|

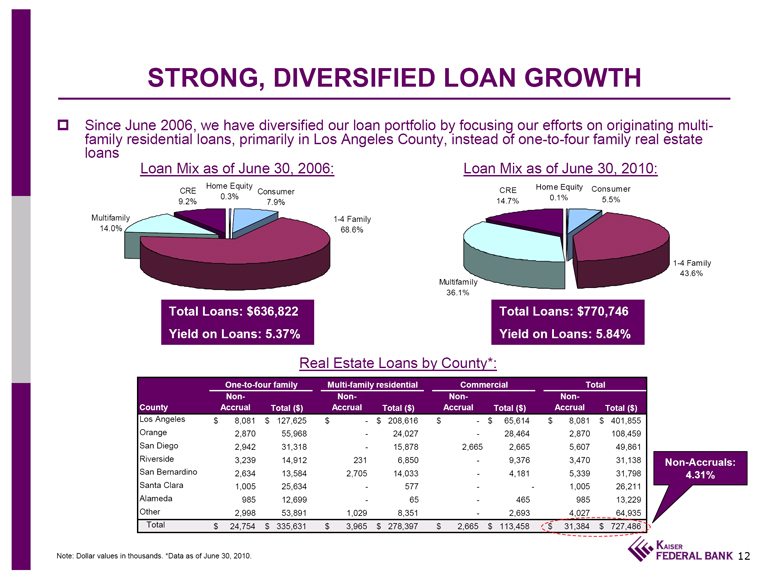

STRONG, DIVERSIFIED LOAN GROWTH

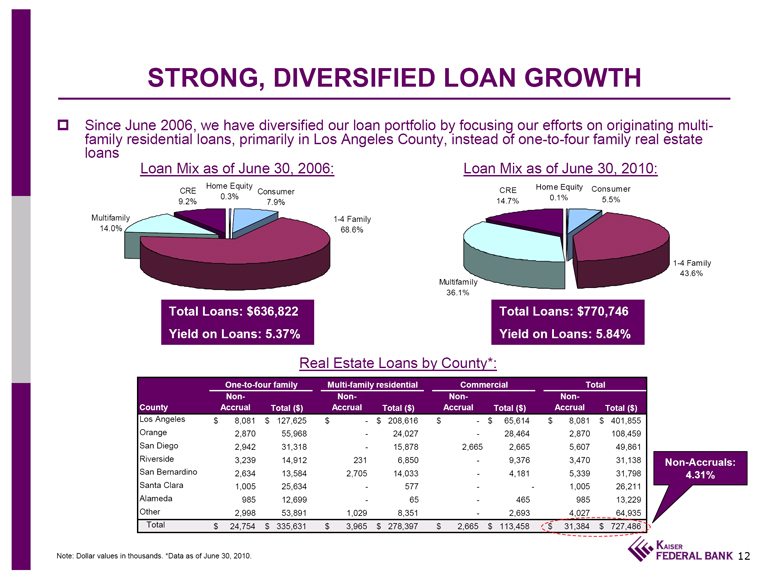

Since June 2006, we have diversified our loan portfolio by focusing our

efforts on originating multi-family residential loans, primarily in Los Angeles

County, instead of one-to-four family real estate loans

Loan Mix as of June 30, 2006:

Multifamily CRE Home Equity Consumer 1-4 Family

14.0% 9.2% 0.3% 7.9% 68.6%

Total Loans: $636,822

Yield on Loans: 5.37%

Loan Mix as of June 30, 2010:

Multifamily CRE Home Equity Consumer 1-4 Family

36.1% 14.7% 0.1% 5.5% 43.6%

Total Loans: $770,746

Yield on Loans: 5.84%

Real Estate Loans by County*:

One-to-four family Multi-family residential Commercial Total

Non- Non- Non- Non-

County Accrual Total ($) Accrual Total ($) Accrual Total ($) Accrual Total ($)

Los Angeles $ 8,081 $ 127,625 $ - $ 208,616 $ - $ 65,614 $ 8,081 $ 401,855

Orange 2,870 55,968 - 24,027 - 28,464 2,870 108,459

San Diego 2,942 31,318 - 15,878 2,665 2,665 5,607 49,861

Riverside 3,239 14,912 231 6,850 - 9,376 3,470 31,138

San Bernardino 2,634 13,584 2,705 14,033 - 4,181 5,339 31,798

Santa Clara 1,005 25,634 - 577 - - 1,005 26,211

Alameda 985 12,699 - 65 - 465 985 13,229

Other 2,998 53,891 1,029 8,351 - 2,693 4,027 64,935

Total $ 24,754 $ 335,631 $ 3,965 $ 278,397 $ 2,665 $ 113,458 $ 31,384 $ 727,486

Non-Accruals: 4.31%

Note: Dollar values in thousands. *Data as of June 30, 2010.

12

|