UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

VWR Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Radnor Corporate Center

Building One, Suite 200

100 Matsonford Road

Radnor, PA 19087

April 10, 2015

Dear Fellow Stockholder:

| | |

It is my pleasure to invite you to join us at the 2015 Annual Meeting of Stockholders of VWR Corporation to be held on Tuesday, May 12, 2015 at 11:00 a.m., Eastern Daylight Time, at the Company’s headquarters, Radnor Corporate Center, Building One, Suite 200, 100 Matsonford Road, Radnor, Pennsylvania 19087. At this year’s meeting, we will vote on the election of three directors to serve a three-year term expiring in 2018 and the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm. We will also conduct a non-binding advisory vote to approve the compensation of the Company’s named executive officers and a non-binding advisory vote on the frequency of the advisory approval on named executive officer compensation. In addition, there will be a report on the Company’s business, and stockholders will have an opportunity to ask questions. | |  |

2014 was an exciting year for VWR as we successfully met the challenge of becoming a public company. In the process, we continued the turnaround of our Americas business, outperformed our peers in Europe, de-leveraged our balance sheet and executed on our acquisition and services strategies.

Your vote is very important. I encourage you to sign and return your proxy card, or use telephone or Internet voting prior to the meeting, so that your shares of common stock will be represented and voted at the meeting even if you cannot attend.

Thank you for your continued trust in VWR and your investment in our business.

Sincerely,

Manuel Brocke-Benz

Director, President and Chief Executive Officer

Table of Contents

Notice of 2015 Annual Meeting of Stockholders

| | | | | | |

Tuesday, May 12, 2015 11:00 a.m. Eastern Daylight Time | | | | Radnor Corporate Center Building One, Suite 200 100 Matsonford Road Radnor, PA 19087 |

The Annual Meeting of Stockholders of VWR Corporation (“VWR” or the “Company”) will be held on Tuesday, May 12, 2015 at 11:00 a.m. EDT, at the Company’s office located at Radnor Corporate Center, Building One, Suite 200, 100 Matsonford Road, Radnor, Pennsylvania 19087. Stockholders of record of VWR common stock at the close of business on March 31, 2015 are entitled to vote at the meeting. You have received these proxy materials because our Board of Directors is soliciting your proxy to vote your shares at the 2015 Annual Meeting of Stockholders.

The purposes of the meeting are:

| | 1. | to elect three directors to serve three-year terms expiring at the 2018 annual meeting of stockholders; |

| | 2. | to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2015; |

| | 3. | to approve, on an advisory basis, named executive officer compensation; |

| | 4. | to approve, on an advisory basis, the frequency of the advisory approval of named executive officer compensation; and |

| | 5. | to transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Enclosed with this Notice of Annual Meeting of Stockholders is a proxy statement, related proxy card with a return envelope and our 2014 Annual Report on Form 10-K. The 2014 Annual Report on Form 10-K contains financial and other information that, except as set forth herein, is not incorporated into the proxy statement and is not deemed to be a part of the proxy soliciting material.

The attached proxy statement provides a summary of the items to be voted on at the Annual Meeting and then a more detailed look at our board of directors and executive compensation. Please consider the issues presented in the proxy statement and vote your shares as promptly as possible.

On behalf of VWR’s Board of Directors,

George Van Kula

Senior Vice President, Human Resources, General Counsel and Secretary

April 10, 2015

| | | | |

| | 1 | |  |

Proxy Summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider. You should read the entire proxy statement and VWR’s 2014 Annual Report on Form 10-K before voting.

2015 ANNUAL MEETING OF STOCKHOLDERS

Time and Date: | 11:00 a.m. Eastern Daylight Time, May 12, 2015 |

Place: | Radnor Corporate Center, Building One, Suite 200, 100 Matsonford Road, Radnor, Pennsylvania 19087 |

Record Date: | March 31, 2015 |

Voting: | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. |

How to Cast Your Vote

Your vote is important! Please cast your vote and play a part in the future of VWR.

Stockholders of record, who hold shares registered in their names, can vote by:

| | | | |

| | | |

| |  | |  |

Internet at www.proxyvote.com | | calling 1-800-690-6903 toll-free from the U.S. or Canada | | mail return the signed proxy card |

The deadline for voting online or by telephone is 11:59 p.m. EDT on May 11, 2015. If you vote by mail, your proxy card must be received before the Annual Meeting.

Beneficial owners, who own shares through a bank, brokerage firm or other financial institution, can vote by returning the voting instruction form, or by following the instructions for voting via telephone or the Internet, provided by the bank, broker or other organization.

If you own shares in different accounts or in more than one name, you may receive different voting instructions for each type of ownership. Please vote all your shares. If you are a stockholder of record or a beneficial owner who has a legal proxy to vote the shares, you may choose to vote in person at the Annual Meeting. Even if you plan to attend our Annual Meeting in person, please cast your vote as soon as possible.

See the “Questions and Answers About the Meeting and Voting” section beginning on page 6 for more details.

| | | | |

| | 2 | | |

Proxy Summary(continued)

Meeting Agenda and Voting Recommendations

| | | | | | |

| | | Board Vote

Recommendation | | Page Reference

(for more detail) |

Item 1 – | | Election of Three Directors to Serve Three-Year Terms Expiring in 2018 | | ü FOR Each

Nominee | | 9 |

Item 2 – | | Ratification of Appointment of KPMG LLP as the Company’s Independent Registered Public Accounting Firm for 2015 | | ü FOR | | 25 |

Item 3 – | | Advisory Approval of Named Executive Officer Compensation | | ü FOR | | 28 |

Item 4 – | | Advisory Vote on the Frequency of the Advisory Approval of Named Executive Officer Compensation | | ü 1 Year | | 29 |

Board Nominees (Page 10)

VWR’s Board of Directors has 11 members divided into three classes. Directors are elected for three-year terms. The following table provides summary information about each director nominee standing for re-election to the Board for a three-year term expiring in 2018.

| | | | | | | | | | |

| Name | | Age | | Principal Occupation | | Independent | | Committee Memberships | | Experience and Qualifications |

Nicholas W. Alexos | | 51 | | Managing Director, Madison Dearborn Partners, LLC | | Yes | | Audit (Chair); Finance | | Senior management experience; accounting, finance, and capital structure; healthcare; international business transactions; and board leadership |

Robert P. DeCresce | | 65 | | Harriet B. Borland Professor and Chair of the Department of Pathology, Rush Medical College | | Yes | | Compensation | | Senior leadership experience; consulting within the healthcare industry; medical professional; and prior board service |

Carlos del Salto | | 72 | | Retired Senior Vice President of Intercontinental and Asia-Pacific Operations at Baxter Healthcare Corporation | | Yes | | Audit | | Senior management experience; accounting and finance; healthcare; and international business strategies |

Corporate Governance Highlights (Page 17)

The Company is committed to good corporate governance, which we believe is important to the success of our business and in advancing stockholder interests. Highlights include:

| ü | | 10 out of 11 Board Members are Independent |

| ü | | Regular Executive Sessions of Independent Directors |

| ü | | Independent Audit, Compensation and Nominating and Governance Committees |

| ü | | Risk Oversight by the Full Board and Committees |

| ü | | Regular Board and Committee Self-Evaluations |

| ü | | Policies Prohibiting Short Sales, Hedging, Margin Accounts and Pledging |

Our corporate governance practices are described in greater detail in the “Corporate Governance” section.

| | | | |

| | 3 | |  |

Proxy Summary(continued)

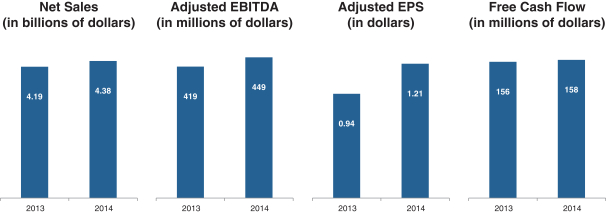

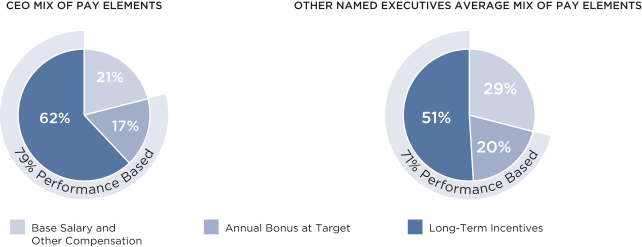

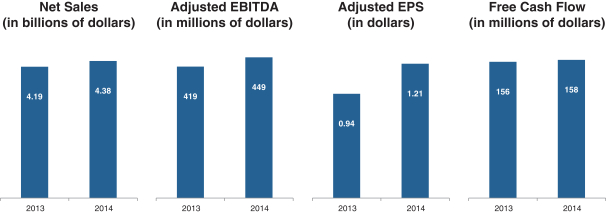

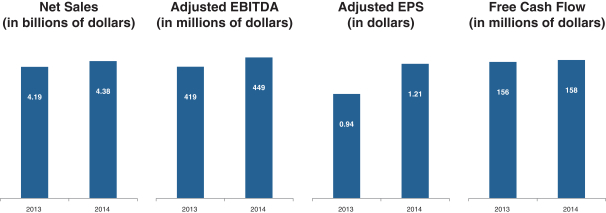

Select Performance Highlights (Page 30)

2014 saw the continued expansion of our position as a leading independent provider of laboratory products, services and solutions to the global life science, general research and applied markets. We did this by expanding our relationships with our global strategic customers, developing new products and services, increasing sales of private label products, enhancing our value-added services offerings under the VWRCATALYST brand, expanding our chemical manufacturing capabilities and continuing the globalization of our best practices. In 2014 we delivered:

| • | | Net sales growth of 4.5%, up 3.1% on an organic basis. |

| • | | Adjusted EBITDA growth of 7.4%. |

| • | | Adjusted Net Income growth of 29.1%. |

| • | | Adjusted EPS growth of 28.7%. |

| • | | Free Cash Flow of $157.5 million, up from $155.6 million in 2013. |

In addition, we strengthened our balance sheet by lowering our Net Leverage ratio to 4.4X at the end of 2014, compared to 6.4X at the end of 2013. Our strengthened balance sheet significantly lowers our interest burden and increases our financial flexibility as we move forward.

See Appendix A for information about our non-GAAP financial measurements, including reconciliations to the most directly comparable GAAP-based financial measurements.

| | | | |

| | 4 | | |

Proxy Summary(continued)

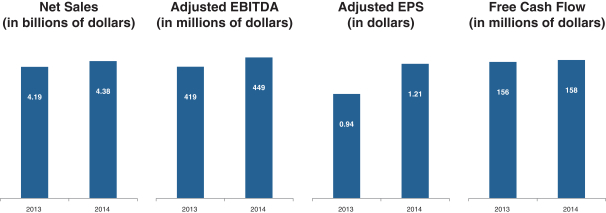

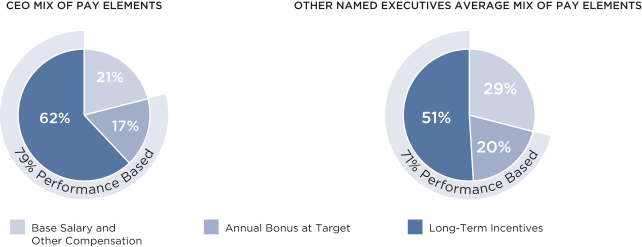

Executive Compensation Highlights (Page 30)

As part of its pre-IPO review of our executive compensation program, the Compensation Committee confirmed several long-standing VWR compensation policies and practices and adopted certain new policies and practices to further align our executive compensation program with stockholder interests.

Our executive compensation practices include the following, each of which the Compensation Committee believes reinforces our executive compensation objectives:

| | | | |

| What we have: | | | | What we don’t have: |

| ü | | Significant percentage of target annual compensation delivered in the form of variable compensation tied to performance |

| ü | | Long-term objectives aligned with the creation of stockholder value |

| ü | | Market comparison of executive compensation against a relevant peer group |

| ü | | Use of an independent compensation consultant reporting directly to the Compensation Committee |

| ü | | Compensation recovery (“clawback”) policy for our equity based long-term incentive program |

| û | | Hedging or short sales of Company stock, or pledging of Company stock except in limited circumstances with pre-approval |

| û | | Option grants below 100% fair market value |

| û | | Enhanced severance benefits upon a change of control |

| | | | |

| | 5 | |  |

Questions and Answers

About the Meeting and Voting

| 1. | Who is entitled to vote and how many votes do I have? |

If you were a holder of record of VWR common stock, par value $0.01 per share (the “common stock”), at the close of business on March 31, 2015, you are eligible to vote at the Annual Meeting. For each matter presented for vote, you have one vote for each share you own.

| 2. | What is the difference between holding shares as a Stockholder of Record/Registered Stockholder and as a beneficial owner of shares? |

Stockholder of Record or Registered Stockholder. If your shares of common stock are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered a “Stockholder of record” or a “registered Stockholder” of those shares.

Beneficial Owner of Shares. If your shares are held in an account at a bank, brokerage firm or other similar organization, then you are a beneficial owner of shares held in street name. In that case, you will have received these proxy materials from the bank, brokerage firm or other similar organization holding your account and, as a beneficial owner, you have the right to direct your bank, brokerage firm or similar organization as to how to vote the shares held in your account.

| 3. | How do I vote if I am a Stockholder of record? |

By Telephone or Internet. All Stockholders of record can vote by touchtone telephone within the United States, U.S. territories and Canada, using the toll-free telephone number on the proxy card, or through the Internet, using the procedures and instructions described on the proxy card. The telephone and Internet voting procedures are designed to authenticate Stockholders’ identities, to allow Stockholders to vote their shares and to confirm that their instructions have been recorded properly.

By Written Proxy. All Stockholders of record can also vote by written proxy card. If you sign and return your proxy card but do not mark any selections giving specific voting instructions, your shares represented by that proxy will be voted as recommended by the Board of Directors.

In Person. All Stockholders of record may vote in person at the meeting. See Question 5 below regarding the requirements for attending the Annual Meeting.

Whether you plan to attend the meeting or not, we encourage you to vote by proxy as soon as possible. Your shares will be voted according to your directions.

| 4. | How do I vote if I am a beneficial owner of shares? |

Your broker is not permitted to vote on your behalf on the election of directors and other matters to be considered at the Annual Meeting (except on ratification of the appointment of KPMG LLP as independent registered public accounting firm for 2015), unless you provide specific instructions by completing and returning the voting instruction form from your broker, bank or other financial institution or following the instructions provided to you for voting your shares via telephone or the Internet. For your vote to be counted, you will need to communicate your voting decisions to your broker, bank or other financial institution before the date of the Annual Meeting. In order to be able to vote your shares at the meeting, you must obtain a legal proxy from that entity and bring it with you to hand in with your ballot.

| 5. | Who can attend the Annual Meeting? |

Only holders of our common stock as of the close of business on the record date, which was March 31, 2015, or their duly appointed proxies, may attend the Annual Meeting. If you hold your shares through a broker, bank or other nominee, you will be required to show the notice or voting instructions form you received from your broker, bank or other nominee or a copy of a statement (such as a brokerage statement) from your broker, bank or other nominee reflecting your stock ownership as of March 31, 2015 in order to be admitted to the Annual Meeting. All attendees must bring a government-issued photo ID to gain admission to the Annual Meeting.

| | | | |

| | 6 | | |

Questions and Answers About the Meeting and Voting(continued)

There are several ways in which you may revoke your proxy or change your voting instructions before the time of voting at the meeting (please note that, in order to be counted, the revocation or change must be received in writing, by our Corporate Secretary by 11:59 p.m. EDT on May 11, 2015):

| | • | | Vote again by telephone or at the Internet website; |

| | • | | Mail a revised proxy card or voting instruction form that is dated later than the prior one; or |

| | • | | Stockholders of record may vote in person at the Annual Meeting. |

| 7. | Is my vote confidential? |

Yes. Proxy cards, ballots and voting tabulations that identify Stockholders are kept confidential, except:

| | • | | as necessary to meet applicable legal requirements and to assert or defend claims for or against the Company; |

| | • | | in the case of a contested proxy solicitation; |

| | • | | if a Stockholder makes a written comment on the proxy card or otherwise communicates his or her vote to management; or |

| | • | | to allow the independent inspector of election to certify the results of the vote. |

Broadridge Investor Communication Solutions, the independent proxy tabulator used by VWR, counts the votes and acts as the judge of election for the meeting.

| 8. | What is a broker non-vote? |

A “broker non-vote” occurs when a broker submits a proxy for the meeting with respect to a discretionary matter but does not vote on non-discretionary matters because the beneficial owner did not provide voting instructions on those matters. Under NASDAQ rules, the proposal to ratify the appointment of an independent registered public accounting firm (Item 2) is considered a “discretionary” item. This means that brokerage firms may vote in their discretion on behalf of clients (beneficial owners) who have not furnished voting instructions at least 15 days before the date of the Annual Meeting. In contrast, all of the other proposals set forth in this proxy statement are “non-discretionary” items—brokerage firms that have not received voting instructions from their clients on these matters may not vote on these proposals.

| 9. | What constitutes a “quorum” for the meeting? |

A quorum consists of a majority of the outstanding shares, present at the meeting or represented by proxy. A quorum is necessary to conduct business at the Annual Meeting. You are part of the quorum if you have voted by proxy. Abstentions and broker non-votes count as “shares present” at the meeting for purposes of determining a quorum. If you vote to abstain on one or more proposals, your shares will be counted as present for purposes of determining the presence of a quorum unless you vote to abstain on all proposals.

| 10. | What is the voting requirement to approve each of the proposals, and how are votes counted? |

At the close of business on March 31, 2015, the record date for the meeting, VWR had 131,358,700 shares of common stock (excluding treasury shares) outstanding. Each share of common stock outstanding on the record date is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. Treasury shares are not voted.

Item 1: Election of three director nominees to serve three-year terms expiring in 2018. A plurality of the votes cast by the shares of common stock present in person or represented by proxy at the meeting and entitled to vote thereon is required to elect each nominee named herein. This means that the three nominees receiving the highest number of votes at the Annual Meeting of Stockholders will be elected, even if those votes do not constitute a majority of the votes cast. Abstentions and broker non-votes will not impact the election of the nominees.

Item 2: Ratification of appointment of KPMG LLP as our independent registered public accounting firm for 2015.The affirmative vote of a majority of the shares of common stock present in person or represented by proxy at the meeting and entitled to vote thereon is required to ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2015. Abstentions will be counted as present and entitled to vote on the proposal and will therefore have the effect of a negative vote. We do not expect there to be any broker non-votes with respect to the proposal.

| | | | |

| | 7 | |  |

Questions and Answers About the Meeting and Voting(continued)

Item 3: Advisory approval of named executive officer compensation. The affirmative vote of a majority of the shares of common stock present in person or represented by proxy at the meeting and entitled to vote thereon is required to approve, on an advisory, non-binding basis, the compensation paid to our named executive officers. Abstentions will be counted as present and entitled to vote on the proposal and will therefore have the effect of a negative vote. Broker non-votes will not be counted as present and entitled to vote on the proposal and will therefore have no effect on the outcome of the proposal.

Item 4: Advisory vote on the frequency of the advisory approval of named executive officer compensation. The advisory, non-binding vote with respect to the determination as to whether the advisory vote to approve named executive officer compensation shall occur every one, two or three years shall be decided by a plurality of the votes cast among the three alternatives. This means that the alternative receiving the most votes will be considered to be the expressed preference of the stockholders, even if those votes do not constitute a majority of the votes cast. Abstentions and broker non-votes will have no effect on the outcome of the proposal.

| 11. | Who pays for the solicitation of proxies? |

VWR pays the cost of soliciting proxies, including preparation, assembly, printing and mailing. Proxies will be solicited on behalf of the Board of Directors by mail, telephone or in person. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for sending proxy materials to Stockholders and obtaining their votes.

| 12. | How do I comment on Company business? |

Your comments are collected when you vote using the Internet. We also collect comments from the proxy card if you vote by mailing the proxy card. You may also send your comments to us in care of the Corporate Secretary: VWR Corporation, Corporate Secretary’s Office, Radnor Corporate Center, Building One, Suite 200, 100 Matsonford Road, Radnor, PA 19087. Although it is not possible to respond to each Stockholder, your comments help us to understand your concerns.

| 13. | May I nominate someone to be a director of VWR? |

Yes, please see “Corporate Governance—Stockholder Nominations for Directors” for details on the procedures for Stockholder nominations of director candidates.

| 14. | When are the 2016 Stockholder proposals due? |

To be considered for inclusion in the Company’s 2016 proxy statement, Stockholder proposals submitted in accordance with SEC Rule 14a-8 must be received in writing at our principal executive offices no later than December 14, 2015. Address all Stockholder proposals to: VWR Corporation, Corporate Secretary’s Office, 100 Matsonford Road, Radnor, PA 19087. For any proposal that is not submitted for inclusion in next year’s proxy statement, but is instead sought to be presented directly at the 2016 annual meeting, notice of intention to present the proposal, including all information required to be provided by the Stockholder in accordance with the Company’s Amended and Restated Bylaws, must be received in writing at our principal executive offices no earlier than January 12, 2016 and no later than February 11, 2016. Address all notices of intention to present proposals at the 2016 annual meeting to: VWR Corporation, Corporate Secretary’s Office, Radnor Corporate Center, Building One, Suite 200, 100 Matsonford Road, Radnor, PA 19087.

| 15. | How may I obtain a copy of VWR’s Annual Report on Form 10-K? |

The Company will provide by mail, without charge, a copy of its Annual Report on Form 10-K for the year ended December 31, 2014 (not including exhibits and documents incorporated by reference), at your request. Please direct all requests to VWR Corporation, Investor Relations, Radnor Corporate Center, Building One, Suite 200, 100 Matsonford Road, Radnor, PA 19087.

| | | | |

| | 8 | | |

Item 1 Election of Directors

As of the date of this proxy statement, VWR’s Board of Directors has 11 members divided into three classes. Directors are elected for three-year terms. The terms for members of each class end in successive years.

The Board of Directors, upon the recommendation of the Nominating and Governance Committee, has nominated three incumbent directors, Nicholas W. Alexos, Robert P. DeCresce and Carlos del Salto, to stand for re-election to the Board for a three-year term expiring in 2018.

In selecting director candidates, the Nominating and Governance Committee and the Board of Directors consider the qualifications and skills of the candidates individually and the composition of the Board as a whole. The Nominating and Governance Committee will also consider criteria such as independence, diversity, age, skills and experience in the context of the needs of the Board. In addressing issues of diversity in particular, the Nominating and Governance Committee considers a nominee’s differences in viewpoint, professional experience, background, education, skill, age, race, gender and national origin. Under our Corporate Governance Guidelines, the Nominating and Governance Committee and the Board review the following for each candidate, among other qualifications deemed appropriate, when considering the suitability of candidates for nomination as director:

| • | | The nominee’s ability to represent all stockholders without a conflict of interest; |

| • | | The nominee’s ability to work in and promote a productive environment; |

| • | | Whether the nominee has sufficient time and willingness to fulfill the substantial duties and responsibilities of a director; |

| • | | Whether the nominee has demonstrated the high level of character and integrity expected by the Company; |

| • | | Whether the nominee possesses the broad professional and leadership experience and skills necessary to effectively respond to the complex issues encountered by a publicly-traded company; and |

| • | | The nominee’s ability to apply sound and independent business judgment. |

The following biographies describe the business experience of each director nominee. Following the biographical information for each director nominee, we have listed the specific experience and qualifications of that nominee that strengthen the Board’s collective qualifications, skills and experience.

If elected, each of the director nominees is expected to serve for a term expiring at the Annual Meeting of Stockholders in 2018, subject to the election and qualification of his or her successor. The Board expects that each of the nominees will be available for election as a director. However, if by reason of an unexpected occurrence one or more of the nominees is not available for election, the persons named in the form of proxy have advised that they will vote for such substitute nominees as the Board may nominate. If a nominee is unable to serve as a director, the Board may reduce its size or choose a substitute.

The Board of Directors recommends a vote “FOR” ITEM 1, the election of each of Nicholas W. Alexos, Robert P. DeCresce and Carlos del Salto to the Board for a three-year term expiring in 2018.

| | | | |

| | 9 | |  |

Item 1 Election of Directors(continued)

Nominees to Serve For a Three-Year Term Expiring in 2018

| | |

| | Nicholas W. Alexos Director since: 2007 Age: 51 Committees: Audit (Chair); Finance |

Mr. Alexos is a Managing Director of Madison Dearborn Partners, LLC, a private equity investment firm based in Chicago, Illinois. Prior to co-founding Madison Dearborn Partners in 1992, he was with First Chicago Venture Capital for four years. Prior to that position, Mr. Alexos was with The First National Bank of Chicago. He concentrates on investments in the healthcare sector and currently also serves on the Boards of Directors of Ikaria, Inc. and Sage Products, LLC. In addition, Mr. Alexos serves on the Board of Trustees of the Lake Forest Country Day School, Children’s Inner City Educational Fund and the Council on Chicago Booth. In the past five years, Mr. Alexos also served as a Director of Sirona Dental Systems, Inc. Mr. Alexos earned a B.A. in business administration from Loyola University and an M.B.A. from the University of Chicago. Mr. Alexos was designated as a director nominee pursuant to the Director Nomination Agreement by and between VWR and Varietal Distribution Holdings, LLC. See “Corporate Governance—Director Independence and Related Person Transactions—Certain Related Party Transactions—Nomination of our Directors” for more information.

Experience and Qualifications: Mr. Alexos’ senior management experience as a Managing Director of Madison Dearborn Partners, board and advisory experience with other companies in the healthcare industry and his extensive experience in the areas of finance, financial accounting (including qualification as an audit committee financial expert), international business transactions and mergers and acquisitions, along with his independence, make him a valuable member of the Board.

| | |

| | Robert P. DeCresce, M.D. Director since: 2007 Age: 65 Committees: Compensation |

Dr. DeCresce is the Harriet B. Borland Professor and Chair of the Department of Pathology at Rush Medical College in Chicago, Illinois. He also currently serves as Associate Vice President for Ancillary Services, is a member of the Board of Trustees and serves as a member of the Executive Committee of the Board of Trustees at Rush University Medical Center. Prior to joining Rush Medical in 1991, he served at Michael Reese Hospital and MetPath Laboratories, also in Chicago, Illinois. In the past five years, Dr. DeCresce served on the Board of PathLab, Inc. In addition, he has served as a consultant to a number of in-vitro diagnostic companies over the past 20 years. He earned a B.S. from Boston College, as well as an M.D., M.P.H., and an M.B.A. from Columbia University.

Experience and Qualifications: Dr. DeCresce’s senior leadership experience at a medical college and past board member and current consulting experience to companies within the healthcare industry, along with his independence, make him a valuable member of the Board.

| | | | |

| | 10 | | |

Item 1 Election of Directors(continued)

| | |

| | Carlos del Salto Director since: 2007 Age: 72 Committees: Audit |

Mr. del Salto retired from Baxter Healthcare Corporation in March 2006, where he was the Senior Vice President responsible for Baxter’s Intercontinental and Asia-Pacific operations. He had been with Baxter Healthcare Corporation since 1973 and held numerous positions, including president of Baxter Healthcare Corporation’s Global Renal business, president of Baxter Latin America/Switzerland/Austria and general manager of Mexico. Mr. del Salto serves on the Advisory Board of Directors of Andean Health and Development. In addition, he is founder and president of the Natividad de los Andes Foundation in Ecuador. He earned a B.A. in accounting from Juan de Velasco College in Ecuador and an M.B.A., with a concentration in finance, from Roosevelt University in Chicago, Illinois.

Experience and Qualifications: Mr. del Salto’s prior senior level experience at a major global healthcare company, including in capacities leading Central and South American and Asia-Pacific operations, his expertise in financial accounting (including qualification as an audit committee financial expert) and strategy in international markets, along with his independence, make him a valuable member of the Board.

| | | | |

| | 11 | |  |

Item 1 Election of Directors(continued)

Other Members of the Board of Directors

Set forth below are the biographies of the continuing directors who are not nominees for election at this Annual Meeting of Stockholders. Robert L. Barchi, Edward A. Blechschmidt, Thompson Dean and Timothy P. Sullivan are Class II directors whose initial terms will expire in 2016, and Manuel Brocke-Benz, Pamela Forbes Lieberman, Harry M. Jansen Kraemer, Jr. and Robert J. Zollars are Class III directors whose initial terms will expire in 2017. Following the biographical information for each director, we have listed the specific experience and qualifications of that director that strengthen the Board’s collective qualifications, skills and experience.

| | |

| | Harry M. Jansen Kraemer, Jr. Chairman Director since: 2007 Age: 60 Committees: Nominating and Governance |

Mr. Kraemer is an Executive Partner of Madison Dearborn Partners, LLC, a private equity investment firm based in Chicago, Illinois. Prior to joining Madison Dearborn Partners in 2005, he was the chairman and chief executive officer of Baxter International Inc., a global healthcare company, until April 2004. Mr. Kraemer had been a director of Baxter International since 1995, chairman of the board since 2000, president since 1997 and chief executive officer since 1999. Mr. Kraemer now serves as clinical professor of management and strategy at the J.L. Kellogg School of Management at Northwestern University. Mr. Kraemer currently serves on the Boards of Directors of Leidos Holdings, Inc. (formerly SAIC, Inc.), where he is the chairman of the Audit Committee, Catamaran Corp., Sage Products, LLC, Sirona Dental Systems, Inc. and Ikaria, Inc.; on the Board of Trustees of Northwestern University and Lawrence University; on the Dean’s Advisory Board of the J.L. Kellogg School of Management; and on the board of trustees of The Conference Board. Mr. Kraemer earned a B.A. in mathematics and economics from Lawrence University and an M.B.A. from Northwestern University’s J.L. Kellogg School of Management.

Experience and Qualifications: Mr. Kraemer’s prior long-term, senior level experience at a major global healthcare company, including serving as chairman and chief executive officer, and his expertise in financial accounting, international business transactions and strategy, along with his independence, make him a valuable member of the Board.

| | |

| | Robert L. Barchi, M.D., Ph.D. Director since: 2006 Age: 68 Committees: Compensation |

Dr. Barchi has been President of Rutgers, The State University of New Jersey, since 2012. Dr. Barchi served as President of Thomas Jefferson University from 2004 to 2008. Prior to that, he was Provost of the University of Pennsylvania, having served in various capacities at that institution for more than 30 years. He was Chair of the University of Pennsylvania’s Department of Neurology and founding Chair of its Department of Neuroscience. Dr. Barchi also served as the Director of the Mahoney Institute of Neurological Sciences for more than 12 years. In addition to his clinical and administrative responsibilities, he has been published extensively in the field of ion channel research, and has been elected to membership in the Institute of Medicine of the National Academy of Sciences. Dr. Barchi is a member of the Board of Covance, Inc. He earned a B.S. and an M.S. from Georgetown University, as well as a Ph.D. and an M.D. from the University of Pennsylvania.

Experience and Qualifications: Dr. Barchi’s senior leadership experience within the healthcare industry, as both the President of a major healthcare organization and as a Board member of a drug development services company, along with his independence, make him a valuable member of the Board.

| | | | |

| | 12 | | |

Item 1 Election of Directors(continued)

| | |

| | Edward A. Blechschmidt Director since: 2007 Age: 62 Committees: Audit |

Mr. Blechschmidt is a retired corporate executive, having served in a variety of executive roles. He was chief executive officer of Novelis Corp. from 2006 until its sale to the Aditya Birla Group in 2007. Mr. Blechschmidt was chairman, chief executive officer and president of Gentiva Health Services, Inc., a leading provider of specialty pharmaceutical and home health care services, from 2000 to 2002. From 1999 to 2000, Mr. Blechschmidt served as chief executive officer and a director of Olsten Corporation, the conglomerate from which Gentiva Health Services was split off and taken public. He served as president of Olsten Corporation from 1998 to 1999. Mr. Blechschmidt also served as president and chief executive officer of Siemens Nixdorf America and Siemens Pyramid Technologies from 1996 to 1998. Prior to Siemens, he spent more than 20 years with Unisys Corporation, including serving as its chief financial officer. Mr. Blechschmidt serves as a member of the board of directors of Lionbridge Technologies, Inc. and Diamond Foods. In addition, he served on the board of directors of Healthsouth Corp. from 2004 to 2012 and Columbia Laboratories from 2004 to 2014. He earned a B.S. in business administration from Arizona State University and is a National Association of Corporate Directors (NACD) Board Leadership Fellow.

Experience and Qualifications: Mr. Blechschmidt’s senior leadership experience, including as chief executive officer and chief financial officer, current and past experience as a board member at other companies, and his experience in finance, strategy and financial accounting (including qualification as an audit committee financial expert), along with his independence, make him a valuable member of the Board.

| | |

| | Manuel Brocke-Benz Director since: 2012 Age: 56 Committees: Finance (Chair) |

Mr. Brocke-Benz was named our President and Chief Executive Officer on January 3, 2013. From July 25, 2012 to January 3, 2013, Mr. Brocke-Benz served as our interim Chief Executive Officer, while also serving as the Senior Vice President and Managing Director of Europe, Lab and Distribution Services, a position he held since January 2006. Prior to assuming his position as Senior Vice President and Managing Director of Europe, Lab and Distribution Services, he served as Senior Vice President and General Manager of Continental Europe from 2003 to 2005 and as Corporate Senior Vice President, Process Excellence from 2001 to 2003. Mr. Brocke-Benz initially joined the Company in 1987. Mr. Brocke-Benz earned a law degree from Albert-Ludwigs University in Freiburg, Germany.

Experience and Qualifications: Mr. Brocke-Benz’s leadership role and more than 20 years of service with us in a variety of senior-level positions, together with his extensive knowledge of our business, strategy and industry on an international basis and his training as a lawyer make him a valuable member of the Board.

| | | | |

| | 13 | |  |

Item 1 Election of Directors(continued)

| | |

| | Thompson Dean Director since: 2007 Age: 56 Committees: Compensation |

Mr. Dean is a Co-Managing Partner and Co-Chief Executive Officer of Avista Capital Partners, L.P., a private equity firm based in New York. Prior to co-founding Avista Capital Partners in 2005, Mr. Dean led DLJ Merchant Banking Partners, for ten years. Mr. Dean has served as Co-Managing Partner of DLJMB since 1995 and was Chairman of the Investment Committees of DLJMB I, DLJMB II, DLJMB III and DLJ Growth Capital Partners through December 2007. Mr. Dean received a B.A. from the University of Virginia in 1979, where he was an Echols Scholar and an M.B.A. with high distinction from Harvard Business School in 1984, where he was a Baker Scholar. Mr. Dean currently serves on the Boards of Acino, ConvaTec, IWCO Direct Holdings, Sidewinder Drilling and Zest Anchors. Mr. Dean formerly served as the chairman of the board of Nycomed, Arcade, DeCrane Aircraft, Mueller and Von Hoffmann. He also formerly served on the boards of American Ref-Fuel, Argyle Television, BioPartners, Charles River Labs, Evergreen Media, Merrill, Safilo and Visant, among others. Mr. Dean is a trustee of Choate Rosemary Hall and The Eaglebrook School. He is Former chairman of the Special Projects Committee of Memorial Sloan Kettering Hospital and served as a member of the College Foundation Board of the University of Virginia. In addition, he serves on various committees of the Boys Club of New York, the Lenox Hill Neighborhood Association and the Museum of the City of New York.

Experience and Qualifications: Mr. Dean’s executive level management experience at Avista, board and advisory experience with other companies in and outside of the healthcare industry, and his extensive experience in the areas of finance, strategy, international business transactions and mergers and acquisitions, along with his independence, make him a valuable member of the Board.

| | |

| | Pamela Forbes Lieberman Director since: 2009 Age: 61 Committees: Audit |

Ms. Forbes Lieberman has served in a variety of executive roles. From March 2006 to August 2006, she served as interim Chief Operating Officer of Entertainment Resource, Inc., which was a distribution business in the entertainment industry. Ms. Forbes Lieberman served as president, chief executive officer and a Board member of TruServ Corporation (now known as True Value Company), a member-owned hardware cooperative, from November 2001 to November 2004, as TruServ’s chief operating officer and chief financial officer from July 2001 through November 2001, and as TruServ’s chief financial officer from March 2001 through July 2001. Prior to March 2001, she held chief financial officer positions at ShopTalk Inc., The Martin-Brower Company, L.L.C. and Fel-Pro Inc., as well as financial leadership positions at Kraft Foods, Inc. and Bunzl Building Supply Inc. Ms. Forbes Lieberman currently serves on the Board of Directors of A.M. Castle & Co., where she is chair of the Audit Committee, Standard Motor Products, Inc., where she is a member of the Audit Committee, the Compensation and Management Development Committee and the Nominating and Corporate Governance Committee and is co-chair of the Strategy Committee, Tempel Steel, and Kreher Steel Company; and the advisory board of privately-held HAVI Group, LP. In addition, Ms. Forbes Lieberman serves on the Board of Trustees at Rush University Medical Center. Ms. Forbes Lieberman earned an M.B.A. from Northwestern University J.L. Kellogg School of Management and a B.S. in accounting from the University of Illinois, Champaign. Ms. Forbes Lieberman, a Certified Public Accountant began her career at PricewaterhouseCoopers LLP.

Experience and Qualifications: Ms. Forbes Lieberman’s senior leadership experience at several distribution and manufacturing companies, including as chief executive officer, chief financial officer and board member, her expertise in finance and financial accounting (including qualification as an audit committee financial expert), as well as her expertise in culture and communications, along with her independence, make her a valuable member of the Board.

| | | | |

| | 14 | | |

Item 1 Election of Directors(continued)

| | |

| | Timothy P. Sullivan Director since: 2007 Age: 57 Committees: Compensation (Chair); Nominating and Governance (Chair); Finance |

Mr. Sullivan is a Managing Director of Madison Dearborn Partners, LLC, a private equity investment firm based in Chicago, Illinois. Prior to co-founding Madison Dearborn Partners in 1992, Mr. Sullivan was with First Chicago Venture Capital for four years after having served in the U.S. Navy. Mr. Sullivan concentrates on investments in the healthcare sector and currently also serves on the Board of Directors of Ikaria, Inc., Sage Products, LLC and Sirona Dental Systems, Inc. In addition, he is on the Board of Trustees of Northwestern University, Northwestern Memorial Hospital, the United States Naval Academy Foundation, Loyola Academy and Northlight Theatre. He also serves on the investment committee of the Archdiocese of Chicago and the Cristo Rey Jesuit High School. Mr. Sullivan earned a B.S. from the United States Naval Academy, an M.S. from the University of Southern California and an M.B.A. from the Stanford University Graduate School of Business.

Experience and Qualifications: Mr. Sullivan’s senior management experience as a Managing Director of Madison Dearborn Partners, board and advisory experience with other companies in the healthcare industry, and his extensive experience in the areas of finance, strategy, international business transactions and mergers and acquisitions, along with his independence, make him a valuable member of the Board.

| | |

| | Robert J. Zollars Director since: 2006 Age: 58 Committees: Compensation; Nominating and Governance |

From June 2013 until June 2014, Mr. Zollars served as the executive chairman of Vocera Communications, Inc., a wireless communications systems company. Mr. Zollars also served as the Chairman and Chief Executive Officer of Vocera Communications from June 2007 until June 2013. Prior to Vocera Communications, he served as the president and chief executive officer and a Director of Wound Care Solutions, LLC, a private equity backed business serving the chronic wound care segment of healthcare, from June 2006 through April 2007. From June 1999 until March 2006, Mr. Zollars was the chairman and CEO of Neoforma, Inc., a healthcare technology company, focusing on supply chain. Prior to joining Neoforma, he was the executive vice president and group president of Cardinal Health, Inc., where he was responsible for five subsidiaries. From 1992 until 1996, Mr. Zollars was the president of the Hospital Supply and Scientific Product distribution businesses at Baxter International Inc. Mr. Zollars currently serves as Chairman of the Boards of Directors of Vocera Communications and Diamond Foods, Inc. and as a Director at Five9, Inc. In the past five years, Mr. Zollars served on the Boards of Silk Road Technology Inc. and InterAct911 Corporation. He earned a B.S. from Arizona State University and an M.B.A. from John F. Kennedy University.

Experience and Qualifications: Mr. Zollars’ experience as a chief executive officer, extensive senior management experience in various positions within the healthcare industry, and board member experience at other companies, along with his independence, make him a valuable member of the Board.

| | | | |

| | 15 | |  |

Director Compensation

Under the Board Compensation Policy, which has been in place since 2007 (the “Board Compensation Policy”), all directors who are not also (i) our officers or employees or (ii) Managing Directors or Managing Partners of the Sponsors (collectively, the “Eligible Directors”), received annual cash compensation of $100,000 for their service on the Board. No separate compensation was paid to Eligible Directors for their service on the Board committees. Commencing after the completion of our initial public offering and in connection with the termination of the Management Services Agreement, Messrs. Alexos, Dean and Sullivan began receiving the same compensation as the Eligible Directors for their service on the Board. All Board members are also entitled to be reimbursed for reasonable travel, lodging and other expenses incurred in connection with their service on the Board and committees of the Board.

The table below sets forth director compensation for 2014:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Name(1) | | Fees Earned or

Paid in Cash | | | Stock Awards | | | Option

Awards(2) | | | Non-Equity

Incentive Plan

Compensation | | | All Other

Compensation | | | Total | |

Harry M. Jansen Kraemer, Jr. | | $ | 100,000 | | | $ | — | | | $ | 140,000 | | | $ | — | | | $ | — | | | $ | 240,000 | |

Nicholas W. Alexos | | | 25,000 | | | | — | | | | 140,000 | | | | — | | | | — | | | | 165,000 | |

Robert L. Barchi | | | 100,000 | | | | — | | | | 140,000 | | | | — | | | | — | | | | 240,000 | |

Edward A. Blechschmidt | | | 100,000 | | | | — | | | | 140,000 | | | | — | | | | — | | | | 240,000 | |

Thompson Dean | | | 25,000 | | | | — | | | | 140,000 | | | | — | | | | — | | | | 165,000 | |

Robert P. DeCresce | | | 100,000 | | | | — | | | | 140,000 | | | | — | | | | — | | | | 240,000 | |

Pamela Forbes Lieberman | | | 100,000 | | | | — | | | | 140,000 | | | | — | | | | — | | | | 240,000 | |

Carlos del Salto | | | 100,000 | | | | — | | | | 140,000 | | | | — | | | | — | | | | 240,000 | |

Timothy P. Sullivan | | | 25,000 | | | | — | | | | 140,000 | | | | — | | | | — | | | | 165,000 | |

Robert J. Zollars | | | 100,000 | | | | — | | | | 140,000 | | | | — | | | | — | | | | 240,000 | |

| (1) | Mr. Brocke-Benz is an employee of the Company and receives no compensation for service as a director. |

| (2) | Upon pricing of the initial public offering, we awarded each of our directors other than Mr. Brocke-Benz options to purchase 22,617 shares of common stock pursuant to the 2014 Equity Incentive Plan. The estimated fair value of each of these awards on the date of grant was $140,000 as calculated using the Black-Scholes option pricing model. The options granted to our non-executive directors were unvested as of the date of grant, and will vest quarterly over three years, subject to the recipient continuously providing services to us through each such date. The options have a seven-year term and the exercise price of the options is $21.00, the initial public offering price. |

Commencing January 1, 2015, each non-management director will receive an annual cash retainer of $75,000 paid quarterly in arrears. In addition, the Chairman of the Board will receive an additional cash retainer of $75,000, Committee Chairman will receive a retainer of $25,000 in the case of the Audit Committee, $15,000 in the case of the Compensation Committee, and $10,000 for other standing committees, and non-management directors will receive additional retainers in the amount of $10,000 for service on the Audit and Compensation Committees, and $5,000 for service on other standing committees.

| | | | |

| | 16 | | |

Corporate Governance

Our success is built on the trust we have earned from our customers, suppliers, distributors, associates, business partners and investors, and trust sustains our success. Part of this trust stems from our commitment to good corporate governance. The framework for our governance practices is found in our Corporate Governance Guidelines, which outline the operating principles of our Board of Directors and the composition and working processes of our Board and its committees. The Nominating and Governance Committee periodically review our Corporate Governance Guidelines and developments in corporate governance and will recommend proposed changes to the Board for approval.

In addition to the Corporate Governance Guidelines and the other policies and procedures described in this section, we highlight below certain of our corporate governance practices:

Board Membership and Participation

| • | | Directors who serve on our audit committee may serve on only two other public companies’ audit committees. |

| • | | Other directors should not serve on more than four outside public company boards in addition to VWR’s Board. |

| • | | Directors’ attendance at annual meetings is expected. |

Prohibitions against Short Sales, Hedging, Margin Accounts and Pledging

Our Insider Trading Policy contains restrictions that, among other things:

| • | | prohibit short sales of VWR securities and derivative or speculative transactions in VWR securities; |

| • | | prohibit the use of financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds) that are designed to hedge or offset any decrease in the market value of VWR securities; and |

| • | | prohibit directors and executive officers from holding VWR securities in margin accounts or pledging VWR securities as collateral. |

The Structure and Role of the Board of Directors

Board Leadership Structure

The Company’s current Board leadership structure is composed of a non-executive Chairman of the Board. We believe that having a non-executive Chairman of the Board emphasizes the importance of the Board’s objectivity and independence from management and best promotes the effective functioning of the Board’s oversight role. Our Chairman’s responsibility is to ensure that our Board functions properly and to work with our President and Chief Executive Officer to set the Board’s agenda. We expect our Chairman to facilitate communications among our directors and between the Board and senior management. While our Chairman provides independent leadership, he also works closely with our President and Chief Executive Officer to ensure that our directors receive the information that they need to perform their responsibilities, including discussing and providing critical review of the matters that come before the Board and assessing management’s performance.

The Board believes that it is in the best interest of the Company and its Stockholders for Mr. Kraemer to continue to serve as Chairman of the Company. Mr. Kraemer possesses significant knowledge and experience in our industry, and a deep understanding of VWR’s strategic objectives, all of which will continue to benefit the Company during the year ahead.

The Board does not believe that any single leadership structure is right for all companies at all times. As a result, the Board will periodically review its leadership structure to determine, based on the circumstances at that time, whether it and its committees are functioning effectively.

The Board’s Role in Risk Oversight

The Board, as a whole and through the Audit Committee, oversees risk management, which is designed to identify, evaluate and respond to our high priority risks and opportunities. This risk management approach facilitates constructive dialog at the senior management and Board level to proactively realize opportunities and manage risks. Our Audit Committee is primarily responsible for overseeing our risk management processes on behalf of the full Board. Our management, including our executive officers, is primarily responsible for managing the risks associated with the operation and business of our company and provides regular updates to the Audit Committee and annual updates to the full board on the risk management program and reports on the identified high priority risks and opportunities.

| | | | |

| | 17 | |  |

Corporate Governance(continued)

Our Compensation Committee considers the extent to which the executive compensation program may create risk for the Company. See “Executive Compensation—Compensation Discussion and Analysis—Compensation Philosophy and Objectives—How We Make Compensation Decisions.” In addition, our Nominating and Governance Committee considers risks related to succession planning for the Board of Directors and oversees the appropriate allocation of responsibility for risk oversight among the committees of the Board.

Board Meetings and Attendance

Under VWR’s Corporate Governance Guidelines, our directors are expected to dedicate sufficient time to the performance of their Board duties, including by attending the annual meeting of stockholders, Board meetings and applicable committee meetings.

The Board met six times in 2014, including regularly scheduled and special meetings. Each director attended 75% or more of the aggregate of all meetings of the Board and the committees on which he or she served during 2014.

Board and Committee Evaluations

The Board of Directors annually assesses the effectiveness of the full Board, the operations of its committees and the contributions of director nominees. The Nominating and Governance Committee oversees the evaluation of the Board as a whole and its committees, as well as individual evaluations of those directors who are being considered for possible re-nomination to the Board.

Committees of the Board

There are four standing committees of the Board. The Board has adopted written charters for each committee, which are available on our website at investor.vwr.com under “Corporate Governance—Charters.”

Each of the Audit, Compensation, and Nominating and Governance Committees consists solely of directors who have been determined by the Board of Directors to be independent in accordance with Securities and Exchange Commission (“SEC”) regulations, NASDAQ listing rules and the Company’s director independence standards (including the heightened independence standards for members of the Audit and Compensation Committees), except for Mr. Alexos, who does not meet the heightened independence standards for service on the Audit Committee because he is a director of VWR Holdings, our largest stockholder. Given the transition period allowances for companies meeting the “controlled company” exemption, Mr. Alexos may continue to serve on our Audit Committee until October 1, 2015.

The following table sets forth the Board committees, the current members of each of the committees and the number of times the respective committees met in 2014:

| | | | | | | | | | | | | | |

| | | Audit | | | | Compensation | | | | Nominating and Governance | | | | Finance |

Harry M. Jansen Kraemer, Jr.* | | | | | | | | | | X | | | | |

Nicholas W. Alexos* | | Chair | | | | | | | | | | | | X |

Robert L. Barchi* | | | | | | X | | | | | | | | |

Edward A. Blechschmidt* | | X | | | | | | | | | | | | |

Manuel Brocke-Benz | | | | | | | | | | | | | | Chair |

Thompson Dean* | | | | | | X | | | | | | | | |

Robert P. DeCresce* | | | | | | X | | | | | | | | |

Pamela Forbes Lieberman* | | X | | | | | | | | | | | | |

Carlos del Salto* | | X | | | | | | | | | | | | |

Timothy P. Sullivan* | | | | | | Chair | | | | Chair | | | | X |

Robert J. Zollars* | | | | | | X | | | | X | | | | |

Number of 2014 meetings | | 6 | | | | 4 | | | | 1 | | | | 1 |

Audit Committee

The Audit Committee is responsible for, among other matters:

| • | | appointing, compensating, retaining, overseeing and terminating our independent registered public accounting firm; |

| • | | reviewing our independent registered public accounting firm independence from management; |

| | | | |

| | 18 | | |

Corporate Governance(continued)

| • | | reviewing with our independent registered public accounting firm the scope of their audit; |

| • | | approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; |

| • | | overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual consolidated financial statements that we file with the SEC; |

| • | | reviewing and monitoring our accounting principles, accounting policies, financial reporting processes and controls and compliance with applicable legal and regulatory requirements; |

| • | | establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, financial reporting, internal controls or auditing matters; and |

| • | | maintaining our compliance with legal and regulatory requirements and our Code of Ethics and Conduct (the “Code of Conduct”). |

Each member of the Audit Committee is financially literate, and the Board of Directors has determined that each member qualifies as an “audit committee financial expert” under applicable SEC rules. No committee member currently sits on more than two other public company’s audit committee.

Compensation Committee

Our Compensation Committee is responsible for, among other matters:

| • | | reviewing and recommending to our Board of Directors the compensation of our chief executive officer; |

| • | | reviewing and approving the compensation of other executive officers; |

| • | | reviewing and approving equity compensation, employment agreements and other similar arrangements between us and our executive officers; |

| • | | reviewing the performance of our chief executive officer; |

| • | | reviewing and approving our stock plans and other incentive compensation plans; and |

| • | | reviewing trends in management compensation. |

The Compensation Committee has sole authority to retain or terminate any compensation consultant or other advisor used to evaluate senior executive compensation and may form and delegate authority to subcommittees when appropriate. The Compensation Committee also approves all engagements and services to be performed by any consultants or advisors to the Compensation Committee. To assist the Compensation Committee in discharging its responsibilities, the Committee has retained an independent compensation consultant—Pearl Meyer & Partners (the “Compensation Consultant”). The consultant reports directly to the Compensation Committee. For additional information about the independence of the Compensation Committee’s consultant, refer to “Compensation Discussion and Analysis—Compensation Philosophy & Objectives—How We Make Compensation Decisions—Guidance from the Independent Compensation Consultant.” For more information on the responsibilities and activities of the Compensation Committee, including its processes for determining executive compensation, see the “Executive Compensation—Compensation Discussion and Analysis” section.

Nominating and Governance Committee

Our Nominating and Governance Committee is responsible for, among other matters:

| • | | identifying individuals qualified to become members of the Board and considering stockholder nominations for membership to the Board consistent with criteria approved by the Board; |

| • | | overseeing the organization of the Board to discharge the Board’s duties and responsibilities properly and efficiently; |

| • | | identifying best practices and recommending corporate governance principles; |

| • | | developing and recommending to the Board a set of corporate governance guidelines and principles applicable to us; |

| • | | reviewing our Code of Conduct and our insider trading policy; |

| • | | reviewing and approving related party transactions; and |

| • | | reviewing and approving the compensation of our directors. |

Finance Committee

Our Finance Committee is responsible for, among other matters:

| • | | reviewing our long-term business direction and goals and the strategy for maintaining that direction and achieving those goals; |

| • | | reviewing with management and recommending to the Board overall financial plans, including capital expenditures, acquisitions and divestitures, securities issuances and incurrences of debt; and |

| • | | approving certain financial commitments and acquisitions and divestitures by us up to specified levels. |

| | | | |

| | 19 | |  |

Corporate Governance(continued)

Communications with Directors

The Board of Directors welcomes input and suggestions. Stockholders and other interested parties wishing to contact any director individually or the directors as a group may do so by sending a written communication to the attention of the Company’s Corporate Secretary by mail at VWR Corporation, Corporate Secretary’s Office, Radnor Corporate Center, Building One, Suite 200, 100 Matsonford Road, Radnor, PA 19087.

Communications addressed to the Board or to a Board member are distributed to the Board or to any individual director or directors as appropriate. Any such communication is promptly distributed to the director or directors named therein unless such communication is considered, either presumptively or in the reasonable judgment of the Company’s Corporate Secretary, to be improper for submission to the intended recipient or recipients. Examples of communications that would presumptively be deemed improper for submission include, without limitation, solicitations, communications that raise grievances that are personal to the sender, communications that relate to the pricing of the Company’s products or services, communications that do not relate directly or indirectly to the Company and communications that are frivolous in nature.

Stockholder Nominations for Directors

Our Nominating and Governance Committee has not adopted a written policy regarding Stockholder nominations for directors. The Nominating and Governance Committee shall, however, consider director candidates timely submitted by the Company’s stockholders in accordance with the notice provisions and procedures set forth in the Company’s Amended and Restated Bylaws, and shall apply the same criteria to the evaluation of those candidates as the Committee applies to other director candidates. The Nominating and Governance Committee will consider stockholder nominations for membership on the Board. The Nominating and Governance Committee will apply the same criteria to the evaluation of stockholder nominated candidates as it does to all other candidates. All stockholder nominations must be duly made by a qualifying stockholder not less than 90 days and not more than 120 days prior to the first anniversary of the preceding year’s annual meeting of stockholders.

Director Independence and Related Person Transactions

Director Independence

We are a “controlled company” under the NASDAQ listing rules because more than 50% of our outstanding voting power is held by VWR Holdings. See “VWR Stock Ownership.” As a result, we may rely upon the “controlled company” exception to the board of directors and committee independence requirements under such stock exchange. Pursuant to this exception, we are exempt from the rules that would otherwise require that our board of directors consist of a majority of independent directors and that its compensation committee and nominating and governance committee be composed entirely of independent directors. The “controlled company” exception does not modify the independence requirements for the audit committee, and we intend to comply with the requirements of Rule 10A-3 of the Exchange Act, Section 3 of the Sarbanes-Oxley Act and the corporate governance standards of NASDAQ, which require that our audit committee consist exclusively of independent directors within one year of our initial public offering.

While relying on the “controlled company” exception, the Board will assess at least annually the independence of directors and determine which members are independent. Our board of directors has affirmatively determined that each of Ms. Forbes Lieberman and Messrs. Kraemer, Alexos, Barchi, Blechschmidt, Dean, DeCresce, del Salto, Sullivan, and Zollars meets the definition of “independent director” under applicable SEC and NASDAQ listing rules.

Transactions with Related Persons

Our Nominating and Governance Committee is responsible for the review, approval and ratification of “related person transactions” between us and any related person pursuant to a written Related Person Transaction Policy adopted by our board of directors. “Related person transactions” include any transaction by the Company with a company or other entity that employs a “related person,” or in which a “related person” has a material ownership or financial interest. Under SEC rules, a related person is an officer, director, nominee for director or beneficial holder of more than of 5% of any class of our voting securities since the beginning of the last fiscal year or an immediate family member of any of the foregoing. In the course of its review and approval or ratification of a related-person transaction, the Nominating and Governance Committee will consider:

| • | | the nature of the related person’s interest in the transaction; |

| • | | the material terms of the transaction, including the amount involved and type of transaction; |

| | | | |

| | 20 | | |

Corporate Governance(continued)

| • | | the importance of the transaction to the related person and to our Company; |

| • | | whether the transaction would impair the judgment of a director or executive officer to act in our best interest and the best interest of our stockholders; and |

| • | | any other matters the Nominating and Governance Committee deems appropriate. |

Any member of the Nominating and Governance Committee who is a related person with respect to a transaction under review will not be able to participate in the deliberations or vote on the approval or ratification of the transaction. However, such a director may be counted in determining the presence of a quorum at a meeting of the committee that considers the transaction.

Certain Related Persons Transactions

Management Services Agreement

Prior to the completion of our initial public offering, we were party to a management services agreement with affiliates of Madison Dearborn Partners, LLC (“Madison Dearborn”) and Avista Capital Partners, L.P. (“Avista” and, together with Madison Dearborn, the “Sponsors”) (the “Management Services Agreement”) pursuant to which they provided us with management and consulting services and financial and other advisory services. Pursuant to the Management Services Agreement, the Sponsors earned an annual management fee of $2.0 million and reimbursement of out-of-pocket expenses incurred in connection with the provision of management and consulting services and financial and other advisory services, as well as board level services. In addition, the Sponsors also were entitled to receive a placement fee of 2.5% of any equity financing that they provided to us prior to a public offering of our common stock. The Management Services Agreement included customary indemnification provisions in favor of the affiliates of the Sponsors.

In connection with our initial public offering, the parties terminated the Management Services Agreement. Following the termination of the Management Services Agreement, the Sponsors have continued to provide mutually agreeable management support services to the Company without payment of any additional consideration.

Income Tax Receivable Agreement

In connection with our initial public offering, we entered into an Income Tax Receivable Agreement (the “ITRA”) that provides Varietal Distribution Holdings, LLC (“VWR Holdings”) with the right to receive payment from us of 85% of the amount of cash savings, if any, in U.S. federal, state and local income tax that we and our subsidiaries actually realize (or are deemed to realize in the case of a change of control, certain subsidiary dispositions or certain other events, as discussed below) as a result of the utilization of our and our subsidiaries’ net operating losses attributable to periods prior to the initial public offering.

While the actual amount and timing of any payments under the ITRA will vary depending upon a number of factors, including the amount and timing of the taxable income we and our subsidiaries generate in the future, and our and our subsidiaries’ use of net operating loss carryforwards, we expect that during the term of the ITRA the payments that we may make could be material.

At December 31, 2014, we reported a liability of $172.9 million for the ITRA, which represents 85% of the full obligation for applicable recognized deferred tax assets. The value of the liability assumes no material changes in the relevant tax law, and that we and our subsidiaries earn sufficient taxable income to realize the full tax benefits subject to the ITRA. As of December 31, 2014, no payments have been made under the ITRA, but we determined that $9.8 million of payments will be due under the ITRA in 2015.

Nomination of our Directors

In connection with our initial public offering, we entered into a Director Nomination Agreement with VWR Holdings that provides VWR Holdings the right to designate nominees for election to our board of directors for so long as VWR Holdings beneficially owns 10% or more of the total number of shares of our common stock then outstanding. Madison Dearborn Partners may cause VWR Holdings to assign its designation rights under the Director Nomination Agreement to Madison Dearborn Partners or to a Madison Dearborn Partners affiliate so long as Madison Dearborn Partners and its affiliates are the beneficial owners of 50% or more of VWR Holdings’ voting equity interests.

The number of nominees that VWR Holdings is entitled to designate under this agreement will bear the same proportion to the total number of members of our board of directors as the number of shares of common stock beneficially owned by VWR Holdings bears to the total number of shares of common stock outstanding, rounded up to the nearest whole number. In

| | | | |

| | 21 | |  |

Corporate Governance(continued)

addition, VWR Holdings shall be entitled to designate the replacement for any of its board designees whose board service terminates prior to the end of the director’s term regardless of VWR Holdings’ beneficial ownership at such time. VWR Holdings shall also have the right to have its designees participate on committees of our board of directors proportionate to its stock ownership, subject to compliance with applicable law and stock exchange rules. This agreement will terminate at such time as VWR Holdings owns less than 10% of our outstanding common stock.

Registration Rights Agreement

In connection with our initial public offering, we entered into a registration rights agreement with VWR Holdings. VWR Holdings is entitled to request that the Company register its shares on a long-form or short-form registration statement on one or more occasions in the future, which registrations may be “shelf registrations.” VWR Holdings is also entitled to participate in certain registered offerings by the Company, subject to the restrictions in the registration rights agreement. The Company will pay VWR Holdings’ expenses in connection with VWR Holdings’ exercise of these rights. The registration rights described in this paragraph apply to (i) shares of our common stock held by VWR Holdings as of the closing of the initial public offering, (ii) any of our capital stock (or that of our subsidiaries) issued or issuable with respect to the common stock described in clause (i) with respect to any dividend, distribution, recapitalization, reorganization, or certain other corporate transactions, and (iii) any of our common stock held by Madison Dearborn Partners and its affiliates (“Registrable Securities”). These registration rights are also for the benefit of any subsequent holder of Registrable Securities; provided that any particular securities will cease to be Registrable Securities when they have been sold in a registered public offering, sold in compliance with Rule 144 of the Securities Act or repurchased by us or our subsidiaries. In addition, with the consent of the Company and holders of a majority of Registrable Securities, any Registrable Securities held by a person other than Madison Dearborn Partners, Avista and their respective affiliates will cease to be Registrable Securities if they can be sold without limitation under Rule 144 of the Securities Act.

Miscellaneous

We sell certain products to Rutgers University, The State University of New Jersey, for which Dr. Barchi became the President in September 2012. In 2014, we had less than $3.1 million of net sales to Rutgers University.

We sell certain products to Sage Products, LLC, which is a portfolio company of affiliated funds of Madison Dearborn Partners. In 2014, we had less than $0.3 million of net sales to Sage Products, LLC.

We purchase certain products from Acino Pharma, which is a portfolio company of affiliated funds of Avista. In 2014, we had less than $0.5 million of purchases from Acino Pharma.

We sell certain products to Lantheus Medical Imaging and AngioDynamics, which are portfolio companies of affiliated funds of Avista. In 2014, we had less than $0.7 million and $0.3 million of net sales to Lantheus Medical Imaging and AngioDynamics, respectively.

Compensation Committee Interlocks and Insider Participation