Maiden Holdings, Ltd. Fourth Quarter 2024 Investor Presentation March 2025

Investor Disclosures 2 Forward Looking Statements This presentation contains "forward-looking statements" which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on Maiden Holdings, Ltd.’s (the “Company”) future developments and their potential effects on the Company including the consummation of the business combination with Kestrel Group LLC ("Kestrel"), as described in the Company's Form 10-K (the "Transaction"), the expected time period to consummate the business combination, and the anticipated benefits of the business combination. There can be no assurance that actual developments will be those anticipated by the Company. Actual results may differ materially from those projected as a result of significant risks and uncertainties, including non-receipt of the expected payments, changes in interest rates, effect of the performance of financial markets on investment income and fair values of investments, developments of claims and the effect on loss reserves, accuracy in projecting loss reserves, the impact of competition and pricing environments, changes in the demand for the Company's products, the effect of general economic conditions and unusual frequency of storm activity, adverse state and federal legislation, regulations and regulatory investigations into industry practices, developments relating to existing agreements, heightened competition, changes in pricing environments, and changes in asset valuations. Additional information about these risks and uncertainties, as well as others that may cause actual results to differ materially from those projected is contained in Item 1A, Risk Factors in the Company's Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on March 10, 2025. The Company undertakes no obligation to publicly update any forward-looking statements, except as may be required by law. Any discrepancies between the amounts included in this presentation and amounts included in the Company’s Form 10-K for the year ended December 31, 2024, filed with the SEC are due to rounding. Non-GAAP Financial Measures In addition to the Summary Consolidated Balance Sheets and Consolidated Statements of Income, management uses certain key financial measures, some of which are non-GAAP measures, to evaluate the Company's financial performance and the overall growth in value generated for the Company’s common shareholders. Management believes that these measures, which may be defined differently by other companies, explain the Company’s results to investors in a manner that allows for a more complete understanding of the underlying trends in the Company’s business. The non-GAAP measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. See the Appendix of this presentation for a reconciliation of the Company’s non-GAAP measures to the nearest GAAP measure.

Investor Disclosures 3 Additional Information Regarding the Transaction and Where to Find It In connection with the transaction, Bermuda NewCo has filed a registration statement on Form S-4 with the SEC that includes a prospectus with respect to Ranger Bermuda Topco Ltd.'s ("Bermuda NewCo") securities to be issued in connection with the transaction and a proxy statement with respect to the Maiden shareholder meeting to approve the transaction and related matters (the "proxy statement/prospectus"). Maiden and Bermuda NewCo may also file or furnish other documents with the SEC regarding the transaction. This presentation is not a substitute for the registration statement, the proxy statement/prospectus or any other document that Maiden or Bermuda NewCo may file or furnish or cause to be filed or furnished with the SEC. INVESTORS IN AND SECURITY HOLDERS OF MAIDEN ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR FURNISHED OR WILL BE FILED OR WILL BE FURNISHED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement, the proxy statement/prospectus and other documents filed with or furnished to the SEC by Maiden or Bermuda NewCo through the web site maintained by the SEC at www.sec.gov or by contacting the investor relations department of Maiden: Maiden Holdings, Ltd., 48 Par-La-Ville Road, Suite 1141, Hamilton HM 11, Bermuda. Participation in the Solicitation Each of Maiden, Bermuda NewCo and their respective directors, executive officers, members of management and employees, and Luke Ledbetter, President and Chief Executive Officer of Kestrel, and Terry Ledbetter, Executive Chairman of Kestrel, may, under the rules of the SEC, be deemed to be participants in the solicitation of proxies from Maiden's shareholders in connection with the Transaction. Information regarding Maiden's directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in Maiden's annual proxy statement filed with the SEC on March 27, 2024, its annual report on Form 10-K for the fiscal year ended December 31, 2024, which was filed with the SEC on March 10, 2025, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Luke Ledbetter serves as President and Chief Executive Officer of Kestrel. Mr. Ledbetter previously served as Chief Underwriting Officer and Head of Business Development with State National Companies. During Mr. Ledbetter's tenure at State National, gross written premium grew to more than $2.5 billion annually. Mr. Ledbetter holds a law degrees from Cambridge University and the University of Texas School of Law in addition to a B.A. from the University of Texas at Austin. Terry Ledbetter serves as Executive Chairman of Kestrel. Mr. Ledbetter co-founded State National Companies in 1973 and served as Chairman, President and Chief Executive Officer until his retirement at the end of 2019. Mr. Ledbetter pioneered the dedicated fronting business model in the property & casualty industry and guided State National through its initial public offering in 2014 and sale to Markel Corporation in 2017. He received his B.B.A from Southern Methodist University. Neither of Luke Ledbetter or Terry Ledbetter own directly any securities of Maiden at this time. Additional information regarding the identity of all potential participants in the solicitation of proxies to Maiden shareholders in connection with the Transaction and other matters to be voted upon at the Maiden shareholders meeting to approve the Transaction, and their direct and indirect interests, by security holdings or otherwise, will be included in the definitive proxy statement/prospectus, when it becomes available. No Offer or Solicitation This presentation is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Maiden Holdings – Q4 2024 Key Messages • Maiden announcement of combination agreement with Kestrel Group realizes strategic pivot to fee- based model communicated to market during 2024 o Additional announcement of planned divestiture of IIS platform in 1H 2025 extends strategy shift • Q4 reserve and other charges of $147.6 million in line with Maiden pre-announcement o After considering impact of LPT/ADC, Q4 charges total $126.6 million o Continuing to pursue finality solutions for AmTrust liabilities not covered by LPT/ADC, including with third parties o Strategic initiatives driving higher expenses in Q4 – will recur in 2025 as transactions are completed • As part of a broader effort to reposition balance sheet in support of strategic initiatives, sold $93.6 million in alternative investments in 2024, reducing that portfolio by 18.6% o Alternative asset portfolio returns still on track to achieve expected returns despite temporary reduction in Q4 o Completed investments totaling $153.1 million have produced IRR of 8.7% and MOIC of 1.19X o Do not expect new additional alternative investment commitments – additional dispositions under active evaluation o Actively exploring opportunities to further reduce alternative portfolio on prudent basis • Pro forma NewCo balance sheet indicates shareholders' equity of $173.3 million or $1.13 per share o Pro forma per share references are fully diluted assuming 55 million shares issued to Kestrel shareholders at closing o Kestrel determined to be accounting acquirer and transaction considered a reverse merger o Kestrel historical financial statements to be considered the financial statements of NewCo, with Maiden assets and liabilities translated to fair value o Bargain purchase option gain of $153.9 million expected at closing per pro forma balance sheet – subject to change based on MHLD share price but no impact on pro forma book value or book value per share o The preliminary fair value estimates are subject to change based on the final valuations o Pro forma unrecognized deferred tax asset per share at closing would be $1.02 per share 4

Maiden Holdings Business Strategy 5 • We create shareholder value by actively managing and allocating our assets and capital o We leverage our deep knowledge of the insurance and related financial services industries into ownership and management of businesses and assets with the opportunity for increased returns o Our strategy allows us to more flexibly allocate capital to activities we believe will produce the greatest returns for our common shareholders • Strategic pivot away from asset management to fee-based strategy realized in Q4 with Kestrel transaction and IIS divestiture announcements o Transaction expected to enable more predictable areas of revenue and profit to emerge Expect to supplement platform by deploying reinsurance capacity from Maiden Reinsurance on selective basis Transaction subject to certain closing conditions including the approval of Maiden's shareholders, approval of listing of the shares of the combined company and receipt of regulatory approvals o Completed a strategic review of the IIS Business and entered into a Stock Purchase Agreement to sell Maiden LF and Maiden GF to UK-based acquirer Regulatory approval process proceeding - expectations continue to target close during the first half of 2025 • Recent strategic focus led by asset management now de-emphasized o Alternative asset portfolio reduced and active process to further divest assets continues although process may occur over extended period – no new commitments made or expected o Completed investments have exceeded target returns to date o Capital management remains viable particularly if exaggerated share price weakness persists • We believe these areas of strategic focus will enhance our profitability o We believe our strategic pivot increases the likelihood of fully utilizing the significant tax NOL carryforwards which would create additional common shareholder value

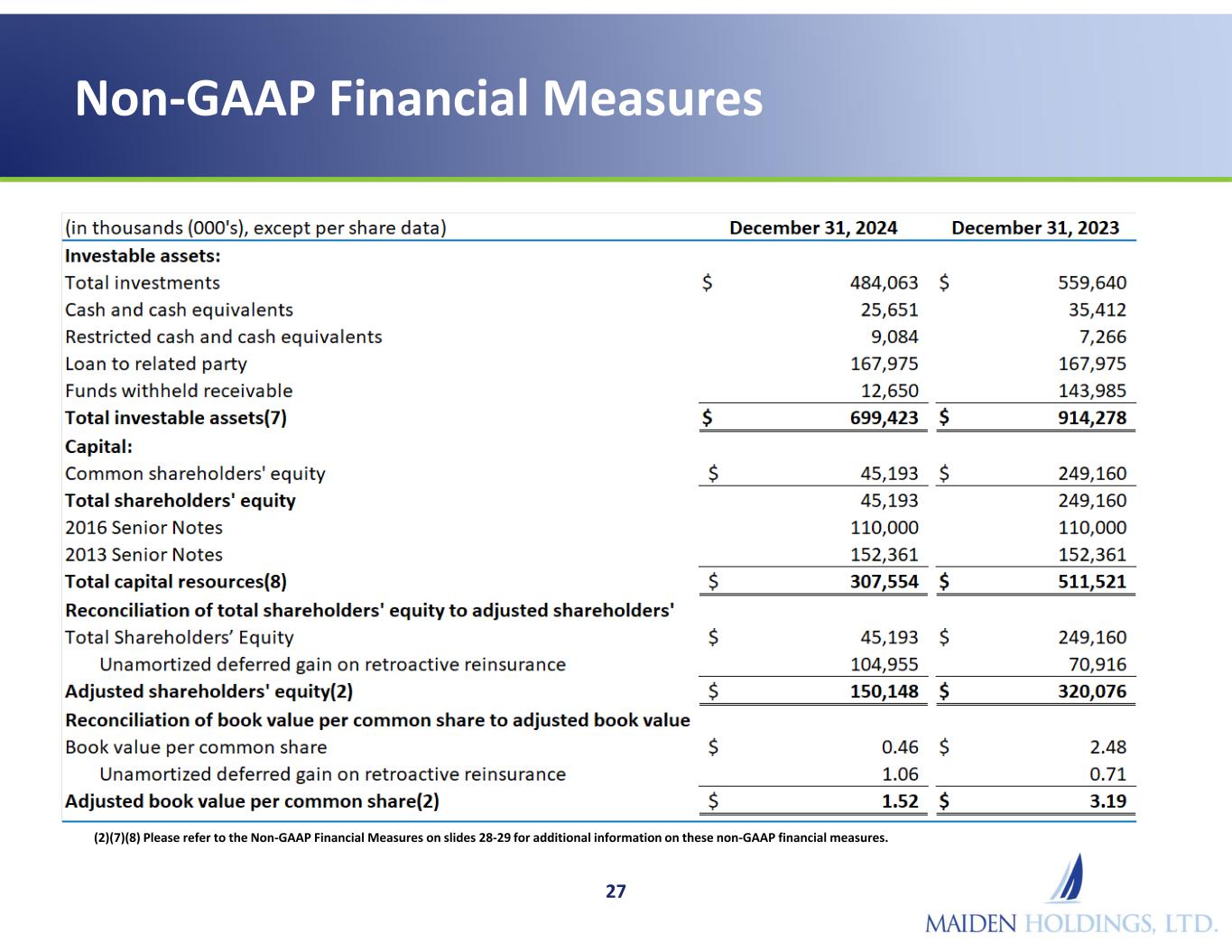

Maiden Holdings Q4 2024 Financial Overview 6 • Adjusted book value $1.52 per share as of December 31, 2024 represents true economic value Maiden – does not consider impacts of combination with Kestrel o Q4 loss from higher adverse development on prior year reserves, loss from AmTrust resolution of uncollected premium dispute, lower investment results o Reported book value per common share lower at $0.46 per share as of December 31, 2024, reflects GAAP P&L volatility from loss development mostly subject to Enstar LPT/ADC • See Q4 results recap starting on slide 12 • $42.0m of total PPD in Q4 2024 will return as future GAAP income from LPT/ADC o Deferred gain of $105.0m or $1.06 per share at 12/31/2024 will be recognized as GAAP income over time as LPT/ADC recoveries are received, subject to reinsurance contract and relevant GAAP accounting rules o LPT/ADC recoveries commenced in Q4 2024 with initial amortization of deferred gain into income of $4.1m along with recoveries from Enstar of $20.8m • Investment results decreased to $4.1m in Q4 2024 compared to $14.6m in Q4 2023 o Q4 2024 investment results were driven by lower investment income, realized/unrealized investment gains and income from equity method investments, reflecting ongoing run-off of liabilities and smaller alternative investment portfolio o Alternative investment portfolio reduced by 0.8% in Q4 2024 – Q4 returns primarily impacted by negative marks on select private equity and alternative asset investments • Deferred tax asset of $1.59 per share not yet recognized in book value o Strategic pivot in Q4, additional reserve strengthening should position ability to recognize more quickly o $459.6m in NOL carryforwards at 12/31/2024 – $79.7m or 17.4% have no expiry date * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein

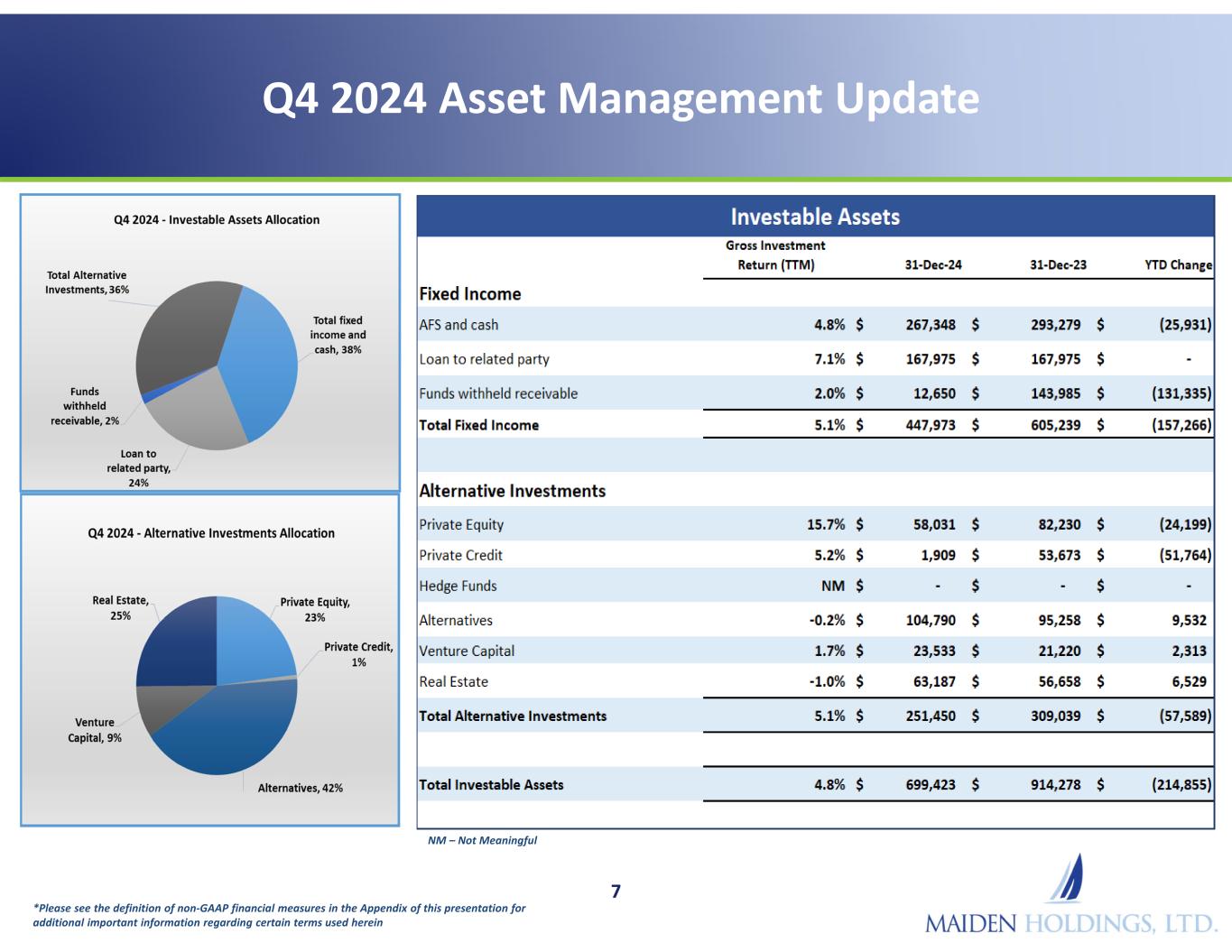

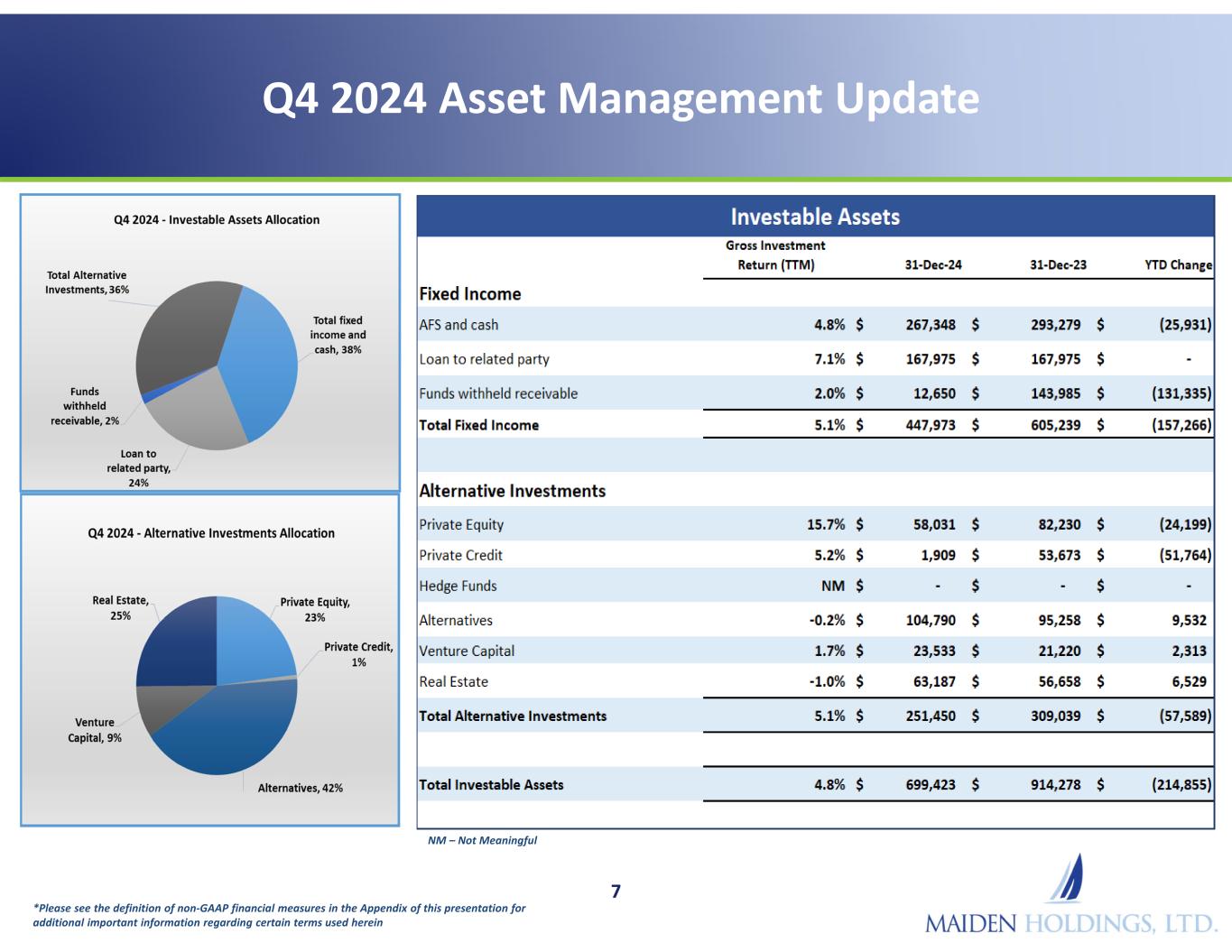

Q4 2024 Asset Management Update 7 *Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein NM – Not Meaningful

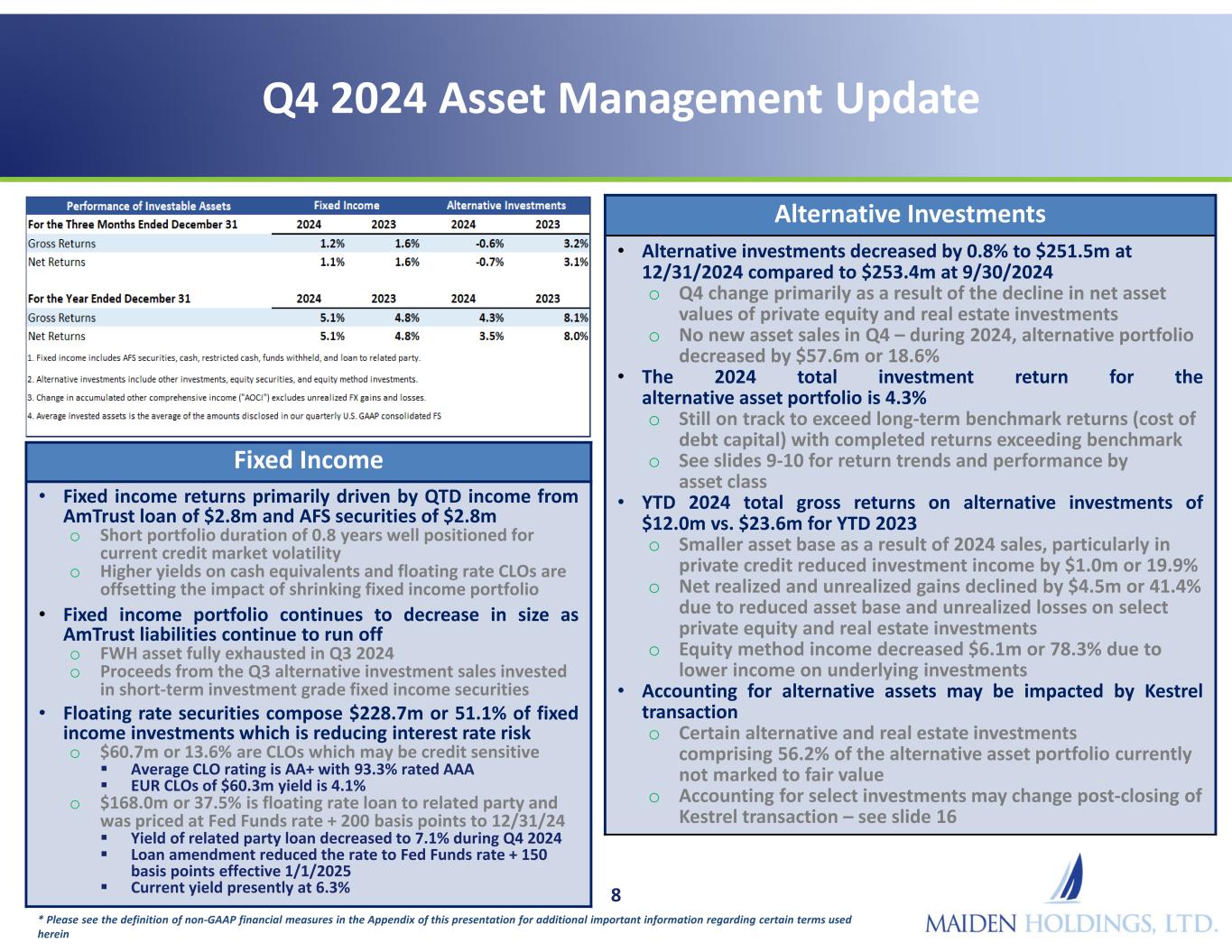

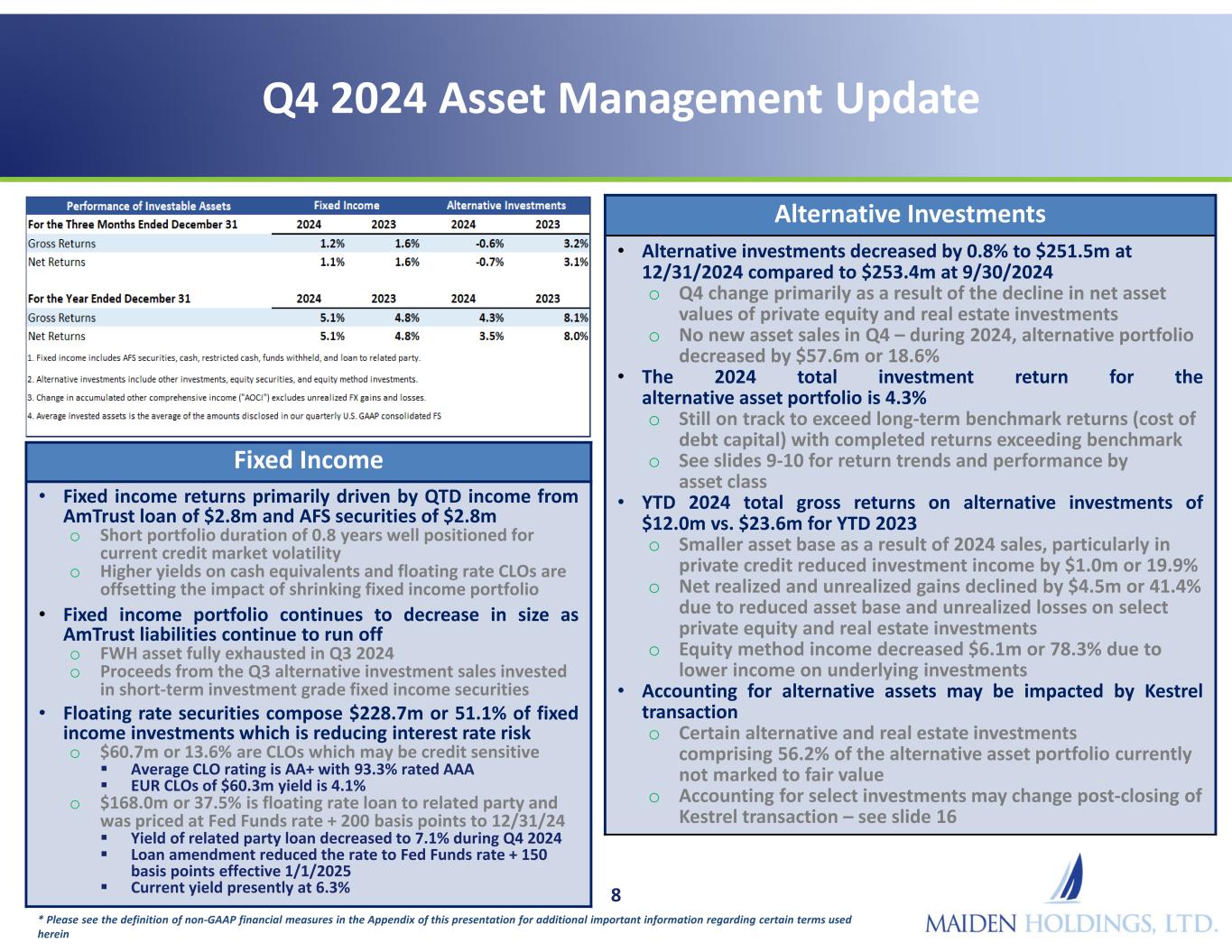

Q4 2024 Asset Management Update 8 * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein Alternative Investments • Alternative investments decreased by 0.8% to $251.5m at 12/31/2024 compared to $253.4m at 9/30/2024 o Q4 change primarily as a result of the decline in net asset values of private equity and real estate investments o No new asset sales in Q4 – during 2024, alternative portfolio decreased by $57.6m or 18.6% • The 2024 total investment return for the alternative asset portfolio is 4.3% o Still on track to exceed long-term benchmark returns (cost of debt capital) with completed returns exceeding benchmark o See slides 9-10 for return trends and performance by asset class • YTD 2024 total gross returns on alternative investments of $12.0m vs. $23.6m for YTD 2023 o Smaller asset base as a result of 2024 sales, particularly in private credit reduced investment income by $1.0m or 19.9% o Net realized and unrealized gains declined by $4.5m or 41.4% due to reduced asset base and unrealized losses on select private equity and real estate investments o Equity method income decreased $6.1m or 78.3% due to lower income on underlying investments • Accounting for alternative assets may be impacted by Kestrel transaction o Certain alternative and real estate investments comprising 56.2% of the alternative asset portfolio currently not marked to fair value o Accounting for select investments may change post-closing of Kestrel transaction – see slide 16 Fixed Income • Fixed income returns primarily driven by QTD income from AmTrust loan of $2.8m and AFS securities of $2.8m o Short portfolio duration of 0.8 years well positioned for current credit market volatility o Higher yields on cash equivalents and floating rate CLOs are offsetting the impact of shrinking fixed income portfolio • Fixed income portfolio continues to decrease in size as AmTrust liabilities continue to run off o FWH asset fully exhausted in Q3 2024 o Proceeds from the Q3 alternative investment sales invested in short-term investment grade fixed income securities • Floating rate securities compose $228.7m or 51.1% of fixed income investments which is reducing interest rate risk o $60.7m or 13.6% are CLOs which may be credit sensitive Average CLO rating is AA+ with 93.3% rated AAA EUR CLOs of $60.3m yield is 4.1% o $168.0m or 37.5% is floating rate loan to related party and was priced at Fed Funds rate + 200 basis points to 12/31/24 Yield of related party loan decreased to 7.1% during Q4 2024 Loan amendment reduced the rate to Fed Funds rate + 150 basis points effective 1/1/2025 Current yield presently at 6.3%

Alternative Investment Returns Remain Above Targets 9 *Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein Total Investment Returns (TTM) • 2024 total investment return on the entire portfolio was 4.8% down from 5.7% in Q4 2023 o The decrease in total investment returns was primarily driven by realized losses from Q3 sales of alternative assets related to strategic pivot along with related investment expenses • Realized portfolio has produced an ITD IRR and MOIC of 8.7% and 1.19x, respectively, total completed investments of $153.1m • 2024 total investment returns on the alternative & fixed income portfolios were 4.3% (vs. 8.1% in Q4 2023) and 5.1% (vs. 4.8% in Q4 2023), respectively

Alternative Investment Returns Continue to Build 10 *Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein Alternative Investment Highlights • Active portfolio has produced an ITD IRR and MOIC of 3.0% and 1.08x, respectively – unaudited pro forma Ranger Bermuda TopCo balance sheet at fair value has produced an ITD IRR and MOIC of 7.4% and 1.21x o 56.2% of our total alternative investments as of 12/31/2024, primarily in the Alternatives and Real Estate asset classes, do not reflect any returns to date based on the development stage of these investments - returns on these investments are expected to increase in the future as the investments mature o Excluding investments still carried at cost, active alternative investments have produced an IRR of 9.0% with an MOIC of 1.21x as of 12/31/2024 - see slide 16 for updated information on returns as part of Kestrel transaction • Realized portfolio has produced an ITD IRR and MOIC of 8.7% and 1.19x, respectively, total completed investments of $153.1m o The alternative assets sale during Q3 2024 is part of the effort to reposition the balance sheet and strengthen the overall liquidity • For the year ended December 31, 2024, total gross return on the alternative investment portfolio was $12.0m, primarily driven by realized & unrealized gains on certain private equity investments o See Form 10-K for further important details on alternative investment portfolio and related returns Note - IRR refers to the Internal Rate of Return & MOIC refers to the Multiple on Invested Capital

Q4 2024 Capital Management Update • Maiden continued active but disciplined long-term capital management in Q4 2024 o Maiden Reinsurance Ltd. ("MRL") repurchased 383,355 common shares in open market at an average price of $1.57 per share in Q4 2024 ITD repurchases as of December 31, 2024, totaled 3,311,330 common shares at $1.85 per share o In connection with the pending transaction with Kestrel, the repurchase program has been suspended • Maiden expects to maintain active but prudent and long-term approach to balance sheet management as part of its overall strategy o Significant Board authorization remains for both common shares and senior notes to cover both open market purchases and privately negotiated trades o $68.5 million and $99.9 million in authorization available for common share and senior note repurchases, respectively, as of March 3, 2025 • MRL owns 31.1% of Maiden common shares as of December 31, 2024, but is presently limited to 9.5% voting power per Maiden bye-laws o Common shares owned by MRL eliminated for accounting and financial reporting purposes on the Company’s consolidated financial statements and presented as treasury shares o Per share computations reflect elimination of MHLD common shares owned by MRL of 44,750,678 as of December 31, 2024 o Proposal to remove the 9.5% voting limitation subject to Maiden shareholders' approval at shareholders meeting 11 * Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein

Maiden Holdings – Q4 2024 Results Recap 12* Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein Comments Q4 2023Q4 2024($ millions, except per share amounts) Net Income and Per Share Data • Summary GAAP and Non-GAAP Financial Measures in Appendix$(20.8) $(0.21) $(158.0) $(1.59) GAAP Net Loss Attributable to Common Shares Per common share Key Income Statement Details • Significantly underwriting loss in Q4 2024 the result of adverse development on prior year reserves of $129.4m compared to $22.2m in corresponding period • AmTrust segment contributed 95.3% of the adverse development in Q4 2024. • See slide 14 for detail on underwriting results and prior period loss development $(21.1)$(161.3)Underwriting Loss • Net investment income 27.2% lower at $6.0m in Q4 2024 vs. $8.3m in Q4 2023 due to lower income earned on the funds withheld receivable which decreased $1.5m in Q4 2024 vs Q4 2023 • Realized and unrealized losses of $0.8m in Q4 2024 vs. gains of $5.5m in Q4 2023 mainly attributable to unrealized losses of certain equity securities • Loss from equity method investments of $1.1m vs. income of $0.9m in Q4 2023 mainly attributable to lower income generated by certain investments in the alternative investment asset class $14.6$4.1Investment Results • Excluding non-recurring expenses, Q4 2024 operating expenses were only $0.1m or 1.1% higher in Q4 2024 compared to Q4 2023 • Q4 2024 included $2.3m in non-recurring expenses related to various strategic initiatives $7.1$9.4Operating Expenses • FX gain in Q4 2024 due to USD strengthening relative to EUR and GBP vs U.S. dollar weakening in Q4 2023 which resulted to FX loss $(4.9)$10.9Foreign Exchange/Other Gains (Losses)

Maiden Holdings – YTD Q4 2024 Results Recap 13* Please see the definition of non-GAAP financial measures in the Appendix of this presentation for additional important information regarding certain terms used herein Comments Q4 2023Q4 2024($ millions, except per share amounts) Net Income and Per Share Data • Summary GAAP and Non-GAAP Financial Measures in Appendix$(38.6) $(0.38) $(201.0) $(2.01) GAAP Net Loss Attributable to Common Shares Per common share Key Income Statement Details • Higher underwriting loss YTD 2024 the result of adverse development on prior year reserves of $154.4m compared to $38.2m in corresponding period. AmTrust segment contributed 95.5% of the adverse development in Q4 2024. • See slide 15 for detail on underwriting results and prior period loss development $(49.5)$(197.4)Underwriting Loss • YTD net investment income 31.7% lower at $25.5m in 2024 vs. $37.4m in 2023 due to lower income from AmTrust funds withheld receivable and higher investment expenses • Lower realized and unrealized gains of $5.6m in 2024 vs. $7.8m in 2023 mainly attributable to losses on equity securities & other investments in the private equity and real estate asset classes in 2024 • Income from equity method investments of $1.7m in 2024 vs. $7.8m in 2023 mainly attributable to reduced income generated by certain investments in the alternative asset class $53.1$32.9Investment Results • Operating expenses in 2024 include $5.7m increase in non-recurring expenses related to various strategic initiatives • Excluding non-recurring expenses, operating expenses decreased $1.2m or 3.9% mainly due to lower cash incentive compensation • Excluding non-recurring expenses, IIS expenses are 19.0% of operating expenses $30.8$35.3Operating Expenses • FX gain in YTD 2024 due to USD strengthening relative to EUR and GBP vs U.S. dollar weakening in YTD 2023 which resulted to FX loss $(5.7)$7.0Foreign Exchange/Other Gains (Losses)

Q4 2024 UW Results and Loss Development • Q4 underwriting loss of $161.3m in 2024 vs. $21.1m in 2023 o Adverse prior year loss development of $129.4m in Q4 2024 vs. $22.2m of adverse prior year loss development in Q4 2023 o AmTrust Reinsurance segment had significant adverse loss development of $123.3m in Q4 2024 vs. $21.7m in Q4 2023 Net adverse prior year loss development in Q4 2024 in Master QS primarily emerged from following lines and classes of business CLD and Program business produced adverse development of $68.8m, SRW adverse development of $21.3m, Hospital Liability adverse development of $44.4m; partly offset by Continued favorable workers' compensation development of $11.2m $42.0m of adverse loss development experienced in the AmTrust segment in Q4 2024 is covered by the Enstar LPT/ADC and will be recognized as future GAAP income over time Amount is offset by $21.0m favorable development in WC commuted reserves o Deferred gain amortization from LPT/ADC Agreement of $4.1m in Q4 offset against the prior period loss development Cumulative paid losses have now exceeded the Agreement retention Maiden recovered $20.8m from Enstar in Q4 2024 o Q4 2024 results include $24.3m charge for resolution of ceded uncollected premium dispute with AmTrust Maiden repaying over eight-year period concurrent with extension of Loan to AmTrust maturity and agreed repayment schedule o Diversified Reinsurance segment experienced adverse loss development of $6.0m in Q4 2024 vs. $0.5m in Q4 2023 Adverse development mostly from GLS and run-off credit loss reserves 14

YTD 2024 UW Results and Loss Development • YTD underwriting loss of $197.4m in 2024 vs. $49.5m in 2023 o Higher YTD adverse prior year loss development of $154.4m in 2024 compared to $38.2m in 2023 o AmTrust segment produced higher YTD adverse loss development of $147.5m in 2024 compared to $33.7m in 2023 Master QS experienced YTD adverse development of $105.0m in 2024 from the following lines of business CLD and Program business had adverse development of $91.7m, SRW business adverse development of $34.2m partly offset by Worker Comp reported continued favorable development of $25.4m Hospital Liability YTD adverse development of $47.0m in 2024 is consistent with developing adverse development trends driven by movements in older years, prior to 2014 2024 development significantly impacted by increase in statutory tables for non-economic damages and had material impact on carried reserves $64.3m or 43.7% of YTD adverse loss development experienced in the AmTrust segment in 2024 is covered by the Enstar LPT/ADC and will be recognized as future GAAP income over time o Deferred gain amortization from LPT/ADC Agreement of $4.1m in Q4 offset against the prior period loss development o YTD results include $24.3m charge in Q4 2024 for resolution of ceded uncollected premium dispute with AmTrust Maiden repaying over eight-year period concurrent with extension of Loan to AmTrust maturity and agreed repayment schedule o Accelerated amortization of deferred acquisition costs due to premium deficiency of $3.3m in AmTrust segment o Diversified Reinsurance segment had YTD adverse loss development of $6.9m in 2024 compared to $4.4m in 2023 Adverse prior year development due to GLS, IIS and Bermuda Run- off contracts 15

Maiden – Kestrel Combination: Ranger Bermuda TopCo Unaudited Pro Forma Condensed Combined Balance Sheet • Combination Agreement between parties will result in Maiden and Kestrel combining to form Ranger Bermuda TopCo (“NewCo”) which will rebrand as Kestrel Group o Summary pro forma balance sheet on slide 17 – additional information on Kestrel in NewCo S-4 • Determination has been made that Kestrel is the “accounting acquirer” in combination, o Result is transaction being accounted for as a “reverse merger” o Kestrel historical financial statements will be the financial statements of the combined company • Under reverse merger accounting, Maiden’s asset and liabilities are converted to fair value o Preliminary pro forma Maiden net assets increased by $183.8 million compared to net assets as of 12/31/2024 – significant changes include recognition of deferred gain, market value of senior notes o Alternative investments, primarily in real estate and alternatives asset classes, preliminarily increased by $37.7 million, increasing pro forma IRR and MOIC of the active portfolio to 7.4% and 1.21x respectively, with 39.3% of assets still marked at cost o NewCo will recognize a bargain purchase option gain of $153.9 million to recognize the difference between Maiden net assets and estimated consideration paid to Kestrel - subject to change based on MHLD share price but no impact on pro forma book value • The preliminary fair value estimates are subject to change based on the final valuations o The estimated preliminary fair values of the Maiden assets and liabilities are based on preliminary valuation studies, the transaction due diligence, and information presented in Maiden’s public filings o The final purchase price and purchase price allocation may be different than the information that is presented herein, and such differences could be material o See NewCo S-4 for details on pro forma financial statements and other related matters • Preliminary pro forma NewCo shareholders' equity of $173.3 million or $1.13 per share o Pro forma per share references are fully diluted assuming 55 million shares issued to Kestrel shareholders at closing o Pro forma balance sheet does not include Maiden unrecognized deferred tax asset - pro forma per share at closing net deferred tax asset would be $1.02 per share 16

Maiden – Kestrel Combination: Ranger Bermuda TopCo Unaudited Pro Forma Condensed Combined Balance Sheet 17 (in thousands (000's), except per share data) December 31, 2024 Assets Total investments $ 521,732 Cash and cash equivalents (including restricted) 9,084 Reinsurance balances receivable, net 8,159 Reinsurance recoverable on unpaid losses 571,331 Loan to related party 133,323 Funds withheld receivable 12,017 Other assets 15,141 Assets held for sale 20,815 Total Assets $ 1,291,602 Liabilities Reserve for loss and loss adjustment expenses $ 786,880 Unearned premiums 29,793 Earn out liability 19,275 Accrued expenses and other liabilities 97,980 Liability for securities purchased 6,480 Senior notes, net 177,010 Liabilities held for sale 883 Total Liabilities 1,118,301 Equity 173,301 Total Liabilities and Equity $ 1,291,602 Book value per common share $ 1.13 Common shares outstanding 154,039,253

Maiden Holdings, Ltd. Fourth Quarter 2024 Investor Presentation - Appendix Financial Data for Period Ended December 31, 2024

Summary Consolidated Balance Sheet 19 (1) Please refer to the Non-GAAP Financial Measures on slide 28 for additional information on this non-GAAP financial measure.

Summary Consolidated Statements of Income 20

Segment Information 21 In thousands ('000's) (3)(4) Please refer to the Non-GAAP Financial Measures on slide 28 for additional information on these non-GAAP financial measures.

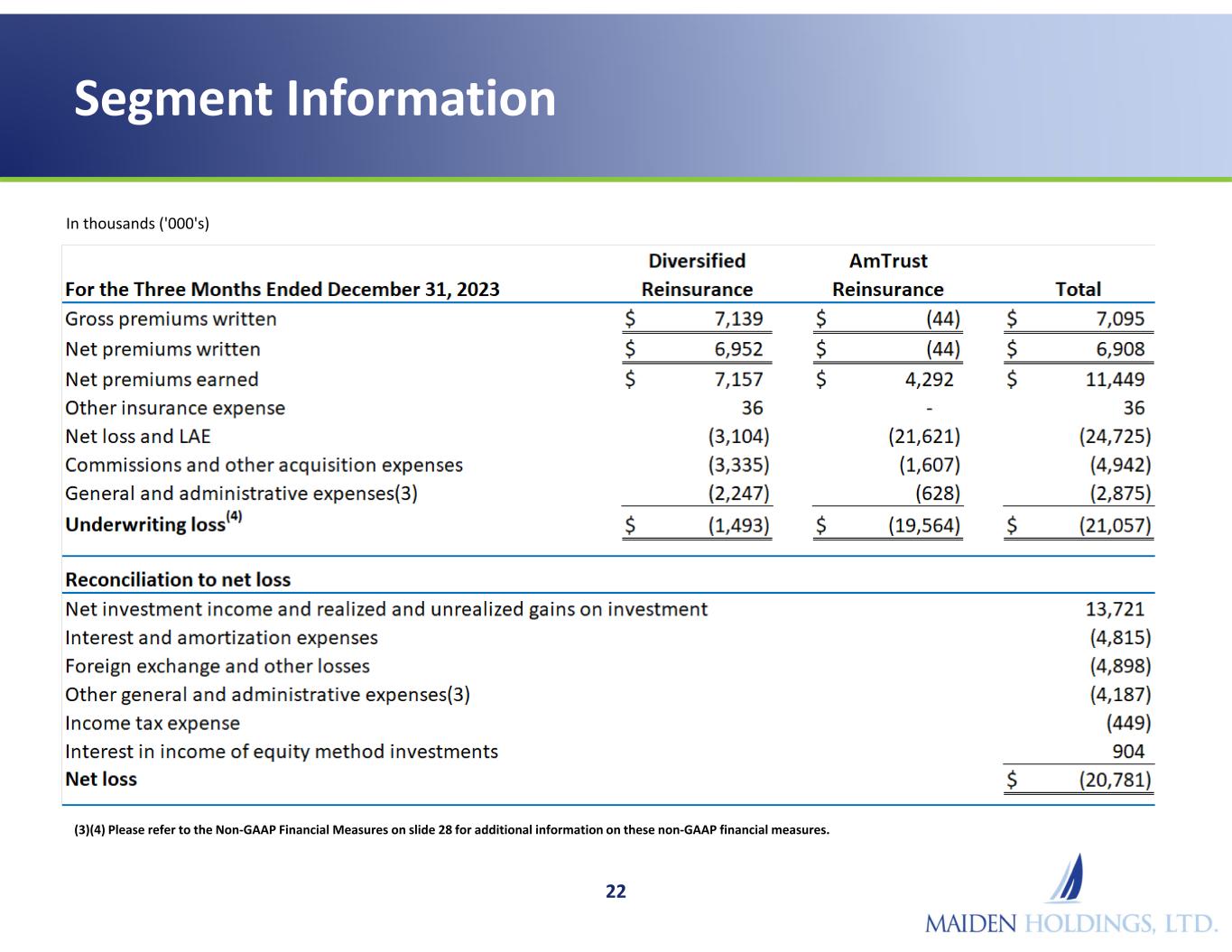

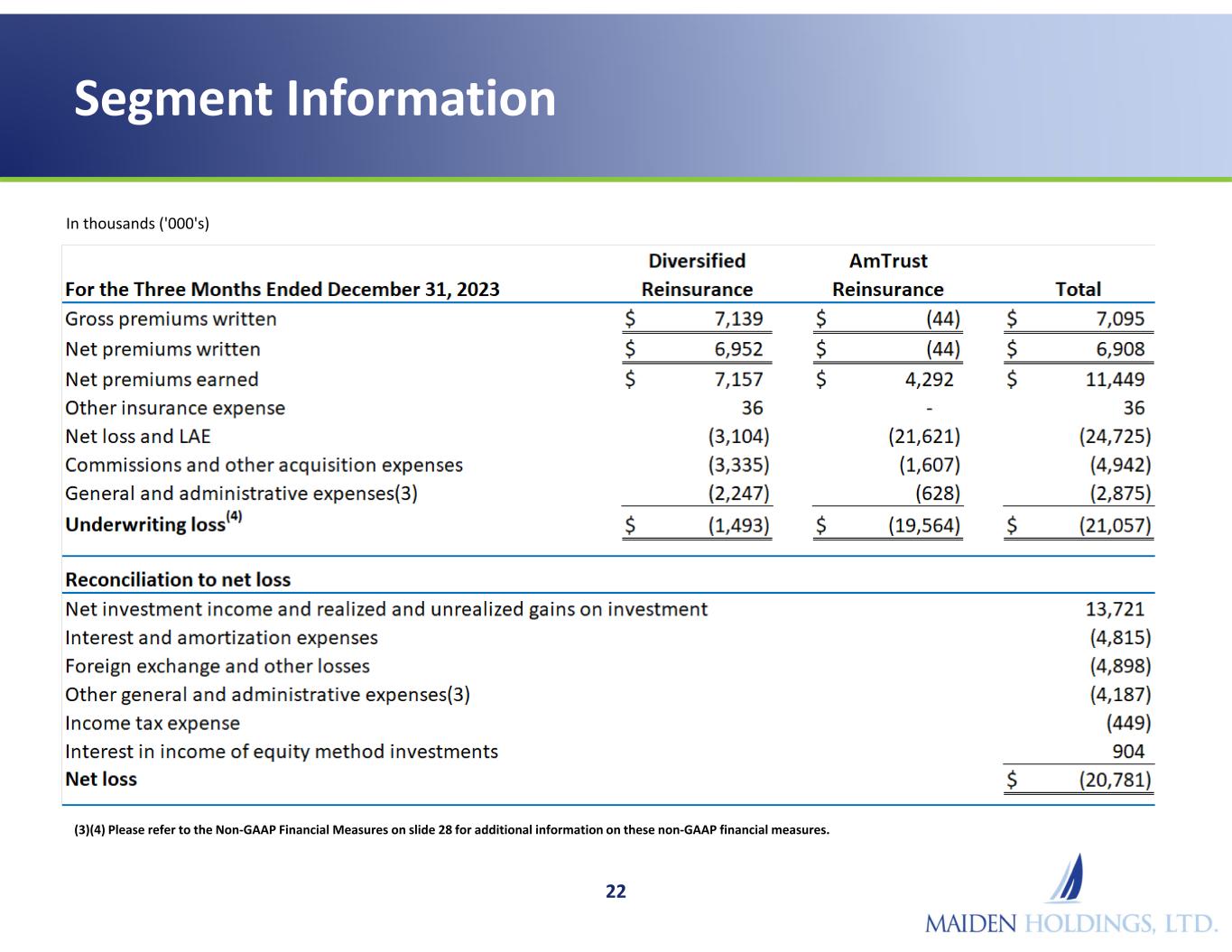

Segment Information 22 In thousands ('000's) (3)(4) Please refer to the Non-GAAP Financial Measures on slide 28 for additional information on these non-GAAP financial measures.

Segment Information 23 In thousands ('000's) (3)(4) Please refer to the Non-GAAP Financial Measures on slide 28 for additional information on these non-GAAP financial measures.

Segment Information 24 In thousands ('000's) (3)(4) Please refer to the Non-GAAP Financial Measures on slide 28 for additional information on these non-GAAP financial measures.

Non-GAAP Financial Measures 25 (5)(6) Please refer to the Non-GAAP Financial Measures on slides 28-29 for additional information on these non-GAAP financial measures.

Non-GAAP Financial Measures 26 (3)(9) Please refer to the Non-GAAP Financial Measures on slides 28-29 for additional information on these non-GAAP financial measures.

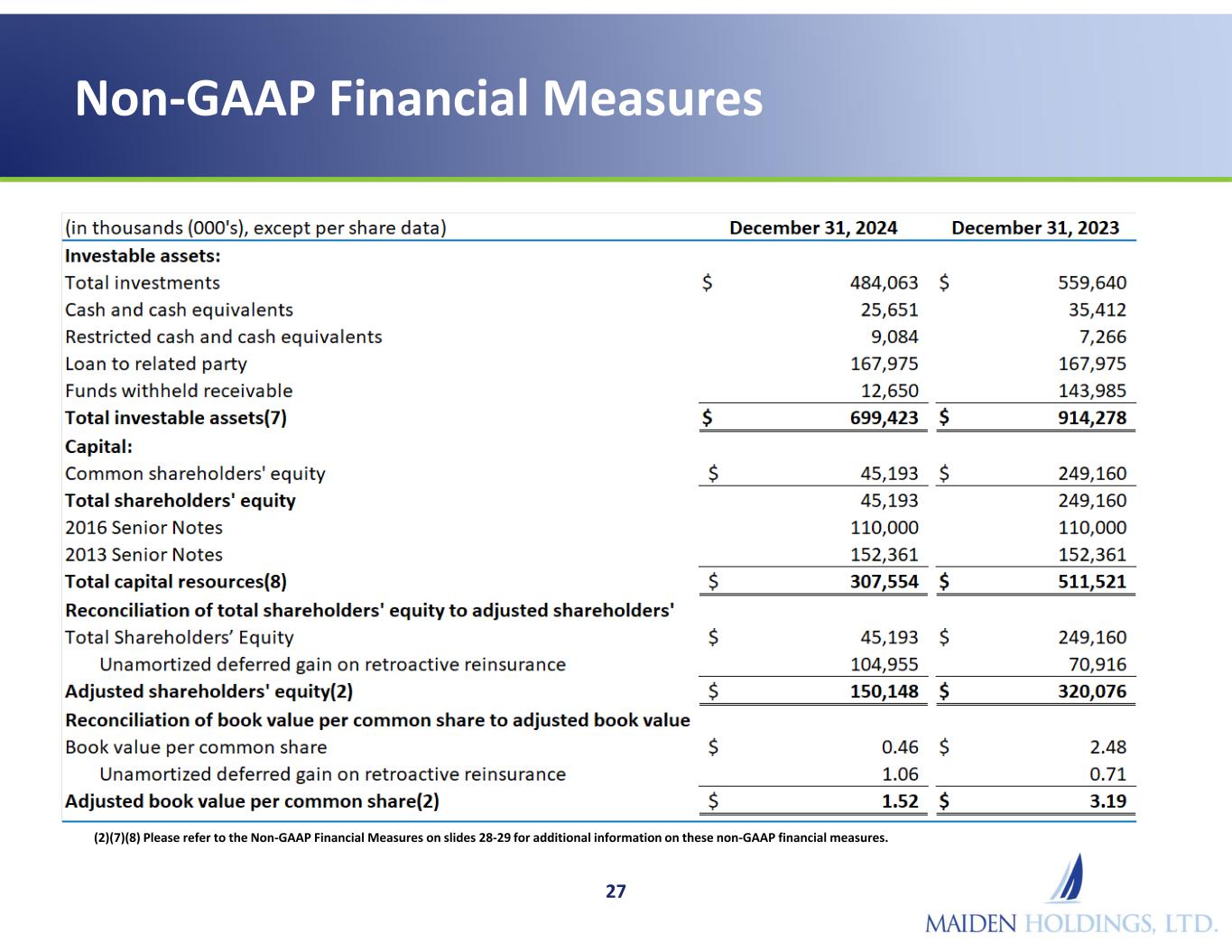

Non-GAAP Financial Measures 27 (2)(7)(8) Please refer to the Non-GAAP Financial Measures on slides 28-29 for additional information on these non-GAAP financial measures.

Non-GAAP Financial Measures 28

Non-GAAP Financial Measures 29