MidWestOne Financial (MOFG) 8-KOther Events

Filed: 8 Mar 10, 12:00am

MidWestOne Financial Group, Inc. 102 South Clinton Street Iowa City, Iowa 52240 319.356.5800 www.MidWestOne.com Investor Presentation Dallas, Texas March 10, 2010 Exhibit 99.1 |

Forward-Looking Statements This presentation contains forward-looking statements relating to the financial condition, results of operations and business of MidWestOne Financial Group, Inc. Forward-looking statements generally include words such as believes, expects, anticipates and other similar expressions. Actual results could differ materially from those indicated. Among the important factors that could cause actual results to differ materially are interest rates, changes in the mix of the company’s business, competitive pressures, general economic conditions and the risk factors detailed in the company’s periodic reports and registration statements filed with the Securities and Exchange Commission. MidWestOne Financial Group, Inc. undertakes no obligation to publicly revise or update these forward-looking statements to reflect events or circumstances after the date of this presentation. 2 |

MidWestOne Overview • MOFG NASDAQ Global Select • Assets: $1.53 Billion - 6 th Largest in Iowa • Market Cap: $94.6 Million • Employees: 425 • Recent Price: $11.00 • 52 Week Range: $5.90 to $11.45 • Tangible Common Eq. $14.42/share • Price/Tangible Book: 76% • Avg. Shares Out: 8.6 Million •Cash Dividend Trailing 12 Months: 30.25 Cents •Assets, Common Equity as of December 31; share pricing as of February 24, 2010. 3 |

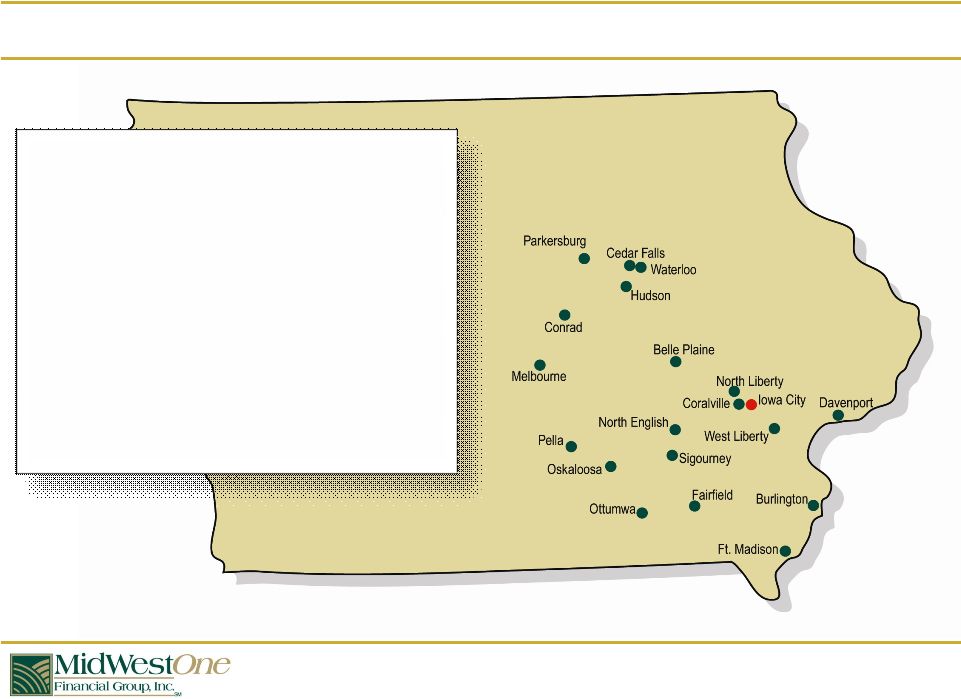

The MidWestOne Footprint • 29 MidWestOne Bank Branches in 20 Iowa Communities • 48 ATMs • Headquartered in Iowa City, Iowa 4 |

The Iowa Market 5 • Stable to growing • Certain markets growing faster • Good demographics • Well educated • Good average income levels in primary markets • Comparatively low unemployment • Over banked • Consolidation due |

Markets Market Market Deposits Share Rank/ Market Branches in Market Population est.: 2009-2014 % Income change 2009-2014 % Johnson County (Iowa City) $482,145 21.17% 2/17 6 +6.88 +4.83 Mahaska County (Oskaloosa) $171,781 37.93% 1/8 3 +.10 +6.14 Des Moines County (Burlington) $109,069 13.33% 3/10 2 -1.84 +5.92 Black Hawk County (Waterloo/ Cedar Falls) $34,517 2.22% 11/12 3 +.130 +5.84 Scott County (Quad Cities) $11,459 0.40% 16/19 1 +1.68 +4.97 Deposit, Share and Rank Source: FDIC as of 06/30/2009 Population & Income Estimates from US Census Bureau 6 |

Top 4 Market Demographics Market 2009 Population Median Income change 2009 - 2014 High School Graduate s Bachelor’s Degree or Higher Median Household Income Unemployment Rate Johnson County (Iowa City) 126,764 4.83% 93.7% 47.6% $52,746 4.3% Mahaska County (Oskaloosa) 22,321 6.14% 82.6% 16.5% $44,234 7.7% Des Moines County (Burlington) 40,629 5.92% 85.8% 16.0% $41,553 9.0% Benton County (Belle Plaine) 26,971 4.25% 81.3% 16.3% $52,903 6.7% Source: US Census Bureau Unemployment rates as of December, 2009 from the Bureau of Labor Statistics 7 Iowa is ranked 4 th nationally with a 6.6% unemployment rate. The national average is 9.7%. |

Key Financials as of 12/31/2009 Total Assets: $1,534,783,000 Total Bank Loans: $966,998,000 Total Loan Pools: $85,186,000 Total Deposits: $1,179,868,000 Total Interest-Bearing Deposits: $1,046,000,000 Total Capital: $152,208,000 Tangible Common Equity: $124,098,000 TARP Capital Purchase Plan Program Investment: $16.0 Million (approved for $35 Million) Total Equity / Total Assets: 9.92%; Tangible Common Equity / Tangible Assets: 8.15% Tier 1 Capital Ratio: 12.66% Corporate Headquarters, Iowa City, Iowa 8 |

Our Strategy •Maintain strong, diverse balance sheet •Improve ROE, ROA and earnings •Increase market share in existing markets •Seek out new markets in our target area •Watch for acquisition opportunities in Iowa •Expand along Avenue of the Saints •Expand other services •Reward shareholders 9 |

Keys to MOFG Non-Interest Income Growth •Wealth Management •Trust – Opportunity to expand trust services to locations within the company previously without those services. •Investor Center – The Investor Center of the former Iowa State Bank & Trust; 2004 through 2007 revenue growth averaged 34% per year. •Home Loan Center – Economies of Scale through utilizing a central hub for real estate lending. •Mortgage Origination & Servicing Fees for 2009: $2.8 million •Mortgage Origination & Servicing Fees for 2008: $0.9 million •$245 Million in real estate loans were closed in 2009. •MidWestOne Insurance Services – In process of building this phase of business in selected MidWestOne communities and we expect that insurance will become a greater factor of non-interest income over the next five years. •Strategic planning goal is to increase non-interest income to 30% of revenues. 10 |

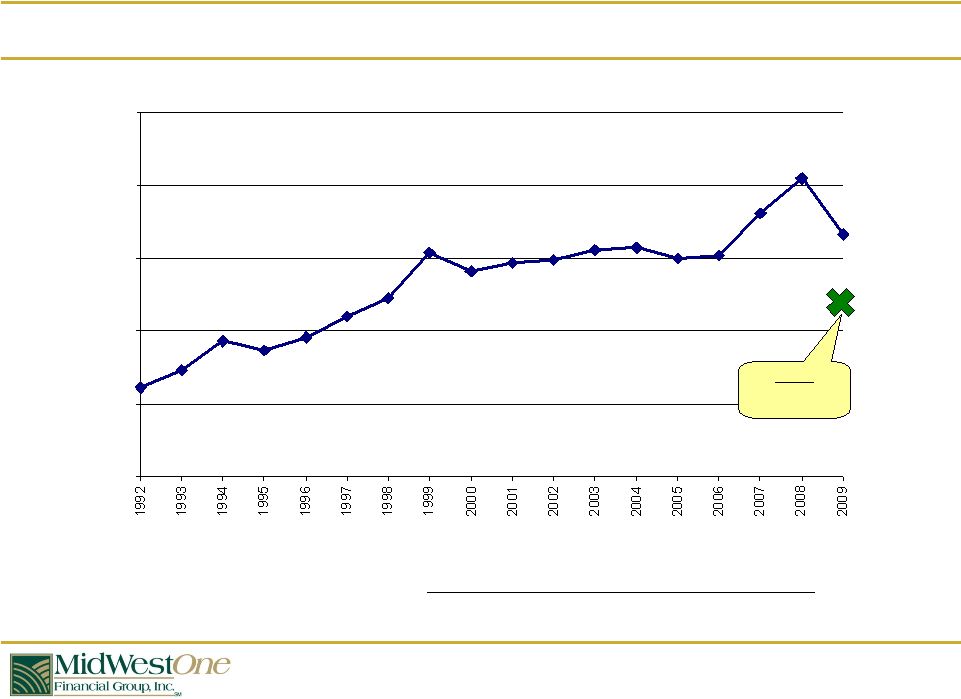

Low Reliance on Wholesale Funding Reliance on Wholesale Funding = (Total Borrowings + Brokered Deposits) (Total Borrowings + Total Deposits) 11 Source: KBW Research and Company Filings Reliance on Wholesale Funding for All Publicy Traded Banks & Thrifts 0% 5% 10% 15% 20% 25% MOFG 11.93% |

Historical Performance MidWestOne Bank (f/k/a Iowa State Bank & Trust) Performance Ratios Year Return on Assets Return on Equity Total Assets ($MM) Net Loan Charge Offs to Avg. Total Loans 2000 1.17% 15.10% $383 0.01% 2001 1.42% 16.52% $408 -0.17% 2002 1.23% 14.17% $450 0.32% 2003 1.23% 14.22% $489 0.11% 2004 1.13% 13.49% $517 0.24% 2005 1.04% 12.71% $536 -0.01% 2006 0.84% 10.68% $561 0.14% 2007 0.95% 11.83% $567 0.09% 12 |

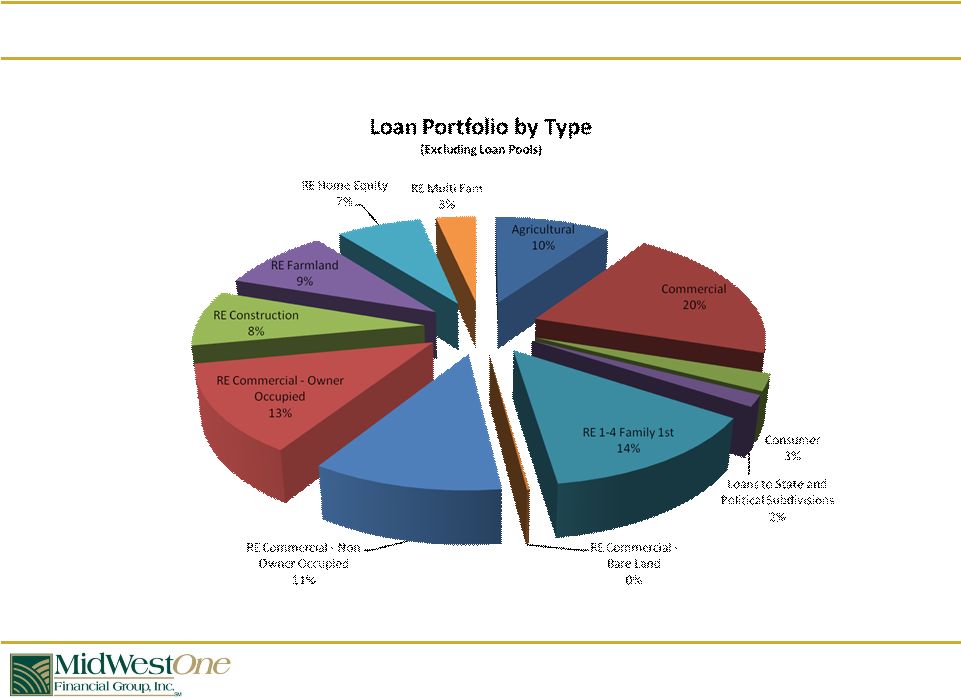

Bank Loan Portfolio *MidWestOne is ranked #58 nationwide in total agricultural loans As of 12/31/2009 Ag loan ranking source: American Bankers Association - 12/31/2008 13 |

Bank Loan Portfolio 14 As of December 31, 2009 |

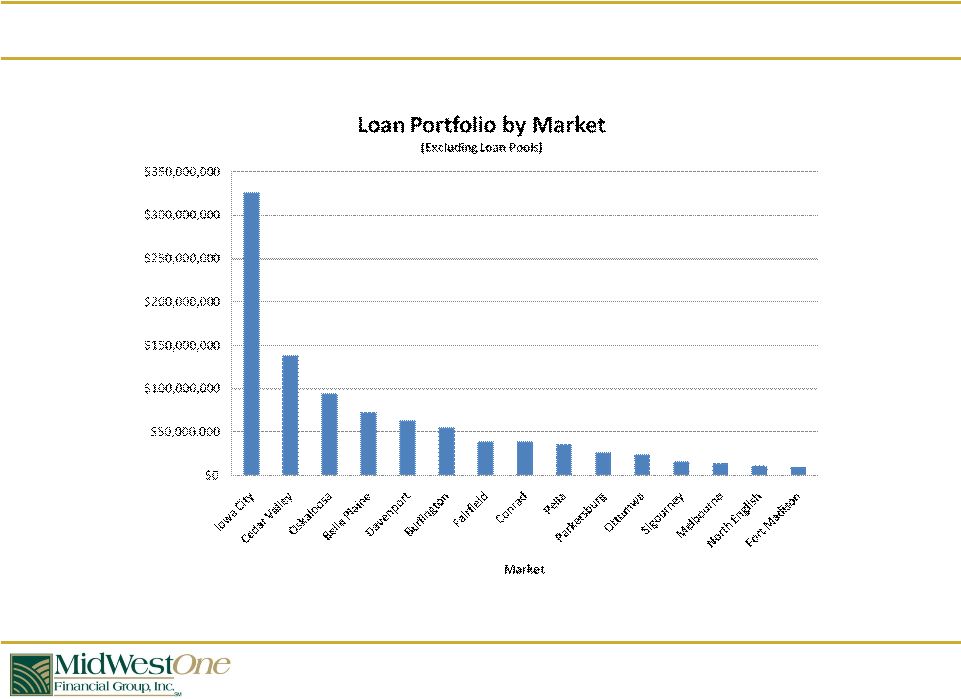

Bank Loan Portfolio 15 As of December 31, 2009 |

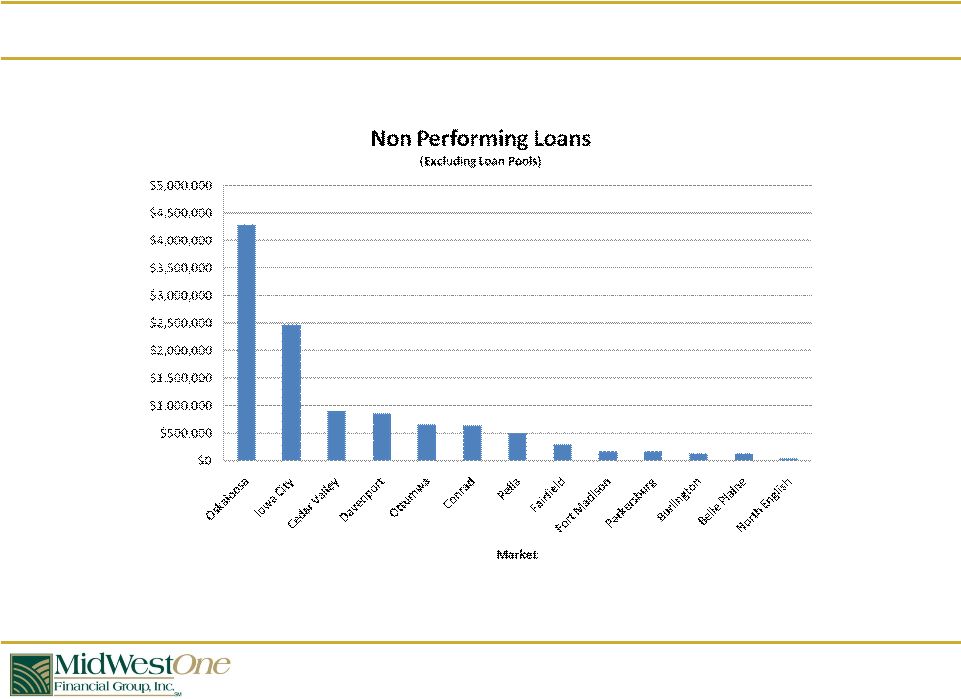

Bank Loan Portfolio 16 As of December 31, 2009 |

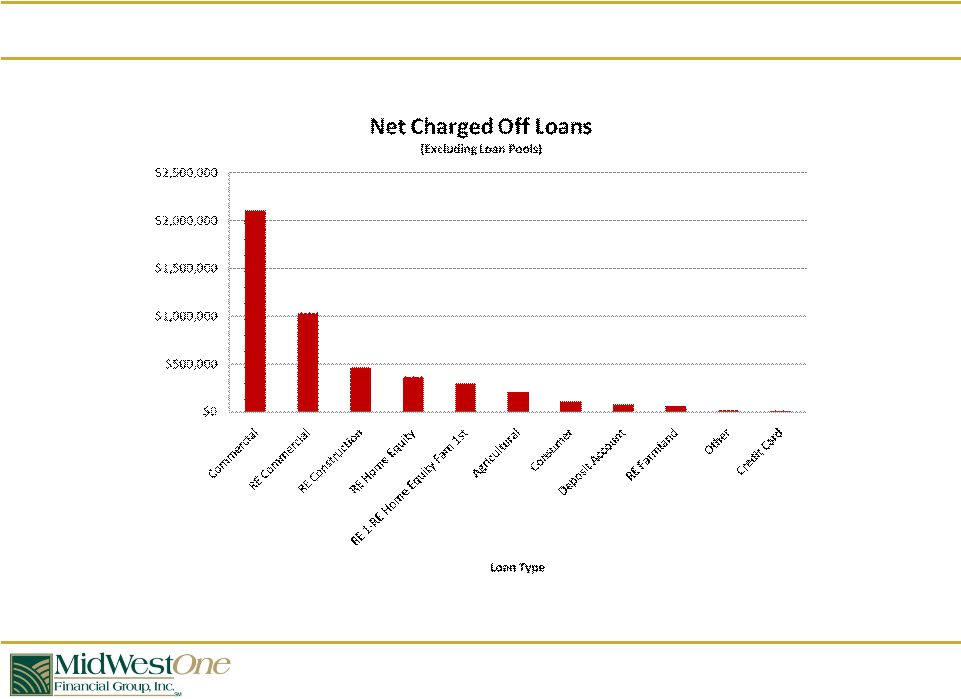

Bank Loan Portfolio 17 As of December 31, 2009 |

Executive Management – Holding Company and Bank Charles N. Funk, President & CEO Mr. Funk was named President & CEO of the organization in November, 2000 and has more than 30 years experience in senior financial leadership positions. He has been a member of the Bank and holding company Board of Directors since joining the company. Mr. Funk is the Chairman-elect of the Iowa Bankers Association, and serves on the faculties of the Colorado Graduate School of Banking in Boulder, Colorado, and the Iowa School of Banking. Education: William Jewell College, B.S. in Business and Accounting Previous Experience: Brenton Bank, Des Moines – President, Des Moines and Central Region Manager; Brenton Bank – Chief Investment Officer; Union National Bank, Wichita – Senior Vice President & Chief Investment Officer Kent L. Jehle, Executive Vice President & Chief Lending Officer As Executive Vice President, Senior Lending Officer, Mr. Jehle oversees all aspects of the organization’s commercial and agricultural lines of business, as well as the Home Loan Center. He joined the organization in May, 1986 as a Commercial Loan Officer and since been promoted to lead the department. Mr. Jehle has 28 years of experience in banking. Education: University of Iowa, B.B.A. in Finance Previous Experience: State of Iowa, Division of Banking – Bank Examiner IV Gary J. Ortale, Executive Vice President & Chief Financial Officer Mr. Ortale was named Executive Vice President & Chief Financial Officer of MidWestOne Financial Group, Inc. and MidWestOne Bank in May, 2009. Ortale joined the organization in 1987 as the Vice President & Controller of Iowa State Bank & Trust Company and in 2002 became the bank’s Senior Vice President & CFO. Following the March 2008 merger of ISB Financial Corp. and the former MidWestOne Financial Group, Inc., Ortale assumed the role of Senior Vice President & Chief Risk Officer. He is a CPA. Education: Drake University, B. S. in Accounting 18 Susan R. Evans, Chief Operating Officer Ms. Evans joined the organization in March, 2001 as Senior Vice President, Retail Banking. She is responsible for developing and implementing the business plan for MidWestOne’s Retail Division, as well as overseeing the Marketing Department. Ms. Evans has 33 years of experience in the financial services industry. She serves on the Board of Trustees of the Colorado Graduate School of Banking. Education: Colorado Graduate School of Banking, Honors Graduate Previous Experience: Brenton Bank, Des Moines – Market President; US Bank, Des Moines – Retail Market and Sales Manager |

Loan Pool Participations At December 31, 2009, our loan pool investment was $85.2 million. As of December 31, 2009, approximately 6% of our earning assets were invested in loan pools, and approximately 2% of our gross total revenue was derived from loan pools. The former MidWestOne had engaged in this business since 1988 and the company continued the business following the merger. These loan pool participations are pools of performing, sub-performing and nonperforming loans purchased at varying discounts from the aggregate outstanding principal amount of the underlying loans. Our basis across the total loan pool portfolio is approximately $0.46 per $1.00 of loan face value as of December 31, 2009. Loan pools are researched, bought, held and serviced by a third-party independent servicing corporation working in cooperation with MOFG management. The bank chooses to invest in certain pools purchased by the servicer from nonaffiliated banking organizations and from the FDIC acting as receiver of failed banks and savings associations. The company has very minimal exposure in loan pools to consumer real estate, subprime credit or to construction and real estate development loans. Please see the White Paper in your information kits. 19 |

Loan Pool Portfolio As of December 31, 2009 20 |

Loan Pool Targets 21 Management has set a target range for loan pool participations of $90 Million to $110 Million and continues to be active in bidding on new pools. The most recently purchased pools have performed well and management believes the business will again perform acceptably over the long term. |

• Strong Capital Position • Ample Liquidity • High Credit and Loan Quality • NPAs are traditionally better than peer group • Excellent historical track record • Major agricultural lender (#58 in the U.S. according to the ABA) • Competitive product lines • Iowa banking likely to consolidate in the next five years • Iowa has the 4th highest number of banking charters in the US • Opportunity to increase market share in larger communities in our footprint • Grow internally and possibly through acquisition • Company has strategic plan to grow • Commitment to our shareholders Why MidWestOne? 22 |

23 MidWestOne Financial Group, Inc. and Subsidiaries Consolidated Statements of Opertations Years Ended Dec. 31 2009, 2008, and 2007 (In thousands, except 2009 2008 2007 Interest income: Interest and fees on loans....................................................................................... 58,697 $ 53,104 $ 27,564 $ Interest and discount on loan pool participations................................................... 1,809 4,459 - Interest on bank deposits........................................................................................ 11 26 - Interest on federal funds sold................................................................................. 47 315 548 Interest on investment securities: Taxable securities................................................................................................ 8,797 8,222 7,552 Tax-exempt securities.......................................................................................... 3,997 4,080 2,641 Total interest income................................................................................. 73,358 70,206 38,305 Interest expense: Interest on deposits: Interest-bearing checking..................................................................................... 4,501 4,149 2,950 Savings................................................................................................................. 213 1,362 159 Certificates of deposit under $100,000................................................................ 11,871 14,369 8,250 Certificates of deposit $100,000 and over.......................................................... 5,026 3,277 3,439 Total interest on deposits......................................................................... 21,611 23,157 14,798 Interest on federal funds purchased....................................................................... 11 67 61 Interest on securities sold under agreements to repurchase................................ 453 1,055 2,053 Interest on Federal Home Loan Bank advances................................................... 5,450 5,348 2,126 Interest on long-term debt....................................................................................... 658 631 - Other borrowings.................................................................................................... 60 137 - Total interest expense.............................................................................. 28,243 30,395 19,038 Net interest income................................................................................... 45,115 39,811 19,267 Provision for loan losses............................................................................................ 7,725 4,366 500 Net interest income after provision for loan losses............................. 37,390 35,445 18,767 Other income: Trust and investment fees....................................................................................... 4,180 4,011 3,688 Service charges and fees on deposit accounts..................................................... 3,988 5,611 2,082 Mortgage origination fees and loan servicing fees................................................ 2,770 907 1,208 Other service charges, commissions and fees...................................................... 2,386 1,527 1,746 Bank-owned life insurance income........................................................................ 778 542 338 Investment securities losses, net: Impairment losses on investment securities....................................................... (2,404) (6,194) - Less: noncredit-related losses............................................................................ - - - Net impairment losses...................................................................................... (2,404) (6,194) - Gain (loss) from sale of available for sale securities............................................. 813 (346) (256) Gain (loss) on sale of fixed assets......................................................................... 8 (516) - Total other income.................................................................................... 12,519 5,542 8,806 Other expenses: Salaries and employee benefits............................................................................. 23,152 20,903 10,926 Net occupancy and equipment expense................................................................ 6,961 4,759 2,978 Professional and other outside services................................................................ 3,635 2,437 2,057 Other operating expense........................................................................................ 5,491 7,374 1,454 Data processing expense....................................................................................... 1,844 1,860 1,145 FDIC Insurance expense........................................................................................ 3,244 595 60 Amortization expense.............................................................................................. 1,252 776 - Goodwill impairment................................................................................................ - 27,295 - Total other expenses................................................................................. 45,579 65,999 18,620 Income (loss) before income taxes......................................................... 4,330 (25,012) 8,953 Federal and state income tax expense (benefit)....................................................... (79) (450) 2,305 Net income (loss)....................................................................................... 4,409 $ (24,562) $ 6,648 $ Less: Preferred stock dividends and discount accretion........................... 779 $ - $ - $ Net income (loss) available to common shareholders......................... 3,630 $ (24,562) $ 6,648 $ Earnings (Loss) per common share: Basic........................................................................................................................ 0.42 $ (3.09) $ 1.29 $ Diluted...................................................................................................................... 0.42 $ (3.09) $ 1.29 $ |

24 Assets 2009 2008 Cash and due from banks.................................................... 25,452 $ 32,383 $ Interest-bearing deposits in banks....................................... 2,136 543 Cash and cash equivalents.............................................. 27,588 32,926 Investment securities Available for sale.............................................................. 362,903 272,380 Held to maturity (fair value 2009 $8,118; 2008 $8,120)... 8,009 8,125 Loans held for sale.............................................................. 1,208 5,279 Loans................................................................................... 966,998 1,014,814 Allowance for loan losses.................................................... (13,957) (10,977) Net loans.......................................................................... 953,041 1,003,837 Loan pool participations, net................................................ 83,052 92,932 Premises and equipment, net.............................................. 28,969 28,748 Accrued interest receivable................................................. 11,534 11,736 Other intangible assets, net................................................. 12,172 13,424 Bank-owned life insurance.................................................. 18,118 17,340 Other real estate owned...................................................... 3,635 996 Deferred income taxes........................................................ 5,163 5,595 Other assets........................................................................ 19,391 15,644 Total assets...................................................... 1,534,783 $ 1,508,962 $ MidWest One Financial Group, Inc. and Subsidiaries Consolidated Balance Sheets December 31, 2009 and 2008 (in thousands, unaudited) *************** *************** *************** *************** *************** ************** |

25 Securities sold under agreements to repurchase................................... 43,098 44,249 Federal Home Loan Bank borrowings.................................................... 130,200 158,782 Deferred compensation liability............................................................... 3,832 1,586 Long-term debt........................................................................................ 15,588 15,640 Accrued interest payable........................................................................ 2,248 2,770 Other liabilities........................................................................................ 5,866 14,354 Total liabilities.......................................................................... 1,382,575 1,378,620 Shareholders' Equity Preferred stock, no par value, with a liquidation preference of $1,000 per share; authorized 500,000 shares; issued and outstanding 16,000 shares as of December 31, 2009; no shares authorized or issued at December 31, 2008............................................................. 15,699 - Capital stock, common, $1 par value; authorized 15,000,000 shares at December 31, 2009 and 10,000,000 at December 31, 2008; 8,690,398 shares issued at December 31, 2009 and 2008; 8,605,333 shares outstanding at December 31, 2009 and 8,603,055 at December 31, 2008........................................................ 8,690 8,690 Additional paid-in capital......................................................................... 81,179 80,757 Treasury stock, at cost; 85,065 shares and 87,343 shares at December 31, 2009 and 2008, respectively...................................... (1,183) (1,215) Retained earnings.................................................................................. 48,079 43,683 Accumulated other comprehensive (loss).............................................. (256) (1,573) Total shareholders' equity..................................................... 152,208 130,342 Total liabilities and shareholders' equity.............................. 1,534,783 $ 1,508,962 $ ************ ************ ************ **** |

•Making decisions for the long term – current strong competitive position permits this emphasis •Growth plans, stable markets, 40% of business from Iowa City, room to grow •Opportunity to continue to reduce expenses •Outstanding service and ongoing training to assure that customer service remains that way •Have executive and IT capacity to grow •Community focused •Our employees give an average of 4,131 hours of their own time to volunteerism each month (9.72 hours per month per employee) •Over $450,000 in community support was given by the Bank and Bank Foundation in 2009 Why MidWestOne? 26 |

27 |