information, our Chief Executive Officer and/or our legal counsel will assess whether the proposed transaction is a Related Person Transaction for purposes of the Related Person Transaction Policy. If it is determined that such transaction is a Related Person Transaction, such transaction is submitted to the Audit and Disclosure Committee for consideration at the next Audit and Disclosure Committee meeting, or, if waiting until the next Audit and Disclosure Committee meeting is determined not to be practicable, to the Audit and Disclosure Committee Chair. The Audit and Disclosure Committee or Audit and Disclosure Committee Chair, as applicable, considers all relevant facts and circumstances concerning the proposed Related Person Transaction and, following such consideration, determines whether to approve the proposed Related Party Transaction.

Trustmark Enterprises, Inc. (formerly known as Alloy Enterprises, Inc.)

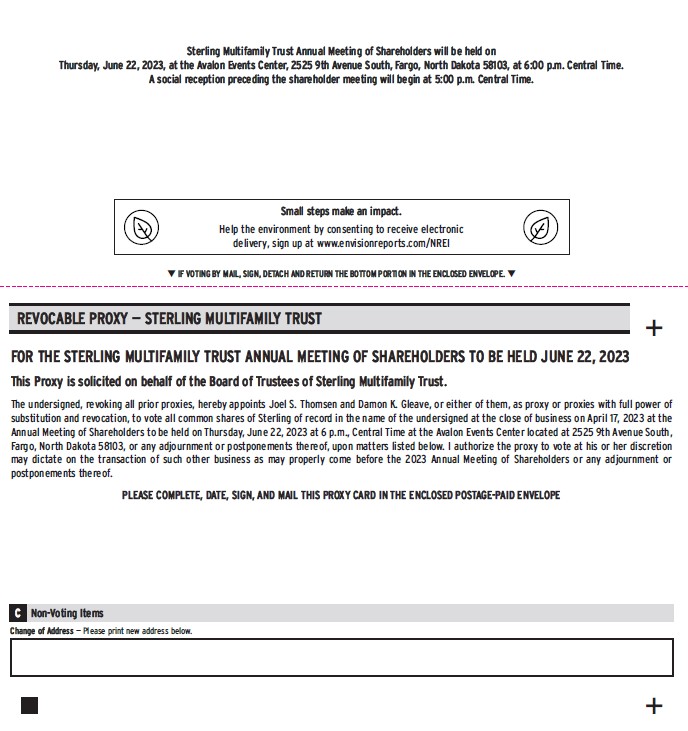

Effective January 1, 2021, Alloy Enterprises, Inc. was formed to act as the holding company for Sterling Management, LLC and GOLDMARK Property Management, Inc. (Effective April 19, 2022, Alloy Enterprises Inc. was renamed Trustmark Enterprises, Inc.) In connection with this restructuring transaction, the owners of Trustmark Enterprises, Inc. indirectly own Sterling Management, LLC and GOLDMARK Property Management, Inc. Trustmark Enterprises, Inc. is owned in part by the Trust’s Chief Executive Officer and Trustee Mr. Kenneth P. Regan (30.0%), by Trustee Mr. James S. Wieland (25.0%), by President and Chief Investment Officer Joel S. Thomsen (18.5%), by Chief Financial Officer and Treasurer Damon K. Gleave (1.0%) and by General Counsel and Secretary Michael P. Carlson (1.0%). In addition, Mr. Regan serves as the Executive Chairman, Chief Executive Officer and President of the Advisor, Mr. Thomsen serves as the Chief Investment Officer of the Advisor, Mr. Gleave serves as the Chief Financial Officer and Treasurer of the Advisor and Mr. Carlson serves as the General Counsel and Secretary of the Advisor. Messrs. Regan, Wieland, Thomsen, Gleave and Carlson also serve on the Board of Governors of both the Advisor and GOLDMARK Property Management, Inc.

Advisor

Sterling Management, LLC, is a North Dakota limited liability company formed in November 2002. The Advisor is responsible for managing day-to-day affairs, overseeing capital projects, and identifying, acquiring, and disposing investments on behalf of the Trust. The independent members of the Board unanimously approved the Advisory Agreement for 2024.

During 2022, the Advisor earned $3,683,000 in advisory management fees, $1,321,000 in acquisition fees, $703,000 in disposition fees, $83,000 in financing fees, and $450,000 in project management fees. In addition, during 2022, the Advisor was reimbursed for operating costs such as travel, legal and office supplies totaling $8,000. During 2021, the Advisor earned $3,348,000 in advisory management fees, $375,000 in acquisition fees, $146,000 in disposition fees, $224,000 in financing fees, and $572,000 in project management fees. In addition, during 2021, the Advisor was reimbursed for operating costs such as travel, legal and office supplies totaling $29,000.

Property Management Fees

GOLDMARK Property Management, Inc., is a North Dakota corporation formed in 1981. GOLDMARK Property Management, Inc. performs property management services for the Trust, acting as the Trust’s primary property manager. Under this agreement, we have agreed to pay GOLDMARK Property Management, Inc. a property management fee of 5% of the monthly gross income from such properties managed. During 2022 and 2021, we paid GOLDMARK Property Management, Inc. $13,833,000 and $12,836,000 in property management fees, respectively. In addition, we paid repair and maintenance related payroll and payroll related expenses to GOLDMARK Property Management, Inc. totaling $7,744,000 and $6,536,000, respectively.