2 Forward Looking Statements Cautionary Note Regarding Forward-Looking Statements Certain statements contained in this presentation that are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements may include information about MidWestOne’s and IOFB’s possible or assumed future economic performance or future results of operations, including MidWestOne’s or IOFB’s future revenues, income, expenses, provision for loan losses, provision for taxes, effective tax rate, earnings per share and cash flows, and MidWestOne’s and IOFB’s future capital expenditures and dividends, future financial condition and changes therein, including changes in MidWestOne’s and IOFB’s loan portfolio and allowance for loan losses, future capital structure or changes therein, as well as the plans and objectives of management for MidWestOne’s and IOFB’s future operations, future or proposed acquisitions, the future or expected effect of acquisitions on MidWestOne’s and IOFB’s operations, results of operations, financial condition, and future economic performance, statements about the benefits of the merger, and the statements of the assumptions underlying any such statement. Such statements are typically, but not exclusively, identified by the use in the statements of words or phrases such as “aim”, “anticipate”, “estimate”, “expect”, “goal”, “guidance”, “intend”, “is anticipated”, “is expected”, “is intended”, “objective”, “plan”, “projected”, “projection”, “will affect”, “will be”, “will continue”, “will decrease”, “will grow”, “will impact”, “will increase”, “will incur”, “will reduce”, “will remain”, “will result”, “would be”, variations of such words or phrases (including where the word “could”, “may”, or “would” is used rather than the word “will” in a phrase) and similar words and phrases indicating that the statement addresses some future result, occurrence, plan or objective. The forward-looking statements that MidWestOne and IOFB make are based on our current expectations and assumptions regarding MidWestOne’s and IOFB’s businesses, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could affect MidWestOne’s or IOFB’s future financial results and performance and could cause those results or performance to differ materially from those expressed in the forward-looking statements. Such risks and uncertainties include, among others: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement, the outcome of any legal proceedings that may be instituted against MidWestOne or IOFB, delays in completing the merger, the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the merger) and shareholder approval or to satisfy any of the other conditions to the merger on a timely basis or at all, the possibility that the anticipated benefits of the merger are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where MidWestOne and IOFB do business, the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, diversion of management’s attention from ongoing business operations and opportunities, potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the merger and MidWestOne’s ability to complete the acquisition and integration of IOFB successfully. Each of MidWestOne and IOFB disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information on MidWestOne, and factors which could affect the forward-looking statements contained herein can be found in MidWestOne’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, its Quarterly Reports on Form 10-Q for the three-month periods ended March 31, 2021 and June 30, 2021 and its other filings with the SEC.

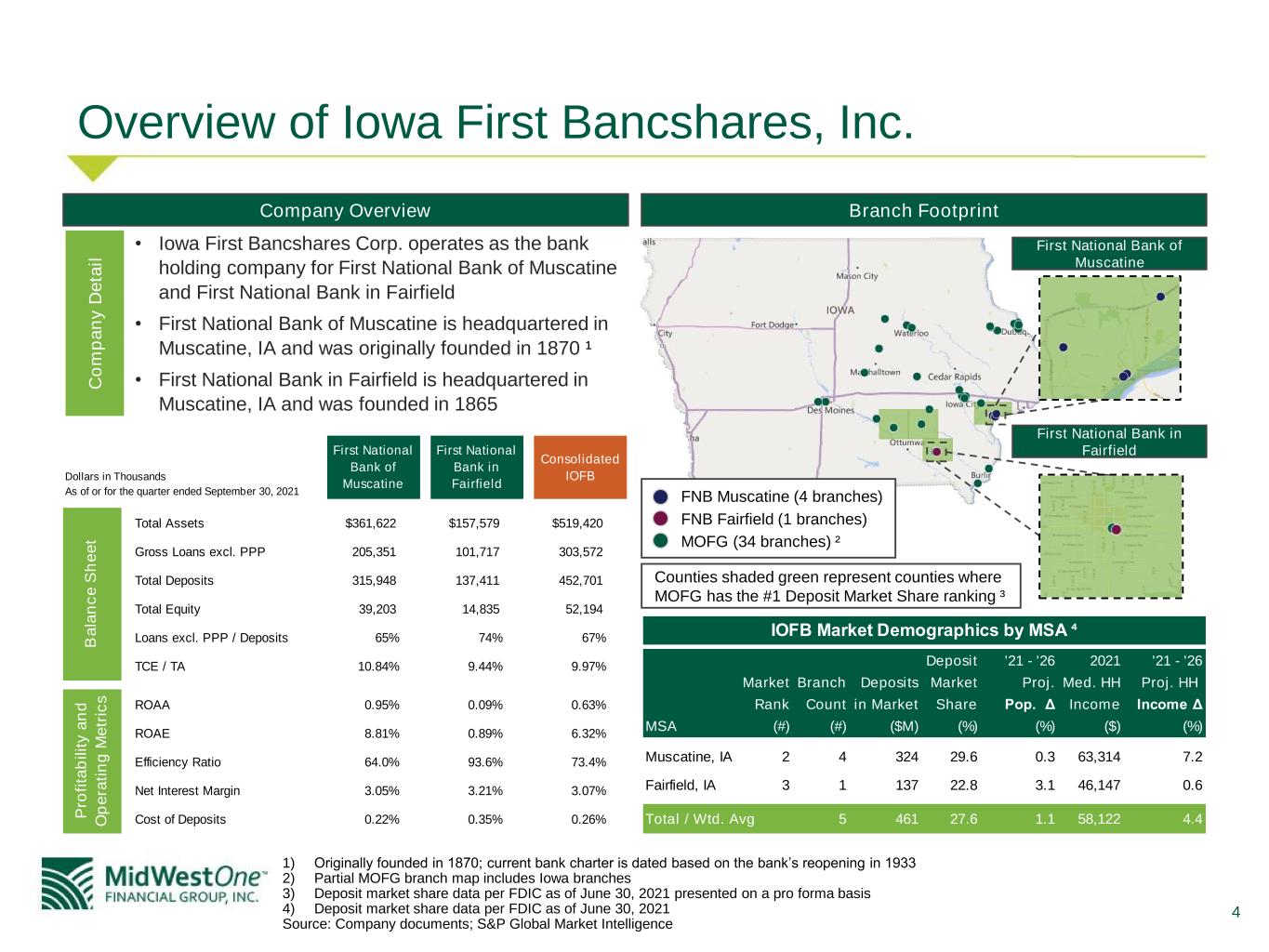

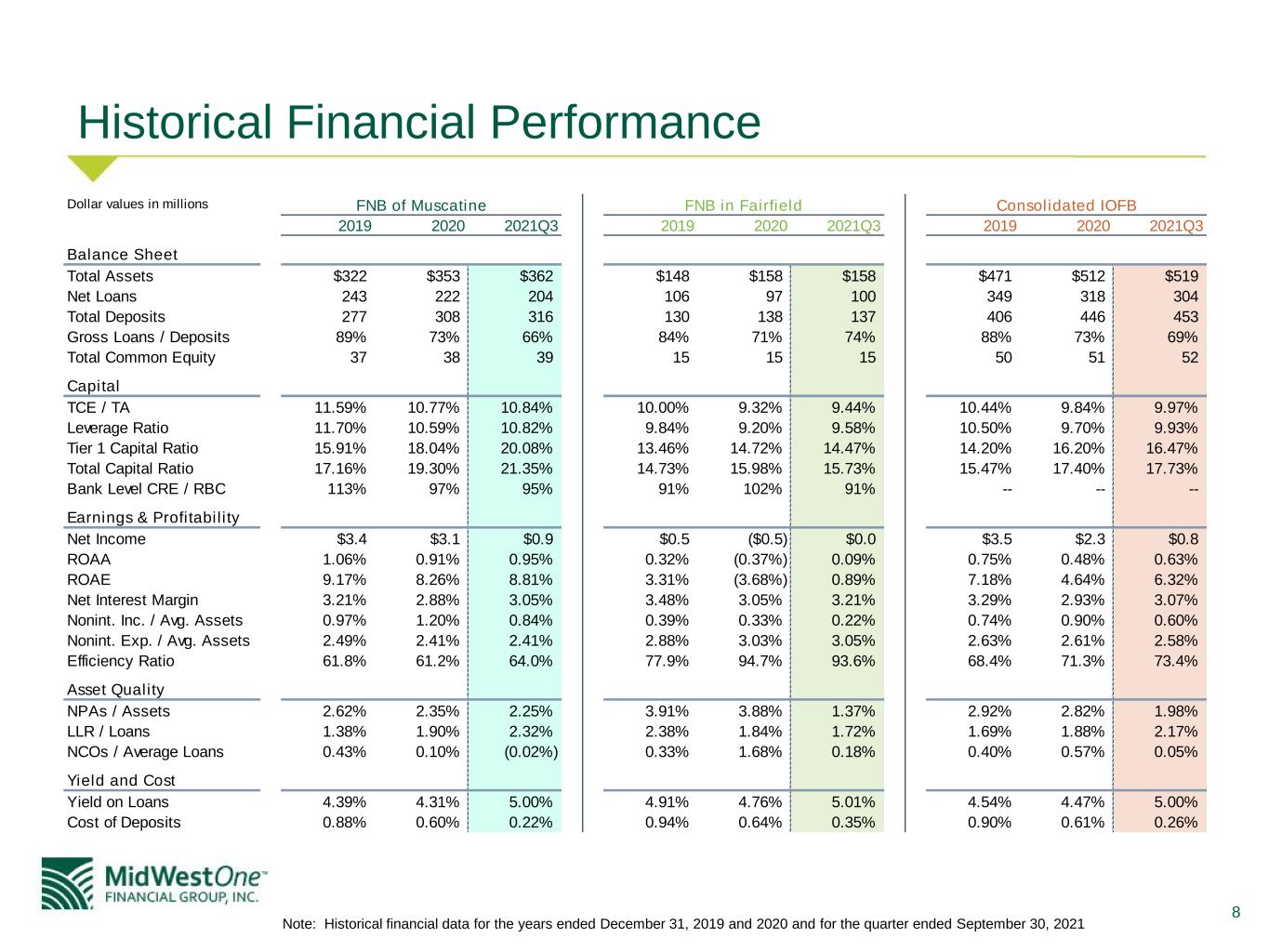

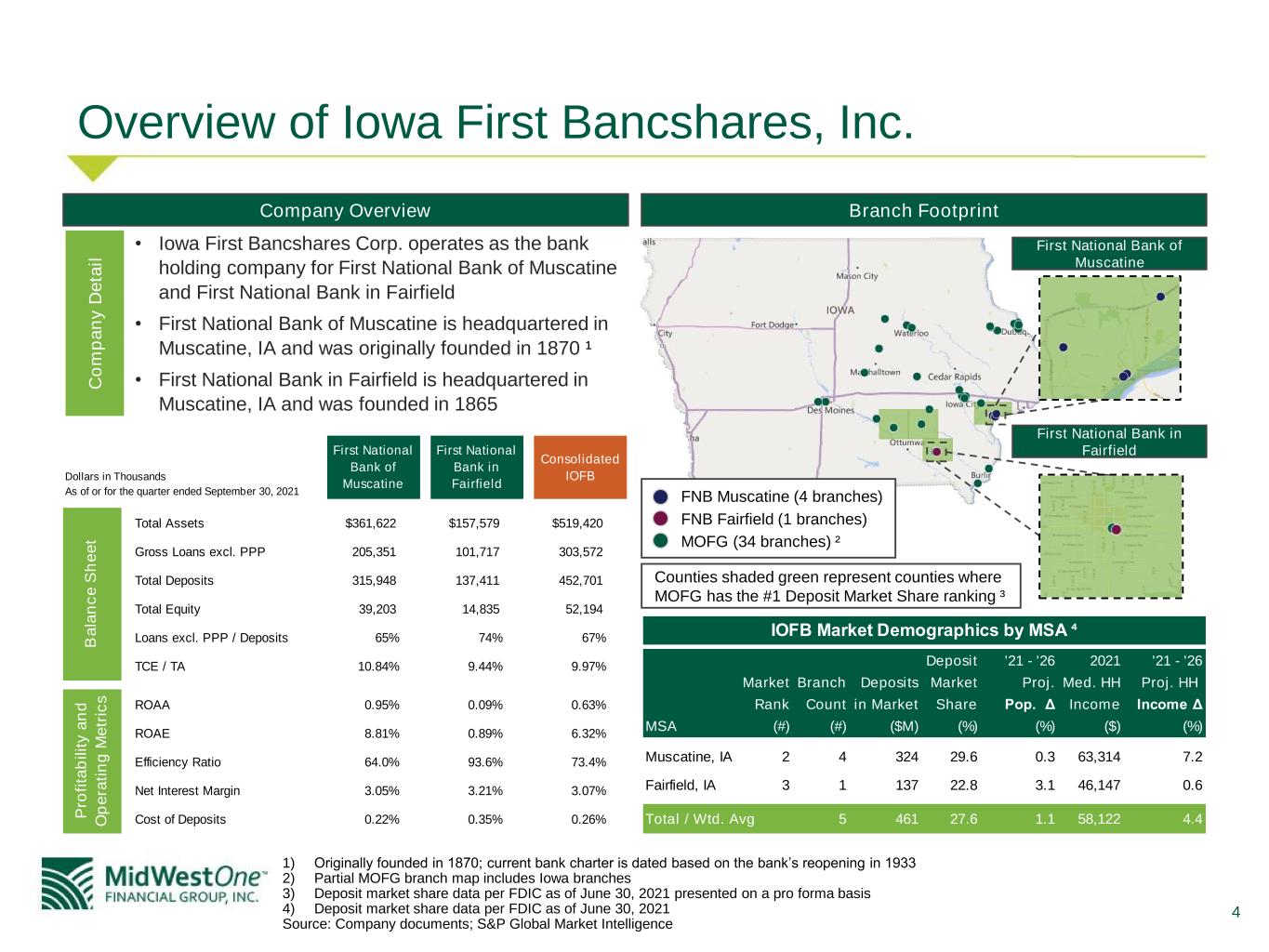

4 IOFB Market Demographics by MSA ⁴ Deposit '21 - '26 2021 '21 - '26 Market Branch Deposits Market Proj. Med. HH Proj. HH Rank Count in Market Share Pop. Δ Income Income Δ MSA (#) (#) ($M) (%) (%) ($) (%) Muscatine, IA 2 4 324 29.6 0.3 63,314 7.2 Fairfield, IA 3 1 137 22.8 3.1 46,147 0.6 Total / Wtd. Avg 5 461 27.6 1.1 58,122 4.4 Overview of Iowa First Bancshares, Inc. 1) Originally founded in 1870; current bank charter is dated based on the bank’s reopening in 1933 2) Partial MOFG branch map includes Iowa branches 3) Deposit market share data per FDIC as of June 30, 2021 presented on a pro forma basis 4) Deposit market share data per FDIC as of June 30, 2021 Source: Company documents; S&P Global Market Intelligence First National Bank of Muscatine First National Bank in Fairfield Consolidated IOFB Total Assets $361,622 $157,579 $519,420 Gross Loans excl. PPP 205,351 101,717 303,572 Total Deposits 315,948 137,411 452,701 Total Equity 39,203 14,835 52,194 Loans excl. PPP / Deposits 65% 74% 67% TCE / TA 10.84% 9.44% 9.97% ROAA 0.95% 0.09% 0.63% ROAE 8.81% 0.89% 6.32% Efficiency Ratio 64.0% 93.6% 73.4% Net Interest Margin 3.05% 3.21% 3.07% Cost of Deposits 0.22% 0.35% 0.26%P ro fi ta b il it y a n d O p e ra ti n g M e tr ic s B a la n c e S h e e t Dollars in Thousands As of or for the quarter ended September 30, 2021 Company Overview C o m p a n y D e ta il • Iowa First Bancshares Corp. operates as the bank holding company for First National Bank of Muscatine and First National Bank in Fairfield • First National Bank of Muscatine is headquartered in Muscatine, IA and was originally founded in 1870 ¹ • First National Bank in Fairfield is headquartered in Muscatine, IA and was founded in 1865 Branch Footprint First National Bank of Muscatine First National Bank in Fairfield FNB Muscatine (4 branches) FNB Fairfield (1 branches) MOFG (34 branches) ² Counties shaded green represent counties where MOFG has the #1 Deposit Market Share ranking ³