February 2014 Investor Presentation

Forward-Looking Statements Except for the historical information contained in this presentation, the matters discussed may be deemed to be forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like “believe,” “expect,” “anticipate,” “estimate” and “intend” or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.” Forward-looking statements, by their nature, are subject to risks and uncertainties. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures; changes in the interest rate environment; demand for loans in Simplicity Bank’s market area; adverse changes in general economic conditions, either nationally or in Simplicity Bank’s market areas; adverse changes within the securities markets; legislative and regulatory changes that could adversely affect the business in which the Company and its subsidiary are engaged; the future earnings and capital levels of Simplicity Bank, which would affect the ability of the Company to pay dividends in accordance with its dividend policies; and other risks detailed from time to time in the Company’s Securities and Exchange Commission filings. Actual strategies and results in future periods may differ materially from those currently expected. We caution readers not to place undue reliance on forward-looking statements. The Company disclaims any obligation to revise or update any forward-looking statements contained in this release to reflect future events or developments. 2

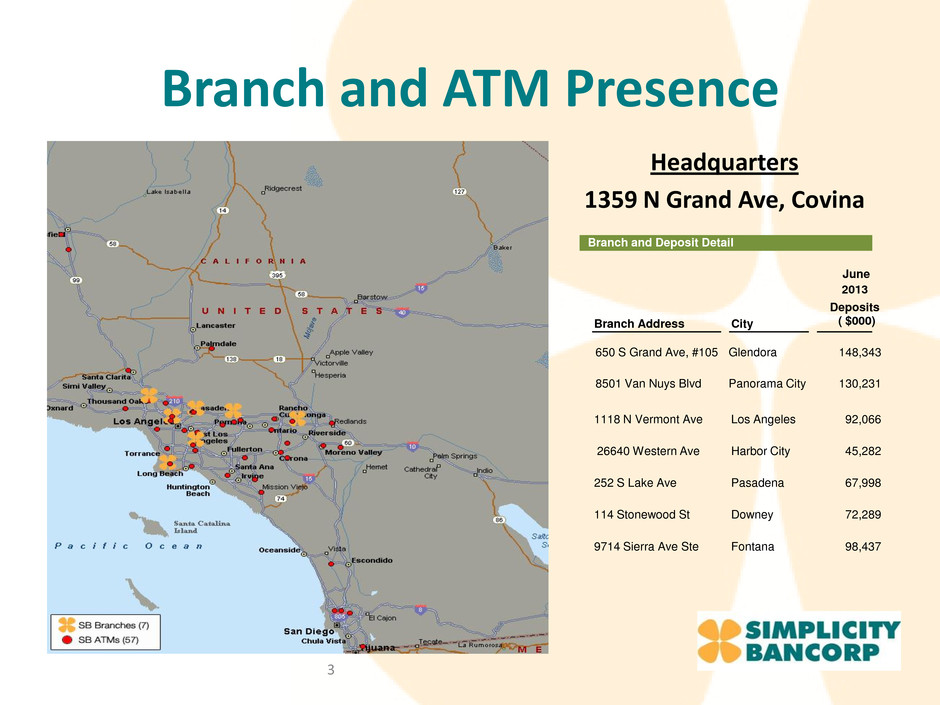

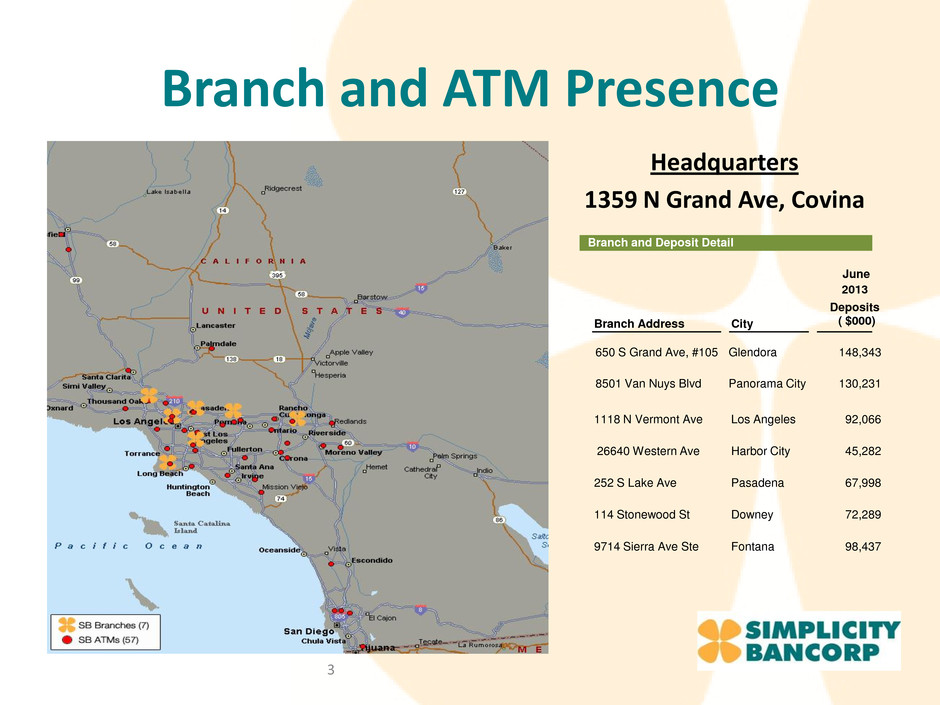

Branch and ATM Presence Headquarters 1359 N Grand Ave, Covina 3 Branch and Deposit Detail Branch Address City June 2013 Deposits ( $000) 8501 Van Nuys Blvd Panorama City 130,231 650 S Grand Ave, #105 Glendora 148,343 1118 N Vermont Ave Los Angeles 92,066 Harbor City 45,282 252 S Lake Ave Pasadena 67,998 114 Stonewood St Downey 72,289 9714 Sierra Ave Ste Fontana 98,437 26640 Western Ave

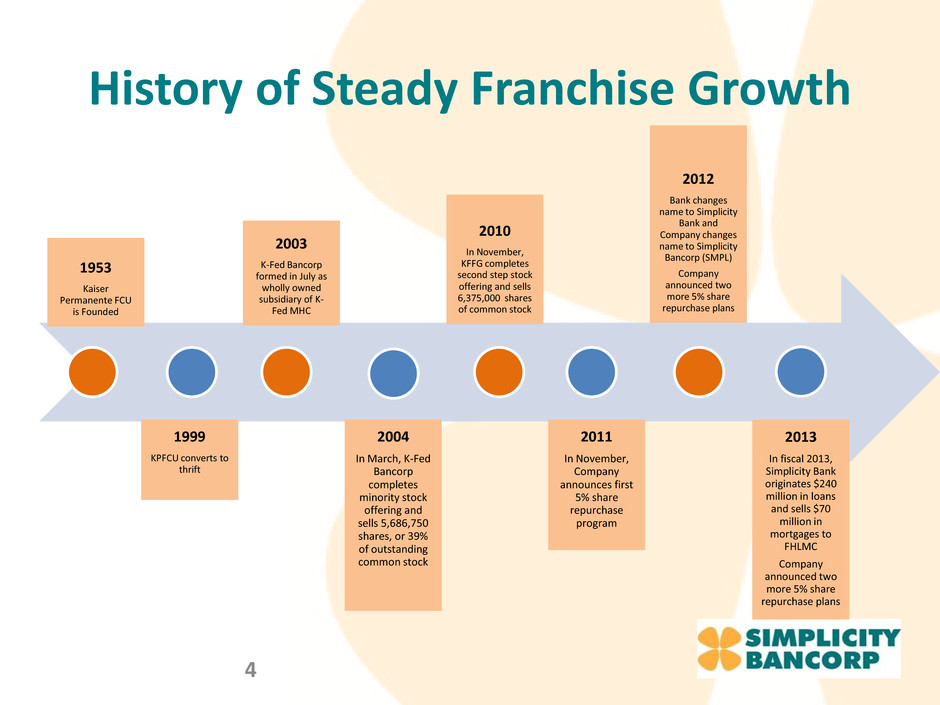

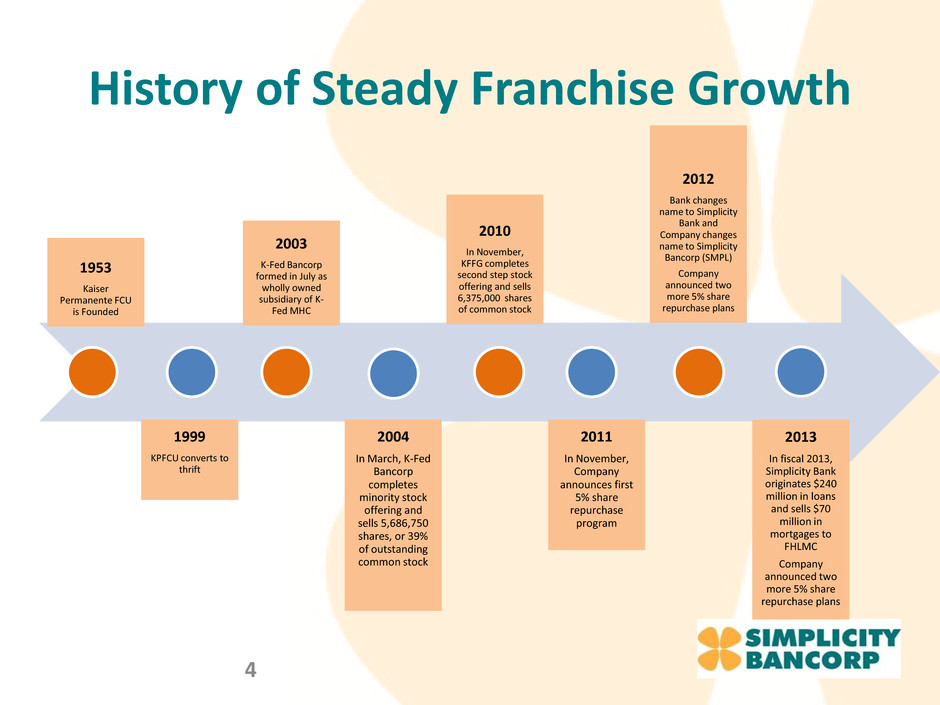

History of Steady Franchise Growth 4 1953 Kaiser Permanente FCU is Founded 1999 KPFCU converts to thrift 2003 K-Fed Bancorp formed in July as wholly owned subsidiary of K- Fed MHC 2004 In March, K-Fed Bancorp completes minority stock offering and sells 5,686,750 shares, or 39% of outstanding common stock 2010 In November, KFFG completes second step stock offering and sells 6,375,000 shares of common stock 2011 In November, Company announces first 5% share repurchase program 2012 Bank changes name to Simplicity Bank and Company changes name to Simplicity Bancorp (SMPL) Company announced two more 5% share repurchase plans 2013 In fiscal 2013, Simplicity Bank originates $240 million in loans and sells $70 million in mortgages to FHLMC Company announced two more 5% share repurchase plans

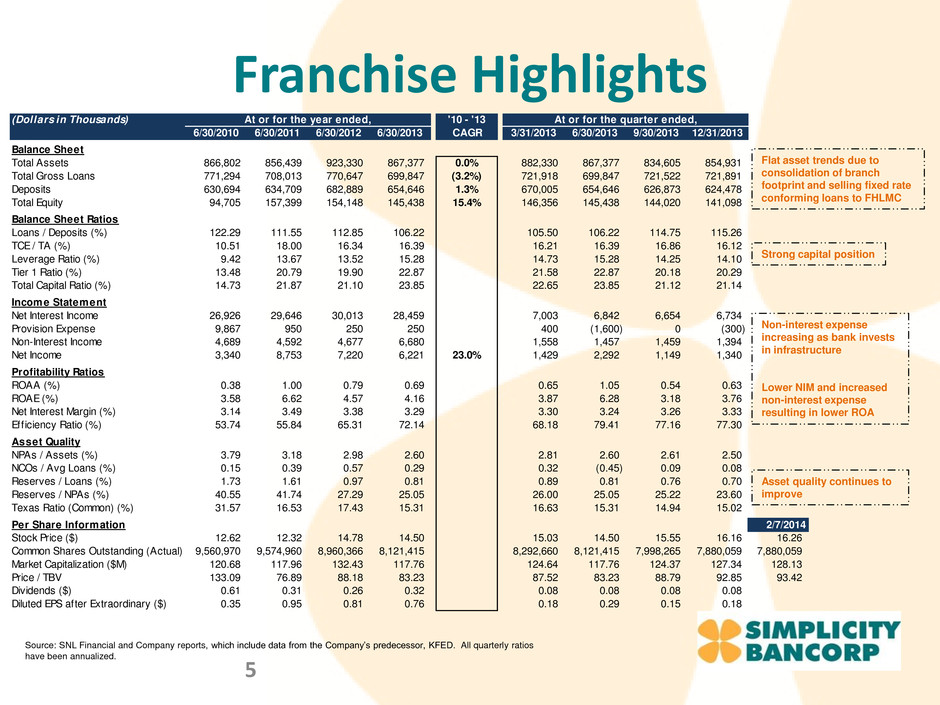

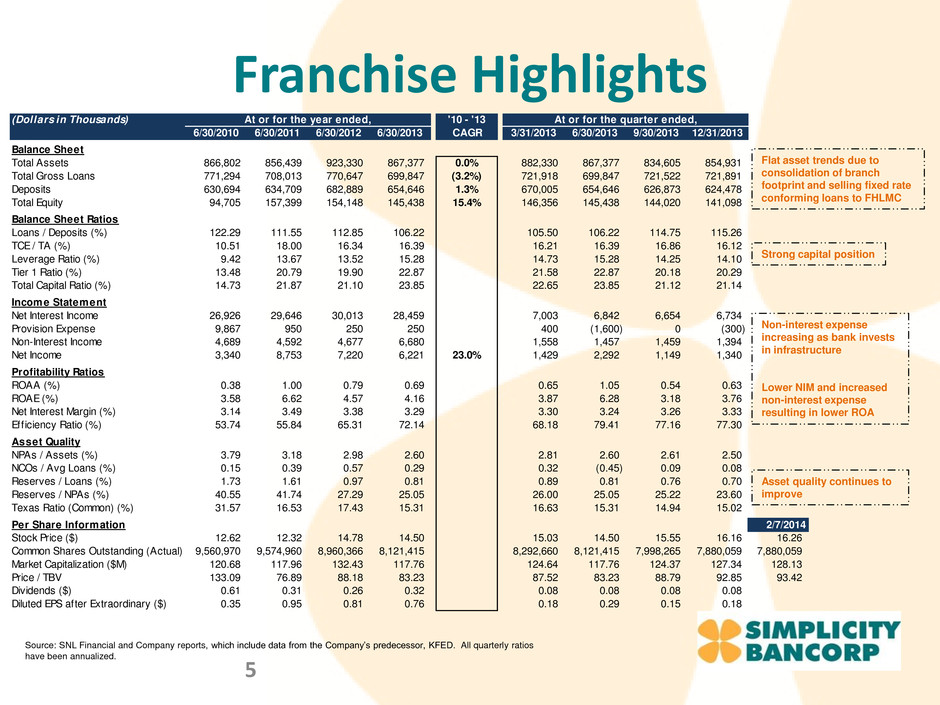

Franchise Highlights 5 Flat asset trends due to consolidation of branch footprint and selling fixed rate conforming loans to FHLMC Strong capital position Non-interest expense increasing as bank invests in infrastructure Lower NIM and increased non-interest expense resulting in lower ROA Asset quality continues to improve Source: SNL Financial and Company reports, which include data from the Company’s predecessor, KFED. All quarterly ratios have been annualized. (Dollars in Thousands) At or for the year ended, '10 - '13 At or for the quarter ended, 6/30/2010 6/30/2011 6/30/2012 6/30/2013 CAGR 3/31/2013 6/30/2013 9/30/2013 12/31/2013 Balance Sheet Total Assets 866,802 856,439 923,330 867,377 0.0% 882,330 867,377 834,605 854,931 Total Gross Loans 771,294 708,013 770,647 699,847 (3.2%) 721,918 699,847 721,522 721,891 Deposits 630,694 634,709 682,889 654,646 1.3% 670,005 654,646 626,873 624,478 Total Equity 94,705 157,399 154,148 145,438 15.4% 146,356 145,438 144,020 141,098 Balance Sheet Ratios Loans / Deposits (%) 122.29 111.55 112.85 106.22 105.50 106.22 114.75 115.26 TCE / TA (%) 10.51 18.00 16.34 16.39 16.21 16.39 16.86 16.12 Leverage Ratio (%) 9.42 13.67 13.52 15.28 14.73 15.28 14.25 14.10 Tier 1 Ratio (%) 13.48 20.79 19.90 22.87 21.58 22.87 20.18 20.29 Total Capital Ratio (%) 14.73 21.87 21.10 23.85 22.65 23.85 21.12 21.14 Income Statement Net Interest Income 26,926 29,646 30,013 28,459 7,003 6,842 6,654 6,734 Provision Expense 9,867 950 250 250 400 (1,600) 0 (300) Non-Interest Income 4,689 4,592 4,677 6,680 1,558 1,457 1,459 1,394 Net Income 3,340 8,753 7,220 6,221 23.0% 1,429 2,292 1,149 1,340 Profitability Ratios ROAA (%) 0.38 1.00 0.79 0.69 0.65 1.05 0.54 0.63 ROAE (%) 3.58 6.62 4.57 4.16 3.87 6.28 3.18 3.76 Net Interest Margin (%) 3.14 3.49 3.38 3.29 3.30 3.24 3.26 3.33 Efficiency Ratio (%) 53.74 55.84 65.31 72.14 68.18 79.41 77.16 77.30 Asset Quality NPAs / Assets (%) 3.79 3.18 2.98 2.60 2.81 2.60 2.61 2.50 NCOs / Avg Loans (%) 0.15 0.39 0.57 0.29 0.32 (0.45) 0.09 0.08 Reserves / Loans (%) 1.73 1.61 0.97 0.81 0.89 0.81 0.76 0.70 Reserves / NPAs (%) 40.55 41.74 27.29 25.05 26.00 25.05 25.22 23.60 Texas Ratio (Common) (%) 31.57 16.53 17.43 15.31 16.63 15.31 14.94 15.02 Per Share Information 2/7/2014 Stock Price ($) 12.62 12.32 14.78 14.50 15.03 14.50 15.55 16.16 16.26 Common Shares Outstanding (Actual) 9,560,970 9,574,960 8,960,366 8,121,415 8,292,660 8,121,415 7,998,265 7,880,059 7,880,059 Market Capitalization ($M) 120.68 117.96 132.43 117.76 124.64 117.76 124.37 127.34 128.13 Price / TBV 133.09 76.89 88.18 83.23 87.52 83.23 88.79 92.85 93.42 Dividends ($) 0.61 0.31 0.26 0.32 0.08 0.08 0.08 0.08 Diluted EPS after Extraordinary ($) 0.35 0.95 0.81 0.76 0.18 0.29 0.15 0.18

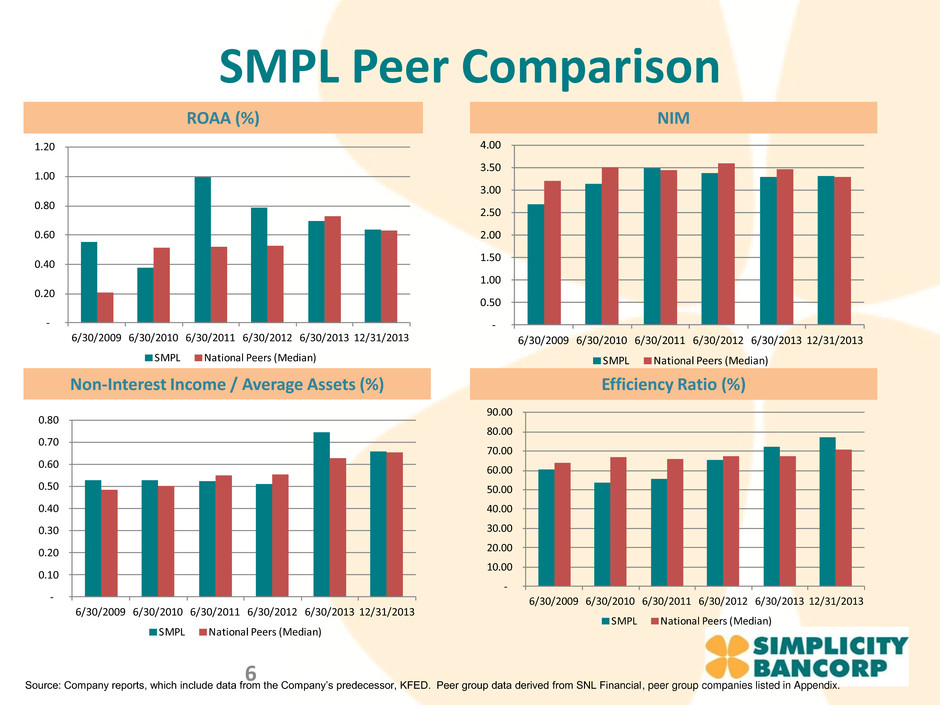

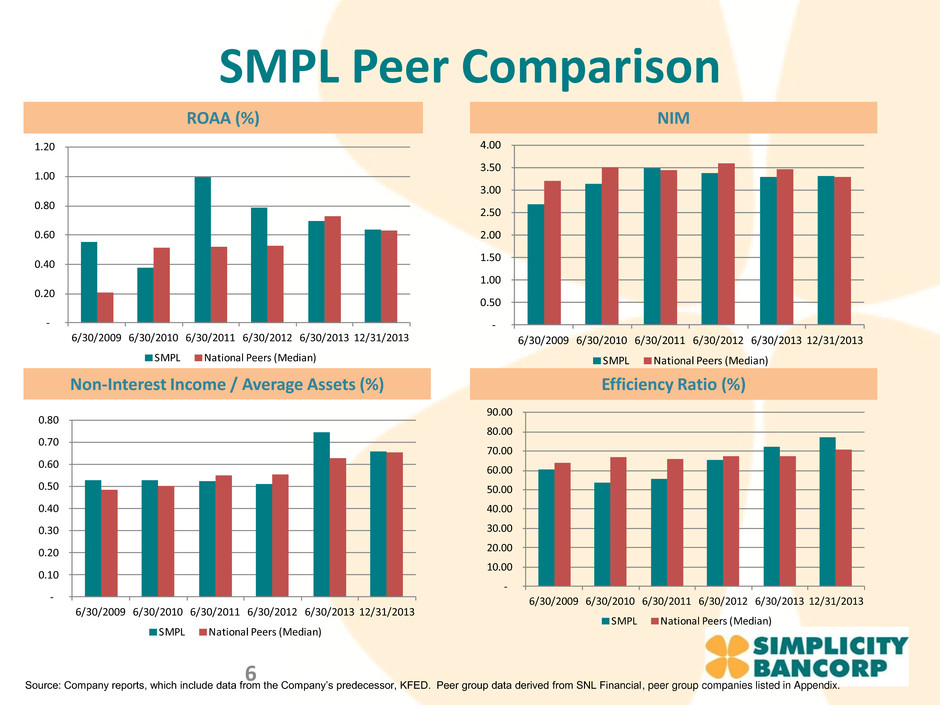

SMPL Peer Comparison 6 ROAA (%) NIM Non-Interest Income / Average Assets (%) Efficiency Ratio (%) Source: Company reports, which include data from the Company’s predecessor, KFED. Peer group data derived from SNL Financial, peer group companies listed in Appendix. - 0.20 0.40 0.60 0.80 1.00 1.20 6/30/2009 6/30/2010 6/30/2011 6/30/2012 6/30/2013 12/31/2013 SMPL National Peers (Median) - 0.10 0.20 0.30 0.40 0.50 6 0.70 0.80 6/30/2009 6/30/2010 6/30/2011 6/30/2012 6/30/2013 12/31/2013 SMPL National Peers (Median) - 10.00 20.00 30.00 40.00 50.00 60.00 70.00 80.00 90.00 6/30/2009 6/30/2010 6/30/2011 6/30/2012 6/30/2013 12/31/2013 SMPL National Peers (Median) - 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 6/30/2009 6/30/2010 6/30/2011 6/30/2012 6/30/2013 12/31/2013 SMPL National Peers (Median)

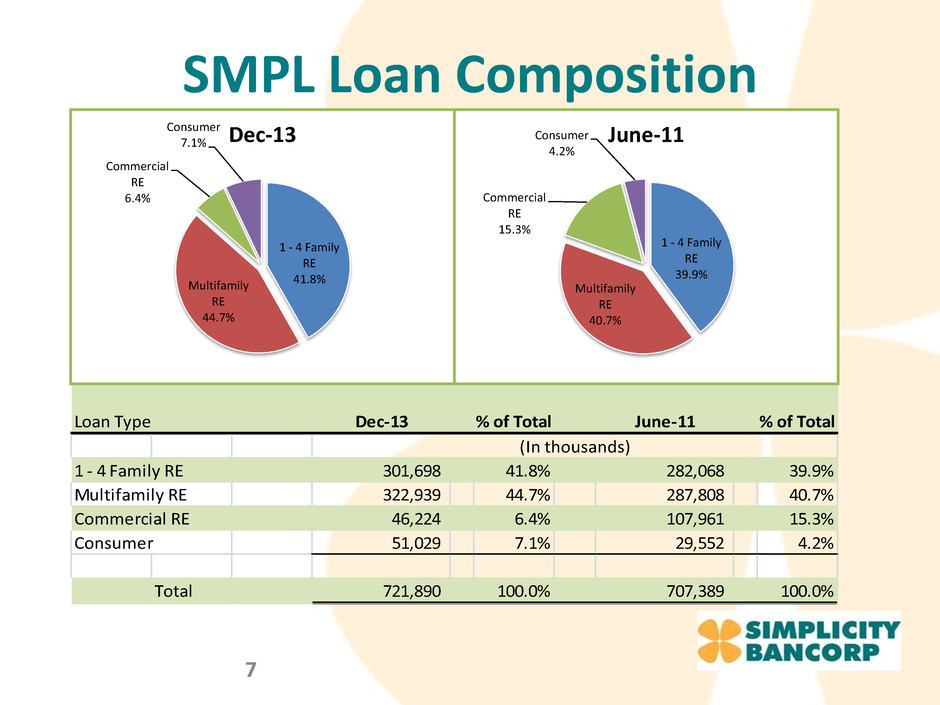

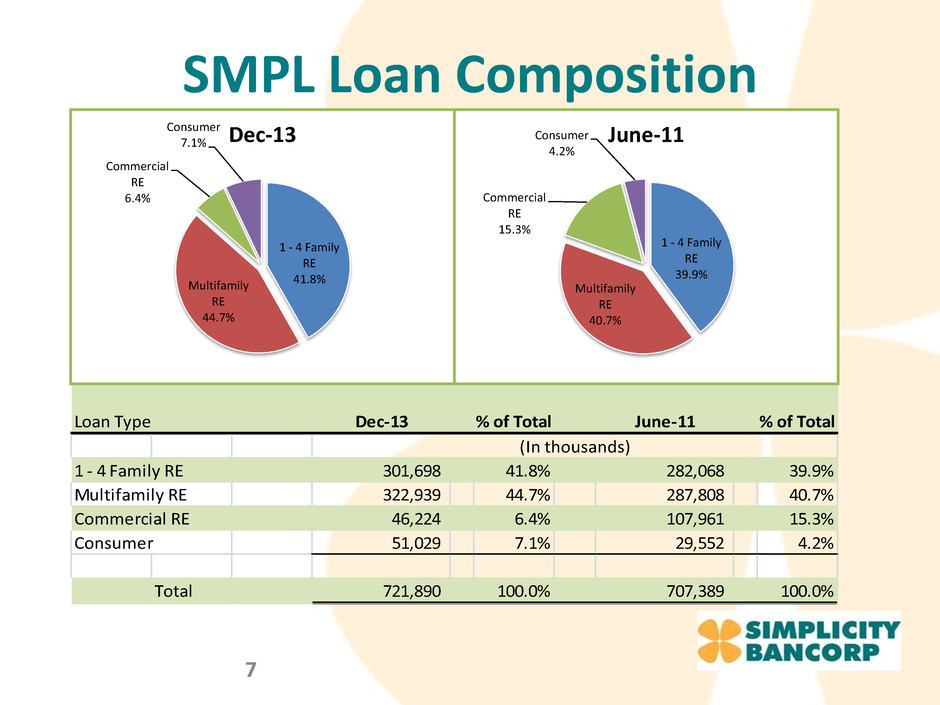

SMPL Loan Composition 7 Loan Type Dec-13 % of Total June-11 % of Total 1 - 4 Family RE 301,698 41.8% 282,068 39.9% Multifamily RE 322,939 44.7% 287,808 40.7% Commercial RE 46,224 6.4% 107,961 15.3% Consumer 51,029 7.1% 29,552 4.2% Total 721,890 100.0% 707,389 100.0% (In thousands) 1 - 4 Family RE 39.9% Multifamily RE 40.7% Commercial RE 15.3% Consumer 4.2% June-11 1 - 4 Family RE 41.8% Multifamily RE 44.7% Commercial RE 6.4% Consumer 7.1% Dec-13

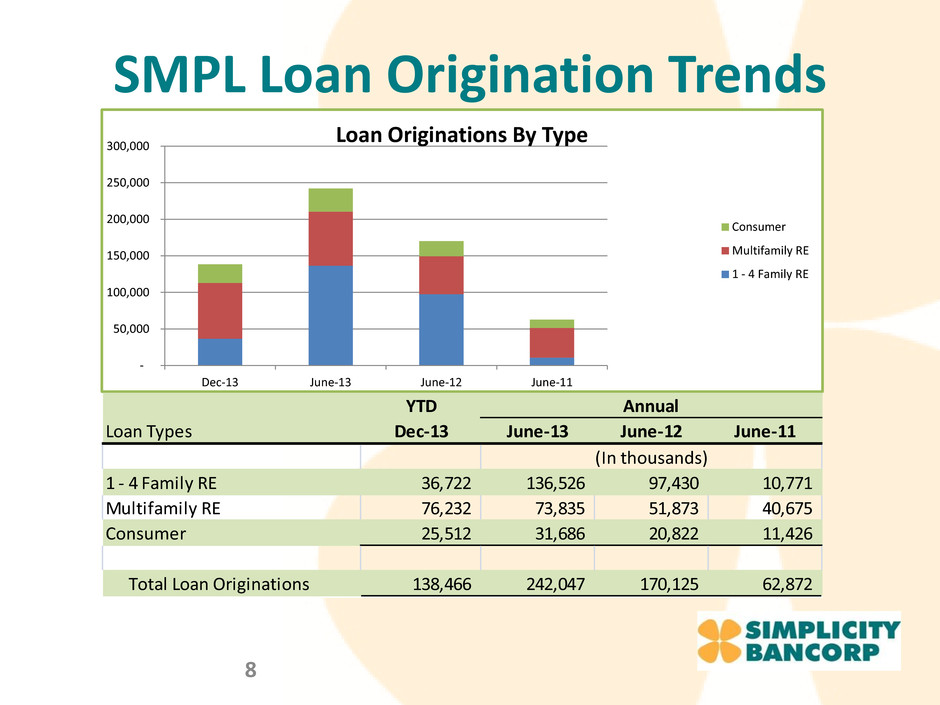

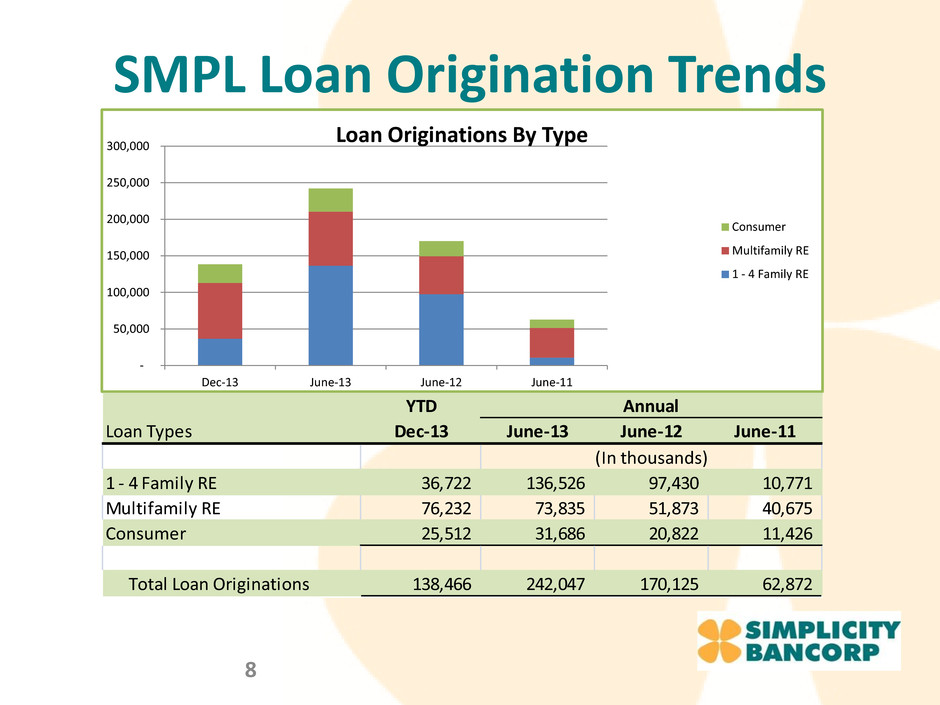

SMPL Loan Origination Trends 8 - 50,000 100,000 150,000 200,000 250,000 300,000 Dec-13 June-13 June-12 June-11 Loan Originations By Type Consumer Multifamily RE 1 - 4 Family RE YTD Loan Types Dec-13 June-13 June-12 June-11 1 - 4 Family RE 36,722 136,526 97,430 10,771 Multifamily RE 76,232 73,835 51,873 40,675 Consumer 25,512 31,686 20,822 11,426 Total Loan Originations 138,466 242,047 170,125 62,872 (In thousands) Annual

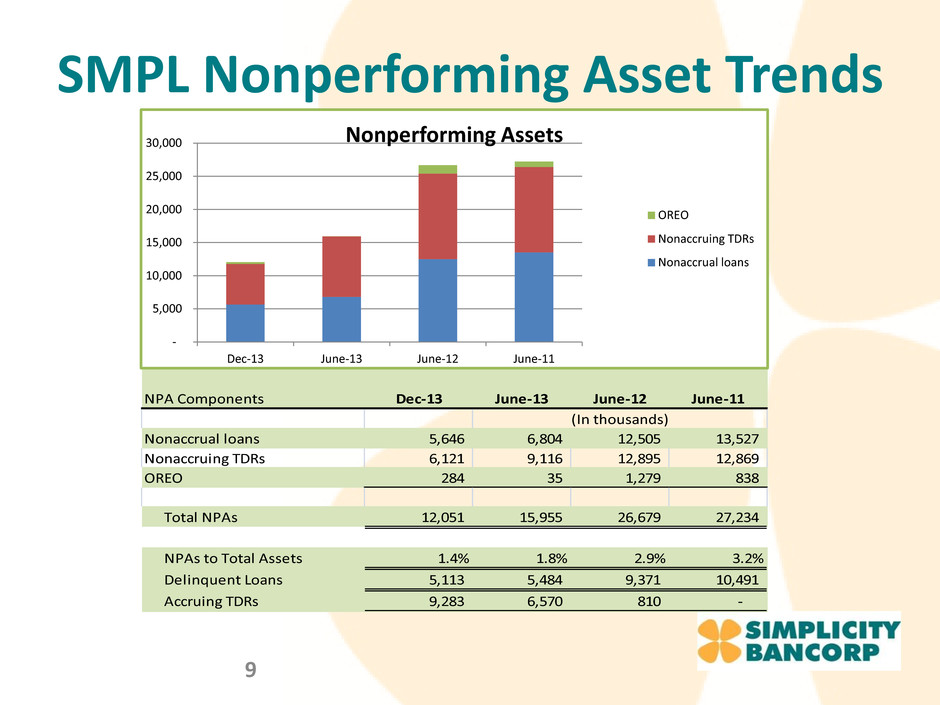

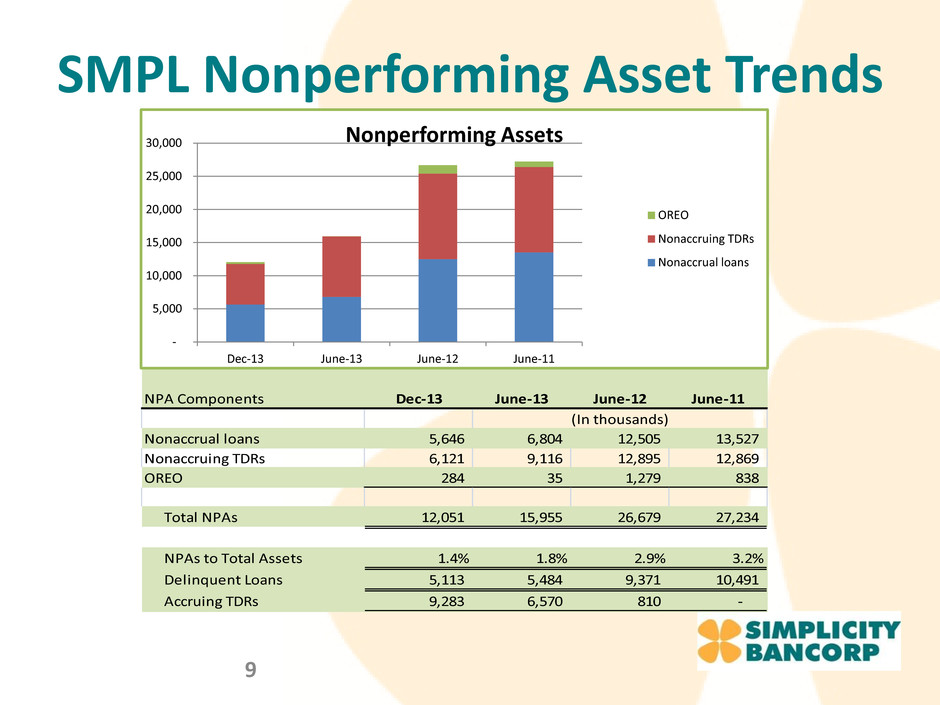

SMPL Nonperforming Asset Trends 9 NPA Components Dec-13 June-13 June-12 June-11 Nonaccrual loans 5,646 6,804 12,505 13,527 Nonaccruing TDRs 6,121 9,116 12,895 12,869 OREO 284 35 1,279 838 Total NPAs 12,051 15,955 26,679 27,234 NPAs to Total Assets 1.4% 1.8% 2.9% 3.2% Delinquent Loans 5,113 5,484 9,371 10,491 Accruing TDRs 9,283 6,570 810 - (In thousands) - 5,000 10,000 15,000 20,000 25,000 30,000 Dec-13 June-13 June-12 June-11 Nonperforming Assets OREO Nonaccruing TDRs Nonaccrual loans

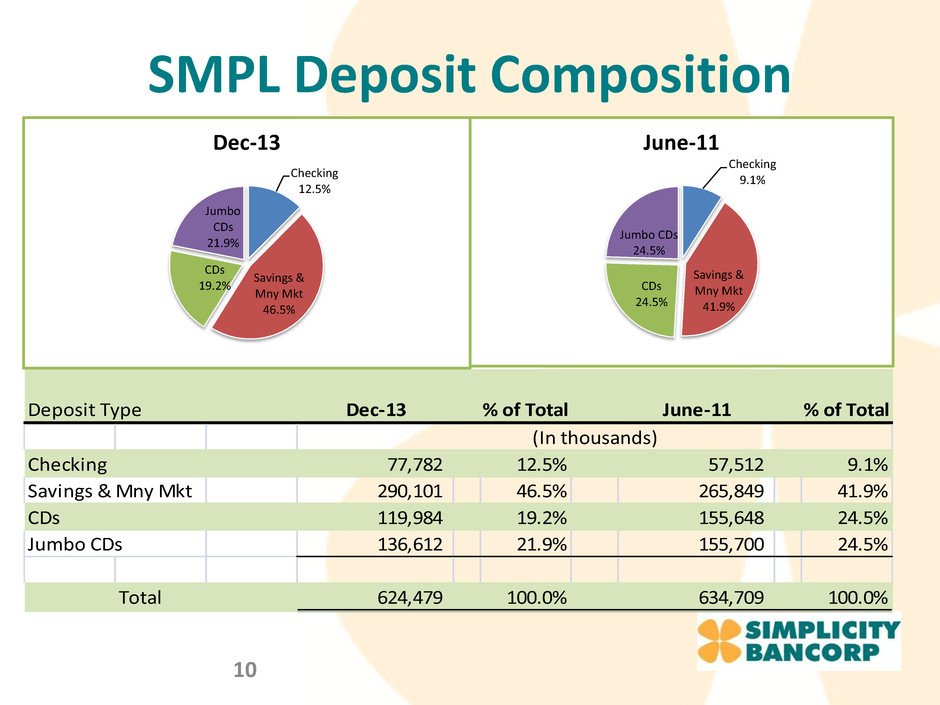

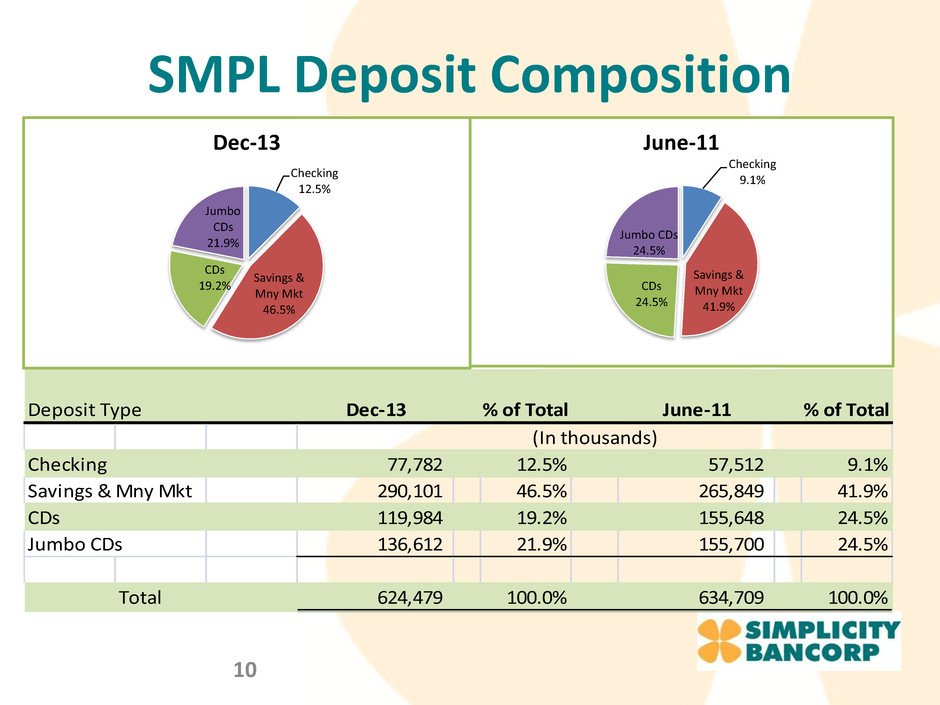

SMPL Deposit Composition 10 Deposit Type Dec-13 % of Total June-11 % of Total Checking 77,782 12.5% 57,512 9.1% Savings & Mny Mkt 290,101 46.5% 265,849 41.9% CDs 119,984 19.2% 155,648 24.5% Jumbo CDs 136,612 21.9% 155,700 24.5% Total 624,479 100.0% 634,709 100.0% (In thousands) Checking 12.5% Savings & Mny Mkt 46.5% CDs 19.2% Jumbo CDs 21.9% Dec-13 Checking 9.1% Savings & Mny Mkt 41.9% CDs 24.5% Jumbo CDs 24.5% June-11

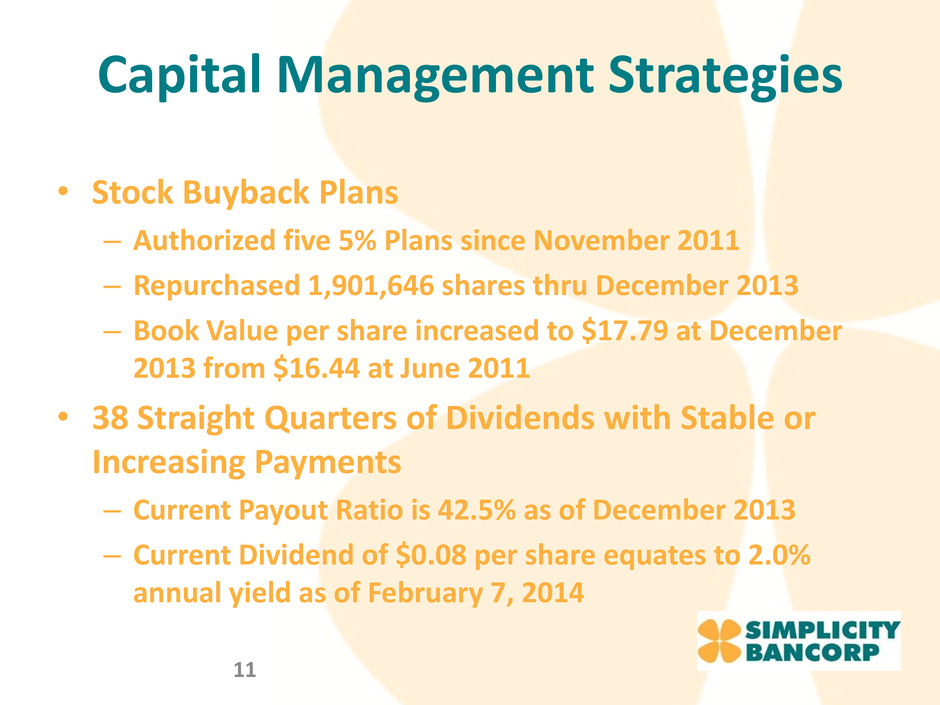

Capital Management Strategies 11 • Stock Buyback Plans – Authorized five 5% Plans since November 2011 – Repurchased 1,901,646 shares thru December 2013 – Book Value per share increased to $17.79 at December 2013 from $16.44 at June 2011 • 38 Straight Quarters of Dividends with Stable or Increasing Payments – Current Payout Ratio is 42.5% as of December 2013 – Current Dividend of $0.08 per share equates to 2.0% annual yield as of February 7, 2014

Strategic Outlook 12 • To Become a Top Performing Retail Bank of Choice in Our Markets – Continue our Emphasis on Building and Expanding Customer Relationships Through Various eCommerce and Traditional Delivery Channels – Focus on Expanding Wallet Share with Current Customers to Generate Increased Non-Interest Income, Core Deposits and Loans – Continue Community Customer Expansion to Increase New Customer Acquisition Opportunities – Continue to Originate Multifamily, 1 to 4 Family and Consumer Loans while Maintaining Our Historical Asset Quality Levels • Opportunities exist in Commercial Real Estate, SBA Lending, and HELOCs – Continue Capital Management Plans including Buybacks and Dividends – Cautiously Evaluate Expansion Opportunities

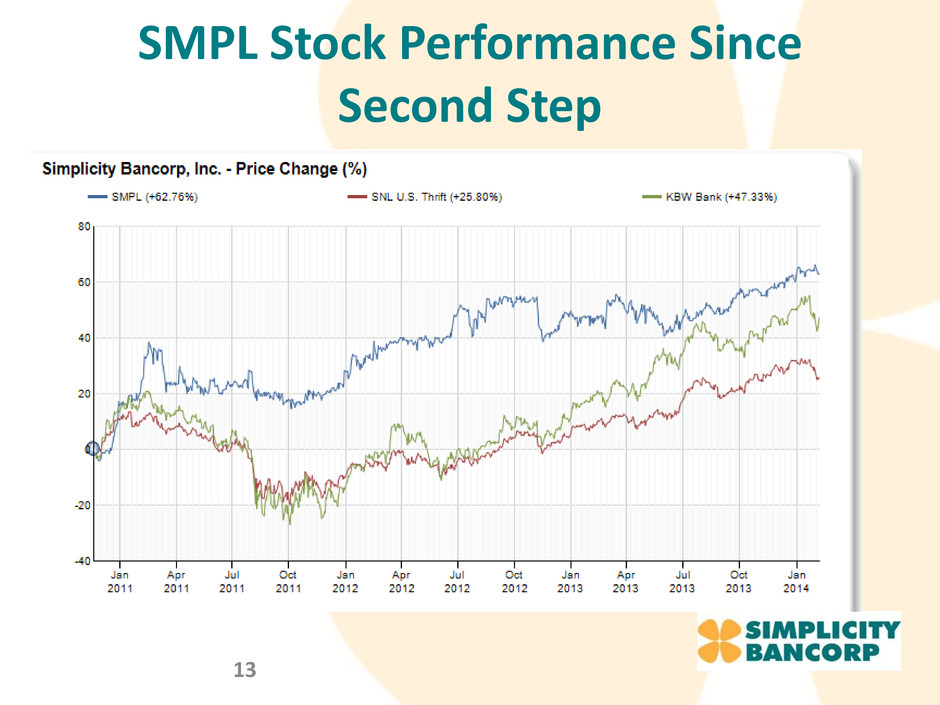

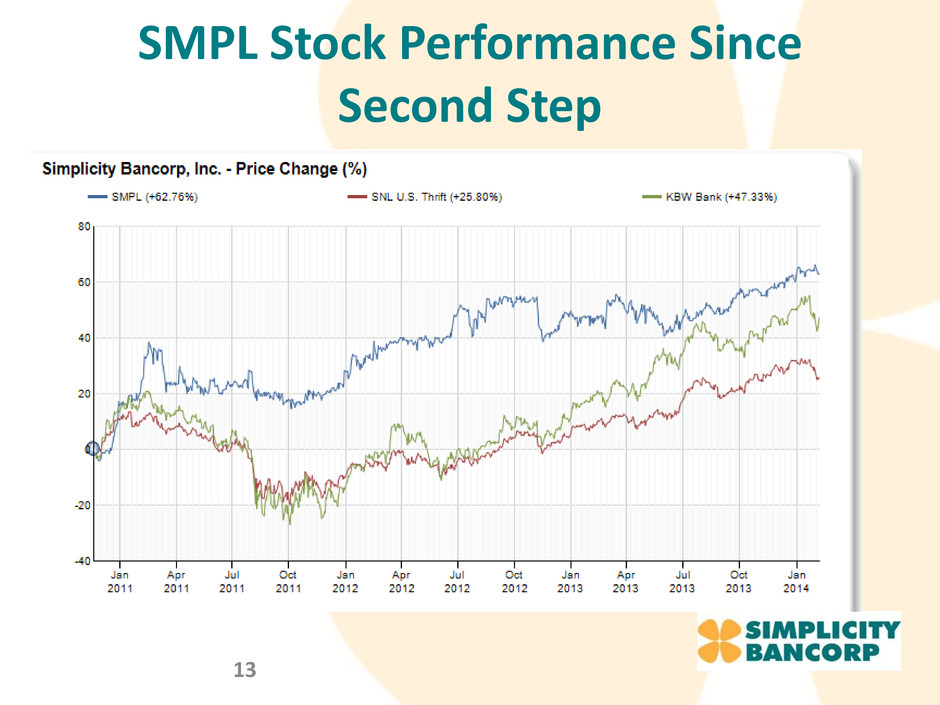

SMPL Stock Performance Since Second Step 13

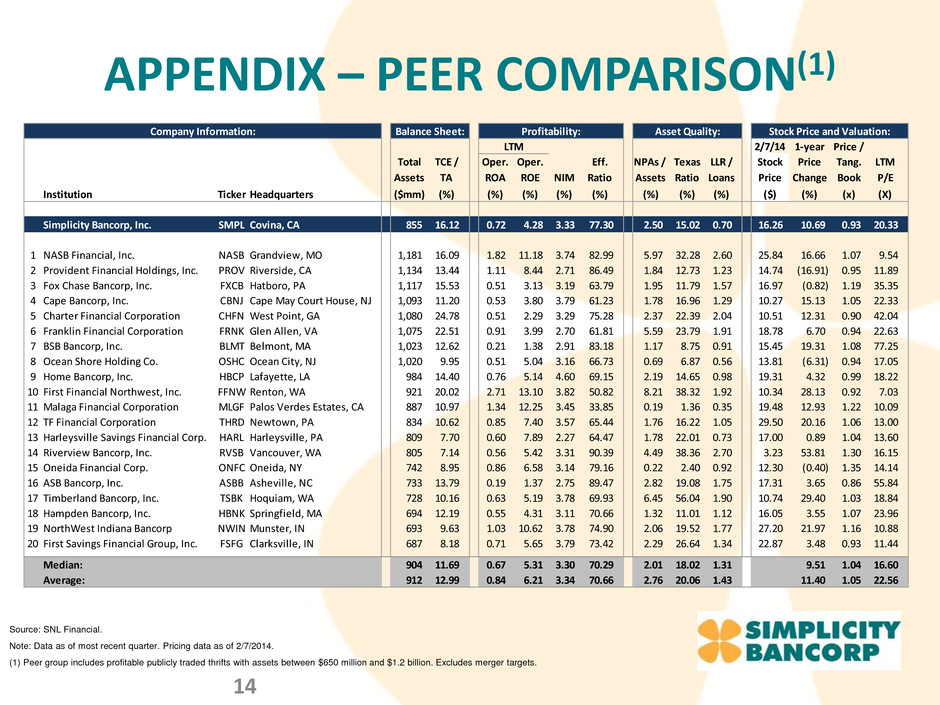

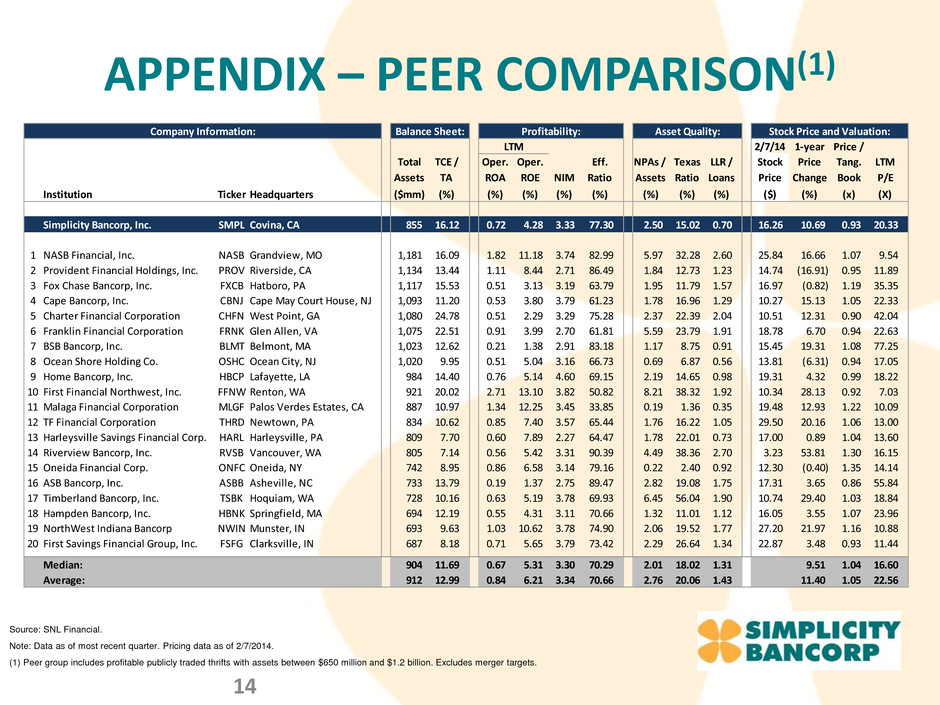

APPENDIX – PEER COMPARISON(1) 14 Source: SNL Financial. Note: Data as of most recent quarter. Pricing data as of 2/7/2014. (1) Peer group includes profitable publicly traded thrifts with assets between $650 million and $1.2 billion. Excludes merger targets. Company Information: Balance Sheet: Profitability: Asset Quality: Stock Price and Valuation: Dividends: LTM 2/7/14 1-year Price / Total TCE / Oper. Oper. Eff. NPAs / Texas LLR / Stock Price Tang. LTM Assets TA ROA ROE NIM Ratio Assets Ratio Loans Price Change Book P/E Institution Ticker Headquarters ($mm) (%) (%) (%) (%) (%) (%) (%) (%) ($) (%) (x) (X) Simplicity Bancorp, Inc. SMPL Covina, CA 855 16.12 0.72 4.28 3.33 77.30 2.50 15.02 0.70 16.26 10.69 0.93 20.33 1 NASB Financial, Inc. NASB Grandview, MO 1,181 16.09 1.82 11.18 3.74 82.99 5.97 32.28 2.60 25.84 16.66 1.07 9.54 2 Provident Financial Holdings, Inc. PROV Riverside, CA 1,134 13.44 1.11 8.44 2.71 86.49 1.84 12.73 1.23 14.74 (16.91) 0.95 11.89 3 Fox Chase Bancorp, Inc. FXCB Hatboro, PA 1,117 15.53 0.51 3.13 3.19 63.79 1.95 11.79 1.57 16.97 (0.82) 1.19 35.35 4 Cape Bancorp, Inc. CBNJ Cape May Court House, NJ 1,093 11.20 0.53 3.80 3.79 61.23 1.78 16.96 1.29 10.27 15.13 1.05 22.33 5 Charter Financial Corporation CHFN West Point, GA 1,080 24.78 0.51 2.29 3.29 75.28 2.37 22.39 2.04 10.51 12.31 0.90 42.04 6 Franklin Financial Corporation FRNK Glen Allen, VA 1,075 22.51 0.91 3.99 2.70 61.81 5.59 23.79 1.91 18.78 6.70 0.94 22.63 7 BSB Bancorp, Inc. BLMT Belmont, MA 1,023 12.62 0.21 1.38 2.91 83.18 1.17 8.75 0.91 15.45 19.31 1.08 77.25 8 Ocean Shore Holding Co. OSHC Ocean City, NJ 1,020 9.95 0.51 5.04 3.16 66.73 0.69 6.87 0.56 13.81 (6.31) 0.94 17.05 9 Home Bancorp, Inc. HBCP Lafayette, LA 984 14.40 0.76 5.14 4.60 69.15 2.19 14.65 0.98 19.31 4.32 0.99 18.22 10 First Financial Northwest, Inc. FFNW Renton, WA 921 20.02 2.71 13.10 3.82 50.82 8.21 38.32 1.92 10.34 28.13 0.92 7.03 11 Malaga Financial Corporation MLGF Palos Verdes Estates, CA 887 10.97 1.34 12.25 3.45 33.85 0.19 1.36 0.35 19.48 12.93 1.22 10.09 12 TF Financial Corporation THRD Newtown, PA 834 10.62 0.85 7.40 3.57 65.44 1.76 16.22 1.05 29.50 20.16 1.06 13.00 13 Harleysville Savings Financial Corp. HARL Harleysville, PA 809 7.70 0.60 7.89 2.27 64.47 1.78 22.01 0.73 17.00 0.89 1.04 13.60 14 Riverview Bancorp, Inc. RVSB Vancouver, WA 805 7.14 0.56 5.42 3.31 90.39 4.49 38.36 2.70 3.23 53.81 1.30 16.15 15 Oneida Financial Corp. ONFC Oneida, NY 742 8.95 0.86 6.58 3.14 79.16 0.22 2.40 0.92 12.30 (0.40) 1.35 14.14 16 ASB Bancorp, Inc. ASBB Asheville, NC 733 13.79 0.19 1.37 2.75 89.47 2.82 19.08 1.75 17.31 3.65 0.86 55.84 17 Timberland Bancorp, Inc. TSBK Hoquiam, WA 728 10.16 0.63 5.19 3.78 69.93 6.45 56.04 1.90 10.74 29.40 1.03 18.84 18 Hampden Bancorp, Inc. HBNK Springfield, MA 694 12.19 0.55 4.31 3.11 70.66 1.32 11.01 1.12 16.05 3.55 1.07 23.96 19 NorthWest Indiana Bancorp NWIN Munster, IN 693 9.63 1.03 10.62 3.78 74.90 2.06 19.52 1.77 27.20 21.97 1.16 10.88 20 First Savings Financial Group, Inc. FSFG Clarksville, IN 687 8.18 0.71 5.65 3.79 73.42 2.29 26.64 1.34 22.87 3.48 0.93 11.44 Median: 904 11.69 0.67 5.31 3.30 70.29 2.01 18.02 1.31 9.51 1.04 16.60 Average: 912 12.99 0.84 6.21 3.34 70.66 2.76 20.06 1.43 11.40 1.05 22.56