 |

NOTICE OF STOCKHOLDER ACTION BY UNANIMOUS WRITTEN CONSENT

Dear Stockholders:

This Notice and the enclosed Information Statement is being furnished by the Board of Directors (the “Board”) of Pretoria Resources Two, Inc., a Nevada corporation (the “Company”), to the holders of record of our common stock, par value $0.0001 per share (the “Common Stock”), to inform you that the holders of all of the outstanding shares of our capital stock (the “Stockholders”) approved an amendment to the Company’s Articles of Incorporation to change our corporate name to “It’s Burger Time Restaurant Group, Inc.” (the “Amendment”).

The Amendment was approved by the unanimous written consent of the Board and the Stockholders dated May 18, 2015 (the “Unanimous Written Consent”). The Amendment and change of our corporate name will become effective when we file a Certificate of Amendment to the Articles of Incorporation with the Secretary of State of the State of Nevada (“Certificate”). The Certificate will not be filed until the date that is at least 20 days after the enclosed Information Statement is first mailed or otherwise delivered to our Stockholders. We have attached as Exhibit A hereto a form of the proposed Certificate.

Because the Unanimous Written Consent satisfies all applicable stockholder voting requirements, we are not asking for a proxy or a consent, please do not send us one.

Only stockholders of record at the close of business on May 17, 2015 (the “Record Date”) will be given a copy of this Notice and Information Statement. The date on which this Information Statement will be sent to shareholders will be on or about June 3, 2015.

Pursuant to the rules and regulations promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), an Information Statement must be provided to the holders of voting stock of the Company who did not receive a consent solicitation pursuant to Section 14(a) of the Exchange Act regarding the actions set forth in the consent. This Notice and the attached Information Statement will also be considered the notice required by Chapter 78 of the Nevada Revised Statutes. You are encouraged to read the attached Information Statement, including the exhibits, for further information regarding these actions.

PLEASE NOTE THAT THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING STOCKHOLDERS OF THE MATTERS DESCRIBED HEREIN.

WE ARE NOT ASKING YOU FOR A CONSENT OR PROXY AND

YOU ARE REQUESTED NOT TO SEND US A CONSENT OR PROXY.

| | By Order of the Board of Directors | |

| | Gary Copperud | |

| | President | |

PRETORIA RESOURCES TWO, INC.

INFORMATION STATEMENT REGARDING ACTION TAKEN BY

UNANIMOUS WRITTEN CONSENT OF THE STOCKHOLDERS IN LIEU OF A MEETING.

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS REQUIRED

IN CONNECTION WITH THIS INFORMATION STATEMENT.

GENERAL INFORMATION

Pretoria Resources Two, Inc. is sending this Information Statement to notify you of actions taken action by the unanimous written consent of the holders of the outstanding shares of our capital stock in lieu of a special meeting of stockholders.

Copies of this Information Statement are being mailed on or about June 3, 2015 to the holders of record of the outstanding shares of our Common Stock on the Record Date.

Action Taken

Pursuant to the unanimous written consent taken on May 18, 2015 in lieu of a special meeting, the Board and the Stockholders approved the Amendment to change our corporate name to It’s Burger Time Restaurant Group, Inc. (the “Name Change”).

WE RECOMMEND THAT YOU READ THIS INFORMATION STATEMENT IN ITS ENTIRETY

FOR A FULL DESCRIPTION OF THE ACTIONS APPROVED BY THE STOCKHOLDERS.

Actions by Written Consent under Nevada Corporate Law

Stockholders may take action pursuant to a written consent in lieu of a meeting in accordance with section 78.320 of the Nevada Revised Statutes, or NRS, which provides that the written consent of the holders of outstanding shares of voting stock, having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted, may be substituted for such a meeting. In order to eliminate the costs involved in holding a special meeting and filing a full proxy statement as would be required under the Exchange Act, our Board elected to utilize the written consent of the holders of all our voting securities to approve the Amendment.

Effective Date of Actions

Pursuant to Rule 14c-2 promulgated under the Exchange Act, the earliest date that the corporate action being taken pursuant to the written consent can become effective is 20 days after the first mailing or other delivery of this Information Statement to our Stockholders. Upon the expiration of the 20-day period, we will file the Certificate with the Secretary of State of the State of Nevada, which filing will result in the Name Change. Therefore, it is expected that the Name Change will become effective on or about June 23, 2015.

Dissenters’ Rights of Appraisal

Under Nevada law, holders of our Common Stock are not entitled to dissenter’s rights of appraisal with respect to the Amendment.

Costs of the Information Statement

We are mailing this Information Statement and will bear the costs associated therewith. We are not making any solicitation.

APPROVAL TO CHANGE THE COMPANY’S NAME

General

On April 23, 2015, the Company consummated a merger of its wholly owned subsidiary, BTND Merger Sub, LLC with BTND, LLC (“BTND”) and, as of such date, assumed all of BTND’s business, which encompasses owning and operating fast food burger restaurants (the “Merger”). On May 18, 2015, our Board and Stockholders unanimously approved the Amendment by written consent, as permitted by the NRS and our bylaws.

Purpose

Our Board determined that the change of our name to “It’s Burger Time Restaurant Group, Inc.” is in the best interest of our Stockholders and will more accurately reflect our new business operations after giving effect to Merger.

Effects of the Name Change

Upon the effectiveness of the Name Change, the Company will be known as It’s Burger Time Restaurant Group, Inc.

DESCRIPTION OF CAPITAL STOCK

Our authorized capital currently consists of 100,000,000 shares of Common Stock and 10,000,000 shares of preferred stock, each having a par value of $0.0001 per share.

Common Stock

Holders of the Company’s common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors. Holders of the Company’s common stock representing a majority of the voting power of the Company’s capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of stockholders. A vote by the holders of a majority of the Company’s outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to the Company’s articles of incorporation.

Subject to the rights of holders of the preferred stock, holders of the Company’s common stock are entitled to share in all dividends that our Board of Directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution or winding up of our Company, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock. The Company’s common stock has no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to the Company’s common stock.

Preferred Stock

The Board is authorized, subject to limits imposed by relevant Nevada laws, to issue shares of preferred stock in one or more classes or series within a class upon authority of the Board without further stockholder approval. Any preferred stock issued in the future may rank senior to the Common Stock with respect to the payment of dividends or amounts upon liquidation, dissolution or winding up of the Company, or both. In addition, any such shares of preferred stock may have class or series voting rights. At the close of business on the Record Date, there were no shares of preferred stock issued or designated.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the number of shares of our common stock beneficially owned as of May 18, 2015 by (i) each person who is known by us to beneficially own more than 5% of the outstanding shares of Common Stock; (ii) each of our directors and named executive officers; and (iii) all officers and directors as a group. Unless otherwise indicated in the table, the persons named in the table have sole voting power and investment power with respect to the Common Stock set forth opposite the stockholder’s name, subject to community property laws, where applicable.

Percentages ownership calculations in the table are based on 11,000,000 shares of Common Stock outstanding as of May 18, 2015, at which date, there were no outstanding options, warrants or other securities convertible into or exercisable for shares of Common Stock. Unless otherwise specified, the address of each of the persons set forth below is in care of the Company at 405 West Main Street, West Fargo, ND 58078.

Name of Beneficial Owner | | Title | | Amount and Nature of Beneficial Ownership | | | Percent

of Class | |

Directors and Officers | | | | | | | | |

Gary Copperud 1 | | President, Chief Financial Officer and Director | | | 2,279,530 | | | | 20.72 | % |

| | | | | | | | | | |

Jeff Zinnecker | | Director | | | 2,279,530 | | | | 20.72 | % |

All officers and directors as group (2 persons named above) | | | | | | | | | | |

5% Stockholders | | | | | | | | | | |

| | | | | | | | | | |

Sally Copperud 1 | | | | | 2,279,530 | | | | 20.72 | % |

| | | | | | | | | | |

Sam Vandeputte | | | | | 1,040,655 | | | | 9.46 | % |

| | | | | | | | | | |

Trost Family Limited Partnership | | | | | 1,040,655 | | | | 9.46 | % |

| | | | | | | | | | |

Bryan Glass 20 West Park Avenue Long Beach NY 11561 | | | | | 589,000 | | | | 5.35 | % |

1. Husband and wife. Each disclaims any beneficial ownership over the other’s shares.

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS

We will only deliver one Information Statement to multiple security holders sharing an address unless we have received contrary instructions from one or more of the security holders. Upon written or oral request, we will promptly deliver a separate copy of this Information Statement and any future annual reports and information statements to any security holder at a shared address to which a single copy of this Information Statement was delivered, or deliver a single copy of this Information Statement and any future annual reports and information statements to any security holder or holders sharing an address to which multiple copies are now delivered.

We undertake to provide without charge to each person to whom a copy of this Information Statement has been delivered, upon request, by first class mail or other equally prompt means, a copy of any or all of the documents incorporated by reference in this Information Statement, other than the exhibits to these documents, unless the exhibits are specifically incorporated by reference into the information that this Information Statement incorporates. You may obtain any of the documents incorporated by reference through the SEC or the SEC’s website as described below. You may request copies of the documents incorporated by reference in this Information Statement, at no cost, by writing to us at:

405 West Main Street, |

West Fargo, ND 58078 |

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly, and current reports and other information with the SEC. Our filings with the SEC are available to the public on the SEC’s website at www.sec.gov. The information we file with the SEC or contained on, or linked to through, our corporate website or any other website that we may maintain is not part of this Information Statement. You may also read and copy, at the SEC’s prescribed rates, any document we file with the SEC at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. You can call the SEC at 1-800-SEC-0330 to obtain information on the operation of the Public Reference Room.

Statements contained in this Information Statement concerning the provisions of any documents are necessarily summaries of those documents, and each statement is qualified in its entirety by reference to the copy of the document filed with the SEC.

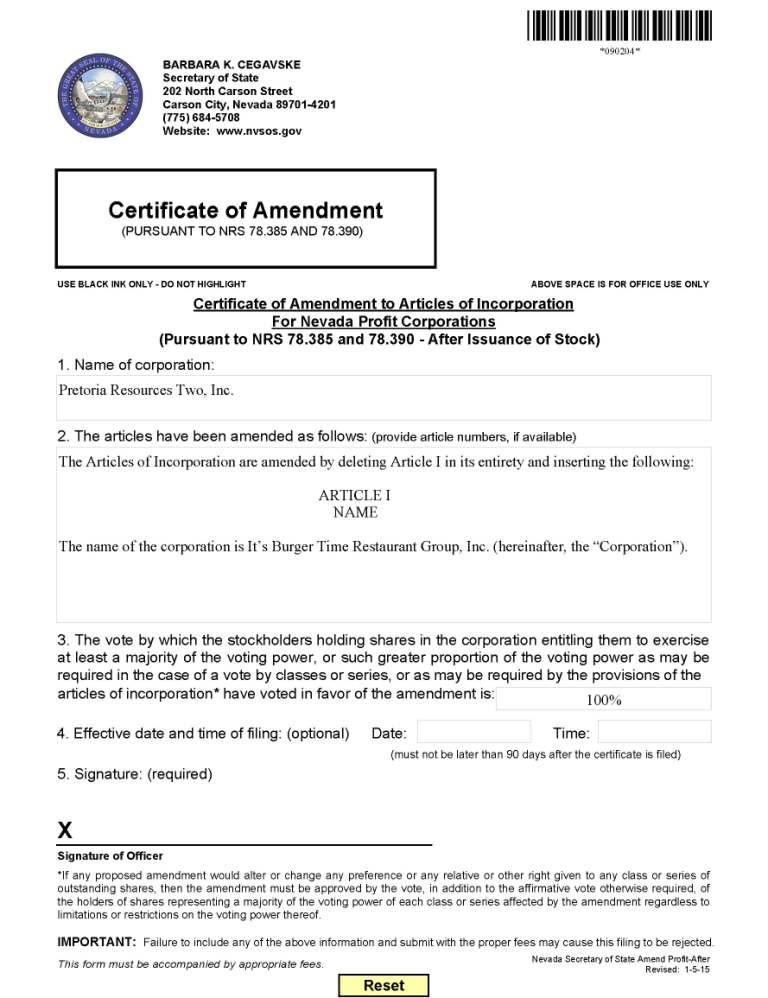

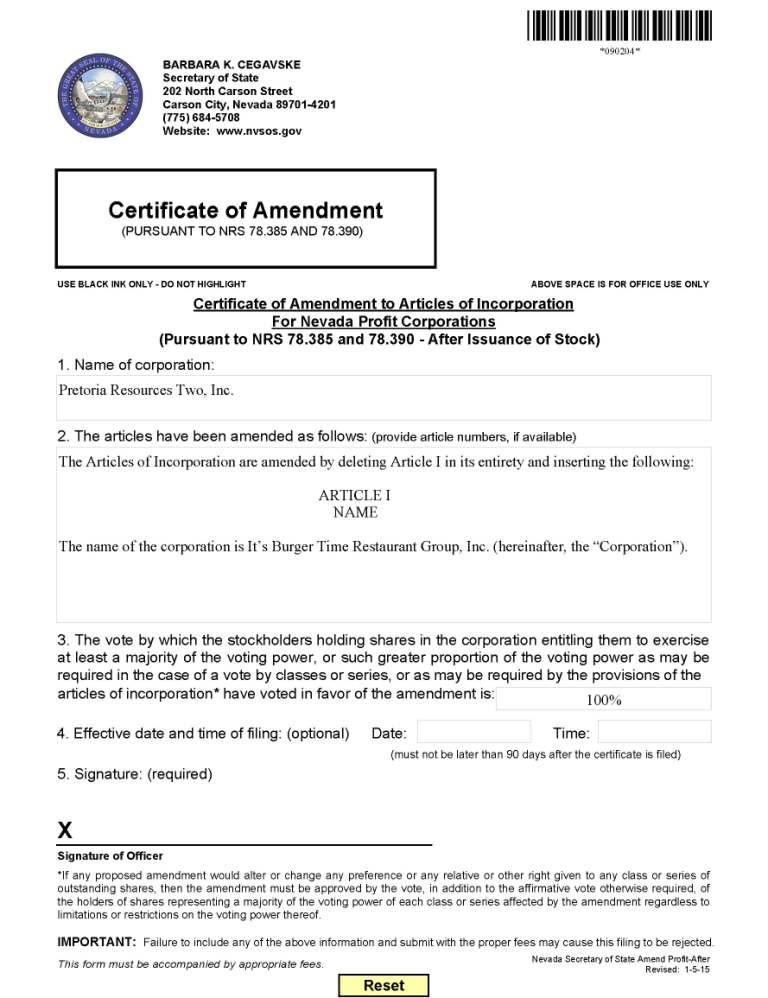

Exhibit A

Form of Certificate of Amendment

to Articles of Incorporation

6