Exhibit 99.1

China Jo-Jo Drugstores, Inc. (NASDAQ:CJJD) March 2011

Safe Harbor Statement Statements in this presentation may be "forward-looking statements" within the meaning of federal securities laws. The matters discussed herein that are forward-looking statements are based on current management expectations that involve risks and uncertainties that may result in such expectations not being realized. Forward-looking statements involve risks and uncertainties that may cause actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial condition expressed or implied in any forward-looking statements. Such risks include, but are not limited to, competition in the retail drugstore industry, outpatient medical services industry, changes to management or key personnel, risks associated with conducting business in China, the Company’s ability to expand into markets outside of Hangzhou, and other risks detailed in the Company’s filings with the Securities and Exchange Commission. Actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements due to numerous potential risks and uncertainties. Forward-looking statements made during this presentation speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this presentation. Because forward-looking statements are subject to risks and uncertainties, we caution you not to place undue reliance on any forward-looking statements. All written or oral forward-looking statements by the Company or persons acting on its behalf are qualified by these cautionary statements.

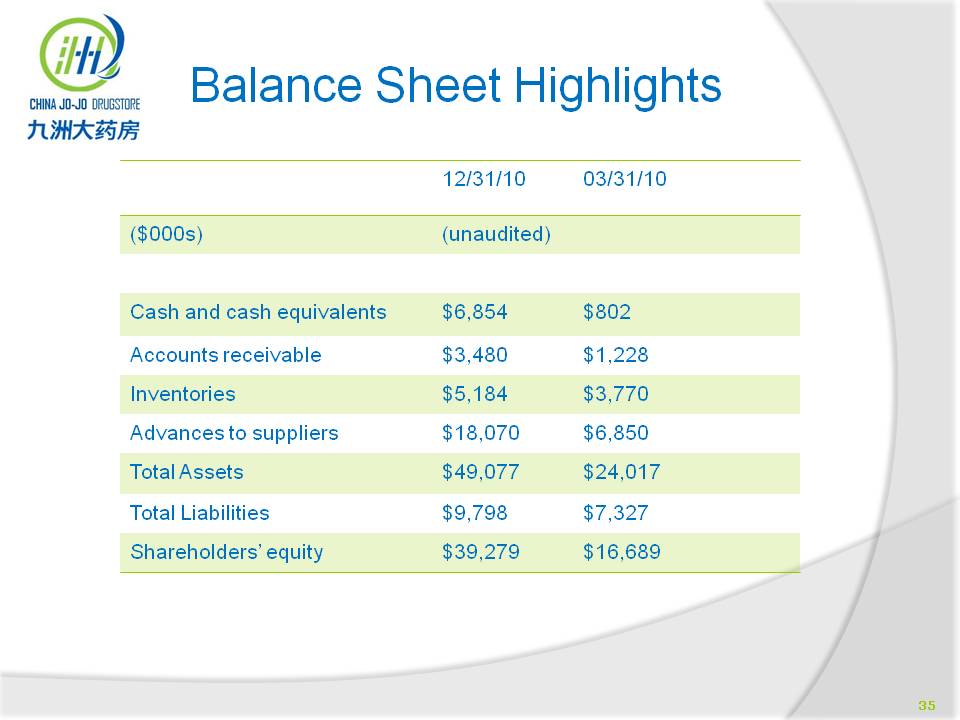

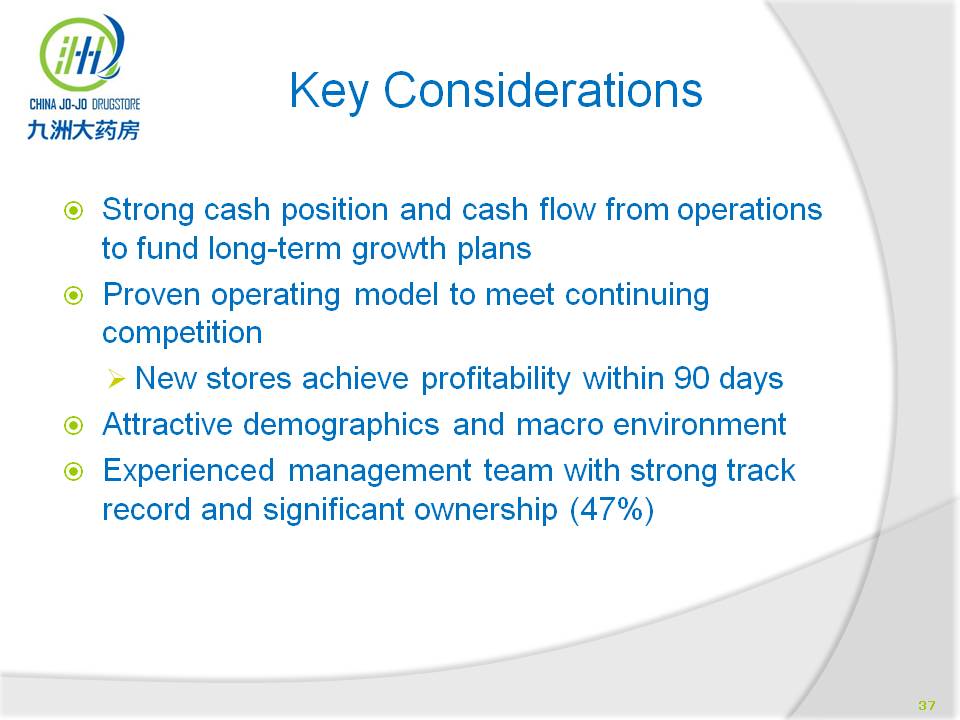

About China Jo-Jo Drugstores Retail pharmacy chain based in Hangzhou, Zhejiang Province, China Unique operating model Pharmacy and physician consultations under one roof Maturing store base and new store opening strategy fueling top line growth Solid balance sheet and strong cash flow from operations support long-term growth plans

Operating Strategy Diverse product offering Scheduled physician hours at all locations Outpatient clinics adjacent to 2 Jo-Jo stores drive traffic and increased brand awareness; recently applied to operate 2 additional clinics Outsourced warehousing and logistics drives strong gross margins Onsite product reps provide added layer of customer service and support

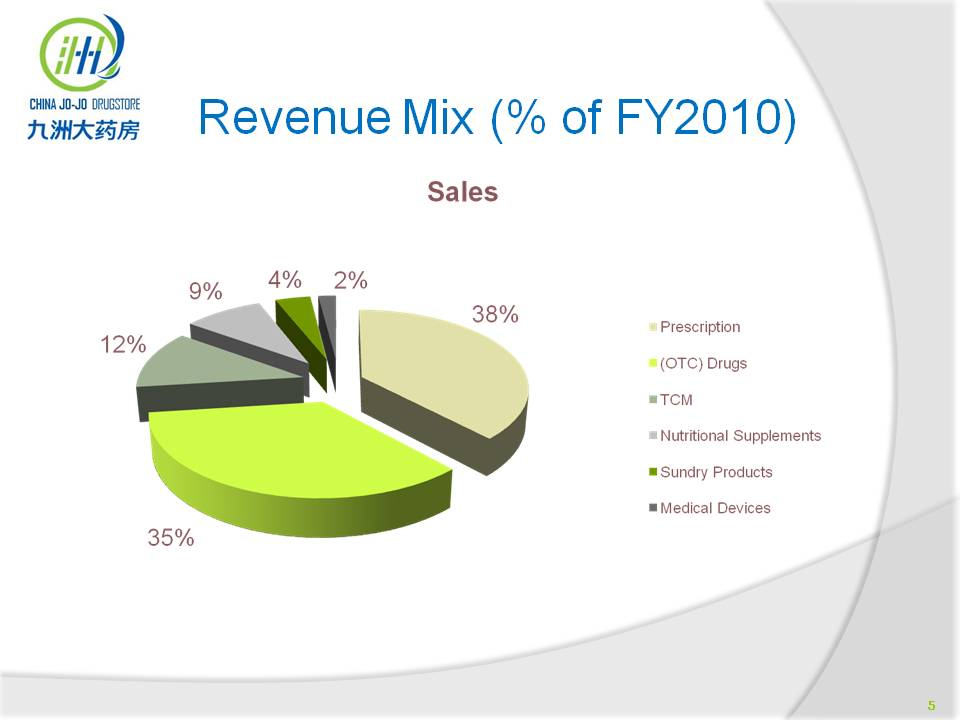

Revenue Mix (% of FY2010) Sales 38% 2% 4% 9% 12% 35% Prescription (OTC) Drugs TCM Nutritional Supplements Sundry Products Medical Devices

Store Locations 50 stores in Zhejiang Province; 1 store in Shanghai Compelling demographics support up to 300 locations in Zhejiang Province Population exceeds 50 million Five cities with over 4 million people; three cities with more than 1 million people GDP growing exponentially

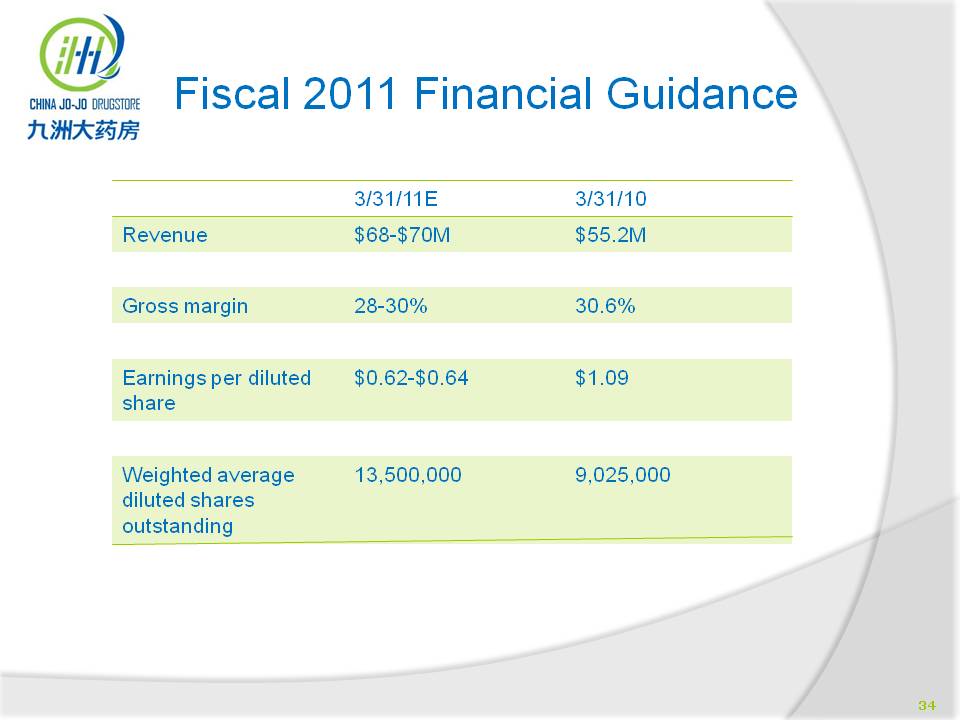

Distribution Strategy Outsourced warehousing and distribution drives strong gross margins of 28-30% Partnership with Zhejiang Yingte Logistics Co., Ltd. since 2008 Automated inventory management Ability to accommodate Jo-Jo’s long-term store expansion plans

Outsourced Distribution Center

Title: New Store Opening Plans 20-30 new stores in fiscal 2012 Emphasis on Zhejiang Province >> Opportunity for up to 300 locations Entering Shanghai market >> Raise visibility >>Increase brand equity >>Opportunity for up to 12 locations >>Population exceeds 19 million Plans expected to be funded through existing cash and future cash flow from operations

Title: Marketing Strategy Outpatient clinics >> Drives traffic >> Raises brand awareness >> Functions like a “flagship” store Product manufacturers reps in all stores >> Provides added layer of customer service and support >> More than 300 reps Customer loyalty program Introduced liquor in December 2010 (Baijiu) Developing online presence; long-term strategy to build the Jo-Jo brand

Title: Developing Online Presence First license to operate an online drugstore issued by the PRC Significant branding and marketing opportunity Purchased website developer in Q3 2011 >> Substantial online selling expertise >> Opportunity to rapidly drive sales and profit Pursuing strategic partnerships with high traffic B2C websites www.jiuzhou-drugstore.com/about.aspx

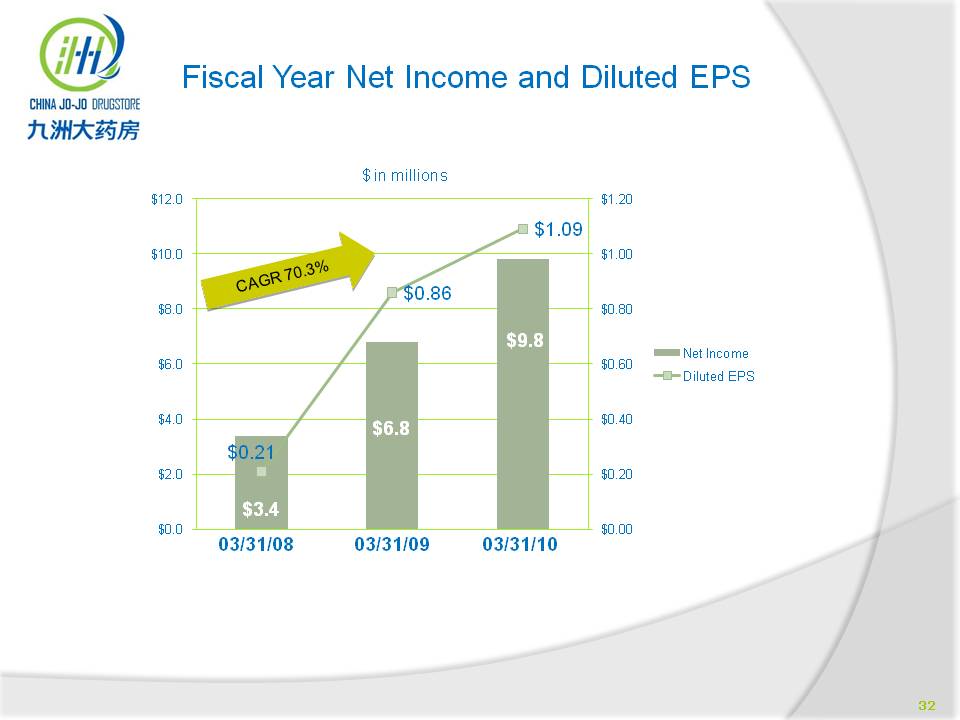

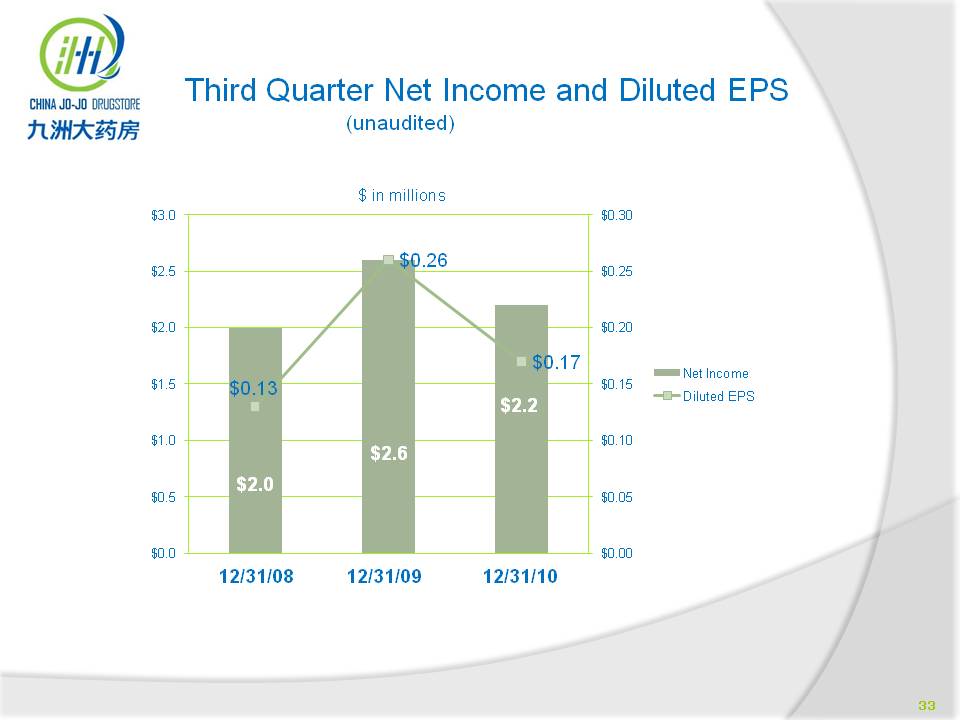

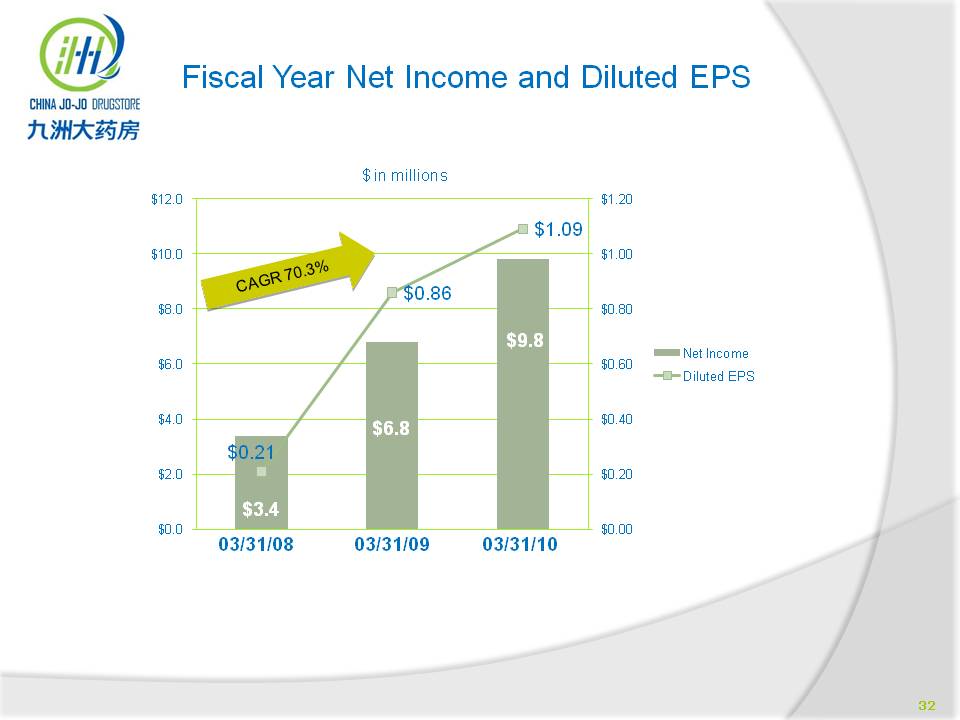

Title: Financial Overview

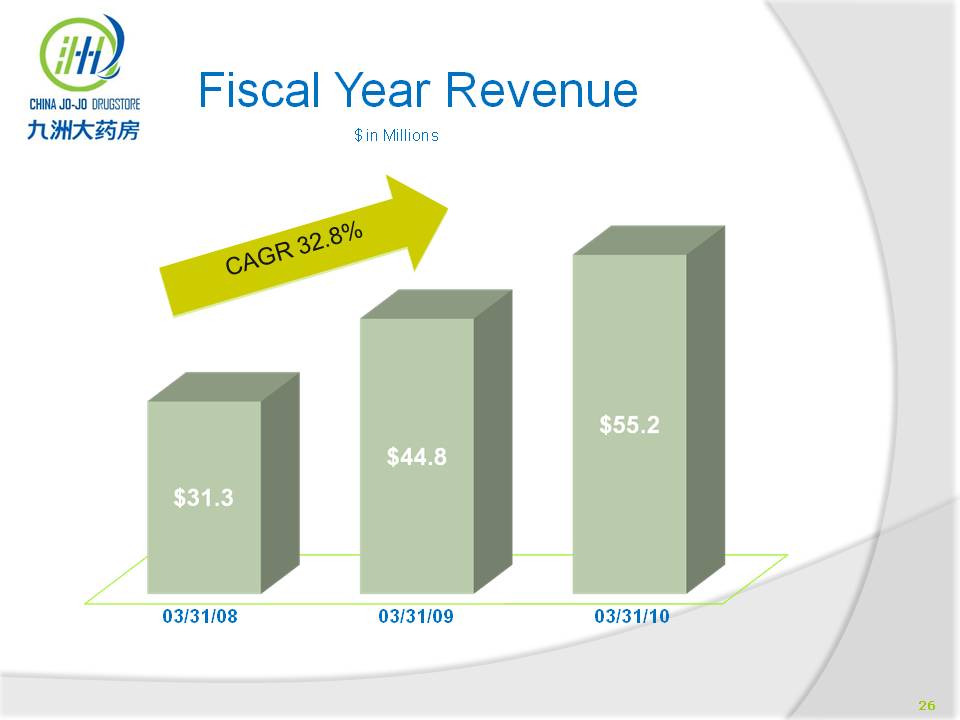

Title: Fiscal Year Revenue $ in Millions CAGR 32.8% $31.3 $44.8 $55.2 03/31/08 03/31/09 03/31/10

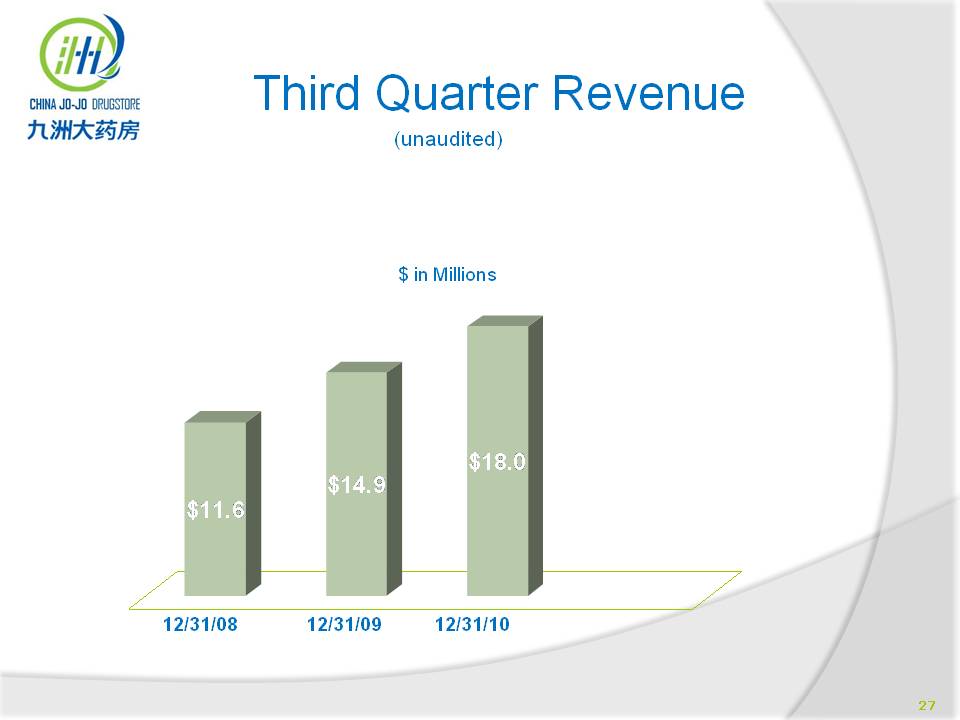

Title: Third Quarter Revenue (unaudited) $ in Millions $11.6 $14.9 $18.0 12/31/08 12/31/09 12/31/10

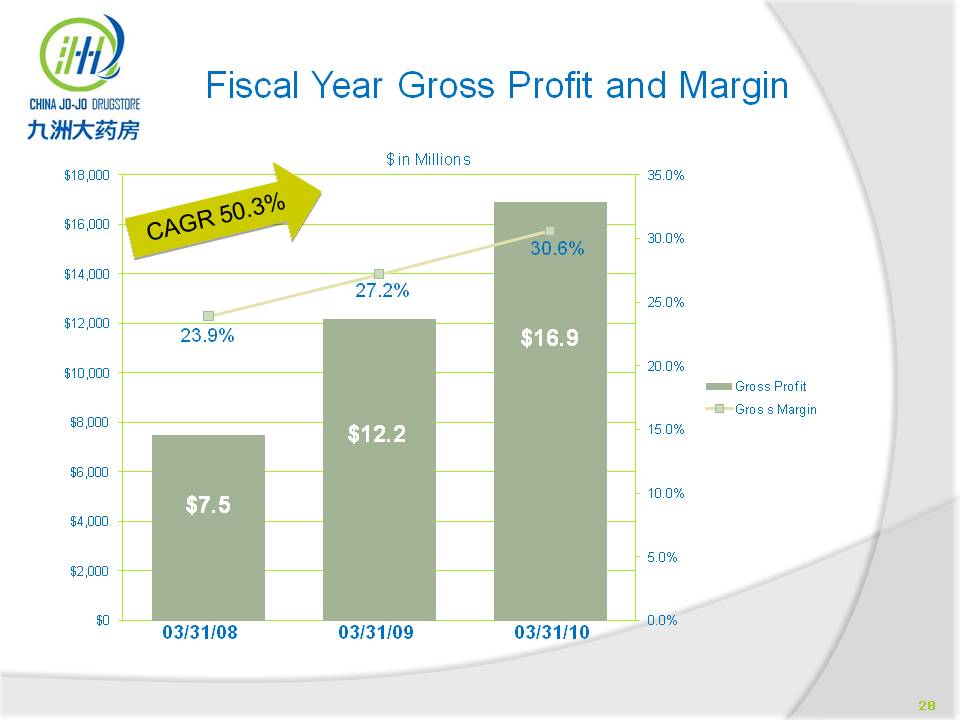

Title: Fiscal Year Gross Profit and Margin $ in Millions CAGR 50.3% $18,000 $16,000 $14,000 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $0 23.9% 27.2% 30.6% $7.5 $12.2 $16.9 03/31/08 03/31/09 03/31/10 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% Gross Profit Gross Margin

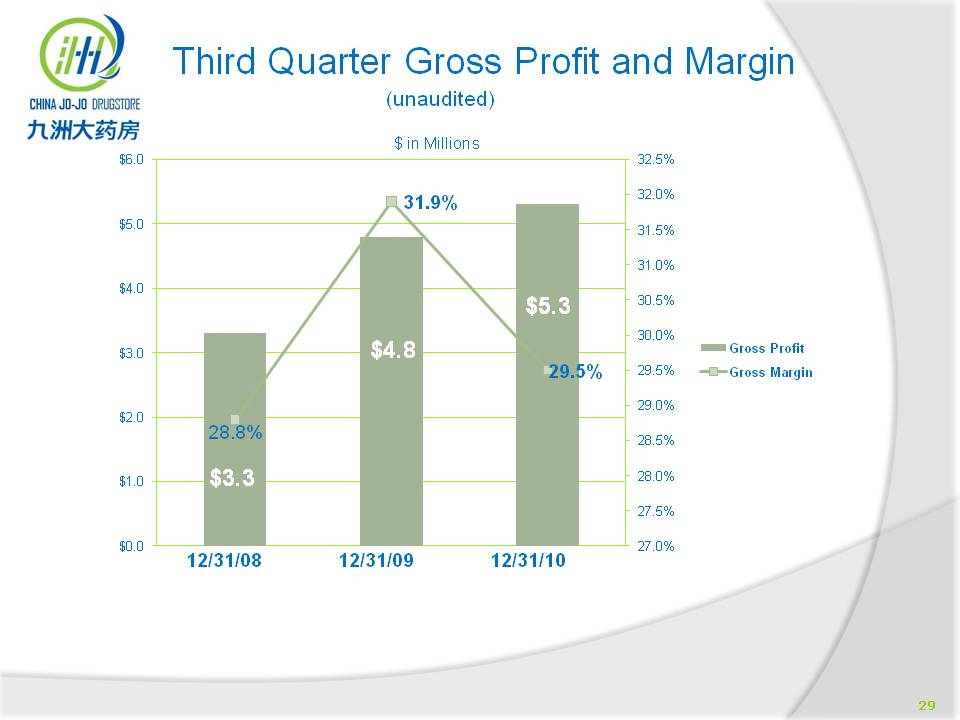

Title: Third Quarter Gross Profit and Margin (unaudited) $ in Millions 6.0 $5.0 $4.0 $3.0 $2.0 $1.0 $0.0 28.8% $3.3 31.9% $4.8 $5.3 $29.5% 12/31/08 12/31/09 12/31/10

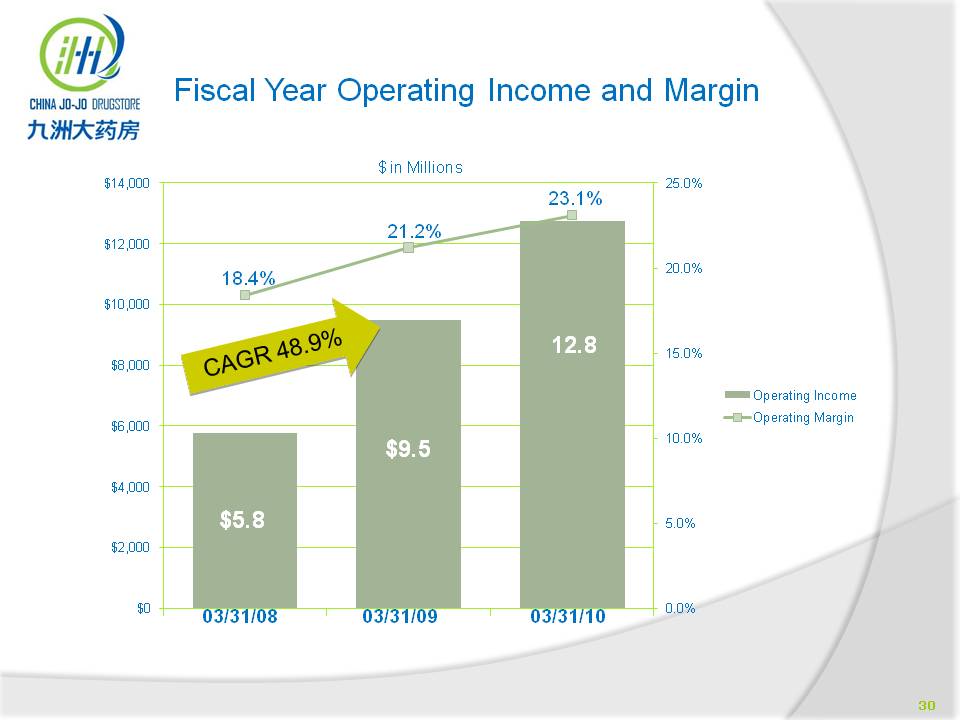

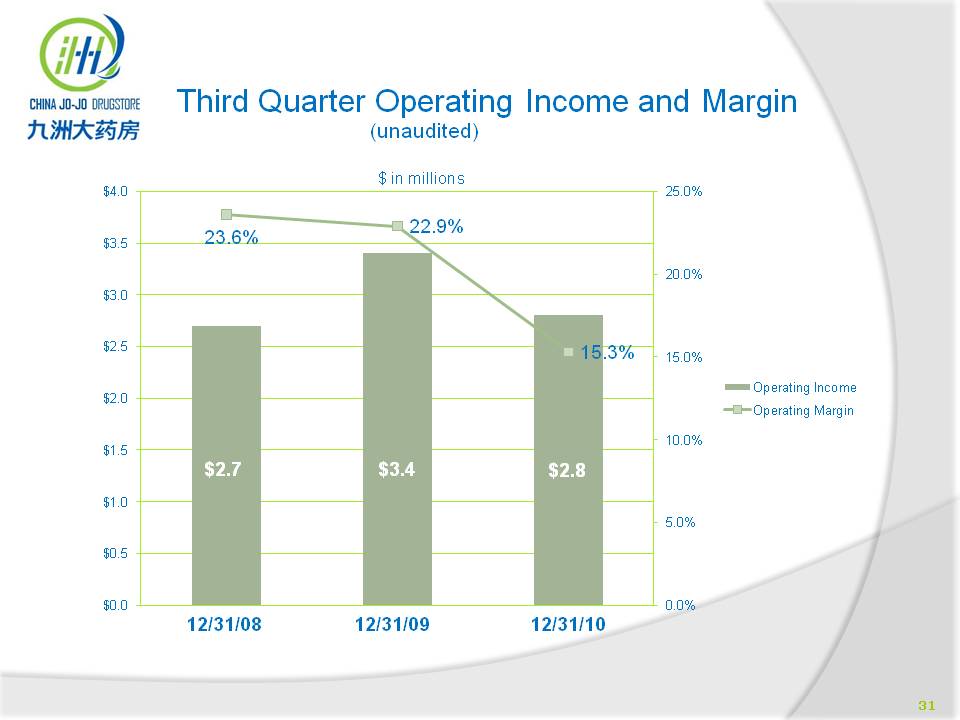

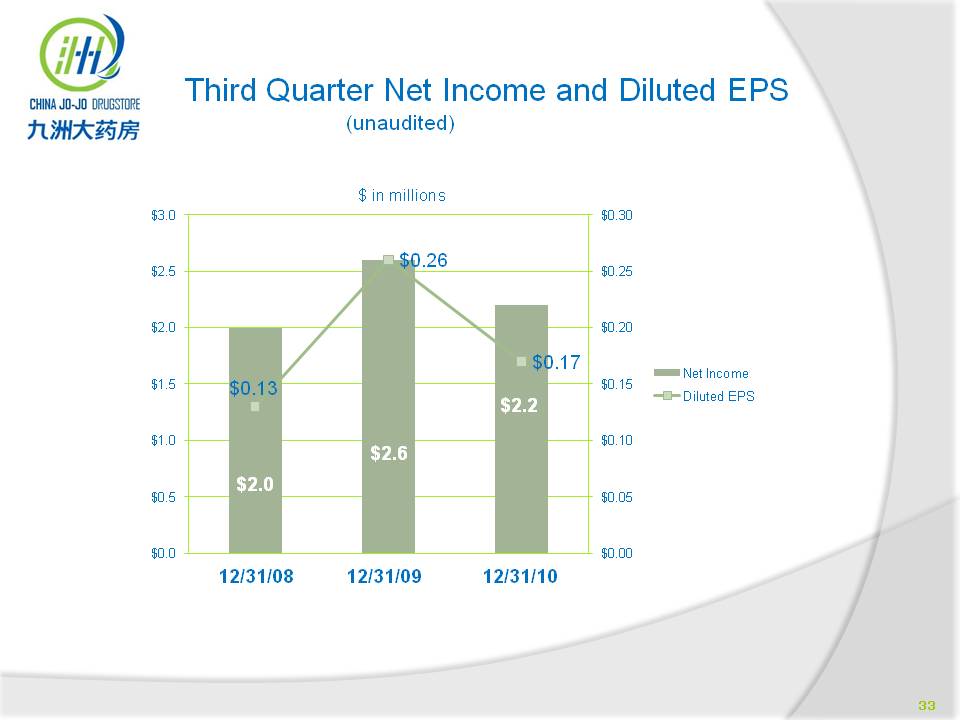

Title: Fiscal Year Operating Income and Margin $14,000 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $0 $ in Millions 18.4% 21.2% 23.1% CAGR 48.9% $5.8 $9.5 $12.8 03/31/08 03/31/09 03/31/10

missing text: Slide: 18 Favorable Macro and Industry Trends PRC population is 1.3 billion strong; world’s No. 2 economy Population aged = 65 increased from 5.6% in 1990 to 8.5% in 2008(1) Urban population expected to increase from 502 million in 2002 to 756 million in 2020(2) Healthcare expenditures expected to increase 66% from $220 billion in 2008 to $370 billion in 2012(3) 18 Sources (1) China National Bureau of Statistics (2) United Nations Population Division (3) World Health Organization Slide: 19 Competitive Landscape in Hangzhou Other Placeholder: Approximately 1,000 drugstores - primarily independents Three major chains China Nepstar (NYSE:NPD) Lao Bai Xing Grand Pharmacy Tian Tian Hao Grand Pharmacy Competitors emphasize private label and generic products Retail footprints are significantly below China Jo-Jo’s average 3,000 square feet Highly fragmented market provides acquisition and growth opportunities Slide: 20 Competitive Advantages Offers high quality brands at a compelling value Provides pharmacy and physician consultations under one roof Scheduled physician hours Physician access and consultation drives pharmacy sales Broad range of services at 2 outpatient clinics offers alternative to hospital visit Focus on higher margin products as well as those to drive traffic Customer loyalty program engages the customer and provides purchasing data Slide: 21 Year Number of Stores 2008 9 Stores 2009 18 Stores 2010 25 Stores 2011E 60 Stores 60 50 40 30 20 10 0 Dramatic Store Expansion (as of Fiscal Year Ending 3/31) Other Placeholder: