- EVO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Evotec SE (EVO) 6-KCurrent report (foreign)

Filed: 14 May 10, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the periods ended December 31, 2009 and March 31, 2010

Evotec Aktiengesellschaft

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34041

Evotec AG

Schnackenburgallee 114

22525 Hamburg

Germany

(49-40) 56-0810

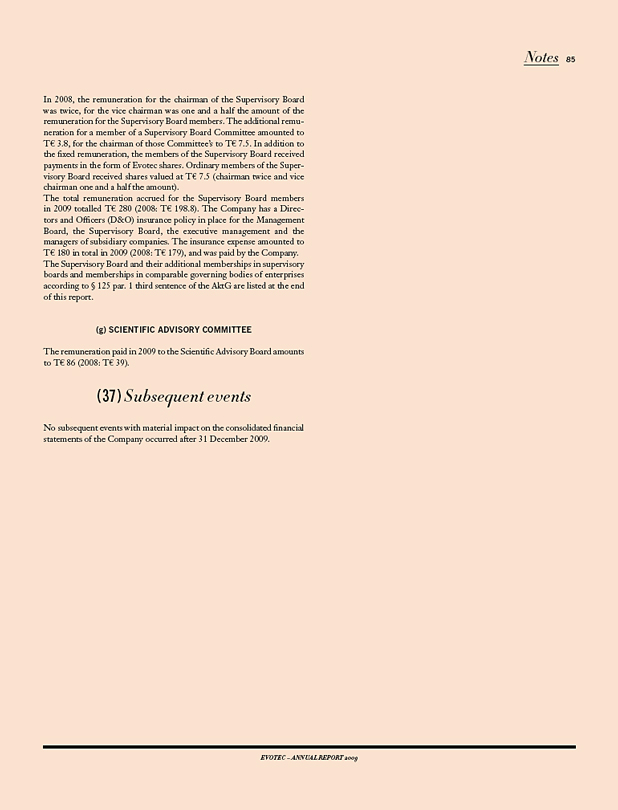

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F Form 20-F xŸŸŸForm 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ¨

Form 6-K

TABLE OF CONTENTS

Item | Page | |

| 3 | ||

| 3 | ||

| 4 | ||

2

On March 25, 2010, EVOTEC AG (Frankfurt Stock Exchange: EVT) (“Evotec”) issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2009 and released its 2009 Annual Report. The press release and the 2009 Annual Report are furnished herewith as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated by reference herein.

On May 12, 2010, Evotec issued a press release announcing its financial results for the first quarter ended March 31, 2010 and released its 2010 First Quarter Report. The press release and 2010 First Quarter Report are furnished herewith as Exhibit 99.3 and Exhibit 99.4, respectively, and are incorporated by reference herein.

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Evotec AG | ||

| By: | /s/ Klaus Maleck | |

| Klaus Maleck | ||

| Chief Financial Officer | ||

Date: May 14, 2010

3

Exhibit | Description | |

| 99.1 | Press Release dated March 25, 2010 – Evotec’s 2009 Results: Significant Step towards Sustainability | |

| 99.2 | Evotec AG, Annual Report 2009 | |

| 99.3 | Press Release dated May 12, 2010 – Evotec’s Drug Discovery Business Set for Strong Growth | |

| 99.4 | Evotec AG, First Quarter Report 2010 | |

4

Exhibit 99.1

News release

For further information please contact:

Dr Werner Lanthaler Chief Executive Officer

+49.(0)40.560 81.242 +49.(0)40.560 81.333 Fax werner.lanthaler@evotec.com

Evotec AG Schnackenburgallee 114 22525 Hamburg Germany www.evotec.com | Evotec’s 2009 Results: Significant Step towards Sustainability | |

Hamburg, Germany – 25 March 2010: Evotec AG (Frankfurt Stock Exchange: EVT, TecDAX) today reported financial results and corporate updates for the year ended 31 December 2009.

Major Achievements: | ||

• Growth of business and execution of restructuring programme lead to strong 2009 performance with all financial targets achieved

- Revenues +8%; operating result before exceptional items +57%

- Positive Q4 operating result before exceptional items

- Liquidity position of > € 70 m; exceeding guidance

- Impairment of higher risk programmes reflecting Evotec’s strategy

• Discovery collaborations provide stable basis for future growth

- Several new alliances and contract extensions including Biogen Idec, CHDI (after period-end) and Ono Pharmaceutical

- Strategic capability and capacity expansion through acquisition of Indian RSIPL

• Strong performance in innovative, risk-shared alliances combining high-end technologies and disease know-how

- New alliances with Boehringer Ingelheim, Vifor (after period-end)

- Important milestones demonstrate progress achieved

• Product development alliance with Roche with significant upside but no downside risk; 2011 $ 65 m milestone opportunity

- Successful completion of first-in-man study with EVT 103 (after period-end)

- Positive feedback from the FDA to initiate Phase II with EVT 101 (after period-end)

• Guidance 2010 - accelerated path to profitability and growth

- Revenue growth of at least 15%; strongest February order book ever

- Significantly improved operating result before impairment with profitability no later than 2012

- Liquidity of > € 64 m; cash consumption markedly reduced

1. Operational performance

Growth of business and execution of “Evotec 2012 - Action Plan to Focus and Grow” lead to strong 2009 financial performance

Based on the Action Plan 2012, Evotec decided in March 2009 to streng-then its discovery alliances, creating the central vehicle for growth, and to implement strict cost cutting and restructuring measures. The Company reduced headcount in administrative and clinical development functions, reprioritised its R&D activities, concentrated its operations in Europe and closed the former facility of Renovis, Inc. in South San Francisco. |

Page 1

News Release

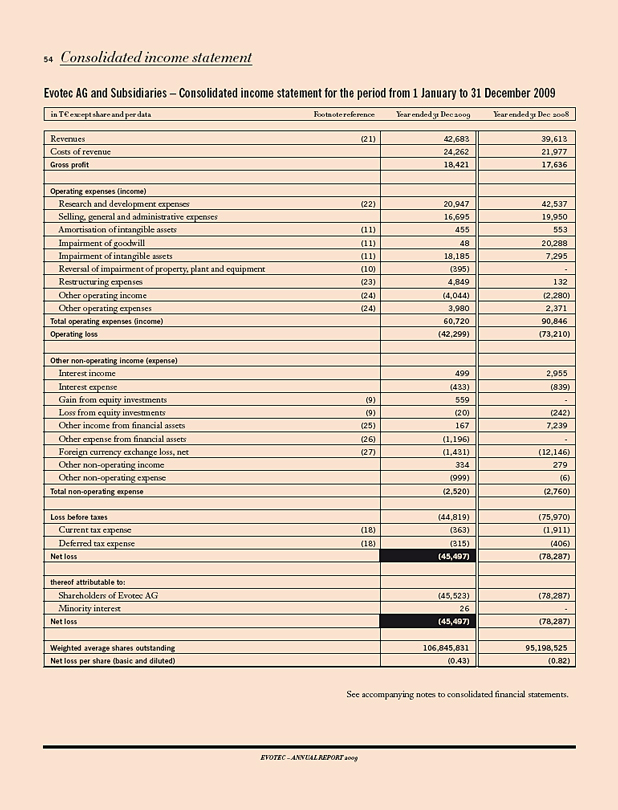

These strategic measures are clearly reflected in the financial results for the 2009 fiscal year. Evotec’s discovery alliances are growing significantly and the Company increased and delivered on all financial targets. Total Grouprevenues amounted to EUR 42.7 m, an increase of 8% compared to the same period of the previous year (2008: EUR 39.6 m). The increase is particularly pleasing because, in 2008, Evotec collected three milestones amounting to payments of EUR 8.5 m as part of its strategic alliance with Boehringer Ingelheim, while in 2009 milestone payments from this collaboration added up to EUR 4.0 m. Due to this strong top-line performance and significant reductions in operating expenses (R&D expenses –51%, SG&A cost -16%) Evotec’soperating loss before exceptional items decreased by 57% to EUR 19.6 m (2008: EUR 45.5 m) for the fiscal year and was positive for the fourth quarter amounting to EUR 2.0 m (2008: EUR (10.4) m). The fourth quarter 2009 was the first one in which the impact of Evotec’s strategic restructuring became fully visible. R&D expenses declined by 87% and SG&A cost adjusted for severance payments by 30% compared to the same period of the prior year, a strong basis to develop the Company to profitability.

The Company reduced its R&D cost base significantly through the partner-ing of the EVT 100 compound series to Roche, the discontinuation of EVT 302 due to its failure in smoking cessation, as well as the reduction of early-stage discovery projects. By only supporting the commercially most promising programmes and seeking to aggressively partner those with pharma partners, Evotec de-risked its pipeline substantially. Reflecting this strategy, higher risk programmes were impaired during the year, i.e. EVT 201, EVT 401 and the VR1 programme, leading to total impairment charges of EUR 18.2 m. Including all impairments and EUR 4.8 m of restructuring expenses, Evotec’s 2009operating loss decreased by 42% to EUR 42.3 m (2008: EUR 73.2 m).

With EUR 70.6 m Evotec ended the year 2009 above itsliquidity target of > EUR 65 m.

2. Discovery alliances update

The productivity challenge facing the pharmaceutical industry is set to drive an increase in strategic outsourcing which will likely lead to larger outsourcing contracts favouring bigger partners. Since the industry is highly fragmented there is a leadership gap which Evotec may successfully fill. Due to its scale, attractive growth profile and its strong reputation in the industry Evotec is ideally positioned to take full advantage of these developments. |

Page 2

News Release

Discovery alliances provide stable basis for future growth

Several new alliances and contract extensions

Throughout the year Evotec won new deals with several customers, including Cubist Pharmaceutical, Alios Biopharma and with Biogen Idec. The Company also extended an important collaboration with its strategic partner Ono Pharmaceutical, initiating a new discovery programme on an ion channel target, and a strategic alliance with CHDI (after period-end) to find new treatments for Huntington’s disease. These important contracts clearly demonstrate the value Evotec brings to its alliance partners in the area of drug discovery.

Strategic capability and capacity expansion through acquisition of RSIPL

To best position the Company for growth in the discovery outsourcing market and optimise its cost structure for large alliances, Evotec has initiated an Asian capacity and capability expansion strategy with its purchase, in August 2009, of a 70% controlling stake in the Indian company Research Support International Private Limited (RSIPL). The company was fully integrated as Evotec (India) Private Ltd.

Strong performance in innovative, risk-shared alliances combining high-end technologies and disease know-how

The integration of high-end technologies and disease know-how represents the strategic ‘sweet spot’ in this industry. Evotec has carried on adding to and enhancing its technology platform (e.g. through the addition of the Summit zebrafish screening operations) and therapeutic area focused expertise to become the clear partner of choice for integrated alliances with pharmaceutical companies in which both parties share risk and reward of discovery programmes.

New alliances with Boehringer Ingelheim and Vifor

Based on the successful collaboration to date, Boehringer Ingelheim signed a new, minimum four-year extension of its discovery collaboration with Evotec. Jointly, both companies aim to identify novel therapeutics in innovative disease-focused programmes with a focus on oncology targets. Evotec receives research payments, payments for the achievement of pre-clinical milestones as well as long-term upside through potential clinical milestone achievements and royalties. In January 2010, Evotec also signed a significant integrated alliance with Vifor Pharma to jointly identify a pre-clinical candidate for the treatment of anaemia.

Important milestones demonstrate progress in disease focused alliances

In 2009, the Company achieved two research milestones in its multi-year drug discovery alliance with Boehringer Ingelheim, leading to payments of EUR 4.0 m. Evotec also achieved a milestone with Cardioxyl Pharmaceuticals for the compound, CXL-1020, that was successfully moved into clinical testing in heart failure, and with Ono for the progression of novel protease inhibitors into lead optimisation. |

Page 3

News Release

Product development alliance with Roche with significant upside but no downside risk

In March 2009, Evotec signed a significant alliance with Roche to unleash the commercial upside of the EVT 100 compound family. This is a joint development programme where Evotec is responsible for conducting the clinical Phase II development of EVT 101 in patients with treatment-resistant depression. The costs of that study are fully borne by Roche and so are the development costs of the follow-on molecule EVT 103. Therefore the downside risk for Evotec is zero, while the upside may be significant.

Successful completion of first-in-man study with EVT 103

Early 2010, Evotec completed the clinical part of the first-in-human Phase I study with EVT 103. The compound was safe and very well tolerated after oral single and multiple dose administration, with excellent bioavailability and only a minimal effect of food on the kinetic profile.

Positive feedback from the FDA to initiate Phase II with EVT 101

For EVT 101, the lead compound in the strategic alliance with Roche, Evotec has received approval from the FDA to initiate the Proof-of-Concept study. The study will start recruiting patients in the second quarter of 2010.

If Roche exercises its buy-back option after completion of the Phase II study, Evotec will receive a $65 m payment in exchange for returning the compounds. The total potential value of the deal exceeds $300 m of development and sales performance commercial payments plus potential double-digit commercial payments.

3. Guidance 2010

Revenue growth of at least 15%, significantly improved operating result before impairment with profitability no later than 2012 and liquidity of > EUR 64 m

In 2010, total Group revenues before out-licensing income are expected to grow by at least 15%. These assumptions are based on the strong February 2010 order book of approximately EUR 28 m (2009: EUR 24 m), expected new contracts and contract extensions as well as the achievement of certain milestones.

With the restructuring measures taken in 2009, Evotec has significantly reduced its cost base going forward. The impact of Evotec’s SG&A savings will be fully reflected in the Company’s financial results for the years 2010 and beyond. In addition, Evotec expects research & development (R&D) expenses to decrease considerably from 2009 levels. The Company will focus on key programmes and targets to invest approximately EUR 10 m in R&D in 2010. As a result, Evotec’s Group operating result before impairment is expected to improve significantly over 2009.

The Evotec Group started the year with EUR 71 m of cash, investments and auction rate securities. In 2010, top-line growth and the adjusted cost base are expected to significantly reduce the cash requirements compared to the 2009 fiscal year. Consequently, at constant year-end 2009 currencies, the Company expects to end 2010 with a liquidity of more than EUR 64 m. |

Page 4

News Release

Webcast / Conference Call

Evotec is going to broadcast today’s press & analyst conference in Frankfurt/Main starting at 10.00 am CET (09.00 am GMT/05.00 am EDT) live on the internet. The Management Board of Evotec will inform about the FY 2009 results as well as the status of its discovery alliances and the Company’s development projects. More-over, they will provide an update on the “Evotec 2012 – Action Plan to Focus and Grow” and the business outlook for 2010. The conference will be held in English. To join theaudio webcast and to access thepresentation slides you will find a link on our home pagewww.evotec.com shortly before the event.

For those who prefer to listen to the presentation via phone, please dial:

From Europe: +49.(0)69.2222 7111 (Germany) +44.(0)20.7784 1036 (UK) From the US: +1.718.354 1358 Access Code: 9745589 Presentation: www.equitystory.com Access code: evotec0310

The on-demand version of the webcast will be available on our website:www.evotec.com - Investors - Events - Financial Calendar.

About Evotec AG

Evotec is a leader in the discovery and development of novel small molecule drugs with operational sites in Europe and Asia. The Company has built substantial drug discovery expertise and an industrialised platform that can drive new innovative small molecule compounds into the clinic. In addition, Evotec has built a deep internal knowledge base in the treatment of diseases related to neuroscience, pain, and inflammation. Leveraging these skills and expertise the Company intends to develop best-in-class differentiated therapeutics and deliver superior science-driven discovery alliances with pharmaceutical and biotechnology companies. Evotec has long-term discovery alliances with partners including Boehringer Ingelheim, CHDI, Novartis, Ono Pharmaceutical and Roche. Evotec has product candidates in clinical development and a series of preclinical compounds and development partnerships, including for example a strategic alliance with Roche for the EVT 100 compound family, subtype selective NMDA receptor antagonists for use in treatment-resistant depression. For additional information please go to www.evotec.com.

Forward-Looking Statements

Information set forth in this press release contains forward-looking statements, which involve a number of risks and uncertainties. Such forward-looking statements include, but are not limited to, statements about our financial outlook for 2010 and beyond; our expectation that our current cash, cash equivalents, investments, and operating revenues will be sufficient to fund our planned activities be-yond 2012, and our belief that we are on course to profitability and sustainability by 2012; our expectations regarding the growth of the pharmaceutical outsourcing drug discovery market, the opportunities such growth will provide us, and our ability to take advantage of such market developments and become a leader in this industry |

Page 5

News Release

| in the coming years; our expectations regarding the impacts, and anticipated timing of such impacts, of the “Evotec 2012 – Action Plan to Focus and Grow”; our expectation that our reentry into the German technology TecDAX in 2009 will in-crease liquidity for our shareholders and that our voluntary delisting from NASDAQ and anticipated de-registration with the SEC will streamline our activities and focus the liquidity of Evotec’s stock on one trading platform; our expectations regarding the impact that the recent global financial crisis will have on our company; our expectations and assumptions concerning regulatory, clinical, and business strategies, the progress of our clinical development programmes and timing of the results of our clinical trials, strategic collaborations, and management’s plans, objectives and strategies. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, and which could cause actual results to differ materially from those contemplated in these forward-looking statements. In particular, the risks and uncertainties include, among other things: risks that we may be unable to achieve the anticipated benefits of our revised business focus, restructuring, and cost containment measures or recognise the results of such measures within the expected time-frames; risks that we will not achieve the anticipated benefits of our collaborations, partnerships and acquisitions in the timeframes expected, or at all; the risk that we will not achieve the anticipated benefits of our voluntarily delisting from NASDAQ and anticipated de-registration from the SEC; risks that product candidates may fail in the clinic or may not be successfully marketed or manufactured; risks relating to our ability to advance the development of product candidates currently in the pipe-line or in clinical trials; our inability to further identify, develop and achieve commercial success for new products and technologies; the risk that competing products may be more successful; our inability to interest potential partners in our technologies and products; our inability to achieve commercial success for our products and technologies; our inability to protect our intellectual property and the cost of enforcing or defending our intellectual property rights; our failure to comply with regulations relating to our products and product candidates, including FDA requirements; the risk that the FDA may interpret the results of our studies differently than we have; the risk that clinical trials may not result in marketable products; the risk that we may be unable to successfully secure regulatory approval of and market our drug candidates; risks of new, changing and competitive technologies and regulations in the U.S. and internationally; general worldwide economic conditions and related uncertainties; future legislative, regulatory, or tax changes as well as other economic, business and/or competitive factors; and the effect of exchange rate fluctuations on our international operations. The list of risks above is not exhaustive. Our Annual Report on Form 20-F most recently filed with the Securities and Exchange Commission, and other filings and items furnished with the Securities and Exchange Commission, contain additional factors that could impact our businesses and financial performance. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any such statements to reflect any change in our expectations or any change in events, conditions or circumstances on which any such statement is based. |

Page 6

Exhibit 99.2

evotec ‘RESEARCH NEVER STOPS’

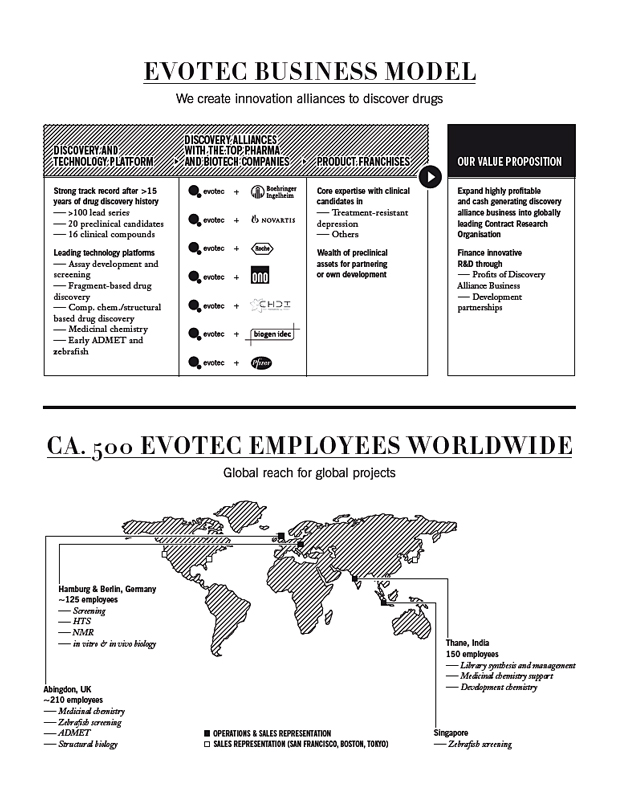

The world in which we operate

The change in the outsourcing world for innovation in drug discovery

see page 04

Leading the field Growing our drug discovery business and entering the path to sustainability

see page 02

2009 results and outlook in

all details The way we work and our corporate governance

see page 19

ANNUAL REPORT 2009

Evotec AG, Schnackenburgallee 114, 22525 Hamburg (Germany), www.evotec.com

FOCUS AND GROW

2009 was a year of renewal for Evotec

What has altered? And what stays forever

PROMISE

and Deliver

Evotec increased and delivered on all financial targets for the fiscal year 2009. Revenues of € 42.7 m were up 8% on 2008 numbers. R&D and SG&A expenses decreased significantly, by 51% and 16% respectively. With a strong liquidity of € 70.6 m, Evotec started 2010 with a strong financial position.

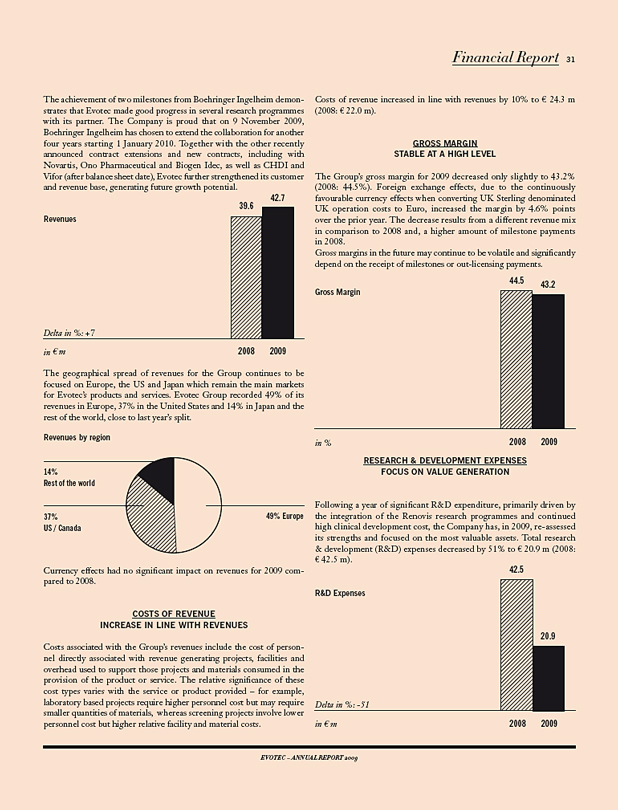

Evotec reported € 42.7 m in revenues, an increase of 8% compared to the same period of the previous year (2008: € 39.6 m). The revenue performance is the result of continued strong research revenues from Evotec’s discovery alliances, a portion of the upfront payment for the EVT 100 compound family from Roche (€ 3 m) as well as of license and royalty income and milestone payments totalling € 7.2 m from Roche, DeveloGen and Boehringer Ingelheim.

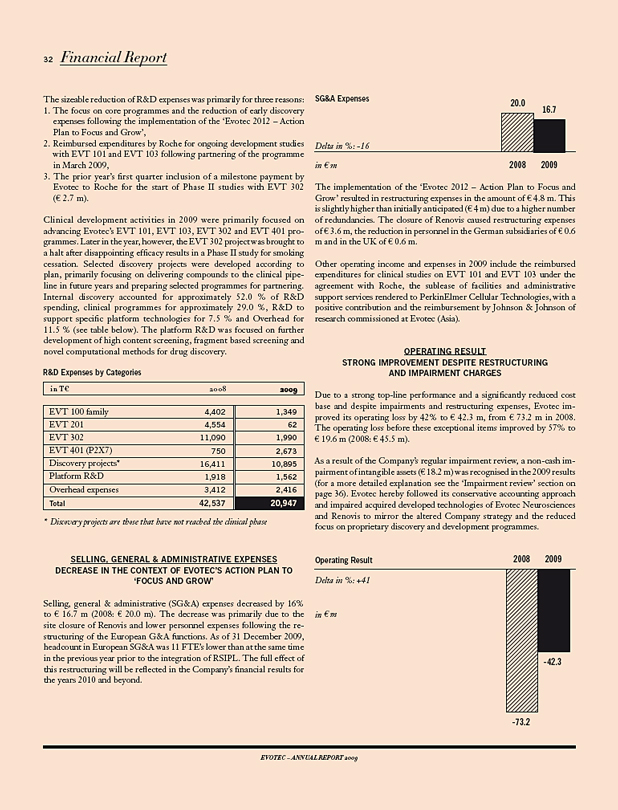

R&D expenses decreased by 51% to € 20.9 m (2008: € 42.5 m). The decrease primarily resulted from the reduction of early discovery programmes, from a focus on fewer, core programmes and from the closure of Evotec’s US site following the implementation of the ‘Evotec 2012 – Action Plan to Focus and Grow’. SG&A expenses decreased by 16% to € 16.7 m (2008: € 20.0 m), primarily as a

consequence of Evotec’s ongoing cost containment measures. The full impact of Evotec’s restructuring on SG&A expenses will be reflected in the financial results for the years 2010 and beyond. continue on page 16

FINANCIAL CALENDAR MEET EVOTEC

25 March 2010 Annual report 2009

12 May 2010 First quarter report 2010

10 June 2010 Annual General Meeting

12 August 2010 Half year report 2010

11 November 2010 Third quarter report 2010

evotec ACTION PLAN

RESEARCH NEVER STOPS

PATH

TO SUSTAINABILITY

The financial results and strategic opportunities of Evotec at the end of the year 2009

The financial results and strategic opportunities of Evotec at the end of the year are supporting the ‘back to the roots’ strategy that the Company adopted in 2009. The Discovery Alliance Business is growing significantly as Evotec continues to optimise its efficiency through technology innovation and global cost leverage. Evotec is on its way to become the leader in high quality drug discovery.

Evotec has de-risked its pipeline significantly by only supporting the commercially most promising programmes. At the same time Evotec has tried to keep the full value potential of its highly promising drug candidates. With this, Evotec has also made a significant step towards sustainability of the Company by substantially growing its revenues and reducing its cost base. With more than € 70 m, the liquidity reserves of the Company are strong, and the tone is set for innovation and growth.

WHAT IS ‘EVOTEC 2012 – ACTION PLAN TO FOCUS AND GROW’?

The 2012 Action Plan was the result of a strategic business review in March 2009. Evotec started the implementation process immediately thereafter in April. The Company evaluated its strengths and weaknesses and made clear decisions regarding its financial resources and strategic direction. The goal was to ensure that all efforts are focused on core differentiated projects and activities capable of delivering the greatest value to stockholders and partners in the near future.

WHAT ARE THE CORE ELEMENTS OF THIS PLAN?

The core element was to strengthen the Discovery Alliance Business to generate the central strategic vehicle for growth. The second goal was to build strategic alliances on selected development projects and to refocus the pipeline on the most valuable assets in order to de-risk the portfolio and reduce R&D cash burn, but without giving away certain significant upsides for shareholders. The third goal was to significantly reduce operating expenses and minimise strategic business risks.

WHAT ARE THE VISIBLE ACHIEVEMENTS OF THIS PLAN TO DATE?

The Alliance Business is working successfully and is about to establish a world class leading position in the discovery outsourcing market. Evotec has excellent collaborations and has throughout 2009 won new deals and reached milestones with e.g. Boehringer Ingelheim, Biogen Idec, Cardioxyl, Ono, Novartis, Roche and others.

CONTENT

Editorial P. 06 Corporate Governance P. 19 Supervisory Board and Management Board P. 86

Financial Calendar P. 01 Outlook P. 49 Supervisory Board Report P. 91

Management Report P. 25 Consolidated Financial Statements P. 51 Imprint P. 03

EVOTEC – ANNUAL REPORT 2009

ACTION PLAN 3

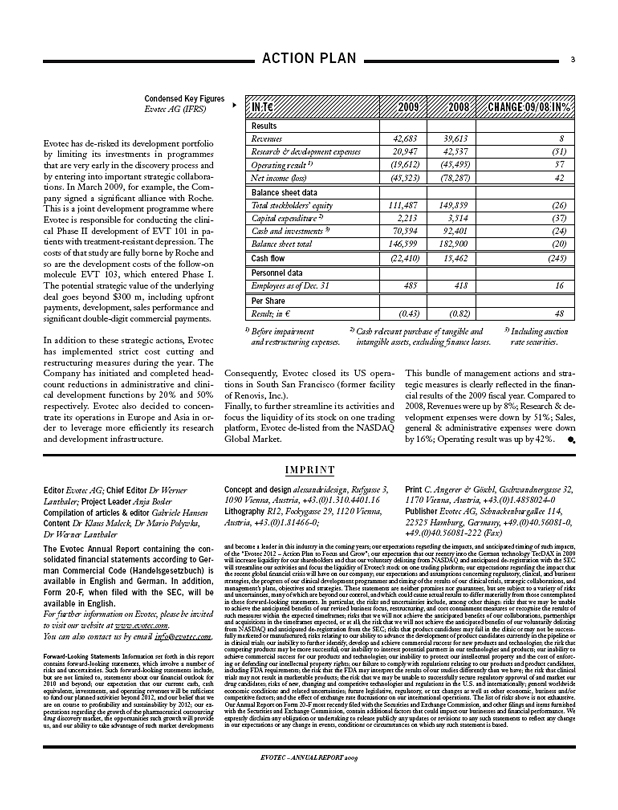

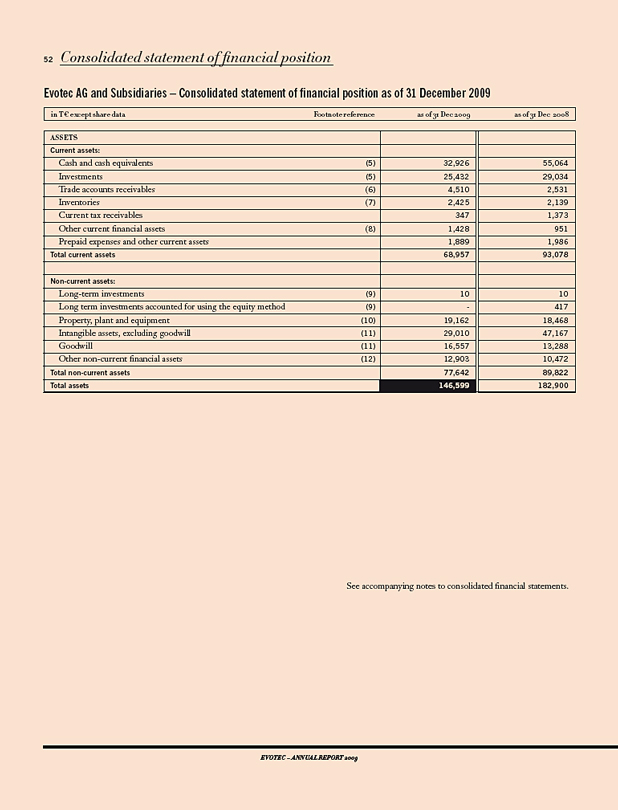

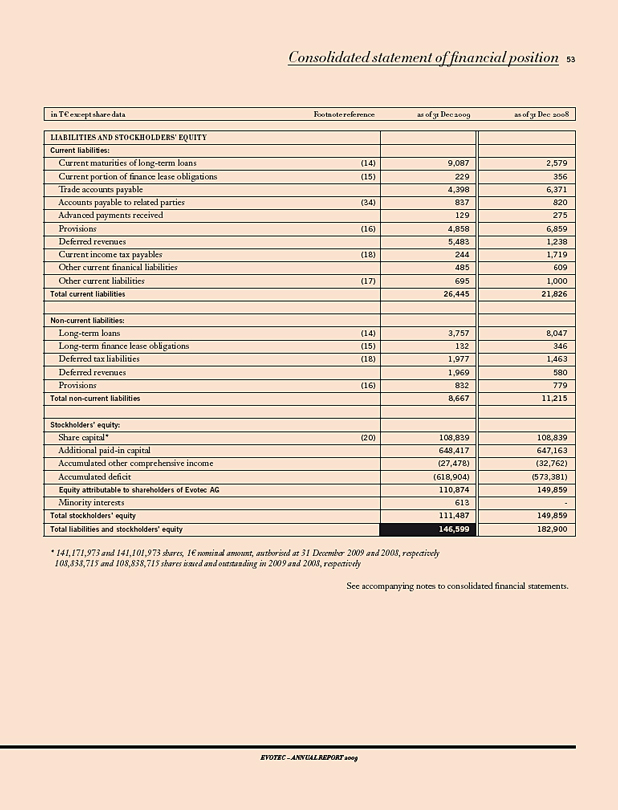

Condensed Key Figures

Evotec AG (IFRS)

Evotec has de-risked its development portfolio by limiting its investments in programmes that are very early in the discovery process and by entering into important strategic collaborations. In March 2009, for example, the Company signed a significant alliance with Roche. This is a joint development programme where Evotec is responsible for conducting the clinical Phase II development of EVT 101 in patients with treatment-resistant depression. The costs of that study are fully borne by Roche and so are the development costs of the follow-on molecule EVT 103, which entered Phase I. The potential strategic value of the underlying deal goes beyond $300 m, including upfront payments, development, sales performance and significant double-digit commercial payments.

In addition to these strategic actions, Evotec has implemented strict cost cutting and restructuring measures during the year. The Company has initiated and completed head-count reductions in administrative and clinical development functions by 20% and 50% respectively. Evotec also decided to concentrate its operations in Europe and Asia in order to leverage more efficiently its research and development infrastructure.

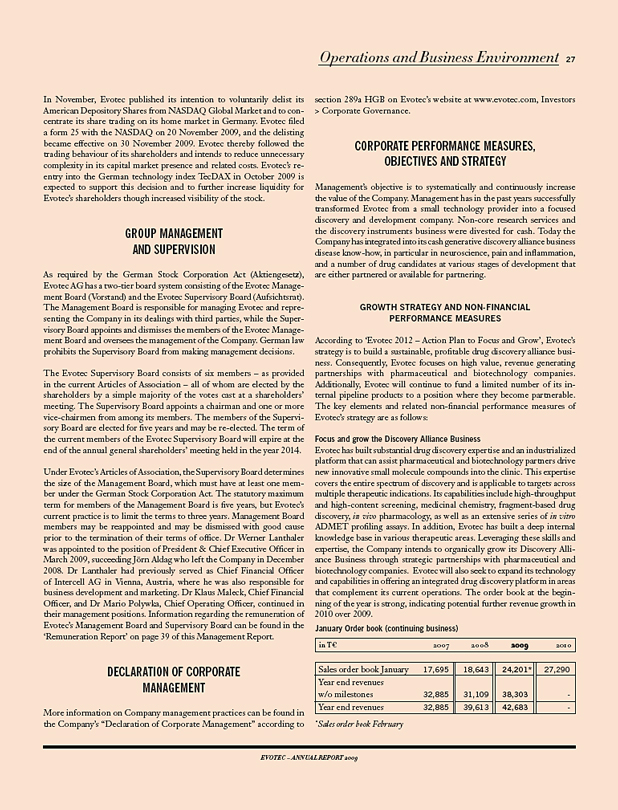

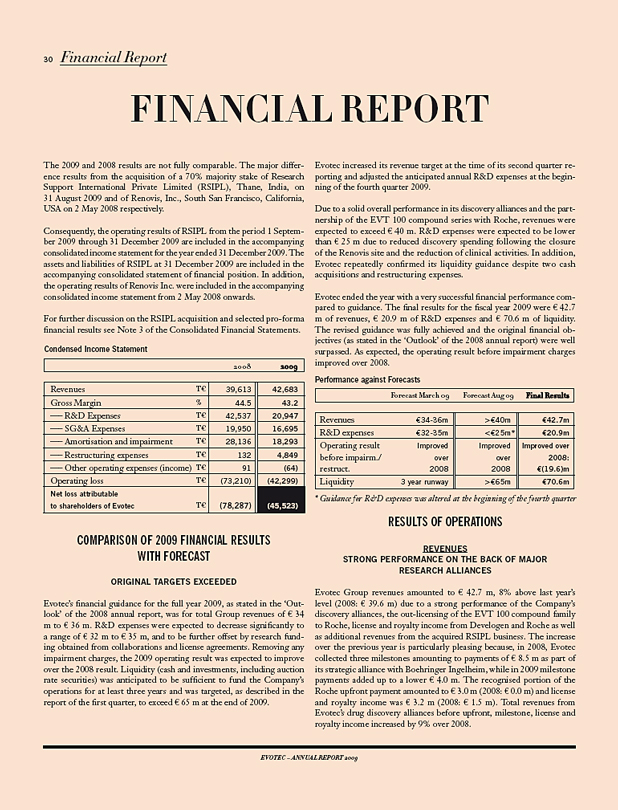

IN T€ 2009 2008 CHANGE 09/08 IN%

Results

Revenues 42,683 39,613 8

Research & development expenses 20,947 42,537 (51)

Operating result 1) (19,612) (45,495) 57

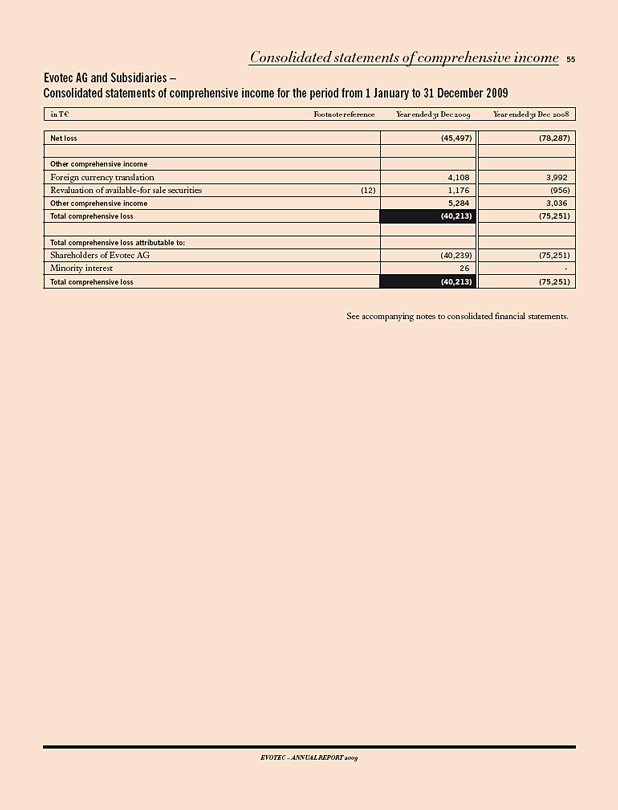

Net income (loss) (45,523) (78,287) 42

Balance sheet data

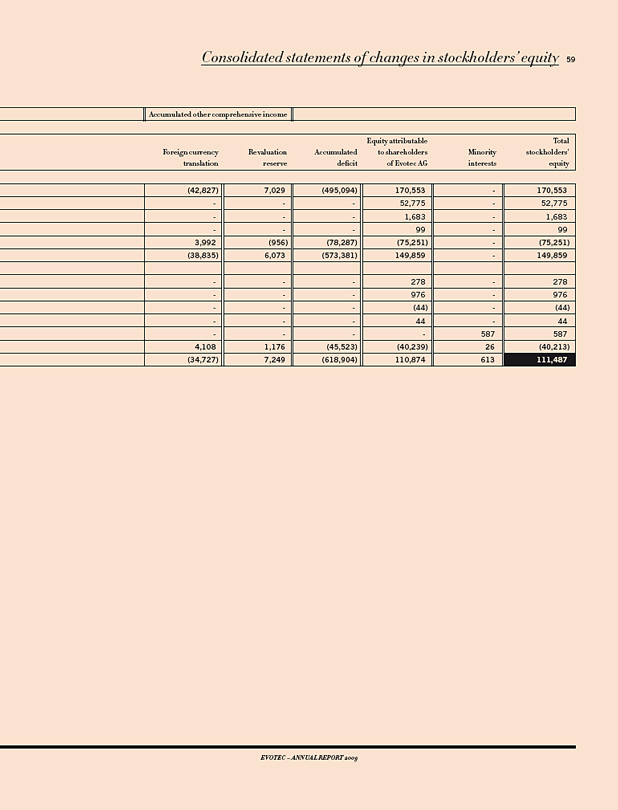

Total stockholders’ equity 111,487 149,859 (26)

Capital expenditure 2) 2,213 3,514 (37)

Cash and investments 3) 70,594 92,401 (24)

Balance sheet total 146,599 182,900 (20)

Cash flow (22,410) 15,462 (245)

Personnel data

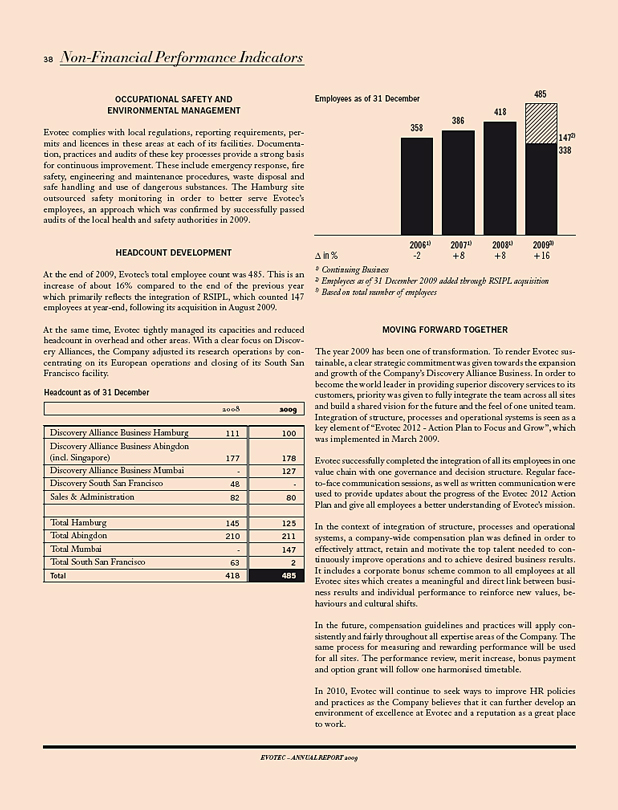

Employees as of Dec. 31 485 418 16

Per Share

Result; in € (0.43) (0.82) 48

1) Before impairment and restructuring expenses. 2) Cash relevant purchase of tangible and intangible assets, excluding finance leases. 3) Including auction rate securities.

Consequently, Evotec closed its US operation in South San Francisco (former facility of Renovis, Inc.).

Finally, to further streamline its activities and focus the liquidity of its stock on one trading platform, Evotec de-listed from the NASDAQ Global Market.

This bundle of management actions and strategic measures is clearly reflected in the financial results of the 2009 fiscal year. Compared to 2008, Revenues were up by 8%; Research & development expenses were down by 51%; Sales, general & administrative expenses were down by 16%; Operating result was up by 42%.

IMPRINT

Editor Evotec AG; Chief Editor Dr Werner

Lanthaler; Project Leader Anja Bosler

Compilation of articles & editor Gabriele Hansen

Content Dr Klaus Maleck, Dr Mario Polywka, Dr Werner Lanthaler

The Evotec Annual Report containing the consolidated financial statements according to German Commercial Code (Handelsgesetzbuch) is available in English and German. In addition, Form 20-F, when filed with the SEC, will be available in English.

For further information on Evotec, please be invited to visit our website at www.evotec.com.

You can also contact us by email info@evotec.com.

Concept and design alessandridesign, Rufgasse 3, 1090 Vienna, Austria, +43.(0)1.310.4401.16

Lithography R12, Fockygasse 29, 1120 Vienna, Austria, +43.(0)1.81466-0;

Print C. Angerer & Göschl, Gschwandnergasse 32, 1170 Vienna, Austria, +43.(0)1.4858024-0

Publisher Evotec AG, Schnackenburgallee 114, 22525 Hamburg, Germany, +49.(0)40.56081-0, +49.(0)40.56081-222 (Fax)

Forward-Looking Statements Information set forth in this report contains forward-looking statements, which involve a number of risks and uncertainties. Such forward-looking statements include, but are not limited to, statements about our financial outlook for 2010 and beyond; our expectation that our current cash, cash equivalents, investments, and operating revenues will be sufficient to fund our planned activities beyond 2012, and our belief that we are on course to profitability and sustainability by 2012; our expectations regarding the growth of the pharmaceutical outsourcing drug discovery market, the opportunities such growth will provide us, and our ability to take advantage of such market developments and become a leader in this industry in the coming years; our expectations regarding the impacts, and anticipated timing of such impacts, of the “Evotec 2012 – Action Plan to Focus and Grow”; our expectation that our reentry into the German technology TecDAX in 2009 will increase liquidity for our shareholders and that our voluntary delisting from NASDAQ and anticipated de-registration with the SEC will streamline our activities and focus the liquidity of Evotec’s stock on one trading platform; our expectations regarding the impact that the recent global financial crisis will have on our company; our expectations and assumptions concerning regulatory, clinical, and business strategies, the progress of our clinical development programmes and timing of the results of our clinical trials, strategic collaborations, and management’s plans, objectives and strategies. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, and which could cause actual results to differ materially from those contemplated in these forward-looking statements. In particular, the risks and uncertainties include, among other things: risks that we may be unable to achieve the anticipated benefits of our revised business focus, restructuring, and cost containment measures or recognise the results of such measures within the expected timeframes; risks that we will not achieve the anticipated benefits of our collaborations, partnerships and acquisitions in the timeframes expected, or at all; the risk that we will not achieve the anticipated benefits of our voluntarily delisting from NASDAQ and anticipated de-registration from the SEC; risks that product candidates may fail in the clinic or may not be successfully marketed or manufactured; risks relating to our ability to advance the development of product candidates currently in the pipeline or in clinical trials; our inability to further identify, develop and achieve commercial success for new products and technologies; the risk that competing products may be more successful; our inability to interest potential partners in our technologies and products; our inability to achieve commercial success for our products and technologies; our inability to protect our intellectual property and the cost of enforcing or defending our intellectual property rights; our failure to comply with regulations relating to our products and product candidates, including FDA requirements; the risk that the FDA may interpret the results of our studies differently than we have; the risk that clinical trials may not result in marketable products; the risk that we may be unable to successfully secure regulatory approval of and market our drug candidates; risks of new, changing and competitive technologies and regulations in the U.S. and internationally; general worldwide economic conditions and related uncertainties; future legislative, regulatory, or tax changes as well as other economic, business and/or competitive factors; and the effect of exchange rate fluctuations on our international operations. The list of risks above is not exhaustive. Our Annual Report on Form 20-F most recently filed with the Securities and Exchange Commission, and other filings and items furnished with the Securities and Exchange Commission, contain additional factors that could impact our businesses and financial performance. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any such statements to reflect any change in our expectations or any change in events, conditions or circumstances on which any such statement is based.

EVOTEC – ANNUAL REPORT 2009

evotec MARKET SPACE

THE WORLD IN WHICH WE OPERATE

The drug discovery industry poised for growth

The global pharmaceutical industry is facing a significant productivity challenge. R&D costs have escalated over the years, yet product pipelines are nowhere near producing the returns experienced in earlier decades. Against this industry backdrop, biotech and pharma companies will increasingly turn to outsourcing R&D activities as they are forced to seek greater cost savings and improvements in efficiency. The use of Contract Research Organisations (CROs) allows fixed costs to be converted into variable costs and also provides expertise in selected areas without the client needing to maintain or build internal capabilities and infrastructure. This market we operate in is worth about $ 8bn.

INCREASED OUTSOURCING OF UPSTREAM ACTIVITIES

Outsourcing has been used by the pharmaceutical industry for more than twenty years, mainly for supporting clinical trials or regulatory affairs in a particular country or region. In the current environment, however, we expect companies to increase their outsourcing of upstream activities in the R&D process. For example, Eli Lilly outsources 100% of its pre-clinical GLP work, whereas Merck and Wyeth only outsource 5%. These latter figures may change dramatically during post-merger strategic realignments. Another major driver for business growth in the drug discovery industry will come from mid-size pharma companies and larger biotech companies, who also seek improvements in R&D efficiency.

OUTSOURCING CAN RESOLVE DRUG DISCOVERY BOTTLENECKS

While innovative scientific technologies and approaches are a rich source for the identification of novel drugs, they have and will continue to make drug discovery more complex, dramatically increasing the number of drug targets and active compounds prosecuted. Many companies do not always have sufficient numbers of experienced scientists in-house to advance all of their required programmes and biotechnology companies often do not have the technical staff or technology to process their targets internally. Here is where discovery out-sourcing can help make the drug discovery and development process more efficient.

‘Trying to do everything yourself won’t work. The odds of owning everything and being at the right place at the right time are not high.’

Peter Johnson, Lilly’s Vice President of Corporate Strategic Planning. Wall Street Journal Online, Jan. 2010

DRUG DISCOVERY OUTSOURCING MARKET IS WORTH ABOUT $8BN

The global drug discovery market reached about $5 bn in 2007, an increase of 15% compared to 2006 according to a study from Kalorama Information and this market is expected to experience robust growth and exceed $8 bn in 2010.

TECHNOLOGY LEADERSHIP WILL DRIVE MARKET GROWTH

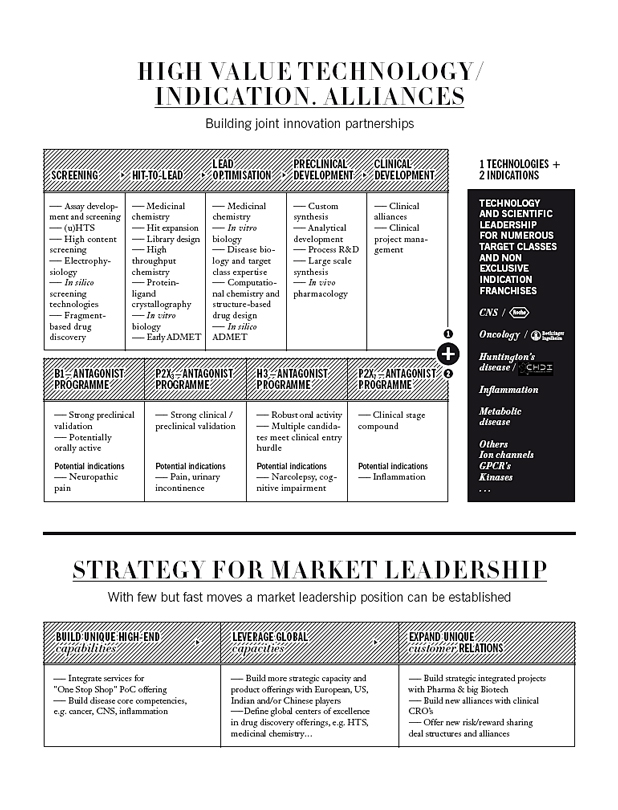

All stages of drug discovery can be outsourced: target identification, target validation, high-throughput screening (HTS) and lead optimisation. Chemistry and biology are the core scientific disciplines utilised in drug discovery.

Chemistry services represent the largest portion of drug discovery outsourcing accounting for over 40% of all outsourcing revenues in 2007. This market share typically includes preclinical process development and early manufacturing. Other outsourced chemistry activities include the medicinal chemistry required to identify and optimise lead compounds towards clinical candidates. Biology services is the fastest growing segment. New technologies will continue to drive the growth of the biology services market. The biology services segment involves such activities as analysis of biological pathways, target identification and validation, structural analysis of biological targets, protein expression, and assay development. High-throughput screening is an attractive area to outsource as automated HTS systems are expensive to buy and maintain and require specially trained operating personnel.

EVOTEC – ANNUAL REPORT 2009

MARKET SPACE 5

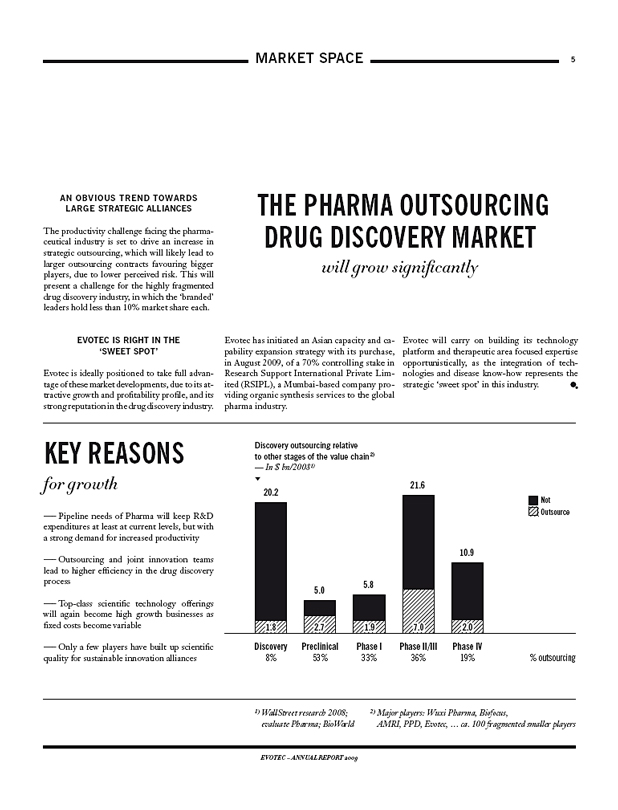

AN OBVIOUS TREND TOWARDS LARGE STRATEGIC ALLIANCES

The productivity challenge facing the pharmaceutical industry is set to drive an increase in strategic outsourcing, which will likely lead to larger outsourcing contracts favouring bigger players, due to lower perceived risk. This will present a challenge for the highly fragmented drug discovery industry, in which the ‘branded’ leaders hold less than 10% market share each.

EVOTEC IS RIGHT IN THE ‘SWEET SPOT’

Evotec is ideally positioned to take full advantage of these market developments, due to its attractive growth and profitability profile, and its strong reputation in the drug discovery industry.

THE PHARMA OUTSOURCING DRUG DISCOVERY MARKET

will grow significantly

Evotec has initiated an Asian capacity and capability expansion strategy with its purchase, in August 2009, of a 70% controlling stake in Research Support International Private Limited (RSIPL), a Mumbai-based company providing organic synthesis services to the global pharma industry.

Evotec will carry on building its technology platform and therapeutic area focused expertise opportunistically, as the integration of technologies and disease know-how represents the strategic ‘sweet spot’ in this industry.

KEY REASONS

for growth

—Pipeline needs of Pharma will keep R&D expenditures at least at current levels, but with a strong demand for increased productivity

—Outsourcing and joint innovation teams lead to higher efficiency in the drug discovery process

—Top-class scientific technology offerings will again become high growth businesses as fixed costs become variable

—Only a few players have built up scientific quality for sustainable innovation alliances

Discovery outsourcing relative to other stages of the value chain2)

— In $ bn/20081)

20.2 5.0 5.8 21.6 10.9

Not Outsource

1.8 2.7 1.9 7.0 2.0

Discovery 8% Preclinical 53% Phase I 33% Phase II/III 36% Phase IV 19% % outsourcing

1) WallStreet research 2008; evaluate Pharma; BioWorld 2) Major players: Wuxi Pharma, Biofocus, AMRI, PPD, Evotec, … ca. 100 fragmented smaller players

EVOTEC – ANNUAL REPORT 2009

evotec EDITORIAL

Dr Werner Lanthaler

in person

If you don’t hear songs like “Nothing else matters …”, probably Werner is on the road!

Dr Werner Lanthaler – he is the Chief Executive Officer of Evotec since March 2009.

From 1995 to 1998 he was Senior Management Consultant at the consulting firm McKinsey & Company. Prior to Evotec he was Chief Financial Officer at Intercell AG for more than eight years. Dr Lanthaler played a pivotal role in many of Intercell’s major corporate milestones including the market approval of the company’s first product and several strategic alliances.

As Chief Executive Officer at Evotec he is responsible for the entire operating business as well as the areas strategy, marketing, communication and investor relations. It is the vision to build a highly innovative biotech company that will make a true difference to help in the fight against diseases with high medical need that motivated Werner to accept this challenging management task. The key element for proper team functioning is communication. Werner’s management style is to communicate and interact as much as possible within the Company and also with partners, shareholders and clients.

Dr Lanthaler holds a doctorate in economics from Vienna University, earned his Master’s degree from Harvard University and holds a degree in Psychology.

DEAR

SHARE– HOLDERS

AND FRIENDS,

First let me thank you for a year of trust, support and also for a year in which Evotec has regained momentum.

YES WE DISCOVER!

In a world where many things change, we know one thing for sure: There is an urgent need to develop new drugs which will increase dramatically in the next few decades. We, at Evotec, are dedicated to build a world-leading pool of innovative technologies and drug discovery and development processes to achieve this goal more efficiently and effectively. This vision is bringing the best scientists and the best pharma and biotech partners together in order to deliver on the promises of discovering better drugs faster. With our strategic programme ‘Evotec 2012 - Action Plan to Focus and Grow’ we have defined and implemented the key strength to truly lead this industry in the next years. 2009 was certainly a year for us in which many things had to be revisited. The first indicators show us that this strategy is already delivering its first successes.

YES WE GROW!

The drug discovery outsourcing market is still immature and the industry is poised for growth. Since it is highly fragmented, there is a leadership gap which we believe Evotec can successfully fill. Before joining Evotec, there was the strategic idea to strengthen the Company’s excellent position and become the driving force behind this growth industry and its consolidation. This also represents an attractive investment case. We still have a lot to do to make this case clearer and better visible to our shareholders, but we will let data and results speak a very clear language to support our growth vision.

The business plan goal is to grow Evotec into a global, sizeable, sustainable, highly innovative and profitable company within 3 - 5 years, with double-digit annual revenue growth.

We see the entrepreneurial chance to make this happen and look forward to a successful 2010 and beyond.

Yours sincerely,

Werner Lanthaler

EVOTEC – ANNUAL REPORT 2009

INDIA 7

WELCOME TO INDIA

Evotec has added Asian capacity in order to optimise its cost structure for large discovery alliances.

Evotec acquired a 70% controlling majority stake in Research Support International Private Limited (RSIPL), a Mumbai-based company providing organic synthesis services to the global pharmaceutical industry, for € 2.4 m in cash. Evotec took full control of the operational business and has a call option for the remaining 30% in the future.

With the RSIPL acquisition, Evotec gained excellent people and facilities and increased its ability to leverage its strategic drug discovery offering: More than 160 highly qualified scientists and seven synthesis laboratories, one analytical laboratory and the existing library synthesis business of the existing joint-venture with DIL have been added to the impressive capabilities of Evotec. These strategic technology and capacity additions further validate Evotec’s goal to become the number one global provider of drug discovery and early development solutions. The aim is to leverage the Company’s global offering with cost efficient scale and enable Evotec to attract large chemistry-based contract work, which is more frequently being outsourced by large pharmaceutical companies.

‘With this acquisition we reinforced our strategic commitment to deliver the highest value, know-how driven services and build the strongest innovation alliances with our customers.’

Dr Mario Polywka, Chief Operating Officer at Evotec

ABOUT RSIPL

Incorporated in 2004, Research Support International Private Limited (RSIPL) was a 100% subsidiary of DIL Ltd (formerly Duphar-Inter-fran Ltd.) providing drug discovery & development services. RSIPL uses its world class infrastructure and facilities to synthesise virtually all types of organic compounds from milligramme to kilogramme scale. The company’s offering includes custom synthesis, process research and development, scale-up and analytical services. RSIPL was conferred the ‘Partner of Choice in

Contract Research - Chemistry Based Services’ award for the year 2007 by Frost & Sullivan in recognition of its experience in offering an organic synthesis services to pharmaceutical and biotech customers worldwide.

INVEST IN ADDITIONAL TECHNOLOGIES – NEW STEPS TO MAKE DRUG DISCOVERY

MORE EFFECTIVE

Evotec anticipates adding to and enhancing its drug discovery offering considerably. As an example, ion channel focused libraries and an electrophysiology screening platform were added in 2009. Evotec signed an agreement with DiscoveRx to access their proprietary technologies (PathHunter™, cAMPHunter™ cell lines and EFC chemilumincescent detection technology). The combination of all these technologies with Evotec’s proprietary technologies and know-how in high-throughput screening means that Evotec can strategically offer unrivalled screening solutions within the drug discovery process for GPCRs, ion channels and other important target classes.

EVOTEC – ANNUAL REPORT 2009

evotec RETROSPECTIVE

SPRING

Highlights

—Strategic business review results in ‘Evotec 2012 – Action Plan to Focus and Grow’

—New alliance with Roche to develop the EVT 100 compound family in treatment-resistant depression

—Successful completion of first Phase I study with EVT 401

—Acquisition of zebrafish screening operations

Lowlights

—Failure of EVT 302 in smoking cessation

—Failure of 2008/2009 partnering process of Evotec’s insomnia drug EVT 201

In March 2009, Evotec appointed Werner Lanthaler as new Chief Executive Officer. In addition Evotec and Roche entered into an agreement for the clinical development of EVT 101 in patients with treatment-resistant depression. This alliance covers the possible development of the entire EVT 100 compound family (NR2B-selective NMDA antagonists) with a total potential deal value exceeding $300 m.

To bring the Company back onto a growth path and to sustainability, the Management Team developed and implemented the ‘Evotec 2012 - Action Plan to Focus and Grow’. The cornerstone of this plan was to re-focus the Company on its key strength, that of its Discovery Alliance Business. In order to enhance the value of its drug discovery offering, Evotec acquired a zebrafish screening operation in the UK and Singapore, expanded its ion channel capabilities, and further added to its electrophysiology screening platform. One unfortunate consequence of this plan was headcount reductions in SG&A and clinical development.

Within its proprietary clinical development programmes, Evotec had to accept the clinical failure of EVT 302, a selective MAO-B inhibitor, in smoking cessation.

In a Phase II quit rate study, the drug candidate failed to demonstrate a significant improvement compared to placebo. Consequently, this programme was terminated. The first Phase I study with 401, an oral P2X7 receptor antagonist, showed a good safety profile. It represents a potentially novel approach to orally treat inflammatory conditions. In partnership with Pfizer, the first small molecule vanilloid receptor 1 (VR1) antagonist that was in Phase I testing to treat pain did not yet meet the optimally required target profile. As a result, Pfizer decided to focus on the development of follow-on antagonists.

A YEAR

SUMMER

Highlights

—New alliances with Cubist, Alios and Biogen Idec

—Milestone payment from Boehringer Ingelheim

—Acquisition of Indian RSIPL (Evotec India)

—Start of Phase I with EVT 103

Lowlights

—Closure of the former facility of Renovis, Inc. in South San Francisco

At the beginning of summer, Evotec signed a number of new alliances: A research agreement on fragment-based drug discovery with Cubist Pharmaceuticals, a high-throughput screening collaboration with Alios Biopharma and a research agreement with Biogen Idec in compound screening. Moreover, a further milestone was successfully achieved in the multi-year drug discovery collaboration with Boehringer Ingelheim.

In August, Evotec acquired a 70% controlling, majority stake of Research Support International Private Limited (RSIPL), India, for €2.4 m to expand capacity and accelerate Evotec’s strategy to become the global, premier partner for drug discovery and early development alliances. On the clinical side, Evotec started a Phase I study with EVT 103, the next generation NR2B-selective NMDA receptor antagonist following EVT 101, planned to enter clinical development in treatment-resistant depression in collaboration with Roche.

The execution of the restructuring programme ‘Evotec 2012 – Action Plan to Focus and Grow’ showed first positive results which are reflected in the financial results for the second quarter. In May, as a further consequence of implementing ‘Evotec 2012 – Action Plan to Focus and Grow’, the Company announced the re-engineering of its research & development operations to more effectively leverage the Discovery Alliance Business. This led to the closure of its South San Francisco facility (ex Renovis) and the concentration of Evotec’s research in Europe.

EVOTEC – ANNUAL REPORT 2009

RETROSPECTIVE 9

FALL

Highlights

— Extension of collaborations with Ono Pharmaceutical and Boehringer Ingelheim

— Compound from Evotec-Cardioxyl collaboration enters the clinic

— Milestone payment from Boehringer Ingelheim

— Evotec shares return to the German technology index TecDAX

Lowlights

— Delay of EVT 101 Phase II start due to FDA safety and toxicology monitoring requests

In October, Evotec announced two development milestones from two important partnerships. One milestone was achieved with Cardioxyl Pharmaceuticals under a collaboration agreement for the compound, CXL-1020, that was successfully moved into clinical testing in heart failure.

The second milestone was achieved with Boehringer Ingelheim and led to a payment of € 2.5 m for the selection of a candidate compound for pre-development studies in a cardiometabolic programme.

Two important contract extensions were also announced in October. Evotec extended the drug discovery collaboration with its strategic partner Ono Pharmaceutical to include an ion channel target. Certainly one of the most important business achievements in 2009 was the extension of the strategic research alliance with Boehringer Ingelheim for at least four

more years with € 15 m in research funding plus milestones and royalties. This collaboration was expanded specifically to build a joint innovation task force in oncology.

Furthermore, Evotec signed an agreement with DiscoveRx to access to their proprietary technologies (PathHunterTM, cAMPHunterTM cell lines and EFC chemiluminescent detection technology).

Finally, Evotec voluntarily de-listed from the NASDAQ and re-entered the German technology index TecDAX. This an important step to regain more visibility for the Company also in the capital markets.

IN

RETROSPECTIVE

WINTER

Highlights

— Milestone payment from Ono Pharmaceutical

— Extension of strategic alliance with CHDI

— Major cooperation agreement with Vifor

— Clearance of FDA for Phase II start with EVT 101

In December 2009, Evotec received a milestone payment from Ono Pharmaceutical for the progression of novel protease inhibitors into lead optimisation. Another important event in the winter was the success of securing a German government research grant of up to € 2.5 m from the BMBF within the Neu2 consortium. The purpose of this grant is to advance research and development activities on the target serine racemase for potential use in neuroprotection.

In January 2010, Evotec announced the extension of a strategic alliance with CHDI, a non-profit organisation. The collaboration is aimed at finding new treatments for

Huntington’s disease and represents one of the largest joint innovation drug discovery alliances within Evotec. It will provide Evotec with up to $ 37.5 m in research funding over the next three years.

Furthermore in January, Evotec signed an agreement with Vifor Pharma. Evotec provides integrated biology, chemistry and preclinical development activities to identify a preclinical candidate for the treatment of anaemia. The collaboration is worth about € 5.5 m.

EVOTEC – ANNUAL REPORT 2009

evotec

PARTNER

UNITE +

Evotec is building integrated alliances with a technology and therapeutic area focus.

CONQUER

We see Evotec as the architect of innovation teams in large alliances designed to develop new drugs.

Both parties in an alliance share innovation, know-how and technology to bring forward best-in-class drugs in areas of highest unmet medical needs. The need for new drugs is urgent in many diseases, getting results faster in today’s very challenging product development environment is Evotec’s mission.

Evotec provides expertise along the full value chain of drug discovery and development. Specifically, Evotec has combined therapeutic area know-how in neurology, pain, inflammation, metabolic diseases and oncology with its world leading drug discovery platform. This, we believe, forms successful innovation teams.

With creative deal structures, but especially with the best and most motivated people, Evotec is confident to deliver on its strategy to be the partner of choice for highly complex and innovative drug discovery franchises. Evotec today is already one of the most innovative outsourcing partners globally, but it is the Company’s clear goal to grow even more aggressively.

CONVINCING TECHNOLOGY, OUTSTANDING QUALITY

and scientific expertise

biogen idec

In 2009, Biogen Idec chose Evotec as a partner to provide assay development and high-throughput screening services against a particular target. Evotec uses its expertise and technologies in protein production, assay development and high-throughput screening to identify hit molecules for Biogen Idec. Further targets may be added to the collaboration as agreed.

A LONG-TERM ALLIANCE

based on success

‘Evotec has continually demonstrated exceptional scientific expertise in support of our research.’

Dr Wolfgang Rettig, Corporate Senior Vice President Research of Boehringer Ingelheim, 2009

Boehringer Ingelheim

To date seven significant milestones have been achieved as part of this long-term agreement. Based on its success, in 2009 this strategic collaboration was extended for a minimum of four more years and has been expanded to specifically include oncology targets.

Evotec and Boehringer Ingelheim started working together in September 2004, initially concentrating their joint research on identifying and developing small molecule therapeutics acting on selected G-Protein Coupled Receptors (GPCRs) with a focus on Central Nervous System diseases. The agreement includes a broad range of services from drug discovery to delivering drug candidates. Boehringer Ingelheim has the global responsibility for all clinical development activities, manufacturing and commercialisation of the compounds identified in the collaboration. Evotec’s success is being rewarded through research payments, preclinical and clinical development related payments and product royalties. In January 2006, the collaboration doubled in size and was extended to the end of 2008. In early 2008, the collaboration was extended for a further twelve months until the end of 2009, when it was extended for at least another four years.

EVOTEC – ANNUAL REPORT 2009

PARTNER 11

Here is just a set of examples of how Evotec is contributing to success in drug discovery partnerships

evotec + Novartis evotec + Boehringer Ingelheim evotec + ONO PHARMACEUTICAL CO., LTD.

evotec + INTERMUNE® evotec + Pfizer evotec + Cardioxyl PHARMACEUTICALS

evotec + Vifor Pharma evotec + Roche evotec + CHDI FOUNDATION, INC.

evotec + spermatech Male contraceptives evotec + biogen idec

WHERE

the sun rises

Ono Pharmaceutical extended an ongoing research collaboration with Evotec and initiated a new discovery collaboration in 2009. This partnership is a good example of Evotec’s ability to grow new relationships into larger alliances based on success. The drug discovery agreement with Ono is now an important part of the portfolios of both companies.

The initial collaboration was signed in early 2008. It applied, amongst other things, Evotec’s proprietary EVOlutionTM platform for fragment-based drug discovery to identify novel and potent compounds against a protease target provided by Ono. The

project has advanced into lead optimisation. Evotec received an upfront payment for access to this industry leading platform, ongoing research funding as well as milestones based on the research progress. Under the new collaboration, Evotec provides integrated drug discovery activities, specifically Evotec’s ion channel drug discovery platform and expertise to discover novel, small molecular weight compounds active against an ion channel target selected by Ono. Evotec will receive research funding and milestone payments.

‘We have a high regard for Evotec’s drug discovery expertise and the capabilities and technologies used in progressing this collaboration.’

Kazuhito Kawabata, Ph.D., Ono, 2009

ONO PHARMACEUTICAL CO., LTD.

THE GENE IS ALREADY

well-known

CHDI FOUNDATION, INC.

In early 2010, Evotec and CHDI Foundation, Inc. extended their collaboration, which was initially signed in 2006, for a further three years to find new treatments for Huntington’s disease. Evotec provides a full range of neurological research activities and expertise to CHDI, including integrated biology and chemistry supported by compound and library management, target validation, screening, computational chemistry, in vitro and in vivo pharmacokinetics and protein crystallography. For this support, Evotec will receive research revenue of up to $ 37.5 m. CHDI is a non-profit organisation with a mission to rapidly discover and develop drugs that delay or slow the progression of Huntington’s disease.

Huntington’s disease is a familial disease caused by a mutation in the huntingtin gene. As a result of carrying the mutation, an individual’s brain cells fail and die leading to cognitive and physical impairments that, over the course of the disease, significantly impair the individual’s quality of life and ultimately cause death. There is currently no way to delay the onset of symptoms or slow the progression of Huntington’s disease.

NEW HOPE FOR

heart failure patients

Cardioxyl PHARMACEUTICALS

Cardioxyl Pharmaceuticals has successfully moved the compound CXL-1020 into clinical testing. CXL-1020 is a novel, proprietary nitroxyl donor currently in development as a potential therapy for acute decompensated heart failure. Evotec has provided medicinal chemistry support to Cardioxyl for over three years. During this time, the compound was developed through lead optimisation and preclinical development, and has now progressed to Phase I/IIa testing in heart failure patients. Meeting this milestone triggered a success payment from Cardioxyl Pharmaceuticals to Evotec.

EVOTEC – ANNUAL REPORT 2009

evotec RESEARCH NEVER STOPS

Dr Mario Polywka

in person

If you hear somebody singing in the corridor,… it is probably Mario!

Dr Mario Polywka – he is the Chief Operating Officer of Evotec since November 2007.

He was one of the co-founders of Oxford Chirality which later became Oxford Asymmetry International (OAI) before it merged with Evotec in 2000. Mario was Chief Executive Officer of OAI during the merger with Evotec. Following the merger he was Chief Operating Officer until 2002. Between 2002 and 2004 he ran a number of spin-out companies in the Oxford area.

As Chief Operating Officer at Evotec, he is responsible for Evotec’s Discovery Alliance Business, managing more than 400 scientists in Abingdon, Hamburg, Mumbai and Singapore. The business collaborates with pharmaceutical and biotech companies in drug discovery. Mario’s secret of a happy and successful workforce is to offer interesting work in a stimulating environment – and this also involves singing and having fun!

Dr Polywka is a Chemist by training, having completed his D. Phil. studies under Professor Steve Davies, at Oxford University, in the field of Mechanistic Organometallic Chemistry, followed by post-doctoral studies on the biosynthesis of Penicillins with Professor Jack Baldwin.

Scientific excellence to fight unmet medical needs

FIN

Evotec has a deep therapeutic knowledge in neurology, pain, inflammation, oncology and metabolic diseases and an exciting pipeline with novel and differentiated compounds in areas of large unmet medical needs. In 2009, Evotec decided to more aggressively create strategic alliances around some of its key assets. With its portfolio of early stage development opportunities, Evotec intends to attract strategic partnerships to progress the development of these assets. The idea is to both de-risk the portfolio, and unleash the commercial upside of its compounds.

RAY OF HOPE FOR DEPRESSION

— EVT 100

One of the most important highlights of the year 2009 was the alliance with Roche in treatment-resistant depression. The agreement covers the development of the EVT 100 compound family (NR2B-selective NMDA antagonists) with a total potential deal value exceeding $ 300 m. The compounds were originally discovered by Roche and licensed to Evotec in 2003 for further development.

Roche has entered into this agreement with Evotec for Phase II clinical development of EVT 101, the most advanced compound, in patients with treatment-resistant depression. Evotec is responsible for conducting a Phase II proof-of-concept study for EVT 101 and Phase I safety and tolerability studies for the follow-on compound EVT 103.

The entire development programme will be funded by Roche. In addition, for the option to buy back rights to the EVT 100 compound family, Roche has paid Evotec an upfront fee of $ 10 m. If Roche exercises its buy-back option after the completion of the Phase II study, Evotec will receive a $ 65 m lump-sum payment from Roche in exchange for returning the compounds. In that case, Evotec is also eligible for further development and sales performance, and scalable double-digit commercial payments.

Preparation of the Phase II study for EVT 101 are ongoing. Evotec expects the study to start in the first half of 2010. The study results are expected in 2011.

The first-in-man Phase I study with EVT 103 started in September. This study was a double-blind, placebo-controlled, randomised ascending dose study in healthy young male subjects that assessed the compound’s safety, tolerability and pharma-cokinetic profile after oral single and multiple dose administration.

In Q1 2010 Evotec announced the successful completion of the clinical part of this study.

‘We believe that EVT 101 has the potential to become an effective new therapy for the high unmet need of these patients.’

Eugene Tierney, Head of CNS at Roche, 2009

Roche

EVOTEC – ANNUAL REPORT 2009

RESEARCH NEVER STOPS 13

DING THE BALANCE

‘We have a solid preclinical pipeline. It’s relatively early but it’s worth the investment. We see options and opportunities but we position this very carefully. We will only let data speak and not sell promises.’

Werner Lanthaler, Chief Executive Officer at Evotec

A CLOSER LOOK AT TREATMENT-RESISTANT

DEPRESSION

It is estimated that over 120 m people suffer from depression and that about one-third of patients treated for major depressive disorder (MDD) do not respond satisfactorily to the first antidepressant pharmacotherapy. Treatment-resistant depression is a term used in clinical psychiatry to describe cases of major depressive disorder that do not respond to adequate courses of at least two antidepressants. There are currently few therapeutic options for TRD, with only very few drugs approved for acute treatment of TRD in the US. There is a need for new treatments and EVT 101 represents one of the few new approaches in clinical development for TRD. According to the National Institute for Mental Health, some of the symptoms include persistent sadness, anxious or ‘empty’ mood, feelings of hopelessness, pessimism or guilt, worthlessness or helplessness, or loss of interest or pleasure in hobbies and activities that were once enjoyed.

PUT TO SLEEP – EVT 201

A past value driver of Evotec has so far failed to deliver its expected commercial success. EVT 201, a partial positive allosteric modulator of GABAA receptors, was tested as a treatment for insomnia in large Phase II clinical trials. Despite very promising scientific data, Evotec

has so far not been in the position to partner this programme. Given the size and investment needed for a decisive Phase III, EVT 201 will not be further developed without a partner.

QUIT SMOKING – QUIT EVT 302

EVT 302 (selective MAO-B inhibitor – smoking cessation & Alzheimer’s disease) failed to demonstrate any significant improvement in the quit rate compared to placebo in a Phase II smoking cessation trial. The company has stopped internal investments but may investigate its potential in the treatment of Alzheimer disease if a suitable partner can be found.

HELP TO IMPROVE LIFE – EVT 401

A first Phase I study with the P2X receptor antagonist EVT 401 was successfully completed. The small molecule drug candidate is a potential novel approach for the oral treatment of inflammatory conditions. EVT 401 was well tolerated and demonstrated the desired pharmacodynamic activity in healthy volunteers. Evotec will focus its efforts on optimising the oral dose formulation, completing the Phase I studies and preparing Phase II studies, if the programme finds an attractive commercial partner.

€ 2.5 M GRANT FOR NEURO-DEGENERATIVE DISEASES RESEARCH

SPONSORED BY THE

Federal Ministry

of Education

and Research

Evotec has been granted up to € 2.5 m in research funds from the Federal Ministry of Education and Research (BMBF) to advance research and development activities on the target serine racemase for potential use in neuropro-tection. The grant will fund the Company’s use of its compound library and fragment-based drug discovery platform to progress the project toward the clinic. The money was awarded as part of Evotec’s involvement in the German government-supported Neu2 consortium. The consortium is focused on developing therapeutics against neurodegenerative diseases including multiple sclerosis. Members include Evotec, MerckSerono, the European ScreeningPort GmbH, Bionamics GmbH, and the University Medical Center Hamburg-Eppendorf.

EVOTEC – ANNUAL REPORT 2009

evotec ZEBRAFISH

POPULAR

Zebrafish jumping out of the aquarium at Evotec Abingdon (UK)

PETS

An example of how Evotec continues to develop its technology portfolio

Evotec acquired the zebrafish screening operations and assets of Summit Corporation plc, including operations in Oxfordshire, UK, and Singapore. Employees and assets associated with the zebrafish business have been transferred. The capability is valuable to drug discovery as it provides important whole organism data about the safety and toxicity of drug-like molecules at an early stage of lead optimisation.

Founded in 2003, Summit built the world’s leading zebrafish capability. The company collaborated with more than 25 pharmaceutical companies worldwide.

The take-over includes a non-exclusive three-year research agreement with Johnson & Johnson signed at the end of 2008 to explore and develop the use of zebrafish screening in drug discovery and development.

THE ZEBRAFISH IS AN IDEAL ORGANISM FOR SMALL MOLECULE STUDIES

Zebrafish have the potential to accelerate and de-risk the drug discovery and development process by reducing attrition rates and lowering the development cost of producing new drugs. The small size and abundance of embryos make zebrafish suitable for screening in a high-throughput manner. Zebrafish are well-characterised model organisms and are used in the screening of potential drug candidates to provide invaluable in vivo safety and efficacy data from the earliest stages of drug discovery and throughout the development process. With a significant genetic similarity to humans and the presence of many vital organs including the heart, brain and liver, the larval zebrafish is highly suitable for screening potential drug candidates for efficacy and safety effects.

New results have been published in the January issue of the journal Science that demonstrates the power of high-throughput behavioural pro-filing in zebrafish to discover and characterise psychotropic drugs and to dissect the pharmacology of complex behaviours.

EVOTEC – ANNUAL REPORT 2009

PEOPLE 15

IRFAN BANDUKWALLA

In August 2009, Evotec acquired a controlling majority stake of Research Support International Private Limited (RSIPL). Within this acquisition, Evotec welcomes Irfan Bandukwalla. He is the General Manager of Evotec India with P&L responsibility for the Indian operations. Before this he was Head of Strategic Planning & Business Development at DIL Ltd. His responsibilities at DIL, amongst others, included establishing, management and business development of RSIPL since its conception in 2004. He is a Chartered Accountant by profession and has about 15 years experience in P&L management, setting up and developing businesses for European multinational organisations in India.

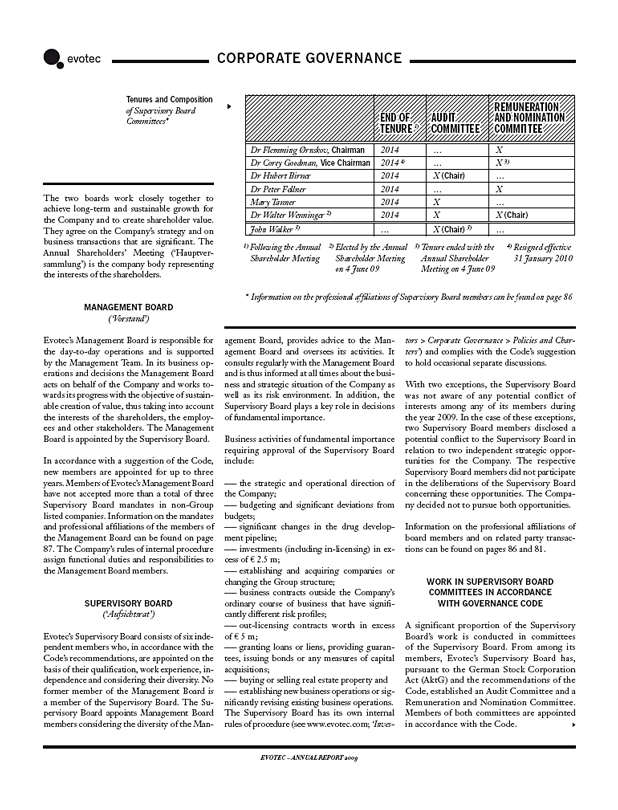

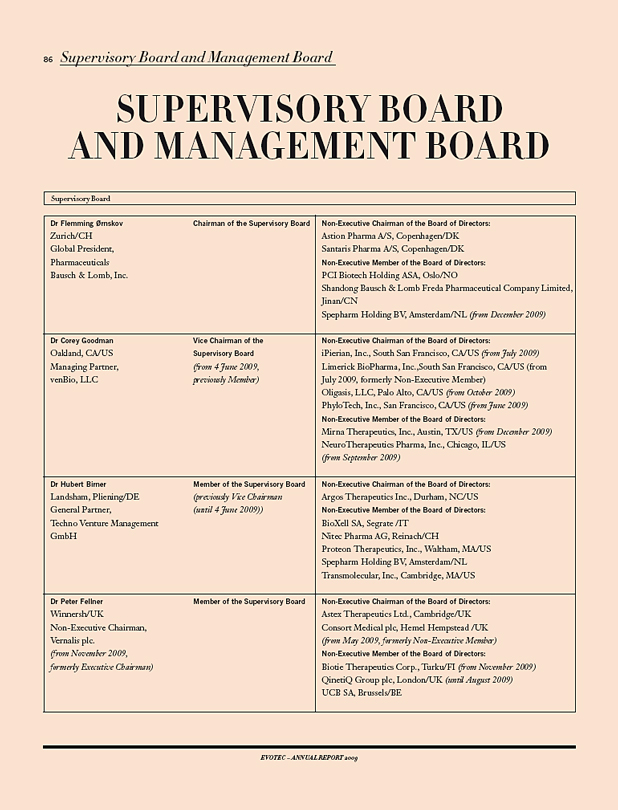

WALTER WENNINGER

Dr Walter Wenninger was elected as new member of the Company’s Supervisory Board at the Annual General Meeting held on 4 June 2009. Dr Wenninger has profound experience in strategic management, research & development and sales & marketing from leading positions in the international pharmaceutical industry. His career includes more than 30 years at Bayer AG where he held top-executive management positions within the life science business in Europe and the United States.

MICHAEL FÄRBER

In November 2009, Michael Färber joined Evotec for a three months internship. He is an advanced student of Molecular Life Science at the University of Luebeck, Germany. Because of the Company’s high reputation as the service provider no 1 for assay development and high-throughput screening he has chosen Evotec for his internship. He felt that his personal interests very much overlap with Evotec’s area of research. And indeed, he had the opportunity to get involved and take an active role in the top-quality research of the Company. He very much enjoyed the high level of responsibility he was given to conduct his own experiments and thereby contributing to the progress of his research project. To share his very positive experience in an inspiring company he highly recommends young students to apply for an internship at Evotec.

PEOPLE

ALEXANDER BÖCKER

In September 2009, Alexander Böcker joined the discovery biology group at Evotec in Hamburg as new Team Leader Discovery Informatics. His job responsibilities range from the statistical evaluation of biological data over the development of chemoinformatic approaches to the implementation and maintenance of software for the analysis and interpretation of biological results. Before this he was working for Boehringer Ingelheim (Canada) Ltd. as Research Scientist where he was responsible for establishing chemoinformatic methodologies. He is a Biologist with additional training in computer science and a Ph.D. in chemistry and has over six years experience in the pharmaceutical and biotech industry.

HEIKE DIEKMANN

Heike Diekmann joined Evotec in May 2009 when the zebrafish unit was acquired from Summit plc. As Principal Scientist, she supervises and develops zebrafish efficacy and disease models. Heike obtained a Ph.D. in biology, with emphasis on developmental biology, at the University of Konstanz, Germany, in 2002. She moved to England in 2005 to work for the zebrafish company Daniolabs in Cambridge, which was acquired by Summit plc in 2007, developing models for neurodegenerative diseases like Alzheimer and Parkinson in zebrafish.

ALEXANDRA RICHENBURG

Alexandra Richenburg works for the HR department in Abingdon. She assists with all aspects of the HR function there and is particularly responsible for training and development. Alexandra began at Evotec in September 2006 as a Scientist in discovery chemistry and worked for just under two years on the CHDI collaboration. In 2008, Alexandra was given the opportunity to transfer to the HR department which she eagerly accepted. The position allows her to utilise her enthusiasm for chemistry but also work even more closely with all the talented employees at Evotec

– Alexandra says it’s sometimes a challenge, but also a real pleasure.

EVOTEC – ANNUAL REPORT 2009

evotec FINANCIAL

PROMISE + DELIVER

Evotec increased and delivered on all financial targets for the fiscal year 2009

continuation cover story

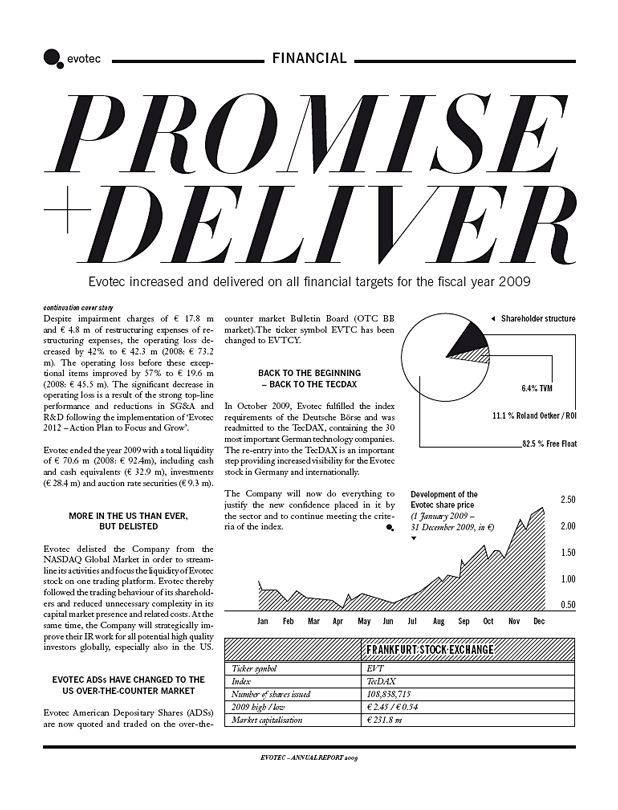

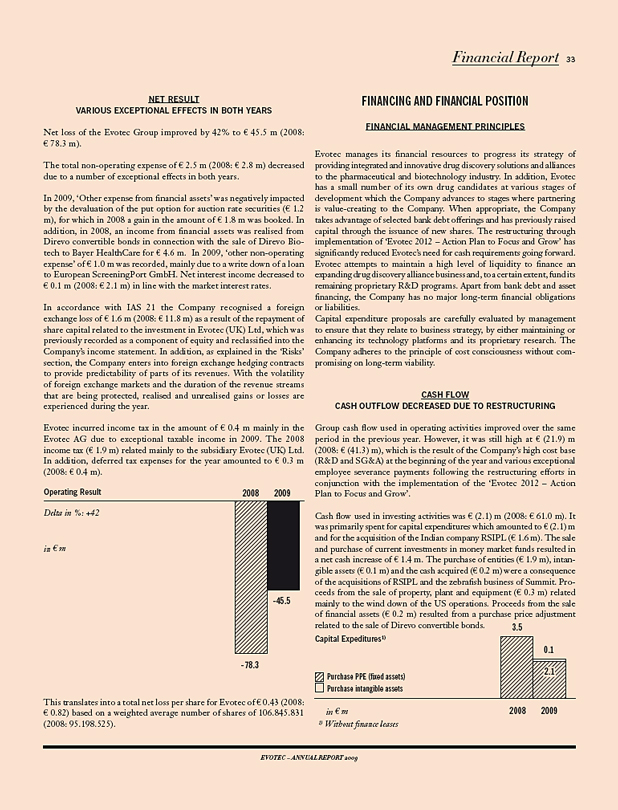

Despite impairment charges of € 17.8 m and € 4.8 m of restructuring expenses of restructuring expenses, the operating loss decreased by 42% to € 42.3 m (2008: € 73.2 m). The operating loss before these exceptional items improved by 57% to € 19.6 m (2008: € 45.5 m). The significant decrease in operating loss is a result of the strong top-line performance and reductions in SG&A and R&D following the implementation of ‘Evotec 2012 – Action Plan to Focus and Grow’.

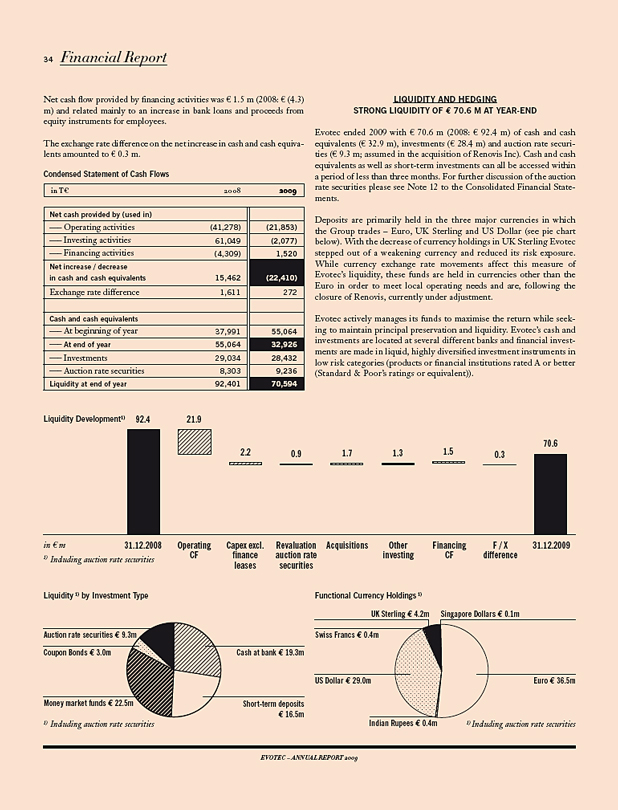

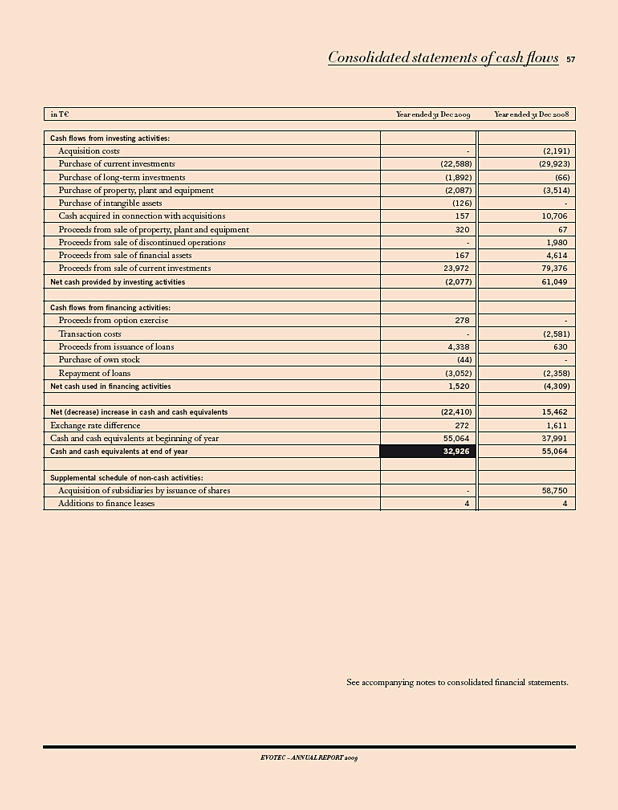

Evotec ended the year 2009 with a total liquidity of € 70.6 m (2008: € 92.4m), including cash and cash equivalents (€ 32.9 m), investments (€ 28.4 m) and auction rate securities (€ 9.3 m).

MORE IN THE US THAN EVER, BUT DELISTED

Evotec delisted the Company from the NASDAQ Global Market in order to streamline its activities and focus the liquidity of Evotec stock on one trading platform. Evotec thereby followed the trading behaviour of its shareholders and reduced unnecessary complexity in its capital market presence and related costs. At the same time, the Company will strategically improve their IR work for all potential high quality investors globally, especially also in the US.

EVOTEC ADSs HAVE CHANGED TO THE US OVER-THE-COUNTER MARKET

Evotec American Depositary Shares (ADSs) are now quoted and traded on the over-the-counter market Bulletin Board (OTC BB market). The ticker symbol EVTC has been changed to EVTCY.

BACK TO THE BEGINNING

– BACK TO THE TECDAX

In October 2009, Evotec fulfilled the index requirements of the Deutsche Börse and was readmitted to the TecDAX, containing the 30 most important German technology companies. The re-entry into the TecDAX is an important step providing increased visibility for the Evotec stock in Germany and internationally.

The Company will now do everything to justify the new confidence placed in it by the sector and to continue meeting the criteria of the index.

Development of the Evotec share price

(1 January 2009 –

31 December 2009, in €)

Shareholder structure

6.4% TVM

11.1 % Roland Oetker / ROI

82.5 % Free Float

2.50

2.00

1.50

1.00

0.50

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

FRANKFURT STOCK EXCHANGE

Ticker symbol EVT

Index TecDAX

Number of shares issued 108,838,715

2009 high / low € 2.45 / € 0.54

Market capitalisation € 231.8 m

EVOTEC – ANNUAL REPORT 2009

OUTSIDE VIEWS 17

Dr Klaus Maleck

in person

If you hear somebody asking why, it’s probably Klaus!

Dr Klaus Maleck – he has been the Chief Financial Officer at Evotec since 2007.

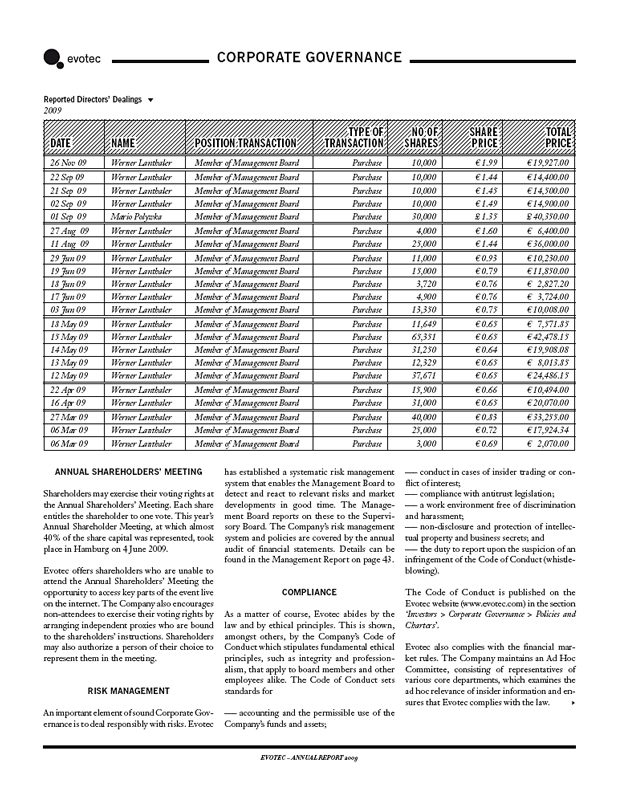

Before joining Evotec, he served as Chief Financial Officer and Vice President Business Development of Bio-GeneriX AG, which he co-founded in 2000. Previously, he worked as a Senior Management Consultant at McKinsey & Co. and as a Genomics Scientist at Novartis, Inc.