As filed with the Securities and Exchange Commission on August 23, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

SGOCO Group, Ltd.

(Exact name of registrant as specified in its charter)

| Cayman Islands | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

Guanke Technology Park, Luoshan

Jinjiang City, Fujian, China 362200

+86 (595) 8200-5598

(Address and telephone number of registrant’s principal executive offices)

Corporation Service Company

2711 Centerville Road, Suite 400

Wilmington, DE 19808

(Name, address and telephone number of agent for service)

with a copy to:

Lloyd H. Spencer, Esq. Nixon Peabody LLP 401 9th Street NW, Suite 900 Washington, DC 20004 Telephone: 1 (202) 585-8000 Facsimile: 1 (202) 585-8080 | | David K. Cheng, Esq. Nixon Peabody LLP 50th Floor, Bank of China Tower 1 Garden Road, Central Hong Kong, SAR Telephone: 852 9307-3900 Facsimile: 852-2521-0220 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. £

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. £

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. £

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. £

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | | | Amount to be registered(1) | | | Proposed maximum aggregate price per unit | | | Proposed maximum aggregate offering price | | | Amount of registration fee | |

| Ordinary shares, par value $0.001 per share, issuable on exercise of public warrants | | | | 598,850 | | | $ | 8.00 | | | $ | 4,790,800 | | | | — | (3) |

| Units issuable on the exercise of the IPO Underwriters’ Unit Purchase Option (“IPO Option”) | | | | 280,000 | | | | 10.00 | (2) | | | 2,800,000 | (2) | | | — | (3) |

| Ordinary shares included as part of the units issuable on exercise of the IPO Option | | | | 280,000 | | | | — | | | | — | | | | — | (4) |

| Warrants included as part of the units issuable on exercise of the IPO Option | | | | 280,000 | | | | — | | | | — | | | | — | (4) |

| Ordinary shares issuable on exercise of the underlying warrants included as part of the units issuable on exercise of the IPO Option | | | | 280,000 | | | | 8.00 | (2) | | | 2,240,000 | (2) | | | — | (3) |

| Ordinary shares issuable on exercise of Underwriters’ Purchase Option (“2010 Offering Warrant”) | | | | 16,937 | | | | 6.00 | | | | 101,622 | | | | — | (3) |

| Total | | | | | | | | | | | $ | 9,932,422 | | | | — | (3) |

| (1) | Pursuant to Rule 416 under the General Rules and Regulations under the Securities Act of 1933, as amended (the “Securities Act”), the registration statement also registers a currently indeterminable number of additional shares of our ordinary shares that may be issued to prevent dilution resulting from share splits, share dividends, recapitalization or other similar transactions. |

| (2) | Pursuant to Rule 457(g) of the Securities Act, the proposed maximum offering price per security represents the exercise price of the security. |

| (3) | Previously paid. On September 18, 2007, the registrant previously paid a filing fee of $1964.80 in connection with the registration of 4,600,000 units on Registration Statement No. 333-146147. On November 18, 2010, the registrant previously paid a filing fee of $864 in connection with the registration of 1,600,000 ordinary shares, including the ordinary shares underlying the 2010 Offering Warrant, on Registration Statement No. 333-170674. |

| (4) | No fee due pursuant to Rule 457(g) under the Securities Act. |

The Registrant is filing a combined prospectus in this registration statement pursuant to Rule 429 under the Securities Act, in order to satisfy the requirements of the Securities Act and the rules and regulations thereunder for this offering, which was registered on earlier registration statements. The combined prospectus in this registration statement relates to, and shall act, upon effectiveness, as: (1) post-effective amendment no. 2 on Form F-3 to the Registration Statement on Form S-1, File No. 333-146147 (the “S-1 Registration Statement”) containing an updated prospectus relating to (i) the offering and sale of ordinary shares issuable upon exercise of warrants that were issued to public investors in connection with the initial public offering of the Registrant’s predecessor, Hambrecht Asia Acquisition Corp. and (ii) certain securities issuable upon exercise of an option sold to the representative of the underwriters in connection with such offering, all of which were initially registered pursuant to the S-1 Registration Statement declared effective by the Securities and Exchange Commission on March 7, 2008; and (2) post-effective amendment no. 1 on Form F-3 to the Registration Statement on Form F-1, File No. 333-170674 (the “F-1 Registration Statement”) containing an updated prospectus relating to ordinary shares issuable upon exercise of an option sold to the representative of the underwriters in connection with such offering, all of which were initially registered pursuant to the F-1 Registration Statement declared effective by the Securities and Exchange Commission on December 20, 2010. All filing fees payable in connection with the registration of the securities covered by such post-effective amendments were previously paid in connection with the filing of the S-1 Registration Statement and the F-1 Registration Statement.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement, which is a new registration statement, also constitutes post-effective amendment no. 2 on Form F-3 to the Registration Statement on Form S-1, File No. 333-146147 (the “S-1 Registration Statement”) and post-effective amendment no. 1 on Form F-3 to the Registration Statement on Form F-1, File No. 333-170674 (the “F-1 Registration Statement”) of SGOCO Group, Ltd. The registration statement is being filed to update and supplement the information contained in the S-1 Registration Statement, as originally declared effective by the Securities and Exchange Commission on March 7, 2008, and the F-1 Registration Statements, as originally declared effective by the Securities and Exchange Commission on December 20, 2010.

| The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting offers to buy these securities in any state where the offer or sale is not permitted. |

| PROSPECTUS | | Subject to completion, dated August 23, 2011 |

SGOCO GROUP, LTD.

1,175,787 Ordinary Shares

This prospectus relates to the issuance by us of up to 1,175,787 ordinary shares, par value $0.001 per share, of which:

| | · | 598,850 are issuable upon the exercise of outstanding warrants that have an exercise price of $8.00 per share and that were issued as a component of the units sold by our predecessor, Hambrecht Asia Acquisition Corp., or “Hambrecht Asia,” in its initial public offering pursuant to a prospectus dated March 7, 2008, or “public warrants”; |

| | · | 280,000 are issuable upon exercise of the units underlying the unit purchase option, or “UPO,” issued by Hambrecht Asia to the underwriters’ representative in Hambrecht Asia’s initial public offering, each unit consisting of one ordinary share and one warrant to purchase one ordinary share, at an exercise price of $10.00 per unit; |

| | · | 280,000 are issuable upon exercise of the warrants that have an exercise price of $8.00 per share, included as part of the units issuable on exercise of the UPO; and |

| | · | 16,937 are issuable upon exercise of the warrants that have an exercise price of $6.00 per share and that were issued by us to the underwriters’ representative in our December 2010 public offering of ordinary shares, or “Underwriter Warrants.” |

Our ordinary shares are traded on the NASDAQ Global Market under the symbol “SGOC.”

This prospectus is not an offer to sell any securities other than the ordinary shares underlying the warrants and the ordinary shares and warrants comprising the units subject to the UPO. This prospectus is not an offer to sell securities in any circumstances in which such an offer is unlawful.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 for a discussion of information that should be considered in connection with investing in our securities.

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2011

SGOCO GROUP, LTD.

Table of Contents

| PROSPECTUS SUMMARY | | 1 |

| RISK FACTORS | | 6 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | | 6 |

| THE OFFERING | | 7 |

| USE OF PROCEEDS | | 7 |

| DIVIDENDS | | 7 |

| CAPITALIZATION AND INDEBTEDNESS | | 9 |

| DESCRIPTION OF THE SECURITIES | | 10 |

| INCORPORATION OF CERTAIN INFORMATION BY REFERENCE | | 11 |

| LEGAL MATTERS | | 12 |

| EXPERTS | | 12 |

| WHERE YOU CAN FIND MORE INFORMATION | | 12 |

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements incorporated by reference into this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks discussed under “Risk Factors” on page 6 before making an investment decision.

Unless otherwise stated in this prospectus,

| | · | “SGOCO”, “we,” “us,” “our,” “Registrant”, or the “our company” refers to SGOCO Group, Ltd., a company organized under the laws of the Cayman Islands. SGOCO Group, Ltd. was previously named SGOCO Technology, Ltd., and prior to the Acquisition described in the section titled “Prospectus Summary”, the company was named Hambrecht Asia Acquisition Corp.; |

| | · | “PRC” or “China” refers to the People’s Republic of China; |

| | · | All references to “U.S. dollars,” “US$,” “dollars” and “$” are to the legal currency of the United States. All references to “RMB” and “Renminbi” refer to the legal currency of China; and |

| | · | Under the laws of the Cayman Islands and our Amended and Restated Memorandum of Association and Articles of Association as currently in effect, we are authorized to issue ordinary shares and holders of our ordinary shares are referred to as “members” rather than “shareholders.” In this prospectus, references that would otherwise be to members are made to shareholders, which term is more familiar to investors on the NASDAQ Global Market, which is where our ordinary shares are traded. |

Our Business

SGOCO is focused on developing its own brands and distribution in the Chinese flat panel display market. Our main products are LCD/LED monitors, TVs and other application-specific products. Our vision is to offer high quality LCD/LED products under brands that we control such as “SGOCO”, “No. 10,” and “Povizon” to consumers residing in China’s Tier 3 and Tier 4 cities.

We currently sell our products via multiple channels including computer stores, distributors and specialty retailers, but are focused on developing a more vertically integrated system, via a strategy referred to as SGOCO Image.

Our business model is marketing-driven with multiple channels and multiple brands. We have three principal elements:

| | · | a distinct distribution channel in the form of a national network of independent retail partners operating under the “SGOCO Image” name; |

| | · | an actively-managed portfolio of brands that have strong local appeal; and |

| | · | a world-class quality, design engineering, and product development capability that supports our distribution channels and brand portfolio. |

By integrating these three elements, we believe we are able to leverage opportunities across the entire value chain and create a competitive advantage for ourselves. We believe most of our competitors in Tier 3 and Tier 4 cities are relatively unsophisticated and either focus on the low margin OEM business or offer generic brands that lack the international quality standard and rich set of features of SGOCO products. While we have focused our marketing and sales efforts on the Chinese market, we are open to opportunistic export orders.

We believe that LCD/LED products, in general, are subject to rapid technological obsolescence. This is because new technologies and features are constantly introduced into the marketplace. However, these new technologies and features are typically marketed first to Tier 1 cities, where brand recognition is the key driver to sales.

China classifies its cities based upon population size, income and GDP. While Tier 1 cities include metropolitan cities like Beijing, Shanghai, Guangzhou and Shenzhen, which are currently major points of demand, we believe the market opportunities and sales growth potentials in Tier 3 and Tier 4 cities are significant. Our goal is to offer our branded products with a full set of features and establish a dominant market position in selected Tier 3 and Tier 4 cities.

Our principal objective is to be a leading developer and distributor of our own branded LCD/LED products and to create a network of SGOCO Image partners in Tier 3 and Tier 4 cities and their adjoining rural areas in China. The strategy is to capitalize on our operating strengths, which include:

| | · | a strong product development capability; |

| | · | competitively priced, feature rich products marketed under brands SGOCO controls; |

| | · | an attractive marketing plan for SGOCO Image partners; |

| | · | a light asset and scalable business model; and |

| | · | an experienced management team. |

In 2009, we initiated an effort to convert select specialty retailers into “SGOCO Image” partners. We believe our SGOCO Image model will allow us to rapidly build a brand presence in fragmented markets and allow SGOCO Image partners to offer differentiated branded products with excellent profit and growth potential. Through this national chain of independent retail partners contracted with the Company and licensed under the name “SGOCO Image,” we are able to reach the end consumer and provide consumer satisfaction. As of June 30, 2011, we had approximately 705 retail partners with a network covering the following 16 municipalities and provinces in China: Shaanxi, Heilongjiang, Hunan, Guangxi, Shandong, Beijing, Hebei; Henan, Hubei, Anhui, Sichuan, Inner Mongolia, Guangdong, Fujian, Jiangsu and Zhejiang.

Historical Structure and Acquisition of Honesty Group

We were a blank check corporation incorporated under the laws of the Cayman Islands on July 18, 2007. We were originally incorporated as “Hambrecht Asia Acquisition Corp.”, which was formed for the purpose of acquiring one or more operating businesses in China through a merger, stock exchange, asset acquisition or similar business combination or control through contractual arrangements.

Pursuant to our charter documents, we were required to enter into a business combination transaction to acquire control of a business with its primary operation in the PRC with a fair market value of at least 80% of the trust account established at the time of our IPO, or the Trust Account, (excluding certain deferred underwriting commissions) prior to March 12, 2010, or dissolve and liquidate. The approval of the business combination transaction required the approval of a majority of the outstanding shares and was conditioned, among other matters, on not more than 30% of the outstanding shares being properly tendered for redemption under our charter documents. Each ordinary share issued in our IPO was entitled to be redeemed if it was voted against the business combination transaction at a price equal to the amount in the Trust Account divided by the number of shares issued in the IPO outstanding at the time, estimated to be approximately $7.98 as of February 17, 2010. We entered into various forward purchase agreements with various hedge funds and other institutions for us to repurchase a total of 2,147,493 shares for an aggregate purchase price of $17,285,811 immediately after the closing of the business combination.

On March 12, 2010, we acquired all of the outstanding shares of Honesty Group (the “Acquisition”). In addition, at the meeting to approve the acquisition, the holders of our outstanding warrants approved an amendment to the warrant agreement under which the warrants were issued to increase the exercise price per share of the warrants from $5.00 to $8.00 and to extend by one year the exercise period, or until March 7, 2014, and to provide for the redemption of the publicly-held warrants, at the option of the holder, for $0.50 per warrant upon the closing of the acquisition. We may redeem the warrants at a price of $0.01 per warrant upon a minimum of 30 days’ prior written notice of redemption if, and only if, the last sale price of our ordinary share equals or exceeds $11.50 per share (subject to adjustment for splits, dividends, recapitalization and other similar events) for any 20 trading days within a 30 trading day period ending three business days before we send the notice of redemption.

After payment of various fees and expenses, the redemption prices of shares and warrants and the forward purchase contracts, the balance of approximately $5.4 million in the Trust Account was released to us upon consummation of the acquisition of Honesty Group. After the closing of the Acquisition and the settlement of related transactions, we had outstanding 16,094,756 ordinary shares, of which 859,668 shares were initially issued in our IPO, and warrants to purchase 1,816,027 shares at a price of $8.00 per share, of which 1,566,027 were initially issued in our IPO.

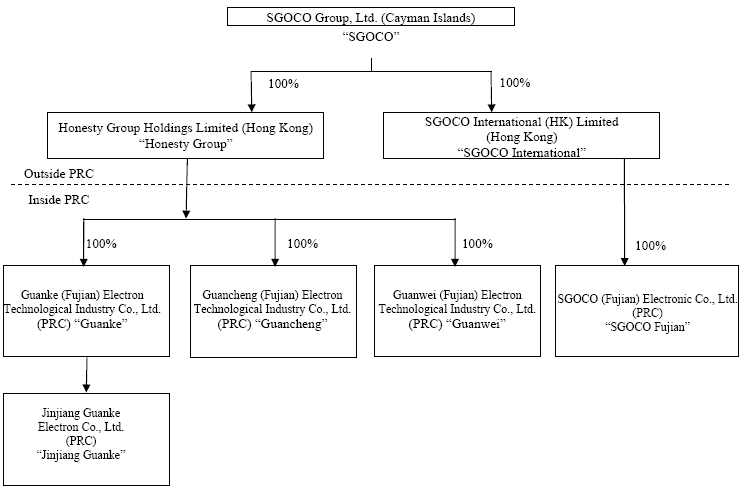

Corporate Structure

Following the consummation of the Acquisition, Honesty Group became a wholly-owned subsidiary of SGOCO. Honesty Group is a limited liability company registered in Hong Kong on September 13, 2005. Honesty Group owns 100% of Guanke, Guanwei, and Guancheng. Guanke, Guanwei and Guancheng are limited liability companies established in Jinjiang City, Fujian Province under the corporate laws of the PRC and have business operating licenses. All three companies qualify as wholly foreign-owned enterprises under PRC law. Jinjiang Guanke is a limited liability company established in Jinjiang City, Fujian Province under the corporate laws of the PRC and has a business operating license, and is a subsidiary of Guanke. In order to create business synergies in line with our strategic goals two subsidiaries in addition to Guanke were established. Guancheng began operations in June 2010, and Jinjiang Guanke began operations in October 2010. Guanwei has no operations as of the date of this prospectus.

On July 26, 2011, SGOCO formed SGOCO International (HK) Limited, a limited liability company registered in Hong Kong, or “SGOCO International,” as a wholly owned subsidiary. SGOCO International owns 100% of SGOCO (Fujian) Electronic Co., Ltd., a limited liability company under the laws of the PRC established for the purpose of conducting LCD/LED monitor and TV product-related product and brand development and distribution.

The following diagram sets forth our corporate structure as of the date of this prospectus:

Recent Events

On August 5, 2011, SGOCO announced the appointment of David Xu as the Company’s Chief Financial Officer. Mr. Xu started working with the Company in May 2011 and has approximately 20 years of finance and accounting experience in both Asia and North America.

On June 29, 2011, SGOCO dismissed its independent registered public accounting firm, Frazer Frost, LLP, which dismissal was approved by the audit committee of our board of directors. Concurrent with the decision to dismiss Frazer Frost, LLP, on June 29, 2011, the audit committee of our board of directors appointed Grant Thornton, China member firm of Grant Thornton International, as our independent registered public accounting firm.

Frazer Frost’s reports on our financial statements as of and for the years ended December 31, 2010 and 2009 did not contain any adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the years ended December 31, 2010 and 2009, and the subsequent interim period through the date of dismissal, there were no “disagreements,” as that term is defined in Item 16F(a)(1)(iv) of Form 20-F and the related instructions to Item 16F of Form 20-F, with Frazer Frost on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Frazer Frost, would have caused it to make reference to the subject matter of the disagreements in connection with its reports on our consolidated financial statements. Furthermore, no “reportable events,” as that term is defined in Item 16F(a)(1)(v) of Form 20-F, occurred within the periods covered by Frazer Frost’s reports on our consolidated financial statements, or subsequently up to the date of Frazer Frost’s dismissal.

SGOCO’s Offices

Our principal executive offices are located at Guanke Technology Park, Luoshan, Jinjiang City, Fujian, China 362200 and our telephone number is 086-595-8200-5598. Our website address is www.sgocogroup.com. The information on, or that can be accessed through, our website is not part of this prospectus.

The Offering

| Ordinary shares in the offering | | 1,175,787 ordinary shares, of which: |

| | ● | 598,850 are issuable upon the exercise of outstanding public warrants originally issued in an initial public offering by Hambrecht Asia pursuant to a prospectus dated March 7, 2008; |

| | | 280,000 are issuable upon exercise of the units underlying the unit purchase option, or “UPO”, issued by Hambrecht Asia to the representatives of the underwriters in Hambrecht Asia’s initial public offering, each unit consisting of one ordinary share and one warrant to purchase one ordinary share, at an exercise price of $10.00 per unit; |

| | | 280,000 are issuable upon exercise of the warrants included as part of the units issuable on exercise of the UPO; and |

| | | 16,937 are issuable upon exercise of the warrants, or “Underwriter Warrants”, issued by us to the representative of the underwriters in our public offering of ordinary shares in December 2010. |

| Ordinary shares outstanding as of August 10, 2011 | | 17,258,356 |

| | | |

| Ordinary shares outstanding assuming exercise of the UPO and all of the outstanding warrants | | 18,434,143 |

| | | |

| NASDAQ Global Market Symbol | | “SGOC” |

| | | |

| Use of proceeds | | We will receive up to an aggregate of $9,932,422 from the exercise of all of the public warrants, UPO and warrants underlying the UPO, and Underwriter Warrants if they are exercised in full. |

RISK FACTORS

An investment in our securities involves risk. Before you invest in securities issued by us, you should carefully consider the risks involved. Accordingly, you should carefully consider:

| | | the information contained in or incorporated by reference into this prospectus; |

| | | the risks described in our Annual Report on Form 20-F for our fiscal year ended December 31, 2010, on file with Securities and Exchange Commission, or SEC, which is incorporated by reference into this prospectus; and |

| | | other risks and other information that may be contained in, or incorporated by reference from, other filings we make with the SEC after the date of this prospectus. |

The discussion of risks related to our business contained in or incorporated by reference into this prospectus comprises material risks of which we are aware. If any of the events or developments described actually occurs, our business, financial condition or results of operations would likely suffer.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements,” including any projections of financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results to differ materially from any future results, performance or achievements described in or implied by such statements. Although we believe that our expectations expressed in these forward-looking statements are reasonable, we cannot assure you that our expectations will turn out to be correct. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, the accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based or the success of our business.

Important factors that could cause actual performance or results to differ materially from those contained in forward-looking statements include, but are not limited to, those factors discussed under the headings “Risk Factors,” including, among others:

| | | requirements or changes adversely affecting the LCD and LED market in China; |

| | | fluctuations in customer demand for LCD and LED products generally; |

| | | our success in promoting our brand of LCD and LED products in China and elsewhere; |

| | | our success in expanding our “SGOCO Image” model; |

| | | our success in manufacturing and distributing products under brands licensed from others; |

| | | management of rapid growth; |

| | | changes in government policy including policy regarding subsidies for purchase of consumer electronic products and local production of consumer goods in China; |

| | | the fluctuations in sales of LCD and LED products in China; |

| | | China’s overall economic conditions and local market economic conditions; |

| | | our ability to expand through strategic acquisitions and establishment of new locations; |

| | | changing principles of generally accepted accounting principles; |

| | | compliance with government regulations; |

| | | legislation or regulatory environments, and |

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

THE OFFERING

With regard to the public warrants and the warrants underlying the UPO, the offering shall remain open until the earlier of March 7, 2014 (the date upon which the outstanding warrants expire), the redemption of the warrants and the date on which all the ordinary shares underlying the public warrants, UPO and warrants underlying the UPO registered pursuant to the registration statement of which this prospectus is a part are distributed. The offering price of the ordinary shares underlying the public warrants and the warrants underlying the UPO, has been determined by reference to the exercise price of the warrants. The exercise price of the public warrants and the warrants underlying the UPO, is $8.00 per share.

With regard to the Underwriter Warrants, the offering shall remain open until the earlier of December 20, 2015 (the date upon which the outstanding Underwriter Warrants expire) and the date on which all the ordinary shares underlying the Underwriter Warrants registered pursuant to this registration statement of which this prospectus is a part are distributed. The offering price of the ordinary shares underlying the Underwriter Warrants has been determined by reference to the exercise price of the warrants. The exercise price of the Underwriter Warrants is $6.00 per share.

We will announce the extension or early closure of the offering, if any, through a press release or other means reasonably sufficient to provide adequate notice to investors.

USE OF PROCEEDS

Assuming the full exercise of all the public warrants, UPO and warrants underlying the UPO and the Underwriter Warrants, we will receive gross proceeds of $9,932,422. The actual exercise of any of these securities, however, is beyond our control and will depend on a number of factors, including the market price of our ordinary shares. There can be no assurance that any of these securities will be exercised. We intend to use the proceeds of the exercise of these securities, if any, for working capital, operating expenses and other general corporate purposes.

DIVIDENDS

We do not currently have any plans to pay any cash dividends in the foreseeable future on our ordinary shares being sold in this offering. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business.

We are a holding company incorporated in the Cayman Islands. We rely on dividends paid by our Hong Kong and Chinese subsidiaries for our cash needs, including the funds necessary to pay dividends to the holders of our ordinary shares. The payment of dividends by entities organized in China is subject to limitations. Regulations in the PRC currently permit payment of dividends only out of accumulated profits as determined in accordance with PRC accounting standards and regulations. Each of our Chinese subsidiaries is also required to set aside at least 10% of its after-tax profit based on China’s accounting standards each year to its general reserves until the cumulative amount of such reserves reach 50% of its registered capital. These reserves are not distributable as cash dividends.

The board of directors of each of our PRC subsidiaries, each of which is a wholly foreign owned enterprise, has the discretion to allocate a portion of its after-tax profits to its staff welfare and bonus funds, which is likewise not distributable to its equity owners except in the event of a liquidation of the foreign-invested enterprise. If we decide to pay dividends in the future, these restrictions may impede our ability to pay dividends. In addition, if any of these Chinese entities incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us.

Our board of directors has discretion on whether to pay dividends. Even if our board of directors decides to pay dividends, the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors that our board of directors may deem relevant.

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth unaudited consolidated capitalization as of March 31, 2011. This table should be read in conjunction with the audited consolidated financial statements incorporated by reference into this prospectus.

| | | As of March 31, 2011 (unaudited) | |

Debt(1) | | | |

| Bank overdraft | | $ | 529,200 | |

| Notes payables | | | 43,831,961 | |

| Short term loan | | | 36,727,548 | |

| Unsecured promissory note due to shareholder | | | 2,109,392 | |

| Total debt | | | 83,198,101 | |

| | | | | |

| Other Liabilities | | | | |

| Warrant derivative liability | | | 677,184 | |

| Total other liabilities | | | 677,184 | |

| | | | | |

| Shareholders’ Equity | | | | |

| Preferred stock, $0.001 par value, 1,000,000 shares authorized, none issued and outstanding | | | — | |

| Ordinary Shares, $0.001 par value, 50,000,000 shares authorized,17,258,356 outstanding | | | 17,258 | |

| Paid-in capital | | | 24,555,414 | |

| Statutory reserves | | | 4,074,142 | |

| Retained earnings | | | 33,675,881 | |

| Accumulated other comprehensive income | | | 4,155,467 | |

| Total shareholders’ equity | | | 66,478,162 | |

| | | | | |

| Total capitalization | | $ | 150,353,447 | |

| (1) | As of March 31, 2011, $40,612,809 of our indebtedness was secured. |

DESCRIPTION OF THE SECURITIES

The following summary of our securities does not purport to be complete and is subject to, and qualified in its entirety by reference to, the provisions of the warrant agreement and the unit purchase option, copies of which are incorporated herein by reference.

Public Warrants

We have outstanding a total of warrants to purchase 598,850 shares which were initially issued in our IPO (excluding warrants underlying the purchase option issued to our underwriters in our IPO discussed below). Each warrant entitles the registered holder to purchase one ordinary share at a price of $8.00 per share, and expires at 5:00 p.m. New York City time, on March 7, 2014 or earlier upon redemption.

We may redeem the outstanding warrants, including the warrants underlying the unit purchase option issued in our IPO if the unit purchase option has been exercised and the warrants are outstanding:

| | • | in whole but not in part, |

| | • | at a price of $0.01 per warrant, |

| | • | upon not less than 30 days’ prior written notice of redemption to each warrant holder, and |

| | • | if, and only if, the reported last sale price of the ordinary shares equals or exceeds $11.50 per share for any 20 trading days within a 30 trading day period ending on the third business day prior to the date of the notice of redemption to warrantholders. |

We have established these redemption criteria to provide warrantholders with a significant premium to the initial warrant exercise price as well as a sufficient degree of liquidity to cushion the market reaction, if any, to our redemption call. If the foregoing conditions are satisfied and we issue notice of redemption of the warrants, each warrant holder shall be entitled to exercise his, her or its warrant prior to the scheduled redemption date. However, there can be no assurance that the price of the ordinary shares will exceed the redemption trigger price or the warrant exercise price after the redemption notice is issued.

The warrants were issued in registered form under a warrant agreement between Continental Stock Transfer & Trust Company, as warrant agent, and us. You should review a copy of the warrant agreement, and the related amendment to the warrant agreement for a complete description of the terms and conditions of the warrants.

The exercise price and number of ordinary shares issuable on exercise of the warrants may be adjusted in certain circumstances including in the event of a share dividend, or our recapitalization, merger or consolidation. However, the exercise price and number of ordinary shares issuable on exercise of the warrants will not be adjusted for issuances of ordinary shares at a price below the warrant exercise price. Under the terms of the warrant agreement, the Company may, in its sole discretion, lower the exercise price for a period of not less than 10 business days, provided any such reduction shall be identical among all of the warrants.

The warrants, when countersigned by the warrant agent, may be exercised upon surrender of the warrant certificate on or prior to the expiration date at the offices of the warrant agent, with the exercise form on the reverse side of the warrant certificate completed and executed as indicated, accompanied by full payment of the exercise price, by cash, certified check or bank draft payable to us, for the number of warrants being exercised. Warrantholders do not have the rights or privileges of holders of ordinary shares, including voting rights, until they exercise their warrants and receive ordinary shares. After the issuance of ordinary shares upon exercise of the warrants, each holder will be entitled to one vote for each share held of record on all matters to be voted on by shareholders.

No fractional shares will be issued upon exercise of the warrants. If a holder exercises warrants and would be entitled to receive a fractional interest of a share, we will round up the number of ordinary shares to be issued to the warrant holder to the nearest whole number of shares.

UPO

In connection with our IPO, we issued the representative of our underwriters the option to acquire 280,000 units, each consisting of one ordinary share and one warrant to purchase an ordinary share. The ordinary shares and warrants which would be issued upon exercise of the option for the units have the same terms and conditions as the ordinary shares and warrants described above. The option is exercisable at $10.00 per Unit.

Underwriter Warrants

In connection with our December 2010 public offering of ordinary shares, we issued the representative of our underwriters a warrant to purchase 66,667 ordinary shares, of which 16,937 remain outstanding as of the date of this prospectus. Each warrant entitles the holder to purchase one ordinary share at a price of $6.00 per share, and expires at 5:00 p.m. Eastern time, on December 20, 2015.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We incorporate by reference the filed documents listed below, except as superseded, supplemented or modified by this prospectus:

| | • | our Annual Report on Form 20-F for the fiscal year ended December 31, 2010, filed with the SEC on April 29, 2011; |

| | • | our Current Reports on Form 6-K filed with the SEC on June 29, 2011, July 1, 2011, August 5, 2011 and August 15, 2011 |

| | • | the description of our ordinary shares contained in our Registration Statement on Form F-1, as amended, under the Securities Act of 1933, as amended, or the Securities Act, as originally filed with the SEC on November 18, 2010 (Registration No. 333-170674) under the heading “Description of Securities” and as incorporated into our Registration Statement on Form 8-A12B, filed with the SEC on December 17, 2010; |

| | • | any Form 20-F, 10-K, 10-Q or 8-K filed with the SEC after the date of this prospectus and prior to the termination of this offering of securities (except to the extent such reports are furnished but not filed with the SEC); and |

| | • | any Report on Form 6-K submitted to the SEC after the date of this prospectus and prior to the termination of this offering of securities, but only to the extent that the forms expressly state that we incorporate them by reference in this prospectus. |

Potential investors, including any beneficial owner, may obtain a copy of any of the documents summarized herein or any of our SEC filings incorporated by reference herein without charge by written or oral request directed to William Krolicki, SGOCO Group, Ltd., 14/F, Bldg. #4, Beijing International Center, 38 Dongsanhuan Beilu, Beijing 100026, China. The telephone number at our executive office is +86 (10) 8587-0170.

Any statement contained in a document incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein, or in a subsequently filed document incorporated by reference herein, modifies or supersedes that statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute part of this prospectus.

LEGAL MATTERS

We are being represented by Nixon Peabody LLP with respect to legal matters of United States federal securities and New York State law. The validity of the ordinary shares offered in this offering and legal matters as to Cayman Islands law will be passed upon for us by Conyers Dill & Pearman.

EXPERTS

The consolidated financial statements of SGOCO Group, Ltd. (formally known as SGOCO Technology, Ltd.) and its subsidiaries as of December 31, 2010 and 2009 and for each of the years in the three-year period ended December 31, 2010, have been incorporated by reference herein and in the registration statement in reliance upon the report of Frazer Frost LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form F-3 under the Securities Act with respect to the offer and sale of securities pursuant to this prospectus. This prospectus, filed as a part of the registration statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules thereto in accordance with the rules and regulations of the SEC and no reference is hereby made to such omitted information. Statements made in this prospectus concerning the contents of any contract, agreement or other document filed as an exhibit to the registration statement are summaries of all of the material terms of such contract, agreement or document, but do not repeat all of their terms. Reference is made to each such exhibit for a more complete description of the matters involved and such statements shall be deemed qualified in their entirety by such reference.

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are applicable to a foreign private issuer. In accordance with the Exchange Act, we file reports with the SEC, including annual reports on Form 20-F which are required to be filed within four months following our fiscal year end. Our fiscal year end is December 31 of each year. We also furnish to the SEC under cover of Form 6-K material information required to be made public in the Cayman Islands, filed with and made public by any stock exchange or automated quotation system or distributed by us to our shareholders. As a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements to shareholders. In addition, our officers, directors and principal shareholders are exempt from the “short-swing profits” reporting and liability provisions contained in Section 16 of the Exchange Act and related Exchange Act rules.

The registration statement and the exhibits and schedules thereto, and reports and other information filed by us with the SEC may be inspected, without charge, and copies may be obtained at prescribed rates, at the public reference facility maintained by the SEC at its principal office at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the public reference facility by calling 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy and information statements and other information regarding registrants that file electronically through the SEC’s Electronic Data Gathering, Analysis and Retrieval (“EDGAR”) system, including the Company, which can be accessed at http://www.sec.gov. For further information pertaining to the securities offered by this prospectus and SGOCO Group, Ltd., reference is made to the registration statement.

SGOCO GROUP, LTD.

1,175,787 Ordinary Shares

The date of this prospectus is , 2011

PART II INFORMATION NOT REQUIRED IN PROSPECTUS

Item 8. Indemnification of Directors and Officers.

Cayman Islands law does not limit the extent to which a company’s articles of association may provide for indemnification of officers and directors, except to the extent any such provision may be held by the Cayman Islands courts to be contrary to public policy, such as to provide indemnification against civil fraud or the consequences of committing a crime. SGOCO’s Memorandum and Articles of Association provide for indemnification of officers and directors for losses, damages, costs and expenses incurred in their capacities as such, except that such indemnity shall not extend to any matter in respect of any fraud or dishonesty.

This provision, however, will not eliminate or limit liability arising under federal securities laws. SGOCO’s Memorandum and Articles of Association do not eliminate its directors’ fiduciary duties. The inclusion of the foregoing provision may, however, discourage or deter shareholders or management from bringing a lawsuit against directors even though such an action, if successful, might otherwise have benefited SGOCO and its shareholders. This provision should not affect the availability of a claim or right of action based upon a director’s fraud or dishonesty.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers or persons controlling the Registrant pursuant to the foregoing provisions, the Registrant has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Item 9. Exhibits

Exhibit Number | | Description |

| | | |

| 2.1 | | Share Exchange Agreement dated as of February 10, 2010, by and among Hambrecht Asia Acquisition., Honesty Group Holdings Limited and shareholders signatories thereto (incorporated by reference to Exhibit 2.1 of the Company’s Form 6-K filed on February 18, 2010) |

| | | |

| 2.2 | | Amendment No. 1 to the Share Exchange Agreement, dated February 12, 2010, by and between the Company, Honesty Group Holdings Limited and its shareholders Sun Zone Investments Limited and Sze Kit Ting (incorporated by reference to Exhibit 2.1 of the Company’s Form 6-K filed on March 11, 2010) |

| | | |

| 4.1 | | Warrant Agreement, dated March 7, 2008, by and between the Company and the warrant agent (incorporated by reference to Exhibit 4.1 of the Company’s Form 6-K filed on February 18, 2010) |

| | | |

| 4.2 | | Amendment No. 1, dated March 12, 2010, to the Warrant Agreement (incorporated by reference to Exhibit 4.1 of the Company’s Form 6-K filed on March 16, 2010) |

| | | |

| 4.3 | | Unit Purchase Option issued to the underwriter in IPO (incorporated by reference to Exhibit 4.6 of the Company’s Form S-1 (file no. 333-146147) filed on February 1, 2008) |

| | | |

| 4.4 | | Specimen Warrant Certificate (incorporated by reference to Exhibit 4.3 of the Company’s Form F-1 (file no. 333-146147) filed on December 24, 2007) |

| | | |

| 4.5 | | Specimen Ordinary Share Certificate (incorporated by reference to Exhibit 4.2 of the Company’s Form S-1 (file no. 333-146147) filed on February 1, 2008) |

| | | |

| 4.6 | | Purchase Option issued to the underwriters in the Company’s December 2010 offering (incorporated by reference to Exhibit 2.8 of the Company’s Form 20-F filed on April 29, 2011) |

| | | |

| 5.1 | | Opinion of Conyers Dill &Pearman, Cayman Islands counsel to the Company |

| | | |

| 5.2 | | Opinion of Nixon Peabody LLP, U.S. counsel to the Company |

| | | |

| 23.1 | | Consent of Frazer Frost LLP |

| | | |

| 23.2 | | Consent of Conyers Dill &Pearman, Cayman Islands counsel to the Company (included in Exhibit 5.1) |

| | | |

| 23.3 | | Consent of Nixon Peabody LLP (included in Exhibit 5.2) |

| | | |

| 24 | | Power of Attorney (included on signature page) |

Item 10. Undertakings.

| (a) | The undersigned Registrant hereby undertakes: |

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement; Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii) to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) To file a post-effective amendment to the registration statement to include any financial statements required by Item 8.A of Form 20-F at the start of any delayed offering or throughout a continuous offering. Financial statements and information otherwise required by Section 10(a)(3) of the Act need not be furnished, provided that the Registrant includes in the prospectus, by means of a post-effective amendment, financial statements required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other information in the prospectus is at least as current as the date of those financial statements. Notwithstanding the foregoing, with respect to registration statements on Form F-3, a post-effective amendment need not be filed to include financial statements and information required by Section 10(a)(3) of the Act or Rule 3-19 of this chapter if such financial statements and information are contained in periodic reports filed with or furnished to the SEC by the Registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Form F-3.

(5) That, for the purpose of determining liability under the Securities Act to any purchaser:

(i) Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

(6) That, for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person of the Registrant in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form F-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Jinjiang, Province of Fujian, Country of People’s Republic of China on August 22, 2011.

| | SGOCO GROUP, LTD. | |

| | | | |

| | By: | /s/ Burnette Or | |

| | Name: | Burnette Or | |

| | Title: | Chairman, Chief Executive Officer and President | |

| | | | |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Burnette Or, acting individually, as true and lawful attorney-in-fact and agent with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities to sign any and all amendments to this Registration Statement (including post-effective amendments, or any abbreviated registration statement and any amendments thereto filed pursuant to Rule 462(b) and otherwise), and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission granting unto said attorney-in-fact and agent the full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the foregoing, as to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | |

| Signature | | Title | | Date |

/s/ Burnette Or Burnette Or | | Chief Executive Officer, President and Director (Principal Executive Officer) | | August 22, 2011 |

| | | | | |

/s/ David G. Xu David G. Xu | | Chief Financial Officer (Principal Financial and Accounting Officer) | | August 22, 2011 |

| | | | | |

/s/ Tin Man Or Tin Man Or | | Director | | August 22, 2011 |

| | | | | |

/s/ Weiwei Shangguan Weiwei Shangguan | | Director | | August 22, 2011 |

| | | | | |

/s/ Frank Wu Frank Wu | | Director | | August 22, 2011 |

| | | | | |

/s/ Robert Eu Robert Eu | | Director | | August 22, 2011 |

| | | | | |

/s/ John Chen John Chen | | Director | | August 22, 2011 |

| | | | | |

/s/ James C. Hu James C. Hu | | Director | | August 22, 2011 |

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN THE UNITED STATES

Pursuant to the Securities Act of 1933, as amended, the undersigned, the duly authorized representative in the United States of SGOCO Group, Ltd., has signed this registration statement or amendment thereto in San Francisco, California, on August 22, 2011.

| | Authorized U.S. Representative | |

| | | | |

| | By: | /s/ Robert Eu | |

| | Name: | Robert Eu, Director | |

Exhibits

Exhibit Number | | Description |

| | | |

| 2.1 | | Share Exchange Agreement dated as of February 10, 2010, by and among Hambrecht Asia Acquisition., Honesty Group Holdings Limited and shareholders signatories thereto (incorporated by reference to Exhibit 2.1 of the Company’s Form 6-K filed on February 18, 2010) |

| | | |

| 2.2 | | Amendment No. 1 to the Share Exchange Agreement, dated February 12, 2010, by and between the Company, Honesty Group Holdings Limited and its shareholders Sun Zone Investments Limited and Sze Kit Ting (incorporated by reference to Exhibit 2.1 of the Company’s Form 6-K filed on March 11, 2010) |

| | | |

| 4.1 | | Warrant Agreement, dated March 7, 2008, by and between the Company and the warrant agent (incorporated by reference to Exhibit 4.1 of the Company’s Form 6-K filed on February 18, 2010) |

| | | |

| 4.2 | | Amendment No. 1, dated March 12, 2010, to the Warrant Agreement (incorporated by reference to Exhibit 4.1 of the Company’s Form 6-K filed on March 16, 2010) |

| | | |

| 4.3 | | Unit Purchase Option issued to the underwriter in IPO (incorporated by reference to Exhibit 4.6 of the Company’s Form S-1 (file no. 333-146147) filed on February 1, 2008) |

| | | |

| 4.4 | | Specimen Warrant Certificate (incorporated by reference to Exhibit 4.3 of the Company’s Form F-1 (file no. 333-146147) filed on December 24, 2007) |

| | | |

| 4.5 | | Specimen Ordinary Share Certificate (incorporated by reference to Exhibit 4.2 of the Company’s Form S-1 (file no. 333-146147) filed on February 1, 2008) |

| | | |

| 4.6 | | Purchase Option issued to the underwriters in the Company’s December 2010 offering (incorporated by reference to Exhibit 2.8 of the Company’s Form 20-F filed on April 29, 2011) |

| | | |

| 5.1 | | Opinion of Conyers Dill &Pearman, Cayman Islands counsel to the Company |

| | | |

| 5.2 | | Opinion of Nixon Peabody LLP, U.S. counsel to the Company |

| | | |

| 23.1 | | Consent of Frazer Frost LLP |

| | | |

| 23.2 | | Consent of Conyers Dill &Pearman, Cayman Islands counsel to the Company (included in Exhibit 5.1) |

| | | |

| 23.3 | | Consent of Nixon Peabody LLP (included in Exhibit 5.2) |

| | | |

| 24 | | Power of Attorney (included on signature page) |