SUPPLEMENTAL INFORMATION FOURTH QUARTER 2020 December 31, 2020

2 Credit Monitoring

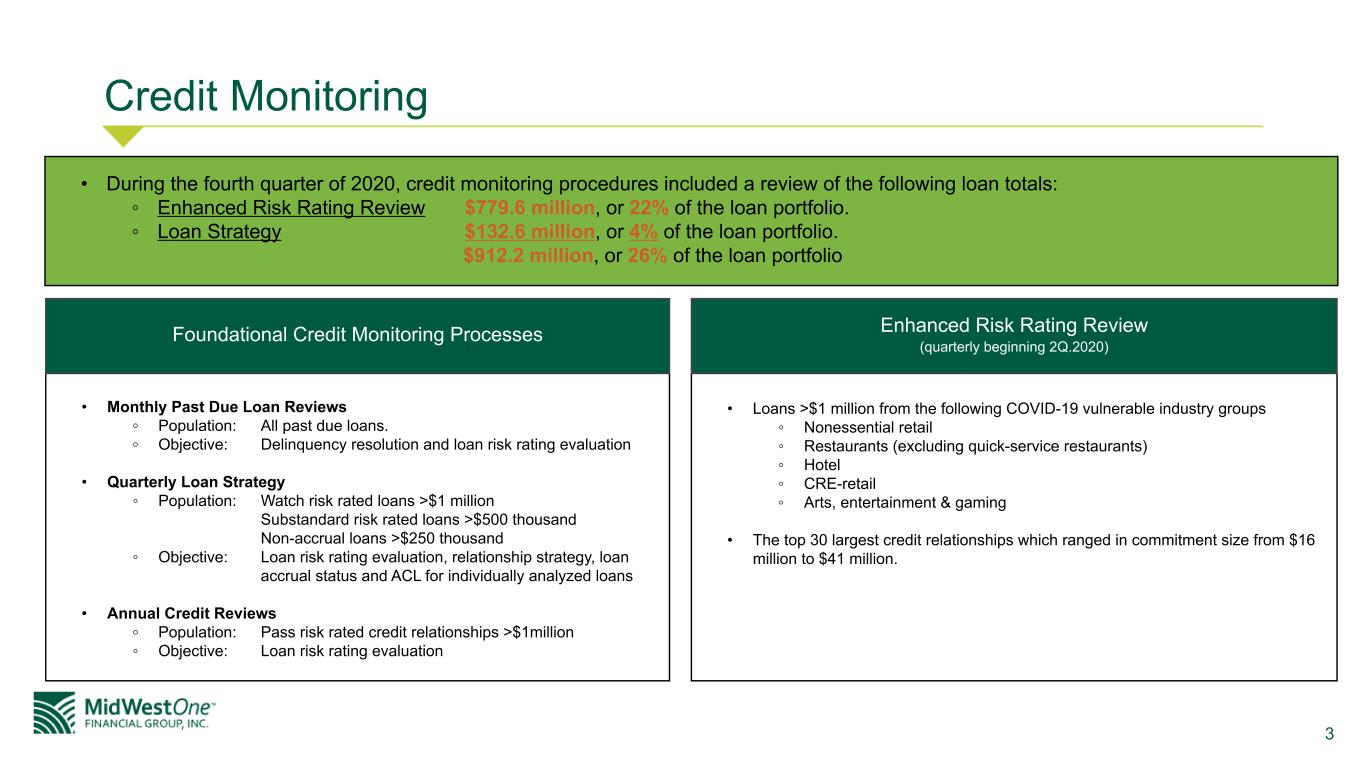

3 Credit Monitoring • Monthly Past Due Loan Reviews ◦ Population: All past due loans. ◦ Objective: Delinquency resolution and loan risk rating evaluation • Quarterly Loan Strategy ◦ Population: Watch risk rated loans >$1 million Substandard risk rated loans >$500 thousand Non-accrual loans >$250 thousand ◦ Objective: Loan risk rating evaluation, relationship strategy, loan accrual status and ACL for individually analyzed loans • Annual Credit Reviews ◦ Population: Pass risk rated credit relationships >$1million ◦ Objective: Loan risk rating evaluation Foundational Credit Monitoring Processes • Loans >$1 million from the following COVID-19 vulnerable industry groups ◦ Nonessential retail ◦ Restaurants (excluding quick-service restaurants) ◦ Hotel ◦ CRE-retail ◦ Arts, entertainment & gaming • The top 30 largest credit relationships which ranged in commitment size from $16 million to $41 million. Enhanced Risk Rating Review (quarterly beginning 2Q.2020) • During the fourth quarter of 2020, credit monitoring procedures included a review of the following loan totals: ◦ Enhanced Risk Rating Review $779.6 million, or 22% of the loan portfolio. ◦ Loan Strategy $132.6 million, or 4% of the loan portfolio. $912.2 million, or 26% of the loan portfolio

4 COVID-19 Vulnerable Industries

5 Exposure in Vulnerable Industries • $ in millions, Loan balances as of 12/31/20 • % are representative of each underlying vulnerable industry as a percentage of the total vulnerable industry loans Loan Portfolio Vulnerable Industries All Other Loans $95.0 $49.9 $117.0 $203.7 $26.9 $ of Portfolio Non-essential Retail Restaurants Hotel CRE - Retail Arts, Entertainment & Gaming $— $25.0 $50.0 $75.0 $100.0 $125.0 $150.0 $175.0 $200.0 $225.0 19% 10% 24% 41% 5% 14% 86% Vulnerable Industries

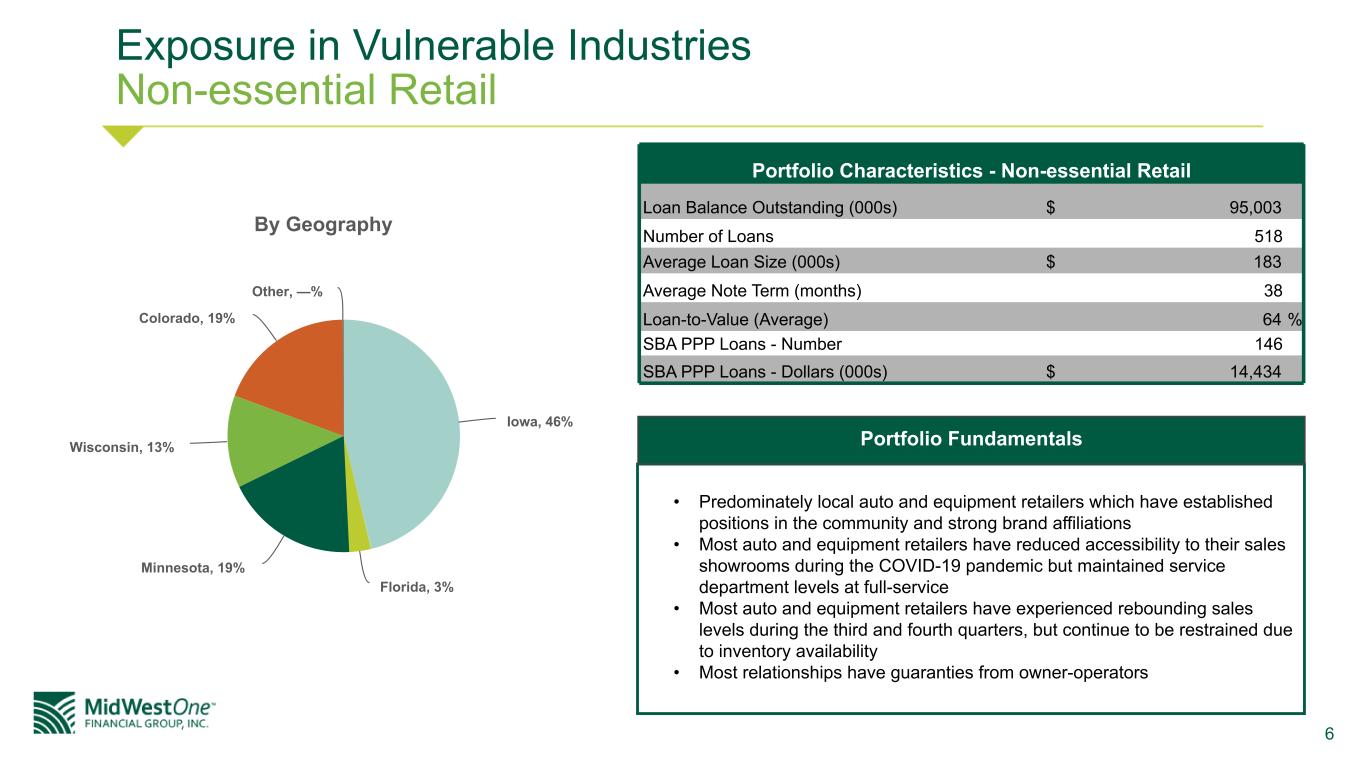

6 Exposure in Vulnerable Industries Non-essential Retail By Geography Iowa, 46% Florida, 3% Minnesota, 19% Wisconsin, 13% Colorado, 19% Other, —% Portfolio Characteristics - Non-essential Retail Loan Balance Outstanding (000s) $ 95,003 Number of Loans 518 Average Loan Size (000s) $ 183 Average Note Term (months) 38 Loan-to-Value (Average) 64 % SBA PPP Loans - Number 146 SBA PPP Loans - Dollars (000s) $ 14,434 • Predominately local auto and equipment retailers which have established positions in the community and strong brand affiliations • Most auto and equipment retailers have reduced accessibility to their sales showrooms during the COVID-19 pandemic but maintained service department levels at full-service • Most auto and equipment retailers have experienced rebounding sales levels during the third and fourth quarters, but continue to be restrained due to inventory availability • Most relationships have guaranties from owner-operators Portfolio Fundamentals

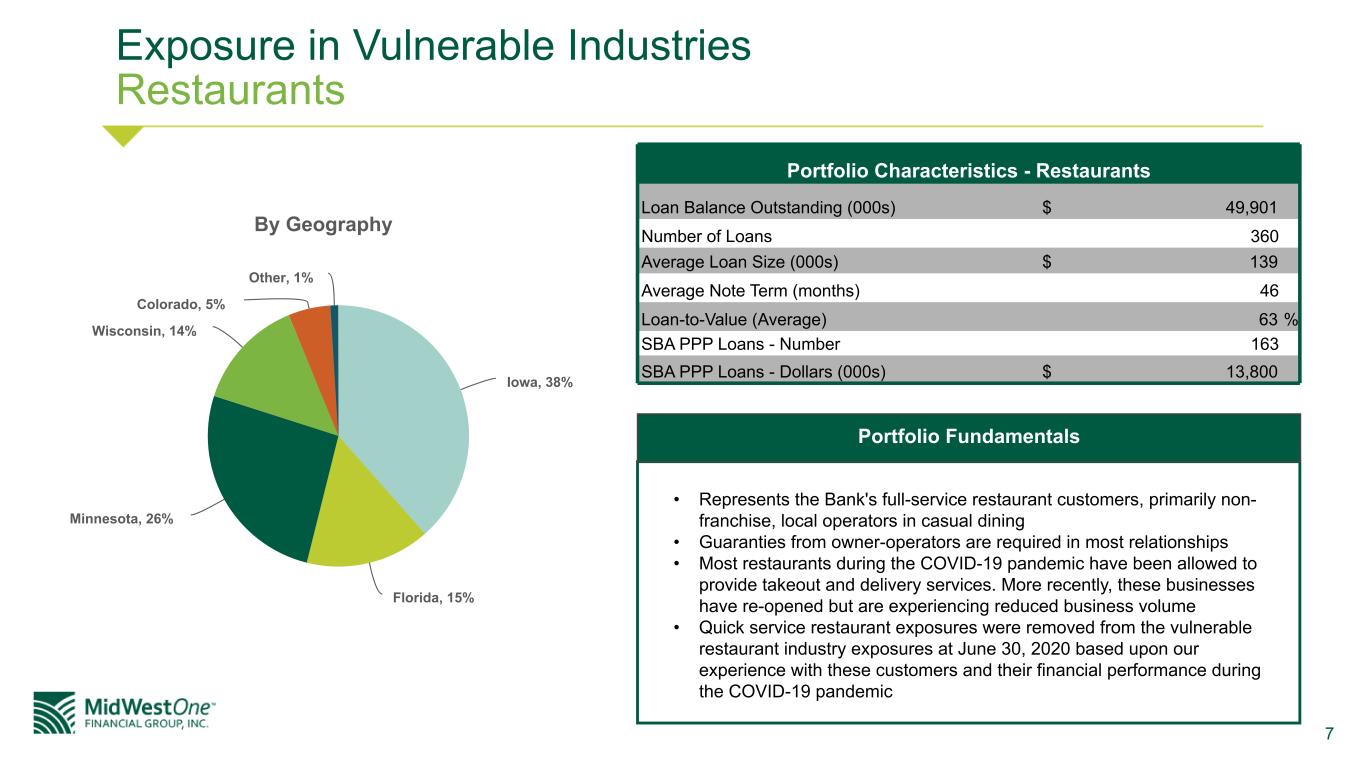

7 Exposure in Vulnerable Industries Restaurants By Geography Iowa, 38% Florida, 15% Minnesota, 26% Wisconsin, 14% Colorado, 5% Other, 1% Portfolio Characteristics - Restaurants Loan Balance Outstanding (000s) $ 49,901 Number of Loans 360 Average Loan Size (000s) $ 139 Average Note Term (months) 46 Loan-to-Value (Average) 63 % SBA PPP Loans - Number 163 SBA PPP Loans - Dollars (000s) $ 13,800 • Represents the Bank's full-service restaurant customers, primarily non- franchise, local operators in casual dining • Guaranties from owner-operators are required in most relationships • Most restaurants during the COVID-19 pandemic have been allowed to provide takeout and delivery services. More recently, these businesses have re-opened but are experiencing reduced business volume • Quick service restaurant exposures were removed from the vulnerable restaurant industry exposures at June 30, 2020 based upon our experience with these customers and their financial performance during the COVID-19 pandemic Portfolio Fundamentals

8 Exposure in Vulnerable Industries Hotel By Geography Iowa, 49% Florida, 18% Minnesota, 22% Wisconsin, 4% Colorado, 1% Other, 6% Portfolio Characteristics - Hotel Loan Balance Outstanding (000s) $ 117,009 Number of Loans 82 Average Loan Size (000s) $ 1,427 Average Note Term (months) 56 Loan-to-Value (Average) 64 % SBA PPP Loans - Number 26 SBA PPP Loans - Dollars (000s) $ 2,195 • Lending focus is on experienced, local developers within the Bank's trade areas. Approximately 80% of properties have major flags while the remainder is comprised of gaming industry related boutique hotels in the Dubuque, IA market • Flagged hotels are primarily core travel hotels that are positioned close to major highways in the Bank's key metropolitan markets with no convention center exposure • Conservative underwriting standards include a maximum LTV of 75% • Guaranties from owner-operators are regularly required. Non-recourse lending is not a material exposure • Occupancy was severely reduced between April and June 2020 (generally to less than 10%). Most operators have since seen improving occupancy trends with some reporting 40% or higher starting in the third quarter of 2020. Further, hotels associated with Dubuque's gaming industry have experienced weekend occupancy rates comparable to pre-pandemic levels Portfolio Fundamentals

9 Exposure in Vulnerable Industries CRE-Retail By Geography Iowa, 17% Florida, 16% Minnesota, 52% Wisconsin, 12% Other, 3% Portfolio Characteristics - CRE-Retail Loan Balance Outstanding (000s) $ 203,725 Number of Loans 213 Average Loan Size (000s) $ 970 Average Note Term (months) 73 Loan-to-Value (Average) 59 % SBA PPP Loans - Number 3 SBA PPP Loans - Dollars (000s) $ 86 • Lending focus is on experienced, local developers and operators, with properties that are within the Bank's trade areas • Exposure is predominately retail strip centers with a diverse tenant base including services, restaurants, and national retailers; malls are not included within the exposure group • Conservative underwriting standards include a maximum LTV of 75% • Guaranties are regularly required; non-recourse is rare and associated with strong properties and LTV <60-65% • This segment has largely stabilized for the current state as businesses have generally re-opened Portfolio Fundamentals

10 Exposure in Vulnerable Industries Arts, Entertainment & Gaming By Geography Iowa, 68% Minnesota, 17% Wisconsin, 9% Colorado, 1% Other, 5% Portfolio Characteristics - Arts, Entertainment & Gaming Loan Balance Outstanding (000s) $ 26,900 Number of Loans 156 Average Loan Size (000s) $ 172 Average Note Term (months) 52 Loan-to-Value (Average) 67 % SBA PPP Loans - Number 62 SBA PPP Loans - Dollars (000s) $ 2,162 • Small overall exposure relative to the portfolio; not a key focus of the Bank's lending efforts • Largest concentration of exposure is gaming operations in our Dubuque, IA market (in the Mississippi River Entertainment district) • While completely shutdown during the initial COVID-19 risk mitigation orders in Iowa, the facilities have since re-opened, with strict risk mitigation guidelines, and are experiencing a solid rebound in business volume Portfolio Fundamentals

11 COVID-19 Loan Modifications

12 COVID-19 Loan Modification Status (dollars in millions) As of December 31, 2020 As of September 30, 2020 % Change 9/30 > 12/31 % Loan Portfolio 12/31Total Modifications Active Modifications Total Modifications Active Modifications # $ # $ # $ # $ $ Agricultural 17 $ 2.0 1 $ 0.1 17 $ 2.6 2 $ 0.2 (50.0) % — % Commercial 296 82.4 16 11.7 285 $ 75.7 12 8.5 37.6 % 0.3 % CRE 428 379.6 22 31.1 418 $ 390.9 41 103.0 (69.8) % 0.9 % RRE 224 24.6 37 1.2 217 $ 25.2 62 4.3 (72.1) % 0.1 % Consumer 79 0.7 — — 80 $ 0.7 4 — nil — % Total 1,044 $ 489.3 76 $ 44.1 (1) 1,017 $ 495.1 121 $ 116.0 (62.0) % 1.3 % (1) $24.6 million in 1st modification, $19.5 million in or being processed for an additional deferral. Declining COVID-19 Deferrals: Down 62% from 9/30/20 to 12/31/20