- EVO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Evotec SE (EVO) 6-KCurrent report (foreign)

Filed: 3 Jul 08, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the Month of July 2008

Evotec Aktiengesellschaft

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34041

Evotec AG

Schnackenburgallee 114

22525 Hamburg

Germany

(49-40) 56-0810

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ¨

DOCUMENTS FURNISHED AS PART OF THIS FORM 6-K

See the Exhibit Index to this Form 6-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Evotec AG | ||

| By: | /s/ Klaus Maleck | |

| Klaus Maleck | ||

| Chief Financial Officer | ||

Date: July 3, 2008

EXHIBIT INDEX

Exhibit Number | Description | |

| 99.1 | Evotec AG Annual Report 2007 | |

Exhibit 99.1

Condensed Key Figures Evotec AG (IFRS)

| 2006 | 2007 | D07/06 in% | ||||||||||

| restated | ||||||||||||

Continuing Operations1) | ||||||||||||

Results: | ||||||||||||

Revenues | T | € | 40,575 | 32,885 | (19 | ) | ||||||

R&D expenses | T | € | 30,307 | 36,938 | 22 | |||||||

Operating result2) | T | € | (31,853 | ) | (46,980 | ) | (47 | ) | ||||

Net income (loss) | T | € | (29,000 | ) | (48,053 | ) | (66 | ) | ||||

Personnel data: | ||||||||||||

Employees as of 31/12 | 358 | 386 | 8 | |||||||||

Per share: | ||||||||||||

Result | € | (0.44 | ) | (0.67 | ) | (52 | ) | |||||

Total Operations | ||||||||||||

Balance sheet data: | ||||||||||||

Total stockholders’ equity | T | € | 168,320 | 170,553 | 1 | |||||||

Capital expenditure3) | T | € | 4,914 | 4,349 | (11 | ) | ||||||

Cash and investments | T | € | 78,723 | 93,676 | 19 | |||||||

Balance sheet total4) | T | € | 243,123 | 207,878 | (14 | ) | ||||||

Cash flow | T | € | 22,425 | (11,374 | ) | (151 | ) |

1) | Excluding contributions from Evotec Technologies and from the Chemical Development Business. |

2) | Before amortization and impairment. |

3) | Cash relevant purchase of tangible and intangible assets, excluding finance leases. |

4) | Including assets held for sale. |

In 2007, Evotec made significant steps in its transformation to become a focused developer of novel Pharmaceuticals. The progress in our clinical pipeline, the divestiture of the Company’s non-core businesses for cash and the acquisition of Renovis, Inc. represented major achievements in the implementation of our strategy developed several years ago.

Today, we have a broad and robust pipeline of drug candidates focused on CNS diseases, including inflammation and pain, a streamlined, focused set of drug discovery and development capabilities, a global organization, and strong financial resources to secure the development of our programs over several years.

We have the appropriate skills and resources to drive clinical compounds to proof-of-concept and to partner these assets with big pharma. And we have created an organization that can drive proprietary compounds into the clinic. The depth and breadth of our pipeline increases the chances of one or more products being successfully introduced to the market.

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

Content

| 04 | To Our Shareholders | |

| 08 | Our Strategy | |

| 14 | Our Pipeline | |

| 24 | Our Collaborations | |

| 31 | The Evotec Stock | |

| 36 | Corporate Governance | |

| 40 | Supervisory Board Report | |

| 42 | Senior Management | |

| 43 | Glossary | |

| 44 | Financial Calendar and Imprint | |

| Key Figures | ||

| Insert: Management Report and | ||

| Consolidated Financial Statements | ||

Our Strategy

Building a Global Pharmaceutical Company

The recently completed merger with Renovis is a transforming event. By adding complementary expertise, an advanced preclinical pipeline and a center of excellence in the Bay Area in the United States, we are now a global organization. > page 08

Management Report

Strong Pro-Forma Year-End Cash Position of € 141 m

Our cash and investments post-merger provide adequate funding through 2010. By the end of 2009, we expect to have 6 compounds in clinical development, 3 of which should have proof-of-concept data to attract partners. > insert

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

To Our Shareholders

The activities of 2007 significantly advanced Evotec’s transition to a focused drug discovery and development company. Today, Evotec has a broad and robust pipeline focused on CNS diseases, including inflammation and pain. Based on our core competencies in each of these areas, we can strike and deliver on deals leading to ongoing revenue streams and success-based future payments. Advances in our clinical pipeline, the acquisition of Renovis, Inc., a San Francisco-based biotechnology company, and the divestiture of the Company’s non-core businesses, represented major milestones towards our strategic goal we set several years ago, namely to enhance shareholder value by becoming a focused developer of new drugs.

| Today, we are appropriately resourced to progress clinical compounds to proof-of-concept and to partner these assets with big pharma. Equally as important, we have created an organization that can drive proprietary compounds into the clinic. As Evotec enters 2008, we do so with a streamlined, focused set of drug discovery and development capabilities, a balanced R&D pipeline with three clinical candidates, a global organization, and strong financial resources.

Highlights of 2007

Divestitures of Non-Core Assets

Over the past three years we have transformed Evotec into a focused discovery and development company. Following a strategic plan developed in 2005, we divested non-core research services and our discovery instruments business. Today, our Company comprises a highly productive discovery and development engine, strong expertise in CNS and a broad pipeline of products to help cure important diseases associated with the central nervous system (CNS).

In 2007, we completed the sale of our 89% interest in Evotec Technologies to PerkinElmer and our Chemical Development Business to Aptuit. In addition, we contributed our chemical library business to a joint venture with Indian RSIL as price became the key competitive factor in this business. We have retained all of the capabilities that we deem critical to the value creation process in our pipeline, both for proprietary |

| 31 | Evotec Stock | 36 | Corporate Governance | 40 | Supervisory Board Report | 04 | 05 |

development as well as for high value partnerships. We have taken this step because we believe that future revenues will mainly come in the form of licensing revenues, milestones and royalties.

The Acquisition of Renovis

In September 2007, Evotec agreed to acquire Renovis, a bio-pharmaceutical company focused on the discovery and development of treatments for pain and inflammatory diseases, in a stock-for-stock transaction, which closed in early May 2008. While the divestitures of assets gave us focus, combining with Renovis gives us several late-stage preclinical candidates, complementary skills, expertise, research assets and cash and investments of $79.4 m as of December 31, 2007 – it adds critical mass in a focused way.

Progress in the Clinic

Evotec’s most advanced product candidate is EVT 201. From two Phase II proof-of-concept studies, first in patients with primary insomnia and later in elderly insomnia patients, we have begun to see evidence that EVT 201’s mode of action may address key limitations of current insomnia treatment regimens. EVT 201 has demonstrated that it has potential to be a “best-in-class” therapy with robust effects on sleep onset and sleep maintenance throughout the night, including the later hours, showing minimal evidence of residual sedation and a strong effect on perceived sleep quality the day after. In addition, one clinical study has provided strong evidence that treatment of primary insomnia in elderly patients with daytime sleepiness results in a clinically significant reduction in the tendency to fall asleep the following day. The preclinical pharmacology of EVT 201 as a Partial Positive Allosteric Modulator (pPAM) suggests that EVT 201 will have a greater safety profile than full agonists in humans, which is supported by the excellent safety and tolerability clinical data obtained to date, and with a lower potential to produce pharmacological tolerance in humans. We are now actively seeking a suitable partner to move the compound into Phase III and to the market.

Evotec’s second most advanced product, EVT 302, is being developed for smoking cessation and potentially, at a later stage, for the treatment of Alzheimer’s disease (AD). Phase I safety data presented in early 2008 confirmed that the drug was well tolerated up to the highest dose levels examined, and PET imaging studies confirmed that these doses exceeded those needed to completely inhibit brain MAO-B activity. By confirming the compound’s safety and tolerability in healthy volunteers in 2007, we laid the foundation for moving forward to Phase II trials which started in February 2008. The compound’s preclinical and clinical profile supports the potential for an improved safety profile over other MAO-B inhibitors, along with better tolerability over current treatments and the elimination of food restrictions. Its compelling pharmacokinetic profile suggests an opportunity for once-a-week dosing at low exposure levels, which could translate into a significant product advantage for individuals trying to quit smoking. A new therapy that can improve cessation success rates could significantly expand and penetrate a market which today is estimated in excess of $2 billion annually.

Evotec’s third clinical compound has successfully completed a Phase I safety and tolerability study. EVT 101 is being evaluated for the treatment of pain and as a therapy for Alzheimer’s disease. In both indications, the market opportunities are large and expected to grow rapidly when potential new therapies, like Evotec’s, successfully address key limitations of existing marketed products. To advance this product, in 2007 we began conducting a series of shorter-term studies to show early signs of CNS activity and to determine the potential therapeutic doses. Data from these studies, reported and expected in the first half of 2008, will help us determine the clinical development path forward as well as profile the market opportunities we can pursue with potential pharma partners. Our brain imaging study completed in March 2008 provided first evidence of an effect on the human brain and revealed encouraging signals of potential activity in both Alzheimer’s disease and pain.

Advanced Preclinical Pipeline from Renovis

Renovis’ innovative preclinical pipeline fills a gap between Evotec’s three clinical programs and its portfolio of early discovery programs. Of the three more advanced Renovis programs, two are expected to enter the clinic in 2008.

One of these focuses on VR1 antagonists as potential pain therapies and is partnered with Pfizer. The success of this

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

program alone would position Evotec to receive potential milestone payments of more than $170 m and double-digit royalties on worldwide net sales of successfully commercialized products.

Renovis’ second program is also slated to enter clinical development in 2008. This program revolves around antagonists of selected purinergic receptors with potential in a broad spectrum of pain and inflammatory conditions.

Finally, Renovis has an earlier program in other potential pain indications and overactive bladder that is based on a target that had previously provided historical challenges in drug development. Based on the promising lead series identified, Renovis expects to produce candidates for entry into the clinic in 2009.

A Differentiated Preclinical and Discovery Portfolio

The most advanced of Evotec’s preclinical programs is a follow-up compound to EVT 101, known as EVT 103. Currently in IND-enabling studies, it has the potential to advance to the clinic as soon as budget allows. Behind it are several discovery programs, all of which have potential in CNS indications and leverage the small molecule expertise resident at Evotec. These programs provide a source not only for fueling our proprietary pipeline but also the basis upon which we can partner with other biotechnology companies as well as big pharma.

Financial Strength

Clearly, we now have a company with CNS capabilities that ranks among the best in our industry. In 2008, we have the opportunity to demonstrate our ability to drive preclinical compounds to the clinic and to continue to advance our clinical programs. All of this would not be possible without a strong financial foundation.

The successful execution of our transformation strategy and the combination of Evotec and Renovis significantly strengthened our balance sheet. Over the past 18 months, disposals and the acquisition of Neuro3d have led to a total increase of available funds of approximately € 83 m so that the pro-forma 2007 year-end liquidity position after anticipated transaction costs amounted to € 141 m. We expect that the combined Company’s liquidity and future payments anticipated from our research collaborations will be sufficient to fund operating requirements at least through 2010.

Year-End Financial Report

For the year-end 2007, Evotec reported € 32.9 m in revenues and € 93.7 m in liquidity. These results were in line with the financial guidance communicated in September following the announcement of the sale of our Chemical Development Business to Aptuit. We are pleased with our revenue performance, considering milestone payment delays, the transfer of the library business into a JV in India and exchange rate fluctuations. It is important to note that revenue generation from assay development, screening, and discovery chemistry services performed strongly, as we expect to leverage these differentiated capabilities in future collaborations with downstream, longer-term milestones and royalties.

Evotec reported a higher operating loss mainly due to increased R&D investment, lower gross profit and an impairment charge related to its 2000 acquisition of Oxford Asymmetry International. The impairment charge is mainly a consequence of using the chemistry asset base increasingly for internal projects and less so for third-party business. Perhaps most significant is the 22% increase in R&D expenditures reported for 2007. This increase is primarily due to two factors: creating greater value in pipeline programs; and driving advanced discovery assets into the development pipeline and converting them to valuable development programs. Finally, SG&A expenses increased by 19%, mainly related to corporate transactions, including the cost related to the US registration statement that was required to consumate the Renovis merger, a NASDAQ listing, as well as increased investment in business development and licensing activities. At the bottom line, Evotec’s net loss increased to € 48.1 m compared to € 29.0 m in 2006, with positive impacts from deferred tax benefits, interest income and foreign exchange gains.

We are stronger today than we have been before. We are transformed, but we have built in a focused and strategic way on the heritage that has brought us success in the past. We are now a global organization. We have a footprint of scientific leadership not only in Europe, but also in the Bay Area’s biotech corridor – a center for innovation in the life sciences. We have critical mass that we believe provides a foundation

| 31 | Evotec Stock | 36 | Corporate Governance | 40 | Supervisory Board Report | 06 | 07 |

for success in both bringing products to the market, and equally important, in discovering products that have the potential for changing the practice of medicine.

Only with the support of our shareholders could all of this have been achieved. We thank our shareholders, partners and employees and look forward to transforming our vision for Evotec into reality.

Jörn Aldag

President & Chief Executive Officer

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

Three Clinical Candidates

Our clinical candidates are expected to advance and produce news flow that will increase the likelihood of accomplishing our partnering goals and enhance the value of Evotec as an investment.

Robust Preclinical Pipeline

Our post-merger pipeline represents a diversity of indications and clinical opportunities coupled with a productive research platform for pursuit by partners and for proprietary programs.

US Footprint

In addition to our powerful science operations in the UK and in Germany, Renovis adds a US footprint and additional core competencies in ion channels, medicinal chemistry and pharmacology.

NASDAQ Liquidity

Through our new listing on the NASDAQ Global Market in the form of ADSs, we anticipate that we will have enhanced access to the US capital markets. We believe that this will expand the liquidity of our investors’ stockholdings and provide more diverse and cost-effective financial resources.

| 31 | Evotec Stock | 36 | Corporate Governance | 40 | Supervisory Board Report | 10 | 11 |

“By merging Evotec and Renovis, we have formed an emerging pharmaceutical company with world-class discovery, a strong, balanced pipeline and significant pharmaceutical research partnerships that provide an ongoing revenue stream.” Jörn Aldag

An Emerging Pharmaceutical Company

Our recent divestitures and the merger with Renovis represented key elements of a strategic corporate development plan. The merger accomplishes a number of important objectives: it gives Evotec what could be considered one of the strongest CNS related pipelines in the biotech industry, adding complementary drug hunting expertise and critical mass in a focused way; enhances the likelihood of our pipeline’s success; and provides greater visibility in the US capital markets. With a newly balanced and enriched pipeline of three clinical programs, four advanced preclinical programs and a host of discovery projects, Evotec has emerged as a leader in drug discovery and development, not only in CNS but also in pain and in inflammation. The pharmaceutical industry today is under pressure; patent expirations will lead to a substantial loss of revenues and force pharma companies to identify new products that can drive earnings growth. Our strategy of developing clinical products through Phase II proof-of-concept directly addresses the interests of big pharma. If we can generate a product profile that will provide “fill” for internal pipeline gaps, we will be successful in attracting new partners. Backed by an industrialized platform of state-of-the-art drug discovery technologies and capabilities, we have built an engine that in a dependable and sustainable way can drive compounds through development as well as bring new compounds from discovery to the clinic.

The Strategic Transformation

Successfully leveraging advanced technologies – initially, for collaborations but more recently, also for proprietary purposes – is the essence of Evotec’s heritage. In an effort that began several years ago, we have successfully retained assets most valuable for drug discovery and deployed them in such a way as to both meet customer needs and fuel a portfolio of diverse yet focused clinical, preclinical and discovery programs. Central to the transformation was a series of divestitures of non-core assets, two of which were completed in 2007. We sold our interest in our instrument business Evotec Technologies GmbH to PerkinElmer for € 23.9 m, and completed the sale of our Chemical Development Business to Aptuit, Inc. for a net purchase price of £30.3 m (approximately € 42.5 m). Equally integral to the plan is the completed strategic merger with Renovis. Renovis’ expertise along with its late-stage preclinical assets and financial resources complements our internal resources and strengths. Our Management and Supervisory Boards believed that the fit was excellent, and that the combined company would advance Evotec’s scientific leadership in the area of small molecule drugs, especially in CNS indications. Our 400+ employee base in the UK, in Germany, and now in the Bay Area in the US presents an integrated discovery-through-development set of capabilities in core competencies that span assay development, screening, medicinal chemistry, fragment-based drug discovery and pharmacology. In summary, drug discovery leadership across the CNS spectrum is now the foundation from which a broad and deep pipeline of opportunity will regularly emanate. Finally, access to the US capital market through our new listing on the NASDAQ Global Market is expected to provide the Company more diverse and cost-effective financial resources and expand the liquidity of our investors’ stockholdings.

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

Spinning Off Non-Core Assets

January 2007

Evotec Technologies Divesture, Transaction Value € 24 million

Effective January 1, 2007, Evotec sold its 89% interest in Evotec Technologies GmbH (ET, Evotec’s former Tools and Technologies Division) to PerkinElmer for € 23.9 m. Evotec Technologies accounted for € 17.3 m, or 20.5%, of Evotec’s total revenue for the fiscal year 2006. ET was not consolidated in the results of the 2007 fiscal year.

October 2007

Library Synthesis Business Joint Venture with RSIL, Holding 49%

In 2007, according to Evotec’s strategy to focus its capabilities on high value-added research, the Company transferred its library business to India. In a JV with Research Support International Limited (RSIL), Evotec-RSIL Ltd. offers the design, synthesis, management and commercialization of compound libraries at competitive prices for customers. In 2006, the library business generated revenues of € 6.6 m.

November 2007

Chemical Development Business Divesture, Transaction Value € 43 million

On November 30, 2007, Evotec completed the sale of its Chemical Development Business (CPD) to Aptuit, Inc. for a net purchase price of £30.3 m (approx. € 43 m). This business represented Evotec’s fee-for-service activities in the development and manufacture of drug compounds and formulations. CPD accounted for € 21.5 m, or 39.5%, of Evotec’s total 2007 revenue. The business was not consolidated in the Evotec Group accounts after November 30, 2007.

Strong Cash Position to Fuel Pipeline Progression

Besides building a strong proprietary pipeline, the combination with Renovis significantly adds to our liquidity position. At the time of the merger announcement, Renovis had $86 m in cash – sufficient to fund the development of their programs through to value-enhancing milestones. In addition, by successfully executing on our transformation strategy, we have secured significant further liquidity. In total, disposals and the acquisition of Neuro3d have led to an increase of available funds of approximately € 83 m and a pro-forma year-end liquidity position of € 141 m. On this basis, we believe that our liquidity and future payments expected from our research collaborations will be sufficient to fund our anticipated operating requirements through 2010.

Three Clinical Candidates and Strong Late-Stage Preclinical Pipeline

With the acquisition of Renovis, our pipeline now represents a diversity of indications and clinical opportunities coupled with a productive research platform for pursuit by partners and on a proprietary basis. The most advanced of our three clinical programs is EVT 201, positioned for ongoing partnership discussions as it appears to have a potentially superior profile than competitive approved therapies. Our second most advanced product, EVT 101, is being evaluated for the treatment of pain and as a therapy for Alzheimer’s disease. To advance this product, a series of shorter-term studies will help determine the therapeutic dose and establish early proof-of-concept. In both indications, the market opportunities are large and growing. Our third clinical compound, EVT 302, is being studied for smoking cessation and potentially, over the long term, for the treatment of Alzheimer’s disease. By confirming the compound’s safety and tolerability in 2007, we laid a foundation for moving forward to Phase II proof-of-concept trials which started in February 2008. The compound’s profile suggests an improved safety profile and better tolerability vs. marketed products. Furthermore, there may well be an opportunity to eliminate food restrictions, and dose once-a-week at low exposure levels – both of which could translate into important advantages for individuals trying to quit smoking. Finally, the innovative late-stage

| 31 | Evotec Stock | 36 | Corporate Governance | 40 | Supervisory Board Report | 12 | 13 |

preclinical pipeline acquired as part of the Renovis merger adds additional clinical opportunities. With Renovis, Evotec adds multiple programs for the treatment of pain and inflammatory conditions, two of which are expected to progress into Phase | clinical trials in 2008. The most advanced of these focuses on VR1 antagonists as potential pain therapies and is partnered with Pfizer. The success of this program alone positions Evotec to receive potential milestone payments of more than $170 m and double-digit royalties on world-wide net sales of successfully commercialized products. Renovis’ second program revolves around antagonists of selected purinergic receptors, with potential in a broad spectrum of pain and inflammatory conditions. In addition, Renovis has an earlier program in other potential pain indications and over-active bladder that is based on a set of targets that have provided historical challenges in drug development. That program is expected to produce clinical candidates in 2009.

Multiple Partners Generating Collaborative Revenues

In addition to product candidates in our proprietary CNS pipeline, we have high-value research collaborations with partners, including among others, Boehringer Ingelheim, CHDI, Ono and Roche. For many years Evotec has generated an ongoing revenue stream for research services provided to many of the world’s top pharmaceutical leaders. The success of these partnerships and the more recent transitioning to new collaborative deal structures will allow Evotec to participate in the success of pharma’s new products, to generate a new source of revenue, and to continue to work with companies that are developing breakthroughs that will lead to improvements in global health. Additionally, in our partnerships with Pfizer and with Boehringer Ingelheim, we have the opportunity to receive more near-term cash payments based on the successful achievement of milestone events, such as starting lead optimization, identifying preclinical development candidates or entering a new drug candidate into clinical development. For example, if addition clinical candidates in the VR1 program are selected, the event will generate a milestone payment by our collaborator, Pfizer, to Evotec. To date, this partnership has generated over $6 m in milestone payments and approximately $20 m in license fees and research funding. As is typical in pharma partnerships, milestones increase as products advance toward regulatory approval and commercialization and prior to the payment of royalties on product sales. Finally, we have a significant opportunity to bolster near-, mid- and long-term cash based on new partnerships. In 2008, we are working toward concluding the partnership of EVT 201, our insomnia candidate drug. Ideally, this would have the effect of reducing clinical expenses related to the product as well as providing a cash down-payment, shared or reimbursed ongoing clinical expenses, milestones prior to product launch and royalties on commercialized product sales.

The innovative preclinical pipeline acquired as part of the Renovis merger fills a gap between Evotec’s three clinical programs and its portfolio of innovative but early discovery programs.

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

Our mission is to discover and develop drugs that will address central nervous system diseases. Following the merger with Renovis, Evotec has a diverse pipeline in neurology, pain and inflammation with strong clinical opportunities.

04 | To Our Shareholders 08 | Our Strategy 14 | Our Pipeline 24 | Our Collaborations

Gaining Pipeline Momentum

Discovery | Preclinical Development | |||

EVT 201 Insomnia GABAA receptor partial positive allosteric modulator | ||||

EVT 302 Smoking cessation MAO-B inhibitor | ||||

EVT 101 Alzheimer’s disease | pain NMDA NR2B subtype selective antagonist, oral | ||||

EVT 103 NMDA NR2B subtype selective antagonist, oral | ||||

| VR1* antagonist program | ||||

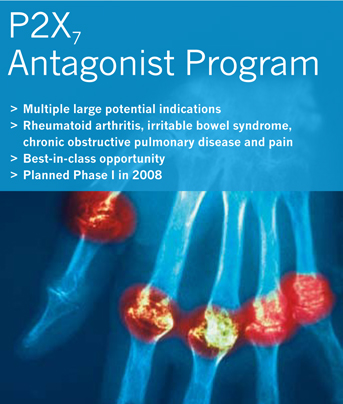

| P2X7* antagonist program | ||||

| P2X3* and P2X2/3* antagonist program | ||||

| FAAH* inhibitor program | ||||

Boehringer Ingelheim collaboration | ||||

| Histamine H3 program | ||||

| B1 program | ||||

| Roche collaboration | Discovery Phase of drug discovery from target identification to the search for and optimization of chemical compounds with desired properties. | Preclinical Development Regulatory studies required prior to clinical trials. | ||

| HTS &FBDD | ||||

| * | Renovis preclinical candidates |

| 31 | Evotec Stock | 36 | Corporate Governance | 40 | Supervisory Board Report | 16 | 17 |

| Phase I | Phase II | Phase III | ||

| Clinical Pipeline | ||||

| Preclinical Pipeline | ||||

Innovative Preclinical Drug Candidates of Renovis Complement Evotec’s Pipeline | ||||

| Clinical Phase I | Clinical Phase II | Clinical Phase III | ||

| Clinical trial conducted in a small number of healthy volunteers, used to determine pharmacokinetics, preferred route of administration, and safe dosage range of a drug. | Phase II trials are performed on patients and are designed to assess the clinical efficacy of the therapy. In addition, the assessment of safety continues in a larger group. | Clinical trial involving a larger number of patients, designed to assess safety, effectiveness and optimum dosage of a drug as administered in a treatment setting. | ||

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

EVT 201 Insomnia Candidate Profile

Unique Approach: Partial Positive Allosteric Modulator (pPAM) of GABAA Receptors

EVT 201 acts on the gold standard GABAA receptor, but, unlike any currently available sleep drug, it only partially activates the receptor.

Other Appoaches

GABAA full agonists, Melatonin agonists, 5HT2A, Orexin antagonists, others

Suggested Advantages

The combination of pPAM mechanism of action and ideal half life shows strong potential to become a leading insomnia therapy.

| • | High affinity for a1 receptor and ideal half life of 3.5 hours: Strong efficacy profile with optimal integration of sleep onset, maintenance and minimal residual effects |

| • | Only minimal difference of pharmacokinetics between elderly and adults: The same doses are expected to be used for all individuals across all age groups. |

| • | Reduced daytime sleepiness in elderly patients |

| • | pPAM pharmacology with minimal variability of receptor potentiation at therapeutic doses and limited potentiation even at high doses: Strong potential for superior safety profile |

Best-in-class potential on efficacy & safety for young and elderly patients

Status

Proof-of-concept (Phase II) established

Next Step

Partnering for further development and marketing

Market Potential

Peak sales according to analysts’ estimate > € 500 m EVT 201, Evotec’s most advanced drug candidate, is being developed for the treatment of insomnia. Compared to current sleep aids, the profile of EVT 201 suggests that, combined with an excellent safety profile, it may be superior in terms of maintaining sleep throughout the night and ensuring next day alertness.

There is No Ideal Sleep Drug – Today

While 54% of the US population report insomnia symptoms at least a few nights a week, the National Sleep Foundation in 2005 reported that only 7% use a prescription sleeping aid. Although the public is well aware of the dangers of sleep deprivation – an awareness that has led to the growth of sleep aid prescriptions, many insomniacs go untreated. They fear the side effects of currently marketed products and are dissatisfied with current treatments with regards to efficacy in maintaining sleep throughout the night – a significant unmet medical need, especially in the elderly.

The vast majority of insomnia drugs on the market today (including market leaders) are full agonists of the GABAA receptor. These include the typical benzodiazepines that are effective treatments for insomnia but typically cause hangover effects, have addictive potential and can be dangerous when used in combination with alcohol and other drugs. Therefore, new prescription sleep aids have entered the market that act faster and typically have a shorter half-life allowing the body to excrete them more quickly. However, despite their popularity and market leadership, these drugs have shown variable levels of efficacy. Many have shown a limited ability to improve sleep maintenance. Moreover, some also produce unwanted side effects such as confusion, drowsiness, dependency and withdrawal symptoms.

| 31 | Evotec Stock | 36 | Corporate Governance | 40 | Supervisory Board Report | 18 | 19 |

EVT 201 Has a Unique Profile

EVT 201 also acts on the GABAA receptor, but, unlike any currently available sleep drug, it only partially activates or agonizes the receptor. This means that the amount of potentiation of the GABAA receptor reaches a ceiling that is not exceeded with increased doses of the drug. This represents an important opportunity to reduce the side effects described above. Furthermore, with the data produced by two Phase II proof-of-concept studies in 2007, we expect to see the product’s distinct profile translate into a uniquely differentiated treatment for insomnia in terms of effectively addressing sleep onset and sleep maintenance problems, while leaving the patient refreshed and alert the next day.

Compelling Clinical Data Demonstrating Superior Efficacy

During 2007, two Phase II trials for EVT 201 were conducted in insomnia patients in sleep labs in the United States. Data from a study of primary insomnia patients showed statistically significant results on all primary and secondary efficacy endpoints, in conjunction with a significant improvement in patient-reported sleep variables and sleep quality. Patient satisfaction with therapy is a key element in driving sales in the market place since many prescriptions are written on patient request.

The second Phase II trial in the United States assessed the hypnotic efficacy of the drug candidate in elderly patients with primary insomnia and daytime sleepiness. This study confirmed the strong effects on sleep onset and sleep maintenance seen in the previous study. The data also indicated that the same doses (1.5mg and 2.5mg) have hypnotic efficacy in young and elderly without significant residual effects. In addition, the study showed that patients were significantly less sleepy during the day after one week’s treatment, as determined by a gold standard objective measure called “Multiple Sleep Latency Test” (MSLT).

In summary, the results achieved from both Phase II studies indicate that, if approved, EVT 201 may be the first treatment that helps patients to fall asleep quickly, maintain sleep throughout the night and yet enables them to wake in the morning feeling rested and without residual effects.

Superior Safety Profile

A general concern over current sleep aids is the side effect profile, in particular at doses above the indicated range. Complex sleep behaviors have received particular attention, where patients get out of bed and perform a variety of tasks (eating, driving) with no recollection of the events the following morning. Such events seem, in part, to be associated with misuse of the drug or its combination with alcohol.

EVT 201’s differentiated pharmacology as a partial positive allosteric modulator (pPAM) provides an important safety benefit since the amount of potentiation of the GABAA receptorwhich the drug produces can only reach a certain maximum independent of a further increase in dose of the drug. Clinical experience has demonstrated the safety of even multiples of the therapeutic doses with no serious adverse events. In addition, the pPAM pharmacology results in a superior preclinical profile with potential for lack of tolerance, lack of dependence and no potentiation of the sedative effects of alcohol.

EVT 201 Ready to Partner

The encouraging results of both Phase II proof-of-concept clinical trials position EVT 201 for out-licensing. Our goal is to identify the right partner to conduct Phase III clinical trials and commercialize EVT 201. In exchange for the rights to this compound, we expect to receive not only upfront and milestone payments, but also royalties from the future sale of EVT 201.

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

Smoking Addiction: A Large Consumer-Driven Market

Evotec’s second most-advanced product candidate is EVT 302. This compound is an orally active, selective and reversible inhibitor of MAO-B in development for smoking cessation. In the United States alone, there are more than 45 million smokers, 70% of whom report a desire to quit. In fact, the average smoker makes six to nine attempts to quit during his or her lifetime. Quitting tobacco use is difficult and users often relapse because of withdrawal symptoms, including anxiety, difficulty concentrating and increased appetite. From a global health as well as economic perspective, an effective smoking cessation therapy will address large unmet market needs. Tobacco is the second major cause of death and fourth most common risk factor for disease in the world. If current smoking patterns continue, it will cause some 10 million deaths each year by 2020. In addition to the high public health costs of treating tobacco-caused disease, tobacco users are also generally less productive while they are alive due to increased sickness. The current market for smoking cessation is dominated by nicotine replacement treatments. In addition, there are two prescription therapies currently available.

Compelling Product Advantages

EVT 302’s prolonged MAO-B inhibition offers smokers the potential to better comply with a smoking cessation program through once-a-week dosing. This may be a significant advantage when smokers’ motivation and willpower to quit fluctuates. In addition, EVT 302 has the potential for a superior safety profile as compared to first generation MAO-B inhibitors; to date, the data suggests that it will not interact adversely with foods that contain high amounts of tyramine, and it has better tolerability than current treatments. MAO-B inhibitors, when used as a monotherapy, have demonstrated a quit rate comparable to that of existing therapies. We therefore believe that EVT 302 has a reasonable probability of demonstrating a successful efficacy profile if used as a mono- therapy but, unlike currently marketed drugs, also has the potential to enhance the effect of nicotine replacement therapies when used in combination with EVT 302.

Phase II Data in 2008/2009

By confirming EVT 302’s safety and tolerability in 2007, we laid a foundation for moving forward to Phase II proof-of-concept trials. A Phase II craving study started in February 2008 and a Phase II quit rate study is expected to start in the middle of the year. The studies will read out in the third quarter 2008 and the first half of 2009, respectively. If positive, the data will position the compound for a strategic partnership that includes upfront and milestone payments, as well as royalties from the future sale of EVT 302.

| 31 | Evotec Stock | 36 | Corporate Governance | 40 | Supervisory Board Report | 20 | 21 |

EVT 101: Potential in Alzheimer’s Disease and Pain

Evotec’s third most-advanced product candidate, EVT 101, is a subtype-selective NMDA receptor antagonist that we are evaluating as a therapy for Alzheimer���s disease and for the treatment of pain. In both indications, the market opportunities are large and growing. Preclinical and clinical studies have shown that EVT 101 has excellent drug-like properties, good oral bioavailability andin vivo pharmacokinetics. It has been safe and well tolerated in initial Phase I trials.

First Evidence of Effect upon the Brain in Humans

In 2007, we began conducting a series of shorter-term Phase Ib studies. These studies were designed to show early signs of CNS activity and to determine the potential therapeutic doses. Encouragingly, our brain imaging study, completed in March 2008, provided first evidence of an effect upon the brain in humans and revealed encouraging signals of potential activity in both Alzheimer’s disease and pain.

Phase II to Start in 2008

The clinical strategy for longer-term Phase II trials will depend upon the final results from the Phase Ib trials. A first Phase II study is expected to start in 2008. Through the original licensing agreement, Roche has a right to take this program back at predetermined terms (upfront, milestones and royalties) after proof-of concept is established. In the event Roche does not exercise this option, we intend to seek partnering opportunities for EVT 101 with a pharmaceutical company to conduct Phase III trials and later, manufacture and distribute an approved product.

A follow-up compound to EVT 101, EVT 103, is also in early development. Currently in IND-enabling studies, we believe that it has the potential to advance to the clinic in 2008, should we decide to do so from a strategic perspective.

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

Expanded Partnership with Pfizer, Planned Phase I in 2008

Certain ion channels are known to be key mediators of pain signaling. A specific family of ion channels, known as transient receptor potential (TRP) ion channels, are attractive targets for drug discovery. TRPV1 (VR1 – vanilloid receptor 1) is one specific member that has compelling preclinical validation as a target for the treatment of a number of different pain states. It may be activated by a wide variety of stimuli, including heat greater than 43°C and capsaicin, the active component of chili peppers. Our VR1 program is partnered with Pfizer. In this global alliance, our combined research and development teams are working together to design drugs that block VR1 and prevent it from signaling the sensation of pain. If successful, we expect to have an effective, non-narcotic, non-addictive and non-steroidal analgesic to treat chronic pain, with minimal side effects. We have demonstrated oral analgesic efficacy in multiple preclinical animal models of pain. In addition, given VR1’s role in inflammatory disease pathologies, it may also be possible to develop treatments for non-neurological conditions, such as urinary incontinence, irritable bowel syndrome and asthma.

The VR1 drug discovery program began at Renovis in 2003 and in May 2005 the program was partnered with Pfizer. Progress under the collaboration in 2006 and 2007 triggered total milestone payments to Renovis in excess of $6.0 m. With Pfizer’s extension of the program in 2007, we expect one of these compounds to advance into human clinical trials in 2008. Although the joint research phase officially ends in June 2008, we are eligible to receive total milestone payments of more than $170.0 m and double-digit royalties on worldwide net sales per product successfully developed and commercialized under this collaboration.

| 31 | Evotec Stock | 36 | Corporate Governance | 40 | Supervisory Board Report | 22 | 23 |

Clinical Candidate Identified, Planned Phase I in 2008

Since its inception, Renovis has consistently focused on families of related molecular targets. On acquiring Renovis, its drug discovery portfolio included a late-stage preclinical program to identify and develop antagonists of the purinergic receptor, P2X7. This is a promising molecular target for potential new therapies in the area of inflammation, including diseases such as rheumatoid arthritis (RA) and inflammatory bowel disease (IBD) – both of which represent large markets with urgent needs for safe and effective small molecule therapies.

The P2X7 receptor is a member of a family of ligand-gated ion channels found primarily in cells of the immune systems where it is thought to play a role in inflammatory processes. As it has been shown to initiate the processing and release of the IL-1 family of cytokines it is believed to play a critical role in the inflammation that underlies diseases like RA and IBD and even respiratory diseases such as chronic obstructive pulmonary disease. The goal for this program is the design of best-in-class P2X7 receptor antagonists that are distinguished by their potency, selectivity, pharmacokinetic properties and safety profiles. To date, we have identified and validated novel, orally bioavailable, potent, selective P2X7 antagonists from multiple proprietary chemical series. A candidate has been selected for entry into the clinic, with the expectation that we will initiate human clinical studies during 2008.

First- and Best-in-Class Opportunity

The P2X3 and P2X2/3 receptors are also members of the P2X purinergic receptor family of ligand-gated ion channels. We believe that the P2X3and P2X3 receptors are promising therapeutic targets for major medical needs in the areas of chronic pain and bladder dysfunction. These receptors are present in a restricted subset of primary sensory neurons which transmit pain signals, and preclinical studies examining their function suggest that they may have important roles in pain signaling and bladder function in humans. Studies conducted using small molecule antagonists of P2X3 and P2X 2/3as well as gene knockdown experiments, have demonstrated profound pain relief in multiple preclinical models of chronic inflammatory and neuropathic pain as well as potential in urinary incontinence. Because the industry has struggled to design or identify drug-like ligands that inhibit these receptors, we believe we have an opportunity for a first- and best-in class drug therapy.

We have identified proprietary small molecule antagonists of P2X3 and P2X2/3 and are actively engaged in optimizing drug-like leads to support the selection of a candidate for IND-enabling studies. Based on Renovis’ progress in 2007 and 2008, we expect to commence clinical development of a first-in-class P2X3 antagonist drug candidate in 2009.

Overall, we believe we have a well balanced drug development pipeline addressing therapeutic areas with significant unmet medical needs. The breadth and depth of our pipeline ameliorates the risks inherent in drug development, and, in turn, significantly increases the chances of one or more products being successfully introduced to the market.

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

Research Collaborations are Generating a Consistent Revenue Stream

Synergistic with our proprietary discovery and development programs and central to our business is the application of our drug discovery and disease biology expertise to collaborative research projects with industry partners, academic institutes and not-for-profit organizations. With an integrated drug discovery platform, Evotec provides to its partners high quality drug discovery solutions from target to clinic. We are proud to collaborate with many of the world’s leading pharmaceutical companies including Boehringer Ingelheim, Daiichi Sankyo, Japan Tobacco, Ono, Pfizer and Roche as well as many biotechnology companies that provide ongoing payments for research activities as well as mid-term revenue possibilities through achieving milestones. In addition, as described in the chapter entitled Our Pipeline, we aim to out-license some of our internal programs, from which we expect to receive upfront license payments, milestone payments and royalties based on future product sales.

High Value-Added, Results-Based Collaborations Plus Substantial Contracts in Preferred Therapeutic Areas Are a Foundation for Growth

In the past, clients have engaged Evotec to provide specific capabilities on a pure fee-for-service basis. Today, our partners also seek broader, more innovative drug discovery solutions that require us to contribute disease expertise, specific know-how and resources previously available through their internal structures. Our expertise in CNS has positioned Evotec as a partner of choice for such large collaborations in this therapeutic area, as illustrated by our partnership with CHDI. To fully capitalize on the potential of our capabilities and expertise, we also offer higher value, results-driven collaborations in which we share in our customers’ success through milestone payments and royalties along with research fees in combination with our more traditional business model.

Roche

In June 2006, we initiated a collaboration with Roche to jointly discover and develop compounds targeting CNS-related diseases and other indications, building on intellectual property previously generated on a biological target within Evotec. Under the terms of the agreement, both companies commit research and development resources to jointly drive novel compounds into clinical development. Screening of both companies’ compound libraries has been completed, and we are optimizing the hits and leads identified. At the clinical development candidate stage, Roche will initially have exclusive rights to the development of such product candidates in exchange for Evotec receiving potential milestone payments of up to € 105 m plus royalties derived from the sale and distribution of such product candidates. If Roche does not exercise its option right, Evotec has reciprocal option rights to the development of such product candidates in exchange for Roche receiving potential milestone payments and royalties based on a percentage of sales.

Roche

CNS Target, Mile-Stones > € 100 m and Royalties

Boehringer Ingelheim

We are in a collaboration with Boehringer Ingelheim to jointly identify and develop preclinical development candidates for the treatment of various diseases including CNS-related disorders since September 2004. Under the terms of the agreement, Boehringer Ingelheim has full ownership and global responsibility for clinical development, manufacturing and commercialization of the compounds identified. In return, Evotec receives ongoing research payments and preclinical milestones, plus clinical milestones and royalties on future sales of drugs derived from the collaboration. In January 2006, the collaboration doubled in size and was extended to the end of 2008. Since then, a team of approximately 80 scientists from both companies continue to work together on various projects. In early 2008, the collaboration was extended for a further 12 months until the end of 2009. Between 2005 and 2008 Evotec has achieved various milestones for the identification of a number of lead compounds on priority targets. Further milestone payments from the collaboration are expected in 2008 and beyond.

In addition to the collaboration discussed above, we entered into a multi-year collaboration with Boehringer Ingelheim to jointly identify novel targets as potential points of intervention in the treatment of Alzheimer’s disease in March 2007. Our scientists, together with the Research Institute of Molecular Pathology in Vienna, or IMP, apply proprietary and well-validated disease models to identify novel Alzheimer’s disease targets. Based on these models, Boehringer Ingelheim will select and further validate target candidates for its in-house drug discovery program with the goal of developing innovative novel therapeutics. Furthermore, this collaboration provides us with an option to support Boehringer Ingelheim in the subsequent target validation process. If Boehringer Ingelheim exercises this option, Evotec is eligible for milestone payments of up to €20 m per target plus royalties based on a percentage of sales.

Boehringer Ingelheim

76 FTEs, 6-Year Collaboration, Milestones and Royalties

Cure Huntington’s Disease Initiative (CHDI)

In March 2006, we entered into a strategic drug discovery partnership with CHDI to help advance a number of their drug discovery programs. CHDI is a not-for-profit organization pursuing a biotech approach to finding therapies for Huntington’s disease. It operates as a virtual biotechnology company, progressing its discovery research entirely through third-party collaborations meaning that partners such as Evotec are critical to their success. Through this business model CHDI seeks to identify and work with a network of the best companies available in order to successfully reach its goal to cure Huntington’s disease. In February of 2008, CHDI extended their collaboration with us to the end of 2010; the extension being worth a potential $37 m in research payments to Evotec. Under the terms of the extension, we will continue to provide CHDI with activities across our integrated discovery offering including assay development, ultra-high-throughput, high-content and fragment-based screening, structural biology, computational chemistry, and medicinal chemistry.

Fragment-Based Drug Discovery Platform EVOlution™ Leads to Significant New Deal Flow

Among the most important highlights of 2007 was the positive impact of our expertise in fragment-based drug discovery on our business. Our capabilities in drug discovery coupled with our proprietary fragment-based drug discovery platform, EVOlution™ have led to a number of high value drug discovery collaborations. The platform integrates, among other things, our proprietary biochemical and NMR-based fragment screening technologies in combination with our high-quality fragment libraries of 40,000 fragments, computational chemistry, structural biology and protein X-ray crystallography.

CHDI

Integrated Drug Discovery Contracts in Huntington’s Disease – Worth up to $37 m

InterMune

With the support of Evotec, InterMune has made considerable progress in their Hepatitis C drug discovery and development program. The collaboration was initiated in early 2007 and applies EVOlution™ in combination with our ultra-high-throughput screening (uHTS) technology to InterMune’s targets. Progress to date is excellent with new lead series having been identified for further optimization. The financial terms nclude a technology access fee for access to the EVOlution™ technology plus ongoing research funding.

Based on the success of this initial project, at the end of 2007 we signed a second drug discovery contract with InterMune further utilizing Evotec’s medicinal chemistry know-how.

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

Ono Pharmaceutical

In early 2008, we signed a drug discovery agreement with Ono Pharmaceutical. The collaboration applies our proprietary EVOlution™ platform for fragment-based drug discovery to identify novel and potent compounds against a protease target provided by Ono. In the collaboration, the platform is combined with our expertise in medicinal chemistry and ADMET to further characterize active compounds identified using the technology and optimize their potency and selectivity to generate molecules for subsequent progression into clinical trials.

Under the agreement, Ono paid an initial, upfront fee for access to our fragment-based drug discovery technology, EVOlution™ together with research funding and success-based milestones based on the progress of the research.

Successful 2007 for Discovery Biology Driven by High-Throughput Screening

Discovery biology had a very strong performance in 2007 driven in the main by a large demand for high-throughput screening (HTS) services. Many customers come to us because of our unique capabilities in HTS and strong track record in assay development. By using our proprietary, ultra sensitive HTS technology we are able to screen numerous drug targets and obtain superior results compared to other screening technologies. By combining this technology with our 250,000 compound screening library and experienced technical team we are able to provide a total solution for HTS to our clients. Against earlier market assumptions that outsourcing of HTS may decline as pharmaceutical companies have invested into their own screening platforms and smaller biotechs move towards development projects, we were pleased to see a strong performance in 2007 and positive indications for 2008. We believe that this strong performance is driven by a number of market factors such as the need for additional capacity (Pharma) and chemical IP for new targets (Biotech) but in the main by the access to a fully integrated solution and strong track record in HTS at Evotec. In 2007, we worked on numerous HTS contracts with companies like Boehringer Ingelheim, CHDI, Eli Lilly, Ferring Pharmaceuticals, Japan Tobacco, Solvay, TiGenix and Vifor.

In summary, success in our collaboration business is based on such things as our strong track record, excellent reputation, and open communication with our clients. We are considered as a premium supplier of high value research collaborations and believe we can not only retain our reputation but will continue to enhance it in the coming years.

Ono Pharmaceutical

3-Year Fragment-Based Drug Discovery/Medicinal Chemistry Agreement

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

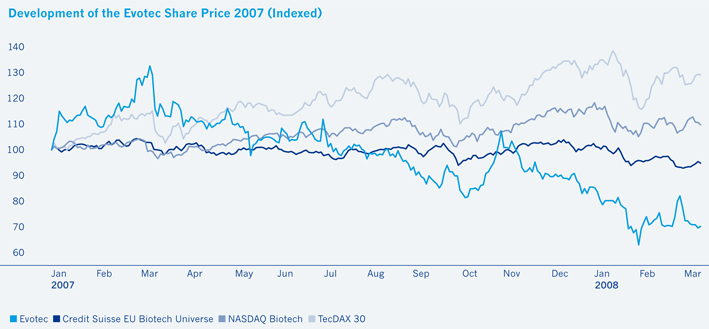

The Evotec Stock

The year 2007 proved altogether disappointing for publicly traded small biotech companies around the world with many stocks losing ground. Particularly in Germany, share prices and investor interest in the biotech sector plunged in the wake of reported product failures. Much like many of its peers, Evotec saw its shares close the year down 28% despite the Company delivering on its strategic business objectives and making progress with its clinical development projects.

Diverse Performance in International Stock Markets

In 2007, German large caps fared better than blue chips elsewhere, thanks to continuing favorable fundamentals. Share price gains in the industrial sectors more than offset the banks’ losses, resulting in another 22% year-on-year increase for the DAX index comprised of leading German stocks. The DAX was able to separate itself from the leading indexes in other industrialized economies. Both the European Stoxx50 and the Dow Jones rose by only 7%, while the NASDAQ Composite Index recorded a 10% gain. The German technology stock index TecDAX shot up by 30%, thanks primarily to the performance of its solar energy stocks.

The Evotec Stock 2007

Xetra | High (Feb 19) | € | 4.39 | |||

Low (Nov 21) | € | 2.02 | ||||

Average share price | € | 3.20 | ||||

Average daily trading volume | pcs. | 269,608 | ||||

Average daily trading volume1) | pcs. | 334,063 | ||||

Price decrease | % | 28 | ||||

Year-end closing price (Dec 28) | € | 2.33 | ||||

Market capitalization (Dec 31) | € m | 172.1 | ||||

Number of shares (Dec 31) | pcs. | 73,868,447 | ||||

Key share data | Earnings2) | € | (0.67 | ) | ||

Dividend | € | 0.00 |

1) | Based on the trading volumes of all German stock exchanges. |

2) | Excluding contributions from Evotec Technologies and from the Chemical Development Business. |

Basic Share Data

| Security identification numbers | Frankfurt Stock Exchange | |

| (Ordinary Bearer Shares) | ||

| ISIN: DE 0005664809 | ||

| NASDAQ Global Market | ||

| (American Depositary Shares, ADSs) | ||

| CUSIP: 30050E105 | ||

| ISIN: US30050E1055 | ||

| Ticker symbol | Frankfurt Stock Exchange: EVT | |

| NASDAQ Global Market: EVTC | ||

| Bloomberg Xetra: EVT GY Equity | ||

| Bloomberg NASDAQ: EVT US Equity | ||

| Reuters Xetra: EVTG.DE | ||

| Reuters NASDAQ: EVTC.O | ||

| 31 | Evotec Stock | 36 | Corporate Governance | 40 | Supervisory Board Report | 32 | 33 |

Downturn in Sentiment for Small Biotech Stocks

Driven by M&A speculation, European biotech stocks had vastly outperformed their US peers in 2006. This trend, however, reversed in 2007. While the AMEX Biotech Index gained 4% and the NASDAQ Biotech Index rose 5%, the Credit Suisse European Biotech Index shed 5%. It is clear that the main reason for the disparity in the performance between the US and European biotech sectors in 2007 is not due to geography but rather the relative weighting of size of companies in each region. Over the past year, analysts report that the markets were particularly harsh for small and micro cap biotechnology companies, regardless of geography, and Europe has a clear dominance of small cap names compared to the US.

Biotech Environment in Germany Impacted by Product Failures

Several German biotech companies significantly disappointed the markets in 2007 by reporting failures in the development of their products. This impaired the sentiment in the sector and reminded investors of the risks inherent with developing new pharmaceuticals, even in the later developmental stages. Investors’ overall interest in German biotech stocks appears to have contracted. Many biotech companies are finding it difficult to counterbalance even modest selling pressure.

Evotec’s Stock Dragged Down Along with the Sector

Evotec made progress on several fronts in 2007. The Company moved several of its drugs in development forward, along with various research collaborations, and implemented its strategy of focusing on drug discovery and development. Operations peripheral to its core business were sold, bringing in a considerable amount of cash, a very important prerequisite for success in today’s difficult financing climate.

In spite of all this, Evotec shares fell by 28% during 2007, closing the year at € 2.33. Although the Company’s shares moved in line with those of its peers (peer companies according to the BioCentury sector performance; see table below), this is still somewhat disappointing in the light of the progress made.

Performance of the Evotec Stock Compared to its Peers by Industry Groupings

Category | Performance in % | ||

Chemistry | (28 | ) | |

High-throughput screening | (39 | ) | |

Neurology | (28 | ) | |

Evotec | (28 | ) | |

| Quelle: BioCentury, Sector Performance 2007 |

The reduced investor interest in German biotech stocks also led to a decrease in the liquidity of the Evotec stock. The average daily trading volume on all German stock exchanges dropped to 334,063 (2006: 408,552). Because the sentiment deteriorated only in the second half of the year, this figure only partly reflects the extent of this trend.

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

New Evotec Shares Issued for Acquisition of Neuro3d and Renovis

To acquire Neuro3d in a share-for-share transaction, Evotec increased its share capital in the second quarter of 2007 by issuing 5.7 million new shares priced at €3.69 per share. By acquiring Neuro3d, Evotec acquired € 18.9 m of net cash and investments as well as further potential cash influxes and some early stage CNS research projects. Through this transaction, the number of Evotec shares outstanding, including the exercise of conditional capital from share options, increased to 73,868,447 at year-end (year-end 2006: 67,973,116).

In May 2008 (after period end), Evotec successfully completed the acquisition of Renovis (see page 8). This was also effected through a share-for-share transaction in which 35.0 million new Evotec shares were issued. Upon completion of the acquisition the number of shares, including those traded as American Depository Shares (ADSs) on NASDAQ, had risen to 108,838,715. Each Evotec ADS represents two ordinary shares of Evotec.

| 31 | Evotec Stock | 36 | Corporate Governance | 40 | Supervisory Board Report | 34 | 35 |

Significant Proportion of US Shareholders as a Consequence of Renovis Acquisition

Shareholders in Europe, especially in Germany, the United Kingdom, Switzerland and France, have traditionally accounted for the largest proportion of ownership in Evotec’s stock. After completion of the Renovis acquisition, approximately 31% of the shares of the combined company were held by the mainly US-based former Renovis shareholders. Renovis stockholders received for each Renovis common share 1.0542 Evotec common shares in the form of 0.5271 Evotec American Depository Shares (ADSs). These Evotec ADSs are listed on NASDAQ’s Global Market segment.

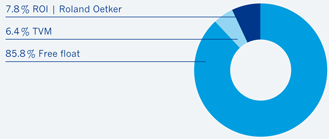

At year-end 2007, two major shareholders were identified. Including their affiliates, TVM V Life Science Ventures GmbH & Co. KG held more than 5% and ROI Verwaltungsgesellschaft mbH more than 10% of Evotec shares.

In 2007, the free float, which is used to determine the weight of the Evotec stock in indexes, was 81% of the share capital. It has since risen to 86%, following the capital increase in the course of the Renovis acquisition.

Investor Relations Activities in Support of Evotec’s Strategy

Evotec places great emphasis on a continuous dialogue with all capital market professionals. For the Company to be valuated fairly, it is essential to communicate its strategy, point to progress being made and to explain the potential of Evotec’s collaborations and pipeline of drug candidates with its inherent opportunities and risks. During 2007, the investor relations activities were determined to a large extent by Evotec’s corporate transactions. The acquisition of Renovis, in particular, brought the need for an in-depth dialogue with Evotec and Renovis shareholders, as Renovis shareholder approval was necessary for the takeover. For the transaction to succeed it was essential to conduct parallel investor relations activities throughout the eight-month merger process in order to get across the strategic rationale behind the merger for both companies.

During this period Evotec increased its presence in the US. The number of one-on-one meetings rose to approximately 180, 60 of which took place in the US. The Company’s management presented at 15 national and international investor conferences, conducted 19 road shows in key financial centers, and hosted various on-site visits at the Company’s facility in Oxford and headquarters in Hamburg. The Company hosted two R&D conferences in London to present the progress made in the clinical programs, including crucial data of two Phase II studies of Evotec’s insomnia drug candidate EVT 201. The Company’s Annual Shareholder Meeting in June 2007 attracted approximately 230 shareholders, representing 33% of the share capital (2006: 47%).

The equity story of a company is communicated not only by its management but also by financial analysts. At year-end 2007, the number of analysts reporting regularly about Evotec was seven, the majority of whom held a favorable view of the Company and its activities. In early 2008, a further renowned investment bank, Piper Jaffray, initiated coverage of Evotec. It is of the utmost importance to Evotec that all shareholders have access to share price relevant information as promptly as possible. The internet plays a significant role in enabling investors to read and download financial reports, press releases and ad hoc notifications. It also provides the opportunity to tune in live to telephone conference calls relating to the Company’s quarterly and annual financial results, R&D days, presentations at international investor conferences, as well as the opening of the Annual Shareholder Meeting and the CEO’s address. A replay of these events is regularly available.

Financial Institutions which Report on Evotec

Cazenove Equities

Credit Suisse

Deutsche Bank

DZ Bank

Landesbank Baden-Württemberg

Piper Jaffray

Sal. Oppenheim

Vontobel Securities

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

Corporate Governance

Effective Corporate Governance is crucial for the management of a company’s business affairs as well as for capital market communication. This goal has always been of paramount importance to Evotec. We believe that our commitment to excellent Corporate Governance standards

| • | Demonstrates to the market participants our dedication to well-balanced and transparent rules; and |

| • | Internally emphasizes the importance of our clearly defined management structure and the responsibilities of management. |

Based on this conviction, the Company complies with all but one (see Declaration of Compliance) of the Corporate Governance recommendations as defined by the German Corporate Governance Code as well as with most of the suggestions the Code contains.

Corporate Governance on Evotec’s Website

Continually updated information regarding Corporate Governance can be found at www.evotec.com

German Corporate Governance Code

The German Corporate Government Code (as revised June 14, 2007; the “Code”) presents essential legal regulations for the management and supervision of German listed companies. In addition, it contains internationally recognized standards for good and responsible company management. With these regulations and standards the Code aims at strengthening the confidence of international and national investors, customers, employees and the public.

Besides the presentation of key legal regulations, the Code sets out a broad range of recommendations and, in addition, suggestions concerning Corporate Governance. With regard to the recommendations, Evotec has made a declaration of compliance as follows:

Declaration of Compliance

In December 2007, the Management Board and the Supervisory Board of Evotec stated in accordance with §161 German Stock Corporation Act (AktG):

“Evotec AG has complied in 2007 with the recommendations of the Governmental Commission on the German Corporate Governance Code as published in the official section of the electronic Federal Gazette and intends to comply in the future with the recommendations of such Code, with the following exception:

The stock option programs in place are based on binding resolutions of several Annual General Meetings. While the exercise of these options requires an increase in the share price, the exercise is not related to other comparison parameters as recommended in Section 4.2.3 of the Code.”

| 31 | Evotec Stock | 36 | Corporate Governance | 40 | Supervisory Board Report | 36 | 37 |

The Company has chosen not to introduce a relative hurdle to the exercising of its stock options due to the lack of relevant stock indices (industry, geography, etc.) as measured by the low correlation of Evotec’s shares against such indices, and the significant firm-specific targeted shareholder value creation.

High Level Compliance also with the Code’s Suggestions

In addition to complying with the recommendations of the Corporate Governance Code as mentioned above, the Company also conforms to almost all suggestions laid down in the Code, some of them being described below.

Best Possible Support and Transparency at Annual General Meetings

Evotec offers shareholders who are unable to attend Annual General Meetings the opportunity to access key parts of the event live on the Internet as suggested by Section 2.3.4 of the Code. The Company also encourages non-attendees to exercise their voting rights by arranging Company independent proxies.

All of Evotec’s Publications in Both English and German

Evotec is committed to fair disclosure of information: It is the Company’s prime concern in its corporate communication strategy that the same information is made available to all relevant target groups at the same time, and this implies communicating in both English and German. The Company’s publications are readily available on its website for viewing or downloading.

Supervisory Board Committees Set Up in Accordance with the Code

Evotec has set up an Audit Committee with a spectrum of tasks comprising among others the review of financial reports and risk management, and guaranteeing the auditors’ independence. The Company has also set up a Remuneration Committee (Sections 5.1.2 and 5.3.3 of the Code), which, among other things, prepares the appointment and remuneration of members to the Management Board. As suggested in Section 5.1.2 of the Code, each initial appointment to the Management Board is effective for a maximum of three years. Evotec also makes sure that neither the Chairman of the Supervisory Board nor a former member of the Management Board serve as Chair of the Audit Committee (Sections 5.2 and 5.3.2). In addition, the Company complies with the suggestion for Supervisory Board members to hold occasional separate discussions (Section 3.6).

Composition of the Supervisory Board Committees

Membership in the Following Committees

| Audit Committee | Remuneration Committee | |||||

Prof Dr Heinz Riesenhuber | ||||||

(Chairman) | x (Chair | ) | ||||

P Schatz (Deputy Chairman) | x (Chair | ) | ||||

Dr H Birner | x | x | ||||

Dr P Fellner | x | |||||

Dr W Jenkins | ||||||

M Tanner | x | |||||

| 04 | To Our Shareholders | 08 | Our Strategy | 14 | Our Pipeline | 24 | Our Collaborations |

Remuneration of the Supervisory Board

The members of Evotec’s Supervisory Board are entitled to a fixed and a performance-related remuneration. Chair and Deputy Chair positions in the Supervisory Board as well as the chair and membership in committees are considered in determining the fixed remuneration of the individual members.

Besides the fixed remuneration, and in accordance with the suggestions of the Code, the members of the Supervisory Board receive a remuneration tied to the Company’s long-term performance: They receive an element of the remuneration to be made in shares of the Company in order to further align the interests of the individual Supervisory Board members and the development of Evotec’s share price. In addition, if the shareholders receive a dividend, every Supervisory Board member will receive an extra € 500 for every cent that the dividend per share exceeds 15 cents.

For their contribution in 2007, the individual members of the Evotec Supervisory Board received the following compensation:

Compensation of the Supervisory Board 2007

| Fixed remuneration in T€ | Equity-based compensation in T€ | Total in T€ | ||||

Prof Dr H Riesenhuber | 37.5 | 15.0 | 52.5 | |||

P Schatz | 30.0 | 11.2 | 41.2 | |||

Dr H Birner | 22.5 | 7.5 | 30.0 | |||

Dr P Fellner | 18.8 | 7.5 | 26.3 | |||

Dr W Jenkins | 15.0 | 7.5 | 22.5 | |||

M Tanner | 18.8 | 7.5 | 26.3 | |||

Total | 142.6 | 56.2 | 198.8 |

Remuneration of the Management Board

The remuneration paid to the members of the Management Board in the financial year 2007 totaled T€ 1,041 of which T€ 380 was variable remuneration.

Fixed remuneration includes base salaries, contributions to personal pension plans, premiums for accident and accidental death insurances as well as the benefit derived from the use of company cars.