Maiden Holdings, Ltd. Investor Update March 2022

Investor Disclosures 1 Forward Looking Statements This presentation contains "forward-looking statements" which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on the Maiden Holdings, Ltd.’s (the “Company”) concerning future developments and their potential effects on the Company. There can be no assurance that actual developments will be those anticipated by the Company. Actual results may differ materially from those projected as a result of significant risks and uncertainties, including non-receipt of the expected payments, changes in interest rates, effect of the performance of financial markets on investment income and fair values of investments, developments of claims and the effect on loss reserves, accuracy in projecting loss reserves, the impact of competition and pricing environments, changes in the demand for the Company's products, the effect of general economic conditions and unusual frequency of storm activity, adverse state and federal legislation, regulations and regulatory investigations into industry practices, developments relating to existing agreements, heightened competition, changes in pricing environments, and changes in asset valuations. Additional information about these risks and uncertainties, as well as others that may cause actual results to differ materially from those projected is contained in Item 1A. Risk Factors in the Company's Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC. The Company undertakes no obligation to publicly update any forward-looking statements, except as may be required by law. Any discrepancies between the amounts included in this presentation and amounts included in the Company’s Form 10-K for the year ended December 31, 2021, filed with the SEC are due to rounding. Non-GAAP Financial Measures In addition to the Summary Consolidated Balance Sheets and Consolidated Statements of Income, management uses certain key financial measures, some of which are non-GAAP measures, to evaluate the Company's financial performance and the overall growth in value generated for the Company’s common shareholders. Management believes that these measures, which may be defined differently by other companies, explain the Company’s results to investors in a manner that allows for a more complete understanding of the underlying trends in the Company’s business. The non-GAAP measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. See the Appendix of this presentation for a reconciliation of the Company’s non-GAAP measures to the nearest GAAP measure.

Maiden Holdings 2021 Highlights 2 • GAAP book value increased 66% to $2.60 per common share o Non-GAAP book value increased 29% to $3.18 per common share • GAAP net income was $117.6 million, a 47% increase over 2020 o Q4 net income available to common shareholders $16.2 million or $0.19 per share • Executed in each pillar of our business strategy during 2021 o Asset management – increased alternative investments by 111% to $225.5 million o Legacy underwriting – completed our first transactions through Genesis Legacy Solutions (“GLS”) in Q4, now with nearly $40 million in reserves in Q1 2022 o Capital management – repurchased $136.2 million preference shares, increasing book value by $1.05 per common share through 12/31/2021 o As of March 11, 2022, now own more than 2/3 of each series of preference shares • Deferred tax asset = $1.04 per share at December 31 – still carries full valuation allowance o Not recognized as an asset on balance sheet currently o Growing but not yet sufficient positive evidence to reduce valuation allowance * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein

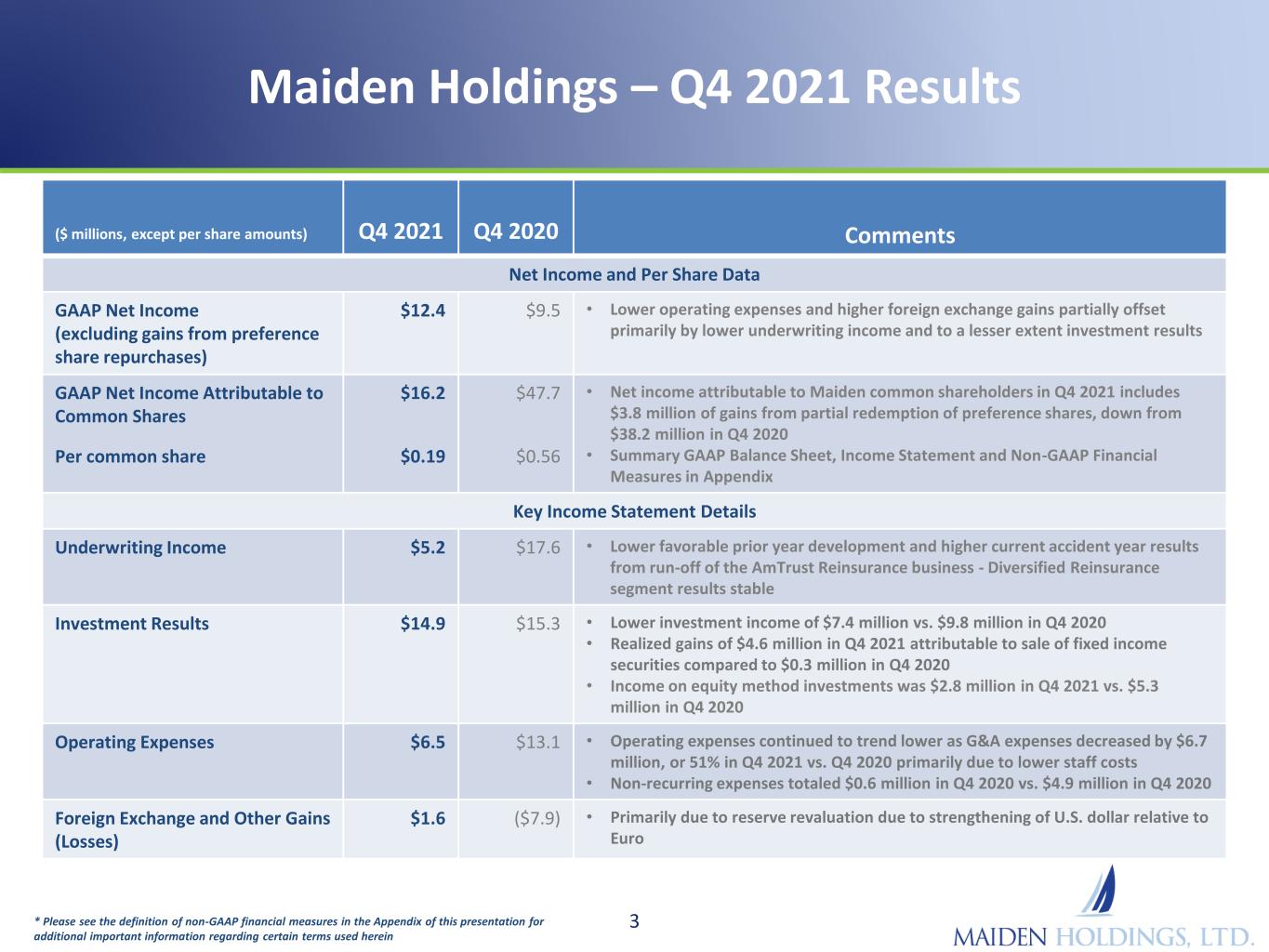

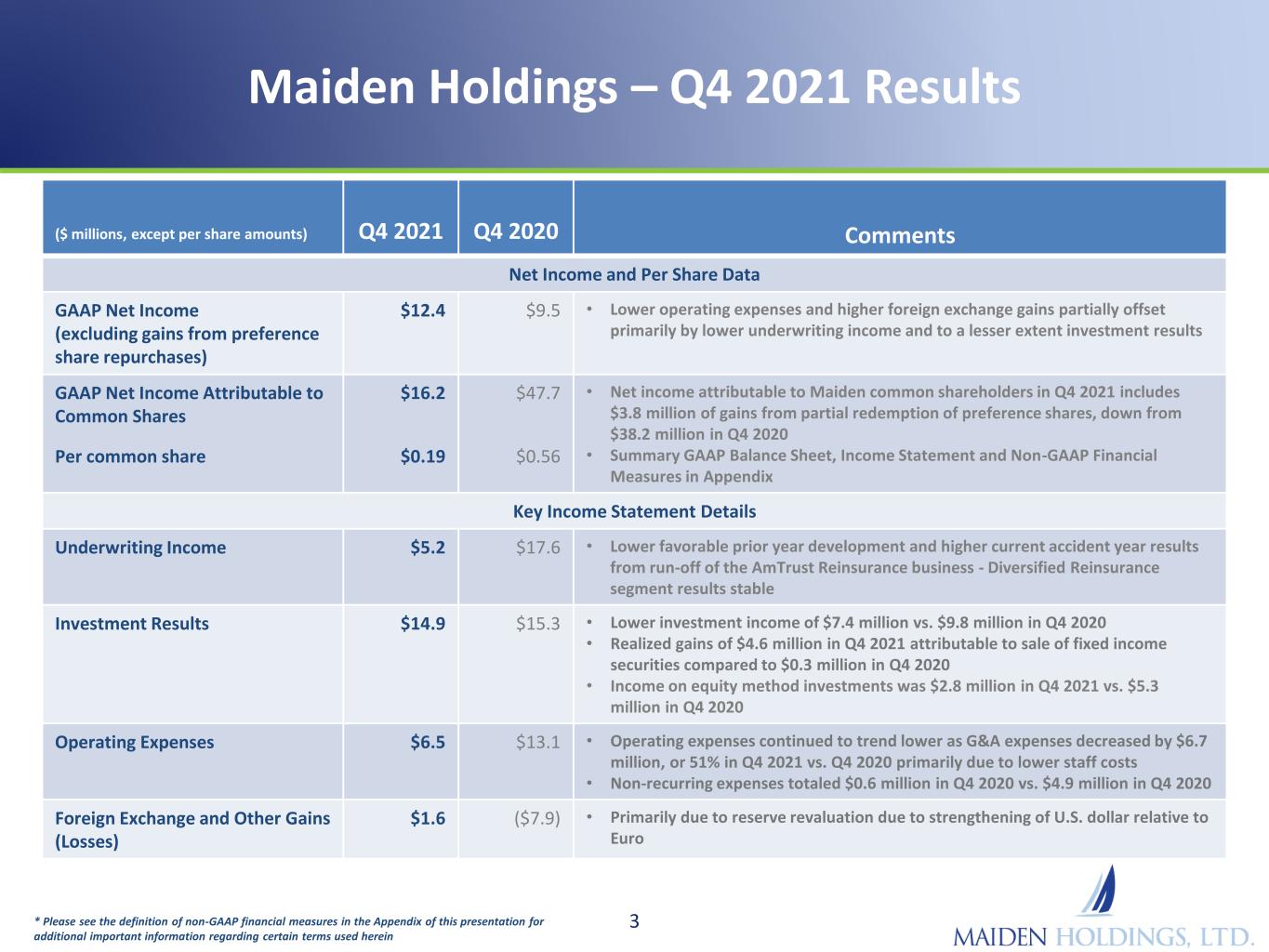

Maiden Holdings – Q4 2021 Results 3* Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein ($ millions, except per share amounts) Q4 2021 Q4 2020 Comments Net Income and Per Share Data GAAP Net Income (excluding gains from preference share repurchases) $12.4 $9.5 • Lower operating expenses and higher foreign exchange gains partially offset primarily by lower underwriting income and to a lesser extent investment results GAAP Net Income Attributable to Common Shares Per common share $16.2 $0.19 $47.7 $0.56 • Net income attributable to Maiden common shareholders in Q4 2021 includes $3.8 million of gains from partial redemption of preference shares, down from $38.2 million in Q4 2020 • Summary GAAP Balance Sheet, Income Statement and Non-GAAP Financial Measures in Appendix Key Income Statement Details Underwriting Income $5.2 $17.6 • Lower favorable prior year development and higher current accident year results from run-off of the AmTrust Reinsurance business - Diversified Reinsurance segment results stable Investment Results $14.9 $15.3 • Lower investment income of $7.4 million vs. $9.8 million in Q4 2020 • Realized gains of $4.6 million in Q4 2021 attributable to sale of fixed income securities compared to $0.3 million in Q4 2020 • Income on equity method investments was $2.8 million in Q4 2021 vs. $5.3 million in Q4 2020 Operating Expenses $6.5 $13.1 • Operating expenses continued to trend lower as G&A expenses decreased by $6.7 million, or 51% in Q4 2021 vs. Q4 2020 primarily due to lower staff costs • Non-recurring expenses totaled $0.6 million in Q4 2020 vs. $4.9 million in Q4 2020 Foreign Exchange and Other Gains (Losses) $1.6 ($7.9) • Primarily due to reserve revaluation due to strengthening of U.S. dollar relative to Euro

Maiden Holdings Business Strategy 4 • We create shareholder value by actively managing and allocating our assets and capital o We leverage our deep knowledge of the insurance and related financial services industries into ownership and management of businesses and assets with the opportunity for increased returns o Change in strategy since 2019 have allowed us to more flexibly allocate capital to activities we believe will produce the greatest returns for shareholders • Our strategy has three principal areas of focus o Asset management – investing in assets and asset classes in a prudent but expansive manner in order to maximize investment returns o We limit the insurance risk we assume relative to the assets we hold and maintain required regulatory capital at very strong levels to manage our aggregate risk profile o Legacy underwriting - judiciously building a portfolio of run-off acquisitions and retroactive reinsurance transactions which we believe will produce attractive underwriting returns o Capital management - effectively managing capital and when appropriate, repurchasing securities or returning capital to enhance common shareholder returns • We believe these areas of strategic focus will enhance our profitability o We believe our strategy increases the likelihood of fully utilizing the significant tax NOL carryforwards which would create additional common shareholder value o Expected returns from each strategic pillar are evaluated relative to our cost of debt capital

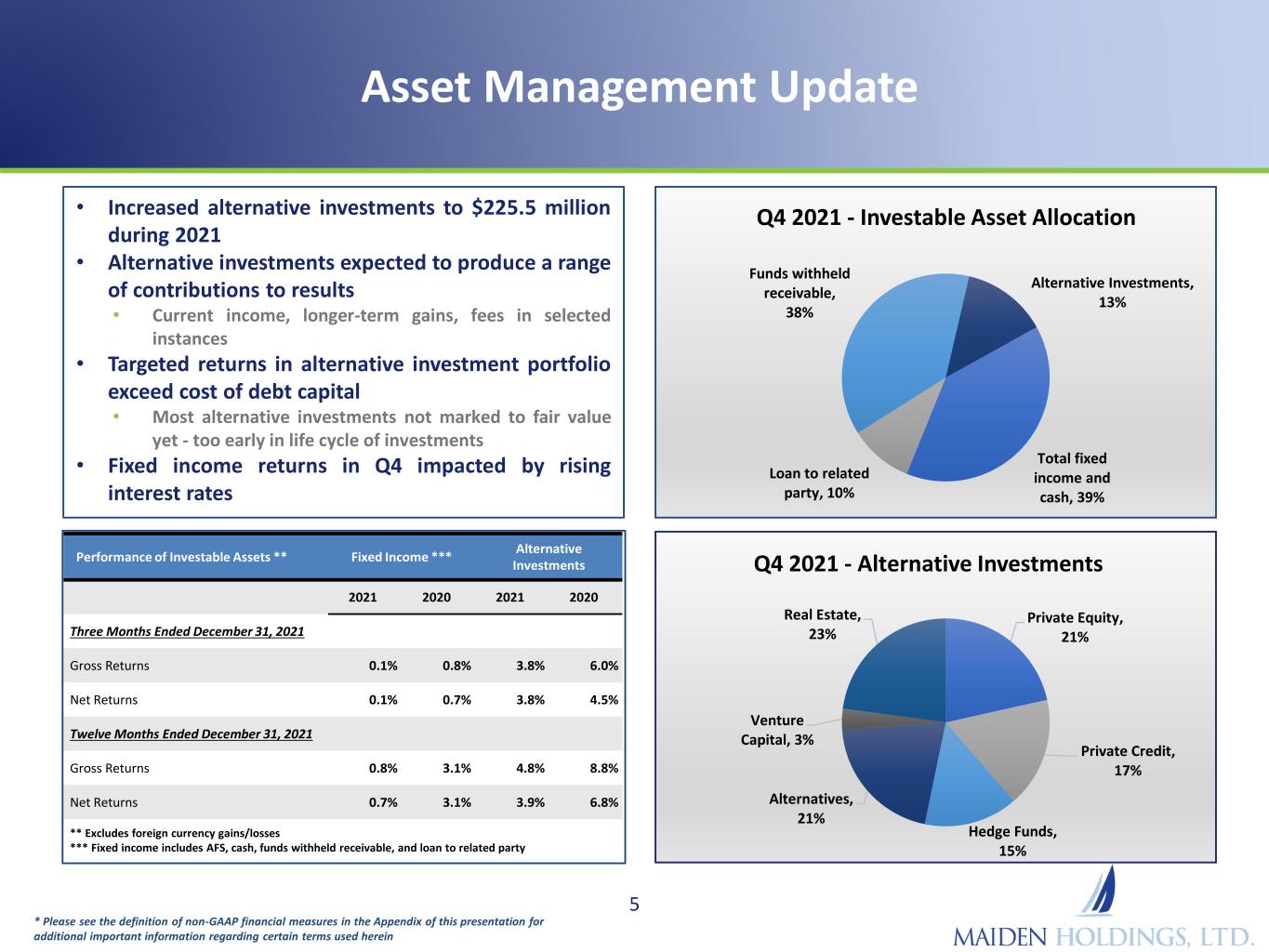

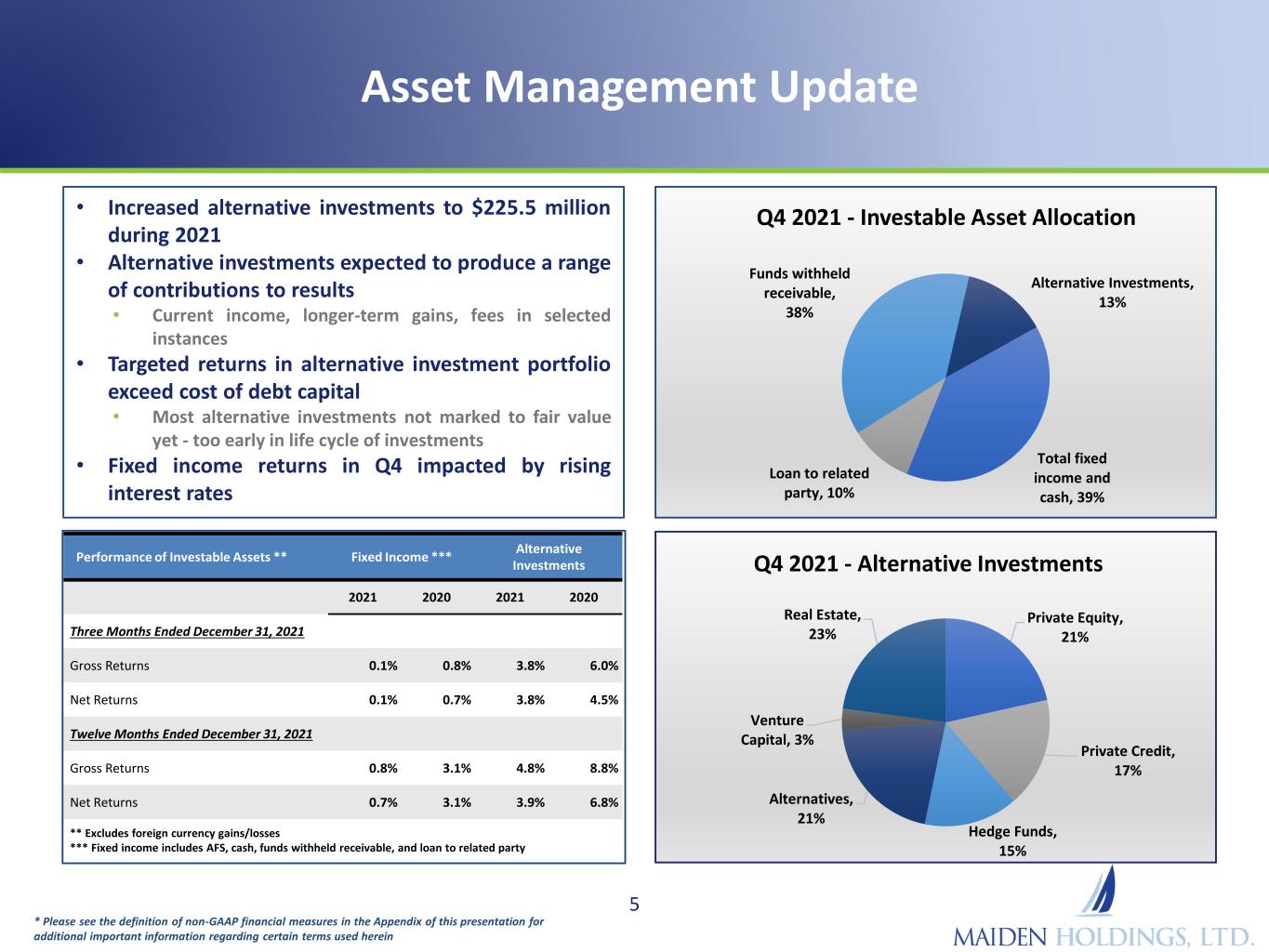

Asset Management Update • Increased alternative investments to $225.5 million during 2021 • Alternative investments expected to produce a range of contributions to results • Current income, longer-term gains, fees in selected instances • Targeted returns in alternative investment portfolio exceed cost of debt capital • Most alternative investments not marked to fair value yet - too early in life cycle of investments • Fixed income returns in Q4 impacted by rising interest rates 5 Total fixed income and cash, 39% Loan to related party, 10% Funds withheld receivable, 38% Alternative Investments, 13% Q4 2021 - Investable Asset Allocation Private Equity, 21% Private Credit, 17% Hedge Funds, 15% Alternatives, 21% Venture Capital, 3% Real Estate, 23% Q4 2021 - Alternative Investments * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein Performance of Investable Assets ** Fixed Income *** Alternative Investments 2021 2020 2021 2020 Three Months Ended December 31, 2021 Gross Returns 0.1% 0.8% 3.8% 6.0% Net Returns 0.1% 0.7% 3.8% 4.5% Twelve Months Ended December 31, 2021 Gross Returns 0.8% 3.1% 4.8% 8.8% Net Returns 0.7% 3.1% 3.9% 6.8% ** Excludes foreign currency gains/losses *** Fixed income includes AFS, cash, funds withheld receivable, and loan to related party

Legacy Underwriting Update 6 • GLS formed in November 2020 • Effective October 1, 2021, GLS completed its first transaction, a loss portfolio transfer transaction which includes an adverse development cover • As of December 31, 2021, GLS had losses and LAE reserves that it assumed through retroactive reinsurance contracts of $14.8 million • GLS continues to write additional retroactive reinsurance transactions in 2022 consistent with its business plan • GLS reserves currently approaching $40 million in Q1 2022 • Robust pipeline for additional transactions consistent with business plan

Capital Management Update 7 • Active Capital Management Continued in Q4 2021 and Q1 2022 o 12,231,607 shares repurchased since launch of tender offer in 2020 and repurchase program in 2021 and Q1 2022, adding $1.53 in book value per common share o During Q4 2021, Maiden Reinsurance Ltd. (“MRL”) repurchased 328,339 shares at an average cost of $12.19 per share for a total cost of $4.0 million o In 2022 through March 11, pursuant to a 10b5-1 plan, 256,461 shares repurchased at cost of $2.9 million and gain of $3.3 million or $0.04 per common share o $10.9 million of unutilized authorization remaining as of March 11, 2022 • As of March 11, 2022, MRL’s ownership percentage of each series of preferred shares is as follows Series % Owned Series A 67.7% Series C 66.7% Series D 67.0% Total 67.1% • Maiden expects to continue to evaluate its capital management options as its broader strategy progresses * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein

Maiden Holdings, Ltd. Investor Update - Appendix Fourth Quarter and Year Ended December 31, 2021 Financial Data

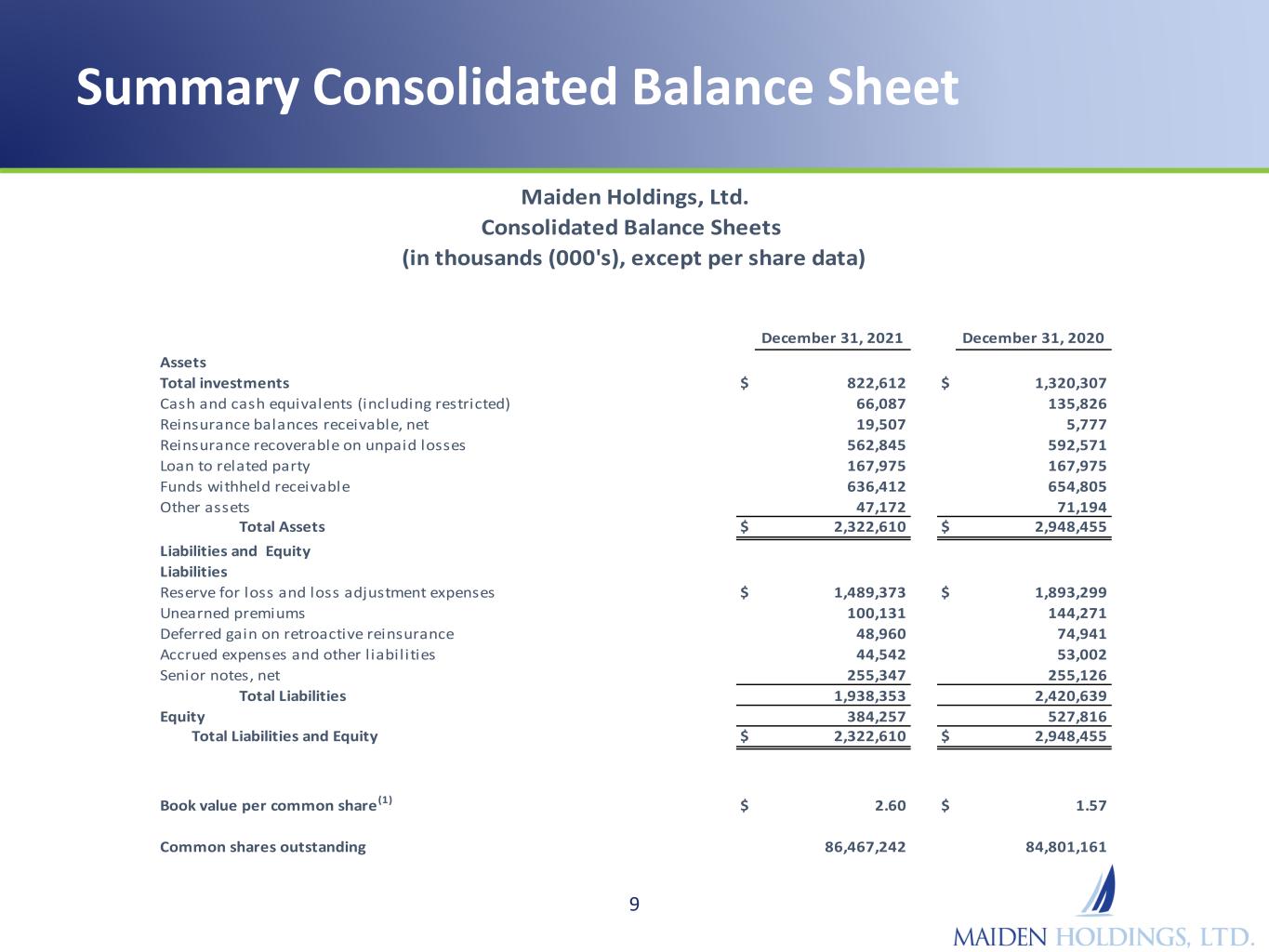

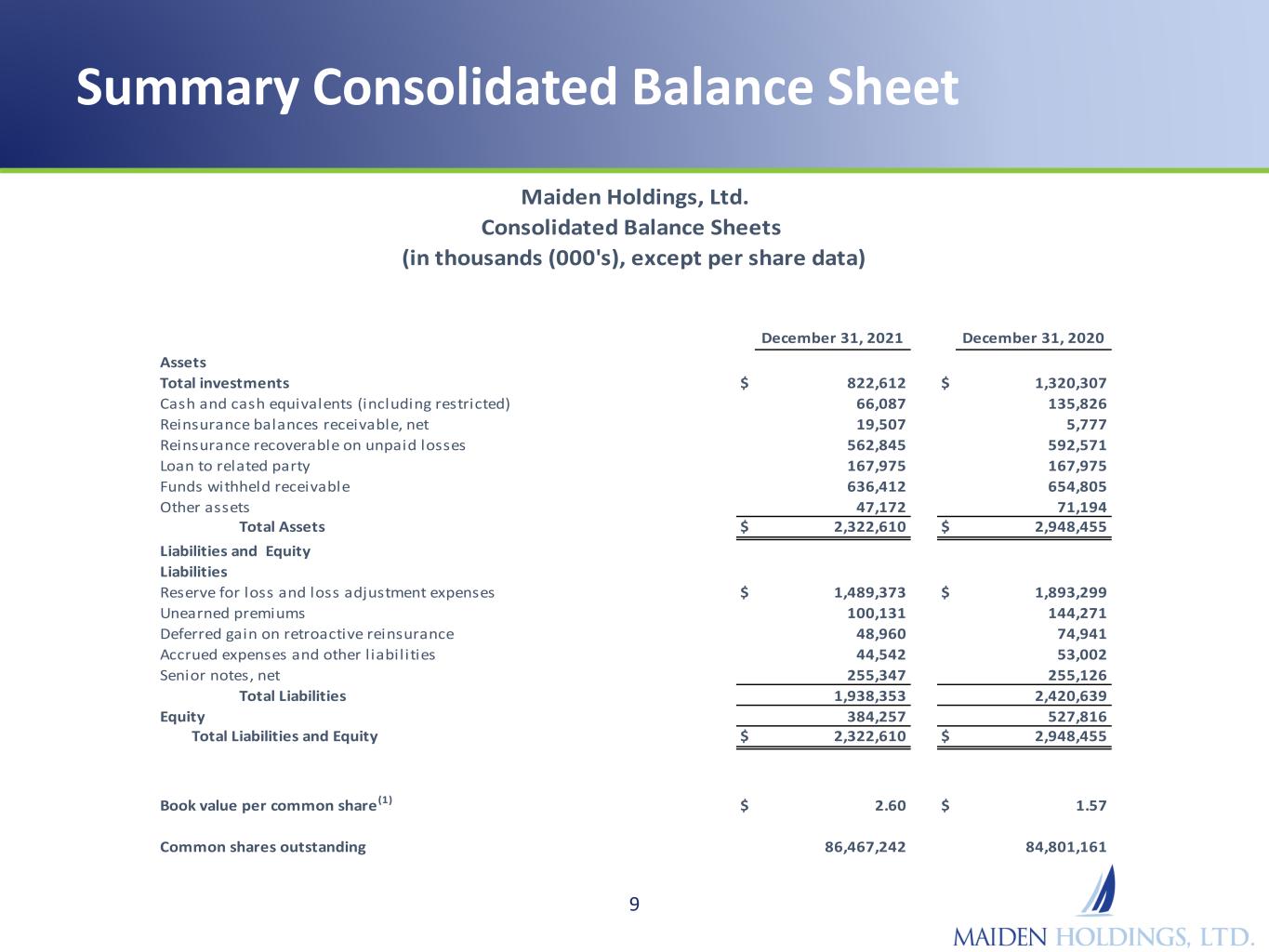

Summary Consolidated Balance Sheet 9 December 31, 2021 December 31, 2020 Assets Total investments $ 822,612 $ 1,320,307 Cash and cash equivalents (including restricted) 66,087 135,826 Reinsurance balances receivable, net 19,507 5,777 Reinsurance recoverable on unpaid losses 562,845 592,571 Loan to related party 167,975 167,975 Funds withheld receivable 636,412 654,805 Other assets 47,172 71,194 Total Assets $ 2,322,610 $ 2,948,455 Liabilities and Equity Liabilities Reserve for loss and loss adjustment expenses $ 1,489,373 $ 1,893,299 Unearned premiums 100,131 144,271 Deferred gain on retroactive reinsurance 48,960 74,941 Accrued expenses and other l iabilities 44,542 53,002 Senior notes, net 255,347 255,126 Total Liabilities 1,938,353 2,420,639 Equity 384,257 527,816 Total Liabilities and Equity $ 2,322,610 $ 2,948,455 Book value per common share(1) $ 2.60 $ 1.57 Common shares outstanding 86,467,242 84,801,161 Maiden Holdings, Ltd. Consolidated Balance Sheets (in thousands (000's), except per share data)

Consolidated Statements of Income 10 Revenues: Gross premiums wri tten $ 3,073 $ 11,156 $ 10,938 $ 31,389 Net premiums wri tten $ 2,885 $ 10,939 $ 10,403 $ 28,432 Change in unearned premiums 10,002 18,314 42,590 77,649 Net premiums earned 12,887 29,253 52,993 106,081 Other insurance revenue 121 357 1,067 1,276 Net investment income 7,417 9,802 32,013 54,761 Net rea l ized ga ins on investment 4,635 273 12,648 24,473 Total other-than-temporary impairment losses - - (2,468) Total revenues 25,060 39,685 98,721 184,123 Expenses: Net loss and loss adjustment expenses (239) 640 7,307 41,799 Commiss ion and other acquis i tion expenses 5,686 9,018 24,840 38,796 General and adminis trative expenses 6,467 13,147 36,020 39,118 Total expenses 11,914 22,805 68,167 119,713 Other expenses: Interest and amortization expenses (4,832) (4,831) (19,327) (19,324) Foreign exchange and other ga ins (losses) 1,615 (7,892) 7,685 (8,526) Total other expenses (3,217) (12,723) (11,642) (27,850) Income before income taxes 9,929 4,157 18,912 36,560 Less : income tax expense (benefi t) (378) (118) 15 (104) Add: interest in income of equity method investments 2,836 5,252 7,748 5,098 Net income 12,387 9,527 26,645 41,762 Gain from repurchase of preference shares 3,830 38,195 90,998 38,195 Net income available to Maiden common shareholders $ 16,217 $ 47,722 $ 117,643 $ 79,957 Basic and diluted earnings per share attributable to Maiden common shareholders $ 0.19 $ 0.56 $ 1.35 $ 0.93 Annualized return on average common equity (3) 29.2% 183.8% 65.6% 90.7% 2021 2020 Maiden Holdings, Ltd. Consolidated Statements of Income (in thousands (000's), except per share data) For the Three Months Ended December 31, For the Year Ended December 31, 2021 2020

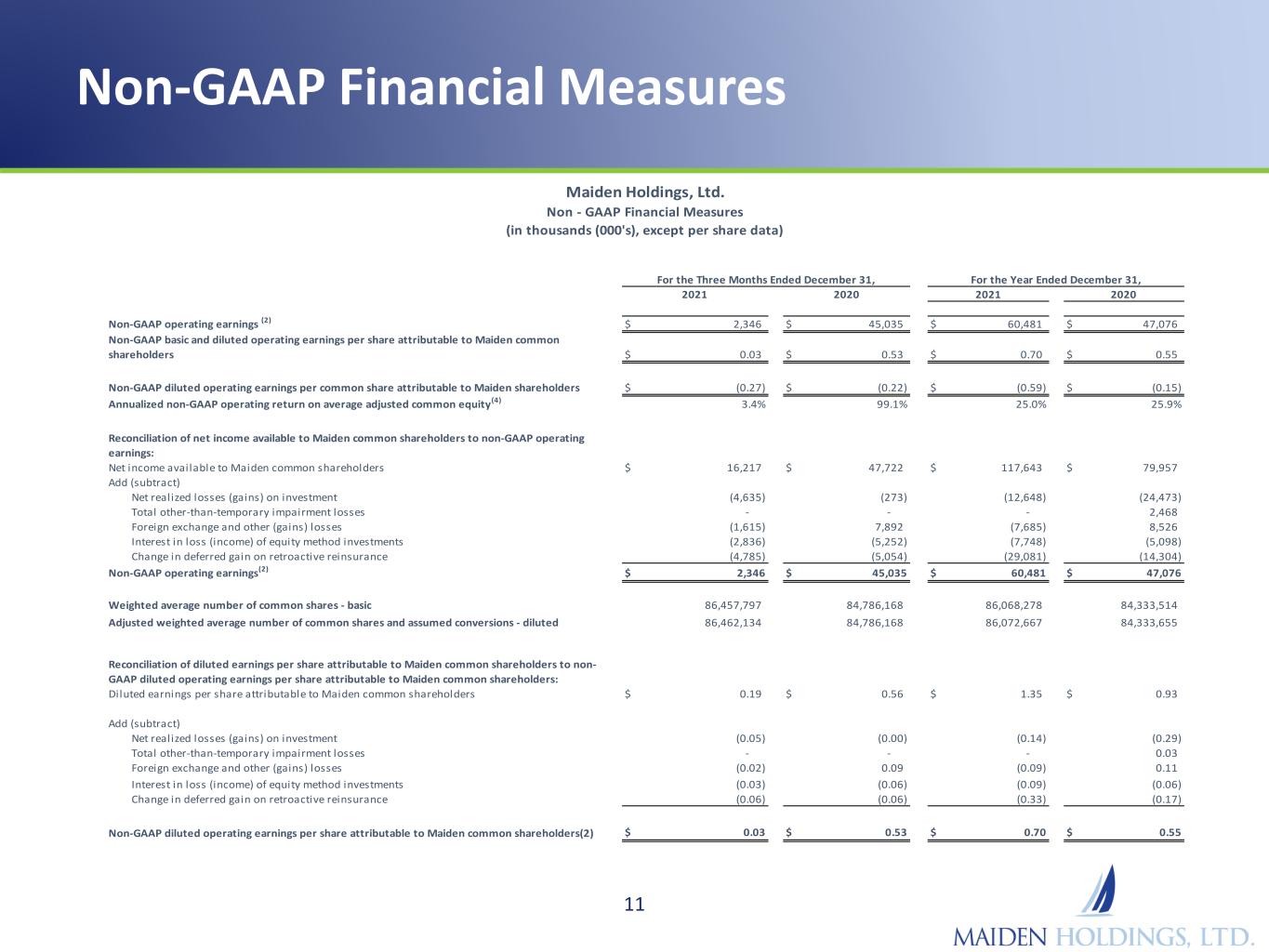

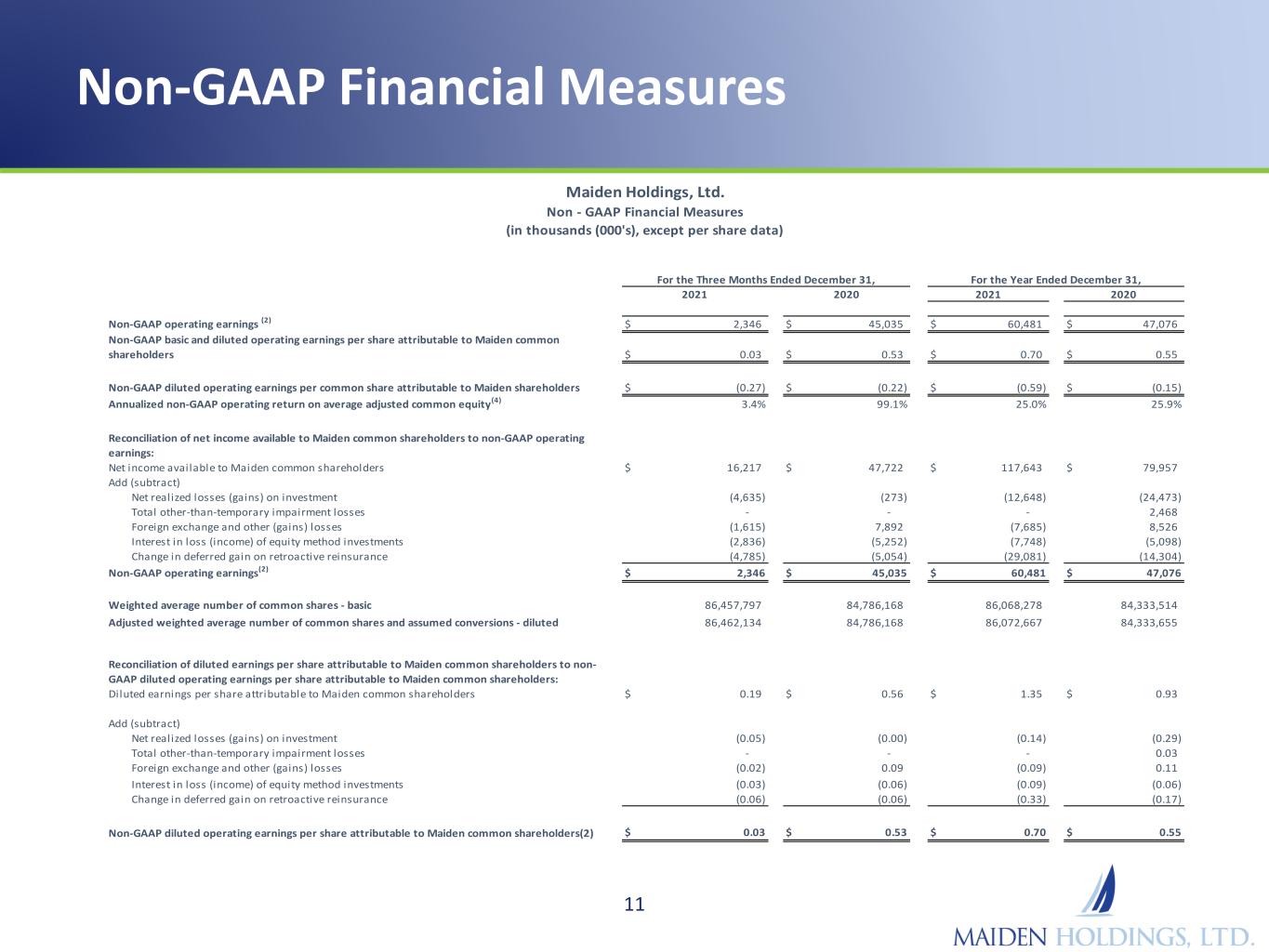

Non-GAAP Financial Measures 11 $ 2,346 $ 45,035 $ 60,481 $ 47,076 $ 0.03 $ 0.53 $ 0.70 $ 0.55 $ (0.27) $ (0.22) $ (0.59) $ (0.15) 3.4% 99.1% 25.0% 25.9% Net income available to Maiden common shareholders $ 16,217 $ 47,722 $ 117,643 $ 79,957 Add (subtract) Net realized losses (gains) on investment (4,635) (273) (12,648) (24,473) Total other-than-temporary impairment losses - - - 2,468 Foreign exchange and other (gains) losses (1,615) 7,892 (7,685) 8,526 Interest in loss (income) of equity method investments (2,836) (5,252) (7,748) (5,098) Change in deferred gain on retroactive reinsurance (4,785) (5,054) (29,081) (14,304) Non-GAAP operating earnings(2) $ 2,346 $ 45,035 $ 60,481 $ 47,076 Weighted average number of common shares - basic 86,457,797 84,786,168 86,068,278 84,333,514 Adjusted weighted average number of common shares and assumed conversions - diluted 86,462,134 84,786,168 86,072,667 84,333,655 Diluted earnings per share attributable to Maiden common shareholders $ 0.19 $ 0.56 $ 1.35 $ 0.93 Add (subtract) Net realized losses (gains) on investment (0.05) (0.00) (0.14) (0.29) Total other-than-temporary impairment losses - - - 0.03 Foreign exchange and other (gains) losses (0.02) 0.09 (0.09) 0.11 Interest in loss (income) of equity method investments (0.03) (0.06) (0.09) (0.06) Change in deferred gain on retroactive reinsurance (0.06) (0.06) (0.33) (0.17) $ 0.03 $ 0.53 $ 0.70 $ 0.55 2021 2020 Non-GAAP operating earnings (2) Non-GAAP diluted operating earnings per common share attributable to Maiden shareholders Annualized non-GAAP operating return on average adjusted common equity(4) Reconciliation of diluted earnings per share attributable to Maiden common shareholders to non- GAAP diluted operating earnings per share attributable to Maiden common shareholders: Reconciliation of net income available to Maiden common shareholders to non-GAAP operating earnings: Non-GAAP diluted operating earnings per share attributable to Maiden common shareholders(2) Non-GAAP basic and diluted operating earnings per share attributable to Maiden common shareholders 2021 2020 For the Year Ended December 31, Maiden Holdings, Ltd. Non - GAAP Financial Measures (in thousands (000's), except per share data) For the Three Months Ended December 31,

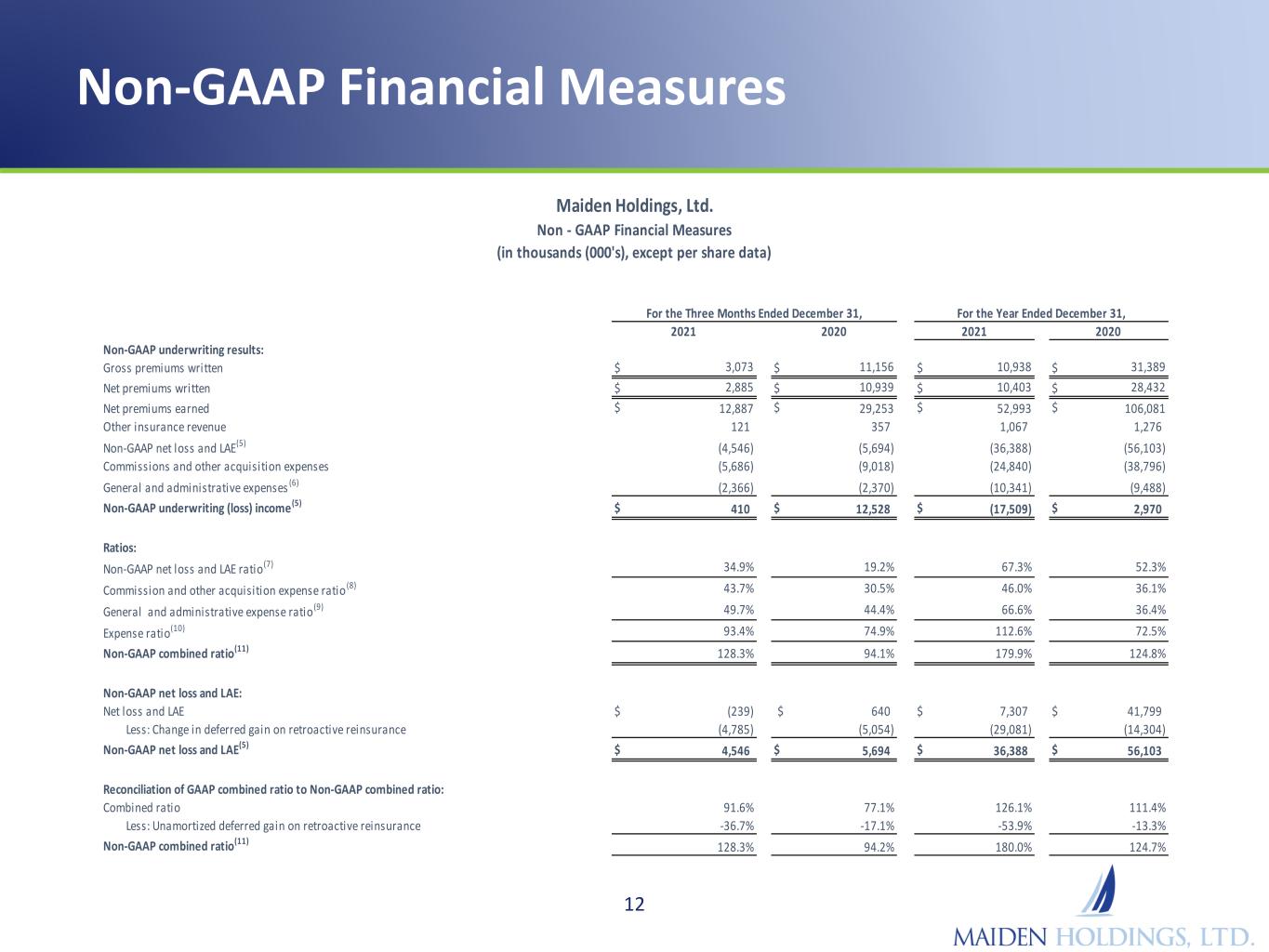

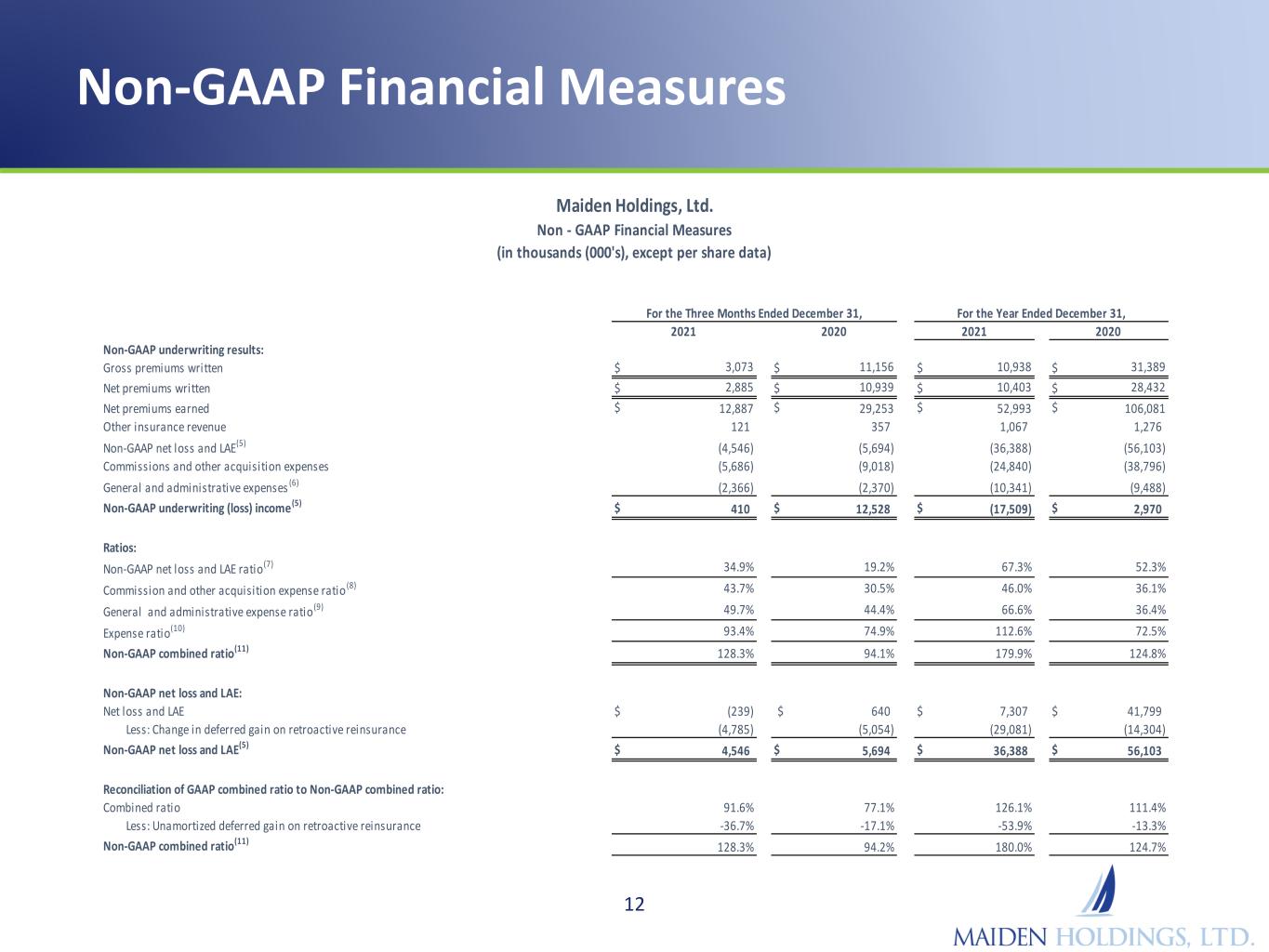

Non-GAAP Financial Measures 12 Non-GAAP underwriting results: Gross premiums written $ 3,073 $ 11,156 $ 10,938 $ 31,389 Net premiums written $ 2,885 $ 10,939 $ 10,403 $ 28,432 Net premiums earned $ 12,887 $ 29,253 $ 52,993 $ 106,081 Other insurance revenue 121 357 1,067 1,276 Non-GAAP net loss and LAE(5) (4,546) (5,694) (36,388) (56,103) Commissions and other acquisition expenses (5,686) (9,018) (24,840) (38,796) General and administrative expenses (6) (2,366) (2,370) (10,341) (9,488) Non-GAAP underwriting (loss) income(5) $ 410 $ 12,528 $ (17,509) $ 2,970 Non-GAAP net loss and LAE ratio(7) 34.9% 19.2% 67.3% 52.3% Commission and other acquisition expense ratio (8) 43.7% 30.5% 46.0% 36.1% General and administrative expense ratio(9) 49.7% 44.4% 66.6% 36.4% Expense ratio(10) 93.4% 74.9% 112.6% 72.5% Non-GAAP combined ratio(11) 128.3% 94.1% 179.9% 124.8% Non-GAAP net loss and LAE: Net loss and LAE $ (239) $ 640 $ 7,307 $ 41,799 Less: Change in deferred gain on retroactive reinsurance (4,785) (5,054) (29,081) (14,304) Non-GAAP net loss and LAE(5) $ 4,546 $ 5,694 $ 36,388 $ 56,103 Combined ratio 91.6% 77.1% 126.1% 111.4% Less: Unamortized deferred gain on retroactive reinsurance -36.7% -17.1% -53.9% -13.3% Non-GAAP combined ratio(11) 128.3% 94.2% 180.0% 124.7% Ratios: 2021 2020 Reconciliation of GAAP combined ratio to Non-GAAP combined ratio: 2021 2020 For the Year Ended December 31, Maiden Holdings, Ltd. Non - GAAP Financial Measures (in thousands (000's), except per share data) For the Three Months Ended December 31,

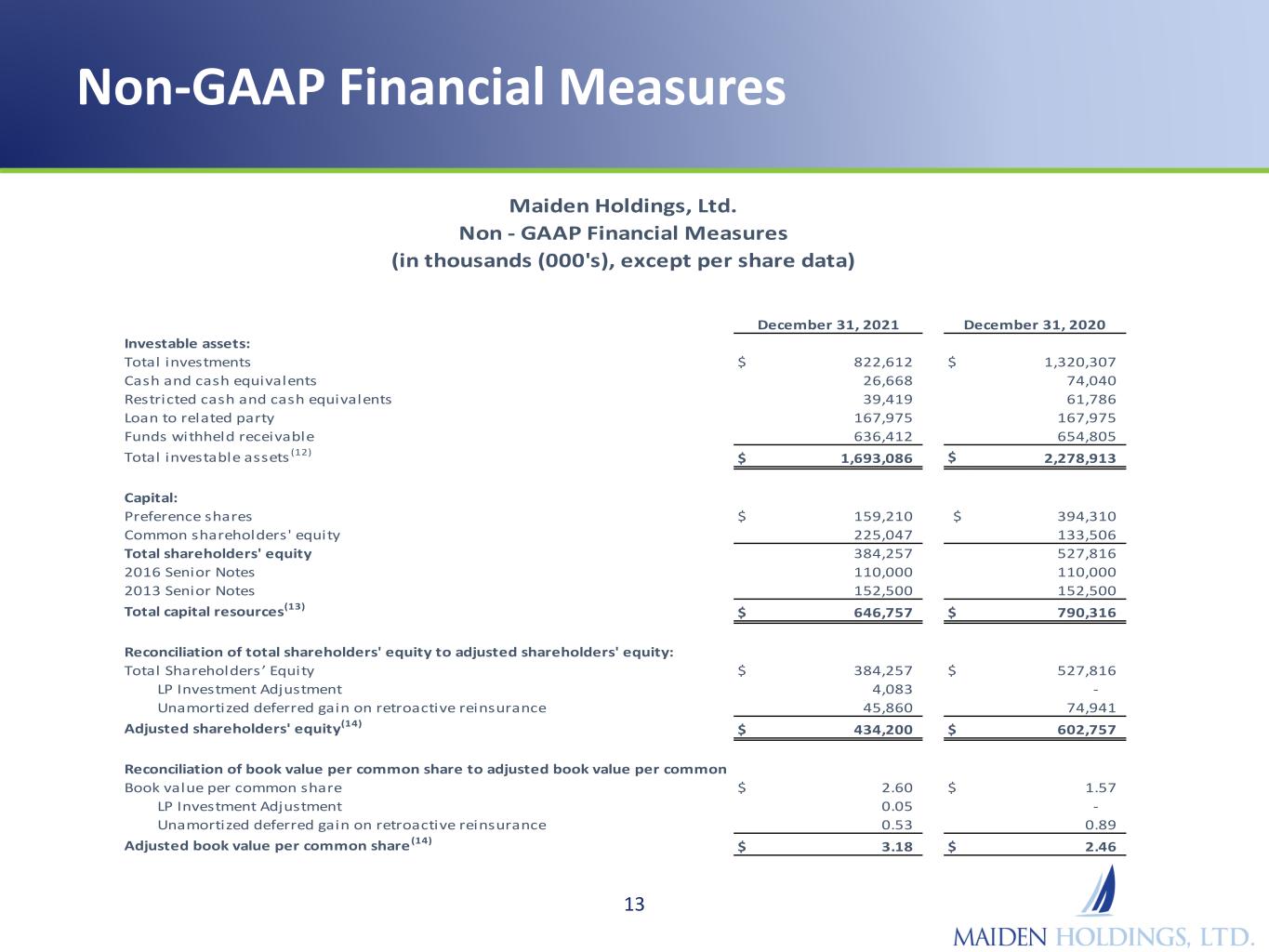

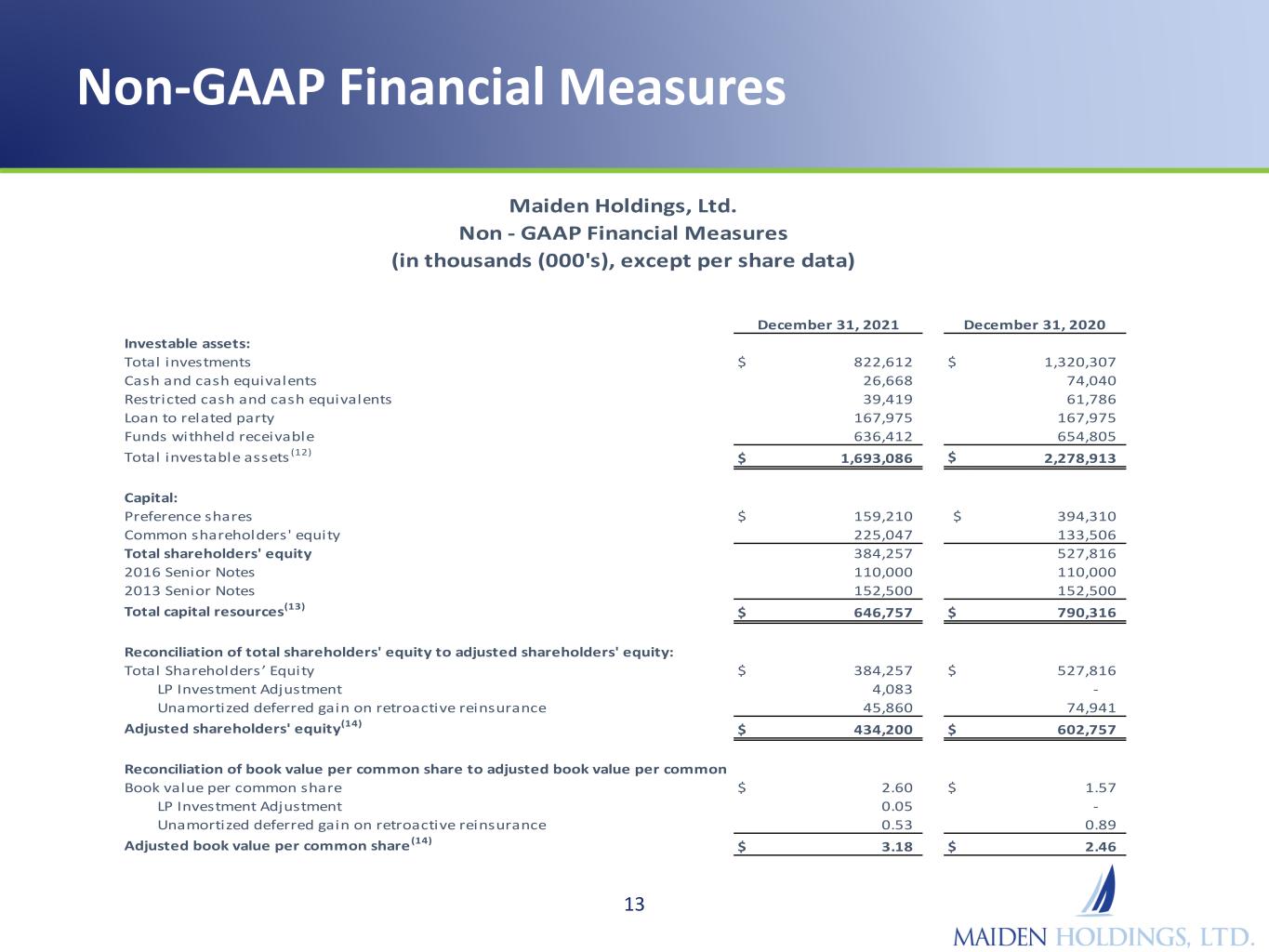

Non-GAAP Financial Measures 13 Investable assets: Total investments $ 822,612 $ 1,320,307 Cash and cash equivalents 26,668 74,040 Restricted cash and cash equivalents 39,419 61,786 Loan to related party 167,975 167,975 Funds withheld receivable 636,412 654,805 Total investable assets (12) $ 1,693,086 $ 2,278,913 Capital: Preference shares $ 159,210 $ 394,310 Common shareholders' equity 225,047 133,506 Total shareholders' equity 384,257 527,816 2016 Senior Notes 110,000 110,000 2013 Senior Notes 152,500 152,500 Total capital resources(13) $ 646,757 $ 790,316 Total Shareholders ’ Equity $ 384,257 $ 527,816 LP Investment Adjustment 4,083 - Unamortized deferred gain on retroactive reinsurance 45,860 74,941 Adjusted shareholders' equity(14) $ 434,200 $ 602,757 Book value per common share $ 2.60 $ 1.57 LP Investment Adjustment 0.05 - Unamortized deferred gain on retroactive reinsurance 0.53 0.89 Adjusted book value per common share (14) $ 3.18 $ 2.46 Reconciliation of total shareholders' equity to adjusted shareholders' equity: Reconciliation of book value per common share to adjusted book value per common December 31, 2021 December 31, 2020 Maiden Holdings, Ltd. Non - GAAP Financial Measures (in thousands (000's), except per share data)

Non-GAAP Financial Measures 14 (3) Return on average common equity is a non-GAAP financial measure. Management uses return on average common equity as a measure of profitability that focuses on the return to common shareholders. It is calculated using net income available to Maiden common shareholders divided by average common shareholders' equity. (1) Book value per common share is calculated using common shareholders’ equity (shareholders' equity excluding the aggregate liquidation value of our preference shares) divided by the number of common shares outstanding. Management uses growth in this metric as a prime measure of the value we are generating for our common shareholders, because management believes that growth in this metric ultimately results in growth in the Company’s common share price. This metric is impacted by the Company’s net income and external factors, such as interest rates, which can drive changes in unrealized gains or losses on our investment portfolio, as well as share repurchases. (4) Non-GAAP operating return on average common equity is a non-GAAP financial measure. Management uses non-GAAP operating return on average adjusted common shareholders' equity as a measure of profitability that focuses on the return to common shareholders. It is calculated using non-GAAP operating earnings divided by average adjusted common shareholders' equity. (2) Non-GAAP operating earnings and non-GAAP basic and diluted operating earnings per common share are non-GAAP financial measure defined by the Company as net income excluding realized investment gains and losses, total other-than-temporary impairment losses, foreign exchange and other gains and losses, interest in income of equity method investments and the change in deferred gain on retroactive reinsurance and should not be considered as an alternative to net income (loss). The Company's management believes that the use of non-GAAP operating earnings and non-GAAP diluted operating earnings per common share enables investors and other users of the Company’s financial information to analyze its performance in a manner similar to how management analyzes performance. Management also believes that these measures generally follow industry practice therefore allowing the users of financial information to compare the Company’s performance with its industry peer group, and that the equity analysts and certain rating agencies which follow the Company, and the insurance industry as a whole, generally exclude these items from their analyses for the same reasons. Non-GAAP operating earnings should not be viewed as a substitute for U.S. GAAP net income.

Non-GAAP Financial Measures 15 (5) Non-GAAP net loss and LAE and Non-GAAP underwriting income (loss): Management has further adjusted the net loss and LAE and underwriting income (loss) by recognizing into income the unamortized deferred gain arising from the LPT/ADC Agreement relating to losses subject to that agreement. The deferred gain represents amounts estimated to be fully recoverable from Cavello and management believes adjusting for this shows the ultimate economic benefit of the LPT/ADC Agreement on Maiden's underwriting income (loss). Management believes reflecting the economic benefit of this retroactive reinsurance agreement is helpful for understanding future trends in our operations. (6) Underwriting related general and administrative expenses is a non-GAAP measure and includes expenses which are segregated for analytical purposes as a component of underwriting loss. (7) Calculated by dividing Non-GAAP net loss and loss adjustment expenses by the sum of net premiums earned and other insurance revenue. (8) Calculated by dividing commission and other acquisition expenses by the sum of net premiums earned and other insurance revenue. (9) Calculated by dividing general and administrative expenses by the sum of net premiums earned and other insurance revenue. (13) Total capital resources is the sum of the Company's principal amount of debt and shareholders' equity. (10) Calculated by adding together the commission and other acquisition expense ratio and general and administrative expense ratio. (11) Calculated by adding together the non-GAAP net loss and loss adjustment expense ratio and expense ratio. (12) Investable assets is the total of the Company's investments, cash and cash equivalents, loan to a related party and funds withheld

Non-GAAP Financial Measures 16 (16) Underwriting income is a non-GAAP measure and is calculated as net premiums earned plus other insurance revenue less net loss and LAE, commission and other acquisition expenses and general and administrative expenses directly related to underwriting activities. For purposes of these non-GAAP operating measures, the fee-generating business which is included in our Diversified Reinsurance segment, is considered part of the underwriting operations of the Company. Management believes that this measure is important in evaluating the underwriting performance of the Company and its segments. This measure is also a useful tool to measure the profitability of the Company separately from the investment results and is also a widely used performance indicator in the insurance industry. (15) Alternative investments is the total of the Company’s investment in equity securities, equity method investments and other investments. (14) Adjusted Total Shareholders' Equity and Adjusted Book Value per Common Share: Management has adjusted GAAP shareholders' equity by adding the following items: 1) the unamortized deferred gain on retroactive reinsurance arising from LPT/ADC Agreement; and 2) an adjustment which reflects the equity method accounting related to the fair value of certain hedged liabilities within an equity method investment in a limited partnership held by the Company wherein the ultimate realizable value of the asset supporting the hedged liabilities cannot currently be recognized at fair value. As a result, by virtue of this adjustment, management has also computed the Adjusted Book Value per Common Share. The deferred gain on retroactive reinsurance represents amounts estimated to be fully recoverable from Cavello and management believes adjusting for this shows the ultimate economic benefit of the LPT/ADC Agreement. The LP Investment Adjustment reflects the fair value of the assets not presently able to be recognized currently. We believe reflecting the economic benefit of both items is helpful to understand future trends in our operations, which will improve the Company's shareholders' equity over the settlement or contract periods, respectively.