QuickLinks -- Click here to rapidly navigate through this document

Pursuant to Rule 424B3

Registration No. 333-148314

PROSPECTUS

VWR FUNDING, INC.

Exchange Offer for

$675,000,000 10.25%/11.25% Senior PIK Toggle Notes

due 2015, Series B

We are offering to exchange:

up to $675,000,000 of our new 10.25%/11.25% Senior PIK Toggle

Notes due 2015, Series B for a like amount of our outstanding

10.25%/11.25% Senior PIK Toggle Notes due 2015

and

Material Terms of Exchange Offer

- w

- The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the transfer restrictions and registration rights relating to the outstanding notes will not apply to the exchange notes.

- w

- The exchange notes will be guaranteed on a senior unsecured basis by all of our existing and future material domestic subsidiaries that guarantee debt under our new senior secured credit facility.

- w

- There is no existing public market for the outstanding notes or the exchange notes. We do not intend to list the exchange notes on any securities exchange or seek approval for quotation through any automated trading system.

- w

- You may withdraw your tender of notes at any time before the expiration of the exchange offer. We will exchange all of the outstanding notes that are validly tendered and not withdrawn.

- w

- Based upon interpretations by the Staff of the SEC, we believe that, subject to some exceptions, the exchange notes may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act.

- w

- The exchange offer expires at 5:00 p.m., New York City time, on February 21, 2008, unless extended.

- w

- The exchange of notes will not be a taxable event for U.S. federal income tax purposes.

- w

- The exchange offer is not subject to any condition other than that it not violate applicable law or any applicable interpretation of the Staff of the SEC.

- w

- We will not receive any proceeds from the exchange offer.

For a discussion of certain factors that you should consider before participating in this exchange offer, see "Risk Factors" beginning on page 17 of this prospectus.

Neither the SEC nor any state securities commission has approved the notes to be distributed in the exchange offer, nor have any of these organizations determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

January 22, 2008

| | Page | |

|---|---|---|

| Summary | 1 | |

| Risk Factors | 17 | |

| Forward-Looking Statements | 29 | |

| Exchange Offer | 30 | |

| Use of Proceeds | 37 | |

| Capitalization | 38 | |

| Unaudited Pro Forma Condensed Consolidated Financial Statements | 39 | |

| Selected Historical Financial Data | 44 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 47 | |

| Business | 71 | |

| Management | 83 | |

| Executive Compensation | 88 | |

| Description of Equity Capital of Holdings | 104 | |

| Security Ownership of Principal Shareholders and Management | 105 | |

| Certain Relationships and Related Party Transactions | 107 | |

| Description of Certain Other Indebtedness | 110 | |

| Description of Notes | 115 | |

| Book Entry; Delivery and Form | 181 | |

| Material United States Federal Tax Considerations | 184 | |

| Certain ERISA Considerations | 190 | |

| Plan of Distribution | 191 | |

| Legal Matters | 192 | |

| Experts | 192 | |

| Where You Can Find Other Information | 192 | |

| Index to Consolidated Financial Statements | F-1 |

We have not authorized anyone to give any information or represent anything to you other than the information contained in this prospectus. You must not rely on any unauthorized information or representations.

Until , , all dealers that, buy, sell or trade the exchange notes, whether or not participating in the exchange offer, may be required to deliver a prospectus. This requirement is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments and subscriptions.

This prospectus incorporates business and financial information about us that is not included in or delivered with this prospectus. This information is available free of charge to security holders upon written or oral request to: VWR Funding, Inc., 1310 Goshen Parkway, P.O. Box 2656, West Chester, PA 19380; Attention: Investor Relations (telephone: (610) 431-1700).

This summary highlights material information about our business and about participating in the exchange offer. This is a summary of material information contained elsewhere in this prospectus and is not complete and may not contain all of the information that may be important to you. For a more complete understanding of our business, you should read this entire prospectus, including the section entitled "Risk Factors" and our audited and unaudited consolidated financial statements and related notes.

Our Business

We are a leader in the global laboratory supply industry. We provide distribution services to a highly fragmented supply chain by offering products from a wide range of manufacturers to a large number of customers. Our business is highly diversified across products and services, geographic regions and customer segments.

Products we distribute include chemicals, glassware, instruments, protective clothing and other assorted laboratory products. The vast majority of our products cost less than $1,000. Many of our products, including chemicals, laboratory consumables, production supplies and science education products, are consumable in nature. These products are basic and essential supplies required by research laboratories and represented approximately 75% of our net sales in each of 2004, 2005 and 2006. We also provide certain services to some of our customers, which are primarily comprised of technical services, on-site storeroom services, warehousing and furniture design, supply and installation. We maintain operations in more than 20 countries and process an average of 52,000 order lines daily from 20 strategically located distribution centers.

We report our financial results on the basis of the following three business segments: North American laboratory distribution, or North American Lab; European laboratory distribution, or European Lab; and Science Education. Asia Pacific operations are embedded within the North American Lab and European Lab segments. Both the North American Lab and European Lab segments are comprised of the distribution of laboratory supplies to customers in the pharmaceutical, biotechnology, chemical, food processing, consumer products and technology industries. Science Education is comprised of the manufacture and distribution of scientific supplies and specialized kits principally to primary and secondary schools in North America.

Industry trade associations estimate that the 2006 industry-wide revenues of the global laboratory supply industry in which our North American Lab and European Lab segments operate were approximately $27 billion. Management estimates that the industry has grown over the last several years at low to mid single digit rates, driven by increasing research and development spending from a diversified collection of end-users, including those in the pharmaceutical, biotechnology, chemical, education, medical research, government and environmental industries. Our net sales are influenced by, but not directly correlated with, the growth of research and development spending, and we expect that results may vary by type of end-user.

We estimate that the 2006 industry-wide sales of scientific supplies to primary and secondary schools in North America, the primary customers of our Science Education segment, were approximately $600 million. Industry sales levels are subject to fluctuations driven by changes in state and local government funding, the timing of the state by state new textbook adoption cycle and population changes.

We maintain a diverse and stable customer base. Our customers include major pharmaceutical, biotechnology, chemical, technology, food processing and consumer products companies. They also include universities and research institutes, governmental agencies, environmental organizations and primary and secondary schools. We serve our customers in North

1

America, Europe, Central America, South America, British Commonwealth countries, Africa, the Middle East and the Pacific Rim through our operations in North America and in 15 European countries. We established a presence in Asia Pacific in 2006 and plan to further expand in this region to respond to the needs of our global customers who are expanding operations there.

We seek to be the principal provider of scientific supplies to our customer base. We are a principal provider of laboratory supplies to a majority of the world's 20 largest pharmaceutical companies, as well as three of the largest North American biotechnology buying consortia. Pharmaceutical and biotechnology companies represented approximately 35% of our 2006 net sales and, together with universities and colleges, accounted for approximately 47% of our 2006 net sales.

We seek to develop long term relationships with our customers. In addition to our product offerings to our customers, we also provide an array of value-added services that integrate us with our customers. Our customized service offerings include outsourcing of customers' purchasing, delivery, receiving and inventory management functions.

2

The Transactions

On June 29, 2007, Varietal Distribution Holdings, LLC, or "Holdings," acquired CDRV Investors, Inc. in a transaction having an aggregate value of approximately $4,152.1 million. Holdings is owned by Madison Dearborn Capital Partners V-A, L.P., Madison Dearborn Capital Partners V-C, L.P. and Madison Dearborn Capital Partners Executive A-L.P. (collectively, "Madison Dearborn"), other co-investors and certain members of our management ("Management Investors"), who we collectively refer to as the "equity investors." See "Security Ownership of Principal Shareholders and Management" for additional information regarding the equity investors. The acquisition was effected through the merger of Varietal Distribution Merger Sub, Inc., or "Merger Sub," a newly formed indirect wholly owned subsidiary of Holdings, with and into CDRV Investors, Inc., which was the surviving corporation.

In connection with the agreement and plan of merger, the following events occurred, which we collectively refer to as the "Transactions":

- •

- the purchase by the equity investors of preferred and common units of Holdings for approximately $1,425.0 million in cash or, with respect to the Management Investors, in cash and/or through a roll-over of existing equity value in CDRV Investors, Inc.;

- •

- the entering into by Merger Sub of a new senior secured credit facility consisting of a $615.0 million U.S. dollar-denominated term loan, €600.0 million Euro-denominated term loan and a $250.0 million multi-currency senior secured revolving credit facility;

- •

- the issuance by Merger Sub of $675.0 million of senior notes and $353.3 million and €125.0 million of senior subordinated notes in a concurrent offering;

- •

- the refinancing of our historical debt, including accrued interest, of which approximately $1,697.4 million was outstanding as of the closing date, and the payment of prepayment and tender offer premiums of approximately $93.0 million;

- •

- the merger of Merger Sub with and into CDRV Investors, Inc., with CDRV Investors, Inc. as the surviving corporation, the payment of the related merger consideration and the assumption by CDRV Investors, Inc. of all of Merger Sub's debt obligations (the "Merger"); and

- •

- the payment of approximately $80.8 million of fees and expenses related to the Transactions and $35.6 million of fees to Madison Dearborn.

Following the Merger, CDRV Investors, Inc. became a wholly-owned direct subsidiary of VWR Investors, Inc., or "Parent," and a wholly-owned indirect subsidiary of Holdings. In addition, immediately following the Merger, CDRV Investors, Inc. changed its name to VWR Funding, Inc. (the "Company" or the "Issuer")

3

Sources and Uses of Funds

The following table summarizes sources and uses of funds for the Transactions.

| Sources of Funds | Amount | Uses of Funds | Amount | ||||||

|---|---|---|---|---|---|---|---|---|---|

| (dollars in millions) | |||||||||

| Cash | $ | 64.0 | Equity purchase price(4) | $ | 2,196.0 | ||||

| Refinance existing debt | 1,697.4 | ||||||||

| Senior secured term loans: | Madison Dearborn fee | 35.6 | |||||||

| U.S. dollar-denominated term loan | 615.0 | Fees and expenses(5) | 80.8 | ||||||

| Euro-denominated term loan(1) | 802.3 | Prepayment and tender offer premiums on existing debt | 93.0 | ||||||

| Other third party debt and capital leases | 49.3 | ||||||||

| Senior notes | 675.0 | ||||||||

| Senior subordinated notes(2) | 521.5 | ||||||||

| Other third party debt and capital leases | 49.3 | ||||||||

| Equity(3) | 1,425.0 | ||||||||

| Total Sources | $ | 4,152.1 | Total Uses | $ | 4,152.1 | ||||

- (1)

- Reflects U.S. dollar equivalent of €600.0 million term loan as of the closing date, net of realized loss on foreign currency forwards.

- (2)

- Reflects the U.S. dollar equivalent as of the closing date of the Euro portion of our new senior subordinated notes, which were issued on the closing date, net of realized loss on foreign currency forwards. See "Description of Certain Other Indebtedness — Senior Subordinated Notes."

- (3)

- Includes cash investments by Madison Dearborn and the Management Investors. See "Certain Relationships and Related Party Transactions — Management Equity Arrangements."

- (4)

- Includes cash payments in respect of outstanding common stock, vested and unvested options, restricted stock units and director stock units.

- (5)

- Fees and expenses associated with the Transactions, including commitment, placement and other financing fees, financial advisory costs and other transaction costs and professional fees. See "Certain Relationships and Related Party Transactions."

4

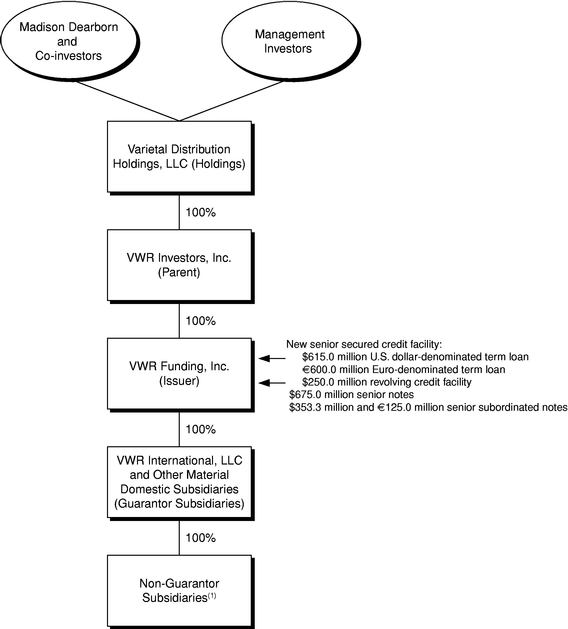

Corporate Structure

The following diagram shows an overview of our corporate structure following the completion of the Transactions on June 29, 2007.

- (1)

- Our non-guarantor subsidiaries include our foreign subsidiaries, domestic holding companies for our foreign subsidiaries and any future immaterial domestic subsidiaries. Our non-guarantor subsidiaries held approximately 43% of our total assets as of September 30, 2007 and generated approximately 45% of our net sales and approximately 41% of our operating income for the periods included in the nine months ended September 30, 2007. Our non-guarantor foreign subsidiaries are primarily held through VWR International Holdings, Inc., a Delaware corporation and a wholly owned subsidiary of VWR International, LLC.

5

Information included in this prospectus about the global laboratory supply industry and the science education supply industry, including our general expectations concerning these industries, are based on estimates prepared using data from various sources and on assumptions made by us. We believe data regarding these industries are inherently imprecise, but based on management's understanding of the markets in which we compete, management believes that such data is generally indicative of these industries. Our estimates, in particular as they relate to our general expectations concerning these industries, involve risks and uncertainties and are subject to change based on various factors, including those discussed under the caption "Risk Factors."

Equity Sponsor

Madison Dearborn Partners, LLC is a leading private equity investment firm based in Chicago, Illinois and focuses on investments in several specific industries, including basic industries, communications, consumer, financial services and healthcare. Madison Dearborn Partners' objective is to invest in companies with strong competitive characteristics that it believes have potential for significant long-term equity appreciation. To achieve this objective, Madison Dearborn Partners seeks to partner with outstanding management teams who have a solid understanding of their businesses and track records of building shareholder value.

Company Information

VWR Funding, Inc. and Parent are Delaware corporations. Our principal executive officers are located at 1310 Goshen Parkway, P.O. Box 2656, West Chester, PA 19380, and our telephone number is (610) 431-1700. Our website is www.vwr.com. Information on our website shall not be deemed part of this prospectus.

6

| The Initial Offering of Outstanding Notes | We sold the outstanding 10.25%/11.25% Senior PIK Toggle Notes due 2015 (the "outstanding notes") on June 29, 2007 to Goldman, Sachs & Co, Banc of America Securities LLC, JP Morgan Securities Inc. and Deutsche Bank Securities Inc. We refer to these parties in this prospectus collectively as the "initial purchasers." The initial purchasers subsequently resold the outstanding notes: (i) to qualified institutional buyers pursuant to Rule 144A; or (ii) outside the United States in compliance with Regulation S. | ||

Registration Rights Agreement | Simultaneously with the initial sale of the outstanding notes, we entered into a registration rights agreement for the exchange offer. In the registration rights agreement, we agreed, among other things, to use our reasonable best efforts to file with the SEC and cause to become effective a registration statement relating to offers to exchange the outstanding notes for an issue of SEC-registered notes with terms identical to the outstanding notes. The exchange offer is intended to satisfy your rights under the registration rights agreement. After the exchange offer is complete, you will no longer be entitled to any exchange or registration rights with respect to your outstanding notes. | ||

The Exchange Offer | We are offering to exchange new 10.25%/11.25% Senior PIK Toggle Notes due 2015, Series B (the "exchange notes"), which have been registered under the Securities Act of 1933, as amended (the "Securities Act"), for your outstanding notes, which were issued on June 29, 2007 in the initial offering. In order to be exchanged, an outstanding note must be properly tendered and accepted. All outstanding notes that are validly tendered and not validly withdrawn will be exchanged. We will issue exchange notes promptly after the expiration of the exchange offer. | ||

Resales | We believe that the exchange notes issued in the exchange offer may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act provided that | ||

• | the exchange notes are being acquired in the ordinary course of your business; | ||

• | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the exchange notes issued to you in the exchange offer; and | ||

• | you are not an affiliate of ours. | ||

If any of these conditions are not satisfied and you transfer any exchange notes issued to you in the exchange offer without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange notes from these requirements, you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. | |||

7

Each broker-dealer that is issued exchange notes in the exchange offer for its own account in exchange for outstanding notes that were acquired by that broker-dealer as a result of market-marking or other trading activities, must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the exchange notes. A broker-dealer may use this prospectus for an offer to resell, resale or other retransfer of the exchange notes issued to it in the exchange offer. | |||

Record Date | We mailed this prospectus and the related exchange offer documents to registered holders of outstanding notes on , . | ||

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on February 21, 2008, unless we decide to extend the expiration date. | ||

Conditions to the Exchange Offers | The exchange offer is not subject to any condition other than that the exchange offer not violate applicable law or any applicable interpretation of the staff of the SEC. | ||

Procedures for Tendering Outstanding Notes | If you wish to tender your outstanding notes for exchange in this exchange offer, you must transmit to the exchange agent on or before the expiration date either: | ||

• | an original or a facsimile of a properly completed and duly executed copy of the letter of transmittal, which accompanies this prospectus, together with your outstanding notes and any other documentation required by the letter of transmittal, at the address provided on the cover page of the letter of transmittal; or | ||

• | if the outstanding notes you own are held of record by The Depository Trust Company, or "DTC," in book-entry form and you are making delivery by book-entry transfer, a computer-generated message transmitted by means of the Automated Tender Offer Program System of DTC, or "ATOP," in which you acknowledge and agree to be bound by the terms of the letter of transmittal and which, when received by the exchange agent, forms a part of a confirmation of book-entry transfer. As part of the book-entry transfer, DTC will facilitate the exchange of your outstanding notes and update your account to reflect the issuance of the exchange notes to you. ATOP allows you to electronically transmit your acceptance of the exchange offer to DTC instead of physically completing and delivering a letter of transmittal to the exchange agent. | ||

In addition, you must deliver to the exchange agent on or before the expiration date: | |||

• | a timely confirmation of book-entry transfer of your outstanding notes into the account of the exchange agent at DTC if you are effecting delivery of book-entry transfer, or | ||

• | if necessary, the documents required for compliance with the guaranteed delivery procedures. | ||

8

Special Procedures for Beneficial Owners | If you are the beneficial owner of book-entry interests and your name does not appear on a security position listing of DTC as the holder of the book-entry interests or if you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the book-entry interest or outstanding notes in the exchange offer, you should contact the person in whose name your book-entry interests or outstanding notes are registered promptly and instruct that person to tender on your behalf. | ||

Withdrawal Rights | You may withdraw the tender of your outstanding notes at any time prior to 5:00 p.m., New York City time on February 21, 2008. | ||

Federal Income Tax Considerations | We believe that the exchange of outstanding notes will not be a taxable event for United States federal income tax purposes. | ||

Use of Proceeds | We will not receive any proceeds from the issuance of exchange notes pursuant to the exchange offer. We will pay all of our expenses incident to the exchange offer. | ||

Exchange Agent | Deutsche Bank National Trust Company is serving as the exchange agent in connection with the exchange offer. | ||

Shelf Registration | In limited circumstances, holders of the outstanding notes may require us to register their outstanding notes under a shelf registration statement. | ||

9

Summary of Terms of the Exchange Notes

The form and terms of the exchange notes are the same as the form and terms of the outstanding notes, except that the exchange notes will be registered under the Securities Act. As a result, the exchange notes will not bear legends restricting their transfer and will not contain the registration rights and liquidated damage provisions contained in the outstanding notes. The exchange notes represent the same debt as the outstanding notes. Both the outstanding notes and the exchange notes are governed by the same indentures. Unless the context otherwise requires, we use the term "notes" in this prospectus to collectively refer to the outstanding notes and the exchange notes.

| Exchange Notes | $675.0 million aggregate principal amount of 10.25%/11.25% Senior PIK Toggle Notes due 2015, Series B. | ||

Maturity Date | The notes will mature on July 15, 2015. | ||

Interest Payments | For any interest period through July 15, 2011 (other than the first interest period), we may, at our option, elect to pay interest on the notes (1) entirely in cash ("Cash Interest"), (2) entirely by increasing the principal amount of the notes ("PIK Interest") or (3) 50% as Cash Interest and 50% as PIK Interest. PIK Interest will accrue on the notes at a rate per annum equal to the cash interest rate of 10.25% plus 100 basis points. We will pay Cash Interest on the notes for the first interest period. Following an increase in the principal amount of the notes as a result of a payment of PIK Interest, the notes will accrue interest on such increased principal amount from the date of such payment. | ||

Interest Payment Dates | Interest on the notes will be payable semi-annually in arrears on January 15 and July 15 of each year. | ||

Guarantees | The notes will be guaranteed, jointly and severally and fully and unconditionally, on an unsecured unsubordinated basis by each of our subsidiaries that guarantees debt under our new senior secured credit facility. | ||

Ranking | The notes and the guarantees thereof will be our and the guarantors' senior unsecured obligations and will be: | ||

• | subordinated to our and the guarantors' obligations under all secured indebtedness, including any borrowings under our new senior secured credit facility and the guarantees thereof; | ||

• | pari passu with all of our and the guarantors' existing and future senior unsecured indebtedness; | ||

• | senior to all of our and our guarantors' existing and future subordinated indebtedness, including the new senior subordinated notes and the guarantees thereof; and | ||

• | structurally subordinated to all existing and future liabilities, including trade and other payables, of our non-guarantor subsidiaries. | ||

As of September 30, 2007, the aggregate amount of liabilities of our non-guarantor subsidiaries was approximately $732.1 million. Our non-guarantor subsidiaries held approximately 43% of our total assets as of September 30, 2007. | |||

10

Because the notes are unsecured, in the event of bankruptcy, liquidation, reorganization or other winding up of our company or the guarantors or upon a default in payment with respect to, or acceleration of, any indebtedness under our new senior secured credit facility or other secured indebtedness, the assets of our company and guarantors that secure such secured indebtedness will be available to pay obligations on the notes and the guarantees only after all indebtedness under such secured indebtedness has been repaid in full from such assets. See "Description of Certain Other Indebtedness." | |||

As of September 30, 2007, we had approximately $1,468.1 million of indebtedness under our new senior secured credit facility (excluding unused availability of $239.9 million and $10.1 million of outstanding letters of credit). | |||

Optional Redemption | We may, at our option, redeem some or all of the notes at 100% of the principal amount thereof plus a "make-whole premium" at any time from time to time prior to July 15, 2011. We may, at our option, redeem some or all of the notes, at any time and from time to time after July 15, 2011, at the redemption prices listed under "Description of Notes — Optional Redemption." | ||

In addition, prior to July 15, 2010, we may, at our option, redeem up to 35% of the notes with the proceeds from certain sales of our equity at the redemption price listed under "Description of Notes — Optional Redemption." | |||

Mandatory Repurchase Offer | If we experience specific types of changes of control, we must offer to repurchase the notes at a price equal to 101% of the principal amount thereof, plus accrued and unpaid interest to the date of purchase, subject to the rights of holders of notes on the relevant record date to receive interest due on the relevant payment date. See "Description of Notes — Repurchase at the Option of Holders — Change of Control." | ||

Mandatory Principal Redemption | If the notes would otherwise constitute "applicable high yield discount obligations" within the meaning of Section 163(i)(1) of the Internal Revenue Code of 1986, as amended (the "Code"), at the end of the first accrual period ending after the fifth anniversary of the issuance of the outstanding notes (the "AHYDO redemption date"), we will be required to redeem for cash a portion of each note then outstanding equal to the "Mandatory Principal Redemption Amount" (such redemption, a "Mandatory Principal Redemption"). The redemption price for the portion of each note redeemed pursuant to a Mandatory Principal Redemption will be 100% of the principal amount of such portion plus any accrued interest thereon on the date of redemption. The "Mandatory Principal Redemption Amount" means the portion of a note required to be redeemed to prevent such note from being treated as an "applicable high yield discount obligation" within the meaning of Section 163(i)(1) of the Code. No partial redemption or repurchase of the notes prior to the AHYDO redemption date pursuant to any other provision of the indenture will alter our obligation to make the Mandatory Principal Redemption with respect to any notes that remain outstanding on the AHYDO redemption date. | ||

11

Original Issue Discount | We have the option to pay interest on the notes in Cash Interest or PIK Interest for any interest payment period after the initial interest payment and prior to the fourth anniversary. For U.S. federal income tax purposes, the existence of this option means that none of the interest payments on the notes will be qualified stated interest even if we never exercise the option to pay PIK Interest. Consequently, the notes will be treated as issued with original issue discount, and U.S. holders will be required to include the original issue discount in gross income for U.S. federal income tax purposes on a constant yield to maturity basis, regardless of whether interest is paid currently in cash. | ||

Certain Covenants | The indenture governing the notes contains covenants that, among other things, limit our ability and the ability of our restricted subsidiaries to: | ||

• | incur additional debt; | ||

• | pay dividends and make other distributions; | ||

• | make certain investments; | ||

• | repurchase stock; | ||

• | incur liens; | ||

• | enter into transactions with affiliates; | ||

• | merge or consolidate; and | ||

• | transfer or sell assets. | ||

These covenants are subject to important exceptions and qualifications, which are described under "Description of Notes — Certain Covenants." | |||

Risk Factors

You should consider all of the information contained in this prospectus before participating in the exchange offer. In particular, you should consider the factors described under "Risk Factors" beginning on page 17.

12

Summary Historical and Pro Forma Financial Data

The summary historical financial data presented below under the captions "Income Statement Data," "Financial Data," "Other Financial Data," "Balance Sheet Data" and "Cash Flow Data" for each of the periods in the two-year period ended December 31, 2006 are derived from our audited consolidated financial statements. The consolidated financial statements for each of the periods in the two-year period ended December 31, 2006 are included elsewhere in this prospectus.

The selected historical financial data presented below under the captions "Income Statement Data," "Financial Data," "Other Financial Data," "Balance Sheet Data" and "Cash Flow Data" for the period January 1 to June 30, 2007 and June 30 to September 30, 2007 and for the nine months ended September 30, 2006 are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The selected historical financial data presented below under the caption "Balance Sheet Data" as of June 30, 2007 are derived from our unaudited consolidated financial statements not included in this prospectus.

The unaudited pro forma financial data for the year ended December 31, 2006 and the nine months ended September 30, 2007 reflect adjustments to our historical financial data to give effect to the Transactions and the acquisitions of KMF Laborchemie Handels GmbH ("KMF") and Bie & Bertsen ("B&B") as if they had occurred on January 1, 2006 for income statement purposes. Unaudited pro forma condensed consolidated balance sheet data for such periods is not presented because the Transactions and acquisitions of KMF and B&B are included in our unaudited consolidated balance sheet as of September 30, 2007. You should read the following summary historical and pro forma financial data in conjunction with our consolidated financial statements and related notes included elsewhere in this prospectus.

13

The term "predecessor" refers to the Company prior to the Transactions. The term "successor" refers to the Company following the Transactions.

| | Predecessor | Successor | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Historical | Pro Forma | |||||||||||||||||||||

| | Year Ended December 31, | | Nine Months Ended September 30, 2007 | | | ||||||||||||||||||

| | | Nine Months Ended September 30, 2007 | | ||||||||||||||||||||

| (Dollars in millions) | 2005 | 2006 | Nine Months Ended September 30, 2006 | January 1 to June 29, 2007 | June 30 to September 30, 2007 | Year Ended December 31, 2006 | |||||||||||||||||

| | | | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||||

| Income Statement Data: | |||||||||||||||||||||||

| Net sales | $ | 3,138.2 | $ | 3,257.6 | $ | 2,428.4 | $ | 1,699.3 | $ | 894.5 | $ | 2,616.0 | $ | 3,317.1 | |||||||||

| Cost of goods sold | 2,334.5 | 2,374.3 | 1,771.3 | 1,230.1 | 641.6 | 1,887.0 | 2,414.5 | ||||||||||||||||

| Gross profit | 803.7 | 883.3 | 657.1 | 469.2 | 252.9 | 729.0 | 902.6 | ||||||||||||||||

| Selling, general and administrative expenses(1) | 640.0 | 693.3 | 511.8 | 371.3 | 199.6 | 604.5 | 772.8 | ||||||||||||||||

| Merger expenses | — | — | — | 36.8 | — | — | — | ||||||||||||||||

| Restructuring charges (credits)(2) | 20.6 | (1.0 | ) | (1.0 | ) | — | — | — | (1.0 | ) | |||||||||||||

| Operating income | 143.1 | 191.0 | 146.3 | 61.1 | 53.3 | 124.5 | 130.8 | ||||||||||||||||

| Interest expense, net | 104.0 | 110.4 | 82.0 | 98.5 | 65.0 | 177.2 | 237.3 | ||||||||||||||||

| Other (income) expense, net(3) | (3.8 | ) | 1.5 | 0.3 | (3.5 | ) | 42.9 | 39.8 | 2.0 | ||||||||||||||

| Income (loss) before income taxes and cumulative effect of a change in accounting principle | 42.9 | 79.1 | 64.0 | (33.9 | ) | (54.6 | ) | (92.5 | ) | (108.5 | ) | ||||||||||||

| Income tax provision (benefit) | 20.9 | 32.7 | 24.0 | (8.3 | ) | (51.9 | ) | (61.8 | ) | (42.0 | ) | ||||||||||||

| Income (loss) before cumulative effect of a change in accounting principle | 22.0 | 46.4 | 40.0 | (25.6 | ) | (2.7 | ) | (30.7 | ) | (66.5 | ) | ||||||||||||

| Cumulative effect of a change in accounting principle(4) | (0.5 | ) | — | — | — | — | — | — | |||||||||||||||

| Net income (loss) | $ | 21.5 | $ | 46.4 | $ | 40.0 | $ | (25.6 | ) | $ | (2.7 | ) | $ | (30.7 | ) | $ | (66.5 | ) | |||||

| Financial Data: | |||||||||||||||||||||||

| Depreciation and amortization | $ | 33.9 | $ | 41.4 | $ | 25.5 | $ | 19.4 | $ | 26.3 | $ | 79.6 | $ | 106.7 | |||||||||

| Capital expenditures | 18.4 | 23.6 | 15.1 | 15.7 | 9.0 | NA | NA | ||||||||||||||||

| Gross profit as a percentage of net sales | 25.6 | % | 27.1 | % | 27.1 | % | 27.6 | % | 28.3 | % | 27.9 | % | 27.2 | % | |||||||||

Other Financial Data: | |||||||||||||||||||||||

| EBITDA(5)(6) | 180.8 | 230.9 | 171.5 | 84.0 | 36.7 | 164.3 | 235.5 | ||||||||||||||||

| | Predecessor | Successor | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Historical | |||||||||||||||

| | December 31, | | | | ||||||||||||

| (Dollars in millions) | 2005 | 2006 | September 30, 2006 | June 30, 2007 | September 30, 2007 | |||||||||||

| | | | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||

| Balance Sheet Data: | ||||||||||||||||

| Cash and cash equivalents | $ | 126.1 | $ | 139.4 | $ | 104.7 | $ | 77.1 | $ | 43.4 | ||||||

| Total assets(7) | 2,591.8 | 2,646.2 | 2,627.8 | 5,754.1 | 5,614.9 | |||||||||||

| Total debt | 1,451.8 | 1,723.7 | 1,379.9 | 2,699.3 | 2,736.0 | |||||||||||

| Total stockholders' equity(8) | $ | 321.3 | $ | 62.9 | $ | 392.1 | $ | 1,340.1 | $ | 1,401.4 | ||||||

14

| | Predecessor | Successor | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Historical | ||||||||||||||||

| | Year Ended December 31, | | Nine Months Ended September 30, 2007 | ||||||||||||||

| (Dollars in millions) | 2005 | 2006 | Nine Months Ended September 30, 2006 | January 1 to June 29, 2007 | June 30 to September 30, 2007 | ||||||||||||

| | | | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||

| Cash Flow Data: | |||||||||||||||||

| Cash flows provided by (used in) | |||||||||||||||||

| Operating activities | $ | 70.1 | $ | 173.2 | $ | 135.2 | $ | 57.0 | $ | (0.9 | ) | ||||||

| Investing activities | (62.2 | ) | (24.1 | ) | (10.7 | ) | (32.9 | ) | (3,833.5 | ) | |||||||

| Financing activities | $ | 3.4 | $ | (139.1 | ) | $ | (147.8 | ) | $ | (29.7 | ) | $ | 3,876.3 | ||||

- (1)

- Effective January 1, 2006, we adopted Statement of Financial Accounting Standards ("SFAS") No. 123(R),Share-Based Payment ("SFAS 123R"), which requires companies to recognize in the income statement, the grant date fair value of stock options and other forms of equity-based compensation issued to employees. We adopted SFAS 123R using the modified prospective transition method. Compensation expense related to equity awards is included in selling, general and administrative ("SG&A") expenses for the nine months ended September 30, 2006 and the year ended December 31, 2006 and prospectively.

- (2)

- During 2006, we reversed $1.0 million of excess accruals and credited operations primarily as a result of the re-deployment of certain personnel originally included in 2005 restructuring programs. During 2005, we recorded pre-tax restructuring charges aggregating $20.6 million to rationalize and streamline our operations. These charges included $17.9 million for severance and termination benefits and $2.7 million for facility exit costs.

- (3)

- Subsequent to the Transactions on June 29, 2007, we have a significant foreign-denominated debt outstanding recorded on our U.S. dollar-denominated balance sheet. The translation of foreign-denominated debt obligations recorded on our U.S. dollar-denominated balance sheet is recorded as an unrealized exchange gain or loss each period. As a result, our operating results are exposed to foreign currency translation risk based on fluctuations in foreign currency exchange rates, principally with respect to the Euro. During the period June 30 to September 30, 2007 and the Pro Forma nine months ended September 30, 2007, we recorded net unrealized exchange losses of ($42.9) million and ($39.8) million respectively, primarily due to the strengthening of the Euro against the U.S. dollar during such time periods.

- (4)

- Effective December 31, 2005, we adopted Financial Accounting Standard Board ("FASB") Interpretation No. 47,Accounting for Conditional Asset Retirement Obligations ("FIN 47"), an Interpretation of FASB No. 143,Accounting for Asset Retirement Obligations ("SFAS 143"). SFAS 143 addresses financial accounting and reporting for obligations associated with the retirement of tangible long-lived assets and the associated asset retirement costs. SFAS 143 requires recognition of a liability at fair value and an increase to the carrying value of the related asset for any retirement obligation. As a result of the adoption, we recognized a non-cash charge of $0.5 million, net of applicable income taxes of $0.3 million.

- (5)

- We define EBITDA as income before cumulative effect of a change in accounting principle before net interest expense, income taxes and depreciation and amortization. EBITDA is considered a non-GAAP financial measure. Generally, a non-GAAP financial measure is a numerical measure of a company's performance, financial position or cash flows that either excludes or includes amounts that are not normally included or excluded in the most directly comparable measure calculated and presented in accordance with GAAP. We believe EBITDA provides investors with helpful information with respect to our operations and cash flows. We included it to provide additional information with respect to our ability to meet our future debt service, capital expenditures and working capital requirements. EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: it does not reflect our capital expenditures or future requirements for capital expenditures or contractual commitments; it does not reflect changes in, or cash requirements for, our working capital needs; it does not reflect the significant interest expense or cash requirements necessary to service interest or principal payments on our debt; and although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements.

15

Historical EBITDA and Pro Forma EBITDA are calculated as follows:

| | Predecessor | Successor | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Historical | Pro Forma | |||||||||||||||||||||

| | | | | Nine Months Ended September 30, 2007 | | | |||||||||||||||||

| | Year Ended December 31, | | | | |||||||||||||||||||

| | | Nine Months Ended September 30, 2007 | | ||||||||||||||||||||

| (Dollars in millions) | 2005 | 2006 | Nine Months Ended September 30, 2006 | January 1 to June 29, 2007 | June 30 to September 30, 2007 | Year Ended December 31, 2006 | |||||||||||||||||

| | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||||

| Income (loss) before cumulative effect of a change in accounting principle | $ | 22.0 | $ | 46.4 | $ | 40.0 | $ | (25.6 | ) | $ | (2.7 | ) | $ | (30.7 | ) | $ | (66.5 | ) | |||||

| Income tax provision (benefit) | 20.9 | 32.7 | 24.0 | (8.3 | ) | (51.9 | ) | (61.8 | ) | (42.0 | ) | ||||||||||||

| Interest expense, net | 104.0 | 110.4 | 82.0 | 98.5 | 65.0 | 177.2 | 237.3 | ||||||||||||||||

| Depreciation and amortization | 33.9 | 41.4 | 25.5 | 19.4 | 26.3 | 79.6 | 106.7 | ||||||||||||||||

| EBITDA | $ | 180.8 | $ | 230.9 | $ | 171.5 | $ | 84.0 | $ | 36.7 | $ | 164.3 | $ | 235.5 | |||||||||

- (6)

- Our year ended December 31, 2006 and nine months ended September 30, 2007 Pro Forma EBITDA does not include the effects of the following items:

| (Dollars in millions) | Estimated Annualized Impact on EBITDA | ||

|---|---|---|---|

| Operational improvements — Ireland(a) | $ | 1.7 | |

| Reduction in Sarbanes-Oxley compliance costs(b) | $ | 3.2 | |

| KMF restructuring(c) | $ | 3.2 | |

| Share-based compensation(d) | $ | 5.1 | |

- (a)

- During the first quarter of 2007, we commenced a restructuring of our operations in Ireland. Approximately 35 employees were terminated and will receive special termination benefits aggregating approximately $0.4 million. In addition, we implemented various spending and cost control initiatives to reduce operating costs. These initiatives are expected to result in annualized cost reductions of approximately $1.7 million, of which approximately $0.8 million is expected to be realized from the reduction in personnel and approximately $0.8 million is expected to be realized from other spending and cost control efforts. The Company has realized approximately $0.8 million of cost savings during the nine month period ended September 30, 2007.

- (b)

- During 2006, we expensed approximately $7.2 million for external assistance related to our Sarbanes-Oxley compliance program. We expect to reduce the costs of our annual compliance program by approximately $3.2 million in light of 2007 being the second year for us operating under these compliance requirements. Compliance costs for the nine months ended September 30, 2007 have declined approximately $2.1 million from the corresponding period in 2006.

- (c)

- During the second quarter of 2007, we implemented a restructuring program to fully integrate our newly acquired KMF operation and incurred a liability of approximately $3.2 million. The program will result in reduced headcount and several facility closures that we expect will result in approximately $3.2 million of annualized cost reductions of which $1.7 million has been realized through the nine months ended September 30, 2007.

- (d)

- This amount reflects the net reduction in historical amounts recorded under our prior equity compensation program and what we would have recorded during the same periods under our new equity compensation program had such program been in existence effective January 1, 2006. Historical amounts eliminated include charges under SFAS 123R subject to service vesting requirements, special bonuses awarded in connection with the increase in the strike prices of options awarded and a retention bonus plan for certain executive officers and other employees that had been awarded restricted stock units. Amounts added reflect share-based compensation under our newly established equity plan, including awards initially recognized at the grant date and awards that are subject to service vesting requirements. Accordingly, SG&A costs would have declined by approximately $5.1 million and $1.5 million for the year ended December 31, 2006 and nine months period ended September 30, 2007, respectively. This new equity plan was established in connection with the Transactions and is more fully described in the Notes to Consolidated Financial Statements for the nine month period ended September 30, 2007 appearing elsewhere in this prospectus.

- (7)

- We adopted FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes ("FIN 48") effective January 1, 2007. This Interpretation clarifies the accounting for uncertainty in income taxes recognized in accordance with SFAS No. 109, Accounting for Income Taxes ("SFAS 109"). FIN 48 requires us to recognize in our consolidated financial statements, the impact of a tax position if that tax position is more likely than not to be sustained upon examination, based on technical merits. At the date of adoption, we increased deferred tax assets by $1.3 million, decreased goodwill by $1.6 million and decreased our reserves for uncertain tax positions by $0.3 million.

- (8)

- We adopted SFAS No. 158, Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans — an amendment of SFAS No 87, 88, 106, and 132(R) ("SFAS 158") as of December 31, 2006. This Statement requires balance sheet recognition of the funded status for all pension and postretirement benefit plans. As a result of the adoption, stockholders' equity decreased by $2.3 million.

16

You should carefully consider the risk factors set forth below, as well as the other information contained in this prospectus when deciding whether to participate in the exchange offer. Any of these risks may have a material adverse effect on our business, financial condition, results of operations and cash flows.

Risk Factors Associated with the Exchange Offers

Because there is no public market for the exchange notes, you may not be able to resell your notes.

The exchange notes will be registered under the Securities Act, but will constitute a new issue of securities with no established trading market, and there can be no assurance as to:

- •

- the liquidity of any trading market that may develop;

- •

- the ability of holders to sell their exchange notes; or

- •

- the price at which the holders would be able to sell their exchange notes.

If a trading market were to develop, the exchange notes might trade at higher or lower prices than their principal amount or purchase price, depending on many factors, including prevailing interest rates, the market for similar securities and our financial performance.

We understand that the initial purchasers presently intend to make a market in the exchange notes. However, they are not obligated to do so, and any market-making activity with respect to the exchange notes may be discontinued at any time without notice. In addition, any market-making activity will be subject to the limits imposed by the Securities Act and the Securities Exchange Act of 1934, as amended (the "Exchange Act") and may be limited during the exchange offer or the pendency of an applicable shelf registration statement. There can be no assurance that an active trading market will exist for the exchange notes or that any trading market that does develop will be liquid.

In addition, any holder of outstanding notes who tenders in the exchange offer for the purpose of participating in a distribution of the exchange notes may be deemed to have received restricted securities, and if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. For a description of these requirements, see "Exchange Offer."

Your outstanding notes will not be accepted for exchange if you fail to follow the exchange offer procedures and, as a result, your outstanding notes will continue to be subject to existing transfer restrictions and you may not be able to sell your outstanding notes.

We will not accept your outstanding notes for exchange if you do not follow the exchange offer procedures. We will issue exchange notes as part of this exchange offer only after a timely receipt of your outstanding notes, a properly completed and duly executed letter of transmittal or agent's message and all other required documents. Therefore, if you want to tender your outstanding notes, please allow sufficient time to ensure timely delivery. If we do not receive your outstanding notes, letter of transmittal or agent's message and other required documents by the expiration date of the exchange offer, we will not accept your outstanding notes for exchange. We are under no duty to give notification of defects or irregularities with respect to the tenders of outstanding notes for exchange. If there are defects or irregularities with respect to your tender of outstanding notes, we may not accept your outstanding notes for exchange. For more information, see "Exchange Offer."

17

If you do not exchange your outstanding notes, your outstanding notes will continue to be subject to the existing transfer restrictions and you may not be able to sell your outstanding notes.

We did not register the outstanding notes, nor do we intend to do so following the exchange offer. Outstanding notes that are not tendered will therefore continue to be subject to the existing transfer restrictions and may be transferred only in limited circumstances under the securities laws. If you do not exchange your outstanding notes, you will lose your right to have your outstanding notes registered under the federal securities laws. As a result, if you hold outstanding notes after the exchange offer, you may not be able to sell your outstanding notes.

Risks Related to the Notes

Our substantial indebtedness could have a material adverse effect on our financial condition and prevent us from fulfilling our obligations under the notes.

After giving effect to the Transactions and related use of proceeds, we have a substantial amount of debt, which requires significant interest and principal payments. As of September 30, 2007, we had $2,736.0 million of total debt outstanding. For the nine months ended September 30, 2007, our pro forma net interest expense was approximately $177.2 million. Our high level of debt could have important consequences to the holders of the notes, including the following:

- •

- making it more difficult for us to satisfy our obligations with respect to the notes and our other debt;

- •

- requiring us to dedicate a substantial portion of our cash flow from operations to be dedicated to debt service payments on our and our subsidiaries' debt, which would reduce the funds available for working capital, capital expenditures, investments or acquisitions and other general corporate purposes;

- •

- limiting our flexibility in planning for, or reacting to, changes in the industry in which we operate;

- •

- placing us at a competitive disadvantage compared to any of our less leveraged competitors;

- •

- increasing our vulnerability to both general and industry-specific adverse economic conditions; and

- •

- limiting our ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions or other general corporate requirements and increasing our cost of borrowing.

Despite current indebtedness levels and restrictive covenants, we may incur additional indebtedness in the future.

Despite our current level of indebtedness, we may be able to incur substantial additional indebtedness, including additional secured indebtedness. Although the terms of the indentures governing the notes and the new senior subordinated notes and the credit agreement governing the new senior secured credit facility restrict us and our restricted subsidiaries from incurring additional indebtedness, these restrictions are subject to important exceptions and qualifications, including with respect to our ability to incur additional senior secured debt. If we or our subsidiaries incur additional indebtedness, the risks that we and they now face as a result of our leverage could intensify. If our financial condition or operating results deteriorate, our relations with our creditors, including the holders of the notes, the lenders under our senior secured credit facility and our suppliers, may be materially and adversely affected.

18

Debt agreements contain restrictions on our ability to operate our business and to pursue our business strategies, and our failure to comply with these covenants could result in an acceleration of our indebtedness.

The credit agreement governing our new senior secured credit facility and the indentures governing the notes and the new senior subordinated notes, and agreements governing future debt issuances may contain covenants that restrict our ability to finance future operations or capital needs, to respond to changing business and economic conditions or to engage in other transactions or business activities that may be important to our growth strategy or otherwise important to us. The credit agreement and the indentures restrict, among other things, our ability and the ability of our subsidiaries to:

- •

- incur additional indebtedness;

- •

- pay dividends or make distributions in respect of our capital stock or to make certain other restricted payments or investments;

- •

- purchase or redeem stock;

- •

- make investments or other specified restricted payments;

- •

- create liens;

- •

- sell assets and subsidiary stock;

- •

- enter into transactions with affiliates; and

- •

- enter into mergers, consolidations and sales of substantially all assets.

In addition, the credit agreement related to the new senior secured credit facility requires us to repay outstanding borrowings under such facility with proceeds we receive from certain sales of property or assets and specified future debt offerings. We cannot assure you that we will be able to maintain compliance with such covenants in the future and, if we fail to do so, that we will be able to obtain waivers from the lenders and/or amend the covenants.

Any breach of the covenants in the credit agreement or the indentures could result in a default of the obligations under such debt and cause a default under other debt. If there were an event of default under the credit agreement related to our new senior secured credit facility that was not cured or waived, the lenders under our new senior secured credit facility could cause all amounts outstanding with respect to the borrowings under the new senior secured credit facility to be due and payable immediately. Our assets and cash flow may not be sufficient to fully repay borrowings under our new senior secured credit facility and our obligations under the notes and the new senior subordinated notes if accelerated upon an event of default. If, as or when required, we are unable to repay, refinance or restructure our indebtedness under, or amend the covenants contained in, our new senior secured credit facility, the lenders under our new senior secured credit facility could institute foreclosure proceedings against the assets securing borrowings under the new senior secured credit facility.

We may not be able to generate sufficient cash flows to meet our debt service obligations.

Our ability to make payments on and to refinance our indebtedness and to fund planned capital expenditures depends on our ability to generate cash from our future operations. This, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

Our business may not generate sufficient cash flow from operations, or future borrowings under our new senior secured credit facility, or from other sources, may not be available to us in an amount sufficient, to enable us to repay our indebtedness or to fund our other liquidity needs, including capital expenditure requirements. If we cannot service our indebtedness, we may have to

19

take actions such as selling assets, seeking additional equity or reducing or delaying capital expenditures, strategic acquisitions, investments or alliances. Our new senior secured credit facility and the indentures governing the notes and the new senior subordinated notes restrict our ability to sell assets and use the proceeds from such sales. Additionally, we may not be able to refinance any of our indebtedness on commercially reasonable terms, or at all. If we cannot service our indebtedness, it could impede the implementation of our business strategy or prevent us from entering into transactions that would otherwise benefit our business.

Our subsidiaries' ability to make scheduled payments or to refinance their and our obligations with respect to their and our debt will depend on our subsidiaries' financial and operating performance, which, in turn, is subject to prevailing economic and competitive conditions and to the following financial and business factors, some of which may be beyond our control:

- •

- operating difficulties;

- •

- increased operating costs;

- •

- decreased demand for our products;

- •

- market cyclicality;

- •

- product prices;

- •

- the response of competitors;

- •

- regulatory developments;

- •

- failure to successfully integrate acquisitions; and

- •

- delays in implementing strategic projects.

The notes are unsecured and are effectively subordinated to our secured indebtedness, including our new senior secured credit facility.

Our obligations under the notes and the guarantors' obligations under the guarantees of the notes are not secured by any of our or our subsidiaries' assets. The indenture governing the notes permits us and our subsidiaries to incur secured indebtedness, including pursuant to our new senior secured credit facility, purchase money instruments and other forms of secured indebtedness. As a result, the notes and the guarantees will be effectively subordinated to all of our and the guarantors' secured indebtedness and other obligations to the extent of the value of the assets securing such obligations. As of September 30, 2007, we had approximately $1,468.1 million of indebtedness under our new senior secured credit facility (excluding unused availability of $239.9 million and $10.1 million of outstanding letters of credit). If we and the guarantors were to become insolvent or otherwise fail to make payments on the notes, holders of our and our guarantors' secured obligations would be paid first and would receive payments from the assets securing such obligations before the holders of the notes would receive any payments. You may therefore not be fully repaid in the event we become insolvent or otherwise fail to make payments on the notes.

The notes are structurally subordinate to all indebtedness of our subsidiaries that are not guarantors of the notes.

The subsidiary guarantors include only our material U.S. subsidiaries. As a result, the notes are effectively subordinated to all existing and future liabilities (including trade payables) of our non-guarantor subsidiaries. As a result, our right to participate in any distribution of assets of our non-guarantor subsidiaries upon the liquidation, reorganization or insolvency of any such subsidiary (and the consequential right of the holders of the notes to participate in the distribution of those

20

assets) will be subject to the prior claims of such subsidiary's creditors. As of September 30, 2007, the aggregate amount of liabilities of our non-guarantor subsidiaries was approximately $732.1 million. Our non-guarantor subsidiaries held approximately 43% of our total assets as of September 30, 2007 and generated approximately 45% of our net sales and approximately 41% of our operating income for the periods included in the nine months ended September 30, 2007. In addition, the indenture governing the notes permits, subject to some limitations, these subsidiaries to incur additional indebtedness and does not contain any limitation on the amount of other liabilities that may be incurred by these non-guarantor subsidiaries.

Our ability to make payments on the notes depends on our ability to receive dividends or other distributions from our subsidiaries.

We are a holding company operating principally through VWR International, LLC and certain of its subsidiaries. As a result, we are substantially dependent on dividends or other distributions from VWR International, LLC to make payments on the notes, the senior subordinated notes and borrowings under the new senior secured credit facility. The ability of VWR International, LLC to pay such dividends may be restricted by law or the instruments governing its indebtedness.

Fraudulent conveyance laws may adversely affect the validity and enforceability of the guarantees.

Under U.S. bankruptcy law and comparable provisions of state fraudulent transfer laws, a court could void claims related to the notes or to a subsidiary guarantee or subordinate claims related to the notes or to a subsidiary guarantee to all of our or such subsidiary guarantor's other debts if, among other things, we or a subsidiary guarantor, at the time we or such subsidiary guarantor incurred the indebtedness evidenced by its subsidiary guarantee:

- •

- intended to hinder, delay or defraud any present or future creditor; or

- •

- received less than reasonably equivalent value or fair consideration in exchange for the incurrence of such indebtedness; and

- •

- we or it was insolvent or became insolvent as a result of such incurrence;

- •

- we were or it was engaged in a business or a transaction, or we were or it was about to engage in a business or a transaction for which our or such guarantor's remaining assets constituted unreasonably small capital; or

- •

- intended to incur, or believed that it would incur, debts that would be beyond our or such guarantor's ability to pay such debts as they mature.

In addition, a court could avoid any payment by us or a subsidiary guarantor pursuant to the notes or a guarantee and require that such payment be returned to such subsidiary guarantor or to a fund for the benefit of the creditors of the subsidiary guarantor. The measures of insolvency for purposes of fraudulent transfer laws will vary depending upon the governing law in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, we or a subsidiary guarantor would be considered insolvent if:

- •

- the sum of our or its debts, including contingent liabilities, is greater than all of its assets at fair value;

- •

- the present fair saleable value of our or its assets is less than the amount that would be required to pay our or its probable liability on our or its existing debts, including contingent liabilities, as they become absolute and mature; or

- •

- it cannot pay its debts as they become due.

21

On the basis of historical financial information, recent operating history and other factors, we believe that we and the subsidiary guarantors will not be insolvent, will not have insufficient capital for the business in which we are engaged and will not have incurred debts beyond our ability to pay as such debts mature.

There can be no assurance, however, as to what standard a court would apply in making such determinations or that a court would agree with our or any subsidiary guarantor's conclusions in this regard.

We may not be able to purchase the notes upon a change of control, which would result in a default in the indenture governing the notes and would adversely affect our business and financial condition.

Upon a change of control, as defined in the indenture, subject to certain conditions, we will be required to offer to repurchase all notes then outstanding at 101% of the principal amount thereof, plus accrued and unpaid interest to the date of repurchase. The source of funds for that purchase of notes will be our available cash or cash generated from our and our subsidiaries' operations or other potential sources, including borrowings, sales of assets or sales of equity. We cannot assure you that sufficient funds from such sources will be available at the time of any change of control to make required repurchases of notes tendered. In addition, the terms of our new senior secured credit facility limit our ability to repurchase your notes and certain change of control events will constitute an event of default under the indenture. Our future debt agreements may contain similar restrictions and provisions. If the holders of the notes exercise their right to require us to repurchase all the notes upon a change of control, the financial effect of this repurchase could cause a default under our other debt, even if the change of control itself would not cause a default. Accordingly, it is possible that we will not have sufficient funds at the time of the change of control to make the required repurchase of our other debt and the notes or that restrictions in our new senior secured credit facility and the indenture will not allow such repurchases. In addition, certain corporate events, such as leveraged recapitalizations that would increase the level of our indebtedness, would not constitute a "change of control" under the indenture. See "Description of Notes — Repurchase at the Option of Holders — Change of Control" for additional information.

The trading prices for the notes will be directly affected by many factors, including our credit rating.

Credit rating agencies continually revise their ratings for companies they follow, including us. Any ratings downgrade could adversely affect the trading price of the notes, or the trading market for the notes, to the extent a trading market for the notes develops. The condition of the financial and credit markets and prevailing interest rates have fluctuated in the past and are likely to fluctuate in the future and any fluctuation may impact the trading price of the notes.

United States Holders will be required to pay U.S. federal income tax on the notes even if we do not pay cash interest.

None of the interest payments on the notes will be qualified stated interest for United States federal income tax purposes, even if we never exercise the option to pay PIK Interest, because the notes provide us with the option to pay cash interest or PIK Interest for any interest period through July 15, 2011 other than the first interest period. Consequently, all stated interest on the notes will be treated as original issue discount for United States federal income tax purposes, and United States Holders (as defined in "Material United States Federal Tax Considerations") will be required to include such original issue discount in gross income on a constant yield to maturity basis, regardless of whether such interest is paid currently in cash. See "Material United States Federal Tax Considerations."

22

Risks Related to Our Business

The demand for our products depends on the level of our customers' research and development and other scientific endeavors. Our business, financial condition and results of operations may be harmed if our customers spend less on these activities.

Our customers are engaged in research, development and production in the pharmaceutical, biotechnology, education, chemical, technology, food processing, consumer products and other industries. The amount of customer spending on research, development and production has a large impact on our sales and profitability. Our customers determine the amounts that they will spend on the basis of, among other things, available resources and their need to develop new products, which, in turn, is dependent upon a number of factors, including their competitors' research, development and production initiatives. In addition, consolidation in the industries in which our customers operate may have an impact on such spending as customers integrate acquired operations, including research and development departments and their budgets. Our customers finance their research and development spending from private and public sources. Government funding of scientific research and education has varied for several reasons, including general economic conditions, growth in population, political priorities, changes in the number of students and other demographic changes. A reduction in spending by our customers could have a material adverse effect on our business, financial condition and results of operations. In addition, some companies have shifted toward outsourcing research, development and production activities overseas. We are expanding into the Asia Pacific region to address this trend, although there is no assurance that we will not experience an adverse impact in the future.

We compete in a highly competitive market. Failure to compete successfully could have a material adverse effect on our business, financial condition and results of operations.

We compete globally with two other major distributors, Thermo Fisher Scientific Inc. and Sigma Aldrich Corporation, as well as many smaller regional, local and specialty distributors, and with manufacturers selling directly to their customers. The bases upon which we compete include price, service and delivery, breadth of customer support, e-business capabilities and the ability to meet the special requirements of customers.

Some of our competitors may have greater financial and other resources than we do. Most of our products are available from several sources, and some of our customers have relationships with several distributors. Our agreements with customers generally provide that the customer can terminate the agreement or reduce the scope of services provided pursuant to the agreement with short or no notice. Lack of product availability, stemming from either our inability to acquire products or interruptions in the supply of products from manufacturers, could have a material adverse effect on our ability to compete. Our competitors could also obtain exclusive rights to distribute some products, thereby foreclosing our ability to distribute these products. Vertically integrated distributors may also have an advantage with respect to the total delivered product cost of certain of their captive products. Additionally, manufacturers could increase their efforts to sell directly to consumers and effectively bypass distributors like us. Consolidation in the laboratory supply industry could result in existing competitors increasing their market share through business combinations, which could have a material adverse effect on our business, financial condition and results of operations. The entry of new distributors in the industry could also have a material adverse effect on our ability to compete.

23

Our business, financial condition and results of operations depend upon maintaining our relationships with manufacturers.

We currently offer products from a wide range of manufacturers. We are dependent on these manufacturers for our supply of products. Merck KGaA supplied products that accounted for approximately 13% of our net sales in 2006. This represents approximately 7% and 25% of our North American Lab and European Lab net sales, respectively.

Our ability to sustain our gross margins has been, and will continue to be, dependent in part upon our ability to obtain favorable terms from our suppliers. These terms may be subject to changes from time to time, and such changes could adversely affect our gross margins over time.

The loss of one or more of our large suppliers, a material reduction in their supply of products to us, or material changes in the terms we obtain from them, could have a material adverse effect on our business, financial condition and results of operations.

Some of our competitors are increasing their manufacturing operations both internally and through acquisitions of manufacturers, including manufacturers that supply products to us. For instance, in 2006, Fisher Scientific International Inc., a supplier of products to us and one of our largest competitors, merged with Thermo Electron Corporation, another supplier to us, to form Thermo Fisher Scientific Inc. To date, we have not experienced an adverse impact on our ability to continue to source products from manufacturers that have been vertically integrated (including Thermo Fisher Scientific Inc.), although there is no assurance that we will not experience such an impact in the future.

We may be unable to manage certain operational functions of our business if we are not able to replace the information technology and logistics services that are provided to us by Merck KGaA after our agreements with them expire or are terminated. Further, any disruptions in Merck KGaA's operations may negatively impact our operations.

Our European Lab segment is dependent on Merck KGaA for certain information technology services pursuant to a five-year information services master agreement as well as warehousing and logistics services pursuant to a logistics service level agreement. These information technology services affect a significant portion of our information technology and operational infrastructure, including the operation and support of the main European enterprise resource planning and business warehouse software and databases. If Merck KGaA terminates any of these agreements at the end of their respective terms or otherwise, we will need to find an alternative supplier of, or create our own infrastructure for, these services. While we have already replaced some of these services, we may not be able to create our own infrastructure in a timely or cost-effective manner or obtain replacement services for the remaining services on terms that are as favorable to us as the current arrangements or on acceptable terms, if at all. In addition, any disruptions in the operational infrastructure or operations of Merck KGaA may negatively impact our operations.

If we do not comply with existing government regulations or if we or our suppliers become subject to more onerous government regulations, we could be adversely affected.

Some of the products we offer and our operations are subject to a number of complex and stringent laws and regulations governing the production, handling, transportation, import, export and distribution of chemicals, drugs and other similar products, including the operating and security standards of the United States Drug Enforcement Administration, the Bureau of Alcohol, Tobacco, Firearms and Explosives, the Food and Drug Administration, the Bureau of Industry and Security and various state boards of pharmacy as well as comparable state and foreign agencies. In addition, our logistics activities must comply with the rules and regulations of the Department of Transportation, the Federal Aviation Administration and similar foreign agencies. Any