1 AMENDED AND RESTATED LOAN AGREEMENT This Amended and Restated Loan Agreement (this “AR Loan Agreement”) is made on January 1, 2025, by and between AmTrust Financial Services, Inc., a Delaware corporation (the “Borrower”), and Maiden Reinsurance Ltd. (formerly known as Maiden Insurance Company, Ltd), a Vermont affiliated reinsurance company (the “Lender” and, together with the Borrower, each a “Party” and collectively, the “Parties”). RECITALS 1. Amtrust International Insurance, Ltd (“AII”) is a wholly-owned subsidiary of the Borrower. 2. On November 16, 2007, AII entered into a loan agreement (as amended, restated, supplemented or otherwise modified from time to time, the “Loan Agreement”) with the Lender pursuant to the Amended and Restated Quota Share Reinsurance Agreement, as amended, between AII, as reinsured, and the Lender, as Reinsurer (the “AR Quota Share”, a copy of which is attached hereto as Exhibit A), by which the Lender agreed to make Advances, as defined therein, to Borrower to satisfy its obligations to provide Borrower collateral under the AR Quota Share. 3. Pursuant to the Loan Agreement, Lender made Advances to AII in the total amount of $167,974,836, which are memorialized in that certain Promissory Note, dated as of December 18, 2007, issued by AII to Lender (the “Note”). A copy of the Note is attached hereto as Exhibit B. 4. On December 31, 2014, AII, with the Lender’s consent, assigned its obligations under the Loan Agreement and Note to the Borrower pursuant to that certain Assignment and Assumption Agreement, dated as of December 31, 2014. A copy of the Assignment and Assumption Agreement is attached hereto as Exhibit C. 5. This AR Loan Agreement is subject to approval or non-disapproval of the Vermont Department of Financial Regulation and is binding on the parties hereto only if such approval or non-disapproval is received pursuant to Section 4.3 herein. NOW, THEREFORE, for good and valuable consideration, the sufficiency of which is hereby acknowledged, the Parties agree as follows: ARTICLE I DEFINTIONS 1.1 Certain Definitions: “Applicable Rate” means Federal Funds Effective Rate plus One Hundred and Fifty basis points. “AR Loan Agreement” has the meaning set forth in the preamble hereto.

2 “Borrower” has the meaning set forth in the preamble hereto. “Business Day” means a day which is not a Saturday, a Sunday or any other day, including public holidays, on which banks in the City of New York are authorized or required by law or executive order to close. “Interest Period” means (i) with respect to the initial Interest Period, the period commencing on the date that this Agreement is executed and ending on the earliest to occur following the date of this Agreement of April 1st, July 1st, October 1st or January 1st and (ii) with respect to all succeeding Interest Periods, the period commencing on the Business Day immediately following the last day of the prior Interest Period and ending on the earliest to occur follow such date of April 1st, July 1st, October 1st or January 1st; provided, however, no Interest Period shall end on a date later than the Maturity Date (in such an instance, the Interest Period shall end on the Business Day prior to the Maturity Date). “Lender” has the meaning set forth in the preamble hereto. “Loan Agreement” has the meaning set forth in the Recitals. “Maturity Date” means January 1, 2033. “Note” has the meaning set forth in the Recitals. “Principal Amount” has the meaning set forth in Section 3.1. 1.2 Other Interpretive Provisions. The definitions of terms herein shall apply equally to the singular and plural forms of the terms defined. The word “including” shall be deemed to be followed by the phrase “without limitation.” The word “will” shall be construed to have the same meaning and effect as the word “shall.” Unless the context requires otherwise, (i) any definition of or reference to any agreement, instrument or other document shall be construed as referring to such agreement, instrument or other document as from time to time amended, restated, supplemented or otherwise modified (subject to any restrictions on such amendments, restatements, supplements or modifications set forth herein, (ii) any reference herein to any Person shall be construed to include such Person’s successors and assigns, (iii) the words “herein,” “hereof” and “hereunder,” and words of similar import when used herein shall be construed to refer to this Agreement in its entirety and not to any particular provision hereof, (iv) all references herein to Articles, Sections, Exhibits and Schedules shall be construed to refer to Articles and Sections of, and Exhibits and Schedules to, this AR Loan Agreement, (v) any reference to any law shall include all statutory and regulatory provisions consolidating, amending, replacing or interpreting such law and any reference to any law or regulation shall, unless otherwise specified, refer to such law or regulation as amended, modified or supplemented from time to time, and (vi) the words “asset” and “property” shall be construed to have the same meaning and effect and to refer to any and all tangible and intangible assets and properties, including cash, securities, accounts and contract rights.

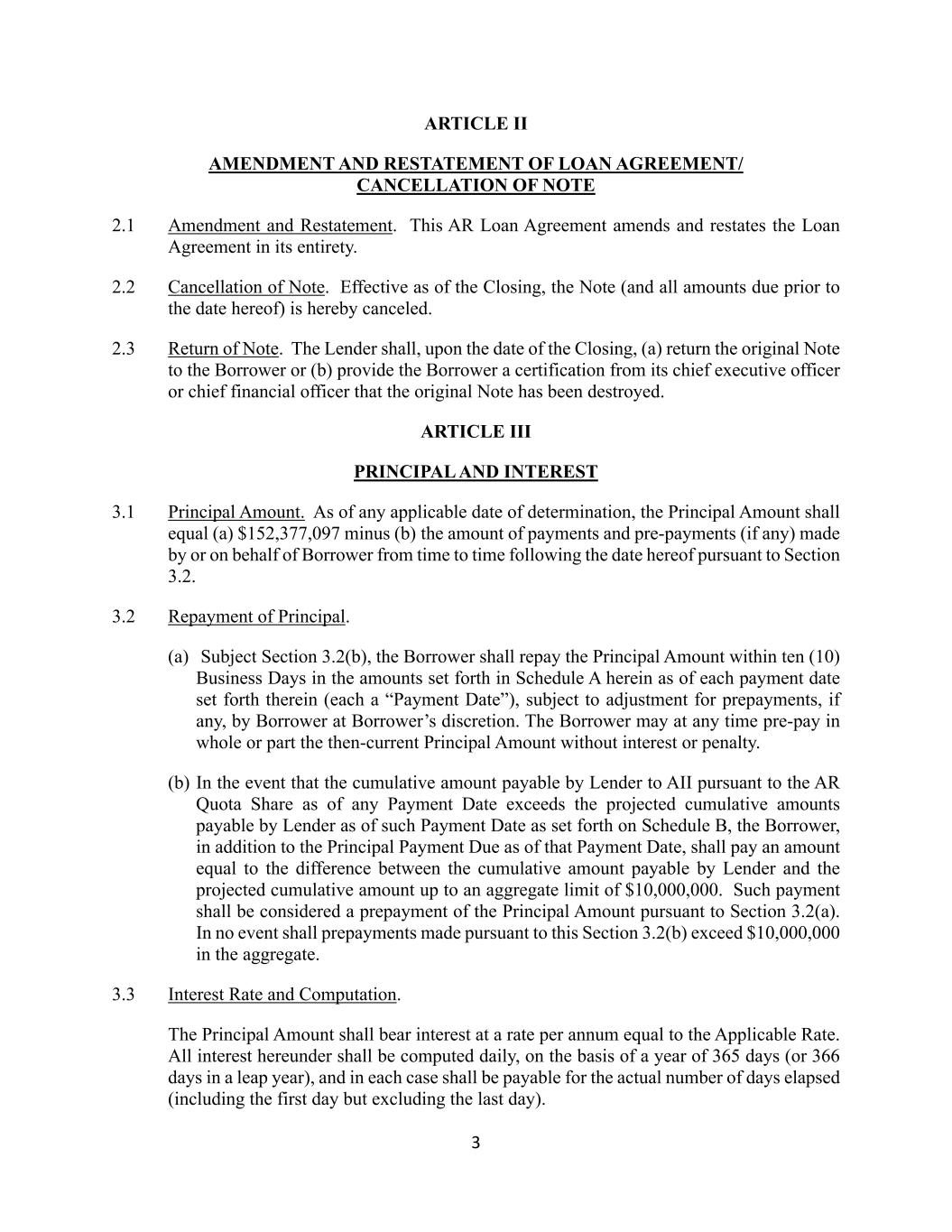

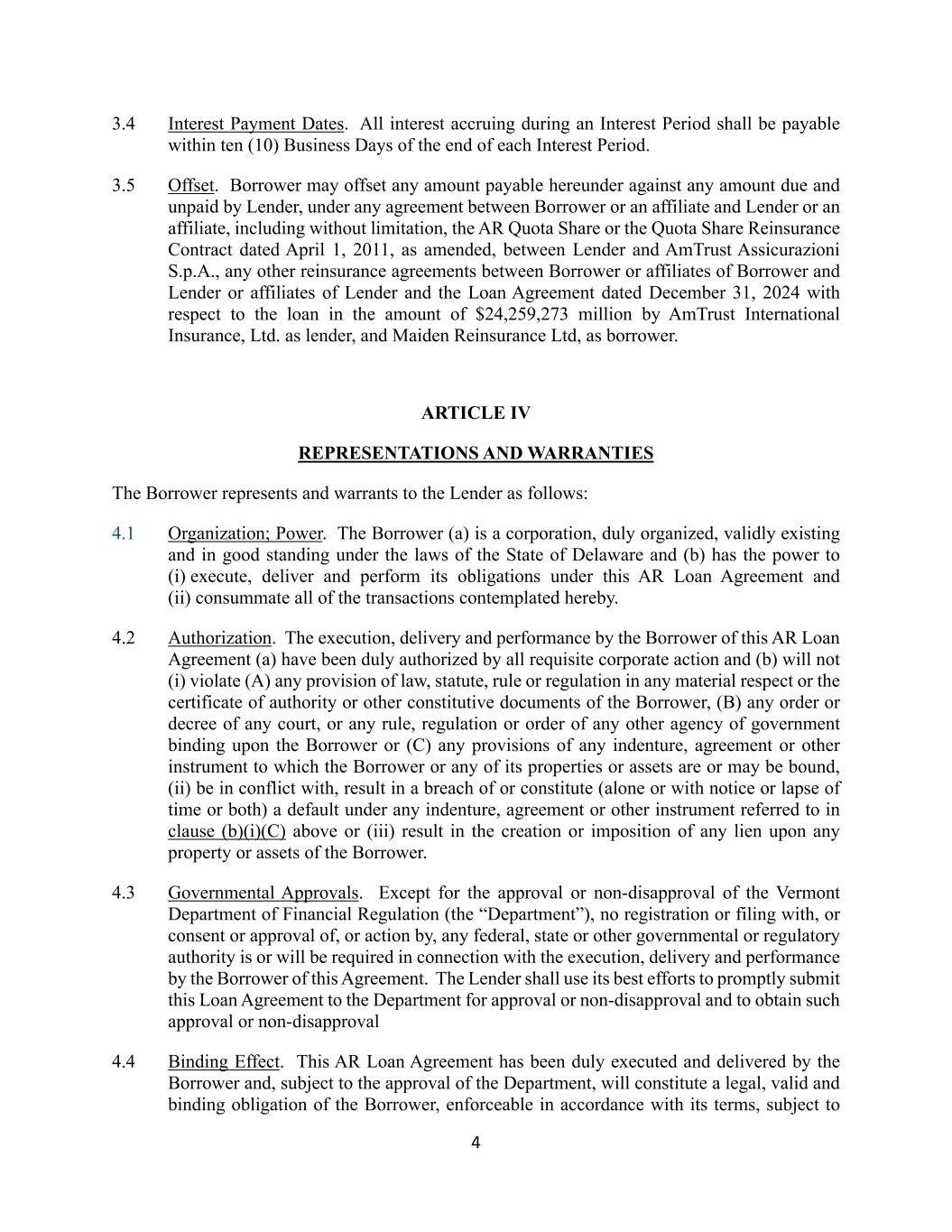

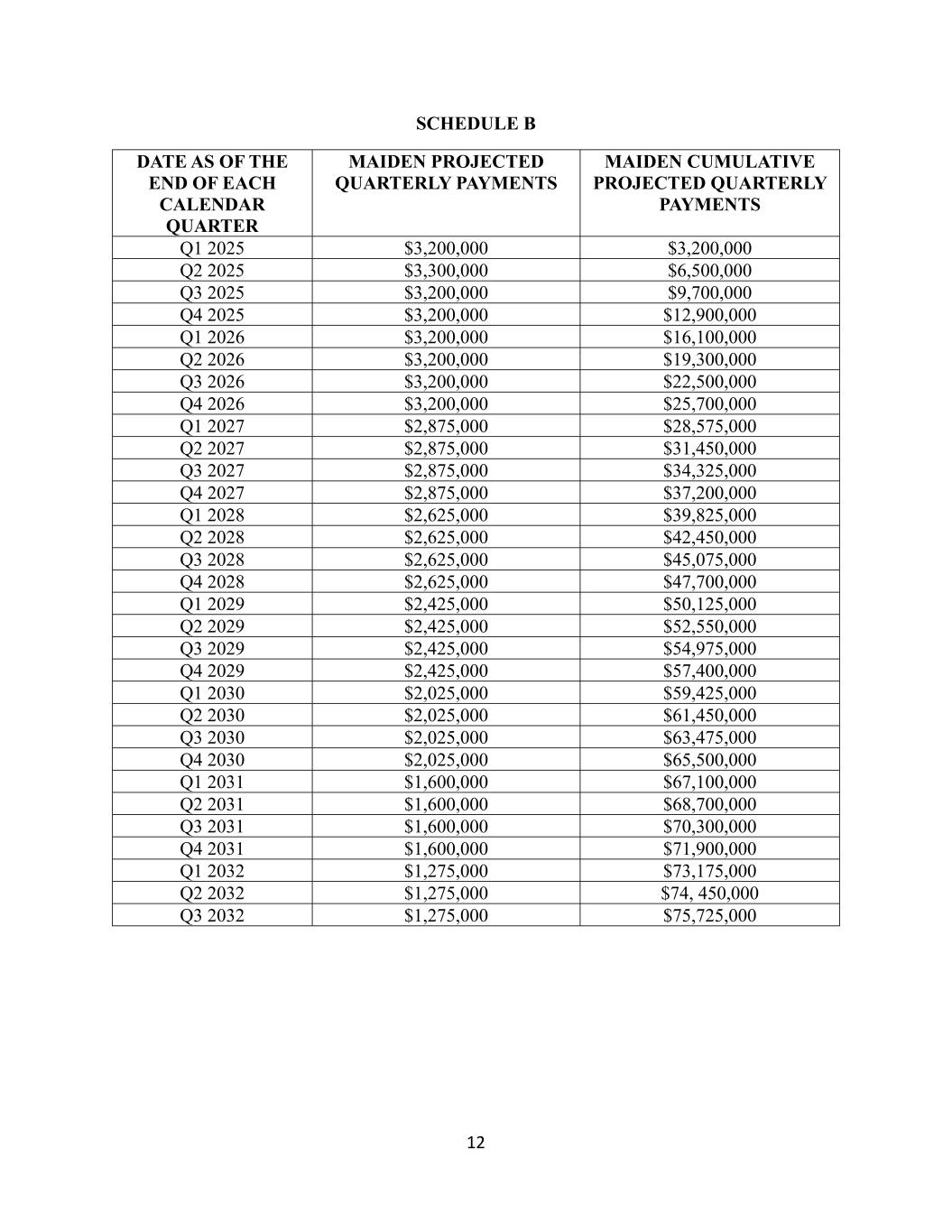

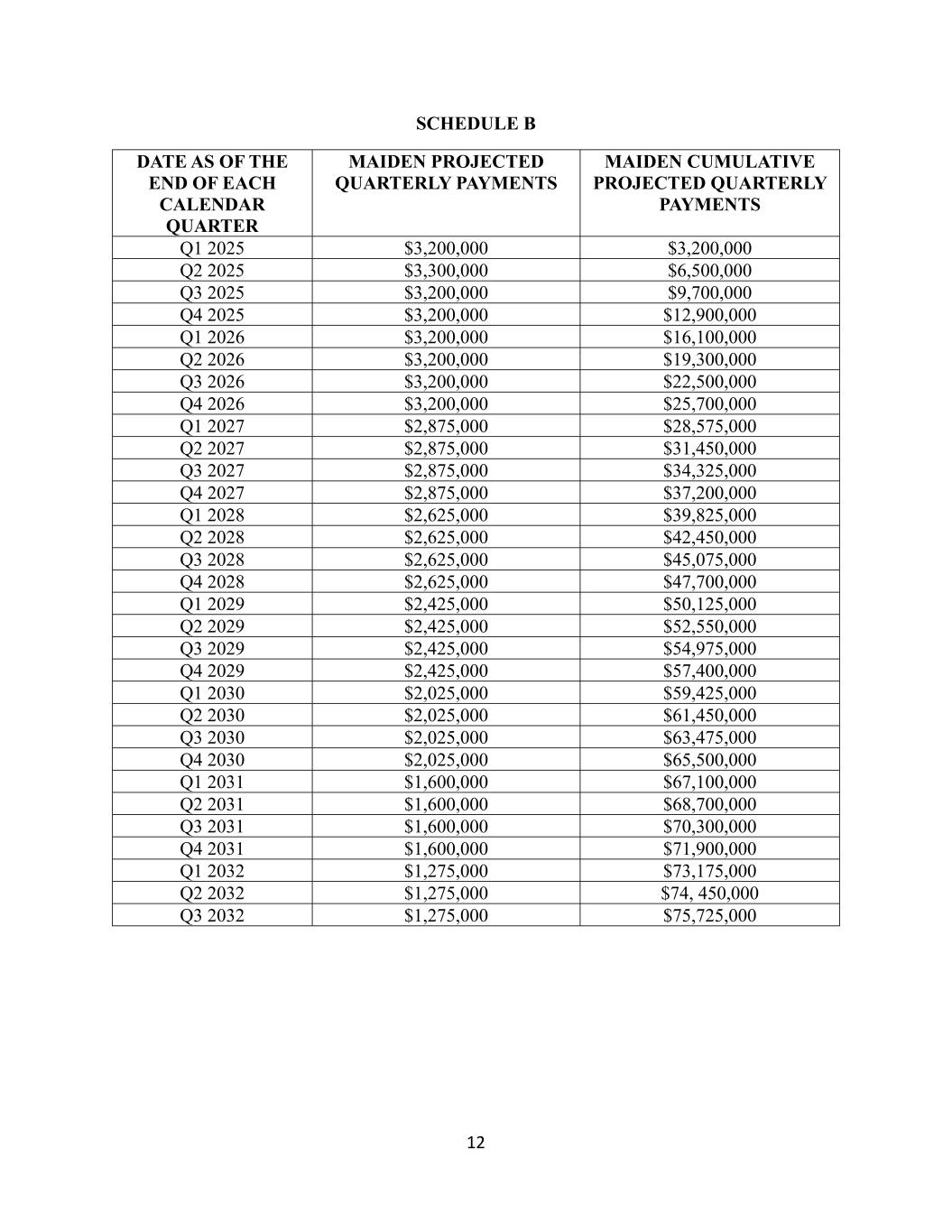

3 ARTICLE II AMENDMENT AND RESTATEMENT OF LOAN AGREEMENT/ CANCELLATION OF NOTE 2.1 Amendment and Restatement. This AR Loan Agreement amends and restates the Loan Agreement in its entirety. 2.2 Cancellation of Note. Effective as of the Closing, the Note (and all amounts due prior to the date hereof) is hereby canceled. 2.3 Return of Note. The Lender shall, upon the date of the Closing, (a) return the original Note to the Borrower or (b) provide the Borrower a certification from its chief executive officer or chief financial officer that the original Note has been destroyed. ARTICLE III PRINCIPAL AND INTEREST 3.1 Principal Amount. As of any applicable date of determination, the Principal Amount shall equal (a) $152,377,097 minus (b) the amount of payments and pre-payments (if any) made by or on behalf of Borrower from time to time following the date hereof pursuant to Section 3.2. 3.2 Repayment of Principal. (a) Subject Section 3.2(b), the Borrower shall repay the Principal Amount within ten (10) Business Days in the amounts set forth in Schedule A herein as of each payment date set forth therein (each a “Payment Date”), subject to adjustment for prepayments, if any, by Borrower at Borrower’s discretion. The Borrower may at any time pre-pay in whole or part the then-current Principal Amount without interest or penalty. (b) In the event that the cumulative amount payable by Lender to AII pursuant to the AR Quota Share as of any Payment Date exceeds the projected cumulative amounts payable by Lender as of such Payment Date as set forth on Schedule B, the Borrower, in addition to the Principal Payment Due as of that Payment Date, shall pay an amount equal to the difference between the cumulative amount payable by Lender and the projected cumulative amount up to an aggregate limit of $10,000,000. Such payment shall be considered a prepayment of the Principal Amount pursuant to Section 3.2(a). In no event shall prepayments made pursuant to this Section 3.2(b) exceed $10,000,000 in the aggregate. 3.3 Interest Rate and Computation. The Principal Amount shall bear interest at a rate per annum equal to the Applicable Rate. All interest hereunder shall be computed daily, on the basis of a year of 365 days (or 366 days in a leap year), and in each case shall be payable for the actual number of days elapsed (including the first day but excluding the last day).

4 3.4 Interest Payment Dates. All interest accruing during an Interest Period shall be payable within ten (10) Business Days of the end of each Interest Period. 3.5 Offset. Borrower may offset any amount payable hereunder against any amount due and unpaid by Lender, under any agreement between Borrower or an affiliate and Lender or an affiliate, including without limitation, the AR Quota Share or the Quota Share Reinsurance Contract dated April 1, 2011, as amended, between Lender and AmTrust Assicurazioni S.p.A., any other reinsurance agreements between Borrower or affiliates of Borrower and Lender or affiliates of Lender and the Loan Agreement dated December 31, 2024 with respect to the loan in the amount of $24,259,273 million by AmTrust International Insurance, Ltd. as lender, and Maiden Reinsurance Ltd, as borrower. ARTICLE IV REPRESENTATIONS AND WARRANTIES The Borrower represents and warrants to the Lender as follows: 4.1 Organization; Power. The Borrower (a) is a corporation, duly organized, validly existing and in good standing under the laws of the State of Delaware and (b) has the power to (i) execute, deliver and perform its obligations under this AR Loan Agreement and (ii) consummate all of the transactions contemplated hereby. 4.2 Authorization. The execution, delivery and performance by the Borrower of this AR Loan Agreement (a) have been duly authorized by all requisite corporate action and (b) will not (i) violate (A) any provision of law, statute, rule or regulation in any material respect or the certificate of authority or other constitutive documents of the Borrower, (B) any order or decree of any court, or any rule, regulation or order of any other agency of government binding upon the Borrower or (C) any provisions of any indenture, agreement or other instrument to which the Borrower or any of its properties or assets are or may be bound, (ii) be in conflict with, result in a breach of or constitute (alone or with notice or lapse of time or both) a default under any indenture, agreement or other instrument referred to in clause (b)(i)(C) above or (iii) result in the creation or imposition of any lien upon any property or assets of the Borrower. 4.3 Governmental Approvals. Except for the approval or non-disapproval of the Vermont Department of Financial Regulation (the “Department”), no registration or filing with, or consent or approval of, or action by, any federal, state or other governmental or regulatory authority is or will be required in connection with the execution, delivery and performance by the Borrower of this Agreement. The Lender shall use its best efforts to promptly submit this Loan Agreement to the Department for approval or non-disapproval and to obtain such approval or non-disapproval 4.4 Binding Effect. This AR Loan Agreement has been duly executed and delivered by the Borrower and, subject to the approval of the Department, will constitute a legal, valid and binding obligation of the Borrower, enforceable in accordance with its terms, subject to

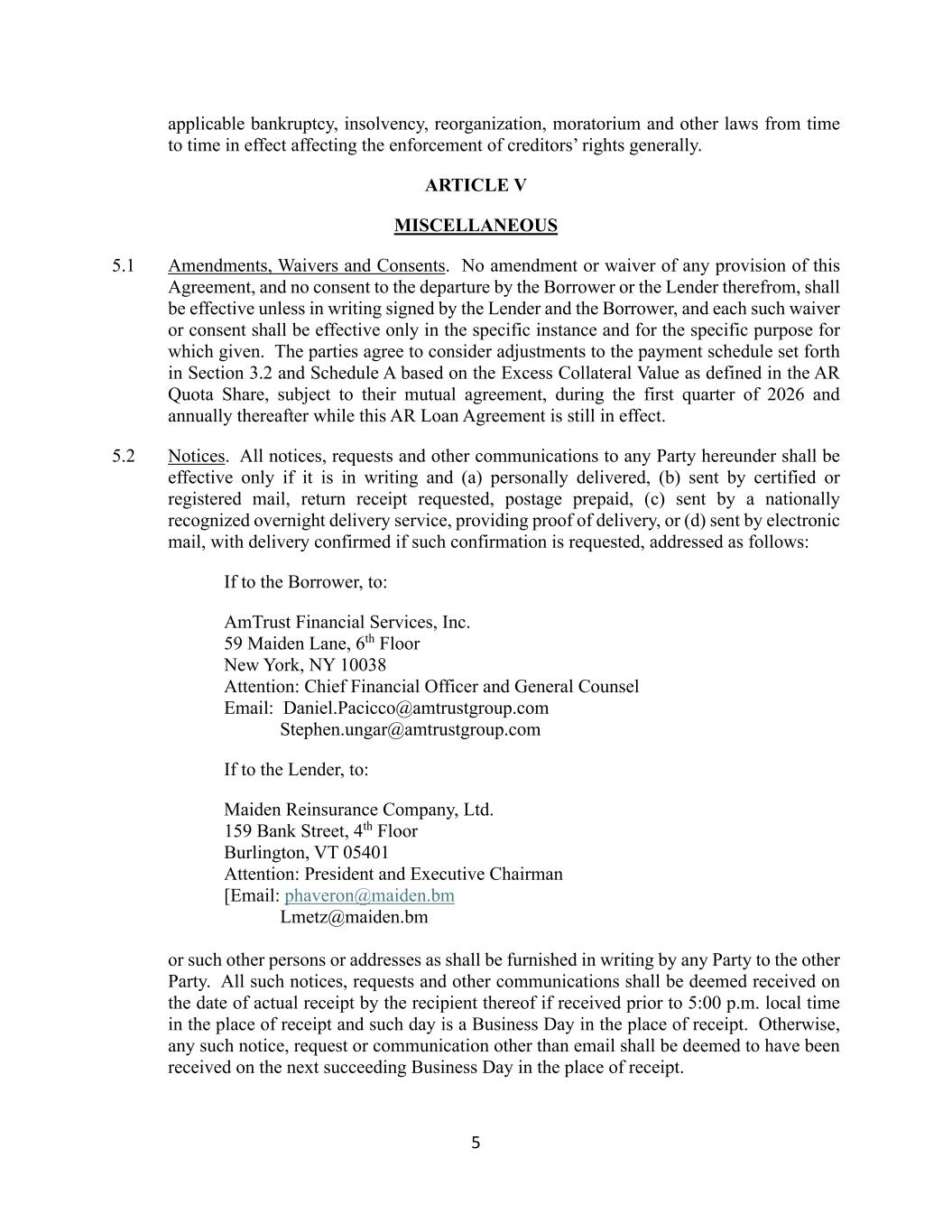

5 applicable bankruptcy, insolvency, reorganization, moratorium and other laws from time to time in effect affecting the enforcement of creditors’ rights generally. ARTICLE V MISCELLANEOUS 5.1 Amendments, Waivers and Consents. No amendment or waiver of any provision of this Agreement, and no consent to the departure by the Borrower or the Lender therefrom, shall be effective unless in writing signed by the Lender and the Borrower, and each such waiver or consent shall be effective only in the specific instance and for the specific purpose for which given. The parties agree to consider adjustments to the payment schedule set forth in Section 3.2 and Schedule A based on the Excess Collateral Value as defined in the AR Quota Share, subject to their mutual agreement, during the first quarter of 2026 and annually thereafter while this AR Loan Agreement is still in effect. 5.2 Notices. All notices, requests and other communications to any Party hereunder shall be effective only if it is in writing and (a) personally delivered, (b) sent by certified or registered mail, return receipt requested, postage prepaid, (c) sent by a nationally recognized overnight delivery service, providing proof of delivery, or (d) sent by electronic mail, with delivery confirmed if such confirmation is requested, addressed as follows: If to the Borrower, to: AmTrust Financial Services, Inc. 59 Maiden Lane, 6th Floor New York, NY 10038 Attention: Chief Financial Officer and General Counsel Email: Daniel.Pacicco@amtrustgroup.com Stephen.ungar@amtrustgroup.com If to the Lender, to: Maiden Reinsurance Company, Ltd. 159 Bank Street, 4th Floor Burlington, VT 05401 Attention: President and Executive Chairman [Email: phaveron@maiden.bm Lmetz@maiden.bm or such other persons or addresses as shall be furnished in writing by any Party to the other Party. All such notices, requests and other communications shall be deemed received on the date of actual receipt by the recipient thereof if received prior to 5:00 p.m. local time in the place of receipt and such day is a Business Day in the place of receipt. Otherwise, any such notice, request or communication other than email shall be deemed to have been received on the next succeeding Business Day in the place of receipt.

6 5.3 No Partnership. The parties hereto are independent contractors, and neither party nor its employees or agents will be deemed to be employees or agents of the other for any purpose or under any circumstances. No partnership, joint venture, alliance, fiduciary or any relationship other than that of independent contractors is created hereby, expressly or by implication. 5.4 Binding Effect; Successors and Assigns. The provisions of this AR Loan Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns permitted hereby, except that no party hereto may assign or otherwise transfer any of its rights or obligations hereunder without the prior written consent of each other party hereto. Except as provided in the preceding sentence, nothing in this Agreement, expressed or implied, shall be construed to give any Person other than the parties hereto any legal or equitable right, remedy or claim under or in respect of this AR Loan Agreement or any covenants, agreements, representations or provisions contained herein. 5.5 No Waiver; Cumulative Remedies. No failure by any Person to exercise, and no delay by any Person in exercising, any right, remedy, power or privilege hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege. The rights, remedies, powers and privileges herein provided are cumulative and not exclusive of any rights, remedies, powers and privileges provided by law. 5.6 Severability. If any provision of this AR Loan Agreement is held to be illegal, invalid or unenforceable, (a) the legality, validity and enforceability of the remaining provisions of this AR Loan Agreement shall not be affected or impaired thereby and (b) the parties shall endeavor in good faith negotiations to replace the illegal, invalid or unenforceable provisions with valid provisions the economic effect of which comes as close as possible to that of the illegal, invalid or unenforceable provisions. The invalidity of a provision in a particular jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction. 5.7 Governing Law; Jurisdiction, Etc. (a) GOVERNING LAW. THIS AR LOAN AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK, WITHOUT REGARD TO ANY CONFLICTS OF LAW PRINCIPLES THAT WOULD CALL FOR THE APPLICATION OF THE LAWS OF ANY OTHER JURISDICTIONS. (b) SUBMISSION TO JURISDICTION. EACH PARTY HERETO IRREVOCABLY AND UNCONDITIONALLY SUBMITS, FOR ITSELF AND ITS PROPERTY, TO THE NONEXCLUSIVE JURISDICTION OF THE COURTS OF THE STATE OF NEW YORK SITTING IN NEW YORK, NEW YORK AND OF THE UNITED STATES DISTRICT COURT OF THE SOUTHERN DISTRICT OF NEW YORK, AND ANY APPELLATE COURT FROM ANY THEREOF, IN ANY ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS AR LOAN AGREEMENT OR FOR RECOGNITION OR

7 ENFORCEMENT OF ANY ARBITRAL AWARD, AND EACH OF THE PARTIES HERETO IRREVOCABLY AND UNCONDITIONALLY AGREES THAT ALL CLAIMS IN RESPECT OF ANY SUCH ACTION OR PROCEEDING MAY BE HEARD AND DETERMINED IN SUCH NEW YORK STATE COURT OR, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, IN SUCH FEDERAL COURT. EACH OF THE PARTIES HERETO AGREES THAT A FINAL JUDGMENT IN ANY SUCH ACTION OR PROCEEDING SHALL BE CONCLUSIVE AND MAY BE ENFORCED IN OTHER JURISDICTIONS BY SUIT ON THE JUDGMENT OR IN ANY OTHER MANNER PROVIDED BY LAW. (c) WAIVER OF VENUE. EACH PARTY HERETO IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY OBJECTION THAT IT MAY NOW OR HEREAFTER HAVE TO THE LAYING OF VENUE OF ANY ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS AR LOAN AGREEMENT IN ANY COURT REFERRED TO IN SECTION 5.7(c). EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, THE DEFENSE OF AN INCONVENIENT FORUM TO THE MAINTENANCE OF SUCH ACTION OR PROCEEDING IN ANY SUCH COURT. (d) SERVICE OF PROCESS. EACH PARTY HERETO IRREVOCABLY CONSENTS TO SERVICE OF PROCESS IN THE MANNER PROVIDED FOR NOTICES IN SECTION 5.2. NOTHING IN THIS AR LOAN AGREEMENT WILL AFFECT THE RIGHT OF ANY PARTY HERETO TO SERVE PROCESS IN ANY OTHER MANNER PERMITTED BY APPLICABLE LAW. 5.8 Waiver of Jury Trial. EACH PARTY HERETO HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AR LOAN AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY (WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY). 5.9 Counterparts; Integration. This AR Loan Agreement may be executed in counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. This AR Loan Agreement constitutes the entire contract among the parties relating to the subject matter hereof and supersedes any and all previous agreements and understandings, oral or written, relating to the subject matter hereof. Delivery of an executed counterpart of a signature page of this AR Loan Agreement by telecopy shall be effective as delivery of a manually executed counterpart of this Agreement. 5.10 Headings. Article and Section headings used herein are for convenience of reference only and are not to affect the construction of, or to be taken into consideration in interpreting, this Agreement.

8 5.11 Termination. This AR Loan Agreement shall terminate in its entirety upon payment in full of the Principal Amount and all interest payable hereunder. [Signature Pages Follow]

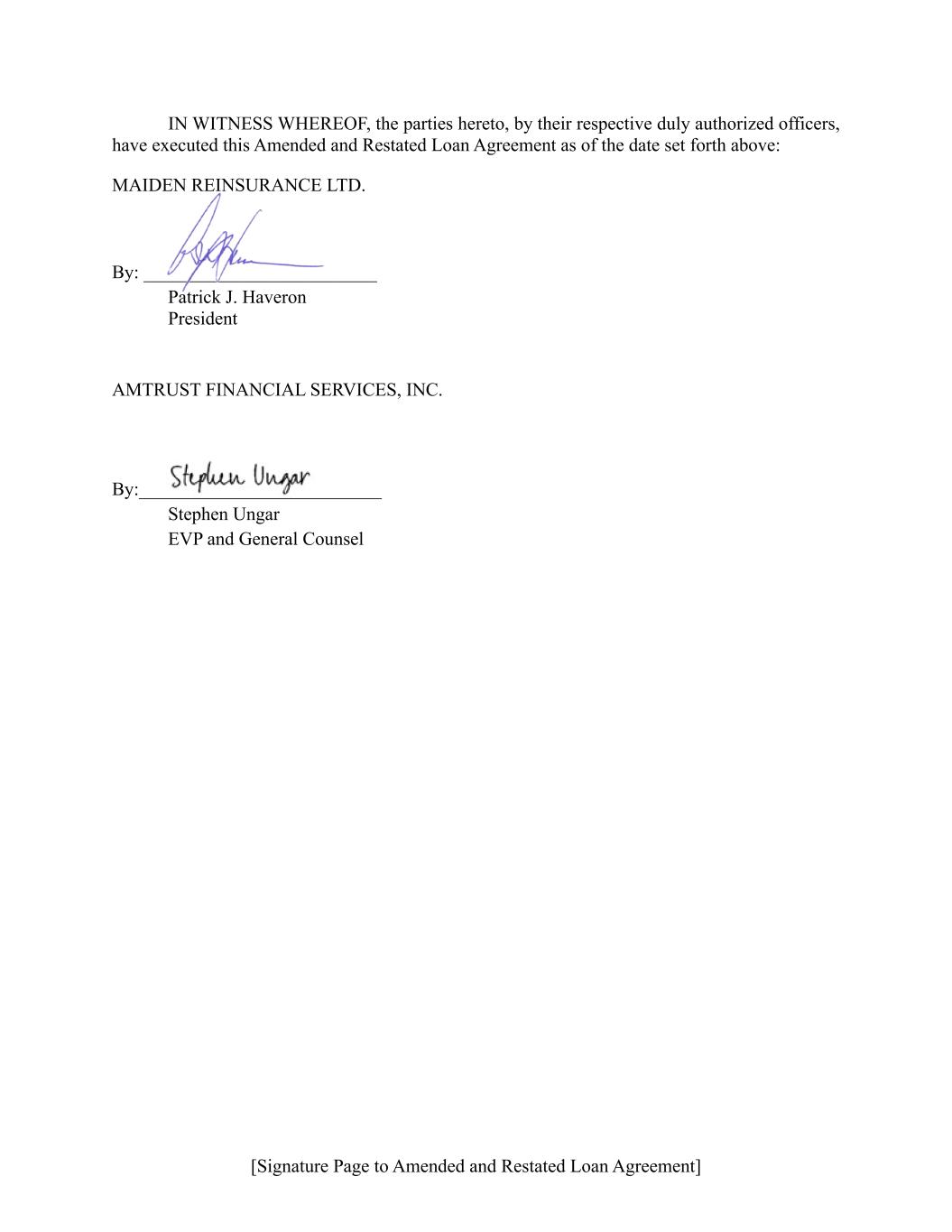

[Signature Page to Amended and Restated Loan Agreement] IN WITNESS WHEREOF, the parties hereto, by their respective duly authorized officers, have executed this Amended and Restated Loan Agreement as of the date set forth above: MAIDEN REINSURANCE LTD. By: _________________________ Patrick J. Haveron President AMTRUST FINANCIAL SERVICES, INC. By:__________________________ Stephen Ungar EVP and General Counsel

SCHEDULE A PAYMENT DATE PRINCIPAL PAYMENT DUE 4/1/2025 $7,500,000 7/1/2025 $7,500,000 10/1/2025 $9,500,000 1/1/2026 $9,000,000 4/1/2026 $9,000,000 7/1//2026 $7,000,000 10/1//2026 $7,000,000 1/1/2027 $4,000,000 4/1//2027 $4,000,000 7/1/2027 $5,000,000 10/1/2027 $5,000,000 1/1/2028 $4,000,000 4/1/2028 $4,000,000 7/12028 $4,000,000 10/1/2028 $4,000,000 1/1/2029 $2,500,000 4/12029 $2,500,000 7/1/2029 $2,500,000 10/1/2029 $2,500,000 1/1/2030 $2,500,000 4/1/2030 $2,500,000 7/1/2030 $2,500,000

11 10/1/2030 $2,500,000 1/1/2031 $2,500,000 4/1/2031 $2,500,000 7/1/2031 $2,500,000 10/1/2031 $2,500,000 1/1/2032 $1,250,000 4/1/2032 $1,250,000 7/1/2032 $1,250,000 10/1/2032 $1,250,000 1/1/2033 $26,877,097

12 SCHEDULE B DATE AS OF THE END OF EACH CALENDAR QUARTER MAIDEN PROJECTED QUARTERLY PAYMENTS MAIDEN CUMULATIVE PROJECTED QUARTERLY PAYMENTS Q1 2025 $3,200,000 $3,200,000 Q2 2025 $3,300,000 $6,500,000 Q3 2025 $3,200,000 $9,700,000 Q4 2025 $3,200,000 $12,900,000 Q1 2026 $3,200,000 $16,100,000 Q2 2026 $3,200,000 $19,300,000 Q3 2026 $3,200,000 $22,500,000 Q4 2026 $3,200,000 $25,700,000 Q1 2027 $2,875,000 $28,575,000 Q2 2027 $2,875,000 $31,450,000 Q3 2027 $2,875,000 $34,325,000 Q4 2027 $2,875,000 $37,200,000 Q1 2028 $2,625,000 $39,825,000 Q2 2028 $2,625,000 $42,450,000 Q3 2028 $2,625,000 $45,075,000 Q4 2028 $2,625,000 $47,700,000 Q1 2029 $2,425,000 $50,125,000 Q2 2029 $2,425,000 $52,550,000 Q3 2029 $2,425,000 $54,975,000 Q4 2029 $2,425,000 $57,400,000 Q1 2030 $2,025,000 $59,425,000 Q2 2030 $2,025,000 $61,450,000 Q3 2030 $2,025,000 $63,475,000 Q4 2030 $2,025,000 $65,500,000 Q1 2031 $1,600,000 $67,100,000 Q2 2031 $1,600,000 $68,700,000 Q3 2031 $1,600,000 $70,300,000 Q4 2031 $1,600,000 $71,900,000 Q1 2032 $1,275,000 $73,175,000 Q2 2032 $1,275,000 $74, 450,000 Q3 2032 $1,275,000 $75,725,000

13 EXHIBIT A LOAN AGREEMENT

14 EXHIBIT B NOTE

15 EXHIBIT C ASSIGNMENT AND ASSUMPTION AGREEMENT 10336163_1:13570-00001