Investor Presentation | Discussion Materials Subordinated Debt Offering | December 2019

Forward-Looking Statements This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the Company’s current views with respect to, among other things, www.levelonebank.com future events and financial performance. The Company generally identifies forward-looking statements by terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of those words or other comparable words. Any forward-looking statements contained in this presentation are NASDAQ: LEVL based on the historical performance of the Company and its subsidiaries or on the Company’s current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company that the future plans, estimates or expectations by the Company will be The Company encourages everyone to visit achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions the Investors Section of its website at relating to the Company’s operations, financial results, financial condition, business prospects, growth strategy www.levelonebank.com, where it has posted and liquidity. If one or more of these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from those indicated in additional important information such as these statements. The Company does not undertake any obligation to publicly update or review any forward- press releases and SEC filings. looking statement, whether as a result of new information, future developments or otherwise. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements. These factors include, but are not limited to, the following, any one or more of which could The Company intends to use its website to materially affect the outcome of future events: expedite public access to time-critical • business and economic conditions generally and in the financial services industry in particular, whether information regarding the Company in nationally, regionally or in the markets in which it operates; advance of or in lieu of distributing a press • the Company’s ability to achieve organic loan and deposit growth, and the composition of that growth; release or a filing with the SEC disclosing • its ability to integrate and achieve anticipated cost savings from acquisitions; • its pending acquisition of Ann Arbor Bancorp, Inc. and its wholly owned subsidiary, Ann Arbor State Bank, the same information. and risks and uncertainties associated with the acquisition, including the possibilities that the transaction may not close, and that the Company may not achieve the anticipated benefits of the acquisition; • changes (or the lack of changes) in interest rates, yield curves and interest rate spread relationships that affect its loan and deposit pricing; • the extent of continuing client demand for the high level of personalized service that is a key element of its banking approach as well as its ability to execute its strategy generally; • the dependence on its management team, and its ability to attract and retain qualified personnel; • changes in the quality or composition of our loan or investment portfolios, including adverse developments in borrower industries or in the repayment ability of individual borrowers; • inaccuracy of the assumptions and estimates its makes in establishing reserves for probable loan losses and other estimates; • the concentration of its business within our geographic areas of operation in Michigan; and • concentration of credit exposure. These factors should not be construed as exhaustive. Additional information on these and other risk factors can be found in Item 1A. “Risk Factors” and Item 7. “Special Note Regarding Forward-Looking Statements” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, filed with the Securities and Exchange Commission. 2

Notice to Recipients: This confidential presentation (this “Presentation”) has been prepared solely for general informational purposes by Level One Bancorp, Inc. (together, with its wholly owned bank subsidiary Level One Bank, the “Company”), and is being furnished solely for use by prospective participants in considering participation in the proposed offering (the “Offering”) of subordinated notes by the Company (the “Securities”). No representation or warranty as to the accuracy, completeness, or fairness of such information is being made by the Company or any other person, and neither the Company nor any other person shall have any liability for any information contained herein, or for any omissions from this Presentation or any other written or oral communications transmitted to the recipient by the Company or any other person in the course of the recipient’s evaluation of the Offering. Investment in the Securities offered hereunder involves a high degree of risk and is suitable only for persons of substantial means who have no need for liquidity from this investment and who are able to bear the economic risks of the investment, including total loss. There is no public market for the Securities and no public market will develop as a result of this Offering. The Securities are not a deposit or bank account, and are not, and will not be, insured or guaranteed by the Federal Deposit Insurance Corporation (the “FDIC”) or any other federal or state government agency. Investment in the Securities has not been approved or disapproved by the Securities and Exchange Commission (the “SEC”), the Office of the Comptroller of the Currency (the “OCC”), the Federal Deposit Insurance Corporation, the Board of Governors of the Federal Reserve System or any other federal or state regulatory authority, nor has any authority passed upon or endorsed the merits of the Offering or the accuracy or adequacy of this Presentation. Any representation to the contrary is a criminal offense. The offer to invest in the Securities and the sale thereof has not been registered under the Securities Act of 1933, as amended (the “1933 Act”), nor under any state securities act. The Securities are being offered and sold in reliance on exemptions from the registration requirements of such acts. Therefore, the Securities may not be sold or transferred absent an exemption from registration under the 1933 Act and under applicable state securities law. The Company reserves the right to withdraw or amend this Offering for any reason and to reject any subscription in whole or in part. The Company has authorized Performance Trust Capital Partners, LLC, to act as its placement agent in the Offering. The information contained herein is intended only as an outline that has been prepared to assist interested parties in making their own evaluations of the Company. It does not purport to be all- inclusive or to contain all of the information that a prospective participant may desire. The information contained herein speaks as of the date hereof. Neither the delivery of this information or any eventual sale of the Securities shall, under any circumstances, imply that the information contained herein is correct as of any future date or that there has been no change in the Company’s business affairs described herein after the date hereof. Nothing contained herein is, or should be relied upon as, a promise or representation as to future performance. Neither the Company nor any of its affiliates undertakes any obligation to update or revise this presentation. Each recipient of the information and data contained herein should perform its own independent investigation and analysis of the Offering and the value of the Company. The information and data contained herein are not a substitute for a recipient’s independent evaluation and analysis. In making an investment decision, prospective participants must rely on their own examination of the Company, including the merits and risks involved. By accepting delivery of the information contained herein, you agree to undertake and rely upon your own independent investigation and analysis and consult with your own attorneys, accountants, and other professional advisors regarding the Company and the merits and risks of an investment in the Securities, including all related legal, investment, tax, and other matters. In the event that any portion of this Presentation is inconsistent with or contrary to any of the terms of the form of a subordinated note purchase agreement (the “Purchase Agreement”), the Purchase Agreement shall control. You will be given the opportunity to ask questions of and receive answers from Company representatives concerning its business and the terms and conditions of the Offering, and to obtain any additional relevant information to the extent the Company possesses such information or can obtain it without unreasonable effort or expense. Except for information provided in response to such requests, the Company has not authorized any other person to give you information that is not found in this Presentation. If such unauthorized information is obtained or provided, the Company cannot and does not assume responsibility for its accuracy, credibility, or validity. The Company is not providing you with any legal, business, tax or other advice regarding an investment in the Securities. You should consult with your own advisors as needed to assist you in making your investment decision and to advise you whether you are legally permitted to purchase the Securities. The information contained herein does not constitute an offer to sell or a solicitation of an offer to purchase the Securities described herein nor shall there be any sale of such Securities in any state or jurisdiction in which such an offer or solicitation is not permitted or would be unlawful. Each investor must comply with all legal requirements in each jurisdiction in which it purchases, offers, or sells the Securities, and must obtain any consent, approval, or permission required by it in connection with the Securities or the Placement. The Company does not make any representation or warranty regarding, and has no responsibility for, the legality of an investment in the Securities under any investment, securities, or similar laws. 3

Confidentiality and Recipient’s Undertaking: The information contained herein is confidential and proprietary to the Company and its subsidiaries. By accepting delivery of this information, the intended recipient is deemed to have acknowledged and agreed to the following: • The information contained herein will be used by the recipient solely for the purpose of deciding whether to proceed with a further investigation of the Company and its subsidiaries. • This information will be kept in strict confidence and will not, whether in whole or in part, be released or discussed by the recipient, nor will any reproductions of such information be made, for any other purpose other than an analysis of the merits of an eventual investment in the Company by its intended recipient. • Upon written request of the Company, this information, any other documents or information furnished and any and all reproductions thereof and notes relating thereto will be promptly returned to the Company or destroyed. 4

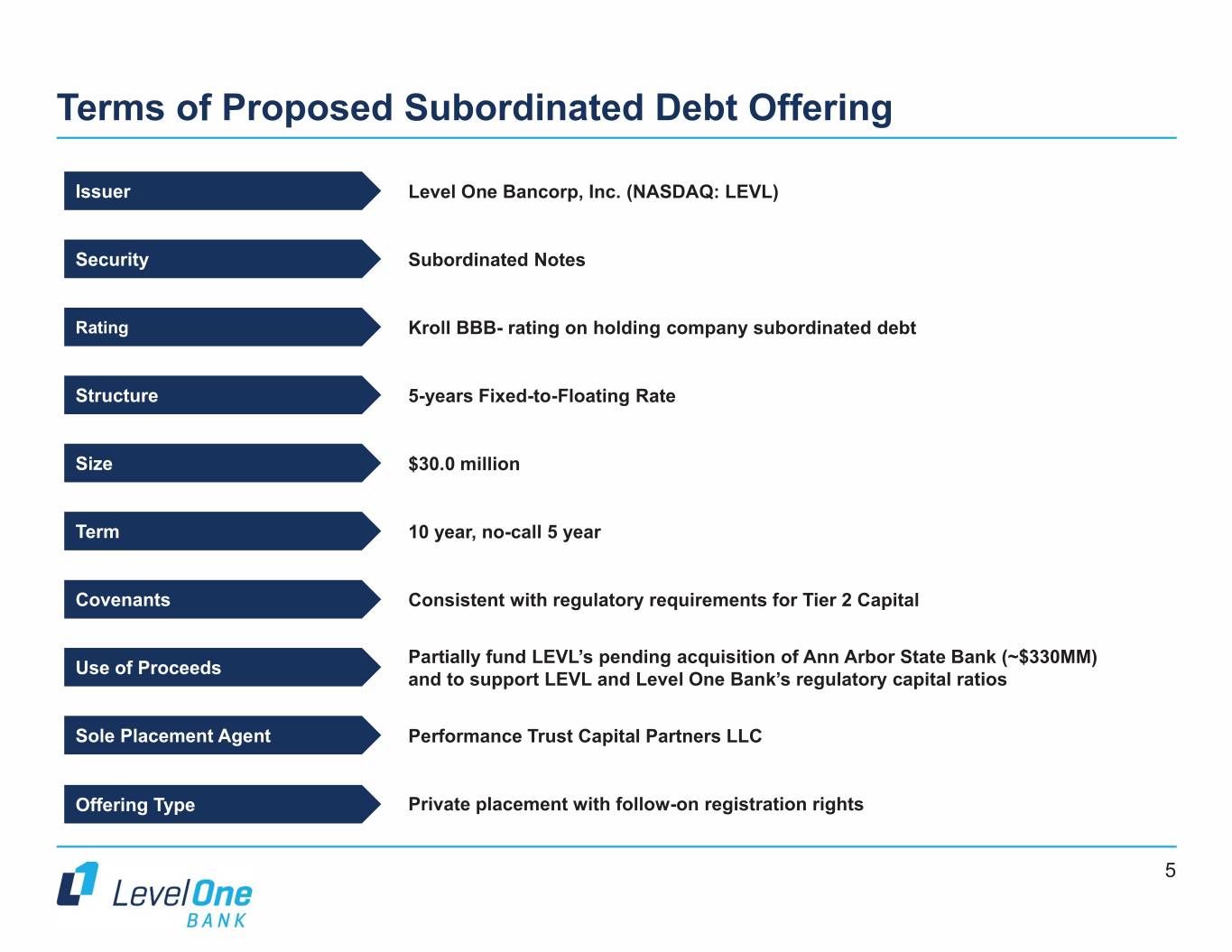

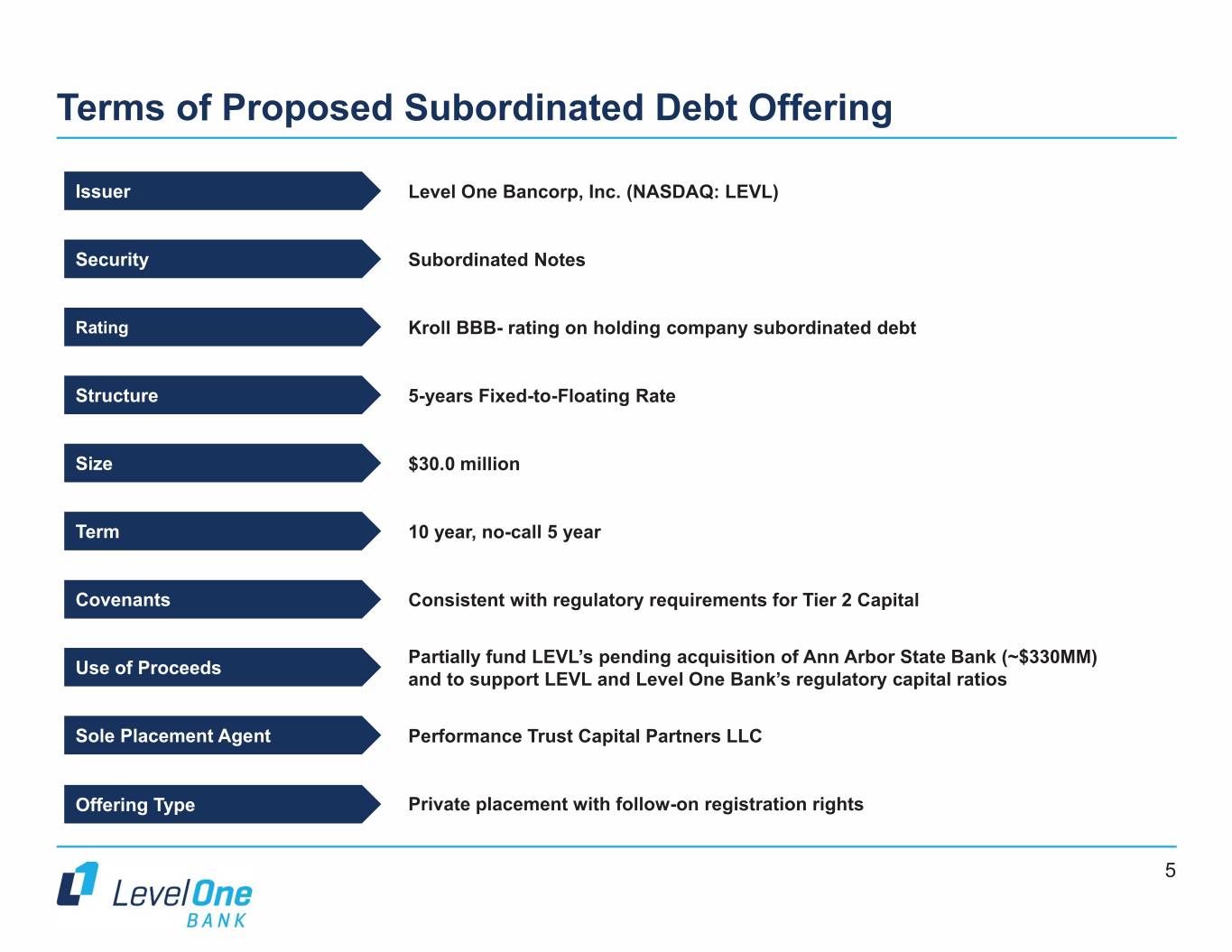

Terms of Proposed Subordinated Debt Offering Issuer Level One Bancorp, Inc. (NASDAQ: LEVL) Security Subordinated Notes Rating Kroll BBB- rating on holding company subordinated debt Structure 5-years Fixed-to-Floating Rate Size $30.0 million Term 10 year, no-call 5 year Covenants Consistent with regulatory requirements for Tier 2 Capital Partially fund LEVL’s pending acquisition of Ann Arbor State Bank (~$330MM) Use of Proceeds and to support LEVL and Level One Bank’s regulatory capital ratios Sole Placement Agent Performance Trust Capital Partners LLC Offering Type Private placement with follow-on registration rights 5

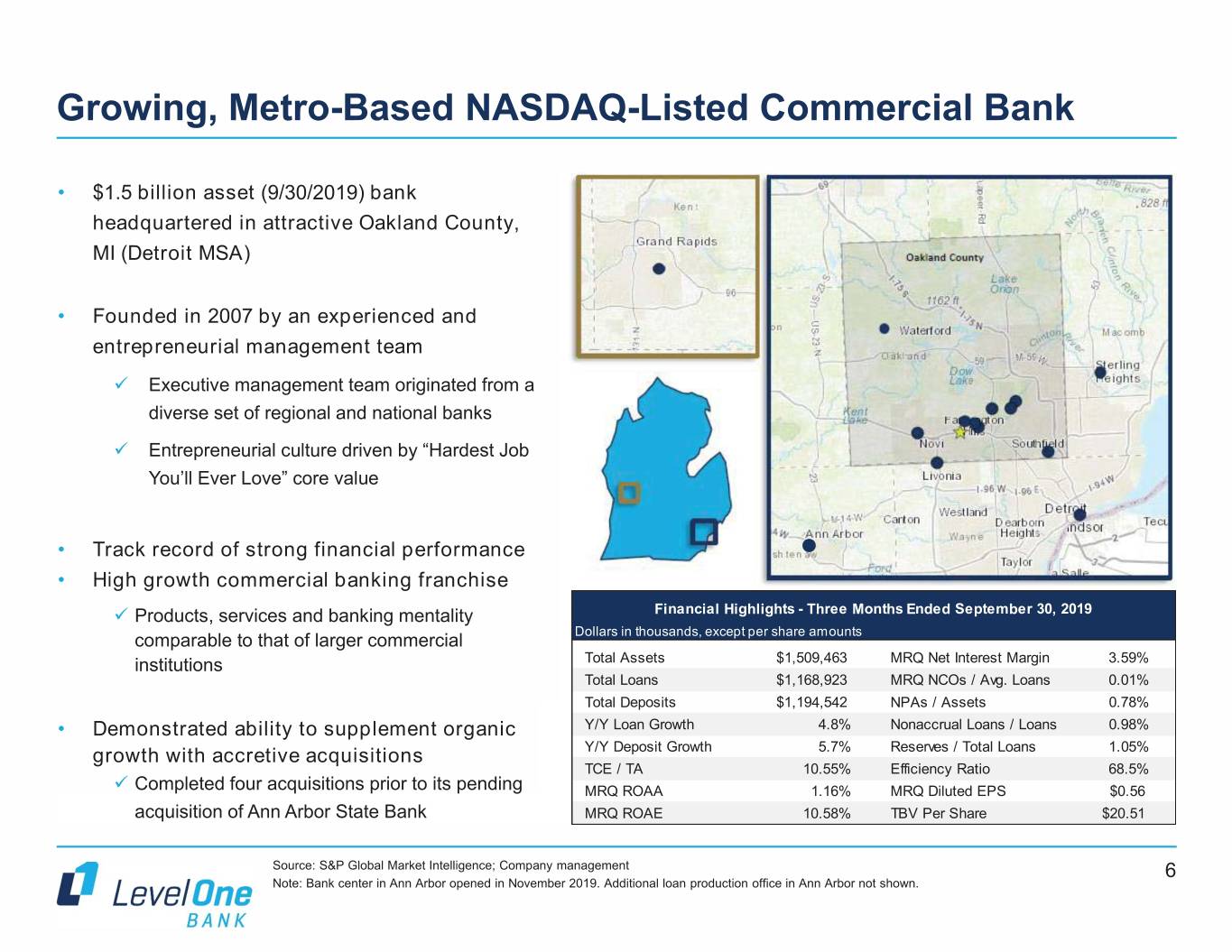

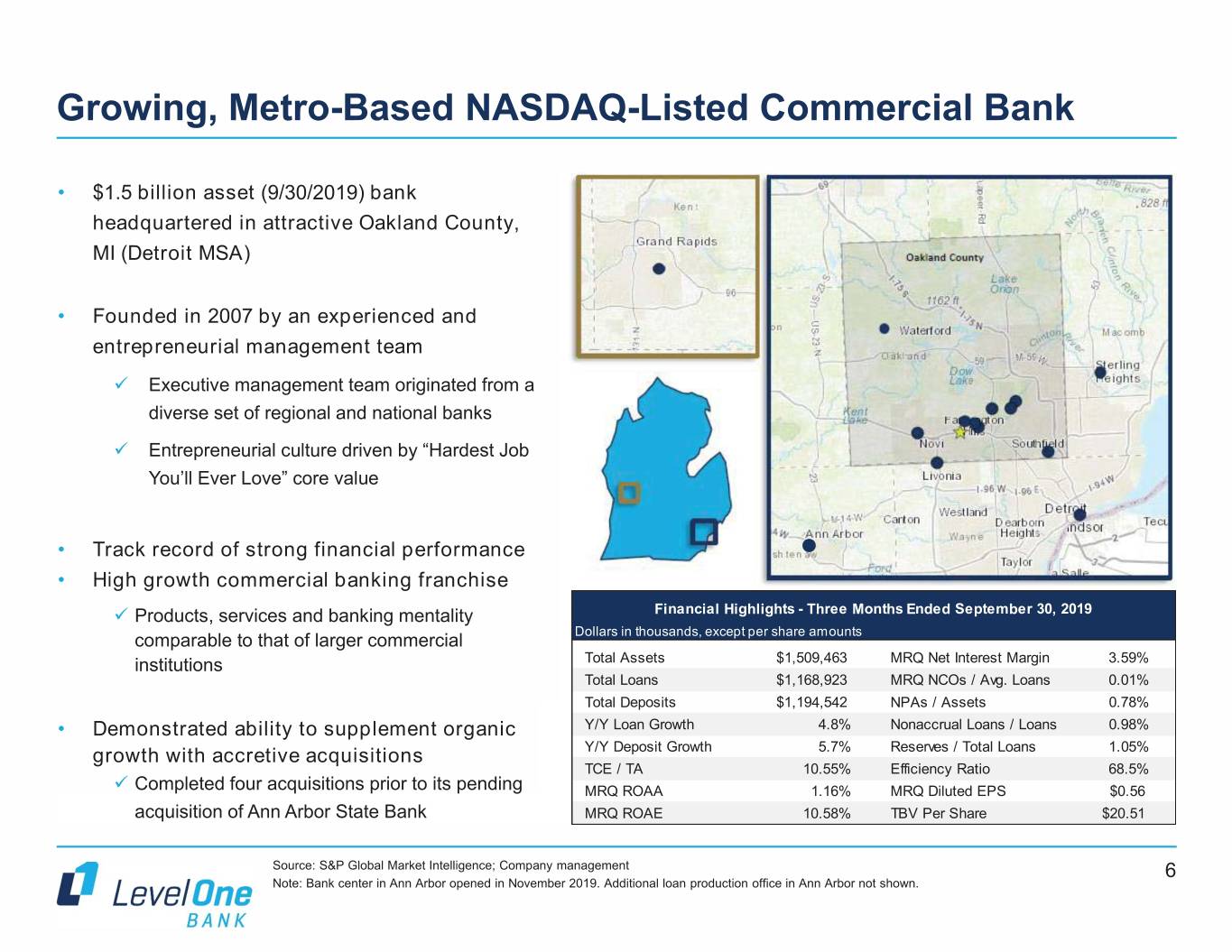

Growing, Metro-Based NASDAQ-Listed Commercial Bank • $1.5 billion asset (9/30/2019) bank headquartered in attractive Oakland County, MI (Detroit MSA) • Founded in 2007 by an experienced and entrepreneurial management team 9 Executive management team originated from a diverse set of regional and national banks 9 Entrepreneurial culture driven by “Hardest Job You’ll Ever Love” core value • Track record of strong financial performance • High growth commercial banking franchise 9 Products, services and banking mentality Financial Highlights - Three Months Ended September 30, 2019 comparable to that of larger commercial Dollars in thousands, except per share amounts institutions Total Assets $1,509,463 MRQ Net Interest Margin 3.59% Total Loans $1,168,923 MRQ NCOs / Avg. Loans 0.01% Total Deposits $1,194,542 NPAs / Assets 0.78% • Demonstrated ability to supplement organic Y/Y Loan Growth 4.8% Nonaccrual Loans / Loans 0.98% growth with accretive acquisitions Y/Y Deposit Growth 5.7% Reserves / Total Loans 1.05% TCE / TA 10.55% Efficiency Ratio 68.5% 9 Completed four acquisitions prior to its pending MRQ ROAA 1.16% MRQ Diluted EPS $0.56 acquisition of Ann Arbor State Bank MRQ ROAE 10.58% TBV Per Share $20.51 Source: S&P Global Market Intelligence; Company management 6 Note: Bank center in Ann Arbor opened in November 2019. Additional loan production office in Ann Arbor not shown.

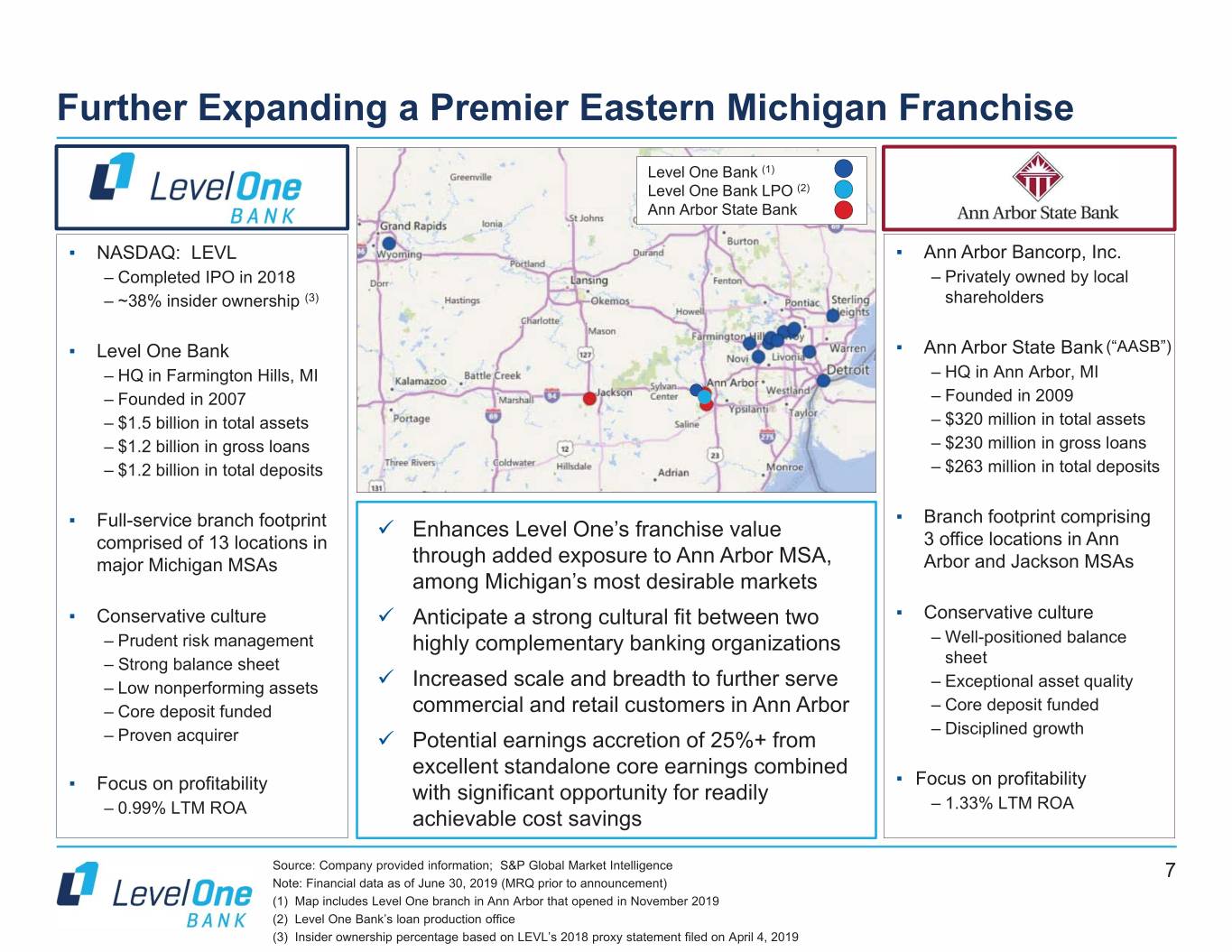

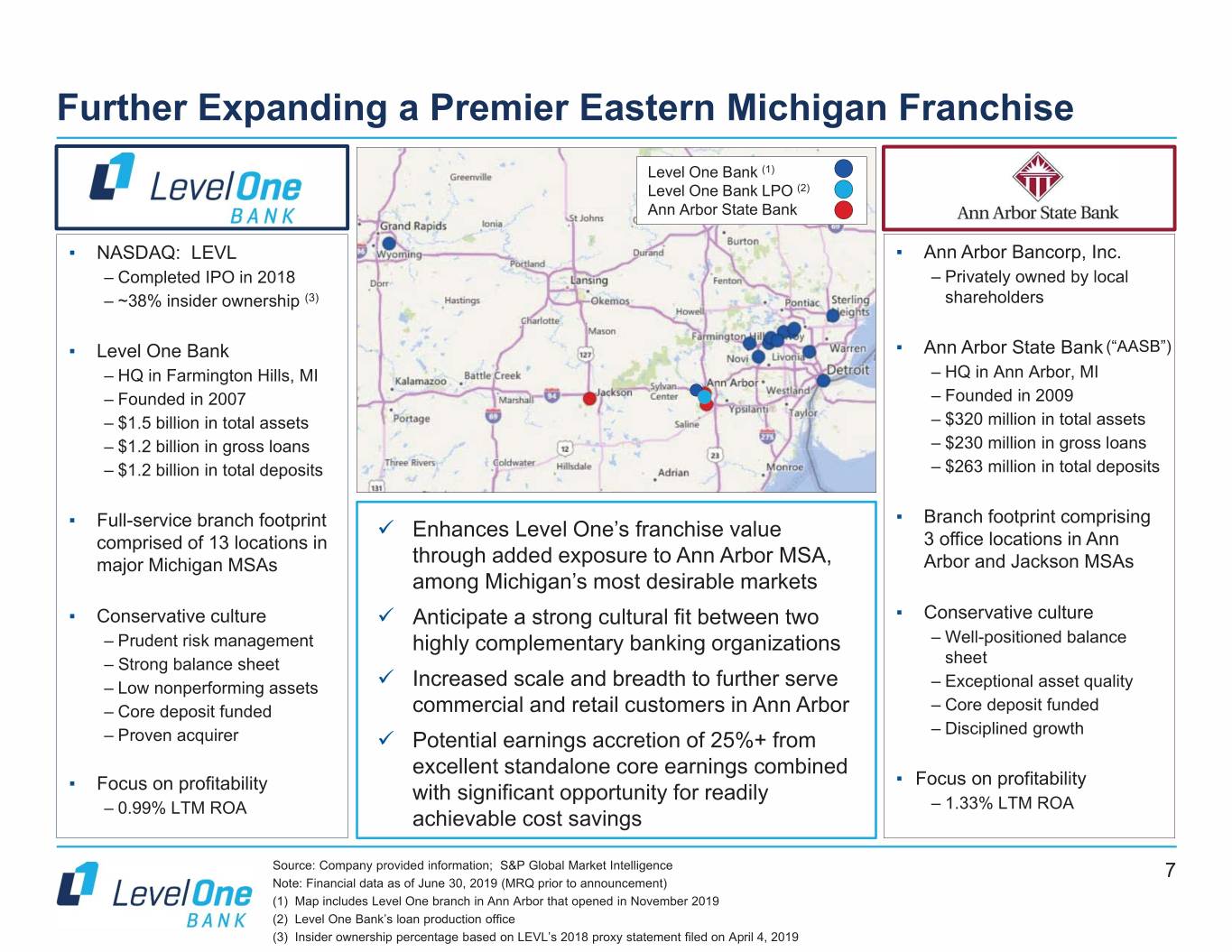

Further Expanding a Premier Eastern Michigan Franchise Level One Bank (1) Level One Bank LPO (2) Ann Arbor State Bank ▪ NASDAQ: LEVL ▪ Ann Arbor Bancorp, Inc. – Completed IPO in 2018 – Privately owned by local – ~38% insider ownership (3) shareholders ▪ Level One Bank ▪ Ann Arbor State Bank (“AASB”) – HQ in Farmington Hills, MI – HQ in Ann Arbor, MI – Founded in 2007 – Founded in 2009 – $1.5 billion in total assets – $320 million in total assets – $1.2 billion in gross loans – $230 million in gross loans – $1.2 billion in total deposits – $263 million in total deposits ▪ Branch footprint comprising ▪ Full-service branch footprint 9 Enhances Level One’s franchise value comprised of 13 locations in 3 office locations in Ann major Michigan MSAs through added exposure to Ann Arbor MSA, Arbor and Jackson MSAs among Michigan’s most desirable markets ▪ Conservative culture 9 Anticipate a strong cultural fit between two ▪ Conservative culture – Prudent risk management highly complementary banking organizations – Well-positioned balance – Strong balance sheet sheet – Low nonperforming assets 9 Increased scale and breadth to further serve – Exceptional asset quality – Core deposit funded commercial and retail customers in Ann Arbor – Core deposit funded – Disciplined growth – Proven acquirer 9 Potential earnings accretion of 25%+ from excellent standalone core earnings combined ▪ Focus on profitability ▪ Focus on profitability with significant opportunity for readily – 1.33% LTM ROA – 0.99% LTM ROA achievable cost savings Source: Company provided information; S&P Global Market Intelligence 7 Note: Financial data as of June 30, 2019 (MRQ prior to announcement) (1) Map includes Level One branch in Ann Arbor that opened in November 2019 (2) Level One Bank’s loan production office (3) Insider ownership percentage based on LEVL’s 2018 proxy statement filed on April 4, 2019

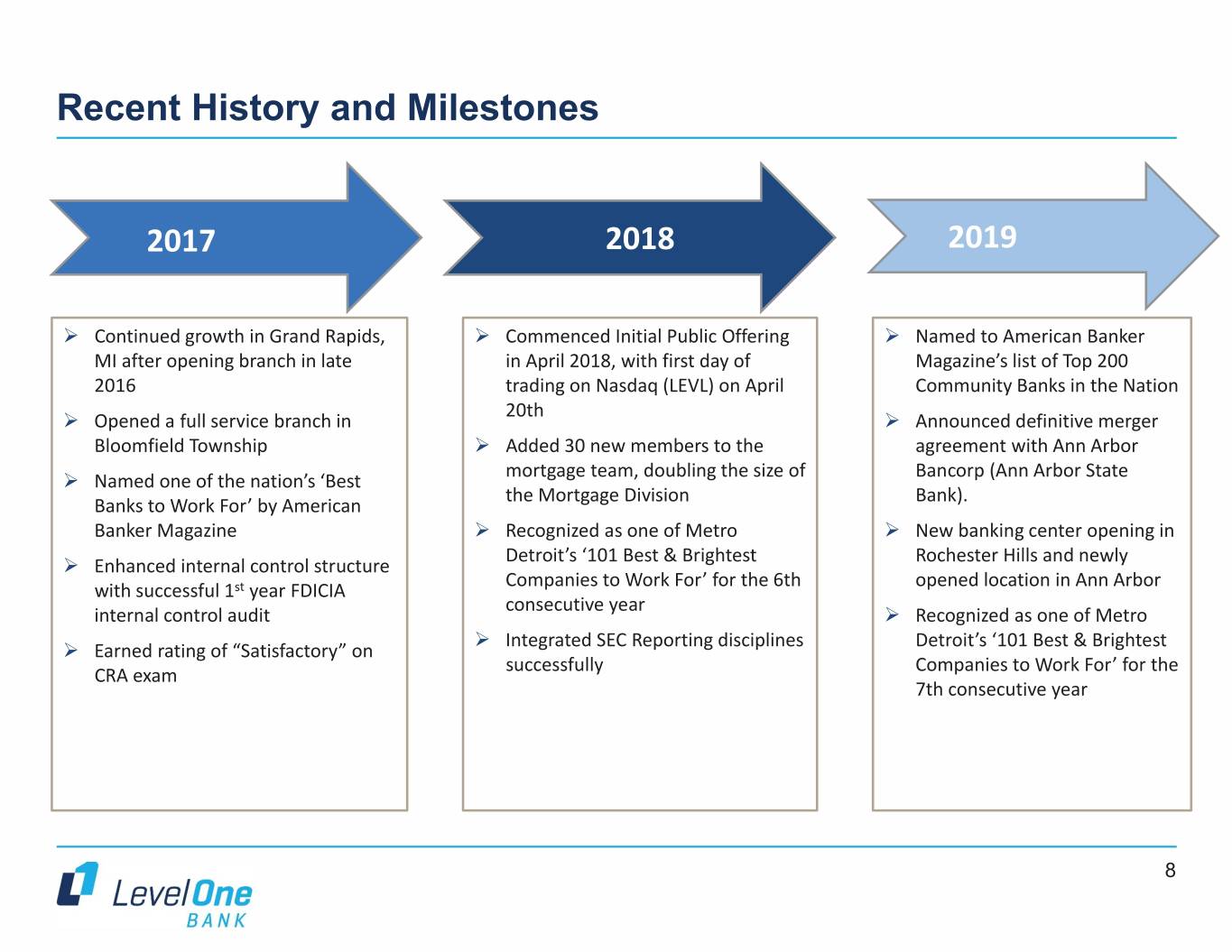

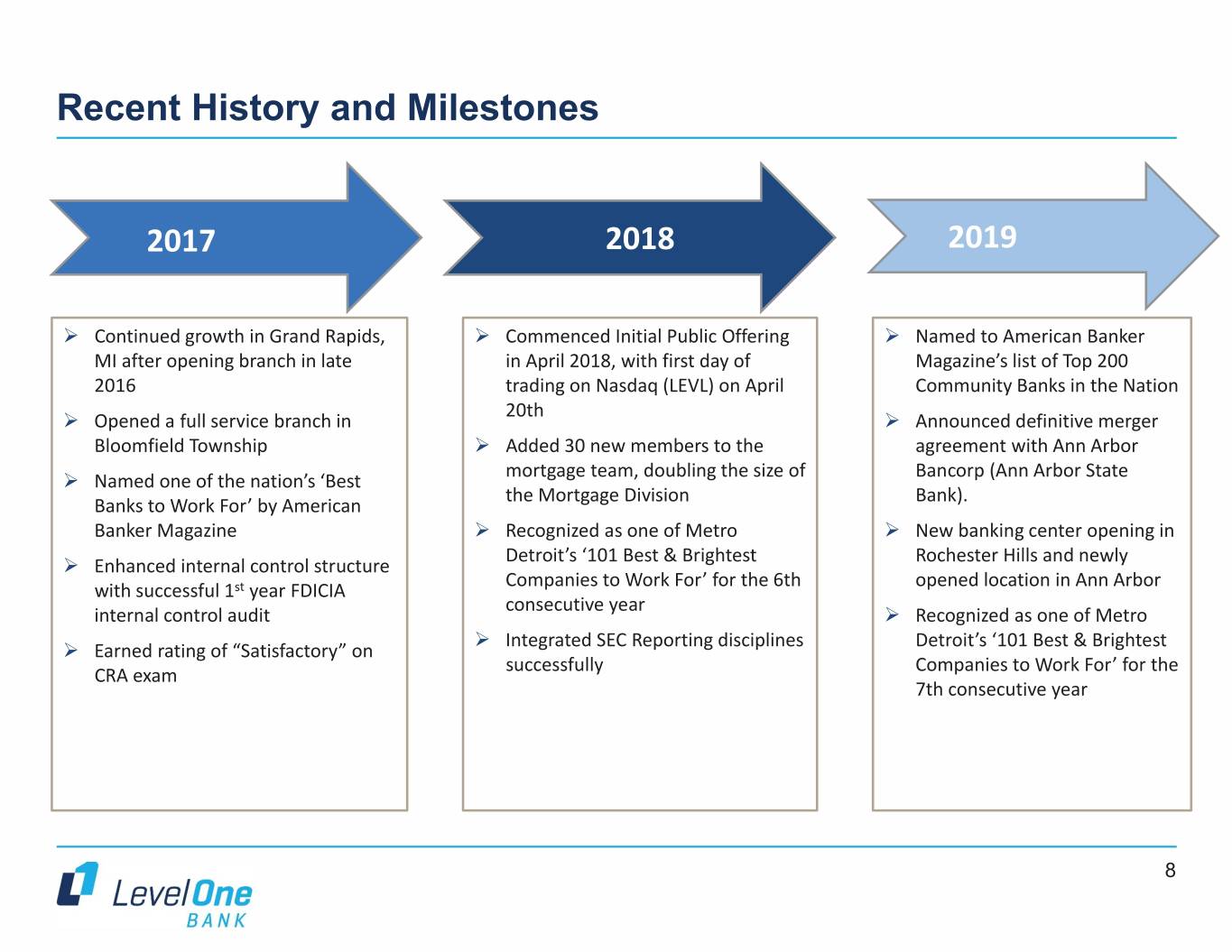

Recent History and Milestones 2017 2018 2019 ¾ Continued growth in Grand Rapids, ¾ Commenced Initial Public Offering ¾ Named to American Banker MI after opening branch in late in April 2018, with first day of Magazine’s list of Top 200 2016 trading on Nasdaq (LEVL) on April Community Banks in the Nation 20th ¾ Opened a full service branch in ¾ Announced definitive merger Bloomfield Township ¾ Added 30 new members to the agreement with Ann Arbor mortgage team, doubling the size of Bancorp (Ann Arbor State ¾ Named one of the nation’s ‘Best the Mortgage Division Bank). Banks to Work For’ by American Banker Magazine ¾ Recognized as one of Metro ¾ New banking center opening in Detroit’s ‘101 Best & Brightest Rochester Hills and newly ¾ Enhanced internal control structure Companies to Work For’ for the 6th opened location in Ann Arbor with successful 1st year FDICIA consecutive year internal control audit ¾ Recognized as one of Metro ¾ Integrated SEC Reporting disciplines Detroit’s ‘101 Best & Brightest ¾ Earned rating of “Satisfactory” on successfully Companies to Work For’ for the CRA exam 7th consecutive year 8

History of Growth 2019 2016 • Announcement of merger with Total Asset Growth • Addition of downtown Detroit Ann Arbor State Bank location • Based on pro forma financials 2014-2018 CAGR: 18.6% • Acquisition of Bank of Michigan − P/TBV: 144% 2017 $1,864.6$1,864.6 2008-2018 CAGR: 34.6% − P/E: 13.3x • Additional Oakland • Expansion into Grand Rapids, MI County branch 2015 2010 • $15 million subordinated $1,509.5 2009 • Two private debt offering $1,416.2 • $5 million private placements for • Acquisition of Lotus Bancorp $1,301.3 placement $21 million total − P/TBV: 132% • FDIC acquisition of • FDIC- assisted − P/E: 30.4x acquisition of $1,127.5 Estimated Michigan Heritage Total Assets Bank; $95.9 million in Paramount 2012 Bank; $173 At Year-End liabilities assumed • $14 million ($ in millions) million in $924.7 private deposits placement 2007 assumed $715.2 • Founded with $16 $618.9 million of $495.9 $463.5 capital $421.7 $170.5 $22.7 $72.4 ’07 ’08 ’09 ’10 ’11 ’12 ’13 ’14 ’15 ’16 ’17 ’18 Q3 ’19 Source: S&P Global Market Intelligence; Company provided documents 9 Note: ’Q3 19 YTD as of September 30, 2019. Pro forma 2019 estimated based on 12/31/19 Pro Forma Balance sheet at close.

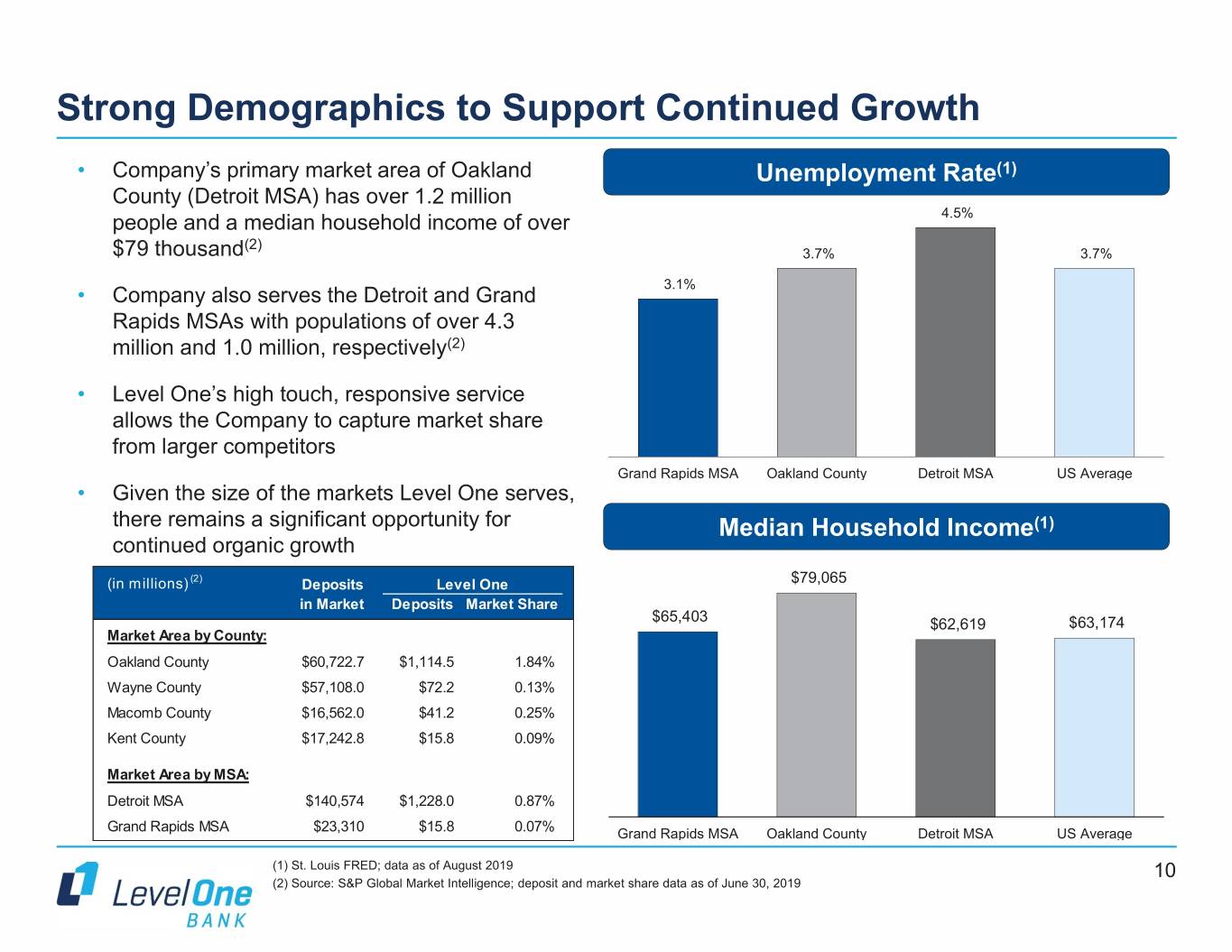

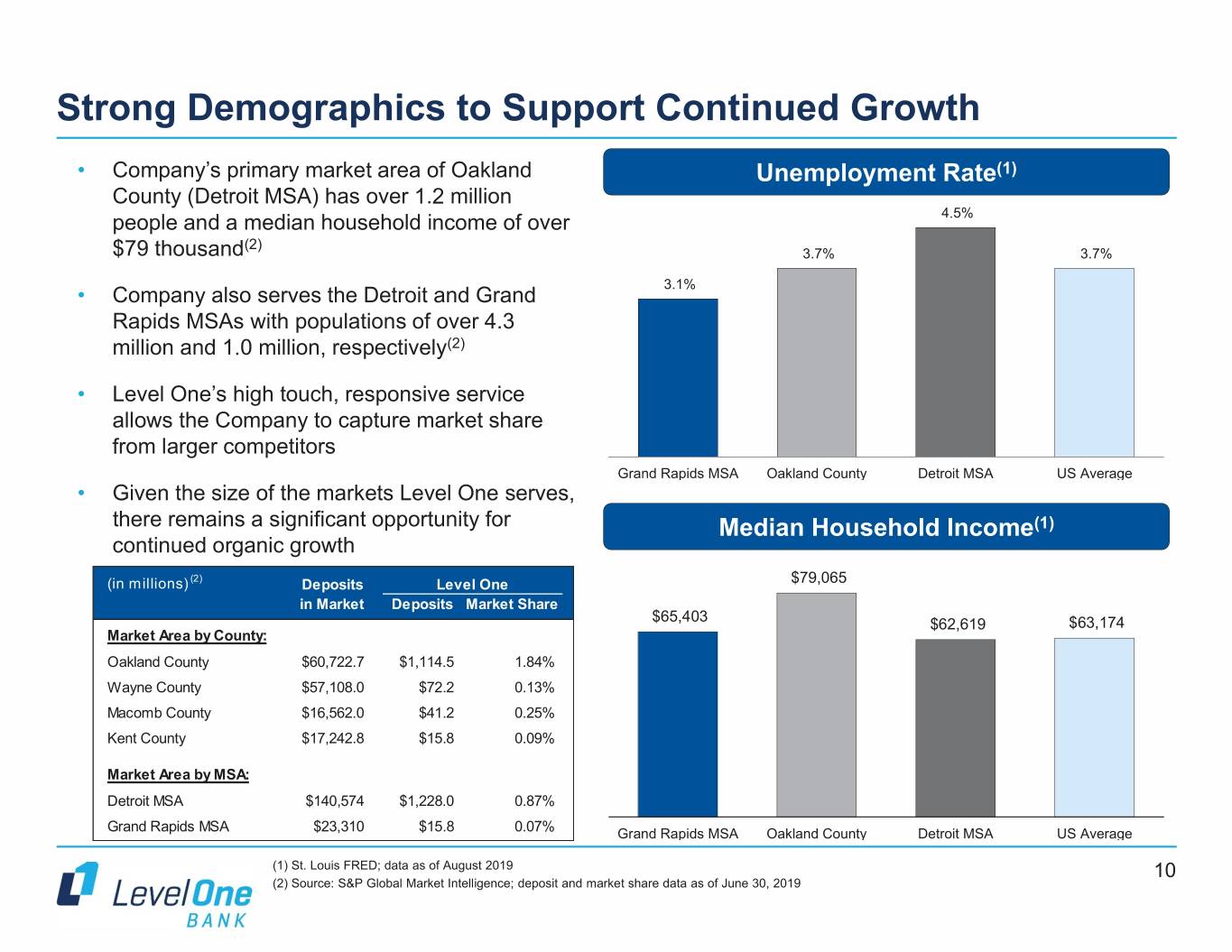

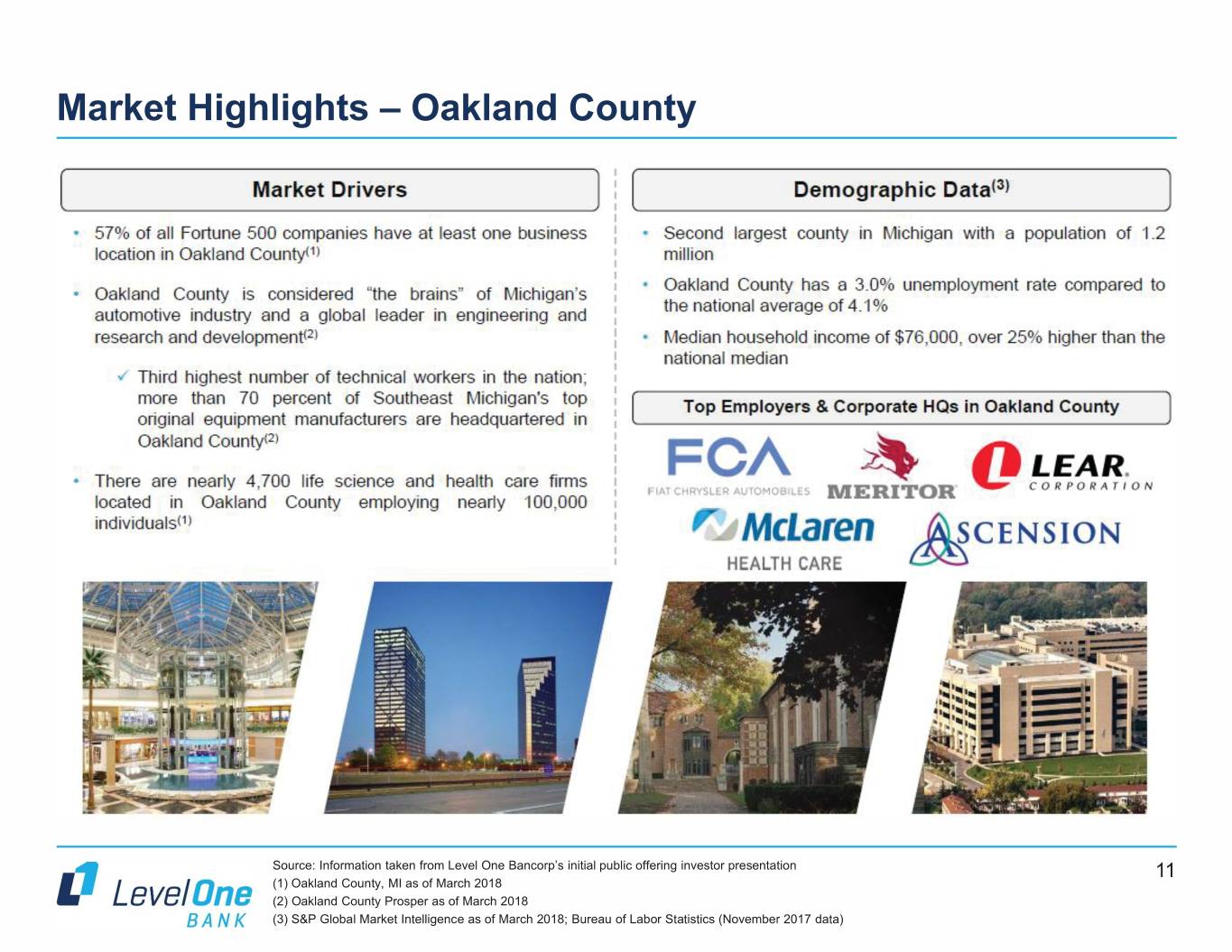

Strong Demographics to Support Continued Growth • Company’s primary market area of Oakland Unemployment Rate(1) County (Detroit MSA) has over 1.2 million people and a median household income of over 4.5% (2) $79 thousand 3.7% 3.7% 3.1% • Company also serves the Detroit and Grand Rapids MSAs with populations of over 4.3 million and 1.0 million, respectively(2) • Level One’s high touch, responsive service allows the Company to capture market share from larger competitors Grand Rapids MSA Oakland County Detroit MSA US Average • Given the size of the markets Level One serves, there remains a significant opportunity for Median Household Income(1) continued organic growth (in millions) (2) Deposits Level One $79,065 in Market Deposits Market Share $65,403 $62,619 $63,174 Market Area by County: Oakland County $60,722.7 $1,114.5 1.84% Wayne County $57,108.0 $72.2 0.13% Macomb County $16,562.0 $41.2 0.25% Kent County $17,242.8 $15.8 0.09% Market Area by MSA: Detroit MSA $140,574 $1,228.0 0.87% Grand Rapids MSA $23,310 $15.8 0.07% Grand Rapids MSA Oakland County Detroit MSA US Average (1) St. Louis FRED; data as of August 2019 10 (2) Source: S&P Global Market Intelligence; deposit and market share data as of June 30, 2019

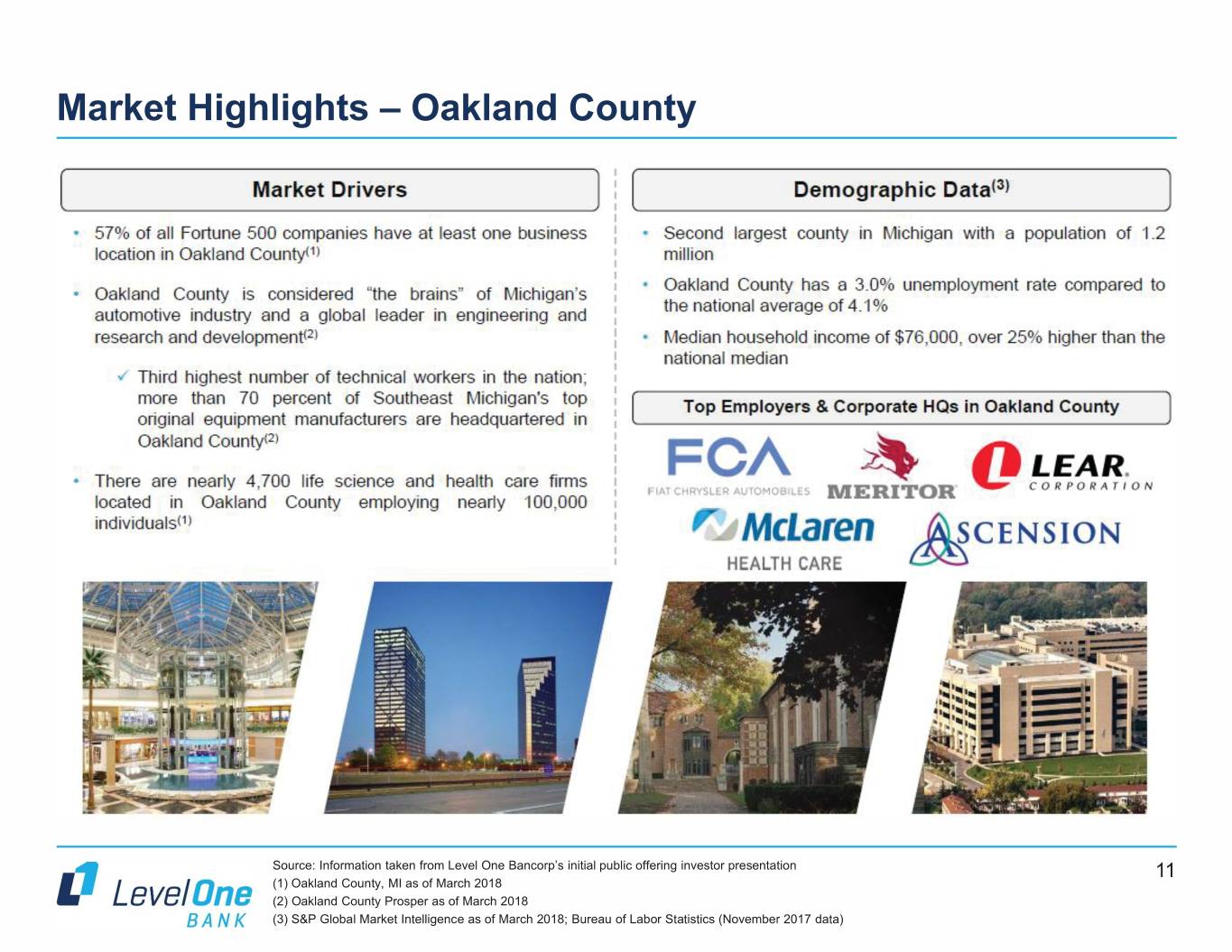

Market Highlights – Oakland County Source: Information taken from Level One Bancorp’s initial public offering investor presentation 11 (1) Oakland County, MI as of March 2018 (2) Oakland County Prosper as of March 2018 (3) S&P Global Market Intelligence as of March 2018; Bureau of Labor Statistics (November 2017 data)

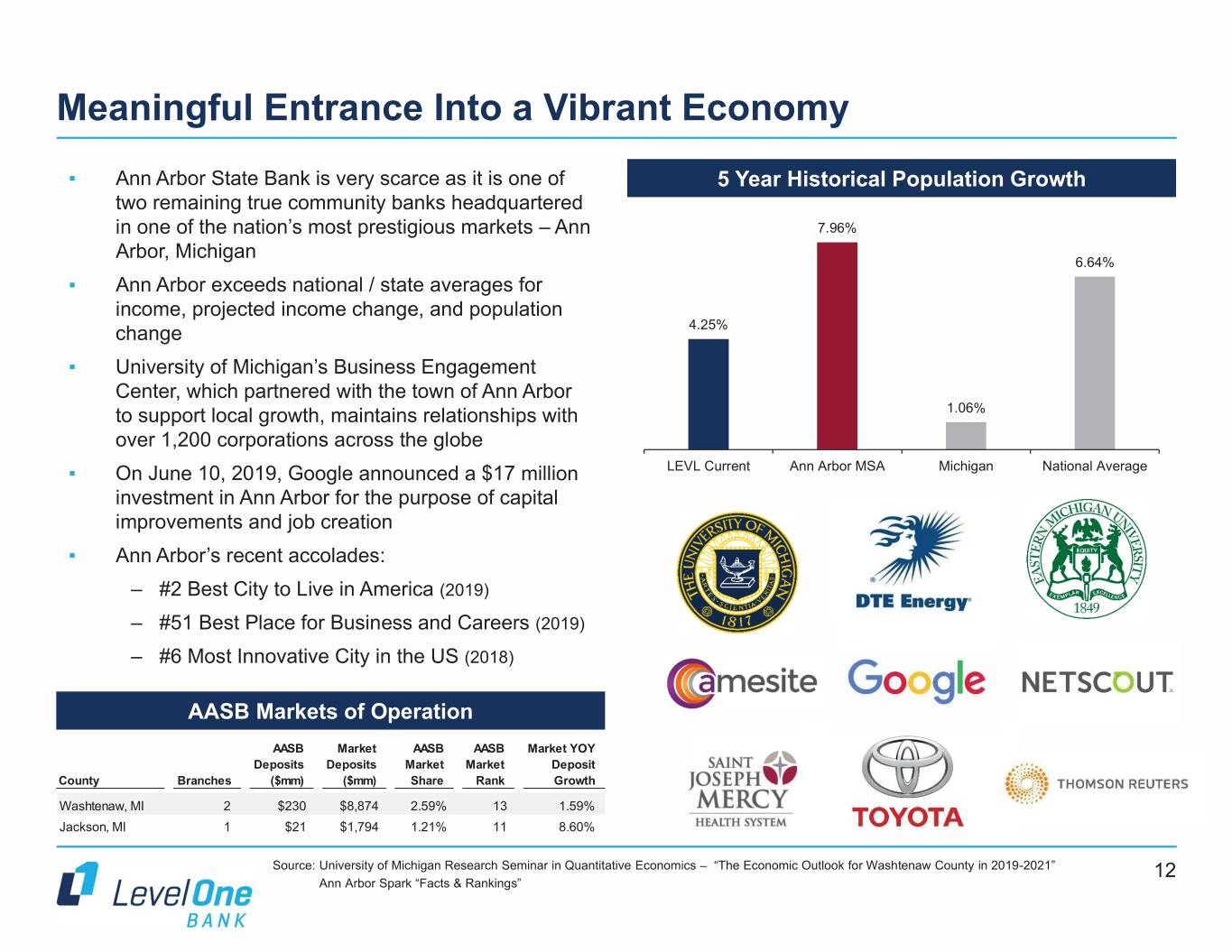

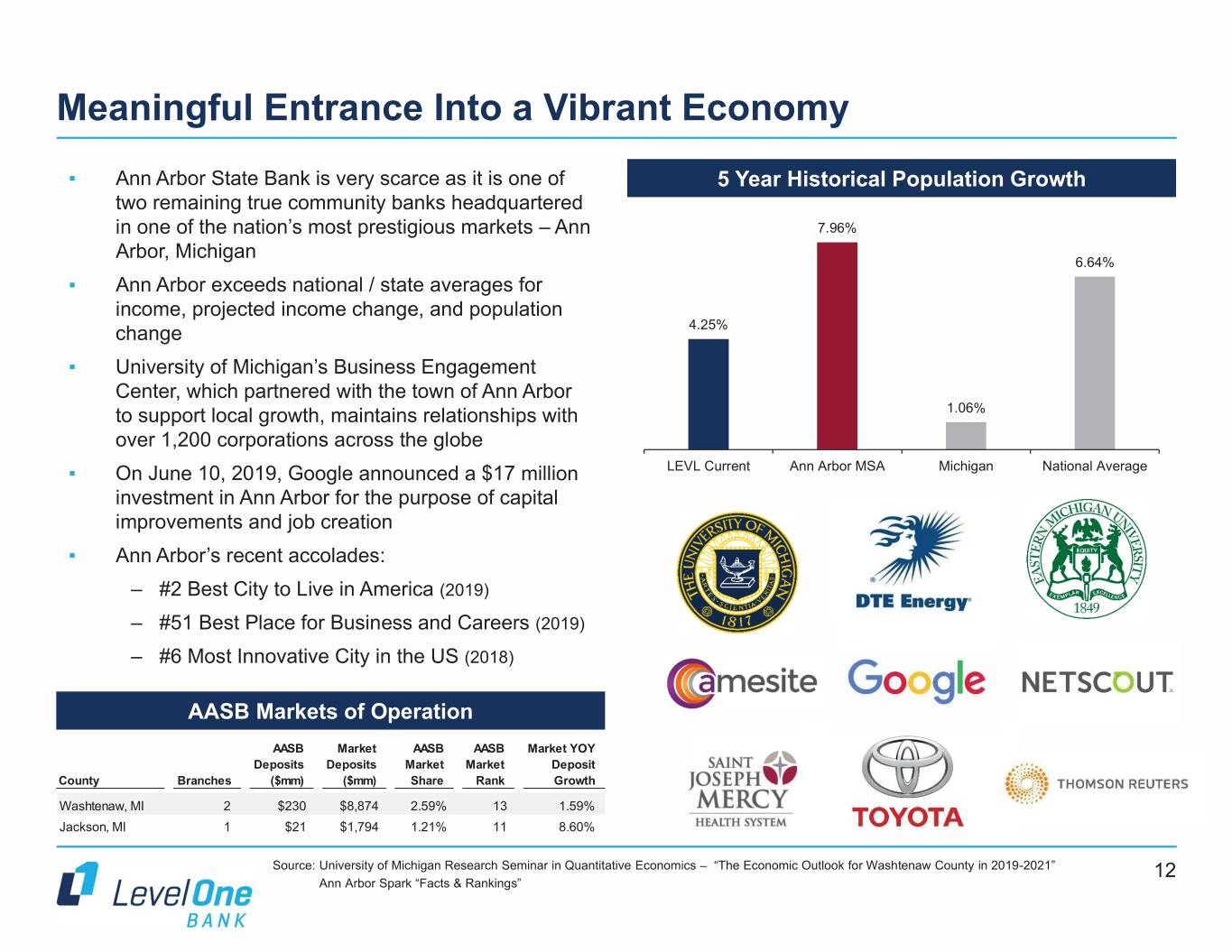

Meaningful Entrance Into a Vibrant Economy ▪ Ann Arbor State Bank is very scarce as it is one of 5 Year Historical Population Growth two remaining true community banks headquartered in one of the nation’s most prestigious markets – Ann 7.96% Arbor, Michigan 6.64% ▪ Ann Arbor exceeds national / state averages for income, projected income change, and population change 4.25% ▪ University of Michigan’s Business Engagement Center, which partnered with the town of Ann Arbor to support local growth, maintains relationships with 1.06% over 1,200 corporations across the globe ▪ On June 10, 2019, Google announced a $17 million LEVL Current Ann Arbor MSA Michigan National Average investment in Ann Arbor for the purpose of capital improvements and job creation ▪ Ann Arbor’s recent accolades: – #2 Best City to Live in America (2019) – #51 Best Place for Business and Careers (2019) – #6 Most Innovative City in the US (2018) AASB Markets of Operation AASB M ar ke t AASB AASB M ar ke t YO Y Deposits Deposits Market Market Deposit County Branches ($mm) ($mm) Share Rank Growth Washtenaw, MI 2 $230 $8,874 2.59% 13 1.59% Jackson, MI 1 $21 $1,794 1.21% 11 8.60% Source: University of Michigan Research Seminar in Quantitative Economics – “The Economic Outlook for Washtenaw County in 2019-2021” 12 Ann Arbor Spark “Facts & Rankings”

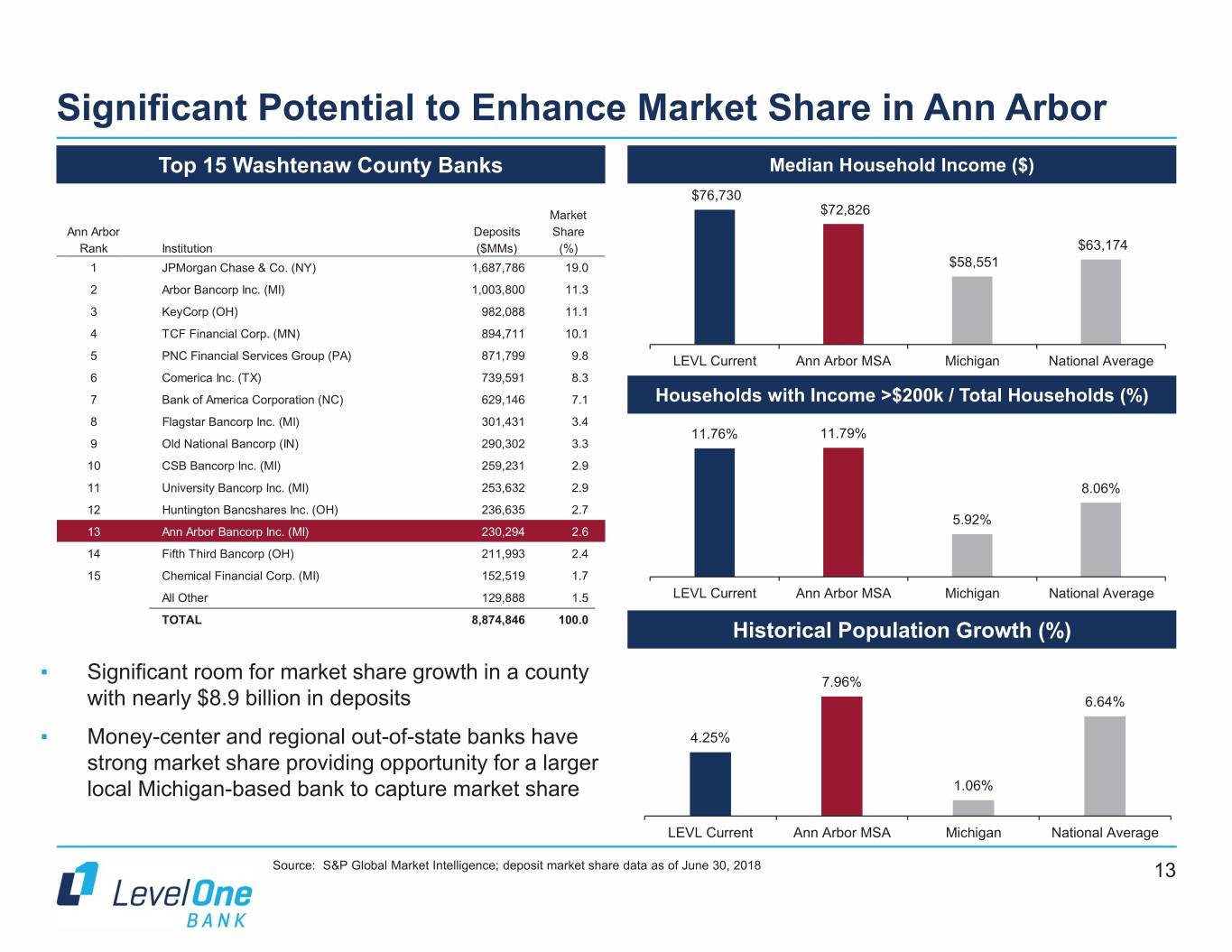

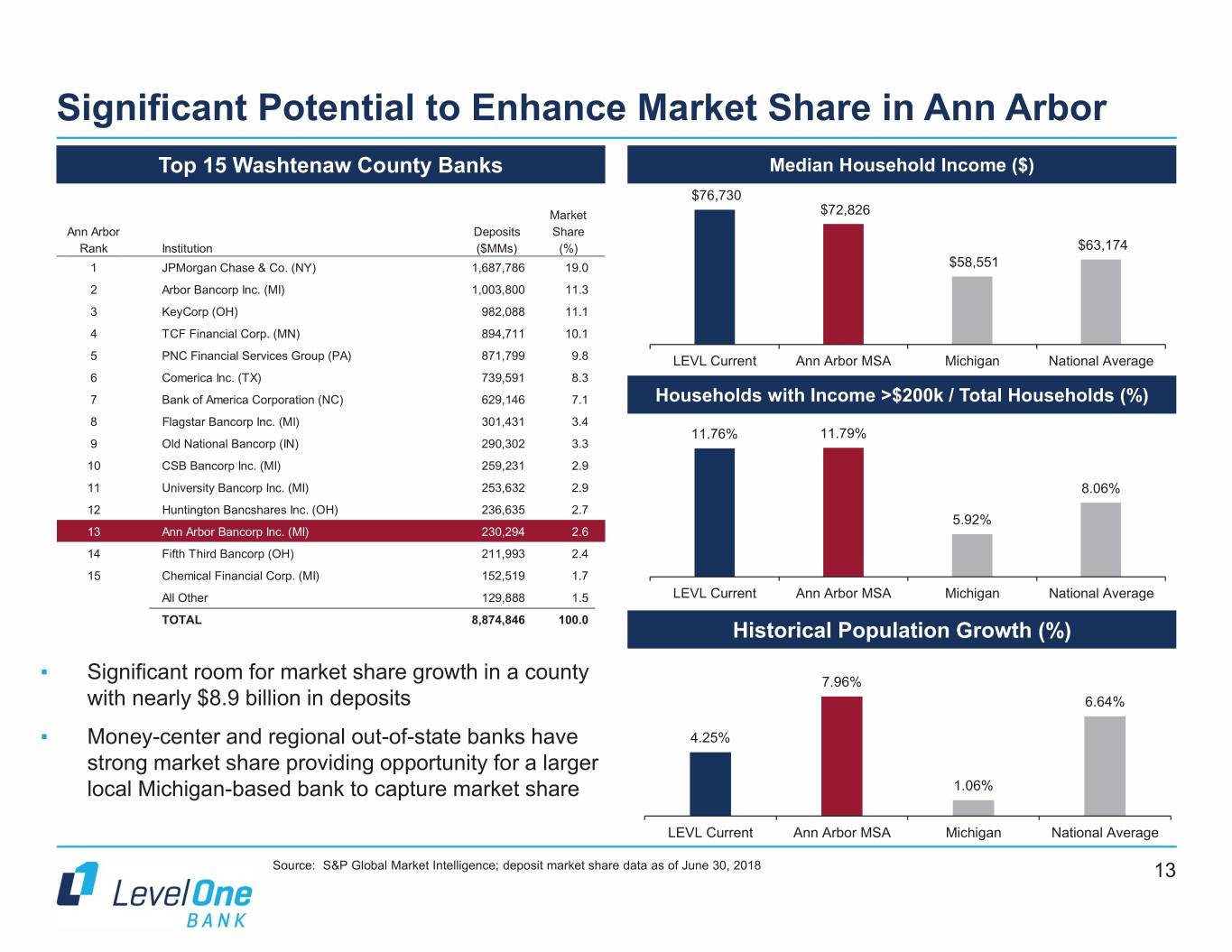

Significant Potential to Enhance Market Share in Ann Arbor Top 15 Washtenaw County Banks Median Household Income ($) $76,730 Market $72,826 Ann Arbor Deposits Share Rank Institution ($MMs) (%) $63,174 1 JPMorgan Chase & Co. (NY) 1,687,786 19.0 $58,551 2 Arbor Bancorp Inc. (MI) 1,003,800 11.3 3 KeyCorp (OH) 982,088 11.1 4 TCF Financial Corp. (MN) 894,711 10.1 5 PNC Financial Services Group (PA) 871,799 9.8 LEVL Current Ann Arbor MSA Michigan National Average 6 Comerica Inc. (TX) 739,591 8.3 7 Bank of America Corporation (NC) 629,146 7.1 Households with Income >$200k / Total Households (%) 8 Flagstar Bancorp Inc. (MI) 301,431 3.4 11.76% 11.79% 9 Old National Bancorp (IN) 290,302 3.3 10 CSB Bancorp Inc. (MI) 259,231 2.9 11 University Bancorp Inc. (MI) 253,632 2.9 8.06% 12 Huntington Bancshares Inc. (OH) 236,635 2.7 5.92% 13 Ann Arbor Bancorp Inc. (MI) 230,294 2.6 14 Fifth Third Bancorp (OH) 211,993 2.4 15 Chemical Financial Corp. (MI) 152,519 1.7 All Other 129,888 1.5 LEVL Current Ann Arbor MSA Michigan National Average TOTAL 8,874,846 100.0 Historical Population Growth (%) ▪ Significant room for market share growth in a county 7.96% with nearly $8.9 billion in deposits 6.64% ▪ Money-center and regional out-of-state banks have 4.25% strong market share providing opportunity for a larger local Michigan-based bank to capture market share 1.06% LEVL Current Ann Arbor MSA Michigan National Average Source: S&P Global Market Intelligence; deposit market share data as of June 30, 2018 13

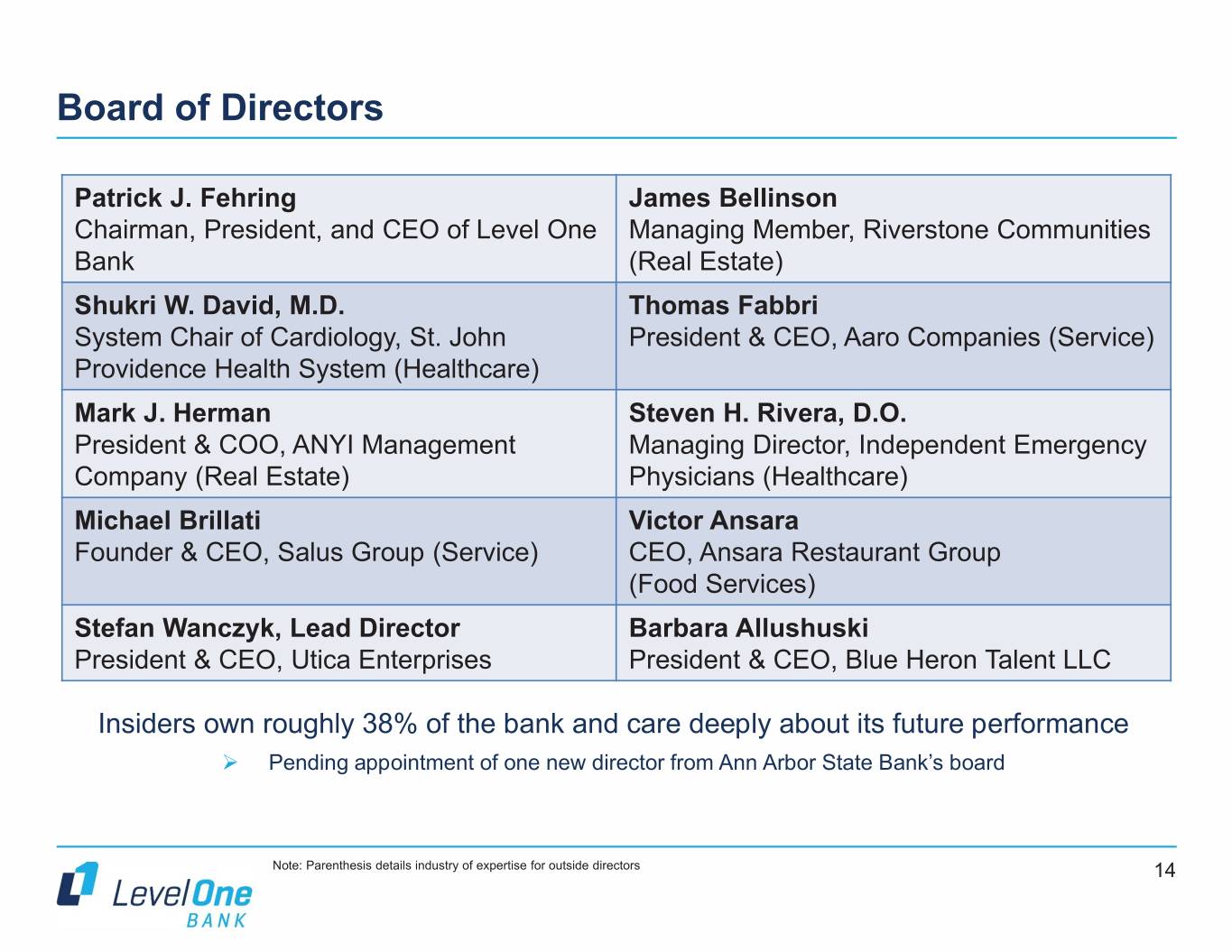

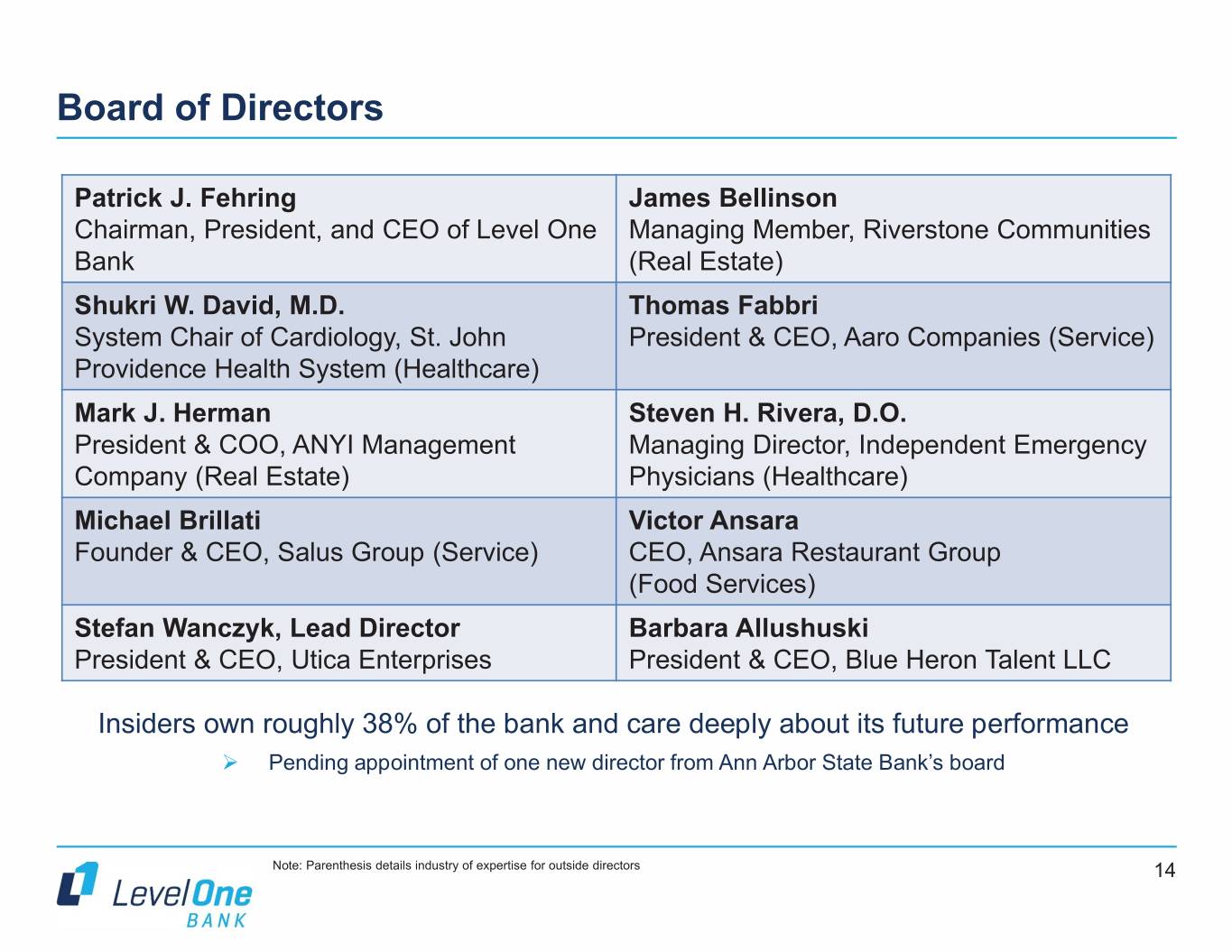

Board of Directors Patrick J. Fehring James Bellinson Chairman, President, and CEO of Level One Managing Member, Riverstone Communities Bank (Real Estate) Shukri W. David, M.D. Thomas Fabbri System Chair of Cardiology, St. John President & CEO, Aaro Companies (Service) Providence Health System (Healthcare) Mark J. Herman Steven H. Rivera, D.O. President & COO, ANYI Management Managing Director, Independent Emergency Company (Real Estate) Physicians (Healthcare) Michael Brillati Victor Ansara Founder & CEO, Salus Group (Service) CEO, Ansara Restaurant Group (Food Services) Stefan Wanczyk, Lead Director Barbara Allushuski President & CEO, Utica Enterprises President & CEO, Blue Heron Talent LLC Insiders own roughly 38% of the bank and care deeply about its future performance ¾ Pending appointment of one new director from Ann Arbor State Bank’s board Note: Parenthesis details industry of expertise for outside directors 14

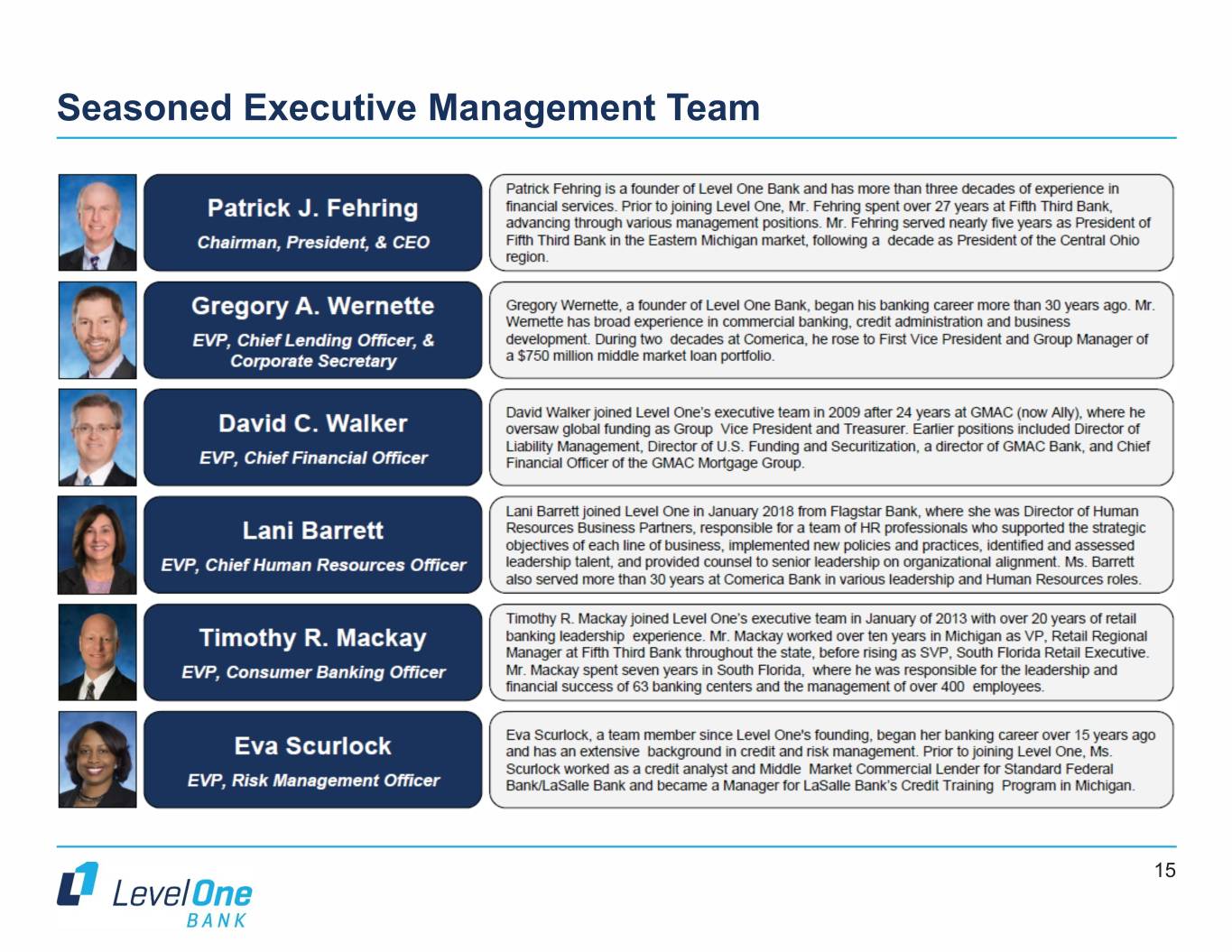

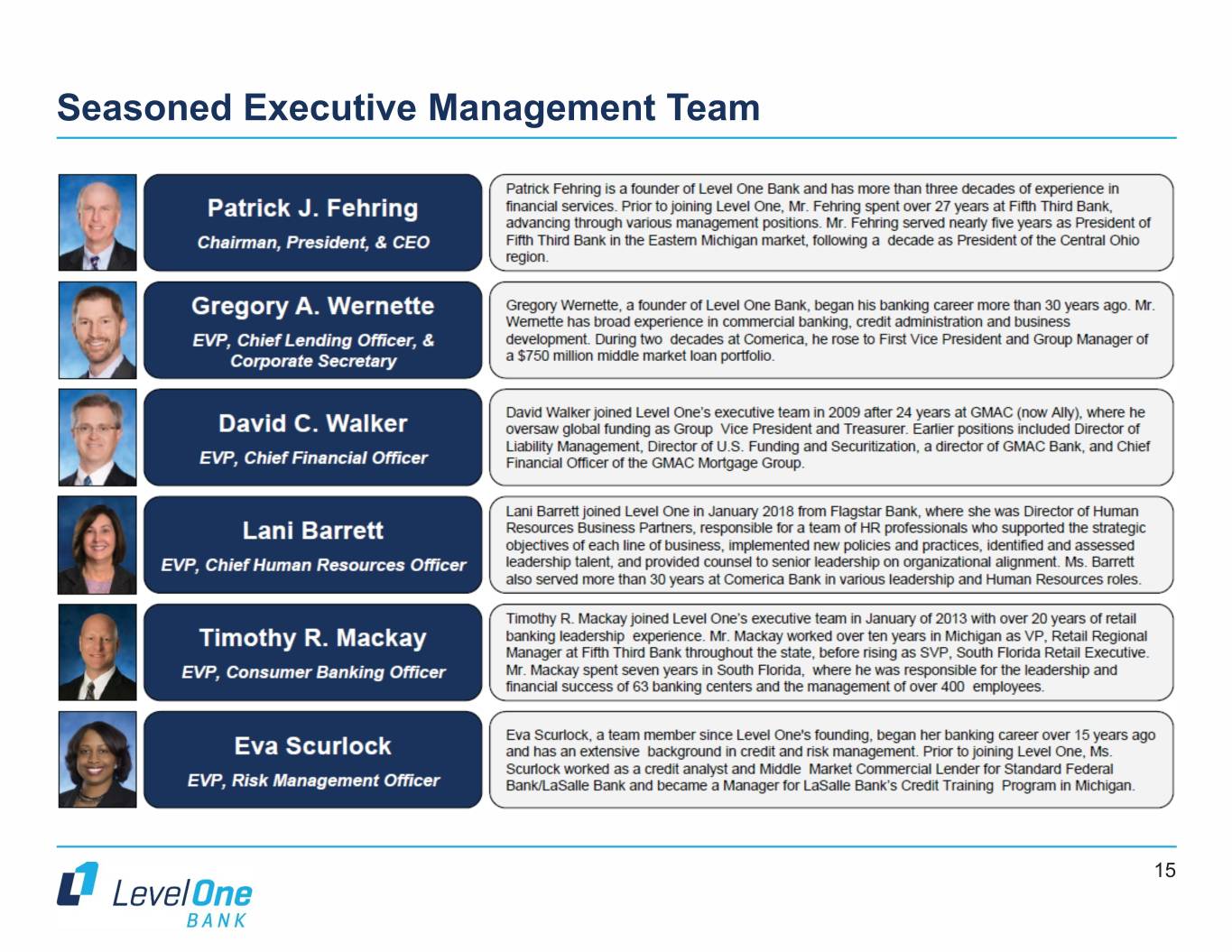

Seasoned Executive Management Team 15

Entrepreneurial Culture (1) Michigan Business & Professional Association 16

Strategic Initiatives 17

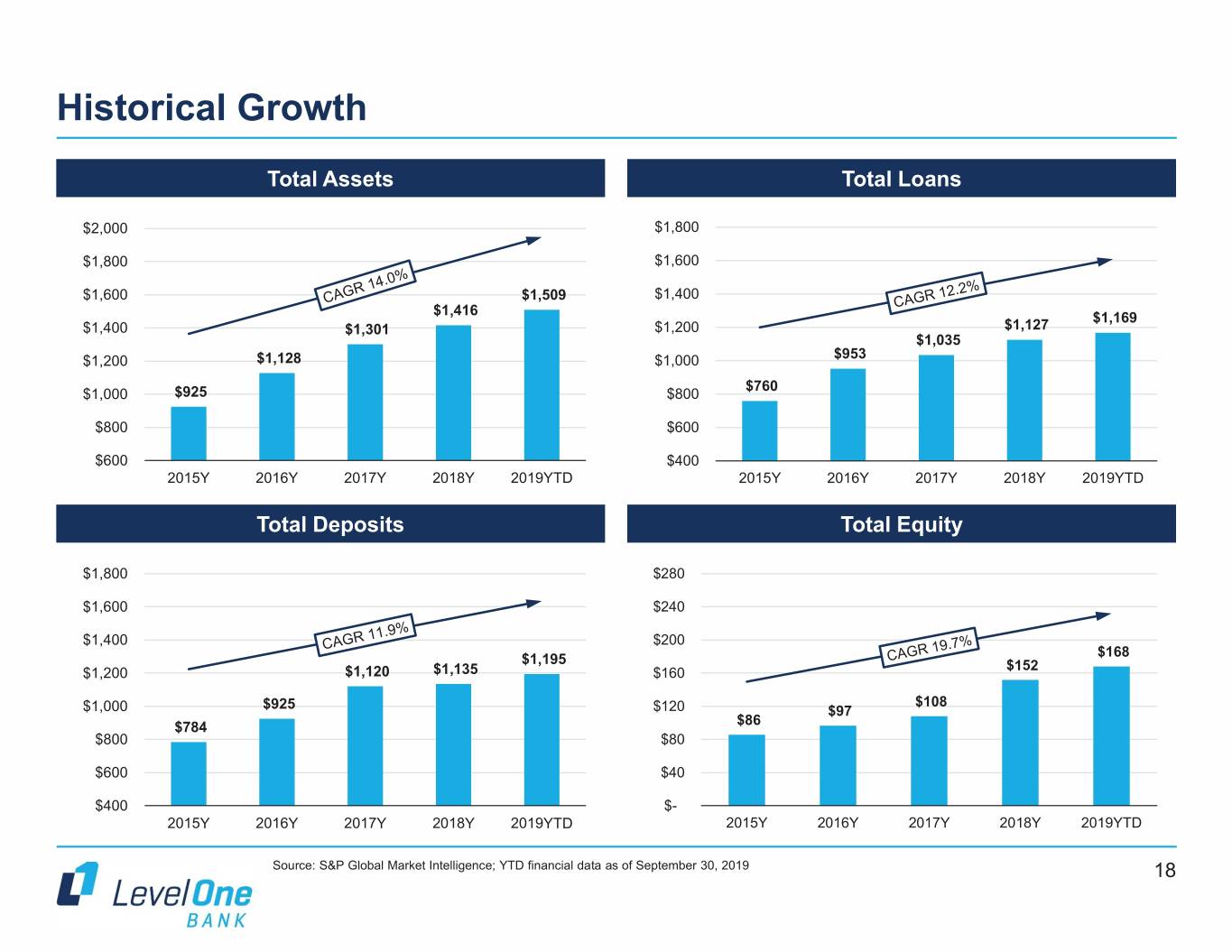

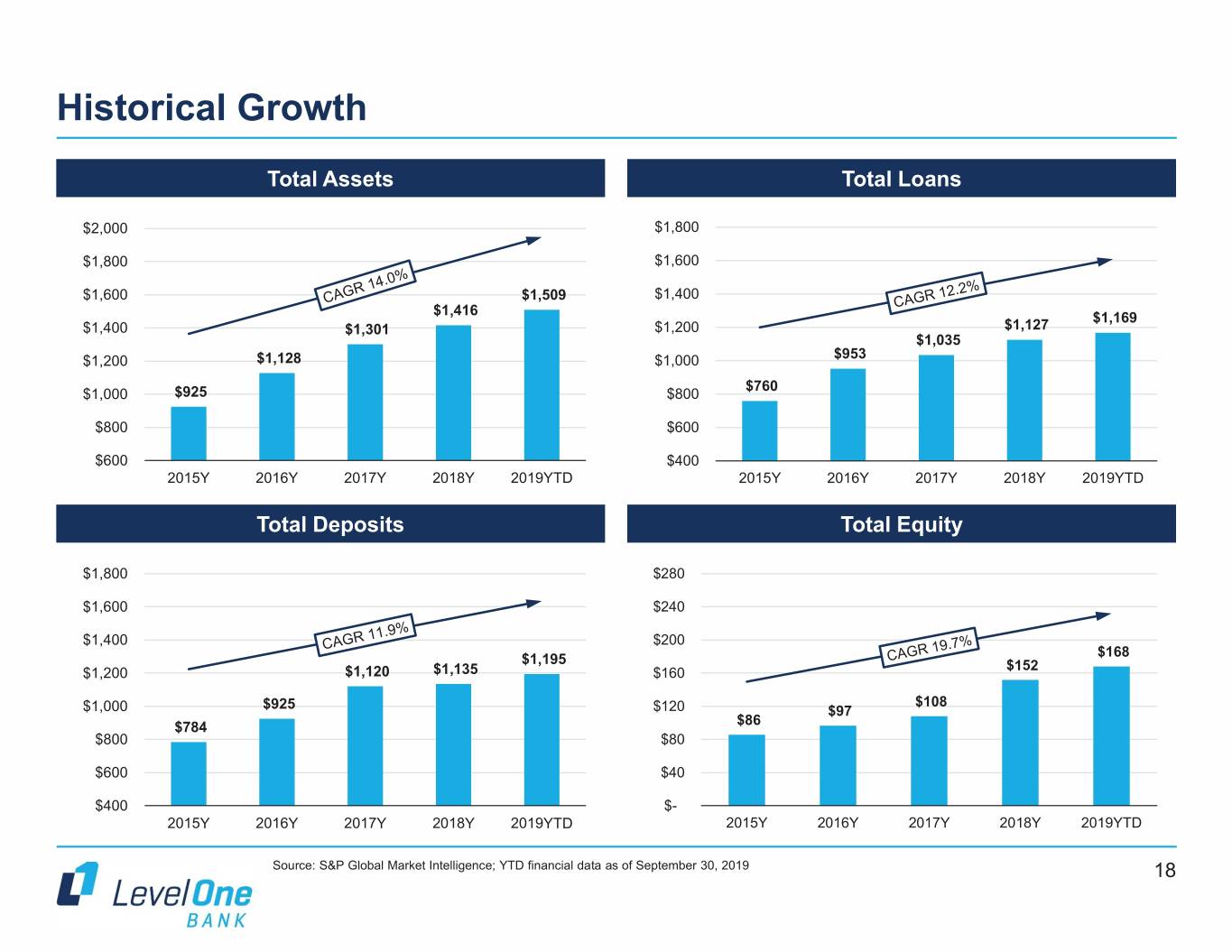

Historical Growth Total Assets Total Loans $2,000 $1,800 $1,800 $1,600 $1,600 $1,509 $1,400 $1,416 $1,169 $1,400 $1,301 $1,200 $1,127 $1,035 $953 $1,200 $1,128 $1,000 $760 $1,000 $925 $800 $800 $600 $600 $400 2015Y 2016Y 2017Y 2018Y 2019YTD 2015Y 2016Y 2017Y 2018Y 2019YTD Total Deposits Total Equity $1,800 $280 $1,600 $240 $1,400 $200 $168 $1,195 $152 $1,200 $1,120 $1,135 $160 $108 $1,000 $925 $120 $97 $784 $86 $800 $80 $600 $40 $400 $- 2015Y 2016Y 2017Y 2018Y 2019YTD 2015Y 2016Y 2017Y 2018Y 2019YTD Source: S&P Global Market Intelligence; YTD financial data as of September 30, 2019 18

Efficiency and Performance Metrics Efficiency and Operating Expense ROATCE & ROAA Efficiency Ratio Noninterest Expense / Avg. Assets ROATCE ROAA 90.0% 10.0% 18.00% 2.00% 16.35% 75.0% 15.00% 68.3% 66.5% 68.0% 8.0% 1.60% Noninterest Expense/ Avg.Assets Noninterest 13.20% 11.67% 57.8% 60.0% 56.0% 12.00% 1.44% 10.64% 10.21% ROAA 6.0% 1.20% ROATCE 45.0% 9.00% 1.05% 1.07% 1.02% Efficiency Efficiency Ratio 4.0% 0.80% 0.82% 30.0% 6.00% 3.0% 2.9% 2.9% 2.8% 2.8% 2.0% 0.40% 15.0% 3.00% 0.0% 0.0% 0.00% 0.00% 2015Y 2016Y 2017Y 2018Y 2019YTD 2015Y 2016Y 2017Y 2018Y 2019YTD Source: S&P Global Market Intelligence; YTD financial data as of September 30, 2019 19

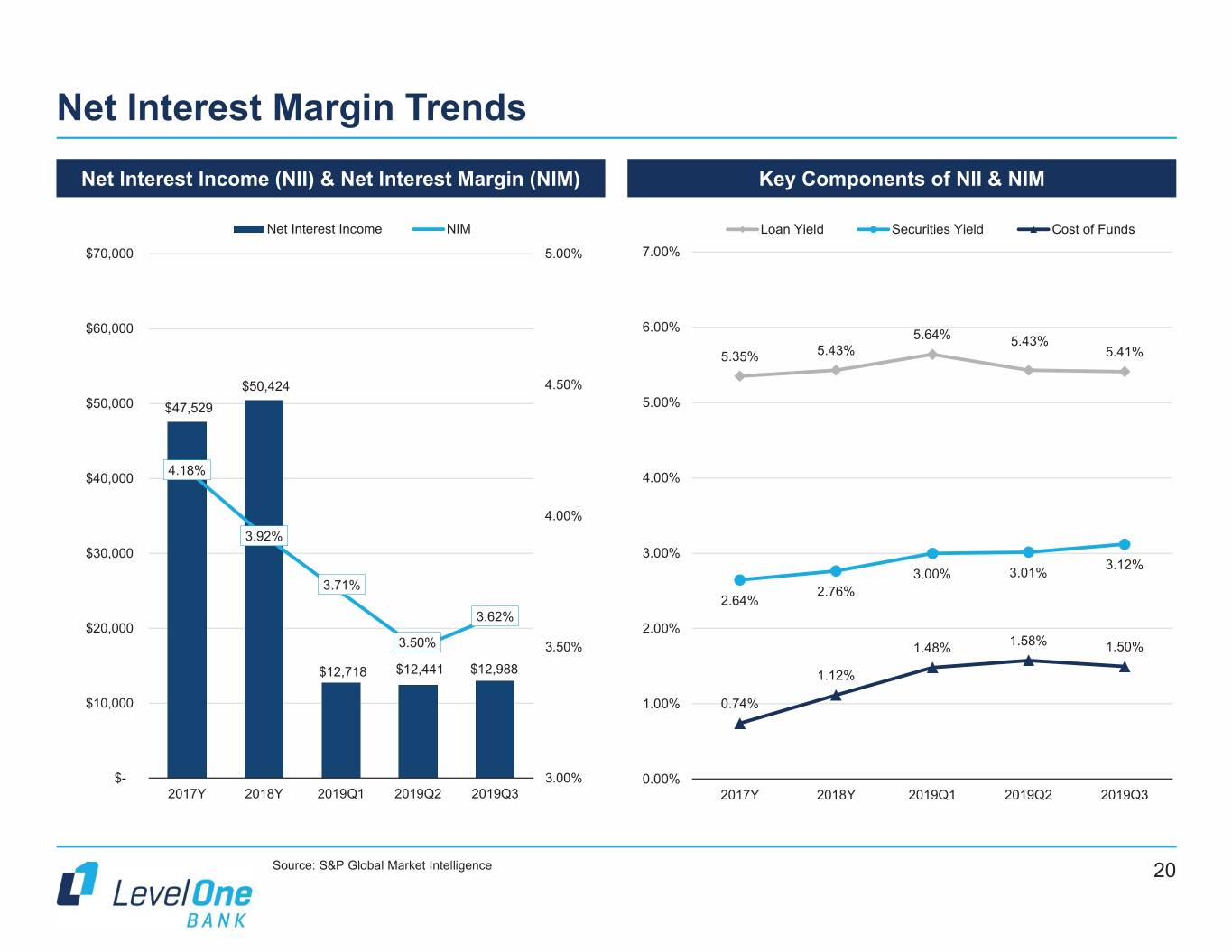

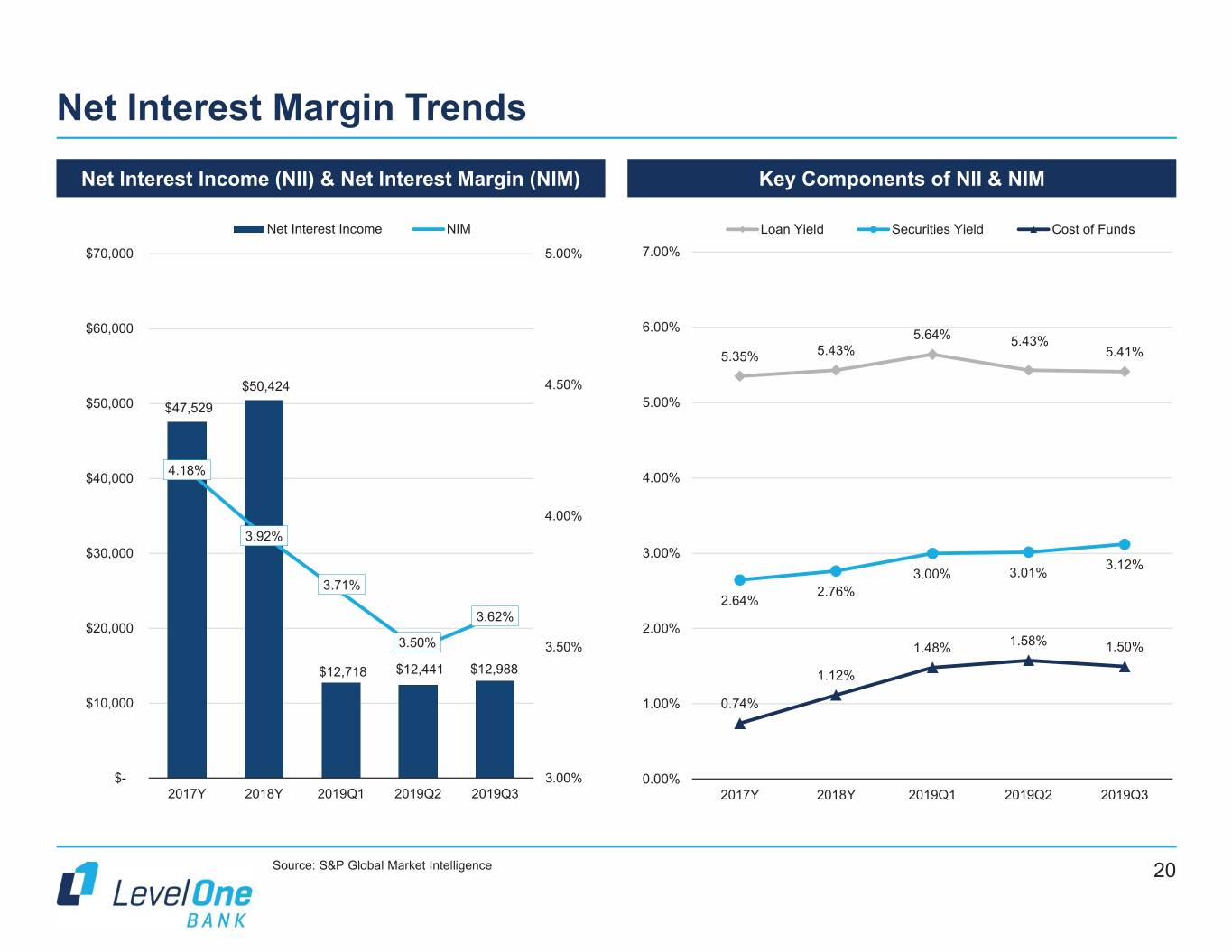

Net Interest Margin Trends Net Interest Income (NII) & Net Interest Margin (NIM) Key Components of NII & NIM Net Interest Income NIM Loan Yield Securities Yield Cost of Funds $70,000 5.00% 7.00% $60,000 6.00% 5.64% 5.43% 5.35% 5.43% 5.41% $50,424 4.50% $50,000 $47,529 5.00% 4.18% $40,000 4.00% 4.00% 3.92% $30,000 3.00% 3.12% 3.00% 3.01% 3.71% 2.76% 2.64% 3.62% $20,000 2.00% 1.58% 3.50% 3.50% 1.48% 1.50% $12,718 $12,441 $12,988 1.12% $10,000 1.00% 0.74% $- 3.00% 0.00% 2017Y 2018Y 2019Q1 2019Q2 2019Q3 2017Y 2018Y 2019Q1 2019Q2 2019Q3 Source: S&P Global Market Intelligence 20

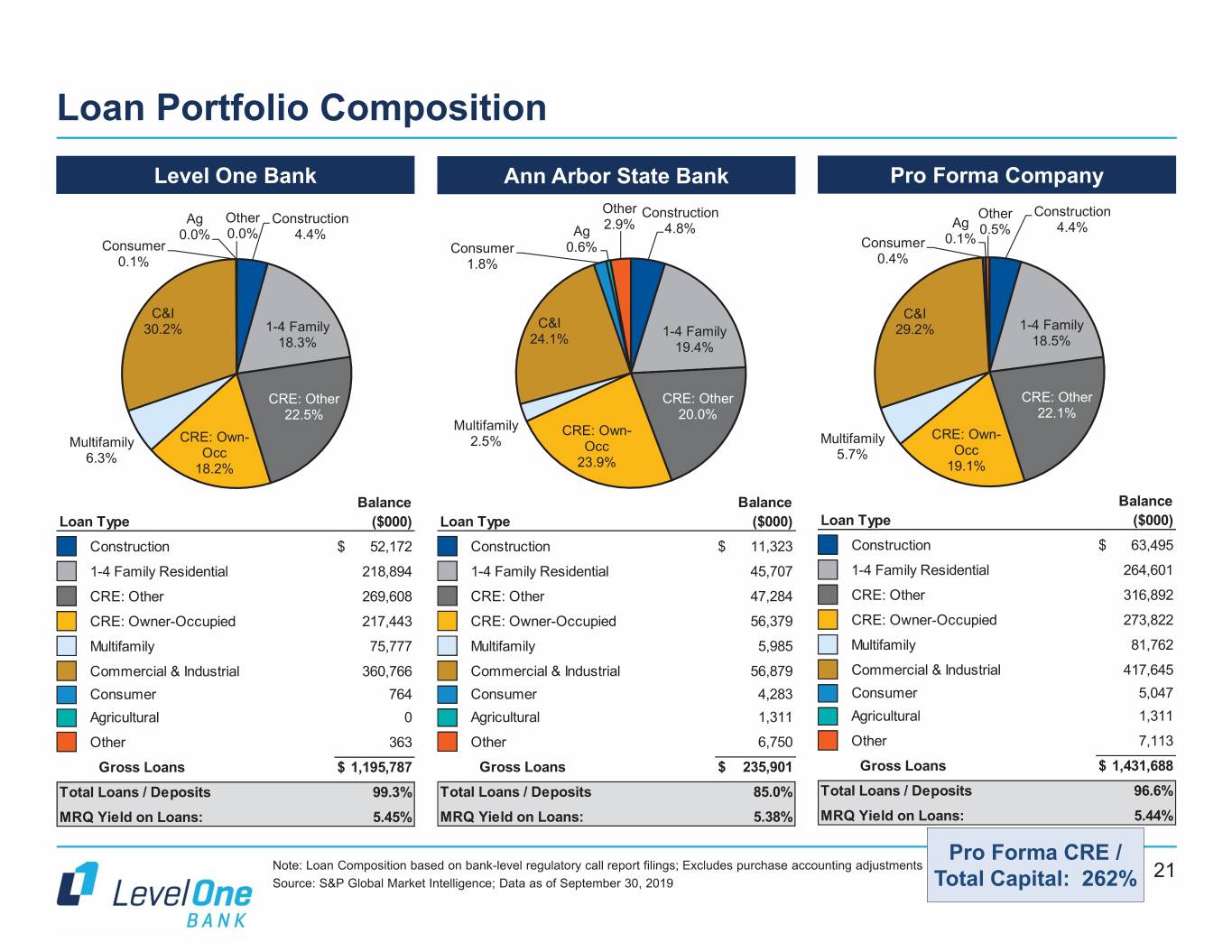

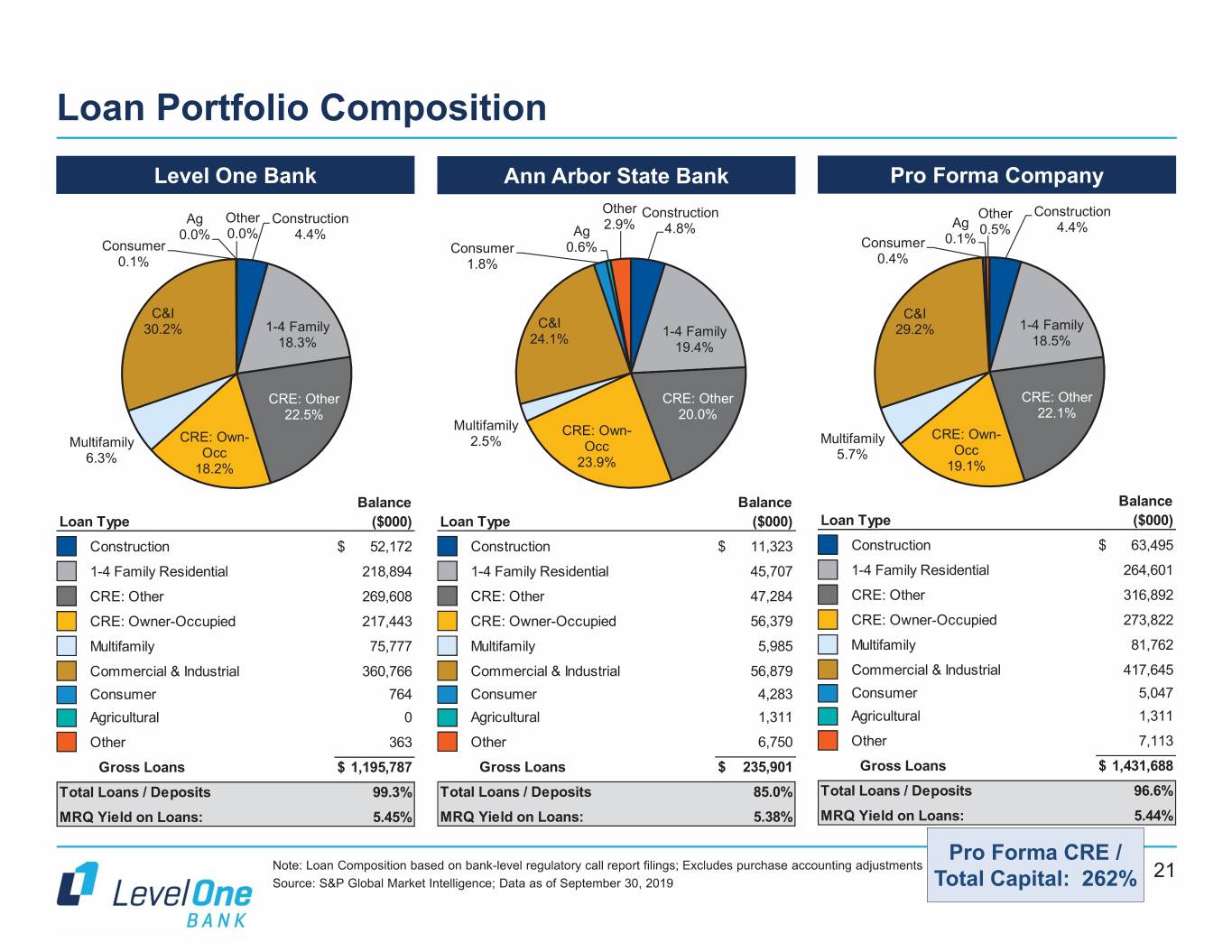

Loan Portfolio Composition Level One Bank Ann Arbor State Bank Pro Forma Company Other Construction Other Construction Ag Other Construction 2.9% Ag Ag 4.8% 0.5% 4.4% 0.0% 0.0% 4.4% 0.1% Consumer Consumer 0.6% Consumer 0.1% 1.8% 0.4% C&I C&I C&I 30.2% 1-4 Family 1-4 Family 29.2% 1-4 Family 24.1% 18.3% 19.4% 18.5% CRE: Other CRE: Other CRE: Other 22.5% 20.0% 22.1% Multifamily CRE: Own- CRE: Own- Multifamily CRE: Own- 2.5% Multifamily Occ Occ 6.3% Occ 5.7% 18.2% 23.9% 19.1% Balance Balance Balance Loan Type ($000) Loan Type ($000) Loan Type ($000) Construction $ 52,172 Construction $ 11,323 Construction $ 63,495 1-4 Family Residential 218,894 1-4 Family Residential 45,707 1-4 Family Residential 264,601 CRE: Other 269,608 CRE: Other 47,284 CRE: Other 316,892 CRE: Owner-Occupied 217,443 CRE: Owner-Occupied 56,379 CRE: Owner-Occupied 273,822 Multifamily 75,777 Multifamily 5,985 Multifamily 81,762 Commercial & Industrial 360,766 Commercial & Industrial 56,879 Commercial & Industrial 417,645 Consumer 764 Consumer 4,283 Consumer 5,047 Agricultural 0 Agricultural 1,311 Agricultural 1,311 Other 363 Other 6,750 Other 7,113 Gross Loans $ 1,195,787 Gross Loans $ 235,901 Gross Loans $ 1,431,688 Total Loans / Deposits 99.3% Total Loans / Deposits 85.0% Total Loans / Deposits 96.6% MRQ Yield on Loans: 5.45% MRQ Yield on Loans: 5.38% MRQ Yield on Loans: 5.44% Pro Forma CRE / Note: Loan Composition based on bank-level regulatory call report filings; Excludes purchase accounting adjustments 21 Source: S&P Global Market Intelligence; Data as of September 30, 2019 Total Capital: 262%

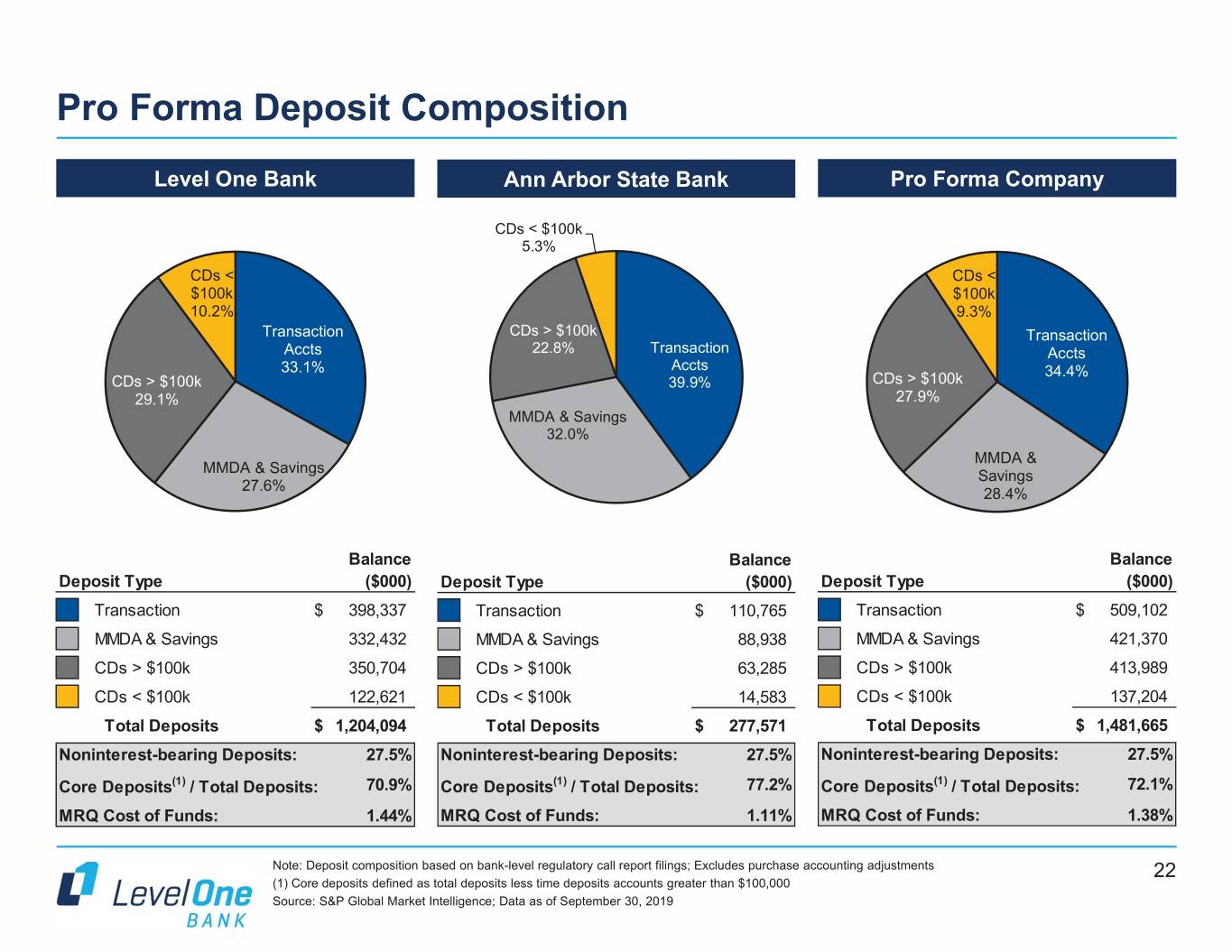

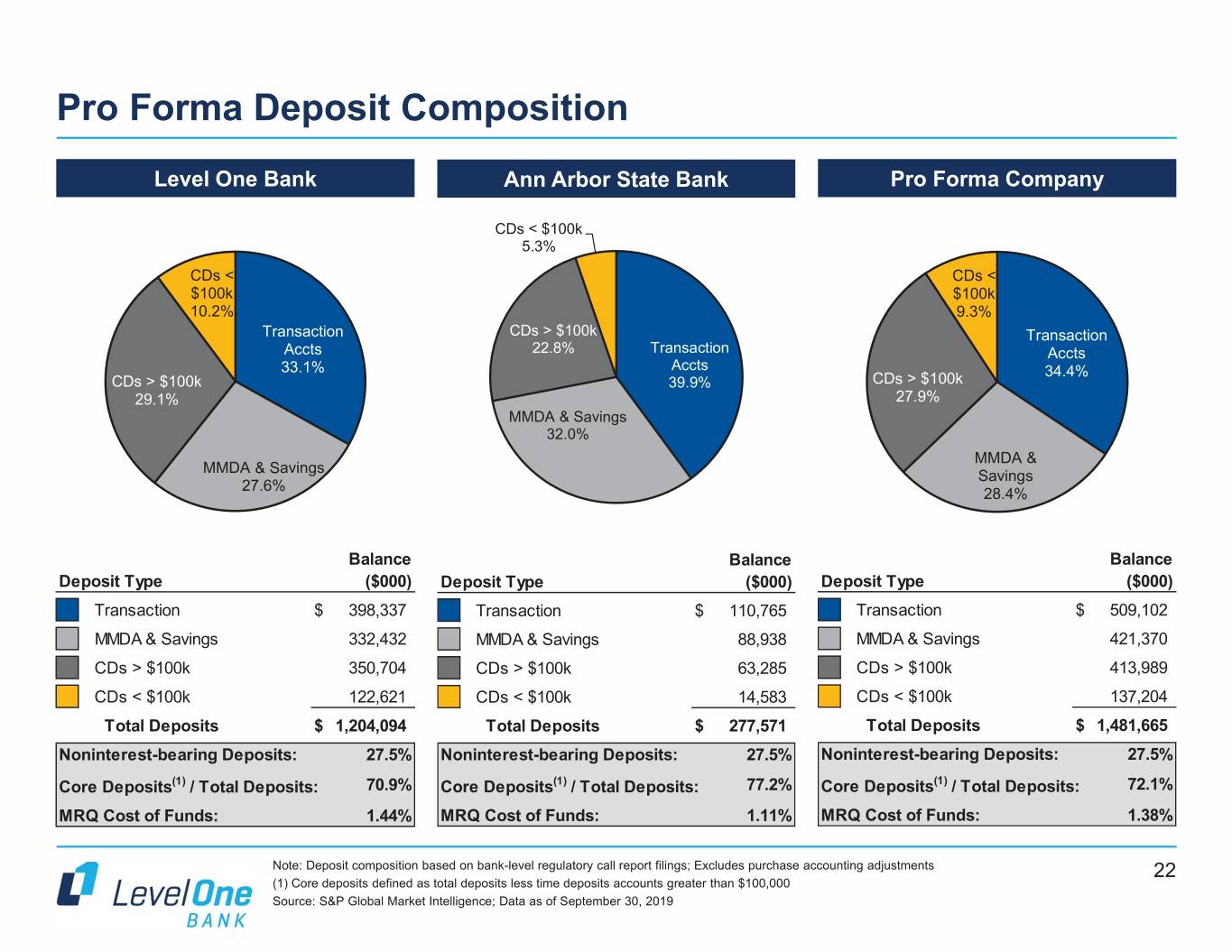

[Section Title] Pro Forma Deposit Composition Level One Bank Ann Arbor State Bank Pro Forma Company CDs < $100k 5.3% CDs < CDs < $100k $100k 10.2% 9.3% Transaction CDs > $100k Transaction Accts 22.8% Transaction Accts 33.1% Accts 34.4% CDs > $100k 39.9% CDs > $100k 29.1% 27.9% MMDA & Savings 32.0% MMDA & MMDA & Savings Savings 27.6% 28.4% Balance Balance Balance Deposit Type ($000) Deposit Type ($000) Deposit Type ($000) Transaction $ 398,337 Transaction $ 110,765 Transaction $ 509,102 MMDA & Savings 332,432 MMDA & Savings 88,938 MMDA & Savings 421,370 CDs > $100k 350,704 CDs > $100k 63,285 CDs > $100k 413,989 CDs < $100k 122,621 CDs < $100k 14,583 CDs < $100k 137,204 Total Deposits $ 1,204,094 Total Deposits $ 277,571 Total Deposits $ 1,481,665 Noninterest-bearing Deposits: 27.5% Noninterest-bearing Deposits: 27.5% Noninterest-bearing Deposits: 27.5% Core Deposits(1) / Total Deposits: 70.9% Core Deposits(1) / Total Deposits: 77.2% Core Deposits(1) / Total Deposits: 72.1% MRQ Cost of Funds: 1.44% MRQ Cost of Funds: 1.11% MRQ Cost of Funds: 1.38% Note: Deposit composition based on bank-level regulatory call report filings; Excludes purchase accounting adjustments 22 (1) Core deposits defined as total deposits less time deposits accounts greater than $100,000 Source: S&P Global Market Intelligence; Data as of September 30, 2019

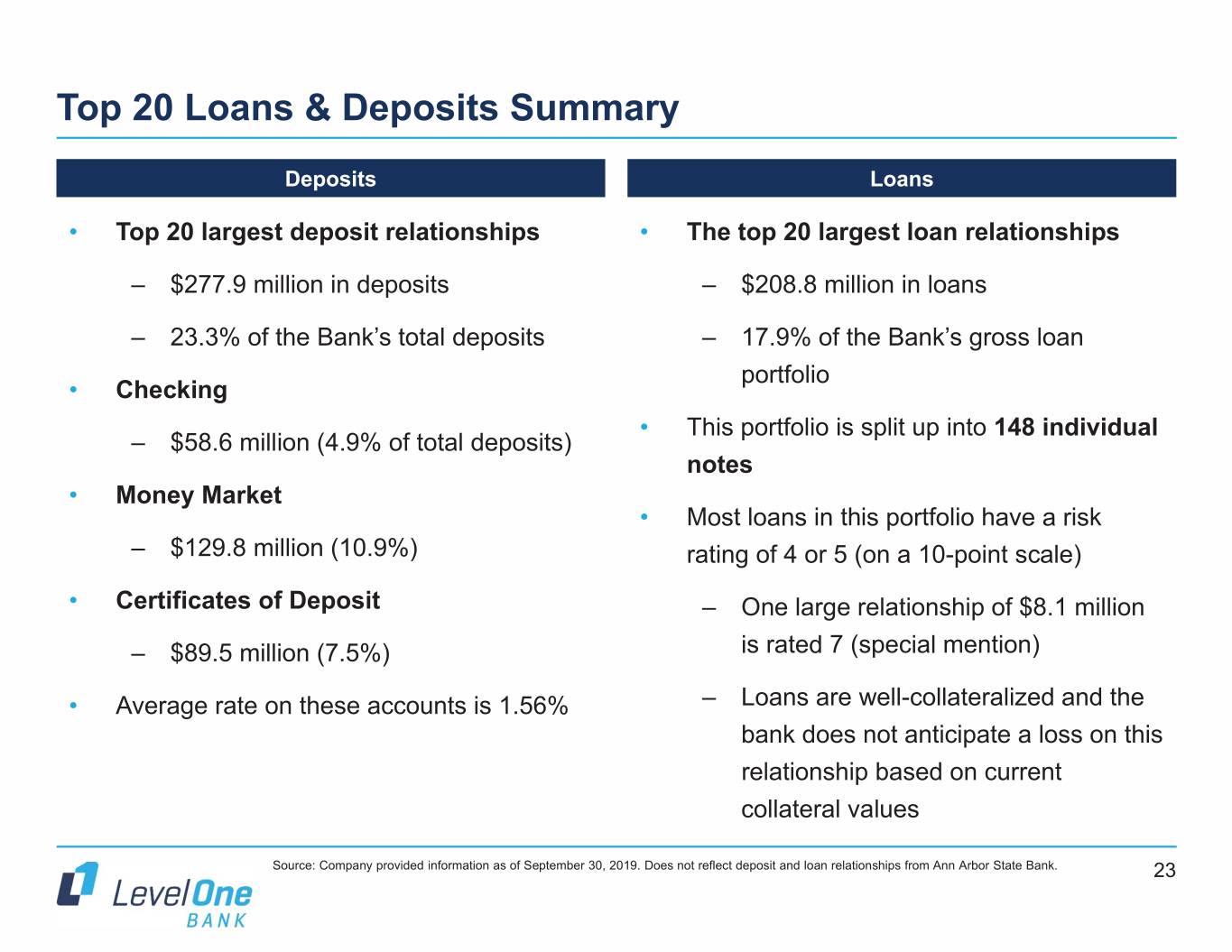

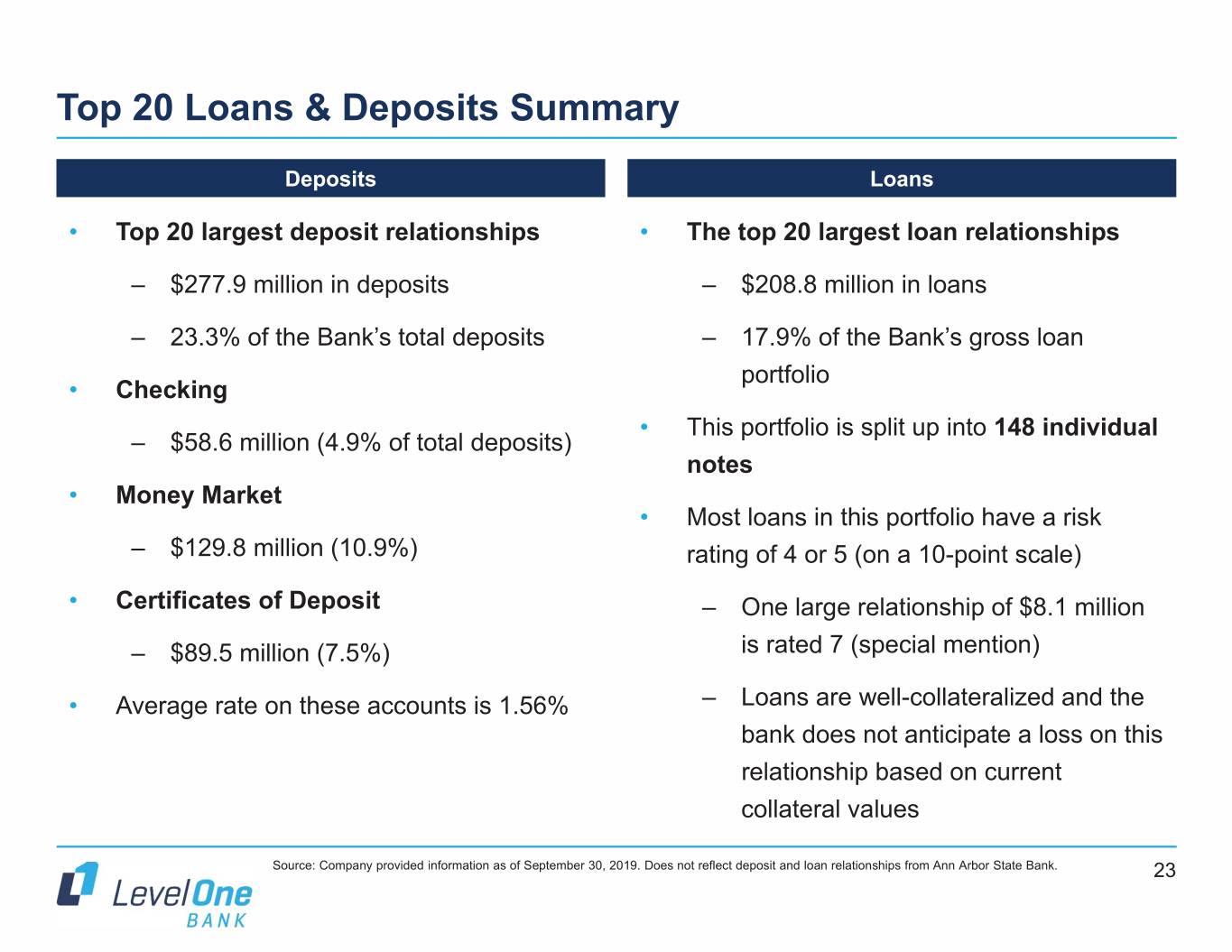

Top 20 Loans & Deposits Summary Deposits Loans • Top 20 largest deposit relationships • The top 20 largest loan relationships – $277.9 million in deposits – $208.8 million in loans – 23.3% of the Bank’s total deposits – 17.9% of the Bank’s gross loan portfolio • Checking • This portfolio is split up into 148 individual – $58.6 million (4.9% of total deposits) notes • Money Market • Most loans in this portfolio have a risk – $129.8 million (10.9%) rating of 4 or 5 (on a 10-point scale) • Certificates of Deposit – One large relationship of $8.1 million – $89.5 million (7.5%) is rated 7 (special mention) • Average rate on these accounts is 1.56% – Loans are well-collateralized and the bank does not anticipate a loss on this relationship based on current collateral values Source: Company provided information as of September 30, 2019. Does not reflect deposit and loan relationships from Ann Arbor State Bank. 23

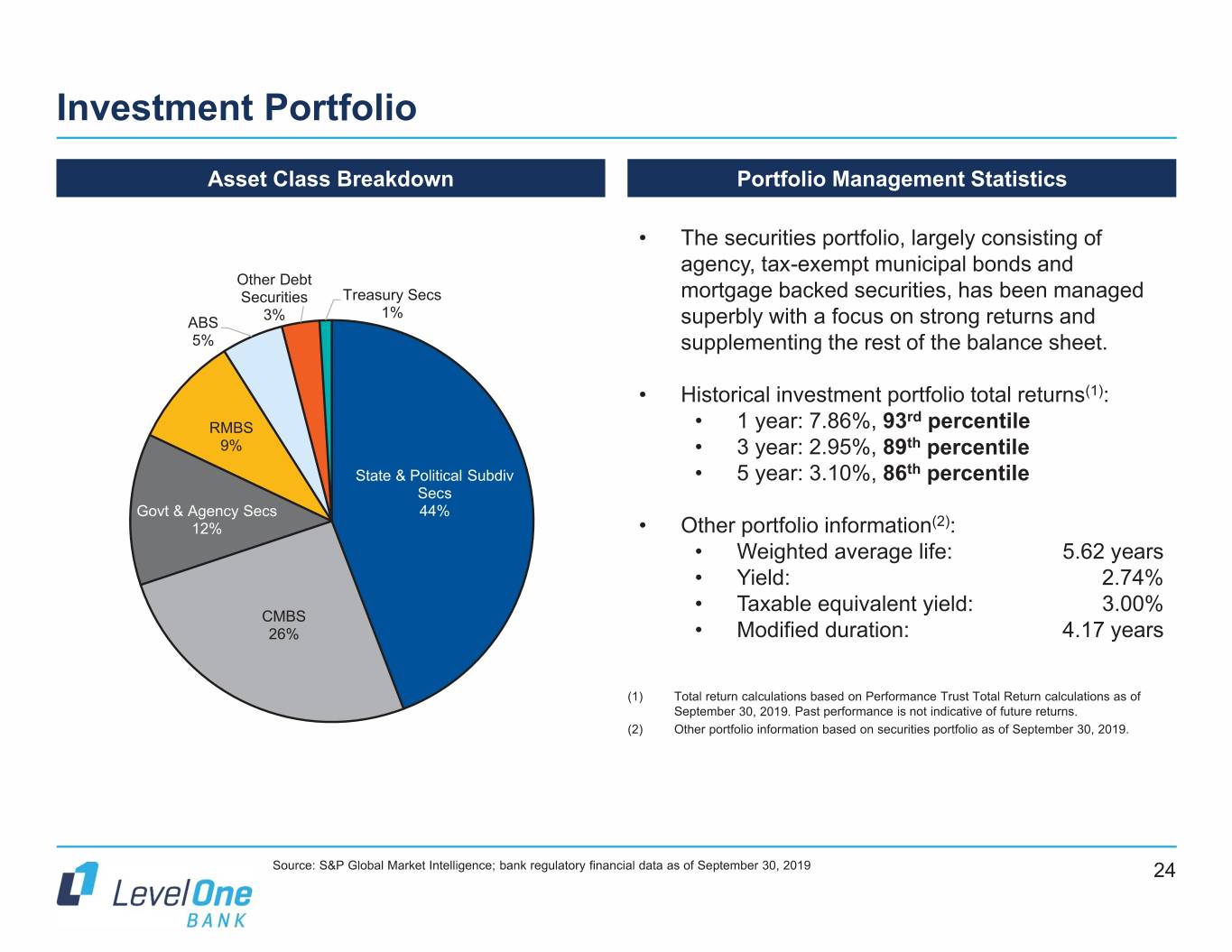

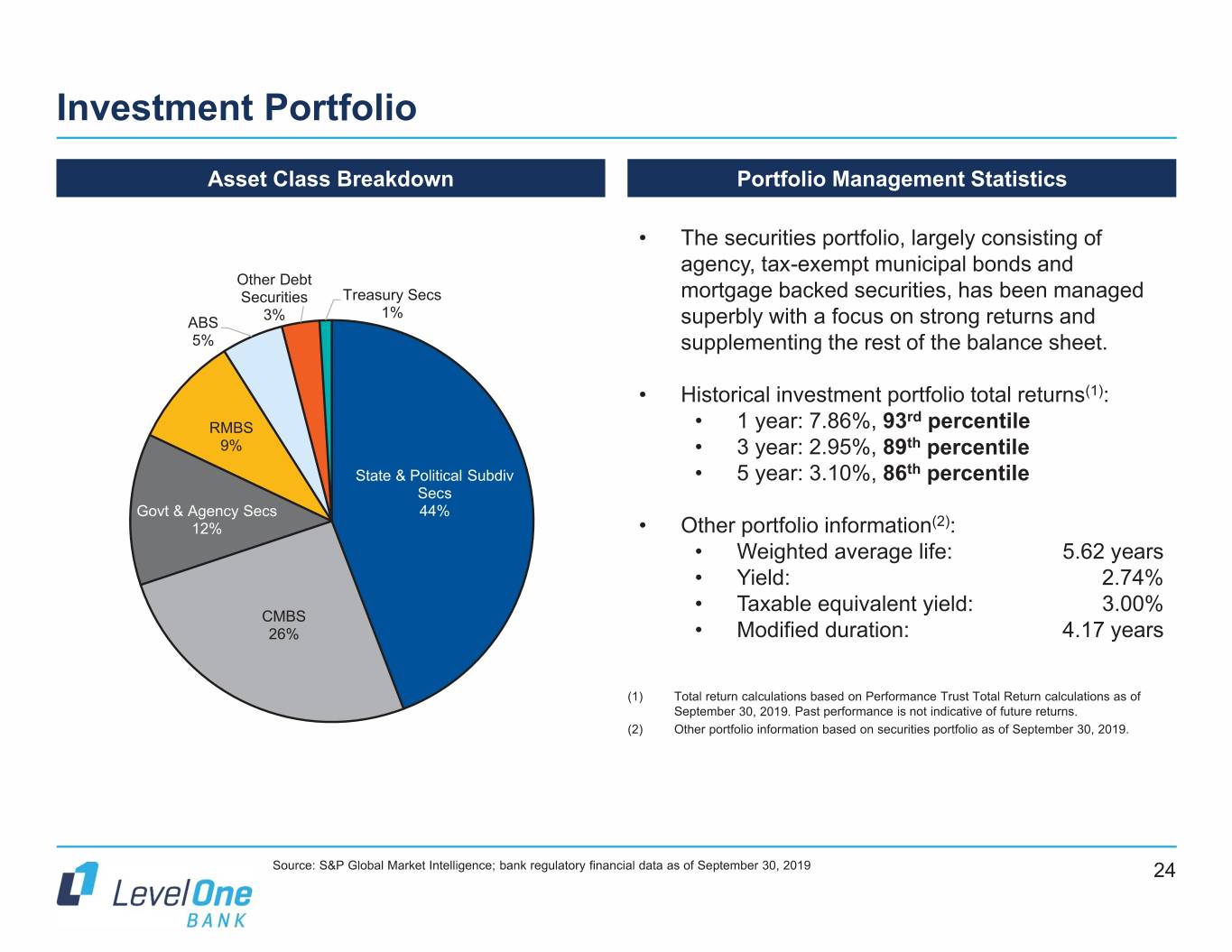

Investment Portfolio Asset Class Breakdown Portfolio Management Statistics • The securities portfolio, largely consisting of agency, tax-exempt municipal bonds and Other Debt Securities Treasury Secs mortgage backed securities, has been managed 1% ABS 3% superbly with a focus on strong returns and 5% supplementing the rest of the balance sheet. • Historical investment portfolio total returns(1): rd RMBS • 1 year: 7.86%, 93 percentile 9% • 3 year: 2.95%, 89th percentile State & Political Subdiv • 5 year: 3.10%, 86th percentile Secs Govt & Agency Secs 44% 12% • Other portfolio information(2): • Weighted average life: 5.62 years • Yield: 2.74% • Taxable equivalent yield: 3.00% CMBS 26% • Modified duration: 4.17 years (1) Total return calculations based on Performance Trust Total Return calculations as of September 30, 2019. Past performance is not indicative of future returns. (2) Other portfolio information based on securities portfolio as of September 30, 2019. Source: S&P Global Market Intelligence; bank regulatory financial data as of September 30, 2019 24

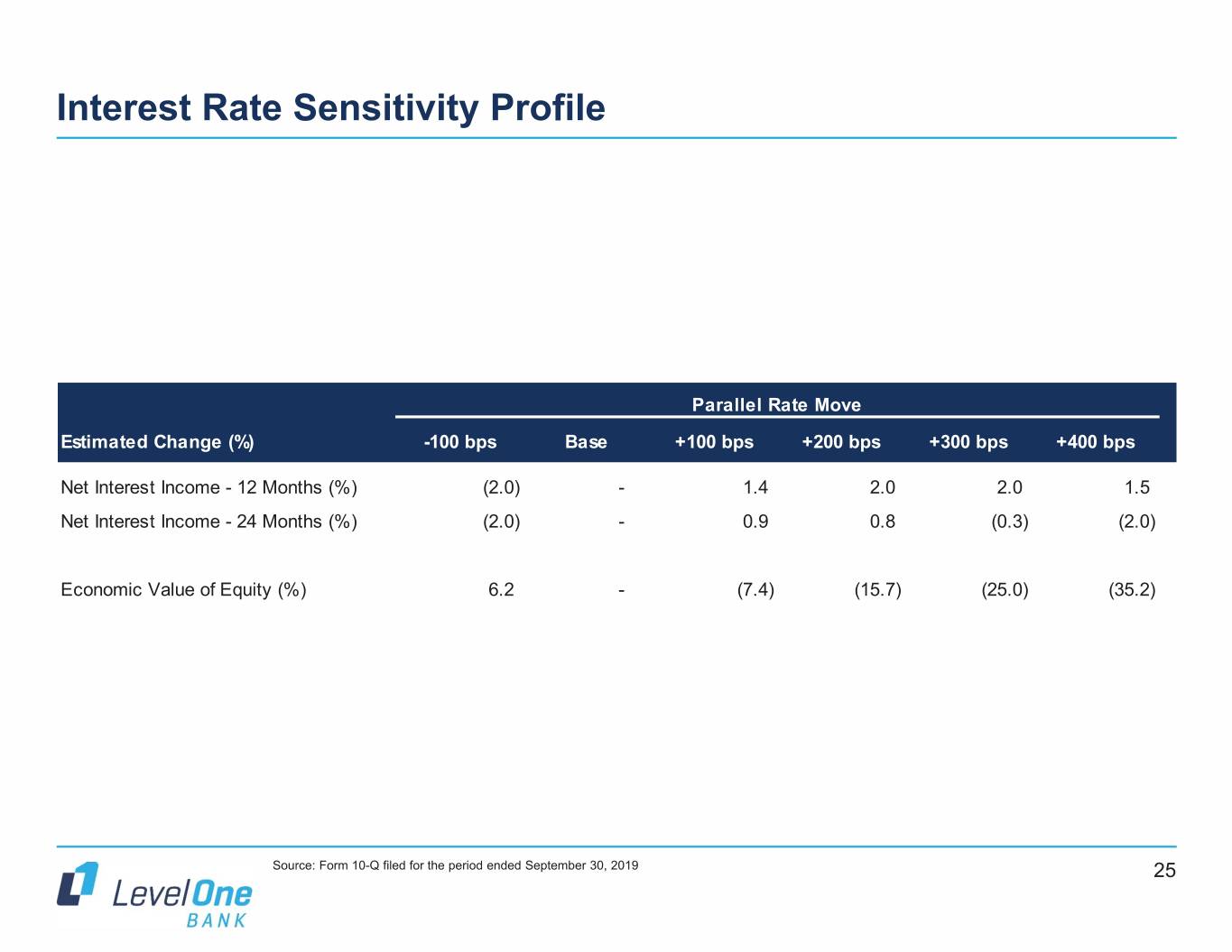

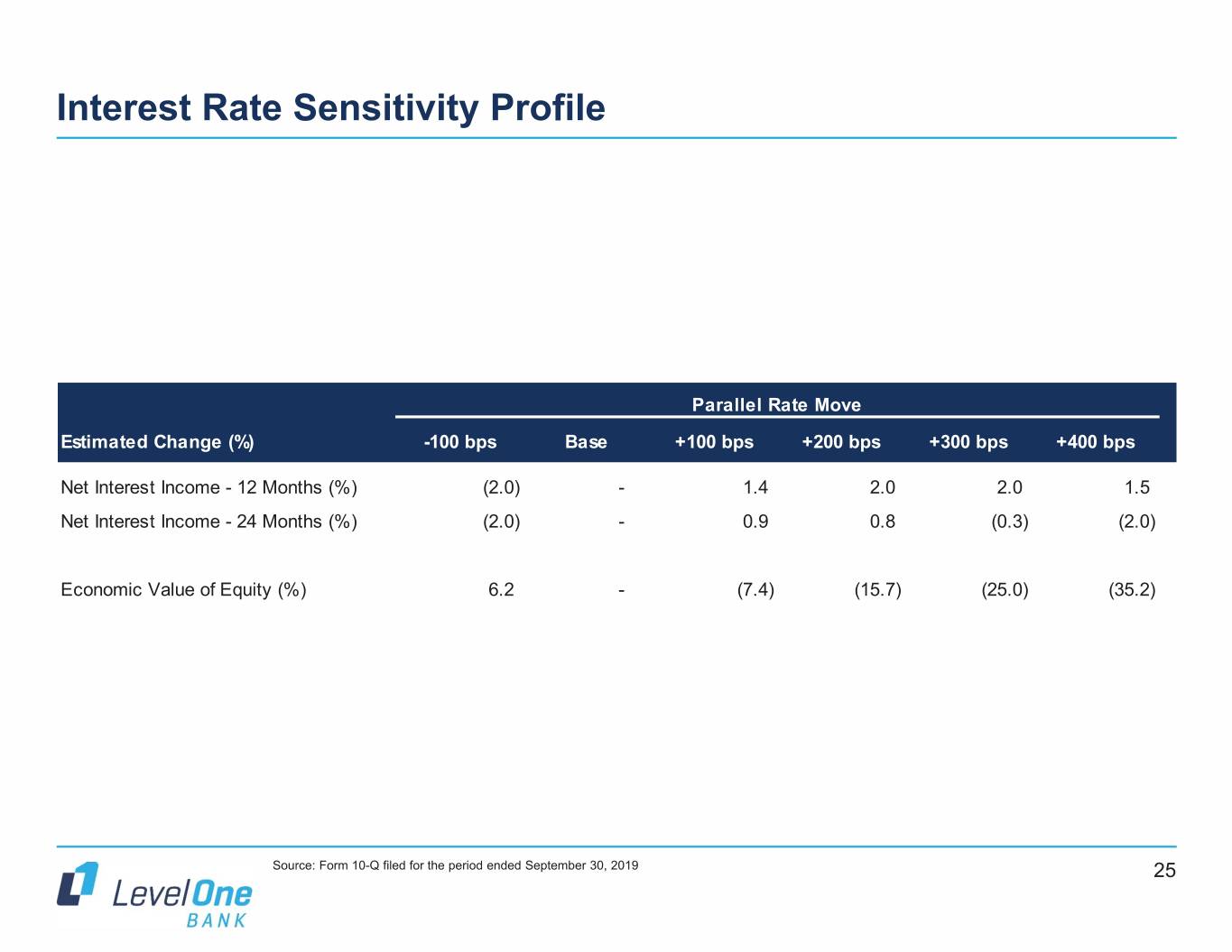

Interest Rate Sensitivity Profile Parallel Rate Move Estimated Change (%) -100 bps Base +100 bps +200 bps +300 bps +400 bps Net Interest Income - 12 Months (%) (2.0) - 1.4 2.0 2.0 1.5 Net Interest Income - 24 Months (%) (2.0) - 0.9 0.8 (0.3) (2.0) Economic Value of Equity (%) 6.2 - (7.4) (15.7) (25.0) (35.2) Source: Form 10-Q filed for the period ended September 30, 2019 25

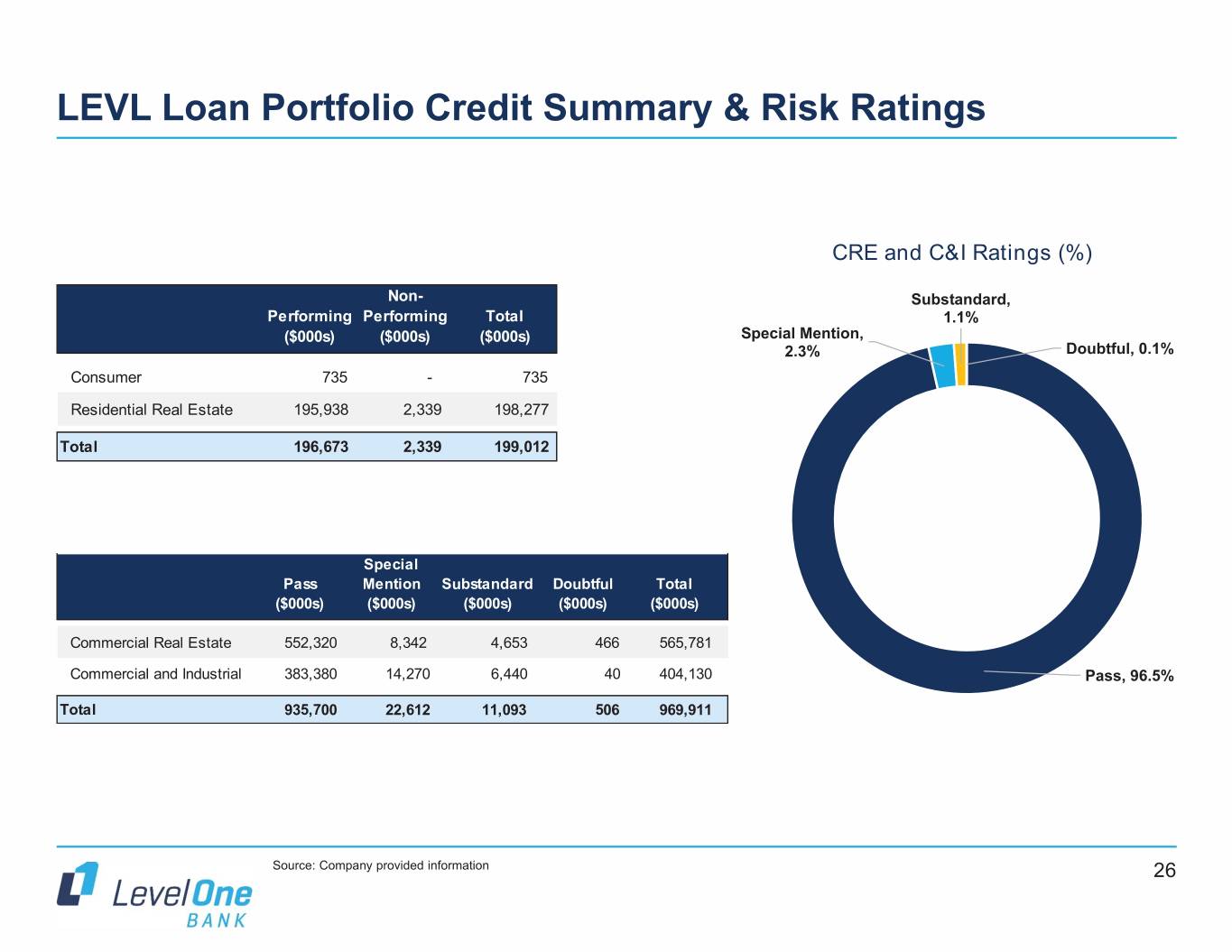

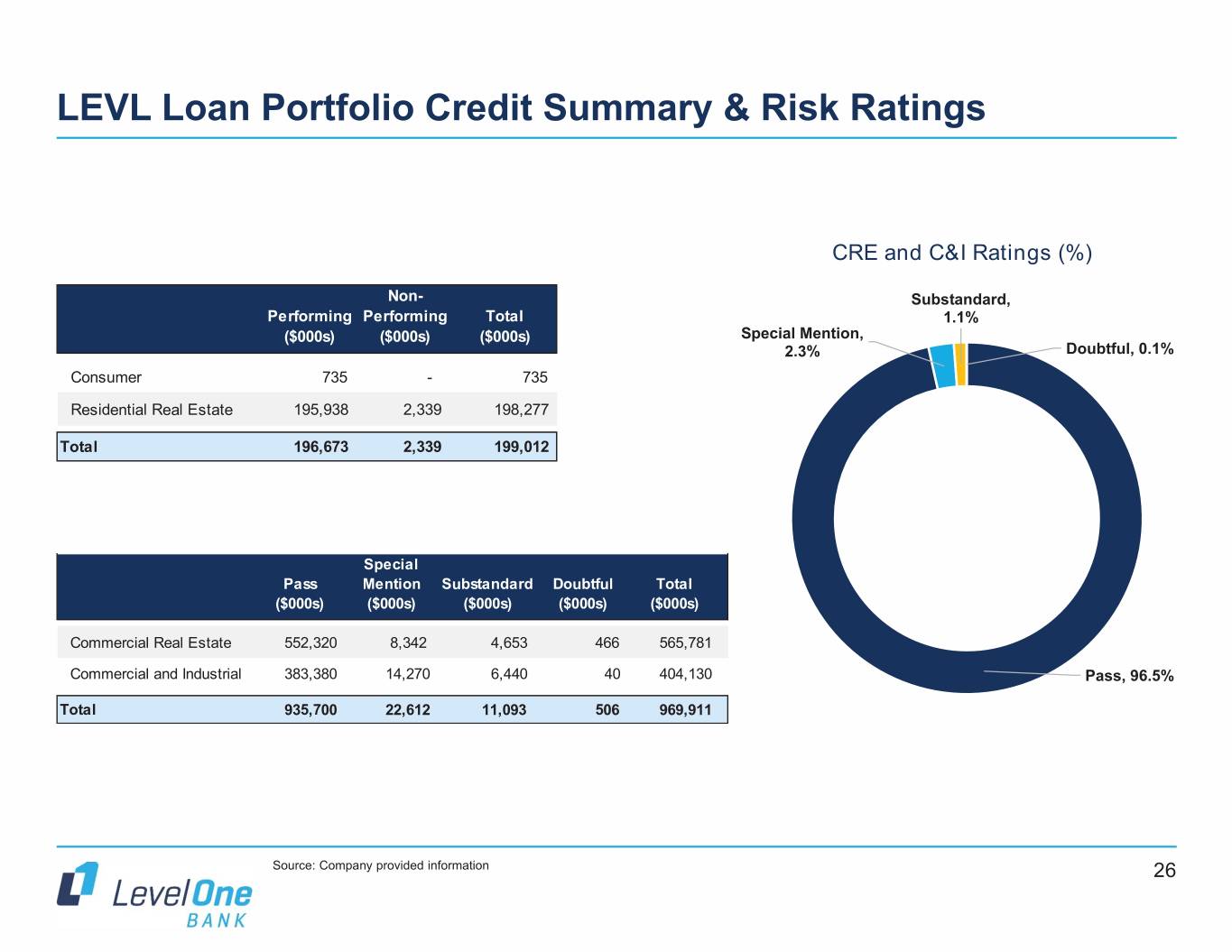

LEVL Loan Portfolio Credit Summary & Risk Ratings CRE and C&I Ratings (%) Non- Substandard, Performing Performing Total 1.1% ($000s) ($000s) ($000s) Special Mention, 2.3% Doubtful, 0.1% Consumer 735 - 735 Residential Real Estate 195,938 2,339 198,277 Total 196,673 2,339 199,012 Special Pass Mention Substandard Doubtful Total ($000s) ($000s) ($000s) ($000s) ($000s) Commercial Real Estate 552,320 8,342 4,653 466 565,781 Commercial and Industrial 383,380 14,270 6,440 40 404,130 Pass, 96.5% Total 935,700 22,612 11,093 506 969,911 Source: Company provided information 26

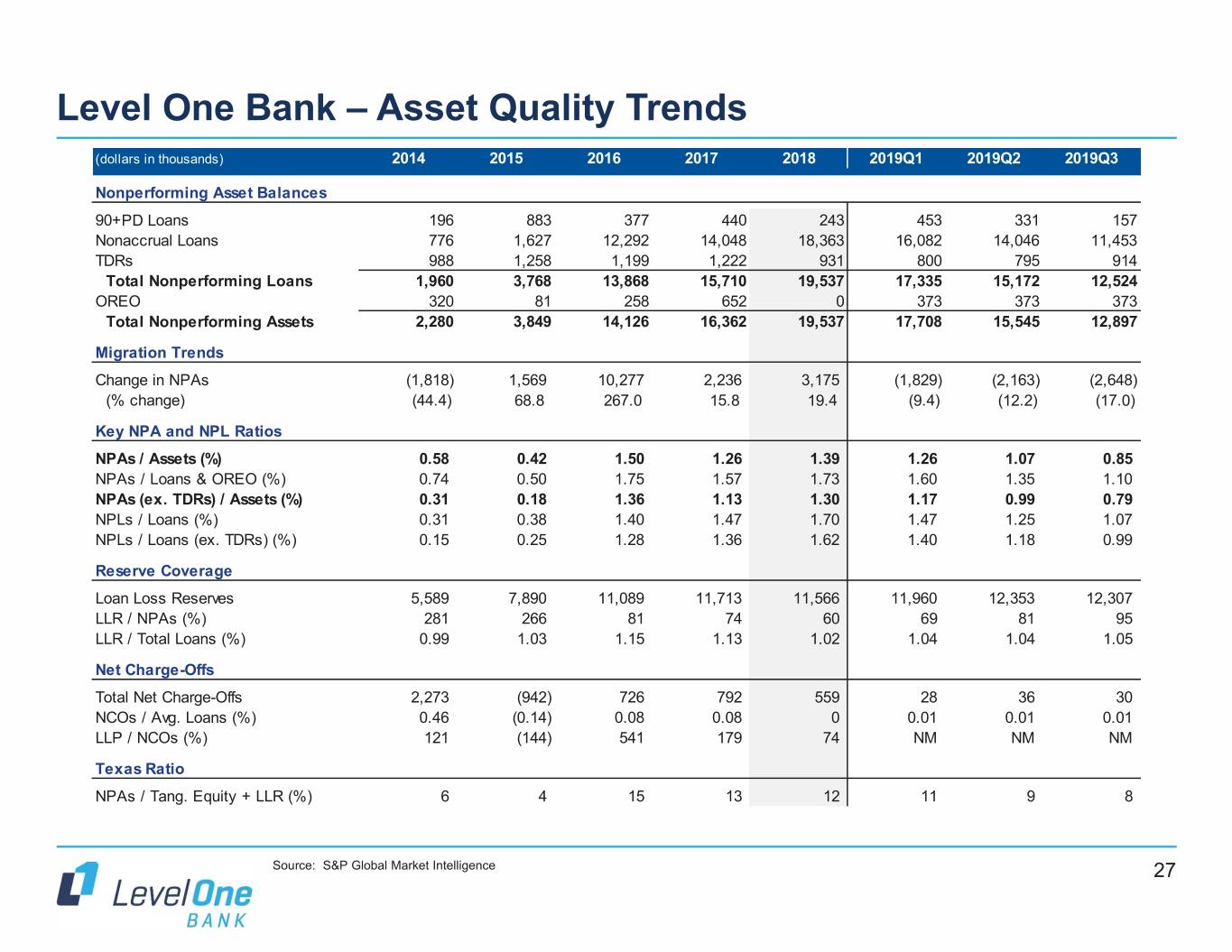

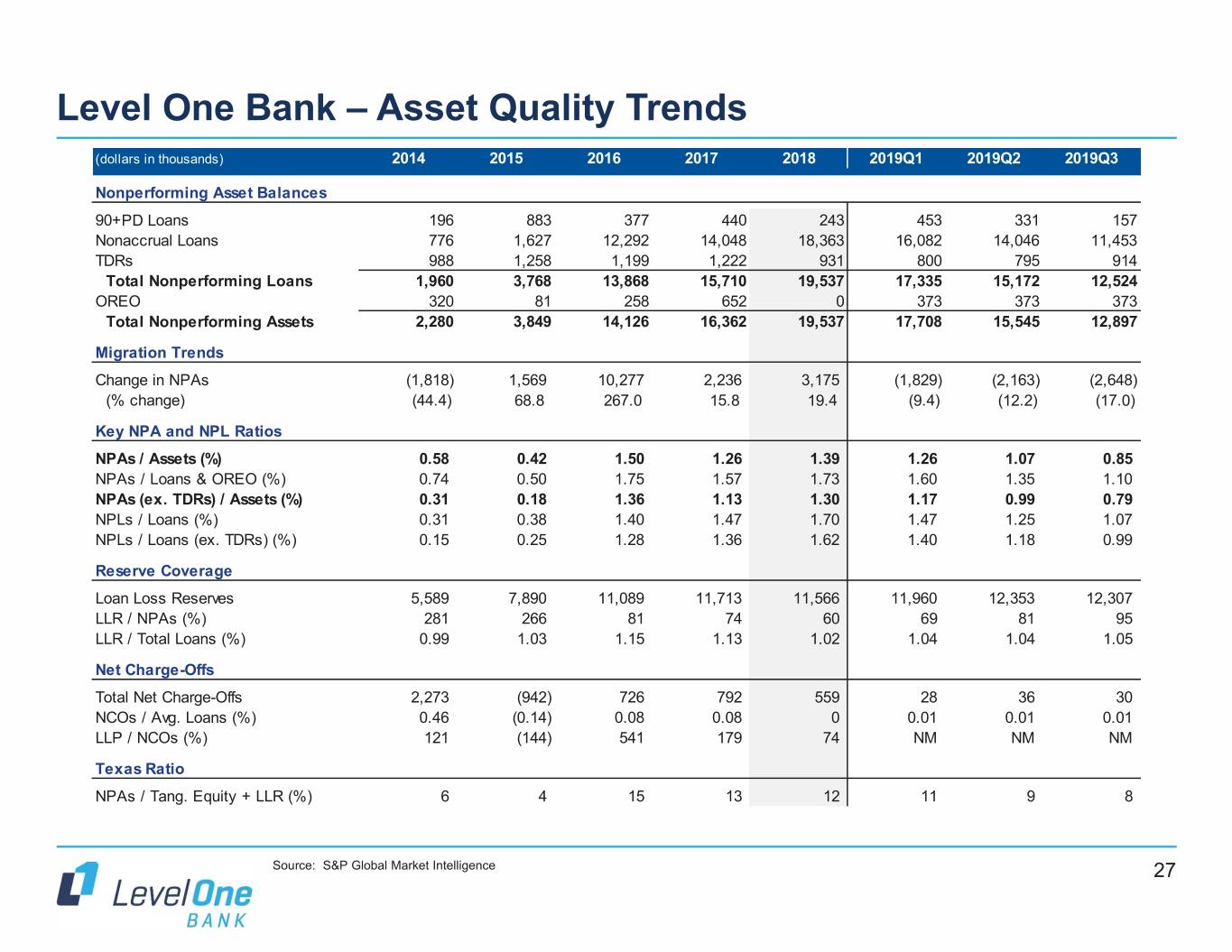

Level One Bank – Asset Quality Trends (dollars in thousands) 2014 2015 2016 2017 2018 2019Q1 2019Q2 2019Q3 Nonperforming Asset Balances 90+PD Loans 196 883 377 440 243 453 331 157 Nonaccrual Loans 776 1,627 12,292 14,048 18,363 16,082 14,046 11,453 TDRs 988 1,258 1,199 1,222 931 800 795 914 Total Nonperforming Loans 1,960 3,768 13,868 15,710 19,537 17,335 15,172 12,524 OREO 320 81 258 652 0 373 373 373 Total Nonperforming Assets 2,280 3,849 14,126 16,362 19,537 17,708 15,545 12,897 Migration Trends Change in NPAs (1,818) 1,569 10,277 2,236 3,175 (1,829) (2,163) (2,648) (% change) (44.4) 68.8 267.0 15.8 19.4 (9.4) (12.2) (17.0) Key NPA and NPL Ratios NPAs / Assets (%) 0.58 0.42 1.50 1.26 1.39 1.26 1.07 0.85 NPAs / Loans & OREO (%) 0.74 0.50 1.75 1.57 1.73 1.60 1.35 1.10 NPAs (ex. TDRs) / Assets (%) 0.31 0.18 1.36 1.13 1.30 1.17 0.99 0.79 NPLs / Loans (%) 0.31 0.38 1.40 1.47 1.70 1.47 1.25 1.07 NPLs / Loans (ex. TDRs) (%) 0.15 0.25 1.28 1.36 1.62 1.40 1.18 0.99 Reserve Coverage Loan Loss Reserves 5,589 7,890 11,089 11,713 11,566 11,960 12,353 12,307 LLR / NPAs (%) 281 266 81 74 60 69 81 95 LLR / Total Loans (%) 0.99 1.03 1.15 1.13 1.02 1.04 1.04 1.05 Net Charge-Offs Total Net Charge-Offs 2,273 (942) 726 792 559 28 36 30 NCOs / Avg. Loans (%) 0.46 (0.14) 0.08 0.08 0 0.01 0.01 0.01 LLP / NCOs (%) 121 (144) 541 179 74 NM NM NM Texas Ratio NPAs / Tang. Equity + LLR (%) 6 4 15 13 12 11 9 8 Source: S&P Global Market Intelligence 27

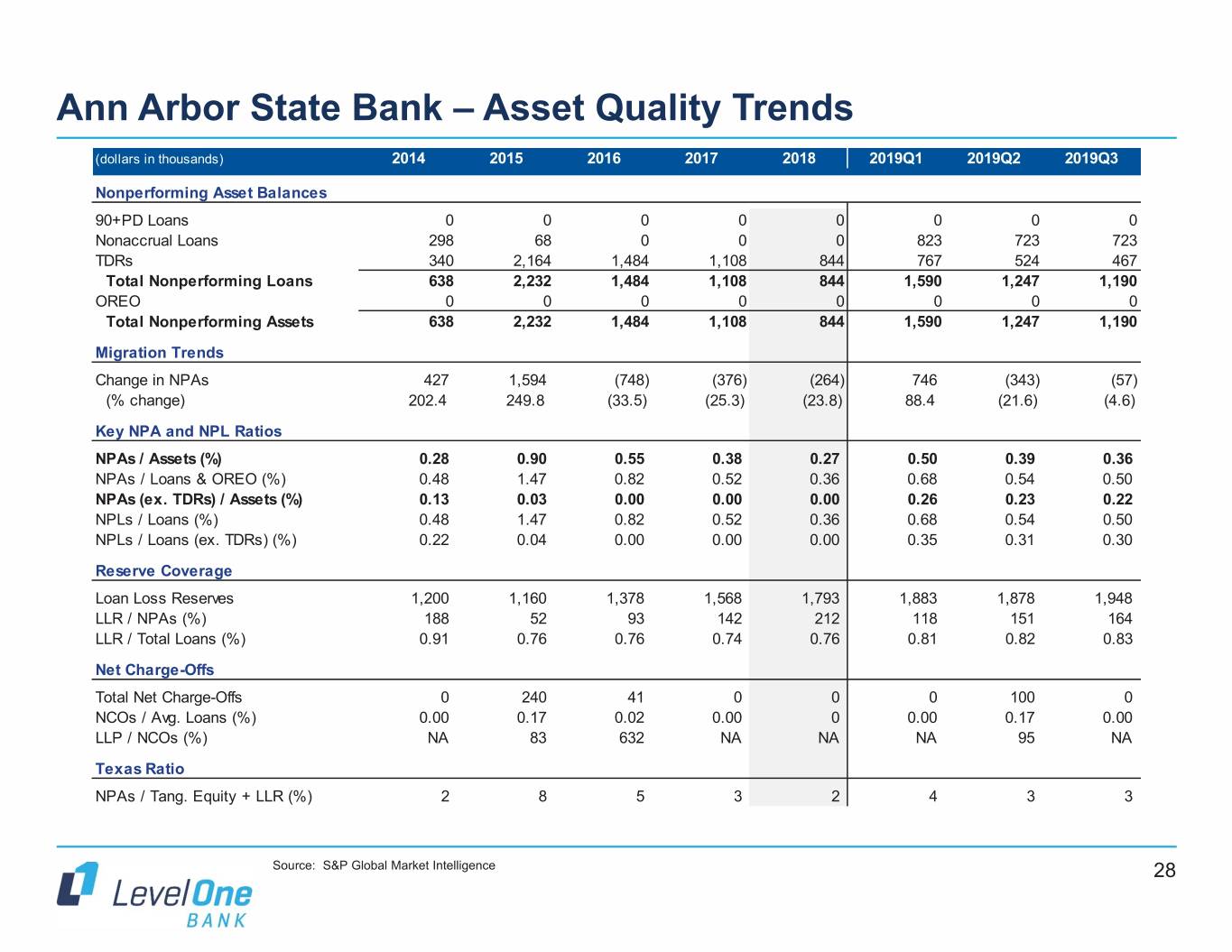

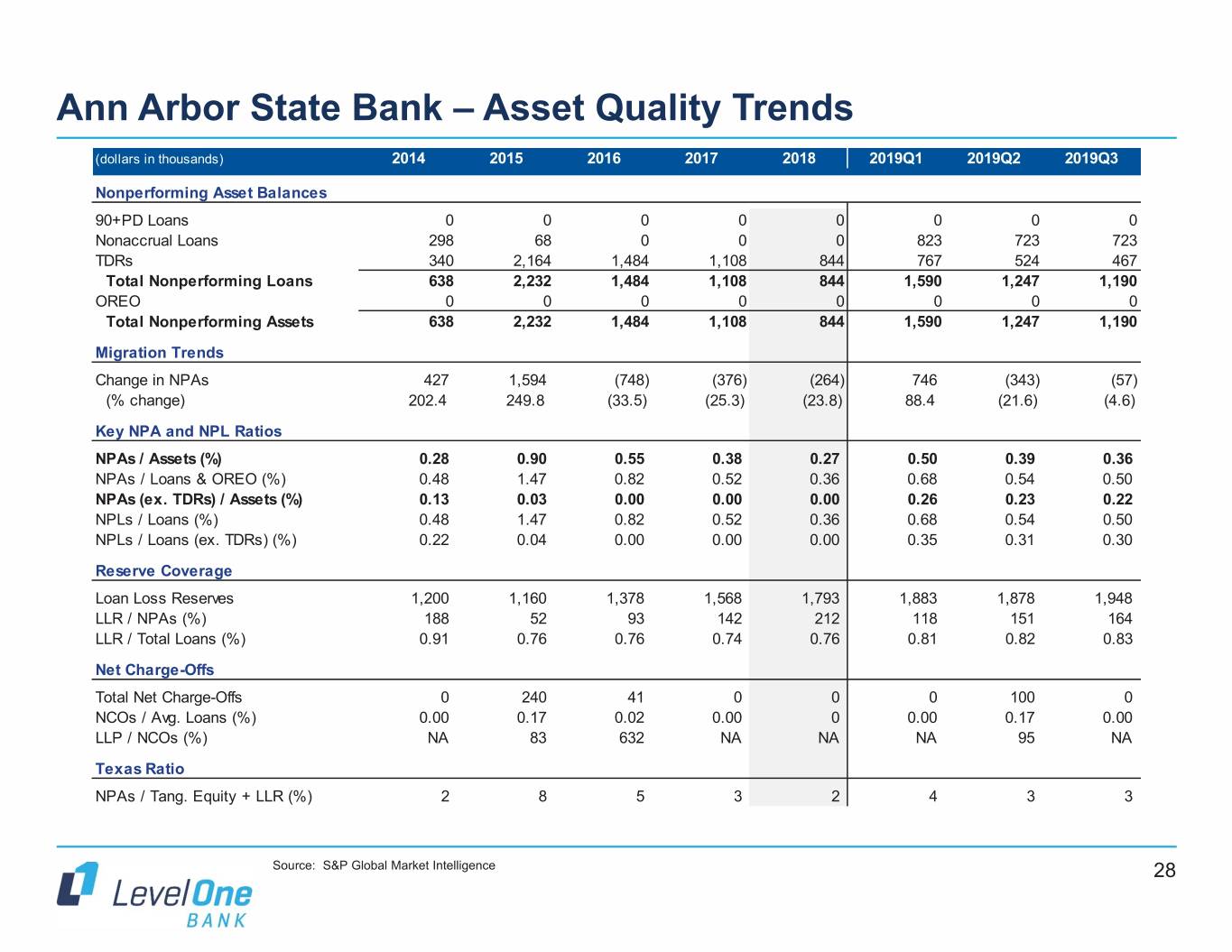

Ann Arbor State Bank – Asset Quality Trends (dollars in thousands) 2014 2015 2016 2017 2018 2019Q1 2019Q2 2019Q3 Nonperforming Asset Balances 90+PD Loans 0 0 0 0 0 0 0 0 Nonaccrual Loans 298 68 0 0 0 823 723 723 TDRs 340 2,164 1,484 1,108 844 767 524 467 Total Nonperforming Loans 638 2,232 1,484 1,108 844 1,590 1,247 1,190 OREO 00000000 Total Nonperforming Assets 638 2,232 1,484 1,108 844 1,590 1,247 1,190 Migration Trends Change in NPAs 427 1,594 (748) (376) (264) 746 (343) (57) (% change) 202.4 249.8 (33.5) (25.3) (23.8) 88.4 (21.6) (4.6) Key NPA and NPL Ratios NPAs / Assets (%) 0.28 0.90 0.55 0.38 0.27 0.50 0.39 0.36 NPAs / Loans & OREO (%) 0.48 1.47 0.82 0.52 0.36 0.68 0.54 0.50 NPAs (ex. TDRs) / Assets (%) 0.13 0.03 0.00 0.00 0.00 0.26 0.23 0.22 NPLs / Loans (%) 0.48 1.47 0.82 0.52 0.36 0.68 0.54 0.50 NPLs / Loans (ex. TDRs) (%) 0.22 0.04 0.00 0.00 0.00 0.35 0.31 0.30 Reserve Coverage Loan Loss Reserves 1,200 1,160 1,378 1,568 1,793 1,883 1,878 1,948 LLR / NPAs (%) 188 52 93 142 212 118 151 164 LLR / Total Loans (%) 0.91 0.76 0.76 0.74 0.76 0.81 0.82 0.83 Net Charge-Offs Total Net Charge-Offs 0 240 41 0 0 0 100 0 NCOs / Avg. Loans (%) 0.00 0.17 0.02 0.00 0 0.00 0.17 0.00 LLP / NCOs (%) NA 83 632 NA NA NA 95 NA Texas Ratio NPAs / Tang. Equity + LLR (%) 2 8 5 3 2 4 3 3 Source: S&P Global Market Intelligence 28

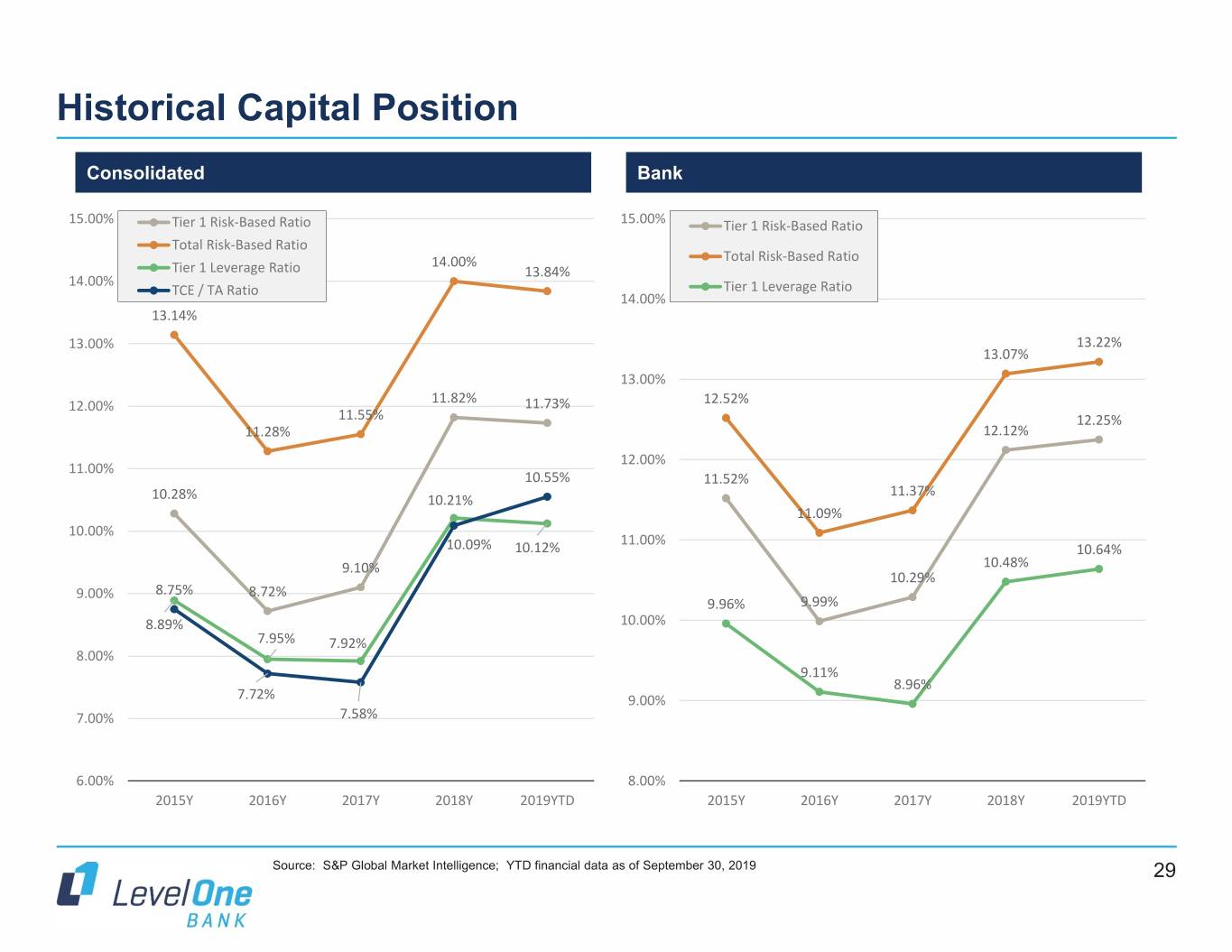

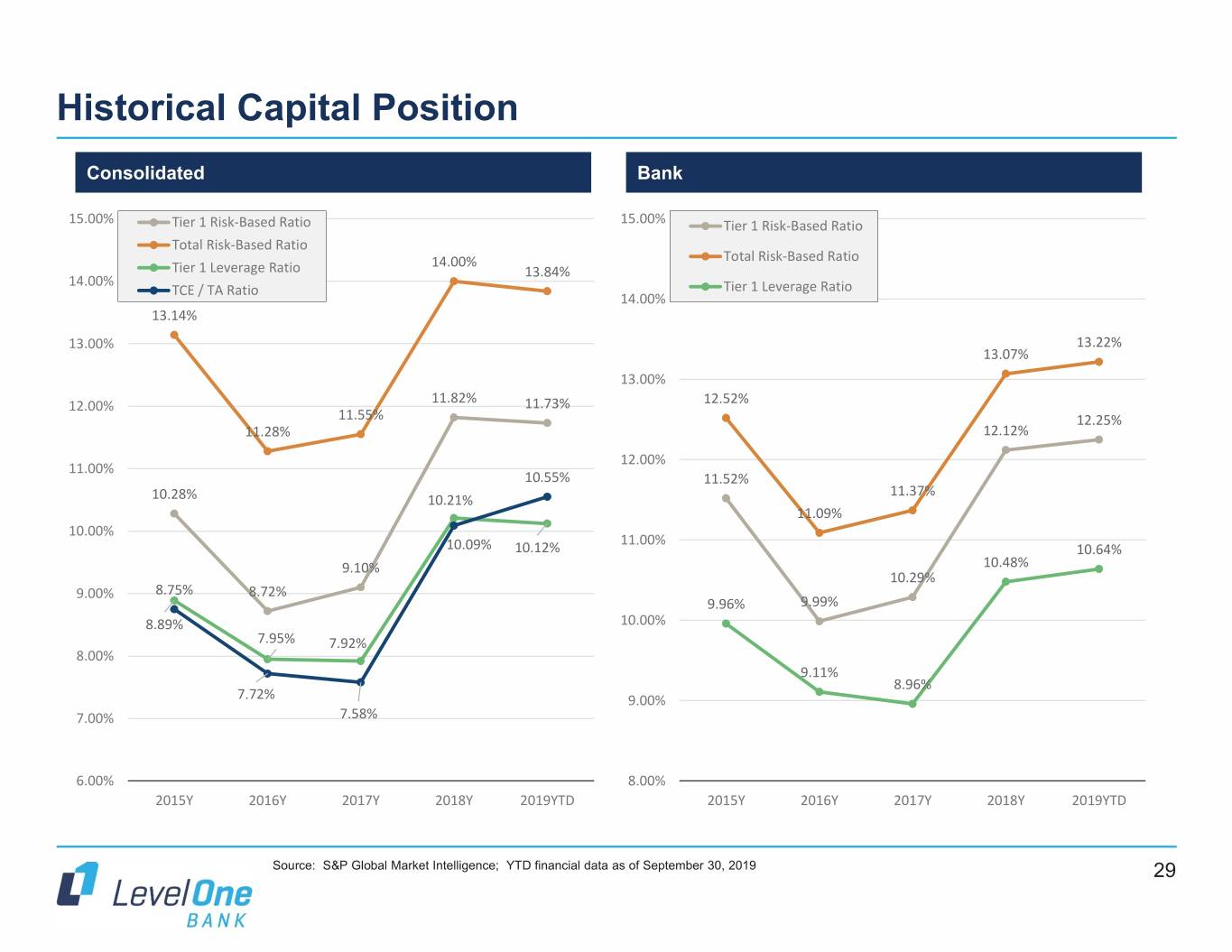

Historical Capital Position Consolidated Bank 15.00% Tier 1 Risk-Based Ratio 15.00% Tier 1 Risk-Based Ratio Total Risk-Based Ratio 14.00% Total Risk-Based Ratio Tier 1 Leverage Ratio 13.84% 14.00% TCE / TA Ratio Tier 1 Leverage Ratio 14.00% 13.14% 13.00% 13.22% 13.07% 13.00% 11.82% 12.00% 11.73% 12.52% 11.55% 12.25% 11.28% 12.12% 12.00% 11.00% 10.55% 11.52% 11.37% 10.28% 10.21% 11.09% 10.00% 11.00% 10.09% 10.12% 10.64% 9.10% 10.48% 10.29% 9.00% 8.75% 8.72% 9.96% 9.99% 8.89% 10.00% 7.95% 7.92% 8.00% 9.11% 8.96% 7.72% 9.00% 7.00% 7.58% 6.00% 8.00% 2015Y 2016Y 2017Y 2018Y 2019YTD 2015Y 2016Y 2017Y 2018Y 2019YTD Source: S&P Global Market Intelligence; YTD financial data as of September 30, 2019 29

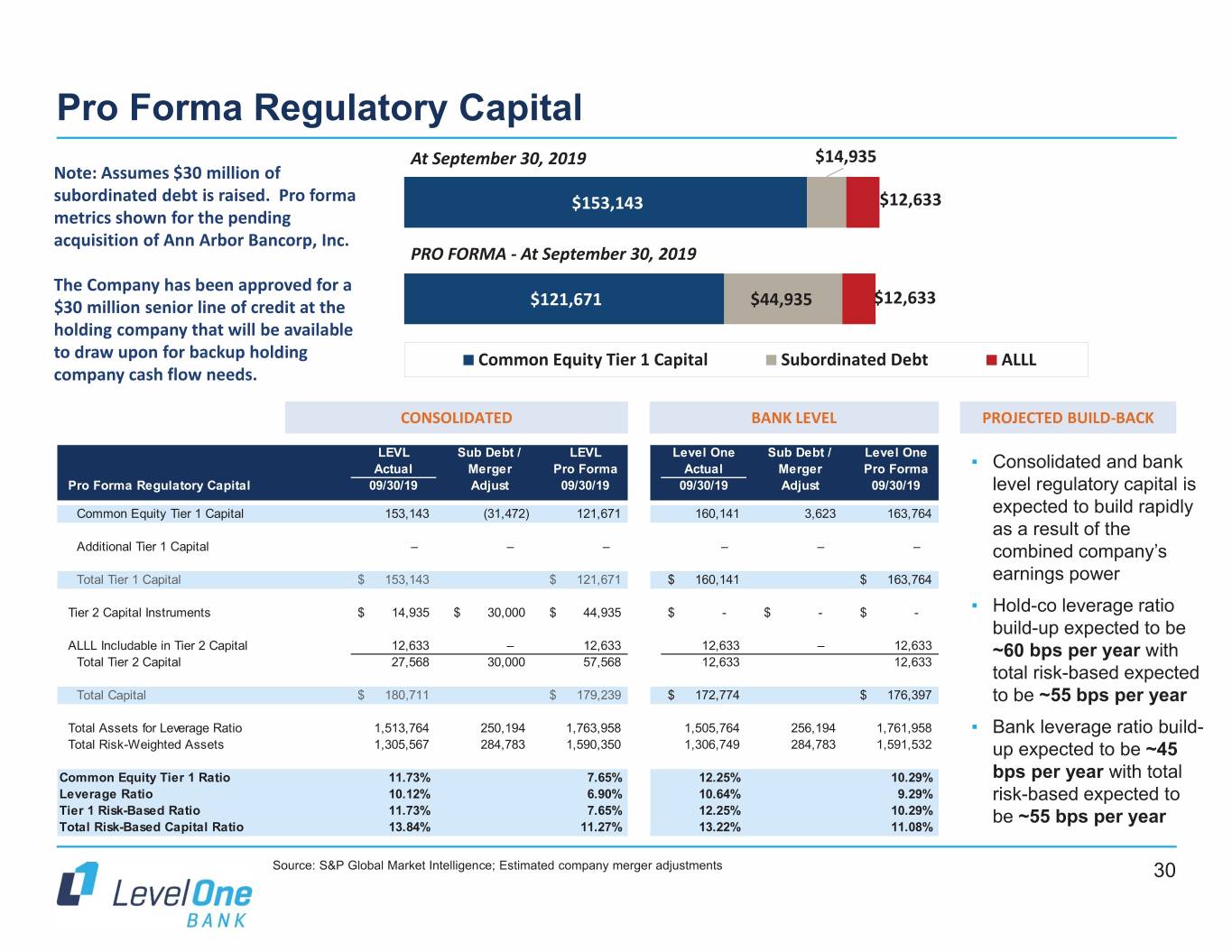

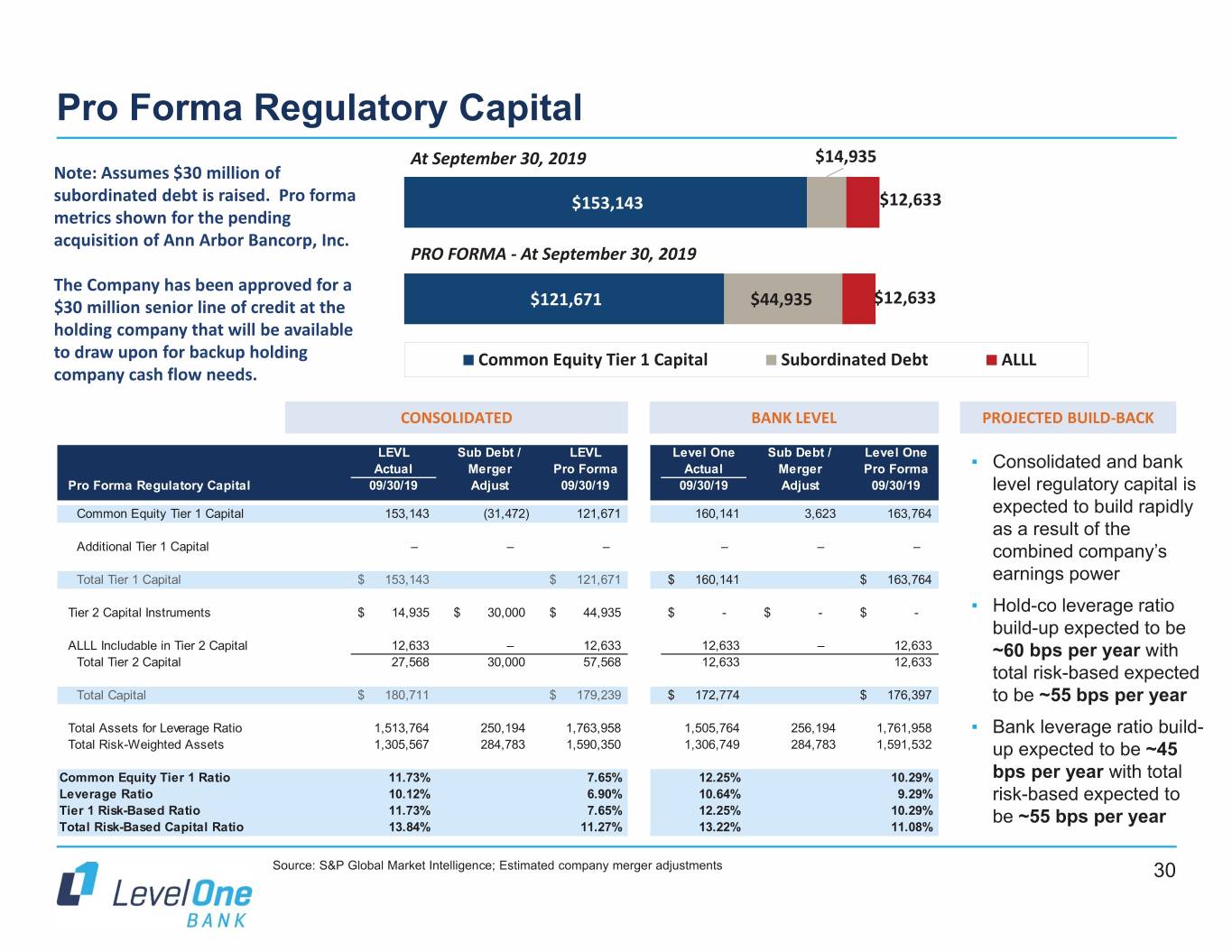

Pro Forma Regulatory Capital At September 30, 2019 $14,935 Note: Assumes $30 million of subordinated debt is raised. Pro forma $153,143 $12,633 metrics shown for the pending acquisition of Ann Arbor Bancorp, Inc. PRO FORMA - At September 30, 2019 The Company has been approved for a $12,633 $30 million senior line of credit at the $121,671 $44,935 holding company that will be available to draw upon for backup holding Common Equity Tier 1 Capital Subordinated Debt ALLL company cash flow needs. CONSOLIDATED BANK LEVEL PROJECTED BUILD-BACK LEVL Sub Debt / LEVL Level One Sub Debt / Level One Actual Merger Pro Forma Actual Merger Pro Forma ▪ Consolidated and bank Pro Forma Regulatory Capital 09/30/19 Adjust 09/30/19 09/30/19 Adjust 09/30/19 level regulatory capital is Common Equity Tier 1 Capital 153,143 (31,472) 121,671 160,141 3,623 163,764 expected to build rapidly as a result of the Additional Tier 1 Capital ––– –––combined company’s Total Tier 1 Capital$ 153,143 $ 121,671 $ 160,141 $ 163,764 earnings power Tier 2 Capital Instruments$ 14,935 $ 30,000 $ 44,935 $ - $ - $ - ▪ Hold-co leverage ratio build-up expected to be ALLL Includable in Tier 2 Capital 12,633 – 12,633 12,633 – 12,633 ~60 bps per year with Total Tier 2 Capital 27,568 30,000 57,568 12,633 12,633 total risk-based expected Total Capital$ 180,711 $ 179,239 $ 172,774 $ 176,397 to be ~55 bps per year Total Assets for Leverage Ratio 1,513,764 250,194 1,763,958 1,505,764 256,194 1,761,958 ▪ Bank leverage ratio build- Total Risk-Weighted Assets 1,305,567 284,783 1,590,350 1,306,749 284,783 1,591,532 up expected to be ~45 Common Equity Tier 1 Ratio 11.73% 7.65% 12.25% 10.29% bps per year with total Leverage Ratio 10.12% 6.90% 10.64% 9.29% risk-based expected to Tier 1 Risk-Based Ratio 11.73% 7.65% 12.25% 10.29% be ~55 bps per year Total Risk-Based Capital Ratio 13.84% 11.27% 13.22% 11.08% Source: S&P Global Market Intelligence; Estimated company merger adjustments 30

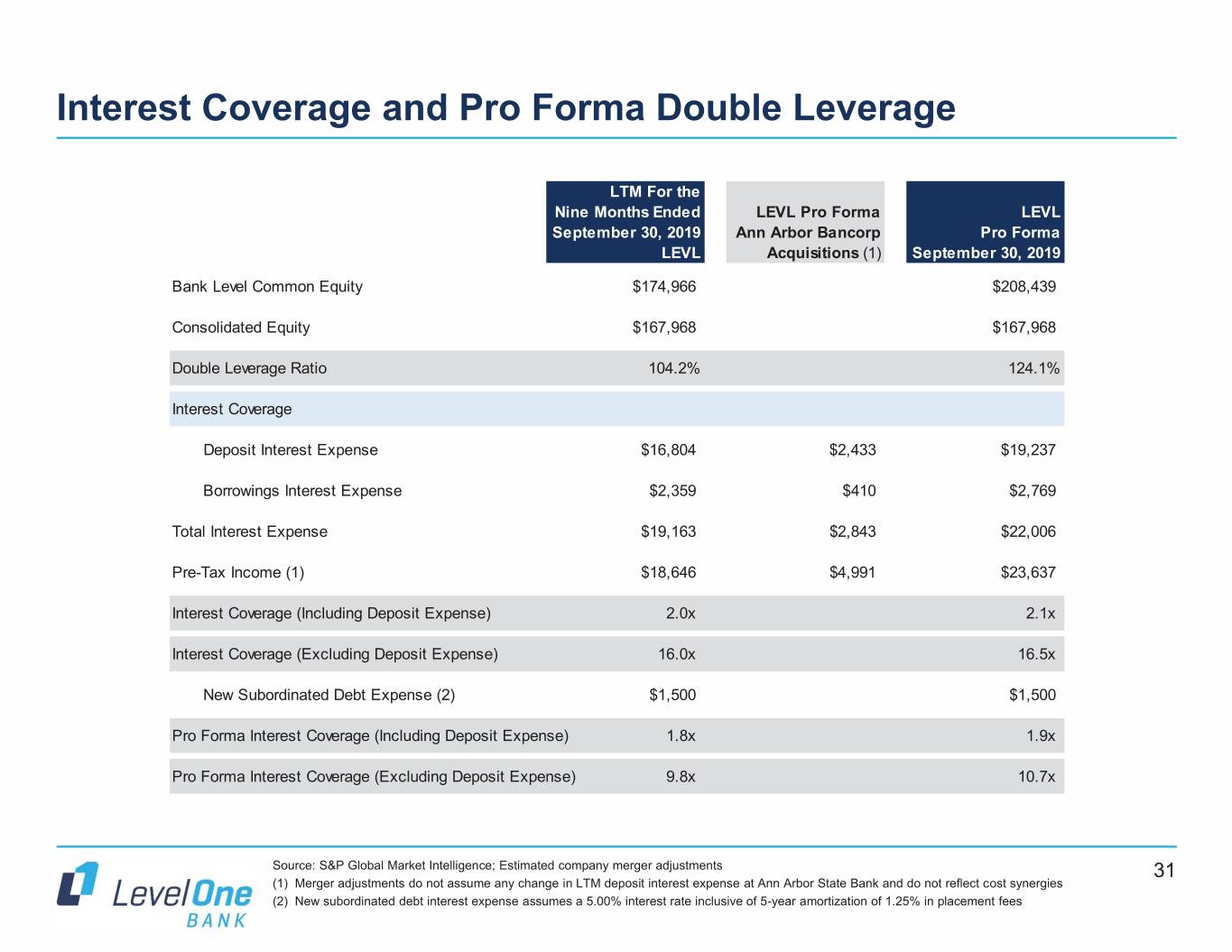

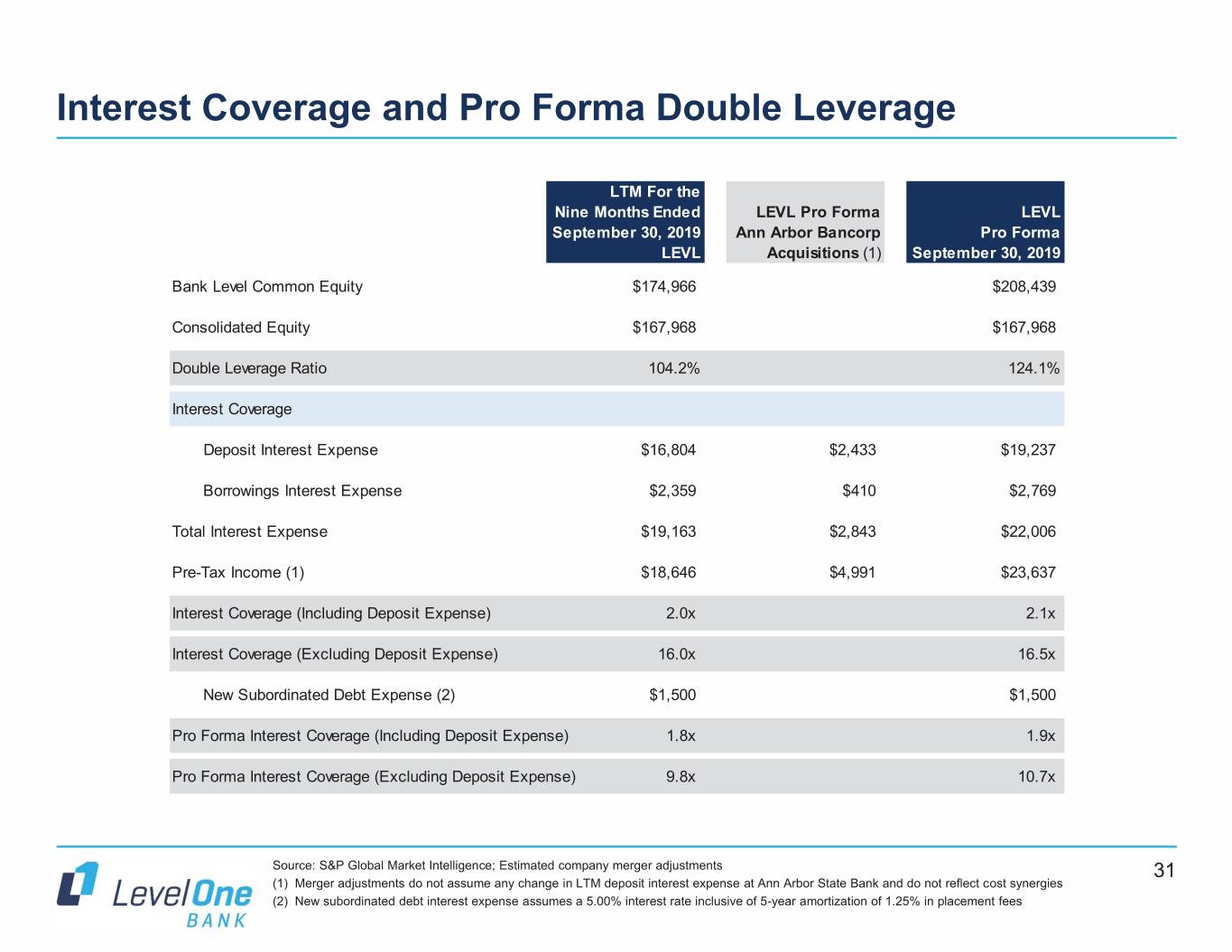

Interest Coverage and Pro Forma Double Leverage LTM For the Nine Months Ended LEVL Pro Forma LEVL September 30, 2019 Ann Arbor Bancorp Pro Forma LEVL Acquisitions (1) September 30, 2019 Bank Level Common Equity $174,966 $208,439 Consolidated Equity $167,968 $167,968 Double Leverage Ratio 104.2% 124.1% Interest Coverage Deposit Interest Expense $16,804 $2,433 $19,237 Borrowings Interest Expense $2,359 $410 $2,769 Total Interest Expense $19,163 $2,843 $22,006 Pre-Tax Income (1) $18,646 $4,991 $23,637 Interest Coverage (Including Deposit Expense) 2.0x 2.1x Interest Coverage (Excluding Deposit Expense) 16.0x 16.5x New Subordinated Debt Expense (2) $1,500 $1,500 Pro Forma Interest Coverage (Including Deposit Expense) 1.8x 1.9x Pro Forma Interest Coverage (Excluding Deposit Expense) 9.8x 10.7x Source: S&P Global Market Intelligence; Estimated company merger adjustments 31 (1) Merger adjustments do not assume any change in LTM deposit interest expense at Ann Arbor State Bank and do not reflect cost synergies (2) New subordinated debt interest expense assumes a 5.00% interest rate inclusive of 5-year amortization of 1.25% in placement fees

Investment Summary 9 Offers investment grade debt at attractive coupon 9 Entrepreneurial culture combined with advanced banking solutions 9 Proven ability to grow organically and through disciplined M&A 9 Solid core performance which is expected to be improved by Ann Arbor State Bank’s balance sheet profile and earnings synergies 9 Experienced executive management team with significant continuity at Level One and an average of 30 years working in financial services 9 Strong credit culture and risk management 9 Scalable infrastructure due to investments in technology, compliance and BSA/AML team 9 Operating in one the largest and most demographically attractive markets in the Midwest (which is further enhanced by the Ann Arbor transaction) 9 Significant insider ownership with focus on enhancing franchise value 32

APPENDIX 33

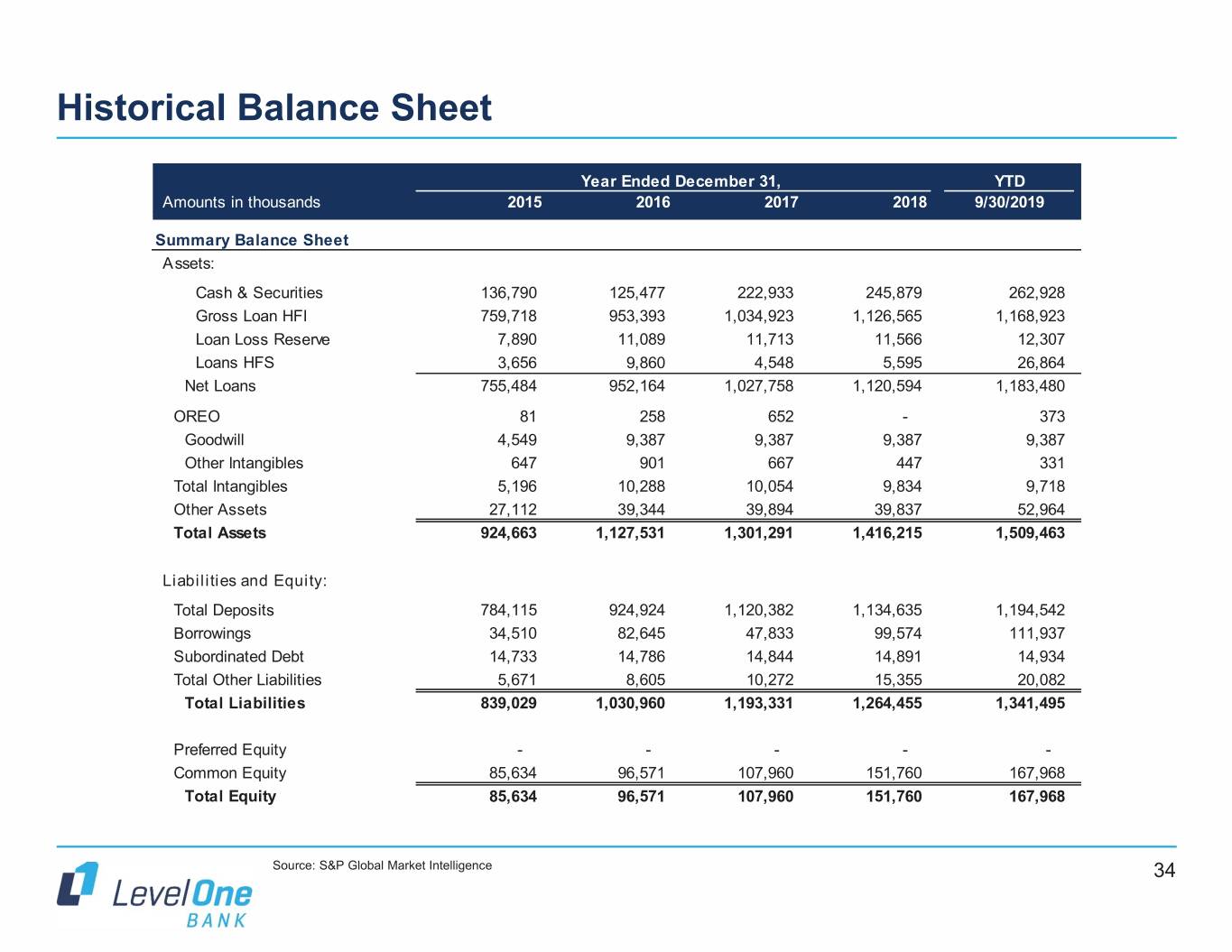

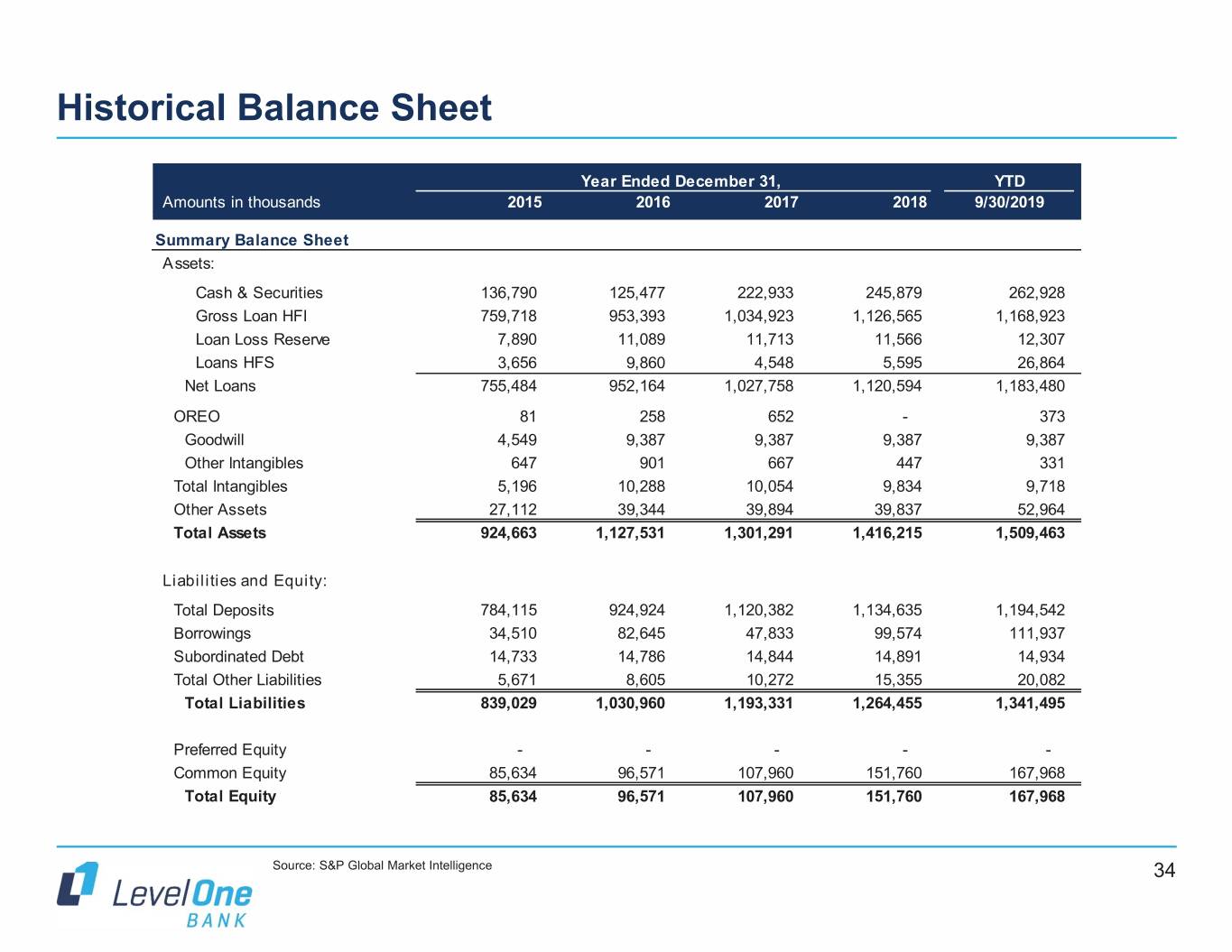

Historical Balance Sheet Year Ended December 31, YTD Amounts in thousands 2015 2016 2017 2018 9/30/2019 Summary Balance Sheet A ssets: Cash & Securities 136,790 125,477 222,933 245,879 262,928 Gross Loan HFI 759,718 953,393 1,034,923 1,126,565 1,168,923 Loan Loss Reserve 7,890 11,089 11,713 11,566 12,307 Loans HFS 3,656 9,860 4,548 5,595 26,864 Net Loans 755,484 952,164 1,027,758 1,120,594 1,183,480 OREO 81 258 652 - 373 Goodwill 4,549 9,387 9,387 9,387 9,387 Other Intangibles 647 901 667 447 331 Total Intangibles 5,196 10,288 10,054 9,834 9,718 Other Assets 27,112 39,344 39,894 39,837 52,964 Total Assets 924,663 1,127,531 1,301,291 1,416,215 1,509,463 Liabilities and Equity: Total Deposits 784,115 924,924 1,120,382 1,134,635 1,194,542 Borrowings 34,510 82,645 47,833 99,574 111,937 Subordinated Debt 14,733 14,786 14,844 14,891 14,934 Total Other Liabilities 5,671 8,605 10,272 15,355 20,082 Total Liabilities 839,029 1,030,960 1,193,331 1,264,455 1,341,495 Preferred Equity - - - - - Common Equity 85,634 96,571 107,960 151,760 167,968 Total Equity 85,634 96,571 107,960 151,760 167,968 Source: S&P Global Market Intelligence 34

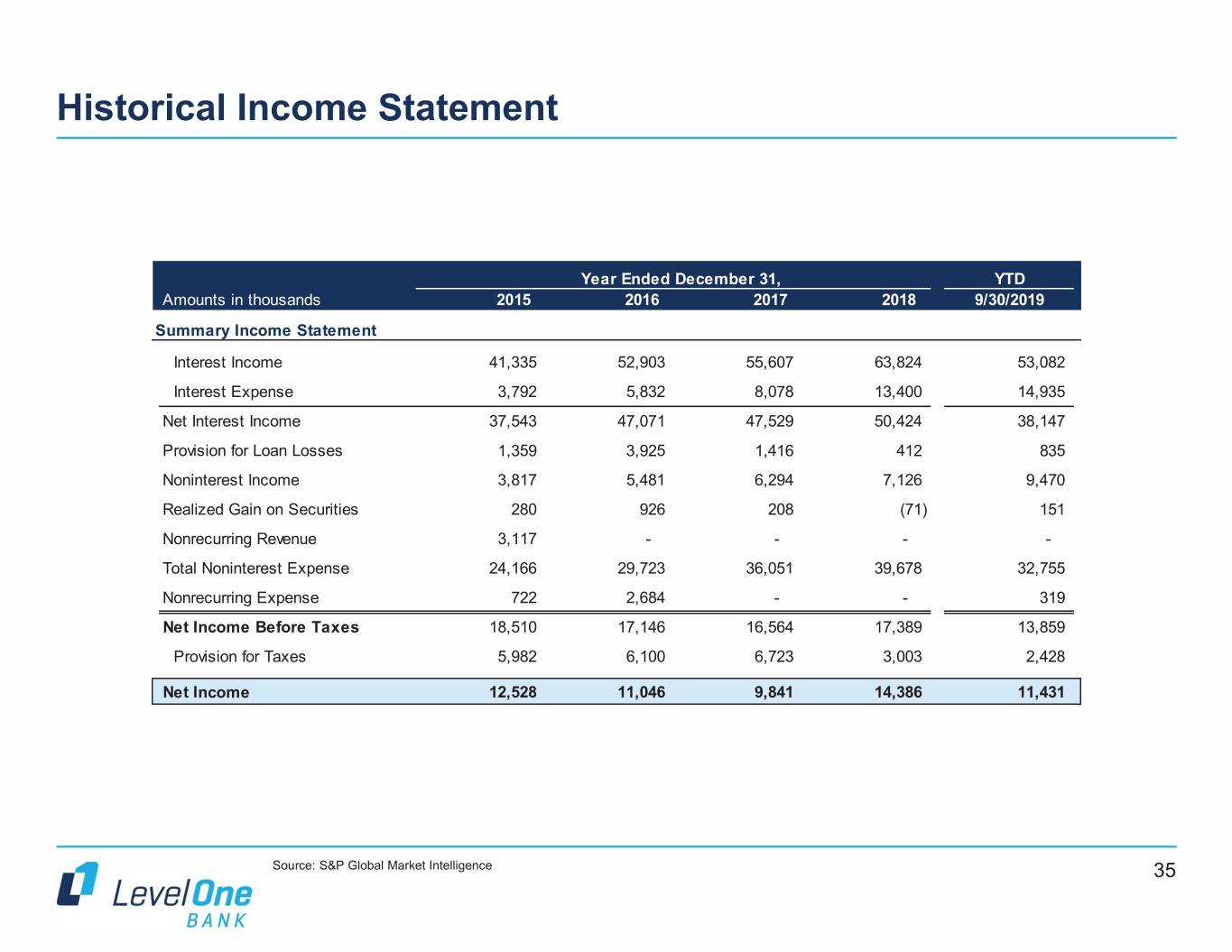

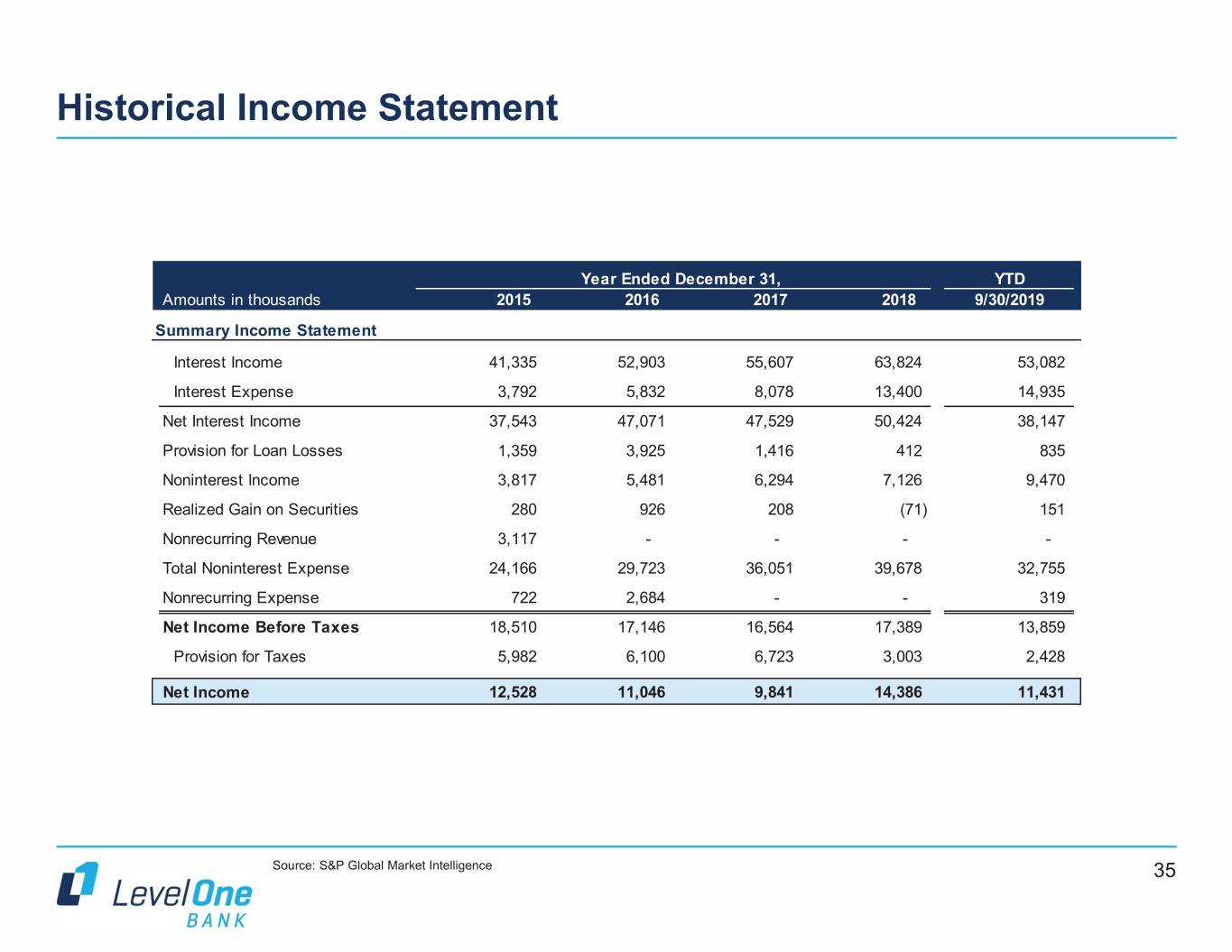

Historical Income Statement Year Ended December 31, YTD Amounts in thousands 2015 2016 2017 2018 9/30/2019 Summary Income Statement Interest Income 41,335 52,903 55,607 63,824 53,082 Interest Expense 3,792 5,832 8,078 13,400 14,935 Net Interest Income 37,543 47,071 47,529 50,424 38,147 Provision for Loan Losses 1,359 3,925 1,416 412 835 Noninterest Income 3,817 5,481 6,294 7,126 9,470 Realized Gain on Securities 280 926 208 (71) 151 Nonrecurring Revenue 3,117 - - - - Total Noninterest Expense 24,166 29,723 36,051 39,678 32,755 Nonrecurring Expense 722 2,684 - - 319 Net Income Before Taxes 18,510 17,146 16,564 17,389 13,859 Provision for Taxes 5,982 6,100 6,723 3,003 2,428 Net Income 12,528 11,046 9,841 14,386 11,431 Source: S&P Global Market Intelligence 35