Maiden Holdings, Ltd. Investor Update May 2022

Investor Disclosures 1 Forward Looking Statements This presentation contains "forward-looking statements" which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on the Maiden Holdings, Ltd.’s (the “Company”) concerning future developments and their potential effects on the Company. There can be no assurance that actual developments will be those anticipated by the Company. Actual results may differ materially from those projected as a result of significant risks and uncertainties, including non-receipt of the expected payments, changes in interest rates, effect of the performance of financial markets on investment income and fair values of investments, developments of claims and the effect on loss reserves, accuracy in projecting loss reserves, the impact of competition and pricing environments, changes in the demand for the Company's products, the effect of general economic conditions and unusual frequency of storm activity, adverse state and federal legislation, regulations and regulatory investigations into industry practices, developments relating to existing agreements, heightened competition, changes in pricing environments, and changes in asset valuations. Additional information about these risks and uncertainties, as well as others that may cause actual results to differ materially from those projected is contained in Item 1A. Risk Factors in the Company's Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC. The Company undertakes no obligation to publicly update any forward-looking statements, except as may be required by law. Any discrepancies between the amounts included in this presentation and amounts included in the Company’s Form 10-Q for the three months ended March 31, 2022, filed with the SEC are due to rounding. Non-GAAP Financial Measures In addition to the Summary Consolidated Balance Sheets and Consolidated Statements of Income, management uses certain key financial measures, some of which are non-GAAP measures, to evaluate the Company's financial performance and the overall growth in value generated for the Company’s common shareholders. Management believes that these measures, which may be defined differently by other companies, explain the Company’s results to investors in a manner that allows for a more complete understanding of the underlying trends in the Company’s business. The non-GAAP measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. See the Appendix of this presentation for a reconciliation of the Company’s non-GAAP measures to the nearest GAAP measure.

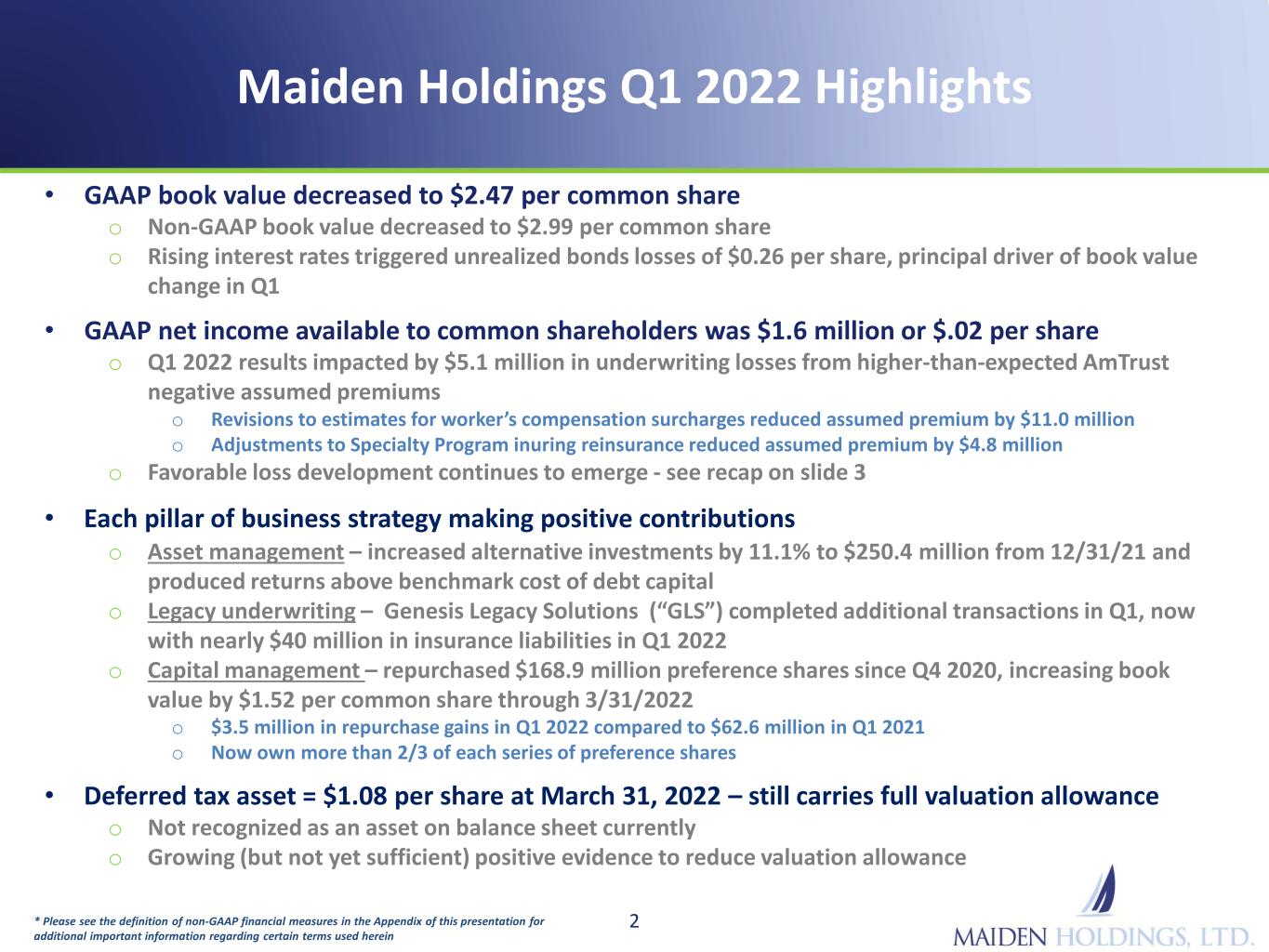

Maiden Holdings Q1 2022 Highlights 2 • GAAP book value decreased to $2.47 per common share o Non-GAAP book value decreased to $2.99 per common share o Rising interest rates triggered unrealized bonds losses of $0.26 per share, principal driver of book value change in Q1 • GAAP net income available to common shareholders was $1.6 million or $.02 per share o Q1 2022 results impacted by $5.1 million in underwriting losses from higher-than-expected AmTrust negative assumed premiums o Revisions to estimates for worker’s compensation surcharges reduced assumed premium by $11.0 million o Adjustments to Specialty Program inuring reinsurance reduced assumed premium by $4.8 million o Favorable loss development continues to emerge - see recap on slide 3 • Each pillar of business strategy making positive contributions o Asset management – increased alternative investments by 11.1% to $250.4 million from 12/31/21 and produced returns above benchmark cost of debt capital o Legacy underwriting – Genesis Legacy Solutions (“GLS”) completed additional transactions in Q1, now with nearly $40 million in insurance liabilities in Q1 2022 o Capital management – repurchased $168.9 million preference shares since Q4 2020, increasing book value by $1.52 per common share through 3/31/2022 o $3.5 million in repurchase gains in Q1 2022 compared to $62.6 million in Q1 2021 o Now own more than 2/3 of each series of preference shares • Deferred tax asset = $1.08 per share at March 31, 2022 – still carries full valuation allowance o Not recognized as an asset on balance sheet currently o Growing (but not yet sufficient) positive evidence to reduce valuation allowance * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein

Maiden Holdings – Q1 2022 Results Recap 3* Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein ($ millions, except per share amounts) Q1 2022 Q1 2021 Comments Net Income and Per Share Data GAAP Net Income Attributable to Common Shares Per common share $1.6 $0.02 $71.7 $0.83 • Net income attributable to Maiden common shareholders in Q1 2022 includes $3.5 million of gains from partial redemption of preference shares, significantly down from $62.5 million in Q1 2021 • Summary GAAP Balance Sheet, Income Statement and Non-GAAP Financial Measures in Appendix GAAP Net (Loss) Income (excluding gains from preference share repurchases) $(1.9) $9.3 • Q1 2022 underwriting loss, lower investment results and higher tax expense partially offset by lower operating expenses and higher foreign exchange and other gains Key Income Statement Details Underwriting (Loss) Income $(1.7) $1.5 • Underwriting results in Q1 2022 impacted by negative premiums on AmTrust of $14.9 million compared to $2.5 million in Q1 2021 and produced underwriting loss of $5.1 million • Negative AmTrust premiums in Q1 2022 arose from Adjustments and reversals of Audit Non-Compliance (“ANC”) surcharges on WC policies Adjustments to inuring reinsurance on Specialty Program business • Prior year favorable development continue to emerge at $7.3 million in Q1 2022 compared to $5.6 million in Q1 2021 Investment Results $10.1 $20.9 • Lower investment income of $6.6 million in Q1 2022 compared to $9.8 million in Q1 2021 due to lower investable assets • Realized gains of $2.3 million in Q1 2022 attributable to sale of fixed income securities and other investments compared to $8.1 million in Q1 2021 • Income on equity method investments was $1.3 million in Q1 2022 vs. $2.9 million in Q1 2021 Operating Expenses $10.9 $14.0 • Operating expenses continued to trend lower as G&A expenses decreased by $3.1 million, or 22.2% in Q1 2022 vs. Q1 2021 due to lower discretionary incentive compensation • Excluding discretionary incentive compensation expenses (cash and equity), operating expenses were $6.5 million in Q1 2022 or 19% lower compared to $8.0 million in Q1 2021 Foreign Exchange and Other Gains $3.9 $3.5 • Primarily due to reserve revaluation due to strengthening of U.S. dollar relative to Euro and British pound

Maiden Holdings Business Strategy 4 • We create shareholder value by actively managing and allocating our assets and capital o We leverage our deep knowledge of the insurance and related financial services industries into ownership and management of businesses and assets with the opportunity for increased returns o Change in strategy since 2019 has allowed us to more flexibly allocate capital to activities we believe will produce the greatest returns for our common shareholders • Our strategy has three principal areas of focus o Asset management – investing in assets and asset classes in a prudent but expansive manner in order to maximize investment returns o We limit the insurance risk we assume relative to the assets we hold and maintain required regulatory capital at very strong levels to manage our aggregate risk profile o Legacy underwriting - judiciously building a portfolio of run-off acquisitions and retroactive reinsurance transactions which we believe will produce attractive underwriting returns o Capital management - effectively managing capital and when appropriate, repurchasing securities or returning capital to enhance common shareholder returns • We believe these areas of strategic focus will enhance our profitability o We believe our strategy increases the likelihood of fully utilizing the significant tax NOL carryforwards which would create additional common shareholder value o Expected returns from each strategic pillar are evaluated relative to our cost of debt capital

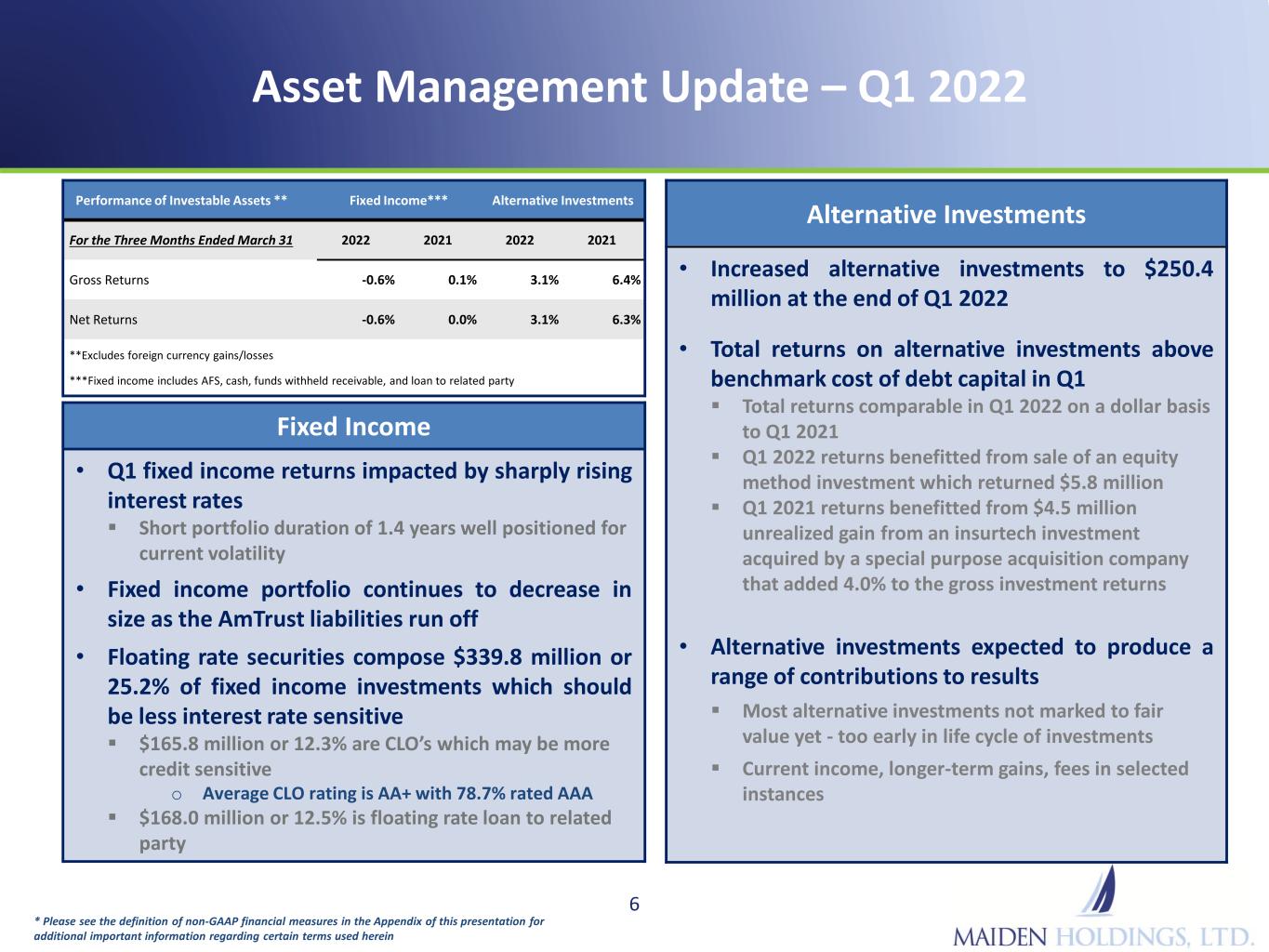

Asset Management Update – Q1 2022 5 * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein Investable Assets 31-Mar-22 31-Dec-21 Q1 Change AFS & cash $543,116 $663,232 $(120,116) Loan to related party 167,975 167,975 - Funds withheld receivable 634,898 636,412 (1,514) Total Fixed Income $1,345,989 $1,467,619 $(121,630) Alternative Investments** Private Equity $57,226 $48,496 $8,770 Private Credit 42,345 38,657 3,689 Hedge Funds 32,861 32,929 (68) Alternatives 51,220 46,489 4,731 Venture Capital 7,007 7,344 (337) Real Estate 59,710 51,551 8,159 Total Alternative Investments $250,410 $225,467 $24,943 Total Investable Assets $1,596,399 $1,693,086 $(96,687) ** Alternative investments categories presented based on underlying risk exposure and not according to financial reporting classifications as shown in the 10-Q Total fixed income and cash, 34% Loan to related party, 10% Funds withheld receivable, 40% Alternative Investments, 16% Q1 2022 - Investable Assets Allocation Private Equity, 23% Private Credit, 17% Hedge Funds, 13% Alternatives, 20% Venture Capital, 3% Real Estate, 24% Q1 2022 - Alternative Investments

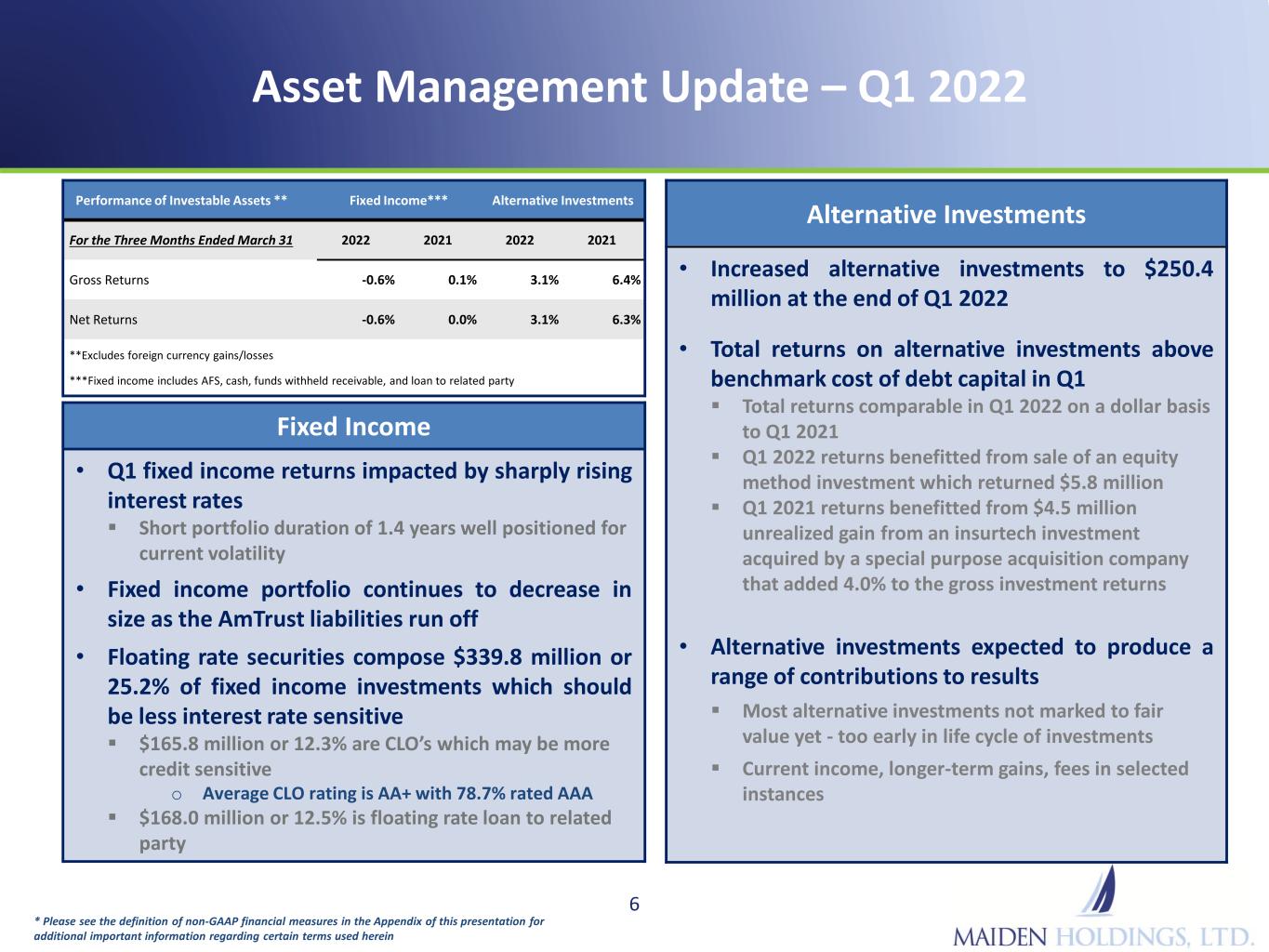

Asset Management Update – Q1 2022 6 * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein Performance of Investable Assets ** Fixed Income*** Alternative Investments For the Three Months Ended March 31 2022 2021 2022 2021 Gross Returns -0.6% 0.1% 3.1% 6.4% Net Returns -0.6% 0.0% 3.1% 6.3% **Excludes foreign currency gains/losses ***Fixed income includes AFS, cash, funds withheld receivable, and loan to related party Alternative Investments • Increased alternative investments to $250.4 million at the end of Q1 2022 • Total returns on alternative investments above benchmark cost of debt capital in Q1 Total returns comparable in Q1 2022 on a dollar basis to Q1 2021 Q1 2022 returns benefitted from sale of an equity method investment which returned $5.8 million Q1 2021 returns benefitted from $4.5 million unrealized gain from an insurtech investment acquired by a special purpose acquisition company that added 4.0% to the gross investment returns • Alternative investments expected to produce a range of contributions to results Most alternative investments not marked to fair value yet - too early in life cycle of investments Current income, longer-term gains, fees in selected instances Fixed Income • Q1 fixed income returns impacted by sharply rising interest rates Short portfolio duration of 1.4 years well positioned for current volatility • Fixed income portfolio continues to decrease in size as the AmTrust liabilities run off • Floating rate securities compose $339.8 million or 25.2% of fixed income investments which should be less interest rate sensitive $165.8 million or 12.3% are CLO’s which may be more credit sensitive o Average CLO rating is AA+ with 78.7% rated AAA $168.0 million or 12.5% is floating rate loan to related party

Legacy Underwriting Update 7 • GLS formed in November 2020 • GLS insurance liabilities currently $37.1 million at 3/31/2022 • GLS continues to complete additional transactions, primarily retroactive reinsurance transactions • Robust pipeline for additional transactions consistent with business plan currently include • Retroactive reinsurance transactions • Balance sheet acquisitions • Fee for service arrangements

Capital Management Update – Q1 2022 8 • Active Capital Management Continued in Q1 2022 o 12,506,468 preferred shares repurchased since launch of tender offer in 2020 and repurchase program in 2021 and Q1 2022, adding $1.52 in book value per common share o During Q1 2022, Maiden Reinsurance Ltd. (“MRL”) repurchased 274,861 preferred shares at an average cost of $11.27 per share for a total cost of $3.1 million resulting in a gain of $3.5 million o $10.7 million of unutilized authorization remaining as of March 31, 2022 • MRL’s ownership percentage of each series of preferred shares as follows Series % Owned Series A 67.7% Series C 66.8% Series D 67.2% Total 67.2% • Maiden is actively evaluating its capital management options as its broader strategy progresses * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein

Maiden Holdings, Ltd. Investor Update - Appendix First Quarter Ended March 31, 2022 Financial Data

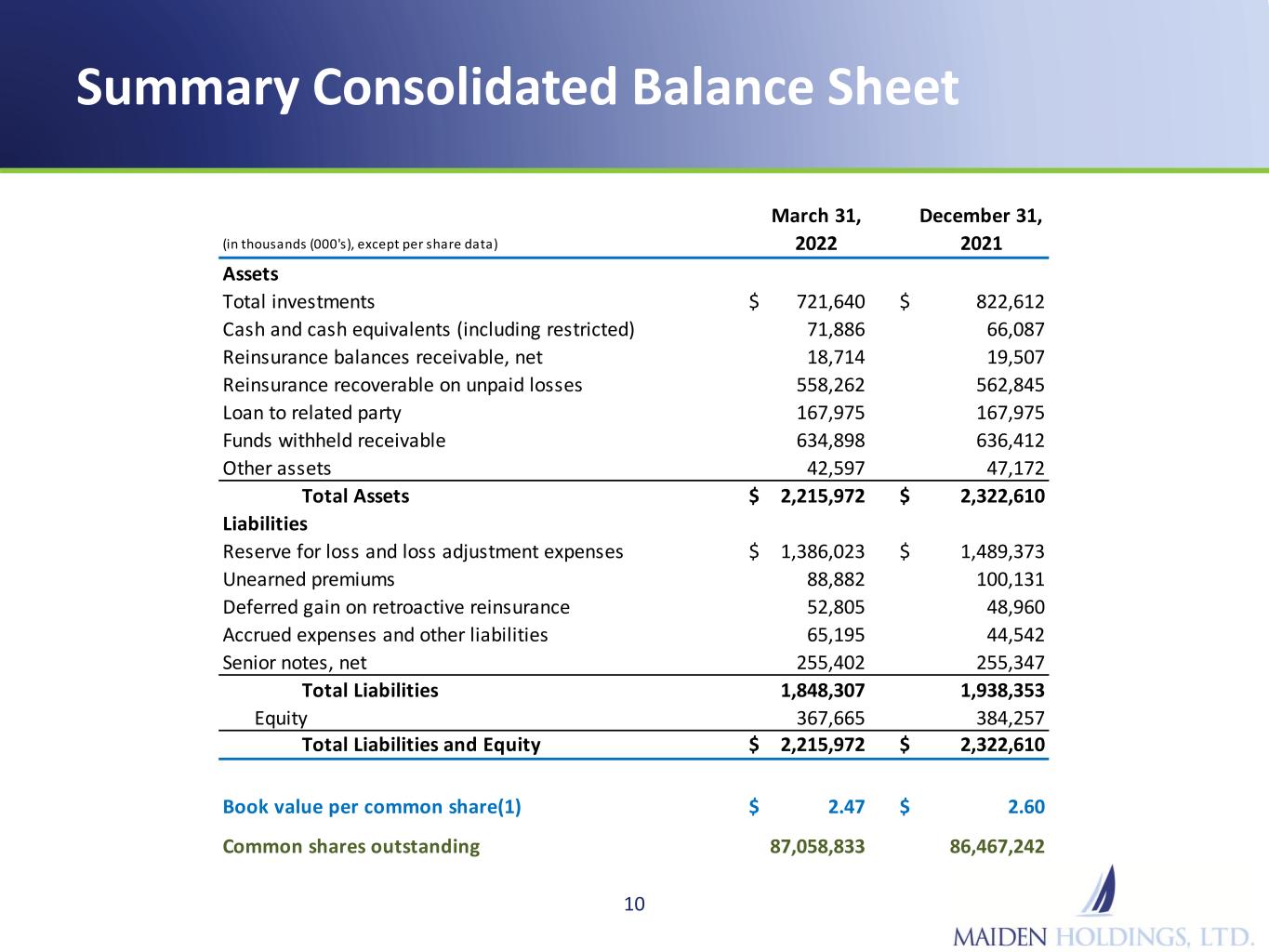

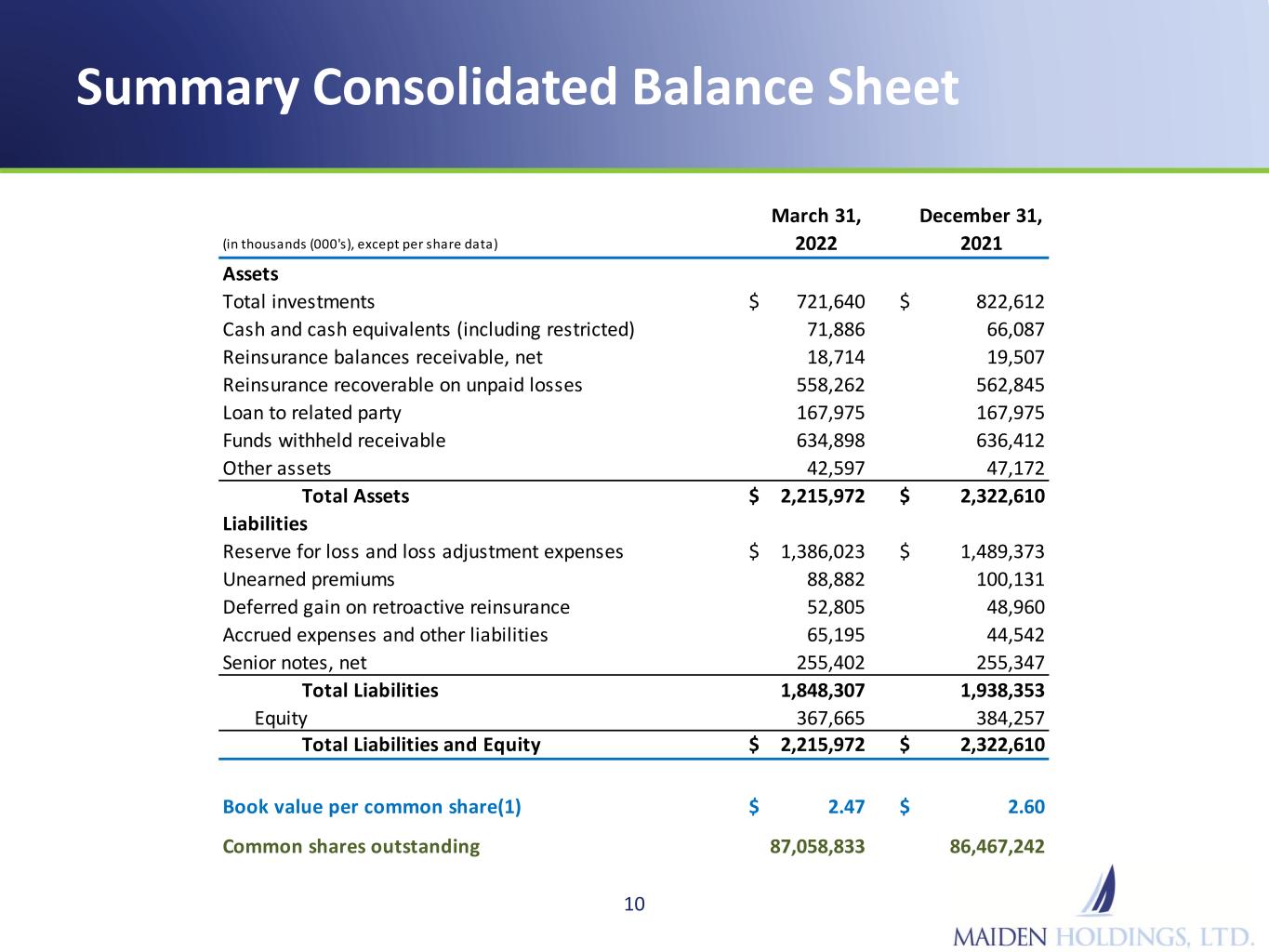

Summary Consolidated Balance Sheet 10 (in thousands (000's), except per share data) March 31, 2022 December 31, 2021 Assets Total investments $ 721,640 $ 822,612 Cash and cash equivalents (including restricted) 71,886 66,087 Reinsurance balances receivable, net 18,714 19,507 Reinsurance recoverable on unpaid losses 558,262 562,845 Loan to related party 167,975 167,975 Funds withheld receivable 634,898 636,412 Other assets 42,597 47,172 Total Assets $ 2,215,972 $ 2,322,610 Liabilities Reserve for loss and loss adjustment expenses $ 1,386,023 $ 1,489,373 Unearned premiums 88,882 100,131 Deferred gain on retroactive reinsurance 52,805 48,960 Accrued expenses and other liabilities 65,195 44,542 Senior notes, net 255,402 255,347 Total Liabilities 1,848,307 1,938,353 Equity 367,665 384,257 Total Liabilities and Equity $ 2,215,972 $ 2,322,610 Book value per common share(1) $ 2.47 $ 2.60 Common shares outstanding 87,058,833 86,467,242

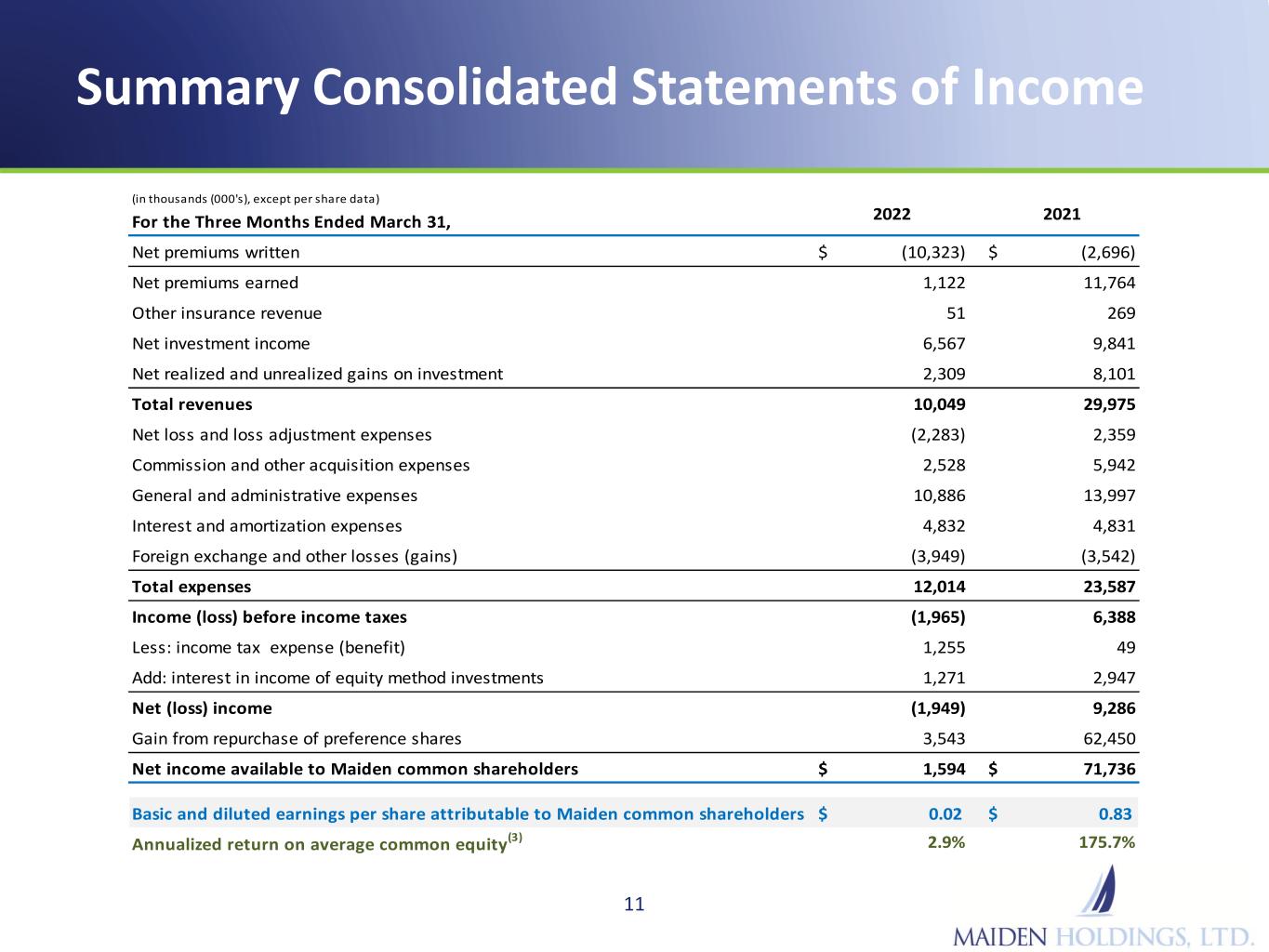

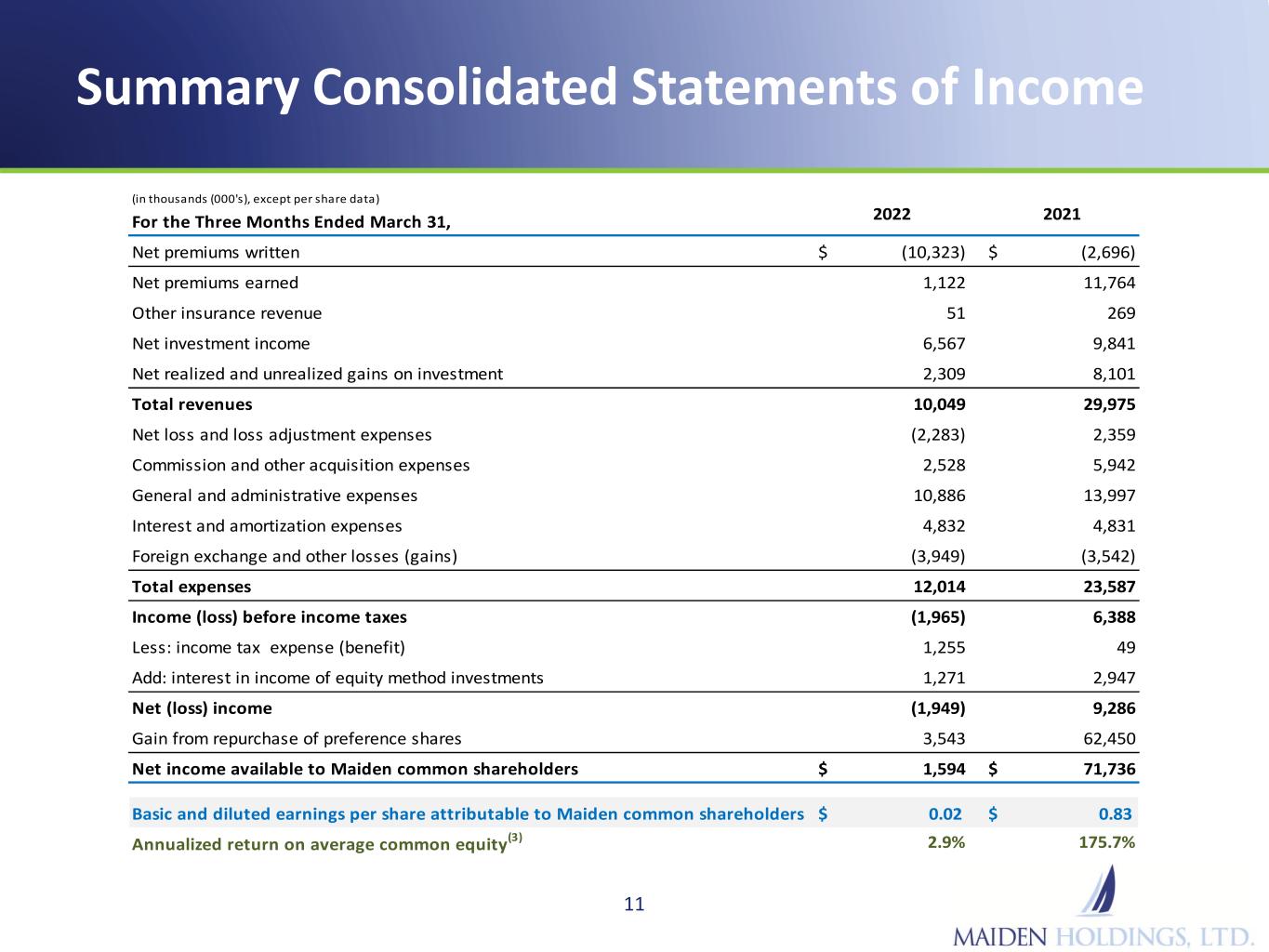

Summary Consolidated Statements of Income 11 (in thousands (000's), except per share data) For the Three Months Ended March 31, Net premiums written $ (10,323) $ (2,696) Net premiums earned 1,122 11,764 Other insurance revenue 51 269 Net investment income 6,567 9,841 Net realized and unrealized gains on investment 2,309 8,101 Total revenues 10,049 29,975 Net loss and loss adjustment expenses (2,283) 2,359 Commission and other acquisition expenses 2,528 5,942 General and administrative expenses 10,886 13,997 Interest and amortization expenses 4,832 4,831 Foreign exchange and other losses (gains) (3,949) (3,542) Total expenses 12,014 23,587 Income (loss) before income taxes (1,965) 6,388 Less: income tax expense (benefit) 1,255 49 Add: interest in income of equity method investments 1,271 2,947 Net (loss) income (1,949) 9,286 Gain from repurchase of preference shares 3,543 62,450 Net income available to Maiden common shareholders $ 1,594 $ 71,736 Basic and diluted earnings per share attributable to Maiden common shareholders $ 0.02 $ 0.83 Annualized return on average common equity(3) 2.9% 175.7% 2022 2021

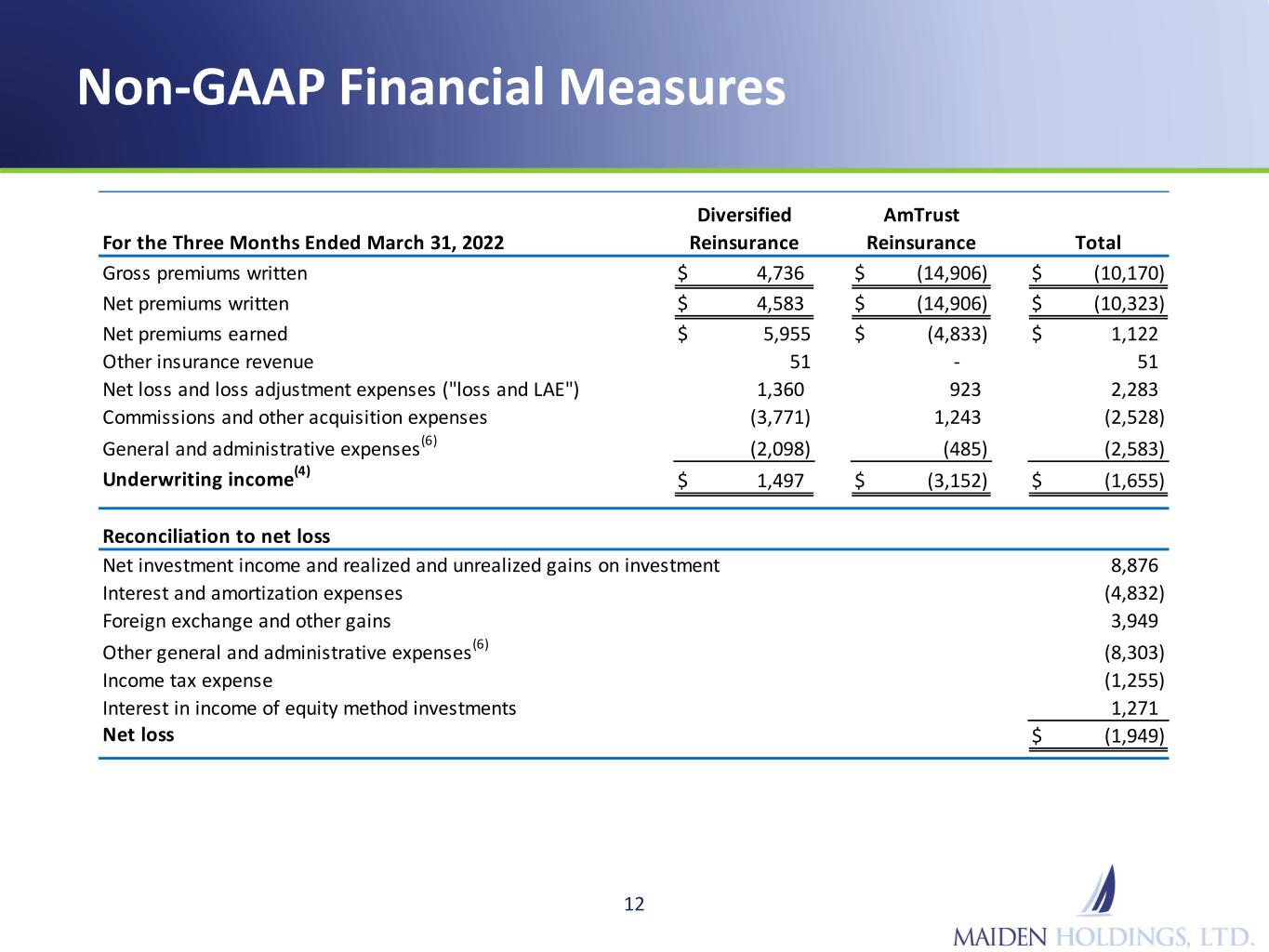

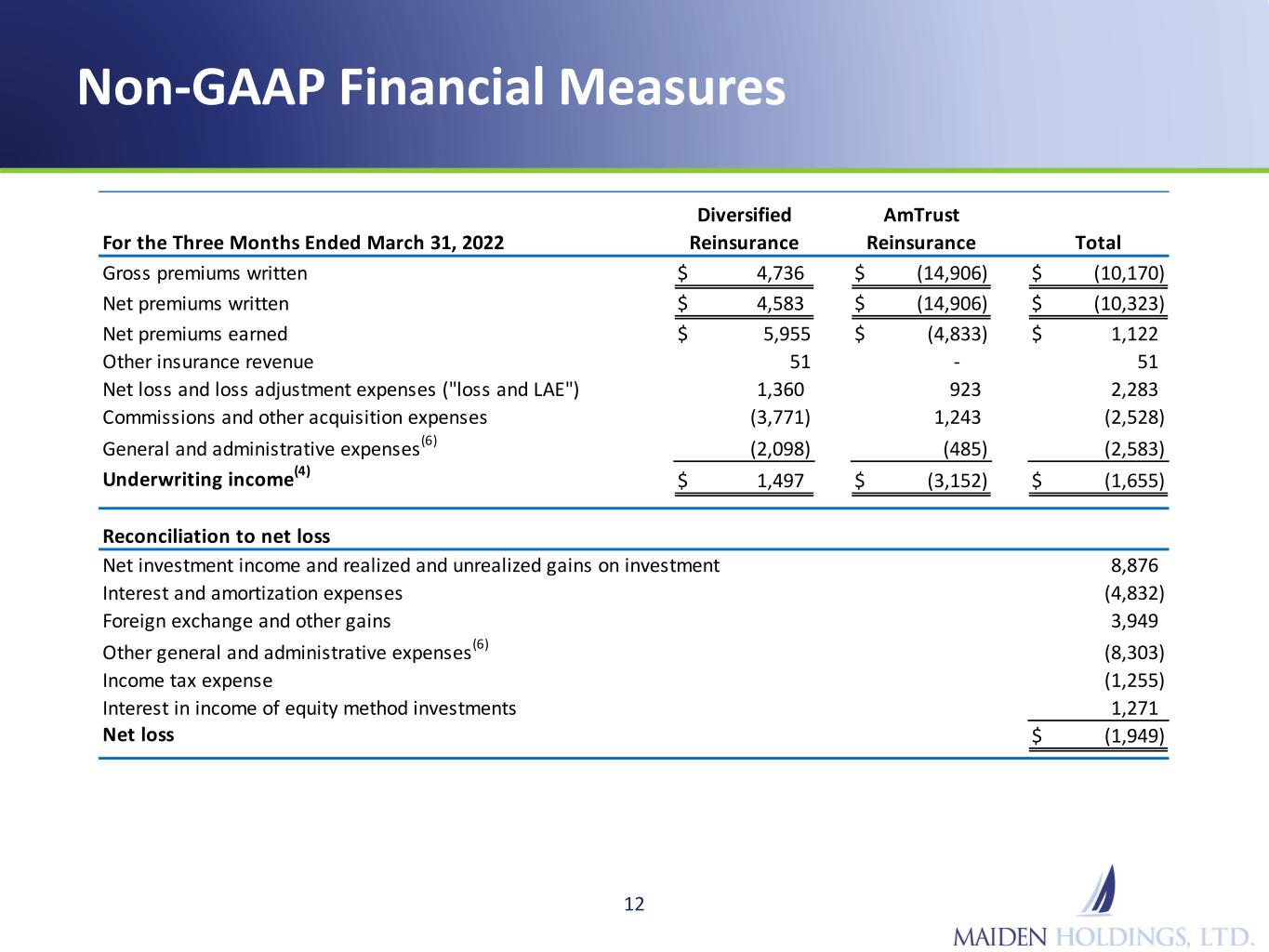

Non-GAAP Financial Measures 12 For the Three Months Ended March 31, 2022 Gross premiums written $ 4,736 $ (14,906) $ (10,170) Net premiums written $ 4,583 $ (14,906) $ (10,323) Net premiums earned $ 5,955 $ (4,833) $ 1,122 Other insurance revenue 51 - 51 Net loss and loss adjustment expenses ("loss and LAE") 1,360 923 2,283 Commissions and other acquisition expenses (3,771) 1,243 (2,528) General and administrative expenses(6) (2,098) (485) (2,583) Underwriting income(4) $ 1,497 $ (3,152) $ (1,655) Reconciliation to net loss Net investment income and realized and unrealized gains on investment 8,876 Interest and amortization expenses (4,832) Foreign exchange and other gains 3,949 Other general and administrative expenses(6) (8,303) Income tax expense (1,255) Interest in income of equity method investments 1,271 Net loss $ (1,949) Total Diversified Reinsurance AmTrust Reinsurance

Non-GAAP Financial Measures 13 For the Three Months Ended March 31, 2021 Gross premiums written $ 72 $ (2,462) $ (2,390) Net premiums written $ (234) $ (2,462) $ (2,696) Net premiums earned $ 6,240 $ 5,524 $ 11,764 Other insurance revenue 269 - 269 Net loss and LAE (1,415) (944) (2,359) Commissions and other acquisition expenses (3,755) (2,187) (5,942) General and administrative expenses(6) (1,574) (603) (2,177) Underwriting income(4) $ (235) $ 1,790 $ 1,555 Reconciliation to net income Net investment income and realized and unrealized gains on investment 17,942 Interest and amortization expenses (4,831) Foreign exchange and other gains 3,542 Other general and administrative expenses(6) (11,820) Income tax expense (49) Interest in income of equity method investments 2,947 Net income $ 9,286 Diversified Reinsurance AmTrust Reinsurance Total

Non-GAAP Financial Measures 14 $ (6,935) $ 47,301 $ (0.08) $ 0.55 -10.4% 81.4% Net income available to Maiden common shareholders $ 1,594 $ 71,736 Add (subtract) Net realized losses (gains) on investment (2,309) (8,101) Foreign exchange and other (gains) losses (3,949) (3,542) Interest in loss (income) of equity method investments (1,271) (2,947) Change in deferred gain on retroactive reinsurance (1,000) (9,845) Non-GAAP operating (losses) earnings(2) $ (6,935) $ 47,301 Weighted average number of common shares - basic 86,547,173 85,132,939 Adjusted weighted average number of common shares and assumed conversions - diluted 86,547,173 85,136,888 Diluted earnings per share attributable to Maiden common shareholders $ 0.02 $ 0.83 Add (subtract) Net realized losses (gains) on investment (0.03) (0.09) Foreign exchange and other (gains) losses (0.05) (0.04) Interest in loss (income) of equity method investments (0.01) (0.03) Change in deferred gain on retroactive reinsurance (0.01) (0.12) $ (0.08) $ 0.55 For the Three Months Ended March 31, Reconciliation of net income available to Maiden common shareholders to non-GAAP operating (losses) earnings: Reconciliation of diluted EPS attributable to Maiden common shareholders to non-GAAP diluted operating (losses) EPS attributable to Maiden common shareholders: Non-GAAP basic and diluted operating (losses) earnings per share attributable to Maiden common shareholders(2) Annualized non-GAAP operating return on average adjusted common equity(10) Non-GAAP diluted operating (losses) earnings per share attributable to Maiden common shareholders 2022 2021 Non-GAAP operating (losses) earnings(2)

Non-GAAP Financial Measures 15 Non-GAAP underwriting results: Gross premiums written $ (10,170) $ (2,390) Net premiums written $ (10,323) $ (2,696) Net premiums earned $ 1,122 $ 11,764 Other insurance revenue 51 269 Non-GAAP net loss and LAE(5) 1,283 (12,204) Commissions and other acquisition expenses (2,528) (5,942) General and administrative expenses(6) (2,583) (2,177) Non-GAAP underwriting loss(5) $ (2,655) $ (8,290) Non-GAAP net loss and LAE: Net loss and LAE $ (2,283) $ 2,359 Less: Change in deferred gain on retroactive reinsurance (1,000) (9,845) Non-GAAP net loss and LAE(5) $ (1,283) $ 12,204 For the Three Months Ended March 31, 2022 2021

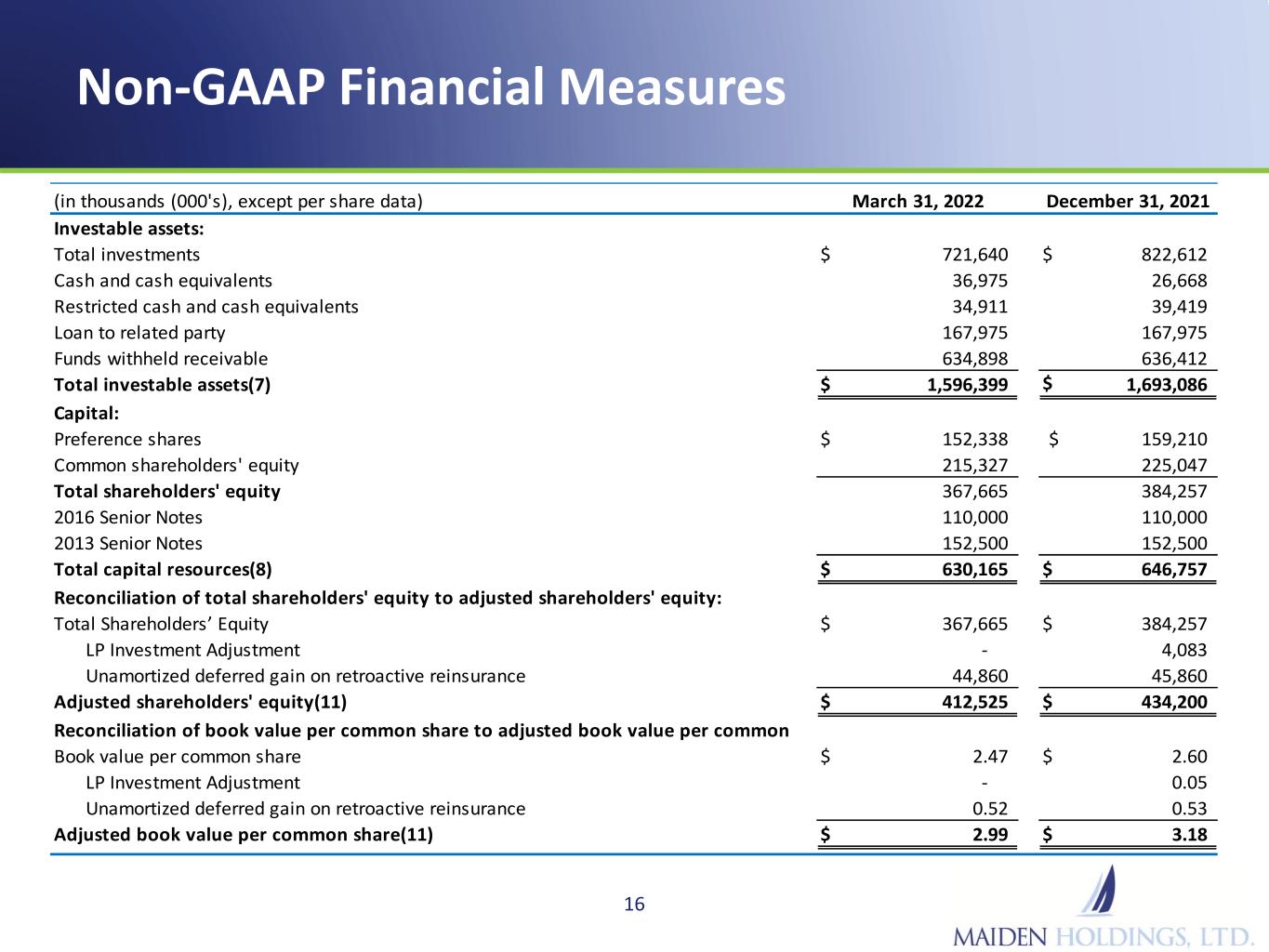

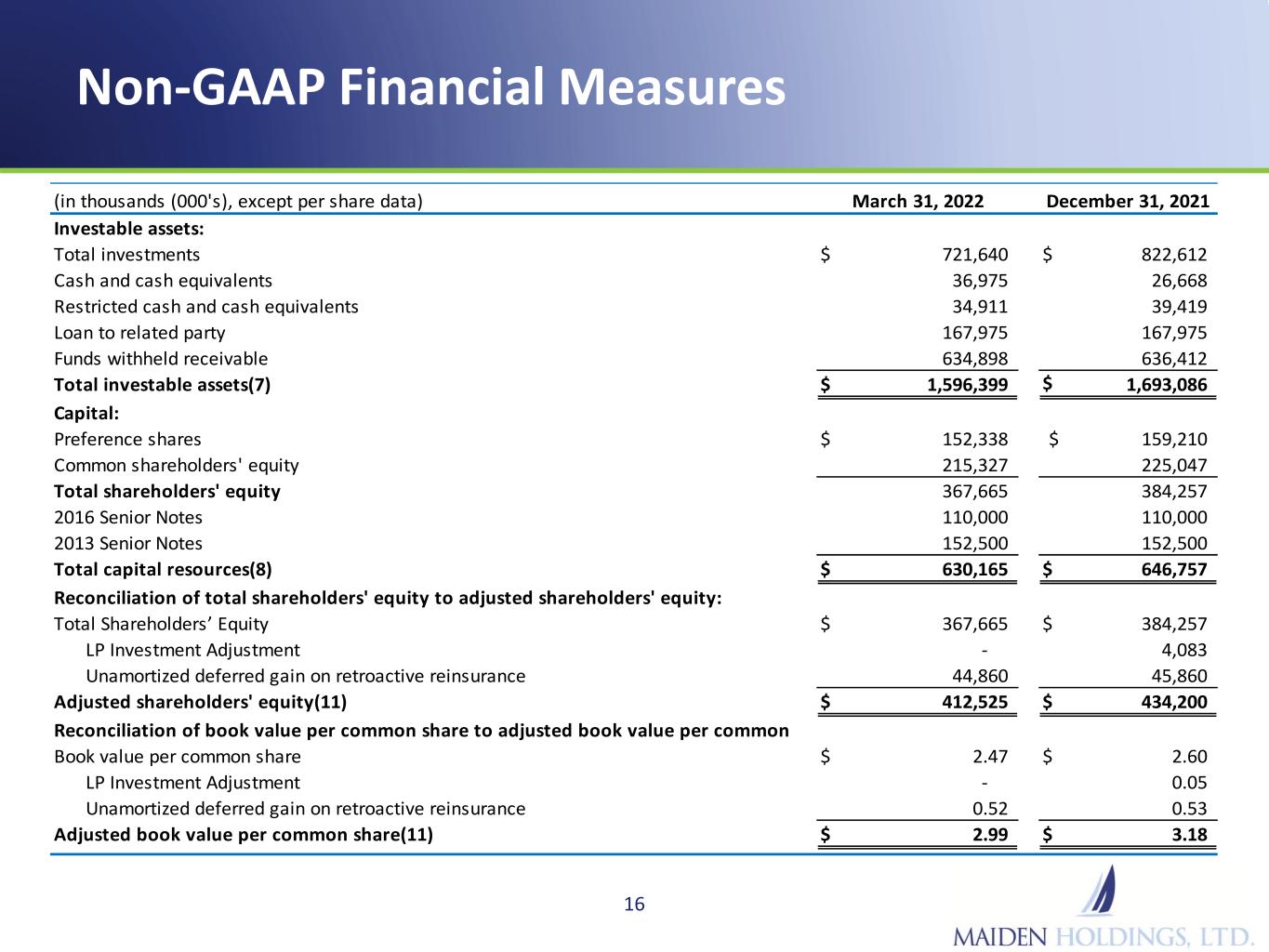

Non-GAAP Financial Measures 16 (in thousands (000's), except per share data) Investable assets: Total investments $ 721,640 $ 822,612 Cash and cash equivalents 36,975 26,668 Restricted cash and cash equivalents 34,911 39,419 Loan to related party 167,975 167,975 Funds withheld receivable 634,898 636,412 Total investable assets(7) $ 1,596,399 $ 1,693,086 Capital: Preference shares $ 152,338 $ 159,210 Common shareholders' equity 215,327 225,047 Total shareholders' equity 367,665 384,257 2016 Senior Notes 110,000 110,000 2013 Senior Notes 152,500 152,500 Total capital resources(8) $ 630,165 $ 646,757 Total Shareholders’ Equity $ 367,665 $ 384,257 LP Investment Adjustment - 4,083 Unamortized deferred gain on retroactive reinsurance 44,860 45,860 Adjusted shareholders' equity(11) $ 412,525 $ 434,200 Book value per common share $ 2.47 $ 2.60 LP Investment Adjustment - 0.05 Unamortized deferred gain on retroactive reinsurance 0.52 0.53 Adjusted book value per common share(11) $ 2.99 $ 3.18 Reconciliation of total shareholders' equity to adjusted shareholders' equity: Reconciliation of book value per common share to adjusted book value per common March 31, 2022 December 31, 2021

Non-GAAP Financial Measures 17 (1) Book value per common share is calculated using common shareholders’ equity (shareholders' equity excluding the aggregate liquidation value of our preference shares) divided by the number of common shares outstanding. Management uses growth in this metric as a prime measure of the value we are generating for our common shareholders, because management believes that growth in this metric ultimately results in growth in the Company’s common share price. This metric is impacted by the Company’s net income and external factors, such as interest rates, which can drive changes in unrealized gains or losses on our investment portfolio, as well as share repurchases. (4) Underwriting income (loss) is a non-GAAP measure and is calculated as net premiums earned plus other insurance revenue less net loss and LAE, commission and other acquisition expenses and general and administrative expenses directly related to underwriting activities. For purposes of these non-GAAP operating measures, the fee-generating business which is included in our Diversified Reinsurance segment, is considered part of the underwriting operations of the Company. Management believes that this measure is important in evaluating the underwriting performance of the Company and its segments. This measure is also a useful tool to measure the profitability of the Company separately from the investment results and is also a widely used performance indicator in the insurance industry. (2) Non-GAAP operating earnings and non-GAAP basic and diluted operating earnings per common share are non-GAAP financial measure defined by the Company as net income excluding realized investment gains and losses, foreign exchange and other gains and losses, interest in income of equity method investments and the change in deferred gain on retroactive reinsurance and should not be considered as an alternative to net income (loss). The Company's management believes that the use of non-GAAP operating earnings and non-GAAP diluted operating earnings per common share enables investors and other users of the Company’s financial information to analyze its performance in a manner similar to how management analyzes performance. Management also believes that these measures generally follow industry practice therefore allowing the users of financial information to compare the Company’s performance with its industry peer group, and that the equity analysts and certain rating agencies which follow the Company, and the insurance industry as a whole, generally exclude these items from their analyses for the same reasons. Non-GAAP operating earnings should not be viewed as a substitute for U.S. GAAP net income. (3) Annualized return on average common equity is a non-GAAP financial measure. Management uses non-GAAP operating return on average common shareholders' equity as a measure of profitability that focuses on the return to common shareholders. It is calculated using non-GAAP operating earnings divided by average common shareholders' equity.

Non-GAAP Financial Measures 18 (6) Underwriting related general and administrative expenses is a non-GAAP measure and includes expenses which are segregated for analytical purposes as a component of underwriting income (loss). (5) Non-GAAP net loss and LAE and Non-GAAP underwriting income (loss): Management has further adjusted the net loss and LAE and underwriting income (loss) (as defined above) by recognizing into income the unamortized deferred gain arising from the LPT/ADC Agreement relating to losses subject to that agreement. The deferred gain represents amounts estimated to be fully recoverable from Cavello and management believes adjusting for this shows the ultimate economic benefit of the LPT/ADC Agreement on Maiden's underwriting income (loss). Management believes reflecting the economic benefit of this retroactive reinsurance agreement is helpful for understanding future trends in our operations. (7) Investable assets is the total of the Company's investments, cash and cash equivalents, loan to a related party and funds withheld receivable. (8) Total capital resources is the sum of the Company's principal amount of debt and shareholders' equity. (9) Alternative investments is the total of the Company's investment in equity securities, equity method investments and other investments. (10) Non-GAAP operating return on average adjusted common equity is a non-GAAP financial measure. Management uses non-GAAP operating return on average adjusted common shareholders' equity as a measure of profitability that focuses on the return to common shareholders. It is calculated using non-GAAP operating earnings divided by average adjusted common shareholders' equity. (11) Adjusted Total Shareholders' Equity and Adjusted Book Value per Common Share: Management has adjusted GAAP shareholders' equity by adding the following items: 1) the unamortized deferred gain on retroactive reinsurance arising from LPT/ADC Agreement; and 2) an adjustment which reflects the equity method accounting related to the fair value of certain hedged liabilities within an equity method investment in a limited partnership held by the Company wherein the ultimate realizable value of the asset supporting the hedged liabilities cannot currently be recognized at fair value. As a result, by virtue of this adjustment, management has also computed the Adjusted Book Value per Common Share. The deferred gain on retroactive reinsurance represents amounts estimated to be fully recoverable from Cavello and management believes adjusting for this shows the ultimate economic benefit of the LPT/ADC Agreement. The LP Investment Adjustment reflects the fair value of the assets not presently able to be recognized currently. We believe reflecting the economic benefit of both items is helpful to understand future trends in our operations, which will improve the Company's shareholders' equity over the settlement or contract periods, respectively.