Quarterly Stakeholder Letter THIRD QUARTER | FISCAL YEAR 2022

QUARTERLY STAKEHOLDER LETTER | THIRD QUARTER 2022 | 2 Dear Phreesia stakeholders, We celebrated an important milestone in September when we exceeded 100 million patient visits enabled by our platform over the previous 12 months. The entire Phreesia team has contributed to this achievement, and I would like to congratulate each and every member of our organization on reaching this milestone. It is the latest in a long line of accomplishments celebrated over the past 16 years, achieved through the hard work and dedication of our current and former team members. We also thank our clients for entrusting us to help them create a better, more engaging healthcare experience. As our capabilities have grown, so too has our impact on each patient visit. Our tools now extend beyond patient registration and revenue cycle management, enabling healthcare organizations to improve patient outcomes through our access, activation and digital engagement offerings. This expansion would not be possible without the significant growth of our team. We have invested in leadership development over many years, both by promoting strong performers within our organization and by recruiting high-caliber talent to Phreesia. I would like to acknowledge all of Phreesia’s managers, whose consistent leadership has enabled us to deliver for our clients as we continue to experience significant growth. It’s due to their excellence that Phreesia was recently recognized as one of Inc.’s Best-Led Companies of 2021. As we move into the final quarter of Fiscal Year 2022 and look ahead to the new year, we will continue to allocate capital based on our team’s ongoing review of opportunities and our performance against our expectations. We wish all of our stakeholders a happy, safe and healthy holiday season, and we look forward to reconnecting in 2022. On behalf of the leadership team, thank you for your interest in Phreesia. Chaim Indig Co-Founder and Chief Executive Officer DECEMBER 8, 2021

QUARTERLY STAKEHOLDER LETTER | THIRD QUARTER 2022 | 3 Fiscal Year 2022 Third-Quarter Highlights We saw strong growth across Total Provider and Life Sciences Revenue, Average Number of Provider Clients and Average Revenue per Provider Client in the quarter. KEY PERFORMANCE METRICS $15.4 Provider Clients Our product-led go-to-market strategy continues to drive provider network growth. In the third quarter, we supported an average of 2,097 provider clients, an increase of 110 clients over the previous quarter, and an increase of 360 clients over the previous year’s third quarter. Our year-over-year client growth is a noteworthy achievement, and we are very pleased with the win rate and close rate metrics we monitor regularly. Phreesia’s value propositions in cash-flow improvement and labor productivity have been key drivers of client growth for many years. Those areas have become even more important over the past several months, as countless media reports have described healthcare

QUARTERLY STAKEHOLDER LETTER | THIRD QUARTER 2022 | 4 Click to watch the webinar organizations curtailing their operating hours and reducing their number of beds—or, even worse, shutting their doors altogether—due to staffing shortages and the COVID-19 pandemic. Meeting healthcare staffing demands is not a new challenge; medical practices and health systems have had trouble finding employees for years. But today, that problem has turned into a full-fledged crisis. In a recent webinar hosted by Phreesia, medical practice operations and revenue cycle management expert Elizabeth Woodcock, DrPH, MBA, FACMPE, CPC, discussed the current staffing landscape and strategies to help weather the labor shortage, encouraging healthcare organizations to embrace technology and automation to improve the patient experience—and increase employee retention. Staff turnover is reaching new, unfortunate heights. The staffing crisis is not a short-term issue that can be overcome in six months. The result of COVID-19 is that your staff can work for anyone, anywhere in the world, from home. We need to fundamentally change the way we do things— automation alone isn’t enough; we have to use technology to optimize the way we work.” —ELIZABETH WOODCOCK, DRPH, MBA, FACMPE, CPC Many clients have told us that they are relying on Phreesia’s digital tools to help them sustain their operational and financial health amid staffing challenges, and to position themselves for ongoing success. We will continue to dedicate ourselves to providing our clients with the resources they need to work safely and efficiently. Through the Phreesia Dashboard, we can have our patients register on their own device, notify them to wait in their cars and direct them to the appropriate area for care. We have eliminated countless hours of redundant work, freeing our staff to do other important tasks.” —PHILIP COBURN, CHIEF OPERATING OFFICER, TRUSTCARE HEALTH

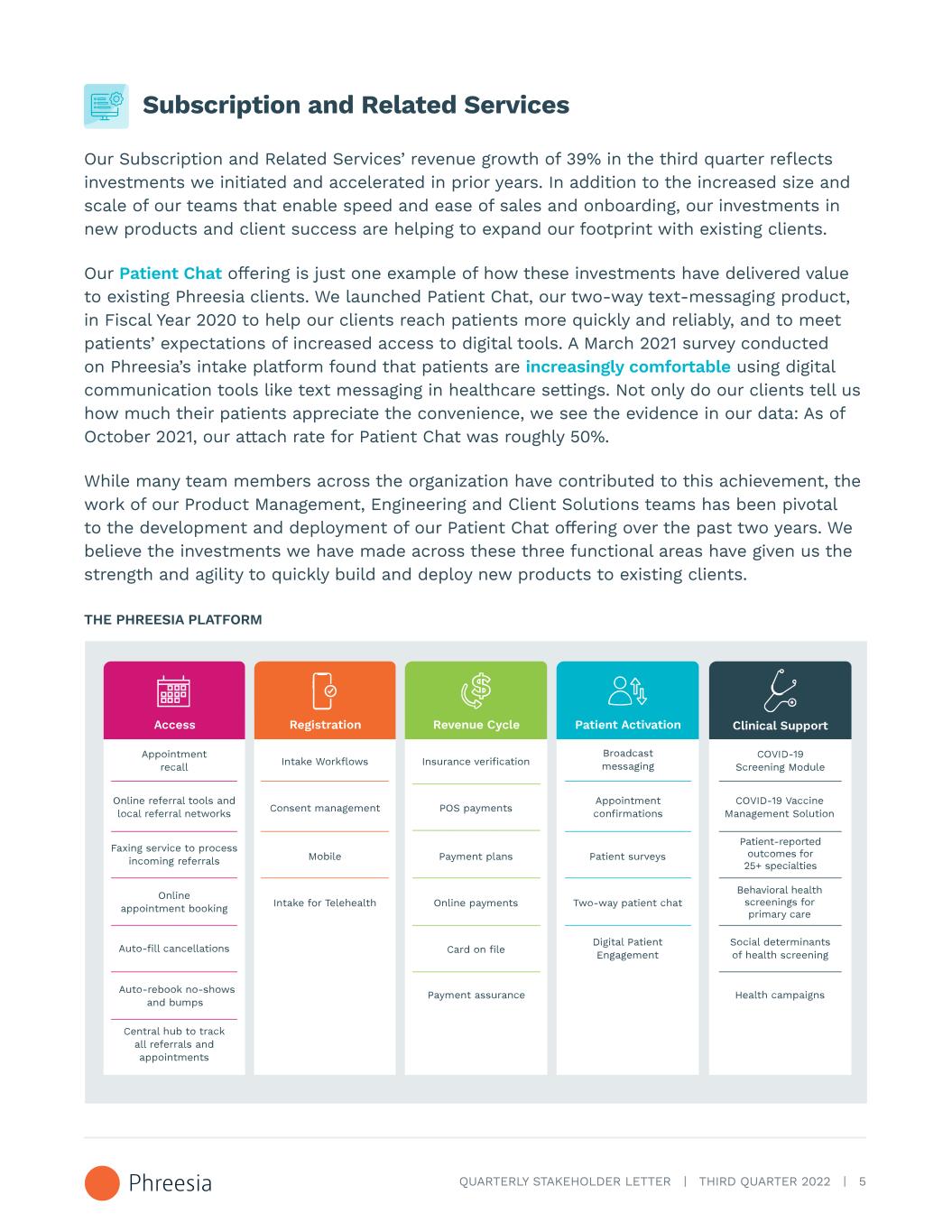

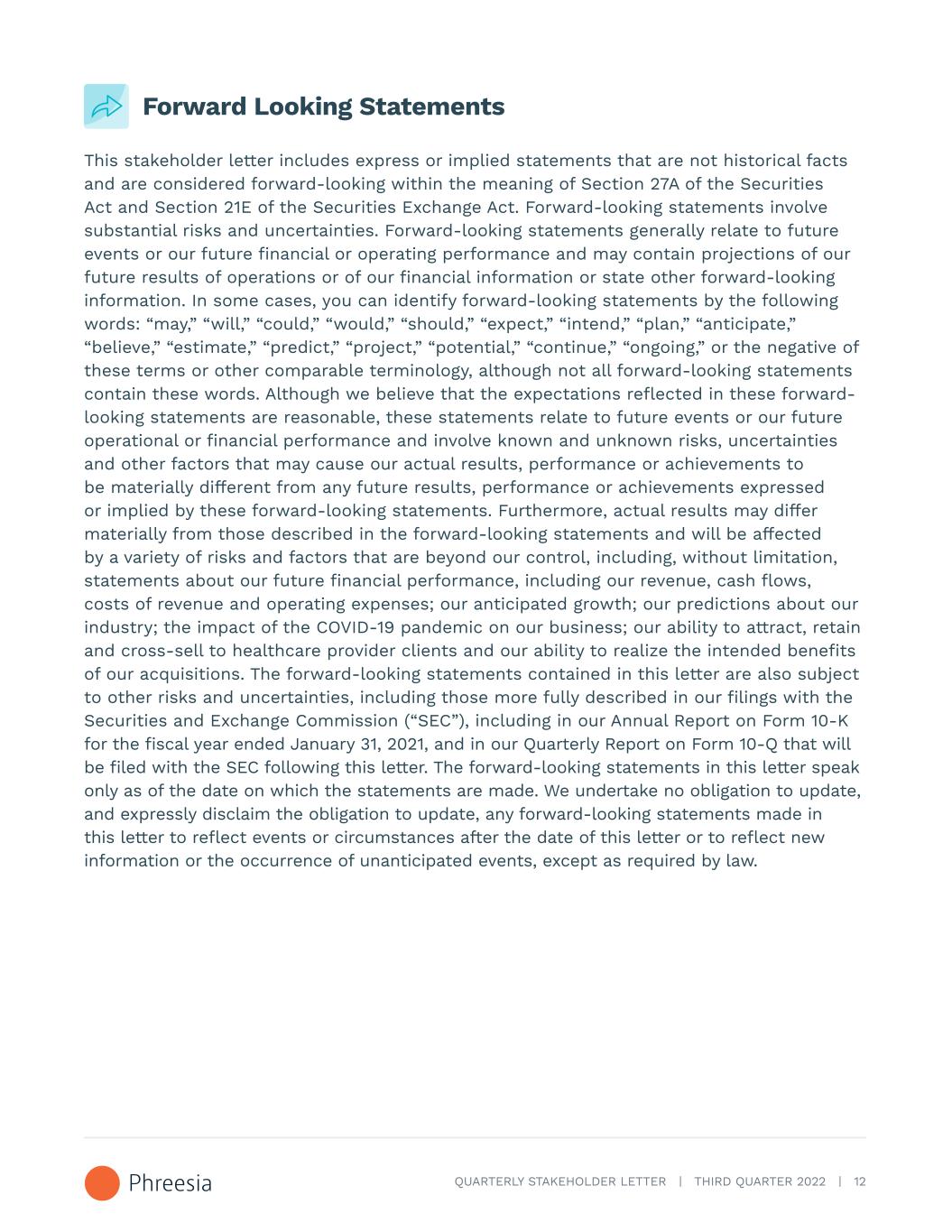

QUARTERLY STAKEHOLDER LETTER | THIRD QUARTER 2022 | 5 Subscription and Related Services Our Subscription and Related Services’ revenue growth of 39% in the third quarter reflects investments we initiated and accelerated in prior years. In addition to the increased size and scale of our teams that enable speed and ease of sales and onboarding, our investments in new products and client success are helping to expand our footprint with existing clients. Our Patient Chat offering is just one example of how these investments have delivered value to existing Phreesia clients. We launched Patient Chat, our two-way text-messaging product, in Fiscal Year 2020 to help our clients reach patients more quickly and reliably, and to meet patients’ expectations of increased access to digital tools. A March 2021 survey conducted on Phreesia’s intake platform found that patients are increasingly comfortable using digital communication tools like text messaging in healthcare settings. Not only do our clients tell us how much their patients appreciate the convenience, we see the evidence in our data: As of October 2021, our attach rate for Patient Chat was roughly 50%. While many team members across the organization have contributed to this achievement, the work of our Product Management, Engineering and Client Solutions teams has been pivotal to the development and deployment of our Patient Chat offering over the past two years. We believe the investments we have made across these three functional areas have given us the strength and agility to quickly build and deploy new products to existing clients. THE PHREESIA PLATFORM

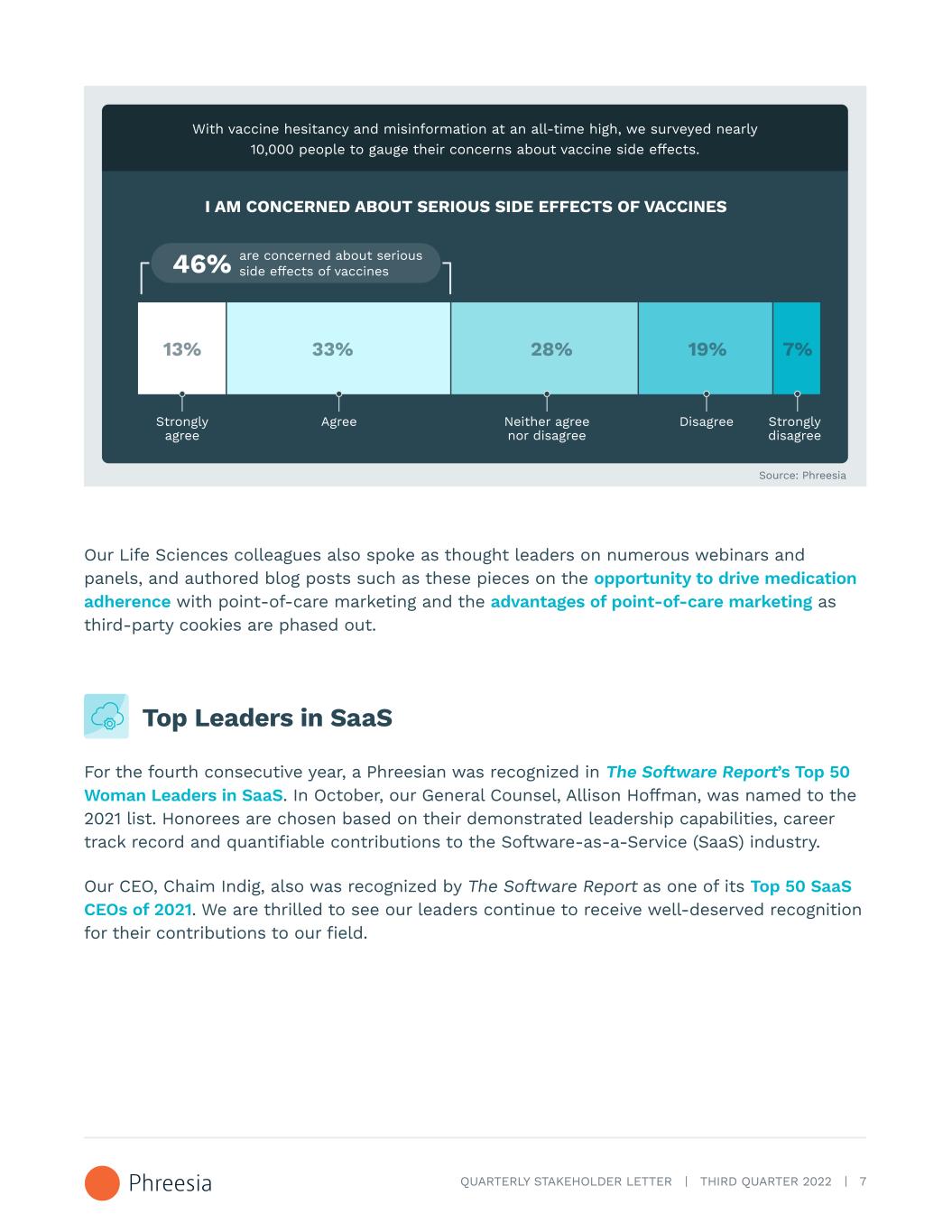

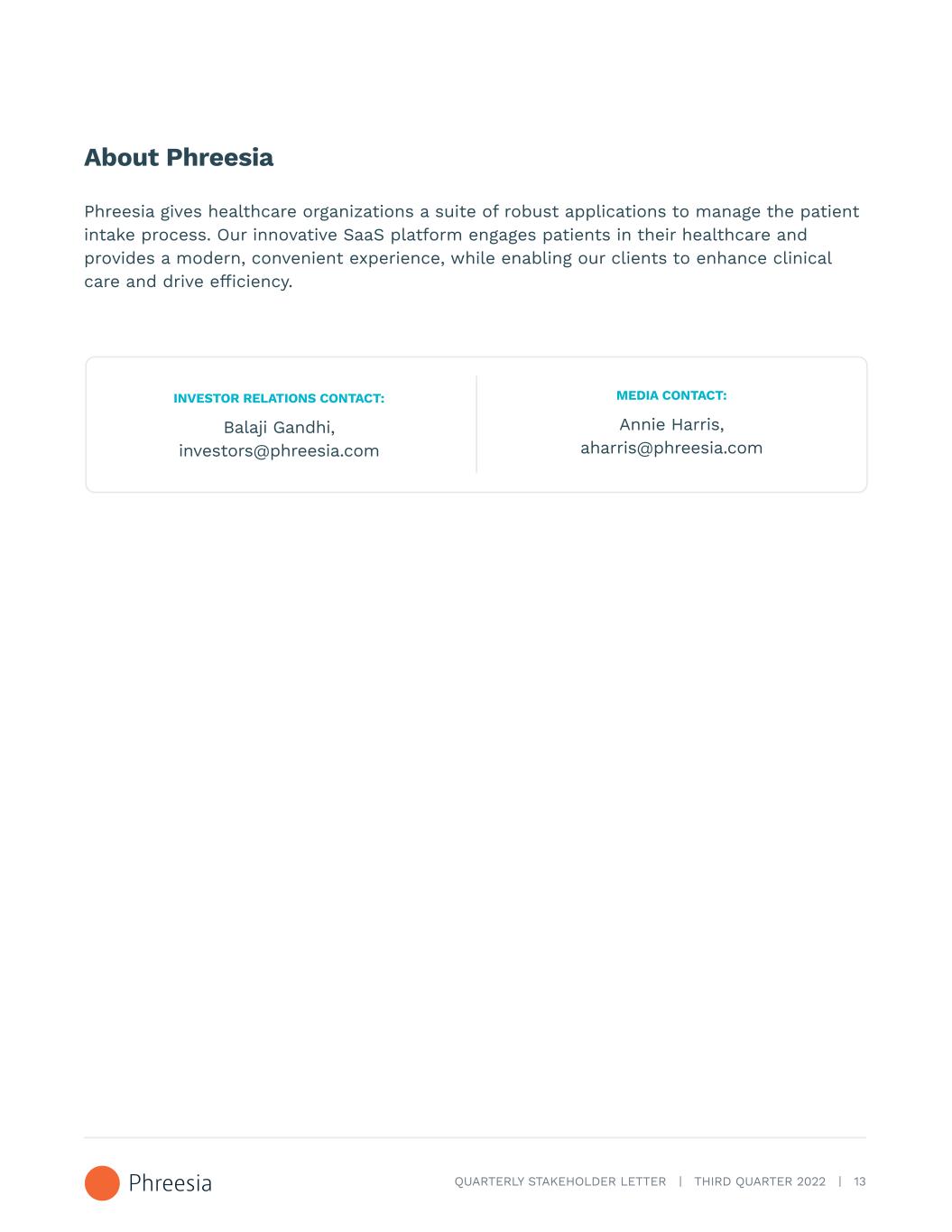

QUARTERLY STAKEHOLDER LETTER | THIRD QUARTER 2022 | 6 Payment Processing Update Our patient payment volume grew 30% over the prior year’s third quarter and decreased a slight 2% over the previous quarter. We anticipated and assumed a dynamic environment in patient visits and payments and incorporated this into our previous revenue outlook. Our payment-facilitator volume percentage was 79%, down 70 basis points year-over-year and up 100 basis points from the previous quarter. The year-over-year decline reflects an increase in the number of clients who utilize Phreesia as a payment gateway but not as a payment facilitator. We anticipate that our payment-facilitator volume percentage will decline slightly over time as we increase our penetration of larger health systems that are less likely to use Phreesia as a payment facilitator. PAYMENT PROCESSING VOLUME TRENDS • Patient payment volume: We believe that patient payment volume is an indicator of both the underlying health of our provider clients’ businesses and the continuing shift of healthcare costs to patients. We measure patient payment volume as the total dollar volume of transactions between our provider clients and their patients who utilize our payment platform, including via credit and debit cards that we process as a payment facilitator, as well as through cash and check payments, and credit and debit transactions for which Phreesia acts as a gateway to other payment processors. • Payment facilitator volume percentage: We define payment facilitator volume percentage as the volume of credit and debit card patient payment volume that we process as a payment facilitator as a percentage of total patient payment volume. Payment facilitator volume is a major driver of our payment processing revenue. Life Sciences Our Life Sciences team was a key contributor to our overall performance, as evidenced by the area’s exceptional 91% year-over-year revenue growth in the quarter. We believe our overall value proposition is resonating well in the market. Our team had many opportunities over the quarter to highlight new survey data collected on Phreesia’s platform, including articles featuring our research on patients’ use of support programs and vaccine education, and engaging social media posts to drive awareness about vaccine hesitancy and misinformation.

QUARTERLY STAKEHOLDER LETTER | THIRD QUARTER 2022 | 7 Our Life Sciences colleagues also spoke as thought leaders on numerous webinars and panels, and authored blog posts such as these pieces on the opportunity to drive medication adherence with point-of-care marketing and the advantages of point-of-care marketing as third-party cookies are phased out. Top Leaders in SaaS For the fourth consecutive year, a Phreesian was recognized in The Software Report’s Top 50 Woman Leaders in SaaS. In October, our General Counsel, Allison Hoffman, was named to the 2021 list. Honorees are chosen based on their demonstrated leadership capabilities, career track record and quantifiable contributions to the Software-as-a-Service (SaaS) industry. Our CEO, Chaim Indig, also was recognized by The Software Report as one of its Top 50 SaaS CEOs of 2021. We are thrilled to see our leaders continue to receive well-deserved recognition for their contributions to our field. Source: Phreesia

QUARTERLY STAKEHOLDER LETTER | THIRD QUARTER 2022 | 8 Information Security and Compliance In September, our platform earned renewed HITRUST CSF Certification for information security. This designation validates Phreesia’s commitment to meeting key regulations and protecting sensitive information. This recertification underscores Phreesia’s dedication to safeguarding sensitive personal health and financial information. We prioritize security in every decision we make as an organization. This continual third-party examination gives patients and providers using our platform confidence that their information is safe with Phreesia.” —WES SHRINER, SENIOR DIRECTOR OF INFORMATION SECURITY, PHREESIA In addition to our HITRUST CSF Certification renewal, Phreesia’s commitment to privacy and security is evidenced by top industry credentials such as SOC 2 Type 2 certification, PCI Point- to-Point Encryption (P2PE) validation and recognition as a Level 1 PCI DSS service provider.

QUARTERLY STAKEHOLDER LETTER | THIRD QUARTER 2022 | 9 Investments in Growth We ended the quarter with 1,490 employees, an increase of 252 team members over the previous quarter and 764 employees over the previous year. We hired more staff in every area of our organization with the most significant increases in our sales, marketing and engineering teams. Our hiring activity is an important aspect of our capital allocation strategy. However, as we have previously communicated, growth is not free. We believe it is important to reward our team members for their past, current and expected future performance. Total compensation increases represented approximately 13% of year-over-year increases in our third-quarter operating expenses: Cost of Revenue, Sales & Marketing, Research & Development and General & Administrative. We know we ask a lot of our team, and our results over the past several quarters reflect their ability to meet the demands of a rapidly growing company in a diverse and complex industry. Our recent compensation increases are a recognition of the high-caliber talent across our organization, and we continue to compensate our team very well in a highly competitive environment. OPERATING EXPENSE TRENDS

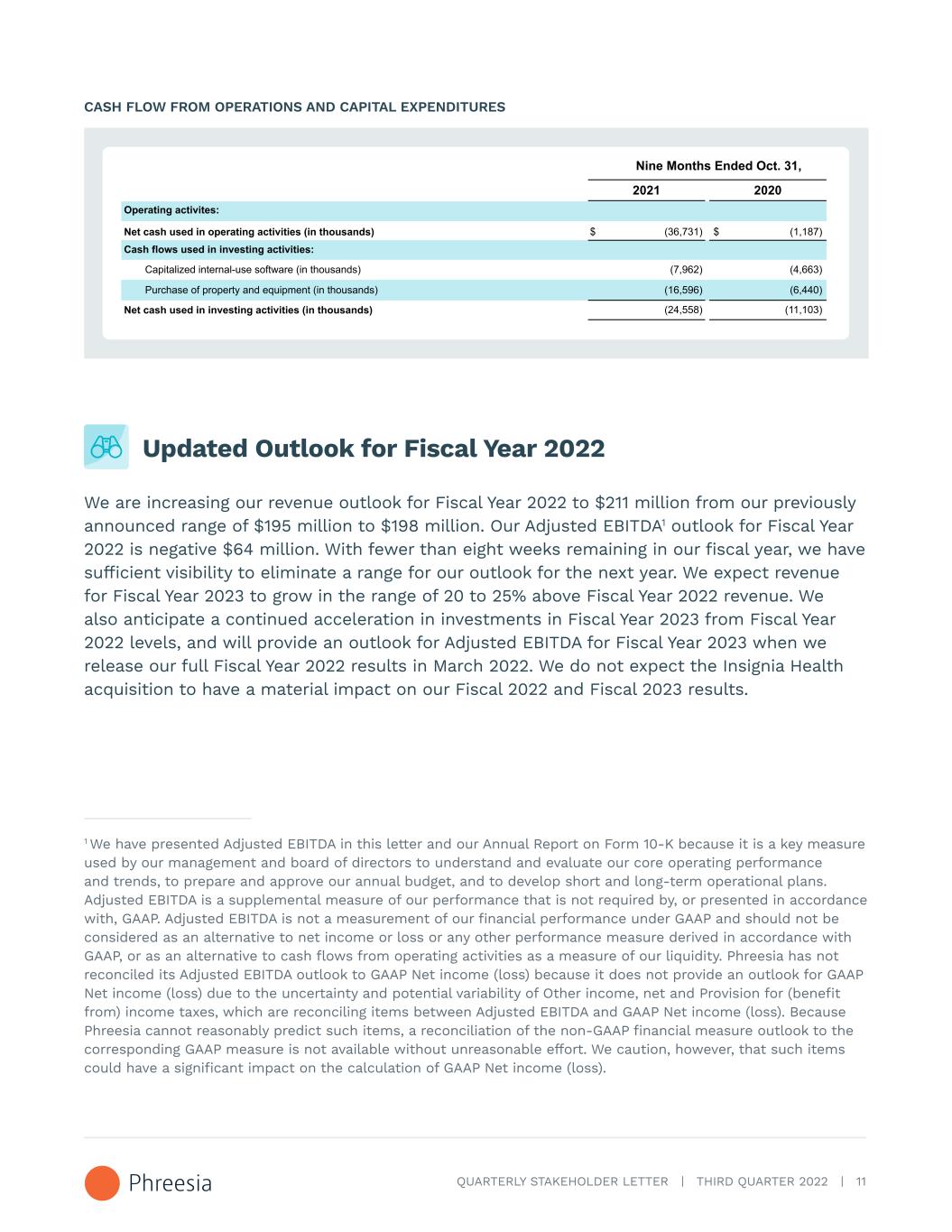

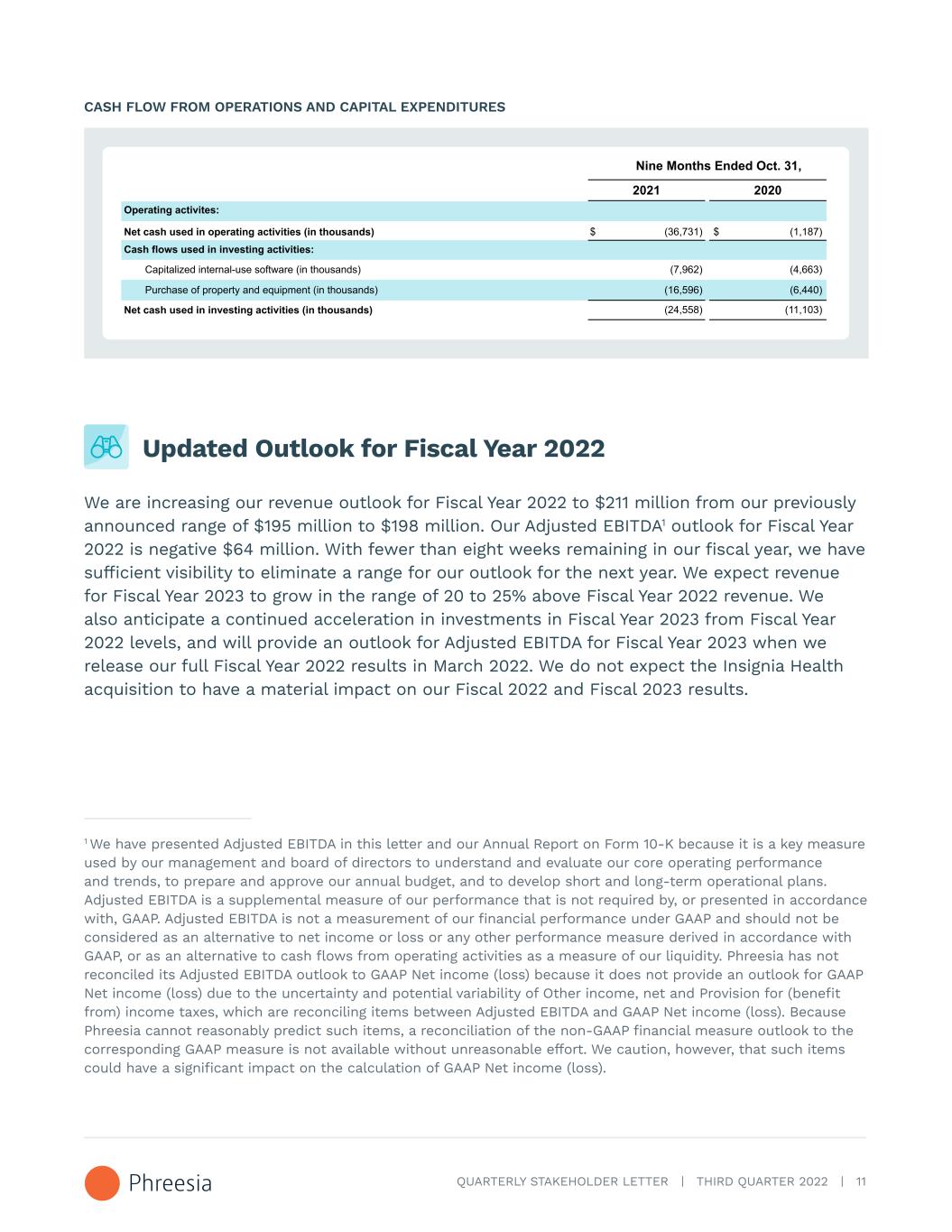

QUARTERLY STAKEHOLDER LETTER | THIRD QUARTER 2022 | 10 Addition of Insignia Health, LLC to Phreesia On December 3, Phreesia entered into an agreement to acquire Insignia Health, LLC, a founder-led and mission-oriented company, for $35 million in cash, subject to customary purchase price adjustments. We acquired the company from its founders, the University of Oregon and its other holders of membership interest. We have closely followed Insignia for several years, and long admired the company’s background in academic research and its commitment to improving health outcomes through an extensively validated approach to helping patients become more active and successful managers of their health. Insignia has an exclusive worldwide license for the Patient Activation Measure (PAM®), which was created by a team of researchers at the University of Oregon led by Dr. Judith Hibbard, who has joined Phreesia in an advisory role. PAM is widely known as the gold standard of patient activation measures, supported by more than 700 peer-reviewed studies published in leading healthcare journals over the past 17 years. The research validates that the brief PAM survey can accurately measure a patient’s level of “activation”—their knowledge, skills and confidence for self-management—which correlates to a patient’s current and future health outcomes. PAM results are used to improve risk identification, guide patient support and evaluate impact as a patient-reported outcome measure (PROM). PAM is the only measure of patient activation to receive an endorsement by the National Quality Forum (NQF), and the only one to be utilized by the U.S. Centers for Medicare and Medicaid Services (CMS) and the U.K.’s National Health Service (NHS) beginning in 2019 and 2017, respectively. Since its founding, Phreesia has put tools in the hands of patients because we believe all patients want the opportunity to participate in their care. Our commitment to driving high rates of self-service utilization has made us experts in reaching the vast majority of patients where they are, leading to better overall experience, data and outcomes. With PAM and related activation-based coaching and patient education solutions, Insignia brings to Phreesia a proprietary and universally accepted model that will enable us to understand and engage patients in more personalized ways based on their level of activation. We believe that this acquisition is a natural extension of our core strengths and aligns with our mission to create a better, more engaging healthcare experience. Cash Flow In addition to income statement line items, we are increasingly investing in property and equipment purchases such as data-center equipment and capitalized software that support our ongoing growth and product expansion.

QUARTERLY STAKEHOLDER LETTER | THIRD QUARTER 2022 | 11 CASH FLOW FROM OPERATIONS AND CAPITAL EXPENDITURES Updated Outlook for Fiscal Year 2022 We are increasing our revenue outlook for Fiscal Year 2022 to $211 million from our previously announced range of $195 million to $198 million. Our Adjusted EBITDA1 outlook for Fiscal Year 2022 is negative $64 million. With fewer than eight weeks remaining in our fiscal year, we have sufficient visibility to eliminate a range for our outlook for the next year. We expect revenue for Fiscal Year 2023 to grow in the range of 20 to 25% above Fiscal Year 2022 revenue. We also anticipate a continued acceleration in investments in Fiscal Year 2023 from Fiscal Year 2022 levels, and will provide an outlook for Adjusted EBITDA for Fiscal Year 2023 when we release our full Fiscal Year 2022 results in March 2022. We do not expect the Insignia Health acquisition to have a material impact on our Fiscal 2022 and Fiscal 2023 results. 1 We have presented Adjusted EBITDA in this letter and our Annual Report on Form 10-K because it is a key measure used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget, and to develop short and long-term operational plans. Adjusted EBITDA is a supplemental measure of our performance that is not required by, or presented in accordance with, GAAP. Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net income or loss or any other performance measure derived in accordance with GAAP, or as an alternative to cash flows from operating activities as a measure of our liquidity. Phreesia has not reconciled its Adjusted EBITDA outlook to GAAP Net income (loss) because it does not provide an outlook for GAAP Net income (loss) due to the uncertainty and potential variability of Other income, net and Provision for (benefit from) income taxes, which are reconciling items between Adjusted EBITDA and GAAP Net income (loss). Because Phreesia cannot reasonably predict such items, a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure is not available without unreasonable effort. We caution, however, that such items could have a significant impact on the calculation of GAAP Net income (loss).

QUARTERLY STAKEHOLDER LETTER | THIRD QUARTER 2022 | 12 Forward Looking Statements This stakeholder letter includes express or implied statements that are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. Forward-looking statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance and may contain projections of our future results of operations or of our financial information or state other forward-looking information. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Although we believe that the expectations reflected in these forward- looking statements are reasonable, these statements relate to future events or our future operational or financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control, including, without limitation, statements about our future financial performance, including our revenue, cash flows, costs of revenue and operating expenses; our anticipated growth; our predictions about our industry; the impact of the COVID-19 pandemic on our business; our ability to attract, retain and cross-sell to healthcare provider clients and our ability to realize the intended benefits of our acquisitions. The forward-looking statements contained in this letter are also subject to other risks and uncertainties, including those more fully described in our filings with the Securities and Exchange Commission (“SEC”), including in our Annual Report on Form 10-K for the fiscal year ended January 31, 2021, and in our Quarterly Report on Form 10-Q that will be filed with the SEC following this letter. The forward-looking statements in this letter speak only as of the date on which the statements are made. We undertake no obligation to update, and expressly disclaim the obligation to update, any forward-looking statements made in this letter to reflect events or circumstances after the date of this letter or to reflect new information or the occurrence of unanticipated events, except as required by law.

QUARTERLY STAKEHOLDER LETTER | THIRD QUARTER 2022 | 13 About Phreesia Phreesia gives healthcare organizations a suite of robust applications to manage the patient intake process. Our innovative SaaS platform engages patients in their healthcare and provides a modern, convenient experience, while enabling our clients to enhance clinical care and drive efficiency. INVESTOR RELATIONS CONTACT: Balaji Gandhi, investors@phreesia.com MEDIA CONTACT: Annie Harris, aharris@phreesia.com