Second Quarter 2024 Earnings Conference Call July 26, 2024

2 Forward Looking Statements & Non-GAAP Measures This presentation contains certain “forward-looking statements” within the meaning of such term in the Private Securities Litigation Reform Act of 1995. We and our representatives may, from time to time, make written or oral statements that are “forward-looking” and provide information other than historical information. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement. These factors include, among other things, the factors listed below. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of our management and on information currently available to management, are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “should,” “could,” “would,” “plans,” “goals,” “intend,” “project,” “estimate,” “forecast,” “may” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, these statements. Readers are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Additionally, we undertake no obligation to update any statement in light of new information or future events, except as required under federal securities law. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors that could have an impact on our ability to achieve operating results, growth plan goals and future prospects include, but are not limited to, the following: (1) the risks of mergers or branch sales (including the recent sale of our Florida banking operations and the acquisition of Denver Bankshares, Inc.), including, without limitation, the related time and costs of implementing such transactions, integrating operations as part of these transactions and possible failures to achieve expected gains, revenue growth and/or expense savings from such transactions; (2) credit quality deterioration, pronounced and sustained reduction in real estate market values, or other uncertainties, including the impact of inflationary pressures on economic conditions and our business, resulting in an increase in the allowance for credit losses, an increase in the credit loss expense, and a reduction in net earnings; (3) the effects of sustained high interest rates, including on our net income and the value of our securities portfolio; (4) changes in the economic environment, competition, or other factors that may affect our ability to acquire loans or influence the anticipated growth rate of loans and deposits and the quality of the loan portfolio and loan and deposit pricing; (5) fluctuations in the value of our investment securities; (6) governmental monetary and fiscal policies; (7) changes in and uncertainty related to benchmark interest rates used to price loans and deposits; (8) legislative and regulatory changes, including changes in banking, securities, trade, and tax laws and regulations and their application by our regulators, and any changes in response to the recent failures of other banks; (9) the ability to attract and retain key executives and employees experienced in banking and financial services; (10) the sufficiency of the allowance for credit losses to absorb the amount of actual losses inherent in our existing loan portfolio; (11) our ability to adapt successfully to technological changes to compete effectively in the marketplace; (12) credit risks and risks from concentrations (by geographic area and by industry) within our loan portfolio; (13) the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds, financial technology companies, and other financial institutions operating in our markets or elsewhere or providing similar services; (14) the failure of assumptions underlying the establishment of allowances for credit losses and estimation of values of collateral and various financial assets and liabilities; (15) volatility of rate-sensitive deposits; (16) operational risks, including data processing system failures or fraud; (17) asset/liability matching risks and liquidity risks; (18) the costs, effects and outcomes of existing or future litigation; (19) changes in general economic, political, or industry conditions, nationally, internationally or in the communities in which we conduct business, including the risk of a recession; (20) changes in accounting policies and practices, as may be adopted by state and federal regulatory agencies and the Financial Accounting Standards Board; (21) war or terrorist activities, including the ongoing Israeli-Palestinian conflict and the Russian invasion of Ukraine, widespread disease or pandemic, or other adverse external events, which may cause deterioration in the economy or cause instability in credit markets; (22) the occurrence of fraudulent activity, breaches, or failures of our or our third-party vendors' information security controls or cyber-security related incidents, including as a result of sophisticated attacks using artificial intelligence and similar tools; (23) the imposition of tariffs or other domestic or international governmental policies impacting the value of the agricultural or other products of our borrowers; (24) potential changes in federal policy and at regulatory agencies as a result of the upcoming 2024 presidential election; (25) the concentration of large deposits from certain clients who have balances above current FDIC insurance limits; (26) the effects of recent developments and events in the financial services industry, including the large-scale deposit withdrawals over a short period of time that resulted in recent bank failures; and (27) other risk factors detailed from time to time in Securities and Exchange Commission filings made by the Company. Non-GAAP Measures This presentation contains non-GAAP measures for tangible common equity, tangible book value per share, tangible common equity ratio, loan yield, tax equivalent, efficiency ratio, pre-tax, pre-provision earnings, return on average tangible equity, and net interest margin, tax equivalent. Management believes these measures provide investors with useful information regarding the Company’s profitability, financial condition and capital adequacy, consistent with how management evaluates the Company’s financial performance. A reconciliation of each non-GAAP measure to the most comparable GAAP measure is included, as necessary, in the Non-GAAP Financial Measures section.

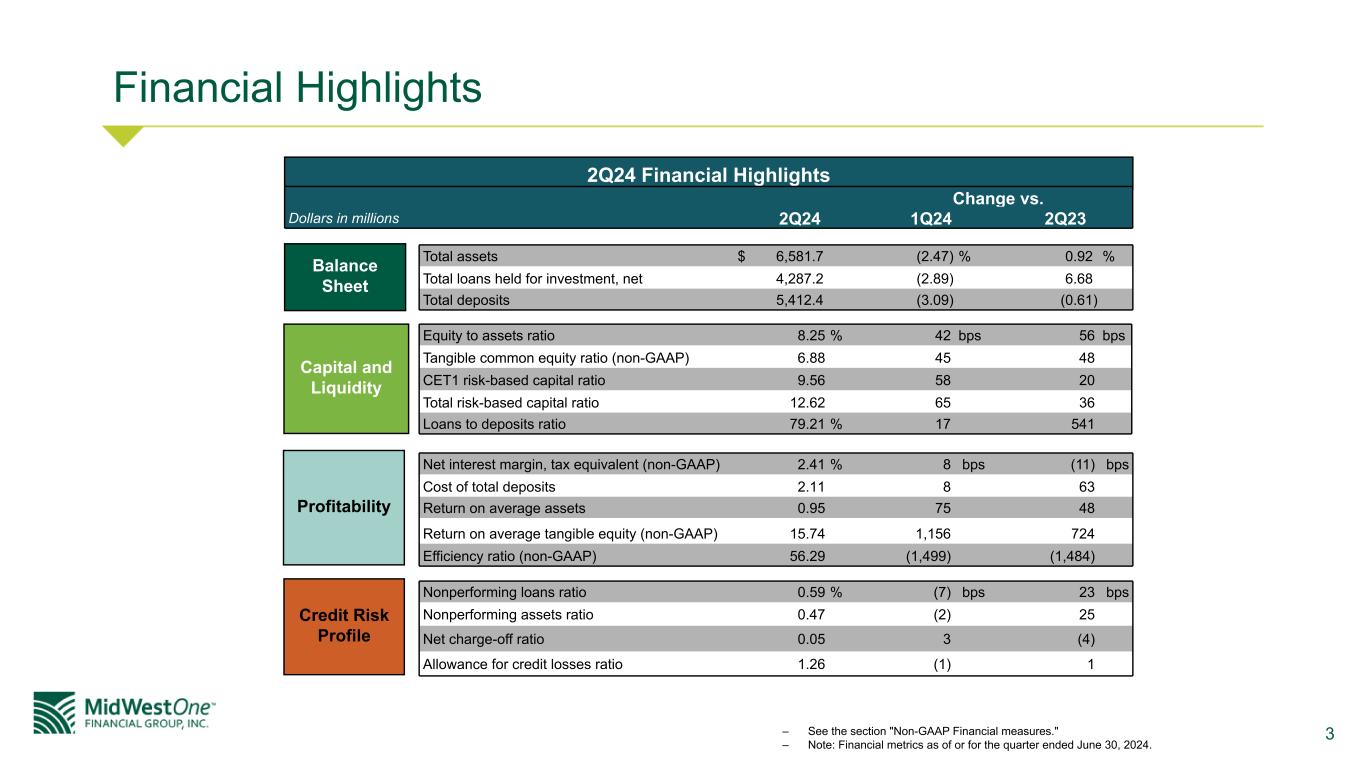

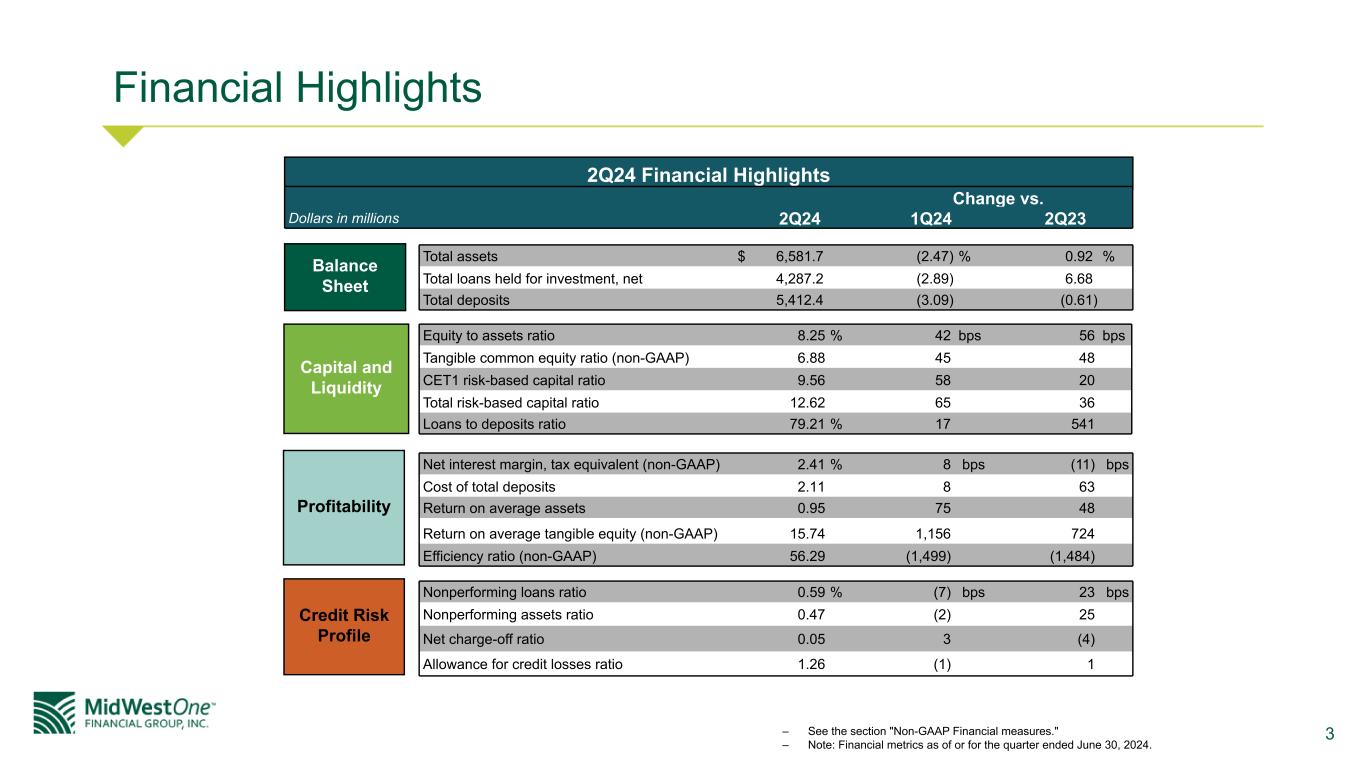

3 Financial Highlights Total assets $ 6,581.7 (2.47) % 0.92 % Total loans held for investment, net 4,287.2 (2.89) 6.68 Total deposits 5,412.4 (3.09) (0.61) Balance Sheet Equity to assets ratio 8.25 % 42 bps 56 bps Tangible common equity ratio (non-GAAP) 6.88 45 48 CET1 risk-based capital ratio 9.56 58 20 Total risk-based capital ratio 12.62 65 36 Loans to deposits ratio 79.21 % 17 541 Capital and Liquidity Net interest margin, tax equivalent (non-GAAP) 2.41 % 8 bps (11) bps Cost of total deposits 2.11 8 63 Return on average assets 0.95 75 48 Return on average tangible equity (non-GAAP) 15.74 1,156 724 Efficiency ratio (non-GAAP) 56.29 (1,499) (1,484) Profitability Nonperforming loans ratio 0.59 % (7) bps 23 bps Nonperforming assets ratio 0.47 (2) 25 Net charge-off ratio 0.05 3 (4) Allowance for credit losses ratio 1.26 (1) 1 Credit Risk Profile 2Q24 Financial Highlights – See the section "Non-GAAP Financial measures." – Note: Financial metrics as of or for the quarter ended June 30, 2024. Change vs. Dollars in millions 2Q24 1Q24 2Q23

4 Denver Bankshares, Inc. Acquisition and Florida Banking Operations Divestiture *The Denver banking offices, loans and deposits were as of the acquisition date 1/31/24 and the Florida banking offices, loans and deposits were as of the sale date 6/7/24. Dollars are reported in millions. **Banking office information is as of 6/30/24. Dollars are reported in millions. Note: Core market information excludes brokered time deposits of $196.0 million. Merger and Divestiture Update • On January 31, 2024, MOFG acquired Denver Bankshares, Inc., a bank holding company for the Bank of Denver. As consideration for the merger, we paid cash in the amount of $32.6 million. • During the first quarter of 2024, the core banking system conversion was completed and we consolidated the operations of a MidWestOne banking office into the former Bank of Denver banking office. • On June 7, 2024, MidWestOne Bank, a wholly-owned subsidiary of MOFG, completed the sale of its Florida banking operations for a 7.5% deposit premium. MOFG Core Markets** State Banking Offices Total Gross Loans in Market Total Deposits in Market Iowa Community 22 $ 868.0 $ 1,759.0 Iowa Metro 17 1,474.2 1,863.8 Twin Cities 15 1,279.5 1,205.9 Denver 2 683.0 387.6 Acquisitions and Divestitures* State Banking Offices Loans Deposits Denver 2 $ 207.1 $ 224.2 Florida 2 $ 163.6 $ 133.3

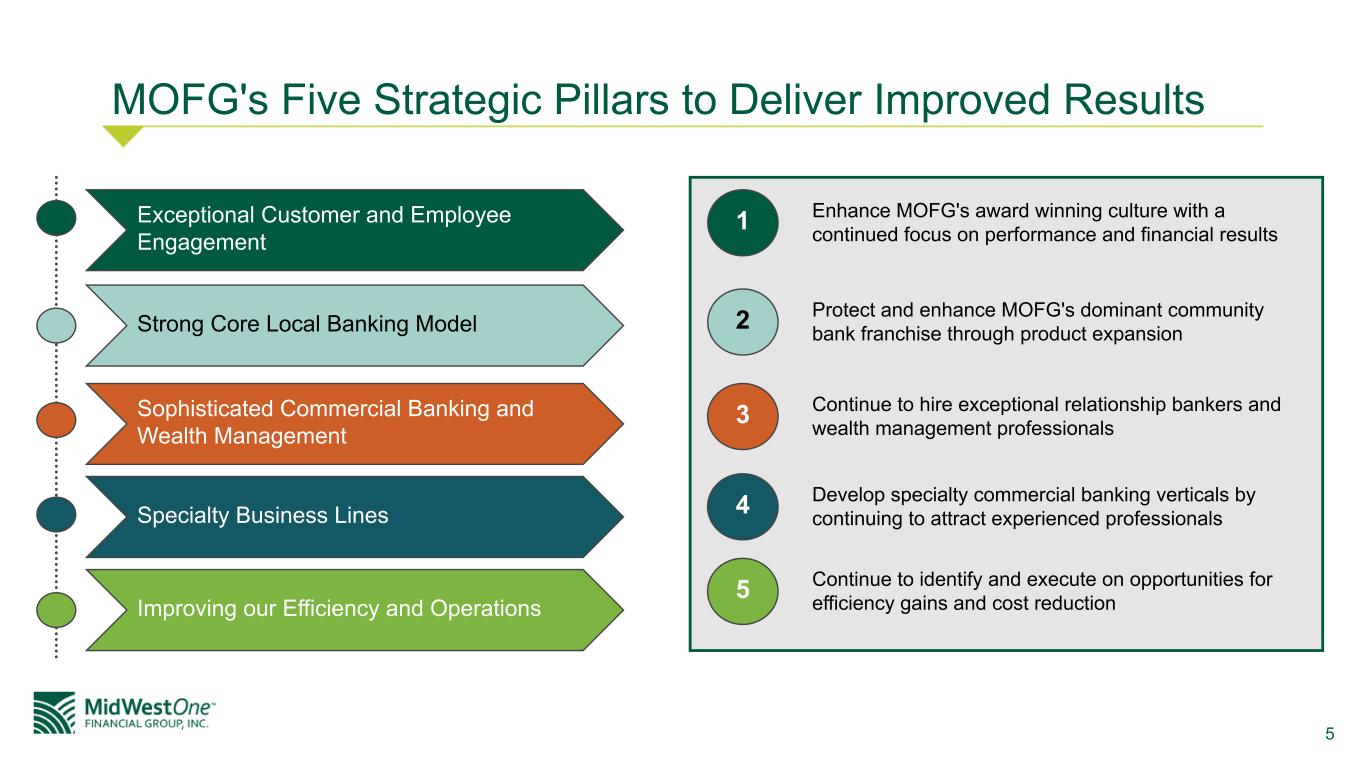

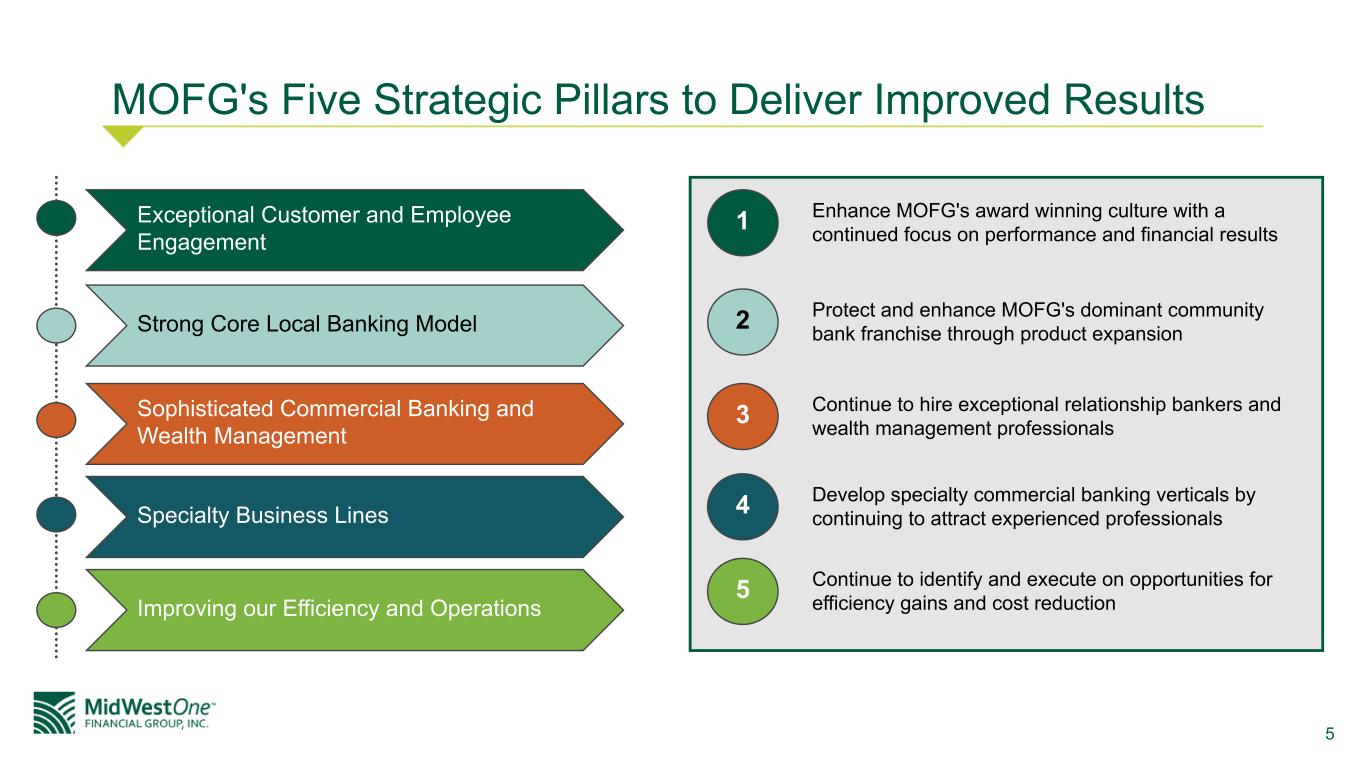

5 MOFG's Five Strategic Pillars to Deliver Improved Results Exceptional Customer and Employee Engagement 1 Enhance MOFG's award winning culture with a continued focus on performance and financial results 2 Protect and enhance MOFG's dominant community bank franchise through product expansion 3 Continue to hire exceptional relationship bankers and wealth management professionals 4 Develop specialty commercial banking verticals by continuing to attract experienced professionals 5 Continue to identify and execute on opportunities for efficiency gains and cost reduction Strong Core Local Banking Model Sophisticated Commercial Banking and Wealth Management Specialty Business Lines Improving our Efficiency and Operations

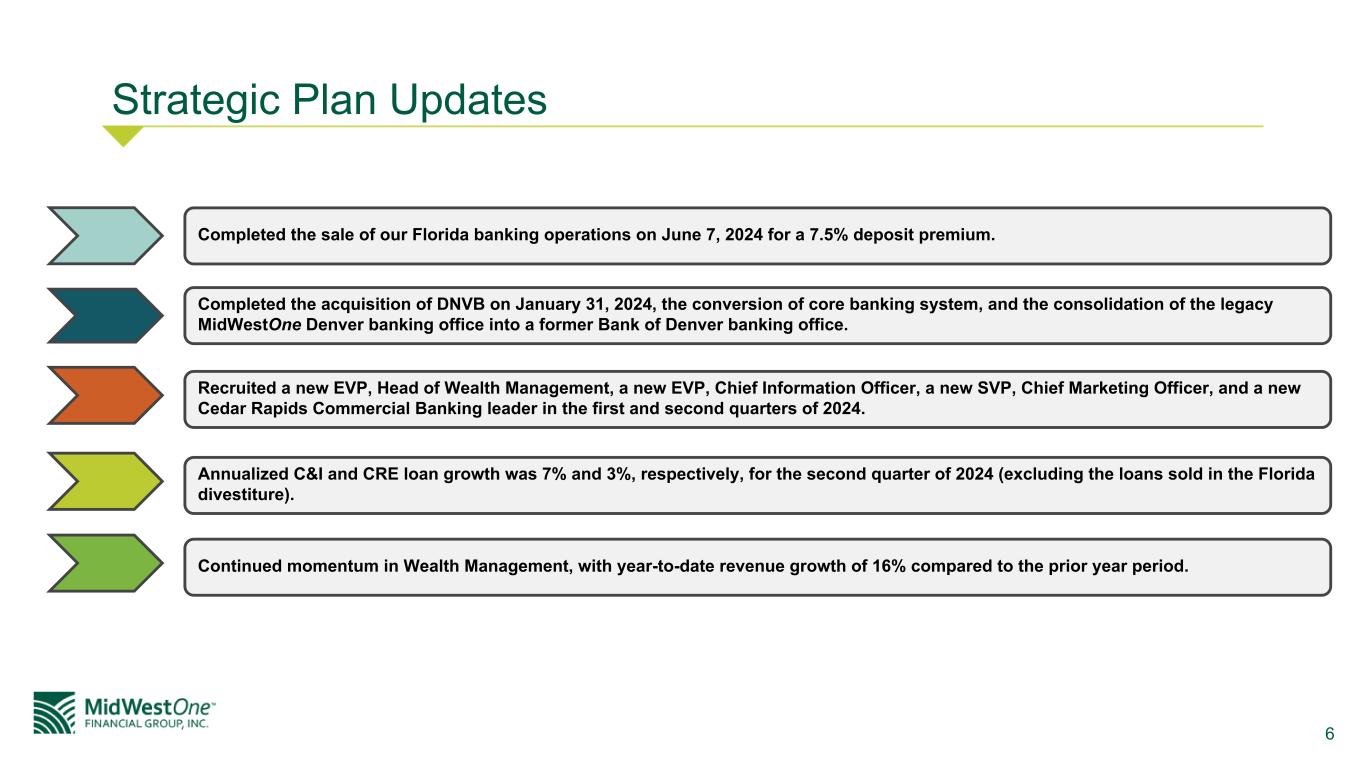

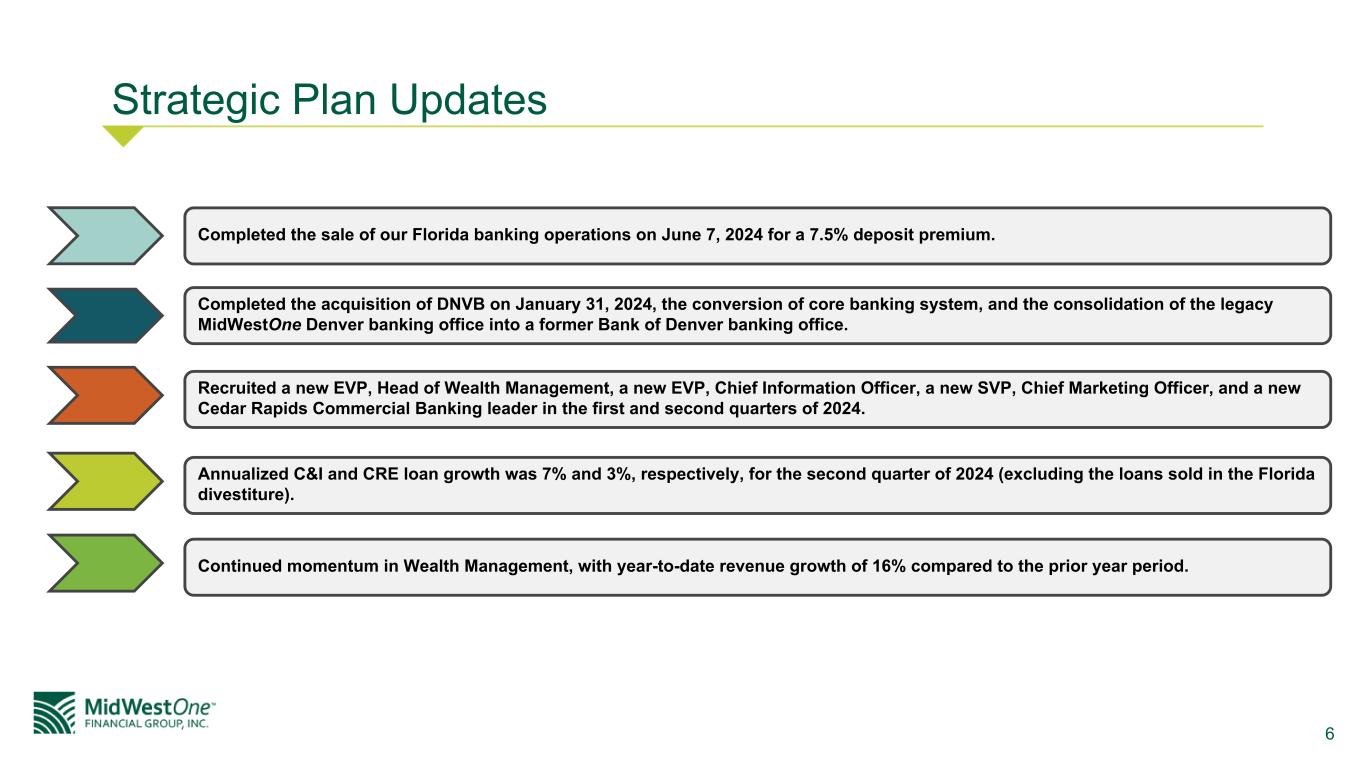

6 Strategic Plan Updates Completed the sale of our Florida banking operations on June 7, 2024 for a 7.5% deposit premium. Recruited a new EVP, Head of Wealth Management, a new EVP, Chief Information Officer, a new SVP, Chief Marketing Officer, and a new Cedar Rapids Commercial Banking leader in the first and second quarters of 2024. Completed the acquisition of DNVB on January 31, 2024, the conversion of core banking system, and the consolidation of the legacy MidWestOne Denver banking office into a former Bank of Denver banking office. Annualized C&I and CRE loan growth was 7% and 3%, respectively, for the second quarter of 2024 (excluding the loans sold in the Florida divestiture). Continued momentum in Wealth Management, with year-to-date revenue growth of 16% compared to the prior year period.

7 Commercial Loan Portfolio Commercial and Industrial, 32% Agricultural, 3% Farmland, 5% Construction & Development, 10% Multifamily, 12% CRE-Other, 38% Commercial Loan Portfolio Mix - June 30, 2024 Commercial Loan Portfolio of $3.5 billion Commercial Loan Growth in Targeted Regions $ in Millions $834.5 $1,077.9 $926.4 $1,182.3 Iowa Metro Twin Cities 06/30/22 06/30/23 06/30/24 $310.5 $660.1 Denver 06/30/22 06/30/23 06/30/24 13% CAGR 14% CAGR

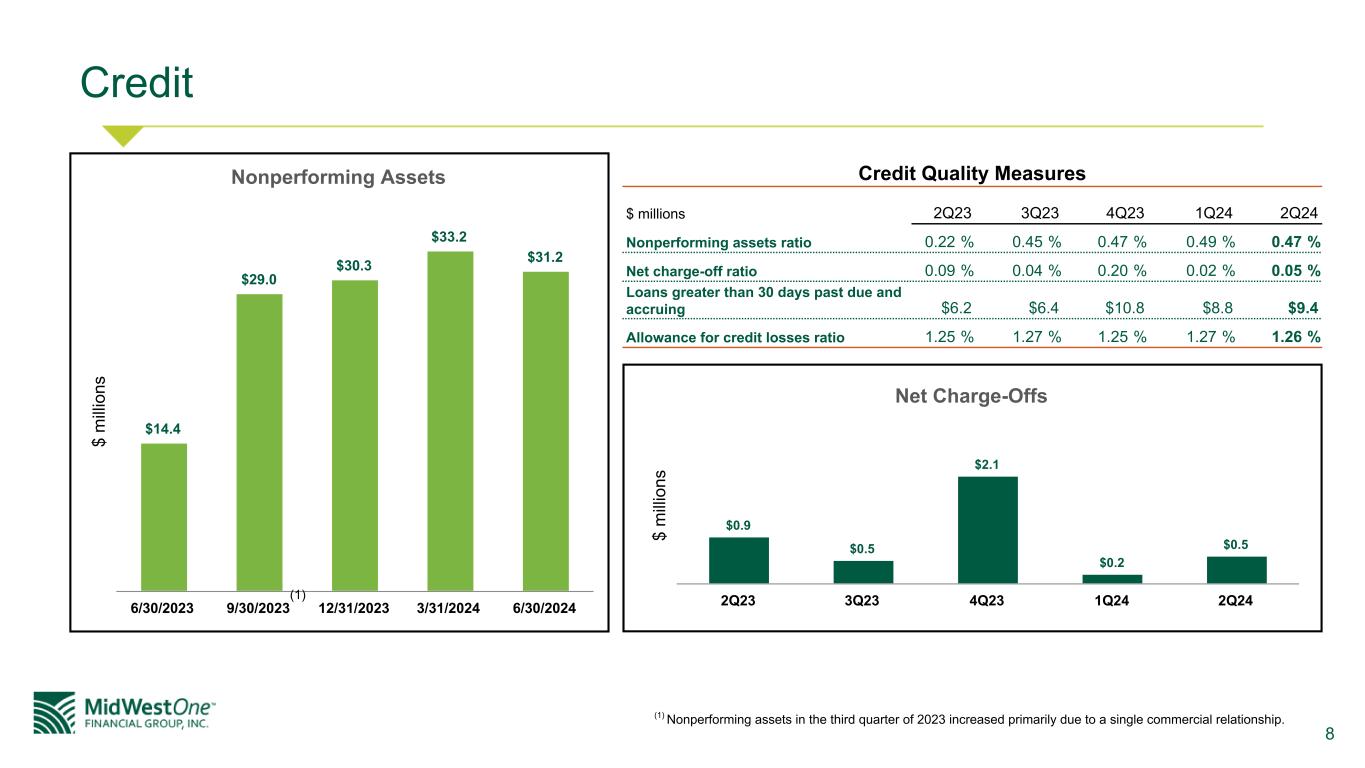

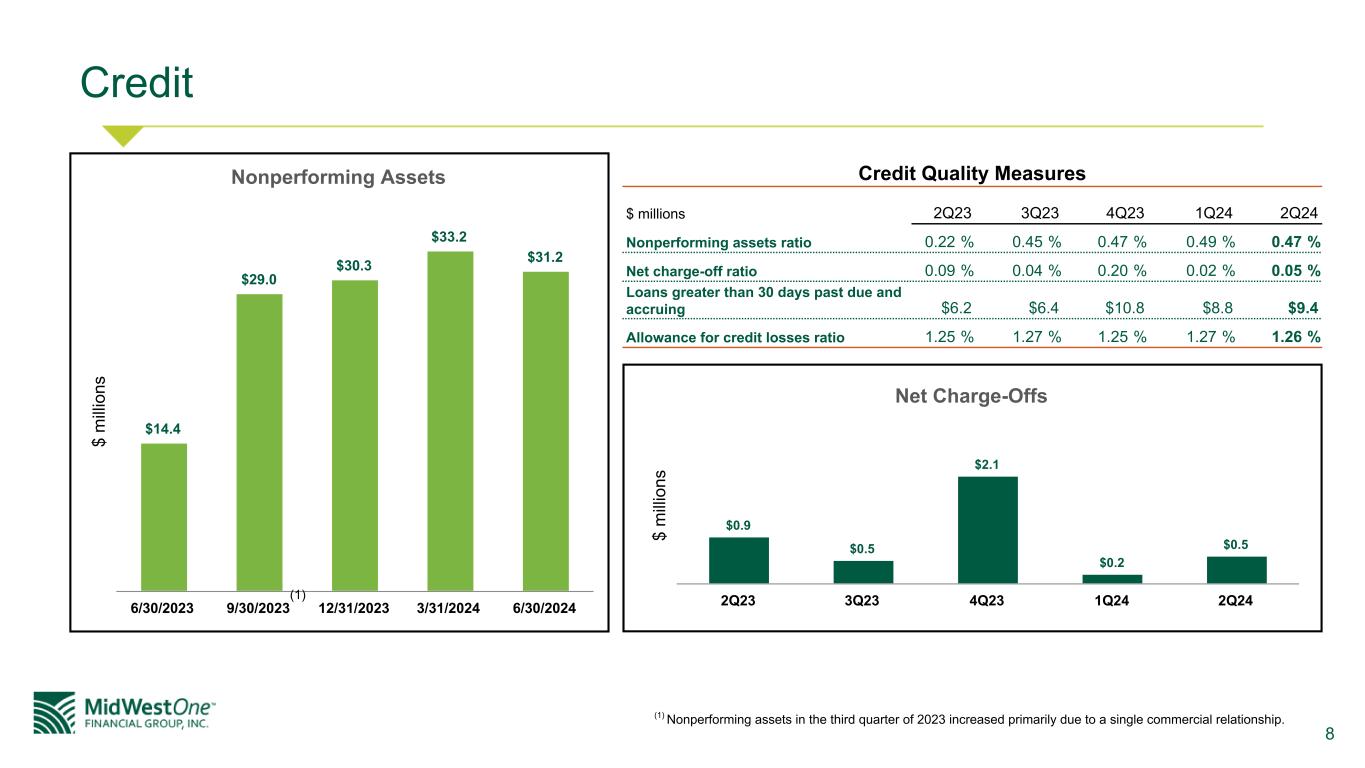

8 Credit $ m illi on s Nonperforming Assets $14.4 $29.0 $30.3 $33.2 $31.2 6/30/2023 9/30/2023 12/31/2023 3/31/2024 6/30/2024 $ m illi on s Net Charge-Offs $0.9 $0.5 $2.1 $0.2 $0.5 2Q23 3Q23 4Q23 1Q24 2Q24 Credit Quality Measures $ millions 2Q23 3Q23 4Q23 1Q24 2Q24 Nonperforming assets ratio 0.22 % 0.45 % 0.47 % 0.49 % 0.47 % Net charge-off ratio 0.09 % 0.04 % 0.20 % 0.02 % 0.05 % Loans greater than 30 days past due and accruing $6.2 $6.4 $10.8 $8.8 $9.4 Allowance for credit losses ratio 1.25 % 1.27 % 1.25 % 1.27 % 1.26 % (1) Nonperforming assets in the third quarter of 2023 increased primarily due to a single commercial relationship. (1)

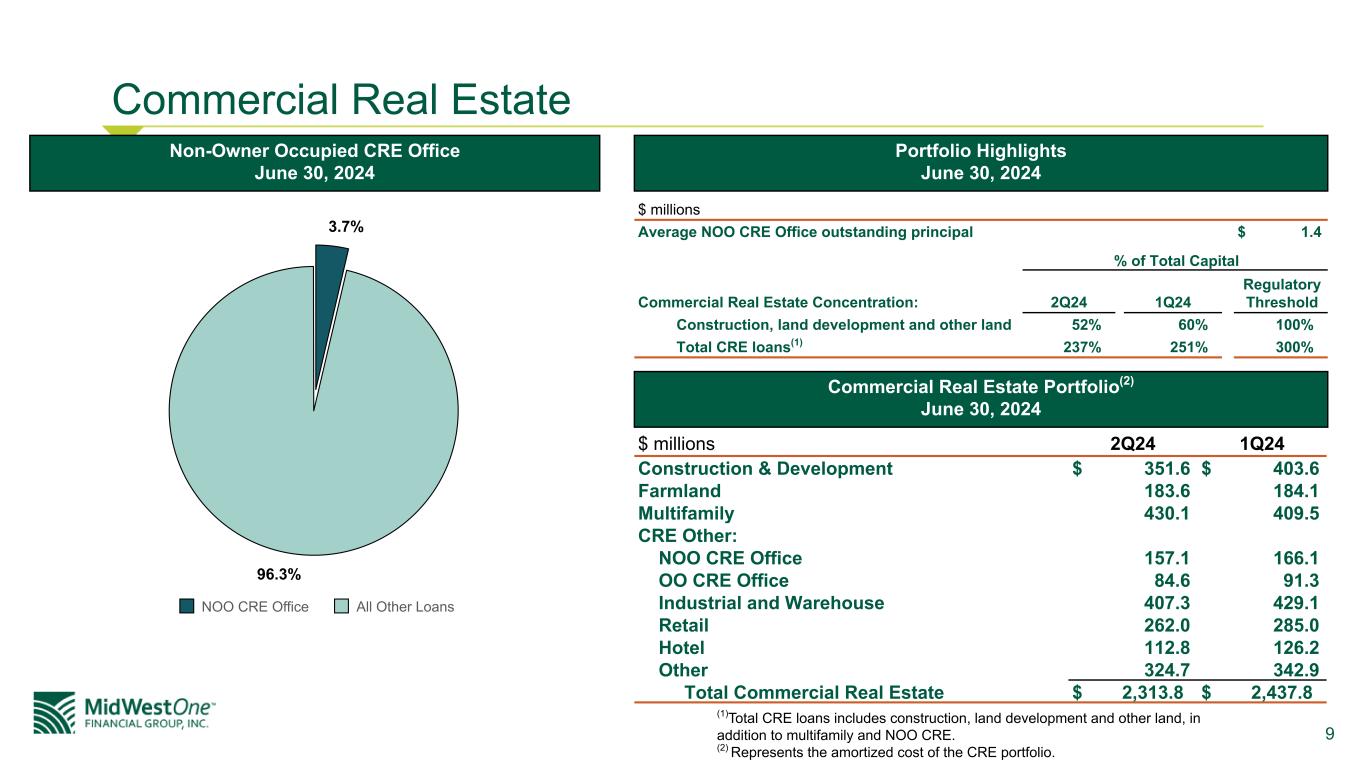

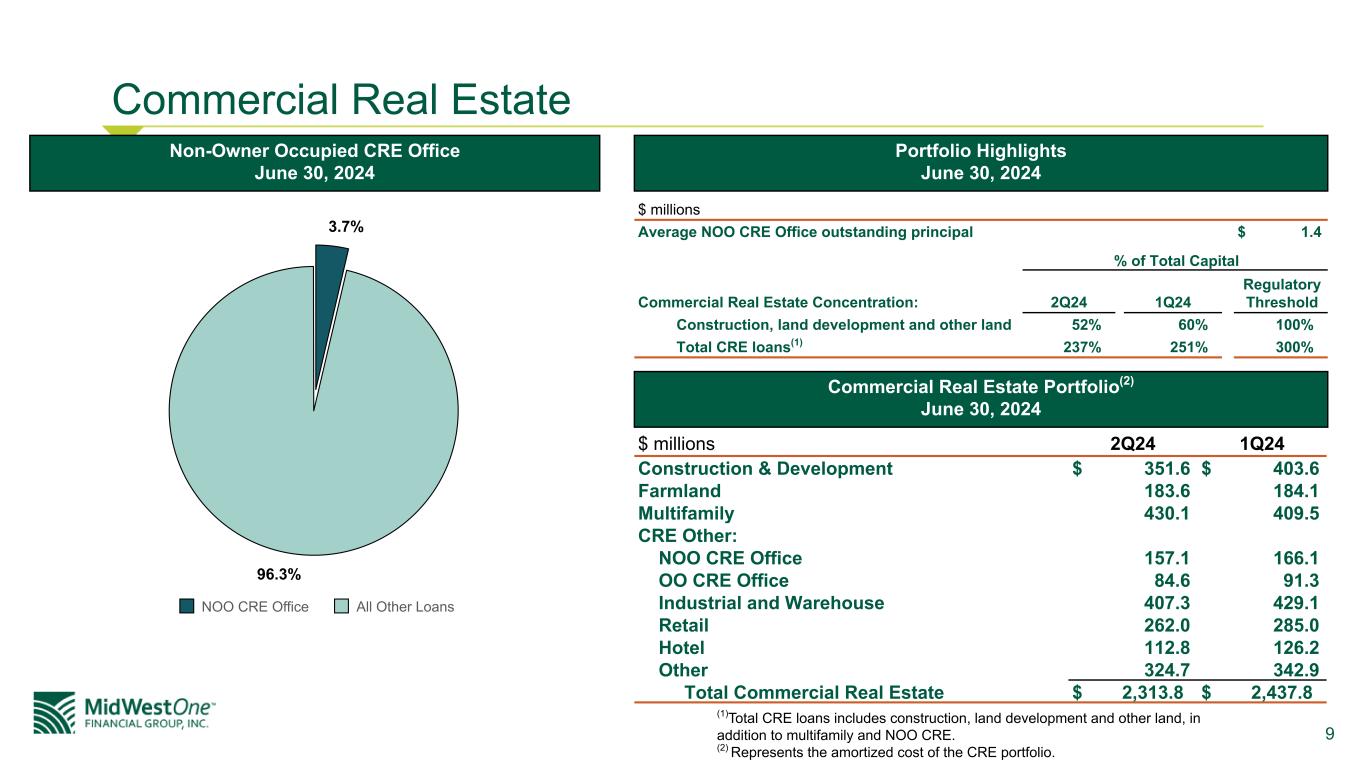

9 Commercial Real Estate 3.7% 96.3% NOO CRE Office All Other Loans Non-Owner Occupied CRE Office June 30, 2024 $ millions 2Q24 1Q24 Construction & Development $ 351.6 $ 403.6 Farmland 183.6 184.1 Multifamily 430.1 409.5 CRE Other: NOO CRE Office 157.1 166.1 OO CRE Office 84.6 91.3 Industrial and Warehouse 407.3 429.1 Retail 262.0 285.0 Hotel 112.8 126.2 Other 324.7 342.9 Total Commercial Real Estate $ 2,313.8 $ 2,437.8 Commercial Real Estate Portfolio(2) June 30, 2024 Portfolio Highlights June 30, 2024 $ millions Average NOO CRE Office outstanding principal $ 1.4 % of Total Capital Commercial Real Estate Concentration: 2Q24 1Q24 Regulatory Threshold Construction, land development and other land 52 % 60 % 100 % Total CRE loans(1) 237 % 251 % 300 % (1)Total CRE loans includes construction, land development and other land, in addition to multifamily and NOO CRE. (2) Represents the amortized cost of the CRE portfolio.

10 Focusing on Growth in Wealth Management $2.44 $2.74 $2.73 $3.01 $3.11 2020 2021 2022 2023 2Q24 $— $1.00 $2.00 $3.00 $4.00 Investment Services and Private Wealth Revenue • Asset amounts presented are in billions of dollars • Revenue amounts presented are in millions of dollars $9.6 $11.7 $11.2 $12.2 $7.0 $3.2 $4.2 $3.9 $3.8 $2.3 $6.4 $7.5 $7.3 $8.4 $4.7 Investment Services Private Wealth 2020 2021 2022 2023 YTD Q2.24 $5.0 $10.0 $15.0 Wealth Management Assets Under Administration Private Banking • Right size book of business with consistent eligibility • Launched new concierge support • Building out product set • Added a new Senior Private Banker in Des Moines during 2024 Private Wealth • Enhance planning with a single platform across Private Wealth and Investment Services • New investment solutions and two new equity managers expected by Fall of 2024 • Increase focus on thought leadership • Enhance fee opportunities with fiduciary services and proprietary investments Investment Services • Adding advisors in Twin Cities & Denver • Focus on building recurring revenue through fee-based business

11 Financial Performance

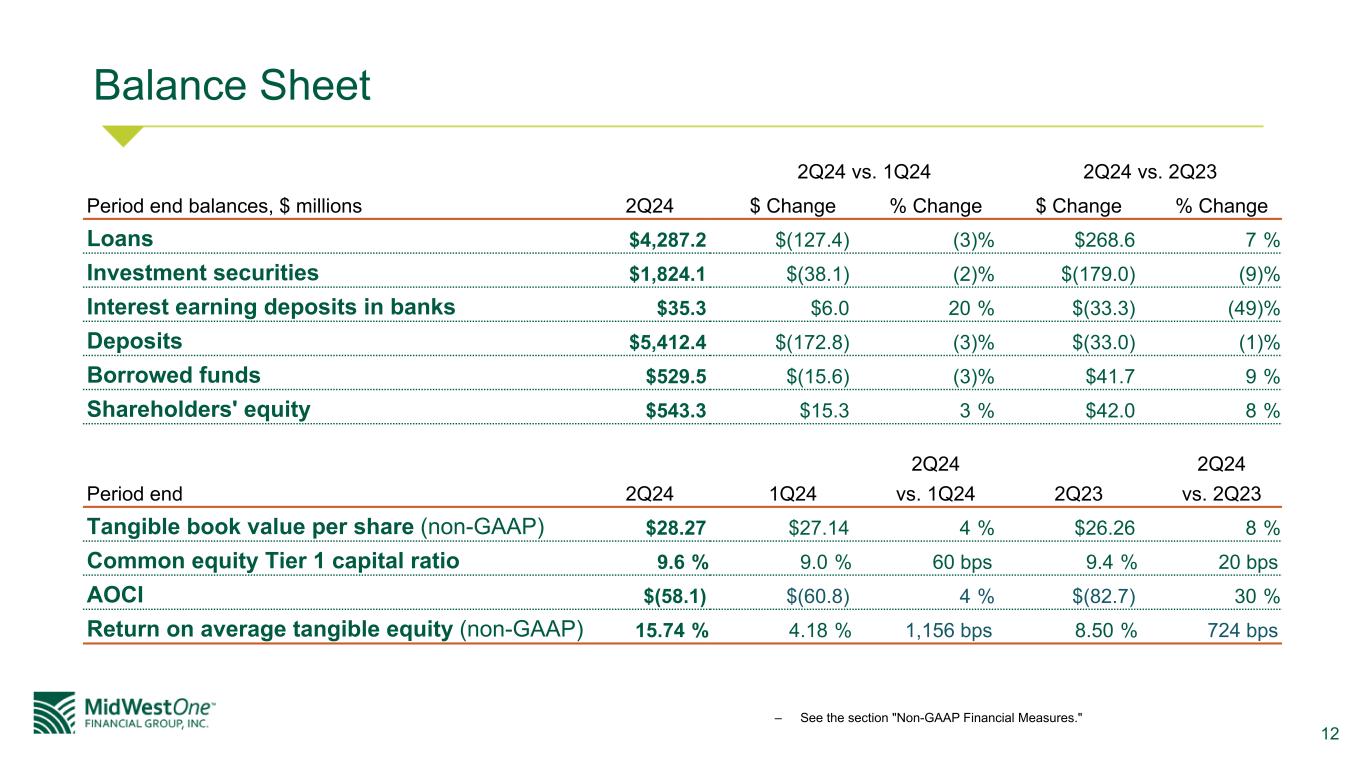

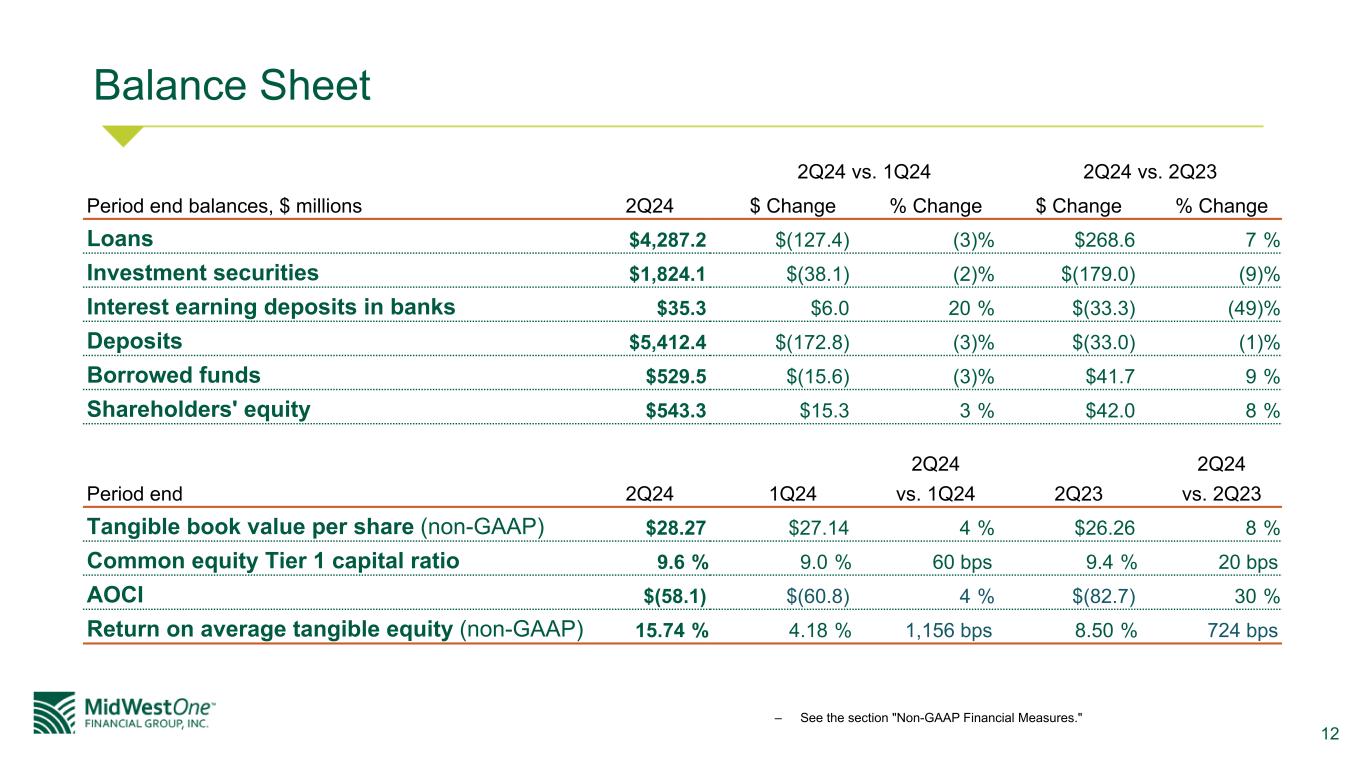

12 Balance Sheet 2Q24 vs. 1Q24 2Q24 vs. 2Q23 Period end balances, $ millions 2Q24 $ Change % Change $ Change % Change Loans $4,287.2 $(127.4) (3) % $268.6 7 % Investment securities $1,824.1 $(38.1) (2) % $(179.0) (9) % Interest earning deposits in banks $35.3 $6.0 20 % $(33.3) (49) % Deposits $5,412.4 $(172.8) (3) % $(33.0) (1) % Borrowed funds $529.5 $(15.6) (3) % $41.7 9 % Shareholders' equity $543.3 $15.3 3 % $42.0 8 % 2Q24 2Q24 Period end 2Q24 1Q24 vs. 1Q24 2Q23 vs. 2Q23 Tangible book value per share (non-GAAP) $28.27 $27.14 4 % $26.26 8 % Common equity Tier 1 capital ratio 9.6 % 9.0 % 60 bps 9.4 % 20 bps AOCI $(58.1) $(60.8) 4 % $(82.7) 30 % Return on average tangible equity (non-GAAP) 15.74 % 4.18 % 1,156 bps 8.50 % 724 bps – See the section "Non-GAAP Financial Measures."

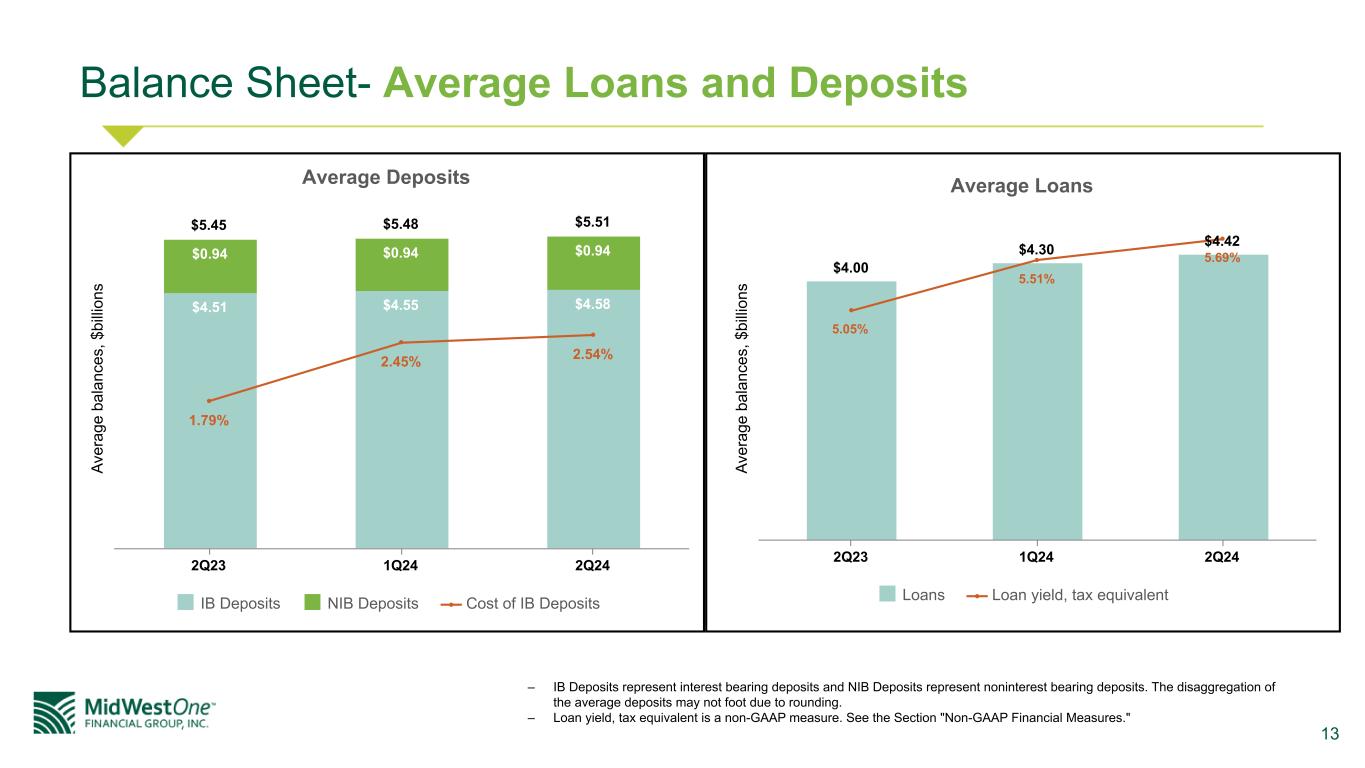

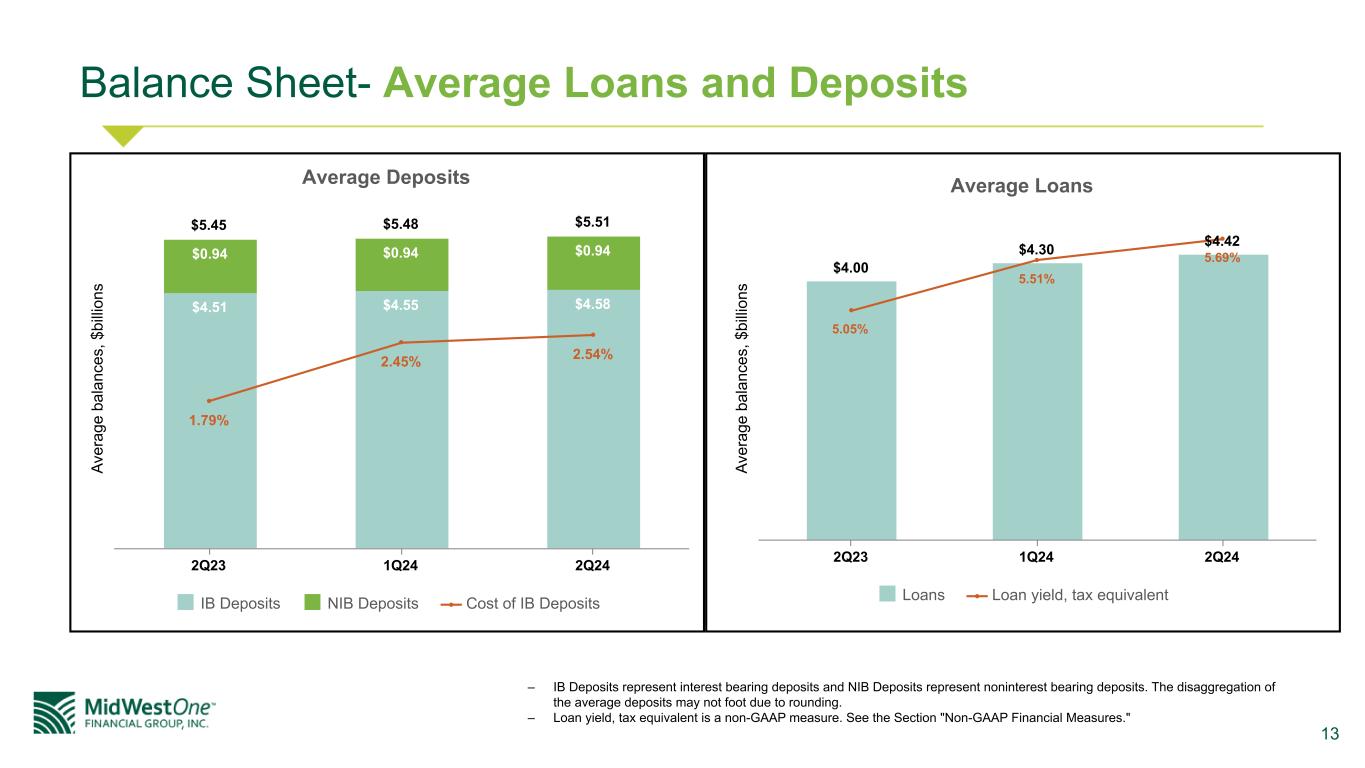

13 Balance Sheet- Average Loans and Deposits – IB Deposits represent interest bearing deposits and NIB Deposits represent noninterest bearing deposits. The disaggregation of the average deposits may not foot due to rounding. – Loan yield, tax equivalent is a non-GAAP measure. See the Section "Non-GAAP Financial Measures." Av er ag e ba la nc es , $ bi lli on s Average Deposits $5.45 $5.48 $5.51 $4.51 $4.55 $4.58 $0.94 $0.94 $0.94 1.79% 2.45% 2.54% IB Deposits NIB Deposits Cost of IB Deposits 2Q23 1Q24 2Q24 Av er ag e ba la nc es , $ bi lli on s Average Loans $4.00 $4.30 $4.42 5.05% 5.51% 5.69% Loans Loan yield, tax equivalent 2Q23 1Q24 2Q24

14 Balance Sheet - Debt Securities Portfolio Municipals, 15% MBS, 1% CLO, 7% CMO, 22% Corporate, 55% 2.35% 2.36% 2.36% 2.46% 2.46% Total Securities Held for Investment (FTE) 2Q23 3Q23 4Q23 1Q24 2Q24 Investment Securities Yield Available for Sale Debt Securities Portfolio Mix June 30, 2024(1) Municipals, 50% MBS, 7% CMO, 43% Held to Maturity Debt Securities Portfolio Mix June 30, 2024(1) • Investment Portfolio Mix: ◦ AFS Securities - $0.8 billion ◦ HTM Securities - $1.1 billion • Investment Portfolio Duration: ◦ AFS Securities - 2.7 ◦ HTM Securities - 6.0 ◦ Total Securities - 4.6 • Allowance for credit losses for investments is $0 Portfolio Composition (1) Percentages may not total 100% due to rounding.

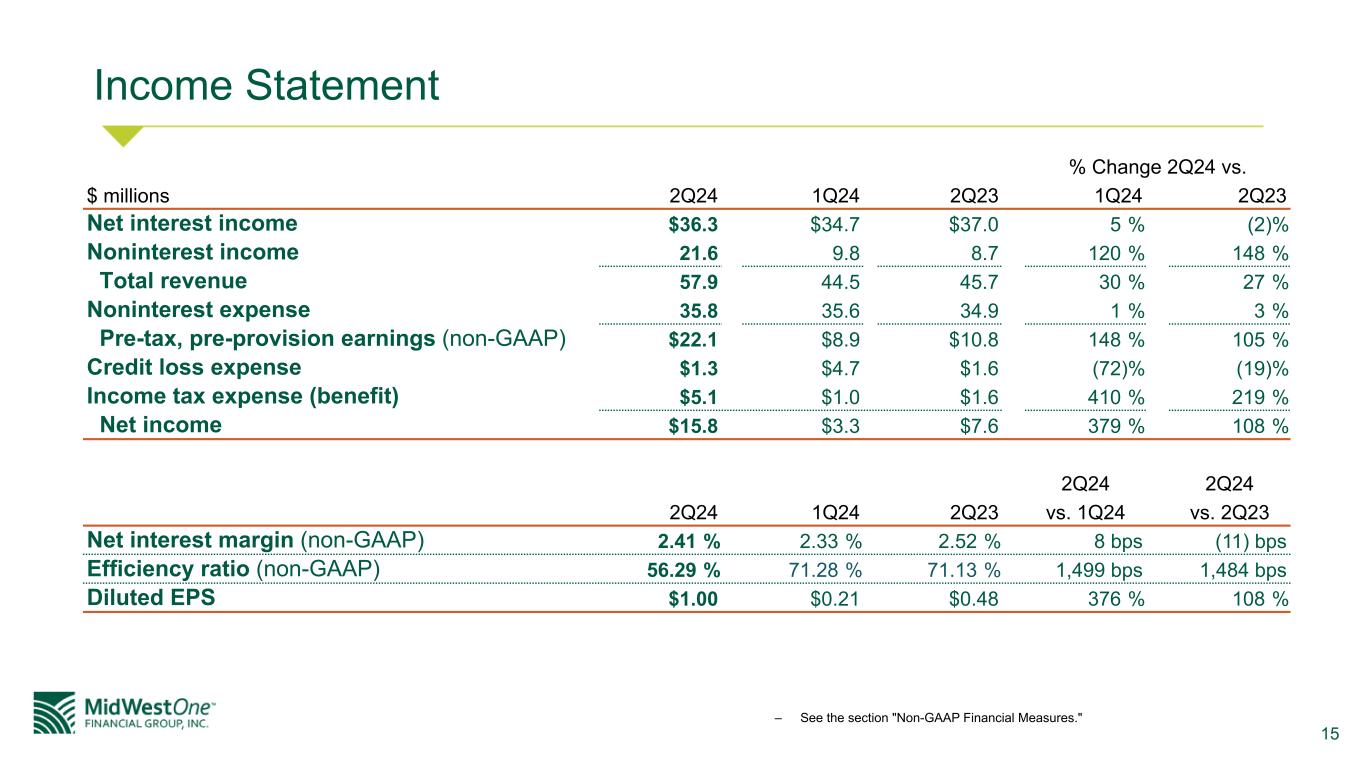

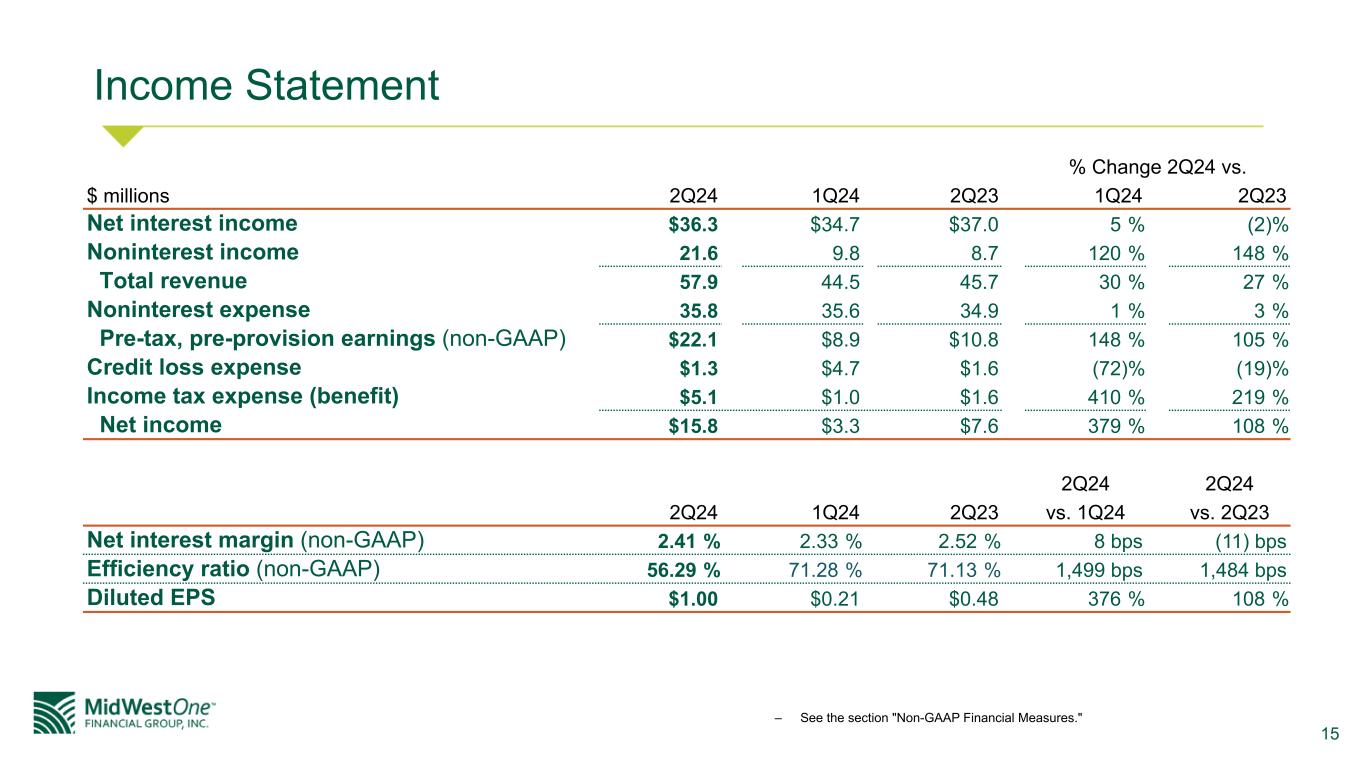

15 Income Statement % Change 2Q24 vs. $ millions 2Q24 1Q24 2Q23 1Q24 2Q23 Net interest income $36.3 $34.7 $37.0 5 % (2) % Noninterest income 21.6 9.8 8.7 120 % 148 % Total revenue 57.9 44.5 45.7 30 % 27 % Noninterest expense 35.8 35.6 34.9 1 % 3 % Pre-tax, pre-provision earnings (non-GAAP) $22.1 $8.9 $10.8 148 % 105 % Credit loss expense $1.3 $4.7 $1.6 (72) % (19) % Income tax expense (benefit) $5.1 $1.0 $1.6 410 % 219 % Net income $15.8 $3.3 $7.6 379 % 108 % 2Q24 2Q24 2Q24 1Q24 2Q23 vs. 1Q24 vs. 2Q23 Net interest margin (non-GAAP) 2.41 % 2.33 % 2.52 % 8 bps (11) bps Efficiency ratio (non-GAAP) 56.29 % 71.28 % 71.13 % 1,499 bps 1,484 bps Diluted EPS $1.00 $0.21 $0.48 376 % 108 % – See the section "Non-GAAP Financial Measures."

16 Non-GAAP Financial Measures

17 Non-GAAP Financial Measures Tangible Common Equity / Tangible Book Value per Share / Tangible Common Equity Ratio June 30, 2023 March 31, 2024 June 30, 2024 dollars in thousands Total shareholders' equity $ 501,341 $ 528,040 $ 543,286 Intangible assets, net (89,446) (100,649) (97,327) Tangible common equity $ 411,895 $ 427,391 $ 445,959 Total assets $ 6,521,489 $ 6,748,015 $ 6,581,658 Intangible assets, net (89,446) (100,649) (97,327) Tangible assets $ 6,432,043 $ 6,647,366 $ 6,484,331 Book value per share $ 31.96 $ 33.53 $ 34.44 Tangible book value per share (1) $ 26.26 $ 27.14 $ 28.27 Shares outstanding 15,685,123 15,750,471 15,773,468 Tangible common equity ratio (2) 6.40 % 6.43 % 6.88 % (1) Tangible common equity divided by shares outstanding. (2) Tangible common equity divided by tangible assets. Loan Yield, Tax Equivalent For the Three Months Ended June 30, 2023 March 31, 2024 June 30, 2024 dollars in thousands Loan interest income, including fees $ 49,726 $ 57,947 $ 61,643 Tax equivalent adjustment (1) 713 920 938 Tax equivalent loan interest income $ 50,439 $ 58,867 $ 62,581 Yield on loans, tax equivalent (2) 5.05 % 5.51 % 5.69 % Average Loans $ 4,003,717 $ 4,298,216 $ 4,419,697 (1) The federal statutory tax rate utilized was 21%. (2) Annualized tax equivalent loan interest income divided by average loans.

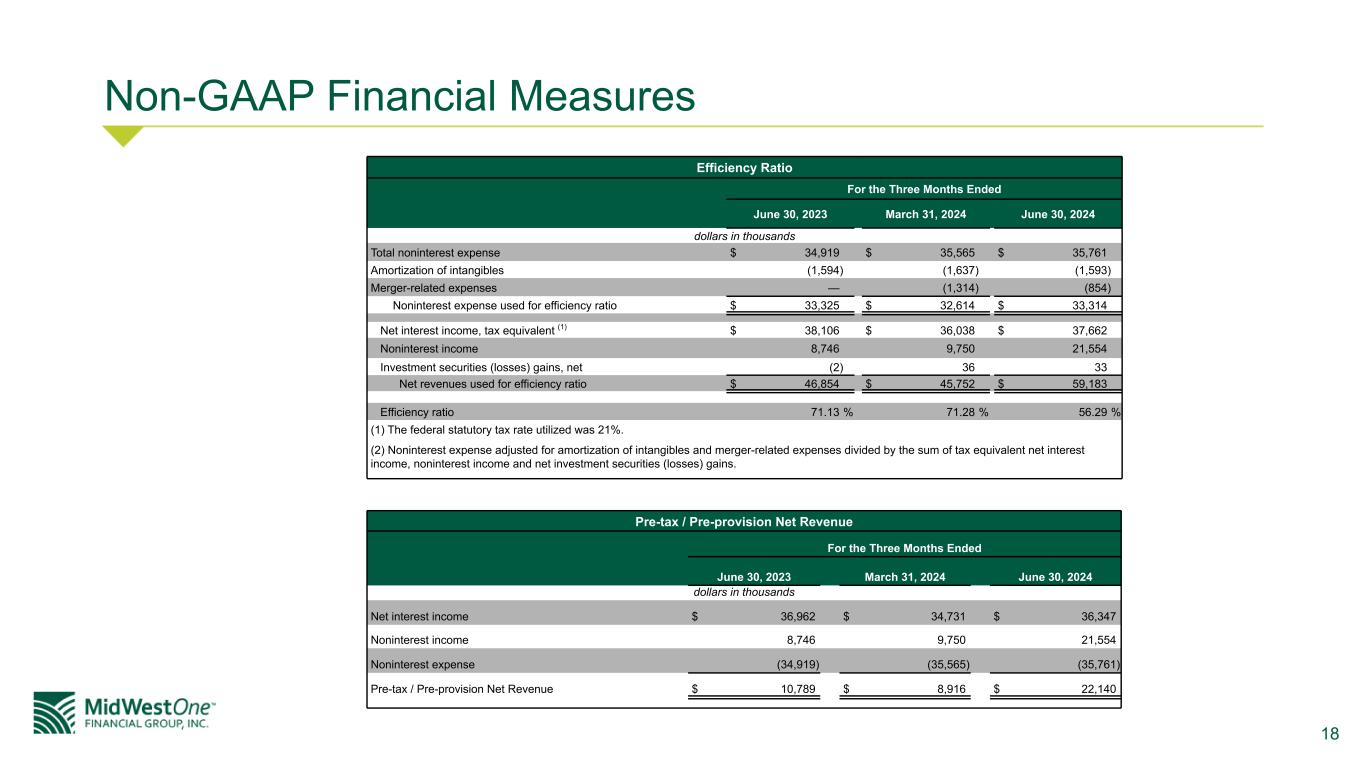

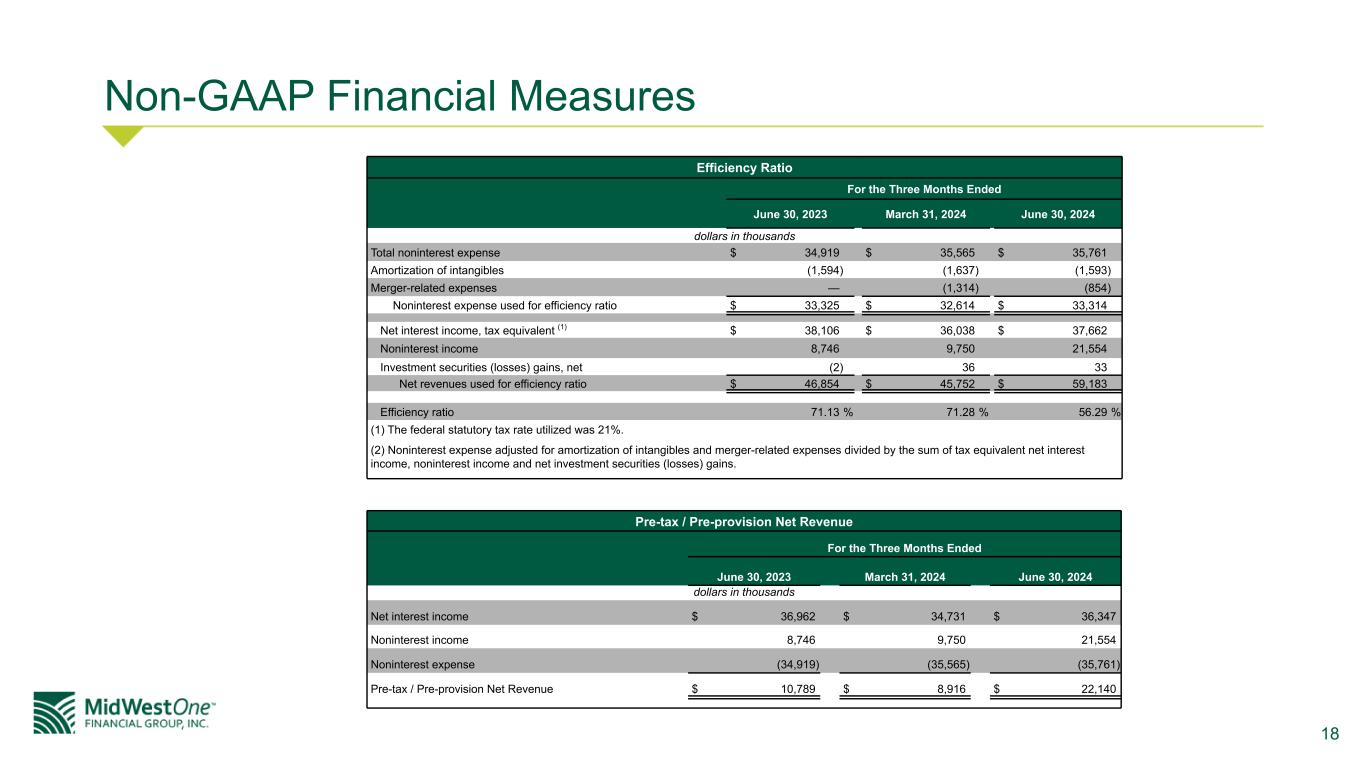

18 Non-GAAP Financial Measures Efficiency Ratio For the Three Months Ended June 30, 2023 March 31, 2024 June 30, 2024 dollars in thousands Total noninterest expense $ 34,919 $ 35,565 $ 35,761 Amortization of intangibles (1,594) (1,637) (1,593) Merger-related expenses — (1,314) (854) Noninterest expense used for efficiency ratio $ 33,325 $ 32,614 $ 33,314 Net interest income, tax equivalent (1) $ 38,106 $ 36,038 $ 37,662 Noninterest income 8,746 9,750 21,554 Investment securities (losses) gains, net (2) 36 33 Net revenues used for efficiency ratio $ 46,854 $ 45,752 $ 59,183 Efficiency ratio 71.13 % 71.28 % 56.29 % (1) The federal statutory tax rate utilized was 21%. (2) Noninterest expense adjusted for amortization of intangibles and merger-related expenses divided by the sum of tax equivalent net interest income, noninterest income and net investment securities (losses) gains. Pre-tax / Pre-provision Net Revenue For the Three Months Ended June 30, 2023 March 31, 2024 June 30, 2024 dollars in thousands Net interest income $ 36,962 $ 34,731 $ 36,347 Noninterest income 8,746 9,750 21,554 Noninterest expense (34,919) (35,565) (35,761) Pre-tax / Pre-provision Net Revenue $ 10,789 $ 8,916 $ 22,140

19 Non-GAAP Financial Measures Return on Average Tangible Equity For the Three Months Ended June 30, 2023 March 31, 2024 June 30, 2024 dollars in thousands Net income $ 7,594 $ 3,269 $ 15,819 Intangible amortization, net of tax (1) 1,196 1,228 1,195 Tangible net income $ 8,790 $ 4,497 $ 17,014 Average shareholders' equity $ 504,988 $ 527,533 $ 533,994 Average intangible assets, net (90,258) (95,296) (99,309) Average tangible equity $ 414,730 $ 432,237 $ 434,685 Return on average equity 6.03 % 2.49 % 11.91 % Return on average tangible equity (2) 8.50 % 4.18 % 15.74 % (1) The combined income tax rate utilized was 25%. (2) Annualized tangible net income divided by average tangible equity. Net Interest Margin, Tax Equivalent For the Three Months Ended June 30, 2023 March 31, 2024 June 30, 2024 dollars in thousands Net interest Income $ 36,962 $ 34,731 $ 36,347 Tax equivalent adjustments: Loans (1) 713 920 938 Securities (1) 431 387 377 Net Interest Income, tax equivalent $ 38,106 $ 36,038 $ 37,662 Average interest earning assets $ 6,056,732 $ 6,215,160 $ 6,282,494 Net interest margin, tax equivalent (2) 2.52 % 2.33 % 2.41 % (1) The federal statutory tax rate utilized was 21%. (2) Annualized tax equivalent net interest income divided by average interest earning assets.