UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22126

Name of Fund: BlackRock Defined Opportunity Credit Trust (BHL)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Defined Opportunity Credit Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 08/31/2014

Date of reporting period: 08/31/2014

| Item 1 – | Report to Stockholders |

| ANNUAL REPORT |  |

Not FDIC Insured • May Lose Value • No Bank Guarantee |

Table of Contents

| Page | ||||||

Shareholder Letter | 3 | |||||

Annual Report: | ||||||

Fund Summaries | 4 | |||||

The Benefits and Risks of Leveraging | 10 | |||||

Derivative Financial Instruments | 10 | |||||

Financial Statements | ||||||

Schedules of Investments | 11 | |||||

Statements of Assets and Liabilities | 50 | |||||

Statements of Operations | 51 | |||||

Statements of Changes in Net Assets | 52 | |||||

Statements of Cash Flows | 55 | |||||

Financial Highlights | 56 | |||||

Notes to Financial Statements | 59 | |||||

Report of Independent Registered Public Accounting Firm | 75 | |||||

Important Tax Information | 75 | |||||

Disclosure of Investment Advisory Agreements | 76 | |||||

Automatic Dividend Reinvestment Plans | 80 | |||||

Officers and Directors | 81 | |||||

Additional Information | 84 |

| 2 | ANNUAL REPORT | AUGUST 31, 2014 |

President, BlackRock Advisors, LLC

| |

| Asset prices pushed higher over the period despite modest global growth, geopolitical risks and a shift toward tighter U.S. monetary policy. |

Total Returns as of August 31, 2014

| 6-month | 12-month | |||||||||

U.S. large cap equities (S&P 500® Index) | 8.84 | % | 25.25 | % | ||||||

U.S. small cap equities (Russell 2000® Index) | (0.06 | ) | 17.68 | |||||||

| International equities (MSCI Europe, Australasia, Far East Index) | 1.24 | 16.44 | ||||||||

| Emerging market equities (MSCI Emerging Markets Index) | 14.52 | 19.98 | ||||||||

| 3-month Treasury bills (BofA Merrill Lynch 3-Month U.S. Treasury Bill Index) | 0.02 | 0.05 | ||||||||

| U.S. Treasury securities (BofA Merrill Lynch 10-Year U.S. Treasury Index) | 4.35 | 7.07 | ||||||||

| U.S. investment grade bonds (Barclays U.S. Aggregate Bond Index) | 2.74 | 5.66 | ||||||||

| Tax-exempt municipal bonds (S&P Municipal Bond Index) | 4.21 | 10.55 | ||||||||

| U.S. high yield bonds (Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | 2.89 | 10.57 | ||||||||

| THIS PAGE NOT PART OF YOUR FUND REPORT | 3 |

Fund Overview

Portfolio Management Commentary

| • | For the 12-month period ended August 31, 2014, the Fund returned 6.75% based on market price and 5.98% based on NAV. For the same period, the closed-end Lipper Loan Participation Funds category posted an average return of 1.03% based on market price and 6.55% based on NAV. All returns reflect reinvestment of dividends. The Fund’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

| • | Selection among individual credits had a positive impact on performance. The Fund was broadly diversified across more than 300 issuers, many of which contributed positively to returns. Notably, the largest contributors were Caesars Entertainment Resort Properties LLC (gaming), First Data Corp. (software), La Quinta Intermediate Holdings (lodging) and HD Supply, Inc. (industrial distribution). The Fund’s preference for B-rated loans over BB-rated loans proved beneficial as the BB-rated segment underperformed during the period. |

| • | The Fund’s limited exposure to CCC and lower-rated as well as less liquid loan credits represented a missed opportunity for additional gains, as these segments performed well during the period. |

| • | During the period, the Fund maintained its overall focus on the higher quality segments of the loan market in terms of loan structure, liquidity and overall credit quality. With the average loan trading recently at or just above par (i.e., with limited or no upside), the Fund has concentrated its investments in strong companies with stable cash flows and high quality collateral, with the ability to meet interest obligations and ultimately return principal. The Fund has been actively participating in the new-issue market, where the more appealing investment opportunities have been emerging. As we expect modest growth and improving economic conditions, in the latter half of the period the Fund modestly increased exposure to CCC-rated loans and reduced exposure to fixed-coupon high yield bonds as valuations in that market moved closer to fair value. |

| • | At period end, the Fund held 95% of its total portfolio in floating rate loan interests (bank loans), with the remainder in corporate bonds and other interests. The Fund maintained a concentration in higher coupon B-rated loans of select issuers while limiting exposure to low coupon BB-rated loans. Additionally, the Fund favored CCC-rated loans, while maintaining generally low exposure to lower quality, less liquid loans. |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

| 4 | ANNUAL REPORT | AUGUST 31, 2014 |

| BlackRock Defined Opportunity Credit Trust |

Fund Information

Symbol on New York Stock Exchange (“NYSE”) | BHL | |||

Initial Offering Date | January 31, 2008 | |||

Current Distribution Rate on Closing Market Price as of August 31, 2014 ($13.84)1 | 5.25% | |||

Current Monthly Distribution per Common Share2 | $0.0605 | |||

Current Annualized Distribution per Common Share2 | $0.7260 | |||

Economic Leverage as of August 31, 20143 | 30% |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a tax return of capital. Past performance does not guarantee future results. |

| 2 | The monthly distribution per common share, declared on October 1, 2014, was decreased to $0.0583 per share. The current distribution rate on closing market price, current monthly distribution per common share and current annualized distribution per common share do not reflect the new distribution rate. The new distribution rate is not constant and is subject to change in the future. |

| 3 | Represents bank borrowings outstanding as a percentage of total managed assets, which is the total assets of the Fund (including any assets attributable to borrowings) minus the sum of liabilities (other than borrowings representing financial leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 10. |

Market Price and Net Asset Value Per Share Summary

| | 8/31/14 | | 8/31/13 | | Change | | High | | Low | |||||||||||||

Market Price | $ | 13.84 | $ | 13.77 | 0.51 | % | $ | 14.20 | $ | 13.48 | ||||||||||||

Net Asset Value | $ | 14.41 | $ | 14.44 | (0.21 | )% | $ | 14.56 | $ | 14.32 | ||||||||||||

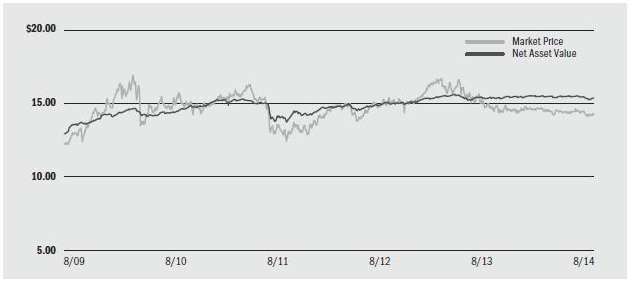

Market Price and Net Asset Value History For the Past Five Years

Overview of the Fund’s Long-Term Investments

| Portfolio Composition | | 8/31/14 | | 8/31/13 | ||||||

Floating Rate Loan Interests | 95 | % | 94 | % | ||||||

Corporate Bonds | 2 | 3 | ||||||||

Asset-Backed Securities | 2 | 2 | ||||||||

Common Stocks | 1 | 1 | ||||||||

| Credit Quality Allocation4 | | 8/31/14 | | 8/31/135 | ||||||

BBB/Baa | 6 | % | 7 | % | ||||||

BB/Ba | 43 | 40 | ||||||||

B | 44 | 43 | ||||||||

CCC/Caa | 4 | 4 | ||||||||

N/R | 3 | 6 | ||||||||

| 4 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 5 | Information has been revised to conform to current year presentation. |

| ANNUAL REPORT | AUGUST 31, 2014 | 5 |

| Fund Summary as of August 31, 2014 | BlackRock Floating Rate Income Strategies Fund, Inc. |

Fund Overview

Portfolio Management Commentary

| • | For the 12-month period ended August 31, 2014, the Fund returned 1.33% based on market price and 6.45% based on NAV. For the same period, the closed-end Lipper Loan Participation Funds category posted an average return of 1.03% based on market price and 6.55% based on NAV. All returns reflect reinvestment of dividends. The Fund’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

| • | Selection among individual credits had a positive impact on performance. The Fund was broadly diversified across more than 300 issuers, many of which contributed positively to returns. Notably, the largest contributors were Caesars Entertainment Resort Properties LLC (gaming), First Data Corp. (software), La Quinta Intermediate Holdings (lodging) and HD Supply, Inc. (industrial distribution). The Fund’s preference for B-rated loans over BB-rated loans proved beneficial as the BB-rated segment underperformed during the period. |

| • | The Fund’s limited exposure to CCC and lower-rated as well as less liquid loan credits represented a missed opportunity for additional gains, as these segments performed well during the period. |

| • | During the period, the Fund maintained its overall focus on the higher quality segments of the loan market in terms of loan structure, liquidity and overall credit quality. With the average loan trading recently at or just above par (i.e., with limited or no upside), the Fund has concentrated its investments in strong companies with stable cash flows and high quality collateral, with the ability to meet interest obligations and ultimately return principal. The Fund has been actively participating in the new-issue market, where the more appealing investment opportunities have been emerging. As we expect modest growth and improving economic conditions, in the latter half of the period the Fund modestly increased exposure to CCC-rated loans and reduced exposure to fixed-coupon high yield bonds as valuations in that market moved closer to fair value. |

| • | At period end, the Fund held 94% of its total portfolio in floating rate loan interests (bank loans), with the remainder in corporate bonds and other interests. The Fund maintained a concentration in higher coupon B-rated loans of select issuers while limiting exposure to low coupon BB-rated loans. Additionally, the Fund favored CCC-rated loans, while maintaining generally low exposure to lower quality, less liquid loans. |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

| 6 | ANNUAL REPORT | AUGUST 31, 2014 |

| BlackRock Floating Rate Income Strategies Fund, Inc. |

Fund Information

Symbol on NYSE | FRA | |||

Initial Offering Date | October 31, 2003 | |||

Current Distribution Rate on Closing Market Price as of August 31, 2014 ($14.26)1 | 5.89% | |||

Current Monthly Distribution per Common Share2 | $0.07 | |||

Current Annualized Distribution per Common Share2 | $0.84 | |||

Economic Leverage as of August 31, 20143 | 29% |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a tax return of capital. Past performance does not guarantee future results. |

| 2 | The monthly distribution per common share, declared on October 1, 2014, was decreased to $0.0674 per share. The current distribution rate on closing market price, current monthly distribution per common share and current annualized distribution per common share do not reflect the new distribution rate. The new distribution rate is not constant and is subject to change in the future. |

| 3 | Represents bank borrowings outstanding as a percentage of total managed assets, which is the total assets of the Fund (including any assets attributable to borrowings) minus the sum of liabilities (other than borrowings representing financial leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 10. |

Market Price and Net Asset Value Per Share Summary

| | 8/31/14 | | 8/31/13 | | Change | | High | | Low | |||||||||||||

Market Price | $ | 14.26 | $ | 14.96 | (4.68 | )% | $ | 15.02 | $ | 14.11 | ||||||||||||

Net Asset Value | $ | 15.38 | $ | 15.36 | 0.13 | % | $ | 15.54 | $ | 15.26 | ||||||||||||

Market Price and Net Asset Value History For the Past Five Years

Overview of the Fund’s Long-Term Investments

| Portfolio Composition | | 8/31/14 | | 8/31/13 | ||||||

Floating Rate Loan Interests | 94 | % | 92 | % | ||||||

Corporate Bonds | 3 | 4 | ||||||||

Asset-Backed Securities | 2 | 3 | ||||||||

Common Stocks | 1 | 1 | ||||||||

| Credit Quality Allocation4 | | 8/31/14 | | 8/31/135 | ||||||

BBB/Baa | 6 | % | 7 | % | ||||||

BB/Ba | 43 | 39 | ||||||||

B | 43 | 44 | ||||||||

CCC/Caa | 4 | 4 | ||||||||

N/R | 4 | 6 | ||||||||

| 4 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 5 | Information has been revised to conform to current year presentation. |

| ANNUAL REPORT | AUGUST 31, 2014 | 7 |

| Fund Summary as of August 31, 2014 | BlackRock Limited Duration Income Trust |

Fund Overview

• | intermediate duration, investment grade corporate bonds, mortgage-related securities, asset-backed securities and US Government and agency securities; |

• | senior, secured floating rate loans made to corporate and other business entities; and |

• | US dollar-denominated securities of US and non-US issuers rated below investment grade and, to a limited extent, non-US dollar denominated securities of non-US issuers rated below investment grade. |

Portfolio Management Commentary

| • | For the 12-month period ended August 31, 2014, the Fund returned 6.89% based on market price and 10.77% based on NAV. For the same period, the closed-end Lipper High Yield Funds (Leveraged) category posted an average return of 15.47% based on market price and 14.60% based on NAV. All returns reflect reinvestment of dividends. The Fund’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

| • | In a generally positive environment for fixed income markets, high yield credit and bank loans performed well. In particular, the strong macroeconomic backdrop and market fundamentals that gave rise to net negative supply supported further spread tightening, particularly in asset-backed securities (“ABS”). The largest contributors to the Fund’s performance were its positions in high yield, bank loans and investment grade industrials. Exposure to non-US dollar positions also had a positive impact on performance, as did commercial mortgage-backed securities (“CMBS”), non-agency adjustable-rate mortgages and collateralized mortgage obligations (“CMOs”). In addition, the Fund’s ABS and equity positions enhanced results. |

| • | Based on the view that short-term rates would remain low, the Fund maintained a high level of leverage to augment income generation throughout the period. |

| • | Conversely, the principal detractor from the Fund’s performance over the past 12 months was the Fund’s derivatives exposure to manage duration. |

| • | The Fund’s allocations remained consistent throughout the 12-month period, with its largest position in high yield, followed by allocations to bank loans and investment grade corporate credit and securitized credits, including CMBS and ABS. |

| • | At period end, the Fund maintained diversified exposure to non-government spread sectors including high yield and investment grade corporate credit, CMBS and ABS, as well as agency and non-agency residential mortgage-backed securities. |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

| 8 | ANNUAL REPORT | AUGUST 31, 2014 |

| BlackRock Limited Duration Income Trust |

Fund Information

Symbol on NYSE | BLW | |||

Initial Offering Date | July 30, 2003 | |||

Current Distribution Rate on Closing Market Price as of August 31, 2014 ($16.81)1 | 7.10% | |||

Current Monthly Distribution per Common Share2 | $0.0995 | |||

Current Annualized Distribution per Common Share2 | $1.1940 | |||

Economic Leverage as of August 31, 20143 | 31% |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a tax return of capital. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. |

| 3 | Represents reverse repurchase agreements outstanding as a percentage of total managed assets, which is the total assets of the Fund (including any assets attributable to borrowing) minus the sum of liabilities (other than borrowings representing financial leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 10. |

Market Price and Net Asset Value Per Share Summary

| | 8/31/14 | | 8/31/13 | | Change | | High | | Low | |||||||||||||

Market Price | $ | 16.81 | $ | 16.89 | (0.47 | )% | $ | 17.62 | $ | 16.15 | ||||||||||||

Net Asset Value | $ | 18.09 | $ | 17.54 | 3.14 | % | $ | 18.31 | $ | 17.54 | ||||||||||||

Market Price and Net Asset Value History For the Past Five Years

Overview of the Fund’s Long-Term Investments

| Portfolio Composition | | 8/31/14 | | 8/31/13 | ||||||

Corporate Bonds | 42 | % | 44 | % | ||||||

Floating Rate Loan Interests | 32 | 36 | ||||||||

Preferred Securities | 8 | 1 | ||||||||

Non-Agency Mortgage-Backed Securities | 7 | 8 | ||||||||

Asset-Backed Securities | 5 | 6 | ||||||||

U.S. Government Sponsored Agency Securities | 4 | 4 | ||||||||

Common Stocks | 1 | 1 | ||||||||

Foreign Agency Obligations | 1 | - | ||||||||

| Credit Quality Allocation4 | | 8/31/14 | | 8/31/135 | ||||||

AAA/Aaa6 | 6 | % | 4 | % | ||||||

AA/Aa | 2 | 2 | ||||||||

A | 3 | 5 | ||||||||

BBB/Baa | 15 | 13 | ||||||||

BB/Ba | 32 | 27 | ||||||||

B | 31 | 32 | ||||||||

CCC/Caa | 7 | 7 | ||||||||

D | — | 1 | ||||||||

N/R | 4 | 9 | ||||||||

| 4 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 5 | Information has been revised to conform to current year presentation. |

| 6 | The investment advisor evaluates the credit quality of not-rated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuer. Using this approach, the investment advisor has deemed U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations as AAA/Aaa. |

| ANNUAL REPORT | AUGUST 31, 2014 | 9 |

| 10 | ANNUAL REPORT | AUGUST 31, 2014 |

| Schedule of Investments August 31, 2014 | BlackRock Defined Opportunity Credit Trust (BHL) (Percentages shown are based on Net Assets) |

| Common Stocks (a) | Shares | Value | |||||||||||||

Diversified Consumer Services — 0.2% | |||||||||||||||

Cengage Thomson Learning | 8,922 | $ | 282,533 | ||||||||||||

Software — 0.4% | |||||||||||||||

HMH Holdings/EduMedia | 24,355 | 467,616 | |||||||||||||

Total Common Stocks — 0.6% | 750,149 | ||||||||||||||

Asset-Backed Securities (b)(c) | Par (000) | ||||||||||||||

ALM Loan Funding, Series 2013-7RA, Class C, 3.68%, 4/24/24 | USD | 500 | 477,941 | ||||||||||||

ALM XIV Ltd., Series 2014-14A: | |||||||||||||||

Class B, 3.18%, 7/28/26 | 563 | 553,845 | |||||||||||||

Class C, 3.68%, 7/28/26 | 713 | 676,305 | |||||||||||||

Atlas Senior Loan Fund Ltd., 3.94%, 10/15/26 (d) | 250 | 237,200 | |||||||||||||

Atrium CDO Corp., Series 9A, Class D, 3.74%, 2/28/24 | 250 | 238,982 | |||||||||||||

Carlyle Global Market Strategies CLO Ltd., Series 2012-4A, Class D, 4.73%, 1/20/25 | 250 | 250,833 | |||||||||||||

Fraser Sullivan CLO VII Ltd., Series 2012-7A, Class C, 4.23%, 4/20/23 | 215 | 213,336 | |||||||||||||

North End CLO Ltd., Series 2013-1A, Class D, 3.73%, 7/17/25 | 250 | 236,452 | |||||||||||||

Octagon Investment Partners XVII Ltd., Series 2013-1A, Class D, 3.43%, 10/25/25 | 250 | 233,424 | |||||||||||||

Octagon Investment Partners XX Ltd., Series 2014-1A, Class C, 3.04%, 8/12/26 | 250 | 245,275 | |||||||||||||

Symphony CLO Ltd., Series 2012-10A, Class D, 5.48%, 7/23/23 | 350 | 350,483 | |||||||||||||

Total Asset-Backed Securities — 2.8% | 3,714,076 | ||||||||||||||

Corporate Bonds | |||||||||||||||

Airlines — 0.7% | |||||||||||||||

American Airlines Pass-Through Trust, Series 2013-2, Class C, 6.00%, 1/15/17 (c) | 250 | 258,750 | |||||||||||||

Delta Air Lines Pass-Through Trust, Series 2009-1, Class B, 9.75%, 12/17/16 | 46 | 51,702 | |||||||||||||

US Airways Pass-Through Trust, Series 2012-2, Class C, 5.45%, 6/03/18 | 590 | 600,325 | |||||||||||||

| 910,777 | |||||||||||||||

Auto Components — 0.2% | |||||||||||||||

Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | |||||||||||||||

3.50%, 3/15/17 | 164 | 165,025 | |||||||||||||

4.88%, 3/15/19 | 105 | 107,887 | |||||||||||||

| 272,912 | |||||||||||||||

Chemicals — 0.1% | |||||||||||||||

INEOS Finance PLC, 8.38%, 2/15/19 (c) | 110 | 119,350 | |||||||||||||

Commercial Services & Supplies — 0.3% | |||||||||||||||

Avis Budget Car Rental LLC/Avis Budget Finance, Inc., 2.98%, 12/01/17 (b) | 68 | 67,660 | |||||||||||||

AWAS Aviation Capital Ltd., 7.00%, 10/17/16 (c) | 250 | 255,594 | |||||||||||||

United Rentals North America, Inc., 5.75%, 7/15/18 | 80 | 84,200 | |||||||||||||

| 407,454 | |||||||||||||||

| Corporate Bonds | Par (000) | Value | |||||||||||||

Communications Equipment — 0.4% | |||||||||||||||

Avaya, Inc., 7.00%, 4/01/19 (c) | USD | 101 | $ | 100,495 | |||||||||||

Zayo Group LLC/Zayo Capital, Inc., 8.13%, 1/01/20 | 380 | 409,925 | |||||||||||||

| 510,420 | |||||||||||||||

Diversified Financial Services — 0.3% | |||||||||||||||

Ally Financial, Inc., 2.91%, 7/18/16 (b) | 275 | 280,363 | |||||||||||||

Reynolds Group Issuer, Inc., 7.13%, 4/15/19 | 120 | 124,650 | |||||||||||||

| 405,013 | |||||||||||||||

Diversified Telecommunication Services — 0.3% | |||||||||||||||

Level 3 Financing, Inc. (c): | |||||||||||||||

3.82%, 1/15/18 (b) | 228 | 229,140 | |||||||||||||

6.13%, 1/15/21 | 127 | 133,985 | |||||||||||||

| 363,125 | |||||||||||||||

Hotels, Restaurants & Leisure — 0.4% | |||||||||||||||

Caesars Entertainment Operating Co., Inc., 9.00%, 2/15/20 | 642 | 514,166 | |||||||||||||

Independent Power and Renewable Electricity Producers — 0.1% | |||||||||||||||

Calpine Corp., 6.00%, 1/15/22 (c) | 80 | 86,200 | |||||||||||||

Media — 0.2% | |||||||||||||||

NAI Entertainment Holdings/NAI Entertainment Holdings Finance Corp., 5.00%, 8/01/18 (c) | 96 | 98,640 | |||||||||||||

Numericable Group SA, 6.00%, 5/15/22 (c) | 200 | 206,000 | |||||||||||||

| 304,640 | |||||||||||||||

Oil, Gas & Consumable Fuels — 0.1% | |||||||||||||||

EP Energy LLC/Everest Acquisition Finance, Inc., 6.88%, 5/01/19 | 145 | 152,975 | |||||||||||||

Road & Rail — 0.2% | |||||||||||||||

Florida East Coast Holdings Corp., 6.75%, 5/01/19 (c) | 196 | 206,780 | |||||||||||||

Wireless Telecommunication Services — 0.0% | |||||||||||||||

T-Mobile USA, Inc., 6.13%, 1/15/22 | 50 | 51,813 | |||||||||||||

Total Corporate Bonds — 3.3% | 4,305,625 | ||||||||||||||

Floating Rate Loan Interests (b) | |||||||||||||||

Aerospace & Defense — 1.7% | |||||||||||||||

DigitalGlobe, Inc., Term Loan B, 3.75%, 1/31/20 | 509 | 506,274 | |||||||||||||

TASC, Inc., 2nd Lien Term Loan, 12.00%, 5/30/21 | 275 | 269,500 | |||||||||||||

Transdigm, Inc.: | |||||||||||||||

Term Loan C, 3.75%, 2/28/20 | 222 | 220,120 | |||||||||||||

Term Loan D, 3.75%, 6/04/21 | 200 | 198,584 | |||||||||||||

TransUnion LLC, Term Loan, 4.00%, 4/09/21 | 1,087 | 1,082,295 | |||||||||||||

| 2,276,773 | |||||||||||||||

Air Freight & Logistics — 0.5% | |||||||||||||||

CEVA Group PLC, Synthetic LC, 6.50%, 3/19/21 | 166 | 160,225 | |||||||||||||

CEVA Intercompany BV, Dutch Term Loan, 6.50%, 3/19/21 | 175 | 170,543 | |||||||||||||

CEVA Logistics Canada ULC, Canadian Term Loan, 6.50%, 3/19/21 | 30 | 29,404 | |||||||||||||

CEVA Logistics U.S. Holdings, Inc., Term Loan, 6.50%, 3/19/21 | 241 | 235,233 | |||||||||||||

| 595,405 | |||||||||||||||

Portfolio Abbreviations

ABS ADS CAD CLO DIP | Asset-Backed Security American Depositary Shares Canadian Dollar Collateralized Loan Obligation Debtor-In-Possession | EUR GBP LIBOR OIS OTC | Euro British Pound London Interbank Offered Rate Overnight Indexed Swap Over-the-Counter | PIK REMIC SGD USD | Payment-In-Kind Real Estate Mortgage Investment Conduit Singapore Dollar U.S. Dollar |

| ANNUAL REPORT | AUGUST 31, 2014 | 11 |

| Schedule of Investments (continued) | BlackRock Defined Opportunity Credit Trust (BHL) (Percentages shown are based on Net Assets) |

| Floating Rate Loan Interests (b) | Par (000) | Value | |||||||||||||

Airlines — 0.8% | |||||||||||||||

Delta Air Lines, Inc., 2018 Term Loan B1, 3.25%, 10/18/18 | USD | 324 | $ | 320,573 | |||||||||||

Northwest Airlines, Inc.: | |||||||||||||||

2.18%, 3/10/17 | 178 | 173,753 | |||||||||||||

1.56%, 9/10/18 | 245 | 233,803 | |||||||||||||

US Airways Group, Inc., Term Loan B1, 3.50%, 5/23/19 | 257 | 254,826 | |||||||||||||

| 982,955 | |||||||||||||||

Auto Components — 4.5% | |||||||||||||||

Affinia Group Intermediate Holdings, Inc., Term Loan B2, 4.75%, 4/27/20 | 293 | 294,212 | |||||||||||||

Armored Autogroup, Inc., Term Loan B, 6.00%, 11/04/16 | 57 | 57,434 | |||||||||||||

Autoparts Holdings Ltd.: | |||||||||||||||

1st Lien Term Loan, 6.50%, 7/28/17 | 625 | 624,485 | |||||||||||||

2nd Lien Term Loan, 10.50%, 1/29/18 | 238 | 228,990 | |||||||||||||

Dayco Products LLC, Term Loan B, 5.25%, 12/12/19 | 358 | 358,200 | |||||||||||||

FPC Holdings, Inc., 1st Lien Term Loan, 5.25%, 11/19/19 | 328 | 324,741 | |||||||||||||

Gates Global, Inc., Term Loan B, 4.25%, 7/05/21 | 2,010 | 1,994,202 | |||||||||||||

The Goodyear Tire & Rubber Co., 2nd Lien Term Loan, 4.75%, 4/30/19 | 1,150 | 1,153,232 | |||||||||||||

Transtar Holding Co., 1st Lien Term Loan, 5.75%, 10/09/18 | 481 | 478,508 | |||||||||||||

UCI International, Inc., Term Loan B, 5.50%, 7/26/17 | 338 | 337,433 | |||||||||||||

| 5,851,437 | |||||||||||||||

Automobiles — 0.3% | |||||||||||||||

Chrysler Group LLC: | |||||||||||||||

2018 Term Loan B, 3.25%, 12/31/18 | 190 | 187,582 | |||||||||||||

Term Loan B, 3.50%, 5/24/17 | 199 | 199,201 | |||||||||||||

| 386,783 | |||||||||||||||

Banks — 0.3% | |||||||||||||||

Redtop Acquisitions Ltd.: | |||||||||||||||

1st Lien Term Loan, 4.50%, 12/03/20 | 259 | 258,268 | |||||||||||||

2nd Lien Term Loan, 8.25%, 6/03/21 | 70 | 71,043 | |||||||||||||

| 329,311 | |||||||||||||||

Building Products — 3.1% | |||||||||||||||

Continental Building Products LLC, 1st Lien Term Loan, 4.00%, 8/28/20 | 373 | 370,594 | |||||||||||||

CPG International, Inc., Term Loan, 4.75%, 9/30/20 | 974 | 973,623 | |||||||||||||

GYP Holdings III Corp., 1st Lien Term Loan, 4.75%, 4/01/21 | 319 | 315,210 | |||||||||||||

Interline Brands, Inc., 2021 Term Loan, 4.00%, 3/17/21 | 394 | 389,336 | |||||||||||||

Nortek, Inc., Term Loan, 3.75%, 10/30/20 | 480 | 477,998 | |||||||||||||

Ply Gem Industries, Inc., Term Loan, 4.00%, 2/01/21 | 224 | 220,299 | |||||||||||||

Quikrete Holdings, Inc., 1st Lien Term Loan, 4.00%, 9/28/20 | 402 | 399,688 | |||||||||||||

Wilsonart LLC: | |||||||||||||||

Incremental Term Loan B2, 4.00%, 10/31/19 | 109 | 107,991 | |||||||||||||

Term Loan B, 4.00%, 10/31/19 | 788 | 777,496 | |||||||||||||

| 4,032,235 | |||||||||||||||

Capital Markets — 0.5% | |||||||||||||||

Affinion Group, Inc.: | |||||||||||||||

2nd Lien Term Loan, 8.50%, 10/12/18 | 212 | 210,417 | |||||||||||||

Term Loan B, 6.75%, 4/30/18 | 301 | 297,706 | |||||||||||||

American Capital Holdings, Inc., 2017 Term Loan, 3.50%, 8/22/17 | 195 | 194,263 | |||||||||||||

| 702,386 | |||||||||||||||

| Floating Rate Loan Interests (b) | Par (000) | Value | |||||||||||||

Chemicals — 5.0% | |||||||||||||||

Allnex (Luxembourg) & Cy SCA, Term Loan B1, 4.50%, 10/03/19 | USD | 254 | $ | 253,873 | |||||||||||

Allnex USA, Inc., Term Loan B2, 4.50%, 10/03/19 | 132 | 131,722 | |||||||||||||

Axalta Coating Systems US Holdings, Inc., Term Loan, 3.75%, 2/01/20 | 473 | 469,535 | |||||||||||||

CeramTec Acquisition Corp., Term Loan B2, 4.25%, 8/28/20 | 27 | 26,758 | |||||||||||||

Chemtura Corp., Term Loan B, 3.50%, 8/27/16 | 324 | 323,809 | |||||||||||||

Chromaflo Technologies Corp.: | |||||||||||||||

1st Lien Term Loan, 4.50%, 12/02/19 | 259 | 257,730 | |||||||||||||

2nd Lien Term Loan, 8.25%, 5/30/20 | 110 | 109,450 | |||||||||||||

Evergreen Acqco 1 LP, Term Loan, 5.00%, 7/09/19 | 476 | 475,788 | |||||||||||||

INEOS US Finance LLC: | |||||||||||||||

3 Year Term Loan, 2.20%, 5/04/15 | 88 | 87,737 | |||||||||||||

6 Year Term Loan, 3.75%, 5/04/18 | 194 | 192,691 | |||||||||||||

MacDermid, Inc., 1st Lien Term Loan, 4.00%, 6/07/20 | 461 | 459,337 | |||||||||||||

Minerals Technology, Inc., Term Loan B, 4.00%, 5/09/21 | 500 | 499,375 | |||||||||||||

Momentive Performance Materials, Inc., DIP Term Loan B, 4.00%, 4/15/15 | 100 | 99,875 | |||||||||||||

Nexeo Solutions LLC, Term Loan B, 5.00%, 9/08/17 | 581 | 578,082 | |||||||||||||

OXEA Finance LLC: | |||||||||||||||

2nd Lien Term Loan, 8.25%, 7/15/20 | 315 | 315,526 | |||||||||||||

Term Loan B2, 4.25%, 1/15/20 | 581 | 578,435 | |||||||||||||

Royal Adhesives and Sealants LLC, 1st Lien Term Loan, 5.50%, 7/31/18 | 156 | 155,887 | |||||||||||||

Solenis International LP: | |||||||||||||||

1st Lien Term Loan, 4.25%, 7/02/21 | 355 | 352,561 | |||||||||||||

2nd Lien Term Loan, 7.75%, 7/02/22 | 390 | 386,490 | |||||||||||||

Tata Chemicals North America, Inc., Term Loan B, 3.75%, 8/07/20 | 134 | 131,979 | |||||||||||||

Tronox Pigments (Netherlands) BV, 2013 Term Loan, 4.00%, 3/19/20 | 406 | 404,954 | |||||||||||||

Univar, Inc., Term Loan B, 5.00%, 6/30/17 | 222 | 222,330 | |||||||||||||

| 6,513,924 | |||||||||||||||

Commercial Services & Supplies — 5.2% | |||||||||||||||

ADS Waste Holdings, Inc., Term Loan, 3.75%, 10/09/19 | 736 | 724,912 | |||||||||||||

ARAMARK Corp.: | |||||||||||||||

Extended Synthetic Line of Credit 2, 3.65%, 7/26/16 | 14 | 13,753 | |||||||||||||

Extended Synthetic Line of Credit 3, 3.65%, 7/26/16 | 9 | 9,301 | |||||||||||||

Term Loan E, 3.25%, 9/07/19 | 664 | 656,611 | |||||||||||||

AWAS Finance Luxembourg 2012 SA, Term Loan, 3.50%, 7/16/18 | 279 | 278,443 | |||||||||||||

Brand Energy & Infrastructure Services, Inc., Term Loan B, 4.75%, 11/26/20 | 868 | 866,878 | |||||||||||||

Catalent Pharma Solutions, Inc., Term Loan, 6.50%, 12/29/17 | 67 | 67,454 | |||||||||||||

Connolly Corp.: | |||||||||||||||

1st Lien Term Loan, 5.00%, 5/14/21 | 675 | 677,956 | |||||||||||||

2nd Lien Term Loan, 8.00%, 5/14/22 | 325 | 326,219 | |||||||||||||

KAR Auction Services, Inc., Term Loan B2, 3.50%, 3/11/21 | 309 | 306,782 | |||||||||||||

Koosharem LLC, Exit Term Loan, 7.50%, 4/29/20 | 550 | 550,687 | |||||||||||||

Livingston International, Inc.: | |||||||||||||||

1st Lien Term Loan, 5.00%, 4/16/19 | 307 | 305,175 | |||||||||||||

2nd Lien Term Loan, 9.00%, 4/20/20 | 200 | 198,362 | |||||||||||||

Spin Holdco, Inc., Term Loan B, 4.25%, 11/14/19 | 924 | 915,709 | |||||||||||||

US Ecology, Inc., Term Loan, 3.75%, 6/17/21 | 225 | 225,000 | |||||||||||||

West Corp., Term Loan B10, 3.25%, 6/30/18 | 598 | 591,691 | |||||||||||||

| 6,714,933 | |||||||||||||||

| 12 | ANNUAL REPORT | AUGUST 31, 2014 |

| Schedule of Investments (continued) | BlackRock Defined Opportunity Credit Trust (BHL) (Percentages shown are based on Net Assets) |

| Floating Rate Loan Interests (b) | Par (000) | Value | |||||||||||||

Communications Equipment — 2.7% | |||||||||||||||

Amaya Holdings BV: | |||||||||||||||

1st Lien Term Loan, 5.00%, 8/01/21 | USD | 190 | $ | 188,147 | |||||||||||

2nd Lien Term Loan, 8.00%, 8/01/22 | 1,325 | 1,340,741 | |||||||||||||

Applied Systems, Inc.: | |||||||||||||||

1st Lien Term Loan, 4.25%, 1/25/21 | 184 | 183,615 | |||||||||||||

2nd Lien Term Loan, 7.50%, 1/23/22 | 85 | 85,510 | |||||||||||||

Avaya, Inc., Extended Term Loan B3, 4.66%, 10/26/17 | 345 | 333,911 | |||||||||||||

CommScope, Inc., Term Loan B3, 2.66% - 2.73%, 1/21/17 | 157 | 157,576 | |||||||||||||

Zayo Group LLC/Zayo Capital, Inc., Term Loan B, 4.00%, 7/02/19 | 1,235 | 1,229,305 | |||||||||||||

| 3,518,805 | |||||||||||||||

Construction & Engineering — 0.4% | |||||||||||||||

BakerCorp International, Inc., Term Loan, 4.25%, 2/14/20 | 300 | 293,633 | |||||||||||||

Centaur Acquisition LLC, 2nd Lien Term Loan, 8.75%, 2/15/20 | 280 | 283,500 | |||||||||||||

| 577,133 | |||||||||||||||

Construction Materials — 1.5% | |||||||||||||||

Filtration Group Corp., 1st Lien Term Loan, 4.50%, 11/21/20 | 219 | 219,009 | |||||||||||||

HD Supply, Inc., Term Loan B, 4.00%, 6/28/18 | 1,604 | 1,595,200 | |||||||||||||

McJunkin Red Man Corp., Term Loan, 5.00%, 11/08/19 | 149 | 148,875 | |||||||||||||

| 1,963,084 | |||||||||||||||

Containers & Packaging — 1.1% | |||||||||||||||

Ardagh Holdings USA, Inc., Incremental Term Loan, 4.00%, 12/17/19 | 209 | 208,254 | |||||||||||||

Berry Plastics Holding Corp., Term Loan E, 3.75%, 1/06/21 | 629 | 620,016 | |||||||||||||

BWAY Holding Co., Inc., Term Loan B, 5.50%, 8/14/20 | 345 | 346,439 | |||||||||||||

CD&R Millennium Holdco 6 Sarl, 1st Lien Term Loan, 4.50%, 7/31/21 | 25 | 24,836 | |||||||||||||

Rexam PLC, 1st Lien Term Loan, 4.25%, 5/02/21 | 170 | 169,787 | |||||||||||||

Tekni-Plex, Inc., Term Loan B, 4.75%, 8/25/19 | 111 | 110,609 | |||||||||||||

| 1,479,941 | |||||||||||||||

Distributors — 1.5% | |||||||||||||||

ABC Supply Co., Inc., Term Loan, 3.50%, 4/16/20 | 1,141 | 1,129,722 | |||||||||||||

American Tire Distributors Holdings, Inc., Term Loan B, 5.75%, 6/01/18 | 329 | 329,289 | |||||||||||||

Crossmark Holdings, Inc., 1st Lien Term Loan, 4.50%, 12/20/19 | 231 | 228,871 | |||||||||||||

VWR Funding, Inc., Term Loan, 3.41%, 4/03/17 | 276 | 274,251 | |||||||||||||

| 1,962,133 | |||||||||||||||

Diversified Consumer Services — 2.5% | |||||||||||||||

Allied Security Holdings LLC: | |||||||||||||||

1st Lien Term Loan, 4.25%, 2/12/21 | 655 | 649,212 | |||||||||||||

2nd Lien Term Loan, 8.00%, 8/13/21 | 91 | 89,963 | |||||||||||||

Bright Horizons Family Solutions, Inc., Term Loan B, 3.75% - 5.00%, 1/30/20 | 635 | 630,960 | |||||||||||||

Fitness International LLC, Term Loan B, 5.50%, 7/01/20 | 250 | 248,958 | |||||||||||||

Garda World Securities Corp.: | |||||||||||||||

Delayed Draw Term Loan, 4.00%, 11/06/20 | 68 | 67,945 | |||||||||||||

Term Loan B, 4.00%, 11/06/20 | 268 | 265,602 | |||||||||||||

ROC Finance LLC, Term Loan, 5.00%, 6/20/19 | 248 | 240,527 | |||||||||||||

ServiceMaster Co., 2014 Term Loan B, 4.25%, 7/01/21 | 610 | 604,968 | |||||||||||||

Weight Watchers International, Inc., Term Loan B2, 4.00%, 4/02/20 | 627 | 492,601 | |||||||||||||

| 3,290,736 | |||||||||||||||

| Floating Rate Loan Interests (b) | Par (000) | Value | |||||||||||||

Diversified Financial Services — 1.3% | |||||||||||||||

AssuredPartners Capital, Inc., 1st Lien Term Loan, 4.50%, 3/31/21 | USD | 335 | $ | 333,466 | |||||||||||

Reynolds Group Holdings, Inc., Dollar Term Loan, 4.00%, 12/01/18 | 745 | 743,366 | |||||||||||||

RPI Finance Trust, Term Loan B3, 3.25%, 11/09/18 | 86 | 86,388 | |||||||||||||

SAM Finance Luxembourg Sarl, Term Loan, 4.25%, 12/17/20 | 592 | 591,101 | |||||||||||||

| 1,754,321 | |||||||||||||||

Diversified Telecommunication Services — 4.2% | |||||||||||||||

Consolidated Communications, Inc., Term Loan B, 4.25%, 12/23/20 | 689 | 689,270 | |||||||||||||

Hawaiian Telcom Communications, Inc., Term Loan B, 5.00%, 6/06/19 | 521 | 522,979 | |||||||||||||

Integra Telecom, Inc.: | |||||||||||||||

2nd Lien Term Loan, 9.75%, 2/22/20 | 255 | 258,825 | |||||||||||||

Term Loan B, 5.25%, 2/22/19 | 459 | 459,045 | |||||||||||||

Level 3 Financing, Inc.: | |||||||||||||||

2019 Term Loan, 4.00%, 8/01/19 | 220 | 218,946 | |||||||||||||

2020 Term Loan B, 4.00%, 1/15/20 | 2,160 | 2,149,200 | |||||||||||||

Syniverse Holdings, Inc., Term Loan B, 4.00%, 4/23/19 | 446 | 441,520 | |||||||||||||

US Telepacific Corp., Term Loan B, 5.75%, 2/23/17 | 728 | 727,534 | |||||||||||||

| 5,467,319 | |||||||||||||||

Electric Utilities — 1.1% | |||||||||||||||

American Energy—Marcellus LLC, 1st Lien Term Loan, 5.25%, 8/04/20 | 400 | 399,879 | |||||||||||||

American Energy—Utica LLC: | |||||||||||||||

2nd Lien Delayed Draw Term Loan, 11.00%, 9/30/18 | 51 | 53,229 | |||||||||||||

2nd Lien Term Loan, 5.50%, 9/30/18 | 231 | 247,609 | |||||||||||||

Incremental 2nd Lien Term Loan, 11.00%, 9/30/18 | 51 | 53,237 | |||||||||||||

Energy Future Intermediate Holding Co LLC, DIP Term Loan, 4.25%, 6/19/16 | 325 | 325,325 | |||||||||||||

Sandy Creek Energy Associates LP, Term Loan B, 5.00%, 11/06/20 | 293 | 294,575 | |||||||||||||

| 1,373,854 | |||||||||||||||

Electrical Equipment — 1.5% | |||||||||||||||

Southwire Co., Term Loan, 3.25%, 2/10/21 | 264 | 262,553 | |||||||||||||

Texas Competitive Electric Holdings Co. LLC: | |||||||||||||||

DIP Term Loan, 3.75%, 5/05/16 | 581 | 584,740 | |||||||||||||

Extended Term Loan, 4.65%, 10/10/17 (a)(e) | 1,505 | 1,163,787 | |||||||||||||

| 2,011,080 | |||||||||||||||

Electronic Equipment, Instruments & Components — 0.5% | |||||||||||||||

CDW LLC, Term Loan, 3.25%, 4/29/20 | 653 | 644,353 | |||||||||||||

Energy Equipment & Services — 0.5% | |||||||||||||||

Dynegy Holdings, Inc., Term Loan B2, 4.00%, 4/23/20 | 257 | 256,919 | |||||||||||||

MEG Energy Corp., Refinancing Term Loan, 3.75%, 3/31/20 | 358 | 356,802 | |||||||||||||

| 613,721 | |||||||||||||||

Food & Staples Retailing — 1.7% | |||||||||||||||

Alliance Boots Holdings Ltd., Term Loan B1, 3.48%, 7/09/15 | GBP | 672 | 1,113,533 | ||||||||||||

New Albertson’s, Inc., Term Loan, 4.75%, 6/27/21 | USD | 335 | 333,010 | ||||||||||||

Rite Aid Corp., 2nd Lien Term Loan, 5.75%, 8/21/20 | 235 | 237,545 | |||||||||||||

Supervalu, Inc., Refinancing Term Loan B, 4.50%, 3/21/19 | 510 | 506,112 | |||||||||||||

| 2,190,200 | |||||||||||||||

| ANNUAL REPORT | AUGUST 31, 2014 | 13 |

| Schedule of Investments (continued) | BlackRock Defined Opportunity Credit Trust (BHL) (Percentages shown are based on Net Assets) |

| Floating Rate Loan Interests (b) | Par (000) | Value | |||||||||||||

Food Products — 3.6% | |||||||||||||||

AdvancePierre Foods, Inc., Term Loan, 5.75%, 7/10/17 | USD | 199 | $ | 199,753 | |||||||||||

CTI Foods Holding Co. LLC, 1st Lien Term Loan, 4.50%, 6/29/20 | 258 | 257,297 | |||||||||||||

Del Monte Foods, Inc., 1st Lien Term Loan, 4.25% - 5.50%, 2/18/21 | 393 | 388,521 | |||||||||||||

Diamond Foods, Inc., Term Loan, 4.25%, 8/20/18 | 682 | 677,215 | |||||||||||||

Dole Food Co., Inc., Term Loan B, 4.50% - 5.75%, 11/01/18 | 598 | 595,514 | |||||||||||||

GFA Brands, Inc., Term Loan B, 4.50%, 7/09/20 | 109 | 109,036 | |||||||||||||

H.J. Heinz Co., Term Loan B1, 3.25%, 6/07/19 | 74 | 74,023 | |||||||||||||

Hearthside Group Holdings LLC, Term Loan, 4.50%, 6/02/21 | 470 | 470,296 | |||||||||||||

Performance Food Group Co., 2nd Lien Term Loan, 6.25%, 11/14/19 | 374 | 374,628 | |||||||||||||

Pinnacle Foods Finance LLC: | |||||||||||||||

Incremental Term Loan H, 3.25%, 4/29/20 | 124 | 122,489 | |||||||||||||

Term Loan G, 3.25%, 4/29/20 | 605 | 597,539 | |||||||||||||

Reddy Ice Corp.: | |||||||||||||||

1st Lien Term Loan, 6.75% - 7.75%, 5/01/19 | 563 | 537,546 | |||||||||||||

2nd Lien Term Loan, 10.75%, 11/01/19 | 270 | 237,600 | |||||||||||||

| 4,641,457 | |||||||||||||||

Health Care Equipment & Supplies — 6.8% | |||||||||||||||

Arysta LifeScience Corp.: | |||||||||||||||

1st Lien Term Loan, 4.50%, 5/29/20 | 931 | 928,468 | |||||||||||||

2nd Lien Term Loan, 8.25%, 11/30/20 | 380 | 383,089 | |||||||||||||

Biomet, Inc., Term Loan B2, 3.66% - 3.73%, 7/25/17 | 707 | 704,907 | |||||||||||||

Capsugel Holdings US, Inc., Term Loan B, 3.50%, 8/01/18 | 467 | 461,270 | |||||||||||||

DJO Finance LLC, 2017 Term Loan, 4.25%, 9/15/17 | 975 | 973,735 | |||||||||||||

Fresenius SE & Co. KGaA: | |||||||||||||||

Incremental Term Loan B, 2.46%, 6/30/19 | EUR | 119 | 156,658 | ||||||||||||

Term Loan B, 2.23%, 8/07/19 | USD | 615 | 614,581 | ||||||||||||

The Hologic, Inc., Term Loan B, 3.25%, 8/01/19 | 760 | 755,518 | |||||||||||||

Iasis Healthcare LLC, Term Loan B2, 4.50%, 5/03/18 | 95 | 95,083 | |||||||||||||

Immucor, Inc., Refinancing Term Loan B2, 5.00%, 8/17/18 | 802 | 801,896 | |||||||||||||

Kinetic Concepts, Inc., Term Loan E1, 4.00%, 5/04/18 | 119 | 118,569 | |||||||||||||

Leonardo Acquisition Corp., Term Loan, 4.25%, 1/31/21 | 509 | 504,274 | |||||||||||||

Millennium Laboratories, Inc., Term Loan B, 5.25%, 4/16/21 | 575 | 575,541 | |||||||||||||

National Vision, Inc.: | |||||||||||||||

1st Lien Term Loan, 4.00%, 3/12/21 | 638 | 626,252 | |||||||||||||

2nd Lien Term Loan, 6.75%, 3/07/22 | 120 | 118,000 | |||||||||||||

Onex Carestream Finance LP, 2nd Lien Term Loan, 9.50%, 12/07/19 | 135 | 135,982 | |||||||||||||

Ortho-Clinical Diagnostics, Inc., Term Loan B, 4.75%, 6/30/21 | 920 | 919,614 | |||||||||||||

| 8,873,437 | |||||||||||||||

Health Care Providers & Services — 7.4% | |||||||||||||||

Amedisys, Inc., 2nd Lien Term Loan, 8.50%, 6/25/20 | 335 | 326,625 | |||||||||||||

American Renal Holdings, Inc., 1st Lien Term Loan, 4.50%, 9/20/19 | 652 | 646,588 | |||||||||||||

Amsurg Corp., 1st Lien Term Loan B, 3.75%, 7/16/21 | 300 | 299,625 | |||||||||||||

Ardent Medical Services, Inc., Term Loan, 6.75%, 7/02/18 | 243 | 242,871 | |||||||||||||

CHG Buyer Corp., Term Loan, 4.25%, 11/19/19 | 394 | 393,123 | |||||||||||||

CHS/Community Health Systems, Inc., Term Loan D, 4.25%, 1/27/21 | 1,955 | 1,959,183 | |||||||||||||

ConvaTec, Inc., Term Loan, 4.00%, 12/22/16 | 540 | 537,865 | |||||||||||||

| Floating Rate Loan Interests (b) | Par (000) | Value | |||||||||||||

Health Care Providers & Services (concluded) | |||||||||||||||

DaVita HealthCare Partners, Inc., Term Loan B, 3.50%, 6/24/21 | USD | 2,215 | $ | 2,207,934 | |||||||||||

Envision Acquisition Co. LLC, 1st Lien Term Loan, 5.75%, 11/04/20 | 238 | 239,391 | |||||||||||||

Envision Healthcare Corp., Term Loan, 4.00%, 5/25/18 | 424 | 423,052 | |||||||||||||

Genesis HealthCare Corp., Term Loan B, 10.00%, 9/25/17 | 269 | 272,554 | |||||||||||||

HCA, Inc., Extended Term Loan B4, 2.98%, 5/01/18 | 233 | 232,510 | |||||||||||||

Ikaria, Inc.: | |||||||||||||||

1st Lien Term Loan, 5.00%, 2/12/21 | 255 | 255,390 | |||||||||||||

2nd Lien Term Loan, 8.75%, 2/14/22 | 70 | 70,788 | |||||||||||||

inVentiv Health, Inc., Incremental Term Loan B3, 7.75% - 8.50%, 5/15/18 | 218 | 216,405 | |||||||||||||

MPH Acquisition Holdings LLC, Term Loan, 4.00%, 3/31/21 | 524 | 520,206 | |||||||||||||

National Mentor Holdings, Inc., Term Loan B, 4.75%, 1/31/21 | 190 | 189,229 | |||||||||||||

Surgery Center Holdings, Inc., 1st Lien Term Loan, 5.25%, 7/09/20 | 226 | 225,888 | |||||||||||||

Surgical Care Affiliates, Inc., Class C, Incremental Term Loan, 4.00%, 6/29/18 | 421 | 419,172 | |||||||||||||

| 9,678,399 | |||||||||||||||

Health Care Technology — 0.9% | |||||||||||||||

IMS Health, Inc., Term Loan, 3.50%, 3/17/21 | 758 | 747,867 | |||||||||||||

MedAssets, Inc., Term Loan B, 4.00%, 12/13/19 | 438 | 434,316 | |||||||||||||

| 1,182,183 | |||||||||||||||

Hotels, Restaurants & Leisure — 12.0% | |||||||||||||||

Bally Technologies, Inc., Term Loan B, 4.25%, 11/25/20 | 321 | 320,894 | |||||||||||||

Belmond Interfin Ltd., Term Loan B, 4.00%, 3/21/21 | 479 | 475,008 | |||||||||||||

Boyd Gaming Corp., Term Loan B, 4.00%, 8/14/20 | 261 | 258,670 | |||||||||||||

Bronco Midstream Funding LLC, Term Loan B, 5.00%, 8/17/20 | 699 | 699,620 | |||||||||||||

Caesars Entertainment Operating Co., Inc.: | |||||||||||||||

Extended Term Loan B6, 6.95%, 3/01/17 | 393 | 368,531 | |||||||||||||

Term Loan B7, 9.75%, 3/01/17 | 341 | 329,683 | |||||||||||||

Caesars Entertainment Resort Properties LLC, Term Loan B, 7.00%, 10/12/20 | 1,006 | 987,498 | |||||||||||||

CCM Merger, Inc., Term Loan B, 4.50%, 7/18/21 | 385 | 384,037 | |||||||||||||

Dave & Buster’s, Inc., Term Loan, 4.50%, 7/25/20 | 190 | 189,478 | |||||||||||||

Diamond Resorts Corporation, Term Loan, 5.50%, 5/09/21 | 550 | 552,750 | |||||||||||||

ESH Hospitality, Inc., Term Loan, 5.00%, 6/24/19 | 100 | 100,875 | |||||||||||||

Four Seasons Holdings, Inc., 2nd Lien Term Loan, 6.25%, 12/28/20 | 330 | 330,825 | |||||||||||||

Hilton Worldwide Finance LLC, Term Loan B2, 3.50%, 10/26/20 | 1,883 | 1,870,811 | |||||||||||||

Intrawest ULC, Term Loan, 5.50%, 11/26/20 | 368 | 369,991 | |||||||||||||

La Quinta Intermediate Holdings LLC, Term Loan B, 4.00%, 4/14/21 | 2,477 | 2,472,768 | |||||||||||||

Las Vegas Sands LLC, Term Loan B, 3.25%, 12/19/20 | 597 | 595,257 | |||||||||||||

MGM Resorts International, Term Loan B, 3.50%, 12/20/19 | 786 | 780,272 | |||||||||||||

Pinnacle Entertainment, Inc., Term Loan B2, 3.75%, 8/13/20 | 410 | 408,158 | |||||||||||||

Playa Resorts Holding BV, Term Loan B, 4.00%, 8/06/19 | 407 | 404,890 | |||||||||||||

RHP Hotel Properties LP, Term Loan B, 3.75%, 1/15/21 | 295 | 294,923 | |||||||||||||

Sabre, Inc.: | |||||||||||||||

Incremental Term Loan, 4.00%, 2/19/19 | 114 | 113,888 | |||||||||||||

Term Loan B, 4.00%, 2/19/19 | 315 | 313,624 | |||||||||||||

Station Casinos LLC, Term Loan B, 4.25%, 3/02/20 | 1,148 | 1,142,922 | |||||||||||||

| 14 | ANNUAL REPORT | AUGUST 31, 2014 |

| Schedule of Investments (continued) | BlackRock Defined Opportunity Credit Trust (BHL) (Percentages shown are based on Net Assets) |

| Floating Rate Loan Interests (b) | Par (000) | Value | |||||||||||||

Hotels, Restaurants & Leisure (concluded) | |||||||||||||||

Travelport Finance (Luxembourg) Sarl, 2014 Term Loan B, 6.00%, 9/02/21 | USD | 765 | $ | 768,190 | |||||||||||

Travelport LLC: | |||||||||||||||

2nd Lien Term Loan 1, 9.50%, 1/29/16 | 250 | 254,251 | |||||||||||||

Refinancing Term Loan, 6.25%, 6/26/19 | 210 | 213,624 | |||||||||||||

Twin River Management Group, Inc., Term Loan B, 5.25%, 7/10/20 | 265 | 265,220 | |||||||||||||

Wendy’s International, Inc., Term Loan B, 3.25%, 5/15/19 | 368 | 367,264 | |||||||||||||

| 15,633,922 | |||||||||||||||

Household Products — 1.1% | |||||||||||||||

Bass Pro Group LLC, Term Loan, 3.75%, 11/20/19 | 634 | 631,383 | |||||||||||||

Prestige Brands, Inc., Term Loan, 3.75%, 1/31/19 | 301 | 300,568 | |||||||||||||

Spectrum Brands, Inc.: | |||||||||||||||

Term Loan A, 3.00%, 9/07/17 | 204 | 203,430 | |||||||||||||

Term Loan C, 3.50%, 9/04/19 | 341 | 338,678 | |||||||||||||

| 1,474,059 | |||||||||||||||

Independent Power and Renewable Electricity Producers — 0.4% | |||||||||||||||

Calpine Corp., Term Loan B1, 4.00%, 4/01/18 | 211 | 210,410 | |||||||||||||

La Frontera Generation LLC, Term Loan, 4.50%, 9/30/20 | 309 | 309,366 | |||||||||||||

| 519,776 | |||||||||||||||

Industrial Conglomerates — 0.8% | |||||||||||||||

Sequa Corp., Term Loan B, 5.25%, 6/19/17 | 1,039 | 1,016,731 | |||||||||||||

Insurance — 2.4% | |||||||||||||||

Alliant Holdings I, Inc., Term Loan B, 4.25%, 12/20/19 | 414 | 411,394 | |||||||||||||

Asurion LLC: | |||||||||||||||

2nd Lien Term Loan, 8.50%, 3/03/21 | 155 | 159,805 | |||||||||||||

Term Loan B1, 5.00%, 5/24/19 | 455 | 456,523 | |||||||||||||

CNO Financial Group, Inc.: | |||||||||||||||

Term Loan B1, 3.00%, 9/28/16 | 267 | 265,418 | |||||||||||||

Term Loan B2, 3.75%, 9/20/18 | 518 | 513,429 | |||||||||||||

Cooper Gay Swett & Crawford Ltd.: | |||||||||||||||

1st Lien Term Loan, 5.00%, 4/16/20 | 416 | 386,694 | |||||||||||||

2nd Lien Term Loan C, 8.25%, 10/16/20 | 200 | 180,000 | |||||||||||||

Sedgwick, Inc.: | |||||||||||||||

1st Lien Term Loan, 3.75%, 3/01/21 | 459 | 451,013 | |||||||||||||

2nd Lien Term Loan, 6.75%, 2/28/22 | 260 | 258,700 | |||||||||||||

| 3,082,976 | |||||||||||||||

Internet Software & Services — 1.5% | |||||||||||||||

Dealertrack Technologies, Inc., Term Loan B, 3.50%, 2/28/21 | 420 | 415,572 | |||||||||||||

Go Daddy Operating Co. LLC, Term Loan B, 4.75%, 5/13/21 | 575 | 573,131 | |||||||||||||

Interactive Data Corp., 2014 Term Loan, 4.75%, 5/02/21 | 450 | 451,125 | |||||||||||||

W3 Co.: | |||||||||||||||

1st Lien Term Loan, 5.75%, 3/13/20 | 405 | 401,839 | |||||||||||||

2nd Lien Term Loan, 9.25%, 9/11/20 | 155 | 151,520 | |||||||||||||

| 1,993,187 | |||||||||||||||

IT Services — 3.9% | |||||||||||||||

First Data Corp.: | |||||||||||||||

2018 Extended Term Loan, 3.66%, 3/23/18 | 2,845 | 2,812,510 | |||||||||||||

2018 Term Loan, 3.66%, 9/24/18 | 295 | 292,327 | |||||||||||||

Genpact International, Inc., Term Loan B, 3.50%, 8/30/19 | 430 | 428,115 | |||||||||||||

InfoGroup, Inc., Term Loan, 7.50%, 5/25/18 | 245 | 229,928 | |||||||||||||

SunGard Availability Services Capital, Inc., Term Loan B, 6.00%, 3/31/19 | 349 | 345,742 | |||||||||||||

| Floating Rate Loan Interests (b) | Par (000) | Value | |||||||||||||

IT Services (concluded) | |||||||||||||||

SunGard Data Systems, Inc.: | |||||||||||||||

Term Loan C, 3.91%, 2/28/17 | USD | 350 | $ | 349,562 | |||||||||||

Term Loan E, 4.00%, 3/08/20 | 126 | 126,132 | |||||||||||||

Vantiv LLC, 2014 Term Loan B, 3.75%, 5/12/21 | 460 | 459,655 | |||||||||||||

| 5,043,971 | |||||||||||||||

Leisure Products — 0.4% | |||||||||||||||

Bauer Performance Sports Ltd., Term Loan B, 4.00%, 4/15/21 | 364 | 361,915 | |||||||||||||

FGI Operating Co. LLC, Term Loan, 5.50%, 4/19/19 | 204 | 204,797 | |||||||||||||

| 566,712 | |||||||||||||||

Machinery — 3.8% | |||||||||||||||

Alliance Laundry Systems LLC: | |||||||||||||||

2nd Lien Term Loan, 9.50%, 12/10/19 | 131 | 131,727 | |||||||||||||

Refinancing Term Loan, 4.25%, 12/10/18 | 357 | 357,135 | |||||||||||||

Faenza Acquisition GmbH: | |||||||||||||||

Term Loan B1, 4.25%, 8/31/20 | 271 | 269,862 | |||||||||||||

Term Loan B3, 4.25%, 8/28/20 | 81 | 81,238 | |||||||||||||

Gardner Denver, Inc., Term Loan: | |||||||||||||||

4.25%, 7/30/20 | 885 | 883,290 | |||||||||||||

4.75%, 7/30/20 | EUR | 126 | 165,958 | ||||||||||||

Generac Power Systems, Inc., Term Loan B, 3.25%, 5/31/20 | USD | 326 | 322,131 | ||||||||||||

Intelligrated, Inc., 1st Lien Term Loan, 4.50%, 7/30/18 | 393 | 389,322 | |||||||||||||

Mirror Bidco Corp., Term Loan, 4.25%, 12/28/19 | 561 | 557,621 | |||||||||||||

Navistar International Corp., Term Loan B, 5.75%, 8/17/17 | 206 | 207,375 | |||||||||||||

Rexnord LLC, 1st Lien Term Loan B, 4.00%, 8/21/20 | 567 | 563,079 | |||||||||||||

Silver II US Holdings LLC, Term Loan, 4.00%, 12/13/19 | 657 | 654,320 | |||||||||||||

STS Operating, Inc., Term Loan, 4.75%, 2/19/21 | 155 | 154,678 | |||||||||||||

Wabash National Corp., Term Loan B, 4.50%, 5/08/19 | 262 | 262,288 | |||||||||||||

| 5,000,024 | |||||||||||||||

Media — 14.9% | |||||||||||||||

Acosta, Inc., Term Loan B, 4.25%, 3/02/18 | 45 | 44,886 | |||||||||||||

Activision Blizzard, Inc., Term Loan B, 3.25%, 10/12/20 | 589 | 588,795 | |||||||||||||

Advanstar Communications, Inc., 2nd Lien Term Loan, 9.50%, 6/06/20 | 255 | 254,362 | |||||||||||||

CBS Outdoor Americas Capital LLC, Term Loan B, 3.00%, 1/31/21 | 170 | 168,810 | |||||||||||||

Cengage Learning Acquisitions, Inc.: | |||||||||||||||

0.00%, 7/03/15 (a)(e) | 591 | — | |||||||||||||

1st Lien Term Loan, 7.00%, 3/31/20 | 1,372 | 1,379,847 | |||||||||||||

Charter Communications Operating LLC: | |||||||||||||||

Term Loan E, 3.00%, 7/01/20 | 460 | 452,487 | |||||||||||||

Term Loan G, 4.25%, 7/24/21 | 935 | 940,264 | |||||||||||||

Clear Channel Communications, Inc.: | |||||||||||||||

Term Loan B, 3.81%, 1/29/16 | 292 | 290,083 | |||||||||||||

Term Loan D, 6.91%, 1/30/19 | 1,564 | 1,539,858 | |||||||||||||

Cumulus Media Holdings, Inc., 2013 Term Loan, 4.25%, 12/23/20 | 550 | 548,117 | |||||||||||||

Getty Images, Inc., Term Loan B, 4.75%, 10/18/19 | 45 | 42,387 | |||||||||||||

Gray Television, Inc., 2014 Term Loan B, 3.75%, 6/10/21 | 285 | 283,504 | |||||||||||||

Hemisphere Media Holdings LLC, Term Loan B, 5.00%, 7/30/20 | 456 | 455,628 | |||||||||||||

Hubbard Radio LLC, Term Loan B, 4.50%, 4/29/19 | 367 | 365,508 | |||||||||||||

IMG Worldwide Holdings LLC: | |||||||||||||||

1st Lien Term Loan, 5.25%, 5/06/21 | 515 | 509,531 | |||||||||||||

2nd Lien Term Loan, 8.25%, 5/01/22 | 205 | 200,900 | |||||||||||||

Intelsat Jackson Holdings SA, Term Loan B2, 3.75%, 6/30/19 | 983 | 977,444 | |||||||||||||

| ANNUAL REPORT | AUGUST 31, 2014 | 15 |

| Schedule of Investments (continued) | BlackRock Defined Opportunity Credit Trust (BHL) (Percentages shown are based on Net Assets) |

| Floating Rate Loan Interests (b) | Par (000) | Value | |||||||||||||

Media (concluded) | |||||||||||||||

Liberty Cablevision of Puerto Rico LLC, 1st Lien Term Loan, 4.50%, 1/07/22 | USD | 350 | $ | 349,783 | |||||||||||

Lions Gate Entertainment Corp., 2nd Lien Term Loan, 5.00%, 7/17/20 | 150 | 150,626 | |||||||||||||

Live Nation Entertainment, Inc., 2020 Term Loan B1, 3.50%, 8/17/20 | 114 | 113,510 | |||||||||||||

MCC Iowa LLC: | |||||||||||||||

Term Loan I, 2.63%, 6/30/17 | 250 | 248,750 | |||||||||||||

Term Loan J, 3.75%, 6/30/21 | 125 | 124,323 | |||||||||||||

Media General, Inc., Delayed Draw Term Loan B, 4.25%, 7/31/20 | 390 | 390,601 | |||||||||||||

Mediacom Communications Corp., Term Loan F, 2.63%, 3/31/18 | 254 | 249,911 | |||||||||||||

Mediacom Illinois LLC, Term Loan G, 3.75%, 6/13/21 | 310 | 306,900 | |||||||||||||

Mediacom LLC, Term Loan E, 3.13%, 10/23/17 | 480 | 477,600 | |||||||||||||

NEP/NCP Holdco, Inc., Incremental Term Loan, 4.25%, 1/22/20 | 527 | 522,688 | |||||||||||||

Numericable U.S. LLC: | |||||||||||||||

Term Loan B1, 4.50%, 5/21/20 | 509 | 510,268 | |||||||||||||

Term Loan B2, 4.50%, 5/21/20 | 440 | 441,451 | |||||||||||||

Salem Communications Corp., Term Loan B, 4.50%, 3/13/20 | 385 | 382,443 | |||||||||||||

SBA Senior Finance II LLC, Term Loan B1, 3.25%, 3/24/21 | 710 | 702,680 | |||||||||||||

Sinclair Television Group, Inc., Term Loan B, 3.00%, 4/09/20 | 370 | 364,300 | |||||||||||||

Tribune Co., 2013 Term Loan, 4.00%, 12/27/20 | 844 | 842,658 | |||||||||||||

Univision Communications, Inc., Term Loan C4, 4.00%, 3/01/20 | 522 | 518,499 | |||||||||||||

UPC Financing Partnership, Term Loan AG, 3.85%, 3/31/21 | EUR | 281 | 369,992 | ||||||||||||

Virgin Media Investment Holdings Ltd.: | |||||||||||||||

Term Loan B, 3.50%, 6/07/20 | USD | 780 | 769,127 | ||||||||||||

Term Loan E, 4.25%, 6/30/23 | GBP | 650 | 1,076,983 | ||||||||||||

WideOpenWest Finance LLC, Term Loan B, 4.75%, 4/01/19 | USD | 510 | 510,668 | ||||||||||||

Ziggo BV: | |||||||||||||||

Term Loan B1A, 3.25%, 1/15/22 | 425 | 416,644 | |||||||||||||

Term Loan B2A, 1.25% - 3.25%, 1/15/22 | 264 | 258,462 | |||||||||||||

Term Loan B3, 0.50%, 1/15/22 | 207 | 202,792 | |||||||||||||

| 19,344,070 | |||||||||||||||

Metals & Mining — 1.8% | |||||||||||||||

Ameriforge Group, Inc., 2nd Lien Term Loan, 8.75%, 12/19/20 | 100 | 101,625 | |||||||||||||

API Heat Transfer, Inc., Term Loan, 5.25%, 5/03/19 | 366 | 365,281 | |||||||||||||

FMG Resources Property Ltd., Term Loan B, 3.75%, 6/30/19 | 543 | 540,420 | |||||||||||||

Novelis, Inc., Term Loan, 3.75%, 3/10/17 | 784 | 781,326 | |||||||||||||

Windsor Financing LLC, Term Loan B, 6.25%, 12/05/17 | 599 | 607,892 | |||||||||||||

| 2,396,544 | |||||||||||||||

Multiline Retail — 2.0% | |||||||||||||||

99¢ Only Stores, Term Loan, 4.50%, 1/11/19 | 451 | 450,043 | |||||||||||||

BJ’s Wholesale Club, Inc.: | |||||||||||||||

1st Lien Term Loan, 4.50%, 9/26/19 | 538 | 535,043 | |||||||||||||

2nd Lien Term Loan, 8.50%, 3/26/20 | 200 | 201,900 | |||||||||||||

Hudson’s Bay Co., 1st Lien Term Loan, 4.75%, 11/04/20 | 430 | 433,054 | |||||||||||||

The Neiman Marcus Group, Inc., 2020 Term Loan, 4.25%, 10/25/20 | 984 | 975,523 | |||||||||||||

| 2,595,563 | |||||||||||||||

| Floating Rate Loan Interests (b) | Par (000) | Value | |||||||||||||

Oil, Gas & Consumable Fuels — 3.3% | |||||||||||||||

Arch Coal, Inc., Term Loan B, 6.25%, 5/16/18 | USD | 428 | $ | 416,149 | |||||||||||

Drillships Ocean Ventures Inc., Term Loan B, 5.50%, 7/18/21 | 675 | 676,971 | |||||||||||||

EP Energy LLC/Everest Acquisition Finance, Inc., Term Loan B3, 3.50%, 5/24/18 | 440 | 435,965 | |||||||||||||

Fieldwood Energy LLC: | |||||||||||||||

1st Lien Term Loan, 3.88%, 9/28/18 | 313 | 311,524 | |||||||||||||

2nd Lien Term Loan, 8.38%, 9/30/20 | 135 | 137,926 | |||||||||||||

Obsidian Natural Gas Trust, Term Loan, 7.00%, 11/02/15 | 199 | 199,224 | |||||||||||||

Offshore Group Investment Ltd., Term Loan B, 5.75%, 3/28/19 | 45 | 44,643 | |||||||||||||

Panda Patriot LLC, Term Loan B1, 6.75%, 12/19/20 | 325 | 331,500 | |||||||||||||

Panda Temple II Power LLC, Term Loan B, 7.25%, 4/03/19 | 360 | 367,200 | |||||||||||||

Power Buyer LLC, 2nd Lien Term Loan, 8.25%, 11/06/20 | 105 | 102,375 | |||||||||||||

Seventy Seven Operating LLC, Term Loan B, 3.75%, 6/25/21 | 250 | 249,895 | |||||||||||||

Southcross Energy Partners LP, 1st Lien Term Loan, 5.25%, 8/04/21 | 270 | 271,520 | |||||||||||||

Southcross Holdings Borrower LP, Term Loan B, 6.00%, 7/16/21 | 215 | 215,806 | |||||||||||||

Western Refining, Inc., Term Loan B, 4.25%, 11/12/20 | 333 | 332,492 | |||||||||||||

WTG Holdings III Corp.: | |||||||||||||||

1st Lien Term Loan, 4.75%, 1/15/21 | 134 | 133,821 | |||||||||||||

2nd Lien Term Loan, 8.50%, 1/15/22 | 30 | 29,950 | |||||||||||||

| 4,256,961 | |||||||||||||||

Personal Products — 0.1% | |||||||||||||||

Prestige Brands, Inc., Term Loan B2, 4.50%, 4/28/21 | 100 | 100,500 | |||||||||||||

Pharmaceuticals — 6.5% | |||||||||||||||

Akorn, Inc.: | |||||||||||||||

Incremental Term Loan, 4.50%, 4/16/21 | 160 | 160,200 | |||||||||||||

Term Loan B, 4.50%, 4/16/21 | 410 | 410,513 | |||||||||||||

Amneal Pharmaceuticals LLC, Term Loan, 4.75% - 6.00%, 11/01/19 | 278 | 277,728 | |||||||||||||

Catalent Pharma Solutions, Inc., Term Loan B, 4.50%, 5/20/21 | 815 | 815,513 | |||||||||||||

CCC Information Services, Inc., Term Loan, 4.00%, 12/20/19 | 212 | 210,252 | |||||||||||||

Endo Luxembourg Finance Co. I Sarl, 2014 Term Loan B, 3.25%, 2/28/21 | 359 | 356,633 | |||||||||||||

Grifols Worldwide Operations USA, Inc., Term Loan B, 3.16%, 2/27/21 | 1,247 | 1,237,374 | |||||||||||||

JLL/Delta Dutch Newco BV, Term Loan, 4.25%, 3/11/21 | 365 | 362,036 | |||||||||||||

Mallinckrodt International Finance SA: | |||||||||||||||

Term Loan, 3.50%, 7/17/21 | 330 | 328,941 | |||||||||||||

Term Loan B, 3.50%, 3/19/21 | 529 | 526,164 | |||||||||||||

Par Pharmaceutical Cos, Inc., Term Loan B2, 4.00%, 9/30/19 | 848 | 840,964 | |||||||||||||

Pharmaceutical Product Development LLC, Term Loan B, 4.00%, 12/05/18 | 986 | 985,515 | |||||||||||||

Quintiles Transnational Corp., Term Loan B3, 3.75%, 6/08/18 | 577 | 571,789 | |||||||||||||

Valeant Pharmaceuticals International, Inc., Term Loan B: | |||||||||||||||

Series C2, 3.75%, 12/11/19 | 524 | 523,026 | |||||||||||||

Series D2, 3.75%, 2/13/19 | 568 | 565,743 | |||||||||||||

Series E, 3.75%, 8/05/20 | 326 | 325,079 | |||||||||||||

| 8,497,470 | |||||||||||||||

| 16 | ANNUAL REPORT | AUGUST 31, 2014 |

| Schedule of Investments (continued) | BlackRock Defined Opportunity Credit Trust (BHL) (Percentages shown are based on Net Assets) |

| Floating Rate Loan Interests (b) | Par (000) | Value | |||||||||||||

Professional Services — 2.9% | |||||||||||||||

Advantage Sales & Marketing, Inc.: | |||||||||||||||

1st Lien Term Loan, 4.25%, 7/23/21 | USD | 455 | $ | 450,108 | |||||||||||

2nd Lien Term Loan, 7.50%, 7/25/22 | 360 | 360,076 | |||||||||||||

Delayed Draw Term Loan, 0.50%, 7/23/21 | 15 | 15,004 | |||||||||||||

Ceridian LLC: | |||||||||||||||

Term Loan B1, 4.16%, 5/09/17 | 651 | 650,332 | |||||||||||||

Term Loan B2, 4.50%, 9/14/20 | 515 | 514,152 | |||||||||||||

Emdeon Business Services LLC, Term Loan B2, 3.75%, 11/02/18 | 720 | 715,697 | |||||||||||||

Intertrust Group Holding BV, 2nd Lien Term Loan, 8.00%, 4/16/22 | 275 | 274,142 | |||||||||||||

SIRVA Worldwide, Inc., Term Loan, 7.50%, 3/27/19 | 425 | 433,117 | |||||||||||||

Truven Health Analytics, Inc., Term Loan B, 4.50%, 6/06/19 | 393 | 390,992 | |||||||||||||

| 3,803,620 | |||||||||||||||

Real Estate Management & Development — 1.3% | |||||||||||||||

CityCenter Holdings LLC, Term Loan B, 4.25%, 10/16/20 | 523 | 522,043 | |||||||||||||

Realogy Corp.: | |||||||||||||||

Extended Letter of Credit, 4.40%, 10/10/16 | 41 | 40,298 | |||||||||||||

Term Loan B, 3.75%, 3/05/20 | 1,188 | 1,182,195 | |||||||||||||

| 1,744,536 | |||||||||||||||

Road & Rail — 0.8% | |||||||||||||||

The Hertz Corp., Term Loan B2, 3.00%, 3/11/18 | 330 | 323,812 | |||||||||||||

Road Infrastructure Investment LLC: | |||||||||||||||

1st Lien Term Loan, 4.25%, 3/31/21 | 464 | 458,814 | |||||||||||||

2nd Lien Term Loan, 7.75%, 9/21/21 | 225 | 222,188 | |||||||||||||

| 1,004,814 | |||||||||||||||

Semiconductors & Semiconductor Equipment — 1.6% | |||||||||||||||

Avago Technologies Cayman Ltd., Term Loan B, 3.75%, 5/06/21 | 1,070 | 1,068,299 | |||||||||||||

Freescale Semiconductor, Inc.: | |||||||||||||||

Term Loan B4, 4.25%, 2/28/20 | 532 | 529,614 | |||||||||||||

Term Loan B5, 5.00%, 1/15/21 | 164 | 164,275 | |||||||||||||

NXP BV, Term Loan D, 3.25%, 1/11/20 | 328 | 324,413 | |||||||||||||

| 2,086,601 | |||||||||||||||

Software — 4.1% | |||||||||||||||

BMC Software Finance, Inc., Term Loan, 5.00%, 9/10/20 | 538 | 535,906 | |||||||||||||

Evertec Group LLC, Term Loan B, 3.50%, 4/17/20 | 243 | 238,305 | |||||||||||||

GCA Services Group, Inc.: | |||||||||||||||

2nd Lien Term Loan, 9.25%, 10/22/20 | 176 | 176,294 | |||||||||||||

Term Loan B, 4.25% - 5.50%, 11/01/19 | 406 | 403,930 | |||||||||||||

Infor US, Inc.: | |||||||||||||||

Term Loan B3, 3.75%, 6/03/20 | 197 | 194,534 | |||||||||||||

Term Loan B5, 3.75%, 6/03/20 | 985 | 976,397 | |||||||||||||

IQOR US, Inc., Term Loan B, 6.00%, 4/01/21 | 203 | 190,117 | |||||||||||||

Kronos Worldwide, Inc., 2014 Term Loan, 4.75%, 2/18/20 | 115 | 114,856 | |||||||||||||

Kronos, Inc., 2nd Lien Term Loan, 9.75%, 4/30/20 | 409 | 419,459 | |||||||||||||

Mitchell International, Inc.: | |||||||||||||||

1st Lien Term Loan, 4.50%, 10/12/20 | 508 | 506,663 | |||||||||||||

2nd Lien Term Loan, 8.50%, 10/11/21 | 350 | 352,408 | |||||||||||||

Regit Eins GmbH, 1st Lien Term Loan, 6.00%, 6/30/21 | 265 | 259,037 | |||||||||||||

RP Crown Parent LLC, 2013 Term Loan, 6.00%, 12/21/18 | 216 | 211,921 | |||||||||||||

Sophia LP, 2014 Term Loan B, 4.00%, 7/19/18 | 665 | 661,976 | |||||||||||||

Websense, Inc., 2nd Lien Term Loan, 8.25%, 12/24/20 | 115 | 114,281 | |||||||||||||

| 5,356,084 | |||||||||||||||

| Floating Rate Loan Interests (b) | Par (000) | Value | |||||||||||||

Specialty Retail — 4.5% | |||||||||||||||

Academy Ltd., Term Loan, 4.50%, 8/03/18 | USD | 521 | $ | 519,599 | |||||||||||

Equinox Holdings, Inc., Repriced Term Loan B, 4.25%, 1/31/20 | 245 | 243,759 | |||||||||||||

General Nutrition Centers, Inc., Term Loan, 3.25%, 3/04/19 | 330 | 325,498 | |||||||||||||

The Gymboree Corp., Initial Term Loan, 5.00%, 2/23/18 | 77 | 61,357 | |||||||||||||

Harbor Freight Tools USA, Inc., 1st Lien Term Loan, 4.75%, 7/26/19 | 452 | 451,741 | |||||||||||||

Jo-Ann Stores, Inc., Term Loan, 4.00%, 3/16/18 | 369 | 360,034 | |||||||||||||

Leslie’s Poolmart, Inc., Term Loan, 4.25%, 10/16/19 | 551 | 547,392 | |||||||||||||

Michaels Stores, Inc.: | |||||||||||||||

Incremental 2014 Term Loan B2, 4.00%, 1/28/20 | 665 | 660,844 | |||||||||||||

Term Loan B, 3.75%, 1/28/20 | 518 | 511,576 | |||||||||||||

Party City Holdings, Inc., Term Loan, 4.00%, 7/27/19 | 948 | 939,479 | |||||||||||||

Petco Animal Supplies, Inc., Term Loan, 4.00%, 11/24/17 | 775 | 772,974 | |||||||||||||

Things Remembered, Inc., Term Loan B, 8.00%, 5/24/18 | 393 | 391,246 | |||||||||||||

Toys ‘R’ Us-Delaware, Inc., Term Loan B3, 5.25%, 5/25/18 | 37 | 31,232 | |||||||||||||

| 5,816,731 | |||||||||||||||

Textiles, Apparel & Luxury Goods — 2.1% | |||||||||||||||

ABG Intermediate Holdings 2 LLC, 1st Lien Term Loan, 5.50%, 5/27/21 | 499 | 497,503 | |||||||||||||

Ascend Performance Materials LLC, Term Loan B, 6.75%, 4/10/18 | 530 | 522,192 | |||||||||||||

J. Crew Group, Inc., Term Loan B, 4.00%, 3/05/21 | 469 | 459,350 | |||||||||||||

Kate Spade & Co., Term Loan B, 4.00%, 4/09/21 | 505 | 497,900 | |||||||||||||

Nine West Holdings, Inc.: | |||||||||||||||

Guarantee Term Loan, 6.25%, 1/08/20 | 185 | 184,075 | |||||||||||||

Term Loan B, 4.75%, 10/08/19 | 215 | 215,269 | |||||||||||||

Polymer Group, Inc., 1st Lien Term Loan, 5.25%, 12/19/19 | 347 | 348,234 | |||||||||||||

| 2,724,523 | |||||||||||||||

Thrifts & Mortgage Finance — 0.3% | |||||||||||||||

IG Investment Holdings LLC, 1st Lien Term Loan, 5.25%, 10/31/19 | 443 | 443,436 | |||||||||||||

Wireless Telecommunication Services — 0.5% | |||||||||||||||

LTS Buyer LLC, 1st Lien Term Loan, 4.00%, 4/13/20 | 604 | 600,379 | |||||||||||||

Total Floating Rate Loan Interests — 134.1% | 174,711,488 | ||||||||||||||

Non-Agency Mortgage Backed Securities — 0.2% | |||||||||||||||

Commercial Mortgage-Backed Securities — 0.2% | |||||||||||||||

Hilton USA Trust, Series 2013-HLT, Class EFX, 5.61%, 11/05/30 (b)(c) | 304 | 311,025 | |||||||||||||

Investment Companies | Shares | ||||||||||||||

Capital Markets — 0.0% | |||||||||||||||

Eaton Vance Floating-Rate Income Trust | 12 | 179 | |||||||||||||

Eaton Vance Senior Income Trust | 3,347 | 22,325 | |||||||||||||

Total Investment Companies — 0.0% | 22,504 | ||||||||||||||

| ANNUAL REPORT | AUGUST 31, 2014 | 17 |

| Schedule of Investments (continued) | BlackRock Defined Opportunity Credit Trust (BHL) (Percentages shown are based on Net Assets) |

| Warrants (f) | | Shares | Value | ||||||||||||

Software — 0.0% | |||||||||||||||

HMH Holdings/EduMedia (Issued/Exercisable 3/09/10, 19 Shares for 1 Warrant, Expires 6/22/19, Strike Price $42.27) | 691 | $ | 3,214 | ||||||||||||

Total Long-Term Investments (Cost — $183,616,880) — 141.0% | 183,818,081 | ||||||||||||||

| Short-Term Securities | | Shares | Value | |||||||||||

BlackRock Liquidity Funds, TempFund, Institutional Class, 0.03% (g)(h) | 2,958,501 | $ | 2,958,501 | |||||||||||

Total Short-Term Securities (Cost — $2,958,501) — 2.3% | 2,958,501 | |||||||||||||

Total Investments (Cost — $186,575,381) — 143.3% | 186,776,582 | |||||||||||||

Liabilities in Excess of Other Assets — (43.3)% | (56,425,771 | ) | ||||||||||||

Net Assets — 100.0% | $ | 130,350,811 | ||||||||||||

Notes to Schedule of Investments

| (a) | Non-income producing security. | |||

| (b) | Variable rate security. Rate shown is as of report date. | |||

| (c) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. | |||

| (d) | When-issued security. Unsettled when-issued transactions were as follows: |

| Counterparty | Value | Unrealized Appreciation | ||||||||

Deutsche Bank Securities, Inc. | $ | 237,200 | — | |||||||

| (e) | Issuer filed for bankruptcy and/or is in default of principal and/or interest payments. | |||

| (f) | Warrants entitle the Fund to purchase a predetermined number of shares of common stock and are non-income producing. The purchase price and number of shares are subject to adjustment under certain conditions until the expiration date, if any. | |||

| (g) | Investments in issuers considered to be an affiliate of the Fund during the year ended August 31, 2014, for purposes of Section 2(a)(3) of the 1940 Act, were as follows: |

| Affiliate | Shares Held at August 31, 2013 | Net Activity | Shares Held at August 31, 2014 | Income | ||||||||||||||

BlackRock Liquidity Funds, TempFund, Institutional Class | 1,298,269 | 1,660,232 | 2,958,501 | $ | 199 | |||||||||||||

| (h) | Represents the current yield as of report date. | |||

| • | Forward foreign currency exchange contracts outstanding as of August 31, 2014 were as follows: |

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation | ||||||||||

USD | 658,896 | EUR | 487,000 | Citibank N.A. | 10/21/14 | $ | 18,814 | |||||||

USD | 2,098,271 | GBP | 1,228,000 | Bank of America N.A. | 10/21/14 | 60,399 | ||||||||

Total | $ | 79,213 | ||||||||||||

| • | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. | |||

| • | Fair Value Measurements — Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| • | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access | |||

| • | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs) | |||

| • | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial instruments) |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. | ||||

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the investment and derivative financial instrument and is not necessarily an indication of the risks associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments and derivative financial instruments, please refer to Note 2 of the Notes to Financial Statements. |

| 18 | ANNUAL REPORT | AUGUST 31, 2014 |

| Schedule of Investments (concluded) | BlackRock Defined Opportunity Credit Trust (BHL) |

The following tables summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy as of August 31, 2014: |

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

Assets: | ||||||||||||||||

Investments: | ||||||||||||||||

Long-Term Investments: | ||||||||||||||||

Common Stocks | $ | 467,616 | $ | 282,533 | — | $ | 750,149 | |||||||||

Asset-Backed Securities | — | 2,792,496 | $ | 921,580 | 3,714,076 | |||||||||||

Corporate Bonds | — | 4,305,625 | — | 4,305,625 | ||||||||||||

Floating Rate Loan Interests | — | 161,112,379 | 13,599,109 | 174,711,488 | ||||||||||||

Non-Agency Mortgage-Backed Securities | — | 311,025 | — | 311,025 | ||||||||||||

Investment Companies | 22,504 | — | — | 22,504 | ||||||||||||

Warrants | — | 3,214 | — | 3,214 | ||||||||||||

Short-Term Securities | 2,958,501 | — | — | 2,958,501 | ||||||||||||