The average balance of money market accounts decreased by $16.4 million, or 14.7% to $95.1 million for the year ended June 30, 2007 from $111.5 million for the year ended June 30, 2006. The average cost of money market accounts increased 74 basis points to 2.84% for the year ended June 30, 2007 from 2.10% for the year ended June 30, 2006. The average balance of savings accounts increased by $21.4 million, or 22.5% to $116.2 million for the year ended June 30, 2007 from $94.8 million for the year ended June 30, 2006. The average cost of savings accounts increased 124 basis points to 1.66% for the year ended June 30, 2007 from 0.42% for the year ended June 30, 2006. The average balance of certificate of deposit accounts increased by $6.3 million, or 2.8%, to $228.7 million for the year ended June 30, 2007 from $222.4 million for the year ended June 30, 2006. The average cost of certificate of deposits increased 62 basis points to 4.48% for the year ended June 30, 2007 from 3.86% for the year ended June 30, 2006.

The average balance of advances from the Federal Home Loan Bank of San Francisco increased $40.8 million, or 27.5%, to $189.2 million for the year ended June 30, 2007 from $148.4 million for the year ended June 30, 2007. The average cost of advances increased 23 basis points to 4.37% for the year ended June 30, 2007 from 4.14% for the year ended June 30, 2006.

The primary factor for the increase in the average balance and average interest rates on deposits and advances was to fund real estate loan purchases to better match our debt maturity schedule with the maturities and repricing terms of our interest-earning assets.

Our provision for loan losses decreased $123,000 to $529,000 for the year ended June 30, 2007 as compared to $652,000 for the year ended June 30, 2006. The allowance for loan losses as a percent of total loans was 0.40% at June 30, 2007 as compared to 0.43% at June 30, 2006. The decrease in the provision was primarily attributable to reduced loan concentrations to higher-risk automobile loan borrowers coupled with a continued history of no losses in our real estate loan portfolio. We used the

same methodology and generally similar assumptions in assessing the adequacy of the allowance for consumer and real estate loans for both years.

Non-interest Income. Non-interest income increased $833,000, or 24.3%, to $4.3 million for the year ended June 30, 2007 from $3.4 million for the year ended June 30, 2006. The increase was primarily the result of a $489,000 reduction in the loss on our equity investment in a California Affordable Housing Program tax credit fund, an $186,000 increase in service charges and fees from deposit accounts and a $131,000 increase in fee and transaction income related to the deployment of additional ATMs.

We account for our equity investment in the California Affordable Housing program in accordance with Accounting Principles Bulletin 18 using the equity method of accounting. The reduction in loss attributable to our equity investment was based upon the most recent financial statement information of the program.

Non-interest Expense. Our non-interest expense increased $1.0 million, or 7.7% to $14.5 million for the year ended June 30, 2007 from $13.5 million for the year ended June 30, 2006. The increase was primarily due to a $321,000 increase in salaries and benefits, a $316,000 increase in occupancy and equipment, a $162,000 increase in professional services and a $102,000 increase in other operating expenses.

Salaries and benefits represented 52.5% and 54.2% of total non-interest expense for the years ended June 30, 2007 and 2006, respectively. Total salaries and benefits increased $321,000, or 4.4%, to $7.6 million for the year ended June 30, 2007 from $7.3 million for the year ended June 30, 2006. The increase was primarily due to compensation expense arising from general salary increases, increased staffing for new financial service centers and an increase in costs related to our employee stock ownership plan as a result of an increase in our average stock price.

Occupancy and equipment expenses increased $316,000, or 17.8% to $2.1 million for the year ended June 30, 2007 from $1.8 million for the year ended June 30, 2006. The increase was primarily due to costs associated with the relocation of our Pasadena Branch and increased costs related to build-outs of financial service centers in Los Angeles and Riverside in addition to increased equipment maintenance expense.

Professional services increased $162,000, or 21.6% to $913,000 for the year ended June 30, 2007 compared to $751,000 for the year ended June 30, 2006. The increase in professional services was primarily due to increased external and internal audit services as a result of complying with Sarbanes-Oxley Section 404 audit requirements.

Other operating expenses increased $102,000, or 7.0% to $1.6 million for the year ended June 30, 2007 from $1.5 million for the year ended June 30, 2006. The increase in other expense was primarily due to increased operational costs to support our continued growth.

Income Tax Expense. Income tax expense for the year ended June 30, 2007 was $2.5 million as compared to $2.7 million for the year ended June 30, 2006. This decrease was primarily the result of a decline in pre-tax income of $417,000 for the year ended June 30, 2007. The effective tax rate was 35.0% and 35.6% for the years ended June 30, 2007 and 2006, respectively.

Comparison of Results of Operations for the Fiscal Years Ended June 30, 2006 and 2005.

General.Net income for the year ended June 30, 2006 was $4.9 million, a decrease of $68,000, or 1.4%, from net income of $5.0 million for the year ended June 30, 2005.

58

Interest Income. Interest income increased $7.7 million, or 27.2%, to $35.8 million for the year ended June 30, 2006 from $28.2 million for the year ended June 30, 2005. The primary factor for the increase in interest income was an increase in the average loans receivable balance of $99.6 million, or 19.5%, to $610.4 million for the year ended June 30, 2006 from $510.8 million for the year ended June 30, 2005. The increase was primarily due to purchases of one- to four-family and multi-family real estate loans. The average yield on loans receivable increased 39 basis points to 5.39% for the year ended June 30, 2006 from 5.00% for the year ended June 30, 2005.

Interest Expense. Interest expense increased $6.7 million, or 61.7%, to $17.5 million for the year ended June 30, 2006 from $10.8 million for the year ended June 30, 2005. The average interest rates on interest-bearing liabilities increased 76 basis points to 3.03% for the year ended June 30, 2006 from 2.27% for the year ended June 30, 2005. This increase was primarily attributable to the increased volume of average deposits, specifically certificates of deposit, and an increase in the average balance and interest rate on advances from the Federal Home Loan Bank of San Francisco.

The average balance of money market accounts increased by $4.2 million, or 3.9%, to $111.5 million for the year ended June 30, 2006 from $107.3 million for the year ended June 30, 2005. The average balance of savings accounts decreased by $1.9 million, or 2.0% to $94.8 million for the year ended June 30, 2006 from $96.7 million for the year ended June 30, 2005. The average balance of certificates of deposit increased by $10.8 million, or 5.1%, to $222.4 million for the year ended June 30, 2006 from $211.6 million for the year ended June 30, 2005.

The average balance of advances from the Federal Home Loan Bank of San Francisco increased $88.0 million, or 145.9%, to $148.4 million for the year ended June 30, 2006 from $60.4 million for the year ended June 30, 2005. The average cost of advances increased 79 basis points to 4.14% for the year ended June 30, 2006 from 3.35% for the year ended June 30, 2005. The primary factor for the increase in the average balance and average interest rates on advances was due to new borrowings used to fund real estate loan purchases in order to better match our debt maturity schedule with the maturities and repricing terms of our interest-earning assets and other interest-bearing liabilities.

Provision for Loan Losses. We maintain an allowance for loan losses to absorb probable incurred losses inherent in the loan portfolio. The allowance is based on ongoing, quarterly assessments of the probable losses inherent in the loan portfolio.

Our provision for loan losses increased $246,000 to $652,000 for the year ended June 30, 2006 as compared to $406,000 for the year ended June 30, 2005. The allowance for loan losses as a percent of total loans was 0.43% at June 30, 2006 as compared to 0.45% at June 30, 2005. The increase in the provision was primarily attributable to an increase in real estate loans. We used the same methodology and generally similar assumptions in assessing the adequacy of the allowance for consumer and real estate loans for both years.

Non-interest Income. Non-interest income increased $370,000, or 12.1%, to $3.4 million for the year ended June 30, 2006 from $3.1 million for the year ended June 30, 2005. The increase was primarily the result of an increase of $337,000 from bank-owned life insurance purchased in April 2005 and a $126,000 increase in ATM fees and charges due to increased usage and deployment of additional ATMs partially offset by an increase in the loss of $83,000 recognized from our investment in an affordable housing tax credit limited liability partnership.

Non-interest Expense. Our non-interest expense increased $1.5 million, or 11.9% to $13.5 million for the year ended June 30, 2006 from $12.0 million for the year ended June 30, 2005. The

59

increase was primarily due to a $736,000 increase in salaries and benefits, a $316,000 increase in occupancy and equipment, and a $235,000 increase in other operating expenses.

Salaries and benefits represented 54.2% and 54.5% of total non-interest expense for the years ended June 30, 2006 and 2005, respectively. Total salaries and benefits increased $736,000, or 11.2%, to $7.3 million for the year ended June 30, 2006 from $6.6 million for the year ended June 30, 2005. The increase was primarily due to an increase of $257,000 in compensation expense arising from general salary increases and additional full-time employees, an increase of $151,000 in stock award expense and the addition of $370,000 in stock option expense related to the to the adoption of SFAS-123(R) partially offset by a reduction in fair market value costs related to our employee stock ownership plan.

Occupancy and equipment expenses increased $316,000, or 21.7% to $1.8 million for the year ended June 30, 2006 from $1.5 million for the year ended June 30, 2005. The increase was primarily due to costs associated with the relocation of our Pasadena Branch and increased costs related to build-outs of financial service centers in Bellflower and Harbor City in addition to increased equipment maintenance expense.

Other operating expenses increased $235,000, or 19.3% to $1.5 million for the year ended June 30, 2006 from $1.2 million for the year ended June 30, 2005. The increase in other expense was primarily due to increased operational costs to support our continued growth.

Income Tax Expense.Income tax expense for the year ended June 30, 2006 was $2.7 million as compared to $3.0 million for the year ended June 30, 2005. This decrease was primarily the result of a decline in pre-tax income of $322,000, combined with an increase in non-taxable income from our bank-owned life insurance and tax credits from our affordable housing investment for the year ended June 30, 2006. The effective tax rate was 35.6% and 37.4% for the years ended June 30, 2006 and 2005, respectively.

Liquidity, Capital Resources and Commitments

Liquidity may increase or decrease depending upon the availability of funds and comparative yields on investments in relation to the return on loans. Historically, we have maintained liquid assets at levels above the minimum requirements previously imposed by Office of Thrift Supervision regulations and above levels believed to be adequate to meet the requirements of normal operations, including potential deposit outflows. Cash flow projections are regularly reviewed and updated to assure that adequate liquidity is maintained.

Our liquidity, represented by cash and cash equivalents and mortgage-backed and related securities, is a product of our operating, investing and financing activities. Our primary sources of funds are deposits, amortization, prepayments and maturities of outstanding loans and mortgage-backed and related securities, and other short-term investments and funds provided from operations. While scheduled payments from the amortization of loans and mortgage-backed related securities and maturing investment securities and short-term investments are relatively predictable sources of funds, deposit flows and loan prepayments are greatly influenced by general interest rates, economic conditions and competition. In addition, we invest excess funds in short-term interest-earning assets, which provide liquidity to meet lending requirements. We also generate cash through borrowings. We utilize Federal Home Loan Bank advances to leverage our capital base and provide funds for our lending and investment activities, and enhance our interest rate risk management.

Liquidity management is both a daily and long-term function of business management. Excess liquidity is generally invested in short-term investments such as overnight deposits. On a longer-term

60

basis, we maintain a strategy of investing in various lending products as described in greater detail under “Business of Kaiser Federal Bank – Lending Activities.” We use our sources of funds primarily to meet ongoing commitments, including loan commitments, to pay maturing certificate of deposits and savings withdrawals and to maintain our portfolio of mortgage-backed and related securities. At June 30, 2007, total approved loan commitments amounted to $13.9 million, which includes the unadvanced portion of loans of $6.4 million. Certificates of deposit and advances from the Federal Home Loan Bank of San Francisco scheduled to mature in one year or less at June 30, 2007, totaled $174.7 million and $20.0 million, respectively. Based on historical experience, management believes that a significant portion of maturing deposits will remain with Kaiser Federal Bank and we anticipate that we will continue to have sufficient funds, through deposits and borrowings, to meet our current commitments.

At June 30, 2007, we had available additional advances from the Federal Home Loan Bank of San Francisco in the amount of $101.4 million.

Contractual Obligations

In the normal course of business, we enter into contractual obligations that meet various business needs. These contractual obligations include deposit account obligations to customers, borrowings from the Federal Home Loan Bank, lease obligations for facilities, and commitments to purchase and/or originate loans. The following table summarizes our long-term contractual obligations at June 30, 2007.

| | | | | | | | | | | | | | | | |

Category of Commitments or

Contractual Obligations | | Total | | Less than

1 year | | 1 to 3

Years | | More than

3 to 5

Years | | More than

5 years | |

| |

| |

| |

| |

| |

| |

| | (In thousands) | |

| | | | | | | | | | | | | | | | |

FHLB advances | | $ | 210,000 | | $ | 20,000 | | $ | 98,000 | | $ | 92,000 | | $ | — | |

Operating lease obligations | | | 3,441 | | | 845 | | | 1,645 | | | 528 | | | 423 | |

Loan commitments to purchase residential mortgage loans | | | — | | | — | | | — | | | — | | | — | |

Loan commitments to originate residential mortgage loans | | | 7,475 | | | 7,475 | | | — | | | — | | | — | |

Available home equity and unadvanced lines of credit | | | 6,415 | | | 6,415 | | | — | | | — | | | — | |

Time deposits | | | 238,717 | | | 174,738 | | | 40,505 | | | 23,474 | | | — | |

Commitments to fund equity investment in tax credit fund | | | 193 | | | 129 | | | 64 | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total commitments and contractual obligations | | $ | 466,241 | | $ | 209,602 | | $ | 140,214 | | $ | 116,002 | | $ | 423 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Off-Balance Sheet Arrangements

As a financial services provider, we routinely are a party to various financial instruments with off-balance-sheet risks, such as commitments to extend credit and unused lines of credit. While these contractual obligations represent our future cash requirements, a significant portion of commitments to extend credit may expire without being drawn upon. Such commitments are subject to the same credit policies and approval process accorded to loans we make. For additional information, see Note 14 of the notes to our consolidated financial statements.

61

Capital

Consistent with our goal to operate a sound and profitable financial organization, we actively seek to maintain a “well capitalized” institution in accordance with regulatory standards. Total stockholders’ equity was $92.3 million at June 30, 2007 or 11.5%, of total assets on that date. As of June 30, 2007, we exceeded all regulatory capital requirements. Kaiser Federal Bank’s regulatory capital ratios at June 30, 2007 were as follows: core capital 8.32%; Tier I risk-based capital 12.76%; and total risk-based capital 13.30%. The regulatory capital requirements to be considered well capitalized are 5%, 6% and 10%, respectively. See “Supervision and Regulation–Capital Requirements.”

For the year ended June 30, 2007, we repurchased 279,845 shares of our common stock at an average cost of $17.67.

Impact of Inflation

The consolidated financial statements presented herein have been prepared in accordance with GAAP. These principles require the measurement of financial position and operating results in terms of historical dollars, without considering changes in the relative purchasing power of money over time due to inflation.

Our primary assets and liabilities are monetary in nature. As a result, interest rates have a more significant impact on our performance than the effects of general levels of inflation. Interest rates, however, do not necessarily move in the same direction or with the same magnitude as the price of goods and services, since such prices are affected by inflation. In a period of rapidly rising interest rates, the liquidity and maturity structure of our assets and liabilities are critical to the maintenance of acceptable performance levels.

The principal effect of inflation, as distinct from levels of interest rates, on earnings, is in the area of non-interest expense. Such expense items as employee compensation, employee benefits and occupancy and equipment costs may be subject to increases as a result of inflation. An additional effect of inflation is the possible increase in the dollar value of the collateral securing loans that we have made. We are unable to determine the extent, if any, to which properties securing our loans have appreciated in dollar value due to inflation.

Recent Accounting Pronouncements

Please refer to Note 1 of the consolidated financial statements.

Management of Market Risk

As part of our attempt to manage our exposure to changes in interest rates and comply with applicable regulations, we monitor our interest rate risk. In monitoring interest rate risk, we continually analyze and manage assets and liabilities based on their payment streams and interest rates, the timing of their maturities, and their sensitivity to actual or potential changes in market interest rates.

In order to minimize the potential for adverse effects of material and prolonged increases in interest rates on our results of operations, we have adopted investment/asset and liability management policies to better match the maturities and repricing terms of our interest-earning assets and interest-bearing liabilities. The Board of Directors sets and recommends the asset and liability policies of Kaiser Federal Bank, which are implemented by the asset/liability management committee.

62

The purpose of the asset/liability management committee is to communicate, coordinate and control asset/liability management consistent with our business plan and board approved policies. The committee establishes and monitors the volume and mix of assets and funding sources taking into account relative costs and spreads, interest rate sensitivity and liquidity needs. The objectives are to manage assets and funding sources to produce results that are consistent with liquidity, capital adequacy, growth, risk and profitability goals.

The asset/liability management committee generally meets on a weekly basis to review, among other things, economic conditions and interest rate outlook, current and projected liquidity needs and capital position, anticipated changes in the volume and mix of assets and liabilities and interest rate risk exposure limits versus current projections pursuant to net present value of portfolio equity analysis and income simulations. The asset/liability management committee recommends appropriate strategy changes based on this review. The chairman or his designee is responsible for reviewing and reporting on the effects of the policy implementations and strategies to the Board of Directors at least monthly.

In order to manage our assets and liabilities and achieve the desired liquidity, credit quality, interest rate risk, profitability and capital targets, we have focused our strategies on:

| | |

| • | Originating and purchasing adjustable rate loans; |

| | |

| • | Originating a reasonable volume of short- and intermediate-term consumer loans; |

| | |

| • | Managing our deposits to establish stable deposit relationships; and |

| | |

| • | Using Federal Home Loan Bank advances and pricing on fixed-term, non-core deposits to align maturities and repricing terms. |

At times, depending on the level of general interest rates, the relationship between long- and short-term interest rates, market conditions and competitive factors, the asset/liability management committee may determine to increase our interest rate risk position somewhat in order to maintain our net interest margin.

The asset/liability management committee regularly reviews interest rate risk by forecasting the impact of alternative interest rate environments on net interest income and market value of portfolio equity, which is defined as the net present value of an institution’s existing assets, liabilities and off-balance sheet instruments, and evaluating such impacts against the maximum potential changes in net interest income and market value of portfolio equity that are authorized by the Board of Directors of Kaiser Federal Bank.

The Office of Thrift Supervision provides Kaiser Federal Bank with the information presented in the following tables, which is based on information provided to the Office of Thrift Supervision by Kaiser Federal Bank. It presents the change in Kaiser Federal Bank’s net portfolio value at June 30, 2007 and June 30, 2006 that would occur upon an immediate change in interest rates based on Office of Thrift Supervision assumptions but without giving effect to any steps that management might take to counteract that change.

63

| | | | | | | | | | | | | | | | |

Change in

interest rates in

basis points

(“bp”) | | June 30, 2007 | |

|

| |

| Net portfolio value (NPV) | | NPV as % of PV of assets | |

|

| |

| |

| $ amount | | $ change | | % change | | NPV ratio | | Change(bp) | |

| |

| |

| |

| |

| |

| |

| | (Dollars in thousands) | |

| | | | | | | | | | | | | | | | |

+300 bp | | $ | 39,973 | | $ | (38,212 | ) | | (49 | )% | | 5.49 | % | | (445 | )bp |

+200 bp | | | 54,079 | | | (24,106 | ) | | (31 | ) | | 7.22 | | | (272 | ) |

+100 bp | | | 67,237 | | | (10,498 | ) | | (14 | ) | | 8.75 | | | (119 | ) |

0 bp | | | 78,185 | | | — | | | — | | | 9.94 | | | — | |

-100 bp | | | 85,981 | | | 7,796 | | | 10 | | | 10.72 | | | 78 | |

-200 bp | | | 88,745 | | | 10,560 | | | 14 | | | 10.92 | | | 98 | |

| | | | | | | | | | | | | | | | |

Change in

interest rates in

basis points

(“bp”) | | June 30, 2006 | |

|

| |

| Net portfolio value (NPV) | | NPV as % of PV of assets | |

|

| |

| |

| $ amount | | $ change | | % change | | NPV ratio | | Change(bp) | |

| |

| |

| |

| |

| |

| |

| | (Dollars in thousands) | |

| | | | | | | | | | | | | | | | |

+300 bp | | $ | 52,074 | | $ | (31,435 | ) | | (38 | )% | | 7.79 | % | | (377 | )bp |

+200 bp | | | 62,793 | | | (20,716 | ) | | (25 | ) | | 9.15 | | | (241 | ) |

+100 bp | | | 73,459 | | | (10,050 | ) | | (12 | ) | | 10.43 | | | (113 | ) |

0 bp | | | 83,509 | | | — | | | — | | | 11.56 | | | — | |

-100 bp | | | 90,540 | | | 7,031 | | | 8 | | | 12.27 | | | 71 | |

-200 bp | | | 89,698 | | | 6,189 | | | 7 | | | 12.03 | | | 47 | |

The Office of Thrift Supervision uses certain assumptions in assessing the interest rate risk of savings associations. These assumptions relate to interest rates, loan prepayment rates, deposit decay rates, and the market values of certain assets under differing interest rate scenarios, among others.

As with any method of measuring interest rate risk, shortcomings are inherent in the method of analysis presented in the foregoing tables. For example, although assets and liabilities may have similar maturities or periods to repricing, they may react in different degrees to changes in the market interest rates. Also, the interest rates on certain types of assets and liabilities may fluctuate in advance of changes in market interest rates, while interest rates on other types may lag behind changes in market rates. Additionally, certain assets, such as adjustable rate mortgage loans, have features, that restrict changes in interest rates on a short-term basis and over the life of the asset. Further, if interest rates change, expected rates of prepayments on loans and early withdrawals from certificates of deposit could deviate significantly from those assumed in calculating the tables.

64

BUSINESS OF KAISER FEDERAL FINANCIAL GROUP, INC.

AND K-FED BANCORP

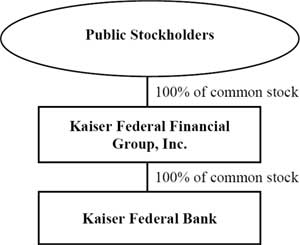

Kaiser Federal Financial Group, Inc.

Kaiser Federal Financial Group, Inc. is a Maryland corporation, organized on September 24, 2007. Upon completion of the conversion and offering, Kaiser Federal Financial Group, Inc. will serve as the holding company for Kaiser Federal Bank and will succeed to all of the business and operations of K-Fed Bancorp, and each of K-Fed Bancorp and K-Fed Mutual Holding Company will cease to exist.

Initially following the completion of the conversion and offering, Kaiser Federal Financial Group, Inc. will have no significant assets other than owning 100% of the outstanding common stock of Kaiser Federal Bank, the net proceeds it retains from the offering, part of which will be used to make a loan to the Kaiser Federal Bank Employee Stock Ownership Plan, and will have no significant liabilities. See “How We Intend to Use the Proceeds From the Offering.” Kaiser Federal Financial Group, Inc. intends to utilize the support staff and offices of Kaiser Federal Bank and will pay Kaiser Federal Bank for these services. If Kaiser Federal Financial Group, Inc. expands or changes its business in the future, it may hire its own employees.

Kaiser Federal Financial Group, Inc. intends to invest the net proceeds of the offering as discussed under “How We Intend to Use the Proceeds From the Offering.” In the future, it may pursue other business activities, including mergers and acquisitions, investment alternatives and diversification of operations. There are, however, no current understandings or agreements for these activities.

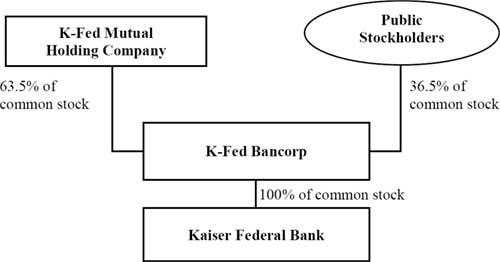

K-Fed Bancorp

K-Fed Bancorp is a federally-chartered stock holding company that was formed in July 2003 as a wholly-owned subsidiary of K-Fed Mutual Holding Company, a federally-chartered mutual holding company, in connection with the mutual holding company reorganization of Kaiser Federal Bank, a federally chartered stock savings association. Upon completion of the mutual holding company reorganization in July 2003, K-Fed Bancorp acquired all of the capital stock of Kaiser Federal Bank. On March 30, 2004, K-Fed Bancorp completed a minority stock offering in which it sold 5,686,750 shares, or 39.09%, of its outstanding common stock to eligible depositors of Kaiser Federal Bank and the Kaiser Federal Bank employee stock ownership plan in a subscription offering. The remaining 8,861,750 outstanding shares of K-Fed Bancorp’s common stock are owned by K-Fed Mutual Holding Company. At June 30, 2007, K-Fed Mutual Holding Company owned 63.5% of the outstanding shares of common stock of K-Fed Bancorp, with the remaining 36.5%, or 5,087,195 shares held by public stockholders. K-Fed Bancorp owns 100% of Kaiser Federal Bank’s outstanding common stock.

At June 30, 2007, K-Fed Bancorp had consolidated assets of $799.6 million, deposits of $494.1 million and stockholders’ equity of $92.3 million. K-Fed Bancorp has not engaged in any significant business to date. Its primary activity is holding all of the outstanding shares of common stock of Kaiser Federal Bank. K-Fed Bancorp does not maintain offices separate from those of Kaiser Federal Bank or utilize persons other than certain of Kaiser Federal Bank’s officers. Our executive offices are located at 1359 North Grand Avenue, Covina, California 91724 and our telephone number is (626) 339-9663.

65

BUSINESS OF KAISER FEDERAL BANK

General

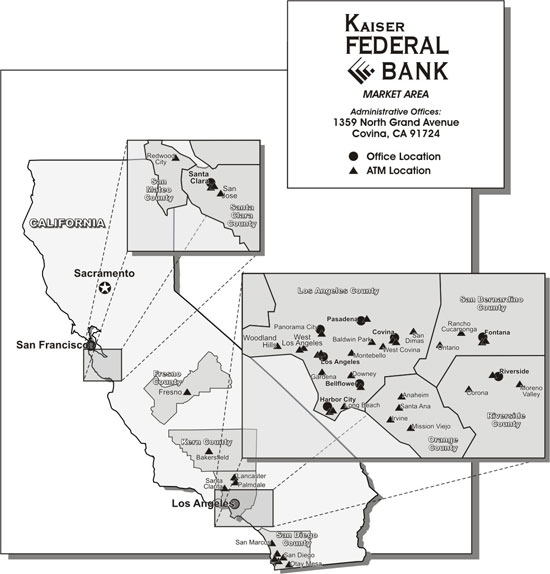

Kaiser Federal Bank is a community oriented financial institution offering a variety of financial services to meet the needs of the communities it serves. We are headquartered in Covina, California, with branches in Pasadena and Panorama City to serve Los Angeles County. We also have financial service centers in Fontana, Riverside and Santa Clara to serve the California Counties of San Bernardino, Riverside and Santa Clara, respectively. We also have financial service centers in Los Angeles, Bellflower and Harbor City in Los Angeles County, California. We have a network of 54 ATMs located in Southern California and the San Francisco Metropolitan Area, primarily located at Kaiser Permanente Medical Centers. We utilize financial service centers, ATMs and purchases of residential mortgage loans to more efficiently use our resources.

We enjoy a strong and positive reputation with our customer base and the local market area. Dating back to our days as a credit union, we have a strong bond with our customers. As a personal-service focused community financial institution, we focus on enhancing customer satisfaction with products and services that address customer needs and are consistent with our charter and risk profile. We strive to offer high quality customer service in the most efficient way. We consistently evaluate ways to broaden the products and services we offer which we expext will enhance our market penetration in the communities we serve.

Kaiser Federal Bank began operations as a credit union in 1953 to serve the employees of the Kaiser Foundation Hospital in Los Angeles, California. On November 1, 1999, the credit union converted to a federal mutual savings association known as Kaiser Federal Bank, which serves the general public as well as Kaiser Permanente employees. On July 1, 2003, we completed our conversion from a federal mutual savings association to a federal stock savings association in conjunction with the mutual holding company reorganization. On March 30, 2004, K-Fed Bancorp completed its initial minority stock offering.

Our principal business consists of attracting retail deposits from the general public and investing those funds primarily in permanent loans secured by first mortgages on owner-occupied, one- to four-family residences and, to a lesser extent, multi-family residential loans and commercial real estate loans. We also originate automobile and other consumer loans. Historically, we have not made or purchased commercial business loans or commercial or residential real estate construction loans and have no current plans to do so.

Our revenues are derived principally from interest on loans and mortgage-backed and related securities. We also generate revenue from service charges and other income.

We offer a variety of deposit accounts having a wide range of interest rates and terms, which generally include savings accounts, money market accounts, demand deposit accounts and certificate of deposit accounts with varied terms ranging from 90 days to five years. We solicit deposits in our primary market area of San Diego, Los Angeles, San Bernardino, Riverside, and Santa Clara Counties, California.

Our website address iswww.k-fed.com. Information on our website is not and should not be considered a part of this prospectus.

66

Market Area

Our California market area provides a large, increasing base of potential customers with per capita income levels favorable to the national average. Los Angeles County is one of the largest counties, by area, in the United States and has the largest population of any county in the United States and is exceeded in population by only by eight states. Historically, Los Angeles County’s economy was tied to the aerospace, entertainment and tourism industries. In the early 1990s, the area suffered recessionary conditions due to the downsizing of the United States military and the economic downturn affecting the national economy. Los Angeles County’s economy has improved dramatically since the mid-1990s as a result of extensive overhauling and restructuring of the region’s basic economic sectors from one formerly dominated by the aerospace, tourism and entertainment industries to a more diversified mix of high-technology commercial endeavors and by-products of the defense related industries, which capitalized on the highly educated and skilled labor force. The largest employers consist of the County of Los Angeles, the Los Angeles United School District and the City of Los Angeles. Emerging growth areas include telecommunications, electronics, computers, software and biomedical technologies as well as international trade.

The Counties of Riverside and San Bernadino are commonly referred to as the “Inland Empire.” While the Inland Empire covers a vast geographic area extending to the Nevada border, Kaiser Federal Bank’s operations are concentrated in the western portion of these counties. This area was also affected by the economic downtown of the early 1990s, but has since recovered. Many firms have moved from the congested and high priced regions of Los Angeles, Orange and San Diego Counties to the Inland Empire, a trend that is expected to continue. The Pacific portion of San Bernardino and Riverside Counties are adjacent to higher housing cost areas of Los Angeles, Orange and San Diego Counties and are a magnet for new residents seeking affordable housing. Manufacturing, transportation and distribution companies provide thousands of jobs in this area.

Santa Clara County is home to a number of leading technology and telecommunication companies and is located in the “Silicon Valley” where the per capita income well exceeds the state and national averages.

The sales of new and existing one- to four-family homes in Southern California is at a 15-year low. A decrease in home sales decreases lending opportunities and may negatively affect our income since a substantial portion of our loan portfolio consists of one- to four-family residential loans. In addition, default rates statewide in California on one- to four-family loans in the second quarter of 2007 were also at the highest levels in a decade. Despite these trends, real estate values have remained relatively stable through the second calendar quarter of 2007.

Competition

We face strong competition in originating real estate and other loans and in attracting deposits. Competition in originating real estate loans comes primarily from other savings institutions, commercial banks, credit unions and mortgage bankers. Other savings institutions, commercial banks, credit unions and finance companies provide vigorous competition in consumer lending. We also face competition from other lenders and investors with respect to loans that we purchase.

We attract all of our deposits through our branch and ATM network. Competition for those deposits is principally from other savings institutions, commercial banks and credit unions, as well as mutual funds and other alternative investments. We compete for these deposits by offering superior service and a variety of deposit accounts at competitive rates. We have less than a 1% market share of deposits in each of the markets in which we compete.

67

Lending Activities

General.We originate and purchase one- to four-family and multi-family residential loans, and to a lesser extent we originate commercial real estate loans. We do not originate or purchase residential or commercial construction loans. We do not offer adjustable rate loans where the initial rate is below the otherwise applicable index rate (known as “teaser rates”). We also originate consumer loans, primarily automobile loans. Our loans carry either a fixed or an adjustable rate of interest. Consumer loans are generally short term and amortize monthly or have interest payable monthly. Mortgage loans generally have a longer term amortization, with maturities up to 30 years, depending upon the type of property with principal and interest due each month. We also have loans in our portfolio that only require interest payments on a monthly basis. At June 30, 2007, our net loan portfolio totaled $699.1 million, which constituted 87.4% of our total assets. We generally underwrite each purchased loan individually in accordance with our underwriting standards. We utilize loan purchases to more efficiently use our resources by reducing operating costs such as staff and marketing. In the Southern California market for an institution of our size, we have found it more efficient to purchase, rather than to originate, loans in order to supplement our lending platform. The majority of the loans that we purchase are acquired with servicing released to allow us to build our portfolio without having to significantly increase our servicing and operations costs. We generally purchase these loans without recourse against the seller.

At June 30, 2007, the maximum amount which we could have loaned to any one borrower and the borrower’s related entities under applicable regulations was $9.7 million, or 15% of Kaiser Federal Bank’s unimpaired capital. At June 30, 2007, we had no loans or group of loans to related borrowers with outstanding balances in excess of this amount. Our five largest lending relationships at June 30, 2007 were as follows: (1) one loan to a limited partnership totaling $5.2 million, secured by an industrial facility located in Riverside County; (2) two loans to an individual totaling $4.8 million, secured by a 38 unit multi-family property located in Orange County and a medical office building located in Los Angeles County; (3) one loan to a limited partnership totaling $4.4 million, secured by six industrial buildings located in Los Angeles County; (4) one loan to a corporation totaling $4.0 million, secured by an office building located in Orange County; and (5) two loans to an individual totaling $3.8 million, secured by a 10 unit multi-family property and a 33 unit multi-family property located in Los Angeles County. At June 30, 2007, these loans were performing in accordance with these terms.

68

The following table presents information concerning the composition of Kaiser Federal Bank’s loan portfolio in dollar amounts and in percentages as of the dates indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | At June 30, | | | | | | | | | | | |

| |

| |

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

| |

| |

| | Amount | | Percent | | Amount | | Percent | | Amount | | Percent | | Amount | | Percent | | Amount | | Percent | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | (Dollars in thousands) | |

Real estate | | | | | | | | | | | | | | | | | | | | | | | | | | |

One- to four-family | | $ | 469,459 | | 66.88 | % | $ | 437,024 | | 68.63 | % | $ | 372,134 | | 69.04 | % | $ | 341,776 | | 68.82 | % | $ | 259,563 | | 66.64 | % |

Commercial | | | 77,821 | | 11.09 | | | 58,845 | | 9.24 | | | 32,383 | | 6.01 | | | 26,879 | | 5.41 | | | 21,266 | | 5.46 | |

Multi-family | | | 88,112 | | 12.55 | | | 89,220 | | 14.01 | | | 87,650 | | 16.26 | | | 72,519 | | 14.60 | | | 42,275 | | 10.85 | |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

Total real estate loans | | | 635,392 | | 90.52 | | | 585,089 | | 91.88 | | | 492,167 | | 91.31 | | | 441,174 | | 88.83 | | | 323,104 | | 82.95 | |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

Other loans | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consumer: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Automobile | | | 53,100 | | 7.56 | | | 41,572 | | 6.53 | | | 38,613 | | 7.16 | | | 47,359 | | 9.54 | | | 56,872 | | 14.60 | |

Home equity | | | 1,446 | | 0.21 | | | 1,787 | | 0.28 | | | 601 | | 0.11 | | | 437 | | 0.08 | | | 664 | | 0.17 | |

Other | | | 12,024 | | 1.71 | | | 8,374 | | 1.31 | | | 7,644 | | 1.42 | | | 7,675 | | 1.55 | | | 8,878 | | 2.28 | |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

Total other loans | | | 66,570 | | 9.48 | | | 51,733 | | 8.12 | | | 46,858 | | 8.69 | | | 55,471 | | 11.17 | | | 66,414 | | 17.05 | |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total loans | | $ | 701,962 | | 100.00 | % | $ | 636,822 | | 100.00 | % | $ | 539,025 | | 100.00 | % | $ | 496,645 | | 100.00 | % | $ | 389,518 | | 100.00 | % |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

Less: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net deferred loan originations fees | | | (134 | ) | | | | (202 | ) | | | | (32 | ) | | | | (332 | ) | | | | (354 | ) | | |

Net premiums on purchased loans | | | 120 | | | | | 195 | | | | | 982 | | | | | 2,221 | | | | | 2,757 | | | |

Allowance for loan losses | | | (2,805 | ) | | | | (2,722 | ) | | | | (2,408 | ) | | | | (2,328 | ) | | | | (2,281 | ) | | |

| |

|

| | | |

|

| | | |

|

| | | |

|

| | | |

|

| | | |

Total loans receivable, net | | $ | 699,143 | | | | $ | 634,093 | | | | $ | 537,567 | | | | $ | 496,206 | | | | $ | 389,640 | | | |

| |

|

| | | |

|

| | | |

|

| | | |

|

| | | |

|

| | | |

69

Loan Maturity. The following schedule illustrates certain information at June 30, 2007 regarding the scheduled repayment of loans maturing in Kaiser Federal Bank’s portfolio based on their contractual terms-to-maturity, but does not include scheduled payments or potential prepayments. Demand loans, loans having no stated schedule of repayments and no stated maturity are reported as due in one year or less. Loan balances do not include undisbursed loan proceeds, unearned discounts, unearned income and allowance for loan losses.

| | | | | | | | | | | | | | | | | | | | | | |

| | Real Estate | | Consumer | |

| |

| |

| | | | |

| | One- to

Four-Family | | Commercial | | Multi-family | | Automobile | | Home Equity | | Other | | Total | |

| |

| |

| |

| |

| |

| |

| |

| |

| | (In thousands) | |

At June 30, 2007 | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Within (1) year | | $ | — | | $ | — | | $ | 37 | | $ | 647 | | $ | 1,446 | | $ | 3,869 | | $ | 5,999 | |

| | | | | | | | | | | | | | | | | | | | | | |

After 1 year: | | | | | | | | | | | | | | | | | | | | | | |

After 1 year through 3 years | | | 156 | | | — | | | — | | | 9,609 | | | — | | | 422 | | | 10,187 | |

After 3 years through 5 years | | | 568 | | | 1,167 | | | — | | | 41,831 | | | — | | | 512 | | | 44,078 | |

After 5 years through 10 years | | | 5,711 | | | 70,045 | | | 2,332 | | | 1,013 | | | — | | | 7,221 | | | 86,322 | |

After 10 years through 15 years | | | 65,775 | | | 6,609 | | | 57,502 | | | — | | | — | | | — | | | 129,886 | |

After 15 years | | | 397,249 | | | — | | | 28,241 | | | — | | | — | | | — | | | 425,490 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total due after 1 year | | | 469,459 | | | 77,821 | | | 88,075 | | | 52,453 | | | — | | | 8,155 | | | 695,963 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Total | | $ | 469,459 | | $ | 77,821 | | $ | 88,112 | | $ | 53,100 | | $ | 1,446 | | $ | 12,024 | | $ | 701,962 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

70

The following tables set forth the scheduled repayments of fixed and adjustable rate loans at June 30, 2007, that are contractually due after June 30, 2008.

| | | | | | | | | | |

| | Due after June 30, 2008 | |

| |

| |

| | Fixed Rate | | Adjustable

Rate | | Total | |

| |

| |

| |

| |

| | (In thousands) | |

Real estate loans | | | | | | | | | | |

One- to four-family | | $ | 348,798 | | $ | 120,661 | | $ | 469,459 | |

Commercial | | | — | | | 77,821 | | | 77,821 | |

Multi-family | | | — | | | 88,075 | | | 88,075 | |

| |

|

| |

|

| |

|

| |

Total real estate loans | | | 348,798 | | | 286,557 | | | 635,355 | |

| |

|

| |

|

| |

|

| |

Other Loans | | | | | | | | | | |

Consumer: | | | | | | | | | | |

Automobile | | | 52,453 | | | — | | | 52,453 | |

Home equity | | | — | | | — | | | — | |

Other loans | | | 8,155 | | | — | | | 8,155 | |

| |

|

| |

|

| |

|

| |

Total other loans | | | 60,608 | | | — | | | 60,608 | |

| |

|

| |

|

| |

|

| |

Total loans | | $ | 409,406 | | $ | 286,557 | | $ | 695,963 | |

| |

|

| |

|

| |

|

| |

One- to Four-Family Residential Lending. At June 30, 2007, our first lien one- to four-family residential mortgage loans totaled $469.5 million, or 66.9%, of our gross loan portfolio, of which $391.9 million, or 83.5%, were purchased from large mortgage originators. We generally underwrite our one- to four-family loans based on the applicant’s employment and credit history and the appraised value of the subject property. With respect to purchased loans, we underwrite each loan based upon our underwriting standards prior to making the purchase. Presently, we lend up to 80% of the lesser of the appraised value or purchase price for one- to four-family residential loans. Should we grant a loan with a loan-to-value ratio in excess of 80%, we require private mortgage insurance in order to reduce our exposure below 80%. Properties securing our one- to four-family loans are generally appraised by independent state licensed fee appraisers approved by our Board of Directors. We require our borrowers to obtain title and hazard insurance, and flood insurance, if necessary, in an amount not less than the value of the property improvements. We currently retain in our portfolio all single-family loans we originate. We purchased $109.8 million in one- to four-family residential mortgage loans within the past fiscal year.

We currently originate one- to four-family mortgage loans on a fixed rate and adjustable rate basis. Our pricing strategy for mortgage loans includes setting interest rates that are competitive with other local financial institutions and consistent with our internal needs. Adjustable rate loans are tied to indices based on the one year London InterBank Offering Rate or U.S. Treasury securities adjusted to a constant maturity of one year. A majority of our adjustable rate loans carry an initial fixed rate of interest for either three or five years which then converts to an interest rate that is adjusted annually based upon the applicable index. At June 30, 2007, $18.2 million, $63.0 million and $18.0 million of our adjustable rate one- to four-family loans will initially reprice during fiscal years ending 2008, 2009 and 2010, respectively. Our home mortgages are structured with a five to 30 year maturity, with amortization periods up to a 30-year period. All of our one- to four-family loans originated or purchased are secured by properties located in California. At June 30, 2007, $154.5 million or 32.9% of the outstanding principal balance of our one- to four-family residential mortgage loans was secured by properties in Los Angeles County, $78.3 million or 16.7% of the outstanding principal balance was secured by properties in Orange County, $43.8 million or 9.3% of the outstanding principal balance was secured by properties in San Diego County and $35.7 million or 7.6% of the outstanding principal balance was secured by properties in Santa Clara County. All other counties represented less than five percent of our loan portfolio calculated by principal balance.

71

All our real estate loans contain a “due on sale” clause allowing us to declare the unpaid principal balance due and payable upon the sale of the security property. The loans originated or purchased by us are underwritten and documented pursuant to our underwriting guidelines. See “—Loan Originations, Purchases, Sales and Repayments.” See “—Asset Quality—Non-Performing Assets” and “Asset Quality—Classified Assets.”

Adjustable rate mortgage loans generally pose different credit risks than fixed rate loan mortgages, primarily because as interest rates rise, the borrower’s payment rises, increasing the potential for default. We have not experienced significant delinquencies for these loans. However, the majority of these loans have been purchased or originated within the past three years. See “—Asset Quality—Non-Performing Assets” and “—Classified Assets.” At June 30, 2007, our one- to four-family adjustable rate mortgage loan portfolio totaled $120.7 million, or 17.2% of our gross loan portfolio. At that date, the fixed rate one- to four-family mortgage loan portfolio totaled $348.8 million, or 49.7% of our gross loan portfolio.

In addition, we have purchased interest-only one- to four-family mortgage loans. As of June 30, 2007, our one- to four-family interest-only mortgage loans totaled $100.4 million, or 14.3% of our gross loan portfolio, with $55.2 million of that amount consisting of adjustable rate loans. We have no plans to significantly increase the number of interest-only loans held in our loan portfolio at this time.

In late 2005, we began to underwrite interest-only loans assuming a fully amortized payment and for adjustable rate loans we qualify the borrower based upon the rate that would apply upon the first interest rate adjustment. An interest-only loan typically provides for the payment of interest (rather than both principal and interest) for a fixed period of three, five or seven years, thereafter the loan payments adjust to include both principal and interest for the remaining term. We believe those loans purchased under these additional underwriting standards should not present greater risk than other loans in our one-to four-family loan portfolio.

The following table describes certain risk characteristics of our one-to four-family non-conforming mortgage loans held for investment as of June 30, 2007:

| | | | | | | | | | | | | | |

Category | | Outstanding

Balance | | Weighted-

Average

Credit Score(1) | | Weighted Average

LTV(2) | | Weighted-

Average

Seasoning(3) | |

| |

| |

| |

| |

| |

| | (Dollars in thousands) | |

|

Interest-only | | $ | 100,424 | | | 737 | | | 70.89 | % | | 1.79 years | |

Stated income(4) | | | 118,842 | | | 741 | | | 66.42 | | | 2.06 | | |

Credit score less than or equal to 660 | | | 32,850 | | | 642 | | | 68.99 | | | 2.03 | | |

| |

(1) | The credit score is one factor in determining the credit worthiness of a borrower based on the borrower’s credit history. |

(2) | LTV (loan-to-value) is the ratio calculated by dividing the original loan balance by the appraised value of the real estate collateral. |

(3) | Seasoning describes the number of years since the funding date of the loan. |

(4) | Stated income is defined as a borrower provided level of income which is not subject to verification during the loan origination process through the borrower’s application, but the reasonableness of the borrower’s income is verified through other sources. Included in interest-only loans are $42.4 million in stated-income loans. |

Multi-Family Residential Lending. We also offer multi-family residential loans. These loans are secured by real estate located in our primary market area. At June 30, 2007, multi-family residential loans totaled $88.1 million, or 12.6%, of our gross loan portfolio.

Our multi-family residential loans are originated primarily with adjustable interest rates. We use a number of indices to set the interest rate, including a rate based on the constant maturity of one year U.S.

72

Treasury securities. Our adjustable rate loans carry an initial fixed rate of interest for either three or five years, which then converts to an interest rate that is adjusted annually based upon the applicable index. Loan-to-value ratios on our multi-family residential loans do not exceed 75% of the appraised value of the property securing the loan. These loans require monthly payments, amortize over a period of up to 30 years and have maximum maturity of 30 years. These loans are secured by properties located in California. We originate these loans through our staff. We retain some of the multi-family loans we originate, while selling participations in others to manage our exposure to any one borrower.

Loans secured by multi-family residential real estate are underwritten based on the income producing potential of the property and the financial strength of the borrower. The net operating income, which is the income derived from the operation of the property less all operating expenses, must be sufficient to cover the payments related to the outstanding debt. We may require an assignment of rents or leases in order to be assured that the cash flow from the project will be used to repay the debt. Appraisals on properties securing multi-family residential loans are performed by independent state licensed fee appraisers approved by our Board of Directors. See “—Loan Originations, Purchases, Sales and Repayments.”

Loans secured by multi-family residential properties are generally larger and involve a greater degree of credit risk than one- to four-family residential mortgage loans. Because payments on loans secured by multi-family residential properties are often dependent on the successful operation or management of the properties, repayment of such loans may be subject to adverse conditions in the real estate market or the economy. If the cash flow from the project is reduced, or if leases are not obtained or renewed, the borrower’s ability to repay the loan may be impaired. In order to monitor the adequacy of cash flows on income-producing properties, the borrowers are required to provide periodic financial information. In addition, many of our multi-family real estate loans are not fully amortizing and contain large balloon payments upon maturity. These balloon payments may require the borrower to either sell or refinance the underlying property in order to make the balloon payment. If we foreclose on a multi-family real estate loan, our holding period for the collateral typically is longer than for one- to four-family residential mortgage loans because there are fewer potential purchasers of the collateral. Further, our multi-family real estate loans generally have relatively large balances to single borrowers or related groups of borrowers. Accordingly, if we make any errors in judgment in the collectibility of our multi-family real estate loans, any resulting charge-offs may be larger on a per loan basis than those incurred with our residential or consumer loan portfolios. See “—Asset Quality—Non-Performing Assets.”

Commercial Real Estate Lending. We offer commercial real estate loans. These loans are secured primarily by small retail establishments, rental properties and small office buildings located in our primary market area and are both owner and non-owner occupied. We originate commercial real estate loans through our own staff. We generally do not purchase commercial real estate loans. At June 30, 2007, commercial real estate loans totaled $77.8 million, or 11.1% of our gross loan portfolio, of which $28.3 million or 36.4% of our commercial real estate loan portfolio, were to borrowers occupying the underlying collateral. Our largest commercial real estate loan at June 30, 2007 was a $5.2 million loan secured by an industrial facility located in Riverside County performing in accordance with its terms. We do not originate commercial construction loans.

We originate only adjustable rate commercial real estate loans. The interest rate on these loans is tied to a rate based on the constant maturity of one-year U.S. Treasury securities. A majority of our adjustable rate loans carry an initial fixed rate of interest for either three or five years which then converts to an interest rate that is adjusted annually based upon the index. Loan-to-value ratios on our commercial real estate loans generally do not exceed 75% of the appraised value of the property securing the loan. These loans require monthly payments, amortize up to 30 years, have maturities of up to 15 years and carry prepayment penalties.

73

Loans secured by commercial real estate are underwritten based on the income producing potential of the property, the financial strength of the borrower and any guarantors. The net operating income, which is the income derived from the operation of the property less all operating expenses, must be sufficient to cover the payments related to the outstanding debt. We may require an assignment of rents or leases in order to be assured that the cash flow from the project will be used to repay the debt. Appraisals on properties securing commercial real estate loans are performed by independent state licensed fee appraisers approved by the Board of Directors. All the properties securing our commercial real estate loans are located in California. In order to monitor the adequacy of cash flows on income producing properties, the borrowers are required to provide periodic financial information. See “—Loan Originations, Purchases, Sales and Repayments.”

Loans secured by commercial real estate properties are generally larger and involve a greater degree of credit risk than one- to four-family residential mortgage loans. Because payments on loans secured by commercial real estate properties are often dependent on the successful operation or management of the properties, repayment of such loans may be subject to adverse conditions in the real estate market or the economy. If the cash flow from the project is reduced, or if leases are not obtained or renewed, the borrower’s ability to repay the loan may be impaired. In addition, many of our commercial real estate loans are not fully amortizing and contain large balloon payments upon maturity. These balloon payments may require the borrower to either sell or refinance the underlying property in order to make the balloon payment. If we foreclose on a commercial real estate loan, our holding period for the collateral typically is longer than for one- to four-family residential mortgage loans because there are fewer potential purchasers of the collateral. Further, our commercial real estate loans generally have relatively large balances to single borrowers or related groups of borrowers. Accordingly, if we make any errors in judgment in the collectibility of our commercial real estate loans, any resulting charge-offs may be larger on a per loan basis than those incurred with our residential or consumer loan portfolios. See “—Asset Quality—Non-Performing Loans.”

Consumer Loans. We offer a variety of secured consumer loans, including home equity lines of credit, new and used automobile loans, and loans secured by savings deposits. We also offer a limited amount of unsecured loans. Consumer loans generally have shorter terms to maturity, which reduces our exposure to changes in interest rates, and carry higher rates of interest than do one- to four-family residential mortgage loans. At June 30, 2007, our consumer loan portfolio, exclusive of automobile loans, totaled $13.5 million, or 1.9%, of our gross loan portfolio.

The most significant component of our consumer lending is automobile loans. We originate automobile loans only on a direct basis with the borrower. Loans secured by automobiles totaled $53.1 million, or 7.6%, of our gross loan portfolio at June 30, 2007. Automobile loans may be written for up to seven years for new automobiles and a maximum of five years for used automobiles (with an age limit of five years) and have fixed rates of interest. Loan-to-value ratios for automobile loans are up to 100% of the sales price for new automobiles and up to 100% of value on used cars, based on valuations from official used car guides.

Each automobile loan requires the borrower to keep the financed vehicle fully insured against loss or damage by fire, theft and collision. In addition, we have the right to force place insurance coverage in the event the required physical damage insurance on the vehicle is not maintained by the borrower. Our primary focus when originating automobile loans is on the ability of the borrower to repay the loan rather than the value of the underlying collateral. The amount financed by us is generally up to the full sales price of the financed vehicle plus sales tax, dealer preparation, license, and title fees, plus the cost of a vehicle and warranty contract.

74

Consumer loans may entail greater risk than one- to four-family residential mortgage loans, particularly in the case of consumer loans that are secured by rapidly depreciable assets, such as automobiles. In these cases, any repossessed collateral for a defaulted loan may not provide an adequate source of repayment of the outstanding loan balance. As a result, consumer loan collections are dependent on the borrower’s continuing financial stability and, thus, are more likely to be adversely affected by job loss, divorce, illness or personal bankruptcy. Furthermore, the application of various federal and state laws, including federal and state bankruptcy and insolvency laws, may limit the amount that can be recovered on these loans.

Loan Originations, Purchases, Sales and Repayments

We originate loans through employees located at our offices. Walk-in customers and referrals from our current customer base, advertisements, real estate brokers and mortgage loan brokers are also important sources of loan originations.

While we originate adjustable rate and fixed rate loans, our ability to originate loans is dependent upon customer demand for loans in our market area. Demand is affected by local competition and the interest rate environment. We also purchase real estate whole loans as well as participation interests in real estate loans. From time to time, we have sold participation interests in some of our larger real estate loans. At June 30, 2007, our real estate loan portfolio totaled $635.4 million or 90.5% of the gross loan portfolio. Purchased real estate loans at June 30, 2007 totaled $406.5 million, or 64.0% of the real estate loan portfolio. At June 30, 2006, our real estate loan portfolio totaled $585.1 million or 91.9% of the gross loan portfolio. Purchased real estate loans at June 30, 2006 totaled $386.9 million or 66.1% of the real estate loan portfolio.

75

The following table shows the loan origination, purchase, sale and repayment activities of Kaiser Federal Bank for the periods indicated, and includes loans originated for both our own portfolio and for sale of participating interests.

| | | | | | | | | | |

| | For the Year Ended June 30, | |

| |

| |

| | 2007 | | 2006 | | 2005 | |

| |

| |

| |

| |

| | (In thousands) | |

Originations by type: | | | | | | | | | | |

Adjustable rate: | | | | | | | | | | |

Real estate-one to four-family | | $ | 2,399 | | $ | — | | $ | 3,942 | |

-commercial | | | 23,432 | | | 32,154 | | | 6,200 | |

-multi-family | | | 13,740 | | | 14,771 | | | 17,750 | |

Non-real estate – other consumer | | | 3,542 | | | 5,694 | | | 4,445 | |

| |

|

| |

|

| |

|

| |

Total adjustable rate | | | 43,113 | | | 52,619 | | | 32,337 | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

Fixed rate: | | | | | | | | | | |

Real estate-one to four-family | | $ | 20,574 | | $ | 14,238 | | $ | 10,446 | |

Non-real estate - consumer automobile | | | 35,654 | | | 26,318 | | | 18,453 | |

- other consumer | | | 11,841 | | | 8,591 | | | 8,617 | |

Total fixed rate | | | 68,069 | | | 49,147 | | | 37,516 | |

| |

|

| |

|

| |

|

| |

Total loans originated | | | 111,182 | | | 101,766 | | | 69,853 | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

Purchases: | | | | | | | | | | |

Adjustable rate: | | | | | | | | | | |

Real estate- one to four-family | | $ | — | | $ | 13,074 | | $ | 73,740 | |

-commercial | | | — | | | — | | | 3,993 | |

-multi-family | | | — | | | 2,430 | | | 10,152 | |

| |

|

| |

|

| |

|

| |

Total adjustable rate | | | — | | | 15,504 | | | 87,885 | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

Fixed rate: | | | | | | | | | | |

Real estate- one to four-family | | $ | 109,830 | | $ | 145,771 | | $ | 62,825 | |

Total fixed rate | | | 109,830 | | | 145,771 | | | 62,825 | |

| |

|

| |

|

| |

|

| |

Total loans purchased | | | 109,830 | | | 161,275 | | | 150,710 | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

Sales and repayments: | | | | | | | | | | |

Sales and loan participations sold | | | — | | | — | | | — | |

Principal repayments | | | 155,872 | | | 165,244 | | | 178,183 | |

Total reductions | | | 155,872 | | | 165,244 | | | 178,183 | |

Decrease in other items, net | | | (90 | ) | | (1,271 | ) | | (1,019 | ) |

| |

|

| |

|

| |

|

| |

Net increase | | $ | 65,050 | | $ | 96,526 | | $ | 41,361 | |

| |

|

| |

|

| |

|

| |

Asset Quality

We do not originate, purchase or hold in our loan portfolio teaser option-adjustable rate mortgage loans or negative amortizing loans. We underwrite all real estate loans based on an applicant’s employment history, credit history and an appraised value of the subject property. At June 30, 2007, one- to four-family residential mortgage loans totaled $469.5 million, or 66.9%, of our gross loan portfolio, of which $348.8 million were fixed rate and $120.7 million were adjustable rate loans. Adjustable rate mortgage loans generally pose different credit risks than fixed rate mortgages, primarily because as interest rates rise, the borrower’s payment rises, increasing the potential for default. Beginning in 2005, we originated and purchased for portfolio more fixed rate loans than adjustable rate loans. At June 30, 2005, one- to four-family fixed rate loans totaled $133.9 million compared to $238.3 million in adjustable rate loans. At June 30, 2006, one- to four-family fixed rate loans totaled $258.9 million compared to $178.1 million in adjustable rate loans. Although we have reduced the amount of adjustable rate loans held in our portfolio, we have not experienced significant delinquencies for these loans.

For one- to four-family residential, multi-family and commercial real estate loans serviced by us, a delinquency notice is sent to the borrower when the loan is eight days past due. When the loan is 20 days past due, we mail a subsequent delinquency notice to the borrower. Typically, before the loan becomes 30 days past due, contact with the borrower is made requesting payment of the delinquent

76

amount in full, or the establishment of an acceptable repayment plan to bring the loan current. If an acceptable repayment plan has not been agreed upon, loan personnel will generally prepare a notice of intent to foreclose. The notice of intent to foreclose allows the borrower up to 10 days to bring the account current. Once the loan becomes 60 days delinquent, and an acceptable repayment plan has not been agreed upon, the servicing officer will turn over the account to the deed of trust trustee with instructions to initiate foreclosure.

Real estate loans serviced by a third party are subject to the servicing institution’s collection policies. However, we track each purchased loan individually to ensure full payments are received as scheduled. Each month, third party servicers are required to provide delinquent loan status reports to our servicing officer, which are included in the month-end delinquent real estate report to management.

When a borrower fails to make a timely payment on a consumer loan, a delinquency notice is sent when the loan is 10 days past due. When the loan is 20 days past due, we mail a subsequent delinquency notice to the borrower. Once a loan is 30 days past due, our staff contacts the borrower by telephone to determine the reason for delinquency and to request payment of the delinquent amount in full or the establishment of an acceptable repayment plan to bring the loan current. If the borrower is unable to make or keep payment arrangements, additional collection action is taken in the form of repossession of collateral for secured loans and small claims or legal action for unsecured loans.

77

Delinquent Loans. The following table sets forth certain information with respect to our loan portfolio delinquencies at the dates indicated.

| | | | | | | | | | | | | | | | | | | |

| | Loans Delinquent: | | | | | | | |

| |

| | Total Delinquent Loans | |

| | 60-89 Days | | 90 Days or More | | |

| |

| |

| |

| |

| | Number of

Loans | | Amount | | Number of

Loans | | Amount | | Number of

Loans | | Amount | |

| |

| |

| |

| |

| |

| |

| |

| | (Dollars in thousands) | |

At June 30, 2007 | | | | | | | | | | | | | | | | | | | |

Real estate loans: | | | | | | | | | | | | | | | | | | | |

One- to four-family | | | — | | $ | — | | | 2 | | $ | 1,115 | | | 2 | | $ | 1,115 | |

Commercial | | | — | | | — | | | — | | | — | | | — | | | — | |

Multi-family | | | — | | | — | | | — | | | — | | | — | | | — | |

Other loans: | | | | | | | | | | | | | | | | | | | |

Automobile | | | 7 | | | 111 | | | 2 | | | 19 | | | 9 | | | 130 | |

Home equity | | | — | | | — | | | — | | | — | | | — | | | — | |

Other | | | 5 | | | 8 | | | 4 | | | 7 | | | 9 | | | 15 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total loans | | | 12 | | $ | 119 | | | 8 | | $ | 1,141 | | | 20 | | $ | 1,260 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | |

At June 30, 2006 | | | | | | | | | | | | | | | | | | | |

Real estate loans: | | | | | | | | | | | | | | | | | | | |

One- to four-family | | | 2 | | $ | 383 | | | — | | $ | — | | | 2 | | $ | 383 | |

Commercial | | | — | | | — | | | — | | | — | | | — | | | — | |

Multi-family | | | — | | | — | | | — | | | — | | | — | | | — | |

Other loans: | | | | | | | | | | | | | | | | | | | |

Automobile | | | 8 | | | 108 | | | 7 | | | 57 | | | 15 | | | 165 | |

Home equity | | | — | | | — | | | — | | | — | | | — | | | — | |

Other | | | 3 | | | 3 | | | 6 | | | 10 | | | 9 | | | 13 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total loans | | | 13 | | $ | 494 | | | 13 | | $ | 67 | | | 26 | | $ | 561 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | |

At June 30, 2005 | | | | | | | | | | | | | | | | | | | |

Real estate loans: | | | | | | | | | | | | | | | | | | | |

One- to four-family | | | — | | $ | — | | | 2 | | $ | 757 | | | 2 | | $ | 757 | |

Commercial | | | — | | | — | | | — | | | — | | | — | | | — | |

Multi-family | | | — | | | — | | | — | | | — | | | — | | | — | |

Other loans: | | | | | | | | | | | | | | | | | | | |

Automobile | | | 6 | | | 50 | | | 2 | | | 28 | | | 8 | | | 78 | |

Home equity | | | — | | | — | | | — | | | — | | | — | | | — | |

Other | | | 10 | | | 10 | | | 1 | | | 2 | | | 11 | | | 12 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total loans | | | 16 | | $ | 60 | | | 5 | | $ | 787 | | | 21 | | $ | 847 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | |

At June 30, 2004 | | | | | | | | | | | | | | | | | | | |

Real estate loans: | | | | | | | | | | | | | | | | | | | |

One- to four-family | | | — | | $ | — | | | — | | $ | — | | | — | | $ | — | |

Commercial | | | — | | | — | | | — | | | — | | | — | | | — | |

Multi-family | | | — | | | — | | | — | | | — | | | — | | | — | |

Other loans: | | | | | | | | | | | | | | | | | | | |

Automobile | | | 40 | | | 502 | | | 9 | | | 79 | | | 49 | | | 581 | |

Home equity | | | — | | | — | | | — | | | — | | | — | | | — | |

Other | | | 97 | | | 93 | | | 2 | | | 3 | | | 99 | | | 96 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total loans | | | 137 | | $ | 595 | | | 11 | | $ | 82 | | | 148 | | $ | 677 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | |

At June 30, 2003 | | | | | | | | | | | | | | | | | | | |

Real estate loans: | | | | | | | | | | | | | | | | | | | |

One- to four-family | | | — | | $ | — | | | — | | $ | — | | | — | | $ | — | |

Commercial | | | — | | | — | | | — | | | — | | | — | | | — | |

Multi-family | | | — | | | — | | | — | | | — | | | — | | | — | |

Other loans: | | | | | | | | | | | | | | | | | | | |

Automobile | | | 7 | | | 129 | | | 1 | | | 13 | | | 8 | | | 142 | |

Home equity | | | — | | | — | | | — | | | — | | | — | | | — | |

Other | | | 60 | | | 92 | | | 3 | | | 13 | | | 63 | | | 105 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total loans | | | 67 | | $ | 221 | | | 4 | | $ | 26 | | | 71 | | $ | 247 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Non-Performing Assets.The following table sets forth the amounts and categories of non-performing assets in our loan portfolio. Non-performing assets consist of non-accrual loans, and foreclosed assets. Loans to a customer whose financial condition has deteriorated are considered for non-accrual status whether or not the loan is 90 days and over past due. All loans past due 90 days and over are classified as non-accrual. On non-accrual loans, interest income is not recognized until actually

78

collected. At the time the loan is placed on non-accrual status, interest previously accrued but not collected is reversed and charged against current income. Interest is not accrued on loans greater than 90 days delinquent. At each date presented we had no troubled debt restructurings (loans for which a portion of interest or principal has been forgiven and loans modified at an interest rate materially less than current market rate).

Foreclosed assets consist of real estate and other assets which have been acquired through foreclosure on loans. At the time of foreclosure, assets are recorded at the lower of their estimated fair value less selling costs or the loan balance, with any write-down charged against the allowance for loan losses.

| | | | | | | | | | | | | | | | |

| | At June 30, | |

| |

| |

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

| |

| |